UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22926

Innovator ETFs Trust II

(Exact name of registrant as specified in charter)

120 N. Hale Street, Suite 200

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

Chapman and Cutler LLP

111 West Monroe St

Chicago, IL 60603

(Name and address of agent for service)

800-208-5212

Registrant's telephone number, including area code

Date of fiscal year end: October 31, 2019

Date of reporting period: April 30, 2019

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

Letter to Shareholders | 1 |

Fund Performance | 2 |

Expense Example | 4 |

Schedule of Investments | 6 |

Statement of Assets and Liabilities | 11 |

Statement of Operations | 12 |

Statements of Changes in Net Assets | 13 |

Financial Highlights | 14 |

Notes to Financial Statements | 15 |

Trustee and Officers | 27 |

Additional Information | 29 |

Letter to Shareholders (Unaudited)

Dear Valued Shareholders,

Thank you for your continued support of the Innovator S&P Investment Grade Preferred ETF. The following shareholder letter covers the one-month period ended April 30, 2019.

The ETF remains the only 100% investment grade preferred ETF in the market.

Effective October 21, 2018 the ETF began including investment grade floating and variable rate preferreds according to its underlying index.

As interest rates moved higher and fear around investment grade issues rose throughout much of 2018, investors shifted into short duration income instruments while investment grade bonds and preferreds ended the year trading at steep discounts to par. In 2019 investment grade credit has stabilized rewarding investors who stepped in towards the end of 2018. The ETF outperformed the broader preferred space over the reporting period and remains positioned to provide investors a way to maintain exposure to the preferred space but with an emphasis on credit quality. As rates stabilize and move lower from their 2018 highs, we believe many investors continue to trade interest rate risk for credit risk to obtain higher yields.

Sincerely,

Bruce Bond

Chief Executive Officer

The views in this report were those of the Fund’s CEO as of April 30, 2019 and may not reflect his views on the date that this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investments and do not constitute investment advice.

Investing involves risks. Principal loss is possible. The Fund’s return may not match the return of the Index. The fund invests in preferred securities which may be subject to many of the risks associated with debt securities, including interest rate risk. The fund invests in equity securities which may be subject to volatile price fluctuations. Because the fund is non-diversified and can invest a greater portion of its assets in securities of individual issuers than a diversified fund, changes in the market value of a single investment could cause greater fluctuations in share price.

Fund Performance

April 30, 2019 (Unaudited)

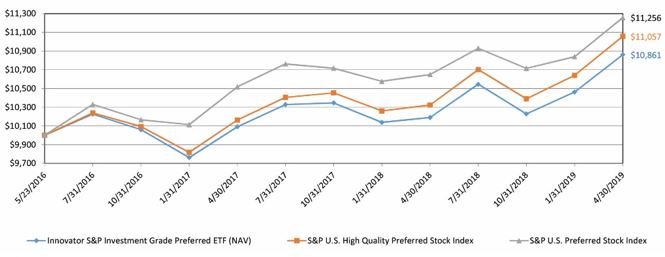

The following chart compares the value of a hypothetical $10,000 investment in the Innovator S&P Investment Grade Preferred ETF from its inception (May 23, 2016) to April 30, 2019 as compared with the S&P U.S. High Quality Preferred Stock Index and the S&P U.S. Preferred Stock Index.

Growth of a Hypothetical $10,000 Investment

at April 30, 2019

| | | Average Annual Total Returns As of April 30, 2019 | |

| | | One Year | | | Since Inception(a) | |

Innovator S&P Investment Grade Preferred ETF | | | | | | | | |

NAV Return | | | 6.59 | % | | | 2.85 | % |

Market Return | | | 6.85 | % | | | 2.72 | % |

S&P U.S. High Quality Preferred Stock Index | | | 7.11 | % | | | 3.48 | % |

S&P U.S. Preferred Stock Index | | | 5.69 | % | | | 4.11 | % |

(a) | Inception date is May 23, 2016. |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the net expense ratio of the Fund was 0.47%. For the most recent month-end performance, please visit the Fund’s website at innovatoretfs.com.

Fund Performance

April 30, 2019 (Unaudited) (Continued)

The line graph and performance table do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of Fund shares. Returns shown for the Fund, the S&P U.S. High Quality Preferred Stock Index and the S&P U.S. Preferred Stock Index include the reinvestment of all dividends, if any.

The S&P U.S. High Quality Preferred Stock Index is designed to provide exposure to U.S. - listed preferred stocks that meet a minimum size, liquidity, type of issuance, and quality criteria.

The S&P U.S. Preferred Stock Index generally represents the U.S. preferred stock market.

The Fund’s portfolio holdings may differ significantly from the securities held in the relevant index and, unlike an exchange-traded fund, the performance of an unmanaged index does not reflect deductions for transaction costs, taxes, management fees or other expenses.

You cannot invest directly in an index.

Premium/Discount Information:

Information regarding the differences between the price of the Fund’s shares on the secondary market and the Fund’s net asset value is available at innovatoretfs.com/EPRF.

Expense Example

For the Period Ended

April 30, 2019 (Unaudited)

As a shareholder of the Fund you incur two types of costs: (1) transaction costs including brokerage commissions on the purchase and sale of fund shares; and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The actual account values and actual expenses are based on the period from April 1, 2019 through April 30, 2019 to reflect the one month period. The Fund’s fiscal year end changed from March 31 to October 31 each year as of April 1, 2019.

The hypothetical account values and hypothetical expenses are based on the six month period from November 1, 2018 through April 30, 2019 for comparative purposes.

ACTUAL EXPENSES

The first line under the Fund in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for the Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Expense Example

For the Period Ended

April 30, 2019 (Unaudited) (Continued)

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line under the Fund in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line under the Fund in the table is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | Annualized | | | | | |

| | | Beginning | | | Ending | | | Expense Ratio | | | Expenses Paid | |

| | | Account Value | | | Account Value | | | for the Period | | | During the Period | |

Innovator S&P Investment Grade Preferred ETF (NAV) | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,007.00 | | | | 0.47 | % | | $ | 0.39 | (a) |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.46 | | | | 0.47 | % | | | 2.36 | (b) |

(a) | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 30/365 (to reflect the one month period). |

(b) | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the six month period). |

Schedule of Investments

April 30, 2019 (Unaudited)

| | | Shares | | | Value | |

PREFERRED STOCKS - 99.72% | | | | | | | | |

Banks - 25.41% | | | | | | | | |

Bank of America Corp., Series 02, 3.279% to 05/28/2019 then 3-Month USD Libor + 0.650% (a) | | | 2,041 | | | $ | 39,412 | |

Bank of America Corp., Series 4, 4.000% to 05/28/2019 then 3-Month USD Libor + 0.750% (a) | | | 1,846 | | | | 40,317 | |

Bank of America Corp., Series 5, 4.000% to 05/21/2019 then 3-Month USD Libor + 0.500% (a) | | | 1,833 | | | | 40,253 | |

Bank of America Corp., Series CC, 6.200% (a) | | | 1,482 | | | | 38,947 | |

Bank of America Corp., Series E, 4.000% to 05/15/2019 then 3-Month USD Libor + 0.350% (a) | | | 1,755 | | | | 39,294 | |

Bank of America Corp., Series EE, 6.000% (a) | | | 1,482 | | | | 38,903 | |

Bank of America Corp., Series GG, 6.000% (a) | | | 1,456 | | | | 38,846 | |

Bank of America Corp., Series HH, 5.875% (a) | | | 1,482 | | | | 38,888 | |

Bank of America Corp., Series W, 6.625% (a) | | | 1,495 | | | | 38,451 | |

Bank of America Corp., Series Y, 6.500% (a) | | | 1,508 | | | | 38,786 | |

BB&T Corp., 5.625% (a) | | | 2,964 | | | | 77,153 | |

BB&T Corp., 5.850% (a) | | | 3,029 | | | | 77,088 | |

BB&T Corp., Series E, 5.625% (a) | | | 3,042 | | | | 77,571 | |

BB&T Corp., Series F, 5.200% (a) | | | 3,094 | | | | 76,979 | |

BB&T Corp., Series G, 5.200% (a) | | | 3,107 | | | | 77,085 | |

HSBC Holdings PLC, Series A, 6.200% (a) | | | 14,885 | | | | 385,521 | |

JPMorgan Chase & Co., Series AA, 6.100% (a) | | | 2,119 | | | | 55,581 | |

JPMorgan Chase & Co., Series BB, 6.150% (a) | | | 2,106 | | | | 55,535 | |

JPMorgan Chase & Co., Series DD, 5.750% (a) | | | 2,145 | | | | 56,864 | |

JPMorgan Chase & Co., Series EE, 6.000% (a) | | | 2,080 | | | | 55,578 | |

JPMorgan Chase & Co., Series P, 5.450% (a) | | | 2,171 | | | | 56,012 | |

JPMorgan Chase & Co., Series W, 6.300% (a) | | | 2,119 | | | | 54,861 | |

JPMorgan Chase & Co., Series Y, 6.125% (a) | | | 2,145 | | | | 55,598 | |

Northern Trust Corp., Series C, 5.850% (a) | | | 15,158 | | | | 385,770 | |

State Street Corp., Series C, 5.250% (a) | | | 3,861 | | | | 96,293 | |

State Street Corp., Series D, 5.900% to 03/15/2024 then 3-Month USD Libor + 3.108% (a) | | | 3,653 | | | | 96,147 | |

State Street Corp., Series E, 6.000% (a) | | | 3,744 | | | | 96,071 | |

State Street Corp., Series G, 5.350% to 03/15/2026 then 3-Month USD Libor + 3.709% (a) | | | 3,692 | | | | 94,958 | |

The Bank of New York Mellon Corp., 5.200% (a) | | | 15,327 | | | | 383,941 | |

The PNC Financial Services Group, Inc., Series P, 6.125% to 05/01/2022 then 3-Month USD Libor + 4.067% (a) | | | 7,189 | | | | 191,299 | |

The PNC Financial Services Group, Inc., Series Q, 5.375% (a) | | | 7,696 | | | | 193,477 | |

US Bancorp., 5.150% (a)(b) | | | 3,874 | | | | 97,819 | |

US Bancorp., Series B, 3.500% to 07/15/2019 then 3-Month USD Libor + 0.600% (a) | | | 5,057 | | | | 97,802 | |

Schedule of Investments

April 30, 2019 (Unaudited) (Continued)

| | | Shares | | | Value | |

US Bancorp., Series F, 6.500% to 01/15/2022 then 3-Month USD Libor + 4.468% (a) | | | 3,614 | | | $ | 96,675 | |

US Bancorp., Series K, 5.500% (a) | | | 3,783 | | | | 98,207 | |

Wells Fargo & Co., 5.200% (a) | | | 1,313 | | | | 32,786 | |

Wells Fargo & Co., Series L, 7.500% (a) | | | 26 | | | | 33,993 | |

Wells Fargo & Co., Series O, 5.125% (a) | | | 1,326 | | | | 32,832 | |

Wells Fargo & Co., Series P, 5.250% (a) | | | 1,313 | | | | 32,917 | |

Wells Fargo & Co., Series Q, 5.850% to 09/15/2023 then 3-Month USD Libor + 3.090% (a) | | | 1,235 | | | | 32,481 | |

Wells Fargo & Co., Series R, 6.625% to 03/15/2024 then 3-Month USD Libor + 3.690% (a) | | | 1,144 | | | | 31,883 | |

Wells Fargo & Co., Series T, 6.000% (a) | | | 1,261 | | | | 32,458 | |

Wells Fargo & Co., Series V, 6.000% (a) | | | 1,235 | | | | 32,530 | |

Wells Fargo & Co., Series W, 5.700% (a) | | | 1,274 | | | | 32,818 | |

Wells Fargo & Co., Series X, 5.500% (a) | | | 1,274 | | | | 32,602 | |

Wells Fargo & Co., Series Y, 5.625% (a) | | | 1,261 | | | | 32,307 | |

| | | | | | | | 3,841,589 | |

Capital Markets - 10.29% | | | | | | | | |

Apollo Global Management LLC, Series A, 6.375% (a) | | | 7,839 | | | | 197,308 | |

Apollo Global Management LLC, Series B, 6.375% (a) | | | 7,852 | | | | 197,399 | |

KKR & Co., Inc., Series A, 6.750% (a) | | | 7,189 | | | | 190,437 | |

KKR & Co., Inc., Series B, 6.500% (a) | | | 7,215 | | | | 190,187 | |

Oaktree Capital Group LLC, Series A, 6.625% (a) | | | 7,683 | | | | 194,764 | |

Oaktree Capital Group LLC, Series B, 6.550% (a) | | | 7,735 | | | | 194,845 | |

The Carlyle Group LP, Series A, 5.875% (a)(b) | | | 16,757 | | | | 389,768 | |

| | | | | | | | 1,554,708 | |

Diversified Financial Services - 5.06% | | | | | | | | |

Allied Capital Corp., 6.875%, 04/15/2047 | | | 7,488 | | | | 190,570 | |

Ares Management Corp., Series A, 7.000% (a) | | | 7,358 | | | | 192,927 | |

The Charles Schwab Corp., Series C, 6.000% (a) | | | 14,508 | | | | 380,544 | |

| | | | | | | | 764,041 | |

Electric - 10.24% | | | | | | | | |

Alabama Power Co., Series A, 5.000% (a) | | | 14,924 | | | | 393,844 | |

Duke Energy Corp., 5.125%, 01/15/2073 | | | 15,431 | | | | 385,003 | |

NextEra Energy Capital Holdings, Inc., 5.000%, 01/15/2073 | | | 7,826 | | | | 188,137 | |

NextEra Energy Capital Holdings, Inc., Series I, 5.125%, 11/15/2072 | | | 7,839 | | | | 192,918 | |

PPL Capital Funding, Inc., Series B, 5.900%, 04/30/2073 (b) | | | 15,210 | | | | 387,095 | |

| | | | | | | | 1,546,997 | |

Hand & Machine Tools - 2.53% | | | | | | | | |

Stanley Black & Decker, Inc., 5.750%, 07/25/2052 | | | 15,145 | | | | 381,805 | |

Schedule of Investments

April 30, 2019 (Unaudited) (Continued)

| | | Shares | | | Value | |

Insurance - 30.65% | | | | | | | | |

Aegon NV, 6.375% (a) | | | 5,005 | | | $ | 128,378 | |

Aegon NV, 6.500% (a) | | | 5,018 | | | | 127,056 | |

Aegon NV, Series 1, 4.000% to 06/17/2019 then 3-Month USD Libor + 0.875% (a) | | | 5,863 | | | | 134,497 | |

American International Group, Inc., Series A, 5.850% (a) | | | 15,106 | | | | 392,755 | |

Arch Capital Group Ltd., Series E, 5.250% (a) | | | 8,255 | | | | 193,332 | |

Arch Capital Group Ltd., Series F, 5.450% (a)(b) | | | 7,891 | | | | 193,014 | |

Aspen Insurance Holdings Ltd., 5.625% (a) | | | 7,865 | | | | 195,760 | |

Aspen Insurance Holdings Ltd., 5.950% to 07/01/2023 then 3-Month USD Libor + 4.060% (a)(b) | | | 7,410 | | | | 195,476 | |

Axis Capital Holdings Ltd., Series D, 5.500% (a) | | | 7,800 | | | | 190,866 | |

Axis Capital Holdings Ltd., Series E, 5.500% (a) | | | 7,891 | | | | 193,566 | |

MetLife, Inc., Series A, 4.000% to 06/17/2019 then 3-Month USD Libor + 1.000% (a) | | | 8,307 | | | | 186,243 | |

MetLife, Inc., Series E, 5.625% (a) | | | 7,475 | | | | 195,247 | |

PartnerRe Ltd., Series H, 7.250% (a) | | | 14,300 | | | | 382,096 | |

Prudential Financial, Inc., 5.700%, 03/15/2053 | | | 7,644 | | | | 193,011 | |

Prudential Financial, Inc., 5.750%, 12/15/2052 | | | 7,592 | | | | 191,926 | |

Prudential PLC, 6.500% (a) | | | 7,215 | | | | 189,899 | |

Prudential PLC, 6.750% (a) | | | 7,345 | | | | 192,072 | |

RenaissanceRe Holdings Ltd., Series E, 5.375% (a)(b) | | | 7,930 | | | | 196,981 | |

RenaissanceRe Holdings Ltd., Series F, 5.750% (a) | | | 7,761 | | | | 196,741 | |

The Allstate Corp., 5.100% to 01/15/2023 then 3-Month USD Libor + 3.165%, 01/15/2053 | | | 15,093 | | | | 384,117 | |

The Hartford Financial Services Group, Inc., 7.875% to 04/15/2022 then 3-Month USD Libor + 5.596%, 04/15/2042 | | | 6,890 | | | | 190,509 | |

The Hartford Financial Services Group, Inc., Series G, 6.000% (a) | | | 7,241 | | | | 190,221 | |

| | | | | | | | 4,633,763 | |

Real Estate Investment Trusts - 15.54% | | | | | | | | |

Federal Realty Investment Trust, Series C, 5.000% (a)(b) | | | 16,042 | | | | 386,291 | |

Kimco Realty Corp., Series I, 6.000% (a) | | | 3,068 | | | | 77,590 | |

Kimco Realty Corp., Series J, 5.500% (a) | | | 3,146 | | | | 77,297 | |

Kimco Realty Corp., Series K, 5.625% (a) | | | 3,120 | | | | 77,688 | |

Kimco Realty Corp., Series L, 5.125% (a)(b) | | | 3,276 | | | | 76,495 | |

Kimco Realty Corp., Series M, 5.250% (a) | | | 3,289 | | | | 76,338 | |

National Retail Properties, Inc., Series E, 5.700% (a) | | | 7,722 | | | | 191,505 | |

National Retail Properties, Inc., Series F, 5.200% (a) | | | 7,891 | | | | 189,463 | |

PS Business Parks, Inc., Series U, 5.750% (a) | | | 3,848 | | | | 97,893 | |

PS Business Parks, Inc., Series W, 5.200% (a) | | | 3,978 | | | | 96,467 | |

PS Business Parks, Inc., Series X, 5.250% (a)(b) | | | 3,913 | | | | 96,651 | |

Schedule of Investments

April 30, 2019 (Unaudited) (Continued)

| | | Shares | | | Value | |

PS Business Parks, Inc., Series Y, 5.200% (a) | | | 4,004 | | | $ | 96,576 | |

Public Storage, Series A, 5.875% (a) | | | 1,248 | | | | 31,749 | |

Public Storage, Series B, 5.400% (a) | | | 1,261 | | | | 31,903 | |

Public Storage, Series C, 5.125% (a) | | | 1,287 | | | | 31,725 | |

Public Storage, Series D, 4.950% (a) | | | 1,300 | | | | 31,616 | |

Public Storage, Series E, 4.900% (a) | | | 1,339 | | | | 31,855 | |

Public Storage, Series F, 5.150% (a) | | | 1,287 | | | | 31,750 | |

Public Storage, Series G, 5.050% (a) | | | 1,261 | | | | 31,311 | |

Public Storage, Series H, 5.600% (a) | | | 1,235 | | | | 32,147 | |

Public Storage, Series U, 5.625% (a) | | | 1,274 | | | | 32,054 | |

Public Storage, Series V, 5.375% (a) | | | 1,274 | | | | 31,621 | |

Public Storage, Series W, 5.200% (a) | | | 1,287 | | | | 31,815 | |

Public Storage, Series Z, 6.000% (a) | | | 1,274 | | | | 32,169 | |

Senior Housing Properties Trust, 5.625%, 08/01/2042 | | | 18,369 | | | | 394,933 | |

Wells Fargo Real Estate Investment Corp., Series A, 6.375% (a) | | | 1,261 | | | | 32,521 | |

| | | | | | | | 2,349,423 | |

TOTAL PREFERRED STOCKS (Cost $15,276,023) | | | | | | | 15,072,326 | |

| | | | | | | | | |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING - 5.01% | | | | | | | | |

Mount Vernon Liquid Assets Portfolio, LLC, 2.61% (c) | | | 757,625 | | | | 757,625 | |

TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING (Cost $757,625) | | | | | | | 757,625 | |

| | | | | | | | | |

SHORT TERM INVESTMENTS - 0.61% | | | | | | | | |

Money Market Funds - 0.61% | | | | | | | | |

First American Government Obligations Fund - Class X, 2.36% (c) | | | 91,472 | | | | 91,472 | |

TOTAL SHORT TERM INVESTMENTS (Cost $91,472) | | | | | | | 91,472 | |

| | | | | | | | | |

Total Investments (Cost $16,125,120) - 105.34% | | | | | | | 15,921,423 | |

Liabilities in Excess of Other Assets - (5.34)% | | | | | | | (807,446 | ) |

TOTAL NET ASSETS - 100.00% | | | | | | $ | 15,113,977 | |

Percentages are stated as a percent of net assets.

USD - United States Dollar

Libor - London Interbank Offered Rate

(a) | Security is perpetual in nature with no stated maturity date. |

(b) | All or a portion of this security is on loan as of April 30, 2019. The total value of securities on loan is $743,162, or 4.92% of net assets. See Note 6. |

(c) | Represents annualized seven-day yield as of the end of the reporting period. |

Schedule of Investments

April 30, 2019 (Unaudited) (Continued)

Asset Type | | % of Net Assets | |

Preferred Stocks | | | 99.72 | % |

Short Term Investments | | | 0.61 | |

Investments Purchased with Proceeds From Securities Lending | | | 5.01 | |

Total Investments | | | 105.34 | |

Liabilities in Excess of Other Assets | | | (5.34 | ) |

Net Assets | | | 100.00 | % |

Statement of Assets and Liabilities

April 30, 2019 (Unaudited)

Assets: | | | | |

Investments, at value (a)(b) | | $ | 15,921,423 | |

Dividends and interest receivables | | | 12,669 | |

Securities lending income receivable | | | 4,684 | |

Total Assets | | | 15,938,776 | |

| | | | | |

Liabilities: | | | | |

Payable to Adviser | | | 5,424 | |

Distribution payable | | | 61,750 | |

Payable for collateral upon return of securities loaned | | | 757,625 | |

Total Liabilities | | | 824,799 | |

Net Assets | | $ | 15,113,977 | |

| | | | | |

Net Assets Consist of: | | | | |

Paid-in capital | | $ | 16,618,590 | |

Total distributable earnings/(accumulated deficit) | | | (1,504,613 | ) |

Net Assets | | $ | 15,113,977 | |

| | | | | |

Net Asset Value: | | | | |

Net assets | | $ | 15,113,977 | |

Shares of beneficial interest outstanding (unlimited shares authorized) | | | 650,000 | |

Net asset value price per share | | $ | 23.25 | |

(a) Cost of investments | | $ | 16,125,120 | |

(b) Including $743,162 of securities on loan at value. | | | | |

Statement of Operations

For the Period Ended April 30, 2019 (a) (Unaudited)

Investment Income: | | | | |

Dividends | | $ | 24,801 | |

Interest | | | 143 | |

Securities lending income, net | | | 4,684 | |

Total Investment Income | | | 29,628 | |

| | | | | |

Expenses: | | | | |

Investment advisory fee | | | 5,424 | |

Expenses | | | 5,424 | |

Net Investment Income/(Loss) | | | 24,204 | |

| | | | | |

Realized and Unrealized Gain/(Loss): | | | | |

Net realized gain/(loss) on: | | | | |

Investments | | | (32,747 | ) |

Net change in unrealized appreciation/(depreciation) on Investments | | | 105,996 | |

Net Realized and Unrealized Gain/(Loss) | | | 73,249 | |

Net Increase/(Decrease) in Net Assets Resulting from Operations | | $ | 97,453 | |

(a) | The period ended April 30, 2019 consists of one month due to the Fund's fiscal year end change. See Note 1. |

Statements of Changes in Net Assets

| | | Period Ended April 30, 2019 (Unaudited) (a) | | | Year Ended March 31, 2019 | | | Year Ended March 31, 2018 | |

Operations: | | | | | | | | | | | | |

Net investment income/(loss) | | $ | 24,204 | | | $ | 881,941 | | | $ | 1,015,689 | |

Net realized gain/(loss) | | | (32,747 | ) | | | (273,580 | ) | | | (80,938 | ) |

Net change in unrealized appreciation/(depreciation) | | | 105,996 | | | | 72,146 | | | | (461,736 | ) |

Net Increase/(Decrease) in Net Assets Resulting From Operations | | | 97,453 | | | | 680,507 | | | | 473,015 | |

| | | | | | | | | | | | | |

Distributions Paid to Shareholders: | | | | | | | | | | | | |

Distributions paid to shareholders | | | (61,750 | ) | | | (884,376 | ) | | | (1,066,089 | )(b) |

Distributions paid to shareholders from return of capital | | | – | | | | – | | | | (31,052 | ) |

Total Distributions to Shareholders | | | (61,750 | ) | | | (884,376 | ) | | | (1,097,141 | ) |

| | | | | | | | | | | | | |

Fund Share Transactions: | | | | | | | | | | | | |

Proceeds from shares sold | | | 1,167,710 | | | | 3,583,797 | | | | 9,663,649 | |

Cost of shares redeemed | | | – | | | | (9,339,003 | ) | | | (1,199,779 | ) |

Net Increase/(Decrease) in Net Assets From Capital Share Transactions | | | 1,167,710 | | | | (5,755,206 | ) | | | 8,463,870 | |

| | | | | | | | | | | | | |

Total Increase/(Decrease) in Net Assets | | | 1,203,413 | | | | (5,959,075 | ) | | | 7,839,744 | |

| | | | | | | | | | | | | |

Net Assets: | | | | | | | | | | | | |

Beginning of period | | | 13,910,564 | | | | 19,869,639 | | | | 12,029,895 | |

End of period | | $ | 15,113,977 | | | $ | 13,910,564 | | | $ | 19,869,639 | (c) |

| | | | | | | | | | | | | |

Change in Shares Outstanding: | | | | | | | | | | | | |

Shares sold | | | 50,000 | | | | 150,000 | | | | 400,000 | |

Shares redeemed | | | – | | | | (400,002 | ) | | | (50,000 | ) |

Net Increase/(Decrease) | | | 50,000 | | | | (250,002 | ) | | | 350,000 | |

(a) | The period ended April 30, 2019 consists of one month due to the Fund's fiscal year end change. See Note 1. |

(b) | Distributions from net investment income. |

(c) | Includes accumulated undistributed net investment income/(loss) of $(6,239). |

Financial Highlights

| | | Period Ended April 30, 2019 (Unaudited)(g) | | | Year Ended March 31, 2019 | | | Year Ended March 31, 2018 | | | Period Ended March 31, 2017(a) | |

Per Share Operating Performance | | | | | | | | | | | | | | | | |

(For a share outstanding throughout each period) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning of Period | | $ | 23.18 | | | $ | 23.38 | | | $ | 24.06 | | | $ | 25.07 | |

| | | | | | | | | | | | | | | | | |

Investment Operations: | | | | | | | | | | | | | | | | |

Net investment income/(loss) (b) | | | 0.04 | | | | 1.18 | | | | 1.29 | | | | 1.21 | |

Net realized and unrealized gain/(loss) | | | 0.13 | | | | (0.18 | ) | | | (0.57 | ) | | | (1.17 | ) |

Total From Investment Operations | | | 0.17 | | | | 1.00 | | | | 0.72 | | | | 0.04 | |

| | | | | | | | | | | | | | | | | |

Distributions Paid to Shareholders: | | | | | | | | | | | | | | | | |

Distributions paid from net investment income | | | (0.10 | ) | | | (1.20 | ) | | | (1.36 | ) | | | (1.05 | ) |

Distributions paid from return of capital | | | — | | | | — | | | | (0.04 | ) | | | — | |

Total Distributions Paid | | | (0.10 | ) | | | (1.20 | ) | | | (1.40 | ) | | | (1.05 | ) |

Change in Net Asset Value for the Period | | | 0.07 | | | | (0.20 | ) | | | (0.68 | ) | | | (1.01 | ) |

Net Asset Value, End of Period | | $ | 23.25 | | | $ | 23.18 | | | $ | 23.38 | | | $ | 24.06 | |

| | | | | | | | | | | | | | | | | |

Total Return | | | 0.70 | %(c) | | | 4.54 | % | | | 2.98 | % | | | 0.18 | %(c) |

| | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $ | 15,114 | | | $ | 13,911 | | | $ | 19,870 | | | $ | 12,030 | |

Ratio of net expenses to average net assets: | | | 0.47 | %(d) | | | 0.47 | % | | | 0.47 | % | | | 0.48 | %(d)(e) |

Ratio of net investment income/(loss) to average net assets: | | | 2.09 | %(d) | | | 5.12 | % | | | 5.39 | % | | | 5.86 | %(d) |

Portfolio turnover rate (f) | | | 7 | %(c) | | | 58 | % | | | 67 | % | | | 171 | %(c) |

(a) | Since Commencement of Operations on May 23, 2016. |

(b) | Net investment income/(loss) per share has been calculated based on average shares outstanding during the period. |

(e) | The ratio of net expenses to average net assets includes tax expense of 0.01%. |

(f) | Excludes in-kind transactions associated with creations and redemptions of the Fund. |

(g) | The period ended April 30, 2019 consists of one month due to the Fund's fiscal year end change. See Note 1. |

Notes to Financial Statements

April 30, 2019 (Unaudited)

1. ORGANIZATION

The Innovator ETFs Trust II (the “Trust”) was organized as a Massachusetts business trust on December 17, 2013, and is authorized to issue an unlimited number of shares. The Trust is an open-end management investment company, registered under the Investment Company Act of 1940, as amended (the “1940 Act”). Effective April 1, 2018, the Trust changed from Elkhorn ETF Trust to Innovator ETFs Trust II. As a result, the Elkhorn S&P High Quality Preferred ETF Fund’s name was changed to the Innovator S&P High Quality Preferred ETF (the “Fund”), the Fund’s ticker symbol remained the same (EPRF). The Fund is classified as a non-diversified series of the Trust. The Fund commenced operations on May 23, 2016. Effective July 16, 2018, the Fund’s name was changed from Innovator S&P High Quality Preferred ETF to Innovator S&P Investment Grade Preferred ETF. The Fund lists and principally trades its shares on Cboe BZX Exchange, Inc. (“Cboe BZX” or the “Exchange”). The Fund seeks investment results that generally correspond (before fees and expenses) to the price and yield of the S&P U.S. High Quality Preferred Stock Index.

On March 21, 2019, the Board of Trustees approved a change in the Fund’s fiscal year end from March 31 to October 31, effective April 1, 2019.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 “Financial Services — Investment Companies”.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Valuation:

The net asset value (“NAV”) of the Fund is determined as of the close of regular trading on the NYSE (normally 4:00 p.m. ET). If the NYSE closes early on a valuation day, the Fund shall determine NAV as of that time.

Notes to Financial Statements

April 30, 2019 (Unaudited) (Continued)

Portfolio securities generally shall be valued utilizing prices provided by independent pricing services. The Trust’s Pricing Committee (“Pricing Committee”) is responsible for establishing valuation of portfolio securities and other instruments held by the Fund in accordance with the Trust’s valuation procedures.

Common stocks, preferred stocks and other equity securities listed on any national or foreign exchange (excluding the NASDAQ National Market (“NASDAQ”) and the London Stock Exchange Alternative Investment Market (“AIM”)) are generally valued at the last sale price on the exchange on which they are principally traded or, for NASDAQ and AIM securities, the official closing price. Securities traded on more than one securities exchange are valued at the last sale price or official closing price, as applicable, at the close of the exchange representing the principal market for such securities. Securities traded in the over-the-counter market are valued at the mean of the bid and the asked price, if available, and otherwise at their closing bid price. Redeemable securities issued by open-end investment companies shall be valued at the investment company’s applicable net asset value, with the exception of exchange-traded open-end investment companies which are priced as equity securities. Government and retail money-market funds, which are not eligible for vendor pricing, are valued at amortized cost, which approximates fair value. Fixed income securities, swaps, currency-, credit- and commodity-linked notes, and other similar instruments will be valued using a pricing service. Fixed income securities having a remaining maturity of 60 days or less when purchased will be valued at cost adjusted for amortization of premiums and accretion of discounts, provided the Pricing Committee has determined that the use of amortized cost is an appropriate reflection of fair value given market and issuer specific conditions existing at the time of the determination. Foreign securities and other assets denominated in foreign currencies are translated into U.S. dollars at the exchange rate of such currencies against the U.S. dollar as provided by the pricing service. All assets denominated in foreign currencies will be converted into U.S. dollars at the exchange rates in effect at the time of valuation. Restricted securities (with the exception of Rule 144A Securities for which market quotations are available) will normally be valued at fair value as determined by the Pricing Committee.

Notes to Financial Statements

April 30, 2019 (Unaudited) (Continued)

If no quotation can be obtained from a pricing service, then the Pricing Committee will then attempt to obtain one or more broker quotes for the security. If no quotation is available from either a pricing service or one or more brokers or if the Pricing Committee has reason to question the reliability or accuracy of a quotation supplied or the use of amortized cost, the value of any portfolio security held by the Fund for which reliable market quotations are not readily available will be determined by the Pricing Committee in a manner that most appropriately reflects fair market value of the security on the valuation date. The use of a fair valuation method may be appropriate if, for example: (i) market quotations do not accurately reflect fair value of an investment; (ii) an investment’s value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (for example, a foreign exchange or market); (iii) a trading halt closes an exchange or market early; or (iv) other events result in an exchange or market delaying its normal close.

Fair valuation measurement:

FASB established a framework for measuring fair value in accordance with U.S. GAAP. Under Accounting Standards Codification, Fair Value Measurement (“ASC 820”), various inputs are used in determining the value of the exchange traded fund’s investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The three Levels of inputs of the fair value hierarchy are defined as follows:

| Level 1 — | Unadjusted quoted prices in active markets for identical assets or liabilities. |

| | | |

| Level 2 — | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | | |

| Level 3 — | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement.

Notes to Financial Statements

April 30, 2019 (Unaudited) (Continued)

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The following table summarizes valuation of the Fund’s investments under the fair value hierarchy levels as of April 30, 2019:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets | | | | | | | | | | | | | | | | |

Preferred Stocks | | $ | 15,072,326 | | | $ | — | | | $ | — | | | $ | 15,072,326 | |

Short Term Investments | | | 91,472 | | | | — | | | | — | | | | 91,472 | |

Investments Purchased with Proceeds From Securities Lending | | | — | | | | 757,625 | | | | — | | | | 757,625 | |

Total Assets | | $ | 15,163,798 | | | $ | 757,625 | | | $ | — | | | $ | 15,921,423 | |

See the Schedule of Investments for the investments detailed by industry classification.

There were no Level 3 Investments held by the Fund during the reporting period.

Investment Transactions and Investment Income:

Investment transactions are recorded on the trade date. Realized gains and losses on sales of investment securities are calculated using specific identification basis. Dividend income, if any, is recorded on the ex-dividend date or, in the case of foreign securities, as soon as the Fund is informed of the ex-dividend dates. Interest income, including accretion of discounts and amortization of premiums, is recorded on an accrual basis using the effective yield method.

Notes to Financial Statements

April 30, 2019 (Unaudited) (Continued)

Distributions received from the Fund’s investments in a Real Estate Investment Trust (“REIT”) may be characterized as ordinary income, net capital gain, or a return of capital. The proper characterization of REIT distributions is generally not known until after the end of each calendar year. As such, the Fund must use estimates in reporting the character of their income and distributions for financial statement purposes. The actual character of distributions to the Fund’s shareholders will be reflected on the Form 1099 received by shareholders after the end of the calendar year. Due to the nature of REIT investments, a portion of the distributions received by the Fund’s shareholders may represent a return of capital.

Use of Estimates:

In preparing financial statements in conformity with U.S. GAAP, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Tax Information, Dividends and Distributions to Shareholders:

The Fund is treated as a separate entity for federal income tax purposes. The Fund intends to qualify as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”). To qualify and remain eligible for the special tax treatment accorded to RICs, the Fund must meet certain annual income and quarterly asset diversification requirements and must distribute annually at least 90% of the sum of (i) its investment company taxable income (which includes dividends, interest and net short-term capital gains) and (ii) certain net tax-exempt income, if any. If so qualified, the Fund will not be subject to federal income tax to the extent it distributes substantially all of its net investment income and capital gains to shareholders.

Distributions to shareholders are recorded on the ex-dividend date. The Fund generally pays out dividends from its net investment income, if any, monthly, and distributes its net capital gains, if any, to shareholders at least annually. The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with Federal income tax regulations, which may differ from U.S. GAAP. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the components of net assets based on their Federal tax basis treatment; temporary differences do not require reclassification. Dividends and distributions, which exceed earnings and profit for tax purposes are reported as a tax return of capital.

Notes to Financial Statements

April 30, 2019 (Unaudited) (Continued)

Management evaluates the Fund’s tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. Interest and penalties related to income taxes would be recorded as income tax expense in the Statement of Operations. During the year ended March 31, 2019, the Fund did not incur any interest or penalties. The Fund’s federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. As of April 30, 2019, the Fund did not have a liability for any unrecognized tax benefits. As of April 30, 2019, the Fund has no examination in progress and management is not aware of any tax positions for which it is reasonably possible that the amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund is subject to examination by U.S. Federal tax authorities for all tax years since inception.

U.S. GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. The permanent differences primarily relate to redemptions in-kind. For the year ended March 31, 2019, the following table shows the reclassifications made:

| | | Distributable Earnings/ (Accumulated Deficit) | | | Paid-In Capital | |

| | $ | (11,850 | ) | | $ | 11,850 | |

Indemnification:

In the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on industry experience, the Fund expects this risk of loss due to these warranties and indemnities to be remote.

Notes to Financial Statements

April 30, 2019 (Unaudited) (Continued)

3. INVESTMENT ADVISORY AND OTHER AGREEMENTS

Investment Advisory:

Effective April 1, 2018, Innovator Capital Management, LLC (the “Adviser”) was appointed to serve as the investment adviser to the Fund, pursuant to an Interim Investment Advisory Agreement with the Trust on behalf of the Fund (“Interim Advisory Agreement”). On April 10, 2018, the Board of Trustees of Elkhorn ETF Trust approved the New Advisory Agreement between the Trust and Innovator and recommended that the New Advisory Agreement be submitted to Fund shareholders for approval. The New Advisory Agreement was approved at the August 1, 2018 shareholder meeting.

Pursuant to the New Advisory Agreement the Fund pays to the Advisor a fee calculated daily and payable monthly, at an annual rate of 0.47% of the Fund’s average daily net assets, in return for management and supervisory services. Subject to the supervision of the Board of Trustees (the “Board”), the Adviser pays substantially all expenses associated with the operation of the Fund, except for distribution and service fees payable pursuant to a Rule 12b-1 plan, if any, brokerage commissions and other expenses connected with the execution of portfolio transactions, taxes, interest, and extraordinary expenses.

Sub-Advisory:

Penserra Capital Management LLC (the “Sub-Adviser”) acts as sub-adviser to the Fund pursuant to sub-advisory agreement between the Adviser and the Sub-Adviser with respect to the Fund (“Sub-Advisory Agreement”) and, pursuant to the Sub-Advisory Agreement, is responsible for execution of the Sub-Adviser’s strategy for the Fund. The Sub-Adviser is responsible for the day-to-day management of the Fund’s portfolio. Pursuant to the Sub-Advisory Agreement between the Adviser and the Sub-Adviser, the Adviser pays the Sub-Adviser a fee for the services and facilities it provides payable on a monthly basis.

Other Agreements:

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services”), serves as the Fund’s Administrator, Accounting Agent and Transfer Agent pursuant to service agreements with the Trust on behalf of the Fund. U.S. Bank, N.A., an affiliate of Fund Services, serves as the Fund’s Custodian pursuant to a custodian agreement with the Trust on behalf of the Fund. Prior to January 25, 2019, The Bank of New York Mellon served in these capacities. Foreside Fund Services, LLC (the “Distributor”) serves as the Fund’s distributor pursuant to a Distribution Service Agreement.

Notes to Financial Statements

April 30, 2019 (Unaudited) (Continued)

4. OFFERING PRICE PER SHARE

There were an unlimited number of shares of beneficial interest (without par value) authorized by the Trust. Individual shares of the Fund may only be purchased and sold at market prices on a national securities exchange through a broker-dealer. Such transactions may be subject to customary commission rates imposed by the broker-dealer, and market prices for the Fund’s shares may be at, above or below its NAV depending on the premium or discount at which the Fund’s shares trade.

The Fund issues and redeems shares at its NAV only in a large specified number of shares each called a “Creation Unit,” or multiples thereof, and only with “authorized participants” who have entered into contractual arrangements with the Distributor. A Creation Unit for the Fund consists of 50,000 shares. Except when aggregated in Creation Units, shares of the Fund are not redeemable. Transactions in shares for the Fund is disclosed in detail in the Statement of Changes in Net Assets. The consideration for a purchase of Creation Units generally consists of the in-kind deposit of specified securities and an amount of cash or, as permitted or required by the Fund, of cash. A fixed transaction fee of $500 is currently imposed on each creation and redemption transaction. The transaction fee is applicable to each purchase and redemption transaction regardless of the number of Creation Units in the transaction.

5. INVESTMENT TRANSACTIONS

For the period ended April 30, 2019, the cost of purchases and the proceeds from sales of investment securities (excluding short- term investments and in-kind purchases and sales) were as follows:

| | | Purchases | | | Sales | |

| | U.S. Government | | | Other | | | U.S. Government | | | Other | |

| | | $ | — | | | $ | 962,735 | | | $ | — | | | $ | 950,238 | |

For the period ended April 30, 2019, the in-kind transactions associated with creations and redemptions were as follows:

| | | In-Kind | | | In-Kind | |

| | Creations | | | Redemptions | |

| | | $ | 1,160,119 | | | $ | — | |

Net Capital gains or losses resulting from in-kind redemptions are excluded from the Fund’s taxable gains and are not distributed to shareholders.

Notes to Financial Statements

April 30, 2019 (Unaudited) (Continued)

6. SECURITIES LENDING

The Fund may lend up to 331/3% of the value of the securities in its portfolio to brokers, dealers and financial institutions (but not individuals) under terms of participation in a securities lending program administered by the Securities Lending Agent. The Trust has entered into a Securities Lending Agreement (“SLA”) with U.S. Bank National Association (the “Agent”). Under the terms of the SLA, the Fund may lend securities to certain broker-dealers and banks in exchange for collateral in the amount of at least 102% of the value of U.S. securities loaned or at least 105% of the value of non-U.S. securities loaned, marked to market daily. The collateral can be received in the form of cash collateral and/or non-cash collateral. Non-cash collateral can include U.S. Government Securities and letters of credit. The cash collateral is invested in the Mount Vernon Liquid Assets Portfolio, LLC (“Mount Vernon”), as noted in the Fund's Schedule of Investments. Mount Vernon seeks to maximize current income to the extent consistent with the preservation of capital and liquidity; and to maintain a stable NAV of $1.00. The market value of the loaned securities is determined daily at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. The Fund continues to benefit from interest or dividends on the securities loaned and may also earn a return from the collateral. The Fund pays various fees in connection with the investment of cash collateral. The Fund pays the Agent fees based on the investment income received from securities lending activities. Although risk is mitigated by the collateral, the Fund could experience a delay in recovering its securities and possible loss of income or value if the borrower fails to return them. Cash and cash equivalent collateral on securities lending transactions are on an overnight and continuous basis.

As of April 30, 2019, the values of the securities on loan, cash collateral received, and fees and interest earned were as follows:

| | | Value of Securities on Loan | | | Cash Collateral Received | | | Fees and Interest Earned | |

| | $ | 743,162 | | | $ | 757,625 | | | $ | 4,684 | |

Notes to Financial Statements

April 30, 2019 (Unaudited) (Continued)

Due to the absence of a master netting agreement related to the Fund’s participation in securities lending, no additional offsetting disclosures have been made on behalf of the Fund for the total borrowings listed above.

7. FEDERAL INCOME TAX MATTERS

At March 31, 2019, the cost of investments and net unrealized appreciation/(depreciation) for federal income tax purposes were as follows:

| | | Federal Tax Cost of Investments | | | Gross Unrealized Appreciation | | | Gross Unrealized Depreciation | | | Net Unrealized Appreciation / (Depreciation) | |

| | $ | 14,800,394 | | | $ | 78,779 | | | $ | (450,915 | ) | | $ | (372,136 | ) |

The differences between book and tax basis cost of investments and net unrealized appreciation/(depreciation) are primarily attributable to wash sales, investments in partnerships and preferred securities.

At March 31, 2019, the components of undistributed or accumulated earnings/(loss) on a tax-basis were as follows:

| | | Accumulated Capital and Other Losses | | | Other Gains / (Losses) | | | Undistributed Net Investment Income / (Loss) | | | Unrealized Appreciation / (Depreciation) on Investments | | | Total Distributable Earnings/ (Accumulated Deficit) | |

| | | | | | | | | | | | | | | | | | | | |

| | | $ | (1,206,539 | ) | | $ | — | | | $ | 38,359 | | | $ | (372,136 | ) | | $ | (1,540,316 | ) |

Notes to Financial Statements

April 30, 2019 (Unaudited) (Continued)

The tax character of distributions paid from ordinary income during the years ended March 31, 2019 and March 31, 2018, were as follows:

| | | Year Ended March 31, 2019 | | | Year Ended March 31, 2018 | |

Distributions paid from: | | | | | | | | |

Net Ordinary Income | | $ | 884,376 | | | $ | 1,066,089 | |

Net Long-Term Capital Gains | | | — | | | | — | |

Return of Capital | | | — | | | | 31,052 | |

Total Distributions Paid | | $ | 884,376 | | | $ | 1,097,141 | |

Certain capital and qualified late year ordinary losses incurred after October 31 and December 31, respectively, and within the current taxable year, are deemed to arise on the first business day of the Fund’s next taxable year. During the fiscal year ended March 31, 2019, the Fund did not elect to defer qualified post-October capital or late year ordinary losses.

At March 31, 2019, for Federal income tax purposes, the fund has capital loss carryforwards available to offset future capital gains for an unlimited period. To the extent that these loss carryforwards are utilized, capital gains so offset will not be distributed to shareholders.

| | | Indefinite Short-Term | | | Indefinite Long-Term | |

| | | | | | | | |

| | | $ | 1,099,823 | | | $ | 106,716 | |

Notes to Financial Statements

April 30, 2019 (Unaudited) (Continued)

8. PRINCIPAL RISKS

In the normal course of business, the Fund makes investments in financial instruments where the risk of potential loss exists due to changes in the market. The following is a description of select risks of investing in the Fund.

Index Risk. The Fund is not actively managed. The Fund invests in securities included in or representative of its Index regardless of its investment merit. Therefore, the Fund would not necessarily buy or sell a security unless that security is added or removed, respectively, from the Index, even if that security generally is underperforming.

Non-Diversified Risk. Because the Fund is non-diversified and can invest a greater portion of its assets in securities of individual issuers than diversified funds, changes in the market value of a single investment could cause greater fluctuations in share price than would a diversified fund.

The Fund’s prospectus contains additional information regarding risks associated with investments in the Fund.

9. NEW ACCOUNTING PRONOUNCEMENT

In August 2018, the FASB issued Accounting Standards Update (ASU) No. 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurements. The amendments in the ASU modify the disclosure requirements on fair value measurements in Topic 820. The ASU is effective for interim and annual reporting periods beginning after December 15, 2019. An entity is permitted to early adopt the removed or modified disclosures upon the issuance of ASU 2018-13 and may delay adoption of the additional disclosures, which are required for public companies only, until their effective date. Management has evaluated ASU 2018-13 and has adopted the disclosure framework.

10. SUBSEQUENT EVENT

Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were issued, and has determined that, other than the above, there were no subsequent events requiring recognition or disclosure in the financial statements.

Trustees and Officers (Unaudited)

Name, Address and Year of Birth | Position with the Trust | Length of Time Served* | Principal Occupation(s) During Past 5 Years | Number of Portfolios in Fund Complex Overseen by Trustee or Officer | Other Directorships Held by Trustee or Officer |

Independent Trustees |

Mark Berg 120 N. Hale Street Suite 200, Wheaton, IL 60187 Year of Birth: 1971 | Trustee | Since 2017 | Founding Principal and Chief Executive Officer (May 2019-present), Founding Principal and President (2001-May 2019), Timothy Financial Counsel Inc. | 18 | None |

Joe Stowell 120 N. Hale Street Suite 200, Wheaton, IL 60187 Year of Birth: 1968 | Trustee | Since 2017 | Chief Operating Officer, Woodmen Valley Chapel (September 2015-present); Executive Vice President and Chief Operating Officer, English Language Institute/China (2007-2015). | 18 | Board of Advisors, Westmont College |

Brian J. Wildman 120 N. Hale Street Suite 200, Wheaton, IL 60187 Year of Birth: 1963 | Trustee | Since 2017 | President, Timothy Financial Counsel Inc. (May 2019-present); Executive Vice President, Consumer Banking (March 2016-May 2019), Chief Risk Officer (April 2013-March 2016), Head of Wealth Management (2003-2013) and Head of Commercial Services (2010-2013), MB Financial Bank. | 18 | MB Financial Bank (2003-May 2019); Missionary Furlough Homes, Inc. (since 2008). |

Trustees and Officers (Unaudited) (Continued)

Interested Trustee & Officer |

H. Bruce Bond (a) 120 N. Hale Street Suite 200, Wheaton, IL 60187 Year of Birth: 1963 | Interested Trustee, President and Principal Executive Officer | Since 2017 | Chief Executive Officer of Innovator Capital Management, LLC (May 2017-present); formerly Chairman (2010-2013) and President and CEO (2006-2010), Invesco PowerShares Capital Management LLC; formerly Co-Founder, President and CEO, PowerShares Capital Management (2002-2006); formerly Chairman; PowerShares Fund Board (2002-2013). | 18 | None |

Officers |

John W. Southard 120 N. Hale Street, Suite 200, Wheaton, IL 60187 Year of Birth: 1969 | Vice President, Treasurer and Principal Financial Accounting Officer | Since May 2017 | Chief Investment Officer, Innovator Capital Management, LLC (May 2017-present); Director and Co-Founder, T2 Capital Management, LLC (2010-present). | 18 | Independent Trustee, ETF Managers Group, LLC (2012 - March 8, 2018) |

James Nash (b) 10 High Street, Suite 302, Boston, MA 02110 Year of Birth: 1981 | Chief Compliance Officer and Anti-Money Laundering Officer | Since June 2018 | Fund Chief Compliance Officer, Foreside Fund Officer Services, LLC (2016-Present); Senior Associate and Regulatory Administration Advisor, JPMorgan Chase & Co. (2014-2016); Product Analyst, Linedata Services (2011-2014). | 18 | None |

* | The Funds’ Trustees serve for an indefinite term until their resignation, death or removal. The Funds’ officers are elected annually by the Board and serve at the Board’s pleasure. |

(a) | H. Bruce Bond is deemed to be an interested person of the Trust (as defined in the 1940 Act) because of his affiliation with the Adviser. |

(b) | Jim Nash is an employee of Foreside Fund Officer Services, LLC, a wholly-owned subsidiary of the Funds’ principal underwriter. |

The Statement of Additional Information includes additional information about the Trustees and is available upon request, without charge, by calling 1-877-386-3890.

Additional Information (Unaudited)

Investors should consider the investment objective and policies, risk considerations, charges and ongoing expenses of an investment carefully before investing. The prospectus contains this and other information relevant to an investment in the Fund. Please read the prospectus carefully before investing. A copy of the Prospectus may be obtained without charge by writing to the Trust’s Distributor, or by calling toll free at 1-800-208-5212 or visiting www.innovatoretfs.com/EPRF.

1. QUARTERLY PORTFOLIO HOLDING INFORMATION

The Fund’s complete schedule of portfolio holdings for the first and third quarters is filed with the SEC on Form N-Q. The Fund’s Form N-Q is available without charge, upon request, by calling 1-800-208-5212, or on the SEC’s website at www.sec.gov. The Trust’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

2. PROXY VOTING INFORMATION

The Fund’s Proxy Voting Policies and Procedures are available without charge, upon request, by calling 1-800-208-5212 and on the SEC’s website at www.sec.gov. Information relating to how the Fund voted proxies relating to portfolio securities held during each year ended June 30 is also available on the SEC’S website at www.sec.gov.

3. DELIVERY OF SHAREHOLDER DOCUMENTS – HOUSEHOLDING

In order to reduce expenses, the Fund delivers one copy of an annual/semiannual report, prospectus and/or proxy statement on behalf of two or more shareholders at a shared address (householding). If you are interested in enrolling in householding and receiving a single copy of the prospectus and other shareholder documents, or you currently are enrolled in householding and wish to change your householding status, please call 1-877-FUND890 (877-386-3890) you may change your status at any time.

INVESTMENT ADVISOR

Innovator Capital Management, LLC

120 North Hale Street, Suite 200

Wheaton, IL 60187

INVESTMENT SUB-ADVISOR

Penserra Capital Management, LLC

140 Broadway, 26th Floor

New York, NY 10005

DISTRIBUTOR

Foreside Fund Services, LLC

Three Canal Plaza, Suite 100 Portland, ME 04101

ADMINISTRATOR, FUND ACCOUNTANT & TRANSFER AGENT

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

CUSTODIAN

U.S. Bank, N.A.

1555 North RiverCenter Drive, Suite 302

Milwaukee, WI 53212

LEGAL COUNSEL

Chapman and Cutler LLP

111 West Monroe Street,

Chicago, Illinois 60603

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen & Company, Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, Ohio 44115

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

The registrant is an issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934, (the “Act”) and has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Act. The independent members of the committee, consisting of the entire Board, are as follows: Brian Wildman, Joe Stowell and Mark Berg.

Item 6. Investments.

| | (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 11. Controls and Procedures.

(a) | The Registrant’s Principal Executive Officer and Principal Financial Officer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

(b) | There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable to open-end investment companies.

Item 13. Exhibits.

(a) (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not Applicable.

(2) A separate certification for each principal executive officer and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

(4) Change in the registrant’s independent public accountant. Not Applicable.

(b) Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Innovator ETFs Trust II

By (Signature and Title)* /s/ Bruce Bond

Bruce Bond, Principal Executive Officer

Date 06/24/19

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* /s/ Bruce Bond

Bruce Bond, Principal Executive Officer

Date 06/24/19

By (Signature and Title)* /s/ John Southard

John Southard, Principal Financial Officer

Date 06/24/19

* Print the name and title of each signing officer under his or her signature.