UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-22912 |

| |

| Dreyfus BNY Mellon Funds, Inc. | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Bennett A. MacDougall, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 10/31 | |

Date of reporting period: | 10/31/15 | |

| | | | | | | |

The following N-CSR relates only to the Registrant’s series listed below and does not affect the other series of the Registrant, which has a different fiscal year end and, therefore, different N-CSR reporting requirement. A separate N-CSR will be filed for those series, as appropriate.

Dreyfus Alternative Diversifier Strategies Fund

Dreyfus Emerging Markets Debt U.S. Dollar Fund

Dreyfus Global Emerging Markets Fund

Dreyfus Select Managers Long/Short Fund

Dreyfus Yield Enhancement Strategy Fund

FORM N-CSR

Item 1. Reports to Stockholders.

Dreyfus Alternative Diversifier Strategies Fund

| | | |

| | ANNUAL REPORT October 31, 2015 |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

T H E F U N D

F O R M O R E I N F O R M AT I O N

Back Cover

| | | | |

| |

Dreyfus Alternative Diversifier Strategies Fund

| | The Fund |

A LETTER FROM THE PRESIDENT

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Alternative Diversifier Strategies Fund, covering the 12-month period from November 1, 2014, through October 31, 2015. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Financial markets proved volatile over the reporting period amid choppy U.S. and global economic growth. U.S. stocks advanced over the final months of 2014 and the spring of 2015, with some broad measures of market performance setting new record highs. Those gains were largely erased over the summer when global economic instability undermined investor sentiment, but a renewed rally in October enabled most broad stock indices to end the reporting period in positive territory. In contrast, international stocks generally lost a degree of value, with developed markets faring far better than emerging markets amid falling commodity prices and depreciating currency values. U.S. bonds generally produced modestly positive total returns, with municipal bonds and longer term U.S. government securities faring better, on average, than corporate-backed bonds.

We expect market volatility to persist over the near term until investors see greater clarity regarding short-term U.S. interest rates and global economic conditions. Our investment strategists and portfolio managers are monitoring developments carefully, keeping a close watch on credit spreads, currency values, commodity prices, corporate profits, economic trends in the emerging markets, and other developments that could influence investor sentiment. Over the longer term, we remain confident that markets are likely to benefit as investors increasingly recognize that inflation is likely to stay low, economic growth expectations are stabilizing, and monetary policies remain accommodative in most regions of the world. In our view, investors will continue to be well served under these circumstances by a long-term perspective and a disciplined investment approach.

Thank you for your continued confidence and support.

Sincerely,

J. Charles Cardona

President

The Dreyfus Corporation

November 16, 2015

2

DISCUSSION OF FUND PERFORMANCE

For the period of November 1, 2014, through October 31, 2015, as provided by Jeffrey M. Mortimer, CFA, Portfolio Manager

Fund and Market Performance Overview

For the 12-month period ended October 31, 2015, Dreyfus Alternative Diversifier Strategies Fund’s Class A shares produced a total return of 0.29%, Class C shares returned –0.37%, Class I shares returned 0.45%, and Class Y shares returned 0.82%.1 In comparison, the Standard & Poor’s® 500 Composite Stock Price Index (“S&P 500 Index”) returned 5.21%, and the Barclays U.S. Aggregate Index returned 1.96% for the same period.2 The Hybrid Index, which reflects a 50%/50% blend of the S&P 500 Index and the Barclays U.S. Aggregate Index, returned 3.92% for that period. 3

Financial markets encountered heightened volatility during the reporting period amid shifting global economic sentiment. The fund lagged the Hybrid Index, mainly due to its exposure to falling commodity prices.

The Fund’s Investment Approach

The fund seeks long-term capital appreciation. To pursue its goal, the fund normally allocates its assets across non-traditional or “alternative” asset classes and investment strategies. The fund is designed to complement and diversify traditional stock and bond portfolios. The fund uses a “fund of funds” approach in which we allocate assets among other investment companies (the underlying funds) that invest in asset classes and investment strategies that typically have had a low correlation to each other and to traditional equity and fixed-income asset classes. We currently intend to allocate the fund’s assets among underlying funds that employ the following alternative investment strategies: long/short equity strategies, absolute return hedge strategies, real estate-related strategies, commodities strategies, global macro strategies, and managed futures strategies.

As of October 31, 2015, the fund held positions in nine underlying funds: AQR Managed Futures Strategy Fund, ASG Global Alternatives Fund, ASG Managed Futures Strategy Fund, DFA Commodity Strategy Portfolio, Dynamic Total Return Fund, Dreyfus Research Long/Short Equity Fund, Dreyfus Select Managers Long/Short Fund, Dreyfus Global Real Estate Securities Fund, and Dreyfus Global Real Return Fund.

Shifting Economic Sentiment Sparked Market Turmoil

Financial markets encountered heightened volatility throughout the reporting period. A U.S. stock market rally over the first several months of the reporting period was sparked by employment gains and improved consumer and business sentiment. In contrast, investors responded negatively in March to sluggish domestic economic growth stemming in part from severe winter weather. The economy regained traction in the spring, and stocks resumed their advance until a debt crisis in Greece and slowing economic growth in China again sent U.S. stock prices lower over the summer, but a strong rebound in October enabled the S&P 500 Index to end the reporting period with a moderate gain.

In the U.S. bond market, aggressively accommodative monetary policies in Europe and Japan triggered robust demand for U.S. government securities from global investors, sending longer term yields lower through the end of 2014. In the spring of 2015, a strengthening

3

DISCUSSION OF FUND PERFORMANCE (continued)

domestic economy sent bond yields higher, erasing previous price gains. However, renewed worries over the summer about economic instability in China caused yields to fall again, and the Barclays U.S. Aggregate Index ended the reporting period in positive territory.

An appreciating U.S. dollar undermined returns from international investments for U.S. residents. Moreover, stocks and bonds in the emerging markets lost considerable value amid economic instability and declining commodity prices.

Alternative Investments Produced Mixed Results

The fund’s various underlying strategies produced divergent results in this environment. Most notably, relative performance was undermined by modest exposure to struggling commodity markets through DFA Commodity Strategy Portfolio. In addition, Dreyfus Research Long/Short Equity Fund experienced shortfalls in the financials sector.

The fund achieved better relative results from ASG Managed Futures Strategy Fund, which benefited from long positions among fixed-income securities and short positions among commodities and emerging-markets currencies. AQR Managed Futures Strategy Fund also fared well. Finally, Dreyfus Select Managers Long/Short Fund successfully established short positions among biotechnology companies in the health care sector and oil-and-gas producers in the energy sector.

Positioned for Continued Market Volatility

We expect market volatility to persist due to uncertain global economic conditions, upcoming short-term interest-rate hikes in the United States, and a strong U.S. dollar. Still, the U.S. economy has continued to grow, inflation has remained low, and aggressively accommodative monetary policies have set the stage for recoveries in several international markets.

In our judgment, the fund’s diversifier strategies can help mitigate the impact of market volatility on more traditional investments. In anticipation of further market turbulence, we recently made several adjustments to the fund’s allocations. We reduced the fund’s exposure to Dreyfus Select Managers Long/Short Fund, Dreyfus Global Real Return Fund, and Dreyfus Dynamic Total Return Fund. We reallocated those assets to increased positions in AQR Managed Futures Strategy Fund, ASG Global Alternatives Fund, and ASG Managed Futures Strategy Fund. In our view, these changes position the fund appropriately for the foreseeable future, and we remain prepared to readjust the fund’s allocations as circumstances warrant.

November 16, 2015

Equity securities are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus. Bond securities are subject generally to interest rate, credit, liquidity, call, sector, and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus.

Investing internationally involves special risks, including changes in currency exchange rates, political, economic, and social instability, a lack of comprehensive company information, differing auditing and legal standards, and less market liquidity. These risks generally are greater with emerging market countries than with more economically and politically established foreign countries.

Short sales involve selling a security the fund does not own in anticipation that the security’s price will decline. Short sales may involve substantial risk and leverage, and expose the fund to the risk that it will be required to buy the security sold short at a time when the security has appreciated in value, thus resulting in a loss to the fund. Short positions in stocks involve more risk than long positions in stocks because the maximum sustainable loss on a stock purchased is limited to the amount paid for the stock plus the transaction costs, whereas there is no maximum attainable price on the shorted stock. In theory, stocks sold short have unlimited risk. It is

4

possible that the market value of securities the fund holds in long positions will decline at the same time that the market value of the securities in the fund has sold short increases, thereby increasing the fund’s potential volatility. Leveraging occurs when the fund increases its assets available for investment using borrowing or similar transactions. Short sales effectively leverage the fund’s assets. The use of leverage may magnify the fund’s gains or losses.

Exposure to the commodities markets may subject the fund to greater volatility than investments in traditional securities. The values of commodities and commodity-linked investments are affected by events that might have less impact on the values of stocks and bonds. Investments linked to the prices of commodities are considered speculative. Prices of commodities and related contracts may fluctuate significantly over short periods for a variety of factors.

1 Total return includes reinvestment of dividends and any capital gains paid, and does not take into consideration the maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Past performance is no guarantee of future results. Share price, yield, and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. Return figures provided reflect the absorption of certain fund expenses pursuant to an agreement by The Dreyfus Corporation in effect until March 1, 2016, at which time it may be extended, terminated, or modified. Had these expenses not been absorbed, the fund’s returns would have been lower.

² SOURCE: Lipper Inc. — Reflects reinvestment of dividends and, where applicable, capital gain distributions. The Standard & Poor’s 500 Composite Stock Price Index is a widely accepted, unmanaged index of U.S. stock market performance. Investors cannot invest directly in any index. The Barclays U.S. Aggregate Index is a widely accepted, unmanaged total return index of corporate, U.S. government and U.S. government agency debt instruments, mortgage-backed securities, and asset-backed securities with an average maturity of 1-10 years. Investors cannot invest directly in any index.

3 SOURCE: FactSet — Reflects reinvestment of dividends and, where applicable, capital gain distributions. The Hybrid Index reflects a 50/50 blend of the Standard & Poor’s 500 Composite Index and the Barclays U.S. Aggregate Index. Investors cannot invest directly in any index.

5

FUND PERFORMANCE

Comparison of change in value of $10,000 investment in Dreyfus Alternative Diversifier Strategies Fund Class A shares, Class C shares, Class I shares, and Class Y shares, with Standard & Poor’s 500 Composite Price Index, the Hybrid Index and Barclays U.S. Aggregate Index

† Source: Lipper Inc.

†† Source: Factset.

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in each of the Class A, Class C, Class I and Class Y shares of Dreyfus Alternative Diversifier Strategies Fund on 3/31/14 (inception date) to a $10,000 investment made in the Standard & Poor’s 500 Composite Stock Price Index (the “S&P 500 Index”) as well as to a Hybrid Index reflecting a 50/50 blend of the Standard & Poor’s 500 Composite Stock Price Index and the Barclays U.S. Aggregate Index (the “Barclays Index”) on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes. The S&P 500 Index is a widely accepted, unmanaged index of U.S. stock market performance. The Barclays Index is a widely accepted, unmanaged index of corporate, government and government agency debt instruments, mortgage-backed securities and asset-backed securities with an average maturity of 1-10 years. Unlike a mutual fund, the indices are not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| | | | |

Average Annual Total Returns as of 10/31/15 |

| | Inception Date | 1 Year | From Inception |

|

Class A shares | | | |

with maximum sales charge (5.75%) | 3/31/14 | -5.46% | -2.65% |

without sales charge | 3/31/14 | 0.29% | 1.03% |

Class C shares | | | |

with applicable redemption charge † | 3/31/14 | -1.36% | 0.47% |

without redemption | 3/31/14 | -0.37% | 0.47% |

Class I shares | 3/31/14 | 0.45% | 1.29% |

Class Y shares | 3/31/14 | 0.82% | 1.57% |

Standard & Poor's 500

Composite Price Index | 3/31/14 | 5.21% | 9.04% |

Barclays U.S. Aggregate Index | 3/31/14 | 1.96% | 3.28% |

Hybrid Index | 3/31/14 | 3.92% | 6.42% |

Past performance is not predictive of future performance. The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses on all classes.

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Alternative Diversifier Strategies Fund from May 1, 2015 to October 31, 2015. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming actual returns for the six months ended October 31, 2015 |

| | | | | | | | |

| | | | Class A | Class C | Class I | Class Y |

Expenses paid per $1,000† | $ 3.96 | $ 7.32 | $ 1.88 | $ 1.44 |

Ending value (after expenses) | $965.30 | $962.40 | $966.90 | $967.80 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming a hypothetical 5% annualized return for the six months ended October 31, 2015 |

| | | | | | | | |

| | | | Class A | Class C | Class I | Class Y |

Expenses paid per $1,000† | $ 4.08 | $ 7.53 | $ 1.94 | $ 1.48 |

Ending value (after expenses) | $1,021.17 | $1,017.74 | $1,023.29 | $1,023.74 |

† Expenses are equal to the fund's annualized expense ratio of .80% for Class A, 1.48% for Class C, .38% for Class I and .29% for Class Y, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

8

STATEMENT OF INVESTMENTS

October 31, 2015

| | | | | | |

Registered Investment Companies - 99.5% | | Shares | | Value ($) | |

Alternative Investments - 32.5% | | | | | |

AQR Managed Futures Strategy Fund, Cl. I | | 2,407,409 | a | 26,144,468 | |

ASG Global Alternatives Fund, Cl. Y | | 3,707,135 | a | 40,037,058 | |

ASG Managed Futures Strategy Fund, Cl. Y | | 2,470,701 | a | 26,510,626 | |

DFA Commodity Strategy Portfolio | | 1,438,414 | | 8,529,796 | |

Dynamic Total Return Fund, Cl. Y | | 3,422,295 | a,b | 54,448,709 | |

| | | | | 155,670,657 | |

Domestic Equity - 39.5% | | | | | |

Dreyfus Research Long/Short Equity Fund, Cl. Y | | 3,603,744 | a,b | 45,875,658 | |

Dreyfus Select Managers Long/Short Fund, Cl. Y | | 11,555,637 | a,b,c | 143,174,337 | |

| | | | | 189,049,995 | |

Foreign Equity - 27.5% | | | | | |

Dreyfus Global Real Estate Securities Fund, Cl. Y | | 5,563,446 | b | 51,294,976 | |

Dreyfus Global Real Return Fund, Cl. Y | | 5,454,238 | b | 80,122,752 | |

| | | | | 131,417,728 | |

Total Registered Investment Companies (cost $473,707,082) | | | | 476,138,380 | |

Total Investments (cost $473,707,082) | | 99.5% | | 476,138,380 | |

Cash and Receivables (Net) | | .5% | | 2,456,205 | |

Net Assets | | 100.0% | | 478,594,585 | |

a Non-income producing security.

b Investment in affiliated mutual fund.

c The fund's investment in the Dreyfus Select Managers Long/Short Fund represents 30.1% of the fund's total investments. The Dreyfus Select Managers Long/Short Fund seeks to provide long-term capital appreciation.

| | |

Portfolio Summary (Unaudited) † | Value (%) |

Mutual Funds: Domestic | 39.5 |

Mutual Funds: Alternative | 32.5 |

Mutual Funds: Foreign | 27.5 |

| | 99.5 |

†Based on net assets.

See notes to financial statements.

9

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2015

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments: | | | | |

Unaffiliated issuers | | 104,098,342 | | 101,221,948 | |

Affiliated issuers | | 369,608,740 | | 374,916,432 | |

Cash | | | | | 2,630,682 | |

Receivable for shares of Common Stock subscribed | | | | | 700,249 | |

Prepaid expenses | | | | | 11,382 | |

| | | | | 479,480,693 | |

Liabilities ($): | | | | |

Due to The Dreyfus Corporation and affiliates—Note 3(c) | | | | | 105,972 | |

Payable for shares of Common Stock redeemed | | | | | 727,116 | |

Accrued expenses | | | | | 53,020 | |

| | | | | 886,108 | |

Net Assets ($) | | | 478,594,585 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 478,164,694 | |

Accumulated distributions in excess of investment income—net | | | | | (750,407) | |

Accumulated net realized gain (loss) on investments | | | | | (1,251,000) | |

Accumulated net unrealized appreciation (depreciation)

on investments | | | | | 2,431,298 | |

Net Assets ($) | | | 478,594,585 | |

| | | | | | |

Net Asset Value Per Share | Class A | Class C | Class I | Class Y | |

Net Assets ($) | 61,550 | 33,652 | 632,984 | 477,866,399 | |

Shares Outstanding | 4,909 | 2,684 | 50,300 | 37,842,254 | |

Net Asset Value Per Share ($) | 12.54 | 12.54 | 12.58 | 12.63 | |

See notes to financial statements.

10

STATEMENT OF OPERATIONS

Year Ended October 31, 2015

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Cash dividends: | | | | |

Unaffiliated issuers | | | 921,754 | |

Affiliated issuers | | | 4,635,891 | |

Total Income | | | 5,557,645 | |

Expenses: | | | | |

Management fee—Note 3(a) | | | 1,075,981 | |

Registration fees | | | 85,630 | |

Professional fees | | | 74,892 | |

Directors’ fees and expenses—Note 3(d) | | | 26,677 | |

Prospectus and shareholders’ reports | | | 14,533 | |

Custodian fees—Note 3(c) | | | 10,076 | |

Loan commitment fees—Note 2 | | | 4,535 | |

Shareholder servicing costs—Note 3(c) | | | 989 | |

Interest expense—Note 2 | | | 319 | |

Distribution fees—Note 3(b) | | | 242 | |

Miscellaneous | | | 19,686 | |

Total Expenses | | | 1,313,560 | |

Less—reduction in expenses due to undertaking—Note 3(a) | | | (129) | |

Less—reduction in fees due to earnings credits—Note 3(c) | | | (1) | |

Net Expenses | | | 1,313,430 | |

Investment Income—Net | | | 4,244,215 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments: | | |

Unaffiliated issuers | | | (178,016) | |

Affiliated issuers | | | (2,634,681) | |

Capital gain distributions on unaffiliated issuers | | | 2,360,305 | |

Capital gain distributions from affiliated issuers | | | 179,914 | |

Net Realized Gain (Loss) | | | (272,478) | |

Net unrealized appreciation (depreciation) on investments: | | | | |

Unaffiliated issuers | | | (3,320,609) | |

Affiliated issuers | | | 684,169 | |

Net Unrealized Appreciation (Depreciation) | | | (2,636,440) | |

Net Realized and Unrealized Gain (Loss) on Investments | | | (2,908,918) | |

Net Increase in Net Assets Resulting from Operations | | 1,335,297 | |

See notes to financial statements.

11

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | | | | | | | |

| | | | Year Ended October 31, |

| | | | 2015 | | | | 2014a | |

Operations ($): | | | | | | | | |

Investment income (loss)—net | | | 4,244,215 | | | | (651,131) | |

Net realized gain (loss) on investments | | (272,478) | | | | 206,457 | |

Net unrealized appreciation (depreciation)

on investments | | (2,636,440) | | | | 5,067,738 | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | 1,335,297 | | | | 4,623,064 | |

Dividends to Shareholders from ($): | | | | | | | | |

Investment income—net: | | | | | | | | |

Class A | | | (724) | | | | - | |

Class C | | | (97) | | | | - | |

Class I | | | (1,946) | | | | - | |

Class Y | | | (5,396,070) | | | | - | |

Net realized gain on investments: | | | | | | | | |

Class A | | | (22) | | | | - | |

Class C | | | (10) | | | | - | |

Class I | | | (55) | | | | - | |

Class Y | | | (147,467) | | | | - | |

Total Dividends | | | (5,546,391) | | | | - | |

Capital Stock Transactions ($): | | | | | | | | |

Net proceeds from shares sold: | | | | | | | | |

Class A | | | 7,491 | | | | 161,520 | |

Class C | | | 8,960 | | | | 38,600 | |

Class I | | | 1,094,238 | | | | 117,592 | |

Class Y | | | 158,975,972 | | | | 383,299,429 | |

Dividends reinvested: | | | | | | | | |

Class A | | | 411 | | | | - | |

Class I | | | 801 | | | | - | |

Class Y | | | 393,646 | | | | - | |

Cost of shares redeemed: | | | | | | | | |

Class A | | | (2,054) | | | | (106,321) | |

Class C | | | (13,827) | | | | - | |

Class I | | | (577,346) | | | | - | |

Class Y | | | (50,637,333) | | | | (14,579,164) | |

Increase (Decrease) in Net Assets

from Capital Stock Transactions | 109,250,959 | | | | 368,931,656 | |

Total Increase (Decrease) in Net Assets | 105,039,865 | | | | 373,554,720 | |

Net Assets ($): | | | | | | | | |

Beginning of Period | | | 373,554,720 | | | | - | |

End of Period | | | 478,594,585 | | | | 373,554,720 | |

Distributions in excess of investment income—net | (750,407) | | | | (564,134) | |

12

| | | | | | | | | | |

| | | | Year Ended October 31, |

| | | | 2015 | | | | 2014a | |

Capital Share Transactions: | | | | | | | | |

Class A | | | | | | | | |

Shares sold | | | 576 | | | | 12,958 | |

Shares issued for dividends reinvested | | | 33 | | | | - | |

Shares redeemed | | | (159) | | | | (8,499) | |

Net Increase (Decrease) in Shares Outstanding | 450 | | | | 4,459 | |

Class C | | | | | | | | |

Shares sold | | | 684 | | | | 3,083 | |

Shares redeemed | | | (1,083) | | | | - | |

Net Increase (Decrease) in Shares Outstanding | (399) | | | | 3,083 | |

Class I | | | | | | | | |

Shares sold | | | 86,139 | | | | 9,351 | |

Shares issued for dividends reinvested | | | 64 | | | | - | |

Shares redeemed | | | (45,254) | | | | - | |

Net Increase (Decrease) in Shares Outstanding | 40,949 | | | | 9,351 | |

Class Y | | | | | | | | |

Shares sold | | | 12,385,722 | | | | 30,528,956 | |

Shares issued for dividends reinvested | | | 31,118 | | | | - | |

Shares redeemed | | | (3,948,427) | | | | (1,155,115) | |

Net Increase (Decrease) in Shares Outstanding | 8,468,413 | | | | 29,373,841 | |

| | | | | | | | | | |

a | From March 31, 2014 (commencement of operations) to October 31, 2014. | |

See notes to financial statements.

13

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. These figures have been derived from the fund’s financial statements.

| | | | | | | |

| | | | |

| | Year Ended October 31, |

Class A Shares | | | 2015 | | 2014a | |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | | 12.67 | | 12.50 | |

Investment Operations: | | | | | | |

Investment income (loss)—netb | | | .07 | | (.04) | |

Net realized and unrealized

gain (loss) on investments | | | (.04) | | .21 | |

Total from Investment Operations | | | .03 | | .17 | |

Distributions: | | | | | | |

Dividends from investment income—net | | | (.16) | | - | |

Dividends from net realized

gain on investments | | | (.00)c | | - | |

Total Distributions | | | (.16) | | - | |

Net asset value, end of period | | | 12.54 | | 12.67 | |

Total Return (%)d | | | .29 | | 1.36e | |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to average net assetsf | | | .86 | | 1.02g | |

Ratio of net expenses to average net assetsf | | | .80 | | .54 g | |

Ratio of net investment income

(loss) to average net assetsf | | | .58 | | (.53)g | |

Portfolio Turnover Rate | | | 16.73 | | .09e | |

Net Assets, end of period ($ x 1,000) | | | 62 | | 57 | |

a From March 31, 2014 (commencement of operations) to October 31, 2014.

b Based on average shares outstanding.

c Amount represents less than $.01 per share.

d Exclusive of sales charge.

e Not annualized.

f Amounts do not include the expenses of the underlying funds.

g Annualized.

See notes to financial statements.

14

| | | | | | | |

| | | | |

| | Year Ended October 31, |

Class C Shares | | | 2015 | | 2014a | |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | | 12.64 | | 12.50 | |

Investment Operations: | | | | | | |

Investment (loss)—netb | | | (.05) | | (.10) | |

Net realized and unrealized

gain (loss) on investments | | | .00c | | .24 | |

Total from Investment Operations | | | (.05) | | .14 | |

Distributions: | | | | | | |

Dividends from investment income—net | | | (.05) | | - | |

Dividends from net realized

gain on investments | | | (.00)c | | - | |

Total Distributions | | | (.05) | | - | |

Net asset value, end of period | | | 12.54 | | 12.64 | |

Total Return (%)d | | | (.37) | | 1.12e | |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to average net assetsf | | | 1.59 | | 2.16g | |

Ratio of net expenses to average net assetsf | | | 1.50 | | 1.34g | |

Ratio of net investment (loss)

to average net assetsf | | | (.36) | | (1.34)g | |

Portfolio Turnover Rate | | | 16.73 | | .09e | |

Net Assets, end of period ($ x 1,000) | | | 34 | | 39 | |

a From March 31, 2014 (commencement of operations) to October 31, 2014.

b Based on average shares outstanding.

c Amount represents less than $.01 per share.

d Exclusive of sales charge.

e Not annualized.

f Amounts do not include the expenses of the underlying funds.

g Annualized.

See notes to financial statements.

15

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | | |

| | | | | | | |

| | Year Ended October 31, |

Class I Shares | | | 2015 | | 2014a | |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | | 12.70 | | 12.50 | |

Investment Operations: | | | | | | |

Investment income (loss)—netb | | | .03 | | (.05) | |

Net realized and unrealized

gain (loss) on investments | | | .02 | | .25 | |

Total from Investment Operations | | | .05 | | .20 | |

Distributions: | | | | | | |

Dividends from investment income—net | | | (.17) | | - | |

Dividends from net realized

gain on investments | | | (.00)c | | - | |

Total Distributions | | | (.17) | | - | |

Net asset value, end of period | | | 12.58 | | 12.70 | |

Total Return (%) | | | .45 | | 1.60d | |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to average net assetse | | | .43 | | 1.06f | |

Ratio of net expenses to average net assetse | | | .41 | | .52 f | |

Ratio of net investment income

(loss)to average net assetse | | | .23 | | (.51) f | |

Portfolio Turnover Rate | | | 16.73 | | .09d | |

Net Assets, end of period ($ x 1,000) | | | 633 | | 119 | |

a From March 31, 2014 (commencement of operations) to October 31, 2014.

b Based on average shares outstanding.

c Amount represents less than $.01 per share.

d Not annualized.

e Amounts do not include the expenses of the underlying funds.

f Annualized.

See notes to financial statements.

16

| | | | | | | | | | |

| | | | | | | |

| | Year Ended October 31, |

Class Y Shares | | | 2015 | | 2014a | |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | | 12.71 | | 12.50 | |

Investment Operations: | | | | | | |

Investment income (loss)—netb | | | .13 | | (.03) | |

Net realized and unrealized

gain (loss) on investments | | | (.03) | | .24 | |

Total from Investment Operations | | | .10 | | .21 | |

Distributions: | | | | | | |

Dividends from investment income—net | | | (.18) | | - | |

Dividends from net realized

gain on investments | | | (.00)c | | - | |

Total Distributions | | | (.18) | | - | |

Net asset value, end of period | | | 12.63 | | 12.71 | |

Total Return (%) | | | .82 | | 1.68d | |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to average net assetse | | | .31 | | .36f | |

Ratio of net expenses to average net assetse | | | .31 | | .36f | |

Ratio of net investment income

(loss) to average net assetse | | | .99 | | (.36)f | |

Portfolio Turnover Rate | | | 16.73 | | .09d | |

Net Assets, end of period ($ x 1,000) | | | 477,866 | | 373,341 | |

a From March 31, 2014 (commencement of operations) to October 31, 2014.

b Based on average shares outstanding.

c Amount represents less than $.01 per share.

d Not annualized.

e Amounts do not include the expenses of the underlying funds.

f Annualized.

See notes to financial statements.

17

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Alternative Diversifier Strategies Fund (the “fund”) is a separate diversified series of Dreyfus BNY Mellon Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering five series, including the fund. The fund’s investment objective is to seek long-term capital appreciation. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus, is the distributor of the fund’s shares. The fund is authorized to issue 100 million shares of $.001 par value Common Stock in each of the following classes of shares: Class A, Class C, Class I and Class Y. Class A and Class C shares are sold primarily to retail investors through financial intermediaries and bear Distribution and/or Shareholder Services Plan fees. Class A shares generally are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class C shares redeemed within one year of purchase. Class I shares are sold primarily to bank trust departments and other financial service providers (including The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, and its affiliates), acting on behalf of customers having a qualified trust or an investment account or relationship at such institution, and bear no Distribution or Shareholder Services Plan fees. Class Y shares are sold at net asset value per share generally to institutional investors, and bear no Distribution or Shareholder Services Plan fees. Class I and Class Y shares are offered without a front-end sales charge or CDSC. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs, and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

As of October 31, 2015, MBC Investments Corp., an indirect subsidiary of BNY Mellon, held 2,000 Class A, 2,000 Class C and 2,000 Class I shares of the fund.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to

18

that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Investments are valued at the net asset value of each underlying fund determined as of the close of the New York Stock Exchange (generally 4

19

NOTES TO FINANCIAL STATEMENTS (continued)

p.m., Eastern time) on the valuation date and are generally categorized within Level 1 of the fair value hierarchy.

The following is a summary of the inputs used as of October 31, 2015 in valuing the fund’s investments:

| | | | | |

| | Level 1 - Unadjusted Quoted Prices | Level 2 - Other Significant Observable Inputs | Level 3 -Significant Unobservable Inputs | Total |

Assets ($) | | | |

Investments in Securities: | | | |

Mutual Funds† | 476,138,380 | - | - | 476,138,380 |

† See Statement of Investments for additional detailed categorizations.

At October 31, 2015, there were no transfers between Level 1, Level 2 and Level 3 of the fair value hierarchy.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

(c) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” under the Act. Investments in affiliated investment companies during the period ended October 31, 2015 were as follows:

| | | | | |

Affiliated

Investment

Company | Value

10/31/2014 ($) | Purchases($)† | Sales ($) | Net Realized

(Loss) ($) |

Dreyfus Global

Real Estate

Securities

Fund, Cl. Y | 39,430,887 | 13,438,832 | 1,449,858 | (38,943) |

Dreyfus Global

Real Return

Fund, Cl. Y | 74,397,390 | 27,809,604 | 19,210,150 | (979,765) |

Dreyfus Research

Long/Short

Equity Fund,

Cl. Y | 36,368,548 | 11,922,251 | 2,157,534 | (20,848) |

20

| | | | | |

Affiliated

Investment

Company | Value

10/31/2014 ($) | Purchases($)† | Sales ($) | Net Realized

(Loss) ($) |

Dreyfus Select

Managers

Long/Short

Fund, Cl. Y | 125,671,368 | 41,663,317 | 25,367,119 | (706,321) |

Dynamic Total

Return

Fund, Cl. Y | 58,238,833 | 18,024,698 | 21,914,123 | (888,804) |

TOTAL | 334,107,026 | 112,858,702 | 70,098,784 | (2,634,681) |

† Includes reinvested dividends/distributions. |

Affiliated

Investment

Company | Change in Net Unrealized Appreciation

(Depreciation) ($) | Value

10/31/2015 ($) | Net

Assets (%) | Dividends/

Distributions ($) |

Dreyfus Global

Real Estate

Securities

Fund, Cl. Y | (85,942) | 51,294,976 | 10.7 | 1,212,995 |

Dreyfus Global

Real Return

Fund, Cl. Y | (1,894,327) | 80,122,752 | 16.7 | 3,602,810 |

Dreyfus Research

Long/Short

Equity

Fund, Cl. Y | (236,759) | 45,875,658 | 9.6 | - |

Dreyfus Select

Managers

Long/Short

Fund, Cl. Y | 1,913,092 | 143,174,337 | 29.9 | - |

Dynamic Total

Return

Fund, Cl. Y | 988,105 | 54,448,709 | 11.4 | - |

TOTAL | 684,169 | 374,916,432 | 78.3 | 4,815,805 |

(d) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

21

NOTES TO FINANCIAL STATEMENTS (continued)

(e) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended October 31, 2015, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended October 31, 2015, the fund did not incur any interest or penalties.

Each tax year in the two-year period ended October 31, 2015 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At October 31, 2015, the components of accumulated earnings on a tax basis were as follows: accumulated capital losses $385,242 and unrealized appreciation $1,565,540. In addition, the fund deferred for tax purposes late year ordinary losses of $750,407 to the first day of the following year.

Under the Regulated Investment Company Modernization Act of 2010, the fund is permitted to carry forward capital losses for an unlimited period. Furthermore, capital loss carryovers retain their character as either short-term or long-term capital losses.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net realized capital gains, if any, realized subsequent to October 31, 2015. The fund has $385,242 of short-term capital losses which can be carried forward for an unlimited period.

The tax character of distributions paid to shareholders during the fiscal periods ended October 31, 2015 and October 31, 2014 were as follows: ordinary income $5,398,837 and $0, and long-term capital gains $147,554 and $0, respectively.

During the period ended October 31, 2015, as a result of permanent book to tax differences, primarily due to the tax treatment for Short-term capital gain distributions from regulated investment company holdings, the fund increased accumulated undistributed investment income-net by $968,349, decreased accumulated net realized gain (loss) on investments by $966,747 and decreased paid-in capital by $1,602. Net assets and net asset value per share were not affected by this reclassification.

22

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $480 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. Prior to October 7, 2015, the unsecured credit facility with Citibank, N.A. was $430 million. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing.

The average amount of borrowings outstanding under the Facilities during the period ended October 31, 2015, was approximately $28,800 with a related weighted average annualized interest rate of 1.11%.

NOTE 3—Management Fee and Other Transactions with Affiliates:

(a) Pursuant to a management agreement with Dreyfus, the fund has agreed to pay a management fee at the annual rate of 1.35% applied to the portion of the fund’s average daily net assets allocated to direct investments in securities and .25% applied to that portion of the fund’s average daily net assets allocated to investments in other investment companies (underlying funds) and money market instruments (including cash and equivalents). Dreyfus has contractually agreed, from November 1, 2014 through March 1, 2016, to waive receipt of its fees and/or assume the direct expenses of the fund, so that the expenses of none of the classes (excluding Rule 12b-1 Distribution Plan fees, Shareholder Services Plan fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceed .55% of the value of the fund’s average daily net assets. The reduction in expenses, pursuant to the undertaking, amounted to $129 during the period ended October 31, 2015.

(b) Under the Distribution Plan adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing its shares at an annual rate of .75% of the value of its average daily net assets. During the period ended October 31, 2015, Class C shares were charged $242 pursuant to the Distribution Plan.

(c) Under the Shareholder Services Plan, Class A and Class C shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets for the provision of certain services. The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports

23

NOTES TO FINANCIAL STATEMENTS (continued)

and other information, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (securities dealers, financial institutions or other industry professionals) with respect to these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended October 31, 2015, Class A and Class C shares were charged $148 and $81, respectively, pursuant to the Shareholder Services Plan.

Under its terms, the Distribution Plan and Shareholder Services Plan shall remain in effect from year to year, provided such continuance is approved annually by a vote of a majority of those Company who are not “interested persons” of the Company and who have no direct or indirect financial interest in the operation of or in any agreement related to the Distribution Plan or Shareholder Services Plan.

The fund has arrangements with the transfer agent and the custodian whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset transfer agency and custody fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing transfer agency and cash management services for the fund. The majority of transfer agency fees are comprised of amounts paid on a per account basis, while cash management fees are related to fund subscriptions and redemptions. During the period ended October 31, 2015, the fund was charged $656 for transfer agency services and $21 for cash management services. These fees are included in Shareholder servicing costs in the Statement of Operations. Cash management fees were partially offset by earnings credits of $1.

The fund compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. These fees are determined based on net assets, geographic region and transaction activity. During the period ended October 31, 2015, the fund was charged $10,076 pursuant to the custody agreement.

During the period ended October 31, 2015, the fund was charged $11,159 for services performed by the Chief Compliance Officer and his staff.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: management fees $99,815, Distribution Plan fees $21, Shareholder Services Plan fees $20, custodian fees $5,142, Chief Compliance Officer fees $882 and transfer agency fees $92.

24

(d) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended October 31, 2015, amounted to $181,840,412 and $71,637,789, respectively.

At October 31, 2015, the cost of investments for federal income tax purposes was $474,572,840; accordingly, accumulated net unrealized appreciation on investments was $1,565,540, consisting of $7,563,222 gross unrealized appreciation and $5,997,682 gross unrealized depreciation.

25

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Board of Directors and Shareholders of

Dreyfus BNY Mellon Funds, Inc.

We have audited the accompanying statement of assets and liabilities of Dreyfus Alternative Diversifier Strategies Fund (the “Fund”), a series of Dreyfus BNY Mellon Funds, Inc., including the statement of investments as of October 31, 2015, and the related statement of operations for the year then ended, the statement of changes in net assets and the financial highlights for each of the year or period in the two-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2015, by correspondence with the custodian, the transfer agent of the underlying funds and brokers or by other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Alternative Diversifier Strategies Fund as of October 31, 2015, and the results of its operations for the year then ended, the changes in its net assets, and the financial highlights for each of the year or period in the two-year period then ended, in conformity with U.S. generally accepted accounting principles.

New York, New York

December 30, 2015

26

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the fund reports the maximum amount allowable, but not less than $5,398,837 as ordinary income dividends paid during the year ended October 31, 2015 as qualified dividend income in accordance with Section 854(b)(1)(B) of the Internal Revenue Code. Also, the fund reports the maximum amount allowable but not less than 100% of ordinary income dividends paid during the year ended October 31, 2015 as eligible for the corporate dividends received deduction provided under Section 243 of the Internal Revenue Code in accordance with Section 854(b)(1)(A) of the Internal Revenue Code. Shareholders will receive notification in early 2016 of the percentage applicable to the preparation of their 2015 income tax returns. Also the fund reports the maximum amount allowable but not less than $.0049 per share as a capital gain dividend in accordance with Section 852(b)(3)(C) of the Internal Revenue Code.

27

BOARD MEMBERS INFORMATION (Unaudited)

INDEPENDENT BOARD MEMBERS

Joseph S. DiMartino (72)

Chairman of the Board (1999)

Principal Occupation During Past 5 Years:

· Corporate Director and Trustee (1995-present)

Other Public Company Board Memberships During Past 5 Years:

· CBIZ (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small and medium size companies, Director (1997-present)

· The Newark Group, a provider of a national market of paper recovery facilities, paperboard mills and paperboard converting plants, Director (2000-2010)

No. of Portfolios for which Board Member Serves: 140

———————

Francine J. Bovich (64)

Board Member (2012)

Principal Occupation During Past 5 Years:

· Trustee, The Bradley Trusts, private trust funds (2011-present)

· Managing Director, Morgan Stanley Investment Management (1993-2010)

Other Public Company Board Memberships During Past 5 Years:

· Annaly Capital Management, Inc., Board Member (May 2014-present)

No. of Portfolios for which Board Member Serves: 79

———————

Kenneth A. Himmel (69)

Board Member (1994)

Principal Occupation During Past 5 Years:

· Managing Partner, Gulf Related, an international real estate development company (2010-present)

· President and CEO, Related Urban Development, a real estate development company (1996-present)

· President and CEO, Himmel & Company, a real estate development company (1980-present)

· CEO, American Food Management, a restaurant company (1983-present)

No. of Portfolios for which Board Member Serves: 29

———————

28

Stephen J. Lockwood (68)

Board Member (1994)

Principal Occupation During Past 5 Years:

· Chairman of the Board, Stephen J. Lockwood and Company LLC, a real estate investment company (2000-present)

No. of Portfolios for which Board Member Serves: 29

———————

Roslyn M. Watson (66)

Board Member (1994)

Principal Occupation During Past 5 Years:

· Principal, Watson Ventures, Inc., a real estate investment company (1993-present)

No. of Portfolios for which Board Member Serves: 65

———————

Benaree Pratt Wiley (69)

Board Member (1998)

Principal Occupation During Past 5 Years:

· Principal, The Wiley Group, a firm specializing in strategy and business development (2005-present)

Other Public Company Board Memberships During Past 5 Years:

· CBIZ (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small and medium size companies, Director (2008-present)

No. of Portfolios for which Board Member Serves: 65

———————

Once elected all Board Members serve for an indefinite term, but achieve Emeritus status upon reaching age 80. The address of the Board Members and Officers is c/o The Dreyfus Corporation, 200 Park Avenue, New York, New York 10166. Additional information about the Board Members is available in the fund's Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-DREYFUS.

James M. Fitzgibbons, Emeritus Board Member

29

OFFICERS OF THE FUND (Unaudited)

BRADLEY J. SKAPYAK, President since January 2010.

Chief Operating Officer and a director of the Manager since June 2009, Chairman of Dreyfus Transfer, Inc., an affiliate of the Manager and the transfer agent of the funds, since May 2011 and Executive Vice President of the Distributor since June 2007. From April 2003 to June 2009, Mr. Skapyak was the head of the Investment Accounting and Support Department of the Manager. He is an officer of 66 investment companies (comprised of 140 portfolios) managed by the Manager. He is 56 years old and has been an employee of the Manager since February 1988.

BENNETT A. MACDOUGALL, Chief Legal Officer since October 2015

Chief Legal Officer of the Manager since June 2015; from June 2005 to June 2015, Director and Associate General Counsel of Deutsche Bank – Asset & Wealth Management Division, and Chief Legal Officer of Deutsche Investment Management Americas Inc. He is an officer of 67 investment companies (comprised of 165 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since June 2015.

JANETTE E. FARRAGHER, Vice President and Secretary since December 2011.

Assistant General Counsel of BNY Mellon, and an officer of 67 investment companies (comprised of 165 portfolios) managed by the Manager. She is 52 years old and has been an employee of the Manager since February 1984.

JAMES BITETTO, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon and Secretary of the Manager, and an officer of 67 investment companies (comprised of 165 portfolios) managed by the Manager. He is 49 years old and has been an employee of the Manager since December 1996.

JONI LACKS CHARATAN, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon, and an officer of 67 investment companies (comprised of 165 portfolios) managed by the Manager. She is 59 years old and has been an employee of the Manager since October 1988.

JOSEPH M. CHIOFFI, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon, and an officer of 67 investment companies (comprised of 165 portfolios) managed by the Manager. He is 53 years old and has been an employee of the Manager since June 2000.

JOHN B. HAMMALIAN, Vice President and Assistant Secretary since August 2005.

Senior Managing Counsel of BNY Mellon, and an officer of 67 investment companies (comprised of 165 portfolios) managed by the Manager. He is 52 years old and has been an employee of the Manager since February 1991.

MAUREEN E. KANE, Vice President and Assistant Secretary since April 2015.

Managing Counsel of BNY Mellon since July 2014; from October 2004 until July 2014, General Counsel, and from May 2009 until July 2014, Chief Compliance Officer of Century Capital Management. She is an officer of 67 investment companies (comprised of 165 portfolios) managed by the Manager. She is 53 years old and has been an employee of the Manager since July 2014.

SARAH S. KELLEHER, Vice President and Assistant Secretary since April 2014.

Senior Counsel of BNY Mellon, and an officer of 67 investment companies (comprised of 165 portfolios) managed by the Manager; from August 2005 to March 2013, Associate General Counsel of Third Avenue Management. She is 40 years old and has been an employee of the Manager since March 2013.

JEFF PRUSNOFSKY, Vice President and Assistant Secretary since August 2005.

Senior Managing Counsel of BNY Mellon, and an officer of 67 investment companies (comprised of 165 portfolios) managed by the Manager. He is 50 years old and has been an employee of the Manager since October 1990.

JAMES WINDELS, Treasurer since November 2001.

Director – Mutual Fund Accounting of the Manager, and an officer of 67 investment companies (comprised of 165 portfolios) managed by the Manager. He is 57 years old and has been an employee of the Manager since April 1985.

30

RICHARD CASSARO, Assistant Treasurer since January 2008.

Senior Accounting Manager – Money Market and Municipal Bond Funds of the Manager, and an officer of 67 investment companies (comprised of 165 portfolios) managed by the Manager. He is 56 years old and has been an employee of the Manager since September 1982.

GAVIN C. REILLY, Assistant Treasurer since December 2005.

Tax Manager of the Investment Accounting and Support Department of the Manager, and an officer of 67 investment companies (comprised of 165 portfolios) managed by the Manager. He is 47 years old and has been an employee of the Manager since April 1991.

ROBERT S. ROBOL, Assistant Treasurer since December 2002.

Senior Accounting Manager – Fixed Income Funds of the Manager, and an officer of 67 investment companies (comprised of 165 portfolios) managed by the Manager. He is 51 years old and has been an employee of the Manager since October 1988.

ROBERT SALVIOLO, Assistant Treasurer since July 2007.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 67 investment companies (comprised of 165 portfolios) managed by the Manager. He is 48 years old and has been an employee of the Manager since June 1989.

ROBERT SVAGNA, Assistant Treasurer since December 2002.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 67 investment companies (comprised of 165 portfolios) managed by the Manager. He is 48 years old and has been an employee of the Manager since November 1990.

JOSEPH W. CONNOLLY, Chief Compliance Officer since October 2004.

Chief Compliance Officer of the Manager and The Dreyfus Family of Funds (67 investment companies, comprised of 165 portfolios). He is 58 years old and has served in various capacities with the Manager since 1980, including manager of the firm’s Fund Accounting Department from 1997 through October 2001.

31

NOTES

32

NOTES

33

Dreyfus Alternative Diversifier Strategies Fund

200 Park Avenue

New York, NY 10166

Manager

The Dreyfus Corporation

200 Park Avenue

New York, NY 10166

Custodian

The Bank of New York Mellon

225 Liberty Street

New York, NY 10286

Transfer Agent &

Dividend Disbursing Agent

Dreyfus Transfer, Inc.

200 Park Avenue

New York, NY 10166

Distributor

MBSC Securities Corporation

200 Park Avenue

New York, NY 10166

| | |

Ticker Symbols: | Class A: DRNAX Class C: DRNCX Class I: DRNIX Class Y: DRYNX |

Telephone Call your financial representative or 1-800-DREYFUS

Mail The Dreyfus Family of Funds, 144 Glenn Curtiss Boulevard, Uniondale, NY 11556-0144

E-mail Send your request to info@dreyfus.com

Internet Information can be viewed online or downloaded at www.dreyfus.com

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The fund’s Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. (phone 1-800-SEC-0330 for information).

A description of the policies and procedures that the fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the fund voted these proxies for the most recent 12-month period ended June 30 is available at www.dreyfus.com and on the SEC’s website at www.sec.gov and without charge, upon request, by calling 1-800-DREYFUS.

| | |

© 2015 MBSC Securities Corporation

6253AR1015 |

|

Dreyfus Emerging Markets Debt U.S. Dollar Fund

| | | |

| | ANNUAL REPORT October 31, 2015 |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

T H E F U N D

F O R M O R E I N F O R M AT I O N

Back Cover

| | | | |

| |

Dreyfus Emerging Markets Debt U.S. Dollar Fund

| | The Fund |

A LETTER FROM THE PRESIDENT

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Emerging Markets Debt U.S. Dollar Fund, from the fund’s inception on December 3, 2014 to the end of its fiscal year on October 31, 2015. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Financial markets proved volatile over the reporting period amid choppy U.S. and global economic growth. U.S. stocks advanced over the final months of 2014 and the spring of 2015, with some broad measures of market performance setting new record highs. Those gains were largely erased over the summer when global economic instability undermined investor sentiment, but a renewed rally in October enabled most broad stock indices to end the reporting period in positive territory. In contrast, international stocks generally lost a degree of value, with developed markets faring far better than emerging markets amid falling commodity prices and depreciating currency values. U.S. bonds generally produced modestly positive total returns, with municipal bonds and longer term U.S. government securities faring better, on average, than corporate-backed bonds.

We expect market volatility to persist over the near term until investors see greater clarity regarding short-term U.S. interest rates and global economic conditions. Our investment strategists and portfolio managers are monitoring developments carefully, keeping a close watch on credit spreads, currency values, commodity prices, corporate profits, economic trends in the emerging markets, and other developments that could influence investor sentiment. Over the longer term, we remain confident that markets are likely to benefit as investors increasingly recognize that inflation is likely to stay low, economic growth expectations are stabilizing, and monetary policies remain accommodative in most regions of the world. In our view, investors will continue to be well served under these circumstances by a long-term perspective and a disciplined investment approach.

.

Thank you for your continued confidence and support.

Sincerely,

J. Charles Cardona

President

The Dreyfus Corporation

November 16, 2015

2

DISCUSSION OF FUND PERFORMANCE

For the period from the fund’s inception on December 3, 2014, through October 31, 2015, as provided by Alexander Kozhemiakin and Josephine Shea, Primary Portfolio Managers

Fund and Market Performance Overview

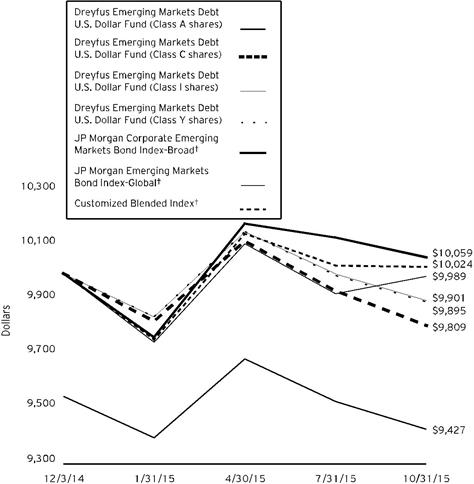

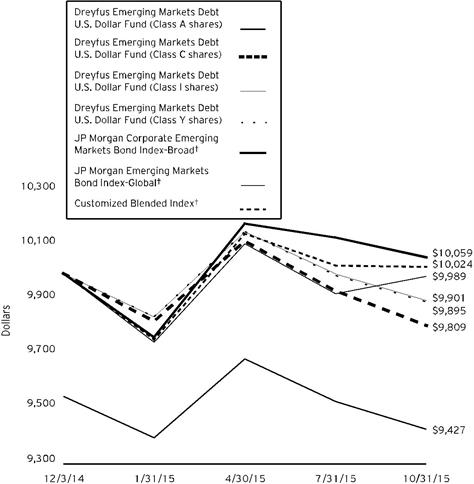

From the fund’s inception on December 3, 2014 to the end of its fiscal year on October 31, 2015, Dreyfus Emerging Markets Debt U.S. Dollar Fund’s Class A shares produced a total return of -1.28%, Class C shares returned -1.91%, Class I shares returned -0.99%, and Class Y shares returned -1.05%.1 For comparison, the fund uses a customized blended index (the “Blended Index”), composed of 50% JPMorgan Corporate Emerging Markets Bond Index — Broad (CEMBI-Broad Index) and 50% JPMorgan Emerging Markets Bond Index — Global (EMBI-Global Index). For the same period, CEMBI-Broad Index returned 0.59%, the EMBI-Global Index returned -0.11%, and the Blended Index returned 0.24%.2 3

Emerging market bonds proved volatile over the reporting period as a result of global macroeconomic headwinds as well as various national and regional developments. The fund’s lack of exposure to Ukrainian and Venezuelan debt securities caused its returns to lag the benchmark.

The Fund’s Investment Approach

The fund seeks to maximize total return. To pursue its goal, the fund normally invests at least 80% of its net assets in emerging market bonds and other debt instruments denominated in U.S. dollars, and in derivative instruments that provide investment exposure to such securities.

When choosing investments, we employ in-depth fundamental country and credit analysis. A “top down” analysis of macroeconomics and financial and political variables guides country allocations, while a “bottom-up” analysis of the fundamental measures of an issuer’s creditworthiness guides securities selection. We also consider technical market factors and the global risk environment. We typically sell a security if we believe it is overvalued from a valuation standpoint, another sector becomes relatively more attractive, or we expect fundamentals to deteriorate.

Macroeconomic Shifts Produced Heightened Volatility

Several ongoing macroeconomic developments led to a volatile environment for financial markets in many developing nations. Slowing demand for industrial materials from the decelerating Chinese economy and falling global commodity prices pressured many exporters of oil and basic materials, such as Russia and Brazil. In China, monetary easing encouraged investors until late summer 2015, when continued economic weakness and a currency devaluation undermined confidence and securities prices. India’s economy proved somewhat insulated from the slowdown in Chinese growth, but the rate of domestic growth disappointed those who expected more from the current, business-friendly government.

U.S. economic developments rippled through the emerging markets as well. Emerging market bonds were affected by shifts in the outlook for changes in U.S. monetary policy from the Federal Reserve Board, with securities’ prices coming under pressure when the timing of expected rate hikes proved uncertain. The rising value of the U.S. dollar against most local currencies also raised some investor concerns over the ability of borrowers to

3

DISCUSSION OF FUND PERFORMANCE (continued)

repay bonds issued in dollars, although most of these issuers have US dollar revenues and have found their competitiveness enhanced. In any case, US dollar-denominated emerging markets bonds were considerably less affected by dollar strength then were bonds denominated in local currencies.

Risk Control Strategies Hampered Fund Performance

The fund’s dollar-denominated investment strategy insulated U.S. investors from the currency fluctuations that sharply undercut the value of emerging market bonds denominated in local currencies. However, the fund’s risk-control approach detracted from returns relative to the benchmark. In particular, the fund avoided both corporate and government securities linked to the fragile Venezuelan and Ukrainian economies. In both cases, the countries’ bonds performed relatively well despite local economic difficulties. In addition, while the fund avoided most exposure to countries heavily leveraged to petroleum and other commodity exports, it held a few oil companies’ bonds that sold off with the decline in petroleum prices. Some company-specific problems affecting corporate holdings in India further hurt relative returns.

On a more positive note, the fund enhanced relative performance with strong security selections in Russia, where we avoided most private sector and pure sovereign bonds. Instead, the fund emphasized bonds issued by government agencies and state-controlled enterprises, which outperformed market averages. Similarly, the fund’s investments in Turkish agency and corporate bonds generated stronger returns than the country’s pure sovereign bonds due to their relative attractive valuations. Good security selections further bolstered relative results in Peru and South Africa. A relatively short average duration starting in July 2015 proved an effective strategy during a widespread market selloff in August and September, as did the fund’s relatively high cash position.

Continuing to Focus on Individual Securities

Emerging market bond valuations generally appear attractive in the wake of the recent market selloff. Therefore, as of the end of the reporting period, we have begun reducing the fund’s cash position, adding opportunistically to pure sovereign bond holdings, an area where the fund has remained underweighted. We have increased the fund’s duration exposure and maintained the generally high credit quality of its portfolio. As for country allocations, we have found a relatively large number of attractive opportunities in Chile, Panama, Brazil, Mexico, and Colombia. In contrast, we have maintained relatively little exposure to the Philippines, South Korea, Hong Kong, China, and Malaysia.

November 16, 2015

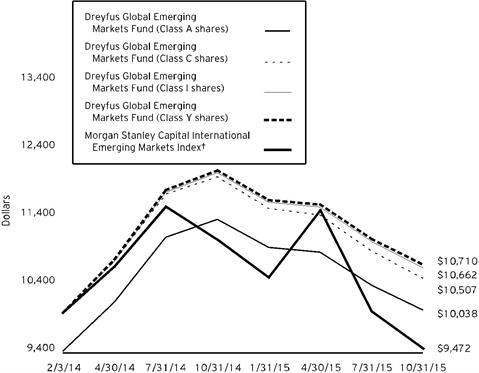

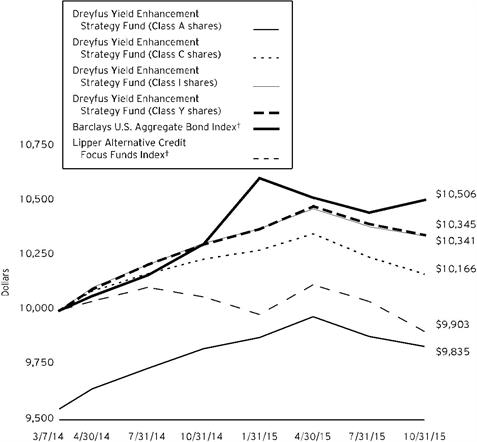

Bond funds are subject generally to interest rate, credit, liquidity, and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes, and rate increases can cause price declines.