Exhibit (c)(3)

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\1

Project Maple

Discussion Materials

7 November 2017

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\2

Project Maple

Table of Contents

Section 1 Market Update

Section 2 Review of Maple Management Forecasts Section 3 Preliminary Financial Analysis Section 4 Tactical Considerations Appendix A PoS Adjusted Financials Appendix BNon-PoS Adjusted Financials Appendix C Assumptions Details Appendix D Financial Analysis Reference Materials Appendix E Partial Purchase Reference Materials

2

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\3

Project Maple

Meeting Objectives

1 • Brief Public Market Update

2 • Review Maple Management Forecast and Assumptions 3 • Discuss Preliminary Standalone Financial Analysis 4 • Review Potential Tactical Responses and Next Steps

3

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\4

Project Maple

Section 1

Market Update

4

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\5

Project Maple

MARKET UPDATE

Maple Share Price Performance

Last Twelve Months

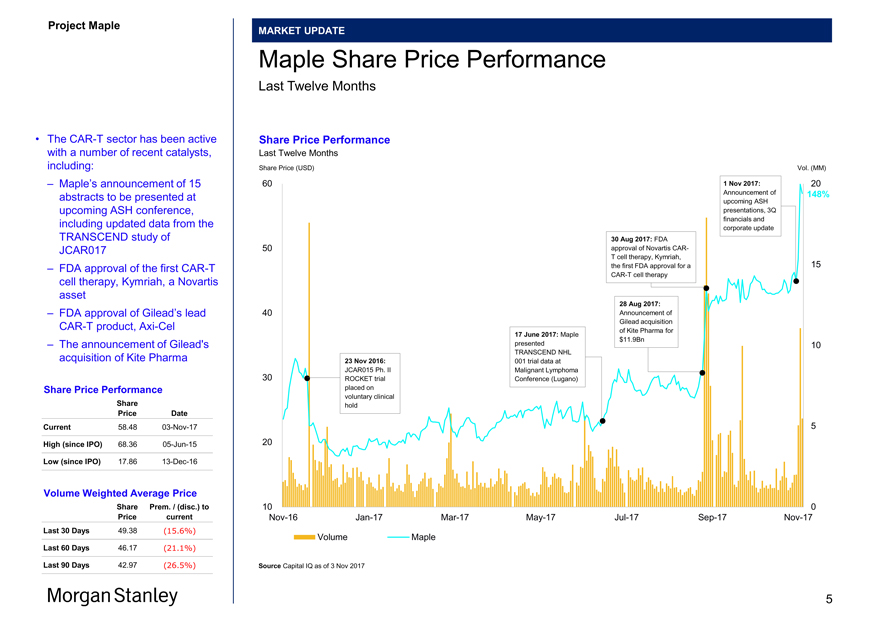

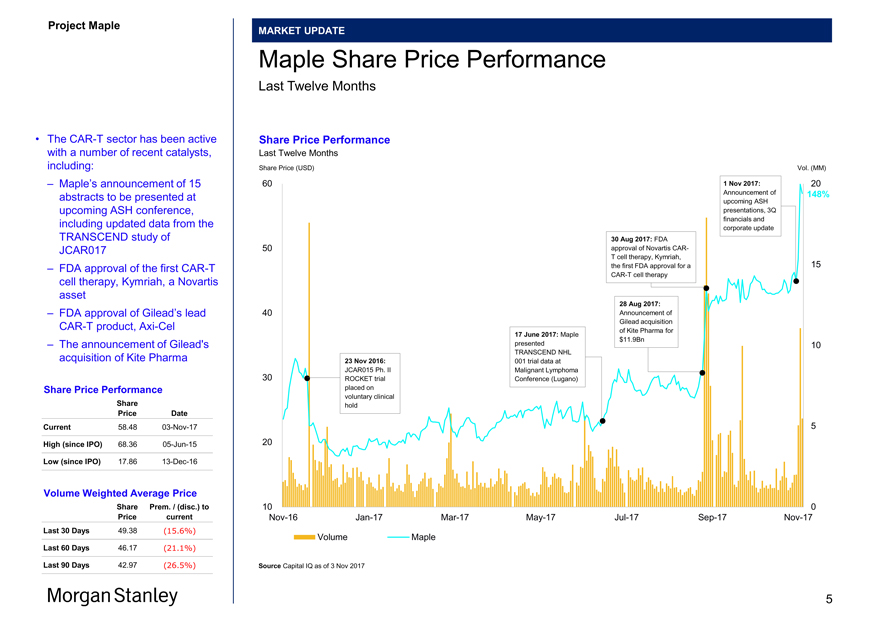

• TheCAR-T sector has been active Share Price Performance with a number of recent catalysts, Last Twelve Months

including: Share Price (USD) Vol. (MM)

– Maple’s announcement of 15 60 1 Nov 2017: 20 abstracts to be presented at Announcement of 148%

upcoming ASH

upcoming ASH conference, presentations, 3Q

financials and

including updated data from the

corporate update

TRANSCEND study of 30 Aug 2017: FDA

JCAR017 50 approval of Novartis CAR-

T cell therapy, Kymriah, 15

– FDA approval of the firstCAR-T the first FDA approval for a

CAR-T cell therapy

cell therapy, Kymriah, a Novartis asset

28 Aug 2017:

– FDA approval of Gilead’s lead 40 Announcement of

CAR-T product,Axi-Cel Gilead acquisition

of Kite Pharma for

17 June 2017: Maple $11.9Bn

– The announcement of Gilead’s presented 10

TRANSCEND NHL

acquisition of Kite Pharma 23 Nov 2016: 001 trial data at

JCAR015 Ph. II Malignant Lymphoma

30 ROCKET trial Conference (Lugano)

Share Price Performance placed on

Share voluntary clinical hold

Price Date

Current 58.4803-Nov-17 5

High (since IPO) 68.3605-Jun-15 20

Low (since IPO) 17.8613-Dec-16

Volume Weighted Average Price

Share Prem. / (disc.) to 10 0

Price currentNov-16Jan-17Mar-17May-17Jul-17Sep-17Nov-17

Last 30 Days 49.38 (15.6%)

Volume Maple

Last 60 Days 46.17 (21.1%)

Last 90 Days 42.97 (26.5%) Source Capital IQ as of 3 Nov 2017

5

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\6

Project Maple

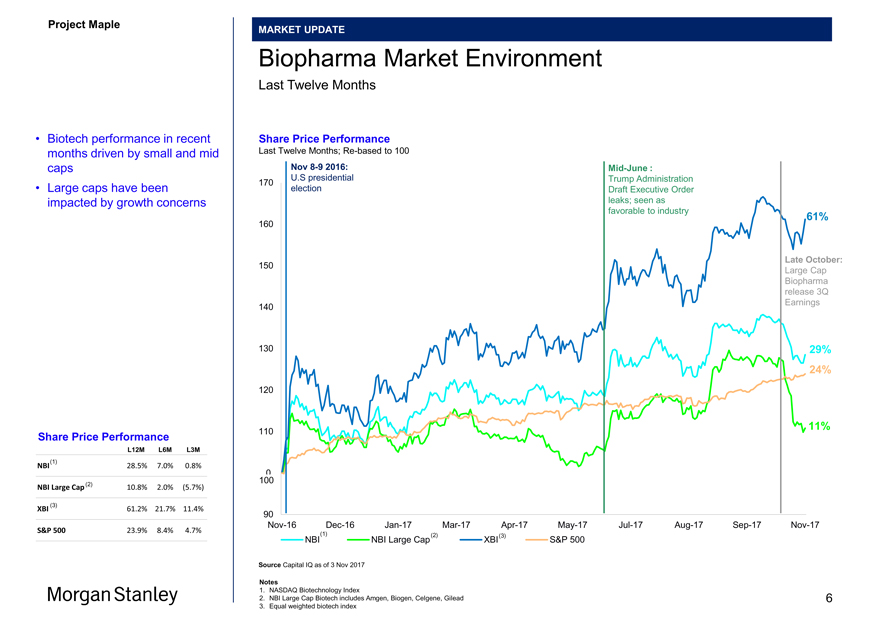

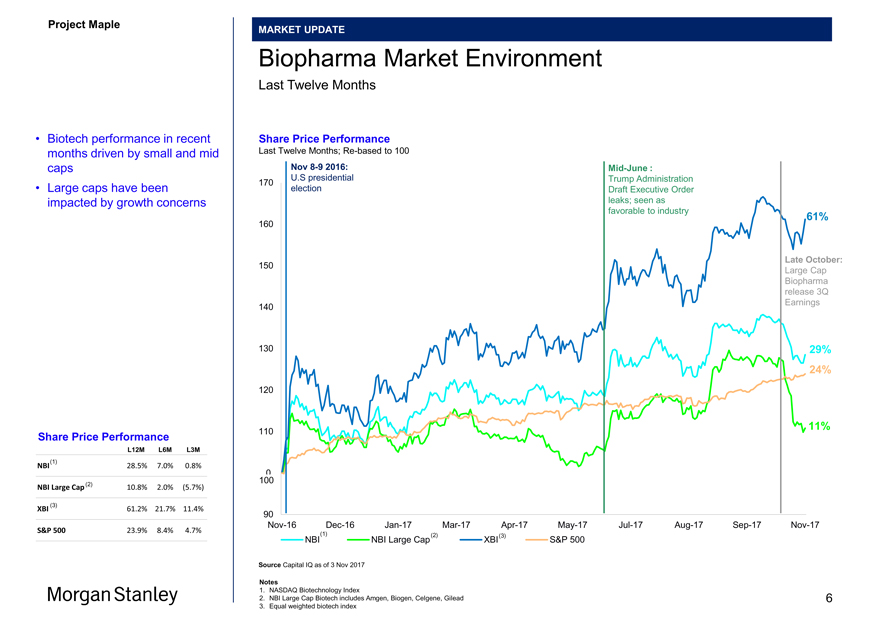

MARKET UPDATE

Biopharma Market Environment

Last Twelve Months

• Biotech performance in recent Share Price Performance

months driven by small and mid Last Twelve Months;Re-based to 100 caps Nov8-9 2016:Mid-June :

U.S presidential Trump Administration 170

• Large caps have been election Draft Executive Order

impacted by growth concerns leaks; seen as

favorable to industry

61%

160

Late October:

150

Large Cap Biopharma release 3Q Earnings 140

130 29% 24%

120

11%

110

Share Price Performance

L12M L6M L3M

(1)

NBI 28.5% 7.0% 0.8% 0 100

NBI Large Cap (2) 10.8% 2.0% (5.7%)

(3)

XBI 61.2% 21.7% 11.4%

90

Nov-16Dec-16Jan-17Mar-17Apr-17May-17Jul-17Aug-17Sep-17Nov-17

S&P 500 23.9% 8.4% 4.7%

(1) (2) (3)

NBI NBI Large Cap XBI S&P 500

Source Capital IQ as of 3 Nov 2017

Notes

1. NASDAQ Biotechnology Index

2. NBI Large Cap Biotech includes Amgen, Biogen, Celgene, Gilead 6

3. Equal weighted biotech index

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\7

Project Maple

Section 2

Review of Maple Management Forecasts

7

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\8

Project Maple

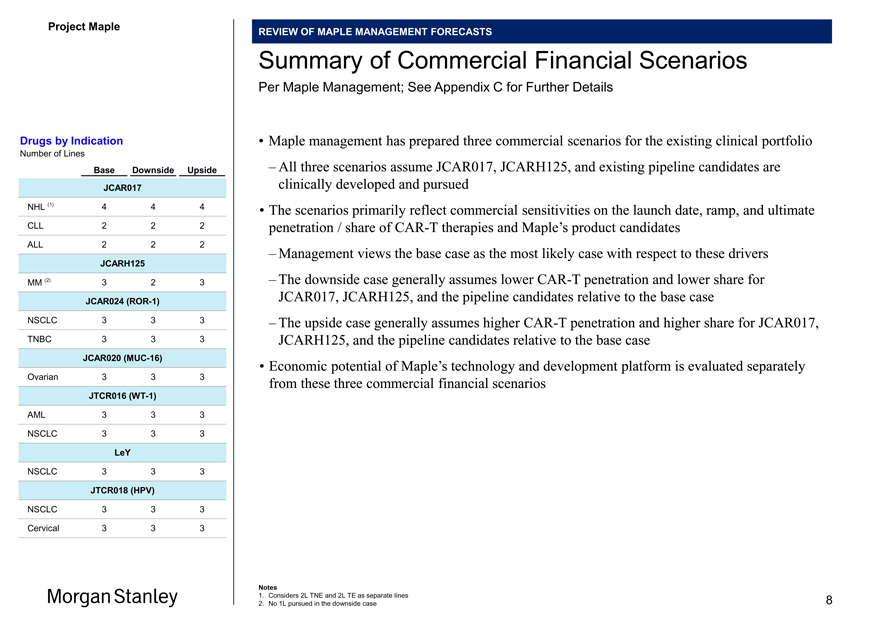

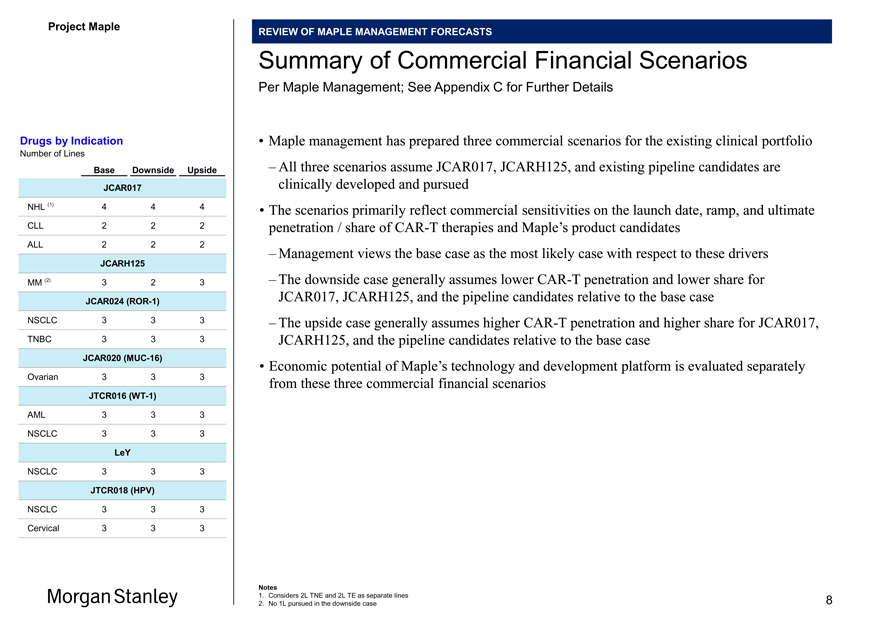

REVIEW OF MAPLE MANAGEMENT FORECASTS

Summary of Commercial Financial Scenarios

Per Maple Management; See Appendix C for Further Details

Drugs by Indication • Maple management has prepared three commercial scenarios for the existing clinical portfolio

Number of Lines

Base Downside Upside – All three scenarios assume JCAR017, JCARH125, and existing pipeline candidates are JCAR017 clinically developed and pursued NHL (1) 4 4 4 • The scenarios primarily reflect commercial sensitivities on the launch date, ramp, and ultimate

CLL 2 2 2 penetration / share ofCAR-T therapies and Maple’s product candidates

ALL 2 2 2

– Management views the base case as the most likely case with respect to these drivers

JCARH125

MM (2) 3 2 3 – The downside case generally assumes lowerCAR-T penetration and lower share for JCAR024(ROR-1) JCAR017, JCARH125, and the pipeline candidates relative to the base case

NSCLC 3 3 3 – The upside case generally assumes higherCAR-T penetration and higher share for JCAR017, TNBC 3 3 3 JCARH125, and the pipeline candidates relative to the base case

JCAR020(MUC-16)

• Economic potential of Maple’s technology and development platform is evaluated separately

Ovarian 3 3 3 from these three commercial financial scenarios

JTCR016(WT-1)

AML 3 3 3 NSCLC 3 3 3

LeY

NSCLC 3 3 3

JTCR018 (HPV)

NSCLC 3 3 3

Cervical 3 3 3

Notes

1. Considers 2L TNE and 2L TE as separate lines 8

2. No 1L pursued in the downside case

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\17

Project Maple

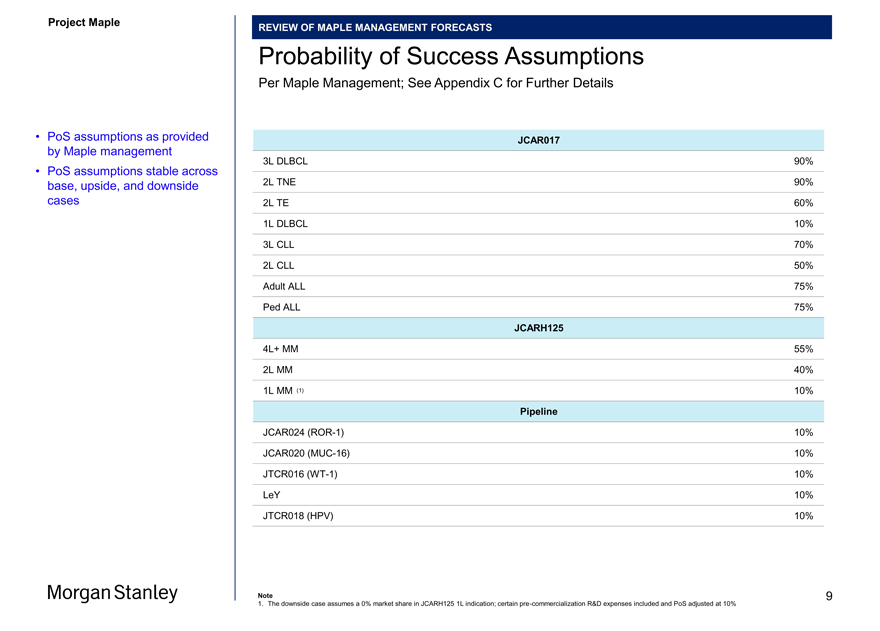

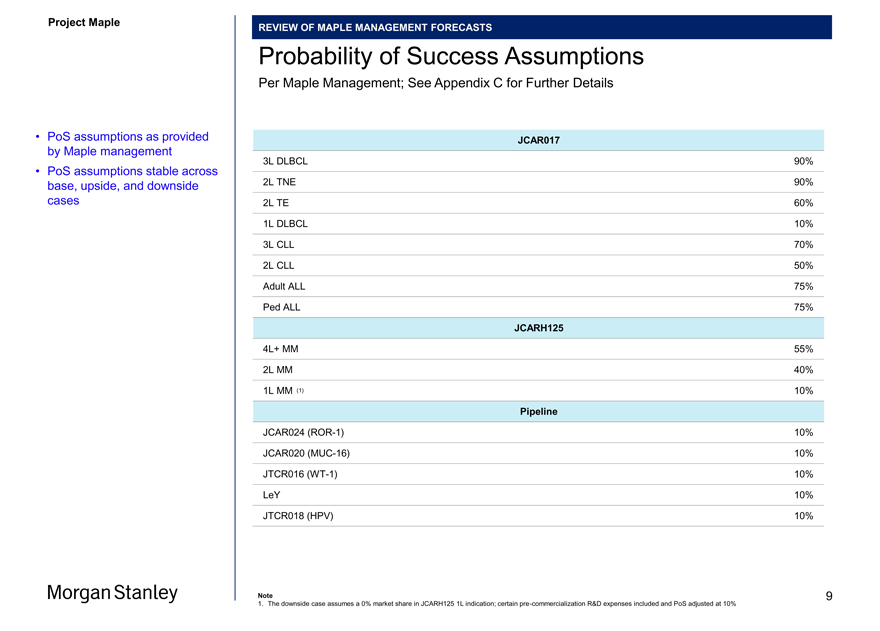

REVIEW OF MAPLE MANAGEMENT FORECASTS

Probability of Success Assumptions

Per Maple Management; See Appendix C for Further Details

• PoS assumptions as provided JCAR017 by Maple management

• PoS assumptions stable across 3L DLBCL 90% base, upside, and downside 2L TNE 90%

cases 2L TE 60%

1L DLBCL 10%

3L CLL 70%

2L CLL 50% Adult ALL 75% Ped ALL 75%

JCARH125

4L+ MM 55%

2L MM 40%

1L MM (1) 10%

Pipeline

JCAR024(ROR-1) 10% JCAR020(MUC-16) 10% JTCR016(WT-1) 10% LeY 10% JTCR018 (HPV) 10%

Note 9

1. The downside case assumes a 0% market share in JCARH125 1L indication; certainpre-commercialization R&D expenses included and PoS adjusted at 10%

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\9

Project Maple

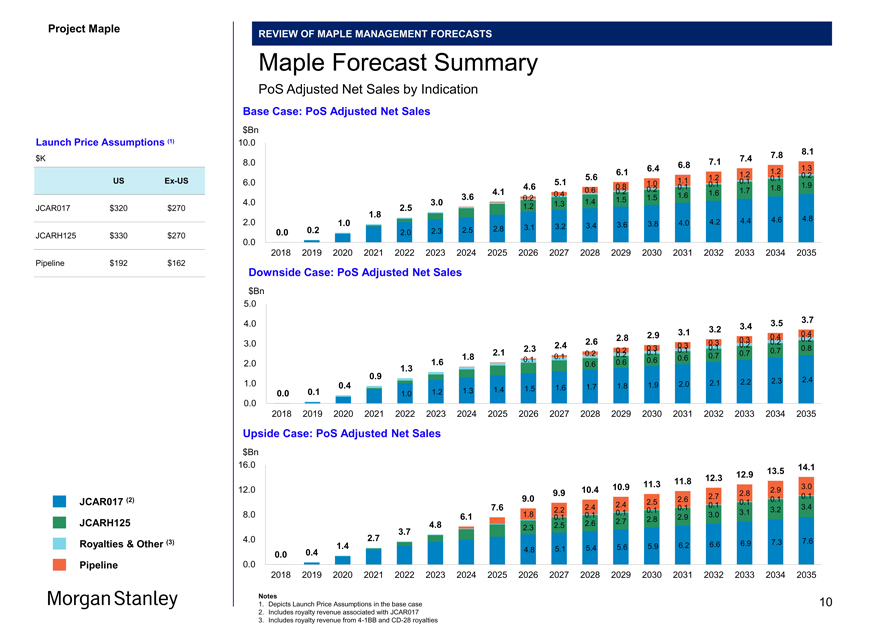

REVIEW OF MAPLE MANAGEMENT FORECASTS

Maple Forecast Summary

PoS Adjusted Net Sales by Indication

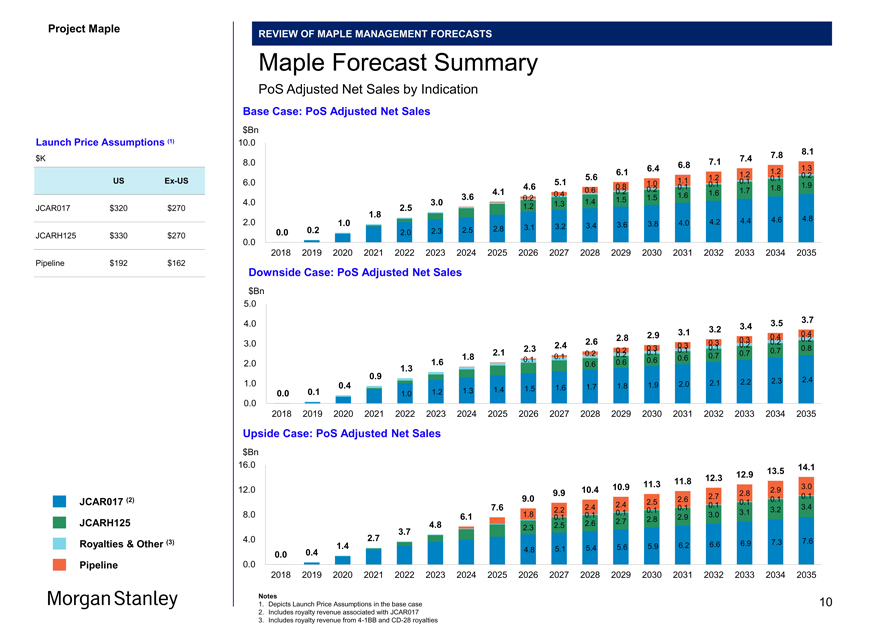

Base Case: PoS Adjusted Net Sales $Bn

Launch Price Assumptions (1) 10.0 $K 7.8 8.1

7.1 7.4

8.0 6.8

6.4 1.3

6.1 1.2 1.2

5.6 1.2 0.1 0.2 USEx-US 6.0 5.1 1.0 1.1 0.1

4.6 0.8 0.1 0.1 1.9

0.6 0.2 1.7 1.8

4.1 0.4 0.2 1.6

3.6 0.2 1.5 1.6

4.0 3.0 1.4 1.5

2.5 1.2 1.3

JCAR017 $320 $270

1.8

4.4 4.6 4.8

2.0 1.0 3.6 3.8 4.0 4.2

2.8 3.1 3.2 3.4

0.0 0.2 2.0 2.3 2.5

JCARH125 $330 $270

0.0

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035

Pipeline $192 $162 Downside Case: PoS Adjusted Net Sales $Bn

5.0

4.0 3.5 3.7

3.2 3.4

2.9 3.1 0.4

2.8 0.3 0.4 0.2

3.0 2.6 0.3 0.2 0.2

2.3 2.4 0.3 0.3 0.1 0.8

2.1 0.2 0.2 0.1 0.1 0.7 0.7

1.8 0.1 0.2 0.7

0.1 0.6 0.6

2.0 1.6 0.6 0.6

0.9 1.3

2.2 2.3 2.4

1.0 0.4 1.8 1.9 2.0 2.1

1.4 1.5 1.6 1.7

0.0 0.1 1.0 1.2 1.3

0.0

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035

Upside Case: PoS Adjusted Net Sales $Bn

16.0 14.1

12.9 13.5 11.8 12.3 10.9 11.3 3.0 12.0 9.9 10.4 2.8 2.9

9.0 2.6 2.7 0.1 0.1

JCAR017 (2) 2.5 0.1

7.6 2.4 2.4 0.1 0.1 3.4

2.2 0.1 0.1 3.1 3.2

8.0 6.1 1.8 0.1 0.1 2.9 3.0

2.7 2.8

JCARH125 4.8 2.5 2.6

2.3

3.7

4.0 2.7 7.6

Royalties & Other (3) 1.4 6.2 6.6 6.9 7.3

5.1 5.4 5.6 5.9

0.4 4.8

0.0

Pipeline 0.0

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035

Notes

1. Depicts Launch Price Assumptions in the base case 10

2. Includes royalty revenue associated with JCAR017

3. Includes royalty revenue from4-1BB andCD-28 royalties

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\10

Project Maple

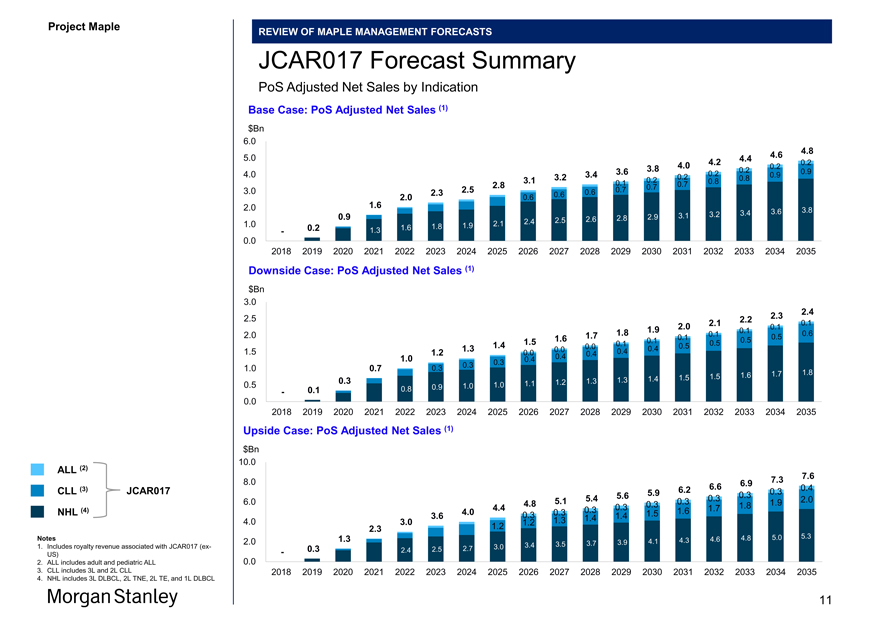

REVIEW OF MAPLE MANAGEMENT FORECASTS

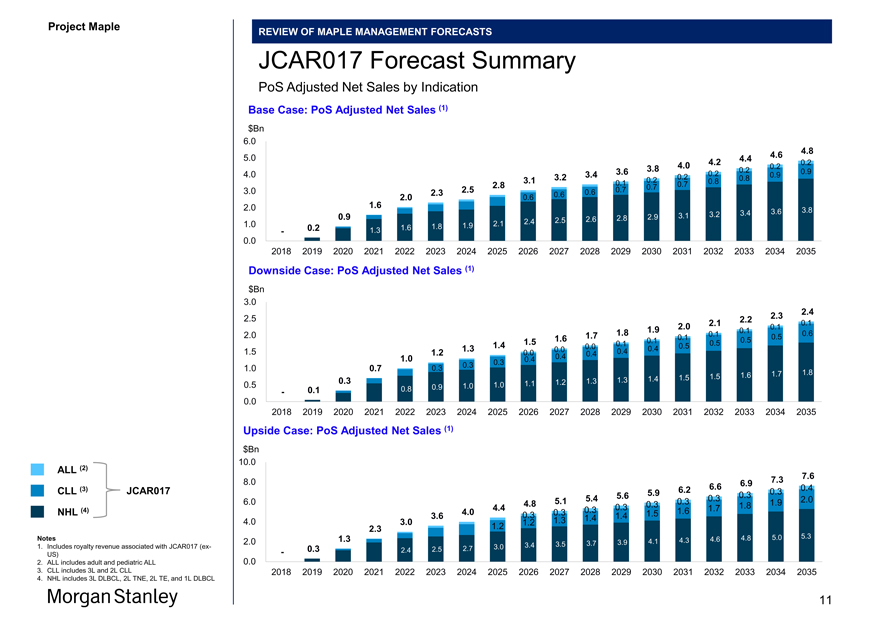

JCAR017 Forecast Summary

PoS Adjusted Net Sales by Indication

Base Case: PoS Adjusted Net Sales (1) $Bn

6.0

4.8

5.0 4.2 4.4 4.6 0.2

3.8 4.0 0.2

3.6 0.2 0.9

4.0 3.2 3.4 0.2 0.2 0.9

3.1 0.2 0.8 0.8

2.8 0.1 0.7

3.0 2.5 0.7 0.7

2.3 0.6 0.6

1.6 2.0 0.6

2.0 3.8

3.2 3.4 3.6

0.9 2.8 2.9 3.1

2.4 2.5 2.6

1.0 1.8 1.9 2.1

- 0.2 1.3 1.6

0.0—

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035

Downside Case: PoS Adjusted Net Sales (1) $Bn

3.0

2.4

2.5 2.1 2.2 2.3 0.1

1.9 2.0 0.1

1.8 0.1 0.6

2.0 1.7 0.1 0.1 0.5

1.5 1.6 0.1 0.5

1.4 0.1 0.5 0.5

1.3 0.0 0.0 0.4

1.5 1.2 0.0 0.4 0.4

1.0 0.4 0.4

0.3 0.3

1.0 0.7 0.3

1.6 1.7 1.8

1.4 1.5 1.5

0.3 1.2 1.3 1.3

0.5 1.0 1.0 1.1

0.1 0.8 0.9

-

0.0—

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035

Upside Case: PoS Adjusted Net Sales (1) $Bn 10.0

ALL (2)

7.3 7.6

8.0 6.9

CLL (3) JCAR017 6.2 6.6 0.4

5.9 0.3 0.3

5.4 5.6 0.3 2.0

6.0 4.8 5.1 0.3 0.3 1.9

4.4 0.3 1.7 1.8 NHL (4) 4.0 0.3 0.3 1.5 1.6

3.6 0.3 1.4 1.4

4.0 3.0 1.2 1.3

2.3 1.2

Notes 1.3 4.6 4.8 5.0 5.3

2.0 3.7 3.9 4.1 4.3

1. Includes royalty revenue associated with JCAR017(ex- 3.0 3.4 3.5

US) — 0.3 2.4 2.5 2.7

2. ALL includes adult and pediatric ALL 0.0

3. CLL includes 3L and 2L CLL 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035

4. NHL includes 3L DLBCL, 2L TNE, 2L TE, and 1L DLBCL

11

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\11

Project Maple

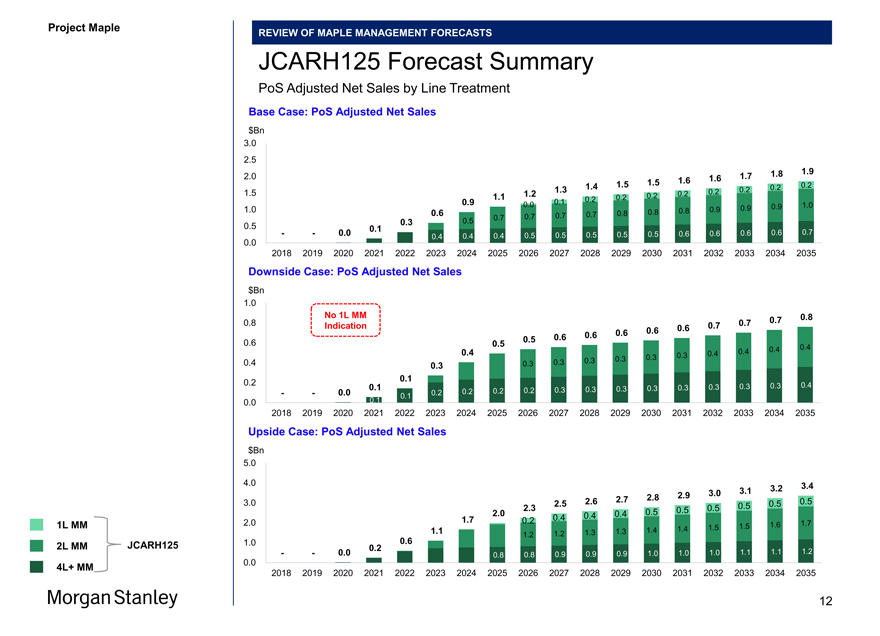

REVIEW OF MAPLE MANAGEMENT FORECASTS

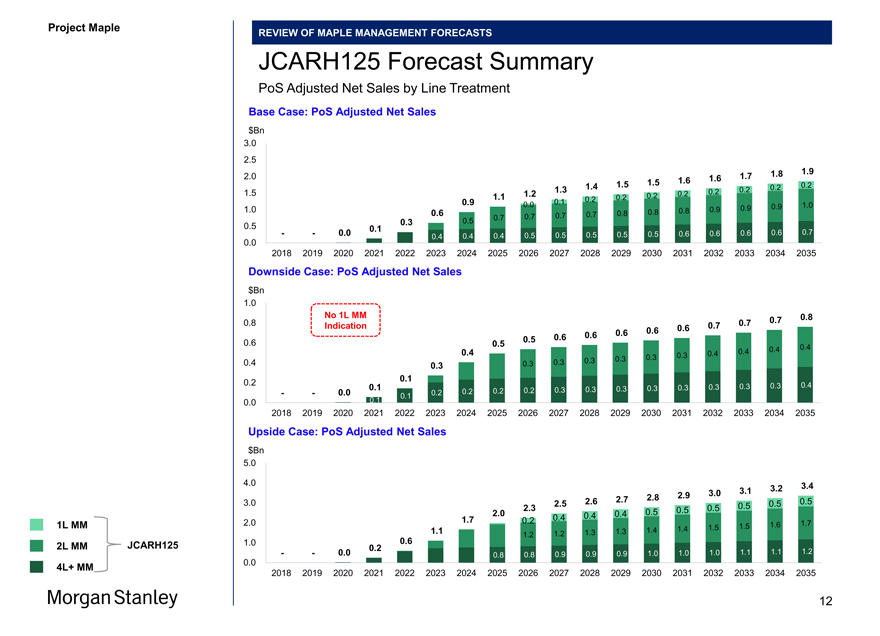

JCARH125 Forecast Summary

PoS Adjusted Net Sales by Line Treatment

Base Case: PoS Adjusted Net Sales $Bn

3.0

2.5

1.8 1.9

2.0 1.6 1.7

1.5 1.6

1.4 1.5 0.2 0.2

1.5 1.3 0.2 0.2

1.1 1.2 0.2 0.2

0.2 0.2

0.9 0.0 0.1 1.0

1.0 0.9 0.9 0.9

0.6 0.8 0.8 0.8

0.3 0.5 0.7 0.7 0.7 0.7

0.5 0.1

- — 0.0 0.5 0.5 0.5 0.5 0.6 0.6 0.6 0.6 0.7

0.0 0.4 0.4 0.4 0.5

- —

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035

Downside Case: PoS Adjusted Net Sales $Bn

1.0

No 1L MM 0.8

0.8 0.7 0.7

Indication 0.6 0.7

0.6 0.6

0.6 0.6

0.6 0.5

0.5 0.4

0.4 0.4 0.4

0.3 0.4

0.3 0.3 0.3

0.4 0.3 0.3 0.3

0.1

0.2 0.3 0.4

0.1 0.3 0.3 0.3 0.3 0.3 0.3

- — 0.0 0.2 0.2 0.2 0.2 0.3

0.1

0.0— — 0.1

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035

Upside Case: PoS Adjusted Net Sales $Bn

5.0

4.0 3.4

3.1 3.2

2.9 3.0

2.6 2.7 2.8 0.5

3.0 2.5 0.5 0.5

2.3 0.5 0.5

2.0 0.4 0.4 0.5

1.7 0.2 0.4

1L MM 2.0 1.5 1.6 1.7

1.1 1.4 1.4 1.5

1.2 1.2 1.3 1.3

JCARH125 1.0 0.6

2L MM 0.2

- — 0.0 0.9 0.9 0.9 1.0 1.0 1.0 1.1 1.1 1.2

0.0 0.8 0.8

4L+ MM

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035

12

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\12

Project Maple

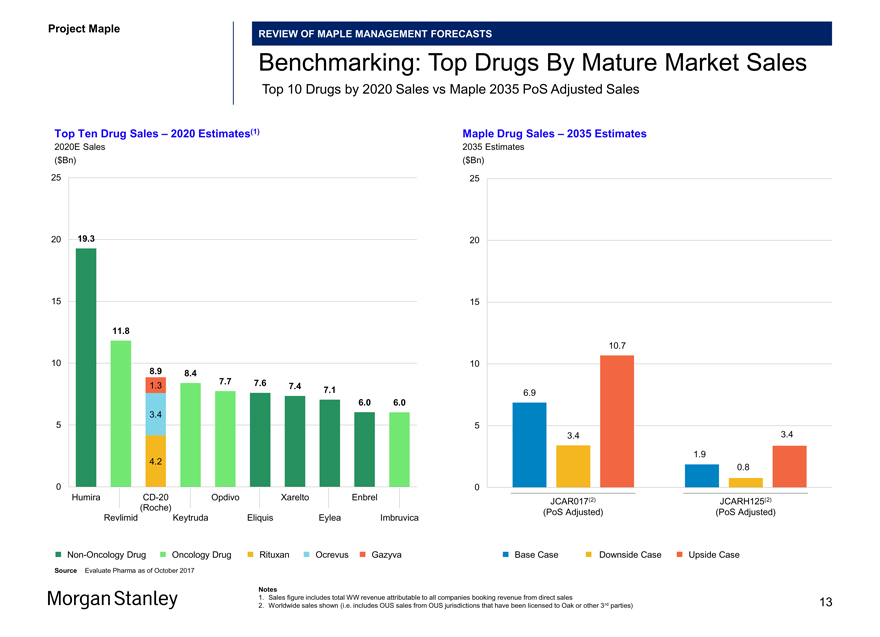

REVIEW OF MAPLE MANAGEMENT FORECASTS

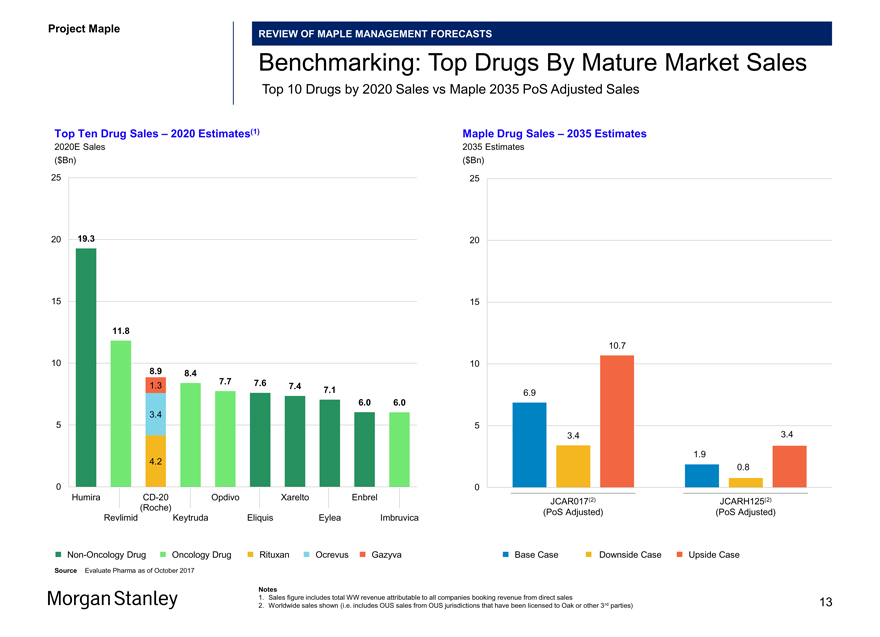

Benchmarking: Top Drugs By Mature Market Sales

Top 10 Drugs by 2020 Sales vs Maple 2035 PoS Adjusted Sales

Top Ten Drug Sales – 2020 Estimates(1) Maple Drug Sales – 2035 Estimates

2020E Sales 2035 Estimates

($Bn) ($Bn)

25 25

20 19.3 20

15 15

11.8

10.7

10 8.9 10

8.4 7.7

1.3 7.6 7.4

7.1 6.9

6.0 6.0

3.4

5 5

3.4 3.4

4.2 1.9

0.8

0 0

HumiraCD-20 Opdivo Xarelto Enbrel (2) (2) JCAR017 JCARH125 (Roche) (PoS Adjusted) (PoS Adjusted) Revlimid Keytruda Eliquis Eylea Imbruvica

Non-Oncology Drug Oncology Drug Rituxan Ocrevus Gazyva Base Case Downside Case Upside Case

Source Evaluate Pharma as of October 2017

Notes

1. Sales figure includes total WW revenue attributable to all companies booking revenue from direct sales

2. Worldwide sales shown (i.e. includes OUS sales from OUS jurisdictions that have been licensed to Oak or other 3rd parties) 13

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\13

Project Maple

REVIEW OF MAPLE MANAGEMENT FORECASTS

Platform R&D Concept

Illustrative Economic Contribution Analysis (1)

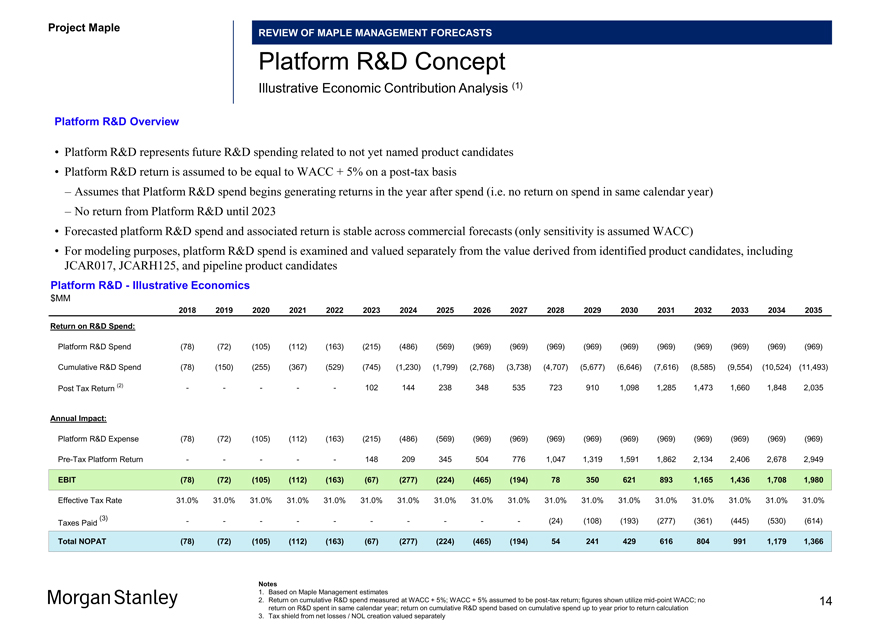

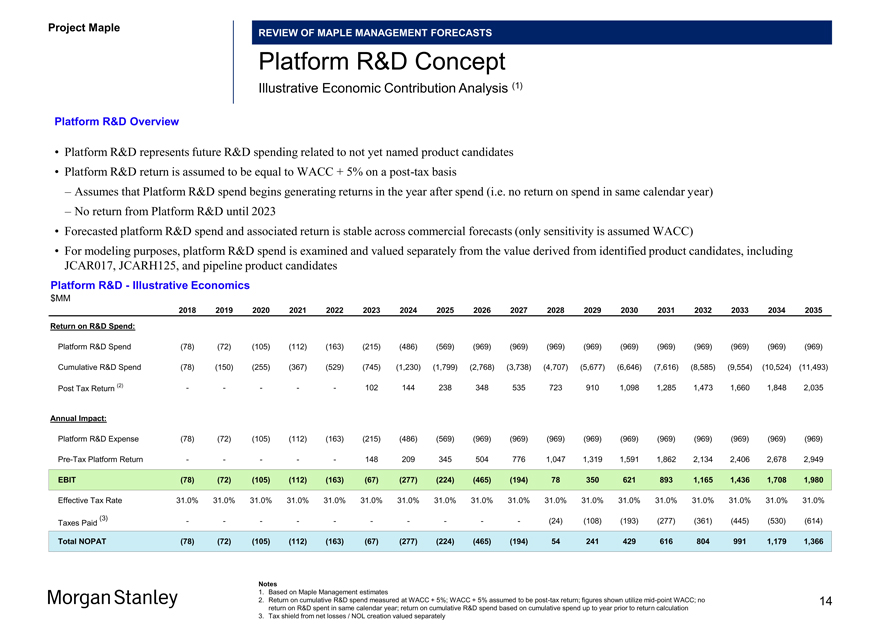

Platform R&D Overview

• Platform R&D represents future R&D spending related to not yet named product candidates

• Platform R&D return is assumed to be equal to WACC + 5% on apost-tax basis

– Assumes that Platform R&D spend begins generating returns in the year after spend (i.e. no return on spend in same calendar year)

– No return from Platform R&D until 2023

• Forecasted platform R&D spend and associated return is stable across commercial forecasts (only sensitivity is assumed WACC)

• For modeling purposes, platform R&D spend is examined and valued separately from the value derived from identified product candidates, including JCAR017, JCARH125, and pipeline product candidates

Platform R&D—Illustrative Economics $MM

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035

Return on R&D Spend:

Platform R&D Spend (78) (72) (105) (112) (163) (215) (486) (569) (969) (969) (969) (969) (969) (969) (969) (969) (969) (969) Cumulative R&D Spend (78) (150) (255) (367) (529) (745) (1,230) (1,799) (2,768) (3,738) (4,707) (5,677) (6,646) (7,616) (8,585) (9,554) (10,524) (11,493) Post Tax Return (2) — ——102 144 238 348 535 723 910 1,098 1,285 1,473 1,660 1,848 2,035

Annual Impact:

Platform R&D Expense (78) (72) (105) (112) (163) (215) (486) (569) (969) (969) (969) (969) (969) (969) (969) (969) (969) (969)

Pre-Tax Platform Return — ——148 209 345 504 776 1,047 1,319 1,591 1,862 2,134 2,406 2,678 2,949

EBIT (78) (72) (105) (112) (163) (67) (277) (224) (465) (194) 78 350 621 893 1,165 1,436 1,708 1,980

Effective Tax Rate 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0%

(3) — — — — — (24) (108) (193) (277) (361) (445) (530) (614) Taxes Paid

Total NOPAT (78) (72) (105) (112) (163) (67) (277) (224) (465) (194) 54 241 429 616 804 991 1,179 1,366

Notes

1. Based on Maple Management estimates

2. Return on cumulative R&D spend measured at WACC + 5%; WACC + 5% assumed to bepost-tax return; figures shown utilizemid-point WACC; no 14 return on R&D spent in same calendar year; return on cumulative R&D spend based on cumulative spend up to year prior to return calculation

3. Tax shield from net losses / NOL creation valued separately

Project Maple

Section 3

Preliminary Financial Analysis

15

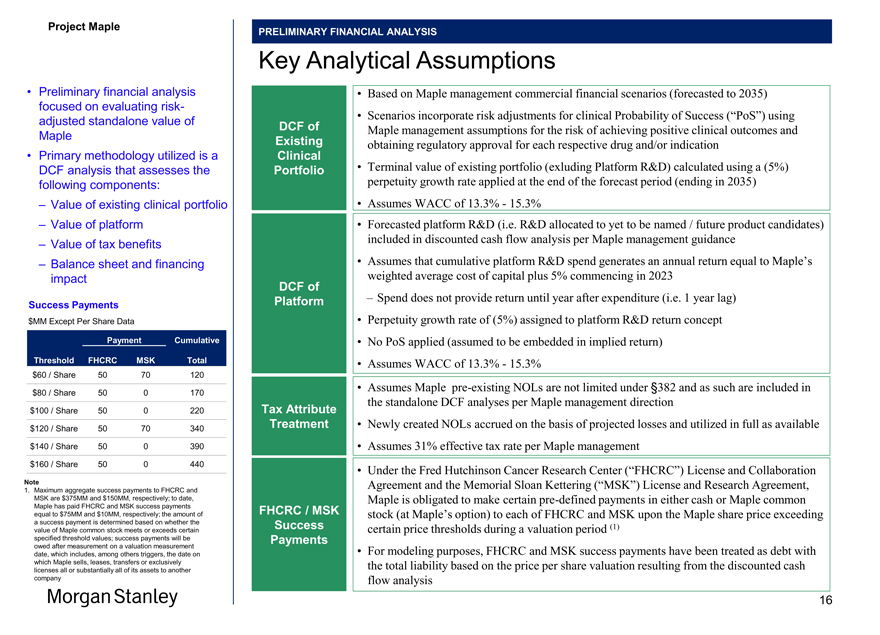

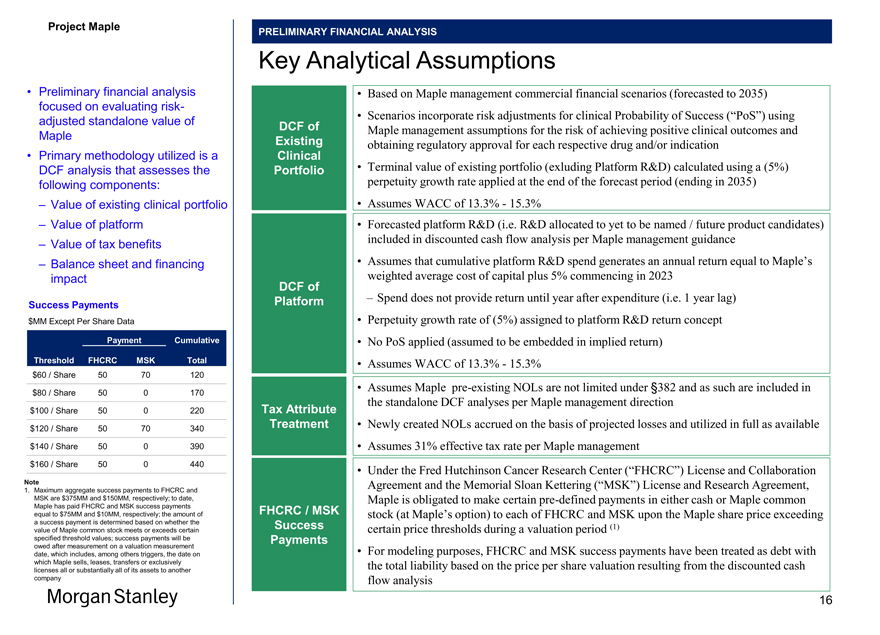

Project Maple Board Discussion Materials v72.ppt x\03 NOV 2017\10:28 PM\15 Project Maple PRELIMINARY FINANCIAL ANALYSIS Key Analytical Assumptions Preliminary financial analysis Based on Maple management commercial financial scenarios (forecasted to 2035) focused on evaluating risk- Scenarios incorporate risk adjustments for clinical Probability of Success (“PoS”) using adjusted standalone value of DCF of Maple management assumptions for the risk of achieving positive clinical outcomes and Maple Existing Primary methodology utilized is a Clinical obtaining regulatory approval for each respective drug and/or indication DCF analysis that assesses the Portfolio Terminal value of existing portfolio (exluding Platform R&D) calculated using a (5%) following components: perpetuity growth rate applied at the end of the forecast period (ending in 2035) – Value of existing clinical portfolio Assumes WACC of 13.3%—15.3% – Value of platform Forecasted platform R&D (i.e. R&D allocated to yet to be named / future product candidates) – Value of tax benefits included in discounted cash flow analysis per Maple management guidance – Balance sheet and financing Assumes that cumulative platform R&D spend generates an annual return equal to Maple’s impact DCF of weighted average cost of capital plus 5% commencing in 2023 Platform – Spend does not provide return until year after expenditure (i.e. 1 year lag) Success Payments $MM Except Per Share Data Perpetuity growth rate of (5%) assigned to platform R&D return concept Payment Cumulative No PoS applied (assumed to be embedded in implied return) Threshold FHCRC MSK Total Assumes WACC of 13.3%—15.3%, $60 / Share 50 70 120 Assumes Maple pre-existing NOLs are not limited under §382 and as such are included in $80 / Share 50 0 170 the standalone DCF analyses per Maple management direction $100 / Share 50 0 220 Tax Attribute $120 / Share 50 70 340 Treatment Newly created NOLs accrued on the basis of projected losses and utilized in full as available $140 / Share 50 0 390 Assumes 31% effective tax rate per Maple management $160 / Share 50 0 440 Under the Fred Hutchinson Cancer Research Center (“FHCRC”) License and Collaboration Note Agreement and the Memorial Sloan Kettering (“MSK”) License and Research Agreement, 1. Maximum aggregate success payments to FHCRC and MSK are $375MM and $150MM, respectively; to date, Maple is obligated to make certainpre-defined payments in either cash or Maple common Maple has paid FHCRC and MSK success payments FHCRC / MSK equal to $75MM and $10MM, respectively; the amount of stock (at Maple’s option) to each of FHCRC and MSK upon the Maple share price exceeding a success payment is determined based on whether the Success (1) value of Maple common stock meets or exceeds certain certain price thresholds during a valuation period specified threshold values; success payments will be Payments owed after measurement on a valuation measurement For modeling purposes, FHCRC and MSK success payments have been treated as debt with date, which includes, among others triggers, the date on which Maple sells, leases, transfers or exclusively the total liability based on the price per share valuation resulting from the discounted cash licenses all or substantially all of its assets to another company flow analysis 16

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\16

Project Maple

PRELIMINARY FINANCIAL ANALYSIS

Key Analytical Assumptions (cont’d)

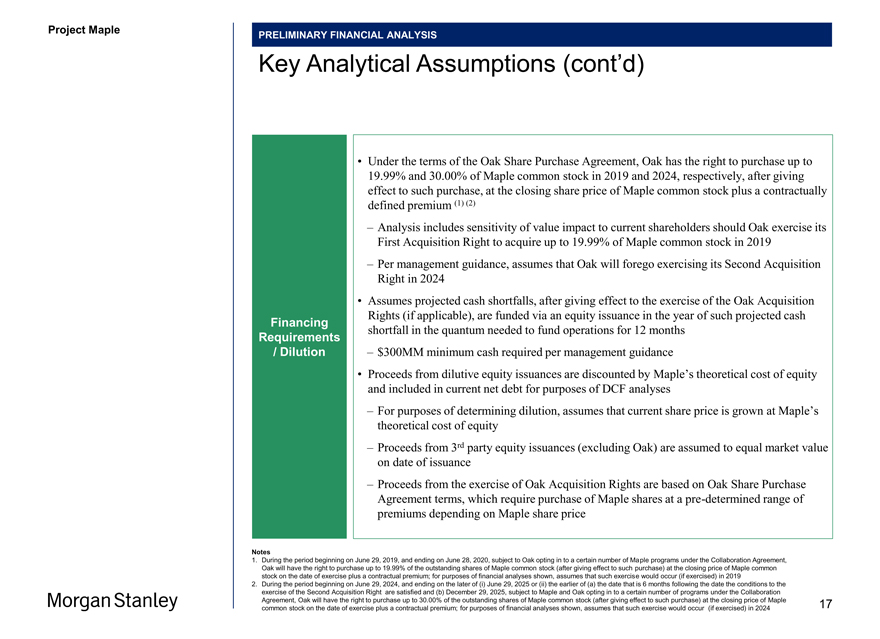

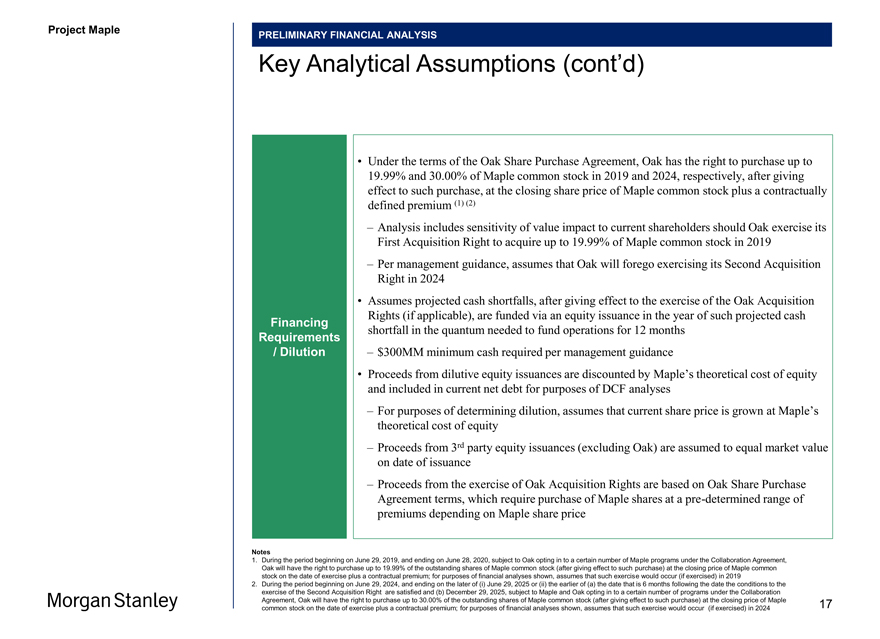

• Under the terms of the Oak Share Purchase Agreement, Oak has the right to purchase up to 19.99% and 30.00% of Maple common stock in 2019 and 2024, respectively, after giving effect to such purchase, at the closing share price of Maple common stock plus a contractually defined premium (1) (2)

– Analysis includes sensitivity of value impact to current shareholders should Oak exercise its First Acquisition Right to acquire up to 19.99% of Maple common stock in 2019

– Per management guidance, assumes that Oak will forego exercising its Second Acquisition Right in 2024

• Assumes projected cash shortfalls, after giving effect to the exercise of the Oak Acquisition Rights (if applicable), are funded via an equity issuance in the year of such projected cash

Financing shortfall in the quantum needed to fund operations for 12 months

Requirements

/ Dilution – $300MM minimum cash required per management guidance

• Proceeds from dilutive equity issuances are discounted by Maple’s theoretical cost of equity and included in current net debt for purposes of DCF analyses

– For purposes of determining dilution, assumes that current share price is grown at Maple’s theoretical cost of equity

– Proceeds from 3rd party equity issuances (excluding Oak) are assumed to equal market value on date of issuance

– Proceeds from the exercise of Oak Acquisition Rights are based on Oak Share Purchase Agreement terms, which require purchase of Maple shares at apre-determined range of premiums depending on Maple share price

Notes

1. During the period beginning on June 29, 2019, and ending on June 28, 2020, subject to Oak opting in to a certain number of Maple programs under the Collaboration Agreement, Oak will have the right to purchase up to 19.99% of the outstanding shares of Maple common stock (after giving effect to such purchase) at the closing price of Maple common stock on the date of exercise plus a contractual premium; for purposes of financial analyses shown, assumes that such exercise would occur (if exercised) in 2019

2. During the period beginning on June 29, 2024, and ending on the later of (i) June 29, 2025 or (ii) the earlier of (a) the date that is 6 months following the date the conditions to the exercise of the Second Acquisition Right are satisfied and (b) December 29, 2025, subject to Maple and Oak opting in to a certain number of programs under the Collaboration

Agreement, Oak will have the right to purchase up to 30.00% of the outstanding shares of Maple common stock (after giving effect to such purchase) at the closing price of Maple 17 common stock on the date of exercise plus a contractual premium; for purposes of financial analyses shown, assumes that such exercise would occur (if exercised) in 2024

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\18

Project Maple

PRELIMINARY FINANCIAL ANALYSIS

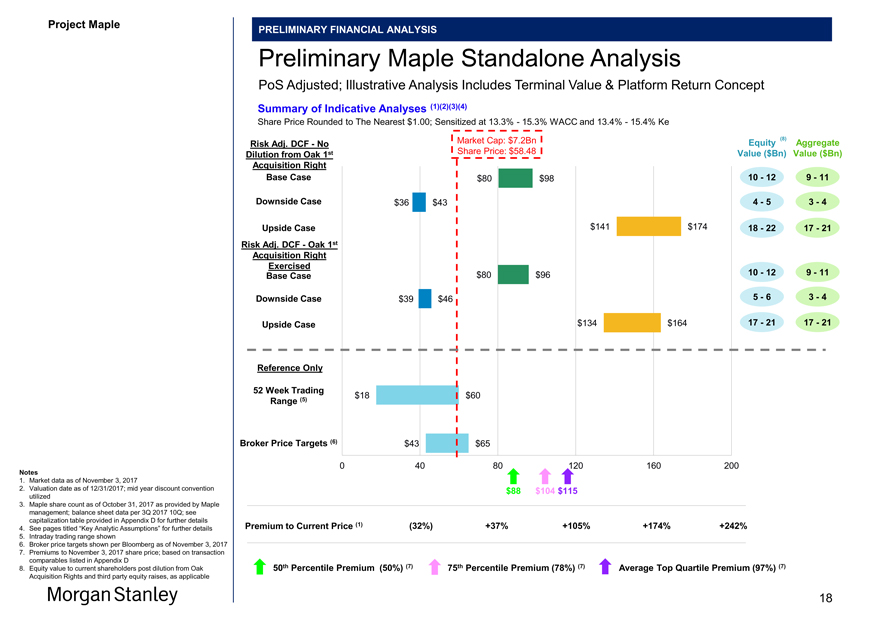

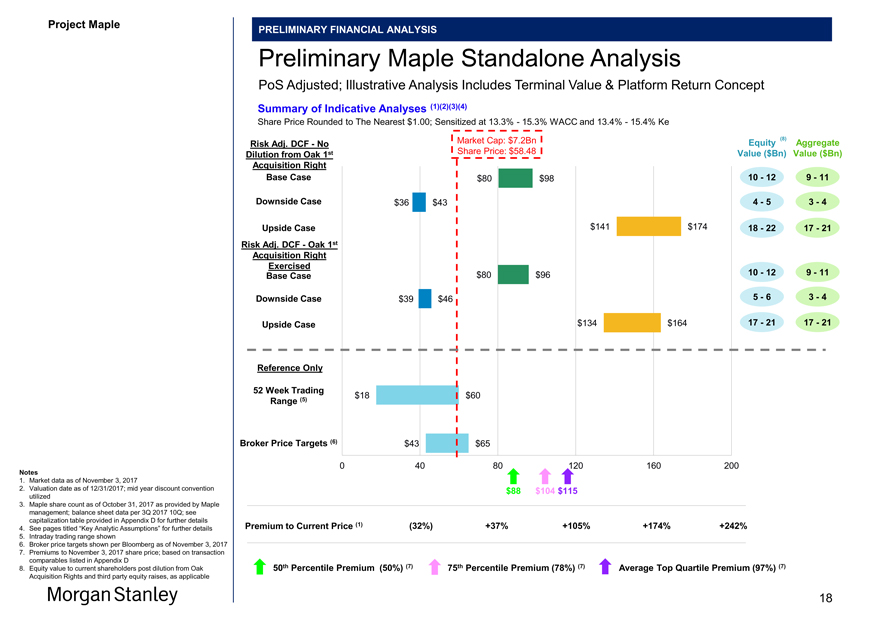

Preliminary Maple Standalone Analysis

PoS Adjusted; Illustrative Analysis Includes Terminal Value & Platform Return Concept

Summary of Indicative Analyses (1)(2)(3)(4)

Share Price Rounded to The Nearest $1.00; Sensitized at 13.3%—15.3% WACC and 13.4%—15.4% Ke

Market Cap: $7.2Bn Equity (8) Aggregate

Risk Adj. DCF—No

Dilution from Oak 1st Share Price: $58.48 Value ($Bn) Value ($Bn) Acquisition Right Base Case $80 $98 10—12 9—11

Downside Case $36 $43 4—5 3—4

Upside Case $141 $174 18—22 17—21 Risk Adj. DCF—Oak 1st Acquisition Right Exercised Base Case $80 $96 10—12 9—11 Downside Case $39 $46 5—6 3—4

Upside Case $134 $164 17—21 17—21

Reference Only

52 Week Trading

$18 $60

Range (5)

Broker Price Targets (6) $43 $65

Notes 0 40 80 120 160 200

1. Market data as of November 3, 2017

2. Valuation date as of 12/31/2017; mid year discount convention $88 $104 $115 utilized

3. Maple share count as of October 31, 2017 as provided by Maple management; balance sheet data per 3Q 2017 10Q; see capitalization table provided in Appendix D for further details

Premium to Current Price (1) (32%) +37% +105% +174% +242%

4. See pages titled “Key Analytic Assumptions” for further details

5. Intraday trading range shown

6. Broker price targets shown per Bloomberg as of November 3, 2017

7. Premiums to November 3, 2017 share price; based on transaction comparables listed in Appendix D th (7) th (7) (7)

8. Equity value to current shareholders post dilution from Oak 50 Percentile Premium (50%) 75 Percentile Premium (78%) Average Top Quartile Premium (97%)

Acquisition Rights and third party equity raises, as applicable

18

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\19

Project Maple

PRELIMINARY FINANCIAL ANALYSIS

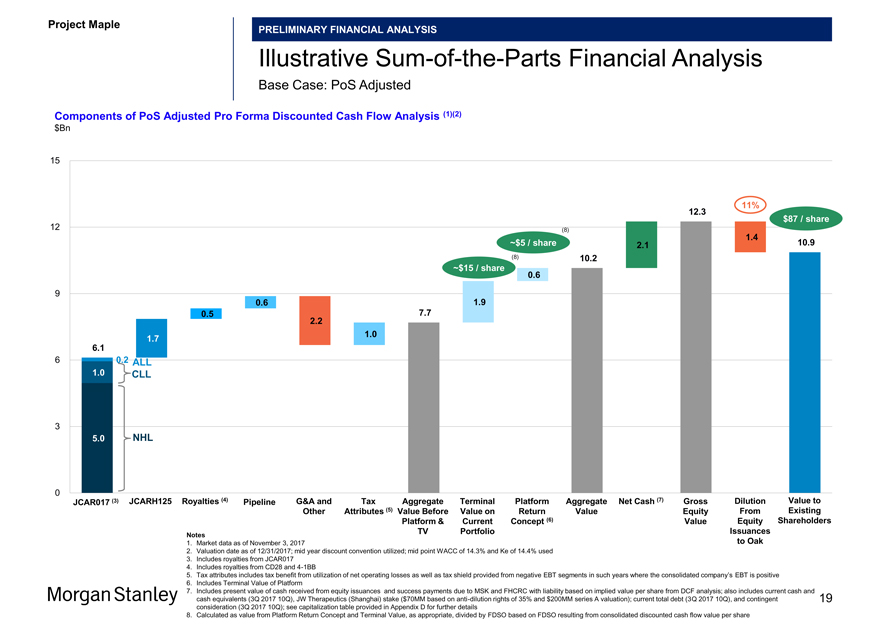

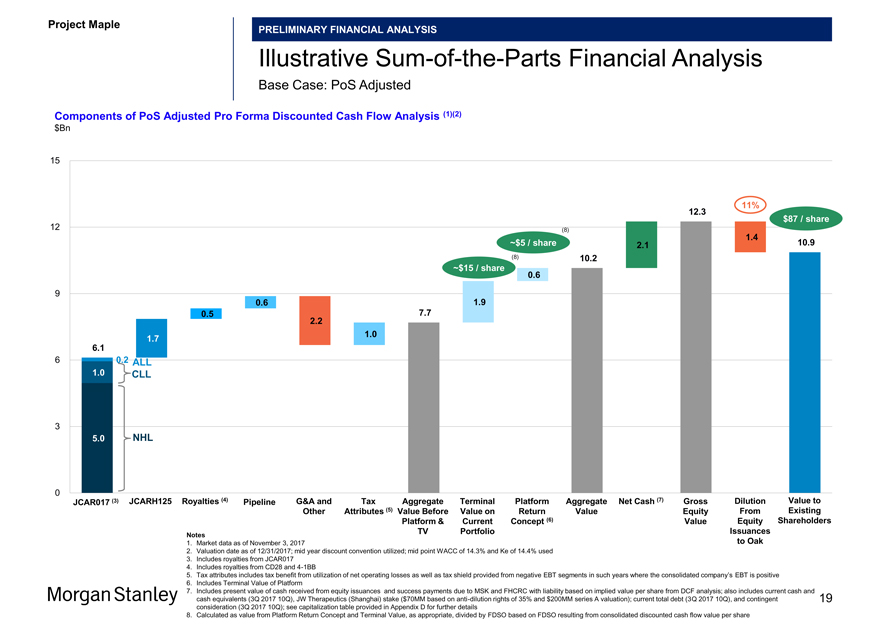

IllustrativeSum-of-the-Parts Financial Analysis

Base Case: PoS Adjusted

Components of PoS Adjusted Pro Forma Discounted Cash Flow Analysis (1)(2) $Bn

15

11% 12.3

12 $87 / share

(8)

1.4

~$5 / share 2.1 10.9 (8) 10.2

~$15 / share

0.6

9

0.6 1.9

0.5 2.2 7.7

1.0

1.7

6.1

6 0.2 ALL

1.0 CLL

3

5.0 NHL

0

JCAR017 (3) JCARH125 Royalties (4) Pipeline G&A and Tax Aggregate Terminal Platform Aggregate Net Cash (7) Gross Dilution Value to Other Attributes (5) Value Before Value on Return Value Equity From Existing Platform & Current Concept (6) Value Equity Shareholders TV Portfolio Issuances

Notes

1. Market data as of November 3, 2017 to Oak

2. Valuation date as of 12/31/2017; mid year discount convention utilized; mid point WACC of 14.3% and Ke of 14.4% used

3. Includes royalties from JCAR017

4. Includes royalties from CD28 and4-1BB

5. Tax attributes includes tax benefit from utilization of net operating losses as well as tax shield provided from negative EBT segments in such years where the consolidated company’s EBT is positive

6. Includes Terminal Value of Platform

7. Includes present value of cash received from equity issuances and success payments due to MSK and FHCRC with liability based on implied value per share from DCF analysis; also includes current cash and cash equivalents (3Q 2017 10Q), JW Therapeutics (Shanghai) stake ($70MM based on anti-dilution rights of 35% and $200MM series A valuation); current total debt (3Q 2017 10Q), and contingent 19 consideration (3Q 2017 10Q); see capitalization table provided in Appendix D for further details

8. Calculated as value from Platform Return Concept and Terminal Value, as appropriate, divided by FDSO based on FDSO resulting from consolidated discounted cash flow value per share

19

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\20

Project Maple

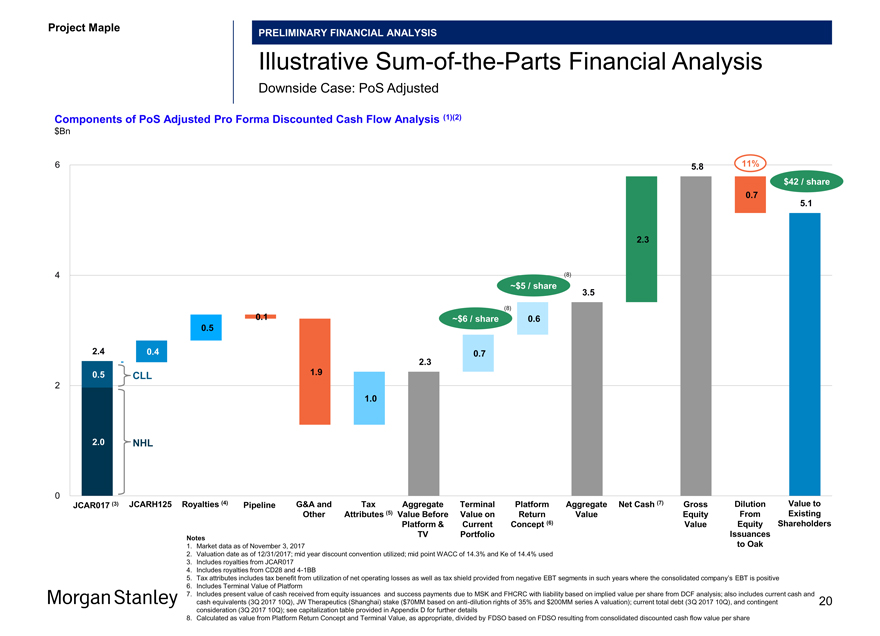

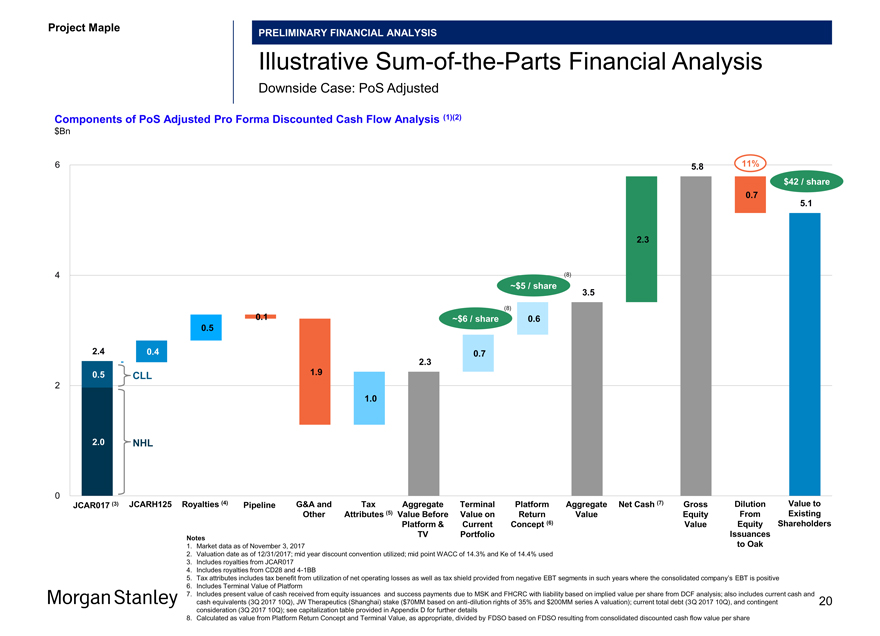

PRELIMINARY FINANCIAL ANALYSIS

IllustrativeSum-of-the-Parts Financial Analysis

Downside Case: PoS Adjusted

Components of PoS Adjusted Pro Forma Discounted Cash Flow Analysis (1)(2) $Bn

6 5.8 11%

$42 / share

0.7 5.1

2.3

4 (8)

~$5 / share

3.5

(8)

0.1 ~$6 / share 0.6

0.5

2.4 0.4 0.7

- 2.3

0.5 CLL 1.9

2

1.0

2.0 NHL

0

JCAR017 (3) JCARH125 Royalties (4) Pipeline G&A and Tax Aggregate Terminal Platform Aggregate Net Cash (7) Gross Dilution Value to Other Attributes (5) Value Before Value on Return Value Equity From Existing Platform & Current Concept (6) Value Equity Shareholders TV Portfolio Issuances

Notes

1. Market data as of November 3, 2017 to Oak

2. Valuation date as of 12/31/2017; mid year discount convention utilized; mid point WACC of 14.3% and Ke of 14.4% used

3. Includes royalties from JCAR017

4. Includes royalties from CD28 and4-1BB

5. Tax attributes includes tax benefit from utilization of net operating losses as well as tax shield provided from negative EBT segments in such years where the consolidated company’s EBT is positive

6. Includes Terminal Value of Platform

7. Includes present value of cash received from equity issuances and success payments due to MSK and FHCRC with liability based on implied value per share from DCF analysis; also includes current cash and cash equivalents (3Q 2017 10Q), JW Therapeutics (Shanghai) stake ($70MM based on anti-dilution rights of 35% and $200MM series A valuation); current total debt (3Q 2017 10Q), and contingent 20 consideration (3Q 2017 10Q); see capitalization table provided in Appendix D for further details

8. Calculated as value from Platform Return Concept and Terminal Value, as appropriate, divided by FDSO based on FDSO resulting from consolidated discounted cash flow value per share

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\21

Project Maple

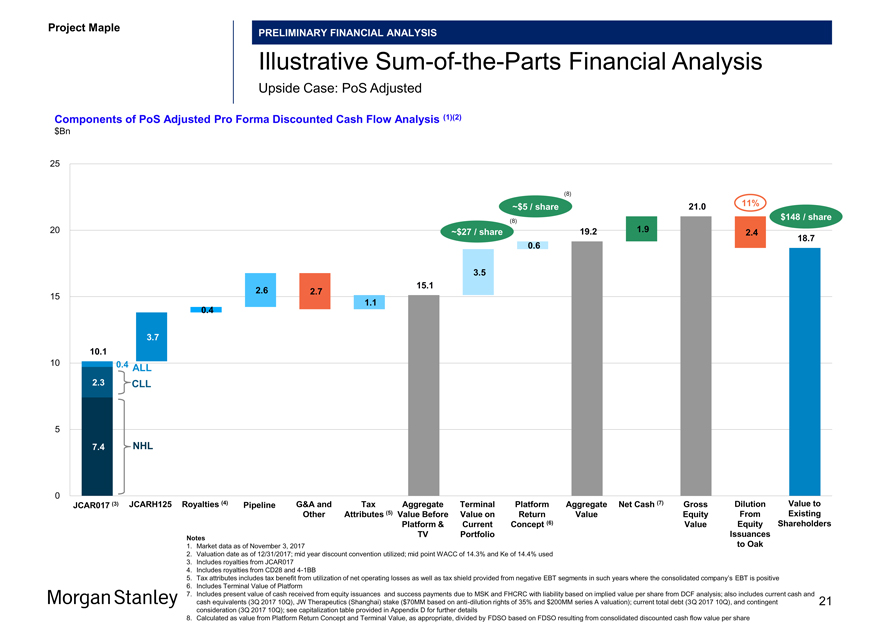

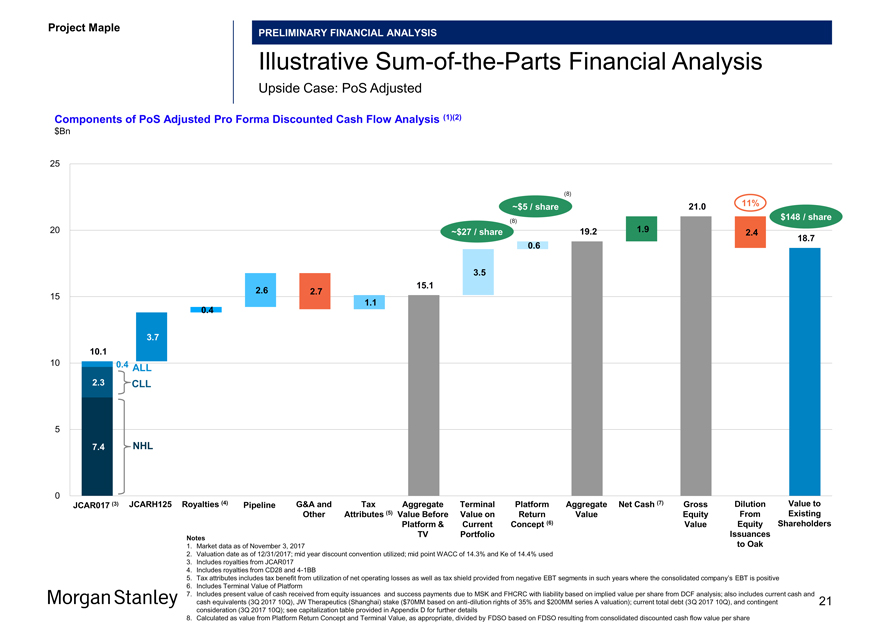

PRELIMINARY FINANCIAL ANALYSIS

IllustrativeSum-of-the-Parts Financial Analysis

Upside Case: PoS Adjusted

Components of PoS Adjusted Pro Forma Discounted Cash Flow Analysis (1)(2) $Bn

25

(8)

~$5 / share 21.0 11% $148 / share

(8)

20 ~$27 / share 19.2 1.9 2.4

0.6 18.7

3.5 15.1

2.6 2.7

15

0.4 1.1

3.7 10.1

10 0.4

ALL

2.3 CLL

5

7.4 NHL

0

JCAR017 (3) JCARH125 Royalties (4) Pipeline G&A and Tax Aggregate Terminal Platform Aggregate Net Cash (7) Gross Dilution Value to Other Attributes (5) Value Before Value on Return Value Equity From Existing Platform & Current Concept (6) Value Equity Shareholders TV Portfolio Issuances

Notes

1. Market data as of November 3, 2017 to Oak

2. Valuation date as of 12/31/2017; mid year discount convention utilized; mid point WACC of 14.3% and Ke of 14.4% used

3. Includes royalties from JCAR017

4. Includes royalties from CD28 and4-1BB

5. Tax attributes includes tax benefit from utilization of net operating losses as well as tax shield provided from negative EBT segments in such years where the consolidated company’s EBT is positive

6. Includes Terminal Value of Platform

7. Includes present value of cash received from equity issuances and success payments due to MSK and FHCRC with liability based on implied value per share from DCF analysis; also includes current cash and cash equivalents (3Q 2017 10Q), JW Therapeutics (Shanghai) stake ($70MM based on anti-dilution rights of 35% and $200MM series A valuation); current total debt (3Q 2017 10Q), and contingent 21 consideration (3Q 2017 10Q); see capitalization table provided in Appendix D for further details

8. Calculated as value from Platform Return Concept and Terminal Value, as appropriate, divided by FDSO based on FDSO resulting from consolidated discounted cash flow value per share

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\22

Project Maple

PRELIMINARY FINANCIAL ANALYSIS

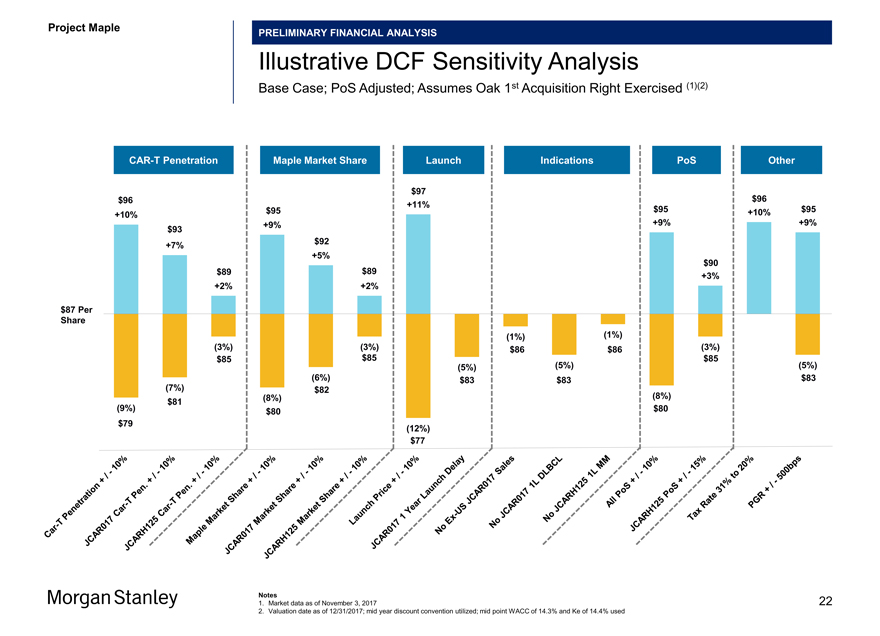

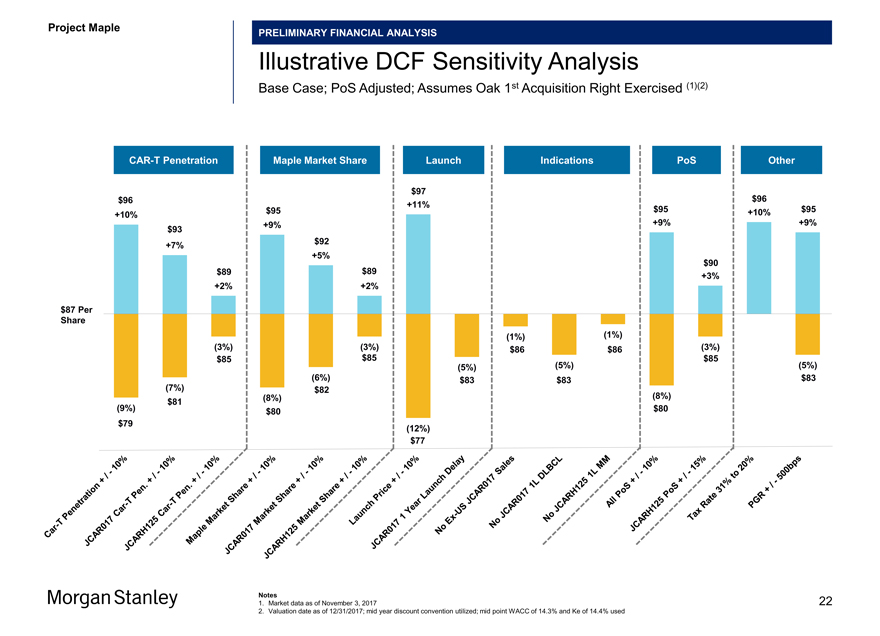

Illustrative DCF Sensitivity Analysis

Base Case; PoS Adjusted; Assumes Oak 1st Acquisition Right Exercised (1)(2)

CAR-T Penetration Maple Market Share Launch Indications PoS Other

$97 $96 $96 +11%

$95 $95 +10% $95 +10% +9% +9% +9% $93 $92 +7% +5% $90

$89 $89

+3% +2% +2%

$87 Per Share

(1%) (1%)

(3%) (3%) $86 $86 (3%)

$85 $85 (5%) $85 (5%) (5%) (6%) $83 $83 $83 (7%) $82 (8%) (8%) $81 (9%) $80 $80 10% $79 10%- (12%) 10% -/ 10%— / +

10%

/

- + $77

-

10%/ + /

- .

+

/ + Sales 15%

. Year

+ Share—Pen 10% 1 MM / Share

- 20% Pen DLBCL + T / T—1L to Share +

- 1L

10%

Car Market— PoS Car Market Lagged JCAR017

/ 31% 500bps Price +— Market US / Penetration

- + T Rate

- Ex JCAR017 JCARH125 PoS

JCARH125 Maple JCAR017 JCARH125 JCAR017 No NoNo JCARH125 Tax PGR Car JCAR017 Launch All

Notes 22

1. Market data as of November 3, 2017

2. Valuation date as of 12/31/2017; mid year discount convention utilized; mid point WACC of 14.3% and Ke of 14.4% used

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\23

Project Maple

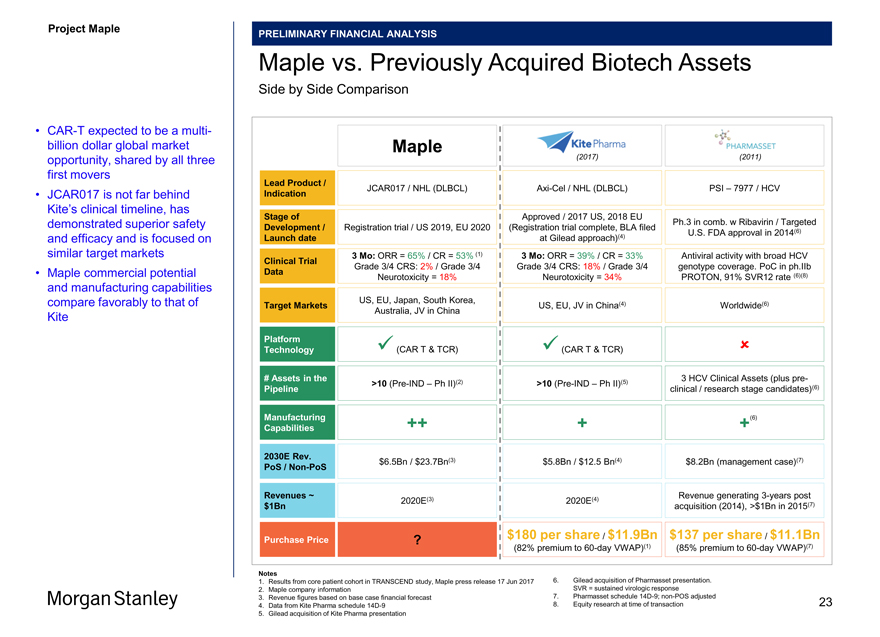

PRELIMINARY FINANCIAL ANALYSIS

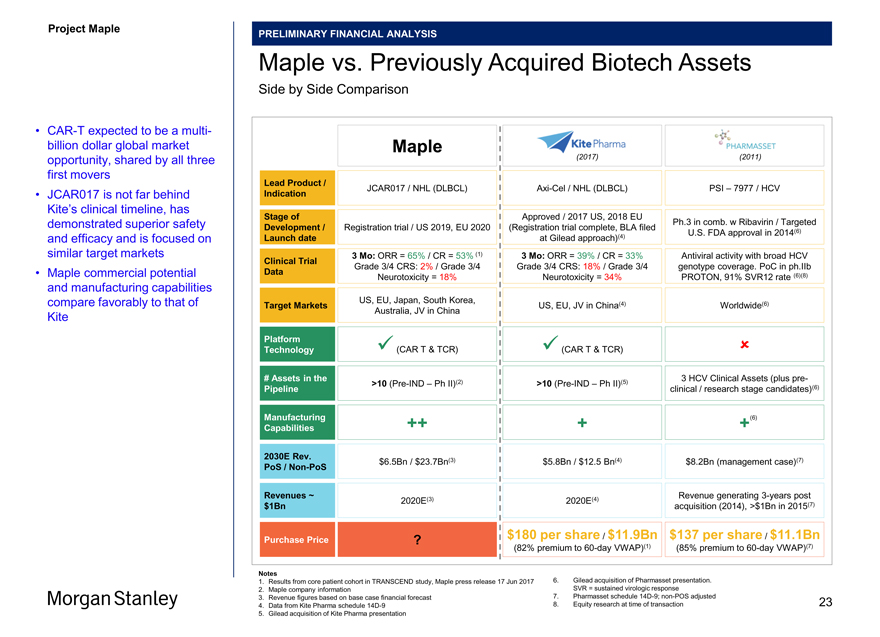

Maple vs. Previously Acquired Biotech Assets

Side by Side Comparison

•CAR-T expected to be a multi-billion dollar global market Maple opportunity, shared by all three (2017) (2011) first movers

Lead Product /

JCAR017 / NHL (DLBCL)Axi-Cel / NHL (DLBCL) PSI – 7977 / HCV

• JCAR017 is not far behind Indication

Kite’s clinical timeline, has

Stage of Approved / 2017 US, 2018 EU demonstrated superior safety Ph.3 in comb. w Ribavirin / Targeted Development / Registration trial / US 2019, EU 2020 (Registration trial complete, BLA filed Launch date at Gilead approach)(4) U.S. FDA approval in 2014(6)

and efficacy and is focused on

similar target markets Clinical Trial 3 Mo: ORR = 65% / CR = 53% (1) 3 Mo: ORR = 39% / CR = 33% Antiviral activity with broad HCV Grade 3/4 CRS: 2% / Grade 3/4 Grade 3/4 CRS: 18% / Grade 3/4 genotype coverage. PoC in ph.IIb

• Maple commercial potential Data

Neurotoxicity = 18% Neurotoxicity = 34% PROTON, 91% SVR12 rate (6)(8)

and manufacturing capabilities

US, EU, Japan, South Korea, compare favorably to that of Target Markets Australia, JV in China US, EU, JV in China(4) Worldwide(6)

Kite

Platform 

Technology  (CAR T & TCR)  (CAR T & TCR)

# Assets in the 3 HCV Clinical Assets (plus pre-Pipeline >10(Pre-IND – Ph II)(2) >10(Pre-IND – Ph II)(5) clinical / research stage candidates)(6)

Manufacturing ++ + +(6) Capabilities

2030E Rev.

PoS /Non-PoS $6.5Bn / $23.7Bn(3) $5.8Bn / $12.5 Bn(4) $8.2Bn (management case)(7)

Revenues ~ Revenue generating3-years post $1Bn 2020E(3) 2020E(4) acquisition (2014), >$1Bn in 2015(7)

Purchase Price $180 per share / $11.9Bn $137 per share / $11.1Bn

(82% premium to60-day VWAP)(1) (85% premium to60-day VWAP)(7)

Notes

1. Results from core patient cohort in TRANSCEND study, Maple press release 17 Jun 2017 6. Gilead acquisition of Pharmasset presentation.

2. Maple company information SVR = sustained virologic response

3. Revenue figures based on base case financial forecast 7. Pharmasset schedule14D-9;non-POS adjusted 23

4. Data from Kite Pharma schedule14D-9 8. Equity research at time of transaction

5. Gilead acquisition of Kite Pharma presentation

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\24

Project Maple

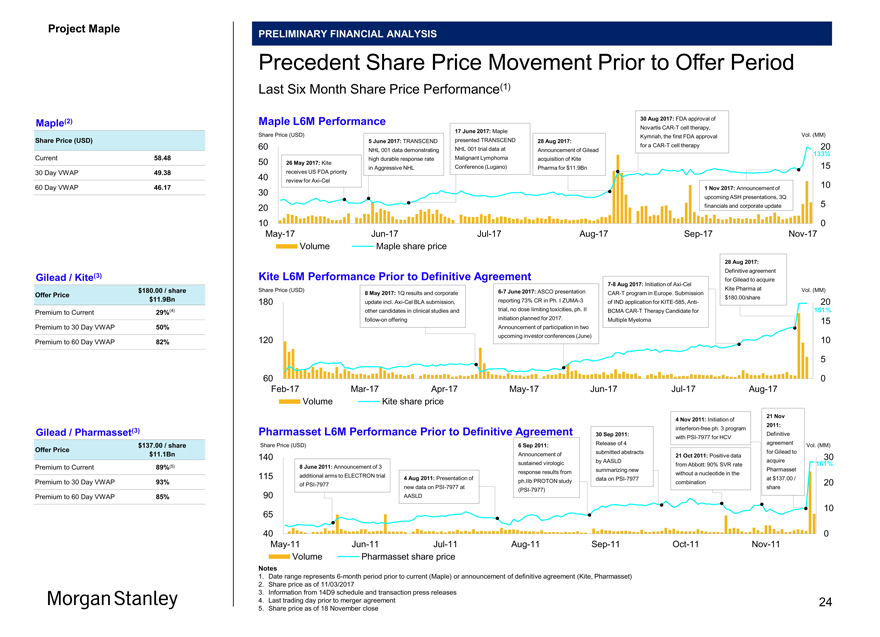

PRELIMINARY FINANCIAL ANALYSIS

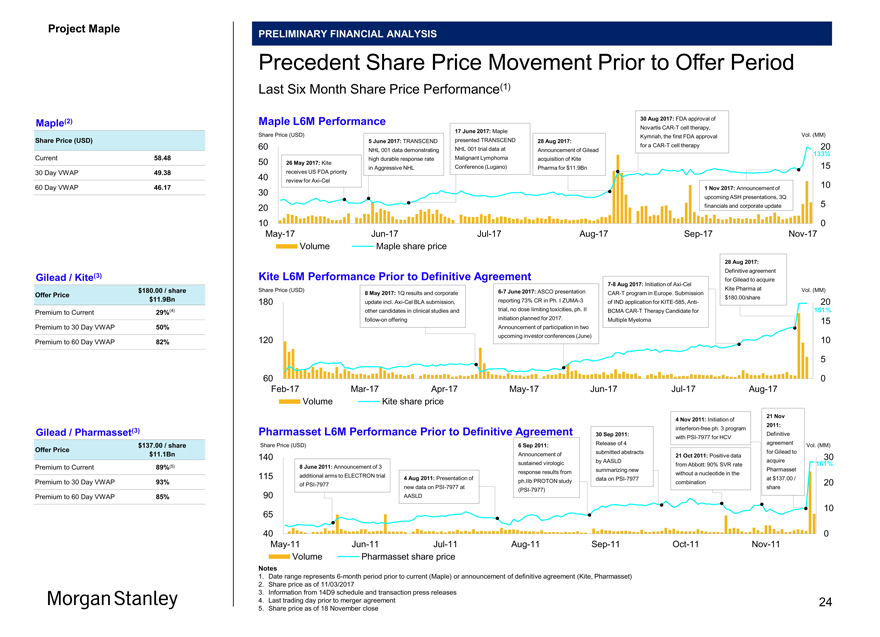

Precedent Share Price Movement Prior to Offer Period

Last Six Month Share Price Performance(1)

Maple(2) Maple L6M Performance 30 Aug 2017: FDA approval of

NovartisCAR-T cell therapy,

17 June 2017: Maple

Share Price (USD) Share Price (USD) presented TRANSCEND Kymriah, the first FDA approval Vol. (MM)

5 June 2017: TRANSCEND 28 Aug 2017:

60 for aCAR-T cell therapy 20 NHL 001 data demonstrating NHL 001 trial data at Announcement of Gilead

133%

Current 58.48 50 26 May 2017: Kite high durable response rate Malignant Lymphoma acquisition of Kite

30 Day VWAP 49.38 receives US FDA priority in Aggressive NHL Conference (Lugano) Pharma for $11.9Bn 15 40 review forAxi-Cel 10

60 Day VWAP 46.17 1 Nov 2017: Announcement of

30

upcoming ASH presentations, 3Q 5 20 financials and corporate update

10 0May-17Jun-17Jul-17Aug-17Sep-17Nov-17 Volume Maple share price

28 Aug 2017:

Definitive agreement

Gilead / Kite(3) Kite L6M Performance Prior to Definitive Agreement

7-8 Aug 2017: Initiation ofAxi-Cel for Gilead to acquire $180.00 / share Share Price (USD) Kite Pharma at Vol. (MM)

8 May 2017: 1Q results and corporate6-7 June 2017: ASCO presentationCAR-T program in Europe. Submission

Offer Price $180.00/share $11.9Bn 180 update incl.Axi-Cel BLA submission, reporting 73% CR in Ph. IZUMA-3 of IND application forKITE-585, Anti- 20 (4) other candidates in clinical studies and trial, no dose limiting toxicities, ph. II BCMACAR-T Therapy Candidate for 151%

Premium to Current 29%follow-on offering initiation planned for 2017. Multiple Myeloma 15 Premium to 30 Day VWAP 50% Announcement of participation in two Premium to 60 Day VWAP 82% 120 upcoming investor conferences (June) 10

5

60 0Feb-17Mar-17Apr-17May-17Jun-17Jul-17Aug-17 Volume Kite share price

21 Nov

4 Nov 2011: Initiation of

2011:

Gilead / Pharmasset(3) Pharmasset L6M Performance Prior to Definitive Agreement interferon-free ph. 3 program

30 Sep 2011: Definitive withPSI-7977 for HCV

Share Price (USD) Release of 4 agreement Vol. (MM) $137.00 / share 6 Sep 2011:

Offer Price submitted abstracts for Gilead to $11.1Bn 140 Announcement of 21 Oct 2011: Positive data 30 by AASLD acquire sustained virologic from Abbott: 90% SVR rate 161%

Premium to Current 89%(5) 8 June 2011: Announcement of 3 summarizing new Pharmasset response results from without a nucleotide in the 115 additional arms to ELECTRON trial

4 Aug 2011: Presentation of data onPSI-7977 at $137.00 /

Premium to 30 Day VWAP 93% ph.IIb PROTON study combination 20 ofPSI-7977 new data onPSI-7977 at share(PSI-7977)

Premium to 60 Day VWAP 85% 90 AASLD

10 65

40 0May-11Jun-11Jul-11Aug-11Sep-11Oct-11Nov-11 Volume Pharmasset share price

Notes

1. Date range represents6-month period prior to current (Maple) or announcement of definitive agreement (Kite, Pharmasset)

2. Share price as of 11/03/2017

3. Information from 14D9 schedule and transaction press releases

4. Last trading day prior to merger agreement 24

5. Share price as of 18 November close

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\25

Project Maple

Section 4

Tactical Considerations

25

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\26

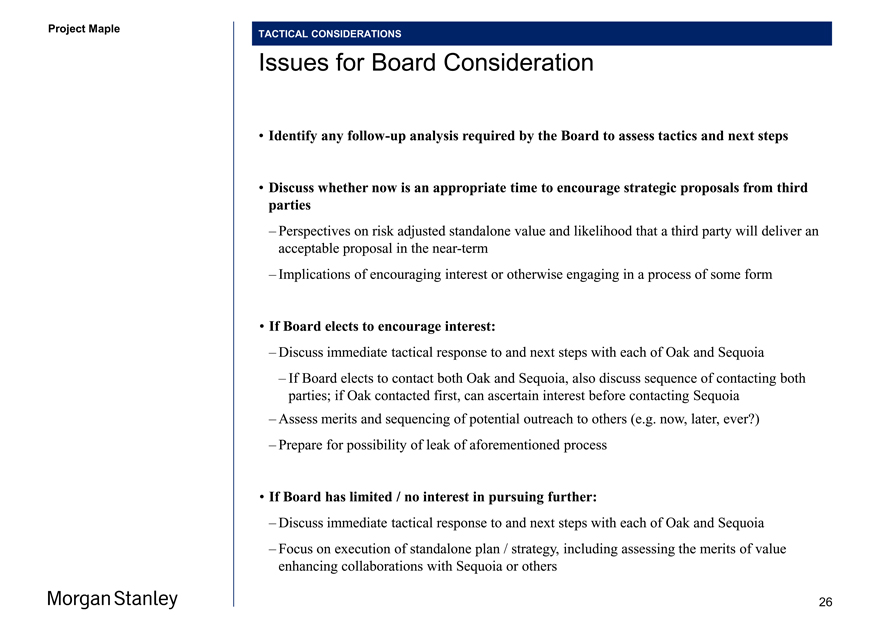

Project Maple

TACTICAL CONSIDERATIONS

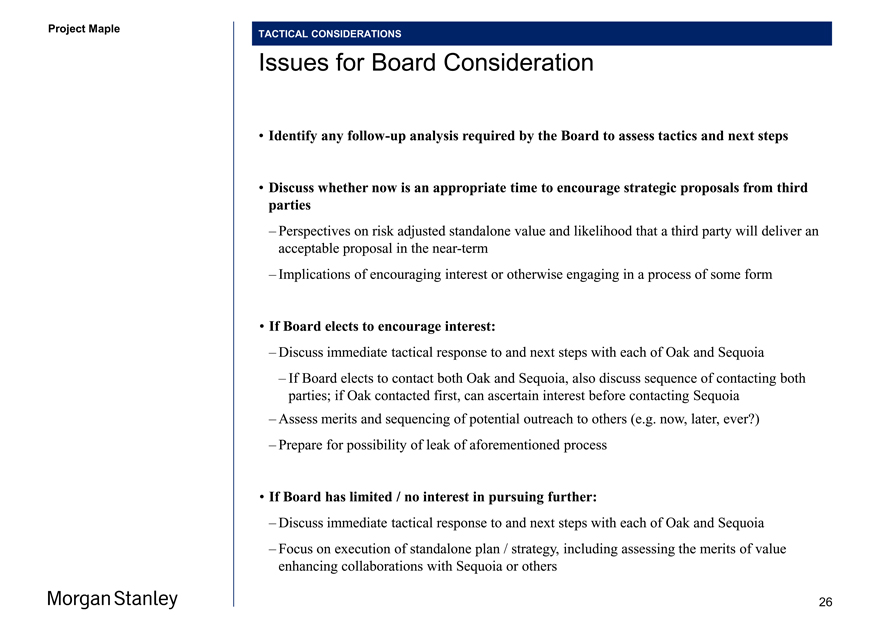

Issues for Board Consideration

• Identify anyfollow-up analysis required by the Board to assess tactics and next steps

• Discuss whether now is an appropriate time to encourage strategic proposals from third parties

– Perspectives on risk adjusted standalone value and likelihood that a third party will deliver an acceptable proposal in the near-term

– Implications of encouraging interest or otherwise engaging in a process of some form

• If Board elects to encourage interest:

– Discuss immediate tactical response to and next steps with each of Oak and Sequoia

– If Board elects to contact both Oak and Sequoia, also discuss sequence of contacting both parties; if Oak contacted first, can ascertain interest before contacting Sequoia

– Assess merits and sequencing of potential outreach to others (e.g. now, later, ever )

– Prepare for possibility of leak of aforementioned process

• If Board has limited / no interest in pursuing further:

– Discuss immediate tactical response to and next steps with each of Oak and Sequoia

– Focus on execution of standalone plan / strategy, including assessing the merits of value enhancing collaborations with Sequoia or others

26

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\27

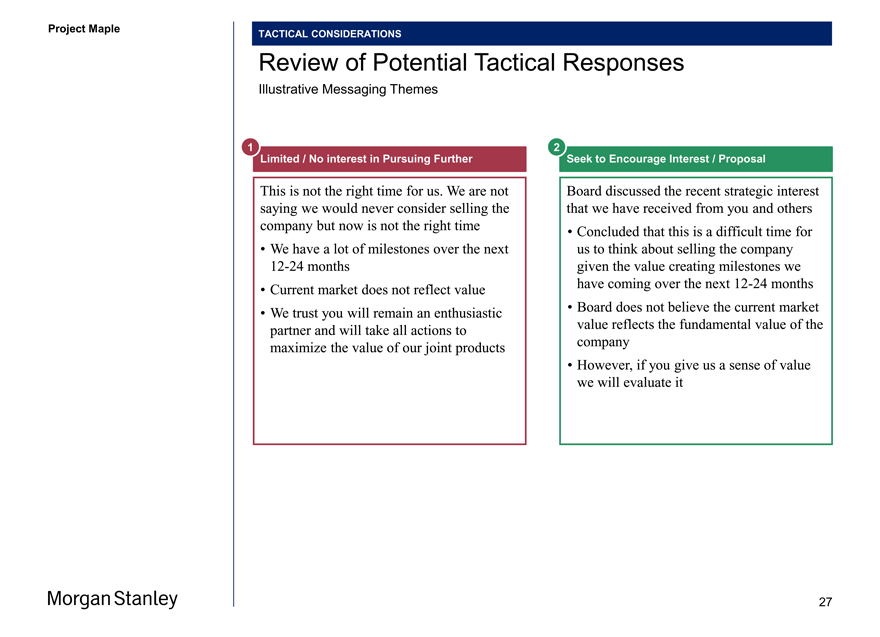

Project Maple

TACTICAL CONSIDERATIONS

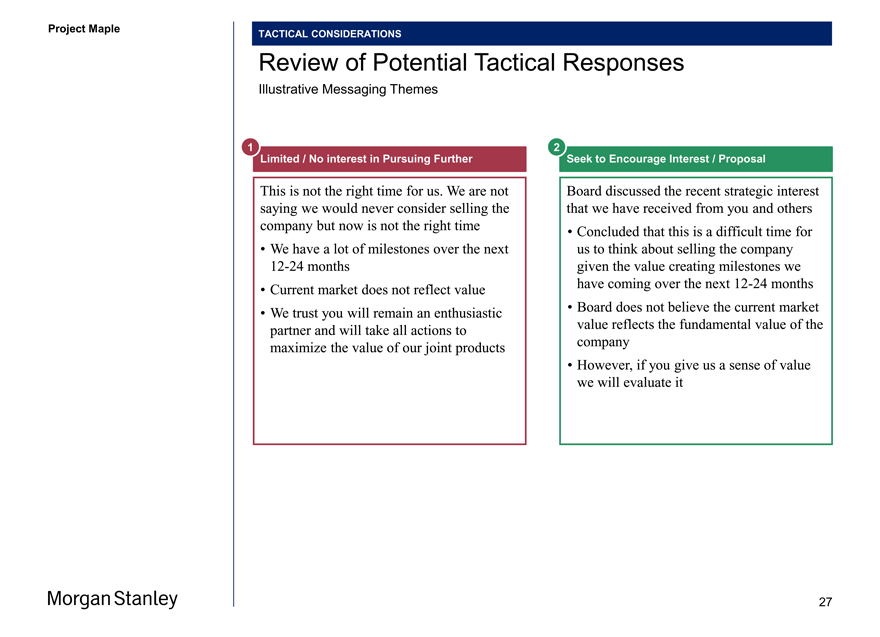

Review of Potential Tactical Responses

Illustrative Messaging Themes

1 2

Limited / No interest in Pursuing Further Seek to Encourage Interest / Proposal

This is not the right time for us. We are not Board discussed the recent strategic interest saying we would never consider selling the that we have received from you and others company but now is not the right time • Concluded that this is a difficult time for

• We have a lot of milestones over the next us to think about selling the company12-24 months given the value creating milestones we have coming over the next12-24 months

• Current market does not reflect value

• We trust you will remain an enthusiastic • Board does not believe the current market partner and will take all actions to value reflects the fundamental value of the maximize the value of our joint products company

• However, if you give us a sense of value we will evaluate it

27

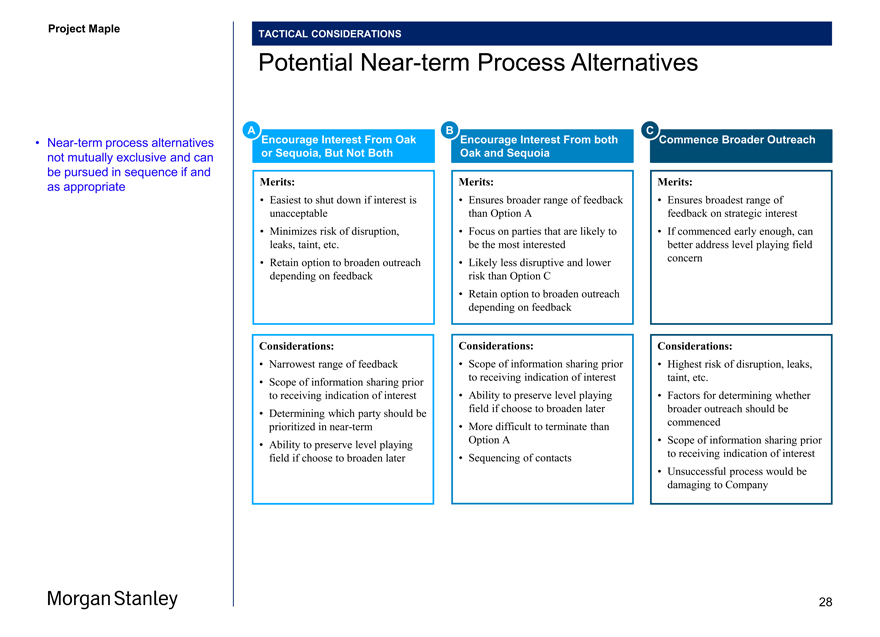

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\28

Project Maple

TACTICAL CONSIDERATIONS

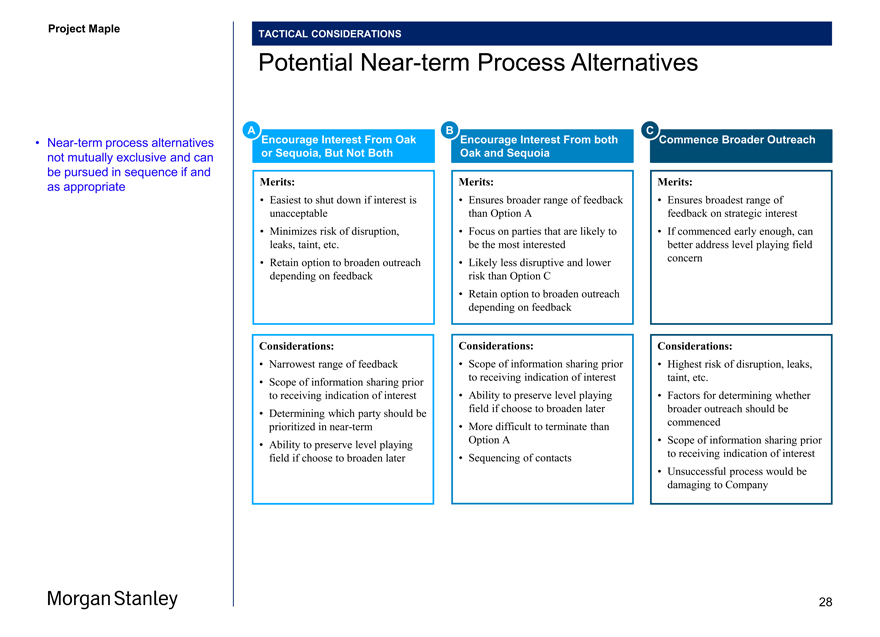

Potential Near-term Process Alternatives

A Encourage Interest From Oak B Encourage Interest From both C Commence Broader Outreach

• Near-term process alternatives or Sequoia, But Not Both Oak and Sequoia not mutually exclusive and can be pursued in sequence if and Merits: Merits: Merits: as appropriate

• Easiest to shut down if interest is • Ensures broader range of feedback • Ensures broadest range of unacceptable than Option A feedback on strategic interest

• Minimizes risk of disruption, • Focus on parties that are likely to • If commenced early enough, can leaks, taint, etc. be the most interested better address level playing field

• Retain option to broaden outreach • Likely less disruptive and lower concern depending on feedback risk than Option C

• Retain option to broaden outreach depending on feedback

Considerations: Considerations: Considerations:

• Narrowest range of feedback • Scope of information sharing prior • Highest risk of disruption, leaks, to receiving indication of interest taint, etc.

• Scope of information sharing prior to receiving indication of interest • Ability to preserve level playing • Factors for determining whether field if choose to broaden later broader outreach should be

• Determining which party should be prioritized in near-term • More difficult to terminate than commenced

Option A • Scope of information sharing prior

• Ability to preserve level playing field if choose to broaden later • Sequencing of contacts to receiving indication of interest

• Unsuccessful process would be damaging to Company

28

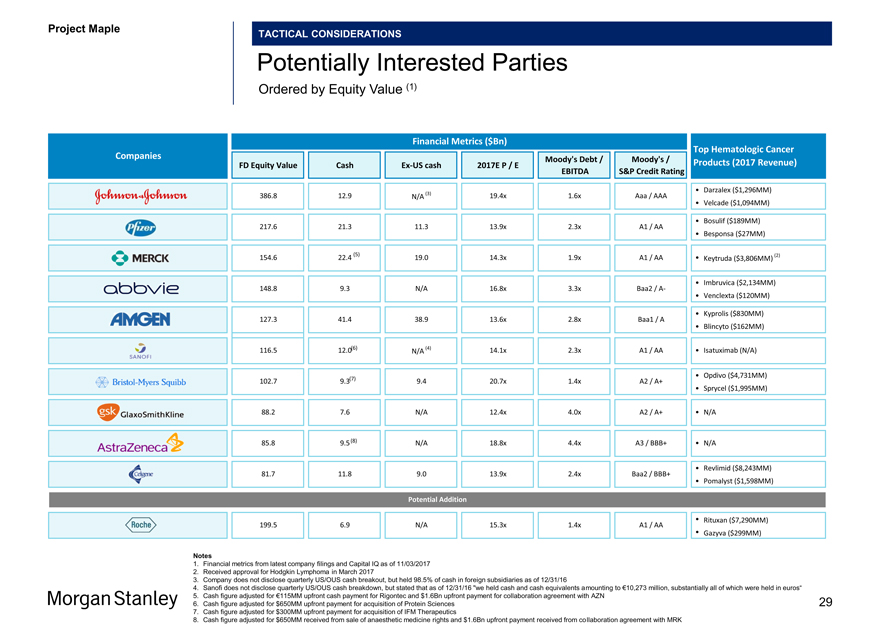

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\29

Project Maple

TACTICAL CONSIDERATIONS

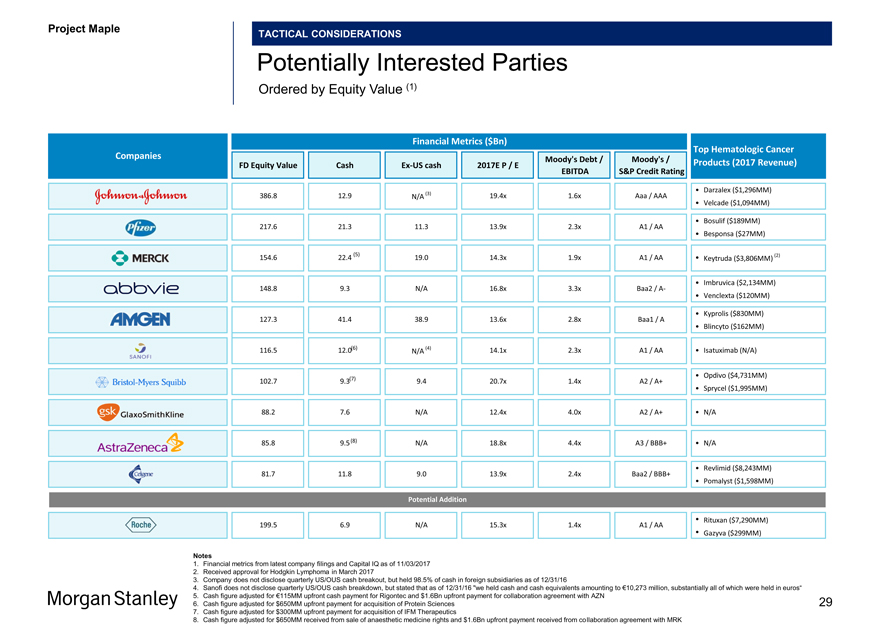

Potentially Interested Parties

Ordered by Equity Value (1)

Financial Metrics ($Bn) Top Hematologic Cancer Companies Moody’s Debt / Moody’s / FD Equity Value CashEx-US cash 2017E P / E Products (2017 Revenue) EBITDA S&P Credit Rating

• Darzalex ($1,296MM) 386.8 12.9 (3) 19.4x 1.6x Aaa / AAA

N/A • Velcade ($1,094MM) 217.6 21.3 11.3 13.9x 2.3x A1 / AA • Bosulif ($189MM)

• Besponsa ($27MM)

(5) (2)

154.6 22.4 19.0 14.3x 1.9x A1 / AA • Keytruda ($3,806MM)

148.8 9.3 N/A 16.8x 3.3x Baa2 /A- • Imbruvica ($2,134MM)

• Venclexta ($120MM)

127.3 41.4 38.9 13.6x 2.8x Baa1 / A • Kyprolis ($830MM)

• Blincyto ($162MM)

116.5 12.0(6) (4) 14.1x 2.3x A1 / AA • Isatuximab (N/A) N/A

• Opdivo ($4,731MM) 102.7 9.3(7) 9.4 20.7x 1.4x A2 / A+

• Sprycel ($1,995MM) 88.2 7.6 N/A 12.4x 4.0x A2 / A+ • N/A

85.8 9.5(8) N/A 18.8x 4.4x A3 / BBB+ • N/A

81.7 11.8 9.0 13.9x 2.4x Baa2 / BBB+ • Revlimid ($8,243MM)

• Pomalyst ($1,598MM)

Potential Addition

199.5 6.9 N/A 15.3x 1.4x A1 / AA • Rituxan ($7,290MM)

• Gazyva ($299MM)

Notes

1. Financial metrics from latest company filings and Capital IQ as of 11/03/2017

2. Received approval for Hodgkin Lymphoma in March 2017

3. Company does not disclose quarterly US/OUS cash breakout, but held 98.5% of cash in foreign subsidiaries as of 12/31/16

4. Sanofi does not disclose quarterly US/OUS cash breakdown, but stated that as of 12/31/16 “we held cash and cash equivalents amounting to €10,273 million, substantially all of which were held in euros“

5. Cash figure adjusted for €115MM upfront cash payment for Rigontec and $1.6Bn upfront payment for collaboration agreement with AZN

6. Cash figure adjusted for $650MM upfront payment for acquisition of Protein Sciences 29

7. Cash figure adjusted for $300MM upfront payment for acquisition of IFM Therapeutics

8. Cash figure adjusted for $650MM received from sale of anaesthetic medicine rights and $1.6Bn upfront payment received from collaboration agreement with MRK

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\30

Project Maple

Appendix A

PoS Adjusted Financials

30

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\31

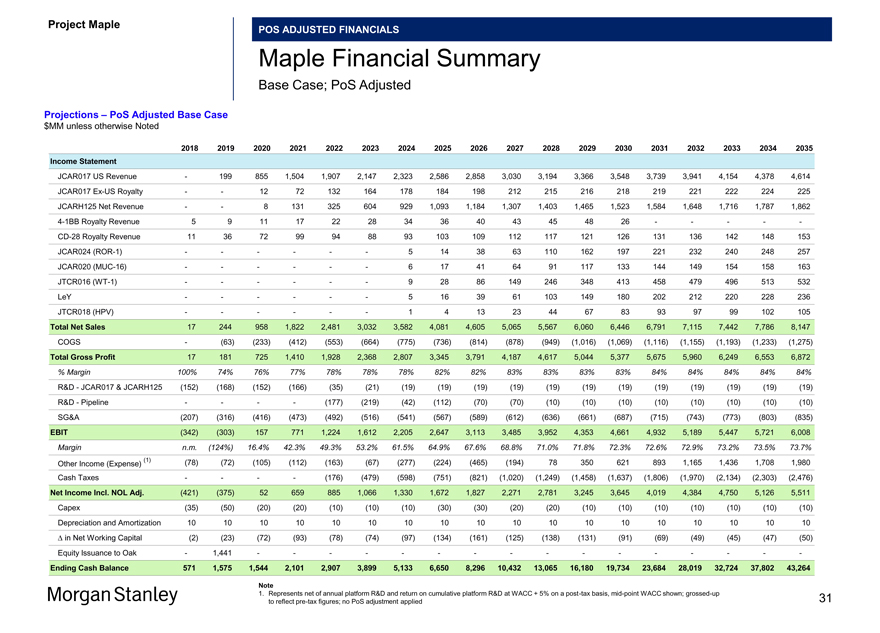

Project Maple

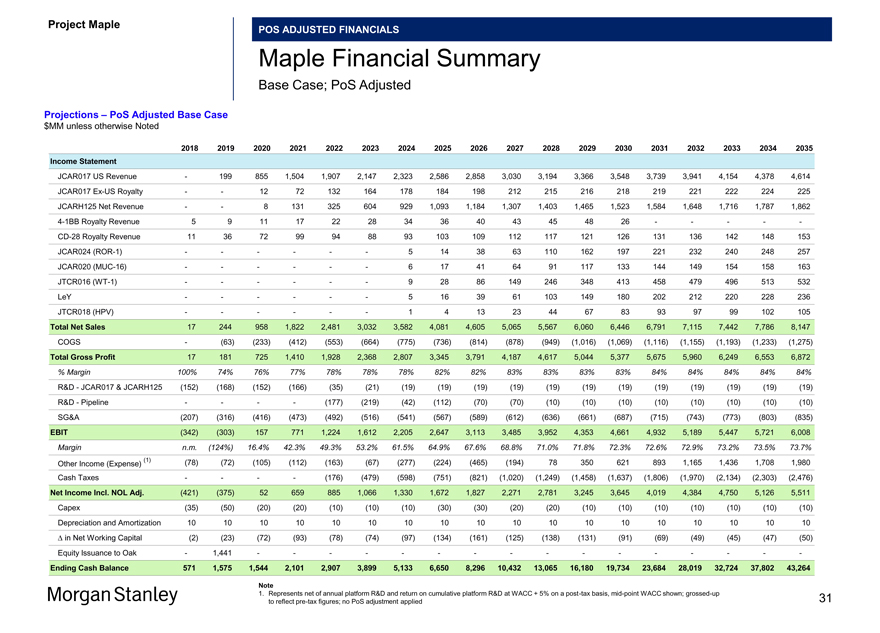

POS ADJUSTED FINANCIALS

Maple Financial Summary

Base Case; PoS Adjusted

Projections – PoS Adjusted Base Case $MM unless otherwise Noted

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Income Statement

JCAR017 US Revenue — 199 855 1,504 1,907 2,147 2,323 2,586 2,858 3,030 3,194 3,366 3,548 3,739 3,941 4,154 4,378 4,614 JCAR017Ex-US Royalty — — 12 72 132 164 178 184 198 212 215 216 218 219 221 222 224 225 JCARH125 Net Revenue — — 8 131 325 604 929 1,093 1,184 1,307 1,403 1,465 1,523 1,584 1,648 1,716 1,787 1,8624-1BB Royalty Revenue 5 9 11 17 22 28 34 36 40 43 45 48 26 — — — —-CD-28 Royalty Revenue 11 36 72 99 94 88 93 103 109 112 117 121 126 131 136 142 148 153 JCAR024(ROR-1) — — — — — — 5 14 38 63 110 162 197 221 232 240 248 257 JCAR020(MUC-16) — — — — — — 6 17 41 64 91 117 133 144 149 154 158 163 JTCR016(WT-1) — — — — — — 9 28 86 149 246 348 413 458 479 496 513 532 LeY — — — — — — 5 16 39 61 103 149 180 202 212 220 228 236 JTCR018 (HPV) — — — — — — 1 4 13 23 44 67 83 93 97 99 102 105 Total Net Sales 17 244 958 1,822 2,481 3,032 3,582 4,081 4,605 5,065 5,567 6,060 6,446 6,791 7,115 7,442 7,786 8,147 COGS — (63) (233) (412) (553) (664) (775) (736) (814) (878) (949) (1,016) (1,069) (1,116) (1,155) (1,193) (1,233) (1,275) Total Gross Profit 17 181 725 1,410 1,928 2,368 2,807 3,345 3,791 4,187 4,617 5,044 5,377 5,675 5,960 6,249 6,553 6,872

% Margin 100% 74% 76% 77% 78% 78% 78% 82% 82% 83% 83% 83% 83% 84% 84% 84% 84% 84%

R&D—JCAR017 & JCARH125 (152) (168) (152) (166) (35) (21) (19) (19) (19) (19) (19) (19) (19) (19) (19) (19) (19) (19) R&D—Pipeline — — — — (177) (219) (42) (112) (70) (70) (10) (10) (10) (10) (10) (10) (10) (10) SG&A (207) (316) (416) (473) (492) (516) (541) (567) (589) (612) (636) (661) (687) (715) (743) (773) (803) (835) EBIT (342) (303) 157 771 1,224 1,612 2,205 2,647 3,113 3,485 3,952 4,353 4,661 4,932 5,189 5,447 5,721 6,008

Margin n.m. (124%) 16.4% 42.3% 49.3% 53.2% 61.5% 64.9% 67.6% 68.8% 71.0% 71.8% 72.3% 72.6% 72.9% 73.2% 73.5% 73.7%

(1) (78) (72) (105) (112) (163) (67) (277) (224) (465) (194) 78 350 621 893 1,165 1,436 1,708 1,980 Other Income (Expense)

Cash Taxes — — — — (176) (479) (598) (751) (821) (1,020) (1,249) (1,458) (1,637) (1,806) (1,970) (2,134) (2,303) (2,476) Net Income Incl. NOL Adj. (421) (375) 52 659 885 1,066 1,330 1,672 1,827 2,271 2,781 3,245 3,645 4,019 4,384 4,750 5,126 5,511 Capex (35) (50) (20) (20) (10) (10) (10) (30) (30) (20) (20) (10) (10) (10) (10) (10) (10) (10) Depreciation and Amortization 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 â^† in Net Working Capital (2) (23) (72) (93) (78) (74) (97) (134) (161) (125) (138) (131) (91) (69) (49) (45) (47) (50) Equity Issuance to Oak — 1,441 — — — — — — — — — — — — — — — -

Ending Cash Balance 571 1,575 1,544 2,101 2,907 3,899 5,133 6,650 8,296 10,432 13,065 16,180 19,734 23,684 28,019 32,724 37,802 43,264

Note

1. Represents net of annual platform R&D and return on cumulative platform R&D at WACC + 5% on apost-tax basis,mid-point WACC shown;grossed-up 31 to reflectpre-tax figures; no PoS adjustment applied

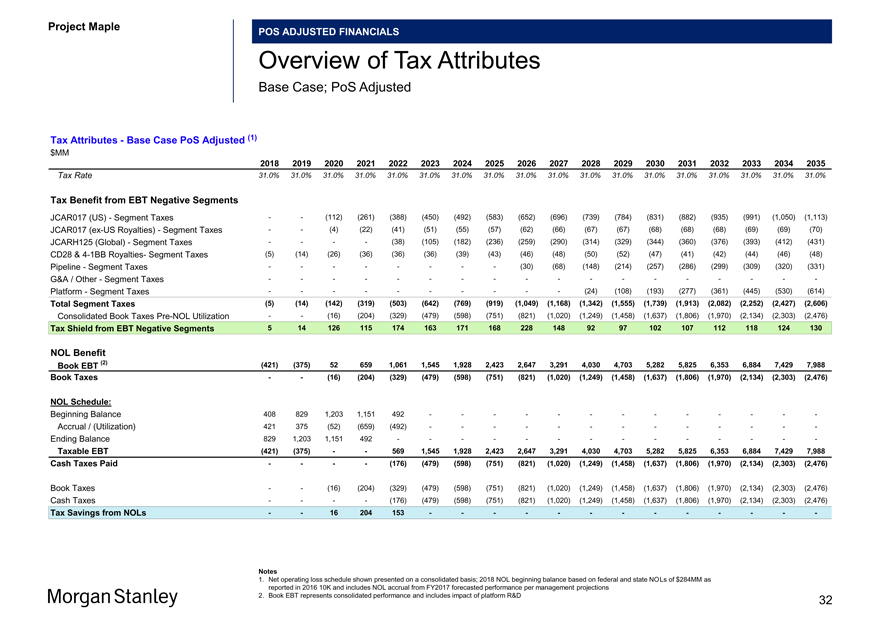

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\32

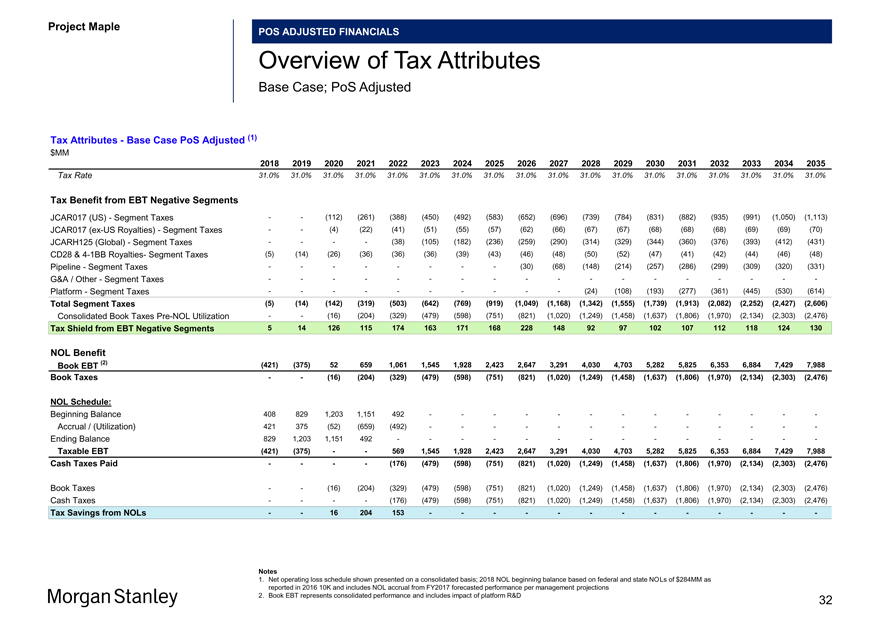

Project Maple

POS ADJUSTED FINANCIALS

Overview of Tax Attributes

Base Case; PoS Adjusted

Tax Attributes—Base Case PoS Adjusted (1) $MM

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035

Tax Rate 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0%

Tax Benefit from EBT Negative Segments

JCAR017 (US)—Segment Taxes — (112) (261) (388) (450) (492) (583) (652) (696) (739) (784) (831) (882) (935) (991) (1,050) (1,113) JCAR017(ex-US Royalties)—Segment Taxes — (4) (22) (41) (51) (55) (57) (62) (66) (67) (67) (68) (68) (68) (69) (69) (70) JCARH125 (Global)—Segment Taxes — — (38) (105) (182) (236) (259) (290) (314) (329) (344) (360) (376) (393) (412) (431) CD28 &4-1BB Royalties- Segment Taxes (5) (14) (26) (36) (36) (36) (39) (43) (46) (48) (50) (52) (47) (41) (42) (44) (46) (48) Pipeline—Segment Taxes — — — — (30) (68) (148) (214) (257) (286) (299) (309) (320) (331)

G&A / Other—Segment Taxes — — — — — — — — —

Platform—Segment Taxes — — — — — (24) (108) (193) (277) (361) (445) (530) (614)

Total Segment Taxes (5) (14) (142) (319) (503) (642) (769) (919) (1,049) (1,168) (1,342) (1,555) (1,739) (1,913) (2,082) (2,252) (2,427) (2,606)

Consolidated Book TaxesPre-NOL Utilization — (16) (204) (329) (479) (598) (751) (821) (1,020) (1,249) (1,458) (1,637) (1,806) (1,970) (2,134) (2,303) (2,476)

Tax Shield from EBT Negative Segments 5 14 126 115 174 163 171 168 228 148 92 97 102 107 112 118 124 130

NOL Benefit

Book EBT (2) (421) (375) 52 659 1,061 1,545 1,928 2,423 2,647 3,291 4,030 4,703 5,282 5,825 6,353 6,884 7,429 7,988 Book Taxes — (16) (204) (329) (479) (598) (751) (821) (1,020) (1,249) (1,458) (1,637) (1,806) (1,970) (2,134) (2,303) (2,476)

NOL Schedule:

Beginning Balance 408 829 1,203 1,151 492 — — — — — — -Accrual / (Utilization) 421 375 (52) (659) (492) — — — — — — -Ending Balance 829 1,203 1,151 492 — — — — — — —

Taxable EBT (421) (375) — 569 1,545 1,928 2,423 2,647 3,291 4,030 4,703 5,282 5,825 6,353 6,884 7,429 7,988 Cash Taxes Paid — — (176) (479) (598) (751) (821) (1,020) (1,249) (1,458) (1,637) (1,806) (1,970) (2,134) (2,303) (2,476)

Book Taxes — (16) (204) (329) (479) (598) (751) (821) (1,020) (1,249) (1,458) (1,637) (1,806) (1,970) (2,134) (2,303) (2,476) Cash Taxes — — (176) (479) (598) (751) (821) (1,020) (1,249) (1,458) (1,637) (1,806) (1,970) (2,134) (2,303) (2,476)

Tax Savings from NOLs — 16 204 153 — — — — — — -

Notes

1. Net operating loss schedule shown presented on a consolidated basis; 2018 NOL beginning balance based on federal and state NOLs of $284MM as reported in 2016 10K and includes NOL accrual from FY2017 forecasted performance per management projections

2. Book EBT represents consolidated performance and includes impact of platform R&D 32

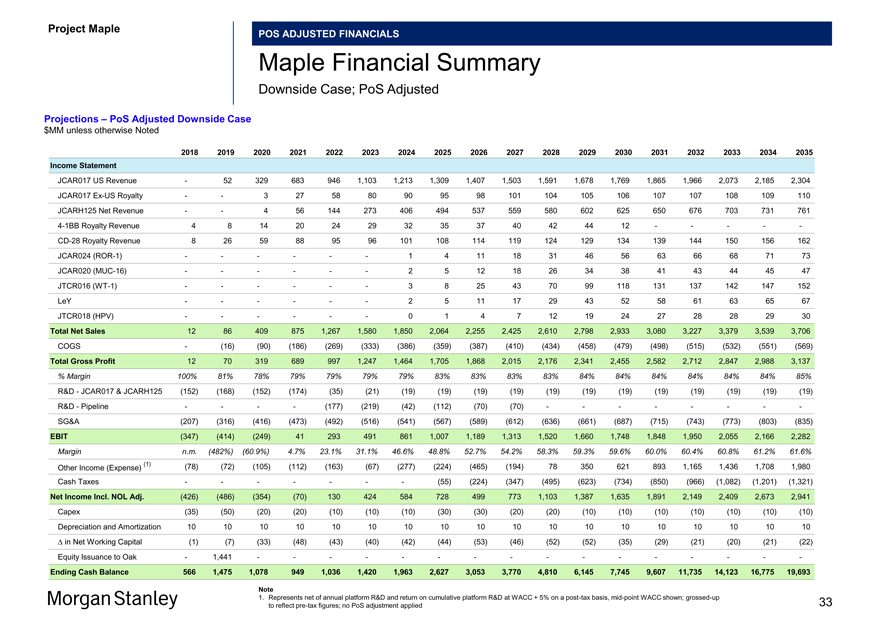

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\33

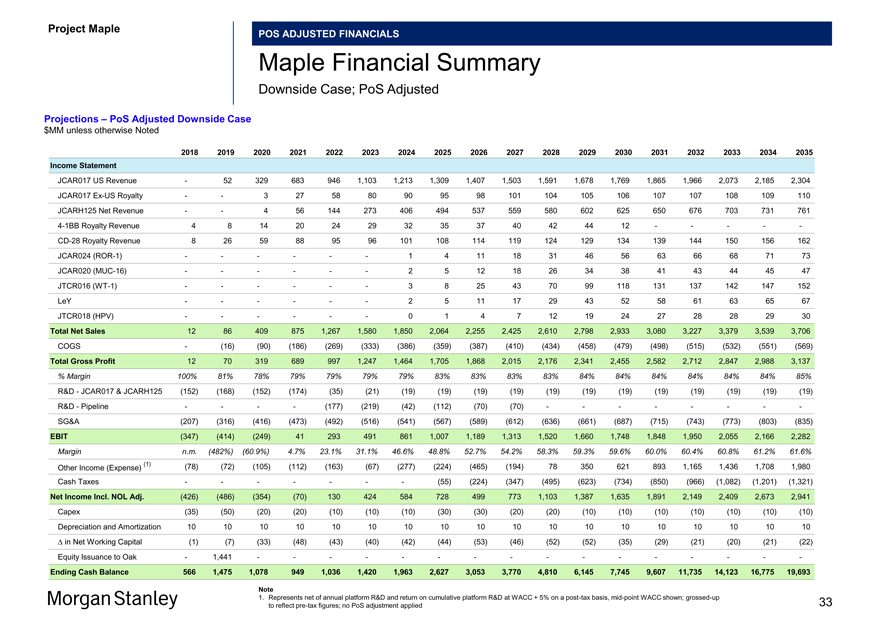

Project Maple

POS ADJUSTED FINANCIALS

Maple Financial Summary

Downside Case; PoS Adjusted

Projections – PoS Adjusted Downside Case $MM unless otherwise Noted

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Income Statement

JCAR017 US Revenue — 52 329 683 946 1,103 1,213 1,309 1,407 1,503 1,591 1,678 1,769 1,865 1,966 2,073 2,185 2,304 JCAR017Ex-US Royalty — — 3 27 58 80 90 95 98 101 104 105 106 107 107 108 109 110 JCARH125 Net Revenue — — 4 56 144 273 406 494 537 559 580 602 625 650 676 703 731 7614-1BB Royalty Revenue 4 8 14 20 24 29 32 35 37 40 42 44 12 — — — —-CD-28 Royalty Revenue 8 26 59 88 95 96 101 108 114 119 124 129 134 139 144 150 156 162 JCAR024(ROR-1) — — — — — — 1 4 11 18 31 46 56 63 66 68 71 73 JCAR020(MUC-16) — — — — — — 2 5 12 18 26 34 38 41 43 44 45 47 JTCR016(WT-1) — — — — — — 3 8 25 43 70 99 118 131 137 142 147 152 LeY — — — — — — 2 5 11 17 29 43 52 58 61 63 65 67 JTCR018 (HPV) — — — — — — 0 1 4 7 12 19 24 27 28 28 29 30 Total Net Sales 12 86 409 875 1,267 1,580 1,850 2,064 2,255 2,425 2,610 2,798 2,933 3,080 3,227 3,379 3,539 3,706 COGS — (16) (90) (186) (269) (333) (386) (359) (387) (410) (434) (458) (479) (498) (515) (532) (551) (569) Total Gross Profit 12 70 319 689 997 1,247 1,464 1,705 1,868 2,015 2,176 2,341 2,455 2,582 2,712 2,847 2,988 3,137

% Margin 100% 81% 78% 79% 79% 79% 79% 83% 83% 83% 83% 84% 84% 84% 84% 84% 84% 85%

R&D—JCAR017 & JCARH125 (152) (168) (152) (174) (35) (21) (19) (19) (19) (19) (19) (19) (19) (19) (19) (19) (19) (19) R&D—Pipeline — — — — (177) (219) (42) (112) (70) (70) — — — — — — —-SG&A (207) (316) (416) (473) (492) (516) (541) (567) (589) (612) (636) (661) (687) (715) (743) (773) (803) (835) EBIT (347) (414) (249) 41 293 491 861 1,007 1,189 1,313 1,520 1,660 1,748 1,848 1,950 2,055 2,166 2,282

Margin n.m. (482%) (60.9%) 4.7% 23.1% 31.1% 46.6% 48.8% 52.7% 54.2% 58.3% 59.3% 59.6% 60.0% 60.4% 60.8% 61.2% 61.6%

(1) (78) (72) (105) (112) (163) (67) (277) (224) (465) (194) 78 350 621 893 1,165 1,436 1,708 1,980 Other Income (Expense)

Cash Taxes — — — — — — — (55) (224) (347) (495) (623) (734) (850) (966) (1,082) (1,201) (1,321) Net Income Incl. NOL Adj. (426) (486) (354) (70) 130 424 584 728 499 773 1,103 1,387 1,635 1,891 2,149 2,409 2,673 2,941 Capex (35) (50) (20) (20) (10) (10) (10) (30) (30) (20) (20) (10) (10) (10) (10) (10) (10) (10) Depreciation and Amortization 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 â^† in Net Working Capital (1) (7) (33) (48) (43) (40) (42) (44) (53) (46) (52) (52) (35) (29) (21) (20) (21) (22) Equity Issuance to Oak — 1,441 — — — — — — — — — — — — — — — -

Ending Cash Balance 566 1,475 1,078 949 1,036 1,420 1,963 2,627 3,053 3,770 4,810 6,145 7,745 9,607 11,735 14,123 16,775 19,693

Note

1. Represents net of annual platform R&D and return on cumulative platform R&D at WACC + 5% on apost-tax basis,mid-point WACC shown;grossed-up 33 to reflectpre-tax figures; no PoS adjustment applied

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\34

Project Maple

POS ADJUSTED FINANCIALS

Overview of Tax Attributes

Downside Case; PoS Adjusted

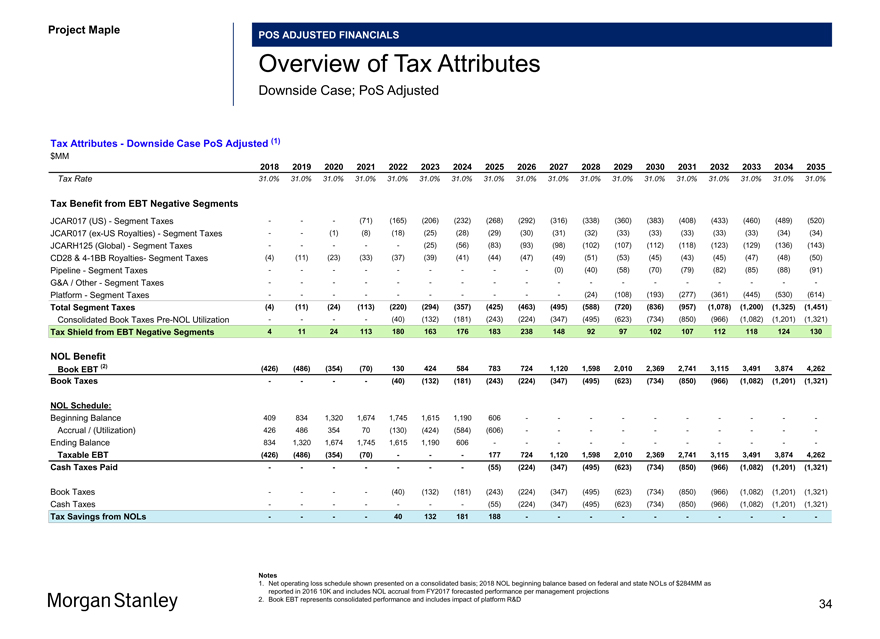

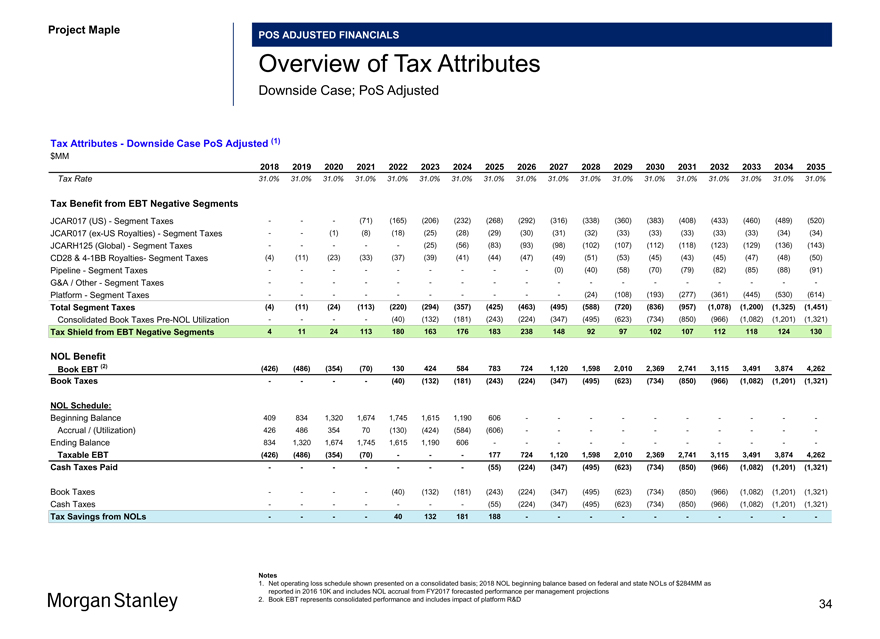

Tax Attributes—Downside Case PoS Adjusted (1) $MM

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035

Tax Rate 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0%

Tax Benefit from EBT Negative Segments

JCAR017 (US)—Segment Taxes ——(71) (165) (206) (232) (268) (292) (316) (338) (360) (383) (408) (433) (460) (489) (520) JCAR017(ex-US Royalties)—Segment Taxes — (1) (8) (18) (25) (28) (29) (30) (31) (32) (33) (33) (33) (33) (33) (34) (34) JCARH125 (Global)—Segment Taxes — ——(25) (56) (83) (93) (98) (102) (107) (112) (118) (123) (129) (136) (143) CD28 &4-1BB Royalties- Segment Taxes (4) (11) (23) (33) (37) (39) (41) (44) (47) (49) (51) (53) (45) (43) (45) (47) (48) (50) Pipeline—Segment Taxes — — — ——(0) (40) (58) (70) (79) (82) (85) (88) (91)

G&A / Other—Segment Taxes — — — — — — — — —

Platform—Segment Taxes — — — — — (24) (108) (193) (277) (361) (445) (530) (614)

Total Segment Taxes (4) (11) (24) (113) (220) (294) (357) (425) (463) (495) (588) (720) (836) (957) (1,078) (1,200) (1,325) (1,451)

Consolidated Book TaxesPre-NOL Utilization — — (40) (132) (181) (243) (224) (347) (495) (623) (734) (850) (966) (1,082) (1,201) (1,321)

Tax Shield from EBT Negative Segments 4 11 24 113 180 163 176 183 238 148 92 97 102 107 112 118 124 130

NOL Benefit

Book EBT (2) (426) (486) (354) (70) 130 424 584 783 724 1,120 1,598 2,010 2,369 2,741 3,115 3,491 3,874 4,262 Book Taxes — — (40) (132) (181) (243) (224) (347) (495) (623) (734) (850) (966) (1,082) (1,201) (1,321)

NOL Schedule:

Beginning Balance 409 834 1,320 1,674 1,745 1,615 1,190 606 — — — — —Accrual / (Utilization) 426 486 354 70 (130) (424) (584) (606) — — — — —Ending Balance 834 1,320 1,674 1,745 1,615 1,190 606 — — — — — -

Taxable EBT (426) (486) (354) (70) ——177 724 1,120 1,598 2,010 2,369 2,741 3,115 3,491 3,874 4,262 Cash Taxes Paid — — ——(55) (224) (347) (495) (623) (734) (850) (966) (1,082) (1,201) (1,321)

Book Taxes — — (40) (132) (181) (243) (224) (347) (495) (623) (734) (850) (966) (1,082) (1,201) (1,321) Cash Taxes — — ——(55) (224) (347) (495) (623) (734) (850) (966) (1,082) (1,201) (1,321)

Tax Savings from NOLs — — 40 132 181 188 — — — — —

Notes

1. Net operating loss schedule shown presented on a consolidated basis; 2018 NOL beginning balance based on federal and state NOLs of $284MM as reported in 2016 10K and includes NOL accrual from FY2017 forecasted performance per management projections

2. Book EBT represents consolidated performance and includes impact of platform R&D 34

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\35

Project Maple

POS ADJUSTED FINANCIALS

Maple Financial Summary

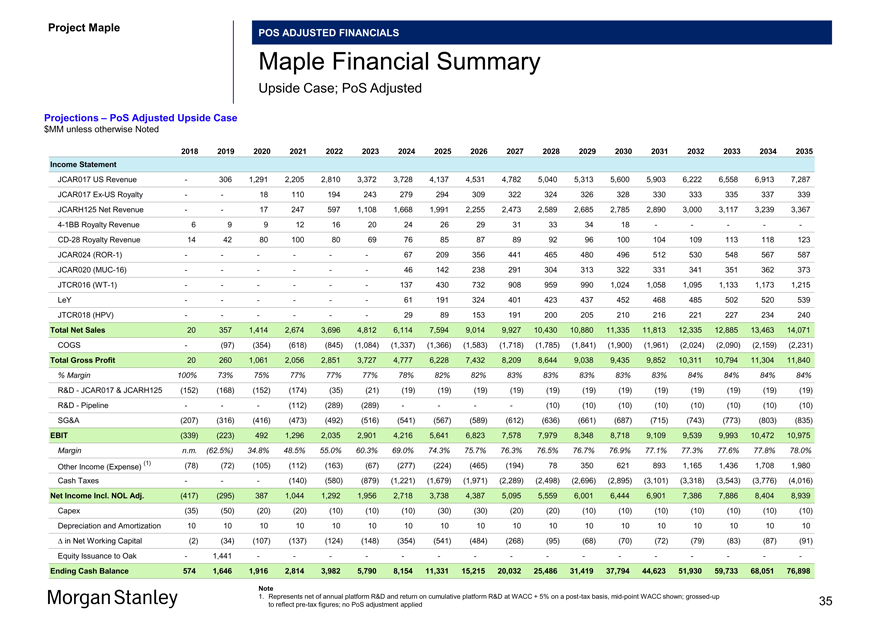

Upside Case; PoS Adjusted

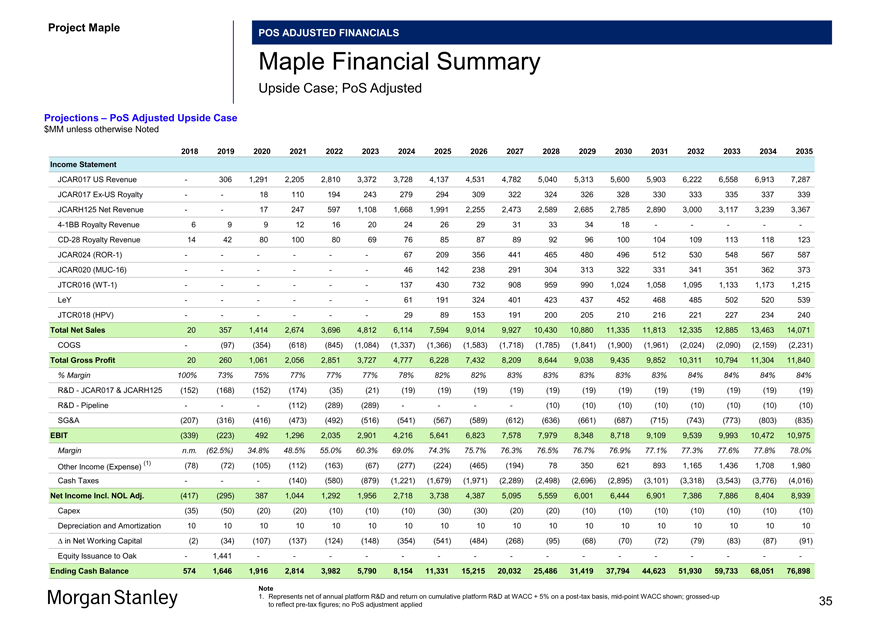

Projections – PoS Adjusted Upside Case $MM unless otherwise Noted

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Income Statement

JCAR017 US Revenue — 306 1,291 2,205 2,810 3,372 3,728 4,137 4,531 4,782 5,040 5,313 5,600 5,903 6,222 6,558 6,913 7,287 JCAR017Ex-US Royalty — — 18 110 194 243 279 294 309 322 324 326 328 330 333 335 337 339 JCARH125 Net Revenue — — 17 247 597 1,108 1,668 1,991 2,255 2,473 2,589 2,685 2,785 2,890 3,000 3,117 3,239 3,3674-1BB Royalty Revenue 6 9 9 12 16 20 24 26 29 31 33 34 18 — — — —-CD-28 Royalty Revenue 14 42 80 100 80 69 76 85 87 89 92 96 100 104 109 113 118 123 JCAR024(ROR-1) — — — — — — 67 209 356 441 465 480 496 512 530 548 567 587 JCAR020(MUC-16) — — — — — — 46 142 238 291 304 313 322 331 341 351 362 373 JTCR016(WT-1) — — — — — — 137 430 732 908 959 990 1,024 1,058 1,095 1,133 1,173 1,215 LeY — — — — — — 61 191 324 401 423 437 452 468 485 502 520 539 JTCR018 (HPV) — — — — — — 29 89 153 191 200 205 210 216 221 227 234 240

Total Net Sales 20 357 1,414 2,674 3,696 4,812 6,114 7,594 9,014 9,927 10,430 10,880 11,335 11,813 12,335 12,885 13,463 14,071 COGS — (97) (354) (618) (845) (1,084) (1,337) (1,366) (1,583) (1,718) (1,785) (1,841) (1,900) (1,961) (2,024) (2,090) (2,159) (2,231)

Total Gross Profit 20 260 1,061 2,056 2,851 3,727 4,777 6,228 7,432 8,209 8,644 9,038 9,435 9,852 10,311 10,794 11,304 11,840

% Margin 100% 73% 75% 77% 77% 77% 78% 82% 82% 83% 83% 83% 83% 83% 84% 84% 84% 84%

R&D—JCAR017 & JCARH125 (152) (168) (152) (174) (35) (21) (19) (19) (19) (19) (19) (19) (19) (19) (19) (19) (19) (19) R&D—Pipeline — — — (112) (289) (289) — — — — (10) (10) (10) (10) (10) (10) (10) (10) SG&A (207) (316) (416) (473) (492) (516) (541) (567) (589) (612) (636) (661) (687) (715) (743) (773) (803) (835) EBIT (339) (223) 492 1,296 2,035 2,901 4,216 5,641 6,823 7,578 7,979 8,348 8,718 9,109 9,539 9,993 10,472 10,975

Margin n.m. (62.5%) 34.8% 48.5% 55.0% 60.3% 69.0% 74.3% 75.7% 76.3% 76.5% 76.7% 76.9% 77.1% 77.3% 77.6% 77.8% 78.0%

(1) (78) (72) (105) (112) (163) (67) (277) (224) (465) (194) 78 350 621 893 1,165 1,436 1,708 1,980 Other Income (Expense) Cash Taxes — — — (140) (580) (879) (1,221) (1,679) (1,971) (2,289) (2,498) (2,696) (2,895) (3,101) (3,318) (3,543) (3,776) (4,016)

Net Income Incl. NOL Adj. (417) (295) 387 1,044 1,292 1,956 2,718 3,738 4,387 5,095 5,559 6,001 6,444 6,901 7,386 7,886 8,404 8,939 Capex (35) (50) (20) (20) (10) (10) (10) (30) (30) (20) (20) (10) (10) (10) (10) (10) (10) (10) Depreciation and Amortization 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 â^† in Net Working Capital (2) (34) (107) (137) (124) (148) (354) (541) (484) (268) (95) (68) (70) (72) (79) (83) (87) (91) Equity Issuance to Oak — 1,441 — — — — — — — — — — — — — — — -

Ending Cash Balance 574 1,646 1,916 2,814 3,982 5,790 8,154 11,331 15,215 20,032 25,486 31,419 37,794 44,623 51,930 59,733 68,051 76,898

Note

1. Represents net of annual platform R&D and return on cumulative platform R&D at WACC + 5% on apost-tax basis,mid-point WACC shown;grossed-up 35 to reflectpre-tax figures; no PoS adjustment applied

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\36

Project Maple

POS ADJUSTED FINANCIALS

Overview of Tax Attributes

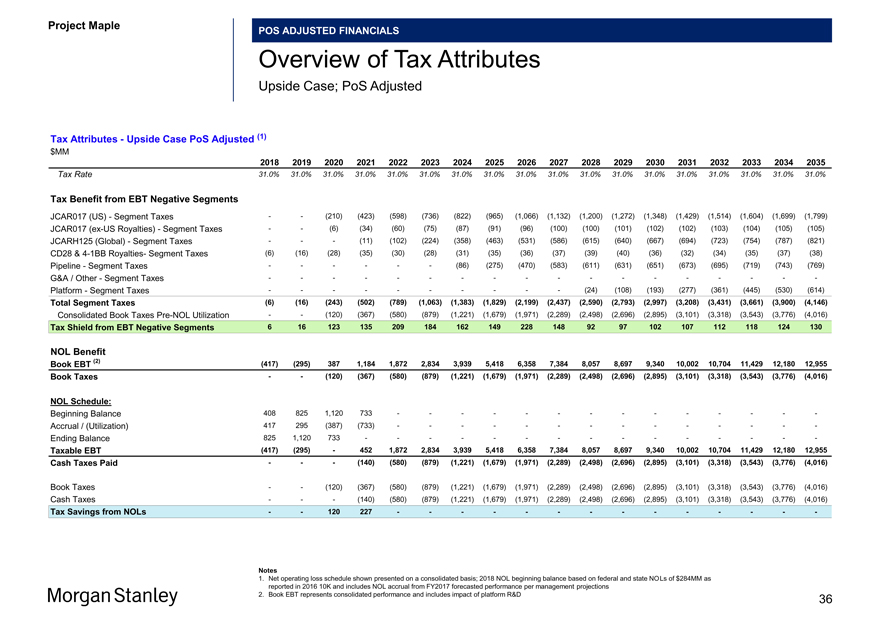

Upside Case; PoS Adjusted

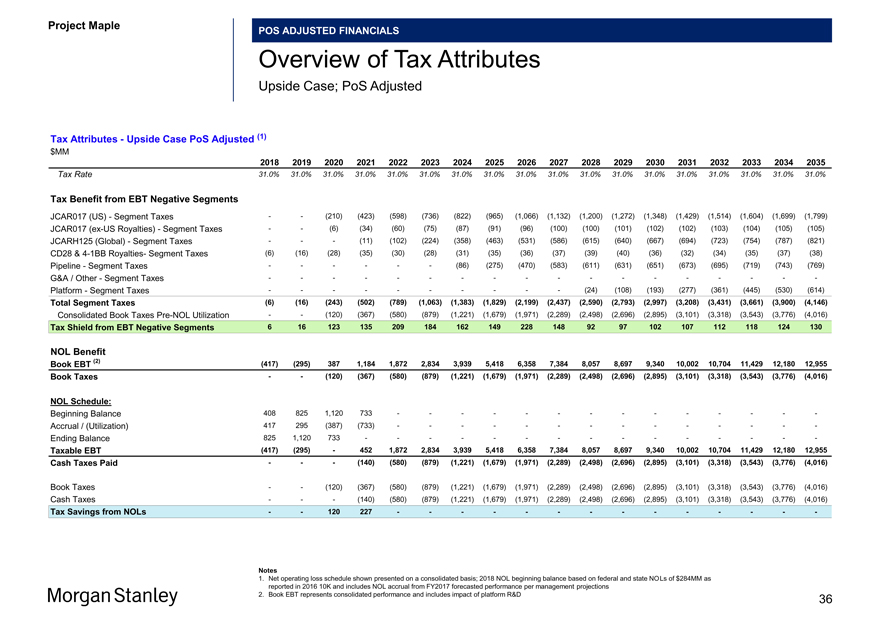

Tax Attributes—Upside Case PoS Adjusted (1) $MM

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035

Tax Rate 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0% 31.0%

Tax Benefit from EBT Negative Segments

JCAR017 (US)—Segment Taxes — (210) (423) (598) (736) (822) (965) (1,066) (1,132) (1,200) (1,272) (1,348) (1,429) (1,514) (1,604) (1,699) (1,799) JCAR017(ex-US Royalties)—Segment Taxes — (6) (34) (60) (75) (87) (91) (96) (100) (100) (101) (102) (102) (103) (104) (105) (105) JCARH125 (Global)—Segment Taxes ——(11) (102) (224) (358) (463) (531) (586) (615) (640) (667) (694) (723) (754) (787) (821) CD28 &4-1BB Royalties- Segment Taxes (6) (16) (28) (35) (30) (28) (31) (35) (36) (37) (39) (40) (36) (32) (34) (35) (37) (38) Pipeline—Segment Taxes — — — (86) (275) (470) (583) (611) (631) (651) (673) (695) (719) (743) (769)

G&A / Other—Segment Taxes — — — — — — — — —

Platform—Segment Taxes — — — — — (24) (108) (193) (277) (361) (445) (530) (614)

Total Segment Taxes (6) (16) (243) (502) (789) (1,063) (1,383) (1,829) (2,199) (2,437) (2,590) (2,793) (2,997) (3,208) (3,431) (3,661) (3,900) (4,146)

Consolidated Book TaxesPre-NOL Utilization — (120) (367) (580) (879) (1,221) (1,679) (1,971) (2,289) (2,498) (2,696) (2,895) (3,101) (3,318) (3,543) (3,776) (4,016)

Tax Shield from EBT Negative Segments 6 16 123 135 209 184 162 149 228 148 92 97 102 107 112 118 124 130

NOL Benefit

Book EBT (2) (417) (295) 387 1,184 1,872 2,834 3,939 5,418 6,358 7,384 8,057 8,697 9,340 10,002 10,704 11,429 12,180 12,955 Book Taxes — (120) (367) (580) (879) (1,221) (1,679) (1,971) (2,289) (2,498) (2,696) (2,895) (3,101) (3,318) (3,543) (3,776) (4,016)

NOL Schedule:

Beginning Balance 408 825 1,120 733 — — — — — — —Accrual / (Utilization) 417 295 (387) (733) — — — — — — —Ending Balance 825 1,120 733 — — — — — — — -

Taxable EBT (417) (295)—452 1,872 2,834 3,939 5,418 6,358 7,384 8,057 8,697 9,340 10,002 10,704 11,429 12,180 12,955 Cash Taxes Paid ——(140) (580) (879) (1,221) (1,679) (1,971) (2,289) (2,498) (2,696) (2,895) (3,101) (3,318) (3,543) (3,776) (4,016)

Book Taxes — (120) (367) (580) (879) (1,221) (1,679) (1,971) (2,289) (2,498) (2,696) (2,895) (3,101) (3,318) (3,543) (3,776) (4,016) Cash Taxes ——(140) (580) (879) (1,221) (1,679) (1,971) (2,289) (2,498) (2,696) (2,895) (3,101) (3,318) (3,543) (3,776) (4,016)

Tax Savings from NOLs — 120 227 — — — — — — —

Notes

1. Net operating loss schedule shown presented on a consolidated basis; 2018 NOL beginning balance based on federal and state NOLs of $284MM as reported in 2016 10K and includes NOL accrual from FY2017 forecasted performance per management projections

2. Book EBT represents consolidated performance and includes impact of platform R&D 36

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\37

Project Maple

Appendix B

Non-PoS Adjusted Financials

37

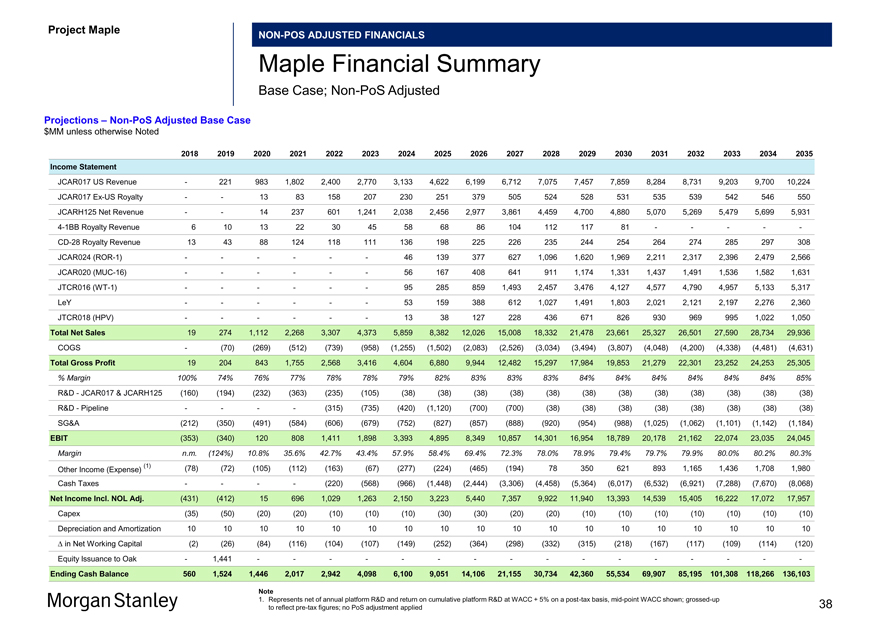

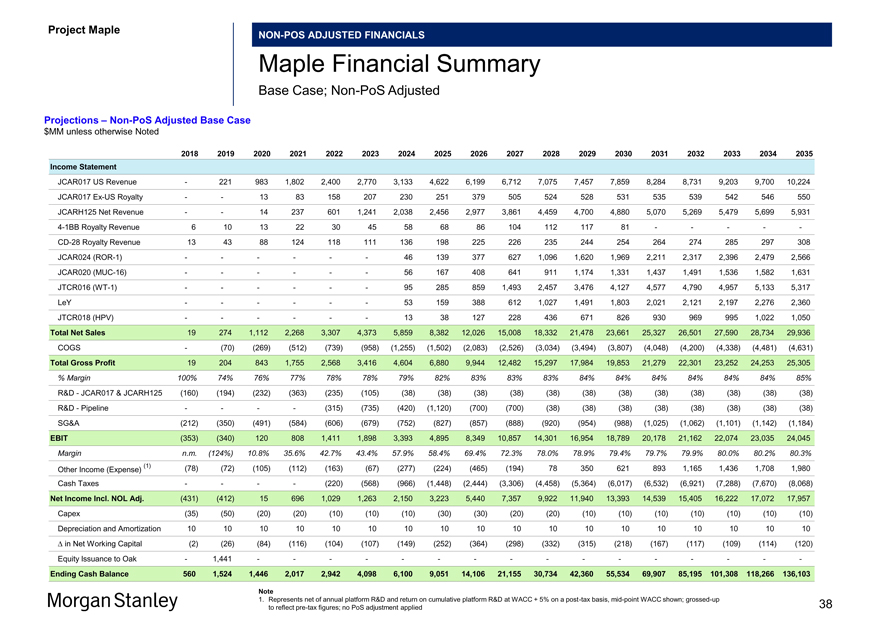

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\38

Project Maple

NON-POS ADJUSTED FINANCIALS

Maple Financial Summary

Base Case;Non-PoS Adjusted

Projections –Non-PoS Adjusted Base Case $MM unless otherwise Noted

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Income Statement

JCAR017 US Revenue — 221 983 1,802 2,400 2,770 3,133 4,622 6,199 6,712 7,075 7,457 7,859 8,284 8,731 9,203 9,700 10,224 JCAR017Ex-US Royalty — — 13 83 158 207 230 251 379 505 524 528 531 535 539 542 546 550 JCARH125 Net Revenue — — 14 237 601 1,241 2,038 2,456 2,977 3,861 4,459 4,700 4,880 5,070 5,269 5,479 5,699 5,9314-1BB Royalty Revenue 6 10 13 22 30 45 58 68 86 104 112 117 81 — — — —-CD-28 Royalty Revenue 13 43 88 124 118 111 136 198 225 226 235 244 254 264 274 285 297 308 JCAR024(ROR-1) — — — — — — 46 139 377 627 1,096 1,620 1,969 2,211 2,317 2,396 2,479 2,566 JCAR020(MUC-16) — — — — — — 56 167 408 641 911 1,174 1,331 1,437 1,491 1,536 1,582 1,631 JTCR016(WT-1) — — — — — — 95 285 859 1,493 2,457 3,476 4,127 4,577 4,790 4,957 5,133 5,317 LeY — — — — — — 53 159 388 612 1,027 1,491 1,803 2,021 2,121 2,197 2,276 2,360 JTCR018 (HPV) — — — — — — 13 38 127 228 436 671 826 930 969 995 1,022 1,050

Total Net Sales 19 274 1,112 2,268 3,307 4,373 5,859 8,382 12,026 15,008 18,332 21,478 23,661 25,327 26,501 27,590 28,734 29,936 COGS — (70) (269) (512) (739) (958) (1,255) (1,502) (2,083) (2,526) (3,034) (3,494) (3,807) (4,048) (4,200) (4,338) (4,481) (4,631) Total Gross Profit 19 204 843 1,755 2,568 3,416 4,604 6,880 9,944 12,482 15,297 17,984 19,853 21,279 22,301 23,252 24,253 25,305

% Margin 100% 74% 76% 77% 78% 78% 79% 82% 83% 83% 83% 84% 84% 84% 84% 84% 84% 85%

R&D—JCAR017 & JCARH125 (160) (194) (232) (363) (235) (105) (38) (38) (38) (38) (38) (38) (38) (38) (38) (38) (38) (38) R&D—Pipeline — — — — (315) (735) (420) (1,120) (700) (700) (38) (38) (38) (38) (38) (38) (38) (38) SG&A (212) (350) (491) (584) (606) (679) (752) (827) (857) (888) (920) (954) (988) (1,025) (1,062) (1,101) (1,142) (1,184)

EBIT (353) (340) 120 808 1,411 1,898 3,393 4,895 8,349 10,857 14,301 16,954 18,789 20,178 21,162 22,074 23,035 24,045

Margin n.m. (124%) 10.8% 35.6% 42.7% 43.4% 57.9% 58.4% 69.4% 72.3% 78.0% 78.9% 79.4% 79.7% 79.9% 80.0% 80.2% 80.3%

(1) (78) (72) (105) (112) (163) (67) (277) (224) (465) (194) 78 350 621 893 1,165 1,436 1,708 1,980 Other Income (Expense) Cash Taxes — — — — (220) (568) (966) (1,448) (2,444) (3,306) (4,458) (5,364) (6,017) (6,532) (6,921) (7,288) (7,670) (8,068) Net Income Incl. NOL Adj. (431) (412) 15 696 1,029 1,263 2,150 3,223 5,440 7,357 9,922 11,940 13,393 14,539 15,405 16,222 17,072 17,957 Capex (35) (50) (20) (20) (10) (10) (10) (30) (30) (20) (20) (10) (10) (10) (10) (10) (10) (10) Depreciation and Amortization 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 â^† in Net Working Capital (2) (26) (84) (116) (104) (107) (149) (252) (364) (298) (332) (315) (218) (167) (117) (109) (114) (120) Equity Issuance to Oak — 1,441 — — — — — — — — — — — — — — — -

Ending Cash Balance 560 1,524 1,446 2,017 2,942 4,098 6,100 9,051 14,106 21,155 30,734 42,360 55,534 69,907 85,195101,308118,266136,103

Note

1. Represents net of annual platform R&D and return on cumulative platform R&D at WACC + 5% on apost-tax basis,mid-point WACC shown;grossed-up 38 to reflectpre-tax figures; no PoS adjustment applied

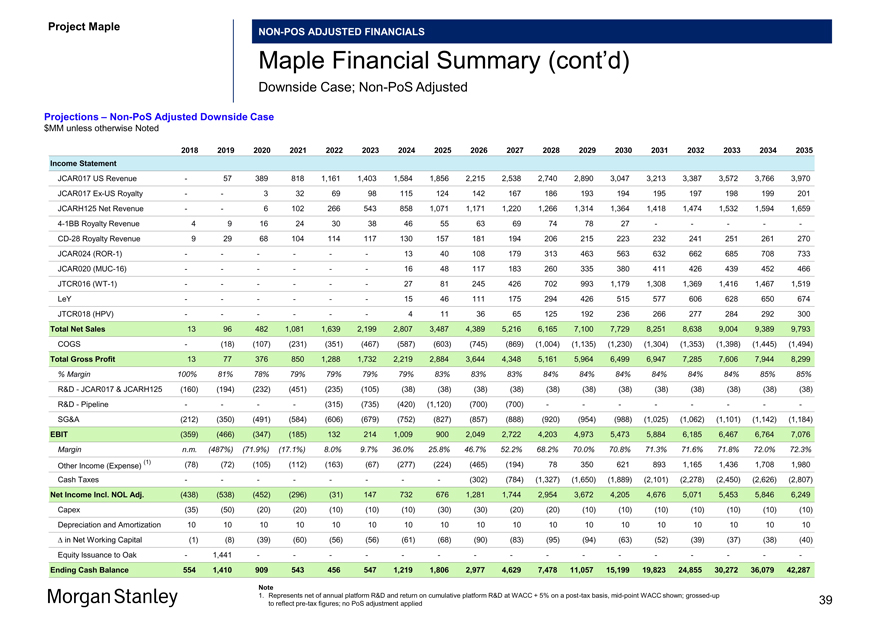

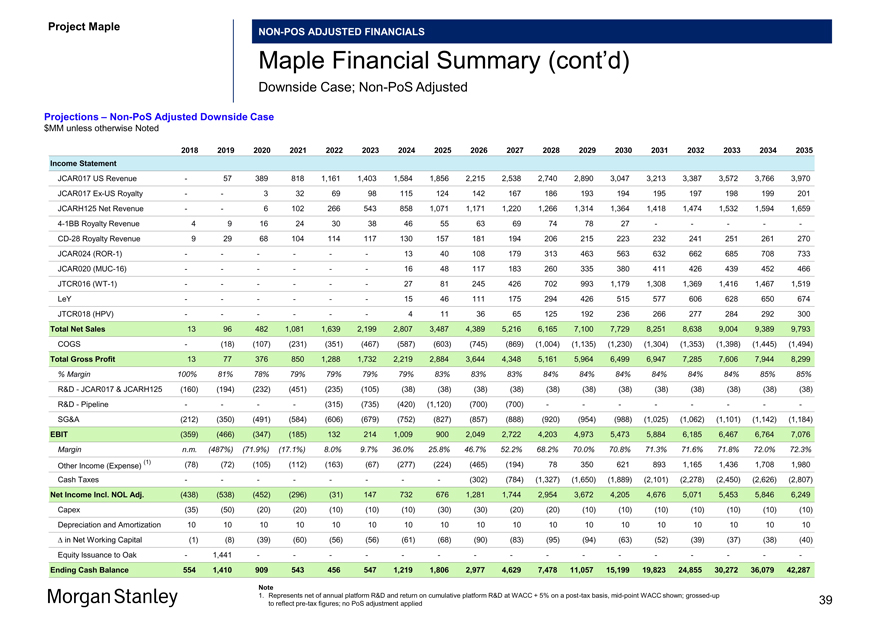

Project Maple

NON-POS ADJUSTED FINANCIALS

Maple Financial Summary (cont’d)

Downside Case;Non-PoS Adjusted

Projections –Non-PoS Adjusted Downside Case $MM unless otherwise Noted

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Income Statement

JCAR017 US Revenue — 57 389 818 1,161 1,403 1,584 1,856 2,215 2,538 2,740 2,890 3,047 3,213 3,387 3,572 3,766 3,970 JCAR017Ex-US Royalty — — 3 32 69 98 115 124 142 167 186 193 194 195 197 198 199 201 JCARH125 Net Revenue — — 6 102 266 543 858 1,071 1,171 1,220 1,266 1,314 1,364 1,418 1,474 1,532 1,594 1,6594-1BB Royalty Revenue 4 9 16 24 30 38 46 55 63 69 74 78 27 — — — —-CD-28 Royalty Revenue 9 29 68 104 114 117 130 157 181 194 206 215 223 232 241 251 261 270 JCAR024(ROR-1) — — — — — — 13 40 108 179 313 463 563 632 662 685 708 733 JCAR020(MUC-16) — — — — — — 16 48 117 183 260 335 380 411 426 439 452 466 JTCR016(WT-1) — — — — — — 27 81 245 426 702 993 1,179 1,308 1,369 1,416 1,467 1,519 LeY — — — — — — 15 46 111 175 294 426 515 577 606 628 650 674 JTCR018 (HPV) — — — — — — 4 11 36 65 125 192 236 266 277 284 292 300 Total Net Sales 13 96 482 1,081 1,639 2,199 2,807 3,487 4,389 5,216 6,165 7,100 7,729 8,251 8,638 9,004 9,389 9,793 COGS — (18) (107) (231) (351) (467) (587) (603) (745) (869) (1,004) (1,135) (1,230) (1,304) (1,353) (1,398) (1,445) (1,494) Total Gross Profit 13 77 376 850 1,288 1,732 2,219 2,884 3,644 4,348 5,161 5,964 6,499 6,947 7,285 7,606 7,944 8,299

% Margin 100% 81% 78% 79% 79% 79% 79% 83% 83% 83% 84% 84% 84% 84% 84% 84% 85% 85%

R&D—JCAR017 & JCARH125 (160) (194) (232) (451) (235) (105) (38) (38) (38) (38) (38) (38) (38) (38) (38) (38) (38) (38) R&D—Pipeline — — — — (315) (735) (420) (1,120) (700) (700) — — — — — — —-SG&A (212) (350) (491) (584) (606) (679) (752) (827) (857) (888) (920) (954) (988) (1,025) (1,062) (1,101) (1,142) (1,184) EBIT (359) (466) (347) (185) 132 214 1,009 900 2,049 2,722 4,203 4,973 5,473 5,884 6,185 6,467 6,764 7,076

Margin n.m. (487%) (71.9%) (17.1%) 8.0% 9.7% 36.0% 25.8% 46.7% 52.2% 68.2% 70.0% 70.8% 71.3% 71.6% 71.8% 72.0% 72.3%

(1) (78) (72) (105) (112) (163) (67) (277) (224) (465) (194) 78 350 621 893 1,165 1,436 1,708 1,980 Other Income (Expense)

Cash Taxes — — — — — — — — (302) (784) (1,327) (1,650) (1,889) (2,101) (2,278) (2,450) (2,626) (2,807) Net Income Incl. NOL Adj. (438) (538) (452) (296) (31) 147 732 676 1,281 1,744 2,954 3,672 4,205 4,676 5,071 5,453 5,846 6,249 Capex (35) (50) (20) (20) (10) (10) (10) (30) (30) (20) (20) (10) (10) (10) (10) (10) (10) (10) Depreciation and Amortization 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 â^† in Net Working Capital (1) (8) (39) (60) (56) (56) (61) (68) (90) (83) (95) (94) (63) (52) (39) (37) (38) (40) Equity Issuance to Oak — 1,441 — — — — — — — — — — — — — — — -

Ending Cash Balance 554 1,410 909 543 456 547 1,219 1,806 2,977 4,629 7,478 11,057 15,199 19,823 24,855 30,272 36,079 42,287

Note

1. Represents net of annual platform R&D and return on cumulative platform R&D at WACC + 5% on apost-tax basis,mid-point WACC shown;grossed-up 39 to reflectpre-tax figures; no PoS adjustment applied

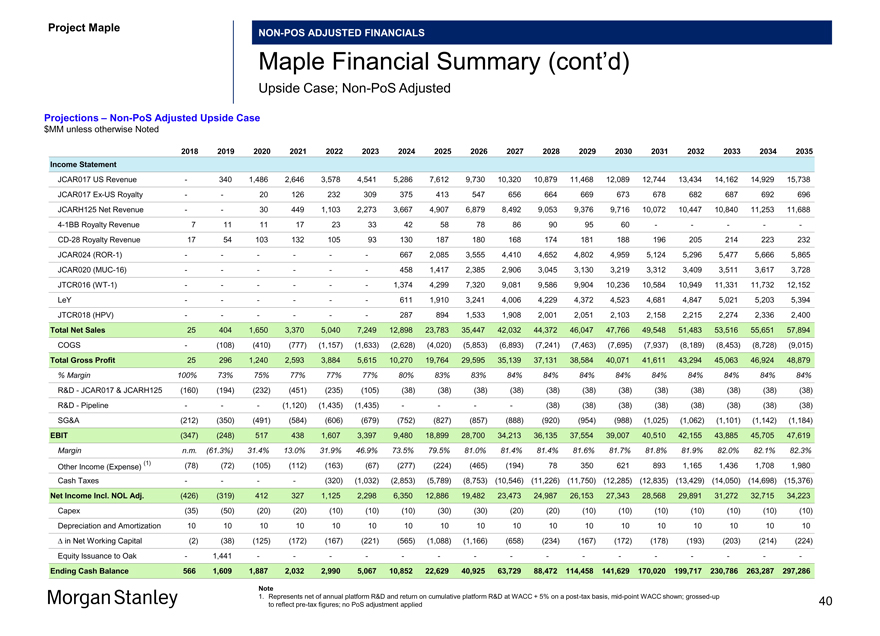

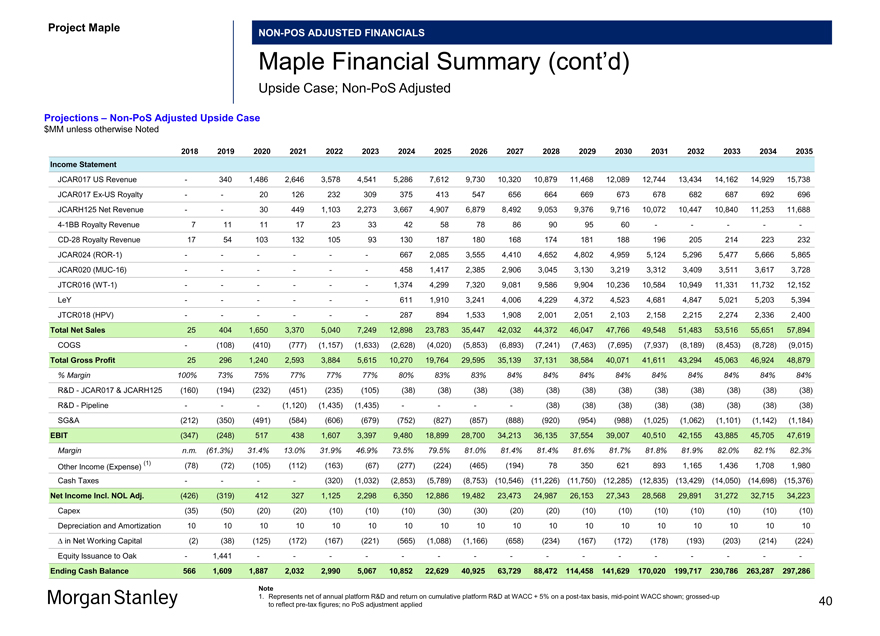

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\40

Project Maple

NON-POS ADJUSTED FINANCIALS

Maple Financial Summary (cont’d)

Upside Case;Non-PoS Adjusted

Projections –Non-PoS Adjusted Upside Case $MM unless otherwise Noted

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Income Statement

JCAR017 US Revenue — 340 1,486 2,646 3,578 4,541 5,286 7,612 9,730 10,320 10,879 11,468 12,089 12,744 13,434 14,162 14,929 15,738 JCAR017Ex-US Royalty — — 20 126 232 309 375 413 547 656 664 669 673 678 682 687 692 696 JCARH125 Net Revenue — — 30 449 1,103 2,273 3,667 4,907 6,879 8,492 9,053 9,376 9,716 10,072 10,447 10,840 11,253 11,6884-1BB Royalty Revenue 7 11 11 17 23 33 42 58 78 86 90 95 60 — — — —-CD-28 Royalty Revenue 17 54 103 132 105 93 130 187 180 168 174 181 188 196 205 214 223 232 JCAR024(ROR-1) — — — — — — 667 2,085 3,555 4,410 4,652 4,802 4,959 5,124 5,296 5,477 5,666 5,865 JCAR020(MUC-16) — — — — — — 458 1,417 2,385 2,906 3,045 3,130 3,219 3,312 3,409 3,511 3,617 3,728 JTCR016(WT-1) — — — — — — 1,374 4,299 7,320 9,081 9,586 9,904 10,236 10,584 10,949 11,331 11,732 12,152 LeY — — — — — — 611 1,910 3,241 4,006 4,229 4,372 4,523 4,681 4,847 5,021 5,203 5,394 JTCR018 (HPV) — — — — — — 287 894 1,533 1,908 2,001 2,051 2,103 2,158 2,215 2,274 2,336 2,400

Total Net Sales 25 404 1,650 3,370 5,040 7,249 12,898 23,783 35,447 42,032 44,372 46,047 47,766 49,548 51,483 53,516 55,651 57,894 COGS — (108) (410) (777) (1,157) (1,633) (2,628) (4,020) (5,853) (6,893) (7,241) (7,463) (7,695) (7,937) (8,189) (8,453) (8,728) (9,015) Total Gross Profit 25 296 1,240 2,593 3,884 5,615 10,270 19,764 29,595 35,139 37,131 38,584 40,071 41,611 43,294 45,063 46,924 48,879

% Margin 100% 73% 75% 77% 77% 77% 80% 83% 83% 84% 84% 84% 84% 84% 84% 84% 84% 84%

R&D—JCAR017 & JCARH125 (160) (194) (232) (451) (235) (105) (38) (38) (38) (38) (38) (38) (38) (38) (38) (38) (38) (38) R&D—Pipeline — — — (1,120) (1,435) (1,435) — — — — (38) (38) (38) (38) (38) (38) (38) (38) SG&A (212) (350) (491) (584) (606) (679) (752) (827) (857) (888) (920) (954) (988) (1,025) (1,062) (1,101) (1,142) (1,184)

EBIT (347) (248) 517 438 1,607 3,397 9,480 18,899 28,700 34,213 36,135 37,554 39,007 40,510 42,155 43,885 45,705 47,619

Margin n.m. (61.3%) 31.4% 13.0% 31.9% 46.9% 73.5% 79.5% 81.0% 81.4% 81.4% 81.6% 81.7% 81.8% 81.9% 82.0% 82.1% 82.3%

(1) (78) (72) (105) (112) (163) (67) (277) (224) (465) (194) 78 350 621 893 1,165 1,436 1,708 1,980 Other Income (Expense) Cash Taxes — — — — (320) (1,032) (2,853) (5,789) (8,753) (10,546) (11,226) (11,750) (12,285) (12,835) (13,429) (14,050) (14,698) (15,376) Net Income Incl. NOL Adj. (426) (319) 412 327 1,125 2,298 6,350 12,886 19,482 23,473 24,987 26,153 27,343 28,568 29,891 31,272 32,715 34,223 Capex (35) (50) (20) (20) (10) (10) (10) (30) (30) (20) (20) (10) (10) (10) (10) (10) (10) (10) Depreciation and Amortization 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 â^† in Net Working Capital (2) (38) (125) (172) (167) (221) (565) (1,088) (1,166) (658) (234) (167) (172) (178) (193) (203) (214) (224) Equity Issuance to Oak — 1,441 — — — — — — — — — — — — — — — -

Ending Cash Balance 566 1,609 1,887 2,032 2,990 5,067 10,852 22,629 40,925 63,729 88,472114,458141,629170,020199,717230,786263,287297,286

Note

1. Represents net of annual platform R&D and return on cumulative platform R&D at WACC + 5% on apost-tax basis,mid-point WACC shown;grossed-up 40 to reflectpre-tax figures; no PoS adjustment applied

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\41

Project Maple

Appendix C

Assumptions Details

41

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\42

Project Maple

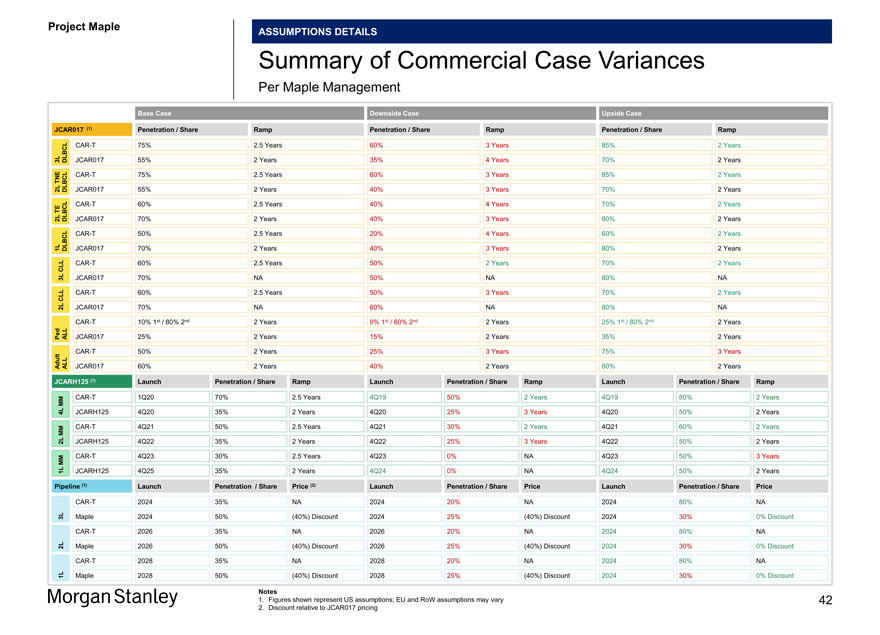

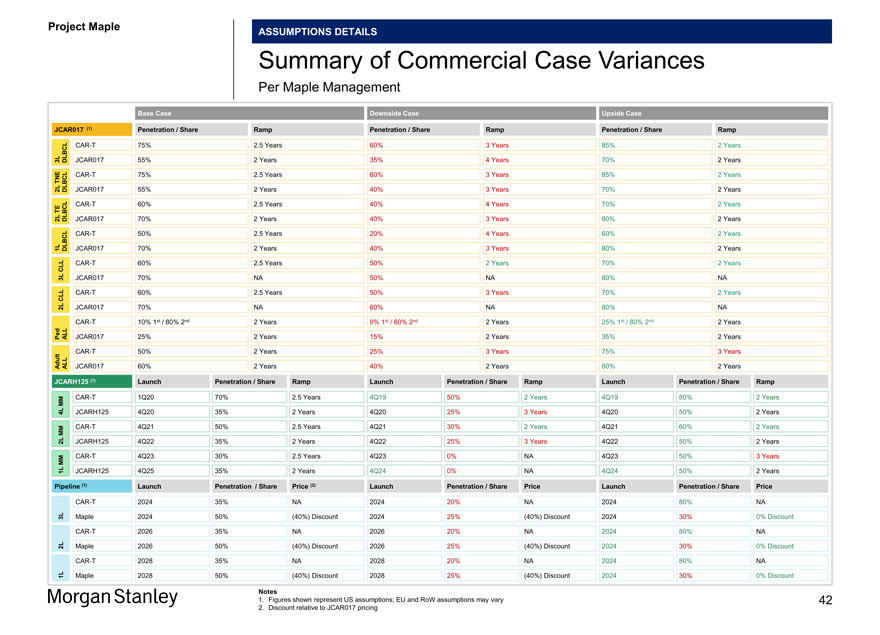

ASSUMPTIONS DETAILS

Summary of Commercial Case Variances

Per Maple Management

Base Case Downside Case Upside Case

JCAR017 (1) Penetration / Share Ramp Penetration / Share Ramp Penetration / Share Ramp

CAR-T 75% 2.5 Years 60% 3 Years 85% 2 Years

3L DLBCL JCAR017 55% 2 Years 35% 4 Years 70% 2 Years TNECAR-T 75% 2.5 Years 60% 3 Years 85% 2 Years

2L DLBCL JCAR017 55% 2 Years 40% 3 Years 70% 2 Years TECAR-T 60% 2.5 Years 40% 4 Years 70% 2 Years

2L DLBCL JCAR017 70% 2 Years 40% 3 Years 80% 2 YearsCAR-T 50% 2.5 Years 20% 4 Years 60% 2 Years

1L DLBCL JCAR017 70% 2 Years 40% 3 Years 80% 2 Years CLLCAR-T 60% 2.5 Years 50% 2 Years 70% 2 Years

3L JCAR017 70% NA 50% NA 80% NA

CLLCAR-T 60% 2.5 Years 50% 3 Years 70% 2 Years

2L JCAR017 70% NA 60% NA 80% NACAR-T 10% 1st / 80% 2nd 2 Years 0% 1st / 60% 2nd 2 Years 25% 1st / 80% 2nd 2 Years Ped ALL JCAR017 25% 2 Years 15% 2 Years 35% 2 YearsCAR-T 50% 2 Years 25% 3 Years 75% 3 Years Adult ALL JCAR017 60% 2 Years 40% 2 Years 80% 2 Years

JCARH125 (1) Launch Penetration / Share Ramp Launch Penetration / Share Ramp Launch Penetration / Share Ramp

MMCAR-T 1Q20 70% 2.5 Years 4Q19 50% 2 Years 4Q19 80% 2 Years

4L JCARH125 4Q20 35% 2 Years 4Q20 25% 3 Years 4Q20 50% 2 Years MMCAR-T 4Q21 50% 2.5 Years 4Q21 30% 2 Years 4Q21 60% 2 Years

2L JCARH125 4Q22 35% 2 Years 4Q22 25% 3 Years 4Q22 50% 2 Years MMCAR-T 4Q23 30% 2.5 Years 4Q23 0% NA 4Q23 50% 3 Years

1L JCARH125 4Q25 35% 2 Years 4Q24 0% NA 4Q24 50% 2 Years

Pipeline (1) Launch Penetration / Share Price (2) Launch Penetration / Share Price Launch Penetration / Share Price

CAR-T 2024 35% NA 2024 20% NA 2024 80% NA

3L Maple 2024 50% (40%) Discount 2024 25% (40%) Discount 2024 30% 0% DiscountCAR-T 2026 35% NA 2026 20% NA 2024 80% NA

2L Maple 2026 50% (40%) Discount 2026 25% (40%) Discount 2024 30% 0% DiscountCAR-T 2028 35% NA 2028 20% NA 2024 80% NA

1L Maple 2028 50% (40%) Discount 2028 25% (40%) Discount 2024 30% 0% Discount

Notes

1. Figures shown represent US assumptions; EU and RoW assumptions may vary 42

2. Discount relative to JCAR017 pricing

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\43

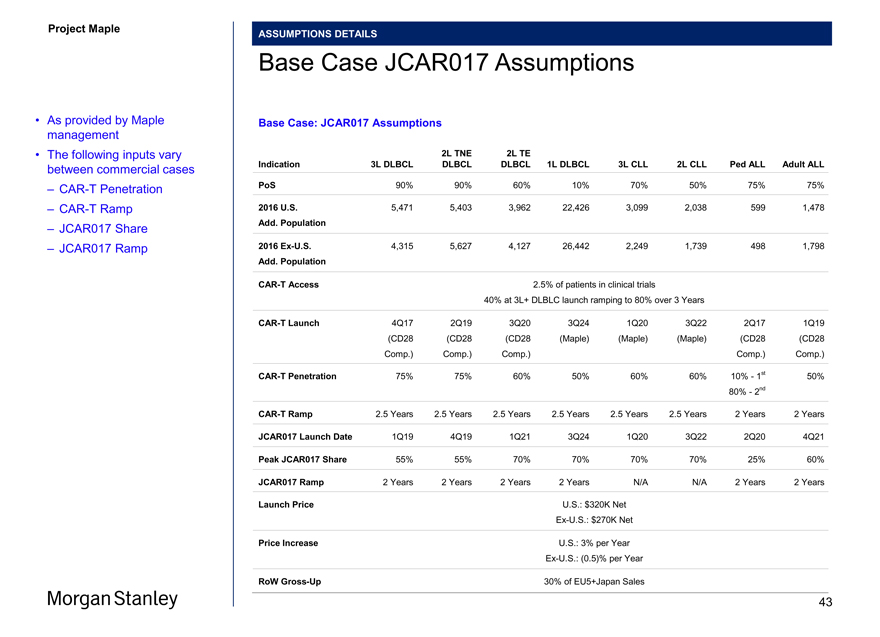

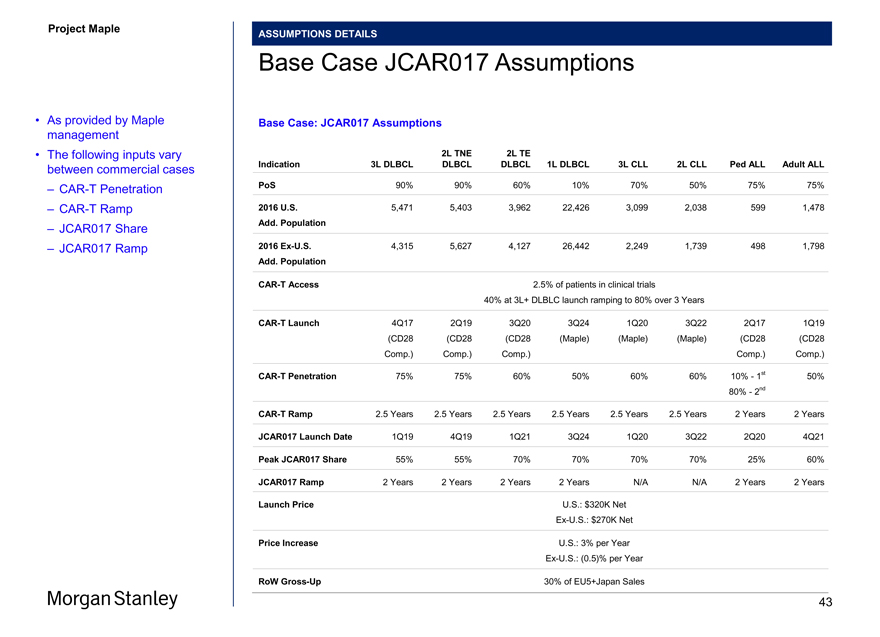

Project Maple

ASSUMPTIONS DETAILS

Base Case JCAR017 Assumptions

• As provided by Maple Base Case: JCAR017 Assumptions management

• The following inputs vary 2L TNE 2L TE

between commercial cases Indication 3L DLBCL DLBCL DLBCL 1L DLBCL 3L CLL 2L CLL Ped ALL Adult ALL

–CAR-T Penetration PoS 90% 90% 60% 10% 70% 50% 75% 75%

–CAR-T Ramp 2016 U.S. 5,471 5,403 3,962 22,426 3,099 2,038 599 1,478

– JCAR017 Share Add. Population

– JCAR017 Ramp 2016Ex-U.S. 4,315 5,627 4,127 26,442 2,249 1,739 498 1,798

Add. Population

CAR-T Access 2.5% of patients in clinical trials

40% at 3L+ DLBLC launch ramping to 80% over 3 Years

CAR-T Launch 4Q17 2Q19 3Q20 3Q24 1Q20 3Q22 2Q17 1Q19 (CD28 (CD28 (CD28 (Maple) (Maple) (Maple) (CD28 (CD28 Comp.) Comp.) Comp.) Comp.) Comp.)

CAR-T Penetration 75% 75% 60% 50% 60% 60% 10%—1st 50% 80%—2nd

CAR-T Ramp 2.5 Years 2.5 Years 2.5 Years 2.5 Years 2.5 Years 2.5 Years 2 Years 2 Years JCAR017 Launch Date 1Q19 4Q19 1Q21 3Q24 1Q20 3Q22 2Q20 4Q21 Peak JCAR017 Share 55% 55% 70% 70% 70% 70% 25% 60% JCAR017 Ramp 2 Years 2 Years 2 Years 2 Years N/A N/A 2 Years 2 Years

Launch Price U.S.: $320K NetEx-U.S.: $270K Net

Price Increase U.S.: 3% per YearEx-U.S.: (0.5)% per Year

RoWGross-Up 30% of EU5+Japan Sales

43

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\44

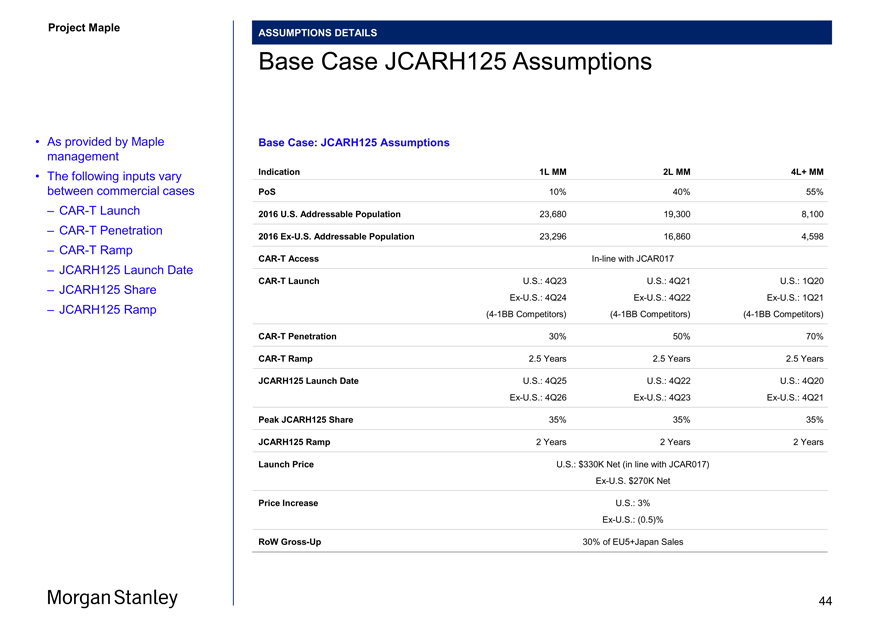

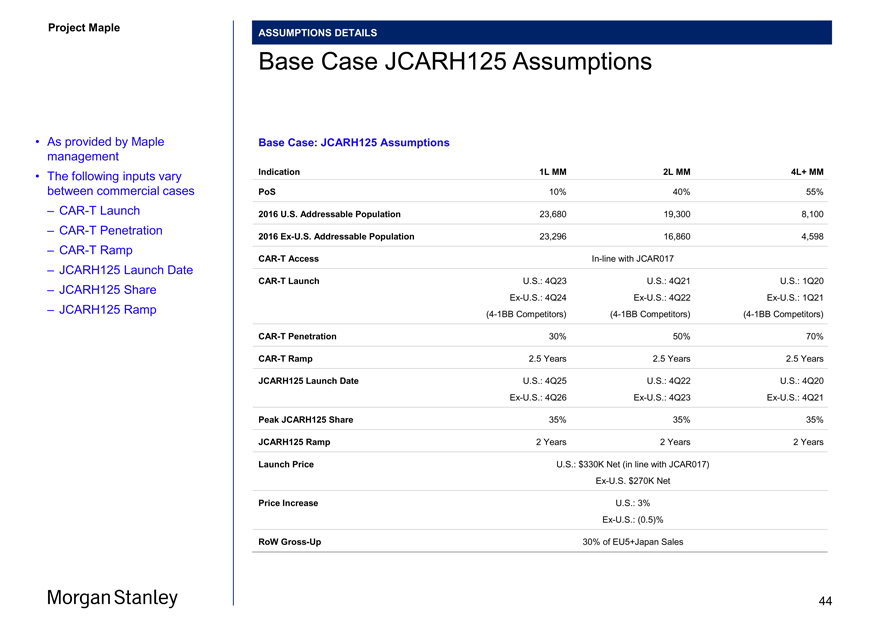

Project Maple

ASSUMPTIONS DETAILS

Base Case JCARH125 Assumptions

• As provided by Maple Base Case: JCARH125 Assumptions management

• The following inputs vary Indication 1L MM 2L MM 4L+ MM

between commercial cases PoS 10% 40% 55%

–CAR-T Launch 2016 U.S. Addressable Population 23,680 19,300 8,100

–CAR-T Penetration

2016Ex-U.S. Addressable Population 23,296 16,860 4,598

–CAR-T RampCAR-T AccessIn-line with JCAR017

– JCARH125 Launch Date

CAR-T Launch U.S.: 4Q23 U.S.: 4Q21 U.S.: 1Q20

– JCARH125 Share

Ex-U.S.: 4Q24Ex-U.S.: 4Q22Ex-U.S.: 1Q21

– JCARH125 Ramp(4-1BB Competitors)(4-1BB Competitors)(4-1BB Competitors)

CAR-T Penetration 30% 50% 70%

CAR-T Ramp 2.5 Years 2.5 Years 2.5 Years

JCARH125 Launch Date U.S.: 4Q25 U.S.: 4Q22 U.S.: 4Q20Ex-U.S.: 4Q26Ex-U.S.: 4Q23Ex-U.S.: 4Q21

Peak JCARH125 Share 35% 35% 35%

JCARH125 Ramp 2 Years 2 Years 2 Years

Launch Price U.S.: $330K Net (in line with JCAR017)Ex-U.S. $270K Net

Price Increase U.S.: 3%

Ex-U.S.: (0.5)%

RoWGross-Up 30% of EU5+Japan Sales

44

Project Maple Board Discussion Materials v72.pptx\03 NOV 2017\10:28 PM\45

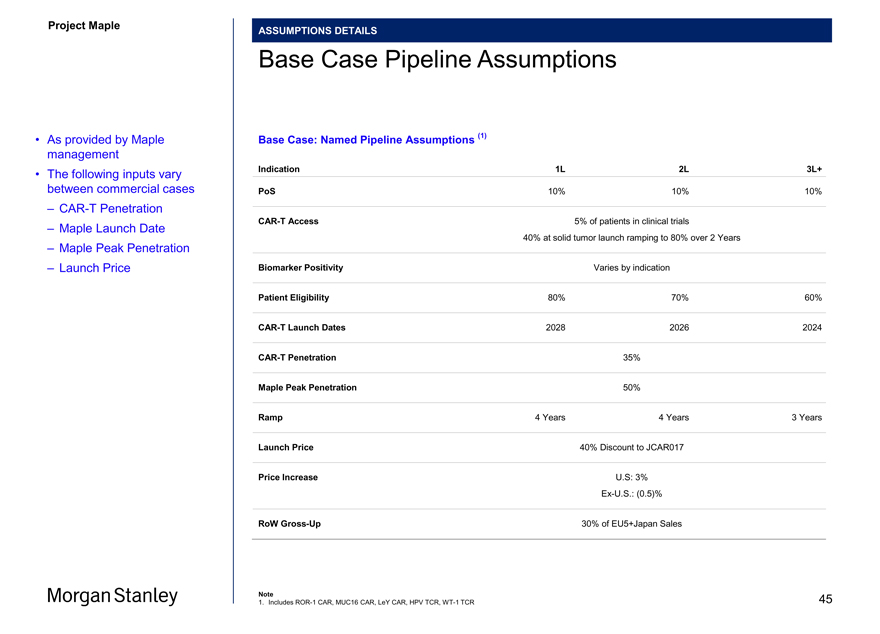

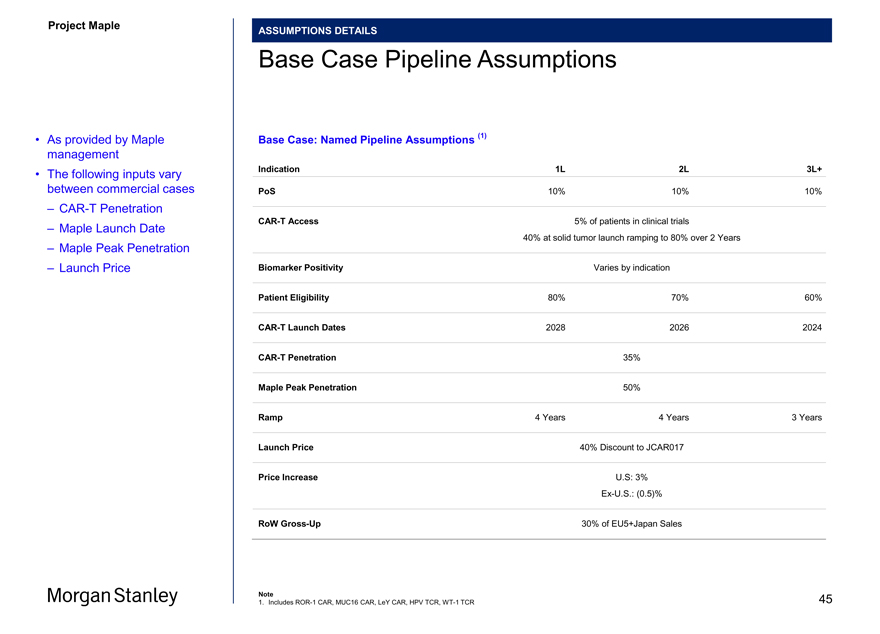

Project Maple

ASSUMPTIONS DETAILS

Base Case Pipeline Assumptions

• As provided by Maple Base Case: Named Pipeline Assumptions (1) management

• The following inputs vary Indication 1L 2L 3L+ between commercial cases PoS 10% 10% 10%

–CAR-T Penetration

CAR-T Access 5% of patients in clinical trials

– Maple Launch Date 40% at solid tumor launch ramping to 80% over 2 Years

– Maple Peak Penetration

– Launch Price Biomarker Positivity Varies by indication

Patient Eligibility 80% 70% 60%CAR-T Launch Dates 2028 2026 2024CAR-T Penetration 35% Maple Peak Penetration 50%

Ramp 4 Years 4 Years 3 Years

Launch Price 40% Discount to JCAR017

Price Increase U.S: 3%

Ex-U.S.: (0.5)%

RoWGross-Up 30% of EU5+Japan Sales

Note 45

1. IncludesROR-1 CAR, MUC16 CAR, LeY CAR, HPV TCR,WT-1 TCR

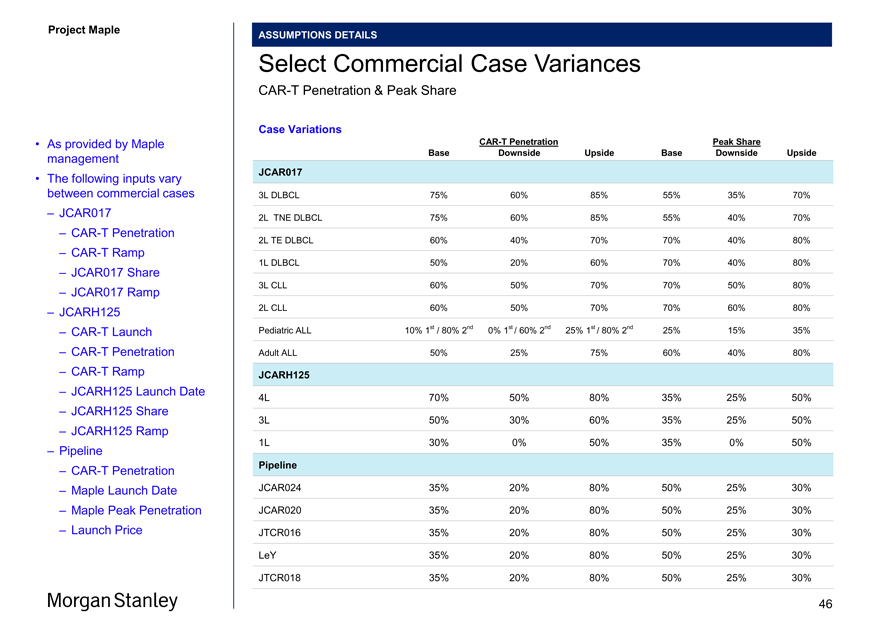

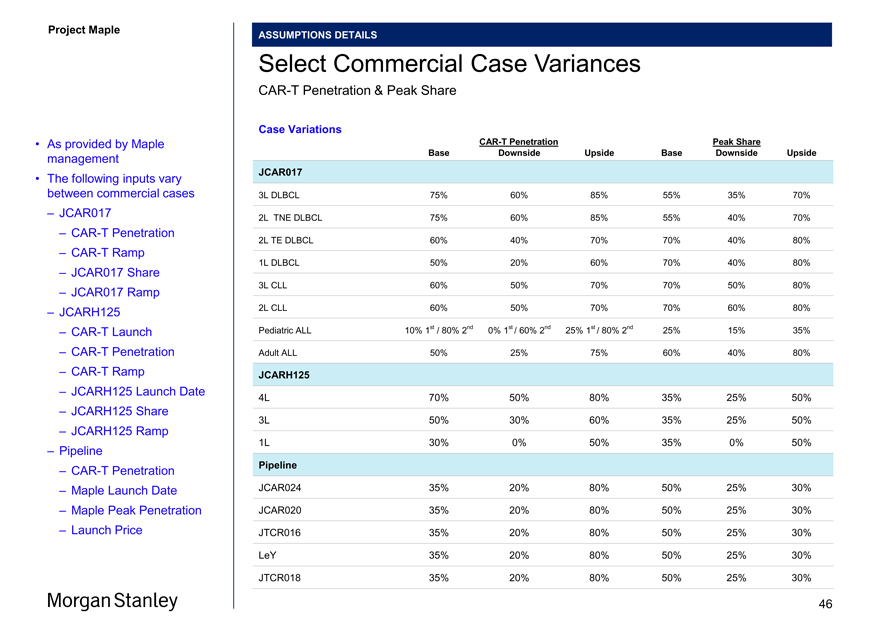

Project Maple

ASSUMPTIONS DETAILS