UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________________________ to

Commission file number: 001-36246

Civeo Corporation

____________

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| British Columbia, Canada | 98-1253716 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

| | | |

| Three Allen Center, 333 Clay Street, Suite 4400, | | |

| Houston, Texas | 77002 | |

| (Address of principal executive offices) | (Zip Code) | |

| | |

| 713 510-2400 |

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Exchange on Which Registered |

| Common Shares, no par value | CVEO | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "accelerated filer," "large accelerated filer," "smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

(Check one):

| | | | | | | | | | | | | | | | | |

| Large Accelerated Filer | ☐ | Accelerated Filer | ☒ | Emerging Growth Company | ☐ |

| | | | | | |

| Non-Accelerated Filer | ☐ | Smaller Reporting Company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

The aggregate market value of common shares held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter, June 30, 2024, was $342,546,231.

The Registrant had 13,653,647 common shares outstanding as of February 21, 2025.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Definitive Proxy Statement for the 2025 Annual General Meeting of Shareholders, which the registrant intends to file with the Securities and Exchange Commission not later than 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K, are incorporated by reference into Part III of this Annual Report on Form 10-K.

CIVEO CORPORATION

INDEX

| | | | | | | | |

| | | Page No. |

| | |

| |

| | | |

| | |

| | |

| | |

| Cybersecurity | |

| | |

| | |

| | |

| | | |

| | |

| | |

| Item 6. | Reserved | |

| | |

| | |

| | |

| | |

| | |

| | |

| Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | |

| | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

| | |

| | |

| | |

| | | |

| |

| |

PART I

This annual report on Form 10-K (annual report) contains certain “forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 (the Securities Act) and Section 21E of the Securities Exchange Act of 1934 (the Exchange Act). Actual results could differ materially from those projected in the forward-looking statements as a result of a number of important factors. For a discussion of known material factors that could affect our results, refer to "Cautionary Statement Regarding Forward-Looking Statements" below and “Part I, Item 1. Business,” “Part I, Item 1A. Risk Factors,” “Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations” and “Part II, Item 7A. Quantitative and Qualitative Disclosures about Market Risk” of this annual report.

In addition, in certain places in this annual report, we refer to reports published by third parties that purport to describe trends or developments in the energy industry. We do so for the convenience of our shareholders and in an effort to provide information available in the market that will assist our investors in a better understanding of the market environment in which we operate. However, we specifically disclaim any responsibility for the accuracy and completeness of such information and undertake no obligation to update such information.

Cautionary Statement Regarding Forward-Looking Statements

We include the following cautionary statement to take advantage of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995 for any "forward-looking statement" made by us or on our behalf. All statements other than statements of historical facts included in this annual report are forward-looking statements. The forward-looking statements can be identified by the use of forward-looking terminology including “may,” “expect,” “anticipate,” “estimate,” “continue,” “believe” or other similar words. Such statements may include statements regarding our future financial position, budgets, capital expenditures, projected costs, plans and objectives of management for future operations and possible future strategic transactions. Where any such forward-looking statement includes a statement of the assumptions or bases underlying such forward-looking statement, we caution that, while we believe such assumptions or bases to be reasonable and make them in good faith, assumed facts or bases almost always vary from actual results. The differences between assumed facts or bases and actual results can be material, depending upon the circumstances. The factors identified in this cautionary statement are important factors (but not necessarily all of the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement made by us, or on our behalf.

In any forward-looking statement where we, or our management, express an expectation or belief as to future results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, there can be no assurance that the statement of expectation or belief will result or be achieved or accomplished. Taking this into account, the following are identified as important factors that could cause actual results to differ materially from those expressed in any forward-looking statement made by, or on behalf of, us:

•the ability to consummate our pending acquisition of four villages in Australia’s Bowen Basin and successfully integrate such assets into our existing operations;

•the level of supply and demand for metallurgical (met) coal, oil, natural gas, iron ore and other minerals;

•the level of activity, spending and natural resource development in Australia and Canada;

•the level of demand, particularly from China and India, for coal and other natural resources from Australia;

•the availability of attractive natural resource projects and assets, which may be affected by governmental actions, including changes in royalty or tax regimes, or environmental activists which may restrict drilling or development;

•fluctuations or sharp declines in the current and future prices of coal, oil, natural gas, iron ore and other minerals;

•failure by our customers to reach positive final investment decisions on, or otherwise not complete, projects with respect to which we have been awarded contracts to provide related hospitality services, which may cause those customers to terminate or postpone the contracts;

•fluctuations in currency exchange rates;

•general global economic conditions, such as the pace of global economic growth, a general slowdown in the global economy, supply chain disruptions, labor shortages, inflationary pressures and geopolitical events such as the ongoing Russia/Ukraine and Middle East conflicts;

•changes in tax laws, tax treaties or tax regulations or the interpretation or enforcement thereof, including taxing authorities not agreeing with our assessment of the effects of such laws, treaties and regulations;

•changes to government and environmental regulations, including climate change legislation and clean energy policies;

•global weather conditions, natural disasters, including wildfires, global health concerns and security threats, including cybersecurity incidents;

•our ability to hire and retain skilled personnel;

•the availability and cost of capital, including instability in the banking sector and the ability to access the debt and equity markets;

•our capital structure and our ability to return cash to shareholders through dividends or common share repurchases;

•our ability to integrate acquisitions;

•the development of new projects, including whether such projects will continue in the future; and

•other factors identified in Item 1A. - "Risk Factors" of this annual report.

Such risks and uncertainties are beyond our ability to control, and in many cases, we cannot predict the risks and uncertainties that could cause our actual results to differ materially from those indicated by the forward-looking statements.

All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by reference to these risks and uncertainties. You should not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and we do not undertake any obligation to publicly update or revise any forward-looking statements except as required by law.

ITEM 1. Business

Available Information

We maintain a website with the address of www.civeo.com. We are not including the information contained on our website as a part of, or incorporating it by reference into, this annual report. We file or furnish annual, quarterly and current reports, proxy statements and other documents with the Securities and Exchange Commission (the SEC). We make available free of charge through our website our Annual Report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to these reports, as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the SEC. Also, the SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us, and our filings are available on the Internet at www.sec.gov and free of charge upon written request to our corporate secretary at the address shown on the cover page of this annual report.

Our Company

We provide hospitality services to remote workforces in Australia and Canada, including catering and food service, lodging, housekeeping and maintenance at accommodation facilities that we or our customers own. We provide services that support the day-to-day operations of these facilities, such as laundry, facility management and maintenance, water and wastewater treatment, power generation, communication systems, security and logistics. We also manage development activities for workforce accommodation facilities, including site selection, permitting, engineering and design and manufacturing and site construction management, along with providing hospitality services once the facility is constructed.

We primarily operate in some of the world’s most active met coal, oil, liquefied natural gas (LNG) and iron ore producing regions, where, in many cases, traditional hospitality accommodations and related infrastructure services often are not accessible, sufficient or cost effective. Our customers include mining companies, major and independent oil companies, engineering companies and oilfield and mining service companies. Our extensive suite of services enables us to meet the unique needs of each of our customers, while providing comfortable accommodations for their employees. Our customers can outsource their hospitality accommodations needs to a single supplier, maintaining employee welfare and satisfaction while focusing their investment on their core resource production efforts.

Our Company is built on the foundation of the following core values: Safety, Respect, Care, Excellence, Integrity and Collaboration. We put the safety of our employees and guests above all. We act with respect in all that we do. We care about our people, guests, customers, environment and communities. We deliver service excellence with passion and pride. We strive to operate with integrity, earning trust and delivering on our promises. We collaborate to share perspectives and to achieve shared success. We firmly believe that living and integrating these values into our operations is a strategic advantage that drives innovation, builds resilience and creates lasting value for our stakeholders.

Our hospitality services span the lifecycle of customer projects, from the initial exploration and resource delineation to long-term production. Initially, as customers assess the resource potential and determine how they will develop it, they typically need our hospitality services for a limited number of employees for an uncertain duration of time. Our fleet of mobile assets in Canada is well-suited to support this initial exploratory stage as customers evaluate their development and construction plans. As development of the resource begins, we can serve their needs through either: (i) our integrated services model in customer-owned facilities, (ii) our scalable lodge or village model or (iii) our fleet of mobile assets, particularly for shorter term projects such as pipeline construction and seasonal drilling programs. As projects grow and headcount needs increase, we are able to meet our customers growing needs at our accommodation facilities or with our hospitality services. By providing infrastructure support and hospitality services early in the project lifecycle, we are well positioned to continue to service our customers throughout the production phase, which typically lasts decades.

We own and operate 25 lodges and villages with approximately 26,000 rooms. We operate approximately 19,000 rooms across 22 locations where the accommodations assets are owned by our customers. Additionally, in Canada, we also offer a fleet of mobile assets which serve shorter term projects, such as pipeline construction. We have long-standing relationships with many of our customers, many of whom are, or are affiliates of, large, investment-grade energy and mining companies.

For the years ended December 31, 2024, 2023 and 2022, we generated $682.1 million, $700.8 million and $697.1 million in revenues and $1.3 million, $39.5 million and $17.0 million in operating income, respectively. The majority of our operations, assets and income are derived from the hospitality services provided at lodges and villages we own that have historically been contracted by our customers under multi-year, take-or-pay or exclusivity contracts. The hospitality services we provide at these facilities generated 60% of our revenue for the year ended December 31, 2024. Important performance metrics include revenue related to our major properties, average daily rates and aggregate billed rooms. The following summarizes these key statistics for the periods presented in this annual report.

| | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2024 | | 2023 | | 2022 |

| | (In thousands, except for room counts and average daily rate) |

Accommodation and Other Services Revenue (1) | | | | | |

| Canada | $ | 214,774 | | | $ | 266,926 | | | $ | 279,455 | |

| Australia | 196,684 | | | 177,834 | | | 152,714 | |

| Other | 10,079 | | | 11,205 | | | 3,058 | |

| Total Accommodation and Other Services Revenue | $ | 421,537 | | | $ | 455,965 | | | $ | 435,227 | |

| | | | | |

Mobile Facility Rental Revenue (2) | | | | | |

| Canada | $ | 1,523 | | | $ | 61,899 | | | $ | 96,400 | |

| Other | — | | | — | | | 18,367 | |

| Total Mobile Facility Rental Revenue | $ | 1,523 | | | $ | 61,899 | | | $ | 114,767 | |

| | | | | |

Food Service and Other Services Revenue (3) | | | | | |

| Canada | $ | 28,790 | | | $ | 23,970 | | | $ | 20,142 | |

| Australia | 230,272 | | | 158,929 | | | 125,538 | |

| Other | — | | | 42 | | | 90 | |

| Total Food Service and Other Services Revenue | $ | 259,062 | | | $ | 182,941 | | | $ | 145,770 | |

| | | | | |

Manufacturing Revenue (4) | | | | | |

| Other | $ | — | | | $ | — | | | $ | 1,288 | |

| Total Manufacturing Revenue | $ | — | | | $ | — | | | $ | 1,288 | |

| | | | | |

| Total Revenue | $ | 682,122 | | | $ | 700,805 | | | $ | 697,052 | |

| | | | | |

Average Daily Rates for Lodges and Villages (5) | | | | | |

| Canada | $ | 97 | | | $ | 97 | | | $ | 100 | |

| Australia | $ | 78 | | | $ | 75 | | | $ | 75 | |

| | | | | |

Total Billed Rooms for Lodges and Villages (6) | | | | | |

| Canada | 2,205,700 | | | 2,710,784 | | | 2,759,521 | |

| Australia | 2,524,108 | | | 2,371,763 | | | 2,024,068 | |

| | | | | |

| Average Exchange Rate | | | | | |

| Canadian dollar to U. S. dollar | $ | 0.73 | | | $ | 0.74 | | | $ | 0.77 | |

| Australian dollar to U. S. dollar | $ | 0.66 | | | $ | 0.66 | | | $ | 0.69 | |

(1)Includes revenues related to lodge and village rooms and hospitality services for Civeo owned rooms for the periods presented.

(2)Includes revenues related to mobile assets for the periods presented.

(3)Includes revenues related to food service, laundry and water and wastewater treatment services and facilities management for the periods presented.

(4)Includes revenues related to modular construction and manufacturing services for the periods presented. Civeo's remaining manufacturing operations in Louisiana were sold in the fourth quarter of 2022.

(5)Average daily rate is based on billed rooms and accommodation and other services revenue for Civeo owned rooms during the periods presented.

(6)Billed rooms represents total billed days for Civeo owned rooms for the periods presented.

Our History

Our history is one of identifying customer and market needs and developing economic solutions. Our historical experience in Canada began in small, mobile camps and evolved into owning and managing large scale remote accommodations. In Australia, our operations originated with a similar build-own-operate model as we operate in our Canadian lodges. Since then and with the addition of an acquisition, we have evolved our service delivery to include operating customer-owned locations with the same hospitality services that we provide at our owned villages.

Our Canadian operations, founded in 1977, began by providing modular rental housing to energy customers, primarily supporting drilling rig crews in the Western Canadian Sedimentary Basin. Over the next decade, we acquired a food service operation, enabling us to provide a more comprehensive accommodation solution. Through our experience with Syncrude’s Mildred Lake Village, a 2,100 bed facility that we operated and managed for them for nearly 20 years, we recognized the need for a premium, and more permanent, solution for workforce accommodations and hospitality services in the Canadian oil sands region. Pursuing this strategy, we opened PTI Lodge in 1998, one of the first independent lodging facilities in the region.

In 2018, we acquired Noralta Lodge Ltd., which provided remote hospitality services in Alberta, Canada through eleven lodges comprising over 5,700 owned rooms and 7,900 total rooms. Over time, we have developed into Canada’s largest third-party provider of accommodations and hospitality services in the Canadian oil sands region.

During 2015, we entered the Canadian LNG market with the construction of our Sitka Lodge. LNG Canada (LNGC), a joint venture among Shell Canada Energy, an affiliate of Shell plc (40 percent), and affiliates of PETRONAS, through its wholly-owned entity, North Montney LNG Limited Partnership (25 percent), PetroChina (15 percent), Mitsubishi Corporation (15 percent) and Korea Gas Corporation (5 percent), is currently constructing a liquefaction and export facility in Kitimat, British Columbia (Kitimat LNG Facility). Construction activity of Phase 1 of the Kitimat LNG Facility is nearing completion, with commercial operations expected to begin in mid-2025. The Coastal GasLink Pipeline was completed in 2024 and entered commercial operations. The majority of our contracted commitments associated with the Coastal GasLink Pipeline were completed in the fourth quarter of 2023. As such, we expect continued lower occupancy at our Sitka Lodge in the near-term until subsequent phases of the LNGC project are approved and commence, or additional construction activity in the region drive increased occupancy demand.

With the acquisition of our Australian business in December 2010, we began providing hospitality services to support the Australian natural resources industry through our villages located in Queensland, New South Wales and Western Australia. Like Canada, our Australian business has a long-history of taking care of customers in remote regions, beginning with our initial Moranbah Village in 1996, and has grown to become Australia’s largest independent provider of hospitality services for people working in remote locations. Our Australian business was the first to introduce resort-style accommodations to the mining sector, adding landscaping, outdoor kitchens, pools, fitness centers and, in some cases, taverns.

In 2019, we acquired Action Industrial Catering, a provider of catering and managed services (which we refer to as our integrated services business) to the mining industry in Western Australia. This acquisition enhanced our service offering, expanded our geographic footprint, added exposure to new commodities in Australia and underlined our focus on pursuing growth opportunities that fit within our core competencies and strategic direction.

Our Customers

We provide our hospitality services to customers in the natural resources industry. Our scalable facilities provide long-term and temporary workforce accommodations where, in many cases, traditional hospitality accommodations and related infrastructure services often are not accessible, sufficient or cost effective.

Through our wide range of hospitality services offerings, we are able to identify, solve and implement solutions and services that enhance the guest experience and reduce the customer’s total cost of housing a workforce in a remote operating location. In addition to catering and food service, lodging, housekeeping and maintenance at accommodation facilities that we or our customers own, our hospitality services have evolved to include fitness centers, water and wastewater treatment, laundry service and many other enhancements.

Our customers either own their accommodations assets or outsource them. Customers may choose to own their accommodations assets because (i) their natural resource project is the only source of demand for rooms in the region; (ii) they believe in the long-term nature of their resource project; and/or (iii) they desire to maintain control over the supply of rooms for their project. Where customers have chosen to own their accommodations assets, customers usually subcontract the management

of the facility and the provision of the hospitality services to a third-party provider, such as Civeo through our integrated services model in customer-owned facilities.

Historically, Australian mining companies and Canadian oil sands developers built and owned the accommodations necessary to house their personnel in these remote regions because local labor and third-party owned rooms were not available. Over the past 20 years, and increasingly over the past 10 years, some customers have moved away from the insourcing business model for a portion of their accommodation needs as they recognize that owning accommodations and providing the related hospitality services are non-core investments for their business.

The accommodations outsourcing model is effective in regions in which multiple customers have on-going or prospective projects where third-party owned and operated accommodations assets can service multiple customers. This allows those customers to share some of the costs associated with their peak accommodations needs, including infrastructure (power, water, sewer and information technology) and central dining and recreation facilities. The Queensland Bowen Basin region and the Canadian oil sands region are two geographic areas that fit this market dynamic.

Initial demand for our hospitality services has historically been driven by our customers’ capital spending programs related to the construction and development of natural resource projects and associated infrastructure. Long-term demand for our services has been driven by natural resource production, maintenance, operation and expansion of those facilities. In general, industry capital spending programs are based on the outlook for commodity prices, production costs, economic growth, perceived political risk, global commodity supply/demand, estimates of resource production and the expectations of our customers' shareholders. As a result, demand for our hospitality services is largely sensitive to expected commodity prices, principally related to met coal, oil, LNG and iron ore, and the resultant impact of these commodity price expectations on our customers’ spending. Other factors that can affect our business and financial results include the general global economic environment, including inflationary pressures, supply chain disruptions and labor shortages, instability affecting the global banking system and financial markets, availability of capital to the natural resource industry and regulatory changes in Canada, Australia and other markets, including governmental measures introduced to fight climate change.

We believe that our existing industry divides accommodations into two primary types: (i) lodges and villages and (ii) mobile assets. Civeo is principally focused on hospitality services at lodges and villages that are either owned by Civeo or customer-owned. Lodges and villages typically contain a larger number of rooms and require more time and capital to develop. These facilities typically have dining areas, meeting rooms, recreational facilities, pubs and taverns and landscaped grounds where weather permits. Lodges and villages are generally supported by multi-year, take-or-pay or exclusivity contracts. These facilities are designed to serve the long-term needs of customers in developing and producing their natural resource developments. Mobile assets are designed to follow customers’ activities and can be deployed rapidly to scale. They are often used to support conventional and in-situ drilling crews, as well as pipeline and seismic crews, and are contracted on a project-by-project or short-term basis. Oftentimes, customers will initially require mobile assets as they evaluate or initially develop a field or mine. Mobile asset projects can be dedicated and committed to a single customer or project or can serve multiple customers.

Our Competitors

The accommodation facilities market supporting the natural resource industry is segmented into competitors that serve components of the overall value chain, but very few offer the entire suite of hospitality services to customers. We estimate that customer-owned rooms represent over 50% of the market. Engineering firms such as Bechtel and Fluor often design accommodations facilities. Many public and private firms, such as ATCO Structures & Logistics Ltd. (ATCO), Alta-Fab Structures Ltd. and Northgate Industries Ltd., build modular accommodations for sale. Dexterra Group Inc. (Dexterra), Black Diamond Group Limited (Black Diamond), ATCO, Royal Camp Services Ltd. and Target Hospitality Corp. primarily own and lease units to customers and, in some cases, provide facility management services, usually on a shorter-term basis with a more limited number of rooms, similar to our mobile assets business. Facility service companies, such as Aramark Corporation (Aramark), Sodexo Inc. (Sodexo), Compass Group PLC (Compass Group) and Cater Care Australia Pty. Ltd. (Cater Care), typically do not invest in and own the accommodations assets but will provide hospitality services at third-party or customer-owned facilities.

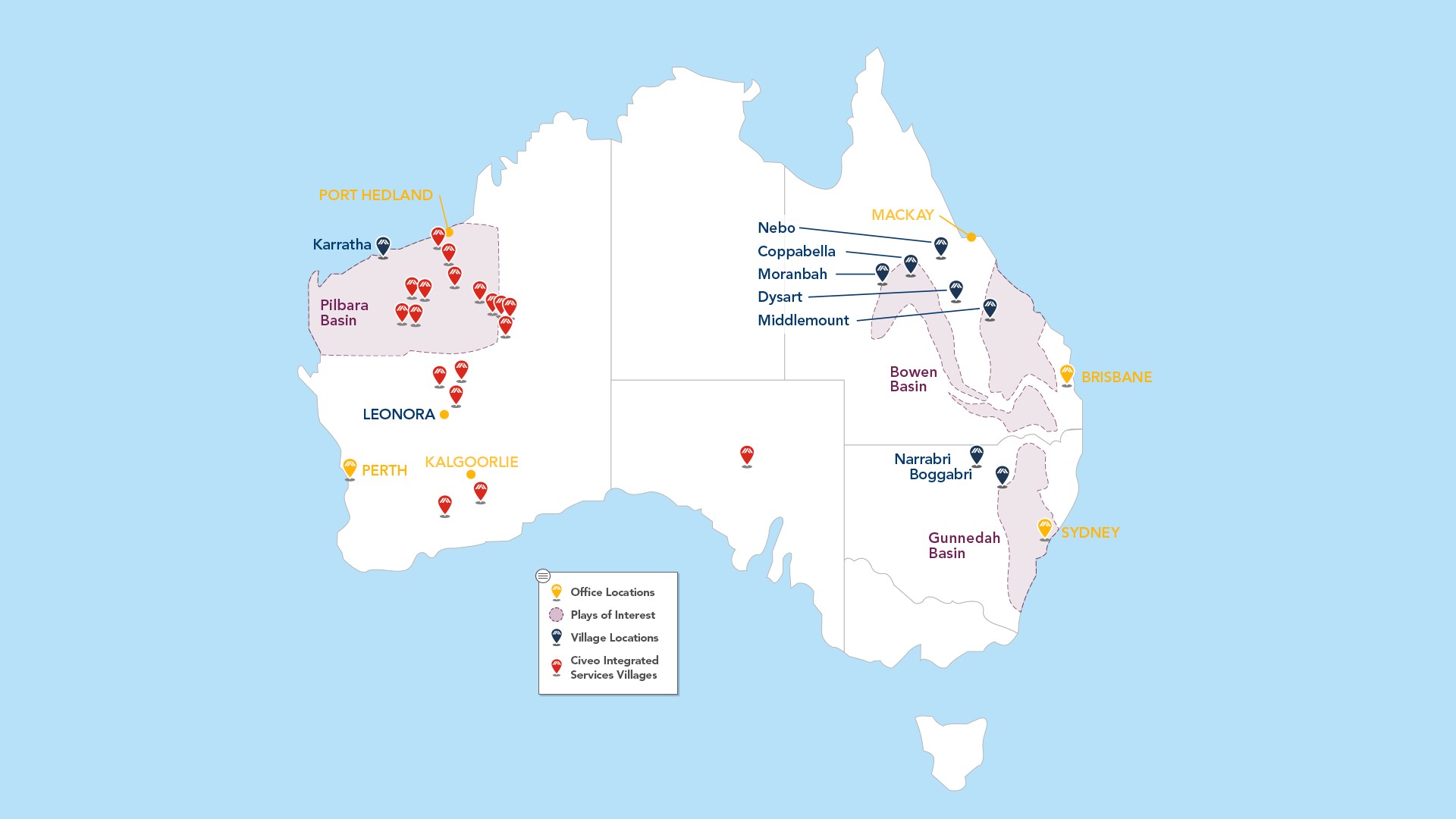

Australia

Overview

During the year ended December 31, 2024, we generated 63% of our revenue from our Australian operations. As of December 31, 2024, we owned 8,950 rooms across eight villages, of which 7,488 rooms service the Bowen Basin of central Queensland, one of the premier met coal basins in the world. We are Australia’s largest provider of hospitality services for people

working in the Bowen Basin. We provide hospitality services on a day rate basis to mining and related service companies (including construction contractors), typically under short- and medium-term contracts (from several months to six years) with minimum nightly room commitments. In addition, we provide integrated services to the mining industry in Western Australia and South Australia. On February 18, 2025, we entered into a definitive asset purchase agreement with a private seller to acquire four villages with 1,340 rooms in Australia’s Bowen Basin and the associated long-term customer contracts (the “Proposed Acquisition”). Under the terms of the agreement, Civeo would acquire the assets and customer contracts for total cash consideration of A$105 million, or approximately US$67 million, funded with cash on hand and borrowings from its existing revolving credit facility. The Proposed Acquisition is anticipated to close in the second quarter of 2025, subject to regulatory approvals and customary conditions.

Australian Market

As the largest contributor to exports and a major contributor to the country’s gross domestic product and government revenue, the Australian natural resources industry plays a vital role in the Australian economy. Australia has broad natural resources, including met and thermal coal, iron ore, conventional and coal seam gas, base metals, copper, lithium and precious metals such as gold. Australia is the largest exporter of met coal and iron ore in the world, in addition to being in close proximity to the largest steel producing countries in the world, primarily in Southeast Asia and India. The growth of Australian natural resource commodity exports over the last decade has been largely driven by strong Asian demand for met coal, iron ore and LNG. Australia’s resources are primarily located in remote regions of the country that lack infrastructure and resident labor forces to produce these resources, as the majority of Australia’s population is located on the east coast of the country. As a result, much of the natural resources labor force works on a rotational basis, which often requires a commute from a major city or the coast to a living arrangement near the resource projects. Consequently, there is substantial need for workforce accommodations and hospitality services to support resource production in the country. Workforce accommodations have historically been built and owned by the resource developer/owner, with third parties providing the hospitality and facility management services, typical of an insourcing business model.

Since 1996, our Australian business has sought to change the insourcing business model through its hospitality services offering, allowing customers to outsource their accommodations needs and focus their investments on resource production operations. Our Australian villages are strategically located in proximity to long-lived, low-cost mines operated by multiple investment-grade, international mining companies.

Our customers are typically developing and producing met coal, iron ore and other minerals which have resource lives that are measured in decades. As such, their spending levels tend to react similarly to commodity prices as the spending levels of our Canadian customers. Spending on producing assets is less sensitive to commodity price decreases in the short and medium term, assuming the projects remain cash flow positive. However, new construction projects and expansionary projects are typically canceled or deferred during periods of lower met coal and iron ore prices. New project construction activity typically requires larger workforces than day-to-day operations, where proximity and availability of customer-owned rooms influences the demand for our rooms and services. Demand for rooms at our Australian villages is primarily driven by production, maintenance and operational activities.

Our Australian operations primarily serve the Bowen Basin of Queensland and the Pilbara region in Western Australia. During the year ended December 31, 2024, our five villages in the Bowen Basin generated 40% of our Australian revenue, or 25% of our consolidated revenue. The Bowen Basin contains one of the largest coal deposits in Australia and is renowned for its premium met coal. In addition, we provide village operation and mine site cleaning services at 11 customer locations in the Pilbara region, which is renowned for high grade iron ore production. Our villages and customer-owned locations are focused on the mines in the central portion of the Pilbara and Bowen Basins and are well positioned for the active mines in the region.

Beyond met coal and iron ore markets served in the Pilbara and Bowen Basins, we serve several other markets with three additional villages and ten customer-owned villages. At the end of 2024, we had two villages with over 1,000 combined rooms in the Gunnedah Basin, a thermal and met coal region in New South Wales. In Western Australia, we serve workforces related to LNG facilities operations on the Northwest Shelf through our Karratha village. In addition, we provide hospitality services in Western Australia and South Australia at ten customer-owned villages which support workforces related to nickel, copper, zinc, silver and gold production in the Goldfields-Esperance region, lithium production in the Pilbara region and copper, silver and gold in Western Australia and South Australia.

Australian Village Locations

Owned Rooms in our Australian Villages

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | As of December 31, |

Villages | | Resource

Basin | | Commodity | | 2024 | | 2023 | | 2022 |

| Coppabella | | Bowen | | met coal | | 3,144 | | | 3,144 | | | 3,048 | |

| Dysart | | Bowen | | met coal | | 1,798 | | | 1,798 | | | 1,798 | |

| Moranbah | | Bowen | | met coal | | 1,240 | | | 1,240 | | | 1,240 | |

| Middlemount | | Bowen | | met coal | | 816 | | | 816 | | | 816 | |

| Boggabri | | Gunnedah | | met/thermal coal | | 662 | | | 622 | | | 622 | |

| Narrabri | | Gunnedah | | met/thermal coal | | 502 | | | 502 | | | 502 | |

| Nebo | | Bowen | | met coal | | 490 | | | 490 | | | 490 | |

| Karratha | | Pilbara | | LNG, iron ore | | 298 | | | 298 | | | 298 | |

| Total Rooms | | | | | | 8,950 | | | 8,910 | | | 8,814 | |

Our Australian segment includes eight company-owned villages with 8,950 rooms as of December 31, 2024, which are strategically located near long-lived, low-cost mines operated by large mining companies. Our Australian business provides hospitality services to mining and related service companies under short- and medium-term contracts. Our growth plan for this part of our business continues to include enhanced occupancy and expansion of these properties where we believe there is durable long-term demand, as well as to provide hospitality services at customer-owned assets.

Our Coppabella, Dysart, Moranbah, Middlemount and Nebo villages are located in the Bowen Basin. Coppabella, at over 3,100 rooms, is our largest village and provides rooms and related hospitality services to a variety of customers. Each of these villages supports both operational workforce needs and contractor needs with resort style amenities, including swimming pools, gyms, a walking track and a tavern.

Our Narrabri and Boggabri villages in New South Wales provide rooms and related hospitality services to met and thermal coal mines and coal seam gas in the Gunnedah Basin. Our Karratha village, in Western Australia, services workforces related to LNG facilities operations on the Northwest Shelf.

Australian Hospitality Services at Third-Party Owned Facilities

We also provide hospitality services at customer-owned villages to the mining industry in Western Australia and South Australia. Historically, this has been focused on natural resource production-related village facilities that are primarily owned by iron ore production companies. We provide village hospitality services at 21 customer-owned locations, which represent over 17,000 rooms, primarily in the Pilbara region of Western Australia, one of the premier iron ore bodies in the world, and in the Goldfields-Esperance region of Western Australia. The facilities we manage range anywhere from 200 to over 1,900 rooms. We work together with our customers to customize our service offerings depending on our customer’s needs. Hospitality services can be performed on an end-to-end basis with catering and food service, housekeeping and site maintenance or just portions of the services offered such as food service only. Mine site office cleaning services are also provided at some of our customer-owned locations.

Canada

Overview

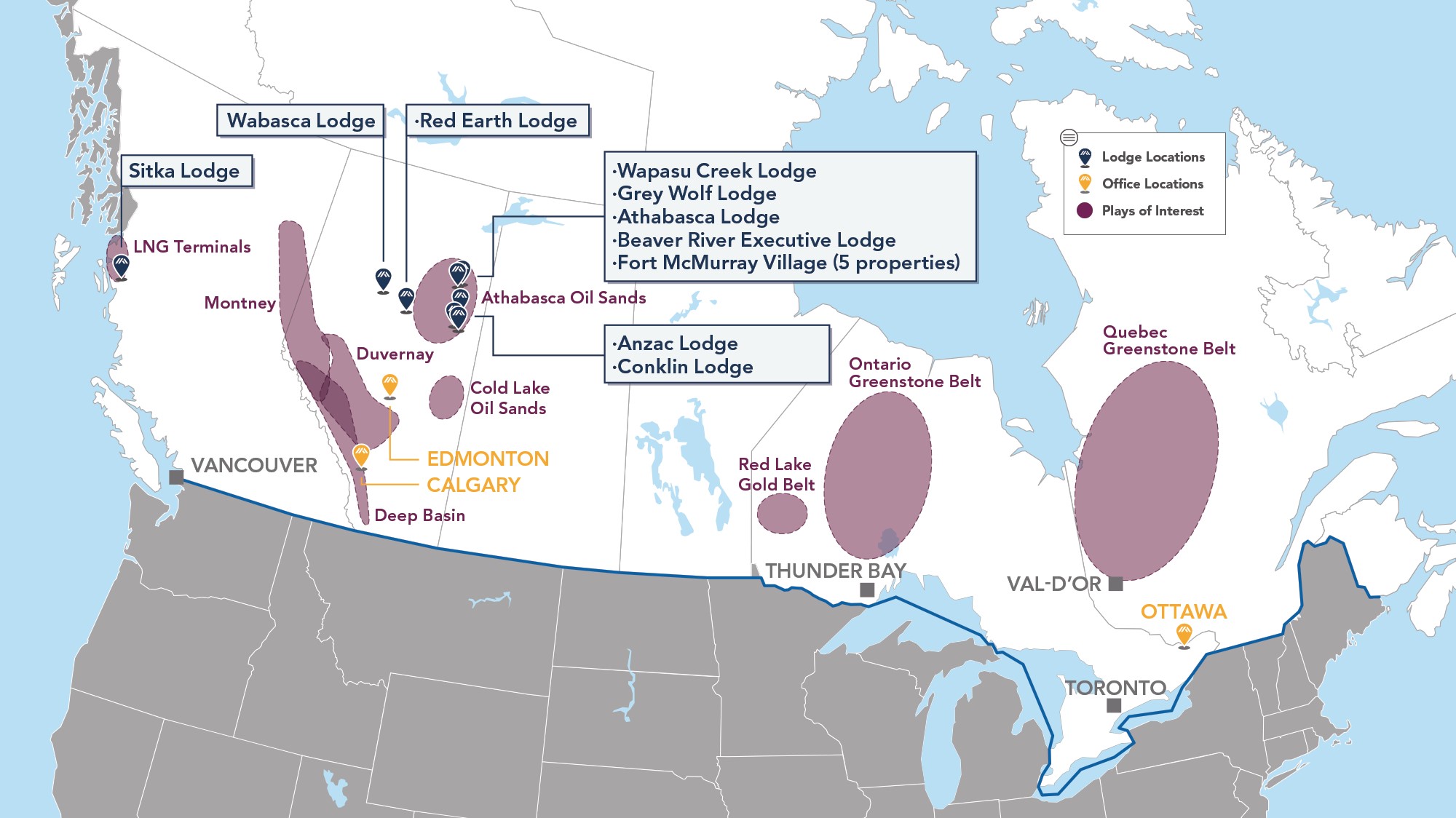

During the year ended December 31, 2024, we generated approximately 36% of our revenue from our Canadian operations. We are western Canada’s largest provider of hospitality services for people working in remote locations. We provide our services through our lodges and mobile assets and at customer-owned locations. Our hospitality services support workforces in the Canadian LNG and oil sands markets and in a variety of oil and natural gas drilling, mining, pipeline and related natural resource applications.

Canadian Market

Demand for our hospitality services in the Canadian market is largely driven by customer capital spending, which is greatly influenced by current and future commodity prices.

In the Canadian oil sands region, demand is primarily influenced by the longer-term outlook for oil prices rather than current energy prices, given the multi-year production life of oil sands projects and the capital investment associated with development of such large-scale projects. Demand for our Canadian lodges is secondarily impacted by oil takeaway capacity which influences the net price our customers receive for their oil production.

Spending on the construction and development of new projects generally decreases as the outlook for oil prices decreases. However, spending on current operations and maintenance has historically reacted less quickly and less severely to changes in oil prices, as customers consider their cash operating costs, rather than overall full-cycle returns. Customers have recently focused on lowering their cash operating costs while maintaining similar levels of production, leading to lower overall customer spending and reduced personnel on site and therefore lower demand for remote accommodations, like we provide. Construction and expansion projects already underway have also been less sensitive to commodity price decreases, as customers generally focus on completion and incremental costs. Natural gas prices also influence oil sands activity as an input cost: as natural gas prices fluctuate, a significant component of our customers’ operating costs fluctuate as well.

Another factor that influences demand for our hospitality services in the Canadian oil sands region is the type of customer project we are supporting. Generally, Canadian customers require larger workforces during construction and expansionary periods, and therefore have higher demand for our rooms and services. Operational and maintenance headcounts are typically a fraction, 20% to 25%, of the headcounts experienced during construction.

In addition, proximity to customer activity and availability of customer-owned and competitor-owned rooms influences the demand for our rooms in the Canadian oil sands region. Typically, customers prefer to first utilize their own rooms on location, and if such customer-owned rooms are insufficient, customers prefer to avoid busing their workforces to housing more than 45 kilometers away.

The Athabasca oil sands are located in northern Alberta, an area that is very remote, with a limited local labor supply. Of Canada’s approximately 41 million residents, approximately half of the population lives in ten cities, while approximately 12% of the population lives in Alberta and less than 1% of the population lives within 100 kilometers of the oil sands activity. The local municipalities, of which the town of Fort McMurray is the largest, have limited infrastructure to respond to workforce accommodation demands and are a significant driving distance from many of the oil sands projects. Civeo lodges are strategically placed near customer mining and production facilities to enhance their productivity and safety of their workforce.

With respect to LNG and related pipeline activity in Canada, a number of multinational energy companies believe there is a potential to export LNG from Canada to meet the increasing global LNG demand, particularly in Asia. Currently, Western Canada does not have any operational LNG export facilities. Phase 1 of the Kitimat LNG Facility is nearing completion, with commercial operations expected to begin in mid-2025. The population of Kitimat and the surrounding area is approximately 9,000 people, whereas the LNGC project had almost 7,500 workers at its peak to construct the Kitimat LNG Facility. See "Canada-Canadian British Columbia Lodge" for more information.

LNG investment and activity in Western Canada, and related demand for hospitality services, is influenced by the global prices for LNG, which are largely tied to global oil prices, global supply/demand dynamics for LNG and Western Canadian wellhead prices for natural gas. Utilization of our existing Canadian capacity and any future expansions will largely depend on continued LNG and oil sands spending related to existing production, maintenance activities and potential future expansion of existing projects.

Canadian Oil Sands Lodges

During the year ended December 31, 2024, activity in the Athabasca oil sands region generated approximately 82% of our Canadian revenue, or 30% of our consolidated revenue. The oil sands region continues to represent one of the world’s largest reserves for heavy oil. Our Wapasu Creek, Athabasca, Beaver River, Fort McMurray Village, Grey Wolf, Hudson, and Borealis lodges are focused on the northern region of the Athabasca oil sands, where customers primarily utilize surface mining to extract bitumen. Oil sands mining operations are characterized by large capital requirements, large reserves, larger personnel requirements, long-term reserve lives, very low exploration or reserve risk and relatively lower cash operating costs per barrel of bitumen produced. Our Conklin, Anzac, Red Earth and Wabasca lodges are focused in the southern portion of the region where we primarily serve in-situ operations and pipeline expansion and maintenance activity. In-situ methods are used on reserves that are too deep for traditional mining methods. In-situ technology typically injects steam or solvents into the deep oil sands in place to separate the bitumen from the sand and pumps it to the surface where it undergoes the same upgrading treatment as the mined bitumen. Reserves requiring in-situ techniques of extraction represent 80% of the established recoverable reserves in Alberta. In comparison to surface mining operations, in-situ operations generally require lower initial capital investment, fewer personnel but produce lower volumes of bitumen per development, with higher ongoing operating expense per barrel of bitumen produced.

Our oil sands lodges primarily support personnel for ongoing operations associated with surface mining and in-situ oil sands projects, as well as maintenance, turnaround and expansionary personnel, generally under short- and medium-term contracts. Most of our oil sands lodges are located on land with leases obtained from the province of Alberta, with initial terms of ten years, or subleased from the resource developer. Our leases have expiration dates that range from 2025 to 2030 with the exception of one lease that expires in 2049. In recent years, we have successfully renewed or extended all expiring land leases which we have requested to renew or extend. We did not renew an expiring land lease associated with our McClelland Lake Lodge in Alberta, Canada, which expired in June 2023, in order to support our customer’s intent to mine the land where the lodge was located. Two of our oil sands properties are located on land which we own.

In order to operate a lodge in Canada, we are required to obtain a development permit from the regional municipality in which the lodge is located. The development permits are granted for a term of five years. Our development permits have expiration dates that range from 2025 to 2028. In recent years, we have successfully renewed or extended all expiring development permits. See “Item 1A. Risk Factors - Risks Related to Our Operations - The majority of our major Canadian lodges are located on land subject to leases. If we are unable to renew a lease or obtain permits necessary to operate on such leased land, we could be materially and adversely affected.” of this annual report for further discussion.

We provide a range of hospitality services at our lodges, including reservation management, food service, housekeeping and facilities management. Our lodge guests receive amenities similar to an economy, full-service, urban hotel with our service offering a room and three meals a day.

We provide our hospitality services at the lodges we own on a day rate or monthly rental basis, and our customers typically commit for short to long-term contracts (from several months up to several years). Most customers make a minimum nightly or monthly room commitment or an aggregate total room night commitment for the term of the contract, and the multi-year contracts typically provide for inflationary escalations in rates for increased food, labor and utilities costs.

Canadian British Columbia Lodge

Phase 1 of the Kitimat LNG Facility is nearing completion, with commercial operations expected to begin in mid-2025. The Coastal GasLink Pipeline was completed in 2024 and entered commercial operations. As such, we expect continued lower occupancy at our Sitka Lodge in the near-term until subsequent phases of the LNGC project are approved and commence, or additional construction activity in the region drives increased occupancy demand.

Canadian Lodge Locations

Rooms in our Canadian Lodges

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | As of December 31, |

Lodges | | Region | | Extraction

Technique | | 2024 | | 2023 | | 2022 |

| Wapasu Creek | | N. Athabasca | | mining/in-situ | | 5,174 | | | 5,174 | | | 5,174 | |

Athabasca (1) | | N. Athabasca | | mining | | 2,005 | | | 2,005 | | | 2,005 | |

McClelland Lake (2) | | N. Athabasca | | mining | | — | | | — | | | 1,997 | |

| Beaver River | | N. Athabasca | | mining | | 1,094 | | | 1,094 | | | 1,094 | |

| Fort McMurray Village: | | | | | | | | | | |

Buffalo (1) | | N. Athabasca | | mining | | 256 | | | — | | | — | |

Black Bear | | N. Athabasca | | mining | | 531 | | | 531 | | | 531 | |

| Bighorn | | N. Athabasca | | mining | | 763 | | | 763 | | | 763 | |

| Lynx | | N. Athabasca | | mining | | 855 | | | 855 | | | 855 | |

| Wolverine | | N. Athabasca | | mining | | 855 | | | 855 | | | 855 | |

Borealis (1) | | N. Athabasca | | mining | | 1,504 | | | 1,504 | | | 1,504 | |

| Grey Wolf | | N. Athabasca | | mining | | 946 | | | 946 | | | 946 | |

Hudson (1) | | N. Athabasca | | mining | | 624 | | | 624 | | | 624 | |

Wabasca (1) | | S. Athabasca | | mining | | 288 | | | 288 | | | 288 | |

Red Earth (1) | | S. Athabasca | | mining | | 216 | | | 216 | | | 216 | |

Conklin (1) | | S. Athabasca | | mining/in-situ | | 610 | | | 610 | | | 610 | |

Anzac (1) | | S. Athabasca | | in-situ | | 526 | | | 526 | | | 526 | |

| Subtotal – Oil Sands | | | | | | 16,247 | | | 15,991 | | | 17,988 | |

| Sitka Lodge | | Kitimat, BC | | LNG | | 961 | | | 961 | | | 961 | |

| Total Rooms | | | | | | 17,208 | | | 16,952 | | | 18,949 | |

(1)Currently closed as of December 31, 2024, due to lodge loading strategy, seasonal activity fluctuations or low activity level in the region. All closed lodges are periodically assessed for impairment at an asset group level, in accordance with U.S. generally accepted accounting principles. See Note 4 - Impairment Charges to the notes to the consolidated financial statements in Item 8 of this annual report for further discussion.

(2)The land lease associated with the assets expired in June 2023 and was not renewed and the assets were demobilized and completely removed from the existing site in the first quarter of 2024.

Canadian Hospitality Services at Third-Party Owned Facilities

We also provide hospitality services at customer-owned facilities. Historically, this has been focused around natural resource production-related housing facilities that are owned by oil production companies. The facilities we manage typically range anywhere from 500 to 1,500 rooms. We customize our service offerings depending on our customer’s needs. Hospitality services can be performed on an end-to-end basis with food service, housekeeping, maintenance and utility services included or in segments such as food service only. Our focus on hospitality service contracts has allowed us to successfully pursue food service only opportunities. Due to our experience servicing customer-owned facilities, this business easily fits into our overall strategy.

Canadian Mobile Assets

Our mobile assets consist of modular, skid-mounted accommodations and central facilities that can be configured to serve a multitude of short- to medium-term accommodation needs. Dormitory, kitchen and ancillary assets can be rapidly mobilized and demobilized and are scalable to support 200 to 800 people in a single location. In addition to asset rental, we provide hospitality services such as food service and housekeeping, as well as other camp management services. Our mobile assets service the traditional oil and gas sector in Alberta and British Columbia and in-situ oil sands drilling and development operations in Alberta, as well as pipeline construction crews throughout Western Canada. These assets have also been used in the past in disaster relief efforts, the 2010 Vancouver Winter Olympic Games and a variety of other non-energy related projects.

Our mobile assets are rented on a per unit basis based on the number of days that a customer utilizes the asset, and, in some cases, involve standby rental arrangements. In cases where we provide food service or ancillary services, the contract can provide for per unit pricing or cost-plus pricing. Customers are also typically responsible for mobilization and demobilization costs. Our focus on hospitality service contracts has allowed us to successfully pursue food service only opportunities. Due to our experience servicing customer-owned facilities, this business easily fits into our overall strategy.

United States

In the first quarter of 2023, we sold our accommodation assets in Louisiana, and in the second quarter of 2024, we sold the land at our Louisiana location. Our remaining U.S. business, which supported completion activity in the Bakken, was closed in the fourth quarter of 2024 due to low activity levels.

Community Engagement

In Australia, our community relations program aims to build and maintain a positive social license to operate by consulting and engaging with local regional communities from project inception, through development, construction and operations. This is a major advantage for our business model, as it facilitates consistent communication, engenders trust and builds relationships to last throughout the resource lifecycle. There is an emphasis on developing partnerships that create a long-term sustainable outcome to address specific community needs. To that end, we partner with local municipalities to improve and expand municipal infrastructure. These improvements provide necessary infrastructure, allowing the local communities an opportunity to expand and improve. We also provide support to local community groups through sponsorship and in-kind contributions to local events and initiatives. In addition, all of our food suppliers are Australian companies and, where possible, are based locally. Through our membership with Supply Nation, a non-profit organization committed to supplier diversity and Indigenous business development, we directed approximately A$15.3 million in 2024, up 24% from A$12.3 million in 2023, into Indigenous-owned and operated companies, and we are always looking for more opportunities to partner with these businesses.

In addition, we have three unincorporated joint venture partnerships with Indigenous landowners in Western Australia. Under these agreements, we strive to develop the business capacity, project management skills and expertise of the Indigenous joint venture members, providing local employment opportunities and training. One of the four unincorporated joint venture partnerships entitles Indigenous landowners to a profit distribution calculated in accordance with the unincorporated joint venture deeds. Additionally, two of the three remaining agreements incentivize the joint venture members via milestone payments for business objectives achieved.

With a focus on long-term Indigenous community participation, our Canadian operations continue to work closely with a number of First Nations to develop mutually beneficial partnerships focused on revenue sharing, capacity building, employment and community investment and support. For over a decade, our Canadian operations supported Buffalo Metis Catering, a partnership with three Metis communities in the Regional Municipality of Wood Buffalo. Through this partnership, food and housekeeping services were delivered to three of our lodges. Beyond these services, this partnership provided a business incubator environment for a number of Metis business ventures. Our Canadian operations also procure services from a number of other First Nations-owned, Metis-owned and member-owned businesses including water hauling, snow removal and security services. In 2024, we purchased more than C$31.3 million in goods and services from the Indigenous business community, representing 16% of our total Canadian local spending, compared to C$64.0 million in goods and services from the Indigenous business community, representing 27% of our total Canadian local spending in 2023.

In 2024, the Fort McMurray First Nation Economic Development Corporation awarded Civeo with the Eagle Award, for Civeo’s commitment to positively impacting and contributing to the long-term benefits of the members of the Fort McMurray First Nation. In 2021, the Fort McKay Metis community awarded Civeo with the inaugural 2020 Fort McKay Metis National President's Award. This award recognizes people or organizations who make a positive contribution to the well-being of the Metis community. In 2023 and in 2019, our Indigenous partnership initiatives earned Civeo a Gold level Partnership Accreditation in Indigenous Relations certification, by a jury comprised of Indigenous business people, which was supported by an unbiased, independent, third-party verification of our performance.

In 2018, Civeo entered into three new Indigenous partnerships in the oil sands region and two new partnerships in British Columbia and, in 2021, Civeo entered into a new partnership in British Columbia. Our partnerships in British Columbia are tied to accommodations contracts secured by Civeo for (i) the Kitimat LNG Facility, (ii) the CGL pipeline project that originates in the North Montney region of north-east British Columbia and (iii) the Trans Mountain expansion project that twins an existing pipeline between Edmonton, Alberta and Burnaby, British Columbia. In 2024, Civeo entered into an agreement with an Indigenous group in Ontario and is currently in the process of developing business opportunities. Beyond revenue sharing, these arrangements provide procurement, employment, training, and ancillary business opportunities for Indigenous owned businesses.

Customers and Competitors

Our customers primarily operate in oil sands mining and development, drilling, exploration and extraction of oil and natural gas and coal and other extractive industries. To a lesser extent, we also support other activities, including pipeline construction, forestry and humanitarian aid. Our largest customers in 2024 were Suncor Energy Inc. and Fortescue Metals Group Ltd., who each accounted for more than 10% of our 2024 revenues.

Our primary competitors in Australia for our village hospitality services are customer-owned and operated villages as well as Ausco Modular (a subsidiary of Modulaire Group), Fleetwood Corporation and smaller independent village operators. We compete against ISS, Sodexo, Compass Group, Northern Rise (as a division of Sirrom Corporation) and Cater Care for third-party facility management services.

Our primary competitors in Canada in lodge and mobile asset hospitality services include ATCO, Black Diamond, Dexterra and Clean Harbors, Inc. Some of these competitors have one or two locations similar to our oil sands lodges; however, based on our estimates, these competitors do not have the breadth or scale of our lodge operations. In Canada, we also compete against Aramark, Sodexo, Compass Group and Royal Camp Services for third-party facility management and hospitality services.

Historically, many customers have invested in their own accommodations. We estimate that our existing and potential customers own approximately 50% of the rooms available in both the Australian coal mining regions and Canadian oil sands.

Our Lodge and Village Contracts

During the year ended December 31, 2024, revenues from our lodges and villages represented over 60% of our consolidated revenues. Our contract terms generally provide for a daily rate for a reserved room and an occupied room rate that compensates us for hospitality services, including food service, housekeeping, utilities and maintenance for workers staying in the lodges and villages. In most multi-year contracts, our rates typically have annual escalation provisions to cover increases in labor, food and consumables costs over the contract term. In some contracts, customers have a contractual right to terminate, for reasons other than a breach, in exchange for a termination fee. Our customers typically contract for hospitality services under contracts with terms that range from several months to twelve years. The contracts expire throughout the year, and for many of the near-term expirations, we are in the process of negotiating extensions or new commitments. We cannot assure that we can renew existing contracts or obtain new business on the same or better terms, if at all.

Long-Term Take-or-Pay Contracts. Over the term of a take-or-pay contract, the customer commits to either a minimum number of rooms over a specified period or an aggregate number of room nights over the period, generally for terms greater than 12 months. During the year ended December 31, 2024, we billed approximately 2.3 million room nights under our long-term take-or-pay contracts, which included 0.5 million room nights in excess of the take-or-pay minimums. For the year ended December 31, 2025, we have commitments for 1.9 million room nights under our long-term take-or-pay contracts.

Short-Term Take-or-Pay Contracts. Customers may contract with us on a take-or-pay basis for less than 12 months, particularly for turnaround projects. Similar to long-term take-or-pay contracts, the customer commits to either a minimum number of rooms over a specified period or an aggregate number of room nights over the period. During the year ended December 31, 2024, we billed approximately 0.7 million room nights under our short-term take-or-pay contracts. For the year ended December 31, 2025, we have commitments for 0.1 million room nights under our short-term take-or-pay contracts.

Exclusivity Contracts. Over the term of an exclusivity contract, rather than receiving a minimum room commitment, we are the exclusive hospitality service provider for the customer's employees working on a specific project or projects. During the year ended December 31, 2024, we billed approximately 1.7 million room nights under our exclusivity contracts.

Casual / Walk-ins. Customers without long-term committed contracts may utilize lodge/village rooms via short-term bookings at lodge/village casual or agreed rates. During the year ended December 31, 2024, we billed approximately 0.1 million room nights to casual or walk-in customers.

Our Integrated Services Contracts

During the year ended December 31, 2024, revenues from our customer-owned locations represented 38% of our consolidated revenues. Our contract terms generally provide a rate on a per guest per day basis for hospitality services, including food service and housekeeping. Similar to our owned lodge and villages contracts, in most multi-year contracts, our rates typically have annual escalation provisions to cover increases in labor, food and consumables costs over the contract term.

Seasonality of Operations

Our operations are directly affected by seasonal weather. During the Australian rainy season between November and April, our operations in Queensland and the northern parts of Western Australia can be affected by cyclones, monsoons and resultant flooding. A portion of our Canadian operations is conducted during the winter months when the winter freeze in remote regions is required for customers’ activity to occur. The spring thaw in these frontier regions restricts operations in the second quarter and adversely affects our customers' operations and our ability to provide services. Customers’ maintenance activities in the oil sands region, such as shutdown and turnaround activity, are typically performed in the second and third quarters annually. Our Canadian operations have also been impacted by forest fires and flooding in the past five years.

Human Capital Resources

We believe that our employees are one of our greatest resources. As of December 31, 2024, we had approximately 2,000 full-time employees and approximately 600 hourly employees. On a consolidated basis, 71% of our employees are located in Australia, 28% are located in Canada and 1% are located in the U.S. We were party to collective bargaining agreements covering 480 employees located in Canada and 1,401 employees located in Australia as of December 31, 2024.

As a company, we acknowledge the significance of a diverse workforce composed of individuals from various backgrounds, experiences, and perspectives. As many of our projects in Canada and Australia operate in traditional territories, we work closely with Indigenous communities to actively explore mutually beneficial investment, employment and business opportunities. Our ability to cultivate and strengthen relationships with Indigenous communities is vital to the success of our business. In Canada, we are committed to expanding our Indigenous workforce to 10%. In 2024, we reached 5% Indigenous employment in Canada, excluding corporate staff. Approximately 6% of our total new hires in Canada were of Indigenous background during 2024.

We strive to offer competitive compensation, benefits and services that meet the needs of our employees, including short- and long-term incentive packages, various defined contribution plans, healthcare benefits, and wellness and employee assistance programs. Management monitors market compensation and benefits in order to attract, retain, and promote employees and reduce turnover and its associated costs.

Safety is a foundational pillar of Civeo’s corporate culture. We are committed to operating in a safe, secure and responsible manner for the benefit of our employees, customers and the communities we serve. Our commitment to safeguarding employees,

contractors, and guests is demonstrated through our employee-named Making Zero Count initiative, which emphasizes the importance of eliminating harm and focuses on the processes required to achieve exceptional performance.

At Civeo, we believe that investing in our employees is fundamental to our success. Our commitment to training and career development enables employees to grow and advance in their careers while supporting our industry-leadership position. Committed to the continuous improvement of our team, we prioritize the development of our workforce’s technical and managerial competencies, with an emphasis on safety, customer service, and leadership development. Our learning and development program encompasses a range of learning modalities, including e-learning modules, in-person training sessions, nationally certified programs and licensed training provided by external partners.

Government Regulation

Our business is significantly affected by Australian and Canadian laws and regulations at the federal, provincial, state and local levels relating to the oil, natural gas and mining industries, worker safety and environmental protection. Changes in these laws, including more stringent regulations and increased levels of enforcement of these laws and regulations, and the development of new laws and regulations could significantly affect our business and result in:

•increased difficulty securing required permits, approvals, licenses or other authorizations issued by federal, provincial and local authorities needed to carry out our operations or our customers' operations;

•increased compliance costs or additional operating restrictions associated with our operations or our customers’ operations;

•other increased costs to our business or our customers’ business;

•reduced demand for oil, natural gas, and other natural resources that our customers produce; and

•reduced demand for our services.

To the extent that these laws and regulations impose more stringent requirements or increased costs or delays upon our customers in the performance of their operations, the resulting demand for our services by those customers may be adversely affected, which impact could be significant and long-lasting. Moreover, climate change laws or regulations could increase the cost of consuming, and thereby reduce demand for, oil and natural gas, which could reduce our customers’ demand for our services. We cannot predict changes in the level of enforcement of existing laws and regulations, how these laws and regulations may be interpreted or the effect changes in these laws and regulations may have on us or our customers or on our future operations or earnings. We also are not able to predict the extent to which new laws and regulations will be adopted or whether such new laws and regulations may impose more stringent or costly restrictions on our customers or our operations.

Our operations and the operations of our customers are subject to numerous stringent and comprehensive foreign, federal, provincial, state and local environmental laws and regulations governing the release or discharge of materials into the environment or otherwise relating to environmental protection. Numerous governmental agencies issue regulations to implement and enforce these laws, for which compliance is often costly yet critical. The violation of these laws and regulations may result in the denial or revocation of permits, issuance of corrective action orders, modification or cessation of operations, assessment of administrative and civil penalties, and even criminal prosecution. Although we do not anticipate that future compliance with existing environmental laws and regulations will have a material effect on our financial condition, results of operations or cash flows over the short term, there can be no assurance that substantial costs for compliance or penalties for non-compliance with these existing requirements will not be incurred in the future by us or our customers. Moreover, it is possible that other developments, such as the adoption of stricter environmental laws, regulations and enforcement policies or more stringent enforcement of existing environmental laws and regulations, could result in additional costs or liabilities upon us or our customers that we cannot currently quantify.

Australian Environmental Regulations

Our Australian segment is regulated by statutory environmental and land use controls at the federal, state and territory and local government levels which may result in land use approval, regulation of operations and compliance risk. These controls include: land use and urban design controls; controls to protect Australia’s natural environment, iconic places and Aboriginal and Torres Strait islander native title and heritage; the regulation of hard and liquid waste, including the requirement for trade waste and/or wastewater permits or licenses; the regulation of water, noise, heat, and atmospheric gases emissions; the regulation of the production, transport and storage of dangerous and hazardous materials (including asbestos); the regulation of pollution and site contamination and requirements to notify of and clean-up environmental contamination.

Federal Controls

At a federal level, the Environment Protection and Biodiversity Conservation Act 1999 (EPBC Act) is Australia’s key piece of environmental legislation. The EPBC Act protects of matters of national environmental significance, for example, threatened species and communities (e.g. Koalas), migratory species, Ramsar wetlands and world heritage properties. Activities that have the potential to impact matters protected by the EPBC Act trigger referral to the federal government for assessment and approval.

In October 2020, the findings of an independent review of the EPBC Act (Independent Review) recommended significant reforms including (but not limited to) introduction of legally binding ‘National Environmental Standards’, a ‘climate change’ referral trigger, measures to harness and recognize the importance of indigenous knowledge, stronger compliance and enforcement powers, proposals for revised bilateral agreements with the States and Territories to streamline the assessment and approval process of some activities regulated by the EPBC Act and criminal penalties for offenses relating to emissions-intensive actions.

In December 2022 the federal government announced its response to the Independent Review. This response proposed various changes to the EPBC Act in line with the Independent Review, for example, the introduction of ‘National Environmental Standards’, creation of a federal Environmental Protection Agency to administer the EPBC Act and the introduction of a requirement to achieve ‘net positive’ outcomes. A comprehensive draft bill to effect these reforms was introduced before Parliament in 2024 together with a draft of the proposed National Environmental Standards. Notably, the federal government is not presently proposing to introduce the climate change referral trigger recommended by the Independent Review; however, there appears to be significant support for the trigger amongst opposition parties, and a federal election will occur in 2025.

If any of the recommended reforms take effect, our obligations under, and compliance with, the EPBC Act ought to be reviewed. However, its implications for our Australian operations are not anticipated to be significant.

Ongoing awareness of these reforms is important as the legislative and policy changes may affect our customers’ operations and have impacts on the non-renewable resources sector generally.

There is an increasing emphasis from regulators on sustainability and energy efficiency in business operations. Federal requirements are now in place for the mandatory disclosure of energy performance under building rating schemes. These schemes require the tracking of specific environmental performance factors. Carbon reporting requirements currently exist for corporations which meet a reporting threshold for greenhouse gases (GHG) or energy use or production for a reporting (financial) year under federal legislation.

From July 1, 2023, new obligations and reporting requirements took effect with respect to the ‘Safeguard Mechanism’ – Australia’s policy for reducing emissions from facilities that emit more than 100,000t CO2-e per financial year that has been in place since 2016. These reforms are intended to assist Australia meet its emissions reduction targets of 43% below 2005 levels by 2030 and affect large scale industry customers.

In 2024, the federal government introduced further legislation requiring companies that satisfy key threshold criteria based upon employee numbers and/or revenue, to make climate-related disclosures, including information about their GHG emissions, climate-related targets, offset contributions, transition plans, and information about strategies, plans and governance procedures/controls in place to monitor and manage climate-related risks and opportunities. These reforms will commence with initial reporting required in 2026 for the preceding year. Civeo meets the relevant thresholds and will be required to make these annual disclosures in Australia.

In addition to our own requirement to commence disclosure to ASIC in accordance with the new legislation, our operations represent a portion of each of our customer’s Scope 3 emissions; we will be required by our customers to provide certain emissions information in order for our customers to meet their disclosure obligations. Complexity and resourcing are identified as significant challenges as we navigate the new legislation.

State and Territory Controls

At a State and Territory level, our operations are authorized and regulated by layers of planning and environmental approvals. Queensland, New South Wales and Western Australia all have multiple acts regulating matters of the environment, conservation, vegetation management and protection of aboriginal and Torres Strait Islander use rights which are administered by each States’ independent environment protection regulator (e.g. Queensland’s Department of Environment, Science and

Innovation). If amendments are made to the EPBC Act to effect new bilateral agreements, the States and Territories will likely be given further power to assess and approve certain actions regulated the EPBC Act.

Under state law, some specified activities, such as sewage treatment at our sites, may require regulation by way of environmental approvals. Such approvals may also impose monitoring and reporting obligations on the holder as well as obligations to rehabilitate the subject site once the regulated activity has ceased.

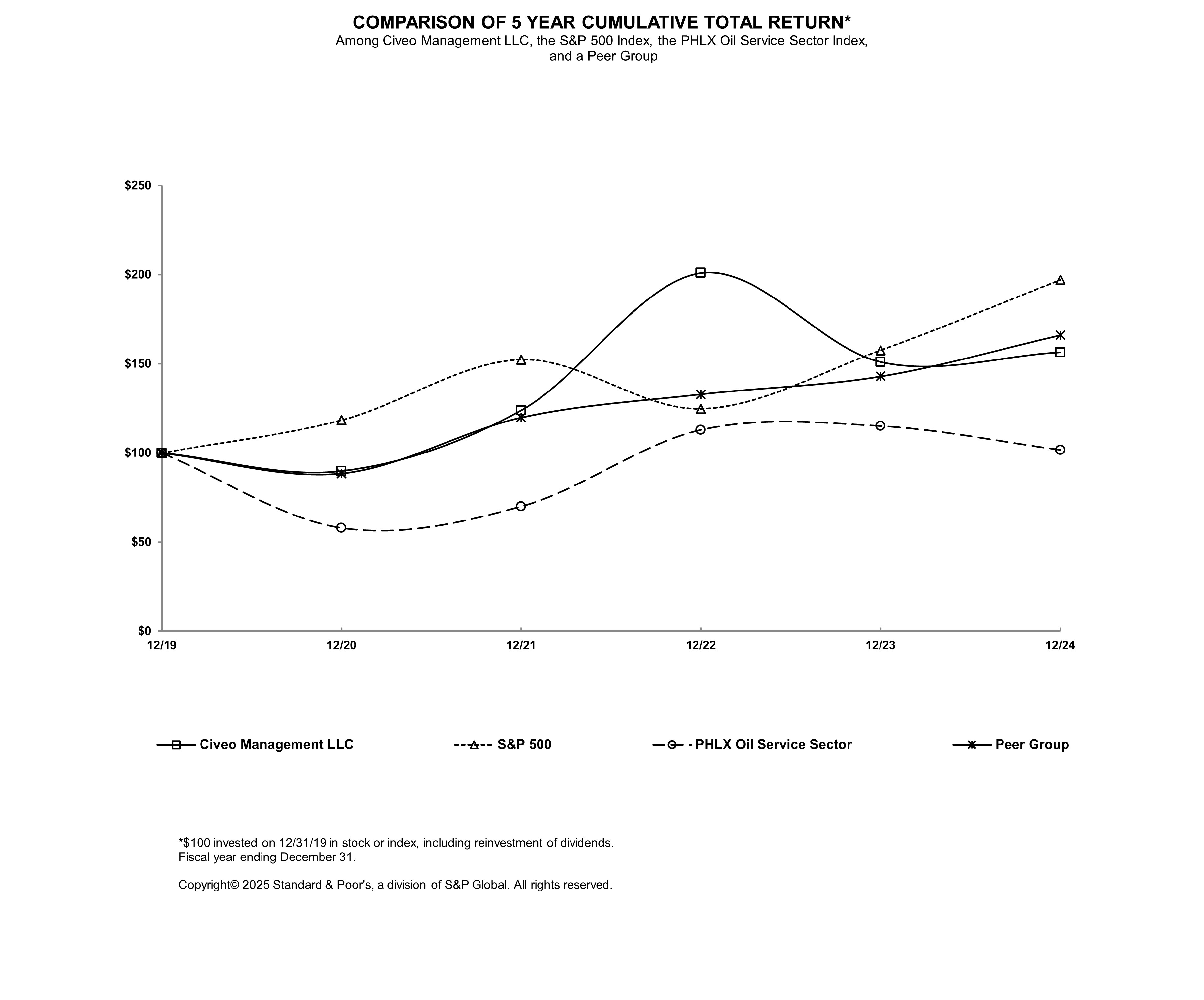

We must ensure that all necessary approvals, permits and licenses are in place to authorize our operations and that the conditions of those approvals, permits and licenses are complied with until the relevant operations cease (and are cleaned-up if necessary). Where approvals are not held and/or complied with, the operation may be unlawful and subject to penalties, including stop-work orders, remediation orders and financial penalties. Our Australian operations continue to comply with our existing approvals, permits and licenses.