Investor Briefing May 3, 2016 Exhibit 99.2

Cautionary Statements Regarding Forward Looking Statements This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the potential timing or consummation of the proposed transaction or the anticipated benefits thereof, including, without limitation, future financial and operating results. IMS Health and Quintiles caution readers that these and other forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to risks and uncertainties related to (i) the ability to obtain shareholder and regulatory approvals, or the possibility that they may delay the transaction or that such regulatory approval may result in the imposition of conditions that could cause the parties to abandon the transaction, (ii) the risk that a condition to closing of the merger may not be satisfied; (iii) the ability of IMS Health and Quintiles to integrate their businesses successfully and to achieve anticipated cost savings and other synergies, (iv) the possibility that other anticipated benefits of the proposed transaction will not be realized, including without limitation, anticipated revenues, expenses, earnings and other financial results, and growth and expansion of the new combined company’s operations, and the anticipated tax treatment, (v) potential litigation relating to the proposed transaction that could be instituted against IMS Health, Quintiles or their respective directors, (vi) possible disruptions from the proposed transaction that could harm IMS Health’s or Quintiles' business, including current plans and operations, (vii) the ability of IMS Health or Quintiles to retain, attract and hire key personnel, (viii) potential adverse reactions or changes to relationships with clients, employees, suppliers or other parties resulting from the announcement or completion of the merger, (ix) potential business uncertainty, including changes to existing business relationships, during the pendency of the merger that could affect IMS Health’s and/or Quintiles' financial performance, (x) certain restrictions during the pendency of the merger that may impact IMS Health’s or Quintiles' ability to pursue certain business opportunities or strategic transactions, (xi) continued availability of capital and financing and rating agency actions, (xii) legislative, regulatory and economic developments and (xiii) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as management’s response to any of the aforementioned factors. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the joint proxy statement/prospectus that will be included in the registration statement on Form S-4 that will be filed with the SEC in connection with the proposed transaction. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S-4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on IMS Health’s or Quintiles' consolidated financial condition, results of operations, credit rating or liquidity. Neither IMS Health nor Quintiles assumes any obligation to provide revisions or updates to any forward looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws.

Important Information About the Transaction and Where to Find It In connection with the proposed transaction, IMS Health and Quintiles will be filing documents with the Securities and Exchange Commission (“SEC”), including the filing by Quintiles of a registration statement on Form S-4, and Quintiles and IMS intend to mail a joint proxy statement regarding the proposed transaction to their respective shareholders that will also constitute a prospectus of Quintiles. After the registration statement is declared effective, IMS Health and Quintiles plan to mail to their respective shareholders the definitive joint proxy statement/prospectus and may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement or any other document which IMS Health or Quintiles may file with the SEC. Investors and security holders of IMS Health and Quintiles are urged to read the registration statement, the joint proxy statement/prospectus and any other relevant documents, as well as any amendments or supplements to these documents, carefully and in their entirety when they become available because they will contain important information. Investors and security holders may obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by IMS Health and Quintiles through the web site maintained by the SEC at www.sec.gov or by contacting the investor relations department of IMS Health or Quintiles at the following: IMS Health Quintiles ir@imshealth.comInvestorRelations@quintiles.com +1.203.448.4600+1.919.998.2590 Investor Relations4820 Emperor Boulevard 83 Wooster Heights RDPO Box 13979 Danbury, CT, 06810Durham, North Carolina 27703 Participants in the Solicitation IMS Health, Quintiles and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction and related matters. Information regarding IMS Health’s directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is contained in IMS Health’s Form 10-K for the year ended December 31, 2015 and its proxy statement filed on February 22, 2016, which are filed with the SEC. Information regarding Quintiles' directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is contained in Quintiles' Form 10-K for the year ended December 31, 2015 and its proxy statement filed on March 21, 2016, which are filed with the SEC. Additional information will be available in the registration statement on Form S-4 and the joint proxy statement/prospectus when they become available. No Offer or Solicitation This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Note on Non-GAAP Financial Measures Non-GAAP results, such as combined adjusted EBITDA, unlevered free cash flow and gross debt, are presented only as a supplement to IMS Health’s and Quintiles’ financial statements based on GAAP. Non-GAAP financial information is provided to enhance understanding of IMS Health’s and Quintiles’ financial performance, but none of these non-GAAP financial measures are recognized terms under GAAP and non-GAAP measures should not be considered in isolation from, or as a substitute analysis for, IMS Health’s and Quintiles’ results of operations as determined in accordance with GAAP. Definitions and reconciliations of non-GAAP measures to the most directly comparable GAAP measures are provided within the schedules attached to this release. IMS Health and Quintiles use non-GAAP measures in their respective operational and financial decision making, and believe that it is useful to exclude certain items in order to focus on what they regard to be a more reliable indicator of the underlying operating performance of the business. As a result, internal management reports feature non-GAAP measures which are also used to prepare strategic plans and annual budgets and review management compensation. IMS Health and Quintiles also believe that investors may find non-GAAP financial measures useful for the same reasons, although investors are cautioned that non-GAAP financial measures are not a substitute for GAAP disclosures. Non-GAAP measures are frequently used by securities analysts, investors and other interested parties in their evaluation of companies comparable to IMS Health and Quintiles, many of which present non-GAAP measures when reporting their results. Non-GAAP measures have limitations as an analytical tool. They are not presentations made in accordance with GAAP, are not measures of financial condition or liquidity and should not be considered as an alternative to profit or loss for the period determined in accordance with GAAP or operating cash flows determined in accordance with GAAP. Non-GAAP measures are not necessarily comparable to similarly titled measures used by other companies. As a result, you should not consider such performance measures in isolation from, or as a substitute analysis for, IMS Health’s and Quintiles’ respective results of operations as determined in accordance with GAAP.

Introducing Global healthcare intelligence to measure and realize value from R&D and Commercial execution to real world patient outcomes Information-powered, technology-enabled, differentiated solutions to address life science’s most pressing issues

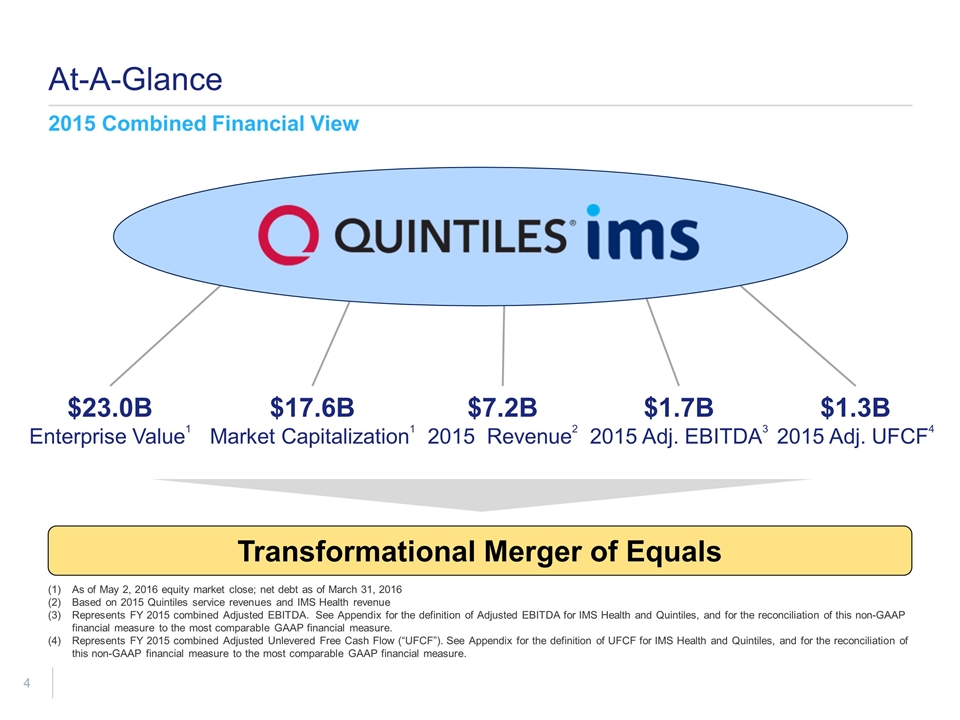

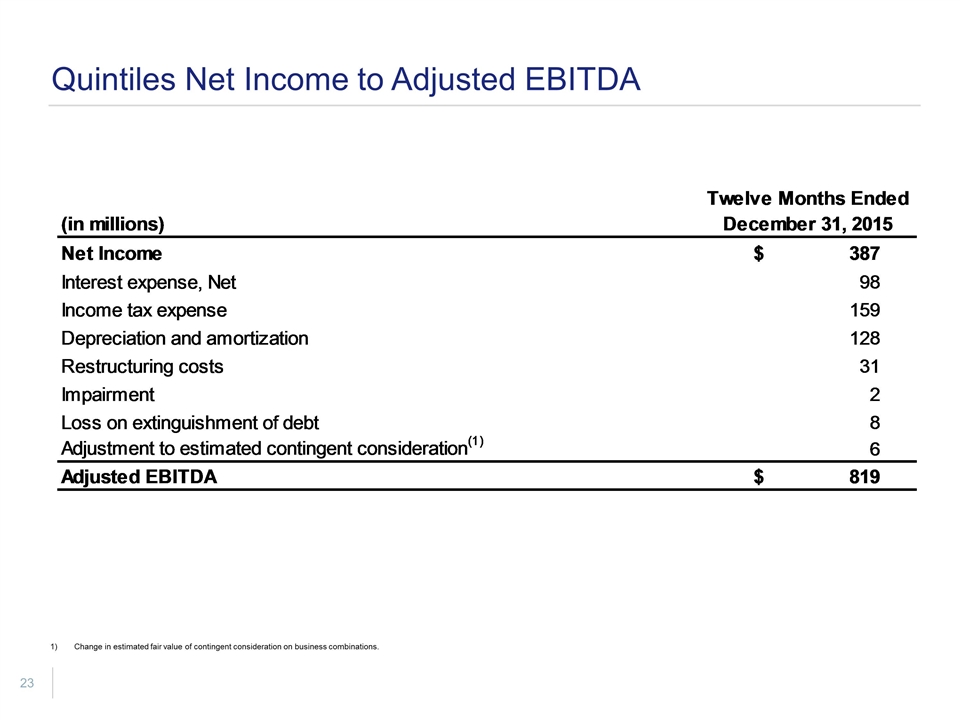

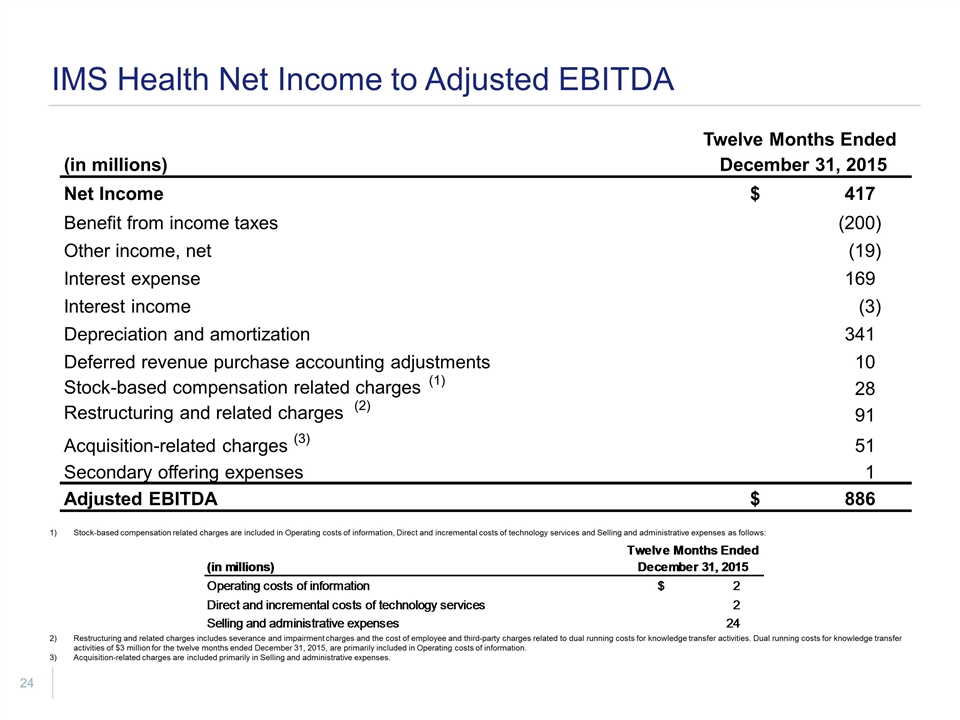

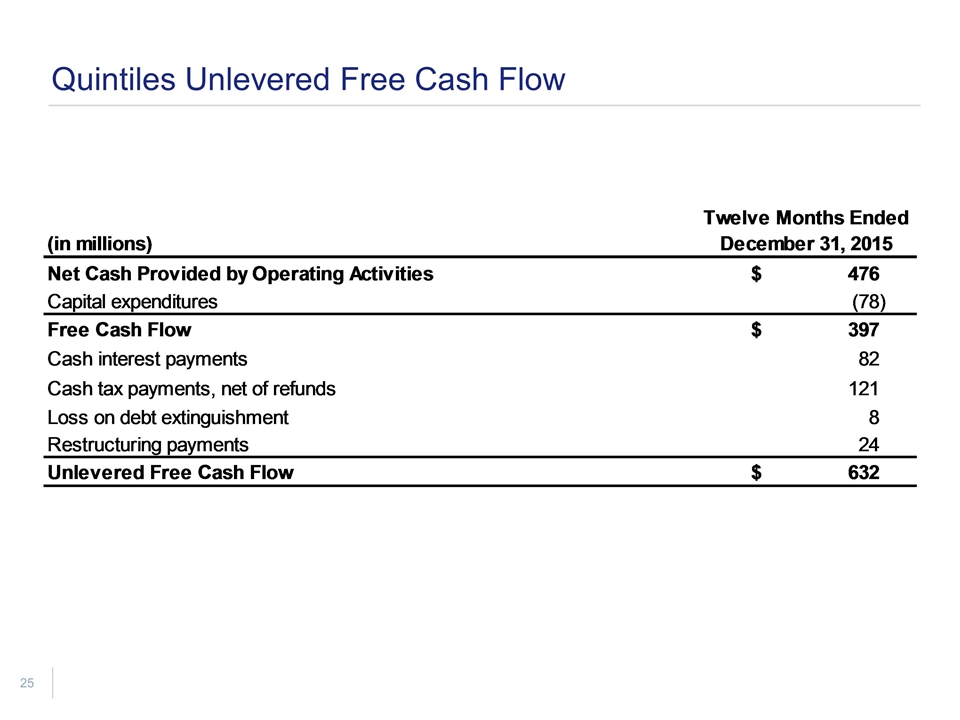

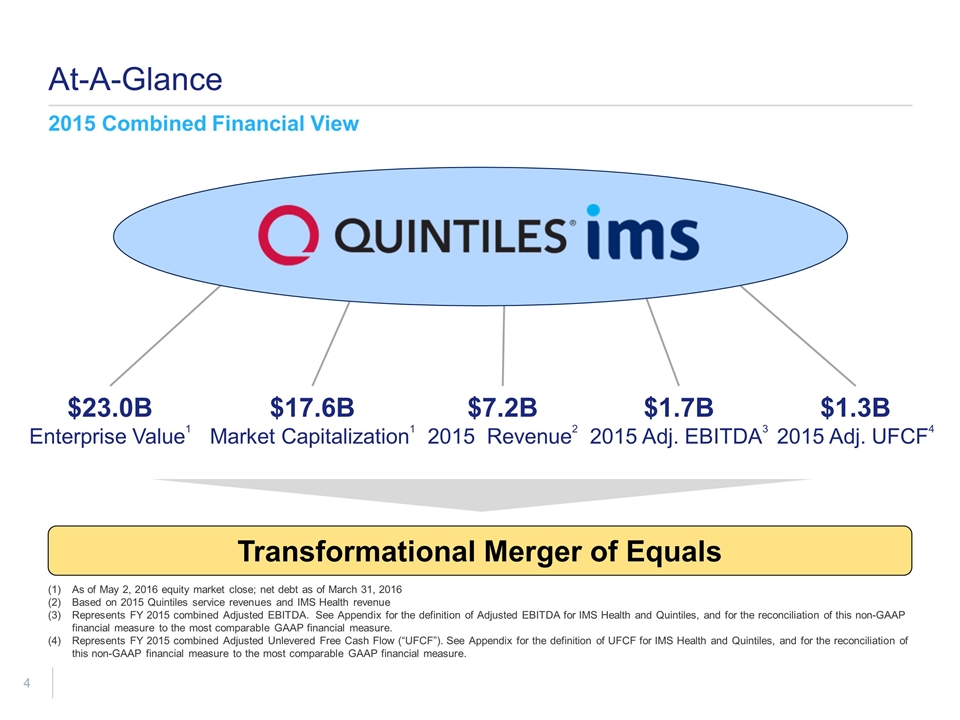

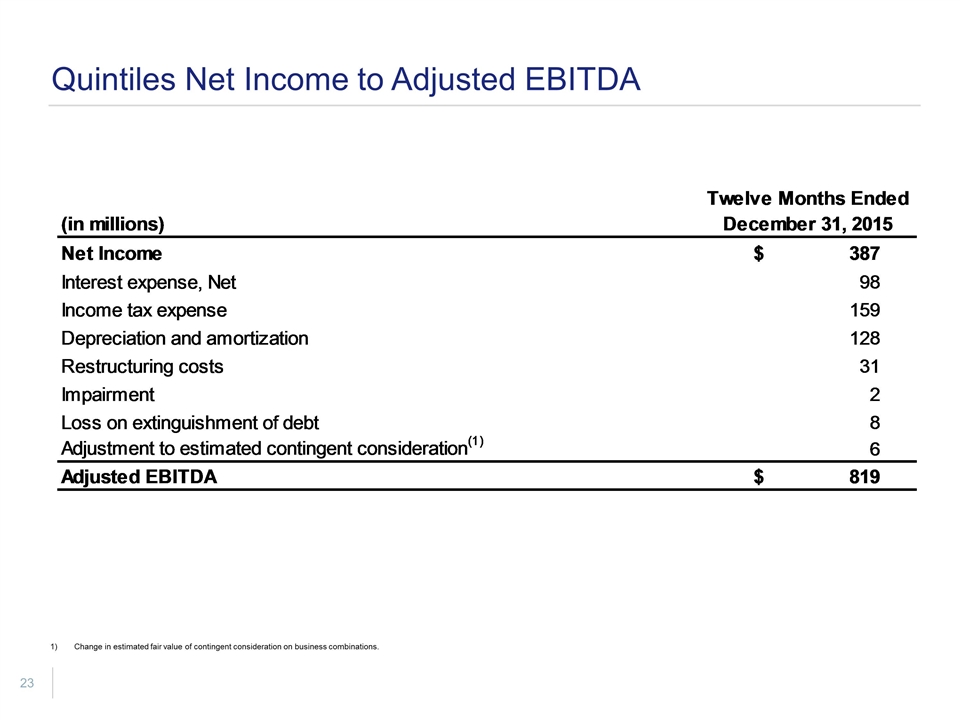

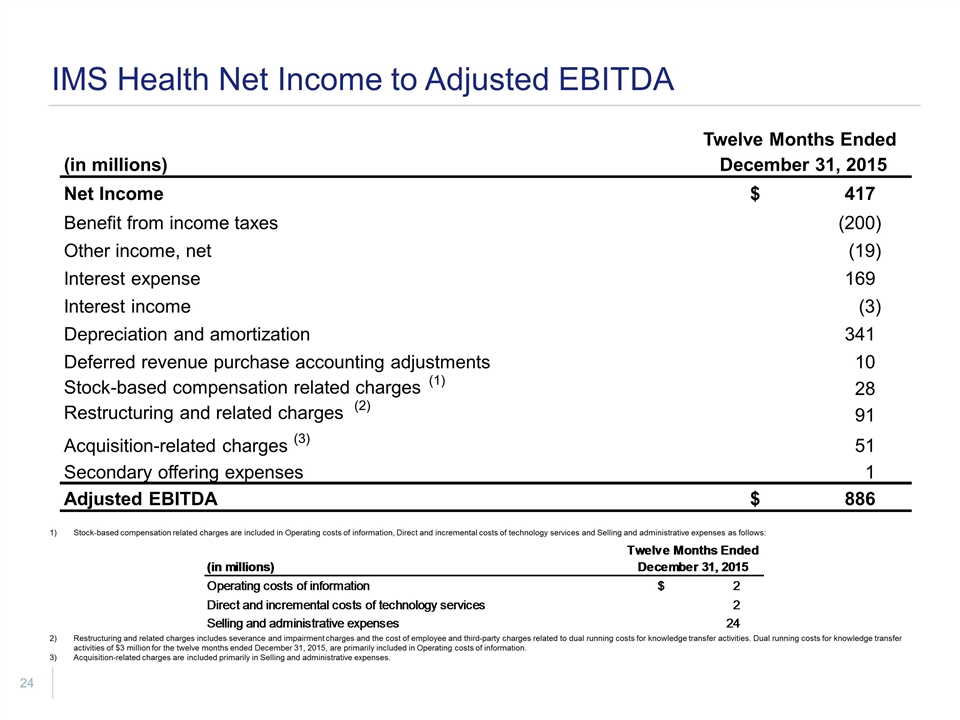

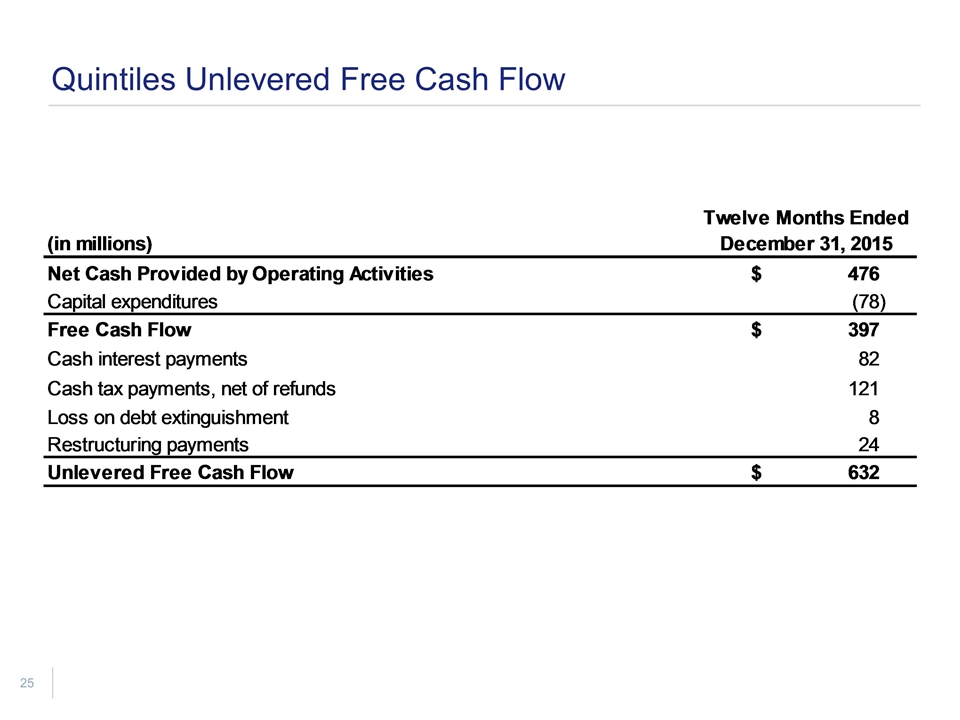

At-A-Glance 2015 Combined Financial View $7.2B 2015 Revenue2 $17.6B Market Capitalization1 $1.7B 2015 Adj. EBITDA3 $1.3B 2015 Adj. UFCF4 Transformational Merger of Equals $23.0B Enterprise Value1 As of May 2, 2016 equity market close; net debt as of March 31, 2016 Based on 2015 Quintiles service revenues and IMS Health revenue Represents FY 2015 combined Adjusted EBITDA. See Appendix for the definition of Adjusted EBITDA for IMS Health and Quintiles, and for the reconciliation of this non-GAAP financial measure to the most comparable GAAP financial measure. Represents FY 2015 combined Adjusted Unlevered Free Cash Flow (“UFCF”). See Appendix for the definition of UFCF for IMS Health and Quintiles, and for the reconciliation of this non-GAAP financial measure to the most comparable GAAP financial measure.

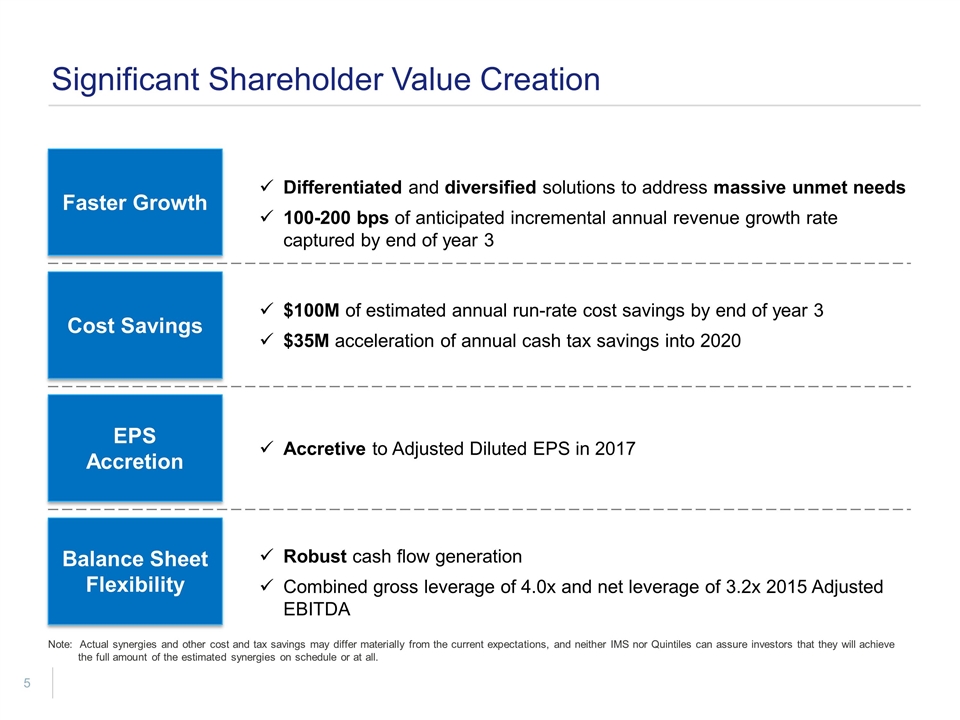

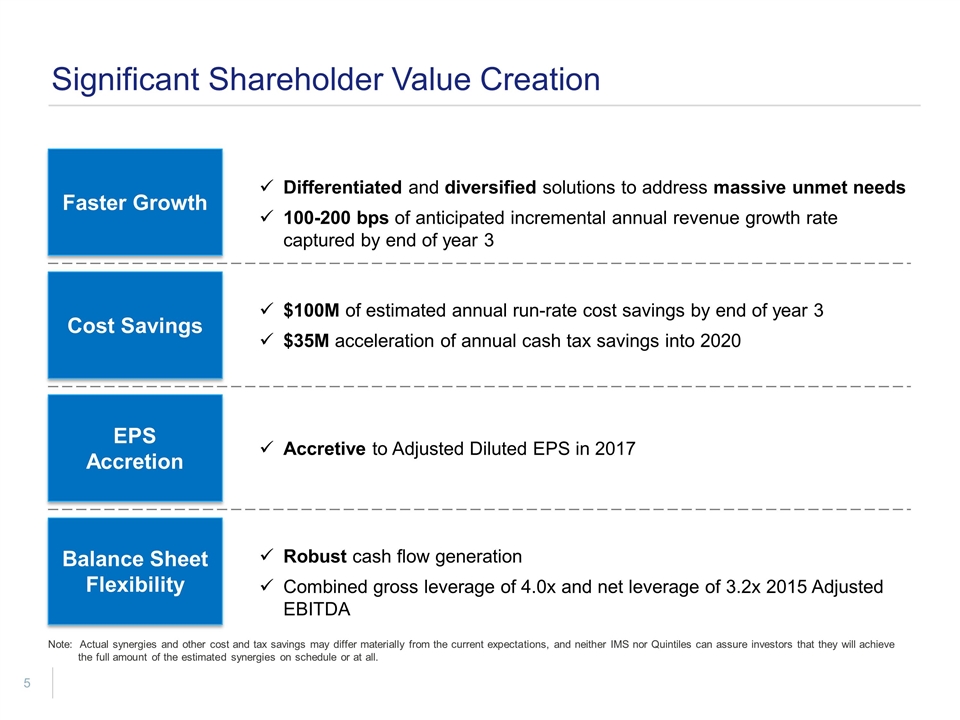

Significant Shareholder Value Creation Faster Growth Differentiated and diversified solutions to address massive unmet needs 100-200 bps of anticipated incremental annual revenue growth rate captured by end of year 3 Cost Savings EPS Accretion Balance Sheet Flexibility $100M of estimated annual run-rate cost savings by end of year 3 $35M acceleration of annual cash tax savings into 2020 Accretive to Adjusted Diluted EPS in 2017 Robust cash flow generation Combined gross leverage of 4.0x and net leverage of 3.2x 2015 Adjusted EBITDA Note: Actual synergies and other cost and tax savings may differ materially from the current expectations, and neither IMS nor Quintiles can assure investors that they will achieve the full amount of the estimated synergies on schedule or at all.

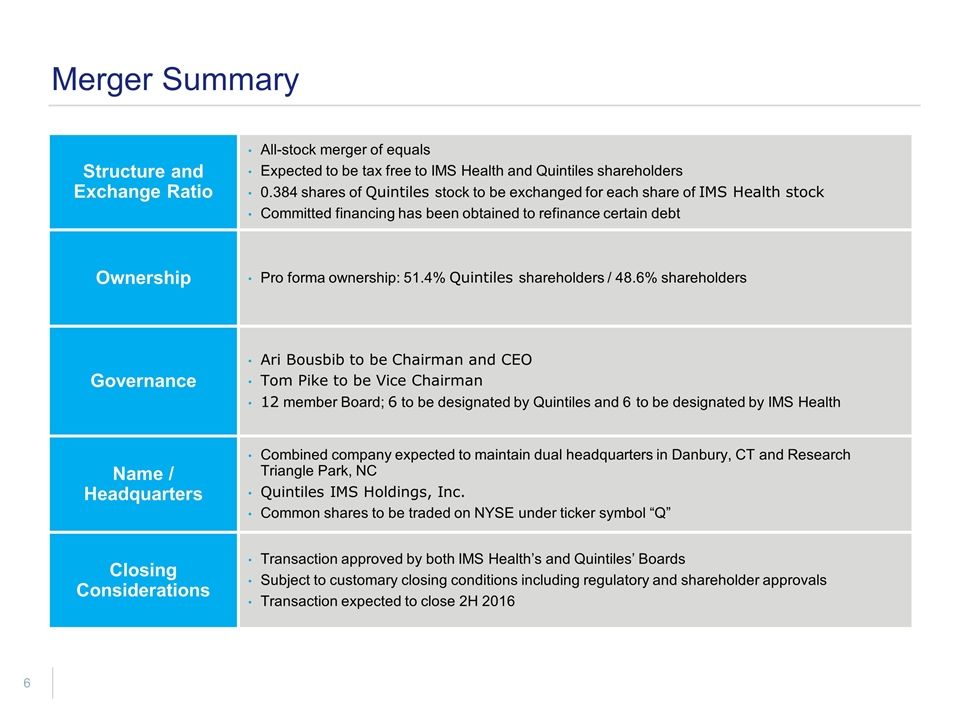

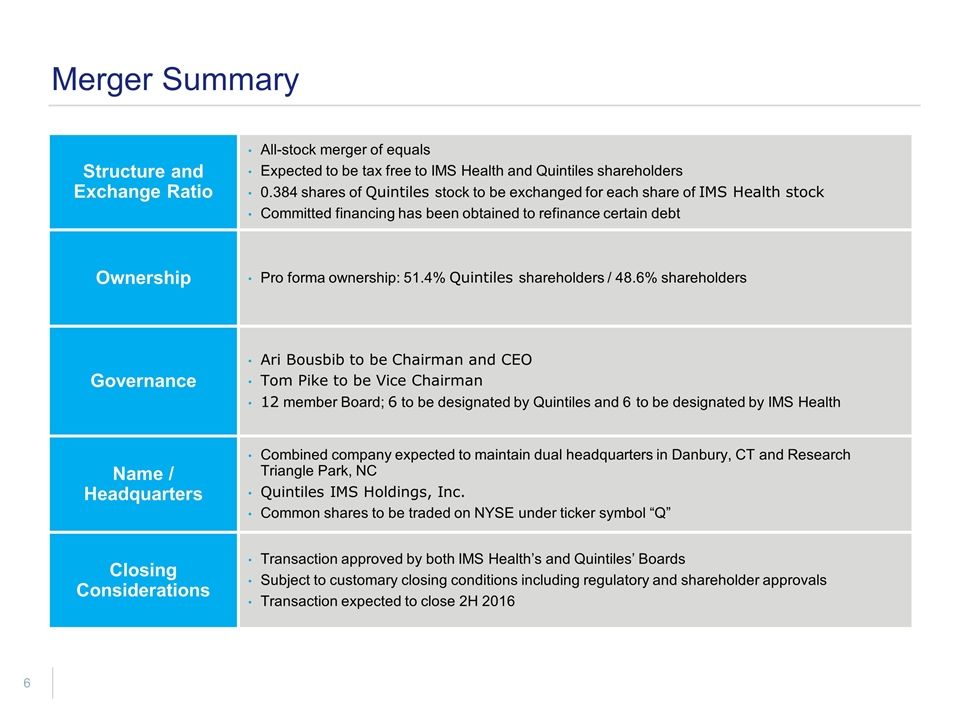

Merger Summary Structure and Exchange Ratio All-stock merger of equals Expected to be tax free to IMS Health and Quintiles shareholders 0.384 shares of Quintiles stock to be exchanged for each share of IMS Health stock Committed financing has been obtained to refinance certain debt Ownership Pro forma ownership: 51.4% Quintiles shareholders / 48.6% shareholders Governance Ari Bousbib to be Chairman and CEO Tom Pike to be Vice Chairman 12 member Board; 6 to be designated by Quintiles and 6 to be designated by IMS Health Name / Headquarters Combined company expected to maintain dual headquarters in Danbury, CT and Research Triangle Park, NC Quintiles IMS Holdings, Inc. Common shares to be traded on NYSE under ticker symbol “Q” Closing Considerations Transaction approved by both IMS Health’s and Quintiles’ Boards Subject to customary closing conditions including regulatory and shareholder approvals Transaction expected to close 2H 2016

Transformational Partner to Life Sciences World Class Talent Serving World Class Clients Multiple Value Creation Levers Compelling Financial Profile

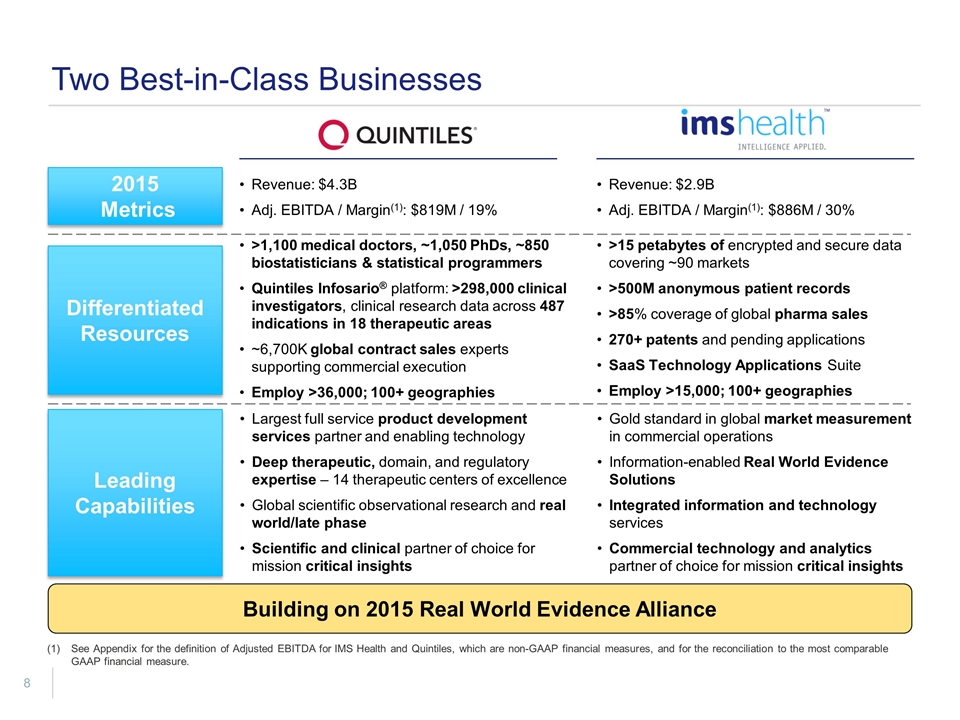

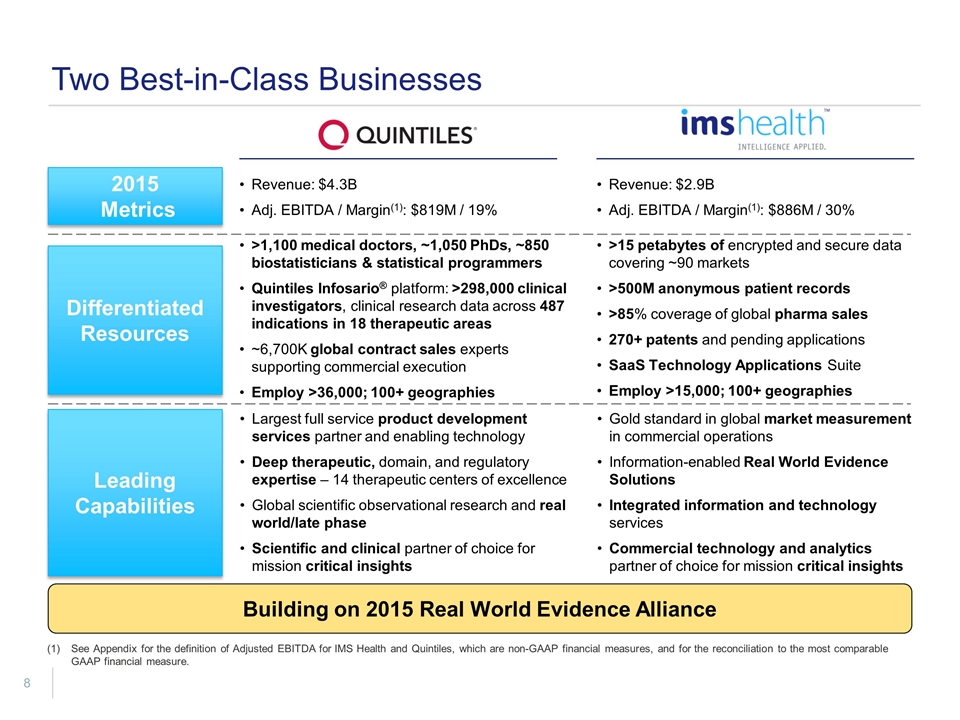

Two Best-in-Class Businesses 2015 Metrics Differentiated Resources Leading Capabilities Revenue: $4.3B Adj. EBITDA / Margin(1): $819M / 19% >1,100 medical doctors, ~1,050 PhDs, ~850 biostatisticians & statistical programmers Quintiles Infosario® platform: >298,000 clinical investigators, clinical research data across 487 indications in 18 therapeutic areas ~6,700K global contract sales experts supporting commercial execution Employ >36,000; 100+ geographies See Appendix for the definition of Adjusted EBITDA for IMS Health and Quintiles, which are non-GAAP financial measures, and for the reconciliation to the most comparable GAAP financial measure. Largest full service product development services partner and enabling technology Deep therapeutic, domain, and regulatory expertise – 14 therapeutic centers of excellence Global scientific observational research and real world/late phase Scientific and clinical partner of choice for mission critical insights Revenue: $2.9B Adj. EBITDA / Margin(1): $886M / 30% >15 petabytes of encrypted and secure data covering ~90 markets >500M anonymous patient records >85% coverage of global pharma sales 270+ patents and pending applications SaaS Technology Applications Suite Employ >15,000; 100+ geographies Gold standard in global market measurement in commercial operations Information-enabled Real World Evidence Solutions Integrated information and technology services Commercial technology and analytics partner of choice for mission critical insights Building on 2015 Real World Evidence Alliance

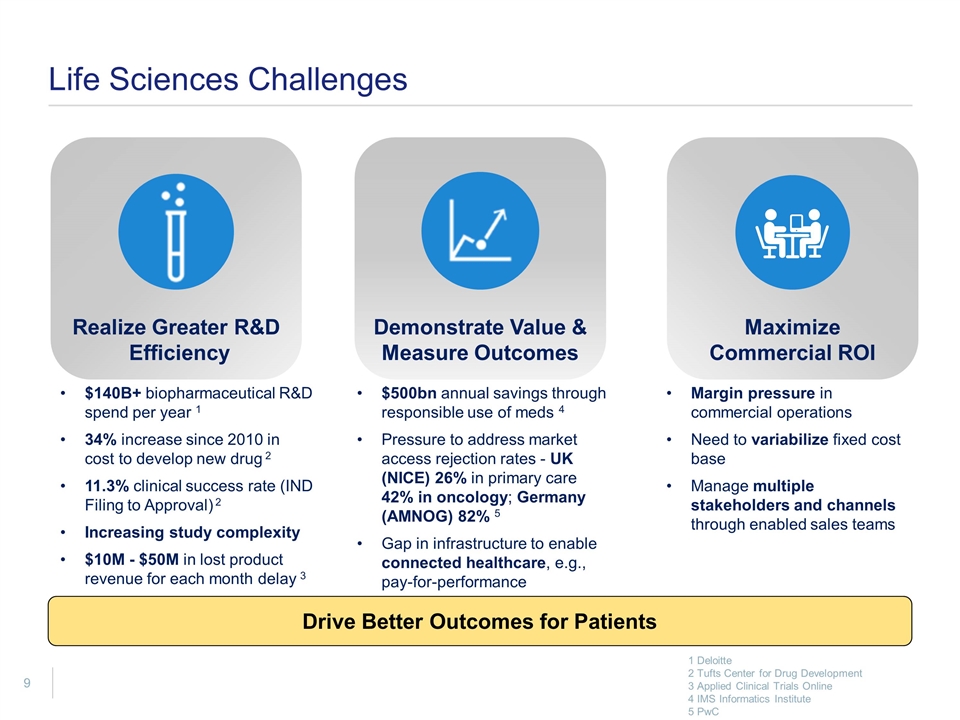

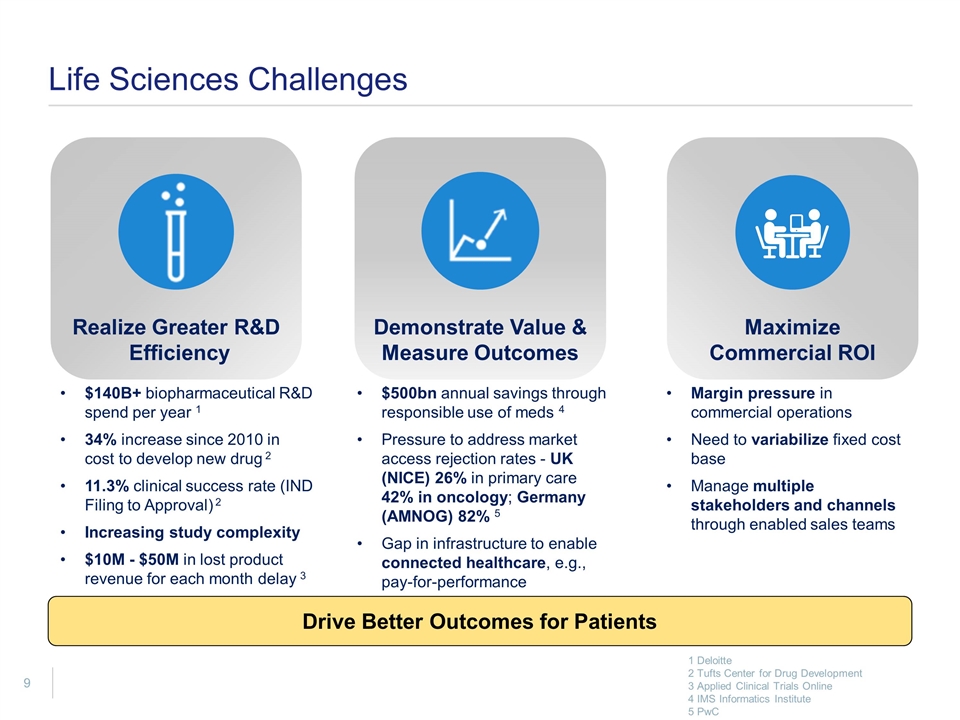

Life Sciences Challenges Realize Greater R&D Efficiency Demonstrate Value & Measure Outcomes Maximize Commercial ROI $140B+ biopharmaceutical R&D spend per year 1 34% increase since 2010 in cost to develop new drug 2 11.3% clinical success rate (IND Filing to Approval) 2 Increasing study complexity $10M - $50M in lost product revenue for each month delay 3 $500bn annual savings through responsible use of meds 4 Pressure to address market access rejection rates - UK (NICE) 26% in primary care 42% in oncology; Germany (AMNOG) 82% 5 Gap in infrastructure to enable connected healthcare, e.g., pay-for-performance Margin pressure in commercial operations Need to variabilize fixed cost base Manage multiple stakeholders and channels through enabled sales teams 1 Deloitte 2 Tufts Center for Drug Development 3 Applied Clinical Trials Online 4 IMS Informatics Institute 5 PwC Drive Better Outcomes for Patients

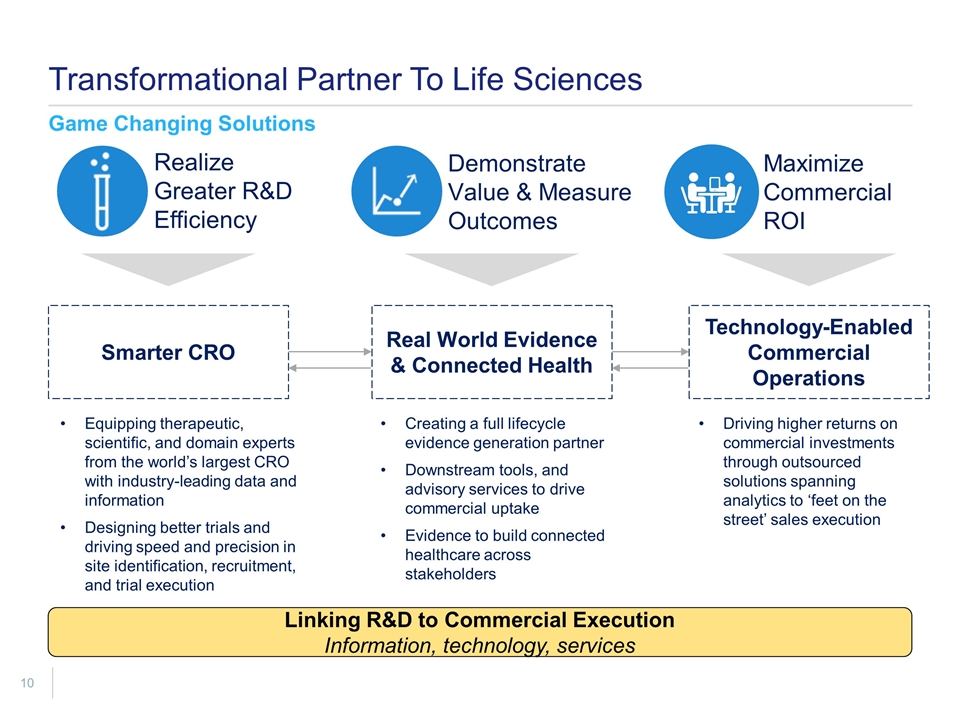

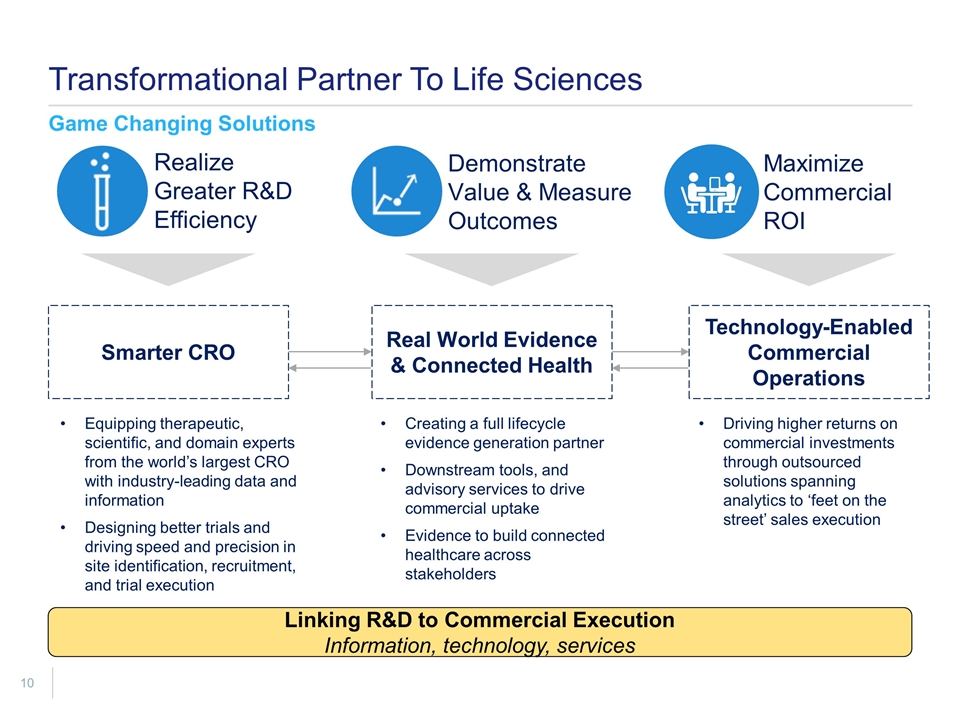

Transformational Partner To Life Sciences Game Changing Solutions Realize Greater R&D Efficiency Demonstrate Value & Measure Outcomes Maximize Commercial ROI Smarter CRO Real World Evidence & Connected Health Technology-Enabled Commercial Operations Equipping therapeutic, scientific, and domain experts from the world’s largest CRO with industry-leading data and information Designing better trials and driving speed and precision in site identification, recruitment, and trial execution Creating a full lifecycle evidence generation partner Downstream tools, and advisory services to drive commercial uptake Evidence to build connected healthcare across stakeholders Driving higher returns on commercial investments through outsourced solutions spanning analytics to ‘feet on the street’ sales execution Linking R&D to Commercial Execution Information, technology, services

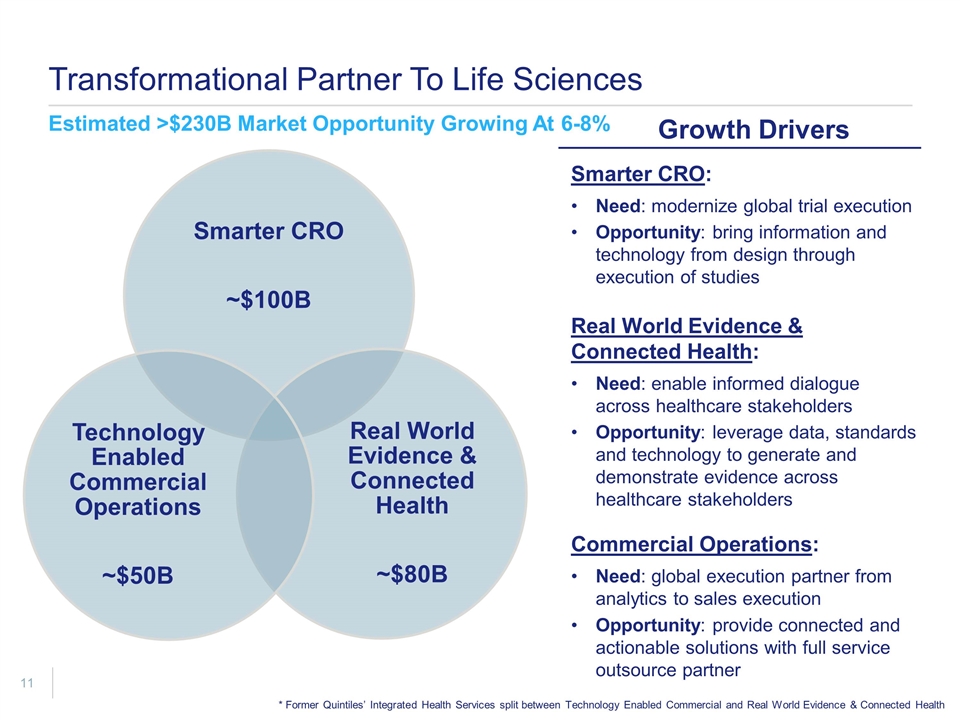

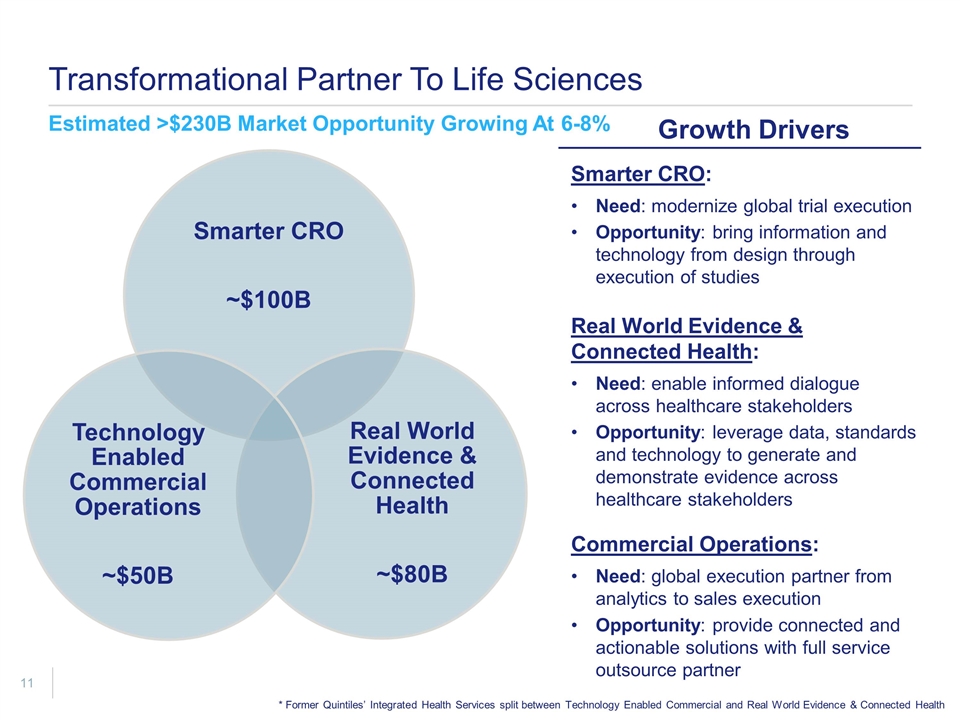

Transformational Partner To Life Sciences Estimated >$230B Market Opportunity Growing At 6-8% Growth Drivers Smarter CRO: Need: modernize global trial execution Opportunity: bring information and technology from design through execution of studies Real World Evidence & Connected Health: Need: enable informed dialogue across healthcare stakeholders Opportunity: leverage data, standards and technology to generate and demonstrate evidence across healthcare stakeholders Commercial Operations: Need: global execution partner from analytics to sales execution Opportunity: provide connected and actionable solutions with full service outsource partner * Former Quintiles’ Integrated Health Services split between Technology Enabled Commercial and Real World Evidence & Connected Health Smarter CRO ~$100B Real World Evidence & Connected Health ~$80B Technology Enabled Commercial Operations ~$50B

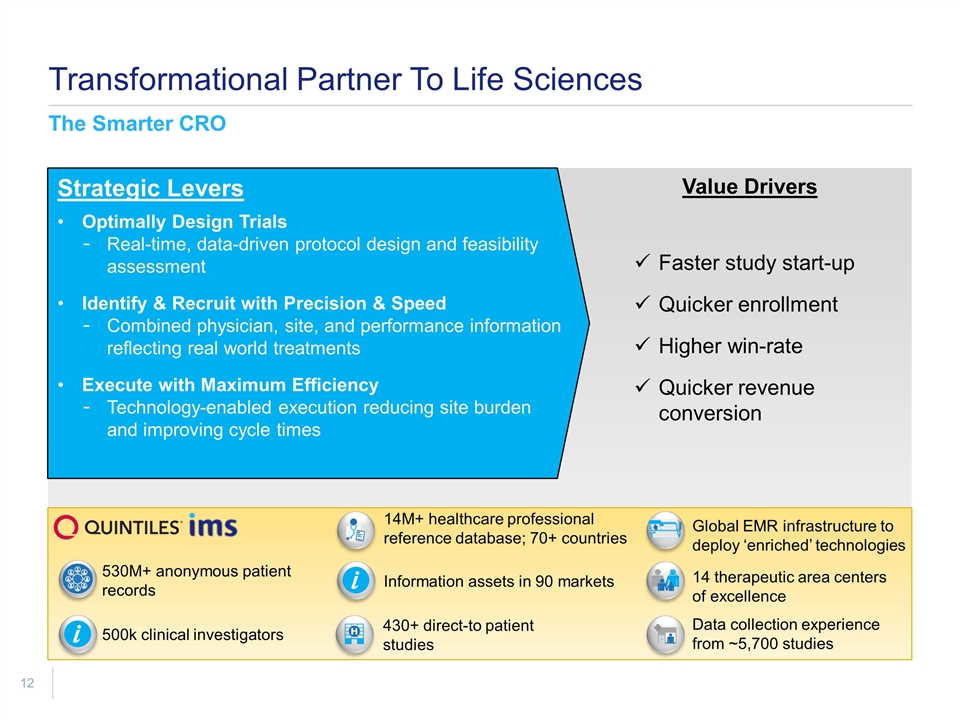

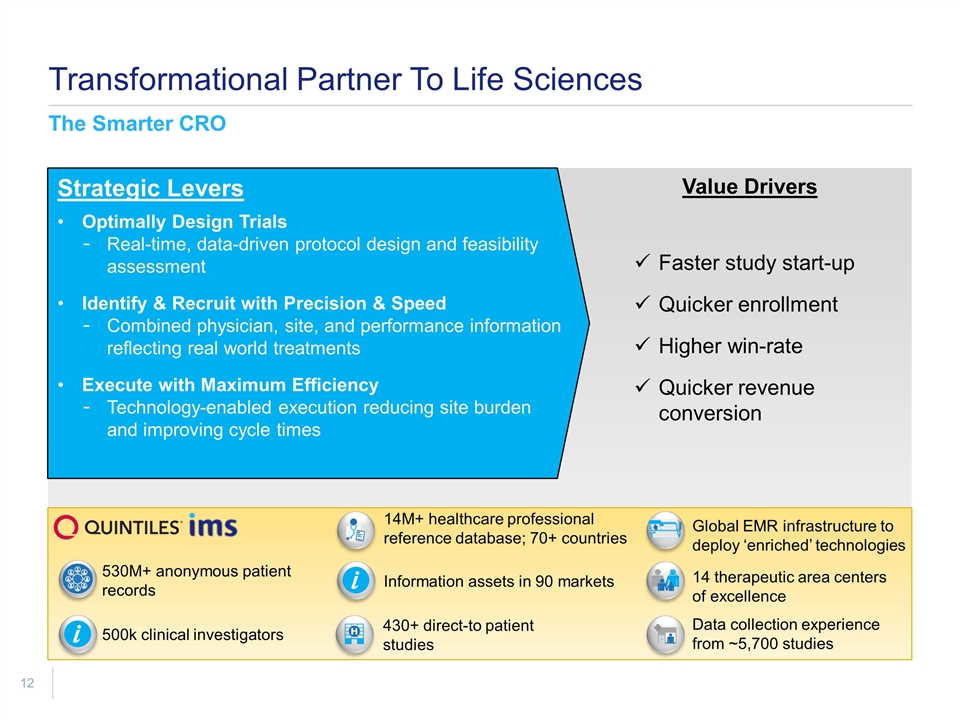

Transformational Partner To Life Sciences The Smarter CRO 530M+ anonymous patient records 14M+ healthcare professional reference database; 70+ countries 500k clinical investigators Information assets in 90 markets 430+ direct-to patient studies Data collection experience from ~5,700 studies Global EMR infrastructure to deploy ‘enriched’ technologies 14 therapeutic area centers of excellence Strategic Levers Optimally Design Trials Real-time, data-driven protocol design and feasibility assessment Identify & Recruit with Precision & Speed Combined physician, site, and performance information reflecting real world treatments Execute with Maximum Efficiency Technology-enabled execution reducing site burden and improving cycle times Value Drivers Faster study start-up Quicker enrollment Higher win-rate Quicker revenue conversion

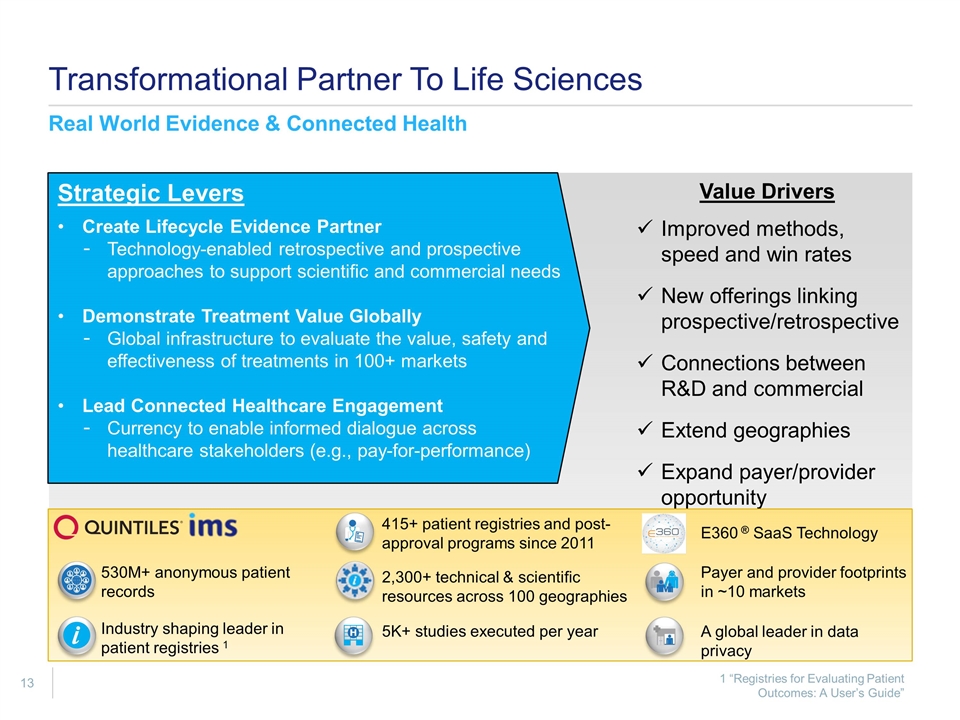

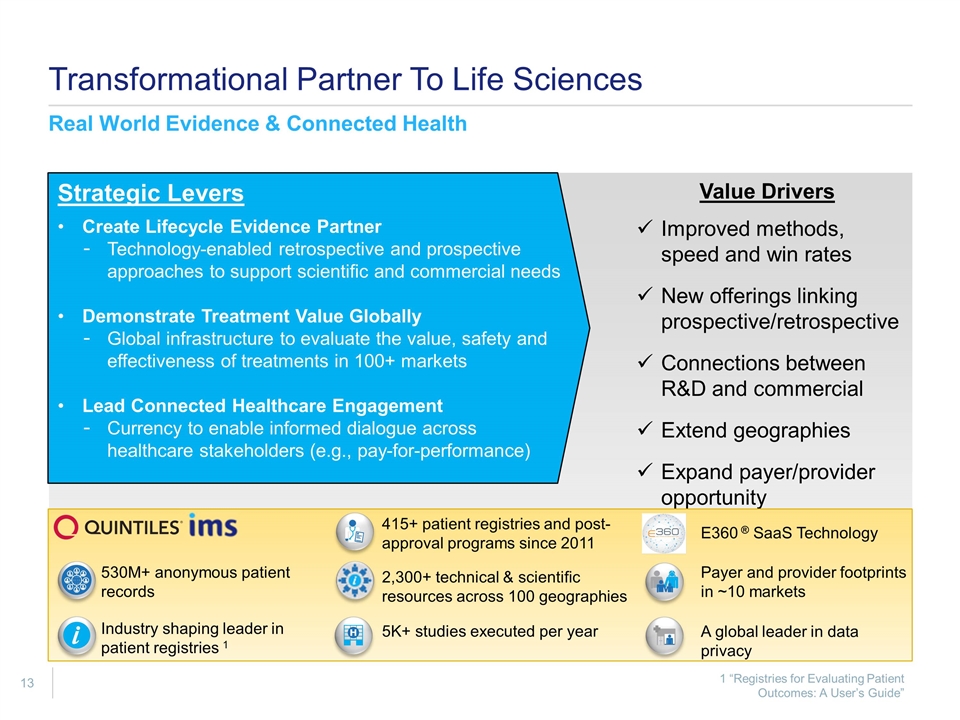

Transformational Partner To Life Sciences Real World Evidence & Connected Health Strategic Levers Create Lifecycle Evidence Partner Technology-enabled retrospective and prospective approaches to support scientific and commercial needs Demonstrate Treatment Value Globally Global infrastructure to evaluate the value, safety and effectiveness of treatments in 100+ markets Lead Connected Healthcare Engagement Currency to enable informed dialogue across healthcare stakeholders (e.g., pay-for-performance) Value Drivers Improved methods, speed and win rates New offerings linking prospective/retrospective Connections between R&D and commercial Extend geographies Expand payer/provider opportunity 530M+ anonymous patient records 415+ patient registries and post-approval programs since 2011 E360 ® SaaS Technology Industry shaping leader in patient registries 1 2,300+ technical & scientific resources across 100 geographies Payer and provider footprints in ~10 markets 5K+ studies executed per year A global leader in data privacy 1 “Registries for Evaluating Patient Outcomes: A User’s Guide”

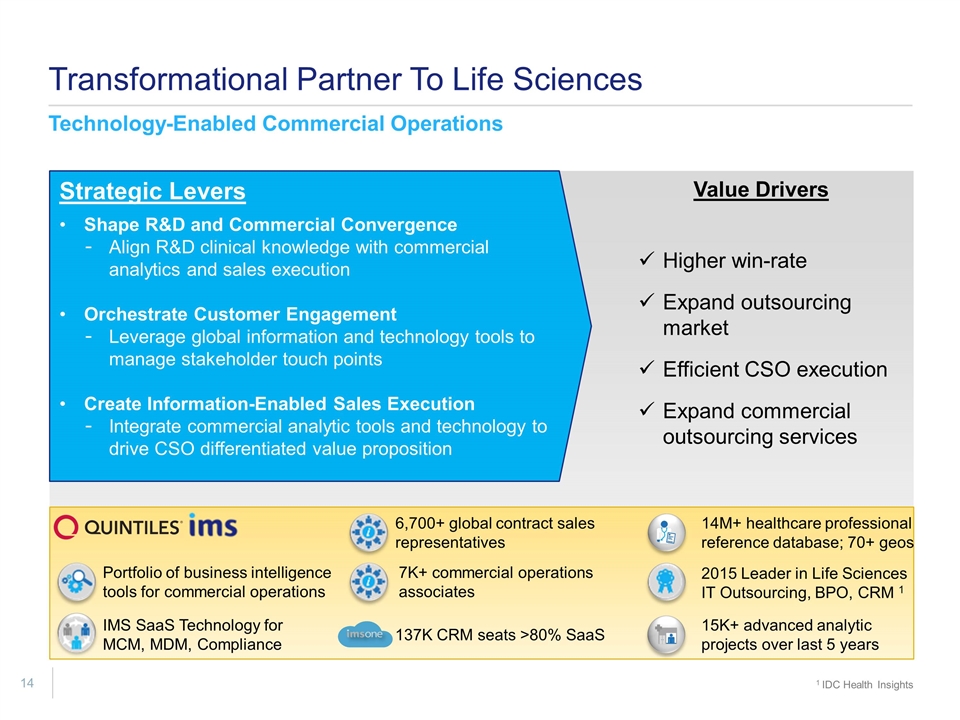

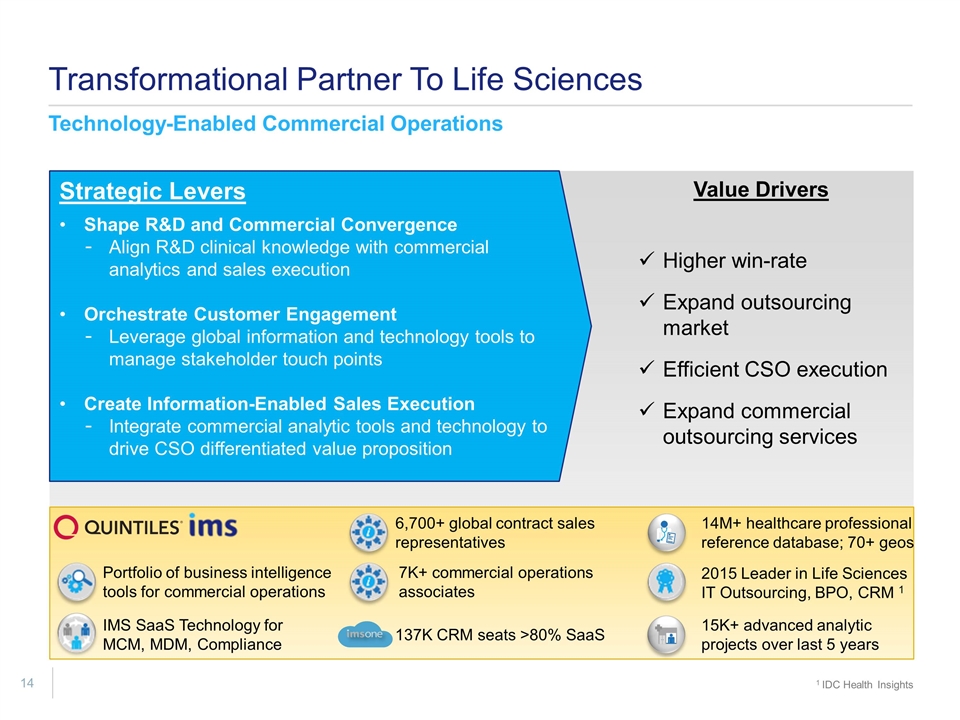

Transformational Partner To Life Sciences Technology-Enabled Commercial Operations Strategic Levers Shape R&D and Commercial Convergence Align R&D clinical knowledge with commercial analytics and sales execution Orchestrate Customer Engagement Leverage global information and technology tools to manage stakeholder touch points Create Information-Enabled Sales Execution Integrate commercial analytic tools and technology to drive CSO differentiated value proposition Value Drivers Higher win-rate Expand outsourcing market Efficient CSO execution Expand commercial outsourcing services Portfolio of business intelligence tools for commercial operations 6,700+ global contract sales representatives IMS SaaS Technology for MCM, MDM, Compliance 2015 Leader in Life Sciences IT Outsourcing, BPO, CRM 1 137K CRM seats >80% SaaS 15K+ advanced analytic projects over last 5 years 7K+ commercial operations associates 14M+ healthcare professional reference database; 70+ geos 1 IDC Health Insights

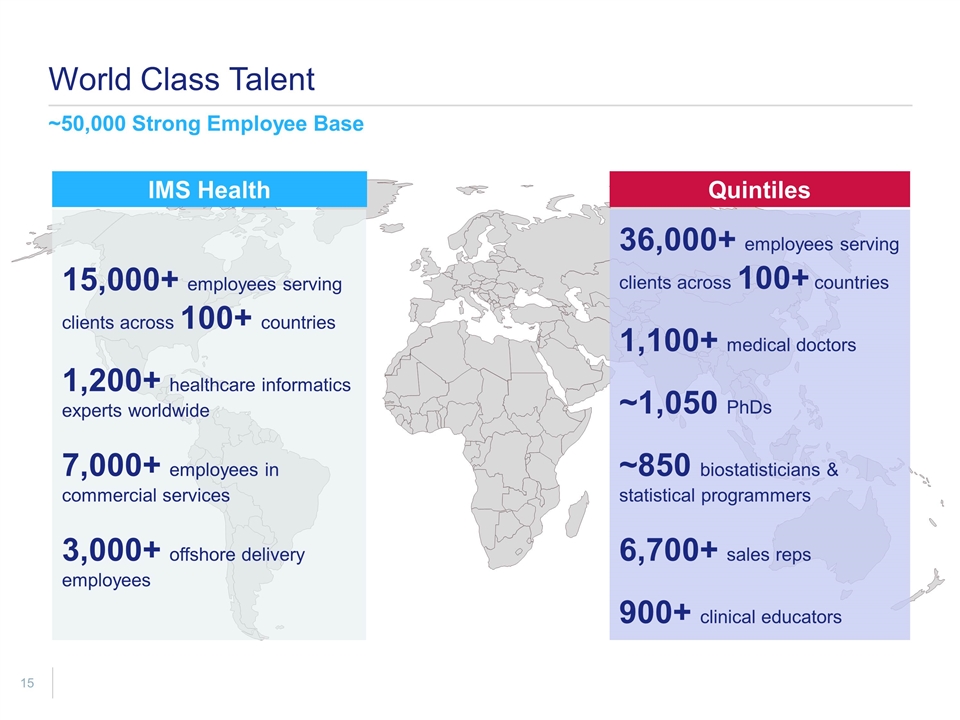

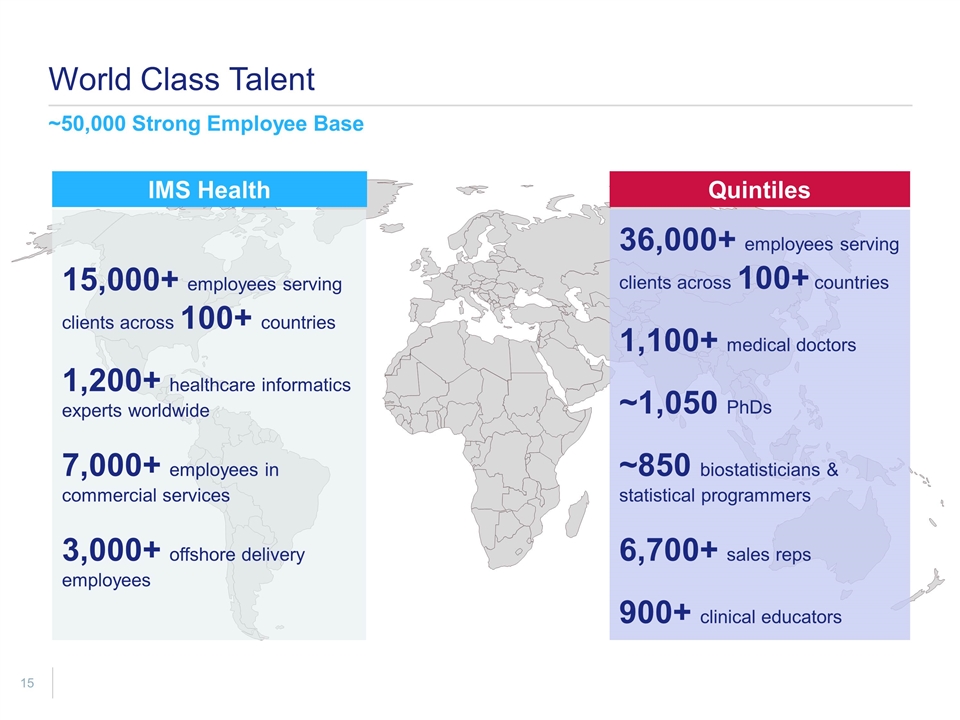

World Class Talent ~50,000 Strong Employee Base 15,000+ employees serving clients across 100+ countries 1,200+ healthcare informatics experts worldwide 7,000+ employees in commercial services 3,000+ offshore delivery employees Quintiles 36,000+ employees serving clients across 100+ countries 1,100+ medical doctors ~1,050 PhDs ~850 biostatisticians & statistical programmers 6,700+ sales reps 900+ clinical educators IMS Health

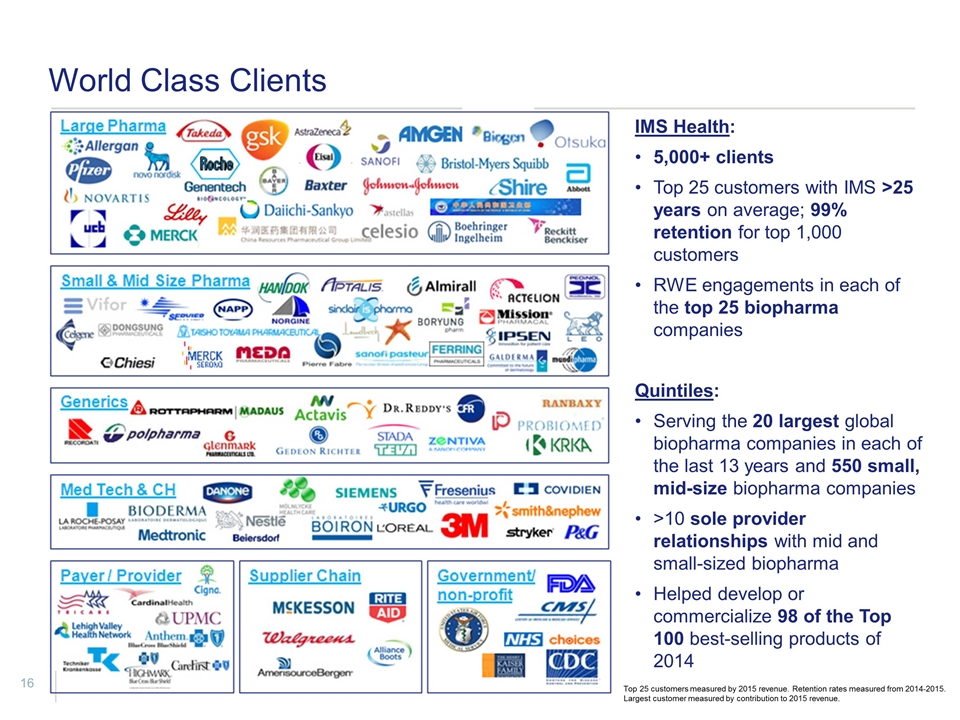

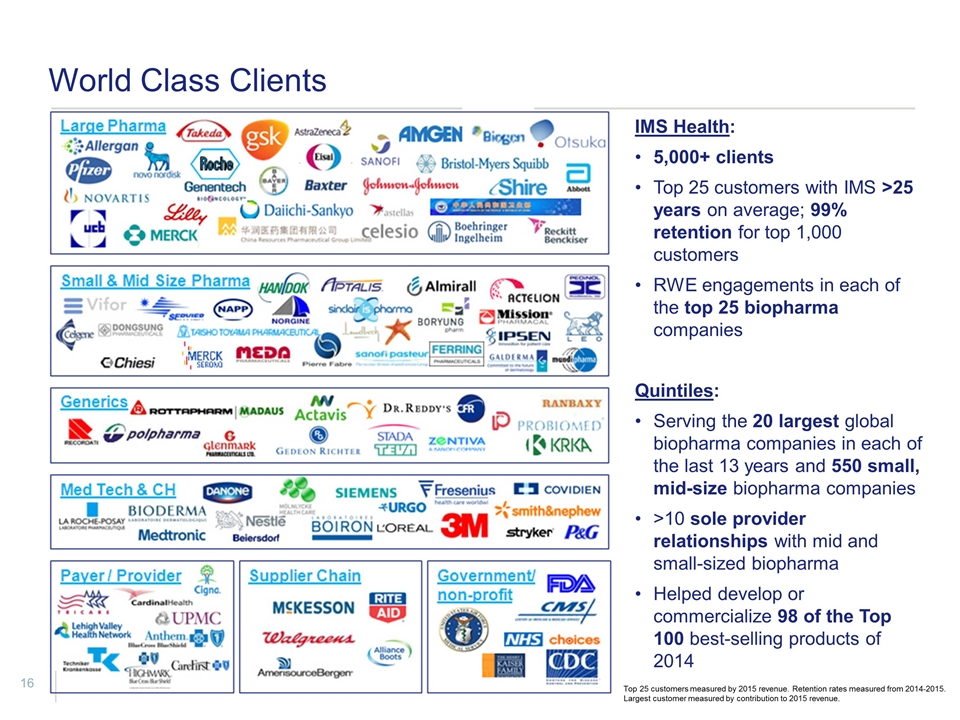

World Class Clients Top 25 customers measured by 2015 revenue. Retention rates measured from 2014-2015. Largest customer measured by contribution to 2015 revenue. IMS Health: 5,000+ clients Top 25 customers with IMS >25 years on average; 99% retention for top 1,000 customers RWE engagements in each of the top 25 biopharma companies Quintiles: Serving the 20 largest global biopharma companies in each of the last 13 years and 550 small, mid-size biopharma companies >10 sole provider relationships with mid and small-sized biopharma Helped develop or commercialize 98 of the Top 100 best-selling products of 2014

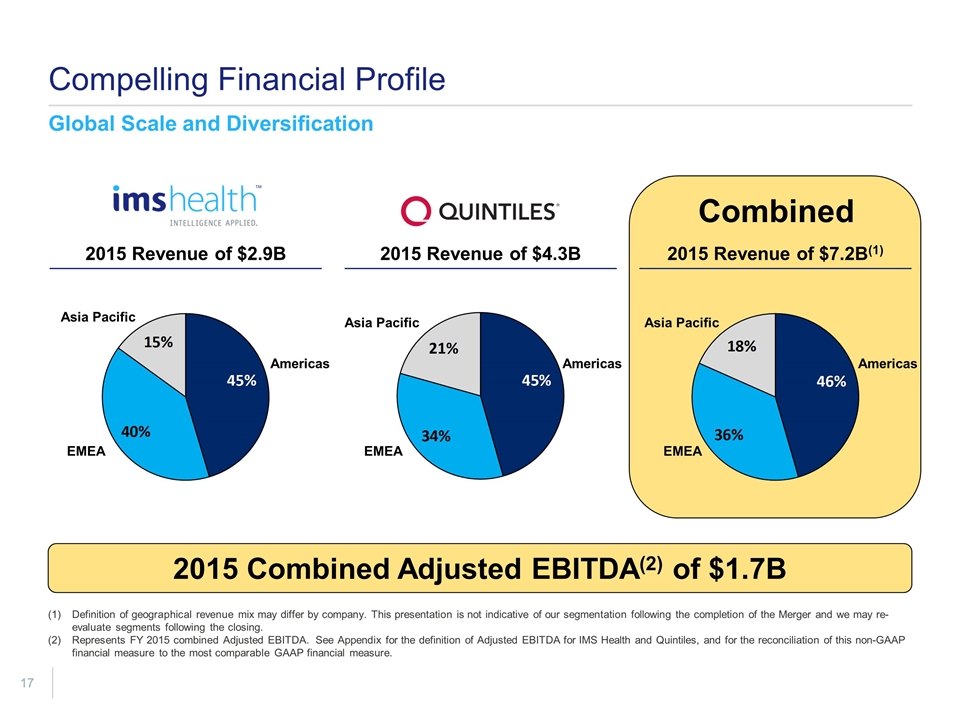

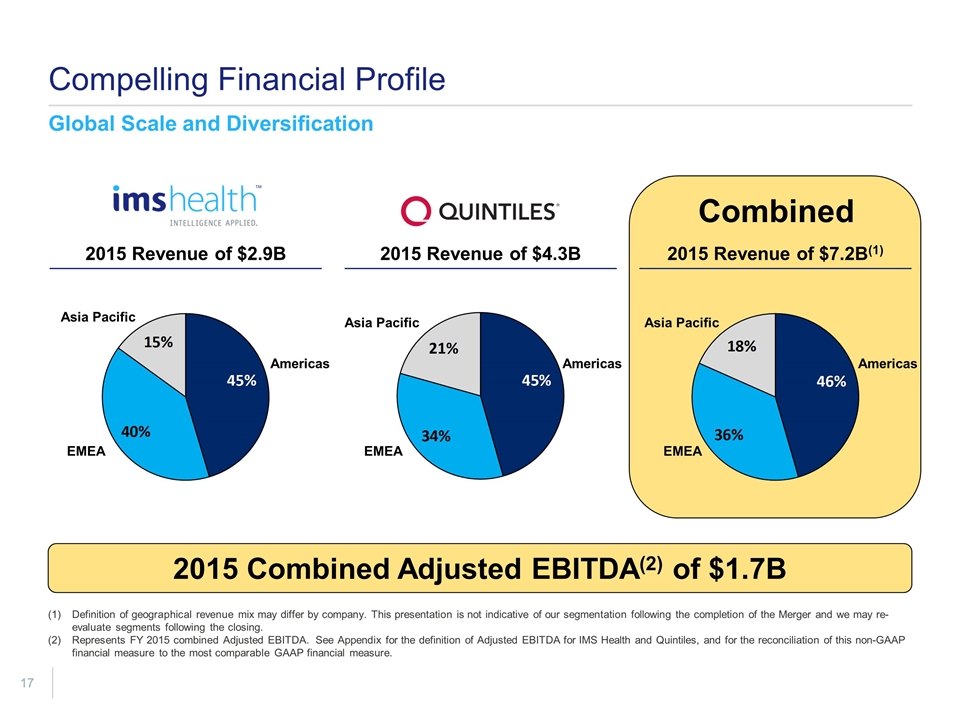

Compelling Financial Profile Global Scale and Diversification Combined 2015 Revenue of $2.9B 2015 Revenue of $4.3B 2015 Revenue of $7.2B(1) Asia Pacific Americas EMEA Americas Asia Pacific EMEA EMEA Americas Asia Pacific Definition of geographical revenue mix may differ by company. This presentation is not indicative of our segmentation following the completion of the Merger and we may re-evaluate segments following the closing. Represents FY 2015 combined Adjusted EBITDA. See Appendix for the definition of Adjusted EBITDA for IMS Health and Quintiles, and for the reconciliation of this non-GAAP financial measure to the most comparable GAAP financial measure. 2015 Combined Adjusted EBITDA(2) of $1.7B

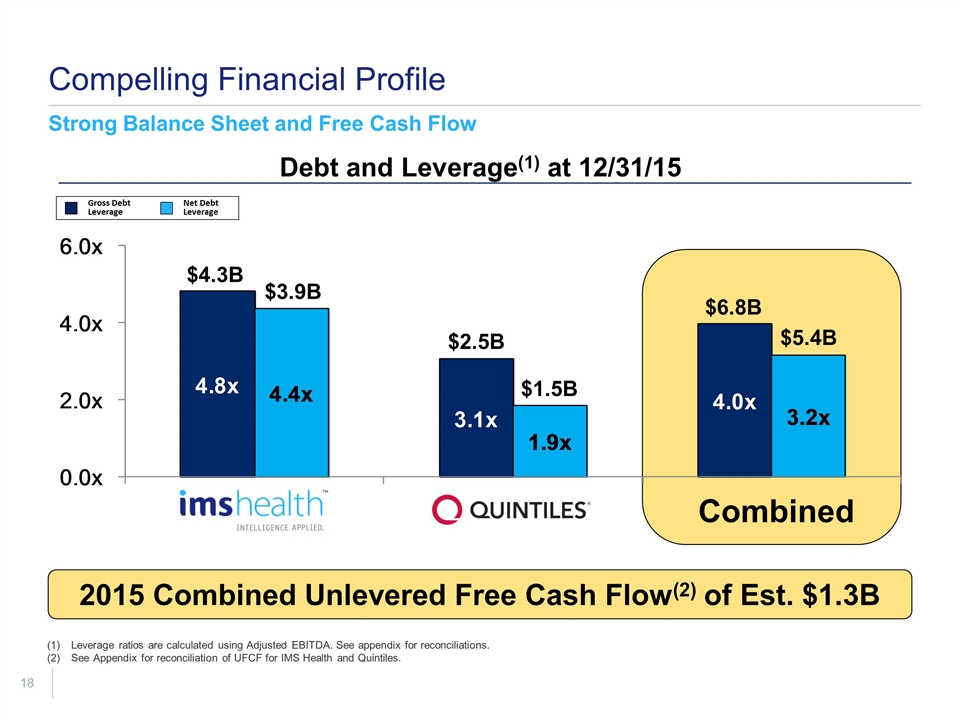

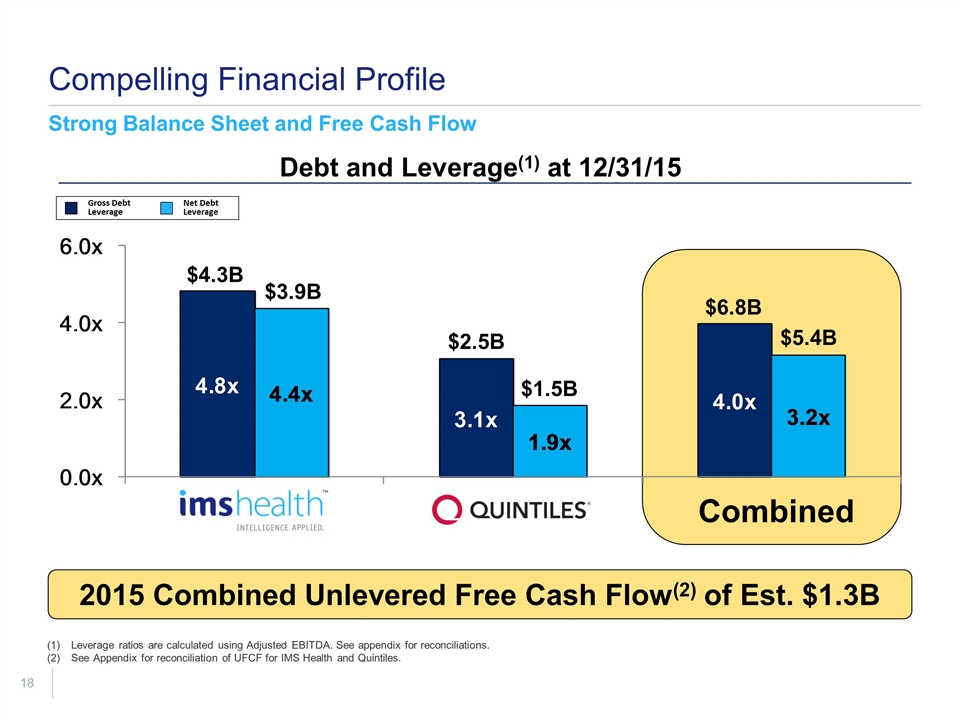

$4.3B $3.9B $2.5B $1.5B $6.8B $5.4B Gross Debt Leverage Net Debt Leverage Compelling Financial Profile Strong Balance Sheet and Free Cash Flow 2015 Combined Unlevered Free Cash Flow(2) of Est. $1.3B Combined Leverage ratios are calculated using Adjusted EBITDA. See appendix for reconciliations. See Appendix for reconciliation of UFCF for IMS Health and Quintiles. Debt and Leverage(1) at 12/31/15

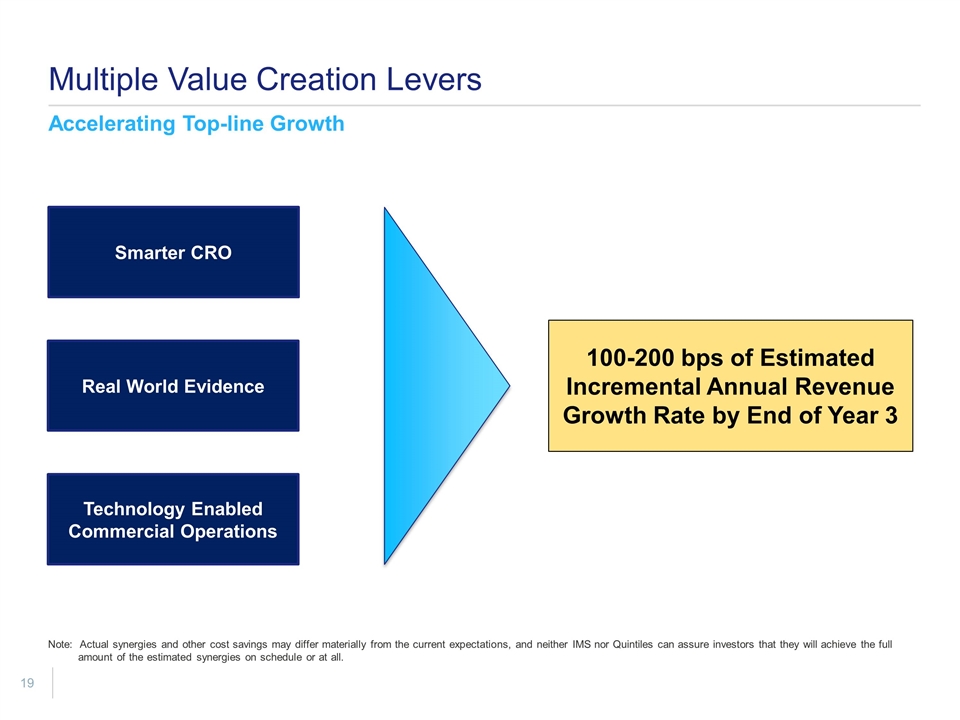

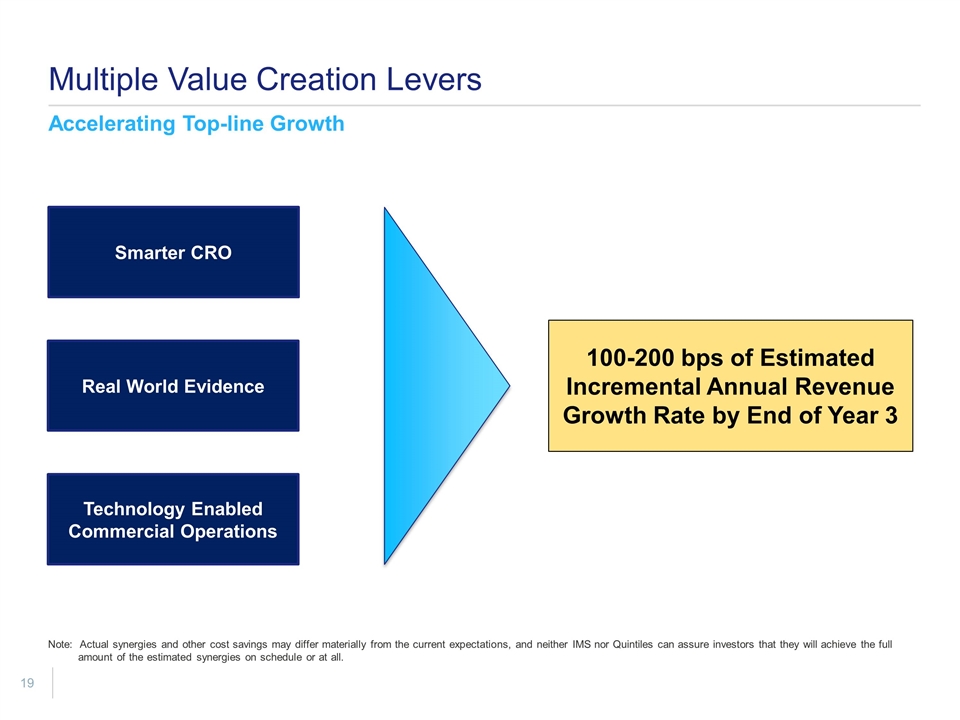

Smarter CRO Real World Evidence Technology Enabled Commercial Operations 100-200 bps of Estimated Incremental Annual Revenue Growth Rate by End of Year 3 Note: Actual synergies and other cost savings may differ materially from the current expectations, and neither IMS nor Quintiles can assure investors that they will achieve the full amount of the estimated synergies on schedule or at all. Accelerating Top-line Growth Multiple Value Creation Levers

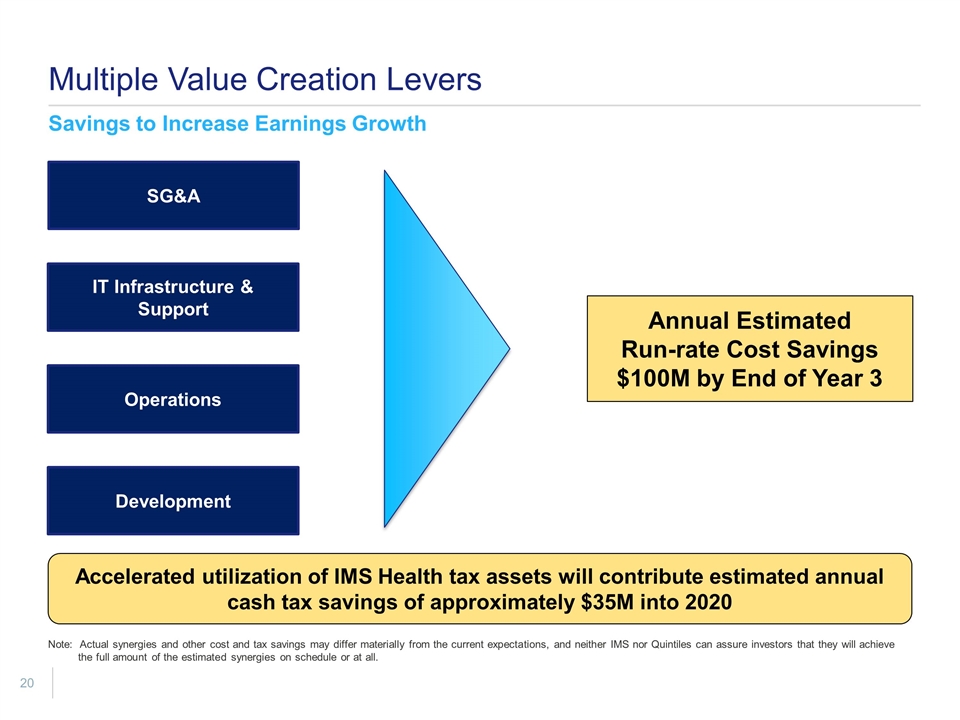

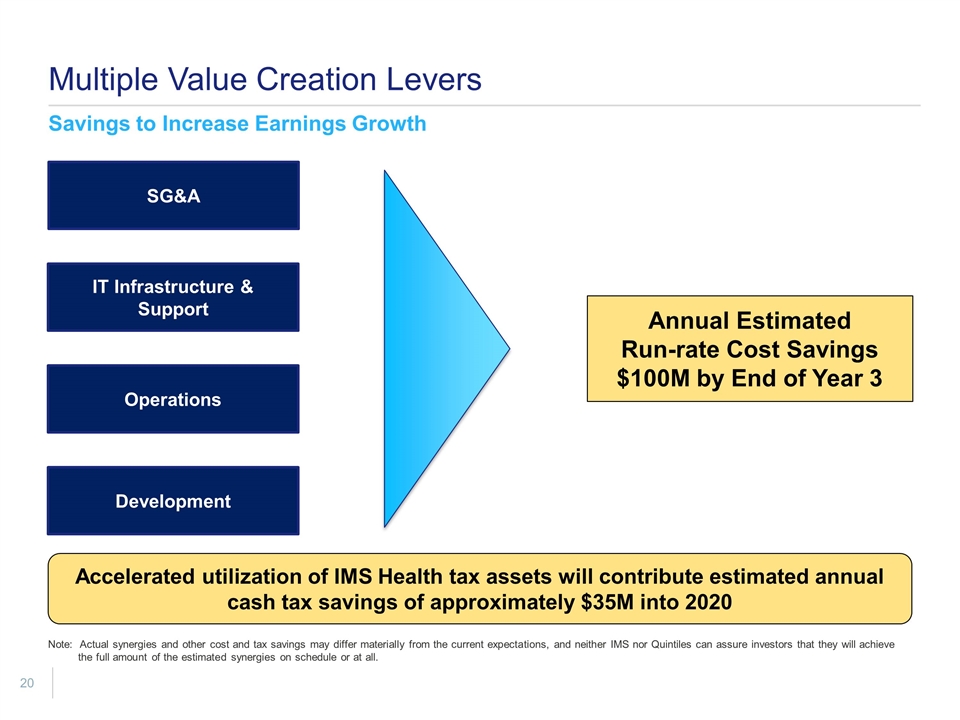

Annual Estimated Run-rate Cost Savings $100M by End of Year 3 SG&A IT Infrastructure & Support Operations Development Note: Actual synergies and other cost and tax savings may differ materially from the current expectations, and neither IMS nor Quintiles can assure investors that they will achieve the full amount of the estimated synergies on schedule or at all. Savings to Increase Earnings Growth Multiple Value Creation Levers Accelerated utilization of IMS Health tax assets will contribute estimated annual cash tax savings of approximately $35M into 2020

Accelerating The Momentum of Two World-Class Franchises Note: Actual synergies and other cost and tax savings may differ materially from the current expectations, and neither IMS nor Quintiles can assure investors that they will achieve the full amount of the estimated synergies on schedule or at all. Faster Growth Differentiated and diversified solutions to address massive unmet needs 100-200 bps of anticipated incremental annual revenue growth rate captured by end of year 3 Cost Savings EPS Accretion Balance Sheet Flexibility $100M of estimated annual run-rate cost savings by end of year 3 $35M acceleration of annual cash tax savings into 2020 Accretive to Adjusted Diluted EPS in 2017 Robust cash flow generation Combined gross leverage of 4.0x and net leverage of 3.2x 2015 Adjusted EBITDA

Appendix: Non-GAAP Financial Measures

Quintiles Net Income to Adjusted EBITDA Change in estimated fair value of contingent consideration on business combinations.

Stock-based compensation related charges are included in Operating costs of information, Direct and incremental costs of technology services and Selling and administrative expenses as follows: Restructuring and related charges includes severance and impairment charges and the cost of employee and third-party charges related to dual running costs for knowledge transfer activities. Dual running costs for knowledge transfer activities of $3 million for the twelve months ended December 31, 2015, are primarily included in Operating costs of information. Acquisition-related charges are included primarily in Selling and administrative expenses. IMS Health Net Income to Adjusted EBITDA (in millions) Net Income $ 417 Benefit from income taxes (200) Other income, net (19) Interest expense 169 Interest income (3) Depreciation and amortization 341 Deferred revenue purchase accounting adjustments 10 Stock-based compensation related charges (1) 28 Restructuring and related charges (2) 91 Acquisition-related charges (3) 51 Secondary offering expenses 1 Adjusted EBITDA $ 886 Twelve Months Ended December 31, 2015

Quintiles Unlevered Free Cash Flow

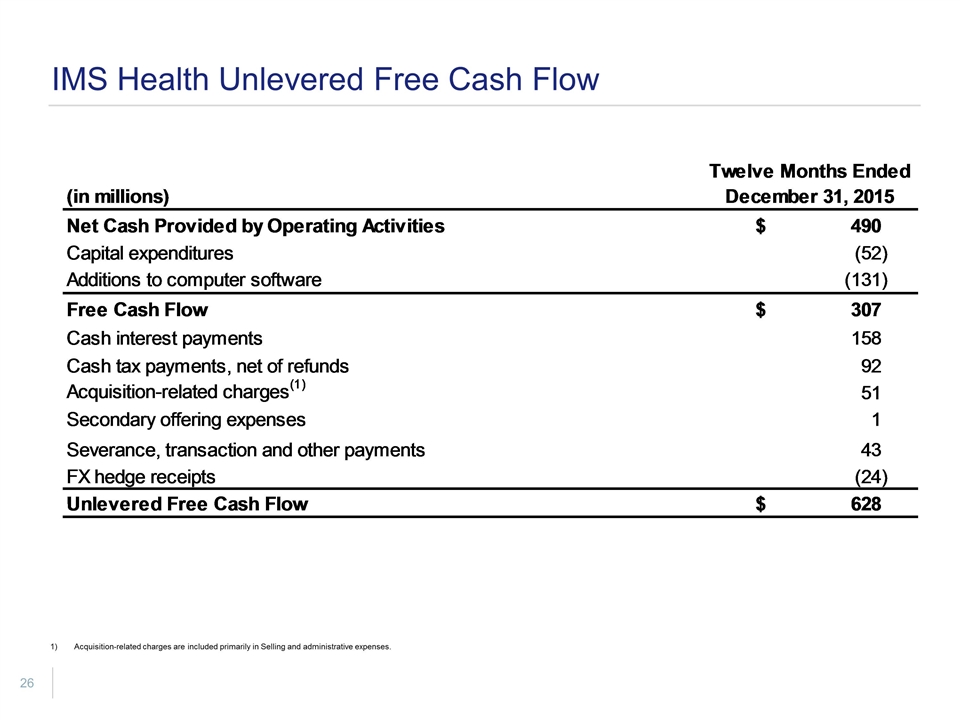

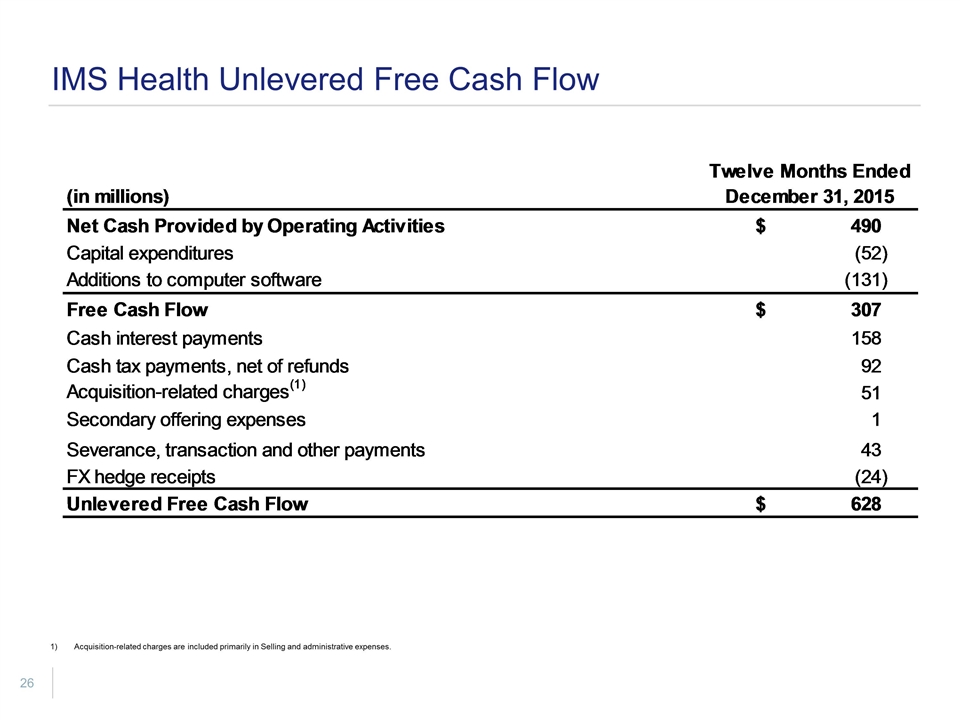

IMS Health Unlevered Free Cash Flow Acquisition-related charges are included primarily in Selling and administrative expenses.

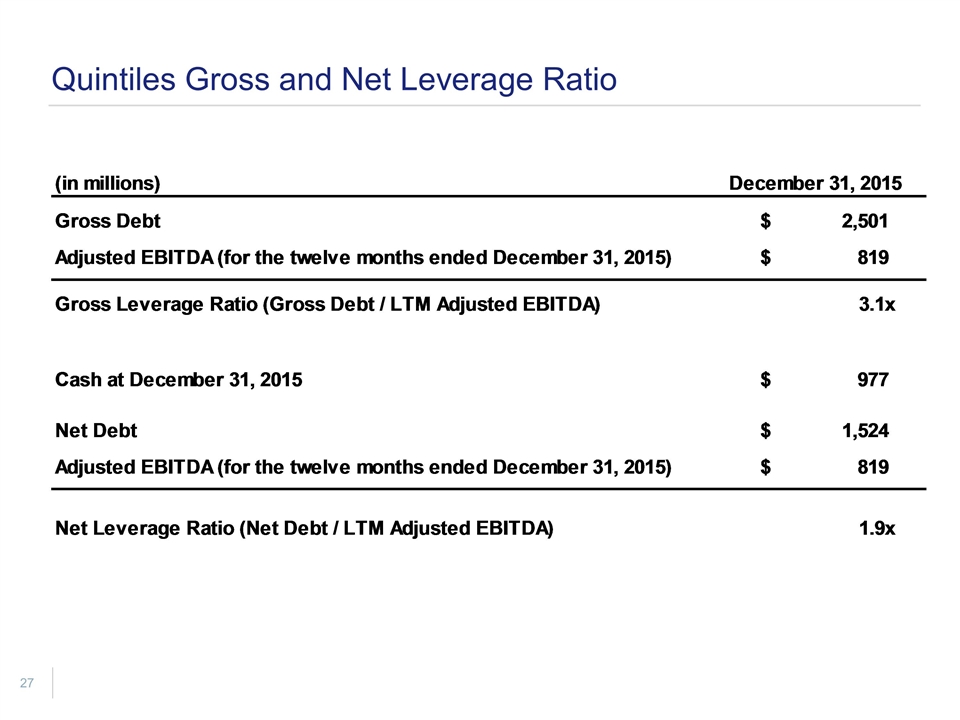

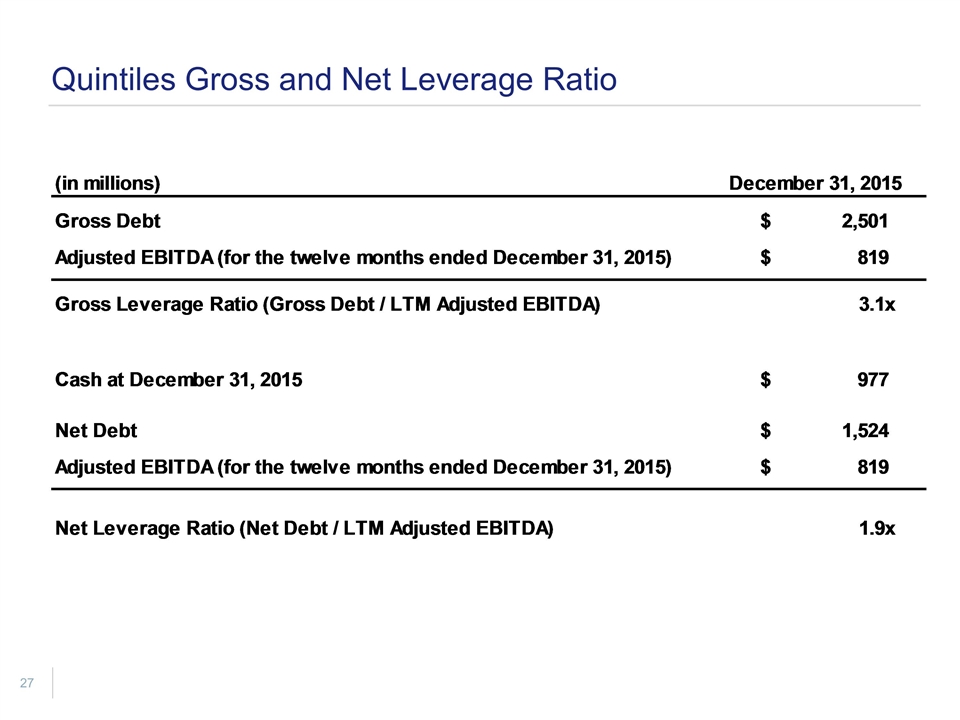

Quintiles Gross and Net Leverage Ratio

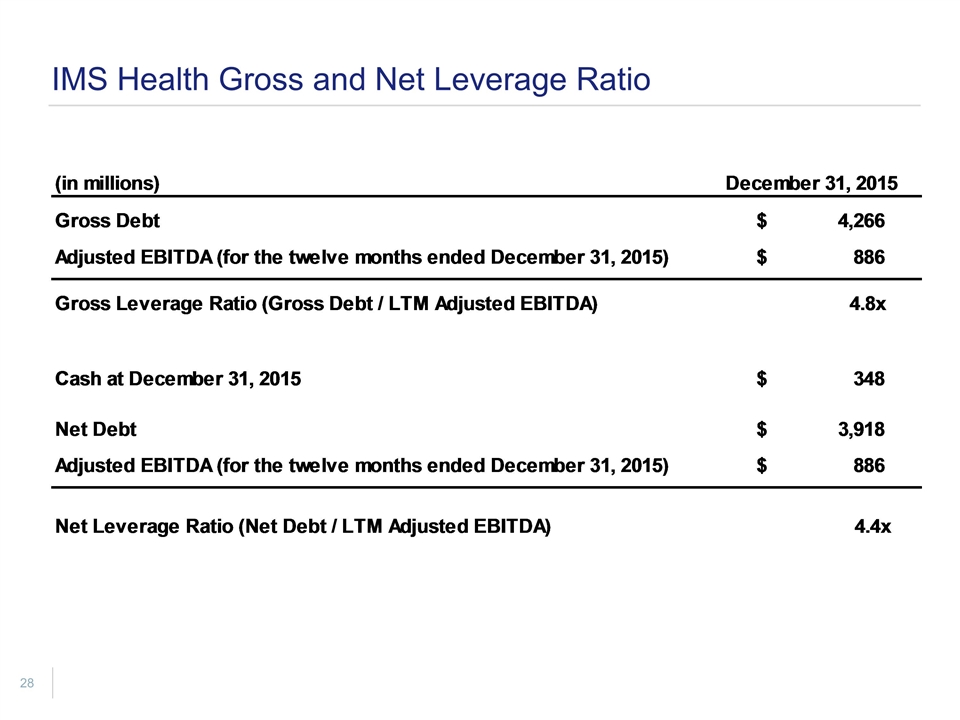

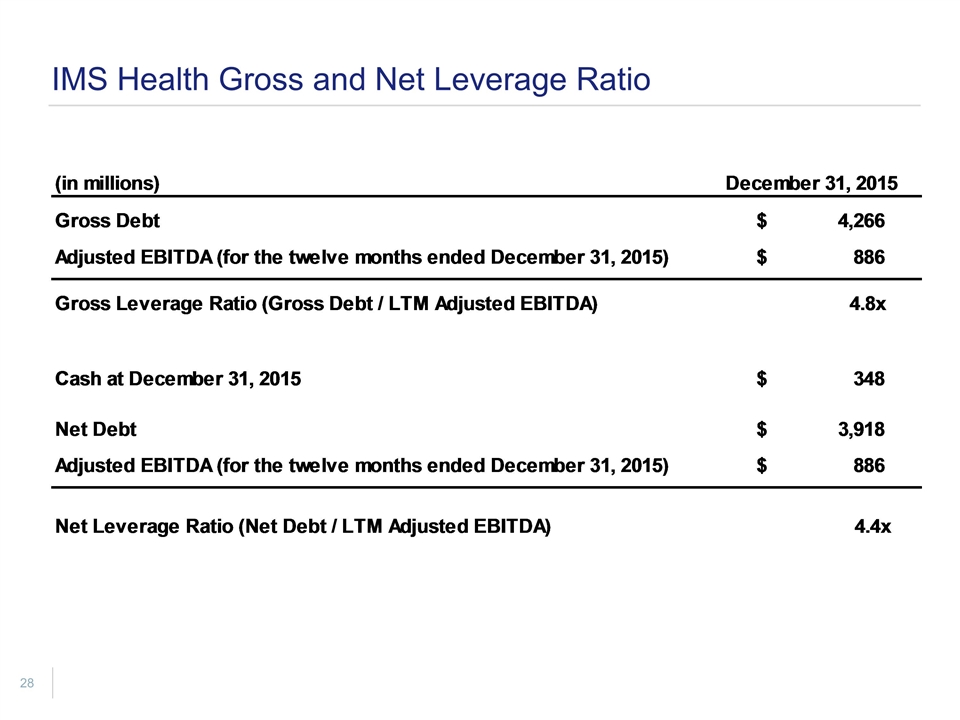

IMS Health Gross and Net Leverage Ratio

Q&A