UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22920

The Advisors’ Inner Circle Fund III

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: (877) 446-3863

Date of fiscal year end: October 31, 2024

Date of reporting period: October 31, 2024

Item 1. Reports to Stockholders.

| (a) | A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto. |

The Advisors' Inner Circle Fund III

Knights of Columbus Limited Duration Fund

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about I Shares of the Knights of Columbus Limited Duration Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.kofcassetadvisors.org/resources/forms/#tab-1-application--account-forms. You can also request this information by contacting us at 1-844-KC-FUNDS (1-844-523-8637).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Knights of Columbus Limited Duration Fund, I Shares | $52 | 0.50% |

How did the Fund perform in the last year?

The Bloomberg 1-3 Year US Government/Credit Index (USD) returned +6.25% for the year ended October 31, 2024. All sectors outperformed Treasuries as investors remained constructive on risk asset performance supported by a resilient domestic economy. Corporate credit performed the best due to substantial amounts of spread tightening over the year.

The Knights of Columbus Limited Duration I Shares Fund returned +6.11% for the year, lagging the benchmark. The primary drivers of the portfolio underperformance for the year were a slight underweight to duration as interest rates rallied and securities selected, and an underweight position in the Financial sector. An overweight position and securities selected in the Industrial sector contributed to relative total returns. Returns also benefitted from our ABS exposure, which is not represented in the index.

Our conservative stance towards the Financial sector was a headwind for the Fund’s performance over the prior year. The U.S. economy proved stronger than expected with overall activity, as well as labor market conditions, remaining stable despite the restrictive Federal Reserve policy stance. Corporate credit spreads are now at their tightest levels since the late 1990s as the market digests a pivot in central bank policy as well as the upcoming new federal government. We continue to believe that exposure to corporate credits with ample liquidity and selective securitized product with strong collateral remain the more attractive option for investor capital, and we remain focused on generating high-quality carry returns in this environment.

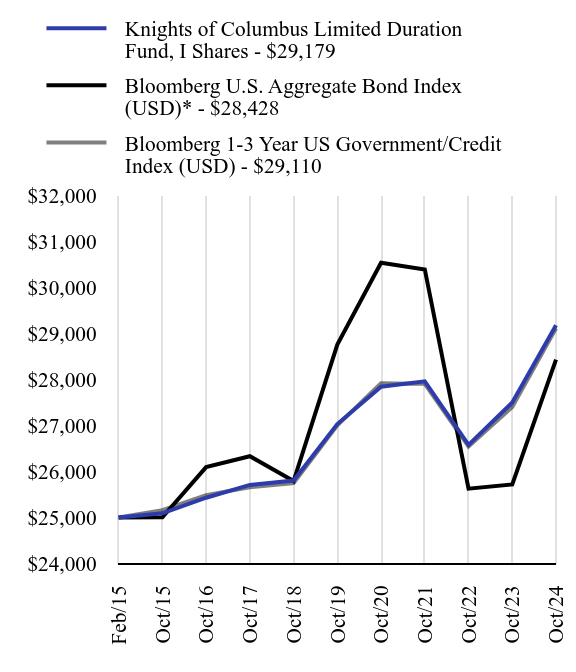

How did the Fund perform since inception?

Total Return Based on $25,000 Investment

| Knights of Columbus Limited Duration Fund, I Shares - $29179 | Bloomberg U.S. Aggregate Bond Index (USD)* - $28428 | Bloomberg 1-3 Year US Government/Credit Index (USD) - $29110 |

|---|

| Feb/15 | $25000 | $25000 | $25000 |

| Oct/15 | $25089 | $25002 | $25156 |

| Oct/16 | $25428 | $26094 | $25485 |

| Oct/17 | $25707 | $26330 | $25657 |

| Oct/18 | $25801 | $25789 | $25744 |

| Oct/19 | $27029 | $28757 | $27003 |

| Oct/20 | $27840 | $30536 | $27917 |

| Oct/21 | $27959 | $30390 | $27903 |

| Oct/22 | $26578 | $25624 | $26542 |

| Oct/23 | $27498 | $25716 | $27398 |

| Oct/24 | $29179 | $28428 | $29110 |

Since its inception on February 27, 2015. The line graph represents historical performance of a hypothetical investment of $25,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-844-KC-FUNDS (1-844-523-8637) for current month-end performance.

Footnote Reference*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Knights of Columbus Limited Duration Fund, I Shares | 6.11% | 1.54% | 1.61% |

| Bloomberg U.S. Aggregate Bond Index (USD)* | 10.55% | -0.23% | 1.34% |

| Bloomberg 1-3 Year US Government/Credit Index (USD) | 6.25% | 1.51% | 1.58% |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $181,893,195 | 145 | $613,478 | 82% |

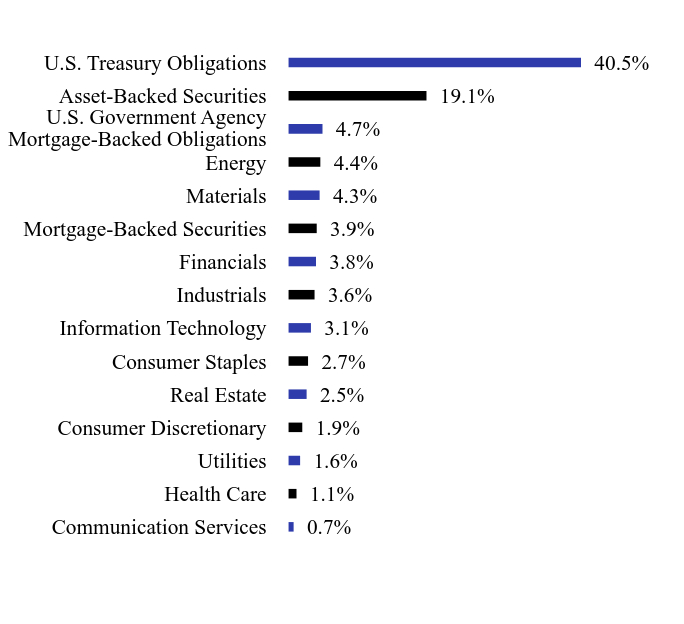

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Communication Services | 0.7% |

| Health Care | 1.1% |

| Utilities | 1.6% |

| Consumer Discretionary | 1.9% |

| Real Estate | 2.5% |

| Consumer Staples | 2.7% |

| Information Technology | 3.1% |

| Industrials | 3.6% |

| Financials | 3.8% |

| Mortgage-Backed Securities | 3.9% |

| Materials | 4.3% |

| Energy | 4.4% |

| U.S. Government Agency Mortgage-Backed Obligations | 4.7% |

| Asset-Backed Securities | 19.1% |

| U.S. Treasury Obligations | 40.5% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | Coupon Rate | Maturity Date | Percentage of Total Net Assets |

|---|

| U.S. Treasury Notes | 4.625% | 11/15/26 | 22.2% |

| U.S. Treasury Notes | 4.375% | 11/30/28 | 6.4% |

| U.S. Treasury Notes | 4.375% | 08/15/26 | 6.2% |

| U.S. Treasury Notes | 3.875% | 12/31/27 | 4.1% |

| GNMA, Ser 2022-212, Cl HP | 5.000% | 06/20/43 | 1.9% |

| U.S. Treasury Notes | 3.500% | 09/30/26 | 1.6% |

| FHLMC, Ser 2020-5036, Cl AB | 2.000% | 05/25/41 | 1.4% |

| FHLMC, Ser 2020-5019, Cl DA | 2.000% | 05/25/41 | 1.4% |

| Oak Street Investment Grade Net Lease Fund Series, Ser 2021-2A, Cl A3 | 2.850% | 11/20/51 | 0.8% |

| TCW CLO, Ser 2022-2A, Cl A1R, TSFR3M + 1.280% | 5.897% | 10/20/32 | 0.7% |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 1-844-KC-FUNDS (1-844-523-8637) to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

The Advisors' Inner Circle Fund III

Knights of Columbus Limited Duration Fund / I Shares - KCLIX

Annual Shareholder Report: October 31, 2024

The Advisors' Inner Circle Fund III

Knights of Columbus Limited Duration Fund

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about Class S Shares of the Knights of Columbus Limited Duration Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.kofcassetadvisors.org/resources/forms/#tab-1-application--account-forms. You can also request this information by contacting us at 1-844-KC-FUNDS (1-844-523-8637).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Knights of Columbus Limited Duration Fund, Class S Shares | $62 | 0.60% |

How did the Fund perform in the last year?

The Bloomberg 1-3 Year US Government/Credit Index (USD) returned +6.25% for the year ended October 31, 2024. All sectors outperformed Treasuries as investors remained constructive on risk asset performance supported by a resilient domestic economy. Corporate credit performed the best due to substantial amounts of spread tightening over the year.

The Knights of Columbus Limited Duration Institutional Class S Shares returned +5.98% for the year, lagging the benchmark. The primary drivers of the portfolio underperformance for the year were a slight underweight to duration as interest rates rallied and securities selected, and an underweight position in the Financial sector. An overweight position and securities selected in the Industrial sector contributed to relative total returns. Returns also benefitted from our ABS exposure, which is not represented in the index.

Our conservative stance towards the Financial sector was a headwind for the Fund’s performance over the prior year. The U.S. economy proved stronger than expected with overall activity, as well as labor market conditions, remaining stable despite the restrictive Federal Reserve policy stance. Corporate credit spreads are now at their tightest levels since the late 1990s as the market digests a pivot in central bank policy as well as the upcoming new federal government. We continue to believe that exposure to corporate credits with ample liquidity and selective securitized product with strong collateral remain the more attractive option for investor capital, and we remain focused on generating high-quality carry returns in this environment.

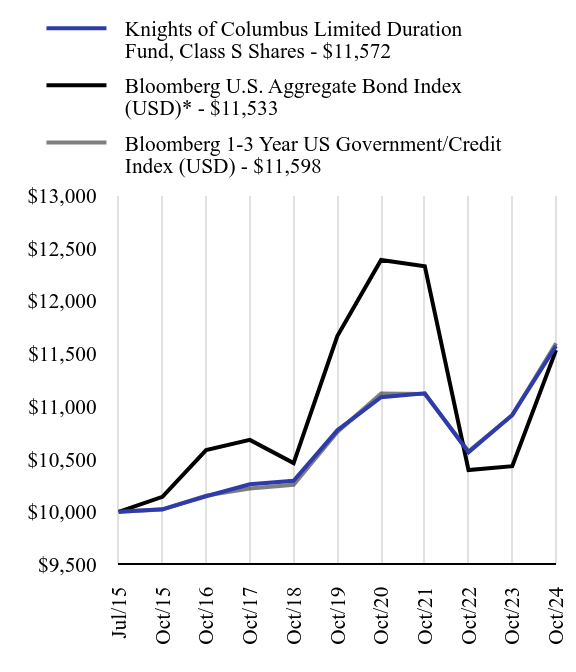

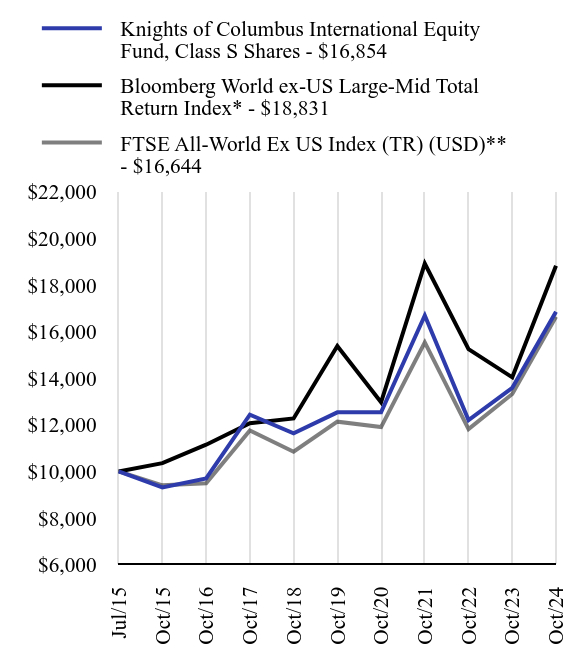

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Knights of Columbus Limited Duration Fund, Class S Shares - $11572 | Bloomberg U.S. Aggregate Bond Index (USD)* - $11533 | Bloomberg 1-3 Year US Government/Credit Index (USD) - $11598 |

|---|

| Jul/15 | $10000 | $10000 | $10000 |

| Oct/15 | $10024 | $10143 | $10023 |

| Oct/16 | $10148 | $10586 | $10154 |

| Oct/17 | $10261 | $10682 | $10222 |

| Oct/18 | $10294 | $10462 | $10257 |

| Oct/19 | $10773 | $11666 | $10758 |

| Oct/20 | $11087 | $12388 | $11123 |

| Oct/21 | $11124 | $12329 | $11117 |

| Oct/22 | $10564 | $10396 | $10575 |

| Oct/23 | $10919 | $10433 | $10916 |

| Oct/24 | $11572 | $11533 | $11598 |

Since its inception on July 14, 2015. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-844-KC-FUNDS (1-844-523-8637) for current month-end performance.

Footnote Reference*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Knights of Columbus Limited Duration Fund, Class S Shares | 5.98% | 1.44% | 1.58% |

| Bloomberg U.S. Aggregate Bond Index (USD)* | 10.55% | -0.23% | 1.54% |

| Bloomberg 1-3 Year US Government/Credit Index (USD) | 6.25% | 1.51% | 1.61% |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $181,893,195 | 145 | $613,478 | 82% |

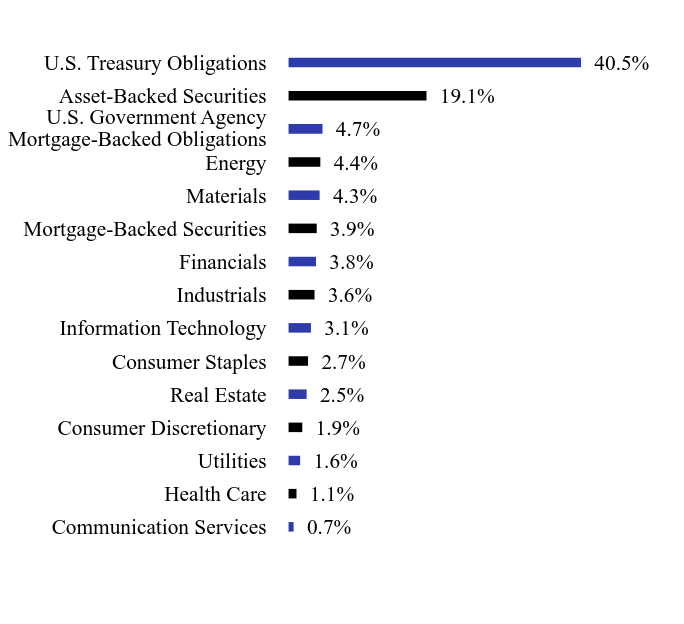

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Communication Services | 0.7% |

| Health Care | 1.1% |

| Utilities | 1.6% |

| Consumer Discretionary | 1.9% |

| Real Estate | 2.5% |

| Consumer Staples | 2.7% |

| Information Technology | 3.1% |

| Industrials | 3.6% |

| Financials | 3.8% |

| Mortgage-Backed Securities | 3.9% |

| Materials | 4.3% |

| Energy | 4.4% |

| U.S. Government Agency Mortgage-Backed Obligations | 4.7% |

| Asset-Backed Securities | 19.1% |

| U.S. Treasury Obligations | 40.5% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | Coupon Rate | Maturity Date | Percentage of Total Net Assets |

|---|

| U.S. Treasury Notes | 4.625% | 11/15/26 | 22.2% |

| U.S. Treasury Notes | 4.375% | 11/30/28 | 6.4% |

| U.S. Treasury Notes | 4.375% | 08/15/26 | 6.2% |

| U.S. Treasury Notes | 3.875% | 12/31/27 | 4.1% |

| GNMA, Ser 2022-212, Cl HP | 5.000% | 06/20/43 | 1.9% |

| U.S. Treasury Notes | 3.500% | 09/30/26 | 1.6% |

| FHLMC, Ser 2020-5036, Cl AB | 2.000% | 05/25/41 | 1.4% |

| FHLMC, Ser 2020-5019, Cl DA | 2.000% | 05/25/41 | 1.4% |

| Oak Street Investment Grade Net Lease Fund Series, Ser 2021-2A, Cl A3 | 2.850% | 11/20/51 | 0.8% |

| TCW CLO, Ser 2022-2A, Cl A1R, TSFR3M + 1.280% | 5.897% | 10/20/32 | 0.7% |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 1-844-KC-FUNDS (1-844-523-8637) to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

The Advisors' Inner Circle Fund III

Knights of Columbus Limited Duration Fund / Class S Shares - KCLSX

Annual Shareholder Report: October 31, 2024

The Advisors' Inner Circle Fund III

Knights of Columbus Core Bond Fund

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about I Shares of the Knights of Columbus Core Bond Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.kofcassetadvisors.org/resources/forms/#tab-1-application--account-forms. You can also request this information by contacting us at 1-844-KC-FUNDS (1-844-523-8637).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Knights of Columbus Core Bond Fund, I Shares | $52 | 0.50% |

How did the Fund perform in the last year?

The Bloomberg U.S. Aggregate Index (USD) returned +10.55% for the year ended October 31, 2024. All sectors outperformed Treasuries as investors remained constructive on risk asset performance supported by a resilient domestic economy. Corporate credit performed the best due to substantial amounts of spread tightening over the year.

The Knights of Columbus Core Bond I Shares Class Fund returned +9.92% for the year, lagging the benchmark. The primary drivers of the portfolio underperformance for the year were a slight underweight to duration as interest rates rallied in the middle of the year and an underweight position in corporate credit, which was offsides of the aforementioned spread tightening trend. Security selection across the spread sectors contributed positive relative return effects.

Our conservative outlook on risk asset performance was again a headwind for the Fund’s performance over the prior year. The U.S. economy proved stronger than expected with overall activity, as well as labor market conditions, remaining stable despite the restrictive Federal Reserve policy stance. Corporate credit spreads are now at their tightest levels since the late 1990s as the market digests a pivot in central bank policy as well as the upcoming new federal government. We continue to believe that wider spreads in higher-rated securitized product positions remain the more attractive option for investor capital, and we remain focused on generating high-quality carry returns in this environment.

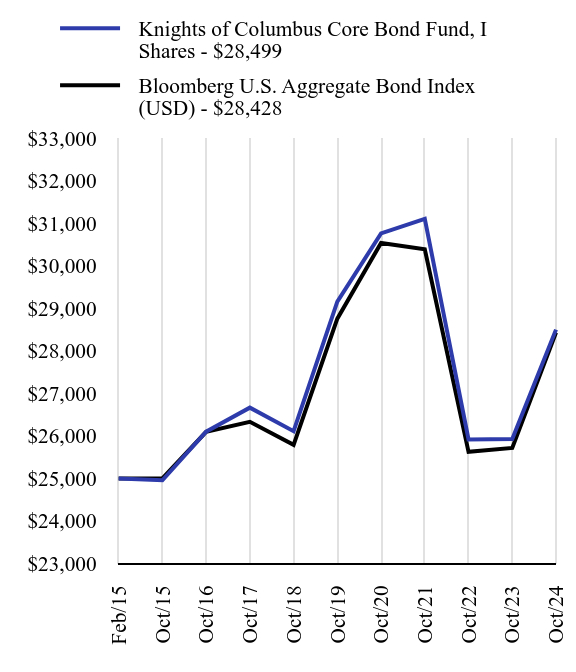

How did the Fund perform since inception?

Total Return Based on $25,000 Investment

| Knights of Columbus Core Bond Fund, I Shares - $28499 | Bloomberg U.S. Aggregate Bond Index (USD) - $28428 |

|---|

| Feb/15 | $25000 | $25000 |

| Oct/15 | $24955 | $25002 |

| Oct/16 | $26099 | $26094 |

| Oct/17 | $26664 | $26330 |

| Oct/18 | $26109 | $25789 |

| Oct/19 | $29157 | $28757 |

| Oct/20 | $30761 | $30536 |

| Oct/21 | $31104 | $30390 |

| Oct/22 | $25916 | $25624 |

| Oct/23 | $25927 | $25716 |

| Oct/24 | $28499 | $28428 |

Since its inception on February 27, 2015. The line graph represents historical performance of a hypothetical investment of $25,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-844-KC-FUNDS (1-844-523-8637) for current month-end performance.

Footnote Reference*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Knights of Columbus Core Bond Fund, I Shares | 9.92% | -0.46% | 1.36% |

| Bloomberg U.S. Aggregate Bond Index (USD) | 10.55% | -0.23% | 1.34% |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $237,332,718 | 238 | $706,989 | 48% |

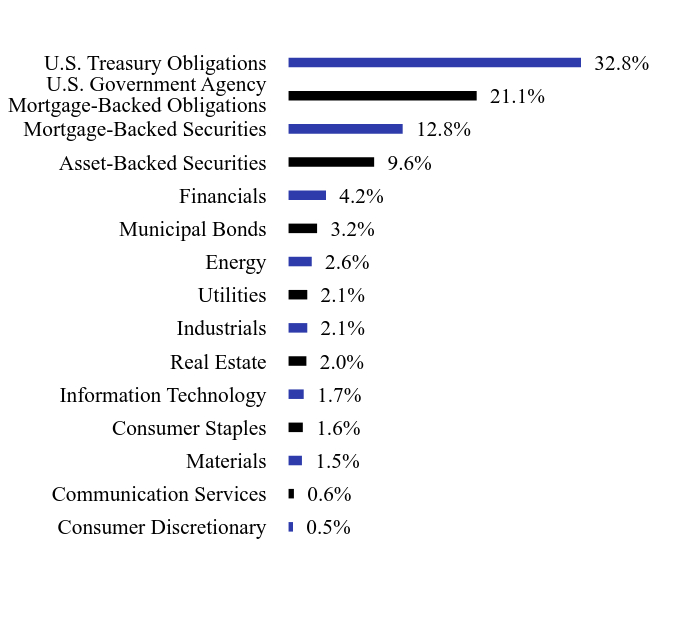

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Consumer Discretionary | 0.5% |

| Communication Services | 0.6% |

| Materials | 1.5% |

| Consumer Staples | 1.6% |

| Information Technology | 1.7% |

| Real Estate | 2.0% |

| Industrials | 2.1% |

| Utilities | 2.1% |

| Energy | 2.6% |

| Municipal Bonds | 3.2% |

| Financials | 4.2% |

| Asset-Backed Securities | 9.6% |

| Mortgage-Backed Securities | 12.8% |

| U.S. Government Agency Mortgage-Backed Obligations | 21.1% |

| U.S. Treasury Obligations | 32.8% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | Coupon Rate | Maturity Date | Percentage of Total Net Assets |

|---|

| U.S. Treasury Notes | 3.875% | 12/31/27 | 4.6% |

| U.S. Treasury Notes | 2.750% | 05/31/29 | 4.6% |

| U.S. Treasury Notes | 2.625% | 05/31/27 | 3.9% |

| U.S. Treasury Notes | 2.750% | 08/15/32 | 3.6% |

| U.S. Treasury Notes | 3.875% | 09/30/29 | 2.7% |

| U.S. Treasury Bonds | 4.000% | 11/15/52 | 2.3% |

| U.S. Treasury Notes | 3.750% | 08/31/26 | 2.1% |

| U.S. Treasury Bonds | 3.750% | 08/15/41 | 1.9% |

| U.S. Treasury Bonds | 2.875% | 05/15/52 | 1.4% |

| U.S. Treasury Bonds | 3.000% | 05/15/45 | 1.3% |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 1-844-KC-FUNDS (1-844-523-8637) to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

The Advisors' Inner Circle Fund III

Knights of Columbus Core Bond Fund / I Shares - KCCIX

Annual Shareholder Report: October 31, 2024

The Advisors' Inner Circle Fund III

Knights of Columbus Core Bond Fund

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about Class S Shares of the Knights of Columbus Core Bond Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.kofcassetadvisors.org/resources/forms/#tab-1-application--account-forms. You can also request this information by contacting us at 1-844-KC-FUNDS (1-844-523-8637).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Knights of Columbus Core Bond Fund, Class S Shares | $63 | 0.60% |

How did the Fund perform in the last year?

The Bloomberg U.S. Aggregate Index (USD) returned +10.55% for the year ended October 31, 2024. All sectors outperformed Treasuries as investors remained constructive on risk asset performance supported by a resilient domestic economy. Corporate credit performed the best due to substantial amounts of spread tightening over the year.

The Knights of Columbus Core Bond Class S Shares Fund returned +9.83% for the year, lagging the benchmark. The primary drivers of the portfolio underperformance for the year were a slight underweight to duration as interest rates rallied in the middle of the year and an underweight position in corporate credit, which was offsides of the aforementioned spread tightening trend. Security selection across the spread sectors contributed positive relative return effects.

Our conservative outlook on risk asset performance was again a headwind for the Fund’s performance over the prior year. The U.S. economy proved stronger than expected with overall activity, as well as labor market conditions, remaining stable despite the restrictive Federal Reserve policy stance. Corporate credit spreads are now at their tightest levels since the late 1990s as the market digests a pivot in central bank policy as well as the upcoming new federal government. We continue to believe that wider spreads in higher-rated securitized product positions remain the more attractive option for investor capital, and we remain focused on generating high-quality carry returns in this environment.

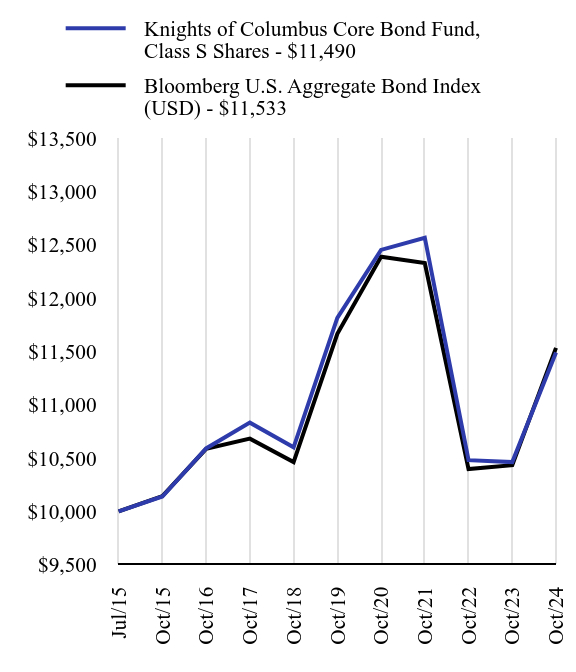

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Knights of Columbus Core Bond Fund, Class S Shares - $11490 | Bloomberg U.S. Aggregate Bond Index (USD) - $11533 |

|---|

| Jul/15 | $10000 | $10000 |

| Oct/15 | $10139 | $10143 |

| Oct/16 | $10590 | $10586 |

| Oct/17 | $10832 | $10682 |

| Oct/18 | $10600 | $10462 |

| Oct/19 | $11815 | $11666 |

| Oct/20 | $12453 | $12388 |

| Oct/21 | $12567 | $12329 |

| Oct/22 | $10480 | $10396 |

| Oct/23 | $10462 | $10433 |

| Oct/24 | $11490 | $11533 |

Since its inception on July 14, 2015. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-844-KC-FUNDS (1-844-523-8637) for current month-end performance.

Footnote Reference*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Knights of Columbus Core Bond Fund, Class S Shares | 9.83% | -0.56% | 1.50% |

| Bloomberg U.S. Aggregate Bond Index (USD) | 10.55% | -0.23% | 1.54% |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $237,332,718 | 238 | $706,989 | 48% |

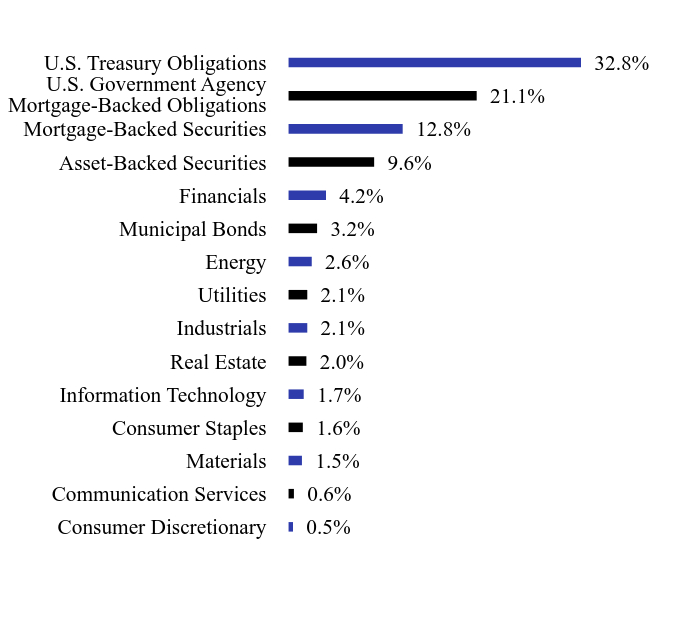

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Consumer Discretionary | 0.5% |

| Communication Services | 0.6% |

| Materials | 1.5% |

| Consumer Staples | 1.6% |

| Information Technology | 1.7% |

| Real Estate | 2.0% |

| Industrials | 2.1% |

| Utilities | 2.1% |

| Energy | 2.6% |

| Municipal Bonds | 3.2% |

| Financials | 4.2% |

| Asset-Backed Securities | 9.6% |

| Mortgage-Backed Securities | 12.8% |

| U.S. Government Agency Mortgage-Backed Obligations | 21.1% |

| U.S. Treasury Obligations | 32.8% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | Coupon Rate | Maturity Date | Percentage of Total Net Assets |

|---|

| U.S. Treasury Notes | 3.875% | 12/31/27 | 4.6% |

| U.S. Treasury Notes | 2.750% | 05/31/29 | 4.6% |

| U.S. Treasury Notes | 2.625% | 05/31/27 | 3.9% |

| U.S. Treasury Notes | 2.750% | 08/15/32 | 3.6% |

| U.S. Treasury Notes | 3.875% | 09/30/29 | 2.7% |

| U.S. Treasury Bonds | 4.000% | 11/15/52 | 2.3% |

| U.S. Treasury Notes | 3.750% | 08/31/26 | 2.1% |

| U.S. Treasury Bonds | 3.750% | 08/15/41 | 1.9% |

| U.S. Treasury Bonds | 2.875% | 05/15/52 | 1.4% |

| U.S. Treasury Bonds | 3.000% | 05/15/45 | 1.3% |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 1-844-KC-FUNDS (1-844-523-8637) to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

The Advisors' Inner Circle Fund III

Knights of Columbus Core Bond Fund / Class S Shares - KCCSX

Annual Shareholder Report: October 31, 2024

The Advisors' Inner Circle Fund III

Knights of Columbus Long/Short Equity Fund

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about I Shares of the Knights of Columbus Long/Short Equity Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.kofcassetadvisors.org/resources/forms/#tab-1-application--account-forms. You can also request this information by contacting us at 1-844-KC-FUNDS (1-844-523-8637).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Knights of Columbus Long/Short Equity Fund, I Shares | $198 | 1.85% |

How did the Fund perform in the last year?

The benchmark HFRX Equity Market Neutral Index rose +8.14% from October 31st, 2023, through October 31st, 2024, and the widely used S&P 500 benchmark returned +38.02%. The Knights of Columbus Long/Short Equity Fund rose +13.72% net over the same period. This performance was achieved despite our gross remaining consistently under 120% and our ex-post realized beta being just 0.16.

The headwinds that we faced in FYE 2024 accelerated.

Specifically:

The 10 biggest contributors to the S&P 500 accounted for 47% of the benchmark return.

ARKK, a common benchmark for low-quality stocks exploded higher, rising nearly 31%.

And the trillions of loss-making stocks avoided their day of reckoning as the proverbial can was kicked down the road.

Yet the Fund did well despite the persistence of these headwinds. Here is why:

Long Portfolio: Our longs had over an 80% hit-rate. Without playing in the dangerous names discussed above, we made our money in mispriced blue-chip stocks that offered a significant margin of safety.

Short Portfolio: 2024 was a year where our proprietary mix of fundamental and quantitative risk controls proved invaluable. In our idiosyncratic single-stock book of shorts, our average drag was only -14bps. We view this as a non-trivial accomplishment.

Outlook: One of the benefits of working for the Knight’s CIO is he is a student of markets, knows it is never different this time, and has a history of sticking with proven but out of favor investment strategies. An investment program helmed by someone with less depth, knowledge and patience fractures the alignment we feel with both the Knights of Columbus Asset Advisors (“KOCAA”) and their investors who we are honored to serve. We believe the importance of our strategy’s non-correlated returns has never been higher.

As Warren E. Buffett ("Mr. Buffett") builds a $300bn+ cash pile, we think he sees what we do: an unsustainable decoupling of aggregate valuations. Unlike Mr. Buffett, we do not have $100s of billions to invest. That allows us to partake in some of the remarkable bargains we see on the long side while pairing this with a mix of shorts that suffer from unsustainable valuations and dubious capital allocation.

Your managers continue to have substantially all our liquid net worth invested in strategies managed by the sub-advisor L2. Your fund managers have well over $1ml invested in KCEIX, specifically. We look forward to the years ahead and thank you for your continued support.

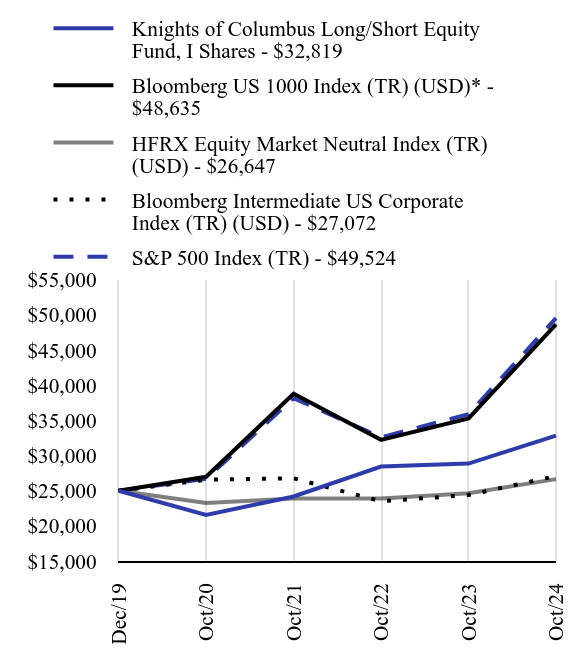

How did the Fund perform since inception?

Total Return Based on $25,000 Investment

| Knights of Columbus Long/Short Equity Fund, I Shares - $32819 | Bloomberg US 1000 Index (TR) (USD)* - $48635 | HFRX Equity Market Neutral Index (TR) (USD) - $26647 | Bloomberg Intermediate US Corporate Index (TR) (USD) - $27072 | S&P 500 Index (TR) - $49524 |

|---|

| Dec/19 | $25000 | $25000 | $25000 | $25000 | $25000 |

| Oct/20 | $21555 | $26983 | $23253 | $26573 | $26696 |

| Oct/21 | $24183 | $38780 | $23881 | $26762 | $38153 |

| Oct/22 | $28427 | $32225 | $23883 | $23503 | $32578 |

| Oct/23 | $28859 | $35267 | $24642 | $24385 | $35883 |

| Oct/24 | $32819 | $48635 | $26647 | $27072 | $49524 |

Since its inception on December 2, 2019. The line graph represents historical performance of a hypothetical investment of $25,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-844-KC-FUNDS (1-844-523-8637) for current month-end performance.

Footnote Reference*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | Annualized Since Inception |

|---|

| Knights of Columbus Long/Short Equity Fund, I Shares | 13.72% | 5.69% |

| Bloomberg US 1000 Index (TR) (USD)* | 37.91% | 14.49% |

| HFRX Equity Market Neutral Index (TR) (USD) | 8.14% | 1.31% |

| Bloomberg Intermediate US Corporate Index (TR) (USD) | 11.02% | 1.63% |

| S&P 500 Index (TR) | 38.02% | 14.91% |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $136,005,126 | 93 | $1,460,089 | 51% |

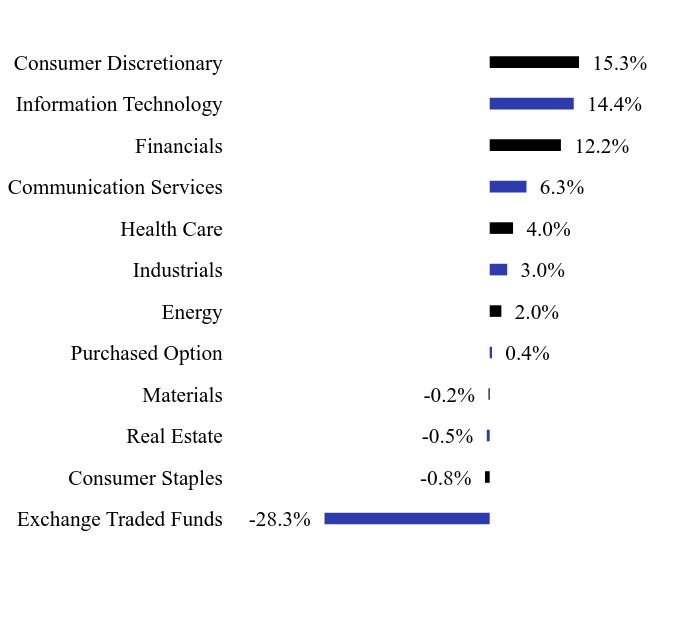

What did the Fund invest in?

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Exchange Traded Funds | -28.3% |

| Consumer Staples | -0.8% |

| Real Estate | -0.5% |

| Materials | -0.2% |

| Purchased Option | 0.4% |

| Energy | 2.0% |

| Industrials | 3.0% |

| Health Care | 4.0% |

| Communication Services | 6.3% |

| Financials | 12.2% |

| Information Technology | 14.4% |

| Consumer Discretionary | 15.3% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| AppLovin, Cl A | | | 4.3% |

| Expedia Group | | | 2.5% |

| Synchrony Financial | | | 2.2% |

| Meta Platforms, Cl A | | | 2.1% |

| Owens Corning | | | 2.0% |

| International Business Machines | | | 2.0% |

| Corpay | | | 2.0% |

| Apple | | | 1.9% |

| Airbnb, Cl A | | | 1.9% |

| Alphabet, Cl A | | | 1.9% |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 1-844-KC-FUNDS (1-844-523-8637) to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

The Advisors' Inner Circle Fund III

Knights of Columbus Long/Short Equity Fund / I Shares - KCEIX

Annual Shareholder Report: October 31, 2024

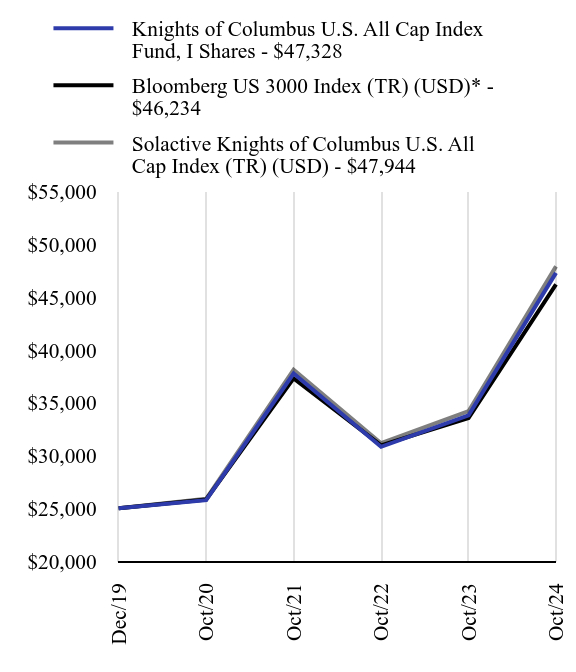

The Advisors' Inner Circle Fund III

Knights of Columbus Large Cap Value Fund

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about I Shares of the Knights of Columbus Large Cap Value Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.kofcassetadvisors.org/resources/forms/#tab-1-application--account-forms. You can also request this information by contacting us at 1-844-KC-FUNDS (1-844-523-8637). This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Knights of Columbus Large Cap Value Fund, I Shares | $89 | 0.76% |

How did the Fund perform in the last year?

The Fund changed the vendor for its primary benchmark, from FTSE Russell to Bloomberg, as of February 29, 2024. All performance discussions and comparisons herein will consider that the fund was managed against the Russell 1000 Value Index for November, December, January and February, and the Bloomberg 1000 Value Index for the rest of the year.

The Russell 1000 Value Index rose +30.98% for the year ended October 31, 2024, while the Bloomberg 1000 Value rose +29.59%. Despite a slight lull in the summer, the indices steadily climbed higher for much of the year. Every sector was positive with Financials (+53%) and Industrials (+44%) leading the way while Energy (+7%) and Health Care (+16%) were the biggest laggards. Securities restricted from investment for Catholic principles underperformed for the year, rising +24% while unrestricted members rose +33%.

The Fund I Shares returned +33.92% during this period. The Health Care sector helped performance. Boston Scientific Corp. (1.6% Average Wgt., +64.1% Total Return) rose 64.1%. The company had several strong earnings reports where they beat expectations on revenue and earnings and raised their full year guidance. Select Medical Holdings Corp. (1.1%, +43.6%) also performed well due to strong earnings reports. They continue normalizing the business towards pre-COVID levels and announced the spin-off of their Concentra business segment.

The Consumer Staples sector detracted from value. Monster Beverage Corp. (1.3%, +3.1%) finished higher but failed to keep up with peers as industry-wide growth in energy drink sales slowed. Also, Monster’s US market share continues to shrink. Mondelez International, Inc. (1.5%, +6.0%) finished higher but also failed to keep up with peers. The company gave weaker than expected guidance for several periods, citing cocoa price inflation as the problem.

Macroeconomic trends and overall economic activity in the U.S. have stayed stronger than expected, lowering expectations for interest rate cuts as the year has progressed and moving yields higher. Trump’s election wins also pushed yields higher as many economists (but not all) believe his tariff proposals will prove inflationary. The rate on 10-year treasury bonds stands at 4.42%, a level last seen in early July 2024, with the looming question of where rates go from here. We are maintaining current positioning for now as we continue to assess macroeconomic trends and potential Trump Administration polices to gauge impacts on economic growth, inflation, and interest rates.

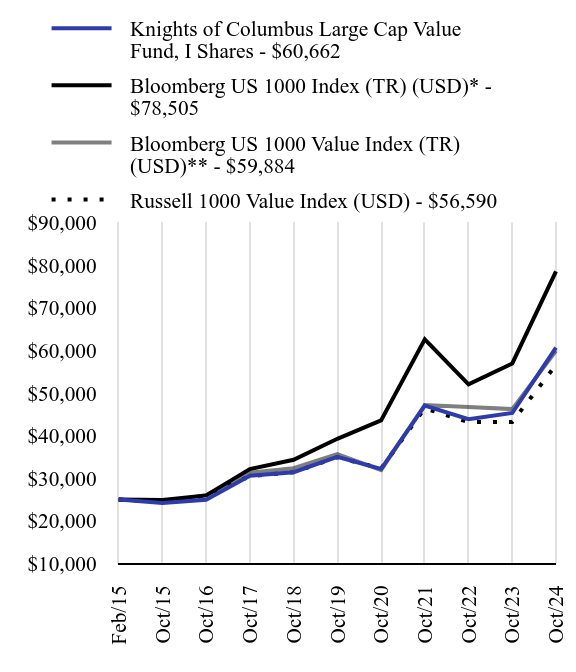

How did the Fund perform since inception?

Total Return Based on $25,000 Investment

| Knights of Columbus Large Cap Value Fund, I Shares - $60662 | Bloomberg US 1000 Index (TR) (USD)* - $78505 | Bloomberg US 1000 Value Index (TR) (USD)** - $59884 | Russell 1000 Value Index (USD) - $56590 |

|---|

| Feb/15 | $25000 | $25000 | $25000 | $25000 |

| Oct/15 | $24159 | $24883 | $24496 | $24320 |

| Oct/16 | $24911 | $25964 | $26016 | $25870 |

| Oct/17 | $30560 | $32132 | $31296 | $30470 |

| Oct/18 | $31406 | $34310 | $32328 | $31394 |

| Oct/19 | $35019 | $39237 | $35675 | $34915 |

| Oct/20 | $32151 | $43554 | $31908 | $32273 |

| Oct/21 | $47013 | $62597 | $47187 | $46395 |

| Oct/22 | $43849 | $52017 | $46686 | $43148 |

| Oct/23 | $45297 | $56926 | $46212 | $43206 |

| Oct/24 | $60662 | $78505 | $59884 | $56590 |

Since its inception on February 27, 2015. The line graph represents historical performance of a hypothetical investment of $25,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-844-KC-FUNDS (1-844-523-8637) for current month-end performance.

Footnote Reference*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

** On February 29, 2024, the Fund’s benchmark changed from the Russell 1000 Value Index (USD) to the Bloomberg 1000 Value Index (TR) (USD) because the Adviser believes that the Bloomberg 1000 Value Index (TR) (USD) better reflects the Fund’s investment strategies.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Knights of Columbus Large Cap Value Fund, I Shares | 33.92% | 11.61% | 9.59% |

| Bloomberg US 1000 Index (TR) (USD)* | 37.91% | 14.88% | 12.55% |

| Bloomberg US 1000 Value Index (TR) (USD)** | 29.59% | 10.92% | 9.44% |

| Russell 1000 Value Index (USD) | 30.98% | 10.14% | 8.80% |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $234,654,152 | 76 | $1,214,842 | 36% |

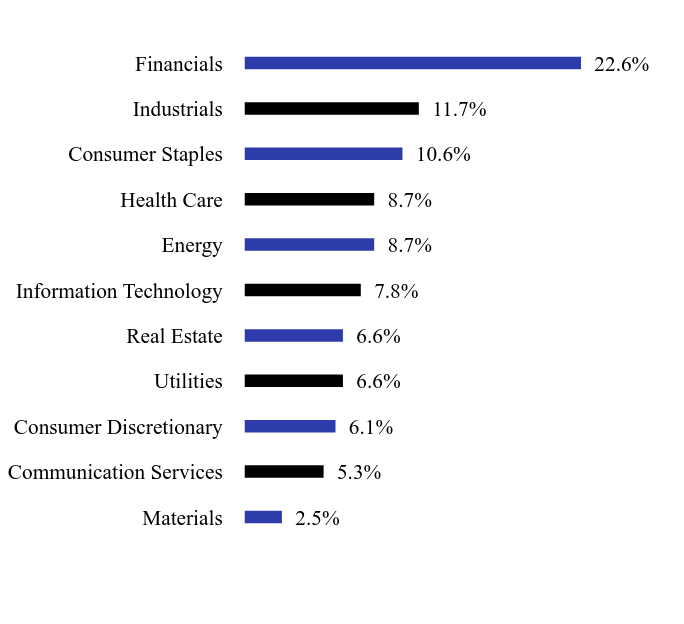

What did the Fund invest in?

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Materials | 2.5% |

| Communication Services | 5.3% |

| Consumer Discretionary | 6.1% |

| Utilities | 6.6% |

| Real Estate | 6.6% |

| Information Technology | 7.8% |

| Energy | 8.7% |

| Health Care | 8.7% |

| Consumer Staples | 10.6% |

| Industrials | 11.7% |

| Financials | 22.6% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Exxon Mobil | | | 4.2% |

| AT&T | | | 2.8% |

| Cisco Systems | | | 2.5% |

| Berkshire Hathaway, Cl B | | | 2.5% |

| JPMorgan Chase | | | 2.4% |

| Entergy | | | 2.2% |

| 3M | | | 1.9% |

| Ameriprise Financial | | | 1.8% |

| Bank of America | | | 1.8% |

| General Motors | | | 1.7% |

On February 29, 2024, Knights of Columbus Large Cap Value Fund changed its primary benchmark, with approval of the Funds’ Board of Trustees, from the Russell 1000 Value Index to the Bloomberg 1000 Value Total Return Index. For detailed information please see the Prospectus Supplement dated March 1, 2024.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 1-844-KC-FUNDS (1-844-523-8637) to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

The Advisors' Inner Circle Fund III

Knights of Columbus Large Cap Value Fund / I Shares - KCVIX

Annual Shareholder Report: October 31, 2024

The Advisors' Inner Circle Fund III

Knights of Columbus Large Cap Value Fund

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about Class S Shares of the Knights of Columbus Large Cap Value Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.kofcassetadvisors.org/resources/forms/#tab-1-application--account-forms. You can also request this information by contacting us at 1-844-KC-FUNDS (1-844-523-8637). This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Knights of Columbus Large Cap Value Fund, Class S Shares | $101 | 0.86% |

How did the Fund perform in the last year?

The Fund changed the vendor for its primary benchmark, from FTSE Russell to Bloomberg, as of February 29, 2024. All performance discussions and comparisons herein will consider that the fund was managed against the Russell 1000 Value Index for November, December, January and February, and the Bloomberg 1000 Value Index for the rest of the year.

The Russell 1000 Value Index rose +30.98% for the year ended October 31, 2024, while the Bloomberg 1000 Value rose +29.59%. Despite a slight lull in the summer, the indices steadily climbed higher for much of the year. Every sector was positive with Financials (+53%) and Industrials (+44%) leading the way while Energy (+7%) and Health Care (+16%) were the biggest laggards. Securities restricted from investment for Catholic principles underperformed for the year, rising +24% while unrestricted members rose +33%.

The Fund Class S Shares returned +33.79% during this period. The Health Care sector helped performance. Boston Scientific Corp. (1.6% Average Wgt., +64.1% Total Return) rose 64.1%. The company had several strong earnings reports where they beat expectations on revenue and earnings and raised their full year guidance. Select Medical Holdings Corp. (1.1%, +43.6%) also performed well due to strong earnings reports. They continue normalizing the business towards pre-COVID levels and announced the spin-off of their Concentra business segment.

The Consumer Staples sector detracted from value. Monster Beverage Corp. (1.3%, +3.1%) finished higher but failed to keep up with peers as industry-wide growth in energy drink sales slowed. Also, Monster’s US market share continues to shrink. Mondelez International, Inc. (1.5%, +6.0%) finished higher but also failed to keep up with peers. The company gave weaker than expected guidance for several periods, citing cocoa price inflation as the problem.

Macroeconomic trends and overall economic activity in the U.S. have stayed stronger than expected, lowering expectations for interest rate cuts as the year has progressed and moving yields higher. Trump’s election wins also pushed yields higher as many economists (but not all) believe his tariff proposals will prove inflationary. The rate on 10-year treasury bonds stands at 4.42%, a level last seen in early July 2024, with the looming question of where rates go from here. We are maintaining current positioning for now as we continue to assess macroeconomic trends and potential Trump Administration polices to gauge impacts on economic growth, inflation, and interest rates.

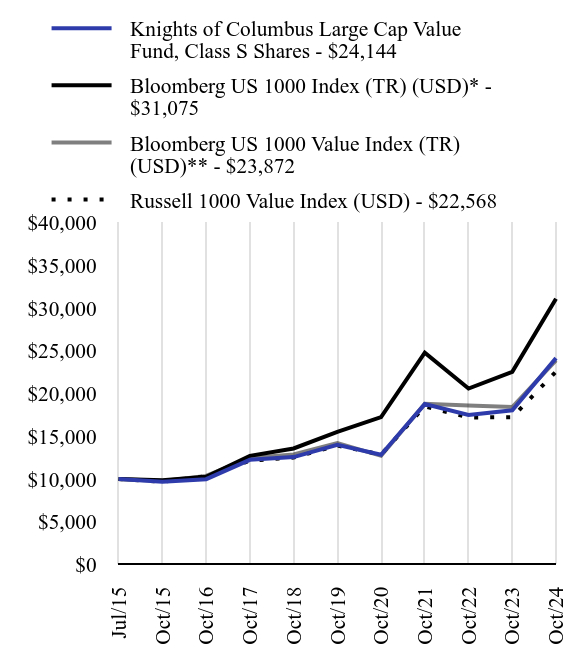

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Knights of Columbus Large Cap Value Fund, Class S Shares - $24144 | Bloomberg US 1000 Index (TR) (USD)* - $31075 | Bloomberg US 1000 Value Index (TR) (USD)** - $23872 | Russell 1000 Value Index (USD) - $22568 |

|---|

| Jul/15 | $10000 | $10000 | $10000 | $10000 |

| Oct/15 | $9690 | $9850 | $9765 | $9699 |

| Oct/16 | $9988 | $10277 | $10371 | $10317 |

| Oct/17 | $12251 | $12719 | $12476 | $12151 |

| Oct/18 | $12575 | $13581 | $12887 | $12520 |

| Oct/19 | $14008 | $15531 | $14221 | $13924 |

| Oct/20 | $12847 | $17240 | $12720 | $12870 |

| Oct/21 | $18768 | $24778 | $18810 | $18502 |

| Oct/22 | $17487 | $20590 | $18611 | $17207 |

| Oct/23 | $18046 | $22534 | $18422 | $17230 |

| Oct/24 | $24144 | $31075 | $23872 | $22568 |

Since its inception on July 14, 2015. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-844-KC-FUNDS (1-844-523-8637) for current month-end performance.

Footnote Reference*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

** On February 29, 2024, the Fund’s benchmark changed from the Russell 1000 Value Index (USD) to the Bloomberg 1000 Value Index (TR) (USD) because the Adviser believes that the Bloomberg 1000 Value Index (TR) (USD) better reflects the Fund’s investment strategies.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Knights of Columbus Large Cap Value Fund, Class S Shares | 33.79% | 11.50% | 9.93% |

| Bloomberg US 1000 Index (TR) (USD)* | 37.91% | 14.88% | 12.96% |

| Bloomberg US 1000 Value Index (TR) (USD)** | 29.59% | 10.92% | 9.80% |

| Russell 1000 Value Index (USD) | 30.98% | 10.14% | 9.14% |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $234,654,152 | 76 | $1,214,842 | 36% |

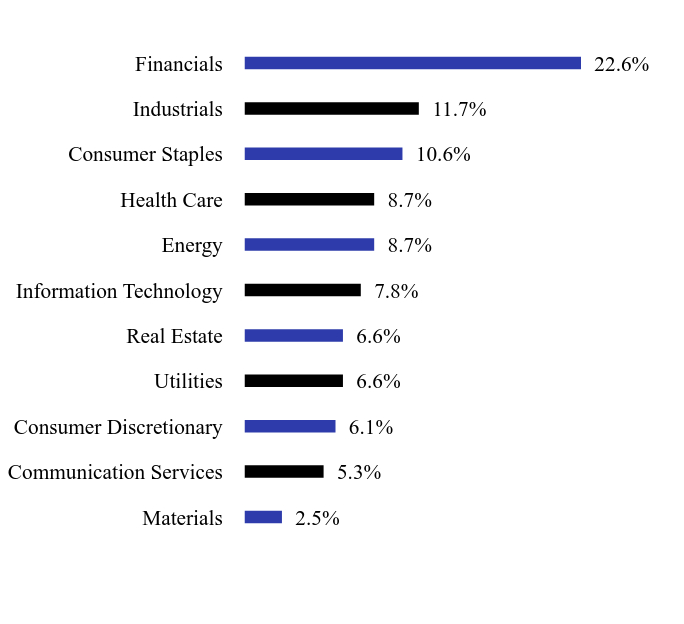

What did the Fund invest in?

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Materials | 2.5% |

| Communication Services | 5.3% |

| Consumer Discretionary | 6.1% |

| Utilities | 6.6% |

| Real Estate | 6.6% |

| Information Technology | 7.8% |

| Energy | 8.7% |

| Health Care | 8.7% |

| Consumer Staples | 10.6% |

| Industrials | 11.7% |

| Financials | 22.6% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Exxon Mobil | | | 4.2% |

| AT&T | | | 2.8% |

| Cisco Systems | | | 2.5% |

| Berkshire Hathaway, Cl B | | | 2.5% |

| JPMorgan Chase | | | 2.4% |

| Entergy | | | 2.2% |

| 3M | | | 1.9% |

| Ameriprise Financial | | | 1.8% |

| Bank of America | | | 1.8% |

| General Motors | | | 1.7% |

On February 29, 2024, Knights of Columbus Large Cap Value Fund changed its primary benchmark, with approval of the Funds’ Board of Trustees, from the Russell 1000 Value Index to the Bloomberg 1000 Value Total Return Index. For detailed information please see the Prospectus Supplement dated March 1, 2024.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 1-844-KC-FUNDS (1-844-523-8637) to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

The Advisors' Inner Circle Fund III

Knights of Columbus Large Cap Value Fund / Class S Shares - KCVSX

Annual Shareholder Report: October 31, 2024

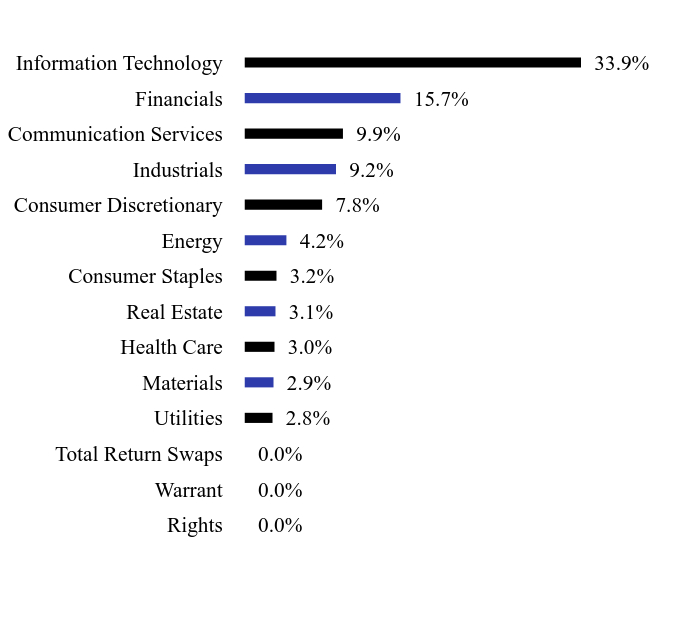

The Advisors' Inner Circle Fund III

Knights of Columbus Large Cap Growth Fund

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about I Shares of the Knights of Columbus Large Cap Growth Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.kofcassetadvisors.org/resources/forms/#tab-1-application--account-forms. You can also request this information by contacting us at 1-844-KC-FUNDS (1-844-523-8637). This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Knights of Columbus Large Cap Growth Fund, I Shares | $91 | 0.76% |

How did the Fund perform in the last year?

The Fund changed the vendor for its primary benchmark, FTSE Russell to Bloomberg, as of February 29, 2024. All performance discussions and comparisons herein will consider that the fund was managed against the Russell 1000 Growth Index from October 2023 to February 2024 and the Bloomberg 1000 Growth Index from March 2024 and beyond.

Fiscal year 2024 generated another year of strong returns for the large-cap growth stocks as the Russell 1000 Growth Index and Bloomberg 1000 Growth Index generated returns of +43.77% and +41.80%, respectively. Continued excitement over artificial intelligence, earnings resilience and prospects of an accommodative Federal Reserve lowering short-term interest rates overcame any trepidation from multiple wars, US elections or fears of a slowing consumer. Breadth increased over the prior year as a wider array of sectors participated in the rally. The Utilities sector, though small, outperformed at +139% in Russell and +55% in Bloomberg as investors began to understand the energy requirements to enable AI computations. Communication Services (+56% / +54%) and Information Technology (+54% / +52%) also outperformed, while Energy (+24% / +4%), Health Care (+24% / +26%) and Consumer Staples (+25% / +22%) were the laggards.

The Fund I Shares gained +40.23% for the fiscal year and underperformed the benchmarks. Cash accounted for the majority of underperformance, despite a moderate weight, given the strength of the rally. Stock selection in Consumer Discretionary also hurt, as did Consumer Staples. Catholic restrictions aided relative performance during the year as stocks restricted for investment underperformed the investable options. Stock selection in Real Estate and Communication Services also helped.

Portfolio positioning exiting the fiscal year can best be described as “neutral.” Sector weights were generally in line, with the few deviations largely driven by Catholic restrictions. Aggregate factor exposures presented a similarly neutral view, accounting for very little active risk, and individual factor exposures were also atypically low. The neutral positioning is reflective of our view that breadth within the growth landscape is improving and signs that leadership may be shifting away from the homogeny of the “Magnificent 7” mega cap tech stocks. We expect to retain our neutral-ish view as we seek further evidence of the next stage of market leadership and evaluate the macroeconomic and geopolitical environment.

How did the Fund perform since inception?

Total Return Based on $25,000 Investment

| Knights of Columbus Large Cap Growth Fund, I Shares - $73613 | Bloomberg US 1000 Index (TR) (USD)* - $78505 | Bloomberg US 1000 Growth Index (TR) (USD)** - $93390 | Russell 1000 Growth Index (USD) (TR) - $104475 |

|---|

| Feb/15 | $25000 | $25000 | $25000 | $25000 |

| Oct/15 | $25039 | $24883 | $25266 | $25454 |

| Oct/16 | $24571 | $25964 | $25889 | $26035 |

| Oct/17 | $31070 | $32132 | $32822 | $33771 |

| Oct/18 | $33557 | $34310 | $35956 | $37388 |

| Oct/19 | $37230 | $39237 | $42235 | $43783 |

| Oct/20 | $46848 | $43554 | $53157 | $56575 |

| Oct/21 | $62826 | $62597 | $75718 | $81021 |

| Oct/22 | $45006 | $52017 | $57332 | $61092 |

| Oct/23 | $52493 | $56926 | $65861 | $72670 |

| Oct/24 | $73613 | $78505 | $93390 | $104475 |

Since its inception on February 27, 2015. The line graph represents historical performance of a hypothetical investment of $25,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-844-KC-FUNDS (1-844-523-8637) for current month-end performance.

Footnote Reference*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

** On February 29, 2024, the Fund’s benchmark changed from the Russell 1000 Growth Index (USD) (TR) to the Bloomberg 1000 Growth Index (TR) (USD) because the Adviser believes that the Bloomberg 1000 Growth Index (TR) (USD) better reflects the Fund’s investment strategies.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Knights of Columbus Large Cap Growth Fund, I Shares | 40.23% | 14.61% | 11.80% |

| Bloomberg US 1000 Index (TR) (USD)* | 37.91% | 14.88% | 12.55% |

| Bloomberg US 1000 Growth Index (TR) (USD)** | 41.80% | 17.20% | 14.58% |

| Russell 1000 Growth Index (USD) (TR) | 43.77% | 19.00% | 15.92% |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $230,670,206 | 76 | $1,223,144 | 44% |

What did the Fund invest in?

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Energy | 0.7% |

| Utilities | 1.2% |

| Materials | 1.7% |

| Real Estate | 2.2% |

| Consumer Staples | 4.2% |

| Health Care | 7.3% |

| Industrials | 7.9% |

| Financials | 8.8% |

| Consumer Discretionary | 9.2% |

| Communication Services | 12.9% |

| Information Technology | 40.1% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| NVIDIA | | | 8.9% |

| Microsoft | | | 8.6% |

| Apple | | | 8.6% |

| Meta Platforms, Cl A | | | 3.9% |

| Alphabet, Cl A | | | 3.2% |

| Alphabet, Cl C | | | 2.7% |

| Broadcom | | | 2.6% |

| Berkshire Hathaway, Cl B | | | 2.0% |

| Tesla | | | 1.8% |

| Netflix | | | 1.5% |

On February 29, 2024, Knights of Columbus Large Cap Growth Fund changed its primary benchmark, with approval of the Funds’ Board of Trustees, from the Russell 1000 Growth Index to the Bloomberg 1000 Growth Total Return Index. For detailed information please see the Prospectus Supplement dated March 1, 2024.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 1-844-KC-FUNDS (1-844-523-8637) to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

The Advisors' Inner Circle Fund III

Knights of Columbus Large Cap Growth Fund / I Shares - KCGIX

Annual Shareholder Report: October 31, 2024

The Advisors' Inner Circle Fund III

Knights of Columbus Large Cap Growth Fund

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about Class S Shares of the Knights of Columbus Large Cap Growth Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.kofcassetadvisors.org/resources/forms/#tab-1-application--account-forms. You can also request this information by contacting us at 1-844-KC-FUNDS (1-844-523-8637). This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Knights of Columbus Large Cap Growth Fund, Class S Shares | $103 | 0.86% |

How did the Fund perform in the last year?

The Fund changed the vendor for its primary benchmark, FTSE Russell to Bloomberg, as of February 29, 2024. All performance discussions and comparisons herein will consider that the fund was managed against the Russell 1000 Growth Index from October 2023 to February 2024 and the Bloomberg 1000 Growth Index from March 2024 and beyond.

Fiscal year 2024 generated another year of strong returns for the large-cap growth stocks as the Russell 1000 Growth Index and Bloomberg 1000 Growth Index generated returns of +43.77% and +41.80%, respectively. Continued excitement over artificial intelligence, earnings resilience and prospects of an accommodative Federal Reserve lowering short-term interest rates overcame any trepidation from multiple wars, US elections or fears of a slowing consumer. Breadth increased over the prior year as a wider array of sectors participated in the rally. The Utilities sector, though small, outperformed at +139% in Russell and +55% in Bloomberg as investors began to understand the energy requirements to enable AI computations. Communication Services (+56% / +54%) and Information Technology (+54% / +52%) also outperformed, while Energy (+24% / +4%), Health Care (+24% / +26%) and Consumer Staples (+25% / +22%) were the laggards.

The Fund Class S Shares gained +40.06% for the fiscal year and underperformed the benchmarks. Cash accounted for the majority of underperformance, despite a moderate weight, given the strength of the rally. Stock selection in Consumer Discretionary also hurt, as did Consumer Staples. Catholic restrictions aided relative performance during the year as stocks restricted for investment underperformed the investable options. Stock selection in Real Estate and Communication Services also helped.

Portfolio positioning exiting the fiscal year can best be described as “neutral.” Sector weights were generally in line, with the few deviations largely driven by Catholic restrictions. Aggregate factor exposures presented a similarly neutral view, accounting for very little active risk, and individual factor exposures were also atypically low. The neutral positioning is reflective of our view that breadth within the growth landscape is improving and signs that leadership may be shifting away from the homogeny of the “Magnificent 7” mega cap tech stocks. We expect to retain our neutral-ish view as we seek further evidence of the next stage of market leadership and evaluate the macroeconomic and geopolitical environment.

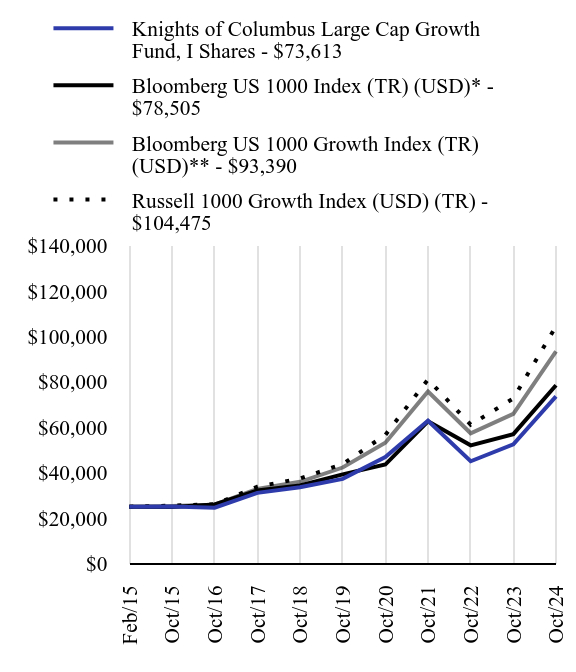

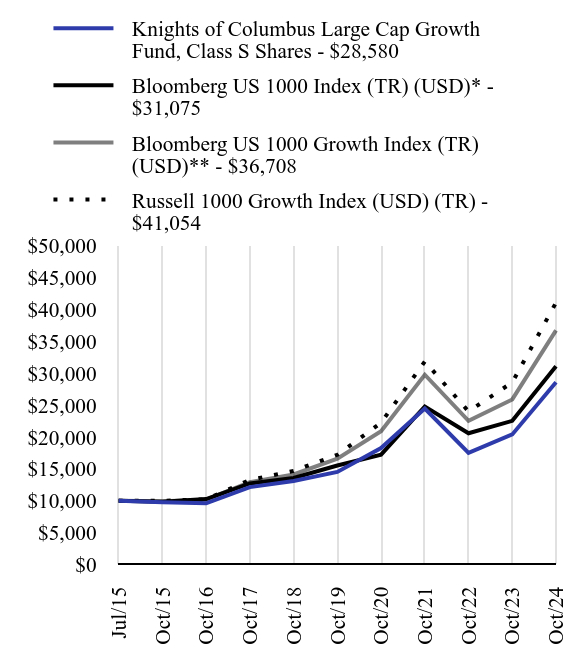

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Knights of Columbus Large Cap Growth Fund, Class S Shares - $28580 | Bloomberg US 1000 Index (TR) (USD)* - $31075 | Bloomberg US 1000 Growth Index (TR) (USD)** - $36708 | Russell 1000 Growth Index (USD) (TR) - $41054 |

|---|

| Jul/15 | $10000 | $10000 | $10000 | $10000 |

| Oct/15 | $9788 | $9850 | $9931 | $10002 |

| Oct/16 | $9601 | $10277 | $10176 | $10231 |

| Oct/17 | $12142 | $12719 | $12901 | $13270 |

| Oct/18 | $13112 | $13581 | $14133 | $14692 |

| Oct/19 | $14531 | $15531 | $16601 | $17204 |

| Oct/20 | $18266 | $17240 | $20894 | $22231 |

| Oct/21 | $24463 | $24778 | $29761 | $31837 |

| Oct/22 | $17518 | $20590 | $22535 | $24006 |

| Oct/23 | $20406 | $22534 | $25887 | $28556 |

| Oct/24 | $28580 | $31075 | $36708 | $41054 |

Since its inception on July 14, 2015. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-844-KC-FUNDS (1-844-523-8637) for current month-end performance.

Footnote Reference*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

** On February 29, 2024, the Fund’s benchmark changed from the Russell 1000 Growth Index (USD) (TR) to the Bloomberg 1000 Growth Index (TR) (USD) because the Adviser believes that the Bloomberg 1000 Growth Index (TR) (USD) better reflects the Fund’s investment strategies.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Knights of Columbus Large Cap Growth Fund, Class S Shares | 40.06% | 14.49% | 11.94% |

| Bloomberg US 1000 Index (TR) (USD)* | 37.91% | 14.88% | 12.96% |

| Bloomberg US 1000 Growth Index (TR) (USD)** | 41.80% | 17.20% | 15.00% |

| Russell 1000 Growth Index (USD) (TR) | 43.77% | 19.00% | 16.39% |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $230,670,206 | 76 | $1,223,144 | 44% |

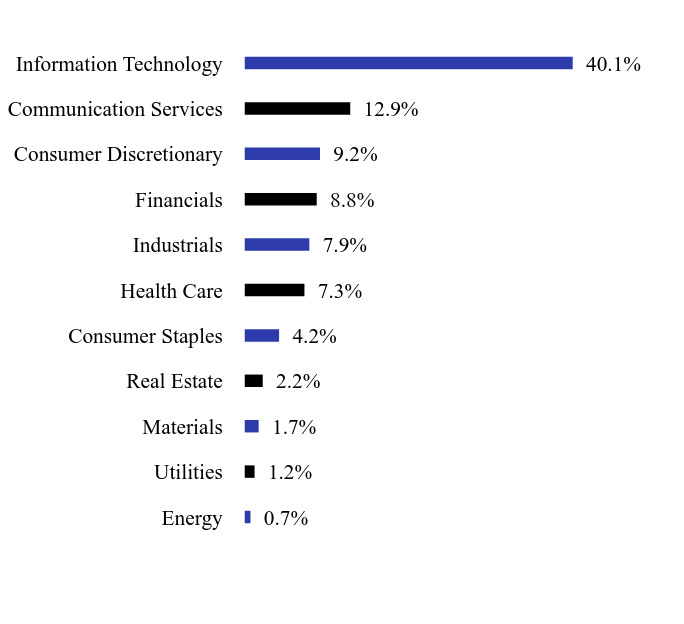

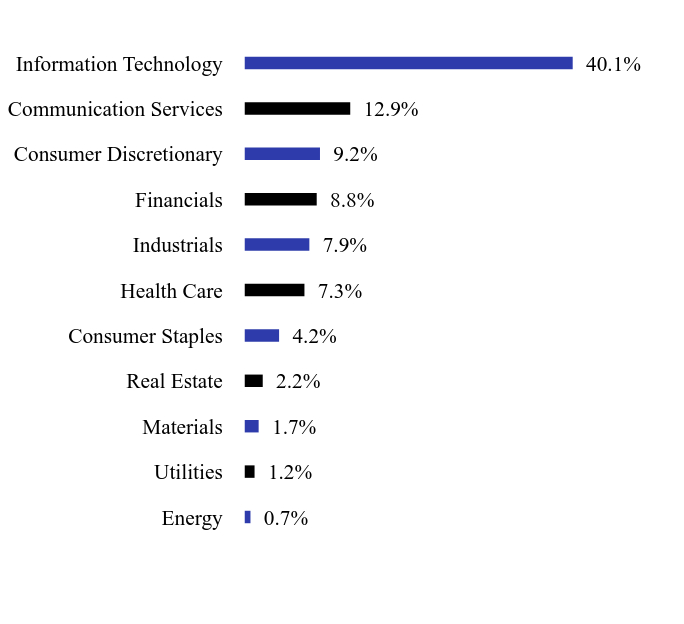

What did the Fund invest in?

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Energy | 0.7% |

| Utilities | 1.2% |

| Materials | 1.7% |

| Real Estate | 2.2% |

| Consumer Staples | 4.2% |

| Health Care | 7.3% |

| Industrials | 7.9% |

| Financials | 8.8% |

| Consumer Discretionary | 9.2% |

| Communication Services | 12.9% |

| Information Technology | 40.1% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| NVIDIA | | | 8.9% |

| Microsoft | | | 8.6% |

| Apple | | | 8.6% |

| Meta Platforms, Cl A | | | 3.9% |

| Alphabet, Cl A | | | 3.2% |

| Alphabet, Cl C | | | 2.7% |

| Broadcom | | | 2.6% |

| Berkshire Hathaway, Cl B | | | 2.0% |

| Tesla | | | 1.8% |

| Netflix | | | 1.5% |

On February 29, 2024, Knights of Columbus Large Cap Growth Fund changed its primary benchmark, with approval of the Funds’ Board of Trustees, from the Russell 1000 Growth Index to the Bloomberg 1000 Growth Total Return Index. For detailed information please see the Prospectus Supplement dated March 1, 2024.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 1-844-KC-FUNDS (1-844-523-8637) to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

The Advisors' Inner Circle Fund III

Knights of Columbus Large Cap Growth Fund / Class S Shares - KCGSX

Annual Shareholder Report: October 31, 2024

The Advisors' Inner Circle Fund III

Knights of Columbus Small Cap Fund

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about I Shares of the Knights of Columbus Small Cap Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.kofcassetadvisors.org/resources/forms/#tab-1-application--account-forms. You can also request this information by contacting us at 1-844-KC-FUNDS (1-844-523-8637). This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Knights of Columbus Small Cap Fund, I Shares | $104 | 0.90% |

How did the Fund perform in the last year?

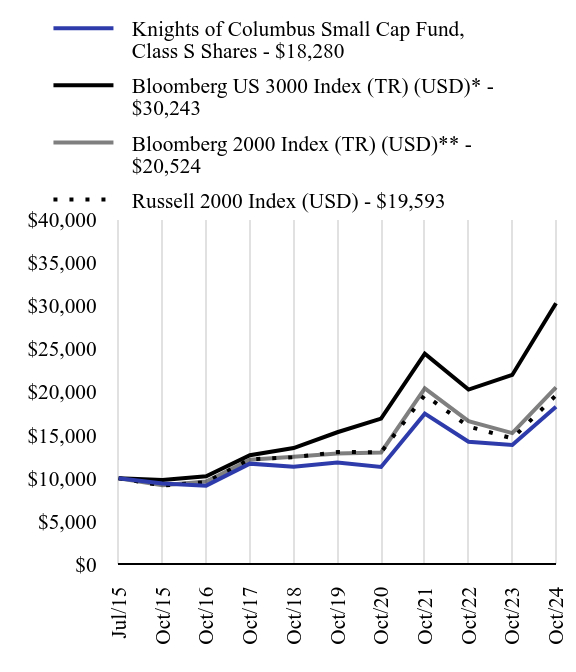

The Fund changed the vendor for its primary benchmark, FTSE Russell to Bloomberg, as of February 29, 2024. All performance discussions and comparisons herein will consider that the fund was managed against the Russell 2000 Index from October 2023 to February 2024 and the Bloomberg 2000 Index from March 2024 and beyond.

Fiscal year 2024 was a strong – albeit volatile – year for small caps, as the Russell 2000 Index was up +34.07% and the Bloomberg 2000 Index was up +34.80%. Small caps traded up sharply in November and December 2023, materially outperforming the large cap Bloomberg 1000 Index in those two months – short-term bucking the trend of large cap outperformance that has been in place since early 2021. The last three months of the fiscal year brought incremental volatility with the short term 9% pull back in early August due to a Yen carry trade unwind, as well as the 6% small cap pullback post Labor Day that also proved to be a buyable dip just ahead of the September FOMC meeting which gave the market its first rate cut since the COVID-driven cuts in early 2020. Within the small cap benchmark, Information Technology and Financials led for the fiscal year, while Energy and Utilities lagged.

In fiscal year 2024, the Fund I Shares was up +32.20%, underperforming the benchmark by 259 basis points (bps).

The Healthcare sector was the largest area of outperformance for the Fund due to selection and allocation. Lantheus Holdings, Inc. (1.0% Average Wgt, +67.8% Total Return) and Insmed Inc. (1.0%, +139.7%) were the biggest contributors to outperformance, with holding period returns of +61.0% and +196.4%, respectively. Conversely, the Information Technology sector was the biggest detractor of relative performance. Sprout Social, Inc. (0.8%, -50.3%) and DoubleVerify Holdings, Inc. (0.7%, -53.6%) were the biggest detractors to performance, with holding period returns of -29.5% and -38.7%, respectively.

Portfolio positioning can continue to best be described as “neutral.” The neutral positioning is reflective of our view that breadth within the growth landscape is improving and signs that leadership may be shifting. We are balancing upside participating in higher-growth, higher-momentum names against downside protection in stable/defensive growth companies. We expect to retain our neutral-ish view as we seek further evidence of the next stage of market leadership and evaluate the macroeconomic and geopolitical environment.

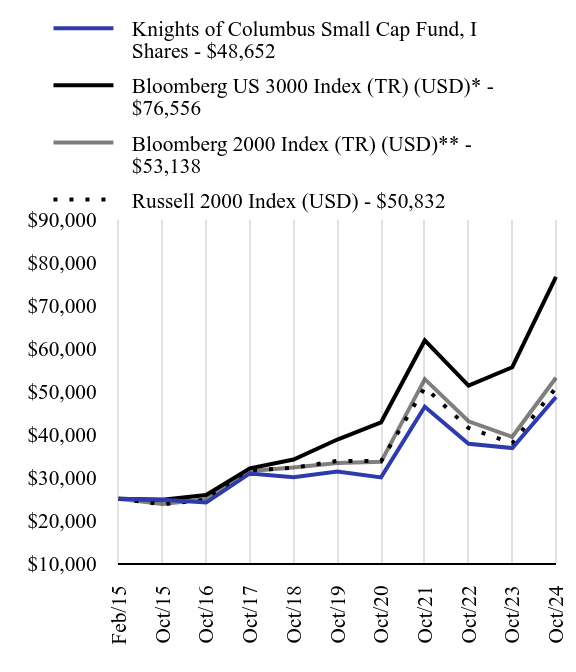

How did the Fund perform since inception?

Total Return Based on $25,000 Investment

| Knights of Columbus Small Cap Fund, I Shares - $48652 | Bloomberg US 3000 Index (TR) (USD)* - $76556 | Bloomberg 2000 Index (TR) (USD)** - $53138 | Russell 2000 Index (USD) - $50832 |

|---|

| Feb/15 | $25000 | $25000 | $25000 | $25000 |

| Oct/15 | $24801 | $24793 | $23790 | $23766 |

| Oct/16 | $24135 | $25873 | $24890 | $24743 |

| Oct/17 | $30896 | $32068 | $31451 | $31634 |

| Oct/18 | $30002 | $34142 | $32300 | $32220 |

| Oct/19 | $31326 | $38778 | $33331 | $33801 |

| Oct/20 | $29982 | $42782 | $33599 | $33754 |

| Oct/21 | $46407 | $61794 | $52800 | $50902 |

| Oct/22 | $37777 | $51278 | $43013 | $41464 |

| Oct/23 | $36801 | $55574 | $39420 | $37913 |

| Oct/24 | $48652 | $76556 | $53138 | $50832 |

Since its inception on February 27, 2015. The line graph represents historical performance of a hypothetical investment of $25,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-844-KC-FUNDS (1-844-523-8637) for current month-end performance.

Footnote Reference*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

** On February 29, 2024, the Fund’s benchmark changed from the Russell 2000 Index (USD) to the Bloomberg 2000 Index (TR) (USD) because the Adviser believes that the Bloomberg 2000 Index (TR) (USD) better reflects the Fund’s investment strategies.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Knights of Columbus Small Cap Fund, I Shares | 32.20% | 9.20% | 7.12% |

| Bloomberg US 3000 Index (TR) (USD)* | 37.75% | 14.57% | 12.25% |

| Bloomberg 2000 Index (TR) (USD)** | 34.80% | 9.78% | 8.10% |

| Russell 2000 Index (USD) | 34.07% | 8.50% | 7.60% |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $152,347,130 | 93 | $1,107,108 | 71% |

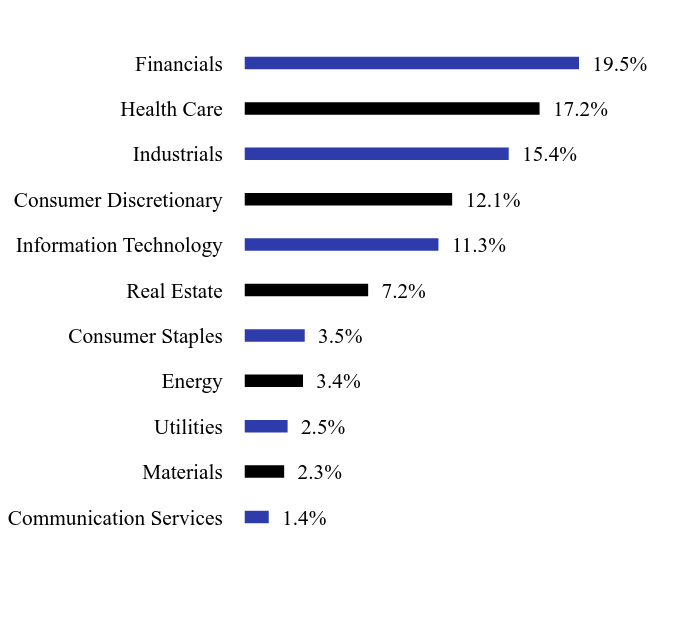

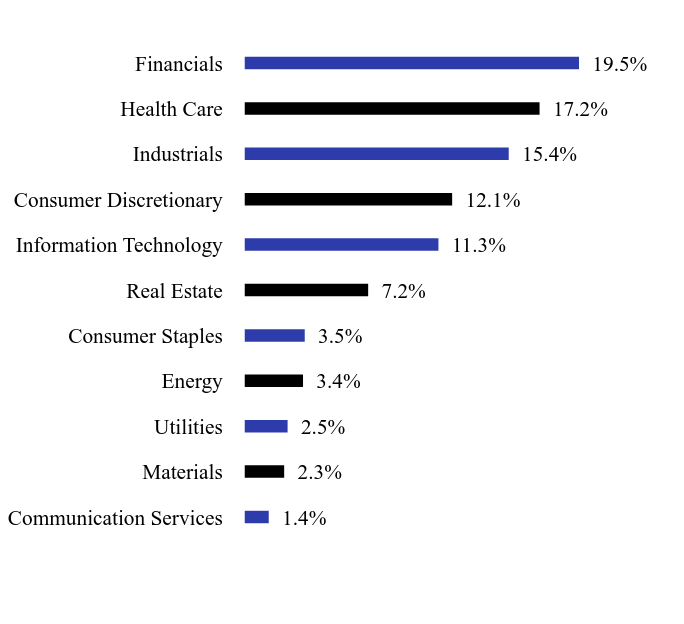

What did the Fund invest in?

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Communication Services | 1.4% |

| Materials | 2.3% |

| Utilities | 2.5% |

| Energy | 3.4% |

| Consumer Staples | 3.5% |