Southwest IDEAS 2014 Investor Conference November 19, 2014

Company Highlights and Strategy Jack Griffin, Chief Executive Officer 2

Cautionary Statement Regarding Forward-Looking Statements The statements contained in this presentation include certain forward-looking statements that are based largely on our current expectations and reflect various estimates and assumptions by us. Forward-looking statements are subject to certain risks, trends and uncertainties that could cause actual results and achievements to differ materially from those expressed in such forward- looking statements. Such risks, trends and uncertainties, which in some instances are beyond our control, are described under the heading “Risk Factors” in Tribune Publishing Company’s filings with the Securities and Exchange Commission, and include: competition and other economic conditions including fragmentation of the media landscape and competition from other media alternatives; changes in advertising demand, circulation levels and audience shares; our ability to develop and grow our online businesses; our reliance on revenue from printing and distributing third-party publications; changes in newsprint prices; macroeconomic trends and conditions; our reliance on third party vendors for various services; our ability to adapt to technological changes; adverse results from litigation, governmental investigations or tax-related proceedings or audits; our ability to realize benefits or synergies from acquisitions or divestitures or to operate our businesses effectively following acquisitions or divestitures; our ability to attract and retain employees; our ability to satisfy pension and other postretirement employee benefit obligations; changes in accounting standards; the effect of labor strikes, lock-outs and labor negotiations; regulatory and judicial rulings; our indebtedness and ability to comply with covenants applicable to our debt financing; our adoption of fresh-start reporting which has caused our combined financial statements for periods subsequent to December 31, 2012 to not be comparable to prior periods; our ability to satisfy future capital and liquidity requirements; and our ability to access the credit and capital markets at the times and in the amounts needed and on acceptable terms. The words “believe,” “expect,” “anticipate,” “estimate,” “could,” “should,” “intend,” “may,” “plan,” “seek” and similar expressions generally identify forward-looking statements. Whether or not any such forward-looking statements are in fact achieved will depend on future events, some of which are beyond our control. You are cautioned not to place undue reliance on such forward- looking statements, which are being made as of the date of this presentation. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. 3

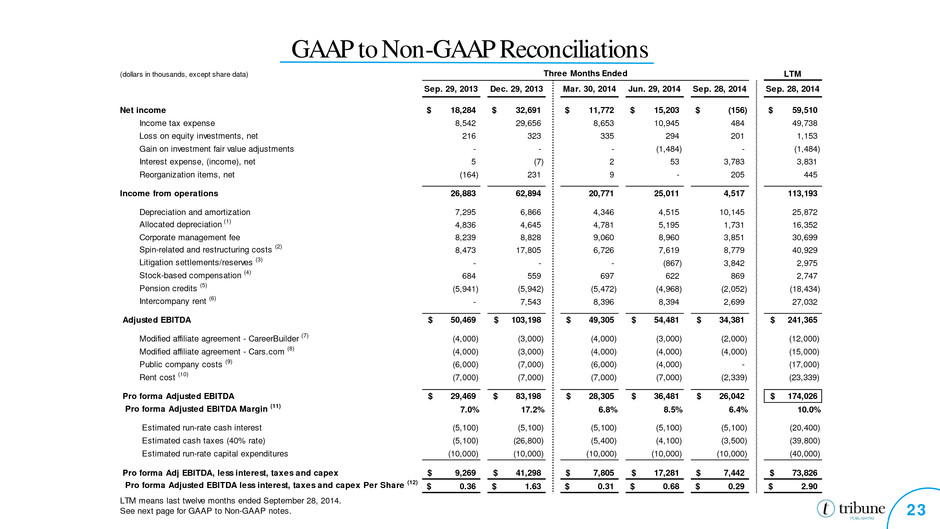

Non-GAAP Financial Measures To provide investors with additional information regarding Tribune Publishing Company‘s (“Tribune Publishing” or “Company”) financial results, this presentation includes references to Adjusted EBITDA, Pro forma Adjusted EBITDA and Pro forma Adjusted EBITDA less interest, taxes and capital expenditures (capex). These measures are not presented in accordance with generally accepted accounting principles in the United States (GAAP), and Tribune Publishing’s use of these terms may vary from that of others in the Company’s industry. These measures should not be considered as an alternative to net income (loss), operating profit, revenues or any other performance measures derived in accordance with GAAP as measures of operating performance or liquidity. Further information regarding the Company’s presentation of these measures, including a reconciliation to net income, the most directly comparable GAAP financial measure, is included in this presentation. Adjusted EBITDA Adjusted EBITDA is defined as net income before income taxes, interest income, interest expense, depreciation and amortization, income and losses from equity investments, corporate management fee from Tribune Media Company (“Tribune Media”), pension credits, stock-based compensation, certain unusual and non- recurring items (including spin-related costs) and reorganization items. The Company's management uses Adjusted EBITDA (a) as a measure of operating performance; (b) for planning and forecasting in future periods; and (c) in communications with the Company’s Board of Directors concerning the Company’s financial performance. Management believes the presentation of Adjusted EBITDA enhances investors’ overall understanding of the financial performance of the Company’s business as a stand- alone company. In addition, Adjusted EBITDA, or a similarly calculated measure, is used as the basis for certain financial maintenance covenants that the Company is subject to in connection with certain credit facilities. Since not all companies use identical calculations, the Company's presentation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies and should not be used by investors as a substitute or alternative to net income or any measure of financial performance calculated and presented in accordance with GAAP. Instead, management believes Adjusted EBITDA should be used to supplement the Company’s financial measures derived in accordance with GAAP to provide a more complete understanding of the trends affecting the business. Although Adjusted EBITDA is frequently used by investors and securities analysts in their evaluations of companies, Adjusted EBITDA has limitations as an analytical tool, and investors should not consider it in isolation or as a substitute for, or more meaningful than, amounts determined in accordance with GAAP. Some of the limitations to using non-GAAP measures as an analytical tool are: they do not reflect the Company’s interest income and expense, or the requirements necessary to service interest or principal payments on the Company’s debt; they do not reflect future requirements for capital expenditures or contractual commitments; and although depreciation and amortization charges are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and non-GAAP measures do not reflect any cash requirements for such replacements. Pro forma Adjusted EBITDA Pro forma Adjusted EBITDA is defined as Adjusted EBITDA after taking into consideration rental expenses and public company costs expected to be incurred post-spin, and reductions for partial economics on reasonable-case modified affiliate agreements for digital products, including CareerBuilder.com and Cars.com. Management believes the presentation of Pro forma Adjusted EBITDA enhances investors’ overall understanding of the financial performance of the Company’s business as a stand- alone company and includes elements used as the basis for forecasting going forward. Management believes this measure improves the understanding and comparability of future results by providing quantitative estimates for historical periods presented. Pro forma Adjusted EBITDA, less interest, taxes and capital expenditures (capex) Pro forma Adjusted EBITDA less interest, taxes and capex is defined as Pro forma Adjusted EBITDA less an estimated interest amount, less estimated taxes and less an estimated run-rate capex. Management believes the presentation of Pro forma Adjusted EBITDA less interest, taxes and capex enhances investors’ overall understanding of the financial performance of the Company’s business as a stand-alone company and includes elements used as the basis for forecasting going forward. Management believes this measure improves the understanding and comparability of future results by providing quantitative estimates for historical periods presented. 4

Major Titles Select Publications Other Key Assets: Premier “Blue-Chip” Media Assets (33%) 5

Leading, Iconic Brands with Deep, Local Market Research 6 Market DMA Rank3 Iconic Brands Circulation (000s)¹ Print Local Market Leadership Digital (mm)2 Digital Local Market Leadership Daily Sunday Unique Visitors Page Views Los Angeles, CA 2 691 966 #1 39 186 #1 Chicago, IL 3 456 769 #1 16 109 #1 South Florida 16 147 203 #1 4 37 #1 Orlando, FL 18 149 247 #1 5 40 #1 Baltimore, MD 26 150 276 #1 5 33 #1 Annapolis, MD 26 28 33 #2 * * NA Carroll County, MD 26 19 22 #3 * * NA Hartford, CT 30 124 179 #1 2 28 #1 Newport News, VA 42 50 86 #2 1 6 #1 Allentown, PA 4 55 68 111 #3 2 14 #5 Ranked #1 amongst local print and digital competition in the majority of our markets (per Kantar Media/TNS) * Less than one million. Note: Circulation and digital traffic statistics may include minimal duplication among the media properties. 1 Alliance for Audited Media; Includes print and digital circulation; Total circulation is average for twelve months ended September 30, 2014; DMA net combined audience except for Sun Sentinel which is NDM net combined audience 2 Average over the nine months ended September 28, 2014. Digital audience is based on Tribune Publishing’s internal metrics. 3 Nielsen estimates as of September 2014. 4The Morning Call focuses on the Lehigh Valley region within the Philadelphia DMA (#4); Ranks 3rd and 5th for print and digital local market leadership in the Philadelphia DMA respectively

Strong Cash Flow & Conservative Capital Structure Deep & Experienced Management Team Deep Multi-Platform Audience Engagement Compelling Suite of Advertising Solutions Trusted, Award-Winning Premium Content Key Investment Highlights 7 Diverse Portfolio of Iconic Brands and Products Leader in Multimedia Local News & Information

Our 7 Strategic Principles Build On Our Leading Local Market Presence Strategically Manage Our Core Print Business Accelerate Innovation and the Digital Transition Monetize Our Consumer Content On Digital Platforms Continue Successful Revenue Diversification Leverage Operating Platform for Opportunistic Consolidation Maintain Disciplined Cost Management and Financial Policies 8 1 2 3 4 5 6 7

Our First 90 Days Five-Year Affiliate Agreement with Cars.com Acquisition of Suburban Chicago Titles Secured Long Term Agreement with the Chicago Sun-Times First Quarterly Dividend Declared - 17.5¢ per share Key Leadership Appointments, primarily replacements 9

10 Trusted, Award-Winning Premium Content Our content makes us the local print and digital leader in the communities we serve Our readers care about their communities and trust our content Our publishing brands stand for integrity and authority in their markets Average publishing history of over 150 years A tradition of journalistic excellence: 88 total Pulitzer Prizes, 27 since 2000 2013 Pulitzer Prize, Staff Public Service The Sun Sentinel was awarded the prestigious Pulitzer Prize Gold Medal for public service journalism for its investigation of off-duty police officers endangering the lives of citizens by speeding.

M&A “Bolt-On” Strategy In Chicago, we acquired six daily, 32 weekly suburban titles from Chicago Sun-Times In Hartford, we acquired Reminder Media, publisher of 15 free weekly titles in Connecticut In Baltimore, we acquired Capital- Gazette and Carroll County Times & Baltimore City Paper 11

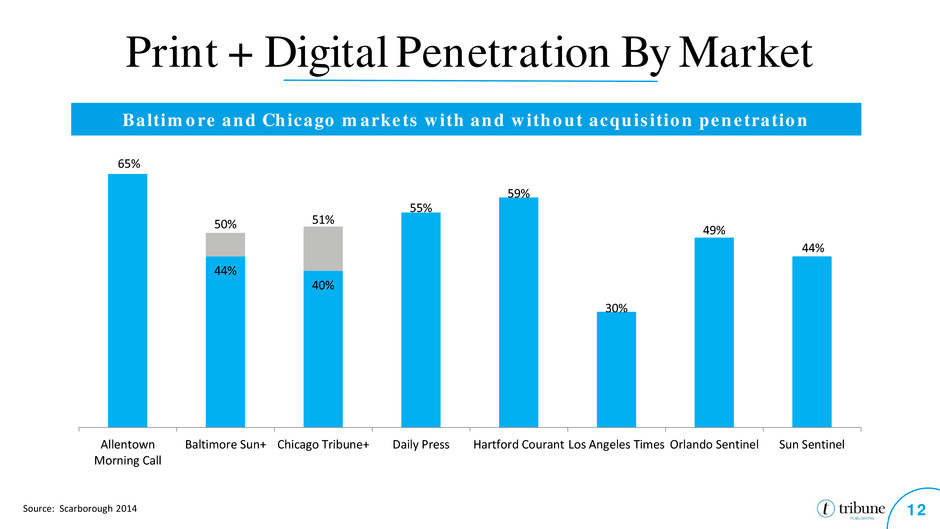

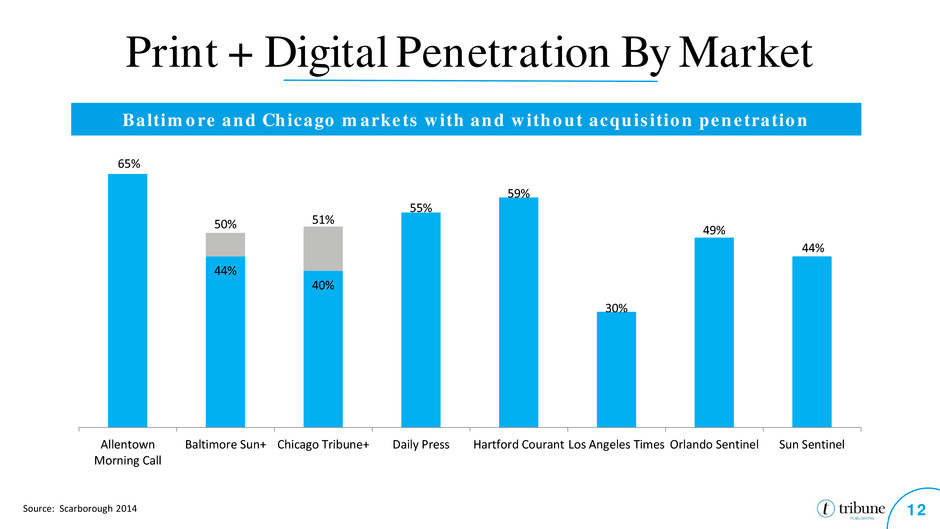

Print + Digital Penetration By Market 12 Source: Scarborough 2014 Baltimore and Chicago markets with and without acquisition penetration 44% 40% 65% 50% 51% 55% 59% 30% 49% 44% Allentown Morning Call Baltimore Sun+ Chicago Tribune+ Daily Press Hartford Courant Los Angeles Times Orlando Sentinel Sun Sentinel

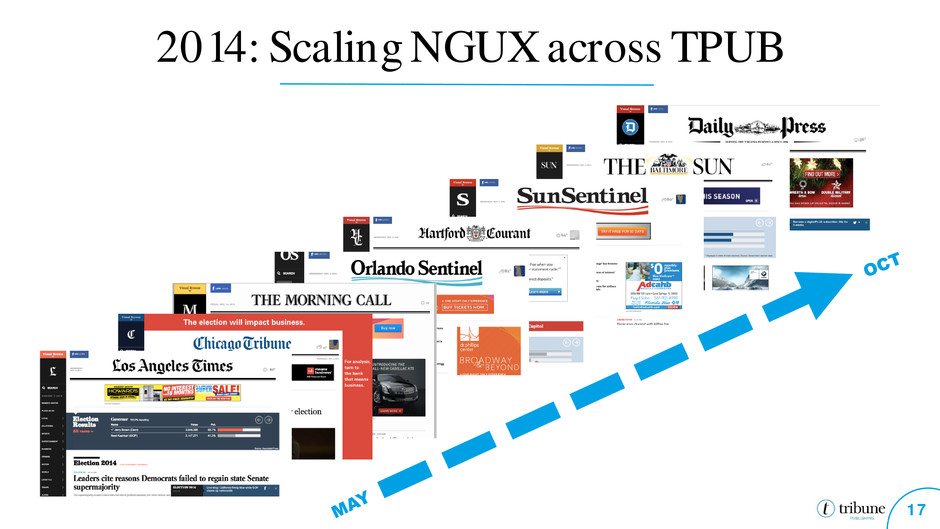

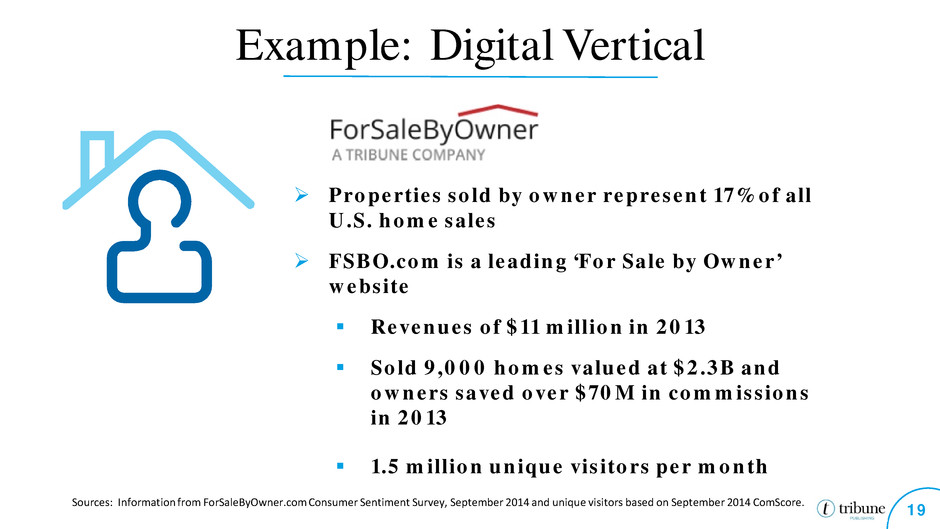

Our Digital Growth Initiatives Leverage NGUX: users, engagement & ad revenue Aggressively grow our digital subscription base Grow our digital marketing services businesses Accelerate video production & monetization Optimize our content & products for mobile Grow our Hispanic businesses & platforms Expand our verticals, e.g. ForSaleByOwner, HomeFinder 1 2 3 4 5 13 6 7

Growing Digital Consumer Revenue ALL-ACCESS MODEL #1 Print Platforms Award-winning NGUX Mobile & Apps 14

Our Paid Consumer Digital Strategy 15 App model: Countdown and then in-app purchase offer of all-access or app only NGUX model: Based on freemium idea. All the breaking news you can read, but premium stories are labeled.

2014: A Year of Building and Transition 16 Award-winning NGUX Mobile & Apps

2014: Scaling NGUX across TPUB 17

Financial Profile John Bode, Chief Financial Officer 18

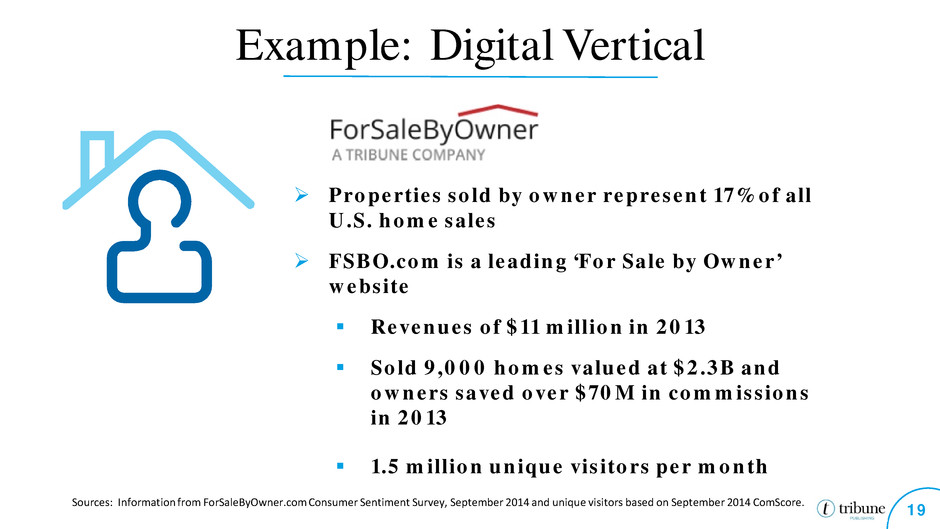

Example: Digital Vertical 19 Sources: Information from ForSaleByOwner.com Consumer Sentiment Survey, September 2014 and unique visitors based on September 2014 ComScore. Properties sold by owner represent 17% of all U.S. home sales FSBO.com is a leading ‘For Sale by Owner’ website Revenues of $11 million in 2013 Sold 9,000 homes valued at $2.3B and owners saved over $70M in commissions in 2013 1.5 million unique visitors per month

Disciplined Approach to Capital Allocation 20 Conservative Balance Sheet Allocate capital to create value Strategic acquisitions Repayment of debt Returns to shareholders Disciplined Capital Policy Maintain strategic flexibility and adequate access to debt capital markets Preserve ample liquidity from strong cash flow and committed ABL facility

Q3 2014 Performance Update – Revenues 21 September 28, September 29, September 28, September 29, 2014 2013 % Change 2014 2013 % Change Advertising Retail 114,653$ 126,458$ (9.3%) 353,889$ 392,421$ (9.8%) National 37,652 45,428 (17.1%) 133,528 151,818 (12.0%) Classified 68,537 72,142 (5.0%) 208,591 212,306 (1.7%) Total advertising 220,842 244,028 (9.5%) 696,008 756,545 (8.0%) Circulation 107,511 106,227 1.2% 323,828 319,859 1.2% Other revenue Commercial print and delivery 43,951 44,707 (1.7%) 133,792 142,530 (6.1%) Direct mail and marketing 17,459 17,219 1.4% 52,987 55,990 (5.4%) Other 14,294 11,596 23.3% 43,887 36,226 21.1% Total other revenue 75,704 73,522 3.0% 230,666 234,746 (1.7%) Total operating revenues 404,057$ 423,777$ (4.7%) 1,250,502$ 1,311,150$ (4.6%) ROP 103,709$ 116,146$ (10.7%) 332,198$ 369,302$ (10.0%) Preprints 72,653 79,867 (9.0%) 225,490 246,328 (8.5%) Digital 44,480 48,015 (7.4%) 138,320 140,915 (1.8%) Total advertising 220,842$ 244,028$ (9.5%) 696,008$ 756,545$ (8.0%) Nine Months EndedThree Months Ended (dollars in thousands) (a) Note (a)

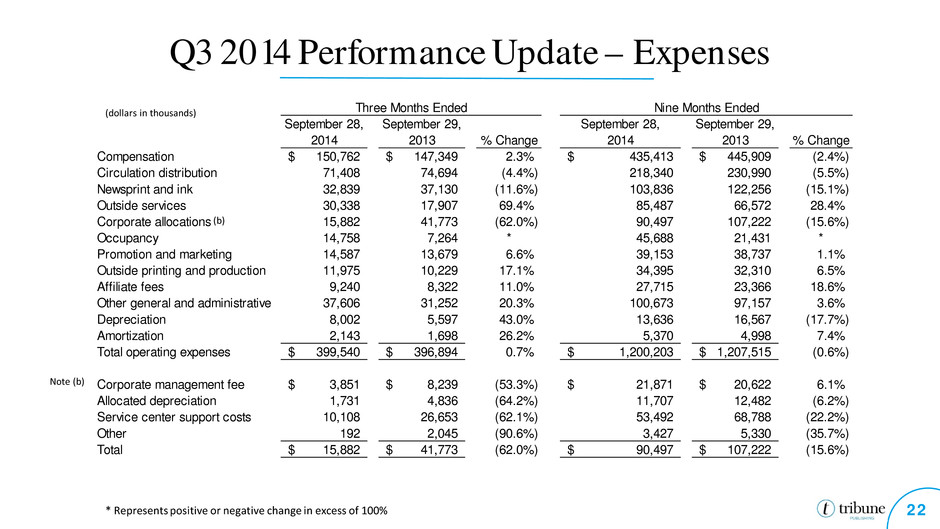

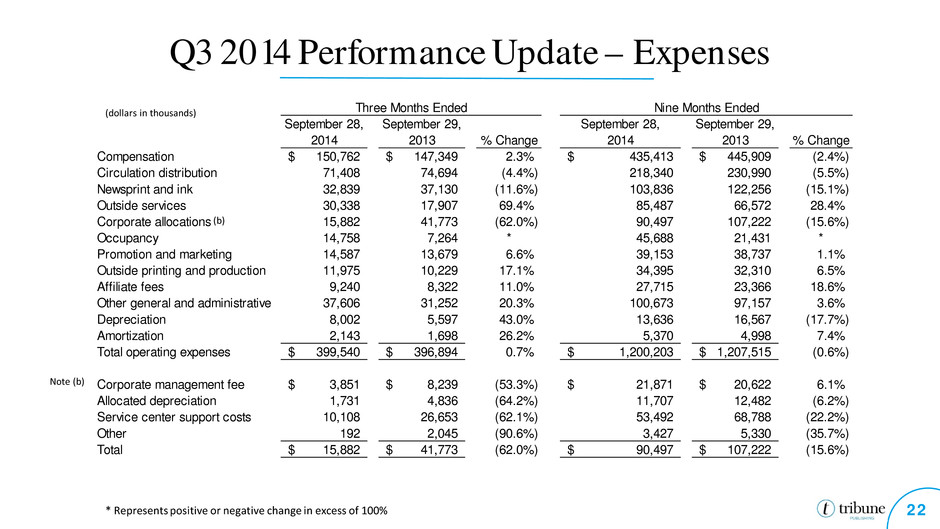

Q3 2014 Performance Update – Expenses 22 September 28, September 29, September 28, September 29, 2014 2013 % Change 2014 2013 % Change Compensation 150,762$ 147,349$ 2.3% 435,413$ 445,909$ (2.4%) Circulation distribution 71,408 74,694 (4.4%) 218,340 230,990 (5.5%) Newsprint and ink 32,839 37,130 (11.6%) 103,836 122,256 (15.1%) Outside services 30,338 17,907 69.4% 85,487 66,572 28.4% Corporate allocations 15,882 41,773 (62.0%) 90,497 107,222 (15.6%) Occupancy 14,758 7,264 * 45,688 21,431 * Promotion and marketing 14,587 13,679 6.6% 39,153 38,737 1.1% Outside printing and production 11,975 10,229 17.1% 34,395 32,310 6.5% Affiliate fees 9,240 8,322 11.0% 27,715 23,366 18.6% Other general and administrative 37,606 31,252 20.3% 100,673 97,157 3.6% Depreciation 8,002 5,597 43.0% 13,636 16,567 (17.7%) Amortization 2,143 1,698 26.2% 5,370 4,998 7.4% Total operating expenses 399,540$ 396,894$ 0.7% 1,200,203$ 1,207,515$ (0.6%) Corporate management fee 3,851$ 8,239$ (53.3%) 21,871$ 20,622$ 6.1% Allocated depreciation 1,731 4,836 (64.2%) 11,707 12,482 (6.2%) Service center support costs 10,108 26,653 (62.1%) 53,492 68,788 (22.2%) Other 192 2,045 (90.6%) 3,427 5,330 (35.7%) Total 15,882$ 41,773$ (62.0%) 90,497$ 107,222$ (15.6%) Three Months Ended Nine Months Ended (b) Note (b) * Represents positive or negative change in excess of 100% (dollars in thousands)

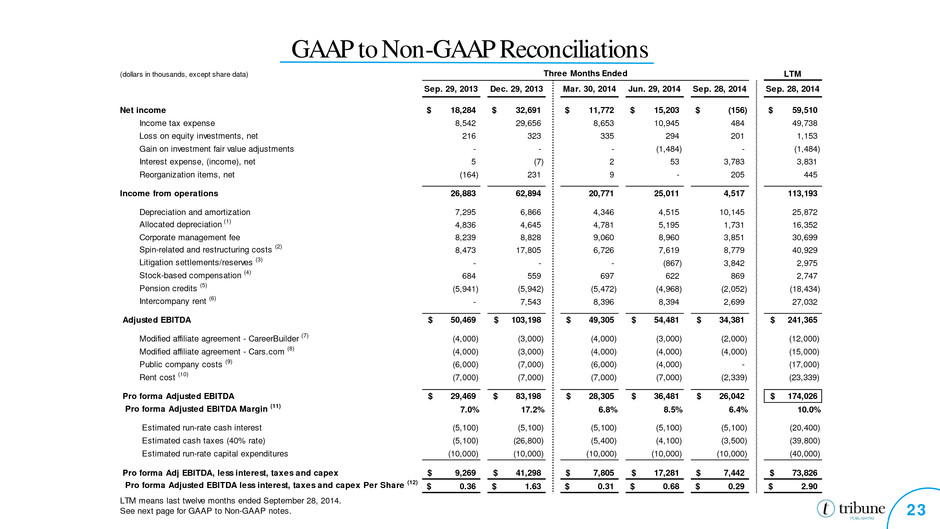

GAAP to Non-GAAP Reconciliations 23 (dollars in thousands, except share data) LTM Sep. 29, 2013 Dec. 29, 2013 Mar. 30, 2014 Jun. 29, 2014 Sep. 28, 2014 Sep. 28, 2014 Net income 18,284$ 32,691$ 11,772$ 15,203$ (156)$ 59,510$ Income tax expense 8,542 29,656 8,653 10,945 484 49,738 Loss on equity investments, net 216 323 335 294 201 1,153 Gain on investment fair value adjustments - - - (1,484) - (1,484) Interest expense, (income), net 5 (7) 2 53 3,783 3,831 Reorganization items, net (164) 231 9 - 205 445 Income from operations 26,883 62,894 20,771 25,011 4,517 113,193 Depreciation and amortization 7,295 6,866 4,346 4,515 10,145 25,872 Allocated depreciation (1) 4,836 4,645 4,781 5,195 1,731 16,352 Corporate management fee 8,239 8,828 9,060 8,960 3,851 30,699 Spin-related and restructuring costs (2) 8,473 17,805 6,726 7,619 8,779 40,929 Litigation settlements/reserves (3) - - - (867) 3,842 2,975 Stock-based compensation (4) 684 559 697 622 869 2,747 Pension credits (5) (5,941) (5,942) (5,472) (4,968) (2,052) (18,434) Intercompany rent (6) - 7,543 8,396 8,394 2,699 27,032 Adjusted EBITDA 50,469$ 103,198$ 49,305$ 54,481$ 34,381$ 241,365$ Modified affiliate agreement - CareerBuilder (7) (4,000) (3,000) (4,000) (3,000) (2,000) (12,000) Modified affiliate agreement - Cars.com (8) (4,000) (3,000) (4,000) (4,000) (4,000) (15,000) Public company costs (9) (6,000) (7,000) (6,000) (4,000) - (17,000) Rent cost (10) (7,000) (7,000) (7,000) (7,000) (2,339) (23,339) Pro forma Adjusted EBITDA 29,469$ 83,198$ 28,305$ 36,481$ 26,042$ 174,026$ Pro forma Adjusted EBITDA Margin (11) 7.0% 17.2% 6.8% 8.5% 6.4% 10.0% Estimated run-rate cash interest (5,100) (5,100) (5,100) (5,100) (5,100) (20,400) Estimated cash taxes (40% rate) (5,100) (26,800) (5,400) (4,100) (3,500) (39,800) Estimated run-rate capital expenditures (10,000) (10,000) (10,000) (10,000) (10,000) (40,000) Pro forma Adj EBITDA, less interest, taxes and capex 9,269$ 41,298$ 7,805$ 17,281$ 7,442$ 73,826$ Pro forma Adjusted EBITDA less interest, taxes and capex Per Share (12) 0.36$ 1.63$ 0.31$ 0.68$ 0.29$ 2.90$ LTM means last twelve months ended September 28, 2014. See next page for GAAP to Non-GAAP notes. Three Months Ended

Notes: GAAP to Non-GAAP Reconciliations 24 (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) (12) Pro forma Adjusted EBITDA less interest, taxes and capex Per Share is calculated by dividing Pro forma Adjusted EBITDA less interest, taxes and capex by 25.4 million shares (outstanding shares at November 5, 2014). Intercompany rent represents rental expense recorded by Tribune Publishing for facilities owned by Tribune Media and its affiliates pursuant to related party lease agreements. No rent expense for these leases was recorded in the comparable periods in 2013 because although the properties subject to related party leases are legally owned by holding companies controlled by Tribune Media, Tribune Publishing determined that pursuant to the terms of the leases, it maintained forms of continuing involvement with the properties, which, pursuant to ASC Topic 840, “Leases,” precluded Tribune Publishing from derecognizing those properties from its consolidated and combined financial statements. As a result, Tribune Publishing continued to account for and depreciate the carrying values of the transferred properties subject to leases until December 1, 2013 when, due to modifications to certain provisions of the leases, Tribune Publishing derecognized the properties from its financial statements and began accounting for these related party operating leases on December 1, 2013. Because of the difference in accounting for the periods presented, intercompany rent expense is added back to net income for the 2014 periods for better comparability between the periods presented. The Company began rent payments effective with the spin-off. On September 1, 2014, Tribune Publishing began a 5-year modified agreement with CareerBuilder.com. On October 1, 2014, Tribune Publishing began a 5-year modified agreement with Cars.com. Pro forma Adjusted EBITDA Margin is calculated by dividing Pro forma Adjusted EBITDA by GAAP total operating revenues. Subsequent to the spin-off, public company costs replaced allocated corporate management fees and are estimated at $25 million annually. For the second quarter ended June 29, 2014, the Pro forma adjustment is $4 million as approximately $2 million of the public company costs were reflected in operating results. Subsequent to the spin-off, Tribune Publishing began rent payments to Tribune Media. Pension credits are due to allocations from Tribune Media for Tribune Media's defined benefit. As part of the spin-off, Tribune Media retained this plan. No pension allocations will be made subsequent to the spin-off. Allocated depreciation represents depreciation for primarily technology assets that were used by Tribune Publishing prior to the spin-off. As a result of the spin-off, these technology assets were assigned to Tribune Publishing and the related depreciation are included in post-spin operating results. Spin-related and restructuring costs include costs related to the internal restructuring and the distribution and separation from Tribune Media. Adjustment to litigation settlement reserve. Stock-based compensation from grants made under the Tribune Publishing's or Tribune Media's equity compensation plans and is included for comparative purposes.

Appendix

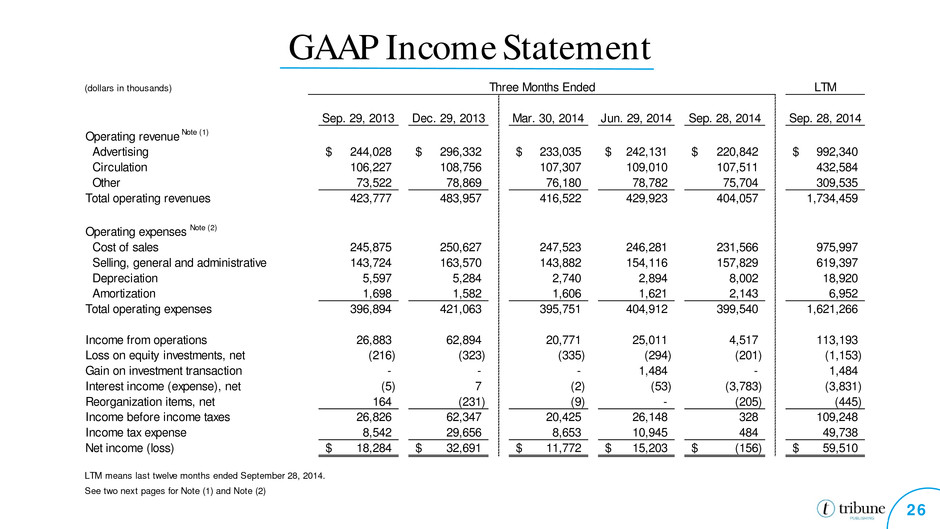

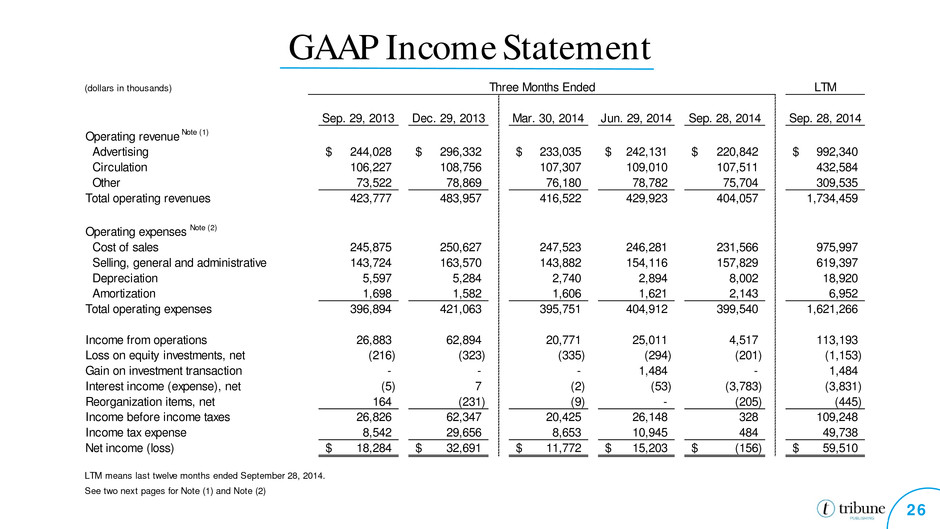

GAAP Income Statement 26 (dollars in thousands) LTM Sep. 29, 2013 Dec. 29, 2013 Mar. 30, 2014 Jun. 29, 2014 Sep. 28, 2014 Sep. 28, 2014 Operating revenue Note (1) Advertising 244,028$ 296,332$ 233,035$ 242,131$ 220,842$ 992,340$ Circulation 106,227 108,756 107,307 109,010 107,511 432,584 Other 73,522 78,869 76,180 78,782 75,704 309,535 Total operating revenues 423,777 483,957 416,522 429,923 404,057 1,734,459 Operating expenses Note (2) Cost of sales 245,875 250,627 247,523 246,281 231,566 975,997 Selling, general and administrative 143,724 163,570 143,882 154,116 157,829 619,397 Depreciation 5,597 5,284 2,740 2,894 8,002 18,920 Amortization 1,698 1,582 1,606 1,621 2,143 6,952 Total operating expenses 396,894 421,063 395,751 404,912 399,540 1,621,266 Income from operations 26,883 62,894 20,771 25,011 4,517 113,193 Loss on equity investments, net (216) (323) (335) (294) (201) (1,153) Gain on investment transaction - - - 1,484 - 1,484 Interest income (expense), net (5) 7 (2) (53) (3,783) (3,831) Reorganization items, net 164 (231) (9) - (205) (445) Income before income taxes 26,826 62,347 20,425 26,148 328 109,248 Income tax expense 8,542 29,656 8,653 10,945 484 49,738 Net income (loss) 18,284$ 32,691$ 11,772$ 15,203$ (156)$ 59,510$ LTM means last twelve months ended September 28, 2014. See two next pages for Note (1) and Note (2) Three Months Ended

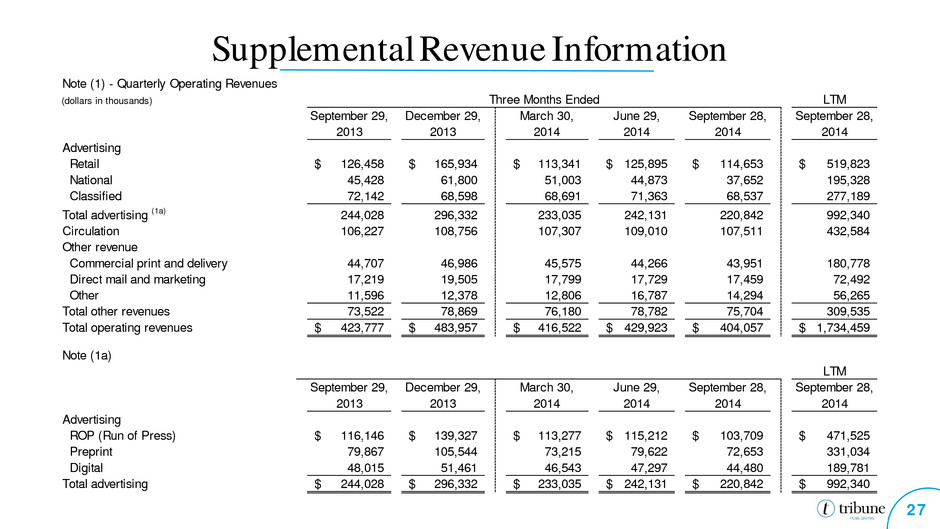

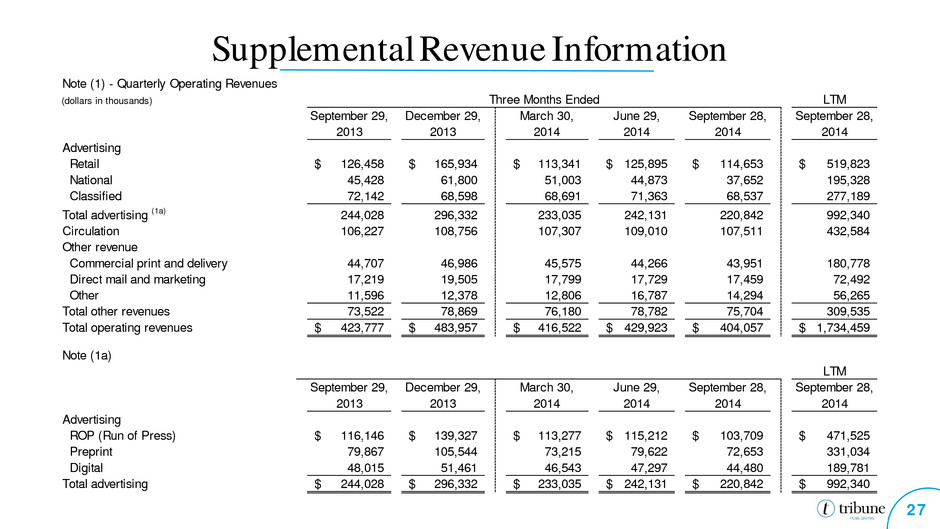

Supplemental Revenue Information 27 Note (1) - Quarterly Operating Revenues (dollars in thousands) LTM September 29, 2013 December 29, 2013 March 30, 2014 June 29, 2014 September 28, 2014 September 28, 2014 Advertising Retail 126,458$ 165,934$ 113,341$ 125,895$ 114,653$ 519,823$ National 45,428 61,800 51,003 44,873 37,652 195,328 Classified 72,142 68,598 68,691 71,363 68,537 277,189 Total advertising (1a) 244,028 296,332 233,035 242,131 220,842 992,340 Circulation 106,227 108,756 107,307 109,010 107,511 432,584 Other revenue Commercial print and delivery 44,707 46,986 45,575 44,266 43,951 180,778 Direct mail and marketing 17,219 19,505 17,799 17,729 17,459 72,492 Other 11,596 12,378 12,806 16,787 14,294 56,265 Total other revenues 73,522 78,869 76,180 78,782 75,704 309,535 Total operating revenues 423,777$ 483,957$ 416,522$ 429,923$ 404,057$ 1,734,459$ Note (1a) LTM September 29, 2013 December 29, 2013 March 30, 2014 June 29, 2014 September 28, 2014 September 28, 2014 Advertising ROP (Run of Press) 116,146$ 139,327$ 113,277$ 115,212$ 103,709$ 471,525$ Preprint 79,867 105,544 73,215 79,622 72,653 331,034 Digital 48,015 51,461 46,543 47,297 44,480 189,781 Total advertising 244,028$ 296,332$ 233,035$ 242,131$ 220,842$ 992,340$ Three Months Ended

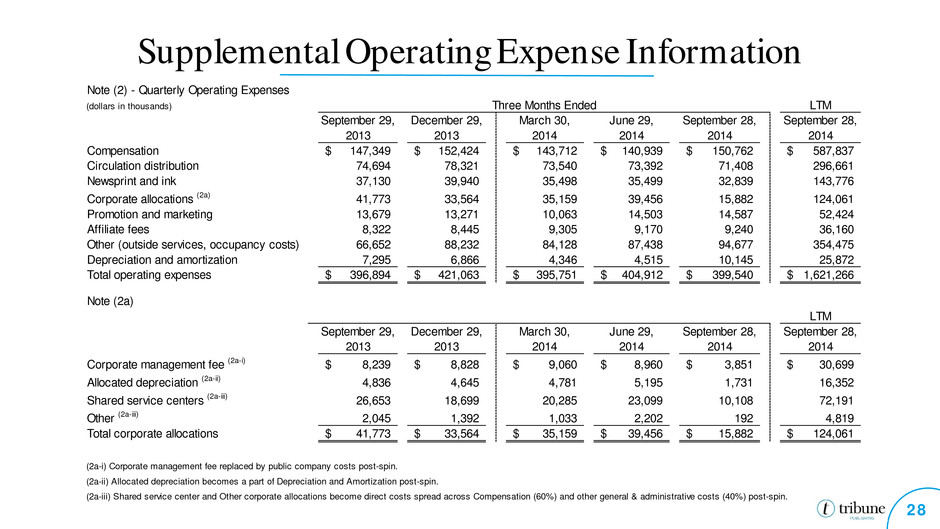

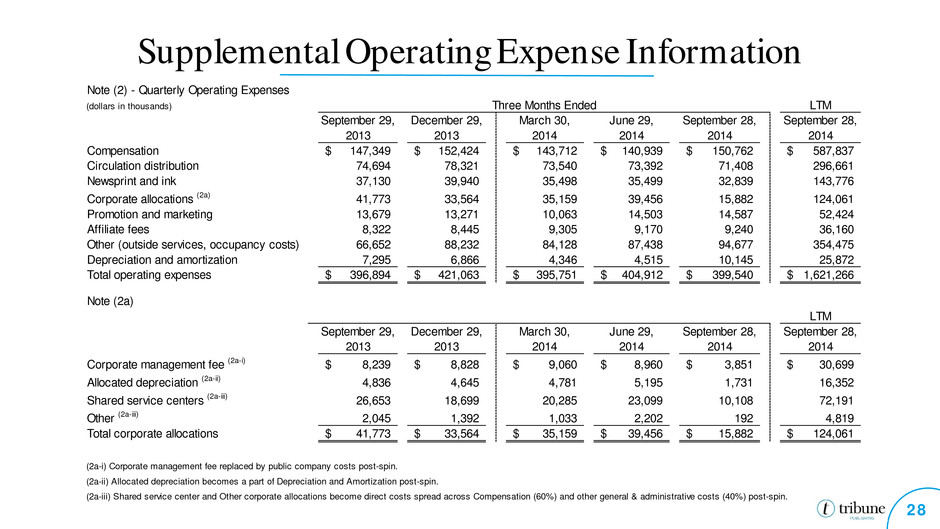

Supplemental Operating Expense Information 28 Note (2) - Quarterly Operating Expenses (dollars in thousands) LTM September 29, 2013 December 29, 2013 March 30, 2014 June 29, 2014 September 28, 2014 September 28, 2014 Compensation 147,349$ 152,424$ 143,712$ 140,939$ 150,762$ 587,837$ Circulation distribution 74,694 78,321 73,540 73,392 71,408 296,661 Newsprint and ink 37,130 39,940 35,498 35,499 32,839 143,776 Corporate allocations (2a) 41,773 33,564 35,159 39,456 15,882 124,061 Promotion and marketing 13,679 13,271 10,063 14,503 14,587 52,424 Affiliate fees 8,322 8,445 9,305 9,170 9,240 36,160 Other (outside services, occupancy costs) 66,652 88,232 84,128 87,438 94,677 354,475 Depreciation and amortization 7,295 6,866 4,346 4,515 10,145 25,872 Total operating expenses 396,894$ 421,063$ 395,751$ 404,912$ 399,540$ 1,621,266$ Note (2a) LTM September 29, 2013 December 29, 2013 March 30, 2014 June 29, 2014 September 28, 2014 September 28, 2014 Corporate management fee (2a-i) 8,239$ 8,828$ 9,060$ 8,960$ 3,851$ 30,699$ Allocated depreciation (2a-ii) 4,836 4,645 4,781 5,195 1,731 16,352 Shared service centers (2a-iii) 26,653 18,699 20,285 23,099 10,108 72,191 Other (2a-iii) 2,045 1,392 1,033 2,202 192 4,819 Total corporate allocations 41,773$ 33,564$ 35,159$ 39,456$ 15,882$ 124,061$ (2a-i) Corporate management fee replaced by public company costs post-spin. (2a-ii) Allocated depreciation becomes a part of Depreciation and Amortization post-spin. (2a-iii) Shared service center and Other corporate allocations become direct costs spread across Compensation (60%) and other general & administrative costs (40%) post-spin. Three Months Ended