UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM N-CSR

________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22920

The Advisors’ Inner Circle Fund III

(Exact name of registrant as specified in charter)

________

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: (877) 446-3863

Date of fiscal year end: October 31, 2024

Date of reporting period: October 31, 2024

Item 1. Reports to Stockholders.

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto.

The Advisors' Inner Circle Fund III

Ninety One Global Franchise Fund

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about I Shares of the Ninety One Global Franchise Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.americanbeaconfunds.com/mutual_funds/NinetyOneGlobal.aspx. You can also request this information by contacting us at 800-658-5811.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Ninety One Global Franchise Fund, I Shares | $93 | 0.85% |

How did the Fund perform in the last year?

Review and outlook: As we approach the closing stretch of 2024, risk-on sentiment has continued to dominate markets. However, with an increasingly uncertain outlook, a market that remains very concentrated, and valuations appearing stretched, we believe a diversified portfolio of quality companies with proven earnings resilience is as important and relevant now as it has ever been. Our holdings are performing well from an earnings and free cash flow perspective, and it is this that drives long-term share price performance.

Performance summary: The Ninety One Global Franchise Fund I Share returned +2.97% over the quarter, lagging the MSCI ACWI, which returned +6.61%, in US dollar terms. Stock selection in IT and communication services detracted at the sector level, offset in part by a lack of exposure to energy and a combination of positioning and stock selection in financials. Lithography equipment maker ASML (5.6%) was a relative detractor amid broader relative weakness for technology stocks. In addition, there were geopolitical rumblings that the US and Netherlands are looking to further restrict China’s access to Western capital equipment. Clinical research company ICON (3.8%) delivered mixed Q2 results, with the revenue guidance midpoint reduced, but the company is operating well, with net new bookings up for the quarter y-o-y. Software company Intuit (4.2%) slipped back, masking a strong fiscal Q4 performance, particularly from QuickBooks. Samsung Electronics (1.5%) drifted lower given weaker sentiment to the broader IT space over the quarter. The company’s results at the end of July were solid with strong growth in memory sales. Microsoft (6.7%) slipped back, on little specific news. At the end of July, Microsoft delivered a decent fiscal Q4 with all the key variables moving in the right direction. More positively, tobacco producer Philip Morris International (5.1%) contributed after raising its forecast for annual profit growth on higher demand for its Zyn nicotine pouches. Cybersecurity company Check Point Software (3.2%) rose after delivering a robust quarter in which billings rose +10% on the prior year, revenue +7% and EPS +8%. Annual guidance was reiterated, and the company also announced Gil’s CEO successor, Nadav Zafrir, well ahead of its previously articulated timeline. Gil is expected to remain heavily involved as Executive Chair. St. James’s Place (1.0%) delivered a credible update, helping alleviate concerns around the new Consumer Duty regulation, charging structure changes and advice provisions. Flows were strong, despite a very challenging environment. Credit rating agency Moody’s (3.6%) reported stellar Q2 results, amid a surge of new issuance fuelled in part by tightening spreads and the impending US election in Q4. Moody’s also upped guidance for FY24 and increased its buyback from $1 billion to $1.3 billion given the extra cash. Not owning NVIDIA (0.0%) also helped relative performance.

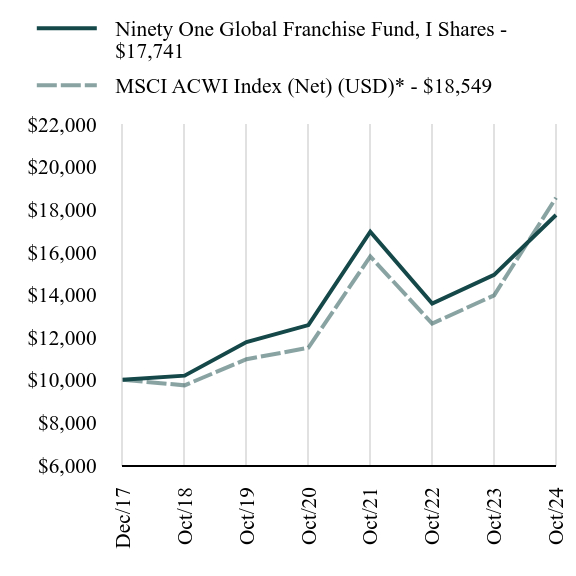

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Ninety One Global Franchise Fund, I Shares - $17741 | MSCI ACWI Index (Net) (USD)* - $18549 |

|---|

| Dec/17 | $10000 | $10000 |

| Oct/18 | $10198 | $9742 |

| Oct/19 | $11774 | $10968 |

| Oct/20 | $12571 | $11505 |

| Oct/21 | $16952 | $15793 |

| Oct/22 | $13577 | $12641 |

| Oct/23 | $14931 | $13969 |

| Oct/24 | $17741 | $18549 |

Since its inception on December 11, 2017. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.Call 800-658-5811 or visit https://www.americanbeaconfunds.com/mutual_funds/NinetyOneGlobal.aspx for current month-end performance.

Footnote Reference*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Ninety One Global Franchise Fund, I Shares | 18.82% | 8.55% | 8.67% |

| MSCI ACWI Index (Net) (USD)* | 32.79% | 11.08% | 9.38% |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $357,682,691 | 28 | $2,238,037 | 28% |

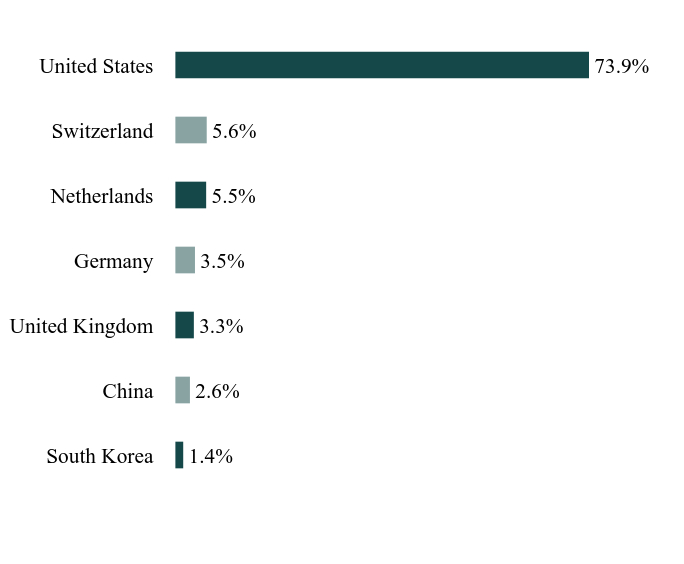

What did the Fund invest in?

Country WeightingsFootnote Reference*

| Value | Value |

|---|

| South Korea | 1.4% |

| China | 2.6% |

| United Kingdom | 3.3% |

| Germany | 3.5% |

| Netherlands | 5.5% |

| Switzerland | 5.6% |

| United States | 73.9% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Visa, Cl A | | | 9.9% |

| Booking Holdings | | | 6.7% |

| Microsoft | | | 6.4% |

| Philip Morris International | | | 5.7% |

| ASML Holding | | | 5.5% |

| Autodesk | | | 4.2% |

| Intuit | | | 4.2% |

| Alphabet, Cl A | | | 4.1% |

| Beiersdorf | | | 3.5% |

| Moody's | | | 3.5% |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 800-658-5811 to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

The Advisors' Inner Circle Fund III

Ninety One Global Franchise Fund / I Shares - ZGFIX

Annual Shareholder Report: October 31, 2024

INV-AR-TSR-2024-5

The Advisors' Inner Circle Fund III

Ninety One Global Franchise Fund

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about A Shares of the Ninety One Global Franchise Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.americanbeaconfunds.com/mutual_funds/NinetyOneGlobal.aspx. You can also request this information by contacting us at 800-658-5811.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Ninety One Global Franchise Fund, A Shares | $120 | 1.10% |

How did the Fund perform in the last year?

Review and outlook: As we approach the closing stretch of 2024, risk-on sentiment has continued to dominate markets. However, with an increasingly uncertain outlook, a market that remains very concentrated, and valuations appearing stretched, we believe a diversified portfolio of quality companies with proven earnings resilience is as important and relevant now as it has ever been. Our holdings are performing well from an earnings and free cash flow perspective, and it is this that drives long-term share price performance.

Performance summary: The Ninety One Global Franchise Fund I Share returned +2.97% over the quarter, lagging the MSCI ACWI, which returned +6.61%, in US dollar terms. Stock selection in IT and communication services detracted at the sector level, offset in part by a lack of exposure to energy and a combination of positioning and stock selection in financials. Lithography equipment maker ASML (5.6%) was a relative detractor amid broader relative weakness for technology stocks. In addition, there were geopolitical rumblings that the US and Netherlands are looking to further restrict China’s access to Western capital equipment. Clinical research company ICON (3.8%) delivered mixed Q2 results, with the revenue guidance midpoint reduced, but the company is operating well, with net new bookings up for the quarter y-o-y. Software company Intuit (4.2%) slipped back, masking a strong fiscal Q4 performance, particularly from QuickBooks. Samsung Electronics (1.5%) drifted lower given weaker sentiment to the broader IT space over the quarter. The company’s results at the end of July were solid with strong growth in memory sales. Microsoft (6.7%) slipped back, on little specific news. At the end of July, Microsoft delivered a decent fiscal Q4 with all the key variables moving in the right direction. More positively, tobacco producer Philip Morris International (5.1%) contributed after raising its forecast for annual profit growth on higher demand for its Zyn nicotine pouches. Cybersecurity company Check Point Software (3.2%) rose after delivering a robust quarter in which billings rose +10% on the prior year, revenue +7% and EPS +8%. Annual guidance was reiterated, and the company also announced Gil’s CEO successor, Nadav Zafrir, well ahead of its previously articulated timeline. Gil is expected to remain heavily involved as Executive Chair. St. James’s Place (1.0%) delivered a credible update, helping alleviate concerns around the new Consumer Duty regulation, charging structure changes and advice provisions. Flows were strong, despite a very challenging environment. Credit rating agency Moody’s (3.6%) reported stellar Q2 results, amid a surge of new issuance fuelled in part by tightening spreads and the impending US election in Q4. Moody’s also upped guidance for FY24 and increased its buyback from $1 billion to $1.3 billion given the extra cash. Not owning NVIDIA (0.0%) also helped relative performance.

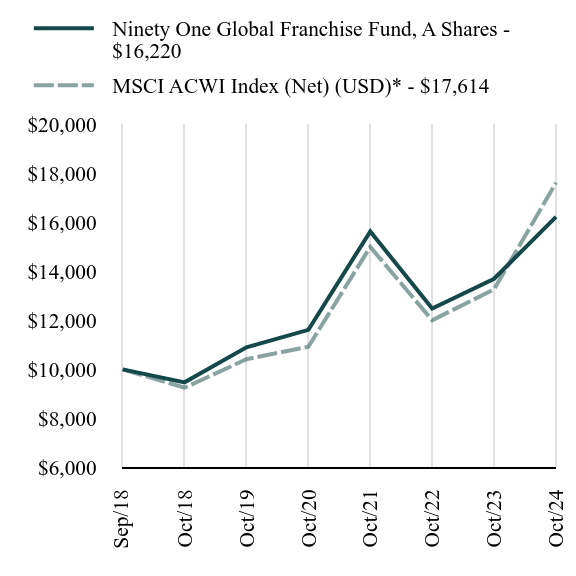

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Ninety One Global Franchise Fund, A Shares - $16220 | MSCI ACWI Index (Net) (USD)* - $17614 |

|---|

| Sep/18 | $10000 | $10000 |

| Oct/18 | $9470 | $9251 |

| Oct/19 | $10900 | $10415 |

| Oct/20 | $11613 | $10924 |

| Oct/21 | $15628 | $14997 |

| Oct/22 | $12482 | $12004 |

| Oct/23 | $13696 | $13265 |

| Oct/24 | $16220 | $17614 |

Since its inception on September 28, 2018. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.Call 800-658-5811 or visit https://www.americanbeaconfunds.com/mutual_funds/NinetyOneGlobal.aspx for current month-end performance.

Footnote Reference*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Ninety One Global Franchise Fund, A Shares | 18.43% | 8.28% | 8.26% |

| MSCI ACWI Index (Net) (USD)* | 32.79% | 11.08% | 9.73% |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $357,682,691 | 28 | $2,238,037 | 28% |

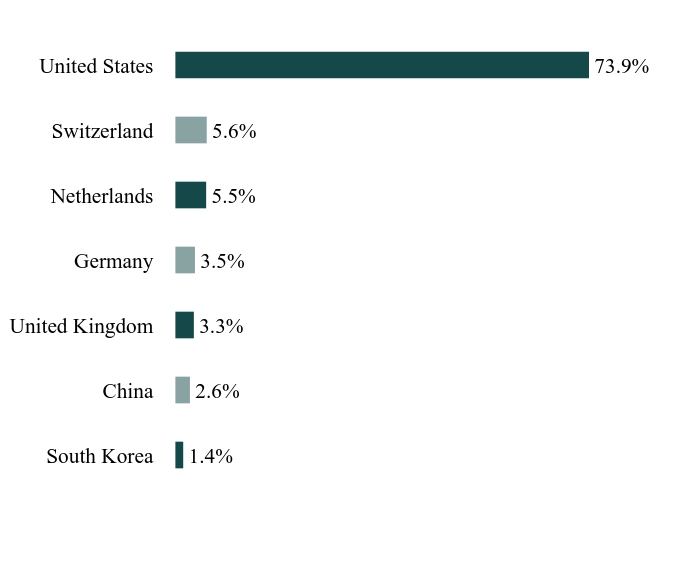

What did the Fund invest in?

Country WeightingsFootnote Reference*

| Value | Value |

|---|

| South Korea | 1.4% |

| China | 2.6% |

| United Kingdom | 3.3% |

| Germany | 3.5% |

| Netherlands | 5.5% |

| Switzerland | 5.6% |

| United States | 73.9% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Visa, Cl A | | | 9.9% |

| Booking Holdings | | | 6.7% |

| Microsoft | | | 6.4% |

| Philip Morris International | | | 5.7% |

| ASML Holding | | | 5.5% |

| Autodesk | | | 4.2% |

| Intuit | | | 4.2% |

| Alphabet, Cl A | | | 4.1% |

| Beiersdorf | | | 3.5% |

| Moody's | | | 3.5% |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 800-658-5811 to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

The Advisors' Inner Circle Fund III

Ninety One Global Franchise Fund / A Shares - ZGFAX

Annual Shareholder Report: October 31, 2024

INV-AR-TSR-2024-4

The Advisors' Inner Circle Fund III

Ninety One International Franchise Fund

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about I Shares of the Ninety One International Franchise Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.americanbeaconfunds.com/mutual_funds/NinetyOneInternational.aspx. You can also request this information by contacting us at 800-658-5811.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Ninety One International Franchise Fund, I Shares | $96 | 0.85% |

How did the Fund perform in the last year?

Review and outlook: As we approach the closing stretch of 2024, risk-on sentiment has continued to dominate markets. However, with an increasingly uncertain outlook, a market that remains very concentrated, and valuations appearing stretched, we believe a diversified portfolio of quality international companies with proven earnings resilience is as important and relevant now as it has ever been. Our holdings are performing well from an earnings and free cash flow perspective, and it is this that drives long-term share price performance.

Performance summary: The Ninety One International Franchise Fund I Shares returned 6.86% over the quarter, lagging the MSCI ACWI ex-US, which returned +8.06%, in US dollar terms. Stock selection in communication services and consumer staples detracted, offset in part by stock selection in IT and a lack of exposure to energy. Lithography equipment maker ASML (3.1%) was a relative detractor amid broader relative weakness for technology stocks. In addition, there were geopolitical rumblings that the US and Netherlands are looking to further restrict China’s access to Western capital equipment. The company’s order book remains healthy, offering long-term visibility. Clinical research company ICON (3.0%) delivered mixed Q2 results, with the revenue guidance midpoint reduced, but the company is operating well, with net new bookings up for the quarter. Brewer Heineken (2.3%) detracted after taking a 874 million-euro impairment on its stake in in China Resources Beer, reflecting a share price decline, in conjunction with Heineken reporting marginally softer results. However, we still believe Heineken brands are well invested moving forward and positively the weakness in Vietnam is starting to stabilise, the company narrowed the range for its full year operating profit forecast, helping provide greater visibility and the brand continues to take share. Chip maker TSMC (3.9%) got caught up in the rotation out of global tech. The risk of tighter US curbs on chip sales to China have also dampened the bullish momentum towards the company. Recent results were excellent. Not holding Alibaba (0.0%) was a relative detractor. More positively, tobacco producer Philip Morris International (3.0%) contributed after raising its forecast for annual profit growth on higher demand for its Zyn nicotine pouches. Software company SAP (8.2%) reported a 25% rise in cloud revenue growth from a year earlier, helped by demand from corporate customers for AI tools. Its current cloud backlog grew by 28% to 14.8 billion euros. Insurer AIA (1.8%) had a positive quarter, with new business value sustaining strong growth, driven by Hong Kong and China and AIA China launched three new cities in 1H24, seeing robust demand. Not holding Novo Nordisk (0.0%) and Samsung Electronics (0.0%) aided relative returns.

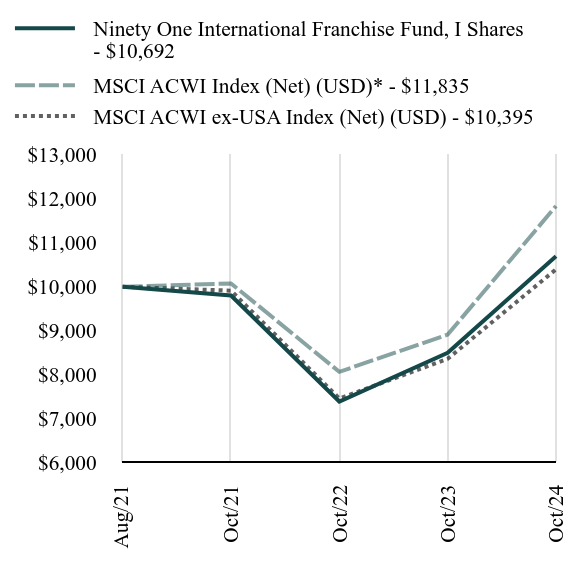

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Ninety One International Franchise Fund, I Shares - $10692 | MSCI ACWI Index (Net) (USD)* - $11835 | MSCI ACWI ex-USA Index (Net) (USD) - $10395 |

|---|

| Aug/21 | $10000 | $10000 | $10000 |

| Oct/21 | $9800 | $10076 | $9911 |

| Oct/22 | $7390 | $8065 | $7460 |

| Oct/23 | $8500 | $8912 | $8361 |

| Oct/24 | $10692 | $11835 | $10395 |

Since its inception on August 31, 2021. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.Call 800-658-5811 or visit https://www.americanbeaconfunds.com/mutual_funds/NinetyOneInternational.aspx for current month-end performance.

Footnote Reference*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | Annualized Since Inception |

|---|

| Ninety One International Franchise Fund, I Shares | 25.78% | 2.13% |

| MSCI ACWI Index (Net) (USD)* | 32.79% | 5.46% |

| MSCI ACWI ex-USA Index (Net) (USD) | 24.33% | 1.23% |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $4,900,535 | 32 | $- | 8% |

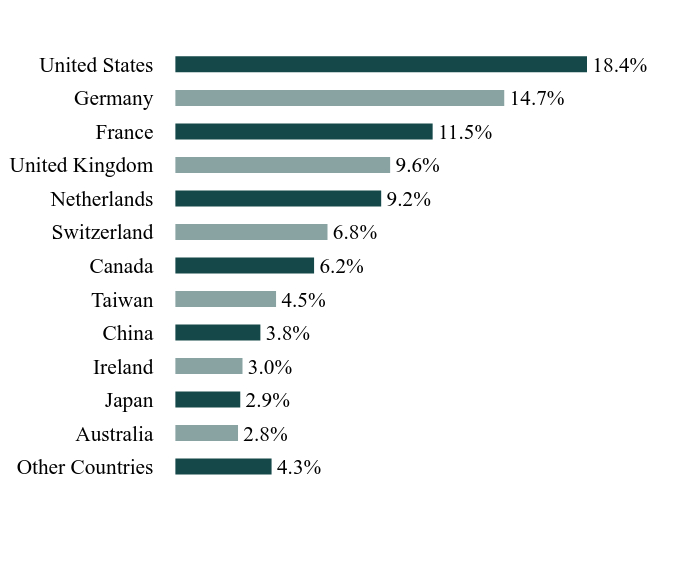

What did the Fund invest in?

Country WeightingsFootnote Reference*

| Value | Value |

|---|

| Other Countries | 4.3% |

| Australia | 2.8% |

| Japan | 2.9% |

| Ireland | 3.0% |

| China | 3.8% |

| Taiwan | 4.5% |

| Canada | 6.2% |

| Switzerland | 6.8% |

| Netherlands | 9.2% |

| United Kingdom | 9.6% |

| France | 11.5% |

| Germany | 14.7% |

| United States | 18.4% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| SAP | | | 8.9% |

| Constellation Software | | | 6.2% |

| Mastercard, Cl A | | | 6.1% |

| London Stock Exchange Group | | | 5.1% |

| EssilorLuxottica | | | 5.0% |

| Taiwan Semiconductor Manufacturing ADR | | | 4.5% |

| Wolters Kluwer | | | 4.3% |

| L'Oreal | | | 3.6% |

| Philip Morris International | | | 3.5% |

| Alcon | | | 3.5% |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 800-658-5811 to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

The Advisors' Inner Circle Fund III

Ninety One International Franchise Fund / I Shares - ZIFIX

Annual Shareholder Report: October 31, 2024

INV-AR-TSR-2024-6

The Advisors' Inner Circle Fund III

Ninety One Emerging Markets Equity Fund

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about I Shares of the Ninety One Emerging Markets Equity Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://ninetyone.com/en/united-states/funds-strategies/mutual-funds/emerging-markets-equity-fund. You can also request this information by contacting us at 1-844-426-8721.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Ninety One Emerging Markets Equity Fund, I Shares | $96 | 0.85% |

How did the Fund perform in the last year?

Looking forward into 2025, we believe one scenario might simply be that we are at the beginning of a “great normalisation” where we could be leaving an era of pandemics, hyper-active central banks, and elevated geo-political risk behind and looking forward to the sort of environment where stock-pickers can focus on the fundamentals of great businesses with fewer distractions from the macro environment. Any normalisation would be very positive for emerging market equities, but perhaps less so for developed markets which have benefited from a strong tailwind of extremely low interest rates and lax monetary policy for 15 years. Without those tailwinds we believe returns between developed and emerging markets should be more correlated.

The Ninety One Emerging Markets Equity Fund I Shares returned 5.78% over the quarter, and underperformed the MSCI Emerging Markets Index, which returned 8.72%, in US dollar terms, primarily attributed to the momentum reversal earlier in the quarter and the China rally towards the end of the quarter, where sharp inflection points can typically be expected to pose a headwind to our process. The momentum reversal led to investors taking profits in positions that had outperformed previously in the year, namely those in India, the technology sector and certain Asia exporters. Among our Indian holdings that derated, property business Macrotech Developers (0.9%) , defence company Hindustan Aeronautics (0.9%) and Pepsi bottler Varun Beverages (1.0%) were the key detractors.

A reassessment of the enthusiasm for AI resulted in a sell-off in many previous winners in the technology sector, which negatively impacted some of our holdings, particularly in South Korea. Semiconductor names like Samsung Electronics (4.0%) and SK hynix (0%) suffered on growing concern that the memory chip cycle may be peaking. Samsung was further impacted by the lack of an update on Nvidia’s qualification test for its HBM3E chip. In the consumer discretionary sector, South Korean auto maker Kia Corp (1.1%) was not helped by numerous profit warnings elsewhere across the automotive sector. China rerated sharply in the last week of September as the market became more hopeful of the government stimulus supporting the market. We saw trading volume pick up in Chinese onshore and offshore equity markets where liquid, large cap, high beta stocks benefited most. Thus, our underweights in internet companies, such as Alibaba Group (1.1%) and JD.com (0%), negatively impacted.

Offsetting some of the losses, our biggest contributors at the single stock level over the quarter also came from China. Insurers, for example, which have faced severe headwinds during the lumpy China recovery, reacted well, with Ping An (1.8%) and AIA (1.8%) among the leading outperformers. The latter also reported strong results ahead of analyst expectations. Our overweight in Chinese online retailer Meituan (2.6%), along with the overweight in Tencent (5.9%), added value, as it posted strong results and announced a further US$1 billion share buyback plan at the end of August.

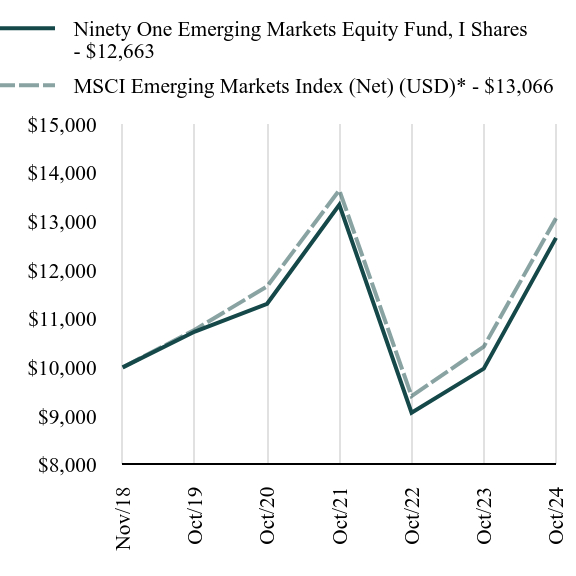

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Ninety One Emerging Markets Equity Fund, I Shares - $12663 | MSCI Emerging Markets Index (Net) (USD)* - $13066 |

|---|

| Nov/18 | $10000 | $10000 |

| Oct/19 | $10737 | $10776 |

| Oct/20 | $11308 | $11665 |

| Oct/21 | $13344 | $13644 |

| Oct/22 | $9068 | $9411 |

| Oct/23 | $9975 | $10427 |

| Oct/24 | $12663 | $13066 |

Since its inception on November 28, 2018. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.Call 1-844-426-8721 or visit https://ninetyone.com/en/united-states/funds-strategies/mutual-funds/emerging-markets-equity-fund for current month-end performance.

Footnote Reference*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Ninety One Emerging Markets Equity Fund, I Shares | 26.95% | 3.35% | 4.06% |

| MSCI Emerging Markets Index (Net) (USD)* | 25.32% | 3.93% | 4.61% |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $330,067,484 | 77 | $1,608,378 | 68% |

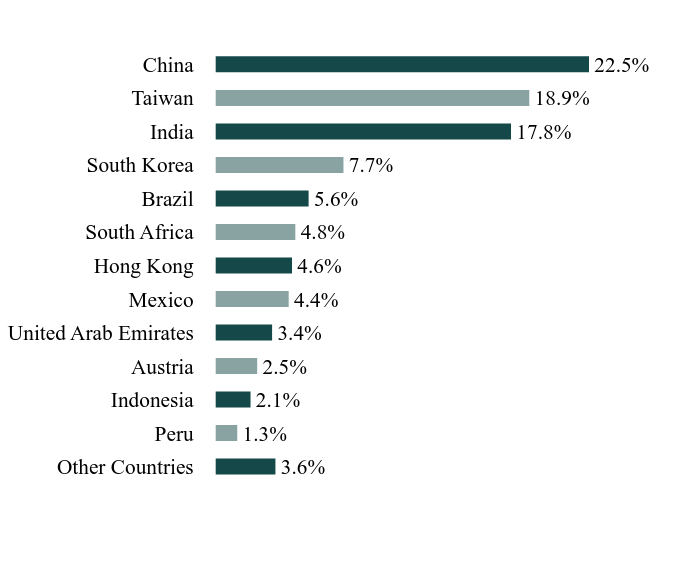

What did the Fund invest in?

Country WeightingsFootnote Reference*

| Value | Value |

|---|

| Other Countries | 3.6% |

| Peru | 1.3% |

| Indonesia | 2.1% |

| Austria | 2.5% |

| United Arab Emirates | 3.4% |

| Mexico | 4.4% |

| Hong Kong | 4.6% |

| South Africa | 4.8% |

| Brazil | 5.6% |

| South Korea | 7.7% |

| India | 17.8% |

| Taiwan | 18.9% |

| China | 22.5% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Taiwan Semiconductor Manufacturing | | | 11.5% |

| Tencent Holdings | | | 5.6% |

| Meituan, Cl B | | | 3.0% |

| Xiaomi, Cl B | | | 2.8% |

| Reliance Industries | | | 2.1% |

| Samsung Electronics | | | 1.9% |

| Hon Hai Precision Industry | | | 1.9% |

| Ping An Insurance Group of China, Cl H | | | 1.8% |

| SK Hynix | | | 1.8% |

| ICICI Bank | | | 1.7% |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 1-844-426-8721 to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

The Advisors' Inner Circle Fund III

Ninety One Emerging Markets Equity Fund / I Shares - ZEMIX

Annual Shareholder Report: October 31, 2024

INV-AR-TSR-2024-1

The Advisors' Inner Circle Fund III

Ninety One Emerging Markets Equity Fund

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about A Shares of the Ninety One Emerging Markets Equity Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://ninetyone.com/en/united-states/funds-strategies/mutual-funds/emerging-markets-equity-fund. You can also request this information by contacting us at 1-844-426-8721.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Ninety One Emerging Markets Equity Fund, A Shares | $125 | 1.10% |

How did the Fund perform in the last year?

Looking forward into 2025, we believe one scenario might simply be that we are at the beginning of a “great normalisation” where we could be leaving an era of pandemics, hyper-active central banks, and elevated geo-political risk behind and looking forward to the sort of environment where stock-pickers can focus on the fundamentals of great businesses with fewer distractions from the macro environment. Any normalisation would be very positive for emerging market equities, but perhaps less so for developed markets which have benefited from a strong tailwind of extremely low interest rates and lax monetary policy for 15 years. Without those tailwinds we believe returns between developed and emerging markets should be more correlated.

The Ninety One Emerging Markets Equity Fund I Shares returned 5.78% over the quarter, and underperformed the MSCI Emerging Markets Index, which returned 8.72%, in US dollar terms, primarily attributed to the momentum reversal earlier in the quarter and the China rally towards the end of the quarter, where sharp inflection points can typically be expected to pose a headwind to our process. The momentum reversal led to investors taking profits in positions that had outperformed previously in the year, namely those in India, the technology sector and certain Asia exporters. Among our Indian holdings that derated, property business Macrotech Developers (0.9%) , defence company Hindustan Aeronautics (0.9%) and Pepsi bottler Varun Beverages (1.0%) were the key detractors.

A reassessment of the enthusiasm for AI resulted in a sell-off in many previous winners in the technology sector, which negatively impacted some of our holdings, particularly in South Korea. Semiconductor names like Samsung Electronics (4.0%) and SK hynix (0%) suffered on growing concern that the memory chip cycle may be peaking. Samsung was further impacted by the lack of an update on Nvidia’s qualification test for its HBM3E chip. In the consumer discretionary sector, South Korean auto maker Kia Corp (1.1%) was not helped by numerous profit warnings elsewhere across the automotive sector. China rerated sharply in the last week of September as the market became more hopeful of the government stimulus supporting the market. We saw trading volume pick up in Chinese onshore and offshore equity markets where liquid, large cap, high beta stocks benefited most. Thus, our underweights in internet companies, such as Alibaba Group (1.1%) and JD.com (0%), negatively impacted.

Offsetting some of the losses, our biggest contributors at the single stock level over the quarter also came from China. Insurers, for example, which have faced severe headwinds during the lumpy China recovery, reacted well, with Ping An (1.8%) and AIA (1.8%) among the leading outperformers. The latter also reported strong results ahead of analyst expectations. Our overweight in Chinese online retailer Meituan (2.6%), along with the overweight in Tencent (5.9%), added value, as it posted strong results and announced a further US$1 billion share buyback plan at the end of August.

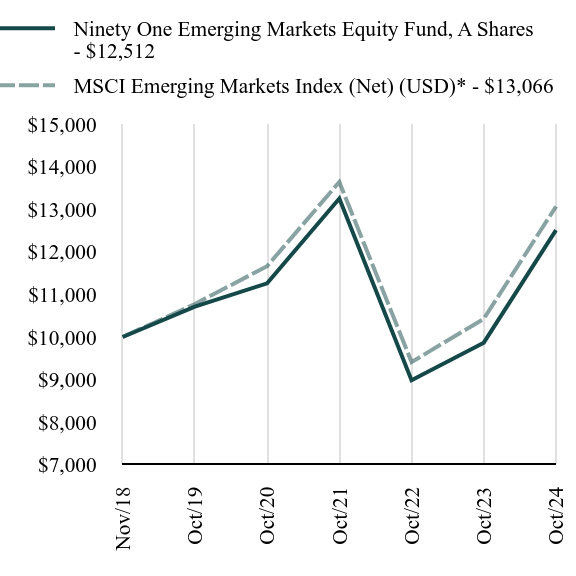

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Ninety One Emerging Markets Equity Fund, A Shares - $12512 | MSCI Emerging Markets Index (Net) (USD)* - $13066 |

|---|

| Nov/18 | $10000 | $10000 |

| Oct/19 | $10714 | $10776 |

| Oct/20 | $11260 | $11665 |

| Oct/21 | $13253 | $13644 |

| Oct/22 | $8983 | $9411 |

| Oct/23 | $9867 | $10427 |

| Oct/24 | $12512 | $13066 |

Since its inception on November 28, 2018. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.Call 1-844-426-8721 or visit https://ninetyone.com/en/united-states/funds-strategies/mutual-funds/emerging-markets-equity-fund for current month-end performance.

Footnote Reference*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Ninety One Emerging Markets Equity Fund, A Shares | 26.80% | 3.15% | 3.85% |

| MSCI Emerging Markets Index (Net) (USD)* | 25.32% | 3.93% | 4.61% |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $330,067,484 | 77 | $1,608,378 | 68% |

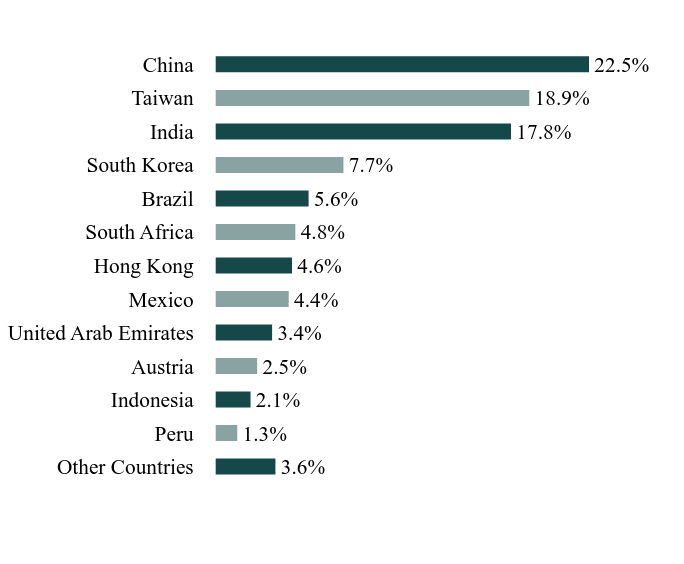

What did the Fund invest in?

Country WeightingsFootnote Reference*

| Value | Value |

|---|

| Other Countries | 3.6% |

| Peru | 1.3% |

| Indonesia | 2.1% |

| Austria | 2.5% |

| United Arab Emirates | 3.4% |

| Mexico | 4.4% |

| Hong Kong | 4.6% |

| South Africa | 4.8% |

| Brazil | 5.6% |

| South Korea | 7.7% |

| India | 17.8% |

| Taiwan | 18.9% |

| China | 22.5% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Taiwan Semiconductor Manufacturing | | | 11.5% |

| Tencent Holdings | | | 5.6% |

| Meituan, Cl B | | | 3.0% |

| Xiaomi, Cl B | | | 2.8% |

| Reliance Industries | | | 2.1% |

| Samsung Electronics | | | 1.9% |

| Hon Hai Precision Industry | | | 1.9% |

| Ping An Insurance Group of China, Cl H | | | 1.8% |

| SK Hynix | | | 1.8% |

| ICICI Bank | | | 1.7% |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 1-844-426-8721 to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

The Advisors' Inner Circle Fund III

Ninety One Emerging Markets Equity Fund / A Shares - ZEMAX

Annual Shareholder Report: October 31, 2024

INV-AR-TSR-2024-2

(b) Not applicable.

Item 2. Code of Ethics.

The Registrant (also referred to as the “Trust”) has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, controller or principal accounting officer, and any person who performs a similar function. There have been no amendments to or waivers granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant’s board of trustees has determined that the Registrant has at least one audit committee financial expert serving on the audit committee.

(a)(2) The Registrant’s audit committee financial experts are Thomas P. Lemke and Jay Nadel, and each of Mr. Lemke and Mr. Nadel is “independent” as that term is defined in Form N-CSR Item 3 (a)(2).

Item 4. Principal Accountant Fees and Services.

Fees billed by PricewaterhouseCoopers LLP (“PwC”) related to the Trust.

PwC billed the Trust aggregate fees for services rendered to the Trust for the last two fiscal years as follows:

| | FYE October 31, 2024 | FYE October 31, 2023 |

| | | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval |

| (a) | Audit Fees(1) | $734,463 | None | None | $717,900 | None | None |

| (b) | Audit-Related Fees | None | None | None | None | None | None |

| (c) | Tax Fees | None | None | $559,700(2) | None | None | $807,756(2) |

| (d) | All Other Fees | None | None | $10,530(4) | None | None | $7,535(4) |

Fees billed by Ernst & Young LLP (“E&Y”) related to the Trust.

E&Y billed the Trust aggregate fees for services rendered to the Trust for the last two fiscal years as follows:

| | FYE October 31, 2024 | FYE October 31, 2023 |

| | | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval |

| (a) | Audit Fees(1) | $113,052 | None | None | $137,200 | None | None |

| (b) | Audit-Related Fees | None | None | None | None | None | None |

| (c) | Tax Fees | None | None | None | None | None | None |

| (d) | All Other Fees | None | None | None | None | None | None |

Fees billed by Deloitte & Touche LLP (“D&T”) related to the Trust.

D&T billed the Trust aggregate fees for services rendered to the Trust for the last two fiscal years as follows

| | FYE October 31, 2024 | FYE October 31, 2023 |

| | | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval |

| (a) | Audit Fees(1) | $30,000 | None | None | $30,624 | None | None |

| (b) | Audit-Related Fees | None | None | None | None | None | None |

| (c) | Tax Fees | None | None | None | None | None | None |

| (d) | All Other Fees | None | None | None | None | None | None |

Fees billed by KPMG (“KPMG”) related to the Trust.

KPMG billed the Trust aggregate fees for services rendered to the Trust for the last two fiscal years as follows

| | FYE October 31, 2024 | FYE October 31, 2023 |

| | | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval |

| (a) | Audit Fees(1) | $45,000 | None | None | $363,625 | None | None |

| (b) | Audit-Related Fees | None | None | None | None | None | None |

| (c) | Tax Fees | None | None | None | None | None | None |

| (d) | All Other Fees | None | None | $154,000(3) | None | None | $282,908(3) |

Notes:

| (1) | Audit fees include amounts related to the audit of the Trust’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. |

| (2) | Tax return preparation fees for affiliates of the Funds. |

| (3) | Non-audit fees consist of SSAE No. 18 report over investment management activities and non-statutory audit reports of Legal & General Investment Management America, Inc. |

| (4) | Non-audit assurance engagements for service affiliates of the funds. |

(e)(1) The Trust’s Audit Committee has adopted and the Board of Trustees has ratified an Audit and Non-Audit Services Pre-Approval Policy (the “Policy”), which sets forth the procedures and the conditions pursuant to which services proposed to be performed by the independent auditor of the Funds may be pre-approved.

The Policy provides that all requests or applications for proposed services to be provided by the independent auditor must be submitted to the Registrant’s Chief Financial Officer (“CFO”) and must include a detailed description of the services proposed to be rendered. The CFO will determine whether such services:

| 1. | require specific pre-approval; |

| 2. | are included within the list of services that have received the general pre-approval of the Audit Committee pursuant to the Policy; or |

| 3. | have been previously pre-approved in connection with the independent auditor’s annual engagement letter for the applicable year or otherwise. In any instance where services require pre-approval, the Audit Committee will consider whether such services are consistent with SEC’s rules and whether the provision of such services would impair the auditor’s independence. |

Requests or applications to provide services that require specific pre-approval by the Audit Committee will be submitted to the Audit Committee by the CFO. The Audit Committee will be informed by the CFO on a quarterly basis of all services rendered by the independent auditor. The Audit Committee has delegated specific pre-approval authority to either the Audit Committee Chair or financial expert, provided that the estimated fee for any such proposed pre-approved service does not exceed $100,000 and any pre-approval decisions are reported to the Audit Committee at its next regularly-scheduled meeting.

Services that have received the general pre-approval of the Audit Committee are identified and described in the Policy. In addition, the Policy sets forth a maximum fee per engagement with respect to each identified service that has received general pre-approval.

All services to be provided by the independent auditor shall be provided pursuant to a signed written engagement letter with the Registrant, the investment adviser, or applicable control affiliate (except that matters as to which an engagement letter would be impractical because of timing issues or because the matter is small may not be the subject of an engagement letter) that sets forth both the services to be provided by the independent auditor and the total fees to be paid to the independent auditor for those services.

In addition, the Audit Committee has determined to take additional measures on an annual basis to meet the Audit Committee’s responsibility to oversee the work of the independent auditor and to assure the auditor's independence from the Registrant, such as (a) reviewing a formal written statement from the independent auditor delineating all relationships between the independent auditor and the Registrant, and (b) discussing with the independent auditor the independent auditor’s methods and procedures for ensuring independence.

(e)(2) Percentage of fees billed applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows (PwC):

| | FYE October 31, 2024 | FYE October 31, 2023 |

| Audit-Related Fees | None | None |

| Tax Fees | None | None |

| All Other Fees | None | None |

(e)(2) Percentage of fees billed applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows (E&Y):

| | FYE October 31, 2024 | FYE October 31, 2023 |

| Audit-Related Fees | None | None |

| Tax Fees | None | None |

| All Other Fees | None | None |

(e)(2) Percentage of fees billed applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows (D&T):

| | FYE October 31, 2024 | FYE October 31, 2023 |

| Audit-Related Fees | None | None |

| Tax Fees | None | None |

| All Other Fees | None | None |

(e)(2) Percentage of fees billed applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows (KPMG):

| | FYE October 31, 2024 | FYE October 31,2023 |

| Audit-Related Fees | None | None |

| Tax Fees | None | None |

| All Other Fees | None | None |

(f) Not applicable.

(g) The aggregate non-audit fees and services billed by PwC for services rendered to the Registrant, and rendered to the Registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant for the last two fiscal-years-ended October 31st were $570,230 and $815,291 for 2024 and 2023, respectively.

(g) The aggregate non-audit fees and services billed by E&Y for services rendered to the Registrant, and rendered to the Registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant for the last two fiscal-years-ended October 31st were $0 and $0 for 2024 and 2023, respectively.

(g) The aggregate non-audit fees and services billed by D&T for services rendered to the Registrant, and rendered to the Registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant for the last two fiscal-years-ended October 31st were $0 and $0 for 2024 and 2023, respectively.

(g) The aggregate non-audit fees and services billed by KPMG for services rendered to the Registrant, and rendered to the Registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant for the last two fiscal-years-ended October 31st were $154,000 and $282,908 for 2024 and 2023, respectively.

(h) During the past fiscal year, all non-audit services provided by the Registrant’s principal accountant to either the Registrant’s investment adviser or to any entity controlling, controlled by, or under common control with the Registrant’s investment adviser that provides ongoing services to the Registrant were pre-approved by the Audit Committee of Registrant’s Board of Trustees. Included in the Audit Committee’s pre-approval of these non-audit service were the review and consideration as to whether the provision of these non-audit services is compatible with maintaining the principal accountant’s independence.

(i) Not applicable. The Registrant has not retained, for the preparation of the audit report on the financial statements included in the Form N-CSR, a registered public accounting firm that has a branch or office that is located in a foreign jurisdiction and that the Public Company Accounting Oversight Board (the “PCAOB”) has determined that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction.

(j) Not applicable. The Registrant is not a “foreign issuer,” as defined in 17 CFR § 240.3b-4.

Item 5. Audit Committee of Listed Registrants.

Not applicable to open-end management investment companies.

Item 6. Schedule of Investments.

(a) The Schedule of Investments is included as part of the Financial Statements and Other Information filed under Item 7 of this form.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Financial statements and financial highlights are filed herein.

| THE ADVISORS’ INNER CIRCLE FUND III | NINETY ONE FUNDS |

| | OCTOBER 31, 2024 |

TABLE OF CONTENTS

| Financial Statements | |

| Schedules of Investments | 1 |

| Statements of Assets and Liabilities | 10 |

| Statements of Operations | 12 |

| Statements of Changes in Net Assets | 14 |

| Financial Highlights | 17 |

| Notes to Financial Statements | 22 |

| Report of Independent Registered Public Accounting Firm | 39 |

| Notice to Shareholders (Unaudited) | 41 |

| Approval of Investment Advisory Agreement (Form N-CSR Item 11) (Unaudited) | 43 |

| THE ADVISORS’ INNER CIRCLE FUND III | NINETY ONE |

| | GLOBAL FRANCHISE FUND |

| | OCTOBER 31, 2024 |

SCHEDULE OF INVESTMENTS

COMMON STOCK — 95.8%

| | | Shares | | | Value | |

| CHINA — 2.6% | | | | | | | | |

| NetEase ADR | | | 116,439 | | | $ | 9,374,504 | |

| | | | | | | | | |

| GERMANY — 3.5% | | | | | | | | |

| Beiersdorf | | | 94,122 | | | | 12,681,324 | |

| | | | | | | | | |

| NETHERLANDS — 5.5% | | | | | | | | |

| ASML Holding | | | 29,323 | | | | 19,700,070 | |

| | | | | | | | | |

| SOUTH KOREA — 1.4% | | | | | | | | |

| Samsung Electronics GDR | | | 4,627 | | | | 4,962,290 | |

| | | | | | | | | |

| SWITZERLAND — 5.6% | | | | | | | | |

| Nestle | | | 116,924 | | | | 11,033,764 | |

| Roche Holding | | | 28,685 | | | | 8,877,760 | |

| | | | | | | | 19,911,524 | |

| UNITED KINGDOM — 3.3% | | | | | | | | |

| London Stock Exchange Group | | | 57,465 | | | | 7,765,584 | |

| St. James's Place | | | 377,495 | | | | 3,948,463 | |

| | | | | | | | 11,714,047 | |

| UNITED STATES — 73.9% | | | | | | | | |

| Align Technology * | | | 19,217 | | | | 3,940,062 | |

| Alphabet, Cl A | | | 85,732 | | | | 14,669,602 | |

| Autodesk * | | | 53,157 | | | | 15,085,957 | |

| Automatic Data Processing | | | 39,556 | | | | 11,441,177 | |

| Booking Holdings (a) | | | 5,148 | | | | 24,073,335 | |

| Check Point Software Technologies * | | | 59,320 | | | | 10,274,817 | |

| Edwards Lifesciences * | | | 111,426 | | | | 7,466,656 | |

| Electronic Arts | | | 76,368 | | | | 11,520,113 | |

| FactSet Research Systems | | | 20,026 | | | | 9,093,006 | |

| ICON * | | | 47,204 | | | | 10,484,480 | |

| Intuit | | | 24,514 | | | | 14,960,894 | |

| Johnson & Johnson | | | 58,524 | | | | 9,355,647 | |

| Microsoft | | | 56,606 | | | | 23,001,848 | |

| Monster Beverage * | | | 122,026 | | | | 6,428,330 | |

| Moody's | | | 27,215 | | | | 12,356,699 | |

| Motorola Solutions | | | 10,533 | | | | 4,733,003 | |

| Philip Morris International (a) | | | 153,324 | | | | 20,346,095 | |

| S&P Global | | | 16,062 | | | | 7,715,542 | |

| VeriSign * | | | 67,015 | | | | 11,850,933 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | NINETY ONE |

| | GLOBAL FRANCHISE FUND |

| | OCTOBER 31, 2024 |

COMMON STOCK — continued

| | | Shares | | | Value | |

| UNITED STATES (continued) | | | | | | | | |

| Visa, Cl A (a) | | | 122,184 | | | $ | 35,415,032 | |

| | | | | | | | 264,213,228 | |

| Total Common Stock | | | | | | | | |

| (Cost $267,310,350) | | | | | | | 342,556,987 | |

| | | | | | | | | |

| Total Investments— 95.8% | | | | | | | | |

| (Cost $267,310,350) | | | | | | $ | 342,556,987 | |

Percentages are based on Net Assets of $357,682,691.

| * | Non-income producing security. |

| (a) | Represents a company categorized as a “non-United States company”, as set forth in the Fund’s Prospectus, because at least 50% of the company’s revenue is generated outside of the United States. |

ADR — American Depositary Receipt

Cl — Class

GDR — Global Depositary Receipt

The following is a summary of the level of the inputs used as of October 31, 2024, in valuing the Fund’s investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | | | | | | | | | | | | | | | |

| China | | $ | 9,374,504 | | | $ | — | | | $ | — | | | $ | 9,374,504 | |

| Germany | | | — | | | | 12,681,324 | | | | — | | | | 12,681,324 | |

| Netherlands | | | — | | | | 19,700,070 | | | | — | | | | 19,700,070 | |

| South Korea | | | 4,962,290 | | | | — | | | | — | | | | 4,962,290 | |

| Switzerland | | | — | | | | 19,911,524 | | | | — | | | | 19,911,524 | |

| United Kingdom | | | — | | | | 11,714,047 | | | | — | | | | 11,714,047 | |

| United States | | | 264,213,228 | | | | — | | | | — | | | | 264,213,228 | |

| Total Investments in Securities | | $ | 278,550,022 | | | $ | 64,006,965 | | | $ | — | | | $ | 342,556,987 | |

Amounts designated as “—“ are $0.

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | NINETY ONE |

| | INTERNATIONAL FRANCHISE FUND |

| | OCTOBER 31, 2024 |

SCHEDULE OF INVESTMENTS

COMMON STOCK — 96.5%

| | | Shares | | | Value | |

| AUSTRALIA — 2.8% | | | | | | | | |

| REA Group | | | 918 | | | $ | 135,073 | |

| | | | | | | | | |

| CANADA — 6.2% | | | | | | | | |

| Constellation Software | | | 101 | | | | 304,245 | |

| | | | | | | | | |

| CHINA — 3.8% | | | | | | | | |

| Hangzhou Tigermed Consulting, Cl H | | | 6,200 | | | | 27,992 | |

| Kweichow Moutai, Cl A | | | 304 | | | | 65,293 | |

| NetEase | | | 5,700 | | | | 91,703 | |

| | | | | | | | 184,988 | |

| FRANCE — 11.5% | | | | | | | | |

| EssilorLuxottica | | | 1,044 | | | | 244,405 | |

| Hermes International SCA | | | 65 | | | | 147,443 | |

| L'Oreal | | | 465 | | | | 174,117 | |

| | | | | | | | 565,965 | |

| GERMANY — 13.5% | | | | | | | | |

| Beiersdorf | | | 987 | | | | 132,981 | |

| SAP | | | 1,862 | | | | 433,908 | |

| Siemens Healthineers | | | 1,867 | | | | 97,278 | |

| | | | | | | | 664,167 | |

| HONG KONG — 1.7% | | | | | | | | |

| AIA Group | | | 10,600 | | | | 83,655 | |

| | | | | | | | | |

| IRELAND — 3.0% | | | | | | | | |

| Accenture, Cl A | | | 426 | | | | 146,893 | |

| | | | | | | | | |

| JAPAN — 2.9% | | | | | | | | |

| Nintendo | | | 2,700 | | | | 142,262 | |

| | | | | | | | | |

| NETHERLANDS — 9.2% | | | | | | | | |

| ASML Holding | | | 194 | | | | 130,335 | |

| Heineken | | | 1,333 | | | | 109,117 | |

| Wolters Kluwer | | | 1,265 | | | | 212,215 | |

| | | | | | | | 451,667 | |

| SPAIN — 2.6% | | | | | | | | |

| Amadeus IT Group | | | 1,747 | | | | 126,401 | |

| | | | | | | | | |

| SWITZERLAND — 6.8% | | | | | | | | |

| Lonza Group | | | 164 | | | | 100,780 | |

| Nestle | | | 1,513 | | | | 142,777 | |

| Novartis | | | 838 | | | | 90,807 | |

| | | | | | | | 334,364 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | NINETY ONE |

| | INTERNATIONAL FRANCHISE FUND |

| | OCTOBER 31, 2024 |

COMMON STOCK — continued

| | | Shares | | | Value | |

| TAIWAN — 4.5% | | | | | | | | |

| Taiwan Semiconductor Manufacturing ADR | | | 1,151 | | | $ | 219,312 | |

| | | | | | | | | |

| UNITED KINGDOM — 9.6% | | | | | | | | |

| InterContinental Hotels Group | | | 1,063 | | | | 116,900 | |

| London Stock Exchange Group | | | 1,860 | | | | 251,353 | |

| Reckitt Benckiser Group | | | 1,664 | | | | 100,647 | |

| | | | | | | | 468,900 | |

| UNITED STATES — 18.4% | | | | | | | | |

| Alcon | | | 1,864 | | | | 170,986 | |

| Experian | | | 2,903 | | | | 141,265 | |

| ICON * | | | 540 | | | | 119,939 | |

| Mastercard, Cl A | | | 596 | | | | 297,756 | |

| Philip Morris International (a) | | | 1,293 | | | | 171,581 | |

| | | | | | | | 901,527 | |

| Total Common Stock | | | | | | | | |

| (Cost $4,205,773) | | | | | | | 4,729,419 | |

| | | | | | | | | |

| PREFERRED STOCK — 1.2% | | | | | | | | |

| | | | | | | | | |

| GERMANY — 1.2% | | | | | | | | |

| Sartorius (b) | | | | | | | | |

| (Cost $84,766) | | | 234 | | | | 60,502 | |

| | | | | | | | | |

| WARRANT — 0.0% | | | | | | | | |

| | Number of

Warrants | | | | |

| CANADA | | | | | | | |

| Constellation Software 08/22/28* (c) | | | | | | | | |

| (Cost $–) | | | 40 | | | | – | |

| | | | | | | | | |

| Total Investments— 97.7% | | | | | | | | |

| (Cost $4,290,539) | | | | | | $ | 4,789,921 | |

Percentages are based on Net Assets of $4,900,535.

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | NINETY ONE |

| | INTERNATIONAL FRANCHISE FUND |

| | OCTOBER 31, 2024 |

| * | Non-income producing security. |

| (a) | Represents a company categorized as a “non-United States company”, as set forth in the Fund’s Prospectus, because at least 50% of the company’s revenue is generated outside of the United States. |

| (b) | There is currently no interest rate available. |

| (c) | Level 3 security in accordance with fair value hierarchy. |

ADR — American Depositary Receipt

Cl — Class

The following is a summary of the level of the inputs used as of October 31, 2024, in valuing the Fund’s investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3^ | | | Total | |

| Common Stock | | | | | | | | | | | | | | | | |

| Australia | | $ | — | | | $ | 135,073 | | | $ | — | | | $ | 135,073 | |

| Canada | | | 304,245 | | | | — | | | | — | | | | 304,245 | |

| China | | | — | | | | 184,988 | | | | — | | | | 184,988 | |

| France | | | — | | | | 565,965 | | | | — | | | | 565,965 | |

| Germany | | | — | | | | 664,167 | | | | — | | | | 664,167 | |

| Hong Kong | | | — | | | | 83,655 | | | | — | | | | 83,655 | |

| Ireland | | | 146,893 | | | | — | | | | — | | | | 146,893 | |

| Japan | | | — | | | | 142,262 | | | | — | | | | 142,262 | |

| Netherlands | | | — | | | | 451,667 | | | | — | | | | 451,667 | |

| Spain | | | — | | | | 126,401 | | | | — | | | | 126,401 | |

| Switzerland | | | — | | | | 334,364 | | | | — | | | | 334,364 | |

| Taiwan | | | 219,312 | | | | — | | | | — | | | | 219,312 | |

| United Kingdom | | | — | | | | 468,900 | | | | — | | | | 468,900 | |

| United States | | | 589,276 | | | | 312,251 | | | | — | | | | 901,527 | |

| Preferred Stock | | | | | | | | | | | | | | | | |

| Germany | | | — | | | | 60,502 | | | | — | | | | 60,502 | |

| Warrant | | | | | | | | | | | | | | | | |

| Canada | | | — | | | | — | | | | — | (1) | | | — | (1) |

| Total Investments in Securities | | $ | 1,259,726 | | | $ | 3,530,195 | | | $ | — | (1) | | $ | 4,789,921 | |

| (1) | Includes securities valued at zero. |

| ^ | A reconciliation of Level 3 investments, including certain disclosures related to significant inputs used in valuing Level 3 investments, is only presented when the Fund has over 1% of Level 3 investments at the end of the period in relation to net assets. |

Amounts designated as “—“ are $0.

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | NINETY ONE |

| | EMERGING MARKETS EQUITY FUND |

| | OCTOBER 31, 2024 |

SCHEDULE OF INVESTMENTS

COMMON STOCK — 99.2%

| | | Shares | | | Value | |

| AUSTRIA — 2.5% | | | | | | | | |

| Erste Group Bank | | | 99,445 | | | $ | 5,614,303 | |

| Mondi | | | 168,318 | | | | 2,717,564 | |

| | | | | | | | 8,331,867 | |

| BRAZIL — 5.6% | | | | | | | | |

| B3 - Brasil Bolsa Balcao | | | 1,053,797 | | | | 1,935,109 | |

| Banco do Brasil | | | 579,696 | | | | 2,629,724 | |

| Cia de Saneamento Basico do Estado de Sao Paulo SABESP | | | 249,789 | | | | 3,981,090 | |

| Embraer * | | | 356,470 | | | | 2,988,467 | |

| Multiplan Empreendimentos Imobiliarios | | | 420,899 | | | | 1,860,645 | |

| PRIO | | | 282,045 | | | | 1,998,616 | |

| Vale ADR, Cl B | | | 300,382 | | | | 3,214,087 | |

| | | | | | | | 18,607,738 | |

| CHINA — 22.5% | | | | | | | | |

| AAC Technologies Holdings | | | 824,000 | | | | 3,328,013 | |

| Alibaba Group Holding | | | 298,136 | | | | 3,646,753 | |

| BeiGene, Cl A * | | | 114,419 | | | | 2,689,759 | |

| China Construction Bank, Cl H | | | 7,029,000 | | | | 5,455,957 | |

| KE Holdings ADR | | | 165,215 | | | | 3,623,165 | |

| Meituan, Cl B * | | | 412,100 | | | | 9,737,701 | |

| PetroChina, Cl H | | | 6,508,000 | | | | 4,886,764 | |

| Ping An Insurance Group of China, Cl H | | | 983,000 | | | | 6,090,221 | |

| Tencent Holdings | | | 353,700 | | | | 18,441,960 | |

| Trip.com Group ADR * | | | 66,135 | | | | 4,258,489 | |

| Xiaomi, Cl B * | | | 2,672,600 | | | | 9,166,387 | |

| Zijin Mining Group, Cl H | | | 1,318,000 | | | | 2,807,326 | |

| | | | | | | | 74,132,495 | |

| GREECE — 0.7% | | | | | | | | |

| National Bank of Greece | | | 311,818 | | | | 2,438,284 | |

| | | | | | | | | |

| HONG KONG — 4.6% | | | | | | | | |

| AIA Group | | | 686,200 | | | | 5,415,500 | |

| Hong Kong Exchanges & Clearing | | | 65,800 | | | | 2,634,555 | |

| Pop Mart International Group | | | 453,400 | | | | 4,098,981 | |

| WH Group | | | 3,877,123 | | | | 3,017,512 | |

| | | | | | | | 15,166,548 | |

| INDIA — 17.8% | | | | | | | | |

| Cipla | | | 230,322 | | | | 4,237,171 | |

| Five-Star Business Finance * | | | 231,945 | | | | 1,957,182 | |

| HCL Technologies | | | 213,374 | | | | 4,464,770 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | NINETY ONE |

| | EMERGING MARKETS EQUITY FUND |

| | OCTOBER 31, 2024 |

COMMON STOCK — continued

| | | Shares | | | Value | |

| INDIA (continued) | | | | | | | | |

| HDFC Bank | | | 212,628 | | | $ | 4,370,508 | |

| Hindustan Aeronautics | | | 57,484 | | | | 2,892,705 | |

| ICICI Bank | | | 370,621 | | | | 5,685,161 | |

| ITC | | | 469,115 | | | | 2,721,755 | |

| Larsen & Toubro | | | 84,414 | | | | 3,626,149 | |

| Macrotech Developers | | | 214,318 | | | | 3,063,983 | |

| Mahindra & Mahindra | | | 129,493 | | | | 4,181,647 | |

| Max Healthcare Institute | | | 280,604 | | | | 3,387,276 | |

| PB Fintech * | | | 167,134 | | | | 3,376,853 | |

| Power Grid Corp of India | | | 1,145,296 | | | | 4,356,683 | |

| Reliance Industries | | | 437,232 | | | | 6,913,502 | |

| Varun Beverages | | | 497,274 | | | | 3,535,008 | |

| | | | | | | | 58,770,353 | |

| INDONESIA — 2.1% | | | | | | | | |

| Bank Central Asia | | | 6,013,400 | | | | 3,927,197 | |

| Bank Mandiri Persero | | | 7,256,413 | | | | 3,080,486 | |

| | | | | | | | 7,007,683 | |

| MALAYSIA — 0.9% | | | | | | | | |

| CIMB Group Holdings | | | 1,694,500 | | | | 3,072,687 | |

| | | | | | | | | |

| MEXICO — 4.4% | | | | | | | | |

| America Movil | | | 2,761,219 | | | | 2,181,578 | |

| Arca Continental | | | 221,629 | | | | 1,888,094 | |

| Fomento Economico Mexicano ADR | | | 25,746 | | | | 2,494,530 | |

| Grupo Mexico | | | 904,319 | | | | 4,738,693 | |

| Ternium ADR | | | 89,730 | | | | 3,060,690 | |

| | | | | | | | 14,363,585 | |

| PERU — 1.3% | | | | | | | | |

| Credicorp | | | 22,930 | | | | 4,222,101 | |

| | | | | | | | | |

| SAUDI ARABIA — 0.9% | | | | | | | | |

| Saudi Awwal Bank | | | 311,954 | | | | 2,807,997 | |

| | | | | | | | | |

| SOUTH AFRICA — 4.8% | | | | | | | | |

| Bid Corp | | | 79,532 | | | | 1,869,836 | |

| Capitec Bank Holdings | | | 22,829 | | | | 4,112,416 | |

| MTN Group | | | 458,482 | | | | 2,270,632 | |

| Naspers, Cl N | | | 18,753 | | | | 4,419,689 | |

| Sanlam | | | 635,686 | | | | 3,154,340 | |

| | | | | | | | 15,826,913 | |

| SOUTH KOREA — 7.7% | | | | | | | | |

| Amorepacific | | | 28,651 | | | | 2,418,326 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | NINETY ONE |

| | EMERGING MARKETS EQUITY FUND |

| | OCTOBER 31, 2024 |

COMMON STOCK — continued

| | | Shares | | | Value | |

| SOUTH KOREA (continued) | | | | | | | | |

| Hyundai Glovis | | | 30,041 | | | $ | 2,643,076 | |

| Kia | | | 7,595 | | | | 502,249 | |

| Krafton * | | | 14,501 | | | | 3,466,755 | |

| Samsung C&T | | | 30,190 | | | | 2,549,135 | |

| Samsung E&A * | | | 96,542 | | | | 1,242,489 | |

| Samsung Electronics | | | 151,236 | | | | 6,421,630 | |

| SK Hynix | | | 45,995 | | | | 6,021,382 | |

| | | | | | | | 25,265,042 | |

| TAIWAN — 18.9% | | | | | | | | |

| Accton Technology | | | 156,000 | | | | 2,621,374 | |

| ASE Technology Holding | | | 675,000 | | | | 3,183,163 | |

| Asustek Computer | | | 242,000 | | | | 4,273,214 | |

| Delta Electronics | | | 276,000 | | | | 3,408,843 | |

| Hon Hai Precision Industry | | | 975,000 | | | | 6,249,481 | |

| MediaTek | | | 128,000 | | | | 4,982,810 | |

| Taiwan Semiconductor Manufacturing | | | 1,206,000 | | | | 37,819,542 | |

| | | | | | | | 62,538,427 | |

| THAILAND — 1.1% | | | | | | | | |

| Bangkok Dusit Medical Services, Cl F | | | 2,511,800 | | | | 2,047,467 | |

| Minor International | | | 1,986,300 | | | | 1,574,396 | |

| | | | | | | | 3,621,863 | |

| UNITED ARAB EMIRATES — 3.4% | | | | | | | | |

| Abu Dhabi Commercial Bank PJSC | | | 1,439,555 | | | | 3,499,209 | |

| Aldar Properties PJSC | | | 2,160,544 | | | | 4,478,450 | |

| Emaar Properties PJSC | | | 1,366,500 | | | | 3,230,913 | |

| | | | | | | | 11,208,572 | |

| Total Common Stock | | | | | | | | |

| (Cost $268,381,579) | | | | | | | 327,382,155 | |

| | | | | | | | | |

| Total Investments— 99.2% | | | | | | | | |

| (Cost $268,381,579) | | | | | | $ | 327,382,155 | |

Percentages are based on Net Assets of $330,067,484.

| * | Non-income producing security. |

ADR — American Depositary Receipt

Cl — Class

PJSC — Public Joint-Stock Company

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | NINETY ONE |

| | EMERGING MARKETS EQUITY FUND |

| | OCTOBER 31, 2024 |

The following is a summary of the level of the inputs used as of October 31, 2024, in valuing the Fund’s investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | | | | | | | | | | | | | | | |

| Austria | | $ | — | | | $ | 8,331,867 | | | $ | — | | | $ | 8,331,867 | |

| Brazil | | | 18,607,738 | | | | — | | | | — | | | | 18,607,738 | |

| China | | | 7,070,819 | | | | 67,061,676 | | | | — | | | | 74,132,495 | |

| Greece | | | — | | | | 2,438,284 | | | | — | | | | 2,438,284 | |

| Hong Kong | | | — | | | | 15,166,548 | | | | — | | | | 15,166,548 | |

| India | | | 3,535,008 | | | | 55,235,345 | | | | — | | | | 58,770,353 | |

| Indonesia | | | 3,927,197 | | | | 3,080,486 | | | | — | | | | 7,007,683 | |

| Malaysia | | | — | | | | 3,072,687 | | | | — | | | | 3,072,687 | |

| Mexico | | | 14,363,585 | | | | — | | | | — | | | | 14,363,585 | |

| Peru | | | 4,222,101 | | | | — | | | | — | | | | 4,222,101 | |

| Saudi Arabia | | | — | | | | 2,807,997 | | | | — | | | | 2,807,997 | |

| South Africa | | | 3,154,340 | | | | 12,672,573 | | | | — | | | | 15,826,913 | |

| South Korea | | | — | | | | 25,265,042 | | | | — | | | | 25,265,042 | |

| Taiwan | | | — | | | | 62,538,427 | | | | — | | | | 62,538,427 | |

| Thailand | | | — | | | | 3,621,863 | | | | — | | | | 3,621,863 | |

| United Arab Emirates | | | — | | | | 11,208,572 | | | | — | | | | 11,208,572 | |

| Total Investments in Securities | | $ | 54,880,788 | | | $ | 272,501,367 | | | $ | — | | | $ | 327,382,155 | |

Amounts designated as “—“ are $0.

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | NINETY ONE FUNDS |

| | OCTOBER 31, 2024 |

STATEMENTS OF ASSETS AND LIABILITIES

| | | Ninety One Global Franchise Fund | | | Ninety One International Franchise Fund | |

| Assets: | | | | | | |

| Investments, at Value (Cost $267,310,350 and $4,290,539) | | $ | 342,556,987 | | | $ | 4,789,921 | |

| Foreign Currency, at Value (Cost $11,899 and $36,428) | | | 11,897 | | | | 35,687 | |

| Cash | | | 14,806,833 | | | | 83,298 | |

| Receivable for Capital Shares Sold | | | 252,703 | | | | – | |

| Reclaim Receivable | | | 357,499 | | | | 6,708 | |

| Dividend and Interest Receivable | | | 36,234 | | | | 1,825 | |

| Receivable due from Investment Adviser | | | – | | | | 22,268 | |

| Prepaid Expenses | | | 12,944 | | | | 10,798 | |

| Total Assets | | | 358,035,097 | | | | 4,950,505 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Payable due to Investment Adviser | | | 185,138 | | | | – | |

| Payable for Capital Shares Redeemed | | | 22,101 | | | | 618 | |

| Audit Fees Payable | | | 31,596 | | | | 31,596 | |

| Payable due to Administrator | | | 28,930 | | | | 10,616 | |

| Printing Fees Payable | | | 21,232 | | | | 292 | |

| Transfer Agent Fees Payable | | | 15,059 | | | | 4,501 | |

| Payable due to Trustees | | | 6,614 | | | | 91 | |

| Chief Compliance Officer Fees Payable | | | 5,642 | | | | 77 | |

| Distribution Fees Payable - A Shares | | | 1,143 | | | | – | |

| Other Accrued Expenses | | | 34,951 | | | | 2,179 | |

| Total Liabilities | | | 352,406 | | | | 49,970 | |

| Commitments and Contingencies†: | | | | | | | | |

| Net Assets | | $ | 357,682,691 | | | $ | 4,900,535 | |

| | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| Paid-in Capital | | $ | 284,769,545 | | | $ | 4,464,500 | |

| Total Distributable Earnings | | | 72,913,146 | | | | 436,035 | |

| Net Assets | | $ | 357,682,691 | | | $ | 4,900,535 | |

| | | | | | | | | |

| I Shares: | | | | | | | | |

| Net Assets | | $ | 352,342,474 | | | $ | 4,900,535 | |

| Outstanding Shares of Beneficial Interest (Unlimited Authorization - No Par Value) | | | 20,464,463 | | | | 464,695 | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 17.22 | | | $ | 10.55 | |

| A Shares: | | | | | | | | |

| Net Assets | | $ | 5,340,217 | | | | N/A | |

| Outstanding Shares of Beneficial Interest (Unlimited Authorization - No Par Value) | | | 311,489 | | | | N/A | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 17.14 | | | | N/A | |

| Maximum Offering Price Per Share ($17.14/94.25%) | | $ | 18.19 | | | | N/A | |

| † | See Note 5 in the Notes to Financial Statements. |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | NINETY ONE FUNDS |

| | OCTOBER 31, 2024 |

STATEMENTS OF ASSETS AND LIABILITIES (continued)

| | | Ninety One Emerging Markets Equity Fund | |

| Assets: | | | |

| Investments, at Value (Cost $268,381,579) | | $ | 327,382,155 | |

| Foreign Currency, at Value (Cost $1,337,653) | | | 1,336,100 | |

| Cash | | | 5,769,214 | |

| Receivable for Investments Sold | | | 218,003 | |

| Dividend and Interest Receivable | | | 179,500 | |

| Receivable for Capital Shares Sold | | | 137,016 | |

| Reclaim Receivable | | | 125,684 | |

| Prepaid Expenses | | | 25,477 | |

| Total Assets | | | 335,173,149 | |

| | | | | |

| Liabilities: | | | | |