- CZR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Caesars Entertainment (CZR) PRE 14APreliminary proxy

Filed: 10 Apr 19, 9:50pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

ELDORADO RESORTS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

ELDORADO RESORTS, INC.

100 West Liberty Street, Suite 1150

Reno, Nevada 89501

Dear Stockholder:

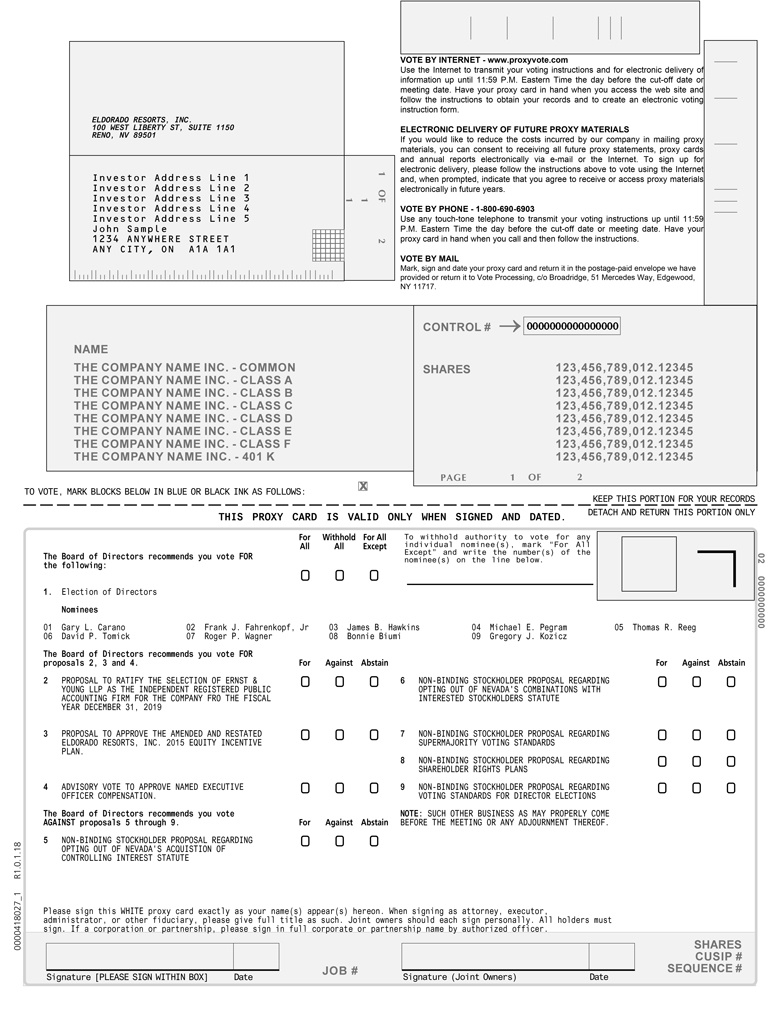

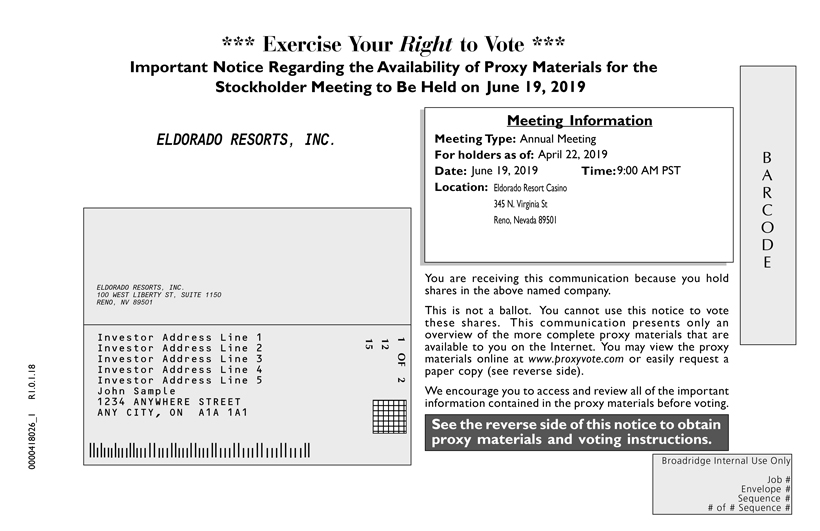

You are cordially invited to attend the Annual Meeting of Stockholders of Eldorado Resorts, Inc. to be held on Wednesday, June 19, 2019 at 9:00 a.m. local time, at the Eldorado Resort Casino, 345 North Virginia Street, Reno, Nevada 89501.

The accompanying Notice of Annual Meeting and Proxy Statement describe the business to be conducted at the meeting. There will be a brief report on the current status of our business.

Whether or not you plan to attend the meeting in person, it is important that your shares be represented and voted. After reading the Notice of Annual Meeting and Proxy Statement, please vote your shares by completing, signing and dating the WHITE proxy card, and return it in the envelope provided.

On behalf of the officers and directors of Eldorado Resorts, Inc., I thank you for your interest in the Company and hope that you will be able to attend our Annual Meeting.

| For the Board of Directors, | ||

| ||

| GARY L. CARANO | ||

| Executive Chairman of the Board of Directors | ||

| April [ ], 2019 | ||

ELDORADO RESORTS, INC.

100 West Liberty Street, Suite 1150

Reno, Nevada 89501

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Eldorado Resorts, Inc. will be held on Wednesday, June 19, 2019 at 9:00 a.m. local time, at the Eldorado Resort Casino, 345 North Virginia Street, Reno, Nevada 89501, for the following purposes:

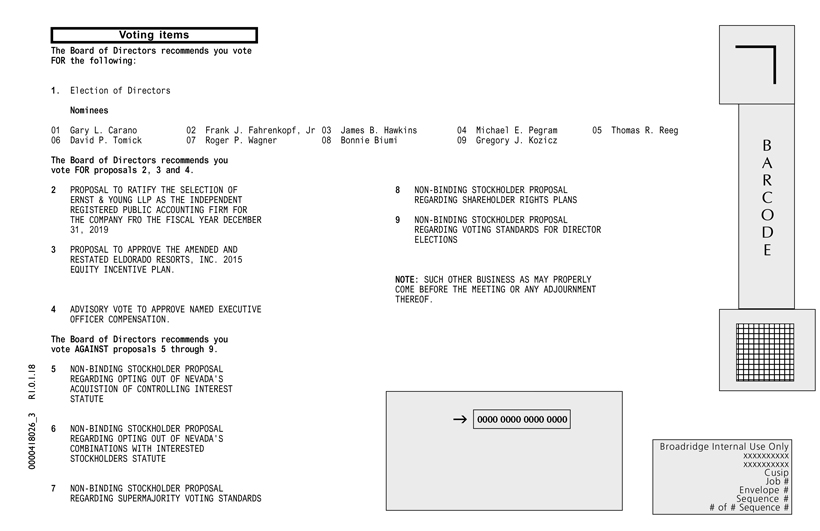

| 1. | To elect the nine (9) director nominees to our Board of Directors, each to serve as directors until the 2020 annual meeting of stockholders, or until the earlier of their resignation or until their respective successors shall have been duly elected and qualified; |

| 2. | To ratify the selection of Ernst & Young LLP as our independent registered public accounting firm; |

| 3. | To approve the Amended and Restated Eldorado Resorts, Inc. 2015 Equity Incentive Plan; |

| 4. | To hold an advisory vote to approve the compensation of our named executive officers; |

| 5. | To consider fivenon-binding stockholder proposals from UNITE HERE, if properly presented at the Annual Meeting (Proposals 5, 6, 7, 8, and 9); and |

| 6. | To transact such other business as may properly be presented at the Annual Meeting or any adjournment or postponement thereof. |

Stockholders entitled to notice of, and to vote at, the meeting will be determined as of the close of business on April 22, 2019, the record date fixed by the Board of Directors for such purposes. A list of these stockholders is available at our corporate offices and will be available at the Annual Meeting.

If you plan to attend the Annual Meeting, please bring photo identification. If your shares are held in the name of a broker or other nominee, please bring with you a letter (and a legal proxy if you wish to vote your shares) from the broker or nominee confirming your ownership as of the record date. For directions to the Annual Meeting, please contact Investor Relations by telephone at775-328-0112 or visit our website at www.eldoradoresorts.com.

| By order of the Board of Directors |

| Edmund L. Quatmann, Jr.,Secretary |

April [ ], 2019

UNITE HERE has filed preliminary proxy materials with the Securities and Exchange Commission seeking shareholder support for Proposals 5, 6, 7, 8, and 9 at the Annual Meeting. As such, you will receive proxy solicitation materials from UNITE HERE, including an opposition proxy statement and blue proxy card. We are not responsible for the accuracy of any information contained in any proxy solicitation materials used by UNITE HERE or any other statements that it may otherwise make. We encourage you to discard and not vote any blue proxy cards that you receive from UNITE HERE.

The Board of Directors does not endorse any of UNITE HERE’s proposals. The Board of Directors also recommends that you disregard any proxy card or solicitation materials that may be sent to you by UNITE HERE. Please note that using UNITE HERE’s blue proxy card to vote on any of the proposals on its proxy card will revoke any proxy you previously submitted. If you have already voted using UNITE HERE’s blue proxy card, you have every right to change your vote by following the instructions on the WHITE proxy card or WHITE voting instruction card you received from your bank, broker, trustee or other nominee, or by completing and submitting the WHITE proxy card provided to you. Only the latest validly executed proxy that you submit will be counted—any proxy may be revoked at any time prior to its exercise at the annual meeting.

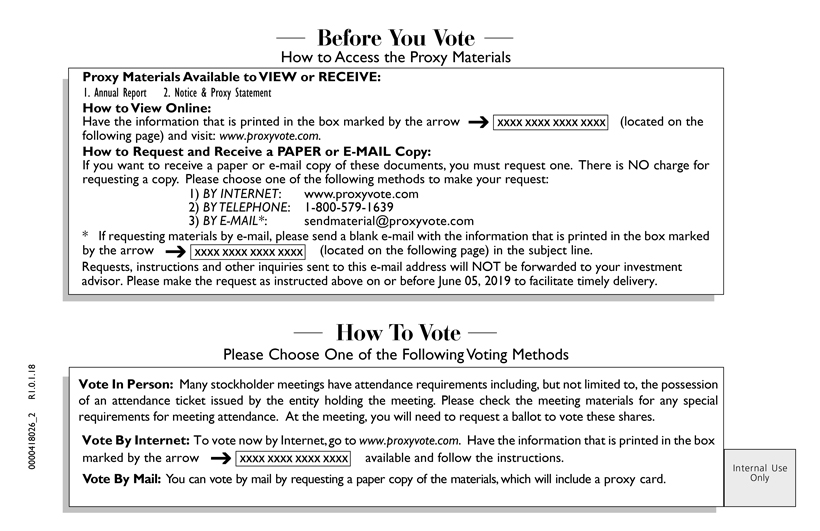

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on June 19, 2019: Our Proxy Statement and Fiscal Year 2018 Annual Report to Stockholders are available at http://www.proxyvote.com.

| 1 | ||||

| 4 | ||||

| 4 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 32 | ||||

| 33 | ||||

Potential Payments upon Termination or Change in Control Table | 34 | |||

| 36 | ||||

PROPOSAL 2 RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 37 | |||

| 38 | ||||

PROPOSAL 3 APPROVAL OF THE ELDORADO RESORTS, INC. AMENDED AND RESTATED 2015 EQUITY INCENTIVE PLAN | 39 | |||

PROPOSAL 4 ADVISORY VOTE TO APPROVE THE COMPENSATION OF NAMED EXECUTIVE OFFICERS | 50 | |||

| 51 | ||||

| 52 | ||||

i

ii

ELDORADO RESORTS, INC.

100 West Liberty Street, Suite 1150

Reno, Nevada 89501

(775) 328-0100

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Eldorado Resorts, Inc. for use at the Annual Meeting of Stockholders to be held on June 19, 2019.

A copy of our annual report with financial statements for the year ended December 31, 2018 is enclosed. This proxy statement and form of proxy are to be first sent to stockholders on or about the date stated on the accompanying Notice of Annual Meeting of Stockholders.

Purpose of Meeting. The purpose of the meeting is to vote on the following proposals:

1. To elect the nine (9) director nominees to our Board of Directors, each to serve as directors until the 2020 annual meeting of stockholders, or until the earlier of their resignation or until their respective successors shall have been duly elected and qualified;

2. To ratify the selection of Ernst & Young LLP as our independent registered public accounting firm;

3. To approve the Amended and Restated Eldorado Resorts, Inc. 2015 Equity Incentive Plan;

4. To hold an advisory vote to approve the compensation of our named executive officers;

5. To consider fivenon-binding stockholder proposals from UNITE HERE, if properly presented at the Annual Meeting (Proposals 5, 6, 7, 8, and 9); and

6. To transact such other business as may properly be presented at the Annual Meeting or any adjournment or postponement thereof.

If You Receive Proxy Cards Sent by UNITE HERE. UNITE HERE has filed preliminary proxy materials with the Securities and Exchange Commission seeking shareholder support for Proposals 5, 6, 7, 8, and 9 at the Annual Meeting. As such, you will receive proxy solicitation materials from UNITE HERE, including an opposition proxy statement and blue proxy card. We are not responsible for the accuracy of any information contained in any proxy solicitation materials used by UNITE HERE or any other statements that it may otherwise make. We encourage you to discard and not vote any blue proxy cards that you receive from UNITE HERE.

The Board of Directors does not endorse any of UNITE HERE’s proposals. The Board of Directors also recommends that you disregard any proxy card or solicitation materials that may be sent to you by UNITE HERE. Please note that using UNITE HERE’s blue proxy card to vote on any of the proposals on its proxy card will revoke any proxy you previously submitted. If you have already voted using UNITE HERE’s blue proxy card, you have every right to change your vote by following the instructions on the WHITE proxy card or WHITE voting instruction card you received from your bank, broker, trustee or other nominee, or by completing and submitting the WHITE proxy card provided to you. Only the latest validly executed proxy that you submit will be counted—any proxy may be revoked at any time prior to its exercise at the annual meeting.

1

Board Recommendations. You are urged to submit the WHITE proxy card provided to you so that your shares can be voted at the Annual Meeting in accordance with your instructions. Our Board of Directors recommends the following votes:

1. FOR each of the director nominees to our Board of Directors;

2. FOR the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm;

3. FOR the approval of the Amended and Restated Eldorado Resorts, Inc. 2015 Equity Incentive Plan;

4. FOR approval of the compensation of our named executive officers; and

5. AGAINST the fivenon-binding stockholder proposals of UNITE HERE (Proposals 5, 6, 7, 8, and 9).

Record Date. Only stockholders of record as of the close of business on April 22, 2019 will be entitled to notice of and to vote at the meeting and any postponement or adjournments thereof. As of April 22, 2019, [ ] shares of our common stock were issued and outstanding. Each share outstanding as of the record date will be entitled to one vote, and stockholders may vote in person or by proxy. Execution of a proxy will not in any way affect a stockholder’s right to attend the meeting and vote in person.

Revocation of Proxies. Any stockholder giving a proxy has the right to revoke it at any time before it is exercised by written notice to the Secretary of Eldorado Resorts, Inc. or by submission of another proxy bearing a later date. In addition, stockholders of record attending the meeting may revoke their proxies at any time before they are exercised. The Board of Directors strongly urges you not to sign or return any proxy card sent to you by UNITE HERE. If you have previously submitted a proxy card sent to you by UNITE HERE, you have the right to revoke that proxy and vote for all matters to be voted on at the Annual Meeting by using the WHITE proxy card provided to you. Only the latest validly executed proxy that you submit will be counted.

Quorum. A majority of the shares of our common stock entitled to vote at the Annual Meeting, represented in person or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting. Shares of our common stock represented in person or by proxy (including shares which abstain, brokernon-votes and shares that are not voted with respect to one or more of the matters presented for stockholder approval) will be counted for purposes of determining whether a quorum is present at the Annual Meeting.

Required Vote. With respect to Proposal 1 (election of directors), stockholders may vote FOR all or some of the nominees or stockholders may vote WITHHOLD with respect to one or more of the nominees. The affirmative vote of the holders of a plurality of the shares represented at the meeting in person or by proxy and entitled to vote thereon is required to elect a director. A vote to WITHHOLD will have the effect of a negative vote.

With respect to Proposal 2 (ratification of Ernst & Young LLP as our independent registered public accounting firm), Proposal 3 (approval of The Amended and Restated Eldorado Resorts, Inc. 2015 Equity Incentive Plan), Proposal 4 (advisory vote to approve the compensation of our named executive officers), Proposal 5(non-binding stockholder proposal regarding opting out of Nevada’s acquisition of controlling interest statute, if properly presented at the Annual Meeting), Proposal 6(non-binding stockholder proposal regarding opting out of Nevada’s combinations with interested stockholders statute, if properly presented at the Annual Meeting), Proposal 7(non-binding stockholder proposal regarding supermajority voting standards, if properly presented at the Annual Meeting), Proposal 8(non-binding stockholder proposal regarding shareholder rights plans, if properly presented at the Annual Meeting), and Proposal 9(non-binding stockholder proposal regarding voting standards for director elections, if properly presented at the Annual Meeting) stockholders may vote FOR, AGAINST or ABSTAIN. Approval of Proposals 2, 3, 4, 5, 6, 7, 8 and 9 requires the affirmative vote of a majority of shares represented at the meeting in person or by proxy and entitled to vote thereon. A vote to ABSTAIN will have the effect of a negative vote.

2

We know of no other matter to be presented at the meeting. If any other matter should be presented at the meeting upon which a vote properly may be taken, then the persons named as proxies will have discretion to vote on those matters according to their best judgment to the same extent as the person signing the proxy would be entitled to vote. At the date of this proxy statement, we do not anticipate that any other matters will be raised at the Annual Meeting.

Broker Non-Votes. A brokernon-vote occurs when a broker or other nominee does not receive voting instructions from the beneficial owner and does not have discretion to direct the voting of the shares.

Brokers have discretionary authority to vote on Proposal 2 (ratification of Ernst & Young LLP as our independent registered public accounting firm), and therefore no brokernon-votes are expected in connection with Proposal 2.

Brokers do not have discretionary authority to vote on Proposal 1 (election of directors), Proposal 3 (approval of the Amended and Restated Eldorado Resorts, Inc. 2015 Equity Incentive Plan), Proposal 4 (non-binding advisory vote to approve the compensation of the Company’s named executive officers), Proposal 5(non-binding stockholder proposal regarding opting out of Nevada’s acquisition of controlling interest statute, if properly presented at the Annual Meeting), Proposal 6(non-binding stockholder proposal regarding opting out of Nevada’s combinations with interested stockholders statute, if properly presented at the Annual Meeting), Proposal 7(non-binding stockholder proposal regarding supermajority voting standards, if properly presented at the Annual Meeting), Proposal 8(non-binding stockholder proposal regarding shareholder rights plans, if properly presented at the Annual Meeting) or Proposal 9(non-binding stockholder proposal regarding voting standards for director elections, if properly presented at the Annual Meeting) and therefore there may be brokernon-votes with respect to Proposals 1, 3, 4, 5, 6, 7, 8 and 9. Brokernon-votes will not affect the outcome of the vote on Proposals 1, 3, 4, 5, 6, 7, 8 and 9 and will not be counted in determining the number of shares necessary for approval of such proposals.

Method and Expenses of Solicitation. We may solicit proxies personally and by telephone or facsimile or other electronic means by our regular employees, without any additional remuneration. The cost of soliciting proxies will be borne by us. We will also make arrangements with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation material to beneficial owners of stock held of record by such persons, and we will reimburse such persons for their reasonableout-of-pocket expenses in forwarding solicitation material.

Copies of Proxy Materials. As permitted by the Securities and Exchange Commission, we are furnishing to stockholders our Notice of Annual Meeting, Proxy Statement, Proxy Card and Annual Report primarily over the internet. On or about April [ ], 2019, we will mail to each of our stockholders (other than those who previously requested electronic or paper delivery) a Notice of Internet Availability of Proxy Materials containing instructions on how to access and review the proxy materials via the internet, and how to access the WHITE Proxy Card to vote on the internet or by telephone. The Notice of Internet Availability of Proxy Materials also contains instructions on how to receive, free of charge, paper copies of the proxy materials. If you received the notice, then you will not receive a paper copy of the proxy materials unless you request one.

Stockholders of Record. If your shares are registered in your own name, you may request paper copies of the proxy materials by following the instructions contained in the notice. Stockholders who have already made a permanent election to receive paper copies of the proxy materials will receive a full set of the proxy documents in the mail.

Beneficial Stockholders. If your shares are not registered in your name, you should receive written instructions on how to request paper copies of the proxy materials from your bank or broker. We recommend that you contact your bank or broker if you do not receive these instructions.

3

Attendance at the Annual Meeting. Attendance at the Annual Meeting will be limited to stockholders as of the record date, their authorized representatives and our guests.

ELECTION OF DIRECTORS

At the Annual Meeting to be held on June 19, 2019, our stockholders are being asked to elect directors, each of whom will serve until the next annual meeting of stockholders or until his or her successor has been elected and qualified, or until his or her earlier resignation or removal. All of the nominees were designated as directors at the last annual meeting of stockholders.

Directors will be elected by the affirmative vote of the holders of a plurality of the shares represented in person or by proxy at the meeting. Stockholders may not vote their shares cumulatively in the election of directors. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Any stockholder submitting a proxy has the right to withhold authority to vote for an individual nominee by writing that nominee’s name in the space provided on the proxy. Shares represented by all proxies received by us and not marked to withhold authority to vote for any individual director or for all directors will be voted FOR the election of all of the nominees named below. If for any reason any nominee is unable to accept the nomination or to serve as a director, an event not currently anticipated, the persons named as proxies reserve the right to exercise their discretionary authority to nominate someone else or to reduce the number of management nominees to such extent as the persons named as proxies may deem advisable.

Gary L. Carano, Bonnie Biumi, Frank J. Fahrenkopf Jr., James B. Hawkins, Gregory J. Kozicz, Michael E. Pegram, Thomas R. Reeg, David P. Tomick and Roger P. Wagner have been nominated to serve as directors by our Board of Directors (“Board”), based upon the recommendation of our Nominating & Governance Committee. Pursuant to the terms of the merger agreement entered into in connection with our merger with Isle of Capri Casinos, Inc. (“Isle” or “Isle of Capri”), we agreed to take all actions necessary to expand the Board from seven directors to nine directors and appoint two members of the board of directors of Isle of Capri mutually agreed upon by us and Isle of Capri to fill the newly created vacancies and to use our reasonable best efforts to cause each such person to bere-elected to the Board at each of our two annual meetings of stockholders occurring after the closing of the merger with Isle of Capri. Ms. Biumi and Mr. Kozicz, who were members of the board of directors of Isle of Capri prior to the consummation of the merger, were appointed to the Board upon consummation of the merger on May 1, 2017.

The following table sets forth certain information regarding the nominees.

Name | Age | Position and Office Held | ||||

Gary L. Carano | 67 | Executive Chairman of the Board | ||||

Bonnie Biumi(1) | 57 | Director | ||||

Frank J. Fahrenkopf(2)(4) | 79 | Director | ||||

James B. Hawkins(1)(3) | 63 | Director | ||||

Gregory J. Kozicz(3) | 57 | Director | ||||

Michael E. Pegram(1)(2)(3) | 67 | Director | ||||

Thomas R. Reeg | 47 | Director; Chief Executive Officer; Chief Financial Officer | ||||

David P. Tomick(1)(4)(5) | 67 | Director | ||||

Roger P. Wagner(3)(4) | 71 | Director | ||||

| (1) | Member of the Audit Committee |

4

| (2) | Member of the Compliance Committee |

| (3) | Member of the Compensation Committee |

| (4) | Member of the Nominating & Governance Committee |

| (5) | Lead Independent Director |

The following briefly describes the business experience and educational background of each nominee for director and details the Board’s reasons for selecting each nominee for service on the Board.

Gary L. Carano, 67, has been Chairman of our Board of Directors since September 2014 and was our Chief Executive Officer from September 2014 until December 31, 2018, when he became Executive Chairman of our Board of Directors. Previously, Mr. Gary L. Carano served as President and Chief Operating Officer of Eldorado Resorts LLC from 2004 to September 2014, and as President and Chief Operating Officer of Eldorado HoldCo LLC from 2009 to September 2014. Mr. Gary L. Carano served as the General Manager and Chief Executive Officer of the Silver Legacy Resort Casino from its opening in 1995 to September 2014. Mr. Gary L. Carano serves on the board of directors of Recreational Enterprises, Inc., a stockholder of the Company. Mr. Gary L. Carano has served on a number of charitable boards and foundations in the state of Nevada. Mr. Gary L. Carano holds a Bachelor’s degree in Business Administration from the University of Nevada, Reno. In May 2012, Silver Legacy filed a voluntary petition for reorganization under Chapter 11 of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the District of Nevada. Silver Legacy emerged from its Chapter 11 reorganization proceedings in November 2012. Mr. Gary L. Carano has been selected to serve as director because of his extensive experience in the gaming and hospitality industry and because of his familiarity with the business of Eldorado Resorts, Inc. Mr. Gary L. Carano is Mr. Anthony L. Carano’s father.

Bonnie Biumi, 57, was a director of Isle of Capri from October 2012 until May 1, 2017, at which time she was appointed to the Board of Directors in accordance with the provisions of the merger agreement with Isle of Capri. Ms. Biumi was President and Chief Financial Officer from 2007 to 2012 of Kerzner International Resorts, a developer, owner and operator of destination resorts, casinos and hotels. Previously, she held senior level financial positions at NCL Corporation, Ltd., Royal Caribbean Cruises, Ltd., Neff Corporation, Peoples Telephone Company, Inc. and Price Waterhouse. Ms. Biumi was a member of the board of directors of Home Properties, Inc., a publicly-traded company, from October 2013 to October 2015, and she is currently a member of the board of directors of Retail Properties of America, Inc., a publicly-traded company, where she serves as a member of the audit committee and chair of the compensation committee. She is a Certified Public Accountant. Ms. Biumi has been selected to serve as a director because of her extensive experience in corporate finance and accounting, investor relations, capital and strategic planning, mergers and acquisitions, as well as her service on the boards of other public companies. Ms. Biumi brings to the Board of Directors important perspectives with respect to leadership, financial and risk management.

Frank J. Fahrenkopf, 79, has served on our Board of Directors since September 2014. He served as President and Chief Executive Officer of the American Gaming Association (“AGA”), an organization that represents the commercialcasino-entertainment industry by addressing federal legislation and regulatory issues, from 1995 until June 2013. At the AGA, Mr. Fahrenkopf was the national advocate for the commercial casino industry and was responsible for positioning the AGA to address regulatory, political and educational issues affecting the gaming industry. Mr. Fahrenkopf is currentlyco-chairman of the Commission on Presidential Debates, which he founded and which conducts debates among presidential candidates. He serves as a board member of the International Republican Institute, which he founded. He also founded the National Endowment for Democracy, where he served as Vice Chairman and a board member from 1983 to 1992. Mr. Fahrenkopf served as chairman of the Republican National Committee from 1983 to 1989. Prior to his role at AGA, Mr. Fahrenkopf was a partner at Hogan & Hartson, where he regularly represented clients before the Nevada gaming regulatory authorities. Mr. Fahrenkopf served as the first Chairman of the American Bar Association Committee on Gaming Law and was a founding Trustee and President of the International Association of Gaming Attorneys. Mr. Fahrenkopf also sits on the board of directors of 12NYSE-listed public companies: First

5

Republic Bank, Gabelli Equity Trust, Inc., Gabelli Utility Trust, Gabelli Global Multimedia Trust, Gabelli Dividend and Income Trust, Gabelli Gold and Natural Resources, Gabelli Small & Midcap Value Fund, Gabelli Goanywhere Trust, Gabelli Natural Resources, Gold & Income Trust, Gabelli NextShares Trust, Bankcroft Fund, and Ellsworth Growth & Income Trust. He is a graduate of the University of Nevada, Reno and holds a Juris Doctor from the University of California Berkeley School of Law. Mr. Fahrenkopf has been selected to serve as a director because of his extensive knowledge of gaming regulatory matters, his relevant legal experience and his experience as a director of many organizations.

James B. Hawkins, 63, has served on our Board of Directors since September 2014. Mr. Hawkins served as Chief Executive Officer and on the board of directors of Natus Medical Incorporated (“Natus”) from April 2004 to July 2018, and as President of Natus from June 2013 to July 2018 and from April 2004 to January 2011. Mr. Hawkins currently serves as a director of OSI Systems, a publicly traded company that develops and markets security and inspection systems, and served as a director of Digirad Corporation, a publicly traded company that provides diagnostic solutions in the science of imaging, from June 2012 until December 2014, and as a director of Iradimed Corporation, a publicly traded company that providesnon-magnetic intravenous infusion pump systems, from 2005 until June 2016. Prior to joining Natus, Mr. Hawkins was President, Chief Executive Officer and on the board of directors of Invivo Corporation, a developer and manufacturer of vital sign monitoring equipment, and its predecessor, from 1985 until 2004, and as Secretary from 1986 until 2004. Mr. Hawkins earned a Bachelor’s degree in Business Commerce from Santa Clara University and an MBA from San Francisco State University. Mr. Hawkins has been selected to serve as a director because of his extensive experience in executive management oversight and as a director of multiple publicly traded companies.

Gregory J. Kozicz,57, was a director Isle of Capri from January 2010 to May 1, 2017, at which time he was appointed to our Board of Directors in accordance with the provisions of the merger agreement with Isle of Capri. Mr. Kozicz is chief executive officer of Alberici Corporation, a St. Louis-based diversified construction, engineering and steel fabrication company. He also served on the Eighth District Real Estate Industry Council of the Federal Reserve Bank of St. Louis from 2006-2016. He has served as president and chief executive officer of Alberici Corporation and Alberici Constructors since 2005 and June 2004, respectively. Prior to his current roles, Kozicz was president of Alberici Constructors Ltd. (Canada). Before joining Alberici in 2001, Kozicz served as a corporate officer and divisional president for Aecon, a publicly-traded construction, engineering and fabrication company. Mr. Kozicz has been selected to serve as a director because he brings extensive experience in the areas of construction, corporate leadership and executive management. Mr. Kozicz has served in various leadership roles and brings important perspectives to the Board of Directors particularly in the area of both private and public companies.

Michael E. Pegram, 67, has served on our Board of Directors since September 2014. Mr. Pegram has been a partner in the Carson Valley Inn in Minden, Nevada since June 2009 and a partner in the Bodines Casino in Carson City, Nevada since January 2007. Mr. Pegram has more than thirty years of experience owning and operatingtwenty-five successful McDonald’s franchises. Mr. Pegram currently serves as a director of, and is the former Chairman of, the Thoroughbred Owners of California and has been the owner of a number of racehorses, including 1998 Kentucky Derby and Preakness Stakes winner,Real Quiet, 2010 Preakness Stakes winner,Lookin at Lucky, 1998 Breeders’ Cup Juvenile Fillies winner and 1999 Kentucky Oaks winner,Silverbulletday, 2001 Dubai World Cup winner,Captain Steve, and the 2007 and 2008 Breeders’ Cup Sprint winner,Midnight Lute. Additionally, Mr. Pegram has served as a director of Skagit State Bancorp since April 1997. Mr. Pegram has been selected to serve as a director because of his extensive experience in the horse racing industry and as an investor, business owner, and director of various companies.

David P. Tomick, 67, has served on our Board of Directors since September 2014. Mr. Tomickco-founded Securus, Inc., a company involved in the GPS monitoring and Personal Emergency Response business, and served as its Chief Financial Officer from 2008 to 2010 and as its Chairman from 2010 to March 2015. From 1997 to 2004 Mr. Tomick was Executive Vice President and Chief Financial Officer of SpectraSite, Inc., aNYSE-listed, wireless tower company. Mr. Tomick was, from 1994 to 1997, the Chief Financial Officer of

6

Masada Security, a company involved in the security monitoring business and, from 1988 to 1994, the VicePresident-Finance of Falcon Cable TV, where he was responsible for debt management, mergers and acquisitions, equity origination and investor relations. Prior to 1988, he managed a team of corporate finance professionals focusing on the communications industry for The First National Bank of Chicago. Mr. Tomick currently serves on the board of directors of Gryppers, Inc., Autocam Medical and First Choice Packaging and has served on the board of directors of the following organizations: Autocam Corporation, NuLink Digital and TransLoc, Inc. Mr. Tomick received his bachelor’s degree from Denison University and a masters of business administration from The Kellogg School of Management at Northwestern University. Mr. Tomick has been selected to serve as a director because of his financial and management expertise and his extensive experience with respect to raising capital, mergers and acquisitions, corporate governance and investor relations.

Roger P. Wagner, 71, has served on our Board of Directors since September 2014 and was a member of the board of directors of MTR Gaming Group, Inc. (“MTR”) from July 2010 to September 2014. Mr. Wagner has over forty years of experience in the gaming and hotel management industry. Mr. Wagner was a founding partner of House Advantage, LLC, a gaming consulting group that focuses on assisting gaming companies in improving market share and bottom line profits. Mr. Wagner served as Chief Operating Officer for Binion Enterprises LLC from 2008 to 2010, assisting Jack Binion in identifying gaming opportunities. From 2005 to 2007, Mr. Wagner served as Chief Operating Officer of Resorts International Holdings. Mr. Wagner served as President of Horseshoe Gaming Holding Corp. from 2001 until its sale in 2004 and as its Senior Vice President and Chief Operating Officer from 1998 to 2001. Prior to joining Horseshoe, Mr. Wagner served as President of the development company for Trump Hotels & Casino Resorts from 1996 to 1998, President and Chief Operating Officer of Trump Castle Casino Resort from 1991 to 1996 and President and Chief Operating Officer of Claridge Casino Hotel from 1983 to 1991. Prior to his employment by Claridge Casino Hotel, he was employed in various capacities by the Edgewater Hotel Casino, Sands Hotel Casino, MGM Grand Casino—Reno, Frontier Hotel Casino and Dunes Hotel Casino. Mr. Wagner holds a Bachelor of Science from the University of Nevada Las Vegas in Hotel Administration. Mr. Wagner has been selected to serve as a director because of his extensive experience in the gaming and hospitality industry and because of his familiarity with the business of MTR.

Thomas R. Reeg, 47, has served on our Board of Directors since September 2014, has served as Chief Financial Officer since March 2016 and became our Chief Executive Officer in January 2019. Mr. Reeg served as our President from September 2014 until December 31, 2018. Mr. Reeg served as a member of the board of managers of Eldorado Resorts LLC from December 2007 to September 2014, as Senior Vice President of Strategic Development for Resorts from January 2011 to September 2014 and a member of the executive committee of Silver Legacy (which is the governing body of Silver Legacy) from August 2011 through August 2014. Mr. Reeg serves on the board of directors of Recreational Enterprises, Inc., a stockholder of the Company. From September 2005 to November 2010, Mr. Reeg was a Senior Managing Director and founding partner of Newport Global Advisors L.P., which was an indirect stockholder of ours. Mr. Reeg was a member of the board of managers of NGA HoldCo, LLC, which was a stockholder of ours, from 2007 through 2011 and served on the board of directors of Autocam Corporation from 2007 to 2010. From 2002 to 2005 Mr. Reeg was a Managing Director and portfolio manager at AIG Global Investment Group (“AIG”), where he was responsible forco-management of thehigh-yield mutual fund portfolios. Prior to his role at AIG, Mr. Reeg was a seniorhigh-yield research analyst covering various sectors, including the casino, lodging and leisure sectors, at Bank One Capital Markets. Mr. Reeg holds a Bachelor of Business Administration in Finance from the University of Notre Dame and is a Chartered Financial Analyst. Mr. Reeg has been selected to serve as a director because of his extensive financial experience and his familiarity with the business of Eldorado Resorts, Inc.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES NAMED ABOVE FOR THEIR ELECTION AS DIRECTORS.

7

For a director to be considered independent, the director must meet the bright line independence standards under the listing standards of The NASDAQ Stock Market, Inc. (“NASDAQ”) and the Board must affirmatively determine that the director has no material relationship with us, directly, or as a partner, stockholder or officer of an organization that has a relationship with us. The Board determines director independence based on an analysis of the independence requirements of the NASDAQ listing standards. In addition, the Board will consider all relevant facts and circumstances in making an independence determination. The Board also considers all commercial, industrial, banking, consulting, legal, accounting, charitable, familial or other business relationships any director may have with us. The Board has determined that the following seven directors satisfy the independence requirements of NASDAQ: Bonnie Biumi, Frank J. Fahrenkopf, James B. Hawkins, Gregory J. Kozicz, Michael E. Pegram, David P. Tomick and Roger P. Wagner.

The Board held seven (7) meetings and acted four (4) times by written consent during the year ended December 31, 2018. Each current director attended at least 75% of the aggregate number of all meetings of the Board of Directors and committees of which he or she was a member (from the time of the appointment to such committee) during such year.

The Audit Committee of the Board of Directors was established by the Board in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to oversee our corporate accounting and financial reporting processes and audits of our financial statements. Our Audit Committee currently consists of Mr. Tomick, as Chair, and Ms. Biumi and Messrs. Hawkins and Pegram, all of whom are independent directors. During the year ended December 31, 2018, the Audit Committee held four (4) meetings. The Audit Committee’s responsibilities are discussed in a written charter adopted by the Board of Directors. The Audit Committee charter is available on our Internet website at ir.eldoradoresorts.com under “Governance—Governance Documents.” Our website and information contained on it or incorporated in it are not intended to be incorporated in this Proxy Statement or our other filings with the Securities and Exchange Commission.

Our Compensation Committee currently consists of Messrs. Wagner, as Chair, Hawkins, Kozicz and Pegram. The Board has determined that each of Messrs. Wagner, Hawkins, Kozicz and Pegram meet the NASDAQ independence requirements. The Compensation Committee’s responsibilities are outlined in a written charter adopted by the Board of Directors. The Compensation Committee charter is available on our Internet website at ir.eldoradoresorts.com under “Governance—Governance Documents.”

The Compensation Committee makes recommendations (and, where appropriate, makes determinations) with respect to salaries, bonuses, restricted stock, and deferred compensation for our executive officers as well as the policies underlying the methods by which we compensate our executives. During the year ended December 31, 2018, the Compensation Committee held four (4) meetings. Except as otherwise delegated by the Board of Directors or the Compensation Committee, the Compensation Committee acts on behalf of the Board with respect to compensation matters. The Compensation Committee may form and delegate authority to subcommittees and may delegate authority to one or more designated Compensation Committee members to perform certain of its duties on its behalf, including, to the extent permitted by applicable law, the delegation to a subcommittee of one director the authority to grant stock options and equity awards. The Compensation Committee reviews the recommendations of our Chief Executive Officer (“CEO”) with respect to individual elements of the total compensation of our executive officers (other than the CEO) and key management.

8

Compensation Policies and Risk Management. It is the responsibility of the Compensation Committee to review our compensation policies and practices in the context of their potential encouragement of excessiverisk-taking behavior. We believe that any risks arising from our current compensation policies and practices are not reasonably likely to have a material adverse effect on us. As described in the section entitled “Compensation Discussion and Analysis” below, we continue to review and develop our compensation policies with the objective of ensuring that management incentives promote disciplined, sustainable achievement of ourlong-term goals.

Nominating and Governance Committee

Our Nominating and Governance Committee currently consists of Messrs. Fahrenkopf, as Chair, Tomick, and Wagner. The Nominating and Governance Committee’s responsibilities are discussed in a written charter adopted by the Board of Directors. The Nominating and Governance Committee charter is available on our Internet website at ir.eldoradoresorts.com under “Governance—Governance Documents.” Our Board of Directors has determined that each of the members of the Nominating and Governance Committee is “independent” within the meaning of the general independence standards in the listing standards of NASDAQ. During the year ended December 31, 2018, the Nominating and Governance Committee held two (2) meetings. The primary purposes and responsibilities of the Nominating and Governance Committee are to (1) identify and vet individuals qualified to become directors, consistent with the criteria approved by our Board of Directors set forth in the Nominating and Governance Committee Charter, (2) nominate qualified individuals for election to the Board of Directors at the next annual meeting of stockholders, and (3) in consultation with the Chairperson of the Board, review the operational relationship of the various committees of the Board as set forth in the Nominating and Governance Committee Charter.

Director Candidate Recommendations and Nominations by Stockholders. The Nominating and Governance Committee’s Charter provides that the Nominating and Governance Committee will consider director candidate nominations by stockholders. In evaluating nominations received from stockholders, the Nominating and Governance Committee will apply the same criteria and follow the same process set forth in the Nominating and Governance Committee Charter as it would with its own nominations.

Nominating and Governance Committee Process for Identifying and Evaluating Director Candidates. The Nominating and Governance Committee identifies and evaluates all director candidates in accordance with the director qualification standards described in the Nominating and Governance Committee Charter. In identifying candidates, the Nominating and Governance Committee has the authority to engage and terminate anythird-party search firm that is used to identify director candidates and has the authority to approve the fees and retention terms of any search firm. The Nominating and Governance Committee evaluates any candidate’s qualifications to serve as a member of our Board based on the totality of the merits of the candidate and not based on minimum qualifications or attributes. In evaluating a candidate, the Nominating and Governance Committee takes into account the background and expertise of individual Board members as well as the background and expertise of our Board as a whole. In addition, the Nominating and Governance Committee evaluates a candidate’s independence and his or her background and expertise in the context of our Board’s needs. The Nominating and Governance Committee Charter requires that the Nominating and Governance Committee ascertain that each nominee has: (i) demonstrated business and industry experience that is relevant to us; (ii) the ability to meet the suitability requirements of all relevant regulatory agencies; (iii) freedom from potential conflicts of interest with us and independence from management with respect to independent director nominees; (iv) the ability to represent the interests of stockholders; (v) the ability to demonstrate a reasonable level of financial literacy; (vi) the availability to work with us and dedicate sufficient time and energy to his or her board duties; (vii) an established reputation for good character, honesty, integrity, prudent business skills, leadership abilities as well as moral and ethical bearing; and (viii) the ability to work constructively with our other directors and management. The Nominating and Governance Committee may also take into consideration whether a candidate’s background and skills meet any specific needs of the Board that the Nominating and Governance Committee has identified and will take into account diversity in professional and personal experience,

9

background, skills, race, gender and other factors of diversity that it considers relevant to the needs of the Board. The Nominating and Governance Committee does not have a formal policy regarding diversity in identifying candidates; however, the Nominating and Governance Committee may consider periodically, at the request of the Board, the desired composition of the Board, including such factors as expertise and diversity.

As a publicly traded corporation registered with and licensed by multiple regulatory bodies and as required by the Nevada Gaming Commission and the Mississippi Gaming Commission, we maintain a Compliance Committee which implements and administers our Compliance Plan. The Compliance Committee’s duties include investigating key employees, vendors of goods and services, sources of financing, consultants, lobbyists and others who wish to do substantial business with us or our subsidiaries and making recommendations to our management concerning suitability. Our Compliance Committee currently includes independent directors Messrs. Fahrenkopf and Pegram, andnon-director members A.J. “Bud” Hicks (who serves as the chairperson and an independent member of the Committee), Anthony L. Carano, Stephanie Lepori and Jeffrey Hendricks (who serves as the Compliance Officer). Mr. Edmund L. Quatmann, Jr. also serves as anex-officio member of the Committee. The Compliance Committee held four (4) meetings in 2018.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee is, or during 2018 was, or has previously been, an officer or employee of us or our subsidiaries. During 2018, no member of the Compensation Committee had any direct or indirect material interest in a transaction or a business relationship with us that would require disclosure under the rules of the SEC relating to disclosure of related party transactions. In 2018, none of our executive officers served on the board of directors or compensation committee of any entity that had one or more of its executive officers serving on our Board or the Compensation Committee.

Stockholders may communicate with the Board of Directors by sending written correspondence to the Chairman of the Nominating and Governance Committee at the following address: Eldorado Resorts, Inc., 100 West Liberty St., Suite 1150, Reno, NV 89501, Attention: Corporate Secretary. The Chairman of the Nominating and Governance Committee and his or her duly authorized representatives shall be responsible for collecting and organizing stockholder communications. Absent a conflict of interest, the Corporate Secretary is responsible for evaluating the materiality of each stockholder communication and determining whether further distribution is appropriate, and, if so, whether to (i) the full Board, (ii) one or more Board members and/or (iii) other individuals or entities.

Board Leadership Structure and Risk Oversight

Effective January 1, 2019, Mr. Gary L. Carano became Executive Chairman of the Board of Directors, Mr. Reeg became our Chief Executive Officer and Mr. Anthony L. Carano became our President and Chief Operating Officer. In these roles, Messrs. Reeg and Anthony L. Carano have general charge and management of our affairs, property and business, while Mr. Gary L. Carano provides independent oversight of senior management and Board matters and serves as a valuable bridge between our Board of Directors and our management. In addition, the Executive Chairman provides guidance to the Chief Executive Officer, sets the agenda of the Board of Directors in consultation with the Chief Executive Officer and Lead Independent Director and presides over meetings of stockholders and the Board.

Mr. Tomick is our Lead Independent Director. He has, in addition to the powers and authorities of any member of the Board of Directors, the power and authority to chair executive sessions and to work closely with the Executive Chairman in determining the appropriate schedule for the Board of Directors meetings and

10

assessing the quality, quantity and timeliness of information provided from our management to the Board of Directors. The Lead Independent Director position is at all times held by a director who is “independent” as defined in Nasdaq Rule 5605(a)(2).

The Board believes that this leadership structure is appropriate at this time. Although the roles of Chief Executive Officer and Chairman of the Board are currently separate, the Board does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board, as the Board believes it is in our best interests and the best interests of our stockholders to make that determination based on the position and direction of our company and the composition of the Board. We believe this structure facilitates independent oversight of management while fostering effective communication between our management and the Board.

Our senior management is responsible for theday-to-day assessment and management of our risks, and our Board is responsible for oversight of our enterprise risk management in general. The risks facing us include risks associated with our financial condition, liquidity, operating performance, ability to meet our debt and master lease obligations and regulations applicable to our operations and compliance therewith. The Board’s oversight is primarily managed and coordinated through Board committees. Our Audit Committee oversees risk management with respect to our significant financial and accounting policies as well as the effectiveness of management’s processes that monitor and manage key business risks, and the Compliance Committee is responsible for overseeing risks associated with our gaming activities and regulatory compliance. Additionally, the Compensation Committee oversees risks related to compensation policies. The Audit, Compensation and Compliance Committees report their findings to the full Board. In addition, at its meetings, the Board discusses risks that we face, including those management has highlighted as the most relevant risks. Furthermore, the Board’s oversight of enterprise risk involves assessment of the risk inherent in ourlong-term strategies, as well as other matters brought to the attention of the Board. We believe that the structure and experience of our Board allows our directors to provide effective oversight of risk management. The Board recognizes that it is our responsibility and the responsibility of our management to identify and attempt to mitigate risks that could cause significant damage to our business or stockholder value.

Audit Committee Financial Expert

The Securities and Exchange Commission adopted a rule requiring disclosure concerning the presence of at least one “audit committee financial expert” on audit committees. Our Board has determined that each of Ms. Biumi and Messrs. Hawkins and Tomick qualify as an “audit committee financial expert” as defined by the Securities and Exchange Commission and that each of them is independent, as independence for Audit Committee members is defined pursuant to the applicable NASDAQ listing requirements.

We have adopted a code of ethics and business conduct applicable to all directors and employees, including the chief executive officer, chief financial officer and principal accounting officer. The code of ethics and business conduct is posted on our website, ir.eldoradoresorts.com under “Governance—Governance Documents” and a printed copy will be delivered on request by writing to the Corporate Secretary at Eldorado Resorts, Inc., c/o Corporate Secretary, 100 West Liberty Street, Suite 1150, Reno, Nevada, 89501. We intend to satisfy the disclosure requirement regarding certain amendments to, or waivers from, provisions of our code of ethics and business conduct by posting such information on our website.

11

Stock Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of April 8, 2019, the ownership of the presently issued and outstanding shares of our common stock by persons known by us to be a beneficial owner of 5% or more of such stock, and the ownership of such stock by our named executive officers and directors, individually and as a group. Unless otherwise indicated, the address for each of the stockholders listed below is c/o 100 West Liberty Street, Suite 1150, Reno, Nevada, 89501.

Name | Amount and Nature of Beneficial Ownership | Percentage of Class | ||||||

Recreational Enterprises, Inc.(1) | 11,129,867 | 14.37 | % | |||||

FMR LLC (2) | 10,440,015 | 13.48 | % | |||||

BlackRock, Inc.(3) | 7,447,282 | 9.62 | % | |||||

The Vanguard Group, LLC(4) | 5,439,819 | 7.03 | % | |||||

Gary L. Carano(5) | 381,525 | * | ||||||

Bonnie Biumi(6) | 18,917 | * | ||||||

Frank J. Fahrenkopf(7) | 43,137 | * | ||||||

James B. Hawkins(8) | 113,137 | * | ||||||

Gregory J. Kozicz(9) | 12,445 | * | ||||||

Michael E. Pegram(10) | 104,834 | * | ||||||

Thomas R. Reeg(11) | 199,374 | * | ||||||

David P. Tomick(10)(13) | 55,937 | * | ||||||

Roger P. Wagner | 134,305 | * | ||||||

Anthony L. Carano(12) | 52,496 | * | ||||||

Edmund L. Quatmann, Jr.(14) | 109,035 | * | ||||||

All Board Members and Executive Officers as a Group(15) | 1,225,142 | 1.58 | % | |||||

| * | Indicates less than one percent. |

| (1) | The voting stock of Recreational Enterprises, Inc. (“REI”) is beneficially owned by the following members of the Carano family in the following percentages: The Donald L. Carano Trust—49.5%; Gary L. Carano—10.1%; Gene R. Carano—10.1%; Gregg R. Carano—10.1%; Cindy L. Carano—10.1% and Glenn T. Carano—10.1%. The voting power and dispositive power with respect to REI’s interest in us is controlled by REI’s board of directors that is elected by the family members (voting in proportion to the percentages above). Gary L. Carano holds his interest in REI directly and indirectly through various trusts. In addition, Gary L. Carano and Thomas R. Reeg are members of the board of directors of REI. Mr. Gary L. Carano and Mr. Reeg do not have voting or dispositive power with respect to the shares of common stock held by REI and disclaim beneficial ownership of such shares of common stock. The address of REI is P.O. Box 2540, Reno, Nevada 89505. |

| (2) | Information regarding the number of shares beneficially owned is included herein in reliance on Schedule 13G/A as filed with the Securities and Exchange Commission on February 13, 2019. The address of FMR LLC is 245 Summer Street, Boston, Massachusetts 02210. |

| (3) | Information regarding the number of shares beneficially owned is included herein in reliance on Schedule 13G/A as filed with the Securities and Exchange Commission on February 7, 2019. The address of BlackRock, Inc. is 55 East 52nd Street, New York, New York 10055. |

| (4) | Information regarding the number of shares beneficially owned is included herein in reliance on Schedule 13G as filed with the Securities and Exchange Commission on February 11, 2019. The address of The Vanguard Group, LLC is 100 Vanguard Blvd, Malvern, PA 19355. |

| (5) | Represents shares of our common stock owned directly by Mr. Gary L. Carano and indirectly by Mr. Gary L. Carano through the Gary L. Carano S Corporation Trust. In addition to the shares of our common stock reported in the table above, Gary L. Carano holds a 10.1% ownership interest in, and is a |

12

| member of the board of directors of, REI. He does not hold voting power or dispositive power with respect to REI’s 11,129,867 shares of our common stock and he disclaims beneficial ownership of REI’s 11,129,867 shares of our common stock except to the extent of any pecuniary interest therein. |

| (6) | Includes 4,612 deferred RSUs that are acquirable within 60 days. |

| (7) | Consists of 43,137 deferred RSUs that are acquirable within 60 days. |

| (8) | Includes 43,137 deferred RSUs that are acquirable within 60 days. |

| (9) | Includes 8,917 deferred RSUs that are acquirable within 60 days. |

| (10) | Includes 38,525 deferred RSUs that are acquirable within 60 days. |

| (11) | Includes 60,894 shares of common stock that are subject to a pledge arrangement. |

| (12) | Includes 20,479 shares of common stock that are subject to a pledge arrangement. |

| (13) | Includes 4,700 shares owned by Mr. Tomick’s wife and 700 shares owned by Mr. Tomick’s son who lives with him. |

| (14) | Includes 22,520 shares issuable upon the exercise of stock options that are exercisable within 60 days. |

| (15) | Includes 176,853 deferred RSUs that are acquirable within 60 days and 22,520 shares issuable upon the exercise of stock options that are exercisable within 60 days. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, executive officers, and the persons who beneficially own more than ten percent of the shares of our common stock, to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Copies of all filed reports are required to be furnished to us. Based solely on the reports received by us and on the representations of the reporting persons, we believe that these persons have complied with all applicable filing requirements during the years ended December 31, 2018 and 2017, except that the following forms were filed late: (a) (i) one Form 4 for Ms. Biumi reporting one transaction, (ii) three Form 4s for Mr. Anthony Carano each reporting one transaction, (iii) three Form 4s for Mr. Reeg each reporting one transaction, (iv) three Form 4s for Ms. Lepori each reporting one transaction, (v) one Form 4 for Mr. Fahrenkopf reporting one transaction, (vi) one Form 4 for Mr. Hawkins reporting one transaction, (vii) one Form 4 for Mr. Pegram reporting one transaction, (viii) one Form 4 for Mr. Tomick reporting one transaction, (ix) one Form 4 for Mr. Wagner reporting one transaction and (x) two Form 4s for Mr. Gary Carano each reporting one transaction, all of which related to equity-based awards, and (b) one Form 3 for Mr. Gene Carano reporting his initial insider status. We are enhancing our controls and procedures to ensure timely compliance.

The Compensation Committee is responsible for reviewing director compensation and making relevant recommendations to the Board. In connection with reviewing and making recommendations with respect to director compensation, the Compensation Committee considers the reports and recommendations provided by Aon, the Compensation Committee’s independent compensation consultant and concluded that our current director compensation structure is reasonable and appropriate. During 2018, ournon-employee directors each received a cash retainer of $60,000 and restricted stock unit awards having a fair value of $150,000. In addition, each committee member, except for the Board committee chairs, is entitled to the following annual cash retainer: Audit Committee: $15,000; Compensation Committee: $10,000; Nominating and Governance Committee: $7,500; Compliance Committee: $7,500. Each Board committee chair is entitled to the following annual retainer: Audit Committee Chair: $25,000; Compensation Committee Chair: $20,000; Nominating and Governance Committee Chair: $15,000. The Lead Independent Director is also entitled to a $25,000 annual cash retainer. The Compliance Committee Chair is a Board representative who is not entitled to compensation. We also reimburse our directors for reasonable expenses incurred in attending meetings.

13

The following table sets forth the compensation of ournon-employee directors for compensation earned in 2018. Directors who are also our employees do not receive compensation (other than their compensation as our employees) for their services on the Board.

Director Compensation 2018 Name | Fees earned($) | Stock awards ($)(1)(2) | Total ($) | |||||||||

| (a) | (b) | (c) | (h) | |||||||||

Bonnie Biumi | 75,000 | 150,000 | 225,000 | |||||||||

Frank J. Fahrenkopf Jr. | 82,500 | 150,000 | 232,500 | |||||||||

James B. Hawkins | 85,000 | 150,000 | 235,000 | |||||||||

Gregory J. Kozicz | 70,000 | 150,000 | 220,000 | |||||||||

Michael E. Pegram | 92,500 | 150,000 | 242,500 | |||||||||

David P. Tomick | 117,500 | 150,000 | 267,500 | |||||||||

Roger P. Wagner | 87,500 | 150,000 | 237,500 | |||||||||

| (1) | Amounts shown represent the grant date fair value of stock awards calculated in accordance withASC 718-Compensation-Stock Compensation (“ASC 718”). During 2018, 4,612 restricted stock units were issued to eachnon-employee director. |

| (2) | As of December 31, 2018, eachnon-employee director, other than Ms. Biumi and Mr. Kozicz who each held 4,612 RSUs, held an aggregate of 38,832 RSUs. |

Transactions with Related Persons

Leased property. We own the entire parcel on which Eldorado Reno is located, except for approximately 30,000 square feet which is leased from C. S. & Y. Associates, which is an entity partially owned by REI, which is owned by members of the Carano family, including Gary L. Carano, and various trusts of which members of the Carano family are beneficiaries. In addition, each of Gary L. Carano and Thomas R. Reeg serve as members of the board of directors of REI. The lease expires on June 30, 2027. Rent pursuant to the lease amounted to $600,000 in 2018.

Compensation Paid to Related Parties. For the period beginning January 1, 2018 to March 31, 2019, family members who are related to Gary L. Carano and Thomas R. Reeg, or are associated with REI, were paid compensation in connection with their positions as follows:

Name | Relationship | Position | Entity | Cash & Other Compensation ($)(1) | 2018 RSUs($)(2) | 2019 RSUs($)(3) | Total ($) | |||||||||||||||

Cindy Carano | Sister of Gary L. Carano | Executive Director of Community Relations | Silver Legacy, Eldorado Reno and Circus Circus Reno | 167,923 | — | — | 167,923 | |||||||||||||||

Gene Carano | Brother of Gary L. Carano | Senior Vice President of Regional Operations; Mr. Gene Carano retired July 1, 2018 | Eldorado Resorts, Inc. | 905,919 | 391,400 | — | 1,297,319 | |||||||||||||||

Glenn Carano | Brother of Gary L. Carano | Senior Vice President of Regional Operations | Eldorado Resorts, Inc. | 964,905 | 367,200 | 374,549 | 1,706,654 | |||||||||||||||

Gregg Carano | Brother of Gary L. Carano | Senior Vice President - Food & Beverage | Eldorado Resorts, Inc. | 452,892 | 330,480 | 45,853 | 829,225 | |||||||||||||||

William Reeg | Brother of Thomas R. Reeg | Vice President of Operations | Eldorado Resorts, Inc. | 255,459 | 81,805 | 117,479 | 454,743 | |||||||||||||||

| (1) | Includes base salary, bonus amounts paid in respect of 2018, 401(k) matching contributions, certain perquisites and, in the case of Gene Carano, severance in connection with his retirement. |

14

| (2) | Represents aggregate grant date fair value of performance andtime-based RSUs granted January 26, 2018 at $32.52 per share at 100% target. Mr. William Reeg’s performance andtime-based RSUs were granted May 7, 2018 at $39.24 per share at 100% target. |

| (3) | Represents aggregate grant date fair value of performance andtime-based RSUs granted January 25, 2019 at $40.65 per share at 100% target. |

Following the end of 2018, two individuals who will qualify as related parties commenced employment with us. Nina Carano, the daughter of Mr. Gary L. Carano, joined us as our Director of Corporate Advertising and has an annual base salary of $165,000, with a cash bonus opportunity equal to 20% of such amount, and received an award of restricted stock units with a grant date value of $75,000. Shawn Clancy, thebrother-in-law of Mr. Reeg, joined us as our Chief Development Officer and has an annual base salary of $275,000, with a cash bonus opportunity equal to 40% of such amount, a long-term incentive opportunity equal to 50% of such amount, and received an award of restricted stock units with a grant date value of $100,000.

Approval of Related Party Transactions

Our Code of Ethics and Business Conduct (the “Code”) requires that any proposed transaction between us and a related party, or in which a related party would have a direct or indirect material interest, be promptly disclosed to our Compliance Committee. The Compliance Committee is required to disclose such proposed transactions promptly to our Audit Committee.

Our Audit Committee Charter requires our Audit Committee to review and approve all of our related party transactions. Any director having an interest in the transaction is not permitted to vote on such transaction. The Audit Committee will determine whether or not to approve any such transaction on acase-by-case basis and in accordance with the provisions of the Audit Committee Charter and the Code, including the standards set forth in the Conflicts of Interest Policy contained in the Code. Under the Code, a “related party” is any of the following:

| • | an executive officer; |

| • | a director (or director nominee); |

| • | an immediate family member of any executive officer or director (or director nominee); |

| • | a beneficial owner of five percent or more of any class of our voting securities; |

| • | an entity in which one of the above described persons has a substantial ownership interest or control of such entity; or |

| • | any other person or entity that would be deemed to be a related person under Item 404 of SECRegulation S-K or applicable NASDAQ rules and regulations. |

Fiscal year 2018 was a year of expansion, integration and transition for our Company. During 2018, we acquired Elgin Riverboat Resort – Riverboat Casino d/b/a Grand Victoria Casino (“Grand Victoria”) and Tropicana Entertainment, Inc. (“Tropicana Entertainment”). As of the date hereof, we own and/or operate 26 properties across 12 states. As discussed in the sections that follow below, a number of our compensation decisions in respect of 2018 reflect the expansion of our organization as a result of the acquisitions of Grand Victoria and Tropicana Entertainment, as well as the leadership efforts exhibited by each of the named executive officers (also referred to herein as “NEOs”) during this period.

2018 BUSINESS REVIEW

The Tropicana Entertainment and Grand Victoria acquisitions added 8 properties across 7 new markets to the ERI portfolio. As a result of the acquisitions (including the 2017 Isle acquisition), in aggregate, Eldorado’s

15

properties feature approximately 28,000 slot machines and video lottery terminals (VLTs) and approximately 775 table games, and over 12,500 hotel rooms resulting in an incremental $575.5 million increase in net revenues in 2018.

Compensation Discussion & Analysis

In this Compensation Discussion and Analysis (“CD&A”), we describe the material components of our executive pay programs for our named executive officers for 2018.

This CD&A provides an overview and explanation of:

| • | our compensation programs and policies for certain of our named executive officers identified below; |

| • | the compensation decisions made by the Compensation Committee under those programs and policies; and |

| • | the material factors that the Compensation Committee considered in making those decisions. |

For 2018, our NEOs and the titles they held as of the last day of 2018 are as follows:

| • | Gary L. Carano,Chief Executive Officer and Chairman of the Board |

| • | Thomas R. Reeg,President and Chief Financial Officer and member of the Board |

| • | Anthony L. Carano,Executive Vice President and Chief Operating Officer |

| • | Edmund L. Quatmann, Jr.,Executive Vice President and Chief Legal Officer |

On September 25, 2018, the Board approved a new executive management structure. These changes were made in order to better leverage the roles, skills and experience of our executive management team. Effective January 1, 2019, Mr. Gary L. Carano became Executive Chairman of the Board of Directors, Mr. Reeg became Chief Executive Officer and Mr. Anthony L. Carano became President and Chief Operating Officer. On February 1, 2019, we entered into an employment agreement with Bret Yunker to serve as our Chief Financial Officer. Mr. Yunker’s employment with us will begin on a mutually agreeable date not later than May 2, 2019.

The following briefly describes the business experience and educational background for Anthony L. Carano and Edmund L. Quatmann, Jr. The biographies of Gary L. Carano and Thomas R. Reeg are provided under the section titled “Nominees for Director.”

Anthony L. Carano, 37, became our Executive Vice President, General Counsel and Secretary in September 2014, Executive Vice President of Operations in August 2016, Executive Vice President and Chief Operating Officer in May 2017 and President and Chief Operating Officer in January 2019. Prior to joining us, Mr. Anthony L. Carano was an attorney at the Nevada law firm of McDonald Carano Wilson, LLP, where his practice was devoted primarily to transactional, gaming and regulatory law. Mr. Anthony L. Carano holds a B.A. from the University of Nevada, his J.D. from the University of San Francisco, School of Law and his M.B.A. in Finance from the University of San Francisco, School of Business. Anthony L. Carano is Gary L. Carano’s son.

Edmund L. Quatmann, Jr., 48, became our Executive Vice President, Chief Legal Officer and Secretary in May 2017. Prior to joining us, Mr. Quatmann served as the Chief Legal Officer and Secretary for Isle of Capri Casinos, Inc. from July 2008 until our merger with Isle of Capri in May 2017. Mr. Quatmann holds a B.S. from Purdue University and a J.D. from St. Louis University School of Law.

2018 Advisory Vote on Executive Compensation(“Say-on-Pay”)

The Compensation Committee and our Board considered the results of the advisory,non-binding stockholder vote to approve executive compensation presented at our 2018 Annual Meeting, where over 98% of

16

votes cast approved the compensation program described in our proxy statement for the 2018 Annual Meeting. We currently hold suchsay-on-pay votes on an annual basis. The Compensation Committee takes seriously its role in the governance of our compensation programs and values thoughtful input from our stockholders, and may consider the results of futuresay-on-pay votes in connection with making future compensation-related decisions to the extent it deems it appropriate to do so. Any changes made to our executive compensation programs for 2018 were based on the Compensation Committee’s ongoing review and assessment of such programs and were not made solely as a result of the 2018say-on-pay vote.

Key Features of Our Executive Compensation Program

| What We Do | What We Don’t Do | |||||

| ✓ | Set stock ownership guidelines for NEOs and directors | × | Nochange-in-control severance multiple in excess of three times annual base salary and target annual bonus | |||

| ✓ | Set maximum payout limit on our annual incentive plan andlong-term incentive plan awards | × | No excise taxgross-ups upon achange-in-control | |||

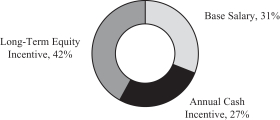

| ✓ | For 2018, emphasize pay for performance, with 57% of our Chief Executive Officer’s total pay opportunity being performance-based “at risk” compensation and an average of 31% being performance-based “at risk” compensation for our other NEOs | ×

× | Nore-pricing or cash buyout of underwater stock options or SARs is allowed

No enhanced retirement benefits for named executive officers | |||

| ✓ | Have an executive compensation clawback policy that allows us to recover certain incentive compensation paid to executives in certain circumstances | |||||

Our Compensation Strategy

Our executive compensation program is designed to attract, motivate and retain critical executive talent, and to motivate actions that drive profitable growth and enhancelong-term value for our stockholders. This program includes base salary andperformance-based incentives (including bothcash-based andequity-based incentives) and is designed to be flexible, market competitive, reward achievement of difficult but fair performance criteria, and enhance stock ownership at the executive level. Our philosophy is that clear, distinct and attainable goals should be established in order to enable the assessment of performance by the Compensation Committee.

Pursuant to that philosophy, the Compensation Committee is guided by the general principles that compensation should be designed to:

| • | enhance stockholder value by focusing our executives’ efforts on the specific performance metrics that drive enterprise value; |

| • | attract, motivate, and retainhighly-qualified executives committed to ourlong-term success; |

| • | assure that our executives receive reasonable compensation opportunities relative to their peers at similar companies, and actual compensation payouts that are aligned with our performance; and |

| • | align critical decision making with our business strategy and goal setting. |

17

The following table summarizes key elements of our 2018 executive compensation program:

Element | Primary Purpose | Key Characteristics | ||||||

Base Salary

|  |

To compensate the executive fairly for his/her day-to-day responsibilities |  |

Fixed compensation component. Reviewed annually. | ||||

Annual Cash Bonus

|  |

To motivate and reward organizational and individual achievement of annual strategic financial and individual objectives. |  |

Variable compensation component based on Adjusted EBITDA. | ||||

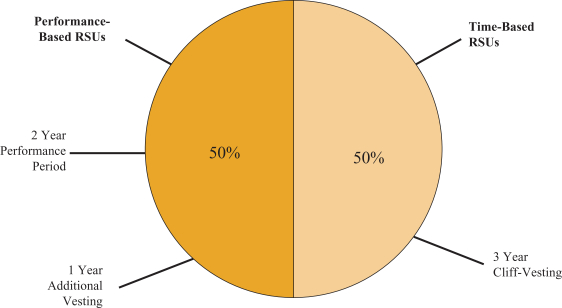

Long-Term Incentives

|  |

To align executives with stockholder interests, and to reinforce long-term stockholder value creation. |  |

Variable compensation component. Combination of 50% performance-based RSUs and 50% time-based RSUs. | ||||

Perquisites and Other

|  |

To provide business-related benefits, where appropriate. |  |

Fixed compensation component. | ||||

Change-in-Control Protection

|  |

To bridge employment if employment is terminated following a change-in-control of the Company and act as an effective retention tool. |  |

Fixed compensation component; Only paid in the event the executive’s employment is terminated following a change-in-control of the Company. | ||||

Severance Protection

|  |

To bridge future employment if employment is terminated other than “for cause” and act as an effective retention tool. |  |

Fixed compensation component; only paid in connection with certain involuntary terminations of employment. |

18

Role of the Compensation Committee

The Compensation Committee’s primary role is to discharge the Board’s responsibilities regarding compensation decisions as they relate to our executive officers. The Compensation Committee consists of independent directors and is responsible to our Board for the oversight of our executive compensation programs. Among its duties, the Compensation Committee is responsible for:

| • | reviewing and assessing competitive market data from the Compensation Committee’s independent compensation consultant; |

| • | reviewing and, in certain cases, approving incentive goals/objectives and compensation recommendations for directors and executive officers, including the named executive officers; |

| • | evaluating the competitiveness of each executive officer’s total compensation package; |

| • | approving any changes to the total compensation package, including, but not limited to, base salary, annual incentives,long-term incentive award opportunities and payouts, and retention programs; and |

| • | ensuring our policies and practices relating to compensation do not encourage excessiverisk-taking conduct. |

Following review and discussion, the Compensation Committee may submit recommendations to the Board for approval. The Compensation Committee is supported in its work by the Chief Financial Officer and his staff (with respect to the establishment of performance metrics), and Aon, its independent compensation consultant.

Role of the Independent Compensation Consultant