UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22961

EA Series Trust

(Exact name of registrant as specified in charter)

19 E. Eagle Road

Havertown, PA 19083

(Address of principal executive offices) (Zip code)

19 E. Eagle Road

Havertown, PA 19083

(Name and address of agent for service)

215-882-9983

Registrant’s telephone number, including area code

Date of fiscal year end: June 30, 2024

Date of reporting period: June 30, 2024

Item 1. Report to Stockholders.

(a)

| | | | | | | | |

| EA Bridgeway Blue Chip ETF Ticker: BBLU Listed on: NYSE Arca, Inc.

| June 30, 2024 Annual Shareholder Report www.bridgewayetfs.com/bblu/ |

|

| | | | | | | | | | | |

| This annual shareholder report contains important information about the EA Bridgeway Blue Chip ETF (the “Fund”) for the period of July 1, 2023 to June 30, 2024 (the “Period”). You can find additional information about the Fund at www.bridgewayetfs.com/bblu/. You can also request this information by contacting us at (215) 882-9983. |

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $17 | | 0.15% |

| | | | | | | | | | | |

PERFORMANCE OF HYPOTHETICAL

$10,000 INVESTMENT |

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

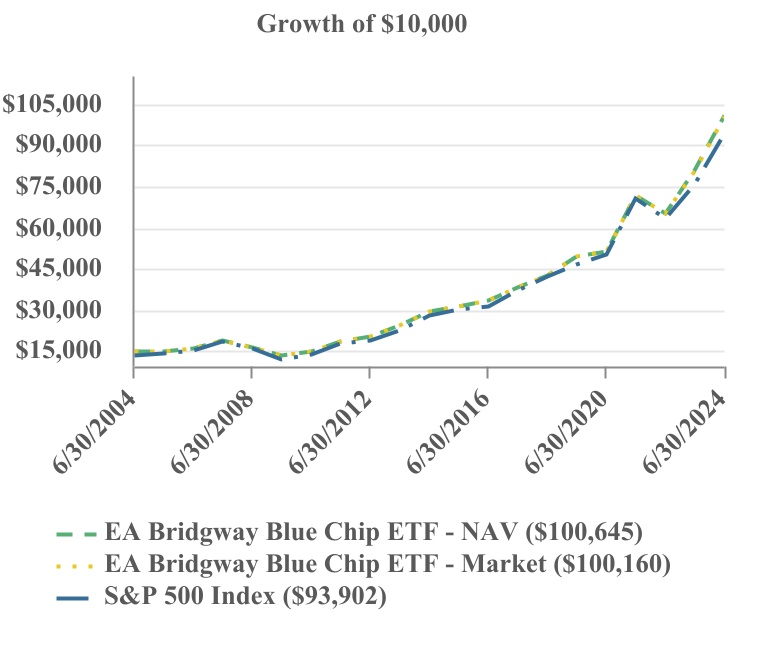

The Fund returned 24.75% (NAV) for the Period vs 24.56% for the S&P 500 Index. During the period, markets responded positively to strong corporate earnings, resilient economic conditions, and Federal Reserve policy.

The Fund’s focus on mega-cap stocks contributed positively to returns, as the largest stocks in the benchmark generally outperformed its smaller constituents. The Fund’s roughly equal weight portfolio design also helped by creating overweightings in some of the smaller stocks in the mega-cap category that performed well during the year.

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS |

| | 1 Year | | 5 Year | | 10 Year |

| EA Bridgeway Blue Chip ETF - NAV | | 24.75% | | 15.29% | | 13.08% |

| EA Bridgeway Blue Chip ETF - Market | | 24.64% | | 15.18% | | 13.02% |

| S&P 500 Index | | 24.56% | | 15.05% | | 12.86% |

| | | | | | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. The Fund converted from a mutual fund to an ETF on October 14, 2022. The Fund has adopted the mutual fund’s prior performance for the periods before the conversion. Visit www.bridgewayetfs.com/bblu/ for more recent performance information. |

Annual Shareholder Report: June 30, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| EA Bridgeway Blue Chip ETF Ticker: BBLU Listed on: NYSE Arca, Inc.

| June 30, 2024 Annual Shareholder Report www.bridgewayetfs.com/bblu/ |

|

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $181,370,007 | | Portfolio Turnover Rate* | | 6% |

| Number of Portfolio Holdings | | 38 | | Advisory Fees Paid | | $204,867 |

| *Excludes in-kind transactions. |

| | | | | |

SECTOR WEIGHTING

(as a % of Net Assets) |

| Information Technology | 25.3 | % |

| Financials | 17.1 | % |

| Communication Services | 14.2 | % |

| Health Care | 13.8 | % |

| Consumer Discretionary | 9.8 | % |

| Consumer Staples | 9.8 | % |

| Energy | 4.9 | % |

| Industrials | 4.8 | % |

| Cash & Cash Equivalents | 0.3 | % |

| | | | | | | | |

TOP 10 HOLDINGS (as a % of Net Assets) |

| Eli Lilly & Co. | 4.0% |

| Nvidia Corp. | 4.0% |

| Meta Platforms, Inc. - Class A | 3.9% |

| Microsoft Corp. | 3.9% |

| JPMorgan Chase & Co. | 3.9% |

| Broadcom, Inc. | 3.7% |

| Apple, Inc. | 3.5% |

| Visa, Inc. - Class A | 3.4% |

| Qualcomm, Inc. | 2.8% |

| Bank of America Corp. | 2.5% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, and holdings, visit www.bridgewayetfs.com/bblu/. Information about the Fund’s proxy voting records is available by calling (215) 882-9983.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: June 30, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| EA Bridgeway Omni Small-Cap Value ETF Ticker: BSVO Listed on: The Nasdaq Stock Market LLC

| June 30, 2024 Annual Shareholder Report www.bridgewayetfs.com/bsvo/ |

|

| | | | | | | | | | | |

| This annual shareholder report contains important information about the EA Bridgeway Omni Small-Cap Value ETF (the “Fund”) for the period of July 1, 2023 to June 30, 2024 (the “Period”). You can find additional information about the Fund at www.bridgewayetfs.com/bsvo/. You can also request this information by contacting us at (215) 882-9983. |

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $51 | | 0.47% |

| | | | | | | | | | | |

PERFORMANCE OF HYPOTHETICAL

$10,000 INVESTMENT |

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

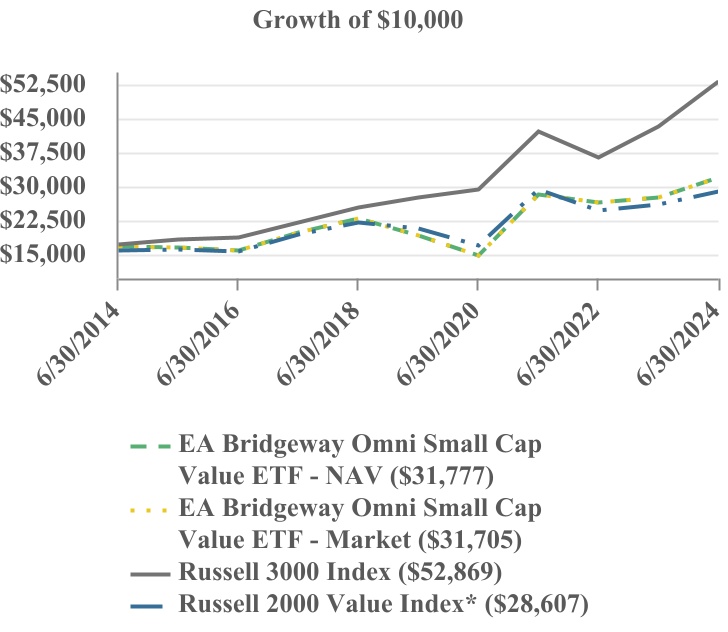

The Fund returned 16.27% (NAV) for the Period vs 23.13% for the Russell 3000 Index. During the period, markets responded positively to strong corporate earnings, resilient economic conditions, and Federal Reserve policy. Markets were led by stocks with larger market capitalization.

The Fund’s tilt toward smaller, deeper value stocks across multiple valuation metrics contributed negatively to returns relative to the benchmark during the period.

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS |

| | 1 Year | | 5 Year | | 10 Year |

| EA Bridgeway Omni Small Cap Value ETF - NAV | | 16.27% | | 10.87% | | 6.81% |

| EA Bridgeway Omni Small Cap Value ETF - Market | | 15.87% | | 10.82% | | 6.79% |

| Russell 3000 Index | | 23.13% | | 14.14% | | 12.15% |

| Russell 2000 Value Index | | 10.90% | | 7.07% | | 6.23% |

| The Russell 3000 Index is provided as a broad measure of market performance. The Russell 2000 Value Index is provided as a measure of the Fund’s investment strategy and universe. |

| | | | | | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. The Fund converted from a mutual fund to an ETF on March 10, 2023. The Fund has adopted the mutual fund’s prior performance for the periods before the conversion. Visit www.bridgewayetfs.com/bsvo/ for more recent performance information. |

Annual Shareholder Report: June 30, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| EA Bridgeway Omni Small-Cap Value ETF Ticker: BSVO Listed on: The Nasdaq Stock Market LLC

| June 30, 2024 Annual Shareholder Report www.bridgewayetfs.com/bsvo/ |

|

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $1,272,957,860 | | Portfolio Turnover Rate* | | 6% |

| Number of Portfolio Holdings | | 605 | | Advisory Fees Paid | | $4,812,357 |

| *Excludes in-kind transactions. |

| | | | | |

SECTOR WEIGHTING

(as a % of Net Assets) |

| Financials | 33.2 | % |

| Industrials | 15.7 | % |

| Consumer Discretionary | 14.0 | % |

| Energy | 12.0 | % |

| Materials | 5.8 | % |

| Communication Services | 5.6 | % |

| Information Technology | 5.1 | % |

| Health Care | 3.7 | % |

| Consumer Staples | 3.0 | % |

| Real Estate | 1.7 | % |

| Cash & Cash Equivalents | 0.2 | % |

| |

| | | | | | | | |

TOP 10 HOLDINGS (as a % of Net Assets) |

| SkyWest, Inc. | 1.1% |

| Golden Ocean Group Ltd. | 1.0% |

| United States Cellular Corp. | 0.9% |

| Warrior Met Coal, Inc. | 0.8% |

| Teekay Tankers Ltd. - Class A | 0.8% |

| Gulfport Energy Corp. | 0.8% |

| Tronox Holdings PLC | 0.8% |

| M/I Homes, Inc. | 0.8% |

| Telephone and Data Systems, Inc. | 0.8% |

| TTM Technologies, Inc. | 0.8% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, and holdings, visit www.bridgewayetfs.com/bsvo/. Information about the Fund’s proxy voting records is available by calling (215) 882-9983.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: June 30, 2024

The Fund is distributed by Quasar Distributors, LLC.

(b)

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any amendments to its code of ethics during the year covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the year covered by this report.

A copy of the registrant’s Code of Ethics is incorporated by reference.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Trustees of the Trust has determined that there is at least one audit committee financial expert serving on its audit committee. Dr. Michael Pagano is an “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past fiscal year. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning, including review of the registrant’s tax returns and calculations of required income, capital gain and excise distributions. There were no “Other services” provided by the principal accountant. The following table details the aggregate fees billed or expected to be billed for the last fiscal year for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | | | | | | | | | | | | | | | | |

| EA Bridgeway Blue

Chip ETF | | EA Bridgeway Omni Small-Cap Value ETF |

| | FYE 06/30/2024 | FYE 06/30/2023 | | FYE 06/30/2024 | FYE 06/30/2023 |

| (a) Audit Fees | $8,750 | $8,750 | | $8,750 | $8,750 |

| (b) Audit-Related Fees | N/A | N/A | | N/A | N/A |

| (c)Tax Fees | $2,250 | $2,250 | | $2,250 | $2,250 |

| (d) All Other Fees | N/A | N/A | | N/A | N/A |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by its principal accountant applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | | | | | | | | | | | | | | | | |

| EA Bridgeway Blue

Chip ETF | | EA Bridgeway Omni Small-Cap Value ETF |

| | FYE 06/30/2024 | FYE 06/30/2023 | | FYE 06/30/2024 | FYE 06/30/2023 |

| Audit-Related Fees | 0% | 0% | | 0% | 0% |

| Tax Fees | 0% | 0% | | 0% | 0% |

| All Other Fees | 0% | 0% | | 0% | 0% |

(f) All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years.

| | | | | | | | | | | | | | | | | |

| Non-Audit Related Fees | EA Bridgeway Blue

Chip ETF | | EA Bridgeway Omni Small-Cap Value ETF |

FYE 06/30/2024 | FYE 06/30/2023 | | FYE 06/30/2024 | FYE 06/30/2023 |

| Registrant | N/A | N/A | | N/A | N/A |

| Registrant’s Investment Adviser | N/A | N/A | | N/A | N/A |

(h) The audit committee of the board of trustees/directors has considered whether the provision of non-audit services that were rendered to the registrant's investment adviser is compatible with maintaining the principal accountant's independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) The registrant has not been identified by the U.S. Securities and Exchange Commission as having filed an annual report issued by a registered public accounting firm branch or office that is located in a foreign jurisdiction where the Public Company Accounting Oversight Board is unable to inspect or completely investigate because of a position taken by an authority in that jurisdiction..

(j) The registrant is not a foreign issuer.

Item 5. Audit Committee of Listed Registrants.

(a) The registrant is an issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934, (the “Act”) and has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Act. The independent members of the committee are as follows: Daniel Dorn, Chukwuemeka (Emeka) Oguh, and Michael Pagano.

(b) Not applicable.

Item 6. Investments

(a)

| | |

| EA BRIDGEWAY BLUE CHIP ETF |

| SCHEDULE OF INVESTMENTS |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% | | Shares | | Value |

| Aerospace & Defense - 2.4% | | | | |

| RTX Corp. | | 44,081 | | | $ | 4,425,292 | |

| | | | |

| Air Freight & Logistics - 2.4% | | | | |

| United Parcel Service, Inc. - Class B | | 32,418 | | | 4,436,403 | |

| | | | |

| Automobile Manufacturers - 2.5% | | | | |

Tesla, Inc.(a) | | 22,895 | | | 4,530,463 | |

| | | | |

| Broadline Retail - 2.4% | | | | |

Amazon.com, Inc.(a) | | 22,394 | | | 4,327,640 | |

| | | | |

| Cable & Satellite - 2.5% | | | | |

| Comcast Corp. - Class A | | 113,851 | | | 4,458,405 | |

| | | | |

| Communications Equipment - 2.4% | | | | |

| Cisco Systems, Inc. | | 93,406 | | | 4,437,719 | |

| | | | |

| Consumer Staples Merchandise Retail - 2.4% | | | | |

| Walmart, Inc. | | 65,215 | | | 4,415,708 | |

| | | | |

| Diversified Banks - 8.9% | | | | |

| Bank of America Corp. | | 115,789 | | | 4,604,928 | |

| JPMorgan Chase & Co. | | 34,891 | | | 7,057,054 | |

| Wells Fargo & Co. | | 76,133 | | | 4,521,539 | |

| | | | 16,183,521 | |

| | | | |

| Home Improvement Retail - 2.5% | | | | |

| Home Depot, Inc. | | 12,968 | | | 4,464,104 | |

| | | | |

| Household Products - 2.5% | | | | |

| Procter & Gamble Co. | | 27,263 | | | 4,496,214 | |

| | | | |

| Integrated Oil & Gas - 4.9% | | | | |

| Chevron Corp. | | 28,289 | | | 4,424,965 | |

| Exxon Mobil Corp. | | 38,421 | | | 4,423,026 | |

| | | | 8,847,991 | |

| | | | |

| Integrated Telecommunication Services - 2.5% | | | | |

| Verizon Communications, Inc. | | 108,371 | | | 4,469,220 | |

The accompanying notes are an integral part of these financial statements.

1

| | |

| EA BRIDGEWAY BLUE CHIP ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| | | | |

| Interactive Media & Services - 6.8% | | | | |

| Alphabet, Inc. - Class A - Class A | | 14,458 | | | $ | 2,633,525 | |

| Alphabet, Inc. - Class C - Class C | | 14,147 | | | 2,594,843 | |

| Meta Platforms, Inc. - Class A | | 14,147 | | | 7,133,200 | |

| | | | 12,361,568 | |

| | | | |

| Managed Health Care - 2.5% | | | | |

| UnitedHealth Group, Inc. | | 8,913 | | | 4,539,034 | |

| | | | |

| Movies & Entertainment - 2.4% | | | | |

| Walt Disney Co. | | 43,771 | | | 4,346,023 | |

| | | | |

| Multi-Sector Holdings - 2.4% | | | | |

Berkshire Hathaway, Inc. - Class B(a) | | 10,855 | | | 4,415,814 | |

| | | | |

| Pharmaceuticals - 11.3% | | | | |

| Eli Lilly & Co. | | 8,007 | | | 7,249,378 | |

| Johnson & Johnson | | 30,515 | | | 4,460,072 | |

| Merck & Co., Inc. | | 34,329 | | | 4,249,930 | |

| Pfizer, Inc. | | 158,741 | | | 4,441,573 | |

| | | | 20,400,953 | |

| | | | |

| Restaurants - 2.4% | | | | |

| McDonald's Corp. | | 17,221 | | | 4,388,600 | |

| | | | |

| Semiconductors - 13.0% | | | | |

| Broadcom, Inc. | | 4,201 | | | 6,744,832 | |

| Intel Corp. | | 144,676 | | | 4,480,616 | |

| Nvidia Corp. | | 58,239 | | | 7,194,846 | |

| Qualcomm, Inc. | | 25,736 | | | 5,126,096 | |

| | | | 23,546,390 | |

| | | | |

| Soft Drinks & Non-alcoholic Beverages - 4.9% | | | | |

| Coca-Cola Co. | | 70,133 | | | 4,463,966 | |

| PepsiCo, Inc. | | 26,982 | | | 4,450,141 | |

| | | | 8,914,107 | |

| | | | |

| Systems Software - 6.4% | | | | |

| Microsoft Corp. | | 15,934 | | | 7,121,701 | |

| Oracle Corp. | | 31,674 | | | 4,472,369 | |

| | | | 11,594,070 | |

| | | | |

| Technology Hardware, Storage & Peripherals - 3.5% | | | | |

| Apple, Inc. | | 30,002 | | | 6,319,021 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

2

| | |

| EA BRIDGEWAY BLUE CHIP ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Transaction & Payment Processing Services - 5.8% | | | | |

| Mastercard, Inc. - Class A | | 9,994 | | | $ | 4,408,953 | |

| Visa, Inc. - Class A | | 23,264 | | | 6,106,102 | |

| | | | 10,515,055 | |

TOTAL COMMON STOCKS (Cost $110,880,800) | | | | 180,833,315 | |

| | | | |

| SHORT-TERM INVESTMENTS - 0.3% | | | | |

| Money Market Funds - 0.3% | | | | |

First American Government Obligations Fund - Class X, 5.23%(b) | | 455,415 | | | 455,415 | |

TOTAL SHORT-TERM INVESTMENTS (Cost $455,415) | | | | 455,415 | |

| | | | |

TOTAL INVESTMENTS - 100.0% (Cost $111,336,215) | | | | $ | 181,288,730 | |

Other Assets in Excess of Liabilities - 0.0%(c) | | | | 81,277 | |

| TOTAL NET ASSETS - 100.0% | | | | $ | 181,370,007 | |

Percentages are stated as a percent of net assets.

| | | | | | | | |

| (a) | | Non-income producing security. |

| (b) | | The rate shown represents the 7-day effective yield as of June 30, 2024. |

| (c) | | Represents less than 0.05% of net assets. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of these financial statements.

3

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% | | Shares | | Value |

| Advertising - 0.6% | | | | |

Advantage Solutions, Inc.(a) | | 1,420,224 | | | $ | 4,573,121 | |

comScore, Inc.(a) | | 8,395 | | | 119,125 | |

| Entravision Communications Corp. - Class A | | 395,550 | | | 802,967 | |

Fluent, Inc.(a) | | 53,767 | | | 194,099 | |

Thryv Holdings, Inc.(a) | | 102,648 | | | 1,829,187 | |

| | | | 7,518,499 | |

| | | | |

Aerospace & Defense - 0.0%(b) | | | | |

SIFCO Industries, Inc.(a) | | 6,050 | | | 18,755 | |

| | | | |

| Agricultural & Farm Machinery - 0.2% | | | | |

Titan International, Inc.(a) | | 282,000 | | | 2,089,620 | |

| | | | |

| Agricultural Products & Services - 0.4% | | | | |

| Alico, Inc. | | 14,993 | | | 388,469 | |

Fresh Del Monte Produce, Inc.(e) | | 236,744 | | | 5,172,856 | |

| | | | 5,561,325 | |

| | | | |

| Air Freight & Logistics - 0.4% | | | | |

Air Transport Services Group, Inc.(a) | | 261,319 | | | 3,624,495 | |

Radiant Logistics, Inc.(a) | | 194,921 | | | 1,109,100 | |

| | | | 4,733,595 | |

| | | | |

| Alternative Carriers - 0.8% | | | | |

Liberty Latin America Ltd. - Class A(a)(e) | | 180,815 | | | 1,737,632 | |

Liberty Latin America Ltd. - Class C(a)(e) | | 845,722 | | | 8,135,846 | |

| | | | 9,873,478 | |

| | | | |

| Aluminum - 0.1% | | | | |

Century Aluminum Co.(a) | | 52,502 | | | 879,408 | |

| | | | |

| Apparel Retail - 2.8% | | | | |

Abercrombie & Fitch Co. - Class A(a) | | 36,628 | | | 6,513,923 | |

| Caleres, Inc. | | 127,362 | | | 4,279,363 | |

Cato Corp. - Class A(c) | | 42,726 | | | 236,702 | |

Citi Trends, Inc.(a) | | 22,877 | | | 486,365 | |

| Designer Brands, Inc. - Class A | | 269,529 | | | 1,840,883 | |

Destination XL Group, Inc.(a) | | 60,128 | | | 218,866 | |

Duluth Holdings, Inc. - Class B(a) | | 83,969 | | | 309,846 | |

| Foot Locker, Inc. | | 363,504 | | | 9,058,520 | |

Genesco, Inc.(a) | | 55,600 | | | 1,437,816 | |

Guess?, Inc.(c) | | 164,226 | | | 3,350,210 | |

Lands' End, Inc.(a) | | 58,480 | | | 794,743 | |

| Shoe Carnival, Inc. | | 122,893 | | | 4,533,523 | |

The accompanying notes are an integral part of these financial statements.

1

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Apparel Retail - 2.8% (Continued) | | | | |

Tilly's, Inc. - Class A(a) | | 119,724 | | | $ | 721,936 | |

Zumiez, Inc.(a) | | 78,861 | | | 1,536,212 | |

| | | | 35,318,908 | |

| | | | |

| Apparel, Accessories & Luxury Goods - 0.8% | | | | |

Delta Apparel, Inc.(a) | | 38,080 | | | 22,086 | |

G-III Apparel Group Ltd.(a) | | 212,632 | | | 5,755,948 | |

| Jerash Holdings US, Inc. | | 700 | | | 2,135 | |

| Lakeland Industries, Inc. | | 11,593 | | | 265,943 | |

| Movado Group, Inc. | | 92,764 | | | 2,306,113 | |

| Superior Group of Cos., Inc. | | 77,483 | | | 1,465,204 | |

Vera Bradley, Inc.(a) | | 136,974 | | | 857,457 | |

Vince Holding Corp.(a) | | 5,633 | | | 7,774 | |

| | | | 10,682,660 | |

| | | | |

| Application Software - 1.0% | | | | |

Cleanspark, Inc.(a)(c) | | 165,747 | | | 2,643,665 | |

E2open Parent Holdings, Inc. - Class A(a) | | 720,107 | | | 3,233,280 | |

NCR Voyix Corp.(a) | | 547,340 | | | 6,759,649 | |

NetSol Technologies, Inc.(a) | | 44,240 | | | 112,370 | |

| | | | 12,748,964 | |

| | | | |

| Asset Management & Custody Banks - 0.2% | | | | |

Great Elm Group, Inc.(a) | | 3,272 | | | 5,890 | |

| Hennessy Advisors, Inc. | | 8,016 | | | 57,074 | |

| US Global Investors, Inc. - Class A | | 50,940 | | | 132,953 | |

| Virtus Investment Partners, Inc. | | 6,427 | | | 1,451,538 | |

| Westwood Holdings Group, Inc. | | 23,901 | | | 291,114 | |

| | | | 1,938,569 | |

| | | | |

| Automobile Manufacturers - 0.5% | | | | |

| Winnebago Industries, Inc. | | 117,893 | | | 6,389,801 | |

| | | | |

| Automotive Parts & Equipment - 1.9% | | | | |

American Axle & Manufacturing Holdings, Inc.(a) | | 497,560 | | | 3,477,944 | |

China Automotive Systems, Inc.(a) | | 129,769 | | | 460,680 | |

| Dana, Inc. | | 564,384 | | | 6,840,334 | |

Holley, Inc.(a) | | 236,377 | | | 846,230 | |

Kandi Technologies Group, Inc.(a) | | 88,749 | | | 194,360 | |

| Patrick Industries, Inc. | | 85,832 | | | 9,317,064 | |

| Standard Motor Products, Inc. | | 99,983 | | | 2,772,529 | |

Strattec Security Corp.(a) | | 4,482 | | | 112,050 | |

| | | | 24,021,191 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

2

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Automotive Retail - 0.1% | | | | |

CarParts.com, Inc.(a) | | 61,064 | | | $ | 61,064 | |

OneWater Marine, Inc. - Class A(a) | | 52,808 | | | 1,455,917 | |

RumbleON, Inc. - Class B(a)(c) | | 62,800 | | | 257,480 | |

| Sonic Automotive, Inc. - Class A | | 969 | | | 52,781 | |

| | | | 1,827,242 | |

| | | | |

| Biotechnology - 0.8% | | | | |

Carisma Therapeutics, Inc.(a)(c) | | 28,964 | | | 44,025 | |

iTeos Therapeutics, Inc.(a) | | 62,417 | | | 926,268 | |

Ovid therapeutics, Inc.(a) | | 137,970 | | | 106,127 | |

Vanda Pharmaceuticals, Inc.(a) | | 216,763 | | | 1,224,711 | |

Vir Biotechnology, Inc.(a) | | 493,504 | | | 4,392,186 | |

Voyager Therapeutics, Inc.(a) | | 42,531 | | | 336,420 | |

XBiotech, Inc.(a) (e) | | 69,137 | | | 355,364 | |

Zymeworks, Inc.(a) | | 318,643 | | | 2,711,652 | |

| | | | 10,096,753 | |

| | | | |

| Broadcasting - 0.7% | | | | |

AMC Networks, Inc. - Class A(a) | | 166,656 | | | 1,609,897 | |

Cumulus Media, Inc. - Class A(a) | | 16,176 | | | 32,999 | |

EW Scripps Co. - Class A(a) | | 262,768 | | | 825,092 | |

| Gray Television, Inc. | | 342,654 | | | 1,781,801 | |

| Saga Communications, Inc. - Class A | | 26,050 | | | 410,287 | |

Salem Media Group, Inc.(a) | | 58,752 | | | 13,513 | |

| Sinclair, Inc. | | 220,298 | | | 2,936,572 | |

| Townsquare Media, Inc. - Class A | | 68,985 | | | 756,076 | |

Urban One, Inc.(a) | | 143,597 | | | 215,395 | |

| | | | 8,581,632 | |

| | | | |

Broadline Retail - 0.0%(b) | | | | |

Qurate Retail, Inc. - Class A(a) | | 483,582 | | | 304,657 | |

| | | | |

| Building Products - 2.0% | | | | |

American Woodmark Corp.(a) | | 80,504 | | | 6,327,615 | |

| AZZ, Inc. | | 20,293 | | | 1,567,634 | |

JELD-WEN Holding, Inc.(a) | | 387,717 | | | 5,222,548 | |

Masterbrand, Inc.(a) | | 587,246 | | | 8,620,771 | |

| Quanex Building Products Corp. | | 136,032 | | | 3,761,285 | |

| | | | 25,499,853 | |

| | | | |

| Cable & Satellite - 0.4% | | | | |

EchoStar Corp. - Class A(a) | | 304,637 | | | 5,425,585 | |

WideOpenWest, Inc.(a) | | 40,024 | | | 216,530 | |

| | | | 5,642,115 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

3

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Cargo Ground Transportation - 1.0% | | | | |

| ArcBest Corp. | | 2,954 | | | $ | 316,314 | |

| Covenant Logistics Group, Inc. | | 85,334 | | | 4,206,113 | |

| Heartland Express, Inc. | | 243,173 | | | 2,998,323 | |

PAM Transportation Services, Inc.(a) | | 58,556 | | | 1,017,118 | |

| Universal Logistics Holdings, Inc. | | 93,197 | | | 3,782,866 | |

| | | | 12,320,734 | |

| | | | |

| Casinos & Gaming - 0.2% | | | | |

Bally's Corp.(a) | | 150,930 | | | 1,806,632 | |

Century Casinos, Inc.(a) | | 71,975 | | | 199,371 | |

| Golden Entertainment, Inc. | | 8,018 | | | 249,440 | |

| | | | 2,255,443 | |

| | | | |

| Coal & Consumable Fuels - 0.2% | | | | |

| CONSOL Energy, Inc. | | 1,449 | | | 147,841 | |

Hallador Energy Co.(a) | | 210,641 | | | 1,636,681 | |

| NACCO Industries, Inc. - Class A | | 32,986 | | | 912,723 | |

| | | | 2,697,245 | |

| | | | |

| Commercial & Residential Mortgage Finance - 1.6% | | | | |

| Federal Agricultural Mortgage Corp. - Class C | | 30,362 | | | 5,490,057 | |

| Guild Holdings Co. - Class A | | 256,213 | | | 3,789,390 | |

loanDepot, Inc. - Class A(a) | | 221,750 | | | 365,887 | |

| Merchants Bancorp | | 152,181 | | | 6,169,418 | |

Onity Group, Inc.(a) | | 40,572 | | | 972,917 | |

Security National Financial Corp. - Class A(a) | | 45,159 | | | 360,820 | |

Velocity Financial, Inc.(a) | | 131,753 | | | 2,362,331 | |

| Waterstone Financial, Inc. | | 70,316 | | | 899,342 | |

| | | | 20,410,162 | |

| | | | |

| Commercial Printing - 0.5% | | | | |

| Deluxe Corp. | | 209,269 | | | 4,700,182 | |

| Quad Graphics, Inc. | | 265,282 | | | 1,445,787 | |

| | | | 6,145,969 | |

| | | | |

| Commodity Chemicals - 1.6% | | | | |

| AdvanSix, Inc. | | 142,814 | | | 3,273,297 | |

Core Molding Technologies, Inc.(a) | | 34,440 | | | 548,973 | |

| Koppers Holdings, Inc. | | 43,126 | | | 1,595,231 | |

| Kronos Worldwide, Inc. | | 76,976 | | | 966,049 | |

| Mativ Holdings, Inc. | | 212,659 | | | 3,606,697 | |

Tronox Holdings PLC (f) | | 654,415 | | | 10,267,771 | |

| | | | 20,258,018 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

4

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Communications Equipment - 0.5% | | | | |

| ClearOne, Inc. | | 26,370 | | | $ | 17,143 | |

KVH Industries, Inc.(a) | | 26,280 | | | 122,202 | |

NETGEAR, Inc.(a) | | 115,220 | | | 1,762,866 | |

NetScout Systems, Inc.(a) | | 232,613 | | | 4,254,492 | |

| Network-1 Technologies, Inc. | | 98,697 | | | 175,681 | |

| | | | 6,332,384 | |

| | | | |

| Construction & Engineering - 0.9% | | | | |

Concrete Pumping Holdings, Inc.(a) | | 288,972 | | | 1,736,722 | |

Limbach Holdings, Inc.(a) | | 8,216 | | | 467,737 | |

Northwest Pipe Co.(a) | | 41,508 | | | 1,410,027 | |

Orion Group Holdings, Inc.(a) | | 237,291 | | | 2,256,637 | |

Tutor Perini Corp.(a) | | 235,845 | | | 5,136,704 | |

| | | | 11,007,827 | |

| | | | |

| Construction Machinery & Heavy Transportation Equipment - 1.0% | | | | |

Commercial Vehicle Group, Inc.(a) | | 94,403 | | | 462,575 | |

| Greenbrier Cos., Inc. | | 144,176 | | | 7,143,921 | |

Manitowoc Co., Inc.(a) | | 159,924 | | | 1,843,924 | |

| REV Group, Inc. | | 380 | | | 9,458 | |

| Twin Disc, Inc. | | 13,161 | | | 155,036 | |

| Wabash National Corp. | | 142,223 | | | 3,106,150 | |

| | | | 12,721,064 | |

| | | | |

| Consumer Electronics - 0.1% | | | | |

Koss Corp.(a)(c) | | 5,955 | | | 26,500 | |

Universal Electronics, Inc.(a) | | 40,836 | | | 474,514 | |

VOXX International Corp.(a)(c) | | 71,190 | | | 224,960 | |

| | | | 725,974 | |

| | | | |

| Consumer Finance - 3.5% | | | | |

Atlanticus Holdings Corp.(a) | | 16,174 | | | 455,783 | |

| Bread Financial Holdings, Inc. | | 206,041 | | | 9,181,187 | |

Consumer Portfolio Services, Inc.(a)(c) | | 135,284 | | | 1,325,783 | |

Encore Capital Group, Inc.(a) | | 80,524 | | | 3,360,266 | |

Enova International, Inc.(a) | | 118,495 | | | 7,376,314 | |

EZCORP, Inc. - Class A(a) | | 308,325 | | | 3,228,163 | |

Green Dot Corp. - Class A(a) | | 167,460 | | | 1,582,497 | |

LendingClub Corp.(a) | | 339,029 | | | 2,868,185 | |

LendingTree, Inc.(a) | | 33,476 | | | 1,392,267 | |

Moneylion, Inc.(a) | | 33,504 | | | 2,463,884 | |

| Navient Corp. | | 421,821 | | | 6,141,714 | |

Nicholas Financial, Inc.(a)(e) | | 26,209 | | | 172,193 | |

Oportun Financial Corp.(a) | | 104,992 | | | 304,477 | |

The accompanying notes are an integral part of these financial statements.

5

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Consumer Finance - 3.5% (Continued) | | | | |

| PROG Holdings, Inc. | | 29,632 | | | $ | 1,027,638 | |

| Regional Management Corp. | | 39,639 | | | 1,139,225 | |

World Acceptance Corp.(a) | | 20,358 | | | 2,515,842 | |

| | | | 44,535,418 | |

| | | | |

| Data Processing & Outsourced Services - 0.2% | | | | |

Conduent, Inc.(a) | | 757,052 | | | 2,467,989 | |

| | | | |

| Distributors - 0.6% | | | | |

| A-Mark Precious Metals, Inc. | | 16,054 | | | 519,668 | |

| AMCON Distributing Co. | | 2,622 | | | 369,702 | |

GigaCloud Technology, Inc. - Class A(a)(c) | | 176,110 | | | 5,357,266 | |

| Weyco Group, Inc. | | 34,300 | | | 1,039,976 | |

| | | | 7,286,612 | |

| | | | |

| Diversified Banks - 0.3% | | | | |

Bank of NT Butterfield & Son Ltd. (e) | | 124,213 | | | 4,362,361 | |

| | | | |

| Diversified Financial Services - 0.1% | | | | |

| Alerus Financial Corp. | | 44,659 | | | 875,763 | |

| | | | |

| Diversified Support Services - 0.3% | | | | |

Civeo Corp.(e) | | 91,039 | | | 2,268,692 | |

| Matthews International Corp. - Class A | | 67,427 | | | 1,689,046 | |

| | | | 3,957,738 | |

| | | | |

| Education Services - 1.2% | | | | |

American Public Education, Inc.(a) | | 82,011 | | | 1,441,753 | |

Chegg, Inc.(a) | | 353,540 | | | 1,117,186 | |

Lincoln Educational Services Corp.(a) | | 134,796 | | | 1,598,681 | |

| Perdoceo Education Corp. | | 340,761 | | | 7,299,101 | |

Universal Technical Institute, Inc.(a) | | 203,361 | | | 3,198,868 | |

| | | | 14,655,589 | |

| | | | |

| Electrical Components & Equipment - 0.1% | | | | |

CBAK Energy Technology, Inc.(a)(c) | | 294,525 | | | 403,499 | |

| LSI Industries, Inc. | | 4,482 | | | 64,855 | |

| Preformed Line Products Co. | | 4,471 | | | 556,818 | |

Servotronics, Inc.(a) | | 1,500 | | | 17,850 | |

Ultralife Corp.(a) | | 33,736 | | | 358,276 | |

| | | | 1,401,298 | |

| | | | |

| Electronic Components - 0.1% | | | | |

| Bel Fuse, Inc. - Class B | | 20,000 | | | 1,304,800 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

6

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Electronic Equipment & Instruments - 0.2% | | | | |

Daktronics, Inc.(a) | | 214,546 | | | $ | 2,992,917 | |

| | | | |

| Electronic Manufacturing Services - 1.5% | | | | |

| Benchmark Electronics, Inc. | | 165,050 | | | 6,512,873 | |

Kimball Electronics, Inc.(a) | | 74,022 | | | 1,627,003 | |

| Methode Electronics, Inc. | | 106,176 | | | 1,098,922 | |

TTM Technologies, Inc.(a) | | 517,472 | | | 10,054,481 | |

| | | | 19,293,279 | |

| | | | |

| Environmental & Facilities Services - 0.7% | | | | |

BrightView Holdings, Inc.(a) | | 449,737 | | | 5,981,502 | |

Enviri Corp.(a) | | 379,221 | | | 3,272,677 | |

| | | | 9,254,179 | |

| | | | |

| Fertilizers & Agricultural Chemicals - 0.1% | | | | |

| American Vanguard Corp. | | 61,699 | | | 530,611 | |

Intrepid Potash, Inc.(a) | | 51,093 | | | 1,197,109 | |

| | | | 1,727,720 | |

| | | | |

| Food Distributors - 1.0% | | | | |

| Andersons, Inc. | | 158,367 | | | 7,855,003 | |

| SpartanNash Co. | | 161,119 | | | 3,022,592 | |

United Natural Foods, Inc.(a) | | 184,856 | | | 2,421,614 | |

| | | | 13,299,209 | |

| Food Retail - 0.8% | | | | |

| Ingles Markets, Inc. - Class A | | 85,293 | | | 5,851,953 | |

| Natural Grocers by Vitamin Cottage, Inc. | | 50,508 | | | 1,070,769 | |

| Village Super Market, Inc. - Class A | | 53,981 | | | 1,425,638 | |

| Weis Markets, Inc. | | 25,544 | | | 1,603,397 | |

| | | | 9,951,757 | |

| | | | |

| Footwear - 0.1% | | | | |

| Rocky Brands, Inc. | | 29,520 | | | 1,091,059 | |

| | | | |

Gold - 0.0%(b) | | | | |

Caledonia Mining Corp. PLC(f) | | 52,108 | | | 506,490 | |

| | | | |

| Health Care Distributors - 0.8% | | | | |

AdaptHealth Corp.(a) | | 541,822 | | | 5,418,220 | |

Owens & Minor, Inc.(a) | | 320,614 | | | 4,328,289 | |

| | | | 9,746,509 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

7

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Health Care Equipment - 0.2% | | | | |

FONAR Corp.(a)(c) | | 17,752 | | | $ | 284,032 | |

Varex Imaging Corp.(a) | | 150,833 | | | 2,221,770 | |

| | | | 2,505,802 | |

| | | | |

| Health Care Services - 1.0% | | | | |

American Shared Hospital Services(a) | | 11,188 | | | 35,746 | |

Cross Country Healthcare, Inc.(a) | | 121,930 | | | 1,687,511 | |

Enhabit, Inc.(a) | | 158,934 | | | 1,417,691 | |

Fulgent Genetics, Inc.(a) | | 85,846 | | | 1,684,299 | |

Pediatrix Medical Group, Inc.(a) | | 253,304 | | | 1,912,445 | |

| Premier, Inc. - Class A | | 332,238 | | | 6,202,883 | |

| | | | 12,940,575 | |

| | | | |

| Health Care Supplies - 0.4% | | | | |

Avanos Medical, Inc.(a) | | 191,234 | | | 3,809,381 | |

OraSure Technologies, Inc.(a) | | 293,209 | | | 1,249,071 | |

| | | | 5,058,452 | |

| | | | |

| Health Care Technology - 0.1% | | | | |

CareCloud, Inc.(a) | | 38,480 | | | 73,882 | |

Multiplan Corp.(a)(c) | | 1,671,040 | | | 649,032 | |

| | | | 722,914 | |

| | | | |

Heavy Electrical Equipment - 0.0%(b) | | | | |

Broadwind, Inc.(a) | | 53,190 | | | 174,463 | |

| | | | |

| Home Furnishings - 0.9% | | | | |

| Bassett Furniture Industries, Inc. | | 24,213 | | | 344,067 | |

| Ethan Allen Interiors, Inc. | | 32,196 | | | 897,946 | |

| Flexsteel Industries, Inc. | | 20,976 | | | 651,515 | |

| Hooker Furnishings Corp. | | 46,776 | | | 677,316 | |

| La-Z-Boy, Inc. | | 192,468 | | | 7,175,207 | |

Live Ventures, Inc.(a) | | 16,911 | | | 383,711 | |

Lovesac Co.(a) | | 46,872 | | | 1,058,370 | |

| | | | 11,188,132 | |

| | | | |

Home Improvement Retail - 0.0%(b) | | | | |

GrowGeneration Corp.(a) | | 106,552 | | | 229,087 | |

| | | | |

| Homebuilding - 1.6% | | | | |

Beazer Homes USA, Inc.(a) | | 154,043 | | | 4,233,102 | |

Hovnanian Enterprises, Inc. - Class A(a) | | 27,732 | | | 3,935,725 | |

Landsea Homes Corp.(a) | | 174,768 | | | 1,606,118 | |

The accompanying notes are an integral part of these financial statements.

8

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Homebuilding - 1.6% (Continued) | | | | |

Legacy Housing Corp.(a) | | 39,602 | | | $ | 908,470 | |

M/I Homes, Inc.(a) | | 83,963 | | | 10,255,241 | |

| | | | 20,938,656 | |

| | | | |

| Homefurnishing Retail - 0.3% | | | | |

| Aaron's Co., Inc. | | 164,139 | | | 1,638,107 | |

| Haverty Furniture Cos., Inc. | | 77,491 | | | 1,959,748 | |

| | | | 3,597,855 | |

| | | | |

| Household Appliances - 0.1% | | | | |

| Hamilton Beach Brands Holding Co. - Class A | | 25,912 | | | 445,427 | |

Traeger, Inc.(a) | | 138,393 | | | 332,143 | |

| | | | 777,570 | |

| | | | |

| Housewares & Specialties - 0.1% | | | | |

| Lifetime Brands, Inc. | | 91,269 | | | 784,001 | |

| | | | |

| Human Resource & Employment Services - 0.5% | | | | |

Asure Software, Inc.(a) | | 35,333 | | | 296,797 | |

| Heidrick & Struggles International, Inc. | | 37,953 | | | 1,198,556 | |

| Kelly Services, Inc. - Class A | | 186,367 | | | 3,990,118 | |

TrueBlue, Inc.(a) | | 121,988 | | | 1,256,476 | |

| | | | 6,741,947 | |

| | | | |

| Industrial Machinery & Supplies & Components - 0.4% | | | | |

| Eastern Co. | | 16,436 | | | 418,625 | |

| Hurco Cos., Inc. | | 26,092 | | | 398,164 | |

Mayville Engineering Co., Inc.(a) | | 82,595 | | | 1,376,032 | |

NN, Inc.(a) | | 170,525 | | | 511,575 | |

| Park-Ohio Holdings Corp. | | 10,338 | | | 267,651 | |

Proto Labs, Inc.(a) | | 58,657 | | | 1,811,915 | |

| | | | 4,783,962 | |

| | | | |

Insurance Brokers - 0.0%(b) | | | | |

| Crawford & Co. - Class A | | 8,316 | | | 71,850 | |

| Crawford & Co. - Class B | | 101 | | | 809 | |

GoHealth, Inc.(a) | | 20,976 | | | 203,887 | |

| | | | 276,546 | |

| | | | |

| Integrated Telecommunication Services - 0.1% | | | | |

| ATN International, Inc. | | 73,204 | | | 1,669,051 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

9

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

Interactive Media & Services - 0.0%(b) | | | | |

DHI Group, Inc.(a) | | 4,460 | | | $ | 9,321 | |

Outbrain, Inc.(a) | | 26,370 | | | 131,323 | |

| | | | 140,644 | |

| | | | |

| Investment Banking & Brokerage - 0.2% | | | | |

| Oppenheimer Holdings, Inc. - Class A | | 40,071 | | | 1,919,802 | |

| | | | |

IT Consulting & Other Services - 0.0%(b) | | | | |

WidePoint Corp.(a) | | 25,720 | | | 107,767 | |

| | | | |

| Leisure Products - 1.3% | | | | |

American Outdoor Brands, Inc.(a) | | 21,376 | | | 192,384 | |

AMMO, Inc.(a) | | 542,462 | | | 911,336 | |

| Clarus Corp. | | 90,464 | | | 608,823 | |

JAKKS Pacific, Inc.(a) | | 51,733 | | | 926,538 | |

| Johnson Outdoors, Inc. - Class A | | 17,473 | | | 611,205 | |

Latham Group, Inc.(a) | | 292,280 | | | 885,608 | |

MasterCraft Boat Holdings, Inc.(a) | | 73,877 | | | 1,394,798 | |

| Smith & Wesson Brands, Inc. | | 70,171 | | | 1,006,252 | |

Solo Brands, Inc. - Class A(a) | | 381,347 | | | 869,471 | |

Vista Outdoor, Inc.(a) | | 252,887 | | | 9,521,196 | |

| | | | 16,927,611 | |

| | | | |

Life & Health Insurance - 0.0%(b) | | | | |

Citizens, Inc.(a)(c) | | 131,313 | | | 357,171 | |

| | | | |

| Marine Transportation - 2.5% | | | | |

Costamare, Inc.(e) | | 543,630 | | | 8,931,841 | |

Genco Shipping & Trading Ltd.(e) | | 242,777 | | | 5,173,578 | |

Golden Ocean Group Ltd.(e) | | 882,462 | | | 12,177,976 | |

Pangaea Logistics Solutions Ltd.(e) | | 321,527 | | | 2,517,556 | |

Safe Bulkers, Inc.(e) | | 493,569 | | | 2,872,571 | |

| | | | 31,673,522 | |

| | | | |

| Movies & Entertainment - 0.6% | | | | |

| Marcus Corp. | | 152,802 | | | 1,737,359 | |

Sphere Entertainment Co.(a) | | 162,337 | | | 5,691,535 | |

| | | | 7,428,894 | |

| | | | |

| Multi-line Insurance - 0.4% | | | | |

| Atlantic American Corp. | | 1,204 | | | 2,035 | |

| Horace Mann Educators Corp. | | 154,739 | | | 5,047,586 | |

| | | | 5,049,621 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

10

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Office Services & Supplies - 1.5% | | | | |

| ACCO Brands Corp. | | 413,811 | | | $ | 1,944,912 | |

| Acme United Corp. | | 3,696 | | | 129,619 | |

| ARC Document Solutions, Inc. | | 242,094 | | | 639,128 | |

| CompX International, Inc. | | 1,500 | | | 37,005 | |

| MillerKnoll, Inc. | | 340,920 | | | 9,030,971 | |

| NL Industries, Inc. | | 147,644 | | | 890,293 | |

| Steelcase, Inc. - Class A | | 529,336 | | | 6,860,194 | |

| | | | 19,532,122 | |

| | | | |

| Oil & Gas Equipment & Services - 2.3% | | | | |

| Archrock, Inc. | | 61,503 | | | 1,243,591 | |

Bristow Group, Inc.(a) | | 35,486 | | | 1,189,846 | |

DMC Global, Inc.(a) | | 86,455 | | | 1,246,681 | |

| Energy Services of America Corp. | | 8,116 | | | 58,111 | |

Forum Energy Technologies, Inc.(a) | | 11,788 | | | 198,746 | |

Geospace Technologies Corp.(a) | | 28,904 | | | 259,558 | |

Helix Energy Solutions Group, Inc.(a) | | 113,018 | | | 1,349,435 | |

Mammoth Energy Services, Inc.(a) | | 79,003 | | | 259,130 | |

Natural Gas Services Group, Inc.(a) | | 84,435 | | | 1,698,832 | |

NCS Multistage Holdings, Inc.(a) | | 18,204 | | | 305,463 | |

Newpark Resources, Inc.(a) | | 90,776 | | | 754,349 | |

Oil States International, Inc.(a) | | 336,783 | | | 1,495,316 | |

ProPetro Holding Corp.(a) | | 500,987 | | | 4,343,557 | |

| Ranger Energy Services, Inc. | | 108,066 | | | 1,136,854 | |

| RPC, Inc. | | 838,466 | | | 5,240,412 | |

SEACOR Marine Holdings, Inc.(a) | | 82,487 | | | 1,112,750 | |

| Select Water Solutions, Inc. | | 545,169 | | | 5,833,308 | |

Smart Sand, Inc.(a) | | 136,747 | | | 288,536 | |

| Solaris Oilfield Infrastructure, Inc. - Class A | | 124,000 | | | 1,063,920 | |

| | | | 29,078,395 | |

| Oil & Gas Exploration & Production - 4.4% | | | | |

Amplify Energy Corp.(a) | | 140,602 | | | 953,282 | |

| Barnwell Industries, Inc. | | 47,768 | | | 112,255 | |

Battalion Oil Corp.(a) | | 993 | | | 3,317 | |

| Berry Corp. | | 368,314 | | | 2,379,308 | |

| Crescent Energy Co. - Class A | | 830,353 | | | 9,839,683 | |

Epsilon Energy Ltd.(f) | | 81,963 | | | 446,698 | |

Gran Tierra Energy, Inc.(a) | | 148,629 | | | 1,437,242 | |

Gulfport Energy Corp.(a) | | 68,271 | | | 10,308,921 | |

HighPeak Energy, Inc.(c) | | 165,044 | | | 2,320,519 | |

PEDEVCO Corp.(a) | | 57,043 | | | 51,601 | |

| PHX Minerals, Inc. | | 122,278 | | | 398,626 | |

PrimeEnergy Resources Corp.(a) | | 2,010 | | | 213,763 | |

The accompanying notes are an integral part of these financial statements.

11

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Oil & Gas Exploration & Production - 4.4% (Continued) | | | | |

| Riley Exploration Permian, Inc. | | 28,092 | | | $ | 795,285 | |

Ring Energy, Inc.(a) | | 577,180 | | | 975,434 | |

| SandRidge Energy, Inc. | | 220,397 | | | 2,849,733 | |

SilverBow Resources, Inc.(a) | | 88,713 | | | 3,356,013 | |

Talos Energy, Inc.(a) | | 729,725 | | | 8,866,159 | |

US Energy Corp.(a) | | 20,376 | | | 20,784 | |

| VAALCO Energy, Inc. | | 490,472 | | | 3,075,259 | |

Vital Energy, Inc.(a) | | 174,355 | | | 7,814,591 | |

| | | | 56,218,473 | |

| | | | |

| Oil & Gas Refining & Marketing - 2.0% | | | | |

| Adams Resources & Energy, Inc. | | 17,604 | | | 492,912 | |

| Delek US Holdings, Inc. | | 303,373 | | | 7,511,515 | |

| FutureFuel Corp. | | 210,874 | | | 1,081,784 | |

Par Pacific Holdings, Inc.(a) | | 283,386 | | | 7,155,496 | |

REX American Resources Corp.(a) | | 68,303 | | | 3,113,934 | |

| World Kinect Corp. | | 260,787 | | | 6,728,305 | |

| | | | 26,083,946 | |

| | | | |

| Oil & Gas Storage & Transportation - 3.1% | | | | |

Ardmore Shipping Corp.(e) | | 197,289 | | | 4,444,921 | |

Dorian LPG Ltd.(e) | | 190,795 | | | 8,005,758 | |

Golar LNG Ltd.(e) | | 57,659 | | | 1,807,610 | |

SFL Corp. Ltd.(e) | | 666,101 | | | 9,245,482 | |

Teekay Corp.(a)(e) | | 644,338 | | | 5,779,712 | |

Teekay Tankers Ltd. - Class A(e) | | 150,192 | | | 10,334,711 | |

| | | | 39,618,194 | |

| | | | |

| Other Specialty Retail - 1.1% | | | | |

1-800-Flowers.com, Inc. - Class A(a) | | 226,565 | | | 2,156,899 | |

Big 5 Sporting Goods Corp.(c) | | 109,355 | | | 323,691 | |

MarineMax, Inc.(a) | | 20,401 | | | 660,380 | |

ODP Corp.(a) | | 176,047 | | | 6,913,366 | |

Sally Beauty Holdings, Inc.(a) | | 315,516 | | | 3,385,487 | |

Sportsman's Warehouse Holdings, Inc.(a) | | 114,428 | | | 275,771 | |

| | | | 13,715,594 | |

| | | | |

| Packaged Foods & Meats - 0.7% | | | | |

| B&G Foods, Inc. | | 299,540 | | | 2,420,283 | |

| Dole PLC | | 440,219 | | | 5,388,281 | |

Seneca Foods Corp. - Class A(a) | | 14,151 | | | 812,267 | |

| | | | 8,620,831 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

12

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Paper & Plastic Packaging Products & Materials - 0.7% | | | | |

| Pactiv Evergreen, Inc. | | 630,941 | | | $ | 7,142,252 | |

Ranpak Holdings Corp.(a) | | 291,425 | | | 1,873,863 | |

| | | | 9,016,115 | |

| Paper Products - 0.6% | | | | |

Clearwater Paper Corp.(a) | | 101,159 | | | 4,903,177 | |

| Mercer International, Inc. | | 267,083 | | | 2,280,889 | |

| | | | 7,184,066 | |

| | | | |

| Passenger Airlines - 2.2% | | | | |

| Allegiant Travel Co. | | 76,675 | | | 3,851,385 | |

JetBlue Airways Corp.(a) | | 1,223,577 | | | 7,451,584 | |

SkyWest, Inc.(a) | | 172,777 | | | 14,179,808 | |

Sun Country Airlines Holdings, Inc.(a) | | 202,591 | | | 2,544,543 | |

| | | | 28,027,320 | |

| | | | |

| Personal Care Products - 0.1% | | | | |

| Lifevantage Corp. | | 78,859 | | | 506,275 | |

| Mannatech, Inc. | | 5,650 | | | 39,606 | |

Natural Alternatives International, Inc.(a) | | 22,848 | | | 137,545 | |

Nature's Sunshine Products, Inc.(a) | | 7,253 | | | 109,303 | |

| | | | 792,729 | |

| | | | |

| Pharmaceuticals - 0.4% | | | | |

Assertio Holdings, Inc.(a)(c) | | 409,937 | | | 508,322 | |

Innoviva, Inc.(a) | | 269,086 | | | 4,413,010 | |

JanOne, Inc.(a) | | 15,822 | | | 35,441 | |

Ocuphire Pharma, Inc.(a)(c) | | 39,305 | | | 60,137 | |

ProPhase Labs, Inc.(a) | | 3,672 | | | 15,349 | |

SCYNEXIS, Inc.(a) | | 95,254 | | | 190,508 | |

| | | | 5,222,767 | |

| | | | |

| Property & Casualty Insurance - 1.5% | | | | |

Ambac Financial Group, Inc.(a) | | 164,139 | | | 2,104,262 | |

| Donegal Group, Inc. - Class A | | 119,856 | | | 1,543,745 | |

| Employers Holdings, Inc. | | 742 | | | 31,631 | |

Hallmark Financial Services, Inc.(a)(d) | | 11,510 | | | 1 | |

Heritage Insurance Holdings, Inc.(a) | | 104,058 | | | 736,731 | |

| Investors Title Co. | | 4,385 | | | 789,870 | |

James River Group Holdings Ltd.(f) | | 107,013 | | | 827,211 | |

| Mercury General Corp. | | 9,139 | | | 485,646 | |

| Stewart Information Services Corp. | | 81,014 | | | 5,029,349 | |

| Tiptree, Inc. | | 167,953 | | | 2,769,545 | |

The accompanying notes are an integral part of these financial statements.

13

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Property & Casualty Insurance - 1.5% (Continued) | | | | |

| United Fire Group, Inc. | | 67,452 | | | $ | 1,449,544 | |

| Universal Insurance Holdings, Inc. | | 176,656 | | | 3,314,067 | |

| | | | 19,081,602 | |

| | | | |

| Publishing - 0.7% | | | | |

Gannett Co., Inc.(a) | | 842,288 | | | 3,882,948 | |

| Scholastic Corp. | | 142,270 | | | 5,046,317 | |

| | | | 8,929,265 | |

| | | | |

| Real Estate Development - 0.6% | | | | |

AMREP Corp.(a) | | 40,652 | | | 768,729 | |

Forestar Group, Inc.(a) | | 231,652 | | | 7,410,548 | |

| | | | 8,179,277 | |

| | | | |

| Real Estate Services - 1.1% | | | | |

Anywhere Real Estate, Inc.(a) | | 520,113 | | | 1,721,574 | |

| Newmark Group, Inc. - Class A | | 707,449 | | | 7,237,203 | |

Opendoor Technologies, Inc.(a) | | 2,497,562 | | | 4,595,514 | |

| RE/MAX Holdings, Inc. - Class A | | 54,304 | | | 439,863 | |

| | | | 13,994,154 | |

| | | | |

| Regional Banks - 23.6% | | | | |

| 1st Source Corp. | | 80,304 | | | 4,305,900 | |

| ACNB Corp. | | 44,996 | | | 1,632,005 | |

| Amalgamated Financial Corp. | | 118,224 | | | 3,239,338 | |

| AmeriServ Financial, Inc. | | 90,192 | | | 203,834 | |

| Ames National Corp. | | 7,916 | | | 162,199 | |

| Arrow Financial Corp. | | 28,744 | | | 748,781 | |

| Auburn National BanCorp, Inc. | | 10,062 | | | 184,034 | |

| Banc of California, Inc. | | 195,893 | | | 2,503,513 | |

| Bank of Marin Bancorp | | 21,572 | | | 349,251 | |

| Bank of the James Financial Group, Inc. | | 18,704 | | | 210,607 | |

| Bank7 Corp. | | 31,164 | | | 975,433 | |

| BankUnited, Inc. | | 300,205 | | | 8,787,000 | |

| Bankwell Financial Group, Inc. | | 18,704 | | | 474,520 | |

| Banner Corp. | | 88,005 | | | 4,368,568 | |

| Bar Harbor Bankshares | | 41,489 | | | 1,115,224 | |

| BayCom Corp. | | 31,187 | | | 634,655 | |

| BCB Bancorp, Inc. | | 69,503 | | | 738,817 | |

| Berkshire Hills Bancorp, Inc. | | 130,852 | | | 2,983,426 | |

Blue Ridge Bankshares, Inc.(a)(c) | | 31,245 | | | 81,549 | |

Bridgewater Bancshares, Inc.(a) | | 15,719 | | | 182,498 | |

| Brookline Bancorp, Inc. | | 230,362 | | | 1,923,523 | |

| Burke & Herbert Financial Services Corp. | | 108 | | | 5,506 | |

The accompanying notes are an integral part of these financial statements.

14

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Regional Banks - 23.6% (Continued) | | | | |

| Business First Bancshares, Inc. | | 71,251 | | | $ | 1,550,422 | |

| Byline Bancorp, Inc. | | 147,301 | | | 3,496,926 | |

C&F Financial Corp.(c) | | 12,862 | | | 619,948 | |

California BanCorp(a) | | 6,493 | | | 139,599 | |

| Camden National Corp. | | 36,016 | | | 1,188,528 | |

| Capital Bancorp, Inc. | | 84,688 | | | 1,736,104 | |

| Capital City Bank Group, Inc. | | 23,603 | | | 671,269 | |

| Capitol Federal Financial, Inc. | | 390,608 | | | 2,144,438 | |

Carter Bankshares, Inc.(a) | | 76,455 | | | 1,156,000 | |

| CB Financial Services, Inc. | | 30,964 | | | 701,644 | |

| Central Pacific Financial Corp. | | 81,963 | | | 1,737,616 | |

| CF Bankshares, Inc. | | 2,672 | | | 50,127 | |

| Chemung Financial Corp. | | 20,173 | | | 968,304 | |

| ChoiceOne Financial Services, Inc. | | 25,720 | | | 736,878 | |

| Citizens Community Bancorp, Inc. | | 55,284 | | | 639,636 | |

| Citizens Financial Services, Inc. | | 1,461 | | | 65,678 | |

| Citizens Holding Co. | | 4,072 | | | 31,965 | |

| Civista Bancshares, Inc. | | 47,589 | | | 737,154 | |

| CNB Financial Corp. | | 65,472 | | | 1,336,283 | |

Coastal Financial Corp.(a) | | 10,548 | | | 486,685 | |

| Codorus Valley Bancorp, Inc. | | 51,704 | | | 1,242,964 | |

| Colony Bankcorp, Inc. | | 33,736 | | | 413,266 | |

| Community Trust Bancorp, Inc. | | 61,224 | | | 2,673,040 | |

| Community West Bancshares | | 72,572 | | | 1,342,582 | |

| ConnectOne Bancorp, Inc. | | 130,004 | | | 2,455,776 | |

CrossFirst Bankshares, Inc.(a) | | 174,027 | | | 2,439,859 | |

Customers Bancorp, Inc.(a) | | 20,568 | | | 986,853 | |

| Dime Community Bancshares, Inc. | | 70,356 | | | 1,435,262 | |

| Eagle Bancorp Montana, Inc. | | 21,376 | | | 283,659 | |

| Eagle Bancorp, Inc. | | 26,960 | | | 509,544 | |

| Enterprise Bancorp, Inc. | | 55,059 | | | 1,369,868 | |

| Enterprise Financial Services Corp. | | 96,930 | | | 3,965,406 | |

| Equity Bancshares, Inc. - Class A | | 70,644 | | | 2,486,669 | |

| ESSA Bancorp, Inc. | | 45,196 | | | 794,998 | |

Evans Bancorp, Inc.(c) | | 3,751 | | | 105,441 | |

| Farmers National Banc Corp. | | 24,715 | | | 308,690 | |

| FB Financial Corp. | | 131,750 | | | 5,142,202 | |

| Financial Institutions, Inc. | | 63,100 | | | 1,219,092 | |

Finwise Bancorp(a) | | 20,376 | | | 208,039 | |

| First Bancorp, Inc. | | 6,344 | | | 157,648 | |

| First Bancorp/Southern Pines NC | | 65,696 | | | 2,097,016 | |

| First Bancshares, Inc. | | 88,376 | | | 2,296,008 | |

| First Bank Hamilton NJ | | 80,221 | | | 1,022,016 | |

The accompanying notes are an integral part of these financial statements.

15

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Regional Banks - 23.6% (Continued) | | | | |

| First Busey Corp. | | 182,152 | | | $ | 4,409,900 | |

| First Business Financial Services, Inc. | | 44,161 | | | 1,633,515 | |

| First Capital, Inc. | | 13,360 | | | 406,812 | |

| First Commonwealth Financial Corp. | | 198,417 | | | 2,740,139 | |

| First Community Bankshares, Inc. | | 27,992 | | | 1,031,225 | |

First Community Corp.(c) | | 35,208 | | | 607,338 | |

| First Financial Bancorp | | 276,442 | | | 6,142,541 | |

| First Financial Corp. | | 43,576 | | | 1,607,083 | |

| First Financial Northwest, Inc. | | 20,276 | | | 428,432 | |

| First Foundation, Inc. | | 49,980 | | | 327,369 | |

| First Guaranty Bancshares, Inc. | | 38,328 | | | 344,952 | |

| First Merchants Corp. | | 199,082 | | | 6,627,440 | |

| First Mid Bancshares, Inc. | | 57,166 | | | 1,879,618 | |

| First National Corp. | | 12,860 | | | 195,343 | |

| First Northwest Bancorp | | 16,132 | | | 156,319 | |

| First of Long Island Corp. | | 55,100 | | | 552,102 | |

| First Savings Financial Group, Inc. | | 30,590 | | | 544,196 | |

| First United Corp. | | 22,507 | | | 459,593 | |

| First US Bancshares, Inc. | | 6,344 | | | 58,682 | |

First Western Financial, Inc.(a) | | 20,787 | | | 353,379 | |

| Flushing Financial Corp. | | 87,622 | | | 1,152,229 | |

| FNCB Bancorp, Inc. | | 122,576 | | | 827,388 | |

| Franklin Financial Services Corp. | | 30,064 | | | 850,210 | |

| FS Bancorp, Inc. | | 32,777 | | | 1,194,722 | |

FVCBankcorp, Inc.(a) | | 51,525 | | | 562,653 | |

| Guaranty Bancshares, Inc. | | 23,253 | | | 733,400 | |

Hanmi Financial Corp.(c) | | 98,220 | | | 1,642,238 | |

| HarborOne Bancorp, Inc. | | 111,894 | | | 1,245,380 | |

| Hawthorn Bancshares, Inc. | | 25,829 | | | 511,414 | |

| Heartland Financial USA, Inc. | | 101,716 | | | 4,521,276 | |

| Heritage Commerce Corp. | | 143,095 | | | 1,244,926 | |

| Heritage Financial Corp. | | 107,366 | | | 1,935,809 | |

| Hilltop Holdings, Inc. | | 180,208 | | | 5,636,906 | |

| HMN Financial, Inc. | | 29,904 | | | 684,503 | |

| Home Bancorp, Inc. | | 28,489 | | | 1,139,845 | |

| HomeTrust Bancshares, Inc. | | 10,524 | | | 316,036 | |

| Hope Bancorp, Inc. | | 389,550 | | | 4,183,767 | |

| Horizon Bancorp, Inc. | | 105,766 | | | 1,308,325 | |

| Independent Bank Corp. | | 110,147 | | | 5,586,656 | |

| Independent Bank Corp. | | 89,479 | | | 2,415,933 | |

| Independent Bank Group, Inc. | | 100,912 | | | 4,593,514 | |

| Investar Holding Corp. | | 48,978 | | | 754,261 | |

| Kearny Financial Corp. | | 159,397 | | | 980,292 | |

The accompanying notes are an integral part of these financial statements.

16

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Regional Banks - 23.6% (Continued) | | | | |

| Landmark Bancorp, Inc. | | 12,943 | | | $ | 248,506 | |

| LCNB Corp. | | 53,012 | | | 737,397 | |

MainStreet Bancshares, Inc.(c) | | 39,546 | | | 701,151 | |

| Mercantile Bank Corp. | | 50,137 | | | 2,034,058 | |

| Metrocity Bankshares, Inc. | | 48,030 | | | 1,267,992 | |

Metropolitan Bank Holding Corp.(a) | | 36,376 | | | 1,531,066 | |

| Mid Penn Bancorp, Inc. | | 33,608 | | | 737,696 | |

| Middlefield Banc Corp. | | 15,732 | | | 378,355 | |

| Midland States Bancorp, Inc. | | 69,899 | | | 1,583,212 | |

| MidWestOne Financial Group, Inc. | | 57,166 | | | 1,285,663 | |

| MVB Financial Corp. | | 11,818 | | | 220,288 | |

| National Bank Holdings Corp. - Class A | | 116,730 | | | 4,558,306 | |

| Nicolet Bankshares, Inc. | | 36,203 | | | 3,006,297 | |

| Northeast Community Bancorp, Inc. | | 58,160 | | | 1,036,411 | |

| Northfield Bancorp, Inc. | | 116,783 | | | 1,107,103 | |

| Northrim BanCorp, Inc. | | 19,759 | | | 1,138,909 | |

| Northwest Bancshares, Inc. | | 326,039 | | | 3,765,750 | |

| Oak Valley Bancorp | | 36,128 | | | 902,116 | |

| OceanFirst Financial Corp. | | 153,868 | | | 2,444,963 | |

| Ohio Valley Banc Corp. | | 8,016 | | | 160,320 | |

| Old Point Financial Corp. | | 17,504 | | | 256,784 | |

| Old Second Bancorp, Inc. | | 109,419 | | | 1,620,495 | |

| OP Bancorp | | 47,768 | | | 458,095 | |

| Origin Bancorp, Inc. | | 81,197 | | | 2,575,569 | |

| Orrstown Financial Services, Inc. | | 23,712 | | | 648,760 | |

| Parke Bancorp, Inc. | | 43,188 | | | 751,471 | |

| Pathward Financial, Inc. | | 1,572 | | | 88,928 | |

| PCB Bancorp | | 49,494 | | | 805,762 | |

| Peapack-Gladstone Financial Corp. | | 46,298 | | | 1,048,650 | |

| Penns Woods Bancorp, Inc. | | 25,920 | | | 532,656 | |

| Peoples Bancorp of North Carolina, Inc. | | 28,804 | | | 841,077 | |

| Peoples Bancorp, Inc. | | 129,514 | | | 3,885,420 | |

| Peoples Financial Services Corp. | | 28,592 | | | 1,302,080 | |

Pioneer Bancorp, Inc.(a) | | 54,571 | | | 546,256 | |

| Plumas Bancorp | | 2,672 | | | 96,139 | |

Ponce Financial Group, Inc.(a) | | 10,088 | | | 92,204 | |

| Preferred Bank | | 44,089 | | | 3,328,279 | |

| Premier Financial Corp. | | 83,761 | | | 1,713,750 | |

| Primis Financial Corp. | | 51,965 | | | 544,593 | |

| Princeton Bancorp, Inc. | | 30,564 | | | 1,011,668 | |

Provident Bancorp, Inc.(a) | | 38,080 | | | 388,035 | |

| Provident Financial Holdings, Inc. | | 24,451 | | | 305,637 | |

| Provident Financial Services, Inc. | | 235,898 | | | 3,385,136 | |

The accompanying notes are an integral part of these financial statements.

17

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Regional Banks - 23.6% (Continued) | | | | |

| QCR Holdings, Inc. | | 60,811 | | | $ | 3,648,660 | |

| RBB Bancorp | | 50,418 | | | 948,363 | |

| Red River Bancshares, Inc. | | 1,350 | | | 64,786 | |

| Renasant Corp. | | 181,429 | | | 5,540,842 | |

| Republic Bancorp, Inc. - Class A | | 60,621 | | | 3,249,892 | |

Rhinebeck Bancorp, Inc.(a) | | 47,768 | | | 375,456 | |

| Riverview Bancorp, Inc. | | 85,326 | | | 340,451 | |

| S&T Bancorp, Inc. | | 123,668 | | | 4,129,275 | |

| Sandy Spring Bancorp, Inc. | | 106,781 | | | 2,601,185 | |

| SB Financial Group, Inc. | | 35,886 | | | 502,404 | |

| Shore Bancshares, Inc. | | 140,326 | | | 1,606,733 | |

| Sierra Bancorp | | 71,242 | | | 1,594,396 | |

| Simmons First National Corp. - Class A | | 318,757 | | | 5,603,748 | |

| SmartFinancial, Inc. | | 63,937 | | | 1,513,389 | |

| Sound Financial Bancorp, Inc. | | 13,075 | | | 574,777 | |

| South Plains Financial, Inc. | | 97,374 | | | 2,629,098 | |

Southern First Bancshares, Inc.(a) | | 13,760 | | | 402,342 | |

| Southern Missouri Bancorp, Inc. | | 18,961 | | | 853,435 | |

| Southern States Bancshares, Inc. | | 6,500 | | | 176,410 | |

| Southside Bancshares, Inc. | | 70,498 | | | 1,946,450 | |

| Stellar Bancorp, Inc. | | 132,112 | | | 3,033,292 | |

Sterling Bancorp, Inc.(a) | | 94,945 | | | 496,562 | |

Third Coast Bancshares, Inc.(a) | | 26,913 | | | 572,439 | |

| Timberland Bancorp, Inc. | | 48,076 | | | 1,302,379 | |

| Towne Bank | | 212,180 | | | 5,786,149 | |

| TriCo Bancshares | | 50,154 | | | 1,984,594 | |

| TrustCo Bank Corp. | | 67,998 | | | 1,956,302 | |

| Trustmark Corp. | | 196,219 | | | 5,894,419 | |

| Union Bankshares, Inc. | | 400 | | | 8,592 | |

| United Bancorp, Inc. | | 1,509 | | | 18,938 | |

| United Security Bancshares | | 46,789 | | | 339,220 | |

| Unity Bancorp, Inc. | | 31,695 | | | 937,221 | |

| Univest Financial Corp. | | 89,001 | | | 2,031,893 | |

| Veritex Holdings, Inc. | | 138,268 | | | 2,916,072 | |

| Virginia National Bankshares Corp. | | 1,687 | | | 55,334 | |

| WaFd, Inc. | | 247,529 | | | 7,074,379 | |

| Washington Trust Bancorp, Inc. | | 42,777 | | | 1,172,518 | |

| WesBanco, Inc. | | 176,552 | | | 4,927,566 | |

| Western New England Bancorp, Inc. | | 75,525 | | | 519,612 | |

| | | | 299,891,520 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

18

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Reinsurance - 0.7% | | | | |

Greenlight Capital Re Ltd. - Class A(a) | | 20,088 | | | $ | 263,153 | |

SiriusPoint Ltd.(a)(e) | | 669,815 | | | 8,171,743 | |

| | | | 8,434,896 | |

| | | | |

| Research & Consulting Services - 0.2% | | | | |

Mistras Group, Inc.(a) | | 183,732 | | | 1,523,138 | |

| Resources Connection, Inc. | | 150,390 | | | 1,660,306 | |

| | | | 3,183,444 | |

| | | | |

| Restaurants - 0.3% | | | | |

| Ark Restaurants Corp. | | 18,804 | | | 244,640 | |

Biglari Holdings, Inc. - Class B(a) | | 8,716 | | | 1,685,500 | |

El Pollo Loco Holdings, Inc.(a) | | 158,561 | | | 1,793,325 | |

| Flanigan's Enterprises, Inc. | | 13,360 | | | 359,117 | |

Good Times Restaurants, Inc.(a) | | 36,008 | | | 91,100 | |

| | | | 4,173,682 | |

| | | | |

| Semiconductor Materials & Equipment - 0.5% | | | | |

AXT, Inc.(a) | | 170,891 | | | 577,611 | |

Photronics, Inc.(a) | | 235,146 | | | 5,801,052 | |

Trio-Tech International(a) | | 32,736 | | | 199,356 | |

| | | | 6,578,019 | |

| | | | |

| Semiconductors - 0.2% | | | | |

Alpha & Omega Semiconductor Ltd.(a)(e) | | 38,293 | | | 1,431,009 | |

Magnachip Semiconductor Corp.(a) | | 125,949 | | | 613,372 | |

| | | | 2,044,381 | |

| | | | |

| Specialized Finance - 0.4% | | | | |

Acacia Research Corp.(a) | | 185,796 | | | 930,838 | |

Banco Latinoamericano de Comercio Exterior S(e) | | 131,827 | | | 3,911,307 | |

SWK Holdings Corp.(a) | | 51,880 | | | 881,441 | |

| | | | 5,723,586 | |

| | | | |

| Specialty Chemicals - 0.3% | | | | |

Alto Ingredients, Inc.(a) | | 229,649 | | | 331,843 | |

Rayonier Advanced Materials, Inc.(a) | | 278,538 | | | 1,515,247 | |

| Valhi, Inc. | | 126,129 | | | 2,248,880 | |

| | | | 4,095,970 | |

| | | | |

| Steel - 2.4% | | | | |

Ascent Industries Co.(a) | | 40,500 | | | 395,280 | |

| Friedman Industries, Inc. | | 33,136 | | | 500,353 | |

Metallus, Inc.(a) | | 228,215 | | | 4,625,918 | |

The accompanying notes are an integral part of these financial statements.

19

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Steel - 2.4% | | | | |

| Olympic Steel, Inc. | | 54,923 | | | $ | 2,462,198 | |

| Radius Recycling, Inc. - Class A | | 120,452 | | | 1,839,302 | |

Ramaco Resources, Inc.(a) | | 109,255 | | | 1,360,225 | |

| Ramaco Resources, Inc. - Class B | | 13,574 | | | 147,414 | |

| Ryerson Holding Corp. | | 182,985 | | | 3,568,207 | |

| SunCoke Energy, Inc. | | 438,585 | | | 4,298,133 | |

Universal Stainless & Alloy Products, Inc.(a) | | 33,536 | | | 918,216 | |

| Warrior Met Coal, Inc. | | 167,614 | | | 10,521,131 | |

| | | | 30,636,377 | |

| | | | |

| Systems Software - 0.1% | | | | |

| Adeia, Inc. | | 125,616 | | | 1,405,015 | |

| | | | |

| Technology Distributors - 0.4% | | | | |

ScanSource, Inc.(a) | | 123,147 | | | 5,456,644 | |

| | | | |

| Technology Hardware, Storage & Peripherals - 0.6% | | | | |

Eastman Kodak Co.(a) | | 325,040 | | | 1,748,715 | |

| Xerox Holdings Corp. | | 531,994 | | | 6,181,770 | |

| | | | 7,930,485 | |

| | | | |

Textiles - 0.0%(b) | | | | |

| Crown Crafts, Inc. | | 40,802 | | | 213,395 | |

Unifi, Inc.(a) | | 34,562 | | | 203,570 | |

| | | | 416,965 | |

| | | | |

| Trading Companies & Distributors - 1.1% | | | | |

BlueLinx Holdings, Inc.(a) | | 42,690 | | | 3,974,012 | |

DNOW, Inc.(a) | | 508,458 | | | 6,981,129 | |

Hudson Technologies, Inc.(a) | | 170 | | | 1,494 | |

Titan Machinery, Inc.(a) | | 77,788 | | | 1,236,829 | |

| Willis Lease Finance Corp. | | 23,682 | | | 1,641,163 | |

| | | | 13,834,627 | |

| | | | |

| Transaction & Payment Processing Services - 0.6% | | | | |

BM Technologies, Inc.(a) | | 23,640 | | | 53,190 | |

Paysafe Ltd.(a) | | 226,388 | | | 4,002,540 | |

Repay Holdings Corp.(a) | | 336,951 | | | 3,558,202 | |

| | | | 7,613,932 | |

| | | | |

| Wireless Telecommunication Services - 1.7% | | | | |

| Telephone and Data Systems, Inc. | | 493,655 | | | 10,233,468 | |

The accompanying notes are an integral part of these financial statements.

20

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 99.7% (CONTINUED) | | Shares | | Value |

| Wireless Telecommunication Services - 1.7% (Continued) | | | | |

United States Cellular Corp.(a) | | 205,097 | | | $ | 11,448,515 | |

| | | | 21,681,983 | |

TOTAL COMMON STOCKS (Cost $1,126,036,342) | | | | 1,269,702,953 | |

| | | | |

CLOSED END FUNDS - 0.0%(b) | | | | |

| Logan Ridge Finance Corp. | | 13,460 | | | 302,716 | |

| Medallion Financial Corp. | | 15,456 | | | 118,702 | |

TOTAL CLOSED END FUNDS (Cost $441,655) | | | | 421,418 | |

| | | | |

CONTINGENT VALUE RIGHTS - 0.0%(b) | | | | |

Pineapple Holdings(a)(d) | | 3,750 | | | 1,387 | |

Resolute Forest Products(a)(d) | | 236,000 | | | 68,440 | |

TOTAL CONTINGENT VALUE RIGHTS (Cost $0) | | | | 69,827 | |

| | | | |

| REAL ESTATE INVESTMENT TRUSTS - 0.1% | | | | |

| AFC Gamma, Inc. | | 55,284 | | | 674,465 | |

Transcontinental Realty Investors, Inc.(a) | | 1,400 | | | 38,822 | |

TOTAL REAL ESTATE INVESTMENT TRUSTS (Cost $871,163) | | | | 713,287 | |

| | | | |

| | | | |

WARRANTS - 0.0%(b) | | Contracts | | |

Oil & Gas Drilling - 0.0%(b) | | | | |

Nabors Industries Ltd., Expires 06/11/2026, Exercise Price $166.67(a)(e) | | 5,200 | | | 34,320 | |

TOTAL WARRANTS (Cost $0) | | | | 34,320 | |

| | | | |

PREFERRED STOCKS - 0.0%(b) | | Shares | | |

Air Freight & Logistics - 0.0%(b) | | | | |

| Air T Funding, 8.00%, 06/07/2049 | | 529 | | | 8,940 | |

TOTAL PREFERRED STOCKS (Cost $11,003) | | | | 8,940 | |

| | | | |

| SHORT-TERM INVESTMENTS - 1.4% | | | | |

| Investments Purchased with Proceeds from Securities Lending - 1.3% | | | | |

First American Government Obligations Fund - Class X, 5.23%(f) | | 15,764,056 | | | 15,764,056 | |

| | | | |

| Money Market Funds - 0.1% | | | | |

First American Government Obligations Fund - Class X, 5.23%(f) | | 1,566,498 | | | 1,566,498 | |

TOTAL SHORT-TERM INVESTMENTS (Cost $17,330,554) | | | | 17,330,554 | |

| | | | |

TOTAL INVESTMENTS - 101.2% (Cost $1,144,690,717) | | | | $ | 1,288,281,299 | |

| Liabilities in Excess of Other Assets - (1.2)% | | | | (15,323,439) | |

| TOTAL NET ASSETS - 100.0% | | | | $ | 1,272,957,860 | |

The accompanying notes are an integral part of these financial statements.

21

| | |

| EA BRIDGEWAY OMNI SMALL CAP VALUE ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| June 30, 2024 |

Percentages are stated as a percent of net assets.

AMBAC American Municipal Bond Assurance Corporation

PLC - Public Limited Company

SA - Sociedad Anónima

| | | | | | | | |

| (a) | | Non-income producing security. |

| (b) | | Represents less than 0.05% of net assets. |

| (c) | | All or a portion of this security is on loan as of June 30, 2024. The total market value of these securities was $14,817,410 which represented 1.2% of net assets. |

| (d) | | Fair value determined using significant unobservable inputs in accordance with procedures established by and under the supervision of the Adviser, acting as Valuation Designee. These securities represented $69,828 or 0.0% of net assets as of June 30, 2024. |

| (e) | | Foreign issued security. |

| (f) | | The rate shown represents the 7-day effective yield as of June 30, 2024. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

(b) Not applicable

The accompanying notes are an integral part of these financial statements.

22

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment

Companies.