EXECUTION VERSION Asset Sale and Purchase Agreement Dated 2025 Each person listed in column 2 of Part A of Schedule 1 (“Seller”) Civeo Pty Ltd (ACN 003 657 510) (“Buyer”) Graham William Cleary (“Seller Guarantor”) King & Wood Mallesons Level 61 Governor Phillip Tower 1 Farrer Place Sydney NSW 2000 Australia T +61 2 9296 2000 F +61 2 9296 3999 DX 113 Sydney www.kwm.com

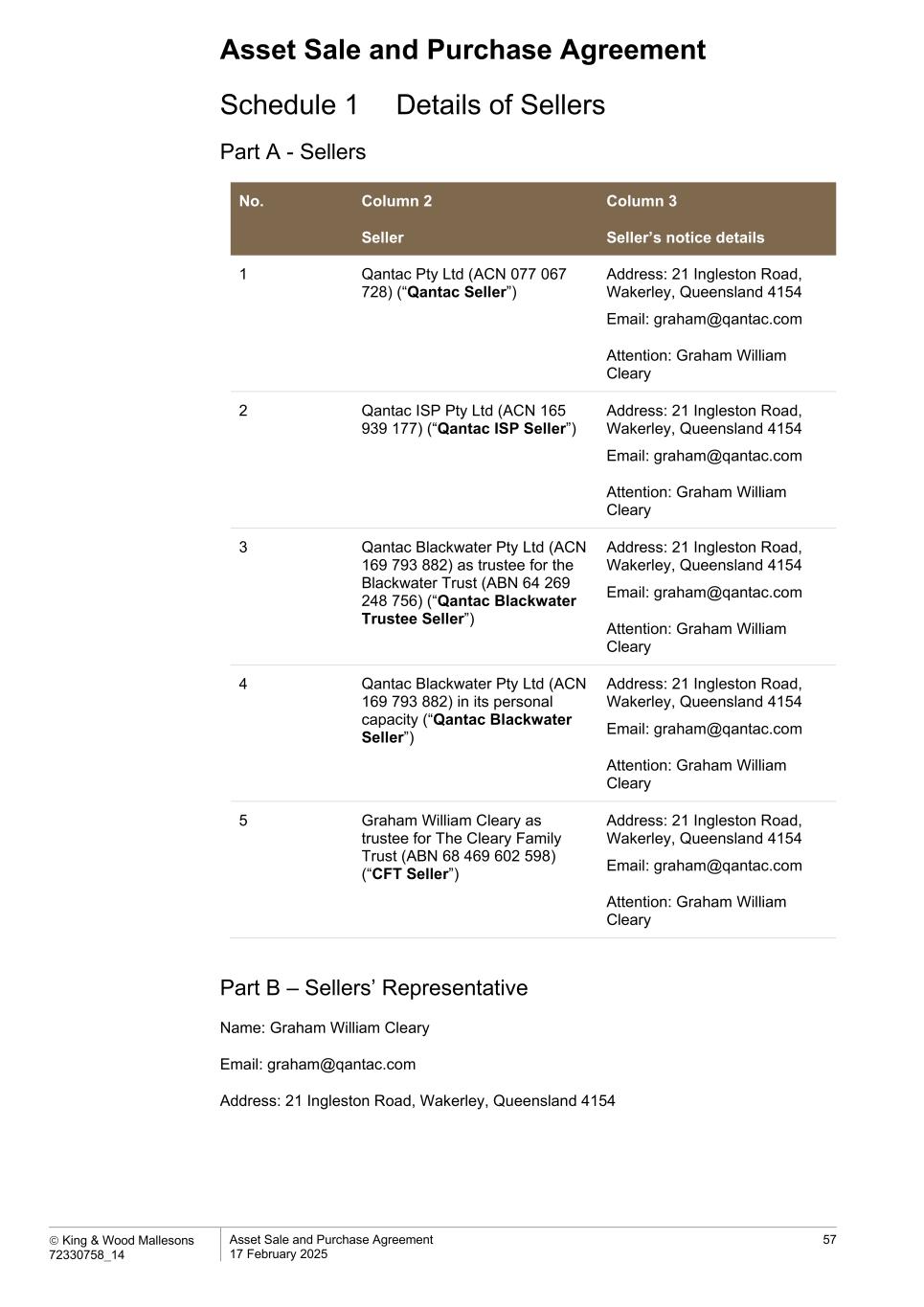

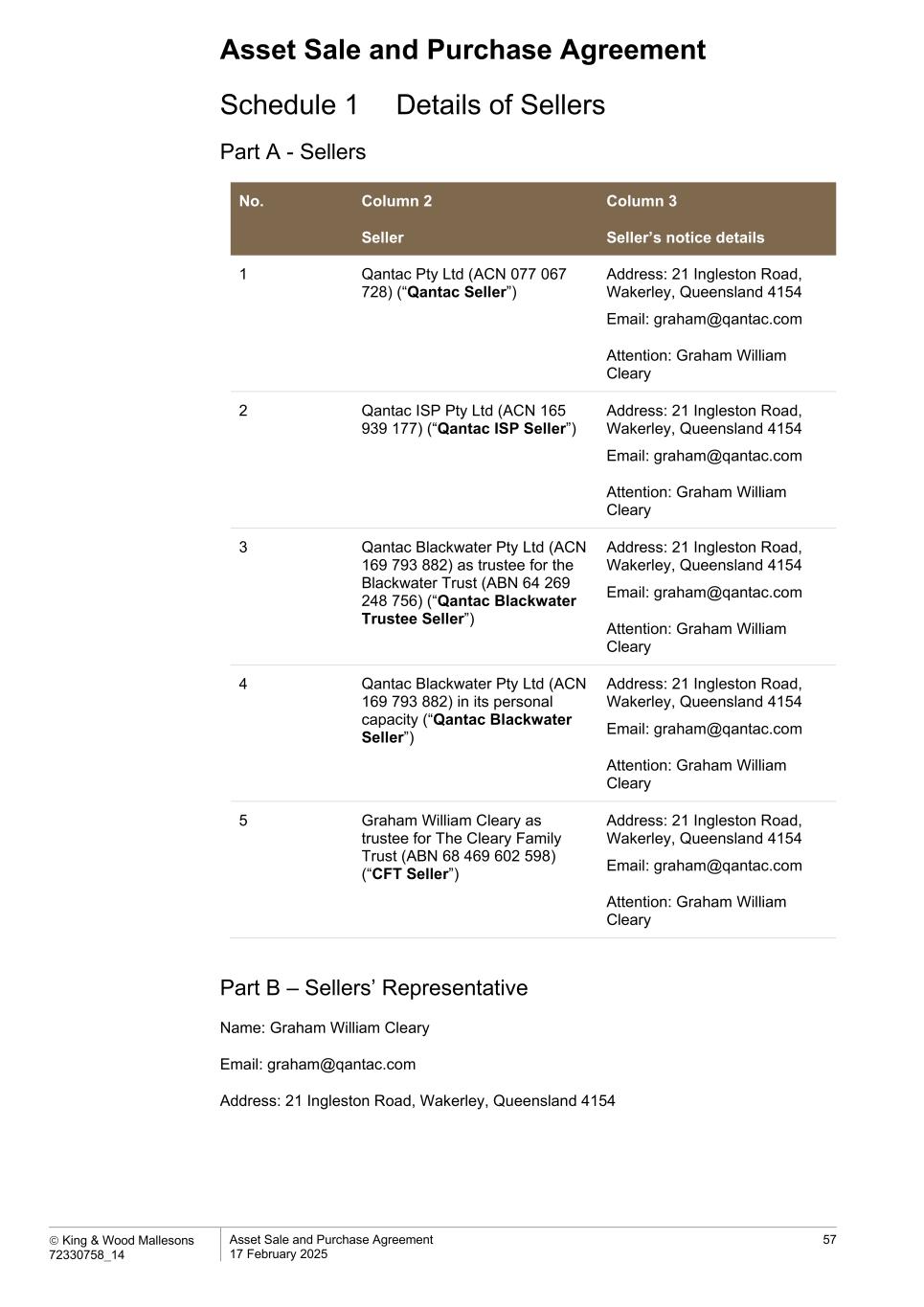

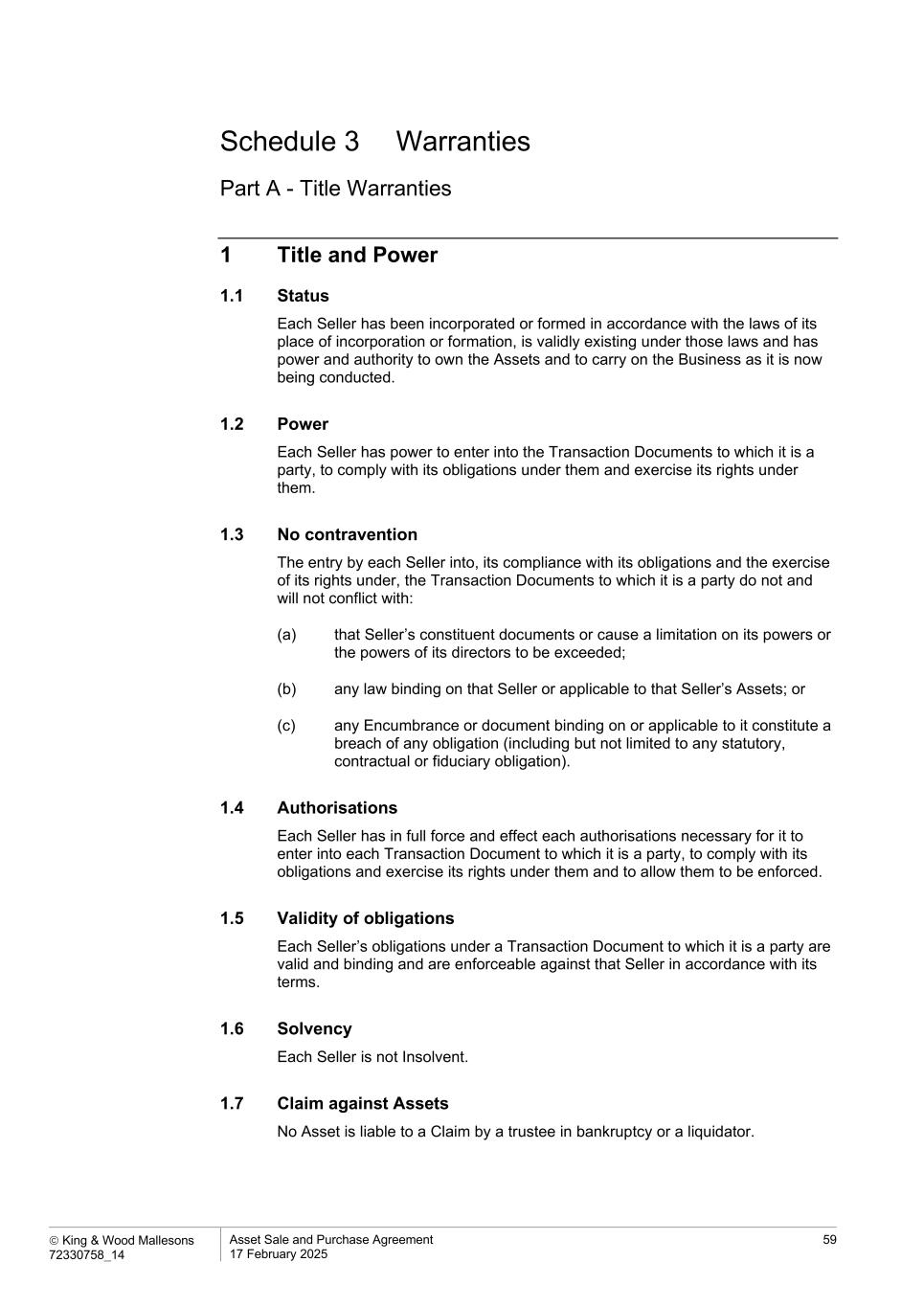

Asset Sale and Purchase Agreement Contents King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 i Details 1 General terms 4 1 Interpretation 4 1.1 Definitions 4 1.2 General interpretation 15 1.3 Multiple Sellers 16 2 Acquisition of Business and Assets 17 2.1 Sale and purchase 17 2.2 Sale of Properties 17 2.3 Obligation to Complete 17 3 Payment of Purchase Price 17 3.1 Purchase Price 17 3.2 Payment of adjustments to Purchase Price 17 3.3 Method of payment 17 4 Conditions Precedent 18 4.1 Conditions Precedent 18 4.2 Reasonable endeavours 18 4.3 Waiver by Buyer 19 5 Completion 19 5.1 Time and place of Completion 19 5.2 Sellers’ obligations 19 5.3 Buyer obligations 21 5.4 Simultaneous actions at Completion 22 5.5 Business Intellectual Property 22 5.6 Post-Completion obligations 22 5.7 Post-Completion notices 22 5.8 Prohibition on the use of Business Intellectual Property 22 6 Pre-Completion Certificate 22 6.1 Pre-Completion Certificate from Sellers’ Representative 22 6.2 Independent Expert to decide and costs 24 7 Apportionments 24 7.1 Entitlement to income 24 7.2 Prepaid goods and services 24 7.3 Apportionment of other outgoings 24 7.4 Apportionment of Outgoings 25 7.5 Means of adjustment 25 7.6 Statement of adjustments 25 8 Actions before and after Completion 25 8.1 Conduct of Business 25 8.2 Restricted activity 26

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 ii 8.3 Permitted conduct 27 8.4 Access to Properties, Buildings, Records and other Assets 27 8.5 Installation Services Agreement 27 8.6 Sirrom Supplier Agreement (Vitrinite) 28 8.7 Access and assistance after Completion 28 8.8 Conduct of Sellers after Completion 28 8.9 Maintenance of Records after Completion 28 8.10 Wrong pockets 28 9 Risk and insurance 29 9.1 Risk 29 9.2 Insurance 29 9.3 Damage to Assets before Completion 29 10 Employees 31 10.1 Offer of employment 31 10.2 Prior Service 31 10.3 Seller’s obligations at or before Completion 31 10.4 Buyer’s obligation after Completion 32 10.5 Adjustment for Transferring Employees Entitlements 32 11 Contracts 32 11.1 Assignment or novation of Contracts 32 11.2 Excluded Contracts 32 11.3 Performance of Contracts 32 11.4 Benefit of Contracts 33 11.5 Indemnity from the Buyer 33 11.6 Indemnity from each Seller 33 12 Business Liabilities 33 12.1 Seller to pay Excluded Liabilities 33 12.2 Buyer to pay Business Liabilities after Completion 33 13 Debtors and creditors 33 13.1 Notifications before Completion 33 13.2 Withheld Amount 34 13.3 Collection of Book Debts and payments of Trade Payables 34 14 Warranties, representations and indemnities 34 14.1 Accuracy 34 14.2 When Warranties given 34 14.3 Separate Warranties 35 14.4 Indemnity 35 14.5 Reliance 35 14.6 Matters disclosed 35 14.7 Buyer acknowledgement 35 14.8 Adjustments to Purchase Price 36

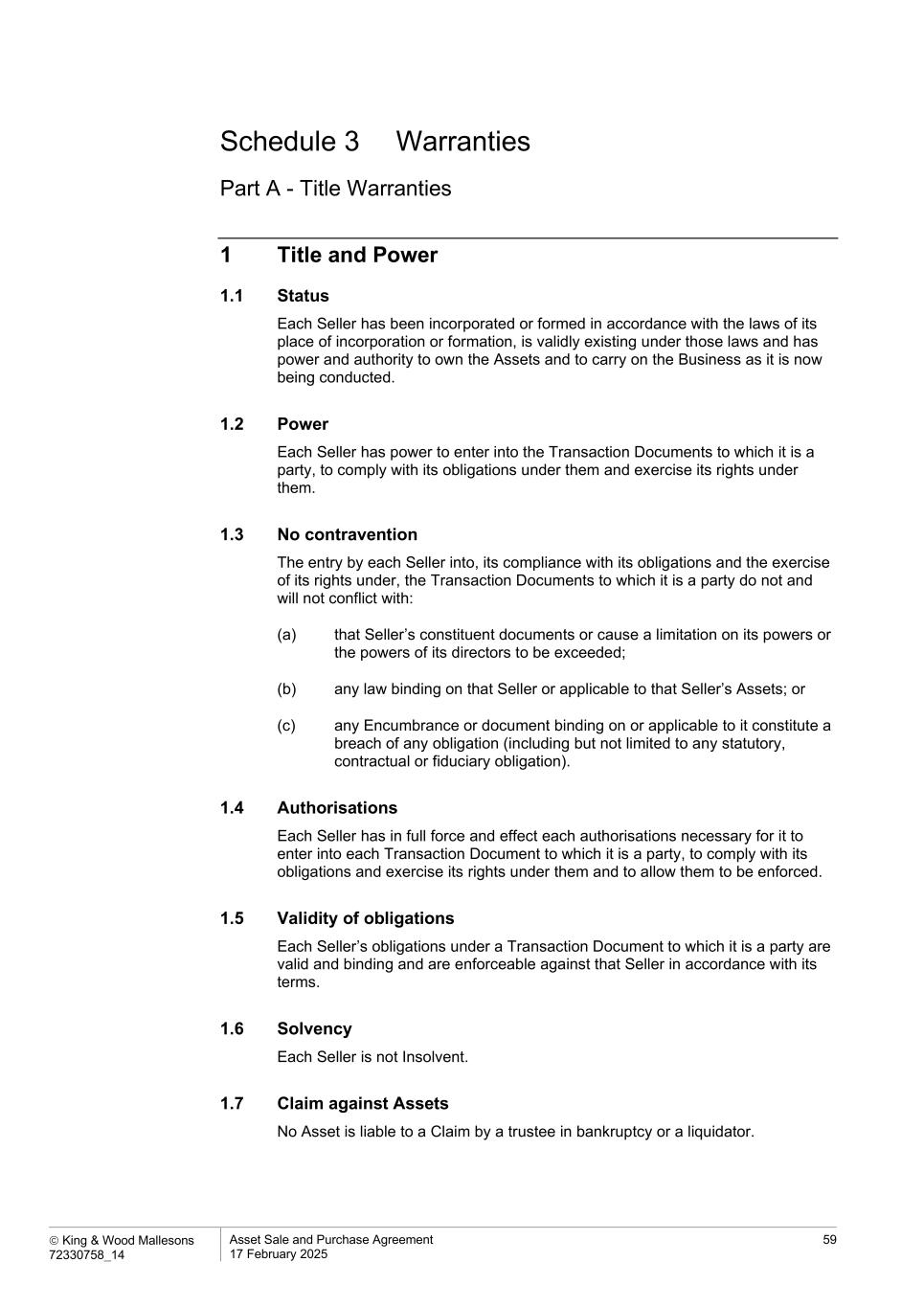

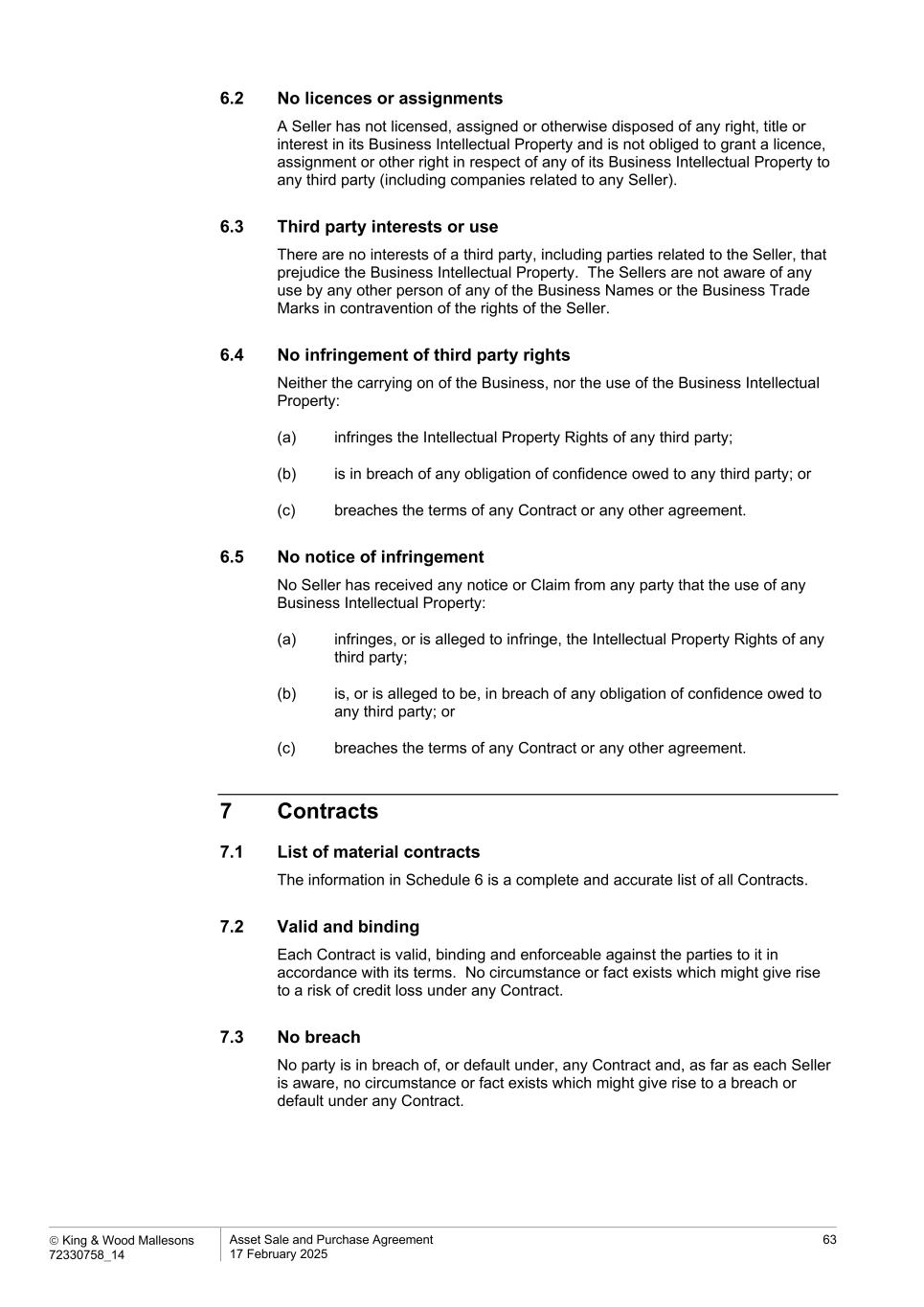

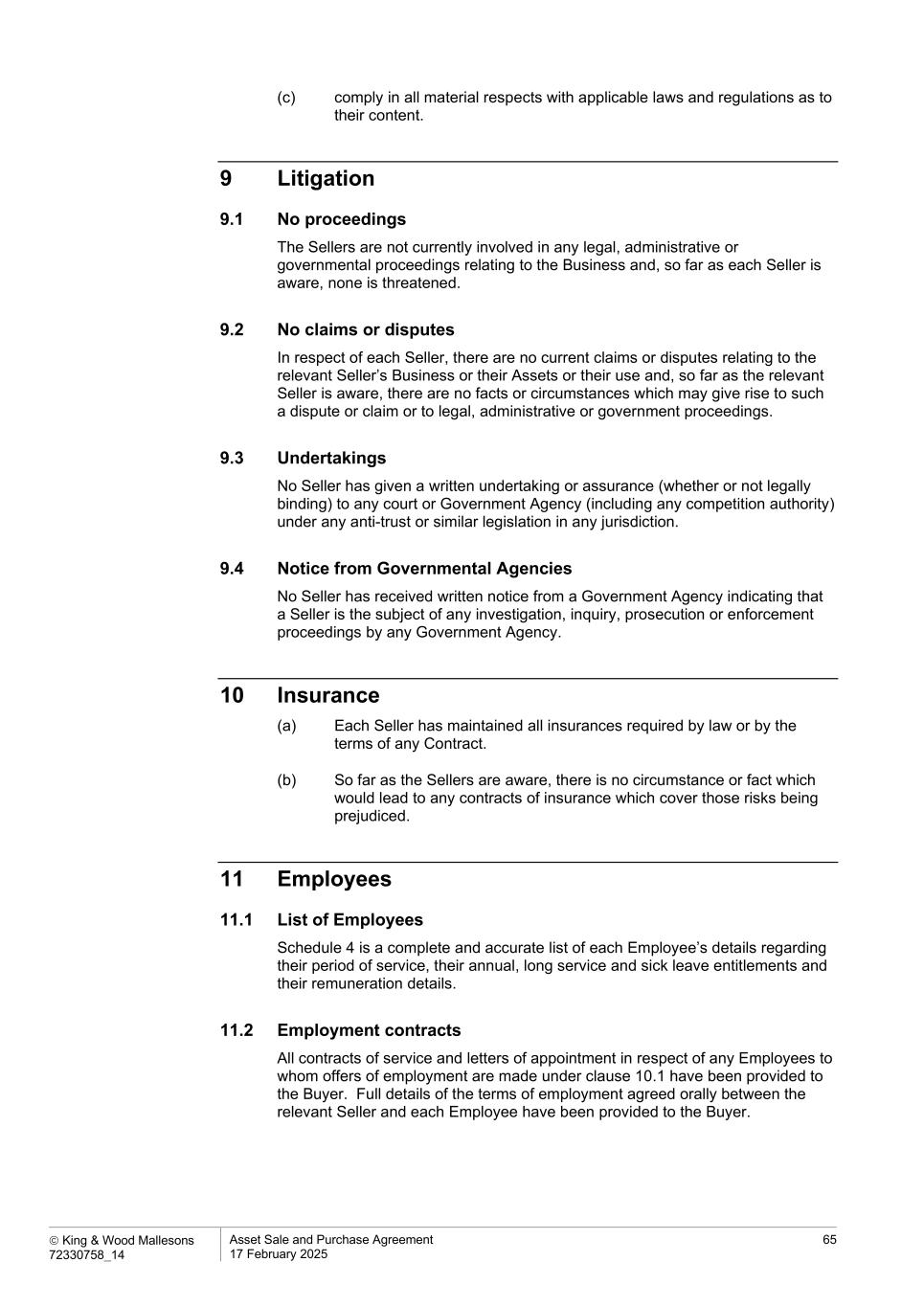

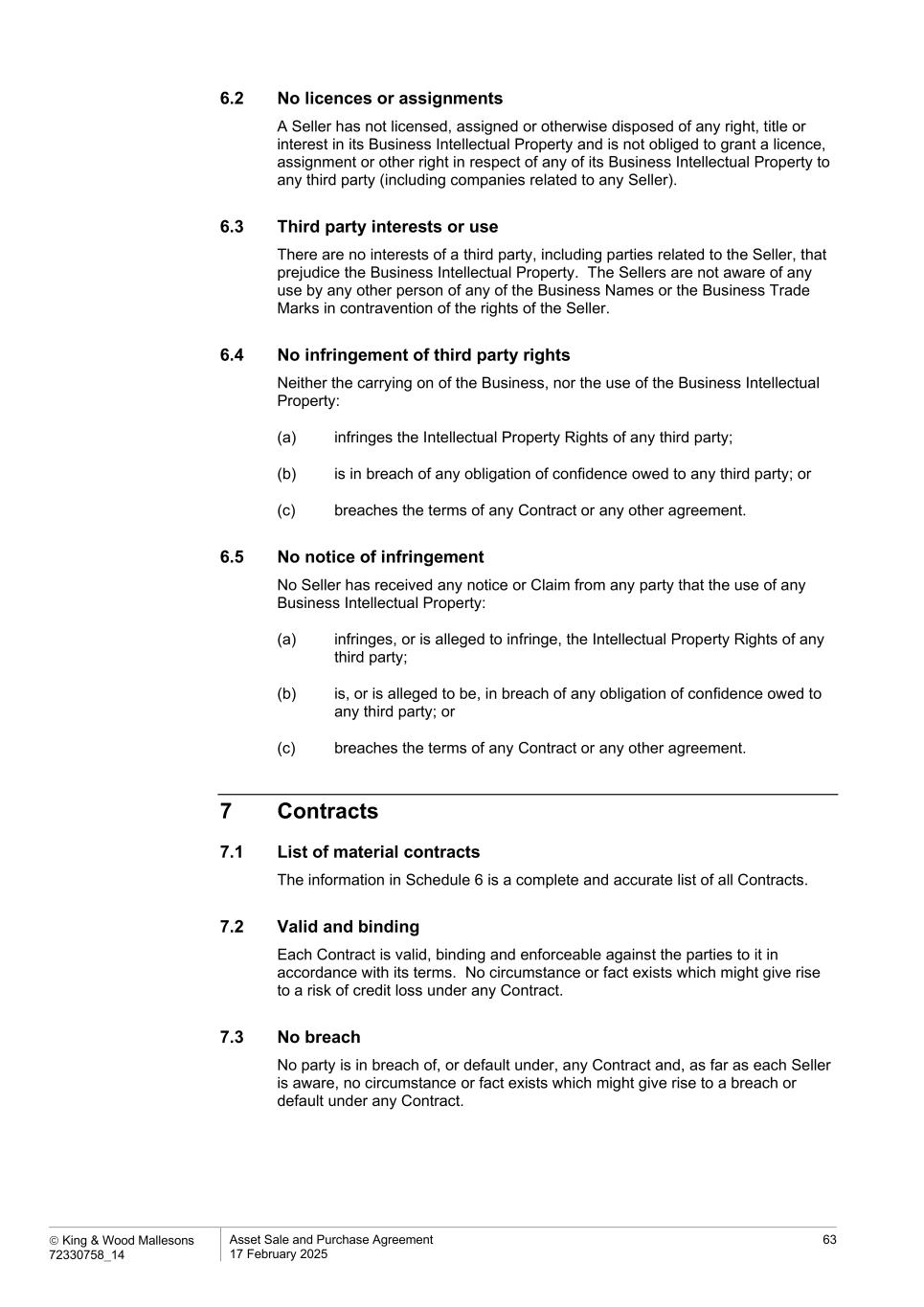

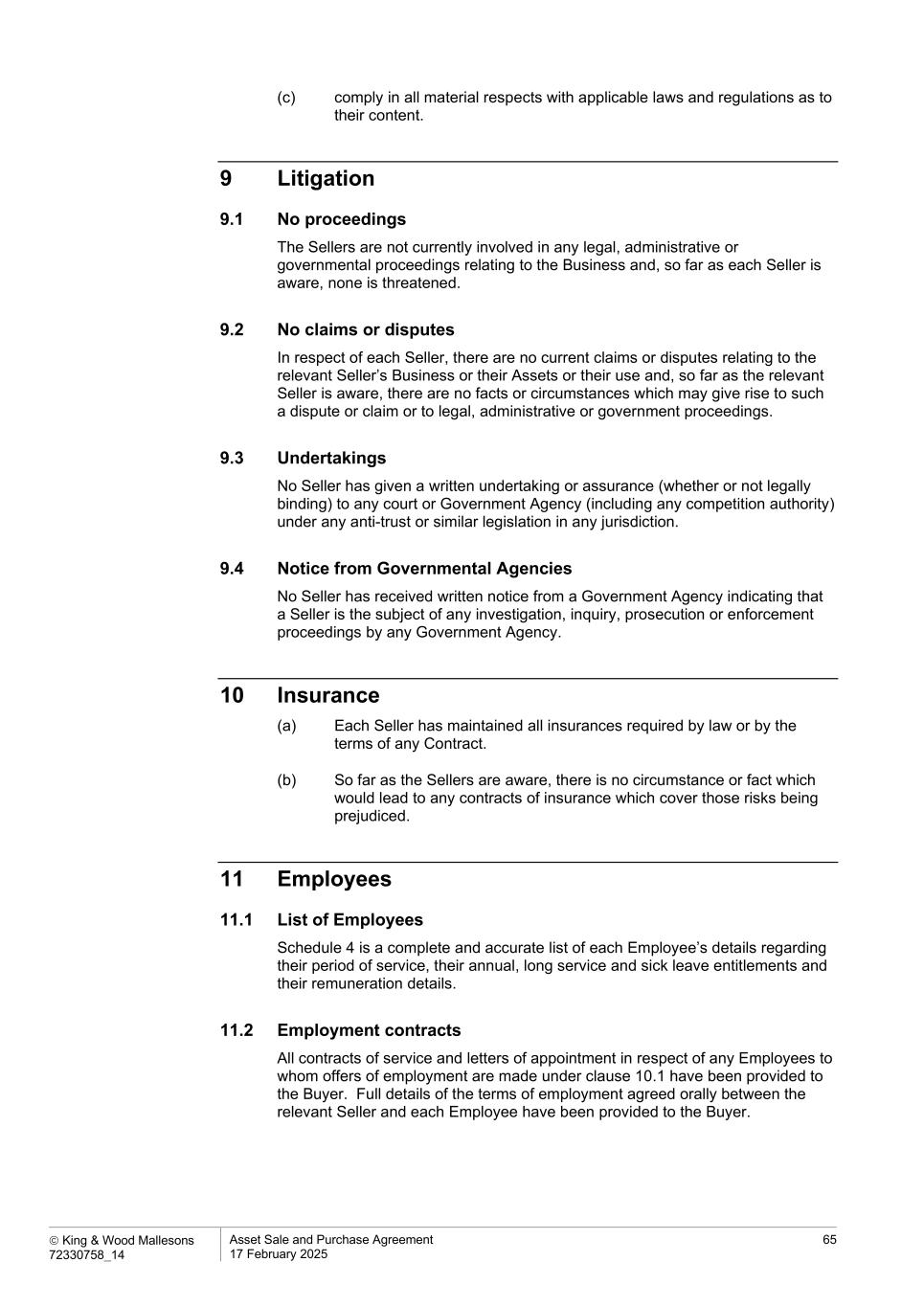

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 iii 15 Specific Indemnities 36 16 Buyer warranties 37 17 Limit of Sellers’ liability and notice of Claims 38 17.1 Notice of Claims 38 17.2 Third party Claims 38 17.3 Sellers’ Representative to consider Claims 38 17.4 Sellers’ Representative to defend Claim 39 17.5 Sellers’ Representative response 39 17.6 Recovery 39 17.7 Time limit for Warranty and Specific Indemnity Claims 40 17.8 Minimum amount of Claim 40 17.9 Maximum liability 40 17.10 Sellers not liable 41 17.11 Fraud 41 18 Guarantee and indemnity 41 18.1 Consideration 41 18.2 Guarantee 41 18.3 Indemnity 41 18.4 Extent of guarantee and indemnity 42 18.5 Obligation to pay interest 42 18.6 Compounding 42 18.7 Payments 43 18.8 If the Seller Guarantor is required to withhold or deduct 43 18.9 No merger 43 18.10 Rights of the Buyer are protected 43 18.11 Seller Guarantor’s rights are suspended 43 18.12 Reinstatement of rights 44 18.13 Costs 44 18.14 Representations and warranties 44 19 Restraint 45 19.1 Restraint 45 19.2 Application of restraint and severance 45 19.3 Deletion of restriction 45 19.4 Severance 46 19.5 Exceptions 46 19.6 Acknowledgement 46 19.7 Damages not an adequate remedy 46 20 Default and termination 46 20.1 Termination for non-satisfaction of Conditions Precedent 46 20.2 Failure by the Buyer to Complete 47 20.3 Failure by the Sellers to Complete 47 20.4 Damage to Rosewood and Waratah 47 20.5 Effect of termination 48 21 Announcements 48 21.1 Public announcements 48 21.2 Public announcements required by law 48

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 iv 22 Confidentiality 48 22.1 Confidential Information 48 22.2 Disclosure of Confidential Information 48 22.3 Use of Confidential Information after Completion 49 23 Costs and stamp duty 49 23.1 Costs 49 23.2 Stamp duty and registration fees 49 24 GST 49 24.1 GST exclusive 49 24.2 Supply of a going concern 49 24.3 Payment of GST 50 24.4 Adjustment events 50 24.5 Reimbursements 50 24.6 Definitions and interpretation 50 25 Sellers’ Representative 51 25.1 Sellers’ Representative 51 25.2 Replacement of Sellers’ Representative 51 26 Seller Trustee as trustee 52 26.1 Trustee acknowledgement 52 26.2 Trustee representations and warranties 52 26.3 Seller Guarantor representations and warranties 52 26.4 Restrictions 52 27 Notices and other communications 53 27.1 Form 53 27.2 Delivery 53 27.3 When effective 53 27.4 When taken to be received 53 27.5 Receipt outside business hours 54 28 General 54 28.1 Approvals, consents or waivers 54 28.2 Assignment or other dealings 54 28.3 Conflict of interest 54 28.4 Counterparts 54 28.5 Discretion in exercising rights 54 28.6 Entire agreement 54 28.7 Further steps 55 28.8 Inconsistent law 55 28.9 Indemnities and reimbursement obligations 55 28.10 Knowledge and belief 55 28.11 No liability for loss 55 28.12 Partial exercising of rights 55 28.13 Remedies cumulative 55 28.14 Representations and undertakings continue 56 28.15 Rules of construction 56 28.16 Severability 56 28.17 Supervening law 56 28.1 Variation and waiver 56

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 v 29 Governing law 56 29.1 Governing law and jurisdiction 56 29.2 Serving documents 56 Schedule 1 Details of Sellers 57 Schedule 2 Apportionment of Purchase Price to Properties 58 Schedule 3 Warranties 59 Schedule 4 Employees 72 Schedule 5 Business Intellectual Property 73 Schedule 6 Contracts 75 Schedule 7 Plant and Equipment 80 Schedule 8 Provisions applying to the sale of the Properties 81 Schedule 9 Buyer Properties 91 Schedule 10 Existing Business 92 Signing page 93 Annexure A Consultancy Agreement 96

Asset Sale and Purchase Agreement King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 1 Details Parties Sellers The persons listed in Schedule 1 Seller Guarantor Name Graham Cleary Address 21 Ingleston Road, Wakerley, Queensland 4154 Email graham@qantac.com Buyer Name Civeo Pty Ltd ACN 003 657 510 Address Level 29, 264 George Street, Sydney, NSW 2000 Email aus.legal@civeo.com Attention Peter McCann Last Balance Date 31 December 2024. Purchase Price $105,000,000, subject to adjustment under clause 6 and the other provisions of this document (see clause 3.1). Calculation Time The time as at which adjustments to the Purchase Price are calculated, being the close of business on the Completion Date (see clauses 6, 7, 9.1, 11, 11.5 and 13). Time limit for Warranty and Specific Indemnity Claims Business Warranties: 3 years after Completion (see clause 17.7). Title Warranties: 7 years after Completion (see clause 17.7). Specific Indemnities (see clause 17.7): (a) 5 years after Completion in respect of the Specific Indemnity in clauses 15(a) and 15(c); (b) 2 years after Completion in respect of the Specific Indemnity in clause 15(b); and (c) 4 years after Completion in respect of the Specific Indemnity in clause 15(d). Per Warranty Claim and aggregate Warranty Claim thresholds Business Warranties: $50,000 (per Claim) and $300,000 (in aggregate) (see clause 17.8). Title Warranties: No Claim thresholds (see clause 17.8).

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 2 Maximum of all Warranty and Specific Indemnity Claims Business Warranties: 60% of the Purchase Price (see clause 17.9). Title Warranties: 100% of the Purchase Price (see clause17.9). Acacia Warranties: 100% of the Acacia Purchase Price (see clause 17.9). Rosewood Warranties: 100% of the Rosewood Purchase Price (see clause 17.9). Vitrinite Warranties: 100% of the Vitrinite Purchase Price (see clause 17.9). Waratah Warranties: 100% of the Waratah Purchase Price (see clause 17.9). Specific Indemnities: 100% of the Purchase Price (see clause17.9). Maximum of all Claims All Claims: 100% of the Purchase Price (see clause 17.9). Restraint Period Restraint Period for the purposes of clause 19 means: (a) the period of 60 months after Completion; (b) the period of 48 months after Completion; (c) the period of 36 months after Completion; (d) the period of 24 months after Completion; and (e) the period of 12 months after Completion. Restraint Area Restraint Area for the purposes of clause 19.1(a) means: (a) Queensland and New South Wales; (b) Queensland; (c) within the Bowen Basin region in Queensland; (d) within 200km from a Combined Property; (e) within 100km from a Combined Property; (f) within 100km from a Property; (g) within 50km from a Property; (h) within 10km from a Property; and (i) within 5km from a Property.

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 3 Last date for satisfaction of Conditions Precedent The date that is 6 months after the date of this document (or such later date notified in writing by the Buyer to the Sellers) (clause 20.1). Governing law and jurisdiction Queensland, Australia (see clause 29). Recitals A The Sellers carry on the Business and own the Assets. B The Sellers have agreed to sell to the Buyer, and the Buyer has agreed to purchase from the Sellers, the Assets and the Business on the terms and conditions of the Transaction Documents as a going concern. C. The Seller Guarantor is the ultimate beneficial owner of each Seller and in consideration of the Buyer agreeing to buy the Assets at the request of the Seller Guarantor, the Seller Guarantor has agreed to make certain promises and give certain undertakings and indemnities under and on the terms and conditions of this document.

Asset Sale and Purchase Agreement King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 4 General terms 1 Interpretation 1.1 Definitions Unless the contrary intention appears, these meanings (together with the meanings in the Details) apply: Acacia Property means the land and improvements contained in Lot 1 on Crown Plan B33769 with title reference 50956222 located at 9 Acacia Street, Blackwater, QLD. Acacia Purchase Price means the consideration payable for the Acacia Property, as apportioned to the Acacia Property in accordance with Schedule 2. Acacia Village means the shared accommodation facilities owned and operated from the Acacia Property. Acacia Warranties means the Warranties set out in paragraph 15 of Schedule 3 as applied to the Acacia Property, and Acacia Warranty has a corresponding meaning. Accounting Standards means: (a) accounting standards as defined in the Corporations Act; and (b) to the extent consistent with paragraph (a), other accounting standards, principles and practices generally accepted in Australia for a business similar to the Business consistently applied. Affiliate means in respect of a person (Primary Person): (a) a person Controlled directly or indirectly by the Primary Person; (b) a person Controlling directly or indirectly the Primary Person; (c) a person directly or indirectly Controlled by a person who Controls the Primary Person (whether alone or with another person or persons); (d) a person directly or indirectly under the common Control of the Primary Person and another person or persons; or (e) where the Primary Person is an individual: (i) a trust which the Primary Person controls (either alone or with their spouse) or where all the beneficiaries are the Primary Person and/or their spouse; (ii) a relative or spouse of the Primary Person; or (iii) a self-managed superannuation fund for the Primary Person, the trustee of which is the Primary Person, the Primary Person and a spouse of the Primary Person, or a company Controlled directly or indirectly by the Primary Person.

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 5 Approval means any certificate, consent, declaration, licence, notification, permit, certification or other authorisation required for the lawful development, occupation or use of any Land (and the conduct of any enterprise on or in connection with Land, including the use of Plant and Equipment) and whether or not: (a) directly related to the Environment; or (b) made under any Environmental and Planning Law. Assets means the Goodwill, the Properties, the Buildings, the Plant and Equipment, the Approvals (including applications for Approvals), the Business Intellectual Property, the Contracts, the Records and all other property and assets owned or used by a Seller in connection with the Business. Book Debts means any trade debts and other receivables owed to a Seller in respect of the Business at the Calculation Time as notified by the Sellers’ Representative to the Buyer in accordance with clause 5.2(b)(viii). Buildings means the buildings and other fixtures, improvements and structures constructed or situated on any of the Properties and which are owned by a Seller. Business means the business conducted by the Sellers using the Assets, being the construction, development, maintenance, management, supply and operation of workforce accommodation in Queensland. Business Day means a day on which banks are open for general banking business in Brisbane, Queensland and Sydney, New South Wales (not being a Saturday, Sunday or public holiday) in that place. Business Intellectual Property means all rights in any registered or unregistered business names, business trademarks and logos, domain names, copyright material, and all other Intellectual Property Rights owned or used by a Seller in connection with the Business, including those listed in Schedule 5. Business Liabilities means those liabilities which solely and directly relate to the performance of Contracts by the Buyer after Completion. Business Names means the registered business names listed in Schedule 5. Business Personal Information means Personal Information which: (a) is collected, used or disclosed in connection with the Business; or (b) is, has been or will be disclosed by a Seller (or its Representatives) to the Buyer, or learnt by the Buyer from the Sellers or their Representatives, under or in connection with this document. Business Trade Marks means the trade marks listed in listed in Schedule 5 and all associated goodwill. Business Warranties means the warranties set out in Schedule 3 other than the Title Warranties, and Business Warranty has a corresponding meaning. Buyer Bank Account means the Australian bank account as the Buyer may notify to the Sellers’ Representative before Completion. Buyer Properties means each of the properties identified in Schedule 9.

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 6 Combined Properties means the Properties and the Buyer Properties, and Combined Property means any one of them. Claim includes any allegation, cause of action, claim, debt, demand, liability, proceeding or suit of any nature howsoever arising and whether actual or contingent, fixed or unascertained, present or future, whether at law, in equity, under statute or otherwise. Completion means completion of the sale and purchase of the Business and the Assets in accordance with clause 4.2, and Complete has a corresponding meaning. Completion Date has the meaning given in clause 5.1. Conditions Precedent means the conditions precedent set out in clause 4.1. Confidential Information means all information (regardless of its Material Form) disclosed to a party (or to its Related Body Corporate or Representative) under or in connection with this document. The term does not include information which: (a) is in the public domain other than through breach of this document or an obligation of confidence owed to the discloser or any Related Body Corporate of the discloser; (b) was already known to the receiver at the time of that disclosure (unless that knowledge arose from a breach of an obligation of confidentiality); or (c) the receiver acquires from a source other than the discloser (or any Related Body Corporate or Representative of the discloser), where that source is entitled to disclose it. Consequential Loss means indirect loss which is loss of business reputation, loss of future reputation or adverse publicity or damage to credit rating, but does not mean: (a) loss which is loss of goodwill, loss of profits, loss of revenue or loss of production; (b) loss arising naturally and in the usual course of things from the relevant circumstances or facts giving rise to the Claim or loss; or (c) any diminution in the value of the Assets or the Business. Constellation Mining means Constellation Mining Pty Ltd (ACN 133 357 310) Consultancy Agreement means the transitional consultancy agreement to be entered into between the Buyer and Qantac Seller, the agreed form of which is included in Annexure A. Contamination means the presence in, on, under or above any Land of a substance at a concentration above the concentration at which the substance is normally present in, on, under or above land in the same locality, being a presence that presents a risk of harm to human health or any other aspect of the Environment, and Contaminant has a corresponding meaning. Contract means any contract or commitment entered into by a Seller in the ordinary course of conducting the Business, including those listed in Schedule 6.

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 7 Control means, with respect to any person other than an individual, the possession, directly or indirectly, of the power to: (a) determine the financial or operating policies of the person; (b) control the membership of the board or other governing body of the person; or (c) control the casting of more than one half of the maximum number of votes that may be cast at a general meeting of the person, regardless of whether the power is in writing or not, expressed or implied, formal or informal or arises by means of trusts, agreements, arrangements, understandings, practices or otherwise, and Controlled and Controlling have a corresponding meaning. Corporations Act means the Corporations Act 2001 (Cth). Customer Contracts means the customer contracts listed in Part A of Schedule 6. Customer Notification Date means: (a) the Completion Date; or (b) such other date as the Sellers’ Representative and the Buyer agree in writing. Data Room means the online data room operated by Ansarada in relation to the transaction contemplated by this document. Disclosed Encumbrance means each of the statutory easements noted on the title to: (a) the Rosewood Property; and (b) the Waratah Property. Disclosing Party means the party disclosing Confidential Information. Domain Name means the internet domain name listed in Schedule 5. Due Diligence Material means all of the information contained in the Data Room as at 5.00pm on the Business Day before the date of this document (including the responses to questions and requests for further information submitted via the Data Room), an index of that information being set out as an annexure to this document. Employees means those employees of a Seller who are listed in Schedule 4, except to the extent any such employee ceases to be engaged by any Seller in the Business (including by reason of giving notice of resignation) before the Completion Date. Encumbrance means any security for the payment of money or performance of obligations, including a mortgage, charge, lien, pledge, trust, power or title retention or flawed deposit arrangement and any “security interest” as defined in sections 12(1) or (2) of the PPSA, or any agreement to create any of them or allow them to exist.

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 8 Engaged or Involved includes direct or indirect involvement as a principal, agent, partner, employee, shareholder, unitholder, director, trustee, beneficiary, manager, consultant, adviser, officer, contractor, joint venturer or financier. Environment means all of the physical surroundings of humans including: (a) land, water, atmosphere, climate, sound, odour and taste; (b) the biological factors of animals and plants; and (c) the social factor of aesthetics affecting any human individually or in their social groupings. Environmental and Planning Laws means any Environmental Law and / or planning laws, regulations, policies, standards and requirements (whether legal, statutory, contractual or otherwise) which relate to or with which the Sellers or the Seller Associates are or were obliged to comply with respect to each Property at any time up to Completion. Environmental Law means any law (including the laws of tort, negligence and nuisance) concerning the Environment. Excluded Liability means any liability or obligation of or in connection with the Business relating to ownership of the Assets or conduct of the Business that are incurred before the Calculation Time, other than the Business Liabilities. Excluded Liabilities include the obligation of Qantac Seller to pay or repay amounts owing in respect of the undocumented $4,600,000 loan relating to the supply and installation of a solar energy system at each of the Waratah Village and Rosewood Village. Existing Business means the business or activity of constructing, maintaining and operating shared accommodation facilities conducted by the Sellers or any Seller Associate at the camps and addresses that are listed in Schedule 10. Fairly Disclosed in relation to a matter means disclosed in sufficient detail and context so as to allow a sophisticated and well advised buyer to be aware of the nature of the matter. Goodwill means the goodwill of the Business, including the exclusive right of the Buyer to represent itself as carrying on the Business as the successor to the Sellers, but excluding the goodwill comprised in the Business Trade Marks. Government Agency means any government, governmental, semi- governmental, administrative, fiscal or judicial body, department, commission, authority, tribunal, agency or entity. Guarantee means the guarantee and indemnity in clause 18. Independent Expert means the person appointed jointly by the Buyer and the Sellers for the purposes of clause 6.2 or, if they do not agree on the person to be appointed within 7 days of 1 party requesting the appointment, the person nominated by the Resolution Institute, who accepts the appointment in accordance with the Resolution Institutes Expert Determination rules. Information means all information regardless of its Material Form relating to or developed, in connection with: (a) the business, technology or other affairs of the Disclosing Party or any Related Body Corporate of the Disclosing Party; or

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 9 (b) any systems, technology, ideas, concepts, know-how, techniques, designs, specifications, blueprints, tracings, diagrams, models, functions, capabilities and designs (including computer software, manufacturing processes or other information embodied in drawings or specifications), intellectual property or any other information which is marked “confidential” or is otherwise indicated to be subject to an obligation of confidence owned or used by or licensed to the Disclosing Party or a Related Body Corporate of the Disclosing Party. Infrastructure Charge means a charge or levy to cover the costs of providing trunk infrastructure issued by way of an Infrastructure Charges Notice to be paid by the owner of a Property. Infrastructure Charges Notice means a notice issued by the relevant local government or a distributor-retailer for an Infrastructure Charge. A person is Insolvent if: (a) it is (or states that it is) an insolvent under administration or insolvent (each as defined in the Corporations Act); (b) it is in liquidation, in provisional liquidation, under administration or wound up or has had a Controller appointed to its property; (c) it is subject to any arrangement, assignment, moratorium or composition, protected from creditors under any statute or dissolved (in each case, other than to carry out a reconstruction or amalgamation while solvent on terms approved by the other parties to this document); (d) an application or order has been made (and in the case of an application, it is not stayed, withdrawn or dismissed within 14 days), resolution passed or any other action taken, in each case in connection with that person, in respect of any of the things described in paragraphs (a), (b) or (c) of this definition; (e) it is taken (under section 459F(1) of the Corporations Act) to have failed to comply with a statutory demand; (f) it is the subject of an event described in section 459C(2)(b) or section 585 of the Corporations Act (or it makes a statement from which another party to this document reasonably deduces it is so subject); (g) it is otherwise unable to pay its debts when they fall due; or (h) something having a substantially similar effect to any of the things described in paragraphs (a) to (g) of this definition happens in connection with that person under the law of any jurisdiction. Intellectual Property Rights means all intellectual property rights, including all current and future registered and unregistered rights in respect of copyright, designs, circuit layouts, trademarks, know-how, confidential information, patents, inventions and discoveries and all other intellectual property as defined in article 2 of the Convention establishing the World Intellectual Property Organisation 1967. Intercompany Licences has the meaning given in clause 4.1(e). Land includes: (a) the surface of the Earth;

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 10 (b) any material beneath the surface (including ground water); (c) the atmosphere above land; and (d) standing or running water. Loss means all damage, loss, cost, claim, liability, obligation or expense (including legal costs and expenses of any kind), but excluding any consequential or indirect losses, economic losses or loss of profits. Material Form includes any form (whether or not visible) of storage from which reproductions can be made. Mobile Camps Business means the business carried on by the Seller immediately following Completion and relating to the construction, development, maintenance, management, supply and operation of mobile workforce accommodation with operational terms of less than 4 years and a development approval issued by the relevant council of less than 4 years duration. Mortgage means each of the following: (a) Mortgage number 722473043; and (b) Mortgage number 722473042. Occupancy Certificate mean a certificate issued to the relevant Seller (in a form acceptable to the Buyer) certifying that the Waratah Village Works are complete (according to the specifications set out in the Waratah Building Approval) and safe to occupy and use, and comply with all relevant laws and regulations. Outgoings means all rates, water charges, taxes (including land tax) assessed as if each of the Properties is the only land owned by the relevant Seller, assessments and charges or other outgoings (periodical or otherwise) chargeable or payable in respect of the Properties or otherwise, which are incurred by the Sellers in connection with ownership or operation of the Properties, but Outgoings do not include income tax, Tenant’s Statutory Outgoings, any non-resident or absentee surcharges or additional taxes payable by virtue of the Seller’s residency or citizenship status, and excluding fines, penalties and interest or other amounts in respect of those taxes. Personal Information has the meaning given in the Privacy Act 1988 (Cth). Plant and Equipment means all plant, equipment, machinery, furniture, computer and communications hardware, fixtures and fittings owned by a Seller or Seller Associate in carrying on the Business as at the Completion Date, including all those items listed in Schedule 7, and all consumables, spare parts, tools and other maintenance items. Pollute means the placing or permitting of any Contaminant by any person into the Environment without lawful authority, and Polluted and Polluting have corresponding meanings. Pollution has the same meaning as in the Environmental Protection Act 1994 (QLD). PPS Register means the Personal Property Securities Register established under the PPSA. PPSA means the Personal Property Securities Act 2009 (Cth). Pre-Completion Certificate has the meaning given in clause 6.1(a).

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 11 Prior Service means an Employee’s service with a Seller up to and including the Completion Date, including any period of service with another employer that is deemed by law to be service with the Seller. Privacy Laws means: (a) the Privacy Act 1988 (Cth), and (b) any other legally binding requirement under Australian law, industry code, policy or statement relating to the handling of Personal Information. Properties means each of: (a) the Acacia Property; (b) the Rosewood Property; (c) the Vitrinite Properties; and (d) the Waratah Property. Purchase Price means the aggregate consideration payable for the Business and Assets calculated and adjusted in accordance with this document. Records means originals and copies, in any form, of all books, files, reports, records, correspondence, documents, manuals and other material of or relating to or used in connection with the Business or the Assets and includes: (a) sales literature, market research reports, brochures and other promotional material (including printing blocks, negatives, sound tracks and associated material); (b) all sales and purchasing records, contracts, designs and working papers; (c) all supplier and customer information; (d) lists of all regular suppliers and customers; (e) spreadsheets, financial models and other business, financial or technical tools, records and documents; and (f) trading and financial records. Related Body Corporate has the meaning given in the Corporations Act. Relevant Damaged Village has the meaning given in clause 9.3(a). Relevant Excluded Assets has the meaning given in clause 9.3(a). Remaining Sale Assets has the meaning given in clause 9.3(a). Representative of a party means an employee, agent, officer, director, auditor, adviser, partner, associate, consultant, joint venturer or sub-contractor of that party or of a Related Body Corporate of that party. Restricted Business means any business or activity which: (a) is the same as or substantially similar to the Business as carried on at the Completion Date; or

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 12 (b) competes with the Business as carried on at the Completion Date. Rosewood Development Approvals means each of: (a) the development permit for a “Material Change of Use” for non-resident worker accommodation (684 rooms), originally issued on 8 August 2014 and changed on 14 October 2015 and 25 August 2016 following change requests (EDQ Reference DEV2013/527), due to expire on 8 August 2025; and (b) the development permit for a “Material Change of Use” for non-resident worker accommodation (104 rooms) approved on 23 November 2016, subject to conditions (EDQ Reference DEV2016/769), due to expire on 23 November 2025. Rosewood Property means the land and improvements contained in Lot 1 in Survey Plan 246036 with title reference 50997243 and located at 10 Rosewood Street, Blackwater QLD. Rosewood Purchase Price means the consideration payable for the Rosewood Property, as apportioned to the Rosewood Property in accordance with Schedule 2. Rosewood Village means the shared accommodation facilities owned and operated from the Rosewood Property. Rosewood Warranties means the Warranties set out in paragraph 15 of Schedule 3 as applied to the Rosewood Property, and Rosewood Warranty has a corresponding meaning. Seller Associate means, in respect of a Seller, each of: (a) Graham William Cleary; (b) any shareholder, director, secretary or officer of the Seller or of any Related Body Corporate or Affiliate of the Seller; (c) any Related Body Corporate or Affiliate of the Seller; (d) any corporation or other entity over which the Seller or any 1 or more of the persons described in paragraphs (a) or (b) of this definition have Control; and (e) any trust in which the Seller or person described in paragraphs (a), (b), (c) or (d) of this definition is a beneficiary or trustee of such trust. Seller Trust has the meaning given in clause 26.1. Seller Trustee has the meaning given in clause 26.1. Sellers’ Representative means the person listed in Part B of Schedule 1, or such other person as the Sellers may notify the Buyer in writing from time to time. Sirrom means Sirrom Accommodation Services Pty Ltd (formerly known as Blackdown Accommodation Services Pty Ltd) (ACN 158 240 272). Sirrom Supplier Agreement (Vitrinite) means the Umbrella Services Contract – 0001 – Master Agreement (Facilities Management, Catering, Grounds and Cleaning Services) between Qantac ISP Seller and Sirrom dated 9 January 2022, and the Notice to Proceed commencing on 1 February 2022 (undated) attaching the Services Package SP001 for Vitrinite Village.

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 13 Specific Indemnity means each of the indemnities set out in clause 15. Supplier Contracts means the supplier contracts listed in Part B of Schedule 6. Taxes means taxes (including income tax, GST and payroll taxes), levies, imposts, charges and duties (including stamp and transaction duties) paid, payable or assessed as being payable by any Government Agency, together with any fines, penalties and interest in connection with them. Tenancy means: (a) a lease, a licence (other than an underlease or a sublicence) and any other agreement in connection with the use or occupation of a Property; and (b) any other agreement of the kind referred to in paragraph (a) entered into by a Seller after the date of this document. Tenant means a person entitled under a Tenancy to use or occupy any part of the Properties. Tenant’s Statutory Outgoings means all rates, levies, taxes and other amounts in relation to a Property, payable by a Tenant direct to an assessing authority, excluding income tax and GST. Titles means: (a) for the Rosewood Property, Lot 1 in Survey Plan 246036 with title reference 50997243; and (b) for the Waratah Property, Lot 4 on Survey Plan 243869 with title reference 50865436. Title Warranties means the warranties set out in Part A and paragraphs 3, 4.1, 6.1, 7.1, 7.2, 7.7, 8.1, 11.1 and 15 of Part B of Schedule 3, and Title Warranty has a corresponding meaning. Trade Payables means any and all trade payables owed by a Seller in respect of the Business, as notified by the Sellers’ Representative to the Buyer in accordance with clause 5.2(b)(viii), other than any debt or payable owed to another Seller or a Seller Associate. Transaction Documents means this document and each of the Property Transfer Form. Transferring Employees means those employees who accept the Buyer’s offer of employment made under clause 10.1. Villages means each of the Acacia Village, the Rosewood Village, the Vitrinite Village and the Waratah Village. Vitrinite Properties means the land and improvements contained in: (a) Lot 43 on Crown Plan M112155 with title reference 50533070; (b) Lot 44 on Crown Plan M112155 with title reference 50533071; and (c) Lot 45 on Crown Plan M112155 with title reference 50533072, and located at 1 Alfred Drive, Middlemount QLD.

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 14 Vitrinite Purchase Price means the consideration payable for the Vitrinite Properties, as apportioned to the Vitrinite Properties in accordance with Schedule 2. Vitrinite Village means the shared accommodation facilities owned and operated from the Vitrinite Properties. Vitrinite Warranties means the Warranties set out in paragraph 15 of Schedule 3 as applied to the Vitrinite Properties, and Vitrinite Warranty has a corresponding meaning. Waratah Accommodation & Catering Agreement means the ‘Agreement – Provision of Accommodation and Catering at Waratah Village’ between Qantac Blackwater Seller and Coronado Curragh Pty Ltd (ACN 009 362 565) contained in document identifier 11.04.01.01 of the Data Room. Waratah Building Approvals means each of the: (a) development permit to carry out “Building Works (Stage 1 – Central Facilities and 192 Accommodation Units)” issued on 31 October 2023 by a private certifier (Certification Reference 20232004); (b) development permit to carry out “Building Works (Stage 2 – Kitchen and Dining Building)” issued on 24 November 2023 by a private certifier (Certification Reference 20232004); and (c) development permit to carry out “Building Works (Stage 3 – Balance of Accommodation Rooms)” issued on 15 May 2024 by a private certifier (Certification Reference 20232004). Waratah Infrastructure Charge Notice means the infrastructure charge notice issued by the Central Highlands Regional Council on 5 March 2021, pursuant to section 116G of the Economic Development Act 2012 (Qld) for the Waratah Development Approval contained in document identifier 15.04.03.01.05 of the Data Room. Waratah Property means the land and improvements contained in Lot 4 on Survey Plan 243869 with title reference 50865436 and located at 14 Waratah Street, Blackwater. Waratah Purchase Price means the consideration payable for the Waratah Property, as apportioned to the Waratah Property in accordance with Schedule 2. Waratah Village means the shared accommodation facilities owned and operated from the Waratah Property. Waratah Village Works means: (a) the construction and development works undertaken by or on behalf of Qantac Seller in respect of Waratah Village; and (b) the required approvals for the rights of occupancy at Waratah Village. Waratah Warranties means the Warranties set out in paragraph 15 of Schedule 3 as applied to the Waratah Property, and Waratah Warranty has a corresponding meaning. Warranties means the Title Warranties and the Business Warranties set out in Schedule 3. Westpac means Westpac Banking Corporation (ABN 33 007 457 141).

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 15 Westpac Facility means the debt financing facility relating to the ‘Bank Bill Business Loan’ dated 29 July 2024 between Qantac Blackwater Seller (as borrower) and Westpac (as lender). Withheld Amount has the meaning given in clause 13.2(a). 1.2 General interpretation Headings and labels used for definitions are for convenience only and do not affect interpretation. Unless the contrary intention appears, in this document: (a) the singular includes the plural and vice versa; (b) the meaning of general words is not limited by specific examples introduced by “including”, “for example”, “such as” or similar expressions; (c) a reference to a document includes any agreement or other legally enforceable arrangement created by it (whether the document is in the form of an agreement, deed or otherwise); (d) a reference to a document also includes any variation, replacement or novation of it; (e) a reference to dollars, $ or A$ is a reference to the currency of Australia; (f) a reference to “law” includes common law, principles of equity and legislation (including regulations); (g) a reference to any legislation includes regulations under it and any consolidations, amendments, re-enactments or replacements of any of them; (h) a reference to “regulations” includes instruments of a legislative character under legislation (such as regulations, rules, by-laws, ordinances and proclamations); (i) a reference to “person” includes an individual, a body corporate, a partnership, a joint venture, an unincorporated association and an authority or any other entity or organisation; (j) a reference to a particular person includes the person’s executors, administrators, successors, substitutes (including persons taking by novation) and assigns; (k) a reference to any thing (including an amount) is a reference to the whole and each part of it; (l) subject to clause 1.3(a) and unless expressly provided otherwise, an agreement, representation, warranty, covenant, obligation or undertaking given or entered into by 2 or more persons binds them jointly and severally and each of them individually; (m) subject to clause 1.3(a), where a party or defined term comprises 2 or more persons, an obligation to be performed or to be observed by that party or parties binds those persons jointly and severally, and a reference to that party is deemed to include a reference to any 2 or more of those persons jointly and to each of them individually; (n) a reference to a time of day is a reference to Brisbane, Australia time;

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 16 (o) a period of time starting from a given day or the day of an act or event is to be calculated exclusive of that day; (p) if a party must do something under this document on or by a given day and it is done after 5.00pm on that day, it is taken to be done on the next day; and (q) if the day on which a party must do something under this document is not a Business Day, the party must do it on the next Business Day. 1.3 Multiple Sellers (a) Any reference to a Seller, or to the Sellers, when used in connection with an Asset, is to the Seller that is the legal owner or title holder of that Asset (including, in relation to a Contract, being the counterparty to that Contract) (“Legal Owner”), such that: (i) the Legal Owner is obliged to perform any relevant obligation (including to deliver or transfer, or take other relevant action in respect of, the relevant Asset); (ii) the Legal Owner is entitled to exercise or enforce any right or remedy, or enjoy any benefit, conferred by or in connection with the relevant Asset; and (iii) each other Seller is in the circumstances described in clause 1.3(c) obliged to procure (and remains jointly and severally liable for) compliance by the Legal Owner with its obligations under clauses 1.3(a)(i) and 1.3(b). (b) Subject to the other provisions of this clause 1.3, each Legal Owner is solely liable for the full amount of any liability or obligation arising from or in connection with an Asset that it owns and is selling to the Buyer under this document. (c) Clause 1.3(b) does not apply, and each Seller is jointly and severally liable for the liabilities and obligations of each other Seller in connection with this document, to the full extent permitted by law, where: (i) the right or remedy of the Buyer, or the circumstance, fact or matter giving rise to the liability or obligation, arises or is connected with Assets owned by more than 1 Seller or conduct (including conduct by omission) of more than 1 Seller; (ii) the liability or obligation is expressed to apply to more than 1 Seller; (iii) a Seller is or becomes Insolvent; (iv) a Seller is wound up or deregistered; or (v) Qantac Blackwater Trustee Seller is removed or replaced as trustee of the Qantac Blackwater Trust or the Qantac Blackwater Trust is terminated or wound up.

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 17 2 Acquisition of Business and Assets 2.1 Sale and purchase (a) Each Seller agrees to sell and the Buyer agrees to buy, free from any Encumbrance, all of each Seller’s right, title and interest in the Assets and the Business on Completion on the terms and conditions of the Transaction Documents. (b) The Assets and the Business must be transferred to the Buyer free from any Encumbrance, on the terms and conditions of the Transaction Documents. 2.2 Sale of Properties The provisions in Schedule 8 apply to the sale of the Properties. 2.3 Obligation to Complete Completion under this document is interdependent with Settlement of the sale of each of the Properties under Schedule 8. Neither the Sellers nor the Buyer are obliged to Complete under this document unless all parties are ready, willing and able to effect Settlement under Schedule 8 on the Completion Date. 3 Payment of Purchase Price 3.1 Purchase Price The Purchase Price for the Assets and the Business is the amount stated in the Details, subject to adjustment on the terms of this document. The amount stated in the Details (subject to any adjustment agreed or determined before Completion, including under clauses 7, and the withholding of the Withheld Amount under clause 13) is payable at Completion by the Buyer to the Sellers in accordance with clause 5.3(b). 3.2 Payment of adjustments to Purchase Price Within 5 Business Days after the agreement or determination of any adjustment to the Purchase Price under clauses 7 or 13 (where the adjustment is only agreed or determined after Completion), the amount of such adjustment is payable: (a) by the Buyer to the Sellers’ Representative, if it is a positive amount; or (b) by the Sellers to the Buyer, if it is a negative amount. 3.3 Method of payment (a) Each payment referred to in this clause 3 must be made by direct deposit of cleared funds (transferred by real time gross settlement) to the credit of a single Australian bank account in the name of the Sellers’ Representative specified in writing by the Sellers’ Representative to the Buyer by no later than 2 Business Days before the due date for payment or by any other method agreed by these parties. (b) Payment by the Buyer into the bank account referred to in clause 3.3(a) will constitute a full and proper discharge of the Buyer’s obligations under clause 3.3(a). The Buyer will have no liability or responsibility for ensuring that, after such payment, each Seller receives all or any portion

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 18 of the Purchase Price attributable or referable to the Assets which it is selling or transferring to the Buyer under this document. 4 Conditions Precedent 4.1 Conditions Precedent Completion is conditional on: (a) (Customer Contracts – assignment and novation) each party (other than a Seller) to each Customer Contract consenting in writing to the assignment of that Contract to the Buyer or a novation of that Contract in favour of the Buyer, in each case on terms acceptable to the Buyer; (b) (Buyer licences) the Buyer having obtained (on terms acceptable to it) all authorisations, consents, licences and permits required for it to conduct the Business from Completion (including shared facility accommodation certificates); (c) (Waratah Building Works) an Occupancy Certificate (in a form acceptable to the Buyer) for the Waratah Building Works being issued to the Sellers in respect of the Waratah Village Works; (d) (Rosewood Development Approvals) the amendment of the Rosewood Development Approvals, such that the Rosewood Development Approvals will no longer expire on 8 August 2025 and 23 November 2025, respectively, or new development approval(s) being granted in respect of the Rosewood Property, in each case on terms acceptable to the Buyer; and (e) (Intercompany Licences): (i) Qantac Seller and Qantac Blackwater Seller enter into a licence agreement (in a form acceptable to the Buyer) under which Qantac Seller licences the use of plant, equipment and certain leasehold improvements on or used on the Waratah Property to Qantac Blackwater Seller; and (ii) Qantac Blackwater Trustee Seller and Qantac Blackwater Seller enter into a licence agreement (in a form acceptable to the Buyer) under which Qantac Blackwater Trustee Seller grants Qantac Blackwater Seller a licence to the Waratah Property to construct, access and use the multi-unit commercial residential accommodation facility and associated facilities, (collectively, the “Intercompany Licences”). 4.2 Reasonable endeavours (a) The Sellers must use their reasonable endeavours to satisfy the Conditions Precedent for which the Sellers are responsible (being the Conditions Precedent in clauses 4.14.1(a) and 4.1(c) to (e) (inclusive), including using reasonable endeavours to procure performance by a third party, as soon as reasonably practicable after the date of this document and by no later than 21 March 2025. (b) The Buyer must use its reasonable endeavours to satisfy the Condition Precedent in clause 4.1(b).

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 19 (c) Without limiting the obligations in clause 4.2(a), the Sellers must: (i) send a draft of deed of novation (substantially in the form agreed between the Sellers’ Representative and the Buyer on or before the date of this document, with the relevant Customer Contract’s details inserted) to each relevant customer by no later than 10 Business Days after the date of this document; (ii) keep the Buyer informed of any developments (including correspondence received from relevant counterparties) with respect to each of the Conditions Precedent in clauses 4.1(a) and 4.1(c) to (e) (inclusive); and (iii) provide the Buyer with such information and assistance as the Buyer may reasonably require to satisfy the Condition Precedent in clause 4.1(b). (d) The parties must keep each other informed of any circumstances which may result in any Condition Precedent not being satisfied in accordance with its terms. 4.3 Waiver by Buyer (a) The Conditions Precedent are for the benefit of the Buyer. (b) A Condition Precedent may only be waived (in whole or in part) by notice in writing given by the Buyer to the Sellers’ Representative. 5 Completion 5.1 Time and place of Completion Completion will take place on the date which is: (a) the 1st day of the month immediately following the month in which the last Condition Precedent in clause 4.1 is satisfied or (if applicable) waived, provided that, if the date on which the last Condition Precedent in clause 4.1 is satisfied or (if applicable) waived is less than 5 days before the first day of the following month, then Completion will take place on the 1st day of 2nd month after the day on which the last Condition Precedent in clause 4.1 is satisfied or (if applicable) waived (for example, if the last Condition Precedent is satisfied on 30 March 2025, then Completion will take place on 1 May 2025 rather than 1 April 2025); or (b) any other date and place agreed in writing between the Sellers’ Representative and the Buyer, by way of electronic exchange of documents and deliverables or by any other means or at any other place agreed in writing between the Sellers’ Representative and the Buyer. 5.2 Sellers’ obligations At Completion, each Seller must: (a) (operating control) deliver operating control of the Seller’s Assets (and part of the Business) to or at the direction of the Buyer;

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 20 (b) (documents and assets) deliver to the Buyer: (i) (transfer documents) subject to any consents not yet obtained under clauses 10 or 11, executed instruments of assignment or transfer (in a form acceptable to the Buyer) that are required to vest the Assets in the Buyer and to enable the Buyer to conduct the Business after Completion in all material respects in the same manner as the Seller conducted it before Completion; (ii) (title documents) all documents of title relating to the Seller’s Assets; (iii) (Business Names and Domain Name) the appropriate documents (if any), each duly executed by the Sellers and in a form acceptable to the Buyer, or relevant key, security or code number (if any), that is required for the Buyer to effect the transfer of the Business Names and Domain Name to the Buyer; (iv) (Customer Contracts and consents) in respect of the Customer Contracts, executed assignments of them to the Buyer and evidence of the written consent of the other party to those assignments, or executed novations of the Customer Contracts in favour of the Buyer, in each case, in a form satisfactory to the Buyer; (v) (Mortgages) evidence to the satisfaction of the Buyer that the Mortgages have been discharged and that the Titles are free of any Encumbrance other than the Disclosed Encumbrances; (vi) (notices of attornment) in respect of the tenancy arrangements at the Acacia Village, evidence that notices of attornment (in a form acceptable to the Buyer) have been delivered to each of the tenants of the Acacia Village on the Completion Date; (vii) (Intercompany Licences) a deed of novation (in a form acceptable to the Buyer) of each Intercompany Licence, duly executed by Qantac Seller, Qantac Blackwater Seller and Qantac Blackwater Trustee Seller; (viii) (Book Debts and Trade Payables) an itemised schedule of the Book Debts and Trade Payables as at the Calculation Time, including details of each debtor’s or creditor’s (as applicable) name and address and a copy of the invoice issued to the relevant debtor or by the relevant creditor (as applicable); (ix) (repayment of Westpac Facility) evidence (in a form acceptable to the Buyer) that the Westpac Facility has been fully repaid; (x) (discharges over Assets) releases and discharges in respect of all Encumbrances, Infrastructure Charges and Infrastructure Charge Notices over any of the Assets, including (where relevant) evidence that all Infrastructure Charges have been paid and an undertaking to remove all registrations in relation to such Encumbrances from the PPS Register within 10 Business Days after Completion, duly executed by the relevant holders of those Encumbrances and in a form acceptable to the Buyer; (xi) (Encumbrances) to the extent not addressed in clause 5.2(b)(x), all documents necessary to discharge the Encumbrances in respect of any Asset;

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 21 (xii) (Consultancy Agreement) the Consultancy Agreement, duly executed by Graham William Cleary; (xiii) (Seller licences) deliver to the Buyer evidence satisfactory to the Buyer that all authorisations, consents, licences and permits held by or in the name of a Seller that can be transferred to the Buyer and that are required to conduct the Business on and from Completion have been registered or transferred into the name of the Buyer (to the extent permitted by law); (xiv) (Information) deliver to the Buyer the Material Form of all Information relating to the Business or the Assets; (xv) (Records) all Records, except that, if the relevant Seller is legally required to retain the originals of any of them, the Seller may deliver copies of them to the Buyer; (xvi) (delivery of Assets) those Assets capable of transfer by delivery and permit the Buyer to take possession of the Assets; and (xvii) (Data Room USB) a USB drive containing all of the information in the Data Room as at 5.00pm on the Business Day before the date of this document; (c) (telephone and other utility services) assist the Buyer by executing the necessary forms and consents to enable the utility services provided to the Business, including those telephone, fax and other communication services which the Buyer request, to be transferred to the Buyer with effect from the Completion Date; and (d) (superannuation) provide the Buyer with details of the superannuation funds to which the Seller was making superannuation contributions on behalf of the Transferring Employees before Completion to assist the Buyer to comply with all of its duties and responsibilities in respect to superannuation payable for the Transferring Employees at and from Completion. 5.3 Buyer obligations At Completion, the Buyer must: (a) (offer to employees) confirm that it has made the offers to the Employees in accordance with clause 10.1; (b) (payment) pay the Sellers’ Representative in accordance with clause 3.1, if the Sellers comply with clause 5.2; and (c) (deliver executed counterparts) deliver executed counterparts of the following documents: (i) the transfer documents referred to in clause 5.2(b)(i); (ii) the assignments of the Business Intellectual Property referred to in clause 5.2(b)(iii); (iii) the assignments or novations of the Customer Contracts referred to in clause 5.2(b)(iv); (iv) the Consultancy Agreement, duly executed by the Buyer; and

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 22 (v) the deeds of novation of the Intercompany Licences executed and accepted by the Buyer under clause 5.2(b)(vii), duly executed by the Buyer. 5.4 Simultaneous actions at Completion In respect of Completion: (a) the obligations of the parties under this document and the obligations of the parties under the Property Schedule are interdependent; and (b) unless otherwise stated, all actions required to be performed by a party at Completion under this document and by the parties at completion or settlement under the Property Schedule are taken to have occurred simultaneously on the Completion Date. 5.5 Business Intellectual Property On Completion, the Seller assigns to the Buyer all of its right, title and interest in and to the Business Intellectual Property, including all accrued rights of action involving the Business Intellectual Property. 5.6 Post-Completion obligations If title to any of the Assets is not effectively vested in the Buyer at Completion, each Seller acknowledges that it will account to the Buyer for any benefits it receives in relation to those Assets until title is effectively vested in the Buyer, unless otherwise provided in this document. 5.7 Post-Completion notices Each party must promptly (and, in any event, within 5 Business Days) give to the other party all payments, notices, correspondence, information or enquiries in relation to a Seller, the Business or the Assets which it receives after Completion and which belong to the other party. 5.8 Prohibition on the use of Business Intellectual Property From Completion, each Seller must not, and must procure that each other Seller Associate does not: (a) use or authorise the use of the Business Intellectual Property in any way; (b) use or authorise the use of any name (including any Business Name or Domain Name) or logo which is substantially identical or deceptively similar to any Business Intellectual Property; or (c) commit any act or omission which would be an infringement of, or inconsistent with, the Buyer’s rights in any Intellectual Property Rights owned by the Buyer. 6 Pre-Completion Certificate 6.1 Pre-Completion Certificate from Sellers’ Representative (a) The Sellers’ Representative must deliver, by no later than 5 Business Days before the Completion Date, to the Buyer a certificate setting out

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 23 an itemised schedule of the following amounts (“Pre-Completion Certificate”): (i) any prepayment made by a Seller in respect of goods, services or other benefits which are received by the Buyer in respect of the Business after the Calculation Time. Any such amount will be reflected as a positive amount and will increase the Purchase Price; (ii) any expenses and outgoings of the Business that will be payable by the Buyer in arrears after the Calculation Time and which relate to the conduct of the Business before the Calculation Time (excluding any Book Debts or Trade Payables dealt with under clause 13). Any such amount will be reflected as a negative amount and will reduce the Purchase Price; (iii) the Leave Adjustment Amount, which will be reflected as a negative amount and will reduce the Purchase Price; (iv) the Withheld Amount; and (v) if applicable, the amount apportioned to any Relevant Excluded Assets under clause 9.3(b)(iii), together with such information as may be reasonably requested by the Buyer to support the relevant calculations, to enable the Buyer to pay the Purchase Price in accordance with clause 3.1. (b) Each amount set out in the Pre-Completion Certificate must represent the Sellers’ genuine and reasonable calculation of the relevant amounts. (c) The Sellers’ Representative and the Buyer agree that, if any party considers an amount set out in the Pre-Completion Certificate to be incorrect, the Sellers’ Representative and the Buyer will work in good faith to agree such amount, and the relevant amount in the Pre- Completion Certificate will be deemed to have been replaced by such agreed amount. If the parties are unable to agree any amount in the Pre-Completion Certificate before the Completion Date, then Completion must occur based on the numbers included by the Sellers’ Representative in the Pre-Completion Certificate, but provided that the Sellers’ Representative and the Buyer expressly acknowledge and agree that: (i) this will not prejudice the Buyer’s right (after Completion) to refer the matter for resolution to an Independent Expert under clause 6.2; (ii) the Independent Expert must determine whether the amount(s) in question have been correctly determined in the Pre- Completion Certificate; and (iii) if the Independent Expert determines that any amount has not been correctly determined in the Pre-Completion Certificate, the Sellers’ Representative and Buyer will take such steps (including making such payments) as are necessary to effect a post- Completion adjustment to the Purchase Price to reflect the determination of the Independent Expert in respect of such amount.

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 24 6.2 Independent Expert to decide and costs (a) If the Sellers and the Buyer cannot agree on the Pre-Completion Certificate within 10 Business Days after the Completion Date, then: (i) either such party may refer the disagreement to an Independent Expert with a request that the Independent Expert make a decision on the disagreement within 30 days; (ii) the parties must procure that the Independent Expert determines the procedures for settlement of the disagreement; and (iii) the parties must appoint the Independent Expert as an expert and not as an arbitrator. (b) The decision of the Independent Expert is conclusive and binding on the parties in the absence of manifest error. (c) The Sellers and the Buyer must each pay one half of the Independent Expert’s costs and expenses in connection with the resolution by the Independent Expert of any disagreement referred to it. 7 Apportionments 7.1 Entitlement to income The Sellers are entitled to all the income, profits, rights and benefits of the Business that accrue in accordance with Accounting Standards before the Calculation Time. The Buyer is entitled to all the income, profits, rights and benefits of the Business that accrue in accordance with Accounting Standards from the Calculation Time. 7.2 Prepaid goods and services To the extent that provision has not been made in the Pre-Completion Certificate, if a Seller has made a prepayment in respect of goods, services or other benefits which are received by the Buyer in respect of the Business after the Calculation Time, the Buyer must pay to the relevant Seller the amount of that prepayment to the extent that it relates to the period after the Calculation Time. 7.3 Apportionment of other outgoings (a) To the extent that provision has not been made in the Pre-Completion Certificate, if the Buyer makes a payment in respect of any expense and outgoing of the Business that is payable in arrears and relates to the conduct of the Business before the Calculation Time, the relevant Seller must pay to the Buyer the amount of that expense or outgoing to the extent it relates to the period before the Calculation Time. For this purpose, any expense or outgoing that relates to the conduct of the Business both before and after the Calculation Time will be apportioned as at the Calculation Time in accordance with Accounting Standards. (b) Clause 7.3(a) does not apply to Book Debts and Trade Payables, the treatment of which is set out in and governed by clause 13.

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 25 7.4 Apportionment of Outgoings All Outgoings must be apportioned between the parties as at the Calculation Time by way of an allowance at the Completion Date, so that: (a) the Sellers must pay all Outgoings relating to the period up to and including the Completion Date; and (b) the Buyer must pay the Outgoings relating to the period after the Completion Date. 7.5 Means of adjustment All Outgoings must be apportioned: (a) in the case of those paid by the Sellers, on the amount actually paid; (b) in the case of those levied but unpaid, on the amount payable disregarding any discount for early payment; (c) in the case of those not levied but where the amount can be ascertained by advice from the relevant rating and taxing authority, on the amount advised by the relevant rating and taxing authority disregarding any discount for early payment; and (d) in the case of those not levied and not ascertainable from the relevant rating and taxing authority and where a separate assessment was issued for the Land for the assessment period immediately before the date of Completion, on the amount payable in that separate assessment disregarding any discount for early payment. 7.6 Statement of adjustments The Sellers must: (a) prepare the statement of adjustments; and (b) provide a 1st draft of the statement of adjustments to the Buyer by no later than 5 Business Days before the Completion Date, and the Buyer and Sellers must use reasonable steps to agree the statement of adjustments no later than 2 Business Days before the Completion Date. 8 Actions before and after Completion 8.1 Conduct of Business Subject to clauses 8.2 and 8.3, until Completion and unless the Buyer otherwise agrees in writing, each Seller agrees to: (a) (ordinary course) carry on the Business in the ordinary course consistent with its usual business practices and policies applied in the 12 months before the date of this document; (b) (capex and opex) pay all capital expenditure and operating expenditure of the Business in the ordinary course of Business, including as is required to construct, maintain, repair or replace the Buildings and/or the Plant and Equipment as determined in the ordinary course of Business;

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 26 (c) (consultation) regularly consult with the Buyer on the manner of conduct of its Business; (d) (Assets) maintain the Business and the Assets; (e) (business relationships) use its reasonable endeavours to preserve the relationship of its Business with suppliers, customers, licensors, licensees, distributors, Employees and other third parties (as applicable); and (f) (Repairs and maintenance) without affecting or limiting clause 8.1(b) carry out repairs and maintenance to the Plant and Equipment and the Buildings in accordance with usual commercial practice and standards of maintenance for the industry. 8.2 Restricted activity Subject to clause 8.1 and unless the Buyer otherwise consents in writing, until Completion, each Seller must not: (a) (corporate actions): (i) revalue any Asset unless required to do so by the Accounting Standards or in the ordinary course of Business; or (ii) amalgamate, merge or consolidate with any other entity or person; (b) (asset disposal) lease, licence or otherwise dispose of any individual asset valued at $50,000 or more, or assets in aggregate valued at $100,000 or more; (c) (asset acquisition) acquire any individual asset valued at $50,000 or more, or assets in aggregate valued at $100,000 or more; (d) (Contracts): (i) vary, terminate or fail to enforce the terms of; or (ii) do anything or omit to do anything which might result in the variation or termination of, or impact the ability to enforce, any Contract, or enter into (or make an offer to enter into) any other contract, work order (or similar), commitment or obligation with a customer of a Seller which is not in the ordinary course of the Business; (e) (leases) lease or hire an item having a value exceeding $50,000; (f) (licences) grant any licence, assignment or other right or interest in respect of the Business Intellectual Property other than in the ordinary course of Business; (g) (creditors): (i) fail to pay any creditor any amount when due for payment; (ii) allow the total amount owing to trade creditors of the Business to exceed the monthly average for the previous 12 months; or

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 27 (iii) enter into, or offer or propose to enter into or effect, any arrangement, compromise or moratorium with any of its creditors (or any class of them); (h) (liability) incur a liability exceeding $50,000, other than in respect of trade creditors incurred in the ordinary course of Business; (i) (salaries) increase the salary or benefits of any Employee, except in relation to any statutory or award increase; (j) (bonuses) grant or agree to grant to any Employee any bonus, retention payment, severance, profit sharing, retirement, deferred compensation, insurance or other compensation or benefit or adopt or establish any new compensation or benefit plans or arrangements; (k) (Information and Records) destroy or otherwise dispose of any Information or Records; (l) (insurance) terminate or permit the early termination or amendment of, or fail to renew on its expiry, any insurance policy in respect of its Business or any of its assets; (m) (Claims and legal proceedings) admit, compromise or settle any Claim or legal proceedings in connection with the Assets that could reasonably be expected to impose an ongoing liability or obligation onto the Buyer or restrict the transferability (or give any person a right to delay, hinder or injunct the transfer) of any Asset; (n) (no Encumbrances) Encumber any of its assets or declare itself the trustee of any asset; (o) (Taxes payable) fail to pay any Taxes when due and payable; and (p) (authorise) authorise or agree to do, or makes any representation or warranty regarding doing, authorising or agreeing to do, any of the matters in clauses 8.2(a) to 8.2(o) (inclusive). 8.3 Permitted conduct Clause 8.2 does not restrict a Seller from: (a) (permitted by Transaction Document) taking any action required or expressly permitted by a Transaction Document; (b) (compliance with law) doing anything required to comply with any law. 8.4 Access to Properties, Buildings, Records and other Assets The Sellers agrees to allow the Buyer and its Representatives access to the Properties, the Buildings, the Records and other Assets on reasonable notice and at all reasonable times before the Completion Date. 8.5 Installation Services Agreement If requested by the Buyer from time to time during the period of 3 years after Completion, Graham William Cleary and the Buyer must use reasonable endeavours to negotiate an agreement under which Graham William Cleary will procure that a Seller Associate constructs or installs new or used rooms within an accommodation village owned or operated by the Buyer (or its Affiliates) within New South Wales or Queensland at cost price (without a margin or mark-up) for the construction services, including project management of the construction

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 28 services, as the Buyer (or its relevant Affiliate) may request from time to time, up to a maximum of 500 rooms. Each such party must act promptly and reasonably in negotiating any such installation services agreement. 8.6 Sirrom Supplier Agreement (Vitrinite) The Sellers must procure that Sirrom agrees (in a form and substance acceptable to the Buyer) to continue the Sirrom Supplier Agreement (Vitrinite) on a month-to-month basis for each calendar month after its expiry on 31 January 2025 until Completion, unless the Buyer otherwise notifies the Sellers’ Representative in writing. 8.7 Access and assistance after Completion After Completion, each party must permit the other party to have access to those books, records and documents (excluding Tax returns of the Sellers and the Buyer) during business hours as the other party reasonably requires, and each party must provide assistance (including copies of relevant documents) reasonably requested by the other party. 8.8 Conduct of Sellers after Completion Each Seller undertakes to the Buyer that it will not take any steps, or procure that any steps are taken, in each case, to wind up or deregister (or commence the winding up or deregistration of) any Seller for a period of 7 years from the Completion Date. 8.9 Maintenance of Records after Completion For 5 years from the Completion Date (or, for Records that the Buyer is obliged by applicable law to maintain, for any shorter period that it is required by applicable law to maintain them): (a) the Buyer must retain the Records delivered to it on Completion; and (b) each Seller must retain the books, records and other documents relating to the Business required to be kept or maintained by the Seller. 8.10 Wrong pockets (a) If the legal title to, or the beneficial interest in, any Asset used by a Seller in the Business immediately before Completion (or which the Buyer otherwise needs to own or control to operate the Business) (each a “Wrong Pocket Asset”) remains vested in a Seller or any Seller Associate after Completion, the applicable Seller must as soon as reasonably practicable and on terms that no additional consideration is provided by any person, including the Buyer, for such transfer: (i) execute, or procure the execution of, any documents as may be necessary for the purpose of transferring (free of any Encumbrance) all right, title and interest in the Wrong Pocket Asset to the Buyer or its nominee; and (ii) do or procure to be done all such further acts or things as necessary for the purpose of vesting all right, title and interest in the Wrong Pocket Asset in the Buyer or its nominee. (b) Each Seller must notify the Buyer as soon as reasonably practicable if it comes to the relevant Seller’s attention that there is any Wrong Pocket Asset.

King & Wood Mallesons 72330758_14 Asset Sale and Purchase Agreement 17 February 2025 29 (c) From the time it comes to a Seller’s attention that there is any Wrong Pocket Asset, that Seller must maintain, or procure the maintenance of, the Wrong Pocket Asset until the date of completion of the transfer of the Wrong Pocket Asset to the Buyer or its nominee. (d) Each Seller must promptly account to the Buyer or its nominee for any benefits it or any of its Seller Associates receives: (i) in connection with any transfer of any Wrong Pocket Asset to the Buyer or its nominee in accordance with clause 8.10(a); and/or (ii) as a result of the holding of any Wrong Pocket Asset for the period from Completion until it is transferred to the Buyer or its nominee. (e) This clause 8.10 does not apply to any Wrong Pocket Asset that cannot legally be transferred to the Buyer or its nominee. 9 Risk and insurance 9.1 Risk The Sellers remains the owners of, and bear all risks in connection with, the Business and the Assets before Completion. Subject to Completion occurring, property in, and the risk in connection with, the Business and the Assets, pass to the Buyer from Completion. 9.2 Insurance Until Completion, the Sellers agree to maintain or, if necessary, take out and maintain with effect from the date of this document, insurance of the Business and the Assets covering such risks and for such amounts as would be maintained in accordance with prudent business practice with a reputable and properly authorised licensed insurer. 9.3 Damage to Assets before Completion (a) Subject to clause 20.4, if any of the Villages (being in each case the Property and the Buildings on that Property) (Relevant Damaged Village) are damaged or otherwise affected before Completion to such a degree that there is a material adverse effect on the value or operation of the Relevant Damaged Village, then the Buyer or the Sellers’ Representative (provided that such damage or affectation is not caused or created by a Seller or Seller Associate or is beyond the reasonable control of a Seller or Seller Associate) may elect, by notice to the other of them given before the Completion Date, to suspend Completion in respect of the whole of the Relevant Damaged Village and any other Assets used exclusively to operate the Business on and from the Relevant Damaged Village (together, the Relevant Excluded Assets). A notice given under this clause 9.3(a) does not affect the parties’ rights and obligations with respect to Completion of the sale and purchase of any Assets other than the Relevant Excluded Assets (Remaining Sale Assets). (b) Subject to clause 9.3(c), if a notice is given under clause 9.3(a), then: (i) the Sellers must (at the Sellers’ cost and expense) use best endeavours to adequately replace or make good the Relevant Damaged Village to the satisfaction of the Buyer as soon as