UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

Amendment No. 1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Commission File Number: 333-198243

DIGITAL CADDIES, INC.

(Exact name of registrant in its charter)

| Oklahoma | 7370 | 47-1386357 |

(State or other jurisdiction of incorporation of organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

15210 N Scottsdale Rd., Suite 280

Scottsdale, AZ 85254

480-626-2423

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

National Registered Agents, Inc. of Oklahoma

1833 South Morgan Road

Oklahoma City, OK 73128

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of communications to:

Luke C. Zouvas, Esq.

Zouvas Law Group, P.C.

2750 Womble Road, Suite 107

San Diego, CA 92106

Tel. No.: (619) 688-1715

Fax No.: (619)-688-1716

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective. If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.☑

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☑ |

| (Do not check if a smaller reporting company) | | |

CALCULATION OF REGISTRATION FEE

Title of Each Class

of Securities to be

Registered (1) | | | Amount to be Registered (2) | | | | Proposed Maximum Offering Price Per Unit/Share | | | | Proposed Maximum Aggregate Offering Price | | | | Amount of Registration Fee | |

| Common units, $0.001 par value per share (3) | | | 10,000,000 | | | $ | 0.40(4) | | | $ | 4,000,000.00 | | | $ | 515.20 | |

| Common stock, $0.001 par value per share | | | 20,567,630 | | | $ | 0.20 (5) | | | $ | 4,113,526.00 | | | $ | 529.82 | |

| Common stock, $0.001 par value per share | | | 1,749,733 | | | $ | 0.20 (6) | | | $ | 349,946.60 | | | $ | 45.07 | |

| Common stock, $0.001 par value per share, issuable upon exercise of First Investor Warrants | | | 10,283,815 | | | $ | 0.40 (7) | | | $ | 4,113,526.00 | | | $ | 529.82 | |

| Common stock, $0.001 par value per share, issuable upon exercise of Placement Agent Private Placement Offering Warrants | | | 3,085,144 | | | $ | 0.40 (8) | | | $ | 1,234,057.60 | | | $ | 158.95 | |

| Common stock, $0.001 par value per share, issuable upon exercise of Placement Agent Debt Offering Warrants | | | 190,402 (9) | | | $ | 0.21(10) | | | $ | 39,984.42 | | | $ | 5.15 | |

| Common stock, $0.001 par value per share, issuable upon exercise of Lender Warrants | | | 2,857,144(11) | | | $ | 0.21(12) | | | $ | 600,000.24 | | | $ | 77.28 | |

| Common stock, $0.001 par value per share, issuable upon exercise of Second Investor Warrants | | | 1,575,000 | | | $ | 0.20 (13) | | | $ | 315,000.00 | | | $ | 40.57 | |

| Common stock, $0.001 par value per share, issuable upon exercise of Third Investor Warrants | | | 5,665,000 | | | $ | 0.20 (14) | | | $ | 1,133,000.00 | | | $ | 145.93 | |

| | | | | | | | | | | | | | | | | |

| Total | | | 55,973,868 | | | $ | — | | | $ | 15,899,040.86 | | | $ | 2047.79 | |

| | (1) | This Registration Statement covers: |

| | a. | A direct public offering by the Company of 10,000,000 common units (each a “Unit”) comprising of: |

| | i. | Up to 20,000,000 shares of our common stock; |

| | ii. | Up to 10,000,000 shares (the “Offering Warrant Shares”) of common stock issuable upon the exercise of the warrants to be issued and registered hereto (the “Offering Warrants”). Each Offering Warrant is immediately exercisable upon issuance to purchase one (1) share of common stock at an exercise price of $0.40 with an expiry date of five (5) years after the date of issuance; and |

| | b. | The resale by our selling shareholders (the “Selling Shareholders”) of: |

| | i. | Up to 20,567,630 shares (the “2014 Purchased Shares”) of common stock previously issued at a price of $0.20 per share to the Selling Shareholders in connection with a private placement that closed on April 17, 2014; |

| | ii. | Up to 1,749,733 shares (the “2013 Purchased Shares”) of common stock previously issued at a price of $0.15 per share to the Selling Shareholders in connection with a private placement that closed on October 28, 2013; |

| | iii. | Up to 10,283,815 shares (the “First Investor Warrant Shares”) of common stock issuable upon the exercise of outstanding investor’s warrants (the “First Investor Warrants”) at an exercise price of $0.40 that were previously issued to the Selling Shareholders in connection with a private placement that closed on April 17, 2014; |

| | iv. | Up to 3,085,144 shares (the “Placement Agent Private Placement Offering Warrant Shares”) of common stock issuable upon the exercise of outstanding placement agent’s warrants (the “Placement Agent Private Placement Offering Warrants”) at an exercise price of $0.40 that were previously issued to the placement agent pursuant to an engagement agreement dated November 7, 2013; |

| | v. | Up to 190,402 shares (the “Placement Agent Debt Offering Warrant Shares”) of common stock issuable upon the exercise of outstanding placement agent’s warrants (the “Placement Agent Debt Offering Warrants”) at an at an exercise price of $0.21 per share that were previously issued to the placement agent pursuant to an engagement agreement dated May 1, 2014; |

| | vi. | Up to 2,857,144shares (the “Lender Warrant Shares”) of common stock issuable upon the exercise of outstanding lender’s warrants (the “Lender Warrants”) at an exercise price of $0.21 per share that were previously issued to Venture Lending & Leasing VI, Inc. and Venture Lending & Leasing VII, Inc. (collectively “Lender”) pursuant to a loan and security agreement dated May 30, 2014; |

| | vii. | Up to 1,575,000 shares (the “Second Investor Warrant Shares”) of common stock issuable upon the exercise of outstanding investor’s warrants (the “Second Investor Warrants”) at an exercise price of $0.20 that were previously issued to the Selling Shareholders in connection with a private placement that closed in January 2013; and |

| | viii. | Up to 5,665,000 shares (the “Third Investor Warrant Shares”) of common stock issuable upon the exercise of outstanding investor’s warrants (the “Third Investor Warrants”) at an exercise price of $0.20 that were previously issued to the Selling Shareholders in connection with a private placement that closed in June 2013. |

| | (2) | This Registration Statement includes an indeterminate number of additional shares of common stock issuable for no additional consideration pursuant to any stock dividend, stock split, recapitalization or other similar transaction effected without the receipt of consideration, which results in an increase in the number of outstanding shares of our common stock. In the event of a stock split, stock dividend or similar transaction involving our common stock, in order to prevent dilution, the number of shares registered shall be automatically increased to cover the additional shares in accordance with Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”). |

| | (3) | Each common Unit registered herein shall be comprised of: (i) two (2) common stock shares of the Company; and (ii) one (1) common stock purchase warrant (the “Offering Warrants”). Each Offering Warrant shall be immediately exercisable upon issuance to purchase one (1) share of common stock at an exercise price of $0.40 with an expiry date of five (5) years after the date of issuance. |

| | (4) | Estimated in accordance with Rule 457(a) of the Securities Act solely for the purposes of calculating the registration fee based upon a bona fide estimate of the maximum offering price. |

| | (5) | Estimated in accordance with Rule 457(a) of the Securities Act solely for the purposes of calculating the registration fee based upon on a bona fide estimate of the maximum offering price. |

| | (6) | Estimated in accordance with Rule 457(a) of the Securities Act solely for the purposes of calculating the registration fee based upon a bona fide estimate of the maximum offering price. |

| | (7) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) of the Securities Act. The proposed maximum offering price is determined by the price at which the Warrants may be exercised. |

| | (8) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) of the Securities Act. The proposed maximum offering price is determined by the price at which the Warrants may be exercised. |

| | (9) | We are registering 190,402 shares of our common stock issuable upon the exercise of outstanding placement agent debt offering warrants (the “Placement Agent Debt Offering Warrants”) at an exercise price of $0.21 per share that were previously issued to Paulson Investment Company LLC and its assigns (collectively “Placement Agent”) pursuant to an engagement agreement dated May 1, 2014 (the “Paulson Debt Offering Engagement Agreement”) which provides that the Placement Agent shall receive that certain number of warrants to purchase the common stock of the Company equal to the number of warrants issued under the Loan and Security Agreement (as defined hereinafter). In the event of stock splits, stock dividends or similar transactions involving the common stock, the number of common shares registered shall, unless otherwise expressly provided, automatically be deemed to cover the additional securities to be offered or issued pursuant to Rule 416 promulgated under the Securities Act of 1933, as amended (the “Securities Act”). In the event that the conversion provisions of the Loan and Security Agreement (as defined hereinafter) require the registrant to issue more shares than are being registered in this registration statement, for reasons other than those stated in Rule 416 of the Securities Act, the registrant will file a new registration statement to register those additional shares. |

| | (10) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) of the Securities Act. The proposed maximum offering price is determined by the price at which the Warrants may be exercised. |

| | (11) | We are registering 2,857,144 shares of our common stock issuable upon the exercise of outstanding lender’s warrants (the “Lender Warrants”) at an exercise price of $0.21 per share that were previously issued to Venture Lending & Leasing VI, Inc. and Venture Lending & Leasing VII, Inc. (collectively “Lender”) pursuant to a loan and security agreement dated May 30, 2014 (the “Loan and Security Agreement”). In the event of stock splits, stock dividends or similar transactions involving the common stock, the number of common shares registered shall, unless otherwise expressly provided, automatically be deemed to cover the additional securities to be offered or issued pursuant to Rule 416 promulgated under the Securities Act of 1933, as amended (the “Securities Act”). In the event that the conversion provisions of the Loan and Security Agreement require the registrant to issue more shares than are being registered in this registration statement, for reasons other than those stated in Rule 416 of the Securities Act, the registrant will file a new registration statement to register those additional shares. |

| | (12) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) of the Securities Act. The proposed maximum offering price is determined by the highest price at which the Warrants may be exercised. |

| | (13) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) of the Securities Act. The proposed maximum offering price is determined by the highest price at which the Warrants may be exercised. |

| | (14) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) of the Securities Act. The proposed maximum offering price is determined by the highest price at which the Warrants may be exercised. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the commission, acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold (except pursuant to a transaction exempt from the registration requirements of the Securities Act) until this registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated August 19, 2014

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

| | · | Direct Public Offering Prospectus.A prospectus regarding our offering of an aggregate of 10,000,000 common Units, which are comprised of the following: (i) up to 20,000,000shares of our common stock; and (ii) up to 10,000,000 shares (the “Offering Warrant Shares”) of common stock issuable upon the exercise of the warrants registered hereto (the “Offering Warrants”) in a direct public offering (the “Direct Public Offering Prospectus”). Each Offering Warrant shall be immediately exercisable to purchase one (1) share of common stock at an exercise price of $0.40 with an expiry date of five (5) years after the date of issuance. Each Unit shall be comprised of two (2) common stock shares and one (1) Offering Warrant. However, while the Company does not have any agreements in place to sell the shares with the involvement of underwriters or broker-dealers, the Company may engage such underwriters or broker-dealers in the future. Should all Units being offered by the Company hereunder be sold, the Company would receive an aggregate of $4,000,000, comprised of $4,000,000 for newly issued Units at an offering price of $0.40 per Unit. The Company may receive an additional $4,000,000 if all of the newly issued Offering Warrants are purchased and exercised. |

| | · | Resale Prospectus. A prospectus to be used for the resale by the Selling Shareholder (the “Resale Prospectus”) of an aggregate of 45,973,868 shares, which includes the following: |

| | i. | Up to 20,567,630 shares (the “2014 Purchased Shares”) of common stock previously issued at a price of $0.20 per share to the Selling Shareholders in connection with a private placement that closed on April 17, 2014; |

| | ii. | Up to 1,749,733shares (the “2013 Purchased Shares”) of common stock previously issued at a price of $0.15 per share to the Selling Shareholders in connection with a private placement that closed on October 28, 2013; |

| | iii. | Up to 10,283,815 shares (the “First Investor Warrant Shares”) of common stock issuable upon the exercise of outstanding investor’s warrants (the “First Investor Warrants”) at an exercise price of $0.40 that were previously issued to the Selling Shareholders in connection with a private placement that closed on April 17, 2014; |

| | iv. | Up to 3,085,144 shares (the “Placement Agent Warrant Shares”) of common stock issuable upon the exercise of outstanding placement agent’s warrants (the “Placement Agent Warrants”) at an exercise price of $0.40 that were previously issued to the placement agent pursuant to an engagement agreement dated November 7, 2013; |

| | v. | Up to 190,402 shares (the “Placement Agent Debt Offering Warrant Shares”) of common stock issuable upon the exercise of outstanding placement agent’s warrants (the “Placement Agent Debt Offering Warrants”) at an at an exercise price of $0.21 per share that were previously issued to the placement agent pursuant to an engagement agreement dated May 1, 2014; |

| | vi. | Up to 2,857,144 shares (the “Lender Warrant Shares”) of common stock issuable upon the exercise of outstanding lender’s warrants (the “Lender Warrants”) at an exercise price of $0.21 per share that were previously issued to Venture Lending & Leasing VI, Inc. and Venture Lending & Leasing VII, Inc. (collectively “Lender”) pursuant to a loan and security agreement dated May 30, 2014.; |

| | vii. | Up to 1,575,000 shares (the “Second Investor Warrant Shares”) of common stock issuable upon the exercise of outstanding investor’s warrants (the “Second Investor Warrants”) at an exercise price of $0.20 that were previously issued to the Selling Shareholders in connection with a private placement that closed in January 2013; and |

| | viii. | Up to 5,665,000 shares (the “Third Investor Warrant Shares”) of common stock issuable upon the exercise of outstanding investor’s warrants (the “Third Investor Warrants”) at an exercise price of $0.20 that were previously issued to the Selling Shareholders in connection with a private placement that closed in June 2013. |

The First Investor Warrants, Second Investor Warrants, Third Investor Warrants, Placement Agent Private Placement Warrants, Placement Agent Debt Offering Warrants and Lender Warrants are referred to collectively as the “Warrants” and the First Investor Warrant Shares, Second Investor Warrant Shares, Third Investor Warrant Shares, Placement Agent Private Placement Warrant Shares, Placement Agent Debt Offering Warrant Shares and Lender Warrant Shares issuable under the Warrants are referred to collectively as the “Warrant Shares”

The Resale Prospectus is substantively identical to the Direct Public Offering Prospectus, except for the following principal points:

| | · | They contain different outside and inside front covers; |

| | · | They contain different Offering sections; |

| | · | They contain different Use of Proceeds sections; |

| | · | A Selling Shareholders section is included in the Resale Prospectus; |

| | · | They contain different Plan of Distribution sections; |

| | · | The Dilution section is deleted from the Resale Prospectus; |

| | · | References in the Direct Public Offering Prospectus to the Resale Prospectus will be deleted from the Resale Prospectus; |

| | · | They contain different outside back covers. |

The Registrant has included in this Registration Statement, after the financial statements, a set of alternate pages to reflect the foregoing differences of the Resale Prospectus as compared to the Direct Public Offering Prospectus.

DIGITAL CADDIES, INC.

15210 N Scottsdale Rd., Suite 280

Scottsdale, AZ 85254

Tel: 480-626-2423

PRELIMINARY PROSPECTUS

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

We are offering for sale up to 10,000,000 common units (“Units”) with an offering price of $0.40 per Unit, comprising of 20,000,000 shares of our common stock (the “Offering Shares”) and 10,000,000 warrants (the “Offering Warrants”) to purchase shares of our common stock (the “Offering”). Each Unit shall be comprised of two (2) common stock shares and one (1) Offering Warrant. This Offering shall be conducted by the Company in a direct private offering. Each Offering Warrant shall be immediately exercisable to purchase one (1) share of common stock at an exercise price of $0.40 with an expiry date of five (5) years after the date of issuance. However, while the Company does not have any agreements in place to sell the shares with the involvement of underwriters or broker-dealers, the Company may engage such underwriters or broker-dealers in the future. Should all Units being offered by the Company hereunder be sold and all Offering Warrants offered hereunder are exercised, the Company would receive an aggregate of $8,000,000, comprised of $4,000,000 for newly issued Units, at an offering price of $0.40 per Unit, and $4,000,000 upon exercise of the newly issued Offering Warrants. There is no minimum number of shares or warrants that must be sold by us for the Offering to proceed, and we will retain the proceeds from the sale of any of the offered shares or the exercise of the offered warrants. The Offering is being conducted on a self-underwritten, best efforts basis, which means our officers and directors will attempt to sell the shares and the warrants. This Prospectus will permit our officers and directors to sell the shares and warrants directly to the public, with no commission or other remuneration payable to them for any shares or warrants they may sell. Our officers and directors will offer our shares at a fixed price of $0.40 per Unit for a period of one hundred and eighty (180) days from the effective date of this prospectus, unless extended by our board of directors for an additional 90 days. Our officers and directors will offer our warrants with an exercise price of $0.40 per share for a period of one hundred and eighty (180) days from the effective date of this prospectus, unless extended by our board of directors for an additional 90 days. In offering the securities on our behalf, our Officers and Directors will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934.

Digital Caddies, Inc. is a development stage company and currently has limited operations. Any investment in the securities offered herein involves a high degree of risk. You should only purchase securities if you can afford a loss of your investment. Our independent registered public accountant has issued an audit opinion for Digital Caddies, Inc.

Our common stock is currently quoted on the OTC Pink marketplace under the symbol “CADY”. On December 17, 2014, the closing price of our common stock was $0.1501 per share.

This prospectus covers the primary direct public offering by the Company of 10,000,000 Units, comprised of 20,000,000 shares of common stock and 10,000,000 warrants to purchase shares of our common stock. Each Unit shall be comprised of two (2) common stock shares and (1) warrant. The Company is concurrently conducting a resale offering for 45,973,868 shares, which is covered in a separate resale prospectus.

THE PURCHASE OF THE SECURITIES OFFERED THROUGH THIS PROSPECTUS INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY READ THIS ENTIRE PROSPECTUS, INCLUDING THE SECTION ENTITLED “RISK FACTORS” BEGINNING ON PAGE 13 HEREOF BEFORE BUYING ANY SHARES OF DIGITAL CADDIES, INC.’S COMMON STOCK.

No dealer, salesperson or any other person is authorized to give any information or make any representations in connection with this offering other than those contained in this prospectus and, if given or made, the information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any security other than the securities offered by this prospectus, or an offer to sell or a solicitation of an offer to buy any securities by anyone in any jurisdiction in which the offer or solicitation is not authorized or is unlawful.

TABLE OF CONTENTS

| | | | Page | |

| Implications Of Being An Emerging Growth Company | | | 9 | |

| Forward Looking Statements | | | 9 | |

| Prospectus Summary | | | 10 | |

| Summary of the Offering | | | 12 | |

| Risk Factors | | | 13 | |

| Determination of Offering Price | | | 24 | |

| Use of Proceeds | | | 24 | |

| Plan of Distribution; Terms of the Offering | | | 25 | |

| Dilution | | | 27 | |

| Description of Property | | | 27 | |

| Description of Securities | | | 27 | |

| Description of Our Business | | | 32 | |

| Legal Proceedings | | | 40 | |

| Market Price of and Dividends on the Registrant’s Common Equity And Related Stockholder Matters | | | 40 | |

| Management’s Discussion and Analysis | | | 42 | |

| Directors, Executive Officers, Promoters and Control Persons | | | 47 | |

| Executive Compensation | | | 50 | |

| Security Ownership of Certain Beneficial Owners and Management | | | 54 | |

| Certain Relationships and Related Transactions | | | 55 | |

| Legal Matters | | | 56 | |

| Experts | | | 56 | |

| Commission Position of Indemnification for Securities Act Liabilities | | | 56 | |

| Where you can find more Information | | | 56 | |

| Index to Financial Statements | | | 57 | |

You should rely only on the information contained or incorporated by reference to this prospectus in deciding whether to purchase our common stock. We have not authorized anyone to provide you with information different from that contained or incorporated by reference to this prospectus. Under no circumstances should the delivery to you of this prospectus or any sale made pursuant to this prospectus create any implication that the information contained in this prospectus is correct as of any time after the date of this prospectus. To the extent that any facts or events arising after the date of this prospectus, individually or in the aggregate, represent a fundamental change in the information presented in this prospectus, this prospectus will be updated to the extent required by law.

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

As a company with less than $1.0 billion in revenue during our most recently completed fiscal year, we qualify as an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended, which we refer to as the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable, in general, to public companies that are not emerging growth companies. These provisions include:

- Reduced disclosure about our executive compensation arrangements;

- No non-binding shareholder advisory votes on executive compensation or golden parachute arrangements; and

- Exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting.

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenues as of the end of a fiscal year, if we are deemed to be a large-accelerated filer under the rules of the Securities and Exchange Commission, or if we issue more than $1.0 billion of non-convertible debt over a three-year-period.

The JOBS Act permits an emerging growth company to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We are choosing to “opt out” of this provision.

FORWARD-LOOKING STATEMENTS

This registration statement contains forward-looking statements concerning our business, operations, financial performance and condition as well as our plans, objectives and expectations for our business, operations and financial performance and condition. Any statements contained in this registration statement that are not of historical facts may be deemed to be forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” Forward-looking statements include, but are not limited to, statements about:

- Our expectations with respect to regulatory submissions and approvals;

- Our expectations with respect to our intellectual property position;

- Our ability to commercialize our products;

- Our expectations regarding the time during which we will be an emerging growth company under the JOBS Act;

- Our ability to develop and commercialize new products; and

- Our estimates regarding our capital requirements and our need for additional financing.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential,” “aims,” “assumes,” “goal,” “intends,” “objective,” “potential,” “positioned,” “target” and similar expressions intended to identify forward-looking statements.

These forward-looking statements are based on current expectations, estimates, forecasts and projections about our business and the industry in which we operate and our management’s beliefs and assumptions. These forward-looking statements are not guarantees of future performance or development and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this registration statement may turn out to be inaccurate. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward- looking statements we make. We have included important factors in the cautionary statements included in this registration statement, particularly in the “Risk Factors” section, that could cause actual results or events to differ materially from the forward- looking statements that we make.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this Prospectus. This summary does not contain all the information that you should consider before investing in the common stock of Digital Caddies, Inc. (referred to herein as the “Company,” “we,” “our,” and “us”). You should carefully read the entire Prospectus, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the accompanying financial statements and notes before making an investment decision.

Corporate History

Digital Caddies, Inc. (“Digital Caddies,” “CADY” or the “Company”) is a corporation which was incorporated under the laws of the State of Oklahoma on September 7, 2011. The shares of stock and warrants of the Company were previously held in the name of DNA Beverage Corp., a Nevada Corporation, prior to the Company completing a holding company formation pursuant to Section 1081(a) of the Oklahoma General Corporation Laws. The Company’s fiscal year end is October 31. Neither the Company nor its predecessors have filed for bankruptcy, receivership or any similar proceedings nor are in the process of filing for bankruptcy, receivership or any similar proceedings.

Prior to its merger with the Company in 2011, Digital Caddies was a private company that was founded in 2003. From 2003 to June 2013, Digital Caddies was initially the Canadian distributer of Golf GPS technology owned by GolfLogix and later obtained worldwide rights to distribute GolfLogix’ technology for use in business to business applications. In 2007, in order to reflect this new relationship with GolfLogix as GolfLogix’ worldwide distributor, the Company briefly changed its name to GolfLogix (US), Inc., but reverted to the name Digital Caddies, Inc. on March 27, 2008. When the Company made the transition to the new business model focused on launching the new advertising platform, the agreement between Digital Caddies and GolfLogix was allowed to expire and there is no longer any current relationship between Digital Caddies, Inc. and GolfLogix. Beginning in June 2013, the Company shifted its business focus so that, instead of generating revenue through sales of tablets, revenue generation was expected to occur through sales of advertising on the newly launched “Digital Caddies platform,” which is expected to enable the Company to generate revenues from a source that is different from its prior business model.

Business Overview

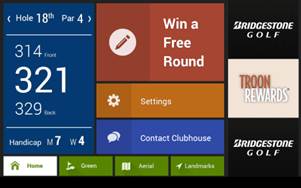

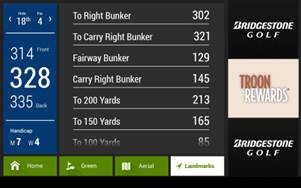

Digital Caddies, Inc. is a golf-centric technology and information-dissemination company that uses tablet technology and wireless connectivity to create The Players Network, an informational medium that enables advertisers to directly market to golfers through multifunctional web-enabled interactive tablets (currently manufactured by Samsung) installed on golf cars owned by the Company’s customer golf course businesses. These Internet-connected interactive tablets are designed to provide services to both golfers and golf courses alike. Once interactive tablets are installed, players are provided with a number of interactive services and applications, such as GPS-based hole/course information, scoring applications, messaging platforms (for cart-to-cart and cart-to-course communications), the ability to wirelessly call for the beverage cart, plus news, weather, sports, and entertainment. In addition, our platform provides a broad portfolio of course management tools designed to enable golf course managers to improve player pace of play via GPS-based cart tracking and communications, potentially increase merchandise and concession sales via real-time on-tablet promotions, and access to additional revenue streams (e.g., sale of local advertising.) All of these services are currently provided to our customer golf courses free of charge, although we may elect to charge for these services in the future.

We launched the beta version of the Digital Caddies platform in June 2013, then formally launched the platform in November 2013, and have signed contracts with several golf course management firms, Troon and OB Sports. To date, we have installations at approximately 170 golf courses, and have entered into several partnerships with third party ad networks, such as Nexage, Millenial Media, LiveRail, MoPub, Inc. and Access Sports Media, to help monetize The Players Network. The majority of our initial revenue will come from the sale of advertising and from sponsorship revenue. Our ability to attract advertisers, generate revenues and obtain premium advertising rates will be highly dependent upon a number of key factors including: (i) the attractiveness and density of our primary demographic; (ii) the amount of reach and/or viewership; (iii) the dwell time (that is, how long a viewer looks at a particular screen); and (iv) data (that is, what is known about a viewer and what information can be collected for the advertiser).

Impressions opportunities equal the number of times we can potentially place an advertisement in front of that golfer. The average round of golf takes 4.5 hours to play. Currently, our ad locations can provide up to 2 advertisements every minute. Therefore, 4.5 hours equals 270 minutes times 2 ad opportunities per minute, equals 540 ad opportunities per round. We currently have 3 ad locations integrated into our service therefore every round of golf provides up to 1620 ad opportunities. Based on our current estimated viewership of approximately 500,000 rounds per month, we generate up to 400 million impression opportunities. In addition, advertisers buy ad space based on the number of impressions they buy multiplied by the price. The pricing is usually based on the price for 1000 impressions, referred to as “CPM” (Cost per thousand). In order to calculate the revenue possibility, we take the number of impressions available and divide it by 1000 and multiply it by the CPM and multiply it by the “fill rate,” which is defined as the number of impressions actually sold. We believe that advertisers will be very interested in presenting their message on our Digital Caddies because of our ability to generate impressions and connect such advertisers with golfers during play.

SUMMARY OF THIS OFFERING

| The Issuer | | Digital Caddies, Inc. |

| | | |

| Securities being offered | | Up to 10,000,000 units are being offered for sale by the Company, comprised of: (i) 20,000,000 shares of Common Stock; and (ii) 10,000,000 shares issuable pursuant to the exercise of warrants to purchase shares of Common Stock. Each Unit shall be comprised of two (2) common stock shares and one (1) Offering Warrant. Each Offering Warrant shall be immediately exercisable to purchase one (1) share of common stock at an exercise price of $0.40 and have an expiry date of five (5) years after the date of issuance. This collectively represents approximately 33% of the currently issued and outstanding shares of the Company's Common Stock. Our Common Stock is described in further detail in the section of this prospectus titled “DESCRIPTION OF SECURITIES.” |

| | | |

| Per Unit Price | | $0.40 |

| | | |

| Duration of Offering | | The shares and warrants are offered for a period not to exceed 180 days, unless extended by our Board of Directors for an additional 90 days. |

| | | |

| Number of shares Outstanding before the Offering | | There are 89,734,973 shares of Common Stock issued and outstanding as of December 17, 2014. |

| | | |

| Net Proceeds to the Company | | The Company is offering a maximum of 10,000,000 Units, at an offering price of $0.40 per Unit, comprised of: (i) 20,000,000 shares of Common Stock, $0.001 par value; and (ii) 10,000,000 shares issuable pursuant to the exercise of warrants to purchase Common Stock, $0.001 par value.Each Unit shall be comprised of two (2) common stock shares and one (1) Offering Warrant. Each Offering Warrant shall be immediately exercisable to purchase one (1) share of common stock at an exercise price of $0.40 and have an expiry date of five (5) years after the date of issuance. The Company shall receive net proceeds of $4,000,000.00 if all of the Units being offered are sold. The full subscription price will be payable at the time of subscription and accordingly, funds received from subscribers in this Offering will be released to the Company when subscriptions are received and accepted. The Company shall receive additional net proceeds of $4,000,000 if all of the Offering Warrants underlying the Units are exercised. The exercise price will be payable at any time after the date of issuance and prior to the expiry date of such warrants and, accordingly, funds received from subscribers in this Offering will be released to the Company when the warrants are exercised. No assurance can be given that the net proceeds from the total number of Units offered hereby or any lesser net amount will be sufficient to accomplish our goals. If proceeds from this offering are insufficient, we may be required to seek additional capital. No assurance can be given that we will be able to obtain such additional capital. |

| | | |

| Use of Proceeds | | We will use the proceeds to build infrastructure for our the network, install golf courses with equipment, pay for wireless connectivity, pay for increased sales and marketing, administrative expenses, operating expenses, and working capital. |

| | | |

| Risk factors | | An investment in our Common Stock involves a high degree of risk. You should carefully consider the risk factors set forth under “Risk Factors” section hereunder and the other information contained in this prospectus before making an investment decision regarding our Common Stock. |

| | | |

| Trading Symbol | | Our common stock is currently quoted on the OTC Pink marketplace under the symbol “CADY”. |

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this Prospectus before making an investment decision with regard to our securities. The statements contained in or incorporated into this Prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO THE OFFERING

As there is no minimum for our offering, subscribers may lose their investment if only a few persons purchase Units.

Since there is no minimum with respect to the number of securities to be sold directly by the Company in this Offering, if only a few securities are sold, we may not have enough capital to sustain our business. In such an event, it is highly likely that any investment would be lost. As such, proceeds from this Offering may not be sufficient to meet the objectives we state in this Prospectus, other corporate milestones that we may set, or to avoid a “going concern” modification in future reports of our auditors as to uncertainty with respect to our ability to continue as a going concern. If we fail to raise sufficient capital, we would expect to have to significantly decrease operating expenses, which will curtail the growth of our business.

Investing in the Company is a highly speculative investment and could result in the loss of your entire investment.

A purchase of the offered securities is significantly speculative and involves significant risks. The offered securities should not be purchased by any person who cannot afford the loss of his or her entire purchase price. The business objectives of the Company are also speculative, and we may be unable to satisfy those objectives. The stockholders of the Company may be unable to realize a substantial return on their purchase of the offered securities, or any return whatsoever, and may lose their entire investment in the Company. For this reason, each prospective purchaser of the offered securities should read this prospectus and all of its exhibits carefully and consult with their attorney, business advisor and/or investment advisor.

Purchasers in this offering will experience immediate and substantial dilution in the book value of their investment.

The offering price of our Common Stock is substantially higher than the net tangible book value per share of our outstanding Common Stock immediately after this Offering. Therefore, if you purchase our Common Stock in this offering, you will incur immediate dilution of $0.1520 in net tangible book value per share from the price you paid.

Purchasers of shares in this offering may not be able to resell their shares, and the shares could be without value, if the Company does not maintain an updated and effective registration statement for the shares being offered.

The shares sold pursuant to this offering will be “restricted securities,” as that term is defined in Rule 144 promulgated under the Securities Act, if the Company does not maintain an updated and effective registration statement for the shares being offered. Accordingly, such shares must be held indefinitely, and may not be resold, unless the Company maintains an updated and effective registration statement for such shares or unless an exemption from such registration is available.

Purchasers of warrants in this offering may not be able to resell their warrants, or resell the shares received upon exercise of such warrants, and the warrants could expire without value if the Company does not maintain an updated and effective registration statement for the the warrants being offered.

The warrant sold pursuant to this offering, and the common stock shares issuable upon exercise of such warrants, will be “restricted securities,” as that term is defined in Rule 144 promulgated under the Securities Act, if the Company does not maintain an updated and effective registration statement for the warrants being offered. Accordingly, such warrants, and any common stock shares issued upon exercise of such warrants, must be held indefinitely, and may not be resold, unless the Company maintains an updated and effective registration statement for the warrants being offered or unless an exemption from such registration is available.

As a result of the concurrent offering by the Company and the Selling Shareholders, we may not be able to sell the Units being offered by us which will reduce the amount of capital available for our operations.

The Company and Selling Shareholders will be offering securities of the Company at the same time. The Selling Shareholders are not officers or directors of the Company and will not be selling shares on behalf of the Company under the Offering. The sale of shares by the Selling Shareholders is not contingent upon the Company selling a minimum number of its Units. Due to the concurrent offering, the Company and Selling Shareholders may be competing for potential investors. Further, the Company is selling its shares underlying the Units at a fixed price while the Selling Shareholders may be offering twice as many shares of the common stock of the Company at a price that may be less than that fixed price. In this regard, the Company is offering 20,000,000 shares underlying the 10,000,000 Units offered for sale at a fixed price of $0.40 per Unit, but the price at which the Selling Shareholders are offering 45,973,868 shares can be any amount, including at market price.

While we do not believe we will be approaching the same potential investors, we may inadvertently do so and if there is a conflict, it is possible that we may not be able to fully subscribe our offering. In that event, the overall proceeds to the Company from our offering may be decreased which would decrease the amount of capital available for our business operations. Further, sales of a substantial number of shares of our common stock by the Selling Shareholders could impair our ability to raise capital through the sale of additional equity securities.

As a result of the concurrent offering by the Company and the Selling Shareholders, the market price of our common stock could be adversely affected.

The combined offerings of up to approximately 55,973,868 shares of our common stock by the Company and the Selling Shareholders could adversely affect the market price of our common stock. Moreover, the perception in the public market that our existing shareholders might sell shares of common stock or that the Company might issue additional shares of common stock could depress the market for our common stock.

RISKS ASSOCIATED WITH OUR COMPANY’S BUSINESS

We are an “Emerging Growth Company” and we cannot be certain if the reduced disclosure requirements applicable to Emerging Growth Companies will make our Common Stock less attractive to Investors.

We are an “emerging growth company,” as defined in the Jumpstart our Business Startups Act of 2012 (“JOBS Act”), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our Common Stock less attractive because we will rely on these exemptions. If some investors find our Common Stock less attractive as a result, there may be a less active trading market for our Common Stock and our stock price may be more volatile.

Under the JOBS Act, “emerging growth companies” can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to “opt out” of such extended transition period and, therefore, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

We will remain an emerging growth company until the earliest of: (A) the last day of the fiscal year following the fifth anniversary of our first sale of common equity securities pursuant to an effective Registration Statement, (B) the last day of the fiscal year in which we have total annual gross revenue of $1.0 billion or more, (C) the date that we are deemed to be a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our Common Stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (D) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

Rule 12b-2 of the Securities Exchange Act of 1934, as amended, defines a “smaller reporting company” as an issuer that is not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent that is not a smaller reporting company and that:

- Had a public float of less than $ 75 million as of the last business day of its most recently completed second fiscal quarter, computed by multiplying the aggregate worldwide number of shares of its voting and non-voting common equity held by non-affiliates by the price at which the common equity was last sold, or the average of the bid and asked prices of common equity, in the principal market for the common equity; or

- In the case of an initial Registration Statement under the Securities Act or Exchange Act for shares of its common equity, had a public float of less than $75 million as of a date within 30 days of the date of the filing of the Registration Statement, computed by multiplying the aggregate worldwide number of such shares held by non-affiliates before the registration plus, in the case of a Securities Act Registration Statement, the number of such shares included in the Registration Statement by the estimated public offering price of the shares; or

- In the case of an issuer whose public float as calculated under paragraph (1) or (2) of this definition was zero, had annual revenues of less than $50 million during the most recently completed fiscal year for which audited financial statements are available.

We qualify as a smaller reporting company, and so long as we remain a smaller reporting company, we benefit from the same exemptions and exclusions as an emerging growth company. In the event that we cease to be an emerging growth company as a result of a lapse of the five year period, but continue to be a smaller reporting company, we would continue to be subject to the exemptions available to emerging growth companies until such time as we were no longer a smaller reporting company.

After, and if ever, we are no longer an “emerging growth company,” we expect to incur significant additional expenses and devote substantial management effort toward ensuring compliance with those requirements applicable to companies that are not “emerging growth companies,” including Section 404 of the Sarbanes-Oxley Act.

We are in the early stages of implementing our network.

While our company has generated revenues in the past from a GPS product for golfers, in November 2013 we launched the new Digital Caddies platform, which is a significant departure from our prior business. Consequently, our business has many of the characteristics, and faces many of the challenges, of a new company. There is no assurance that we will be able to generate significant or sufficient revenue from our new operations to reach or sustain profitability. New or emerging companies frequently face cash flow and other problems as they grow. Frequently such companies require substantial additional capital to reach a point where cash flow becomes positive. Therefore we may be faced with problems in the future that we have not yet encountered. Our future success will depend on our ability to attract and retain golf course management companies and course operators to deploy our networked tablet-based services and applications and to attract advertisers. We have only just started this new venture and have not yet tested out ability to sustain operations through advertising; therefore, we cannot guarantee that we will be successful.

We have a limited operating history, which may make it more difficult for investors to evaluate our business.

Although our founders have been working on the concepts underpinning our recently launched network since 2003, our new business model, which is an advertising-based revenue stream, was only implemented in November 2013. Our platform has only been installed in 170 courses to date, and, although we earned $992,538 in revenue for the fiscal year ending October 31, 2013 primarily from sponsor revenue, our operating history is limited. Therefore, our Company has a limited operating history on which to base an evaluation of our new business and future prospects. Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered by companies in their early stage of development, particularly companies in new and evolving markets such as ours. The risks include, but are not limited to, unproven ability to attract advertisers willing to pay rates we deem adequate and the management of growth. To address these risks, we must, among other things, implement and successfully execute our business and marketing strategy, develop our marketing capabilities, provide high quality dependable products and service, develop and implement financial and other business systems, respond to competitive developments and attract, retain and motivate qualified personnel. We cannot assure you that we will be successful in addressing the risks we may encounter, and our failure to do so could have a material adverse effect on our business, prospects, financial condition and results of operations.

We may not be able to achieve or subsequently maintain profitability.

We have earned $992,538 in total revenue during the fiscal year ended October 31, 2013, primarily from sponsorship from the Company’s partners, and $195,484 in total revenue for the nine months ending July 31, 2014. However, we incurred net losses of $1,903,006 for the fiscal year ending October 31, 2013 and net losses of $4,630,669 for the nine months ending July 31, 2014. Our ability to generate revenue and profitability will first require us to install a meaningful and sustainable number of tablets on golf cars in order to convince advertisers to spend their dollars to reach our users. To date, we have implemented our Digital Caddies tablets on cars at 170 courses. Until we reach a significantly greater critical mass that is also proven to be sustainable, it will be difficult to attract advertisers and command the advertising rates we feel is warranted and that we will need to achieve and maintain profitability. We may never reach that critical mass point, and even if we do, there is no assurance that we will be able to maintain profitability.

If we are unable to maintain and promote our brand, our business and operating results may be harmed.

We believe that maintaining and promoting our brand is critical to expanding our base of users and advertisers. Maintaining and promoting our brand will depend largely on our ability to provide useful, interesting and/or entertaining information and services for golfers and course operators on a platform that works reliably and delivers as promised. We may introduce new features, products or services that golfers, golf course managers or advertisers do not like, or our network may not function as it should, either of which could negatively impact our brand. Maintaining and enhancing our brand may require us to make substantial investments, and these investments may not achieve the desired goals. If we fail to successfully promote and maintain our brand or if we incur excessive expenses in this effort, our business and operating results could be adversely affected. If Digital Caddies users do not have a positive experience, it will be more difficult to market our offerings, which will, in turn, impact our ability to increase revenues through quality advertising.

Our growth will depend on our ability to develop and maintain our reputation.

Although our revenues will be derived primarily from advertising placed on wireless tablets installed on golf cars, our success will depend in large part on satisfying golf course management and operators and their golf patrons by providing the applications and services on Digital Caddies that they want or need, and by a delivering high quality products and service. If we provide a platform that does not function as promised, our reputation could be damaged and it may become difficult to attract users for Digital Caddies and advertisers willing to spend their advertising dollars to place ads on our network. This, in turn, could have a negative effect on our operations and results, and it could be difficult to recover once our reputation is damaged.

We expect to need additional financing, there is no certainty that we will have access to capital when needed, and such additional financings may result in dilution to our stockholders.

Even if the Offering is fully subscribed, of which there is no assurance, we may need to raise additional capital in order to fully implement our plan. In order to fully implement our business plan, we expect to need a total of $10,000,000.

Our ability to obtain additional financing, if and when required, will depend on investor and lender demand, our operating performance, the condition of the capital markets and other factors, and we cannot assure you that additional financing will be available to us on favorable terms when required, or at all. If we raise additional funds through the issuance of equity, equity-linked or debt securities, those securities may have rights, preferences or privileges senior to the rights of our Common Stock, and our existing stockholders may experience dilution. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to support the operation or growth of our business could be significantly impaired and our operating results may be harmed.

If we fail to grow our user base, we may have difficulty attracting advertisers, which could stifle revenue growth and could impact our ability to achieve profitability.

Under our current business plan, we provide the Digital Caddies platform to golf course operators at no cost. While our wireless tablet-based platform makes available a broad portfolio of applications and data of interest to both golfers and golf course operators, our revenue is generated from digital advertisers eager to engage the highly sought after golfer demographic by means of targeted advertising on the wireless-enabled tablet. Therefore, our future financial performance will be significantly determined by our success in growing the number of golfers who sit in golf cars equipped with theDigital Caddies tablet platform. We expect to generate a substantial portion of our revenue based upon engagement by golfers with the ads that are displayed on the tablets. Therefore, it is critically important that we be able to demonstrate to golf course operators the value we can bring to their operations, in terms of improved player turnover and increased revenue from merchandise and concession sales, as well as to create a more exciting, interactive and satisfying golf experience for their patrons. If golf course operators do not perceive meaningful benefits from using our platform, it will be much more difficult to grow our user base and consequently, our revenues. There is no assurance that we will be successful in these efforts.

We expect to generate the majority of our revenue from advertising. The failure to attract advertisers and the loss of advertising revenue if we are not able to maintain our relationships with advertisers could harm our business.

The substantial majority of our revenue will be generated from third parties advertising on theDigital Caddies platform. Our advertisers do not have long-term advertising commitments with us, and there are numerous outlets for these companies to spend their advertising dollars. Advertising agencies and potential new advertisers may perceive the Digital Caddies platform as experimental and unproven, and we may need to devote additional time and resources to educate them about our products and services. Advertisers will not continue to do business with us, or they will reduce the prices they are willing to pay to advertise with us, if we do not deliver ads in an effective manner or if they do not believe that their investment in advertising with us will generate a competitive return relative to alternatives. An inability to generate advertising interest in the Digital Caddies platform or a reduction in demand for advertising space on our platform, either of which could reduce the prices we command for our ads, could negatively affect our revenue and operating results.

If we are unable to compete effectively for advertisers, our business and operating results could be harmed.

Although we have developed a platform that provides a broad array of applications and data we believe will be highly sought after by golfers and golf course operators, we face intense competition for advertising dollars in the golf space. We compete against many companies and businesses for advertising dollars, including companies with far greater financial resources and substantially larger user bases, such as online and mobile businesses, and traditional media outlets such as television, radio and print. In order to grow our revenue and improve our operating results, we must develop a sound marketing strategy and allocate any funds devoted to growing our marketing base in a profitable manner. There is no assurance that we will be successful.

Our business could be harmed if we lose a member of our management team.

Our future performance will be substantially dependent on the continued services of our management team and our ability to retain and motivate them. The loss of the services of any of our executive officers could harm our business.

We may not be able to hire and retain a sufficient number of qualified employees.

In part, our future success will depend on our ability to attract, train, retain and motivate other highly skilled technical, managerial, marketing and customer support personnel as necessary. Competition for these personnel can be intense, and we may be unable to successfully attract sufficiently qualified personnel. Our Company currently is operated by the members of our management team, most of whom who have been with our Company since its inception, and independent contractors. We expect that our rate of hiring will proceed at a rapid pace after completion of this Offering. To manage the expected growth of our operations, we will need to integrate new employees into our business operations. Our inability to hire, integrate and retain qualified personnel as necessary may reduce the quality of our programs, products and services and could harm our business.

We would be harmed if security measures fail.

We rely on systems and security to protect our trade secrets and other proprietary information. Although strict non-disclosure agreements are in place, if the security measures that we use to protect trade secret information and our engineering and databases are ineffective, our business would be harmed. We cannot predict whether new technological developments could allow these security measures to be circumvented. In addition, our software, databases and servers may be vulnerable to computer viruses, physical or electronic break-ins and similar disruptions. We may need to spend resources to protect against security breaches or to alleviate problems caused by any breaches. We cannot assure that we can prevent all security breaches.

Our operating results may fluctuate from period to period, which makes them difficult to predict.

Our limited operating history and the rapid evolution of the market for our products and services make it difficult for us to predict our future performance. Additionally, although our prior business model was golf-centric, it bears little resemblance to our current business. Therefore, our past quarterly operating results cannot be used as an indicator of future performance. Our operating results in any given quarter can be influenced by numerous factors, many of which we are unable to predict or are outside of our control, including:

| | · | Our ability to grow our user base and user engagement; |

| | · | Our ability to attract and retain advertisers; |

| | · | Fluctuations in spending by our advertisers, including as a result of seasonality and extraordinary events; |

| | · | Our ability to maintain or increase revenue, improve gross margins and operating margins; |

| | · | Increases in research and development, marketing and sales and other operating expenses that we may incur to grow and expand our operations and to remain competitive; |

| | · | System failures resulting in the inaccessibility of our products and services; |

| | · | Breaches of securities or privacy, and the costs associated with remediating any such breaches; and |

| | · | Changes in global business or macroeconomic conditions. |

Investors should not rely on our operating results for any prior periods as an indication of our future operating performance. Fluctuations in our revenue can lead to even greater fluctuations in our operating results. Our budgeted expense levels depend in part on our expectations of long-term future revenue. Given relatively fixed operating costs related to our personnel and facilities, any substantial adjustment to our expenses to account for lower than expected levels of revenue will be difficult and take time. Consequently, if our revenue does not meet projected levels, our operating expenses would be high relative to our revenue, which would negatively affect our operating performance. If our revenue or operating results do not meet or exceed the expectations of investors or securities analysts or fall below any guidance we may in the future provide to the market, the price of our common stock may decline.

Our business depends on continued and unimpeded access to our Digital Caddies platform through the Internet by our users and advertisers. If we or our users experience disruptions in Internet service, we could incur additional expenses and the loss of users and advertisers.

We depend on the ability of our users and advertisers to access the Internet. Currently, this access is provided under a contract with Sprint Solutions, Inc. and is completely out of our control. Players will be accessing the Digital Caddies platform during their time on the golf course and therefore, disruptions in Internet access during their golf games will render our product and services unworkable for the intended purposes. If access problems become commonplace so that our users are unable to access the applications and data precisely at the time they want access, we will find it more difficult to retain users and advertisers and to attract new users and advertisers. In such circumstances, our operating results could be adversely affected.

If we are unable to maintain a high level of product quality, customer satisfaction and demand for our products and services could suffer, which could, in turn, cause a decline in advertising revenue.

Advertising revenue is a function of a number of factors, including, among others, the targeted demographic group, the number of eyeballs, the likelihood of engagement and the amount of likely time spent engaging. We believe the Digital Caddies platform offers advertisers compelling reasons to choose to advertise on our platform, given the highly sought after demographic that typically plays golf and the amount of time spent playing each round. However, in order to attract and retain advertisers and to be able to generate the advertising price we believe is warranted, we must provide customers (the golf course operators and their patrons) with quality applications and information that our users will find valuable, interesting or entertaining. If we are unable to provide customers with quality products and customer support, we could face customer dissatisfaction, decreased overall demand for our platform and loss of revenue. In addition, our inability to meet customer service expectations may damage our reputation and could consequently limit our ability to retain existing customers and attract new customers, which would adversely affect our ability to generate advertising revenue and negatively impact our operating results.

We may not be able to continue to add new customers and increase sales to our existing customers, which could adversely affect our operating results.

Our growth is dependent on our ability to continue to attract new customers while retaining and expanding our service offerings to existing customers. Growth in the demand for our services may be inhibited, and we may be unable to sustain growth in our customer base, for a number of reasons, such as:

| | · | Our inability to market our services in a cost-effective manner to new customers; |

| | · | The inability of our customers to differentiate our services from those of our competitors or our inability to effectively communicate such distinctions; |

| | · | Our inability to successfully communicate to businesses the benefits of outsourcing their hosting needs; |

| | · | Our inability to penetrate international markets; |

| | · | Our inability to expand our sales to existing customers; |

| | · | Our inability to strengthen awareness of our brand; and |

| | · | Reliability, quality or compatibility problems with our network. |

Our costs associated with increasing revenue from existing customers are generally lower than costs associated with generating revenue from new customers. Therefore, a reduction in the rate of revenue increase from our existing customers, even if offset by an increase in revenue from new customers, could reduce our operating margins. Any failure by us to continue attracting new customers or grow our revenue from existing customers could have a material adverse effect on our operating results.

If we fail to effectively manage our growth, our business and operating results could be harmed.

Providing the Digital Caddies platform to our users is costly, and we expect our expenses to continue to increase in the future as we broaden our user base and increase user engagement, and as we develop and implement new features, products and services that could require more infrastructure. In addition, our operating expenses, such as our research and development expenses and sales and marketing expenses, are expected to grow rapidly as we have expand our business. We expect to continue to invest in our infrastructure in order to enable us to provide our products and services rapidly and reliably to users around the country and eventually, internationally, including in countries where we do not expect significant near-term monetization. Continued growth could also strain our ability to maintain reliable service levels for our users and advertisers, develop and improve our operational, financial, legal and management controls, and enhance our reporting systems and procedures. Our expenses may grow faster than our revenue, and our expenses may be greater than we anticipate. Managing our growth will require significant expenditures and allocation of valuable management resources. If we fail to achieve the necessary level of efficiency in our organization as it grows, our business, operating results and financial condition would be harmed.

We expect to experience growth in our headcount and operations following this Offering, which will place significant demands on our management, operational and financial infrastructure. We expect to make substantial investments to expand our operations, research and development, sales and marketing and general and administrative organizations. We face significant competition for employees, and we may not be able to hire employees quickly enough to meet our needs. To attract highly skilled personnel, we have to offer highly competitive compensation packages. As we continue to grow, we could become subject to the risks of over-hiring, over-compensating our employees and over-expanding our operating infrastructure, and to the challenges of integrating, developing and motivating a rapidly growing employee base in dispersed geographic locations, including, eventually, various countries around the world. If we fail to effectively manage our hiring needs and successfully integrate our new hires, our efficiency and ability to meet our forecasts and our employee morale, productivity and retention could suffer and our business and operating results could be adversely affected.

If we are unable to adapt to evolving industry standards and customer demands in a timely and cost-effective manner, our ability to sustain and grow our business may suffer.

Our market is characterized by evolving industry standards, and frequent new product announcements, all of which impact the way in which the market may potentially receive our products. These characteristics are magnified by the intense competition in our industry. To be successful, we must adapt to our rapidly changing market by continually improving the performance, features, and quality of our products and marketing and modifying our business strategies accordingly. Our ability to sustain and grow our business would suffer if we fail to respond to these changes in a timely and cost-effective manner. Our failure to provide services to compete with new products could lead us to lose current and potential customers or could cause us to incur substantial costs, which would harm our operating results and financial condition.

We may not be able to compete successfully against competitors in our industry who provide similar information as our tablets through applications on smart phones and other mobile devices.

Although the Company primarily focuses its business model on distributing its tablets to businesses, such as golf courses, and not directly to consumers, we expect that we will face additional competition from competitors in our industry whoprovide similar information as our tablets through applications on smart phones and other mobile devices. The use of applications on smart phones and other mobile devices from such competitors may lead to a reduction in the usage of our products. Reductions in the use of our products, in turn, may cause a reduction in our ability to increase, maintain or even generate revenues.

We may not be able to compete successfully against current and future competitors.

Our industry is highly competitive. We expect that we will face additional competition from our existing competitors as well as new market entrants in the future. Many of our current and potential competitors have substantially greater financial, technical and marketing resources, larger customer bases, longer operating histories, greater brand recognition, and more established relationships in the industry than we do. As a result, some of these competitors may be able to:

| | · | Develop superior products or services, gain greater market acceptance, and expand their service offerings more efficiently or more rapidly; |

| | · | Adapt to new or emerging technologies and changes in customer requirements more quickly; |

| | · | Take advantage of acquisition and other opportunities more readily; |

| | · | Adopt more aggressive pricing policies and devote greater resources to the promotion, marketing, and sales of their services; and |

| | · | Devote greater resources to the research and development of their products and services. |

If our security measures are breached, or if our products and services are subject to attacks that degrade or deny the ability of users to access our products and services, our products and services may be perceived as not being secure, users and advertisers may curtail or stop using our products and services and our business and operating results could be harmed.