UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22920

The Advisors’ Inner Circle Fund III

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: (877) 446-3863

Date of fiscal year end: October 31, 2024

Date of reporting period: October 31, 2024

Item 1. Reports to Stockholders.

| (a) | A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto. |

The Advisors' Inner Circle Fund III

PineBridge Dynamic Asset Allocation Fund

Institutional Shares - PDAIX

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about Institutional Shares of the PineBridge Dynamic Asset Allocation Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.pinebridge.com/en-us/intermediary/funds/pinebridge-dynamic-assetallocation-fund/institutional. You can also request this information by contacting us at 877-225-4164.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| PineBridge Dynamic Asset Allocation Fund, Institutional Shares | $81 | 0.75% |

How did the Fund perform in the last year?

As of October 2024, on a rolling 1 year basis, the Fund had a gross return of 15.82%, outperforming the return objective of the Consumer Price Index +5% (CPI+5%). We note that the Fund seeks a total return of CPI+5% over rolling five-year periods while dynamically managing risk to the 60% MSCI ACWI/40% Bloomberg Barclays Global Treasury risk budget over full market cycles. We aim to offer our investors a diversifying return stream that offers growth-like returns, but with lower volatility, helping to balance return and risk in their portfolio.

At the start of the period, we maintained a defensive risk posture, anticipating that central banks would keep policy rates elevated longer than expected to curb growth and combat inflation. We expected liquidity pressures to reveal additional vulnerabilities within the financial and economic landscape, increasing the probability of recession in developed economies facing persistent inflation. As we moved into late 2023, we adopted a more constructive stance on risk, supported by resilient corporate earnings, steady growth, and a gradual easing of inflationary pressures. In our view, the resilience of the U.S. economy and supply-driven disinflation significantly increased the likelihood of a soft landing, fostering a more favorable environment for risk-taking. We remained positioned with more risk than our risk budget for much of 2024 as soft landings generally favor equity over duration.

Investments in resilient segments of the market—such as productivity-enhancing software companies and high-quality U.S. equities—were key contributors to positive performance, benefiting from structural growth drivers and the adoption of generative AI. In contrast, other areas of the market, especially those with less defensive characteristics, experienced heightened volatility amid uncertainties around central bank policies, recession risks, and geopolitical factors. An allocation to gold, which we added at the very beginning of the period, was also a top contributor to performance as gold markets kept pace with a surging equity market. Geopolitical tensions, a declining real rate environment and China’s efforts to de-dollarize the Global South by shifting out of US treasuries and into gold have been supportive to gold prices.

Near the end of the first half of 2024, we shifted the portfolio toward a more diversified, style-neutral profile, aiming to balance risk between asset classes positioned to benefit from structural growth themes and those that were deeply discounted and likely to gain from the onset of a global easing cycle. Periods of economic expansion with declining rates and importantly a steepening yield curve tend to benefit asset classes such as US mid-caps, UK mid-caps, and US banks.

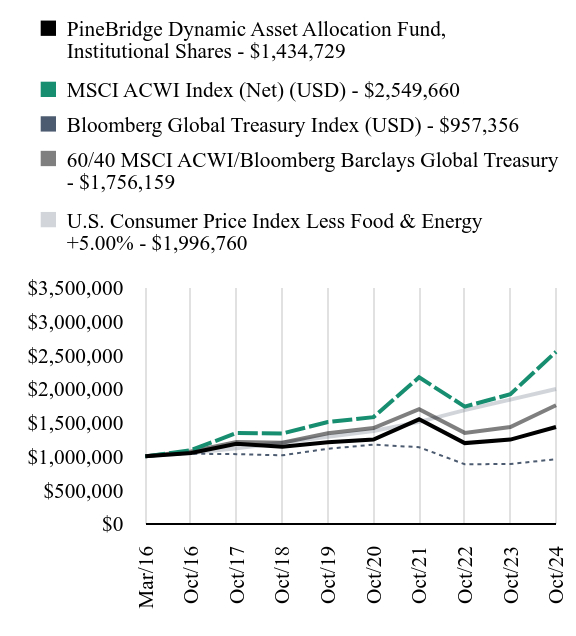

How did the Fund perform since inception?

Total Return Based on $1,000,000 Investment

| PineBridge Dynamic Asset Allocation Fund, Institutional Shares - $1434729 | MSCI ACWI Index (Net) (USD) - $2549660 | Bloomberg Global Treasury Index (USD) - $957356 | 60/40 MSCI ACWI/Bloomberg Barclays Global Treasury - $1756159 | U.S. Consumer Price Index Less Food & Energy +5.00% - $1996760 |

|---|

| Mar/16 | $1000000 | $1000000 | $1000000 | $1000000 | $1000000 |

| Oct/16 | $1051000 | $1092513 | $1039138 | $1071540 | $1047878 |

| Oct/17 | $1185455 | $1346008 | $1032859 | $1212545 | $1119706 |

| Oct/18 | $1142825 | $1339040 | $1015064 | $1202096 | $1200735 |

| Oct/19 | $1207541 | $1507645 | $1112479 | $1343555 | $1289832 |

| Oct/20 | $1249371 | $1581335 | $1173393 | $1420281 | $1376048 |

| Oct/21 | $1548480 | $2170815 | $1135512 | $1699606 | $1510503 |

| Oct/22 | $1196173 | $1737579 | $883119 | $1347967 | $1685286 |

| Oct/23 | $1248054 | $1920058 | $887179 | $1435540 | $1840584 |

| Oct/24 | $1434729 | $2549660 | $957356 | $1756159 | $1996760 |

Since its inception on March 2, 2016. The line graph represents historical performance of a hypothetical investment of $1,000,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 877-225-4164 or visit https://www.pinebridge.com/en-us/intermediary/funds/pinebridge-dynamic-assetallocation-fund/institutional for current month-end performance.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| PineBridge Dynamic Asset Allocation Fund, Institutional Shares | 14.96% | 3.51% | 4.25% |

| MSCI ACWI Index (Net) (USD) | 32.79% | 11.08% | 11.40% |

| Bloomberg Global Treasury Index (USD) | 7.91% | -2.96% | -0.50% |

| 60/40 MSCI ACWI/Bloomberg Barclays Global Treasury | 22.33% | 5.50% | 6.71% |

| U.S. Consumer Price Index Less Food & Energy +5.00% | 8.49% | 9.13% | 8.30% |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $119,677,471 | 762 | $508,916 | 132% |

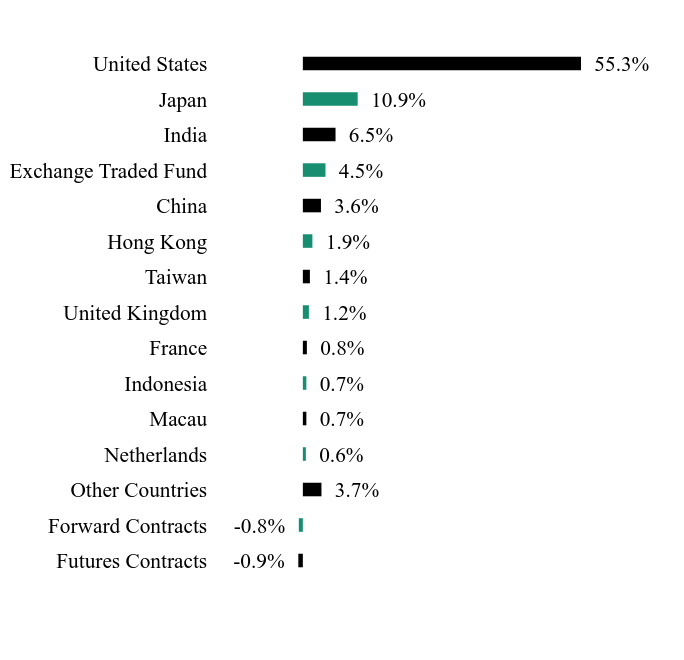

What did the Fund invest in?

Country/Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Futures Contracts | -0.9% |

| Forward Contracts | -0.8% |

| Other Countries | 3.7% |

| Netherlands | 0.6% |

| Macau | 0.7% |

| Indonesia | 0.7% |

| France | 0.8% |

| United Kingdom | 1.2% |

| Taiwan | 1.4% |

| Hong Kong | 1.9% |

| China | 3.6% |

| Exchange Traded Fund | 4.5% |

| India | 6.5% |

| Japan | 10.9% |

| United States | 55.3% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Microsoft | | | 3.3% |

| JPMorgan Chase | | | 2.9% |

| NVIDIA | | | 2.7% |

| iShares Core S&P Mid-Capital ETF | | | 2.5% |

| U.S. Treasury Bills, 4.67%, 11/19/2024 | | | 2.0% |

| U.S. Treasury Bills, 4.64%, 12/17/2024 | | | 2.0% |

| Invesco DB Precious Metals Fund | | | 2.0% |

| Bank of America | | | 1.1% |

| Broadcom | | | 1.0% |

| Taiwan Semiconductor Manufacturing | | | 1.0% |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 877-225-4164 to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

PineBridge Dynamic Asset Allocation Fund

The Advisors' Inner Circle Fund III/Institutional Shares - PDAIX

Annual Shareholder Report: October 31, 2024

PBI-AR-TSR-2024-1

The Advisors' Inner Circle Fund III

PineBridge Dynamic Asset Allocation Fund

Investor Servicing Shares - PDAVX

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about Investor Servicing Shares of the PineBridge Dynamic Asset Allocation Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.pinebridge.com/en-us/intermediary/funds/pinebridge-dynamic-assetallocation-fund/institutional. You can also request this information by contacting us at 877-225-4164.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| PineBridge Dynamic Asset Allocation Fund, Investor Servicing Shares | $97 | 0.90% |

How did the Fund perform in the last year?

As of October 2024, on a rolling 1 year basis, the Fund had a gross return of 15.82%, outperforming the return objective of the Consumer Price Index +5% (CPI+5%). We note that the Fund seeks a total return of CPI+5% over rolling five-year periods while dynamically managing risk to the 60% MSCI ACWI/40% Bloomberg Barclays Global Treasury risk budget over full market cycles. We aim to offer our investors a diversifying return stream that offers growth-like returns, but with lower volatility, helping to balance return and risk in their portfolio.

At the start of the period, we maintained a defensive risk posture, anticipating that central banks would keep policy rates elevated longer than expected to curb growth and combat inflation. We expected liquidity pressures to reveal additional vulnerabilities within the financial and economic landscape, increasing the probability of recession in developed economies facing persistent inflation. As we moved into late 2023, we adopted a more constructive stance on risk, supported by resilient corporate earnings, steady growth, and a gradual easing of inflationary pressures. In our view, the resilience of the U.S. economy and supply-driven disinflation significantly increased the likelihood of a soft landing, fostering a more favorable environment for risk-taking. We remained positioned with more risk than our risk budget for much of 2024 as soft landings generally favor equity over duration.

Investments in resilient segments of the market—such as productivity-enhancing software companies and high-quality U.S. equities—were key contributors to positive performance, benefiting from structural growth drivers and the adoption of generative AI. In contrast, other areas of the market, especially those with less defensive characteristics, experienced heightened volatility amid uncertainties around central bank policies, recession risks, and geopolitical factors. An allocation to gold, which we added at the very beginning of the period, was also a top contributor to performance as gold markets kept pace with a surging equity market. Geopolitical tensions, a declining real rate environment and China’s efforts to de-dollarize the Global South by shifting out of US treasuries and into gold have been supportive to gold prices.

Near the end of the first half of 2024, we shifted the portfolio toward a more diversified, style-neutral profile, aiming to balance risk between asset classes positioned to benefit from structural growth themes and those that were deeply discounted and likely to gain from the onset of a global easing cycle. Periods of economic expansion with declining rates and importantly a steepening yield curve tend to benefit asset classes such as US mid-caps, UK mid-caps, and US banks.

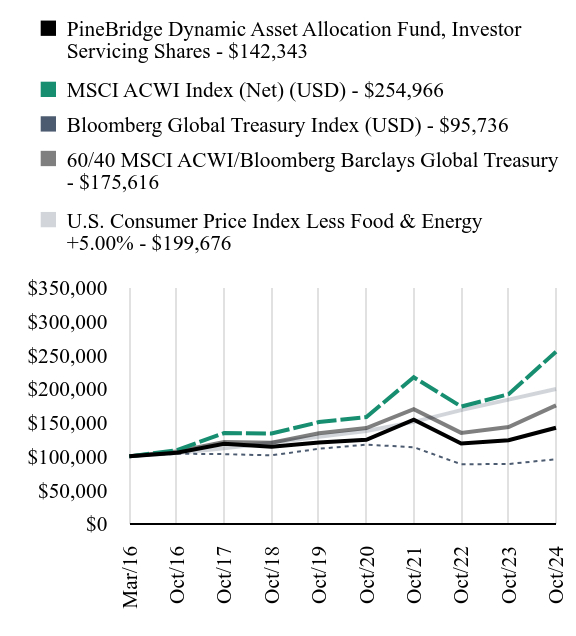

How did the Fund perform since inception?

Total Return Based on $100,000 Investment

| PineBridge Dynamic Asset Allocation Fund, Investor Servicing Shares - $142343 | MSCI ACWI Index (Net) (USD) - $254966 | Bloomberg Global Treasury Index (USD) - $95736 | 60/40 MSCI ACWI/Bloomberg Barclays Global Treasury - $175616 | U.S. Consumer Price Index Less Food & Energy +5.00% - $199676 |

|---|

| Mar/16 | $100000 | $100000 | $100000 | $100000 | $100000 |

| Oct/16 | $105300 | $109251 | $103914 | $107154 | $104788 |

| Oct/17 | $118645 | $134601 | $103286 | $121255 | $111971 |

| Oct/18 | $114120 | $133904 | $101506 | $120210 | $120073 |

| Oct/19 | $120487 | $150764 | $111248 | $134356 | $128983 |

| Oct/20 | $124513 | $158133 | $117339 | $142028 | $137605 |

| Oct/21 | $154215 | $217082 | $113551 | $169961 | $151050 |

| Oct/22 | $119011 | $173758 | $88312 | $134797 | $168529 |

| Oct/23 | $123925 | $192006 | $88718 | $143554 | $184058 |

| Oct/24 | $142343 | $254966 | $95736 | $175616 | $199676 |

Since its inception on March 2, 2016. The line graph represents historical performance of a hypothetical investment of $100,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 877-225-4164 or visit https://www.pinebridge.com/en-us/intermediary/funds/pinebridge-dynamic-assetallocation-fund/institutional for current month-end performance.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| PineBridge Dynamic Asset Allocation Fund, Investor Servicing Shares | 14.86% | 3.39% | 4.16% |

| MSCI ACWI Index (Net) (USD) | 32.79% | 11.08% | 11.40% |

| Bloomberg Global Treasury Index (USD) | 7.91% | -2.96% | -0.50% |

| 60/40 MSCI ACWI/Bloomberg Barclays Global Treasury | 22.33% | 5.50% | 6.71% |

| U.S. Consumer Price Index Less Food & Energy +5.00% | 8.49% | 9.13% | 8.30% |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $119,677,471 | 762 | $508,916 | 132% |

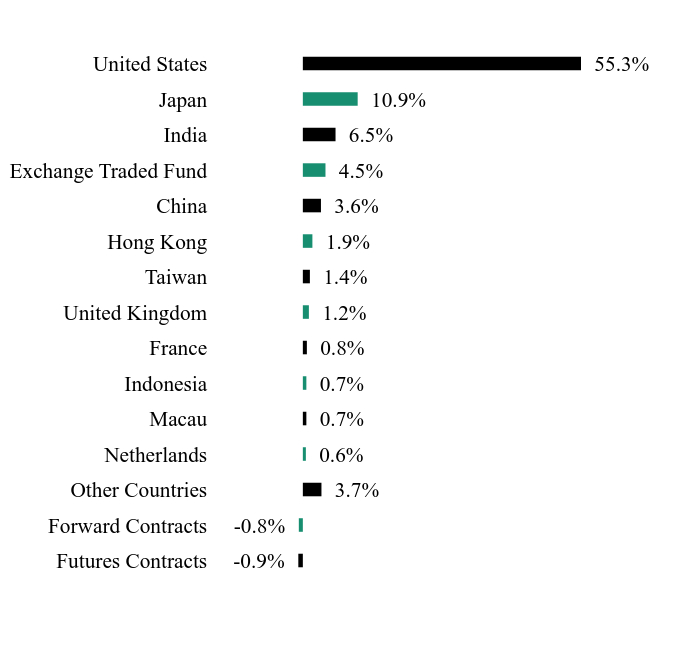

What did the Fund invest in?

Country/Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Futures Contracts | -0.9% |

| Forward Contracts | -0.8% |

| Other Countries | 3.7% |

| Netherlands | 0.6% |

| Macau | 0.7% |

| Indonesia | 0.7% |

| France | 0.8% |

| United Kingdom | 1.2% |

| Taiwan | 1.4% |

| Hong Kong | 1.9% |

| China | 3.6% |

| Exchange Traded Fund | 4.5% |

| India | 6.5% |

| Japan | 10.9% |

| United States | 55.3% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Microsoft | | | 3.3% |

| JPMorgan Chase | | | 2.9% |

| NVIDIA | | | 2.7% |

| iShares Core S&P Mid-Capital ETF | | | 2.5% |

| U.S. Treasury Bills, 4.67%, 11/19/2024 | | | 2.0% |

| U.S. Treasury Bills, 4.64%, 12/17/2024 | | | 2.0% |

| Invesco DB Precious Metals Fund | | | 2.0% |

| Bank of America | | | 1.1% |

| Broadcom | | | 1.0% |

| Taiwan Semiconductor Manufacturing | | | 1.0% |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 877-225-4164 to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

PineBridge Dynamic Asset Allocation Fund

The Advisors' Inner Circle Fund III/Investor Servicing Shares - PDAVX

Annual Shareholder Report: October 31, 2024

PBI-AR-TSR-2024-2

Item 2. Code of Ethics.

The Registrant (also referred to as the “Trust”) has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, controller or principal accounting officer, and any person who performs a similar function. There have been no amendments to or waivers granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant’s board of trustees has determined that the Registrant has at least one audit committee financial expert serving on the audit committee.

(a)(2) The Registrant’s audit committee financial experts are Thomas P. Lemke and Jay Nadel, and each of Mr. Lemke and Mr. Nadel is “independent” as that term is defined in Form N-CSR Item 3 (a)(2).

Item 4. Principal Accountant Fees and Services.

Fees billed by PricewaterhouseCoopers LLP (“PwC”) related to the Trust.

PwC billed the Trust aggregate fees for services rendered to the Trust for the last two fiscal years as follows:

| | FYE October 31, 2024 | FYE October 31, 2023 |

| | | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval |

| (a) | Audit Fees(1) | $734,463 | None | None | $717,900 | None | None |

| (b) | Audit-Related Fees | None | None | None | None | None | None |

| (c) | Tax Fees | None | None | $559,700(2) | None | None | $807,756(2) |

| (d) | All Other Fees | None | None | $10,530(4) | None | None | $7,535(4) |

Fees billed by Ernst & Young LLP (“E&Y”) related to the Trust.

E&Y billed the Trust aggregate fees for services rendered to the Trust for the last two fiscal years as follows:

| | FYE October 31, 2024 | FYE October 31, 2023 |

| | | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval |

| (a) | Audit Fees(1) | $113,052 | None | None | $137,200 | None | None |

| (b) | Audit-Related Fees | None | None | None | None | None | None |

| (c) | Tax Fees | None | None | None | None | None | None |

| (d) | All Other Fees | None | None | None | None | None | None |

Fees billed by Deloitte & Touche LLP (“D&T”) related to the Trust.

D&T billed the Trust aggregate fees for services rendered to the Trust for the last two fiscal years as follows

| | FYE October 31, 2024 | FYE October 31, 2023 |

| | | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval |

| (a) | Audit Fees(1) | $30,000 | None | None | $30,624 | None | None |

| (b) | Audit-Related Fees | None | None | None | None | None | None |

| (c) | Tax Fees | None | None | None | None | None | None |

| (d) | All Other Fees | None | None | None | None | None | None |

Fees billed by KPMG (“KPMG”) related to the Trust.

KPMG billed the Trust aggregate fees for services rendered to the Trust for the last two fiscal years as follows

| | FYE October 31, 2024 | FYE October 31, 2023 |

| | | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval |

| (a) | Audit Fees(1) | $45,000 | None | None | $363,625 | None | None |

| (b) | Audit-Related Fees | None | None | None | None | None | None |

| (c) | Tax Fees | None | None | None | None | None | None |

| (d) | All Other Fees | None | None | $154,000(3) | None | None | $282,908(3) |

Notes:

| (1) | Audit fees include amounts related to the audit of the Trust’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. |

| (2) | Tax return preparation fees for affiliates of the Funds. |

| (3) | Non-audit fees consist of SSAE No. 18 report over investment management activities and non-statutory audit reports of Legal & General Investment Management America, Inc. |

| (4) | Non-audit assurance engagements for service affiliates of the funds. |

(e)(1) The Trust’s Audit Committee has adopted and the Board of Trustees has ratified an Audit and Non-Audit Services Pre-Approval Policy (the “Policy”), which sets forth the procedures and the conditions pursuant to which services proposed to be performed by the independent auditor of the Funds may be pre-approved.

The Policy provides that all requests or applications for proposed services to be provided by the independent auditor must be submitted to the Registrant’s Chief Financial Officer (“CFO”) and must include a detailed description of the services proposed to be rendered. The CFO will determine whether such services:

| 1. | require specific pre-approval; |

| 2. | are included within the list of services that have received the general pre-approval of the Audit Committee pursuant to the Policy; or |

| 3. | have been previously pre-approved in connection with the independent auditor’s annual engagement letter for the applicable year or otherwise. In any instance where services require pre-approval, the Audit Committee will consider whether such services are consistent with SEC’s rules and whether the provision of such services would impair the auditor’s independence. |

Requests or applications to provide services that require specific pre-approval by the Audit Committee will be submitted to the Audit Committee by the CFO. The Audit Committee will be informed by the CFO on a quarterly basis of all services rendered by the independent auditor. The Audit Committee has delegated specific pre-approval authority to either the Audit Committee Chair or financial expert, provided that the estimated fee for any such proposed pre-approved service does not exceed $100,000 and any pre-approval decisions are reported to the Audit Committee at its next regularly-scheduled meeting.

Services that have received the general pre-approval of the Audit Committee are identified and described in the Policy. In addition, the Policy sets forth a maximum fee per engagement with respect to each identified service that has received general pre-approval.

All services to be provided by the independent auditor shall be provided pursuant to a signed written engagement letter with the Registrant, the investment adviser, or applicable control affiliate (except that matters as to which an engagement letter would be impractical because of timing issues or because the matter is small may not be the subject of an engagement letter) that sets forth both the services to be provided by the independent auditor and the total fees to be paid to the independent auditor for those services.

In addition, the Audit Committee has determined to take additional measures on an annual basis to meet the Audit Committee’s responsibility to oversee the work of the independent auditor and to assure the auditor's independence from the Registrant, such as (a) reviewing a formal written statement from the independent auditor delineating all relationships between the independent auditor and the Registrant, and (b) discussing with the independent auditor the independent auditor’s methods and procedures for ensuring independence.

(e)(2) Percentage of fees billed applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows (PwC):

| | FYE

October 31, 2024 | FYE October 31, 2023 |

Audit-Related Fees | None | None |

| Tax Fees | None | None |

All Other Fees | None | None |

(e)(2) Percentage of fees billed applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows (E&Y):

| | FYE October 31, 2024 | FYE October 31, 2023 |

Audit-Related Fees | None | None |

| Tax Fees | None | None |

All Other Fees | None | None |

(e)(2) Percentage of fees billed applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows (D&T):

| | FYE

October 31, 2024 | FYE October 31, 2023 |

Audit-Related Fees | None | None |

| Tax Fees | None | None |

All Other Fees | None | None |

(e)(2) Percentage of fees billed applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows (KPMG):

| | FYE

October 31, 2024 | FYE October 31,2023 |

Audit-Related Fees | None | None |

| Tax Fees | None | None |

All Other Fees | None | None |

(f) Not applicable.

(g) The aggregate non-audit fees and services billed by PwC for services rendered to the Registrant, and rendered to the Registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant for the last two fiscal-years-ended October 31st were $570,230 and $815,291 for 2024 and 2023, respectively.

(g) The aggregate non-audit fees and services billed by E&Y for services rendered to the Registrant, and rendered to the Registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant for the last two fiscal-years-ended October 31st were $0 and $0 for 2024 and 2023, respectively.

(g) The aggregate non-audit fees and services billed by D&T for services rendered to the Registrant, and rendered to the Registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant for the last two fiscal-years-ended October 31st were $0 and $0 for 2024 and 2023, respectively.

(g) The aggregate non-audit fees and services billed by KPMG for services rendered to the Registrant, and rendered to the Registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant for the last two fiscal-years-ended October 31st were $154,000 and $282,908 for 2024 and 2023, respectively.

(h) During the past fiscal year, all non-audit services provided by the Registrant’s principal accountant to either the Registrant’s investment adviser or to any entity controlling, controlled by, or under common control with the Registrant’s investment adviser that provides ongoing services to the Registrant were pre-approved by the Audit Committee of Registrant’s Board of Trustees. Included in the Audit Committee’s pre-approval of these non-audit service were the review and consideration as to whether the provision of these non-audit services is compatible with maintaining the principal accountant’s independence.

(i) Not applicable. The Registrant has not retained, for the preparation of the audit report on the financial statements included in the Form N-CSR, a registered public accounting firm that has a branch or office that is located in a foreign jurisdiction and that the Public Company Accounting Oversight Board (the “PCAOB”) has determined that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction.

(j) Not applicable. The Registrant is not a “foreign issuer,” as defined in 17 CFR § 240.3b-4.

Item 5. Audit Committee of Listed Registrants.

Not applicable to open-end management investment companies.

Item 6. Schedule of Investments.

(a) The Schedule of Investments is included as part of the Financial Statements and Other Information filed under Item 7 of this form.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Financial statements and financial highlights are filed herein.

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC

ASSET ALLOCATION FUND

OCTOBER 31, 2024 |

TABLE OF CONTENTS

| Financial Statements (Form N-CSR Item 7) | |

| Schedule of Investments | 1 |

| Statement of Assets and Liabilities | 29 |

| Statement of Operations | 30 |

| Statements of Changes in Net Assets | 31 |

| Financial Highlights | 32 |

| Notes to Financial Statements | 34 |

| Report of Independent Registered Public Accounting Firm | 59 |

| Notice to Shareholders (Unaudited) | 61 |

| Approval of Investment Advisory Agreement (Form N-CSR Item 11) (Unaudited) | 62 |

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC

ASSET ALLOCATION FUND

OCTOBER 31, 2024 |

SCHEDULE OF INVESTMENTS

COMMON STOCK — 77.5%

| | | Shares | | | Value | |

| Australia — 0.2% | | | | | | | | |

| Paladin Energy * | | | 9,565 | | | $ | 62,972 | |

| WiseTech Global | | | 1,473 | | | | 113,094 | |

| Xero * | | | 1,249 | | | | 121,347 | |

| | | | | | | | 297,413 | |

| Austria — 0.0% | | | | | | | | |

| Verbund | | | 295 | | | | 24,294 | |

| | | | | | | | | |

| Belgium — 0.1% | | | | | | | | |

| UCB | | | 396 | | | | 76,249 | |

| | | | | | | | | |

| Brazil — 0.3% | | | | | | | | |

| Hapvida Participacoes e Investimentos * | | | 58,700 | | | | 35,641 | |

| Itau Unibanco Holding ADR | | | 6,902 | | | | 41,757 | |

| MercadoLibre * | | | 30 | | | | 61,115 | |

| Raia Drogasil | | | 9,258 | | | | 39,156 | |

| Rumo | | | 35,993 | | | | 123,466 | |

| TIM | | | 26,515 | | | | 76,001 | |

| | | | | | | | 377,136 | |

| Canada — 0.0% | | | | | | | | |

| Algonquin Power & Utilities | | | 1,915 | | | | 9,256 | |

| Northland Power | | | 725 | | | | 11,018 | |

| RB Global | | | 477 | | | | 40,415 | |

| | | | | | | | 60,689 | |

| China — 2.3% | | | | | | | | |

| Agricultural Bank of China, Cl A | | | 118,400 | | | | 78,753 | |

| Alibaba Group Holding | | | 17,813 | | | | 217,894 | |

| Anhui Conch Cement, Cl A | | | 15,400 | | | | 57,916 | |

| Baidu ADR * | | | 1,131 | | | | 103,181 | |

| Baoshan Iron & Steel, Cl A | | | 62,000 | | | | 56,898 | |

| Beijing Career International, Cl A | | | 15,800 | | | | 43,531 | |

| China Minsheng Banking, Cl A | | | 79,700 | | | | 42,349 | |

| China State Construction Engineering, Cl A | | | 105,200 | | | | 89,103 | |

| China Vanke, Cl A * | | | 25,200 | | | | 32,950 | |

| Contemporary Amperex Technology, Cl A | | | 600 | | | | 20,824 | |

| Fujian Sunner Development, Cl A | | | 27,800 | | | | 55,907 | |

| Gree Electric Appliances of Zhuhai, Cl A | | | 11,500 | | | | 70,360 | |

| Guangdong Haid Group, Cl A | | | 11,200 | | | | 69,087 | |

| Guangxi LiuYao Group, Cl A | | | 10,500 | | | | 26,697 | |

| Han's Laser Technology Industry Group, Cl A | | | 13,500 | | | | 48,882 | |

| Huadong Medicine, Cl A | | | 13,600 | | | | 63,161 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC

ASSET ALLOCATION FUND

OCTOBER 31, 2024 |

COMMON STOCK — continued

| | | Shares | | | Value | |

| China — continued | | | | | | | | |

| Industrial & Commercial Bank of China, Cl A | | | 69,300 | | | $ | 58,879 | |

| Industrial Bank, Cl A | | | 33,600 | | | | 86,370 | |

| Inner Mongolia Yili Industrial Group, Cl A | | | 15,100 | | | | 59,343 | |

| Jiangsu Hengrui Pharmaceuticals, Cl A | | | 7,400 | | | | 48,543 | |

| Kweichow Moutai, Cl A | | | 300 | | | | 64,434 | |

| LONGi Green Energy Technology, Cl A | | | 17,800 | | | | 49,436 | |

| Luxshare Precision Industry, Cl A | | | 14,100 | | | | 83,073 | |

| Nantong Jianghai Capacitor, Cl A | | | 29,700 | | | | 62,081 | |

| PDD Holdings ADR * | | | 640 | | | | 77,178 | |

| Ping An Insurance Group of China, Cl A | | | 4,500 | | | | 35,405 | |

| SAIC Motor, Cl A | | | 30,100 | | | | 54,458 | |

| Sailun Group, Cl A | | | 14,100 | | | | 28,714 | |

| SDIC Power Holdings, Cl A | | | 5,200 | | | | 11,119 | |

| Sieyuan Electric, Cl A | | | 5,700 | | | | 61,214 | |

| Sungrow Power Supply, Cl A | | | 14,705 | | | | 187,423 | |

| Suzhou Gold Mantis Construction Decoration, Cl A | | | 47,600 | | | | 24,292 | |

| Trip.com Group ADR * | | | 2,460 | | | | 158,424 | |

| Wanhua Chemical Group, Cl A | | | 4,100 | | | | 43,406 | |

| Weifu High-Technology Group, Cl A | | | 40,900 | | | | 102,082 | |

| Wellhope Foods, Cl A * | | | 26,600 | | | | 30,641 | |

| Yifeng Pharmacy Chain, Cl A | | | 7,000 | | | | 23,351 | |

| YTO Express Group, Cl A | | | 32,100 | | | | 74,069 | |

| Yutong Bus, Cl A | | | 28,800 | | | | 98,086 | |

| Zhejiang Dahua Technology, Cl A | | | 16,900 | | | | 38,980 | |

| Zhejiang Sanhua Intelligent Controls, Cl A | | | 11,200 | | | | 34,309 | |

| Zhongji Innolight, Cl A | | | 2,200 | | | | 43,471 | |

| | | | | | | | 2,716,274 | |

| Finland — 0.1% | | | | | | | | |

| Fortum | | | 5,144 | | | | 75,950 | |

| | | | | | | | | |

| France — 0.8% | | | | | | | | |

| Cie de Saint-Gobain | | | 2,522 | | | | 228,707 | |

| Engie | | | 1,476 | | | | 24,740 | |

| Legrand | | | 3,372 | | | | 380,592 | |

| Schneider Electric | | | 430 | | | | 111,391 | |

| STMicroelectronics | | | 3,941 | | | | 107,126 | |

| Vinci | | | 704 | | | | 78,862 | |

| | | | | | | | 931,418 | |

| Germany — 0.4% | | | | | | | | |

| E.ON | | | 1,666 | | | | 22,483 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC

ASSET ALLOCATION FUND

OCTOBER 31, 2024 |

COMMON STOCK — continued

| | | Shares | | | Value | |

| Germany — continued | | | | | | | | |

| Infineon Technologies | | | 3,626 | | | $ | 114,671 | |

| RWE | | | 637 | | | | 20,645 | |

| SAP | | | 1,213 | | | | 283,217 | |

| | | | | | | | 441,016 | |

| Greece — 0.1% | | | | | | | | |

| JUMBO | | | 2,156 | | | | 57,543 | |

| Piraeus Financial Holdings | | | 19,597 | | | | 73,838 | |

| | | | | | | | 131,381 | |

| Hong Kong — 0.9% | | | | | | | | |

| China Construction Bank, Cl H | | | 199,054 | | | | 154,513 | |

| China Everbright Bank, Cl H | | | 183,000 | | | | 61,858 | |

| China Railway Group, Cl H | | | 92,000 | | | | 45,910 | |

| China Railway Signal & Communication, Cl H | | | 140,000 | | | | 57,706 | |

| Geely Automobile Holdings | | | 60,087 | | | | 105,627 | |

| Haitong Securities, Cl H | | | 37,600 | | | | 31,317 | |

| Kingsoft | | | 5,000 | | | | 17,231 | |

| Lenovo Group | | | 63,831 | | | | 84,170 | |

| Meituan, Cl B * | | | 8,151 | | | | 192,611 | |

| Ping An Insurance Group of China, Cl H | | | 11,473 | | | | 71,084 | |

| Tencent Holdings | | | 5,864 | | | | 305,762 | |

| | | | | | | | 1,127,789 | |

| Hungary — 0.2% | | | | | | | | |

| OTP Bank Nyrt | | | 2,483 | | | | 123,618 | |

| Richter Gedeon Nyrt | | | 5,726 | | | | 165,497 | |

| | | | | | | | 289,115 | |

| India — 5.7% | | | | | | | | |

| AIA Engineering | | | 2,216 | | | | 100,511 | |

| Amara Raja Energy & Mobility | | | 9,570 | | | | 157,674 | |

| Angel One | | | 1,750 | | | | 63,168 | |

| Bajaj Auto | | | 1,754 | | | | 204,857 | |

| Bajaj Finance | | | 1,790 | | | | 146,208 | |

| Bank of Baroda | | | 177,187 | | | | 526,919 | |

| Bank of India | | | 158,700 | | | | 204,262 | |

| Bharat Electronics | | | 27,300 | | | | 92,154 | |

| Canara Bank | | | 69,500 | | | | 84,449 | |

| Caplin Point Laboratories | | | 2,400 | | | | 57,947 | |

| Central Depository Services India | | | 4,000 | | | | 73,310 | |

| Chaman Lal Setia Exports | | | 8,671 | | | | 32,411 | |

| CMS Info Systems | | | 10,400 | | | | 66,248 | |

| Deepak Nitrite | | | 900 | | | | 28,168 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC

ASSET ALLOCATION FUND

OCTOBER 31, 2024 |

COMMON STOCK — continued

| | | Shares | | | Value | |

| India — continued | | | | | | | | |

| Dhanuka Agritech | | | 2,000 | | | $ | 37,351 | |

| Dodla Dairy | | | 4,470 | | | | 63,039 | |

| eClerx Services | | | 4,400 | | | | 151,920 | |

| Electronics Mart India * | | | 20,000 | | | | 45,346 | |

| Emami | | | 26,700 | | | | 222,840 | |

| General Insurance Corp of India | | | 14,500 | | | | 63,331 | |

| GHCL | | | 2,000 | | | | 14,139 | |

| Gland Pharma | | | 3,100 | | | | 60,822 | |

| Granules India | | | 5,800 | | | | 39,205 | |

| HDFC Bank | | | 37,463 | | | | 770,041 | |

| Hero MotoCorp | | | 1,830 | | | | 108,209 | |

| Hindustan Unilever | | | 1,855 | | | | 55,694 | |

| Honasa Consumer * | | | 15,782 | | | | 73,797 | |

| ICICI Bank | | | 11,183 | | | | 171,542 | |

| ICICI Bank ADR | | | 7,000 | | | | 212,870 | |

| Indian Bank | | | 57,000 | | | | 401,203 | |

| InterGlobe Aviation * | | | 750 | | | | 36,030 | |

| Just Dial * | | | 4,500 | | | | 60,592 | |

| KSB | | | 8,000 | | | | 76,017 | |

| National Aluminium | | | 88,000 | | | | 236,410 | |

| NHPC | | | 64,500 | | | | 63,150 | |

| Orchid Pharma * | | | 1,400 | | | | 24,184 | |

| Petronet LNG | | | 27,000 | | | | 106,545 | |

| PG Electroplast | | | 18,400 | | | | 138,780 | |

| Polycab India | | | 2,450 | | | | 187,905 | |

| Punjab National Bank | | | 121,400 | | | | 141,006 | |

| Rategain Travel Technologies, Cl A * | | | 6,483 | | | | 57,811 | |

| Reliance Industries | | | 5,556 | | | | 87,851 | |

| Shree Cement | | | 1,250 | | | | 371,804 | |

| State Bank of India | | | 10,600 | | | | 103,151 | |

| Stylam Industries | | | 2,000 | | | | 54,128 | |

| Sun Pharmaceutical Industries | | | 3,850 | | | | 84,489 | |

| Tata Consultancy Services | | | 7,518 | | | | 353,625 | |

| Union Bank of India | | | 163,000 | | | | 226,040 | |

| Updater Services * | | | 13,500 | | | | 65,471 | |

| Varun Beverages | | | 6,000 | | | | 42,653 | |

| | | | | | | | 6,847,277 | |

| Indonesia — 0.2% | | | | | | | | |

| Bank Central Asia | | | 169,518 | | | | 110,708 | |

| Bank Negara Indonesia Persero | | | 295,889 | | | | 98,690 | |

| | | | | | | | 209,398 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC

ASSET ALLOCATION FUND

OCTOBER 31, 2024 |

COMMON STOCK — continued

| | | Shares | | | Value | |

| Ireland — 0.1% | | | | | | | | |

| Kerry Group, Cl A | | | 1,631 | | | $ | 162,897 | |

| | | | | | | | | |

| Italy — 0.1% | | | | | | | | |

| Enel | | | 3,225 | | | | 24,459 | |

| ERG | | | 885 | | | | 19,875 | |

| Prysmian | | | 1,062 | | | | 74,950 | |

| Terna - Rete Elettrica Nazionale | | | 2,778 | | | | 24,062 | |

| | | | | | | | 143,346 | |

| Japan — 10.6% | | | | | | | | |

| Advantest | | | 8,100 | | | | 468,987 | |

| Ajinomoto | | | 4,900 | | | | 188,237 | |

| Asahi Group Holdings | | | 17,000 | | | | 204,090 | |

| Asics | | | 5,400 | | | | 94,321 | |

| Astellas Pharma | | | 13,700 | | | | 160,404 | |

| Chiba Bank | | | 11,200 | | | | 81,734 | |

| Chugai Pharmaceutical | | | 9,351 | | | | 444,935 | |

| CMK | | | 4,300 | | | | 11,384 | |

| Concordia Financial Group | | | 52,500 | | | | 260,048 | |

| Dai-ichi Life Holdings | | | 13,900 | | | | 346,532 | |

| Fuji Electric | | | 5,100 | | | | 259,732 | |

| Fuji Oil Holdings | | | 7,300 | | | | 157,141 | |

| FUJIFILM Holdings | | | 9,300 | | | | 221,231 | |

| Fujikura | | | 4,600 | | | | 169,065 | |

| Fujitsu | | | 5,700 | | | | 109,587 | |

| Fukuoka Financial Group | | | 3,300 | | | | 75,278 | |

| GS Yuasa | | | 9,100 | | | | 160,995 | |

| Hitachi | | | 34,516 | | | | 867,210 | |

| Hoya | | | 900 | | | | 120,415 | |

| Insource | | | 17,700 | | | | 110,921 | |

| ITOCHU | | | 8,200 | | | | 405,636 | |

| Japan Post Bank | | | 18,600 | | | | 166,123 | |

| Japan Post Insurance | | | 5,000 | | | | 82,391 | |

| JCR Pharmaceuticals | | | 20,300 | | | | 90,775 | |

| JMDC | | | 4,100 | | | | 114,257 | |

| Keyence | | | 1,437 | | | | 648,682 | |

| Kyoto Financial Group | | | 5,500 | | | | 80,720 | |

| Lasertec | | | 700 | | | | 94,987 | |

| M&A Capital Partners | | | 9,600 | | | | 136,167 | |

| MINEBEA MITSUMI | | | 9,900 | | | | 174,284 | |

| Mitsubishi Gas Chemical | | | 9,500 | | | | 165,105 | |

| Mitsubishi UFJ Financial Group | | | 55,700 | | | | 587,092 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC

ASSET ALLOCATION FUND

OCTOBER 31, 2024 |

COMMON STOCK — continued

| | | Shares | | | Value | |

| Japan — continued | | | | | | | | |

| Mitsui Fudosan | | | 22,100 | | | $ | 188,565 | |

| Mizuho Financial Group | | | 8,600 | | | | 178,631 | |

| Morinaga Milk Industry | | | 900 | | | | 20,929 | |

| NEC | | | 3,100 | | | | 263,780 | |

| Nippon Telegraph & Telephone | | | 473,200 | | | | 456,560 | |

| Nitori Holdings | | | 1,400 | | | | 178,297 | |

| Obic | | | 3,100 | | | | 101,300 | |

| Oracle Japan | | | 1,100 | | | | 105,229 | |

| Osaka Soda | | | 10,600 | | | | 111,335 | |

| Pan Pacific International Holdings | | | 7,100 | | | | 176,139 | |

| Raito Kogyo | | | 4,900 | | | | 71,491 | |

| Rengo | | | 34,400 | | | | 208,359 | |

| Resona Holdings | | | 17,300 | | | | 114,141 | |

| Rohto Pharmaceutical | | | 7,100 | | | | 159,660 | |

| Shikoku Kasei Holdings | | | 2,400 | | | | 32,251 | |

| Shin-Etsu Chemical | | | 7,400 | | | | 271,165 | |

| Shizuoka Financial Group | | | 9,700 | | | | 77,402 | |

| SKY Perfect JSAT Holdings | | | 26,800 | | | | 153,065 | |

| Sony Group | | | 20,000 | | | | 351,950 | |

| Sumitomo Mitsui Financial Group | | | 24,800 | | | | 526,121 | |

| Sumitomo Mitsui Trust Holdings | | | 5,400 | | | | 118,424 | |

| Suzuki Motor | | | 16,500 | | | | 163,735 | |

| T&D Holdings | | | 6,100 | | | | 97,370 | |

| Takasago Thermal Engineering | | | 5,000 | | | | 160,346 | |

| Tokyo Electron | | | 900 | | | | 132,438 | |

| Tokyu | | | 13,000 | | | | 160,269 | |

| Toyo Suisan Kaisha | | | 2,500 | | | | 146,859 | |

| Toyota Motor | | | 25,900 | | | | 446,267 | |

| Treasure Factory | | | 6,300 | | | | 55,218 | |

| Trend Micro | | | 4,000 | | | | 209,290 | |

| | | | | | | | 12,695,052 | |

| Mexico — 0.1% | | | | | | | | |

| Gentera | | | 30,863 | | | | 39,486 | |

| Grupo Mexico | | | 17,772 | | | | 93,250 | |

| | | | | | | | 132,736 | |

| Netherlands — 0.6% | | | | | | | | |

| Argenx ADR * | | | 345 | | | | 202,273 | |

| ASM International | | | 565 | | | | 315,556 | |

| ASML Holding | | | 333 | | | | 224,153 | |

| | | | | | | | 741,982 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC

ASSET ALLOCATION FUND

OCTOBER 31, 2024 |

COMMON STOCK — continued

| | | Shares | | | Value | |

| Poland — 0.1% | | | | | | | | |

| Allegro.eu * | | | 7,127 | | | $ | 62,714 | |

| | | | | | | | | |

| Portugal — 0.1% | | | | | | | | |

| EDP | | | 5,672 | | | | 22,330 | |

| EDP Renovaveis | | | 1,510 | | | | 20,466 | |

| Galp Energia SGPS | | | 3,441 | | | | 58,813 | |

| | | | | | | | 101,609 | |

| South Africa — 0.0% | | | | | | | | |

| FirstRand | | | 12,683 | | | | 55,725 | |

| | | | | | | | | |

| South Korea — 0.5% | | | | | | | | |

| Samsung Electronics | | | 3,260 | | | | 138,423 | |

| SK Hynix | | | 2,566 | | | | 335,925 | |

| Woori Financial Group | | | 6,840 | | | | 76,150 | |

| | | | | | | | 550,498 | |

| Spain — 0.1% | | | | | | | | |

| Acciona | | | 187 | | | | 23,998 | |

| Endesa | | | 1,184 | | | | 25,552 | |

| Iberdrola | | | 1,765 | | | | 26,218 | |

| Redeia | | | 1,319 | | | | 24,422 | |

| | | | | | | | 100,190 | |

| Switzerland — 0.2% | | | | | | | | |

| ABB | | | 1,840 | | | | 102,251 | |

| VAT Group | | | 217 | | | | 90,357 | |

| | | | | | | | 192,608 | |

| Taiwan — 1.4% | | | | | | | | |

| Delta Electronics | | | 4,878 | | | | 60,248 | |

| Hon Hai Precision Industry | | | 20,316 | | | | 130,220 | |

| Largan Precision | | | 868 | | | | 60,795 | |

| MediaTek | | | 5,023 | | | | 195,536 | |

| Taiwan Semiconductor Manufacturing | | | 37,935 | | | | 1,189,622 | |

| | | | | | | | 1,636,421 | |

| Turkey — 0.0% | | | | | | | | |

| Akbank | | | 28,059 | | | | 41,481 | |

| | | | | | | | | |

| United Kingdom — 1.0% | | | | | | | | |

| ARM Holdings ADR * | | | 1,230 | | | | 173,799 | |

| Coats Group | | | 61,166 | | | | 75,062 | |

| Hikma Pharmaceuticals | | | 4,021 | | | | 96,303 | |

| Sage Group | | | 9,217 | | | | 115,193 | |

| Spirax Group | | | 2,809 | | | | 234,470 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC

ASSET ALLOCATION FUND

OCTOBER 31, 2024 |

COMMON STOCK — continued

| | | Shares | | | Value | |

| United Kingdom — continued | | | | | | | | |

| SSE | | | 958 | | | $ | 21,769 | |

| Weir Group | | | 12,969 | | | | 349,258 | |

| Yellow Cake * | | | 10,892 | | | | 76,038 | |

| | | | | | | | 1,141,892 | |

| United States — 51.3% | | | | | | | | |

| Communication Services — 2.1% | | | | | | | | |

| Alphabet, Cl A | | | 3,573 | | | | 611,376 | |

| Alphabet, Cl C | | | 315 | | | | 54,397 | |

| AT&T | | | 9,760 | | | | 219,990 | |

| Comcast, Cl A | | | 10,704 | | | | 467,444 | |

| Frontier Communications Parent * | | | 818 | | | | 29,227 | |

| Iridium Communications | | | 910 | | | | 26,690 | |

| Meta Platforms, Cl A | | | 672 | | | | 381,414 | |

| Netflix * | | | 330 | | | | 249,490 | |

| New York Times, Cl A | | | 748 | | | | 41,768 | |

| Nexstar Media Group, Cl A | | | 153 | | | | 26,916 | |

| Spotify Technology * | | | 303 | | | | 116,685 | |

| TEGNA | | | 1,570 | | | | 25,795 | |

| TKO Group Holdings, Cl A * | | | 215 | | | | 25,106 | |

| Trade Desk, Cl A * | | | 996 | | | | 119,729 | |

| Yelp, Cl A * | | | 1,411 | | | | 48,172 | |

| ZoomInfo Technologies, Cl A * | | | 1,817 | | | | 20,078 | |

| | | | | | | | 2,464,277 | |

| Consumer Discretionary — 2.7% | | | | | | | | |

| Abercrombie & Fitch, Cl A * | | | 173 | | | | 22,800 | |

| Airbnb, Cl A * | | | 742 | | | | 100,014 | |

| Amazon.com * | | | 1,170 | | | | 218,088 | |

| Aramark | | | 4,599 | | | | 173,980 | |

| Booking Holdings | | | 31 | | | | 144,964 | |

| Brunswick | | | 266 | | | | 21,211 | |

| Burlington Stores * | | | 256 | | | | 63,429 | |

| Churchill Downs | | | 256 | | | | 35,866 | |

| Columbia Sportswear | | | 317 | | | | 25,509 | |

| Crocs * | | | 264 | | | | 28,464 | |

| Dick's Sporting Goods | | | 236 | | | | 46,197 | |

| Dillard's, Cl A | | | 178 | | | | 66,131 | |

| Domino's Pizza | | | 208 | | | | 86,056 | |

| Duolingo, Cl A * | | | 128 | | | | 37,500 | |

| eBay | | | 1,998 | | | | 114,905 | |

| Five Below * | | | 305 | | | | 28,911 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC ASSET ALLOCATION FUND OCTOBER 31, 2024 |

| COMMON STOCK — continued | | | | | | |

| | | Shares | | | Value | |

| United States — continued | | | | | | | | |

| Consumer Discretionary — continued | | | | | | | | |

| Floor & Decor Holdings, Cl A * | | | 437 | | | $ | 45,033 | |

| GameStop, Cl A * | | | 1,099 | | | | 24,376 | |

| Gap | | | 933 | | | | 19,378 | |

| Grand Canyon Education * | | | 136 | | | | 18,647 | |

| H&R Block | | | 562 | | | | 33,568 | |

| Harley-Davidson | | | 912 | | | | 29,138 | |

| Home Depot | | | 705 | | | | 277,594 | |

| KB Home | | | 354 | | | | 27,789 | |

| Lear | | | 341 | | | | 32,654 | |

| Light & Wonder, Cl A * | | | 371 | | | | 34,792 | |

| Lithia Motors, Cl A | | | 121 | | | | 40,217 | |

| Lowe's | | | 1,205 | | | | 315,505 | |

| Lululemon Athletica * | | | 337 | | | | 100,392 | |

| Macy's | | | 1,459 | | | | 22,381 | |

| Mattel * | | | 1,517 | | | | 30,916 | |

| Murphy USA | | | 87 | | | | 42,495 | |

| NIKE, Cl B | | | 1,827 | | | | 140,916 | |

| Ollie's Bargain Outlet Holdings * | | | 226 | | | | 20,754 | |

| O'Reilly Automotive * | | | 64 | | | | 73,801 | |

| Planet Fitness, Cl A * | | | 475 | | | | 37,297 | |

| Pool | | | 103 | | | | 37,249 | |

| PVH | | | 337 | | | | 33,181 | |

| Service International | | | 645 | | | | 52,664 | |

| Taylor Morrison Home, Cl A * | | | 403 | | | | 27,605 | |

| Tempur Sealy International | | | 643 | | | | 30,806 | |

| Texas Roadhouse, Cl A | | | 175 | | | | 33,446 | |

| Thor Industries | | | 247 | | | | 25,708 | |

| TJX | | | 167 | | | | 18,876 | |

| Toll Brothers | | | 322 | | | | 47,154 | |

| TopBuild * | | | 126 | | | | 44,526 | |

| Travel + Leisure | | | 611 | | | | 29,212 | |

| Vail Resorts | | | 258 | | | | 42,748 | |

| Valvoline * | | | 769 | | | | 30,975 | |

| Visteon * | | | 247 | | | | 22,292 | |

| Whirlpool | | | 337 | | | | 34,883 | |

| Williams-Sonoma | | | 554 | | | | 74,308 | |

| Wingstop | | | 111 | | | | 31,934 | |

| Wyndham Hotels & Resorts | | | 443 | | | | 39,126 | |

| YETI Holdings * | | | 533 | | | | 18,767 | |

| | | | | | | | 3,257,128 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC ASSET ALLOCATION FUND OCTOBER 31, 2024 |

| COMMON STOCK — continued | | | | | | |

| | | Shares | | | Value | |

| United States — continued | | | | | | | | |

| Consumer Staples — 1.5% | | | | | | | | |

| Altria Group | | | 705 | | | $ | 38,394 | |

| BellRing Brands * | | | 454 | | | | 29,887 | |

| BJ's Wholesale Club Holdings * | | | 543 | | | | 46,008 | |

| Casey's General Stores | | | 198 | | | | 78,016 | |

| Celsius Holdings * | | | 582 | | | | 17,507 | |

| Coca-Cola | | | 2,768 | | | | 180,778 | |

| Costco Wholesale | | | 64 | | | | 55,948 | |

| Darling Ingredients * | | | 863 | | | | 33,752 | |

| elf Beauty * | | | 230 | | | | 24,208 | |

| Flowers Foods | | | 1,067 | | | | 23,719 | |

| Ingredion | | | 415 | | | | 55,095 | |

| Kroger | | | 465 | | | | 25,933 | |

| Performance Food Group * | | | 639 | | | | 51,919 | |

| Philip Morris International | | | 357 | | | | 47,374 | |

| Procter & Gamble | | | 1,657 | | | | 273,703 | |

| Sprouts Farmers Market * | | | 432 | | | | 55,482 | |

| Target | | | 575 | | | | 86,273 | |

| US Foods Holding * | | | 999 | | | | 61,588 | |

| Walmart | | | 7,678 | | | | 629,212 | |

| | | | | | | | 1,814,796 | |

| Energy — 1.3% | | | | | | | | |

| Antero Midstream | | | 1,608 | | | | 23,107 | |

| Antero Resources * | | | 1,325 | | | | 34,291 | |

| Cameco | | | 1,623 | | | | 84,753 | |

| ChampionX | | | 893 | | | | 25,200 | |

| Chesapeake Energy | | | 807 | | | | 68,369 | |

| Chevron | | | 888 | | | | 132,152 | |

| Chord Energy | | | 183 | | | | 22,893 | |

| Civitas Resources | | | 360 | | | | 17,564 | |

| CNX Resources * | | | 820 | | | | 27,905 | |

| ConocoPhillips | | | 322 | | | | 35,272 | |

| Denison Mines * | | | 38,096 | | | | 80,002 | |

| DT Midstream | | | 543 | | | | 48,951 | |

| EOG Resources | | | 109 | | | | 13,294 | |

| Exxon Mobil | | | 2,409 | | | | 281,323 | |

| HF Sinclair | | | 569 | | | | 21,969 | |

| Marathon Petroleum | | | 639 | | | | 92,955 | |

| Murphy Oil | | | 686 | | | | 21,595 | |

| NexGen Energy * | | | 11,244 | | | | 82,756 | |

| NOV | | | 1,768 | | | | 27,422 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC ASSET ALLOCATION FUND OCTOBER 31, 2024 |

| COMMON STOCK — continued | | | | | | |

| | | Shares | | | Value | |

| United States — continued | | | | | | | | |

| Energy — continued | | | | | | | | |

| Ovintiv | | | 1,210 | | | $ | 47,432 | |

| Permian Resources, Cl A | | | 2,039 | | | | 27,792 | |

| Range Resources | | | 1,195 | | | | 35,886 | |

| Texas Pacific Land | | | 72 | | | | 83,952 | |

| Uranium Energy * | | | 12,235 | | | | 90,784 | |

| Valero Energy | | | 345 | | | | 44,767 | |

| Weatherford International | | | 298 | | | | 23,542 | |

| | | | | | | | 1,495,928 | |

| Financials — 10.5% | | | | | | | | |

| Affiliated Managers Group | | | 181 | | | | 35,096 | |

| Ally Financial | | | 1,137 | | | | 39,852 | |

| Ameriprise Financial | | | 32 | | | | 16,330 | |

| Annaly Capital Management ‡ | | | 2,203 | | | | 41,879 | |

| Associated Banc-Corp | | | 1,359 | | | | 32,263 | |

| Bank of America | | | 31,214 | | | | 1,305,369 | |

| Bank OZK | | | 515 | | | | 22,531 | |

| Cadence Bank | | | 976 | | | | 32,628 | |

| Carlyle Group | | | 850 | | | | 42,526 | |

| Citigroup | | | 8,959 | | | | 574,899 | |

| CME Group, Cl A | | | 1,167 | | | | 262,995 | |

| CNO Financial Group | | | 760 | | | | 26,144 | |

| Columbia Banking System | | | 1,003 | | | | 28,596 | |

| Commerce Bancshares | | | 694 | | | | 43,375 | |

| East West Bancorp | | | 571 | | | | 55,667 | |

| Equitable Holdings | | | 1,225 | | | | 55,542 | |

| Erie Indemnity, Cl A | | | 68 | | | | 30,521 | |

| Essent Group | | | 366 | | | | 21,964 | |

| Evercore, Cl A | | | 357 | | | | 94,309 | |

| Fidelity National Financial | | | 795 | | | | 47,835 | |

| Fidelity National Information Services | | | 2,166 | | | | 194,355 | |

| First American Financial | | | 609 | | | | 39,067 | |

| First Horizon | | | 2,124 | | | | 36,809 | |

| Glacier Bancorp | | | 884 | | | | 46,101 | |

| Goldman Sachs Group | | | 2,041 | | | | 1,056,809 | |

| Hanover Insurance Group | | | 236 | | | | 35,006 | |

| Interactive Brokers Group, Cl A | | | 383 | | | | 58,438 | |

| Invesco | | | 3,687 | | | | 63,933 | |

| Janus Henderson Group | | | 1,133 | | | | 46,804 | |

| Jefferies Financial Group | | | 631 | | | | 40,371 | |

| JPMorgan Chase | | | 15,883 | | | | 3,524,755 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC ASSET ALLOCATION FUND OCTOBER 31, 2024 |

| COMMON STOCK — continued | | | | | | |

| | | Shares | | | Value | |

| United States — continued | | | | | | | | |

| Financials — continued | | | | | | | | |

| Kinsale Capital Group | | | 83 | | | $ | 35,533 | |

| MarketAxess Holdings | | | 422 | | | | 122,135 | |

| Mastercard, Cl A | | | 847 | | | | 423,153 | |

| MGIC Investment | | | 1,180 | | | | 29,547 | |

| Morgan Stanley | | | 5,996 | | | | 697,035 | |

| Morningstar | | | 102 | | | | 33,461 | |

| Old National Bancorp | | | 1,510 | | | | 29,083 | |

| Old Republic International | | | 910 | | | | 31,786 | |

| PayPal Holdings * | | | 1,329 | | | | 105,390 | |

| Pinnacle Financial Partners | | | 403 | | | | 42,496 | |

| Primerica | | | 158 | | | | 43,736 | |

| Progressive | | | 1,111 | | | | 269,784 | |

| Reinsurance Group of America | | | 228 | | | | 48,126 | |

| RenaissanceRe Holdings | | | 168 | | | | 44,083 | |

| RLI | | | 230 | | | | 35,873 | |

| Selective Insurance Group | | | 535 | | | | 48,589 | |

| SLM | | | 1,103 | | | | 24,299 | |

| SouthState | | | 411 | | | | 40,085 | |

| State Street | | | 3,531 | | | | 327,677 | |

| Stifel Financial | | | 320 | | | | 33,158 | |

| Synovus Financial | | | 899 | | | | 44,833 | |

| T Rowe Price Group | | | 794 | | | | 87,229 | |

| Truist Financial | | | 3,502 | | | | 150,761 | |

| UMB Financial | | | 313 | | | | 34,345 | |

| United Bankshares | | | 858 | | | | 32,329 | |

| Unum Group | | | 569 | | | | 36,518 | |

| Valley National Bancorp | | | 3,668 | | | | 34,736 | |

| Visa, Cl A | | | 1,533 | | | | 444,340 | |

| Voya Financial | | | 501 | | | | 40,230 | |

| Webster Financial | | | 805 | | | | 41,699 | |

| Wells Fargo | | | 16,240 | | | | 1,054,301 | |

| Western Union | | | 2,021 | | | | 21,746 | |

| WEX * | | | 239 | | | | 41,251 | |

| Willis Towers Watson | | | 308 | | | | 93,075 | |

| Zions Bancorp | | | 743 | | | | 38,681 | |

| | | | | | | | 12,613,872 | |

| Health Care — 3.0% | | | | | | | | |

| Abbott Laboratories | | | 2,723 | | | | 308,707 | |

| Acadia Healthcare * | | | 530 | | | | 22,626 | |

| Alcon | | | 2,194 | | | | 201,738 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC ASSET ALLOCATION FUND OCTOBER 31, 2024 |

| COMMON STOCK — continued | | | | | | |

| | | Shares | | | Value | |

| United States — continued | | | | | | | | |

| Health Care — continued | | | | | | | | |

| Amedisys * | | | 215 | | | $ | 20,339 | |

| Avantor * | | | 2,588 | | | | 57,894 | |

| BioMarin Pharmaceutical * | | | 756 | | | | 49,813 | |

| Bristol-Myers Squibb | | | 392 | | | | 21,862 | |

| Bruker | | | 471 | | | | 26,663 | |

| Charles River Laboratories International * | | | 667 | | | | 119,113 | |

| Chemed | | | 62 | | | | 33,495 | |

| Cigna Group | | | 52 | | | | 16,370 | |

| CVS Health | | | 224 | | | | 12,647 | |

| Cytokinetics * | | | 511 | | | | 26,061 | |

| Danaher | | | 351 | | | | 86,227 | |

| DENTSPLY SIRONA | | | 1,274 | | | | 29,519 | |

| Edwards Lifesciences * | | | 216 | | | | 14,474 | |

| Elevance Health | | | 198 | | | | 80,340 | |

| Encompass Health | | | 505 | | | | 50,227 | |

| Exelixis * | | | 1,086 | | | | 36,055 | |

| Gilead Sciences | | | 175 | | | | 15,543 | |

| Globus Medical, Cl A * | | | 454 | | | | 33,387 | |

| Haemonetics * | | | 315 | | | | 22,415 | |

| Halozyme Therapeutics * | | | 547 | | | | 27,662 | |

| HealthEquity * | | | 386 | | | | 32,906 | |

| IDEXX Laboratories * | | | 628 | | | | 255,546 | |

| Illumina * | | | 650 | | | | 93,691 | |

| Intuitive Surgical * | | | 61 | | | | 30,734 | |

| Jazz Pharmaceuticals * | | | 322 | | | | 35,430 | |

| Johnson & Johnson | | | 2,407 | | | | 384,783 | |

| Lantheus Holdings * | | | 302 | | | | 33,172 | |

| Medpace Holdings * | | | 87 | | | | 27,337 | |

| Merck | | | 1,870 | | | | 191,338 | |

| Mettler-Toledo International * | | | 56 | | | | 72,338 | |

| Neurocrine Biosciences * | | | 422 | | | | 50,754 | |

| Option Care Health * | | | 856 | | | | 19,722 | |

| Penumbra * | | | 202 | | | | 46,232 | |

| Repligen * | | | 253 | | | | 33,970 | |

| Sarepta Therapeutics * | | | 351 | | | | 44,226 | |

| Tenet Healthcare * | | | 345 | | | | 53,482 | |

| Thermo Fisher Scientific | | | 485 | | | | 264,965 | |

| United Therapeutics * | | | 181 | | | | 67,689 | |

| UnitedHealth Group | | | 367 | | | | 207,171 | |

| Veeva Systems, Cl A * | | | 655 | | | | 136,784 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC ASSET ALLOCATION FUND OCTOBER 31, 2024 |

| COMMON STOCK — continued | | | | | | |

| | | Shares | | | Value | |

| United States — continued | | | | | | | | |

| Health Care — continued | | | | | | | | |

| Vertex Pharmaceuticals * | | | 274 | | | $ | 130,419 | |

| | | | | | | | 3,525,866 | |

| Industrials — 5.2% | | | | | | | | |

| Acuity Brands | | | 179 | | | | 53,824 | |

| Advanced Drainage Systems | | | 273 | | | | 40,917 | |

| AECOM | | | 541 | | | | 57,779 | |

| AGCO | | | 330 | | | | 32,947 | |

| Allegion | | | 1,890 | | | | 263,901 | |

| Applied Industrial Technologies | | | 149 | | | | 34,507 | |

| Automatic Data Processing | | | 109 | | | | 31,527 | |

| Booz Allen Hamilton Holding, Cl A | | | 670 | | | | 121,712 | |

| Broadridge Financial Solutions | | | 804 | | | | 169,531 | |

| BWX Technologies | | | 1,183 | | | | 144,030 | |

| CACI International, Cl A * | | | 89 | | | | 49,178 | |

| Carlisle | | | 164 | | | | 69,246 | |

| Caterpillar | | | 330 | | | | 124,146 | |

| Chart Industries * | | | 187 | | | | 22,575 | |

| Cintas | | | 421 | | | | 86,646 | |

| Clean Harbors * | | | 132 | | | | 30,526 | |

| Comfort Systems USA | | | 149 | | | | 58,265 | |

| Core & Main, Cl A * | | | 765 | | | | 33,874 | |

| Crane | | | 219 | | | | 34,444 | |

| Curtiss-Wright | | | 141 | | | | 48,639 | |

| Donaldson | | | 686 | | | | 50,188 | |

| Eaton | | | 337 | | | | 111,743 | |

| EMCOR Group | | | 311 | | | | 138,728 | |

| Emerson Electric | | | 119 | | | | 12,884 | |

| ExlService Holdings * | | | 982 | | | | 40,920 | |

| Exponent | | | 207 | | | | 19,537 | |

| Fastenal | | | 301 | | | | 23,532 | |

| FedEx | | | 245 | | | | 67,093 | |

| Flowserve | | | 662 | | | | 34,848 | |

| Fluor * | | | 588 | | | | 30,741 | |

| Fortune Brands Innovations | | | 788 | | | | 65,664 | |

| FTI Consulting * | | | 166 | | | | 32,383 | |

| GATX | | | 279 | | | | 38,435 | |

| GE Vernova * | | | 323 | | | | 97,436 | |

| Generac Holdings * | | | 278 | | | | 46,023 | |

| General Electric | | | 873 | | | | 149,964 | |

| Graco | | | 814 | | | | 66,300 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC ASSET ALLOCATION FUND OCTOBER 31, 2024 |

| COMMON STOCK — continued | | | | | | |

| | | Shares | | | Value | |

| United States — continued | | | | | | | | |

| Industrials — continued | | | | | | | | |

| GXO Logistics * | | | 635 | | | $ | 37,979 | |

| Hexcel | | | 460 | | | | 26,997 | |

| Honeywell International | | | 1,801 | | | | 370,430 | |

| Hubbell, Cl B | | | 122 | | | | 52,098 | |

| Illinois Tool Works | | | 306 | | | | 79,906 | |

| ITT | | | 362 | | | | 50,723 | |

| KBR | | | 788 | | | | 52,804 | |

| Knight-Swift Transportation Holdings, Cl A | | | 690 | | | | 35,935 | |

| Landstar System | | | 503 | | | | 88,412 | |

| Lennox International | | | 147 | | | | 88,578 | |

| Lincoln Electric Holdings | | | 256 | | | | 49,295 | |

| Lockheed Martin | | | 32 | | | | 17,474 | |

| MasTec * | | | 1,292 | | | | 158,774 | |

| MSA Safety | | | 211 | | | | 35,015 | |

| NuScale Power * | | | 7,484 | | | | 143,244 | |

| nVent Electric | | | 1,238 | | | | 92,318 | |

| Old Dominion Freight Line | | | 476 | | | | 95,828 | |

| Owens Corning | | | 362 | | | | 63,998 | |

| Parker-Hannifin | | | 174 | | | | 110,328 | |

| Paychex | | | 996 | | | | 138,773 | |

| Paylocity Holding * | | | 247 | | | | 45,589 | |

| Quanta Services | | | 511 | | | | 154,133 | |

| Regal Rexnord | | | 266 | | | | 44,300 | |

| Republic Services, Cl A | | | 322 | | | | 63,756 | |

| Rockwell Automation | | | 765 | | | | 204,033 | |

| Ryder System | | | 273 | | | | 39,934 | |

| Saia * | | | 104 | | | | 50,815 | |

| Simpson Manufacturing | | | 164 | | | | 29,486 | |

| Sunrun * | | | 2,655 | | | | 38,365 | |

| Terex | | | 398 | | | | 20,581 | |

| Tetra Tech | | | 959 | | | | 46,876 | |

| Toro | | | 545 | | | | 43,862 | |

| Trane Technologies | | | 269 | | | | 99,573 | |

| Trex * | | | 371 | | | | 26,285 | |

| UFP Industries | | | 175 | | | | 21,410 | |

| Union Pacific | | | 1,048 | | | | 243,209 | |

| United Parcel Service, Cl B | | | 695 | | | | 93,172 | |

| United Rentals | | | 129 | | | | 104,851 | |

| Valmont Industries | | | 94 | | | | 29,298 | |

| Vertiv Holdings, Cl A | | | 600 | | | | 65,574 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC ASSET ALLOCATION FUND OCTOBER 31, 2024 |

| COMMON STOCK — continued | | | | | | |

| | | Shares | | | Value | |

| United States — continued | | | | | | | | |

| Industrials — continued | | | | | | | | |

| Watsco | | | 126 | | | $ | 59,599 | |

| Watts Water Technologies, Cl A | | | 207 | | | | 39,452 | |

| WESCO International | | | 196 | | | | 37,626 | |

| Westinghouse Air Brake Technologies | | | 1,148 | | | | 215,801 | |

| Woodward | | | 290 | | | | 47,586 | |

| WW Grainger | | | 30 | | | | 33,277 | |

| XPO * | | | 428 | | | | 55,867 | |

| | | | | | | | 6,277,852 | |

| Information Technology — 20.9% | | | | | | | | |

| Accenture, Cl A | | | 1,401 | | | | 483,093 | |

| Adobe * | | | 835 | | | | 399,197 | |

| Advanced Micro Devices * | | | 1,920 | | | | 276,614 | |

| Akamai Technologies * | | | 2,582 | | | | 260,988 | |

| Amphenol, Cl A | | | 1,352 | | | | 90,611 | |

| Analog Devices | | | 773 | | | | 172,464 | |

| Appfolio, Cl A * | | | 113 | | | | 23,489 | |

| Apple | | | 1,972 | | | | 445,494 | |

| Applied Materials | | | 934 | | | | 169,596 | |

| AppLovin, Cl A * | | | 3,111 | | | | 526,972 | |

| Arista Networks * | | | 474 | | | | 183,172 | |

| ASGN * | | | 309 | | | | 28,459 | |

| Aspen Technology * | | | 155 | | | | 36,383 | |

| Atlassian, Cl A * | | | 805 | | | | 151,775 | |

| Autodesk * | | | 544 | | | | 154,387 | |

| Avnet | | | 816 | | | | 44,235 | |

| Belden | | | 262 | | | | 29,834 | |

| Blackbaud * | | | 315 | | | | 23,786 | |

| Broadcom | | | 7,210 | | | | 1,224,042 | |

| Cadence Design Systems * | | | 630 | | | | 173,956 | |

| CCC Intelligent Solutions Holdings * | | | 19,099 | | | | 198,821 | |

| Check Point Software Technologies * | | | 1,461 | | | | 253,060 | |

| Ciena * | | | 658 | | | | 41,790 | |

| Cirrus Logic * | | | 266 | | | | 29,212 | |

| Cisco Systems | | | 4,408 | | | | 241,426 | |

| Cloudflare, Cl A * | | | 3,981 | | | | 349,173 | |

| Cognex | | | 699 | | | | 28,121 | |

| Coherent * | | | 533 | | | | 49,270 | |

| CommVault Systems * | | | 185 | | | | 28,895 | |

| Crowdstrike Holdings, Cl A * | | | 1,916 | | | | 568,803 | |

| CyberArk Software * | | | 859 | | | | 237,531 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC ASSET ALLOCATION FUND OCTOBER 31, 2024 |

| COMMON STOCK — continued | | | | | | |

| | | Shares | | | Value | |

| United States — continued | | | | | | | | |

| Information Technology — continued | | | | | | | | |

| Datadog, Cl A * | | | 3,222 | | | $ | 404,168 | |

| DocuSign, Cl A * | | | 1,778 | | | | 123,358 | |

| Dolby Laboratories, Cl A | | | 454 | | | | 33,097 | |

| Dropbox, Cl A * | | | 1,204 | | | | 31,123 | |

| Dynatrace * | | | 6,041 | | | | 325,006 | |

| Enphase Energy * | | | 401 | | | | 33,299 | |

| First Solar * | | | 213 | | | | 41,424 | |

| Fortinet * | | | 8,067 | | | | 634,550 | |

| Gartner * | | | 27 | | | | 13,567 | |

| Gen Digital | | | 12,308 | | | | 358,286 | |

| GLOBALFOUNDRIES * | | | 2,765 | | | | 100,922 | |

| GoDaddy, Cl A * | | | 795 | | | | 132,606 | |

| Guidewire Software * | | | 672 | | | | 125,167 | |

| HubSpot * | | | 243 | | | | 134,814 | |

| International Business Machines | | | 913 | | | | 188,735 | |

| Intuit | | | 358 | | | | 218,487 | |

| KLA | | | 228 | | | | 151,900 | |

| Kyndryl Holdings * | | | 935 | | | | 21,402 | |

| Lam Research | | | 2,211 | | | | 164,388 | |

| Lattice Semiconductor * | | | 752 | | | | 38,096 | |

| Littelfuse | | | 130 | | | | 31,802 | |

| Manhattan Associates * | | | 695 | | | | 183,035 | |

| Marvell Technology | | | 2,113 | | | | 169,272 | |

| Microchip Technology | | | 1,710 | | | | 125,463 | |

| Micron Technology | | | 1,592 | | | | 158,643 | |

| Microsoft | | | 9,864 | | | | 4,008,236 | |

| MKS Instruments | | | 334 | | | | 33,176 | |

| Monday.com * | | | 444 | | | | 130,478 | |

| MongoDB, Cl A * | | | 467 | | | | 126,277 | |

| Motorola Solutions | | | 676 | | | | 303,761 | |

| Novanta * | | | 200 | | | | 34,048 | |

| Nutanix, Cl A * | | | 2,027 | | | | 125,877 | |

| NVIDIA | | | 24,143 | | | | 3,205,225 | |

| Okta, Cl A * | | | 3,247 | | | | 233,427 | |

| ON Semiconductor * | | | 1,616 | | | | 113,912 | |

| Onto Innovation * | | | 232 | | | | 46,013 | |

| Oracle | | | 3,640 | | | | 610,938 | |

| Palantir Technologies, Cl A * | | | 3,433 | | | | 142,675 | |

| Palo Alto Networks * | | | 1,892 | | | | 681,744 | |

| Power Integrations | | | 409 | | | | 24,716 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC ASSET ALLOCATION FUND OCTOBER 31, 2024 |

| COMMON STOCK — continued | | | | | | |

| | | Shares | | | Value | |

| United States — continued | | | | | | | | |

| Information Technology — continued | | | | | | | | |

| Pure Storage, Cl A * | | | 3,502 | | | $ | 175,275 | |

| QUALCOMM | | | 3,054 | | | | 497,100 | |

| Rambus * | | | 599 | | | | 28,644 | |

| Roper Technologies | | | 449 | | | | 241,441 | |

| Salesforce | | | 969 | | | | 282,338 | |

| Samsara, Cl A * | | | 2,347 | | | | 112,163 | |

| SentinelOne, Cl A * | | | 8,730 | | | | 225,147 | |

| ServiceNow * | | | 501 | | | | 467,428 | |

| Silicon Laboratories * | | | 247 | | | | 25,653 | |

| Snowflake, Cl A * | | | 1,158 | | | | 132,962 | |

| SolarEdge Technologies * | | | 1,660 | | | | 28,320 | |

| Super Micro Computer * | | | 3,697 | | | | 107,620 | |

| Synopsys * | | | 815 | | | | 418,592 | |

| TD SYNNEX | | | 239 | | | | 27,569 | |

| TE Connectivity | | | 1,868 | | | | 275,381 | |

| Teradata * | | | 714 | | | | 23,012 | |

| Texas Instruments | | | 1,208 | | | | 245,417 | |

| Twilio, Cl A * | | | 1,755 | | | | 141,541 | |

| Universal Display | | | 166 | | | | 29,933 | |

| Varonis Systems, Cl B * | | | 3,681 | | | | 185,412 | |

| Workday, Cl A * | | | 637 | | | | 148,962 | |

| Zoom Video Communications, Cl A * | | | 1,831 | | | | 136,849 | |

| Zscaler * | | | 1,754 | | | | 317,106 | |

| | | | | | | | 24,961,627 | |

| Materials — 0.8% | | | | | | | | |

| Alcoa | | | 771 | | | | 30,909 | |

| AptarGroup | | | 307 | | | | 51,548 | |

| Axalta Coating Systems * | | | 1,419 | | | | 53,809 | |

| Berry Global Group | | | 556 | | | | 39,170 | |

| Cabot | | | 309 | | | | 33,320 | |

| Chemours | | | 869 | | | | 15,781 | |

| Cleveland-Cliffs * | | | 1,849 | | | | 24,000 | |

| Commercial Metals | | | 639 | | | | 34,378 | |

| Crown Holdings | | | 486 | | | | 45,465 | |

| DuPont de Nemours | | | 1,136 | | | | 94,277 | |

| Graphic Packaging Holding | | | 1,442 | | | | 40,751 | |

| Knife River * | | | 285 | | | | 27,736 | |

| Linde | | | 412 | | | | 187,934 | |

| Louisiana-Pacific | | | 281 | | | | 27,791 | |

| Olin | | | 624 | | | | 25,603 | |

The accompanying notes are an integral part of the financial statements.

| THE ADVISORS’ INNER CIRCLE FUND III | PINEBRIDGE DYNAMIC ASSET ALLOCATION FUND OCTOBER 31, 2024 |

| COMMON STOCK — continued | | | | | | |

| | | Shares | | | Value | |

| United States — continued | | | | | | | | |

| Materials — continued | | | | | | | | |

| Reliance | | | 219 | | | $ | 62,709 | |

| Royal Gold | | | 322 | | | | 47,031 | |

| RPM International | | | 547 | | | | 69,529 | |

| Sonoco Products | | | 577 | | | | 30,304 | |

| Southern Copper | | | 291 | | | | 31,879 | |

| | | | | | | | 973,924 | |

| Real Estate — 2.6% | | | | | | | | |

| Agree Realty ‡ | | | 396 | | | | 29,403 | |

| American Homes 4 Rent, Cl A ‡ | | | 1,044 | | | | 36,791 | |

| American Tower ‡ | | | 1,503 | | | | 320,951 | |

| Brixmor Property Group ‡ | | | 1,227 | | | | 33,068 | |

| COPT Defense Properties ‡ | | | 1,057 | | | | 34,035 | |

| Cousins Properties ‡ | | | 1,370 | | | | 41,963 | |

| Crown Castle ‡ | | | 2,506 | | | | 269,370 | |

| CubeSmart ‡ | | | 1,110 | | | | 53,102 | |

| Digital Realty Trust ‡ | | | 1,815 | | | | 323,487 | |

| EastGroup Properties ‡ | | | 245 | | | | 41,964 | |

| Equinix ‡ | | | 379 | | | | 344,162 | |

| Equity LifeStyle Properties ‡ | | | 515 | | | | 36,112 | |