UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22961

EA Series Trust

(Exact name of registrant as specified in charter)

19 E. Eagle Road

Havertown, PA 19083

(Address of principal executive offices) (Zip code)

19 E. Eagle Road

Havertown, PA 19083

(Name and address of agent for service)

215-882-9983

Registrant’s telephone number, including area code

Date of fiscal year end: May 31, 2024

Date of reporting period: May 31, 2024

Item 1. Report to Stockholders.

| | | | | | | | |

| Sparkline Intangible Value ETF Ticker: ITAN Listed on: NYSE Arca, Inc. | May 31, 2024 Annual Shareholder Report etf.sparklinecapital.com |

|

| | | | | | | | | | | |

| This annual shareholder report contains important information about the Sparkline Intangible Value ETF (the “Fund”) for the period of June 1, 2023 to May 31, 2024 (the “Period). You can find additional information about the Fund at etf.sparklinecapital.com. You can also request this information by contacting us at (215) 882-9983. |

| | | | | | | | | | | |

| WHAT WERE THE FUND COSTS FOR THE PERIOD? (based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $56 | | 0.50% |

| | | | | | | | | | | |

PERFORMANCE OF HYPOTHETICAL $10,000 INVESTMENT |

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

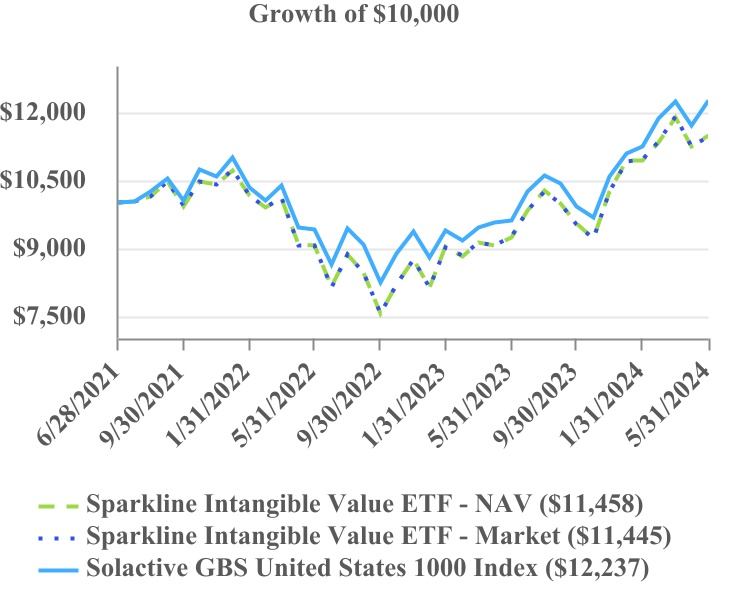

During the Period, the Fund returned 24.37% (on a NAV basis). From a high level, this exceptional performance was the result of favorable macroeconomic factors, such as a robust economy, moderating inflation, and healthy corporate profits. The Fund also benefited from rising interest in AI-related investments, given its heavy exposure to firms with innovative intangible assets. In addition, the Fund’s allocation to companies with strong human capital and brand equity contributed meaningfully to returns.

Despite strong absolute performance, the Fund lagged the broader U.S. stock market index over this Period. This underperformance mostly occurred in the final month of the fiscal year, during which U.S. mega-cap tech stocks (e.g., the so-called “Magnificent 7”) surged. Due to its flatter market-cap weighting scheme, the Fund is less concentrated in mega-cap stocks than the market index. While this may lead to underperformance in periods of mega-cap dominance, we believe that diversification will prove beneficial over the long run.

| | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS |

| | One Year | | Since Inception (6/28/2021) |

| Sparkline Intangible Value ETF - NAV | | 24.37% | | 4.76% |

| Sparkline Intangible Value ETF - Market | | 24.02% | | 4.72% |

| Solactive GBS United States 1000 Index | | 27.55% | | 7.15% |

| The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

| Visit etf.sparklinecapital.com for more recent performance information. |

Annual Shareholder Report: May 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Sparkline Intangible Value ETF Ticker: ITAN Listed on: NYSE Arca, Inc. | May 31, 2024 Annual Shareholder Report etf.sparklinecapital.com |

|

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $35,493,918 | | Portfolio Turnover Rate* | | 35% |

| # of Portfolio Holdings | | 152 | | Advisory Fees Paid | | $152,316 |

| *Portfolio turnover is calculated without regard to short-term securities having a maturity of less than one year. Excludes impact of in-kind transactions. |

|

| | | | | |

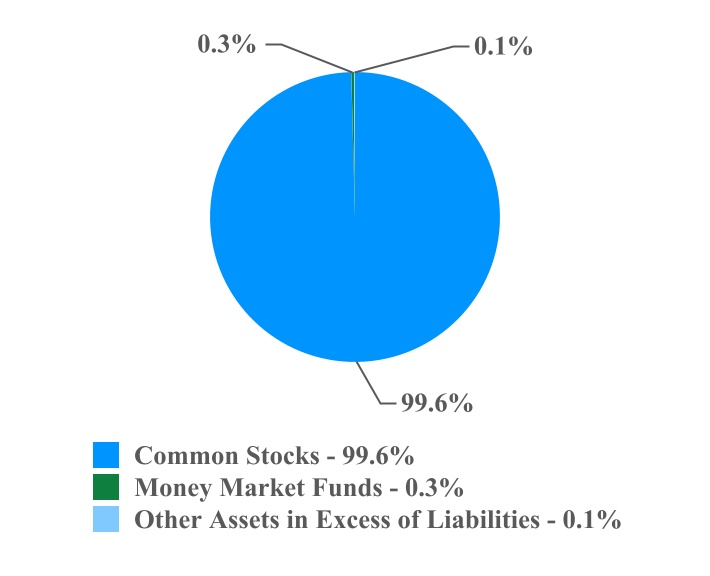

SECTOR WEIGHTING

(as a % of Net Assets) |

| Information Technology | 28.8%(1) |

| Industrials | 17.8% |

| Communication Services | 17.3% |

| Consumer Discretionary | 12.0% |

| Health Care | 11.7% |

| Financials | 6.4% |

| Consumer Staples | 2.6% |

| Materials | 1.6% |

| Energy | 0.7% |

| Real Estate | 0.7% |

| Money Market Funds | 0.3% |

Other Assets in Excess of Liabilities (2) | 0.1% |

| Total | 100.0% |

| |

(1) For purposes of the Fund’s compliance with its concentration limits, the Fund uses various sub-classifications and none of the Fund’s holdings in the sub-classifications exceed 25% of the Fund’s total assets. |

(2) Cash, cash equivalents and other assets in excess of liabilities. |

| | | | | | | | | | | |

ASSET WEIGHTING (as a % of Net Assets) |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, and holdings, visit etf.sparklinecapital.com. Information about the Fund’s proxy voting records is available by calling (215) 882-9983.

Annual Shareholder Report: May 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any amendments to its code of ethics during the year covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the year covered by this report.

A copy of the registrant’s Code of Ethics is incorporated by reference.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Trustees of the Trust has determined that there is at least one audit committee financial expert serving on its audit committee. Dr. Michael Pagano is an “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past fiscal year. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning, including review of the registrant’s tax returns and calculations of required income, capital gain and excise distributions. There were no “Other services” provided by the principal accountant. The following table details the aggregate fees billed or expected to be billed for the last fiscal year for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | | | | | | | |

| | FYE 5/31/2024 | FYE 5/31/2023 |

| (a) Audit Fees | $8,750 | $8,750 |

| (b) Audit-Related Fees | N/A | N/A |

| (c)Tax Fees | $2,250 | $2,250 |

| (d) All Other Fees | N/A | N/A |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by its principal accountant applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | | | | | | | |

| | FYE 5/31/2024 | FYE 5/31/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years.

| | | | | | | | |

| Non-Audit Related Fees | FYE 5/31/2024 | FYE 5/31/2023 |

| Registrant | N/A | N/A |

| Registrant’s Investment Adviser | N/A | N/A |

(h) The audit committee of the board of trustees/directors has considered whether the provision of non-audit services that were rendered to the registrant's investment adviser is compatible with maintaining the principal accountant's independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) The registrant has not been identified by the U.S. Securities and Exchange Commission as having filed an annual report issued by a registered public accounting firm branch or office that is located in a foreign jurisdiction where the Public Company Accounting Oversight Board is unable to inspect or completely investigate because of a position taken by an authority in that jurisdiction..

(j) The registrant is not a foreign issuer.

Item 5. Audit Committee of Listed Registrants.

(a) The registrant is an issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934, (the “Act”) and has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Act. The independent members of the committee are as follows: Daniel Dorn, Chukwuemeka (Emeka) Oguh, and Michael Pagano.

(b) Not applicable.

Item 6. Investments.

| | |

| SPARKLINE INTANGIBLE VALUE ETF |

| SCHEDULE OF INVESTMENTS |

| May 31, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.6% | | Shares | | Value |

| Aerospace & Defense - 6.7% | | | | |

Boeing Co.(a) | | 2,277 | | | $ | 404,418 | |

| General Dynamics Corp. | | 899 | | | 269,493 | |

| General Electric Co. | | 2,232 | | | 368,593 | |

| L3Harris Technologies, Inc. | | 1,082 | | | 243,266 | |

| Lockheed Martin Corp. | | 680 | | | 319,831 | |

| Northrop Grumman Corp. | | 693 | | | 312,384 | |

| RTX Corp. | | 4,136 | | | 445,902 | |

| | | | 2,363,887 | |

| | | | |

| Agricultural & Farm Machinery - 0.2% | | | | |

| AGCO Corp. | | 810 | | | 86,937 | |

| | | | |

| Air Freight & Logistics - 0.8% | | | | |

| FedEx Corp. | | 1,183 | | | 300,435 | |

| | | | |

| Apparel Retail - 0.3% | | | | |

| Gap, Inc. | | 3,851 | | | 111,525 | |

| | | | |

| Apparel, Accessories & Luxury Goods - 0.3% | | | | |

| Tapestry, Inc. | | 2,665 | | | 115,901 | |

| | | | |

| Application Software - 4.8% | | | | |

Autodesk, Inc.(a) | | 896 | | | 180,634 | |

Box, Inc. - Class A(a) | | 2,344 | | | 63,874 | |

DocuSign, Inc.(a) | | 2,677 | | | 146,539 | |

Dropbox, Inc. - Class A(a) | | 5,693 | | | 128,263 | |

Nutanix, Inc. - Class A(a) | | 2,821 | | | 156,044 | |

| Salesforce, Inc. | | 2,621 | | | 614,467 | |

Unity Software, Inc.(a) | | 3,726 | | | 68,074 | |

Workday, Inc. - Class A(a) | | 880 | | | 186,076 | |

Zoom Video Communications, Inc. - Class A(a) | | 2,327 | | | 142,738 | |

| | | | 1,686,709 | |

| | | | |

| Asset Management & Custody Banks - 0.2% | | | | |

Invesco Ltd. (b) | | 5,362 | | | 84,237 | |

| | | | |

| Automobile Manufacturers - 1.8% | | | | |

| Ford Motor Co. | | 25,234 | | | 306,088 | |

| General Motors Co. | | 7,409 | | | 333,331 | |

| | | | 639,419 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

1

| | |

| SPARKLINE INTANGIBLE VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| May 31, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.6% (CONTINUED) | | Shares | | Value |

| Automotive Parts & Equipment - 0.6% | | | | |

Aptiv PLC(a) | | 1,581 | | | $ | 131,634 | |

| BorgWarner, Inc. | | 2,482 | | | 88,508 | |

| | | | 220,142 | |

| Automotive Retail - 0.3% | | | | |

Carvana Co.(a) | | 935 | | | 93,481 | |

| | | | |

| Biotechnology - 1.5% | | | | |

Biogen, Inc.(a) | | 840 | | | 188,950 | |

Exact Sciences Corp.(a) | | 1,743 | | | 79,219 | |

| Gilead Sciences, Inc. | | 4,348 | | | 279,446 | |

| | | | 547,615 | |

| | | | |

| Brewers - 0.3% | | | | |

| Molson Coors Beverage Co. - Class B | | 1,789 | | | 98,055 | |

| | | | |

| Broadcasting - 0.3% | | | | |

| Paramount Global - Class B | | 7,769 | | | 92,529 | |

| | | | |

| Broadline Retail - 5.3% | | | | |

Amazon.com, Inc.(a) | | 8,071 | | | 1,424,047 | |

| eBay, Inc. | | 4,613 | | | 250,117 | |

Etsy, Inc.(a) | | 1,768 | | | 112,215 | |

| Kohl's Corp. | | 2,138 | | | 47,870 | |

| Macy's, Inc. | | 3,344 | | | 65,141 | |

| | | | 1,899,390 | |

| | | | |

| Building Products - 0.7% | | | | |

Johnson Controls International PLC (b) | | 3,414 | | | 245,501 | |

| | | | |

| Cable & Satellite - 1.7% | | | | |

Charter Communications, Inc. - Class A(a) | | 811 | | | 232,855 | |

| Comcast Corp. - Class A | | 9,443 | | | 378,003 | |

| | | | 610,858 | |

| | | | |

| Communications Equipment - 2.9% | | | | |

Ciena Corp.(a) | | 2,529 | | | 121,822 | |

| Cisco Systems, Inc. | | 12,824 | | | 596,316 | |

F5, Inc.(a) | | 841 | | | 142,104 | |

| Juniper Networks, Inc. | | 4,288 | | | 152,953 | |

| | | | 1,013,195 | |

| Computer & Electronics Retail - 0.5% | | | | |

| Best Buy Co., Inc. | | 2,204 | | | 186,943 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

2

| | |

| SPARKLINE INTANGIBLE VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| May 31, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.6% (CONTINUED) | | Shares | | Value |

| Construction & Engineering - 0.4% | | | | |

| AECOM | | 1,470 | | | $ | 128,390 | |

| | | | |

| Construction Machinery & Heavy Transportation Equipment - 0.8% | | | | |

| Cummins, Inc. | | 981 | | | 276,377 | |

| | | | |

| Consumer Finance - 1.3% | | | | |

| Ally Financial, Inc. | | 3,481 | | | 135,654 | |

| Capital One Financial Corp. | | 2,406 | | | 331,138 | |

| | | | 466,792 | |

| | | | |

| Consumer Staples Merchandise Retail - 1.1% | | | | |

| Target Corp. | | 2,502 | | | 390,712 | |

| | | | |

| Data Processing & Outsourced Services - 0.2% | | | | |

Genpact Ltd. (b) | | 2,569 | | | 84,931 | |

| | | | |

| Diversified Banks - 1.4% | | | | |

| Wells Fargo & Co. | | 8,382 | | | 502,249 | |

| | | | |

| Drug Retail - 0.4% | | | | |

| Walgreens Boots Alliance, Inc. | | 8,501 | | | 137,886 | |

| | | | |

| Electrical Components & Equipment - 0.2% | | | | |

Sunrun, Inc.(a) | | 5,199 | | | 75,178 | |

| | | | |

| Electronic Components - 0.6% | | | | |

| Corning, Inc. | | 5,400 | | | 201,204 | |

| | | | |

| Electronic Equipment & Instruments - 0.8% | | | | |

Trimble, Inc.(a) | | 2,253 | | | 125,447 | |

Zebra Technologies Corp. - Class A(a) | | 552 | | | 172,412 | |

| | | | 297,859 | |

| | | | |

| Electronic Manufacturing Services - 0.9% | | | | |

| Jabil, Inc. | | 1,155 | | | 137,330 | |

| TE Connectivity Ltd. | | 1,329 | | | 198,951 | |

| | | | 336,281 | |

| | | | |

| Food Retail - 0.8% | | | | |

| Albertsons Cos., Inc. - Class A | | 5,507 | | | 113,664 | |

| Kroger Co. | | 3,375 | | | 176,749 | |

| | | | 290,413 | |

| | | | |

| Health Care Distributors - 0.5% | | | | |

| Cardinal Health, Inc. | | 1,763 | | | 175,013 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

3

| | |

| SPARKLINE INTANGIBLE VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| May 31, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.6% (CONTINUED) | | Shares | | Value |

| Health Care Equipment - 2.5% | | | | |

| Baxter International, Inc. | | 5,190 | | | $ | 176,927 | |

| Becton Dickinson & Co. | | 990 | | | 229,650 | |

Masimo Corp.(a) | | 568 | | | 70,716 | |

Medtronic PLC (b) | | 5,155 | | | 419,463 | |

| | | | 896,756 | |

| Health Care Services - 2.3% | | | | |

| CVS Health Corp. | | 6,440 | | | 383,824 | |

DaVita, Inc.(a) | | 996 | | | 146,531 | |

| Labcorp Holdings, Inc. | | 712 | | | 138,776 | |

| Quest Diagnostics, Inc. | | 1,033 | | | 146,655 | |

| | | | 815,786 | |

| Homefurnishing Retail - 0.3% | | | | |

Wayfair, Inc. - Class A(a) | | 1,694 | | | 100,776 | |

| | | | |

| Hotels, Resorts & Cruise Lines - 0.5% | | | | |

Expedia Group, Inc.(a) | | 1,564 | | | 176,513 | |

| | | | |

| Household Appliances - 0.3% | | | | |

| Whirlpool Corp. | | 992 | | | 92,286 | |

| | | | |

| Human Resource & Employment Services - 0.2% | | | | |

| Robert Half, Inc. | | 1,109 | | | 71,231 | |

| | | | |

| Industrial Conglomerates - 1.9% | | | | |

| 3M Co. | | 2,910 | | | 291,407 | |

| Honeywell International, Inc. | | 1,857 | | | 375,467 | |

| | | | 666,874 | |

| | | | |

| Industrial Machinery & Supplies & Components - 0.3% | | | | |

| Stanley Black & Decker, Inc. | | 1,233 | | | 107,481 | |

| | | | |

| Integrated Telecommunication Services - 3.0% | | | | |

| AT&T, Inc. | | 29,734 | | | 541,754 | |

| Verizon Communications, Inc. | | 12,495 | | | 514,169 | |

| | | | 1,055,923 | |

| | | | |

| Interactive Home Entertainment - 0.5% | | | | |

| Electronic Arts, Inc. | | 1,254 | | | 166,632 | |

| | | | |

| Interactive Media & Services - 7.9% | | | | |

Alphabet, Inc. - Class A(a) | | 4,398 | | | 758,655 | |

Alphabet, Inc. - Class C(a) | | 4,352 | | | 757,074 | |

| Meta Platforms, Inc. - Class A | | 2,343 | | | 1,093,783 | |

Snap, Inc. - Class A(a) | | 14,014 | | | 210,490 | |

| | | | 2,820,002 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

4

| | |

| SPARKLINE INTANGIBLE VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| May 31, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.6% (CONTINUED) | | Shares | | Value |

| Internet Services & Infrastructure - 1.2% | | | | |

Akamai Technologies, Inc.(a) | | 1,356 | | | $ | 125,077 | |

Okta, Inc.(a) | | 1,707 | | | 151,377 | |

Twilio, Inc. - Class A(a) | | 2,394 | | | 137,416 | |

| | | | 413,870 | |

| | | | |

| IT Consulting & Other Services - 4.0% | | | | |

Accenture PLC - Class A (b) | | 1,756 | | | 495,701 | |

| Amdocs Ltd. | | 1,085 | | | 85,715 | |

| Cognizant Technology Solutions Corp. - Class A | | 3,880 | | | 256,662 | |

| International Business Machines Corp. | | 3,417 | | | 570,127 | |

| | | | 1,408,205 | |

| | | | |

| Leisure Products - 0.8% | | | | |

| Hasbro, Inc. | | 1,596 | | | 95,409 | |

Mattel, Inc.(a) | | 4,466 | | | 79,450 | |

| Polaris, Inc. | | 1,198 | | | 100,153 | |

| | | | 275,012 | |

| | | | |

| Life & Health Insurance - 0.6% | | | | |

| Prudential Financial, Inc. | | 1,633 | | | 196,532 | |

| | | | |

| Life Sciences Tools & Services - 0.4% | | | | |

Illumina, Inc.(a) | | 1,471 | | | 153,396 | |

| | | | |

| Managed Health Care - 1.3% | | | | |

Centene Corp.(a) | | 3,165 | | | 226,582 | |

| Humana, Inc. | | 616 | | | 220,602 | |

| | | | 447,184 | |

| | | | |

| Motorcycle Manufacturers - 0.2% | | | | |

| Harley-Davidson, Inc. | | 2,045 | | | 73,375 | |

| | | | |

| Movies & Entertainment - 2.6% | | | | |

Roku, Inc.(a) | | 2,205 | | | 126,567 | |

Spotify Technology SA(a) | | 713 | | | 211,604 | |

| Walt Disney Co. | | 4,007 | | | 416,367 | |

Warner Bros Discovery, Inc.(a) | | 19,510 | | | 160,763 | |

| | | | 915,301 | |

| | | | |

| Oil & Gas Equipment & Services - 0.7% | | | | |

| Halliburton Co. | | 4,338 | | | 159,204 | |

| NOV, Inc. | | 4,380 | | | 82,432 | |

| | | | 241,636 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

5

| | |

| SPARKLINE INTANGIBLE VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| May 31, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.6% (CONTINUED) | | Shares | | Value |

| Paper & Plastic Packaging Products & Materials - 0.7% | | | | |

| International Paper Co. | | 2,970 | | | $ | 133,917 | |

| Westrock Co. | | 2,358 | | | 126,483 | |

| | | | 260,400 | |

| | | | |

| Passenger Airlines - 1.7% | | | | |

Alaska Air Group, Inc.(a) | | 1,828 | | | 76,813 | |

American Airlines Group, Inc.(a) | | 10,239 | | | 117,748 | |

| Delta Air Lines, Inc. | | 4,079 | | | 208,111 | |

United Airlines Holdings, Inc.(a) | | 3,649 | | | 193,360 | |

| | | | 596,032 | |

| | | | |

| Passenger Ground Transportation - 1.1% | | | | |

Lyft, Inc. - Class A(a) | | 6,661 | | | 103,978 | |

Uber Technologies, Inc.(a) | | 4,720 | | | 304,723 | |

| | | | 408,701 | |

| | | | |

| Pharmaceuticals - 3.2% | | | | |

| Bristol-Myers Squibb Co. | | 6,947 | | | 285,452 | |

Elanco Animal Health, Inc.(a) | | 7,368 | | | 130,267 | |

Jazz Pharmaceuticals PLC(a) (b) | | 880 | | | 92,620 | |

| Pfizer, Inc. | | 16,788 | | | 481,144 | |

| Viatris, Inc. | | 14,520 | | | 153,912 | |

| | | | 1,143,395 | |

| | | | |

| Property & Casualty Insurance - 1.0% | | | | |

| Allstate Corp. | | 1,519 | | | 254,463 | |

| First American Financial Corp. | | 1,556 | | | 86,482 | |

| | | | 340,945 | |

| | | | |

| Real Estate Services - 0.7% | | | | |

Jones Lang LaSalle, Inc.(a) | | 635 | | | 128,315 | |

Zillow Group, Inc. - Class C (a) | | 2,675 | | | 109,541 | |

| | | | 237,856 | |

| | | | |

| Research & Consulting Services - 2.6% | | | | |

| Booz Allen Hamilton Holding Corp. | | 1,198 | | | 182,348 | |

CACI International, Inc. - Class A (a) | | 332 | | | 140,927 | |

| Jacobs Solutions, Inc. | | 1,358 | | | 189,224 | |

| Leidos Holdings, Inc. | | 1,237 | | | 181,901 | |

| Science Applications International Corp. | | 845 | | | 113,779 | |

| TransUnion | | 1,531 | | | 110,109 | |

| | | | 918,288 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

6

| | |

| SPARKLINE INTANGIBLE VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| May 31, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.6% (CONTINUED) | | Shares | | Value |

| Restaurants - 0.6% | | | | |

DoorDash, Inc. - Class A(a) | | 1,977 | | | $ | 217,687 | |

| | | | |

| Semiconductors - 4.6% | | | | |

| Intel Corp. | | 16,888 | | | 520,995 | |

NXP Semiconductors NV (b) | | 1,147 | | | 312,099 | |

Qorvo, Inc.(a) | | 1,079 | | | 106,163 | |

| Qualcomm, Inc. | | 3,471 | | | 708,257 | |

| | | | 1,647,514 | |

| | | | |

| Specialized Consumer Services - 0.2% | | | | |

| H&R Block, Inc. | | 1,696 | | | 84,189 | |

| | | | |

| Specialty Chemicals - 0.9% | | | | |

| DuPont de Nemours, Inc. | | 2,073 | | | 170,318 | |

| Eastman Chemical Co. | | 1,302 | | | 131,931 | |

| | | | 302,249 | |

| | | | |

| Systems Software - 4.0% | | | | |

| Gen Digital, Inc. | | 5,835 | | | 144,883 | |

| Oracle Corp. | | 6,627 | | | 776,618 | |

Palo Alto Networks, Inc.(a) | | 1,016 | | | 299,629 | |

Tenable Holdings, Inc.(a) | | 1,413 | | | 59,614 | |

Zscaler, Inc.(a) | | 847 | | | 143,956 | |

| | | | 1,424,700 | |

| | | | |

| Technology Distributors - 0.3% | | | | |

Arrow Electronics, Inc.(a) | | 740 | | | 97,169 | |

| | | | |

| Technology Hardware, Storage & Peripherals - 4.7% | | | | |

| Dell Technologies, Inc. - Class C | | 3,510 | | | 489,856 | |

| Hewlett Packard Enterprise Co. | | 11,860 | | | 209,329 | |

| HP, Inc. | | 8,523 | | | 311,089 | |

| NetApp, Inc. | | 2,064 | | | 248,568 | |

Pure Storage, Inc. - Class A(a) | | 3,180 | | | 191,722 | |

Western Digital Corp.(a) | | 3,082 | | | 232,044 | |

| | | | 1,682,608 | |

| | | | |

| Transaction & Payment Processing Services - 1.9% | | | | |

Block, Inc.(a) | | 3,965 | | | 254,077 | |

PayPal Holdings, Inc.(a) | | 5,198 | | | 327,422 | |

| Western Union Co. | | 6,288 | | | 80,487 | |

| | | | 661,986 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

7

| | |

| SPARKLINE INTANGIBLE VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| May 31, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.6% (CONTINUED) | | Shares | | Value |

| Wireless Telecommunication Services - 1.3% | | | | |

| T-Mobile US, Inc. | | 2,595 | | | $ | 454,021 | |

TOTAL COMMON STOCKS (Cost $31,837,421) | | | | 35,332,555 | |

| | | | |

| SHORT-TERM INVESTMENTS - 0.3% | | | | |

| Money Market Funds - 0.3% | | | | |

First American Government Obligations Fund - Class X, 5.24%(c) | | 113,601 | | | 113,601 | |

TOTAL SHORT-TERM INVESTMENTS (Cost $113,601) | | | | 113,601 | |

| | | | |

TOTAL INVESTMENTS - 99.9% (Cost $31,951,022) | | | | $ | 35,446,156 | |

| Other Assets in Excess of Liabilities - 0.1% | | | | 47,762 | |

| TOTAL NET ASSETS - 100.0% | | | | $ | 35,493,918 | |

Percentages are stated as a percent of net assets.

NV - Naamloze Vennootschap

PLC - Public Limited Company

SA - Sociedad Anónima

(a) Non-income producing security.

(b) Foreign issued security.

(c) The rate shown represents the 7-day effective yield as of May 31, 2024.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

(b) Not applicable

The accompanying notes are an integral part of these financial statements.

8

SPARKLINE INTANGIBLE VALUE ETF

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment

Companies.

STATEMENT OF ASSETS AND LIABILITIES

May 31, 2024

| | | | | | | | |

| Assets: | | |

| Investments in securities, at value (See Note 2) | | $ | 35,446,156 | |

| Dividends and interest receivable | | 62,848 | |

| Securities lending income receivable (See Note 5) | | 4 | |

| Total assets | | 35,509,008 | |

| | |

| Liabilities: | | |

| Accrued investment advisory fees (See Note 4) | | 15,090 | |

| Total liabilities | | 15,090 | |

| Net Assets | | $ | 35,493,918 | |

| | |

| Net Assets Consist of: | | |

| Paid-in capital | | $ | 32,435,501 | |

| Total distributable earnings (accumulated deficit) | | 3,058,417 | |

| Net Assets: | | $ | 35,493,918 | |

| | |

| Calculation of Net Asset Value Per Share: | | |

| Net Assets | | $ | 35,493,918 | |

| Shares Outstanding (unlimited shares of beneficial interest authorized, no par value) | | 1,270,000 | |

| Net Asset Value per Share | | $ | 27.95 | |

| | |

| Cost of Investments in Securities | | $ | 31,951,022 | |

The accompanying notes are an integral part of these financial statements.

1

SPARKLINE INTANGIBLE VALUE ETF

STATEMENT OF OPERATIONS

For the Year Ended May 31, 2024

| | | | | | | | |

| Investment Income: | | |

| Dividend income (Net of foreign tax of $754) | | $ | 542,499 | |

| Interest income | | 5,722 | |

| Securities lending income, net (See Note 5) | | 266 | |

| Total investment income | | 548,487 | |

| | |

| Expenses: | | |

| Investment advisory fees (See Note 4) | | 152,316 | |

| Net expenses | | 152,316 | |

| | |

| Net Investment Income (Loss) | | 396,171 | |

| | |

| Realized and Unrealized Gain (Loss) on Investments: | | |

| Net realized gain (loss) on: | | |

| Investments | | 2,763,347 | |

| | 2,763,347 | |

| Net change in unrealized appreciation (depreciation) on: | | |

| Investments | | 3,023,978 | |

| | 3,023,978 | |

| Net realized and unrealized gain (loss) on investments: | | 5,787,325 | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 6,183,496 | |

The accompanying notes are an integral part of these financial statements.

2

SPARKLINE INTANGIBLE VALUE ETF

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | | | | | |

| | For the Year Ended

May 31, 2024 | | For the Year Ended May 31, 2023 |

| Increase (Decrease) in Net Assets from: | | | | |

| Operations: | | | | |

| Net investment income (loss) | | $ | 396,171 | | | $ | 126,296 | |

| Net realized gain (loss) on investments | | 2,763,347 | | (36,544) |

| Net change in unrealized appreciation (depreciation) on investments | | 3,023,978 | | 1,015,849 |

| Net increase (decrease) in net assets resulting from operations | | 6,183,496 | | 1,105,601 |

| | | | |

| Distributions to Shareholders: | | | | |

| Distributable earnings | | (364,549) | | (92,348) |

| Total distributions to shareholders | | (364,549) | | (92,348) |

| | | | |

| Capital Share Transactions: | | | | |

| Proceeds from shares sold | | 18,176,585 | | 20,994,013 |

| Payments for shares redeemed | | (11,013,272) | | (3,772,576) |

| Net increase (decrease) in net assets derived from net change in capital share transactions | | 7,163,313 | | 17,221,437 |

| Net Increase (Decrease) in Net Assets | | 12,982,260 | | 18,234,690 |

| | | | |

| Net Assets: | | | | |

| Beginning of year | | 22,511,658 | | 4,276,968 |

| End of year | | $ | 35,493,918 | | | $ | 22,511,658 | |

| | | | |

| Changes in Shares Outstanding: | | | | |

| Shares outstanding, beginning of year | | 990,000 | | 190,000 |

| Shares sold | | 700,000 | | 970,000 |

| Shares repurchased | | (420,000) | | (170,000) |

| Shares outstanding, end of year | | 1,270,000 | | 990,000 |

The accompanying notes are an integral part of these financial statements.

3

SPARKLINE INTANGIBLE VALUE ETF

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Net Asset Value, Beginning of Period | | Net Investment Income (Loss)(1) | | Net Realized and Unrealized Gain (Loss) on Investments | | Net Increase (Decrease) in Net Asset Value Resulting from Operations | | Distributions from Net Investment Income | | Total Distributions | | Net Asset Value, End of Period | | Total Return(2) | | Net Assets, End of Period (000's) | | Net Expenses(3)(4) | | Net Investment Income (Loss)(3) | | Portfolio Turnover Rate(5) |

| For the Year Ended May 31, 2024 | | $22.74 | | 0.33 | | 5.18 | | 5.51 | | (0.30) | | (0.30) | | $27.95 | | 24.37% | | $35,494 | | 0.50% | | 1.30% | | 35% |

| For the Year Ended May 31, 2023 | | $22.51 | | 0.28 | | 0.12 | | 0.40 | | (0.17) | | (0.17) | | $22.74 | | 1.85% | | $22,512 | | 0.50% | | 1.28% | | 56% |

For the Period June 28, 2021(6) to May 31, 2022 | | $25.00 | | 0.21 | | (2.58) | | (2.37) | | (0.12) | | (0.12) | | $22.51 | | -9.55% | | $4,277 | | 0.50% | | 0.93% | | 49% |

| | |

| (1) Net investment income per share represents net investment income divided by the daily average shares of beneficial interest outstanding throughout the period. |

| (2) All returns reflect reinvested dividends, if any, but do not reflect the impact of taxes. Total return for a period of less than one year is not annualized. |

| (3) For periods of less than one year, these ratios are annualized. |

| (4) Net expenses include effects of any reimbursement or recoupment. |

| (5) For periods of less than one year portfolio turnover is not annualized and is calculated without regard to short-term securities having a maturity of less than one year. Excludes the impact of in-kind transactions. |

| (6) Commencement of operations. |

The accompanying notes are an integral part of these financial statements.

4

SPARKLINE INTANGIBLE VALUE ETF

NOTES TO THE FINANCIAL STATEMENTS

May 31, 2024

NOTE 1 – ORGANIZATION

Sparkline Intangible Value ETF (the “Fund”) is a series of the EA Series Trust (the “Trust”), which was organized as a Delaware statutory trust on October 11, 2013. The Trust is registered with the Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company and the offering of the Fund’s shares (“Shares”) is registered under the Securities Act of 1933, as amended (the “Securities Act”). The Fund is considered diversified under the 1940 Act. The Fund commenced operations on June 28, 2021. The Fund qualifies as an investment company as defined in the Financial Accounting Standards Codification Topic 946-Financial Services- Investment Companies. The Fund’s investment objective is to seek long-term capital appreciation.

Shares of the Fund are listed and traded on the NYSE Arca, Inc. Market prices for the shares may be different from their net asset value (“NAV”). The Fund issues and redeems shares on a continuous basis at NAV only in blocks of 10,000 shares, called “Creation Units.” Creation Units are issued and redeemed principally in-kind for securities included in a specified universe. Once created, shares generally trade in the secondary market at market prices that change throughout the day in share amounts less than a Creation Unit. Except when aggregated in Creation Units, shares are not redeemable securities of the Fund. Shares of the Fund may only be purchased or redeemed by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a DTC participant and, in each case, must have executed a Participant Agreement with the Distributor. Most retail investors do not qualify as Authorized Participants nor have the resources to buy and sell whole Creation Units. Therefore, they are unable to purchase or redeem the shares directly from the Fund. Rather, most retail investors may purchase shares in the secondary market with the assistance of a broker and are subject to customary brokerage commissions or fees.

Authorized Participants may be required to pay a transaction fee to compensate the Trust or its custodian for costs incurred in connection with creation and redemption transactions. The standard transaction fee, which is payable to the Trust’s custodian, typically applies to in-kind purchases of the Fund effected through the clearing process on any business day, regardless of the number of Creation Units purchased or redeemed that day (“Standard Transaction Fees”). Variable fees are imposed to compensate the Fund for the transaction costs associated with the cash transactions fees. Certain fund deposits consisting of cash-in-lieu or cash value may be subject to a variable charge (“Variable Transaction Fees”), which is payable to the Fund, of up to 2.00% of the value of the order in addition to the Standard Transaction Fees. Variable Transaction Fees received by the Fund, if any, are displayed in the Capital Share Transactions sections of the Statements of Changes in Net Assets.

Because, among other things, the Fund imposes transaction fees on purchases and redemptions of Shares to cover the custodial and other costs incurred by the Fund in effecting trades, the Board determined that it is not necessary to adopt policies and procedures to detect and deter market timing of the Fund’s Shares.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

A.Security Valuation. Equity securities that are traded on a national securities exchange, except those listed on the NASDAQ Global Market® (“NASDAQ”) are valued at the last reported sale price on the exchange on which the security is principally traded. Securities traded on NASDAQ will be valued at the NASDAQ Official Closing Price (“NOCP”). If, on a particular day, an exchange-traded or NASDAQ security does not trade, then the most recent quoted bid for exchange-traded or the mean between the most recent quoted bid and ask price for NASDAQ securities will be used. Equity securities that are not traded on a listed exchange are generally valued at the last sale price in the over-the-counter market. If a non-exchange traded security does not trade on a particular day, then the mean between the last quoted closing bid and asked price will be used. Prices denominated in foreign currencies are converted to U.S. dollar equivalents at the current exchange rate, which approximates fair value. Redeemable securities issued by open-end investment companies are valued at the investment company’s applicable net asset value, with the exception of exchange-traded open-end investment companies which are priced as equity securities. Fair values for long-term debt securities, including asset-backed securities (“ABS”), collateralized loan obligations (“CLO”), collateralized mortgage obligations (“CMO”), corporate obligations, whole loans, and mortgage-backed

SPARKLINE INTANGIBLE VALUE ETF

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

May 31, 2024

securities (“MBS”) are normally determined on the basis of valuations provided by independent pricing services. Vendors typically value such securities based on one or more inputs, including but not limited to, benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and pricing models such as yield measurers calculated using factors such as cash flows, financial or collateral performance and other reference data. In addition to these inputs, MBS and ABS may utilize cash flows, prepayment information, default rates, delinquency and loss assumptions, collateral characteristics, credit enhancements and specific deal information. Reverse repurchase agreements are priced at their acquisition cost, and assessed for credit adjustments, which represents fair value. Futures contracts are carried at fair value using the primary exchange’s closing (settlement) price.

Subject to its oversight, the Trust’s Board of Trustees (the “Board”) has delegated primary responsibility for determining or causing to be determined the value of the Fund’s investments to Empowered Funds, LLC dba EA Advisers (the “Adviser”), pursuant to the Trust’s valuation policy and procedures, which have been adopted by the Trust and approved by the Board. In accordance with Rule 2a-5 under the 1940 Act, the Board designated the Adviser as the “valuation designee” of the Fund. If the Adviser, as valuation designee, determines that reliable market quotations are not readily available for an investment, the investment is valued at fair value as determined in good faith by the Adviser in accordance with the Trust’s fair valuation policy and procedures. The Adviser will provide the Board with periodic reports, no less frequently than quarterly, that discuss the functioning of the valuation process, if applicable, and that identify issues and valuation problems that have arisen, if any. As appropriate, the Adviser and the Board will review any securities valued by the Adviser in accordance with the Trust’s valuation policies during these periodic reports. The use of fair value pricing by the Fund may cause the net asset value of its shares to differ significantly from the net asset value that would be calculated without regard to such considerations. As of May 31, 2024, the Fund did not hold any securities that required fair valuation due to unobservable inputs.

As described above, the Fund may use various methods to measure the fair value of their investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

SPARKLINE INTANGIBLE VALUE ETF

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

May 31, 2024

The following is a summary of the fair value classification of the Fund’s investments as of May 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| DESCRIPTION | | LEVEL 1 | | LEVEL 2 | | LEVEL 3 | | TOTAL |

| Assets | | | | | | | | |

| Common Stocks | | $ | 35,332,555 | | | $ | — | | | $ | — | | | $ | 35,332,555 | |

| Money Market Funds | | 113,601 | | | — | | | — | | | 113,601 | |

| Total Investments in Securities | | $ | 35,446,156 | | | $ | — | | | $ | — | | | $ | 35,446,156 | |

Refer to the Schedule of Investments for industry classifications.

During the fiscal year ended May 31, 2024, the Fund did not invest in any Level 3 investments and recognized no transfers to/from Level 3. Transfers between levels are recognized at the end of the reporting period.

B.Foreign Currency. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts using the spot rate of exchange at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions.The Fund isolates the portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. That portion of gains (losses) attributable to the changes in market prices and the portion of gains (losses) attributable to changes in foreign exchange rates are included on the “Statement of Operations” under “Net realized gain (loss) – Foreign currency” and “Change in Net Unrealized Appreciation (Depreciation) – Foreign Currency,” respectively.

The Fund reports net realized foreign exchange gains or losses that arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates.

C.Federal Income Taxes. The Fund intends to continue to comply with the requirements of subchapter M of the Internal Revenue Code of 1986, as amended, as necessary to qualify as a regulated investment company and distribute substantially all net taxable investment income and net realized gains to shareholders in a manner which results in no tax cost to the Fund. Therefore, no federal income tax provision is required. As of and during the fiscal year ended May 31, 2024, the Fund did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. As of and during the fiscal year ended May 31, 2024, the Fund did not have liabilities for any unrecognized tax benefits. The Fund would/will recognize interest and penalties, if any, related to unrecognized tax benefits on uncertain tax positions as income tax expense in the Statement of Operations. During the fiscal year ended May 31, 2024, the Fund did not incur any interest or penalties. The Fund is subject to examination by U.S. taxing authorities for the tax periods since the Fund’s commencement of operations.

The Fund may be subject to taxes imposed on realized and unrealized gains on securities of certain foreign countries in which the Fund invests. The foreign tax expense, if any, was recorded on an accrual basis and is included in “Net realized gain (loss) on investments” and “Net increase (decrease) in unrealized appreciation or depreciation on investments” on the accompanying Statements of Operations. The amount of foreign tax owed, if any, is included in“Payable for foreign taxes” on the accompanying Statements of Assets and Liabilities and is comprised of and taxes on unrealized gains.

D.Security Transactions and Investment Income. Investment securities transactions are accounted for on the trade date. Gains and losses realized on sales of securities are determined on a specific identification basis. Dividend income is recorded on the ex-dividend date, net of any foreign taxes withheld at source. Interest income is recorded on an

SPARKLINE INTANGIBLE VALUE ETF

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

May 31, 2024

accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable tax rules and regulations.

Distributions to shareholders from net investment income for the Fund are declared and paid on a quarterly basis and distributions to shareholders from net realized gains on securities normally are declared and paid on an annual basis. Distributions are recorded on the ex-dividend date. The Fund may distribute more frequently, if necessary, for tax purposes.

E.Use of Estimates. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements, as well as the reported amounts of increases and decreases in net assets from operations during the period. Actual results could differ from those estimates.

F.Share Valuation. The NAV per share of the Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash and other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding for the Fund, rounded to the nearest cent. The Fund’s shares will not be priced on the days on which the New York Stock Exchange (“NYSE”) is closed for regular trading. The offering and redemption price per share for the Fund is equal to the Fund’s net asset value per share.

G.Guarantees and Indemnifications. In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. Additionally, as is customary, the Trust’s organizational documents permit the Trust to indemnify its officers and trustees against certain liabilities under certain circumstances. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be against the Fund that have not yet occurred. As of the date of this report, no claim has been made for indemnification pursuant to any such agreement of the Fund.

H.Reclassification of Capital Accounts. GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. The Fund’s realized net capital gains resulting from in-kind redemptions, in which shareholders exchanged Fund shares for securities held by the Fund rather than for cash, are not taxable to the Fund and are not distributed to shareholders. As such, they have been reclassified from distributable earnings to paid-in capital. For the fiscal year ended May 31, 2024, the following table shows the reclassifications made:

| | | | | | | | |

Distributable

Earnings | | Paid in

Capital |

| $ | (2,736,168) | | | $ | 2,736,168 | |

NOTE 3 – RISKS

Markets may perform poorly and the returns from the securities in which the Fund invests may underperform returns from the general securities markets. Securities markets may experience periods of high volatility and reduced liquidity in response to governmental actions or intervention, economic or market developments, or other external factors. The value of a company’s securities may rise or fall in response to company, market, economic or other news.

Investment Risk. When you sell your Shares of the Fund, they could be worth less than what you paid for them. The Fund could lose money due to short-term market movements and over longer periods during market downturns. Securities may decline in value due to factors affecting securities markets generally or particular asset classes or industries represented in the markets. The value of a security may decline due to general market conditions, economic trends or events that are not specifically related to the issuer of the security or to factors that affect a particular industry or group of industries. During a general downturn in the securities markets, multiple asset classes may be negatively affected. Therefore, you may lose money by investing in the Fund.

SPARKLINE INTANGIBLE VALUE ETF

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

May 31, 2024

Value Style Investing Risk. A value stock may not increase in price if other investors fail to recognize the company’s value and bid up the price, or the markets favor faster-growing companies. Investing in or having exposure to “value” stocks presents the risk that the stocks may never reach what the Sub-Adviser believes are their full market values, either because the market fails to recognize what the Sub-Adviser considers to be the companies’ true business values, including its assessment of their intangible value, or because the Sub-Adviser misjudged.

Alternate Valuation Risk. The Sub-Adviser assesses the intrinsic values of companies by incorporating alternate, non-traditional measurements, within its calculations. There is a risk that the alternate measurements may be incorrect or the Sub-Adviser’s assessment of them may not be reflected in the company’s stock price. In addition, there is a risk that some alternate valuation data for particular companies may be impossible or difficult to obtain, or difficult to analyze even with the aid of NLP tools. As a result, the Sub-Adviser may need to rely on different data sources when valuing differing companies. Therefore, the Sub-Adviser’s strategy of incorporating alternate valuations with traditional valuations may not produce the desired results and may not perform as expected.

Equity Investing Risk. An investment in the Fund involves risks similar to those of investing in any fund holding equity securities, such as market fluctuations, changes in interest rates and perceived trends in stock prices. The values of equity securities could decline generally or could underperform other investments. In addition, securities may decline in value due to factors affecting a specific issuer, market or securities markets generally.

Technology Sector Risk. The Fund will have exposure to companies operating in the technology sector. Technology companies, including information technology companies, may have limited product lines, financial resources and/or personnel. Technology companies typically face intense competition and potentially rapid product obsolescence. They are also heavily dependent on intellectual property rights and may be adversely affected by the loss or impairment of those rights.

Communications Sector Risk. The Fund will have exposure to companies operating in the communications sector. Communication companies are particularly vulnerable to the potential obsolescence of products and services due to technological advancement and the innovation of competitors. Companies in the communications sector may also be affected by other fierce competitive pressures, including pricing competition. They may also be adversely affected by research and development costs, substantial capital requirements, and increased governmental regulation.

Consumer Discretionary Sector Risk. The Fund will have exposure to companies operating in the consumer discretionary sector. The consumer discretionary sector may be affected by changes in domestic and international economies, exchange and interest rates, competition, consumers’ disposable income and consumer preferences, social trends and marketing campaigns.

Healthcare Sector Risk. The Fund will have exposure to companies operating in the healthcare sector. Companies in the healthcare sector, including drug related companies, may be heavily dependent on clinical trials with uncertain outcomes and decisions made by the governments and regulatory authorities. Further, these companies are dependent on patent protection, and the expiration of patents may adversely affect the profitability of the companies. Additionally, the profitability of some healthcare and life sciences companies may be dependent on a relatively limited number of products, and their products can become obsolete due to sector innovation, changes in technologies or other market developments.

Quantitative Security Selection Risk. Data for some companies may be less available and/or less current than data for companies in other markets. The Sub-Adviser uses quantitative models, and its processes could be adversely affected if erroneous or outdated data is utilized. In addition, securities selected using a quantitative model could perform differently from the financial markets as a whole as a result of the characteristics used in the analysis, the weight placed on each characteristic and changes in the characteristic’s historical trends.

Machine Learning Risk. The Fund relies heavily on a proprietary “machine learning” selection process as well as data and information supplied by third parties that are utilized in that process. To the extent the machine learning process does not perform as designed or as intended, the Fund’s strategy may not be successfully implemented and the Fund may lose value. If the input data is incorrect or incomplete, any decisions made in reliance thereon may lead to the inclusion or exclusion of securities that would have been excluded or included had the data been correct and complete.

SPARKLINE INTANGIBLE VALUE ETF

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

May 31, 2024

Alternative Data Risk. The Sub-Adviser employs so-called “alternative data,” which generally refers to data that is not the traditional exchange or accounting data that has been widely used by the mainstream investment industry. Risks associated with alternative data include the possibility of new legal and regulatory frameworks targeting the collection and use of the data or technological changes that may make the data less useful or available. There is also the possibility that the organizations providing alternative data may cease operations, change business models, or suffer temporary outages due to technical issues. Insider trading and “fair practice” laws are generally untested in this area. Investment decisions based on alternative data may be flawed for various reasons, such as incomplete, “dirty” or misunderstood data, or problems with the technology used to collect and analyze it.

Management Risk. The Fund is actively managed and may not meet its investment objective based on the Adviser’s or Sub-Adviser’s success or failure to implement investment strategies for the Fund. In addition, the Fund’s principal investment strategies are dependent upon the Sub-Adviser’s use of its proprietary machine learning security selection process and, as a result, the Sub-Adviser’s skill in understanding and utilizing such process.

Small & Mid-Capitalization Companies Risk. Investing in securities of small- and medium-capitalization companies involves greater risk than customarily is associated with investing in larger, more established companies. These companies’ securities may be more volatile and less liquid than those of more established companies. Often small- and medium-capitalization companies and the industries in which they focus are still evolving and, as a result, they may be more sensitive to changing market conditions.

REIT Risk. A Real Estate Investment Trust (REIT) is a company that owns or finances income-producing real estate. Through its investments in REITs, the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters. Investments in REITs may be volatile. REITs are pooled investment vehicles with their own fees and expenses and the Fund will indirectly bear a proportionate share of those fees and expenses.

Geopolitical/Natural Disaster Risks. The Fund’s investments are subject to geopolitical and natural disaster risks, such as war, terrorism, trade disputes, political or economic dysfunction within some nations, public health crises and related geopolitical events, as well as environmental disasters, epidemics and/or pandemics, which may add to instability in world economies and volatility in markets. The impact may be short-term or may last for extended periods.

See the Fund’s Prospectus and Statement of Additional Information regarding the risks of investing in shares of the Fund.

NOTE 4 – COMMITMENTS AND OTHER RELATED PARTY TRANSACTIONS.

Empowered Funds, LLC dba EA Advisers (the “Adviser”) serves as the investment adviser to the Fund. Pursuant to an investment advisory agreement (the “Advisory Agreement”) between the Trust, on behalf of the Fund, and the Adviser, the Adviser provides investment advice to the Fund and oversees the day-to-day operations of the Fund, subject to the direction and control of the Board and the officers of the Trust. Under the Advisory Agreement, the Adviser is also responsible for arranging transfer agency, custody, fund administration and accounting, and other non-distribution related services necessary for the Fund to operate. The Adviser administers the Fund’s business affairs, provides office facilities and equipment and certain clerical, bookkeeping and administrative services. The Adviser agrees to pay all expenses incurred by the Fund except for the fee paid to the Adviser pursuant to the Advisory Agreement, payments under any distribution plan adopted pursuant to Rule 12b-1, brokerage expenses, acquired fund fees and expenses, taxes (including tax-related services), interest (including borrowing costs), litigation expense (including class action-related services) and other non-routine or extraordinary expenses.

Sparkline Capital LP (the “Sub-Adviser”) serves as a non-discretionary investment sub-adviser to the Fund. Pursuant to an investment sub-advisory agreement (the “Sub-Advisory Agreement”) among the Trust, the Adviser and the Sub-Adviser, the Sub-Adviser is responsible for determining the investment exposures for the Fund, subject to the overall supervision and oversight of the Adviser and the Board.

SPARKLINE INTANGIBLE VALUE ETF

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

May 31, 2024

At a Board meeting held on March 8, 2024, the Board of Trustees of the Trust (the “Trustees”) including each Trustee who is not an “interested person” of the Trust, as defined in the 1940 Act, renewed the Advisory and Sub-Advisory Agreements. Per the Advisory Agreement, the Fund pays an annual rate of 0.50% to the Adviser monthly based on average daily net assets.

U.S. Bancorp Fund Services, LLC (“Fund Services” or “Administrator”), doing business as U.S. Bank Global Fund Services, acts as the Fund’s Administrator and, in that capacity, performs various administrative and accounting services for the Fund. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund, including regulatory compliance monitoring and financial reporting; prepares reports and materials to be supplied to the trustees; monitors the activities of the Fund’s Custodian, transfer agent and fund accountant. Fund Services also serves as the transfer agent and fund accountant to the Fund. U.S. Bank N.A. (the “Custodian”), an affiliate of the Administrator, serves as the Fund’s Custodian.

The Custodian acts as the securities lending agent (the “Securities Lending Agent”) for the Fund.

NOTE 5 – SECURITIES LENDING

The Fund may lend up to 33⅓% of the value of the securities in its portfolio to brokers, dealers and financial institutions (but not individuals) under terms of participation in a securities lending program administered by the Securities Lending Agent. The securities lending agreement requires that loans are collateralized at all times in an amount equal to at least 102% of the value of any domestic loaned securities at the time of the loan, plus accrued interest. The use of loans of foreign securities, which are denominated and payable in U.S. dollars, shall be collateralized in an amount equal to 105% of the value of any loaned securities at the time of the loan plus accrued interest. The Fund receives compensation in the form of fees and earns interest on the cash collateral. The amount of fees depends on a number of factors including the type of security and length of the loan. The Fund continues to receive interest payments or dividends on the securities loaned during the borrowing period. Gain or loss on the value of securities loaned that may occur during the term of the loan will be for the account of the Fund. The Fund has the right under the terms of the securities lending agreement to recall the securities from the borrower on demand.

The securities lending agreement provides that, in the event of a borrower’s material default, the Securities Lending Agent shall take all actions the Securities Lending Agent deems appropriate to liquidate the collateral, purchase replacement securities at the Securities Lending Agent’s expense, or pay the Fund an amount equal to the market value of the loaned securities, subject to certain limitations which are set forth in detail in the securities lending agreement between the Fund and the Securities Lending Agent.

During the current fiscal year, the Fund had loaned securities and received cash collateral for the loans. The cash collateral is invested by the Securities Lending Agent in accordance with the Trust approved investment guidelines. Those guidelines require the cash collateral to be invested in readily marketable, high quality, short-term obligations; however, such investments are subject to risk of payment delays or default on the part of the issuer or counterparty or otherwise may not generate sufficient interest to support the costs associated with securities lending. The Fund could also experience delays in recovering its securities and possible loss of income or value if the borrower fails to return the borrowed securities, although the Fund is indemnified from this risk by contract with the Securities Lending Agent.

As of the end of the current fiscal year, there were no securities on loan for the Fund.

The interest income earned by the Fund on the investment of cash collateral received from borrowers for the securities loaned to them (“Securities Lending Income, Net") for the fiscal period was $266.

Due to the absence of a master netting agreement related to the Fund's participation in securities lending, no additional offsetting disclosures have been made on behalf of the Fund for the total borrowings listed above.

SPARKLINE INTANGIBLE VALUE ETF

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

May 31, 2024

NOTE 6 – PURCHASES AND SALES OF SECURITIES

For the fiscal year ended May 31, 2024, purchases and sales of securities for the Fund, excluding short-term securities and in-kind transactions, were as follows:

| | | | | | | | |

| Purchases | | Sales |

| $ | 18,038,915 | | | $ | 10,634,594 | |

For the fiscal year ended May 31, 2024, in-kind transactions associated with creations and redemptions were as follows:

| | | | | | | | |

| Purchases | | Sales |

| $ | 10,467,838 | | | $ | 10,693,374 | |

For the fiscal year ended May 31, 2024, short-term and long-term gains on in-kind transactions were as follows:

| | | | | | | | |

| Short Term | | Long Term |

| $ | 1,727,043 | | | $ | 1,009,125 | |

There were no purchases or sales of U.S. Government securities during the fiscal year.

NOTE 7 – TAX INFORMATION

The components of tax basis cost of investments and net unrealized appreciation (depreciation) for federal income tax purposes at May 31, 2024 were as follows:

| | | | | | | | |

| Tax cost of Investments | | $ | 32,381,483 | |

| Gross tax unrealized appreciation | | 5,137,475 | |

| Gross tax unrealized depreciation | | (2,072,801) | |

| Net tax unrealized appreciation (depreciation) | | $ | 3,064,674 | |

| Undistributed ordinary income | | 80,109 | |

| Undistributed long-term gain | | — | |

| Total distributable earnings | | 80,109 | |

| Other accumulated gain (loss) | | (86,366) | |

| Total accumulated gain (loss) | | $ | 3,058,417 | |

Under tax law, certain capital and foreign currency losses realized after October 31st and within the taxable year are deemed to arise on the first business day of the Fund’s next taxable year.

For the fiscal year ended May 31, 2024, the Fund did not defer any post-October capital or late-year losses.

At May 31, 2024, the Fund had the following capital loss carryforwards:

| | | | | | | | |

Unlimited

Short-Term | | Unlimited

Long-Term |

| $ | (86,366) | | | $ | — | |

SPARKLINE INTANGIBLE VALUE ETF

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

May 31, 2024

NOTE 8 – DISTRIBUTIONS TO SHAREHOLDERS

The tax character of distributions paid by the Fund during the fiscal years ended May 31, 2024, and May 31, 2023, were as follows:

| | | | | | | | |

Fiscal Year Ended

May 31, 2024 | | Fiscal Year Ended

May 31, 2023 |

| Ordinary Income | | Ordinary Income |

| $364,549 | | $92,348 |

NOTE 9 – SUBSEQUENT EVENTS

In preparing these financial statements, management of the Fund has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued. There were no transactions that occurred during the year subsequent to May 31, 2024, that materially impacted the amounts or disclosures in the Fund’s financial statements.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of

Sparkline Intangible Value ETF and

The Board of Trustees of

EA Series Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Sparkline Intangible Value ETF (the “Fund”), a series of EA Series Trust (the “Trust”), including the schedule of investments, as of May 31, 2024, the related statement of operations for the year ended May 31, 2024, the statements of changes in net assets and the financial highlights for each of the two years ended May 31, 2024 and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of May 31, 2024, and the results of its operations, the changes in its net assets and the financial highlights for the periods stated above, in conformity with accounting principles generally accepted in the United States of America.

The financial highlights for the period from June 28, 2021 (commencement of operations) to May 31, 2022 have been audited by other auditors, whose report dated July 29, 2022 expressed an unqualified opinion on such financial statement and financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We have served as the auditor of one or more of the funds in the Trust since 2023.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of May 31, 2024 by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

July 29, 2024

SPARKLINE INTANGIBLE VALUE ETF

FEDERAL TAX INFORMATION (UNAUDITED)

For the fiscal year ended May 31, 2024, certain dividends paid by the Fund may be subject to a maximum tax rate of 23.8%, as provided for by the Tax Cuts and Jobs Act of 2017. The percentage of dividends declared from ordinary income designated as qualified dividend income for the Fund was 100.00%.

For corporate shareholders, the percent of ordinary income distributions qualifying for the corporate dividends received deduction for the fiscal year ended May 31, 2024, for the Fund was 100.00%.

The percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under the Internal Revenue Section 871 (k)(2)(C) for the Fund was 0.00% (unaudited).

Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment

Companies.

There were no matters concerning changes in and disagreements with Accountants on accounting and financial disclosures required by Item 304 of Regulation S-K.

Item 9. Proxy Disclosures for Open-End Management Investment Companies.

There were no matters submitted during the period covered by the report to a vote of shareholders.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management

Investment Companies

Not applicable. The Independent Trustees are paid by the Adviser out of the advisory fee. See Note 4 to the Financial Statements under Item 7.

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contracts.

The Board (the members of which are referred to as “Trustees”) of the EA Series Trust (the “Trust”) met in-person on March 8-9, 2024 to consider the approval of the continuation of the Advisory Agreement between the Trust, on behalf of the Sparkline Intangible Value ETF (the “Fund”), and Empowered Funds, LLC dba EA Advisers (the “Adviser”), as well as to consider the approval of the continuation of the Sub-Advisory Agreement between the Adviser and Sparkline Capital LP (the “Sub-Adviser), each for an additional annual term. In accordance with Section 15(c) of the 1940 Act, the Board requested, reviewed and considered materials furnished by the Adviser and Sub-Adviser relevant to the Board’s consideration of whether to approve the continuation of the Advisory Agreement and Sub-Advisory Agreement. In connection with considering the approval of both the Advisory Agreement and Sub-Advisory Agreement, the Trustees who are not “interested persons” of the Trust, as that term is defined in the 1940 Act (the “Independent Trustees”), met in executive session with counsel to the Trust, who provided assistance and advice. In reaching the decision to approve both the Advisory Agreement and Sub-Advisory Agreement, the Board considered and reviewed information provided by the Adviser and Sub-Adviser at this meeting and throughout the year, including among other things information about their respective personnel, operations, financial condition, and compliance and risk management. The Board also reviewed the Advisory Agreement and Sub-Advisory Agreement. During its review and consideration, the Board focused on and reviewed the factors it deemed relevant, including:

Nature, Quality, and Extent of Services. The Board was presented with and considered information concerning the nature, quality, and extent of the overall services provided by the Adviser to the Fund. In this connection, the Board considered the responsibilities of the Adviser, recognizing that the Adviser had invested significant time and effort in structuring the Trust and the Fund, and arranging service providers for the Fund. In addition, the Board considered that the Adviser is responsible for providing investment advisory oversight services to the Fund, executing all Fund transactions, monitoring compliance with the Fund’s objectives, policies and restrictions, and carrying out directives of the Board. The Board also considered the services provided by the Adviser in the oversight of the Trust’s administrator, transfer agent and custodian. In addition, the Board evaluated the integrity of each of the Adviser’s and Sub-Adviser’s personnel, the experience of the portfolio managers in managing assets and the adequacy of each of the Adviser’s and the Sub-Adviser’s resources to perform the services provided under the Advisory Agreement and Sub-Advisory Agreement. The Board also considered the Adviser’s ongoing oversight responsibilities vis-à-vis the Sub-Adviser.

Performance. The Board considered the third-party peer group analysis comparing the Fund’s performance to the performance of other funds that the third-party deemed to be comparable to the Fund. It was determined that the Adviser and the Sub-Adviser have consistently managed the Fund’s portfolio in accordance with its stated investment objective and strategies. The Board noted that the Fund outperformed the average total return of its ETF and mutual fund peer groups by 764 (7.64%) and 2034 (20.34%) basis points, respectively, over the past 12 months ended December 31, 2023. The Trustees further noted that the Fund underperformed the average total return of its ETF peer group by 200 (2.00%) basis points over the past 24 months ended December 31, 2023, but outperformed the average total return of its mutual fund peer group by 309 (3.09%) basis points over the past 24 months ended December 31, 2023. The Board concluded that the Fund’s performance was reasonable.