Investor Presentation Hamilton Insurance Group, Ltd. December 31, 2023

2 Special Note Regarding Forward-Looking Statements This information may contain forward-looking statements which reflect the Company's current views with respect to future events and financial performance and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward- looking statements are made based on management's current expectations and beliefs concerning future developments and their potential effects upon Hamilton. There can be no assurance that future developments affecting Hamilton will be those anticipated by management. Forward-looking statements include, without limitation, all matters that are not historical facts. These forward-looking statements are not a guarantee of future performance and involve risk and uncertainties, and there are certain important factors that could cause actual results to differ, possibly materially, from expectations or estimates reflected in such forward-looking statements, including the following: • our results of operations and financial condition could be adversely affected by unpredictable catastrophic events, global climate change or emerging claim and coverage issues; • our business could be materially adversely affected if we do not accurately assess our underwriting risk, our reserves are inadequate to cover our actual losses, our models or assessments and pricing of risks are incorrect or we lose important broker relationships; • the insurance and reinsurance business is historically cyclical and the pricing and terms for our products may decline, which would affect our profitability and ability to maintain or grow premiums; • we have significant foreign operations that expose us to certain additional risks, including foreign currency risks and political risk; • we do not control the allocations to and/or the performance of the Two Sigma Hamilton Fund, LLC ("TS Hamilton Fund")’s investment portfolio, and its performance depends on the ability of its investment manager, Two Sigma, to select and manage appropriate investments and we have a limited ability to withdraw our capital accounts; • Two Sigma Principals, LLC, Two Sigma and their respective affiliates have potential conflicts of interest that could adversely affect us; • the historical performance of Two Sigma Investments, LP ("Two Sigma") is not necessarily indicative of the future results of the TS Hamilton Fund’s investment portfolio or of our future results; • our ability to manage risks associated with macroeconomic conditions resulting from geopolitical and global economic events, including public health crises, current or anticipated military conflicts, terrorism, sanctions, rising energy prices, inflation and interest rates and other global events; • our ability to compete successfully with more established competitors and risks relating to consolidation in the reinsurance and insurance industries; • downgrades, potential downgrades or other negative actions by rating agencies;

3 • our dependence on key executives, including the potential loss of Bermudian personnel as a result of Bermuda employment restrictions, and the inability to attract qualified personnel, particularly in very competitive hiring conditions; • our dependence on letter of credit facilities that may not be available on commercially acceptable terms; • our potential need for additional capital in the future and the potential unavailability of such capital to us on favorable terms or at all; • the suspension or revocation of our subsidiaries’ insurance licenses; • risks associated with our investment strategy, including such risks being greater than those faced by competitors; • changes in the regulatory environment and the potential for greater regulatory scrutiny of the Company going forward; • a cyclical downturn of the reinsurance industry; • operational failures, failure of information systems or failure to protect the confidentiality of customer information, including by service providers, or losses due to defaults, errors or omissions by third parties or our affiliates; • we are a holding company with no direct operations, and our insurance and reinsurance subsidiaries’ ability to pay dividends and other distributions to us is restricted by law; • risks relating to our ability to identify and execute opportunities for growth or our ability to complete transactions as planned or realize the anticipated benefits of our acquisitions or other investments; • our potentially becoming subject to U.S. federal income taxation, Bermuda taxation or other taxes as a result of a change of tax laws or otherwise; • the potential characterization of us and/or any of our subsidiaries as a passive foreign investment company, or PFIC; • our potentially becoming subject to U.S. withholding and information reporting requirements under the U.S. Foreign Account Tax Compliance Act, or FATCA, provisions; • our costs will increase as a result of operating as a public company, and our management will be required to devote substantial time to complying with public company regulations; • if we were to identify a material weakness and were unable to remediate such material weakness, or fail to achieve and maintain effective internal controls, our operating results and financial condition could be impacted and the market price of our Class B common shares may be negatively affected; • the lack of a prior public market for our Class B common shares means our share price may be volatile and anti-takeover provisions contained in our organizational documents could delay management changes; • the potential that the market price of our Class B common shares could decline due to future sales of shares by our existing shareholders; • applicable insurance laws, which could make it difficult to effect a change of control of our company; • investors may have difficulties in serving process or enforcing judgments against us in the United States; and • other factors affecting future results disclosed in the Company’s filing with the SEC, including the Form 10-K. Special Note Regarding Forward-Looking Statements, continued

Introduction to Hamilton

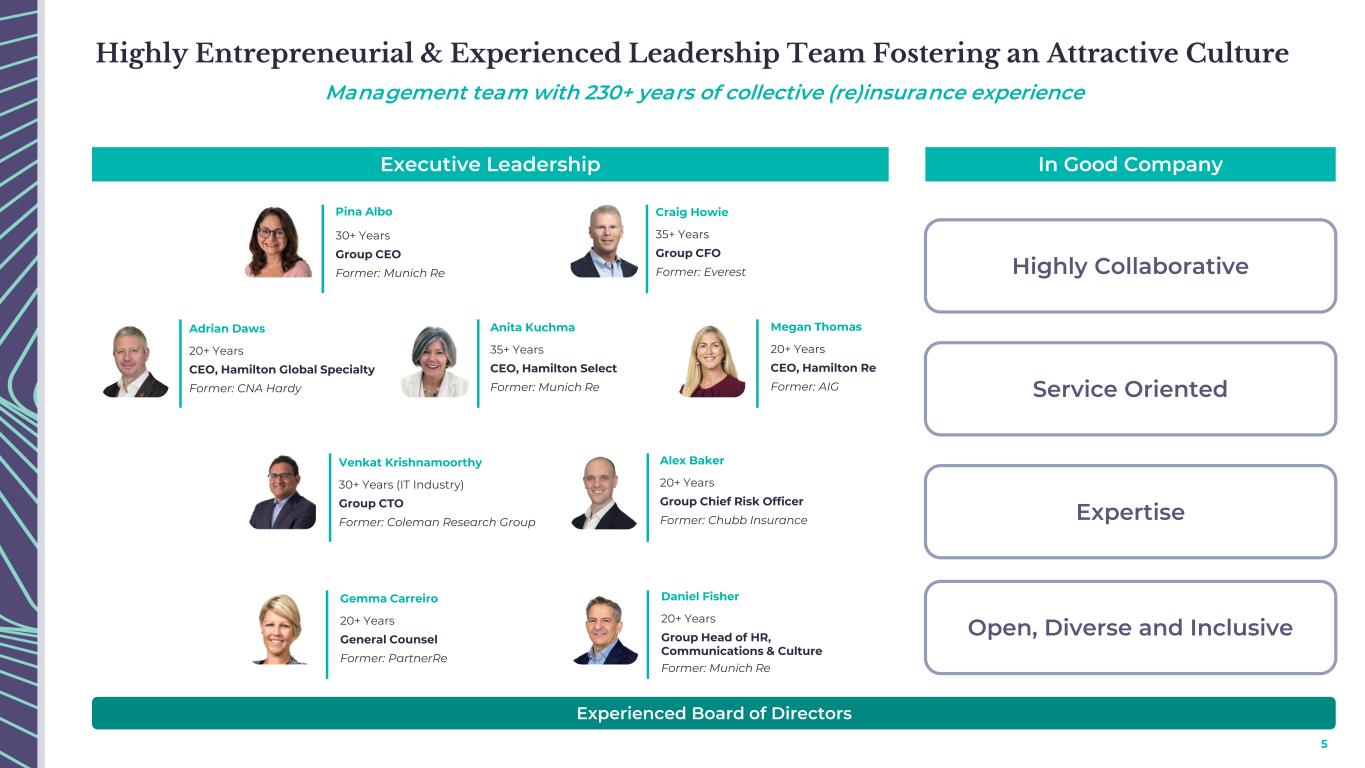

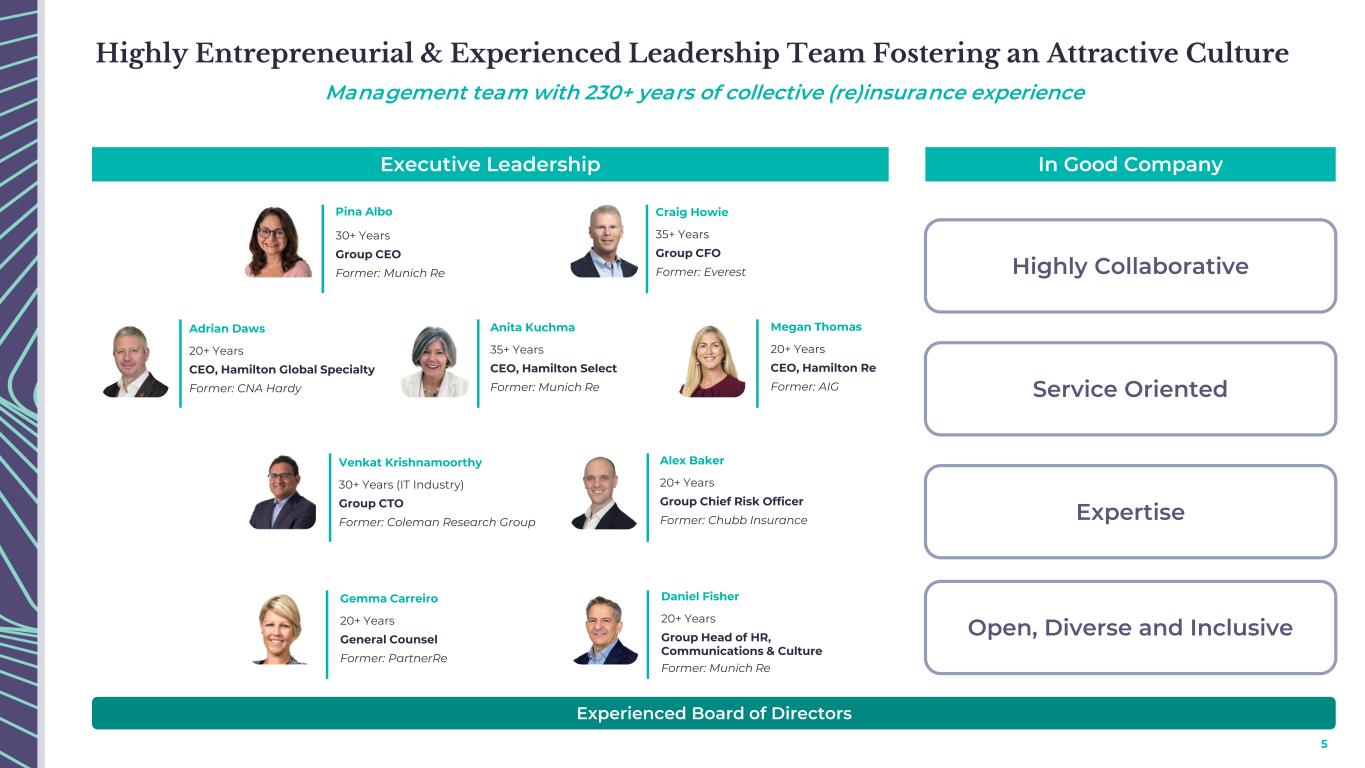

5 Highly Entrepreneurial & Experienced Leadership Team Fostering an Attractive Culture Gemma Carreiro 20+ Years General Counsel Former: PartnerRe Pina Albo 30+ Years Group CEO Former: Munich Re Megan Thomas 20+ Years CEO, Hamilton Re Former: AIG Venkat Krishnamoorthy 30+ Years (IT Industry) Group CTO Former: Coleman Research Group Craig Howie 35+ Years Group CFO Former: Everest Anita Kuchma 35+ Years CEO, Hamilton Select Former: Munich Re Alex Baker 20+ Years Group Chief Risk Officer Former: Chubb Insurance Adrian Daws 20+ Years CEO, Hamilton Global Specialty Former: CNA Hardy Daniel Fisher 20+ Years Group Head of HR, Communications & Culture Former: Munich Re Executive Leadership In Good Company Management team with 230+ years of collective (re)insurance experience Highly Collaborative Service Oriented Open, Diverse and Inclusive Expertise Experienced Board of Directors

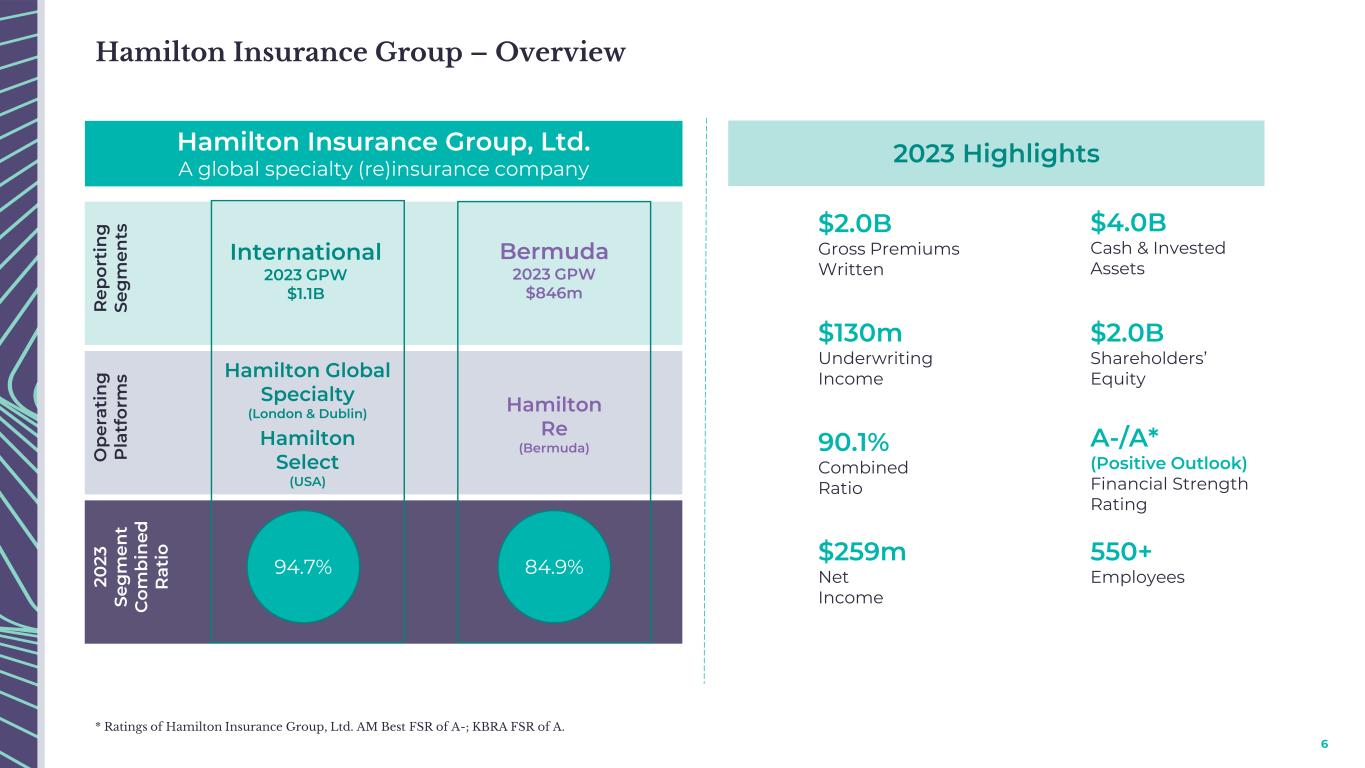

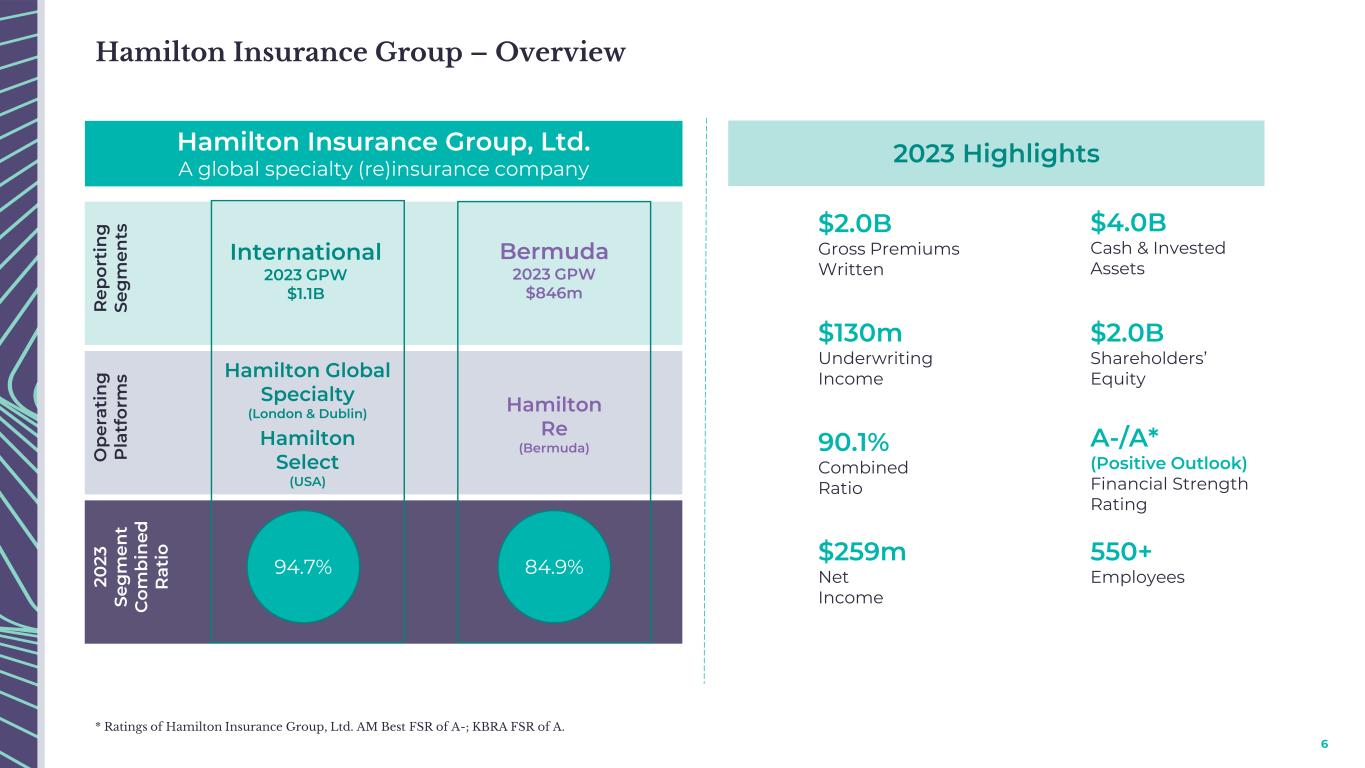

6 Hamilton Insurance Group – Overview Hamilton Insurance Group, Ltd. A global specialty (re)insurance company R e p o rt in g S e g m e n ts International 2023 GPW $1.1B Bermuda 2023 GPW $846m Hamilton Global Specialty (London & Dublin) Hamilton Select (USA) Hamilton Re (Bermuda)O p e ra ti n g P la tf o rm s 20 23 S e g m e n t C o m b in e d R at io 94.7% 84.9% 2023 Highlights $2.0B Gross Premiums Written $130m Underwriting Income 90.1% Combined Ratio $259m Net Income $4.0B Cash & Invested Assets $2.0B Shareholders’ Equity 550+ Employees A-/A* (Positive Outlook) Financial Strength Rating * Ratings of Hamilton Insurance Group, Ltd. AM Best FSR of A-; KBRA FSR of A.

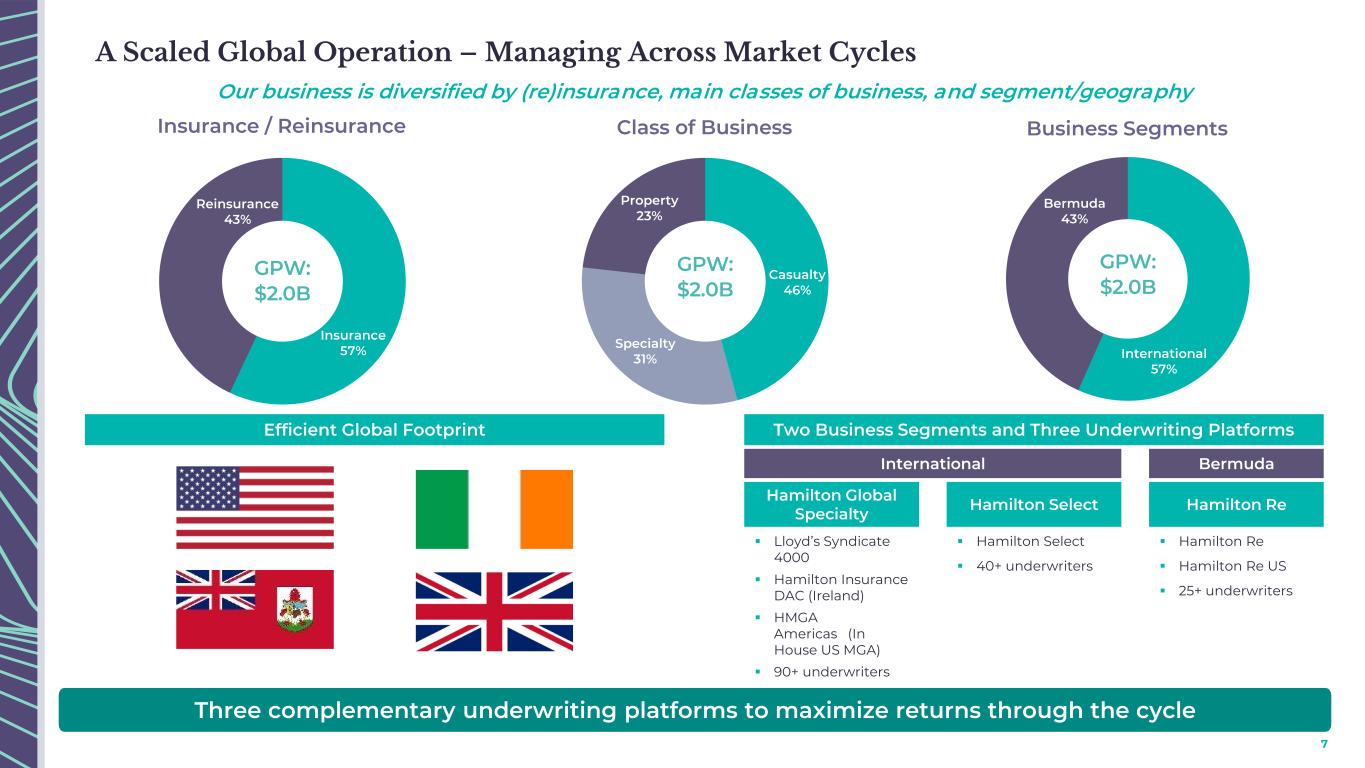

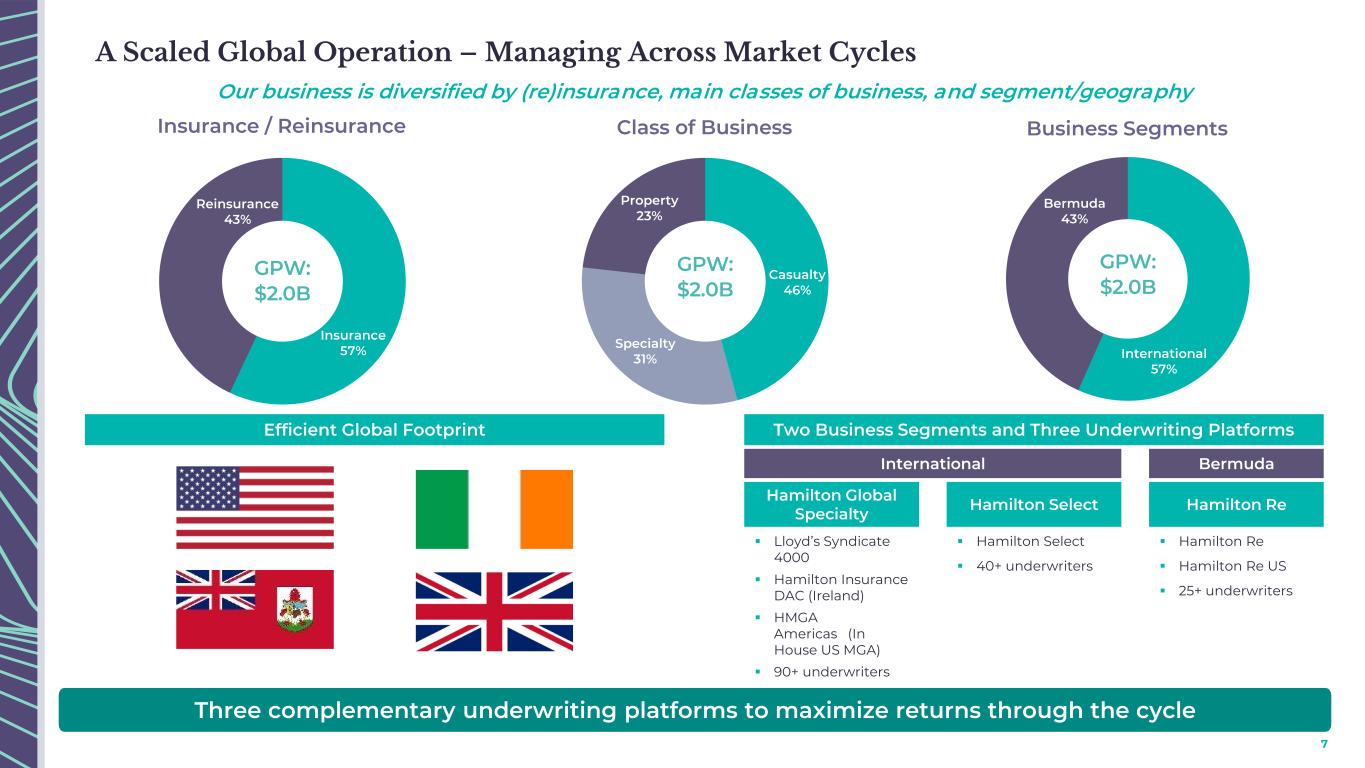

7 ▪ Lloyd’s Syndicate 4000 ▪ Hamilton Insurance DAC (Ireland) ▪ HMGA Americas (In House US MGA) ▪ 90+ underwriters Insurance 57% Reinsurance 43% Insurance / Reinsurance GPW: $2.0B Casualty 46% Specialty 31% Property 23% Class of Business GPW: $2.0B International 57% Bermuda 43% Business Segments GPW: $2.0B Efficient Global Footprint A Scaled Global Operation – Managing Across Market Cycles Our business is diversified by (re)insurance, main classes of business, and segment/geography Two Business Segments and Three Underwriting Platforms Hamilton Global Specialty Hamilton Select Hamilton Re ▪ Hamilton Select ▪ 40+ underwriters ▪ Hamilton Re ▪ Hamilton Re US ▪ 25+ underwriters International Bermuda Three complementary underwriting platforms to maximize returns through the cycle

8 Hamilton is Guided by Four Business Imperatives • Data driven, disciplined underwriting & risk-management culture • Significant reduction of volatility from natural catastrophe events Sustainable Underwriting Profitability • 3 complementary underwriting platforms with expertise in cycle management • Double digit growth every year since 2018 reflecting cycle dynamicsStrategic Growth • Combination of proprietary and partner technology solutions • Enable data informed decisions, operational efficiency and digital automationTechnology Enablement • Attracting and retaining top talent in a highly competitive marketplace • Collaborative culture with high accountability and ownership mentalityMagnet for Talent You’re “In good company” with Hamilton 1 2 3 4

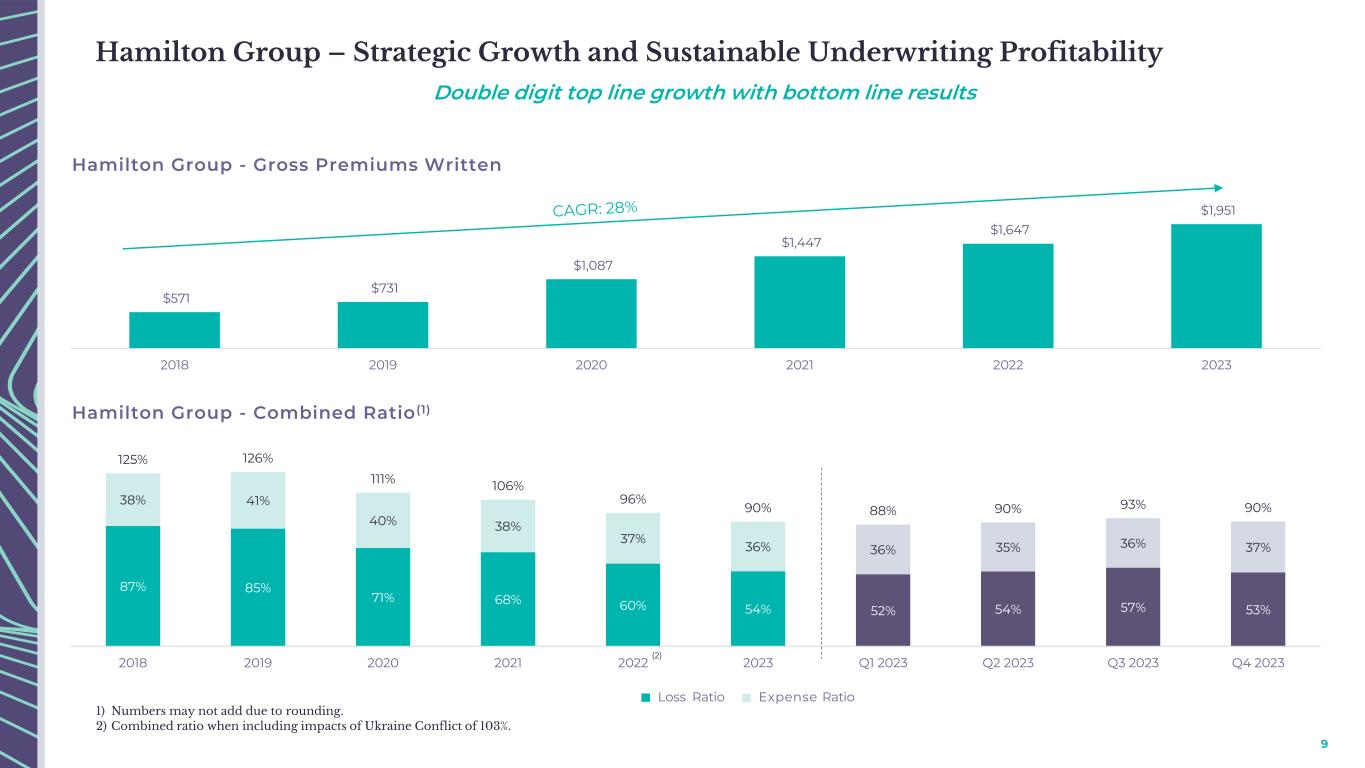

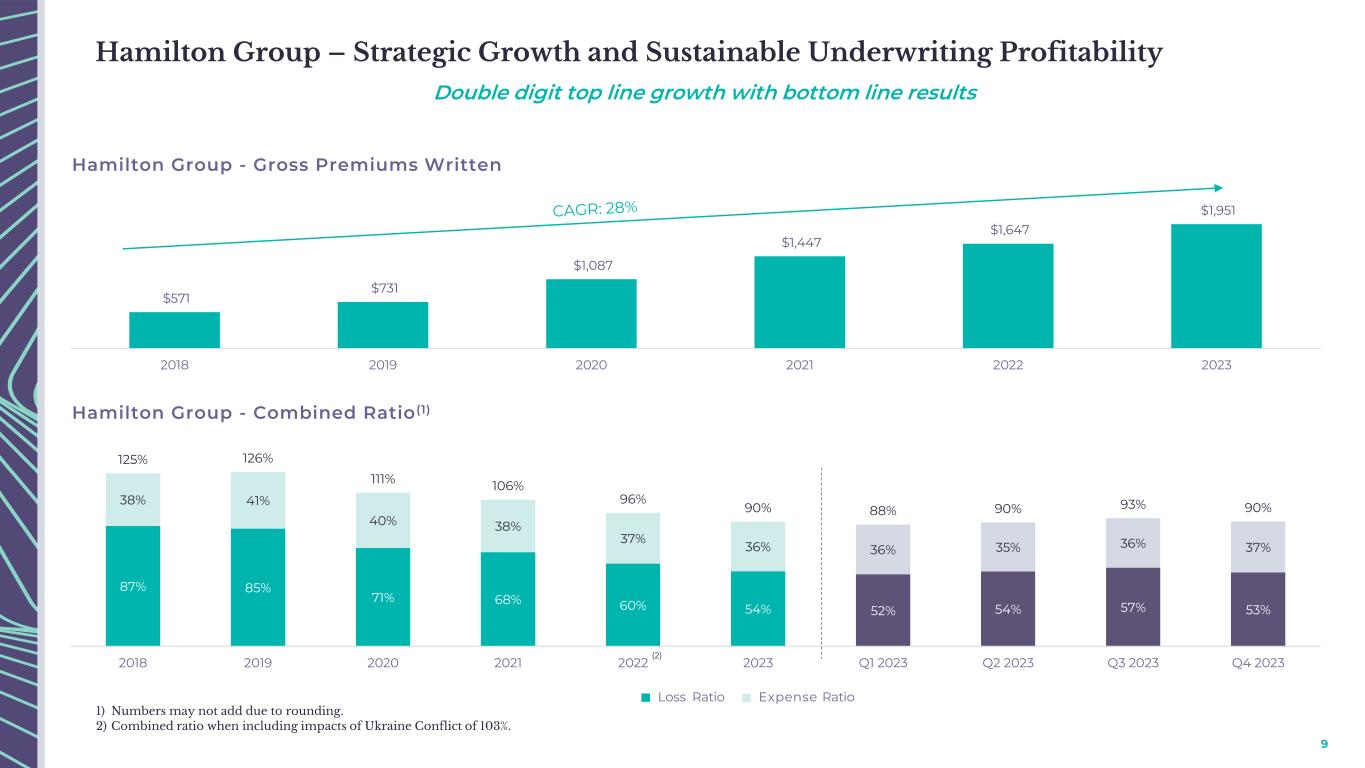

9 87% 85% 71% 68% 60% 54% 52% 54% 57% 53% 38% 41% 40% 38% 37% 36% 36% 35% 36% 37% 125% 126% 111% 106% 96% 90% 88% 90% 93% 90% 2018 2019 2020 2021 2022 2023 Q1 2023 Q2 2023 Q3 2023 Q4 2023 $571 $731 $1,087 $1,447 $1,647 $1,951 2018 2019 2020 2021 2022 2023 Hamilton Group – Strategic Growth and Sustainable Underwriting Profitability Hamilton Group - Gross Premiums Written Hamilton Group - Combined Ratio (1) Loss Ratio Expense Ratio (2) 1) Numbers may not add due to rounding. 2) Combined ratio when including impacts of Ukraine Conflict of 103%. Double digit top line growth with bottom line results

Segment Results

11 Hamilton International: Market Leading Writer of Specialty (Re)Insurance Business Specialty insurance products written in Lloyd’s, HIDAC, Hamilton Americas and Hamilton Select 12% 45% 43% Property Casualty Specialty 2023 GPW Business Mix 90% 10% Insurance Reinsurance $1.1B Leading specialty insurance business with a track record of profitability and low volatility Specialized underwriters leading consortia on behalf of other brand name peers Ability to offer both Lloyd’s and company paper across multiple platforms Longstanding client & broker relationships fuel growth in core E&S markets Limited legacy exposures Hamilton Select: New US domiciled carrier writing SME hard-to-place E&S business Hamilton Select $78m / 7%

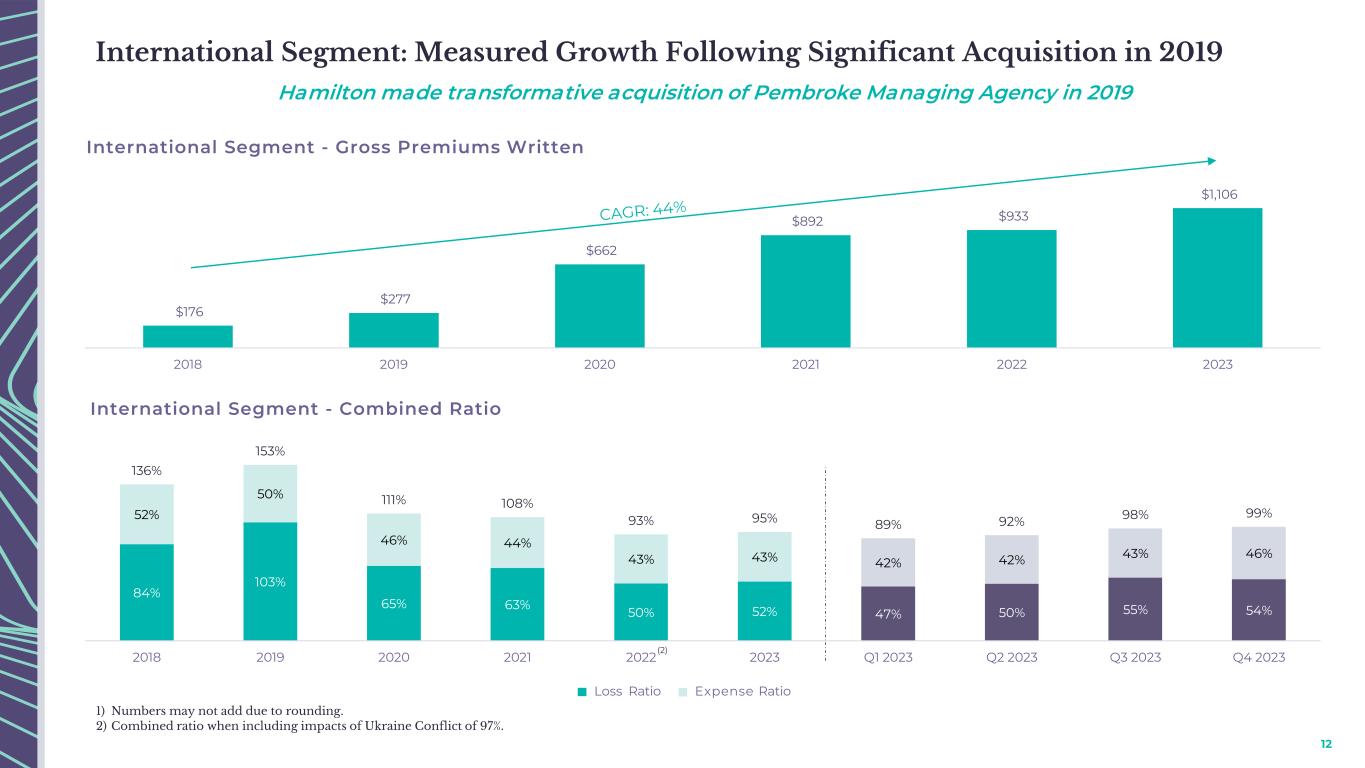

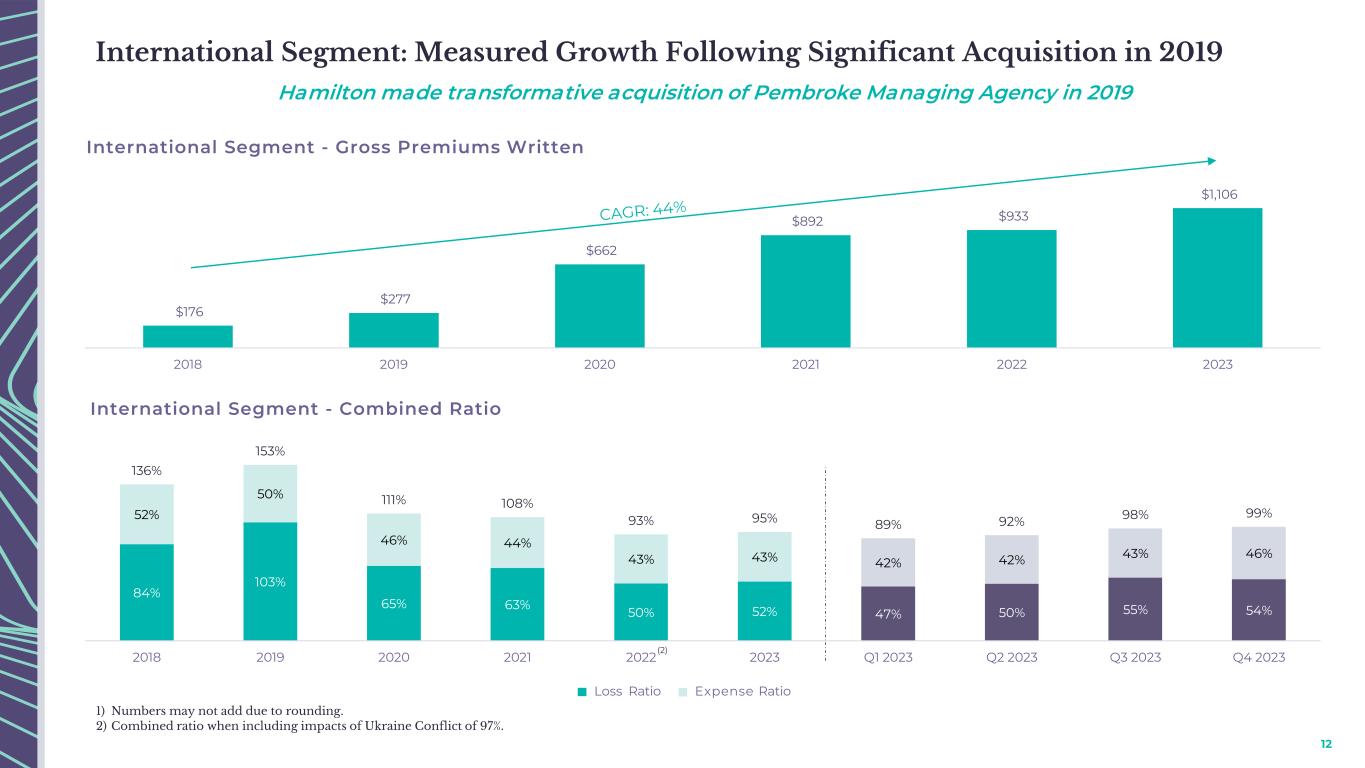

12 84% 103% 65% 63% 50% 52% 47% 50% 55% 54% 52% 50% 46% 44% 43% 43% 42% 42% 43% 46% 136% 153% 111% 108% 93% 95% 89% 92% 98% 99% 2018 2019 2020 2021 2022 2023 Q1 2023 Q2 2023 Q3 2023 Q4 2023 (2) Hamilton made transformative acquisition of Pembroke Managing Agency in 2019 International Segment: Measured Growth Following Significant Acquisition in 2019 $176 $277 $662 $892 $933 $1,106 2018 2019 2020 2021 2022 2023 International Segment - Gross Premiums Written International Segment - Combined Ratio Loss Ratio Expense Ratio 1) Numbers may not add due to rounding. 2) Combined ratio when including impacts of Ukraine Conflict of 97%.

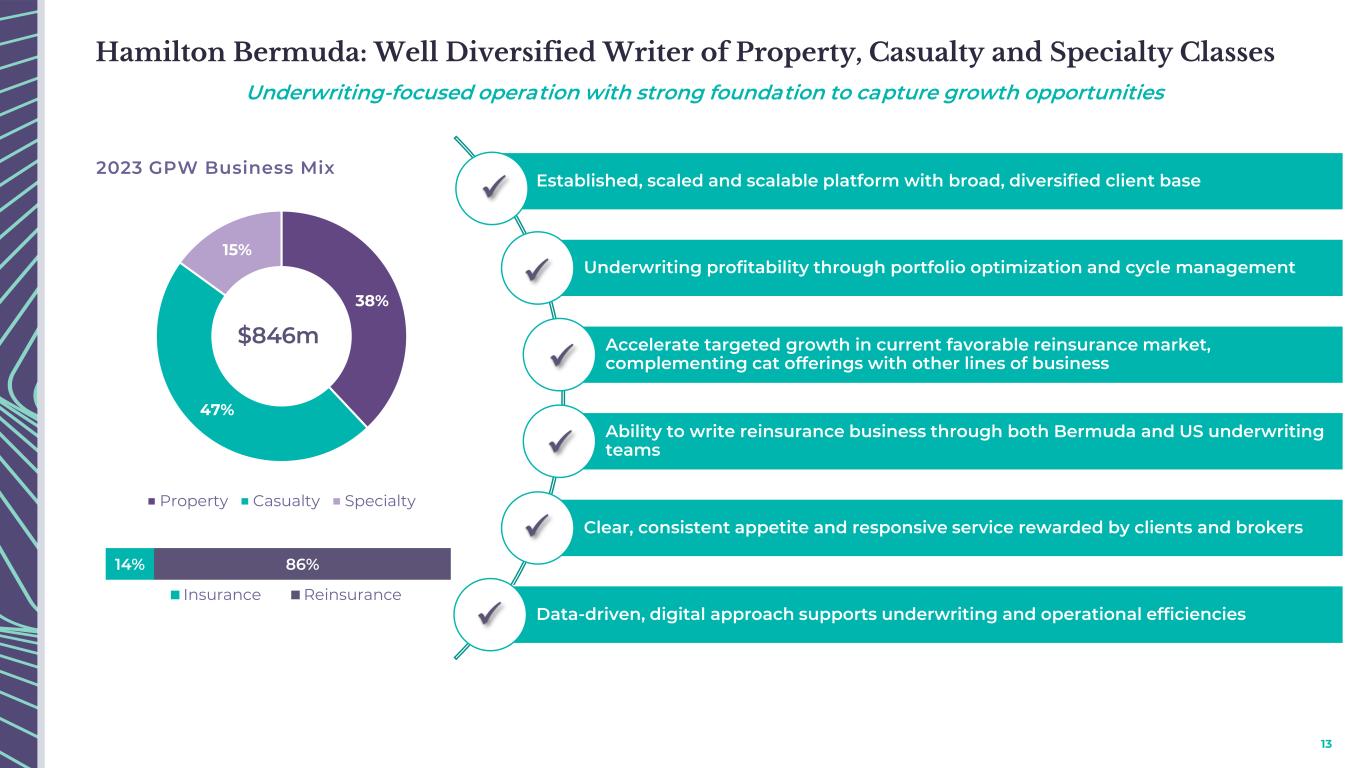

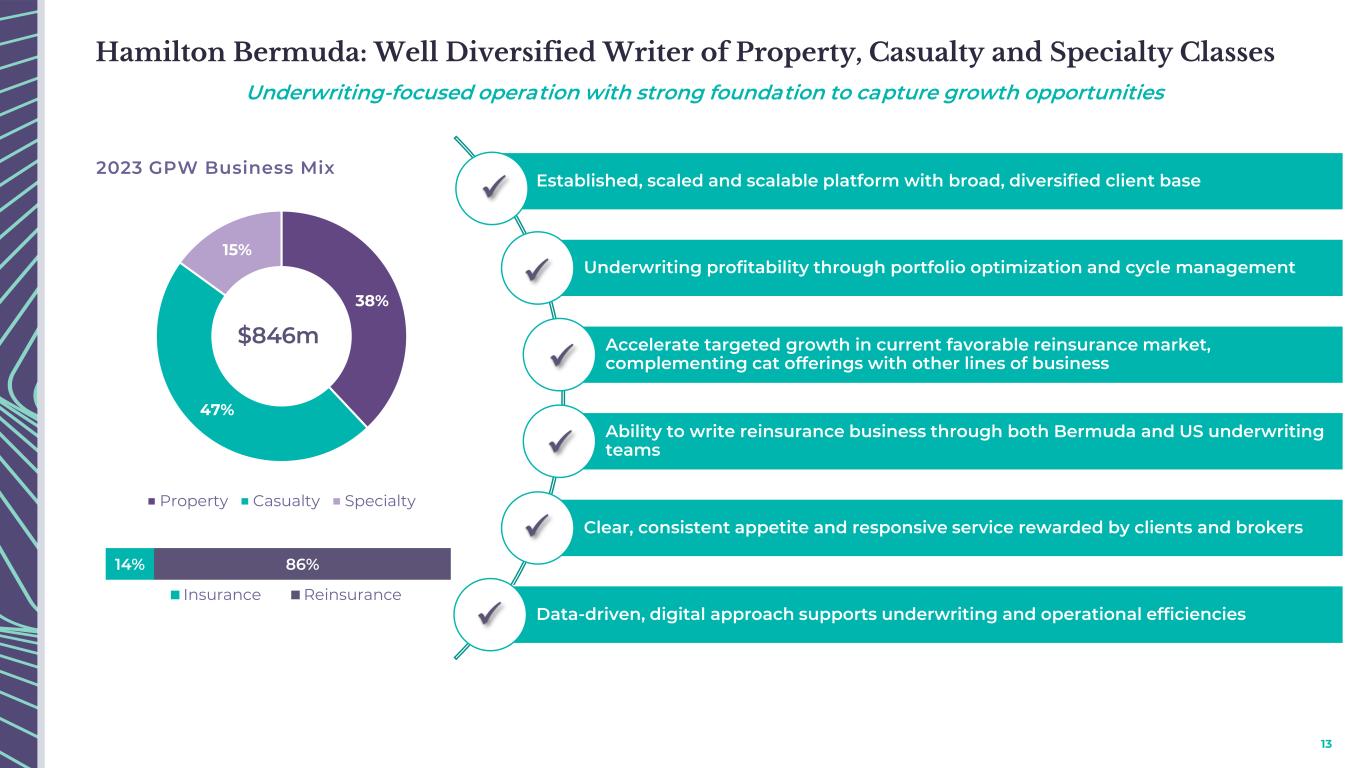

13 Established, scaled and scalable platform with broad, diversified client base Underwriting profitability through portfolio optimization and cycle management Accelerate targeted growth in current favorable reinsurance market, complementing cat offerings with other lines of business Ability to write reinsurance business through both Bermuda and US underwriting teams Clear, consistent appetite and responsive service rewarded by clients and brokers Data-driven, digital approach supports underwriting and operational efficiencies Hamilton Bermuda: Well Diversified Writer of Property, Casualty and Specialty Classes Underwriting-focused operation with strong foundation to capture growth opportunities 38% 47% 15% Property Casualty Specialty 14% 86% Insurance Reinsurance 2023 GPW Business Mix $846m

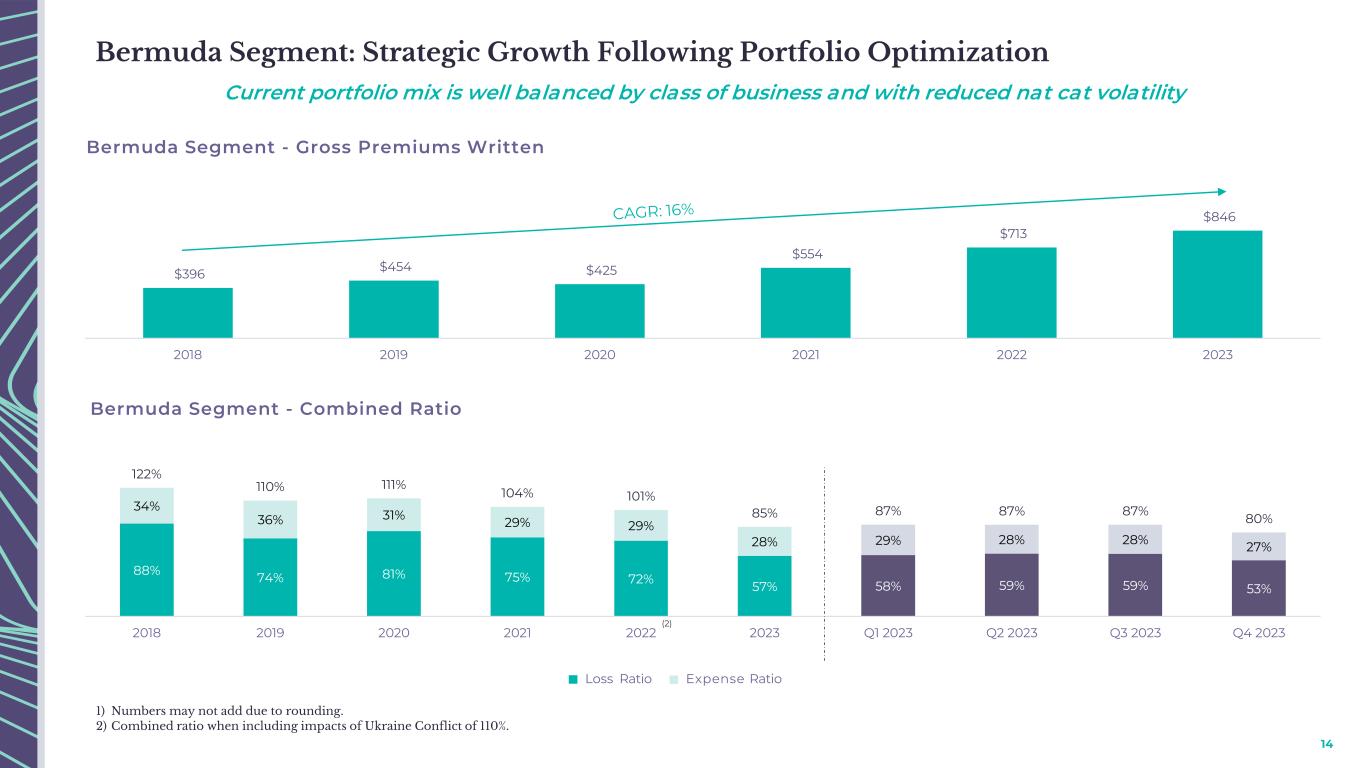

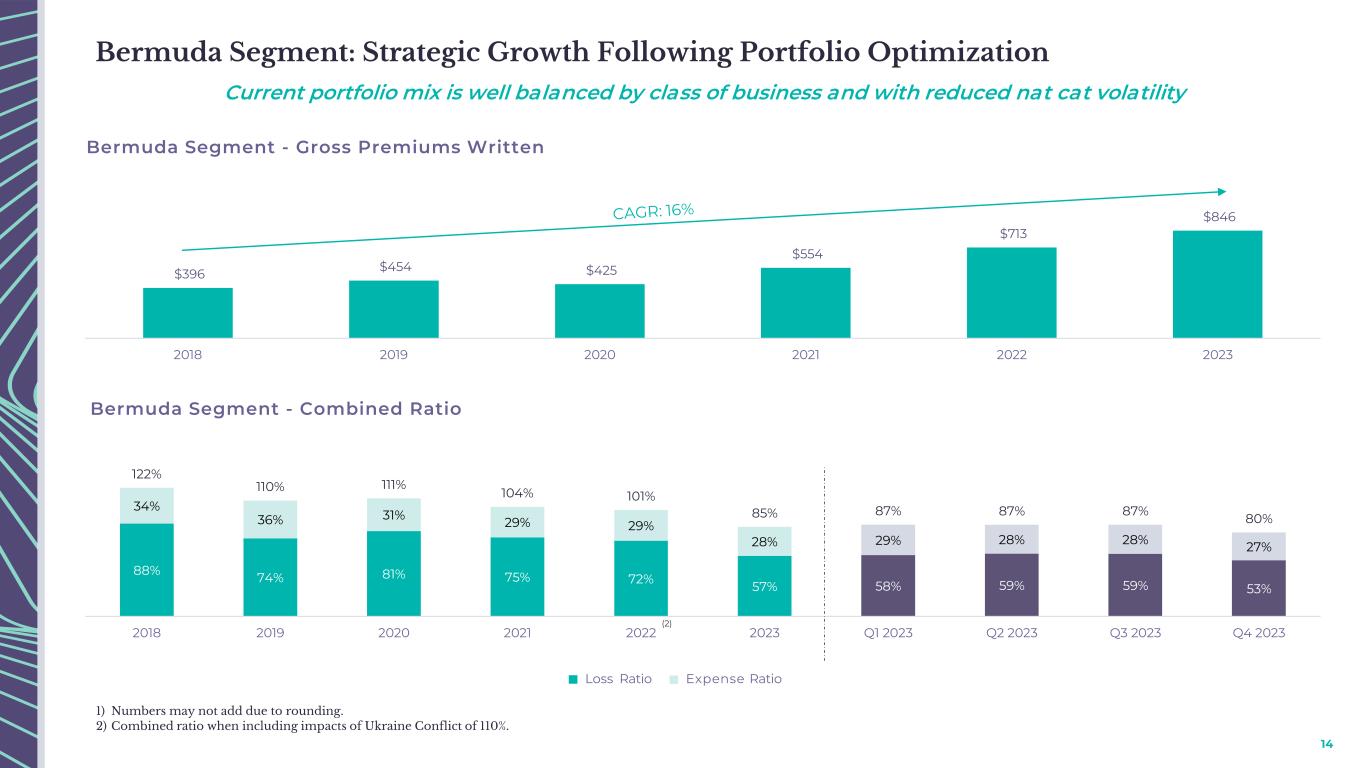

14 Current portfolio mix is well balanced by class of business and with reduced nat cat volatility Bermuda Segment: Strategic Growth Following Portfolio Optimization 88% 74% 81% 75% 72% 57% 58% 59% 59% 53% 34% 36% 31% 29% 29% 28% 29% 28% 28% 27% 122% 110% 111% 104% 101% 85% 87% 87% 87% 80% 2018 2019 2020 2021 2022 2023 Q1 2023 Q2 2023 Q3 2023 Q4 2023 $396 $454 $425 $554 $713 $846 2018 2019 2020 2021 2022 2023 Bermuda Segment - Gross Premiums Written Bermuda Segment - Combined Ratio Loss Ratio Expense Ratio 1) Numbers may not add due to rounding. 2) Combined ratio when including impacts of Ukraine Conflict of 110%. (2)

Invested Assets

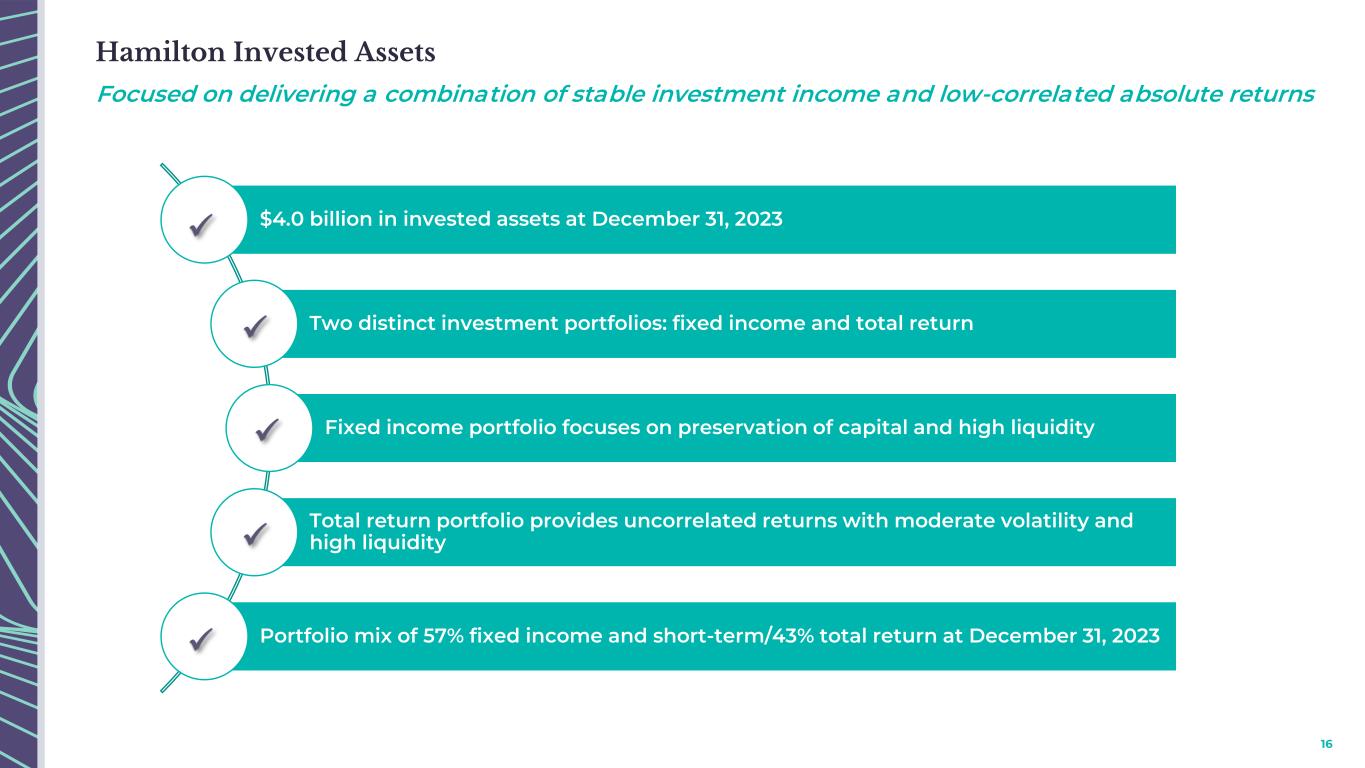

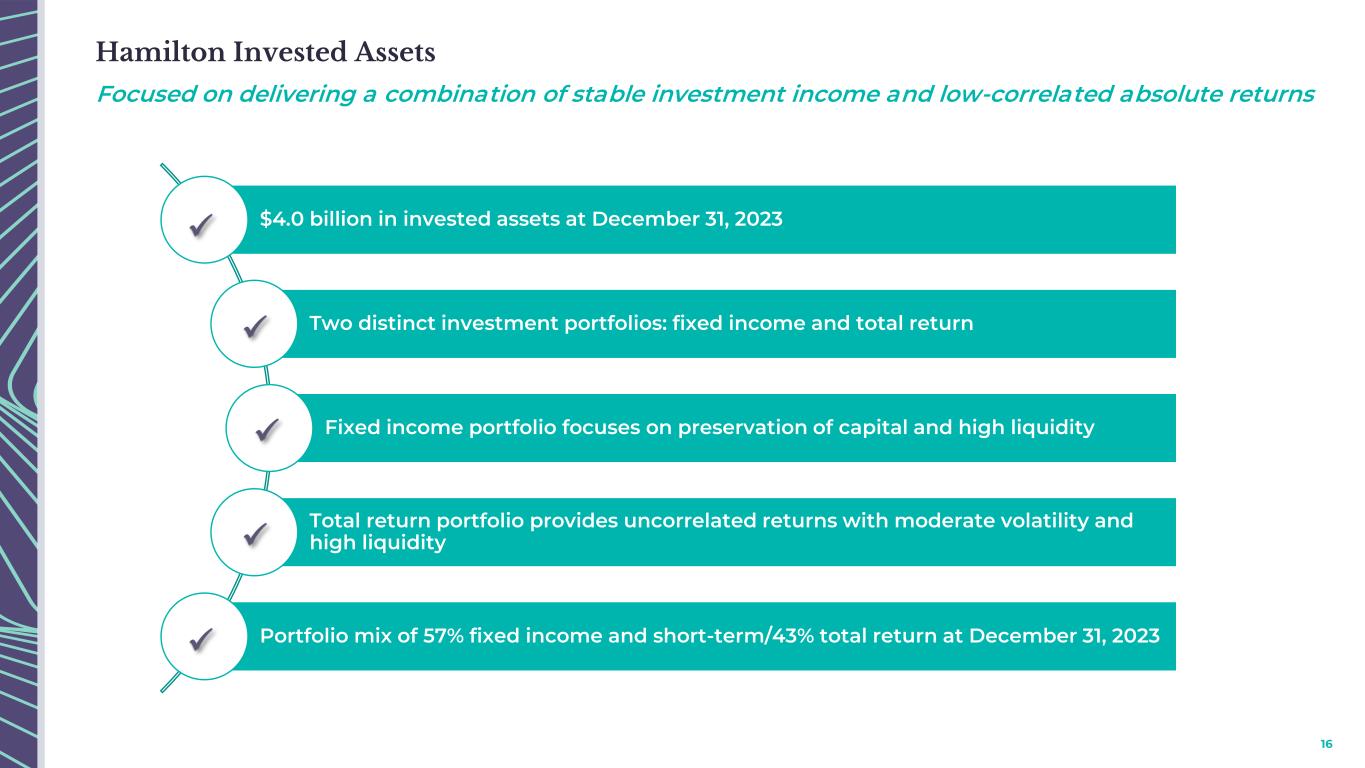

16 Focused on delivering a combination of stable investment income and low-correlated absolute returns Hamilton Invested Assets $4.0 billion in invested assets at December 31, 2023 Two distinct investment portfolios: fixed income and total return Fixed income portfolio focuses on preservation of capital and high liquidity Total return portfolio provides uncorrelated returns with moderate volatility and high liquidity Portfolio mix of 57% fixed income and short-term/43% total return at December 31, 2023

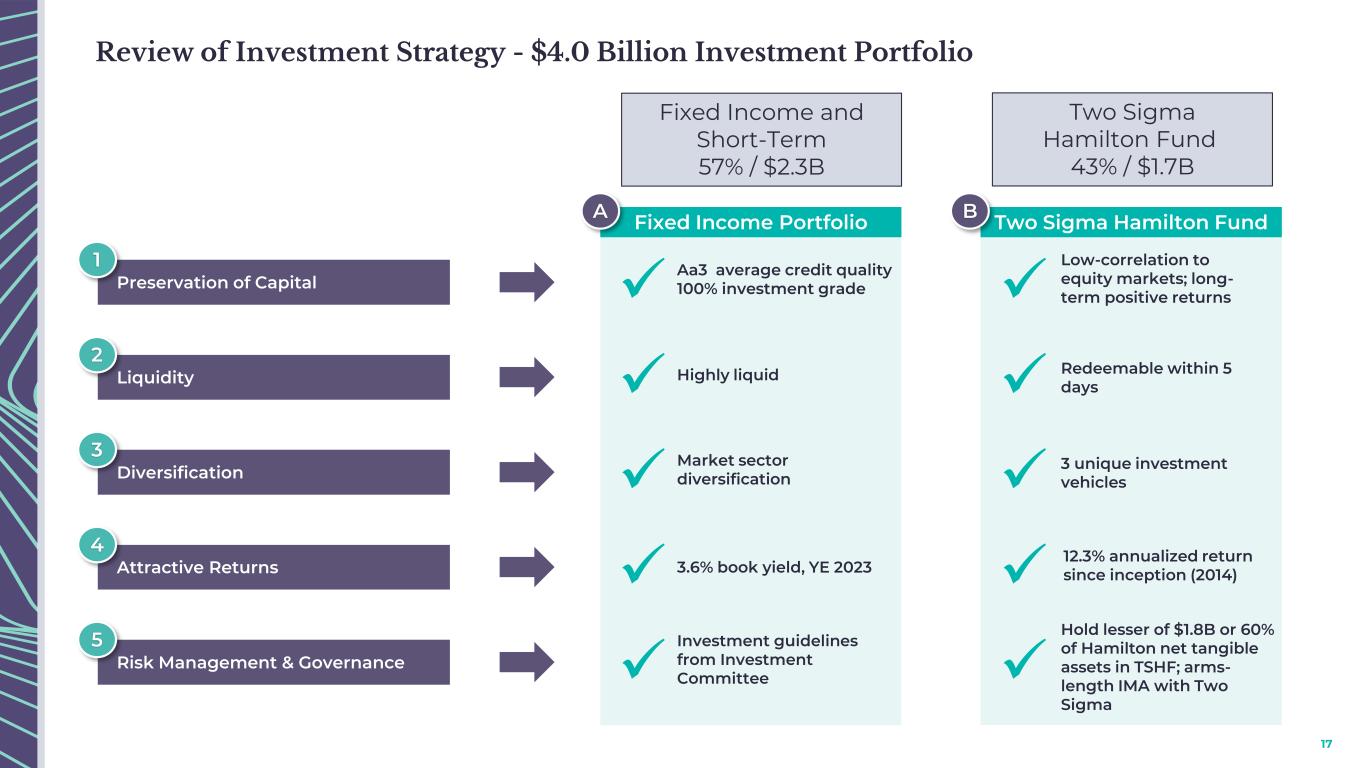

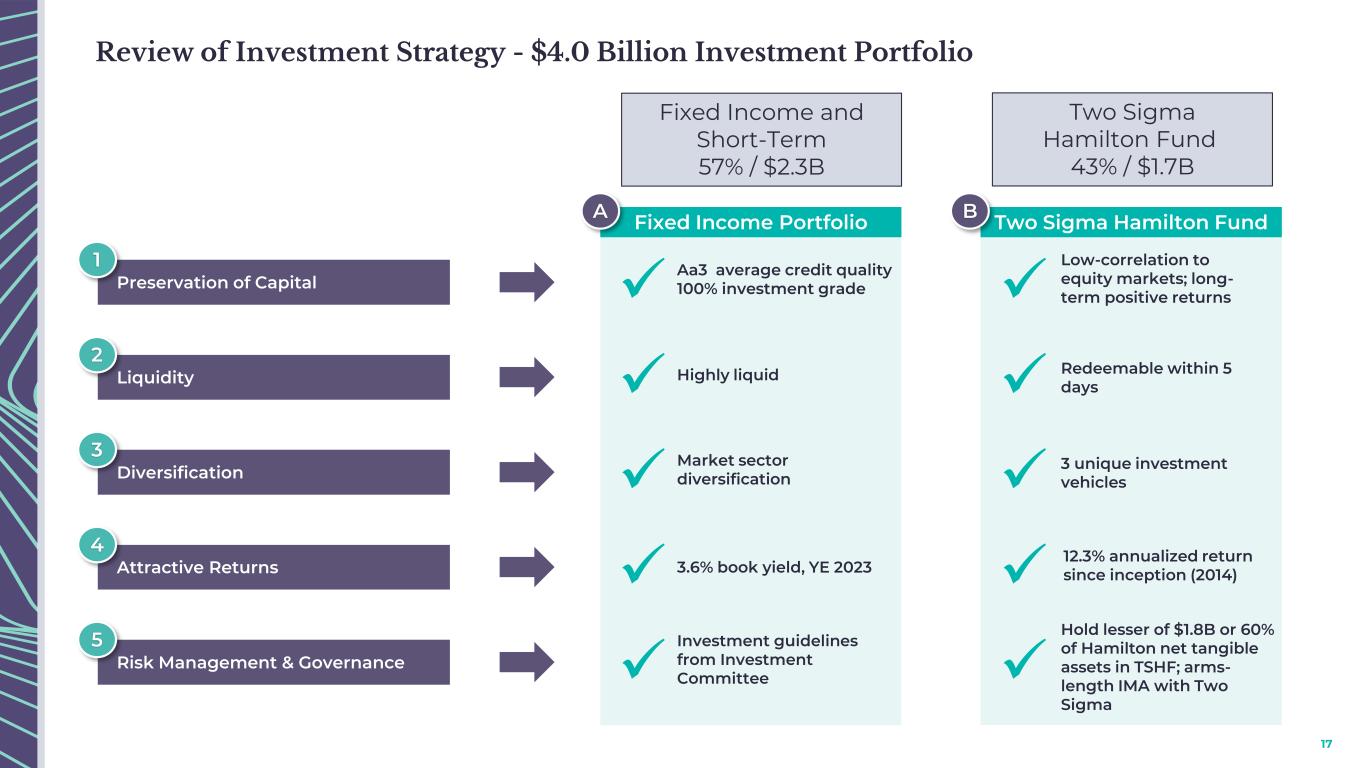

17 Two Sigma Hamilton FundFixed Income PortfolioA B Preservation of Capital 1 Liquidity 2 Diversification 3 Attractive Returns 4 Risk Management & Governance 5 ✓ Aa3 average credit quality 100% investment grade ✓ Highly liquid ✓ Market sector diversification ✓ 3.6% book yield, YE 2023 ✓ Investment guidelines from Investment Committee ✓ Low-correlation to equity markets; long- term positive returns ✓ Redeemable within 5 days ✓ 3 unique investment vehicles ✓ 12.3% annualized return since inception (2014) ✓ Hold lesser of $1.8B or 60% of Hamilton net tangible assets in TSHF; arms- length IMA with Two Sigma Review of Investment Strategy - $4.0 Billion Investment Portfolio Fixed Income and Short-Term 57% / $2.3B Two Sigma Hamilton Fund 43% / $1.7B

18 Fixed Income Investment Portfolio as of December 31, 2023 47% 39% 9% 5% Corporate US Treasury US Agency Other $1.8B Corporate A3 US Treas. Aaa US Agency Aaa Other Aa2 Fixed Income portfolio is managed by two external managers Fixed income investments of $1.8 billion – Average rating of Aa3, and duration of 3.3 years

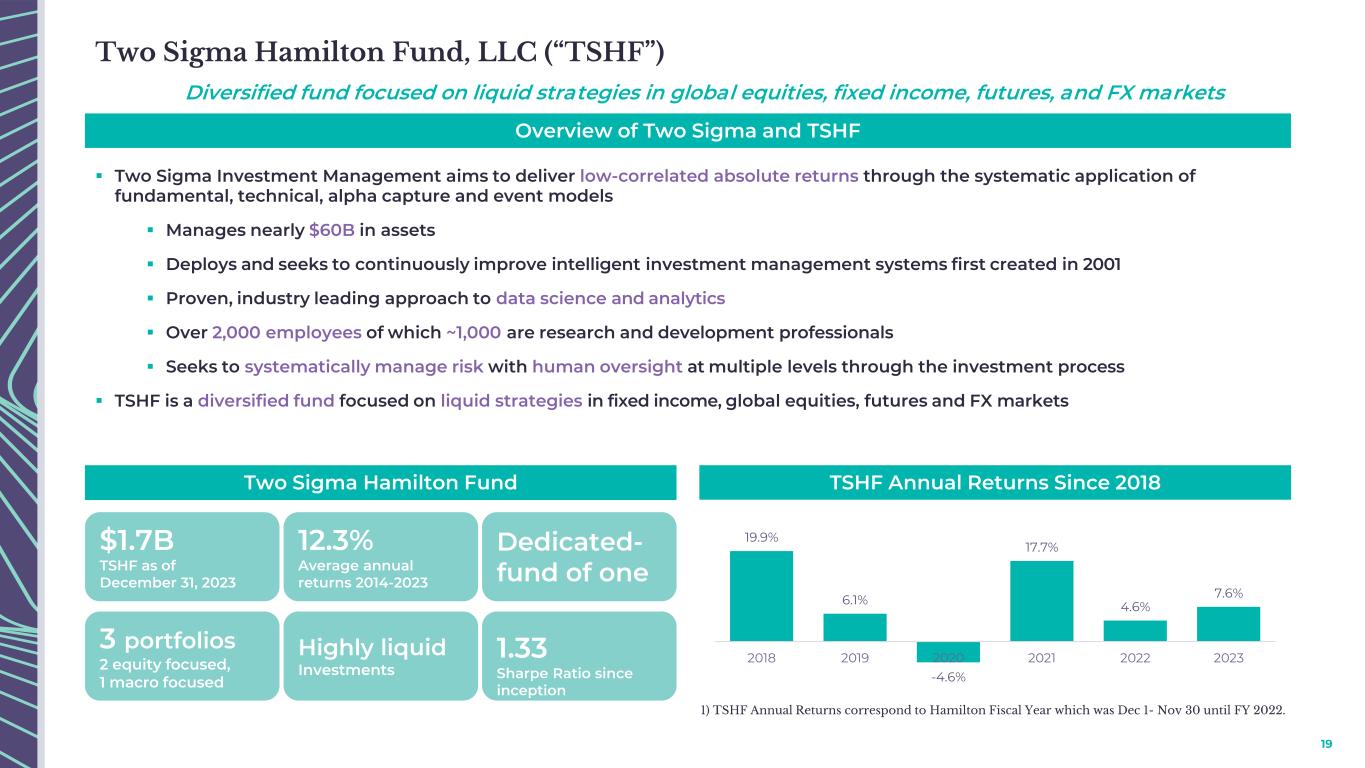

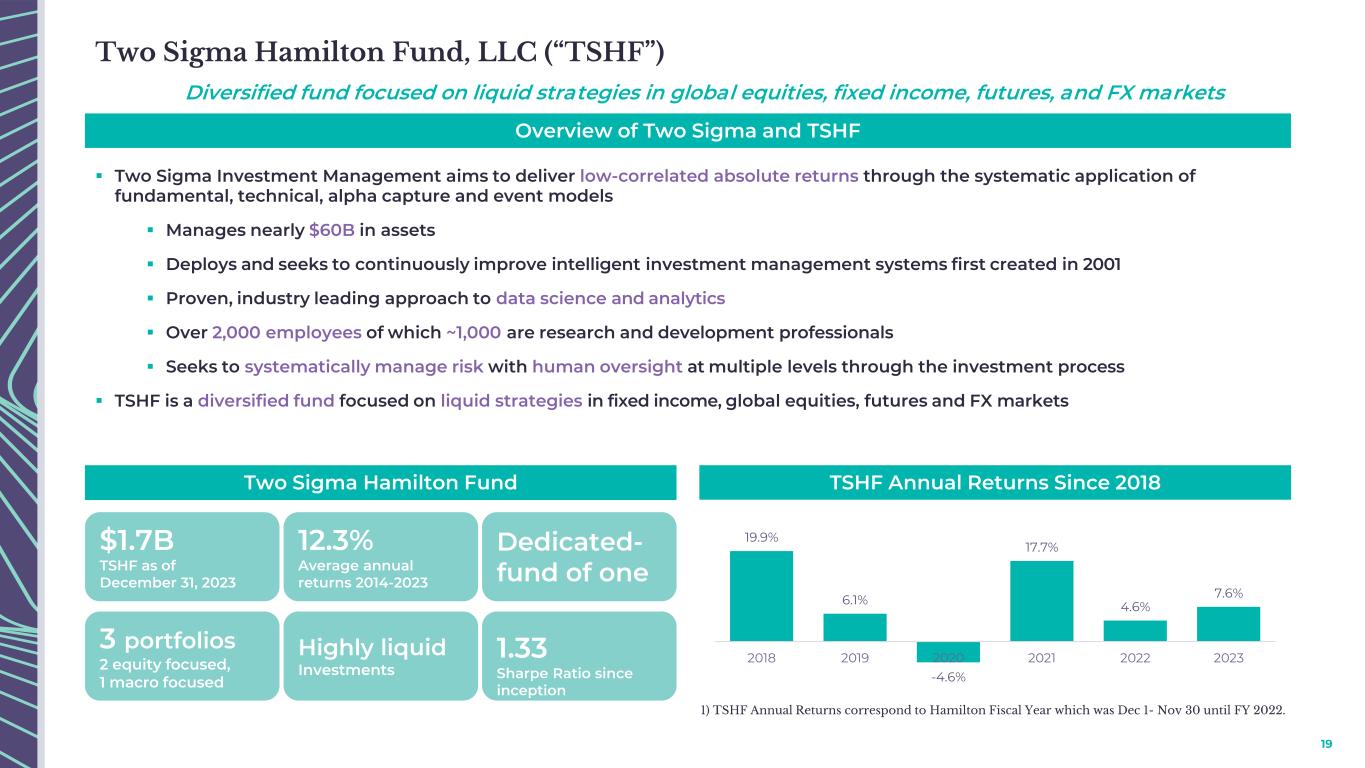

19 Overview of Two Sigma and TSHF Diversified fund focused on liquid strategies in global equities, fixed income, futures, and FX markets ▪ Two Sigma Investment Management aims to deliver low-correlated absolute returns through the systematic application of fundamental, technical, alpha capture and event models ▪ Manages nearly $60B in assets ▪ Deploys and seeks to continuously improve intelligent investment management systems first created in 2001 ▪ Proven, industry leading approach to data science and analytics ▪ Over 2,000 employees of which ~1,000 are research and development professionals ▪ Seeks to systematically manage risk with human oversight at multiple levels through the investment process ▪ TSHF is a diversified fund focused on liquid strategies in fixed income, global equities, futures and FX markets Two Sigma Hamilton Fund $1.7B TSHF as of December 31, 2023 12.3% Average annual returns 2014-2023 Dedicated- fund of one 3 portfolios 2 equity focused, 1 macro focused Highly liquid Investments TSHF Annual Returns Since 2018 Two Sigma Hamilton Fund, LLC (“TSHF”) 1.33 Sharpe Ratio since inception 19.9% 6.1% -4.6% 17.7% 4.6% 7.6% 2018 2019 2020 2021 2022 2023 1) TSHF Annual Returns correspond to Hamilton Fiscal Year which was Dec 1- Nov 30 until FY 2022.

Investing in Hamilton

21 5 A scaled, diversified, global specialty insurance and reinsurance operation Highly entrepreneurial & experienced leadership team fostering a distinctive and attractive culture Disciplined and data-driven underwriting approach to drive sustainable profitability Strong balance sheet with significant financial flexibility Proprietary technology infrastructure to support underwriting and operational efficiencies Differentiated asset management capabilities with Two Sigma to enhance investment returns Ability to grow profitably, navigating across all market cycles Poised to Deliver Significant Shareholder Value Hamilton Insurance Group - Who We Are Today

Hamilton Insurance Group, Ltd. Wellesley House North, 1st Floor 90 Pitts Bay Road, Pembroke HM08, Bermuda +1 (441) 405 5200 hamiltongroup.com Contact us at: Investor.Relations@hamiltongroup.com