Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 Confidential Material Omitted – To be filed separately with the Securities and Exchange Commission upon request. Double asterisks denote omissions. This document is an English translation of a legally binding French document. While efforts have been made to provide an accurate translation, in the event of any discrepancies or conflicts between this translation and the original French version, the original French document shall prevail. LOAN CONTRACT BETWEEN RAYONIER A.M. FRANCE (Guarantor) RYAM BIONOVA (Borrower) CREDIT LYONNAIS (Mandated Arranger) CREDIT ENTITIES AND INSTITUTIONS listed in Appendix 1 (Lenders) CREDIT LYONNAIS (Agent) CREDIT LYONNAIS (ESG Coordinator and ESG Agent) 12 November 2024 Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 - 2 - CONTENTS ARTICLE 1 - DEFINITIONS .................................................................................................................................................... - 7 - ARTICLE 2 - THE CAPEX LOAN ............................................................................................................................................. - 34 - 2.1. Amount ....................................................................................................................................................................... - 34 - ARTICLE 3 - PURPOSE............................................................................................................................................................ - 34 - 3.1. Purpose ...................................................................................................................................................................... - 34 - 3.2. Compliance of uses with the purpose ........................................................................................................................ - 35 - ARTICLE 4 - CONDITIONS PRECEDENT................................................................................................................................ - 35 - 4.1. Conditions precedent to be met on the Signature Date ............................................................................................. - 35 - 4.2. Conditions precedent to any Drawdown under the Capex Loan ................................................................................ - 35 - ARTICLE 5 - RELEASE OF THE CAPEX LOAN...................................................................................................................... - 36 - 5.1. Availability Period........................................................................................................................................................ - 36 - 5.2. Amount ....................................................................................................................................................................... - 36 - 5.3. Number of Drawdowns ............................................................................................................................................... - 36 - 5.4. Drawdowns and Drawdown Notices............................................................................................................................ - 36 - ARTICLE 6 - REPAYMENT........................................................................................................................................................ - 37 - 6.1. Normal repayment....................................................................................................................................................... - 37 - 6.2. Voluntary early repayment .......................................................................................................................................... - 38 - 6.5. Mandatory early repayments ...................................................................................................................................... - 41 - 6.6. Provisions common to repayments............................................................................................................................. - 47 - ARTICLE 7 - INTEREST AND LATE PAYMENT INTEREST.................................................................................................... - 49 - 7.1. Interest ........................................................................................................................................................................ - 49 - 7.2. Interest periods ........................................................................................................................................................... - 49 - 7.3. Late payment interest ................................................................................................................................................. - 50 - 7.4. Capitalisation .............................................................................................................................................................. - 50 - 7.5. Adjustments of Applicable Margins ............................................................................................................................ - 50 - 7.6. Changes to the interest calculation ............................................................................................................................ - 52 - ARTICLE 8 - OVERALL EFFECTIVE RATE ............................................................................................................................ - 53 - ARTICLE 9 – COMMISSIONS .................................................................................................................................................. - 53 - 9.1. Agent’s commission ................................................................................................................................................... - 53 - 9.2. Commissions of the ESG Coordinator and ESG Agent ............................................................................................. - 54 - 9.3. Arrangement commission............................................................................................................................................ - 54 - 9.4. Participation commission ............................................................................................................................................ - 54 - 9.5. Non-use commission................................................................................................................................................... - 54 - ARTICLE 10 - ADDITIONAL PAYMENT OBLIGATIONS ........................................................................................................ - 55 - 10.1. Increase of payments ................................................................................................................................................. - 55 - 10.2. Indemnification of tax risk............................................................................................................................................ - 56 - 10.3. Tax Credit ................................................................................................................................................................... - 57 - Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 - 3 - 10.4. Registration duties. ............................................................................................................................................... - 58 - 10.5. Value added tax .................................................................................................................................................... - 58 - 10.6. Additional costs ..................................................................................................................................................... - 59 - 10.7. FATCA information ................................................................................................................................................ - 60 - 10.8. FATCA withholding tax .......................................................................................................................................... - 61 - 10.9. Confirmation of the tax status of Lenders .............................................................................................................. - 61 - 10.10. Cost of Reuse of Funds ......................................................................................................................................... - 62 - 10.11. Other indemnities................................................................................................................................................... - 62 - 10.12. Charges.................................................................................................................................................................. - 63 - 10.13. Mitigation measures .............................................................................................................................................. - 63 - ARTICLE 11 - REPRESENTATIONS AND WARRANTIES ................................................................................................ - 64 - ARTICLE 12 - COMMITMENTS............................................................................................................................................ - 70 - 12.1 Information commitments ...................................................................................................................................... - 70 - 12.2 Financial commitments .......................................................................................................................................... - 75 - 12.3 Commitments not to do ......................................................................................................................................... - 76 - 12.4 Commitments to do ............................................................................................................................................... - 80 - 12.5 Key Persons Insurance Pledge/Delegation ........................................................................................................... - 84 - ARTICLE 13 - EVENT OF DEFAULT................................................................................................................................... - 84 - 13.1. Events constituting an Event of Default ................................................................................................................. - 84 - 13.2. Consequences of an Event of Default ................................................................................................................... - 90 - ARTICLE 14 - SURETY........................................................................................................................................................ - 90 - ARTICLE 15 - BENEFIT OF THE CONTRACT.................................................................................................................... - 93 - 15.1. Successors and assigns ........................................................................................................................................ - 93 - 15.2. Prohibition on assignment of the rights or rights and obligations of the Obligees ................................................. - 93 - 15.3. Assignment of rights or rights and obligations by a Lender.................................................................................... - 93 - 15.4. Assignment commission ........................................................................................................................................ - 95 - 15.5. Limitation of Liability of Assignor Lenders ............................................................................................................. - 95 - 15.6. Copy of the Deed of Assignment ........................................................................................................................... - 96 - 15.7. Real Security Interests / Assignment relative to Lenders’ rights ........................................................................... - 96 - ARTICLE 16 - AGENT AND LENDERS - REFERENCE BANKS........................................................................................ - 97 - 16.1. Mandate ................................................................................................................................................................ - 97 - 16.2. Agent’s duties ........................................................................................................................................................ - 98 - 16.3. Role of the Mandated Arranger.............................................................................................................................. - 98 - 16.4. Fiduciary duties ..................................................................................................................................................... - 98 - 16.5. Security Interests ................................................................................................................................................... - 98 - 16.6. Business relations with the Group ........................................................................................................................ - 99 - 16.7. Agent’s rights and prerogatives............................................................................................................................. - 99 - 16.8. Instructions from the Majority of Lenders or unanimous Lenders ....................................................................... - 100 - 16.9. Responsibility for documentation ........................................................................................................................ - 100 - 16.10. Exclusion of liability ............................................................................................................................................. - 101 - 16.11. Indemnification of the Agent by the Lenders ....................................................................................................... - 102 - Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 - 4 - 16.12. Resignation of the Agent...................................................................................................................................... - 102 - 16.13. Credit analysis...................................................................................................................................................... - 103 - 16.17. Role of the Reference Banks............................................................................................................................... - 104 - 16.18. Other business relations ...................................................................................................................................... - 105 - ARTICLE 17 - EQUALISATION OF PAYMENTS .............................................................................................................. - 105 - 17.1. Equalisation provisions ........................................................................................................................................ - 105 - 17.2. Obligation of redistribution by Lenders ................................................................................................................ - 105 - ARTICLE 18 - PAYMENT PROVISIONS ........................................................................................................................... - 106 - 18.1. Payments ............................................................................................................................................................ - 106 - 18.2. Return of funds by the Agent ............................................................................................................................... - 106 - 18.3. Calculation basis.................................................................................................................................................. - 106 - 18.4. Business Day Agreement..................................................................................................................................... - 107 - 18.5. Allocation of payments ........................................................................................................................................ - 107 - 18.6. Agent’s accounts ................................................................................................................................................. - 107 - 18.7. Lenders’ Accounts................................................................................................................................................ - 107 - 18.8. Nature of operations ............................................................................................................................................ - 107 - 18.9. Determinations by the Agent ............................................................................................................................... - 108 - ARTICLE 19 - OFFSET....................................................................................................................................................... - 108 - 19.1. Offset by the Lenders .......................................................................................................................................... - 108 - 19.2. Prohibition of set-off by the Obligees ................................................................................................................... - 108 - ARTICLE 20 - NOTICES .................................................................................................................................................... - 108 - 20.1. Provisions............................................................................................................................................................. - 108 - 20.2. Addresses ............................................................................................................................................................ - 108 - ARTICLE 21 - EXERCISE OF RIGHTS - NON-WAIVER - UNPREDICTABILITY .............................................................. - 109 - ARTICLE 22 - PARTIAL NULLITY - LAPSE...................................................................................................................... - 109 - ARTICLE 23 – MODIFICATIONS ....................................................................................................................................... - 109 - 23.1. Modifications - Lenders’ Agreement .................................................................................................................... - 109 - 23.2. Agent’s consent ................................................................................................................................................... - 110 - 23.3. Agent’s power ...................................................................................................................................................... - 110 - 23.4. Replacement of the Screen Rate ........................................................................................................................ - 111 - ARTICLE 24 - CONFIDENTIALITY OF RATE DETERMINATIONS BY THE REFERENCE BANKS . .................... - 111 - 24.1. Confidentiality ...................................................................................................................................................... - 111 - 24.2. Authorised communications ................................................................................................................................ - 111 - ARTICLE 25 - CONFIDENTIALITY OF INFORMATION.................................................................................................... - 113 - 25.1. Confidential Information....................................................................................................................................... - 113 - 25.2. Communication of Confidential Information......................................................................................................... - 113 - 25.3. Entire agreements ............................................................................................................................................... - 115 - 25.4. Inside information ................................................................................................................................................ - 116 - 25.5. Communication notification.................................................................................................................................. - 116 -

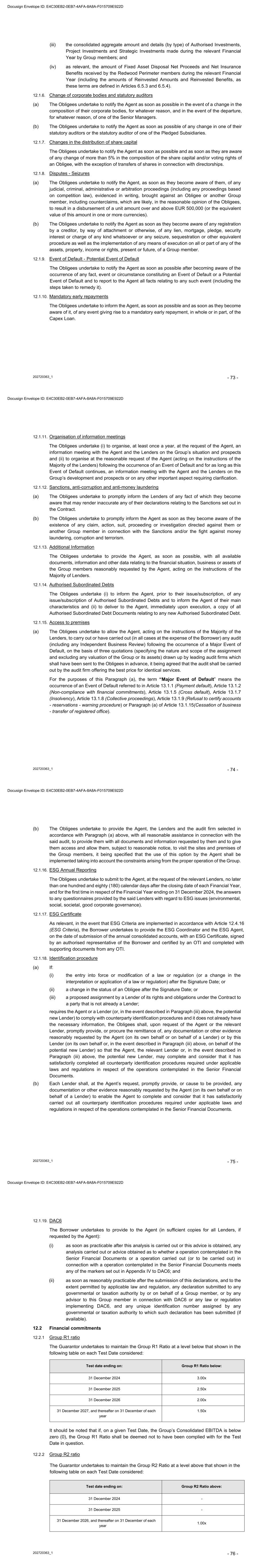

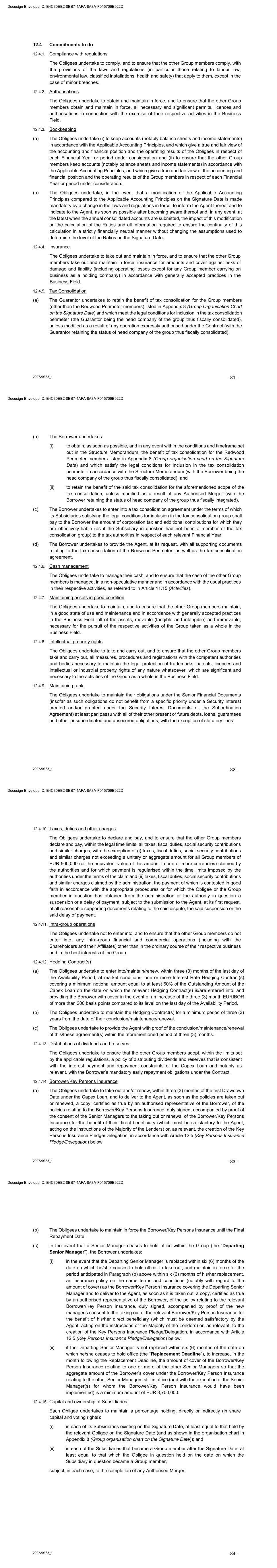

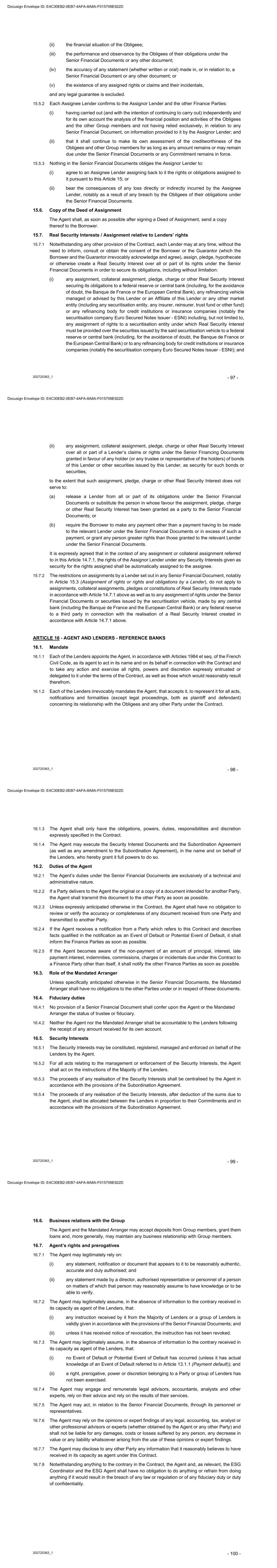

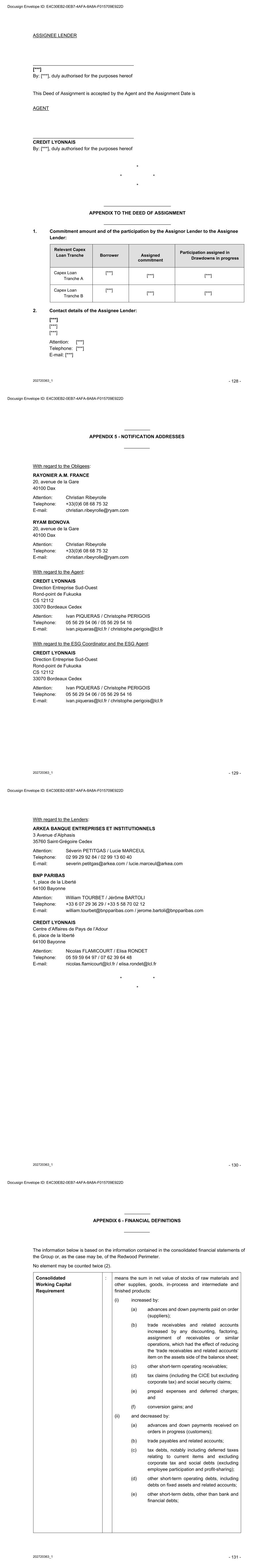

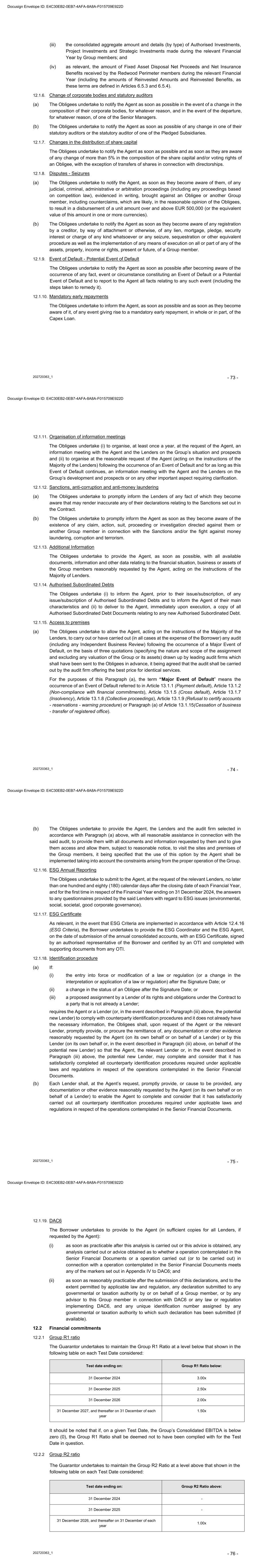

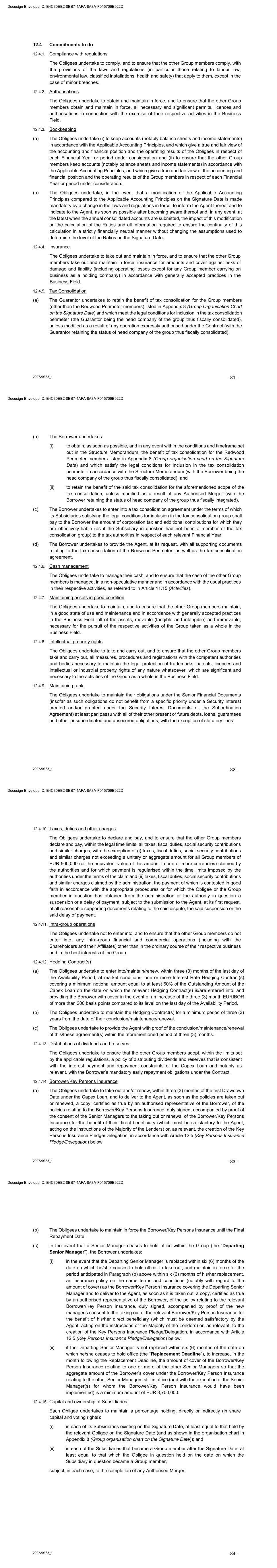

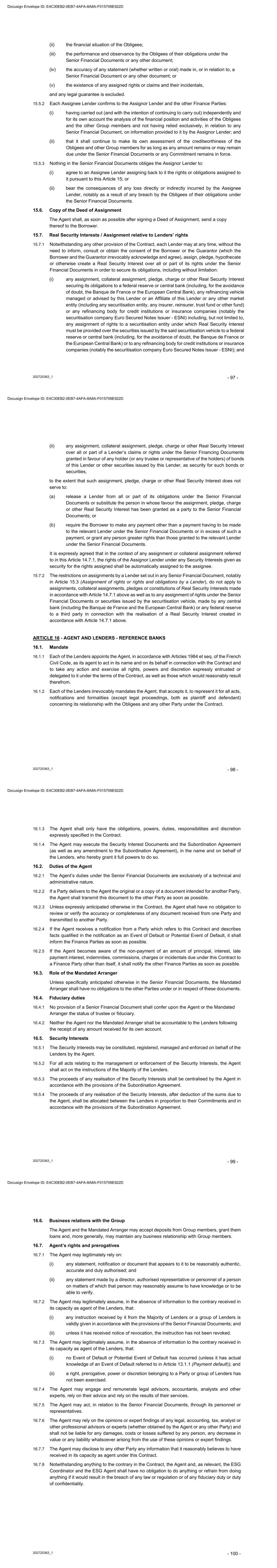

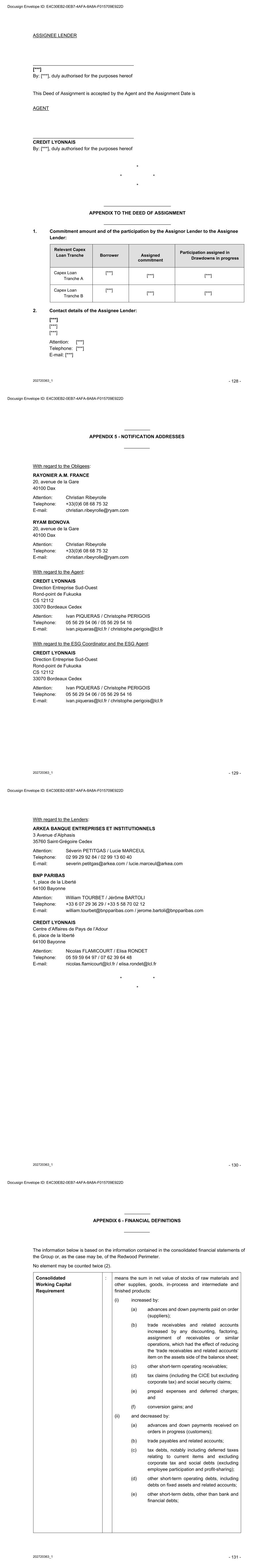

Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 - 5 - 25.6. Maintaining of obligations..................................................................................................................................... - 116 - 25.7. Other business relations ...................................................................................................................................... - 116 - 25.8. DAC6 ................................................................................................................................................................... - 116 - 25.9. Protection of personal data .................................................................................................................................. - 117 - ARTICLE 26 - APPLICABLE LAW - COMPETENT JURISDICTION................................................................................. - 117 - 26.1. Applicable law ...................................................................................................................................................... - 117 - 26.2. Competent jurisdiction.......................................................................................................................................... - 117 - APPENDIX 1 - LIST AND COMMITMENTS OF THE LENDERS....................................................................................... - 119 - APPENDIX 2 - CONDITIONS PRECEDENT ON THE SIGNATURE DATE ...................................................................... - 120 - APPENDIX 3 - SAMPLE DRAWDOWN NOTICE UNDER THE CAPEX LOAN................................................................. - 125 - APPENDIX 4 - MODEL DEED OF ASSIGNMENT ............................................................................................................ - 126 - APPENDIX 5 - NOTIFICATION ADDRESSES................................................................................................................... - 129 - APPENDIX 6 - FINANCIAL DEFINITIONS ......................................................................................................................... - 131 - APPENDIX 7 - EXISTING DEBTS AND RELATED SECURITIES .................................................................................... - 135 - APPENDIX 8 - GROUP ORGANISATION CHART ON SIGNATURE DATE..................................................................... - 136 - APPENDIX 9 - PAYMENT REQUEST FORM ................................................................................................................... - 137 - APPENDIX 10 - LIST OF DISPUTES ON THE SIGNATURE DATE ................................................................................ - 138 - Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 - 6 - BETWEEN THE UNDERSIGNED: 1. RAYONIER A.M. FRANCE, a simplified joint stock company (SAS) having its registered office at 20, avenue de la Gare, Dax (40100), registered with the Dax TCR under number 424 500 486 (hereinafter referred to as the “Guarantor”), 2. RYAM BIONOVA, a simplified joint stock company (SAS) having its registered office at 20, avenue de la Gare, Dax (40100), registered with the Dax TCR under number 980 638 548 (hereinafter referred to as the “Borrower”), OF THE FIRST PART, 3. CREDIT LYONNAIS, a public limited company (SA) having its registered office at 18, rue de la République, Lyon (69002) and its head office at 20, avenue de Paris, Villejuif (94811), registered with the Lyon TCR under number 954 509 741, acting as mandated arranger (hereinafter referred to as the “Mandated Arranger”), OF THE SECOND PART, 4. ARKEA BANQUE ENTREPRISES ET INSTITUTIONNELS, a public limited company (SA) with Management Board and Supervisory Board, having its registered office at Allée Louis Lichou, Relecq Kerhuon (29480), registered with the Brest TCR under SIREN number 378 398 911, as Lender, 5. BNP PARIBAS, a public limited company (SA) having its registered office at 16 boulevard des Italiens, 75009 Paris, registered with the Paris TCR under number 662 042 449, ADEME n° FR200182_01XHWE, as Lender, 6. CREDIT LYONNAIS, a public limited company (SA) having its registered office at 18, rue de la République, Lyon (69002) and its head office at 20, avenue de Paris, Villejuif (94811), registered with the Lyon TCR under number 954 509 741, as Lender, OF THE THIRD PART, 7. CREDIT LYONNAIS, a public limited company (SA) having its registered office at 18, rue de la République, Lyon (69002) and its head office at 20, avenue de Paris, Villejuif (94811), registered with the Lyon TCR under number 954 509 741, acting as agent for the Lenders under the Contract (hereinafter referred to as the “Agent”), OF THE FOURTH PART, 8. CREDIT LYONNAIS, a public limited company (SA) having its registered office at 18, rue de la République, Lyon (69002) and its head office at 20, avenue de Paris, Villejuif (94811), registered with the Lyon TCR under number 954 509 741, as ESG coordinator and ESG agent (hereinafter referred to as the “ESG Coordinator” and the “ESG Agent”), OF THE FIFTH PART. Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 - 7 - THE FOLLOWING HAS BEEN PREVIOUSLY STATED: A. THE CAPEX LOAN The Borrower has asked the Lenders to make available to it a loan in the maximum principal amount of EUR 37,000,000, divided into two tranches, for the purpose of financing or refinancing, directly or indirectly (by way of a Capex Advance), any Project Investment. B. The Lenders have declared their willingness to grant the loan referred to in Paragraph A. above to the Borrower, under the conditions stipulated in this Contract. THIS HAVING BEEN STATED, IT HAS BEEN AGREED AS FOLLOWS: ARTICLE 1 - DEFINITIONS 1.1 Definitions Unless otherwise specified, capitalized terms and expressions used in this Contract shall have the meanings set out below: Acquisition means the acquisition on the Signature Date by the Borrower, by way of contribution in kind, of 100% of the share capital and voting rights of Ryam BioNova France and Ryam BioNova US, as described in the Structure Memorandum. Authorised Acquisitions means: (i) (Acquisition) the Acquisition; (ii) (intra-group creation) any creation, by an Obligee or another Group member, of a company which becomes a Group member holding 100% of the share capital and voting rights, provided that the liability of the company’s shareholders or members (in respect of its corporate form) is limited to their capital contribution; (iii) (intra-group acquisitions) any acquisition by one Group member of fixed assets assigned or contributed by another Group member as part of an Authorised Fixed Asset Assignment or an Authorised Merger; (iv) (Investment Securities) any acquisition or subscription by a Group member of Investment Securities; and (v) (intra-group issue) in the context of a share issue by a Group member, any subscription for shares in any Subsidiary of the Guarantor by another Group member that is a direct shareholder of this Subsidiary, provided that the Group members hold, after the said issue, at least the same percentage of share capital and voting rights in the Group member in question as they held immediately before the said issue. Deed of Assignment means a deed substantially in the form of the model set out in Appendix 4 (Model Deed of Assignment) or in any other form agreed between the Agent and the Borrower. Shareholders means, as the context requires, the Guarantor Shareholders or the Redwood Shareholders. Guarantor Shareholders means all natural persons and entities holding, directly or indirectly, shares in the Guarantor. Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 - 8 - Redwood Shareholders means, together, the natural persons and entities holding shares in the Borrower, namely, as on the Signature Date, the Guarantor, Rayonier Advanced Materials Inc. and the Financial Investor. Affiliate means: (i) in the case of a Person who is a natural person, (x) his/her ascendants, descendants and, more generally, all of his/her universal assigns and (y) (as relevant) any holding company of which that Person holds (or the universal assigns thereof hold), directly or indirectly, control (or the verb “to control”) within the meaning of article L.233-3 I and II of the French Commercial Code); (ii) in the case of a Person that is a legal entity (the “first company”), any company controlled (directly or indirectly) by that first company, controlling (directly or indirectly) that first company or placed under the control of another company which itself controls (directly or indirectly) that first company (the notion of “control” (or the verb “to control”) within the meaning of Article L.233-3 I and II of the French Commercial Code); (iii) in the case of an investment fund (the “first fund”), its management company, manager, investment advisor, any other investment fund which has the same management company, manager or investment advisor as the first fund or the management company of which is an affiliate (within the meaning of Paragraph (ii) above) of the management company, manager or investment advisor of the first fund; (iv) in the case of a Person that is a Lender, an Affiliate or a Related Fund and: (a) as regards Arkéa Banque Entreprises et Institutionnels, any other member of the Crédit Mutuel Arkéa group (including Crédit Mutuel Arkéa); (b) as regards BNP Paribas, any entity of the BNP Paribas Group (including any fund managed by, or whose management company is, an entity of the BNP Paribas Group); and (c) as regards Crédit Lyonnais, any Caisse Régionale de Crédit Agricole Mutuel, the central body of the Crédit Agricole group and any member company of the Crédit Agricole group, Crédit Lyonnais and Amundi, including any fund managed by, or whose management company is, an entity of the Crédit Agricole group. Credit Agency means, in respect of each Lender, the agency or branch at which its participation in the Capex Loan is recorded for the purposes of the Contract. Agent means Crédit Lyonnais, as named at the start of this Contract, or any successor credit institution in accordance with the provisions of Article 16.12 (Resignation of the Agent). ESG Agent means Crédit Lyonnais, as designated at the start of this Contract. Mandated Arranger means Crédit Lyonnais, as designated at the start of the Contract. Borrower/Key Persons Insurance means the “borrower” or, at the Borrower’s option, “key person” insurance policies to be taken out, extended and/or supplemented by the Borrower, in accordance with Article 12.4.14 (Borrower/Key Persons Insurance), with one or more French or foreign insurance company(ies) acting through an establishment in France, to cover the Borrower for a minimum total amount of EUR 3,700,000 (including at least EUR 2,220,000 on Mr. Christian Ribeyrolle and at least EUR 1,480,000 on Mrs. Estelle Castex Hirel), in the event of death or total and irreversible loss of autonomy of the Senior Managers.

Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 - 9 - 2024 Capital Increases means, together, the 2024 Capital Increases in Kind and the 2024 Capital Increases in Cash. 2024 Capital Increases in Kind means the capital increases in kind of the Borrower for a total amount, including issue premium, of EUR 49,664,500 fully subscribed and paid up on the Signature Date by the Guarantor and Rayonier Advanced Materials Inc. through the contribution of all of the securities held by them in the share capital of Ryam BioNova France and Ryam BioNova US, in accordance with the Structure Memorandum. 2024 Capital Increases in Cash means, together, (i) the capital increases in cash of the Borrower for a total nominal amount, including issue premium, of EUR 20,000,000 fully subscribed and paid up in cash on the Signature Date by the Guarantor and (ii) the capital increase in cash of the Borrower for a total nominal amount, including issue premium, of EUR 15,000,000 fully subscribed and paid up in cash on the Signature Date by the Financial Investor, in accordance with the Structure Memorandum. 2025 Capital Increases in Cash means, together, the capital increases in cash of the Borrower to be carried out, on one or more occasions, after the Signature Date and no later than 31 December 2025, notably for the purpose of partially financing the Project Investments, up to a total maximum nominal amount, including issue premium, of EUR 35,000,000 (the “2025 AKA Maximum Amount”) to be subscribed and paid up in cash by the Guarantor up to a maximum amount of EUR 20,000,000 and by the Financial Investor up to a maximum amount of EUR 15,000,000; it being specified that (x) in the event that the Group decides to abandon a plant construction project anticipated in the Business Plan (i.e. the bioethanol production plant located in the United States, the CTO production plants located in France and in the United States, and a prebiotics production plant located in the United States) or (y) in the event that the construction of a plant anticipated in the Business Plan could not have commenced by 31 December 2025 at the latest (the commencement of any plant anticipated in the Business Plan being evidenced by any order for civil engineering for the said plant), the maximum individual amount of the Guarantor and the maximum individual amount of the Financial Investor in the 2025 AKA Maximum Amount shall be respectively reduced accordingly in accordance with the following formula: ICR = IC x %RCAPEX Where: “ICR” means the in the additional investment commitment reduction of the Shareholder in question; “IC” means the additional investment commitment of the Shareholder in question, i.e. EUR 20,000,000 in the case of the Guarantor and EUR 15,000,000 in the case of the Financial Investor; “%RCAPEX” means the percentage of Project Investments ultimately not used as a result of abandoning a plant construction project anticipated in the Business Plan or should the construction of a plant anticipated in the Business Plan not have commenced by 31 December 2025 at the latest, in accordance with the following provisions: (i) in the case of a bioethanol plant in the United States: %RCAPEX = 64.17%; (ii) in the case of a CTO plant in France: %RCAPEX = 4.22%; (iii) in the case of a CTO plant in the United States: %RCAPEX = 7.67%; and (iv) in the case of a prebiotics plant in the United States: %RCAPEX = 23.95%, Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 - 10 - it being specified that: (a) the “ICR” amount of the additional investment commitment reduction of the Guarantor and Financial Investor may not exceed EUR 20,000,000 in the case of the Guarantor and EUR 15,000,000 in the case of the Financial Investor; and (b) for the purposes of Article 6.4 (Automatic Cancellation of the Available Amount), for any reduction of the 2025 AKA Maximum Amount, the sum of ICR of the Guarantor and of the ICR of the Financial Investor is hereinafter referred to as a “Reduction of the 2025 AKA Amount”. Authorisation means an authorisation, consent, approval, deliberation, permit, exemption, inscription, notarial attestation or registration. Capex Advance means any current account advance or intra-group loan, financed in whole or in part by means of a Drawdown under the Capex Loan, granted by the Borrower to one of its Subsidiaries for the purpose of enabling it to carry out a Project Investment. Borrower Advances means (i) any Capex Advance and (ii) any other intra-group loan or advance possibly made available by the Borrower to a member of the Redwood Perimeter and which shall be governed by the Borrower Advances Framework Agreement. ESG Criteria Amendment has the meaning attributed to it in Article 12.4.16 (ESG Criteria). Drawdown Notice means a drawdown notice, the model of which is set out in Appendix 3 (Model Drawdown Notice under the Capex Loan), to be sent by the Borrower to the Agent in accordance with Article 5.4 (Drawdowns and Drawdown Notice) with a view to a Drawdown under the Capex Loan. Hedging Bank(s) means the Lender(s) party to the Contract (or their Affiliates) that shall be signatories to the Hedging Contract(s) with the Borrower, it being specified that if a Hedging Bank ceases to be a Lender (or a Affiliate of a Lender), it shall retain its status as a Hedging Bank if it was a Lender (or Affiliate of a Lender) on the conclusion date of the relevant Hedging Contract(s). Reference Banks means, for the purpose of determining the interest rate in the absence of publication of the EURIBOR, the main credit institutions in Paris designated by the Agent (acting on the instructions of the Majority of Lenders and after consultation with the Borrower), subject to the agreement of the institution in question. Business Plan means the forecast reference management plan prepared on a consolidated basis at Group level for the 2024-2034 period, which served as the basis for the structuring of the Capex Loan and which is provided under Appendix 2 (Conditions Precedent on the Signature Date). Event of Default means any of the events referred to in Article 13.1 (Events constituting an Event of Default). Potential Event of Default means any of the events referred to in Article 13.1 (Events constituting an Event of Default), which event, upon the giving of notice and/or the lapse of time and/or the fulfilment of any other condition anticipated in that Article, would become an Event of Default, unless this Potential Event of Default is remedied prior to the giving of this notice and/or the lapse of time and/or the fulfilment of this condition. Guarantor means Rayonier A.M. France, as designated at the start of this Contract. Surety means the personal, joint and indivisible surety granted by the Guarantor under the terms of Article 14 (Surety). Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 - 11 - Certificate means, as the case may be: (i) for the calculation of the Group R1 Ratio and the Group R2 Ratio at the closing date of each Financial Year, the certificate, signed by an authorised representative of the Guarantor and approved by the Guarantor’s statutory auditors, delivered to the Agent in accordance with Paragraph (a) of Article 12.1.4 (Ratios and aggregates) and containing the information referred to in the said Paragraph; and (ii) for the calculation of the Redwood Perimeter R1 Bis Ratio and the Consolidated Excess Cash Flow at the end of each Financial Year, the certificate, signed by an authorised representative of the Borrower and approved by the Borrower’s statutory auditors, delivered to the Agent in accordance with Paragraph (b) of Article 12.1.4 (Ratios and aggregates) and containing the information referred to in that Paragraph. ESG Certificate means any certificate issued to the ESG Agent attesting to the scores achieved for each ESG Criterion in respect of the relevant Financial Year in accordance with the provisions of Article 12.1.17 (ESG Certificate). Authorised Fixed Asset Disposals means, without prejudice to the application of the cases of mandatory early repayment referred to in Article 6.5.3 (Mandatory early repayment of the Capex Loan in the event of the disposal of assets (other than Disposals of Excluded Assets)): (i) (Intra-Group) any disposal of fixed assets between Group members (outside the Redwood Perimeter) and any disposal of fixed assets between Redwood Perimeter members; (ii) (Obsolete assets) any disposal of fixed assets that are obsolete, worn out or no longer required for the Group’s business; (iii) (Exchange of Assets) any disposal by way of exchange of materials or equipment carried out in accordance with the Group’s usual practices; (iv) (Intra-Group Restructuring) any disposal carried out as part of an Authorised Merger; (v) (Investment Securities) any assignment by a Group member of Investment Securities; (vi) (Legal/Statutory Holding) any assignment of shares or corporate rights made for the purpose of complying with the legal or statutory provisions relating to the shares to be held by directors or the minimum number of shareholders or associates and within the limit of the legal or statutory minimum or of one share per assignee, as the case may be; (vii) (General Basket - Group (excluding Redwood Perimeter)) any disposal by a Group member (excluding Redwood Perimeter) of fixed assets (other than financial securities, company rights or business goodwill) to a third party to the Group not authorised under the terms of the preceding Paragraphs, made on normal commercial terms for a disposal price (all charges, taxes and costs) which, together with the disposal price (including all charges, taxes and costs) of the other fixed assets (other than financial securities, company rights or business goodwill) disposed of by one (or more) Group member(s) (excluding the Redwood Perimeter) under this Paragraph since the Signature Date, does not exceed, at any time, EUR 2,000,000 (or the equivalent of this amount in one or more currencies); and Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 - 12 - (viii) (General Basket - Redwood Perimeter) any disposal by a member of the Redwood Perimeter of fixed assets (other than financial securities, company rights or business goodwill) to a third party to the Redwood Perimeter not authorised under the terms of the preceding Paragraphs, made on normal commercial terms for a disposal price (all charges, taxes and costs) which, together with the disposal price (including all charges, taxes and costs) of the other fixed assets (other than financial securities, company rights or business goodwill) disposed of by one (or more) member(s) of the Redwood Perimeter under this Paragraph since the Signature Date, does not exceed, at any time, EUR 2,000,000 (or the equivalent of this amount in one or more currencies). Borrower Advances Dailly Assignment means the assignment of receivables by way of guarantee (in accordance with the provisions of Articles L.313-23 et seq. of the French Monetary and Financial Code) to be granted by the Borrower to the Lenders on the Signature Date, relating to the Borrower’s receivables from its Subsidiaries in respect of any Borrower Advance granted or to be granted by the Borrower to its Subsidiaries, as security interest and guarantee for the repayment of the principal and the payment of all interest, all commissions, and all costs, incidentals and sums whatsoever owed by the Borrower to the Lenders under the Senior Financial Documents. Change of Control means that Rayonier Advanced Materials Inc. ceases to hold, directly or indirectly, for any reason whatsoever, at least 50.01% of the share capital and/or voting rights of the Guarantor and/or the Borrower, it being specified that the occurrence of a Change of Control referred to above shall be assessed before and after any dilution resulting from financial securities giving access to the capital of the entity in question, excluding any dilution resulting from the exercise, conversion or redemption of securities giving access, immediately or in the future, to the capital of the entity in question, the exercise, conversion or redemption of which may only take place after the Capex Loan has been repaid in full. Code means the US Internal Revenue Code of 1986, as amended. Contract means this contract, its Preamble and its Appendices, which form an integral part of this contract, as well as any amendment to this contract. Borrower Advances Framework Agreement means the intra-group loan framework agreement entered into on the Signature Date between the Borrower, as lender, and certain Redwood Perimeter members, as borrowers, and governing the provisions and conditions under which the Borrower Advances are made available. Borrower Advances Dailly Assignment Framework Agreement means the framework agreement for the assignment of trade receivables to be entered into, on the Signature Date, between the Borrower, the Agent and the Lenders and the related deeds for the assignment of trade receivables relating to the Borrower Advances Dailly Assignment. Hedging Contract(s) means the interest rate hedging contract(s) to be entered into/maintained/renewed with the Hedging Bank(s) or any other credit institution, in accordance with the terms and conditions set out in Article 12.4.12 (Hedging Contract(s)). French Subsidiary Securities Account Pledge Agreement means the agreement to be entered into on the Signature Date between the Borrower, the Agent and the Lenders, together with the related pledge declaration, relating to the French Subsidiary Securities Account Pledge.

Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 - 13 - USA Subsidiary Securities Pledge Agreement means the securities pledge agreement to be entered into on the Signature Date between the Borrower and the Agent in respect of the USA Subsidiary Securities Pledge. Subordination Agreement means the agreement to be entered into on the Signature Date, between the Agent, the Lenders, the Redwood Subordinated Creditors and the Borrower, to which the Hedging Banks shall concomitantly adhere on the date of execution of the Hedging Contracts. ESG Coordinator means Crédit Lyonnais, as designated at the start of this Contract. Cost of Reuse of Funds means, in the event of repayment to a Lender of all or part of its interest in Drawdowns or settlement of an Outstanding Amount on a date other than an Interest Payment Date applicable to the Drawdown(s) in question or to the Outstanding Amount, for whatever reason (the “Repaid Amount”): (i) as long as the Screen Rate is not negative, the difference, if positive, between: (a) the amount of interest (excluding the Applicable Margin) that a Lender should have received on the Repaid Amount between its date of receipt and the next Interest Payment Date (the “Calculation Period”) applicable to the relevant Drawdown(s) or the Outstanding Amount; and (b) the amount of interest that this Lender could receive by placing the Repaid Amount with a leading bank on the European interbank market during the Calculation Period; or (ii) as relevant, if the Screen Rate is negative, the difference, if positive, between: (a) the sum that this Lender may have to pay by placing the Repaid Amount with a first- ranking bank on the relevant European interbank market during the Calculation Period; and (b) the amount of interest (excluding the Applicable Margin and any applicable floor rate) calculated over the Calculation Period on the Repaid Amount and at the Screen Rate applicable to the Interest Period relating to the Drawdown(s) in question or to the Outstanding Amount. Subordinated Creditors means, as the context requires, the Group Subordinated Creditors or the Redwood Subordinated Creditors. Group Subordinated Creditors means, together, the Guarantor Shareholders and any holder of Authorised Guarantor Subordinated Debts. Redwood Subordinated Creditors means, together, the Redwood Shareholders and any holder of Authorised Redwood Subordinated Debts. Capex Loan means the loan of a maximum principal amount of EUR 37,000,000, made available to the Borrower under the conditions anticipated in the Contract, by means of one or more Drawdowns. FATCA Application Date means: (i) with respect to a withholdable payment as described in Article 1473(1)(A)(i) of the Code (which refers to interest payments and certain other American source payments), on 1 July 2014; or Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 - 14 - (ii) with respect to a “passthru payment” described in Article 1471(d)(7) of the Code that does not fall within Paragraph (a) above, the earliest date from which such payment would be subject to deduction or withholding required by FATCA. Assignment Date means, in respect of an assignment, the later of the following two dates: (i) the assignment date indicated in the relevant Deed of Assignment; and (ii) the date on which the Agent signs the Deed of Assignment. Rate Determination Date means, in respect of a period for which an interest rate is to be fixed, two (2) TARGET days prior to the first day of the relevant Interest Period, unless otherwise customary in the European interbank market, in which case the Agent shall follow the practices of that market in determining the Rate Determination Date (and if the determination of a rate is usually given on different days, the Agent shall use the last of these days as the Rate Determination Date). Interest Payment Date means the last day of an Interest Period. Final Repayment Date means the date on which all sums due by the Borrower under the Contract are to be paid and/or repaid. The Final Repayment Date of Capex Loan Tranche A is 12 November 2031. The Final Repayment Date of Capex Loan Tranche B is 12 November 2032. Signature Date means the date on which this Contract is signed, i.e. 12 November 2024. Test Date means the last day of a given Test Period. Drawdown Date means the date on which a Drawdown is to be made available to the Borrower by the Lenders. Non-Reiterated Representations means the representations and warranties referred to in Article 11.7.1 (Absence of Litigation), Article 11.9 (Absence of Withholding Tax - Registration and Stamp Duties), Article 11.12.1 (Taxes and Other Charges), Article 11.14 (Authorisations for Activities), Article 11.15 (Activities), Article 11.16 (Compliance with Laws), Article 11.17.1 (Information Accuracy), Article 11.18 (Business Plan), Article 11.19 (Collective proceedings - Insolvency), Article 11.20 (Borrowings - Security Interests - Off-Balance Sheet Commitments), Article 11.21 (Capital and holdings of Obligees and other Group members), Article 11.26 (Structure Memorandum) and Article 11.29(DAC6). Existing Debts means the Group’s existing indebtedness as on the Signature Date, a list of which, together with the principal amounts outstanding at that date, is set out in Appendix 7 (Existing Debts and Related Security Interests). Authorised Subordinated Debts means, together, all Authorised Guarantor Subordinated Debts and all Authorised Redwood Subordinated Debts. Authorised Guarantor Subordinated Debts means, together: (i) any loan or advance on a partner’s current account granted by the Guarantor Shareholders to the Guarantor; and (ii) any issue of debt-like financial securities (including any issue of ordinary bonds or bonds giving immediate or future access to capital) by the Guarantor and subscribed and held, after the Signature Date, by the Guarantor Shareholders, Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 - 15 - provided that the said loans, advances or financial securities: (a) are fully subordinated (in principal or capital, as the case may be, interest (which shall be fully capitalised) or in respect of any related sums) to the Capex Loan and the Hedging Contracts in accordance with the terms of Article 12.3.14 (Payments to Shareholders); (b) are not secured by a Real Security Interest and/or a Personal Security Interest granted by a Group member; and (c) in the case of financial securities, have a maturity date at least six (6) months after the Final Repayment Date of Capex Loan Tranche B. Authorised Redwood Subordinated Debts means, together, (i) the Existing Redwood Subordinated Debts, (ii) any other loan or advance on a partner’s current account granted by the Redwood Shareholders to the Borrower subsequent to the Signature Date and (iii) any issue of debt-like financial instruments (including any issue of straight bonds or bonds giving immediate or future access to the capital) by the Borrower and subscribed for and held, after the Signature Date, by the Redwood Shareholders or any other person who has entered into the Subordination Agreement as a Redwood Subordinated Creditor, provided that such loans, advances or financial securities (a) are fully subordinated (in principal or capital, as the case may be, interest (which shall be fully capitalised) or in respect of any related sums) to the Capex Loan and the Hedging Contracts in accordance with the terms of the Subordination Agreement, (b) are not secured by a Real Security Interest and/or a Personal Security Interest granted by a Group member and (c) in the case of financial securities, have a maturity date of at least six (6) months after the Final Repayment Date of Capex Loan Tranche B. Existing Redwood Subordinated Debts means the current account advance, existing on the Signature Date, granted by the Guarantor to Ryam BioNova France for a total principal amount on the Signature Date of EUR 3,937,500. Distribution means any distribution of dividends, interim dividends, reserves or premiums by an Obligee, any redemption/payment of any Authorised Subordinated Debt by an Obligee, any reduction of the capital of an Obligee or any repurchase/amortisation of financial securities of an Obligee. Authorised Redwood Distribution means any Distribution by the Borrower which complies with the following aggregate conditions: (i) the Distribution in question is made after 31 December 2026; (ii) no Event of Default continues on the date of the Distribution in question and no Event of Default or Potential Event of Default shall result from the payment of the said Distribution; (iii) prior delivery to the Agent of a certificate, signed by an authorised representative of the Borrower, demonstrating that the level of the Redwood R1 Bis Ratio, calculated on a pro forma basis after notably taking into account the relevant Distribution, is less than 1.50; (iv) prior delivery to the Agent of a certificate signed by an authorised representative of the Borrower, confirming that: (a) immediately prior to the Distribution in question, the FCFE Amount exceeds EUR 5,000,000; and Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 - 16 - (b) immediately after completion of the Distribution in question and, as relevant, the mandatory early repayment anticipated in Article 6.5.6 (Mandatory early repayment of the Capex Loan in the event of an Authorised Distribution), the Consolidated Cash of the Redwood Perimeter is greater than EUR 10,000,000; and (v) the amount of the Distribution is less than or equal to EUR 5,000,000 or, if the amount of the Distribution exceeds EUR 5,000,000, the Borrower shall make the mandatory early repayment anticipated in Article 6.5.6 (Mandatory early repayment of the Capex Loan in the event of an Authorised Distribution) on the date of payment of the Distribution in question. Authorised Subordinated Debt Documents means all documents relating to Authorised Subordinated Debts. Financial Documents means, together, the Authorised Subordinated Debt Documents and the Senior Financial Documents. Senior Financial Documents means, collectively, the Contract, the Mandate Letter, the Subordination Agreement, the commission letters referred to in Article 9 (Commissions) and, from the date of their execution, the Security Interest Documents, any Drawdown Notice and the Hedging Contract(s) entered into with a Hedging Bank, as well as any other document designated as such by the Agent and the Borrower. Security Interest Documents means, together, the Borrower Advances Dailly Assignment Framework Agreement, the French Subsidiary Securities Account Pledge Agreement and the USA Subsidiary Securities Pledge Agreement, all documents relating to the Key Persons Insurance Pledge/Delegation (or the documents relating to the Borrower/Key Persons Insurance in the event that the latter take the form of a “borrower” insurance policy naming the Agent (acting on behalf of the Lenders) as sole accepting beneficiary), to any Subsequent Rank Pledge, as well as all other documents to be signed in respect of the Security Interests. Business Field means the development and production of celluloses and speciality celluloses, bioethanol, lignosulphonates, crude tall oil and prebiotics. Consolidated EBITDA has the meaning attributed to it in Appendix 6 (Financial Definitions). Borrower means Ryam BioNova, as designated at the start of this Contract. Outstanding Amount means, on a given date, in respect of a Capex Loan Tranche or the Capex Loan and on a given date, the principal amount outstanding on that date owed by the Borrower in respect of that Capex Loan Tranche or, as the case may be, the Capex Loan. Financial Indebtedness means, without double counting, any indebtedness relating to: (i) sums borrowed (other than any debts contracted with suppliers); (ii) funds mobilized through the acceptance by a third party of bills of exchange (or any equivalent instrument in dematerialized form); (iii) funds raised through the purchase of promissory notes or through the issue of bonds, savings bonds, commercial paper, negotiable securities (short- or medium-term) or other debt securities; (iv) commitments under finance leases, leaseback agreements or finance leases (other than commitments under leases that would have qualified as operating leases under the applicable accounting principles in force prior to 1 January 2019);

Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 - 17 - (v) an assignment of receivables or discounting (including receivables assigned or discounted without recourse) or a factoring operation (including factoring without recourse); (vi) funds raised under any other operation (including forward sales and purchases) having the economic effect of a loan, including all deferred payment obligations entered into for the purpose of acquiring any asset (including any vendor credit); (vii) derivative operations entered into in order to hedge the risk of, or profit from, a fluctuation of rates or prices (it being specified that in calculating the value of such an operation, only its market value, or if an actual amount is due following the termination or unwinding of this operation, this amount, shall be retained); (viii) a possible obligation to repay as principal in respect of a surety, guarantee, standby or documentary letter of credit or any other commitment by signature issued by a bank or financial institution; and (ix) any personal guarantee commitment relating to any of the types of indebtedness listed in the Paragraphs above. Authorised Financial Indebtedness means: (i) (Existing Debts) the Group’s existing debts as on the Signature Date, as listed in Appendix 7 (Existing Debts and Related Security Interests); (ii) (Capex Loan) the Capex Loan; (iii) (Subordinated debts) Authorised Guarantor Subordinated Debts and Authorised Redwood Subordinated Debts; (iv) (Intra-Group loans) Authorised loans/credits; (v) (Off-balance sheet) off-balance sheet commitments authorised under Personal Security Interests and Authorised Off-Balance Sheet Commitments; (vi) (Short-term) the additional Financial Indebtedness in respect of any short-term credit facility (other than any form of receivables financing) entered into by Group members after the Signature Date, up to a total aggregate amount outstanding at Group level not exceeding, at any time, EUR 10,000,000 (or the equivalent value of this amount in one or more currencies); (vii) (Mobilisation of receivables) the additional Financial Indebtedness in respect of any short- term credit in the form of mobilisation, discounting or assignment of receivables (including by factoring or securitisation) contracted by the Group members after the Signature Date, with or without recourse, up to a total aggregate amount outstanding at Group level not exceeding, at any time, EUR 22,000,000 (or the equivalent value of this amount in one or more currencies); (viii) (Medium/long-term) Additional Financial Indebtedness in respect of any medium- or long- term loan (including under a lease contract or finance lease), for the purpose of financing: (a) Strategic Investments actually made by Group members (excluding the Redwood Perimeter) by 31 December 2026 at the latest, up to a total aggregate amount outstanding at Group level (excluding the Redwood Perimeter) not exceeding, at any time, EUR 11,000,000 (or the equivalent value of this amount in one or more currencies); Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 - 18 - (b) the Project Investments actually made by the Redwood Perimeter members up to an amount not exceeding the portion not financed by means of the Capex Loan, the limit (possibly increased) of the Project Investments for the Financial Year in question as made (or the equivalent value of this amount in one or more currencies); and (c) Authorised Investments actually made by Group members and not exceeding, for the Financial Year in question, 100% of the limit (possibly increased) of Authorised Investments for the Financial Year in question as made (or the equivalent value of this amount in one or more currencies). Commitments means: (i) for each Lender party on the Signature Date, the amount in Euros appearing opposite its name in Appendix 1 (List and Commitments of Lenders) under the heading “Commitments” and the amount of any other Commitment under the Capex Loan assigned to it; and (ii) for any other Lender, the amount of any Commitment under the Capex Loan assigned to it in accordance with the terms of the Contract, as reduced, terminated or assigned as relevant under the Contract. Overall Commitment means, at a given date, the sum of the Commitments of the Lenders under the Capex Loan or any of the Capex Loan Tranches. Non-Cooperative State or Territory means a non-cooperative State or territory referred to in the list in article 238-0 A of the French General Tax Code, as this list may be updated. EUR or euro means the single European currency that is legal tender in France, in accordance with European Union and/or French regulations. EURIBOR means, in respect of any Interest Period (including any Outstanding Amount): (i) the Screen Rate applicable at 11 AM (Paris time) on the Rate Determination Date and for a period equal in duration to that of the Interest Period of a Drawdown; or (ii) as otherwise determined in accordance with Article 7.6.1 (Unavailability of the Screen Rate); if one of the rates referred to in Paragraphs (i) or (ii) above is less than zero (0), it shall be deemed to be equal to zero (0). In the event that, in application of the provisions of Article 7.2 (Interest Periods), an Interest Period is shortened to a duration of less than one (1) month, the EURIBOR applicable to this Interest Period shall be the EURIBOR for one (1) month. Screen Rate Replacement Event means, in respect of the Screen Rate, one of the following situations: (i) in the opinion of the Majority of Lenders and the Borrower, there has been a significant change to the methodology, formula or other means by which the Screen Rate is determined; or (ii) (a) (A) the administrator of the Screen Rate or its supervisor has publicly announced that such administrator is insolvent or (B) information is published in any order, decree, notice, petition or application (however qualified) or filed with any court, tribunal, stock exchange, regulatory authority or similar administrative, regulatory or judicial body reasonably confirming the insolvency of the administrator of the Screen Rate; Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 - 19 - provided that, in each case, as at that date, no successor to the administrator in question continues to provide the Screen Rate; or (b) the administrator of the Screen Rate publicly announces that it has ceased or shall cease to provide the Screen Rate permanently or indefinitely and, as at that date, no successor to that administrator continues to provide the Screen Rate; or (c) the supervisor of the Screen Rate administrator publicly announces that the Screen Rate has been or shall be permanently or indefinitely deleted; or (d) the Screen Rate administrator or his supervisor has announced that the Screen Rate can no longer be used; or (iii) the Screen Rate administrator determines that the Screen Rate shall be calculated in accordance with its reduced submissions or other contingency arrangements or fallback policies and other arrangements and that: (a) the circumstance(s) or event(s) giving rise to such calculation are not (in the opinion of the Majority of Lenders and the Borrower) temporary; or (b) this Screen Rate is calculated in accordance with the said policy or arrangement for a period of at least fifteen (15) Business Days; or (iv) in the opinion of the Majority of the Lenders and the Borrower, the Screen Rate is no longer appropriate for the purposes of calculating interest under the Contract; or (v) the supervisor of the administrator of this Screen Rate publicly announces or publishes the information: (a) that such Screen Rate ceases, or shall cease at a specified future date, to be representative of the market or economic reality that such rate measures and that such representativeness shall not be restored (as determined by such supervisor); and (b) bearing in mind that such an announcement or publication may lead to the application of fallback clauses in contracts that may be affected by such an announcement or publication of termination. Significant Adverse Event means the occurrence or discovery of any fact or event, whatever its nature, cause or origin (notably including any legal, arbitration or administrative proceedings brought against any Group member): (i) affecting or likely to affect, adversely and significantly, immediately or in the future: (a) the financial, economic or legal situation, assets or activities of an Obligee or of the Group as a whole; or (b) the ability of an Obligee to meet its obligations under the Senior Financial Documents; or (ii) affecting or likely to affect, immediately or in the future, the validity, legality or enforceability of any of the Security Interest Documents or the stipulations relating thereto or the ranking of a Security Interest granted under a Security Interest Document. Consolidated Excess Cash Flow has the meaning attributed to it in Appendix 6 (Financial definitions). Docusign Envelope ID: E4C30EB2-0EB7-4AFA-8A8A-F015709E922D 202720363_1 - 20 - Financial Year means, for the purposes of the Contract, each twelve (12) month period ending on 31 December of each year (including when the Borrower’s first financial year has a different duration). FATCA means: (i) sections 1471 to 1474 of the Code and all related regulations; (ii) any treaty, law or regulation of any other jurisdiction, or an inter-governmental agreement between the United States and any other jurisdiction, which (in each case) facilitates the implementation of any law or regulation referred to in Paragraph (i) above; or (iii) any agreement to implement any treaty, law or regulation referred to in Paragraphs (i) or (ii) above entered into with the American Internal Revenue Service, the American Government or any other governmental or tax authority of any other jurisdiction. Subsidiaries means all companies controlled, directly or indirectly, by another company within the meaning of article L.233-3 of the French Commercial Code. Pledged Subsidiaries means, together, (i) on the Signature Date, Ryam BioNova France and Ryam BioNova US and (ii) as relevant, after the Signature Date, any member of the Redwood Perimeter whose securities are pledged under the Security Interests. Related Fund means (i) in relation to a Lender, a fund managed or advised by an investment manager or investment advisor that is a Lender or an Affiliate of a Lender or (ii) in relation to a fund (the “first fund”), a fund managed or advised by the same investment manager as the first fund or, if managed or advised by a different investment manager, a fund whose investment manager is an Affiliate of the investment manager of the first fund. Formalities means any registration (including any registration of any security interest in a register of shareholders), filing, endorsement, stamping or notification of the Security Interest Documents or the Security Interest so created. Authorised Merger(s) means any merger (including any liquidation involving the transfer of all assets and liabilities), demerger, contribution or other similar operation carried out between Group members, on the conditions that: (i) if the Borrower or a Pledged Subsidiary is involved, it remains in any event the surviving entity or the entity benefiting from the contributions; (ii) such operation does not adversely affect, immediately or in the future, the Security Interests (including their existence, value or effectiveness) or the rights of the Lenders under the Senior Financial Documents; (iii) the said operation is in the corporate interest of the entities in question and has no material adverse effect, either immediately or in the future, on the distributive capacity of the entities resulting from the proposed operation compared with that existing prior to the said operation; (iv) the Borrower delivers to the Agent, on the completion date of the operation, (x) a legal opinion from its advisor confirming that the operation is compliant with applicable corporate law (subject to the completion of any post-merger publicity and registration requirements and notably taking into account the absence of any objection from creditors in accordance with applicable law) and (y) a note from its advisor confirming that the operation has no material adverse effect on the Group for tax purposes; and