Hamilton Insurance Group, Ltd. Supplementary Financial Information December 31, 2023 Investor Contact Investor.Relations@hamiltongroup.com

Hamilton Insurance Group, Ltd. Table of Contents Page I. Basis of Presentation 1 II. Financial Highlights Financial Highlights 3 Key Operating and Financial Metrics 4 III. Summary Consolidated Results Statements of Operations 5 Consolidated Balance Sheets 6 Reconciliation of Consolidated GAAP Balance Sheet to Unconsolidated Balance Sheet 7 Net Investment Return 8 Fixed Maturity and Short-Term Investments 9 IV. Segment Results Consolidated Underwriting Results 10 - 11 5Q Consolidated Underwriting Results 12 5Q Underwriting Results - International 13 5Q Underwriting Results - Bermuda 14 V. Other Information Modeled Exposure to Catastrophe Losses (PML) 15 Non-GAAP Measures 16 - 17

Basis of Presentation Cautionary Note Regarding Forward-Looking Statements • our results of operations and financial condition could be adversely affected by unpredictable catastrophic events, global climate change or emerging claim and coverage issues; • our business could be materially adversely affected if we do not accurately assess our underwriting risk, our reserves are inadequate to cover our actual losses, our models or assessments and pricing of risks are incorrect or we lose important broker relationships; • the insurance and reinsurance business is historically cyclical and the pricing and terms for our products may decline, which would affect our profitability and ability to maintain or grow premiums; • we have significant foreign operations that expose us to certain additional risks, including foreign currency risks and political risk; • we do not control the allocations to and/or the performance of the Two Sigma Hamilton Fund, LLC ("TS Hamilton Fund")’s investment portfolio, and its performance depends on the ability of its investment manager, Two Sigma, to select and manage appropriate investments and we have a limited ability to withdraw our capital accounts; • Two Sigma Principals, LLC, Two Sigma and their respective affiliates have potential conflicts of interest that could adversely affect us; • the historical performance of Two Sigma Investments, LP ("Two Sigma") is not necessarily indicative of the future results of the TS Hamilton Fund’s investment portfolio or of our future results; • our ability to manage risks associated with macroeconomic conditions resulting from geopolitical and global economic events, including public health crises, current or anticipated military conflicts, terrorism, sanctions, rising energy prices, inflation and interest rates and other global events; • our ability to compete successfully with more established competitors and risks relating to consolidation in the reinsurance and insurance industries; • downgrades, potential downgrades or other negative actions by rating agencies; All financial information contained herein is unaudited, however, certain information relating to the consolidated balance sheet at the most recent year end is derived from or agrees to audited financial information. Unless otherwise noted, all data is in thousands, except for share and per share amounts and ratio information. This information is being provided for informational purposes only. It should be read in conjunction with the documents filed by Hamilton Insurance Group, Inc. ("Hamilton") with the U.S Securities and Exchange Commission, including its Form 10-K. This information may contain forward-looking statements which reflect the Company's current views with respect to future events and financial performance and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are made based on management's current expectations and beliefs concerning future developments and their potential effects upon Hamilton. There can be no assurance that future developments affecting Hamilton will be those anticipated by management. Forward-looking statements include, without limitation, all matters that are not historical facts. These forward-looking statements are not a guarantee of future performance and involve risk and uncertainties, and there are certain important factors that could cause actual results to differ, possibly materially, from expectations or estimates reflected in such forward-looking statements, including the following: 1

Cautionary Note Regarding Forward-Looking Statements (continued) • our dependence on key executives, including the potential loss of Bermudian personnel as a result of Bermuda employment restrictions, and the inability to attract qualified personnel, particularly in very competitive hiring conditions; • our dependence on letter of credit facilities that may not be available on commercially acceptable terms; • our potential need for additional capital in the future and the potential unavailability of such capital to us on favorable terms or at all; • the suspension or revocation of our subsidiaries’ insurance licenses; • risks associated with our investment strategy, including such risks being greater than those faced by competitors; • changes in the regulatory environment and the potential for greater regulatory scrutiny of the Company going forward; • a cyclical downturn of the reinsurance industry; • operational failures, failure of information systems or failure to protect the confidentiality of customer information, including by service providers, or losses due to defaults, errors or omissions by third parties or our affiliates; • we are a holding company with no direct operations, and our insurance and reinsurance subsidiaries’ ability to pay dividends and other distributions to us is restricted by law; • risks relating to our ability to identify and execute opportunities for growth or our ability to complete transactions as planned or realize the anticipated benefits of our acquisitions or other investments; • our potentially becoming subject to U.S. federal income taxation, Bermuda taxation or other taxes as a result of a change of tax laws or otherwise; • the potential characterization of us and/or any of our subsidiaries as a passive foreign investment company, or PFIC; • our potentially becoming subject to U.S. withholding and information reporting requirements under the U.S. Foreign Account Tax Compliance Act, or FATCA, provisions; • our costs will increase as a result of operating as a public company, and our management will be required to devote substantial time to complying with public company regulations; • if we were to identify a material weakness and were unable to remediate such material weakness, or fail to achieve and maintain effective internal controls, our operating results and financial condition could be impacted and the market price of our Class B common shares may be negatively affected; • the lack of a prior public market for our Class B common shares means our share price may be volatile and anti-takeover provisions contained in our organizational documents could delay management changes; • the potential that the market price of our Class B common shares could decline due to future sales of shares by our existing shareholders; • applicable insurance laws, which could make it difficult to effect a change of control of our company; • investors may have difficulties in serving process or enforcing judgments against us in the United States; and • other factors affecting future results disclosed in the Company’s filing with the SEC, including Form 10-K. 2

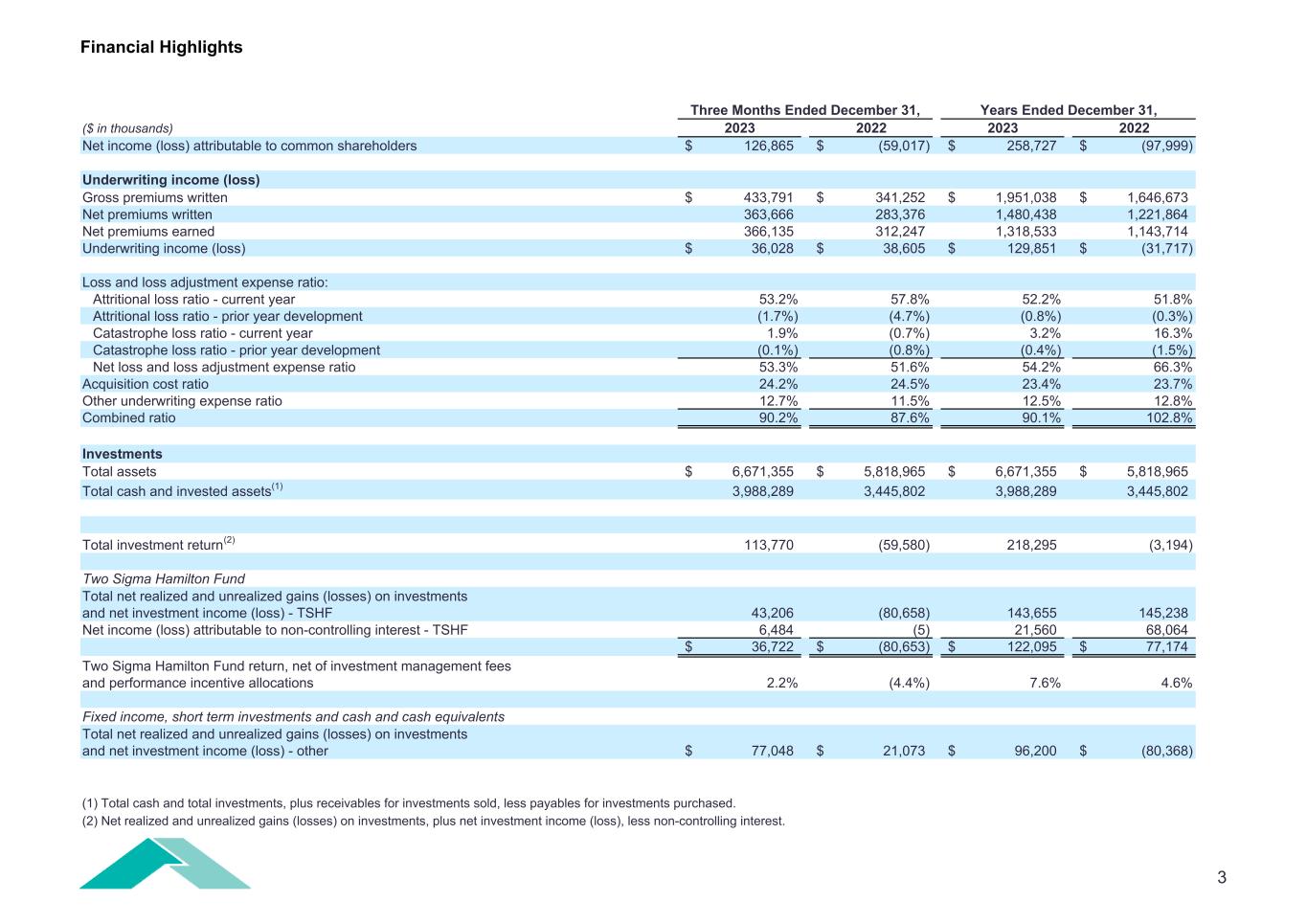

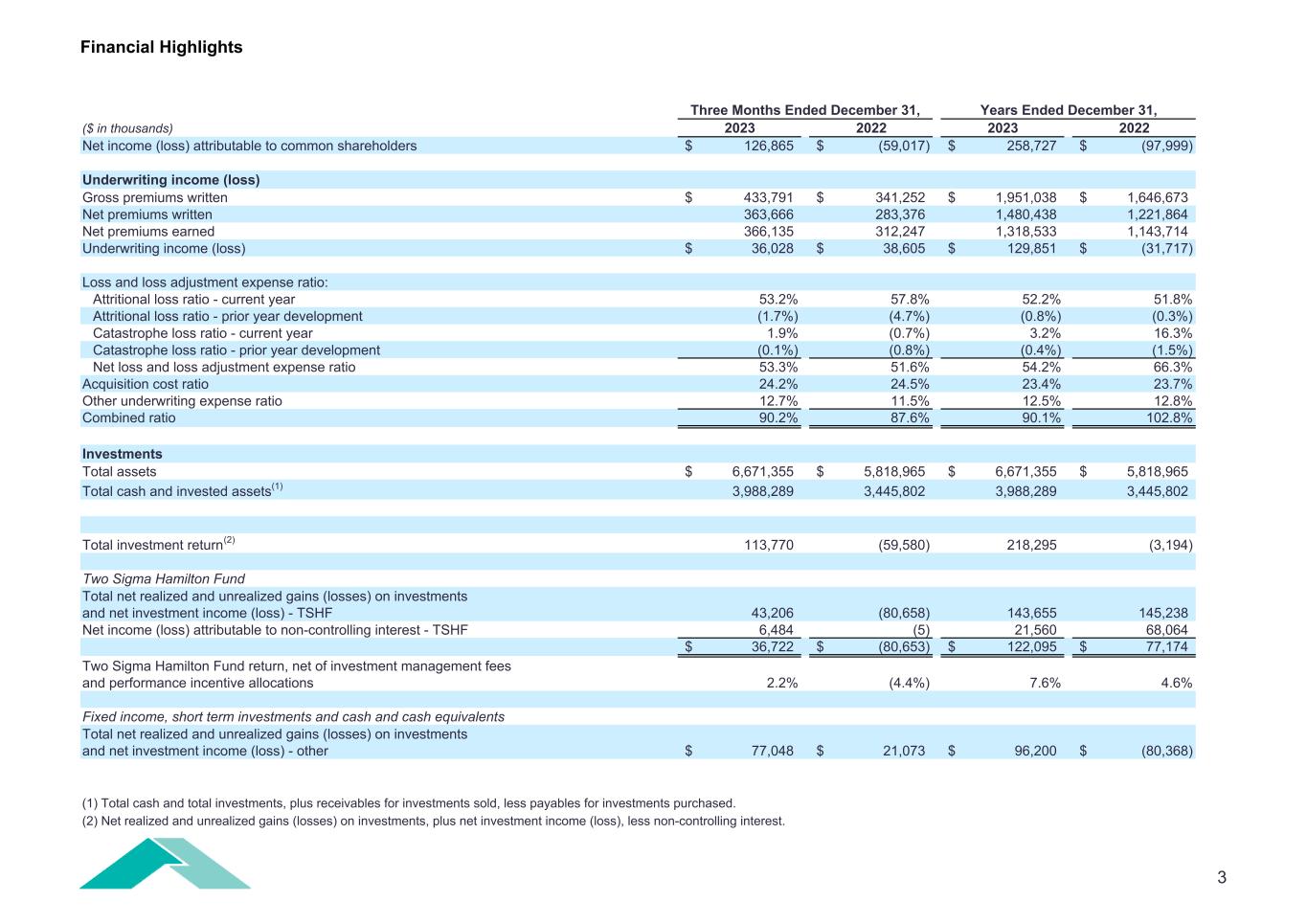

Financial Highlights Three Months Ended December 31, ($ in thousands) 2023 2022 2023 2022 Net income (loss) attributable to common shareholders 126,865$ (59,017)$ 258,727$ (97,999)$ Underwriting income (loss) Gross premiums written 433,791$ 341,252$ 1,951,038$ 1,646,673$ Net premiums written 363,666 283,376 1,480,438 1,221,864 Net premiums earned 366,135 312,247 1,318,533 1,143,714 Underwriting income (loss) 36,028$ 38,605$ 129,851$ (31,717)$ Loss and loss adjustment expense ratio: Attritional loss ratio - current year 53.2% 57.8% 52.2% 51.8% Attritional loss ratio - prior year development (1.7%) (4.7%) (0.8%) (0.3%) Catastrophe loss ratio - current year 1.9% (0.7%) 3.2% 16.3% Catastrophe loss ratio - prior year development (0.1%) (0.8%) (0.4%) (1.5%) Net loss and loss adjustment expense ratio 53.3% 51.6% 54.2% 66.3% Acquisition cost ratio 24.2% 24.5% 23.4% 23.7% Other underwriting expense ratio 12.7% 11.5% 12.5% 12.8% Combined ratio 90.2% 87.6% 90.1% 102.8% Investments Total assets 6,671,355$ 5,818,965$ 6,671,355$ 5,818,965$ Total cash and invested assets(1) 3,988,289 3,445,802 3,988,289 3,445,802 Total investment return(2) 113,770 (59,580) 218,295 (3,194) Two Sigma Hamilton Fund Total net realized and unrealized gains (losses) on investments and net investment income (loss) - TSHF 43,206 (80,658) 143,655 145,238 Net income (loss) attributable to non-controlling interest - TSHF 6,484 (5) 21,560 68,064 36,722$ (80,653)$ 122,095$ 77,174$ Two Sigma Hamilton Fund return, net of investment management fees and performance incentive allocations 2.2% (4.4%) 7.6% 4.6% Fixed income, short term investments and cash and cash equivalents Total net realized and unrealized gains (losses) on investments and net investment income (loss) - other 77,048$ 21,073$ 96,200$ (80,368)$ (1) Total cash and total investments, plus receivables for investments sold, less payables for investments purchased. (2) Net realized and unrealized gains (losses) on investments, plus net investment income (loss), less non-controlling interest. Years Ended December 31, 3

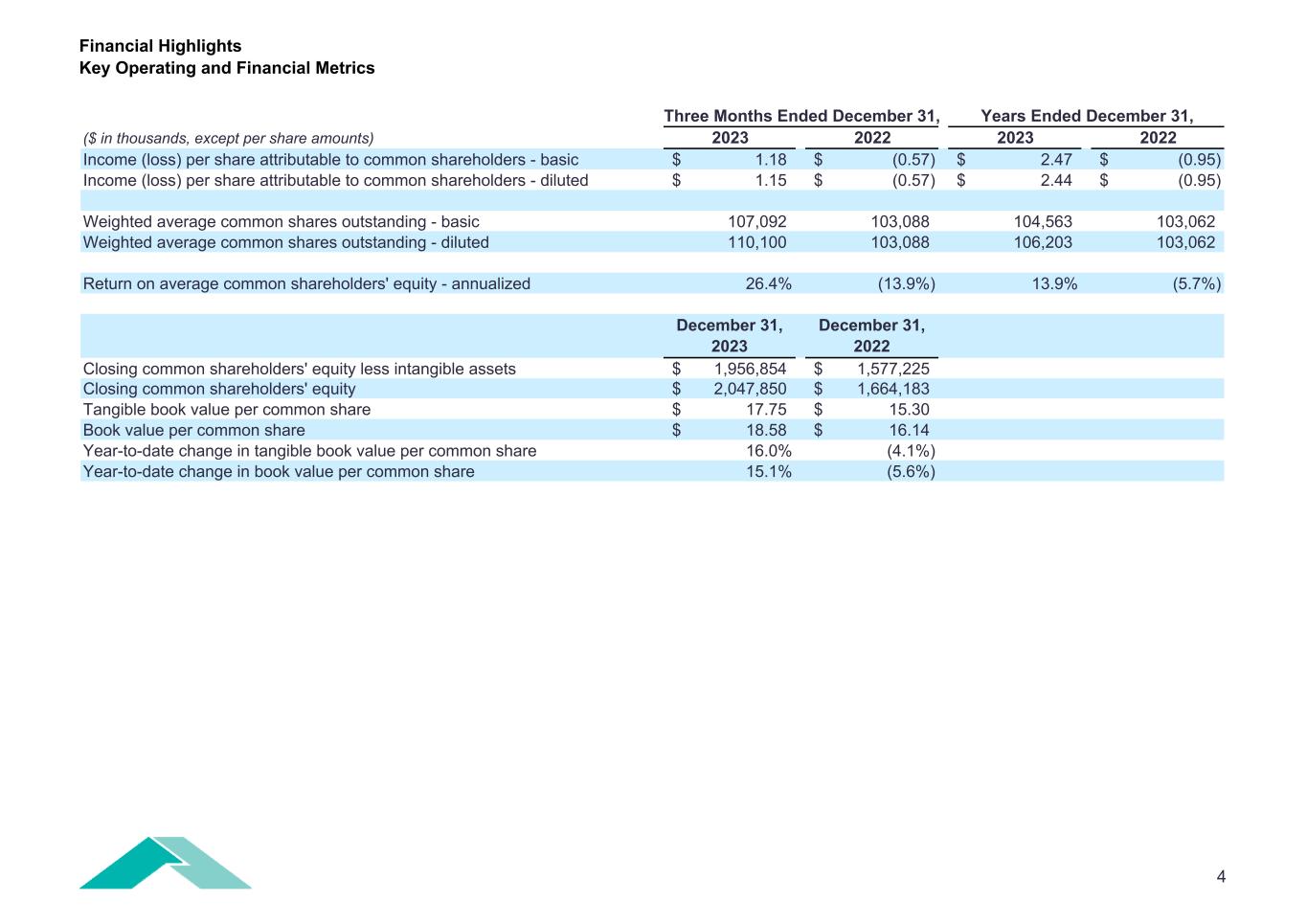

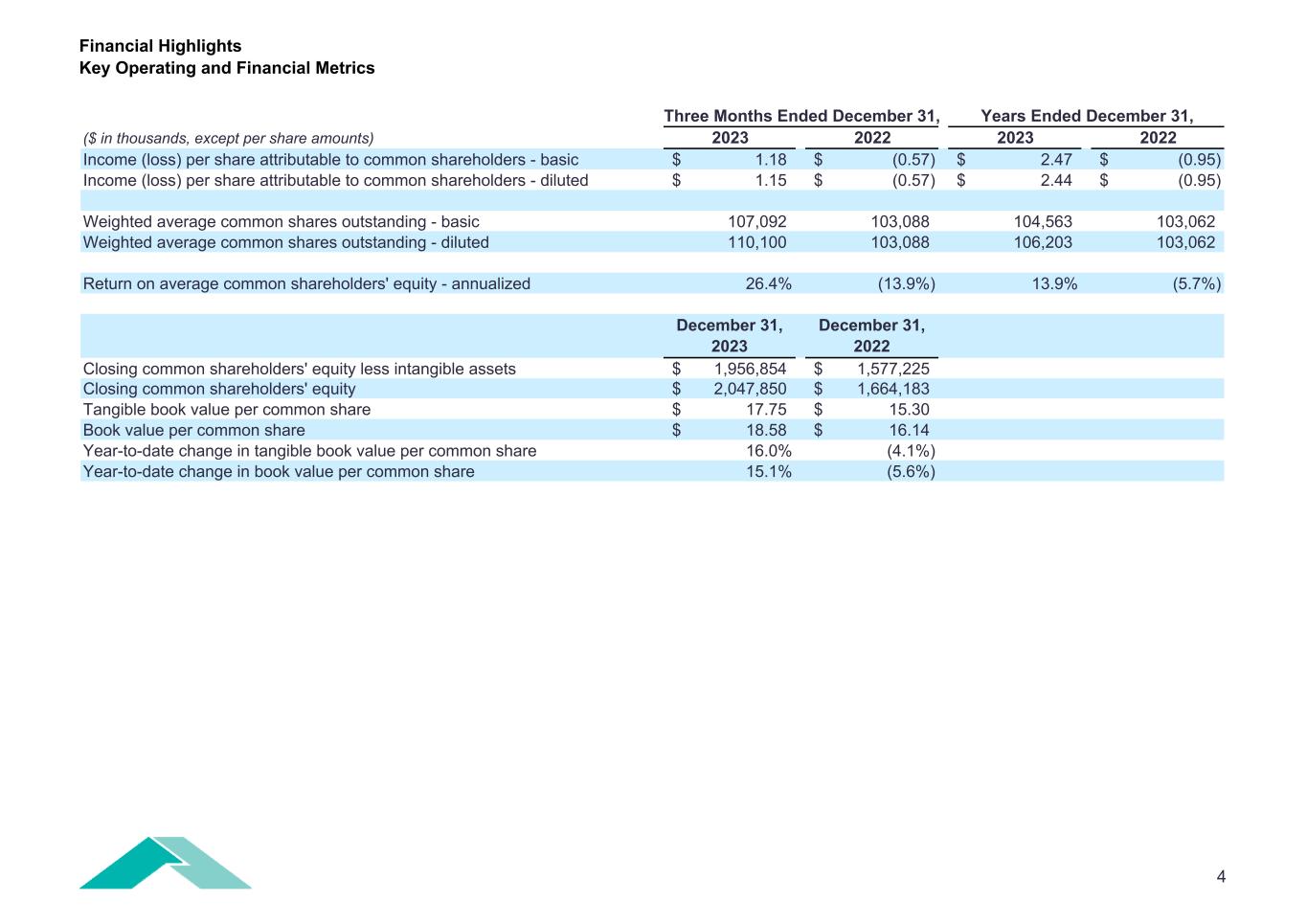

Financial Highlights Key Operating and Financial Metrics Three Months Ended December 31, Years Ended December 31, ($ in thousands, except per share amounts) 2023 2022 2023 2022 Income (loss) per share attributable to common shareholders - basic 1.18$ (0.57)$ 2.47$ (0.95)$ Income (loss) per share attributable to common shareholders - diluted 1.15$ (0.57)$ 2.44$ (0.95)$ Weighted average common shares outstanding - basic 107,092 103,088 104,563 103,062 Weighted average common shares outstanding - diluted 110,100 103,088 106,203 103,062 Return on average common shareholders' equity - annualized 26.4% (13.9%) 13.9% (5.7%) December 31, 2023 December 31, 2022 Closing common shareholders' equity less intangible assets 1,956,854$ 1,577,225$ Closing common shareholders' equity 2,047,850$ 1,664,183$ Tangible book value per common share 17.75$ 15.30$ Book value per common share 18.58$ 16.14$ Year-to-date change in tangible book value per common share 16.0% (4.1%) Year-to-date change in book value per common share 15.1% (5.6%) 4

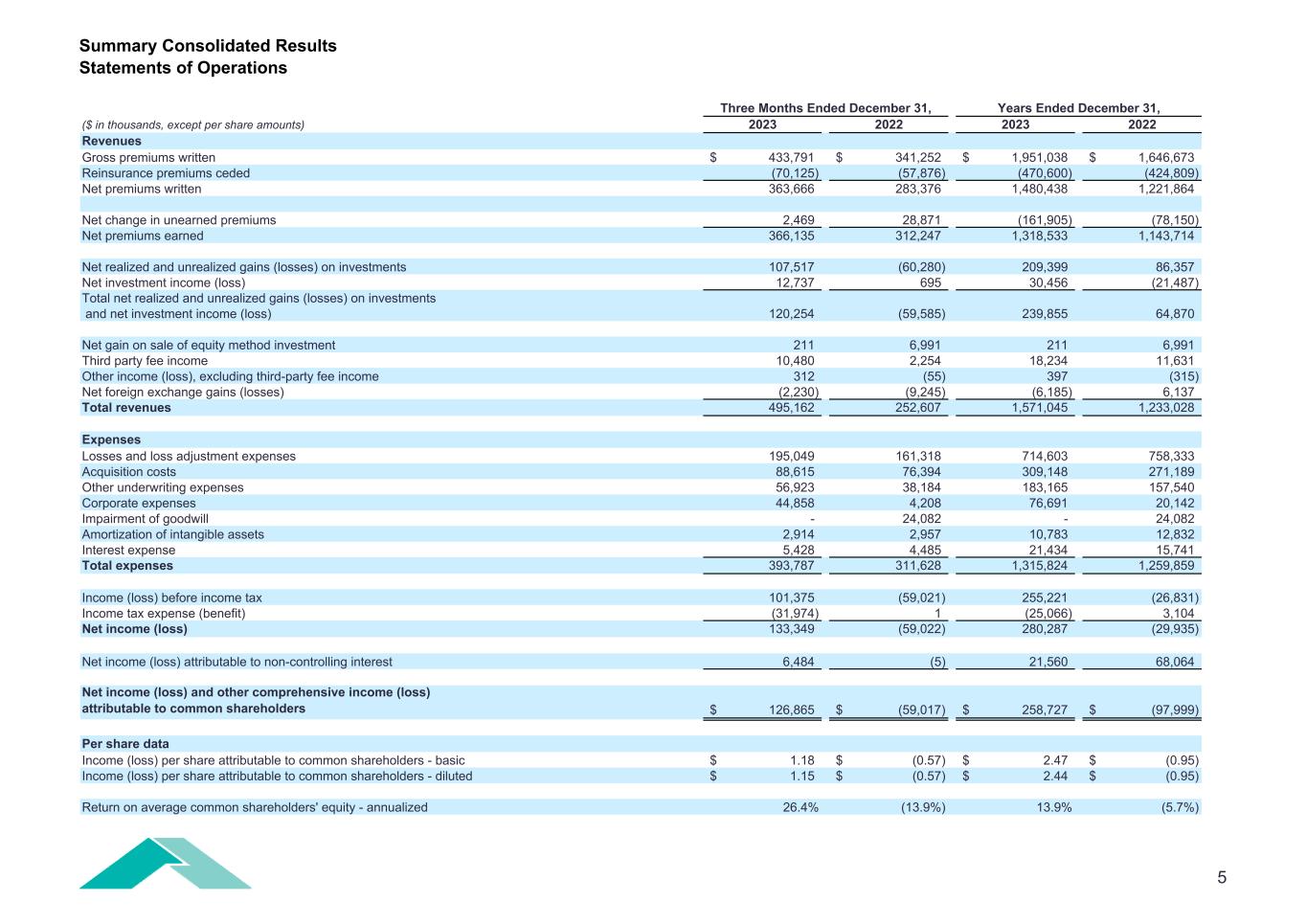

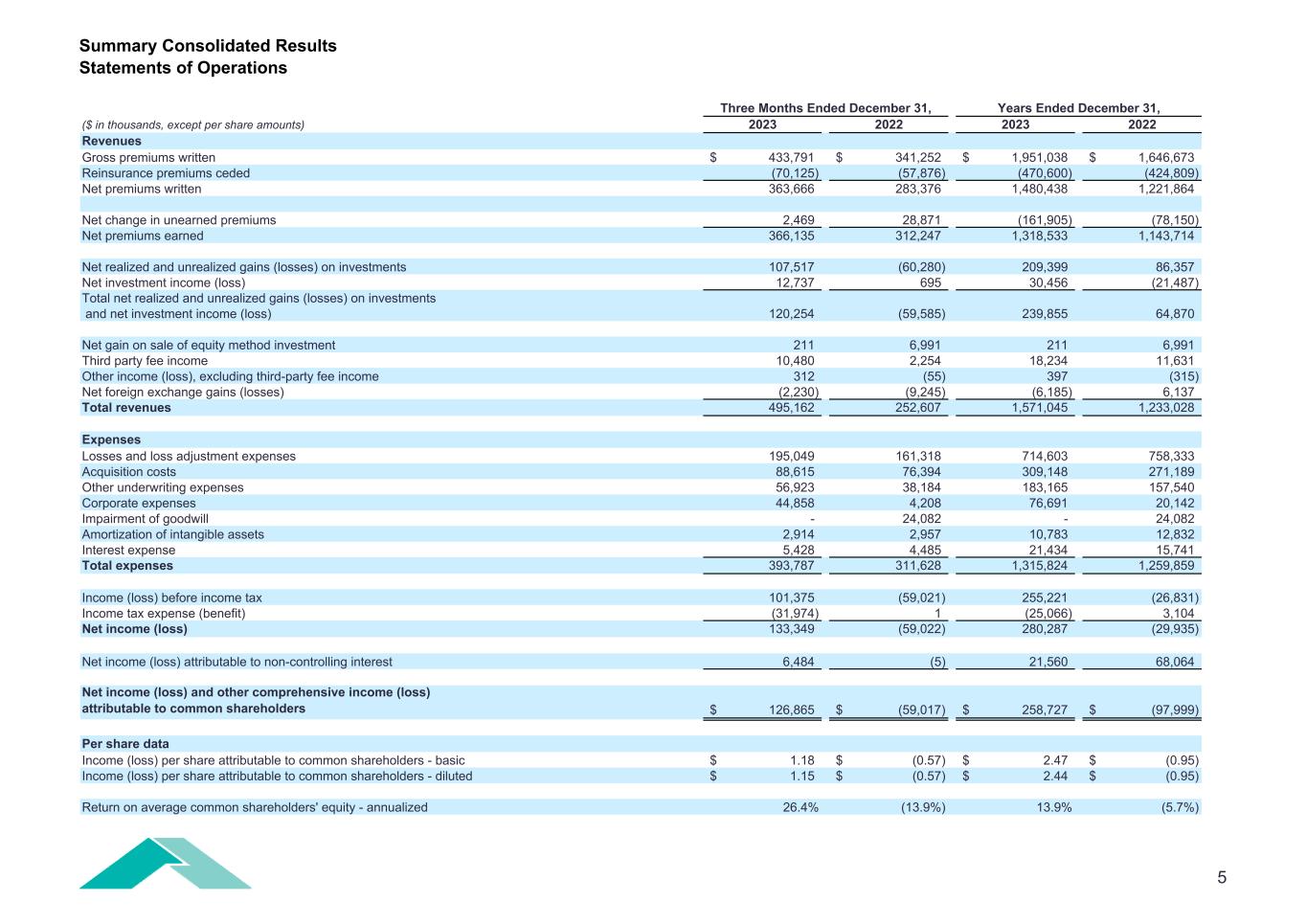

Summary Consolidated Results Statements of Operations ($ in thousands, except per share amounts) 2023 2022 2023 2022 Revenues Gross premiums written 433,791$ 341,252$ 1,951,038$ 1,646,673$ Reinsurance premiums ceded (70,125) (57,876) (470,600) (424,809) Net premiums written 363,666 283,376 1,480,438 1,221,864 Net change in unearned premiums 2,469 28,871 (161,905) (78,150) Net premiums earned 366,135 312,247 1,318,533 1,143,714 Net realized and unrealized gains (losses) on investments 107,517 (60,280) 209,399 86,357 Net investment income (loss) 12,737 695 30,456 (21,487) Total net realized and unrealized gains (losses) on investments and net investment income (loss) 120,254 (59,585) 239,855 64,870 Net gain on sale of equity method investment 211 6,991 211 6,991 Third party fee income 10,480 2,254 18,234 11,631 Other income (loss), excluding third-party fee income 312 (55) 397 (315) Net foreign exchange gains (losses) (2,230) (9,245) (6,185) 6,137 Total revenues 495,162 252,607 1,571,045 1,233,028 Expenses Losses and loss adjustment expenses 195,049 161,318 714,603 758,333 Acquisition costs 88,615 76,394 309,148 271,189 Other underwriting expenses 56,923 38,184 183,165 157,540 Corporate expenses 44,858 4,208 76,691 20,142 Impairment of goodwill - 24,082 - 24,082 Amortization of intangible assets 2,914 2,957 10,783 12,832 Interest expense 5,428 4,485 21,434 15,741 Total expenses 393,787 311,628 1,315,824 1,259,859 Income (loss) before income tax 101,375 (59,021) 255,221 (26,831) Income tax expense (benefit) (31,974) 1 (25,066) 3,104 Net income (loss) 133,349 (59,022) 280,287 (29,935) Net income (loss) attributable to non-controlling interest 6,484 (5) 21,560 68,064 Net income (loss) and other comprehensive income (loss) attributable to common shareholders 126,865$ (59,017)$ 258,727$ (97,999)$ Per share data Income (loss) per share attributable to common shareholders - basic 1.18$ (0.57)$ 2.47$ (0.95)$ Income (loss) per share attributable to common shareholders - diluted 1.15$ (0.57)$ 2.44$ (0.95)$ Return on average common shareholders' equity - annualized 26.4% (13.9%) 13.9% (5.7%) Years Ended December 31,Three Months Ended December 31, 5

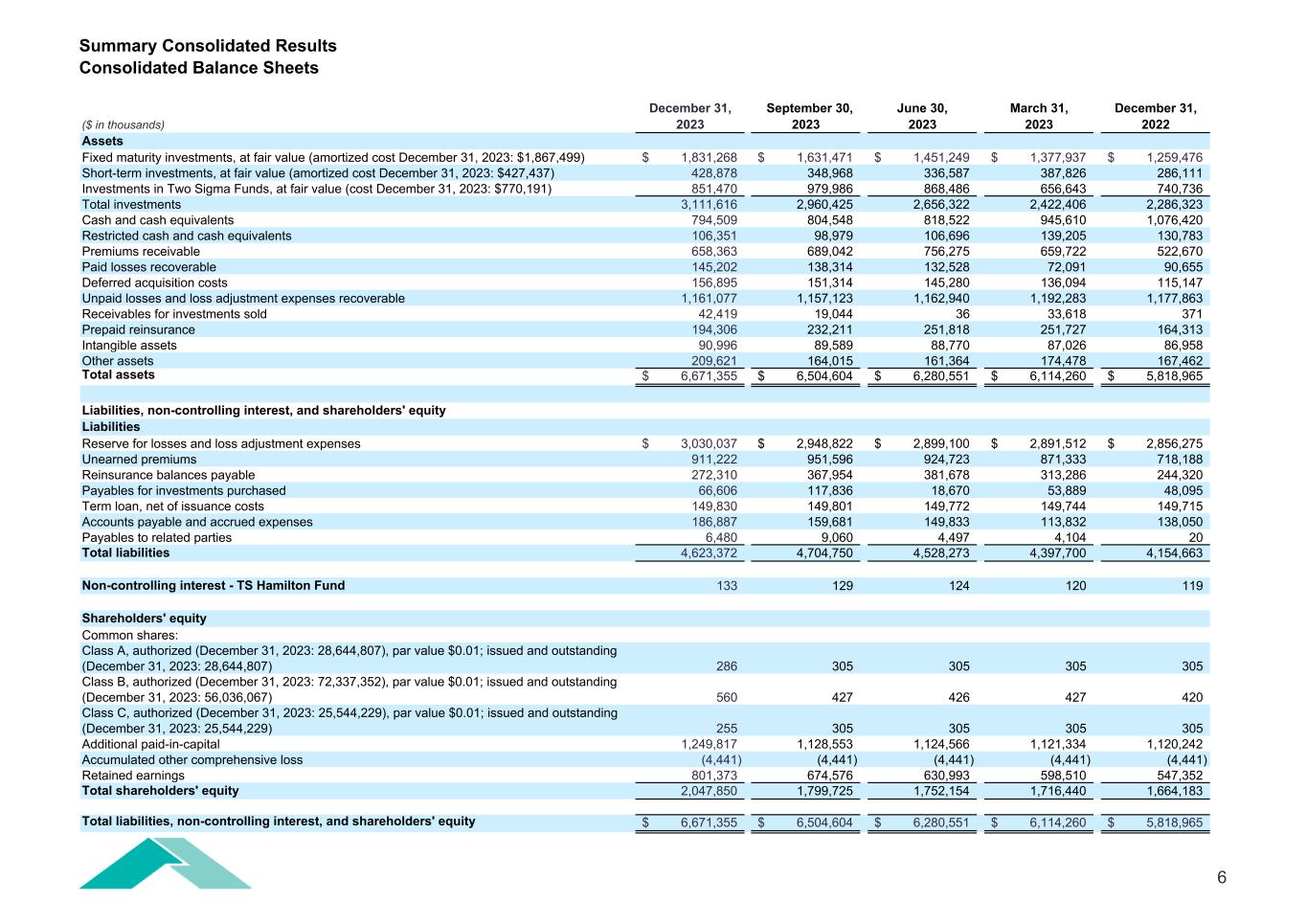

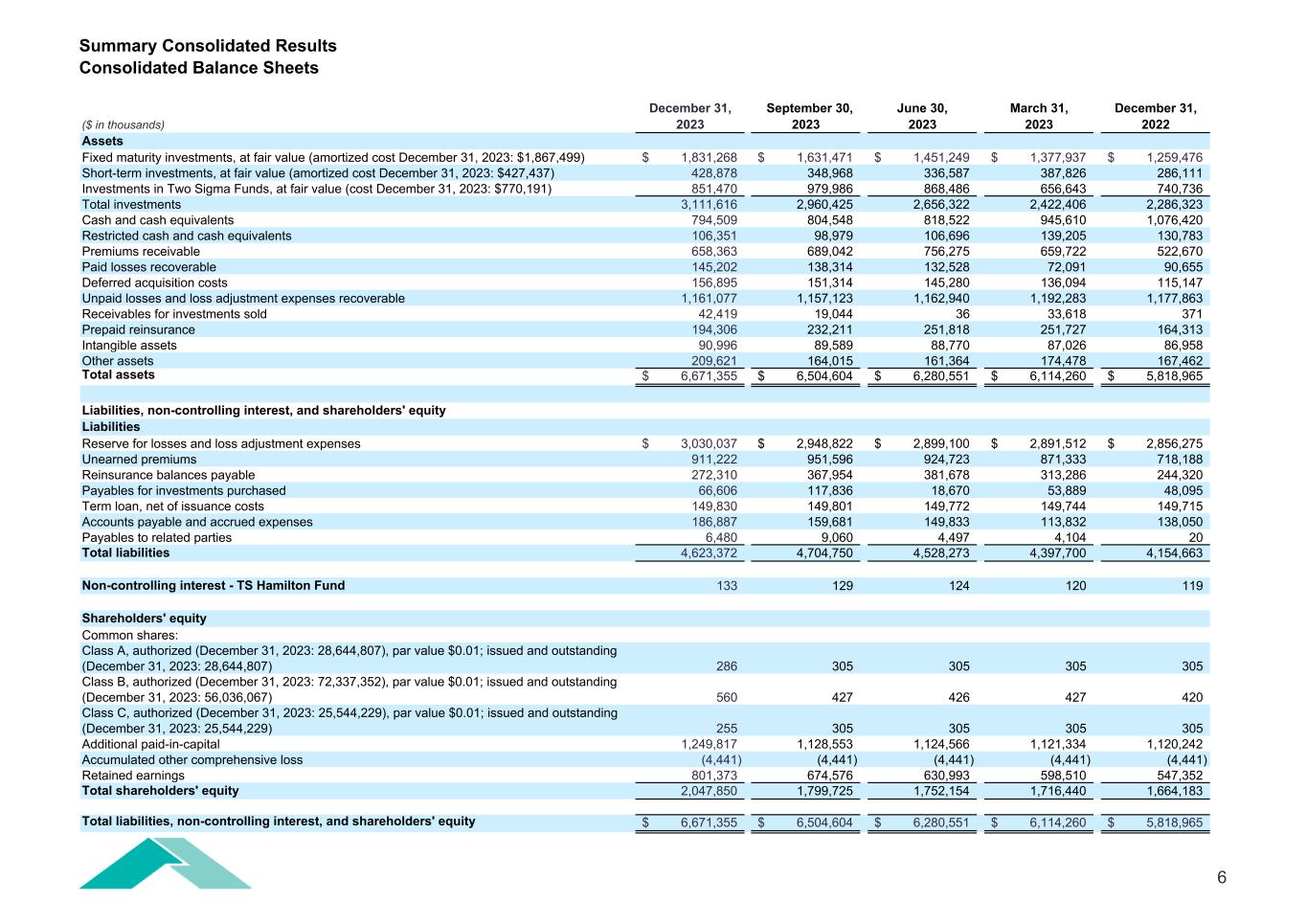

Summary Consolidated Results Consolidated Balance Sheets December 31, September 30, June 30, March 31, December 31, ($ in thousands) 2023 2023 2023 2023 2022 Assets Fixed maturity investments, at fair value (amortized cost December 31, 2023: $1,867,499) 1,831,268$ 1,631,471$ 1,451,249$ 1,377,937$ 1,259,476$ Short-term investments, at fair value (amortized cost December 31, 2023: $427,437) 428,878 348,968 336,587 387,826 286,111 Investments in Two Sigma Funds, at fair value (cost December 31, 2023: $770,191) 851,470 979,986 868,486 656,643 740,736 Total investments 3,111,616 2,960,425 2,656,322 2,422,406 2,286,323 Cash and cash equivalents 794,509 804,548 818,522 945,610 1,076,420 Restricted cash and cash equivalents 106,351 98,979 106,696 139,205 130,783 Premiums receivable 658,363 689,042 756,275 659,722 522,670 Paid losses recoverable 145,202 138,314 132,528 72,091 90,655 Deferred acquisition costs 156,895 151,314 145,280 136,094 115,147 Unpaid losses and loss adjustment expenses recoverable 1,161,077 1,157,123 1,162,940 1,192,283 1,177,863 Receivables for investments sold 42,419 19,044 36 33,618 371 Prepaid reinsurance 194,306 232,211 251,818 251,727 164,313 Intangible assets 90,996 89,589 88,770 87,026 86,958 Other assets 209,621 164,015 161,364 174,478 167,462 Total assets 6,671,355$ 6,504,604$ 6,280,551$ 6,114,260$ 5,818,965$ Liabilities, non-controlling interest, and shareholders' equity Liabilities Reserve for losses and loss adjustment expenses 3,030,037$ 2,948,822$ 2,899,100$ 2,891,512$ 2,856,275$ Unearned premiums 911,222 951,596 924,723 871,333 718,188 Reinsurance balances payable 272,310 367,954 381,678 313,286 244,320 Payables for investments purchased 66,606 117,836 18,670 53,889 48,095 Term loan, net of issuance costs 149,830 149,801 149,772 149,744 149,715 Accounts payable and accrued expenses 186,887 159,681 149,833 113,832 138,050 Payables to related parties 6,480 9,060 4,497 4,104 20 Total liabilities 4,623,372 4,704,750 4,528,273 4,397,700 4,154,663 Non-controlling interest - TS Hamilton Fund 133 129 124 120 119 Shareholders' equity Common shares: Class A, authorized (December 31, 2023: 28,644,807), par value $0.01; issued and outstanding (December 31, 2023: 28,644,807) 286 305 305 305 305 Class B, authorized (December 31, 2023: 72,337,352), par value $0.01; issued and outstanding (December 31, 2023: 56,036,067) 560 427 426 427 420 Class C, authorized (December 31, 2023: 25,544,229), par value $0.01; issued and outstanding (December 31, 2023: 25,544,229) 255 305 305 305 305 Additional paid-in-capital 1,249,817 1,128,553 1,124,566 1,121,334 1,120,242 Accumulated other comprehensive loss (4,441) (4,441) (4,441) (4,441) (4,441) Retained earnings 801,373 674,576 630,993 598,510 547,352 Total shareholders' equity 2,047,850 1,799,725 1,752,154 1,716,440 1,664,183 Total liabilities, non-controlling interest, and shareholders' equity 6,671,355$ 6,504,604$ 6,280,551$ 6,114,260$ 5,818,965$ 6

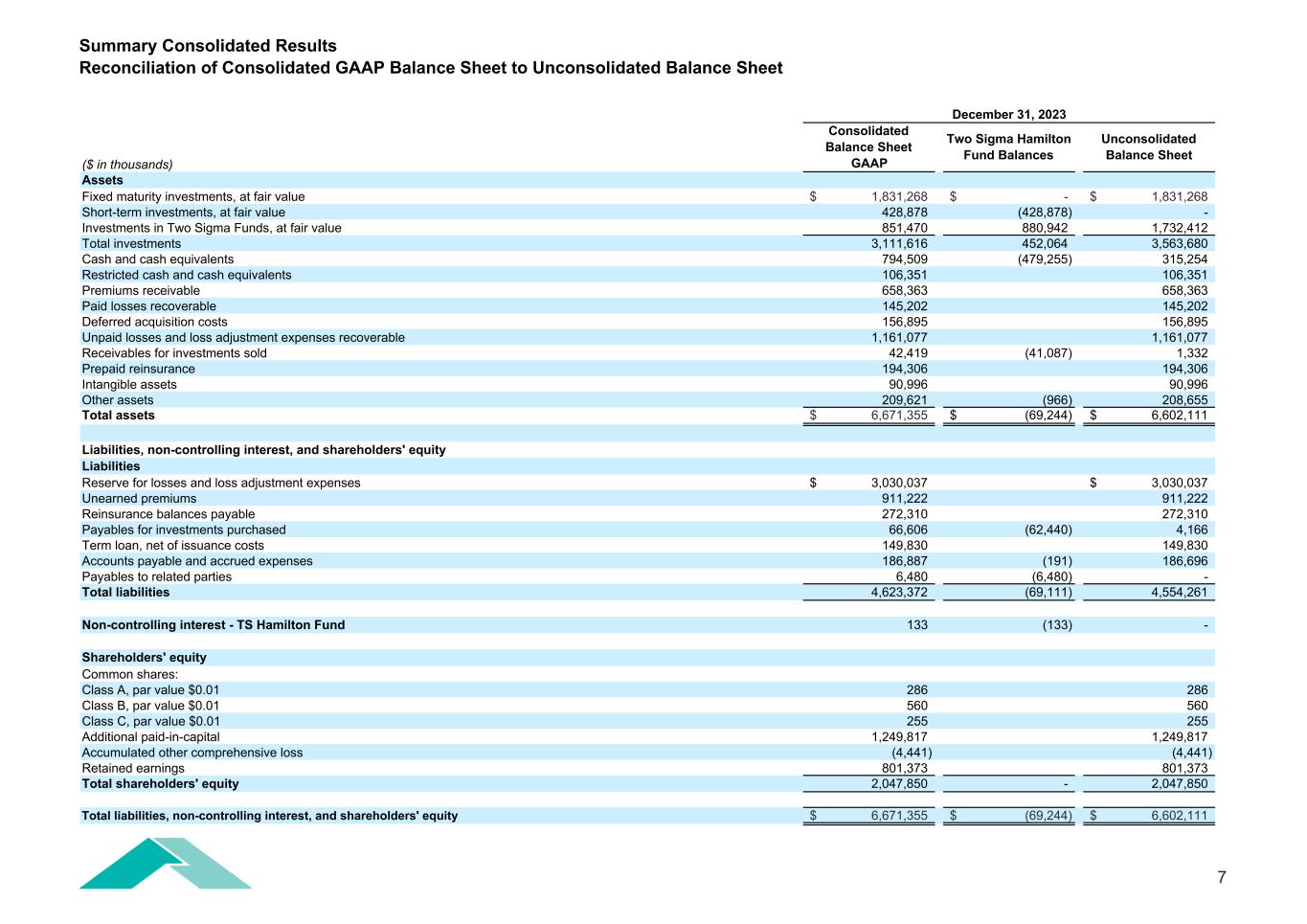

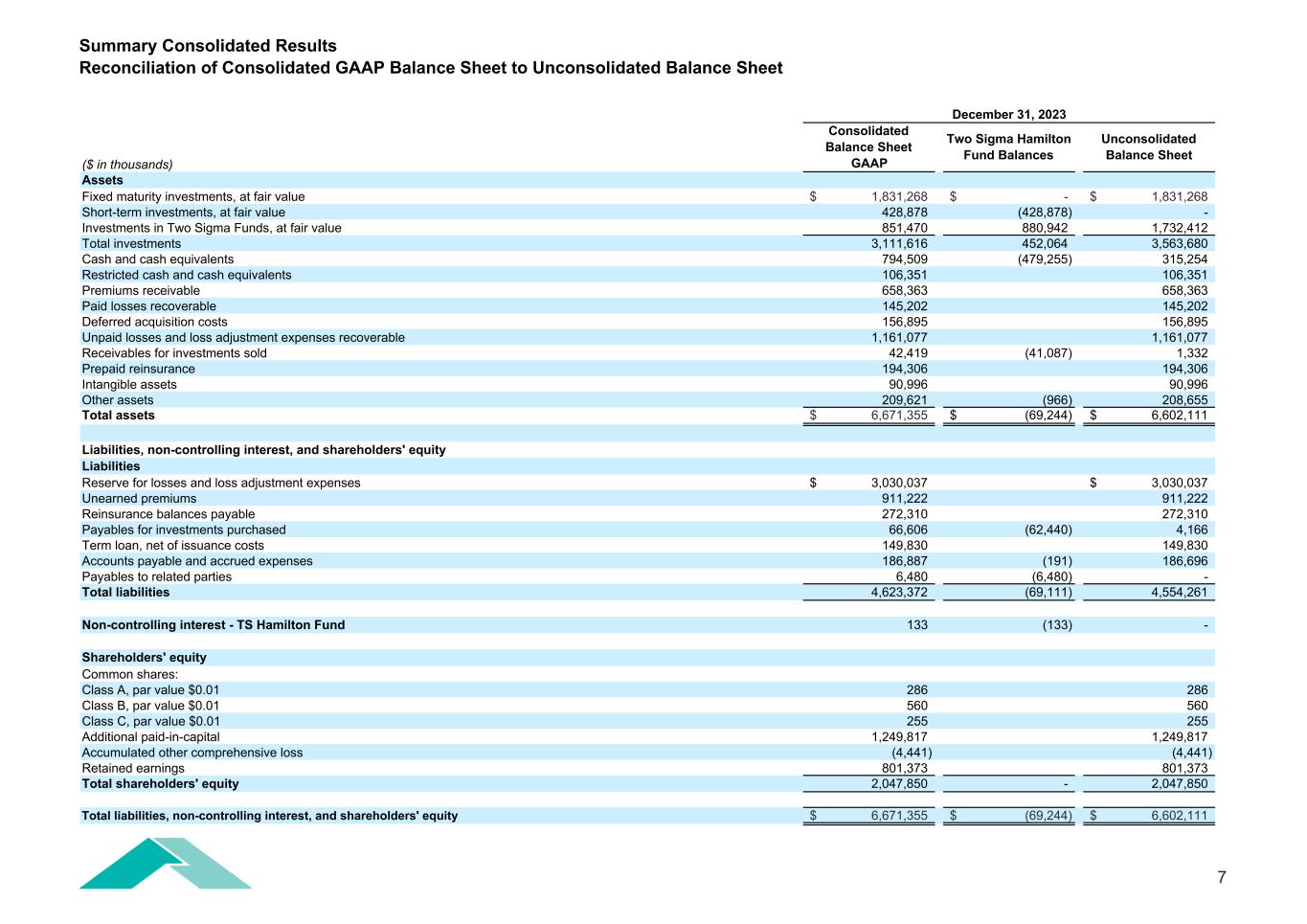

Summary Consolidated Results Reconciliation of Consolidated GAAP Balance Sheet to Unconsolidated Balance Sheet December 31, 2023 ($ in thousands) Assets Fixed maturity investments, at fair value 1,831,268$ -$ 1,831,268$ Short-term investments, at fair value 428,878 (428,878) - Investments in Two Sigma Funds, at fair value 851,470 880,942 1,732,412 Total investments 3,111,616 452,064 3,563,680 Cash and cash equivalents 794,509 (479,255) 315,254 Restricted cash and cash equivalents 106,351 106,351 Premiums receivable 658,363 658,363 Paid losses recoverable 145,202 145,202 Deferred acquisition costs 156,895 156,895 Unpaid losses and loss adjustment expenses recoverable 1,161,077 1,161,077 Receivables for investments sold 42,419 (41,087) 1,332 Prepaid reinsurance 194,306 194,306 Intangible assets 90,996 90,996 Other assets 209,621 (966) 208,655 Total assets 6,671,355$ (69,244)$ 6,602,111$ Liabilities, non-controlling interest, and shareholders' equity Liabilities Reserve for losses and loss adjustment expenses 3,030,037$ 3,030,037$ Unearned premiums 911,222 911,222 Reinsurance balances payable 272,310 272,310 Payables for investments purchased 66,606 (62,440) 4,166 Term loan, net of issuance costs 149,830 149,830 Accounts payable and accrued expenses 186,887 (191) 186,696 Payables to related parties 6,480 (6,480) - Total liabilities 4,623,372 (69,111) 4,554,261 Non-controlling interest - TS Hamilton Fund 133 (133) - Shareholders' equity Common shares: Class A, par value $0.01 286 286 Class B, par value $0.01 560 560 Class C, par value $0.01 255 255 Additional paid-in-capital 1,249,817 1,249,817 Accumulated other comprehensive loss (4,441) (4,441) Retained earnings 801,373 801,373 Total shareholders' equity 2,047,850 - 2,047,850 Total liabilities, non-controlling interest, and shareholders' equity 6,671,355$ (69,244)$ 6,602,111$ Consolidated Balance Sheet GAAP Unconsolidated Balance Sheet Two Sigma Hamilton Fund Balances 7

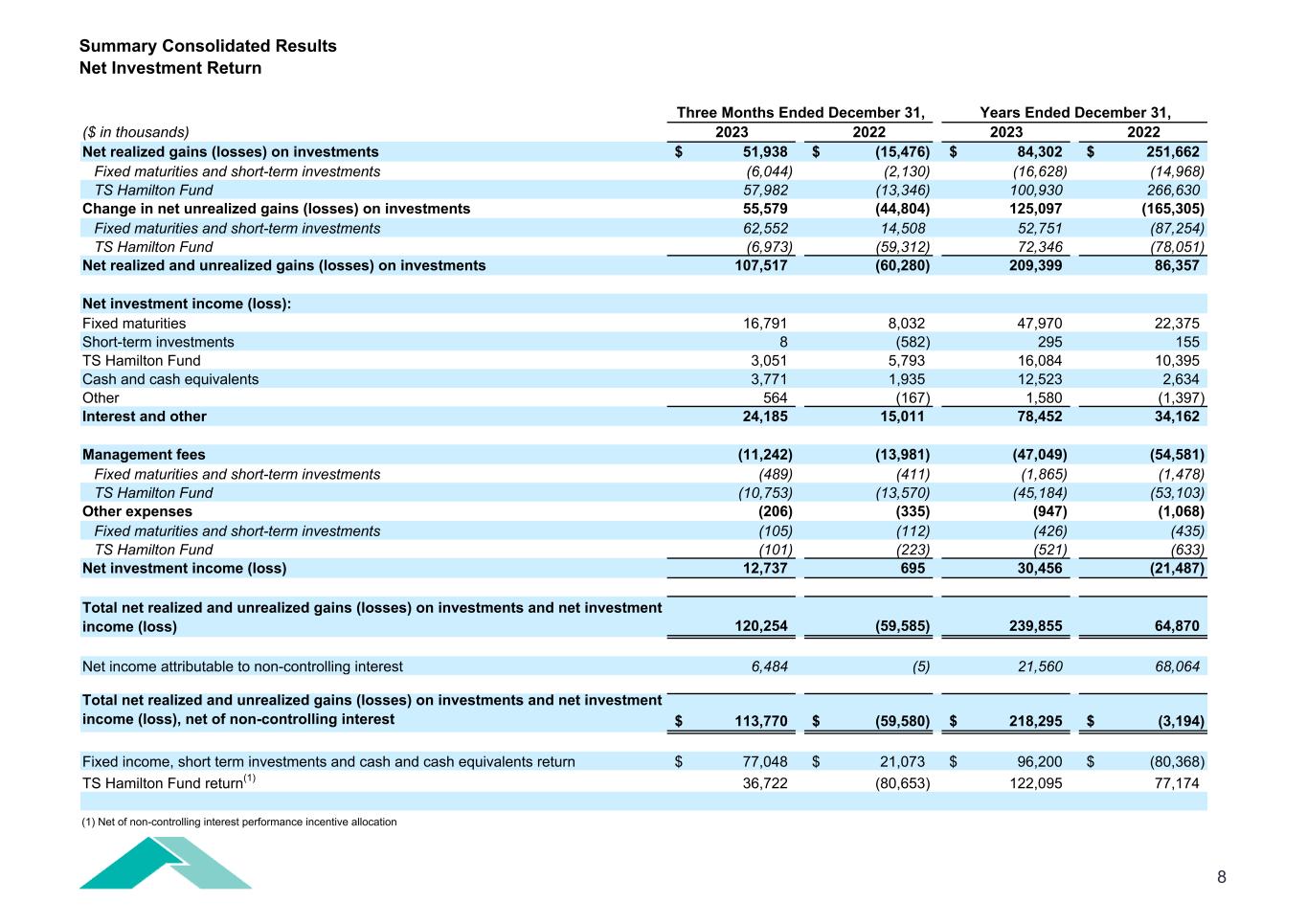

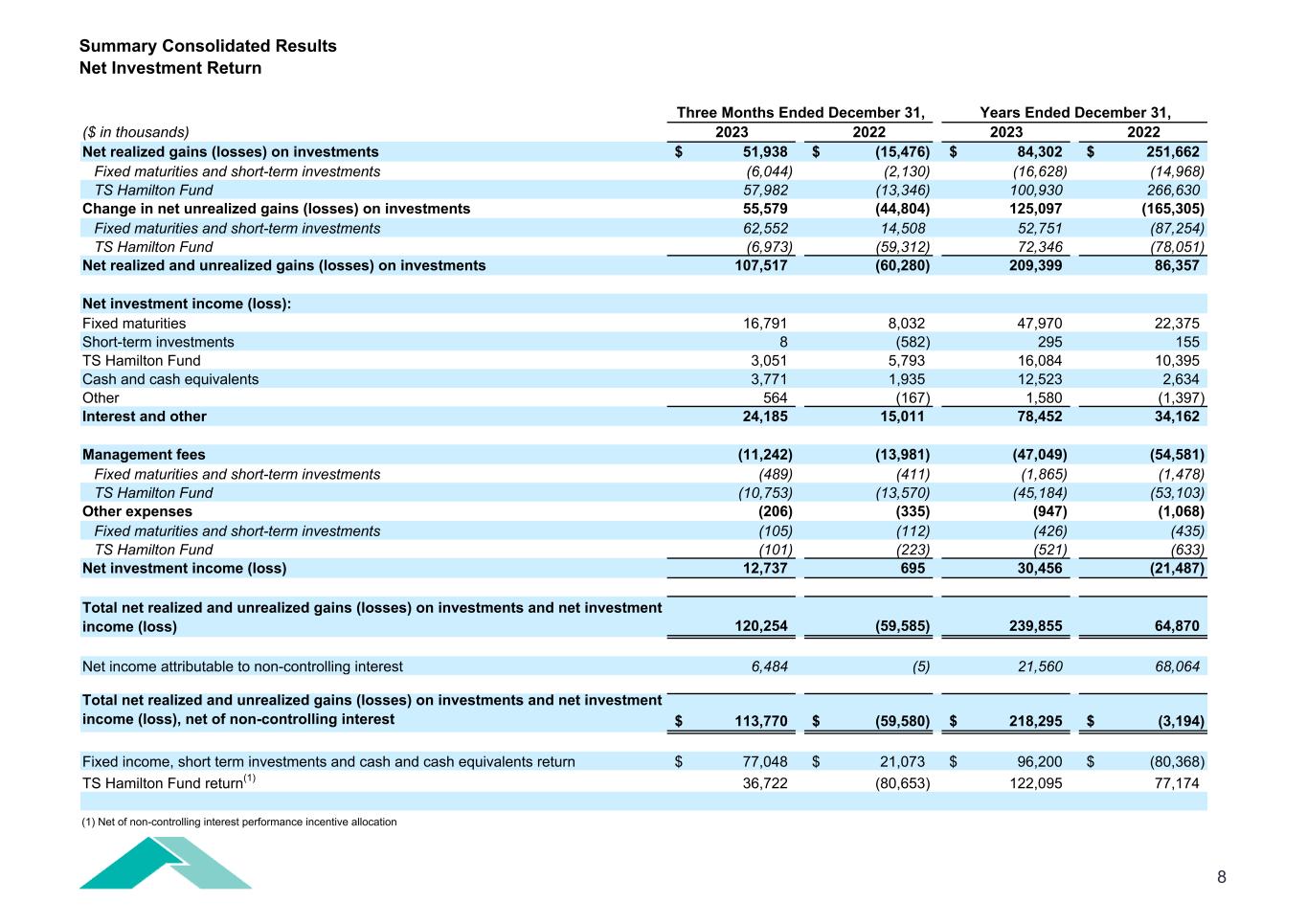

Summary Consolidated Results Net Investment Return Three Months Ended December 31, ($ in thousands) 2023 2022 2023 2022 Net realized gains (losses) on investments 51,938$ (15,476)$ 84,302$ 251,662$ Fixed maturities and short-term investments (6,044) (2,130) (16,628) (14,968) TS Hamilton Fund 57,982 (13,346) 100,930 266,630 Change in net unrealized gains (losses) on investments 55,579 (44,804) 125,097 (165,305) Fixed maturities and short-term investments 62,552 14,508 52,751 (87,254) TS Hamilton Fund (6,973) (59,312) 72,346 (78,051) Net realized and unrealized gains (losses) on investments 107,517 (60,280) 209,399 86,357 Net investment income (loss): Fixed maturities 16,791 8,032 47,970 22,375 Short-term investments 8 (582) 295 155 TS Hamilton Fund 3,051 5,793 16,084 10,395 Cash and cash equivalents 3,771 1,935 12,523 2,634 Other 564 (167) 1,580 (1,397) Interest and other 24,185 15,011 78,452 34,162 Management fees (11,242) (13,981) (47,049) (54,581) Fixed maturities and short-term investments (489) (411) (1,865) (1,478) TS Hamilton Fund (10,753) (13,570) (45,184) (53,103) Other expenses (206) (335) (947) (1,068) Fixed maturities and short-term investments (105) (112) (426) (435) TS Hamilton Fund (101) (223) (521) (633) Net investment income (loss) 12,737 695 30,456 (21,487) Total net realized and unrealized gains (losses) on investments and net investment income (loss) 120,254 (59,585) 239,855 64,870 Net income attributable to non-controlling interest 6,484 (5) 21,560 68,064 Total net realized and unrealized gains (losses) on investments and net investment income (loss), net of non-controlling interest 113,770$ (59,580)$ 218,295$ (3,194)$ Fixed income, short term investments and cash and cash equivalents return 77,048$ 21,073$ 96,200$ (80,368)$ TS Hamilton Fund return(1) 36,722 (80,653) 122,095 77,174 (1) Net of non-controlling interest performance incentive allocation Years Ended December 31, 8

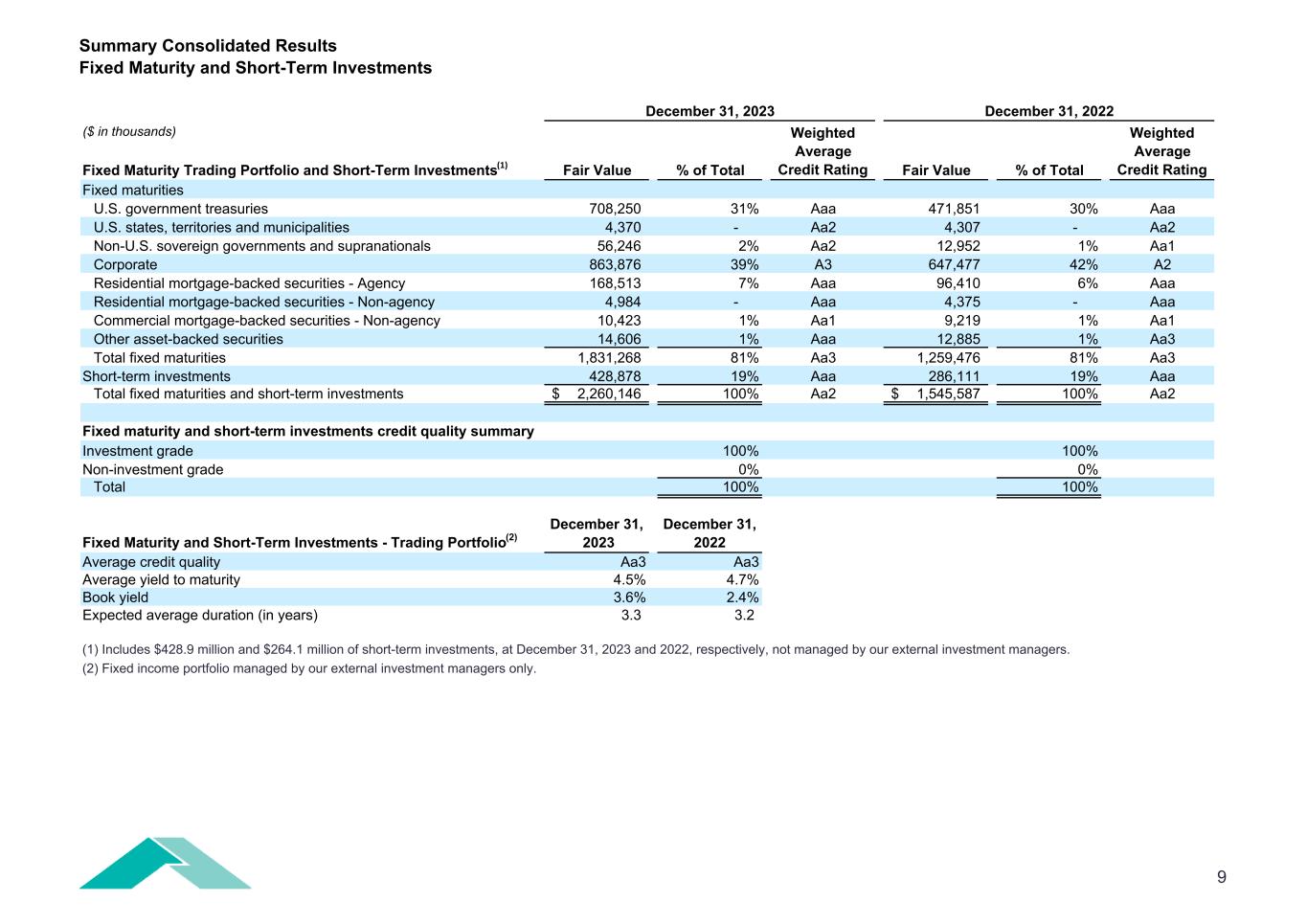

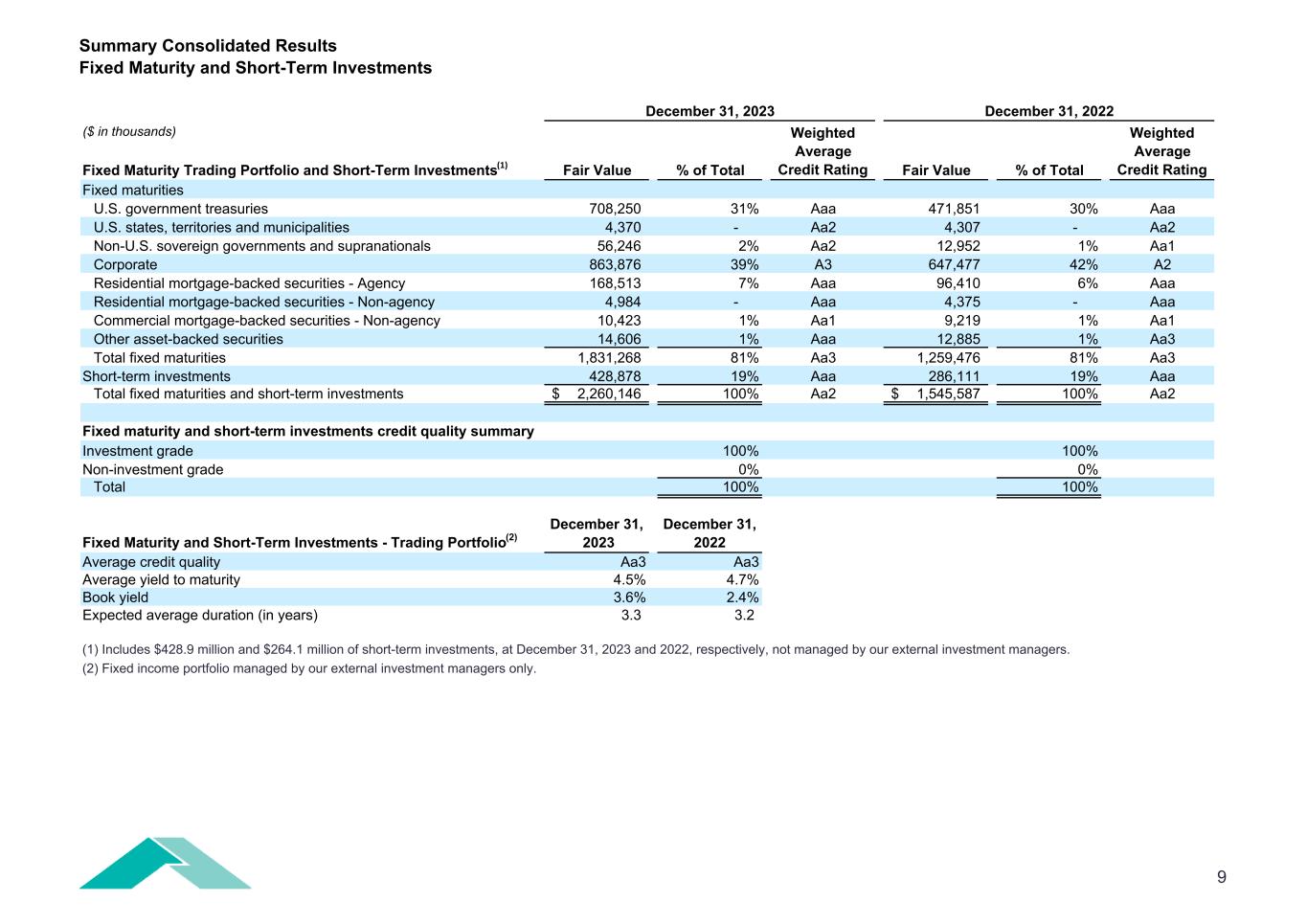

Summary Consolidated Results Fixed Maturity and Short-Term Investments December 31, 2023 December 31, 2022 ($ in thousands) Fixed Maturity Trading Portfolio and Short-Term Investments(1) Fair Value % of Total Weighted Average Credit Rating Fair Value % of Total Weighted Average Credit Rating Fixed maturities U.S. government treasuries 708,250 31% Aaa 471,851 30% Aaa U.S. states, territories and municipalities 4,370 - Aa2 4,307 - Aa2 Non-U.S. sovereign governments and supranationals 56,246 2% Aa2 12,952 1% Aa1 Corporate 863,876 39% A3 647,477 42% A2 Residential mortgage-backed securities - Agency 168,513 7% Aaa 96,410 6% Aaa Residential mortgage-backed securities - Non-agency 4,984 - Aaa 4,375 - Aaa Commercial mortgage-backed securities - Non-agency 10,423 1% Aa1 9,219 1% Aa1 Other asset-backed securities 14,606 1% Aaa 12,885 1% Aa3 Total fixed maturities 1,831,268 81% Aa3 1,259,476 81% Aa3 Short-term investments 428,878 19% Aaa 286,111 19% Aaa Total fixed maturities and short-term investments 2,260,146$ 100% Aa2 1,545,587$ 100% Aa2 Fixed maturity and short-term investments credit quality summary Investment grade 100% 100% Non-investment grade 0% 0% Total 100% 100% Fixed Maturity and Short-Term Investments - Trading Portfolio(2) December 31, 2023 December 31, 2022 Average credit quality Aa3 Aa3 Average yield to maturity 4.5% 4.7% Book yield 3.6% 2.4% Expected average duration (in years) 3.3 3.2 (1) Includes $428.9 million and $264.1 million of short-term investments, at December 31, 2023 and 2022, respectively, not managed by our external investment managers. (2) Fixed income portfolio managed by our external investment managers only. 9

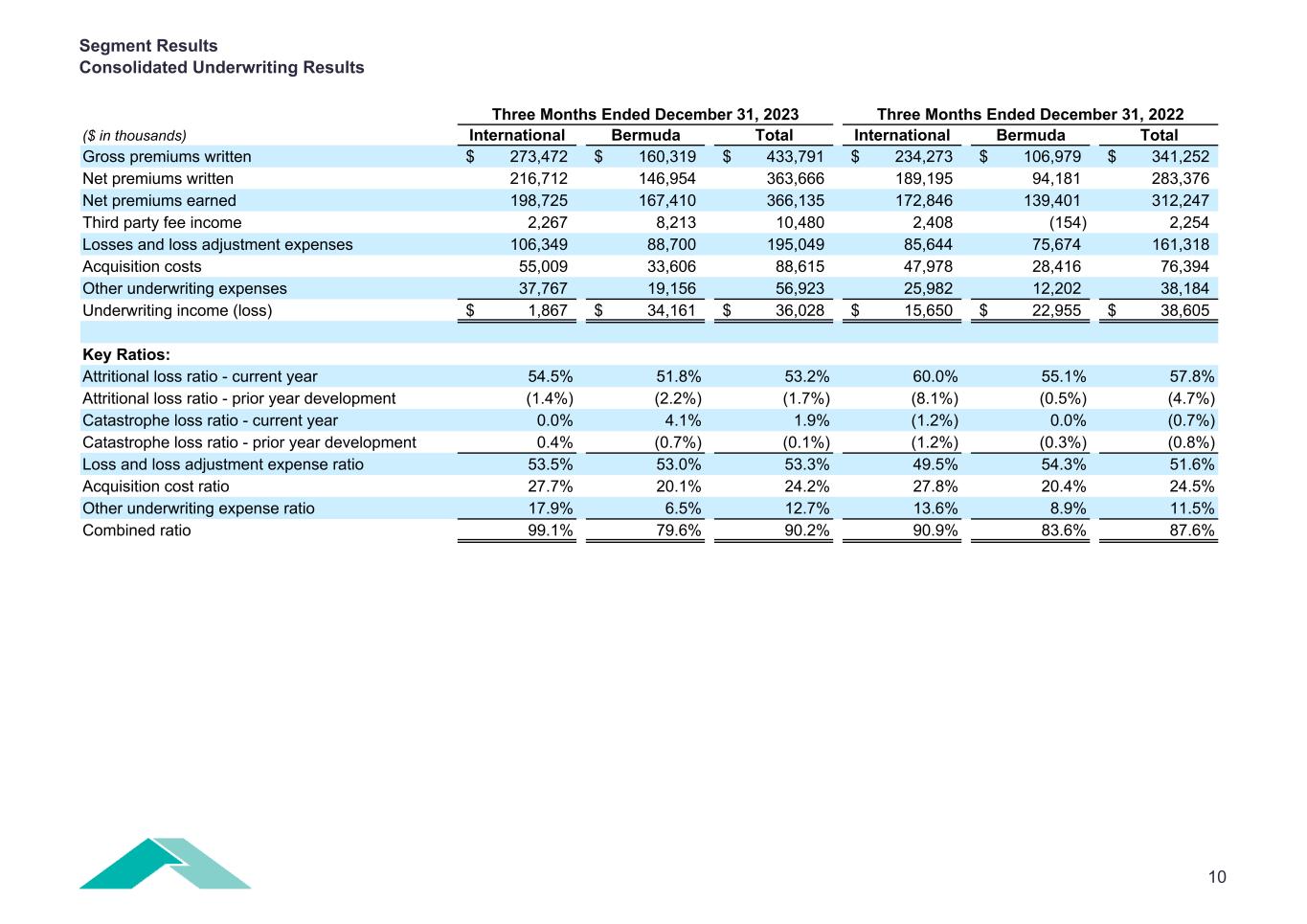

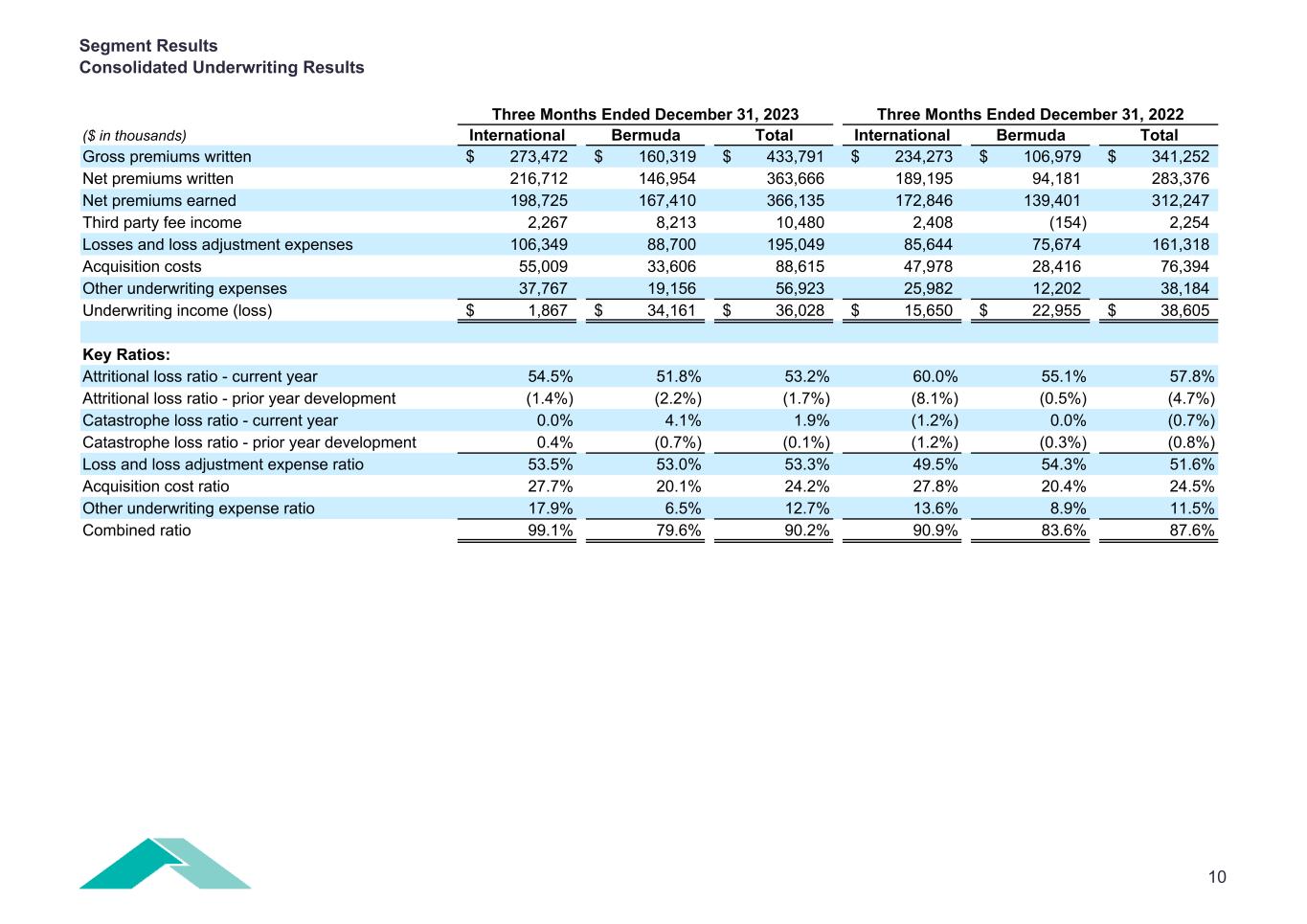

Segment Results Consolidated Underwriting Results Three Months Ended December 31, 2023 Three Months Ended December 31, 2022 ($ in thousands) International Bermuda Total International Bermuda Total Gross premiums written 273,472$ 160,319$ 433,791$ 234,273$ 106,979$ 341,252$ Net premiums written 216,712 146,954 363,666 189,195 94,181 283,376 Net premiums earned 198,725 167,410 366,135 172,846 139,401 312,247 Third party fee income 2,267 8,213 10,480 2,408 (154) 2,254 Losses and loss adjustment expenses 106,349 88,700 195,049 85,644 75,674 161,318 Acquisition costs 55,009 33,606 88,615 47,978 28,416 76,394 Other underwriting expenses 37,767 19,156 56,923 25,982 12,202 38,184 Underwriting income (loss) 1,867$ 34,161$ 36,028$ 15,650$ 22,955$ 38,605$ Key Ratios: Attritional loss ratio - current year 54.5% 51.8% 53.2% 60.0% 55.1% 57.8% Attritional loss ratio - prior year development (1.4%) (2.2%) (1.7%) (8.1%) (0.5%) (4.7%) Catastrophe loss ratio - current year 0.0% 4.1% 1.9% (1.2%) 0.0% (0.7%) Catastrophe loss ratio - prior year development 0.4% (0.7%) (0.1%) (1.2%) (0.3%) (0.8%) Loss and loss adjustment expense ratio 53.5% 53.0% 53.3% 49.5% 54.3% 51.6% Acquisition cost ratio 27.7% 20.1% 24.2% 27.8% 20.4% 24.5% Other underwriting expense ratio 17.9% 6.5% 12.7% 13.6% 8.9% 11.5% Combined ratio 99.1% 79.6% 90.2% 90.9% 83.6% 87.6% 10

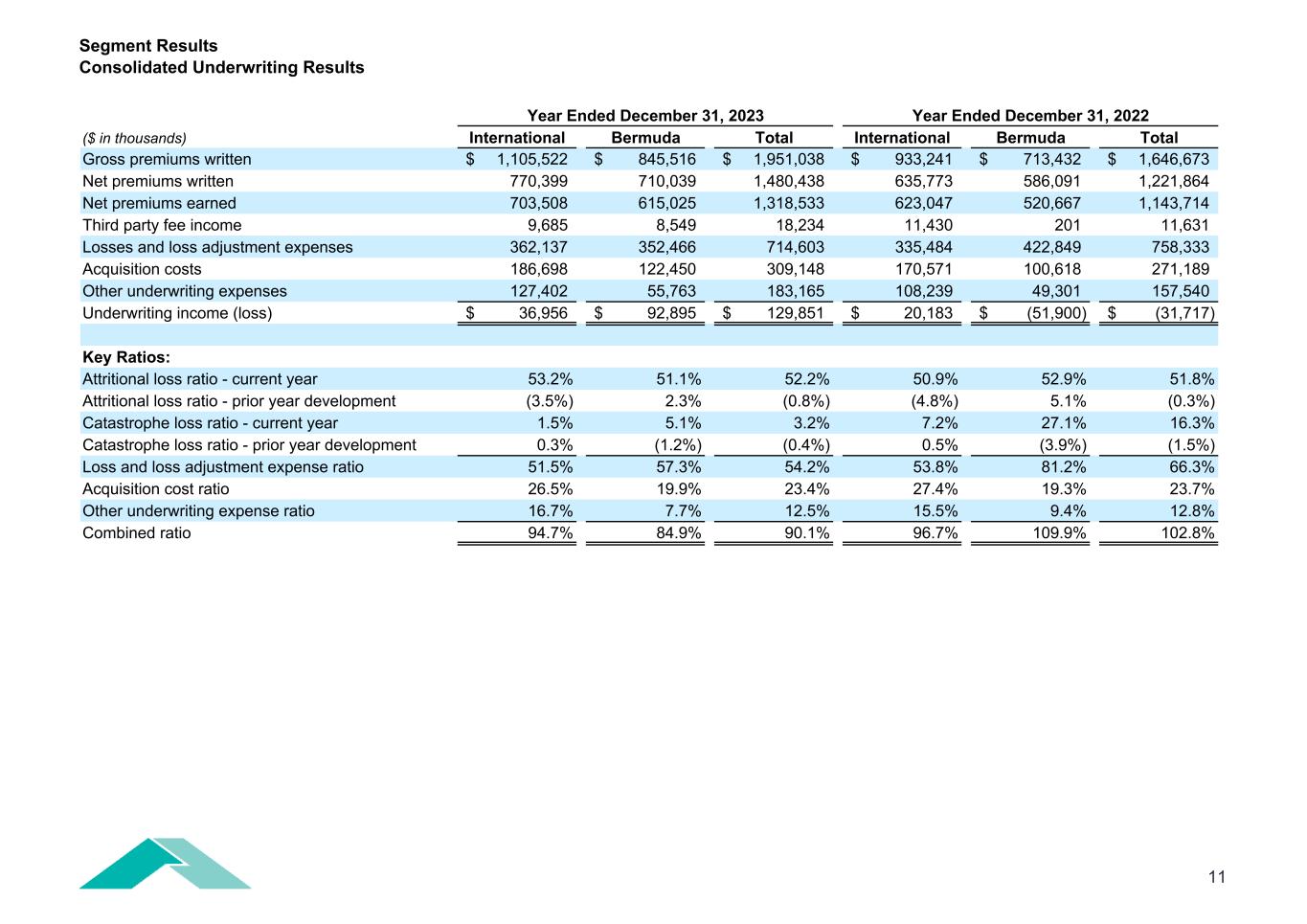

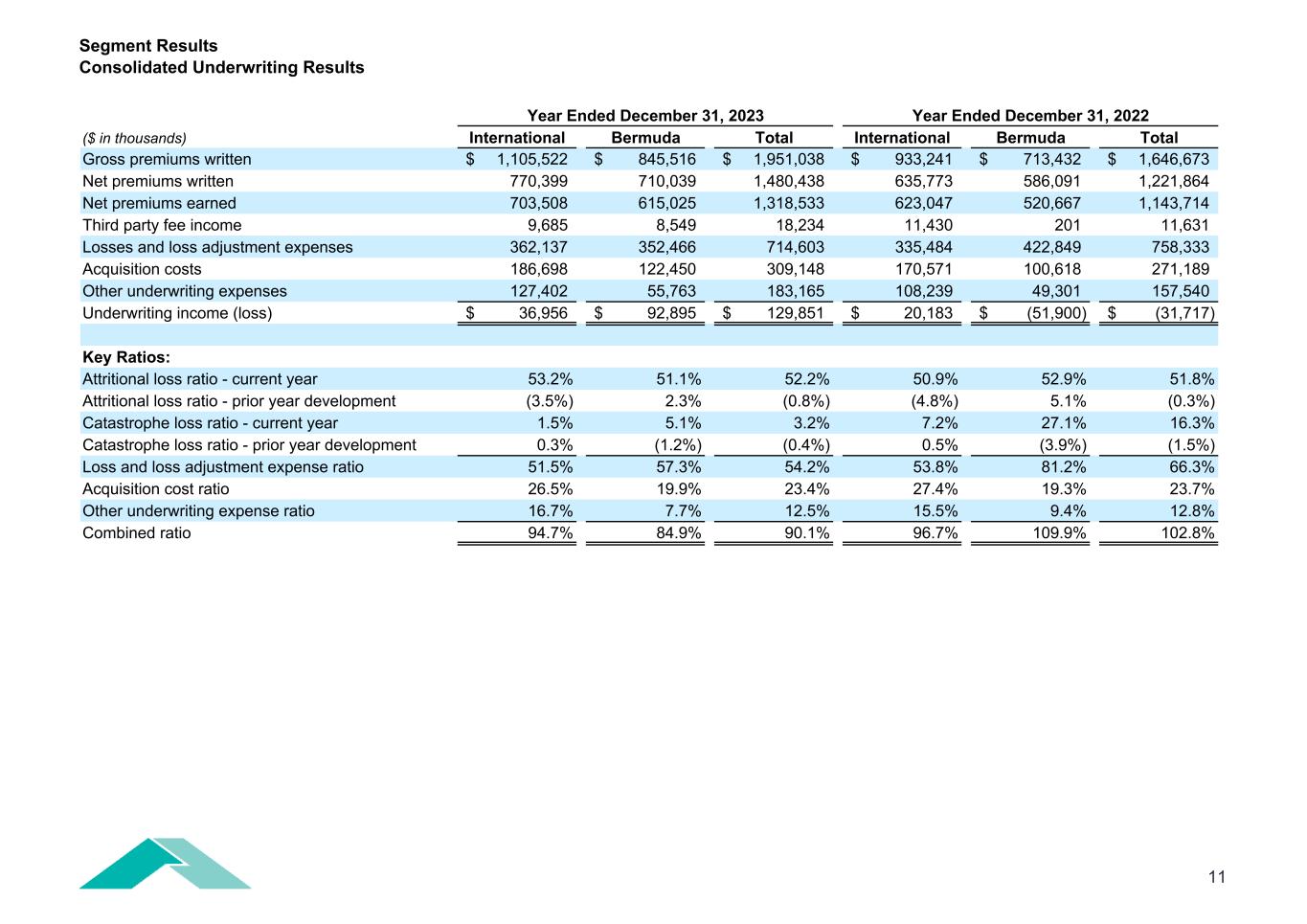

Segment Results Consolidated Underwriting Results Year Ended December 31, 2023 Year Ended December 31, 2022 ($ in thousands) International Bermuda Total International Bermuda Total Gross premiums written 1,105,522$ 845,516$ 1,951,038$ 933,241$ 713,432$ 1,646,673$ Net premiums written 770,399 710,039 1,480,438 635,773 586,091 1,221,864 Net premiums earned 703,508 615,025 1,318,533 623,047 520,667 1,143,714 Third party fee income 9,685 8,549 18,234 11,430 201 11,631 Losses and loss adjustment expenses 362,137 352,466 714,603 335,484 422,849 758,333 Acquisition costs 186,698 122,450 309,148 170,571 100,618 271,189 Other underwriting expenses 127,402 55,763 183,165 108,239 49,301 157,540 Underwriting income (loss) 36,956$ 92,895$ 129,851$ 20,183$ (51,900)$ (31,717)$ Key Ratios: Attritional loss ratio - current year 53.2% 51.1% 52.2% 50.9% 52.9% 51.8% Attritional loss ratio - prior year development (3.5%) 2.3% (0.8%) (4.8%) 5.1% (0.3%) Catastrophe loss ratio - current year 1.5% 5.1% 3.2% 7.2% 27.1% 16.3% Catastrophe loss ratio - prior year development 0.3% (1.2%) (0.4%) 0.5% (3.9%) (1.5%) Loss and loss adjustment expense ratio 51.5% 57.3% 54.2% 53.8% 81.2% 66.3% Acquisition cost ratio 26.5% 19.9% 23.4% 27.4% 19.3% 23.7% Other underwriting expense ratio 16.7% 7.7% 12.5% 15.5% 9.4% 12.8% Combined ratio 94.7% 84.9% 90.1% 96.7% 109.9% 102.8% 11

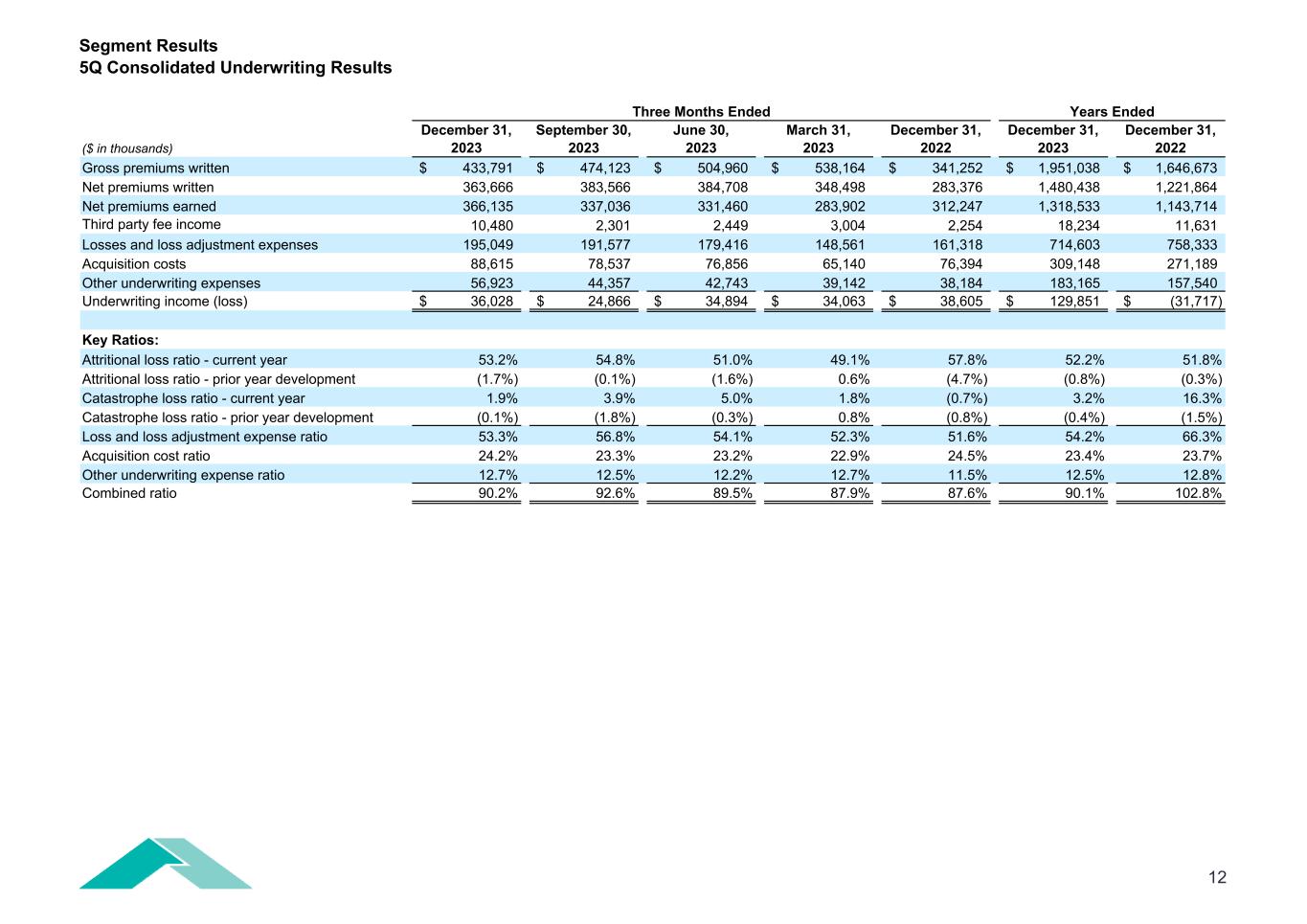

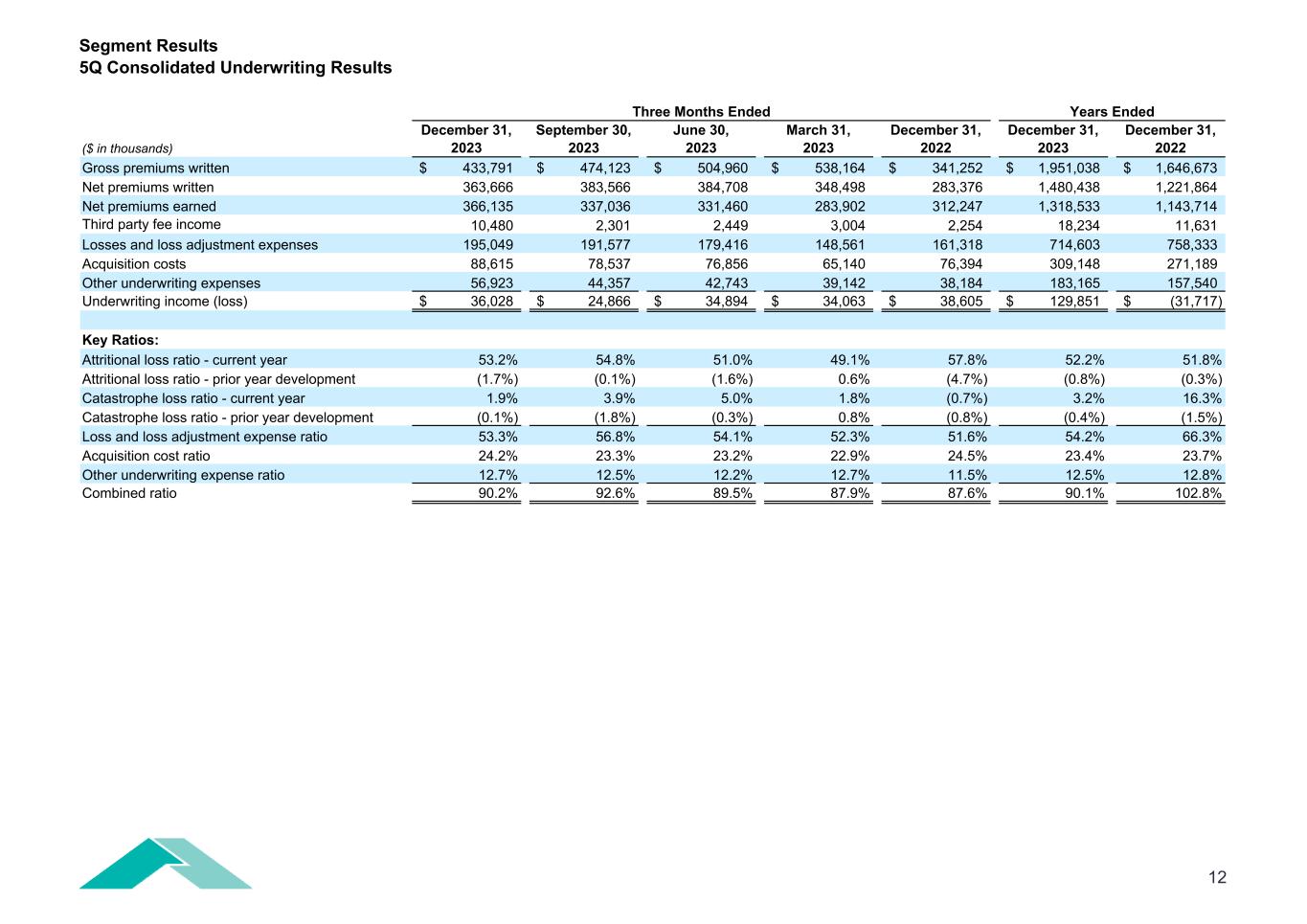

Segment Results 5Q Consolidated Underwriting Results Years Ended ($ in thousands) December 31, 2023 September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 December 31, 2023 December 31, 2022 Gross premiums written 433,791$ 474,123$ 504,960$ 538,164$ 341,252$ 1,951,038$ 1,646,673$ Net premiums written 363,666 383,566 384,708 348,498 283,376 1,480,438 1,221,864 Net premiums earned 366,135 337,036 331,460 283,902 312,247 1,318,533 1,143,714 Third party fee income 10,480 2,301 2,449 3,004 2,254 18,234 11,631 Losses and loss adjustment expenses 195,049 191,577 179,416 148,561 161,318 714,603 758,333 Acquisition costs 88,615 78,537 76,856 65,140 76,394 309,148 271,189 Other underwriting expenses 56,923 44,357 42,743 39,142 38,184 183,165 157,540 Underwriting income (loss) 36,028$ 24,866$ 34,894$ 34,063$ 38,605$ 129,851$ (31,717)$ Key Ratios: Attritional loss ratio - current year 53.2% 54.8% 51.0% 49.1% 57.8% 52.2% 51.8% Attritional loss ratio - prior year development (1.7%) (0.1%) (1.6%) 0.6% (4.7%) (0.8%) (0.3%) Catastrophe loss ratio - current year 1.9% 3.9% 5.0% 1.8% (0.7%) 3.2% 16.3% Catastrophe loss ratio - prior year development (0.1%) (1.8%) (0.3%) 0.8% (0.8%) (0.4%) (1.5%) Loss and loss adjustment expense ratio 53.3% 56.8% 54.1% 52.3% 51.6% 54.2% 66.3% Acquisition cost ratio 24.2% 23.3% 23.2% 22.9% 24.5% 23.4% 23.7% Other underwriting expense ratio 12.7% 12.5% 12.2% 12.7% 11.5% 12.5% 12.8% Combined ratio 90.2% 92.6% 89.5% 87.9% 87.6% 90.1% 102.8% Three Months Ended 12

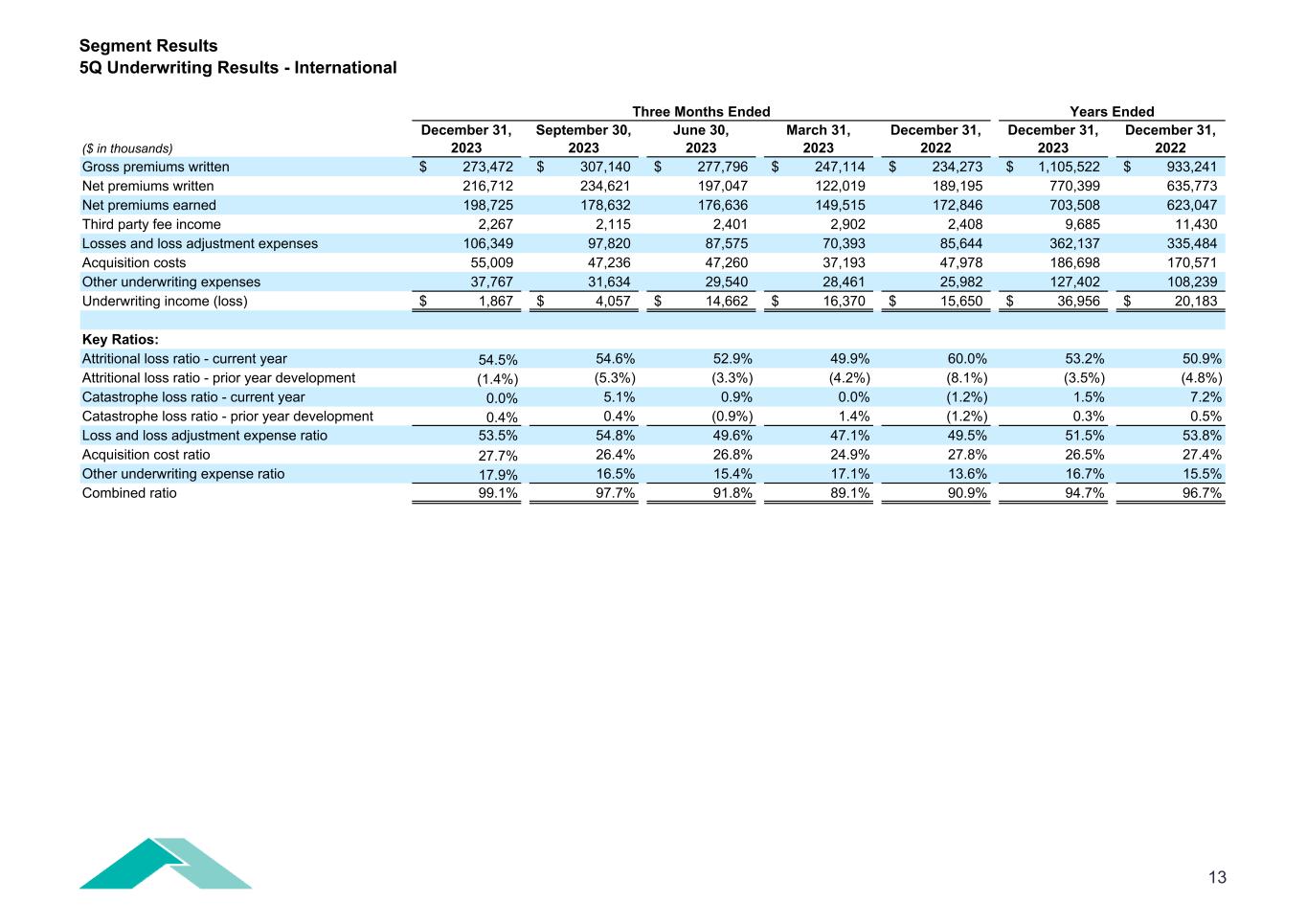

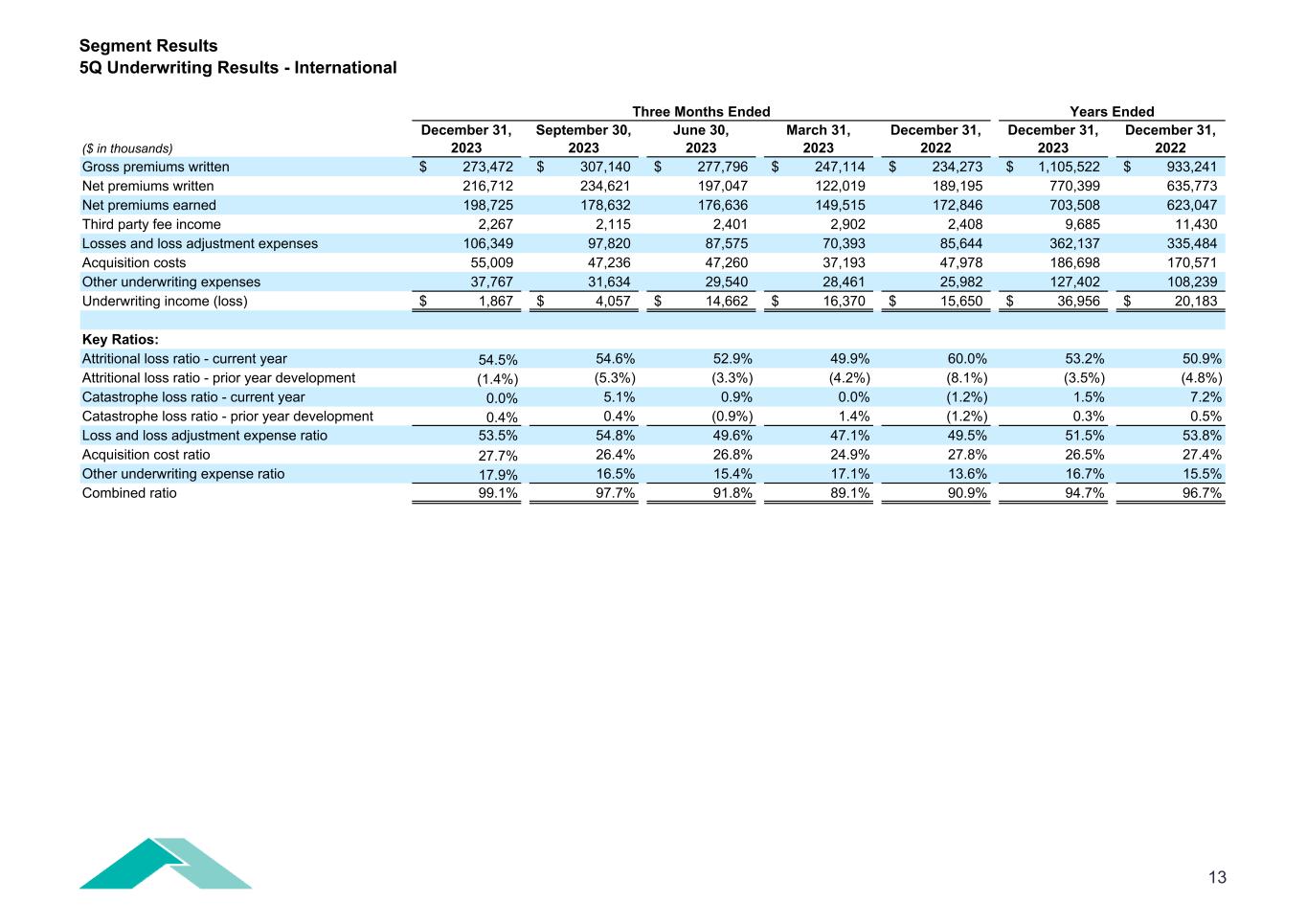

Segment Results 5Q Underwriting Results - International Years Ended ($ in thousands) December 31, 2023 September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 December 31, 2023 December 31, 2022 Gross premiums written 273,472$ 307,140$ 277,796$ 247,114$ 234,273$ 1,105,522$ 933,241$ Net premiums written 216,712 234,621 197,047 122,019 189,195 770,399 635,773 Net premiums earned 198,725 178,632 176,636 149,515 172,846 703,508 623,047 Third party fee income 2,267 2,115 2,401 2,902 2,408 9,685 11,430 Losses and loss adjustment expenses 106,349 97,820 87,575 70,393 85,644 362,137 335,484 Acquisition costs 55,009 47,236 47,260 37,193 47,978 186,698 170,571 Other underwriting expenses 37,767 31,634 29,540 28,461 25,982 127,402 108,239 Underwriting income (loss) 1,867$ 4,057$ 14,662$ 16,370$ 15,650$ 36,956$ 20,183$ Key Ratios: Attritional loss ratio - current year 54.5% 54.6% 52.9% 49.9% 60.0% 53.2% 50.9% Attritional loss ratio - prior year development (1.4%) (5.3%) (3.3%) (4.2%) (8.1%) (3.5%) (4.8%) Catastrophe loss ratio - current year 0.0% 5.1% 0.9% 0.0% (1.2%) 1.5% 7.2% Catastrophe loss ratio - prior year development 0.4% 0.4% (0.9%) 1.4% (1.2%) 0.3% 0.5% Loss and loss adjustment expense ratio 53.5% 54.8% 49.6% 47.1% 49.5% 51.5% 53.8% Acquisition cost ratio 27.7% 26.4% 26.8% 24.9% 27.8% 26.5% 27.4% Other underwriting expense ratio 17.9% 16.5% 15.4% 17.1% 13.6% 16.7% 15.5% Combined ratio 99.1% 97.7% 91.8% 89.1% 90.9% 94.7% 96.7% Three Months Ended 13

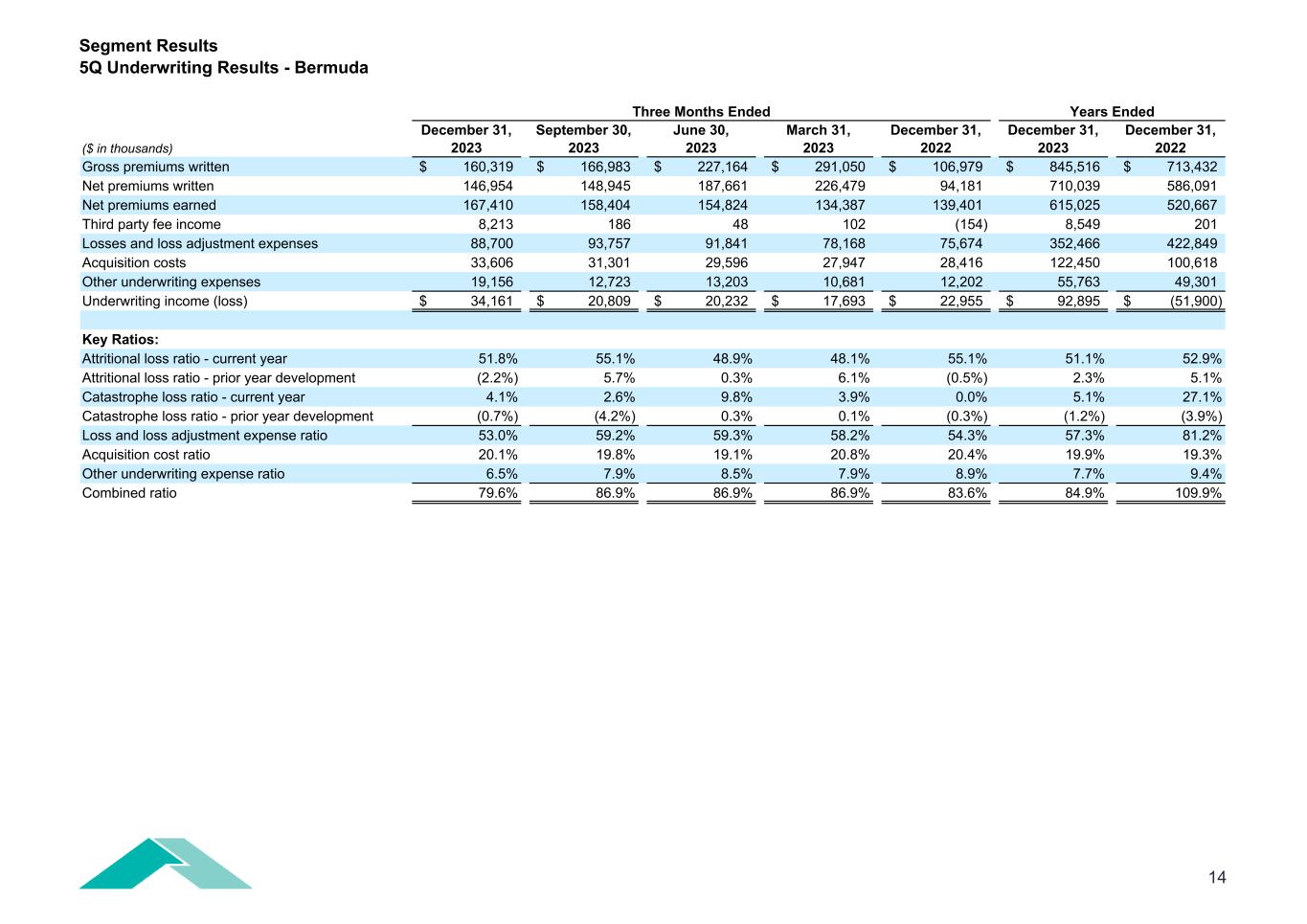

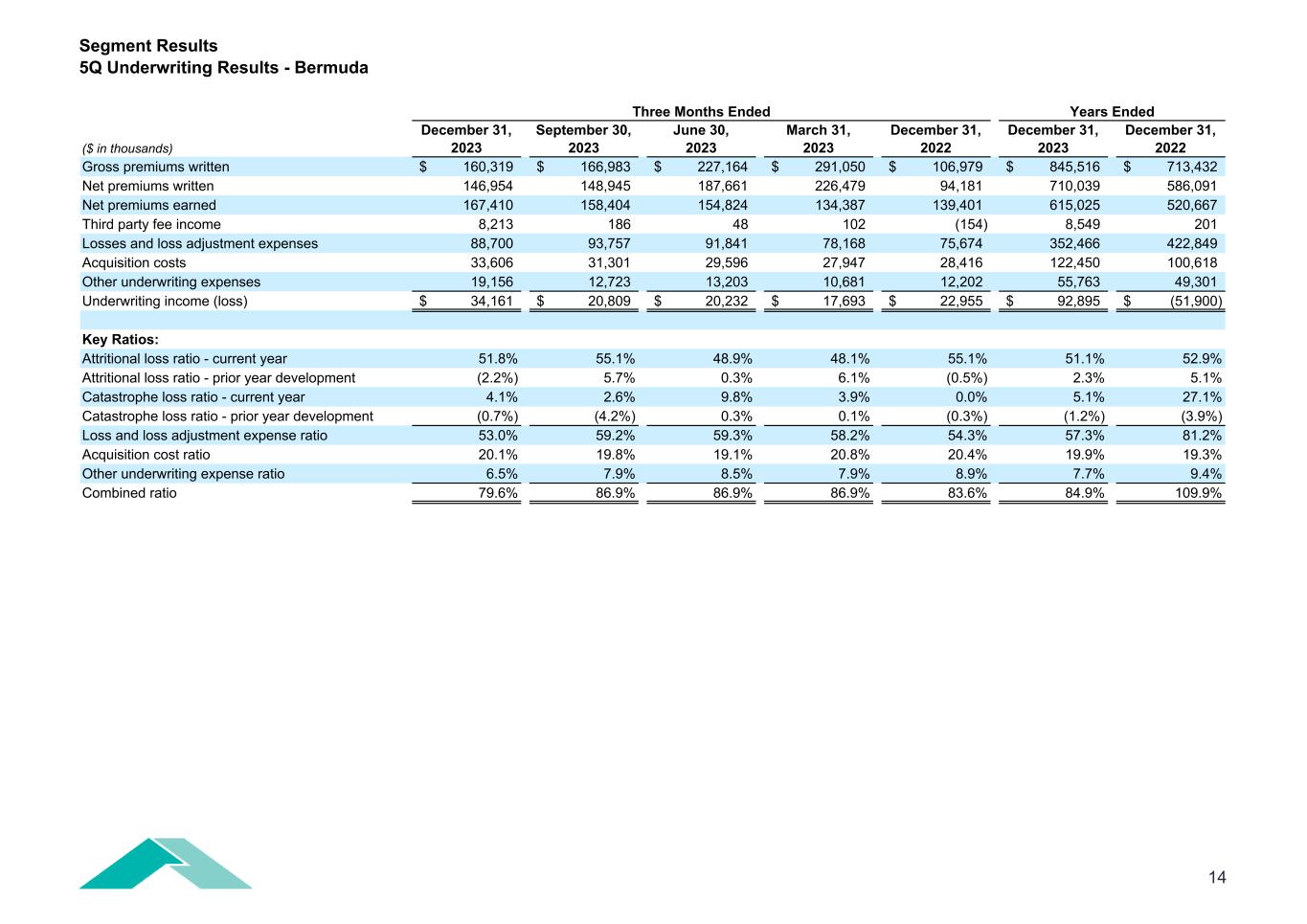

Segment Results 5Q Underwriting Results - Bermuda Years Ended ($ in thousands) December 31, 2023 September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 December 31, 2023 December 31, 2022 Gross premiums written 160,319$ 166,983$ 227,164$ 291,050$ 106,979$ 845,516$ 713,432$ Net premiums written 146,954 148,945 187,661 226,479 94,181 710,039 586,091 Net premiums earned 167,410 158,404 154,824 134,387 139,401 615,025 520,667 Third party fee income 8,213 186 48 102 (154) 8,549 201 Losses and loss adjustment expenses 88,700 93,757 91,841 78,168 75,674 352,466 422,849 Acquisition costs 33,606 31,301 29,596 27,947 28,416 122,450 100,618 Other underwriting expenses 19,156 12,723 13,203 10,681 12,202 55,763 49,301 Underwriting income (loss) 34,161$ 20,809$ 20,232$ 17,693$ 22,955$ 92,895$ (51,900)$ Key Ratios: Attritional loss ratio - current year 51.8% 55.1% 48.9% 48.1% 55.1% 51.1% 52.9% Attritional loss ratio - prior year development (2.2%) 5.7% 0.3% 6.1% (0.5%) 2.3% 5.1% Catastrophe loss ratio - current year 4.1% 2.6% 9.8% 3.9% 0.0% 5.1% 27.1% Catastrophe loss ratio - prior year development (0.7%) (4.2%) 0.3% 0.1% (0.3%) (1.2%) (3.9%) Loss and loss adjustment expense ratio 53.0% 59.2% 59.3% 58.2% 54.3% 57.3% 81.2% Acquisition cost ratio 20.1% 19.8% 19.1% 20.8% 20.4% 19.9% 19.3% Other underwriting expense ratio 6.5% 7.9% 8.5% 7.9% 8.9% 7.7% 9.4% Combined ratio 79.6% 86.9% 86.9% 86.9% 83.6% 84.9% 109.9% Three Months Ended 14

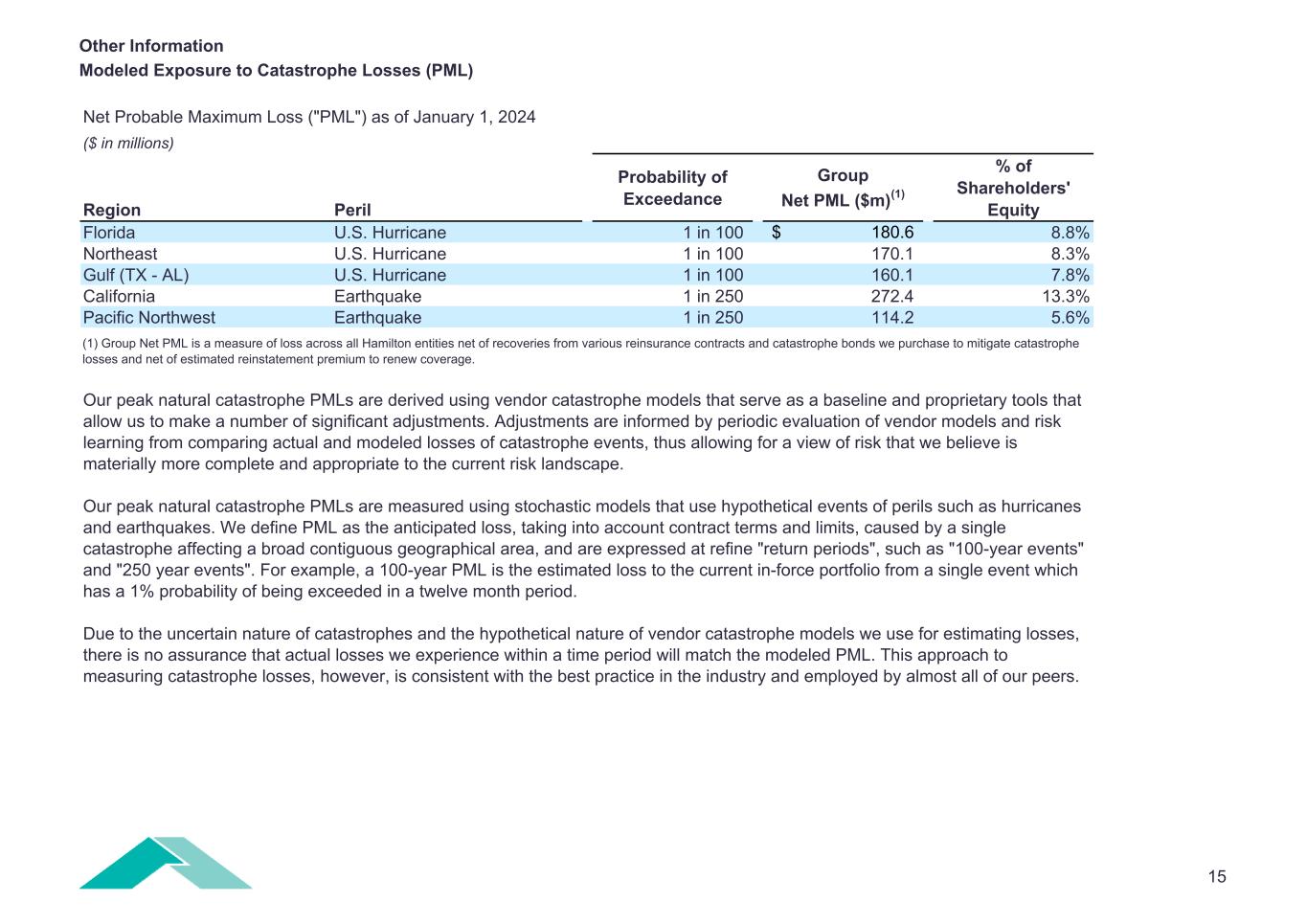

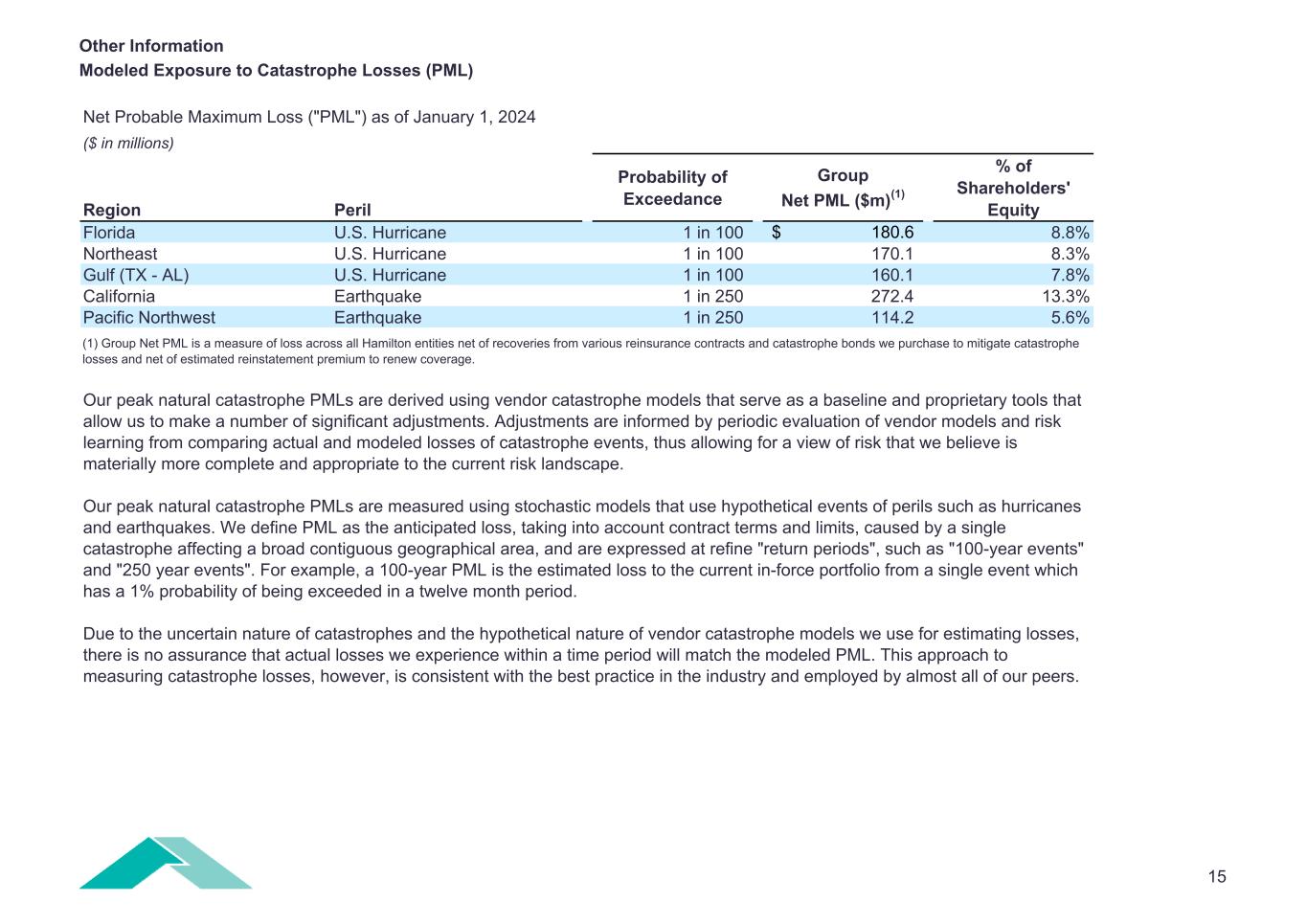

Other Information Modeled Exposure to Catastrophe Losses (PML) Net Probable Maximum Loss ("PML") as of January 1, 2024 ($ in millions) Region Peril Probability of Exceedance Group Net PML ($m)(1) % of Shareholders' Equity Florida U.S. Hurricane 1 in 100 180.6$ 8.8% Northeast U.S. Hurricane 1 in 100 170.1 8.3% Gulf (TX - AL) U.S. Hurricane 1 in 100 160.1 7.8% California Earthquake 1 in 250 272.4 13.3% Pacific Northwest Earthquake 1 in 250 114.2 5.6% (1) Group Net PML is a measure of loss across all Hamilton entities net of recoveries from various reinsurance contracts and catastrophe bonds we purchase to mitigate catastrophe losses and net of estimated reinstatement premium to renew coverage. Our peak natural catastrophe PMLs are derived using vendor catastrophe models that serve as a baseline and proprietary tools that allow us to make a number of significant adjustments. Adjustments are informed by periodic evaluation of vendor models and risk learning from comparing actual and modeled losses of catastrophe events, thus allowing for a view of risk that we believe is materially more complete and appropriate to the current risk landscape. Our peak natural catastrophe PMLs are measured using stochastic models that use hypothetical events of perils such as hurricanes and earthquakes. We define PML as the anticipated loss, taking into account contract terms and limits, caused by a single catastrophe affecting a broad contiguous geographical area, and are expressed at refine "return periods", such as "100-year events" and "250 year events". For example, a 100-year PML is the estimated loss to the current in-force portfolio from a single event which has a 1% probability of being exceeded in a twelve month period. Due to the uncertain nature of catastrophes and the hypothetical nature of vendor catastrophe models we use for estimating losses, there is no assurance that actual losses we experience within a time period will match the modeled PML. This approach to measuring catastrophe losses, however, is consistent with the best practice in the industry and employed by almost all of our peers. 15

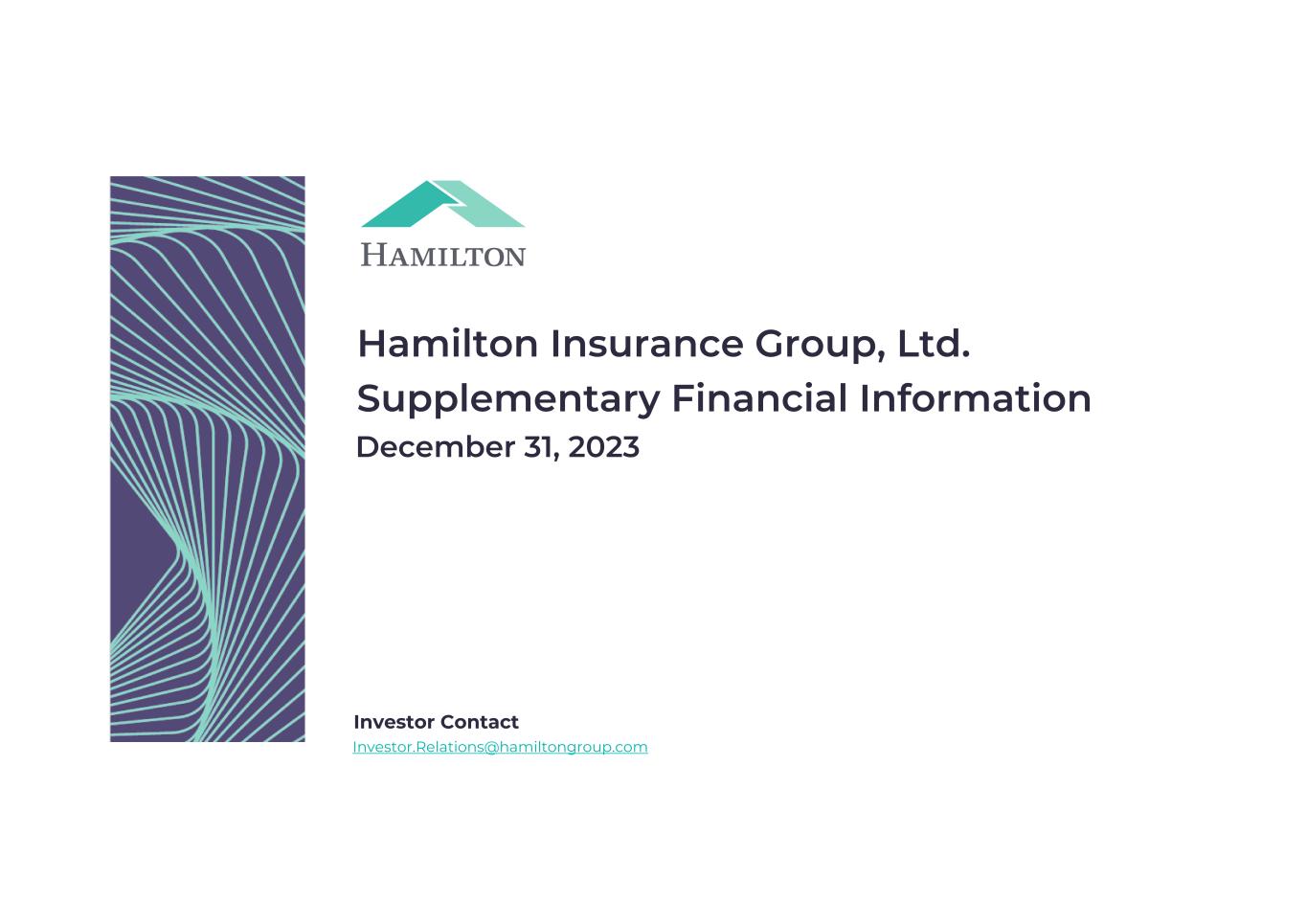

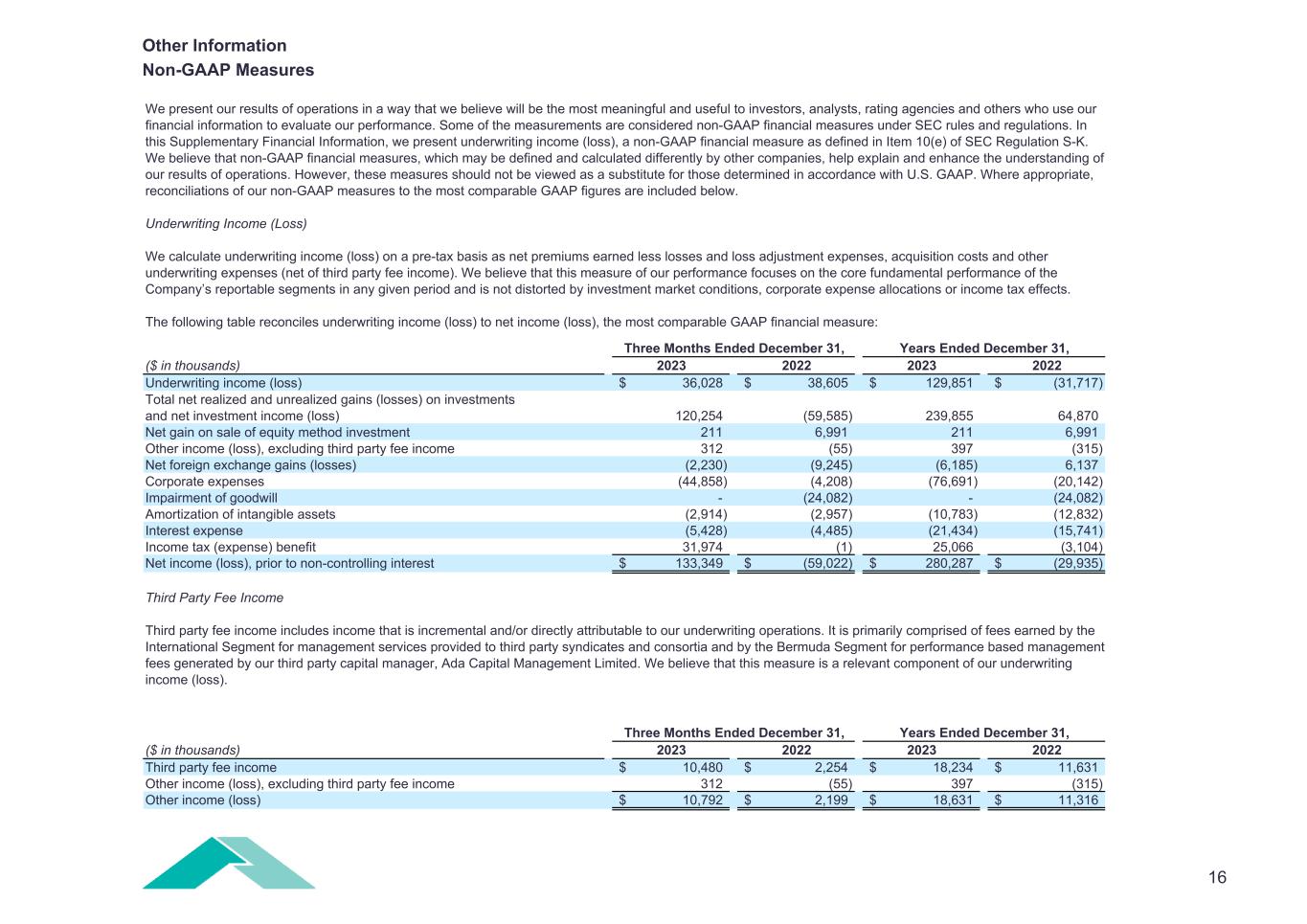

Other Information Non-GAAP Measures Three Months Ended December 31, ($ in thousands) 2023 2022 2023 2022 Underwriting income (loss) 36,028$ 38,605$ 129,851$ (31,717)$ Total net realized and unrealized gains (losses) on investments and net investment income (loss) 120,254 (59,585) 239,855 64,870 Net gain on sale of equity method investment 211 6,991 211 6,991 Other income (loss), excluding third party fee income 312 (55) 397 (315) Net foreign exchange gains (losses) (2,230) (9,245) (6,185) 6,137 Corporate expenses (44,858) (4,208) (76,691) (20,142) Impairment of goodwill - (24,082) - (24,082) Amortization of intangible assets (2,914) (2,957) (10,783) (12,832) Interest expense (5,428) (4,485) (21,434) (15,741) Income tax (expense) benefit 31,974 (1) 25,066 (3,104) Net income (loss), prior to non-controlling interest 133,349$ (59,022)$ 280,287$ (29,935)$ Three Months Ended December 31, ($ in thousands) 2023 2022 2023 2022 Third party fee income 10,480$ 2,254$ 18,234$ 11,631$ Other income (loss), excluding third party fee income 312 (55) 397 (315) Other income (loss) 10,792$ 2,199$ 18,631$ 11,316$ Third Party Fee Income Third party fee income includes income that is incremental and/or directly attributable to our underwriting operations. It is primarily comprised of fees earned by the International Segment for management services provided to third party syndicates and consortia and by the Bermuda Segment for performance based management fees generated by our third party capital manager, Ada Capital Management Limited. We believe that this measure is a relevant component of our underwriting income (loss). We present our results of operations in a way that we believe will be the most meaningful and useful to investors, analysts, rating agencies and others who use our financial information to evaluate our performance. Some of the measurements are considered non-GAAP financial measures under SEC rules and regulations. In this Supplementary Financial Information, we present underwriting income (loss), a non-GAAP financial measure as defined in Item 10(e) of SEC Regulation S-K. We believe that non-GAAP financial measures, which may be defined and calculated differently by other companies, help explain and enhance the understanding of our results of operations. However, these measures should not be viewed as a substitute for those determined in accordance with U.S. GAAP. Where appropriate, reconciliations of our non-GAAP measures to the most comparable GAAP figures are included below. Underwriting Income (Loss) We calculate underwriting income (loss) on a pre-tax basis as net premiums earned less losses and loss adjustment expenses, acquisition costs and other underwriting expenses (net of third party fee income). We believe that this measure of our performance focuses on the core fundamental performance of the Company’s reportable segments in any given period and is not distorted by investment market conditions, corporate expense allocations or income tax effects. The following table reconciles underwriting income (loss) to net income (loss), the most comparable GAAP financial measure: Years Ended December 31, Years Ended December 31, 16

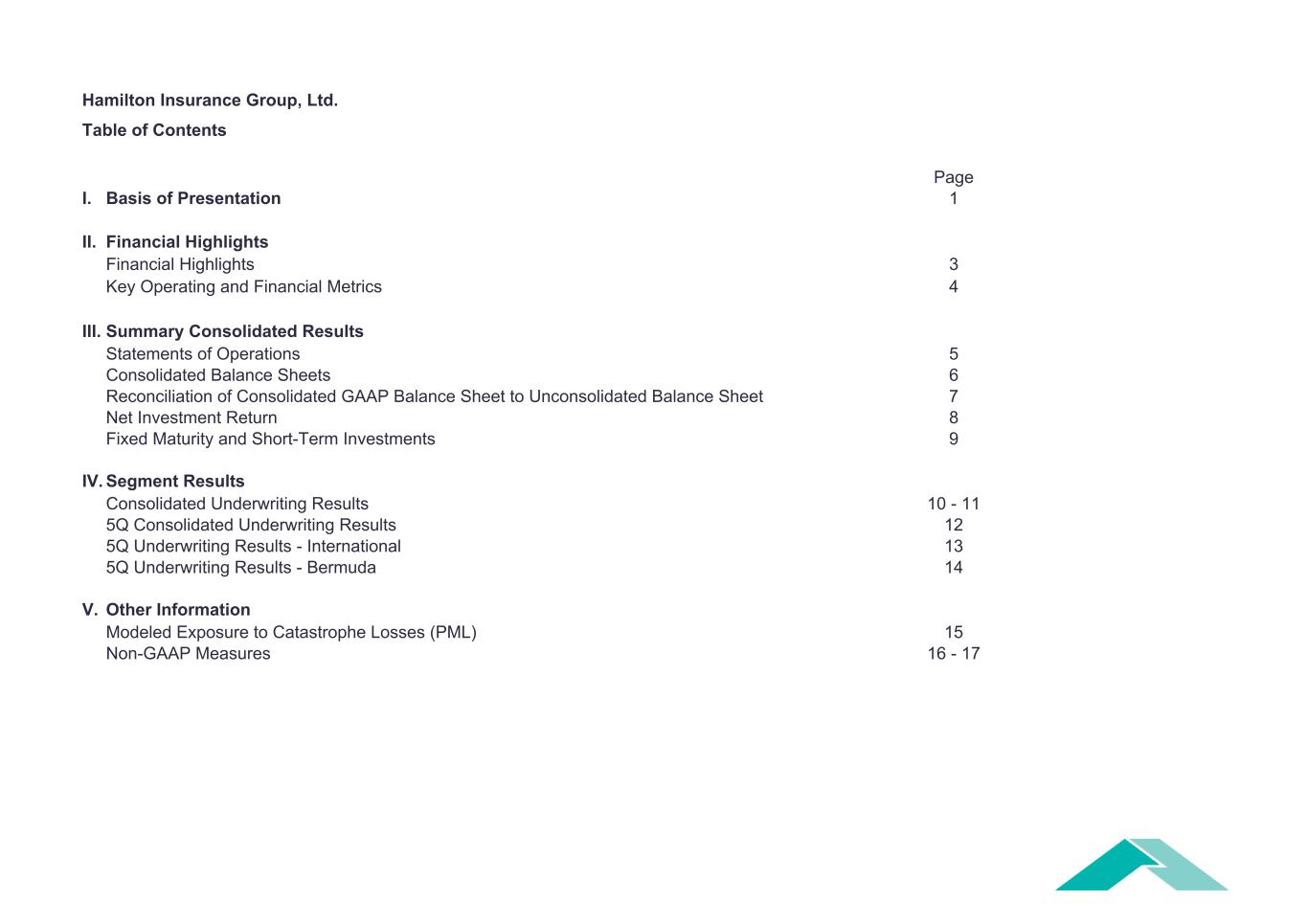

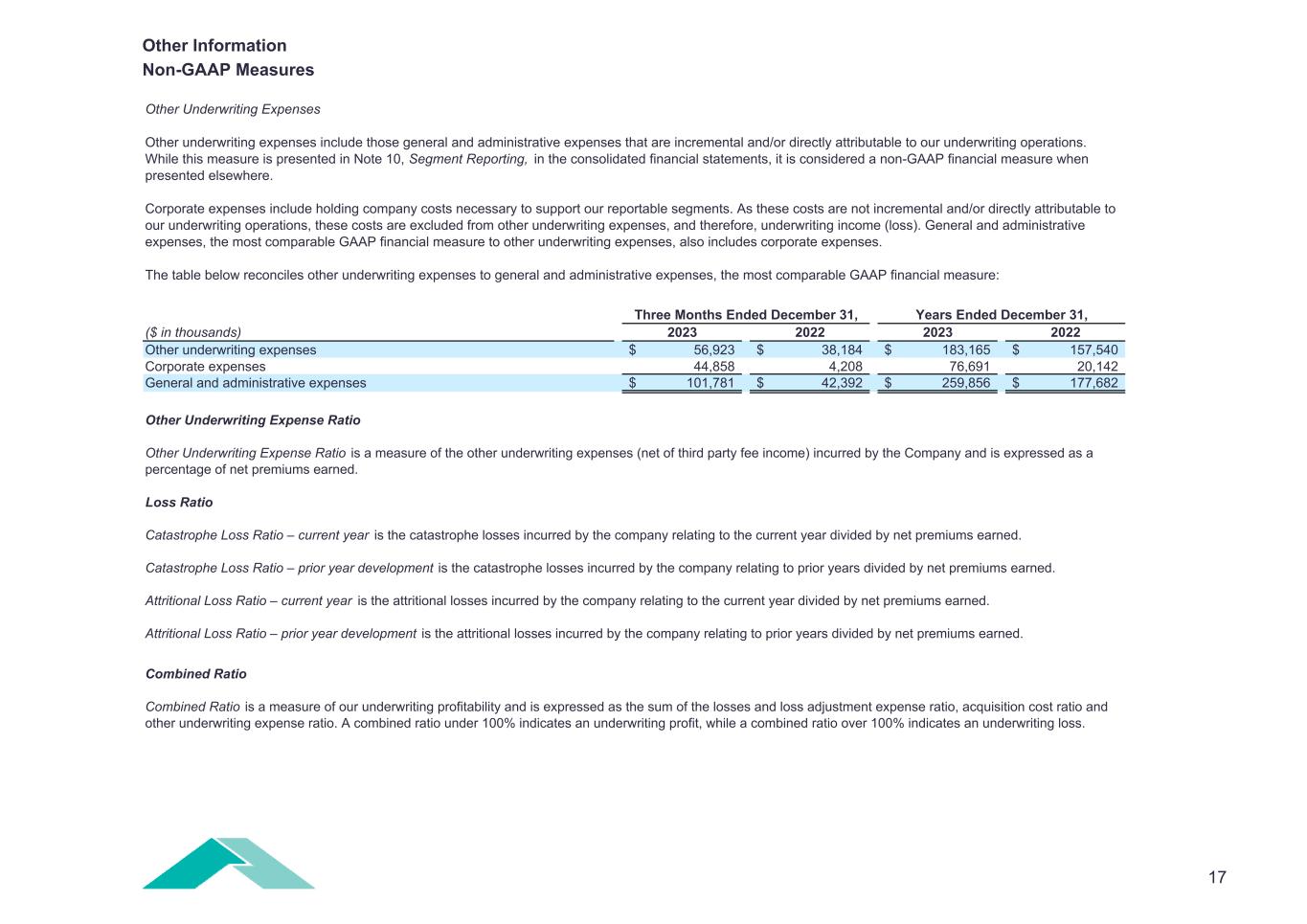

Other Information Non-GAAP Measures Three Months Ended December 31, ($ in thousands) 2023 2022 2023 2022 Other underwriting expenses 56,923$ 38,184$ 183,165$ 157,540$ Corporate expenses 44,858 4,208 76,691 20,142 General and administrative expenses 101,781$ 42,392$ 259,856$ 177,682$ Other Underwriting Expense Ratio Other Underwriting Expense Ratio is a measure of the other underwriting expenses (net of third party fee income) incurred by the Company and is expressed as a percentage of net premiums earned. Loss Ratio Catastrophe Loss Ratio – current year is the catastrophe losses incurred by the company relating to the current year divided by net premiums earned. Catastrophe Loss Ratio – prior year development is the catastrophe losses incurred by the company relating to prior years divided by net premiums earned. Attritional Loss Ratio – current year is the attritional losses incurred by the company relating to the current year divided by net premiums earned. Attritional Loss Ratio – prior year development is the attritional losses incurred by the company relating to prior years divided by net premiums earned. Other Underwriting Expenses Other underwriting expenses include those general and administrative expenses that are incremental and/or directly attributable to our underwriting operations. While this measure is presented in Note 10, Segment Reporting, in the consolidated financial statements, it is considered a non-GAAP financial measure when presented elsewhere. Corporate expenses include holding company costs necessary to support our reportable segments. As these costs are not incremental and/or directly attributable to our underwriting operations, these costs are excluded from other underwriting expenses, and therefore, underwriting income (loss). General and administrative expenses, the most comparable GAAP financial measure to other underwriting expenses, also includes corporate expenses. The table below reconciles other underwriting expenses to general and administrative expenses, the most comparable GAAP financial measure: Years Ended December 31, Combined Ratio Combined Ratio is a measure of our underwriting profitability and is expressed as the sum of the losses and loss adjustment expense ratio, acquisition cost ratio and other underwriting expense ratio. A combined ratio under 100% indicates an underwriting profit, while a combined ratio over 100% indicates an underwriting loss. 17