UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ | |

Filed by a Party other than the Registrant ☐ | |

Check the appropriate box: | |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a‑12 |

ELDORADO RESORTS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): | ||

☒ | No fee required.

| |

☐ | Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0‑11. | |

| (1) | Title of each class of securities to which transaction applies:

|

| (2) | Aggregate number of securities to which transaction applies:

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| (4) | Proposed maximum aggregate value of transaction:

|

| (5) | Total fee paid:

|

☐ | Fee paid previously with preliminary materials.

| |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid:

|

| (2) | Form, Schedule or Registration Statement No.:

|

| (3) | Filing Party:

|

| (4) | Date Filed:

|

100 West Liberty Street, Suite 1150

Reno, Nevada 89501

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Eldorado Resorts, Inc. to be held on Wednesday, June 14, 2017 at 9:00 a.m. local time, at the Eldorado Resort Casino, 345 North Virginia Street, Reno, Nevada 89501.

The accompanying Notice of Annual Meeting and Proxy Statement describe the business to be conducted at the meeting. There will be a brief report on the current status of our business.

Whether or not you plan to attend the meeting in person, it is important that your shares be represented and voted. After reading the Notice of Annual Meeting and Proxy Statement, please complete, sign and date your proxy ballot, and return it in the envelope provided.

On behalf of the officers and directors of Eldorado Resorts, Inc., I thank you for your interest in the Company and hope that you will be able to attend our Annual Meeting.

| For the Board of Directors, |

|

|

| GARY L. CARANO |

| Chairman of the Board of Directors |

May 1, 2017 |

|

100 West Liberty Street, Suite 1150

Reno, Nevada 89501

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Eldorado Resorts, Inc. will be held on Wednesday, June 14, 2017 at 9:00 a.m. local time, at the Eldorado Resort Casino, 345 North Virginia Street, Reno, Nevada 89501, for the following purposes:

| 1. | To elect the nine (9) director nominees of the Board of Directors of the Company, each to serve as directors of the Company until the 2018 annual meeting of stockholders, or until the earlier of their resignation or until their respective successors shall have been duly elected and qualified; |

| 2. | To ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm; |

| 3. | To hold an advisory vote to approve the compensation of the Company’s named executive officers; and |

| 4. | To transact such other business as may properly be presented at the Annual Meeting or any adjournment or postponement thereof. |

Stockholders entitled to notice of, and to vote at, the meeting will be determined as of the close of business on April 20, 2017, the record date fixed by the Board of Directors for such purposes. A list of these stockholders is available at the corporate offices of the Company and will be available at the Annual Meeting.

If you plan to attend the Annual Meeting, please bring photo identification. If your shares are held in the name of a broker or other nominee, please bring with you a letter (and a legal proxy if you wish to vote your shares) from the broker or nominee confirming your ownership as of the record date. For directions to the Annual Meeting, please contact Investor Relations by telephone at 775‑328‑0112 or visit our website at www.eldoradoresorts.com.

| By order of the Board of Directors |

|

|

| Anthony L. Carano, Secretary |

May 1, 2017

Please sign the enclosed proxy and return it promptly in the enclosed envelope.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on June 14, 2017: The Company’s Proxy Statement and Fiscal Year 2016 Annual Report to Stockholders are available at http://www.proxyvote.com.

| 1 | |

| 2 | |

| 3 | |

| 6 | |

| 7 | |

| 7 | |

| 7 | |

| 8 | |

| 8 | |

| 9 | |

| 9 | |

| 9 | |

| 9 | |

| 10 | |

| 11 | |

| 11 | |

| 12 | |

| 14 | |

| 14 | |

| 17 | |

| 17 | |

| 18 | |

| 18 | |

| 18 | |

| 22 | |

| 22 | |

| 23 | |

| 24 | |

| 24 | |

| 25 | |

| 26 | |

| 28 | |

| 29 | |

| 29 | |

Potential Payments upon Termination or Change in Control Table |

| 30 |

PROPOSAL 2 RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| 32 |

| 33 | |

PROPOSAL 3 ADVISORY VOTE ON THE COMPENSATION OF NAMED EXECUTIVE OFFICERS |

| 34 |

| 35 | |

| 35 | |

| 35 | |

| 35 |

i

100 West Liberty Street, Suite 1150

Reno, Nevada 89501

(775) 328‑0100

INTRODUCTION

This Proxy Statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors of Eldorado Resorts, Inc. (the “Company”) for use at the Annual Meeting of Stockholders to be held on June 14, 2017.

A copy of the Company’s annual report with financial statements for the year ended December 31, 2016 is enclosed. This proxy statement and form of proxy are to be first sent to stockholders on or about the date stated on the accompanying Notice of Annual Meeting of Stockholders.

Record Date. Only stockholders of record as of the close of business on April 20, 2017 will be entitled to notice of and to vote at the meeting and any postponement or adjournments thereof. As of April 20, 2017, 47,205,284 shares of the Company’s common stock (“Common Stock”) were issued and outstanding. Each share outstanding as of the record date will be entitled to one vote, and stockholders may vote in person or by proxy. Execution of a proxy will not in any way affect a stockholder’s right to attend the meeting and vote in person.

Revocation of Proxies. Any stockholder giving a proxy has the right to revoke it at any time before it is exercised by written notice to the Secretary of the Company or by submission of another proxy bearing a later date. In addition, stockholders of record attending the meeting may revoke their proxies at any time before they are exercised.

Quorum. A majority of the shares of Common Stock entitled to vote at the Annual Meeting, represented in person or by proxy (and in no event less than 331/3 percent of the outstanding shares of Common Stock), will constitute a quorum for the transaction of business at the Annual Meeting. Shares of Common Stock represented in person or by proxy (including shares which abstain, broker non‑votes and shares that are not voted with respect to one or more of the matters presented for stockholder approval) will be counted for purposes of determining whether a quorum is present at the Annual Meeting.

Required Vote. With respect to Proposal 1 (election of directors), stockholders may vote FOR all or some of the nominees or stockholders may vote WITHHOLD with respect to one or more of the nominees. The affirmative vote of the holders of a plurality of the shares represented at the meeting in person or by proxy and entitled to vote thereon is required to elect a director. A vote to WITHHOLD will have the effect of a negative vote.

With respect to Proposal 2 (ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm), and Proposal 3 (advisory vote to approve named executive officer compensation), stockholders may vote FOR, AGAINST or ABSTAIN. Approval of Proposals 2 and 3 requires the affirmative vote of a majority of shares represented at the meeting in person or by proxy and entitled to vote thereon. A vote to ABSTAIN will have the effect of a negative vote.

The Company knows of no other matter to be presented at the meeting. If any other matter should be presented at the meeting upon which a vote properly may be taken, then the persons named as proxies will have discretion to vote on those matters according to their best judgment to the same extent as the person signing the proxy would be entitled to vote. At the date of this proxy statement, we do not anticipate that any other matters will be raised at the Annual Meeting.

Broker Non‑Votes. A broker non‑vote occurs when a broker or other nominee does not receive voting instructions from the beneficial owner and does not have discretion to direct the voting of the shares.

Brokers have discretionary authority to vote on Proposal 2 (ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm), and therefore no broker non‑votes are expected in connection with Proposal 2.

1

Brokers do not have discretionary authority to vote on Proposal 1 (election of directors) or Proposal 3 (advisory vote to approve named executive officer compensation) and therefore there may be broker non‑votes with respect to Proposals 1 and 3. Broker non‑votes will not affect the outcome of the vote on Proposals 1 and 3 and will not be counted in determining the number of shares necessary for approval of such proposals.

Method and Expenses of Solicitation. Proxies may also be solicited personally and by telephone or facsimile or other electronic means by regular employees of the Company, without any additional remuneration. The cost of soliciting proxies will be borne by the Company. The Company will also make arrangements with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation material to beneficial owners of stock held of record by such persons, and the Company will reimburse such persons for their reasonable out‑of‑pocket expenses in forwarding solicitation material.

Copies of Proxy Materials. As permitted by the Securities and Exchange Commission (the “SEC”), we are furnishing to stockholders our Notice of Annual Meeting, Proxy Statement, Proxy Card and Annual Report primarily over the internet. On or about May 1, 2017, we will mail to each of our stockholders (other than those who previously requested electronic or paper delivery) a Notice of Internet Availability of Proxy Materials containing instructions on how to access and review the proxy materials via the internet, and how to access the Proxy Card to vote on the internet or by telephone. The Notice of Internet Availability of Proxy Materials also contains instructions on how to receive, free of charge, paper copies of the proxy materials. If you received the notice, then you will not receive a paper copy of the proxy materials unless you request one.

Stockholders of Record. If your shares are registered in your own name, you may request paper copies of the proxy materials by following the instructions contained in the notice. Stockholders who have already made a permanent election to receive paper copies of the proxy materials will receive a full set of the proxy documents in the mail.

Beneficial Stockholders. If your shares are not registered in your name, you should receive written instructions on how to request paper copies of the proxy materials from your bank or broker. We recommend that you contact your bank or broker if you do not receive these instructions.

Attendance at the Annual Meeting. Attendance at the Annual Meeting will be limited to stockholders as of the record date, their authorized representatives and guests of the Company.

ELECTION OF DIRECTORS

At the Annual Meeting to be held on June 14, 2017, our stockholders are being asked to elect directors, each of whom will serve until the next annual meeting of stockholders or until his successor has been elected and qualified, or until his earlier resignation or removal. All of the nominees were designated as directors at the last annual meeting of stockholders.

Directors will be elected by the affirmative vote of the holders of a plurality of the shares represented in person or by proxy at the meeting. Stockholders may not vote their shares cumulatively in the election of directors. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Any stockholder submitting a proxy has the right to withhold authority to vote for an individual nominee to the Board by writing that nominee’s name in the space provided on the proxy. Shares represented by all proxies received by the Company and not marked to withhold authority to vote for any individual director or for all directors will be voted FOR the election of all of the nominees named below. If for any reason any nominee is unable to accept the nomination or to serve as a director, an event not currently anticipated, the persons named as proxies reserve the right to exercise their discretionary authority to nominate someone else or to reduce the number of management nominees to such extent as the persons named as proxies may deem advisable.

2

Gary L. Carano, Frank J. Fahrenkopf Jr., James B. Hawkins, Michael E. Pegram, Thomas R. Reeg, David P. Tomick, Roger P. Wagner, Bonnie Biumi and Gregory J. Kozicz have been nominated by the Company’s Board of Directors, based upon the recommendation of the Company’s Nominating & Governance Committee to serve as directors. Each of the nominees for director currently serves as a director of the Company. Pursuant to the terms of the merger agreement (the “Merger Agreement”) entered into in connection with the merger (the “Isle Merger”) of the Company and Isle of Capri Casinos, Inc. (“Isle” or “Isle of Capri”), the Company agreed to take all actions necessary to expand the Board from seven directors to nine directors and appoint two members of the board of directors of Isle of Capri mutually agreed upon by the Company and Isle of Capri to fill the newly created vacancies and to use its reasonable best efforts to cause each such person to be re-elected to the Board at each of the two annual meetings of stockholders of the Company occurring after the closing of the Isle Merger. In accordance with the terms of the Merger Agreement, Ms. Biumi and Mr. Kozicz, who were members of the board of directors of Isle of Capri prior to the consummation of the Isle Merger, were appointed to the Board upon consummation of the Isle Merger on May 1, 2017.

The following table sets forth certain information regarding the nominees.

Name |

| Age |

|

| Position and Office Held | |

Gary L. Carano |

|

| 65 |

|

| Chairman of the Board; Chief Executive Officer |

Frank J. Fahrenkopf Jr.(2)(4) |

|

| 77 |

|

| Director |

James B. Hawkins(1)(3) |

|

| 61 |

|

| Director |

Michael E. Pegram(1)(2)(3) |

|

| 65 |

|

| Director |

Thomas R. Reeg(5) |

|

| 45 |

|

| Director; President; Chief Financial Officer |

David P. Tomick(1)(4)(6) |

|

| 65 |

|

| Director |

Roger P. Wagner(3)(4) |

|

| 69 |

|

| Director |

Bonnie Biumi |

|

| 55 |

|

| Director |

Gregory J. Kozicz |

|

| 55 |

|

| Director |

(1) | Member of the Audit Committee |

(2) | Member of the Compliance Committee |

(3) | Member of the Compensation Committee |

(4) | Member of the Nominating & Governance Committee |

(5) | Robert M. Jones retired as Chief Financial Officer effective March 15, 2016. The Board of Directors appointed Mr. Reeg to serve as Chief Financial Officer beginning on March 16, 2016. |

(6) | Lead Independent Director. |

The following briefly describes the business experience and educational background of each nominee for director and details the Board’s reasons for selecting each nominee for service on the Board.

Gary L. Carano, 65, has served as the chairman of the board of directors of the Company and the Chief Executive Officer of the Company and its subsidiaries since September 2014. Previously, Mr. Carano served as President and Chief Operating Officer of Eldorado Resorts LLC (“Resorts”) from 2004 to September 2014, and as President and Chief Operating Officer of Eldorado HoldCo LLC (“Holdco”) from 2009 to September 2014. Mr. Carano served as the General Manager and Chief Executive Officer of the Silver Legacy Resort Casino (“Silver Legacy”) from its opening in 1995 to September 2014. Mr. Carano has served on a number of charitable boards and foundations in the state of Nevada. Mr. Carano holds a Bachelor’s degree in Business Administration from the University of Nevada, Reno. In May 2012, Silver Legacy filed a voluntary petition for reorganization under Chapter 11 of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the District of Nevada. Silver Legacy emerged from its Chapter 11 reorganization proceedings in November 2012. Mr. Carano has been selected to serve as director because of his extensive experience in the gaming and hospitality industry and because of his familiarity with the business of Resorts. Gary L. Carano is Anthony L. Carano’s father.

3

Frank J. Fahrenkopf, Jr., 77, has served as a director of the Company since September 2014. Mr. Fahrenkopf serves as the chair of the Nominating and Governance Committee of the board of directors of the Company and a member of the Compliance Committee of the Company. He served as President and Chief Executive Officer of the American Gaming Association (“AGA”), an organization that represents the commercial casino‑entertainment industry by addressing federal legislation and regulatory issues, from 1995 until June 2013. At the AGA, Mr. Fahrenkopf was the national advocate for the commercial casino industry and was responsible for positioning the AGA to address regulatory, political and educational issues affecting the gaming industry. Mr. Fahrenkopf is currently co‑chairman of the Commission on Presidential Debates, which he founded and which conducts debates among presidential candidates. He serves as a board member of the International Republican Institute, which he founded. He also founded the National Endowment for Democracy, where he served as Vice Chairman and a board member from 1983 to 1992. Mr. Fahrenkopf served as chairman of the Republican National Committee from 1983 to 1989. Prior to his role at AGA, Mr. Fahrenkopf was a partner at Hogan & Hartson, where he regularly represented clients before the Nevada gaming regulatory authorities. Mr. Fahrenkopf served as the first Chairman of the American Bar Association Committee on Gaming Law and was a founding Trustee and President of the International Association of Gaming Attorneys. Mr. Fahrenkopf also sits on the board of directors of six NYSE‑listed public companies: First Republic Bank, Gabelli Equity Trust, Inc., Gabelli Utility Trust, Gabelli Global Multimedia Trust, Gabelli Dividend and Income Trust, and Gabelli Gold and Natural Resources. He is a graduate of the University of Nevada, Reno and holds a Juris Doctor from the University of California Berkeley School of Law. Mr. Fahrenkopf has been selected to serve as a director because of his extensive knowledge of gaming regulatory matters, his relevant legal experience and his experience as a director of many organizations.

James B. Hawkins, 61, has served as a director of the Company since September 2014. Mr. Hawkins is a member of the Audit Committee and Compensation Committee of the board of directors of the Company. Mr. Hawkins has served as Chief Executive Officer and on the board of directors of Natus Medical Inc. (“Natus”) since April 2004 and as President of Natus since June 2013. He also previously served as President of Natus from April 2004 to January 2011. Mr. Hawkins currently serves as the chairman of the board of directors of Iradimed Corporation, a publicly traded company that provides non‑magnetic intravenous infusion pump systems and as a director of OSI Systems, a publicly traded company that develops and markets security and inspection systems and previously served as a director of Digirad Corporation, a publicly traded company that provides diagnostic solutions in the science of imaging from June 2012 until December 2014. Prior to joining Natus, Mr. Hawkins was President, Chief Executive Officer and on the board of directors of Invivo Corporation, a developer and manufacturer of vital sign monitoring equipment, and its predecessor, from 1985 until 2004, and as Secretary from 1986 until 2004. Mr. Hawkins earned a Bachelor’s degree in Business Commerce from Santa Clara University and an MBA from San Francisco State University. Mr. Hawkins has been selected to serve as a director because of his extensive experience in executive management oversight and as a director of multiple publicly traded companies.

Michael E. Pegram, 65, has served as a director of the Company since September 2014. Mr. Pegram is a member of the Audit Committee, Compensation Committee and Compliance Committee of the board of directors of the Company. Mr. Pegram has been a partner in the Carson Valley Inn in Minden, Nevada since June 2009 and a partner in the Bodines Casino in Carson City, Nevada since January 2007. Mr. Pegram has more than thirty years of experience owning and operating twenty‑five successful McDonald’s franchises. Mr. Pegram currently serves as Chairman of the Thoroughbred Owners of California and has been the owner of a number of racehorses, including 1998 Kentucky Derby and Preakness Stakes winner, Real Quiet, 2010 Preakness Stakes winner, Lookin at Lucky, 1998 Breeders’ Cup Juvenile Fillies winner and 1999 Kentucky Oaks winner, Silverbulletday, 2001 Dubai World Cup winner, Captain Steve, and the 2007 and 2008 Breeders’ Cup Sprint winner, Midnight Lute. Additionally, Mr. Pegram has served as a director of Skagit State Bancorp since 1996. Mr. Pegram has been selected to serve as a director because of his extensive experience in the horse racing industry and as an investor, business owner, and director of various companies.

4

David P. Tomick, 65, has served as a director of the Company since September 2014. Mr. Tomick is the Lead Independent Director, chair of the Audit Committee and a member of the Nominating and Governance Committee of the board of directors of the Company. Mr. Tomick co‑founded Securus, Inc., a company involved in the GPS monitoring and Personal Emergency Response business, and served as its Chief Financial Officer from 2008 to 2010 and as its Chairman from 2010 to March 2015. From 1997 to 2004 Mr. Tomick was Executive Vice President and Chief Financial Officer of SpectraSite, Inc., a NYSE‑listed, wireless tower company. Mr. Tomick was, from 1994 to 1997, the Chief Financial Officer of Masada Security, a company involved in the security monitoring business and, from 1988 to 1994, the Vice President‑Finance of Falcon Cable TV, where he was responsible for debt management, mergers and acquisitions, equity origination and investor relations. Prior to 1988, he managed a team of corporate finance professionals focusing on the communications industry for The First National Bank of Chicago. Mr. Tomick has served on the board of directors of the following organizations: Autocam Corporation, Autocam Medical, First Choice Packaging, NuLink Digital and TransLoc, Inc. Mr. Tomick received his bachelor’s degree from Denison University and a masters of business administration from The Kellogg School of Management at Northwestern University. Mr. Tomick has been selected to serve as a director because of his financial and management expertise and his extensive experience with respect to raising capital, mergers and acquisitions, corporate governance and investor relations.

Roger P. Wagner, 69, has served as a director of the Company since September 2014 and was a member of the board of directors of MTR Gaming Group, Inc. (“MTR”) from July 2010 to September 2014. Mr. Wagner is the chair of the Compensation Committee and a member of the Nominating and Governance Committee of the board of directors of the Company. Mr. Wagner has over forty years of experience in the gaming and hotel management industry. Mr. Wagner was a founding partner of House Advantage, LLC, a gaming consulting group that focuses on assisting gaming companies in improving market share and bottom line profits. Mr. Wagner served as Chief Operating Officer for Binion Enterprises LLC from 2008 to 2010, assisting Jack Binion in identifying gaming opportunities. From 2005 to 2007, Mr. Wagner served as Chief Operating Officer of Resorts International Holdings. Mr. Wagner served as President of Horseshoe Gaming Holding Corp. from 2001 until its sale in 2004 and as its Senior Vice President and Chief Operating Officer from 1998 to 2001. Prior to joining Horseshoe, Mr. Wagner served as President of the development company for Trump Hotels & Casino Resorts from 1996 to 1998, President and Chief Operating Officer of Trump Castle Casino Resort from 1991 to 1996 and President and Chief Operating Officer of Claridge Casino Hotel from 1983 to 1991. Prior to his employment by Claridge Casino Hotel, he was employed in various capacities by the Edgewater Hotel Casino, Sands Hotel Casino, MGM Grand Casino—Reno, Frontier Hotel Casino and Dunes Hotel Casino. Mr. Wagner holds a Bachelor of Science from the University of Nevada Las Vegas in Hotel Administration. Mr. Wagner has been selected to serve as a director because of his extensive experience in the gaming and hospitality industry and because of his familiarity with the business of MTR.

Thomas R. Reeg, 45, has served as a director of the Company since September 2014 and served as a member of Eldorado Resorts LLC’s (“Resorts”) board of managers from December 2007 to September 2014. Mr. Reeg was named Chief Financial Officer of the Company and its subsidiaries in March 2016 in addition to serving as President of the Company and its subsidiaries since September 2014 and served as Senior Vice President of Strategic Development for Resorts from January 2011 to September 2014. From September 2005 to November 2010, Mr. Reeg was a Senior Managing Director and founding partner of Newport Global Advisors L.P., which is an indirect stockholder of the Company. Mr. Reeg was a member of the executive committee of Silver Legacy (which is the governing body of Silver Legacy) from August 2011 through August 2014. Mr. Reeg was a member of the board of managers of NGA HoldCo, LLC, which is a stockholder of the Company, from 2007 through 2011 and served on the board of directors of Autocam Corporation from 2007 to 2010. From 2002 to 2005 Mr. Reeg was a Managing Director and portfolio manager at AIG Global Investment Group (“AIG”), where he was responsible for co‑management of the high‑yield mutual fund portfolios. Prior to his role at AIG, Mr. Reeg was a senior high‑yield research analyst covering various sectors, including the casino, lodging and leisure sectors, at Bank One Capital Markets. Mr. Reeg holds a Bachelor of Business Administration in Finance from the University of Notre Dame and is a Chartered Financial Analyst. Mr. Reeg has been selected to serve as a director because of his extensive financial experience and his familiarity with the business of Resorts.

5

Bonnie Biumi, 55, was a director of Isle of Capri from October 2012 until May 1, 2017, at which time she was appointed to the Board of Directors of the Company in accordance with the provisions of the Merger Agreement. Ms. Biumi was President and Chief Financial Officer from 2007 to 2012 of Kerzner International Resorts, a developer, owner and operator of destination resorts, casinos and hotels. Previously, she held senior level financial positions at NCL Corporation, Ltd., Royal Caribbean Cruises, Ltd., Neff Corporation, Peoples Telephone Company, Inc. and Price Waterhouse. Ms. Biumi was a member of the board of directors of Home Properties, Inc., a publicly-traded company, from October 2013 to October 2015 and she is currently a member of the board of directors of Retail Properties of America, Inc., a publicly-traded company, where she serves as a member of the audit and compensation committees. She is a Certified Public Accountant. Ms. Biumi has been selected to serve as a director because of her extensive experience in corporate finance and accounting, investor relations, capital and strategic planning, mergers and acquisitions, as well as her service on the boards of other public companies. Ms. Biumi brings to the Board of Directors important perspectives with respect to leadership, financial and risk management. Pursuant to the terms of the Merger Agreement, the Company agreed to take all actions necessary to expand the Board from seven directors to nine directors and appoint two members of the board of directors of Isle of Capri mutually agreed upon by the Company and Isle of Capri to fill the newly created vacancies and to use its reasonable best efforts to cause each such person to be re-elected to the Board at each of the two annual meetings of stockholders of the Company occurring after the closing of the Isle Merger. Pursuant to such agreement, Ms. Biumi was appointed to the Board upon consummation of the Isle Merger and has been proposed for election at the Annual Meeting.

Gregory J. Kozicz, 55, was a director Isle of Capri from January 2010 to May 1, 2017, at which time he was appointed to the Board of Directors of the Company in accordance with the provisions of the Merger Agreement. Mr. Kozicz is president and chief executive officer of Alberici Corporation, a St. Louis-based diversified construction, engineering and steel fabrication company, and Alberici Constructors Inc., a wholly-owned subsidiary of Alberici Corporation. He also served on the Eighth District Real Estate Industry Council of the Federal Reserve Bank of St. Louis from 2006-2016. He has served as president and chief executive officer of Alberici Corporation and Alberici Constructors since 2005 and June 2004, respectively. Prior to his current roles, Kozicz was president of Alberici Constructors Ltd. (Canada). Before joining Alberici in 2001, Kozicz served as a corporate officer and divisional president for Aecon, a publicly-traded construction, engineering and fabrication company. Mr. Kozicz has been selected to serve as a director because he brings extensive experience in the areas of construction, corporate leadership and executive management. Mr. Kozicz has served in various leadership roles and brings important perspectives to the Board of Directors particularly in the area of both private and public companies. Pursuant to the terms of the Merger Agreement, the Company agreed to take all actions necessary to expand the Board from seven directors to nine directors and appoint two members of the board of directors of Isle of Capri mutually agreed upon by the Company and Isle of Capri to fill the newly created vacancies and to use its reasonable best efforts to cause each such person to be re-elected to the Board at each of the two annual meetings of stockholders of the Company occurring after the closing of the Isle Merger. Pursuant to such agreement, Mr. Kozicz was appointed to the Board upon consummation of the Isle Merger and has been proposed for election at the Annual Meeting.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES NAMED ABOVE FOR THEIR ELECTION AS DIRECTORS.

For a director to be considered independent, the director must meet the bright line independence standards under the listing standards of The NASDAQ Stock Market, Inc. (“NASDAQ”) and the Board must affirmatively determine that the director has no material relationship with us, directly, or as a partner, stockholder or officer of an organization that has a relationship with us. The Board determines director independence based on an analysis of the independence requirements of the NASDAQ listing standards. In addition, the Board will consider all relevant facts and circumstances in making an independence determination. The Board also considers all commercial, industrial, banking, consulting, legal, accounting, charitable, familial or other business relationships any director may have with us. The Board has determined that the following seven directors satisfy the independence requirements of NASDAQ: Frank J. Fahrenkopf Jr., James B. Hawkins, Michael E. Pegram, David P. Tomick, Roger P. Wagner, Bonnie Biumi, Gregory J. Kozicz.

The Board held ten (10) meetings and acted six (6) times by written consent during the fiscal year ended December 31, 2016. Each current director attended at least 75% of the aggregate number of all meetings of the Board of Directors and committees of which he was a member (from the time of the appointment to such committee) during such year. Ms. Biumi and Mr. Kozicz have not yet been appointed to committees.

6

The Audit Committee of the Board of Directors was established by the Board in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to oversee the Company’s corporate accounting and financial reporting processes and audits of its financial statements. Messrs. Hawkins, Pegram, and Tomick, all of whom are independent directors, make up the Board’s Audit Committee. Mr. Tomick is Chairperson of the Audit Committee. During the fiscal year ended December 31, 2016, the Audit Committee held four (4) meetings. The Audit Committee’s responsibilities are discussed in a written charter adopted by the Board of Directors. The Audit Committee charter is available on our Internet website at ir.eldoradoresorts.com under “Governance—Governance Documents.” Our website and information contained on it or incorporated in it are not intended to be incorporated in this Proxy Statement or our other filings with the Securities and Exchange Commission.

Messrs. Hawkins, Pegram, and Wagner, all of whom are independent directors, make up the Board’s Compensation Committee (and meet the NASDAQ independence requirements with respect to Compensation Committee members). Mr. Wagner serves as Chairperson of the Compensation Committee. The Compensation Committee’s responsibilities are discussed in a written charter adopted by the Board of Directors. The Compensation Committee charter is available on our Internet website at ir.eldoradoresorts.com under “Governance—Governance Documents.” The Compensation Committee makes recommendations with respect to salaries, bonuses, restricted stock, and deferred compensation for the Company’s executive officers as well as the policies underlying the methods by which the Company compensates its executives. During the fiscal year ended December 31, 2016, the Compensation Committee held three (3) meetings. Except as otherwise delegated by the Board of Directors or the Compensation Committee, the Compensation Committee acts on behalf of the Board with respect to compensation matters. The Compensation Committee may form and delegate authority to subcommittees and may delegate authority to one or more designated Committee members to perform certain of its duties on its behalf, including, to the extent permitted by applicable law, the delegation to a subcommittee of one director the authority to grant stock options and equity awards. The Compensation Committee reviews the recommendations of the Company’s CEO with respect to individual elements of the total compensation of the Company’s executive officers (other than the CEO) and key management.

Compensation Policies and Risk Management. It is the responsibility of the Compensation Committee to review the Company’s compensation policies and practices in the context of their potential encouragement of excessive risk‑taking behavior. The Company believes that any risks arising from its current compensation policies and practices are not reasonably likely to have a material adverse effect on the Company. As described in the section entitled “Compensation Discussion and Analysis” below, the Company continues to review and develop its compensation policies with the objective of ensuring that management incentives promote disciplined, sustainable achievement of the Company’s long‑term goals.

Nominating and Governance Committee

The Nominating and Governance Committee of the Company currently includes independent directors Messrs. Fahrenkopf Jr., Tomick, and Wagner, with Mr. Fahrenkopf Jr. as Chairperson. The Nominating and Governance Committee’s responsibilities are discussed in a written charter adopted by the Board of Directors. The Nominating and Governance Committee charter is available on our Internet website at ir.eldoradoresorts.com under “Governance—Governance Documents.” Our Board of Directors has determined that each of the members of the Nominating and Governance Committee is “independent” within the meaning of the general independence standards in the listing standards of NASDAQ. During the fiscal year ended December 31, 2016, the Nominating and Governance Committee held three (3) meetings. The primary purposes and responsibilities of the Nominating and Governance Committee are to (1) identify and vet individuals qualified to become directors, consistent with the criteria approved by our Board of Directors set forth in the Nominating and Governance Committee Charter, (2) nominate qualified individuals for election to the Board of Directors at the next annual meeting of stockholders, and (3) in consultation with the Chairperson of the Board, review the operational relationship of the various committees of the Board as set forth in the Nominating and Governance Committee Charter.

Director Candidate Recommendations and Nominations by Stockholders. The Nominating and Governance Committee’s Charter provides that the Nominating and Governance Committee will consider director candidate nominations by stockholders. In evaluating nominations received from stockholders, the Nominating and Governance Committee will apply the same criteria and follow the same process set forth in the Nominating and Governance Committee Charter as it would with its own nominations.

7

Nominating and Governance Committee Process for Identifying and Evaluating Director Candidates. The Nominating and Governance Committee identifies and evaluates all director candidates in accordance with the director qualification standards described in the Nominating and Governance Committee Charter. In identifying candidates, the Nominating and Governance Committee has the authority to engage and terminate any third‑party search firm that is used to identify director candidates and has the authority to approve the fees and retention terms of any search firm. The Nominating and Governance Committee evaluates any candidate’s qualifications to serve as a member of our Board based on the totality of the merits of the candidate and not based on minimum qualifications or attributes. In evaluating a candidate, the Nominating and Governance Committee takes into account the background and expertise of individual Board members as well as the background and expertise of our Board as a whole. In addition, the Nominating and Governance Committee evaluates a candidate’s independence and his or her background and expertise in the context of our Board’s needs. The Nominating and Governance Committee Charter requires that the Nominating and Governance Committee ascertain that each nominee has: (i) demonstrated business and industry experience that is relevant to the Company; (ii) the ability to meet the suitability requirements of all relevant regulatory agencies; (iii) freedom from potential conflicts of interest with the Company and independence from management with respect to independent director nominees; (iv) the ability to represent the interests of stockholders; (v) the ability to demonstrate a reasonable level of financial literacy; (vi) the availability to work with the Company and dedicate sufficient time and energy to his or her board duties; (vii) an established reputation for good character, honesty, integrity, prudent business skills, leadership abilities as well as moral and ethical bearing; and (viii) the ability to work constructively with the Company’s other directors and management. The Nominating and Governance Committee may also take into consideration whether a candidate’s background and skills meet any specific needs of the Board that the Nominating and Governance Committee has identified and will take into account diversity in professional and personal experience, background, skills, race, gender and other factors of diversity that it considers relevant to the needs of the Board.

As a publicly traded corporation registered with and licensed by the Nevada Gaming Commission, the Nevada State Gaming Control Board, the Louisiana Gaming Control Board, the West Virginia Lottery Commission, the West Virginia Racing Commission, the Pennsylvania Gaming Control Board, the Pennsylvania Racing Commission, the Ohio Lottery Commission, and the Ohio State Racing Commission, the Company has a Compliance Committee which implements and administers the Company’s Compliance Plan. The Committee’s duties include investigating key employees, vendors of goods and services, sources of financing, consultants, lobbyists and others who wish to do substantial business with the Company or its subsidiaries and making recommendations to the Company’s management concerning suitability. The Compliance Committee of the Company currently includes independent directors Messrs. Fahrenkopf Jr. and Pegram, and non‑director members A.J. “Bud” Hicks (who serves as the chairperson), Anthony L. Carano and Stephanie Lepori. The Compliance Committee held four (4) meetings in 2016.

Compensation Committee Interlocks and Insider Participation

The current members of the Company’s Compensation Committee are Messrs. Hawkins, Pegram, and Wagner, each of whom is an independent director. No member of the Compensation Committee (i) was, during 2016, or had previously been an officer or employee of the Company or its subsidiaries nor (ii) had any direct or indirect material interest in a transaction of the Company or a business relationship with the Company, in each case that would require disclosure under the applicable rules of the SEC. No interlocking relationship existed between any member of the Compensation Committee or an executive officer of the Company, on the one hand, and any member of the compensation committee (or committee performing equivalent functions, or the full board of directors) or an executive officer of any other entity, on the other hand, requiring disclosure pursuant to the applicable rules of the SEC.

The Compensation Committee is authorized to review all compensation matters involving directors and executive officers, and Compensation Committee approval is required for any compensation to be paid to executive officers or directors who are employees of the Company.

8

Stockholders may communicate with the Board of Directors by sending written correspondence to the Chairman of the Nominating and Governance Committee at the following address: Eldorado Resorts, Inc., 100 West Liberty St., Suite 1150, Reno, NV 89501, Attention: Corporate Secretary. The Chairman of the Nominating and Governance Committee and his or her duly authorized representatives shall be responsible for collecting and organizing stockholder communications. Absent a conflict of interest, the Corporate Secretary is responsible for evaluating the materiality of each stockholder communication and determining whether further distribution is appropriate, and, if so, whether to (i) the full Board, (ii) one or more Board members and/or (iii) other individuals or entities.

Board Leadership Structure and Risk Oversight

The Board does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board, since the Board believes it is in the best interests of the Company and its stockholders to make that determination based on the position and direction of the Company and the composition of the Board. The Company believes this structure facilitates independent oversight of management while fostering effective communication between the Company’s management and the Board. The roles of Chief Executive Officer and Chairman of the Board are currently combined and held by Mr. Gary L. Carano.

The Company’s senior management is responsible for the day‑to‑day assessment and management of the Company’s risks, and our Board is responsible for oversight of the Company’s enterprise risk management in general. The risks facing our Company include risks associated with the Company’s financial condition, liquidity, operating performance, ability to meet its debt obligations and regulations applicable to our operations and compliance therewith. The Board’s oversight is primarily managed and coordinated through Board Committees. Our Audit Committee oversees the Company’s risk management with respect to significant financial and accounting policies as well as the effectiveness of management’s processes that monitor and manage key business risks, and the Compliance Committee is responsible for overseeing risks associated with the Company’s gaming activities and regulatory compliance. Additionally, the Compensation Committee oversees risks related to compensation policies. The Audit, Compensation and Compliance Committees report their findings to the full Board. In addition, at its meetings, the Board discusses risks that the Company faces, including those management has highlighted as the most relevant risks to the Company. Furthermore, the Board’s oversight of enterprise risk involves assessment of the risk inherent in the Company’s long‑term strategies reviewed by the Board, as well as other matters brought to the attention of the Board. We believe that the structure and experience of our Board allows our directors to provide effective oversight of risk management. The Board recognizes that it is the Company’s and its management’s responsibility to identify and attempt to mitigate risks that could cause significant damage to the Company’s business or stockholder value.

Audit Committee Financial Expert

The Securities and Exchange Commission adopted a rule requiring disclosure concerning the presence of at least one “audit committee financial expert” on audit committees. Our Board has determined that Mr. Tomick qualifies as an “audit committee financial expert” as defined by the Securities and Exchange Commission and that Mr. Tomick is independent, as independence for Audit Committee members is defined pursuant to the applicable NASDAQ listing requirements.

We have adopted a code of ethics and business conduct applicable to all directors and employees, including the chief executive officer, chief financial officer and principal accounting officer. The code of ethics and business conduct is posted on our website, ir.eldoradoresorts.com under “Governance—Governance Documents” and a printed copy will be delivered on request by writing to the Corporate Secretary at Eldorado Resorts, Inc., c/o Corporate Secretary, 100 West Liberty Street, Suite 1150, Reno, Nevada, 89501. We intend to satisfy the disclosure requirement regarding certain amendments to, or waivers from, provisions of our code of ethics and business conduct by posting such information on our website.

9

Stock Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of April 20, 2017, the ownership of the presently issued and outstanding shares of Common Stock by persons known by the Company to be a beneficial owner of 5% or more of such stock, and the ownership of such stock by our named executive officers and directors, individually and as a group. As of April 20, 2017, there were 47,205,284 shares of Common Stock outstanding. Unless otherwise indicated, the address for each of the stockholders listed below is c/o 100 West Liberty Street, Suite 1150, Reno, Nevada, 89501.

Name |

| Amount and Nature of Beneficial Ownership |

|

| Percentage of Class |

| ||

Recreational Enterprises, Inc.(1)(5) |

|

| 11,129,867 |

|

|

| 23.58 | % |

Hotel Casino Management, Inc.(2)(6) |

|

| 5,118,461 |

|

|

| 10.84 | % |

PAR Investment Partners, L.P.(3)(6) |

|

| 4,665,000 |

|

|

| 9.88 | % |

Park West Asset Management LLC(4)(6) |

|

| 2,839,757 |

|

|

| 6.02 | % |

Gary L. Carano(7) |

|

| 216,571 |

|

| * |

| |

Frank J. Fahrenkopf, Jr. |

|

| — |

|

| * |

| |

James B. Hawkins |

|

| 65,000 |

|

| * |

| |

Michael E. Pegram |

|

| 51,697 |

|

| * |

| |

Thomas R. Reeg |

|

| 43,700 |

|

| * |

| |

David P. Tomick |

|

| 10,400 |

|

| * |

| |

Roger P. Wagner |

|

| 142,000 |

|

| * |

| |

Anthony L. Carano |

|

| 8,500 |

|

| * |

| |

Bonnie Biumi(8)(9) |

|

| — |

|

| * |

| |

Gregory J. Kozicz(8)(9) |

|

| — |

|

| * |

| |

All Board Members and Executive Officers as a Group |

|

| 537,868 |

|

|

| 1.14 | % |

* | Indicates less than one percent. |

(1) | The voting stock of Recreational Enterprises, Inc. (“REI”) is beneficially owned by the following members of the Carano family in the following percentages: Donald L. Carano—49.5%; Gary L. Carano—10.1%; Gene R. Carano—10.1%; Gregg R. Carano—10.1%; Cindy L. Carano—10.1% and Glenn T. Carano—10.1%. The voting power and dispositive power with respect to REI’s 23.58% interest in the Company is controlled by REI’s board of directors that is elected by the family members (voting in proportion to the percentages above). Gary L. Carano holds his interest in REI directly and indirectly through various trusts. Gary L. Carano disclaims beneficial ownership of REI’s 23.58% interest in the Company except to the extent of any pecuniary interest therein. The address of REI is P.O. Box 2540, Reno, Nevada 89505. |

(2) | The voting stock of Hotel Casino Management, Inc. (“HCM”) is beneficially owned by the following members of the Poncia family in the following percentages: Raymond J. Poncia, Jr.—36.780%; Cathy L. Poncia—Vigen—15.805%; Linda R. Poncia Ybarra—15.805%; Michelle L. Poncia Staunton—15.805% and Tammy R. Poncia—15.805%. The voting power and dispositive power with respect to HCM’s 10.84% interest in the Company is controlled by HCM’s board of directors that is elected by the family members (voting in proportion to the percentages above). Cathy, Linda, Michelle and Tammy each hold all of their respective interests in HCM through various trusts. Cathy, Linda, Michelle and Tammy each disclaim beneficial ownership of HCM’s 10.84% interest in the Company except to the extent of any pecuniary interest therein. The address of HCM is P.O. Box 429, Verdi, Nevada 89439. |

(3) | The address of Par Investment Partners, L.P. is One International Place, Suite 2041, Boston, MA, 02110. |

(4) | The address of Park West Asset Management LLC is 900 Larkspur Landing Circle, Suite 163, Larkspur, California 94939. |

(5) | As reported in Eldorado Resorts, Inc. S-4/A filing made on December 22, 2016. |

(6) | Based on filings made under Sections 13(d) and 13(g) of the Exchange Act during February and March 2017. |

(7) | Represents shares of Common Stock owned directly by Mr. Carano and indirectly by Mr. Carano through the Gary L. Carano S Corporation Trust. In addition to the shares of Common Stock reported in the table above, Gary L. Carano holds a 10.1% ownership interest in REI. He does not hold voting power or dispositive power with respect to REI’s 11,129,867 shares of Common Stock and he disclaims beneficial ownership of REI’s 11,129,867 shares of Common Stock except to the extent of any pecuniary interest therein. |

10

(8) | The address of Ms. Biumi and Mr. Kozicz is currently c/o Isle of Capri Casinos, Inc., 600 Emerson Road, St. Louis, Missouri 63141. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, executive officers, and the persons who beneficially own more than ten percent of the shares of Common Stock, to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Copies of all filed reports are required to be furnished to us. Based solely on the reports received by us and on the representations of the reporting persons, we believe that these persons have complied with all applicable filing requirements during the fiscal year ended December 31, 2016, except HCM did not report a transaction that occurred on November 28, 2016 until December 7, 2017, and Mr. Tomick did not report one purchase transaction by his spouse on November 11, 2016 until he filed a Form 4 reporting such transaction on March 7, 2017.

During 2016, the Compensation Committee reviewed the compensation structure for the members of the Company’s Board of Directors to ensure that the annual stipend and committee fees represent fair and adequate compensation for the level of work and responsibility assigned to different members of the Board. Based on a study of the Company’s peer competitor group (which is the same peer group that the Compensation Committee used with respect to the named executive officer’s compensation as described under “Peer Companies and Competitive Benchmarking”), the Compensation Committee established a target compensation level for its Board members that is equal to the median level paid by its peers in the gaming industry. In addition, the Compensation Committee compared its current compensation practices for our Board members with a recent report published by the National Association of Corporate Directors (NACD). This study of proxy statements indicated that our compensation structure is reasonable and appropriate when compared with the median average board member compensation for the peer group. Additionally, consistent with the Company’s objective of ensuring that directors’ interests are aligned with those of the Company’s stockholders, at least half of each director’s average annual base retainer fee is comprised of restricted stock unit grants. During 2016, 6,984 restricted stock units (“RSUs”) were issued to each non‑employee director.

During 2016, the Company’s non‑employee directors each received a cash stipend of $50,000. In addition, each committee member, except the committee chairman, is entitled to the following annual cash stipend: Audit Committee: $10,000; Compensation Committee: $5,000; Nominating and Governance Committee: $5,000; Compliance Committee: $5,000. Each Board committee chairman is entitled to the following annual stipend: Audit Committee: $20,000; Compensation Committee: $10,000; Nominating and Governance Committee: $10,000. The Lead Independent Director is also entitled to a $25,000 cash stipend. The Compliance Committee chair is a Board representative who is not entitled to compensation. We also reimburse our directors for expenses incurred in attending meetings.

During 2017, upon completion of a competitive market study, the Company’s non‑employee director’s cash stipend increased to $60,000. In addition, each non-chairman committee member’s annual cash stipend increased to the following amounts: Audit Committee: $15,000; Compensation Committee: $10,000; Nominating and Governance Committee: $7,500; Compliance Committee: $7,500. Each Board committee chairman annual cash stipend increased to: Audit Committee: $25,000; Compensation Committee: $20,000; Nominating and Governance Committee: $15,000. The Lead Independent Director cash stipend remained at $25,000.

11

The following table sets forth the compensation of the Company’s non‑employee directors for services rendered in 2016. Directors who are also employees of the Company do not receive compensation (other than their compensation as employees of the Company) for their services on the Board.

Director Compensation 2016 Name |

| Fees earned or paid in cash ($) |

|

| Stock awards ($)(1) |

|

| Total ($) |

| |||

(a)(2) |

| (b) |

|

| (c) |

|

| (h) |

| |||

Frank J. Fahrenkopf Jr. |

|

| 65,000 |

|

|

| 75,000 |

|

|

| 140,000 |

|

James B. Hawkins |

|

| 65,000 |

|

|

| 75,000 |

|

|

| 140,000 |

|

Michael E. Pegram |

|

| 70,000 |

|

|

| 75,000 |

|

|

| 145,000 |

|

David P. Tomick |

|

| 100,000 |

|

|

| 75,000 |

|

|

| 175,000 |

|

Roger P. Wagner |

|

| 65,000 |

|

|

| 75,000 |

|

|

| 140,000 |

|

Transactions with Related Persons

Leased property. Resorts owns the parcel on which Eldorado Reno is located, except for approximately 30,000 square feet which is leased from C. S. & Y. Associates, a general partnership of which Donald L. Carano is a general partner (the “CSY Lease”). The CSY Lease expires on June 30, 2027. Annual rent is payable in an amount equal to the greater of (i) $400,000 or (ii) an amount based on a decreasing percentage of Eldorado Reno’s gross gaming revenues for the year ranging from 3% of the first $6.5 million of gross gaming revenues to 0.1% of gross gaming revenues in excess of $75 million. Rent pursuant to the CSY Lease amounted to approximately $600,000 in 2016, and approximately $100,000 in 2017.

12

Compensation Paid to Related Parties. The Carano and Poncia families hold significant ownership interests in the Company. For the period beginning January 1, 2016 to April 15, 2017, members of the Carano family who are related to Gary L. Carano, Anthony L. Carano and Donald L. Carano, a member of Robert M. Jones’ family and Raymond J. Poncia were paid compensation in connection with their positions at Eldorado Reno and the Company as follows:

Name |

| Relationship |

| Position |

| Entity |

| Compensation including Perquisites($)(3) |

|

| 2016 RSUs($)(4) |

|

| 2017 RSUs($)(5) |

|

| Total ($) |

| ||||

Cindy Carano |

| Sister of Gary L. Carano and daughter of Donald L. Carano |

| Executive Director of Community Relations(1) |

| Silver Legacy, Eldorado Reno and Circus Circus Reno |

|

| 247,266 |

|

|

| — |

|

|

| — |

|

|

| 247,266 |

|

Donald L. Carano |

| Father of Gary L. Carano and grandfather of Anthony L. Carano and majority owner of REI |

| Consultant |

| Silver Legacy, Eldorado Reno and Circus Circus Reno |

|

| 561,258 |

|

|

| — |

|

|

| — |

|

|

| 561,258 |

|

Gene Carano |

| Brother of Gary L. Carano and son of Donald L. Carano |

| Senior Vice President of Regional Operations |

| Company |

|

| 836,929 |

|

|

| 200,000 |

|

|

| 380,000 |

|

|

| 1,416,929 |

|

Glenn Carano |

| Brother of Gary L. Carano and son of Donald L. Carano |

| General Manager |

| Silver Legacy, Eldorado Reno and Circus Circus Reno |

|

| 772,495 |

|

|

| 194,000 |

|

|

| 202,500 |

|

|

| 1,168,995 |

|

Gregg Carano |

| Brother of Gary L. Carano and son of Donald L. Carano |

| General Manager and Senior Vice President of Food and Beverage |

| Mountaineer Park and Company |

|

| 773,161 |

|

|

| 187,500 |

|

|

| 202,500 |

|

|

| 1,163,161 |

|

Josh Jones |

| Son of Robert M. Jones |

| Vice President Corporate Finance |

| Company |

|

| 254,353 |

|

|

| 45,000 |

|

|

| 100,000 |

|

|

| 399,353 |

|

Raymond J. Poncia |

| Majority owner of HCM |

| Consultant |

| Silver Legacy, Eldorado Reno and Circus Circus Reno |

|

| 304,840 |

|

|

| — |

|

|

| — |

|

|

| 304,840 |

|

Rhonda Carano |

| Wife of Donald L. Carano |

| Senior Vice President of Design and Development(2) |

| Company |

|

| 260,584 |

|

|

| 75,000 |

|

|

| — |

|

|

| 335,584 |

|

(1) | Cindy Carano was previously the Executive Director of Hotel Operations until her position changed effective August 2016. |

(2) | Rhonda Carano retired on September 1, 2016 and is currently a consultant to the Company. Mrs. Carano’s compensation from January 1, 2016 to April 15, 2017 includes consulting fees totaling $26,750. |

(3) | Includes base salary and bonus amounts paid, and perquisites comprised of 401(k) match, company paid memberships and life insurance premiums. |

(4) | Represents performance and time‑based RSUs granted January 22, 2016 at $10.74 per share at 100% target. |

(5) | Represents performance and time‑based RSUs granted January 27, 2017 at $16.21 per share at 100% target. |

From January 2016 through September 2016, Gregg Carano had the use of a residence rented by the Company in Columbus, Ohio, which averaged rent of approximately $2,200 per month.

Approval of Related Party Transactions

The Company’s Code of Ethics and Business Conduct (the “Code”) requires that any proposed transaction between the Company and a related party, or in which a related party would have a direct or indirect material interest, be promptly disclosed to the Compliance Committee of the Company. The Compliance Committee is required to disclose such proposed transactions promptly to the Company’s Audit Committee.

The Company’s Audit Committee Charter requires the Audit Committee of the Company to review and approve all related party transactions of the Company. Any director having an interest in the transaction is not permitted to vote on such transaction. The Audit Committee will determine whether or not to approve any such transaction on a case‑by‑case basis and in accordance with the provisions of the Audit Committee Charter and the Code, including the standards set forth in the Conflicts of Interest Policy contained in the Code. Under the Code, a “related party” is any of the following:

| • | an executive officer of the Company; |

| • | a director (or director nominee) of the Company; |

13

| • | a beneficial owner of five percent or more of any class of the Company’s voting securities; |

| • | an entity in which one of the above described persons has a substantial ownership interest or control of such entity; or |

| • | any other person or entity that would be deemed to be a related person under Item 404 of SEC Regulation S‑K or applicable NASDAQ rules and regulations. |

For a director to be considered independent, the director must meet the bright line independence standards under the listing standards of NASDAQ and the Board must affirmatively determine that the director has no material relationship with us, directly, or as a partner, stockholder or officer of an organization that has a relationship with us. The Board determines director independence based on an analysis of the independence requirements of the NASDAQ listing standards. In addition, the Board will consider all relevant facts and circumstances in making an independence determination. The Board also considers all commercial, industrial, banking, consulting, legal, accounting, charitable, familial or other business relationships any director may have with us. The Board has determined that the following seven directors satisfy the independence requirements of NASDAQ: Frank J. Fahrenkopf Jr., James B. Hawkins, Michael E. Pegram, David P. Tomick, Roger P. Wagner, Bonnie Biumi, Gregory J. Kozicz.

The Company completed its acquisition of Isle of Capri in a cash and stock transaction on May 1, 2017. Pursuant to an agreement and Plan of Merger entered into on September 19, 2016, between the Company and Isle, the Company acquired all of the outstanding shares of Isle for aggregate consideration of $552.0 million in cash and approximately 28.5 million newly issued shares of Common Stock. Following the consummation of the Isle Merger, the Company has approximately 75.6 million common shares outstanding, and added twelve additional properties to its portfolio after giving effect to the planned disposition of Isle of Capri Casino Hotel Lake Charles. The combination creates a diversified regional gaming company with combined annual revenue of more than $1.7 billion for the year ended December 31, 2016 for the Company and January 22, 2017 for Isle of Capri.

Compensation Discussion & Analysis

In this Compensation and Discussion and Analysis (“CD&A”), we describe the material components of our executive pay programs for our named executive officers for 2016 (also referred to herein as “NEOs”). We have included certain information in the CD&A (in this section generally) for periods subsequent to December 31, 2016 that we believe may be useful for a complete understanding of our executive compensation arrangements. Executive compensation is included in the tables following this discussion in accordance with SEC rules.

This CD&A provides an overview and explanation of:

| • | our compensation programs and policies for certain of our named executive officers identified below; |

| • | the material compensation decisions made by the Compensation Committee of the Board (the “Compensation Committee”) under those programs and policies; and |

| • | the material factors that the Compensation Committee considered in making those decisions. |

Our Named Executive Officers During 2016

| • | Gary L. Carano, Chief Executive Officer and Chairman of the Board |

| • | Thomas R. Reeg, President and Chief Financial Officer |

| • | Anthony L. Carano, General Counsel |

| • | Robert M. Jones, former Chief Financial Officer |

| • | Joseph L. Billhimer, Jr., former Chief Operating Officer |

Mr. Billhimer left the Company on January 5, 2016. Mr. Jones retired effective March 15, 2016. In light of Mr. Jones’ retirement, the Board of Directors appointed Mr. Reeg to also serve as Chief Financial Officer beginning March 16, 2016.

14

The following briefly describes the business experience and educational background for Anthony L. Carano, Robert M. Jones and Joseph L. Billhimer. The biographies of Gary L. Carano and Thomas R. Reeg begin on page 3 herein.

Anthony L. Carano, 35, has served as Executive Vice President, General Counsel and Secretary of the Company since September 2014. On August 24, 2016, Mr. Carano was named Executive Vice President of Operations. Prior to joining the Company, Mr. Carano was an attorney at the Nevada law firm of McDonald Carano Wilson, LLP, where his practice was devoted primarily to transactional, gaming and regulatory law. Mr. Carano holds a B.A. from the University of Nevada, his J.D. from the University of San Francisco, School of Law and his M.B.A. in Finance from the University of San Francisco, School of Business. Anthony L. Carano is Gary L. Carano’s son.

Robert M. Jones, 74, served as the Executive Vice President and Chief Financial Officer of the Company from September 2014 until this retirement in March 2016 and the Chief Financial Officer of Resorts for over thirty years. Mr. Jones earned a bachelor’s degree in accounting from the University of Arizona and a MBA in business administration from Golden Gate University.

Joseph L. Billhimer Jr., 53, served as Executive Vice President and Chief Operating Officer of the Company and Resorts since September 2014 until January 2016 when he left the Company. Mr. Billhimer joined MTR in April 2011 and served as Chief Operating Officer of MTR from 2012 and as President of MTR from September 2013 to September 2014. Mr. Billhimer served as Executive Vice President of MTR from 2012 to 2013 and Senior Vice President of Operations & Development at MTR and President and General Manager of the Mountaineer Casino, Racetrack and Resort since 2012. Mr. Billhimer was a principal of Foundation Gaming Group, an advisory and management services firm for the gaming industry, which among other engagements, managed Harlow’s Casino & Resort in Greenville, Mississippi from 2009 to 2010 and marketed its sale to Churchill Downs. Prior to Foundation Gaming Group, Mr. Billhimer served as president of Trilliant Gaming Illinois, LLC, a gaming development company, from 2008 to 2009. From 2003 to 2008, he was president and chief executive officer of Premier Entertainment LLC, the developer and parent of the Hard Rock Hotel and Casino in Biloxi, Mississippi. While at Premier Entertainment, he was named Casino Journal’s Executive of the Year in 2007 for his efforts in re-developing the Hard Rock Hotel and Casino after it was destroyed by Hurricane Katrina and filed bankruptcy. Prior to Premier Entertainment, Mr. Billhimer spent three years as President and General Manager of Caesars Entertainment’s Grand Casino Resort in Gulfport, Mississippi, and prior to that experience, eight years with Pinnacle Entertainment where he was Executive Vice President and General Manager of Casino Magic in Bay St. Louis, Mississippi.

Advisory Vote on Executive Compensation (“Say-on-Pay”)

The Compensation Committee and our Board considered the results of our stockholder vote regarding the advisory, non-binding resolution on executive compensation presented at the Company’s 2016 Annual Meeting, where over 99% of votes cast approved the compensation program described in the Company’s proxy statement for the 2016 Annual Meeting. The Compensation Committee takes seriously its role in the governance of the Company’s compensation programs and values thoughtful input from the Company’s stockholders, and may consider the result of future say-on-pay votes in connection with making its compensation-related decisions to the extent it deems it appropriate to do so. Any changes made to our executive compensation programs for 2016 were based on the Compensation Committee’s ongoing review and assessment of such programs. The Company currently holds such say-on-pay votes on an annual basis.

Our Compensation Strategy

Our executive compensation program is designed to attract, motivate and retain critical executive talent, and to motivate actions that drive profitable growth and the enhancement of long‑term value for our stockholders. Our program includes base salary and performance‑based incentives (including both cash‑based and equity‑based incentives) and is designed to be flexible, market competitive, reward achievement of difficult but fair performance criteria, and enhance stock ownership at the executive level. Our philosophy is that clear, distinct and attainable goals should be established in order to enable the assessment of performance by the Compensation Committee.

Pursuant to that philosophy, the Compensation Committee is guided by the general principles that compensation should be designed to:

| • | enhance stockholder value by focusing our executives’ efforts on the specific performance metrics that drive enterprise value; |

| • | attract, motivate, and retain highly‑qualified executives committed to our long‑term success; |

15

| • | assure that the Company’s executives receive fair compensation opportunities relative to their peers at similar companies, and fair actual compensation relative to Company performance; and |

| • | align critical decision making with the Company’s business strategy and goal setting. |

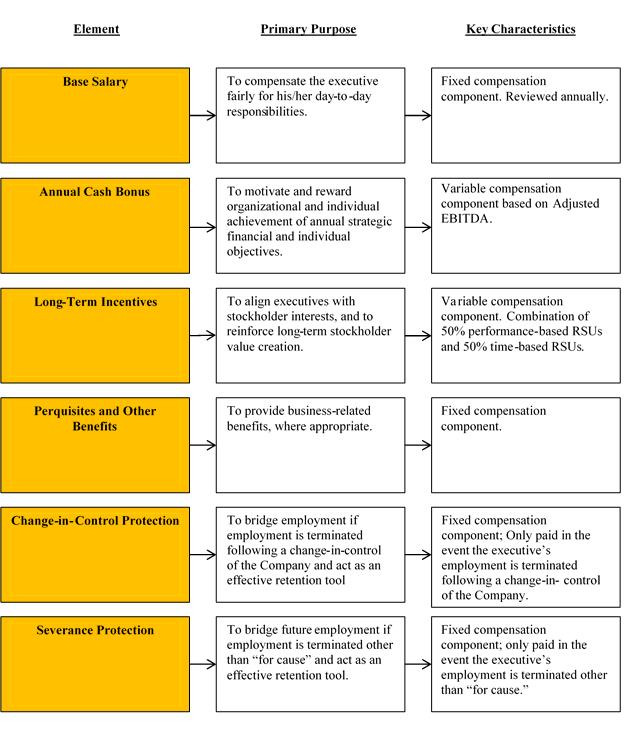

The following table summarizes key elements of our executive compensation program going forward:

16

Role of the Compensation Committee

The Compensation Committee’s primary role is to discharge the Board’s responsibilities regarding compensation decisions relating to our named executive officers. The Compensation Committee consists of independent directors and is responsible to our Board for the oversight of our executive compensation programs. Among its duties, the Compensation Committee is responsible for:

| • | reviewing and assessing competitive market data from the Compensation Committee’s independent compensation consultant; |

| • | reviewing and, in certain cases, approving incentive goals/objectives and compensation recommendations for directors and executive officers, including the named executive officers; |

| • | ensuring the Company’s policies and practices relating to compensation do not encourage excessive risk‑taking conduct. |

Following review and discussion, the Compensation Committee may submit recommendations to the Board for approval. The Compensation Committee is supported in its work by the Chief Financial Officer and staff, and Aon Hewitt, its independent executive compensation consultant.

Role of the Independent Compensation Consultant

The Compensation Committee retained Aon Hewitt for independent executive compensation advisory services, namely, to conduct its annual total compensation study for executive and key manager positions. Aon Hewitt reports directly to the Compensation Committee, and the Compensation Committee directly oversees the fees paid for the services provided. The Compensation Committee instructs Aon Hewitt to give advice to the Compensation Committee independent of management and to provide such advice for the benefit of our Company and stockholders. With the Compensation Committee’s approval, Aon Hewitt may work directly with management on certain executive compensation matters. Aon Hewitt did not perform any other consulting services for the Company in 2016. The Compensation Committee reviews the independence of its compensation consultant on an annual basis, taking into account a number of factors, including the six factors articulated in the NASDAQ listing standards and applicable SEC guidance. For 2016, the Compensation Committee determined that Aon Hewitt and its services to the Compensation Committee did not raise any conflicts of interests among the Compensation Committee, the Company, and management.

Specific roles of Aon Hewitt include, but are not limited to, the following:

| • | identifying and advising the Compensation Committee on executive compensation trends and regulatory developments; |

| • | providing a total compensation study for executives against peer companies and recommendations for named executive officer pay; |

| • | providing advice to the Compensation Committee on governance best practices as well as any other areas of concern or risk; |

| • | serving as a resource to the Compensation Committee Chair for meeting agendas and supporting materials in advance of each meeting; and |

17

Role of Management in Compensation Decisions

The CEO makes recommendations to the Compensation Committee concerning the compensation of the other named executive officers and other senior management. In addition, the CEO and CFO are involved in setting the business goals that are used as the performance goals for the annual incentive plan and long‑term performance units, subject to the Compensation Committee’s approval. The CEO and CFO work closely with the Compensation Committee, Aon Hewitt and management to (i) ensure that the Compensation Committee is provided with the appropriate information to make its decisions, (ii) propose recommendations for the Compensation Committee’s consideration and (iii) communicate those decisions to management for implementation. None of the named executive officers, however, play a role in determining their own compensation and are not present at executive sessions in which their pay is discussed.

In an executive session without management present, the Compensation Committee reviews and evaluates CEO compensation. The Compensation Committee reviews competitive market data, and both corporate financial performance and individual performance. Pay recommendations for the CEO, including base salary, incentive payments for the previous year, and equity grants for the current year, are presented to the independent members of the Board. During an executive session of the Board, the Board conducts its own review and evaluation of the CEO’s performance.

Peer Companies and Competitive Benchmarking

As previously noted, the Compensation Committee commissioned Aon Hewitt to conduct an annual total compensation study for executive officer and key manager positions. The Compensation Committee reviewed competitive market data to gain a comprehensive understanding of market pay practices, and combined that information with the discretion to consider experience, tenure, position, and individual contributions to assist with individual pay decisions (i.e., salary adjustments, target bonus, and long‑term incentive grants).

For conducting a competitive assessment of the compensation levels of each of its named executives in fiscal year 2016, the Compensation Committee approved a peer group of eleven companies, as follows:

Affinity Gaming | Penn National |

Boyd Gaming | Pinnacle Entertainment |

Choice Hotels | Red Rock Resorts |