Hamilton Insurance Group, Ltd. Supplementary Financial Information December 31, 2024 Investor Contact Investor.Relations@hamiltongroup.com

Hamilton Insurance Group, Ltd. Table of Contents Page I. Basis of Presentation ......................................................................................................................................................................................................... 1 II. Financial Highlights Financial Highlights ............................................................................................................................................................................................................... 4 Key Operating and Financial Metrics ................................................................................................................................................................................. 5 III. Summary Consolidated Results Statements of Operations ................................................................................................................................................................................................... 6 Consolidated Balance Sheets ............................................................................................................................................................................................. 7 Reconciliation of Consolidated GAAP Balance Sheet to Unconsolidated Balance Sheet ....................................................................................... 8 Net Investment Return ......................................................................................................................................................................................................... 9 Fixed Maturity and Short-Term Investments ..................................................................................................................................................................... 10 IV. Segment Results Consolidated Underwriting Results .................................................................................................................................................................................... 11 5Q Consolidated Underwriting Results - Group ............................................................................................................................................................... 13 5Q Underwriting Results - International ............................................................................................................................................................................ 14 5Q Underwriting Results - Bermuda .................................................................................................................................................................................. 15 V. Other Information Modeled Exposure to Catastrophe Losses (PML) .......................................................................................................................................................... 16 Non-GAAP Measures ........................................................................................................................................................................................................... 17

1 Basis of Presentation All financial information contained herein is unaudited, however, certain information relating to the consolidated balance sheet at the most recent year end is derived from or agrees to audited financial information. Unless otherwise noted, all data is in thousands, except for share and per share amounts and ratio information. This information is being provided for informational purposes only. It should be read in conjunction with the documents filed by Hamilton Insurance Group, Ltd. (referred to herein as "Hamilton," the "Company," "we," "us" and "our") with the U.S. Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 (the “Form 10-K”). Special Note Regarding Forward-Looking Statements This information includes “forward looking statements” pursuant to the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the use of terms such as “believes,” “expects,” “may,” “will,” “target,” “should,” “could,” “would,” “seeks,” “intends,” “plans,” “contemplates,” “estimates,” or “anticipates,” or similar expressions which concern our strategy, plans, projections or intentions. These forward-looking statements appear in a number of places throughout and relate to matters such as our industry, growth strategy, goals and expectations concerning our market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources and other financial and operating information. By their nature, forward-looking statements: speak only as of the date they are made; are not statements of historical fact or guarantees of future performance; and are subject to risks, uncertainties, assumptions, or changes in circumstances that are difficult to predict or quantify. Our expectations, beliefs, and projections are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs and projections will be achieved and actual results may vary materially from what is expressed in or indicated by the forward-looking statements. There are a number of risks, uncertainties, and other important factors that could cause our actual results to differ materially from the forward-looking statements contained herein. Such risks, uncertainties, and other important factors include, among others, the risks, uncertainties and factors set forth in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our Form 10-K and other subsequent periodic reports filed with the Securities and Exchange Commission and the following: • challenges from competitors, including those arising from industry consolidation and technological advancements; • unpredictable catastrophic events, global climate change and/or emerging claim and coverage issues; • our ability, or those of the third parties on which we rely, to ensure reserves are adequate to cover actual losses and to accurately evaluate underwriting risk, models, assessments and/or pricing of risks; • our ability to defend our intellectual property rights, including our proprietary technology platforms, to comply with our obligations under our license and technology agreements or to license rights to technology or data on reasonable terms; • the impact of risks associated with human error, fraud, model uncertainties, cybersecurity threats such as cyber-attacks and security breaches and our reliance on third-party information technology ("IT") systems that can fail or need replacement; • our ability to secure necessary credit facilities, or additional types of credit, on favorable terms or at all; • our limited financial and operating flexibility due to the covenants in our existing credit facilities; • our exposure to the credit risk of the intermediaries on which we rely; • our failure to pay claims in a timely manner or the need to sell investments under unfavorable conditions to meet liquidity requirements;

2 Basis of Presentation (continued) Special Note Regarding Forward-Looking Statements (continued) • downgrades, potential downgrades or other negative actions by rating agencies; • our ability to manage risks associated with macroeconomic conditions resulting from geopolitical and global economic events, including current or anticipated military conflicts, public health crises, terrorism, sanctions, rising energy prices, inflation and interest rates and other global events; • the cyclical nature of the insurance and reinsurance business, which may cause the pricing and terms for our products to decline; • our results of operations potentially fluctuating significantly from period to period and not being indicative of our long-term prospects; • our ability to execute our strategy and to modify our business and strategic plan without shareholder approval; • our dependence on key executives, including the potential loss of Bermudian personnel, and our ability to attract qualified personnel, particularly in very competitive hiring conditions; • foreign operational risk such as foreign currency risk and political risk; • our ability to identify and execute opportunities for growth, to complete transactions as planned or realize the anticipated benefits of any acquisitions or other investments; • our management of alternative reinsurance platforms on behalf of investors in entities managed by Hamilton Strategic Partnerships; • our inability to control the allocations to, and/or the performance of, the Two Sigma Hamilton Fund, LLC (“TS Hamilton Fund” or "Two Sigma Hamilton Fund") investment portfolio and our limited ability to withdraw our capital accounts; • the impact of risks from conflicts of interest among Two Sigma Principals, LLC, Two Sigma Investments, LP (“Two Sigma”) and their respective affiliates affecting our business; • the historical performance of Two Sigma not being indicative of the future results of the TS Hamilton Fund’s investment portfolio and/or of our future results; • the impacts of risks associated with our investment strategy, including that such risks are greater than those faced by our competitors; • our potentially becoming subject to U.S. federal income taxation, Bermuda taxation or other taxes as a result of a change of tax laws or otherwise; • the potential characterization of us and/or any of our subsidiaries as a passive foreign investment company, or PFIC; • our potentially becoming subject to U.S. withholding and information reporting requirements under the U.S. Foreign Account Tax Compliance Act, or FATCA, provisions; • our ability to compete effectively in a heavily regulated industry in light of new domestic or international laws and regulations, including accounting practices, and the impact of new interpretations of current laws and regulations; • the suspension or revocation of our subsidiaries’ insurance licenses; • significant legal, governmental or regulatory proceedings; • our insurance and reinsurance subsidiaries’ ability to pay dividends and other distributions to us being restricted by law; • challenges related to compliance with the applicable laws, rules and regulations related to being a public company, which is expensive and time consuming; • the limited ability of investors to influence corporate matters due to our multiple class common share structure and the voting provisions of our Bye-laws; • the risk that anti-takeover provisions in our Bye-laws could discourage, delay, or prevent a change in control, even if the change in control would be beneficial to our shareholders; • the difficulties investors may face in protecting their interests and serving process or enforcing judgments against us in the United States; and • our current strategy does not include paying cash dividends on our Class B common shares in the near term.

3 Basis of Presentation (continued) Special Note Regarding Forward-Looking Statements (continued) There may be other factors that could cause our actual results to differ materially from the forward-looking statements, including factors disclosed under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Form 10-K and other subsequent periodic reports filed with the Securities and Exchange Commission. You should evaluate all forward-looking statements made herein in the context of these risks and uncertainties. You should read this information completely and with the understanding that actual future results may be materially different from expectations. We caution you that the risks, uncertainties, and other factors referenced above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits, or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. All forward-looking statements contained herein apply only as of the date hereof and are expressly qualified in their entirety by these cautionary statements. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

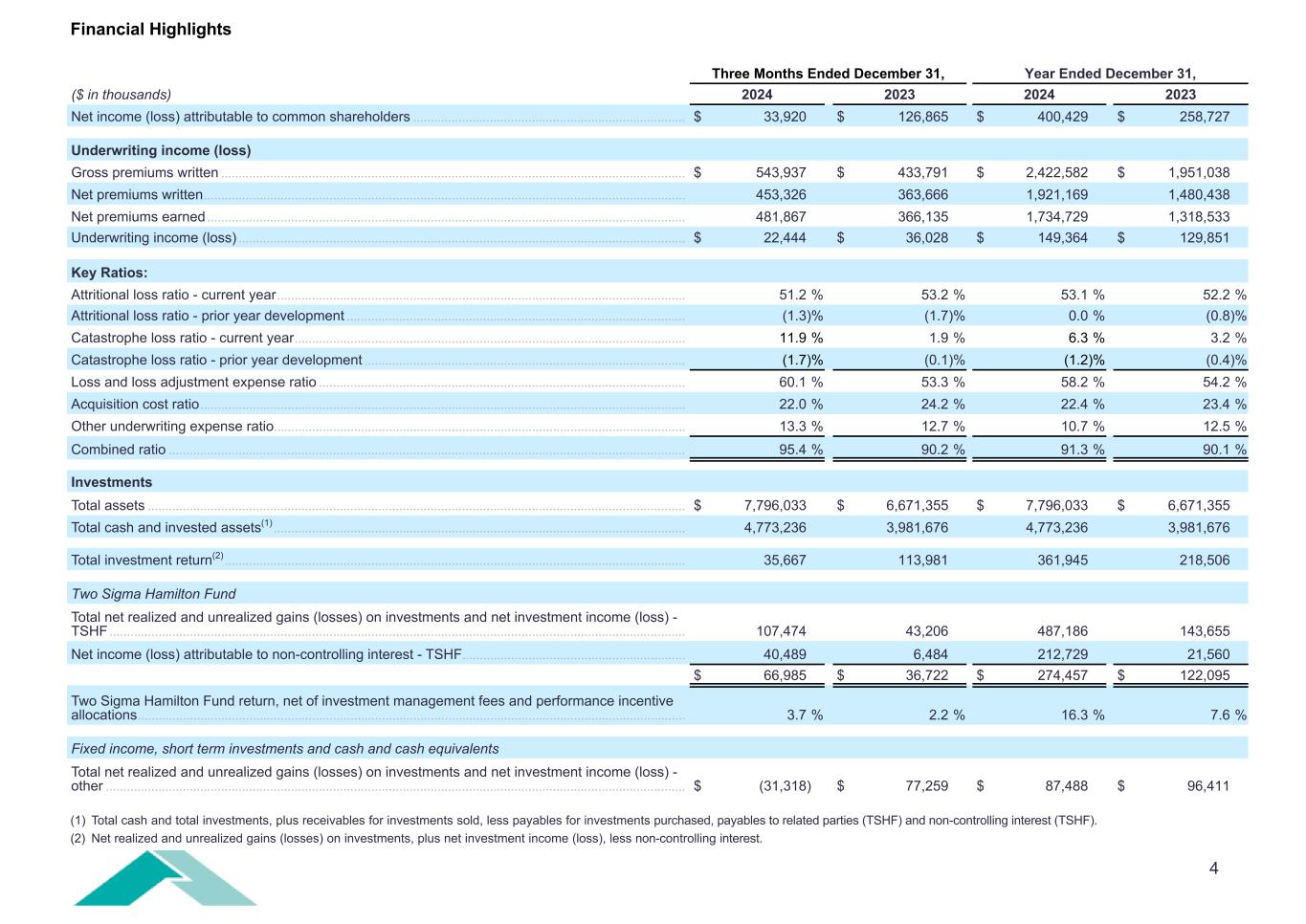

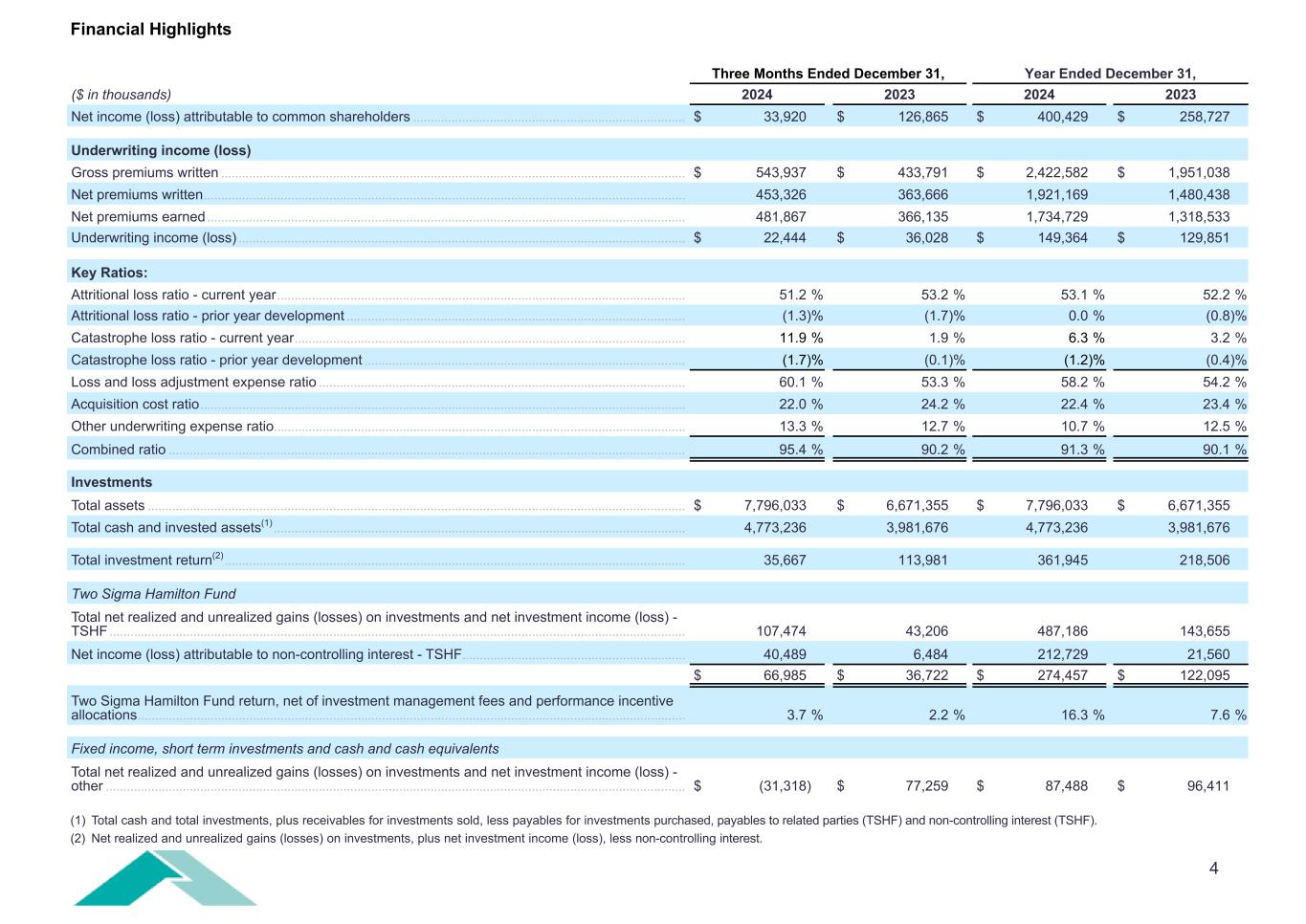

4 Financial Highlights Three Months Ended December 31, Year Ended December 31, ($ in thousands) 2024 2023 2024 2023 Net income (loss) attributable to common shareholders .............................................................................. $ 33,920 $ 126,865 $ 400,429 $ 258,727 Underwriting income (loss) Gross premiums written ..................................................................................................................................... $ 543,937 $ 433,791 $ 2,422,582 $ 1,951,038 Net premiums written .......................................................................................................................................... 453,326 363,666 1,921,169 1,480,438 Net premiums earned ......................................................................................................................................... 481,867 366,135 1,734,729 1,318,533 Underwriting income (loss) ................................................................................................................................ $ 22,444 $ 36,028 $ 149,364 $ 129,851 Key Ratios: Attritional loss ratio - current year ..................................................................................................................... 51.2 % 53.2 % 53.1 % 52.2 % Attritional loss ratio - prior year development ................................................................................................. (1.3) % (1.7) % 0.0 % (0.8) % Catastrophe loss ratio - current year ................................................................................................................ 11.9 % 1.9 % 6.3 % 3.2 % Catastrophe loss ratio - prior year development ............................................................................................ (1.7) % (0.1) % (1.2) % (0.4) % Loss and loss adjustment expense ratio ......................................................................................................... 60.1 % 53.3 % 58.2 % 54.2 % Acquisition cost ratio ........................................................................................................................................... 22.0 % 24.2 % 22.4 % 23.4 % Other underwriting expense ratio ...................................................................................................................... 13.3 % 12.7 % 10.7 % 12.5 % Combined ratio .................................................................................................................................................... 95.4 % 90.2 % 91.3 % 90.1 % Investments Total assets .......................................................................................................................................................... $ 7,796,033 $ 6,671,355 $ 7,796,033 $ 6,671,355 Total cash and invested assets(1) ...................................................................................................................... 4,773,236 3,981,676 4,773,236 3,981,676 Total investment return(2) .................................................................................................................................... 35,667 113,981 361,945 218,506 Two Sigma Hamilton Fund Total net realized and unrealized gains (losses) on investments and net investment income (loss) - TSHF ..................................................................................................................................................................... 107,474 43,206 487,186 143,655 Net income (loss) attributable to non-controlling interest - TSHF ................................................................ 40,489 6,484 212,729 21,560 $ 66,985 $ 36,722 $ 274,457 $ 122,095 Two Sigma Hamilton Fund return, net of investment management fees and performance incentive allocations ............................................................................................................................................................. 3.7 % 2.2 % 16.3 % 7.6 % Fixed income, short term investments and cash and cash equivalents Total net realized and unrealized gains (losses) on investments and net investment income (loss) - other ...................................................................................................................................................................... $ (31,318) $ 77,259 $ 87,488 $ 96,411 (1) Total cash and total investments, plus receivables for investments sold, less payables for investments purchased, payables to related parties (TSHF) and non-controlling interest (TSHF). (2) Net realized and unrealized gains (losses) on investments, plus net investment income (loss), less non-controlling interest.

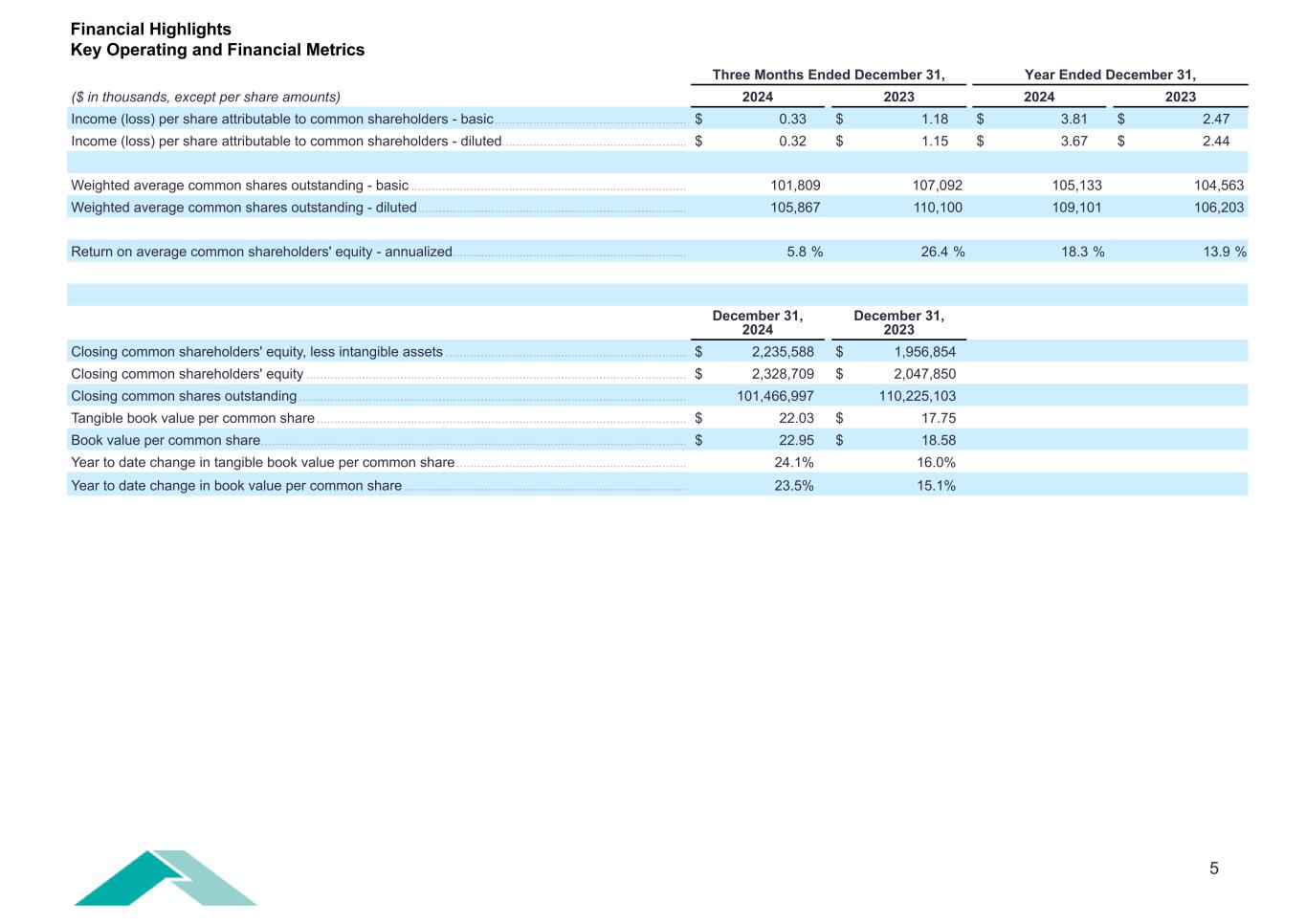

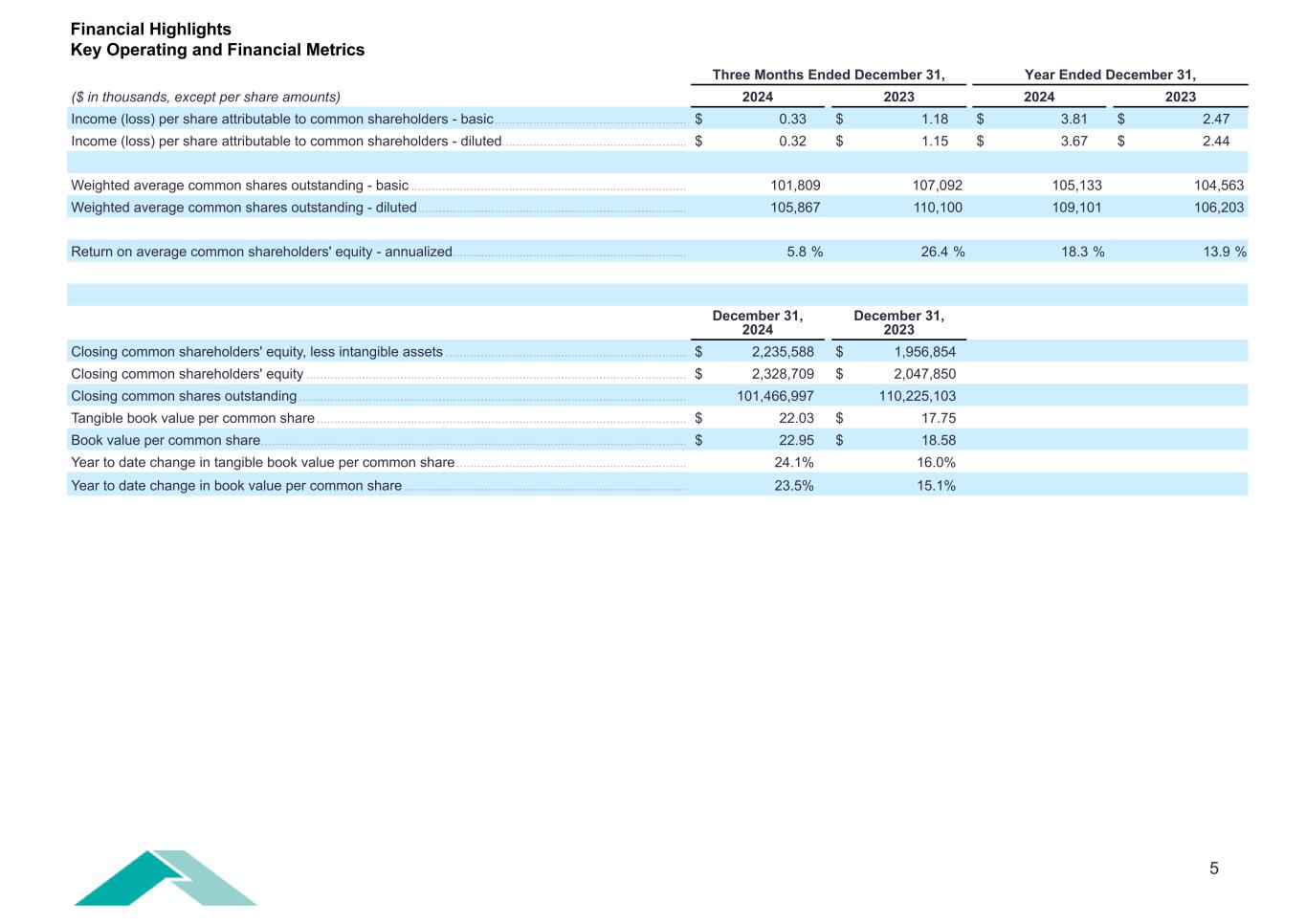

5 Three Months Ended December 31, Year Ended December 31, ($ in thousands, except per share amounts) 2024 2023 2024 2023 Income (loss) per share attributable to common shareholders - basic ....................................................... $ 0.33 $ 1.18 $ 3.81 $ 2.47 Income (loss) per share attributable to common shareholders - diluted ..................................................... $ 0.32 $ 1.15 $ 3.67 $ 2.44 Weighted average common shares outstanding - basic ............................................................................... 101,809 107,092 105,133 104,563 Weighted average common shares outstanding - diluted ............................................................................. 105,867 110,100 109,101 106,203 Return on average common shareholders' equity - annualized ................................................................... 5.8 % 26.4 % 18.3 % 13.9 % December 31, 2024 December 31, 2023 Closing common shareholders' equity, less intangible assets ..................................................................... $ 2,235,588 $ 1,956,854 Closing common shareholders' equity ............................................................................................................. $ 2,328,709 $ 2,047,850 Closing common shares outstanding ............................................................................................................... 101,466,997 110,225,103 Tangible book value per common share .......................................................................................................... $ 22.03 $ 17.75 Book value per common share .......................................................................................................................... $ 22.95 $ 18.58 Year to date change in tangible book value per common share .................................................................. 24.1 % 16.0 % Year to date change in book value per common share ................................................................................. 23.5 % 15.1 % Financial Highlights Key Operating and Financial Metrics

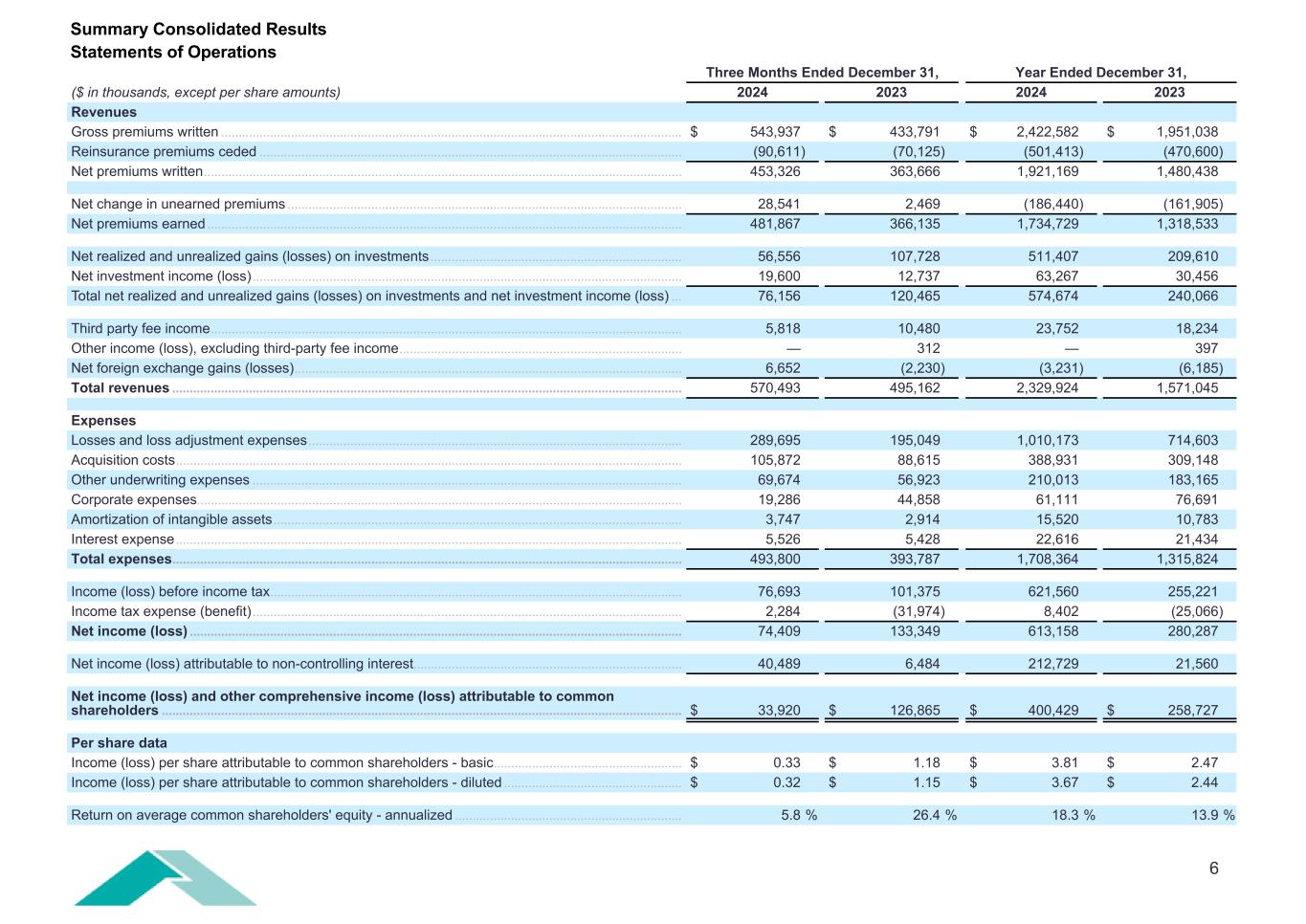

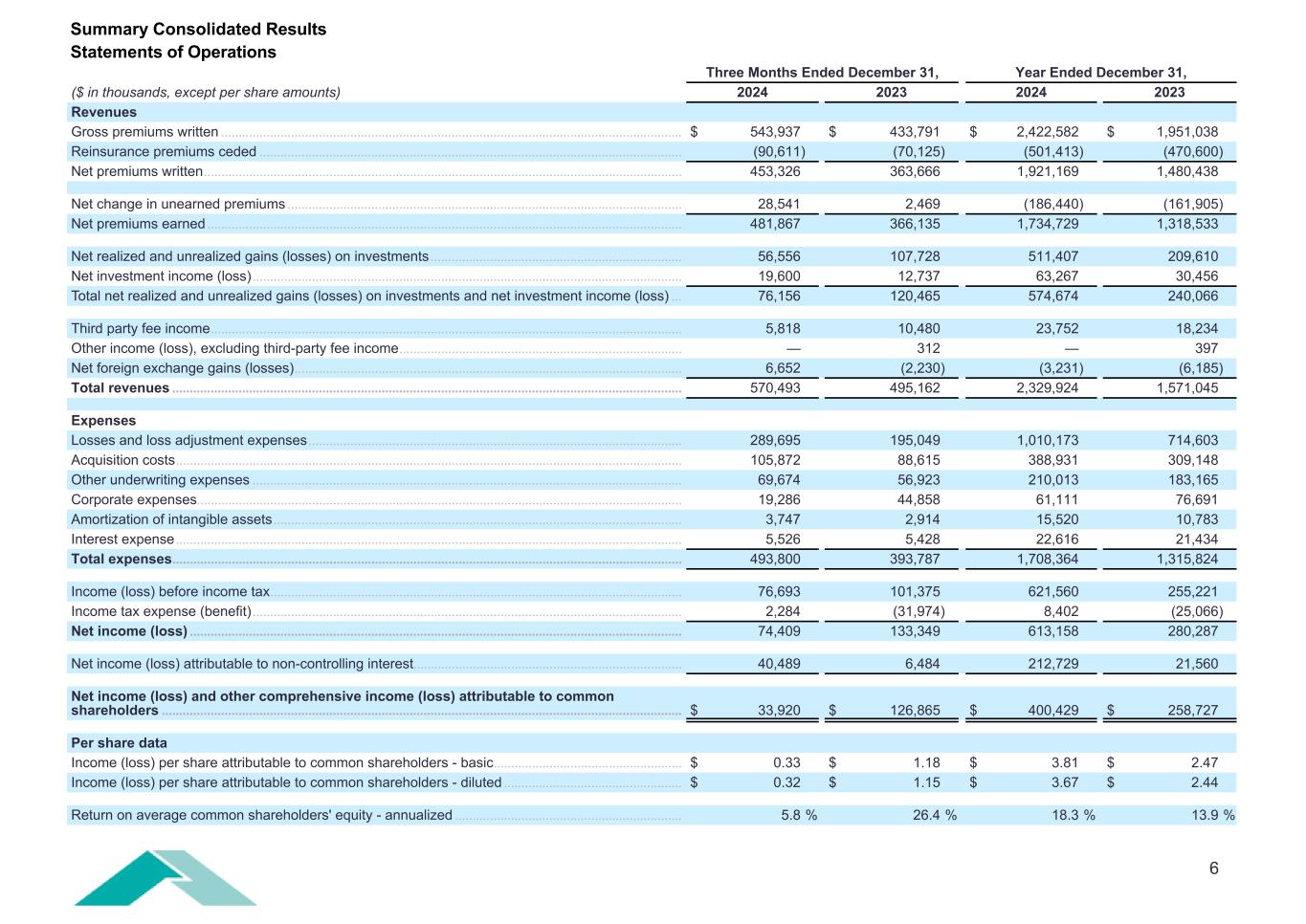

6 Three Months Ended December 31, Year Ended December 31, ($ in thousands, except per share amounts) 2024 2023 2024 2023 Revenues Gross premiums written .................................................................................................................................... $ 543,937 $ 433,791 $ 2,422,582 $ 1,951,038 Reinsurance premiums ceded ......................................................................................................................... (90,611) (70,125) (501,413) (470,600) Net premiums written ......................................................................................................................................... 453,326 363,666 1,921,169 1,480,438 Net change in unearned premiums ................................................................................................................. 28,541 2,469 (186,440) (161,905) Net premiums earned ........................................................................................................................................ 481,867 366,135 1,734,729 1,318,533 Net realized and unrealized gains (losses) on investments ........................................................................ 56,556 107,728 511,407 209,610 Net investment income (loss) ........................................................................................................................... 19,600 12,737 63,267 30,456 Total net realized and unrealized gains (losses) on investments and net investment income (loss) ... 76,156 120,465 574,674 240,066 Third party fee income ....................................................................................................................................... 5,818 10,480 23,752 18,234 Other income (loss), excluding third-party fee income ................................................................................. — 312 — 397 Net foreign exchange gains (losses) ............................................................................................................... 6,652 (2,230) (3,231) (6,185) Total revenues .................................................................................................................................................. 570,493 495,162 2,329,924 1,571,045 Expenses Losses and loss adjustment expenses ........................................................................................................... 289,695 195,049 1,010,173 714,603 Acquisition costs ................................................................................................................................................. 105,872 88,615 388,931 309,148 Other underwriting expenses ........................................................................................................................... 69,674 56,923 210,013 183,165 Corporate expenses ........................................................................................................................................... 19,286 44,858 61,111 76,691 Amortization of intangible assets ..................................................................................................................... 3,747 2,914 15,520 10,783 Interest expense ................................................................................................................................................. 5,526 5,428 22,616 21,434 Total expenses .................................................................................................................................................. 493,800 393,787 1,708,364 1,315,824 Income (loss) before income tax ...................................................................................................................... 76,693 101,375 621,560 255,221 Income tax expense (benefit) ........................................................................................................................... 2,284 (31,974) 8,402 (25,066) Net income (loss) ............................................................................................................................................. 74,409 133,349 613,158 280,287 Net income (loss) attributable to non-controlling interest ............................................................................. 40,489 6,484 212,729 21,560 Net income (loss) and other comprehensive income (loss) attributable to common shareholders ..................................................................................................................................................... $ 33,920 $ 126,865 $ 400,429 $ 258,727 Per share data Income (loss) per share attributable to common shareholders - basic ...................................................... $ 0.33 $ 1.18 $ 3.81 $ 2.47 Income (loss) per share attributable to common shareholders - diluted ................................................... $ 0.32 $ 1.15 $ 3.67 $ 2.44 Return on average common shareholders' equity - annualized ................................................................. 5.8 % 26.4 % 18.3 % 13.9 % Summary Consolidated Results Statements of Operations

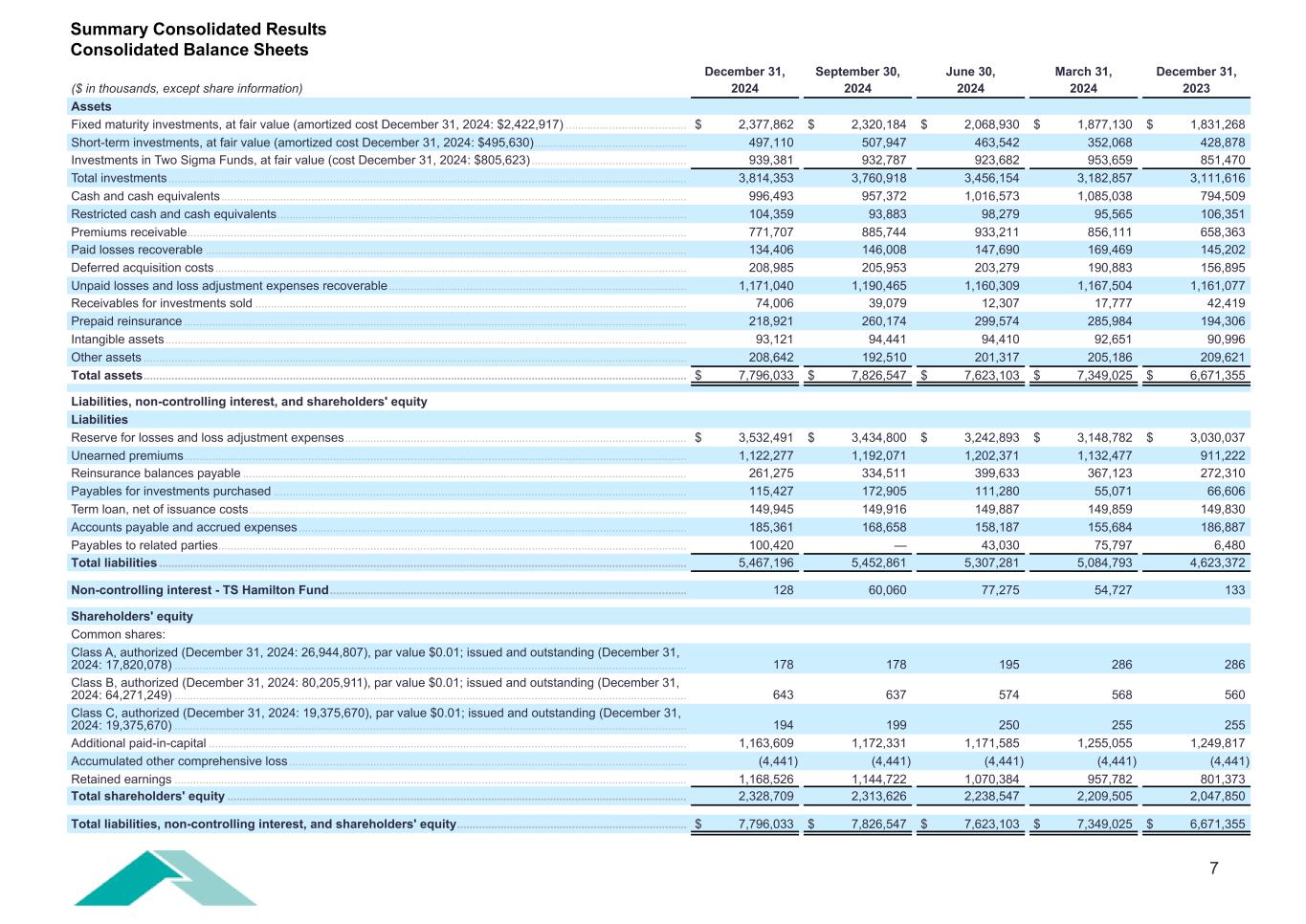

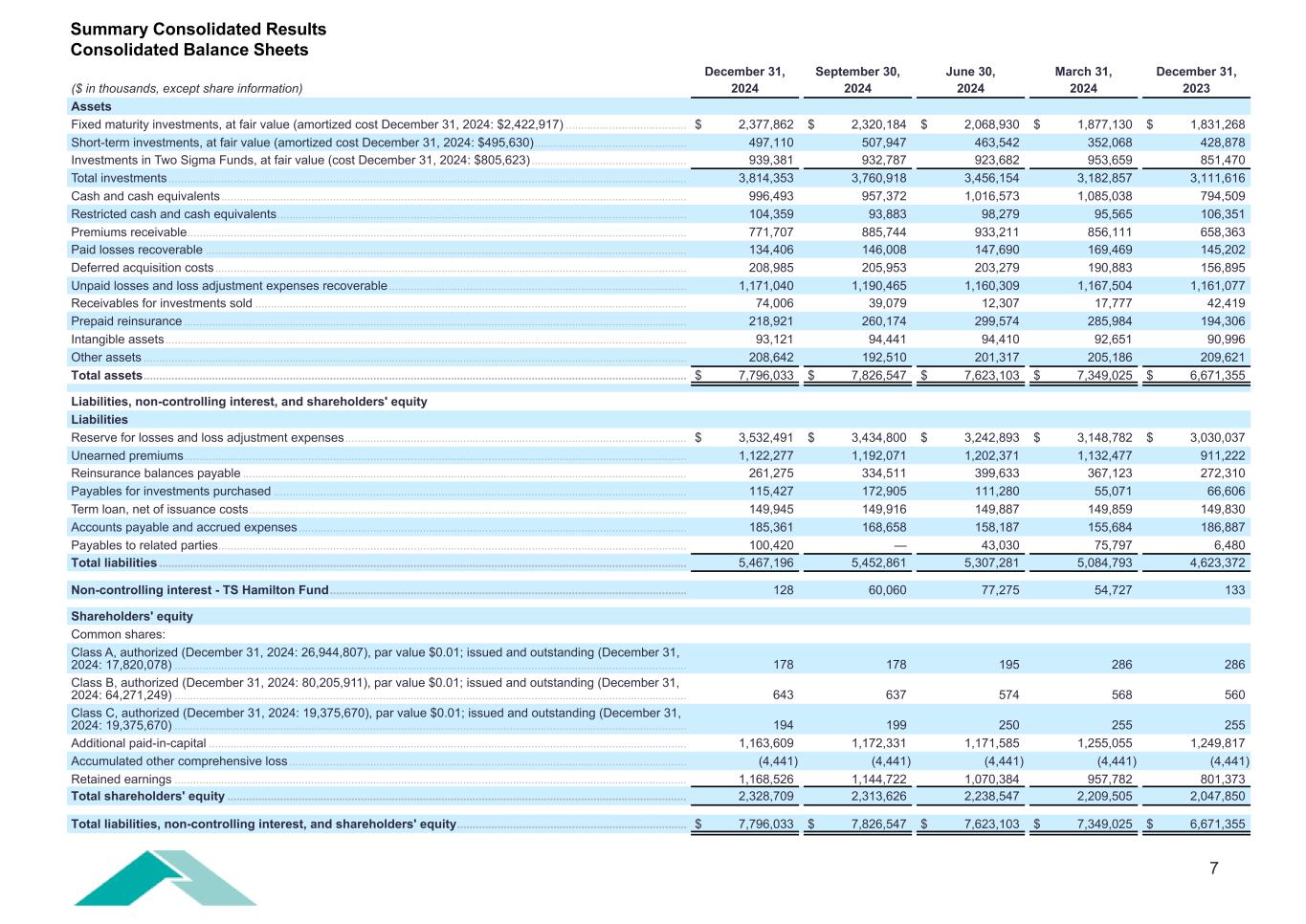

7 December 31, September 30, June 30, March 31, December 31, ($ in thousands, except share information) 2024 2024 2024 2024 2023 Assets Fixed maturity investments, at fair value (amortized cost December 31, 2024: $2,422,917) ....................................... $ 2,377,862 $ 2,320,184 $ 2,068,930 $ 1,877,130 $ 1,831,268 Short-term investments, at fair value (amortized cost December 31, 2024: $495,630) ................................................. 497,110 507,947 463,542 352,068 428,878 Investments in Two Sigma Funds, at fair value (cost December 31, 2024: $805,623) .................................................. 939,381 932,787 923,682 953,659 851,470 Total investments ....................................................................................................................................................................... 3,814,353 3,760,918 3,456,154 3,182,857 3,111,616 Cash and cash equivalents ...................................................................................................................................................... 996,493 957,372 1,016,573 1,085,038 794,509 Restricted cash and cash equivalents .................................................................................................................................... 104,359 93,883 98,279 95,565 106,351 Premiums receivable ................................................................................................................................................................. 771,707 885,744 933,211 856,111 658,363 Paid losses recoverable ........................................................................................................................................................... 134,406 146,008 147,690 169,469 145,202 Deferred acquisition costs ........................................................................................................................................................ 208,985 205,953 203,279 190,883 156,895 Unpaid losses and loss adjustment expenses recoverable ................................................................................................ 1,171,040 1,190,465 1,160,309 1,167,504 1,161,077 Receivables for investments sold ........................................................................................................................................... 74,006 39,079 12,307 17,777 42,419 Prepaid reinsurance .................................................................................................................................................................. 218,921 260,174 299,574 285,984 194,306 Intangible assets ........................................................................................................................................................................ 93,121 94,441 94,410 92,651 90,996 Other assets ............................................................................................................................................................................... 208,642 192,510 201,317 205,186 209,621 Total assets ............................................................................................................................................................................... $ 7,796,033 $ 7,826,547 $ 7,623,103 $ 7,349,025 $ 6,671,355 Liabilities, non-controlling interest, and shareholders' equity Liabilities Reserve for losses and loss adjustment expenses .............................................................................................................. $ 3,532,491 $ 3,434,800 $ 3,242,893 $ 3,148,782 $ 3,030,037 Unearned premiums .................................................................................................................................................................. 1,122,277 1,192,071 1,202,371 1,132,477 911,222 Reinsurance balances payable ............................................................................................................................................... 261,275 334,511 399,633 367,123 272,310 Payables for investments purchased ..................................................................................................................................... 115,427 172,905 111,280 55,071 66,606 Term loan, net of issuance costs ............................................................................................................................................. 149,945 149,916 149,887 149,859 149,830 Accounts payable and accrued expenses ............................................................................................................................. 185,361 168,658 158,187 155,684 186,887 Payables to related parties ....................................................................................................................................................... 100,420 — 43,030 75,797 6,480 Total liabilities .......................................................................................................................................................................... 5,467,196 5,452,861 5,307,281 5,084,793 4,623,372 Non-controlling interest - TS Hamilton Fund ................................................................................................................... 128 60,060 77,275 54,727 133 Shareholders' equity Common shares: Class A, authorized (December 31, 2024: 26,944,807), par value $0.01; issued and outstanding (December 31, 2024: 17,820,078) ..................................................................................................................................................................... 178 178 195 286 286 Class B, authorized (December 31, 2024: 80,205,911), par value $0.01; issued and outstanding (December 31, 2024: 64,271,249) ..................................................................................................................................................................... 643 637 574 568 560 Class C, authorized (December 31, 2024: 19,375,670), par value $0.01; issued and outstanding (December 31, 2024: 19,375,670) ..................................................................................................................................................................... 194 199 250 255 255 Additional paid-in-capital .......................................................................................................................................................... 1,163,609 1,172,331 1,171,585 1,255,055 1,249,817 Accumulated other comprehensive loss ................................................................................................................................ (4,441) (4,441) (4,441) (4,441) (4,441) Retained earnings ..................................................................................................................................................................... 1,168,526 1,144,722 1,070,384 957,782 801,373 Total shareholders' equity .................................................................................................................................................... 2,328,709 2,313,626 2,238,547 2,209,505 2,047,850 Total liabilities, non-controlling interest, and shareholders' equity .......................................................................... $ 7,796,033 $ 7,826,547 $ 7,623,103 $ 7,349,025 $ 6,671,355 Summary Consolidated Results Consolidated Balance Sheets

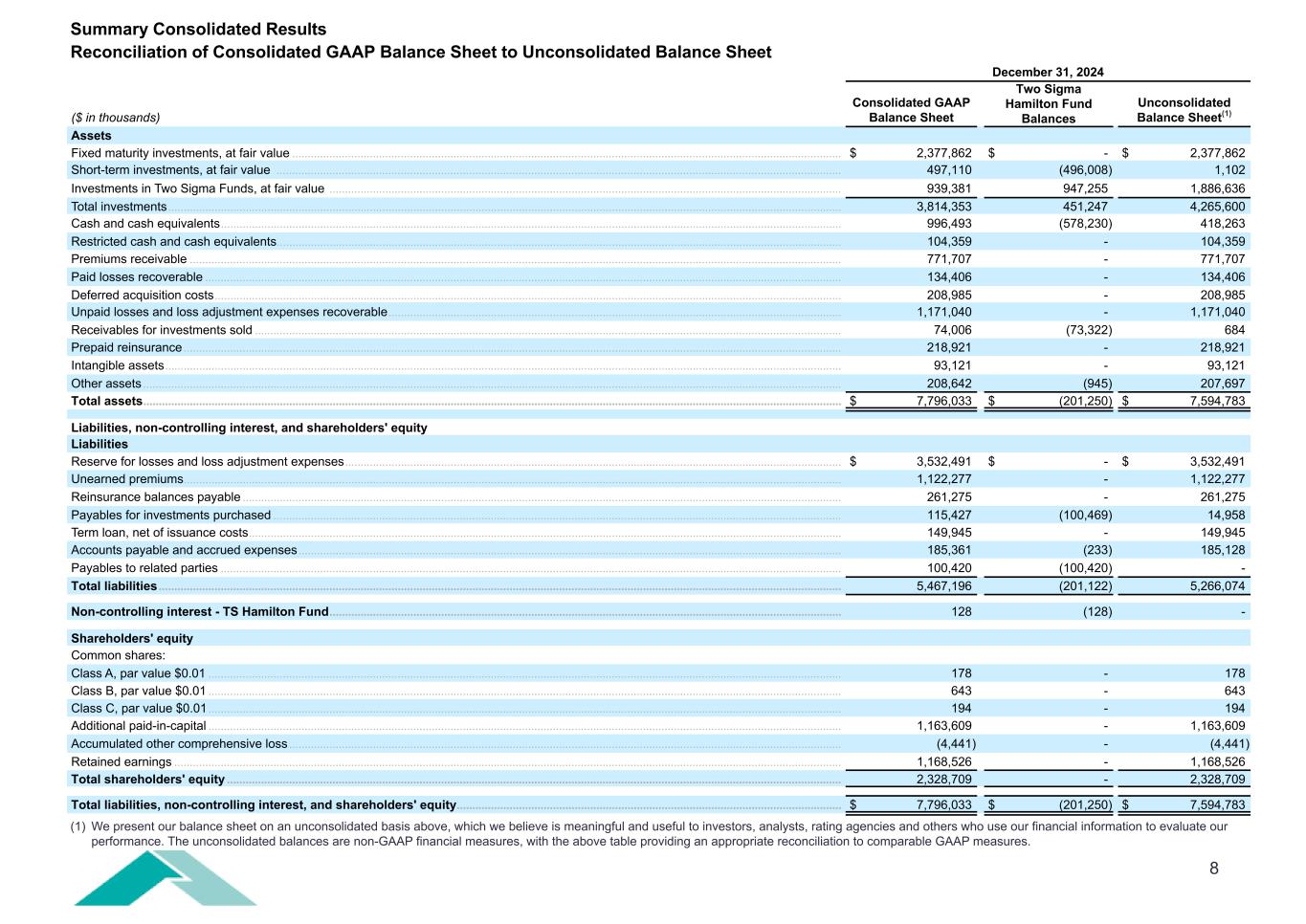

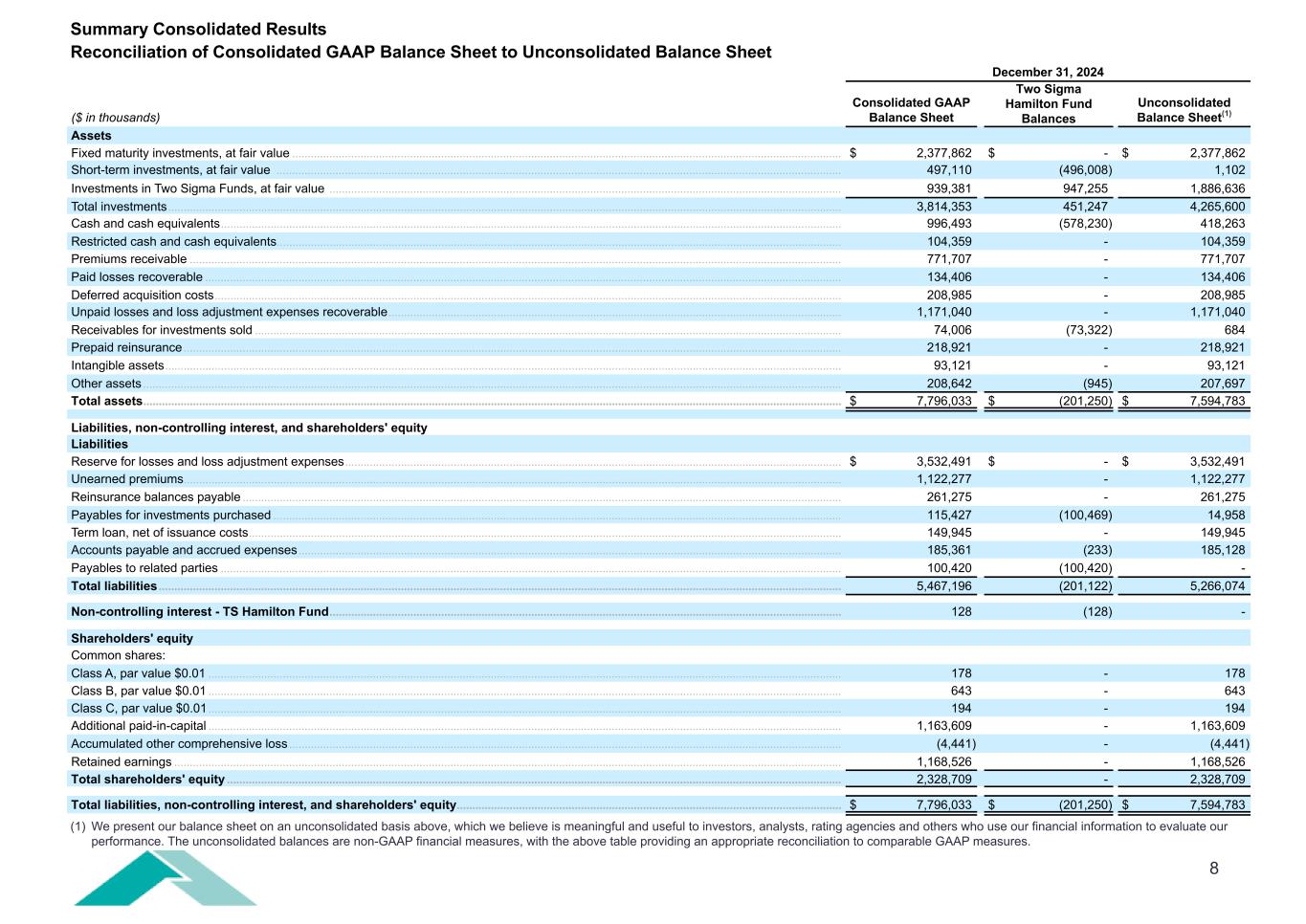

8 December 31, 2024 ($ in thousands) Consolidated GAAP Balance Sheet Two Sigma Hamilton Fund Balances Unconsolidated Balance Sheet(1) Assets Fixed maturity investments, at fair value ................................................................................................................................................................................. $ 2,377,862 $ - $ 2,377,862 Short-term investments, at fair value ...................................................................................................................................................................................... 497,110 (496,008) 1,102 Investments in Two Sigma Funds, at fair value ..................................................................................................................................................................... 939,381 947,255 1,886,636 Total investments ......................................................................................................................................................................................................................... 3,814,353 451,247 4,265,600 Cash and cash equivalents ........................................................................................................................................................................................................ 996,493 (578,230) 418,263 Restricted cash and cash equivalents ...................................................................................................................................................................................... 104,359 - 104,359 Premiums receivable .................................................................................................................................................................................................................. 771,707 - 771,707 Paid losses recoverable ............................................................................................................................................................................................................. 134,406 - 134,406 Deferred acquisition costs .......................................................................................................................................................................................................... 208,985 - 208,985 Unpaid losses and loss adjustment expenses recoverable .................................................................................................................................................. 1,171,040 - 1,171,040 Receivables for investments sold ............................................................................................................................................................................................. 74,006 (73,322) 684 Prepaid reinsurance .................................................................................................................................................................................................................... 218,921 - 218,921 Intangible assets .......................................................................................................................................................................................................................... 93,121 - 93,121 Other assets ................................................................................................................................................................................................................................. 208,642 (945) 207,697 Total assets ................................................................................................................................................................................................................................. $ 7,796,033 $ (201,250) $ 7,594,783 Liabilities, non-controlling interest, and shareholders' equity Liabilities Reserve for losses and loss adjustment expenses ................................................................................................................................................................ $ 3,532,491 $ - $ 3,532,491 Unearned premiums .................................................................................................................................................................................................................... 1,122,277 - 1,122,277 Reinsurance balances payable ................................................................................................................................................................................................. 261,275 - 261,275 Payables for investments purchased ....................................................................................................................................................................................... 115,427 (100,469) 14,958 Term loan, net of issuance costs ............................................................................................................................................................................................... 149,945 - 149,945 Accounts payable and accrued expenses ............................................................................................................................................................................... 185,361 (233) 185,128 Payables to related parties ........................................................................................................................................................................................................ 100,420 (100,420) - Total liabilities ............................................................................................................................................................................................................................ 5,467,196 (201,122) 5,266,074 Non-controlling interest - TS Hamilton Fund ..................................................................................................................................................................... 128 (128) - Shareholders' equity Common shares: Class A, par value $0.01 ............................................................................................................................................................................................................ 178 - 178 Class B, par value $0.01 ............................................................................................................................................................................................................ 643 - 643 Class C, par value $0.01 ............................................................................................................................................................................................................ 194 - 194 Additional paid-in-capital ............................................................................................................................................................................................................ 1,163,609 - 1,163,609 Accumulated other comprehensive loss .................................................................................................................................................................................. (4,441) - (4,441) Retained earnings ....................................................................................................................................................................................................................... 1,168,526 - 1,168,526 Total shareholders' equity ...................................................................................................................................................................................................... 2,328,709 - 2,328,709 Total liabilities, non-controlling interest, and shareholders' equity ............................................................................................................................ $ 7,796,033 $ (201,250) $ 7,594,783 Summary Consolidated Results Reconciliation of Consolidated GAAP Balance Sheet to Unconsolidated Balance Sheet (1) We present our balance sheet on an unconsolidated basis above, which we believe is meaningful and useful to investors, analysts, rating agencies and others who use our financial information to evaluate our performance. The unconsolidated balances are non-GAAP financial measures, with the above table providing an appropriate reconciliation to comparable GAAP measures.

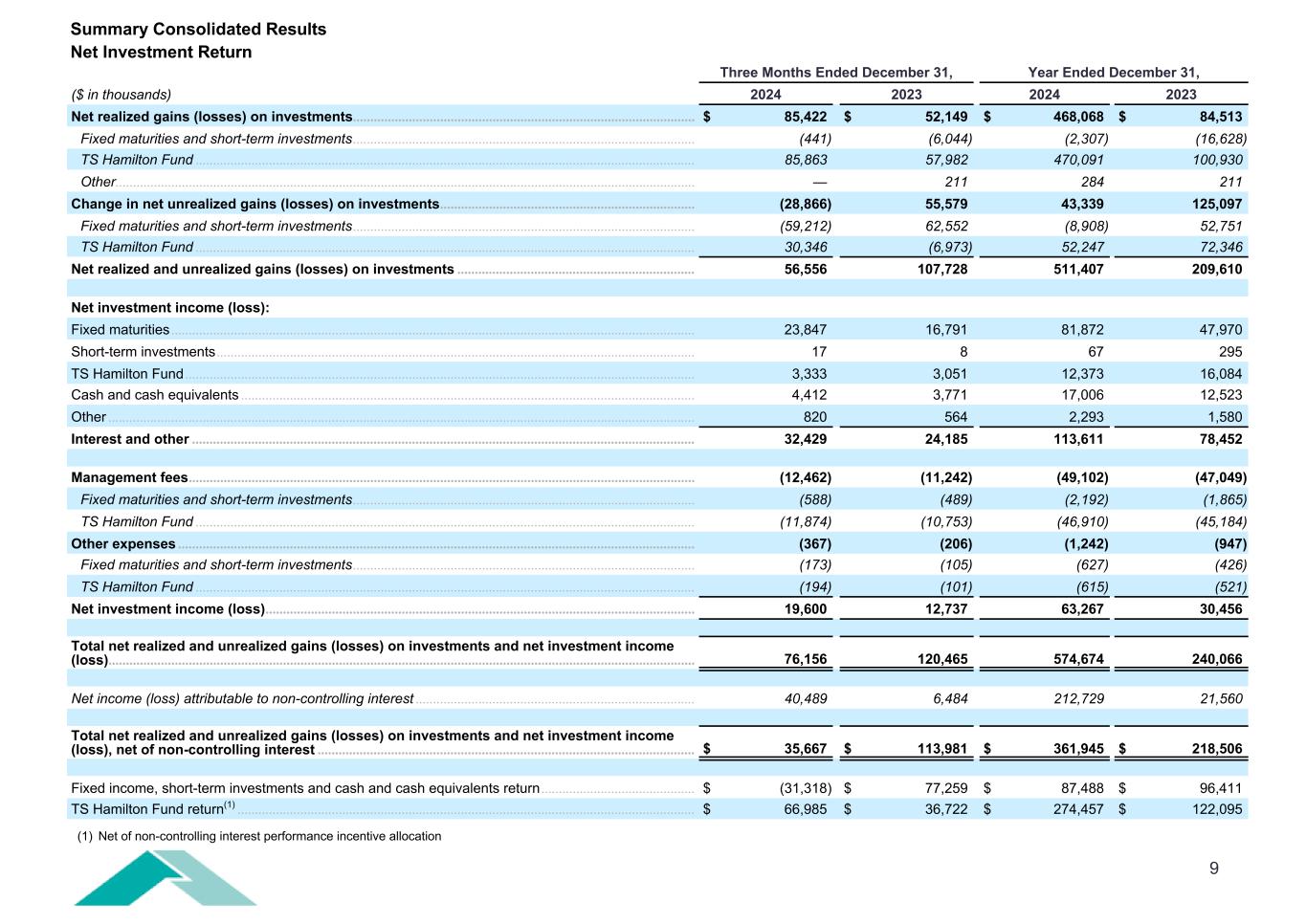

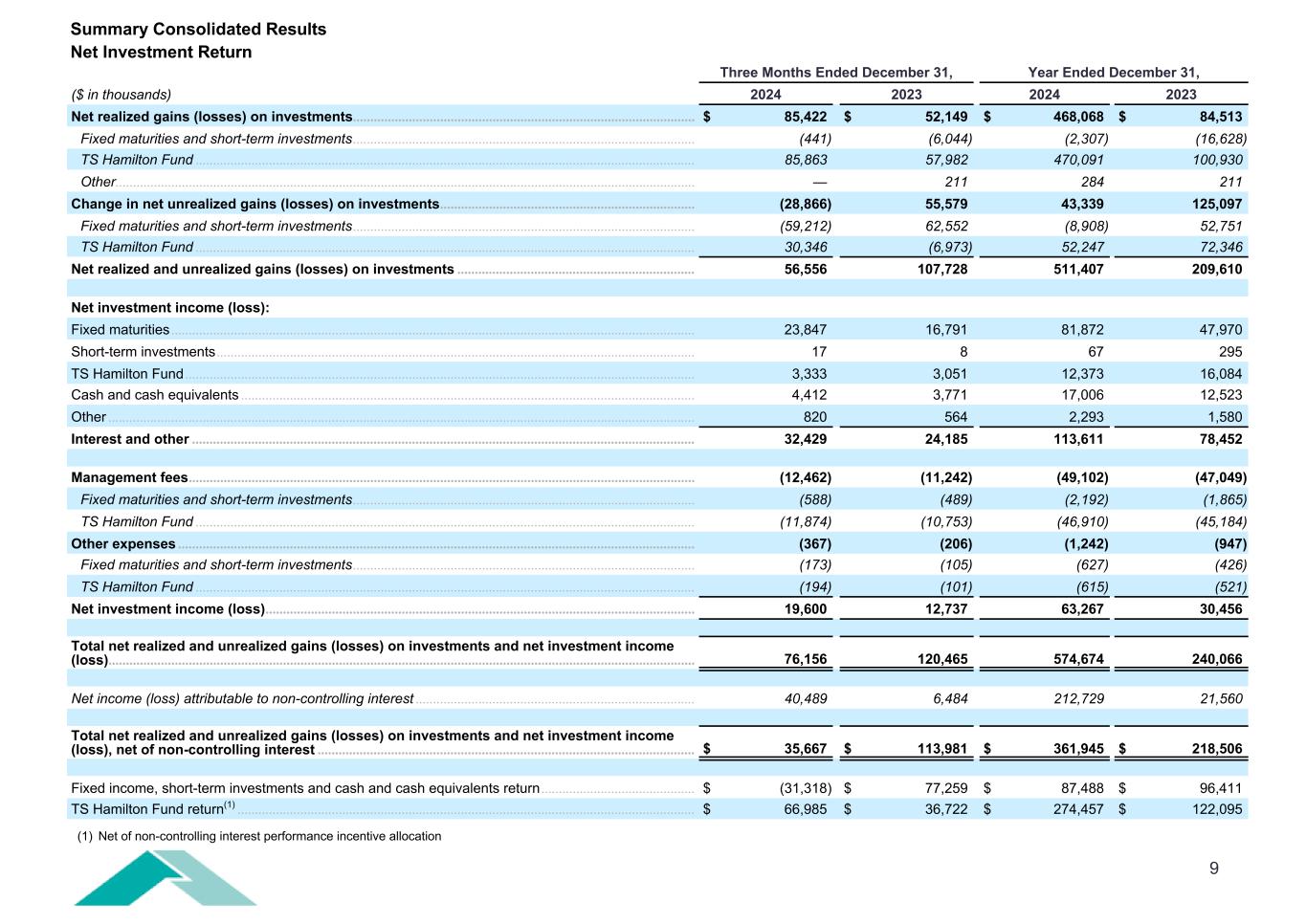

9 Three Months Ended December 31, Year Ended December 31, ($ in thousands) 2024 2023 2024 2023 Net realized gains (losses) on investments .................................................................................................. $ 85,422 $ 52,149 $ 468,068 $ 84,513 Fixed maturities and short-term investments .................................................................................................. (441) (6,044) (2,307) (16,628) TS Hamilton Fund ............................................................................................................................................... 85,863 57,982 470,091 100,930 Other...................................................................................................................................................................... — 211 284 211 Change in net unrealized gains (losses) on investments ......................................................................... (28,866) 55,579 43,339 125,097 Fixed maturities and short-term investments .................................................................................................. (59,212) 62,552 (8,908) 52,751 TS Hamilton Fund ............................................................................................................................................... 30,346 (6,973) 52,247 72,346 Net realized and unrealized gains (losses) on investments .................................................................... 56,556 107,728 511,407 209,610 Net investment income (loss): Fixed maturities ...................................................................................................................................................... 23,847 16,791 81,872 47,970 Short-term investments ......................................................................................................................................... 17 8 67 295 TS Hamilton Fund .................................................................................................................................................. 3,333 3,051 12,373 16,084 Cash and cash equivalents .................................................................................................................................. 4,412 3,771 17,006 12,523 Other ........................................................................................................................................................................ 820 564 2,293 1,580 Interest and other ................................................................................................................................................ 32,429 24,185 113,611 78,452 Management fees ................................................................................................................................................. (12,462) (11,242) (49,102) (47,049) Fixed maturities and short-term investments .................................................................................................. (588) (489) (2,192) (1,865) TS Hamilton Fund ............................................................................................................................................... (11,874) (10,753) (46,910) (45,184) Other expenses .................................................................................................................................................... (367) (206) (1,242) (947) Fixed maturities and short-term investments .................................................................................................. (173) (105) (627) (426) TS Hamilton Fund ............................................................................................................................................... (194) (101) (615) (521) Net investment income (loss) ........................................................................................................................... 19,600 12,737 63,267 30,456 Total net realized and unrealized gains (losses) on investments and net investment income (loss) ........................................................................................................................................................................ 76,156 120,465 574,674 240,066 Net income (loss) attributable to non-controlling interest ................................................................................ 40,489 6,484 212,729 21,560 Total net realized and unrealized gains (losses) on investments and net investment income (loss), net of non-controlling interest ............................................................................................................ $ 35,667 $ 113,981 $ 361,945 $ 218,506 Fixed income, short-term investments and cash and cash equivalents return ............................................ $ (31,318) $ 77,259 $ 87,488 $ 96,411 TS Hamilton Fund return(1) ................................................................................................................................... $ 66,985 $ 36,722 $ 274,457 $ 122,095 Summary Consolidated Results Net Investment Return (1) Net of non-controlling interest performance incentive allocation

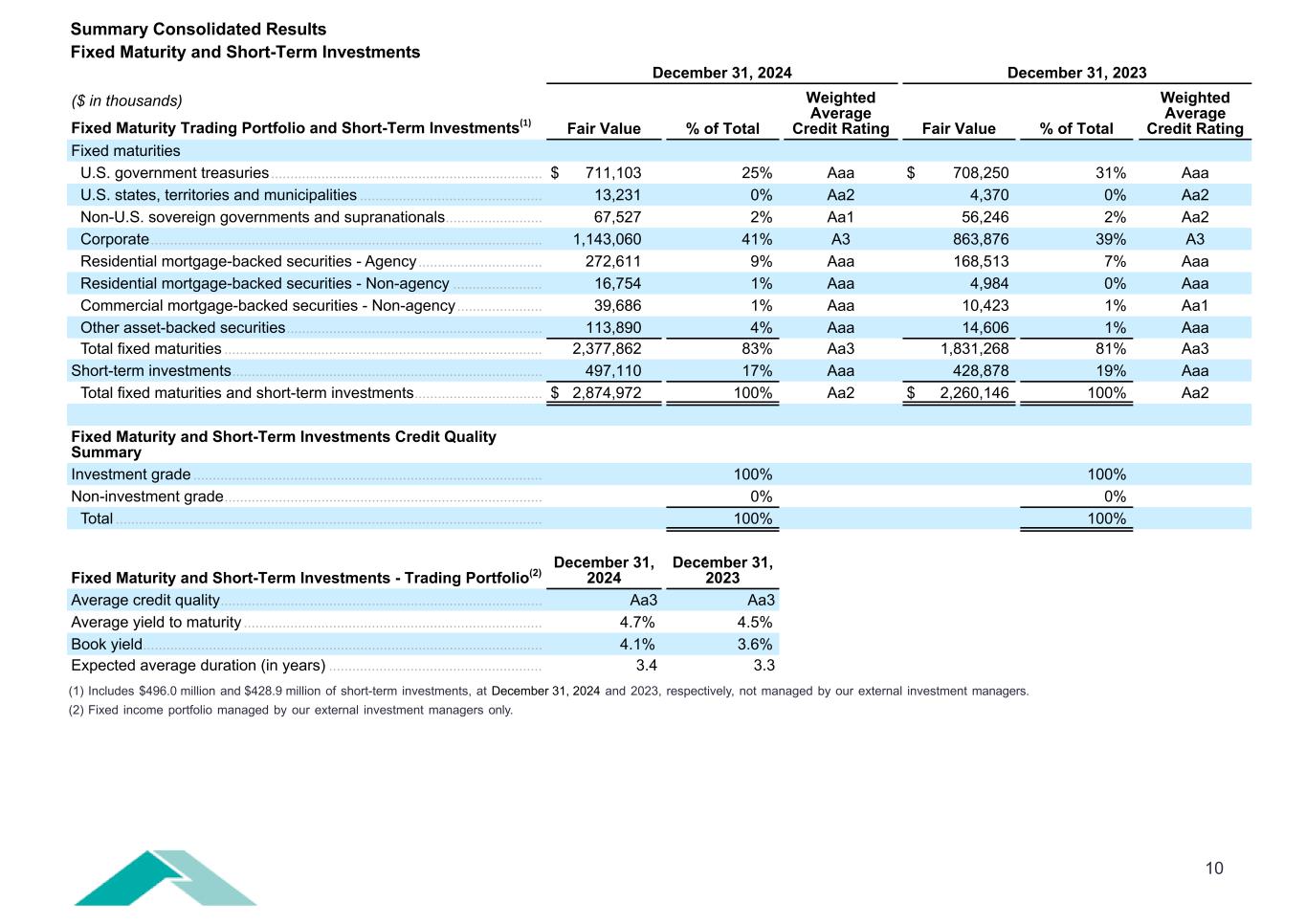

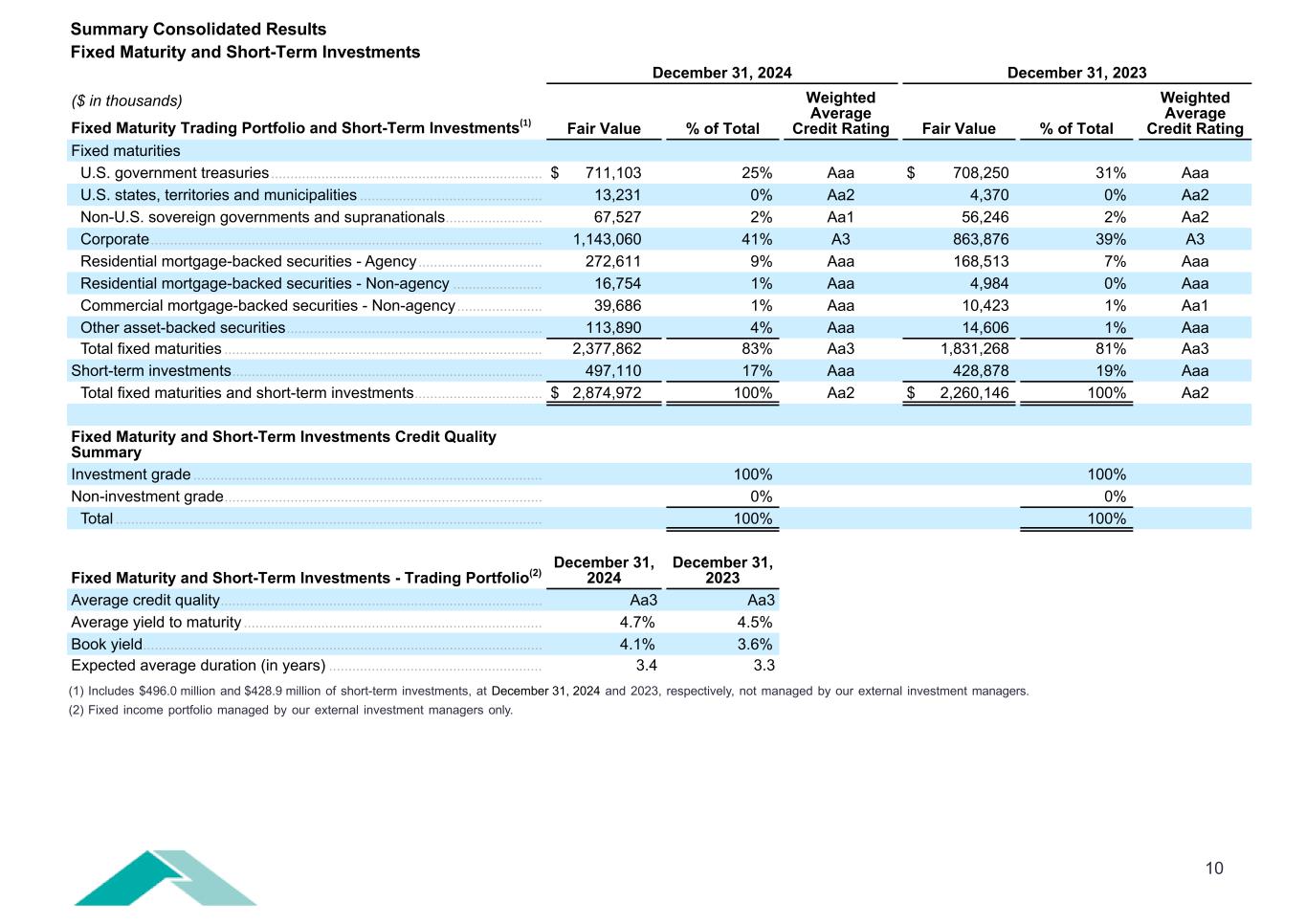

10 December 31, 2024 December 31, 2023 ($ in thousands) Fair Value % of Total Weighted Average Credit Rating Fair Value % of Total Weighted Average Credit RatingFixed Maturity Trading Portfolio and Short-Term Investments(1) Fixed maturities U.S. government treasuries ...................................................................... $ 711,103 25% Aaa $ 708,250 31% Aaa U.S. states, territories and municipalities ............................................... 13,231 0% Aa2 4,370 0% Aa2 Non-U.S. sovereign governments and supranationals ......................... 67,527 2% Aa1 56,246 2% Aa2 Corporate ..................................................................................................... 1,143,060 41% A3 863,876 39% A3 Residential mortgage-backed securities - Agency ................................ 272,611 9% Aaa 168,513 7% Aaa Residential mortgage-backed securities - Non-agency ....................... 16,754 1% Aaa 4,984 0% Aaa Commercial mortgage-backed securities - Non-agency ...................... 39,686 1% Aaa 10,423 1% Aa1 Other asset-backed securities .................................................................. 113,890 4% Aaa 14,606 1% Aaa Total fixed maturities .................................................................................. 2,377,862 83% Aa3 1,831,268 81% Aa3 Short-term investments ................................................................................ 497,110 17% Aaa 428,878 19% Aaa Total fixed maturities and short-term investments ................................. $ 2,874,972 100% Aa2 $ 2,260,146 100% Aa2 Fixed Maturity and Short-Term Investments Credit Quality Summary Investment grade .......................................................................................... 100% 100% Non-investment grade .................................................................................. 0% 0% Total .............................................................................................................. 100% 100% Fixed Maturity and Short-Term Investments - Trading Portfolio(2) December 31, 2024 December 31, 2023 Average credit quality ................................................................................... Aa3 Aa3 Average yield to maturity ............................................................................. 4.7% 4.5% Book yield ....................................................................................................... 4.1% 3.6% Expected average duration (in years) ....................................................... 3.4 3.3 (1) Includes $496.0 million and $428.9 million of short-term investments, at December 31, 2024 and 2023, respectively, not managed by our external investment managers. (2) Fixed income portfolio managed by our external investment managers only. Summary Consolidated Results Fixed Maturity and Short-Term Investments

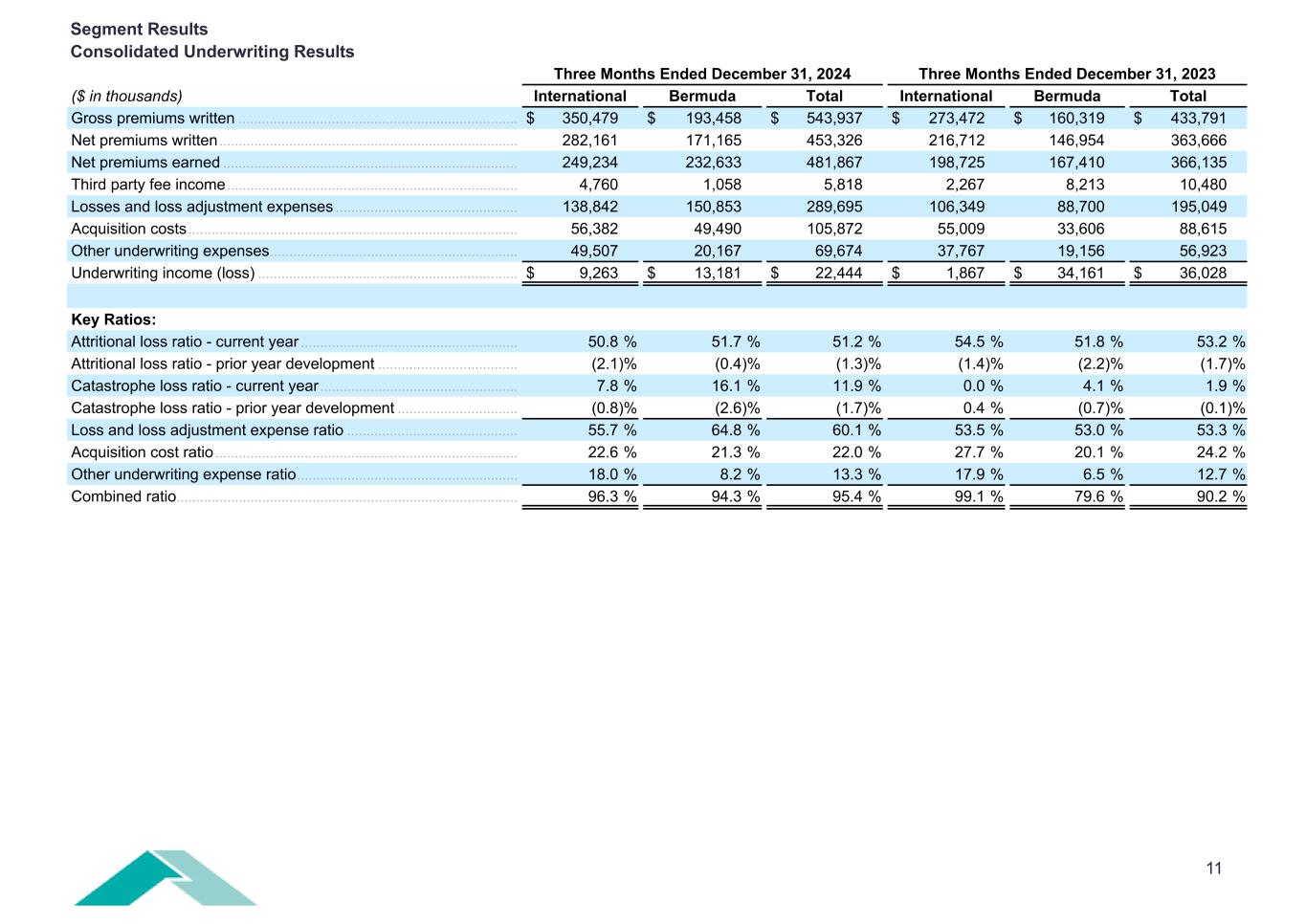

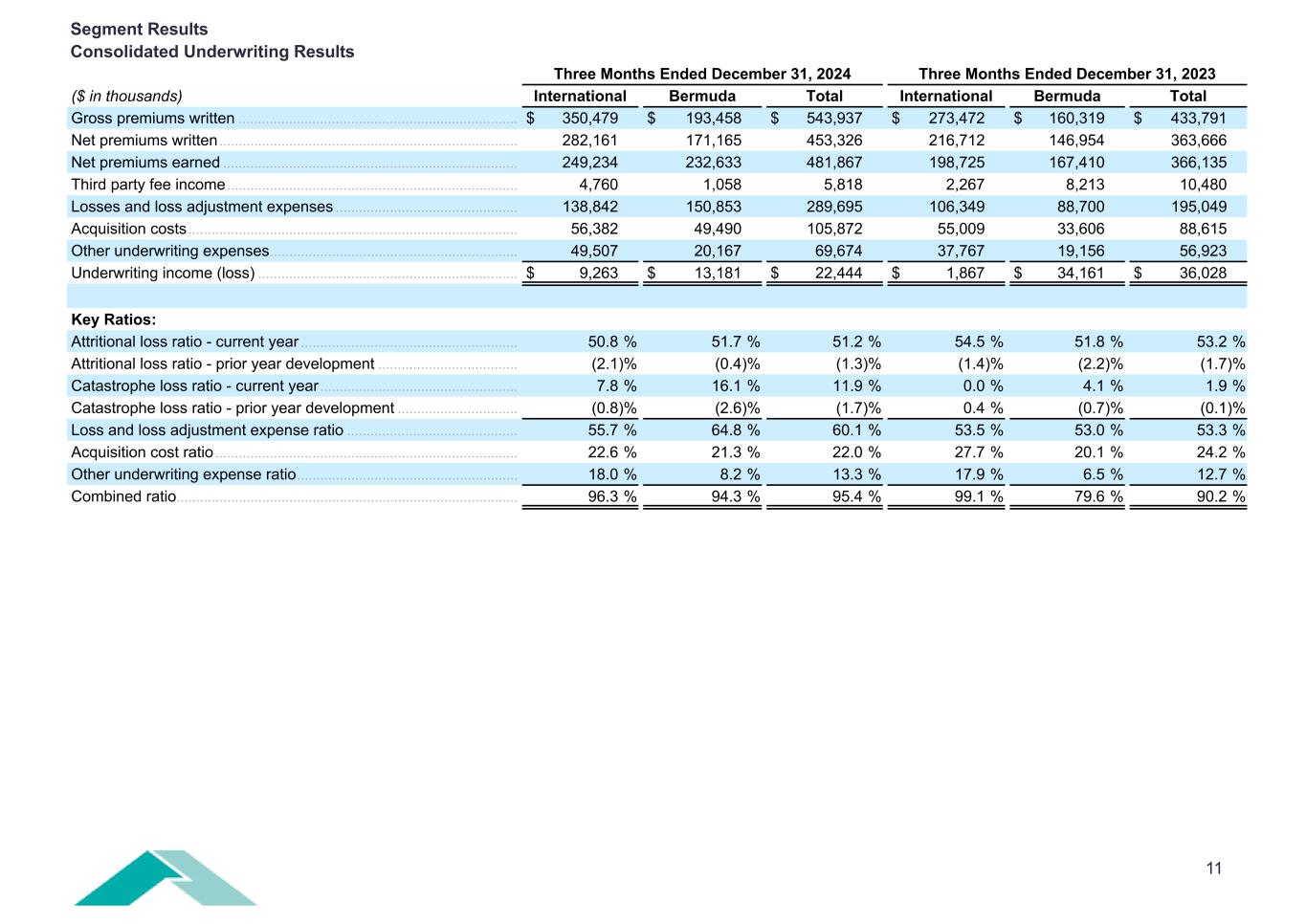

11 Three Months Ended December 31, 2024 Three Months Ended December 31, 2023 ($ in thousands) International Bermuda Total International Bermuda Total Gross premiums written ........................................................................ $ 350,479 $ 193,458 $ 543,937 $ 273,472 $ 160,319 $ 433,791 Net premiums written ............................................................................. 282,161 171,165 453,326 216,712 146,954 363,666 Net premiums earned ............................................................................ 249,234 232,633 481,867 198,725 167,410 366,135 Third party fee income ........................................................................... 4,760 1,058 5,818 2,267 8,213 10,480 Losses and loss adjustment expenses ............................................... 138,842 150,853 289,695 106,349 88,700 195,049 Acquisition costs ..................................................................................... 56,382 49,490 105,872 55,009 33,606 88,615 Other underwriting expenses ................................................................ 49,507 20,167 69,674 37,767 19,156 56,923 Underwriting income (loss) ................................................................... $ 9,263 $ 13,181 $ 22,444 $ 1,867 $ 34,161 $ 36,028 Key Ratios: Attritional loss ratio - current year ........................................................ 50.8 % 51.7 % 51.2 % 54.5 % 51.8 % 53.2 % Attritional loss ratio - prior year development .................................... (2.1) % (0.4) % (1.3) % (1.4) % (2.2) % (1.7) % Catastrophe loss ratio - current year ................................................... 7.8 % 16.1 % 11.9 % 0.0 % 4.1 % 1.9 % Catastrophe loss ratio - prior year development ............................... (0.8) % (2.6) % (1.7) % 0.4 % (0.7) % (0.1) % Loss and loss adjustment expense ratio ............................................ 55.7 % 64.8 % 60.1 % 53.5 % 53.0 % 53.3 % Acquisition cost ratio .............................................................................. 22.6 % 21.3 % 22.0 % 27.7 % 20.1 % 24.2 % Other underwriting expense ratio ......................................................... 18.0 % 8.2 % 13.3 % 17.9 % 6.5 % 12.7 % Combined ratio ........................................................................................ 96.3 % 94.3 % 95.4 % 99.1 % 79.6 % 90.2 % Segment Results Consolidated Underwriting Results

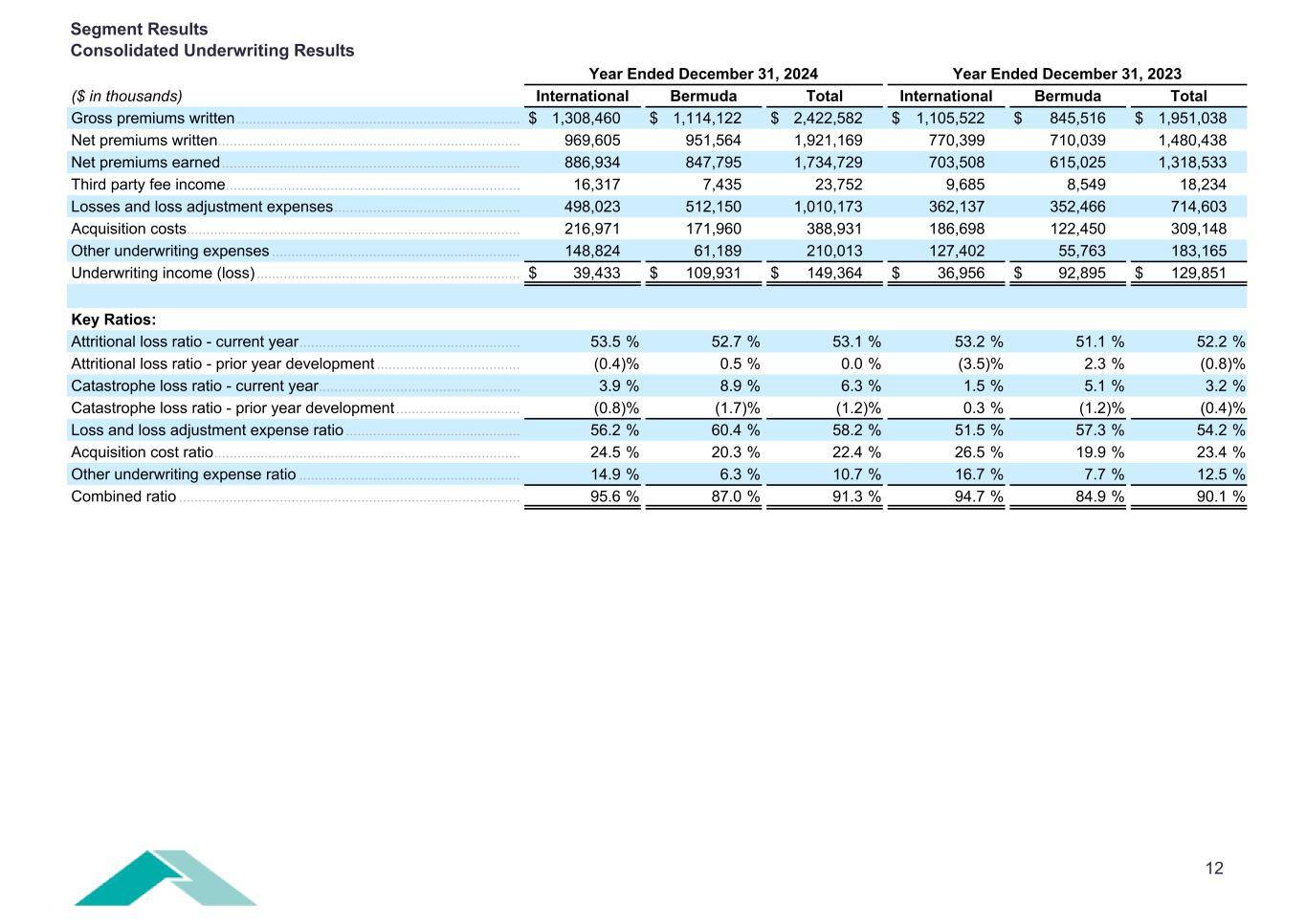

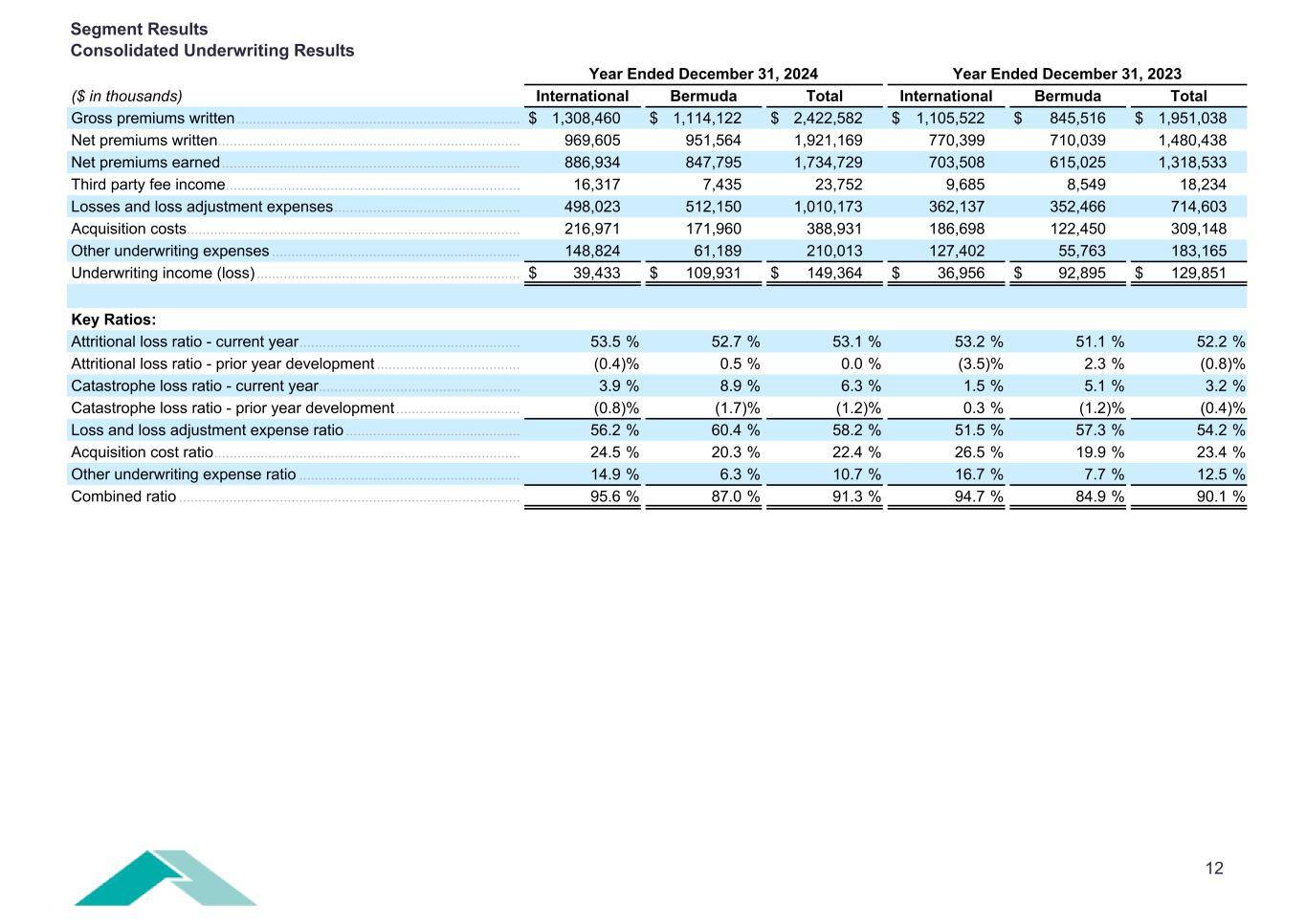

12 Year Ended December 31, 2024 Year Ended December 31, 2023 ($ in thousands) International Bermuda Total International Bermuda Total Gross premiums written ......................................................................... $ 1,308,460 $ 1,114,122 $ 2,422,582 $ 1,105,522 $ 845,516 $ 1,951,038 Net premiums written .............................................................................. 969,605 951,564 1,921,169 770,399 710,039 1,480,438 Net premiums earned ............................................................................. 886,934 847,795 1,734,729 703,508 615,025 1,318,533 Third party fee income ............................................................................ 16,317 7,435 23,752 9,685 8,549 18,234 Losses and loss adjustment expenses ................................................ 498,023 512,150 1,010,173 362,137 352,466 714,603 Acquisition costs ...................................................................................... 216,971 171,960 388,931 186,698 122,450 309,148 Other underwriting expenses ................................................................ 148,824 61,189 210,013 127,402 55,763 183,165 Underwriting income (loss) .................................................................... $ 39,433 $ 109,931 $ 149,364 $ 36,956 $ 92,895 $ 129,851 Key Ratios: Attritional loss ratio - current year ......................................................... 53.5 % 52.7 % 53.1 % 53.2 % 51.1 % 52.2 % Attritional loss ratio - prior year development ..................................... (0.4) % 0.5 % 0.0 % (3.5) % 2.3 % (0.8) % Catastrophe loss ratio - current year .................................................... 3.9 % 8.9 % 6.3 % 1.5 % 5.1 % 3.2 % Catastrophe loss ratio - prior year development ................................ (0.8) % (1.7) % (1.2) % 0.3 % (1.2) % (0.4) % Loss and loss adjustment expense ratio ............................................. 56.2 % 60.4 % 58.2 % 51.5 % 57.3 % 54.2 % Acquisition cost ratio ............................................................................... 24.5 % 20.3 % 22.4 % 26.5 % 19.9 % 23.4 % Other underwriting expense ratio ......................................................... 14.9 % 6.3 % 10.7 % 16.7 % 7.7 % 12.5 % Combined ratio ........................................................................................ 95.6 % 87.0 % 91.3 % 94.7 % 84.9 % 90.1 % Segment Results Consolidated Underwriting Results

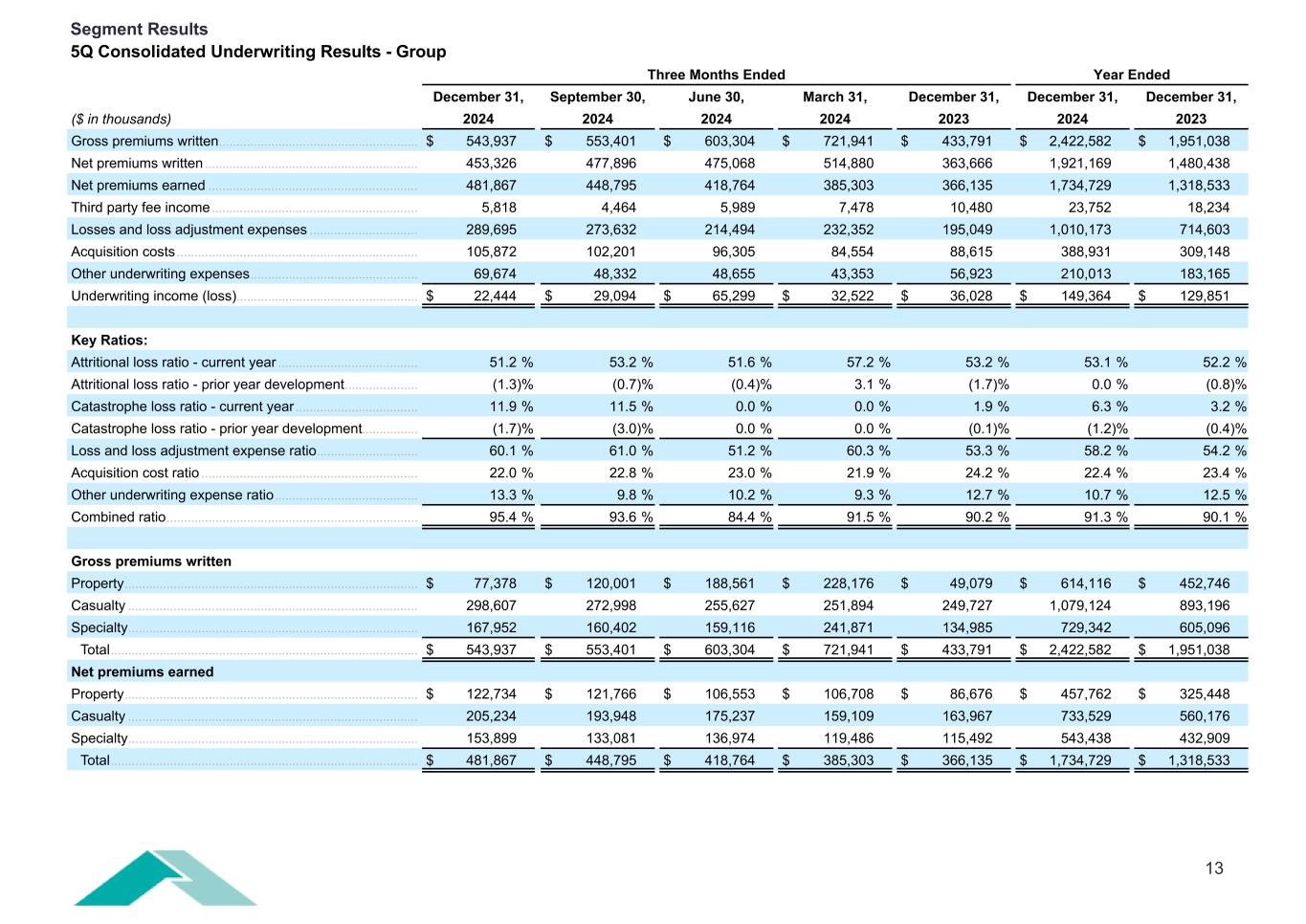

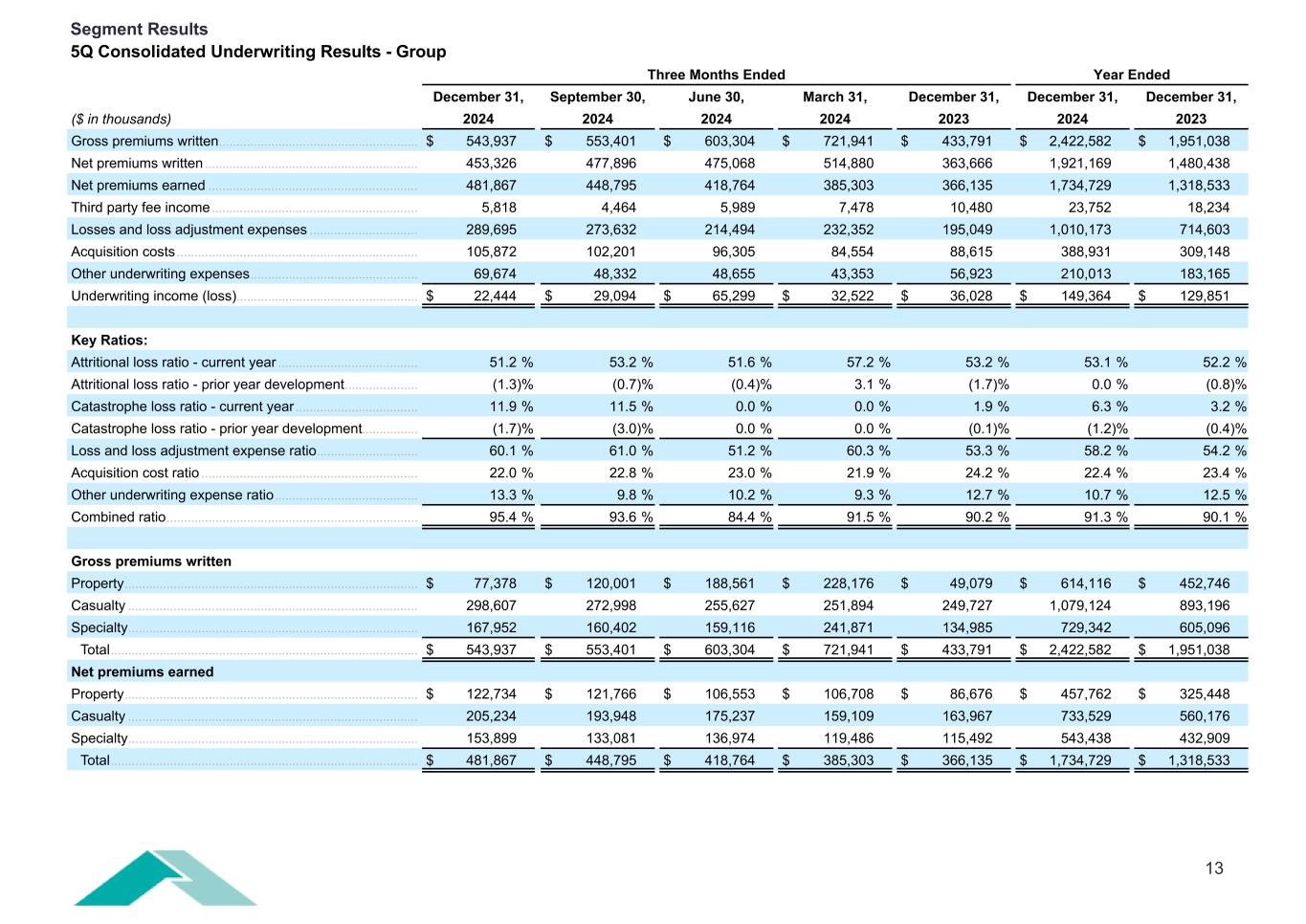

13 Three Months Ended Year Ended December 31, September 30, June 30, March 31, December 31, December 31, December 31, ($ in thousands) 2024 2024 2024 2024 2023 2024 2023 Gross premiums written ......................................................... $ 543,937 $ 553,401 $ 603,304 $ 721,941 $ 433,791 $ 2,422,582 $ 1,951,038 Net premiums written ............................................................. 453,326 477,896 475,068 514,880 363,666 1,921,169 1,480,438 Net premiums earned ............................................................ 481,867 448,795 418,764 385,303 366,135 1,734,729 1,318,533 Third party fee income ........................................................... 5,818 4,464 5,989 7,478 10,480 23,752 18,234 Losses and loss adjustment expenses ............................... 289,695 273,632 214,494 232,352 195,049 1,010,173 714,603 Acquisition costs ..................................................................... 105,872 102,201 96,305 84,554 88,615 388,931 309,148 Other underwriting expenses ................................................ 69,674 48,332 48,655 43,353 56,923 210,013 183,165 Underwriting income (loss) .................................................... $ 22,444 $ 29,094 $ 65,299 $ 32,522 $ 36,028 $ 149,364 $ 129,851 Key Ratios: Attritional loss ratio - current year ........................................ 51.2 % 53.2 % 51.6 % 57.2 % 53.2 % 53.1 % 52.2 % Attritional loss ratio - prior year development ..................... (1.3) % (0.7) % (0.4) % 3.1 % (1.7) % 0.0 % (0.8) % Catastrophe loss ratio - current year ................................... 11.9 % 11.5 % 0.0 % 0.0 % 1.9 % 6.3 % 3.2 % Catastrophe loss ratio - prior year development ................ (1.7) % (3.0) % 0.0 % 0.0 % (0.1) % (1.2) % (0.4) % Loss and loss adjustment expense ratio ............................. 60.1 % 61.0 % 51.2 % 60.3 % 53.3 % 58.2 % 54.2 % Acquisition cost ratio .............................................................. 22.0 % 22.8 % 23.0 % 21.9 % 24.2 % 22.4 % 23.4 % Other underwriting expense ratio ......................................... 13.3 % 9.8 % 10.2 % 9.3 % 12.7 % 10.7 % 12.5 % Combined ratio ........................................................................ 95.4 % 93.6 % 84.4 % 91.5 % 90.2 % 91.3 % 90.1 % Gross premiums written Property .................................................................................... $ 77,378 $ 120,001 $ 188,561 $ 228,176 $ 49,079 $ 614,116 $ 452,746 Casualty ................................................................................... 298,607 272,998 255,627 251,894 249,727 1,079,124 893,196 Specialty ................................................................................... 167,952 160,402 159,116 241,871 134,985 729,342 605,096 Total ........................................................................................ $ 543,937 $ 553,401 $ 603,304 $ 721,941 $ 433,791 $ 2,422,582 $ 1,951,038 Net premiums earned Property .................................................................................... $ 122,734 $ 121,766 $ 106,553 $ 106,708 $ 86,676 $ 457,762 $ 325,448 Casualty ................................................................................... 205,234 193,948 175,237 159,109 163,967 733,529 560,176 Specialty ................................................................................... 153,899 133,081 136,974 119,486 115,492 543,438 432,909 Total ........................................................................................ $ 481,867 $ 448,795 $ 418,764 $ 385,303 $ 366,135 $ 1,734,729 $ 1,318,533 Segment Results 5Q Consolidated Underwriting Results - Group

14 Three Months Ended Year Ended December 31, September 30, June 30, March 31, December 31, December 31, December 31, ($ in thousands) 2024 2024 2024 2024 2023 2024 2023 Gross premiums written ......................................................... $ 350,479 $ 325,525 $ 311,616 $ 320,841 $ 273,472 $ 1,308,460 $ 1,105,522 Net premiums written ............................................................. 282,161 268,106 234,305 185,033 216,712 969,605 770,399 Net premiums earned ............................................................ 249,234 225,244 215,643 196,814 198,725 886,934 703,508 Third party fee income ........................................................... 4,760 4,170 3,798 3,586 2,267 16,317 9,685 Losses and loss adjustment expenses ............................... 138,842 130,135 112,884 116,162 106,349 498,023 362,137 Acquisition costs ..................................................................... 56,382 59,713 53,157 47,720 55,009 216,971 186,698 Other underwriting expenses ................................................ 49,507 34,143 33,972 31,203 37,767 148,824 127,402 Underwriting income (loss) .................................................... $ 9,263 $ 5,423 $ 19,428 $ 5,315 $ 1,867 $ 39,433 $ 36,956 Key Ratios: Attritional loss ratio - current year ........................................ 50.8 % 55.3 % 52.5 % 56.0 % 54.5 % 53.5 % 53.2 % Attritional loss ratio - prior year development ..................... (2.1) % (1.5) % (0.2) % 2.9 % (1.4) % (0.4) % (3.5) % Catastrophe loss ratio - current year ................................... 7.8 % 6.4 % 0.0 % 0.0 % 0.0 % 3.9 % 1.5 % Catastrophe loss ratio - prior year development ................ (0.8) % (2.4) % 0.0 % 0.1 % 0.4 % (0.8) % 0.3 % Loss and loss adjustment expense ratio ............................. 55.7 % 57.8 % 52.3 % 59.0 % 53.5 % 56.2 % 51.5 % Acquisition cost ratio .............................................................. 22.6 % 26.5 % 24.7 % 24.2 % 27.7 % 24.5 % 26.5 % Other underwriting expense ratio ......................................... 18.0 % 13.3 % 14.0 % 14.0 % 17.9 % 14.9 % 16.7 % Combined ratio ........................................................................ 96.3 % 97.6 % 91.0 % 97.2 % 99.1 % 95.6 % 94.7 % Gross premiums written Property .................................................................................... $ 47,684 $ 51,441 $ 53,540 $ 37,704 $ 26,745 $ 190,369 $ 134,450 Casualty ................................................................................... 157,013 144,107 132,129 121,165 132,033 554,413 490,465 Specialty ................................................................................... 145,782 129,977 125,947 161,972 114,694 563,678 480,607 Total ........................................................................................ $ 350,479 $ 325,525 $ 311,616 $ 320,841 $ 273,472 $ 1,308,460 $ 1,105,522 Net premiums earned Property .................................................................................... $ 44,621 $ 37,033 $ 32,689 $ 34,974 $ 28,392 $ 149,318 $ 104,789 Casualty ................................................................................... 84,776 86,062 75,770 72,928 79,346 319,536 269,921 Specialty ................................................................................... 119,837 102,149 107,184 88,912 90,987 418,080 328,798 Total ........................................................................................ $ 249,234 $ 225,244 $ 215,643 $ 196,814 $ 198,725 $ 886,934 $ 703,508 Segment Results 5Q Underwriting Results - International

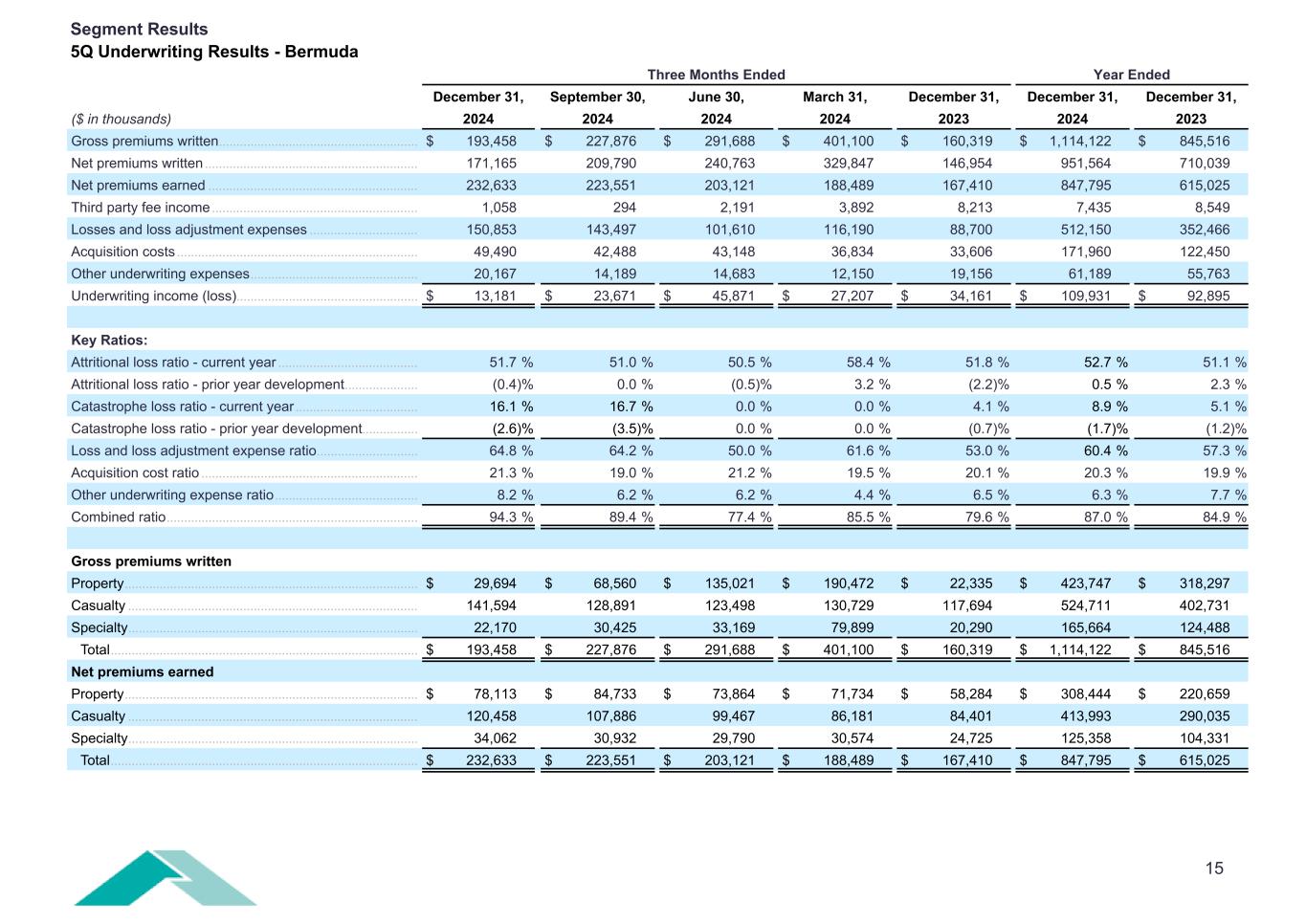

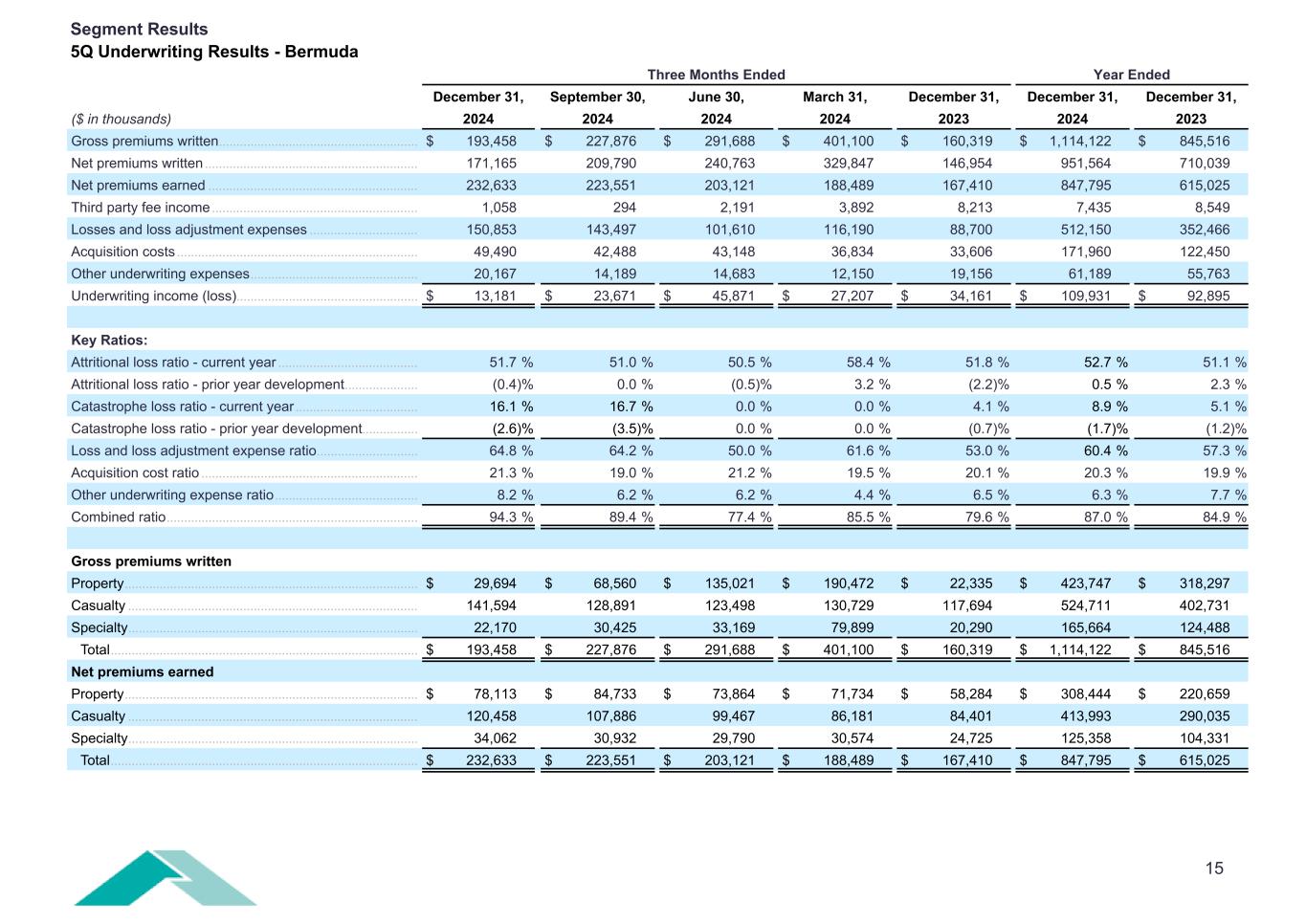

15 Three Months Ended Year Ended December 31, September 30, June 30, March 31, December 31, December 31, December 31, ($ in thousands) 2024 2024 2024 2024 2023 2024 2023 Gross premiums written ......................................................... $ 193,458 $ 227,876 $ 291,688 $ 401,100 $ 160,319 $ 1,114,122 $ 845,516 Net premiums written ............................................................. 171,165 209,790 240,763 329,847 146,954 951,564 710,039 Net premiums earned ............................................................ 232,633 223,551 203,121 188,489 167,410 847,795 615,025 Third party fee income ........................................................... 1,058 294 2,191 3,892 8,213 7,435 8,549 Losses and loss adjustment expenses ............................... 150,853 143,497 101,610 116,190 88,700 512,150 352,466 Acquisition costs ..................................................................... 49,490 42,488 43,148 36,834 33,606 171,960 122,450 Other underwriting expenses ................................................ 20,167 14,189 14,683 12,150 19,156 61,189 55,763 Underwriting income (loss) .................................................... $ 13,181 $ 23,671 $ 45,871 $ 27,207 $ 34,161 $ 109,931 $ 92,895 Key Ratios: Attritional loss ratio - current year ........................................ 51.7 % 51.0 % 50.5 % 58.4 % 51.8 % 52.7 % 51.1 % Attritional loss ratio - prior year development ..................... (0.4) % 0.0 % (0.5) % 3.2 % (2.2) % 0.5 % 2.3 % Catastrophe loss ratio - current year ................................... 16.1 % 16.7 % 0.0 % 0.0 % 4.1 % 8.9 % 5.1 % Catastrophe loss ratio - prior year development ................ (2.6) % (3.5) % 0.0 % 0.0 % (0.7) % (1.7) % (1.2) % Loss and loss adjustment expense ratio ............................. 64.8 % 64.2 % 50.0 % 61.6 % 53.0 % 60.4 % 57.3 % Acquisition cost ratio .............................................................. 21.3 % 19.0 % 21.2 % 19.5 % 20.1 % 20.3 % 19.9 % Other underwriting expense ratio ......................................... 8.2 % 6.2 % 6.2 % 4.4 % 6.5 % 6.3 % 7.7 % Combined ratio ........................................................................ 94.3 % 89.4 % 77.4 % 85.5 % 79.6 % 87.0 % 84.9 % Gross premiums written Property .................................................................................... $ 29,694 $ 68,560 $ 135,021 $ 190,472 $ 22,335 $ 423,747 $ 318,297 Casualty ................................................................................... 141,594 128,891 123,498 130,729 117,694 524,711 402,731 Specialty ................................................................................... 22,170 30,425 33,169 79,899 20,290 165,664 124,488 Total ........................................................................................ $ 193,458 $ 227,876 $ 291,688 $ 401,100 $ 160,319 $ 1,114,122 $ 845,516 Net premiums earned Property .................................................................................... $ 78,113 $ 84,733 $ 73,864 $ 71,734 $ 58,284 $ 308,444 $ 220,659 Casualty ................................................................................... 120,458 107,886 99,467 86,181 84,401 413,993 290,035 Specialty ................................................................................... 34,062 30,932 29,790 30,574 24,725 125,358 104,331 Total ........................................................................................ $ 232,633 $ 223,551 $ 203,121 $ 188,489 $ 167,410 $ 847,795 $ 615,025 Segment Results 5Q Underwriting Results - Bermuda

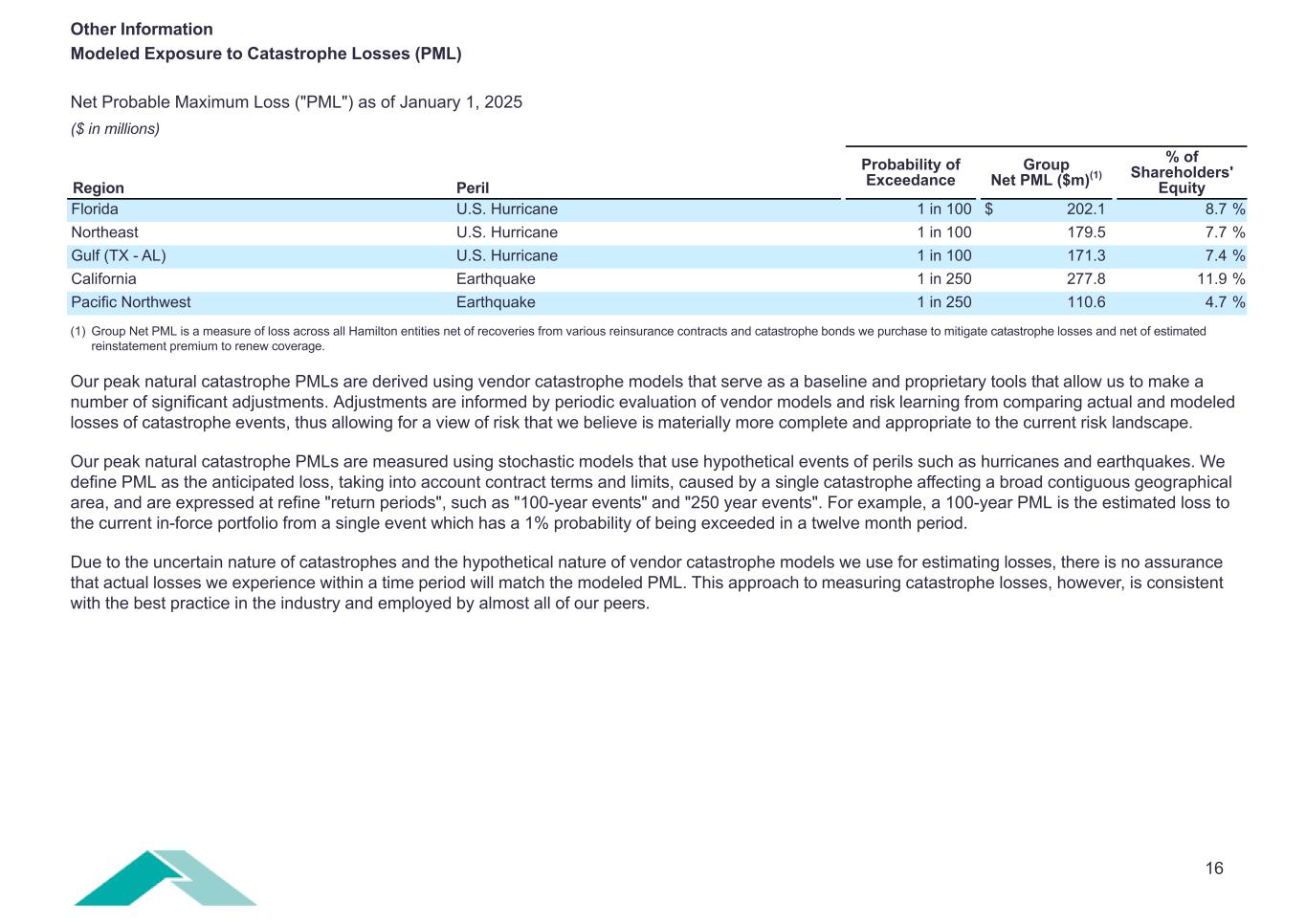

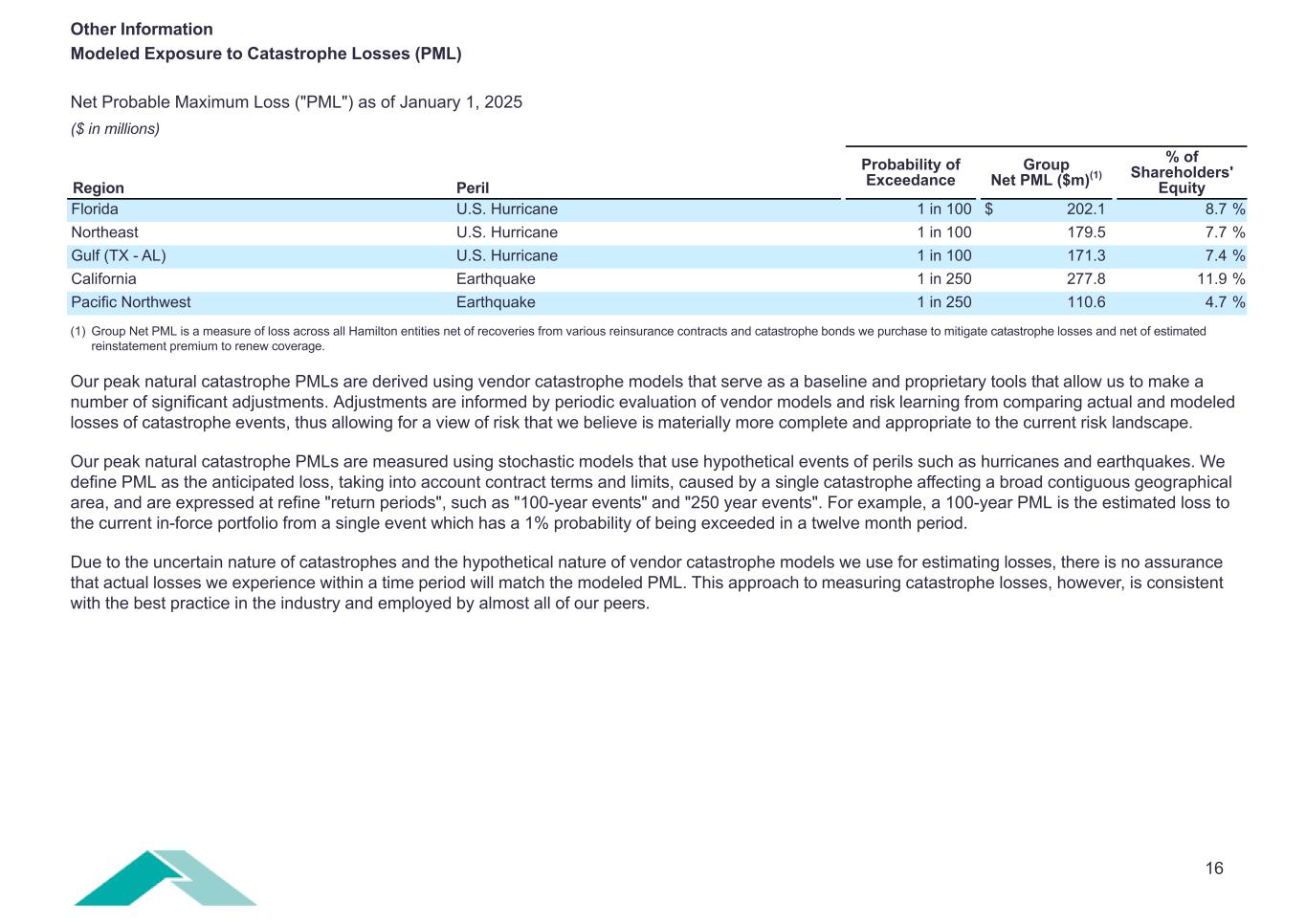

16 Region Peril Probability of Exceedance Group Net PML ($m)(1) % of Shareholders' Equity Florida U.S. Hurricane 1 in 100 $ 202.1 8.7 % Northeast U.S. Hurricane 1 in 100 179.5 7.7 % Gulf (TX - AL) U.S. Hurricane 1 in 100 171.3 7.4 % California Earthquake 1 in 250 277.8 11.9 % Pacific Northwest Earthquake 1 in 250 110.6 4.7 % (1) Group Net PML is a measure of loss across all Hamilton entities net of recoveries from various reinsurance contracts and catastrophe bonds we purchase to mitigate catastrophe losses and net of estimated reinstatement premium to renew coverage. Our peak natural catastrophe PMLs are derived using vendor catastrophe models that serve as a baseline and proprietary tools that allow us to make a number of significant adjustments. Adjustments are informed by periodic evaluation of vendor models and risk learning from comparing actual and modeled losses of catastrophe events, thus allowing for a view of risk that we believe is materially more complete and appropriate to the current risk landscape. Our peak natural catastrophe PMLs are measured using stochastic models that use hypothetical events of perils such as hurricanes and earthquakes. We define PML as the anticipated loss, taking into account contract terms and limits, caused by a single catastrophe affecting a broad contiguous geographical area, and are expressed at refine "return periods", such as "100-year events" and "250 year events". For example, a 100-year PML is the estimated loss to the current in-force portfolio from a single event which has a 1% probability of being exceeded in a twelve month period. Due to the uncertain nature of catastrophes and the hypothetical nature of vendor catastrophe models we use for estimating losses, there is no assurance that actual losses we experience within a time period will match the modeled PML. This approach to measuring catastrophe losses, however, is consistent with the best practice in the industry and employed by almost all of our peers. Other Information Modeled Exposure to Catastrophe Losses (PML) Net Probable Maximum Loss ("PML") as of January 1, 2025 ($ in millions)

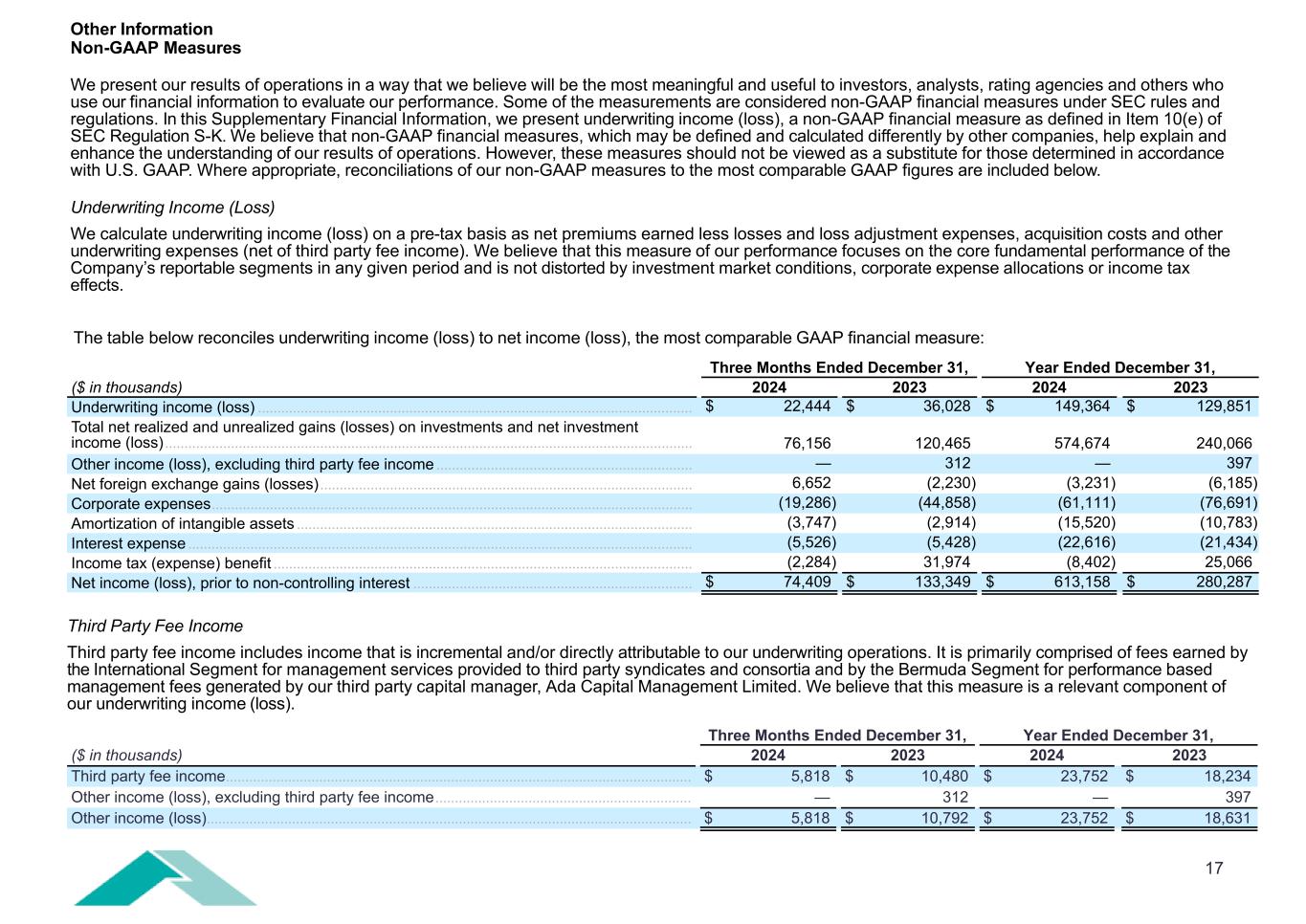

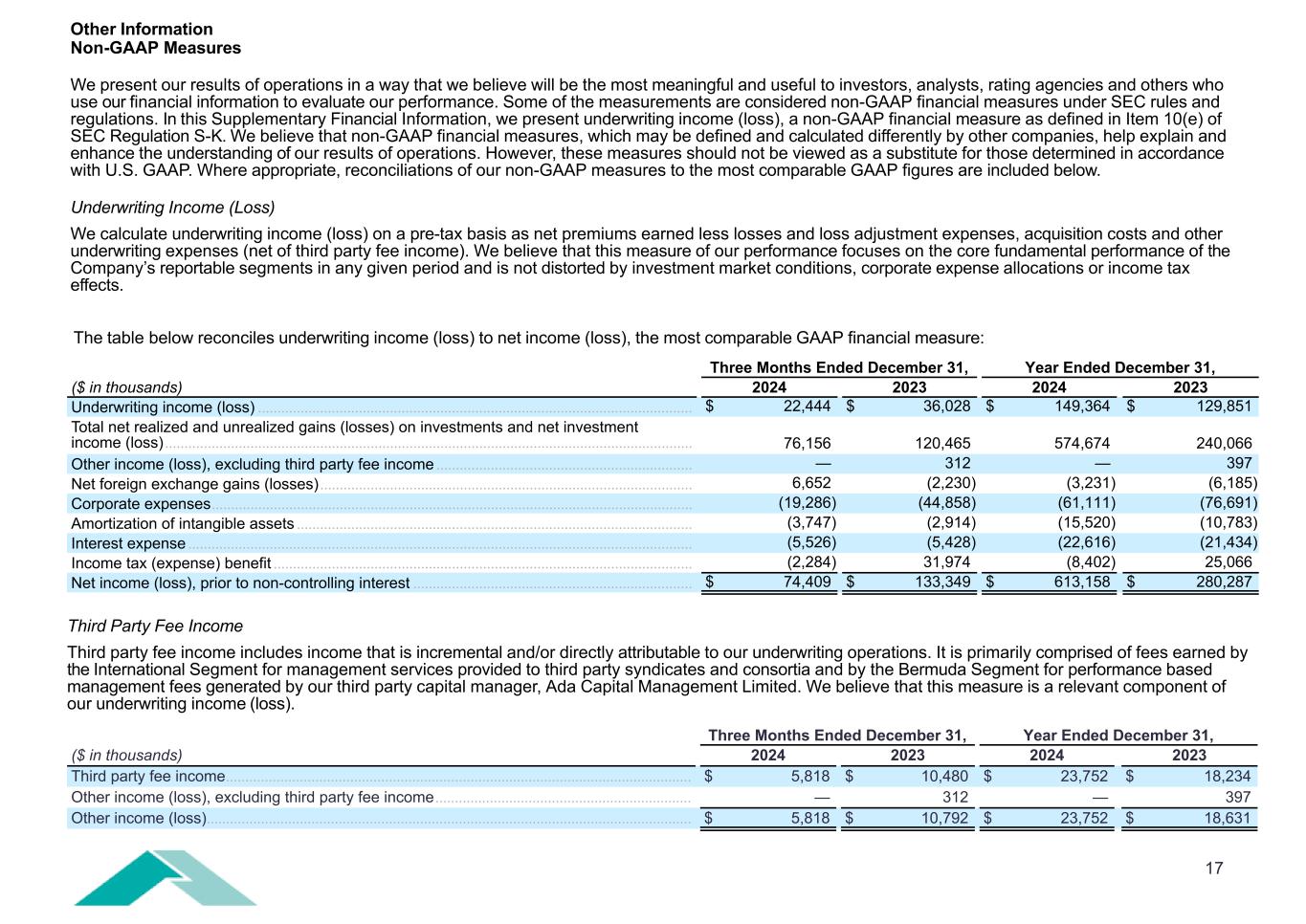

17 Other Information Non-GAAP Measures We present our results of operations in a way that we believe will be the most meaningful and useful to investors, analysts, rating agencies and others who use our financial information to evaluate our performance. Some of the measurements are considered non-GAAP financial measures under SEC rules and regulations. In this Supplementary Financial Information, we present underwriting income (loss), a non-GAAP financial measure as defined in Item 10(e) of SEC Regulation S-K. We believe that non-GAAP financial measures, which may be defined and calculated differently by other companies, help explain and enhance the understanding of our results of operations. However, these measures should not be viewed as a substitute for those determined in accordance with U.S. GAAP. Where appropriate, reconciliations of our non-GAAP measures to the most comparable GAAP figures are included below. Underwriting Income (Loss) We calculate underwriting income (loss) on a pre-tax basis as net premiums earned less losses and loss adjustment expenses, acquisition costs and other underwriting expenses (net of third party fee income). We believe that this measure of our performance focuses on the core fundamental performance of the Company’s reportable segments in any given period and is not distorted by investment market conditions, corporate expense allocations or income tax effects. The table below reconciles underwriting income (loss) to net income (loss), the most comparable GAAP financial measure: Three Months Ended December 31, Year Ended December 31, ($ in thousands) 2024 2023 2024 2023 Underwriting income (loss) ................................................................................................................ $ 22,444 $ 36,028 $ 149,364 $ 129,851 Total net realized and unrealized gains (losses) on investments and net investment income (loss) ........................................................................................................................................ 76,156 120,465 574,674 240,066 Other income (loss), excluding third party fee income .................................................................. — 312 — 397 Net foreign exchange gains (losses) ................................................................................................ 6,652 (2,230) (3,231) (6,185) Corporate expenses ............................................................................................................................ (19,286) (44,858) (61,111) (76,691) Amortization of intangible assets ...................................................................................................... (3,747) (2,914) (15,520) (10,783) Interest expense .................................................................................................................................. (5,526) (5,428) (22,616) (21,434) Income tax (expense) benefit ............................................................................................................ (2,284) 31,974 (8,402) 25,066 Net income (loss), prior to non-controlling interest ........................................................................ $ 74,409 $ 133,349 $ 613,158 $ 280,287 Three Months Ended December 31, Year Ended December 31, ($ in thousands) 2024 2023 2024 2023 Third party fee income ........................................................................................................................ $ 5,818 $ 10,480 $ 23,752 $ 18,234 Other income (loss), excluding third party fee income .................................................................. — 312 — 397 Other income (loss) ............................................................................................................................. $ 5,818 $ 10,792 $ 23,752 $ 18,631 Third Party Fee Income Third party fee income includes income that is incremental and/or directly attributable to our underwriting operations. It is primarily comprised of fees earned by the International Segment for management services provided to third party syndicates and consortia and by the Bermuda Segment for performance based management fees generated by our third party capital manager, Ada Capital Management Limited. We believe that this measure is a relevant component of our underwriting income (loss).

18 Three Months Ended December 31, Year Ended December 31, ($ in thousands) 2024 2023 2024 2023 Other underwriting expenses ............................................................................................................ $ 69,674 $ 56,923 $ 210,013 $ 183,165 Corporate expenses ........................................................................................................................... 19,286 44,858 61,111 76,691 General and administrative expenses ............................................................................................. $ 88,960 $ 101,781 $ 271,124 $ 259,856 Other Information Non-GAAP Measures Other Underwriting Expenses Other underwriting expenses include those general and administrative expenses that are incremental and/or directly attributable to our underwriting operations. While this measure is presented in Note 9, Segment Reporting, in the audited consolidated financial statements, it is considered a non-GAAP financial measure when presented elsewhere. Corporate expenses include holding company costs necessary to support our reportable segments. As these costs are not incremental and/or directly attributable to our underwriting operations, these costs are excluded from other underwriting expenses, and therefore, underwriting income (loss). General and administrative expenses, the most comparable GAAP financial measure to other underwriting expenses, also includes corporate expenses. The table below reconciles other underwriting expenses to general and administrative expenses, the most comparable GAAP financial measure: Other Underwriting Expense Ratio Other Underwriting Expense Ratio is a measure of the other underwriting expenses (net of third party fee income) incurred by the Company and is expressed as a percentage of net premiums earned. Loss Ratio Attritional Loss Ratio – current year is the attritional losses incurred by the company relating to the current year divided by net premiums earned. Attritional Loss Ratio – prior year development is the attritional losses incurred by the company relating to prior years divided by net premiums earned. Catastrophe Loss Ratio – current year is the catastrophe losses incurred by the company relating to the current year divided by net premiums earned. Catastrophe Loss Ratio – prior year development is the catastrophe losses incurred by the company relating to prior years divided by net premiums earned. Combined Ratio Combined Ratio is a measure of our underwriting profitability and is expressed as the sum of the loss and loss adjustment expense ratio, acquisition cost ratio and other underwriting expense ratio. A combined ratio under 100% indicates an underwriting profit, while a combined ratio over 100% indicates an underwriting loss.