UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22961

EA Series Trust

(Exact name of registrant as specified in charter)

19 E. Eagle Road

Havertown, PA 19083

(Address of principal executive offices) (Zip code)

19 E. Eagle Road

Havertown, PA 19083

(Name and address of agent for service)

215-882-9983

Registrant’s telephone number, including area code

Date of fiscal year end: July 31, 2024

Date of reporting period: July 31, 2024

Item 1. Report to Stockholders.

(a)

| | | | | | | | |

| Fund Name: Strive 500 ETF Ticker: STRV Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/strv |

|

| | | | | | | | | | | |

| This annual shareholder report contains important information about the Strive 500 ETF (the “Fund”) for the period of August 1, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.strivefunds.com/strv. You can also request this information by contacting us at (215) 882-9983. This report describes changes to the Fund that occurred during the Period. |

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $6 | 0.05% |

| | | | | | | | | | | |

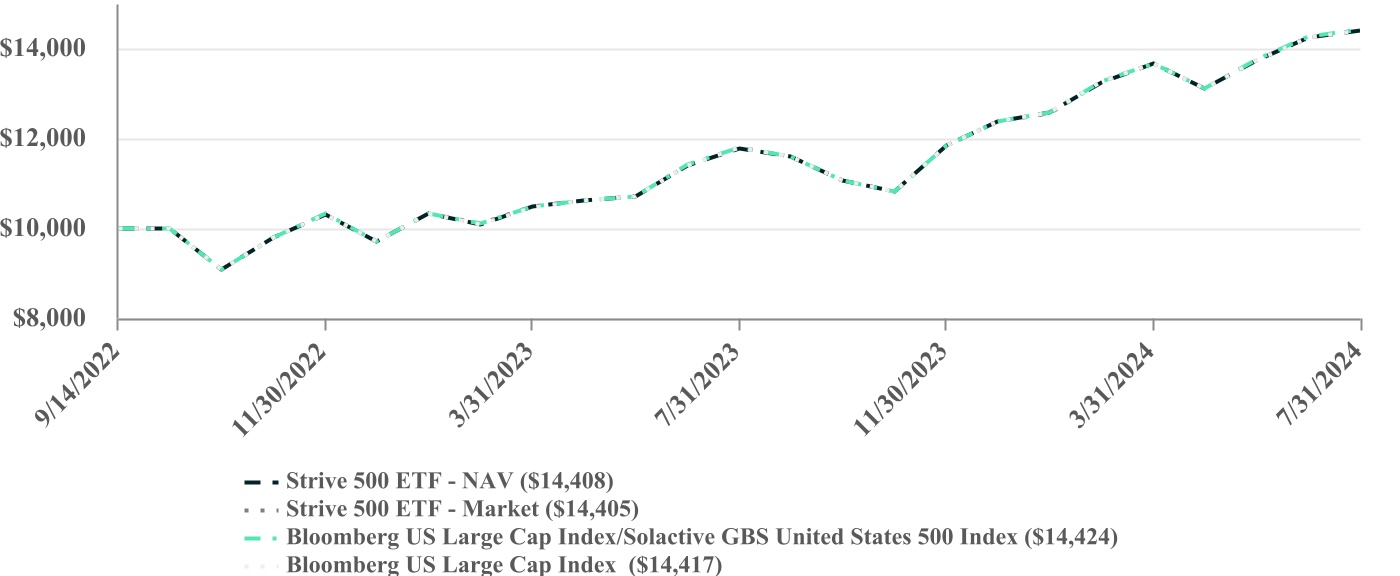

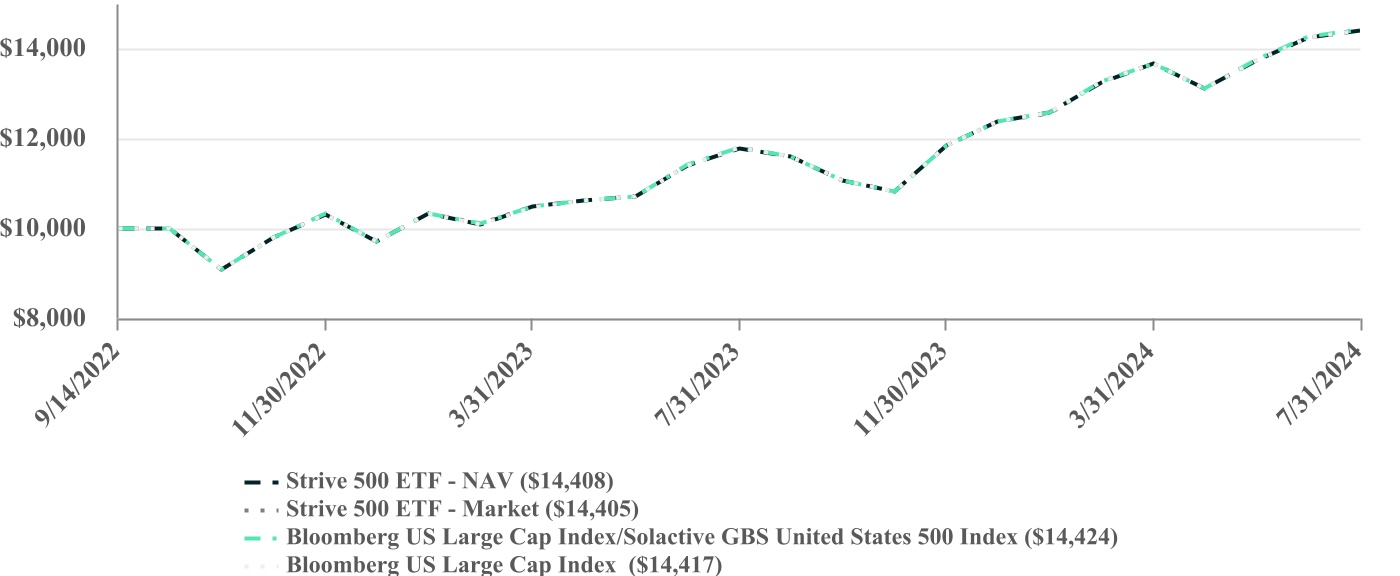

| PERFORMANCE OF A HYPOTHETICAL $10,000 INVESTMENT |

| | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS |

| | One Year | | Since Inception (9/14/2022) |

| Strive 500 ETF - NAV | | 22.26% | | 21.48% |

| Strive 500 ETF - Market | | 22.16% | | 21.47% |

| Bloomberg US Large Cap Index/Solactive GBS United States 500 Index | | 22.29% | | 21.55% |

| Bloomberg US Large Cap Index | | 21.52% | | 22.24% |

| | | | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Effective January 26, 2024, the Fund’s investment strategy changed to track the investment results of the Bloomberg US Large Cap Index. Prior to January 26, 2024, the Fund’s investment strategy was to track the investment results of the Solactive GBS United States 500 Index. Performance shown for the Bloomberg US Large Cap Index/Solactive GBS United States 500 Index for the period prior to January 26, 2024 is that of the Solactive GBS United States 500 Index and for the period beginning January 26, 2024 is that of the Bloomberg US Large Cap Index. Visit www.strivefunds.com/strv for more recent performance information. |

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

U.S. large-cap stocks rose strongly during the Period amid solid economic growth, easing inflation, and shifting monetary policy. Companies in the technology sector, particularly those in the semiconductor industry, benefited from increased demand due to the rapid advancements in artificial intelligence (AI) technology, demand for specialized chips, and increased computing power. Companies in the financials sector benefited from elevated interest rates and stable economic conditions.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive 500 ETF Ticker: STRV Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/strv |

|

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $601,207,978 | | Portfolio Turnover Rate* | | 4% |

| # of Portfolio Holdings | | 501 | | Advisory Fees Paid | | $222,292 |

| *Excludes impact of in-kind transactions. |

| | | | | | |

| | | | | |

SECTOR WEIGHTING

(as a % of Net Assets) |

| Information Technology | 32.0% |

| Financials | 12.7% |

| Health Care | 12.0% |

| Consumer Discretionary | 9.9% |

| Communication Services | 9.0% |

| Industrials | 8.3% |

| Consumer Staples | 5.8% |

| Energy | 3.7% |

| Utilities | 2.2% |

| Real Estate | 2.1% |

| Materials | 1.9% |

| Cash & Cash Equivalents | 0.4% |

| | | | | |

TOP 10 HOLDINGS

(as a % of Net Assets) |

| Apple, Inc. | 6.9% |

| Microsoft Corp. | 6.7% |

| Nvidia Corp. | 6.0% |

| Amazon.com, Inc. | 3.7% |

| Meta Platforms, Inc. - Class A | 2.2% |

| Alphabet, Inc. - Class A | 2.2% |

| Alphabet, Inc. - Class C | 1.8% |

| Broadcom, Inc. | 1.6% |

| Eli Lilly & Co. | 1.5% |

| Tesla, Inc. | 1.4% |

Material Fund Changes

Effective January 26, 2024, the Fund’s investment strategy changed to track the investment results of the Bloomberg US Large Cap Index. Prior to January 26, 2024, the Fund’s investment strategy was to track the investment results of the Solactive GBS United States 500 Index. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by November 30, 2024 at www.strivefunds.com/strv or upon request by calling (215) 882-9983.

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy information, visit www.strivefunds.com/strv. You can also request information by calling (215) 882-9983.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive Mid-Cap ETF Ticker: STXM Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/stxm |

|

| | | | | | | | | | | |

| This annual shareholder report contains important information about the Strive Mid-Cap ETF (the “Fund”) for the period of April 10, 2024 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.strivefunds.com/stxm. You can also request this information by contacting us at (215) 882-9983. |

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $6 | 0.18% |

| | | | | | | | | | | |

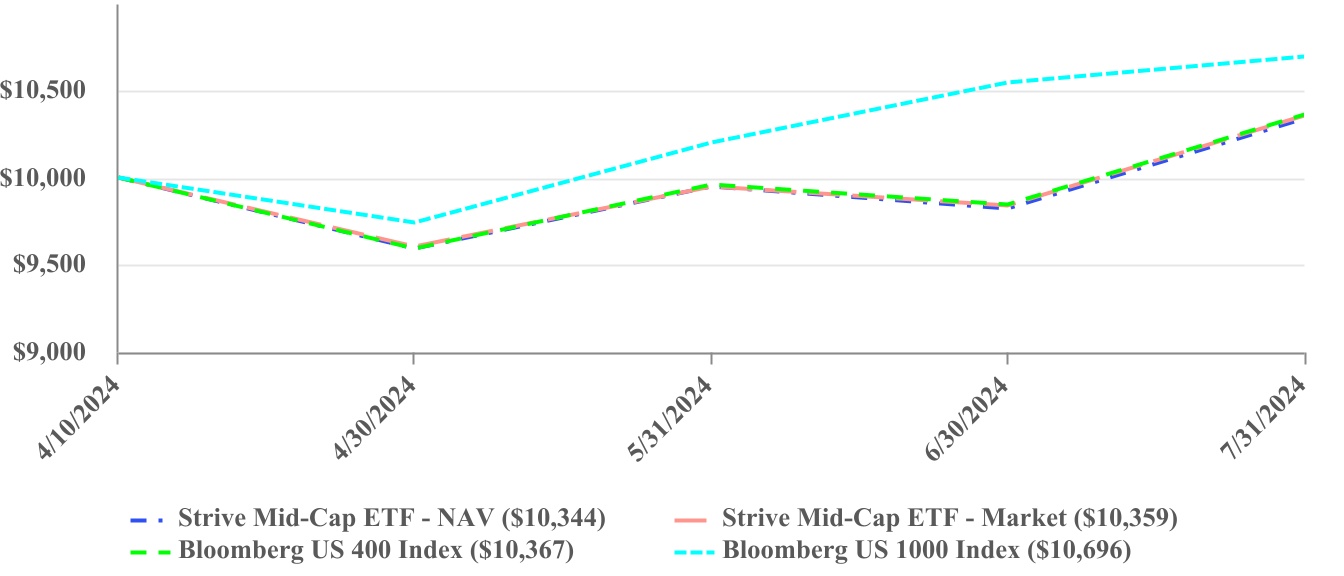

| PERFORMANCE OF A HYPOTHETICAL $10,000 INVESTMENT |

| | | | | | | | | | | | | | |

| CUMULATIVE TOTAL RETURNS |

| | | | Since Inception (4/10/2024) |

| Strive Mid-Cap ETF - NAV | | | | 3.44% |

| Strive Mid-Cap ETF - Market | | | | 3.59% |

| Bloomberg US 400 Index | | | | 3.67% |

| Bloomberg US 1000 Index | | | | 6.96% |

| | | | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Visit www.strivefunds.com/stxm for more recent performance information. |

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

U.S. mid-cap stocks rose modestly for the Period amid solid economic growth, easing inflation, and shifting monetary policy. Companies in the financials sector benefited from elevated interest rates and stable economic conditions. Companies in the consumer discretionary sector benefited from the home construction industry’s favorable performance despite elevated interest rates and higher borrowing costs.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive Mid-Cap ETF Ticker: STXM Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/stxm |

|

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $12,387,821 | | Portfolio Turnover Rate* | | 4% |

| # of Portfolio Holdings | | 397 | | Advisory Fees Paid | | $4,421 |

| *Portfolio turnover is not annualized and is calculated without regard to short-term securities having a maturity of less than one year. Excludes impact of in-kind transactions. |

| | | | | | |

| | | | | |

SECTOR WEIGHTING

(as a % of Net Assets) |

| Industrials | 20.9% |

| Consumer Discretionary | 14.4% |

| Financials | 14.2% |

| Information Technology | 14.0% |

| Health Care | 8.8% |

| Real Estate | 7.3% |

| Materials | 6.6% |

| Consumer Staples | 4.2% |

| Energy | 4.2% |

| Communication Services | 2.5% |

| Utilities | 2.5% |

| Cash & Cash Equivalents | 0.4% |

| | | | | |

TOP 10 HOLDINGS

(as a % of Net Assets) |

| Vistra Corp. | 0.8% |

| MicroStrategy, Inc. - Class A | 0.7% |

| GoDaddy, Inc. - Class A | 0.6% |

| Carlisle Cos., Inc. | 0.6% |

| Williams-Sonoma, Inc. | 0.6% |

| Lennox International, Inc. | 0.6% |

| AerCap Holdings NV | 0.5% |

| Pure Storage, Inc. - Class A | 0.5% |

| EMCOR Group, Inc. | 0.5% |

| Textron, Inc. | 0.5% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy information, visit www.strivefunds.com/stxm. You can also request information by calling (215) 882-9983.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive Small-Cap ETF Ticker: STXK Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/stxk |

|

| | | | | | | | | | | |

| This annual shareholder report contains important information about the Strive Small-Cap ETF (the “Fund”) for the period of August 1, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.strivefunds.com/stxk. You can also request this information by contacting us at (215) 882-9983. |

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $19 | 0.18% |

| | | | | | | | | | | |

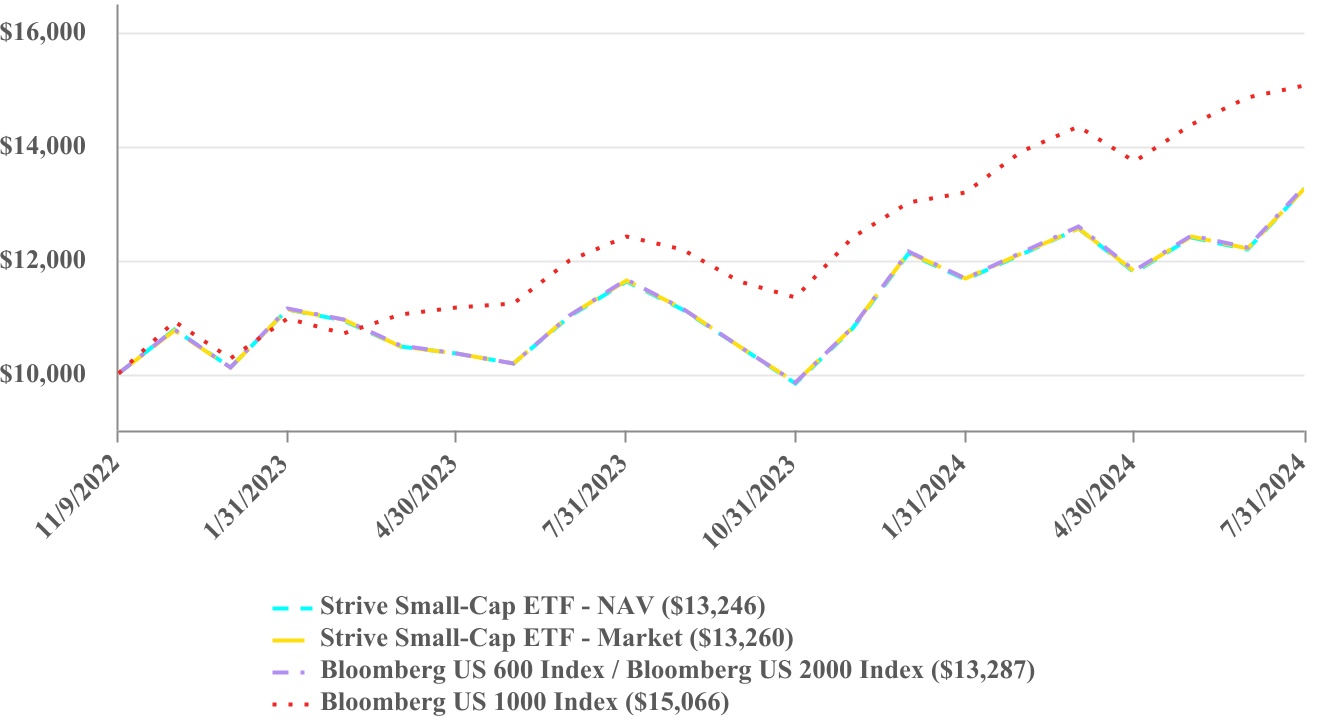

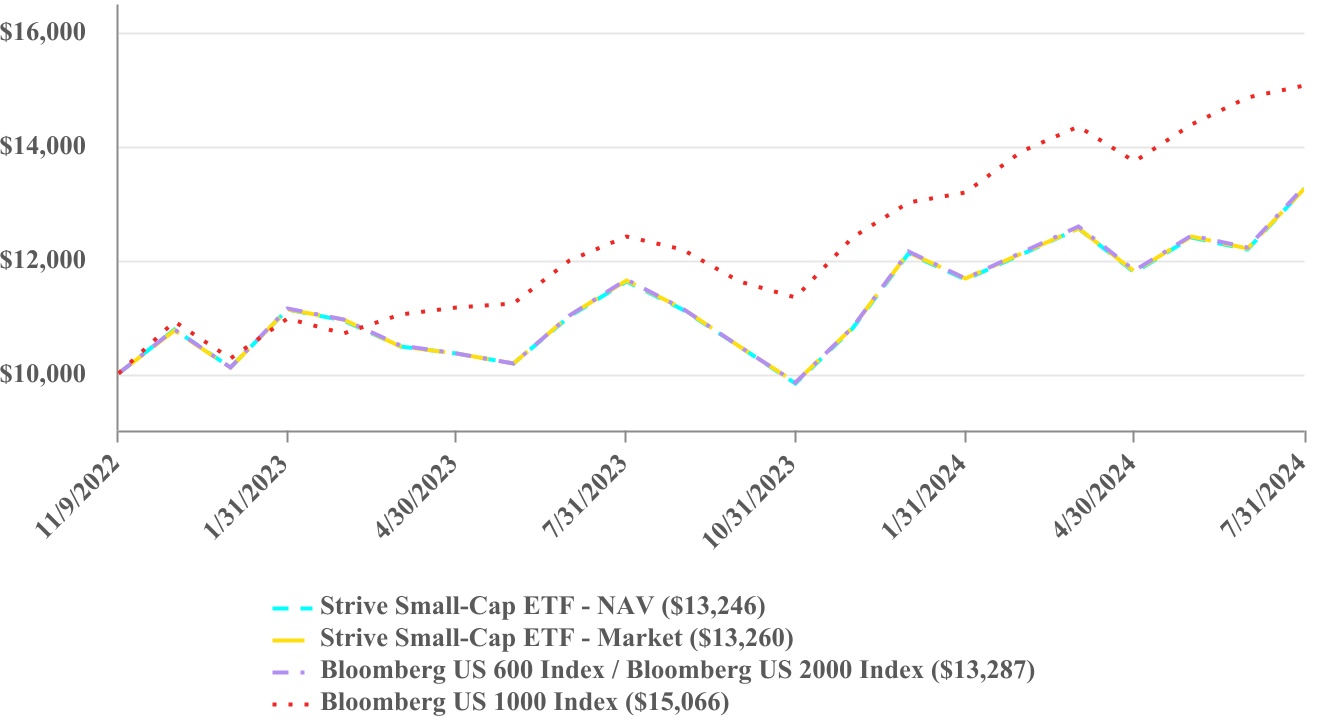

| PERFORMANCE OF A HYPOTHETICAL $10,000 INVESTMENT |

| | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS |

| | One Year | | Since Inception (11/9/2022) |

| Strive Small-Cap ETF - NAV | | 13.99% | | 17.72% |

| Strive Small-Cap ETF - Market | | 13.99% | | 17.79% |

| Bloomberg US 600 Index/Bloomberg US 2000 Index | | 14.14% | | 17.93% |

| Bloomberg US 1000 Index | | 21.51% | | 26.85% |

| | | | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Effective January 25, 2023, the Fund’s investment objective changed to track the total return performance, before fees and expenses, of an index composed of U.S. small-capitalization companies, and the Fund’s investment strategy changed to track the investment results of the Bloomberg 600 Index. Prior to January 25, 2023, the Fund’s investment objective was to track the total return performance, before fees and expenses, of an index composed of U.S. small- and mid-capitalization companies, and the Fund’s investment strategy was to track the investment results of the Bloomberg US 2000 Index. Performance shown for the Bloomberg US 600 Index/Bloomberg US 2000 Index for periods prior to January 25, 2023 is that of the Bloomberg US 2000 Index and for periods beginning January 25, 2023 is that of the Bloomberg US 600 Index. Visit www.strivefunds.com/stxk for more recent performance information. |

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive Small-Cap ETF Ticker: STXK Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/stxk |

|

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

U.S. small-cap stocks rose strongly during the Period amid solid economic growth, easing inflation, and shifting monetary policy. Companies in the financials sector, particularly those in the financial services, banking, and insurance industries, benefited from elevated interest rates and stable economic conditions. Companies in the industrials sector benefited from economic data bolstering estimates of future demand.

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $54,845,733 | | Portfolio Turnover Rate* | | 31% |

| # of Portfolio Holdings | | 590 | | Advisory Fees Paid | | $66,975 |

| *Excludes impact of in-kind transactions. |

| | | | | |

SECTOR WEIGHTING

(as a % of Net Assets) |

| Industrials | 18.0% |

| Financials | 16.9% |

| Information Technology | 12.9% |

| Health Care | 12.9% |

| Consumer Discretionary | 12.3% |

| Materials | 6.4% |

| Real Estate | 6.1% |

| Energy | 5.3% |

| Utilities | 4.1% |

| Consumer Staples | 2.8% |

| Communication Services | 2.1% |

| Cash & Cash Equivalents | 0.2% |

| | | | | |

TOP 10 HOLDINGS

(as a % of Net Assets) |

| Insmed, Inc | 0.6% |

| Sprouts Farmers Market, Inc. | 0.5% |

| FTAI Aviation Ltd. | 0.5% |

| ATI, Inc. | 0.4% |

| Mueller Industries, Inc. | 0.4% |

| Allison Transmission Holdings, Inc. | 0.4% |

| DT Midstream, Inc. | 0.4% |

| Abercrombie & Fitch Co. - Class A | 0.4% |

| Carpenter Technology Corp. | 0.4% |

| Kirby Corp. | 0.4% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy information, visit www.strivefunds.com/stxk. You can also request information by calling (215) 882-9983.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive 1000 Growth ETF Ticker: STXG Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/stxg |

|

| | | | | | | | | | | |

| This annual shareholder report contains important information about the Strive 1000 Growth ETF (the “Fund”) for the period of August 1, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.strivefunds.com/stxg. You can also request this information by contacting us at (215) 882-9983. |

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $20 | 0.18% |

| | | | | | | | | | | |

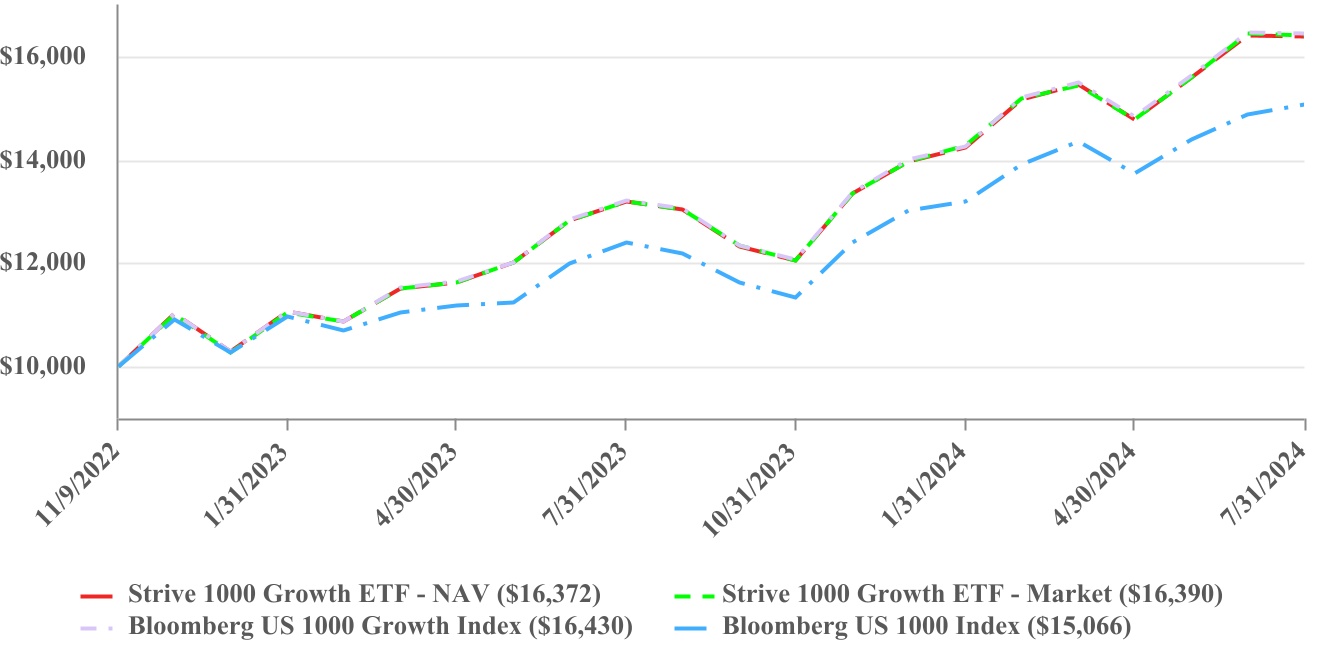

| PERFORMANCE OF A HYPOTHETICAL $10,000 INVESTMENT |

| | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS |

| | One Year | | Since Inception (11/9/2022) |

| Strive 1000 Growth ETF - NAV | | 24.14% | | 33.12% |

| Strive 1000 Growth ETF - Market | | 24.37% | | 33.20% |

| Bloomberg US 1000 Growth Index | | 24.36% | | 33.39% |

| Bloomberg US 1000 Index | | 21.51% | | 26.85% |

| | | | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Visit www.strivefunds.com/stxg for more recent performance information. |

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

Growth tilted U.S. large- and mid-cap stocks rose strongly during the Period as solid economic growth, easing inflation, and shifting monetary policy supported equities. Companies in the technology sector, particularly those in the semiconductor industry, benefited from increased demand due to the rapid advancements in artificial intelligence (AI) technology, demand for specialized chips, and increased computing power. Companies in the communications sector, particularly those in the internet media and services industry, benefited from the growth of online advertising, which boosted revenue and income.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive 1000 Growth ETF Ticker: STXG Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/stxg |

|

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $86,952,529 | | Portfolio Turnover Rate* | | 9% |

| # of Portfolio Holdings | | 698 | | Advisory Fees Paid | | $94,514 |

| *Excludes impact of in-kind transactions. |

| | | | | |

SECTOR WEIGHTING

(as a % of Net Assets) |

| Information Technology | 41.1% |

| Consumer Discretionary | 11.8% |

| Health Care | 10.9% |

| Communication Services | 10.1% |

| Industrials | 8.8% |

| Financials | 8.2% |

| Consumer Staples | 3.8% |

| Real Estate | 2.0% |

| Materials | 1.8% |

| Energy | 0.8% |

| Utilities | 0.4% |

| Cash & Cash Equivalents | 0.3% |

| | | | | |

TOP 10 HOLDINGS

(as a % of Net Assets) |

| Apple, Inc. | 9.2% |

| Microsoft Corp. | 8.8% |

| Nvidia Corp. | 8.0% |

| Amazon.com, Inc. | 4.9% |

| Meta Platforms, Inc. - Class A | 3.0% |

| Alphabet, Inc. - Class A | 2.9% |

| Alphabet, Inc. - Class C | 2.4% |

| Broadcom, Inc. | 2.1% |

| Eli Lilly & Co. | 1.9% |

| Tesla, Inc. | 1.8% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy information, visit www.strivefunds.com/stxg. You can also request information by calling (215) 882-9983.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive 1000 Value ETF Ticker: STXV Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/stxv |

|

| | | | | | | | | | | |

| This annual shareholder report contains important information about the Strive 1000 Value ETF (the “Fund”) for the period of August 1, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.strivefunds.com/stxv. You can also request this information by contacting us at (215) 882-9983. |

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $19 | 0.18% |

| | | | | | | | | | | |

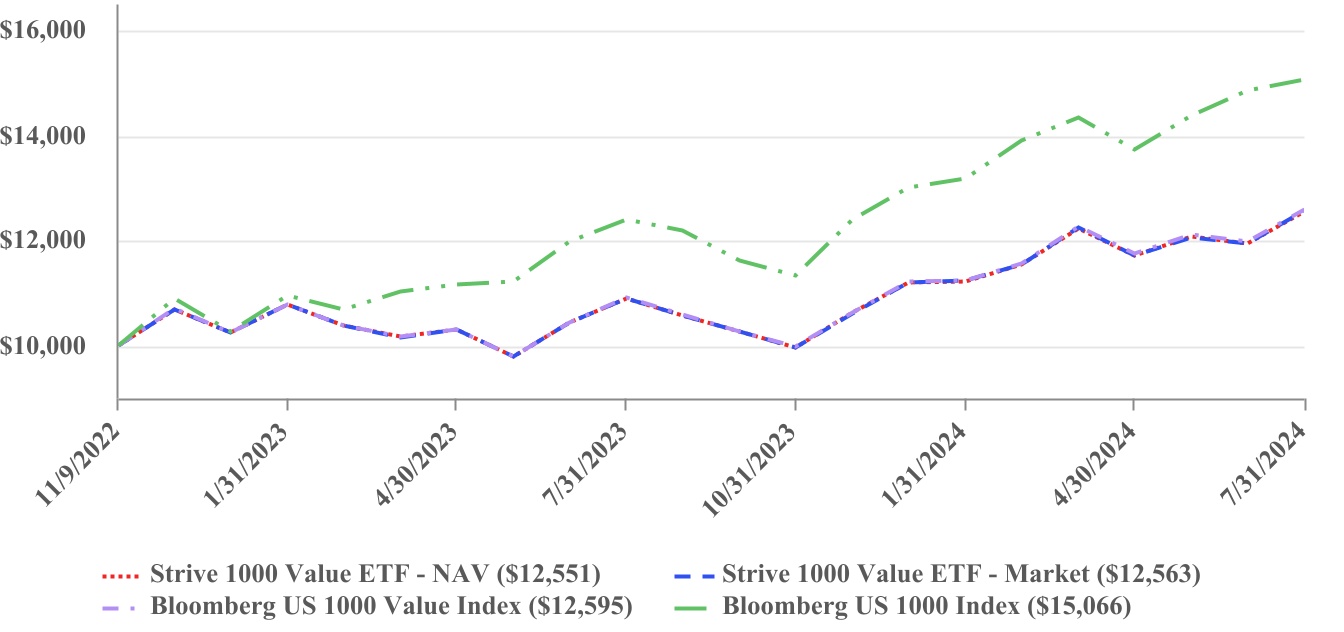

| PERFORMANCE OF A HYPOTHETICAL $10,000 INVESTMENT |

| | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS |

| | One Year | | Since Inception (11/9/2022) |

| Strive 1000 Value ETF - NAV | | 15.12% | | 14.09% |

| Strive 1000 Value ETF - Market | | 15.33% | | 14.16% |

| Bloomberg US 1000 Value Index | | 15.39% | | 14.33% |

| Bloomberg US 1000 Index | | 21.51% | | 26.85% |

| | | | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Visit www.strivefunds.com/stxv for more recent performance information. |

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

U.S. large- and mid-cap stocks rose strongly during the Period as solid economic growth, easing inflation, and shifting monetary policy supported equities, though value-tilted stocks trailed the stronger returns of growth-tilted companies favored by investors during the Period. Companies in the financials sector, particularly those in the financial services, banking, and insurance industries, benefited from elevated interest rates and stable economic conditions. Companies in the industrials sector benefited from economic data bolstering estimates of future demand. Value-tilted companies in the technology sector benefited from increased demand due to the rapid advancements in artificial intelligence (AI) technology.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive 1000 Value ETF Ticker: STXV Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/stxv |

|

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $54,678,934 | | Portfolio Turnover Rate* | | 13% |

| # of Portfolio Holdings | | 700 | | Advisory Fees Paid | | $55,133 |

| *Excludes impact of in-kind transactions. |

| | | | | |

SECTOR WEIGHTING

(as a % of Net Assets) |

| Financials | 23.6% |

| Health Care | 13.8% |

| Energy | 10.5% |

| Industrials | 10.2% |

| Consumer Staples | 9.9% |

| Utilities | 6.5% |

| Information Technology | 6.3% |

| Consumer Discretionary | 6.0% |

| Communication Services | 5.3% |

| Real Estate | 3.7% |

| Materials | 3.6% |

| Cash & Cash Equivalents | 0.6% |

| | | | | |

TOP 10 HOLDINGS

(as a % of Net Assets) |

| JPMorgan Chase & Co. | 4.0% |

| Exxon Mobil Corp. | 3.4% |

| Chevron Corp. | 1.8% |

| Bank of America Corp. | 1.8% |

| Johnson & Johnson | 1.8% |

| Walmart, Inc. | 1.4% |

| Wells Fargo & Co. | 1.4% |

| Berkshire Hathaway, Inc. - Class B | 1.3% |

| AbbVie, Inc. | 1.2% |

| Philip Morris International, Inc. | 1.2% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy information, visit www.strivefunds.com/stxv. You can also request information by calling (215) 882-9983.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive 1000 Dividend Growth ETF Ticker: STXD Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/stxd |

|

| | | | | | | | | | | |

| This annual shareholder report contains important information about the Strive 1000 Dividend Growth ETF (the “Fund”) for the period of August 1, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.strivefunds.com/stxd. You can also request this information by contacting us at (215) 882-9983. |

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $38 | 0.35% |

| | | | | | | | | | | |

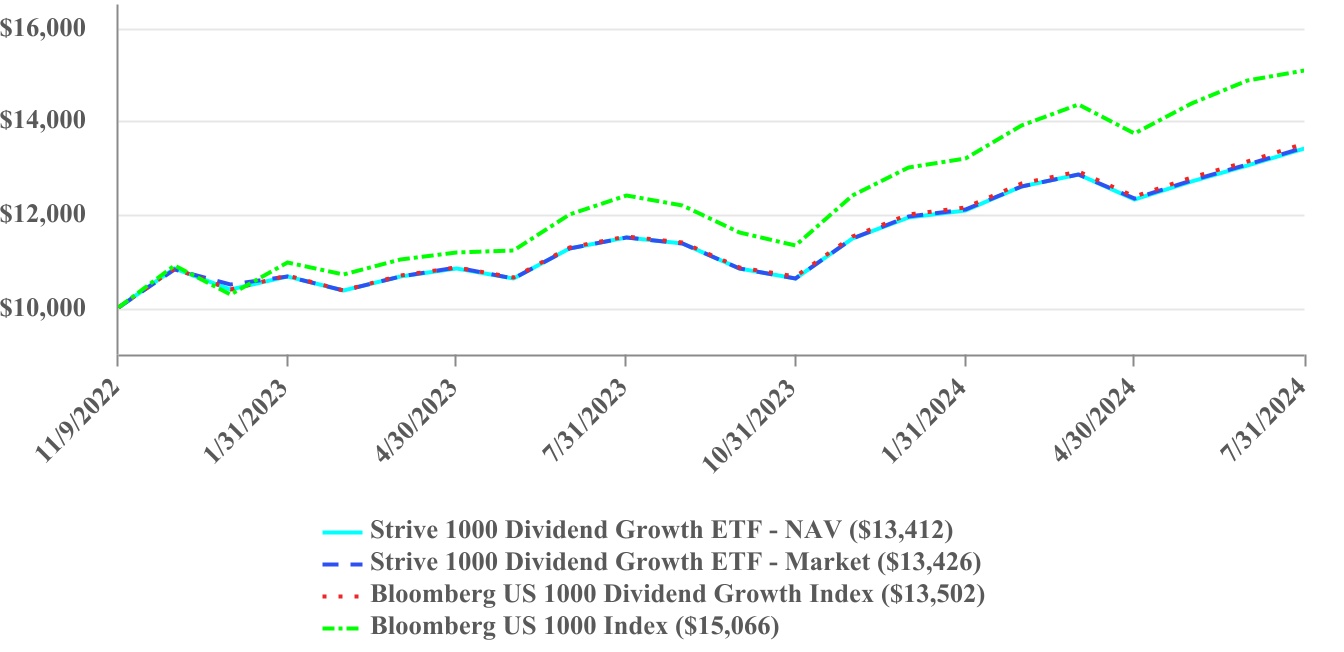

| PERFORMANCE OF A HYPOTHETICAL $10,000 INVESTMENT |

| | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS |

| | One Year | | Since Inception (11/9/2022) |

| Strive 1000 Dividend Growth ETF - NAV | | 16.73% | | 18.57% |

| Strive 1000 Dividend Growth ETF - Market | | 16.78% | | 18.64% |

| Bloomberg US 1000 Dividend Growth Index | | 17.18% | | 19.03% |

| Bloomberg US 1000 Index | | 21.51% | | 26.85% |

| | | | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Visit www.strivefunds.com/stxd for more recent performance information. |

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

Growth tilted U.S. large- and mid-cap stocks with a history of consistently growing dividends rose strongly during the Period. Companies in the technology sector, particularly those in the semiconductor industry, benefited from increased demand due to the rapid advancements in artificial intelligence (AI) technology, demand for specialized chips, and increased computing power. Companies in the health care sector, particularly those in the pharmaceuticals industry, benefited from the development of new drugs, like the popular new GLP-1 drugs for weight loss. Companies in the financials sector benefited from elevated interest rates and stable economic conditions.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive 1000 Dividend Growth ETF Ticker: STXD Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/stxd |

|

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $43,199,757 | | Portfolio Turnover Rate* | | 10% |

| # of Portfolio Holdings | | 215 | | Advisory Fees Paid | | $116,836 |

| *Excludes impact of in-kind transactions. |

| | | | | |

SECTOR WEIGHTING

(as a % of Net Assets) |

| Information Technology | 24.7% |

| Health Care | 22.8% |

| Industrials | 14.1% |

| Financials | 13.8% |

| Consumer Staples | 8.1% |

| Consumer Discretionary | 7.5% |

| Materials | 3.6% |

| Real Estate | 3.1% |

| Utilities | 1.6% |

| Energy | 0.4% |

| Communication Services | 0.1% |

| Cash & Cash Equivalents | 0.2% |

| | | | | |

TOP 10 HOLDINGS

(as a % of Net Assets) |

| Apple, Inc. | 5.2% |

| Broadcom, Inc. | 4.7% |

| Microsoft Corp. | 4.6% |

| Eli Lilly & Co. | 4.4% |

| UnitedHealth Group, Inc. | 3.4% |

| Visa, Inc. - Class A | 2.7% |

| Mastercard, Inc. - Class A | 2.4% |

| Procter & Gamble Co. | 2.4% |

| Johnson & Johnson | 2.4% |

| Home Depot, Inc. | 2.3% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy information, visit www.strivefunds.com/stxd. You can also request information by calling (215) 882-9983.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive U.S. Energy ETF Ticker: DRLL Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/drll |

|

This annual shareholder report contains important information about the Strive U.S. Energy ETF (the “Fund”) for the period of August 1, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.strivefunds.com/drll. You can also request this information by contacting us at (215) 882-9983. This report describes changes to the Fund that occurred during the Period.

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $42 | 0.41% |

| | | | | | | | | | | |

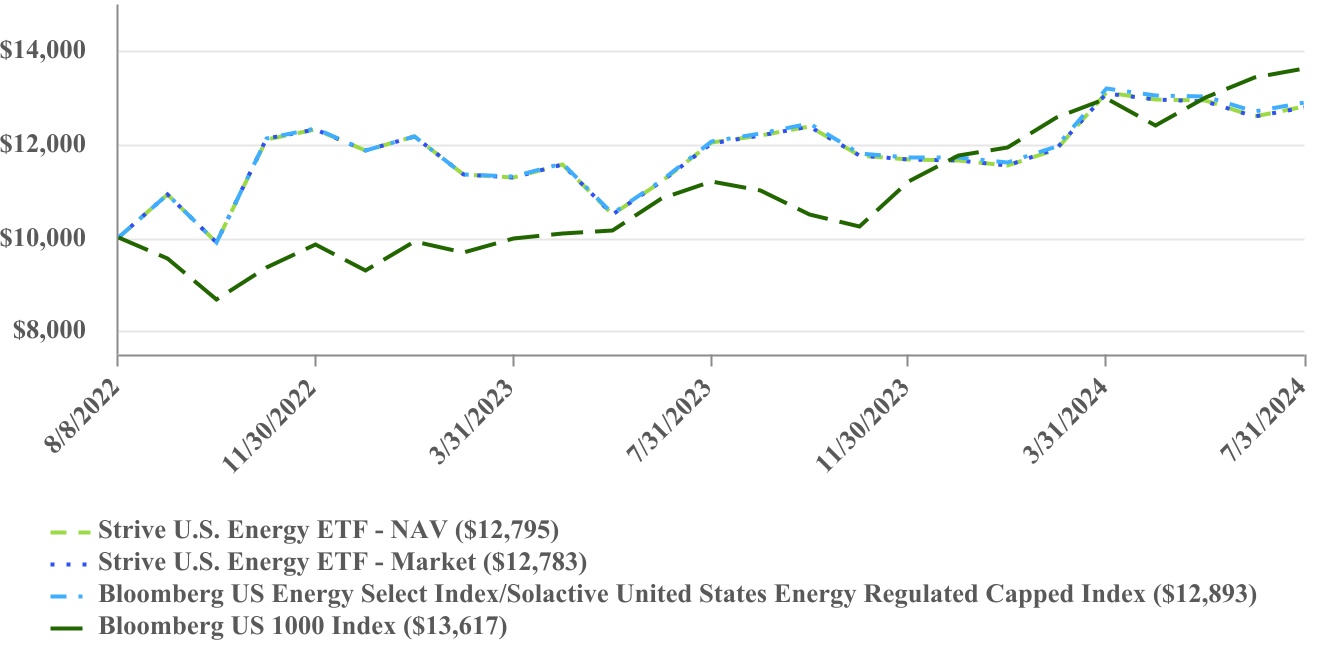

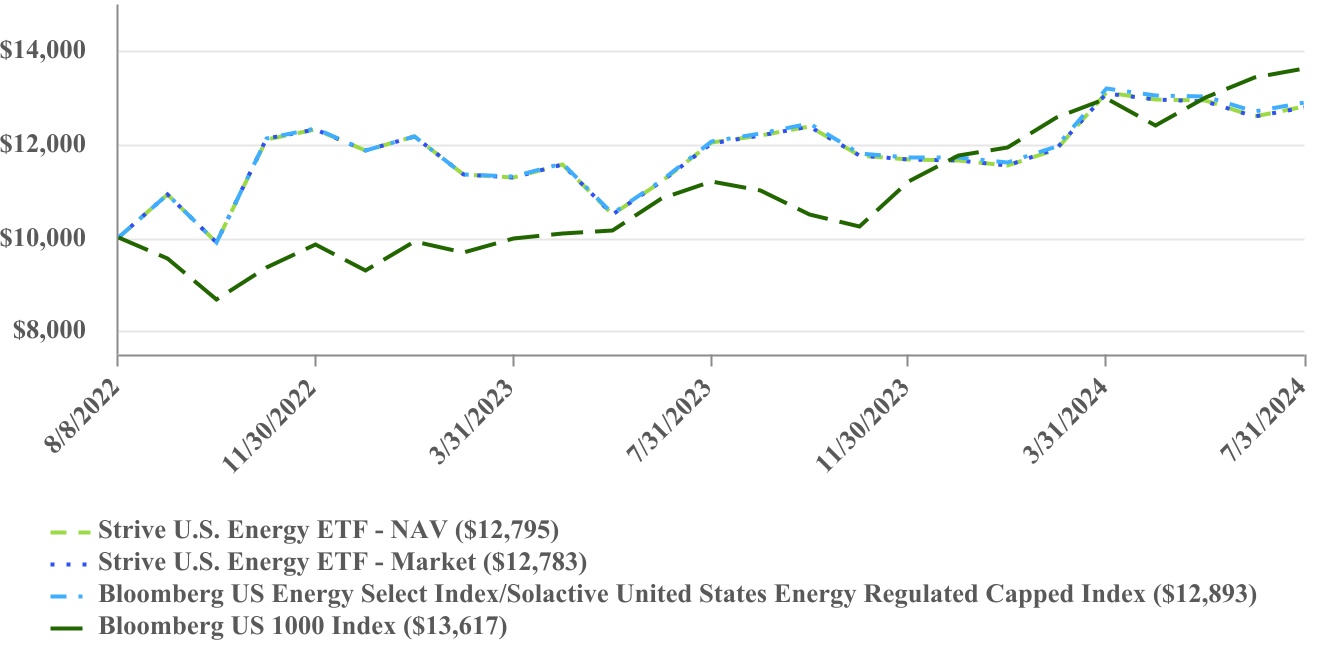

| PERFORMANCE OF A HYPOTHETICAL $10,000 INVESTMENT |

| | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS |

| | One Year | | Since Inception (8/8/2022) |

| Strive U.S. Energy ETF - NAV | | 6.43% | | 13.27% |

| Strive U.S. Energy ETF - Market | | 6.40% | | 13.22% |

| Bloomberg US Energy Select Index/Solactive United States Energy Regulated Capped Index | | 6.91% | | 13.71% |

| Bloomberg US 1000 Index | | 21.51% | | 16.89% |

| | | | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Effective April 11, 2024, the Fund’s investment strategy changed to track the investment results of the Bloomberg US Energy Select Index. Prior to April 11, 2024, the Fund’s investment strategy was to track the investment results of the Solactive United States Energy Regulated Capped Index. Performance shown for the Bloomberg US Energy Select Index/Solactive United States Energy Regulated Capped Index for periods prior to April 11, 2024 is that of the Solactive United States Energy Regulated Capped Index and for periods beginning April 11, 2024 is that of the Bloomberg US Energy Select Index. Visit www.strivefunds.com/drll for more recent performance information. |

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive U.S. Energy ETF Ticker: DRLL Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/drll |

|

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

U.S. large- and mid-cap energy stocks returned positive in the Period amid a volatile year for the energy sector. The Fund’s return was largely correlated to the price of oil, which saw significant volatility in the fall and declined by the end of the calendar year 2023. Oil prices and the corresponding energy sector equities then recovered rapidly during February and March 2024.

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $344,210,854 | | Portfolio Turnover Rate* | | 21% |

| # of Portfolio Holdings | | 40 | | Advisory Fees Paid | | $1,419,497 |

| *Excludes impact of in-kind transactions. |

| | | | | |

INDUSTRY WEIGHTING

(as a % of Net Assets) |

| Integrated Oil & Gas | 47.5% |

| Oil & Gas Exploration & Production | 36.5% |

| Oil & Gas Refining & Marketing | 15.0% |

| Automotive Retail | 0.9% |

| Cash & Cash Equivalents | 0.1% |

| | | | | |

Top 10 Holdings

(as a % of Net Assets) |

| Exxon Mobil Corp. | 22.9% |

| Chevron Corp. | 20.9% |

| Phillips 66 | 4.5% |

| EOG Resources, Inc. | 4.5% |

| Marathon Petroleum Corp. | 4.5% |

| Valero Energy Corp. | 4.3% |

| Hess Corp. | 4.2% |

| ConocoPhillips | 3.7% |

| Occidental Petroleum Corp. | 3.5% |

| Diamondback Energy, Inc. | 2.9% |

Material Fund Changes

Effective April 11, 2024, the Fund’s investment strategy changed to track the investment results of the Bloomberg US Energy Select Index. Prior to April 11, 2024, the Fund’s investment strategy was to track the investment results of the Solactive United States Energy Regulated Capped Index. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by November 30, 2024, at www.strivefunds.com/drll or upon request by calling (215) 882-9983.

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy information, visit www.strivefunds.com/drll. You can also request information by calling (215) 882-9983.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

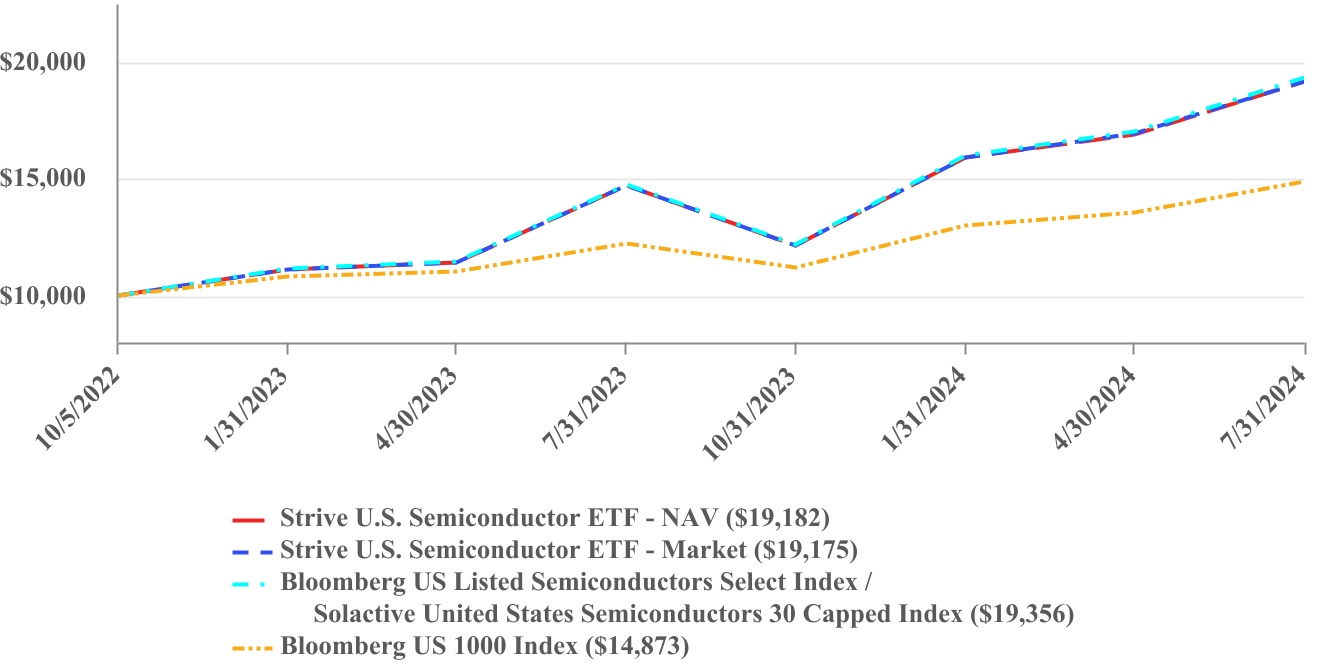

| Fund Name: Strive U.S. Semiconductor ETF Ticker: SHOC Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/shoc |

|

| | | | | | | | | | | |

| This annual shareholder report contains important information about the Strive U.S. Semiconductor ETF (the “Fund”) for the period of August 1, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.strivefunds.com/shoc. You can also request this information by contacting us at (215) 882-9983. This report describes changes to the Fund that occurred during the Period. |

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $46 | 0.40% |

| | | | | | | | | | | |

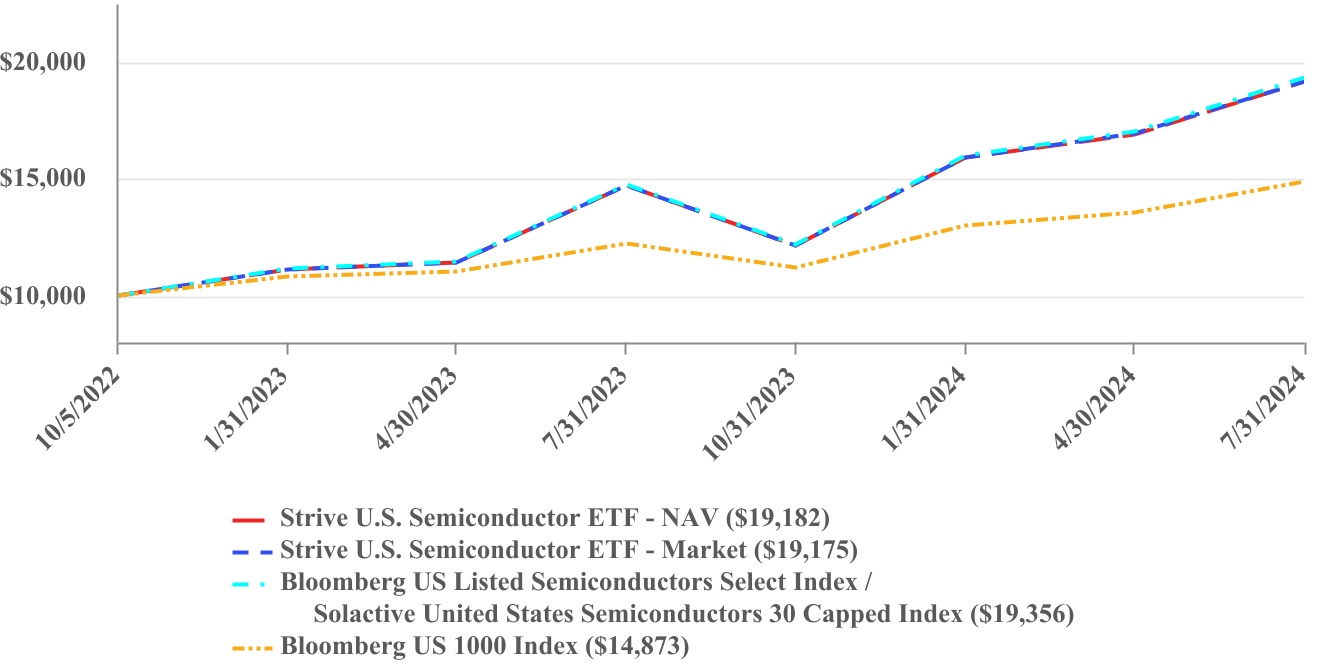

| PERFORMANCE OF A HYPOTHETICAL $10,000 INVESTMENT |

| | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS |

| | One Year | | Since Inception (10/5/2022) |

| Strive U.S. Semiconductor ETF - NAV | | 30.46% | | 43.03% |

| Strive U.S. Semiconductor ETF - Market | | 30.38% | | 43.06% |

| Bloomberg US Listed Semiconductors Select Index/Solactive United States Semiconductors 30 Capped Index | | 31.12% | | 43.77% |

| Bloomberg US 1000 Index | | 21.51% | | 24.39% |

| | | | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Effective March 21, 2024, the Fund’s investment strategy changed to track the investment results of the Bloomberg US Listed Semiconductors Select Index. Prior to March 21, 2024, the Fund’s investment strategy was to track the investment results of the Solactive United States Semiconductors 30 Capped Index. Performance shown for the Bloomberg US Listed Semiconductors Select Index/Solactive United States Semiconductors 30 Capped Index for periods prior to March 21, 2024 is that of the Solactive United States Semiconductors 30 Capped Index and for periods beginning March 21, 2024 is that of the Bloomberg US Listed Semiconductors Select Index. Visit www.strivefunds.com/shoc for more recent performance information. |

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive U.S. Semiconductor ETF Ticker: SHOC Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/shoc |

|

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

The U.S. listed semiconductor industry saw remarkable returns over the Period as a result of major advancements in artificial intelligence (AI) technology. The rapid advancements in generative AI and large language models, which allow users to generate output from simple natural language queries, drove a surge in demand for specialized chips and increased computing power. | | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $83,169,291 | | Portfolio Turnover Rate* | | 29% |

| # of Portfolio Holdings | | 31 | | Advisory Fees Paid | | $211,458 |

| *Excludes impact of in-kind transactions. |

| | | | | |

INDUSTRY WEIGHTING

(as a % of Net Assets) |

| Semiconductors | 62.8% |

| Semiconductor Materials & Equipment | 25.2% |

| Electronic Components | 2.7% |

| Application Software | 5.4% |

| Electronic Manufacturing Services | 1.6% |

| Electronic Equipment & Instruments | 0.8% |

| Specialty Chemicals | 0.4% |

| Electrical Components & Equipment | 0.2% |

| Cash & Cash Equivalents | 0.9% |

| | | | | |

TOP 10 HOLDINGS

(as a % of Net Assets) |

| Nvidia Corp. | 24.7% |

| ASML Holding NV | 11.3% |

| Advanced Micro Devices, Inc. | 7.2% |

| Broadcom, Inc. | 5.1% |

| Texas Instruments, Inc. | 4.5% |

| Intel Corp. | 4.4% |

| Applied Materials, Inc. | 4.3% |

| Lam Research Corp. | 4.1% |

| Analog Devices, Inc. | 4.0% |

| Micron Technology, Inc. | 3.9% |

Material Fund Changes

Effective March 21, 2024, the Fund’s investment strategy changed to track the investment results of the Bloomberg US Listed Semiconductors Select Index. Prior to March 21, 2024, the Fund’s investment strategy was to track the investment results of the Solactive United States Semiconductors 30 Capped Index. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by November 30, 2024, at www.strivefunds.com/shoc or upon request by calling (215) 882-9983.

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy information, visit www.strivefunds.com/shoc. You can also request information by calling (215) 882-9983.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive Natural Resources and Security ETF Ticker: FTWO Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/ftwo |

|

| | | | | | | | | | | |

| This annual shareholder report contains important information about the Strive Natural Resources and Security ETF (the “Fund”) for the period of August 30, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.strivefunds.com/ftwo. You can also request this information by contacting us at (215) 882-9983. This report describes changes to the Fund that occurred subsequent to the Period end. |

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $49 | 0.49% |

| | | | | | | | | | | |

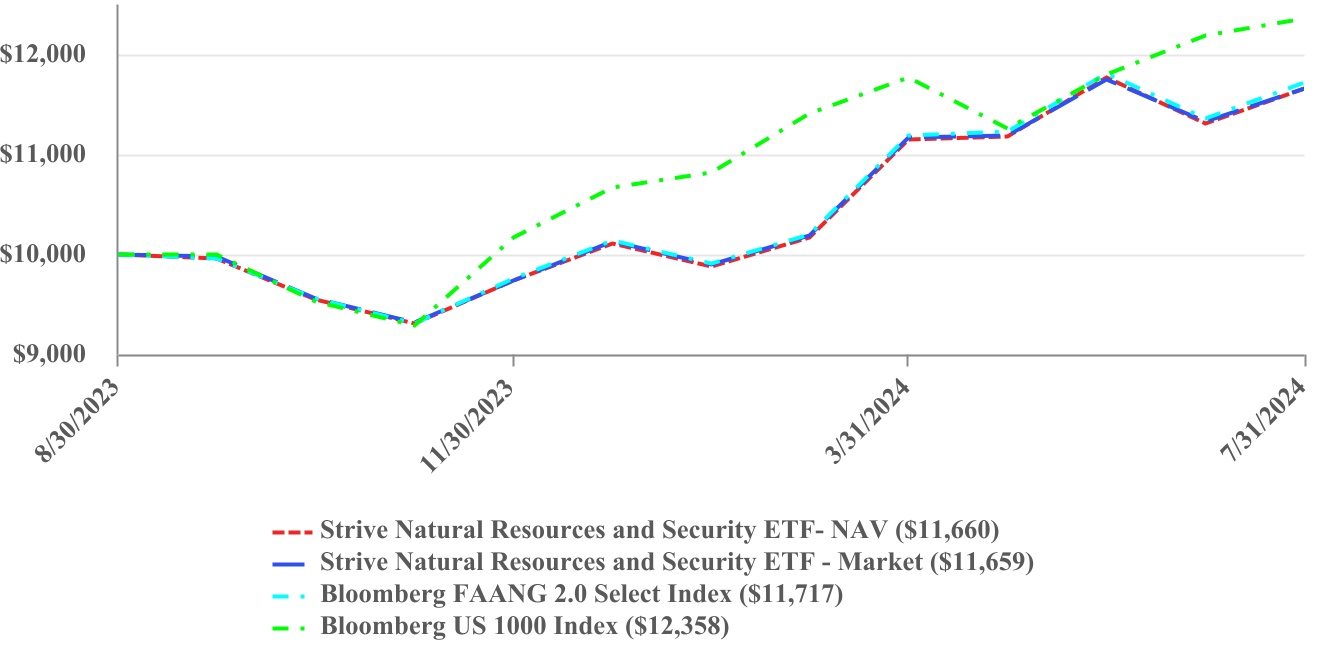

| PERFORMANCE OF A HYPOTHETICAL $10,000 INVESTMENT |

| | | | | | | | | | | | | | |

| CUMULATIVE TOTAL RETURNS |

| | | | Since Inception (8/30/2023) |

| Strive Natural Resources and Security ETF - NAV | | | | 16.60% |

| Strive Natural Resources and Security ETF- Market | | | | 16.59% |

| Bloomberg FAANG 2.0 Select Index | | | | 17.17% |

| Bloomberg US 1000 Index | | | | 23.58% |

| | | | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit www.strivefunds.com/ftwo for more recent performance information. |

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

North American stocks in the natural resources and security industries rose strongly during the reporting period. The Fund invests in companies whose primary business activities are involved in Fuel, Aerospace & Defense, Agriculture, Nuclear, and Gold & Precious Metals. Companies in the nuclear energy industry benefited from the market’s expectation for significant demand growth as advances in artificial intelligence (AI) technology require large amounts of reliable energy. Fuel companies benefited from the price of oil during the Period. Both Aerospace & Defense and Gold & Precious Metals companies benefited from increased revenue due to increased geopolitical tensions and expectations of persistent inflation.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive Natural Resources and Security ETF Ticker: FTWO Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/ftwo |

|

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $23,207,766 | | Portfolio Turnover Rate* | | 27% |

| # of Portfolio Holdings | | 49 | | Advisory Fees Paid | | $35,619 |

| *Portfolio turnover is not annualized and is calculated without regard to short-term securities having a maturity of less than one year. Excludes impact of in-kind transactions. |

| | | | | |

SECTOR WEIGHTING

(as a % of Net Assets) |

| Industrials | 33.5% |

| Materials | 29.0% |

| Energy | 25.6% |

| Utilities | 10.9% |

| Consumer Staples | 0.7% |

| Cash & Cash Equivalents | 0.3% |

| | | | | |

TOP 10 HOLDINGS

(as a % of Net Assets) |

| Constellation Energy Corp. | 10.9% |

| Deere & Co. | 8.3% |

| Exxon Mobil Corp. | 8.0% |

| Freeport-McMoRan, Inc. | 4.8% |

| General Electric Co. | 4.3% |

| Newmont Corp. | 4.2% |

| Chevron Corp. | 4.2% |

| RTX Corp. | 3.7% |

| Cameco Corp. | 3.6% |

| Corteva, Inc. | 3.3% |

Material Fund Changes

Effective August 16, 2024, the Fund’s name changed from Strive FAANG 2.0 ETF to Strive Natural Resources and Security ETF. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by November 30, 2024, at www.strivefunds.com/ftwo or upon request by calling (215) 882-9983.

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy information, visit www.strivefunds.com/ftwo. You can also request information by calling (215) 882-9983.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive Emerging Markets Ex-China ETF Ticker: STXE Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/stxe |

|

| | | | | | | | | | | |

| This annual shareholder report contains important information about the Strive Emerging Markets Ex-China ETF (the “Fund”) for the period of August 1, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.strivefunds.com/stxe. You can also request this information by contacting us at (215) 882-9983. |

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $34 | 0.32% |

| | | | | | | | | | | |

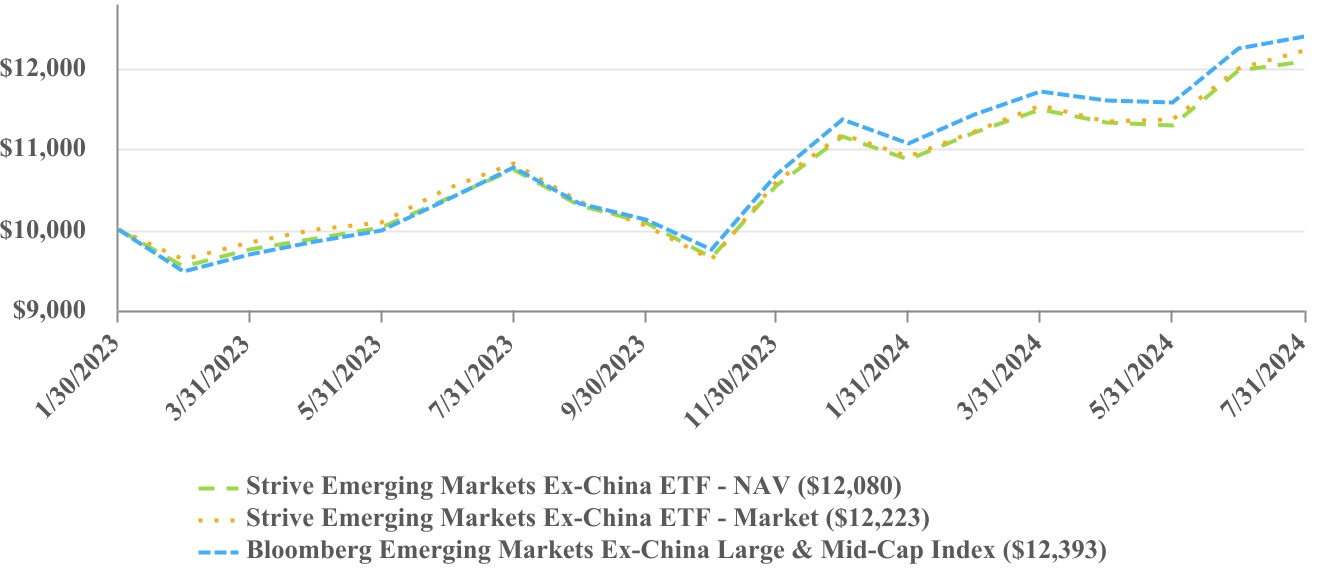

| PERFORMANCE OF A HYPOTHETICAL $10,000 INVESTMENT |

| | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS |

| | One Year | | Since Inception (1/30/2023) |

| Strive Emerging Markets Ex-China ETF - NAV | | 12.38% | | 13.44% |

| Strive Emerging Markets Ex-China ETF - Market | | 12.92% | | 14.33% |

| Bloomberg Emerging Markets Ex-China Large & Mid-Cap Index | | 15.14% | | 15.39% |

| | | | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Visit www.strivefunds.com/stxe for more recent performance information. |

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

Stocks in the emerging market countries excluding China increased during the reporting period, led by strong returns from equities in India and Taiwan. Indian companies benefited from increasing infrastructure investment, and other Southeast Asian countries benefited from stable demand for manufactured goods. Stocks in the emerging market countries excluding China trailed markets in the United States due to a strong dollar and higher-than-expected interest rates set by the Federal Reserve.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive Emerging Markets Ex-China ETF Ticker: STXE Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/stxe |

|

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $100,345,667 | | Portfolio Turnover Rate* | | 80% |

| # of Portfolio Holdings | | 271 | | Advisory Fees Paid | | $305,035 |

| *Excludes impact of in-kind transactions. |

| | | | | |

SECTOR WEIGHTING

(as a % of Net Assets) |

| Information Technology | 31.5% |

| Financials | 28.9% |

| Materials | 7.0% |

| Energy | 5.8% |

| Consumer Discretionary | 5.5% |

| Industrials | 5.3% |

| Consumer Staples | 5.1% |

| Communication Services | 3.9% |

| Utilities | 3.2% |

| Health Care | 2.6% |

| Real Estate | 0.9% |

| Cash & Cash Equivalents | 0.3% |

| | | | | |

TOP 10 HOLDINGS

(as a % of Net Assets) |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 13.1% |

| Samsung Electronics Co. Ltd. | 6.7% |

| HDFC Bank Ltd. | 3.0% |

| Reliance Industries Ltd. | 2.3% |

| ICICI Bank Ltd. | 2.1% |

| Al Rajhi Bank | 2.0% |

| Infosys Ltd. | 1.5% |

| SK Hynix, Inc. | 1.5% |

| Hon Hai Precision Industry Co. Ltd. | 1.3% |

| Tata Consultancy Services Ltd. | 1.0% |

| | | | | |

COUNTRY WEIGHTING

(as a % of Net Assets) |

| India | 30.5% |

| Taiwan | 22.9% |

| South Korea | 15.1% |

| Saudi Arabia | 7.2% |

| Brazil | 5.9% |

| Mexico | 3.1% |

| South Africa | 2.8% |

| Indonesia | 2.4% |

| United Arab Emirates | 2.2% |

| Thailand | 2.0% |

| Kuwait | 1.1% |

| Poland | 1.1% |

| Qatar | 0.8% |

| Philippines | 0.7% |

| Malaysia | 0.6% |

| Turkey | 0.4% |

| Hungry | 0.3% |

| Peru | 0.3% |

| Greece | 0.1% |

| Chile | 0.1% |

| Cash & Cash Equivalents | 0.3% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy information, visit www.strivefunds.com/stxe. You can also request information by calling (215) 882-9983.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive International Developed Markets ETF Ticker: STXI Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/stxi |

|

| | | | | | | | | | | |

| This annual shareholder report contains important information about the Strive International Developed Markets ETF (the “Fund”) for the period of June 25, 2024 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.strivefunds.com/stxi. You can also request this information by contacting us at (215) 882-9983. |

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $3 | 0.29% |

| | | | | | | | | | | |

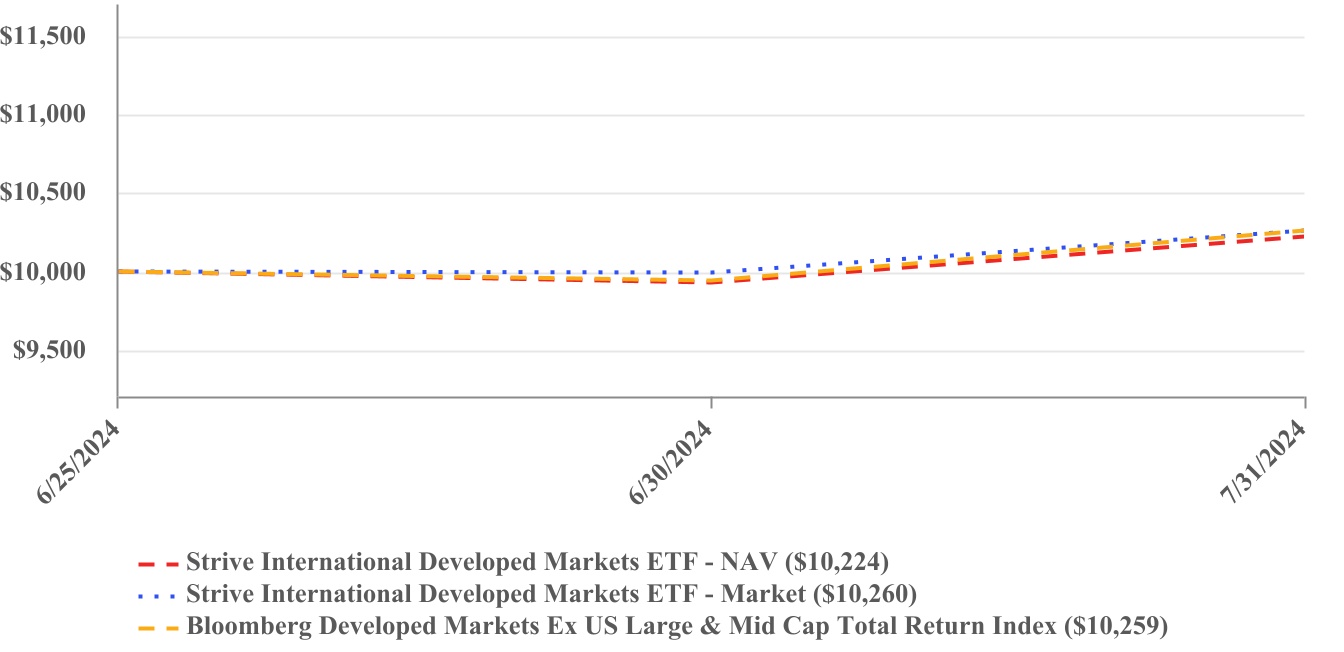

| PERFORMANCE OF A HYPOTHETICAL $10,000 INVESTMENT |

| | | | | | | | | | | | | | |

| CUMULATIVE TOTAL RETURNS |

| | | | Since Inception (6/25/2024) |

| Strive International Developed Markets ETF - NAV | | | | 2.24% |

| Strive International Developed Markets ETF - Market | | | | 2.60% |

| Bloomberg Developed Markets Ex US Large & Mid Cap Total Return Index | | | | 2.59% |

| | | | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Visit www.strivefunds.com/stxi for more recent performance information. |

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

Stocks in developed market countries outside of the United States returned modestly positive results in the reporting period since the Fund’s inception. Japan and Canada led performance of developed markets equities outside of the United States. Stocks in ex-U.S. markets trailed those in the United States due to a strong dollar and higher-than-expected interest rates set by the Federal Reserve.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive International Developed Markets ETF Ticker: STXI Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/stxi |

|

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $10,269,481 | | Portfolio Turnover Rate* | | 0% |

| # of Portfolio Holdings | | 269 | | Advisory Fees Paid | | $1,863 |

| *Portfolio turnover is not annualized and is calculated without regard to short-term securities having a maturity of less than one year. Excludes impact of in-kind transactions. |

| | | | | |

SECTOR WEIGHTING

(as a % of Net Assets) |

| Financials | 24.0% |

| Industrials | 15.6% |

| Health Care | 13.5% |

| Consumer Discretionary | 10.1% |

| Information Technology | 9.4% |

| Consumer Staples | 7.8% |

| Materials | 6.9% |

| Energy | 5.8% |

| Communication Services | 3.4% |

| Utilities | 2.4% |

| Real Estate | 0.8% |

| Cash & Cash Equivalents | 0.3% |

| | | | | |

TOP 10 HOLDINGS

(as a % of Net Assets) |

| Novo Nordisk AS | 3.1% |

| ASML Holding NV | 2.4% |

| Nestle SA | 1.8% |

| Novartis AG | 1.6% |

| AstraZeneca PLC | 1.6% |

| Shell PLC | 1.6% |

| Roche Holding AG | 1.6% |

| SAP SE | 1.5% |

| Toyota Motor Corp. | 1.5% |

| LVMH Moet Hennessy Louis Vuitton SE | 1.2% |

| | | | | |

COUNTRY WEIGHTING

(as a % of Net Assets) |

| Japan | 19.8% |

| United Kingdom | 13.4% |

| France | 11.6% |

| Canada | 11.3% |

| Switzerland | 10.6% |

| Germany | 7.7% |

| Australia | 6.3% |

| Netherlands | 4.9% |

| Denmark | 3.8% |

| Spain | 2.6% |

| Sweden | 2.0% |

| Italy | 2.0% |

| Singapore | 1.0% |

| Hong Kong | 0.9% |

| Belgium | 0.7% |

| Finland | 0.6% |

| Ireland | 0.5% |

| Cash & Cash Equivalents | 0.3% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy information, visit www.strivefunds.com/stxi. You can also request information by calling (215) 882-9983.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive Total Return Bond ETF Ticker: STXT Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/stxt |

|

| | | | | | | | | | | |

| This annual shareholder report contains important information about the Strive Total Return Bond ETF (the “Fund”) for the period of August 9, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.strivefunds.com/stxt. You can also request this information by contacting us at (215) 882-9983. |

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $49 | 0.49% |

| | | | | | | | | | | |

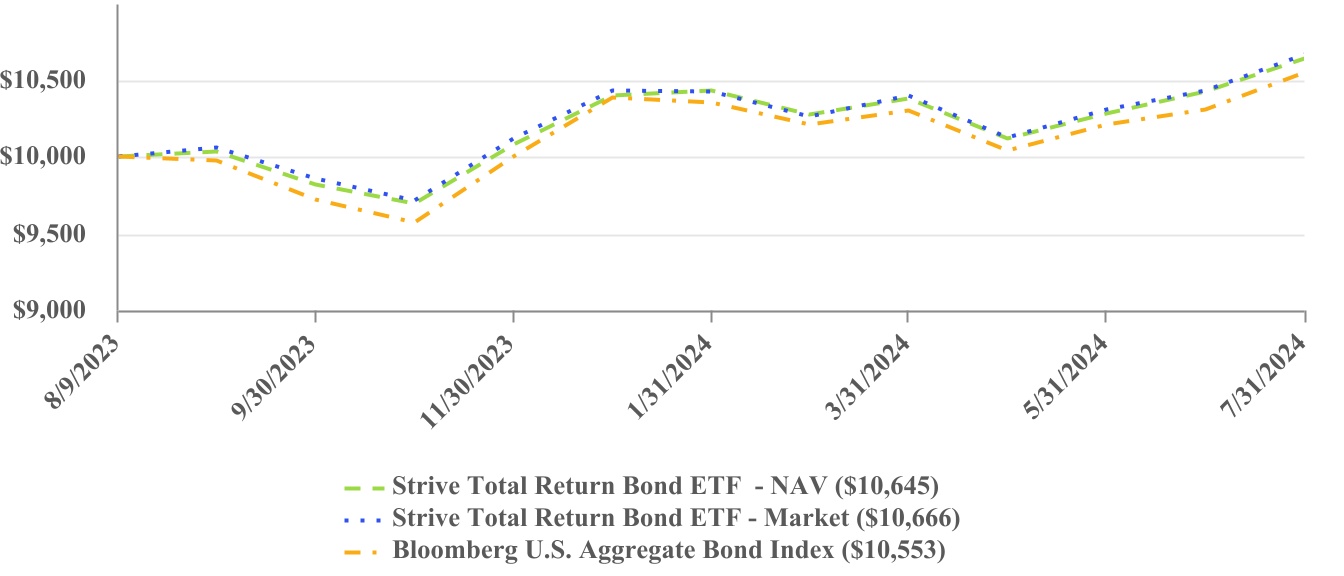

| PERFORMANCE OF A HYPOTHETICAL $10,000 INVESTMENT |

| | | | | | | | | | | | | | |

| CUMULATIVE TOTAL RETURNS |

| | | | Since Inception (8/9/2023) |

| Strive Total Return Bond ETF - NAV | | | | 6.45% |

| Strive Total Return Bond ETF - Market | | | | 6.66% |

| Bloomberg U.S. Aggregate Bond Index | | | | 5.53% |

| | | | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Visit www.strivefunds.com/stxt for more recent performance information. |

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

The Fund provides actively managed core fixed income exposure with a tactical allocation to structured credit and high-yield corporates. The Fund’s return was impacted by changes in interest rates over the Period.

The Fund’s allocation to agency residential mortgage-backed securities (RMBS), asset-backed securities, and non-agency RMBS were the most significant drivers of positive performance, while collateralized loan obligations, corporate bonds, and non-agency commercial mortgage-backed securities were smaller positive contributors to overall performance. The Fund’s allocation to agency RMBS was the largest contributor to positive performance because of bond selection and an overweight up-in-coupon. The use of treasury futures to increase the Fund’s duration in line with the Bloomberg U.S. Aggregate Bond Index detracted from performance, particularly in the first half of 2024, with a move wider in treasury rates.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive Total Return Bond ETF Ticker: STXT Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/stxt |

|

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $101,856,254 | | Portfolio Turnover Rate* | | 51% |

| # of Portfolio Holdings | | 201 | | Advisory Fees Paid | | $339,288 |

| *Portfolio turnover is not annualized and is calculated without regard to short-term securities having a maturity of less than one year. Excludes impact of in-kind transactions. |

| | | | | |

SECTOR WEIGHTING

(as a % of Net Assets) |

| Mortgage-Backed Securities | 45.6% |

| Asset-Backed Securities | 17.2% |

| U.S. Treasury Securities | 15.2% |

| Corporate Bonds | 9.8% |

| Collateralized Loan Obligations | 4.8% |

| Collateralized Mortgage Obligations | 4.5% |

| Cash & Cash Equivalents | 2.9% |

| | | | | |

TOP 10 HOLDINGS

(as a % of Net Assets) |

| Federal Home Loan Mortgage Corp. Pool SD8384, 6.00%, 12/01/2053 | 2.3% |

| Ginnie Mae II Pool Pool SD8384, 6.00%, 12/01/2053 | 2.1% |

| Ginnie Mae II Pool Pool MA9105, 5.00%, 08/20/2053 | 1.9% |

| Federal Home Loan Mortgage Corp. Pool SD8256, 4.00%, 10/01/2052 | 1.8% |

| United States Treasury Note/Bond 4.13%, 10/31/2027 | 1.8% |

| Federal National Mortgage Association Pool FS5635, 4.00%, 11/01/2052 | 1.7% |

| Ginnie Mae II Pool Pool MA8491, 5.50%, 12/20/2052 | 1.5% |

| United States Treasury Note/Bond 3.13%, 08/15/2025 | 1.4% |

| Ginnie Mae II Pool Pool MA9106, 5.50%, 08/20/2053 | 1.4% |

| Federal Home Loan Mortgage Corp. Pool SD5809, 6.00%, 07/01/2054 | 1.4% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy information, visit www.strivefunds.com/stxt. You can also request information by calling (215) 882-9983.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive Enhanced Income Short Maturity ETF Ticker: BUXX Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/buxx |

|

| | | | | | | | | | | |

| This annual shareholder report contains important information about the Strive Enhanced Income Short Maturity ETF (the “Fund”) for the period of August 9, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.strivefunds.com/buxx. You can also request this information by contacting us at (215) 882-9983. |

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $25 | 0.25% |

| | | | | | | | | | | |

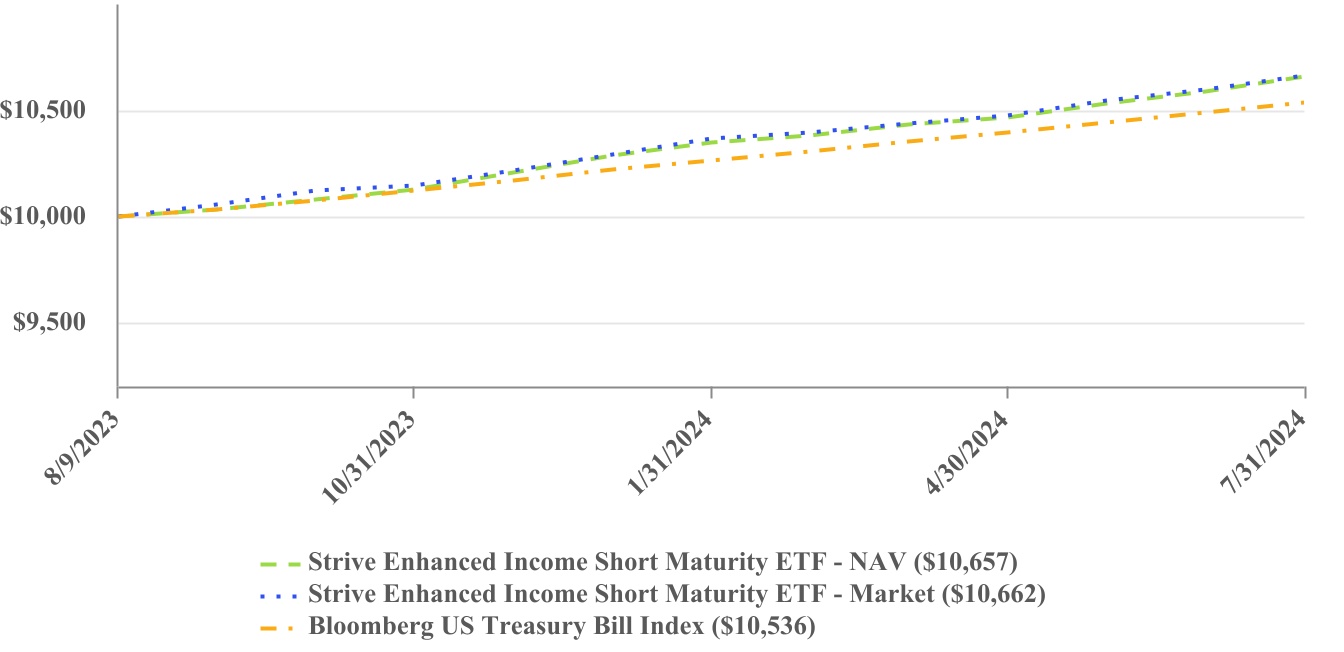

| PERFORMANCE OF A HYPOTHETICAL $10,000 INVESTMENT |

| | | | | | | | | | | | | | |

| CUMULATIVE TOTAL RETURNS |

| | | | Since Inception (8/9/2023) |

| Strive Enhanced Income Short Maturity ETF - NAV | | | | 6.57% |

| Strive Enhanced Income Short Maturity ETF - Market | | | | 6.62% |

| Bloomberg US Treasury Bill Index | | | | 5.36% |

| | | | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Visit www.strivefunds.com/buxx for more recent performance information. |

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

The Fund provides exposure to short-term investment grade assets in structured credit and investment grade corporate sectors to provide durable enhanced yield and outperformance over a full market cycle. The Fund’s return was impacted by changes in interest rates over the Period.

The Fund’s allocations to asset-backed securities (ABS), corporate bonds, and agency commercial mortgage-backed securities were the most significant drivers of positive performance, while exposure to collateralized loan obligations, non-agency residential mortgage-backed securities, and Treasuries were smaller positive contributions to overall performance. ABS was the most significant contributor to positive performance, specifically with income generation coming from an overweight to short-duration auto and consumer credits that benefited from the attractive higher yields on the front end of the yield curve. The Fund’s higher yield, duration, and tighter spreads contributed to relative performance versus the benchmark. The Fund’s overweight to investment grade bonds led to less relative outperformance versus other fixed income sectors like securitized credit during the Period.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

| | | | | | | | |

| Fund Name: Strive Enhanced Income Short Maturity ETF Ticker: BUXX Listed on: New York Stock Exchange | July 31, 2024 Annual Shareholder Report www.strivefunds.com/buxx |

|

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $115,628,066 | | Portfolio Turnover Rate* | | 83% |

| # of Portfolio Holdings | | 220 | | Advisory Fees Paid | | $175,960 |

| *Portfolio turnover is not annualized and is calculated without regard to short-term securities having a maturity of less than one year. Excludes impact of in-kind transactions. |

| | | | | |

SECTOR WEIGHTING

(as a % of Net Assets) |

| Asset-Backed Securities | 28.0% |

| Corporate Bonds | 27.3% |

| Collateralized Mortgage Obligations | 26.4% |

| Collateralized Loan Obligations | 9.8% |

| U.S. Treasury Securities | 1.5% |

| Mortgage-Backed Securities | 0.6% |

| Cash & Cash Equivalents | 6.4% |

| | | | | |

TOP 10 HOLDINGS

(as a % of Net Assets) |

| Federal Home Loan Mortgage Corp. Series K056, Class A2, 2.53%, 05/25/2026 | 2.1% |

| Federal Home Loan Mortgage Corp. Series K048, Class A2, 3.28%, 06/25/2025 | 1.7% |

| Federal Home Loan Mortgage Corp. Series K047, Class A2, 3.33%, 05/25/2025 | 1.4% |

| Freddie Mac Structured Agency Credit Risk Debt Notes Series 2024-DNA1, Class M1, 6.70% (30 day avg SOFR US +1.35%), 02/25/2044 | 1.3% |

| THL Credit Lake Shore MM CLO Ltd. Series 2019-2A, Class A1RR, 6.69% (3mo. Term SOFR + 1.40%), 10/17/2031 | 1.3% |

| Gallatin CLO Ltd., Series 2017-1a, Class A1R, 6.65% (3 mo. Term SOFR + 1.35%), 07/15/2031 | 1.2% |

| American Credit Acceptance Receivables Trust, Series 2022-4, Class D, 8.00%, 02/15/2029 | 1.2% |

| Pagaya AI Debt Selection Trust, Series 2024-3, Class B, 6.57%, 10/15/2031 | 1.1% |

| Federal Home Loan Mortgage Corp. Series K055, Class A2, 2.67%, 03/25/2026 | 1.0% |

| Federal Home Loan Mortgage Corp. Series K057, Class A2, 2.57%, 07/25/2026 | 1.0% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy information, visit www.strivefunds.com/buxx. You can also request information by calling (215) 882-9983.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: July 31, 2024

The Fund is distributed by Quasar Distributors, LLC.

(b) Not applicable

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any amendments to its code of ethics during the year covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the year covered by this report.

A copy of the registrant’s Code of Ethics is incorporated by reference.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Trustees of the Trust has determined that there is at least one audit committee financial expert serving on its audit committee. Dr. Michael Pagano is an “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past fiscal year. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning, including review of the registrant’s tax returns and calculations of required income, capital gain and excise distributions. There were no “Other services” provided by the principal accountant. The following table details the aggregate fees billed or expected to be billed for the last fiscal year for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| STRV | | STXM | | | STXK | | STXG |

| | FYE 7/31/2024 | FYE 7/31/2023 | | FYE 7/31/2024 | | | FYE 7/31/2024 | FYE 7/31/2023 | | FYE 7/31/2024 | FYE 7/31/2023 |

| (a) Audit Fees | $8,750 | $7,250 | | $7,250 | | | $8,750 | $7,250 | | $8,750 | $7,250 |

| (b) Audit-Related Fees | N/A | N/A | | N/A | | | N/A | N/A | | N/A | N/A |

| (c)Tax Fees | $2,250 | $1,750 | | $1,750 | | | $2,250 | $1,750 | | $2,250 | $1,750 |

| (d) All Other Fees | N/A | N/A | | N/A | | | N/A | N/A | | N/A | N/A |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | STXV | | STXD | | DRLL | | SHOC |

FYE 7/31/2024 | FYE 7/31/2023 | | FYE 7/31/2024 | FYE 7/31/2023 | | FYE 7/31/2024 | FYE 7/31/2023 | | FYE 7/31/2024 | FYE 7/31/2023 |

| (a) Audit Fees | $8,750 | $7,250 | | $8,750 | $7,250 | | $8,750 | $7,250 | | $8,750 | $7,250 |

| (b) Audit-Related Fees | N/A | N/A | | N/A | N/A | | N/A | N/A | | N/A | N/A |

| (c)Tax Fees | $2,250 | $1,750 | | $2,250 | $1,750 | | $2,250 | $1,750 | | $2,250 | $1,750 |

| (d) All Other Fees | N/A | N/A | | N/A | N/A | | N/A | N/A | | N/A | N/A |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | FTWO | | STXE | | STXI | | STXT | | BUXX | |

FYE 7/31/2024 | | | FYE 7/31/2024 | FYE 7/31/2023 | | FYE 7/31/2024 | | | FYE 7/31/2024 | | FYE 7/31/2024 | |

| (a) Audit Fees | $7,250 | | | $8,750 | $7,250 | | $7,250 | | | $7,250 | | $7,250 | |

| (b) Audit-Related Fees | N/A | | | N/A | N/A | | N/A | | | N/A | | N/A | |

| (c)Tax Fees | $1,750 | | | $2,250 | $1,750 | | $1,750 | | | $1,750 | | $1,750 | |

| (d) All Other Fees | N/A | | | N/A | N/A | | N/A | | | N/A | | N/A | |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) None of the fees billed by any Fund's principal accountant were applicable to non-audit services pursuant to a waiver of the pre-approval requirement.

(f) All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

(g) None of the fees billed by any Fund's principal accountant were applicable to non-audit services billed or expected to be billed to any Fund’s imvestment adviser.

(h) The audit committee of the board of trustees/directors has considered whether the provision of non-audit services that were rendered to the registrant's investment adviser is compatible with maintaining the principal accountant's independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) The registrant has not been identified by the U.S. Securities and Exchange Commission as having filed an annual report issued by a registered public accounting firm branch or office that is located in a foreign jurisdiction where the Public Company Accounting Oversight Board is unable to inspect or completely investigate because of a position taken by an authority in that jurisdiction..

(j) The registrant is not a foreign issuer.

Item 5. Audit Committee of Listed Registrants.

(a) The registrant is an issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934, (the “Act”) and has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Act. The independent members of the committee are as follows: Daniel Dorn, Chukwuemeka (Emeka) Oguh, and Michael Pagano.

(b) Not applicable.

Item 6. Investments

(a)

| | |

| STRIVE 500 ETF |

| SCHEDULE OF INVESTMENTS |

| July 31, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 97.6% | | Shares | | Value |

| Advertising - 0.1% | | | | |

| Omnicom Group, Inc. | | 2,389 | | | $ | 234,218 | |

Trade Desk, Inc. - Class A (a) | | 5,590 | | | 502,429 | |

| | | | 736,647 | |

| | | | |

| Aerospace & Defense - 2.0% | | | | |

Axon Enterprise, Inc. (a) | | 786 | | | 235,808 | |

Boeing Co. (a) | | 8,130 | | | 1,549,578 | |

| General Dynamics Corp. | | 3,147 | | | 940,040 | |

| General Electric Co. | | 13,829 | | | 2,353,696 | |

| Heico Corp. | | 457 | | | 110,292 | |

| Heico Corp. - Class A | | 839 | | | 159,502 | |

| Howmet Aerospace, Inc. | | 5,156 | | | 493,429 | |

| L3Harris Technologies, Inc. | | 2,312 | | | 524,570 | |

| Lockheed Martin Corp. | | 3,065 | | | 1,660,985 | |

| Northrop Grumman Corp. | | 1,739 | | | 842,233 | |

| RTX Corp. | | 17,165 | | | 2,016,716 | |

| TransDigm Group, Inc. | | 713 | | | 922,779 | |

| | | | 11,809,628 | |

| | | | |

| Agricultural & Farm Machinery - 0.2% | | | | |

| Deere & Co. | | 3,459 | | | 1,286,679 | |

| | | | |

| Agricultural Products & Services - 0.1% | | | | |

| Archer-Daniels-Midland Co. | | 6,813 | | | 422,474 | |

| | | | |

| Air Freight & Logistics - 0.4% | | | | |

| Expeditors International of Washington, Inc. | | 1,833 | | | 228,795 | |

| FedEx Corp. | | 2,870 | | | 867,458 | |

| United Parcel Service, Inc. - Class B | | 9,201 | | | 1,199,534 | |

| | | | 2,295,787 | |

| | | | |

| Apparel Retail - 0.4% | | | | |

| Ross Stores, Inc. | | 4,139 | | | 592,829 | |

| TJX Cos., Inc. | | 14,505 | | | 1,639,355 | |

| | | | 2,232,184 | |

| | | | |

| Apparel, Accessories & Luxury Goods - 0.1% | | | | |

Lululemon Athletica, Inc. (a) | | 1,441 | | | 372,729 | |

| | | | |

| Application Software - 2.7% | | | | |

Adobe, Inc. (a) | | 5,821 | | | 3,211,155 | |

Ansys, Inc. (a) | | 1,218 | | | 382,001 | |

Atlassian Corp. - Class A (a) | | 1,930 | | | 340,780 | |

Autodesk, Inc. (a) | | 2,607 | | | 645,285 | |

The accompanying notes are an integral part of these financial statements.

1

| | |

| STRIVE 500 ETF |

| SCHEDULE OF INVESTMENTS (CONTINUED) |

| July 31, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 97.6% (CONTINUED) | | Shares | | Value |

| Application Software - 2.7% (Continued) | | | | |

| Bentley Systems, Inc. - Class B | | 2,692 | | | $ | 131,208 | |

Cadence Design Systems, Inc. (a) | | 3,458 | | | 925,568 | |

Datadog, Inc. - Class A (a) | | 3,533 | | | 411,382 | |

Fair Isaac Corp. (a) | | 310 | | | 496,000 | |

HubSpot, Inc. (a) | | 692 | | | 343,945 | |