UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☐ Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☒ | Soliciting Material Pursuant to§240.14a-12 | |

EQT CORPORATION

(Name of the Registrant as Specified In Its Charter)

Toby Z. Rice

Derek A. Rice

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

This filing contains a press release issued by Toby Z. Rice and Derek A. Rice on February 5, 2019. This filing also contains a copy of the presentation Toby Z. Rice and Derek A. Rice delivered to investors on February 5, 2019.

A copy of the press release and the presentation, along with a replay of the conference call held with investors is available at www.eqtpathforward.com.

IMPORTANT INFORMATION

Toby Z. Rice and Derek A. Rice, as well as certain of their affiliates, may file a proxy statement with the U.S. Securities and Exchange Commission (“SEC”) to solicit proxies from stockholders of EQT Corporation (“EQT”) for use at EQT’s 2019 annual meeting of stockholders. TOBY Z. RICE AND DEREK A. RICE STRONGLY ADVISE ALL SECURITY HOLDERS OF EQT TO READ ANY SUCH PROXY STATEMENT IF AND WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Any such proxy statement, if and when filed, and any other relevant documents will be available at no charge on the SEC’s website at http://www.sec.gov/.

PARTICIPANT INFORMATION

In accordance with Rule14a-12(a)(1)(i) under the Securities Exchange Act of 1934, as amended, the following persons are, or may be deemed to be, participants in the potential proxy solicitation: Toby Z. Rice and Derek A. Rice. Toby Z. Rice holds a total of 400,000 shares of common stock, both directly and indirectly, in EQT, and Derek A. Rice holds a total of 272,651 shares of common stock, both directly and indirectly, in EQT. In addition, Toby Z. Rice and Derek A. Rice are potential beneficiaries of the Rice Energy 2016 Irrevocable Trust, which holds a total of 5,676,000 shares of EQT’s common stock.

RICE TEAM DETAILS VALUE CREATION PLAN FOR EQT

Carnegie, PA, February 5, 2019 — Toby Z. Rice and Derek A. Rice, shareholders of EQT Corporation (NYSE: EQT), today presented a detailed plan to improve operational performance and increase shareholder value at EQT. A presentation is now available on the Rice Team websitewww.eqtpathforward.com and the Rice Team will hold an investor call today at 10:00 A.M. ET to discuss its plan.

On the call, the Rice Team will address:

| • | Its analysis of EQT’s 2019 plan and why this plan will not capture the company’s full value |

| • | How the Rice Team plans to transform EQT into the lowest-cost gas operator in the U.S. and generate at least $500 million in incremental free cash flow per year |

| • | Rice’s response to EQT’s claims, highlighting Rice’s confidence in delivering the results based on their track record & experience operating these assets |

| • | Why EQT needs a reconstituted Board to oversee the required transformation |

Interested parties may access the call as follows:

| • | Dial (866)547-1509, using the conference ID 7147404 |

| • | Listen to a live webcast on the Rice Team websitewww.eqtpathforward.com |

| • | A replay of the conference call will be available on the website beginning at 1:00 P.M. ET or by calling (404)537-3406 and using conference ID 7147404 |

IMPORTANT INFORMATION

Toby Z. Rice and Derek A. Rice, as well as certain of their affiliates, may file a proxy statement with the U.S. Securities and Exchange Commission (“SEC”) to solicit proxies from stockholders of EQT for use at EQT’s 2019 annual meeting of stockholders. TOBY Z. RICE AND DEREK A. RICE STRONGLY ADVISE ALL SECURITY HOLDERS OF EQT TO READ ANY SUCH PROXY STATEMENT IF AND WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Any such proxy statement, if and when filed, and any other relevant documents will be available at no charge on the SEC’s website at http://www.sec.gov/.

PARTICIPANT INFORMATION

In accordance with Rule14a-12(a)(1)(i) under the Securities Exchange Act of 1934, as amended, the following persons are, or may be deemed to be, participants in the potential proxy solicitation: Toby Z. Rice and Derek A. Rice. Toby Z. Rice holds a total of 400,000 shares of common stock, both directly and indirectly, in EQT, and Derek A. Rice holds a total of 272,651 shares of common stock, both directly and indirectly, in EQT. In addition, Toby Z. Rice and Derek A. Rice are potential beneficiaries of the Rice Energy 2016 Irrevocable Trust, which holds a total of 5,676,000 shares of EQT’s common stock.

Contacts:

For Investor Inquiries:

Kyle Derham

kyle@teamrice.com

For Media Inquiries:

Sard Verbinnen & Co

Jim Barron:212-687-8080

Frances Jeter 832.680.5120

Realizing EQT’s Potential February 2019

We Want To Deliver EQT’s Potential to Shareholders What Is Our Goal? Transform EQT into the lowest cost gas operator in the U.S. Reduce well costs to levels this asset base merits and realize the synergies EQT promised from the RICE merger Having reviewed EQT’s 2019 development plan, we are even more confident in our ability to generate $500mm/year (10% of EQT’s market cap/year) of additional free cash flow versus the current EQT plan Why Are We Involved? As significant shareholders (7.5mm shares), we were disappointed with EQT’s 2018 operational miss. This miss prompted significant shareholder outreach to the Rice team due to our experience developing EQT’s assets Rice initiated private dialogue with EQT to offer our assistance in fixing the business. EQT ignored our outreach and the views of many shareholders EQT’s 2019 plan demonstrates their lack of vision about what is possible with its assets What Are We Offering? Qualified CEO with proven track record and10-15 former Rice Energy operational leaders standing by Team that has consistently delivered superior operating performance on substantially the same asset base We have highly qualified director candidates whom we will nominate if the Company will not meaningfully engage with us 2

The Rice Plan

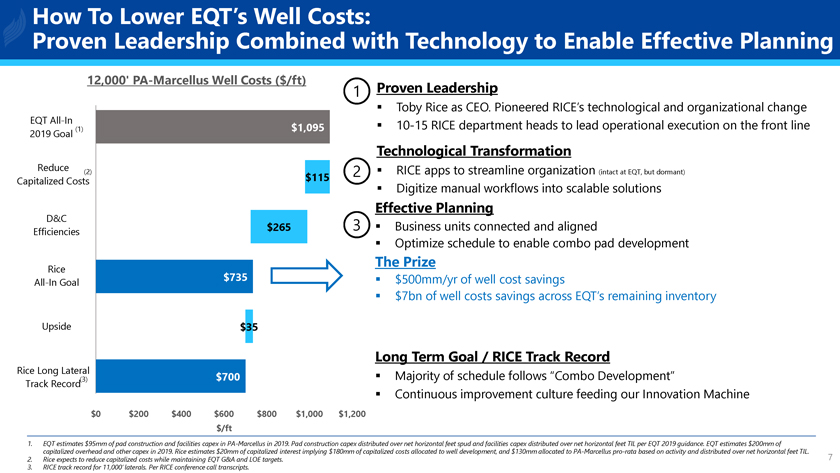

Our Plan is to Transform EQT into the Lowest Cost Gas Operator Transform EQT into the lowest cost gas operator in the U.S. Decrease well costs to improve EQT’s free cash flow profile by $500mm/yr (10% of EQT’s market cap/yr) We see substantial additional opportunities for further free cash flow beyond our initial $500mm/yr goal How? 1. Add Proven Leadership: RICE delivered peer leading well costs & productivity while being named #1 Top Workplace in Pittsburgh. Full team is standing by 2. Implement Technology Platform: RICE apps to streamline organization and digitize workflows 3. Effective Planning: Align and incentivize employees, optimize schedule to enable combo pad development(1) What do we need? Toby Rice as CEO, former COO of Rice Energy who pioneered RICE’s digital transformation New Board Leadership to oversee shareholder mandate for change 1. See Appendix (slide 32) for details on combo development. 4

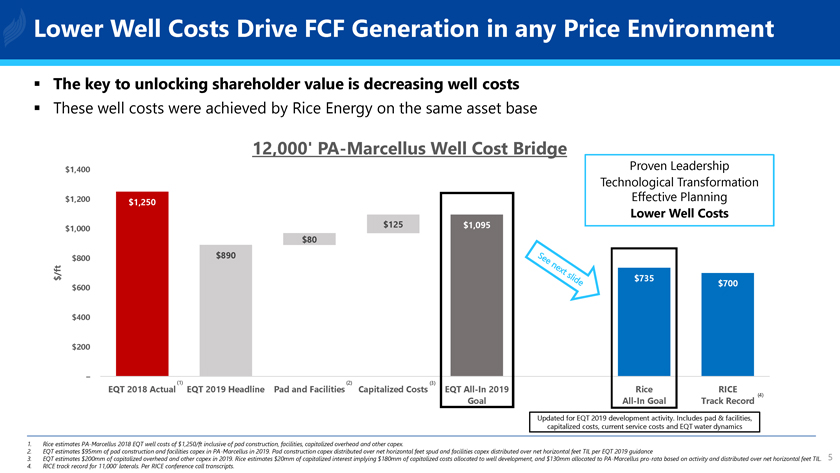

Lower Well Costs Drive FCF Generation in any Price Environment The key to unlocking shareholder value is decreasing well costs These well costs were achieved by Rice Energy on the same asset base 12,000’PA-Marcellus Well Cost Bridge $1,400 $1,200 $1,250 $1,000 $125 $1,095 $80 $800 $890 $ /ft $600 $400 $200 – (1) (2) (3) EQT 2018 Actual EQT 2019 Headline Pad and Facilities Capitalized Costs EQTAll-In 2019 Goal Proven Leadership Technological Transformation Effective Planning Lower Well Costs $735 $700 Rice RICE(4) All-In Goal Track Record Updated for EQT 2019 development activity. Includes pad & facilities, capitalized costs, current service costs and EQT water dynamics 1. Rice estimatesPA-Marcellus 2018 EQT well costs of $1,250/ft inclusive of pad construction, facilities, capitalized overhead and other capex. 2. EQT estimates $95mm of pad construction and facilities capex inPA-Marcellus in 2019. Pad construction capex distributed over net horizontal feet spud and facilities capex distributed over net horizontal feet TIL per EQT 2019 guidance 3. EQT estimates $200mm of capitalized overhead and other capex in 2019. Rice estimates $20mm of capitalized interest implying $180mm of capitalized costs allocated to well development, and $130mm allocated toPA-Marcelluspro-rata based on activity and distributed over net horizontal feet TIL. 4. RICE track record for 11,000’ laterals. Per RICE conference call transcripts.

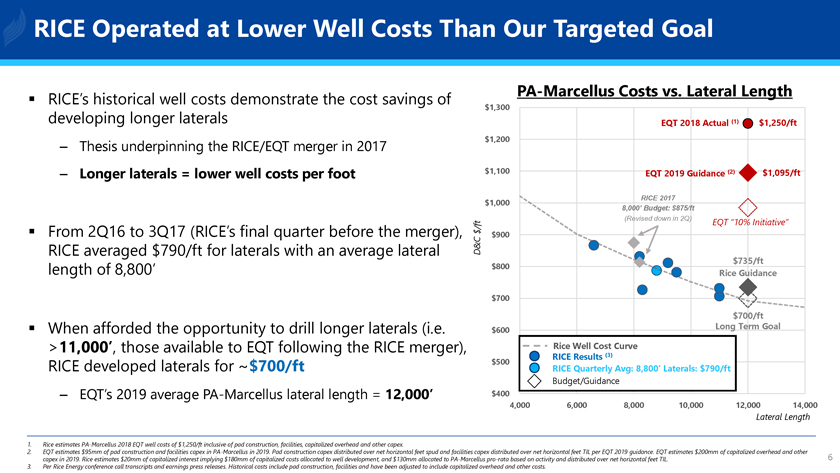

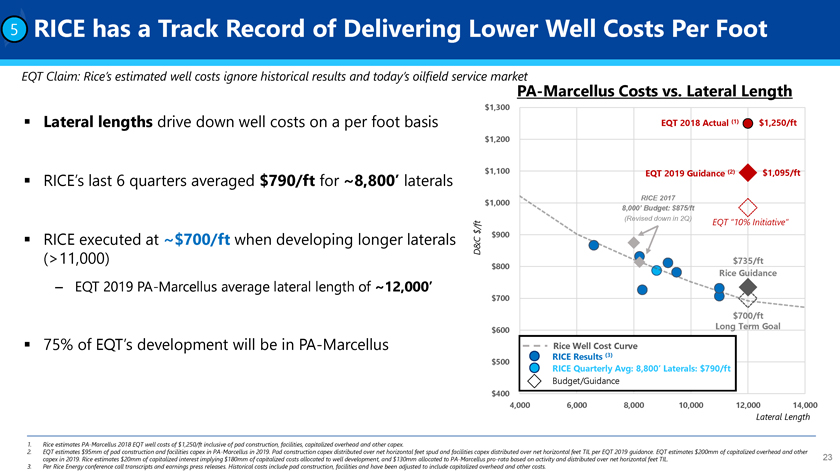

RICE Operated at Lower Well Costs Than Our Targeted Goal RICE’s historical well costs demonstrate the cost savings of developing longer laterals Thesis underpinning the RICE/EQT merger in 2017 Longer laterals = lower well costs per foot From 2Q16 to 3Q17 (RICE’s final quarter before the merger), RICE averaged $790/ft for laterals with an average lateral length of 8,800’ When afforded the opportunity to drill longer laterals (i.e. >11,000’, those available to EQT following the RICE merger), RICE developed laterals for ~$700/ft EQT’s 2019 averagePA-Marcellus lateral length = 12,000’PA-Marcellus Costs vs. Lateral Length $1,300 $1,200 $1,100 $1,000 $ /ft D&C $900 $800 $700 $600 $500 $400 EQT 2018 Actual (1) $1,250/ft EQT 2019 Guidance (2) $1,095/ft RICE 2017 Budget: $875/ft (Revised down in 2Q) EQT “10% Initiative” $735/ft Rice Guidance $700/ft Long Term Goal Rice Well Cost Curve RICE Results (3) RICE Quarterly Avg: 8,800’ Laterals: $790/ft Budget/Guidance 4,000 6,000 8,000 10,000 12,000 14,000 Lateral Length 1. Rice estimatesPA-Marcellus 2018 EQT well costs of $1,250/ft inclusive of pad construction, facilities, capitalized overhead and other capex. 2. EQT estimates $95mm of pad construction and facilities capex inPA-Marcellus in 2019. Pad construction capex distributed over net horizontal feet spud and facilities capex distributed over net horizontal feet TIL per EQT 2019 guidance. EQT estimates $200mm of capitalized overhead and other capex in 2019. Rice estimates $20mm of capitalized interest implying $180mm of capitalized costs allocated to well development, and $130mm allocated toPA-Marcelluspro-rata based on activity and distributed over net horizontal feet TIL. 3. Per Rice Energy conference call transcripts and earnings press releases. Historical costs include pad construction, facilities and have been adjusted to include capitalized overhead and other costs. 6

How Proven To Leadership Lower EQT’s Combined Well Costs: with Technology to Enable Effective Planning 12,000’PA-Marcellus Well Costs ($/ft) EQTAll-In (1) 2019 Goal Reduce (2) Capitalized Costs D&C Efficiencies RiceAll-In Goal Upside Rice Long Lateral (3) Track Record $1,095 $115 $265 $735 $35 $700 $0 $200 $400 $600 $800 $1,000 $1,200 $/ft 1 Proven Leadership â–ª Toby Rice as CEO. Pioneered RICE’s technological and organizational change â–ª10-15 RICE department heads to lead operational execution on the front line Technological Transformation 2 â–ª RICE apps to streamline organization (intact at EQT, but dormant) â–ª Digitize manual workflows into scalable solutions Effective Planning 3 â–ª Business units connected and aligned â–ª Optimize schedule to enable combo pad development The Prize â–ª $500mm/yr of well cost savings â–ª $7bn of well costs savings across EQT’s remaining inventory Long Term Goal / RICE Track Record â–ª Majority of schedule follows “Combo Development” â–ª Continuous improvement culture feeding our Innovation Machine 1. EQT estimates $95mm of pad construction and facilities capex inPA-Marcellus in 2019. Pad construction capex distributed over net horizontal feet spud and facilities capex distributed over net horizontal feet TIL per EQT 2019 guidance. EQT estimates $200mm of capitalized overhead and other capex in 2019. Rice estimates $20mm of capitalized interest implying $180mm of capitalized costs allocated to well development, and $130mm allocated toPA-Marcelluspro-rata based on activity and distributed over net horizontal feet TIL. 2. Rice expects to reduce capitalized costs while maintaining EQT G&A and LOE targets. 7 3. RICE track record for 11,000’ laterals. Per RICE conference call transcripts.

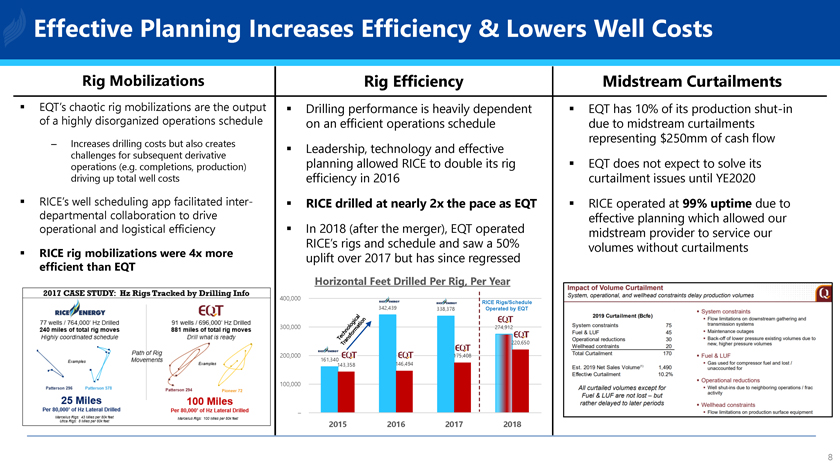

Effective Planning Increases Efficiency & Lowers Well Costs Rig Mobilizations â–ª EQT’s chaotic rig mobilizations are the output of a highly disorganized operations schedule – Increases drilling costs but also creates challenges for subsequent derivative operations (e.g. completions, production) driving up total well costs â–ª RICE’s well scheduling app facilitated interdepartmental collaboration to drive operational and logistical efficiency â–ª RICE rig mobilizations were 4x more efficient than EQT Rig Efficiency â–ª Drilling performance is heavily dependent on an efficient operations schedule â–ª Leadership, technology and effective planning allowed RICE to double its rig efficiency in 2016 â–ª RICE drilled at nearly 2x the pace as EQT â–ª In 2018 (after the merger), EQT operated RICE’s rigs and schedule and saw a 50% uplift over 2017 but has since regressed Horizontal Feet Drilled Per Rig, Per Year 400,000 342,439 RICE Rigs/Schedule 338,378 Operated by EQT 300,000 274,912 220,650 200,000 175,408 161,340 143,358 146,494 100,000 – 2015 2016 2017 2018 Midstream Curtailments â–ª EQT has 10% of its productionshut-in due to midstream curtailments representing $250mm of cash flow â–ª EQT does not expect to solve its curtailment issues until YE2020 â–ª RICE operated at 99% uptime due to effective planning which allowed our midstream provider to service our volumes without curtailments 8

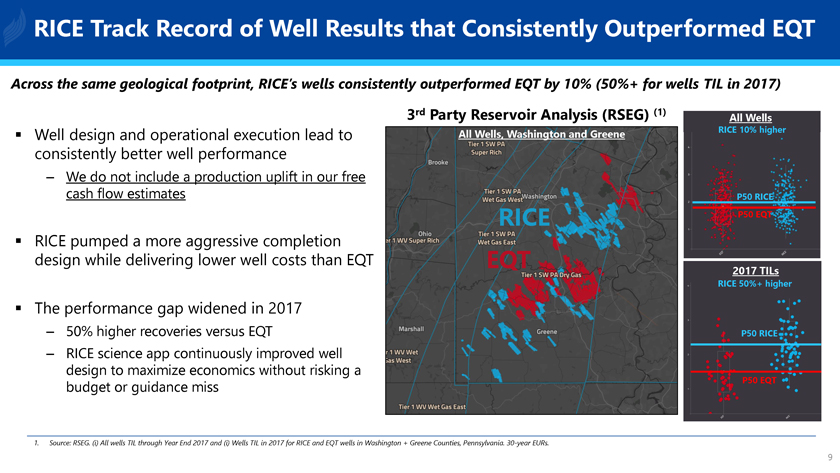

RICE Track Record of Well Results that Consistently Outperformed EQT Across the same geological footprint, RICE’s wells consistently outperformed EQT by 10% (50%+ for wells TIL in 2017) â–ª Well design and operational execution lead to consistently better well performance – We do not include a production uplift in our free cash flow estimates â–ª RICE pumped a more aggressive completion design while delivering lower well costs than EQT â–ª The performance gap widened in 2017 – 50% higher recoveries versus EQT – RICE science app continuously improved well design to maximize economics without risking a budget or guidance miss 3rd Party Reservoir Analysis (RSEG) (1) All Wells All Wells, Washington and Greene RICE 10% higher P50 RICE RICE P50 EQT EQT 2017 TILs RICE 50%+ higher P50 RICE P50 EQT 1. Source: RSEG. (i) All wells TIL through Year End 2017 and (i) Wells TIL in 2017 for RICE and EQT wells in Washington + Greene Counties, Pennsylvania.30-year EURs. 9

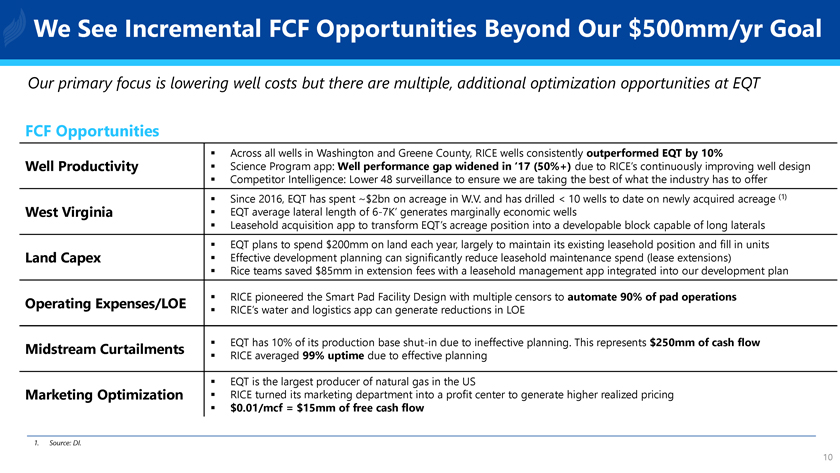

We See Incremental FCF Opportunities Beyond Our $500mm/yr Goal Our primary focus is lowering well costs but there are multiple, additional optimization opportunities at EQT FCF Opportunities Well Productivity West Virginia Land Capex Operating Expenses/LOE Midstream Curtailments Marketing Optimization Across all wells in Washington and Greene County, RICE wells consistently outperformed EQT by 10% Science Program app: Well performance gap widened in ‘17 (50%+) due to RICE’s continuously improving well design Competitor Intelligence: Lower 48 surveillance to ensure we are taking the best of what the industry has to offer Since 2016, EQT has spent ~$2bn on acreage in W.V. and has drilled < 10 wells to date on newly acquired acreage (1) EQT average lateral length of6-7K’ generates marginally economic wells Leasehold acquisition app to transform EQT’s acreage position into a developable block capable of long laterals EQT plans to spend $200mm on land each year, largely to maintain its existing leasehold position and fill in units Effective development planning can significantly reduce leasehold maintenance spend (lease extensions) Rice teams saved $85mm in extension fees with a leasehold management app integrated into our development plan RICE pioneered the Smart Pad Facility Design with multiple censors to automate 90% of pad operations RICE’s water and logistics app can generate reductions in LOE EQT has 10% of its production baseshut-in due to ineffective planning. This represents $250mm of cash flow RICE averaged 99% uptime due to effective planning EQT is the largest producer of natural gas in the US RICE turned its marketing department into a profit center to generate higher realized pricing $0.01/mcf = $15mm of free cash flow 1. Source: DI. 10

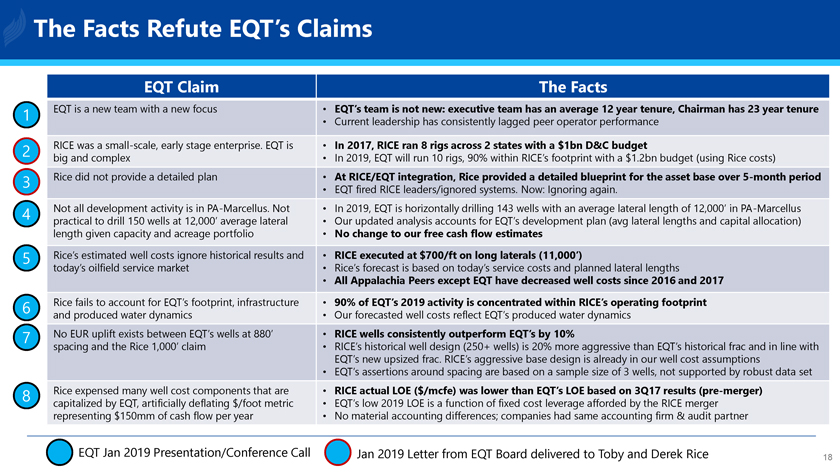

Attempt Response To Discredit to EQT’s Rice

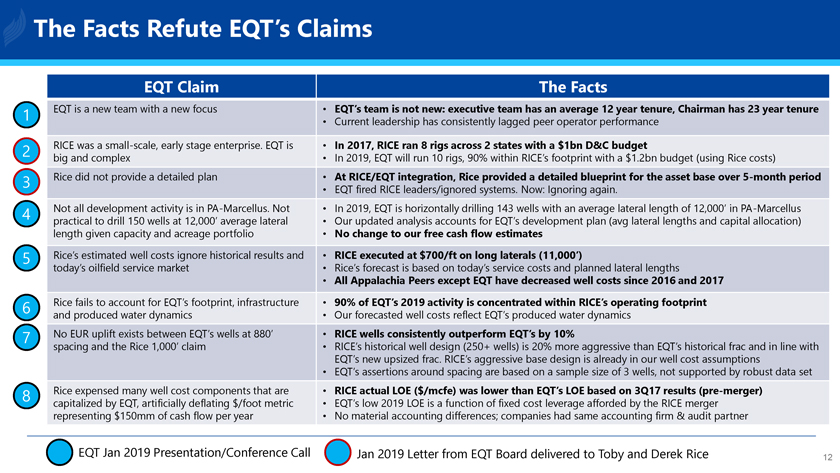

The Facts Refute EQT’s Claims EQT Claim EQT is a new team with a new focus RICE was a small-scale, early stage enterprise. EQT is big and complex Rice did not provide a detailed plan Not all development activity is inPA-Marcellus. Not practical to drill 150 wells at 12,000’ average lateral length given capacity and acreage portfolio Rice’s estimated well costs ignore historical results and today’s oilfield service market Rice fails to account for EQT’s footprint, infrastructure and produced water dynamics No EUR uplift exists between EQT’s wells at 880’ spacing and the Rice 1,000’ claim Rice expensed many well cost components that are capitalized by EQT, artificially deflating $/foot metric representing $150mm of cash flow per year 1 2 3 4 5 6 7 8 The Facts EQT’s team is not new: executive team has an average 12 year tenure, Chairman has 23 year tenure Current leadership has consistently lagged peer operator performance In 2017, RICE ran 8 rigs across 2 states with a $1bn D&C budget In 2019, EQT will run 10 rigs, 90% within RICE’s footprint with a $1.2bn budget (using Rice costs) At RICE/EQT integration, Rice provided a detailed blueprint for the asset base over5-month period EQT fired RICE leaders/ignored systems. Now: Ignoring again. In 2019, EQT is horizontally drilling 143 wells with an average lateral length of 12,000’ inPA-Marcellus Our updated analysis accounts for EQT’s development plan (avg lateral lengths and capital allocation) No change to our free cash flow estimates RICE executed at $700/ft on long laterals (11,000’) Rice’s forecast is based on today’s service costs and planned lateral lengths All Appalachia Peers except EQT have decreased well costs since 2016 and 2017 90% of EQT’s 2019 activity is concentrated within RICE’s operating footprint Our forecasted well costs reflect EQT’s produced water dynamics RICE wells consistently outperform EQT’s by 10% RICE’s historical well design (250+ wells) is 20% more aggressive than EQT’s historical frac and in line with EQT’s new upsized frac. RICE’s aggressive base design is already in our well cost assumptions EQT’s assertions around spacing are based on a sample size of 3 wells, not supported by robust data set RICE actual LOE ($/mcfe) was lower than EQT’s LOE based on 3Q17 results(pre-merger) EQT’s low 2019 LOE is a function of fixed cost leverage afforded by the RICE merger No material accounting differences; companies had same accounting firm & audit partner EQT Jan 2019 Presentation/Conference Call Jan 2019 Letter from EQT Board delivered to Toby and Derek Rice 12

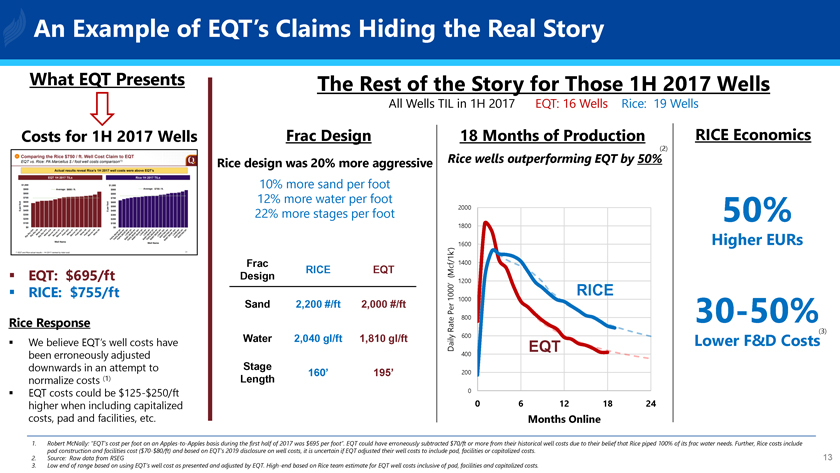

An Example of EQT’s Claims Hiding the Real Story What EQT Presents Costs for 1H 2017 Wells â–ª EQT: $695/ft â–ª RICE: $755/ft Rice Response â–ª We believe EQT’s well costs have been erroneously adjusted downwards in an attempt to normalize costs (1) â–ª EQT costs could be$125-$250/ft higher when including capitalized costs, pad and facilities, etc. The Rest of the Story for Those 1H 2017 Wells All Wells TIL in 1H 2017 EQT: 16 Wells Rice: 19 Wells Frac Design Rice design was 20% more aggressive 10% more sand per foot 12% more water per foot 22% more stages per foot Frac RICE EQT Design Sand 2,200 #/ft 2,000 #/ft Water 2,040 gl/ft 1,810 gl/ft Stage 160’ 195’ Length 18 Months of Production (2) Rice wells outperforming EQT by 50% 2000 1800 1600 (Mcf/1k’) 1400 1200 1000’ RICE 1000 Per 800 Rate Daily 600 EQT 400 200 0 0 6 12 18 24 Months Online RICE Economics 50% Higher EURs30-50% Lower F&D Costs(3) 1. Robert McNally: “EQT’s cost per foot on anApples-to-Apples basis during the first half of 2017 was $695 per foot”. EQT could have erroneously subtracted $70/ft or more from their historical well costs due to their belief that Rice piped 100% of its frac water needs. Further, Rice costs include pad construction and facilities cost($70-$80/ft) and based on EQT’s 2019 disclosure on well costs, it is uncertain if EQT adjusted their well costs to include pad, facilities or capitalized costs. 13 2. Source: Raw data from RSEG 3. Low end of range based on using EQT’s well cost as presented and adjusted by EQT.High-end based on Rice team estimate for EQT well costs inclusive of pad, facilities and capitalized costs.

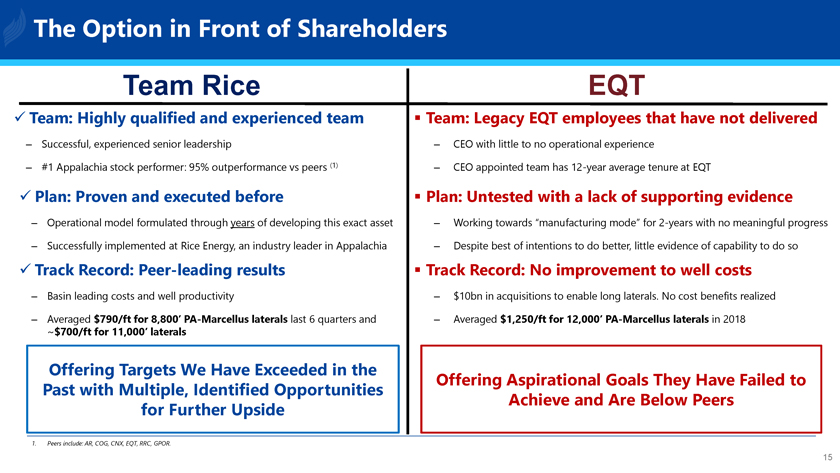

Conclusion

The Option in Front of Shareholders Team Rice ✓Team: Highly qualified and experienced team – Successful, experienced senior leadership – #1 Appalachia stock performer: 95% outperformance vs peers (1) ✓Plan: Proven and executed before – Operational model formulated through years of developing this exact asset – Successfully implemented at Rice Energy, an industry leader in Appalachia ✓Track Record: Peer-leading results – Basin leading costs and well productivity – Averaged $790/ft for 8,800’PA-Marcellus laterals last 6 quarters and ~$700/ft for 11,000’ laterals Offering Targets We Have Exceeded in the Past with Multiple, Identified Opportunities for Further Upside 1. Peers include: AR, COG, CNX, EQT, RRC, GPOR. EQT â–ª Team: Legacy EQT employees that have not delivered – CEO with little to no operational experience – CEO appointed team has12-year average tenure at EQT â–ª Plan: Untested with a lack of supporting evidence – Working towards “manufacturing mode” for2-years with no meaningful progress – Despite best of intentions to do better, little evidence of capability to do so â–ª Track Record: No improvement to well costs – $10bn in acquisitions to enable long laterals. No cost benefits realized – Averaged $1,250/ft for 12,000’PA-Marcellus laterals in 2018 Offering Aspirational Goals They Have Failed to Achieve and Are Below Peers 15

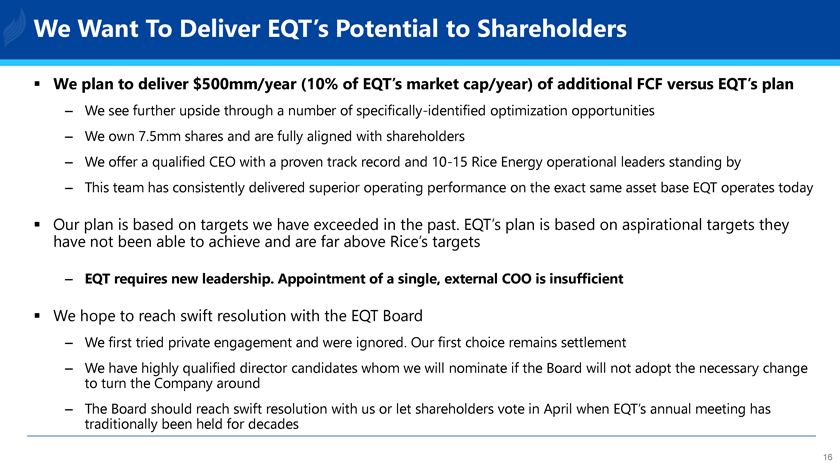

We Want To Deliver EQT’s Potential to Shareholders â–ª We plan to deliver $500mm/year (10% of EQT’s market cap/year) of additional FCF versus EQT’s plan – We see further upside through a number of specifically-identified optimization opportunities – We own 7.5mm shares and are fully aligned with shareholders – We offer a qualified CEO with a proven track record and10-15 Rice Energy operational leaders standing by – This team has consistently delivered superior operating performance on the exact same asset base EQT operates today â–ª Our have plan not been is based able on to targets achieve we and have are exceeded far above in Rice’s the past. targets EQT’s plan is based on aspirational targets they – EQT requires new leadership. Appointment of a single, external COO is insufficient â–ª We hope to reach swift resolution with the EQT Board – We first tried private engagement and were ignored. Our first choice remains settlement – We to turn have the highly Company qualified around director candidates whom we will nominate if the Board will not adopt the necessary change – The traditionally Board should been reach held for swift decades resolution with us or let shareholders vote in April when EQT’s annual meeting has 16

Specific Response Appendix: to EQT’s False Claims

The Facts Refute EQT’s Claims EQT Claim EQT is a new team with a new focus RICE was a small-scale, early stage enterprise. EQT is big and complex Rice did not provide a detailed plan Not all development activity is inPA-Marcellus. Not practical to drill 150 wells at 12,000’ average lateral length given capacity and acreage portfolio Rice’s estimated well costs ignore historical results and today’s oilfield service market Rice fails to account for EQT’s footprint, infrastructure and produced water dynamics No EUR uplift exists between EQT’s wells at 880’ spacing and the Rice 1,000’ claim Rice expensed many well cost components that are capitalized by EQT, artificially deflating $/foot metric representing $150mm of cash flow per year 1 2 3 4 5 6 7 8 The Facts EQT’s team is not new: executive team has an average 12 year tenure, Chairman has 23 year tenure Current leadership has consistently lagged peer operator performance In 2017, RICE ran 8 rigs across 2 states with a $1bn D&C budget In 2019, EQT will run 10 rigs, 90% within RICE’s footprint with a $1.2bn budget (using Rice costs) At RICE/EQT integration, Rice provided a detailed blueprint for the asset base over5-month period EQT fired RICE leaders/ignored systems. Now: Ignoring again. In 2019, EQT is horizontally drilling 143 wells with an average lateral length of 12,000’ inPA-Marcellus Our updated analysis accounts for EQT’s development plan (avg lateral lengths and capital allocation) No change to our free cash flow estimates RICE executed at $700/ft on long laterals (11,000’) Rice’s forecast is based on today’s service costs and planned lateral lengths All Appalachia Peers except EQT have decreased well costs since 2016 and 2017 90% of EQT’s 2019 activity is concentrated within RICE’s operating footprint Our forecasted well costs reflect EQT’s produced water dynamics RICE wells consistently outperform EQT’s by 10% RICE’s historical well design (250+ wells) is 20% more aggressive than EQT’s historical frac and in line with EQT’s new upsized frac. RICE’s aggressive base design is already in our well cost assumptions EQT’s assertions around spacing are based on a sample size of 3 wells, not supported by robust data set RICE actual LOE ($/mcfe) was lower than EQT’s LOE based on 3Q17 results(pre-merger) EQT’s low 2019 LOE is a function of fixed cost leverage afforded by the RICE merger No material accounting differences; companies had same accounting firm & audit partner EQT Jan 2019 Presentation/Conference Call Jan 2019 Letter from EQT Board delivered to Toby and Derek Rice 18

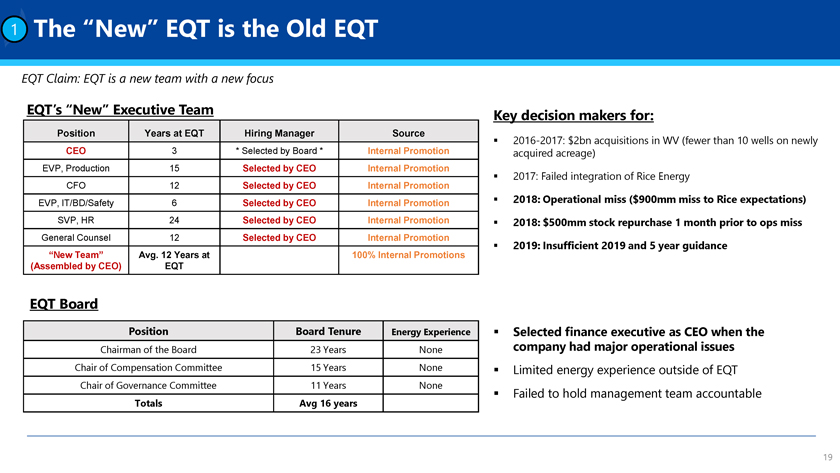

1 The “New” EQT is the Old EQT EQT Claim: EQT is a new team with a new focus EQT’s “New” Executive Team Position Years at EQT Hiring ManagerSource CEO3* Selected by Board *Internal Promotion EVP, Production15Selected by CEOInternal Promotion CFO12Selected by CEOInternal Promotion EVP, IT/BD/Safety6Selected by CEOInternal Promotion SVP, HR24Selected by CEOInternal Promotion General Counsel12Selected by CEOInternal Promotion “New Team”Avg. 12 Years at100% Internal Promotions (Assembled by CEO)EQT EQT Board PositionBoard TenureEnergy Experience Chairman of the Board23 YearsNone Chair of Compensation Committee15 YearsNone Chair of Governance Committee11 YearsNone TotalsAvg 16 years Key decision makers for: â–ª 2016-2017: $2bn acquisitions in WV (fewer than 10 wells on newly acquired acreage) â–ª 2017: Failed integration of Rice Energy â–ª 2018: Operational miss ($900mm miss to Rice expectations) â–ª 2018: $500mm stock repurchase 1 month prior to ops miss â–ª 2019: Insufficient 2019 and 5 year guidance â–ª Selected finance executive as CEO when the company had major operational issues â–ª Limited energy experience outside of EQT â–ª Failed to hold management team accountable

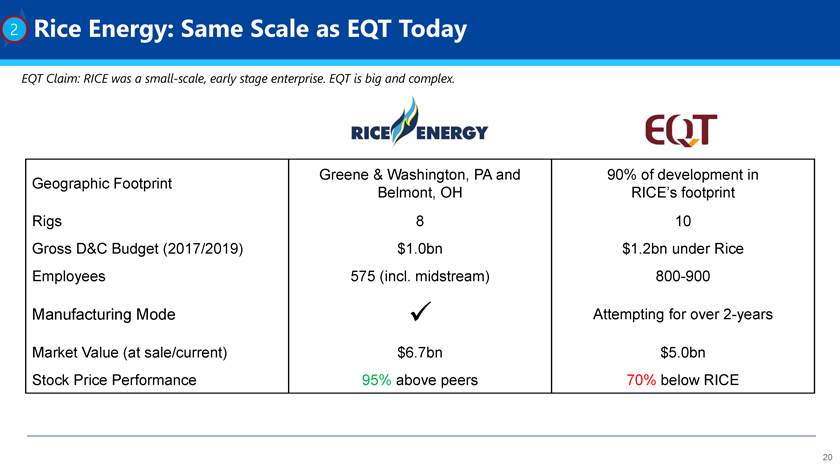

2 Rice Energy: Same Scale as EQT Today EQT Claim: RICE was a small-scale, early stage enterprise. EQT is big and complex. Geographic Footprint Rigs Gross D&C Budget (2017/2019) Employees Manufacturing Mode Market Value (at sale/current) Stock Price Performance Greene & Washington, PA and Belmont, OH 8 $1.0bn 575 (incl. midstream) ✓ $6.7bn 95% above peers 90% of development in RICE’s footprint 10 $1.2bn under Rice800-900 Attempting for over2-years $5.0bn 70% below RICE 20

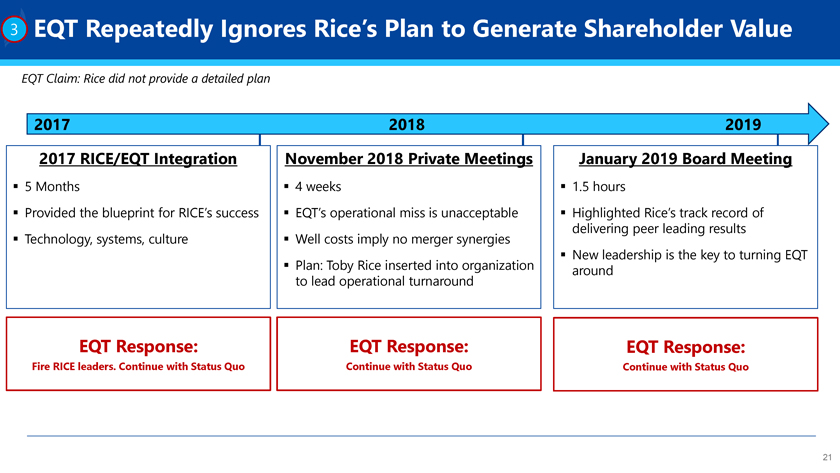

3 EQT Repeatedly Ignores Rice’s Plan to Generate Shareholder Value EQT Claim: Rice did not provide a detailed plan 2017 2018 2019 2017 RICE/EQT Integration â–ª 5 Months â–ª Provided the blueprint for RICE’s success â–ª Technology, systems, culture EQT Response: Fire RICE leaders. Continue with Status Quo November 2018 Private Meetings â–ª 4 weeks â–ª EQT’s operational miss is unacceptable â–ª Well costs imply no merger synergies â–ª Plan: Toby Rice inserted into organization to lead operational turnaround EQT Response: Continue with Status Quo January 2019 Board Meeting â–ª 1.5 hours â–ª Highlighted Rice’s track record of delivering peer leading results â–ª New leadership is the key to turning EQT around EQT Response: Continue with Status Quo 21

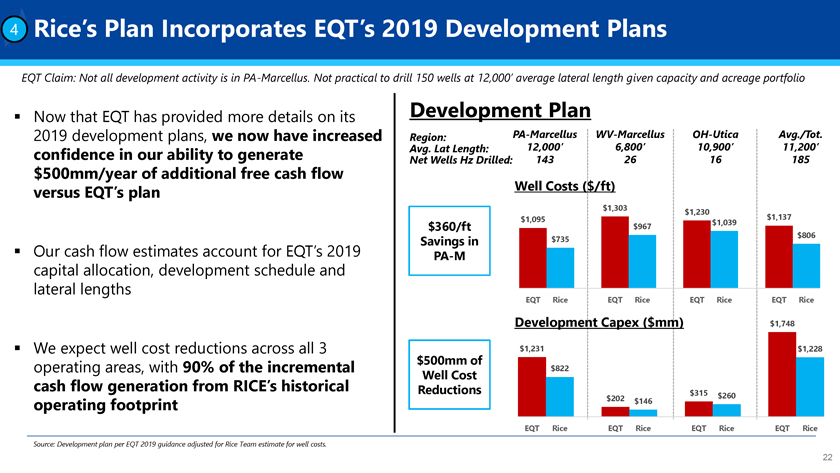

4 Rice’s Plan Incorporates EQT’s 2019 Development Plans EQT Claim: Not all development activity is inPA-Marcellus. Not practical to drill 150 wells at 12,000’ average lateral length given capacity and acreage portfolio Now that EQT has provided more details on its 2019 development plans, we now have increased confidence in our ability to generate $500mm/year of additional free cash flow versus EQT’s plan Our cash flow estimates account for EQT’s 2019 capital allocation, development schedule and lateral lengths We expect well cost reductions across all 3 operating areas, with 90% of the incremental cash flow generation from RICE’s historical operating footprint Development Plan Region:PA-MarcellusWV-MarcellusOH-Utica Avg./Tot. Avg. Lat Length: 12,000’ 6,800’ 10,900’ 11,200’ Net Wells Hz Drilled: 143 26 16 185 Well Costs ($/ft) $1,303 $1,230 $1,095 $1,137 $360/ft $967 $1,039 Savings in $735 $806PA-M EQT Rice EQT Rice EQT Rice EQT Rice Development Capex ($mm) $1,748 $500mm of $1,231 $1,228 Well Cost $822 Reductions $315 $202 $260 $146 EQT Rice EQT Rice EQT Rice EQT Rice Source: Development plan per EQT 2019 guidance adjusted for Rice Team estimate for well costs. 22

5 RICE has a Track Record of Delivering Lower Well Costs Per Foot EQT Claim: Rice’s estimated well costs ignore historical results and today’s oilfield service market Lateral lengths drive down well costs on a per foot basis RICE’s last 6 quarters averaged $790/ft for ~8,800’ laterals RICE executed at ~$700/ft when developing longer laterals (>11,000) – EQT 2019PA-Marcellus average lateral length of ~12,000’ 75% of EQT’s development will be inPA-MarcellusPA-Marcellus Costs vs. Lateral Length $1,300 EQT 2018 Actual (1) $1,250/ft $1,200 $1,100 EQT 2019 Guidance (2) $1,095/ft $1,000 RICE 2017 8,000’ Budget: $875/ft /ft (Revised down in 2Q) EQT “10% Initiative” $ $900 D&C $735/ft $800 Rice Guidance $700 $700/ft $600 Long Term Goal Rice Well Cost Curve RICE Results (3) $500 RICE Quarterly Avg: 8,800’ Laterals: $790/ft Budget/Guidance $400 4,000 6,000 8,000 10,000 12,000 14,000 Lateral Length 1. Rice estimatesPA-Marcellus 2018 EQT well costs of $1,250/ft inclusive of pad construction, facilities, capitalized overhead and other capex. 2. EQT estimates $95mm of pad construction and facilities capex inPA-Marcellus in 2019. Pad construction capex distributed over net horizontal feet spud and facilities capex distributed over net horizontal feet TIL per EQT 2019 guidance. EQT estimates $200mm of capitalized overhead and other capex in 2019. Rice estimates $20mm of capitalized interest implying $180mm of capitalized costs allocated to well development, and $130mm allocated toPA-Marcelluspro-rata based on activity and distributed over net horizontal feet TIL. 23 3. Per Rice Energy conference call transcripts and earnings press releases. Historical costs include pad construction, facilities and have been adjusted to include capitalized overhead and other costs.

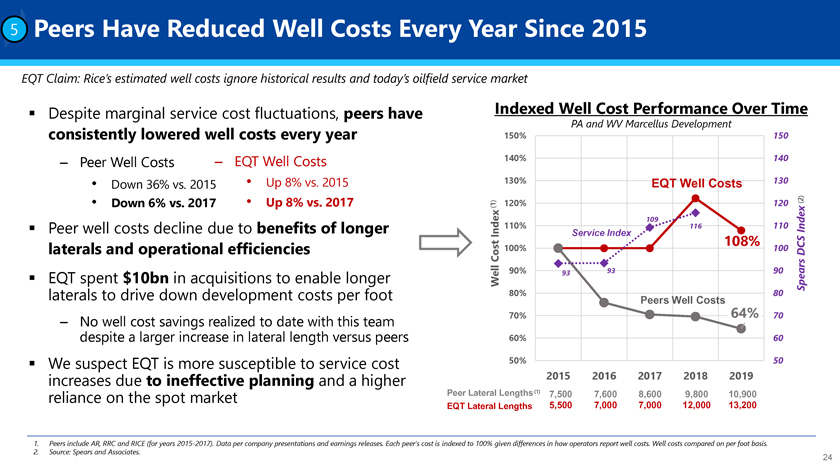

5 Peers Have Reduced Well Costs Every Year Since 2015 EQT Claim: Rice’s estimated well costs ignore historical results and today’s oilfield service market Despite marginal service cost fluctuations, peers have consistently lowered well costs every year – Peer Well Costs – EQT Well Costs • Down 36% vs. 2015 • Up 8% vs. 2015 • Down 6% vs. 2017 • Up 8% vs. 2017 Peer well costs decline due to benefits of longer laterals and operational efficiencies EQT laterals spent to drive $10bn down in acquisitions development to enable costs per longer foot – despite No well a cost larger savings increase realized in lateral to date length with versus this team peers We increases suspect due EQT to is ineffective more susceptible planning to and service a higher cost reliance on the spot market Indexed Well Cost Performance Over Time PA and WV Marcellus Development 150% 150 140% 140 130% EQT Well Costs 130 120% 120 (2) (1) 109 110% 116 110 Index Index Service Index 108% 100% 100 DCS Cost rs Well 90% 93 93 90 Spea 80% 80 Peers Well Costs 70% 64% 70 60% 60 50% 50 2015 2016 2017 2018 2019 Peer Lateral Lengths(1) 7,500 7,600 8,600 9,800 10,900 EQT Lateral Lengths 5,500 7,000 7,000 12,000 13,200 1. Peers include AR, RRC and RICE (for years 2015-2017). Data per company presentations and earnings releases. Each peer’s cost is indexed to 100% given differences in how operators report well costs. Well costs compared on per foot basis. 2. Source: Spears and Associates. 24

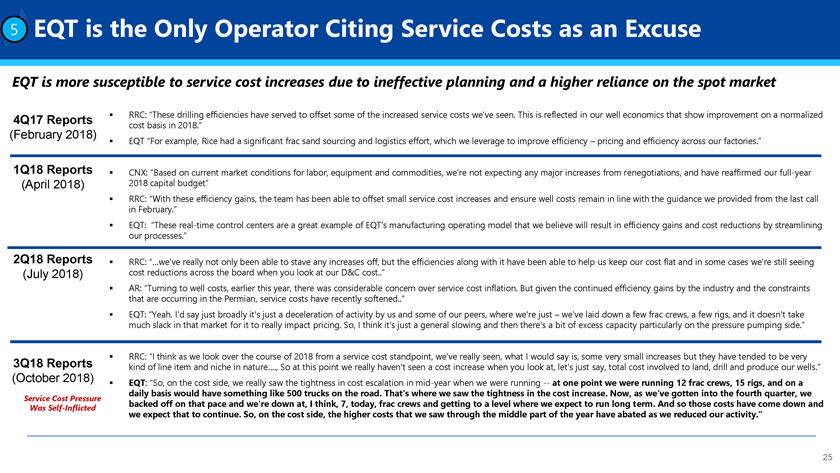

5 EQT is the Only Operator Citing Service Costs as an Excuse EQT is more susceptible to service cost increases due to ineffective planning and a higher reliance on the spot market 4Q17 Reports (February 2018) 1Q18 Reports (April 2018) 2Q18 Reports (July 2018) 3Q18 Reports (October 2018) Service Cost Pressure Was Self-Inflicted RRC: “These drilling efficiencies have served to offset some of the increased service costs we’ve seen. This is reflected in our well economics that show improvement on a normalized cost basis in 2018.” EQT “For example, Rice had a significant frac sand sourcing and logistics effort, which we leverage to improve efficiency – pricing and efficiency across our factories.” CNX: “Based on current market conditions for labor, equipment and commodities, we’re not expecting any major increases from renegotiations, and have reaffirmed our full-year 2018 capital budget” RRC: “With these efficiency gains, the team has been able to offset small service cost increases and ensure well costs remain in line with the guidance we provided from the last call in February.” EQT: “These real-time control centers are a great example of EQT’s manufacturing operating model that we believe will result in efficiency gains and cost reductions by streamlining our processes.” RRC: “…we’ve really not only been able to stave any increases off, but the efficiencies along with it have been able to help us keep our cost flat and in some cases we’re still seeing cost reductions across the board when you look at our D&C cost ” AR: “Turning to well costs, earlier this year, there was considerable concern over service cost inflation. But given the continued efficiency gains by the industry and the constraints that are occurring in the Permian, service costs have recently softened ” EQT: “Yeah. I’d say just broadly it’s just a deceleration of activity by us and some of our peers, where we’re just – we’ve laid down a few frac crews, a few rigs, and it doesn’t take much slack in that market for it to really impact pricing. So, I think it’s just a general slowing and then there’s a bit of excess capacity particularly on the pressure pumping side.” RRC: “I think as we look over the course of 2018 from a service cost standpoint, we’ve really seen, what I would say is, some very small increases but they have tended to be very kind of line item and niche in nature…., So at this point we really haven’t seen a cost increase when you look at, let’s just say, total cost involved to land, drill and produce our wells.” EQT: “So, on the cost side, we really saw the tightness in cost escalation inmid-year when we were running — at one point we were running 12 frac crews, 15 rigs, and on a daily basis would have something like 500 trucks on the road. That’s where we saw the tightness in the cost increase. Now, as we’ve gotten into the fourth quarter, we backed off on that pace and we’re down at, I think, 7, today, frac crews and getting to a level where we expect to run long term. And so those costs have come down and we expect that to continue. So, on the cost side, the higher costs that we saw through the middle part of the year have abated as we reduced our activity.” 25

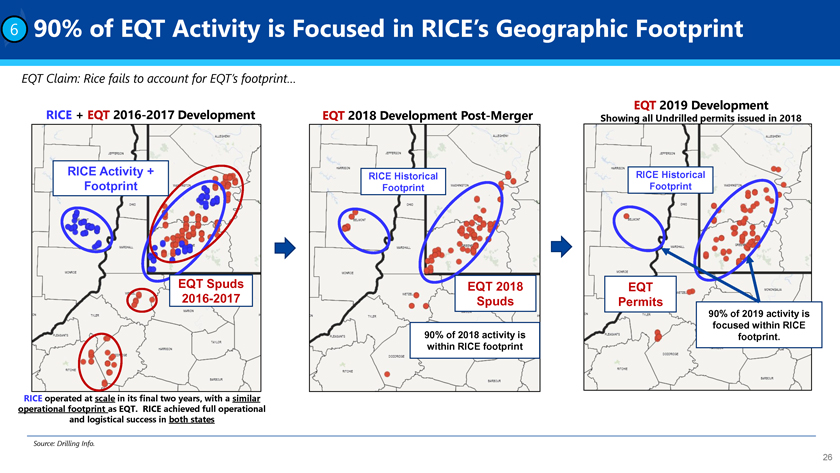

6 90% of EQT Activity is Focused in RICE’s Geographic Footprint EQT Claim: Rice fails to account for EQT’s footprint… RICE + EQT 2016-2017 Development RICE Activity + Footprint EQT Spuds 2016-2017 RICE operated at scale in its final two years, with a similar operational footprint as EQT. RICE achieved full operational and logistical success in both states EQT 2018 Development Post-Merger RICE Historical Footprint EQT 2018 Spuds 90% of 2018 activity is within RICE footprint EQT 2019 Development Showing all Undrilled permits issued in 2018 RICE Historical Footprint EQT Permits 90% of 2019 activity is focused within RICE footprint. Source: Drilling Info. 26

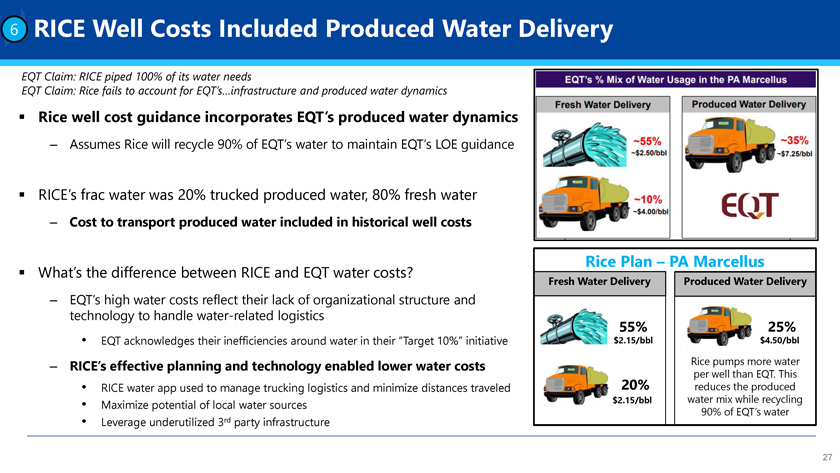

6 RICE Well Costs Included Produced Water Delivery EQT Claim: RICE piped 100% of its water needs EQT Claim: Rice fails to account for EQT’s…infrastructure and produced water dynamics â–ª Rice well cost guidance incorporates EQT’s produced water dynamics – Assumes Rice will recycle 90% of EQT’s water to maintain EQT’s LOE guidance â–ª RICE’s frac water was 20% trucked produced water, 80% fresh water – Cost to transport produced water included in historical well costs â–ª What’s the difference between RICE and EQT water costs? – EQT’s high water costs reflect their lack of organizational structure and technology to handle water-related logistics • EQT acknowledges their inefficiencies around water in their “Target 10%” initiative – RICE’s effective planning and technology enabled lower water costs • RICE water app used to manage trucking logistics and minimize distances traveled • Maximize potential of local water sources • Leverage underutilized 3rd party infrastructure Rice Plan – PA Marcellus Fresh Water Delivery Produced Water Delivery 55% 25% $2.15/bbl $4.50/bbl Rice pumps more water per well than EQT. This 20% reduces the produced $2.15/bbl water mix while recycling 90% of EQT’s water 27

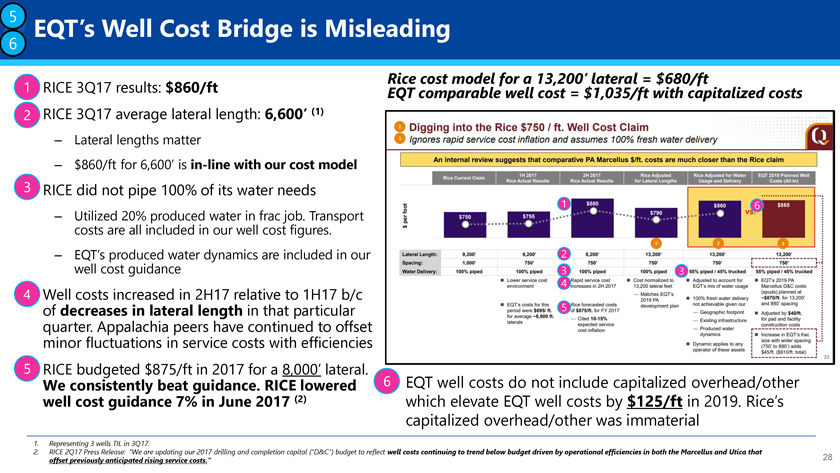

5 EQT’s Well Cost Bridge is Misleading 6 â–ª1 RICE 3Q17 results: $860/ft â–ª2 RICE 3Q17 average lateral length: 6,600’ (1) – Lateral lengths matter – $860/ft for 6,600’ isin-line with our cost model â–ª3 RICE did not pipe 100% of its water needs – costs Utilized are 20% all included produced in water our well in frac cost job. figures. Transport – well EQT’s cost produced guidance water dynamics are included in our â–ª4 of Well decreases costs increased in lateral in 2H17 length relative in that to particular 1H17 b/c minor quarter. fluctuations Appalachia in peers service have costs continued with efficiencies to offset â–ª5 RICE budgeted $875/ft in 2017 for a 8,000’ lateral. We consistently beat guidance. RICE lowered well cost guidance 7% in June 2017 (2) Rice cost model for a 13,200’ lateral = $680/ft EQT comparable well cost = $1,035/ft with capitalized costs 1 6 2 3 3 4 5 6 â–ª EQT well costs do not include capitalized overhead/other which elevate EQT well costs by $125/ft in 2019. Rice’s capitalized overhead/other was immaterial 1. Representing 3 wells TIL in 3Q17. 2. RICE 2Q17 Press Release: “We are updating our 2017 drilling and completion capital (“D&C”) budget to reflect well costs continuing to trend below budget driven by operational efficiencies in both the Marcellus and Utica that offset previously anticipated rising service costs.” 28

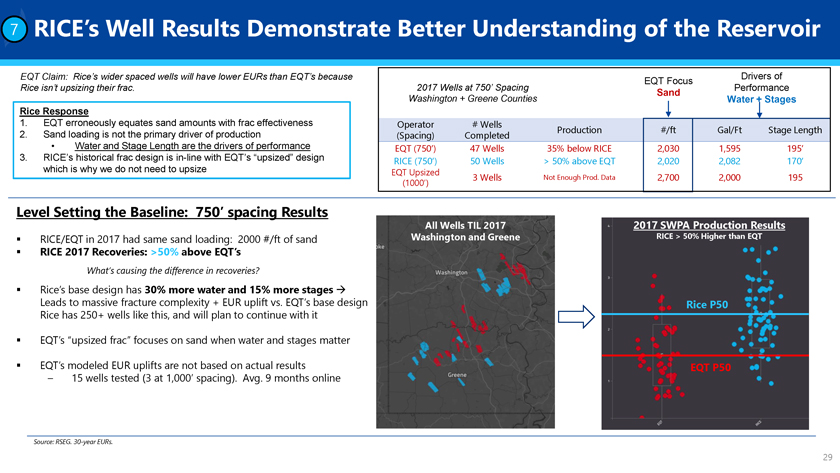

7 RICE’s Well Results Demonstrate Better Understanding of the Reservoir EQT Claim: Rice’s wider spaced wells will have lower EURs than EQT’s because Rice isn’t upsizing their frac. Rice Response 1. EQT erroneously equates sand amounts with frac effectiveness 2. Sand loading is not the primary driver of production • Water and Stage Length are the drivers of performance 3. RICE’s historical frac design isin-line with EQT’s “upsized” design which is why we do not need to upsize Level Setting the Baseline: 750’ spacing Results â–ª RICE/EQT in 2017 had same sand loading: 2000 #/ft of sand â–ª RICE 2017 Recoveries: >50% above EQT’s What’s causing the difference in recoveries? â–ª Rice’s base design has 30% more water and 15% more stages → Leads to massive fracture complexity + EUR uplift vs. EQT’s base design Rice has 250+ wells like this, and will plan to continue with it â–ª EQT’s “upsized frac” focuses on sand when water and stages matter â–ª EQT’s modeled EUR uplifts are not based on actual results – 15 wells tested (3 at 1,000’ spacing). Avg. 9 months online EQT FocusDrivers of 2017 Wells at 750’ SpacingPerformance Sand Washington + Greene CountiesWater + Stages Operator# WellsProduction#/ftGal/FtStage Length (Spacing)Completed EQT (750’)47 Wells35% below RICE2,0301,595195’ RICE (750’)50 Wells> 50% above EQT2,0202,082170’ EQT Upsized3 WellsNot Enough Prod. Data2,7002,000195 (1000’) All Wells TIL 2017 2017 SWPA Production Results Washington and Greene RICE > 50% Higher than EQT Rice P50 EQT P50 29 Source: RSEG.30-year EURs.

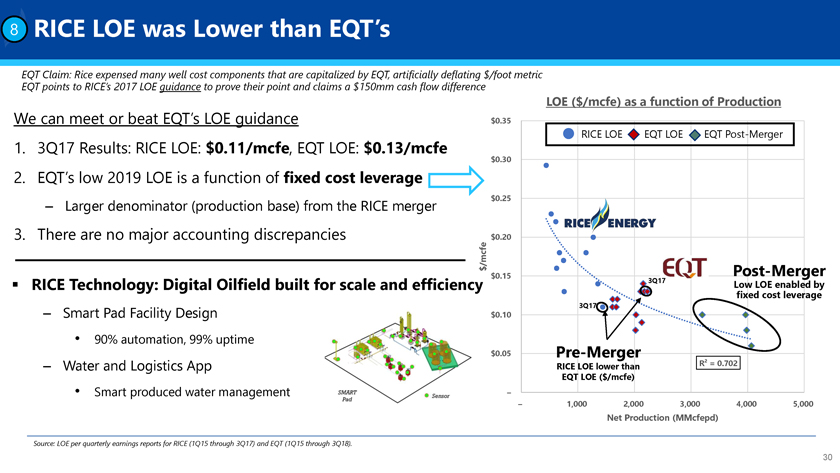

8 RICE LOE was Lower than EQT’s EQT Claim: Rice expensed many well cost components that are capitalized by EQT, artificially deflating $ EQT points to RICE’s 2017 LOE guidance to prove their point and claims a $150mm cash flow difference We can meet or beat EQT’s LOE guidance 1. 3Q17 Results: RICE LOE: $0.11/mcfe, EQT LOE: $0.13/mcfe 2. EQT’s low 2019 LOE is a function of fixed cost leverage – Larger denominator (production base) from the RICE merger 3. There are no major accounting discrepancies $ /mcfe â–ª RICE Technology: Digital Oilfield built for scale and efficiency – Smart Pad Facility Design • 90% automation, 99% uptime – Water and Logistics App • Smart produced water management /foot metric LOE ($/mcfe) as a function of Production 0.35 RICE LOE EQT LOE EQT Post-Merger 0.30 0.25 0.20 0.15 Post-Merger 3Q17 Low LOE enabled by fixed cost leverage 3Q17 0.10 0.05Pre-Merger RICE LOE lower than R² = 0.702 EQT LOE ($/mcfe) – – 1,000 2,000 3,000 4,000 5,000 Net Production (MMcfepd) Source: LOE per quarterly earnings reports for RICE (1Q15 through 3Q17) and EQT (1Q15 through 3Q18). 30

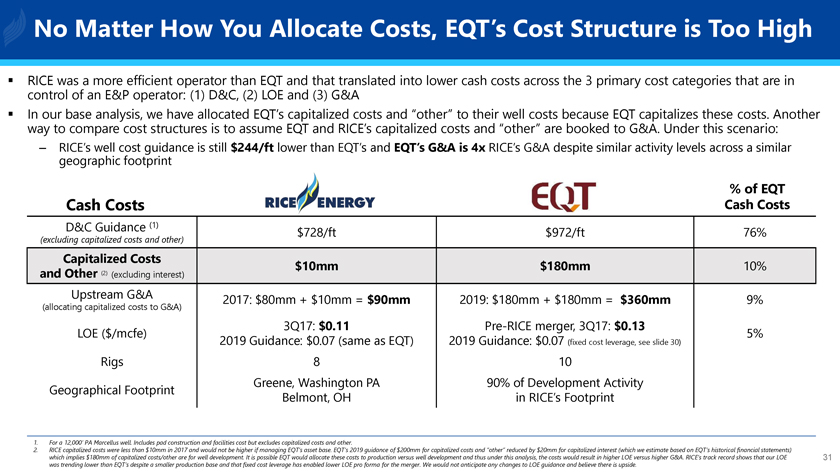

No Matter How You Allocate Costs, EQT’s Cost Structure is Too High RICE control was of a an more E&P efficient operator: operator (1) D&C, than (2) EQT LOE and and that (3) G&A translated into lower cash costs across the 3 primary cost categories that are in In way our to base compare analysis, cost we structures have allocated is to assume EQT’s EQT capitalized and RICE’s costs capitalized and “other” costs to their and “other” well costs are because booked EQT to G&A. capitalizes Under these this scenario: costs. Another – RICE’s geographic well cost footprint guidance is still $244/ft lower than EQT’s and EQT’s G&A is 4x RICE’s G&A despite similar activity levels across a similar % of EQT Cash CostsCash Costs D&C Guidance (1)$728/ft$972/ft76% (excluding capitalized costs and other) Capitalized Costs$10mm$180mm10% and Other (2) (excluding interest) Upstream G&A2017: $80mm + $10mm = $90mm2019: $180mm + $180mm = $360mm9% (allocating capitalized costs to G&A) 3Q17:$0.11Pre-RICE merger, 3Q17: $0.13 LOE ($/mcfe)5% 2019 Guidance: $0.07 (same as EQT)2019 Guidance: $0.07 (fixed cost leverage, see slide 30) Rigs810 Geographical FootprintGreene, Washington PA90% of Development Activity Belmont, OHin RICE’s Footprint 1. For a 12,000’ PA Marcellus well. Includes pad construction and facilities cost but excludes capitalized costs and other. 2. RICE capitalized costs were less than $10mm in 2017 and would not be higher if managing EQT’s asset base. EQT’s 2019 guidance of $200mm for capitalized costs and “other” reduced by $20mm for capitalized interest (which we estimate based on EQT’s historical financial statements) which implies $180mm of capitalized costs/other are for well development. It is possible EQT would allocate these costs to production versus well development and thus under this analysis, the costs would result in higher LOE versus higher G&A. RICE’s track record shows that our LOE 31 was trending lower than EQT’s despite a smaller production base and that fixed cost leverage has enabled lower LOE pro forma for the merger. We would not anticipate any changes to LOE guidance and believe there is upside.

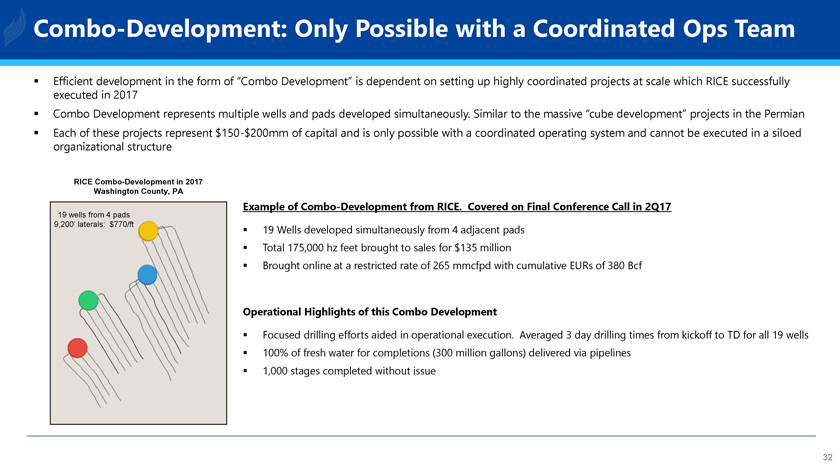

Combo-Development: Only Possible with a Coordinated Ops Team â–ª Efficient development in the form of “Combo Development” is dependent on setting up highly coordinated projects at scale which RICE successfully executed in 2017 â–ª Combo Development represents multiple wells and pads developed simultaneously. Similar to the massive “cube development” projects in the Permian â–ª Each of these projects represent$150-$200mm of capital and is only possible with a coordinated operating system and cannot be executed in a siloed organizational structure RICE Combo-Development in 2017 Washington County, PA 19 wells from 4 pads 9,200’ laterals: $770/ft Example of Combo-Development from RICE. Covered on Final Conference Call in 2Q17 â–ª 19 Wells developed simultaneously from 4 adjacent pads â–ª Total 175,000 hz feet brought to sales for $135 million â–ª Brought online at a restricted rate of 265 mmcfpd with cumulative EURs of 380 Bcf Operational Highlights of this Combo Development â–ª Focused drilling efforts aided in operational execution. Averaged 3 day drilling times from kickoff to TD for all 19 wells â–ª 100% of fresh water for completions (300 million gallons) delivered via pipelines â–ª 1,000 stages completed without issue 32

Disclaimer The materials contained herein (“Materials”) are for informational purposes only and may not be relied on by any person for any purpose and are not, and should not be construed as investment, financial, legal, tax or other advice. The Materials represent the opinions of Toby Rice, Derek Rice and other former members of the Rice Energy leadership team (collectively, the “Rice Team”) and have been compiled based on publicly available information. The Materials do not purport to be complete or comprehensive; or constitute an agreement, offer, a solicitation of an offer, or any advice to enter into or conclude any transaction or take or refrain from taking any other course of action (whether on the terms shown therein or otherwise). The Materials contain“forward-looking statements.” Specificforward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “targets,” “forecasts,” “seeks,” “could” or the negative of such terms or other variation on such terms or comparable terminology. Similarly, statements that describe the Rice Team’s objectives, plans or goals areforward-looking. Anyforward-looking statements are based on the Rice Team’s current intent, belief, expectations, estimates and projections. These statements are not guarantees of future performance and involve risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to differ materially. Accordingly, you should not rely uponforward-looking statements as a prediction of actual results and actual results may vary materially from what is expressed in or indicated by theforward-looking statements. Any representation, statement or opinion expressed or implied in any of the Materials is provided in good faith but only on the basis that no reliance will be placed on any of the contents therein. You should obtain your own professional advice and conduct your own independent evaluation with respect to the subject matter therein. the Rice Team expressly disclaims any responsibility or liability for any loss howsoever arising from any use of or reliance on any of the Materials or any of their contents as a whole or in part by any person, or otherwise howsoever arising in connection with the same. There is no assurance or guarantee with respect to the prices at which any securities of the Issuer will trade, and such securities may not trade at prices that may be implied herein. the Rice Team is not under any obligation to provide any updated or additional information or to correct any inaccuracies in the Materials. Funds managed by the Rice Team currently beneficially own, and/or have an economic interest in, securities of EQT Corporation (the “Issuer”). These funds are in the business of trading, buying and selling securities. It is possible that there will be developments in the future (including changes in price of the Issuer’s securities) that cause one or more of such funds or accounts from time to time to sell all or a portion of their holdings of the Issuer in open market transactions or otherwise (including via short sales), buy additional securities (in open market or privately negotiated transactions or otherwise), or trade in options, puts, calls or other derivative instruments relating to some or all of such securities. To the extent that the Rice Team discloses information about its position or economic interest in the securities of the Issuer in the Materials, it is subject to change and the Rice Team expressly disclaims any obligation to update such information. The Materials shall not constitute an offer to sell or the solicitation of an offer to buy any interests in any fund managed by the Rice Team. All trade names, trademarks, service marks, and logos herein are the property of their respective owners who retain all proprietary rights over their use. 33

Disclaimer (Cont’d) IMPORTANT INFORMATION Toby Z. Rice and Derek A. Rice, as well as certain of their affiliates, may file a proxy statement with the U.S. Securities and Exchange Commission (“SEC”) to solicit proxies from stockholders of EQT for use at EQT’s 2019 annual meeting of stockholders. TOBY Z. RICE AND DEREK A. RICE STRONGLY ADVISE ALL SECURITY HOLDERS OF EQT TO READ ANY SUCH PROXY STATEMENT IF AND WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Any such proxy statement, if and when filed, and any other relevant documents will be available at no charge on the SEC’s website at http://www.sec.gov/. PARTICIPANT INFORMATION In accordance with Rule14a-12(a)(1)(i) under the Securities Exchange Act of 1934, as amended, the following persons are, or may be deemed to be, participants in the potential proxy solicitation: Toby Z. Rice and Derek A. Rice. Toby Z. Rice holds a total of 400,000 shares of common stock, both directly and indirectly, in EQT, and Derek A. Rice holds a total of 272,651 shares of common stock, both directly and indirectly, in EQT. In addition, Toby Z. Rice and Derek A. Rice are potential beneficiaries of the Rice Energy 2016 Irrevocable Trust, which holds a total of 5,676,000 shares of EQT’s common stock. 34

Contact information For Investor Inquiries: Kyle Derham kyle@teamrice.com For Media Inquiries: Sard Verbinnen & Co Jim Barron:212-687-8080 Frances Jeter:832-680-5120 35