Investor Presentation Hamilton Insurance Group, Ltd. December 31, 2024

2 Special Note Regarding Forward-Looking Statements This information includes “forward looking statements” pursuant to the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the use of terms such as “believes,” “expects,” “may,” “will,” “target,” “should,” “could,” “would,” “seeks,” “intends,” “plans,” “contemplates,” “estimates,” or “anticipates,” or similar expressions which concern our strategy, plans, projections or intentions. These forward-looking statements appear in a number of places throughout and relate to matters such as our industry, growth strategy, goals and expectations concerning our market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources and other financial and operating information. By their nature, forward-looking statements: speak only as of the date they are made; are not statements of historical fact or guarantees of future performance; and are subject to risks, uncertainties, assumptions, or changes in circumstances that are difficult to predict or quantify. Our expectations, beliefs, and projections are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs and projections will be achieved and actual results may vary materially from what is expressed in or indicated by the forward-looking statements. There are a number of risks, uncertainties, and other important factors that could cause our actual results to differ materially from the forward-looking statements contained herein. Such risks, uncertainties, and other important factors include, among others, the risks, uncertainties and factors set forth in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 (the “Form 10-K”) and other subsequent periodic reports filed with the Securities and Exchange Commission and the following: • challenges from competitors, including those arising from industry consolidation and technological advancements; • unpredictable catastrophic events, global climate change and/or emerging claim and coverage issues; • our ability, or those of the third parties on which we rely, to ensure reserves are adequate to cover actual losses and to accurately evaluate underwriting risk, models, assessments and/or pricing of risks; • our ability to defend our intellectual property rights, including our proprietary technology platforms, to comply with our obligations under our license and technology agreements or to license rights to technology or data on reasonable terms; • the impact of risks associated with human error, fraud, model uncertainties, cybersecurity threats such as cyber-attacks and security breaches and our reliance on third- party information technology systems that can fail or need replacement; • our ability to secure necessary credit facilities, or additional types of credit, on favorable terms or at all; • our limited financial and operating flexibility due to the covenants in our existing credit facilities; • our exposure to the credit risk of the intermediaries on which we rely; • our failure to pay claims in a timely manner or the need to sell investments under unfavorable conditions to meet liquidity requirements; • downgrades, potential downgrades or other negative actions by rating agencies; • our ability to manage risks associated with macroeconomic conditions resulting from geopolitical and global economic events, including current or anticipated military conflicts, public health crises, terrorism, sanctions, rising energy prices, inflation and interest rates and other global events; • the cyclical nature of the insurance and reinsurance business, which may cause the pricing and terms for our products to decline; • our results of operations potentially fluctuating significantly from period to period and not being indicative of our long-term prospects; • our ability to execute our strategy and to modify our business and strategic plan without shareholder approval; • our dependence on key executives, including the potential loss of Bermudian personnel, and our ability to attract qualified personnel, particularly in very competitive hiring conditions; • foreign operational risk such as foreign currency risk and political risk;

3 • our ability to identify and execute opportunities for growth, to complete transactions as planned or realize the anticipated benefits of any acquisitions or other investments; • our management of alternative reinsurance platforms on behalf of investors in entities managed by our strategic partnerships division; • our inability to control the allocations to, and/or the performance of, the Two Sigma Hamilton Fund, LLC (“Two Sigma Hamilton Fund” or “TSHF”) investment portfolio and our limited ability to withdraw our capital accounts; • the impact of risks from conflicts of interest among Two Sigma Principals, LLC, Two Sigma Investments, LP (“Two Sigma”) and their respective affiliates affecting our business; • the historical performance of Two Sigma not being indicative of the future results of the Two Sigma Hamilton Fund’s investment portfolio and/or of our future results; • the impacts of risks associated with our investment strategy, including that such risks are greater than those faced by our competitors; • our potentially becoming subject to U.S. federal income taxation, Bermuda taxation or other taxes as a result of a change of tax laws or otherwise; • the potential characterization of us and/or any of our subsidiaries as a passive foreign investment company; • our potentially becoming subject to U.S. withholding and information reporting requirements under the U.S. Foreign Account Tax Compliance Act, or FATCA, provisions; • our ability to compete effectively in a heavily regulated industry in light of new domestic or international laws and regulations, including accounting practices, and the impact of new interpretations of current laws and regulations; • the suspension or revocation of our subsidiaries’ insurance licenses; • significant legal, governmental or regulatory proceedings; • our insurance and reinsurance subsidiaries’ ability to pay dividends and other distributions to us being restricted by law; • challenges related to compliance with the applicable laws, rules and regulations related to being a public company, which is expensive and time consuming; • the limited ability of investors to influence corporate matters due to our multiple class common share structure and the voting provisions of our Bye-laws; • the risk that anti-takeover provisions in our Bye-laws could discourage, delay, or prevent a change in control, even if the change in control would be beneficial to our shareholders; • the difficulties investors may face in protecting their interests and serving process or enforcing judgments against us in the United States; and • our current strategy does not include paying cash dividends on our Class B common shares in the near term. There may be other factors that could cause our actual results to differ materially from the forward-looking statements, including factors disclosed under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Form 10-K. You should evaluate all forward- looking statements made herein in the context of these risks and uncertainties. You should read this information completely and with the understanding that actual future results may be materially different from expectations. We caution you that the risks, uncertainties, and other factors referenced above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits, or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. All forward-looking statements contained herein apply only as of the date hereof and are expressly qualified in their entirety by these cautionary statements. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances. Special Note Regarding Forward-Looking Statements, Continued

Introduction to Hamilton

5 Highly Entrepreneurial & Experienced Leadership Team Gemma Carreiro 20+ Years General Counsel Former: PartnerRe Pina Albo 30+ Years Group CEO Former: Munich Re Megan Graves 20+ Years CEO, Hamilton Re Former: AIG Venkat Krishnamoorthy 30+ Years (IT Industry) Group CTO Former: Coleman Research Group Craig Howie 35+ Years Group CFO Former: Everest Anita Kuchma 35+ Years CEO, Hamilton Select Former: Munich Re Alex Baker 20+ Years Group Chief Risk Officer Former: Chubb Insurance Adrian Daws 20+ Years CEO, Hamilton Global Specialty Former: CNA Hardy Daniel Fisher 20+ Years Group Head of HR, Communications & Culture Former: Munich Re Executive Leadership Hamilton: In Good Company Fostering an inclusive, collaborative and productive culture Highly Collaborative Service Oriented Open, Diverse and Inclusive Expertise Experienced Board of Directors

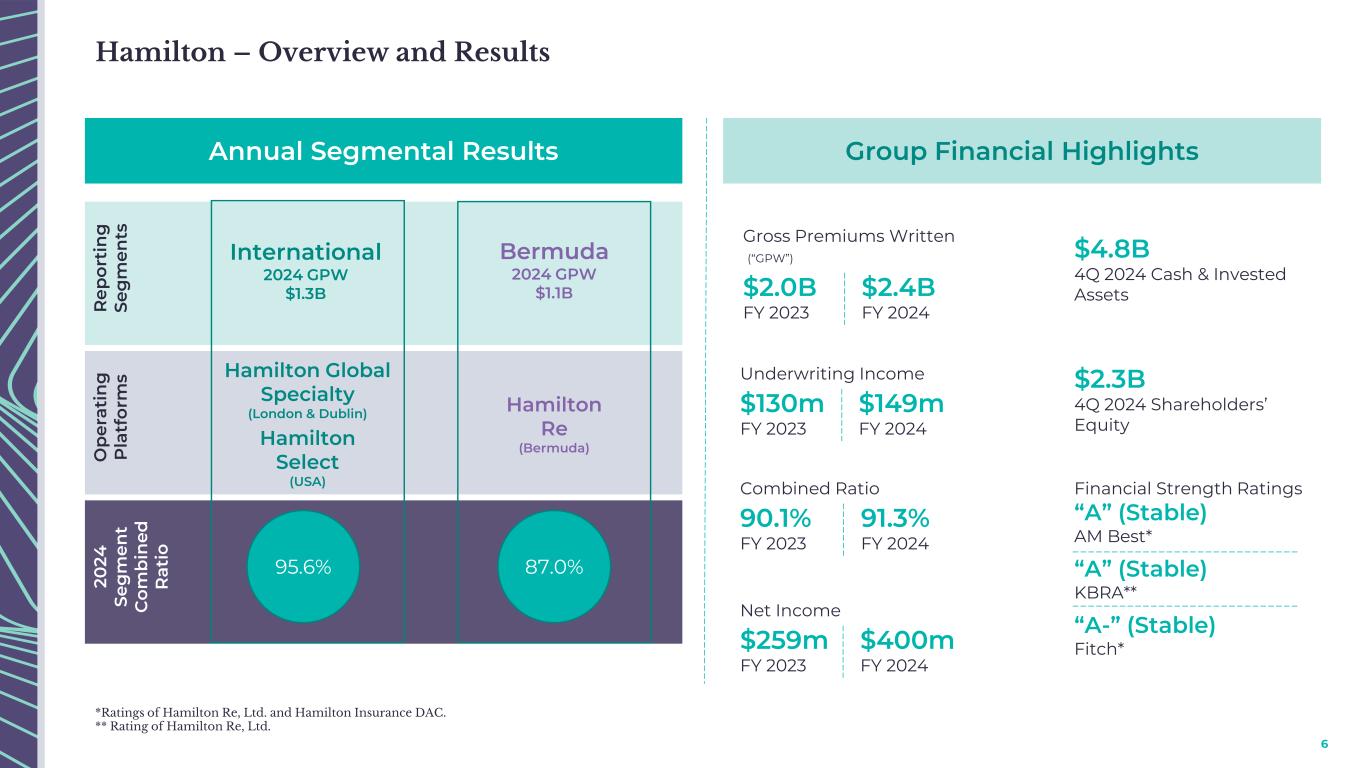

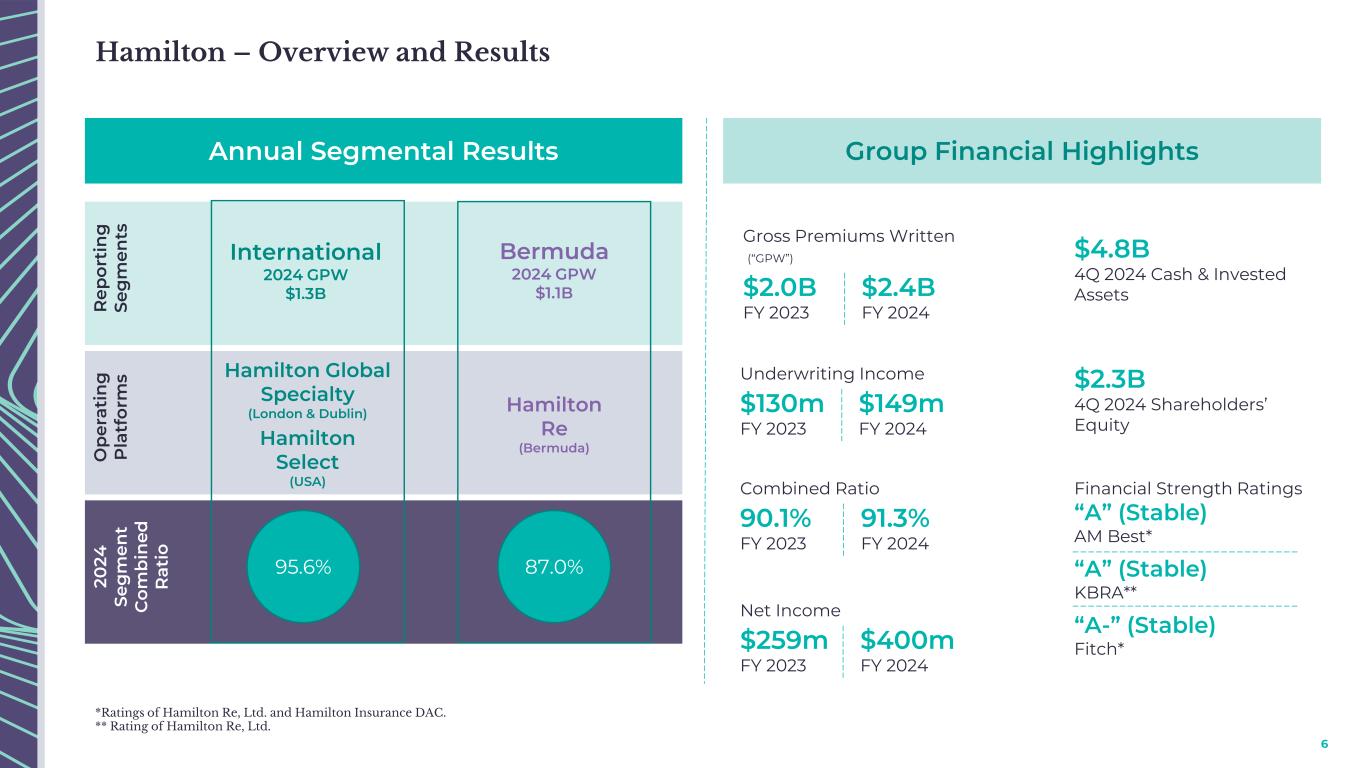

6 Hamilton – Overview and Results Annual Segmental Results Group Financial Highlights $4.8B 4Q 2024 Cash & Invested Assets $2.3B 4Q 2024 Shareholders’ Equity $2.0B FY 2023 $2.4B FY 2024 Gross Premiums Written (“GPW”) $130m FY 2023 $149m FY 2024 Underwriting Income 90.1% FY 2023 91.3% FY 2024 Combined Ratio $259m FY 2023 $400m FY 2024 Net Income R e p o rt in g S e g m e n ts International 2024 GPW $1.3B Bermuda 2024 GPW $1.1B Hamilton Global Specialty (London & Dublin) Hamilton Select (USA) Hamilton Re (Bermuda)O p e ra ti n g P la tf o rm s 20 24 S e g m e n t C o m b in e d R at io 95.6% 87.0% Financial Strength Ratings “A” (Stable) AM Best* “A” (Stable) KBRA** “A-” (Stable) Fitch* *Ratings of Hamilton Re, Ltd. and Hamilton Insurance DAC. ** Rating of Hamilton Re, Ltd.

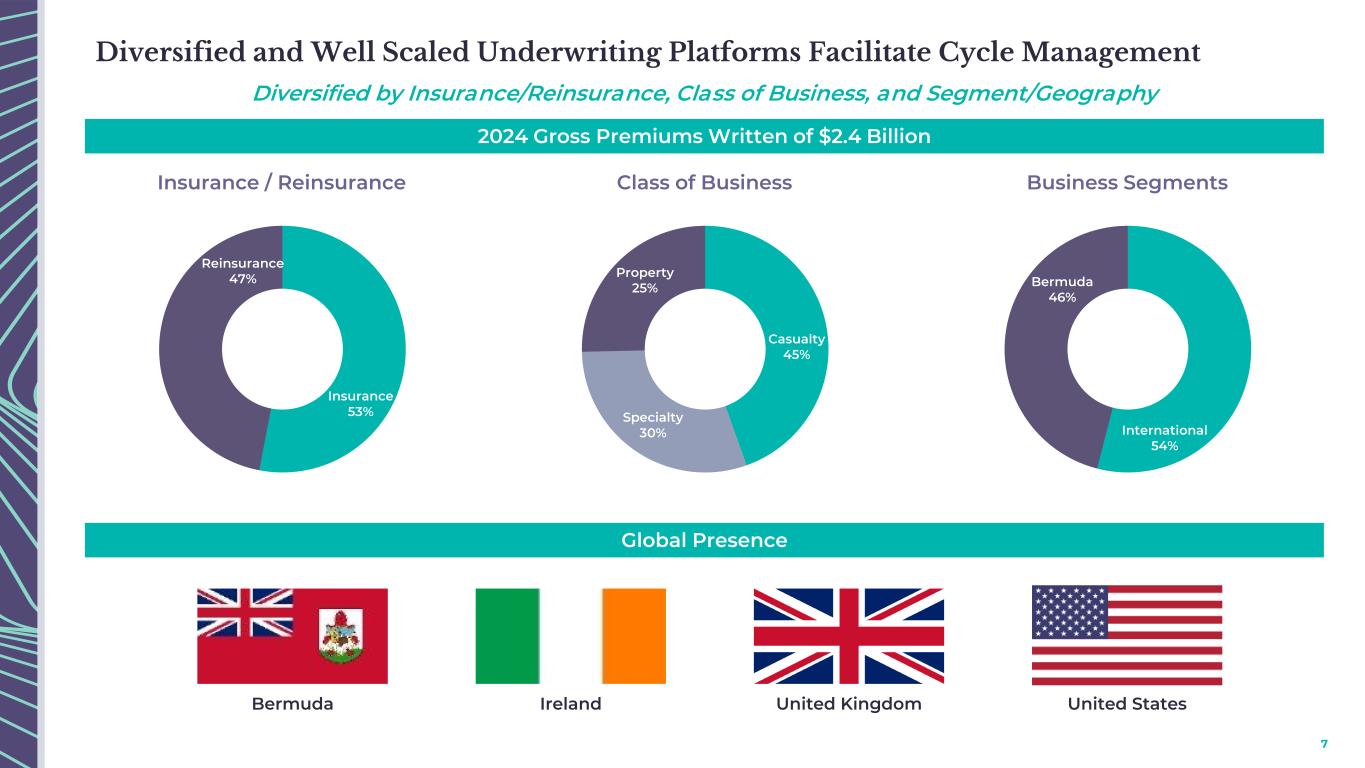

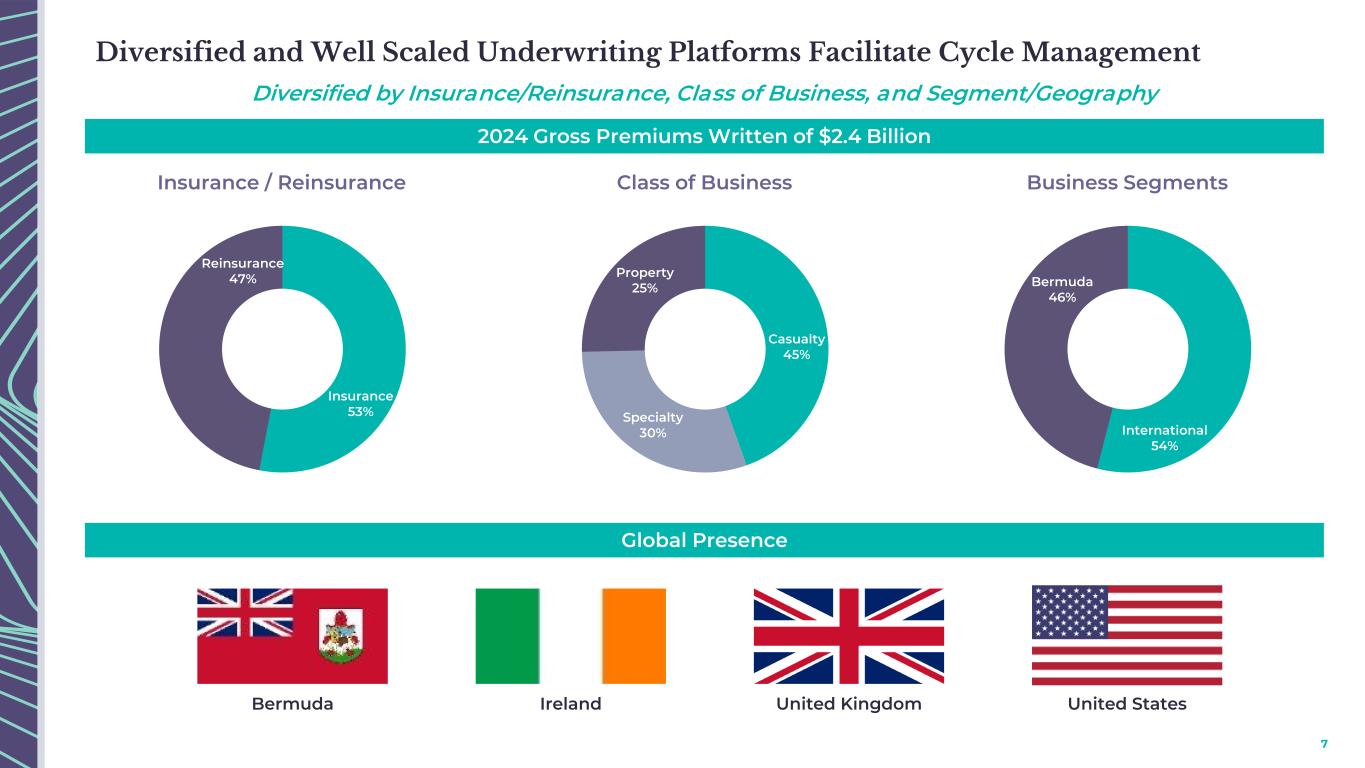

7 Insurance 53% Reinsurance 47% Insurance / Reinsurance Casualty 45% Specialty 30% Property 25% Class of Business International 54% Bermuda 46% Business Segments 2024 Gross Premiums Written of $2.4 Billion Global Presence Bermuda Ireland United Kingdom United States Diversified and Well Scaled Underwriting Platforms Facilitate Cycle Management Diversified by Insurance/Reinsurance, Class of Business, and Segment/Geography

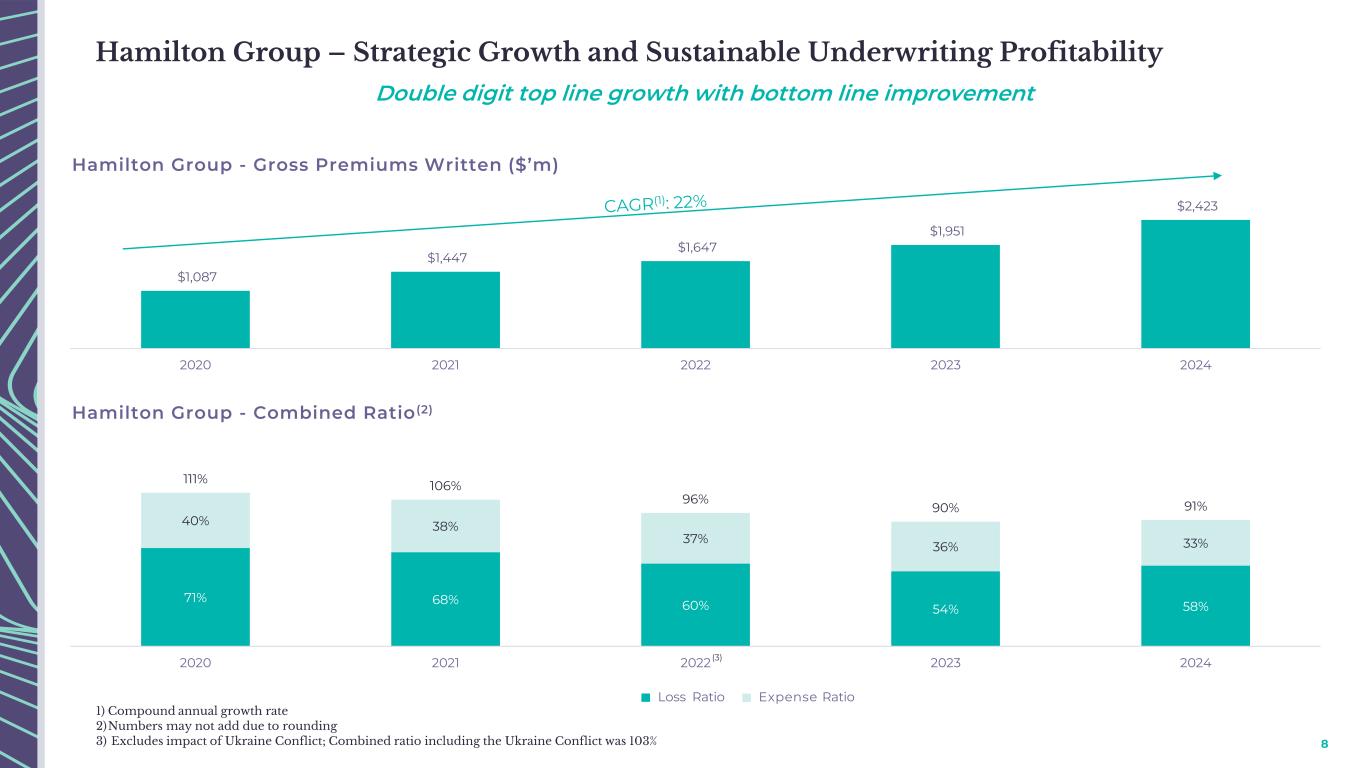

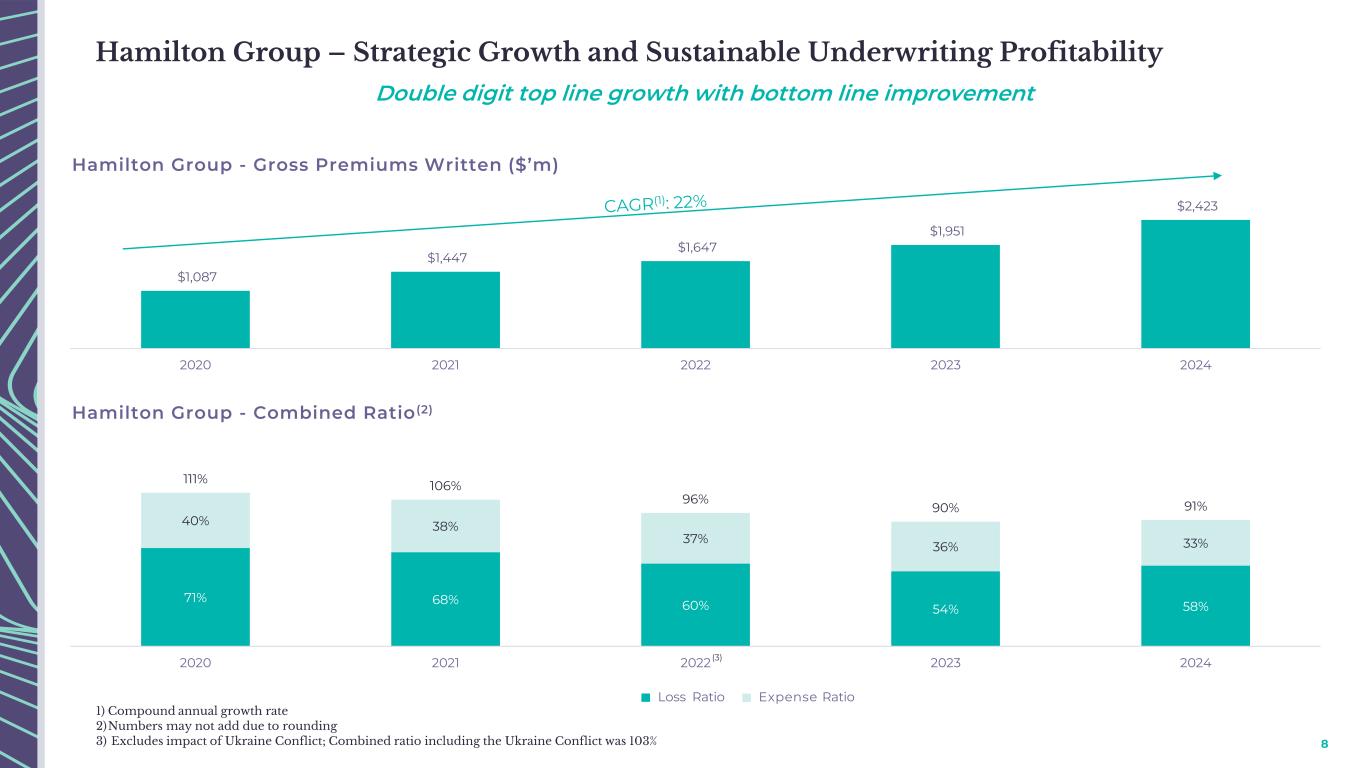

8 71% 68% 60% 54% 58% 40% 38% 37% 36% 33% 111% 106% 96% 90% 91% 2020 2021 2022 2023 2024 $1,087 $1,447 $1,647 $1,951 $2,423 2020 2021 2022 2023 2024 Hamilton Group – Strategic Growth and Sustainable Underwriting Profitability Hamilton Group - Gross Premiums Written ($’m) Hamilton Group - Combined Ratio (2) Loss Ratio Expense Ratio (3) 1) Compound annual growth rate 2)Numbers may not add due to rounding 3) Excludes impact of Ukraine Conflict; Combined ratio including the Ukraine Conflict was 103% Double digit top line growth with bottom line improvement

Segment Results

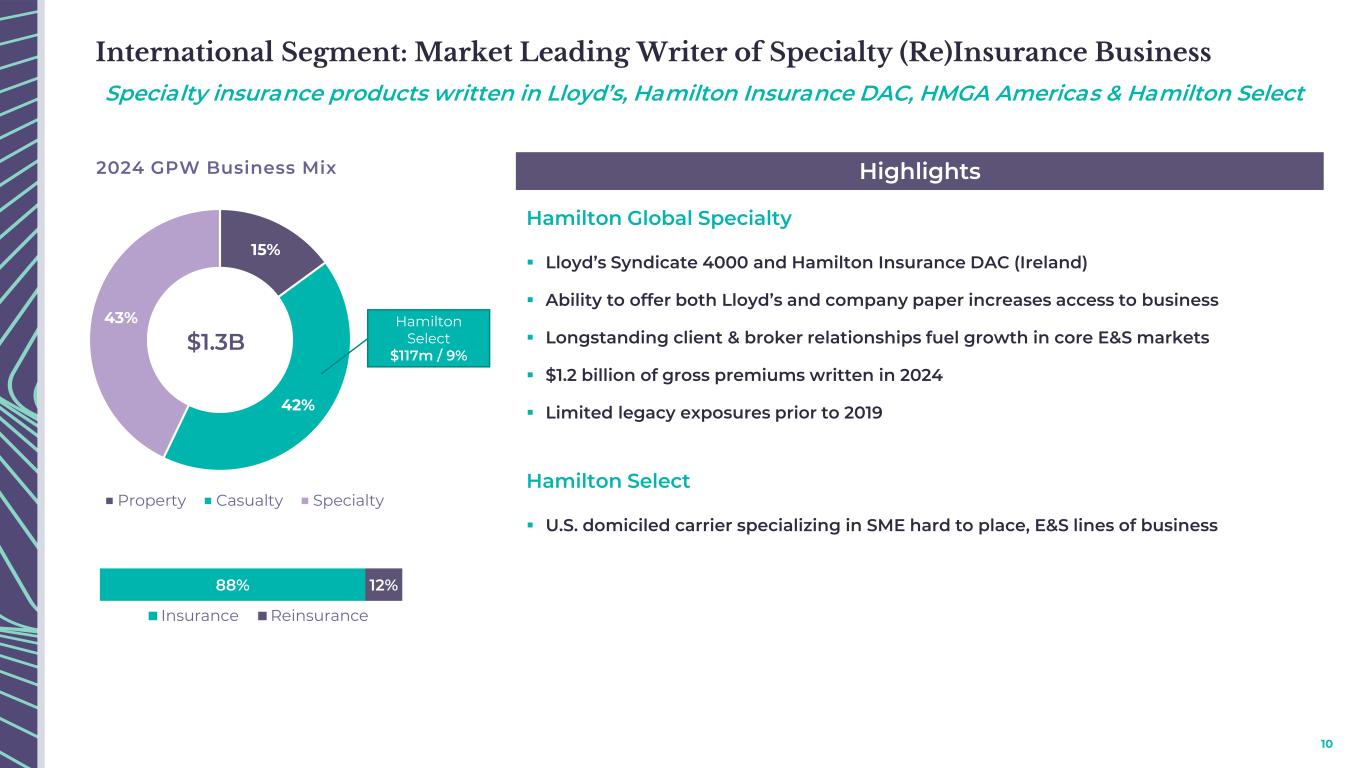

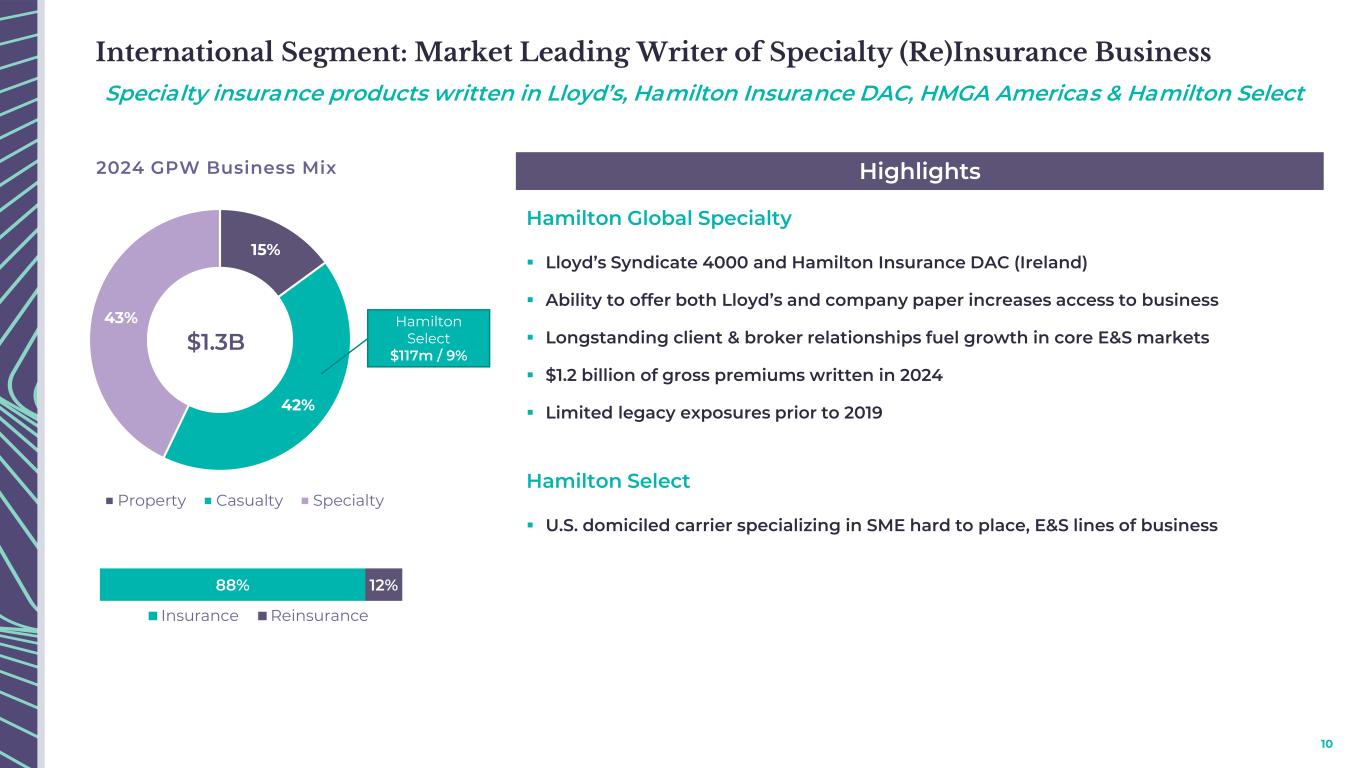

10 International Segment: Market Leading Writer of Specialty (Re)Insurance Business Specialty insurance products written in Lloyd’s, Hamilton Insurance DAC, HMGA Americas & Hamilton Select 15% 42% 43% Property Casualty Specialty 2024 GPW Business Mix 88% 12% Insurance Reinsurance $1.3B Hamilton Select $117m / 9% Hamilton Global Specialty ▪ Lloyd’s Syndicate 4000 and Hamilton Insurance DAC (Ireland) ▪ Ability to offer both Lloyd’s and company paper increases access to business ▪ Longstanding client & broker relationships fuel growth in core E&S markets ▪ $1.2 billion of gross premiums written in 2024 ▪ Limited legacy exposures prior to 2019 Hamilton Select ▪ U.S. domiciled carrier specializing in SME hard to place, E&S lines of business Highlights

11 65% 63% 50% 52% 56% 46% 44% 43% 43% 39% 111% 108% 93% 95% 96% 2020 2021 2022 2023 2024(3) Results reflect the diversified, lower volatility portfolio we have built over time International Segment: Measured Growth and Profitability Improvement $662 $892 $933 $1,106 $1,308 2020 2021 2022 2023 2024 International Segment - Gross Premiums Written ($’m) International Segment - Combined Ratio (2) Loss Ratio Expense Ratio 1) Compound annual growth rate 2)Numbers may not add due to rounding 3) Excludes impact of Ukraine Conflict; Combined ratio including the Ukraine Conflict was 97%

12 Bermuda Segment: Well Diversified Writer of Property, Casualty and Specialty Classes Underwriting-focused operation with strong foundation to capture growth opportunities 38% 47% 15% Property Casualty Specialty 12% 88% Insurance Reinsurance 2024 GPW Business Mix $1.1B Hamilton Re ▪ Established, scaled and scalable platform with broad, diversified client base ▪ Demonstrated underwriting profitability through portfolio optimization and thoughtful cycle management ▪ Strategic growth enhanced by diversified product offering: property, casualty and specialty ▪ Reinsurance business written both by Bermuda and US underwriting teams ▪ Clear, consistent appetite and responsive service rewarded by clients and brokers ▪ Data-driven approach supports underwriting and operational efficiencies Highlights

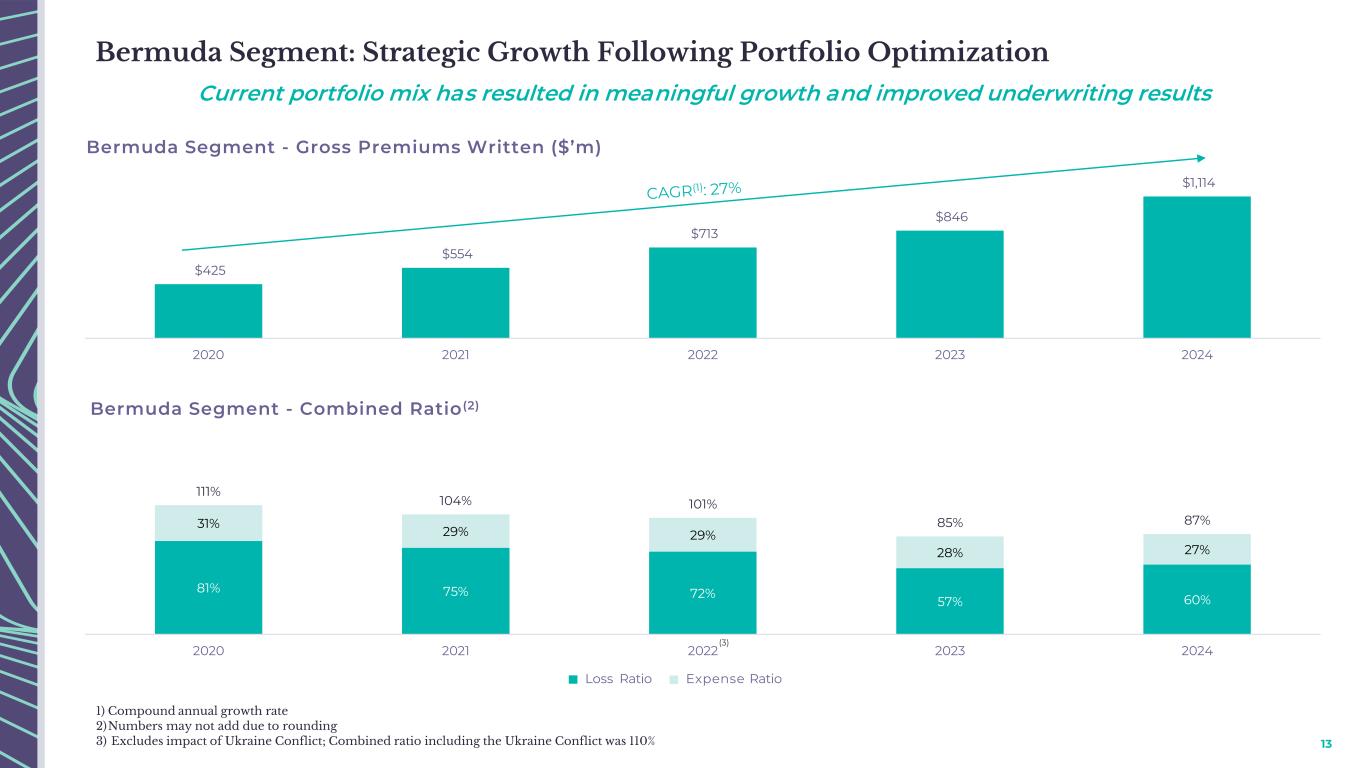

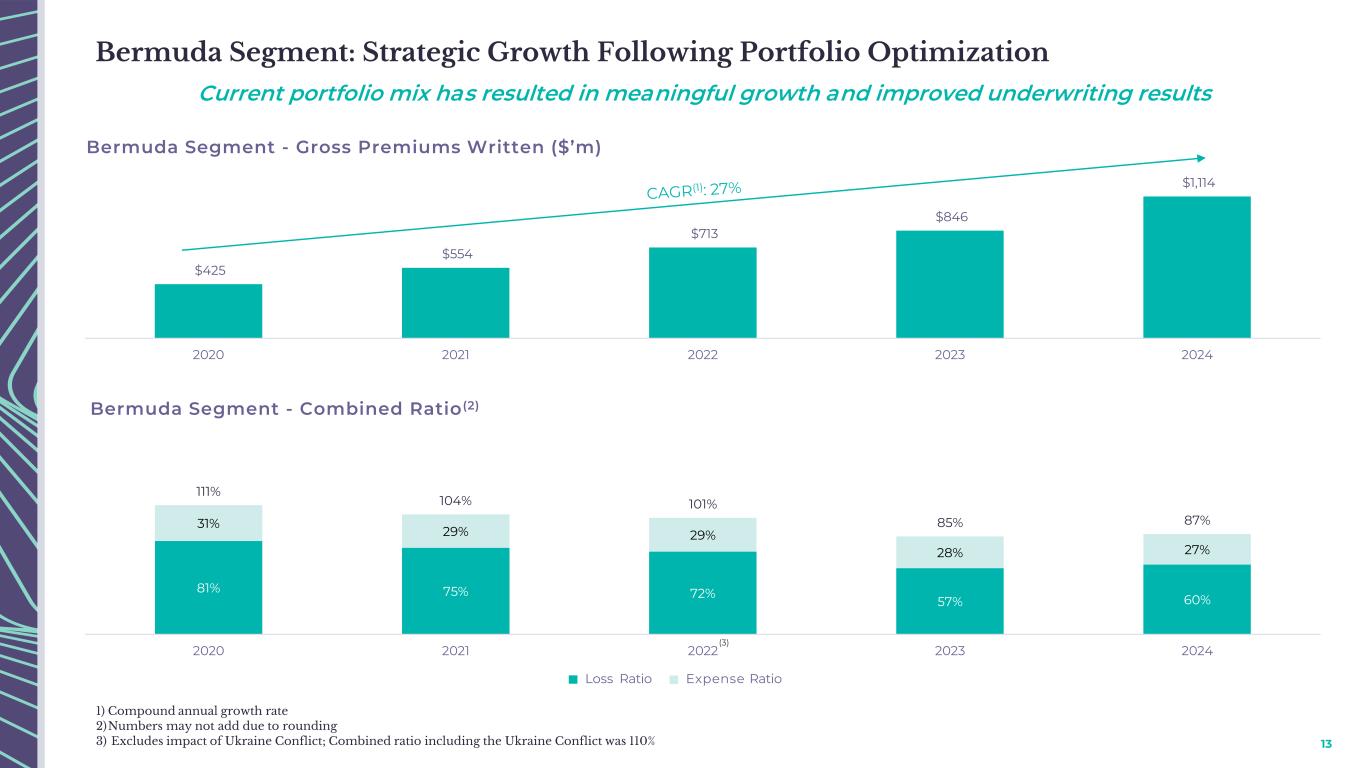

13 Current portfolio mix has resulted in meaningful growth and improved underwriting results Bermuda Segment: Strategic Growth Following Portfolio Optimization 81% 75% 72% 57% 60% 31% 29% 29% 28% 27% 111% 104% 101% 85% 87% 2020 2021 2022 2023 2024 $425 $554 $713 $846 $1,114 2020 2021 2022 2023 2024 Bermuda Segment - Gross Premiums Written ($’m) Bermuda Segment - Combined Ratio (2) Loss Ratio Expense Ratio 1) Compound annual growth rate 2)Numbers may not add due to rounding 3) Excludes impact of Ukraine Conflict; Combined ratio including the Ukraine Conflict was 110% (3)

Invested Assets

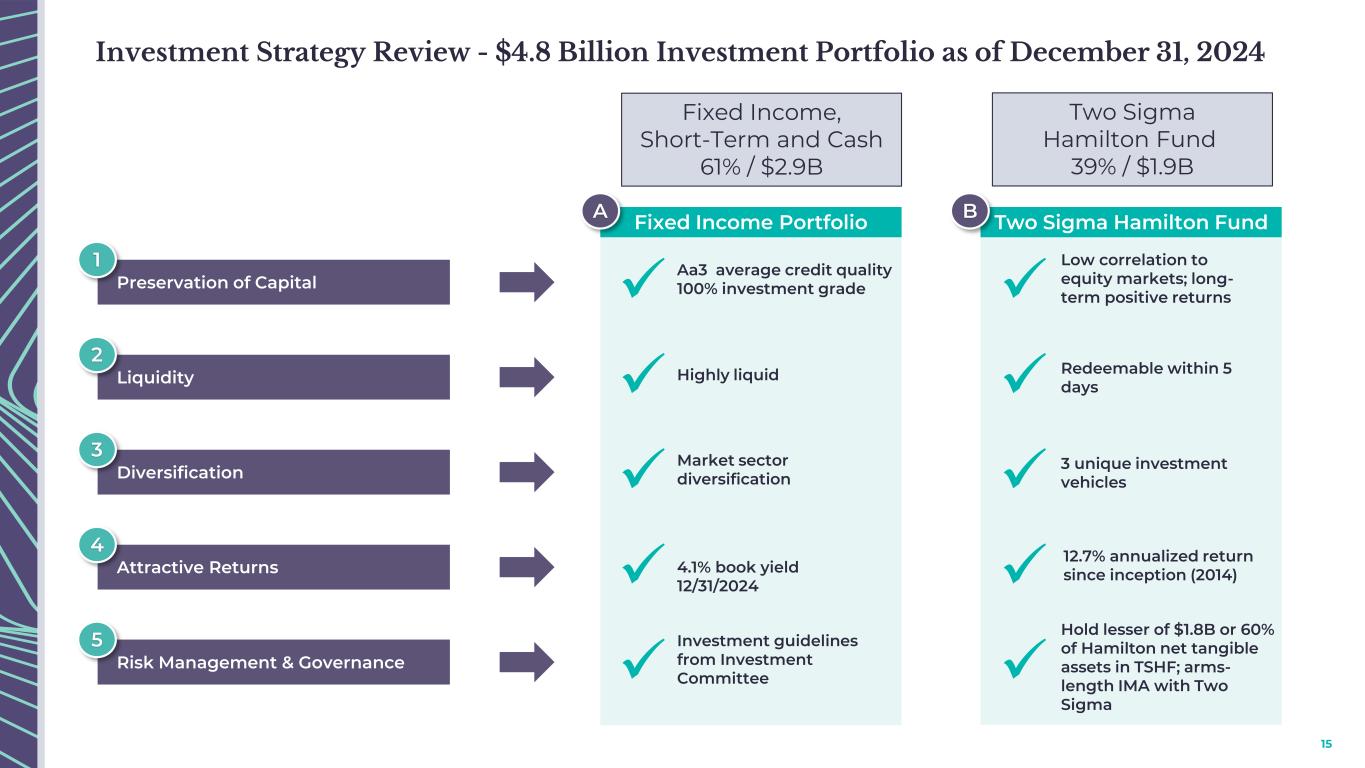

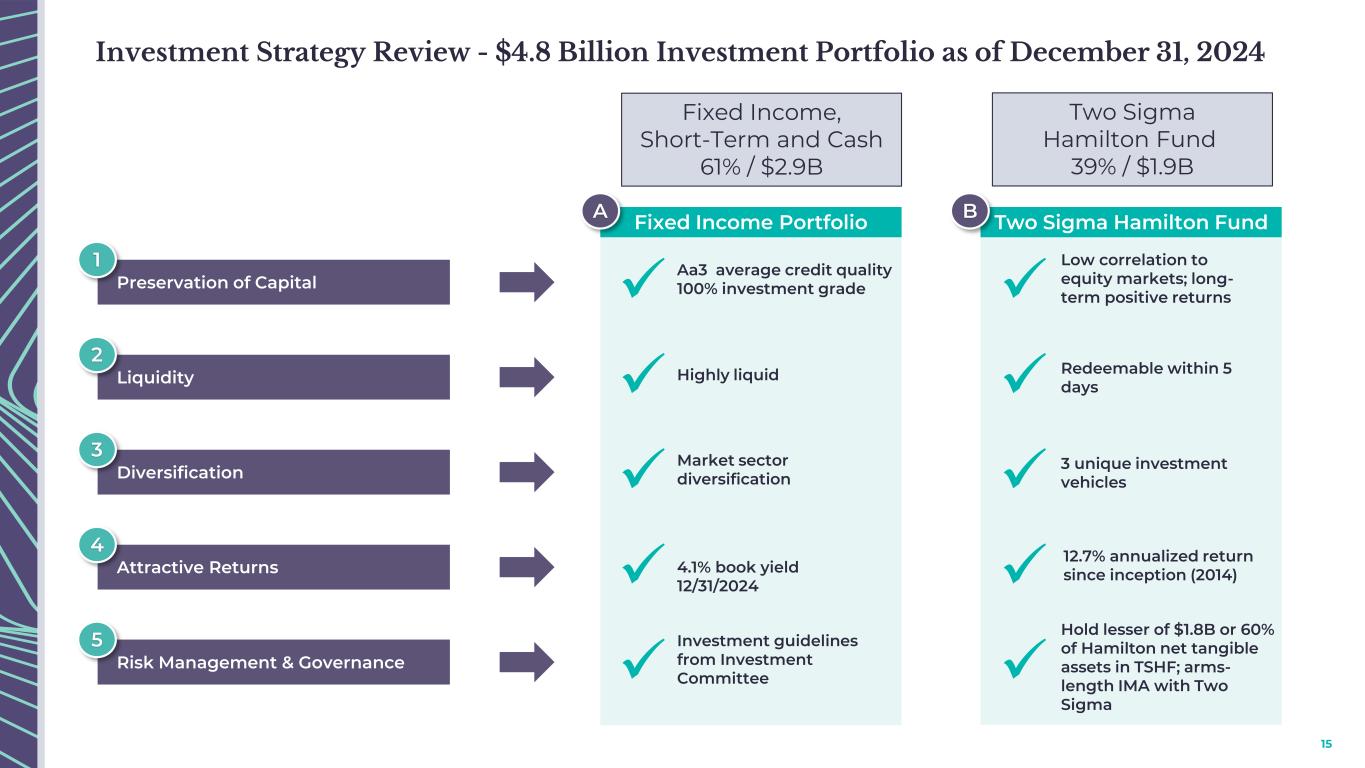

15 Two Sigma Hamilton FundFixed Income PortfolioA B Preservation of Capital 1 Liquidity 2 Diversification 3 Attractive Returns 4 Risk Management & Governance 5 ✓ Aa3 average credit quality 100% investment grade ✓ Highly liquid ✓ Market sector diversification ✓ 4.1% book yield 12/31/2024 ✓ Investment guidelines from Investment Committee ✓ Low correlation to equity markets; long- term positive returns ✓ Redeemable within 5 days ✓ 3 unique investment vehicles ✓ 12.7% annualized return since inception (2014) ✓ Hold lesser of $1.8B or 60% of Hamilton net tangible assets in TSHF; arms- length IMA with Two Sigma Investment Strategy Review - $4.8 Billion Investment Portfolio as of December 31, 2024 Fixed Income, Short-Term and Cash 61% / $2.9B Two Sigma Hamilton Fund 39% / $1.9B

16 Fixed Income Investment Portfolio as of December 31, 2024 48% 30% 11% 11% Corporate US Treasury US Agency Other $2.4B Corporate A3 US Treas. Aaa US Agency Aaa Other Aa1 Fixed income portfolio is managed by two external managers Fixed income investments of $2.4 billion – Average rating of Aa3, and duration of 3.4 years

17 Overview of Two Sigma and TSHF Diversified fund focused on liquid strategies in global equities, fixed income, futures, and FX markets ▪ Two Sigma Investment Management aims to deliver low-correlated absolute returns through the systematic application of fundamental, technical, alpha capture and event models ▪ Manages over $65B in assets ▪ Deploys and seeks to continuously improve intelligent investment management systems first created in 2001 ▪ Proven, industry leading approach to data science and analytics ▪ Over 1,700 employees of which include an experienced and diverse team of employees in R&D ▪ Seeks to systematically manage risk with human oversight at multiple levels through the investment process ▪ TSHF is a diversified fund focused on liquid strategies in fixed income, global equities, futures and FX markets Two Sigma Hamilton Fund $1.9B TSHF as of December 31, 2024 12.7% Average annual returns 2014-2024 Dedicated- fund of one 3 portfolios 2 equity focused 1 macro focused Highly liquid Investments TSHF Annual Returns Since 2018 Two Sigma Hamilton Fund, LLC (“TSHF”) 1.37 Sharpe Ratio since inception 19.9% 6.1% -4.6% 17.7% 4.6% 7.6% 16.3% 2018 2019 2020 2021 2022 2023 2024 1) TSHF Annual Returns correspond to Hamilton fiscal year which was Dec 1- Nov 30 until FY 2022.

Investing in Hamilton

19 5 A scaled, diversified, global specialty insurance and reinsurance operation Highly entrepreneurial & experienced leadership team fostering a distinctive and attractive culture Disciplined underwriting approach focused on sustainable profitability Strong balance sheet with significant financial flexibility Strong financial strength ratings including an AM Best “A” rating for Hamilton Re and HIDAC Differentiated asset management capabilities due to unique partnership with Two Sigma Demonstrated ability to grow profitably, navigating across market cycles 23.5% growth in book value per share during 2024 Hamilton Insurance Group - Who We Are Today

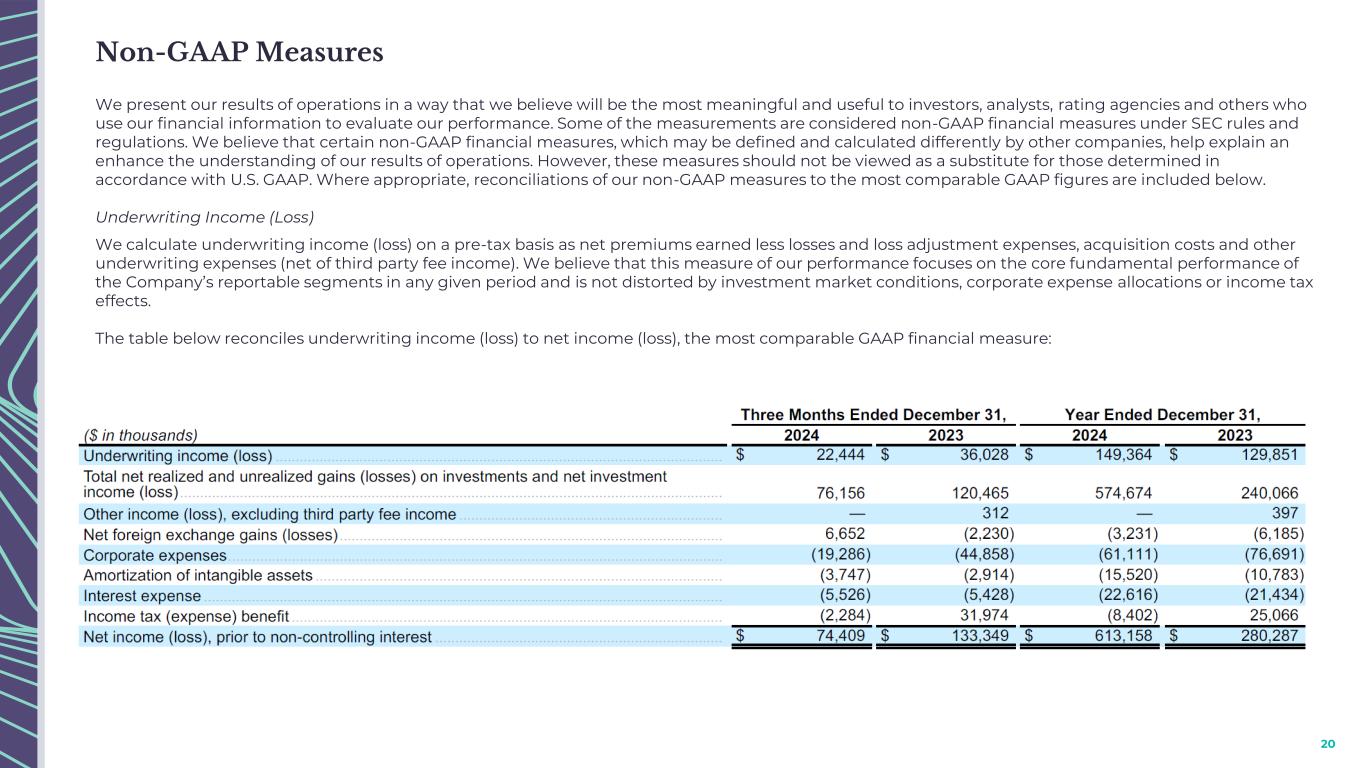

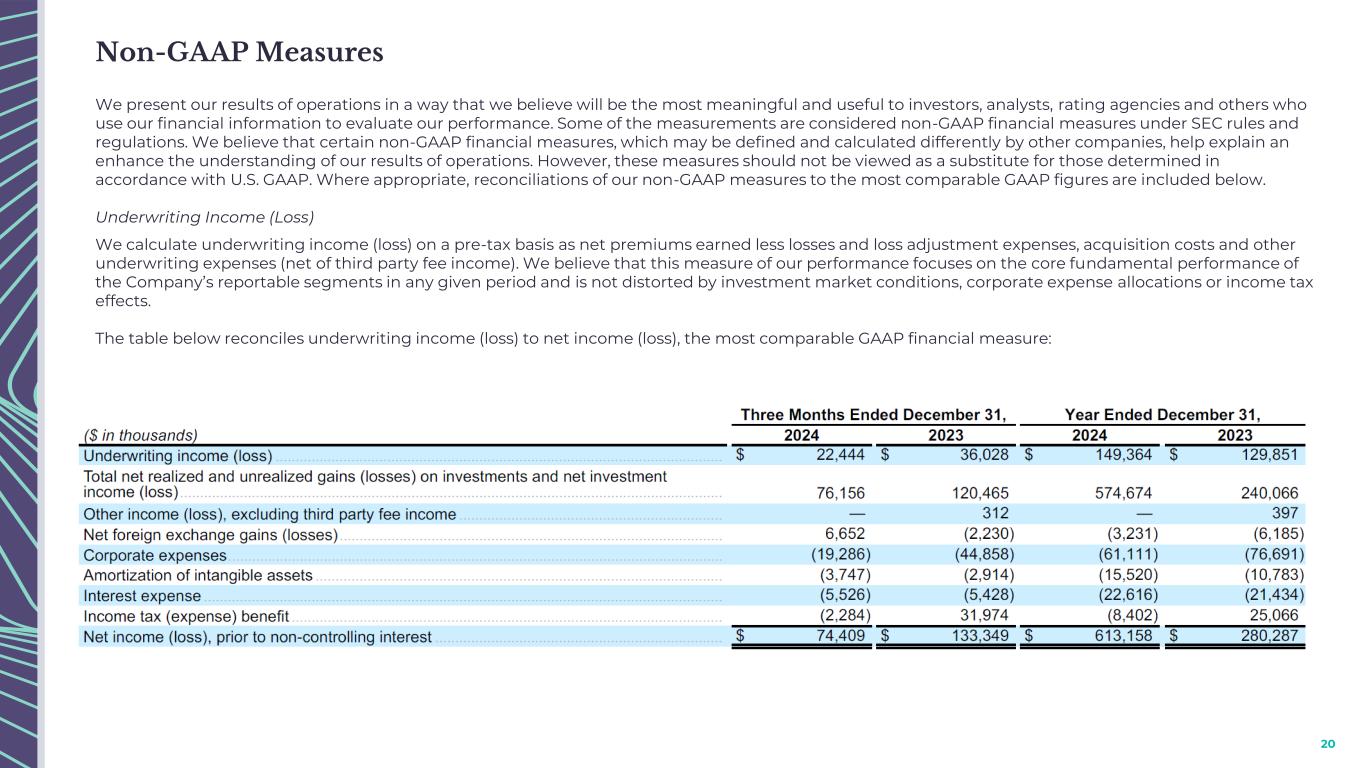

20 Non-GAAP Measures We present our results of operations in a way that we believe will be the most meaningful and useful to investors, analysts, rating agencies and others who use our financial information to evaluate our performance. Some of the measurements are considered non-GAAP financial measures under SEC rules and regulations. We believe that certain non-GAAP financial measures, which may be defined and calculated differently by other companies, help explain an enhance the understanding of our results of operations. However, these measures should not be viewed as a substitute for those determined in accordance with U.S. GAAP. Where appropriate, reconciliations of our non-GAAP measures to the most comparable GAAP figures are included below. Underwriting Income (Loss) We calculate underwriting income (loss) on a pre-tax basis as net premiums earned less losses and loss adjustment expenses, acquisition costs and other underwriting expenses (net of third party fee income). We believe that this measure of our performance focuses on the core fundamental performance of the Company’s reportable segments in any given period and is not distorted by investment market conditions, corporate expense allocations or income tax effects. The table below reconciles underwriting income (loss) to net income (loss), the most comparable GAAP financial measure:

Hamilton Insurance Group, Ltd. Wellesley House North, 1st Floor 90 Pitts Bay Road, Pembroke HM08, Bermuda +1 (441) 405 5200 hamiltongroup.com Contact us at: Investor.Relations@hamiltongroup.com