UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-22930

USCF ETF TRUST

(Exact name of registrant as specified in charter)

1999 Harrison Street, Suite 1530, Oakland, California 94612

(Address of principal executive offices)(Zip code)

USCF Advisers LLC

Mr. Stuart P. Crumbaugh

1999 Harrison Street, Suite 1530

Oakland, California 94612

(Name and address of agent for service)

Registrant’s telephone number, including area code: (510) 522-9600

Date of fiscal year end: June 30

Date of reporting period: December 31, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORT TO SHAREHOLDERS.

The following is a copy of the report to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

USCF ETF TRUST

TABLE OF CONTENTS

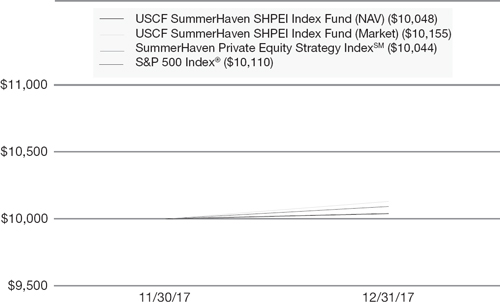

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN USCF SUMMERHAVEN SHPEI INDEX FUND (BUY), THE SUMMERHAVEN PRIVATE EQUITY STRATEGY INDEXSM (SHPEI) AND S&P 500 INDEX® FROM NOVEMBER 30, 2017 (INCEPTION DATE)* TO DECEMBER 31, 2017.

The following graph depicts the performance of USCF SummerHaven SHPEI Index Fund (Net Asset Value and Market Value) vs. the SummerHaven Private Equity Strategy IndexSM1 and S&P 500 Index®2

| | | Since | |

| | | Inception Return | |

| | | (11/30/2017) | |

| USCF SummerHaven SHPEI Index Fund (NAV) | | | 0.48 | % |

| USCF SummerHaven SHPEI Index Fund (Market Value) | | | 1.55 | % |

| SummerHaven Private Equity Strategy IndexSM | | | 0.44 | % |

| S&P 500 Index® | | | 1.10 | % |

| * | The inception date is the date the first shares were purchased to meet the outstanding shares required for listing on the NYSE Arca, Inc. BUY was listed on the NYSE Arca, Inc. on December 1, 2017. |

| 2 | Semi-Annual Report December 31, 2017 |

| 1 | The SummerHaven Private Equity Strategy Index (SHPEI) attempts to replicate the long-term (i.e., 10 years or more) return characteristics of diversified private equity allocations. SHPEI is designed to include publicly-traded companies that possess characteristics similar to the companies that private equity firms have historically selected for investment, as well as companies that SummerHaven Index Management, LLC (SHIM), as the index provider believes private equity firms are likely to select for investment in the future. However, SHPEI does not include, and the Fund does not invest in, private equity funds or private equity of companies. SHPEI is constructed using a proprietary methodology that favors companies with low enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA) ratios; low net equity issuance; low market capitalization; and moderate profitability. From a universe of approximately 3,000 U.S. companies, SHIM applies proprietary screens to determine an investable universe. SHPEI includes the greater of 200 companies or 20% of such investable universe. SHPEI is equally- weighted and rebalanced annually. |

| 2 | The Standard & Poor’s (S&P) 500 Index is an unmanaged index consisting of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-weighted index (stock price times number of shares outstanding) with each stock’s weight in the Index proportionate to its market value. |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. Return calculations assume the reinvestment of distributions and do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Performance figures reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investments returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than the original cost.

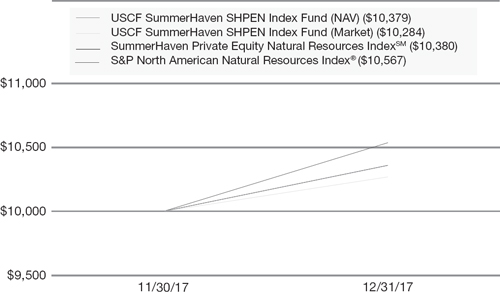

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN USCF SUMMERHAVEN SHPEN INDEX FUND (BUYN), THE SUMMERHAVEN PRIVATE EQUITY NATURAL RESOURCES INDEXSM (SHPEN) AND S&P NORTH AMERICAN NATURAL RESOURCES INDEX® FROM NOVEMBER 30, 2017 (INCEPTION DATE)* TO DECEMBER 31, 2017.

The following graph depicts the performance of USCF SummerHaven SHPEN Index Fund (Net Asset Value and Market Value) vs. the SummerHaven Private Equity Natural Resources IndexSM1 and S&P North American Natural Resources Index®2

| | | Since | |

| | | Inception Return | |

| | | (11/30/2017) | |

| USCF SummerHaven SHPEN Index Fund (NAV) | | | 3.79 | % |

| USCF SummerHaven SHPEN Index Fund (Market Value) | | | 2.84 | % |

| SummerHaven Private Equity Natural Resources IndexSM | | | 3.80 | % |

| S&P North American Natural Resources Index® | | | 5.67 | % |

| * | The inception date is the date the first shares were purchased to meet the outstanding shares required for listing on the NYSE Arca, Inc. BUYN was listed on the NYSE Arca, Inc. on December 1, 2017. |

| 4 | Semi-Annual Report December 31, 2017 |

| 1 | The SummerHaven Private Equity Natural Resources Index (SHPEN) attempts to replicate the long-term return (i.e., return over 10 years or longer) of diversified natural resources private equity allocations. SHPEN is designed to include publicly- traded companies that possess characteristics similar to the companies that private equity firms focusing on natural resources have historically selected for investment, as well as companies that SummerHaven Index Management, LLC (SHIM), as the index provider believes private equity firms focusing on natural resource investments are likely to select for investment in the future. However, SHPEN does not include, and the Fund does not invest in, private equity funds or private equity of companies. The Fund does not invest directly in natural resource commodities. SHPEN is constructed using a proprietary methodology that favors companies with low enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA) ratios; low net equity issuance; low market capitalization; and moderate profitability. Proprietary screens are applied to a universe of approximately 600 U.S. companies to determine an investable universe. SHPEN includes the greater of 80 companies or 40% of such investable universe. The Index SHPEN is equally-weighted and rebalanced annually. |

| | |

| 2 | The S&P North American Natural Resources Index provides investors with a benchmark that represents U.S. traded securities that are classified under the GICS® energy and materials sector excluding the chemicals industry; and steel sub-industry. |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. Return calculations assume the reinvestment of distributions and do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Performance figures reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investments returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than the original cost.

DISCLOSURE OF FUND EXPENSES (unaudited)

As a shareholder of the USCF SummerHaven SHPEI Index Fund or the USCF SummerHaven SHPEN Index Fund (each a “Fund” and collectively, the “Funds”), both series of the USCF ETF Trust (the “Trust”), you may incur two potential types of costs: (1) transaction costs, such as brokerage commission purchases and sales of your Fund shares, and (2) ongoing costs, including management fees and other Funds expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds. The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from November 30, 2017* until December 31, 2017.

Actual Return. The table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Actual Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical 5% Return. The table below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other exchange traded funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing costs only and do not reflect any transaction fees, such as brokerage commission paid on purchases and sales of Fund shares. Therefore, the number under the heading “Hypothetical Expenses paid during the period” is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds.

| 6 | Semi-Annual Report December 31, 2017 |

USCF ETF TRUST

| Fund | | Beginning

Account

Value

11/30/17* | | | Actual

Ending

Account

Value

12/31/17 | | | Hypothetical

Ending

Account

Value

12/31/17 | | | Actual

Expenses

Paid

During

the

Period (a) | | | Hypothetical

Expenses

Paid

During the

Period (a) | | | Annualized

Expense

Ratio | |

| USCF SummerHaven SHPEI Index Fund | | $ | 1,000.00 | | | $ | 1,004.80 | | | $ | 1,008.26 | | | $ | 0.81 | | | $ | 0.81 | | | | 0.95 | % |

| USCF SummerHaven SHPEN Index Fund | | | 1,000.00 | | | | 1,037.70 | | | | 1,041.27 | | | | 0.82 | | | | 0.82 | | | | 0.95 | % |

| * | Inception date, November 30, 2017. |

| (a) | Expenses (net of fee waivers and/or expense reimbursements) are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days (31 days) in the most recent fiscal half-year, then divided by 365 (to reflect the one-half year period). |

USCF ETF TRUST – USCF SUMMERHAVEN SHPEI INDEX FUND

SCHEDULE OF INVESTMENTS

AT DECEMBER 31, 2017 (unaudited)

| | | % of Total | | | | | | Market | |

| | | Net Assets | | | Shares | | | Value | |

| Common Stocks | | | 99.8 | % | | | | | | | | |

| Aerospace & Defense | | | 1.2 | % | | | | | | | | |

| AAR Corp. | | | 0.3 | % | | | 205 | | | $ | 8,054 | |

| Ducommun, Inc.(a) | | | 0.3 | % | | | 235 | | | | 6,686 | |

| Triumph Group, Inc. | | | 0.3 | % | | | 232 | | | | 6,310 | |

| Vectrus, Inc.(a) | | | 0.3 | % | | | 222 | | | | 6,849 | |

| | | | | | | | | | | | 27,899 | |

| Air Freight & Logistics | | | 0.6 | % | | | | | | | | |

| Air Transport Services Group, Inc.(a) | | | 0.3 | % | | | 328 | | | | 7,590 | |

| Radiant Logistics, Inc.(a) | | | 0.3 | % | | | 1,428 | | | | 6,569 | |

| | | | | | | | | | | | 14,159 | |

| Airlines | | | 0.7 | % | | | | | | | | |

| Hawaiian Holdings, Inc. | | | 0.3 | % | | | 162 | | | | 6,456 | |

| SkyWest, Inc. | | | 0.4 | % | | | 206 | | | | 10,939 | |

| | | | | | | | | | | | 17,395 | |

| Auto Components | | | 2.7 | % | | | | | | | | |

| Cooper Tire & Rubber Co. | | | 0.3 | % | | | 211 | | | | 7,459 | |

| Lear Corp. | | | 0.4 | % | | | 52 | | | | 9,186 | |

| Shiloh Industries, Inc.(a) | | | 0.2 | % | | | 738 | | | | 6,052 | |

| Stoneridge, Inc.(a) | | | 0.5 | % | | | 501 | | | | 11,453 | |

| Superior Industries International, Inc. | | | 0.2 | % | | | 384 | | | | 5,702 | |

| Tenneco, Inc. | | | 0.3 | % | | | 128 | | | | 7,493 | |

| Tower International, Inc. | | | 0.4 | % | | | 352 | | | | 10,754 | |

| Visteon Corp.(a) | | | 0.4 | % | | | 72 | | | | 9,010 | |

| | | | | | | | | | | | 67,109 | |

| Banks | | | 9.8 | % | | | | | | | | |

| American National Bankshares, Inc. | | | 0.3 | % | | | 205 | | | | 7,852 | |

| Bank of Commerce Holdings | | | 0.3 | % | | | 678 | | | | 7,797 | |

| C&F Financial Corp. | | | 0.4 | % | | | 154 | | | | 8,932 | |

| Capital City Bank Group, Inc. | | | 0.3 | % | | | 364 | | | | 8,350 | |

| Chemung Financial Corp. | | | 0.4 | % | | | 185 | | | | 8,899 | |

| Civista Bancshares, Inc. | | | 0.3 | % | | | 358 | | | | 7,876 | |

| Evans Bancorp, Inc. | | | 0.3 | % | | | 183 | | | | 7,668 | |

| Farmers & Merchants Bancorp, Inc. | | | 0.4 | % | | | 247 | | | | 10,078 | |

| Farmers Capital Bank Corp. | | | 0.3 | % | | | 195 | | | | 7,508 | |

| Fidelity Southern Corp. | | | 0.3 | % | | | 328 | | | | 7,150 | |

| First Community Bancshares, Inc. | | | 0.3 | % | | | 274 | | | | 7,872 | |

| First Financial Corp. | | | 0.3 | % | | | 164 | | | | 7,437 | |

| First Guaranty Bancshares, Inc. | | | 0.3 | % | | | 314 | | | | 7,850 | |

The accompanying notes are an integral part of the financial statements.

| 8 | Semi-Annual Report December 31, 2017 |

USCF ETF TRUST – USCF SUMMERHAVEN SHPEI INDEX FUND

SCHEDULE OF INVESTMENTS

AT DECEMBER 31, 2017 (unaudited) (continued)

| | | % of Total | | | | | | Market | |

| | | Net Assets | | | Shares | | | Value | |

| Banks (continued) | | | 9.8 | % | | | | | | | | |

| Independent Bank Corp./MI | | | 0.3 | % | | | 356 | | | $ | 7,957 | |

| MBT Financial Corp. | | | 0.3 | % | | | 758 | | | | 8,035 | |

| National Bankshares, Inc. | | | 0.3 | % | | | 185 | | | | 8,408 | |

| National Commerce Corp.(a) | | | 0.3 | % | | | 187 | | | | 7,527 | |

| Northrim Bancorp, Inc. | | | 0.3 | % | | | 248 | | | | 8,395 | |

| OFG Bancorp | | | 0.3 | % | | | 764 | | | | 7,182 | |

| Ohio Valley Banc Corp. | | | 0.3 | % | | | 204 | | | | 8,242 | |

| Old Point Financial Corp. | | | 0.3 | % | | | 225 | | | | 6,694 | |

| Parke Bancorp, Inc. | | | 0.3 | % | | | 336 | | | | 6,905 | |

| Peoples Bancorp of North Carolina, Inc. | | | 0.3 | % | | | 260 | | | | 7,979 | |

| Preferred Bank | | | 0.3 | % | | | 134 | | | | 7,877 | |

| Shore Bancshares, Inc. | | | 0.3 | % | | | 451 | | | | 7,532 | |

| Sierra Bancorp | | | 0.3 | % | | | 314 | | | | 8,340 | |

| SmartFinancial, Inc.(a) | | | 0.3 | % | | | 302 | | | | 6,553 | |

| Southern First Bancshares, Inc.(a) | | | 0.4 | % | | | 205 | | | | 8,456 | |

| Two River Bancorp | | | 0.3 | % | | | 424 | | | | 7,687 | |

| United Security Bancshares | | | 0.4 | % | | | 780 | | | | 8,580 | |

| Unity Bancorp, Inc. | | | 0.3 | % | | | 422 | | | | 8,335 | |

| | | | | | | | | | | | 245,953 | |

| Building Products | | | 2.4 | % | | | | | | | | |

| American Woodmark Corp.(a) | | | 0.4 | % | | | 78 | | | | 10,160 | |

| Armstrong Flooring, Inc.(a) | | | 0.3 | % | | | 428 | | | | 7,242 | |

| Gibraltar Industries, Inc.(a) | | | 0.3 | % | | | 228 | | | | 7,524 | |

| Griffon Corp. | | | 0.3 | % | | | 358 | | | | 7,285 | |

| Insteel Industries, Inc. | | | 0.3 | % | | | 226 | | | | 6,400 | |

| Patrick Industries, Inc.(a) | | | 0.4 | % | | | 153 | | | | 10,626 | |

| Universal Forest Products, Inc. | | | 0.4 | % | | | 265 | | | | 9,969 | |

| | | | | | | | | | | | 59,206 | |

| Capital Markets | | | 1.9 | % | | | | | | | | |

| B. Riley Financial, Inc. | | | 0.3 | % | | | 398 | | | | 7,204 | |

| Donnelley Financial Solutions, Inc.(a) | | | 0.3 | % | | | 338 | | | | 6,588 | |

| Greenhill & Co., Inc. | | | 0.3 | % | | | 378 | | | | 7,371 | |

| Investment Technology Group, Inc. | | | 0.3 | % | | | 358 | | | | 6,892 | |

| Piper Jaffray Cos. | | | 0.4 | % | | | 118 | | | | 10,178 | |

| Waddell & Reed Financial, Inc. - Class A | | | 0.3 | % | | | 382 | | | | 8,534 | |

| | | | | | | | | | | | 46,767 | |

The accompanying notes are an integral part of the financial statements.

USCF ETF TRUST – USCF SUMMERHAVEN SHPEI INDEX FUND

SCHEDULE OF INVESTMENTS

AT DECEMBER 31, 2017 (unaudited) (continued)

| | | % of Total | | | | | | Market | |

| | | Net Assets | | | Shares | | | Value | |

| Chemicals | | | 2.4 | % | | | | | | | | |

| A Schulman, Inc. | | | 0.4 | % | | | 247 | | | $ | 9,201 | |

| Ashland Global Holdings, Inc. | | | 0.3 | % | | | 116 | | | | 8,259 | |

| Core Molding Technologies, Inc. | | | 0.3 | % | | | 346 | | | | 7,508 | |

| Innophos Holdings, Inc. | | | 0.3 | % | | | 178 | | | | 8,318 | |

| KMG Chemicals, Inc. | | | 0.4 | % | | | 150 | | | | 9,912 | |

| Rayonier Advanced Materials, Inc. | | | 0.4 | % | | | 485 | | | | 9,918 | |

| Trinseo SA | | | 0.3 | % | | | 108 | | | | 7,841 | |

| | | | | | | | | | | | 60,957 | |

| Commercial Services & Supplies | | | 2.5 | % | | | | | | | | |

| ACCO Brands Corp.(a) | | | 0.3 | % | | | 644 | | | | 7,857 | |

| Brink’s Co. (The) | | | 0.3 | % | | | 110 | | | | 8,657 | |

| CECO Environmental Corp. | | | 0.2 | % | | | 780 | | | | 4,001 | |

| Ennis, Inc. | | | 0.3 | % | | | 404 | | | | 8,383 | |

| Essendant, Inc. | | | 0.2 | % | | | 555 | | | | 5,145 | |

| LSC Communications, Inc. | | | 0.2 | % | | | 378 | | | | 5,727 | |

| Pitney Bowes, Inc. | | | 0.2 | % | | | 505 | | | | 5,646 | |

| SP Plus Corp.(a) | | | 0.4 | % | | | 241 | | | | 8,941 | |

| Viad Corp. | | | 0.4 | % | | | 160 | | | | 8,864 | |

| | | | | | | | | | | | 63,221 | |

| Construction & Engineering | | | 3.3 | % | | | | | | | | |

| Aegion Corp.–Class A(a) | | | 0.3 | % | | | 334 | | | | 8,494 | |

| Argan, Inc. | | | 0.2 | % | | | 122 | | | | 5,490 | |

| Chicago Bridge & Iron Co. NV | | | 0.3 | % | | | 434 | | | | 7,005 | |

| Comfort Systems USA, Inc. | | | 0.4 | % | | | 211 | | | | 9,210 | |

| Dycom Industries, Inc.(a) | | | 0.4 | % | | | 84 | | | | 9,360 | |

| Fluor Corp. | | | 0.3 | % | | | 168 | | | | 8,677 | |

| IES Holdings, Inc.(a) | | | 0.3 | % | | | 426 | | | | 7,348 | |

| MYR Group, Inc.(a) | | | 0.4 | % | | | 249 | | | | 8,897 | |

| NV5 Global, Inc.(a) | | | 0.4 | % | | | 183 | | | | 9,909 | |

| Orion Group Holdings, Inc.(a) | | | 0.3 | % | | | 1,032 | | | | 8,081 | |

| | | | | | | | | | | | 82,471 | |

| Construction Materials | | | 0.3 | % | | | | | | | | |

| US Concrete, Inc.(a) | | | 0.3 | % | | | 96 | | | | 8,030 | |

| | | | | | | | | | | | | |

| Consumer Finance | | | 0.6 | % | | | | | | | | |

| Enova International, Inc.(a) | | | 0.3 | % | | | 466 | | | | 7,083 | |

| World Acceptance Corp.(a) | | | 0.3 | % | | | 98 | | | | 7,911 | |

| | | | | | | | | | | | 14,994 | |

The accompanying notes are an integral part of the financial statements.

| 10 | Semi-Annual Report December 31, 2017 |

USCF ETF TRUST – USCF SUMMERHAVEN SHPEI INDEX FUND

SCHEDULE OF INVESTMENTS

AT DECEMBER 31, 2017 (unaudited) (continued)

| | | % of Total | | | | | | Market | |

| | | Net Assets | | | Shares | | | Value | |

| Containers & Packaging | | | 0.3 | % | | | | | | | | |

| UFP Technologies, Inc.(a) | | | 0.3 | % | | | 274 | | | $ | 7,617 | |

| | | | | | | | | | | | | |

| Distributors | | | 0.3 | % | | | | | | | | |

| Weyco Group, Inc. | | | 0.3 | % | | | 274 | | | | 8,143 | |

| | | | | | | | | | | | | |

| Diversified Consumer Services | | | 2.1 | % | | | | | | | | |

| American Public Education, Inc.(a) | | | 0.3 | % | | | 342 | | | | 8,567 | |

| Cambium Learning Group, Inc.(a) | | | 0.3 | % | | | 1,528 | | | | 8,679 | |

| Capella Education Co. | | | 0.3 | % | | | 88 | | | | 6,811 | |

| Collectors Universe, Inc. | | | 0.4 | % | | | 310 | | | | 8,878 | |

| K12, Inc.(a) | | | 0.3 | % | | | 428 | | | | 6,805 | |

| Regis Corp.(a) | | | 0.5 | % | | | 762 | | | | 11,704 | |

| | | | | | | | | | | | 51,444 | |

| Electrical Equipment | | | 1.6 | % | | | | | | | | |

| General Cable Corp. | | | 0.5 | % | | | 457 | | | | 13,527 | |

| Powell Industries, Inc. | | | 0.3 | % | | | 234 | | | | 6,704 | |

| Preformed Line Products Co. | | | 0.5 | % | | | 162 | | | | 11,510 | |

| TPI Composites, Inc.(a) | | | 0.3 | % | | | 408 | | | | 8,348 | |

| | | | | | | | | | | | 40,089 | |

| Electronic Equipment, Instruments & Components | | | 2.8 | % | | | | | | | | |

| AVX Corp. | | | 0.3 | % | | | 447 | | | | 7,733 | |

| Benchmark Electronics, Inc.(a) | | | 0.3 | % | | | 229 | | | | 6,664 | |

| ePlus, Inc.(a) | | | 0.3 | % | | | 98 | | | | 7,369 | |

| Jabil, Inc. | | | 0.3 | % | | | 255 | | | | 6,694 | |

| KEMET Corp.(a) | | | 0.3 | % | | | 481 | | | | 7,244 | |

| Kimball Electronics, Inc.(a) | | | 0.3 | % | | | 412 | | | | 7,519 | |

| PC Connection, Inc. | | | 0.3 | % | | | 290 | | | | 7,601 | |

| PCM, Inc.(a) | | | 0.1 | % | | | 382 | | | | 3,782 | |

| Sanmina Corp.(a) | | | 0.3 | % | | | 193 | | | | 6,369 | |

| Tech Data Corp.(a) | | | 0.3 | % | | | 72 | | | | 7,054 | |

| | | | | | | | | | | | 68,029 | |

| Energy Equipment & Services | | | 5.1 | % | | | | | | | | |

| Archrock, Inc. | | | 0.3 | % | | | 682 | | | | 7,161 | |

| Diamond Offshore Drilling, Inc.(a) | | | 0.5 | % | | | 712 | | | | 13,236 | |

| Ensco PLC - Class A | | | 0.4 | % | | | 1,550 | | | | 9,161 | |

| Era Group, Inc.(a) | | | 0.4 | % | | | 828 | | | | 8,901 | |

The accompanying notes are an integral part of the financial statements.

USCF ETF TRUST – USCF SUMMERHAVEN SHPEI INDEX FUND

SCHEDULE OF INVESTMENTS

AT DECEMBER 31, 2017 (unaudited) (continued)

| | | % of Total | | | | | | Market | |

| | | Net Assets | | | Shares | | | Value | |

| Energy Equipment & Services (continued) | | | 5.1 | % | | | | | | | | |

| Exterran Corp.(a) | | | 0.3 | % | | | 280 | | | $ | 8,803 | |

| Gulf Island Fabrication, Inc. | | | 0.4 | % | | | 686 | | | | 9,210 | |

| Helix Energy Solutions Group, Inc.(a) | | | 0.4 | % | | | 1,412 | | | | 10,646 | |

| Matrix Service Co.(a) | | | 0.6 | % | | | 815 | | | | 14,507 | |

| Oceaneering International, Inc. | | | 0.3 | % | | | 338 | | | | 7,145 | |

| RigNet, Inc.(a) | | | 0.3 | % | | | 434 | | | | 6,488 | |

| Rowan Cos. PLC - Class A(a) | | | 0.4 | % | | | 728 | | | | 11,400 | |

| SEACOR Holdings, Inc.(a) | | | 0.4 | % | | | 231 | | | | 10,677 | |

| Unit Corp.(a) | | | 0.4 | % | | | 422 | | | | 9,284 | |

| | | | | | | | | | | | 126,619 | |

| Food & Staples Retailing | | | 1.3 | % | | | | | | | | |

| Natural Grocers by Vitamin Cottage, Inc.(a) | | | 0.3 | % | | | 962 | | | | 8,591 | |

| SpartanNash Co. | | | 0.3 | % | | | 294 | | | | 7,844 | |

| United Natural Foods, Inc.(a) | | | 0.4 | % | | | 215 | | | | 10,593 | |

| Weis Markets, Inc. | | | 0.3 | % | | | 160 | | | | 6,622 | |

| | | | | | | | | | | | 33,650 | |

| Food Products | | | 0.9 | % | | | | | | | | |

| Dean Foods Co. | | | 0.2 | % | | | 504 | | | | 5,826 | |

| Fresh Del Monte Produce, Inc. | | | 0.3 | % | | | 148 | | | | 7,055 | |

| Pilgrim’s Pride Corp.(a) | | | 0.4 | % | | | 354 | | | | 10,995 | |

| | | | | | | | | | | | 23,876 | |

| Gas Utilities | | | 0.3 | % | | | | | | | | |

| RGC Resources, Inc. | | | 0.3 | % | | | 263 | | | | 7,122 | |

| | | | | | | | | | | | | |

| Health Care Providers & Services | | | 3.2 | % | | | | | | | | |

| American Renal Associates Holdings, Inc.(a) | | | 0.3 | % | | | 422 | | | | 7,343 | |

| AMN Healthcare Services, Inc.(a) | | | 0.4 | % | | | 207 | | | | 10,195 | |

| Civitas Solutions, Inc.(a) | | | 0.3 | % | | | 428 | | | | 7,319 | |

| Community Health Systems, Inc.(a) | | | 0.1 | % | | | 782 | | | | 3,331 | |

| Cross Country Healthcare, Inc.(a) | | | 0.3 | % | | | 619 | | | | 7,898 | |

| LifePoint Health, Inc.(a) | | | 0.2 | % | | | 118 | | | | 5,876 | |

| Magellan Health, Inc.(a) | | | 0.4 | % | | | 104 | | | | 10,041 | |

| Molina Healthcare, Inc.(a) | | | 0.3 | % | | | 106 | | | | 8,128 | |

| Providence Service Corp. (The)(a) | | | 0.4 | % | | | 154 | | | | 9,138 | |

| Tenet Healthcare Corp.(a) | | | 0.2 | % | | | 396 | | | | 6,003 | |

| WellCare Health Plans, Inc.(a) | | | 0.3 | % | | | 42 | | | | 8,447 | |

| | | | | | | | | | | | 83,719 | |

The accompanying notes are an integral part of the financial statements.

| 12 | Semi-Annual Report December 31, 2017 |

USCF ETF TRUST – USCF SUMMERHAVEN SHPEI INDEX FUND

SCHEDULE OF INVESTMENTS

AT DECEMBER 31, 2017 (unaudited) (continued)

| | | % of Total | | | | | | Market | |

| | | Net Assets | | | Shares | | | Value | |

| Hotels, Restaurants & Leisure | | | 4.7 | % | | | | | | | | |

| BJ’s Restaurants, Inc. | | | 0.3 | % | | | 210 | | | $ | 7,644 | |

| Bojangles’, Inc.(a) | | | 0.2 | % | | | 487 | | | | 5,746 | |

| Brinker International, Inc. | | | 0.3 | % | | | 207 | | | | 8,040 | |

| Carrols Restaurant Group, Inc.(a) | | | 0.3 | % | | | 625 | | | | 7,594 | |

| Century Casinos, Inc.(a) | | | 0.4 | % | | | 1,028 | | | | 9,386 | |

| DineEquity, Inc. | | | 0.4 | % | | | 178 | | | | 9,030 | |

| Fogo De Chao, Inc.(a) | | | 0.3 | % | | | 570 | | | | 6,612 | |

| J Alexander’s Holdings, Inc.(a) | | | 0.3 | % | | | 674 | | | | 6,538 | |

| Nathan’s Famous, Inc. | | | 0.3 | % | | | 118 | | | | 8,909 | |

| Pinnacle Entertainment, Inc.(a) | | | 0.5 | % | | | 382 | | | | 12,503 | |

| Potbelly Corp.(a) | | | 0.3 | % | | | 609 | | | | 7,491 | |

| RCI Hospitality Holdings, Inc. | | | 0.4 | % | | | 320 | | | | 8,953 | |

| Ruth’s Hospitality Group, Inc. | | | 0.3 | % | | | 360 | | | | 7,794 | |

| Zoe’s Kitchen, Inc.(a) | | | 0.4 | % | | | 666 | | | | 11,135 | |

| | | | | | | | | | | | 117,375 | |

| Household Durables | | | 2.9 | % | | | | | | | | |

| Bassett Furniture Industries, Inc. | | | 0.3 | % | | | 199 | | | | 7,482 | |

| CSS Industries, Inc. | | | 0.3 | % | | | 290 | | | | 8,071 | |

| Flexsteel Industries, Inc. | | | 0.2 | % | | | 136 | | | | 6,362 | |

| Hooker Furniture Corp. | | | 0.3 | % | | | 181 | | | | 7,683 | |

| LGI Homes, Inc.(a) | | | 0.5 | % | | | 181 | | | | 13,580 | |

| Libbey, Inc. | | | 0.3 | % | | | 948 | | | | 7,129 | |

| Lifetime Brands, Inc. | | | 0.3 | % | | | 402 | | | | 6,633 | |

| ZAGG, Inc.(a) | | | 0.7 | % | | | 901 | | | | 16,623 | |

| | | | | | | | | | | | 73,563 | |

| Insurance | | | 2.9 | % | | | | | | | | |

| American Financial Group, Inc. | | | 0.3 | % | | | 76 | | | | 8,249 | |

| Argo Group International Holdings Ltd. | | | 0.3 | % | | | 126 | | | | 7,768 | |

| Hallmark Financial Services, Inc.(a) | | | 0.3 | % | | | 690 | | | | 7,197 | |

| HCI Group, Inc. | | | 0.2 | % | | | 164 | | | | 4,904 | |

| Heritage Insurance Holdings, Inc. | | | 0.4 | % | | | 626 | | | | 11,281 | |

| Investors Title Co. | | | 0.3 | % | | | 40 | | | | 7,934 | |

| Kingstone Cos., Inc. | | | 0.4 | % | | | 483 | | | | 9,080 | |

| Safety Insurance Group, Inc. | | | 0.4 | % | | | 110 | | | | 8,844 | |

| Validus Holdings Ltd. | | | 0.3 | % | | | 146 | | | | 6,850 | |

| | | | | | | | | | | | 72,107 | |

The accompanying notes are an integral part of the financial statements.

USCF ETF TRUST – USCF SUMMERHAVEN SHPEI INDEX FUND

SCHEDULE OF INVESTMENTS

AT DECEMBER 31, 2017 (unaudited) (continued)

| | | % of Total | | �� | | | | Market | |

| | | Net Assets | | | Shares | | | Value | |

| Internet & Direct Marketing Retail | | | 0.4 | % | | | | | | | | |

| FTD Cos., Inc.(a) | | | 0.1 | % | | | 396 | | | $ | 2,847 | |

| HSN, Inc. | | | 0.3 | % | | | 201 | | | | 8,110 | |

| | | | | | | | | | | | 10,957 | |

| | | | | | | | | | | | | |

| IT Services | | | 1.3 | % | | | | | | | | |

| Hackett Group, Inc. (The) | | | 0.3 | % | | | 479 | | | | 7,525 | |

| Syntel, Inc.(a) | | | 0.4 | % | | | 463 | | | | 10,644 | |

| Teradata Corp.(a) | | | 0.4 | % | | | 265 | | | | 10,192 | |

| Unisys Corp.(a) | | | 0.2 | % | | | 586 | | | | 4,776 | |

| | | | | | | | | | | | 33,137 | |

| | | | | | | | | | | | | |

| Leisure Products | | | 0.5 | % | | | | | | | | |

| MCBC Holdings, Inc.(a) | | | 0.3 | % | | | 382 | | | | 8,488 | |

| Vista Outdoor, Inc.(a) | | | 0.2 | % | | | 342 | | | | 4,983 | |

| | | | | | | | | | | | 13,471 | |

| | | | | | | | | | | | | |

| Machinery | | | 5.2 | % | | | | | | | | |

| American Railcar Industries, Inc. | | | 0.3 | % | | | 209 | | | | 8,703 | |

| Blue Bird Corp.(a) | | | 0.3 | % | | | 436 | | | | 8,676 | |

| Briggs & Stratton Corp. | | | 0.3 | % | | | 316 | | | | 8,017 | |

| Chart Industries, Inc.(a) | | | 0.4 | % | | | 217 | | | | 10,169 | |

| Commercial Vehicle Group, Inc.(a) | | | 0.4 | % | | | 873 | | | | 9,332 | |

| Eastern Co. (The) | | | 0.3 | % | | | 247 | | | | 6,459 | |

| FreightCar America, Inc. | | | 0.3 | % | | | 450 | | | | 7,686 | |

| Global Brass & Copper Holdings, Inc. | | | 0.3 | % | | | 249 | | | | 8,242 | |

| Hardinge, Inc. | | | 0.4 | % | | | 611 | | | | 10,644 | |

| Hurco Cos, Inc. | | | 0.4 | % | | | 225 | | | | 9,495 | |

| LB Foster Co. - Class A(a) | | | 0.4 | % | | | 360 | | | | 9,774 | |

| Miller Industries, Inc. | | | 0.3 | % | | | 304 | | | | 7,843 | |

| Park-Ohio Holdings Corp. | | | 0.4 | % | | | 199 | | | | 9,144 | |

| SPX Corp.(a) | | | 0.4 | % | | | 282 | | | | 8,852 | |

| Wabash National Corp. | | | 0.3 | % | | | 344 | | | | 7,465 | |

| | | | | | | | | | | | 130,501 | |

| | | | | | | | | | | | | |

| Media | | | 1.8 | % | | | | | | | | |

| Gannett Co., Inc. | | | 0.4 | % | | | 893 | | | | 10,350 | |

| National CineMedia, Inc. | | | 0.3 | % | | | 1,056 | | | | 7,244 | |

The accompanying notes are an integral part of the financial statements.

| 14 | Semi-Annual Report December 31, 2017 |

USCF ETF TRUST – USCF SUMMERHAVEN SHPEI INDEX FUND

SCHEDULE OF INVESTMENTS

AT DECEMBER 31, 2017 (unaudited) (continued)

| | | % of Total | | | | | | Market | |

| | | Net Assets | | | Shares | | | Value | |

| Media (continued) | | | 1.8 | % | | | | | | | | |

| TEGNA, Inc. | | | 0.3 | % | | | 533 | | | $ | 7,505 | |

| Time, Inc. | | | 0.4 | % | | | 563 | | | | 10,387 | |

| tronc, Inc.(a) | | | 0.4 | % | | | 609 | | | | 10,712 | |

| | | | | | | | | | | | 46,198 | |

| | | | | | | | | | | | | |

| Metals & Mining | | | 1.5 | % | | | | | | | | |

| Alcoa Corp.(a) | | | 0.5 | % | | | 221 | | | | 11,905 | |

| Ryerson Holding Corp.(a) | | | 0.3 | % | | | 856 | | | | 8,902 | |

| Steel Dynamics, Inc. | | | 0.4 | % | | | 213 | | | | 9,187 | |

| SunCoke Energy, Inc.(a) | | | 0.3 | % | | | 698 | | | | 8,369 | |

| | | | | | | | | | | | 38,363 | |

| | | | | | | | | | | | | |

| Multiline Retail | | | 1.5 | % | | | | | | | | |

| Big Lots, Inc. | | | 0.4 | % | | | 162 | | | | 9,096 | |

| Kohl’s Corp. | | | 0.4 | % | | | 205 | | | | 11,117 | |

| Macy’s, Inc. | | | 0.4 | % | | | 360 | | | | 9,068 | |

| Nordstrom, Inc. | | | 0.3 | % | | | 164 | | | | 7,770 | |

| | | | | | | | | | | | 37,051 | |

| | | | | | | | | | | | | |

| Oil, Gas & Consumable Fuels | | | 4.6 | % | | | | | | | | |

| Adams Resources & Energy, Inc. | | | 0.3 | % | | | 183 | | | | 7,960 | |

| Contango Oil & Gas Co.(a) | | | 0.2 | % | | | 1,177 | | | | 5,544 | |

| CVR Energy, Inc. | | | 0.5 | % | | | 348 | | | | 12,959 | |

| Green Plains, Inc. | | | 0.3 | % | | | 396 | | | | 6,673 | |

| Hallador Energy Co. | | | 0.2 | % | | | 923 | | | | 5,621 | |

| HollyFrontier Corp. | | | 0.6 | % | | | 280 | | | | 14,342 | |

| Peabody Energy Corp.(a) | | | 0.5 | % | | | 288 | | | | 11,338 | |

| QEP Resources, Inc.(a) | | | 0.3 | % | | | 824 | | | | 7,886 | |

| Renewable Energy Group, Inc.(a) | | | 0.3 | % | | | 631 | | | | 7,446 | |

| REX American Resources Corp.(a) | | | 0.3 | % | | | 80 | | | | 6,623 | |

| Southwestern Energy Co.(a) | | | 0.3 | % | | | 1,314 | | | | 7,332 | |

| Teekay Corp. | | | 0.4 | % | | | 1,130 | | | | 10,532 | |

| Whiting Petroleum Corp.(a) | | | 0.4 | % | | | 364 | | | | 9,639 | |

| | | | | | | | | | | | 113,895 | |

| | | | | | | | | | | | | |

| Paper & Forest Products | | | 0.3 | % | | | | | | | | |

| Clearwater Paper Corp.(a) | | | 0.3 | % | | | 162 | | | | 7,355 | |

The accompanying notes are an integral part of the financial statements.

USCF ETF TRUST – USCF SUMMERHAVEN SHPEI INDEX FUND

SCHEDULE OF INVESTMENTS

AT DECEMBER 31, 2017 (unaudited) (continued)

| | | % of Total | | | | | | Market | |

| | | Net Assets | | | Shares | | | Value | |

| Personal Products | | | 0.7 | % | | | | | | | | |

| Medifast, Inc. | | | 0.5 | % | | | 189 | | | $ | 13,194 | |

| Natural Health Trends Corp. | | | 0.2 | % | | | 264 | | | | 4,010 | |

| | | | | | | | | | | | 17,204 | |

| | | | | | | | | | | | | |

| Pharmaceuticals | | | 0.2 | % | | | | | | | | |

| Endo International PLC(a) | | | 0.2 | % | | | 652 | | | | 5,053 | |

| | | | | | | | | | | | | |

| Professional Services | | | 3.0 | % | | | | | | | | |

| Barrett Business Services, Inc. | | | 0.3 | % | | | 132 | | | | 8,513 | |

| BG Staffing, Inc. | | | 0.3 | % | | | 426 | | | | 6,790 | |

| CRA International, Inc. | | | 0.4 | % | | | 210 | | | | 9,439 | |

| GP Strategies Corp.(a) | | | 0.3 | % | | | 282 | | | | 6,542 | |

| Heidrick & Struggles International, Inc. | | | 0.4 | % | | | 352 | | | | 8,642 | |

| Insperity, Inc. | | | 0.5 | % | | | 213 | | | | 12,216 | |

| ManpowerGroup, Inc. | | | 0.3 | % | | | 66 | | | | 8,323 | |

| Resources Connection, Inc. | | | 0.3 | % | | | 557 | | | | 8,606 | |

| Willdan Group, Inc.(a) | | | 0.2 | % | | | 235 | | | | 5,626 | |

| | | | | | | | | | | | 74,697 | |

| | | | | | | | | | | | | |

| Real Estate Management & Development | | | 0.4 | % | | | | | | | | |

| Altisource Portfolio Solutions SA(a) | | | 0.4 | % | | | 352 | | | | 9,856 | |

| | | | | | | | | | | | | |

| Road & Rail | | | 1.8 | % | | | | | | | | |

| ArcBest Corp. | | | 0.5 | % | | | 352 | | | | 12,584 | |

| Avis Budget Group, Inc.(a) | | | 0.4 | % | | | 259 | | | | 11,365 | |

| Universal Logistics Holdings, Inc. | | | 0.5 | % | | | 501 | | | | 11,899 | |

| YRC Worldwide, Inc.(a) | | | 0.4 | % | | | 628 | | | | 9,030 | |

| | | | | | | | | | | | 44,878 | |

| | | | | | | | | | | | | |

| Semiconductors & Semiconductor Equipment | | | 1.4 | % | | | | | | | | |

| Alpha & Omega Semiconductor Ltd. (a) | | | 0.3 | % | | | 442 | | | | 7,231 | |

| Cirrus Logic, Inc.(a) | | | 0.2 | % | | | 118 | | | | 6,119 | |

| Cohu, Inc. | | | 0.4 | % | | | 438 | | | | 9,614 | |

| CyberOptics Corp.(a) | | | 0.2 | % | | | 334 | | | | 5,010 | |

| Ultra Clean Holdings, Inc.(a) | | | 0.3 | % | | | 350 | | | | 8,082 | |

| | | | | | | | | | | | 36,056 | |

The accompanying notes are an integral part of the financial statements.

| 16 | Semi-Annual Report December 31, 2017 |

USCF ETF TRUST – USCF SUMMERHAVEN SHPEI INDEX FUND

SCHEDULE OF INVESTMENTS

AT DECEMBER 31, 2017 (unaudited) (continued)

| | | % of Total | | | | | | Market | |

| | | Net Assets | | | Shares | | | Value | |

| Software | | | 0.1 | % | | | | | | | | |

| Rubicon Project, Inc. (The)(a) | | | 0.1 | % | | | 1,540 | | | $ | 2,880 | |

| | | | | | | | | | | | | |

| Specialty Retail | | | 11.1 | % | | | | | | | | |

| Abercrombie & Fitch Co. - Class A | | | 0.6 | % | | | 856 | | | | 14,920 | |

| American Eagle Outfitters, Inc. | | | 0.5 | % | | | 678 | | | | 12,746 | |

| Asbury Automotive Group, Inc.(a) | | | 0.3 | % | | | 134 | | | | 8,576 | |

| Barnes & Noble Education, Inc.(a) | | | 0.3 | % | | | 861 | | | | 7,095 | |

| Bed Bath & Beyond, Inc. | | | 0.2 | % | | | 270 | | | | 5,937 | |

| Big 5 Sporting Goods Corp. | | | 0.2 | % | | | 666 | | | | 5,062 | |

| Boot Barn Holdings, Inc.(a) | | | 0.8 | % | | | 1,191 | | | | 19,783 | |

| Buckle, Inc. (The) | | | 0.4 | % | | | 466 | | | | 11,067 | |

| Build-A-Bear Workshop, Inc.(a) | | | 0.3 | % | | | 718 | | | | 6,606 | |

| Caleres, Inc. | | | 0.4 | % | | | 288 | | | | 9,642 | |

| Chico’s FAS, Inc. | | | 0.3 | % | | | 893 | | | | 7,876 | |

| Children’s Place, Inc. (The) | | | 0.4 | % | | | 72 | | | | 10,465 | |

| Citi Trends, Inc. | | | 0.4 | % | | | 370 | | | | 9,790 | |

| Container Store Group, Inc. (The)(a) | | | 0.3 | % | | | 1,352 | | | | 6,408 | |

| Francesca’s Holdings Corp.(a) | | | 0.2 | % | | | 778 | | | | 5,687 | |

| GameStop Corp. - Class A | | | 0.3 | % | | | 364 | | | | 6,534 | |

| Gap, Inc. (The) | | | 0.5 | % | | | 354 | | | | 12,057 | |

| Genesco, Inc.(a) | | | 0.3 | % | | | 247 | | | | 8,028 | |

| GNC Holdings, Inc. - Class A(a) | | | 0.1 | % | | | 991 | | | | 3,657 | |

| Hibbett Sports, Inc.(a) | | | 0.3 | % | | | 394 | | | | 8,038 | |

| Kirkland’s, Inc.(a) | | | 0.4 | % | | | 796 | | | | 9,524 | |

| Murphy USA, Inc.(a) | | | 0.3 | % | | | 106 | | | | 8,518 | |

| Pier 1 Imports, Inc. | | | 0.3 | % | | | 1,631 | | | | 6,752 | |

| Shoe Carnival, Inc. | | | 0.4 | % | | | 410 | | | | 10,968 | |

| Sleep Number Corp.(a) | | | 0.4 | % | | | 249 | | | | 9,360 | |

| Sportsman’s Warehouse Holdings, Inc.(a) | | | 0.4 | % | | | 1,534 | | | | 10,140 | |

| Tailored Brands, Inc. | | | 0.7 | % | | | 744 | | | | 16,242 | |

| Urban Outfitters, Inc.(a) | | | 0.6 | % | | | 434 | | | | 15,216 | |

| Zumiez, Inc.(a) | | | 0.5 | % | | | 626 | | | | 13,036 | |

| | | | | | | | | | | | 279,730 | |

The accompanying notes are an integral part of the financial statements.

USCF ETF TRUST – USCF SUMMERHAVEN SHPEI INDEX FUND

SCHEDULE OF INVESTMENTS

AT DECEMBER 31, 2017 (unaudited) (continued)

| | | % of Total | | | | | | Market | |

| | | Net Assets | | | Shares | | | Value | |

| Technology Hardware, Storage & Peripherals | | | 0.4 | % | | | | | | | | |

| Avid Technology, Inc.(a) | | | 0.3 | % | | | 1,462 | | | $ | 7,880 | |

| Eastman Kodak Co.(a) | | | 0.1 | % | | | 837 | | | | 2,595 | |

| | | | | | | | | | | | 10,475 | |

| Textiles, Apparel & Luxury Goods | | | 3.2 | % | | | | | | | | |

| Crocs, Inc.(a) | | | 0.5 | % | | | 1,014 | | | | 12,817 | |

| Culp, Inc. | | | 0.3 | % | | | 231 | | | | 7,738 | |

| Delta Apparel, Inc.(a) | | | 0.3 | % | | | 362 | | | | 7,312 | |

| Fossil Group, Inc.(a) | | | 0.2 | % | | | 806 | | | | 6,263 | |

| Iconix Brand Group, Inc.(a) | | | 0.1 | % | | | 1,210 | | | | 1,561 | |

| Michael Kors Holdings Ltd. (a) | | | 0.6 | % | | | 229 | | | | 14,416 | |

| Perry Ellis International, Inc.(a) | | | 0.4 | % | | | 414 | | | | 10,367 | |

| Superior Uniform Group, Inc. | | | 0.4 | % | | | 340 | | | | 9,081 | |

| Vera Bradley, Inc.(a) | | | 0.4 | % | | | 827 | | | | 10,073 | |

| | | | | | | | | | | | 79,628 | |

| Thrifts & Mortgage Finance | | | 2.5 | % | | | | | | | | |

| Charter Financial Corp. | | | 0.3 | % | | | 416 | | | | 7,297 | |

| Greene County Bancorp, Inc. | | | 0.4 | % | | | 286 | | | | 9,324 | |

| Home Bancorp, Inc. | | | 0.3 | % | | | 178 | | | | 7,693 | |

| PHH Corp.(a) | | | 0.2 | % | | | 543 | | | | 5,593 | |

| Provident Financial Holdings, Inc. | | | 0.3 | % | | | 400 | | | | 7,360 | |

| Riverview Bancorp, Inc. | | | 0.4 | % | | | 1,066 | | | | 9,242 | |

| Timberland Bancorp, Inc. | | | 0.3 | % | | | 292 | | | | 7,753 | |

| Walker & Dunlop, Inc.(a) | | | 0.3 | % | | | 146 | | | | 6,935 | |

| | | | | | | | | | | | 61,197 | |

| Trading Companies & Distributors | | | 0.8 | % | | | | | | | | |

| Huttig Building Products, Inc.(a) | | | 0.3 | % | | | 1,106 | | | | 7,355 | |

| Veritiv Corp.(a) | | | 0.2 | % | | | 180 | | | | 5,202 | |

| Willis Lease Finance Corp.(a) | | | 0.3 | % | | | 284 | | | | 7,091 | |

| | | | | | | | | | | | 19,648 | |

| | | | | | | | | | | | | |

| Wireless Telecommunication Services | | | 0.3 | % | | | | | | | | |

| Spok Holdings, Inc. | | | 0.3 | % | | | 450 | | | | 7,043 | |

The accompanying notes are an integral part of the financial statements.

| 18 | Semi-Annual Report December 31, 2017 |

USCF ETF TRUST – USCF SUMMERHAVEN SHPEI INDEX FUND

SCHEDULE OF INVESTMENTS

AT DECEMBER 31, 2017 (unaudited) (continued)

| | | % of Total | | | | | | Market | |

| | | Net Assets | | | Shares | | | Value | |

Total Common Stocks

(Cost $2,491,120) | | | 99.8 | % | | | | | | $ | 2,500,787 | |

| | | | | | | | | | | | | |

Total Investments

(Cost $2,491,120)(b) | | | 99.8 | % | | | | | | | 2,500,787 | |

| Other Assets in Excess of Liabilities | | | 0.2 | % | | | | | | | 5,459 | |

| Total Net Assets | | | 100.0 | % | | | | | | $ | 2,506,246 | |

| (a) | Non income producing security. |

| (b) | The aggregate cost of investments for tax purposes was $2,491,120. The net unrealized appreciation was $9,667 which consisted of aggregate gross unrealized appreciation of $86,996 and aggregate gross unrealized depreciation of $77,329. |

Summary of Investments by Country^ | | | | |

| United States | | | 96.9 | % |

| Bermuda | | | 1.0 | |

| United Kingdom | | | 0.9 | |

| Luxembourg | | | 0.4 | |

| Puerto Rico | | | 0.3 | |

| Netherlands | | | 0.3 | |

| Ireland | | | 0.2 | |

| | | | 100.0 | % |

| Summary of Investments by Sector^ | | | | |

| Consumer Discretionary | | | 31.4 | % |

| Industrials | | | 23.0 | |

| Financials | | | 17.6 | |

| Energy | | | 9.6 | |

| Information Technology | | | 6.0 | |

| Materials | | | 4.9 | |

| Health Care | | | 3.5 | |

| Consumer Staples | | | 3.0 | |

| Real Estate | | | 0.4 | |

| Utilities | | | 0.3 | |

| Telecommunication Services | | | 0.3 | |

| | | | 100.0 | % |

| | | | | |

| ^ As a percentage of total investments. All stocks are listed on U.S. Exchanges. |

The accompanying notes are an integral part of the financial statements.

USCF ETF TRUST – USCF SUMMERHAVEN SHPEN INDEX FUND

SCHEDULE OF INVESTMENTS

AT DECEMBER 31, 2017 (unaudited)

| | | % of Total | | | | | | Market | |

| | | Net Assets | | | Shares | | | Value | |

| Common Stocks | | | 100.0 | % | | | | | | | | |

| Auto Components | | | 2.1 | % | | | | | | | | |

| Cooper Tire & Rubber Co. | | | 1.1 | % | | | 784 | | | $ | 27,714 | |

| Goodyear Tire & Rubber Co. (The) | | | 1.0 | % | | | 786 | | | | 25,396 | |

| | | | | | | | | | | | 53,110 | |

| Chemicals | | | 1.6 | % | | | | | | | | |

| CF Industries Holdings, Inc. | | | 1.6 | % | | | 980 | | | | 41,689 | |

| | | | | | | | | | | | | |

| Construction Materials | | | 2.1 | % | | | | | | | | |

| United States Lime & Minerals, Inc. | | | 1.0 | % | | | 352 | | | | 27,139 | |

| US Concrete, Inc.(a) | | | 1.1 | % | | | 356 | | | | 29,779 | |

| | | | | | | | | | | | 56,918 | |

| Containers & Packaging | | | 3.4 | % | | | | | | | | |

| Bemis Co., Inc. | | | 1.1 | % | | | 610 | | | | 29,152 | |

| Graphic Packaging Holding Co. | | | 1.2 | % | | | 2,044 | | | | 31,580 | |

| UFP Technologies, Inc.(a) | | | 1.1 | % | | | 1,016 | | | | 28,245 | |

| | | | | | | | | | | | 88,977 | |

| Energy Equipment & Services | | | 21.6 | % | | | | | | | | |

| Archrock, Inc. | | | 1.0 | % | | | 2,544 | | | | 26,712 | |

| Bristow Group, Inc. | | | 2.2 | % | | | 4,348 | | | | 58,568 | |

| Diamond Offshore Drilling, Inc.(a) | | | 1.9 | % | | | 2,650 | | | | 49,264 | |

| Ensco PLC - Class A | | | 1.3 | % | | | 5,776 | | | | 34,136 | |

| Era Group, Inc.(a) | | | 1.3 | % | | | 3,082 | | | | 33,132 | |

| Exterran Corp.(a) | | | 1.3 | % | | | 1,044 | | | | 32,823 | |

| Gulf Island Fabrication, Inc. | | | 1.3 | % | | | 2,554 | | | | 34,287 | |

| Helix Energy Solutions Group, Inc.(a) | | | 1.5 | % | | | 5,260 | | | | 39,660 | |

| Matrix Service Co.(a) | | | 2.1 | % | | | 3,016 | | | | 53,685 | |

| Nabors Industries Ltd. | | | 1.0 | % | | | 3,770 | | | | 25,749 | |

| Oceaneering International, Inc. | | | 1.0 | % | | | 1,258 | | | | 26,594 | |

| Rowan Cos. PLC - Class A(a) | | | 1.6 | % | | | 2,716 | | | | 42,533 | |

| SEACOR Holdings, Inc.(a) | | | 1.5 | % | | | 854 | | | | 39,472 | |

| Smart Sand, Inc.(a) | | | 1.3 | % | | | 4,034 | | | | 34,934 | |

| Unit Corp.(a) | | | 1.3 | % | | | 1,572 | | | | 34,584 | |

| | | | | | | | | | | | 566,133 | |

| Food Products | | | 10.4 | % | | | | | | | | |

| Calavo Growers, Inc. | | | 1.3 | % | | | 414 | | | | 34,942 | |

| Dean Foods Co. | | | 0.8 | % | | | 1,878 | | | | 21,710 | |

| Farmer Brothers Co.(a) | | | 1.2 | % | | | 950 | | | | 30,542 | |

The accompanying notes are an integral part of the financial statements.

| 20 | Semi-Annual Report December 31, 2017 |

USCF ETF TRUST – USCF SUMMERHAVEN SHPEN INDEX FUND

SCHEDULE OF INVESTMENTS

AT DECEMBER 31, 2017 (unaudited) (continued)

| | | % of Total | | | | | | Market | |

| | | Net Assets | | | Shares | | | Value | |

| Food Products (continued) | | | 10.4 | % | | | | | | | | |

| Fresh Del Monte Produce, Inc. | | | 1.0 | % | | | 548 | | | $ | 26,123 | |

| Ingredion, Inc. | | | 1.3 | % | | | 242 | | | | 33,832 | |

| Landec Corp.(a) | | | 1.0 | % | | | 1,990 | | | | 25,074 | |

| Lifeway Foods, Inc.(a) | | | 0.9 | % | | | 3,036 | | | | 24,288 | |

| Pilgrim’s Pride Corp.(a) | | | 1.6 | % | | | 1,314 | | | | 40,813 | |

| Sanderson Farms, Inc. | | | 1.3 | % | | | 246 | | | | 34,140 | |

| | | | | | | | | | | | 271,464 | |

| Machinery | | | 13.1 | % | | | | | | | | |

| Alamo Group, Inc. | | | 1.3 | % | | | 306 | | | | 34,538 | |

| American Railcar Industries, Inc. | | | 1.2 | % | | | 776 | | | | 32,313 | |

| Blue Bird Corp.(a) | | | 1.2 | % | | | 1,624 | | | | 32,318 | |

| Commercial Vehicle Group, Inc.(a) | | | 1.3 | % | | | 3,234 | | | | 34,571 | |

| Douglas Dynamics, Inc. | | | 1.3 | % | | | 888 | | | | 33,566 | |

| FreightCar America, Inc. | | | 1.1 | % | | | 1,674 | | | | 28,592 | |

| Meritor, Inc.(a) | | | 1.5 | % | | | 1,602 | | | | 37,583 | |

| Miller Industries, Inc. | | | 1.1 | % | | | 1,126 | | | | 29,051 | |

| Spartan Motors, Inc. | | | 2.0 | % | | | 3,240 | | | | 51,030 | |

| Wabash National Corp. | | | 1.1 | % | | | 1,278 | | | | 27,733 | |

| | | | | | | | | | | | 341,295 | |

| Metals & Mining | | | 13.5 | % | | | | | | | | |

| AK Steel Holding Corp.(a) | | | 1.0 | % | | | 4,574 | | | | 25,889 | |

| Alcoa Corp.(a) | | | 1.7 | % | | | 820 | | | | 44,173 | |

| Allegheny Technologies, Inc.(a) | | | 1.5 | % | | | 1,594 | | | | 38,479 | |

| Commercial Metals Co. | | | 1.2 | % | | | 1,422 | | | | 30,317 | |

| Olympic Steel, Inc. | | | 1.3 | % | | | 1,548 | | | | 33,267 | |

| Reliance Steel & Aluminum Co. | | | 1.3 | % | | | 388 | | | �� | 33,287 | |

| Ryerson Holding Corp.(a) | | | 1.3 | % | | | 3,186 | | | | 33,134 | |

| Steel Dynamics, Inc. | | | 1.3 | % | | | 788 | | | | 33,986 | |

| SunCoke Energy, Inc.(a) | | | 1.2 | % | | | 2,584 | | | | 30,982 | |

| United States Steel Corp. | | | 1.7 | % | | | 1,240 | | | | 43,636 | |

| | | | | | | | | | | | 347,150 | |

| Oil, Gas & Consumable Fuels | | | 25.8 | % | | | | | | | | |

| Adams Resources & Energy, Inc. | | | 1.1 | % | | | 676 | | | | 29,406 | |

| Bonanza Creek Energy, Inc.(a) | | | 1.0 | % | | | 990 | | | | 27,314 | |

| California Resources Corp.(a) | | | 2.8 | % | | | 3,796 | | | | 73,794 | |

| Contango Oil & Gas Co.(a) | | | 0.8 | % | | | 4,362 | | | | 20,545 | |

The accompanying notes are an integral part of the financial statements.

| USCF ETF TRUST – USCF SUMMERHAVEN SHPEN INDEX FUND | | | | | | | | | |

| SCHEDULE OF INVESTMENTS | | | | | | | | | |

| AT DECEMBER 31, 2017 (unaudited) (continued) | | | | | | | | | |

| | | | | | | | | | |

| | % of Total | | | | | | Market | |

| | | Net Assets | | | Shares | | | Value | |

| Oil, Gas & Consumable Fuels (continued) | | | 25.8 | % | | | | | | | | |

| CVR Energy, Inc. | | | 1.8 | % | | | 1,290 | | | $ | 48,040 | |

| Frontline Ltd. | | | 0.9 | % | | | 4,898 | | | | 22,482 | |

| Gener8 Maritime, Inc.(a) | | | 1.3 | % | | | 4,958 | | | | 32,822 | |

| Green Plains, Inc. | | | 0.9 | % | | | 1,466 | | | | 24,702 | |

| Hallador Energy Co. | | | 0.8 | % | | | 3,420 | | | | 20,828 | |

| HollyFrontier Corp. | | | 2.0 | % | | | 1,046 | | | | 53,576 | |

| International Seaways, Inc.(a) | | | 0.9 | % | | | 1,268 | | | | 23,407 | |

| Murphy Oil Corp. | | | 1.4 | % | | | 1,148 | | | | 35,645 | |

| Nordic American Tankers Ltd. | | | 0.4 | % | | | 4,646 | | | | 11,429 | |

| Peabod1p4y Energy Corp.(a) | | | 1.6 | % | | | 1,076 | | | | 42,362 | |

| Penn Virginia Corp.(a) | | | 1.1 | % | | | 754 | | | | 29,489 | |

| QEP Resources, Inc.(a) | | | 1.1 | % | | | 3,072 | | | | 29,399 | |

| Renewable Energy Group, Inc.(a) | | | 1.1 | % | | | 2,344 | | | | 27,659 | |

| REX American Resources Corp.(a) | | | 0.9 | % | | | 296 | | | | 24,506 | |

| Southwestern Energy Co.(a) | | | 1.0 | % | | | 4,898 | | | | 27,331 | |

| Teekay Corp. | | | 1.5 | % | | | 4,214 | | | | 39,274 | |

| Whiting Petroleum Corp.(a) | | | 1.4 | % | | | 1,356 | | | | 35,907 | |

| | | | | | | | | | | | 679,917 | |

| Paper & Forest Products | | | 6.4 | % | | | | | | | | |

| Boise Cascade Co. | | | 1.5 | % | | | 1,006 | | | | 40,139 | |

| Clearwater Paper Corp.(a) | | | 1.1 | % | | | 604 | | | | 27,422 | |

| Domtar Corp. | | | 1.4 | % | | | 748 | | | | 37,041 | |

| Neenah Paper, Inc. | | | 1.2 | % | | | 360 | | | | 32,634 | |

| PH Glatfelter Co. | | | 1.2 | % | | | 1,446 | | | | 31,002 | |

| | | | | | | | | | | | 168,238 | |

| Total Common Stocks | | | | | | | | | | | | |

| (Cost $2,520,610) | | | 100.0 | % | | | | | | | 2,614,891 | |

| Total Investments | | | | | | | | | | | | |

| (Cost $2,520,610)(b) | | | 100.0 | % | | | | | | | 2,614,891 | |

| Other Assets in Excess of Liabilities | | | 0.0 | %* | | | | | | | 293 | |

| Total Net Assets | | | 100.0 | % | | | | | | $ | 2,615,184 | |

| (a) | Non income producing security. |

| (b) | The aggregate cost of investments for tax purposes was $2,520,610. The net unrealized appreciation was $94,281 which consisted of aggregate gross unrealized appreciation of $163,246 and aggregate gross unrealized depreciation of $68,965. |

The accompanying notes are an integral part of the financial statements.

| 22 | Semi-Annual Report December 31, 2017 |

| USCF ETF TRUST – USCF SUMMERHAVEN SHPEN INDEX FUND | | | |

| SCHEDULE OF INVESTMENTS | | | |

| AT DECEMBER 31, 2017 (unaudited) (continued) | | | |

| | | | |

| Summary of Investments by Country^ | | | | |

| United States | | | 95.9 | % |

| Bermuda | | | 1.5 | |

| United Kingdom | | | 1.3 | |

| Norway | | | 1.3 | |

| | | | 100.0 | % |

| | | | | |

| Summary of Investments by Sector^ | | | | |

| Energy | | | 47.6 | % |

| Materials | | | 26.9 | |

| Industrials | | | 13.1 | |

| Consumer Staples | | | 10.4 | |

| Consumer Discretionary | | | 2.0 | |

| | | | 100.0 | % |

^ As a percentage of total investments. All stocks are listed on U.S. Exchanges.

* Position represents less than 0.05%.

The accompanying notes are an integral part of the financial statements.

| USCF ETF TRUST | | | | | | |

| STATEMENTS OF ASSETS AND LIABILITIES | | | | | | |

| DECEMBER 31, 2017 (unaudited) | | | | | | |

| | | | | | | |

| | | USCF SummerHaven | | | USCF SummerHaven | |

| | | SHPEI Index Fund | | | SHPEN Index Fund | |

| Assets: | | | | | | | | |

| Investments, at Market Value | | $ | 2,500,787 | | | $ | 2,614,891 | |

| Cash | | | 5,356 | | | | 1,386 | |

| Receivables: | | | | | | | | |

| Dividends | | | 2,119 | | | | 957 | |

| Total Assets | | | 2,508,262 | | | | 2,617,234 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Payables: | | | | | | | | |

| Accrued Management Fees | | | 2,016 | | | | 2,050 | |

| Total Liabilities | | | 2,016 | | | | 2,050 | |

| Total Net Assets | | $ | 2,506,246 | | | $ | 2,615,184 | |

| | | | | | | | | |

| Net Assets Consist of: | | | | | | | | |

| Capital Paid In | | $ | 2,494,367 | | | $ | 2,519,569 | |

| Accumulated Undistributed Net Investment Income (Loss) | | | 2,135 | | | | 1,135 | |

| Accumulated Net Realized Gain (Loss) on Investments | | | 77 | | | | 199 | |

| Net Unrealized Appreciation (Depreciation) on Investments | | | 9,667 | | | | 94,281 | |

| Total Net Assets | | $ | 2,506,246 | | | $ | 2,615,184 | |

| | | | | | | | | |

| Net Asset Value Per Share | | | | | | | | |

| Total Net Assets | | $ | 2,506,246 | | | $ | 2,615,184 | |

| Shares of Beneficial Interest Outstanding (Unlimited Shares of $0.001 Par Value Authorized) | | | 100,001 | | | | 100,001 | |

| Net Asset Value | | $ | 25.06 | | | $ | 26.15 | |

| Investments, at Cost | | $ | 2,491,120 | | | $ | 2,520,610 | |

The accompanying notes are an integral part of the financial statements.

| 24 | Semi-Annual Report December 31, 2017 |

| USCF ETF TRUST | | | | | | |

| STATEMENTS OF OPERATIONS | | | | | | |

| FOR THE PERIOD ENDED DECEMBER 31, 2017* (unaudited) | | | | | | |

| | | | | | | |

| | | USCF SummerHaven | | | USCF SummerHaven | |

| | | SHPEN Index Fund | | | SHPEI Index Fund | |

| Investment Income: | | | | | | | | |

| Dividend Income (less net foreign withholding tax $5 and $0, respectively) | | $ | 4,152 | | | $ | 3,186 | |

| Total Investment Income | | | 4,152 | | | | 3,186 | |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| Management Fees | | | 2,017 | | | | 2,051 | |

| Total Expenses | | | 2,017 | | | | 2,051 | |

| Net Investment Income (Loss) | | | 2,135 | | | | 1,135 | |

| | | | | | | | | |

| Realized and Unrealized Gain (Loss) on Investments: | | | | | | | | |

| Net Realized Gain (Loss) on Investments | | | 77 | | | | 199 | |

| Net Change in Unrealized Appreciation (Depreciation) on Investments | | | 9,667 | | | | 94,281 | |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | 9,744 | | | | 94,480 | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 11,879 | | | $ | 95,615 | |

| | | | | | | | | |

| * Inception Date, November 30, 2017. | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| USCF ETF TRUST | | | | | | |

| STATEMENTS OF CHANGES IN NET ASSETS | | | | | | |

| FOR THE PERIOD ENDED DECEMBER 31, 2017* (unaudited) | | | | | | |

| | | | | | | |

| | | USCF SummerHaven | | | USCF SummerHaven | |

| | | SHPEI Index Fund | | | SHPEN Index Fund | |

| Operations: | | | | | | | | |

| Net Investment Income (Loss) | | $ | 2,135 | | | $ | 1,135 | |

| Net Realized Gain (Loss) on Investments | | | 77 | | | | 199 | |

| Net Change in Unrealized Appreciation (Depreciation) on Investments | | | 9,667 | | | | 94,281 | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | | 11,879 | | | | 95,615 | |

| | | | | | | | | |

| Shareholder transactions: | | | | | | | | |

| Proceeds from Shares Sold | | | 2,494,342 | | | | 2,519,544 | |

| Net Increase (Decrease) in Net Assets from Shares Transactions | | | 2,494,342 | | | | 2,519,544 | |

| Net Increase (Decrease) in Net Assets | | | 2,506,221 | | | | 2,615,159 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of Period | | | 25 | | | | 25 | |

| End of Period1 | | $ | 2,506,246 | | | $ | 2,615,184 | |

| 1 Includes Accumulated Undistributed Net Investment Income (Loss) of: | | $ | 2,135 | | | $ | 1,135 | |

| | | | | | | | | |

| Changes in Shares outstanding: | | | | | | | | |

| Shares Outstanding, Beginning of Period | | | 1 | * | | | 1 | * |

| Shares Issued | | | 100,000 | | | | 100,000 | |

| Shares Issued in Reinvestment of Dividends and Distributions | | | — | | | | — | |

| Shares Redeemed | | | — | | | | — | |

| Shares Outstanding, End of Period | | | 100,001 | | | | 100,001 | |

| | | | | | | | | |

| * Inception Date, November 30, 2017. | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| 26 | Semi-Annual Report December 31, 2017 |

| USCF ETF TRUST FINANCIAL HIGHLIGHTS |

| FOR THE PERIOD ENDED DECEMBER 31, 2017* (unaudited) |

| |

| SELECTED DATA FOR A SHARE OF COMMON STOCK OUTSTANDING |

| THROUGHOUT THE PERIOD INDICATED: |

| | | | | | | |

| | | USCF SummerHaven | | | USCF SummerHaven | |

| | | SHPEI Index Fund | | | SHPEN Index Fund | |

| Net Asset Value, Beginning of Period Income (Loss) from Operations: | | $ | 24.94 | | | $ | 25.20 | |

| Net Investment Income (Loss)(a) | | | 0.02 | | | | 0.01 | |

| Net Realized and Unrealized Gain (Loss) | | | 0.10 | | | | 0.94 | |

| Total Income (Loss) from Operations | | | 0.12 | | | | 0.95 | |

| Net Asset Value, End of Period | | $ | 25.06 | | | $ | 26.15 | |

| | | | | | | | | |

| Total Return(b) | | | 0.48 | % | | | 3.77% | |

| Net Assets, End of Period (thousands) Ratios of Average Net Assets: | | $ | 2,506 | | | $ | 2,615 | |

| Net Expenses | | | 0.95 | %** | | | 0.95 | %** |

| Net Investment Income (Loss) | | | 1.01 | %** | | | 0.53 | %** |

| Portfolio Turnover Rate(c) | | | 0 | %*** | | | 0 | %*** |

| * | Inception Date, November 30, 2017. |

| *** | Percentage represents less than 0.5%. |

| (a) | Per share amounts have been calculated using the weighted average shares method. |

| (b) | Total Return may reflect fee waivers and/or expense reimbursements and assume reinvestment of dividend distribution. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| (c) | Portfolio turnover rate is not annualized for periods of less than one year and does not include securities received or delivered from processing creations or redemptions. |

The accompanying notes are an integral part of the financial statements.

USCF ETF TRUST

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2017 (unaudited)

1) ORGANIZATION

The USCF ETF Trust (the “Trust”) was organized as a Delaware statutory trust in accordance with a Declaration of Trust dated November 6, 2013. The Declaration of Trust was amended and restated on June 16, 2014. The Trust is authorized to have multiple segregated series or portfolios. The Trust is an open-end management investment company registered under the Investment Company Act of 1940 (the “1940 Act”). The Trust currently consists of two investment portfolios: the USCF SummerHaven SHPEI Index Fund (“BUY”) and USCF SummerHaven SHPEN Index Fund (“BUYN”) (each a “Fund” and collectively, the “Funds”). BUY and BUYN commenced operations on November 30, 2017. The Funds were listed on the NYSE Arca Equity, Inc. (“NYSE Arca”) on December 1, 2017. Other series or portfolios may be added to the Trust in the future. USCF Advisers LLC serves as the investment adviser to the Funds (the “Adviser”). The Adviser has been registered as an investment adviser with the Securities Exchange Commission (the “SEC”) since July 1, 2014 and is a wholly-owned subsidiary of Wainwright Holdings, Inc. SummerHaven Investment Management, LLC (the “Sub-Adviser”) serves as the sub-adviser to the Funds. The Adviser was also the investment adviser for the Stock Split Index Fund (“TOFR”) and the USCF Restaurant Leaders Fund (“MENU”), each of which was a series of the USCF ETF Trust, until October 2017, when both funds liquidated all of their assets and distributed cash pro rata to all remaining shareholders.

2) SIGNIFICANT ACCOUNTING POLICIES

The accompanying financial statements were prepared in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”), which require the use of estimates and assumptions made by management. These may affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The following is a summary of significant accounting policies consistently followed by the Funds in preparation of their financial statements.

Basis of Presentation

The financial statements have been prepared in conformity with GAAP as detailed in the Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”). The Funds are investment companies and follow the accounting and reporting guidance in FASB Topic 946.

| 28 | Semi-Annual Report December 31, 2017 |

Calculation of NAV

The Net Asset Value (“NAV”) of a Fund’s shares is calculated each day the national securities exchanges are open for trading as of the close of regular trading on NYSE Arca, generally 4:00 p.m. New York time (the “NAV Calculation Time”). NAV per share is calculated by dividing the Fund’s net assets by the number of the Fund’s outstanding shares.

In calculating its NAV, a Fund generally values its assets on the basis of market quotations, last sale prices, or estimates of value furnished by a pricing service or brokers who make markets in such instruments. Debt obligations with maturities of 60 days or less are valued at amortized cost.

Fair value pricing is used by a Fund when reliable market valuations are not readily available or are not deemed to reflect current market values. Securities that may be valued using “fair value” pricing may include, but are not limited to, securities for which there are no current market quotations or whose issuer is in default or bankruptcy, securities subject to corporate actions (such as mergers or reorganizations), securities subject to non-U.S. investment limits or currency controls, and securities affected by “significant events.” An example of a significant event is an event, occurring after the close of the market in which a security trades but before a Fund’s next NAV Calculation Time that may materially affect the value of the Fund’s investment (e.g., government action, natural disaster, or significant market fluctuation). When fair-value pricing is employed, the prices of securities used by a Fund to calculate its NAV may differ from quoted or published prices for the same securities.

Security Valuation

Investments in securities are carried at market value. All equity securities that are traded on a national securities exchange are valued at the last sale price at the time of the close of the New York Stock Exchange (“NYSE”). If on a particular day an exchange-listed security does not trade, then the mean between the closing bids and asked prices will be used. In the case of securities listed on more than one national securities exchange, the last quoted sale, up to the time of valuation, on the exchange on which the security is principally traded will be/is used. If there were no sales on that exchange, the last quoted sale on the other exchange will be/is used.

For securities that are traded on the NASDAQ, the NASDAQ Official Closing Price (e.g., the NASDAQ Closing Cross price, if available) is used. All non-NASDAQ equity securities that are not traded on a listed exchange are valued at the last sale price at the close of the NYSE. If a non-exchange listed security does not trade on a particular day, or if a last sales price or NASDAQ Official Closing Price is not available, then the mean between the closing bid and asked price will be used.

Securities having a remaining maturity of 60 days or less are valued at amortized cost, which approximates market value.

The cost of securities sold is determined on the identified cost basis. When market quotations are not readily available or when events occur that make established valuation methods unreliable, securities of the Funds may be valued at fair value determined in good faith by or under the direction of the Board of Trustees.

Security transactions are recorded on the dates the transactions are entered, which is the trade date.

Fair Value Measurement

The Funds utilize various methods to measure the fair value of most of their investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access.

Level 2 - Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument or an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

| 30 | Semi-Annual Report December 31, 2017 |

The following tables summarize the valuation of securities at December 31, 2017 for the Funds, using the fair value hierarchy:

| BUY | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Investments, at value | | Total | | | Level 1 | | | Level 2 | | | Level 3 | |

| Common Stocks: | | | | | | | | | | | | | | | | |

| Aerospace & Defense | | $ | 27,899 | | | $ | 27,899 | | | $ | — | | | $ | — | |

| Air Freight & Logistics | | | 14,159 | | | | 14,159 | | | | — | | | | — | |

| Airlines | | | 17,395 | | | | 17,395 | | | | — | | | | — | |

| Auto Components | | | 67,109 | | | | 67,109 | | | | — | | | | — | |

| Banks | | | 245,953 | | | | 245,953 | | | | — | | | | — | |

| Building Products | | | 59,206 | | | | 59,206 | | | | — | | | | — | |

| Capital Markets | | | 46,767 | | | | 46,767 | | | | — | | | | — | |

| Chemicals | | | 60,957 | | | | 60,957 | | | | — | | | | — | |

| Commercial Services & Supplies | | | 63,221 | | | | 63,221 | | | | — | | | | — | |

| Construction & Engineering | | | 82,471 | | | | 82,471 | | | | — | | | | — | |

| Construction Materials | | | 8,030 | | | | 8,030 | | | | — | | | | — | |

| Consumer Finance | | | 14,994 | | | | 14,994 | | | | — | | | | — | |

| Containers & Packaging | | | 7,617 | | | | 7,617 | | | | — | | | | — | |

| Distributors | | | 8,143 | | | | 8,143 | | | | — | | | | — | |

| Diversified Consumer Services | | | 51,444 | | | | 51,444 | | | | — | | | | — | |

| Electrical Equipment | | | 40,089 | | | | 40,089 | | | | — | | | | — | |

| Electronic Equipment, Instruments & Components | | | 68,029 | | | | 68,029 | | | | — | | | | — | |

| Energy Equipment & Services | | | 126,619 | | | | 126,619 | | | | — | | | | — | |

| Food & Staples Retailing | | | 33,650 | | | | 33,650 | | | | — | | | | — | |

| Food Products | | | 23,876 | | | | 23,876 | | | | — | | | | — | |

| Gas Utilities | | | 7,122 | | | | 7,122 | | | | — | | | | — | |

| Health Care Providers & Services | | | 83,719 | | | | 83,719 | | | | — | | | | — | |

| Hotels, Restaurants & Leisure | | | 117,375 | | | | 117,375 | | | | — | | | | — | |

| Household Durables | | | 73,563 | | | | 73,563 | | | | — | | | | — | |

| Insurance | | | 72,107 | | | | 72,107 | | | | — | | | | — | |

| Internet & Direct Marketing Retail | | | 10,957 | | | | 10,957 | | | | — | | | | — | |

| IT Services | | | 33,137 | | | | 33,137 | | | | — | | | | — | |

| Leisure Products | | | 13,471 | | | | 13,471 | | | | — | | | | — | |

| Machinery | | | 130,501 | | | | 130,501 | | | | — | | | | — | |

| Media | | | 46,198 | | | | 46,198 | | | | — | | | | — | |

| Metals & Mining | | | 38,363 | | | | 38,363 | | | | — | | | | — | |

| Multiline Retail | | | 37,051 | | | | 37,051 | | | | — | | | | — | |

| Oil, Gas & Consumable Fuels | | | 113,895 | | | | 113,895 | | | | — | | | | — | |

| Paper & Forest Products | | | 7,355 | | | | 7,355 | | | | — | | | | — | |

| Personal Products | | | 17,204 | | | | 17,204 | | | | — | | | | — | |

| Pharmaceuticals | | | 5,053 | | | | 5,053 | | | | — | | | | — | |

| Professional Services | | | 74,697 | | | | 74,697 | | | | — | | | | — | |

| Investments, at value | | Total | | | Level 1 | | | Level 2 | | | Level 3 | |

| Real Estate Management &Development | | $ | 9,856 | | | $ | 9,856 | | | $ | — | | | $ | — | |

| Road & Rail | | | 44,878 | | | | 44,878 | | | | — | | | | — | |

| Semiconductors & Semiconductor | | | 36,056 | | | | 36,056 | | | | — | | | | — | |

| Equipment | | | | | | | | | | | | | | | | |

| Software | | | 2,880 | | | | 2,880 | | | | — | | | | — | |

| Specialty Retail | | | 279,730 | | | | 279,730 | | | | — | | | | — | |

| Technology Hardware, Storage & Peripherals | | | 10,475 | | | | 10,475 | | | | — | | | | — | |

| Textiles, Apparel & Luxury Goods | | | 79,628 | | | | 79,628 | | | | — | | | | — | |

| Thrifts & Mortgage Finance | | | 61,197 | | | | 61,197 | | | | — | | | | — | |

| Trading Companies & Distributors | | | 19,648 | | | | 19,648 | | | | — | | | | — | |

| Wireless Telecommunication Services | | | 7,043 | | | | 7,043 | | | | — | | | | — | |

| Total Investments, at value | | $ | 2,500,787 | | | $ | 2,500,787 | | | $ | — | | | $ | — | |

| BUYN | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Investments, at value | | Total | | | Level 1 | | | Level 2 | | | Level 3 | |

| Common Stocks: | | | | | | | | | | | | | | | | |

| Auto Components | | $ | 53,110 | | | $ | 53,110 | | | $ | — | | | $ | — | |

| Chemicals | | | 41,689 | | | | 41,689 | | | | — | | | | — | |

| Construction Materials | | | 56,918 | | | | 56,918 | | | | — | | | | — | |

| Containers & Packaging | | | 88,977 | | | | 88,977 | | | | — | | | | — | |

| Energy Equipment & Services | | | 566,133 | | | | 566,133 | | | | — | | | | — | |

| Food Products | | | 271,464 | | | | 271,464 | | | | — | | | | — | |

| Machinery | | | 341,295 | | | | 341,295 | | | | — | | | | — | |

| Metals & Mining | | | 347,150 | | | | 347,150 | | | | — | | | | — | |

| Oil, Gas & Consumable Fuels | | | 679,917 | | | | 679,917 | | | | — | | | | — | |

| Paper & Forest Products | | | 168,238 | | | | 168,238 | | | | — | | | | — | |

| Total Investments, at value | | $ | 2,614,891 | | | $ | 2,614,891 | | | $ | — | | | $ | — | |

For the period ended December 31, 2017, the Funds did not have any transfers between Level 1, Level 2 and Level 3 securities.

Income

Dividend income is recorded on the ex-dividend date, as soon as information is available to the Funds. Distributions to shareholders, which are determined in accordance with income tax regulations, are also recorded on the ex-dividend date. Interest income is recorded as earned. Discounts and premiums on securities purchased are amortized over the life of the respective securities.

| 30 | Semi-Annual Report December 31, 2017 |

As of and during the period ended December 31, 2017, the Funds did not have a liability for any unrecognized tax benefits in the accompanying financial statements. The Funds file income tax returns in the U.S. federal jurisdiction and Delaware.

The Funds follow ASC 740 “Income Taxes”, which requires that the financial statements effects of a tax position taken or expected to be taken in a tax return be recognized in the financial statements when it is more likely than not, based on the technical merits, that the position will be sustained upon examination. Management has concluded that the Funds have taken no uncertain tax positions that require adjustment to the financial statements.

Federal and Other Taxes

It is the Trust’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, the Funds intend to distribute substantially all of their income and net realized gains on investments, if any, to shareholders each year. Therefore, no federal income tax provision is required in the Funds’ financial statements. Under the applicable foreign tax laws, a withholding tax may be imposed on interest, dividends and capital gains at various rates.

Management has reviewed the tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years or expected to be taken with the 2017 tax returns. Each Fund’s federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service.

Dividends and Distributions

Each Fund intends to pay out dividends on a quarterly basis. Nonetheless, each Fund may not make a dividend payment every quarter. Each Fund intends to distribute its net realized capital gains, if any, to investors annually. Each Fund may occasionally be required to make supplemental distributions at some other time during the year. Distributions in cash may be reinvested automatically in additional whole shares only if the broker through whom you purchased shares makes such option available. Your broker is responsible for distributing the income and capital gain distributions to you.