Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 Confidential Material Omitted – To be filed separately with the Securities and Exchange Commission upon request. Double asterisks denote omissions. This document is an English translation of a legally binding French document. While efforts have been made to provide an accurate translation, in the event of any discrepancies or conflicts between this translation and the original French version, the original French document shall prevail. 12 NOVEMBER 2024 SHAREHOLDER PACT RELATIVE TO THE COMPANY RYAM BIONOVA BETWEEN: Rayonier A.M. France Rayonier Advanced Materials, Inc. AND SWEN IMPACT FUND FOR TRANSITION 3 IN THE PRESENCE OF: RYAM BIONOVA Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 2 BETWEEN THE UNDERSIGNED: (1) Rayonier A.M. France, a simplified joint stock company under French law, having its registered office at 20 avenue de la Gare – 40100 Dax and registered with the Dax Trade and Companies Register under number 424 500 486, represented by Estelle Castex Hirel, duly authorised; (hereinafter referred to as “RYAM France”) AND (2) Rayonier Advanced Materials, Inc., a company under the laws of the United States incorporated in the State of Delaware, having its registered office at 1209 Orange Street – Wilmington, New Castle, Delaware (United States), represented by Marcus Moeltner, duly authorised; (hereinafter referred to as “RYAM Inc.”, acting jointly and severally with RYAM France for the purposes hereof) (RYAM France and RYAM Inc. acting jointly and severally, hereinafter referred to together as the “Majority Shareholder”) OF THE FIRST PART AND (3) SWEN IMPACT FUND FOR TRANSITION 3, an open-ended investment company and reserved alternative investment fund in the form of a limited partnership with shares, having its registered office at 4, rue Peternelchen, L-2370 Luxembourg, registered with the Luxembourg Trade and Companies Register under number B284339, represented by its alternative investment fund manager, SWEN Capital Partners, itself represented by Charlotte Virally, duly authorised; (hereinafter referred to as the “Investor”) OF THE SECOND PART The Majority Shareholder and the Investor and their successors and transferees that shall adhere to this Pact (as this term is defined below) under Article 22.2 of the Pact, are hereinafter referred to collectively as the “Parties” and individually as a “Party”. IN THE PRESENCE OF: (4) RYAM BIONOVA, a simplified joint stock company under French law, having its registered office at 20 avenue de la Gare – 40100 Dax and registered with the Dax Trade and Companies Register under number 980 638 548, represented by Estelle Castex Hirel, duly authorised; (hereinafter referred to as the “Company”). Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 3 AFTER HAVING RECALLED THAT: (A) The Parties have entered into an investment agreement dated 12 November 2024 (the “Investment Protocol”) relating to the terms and conditions of the investment (i) by the Investor of a total amount of fifteen million (15,000,000) euros by way of subscription for one hundred and eleven thousand (111,111) preference shares of class A ADP issued by the Company and (ii) by the Majority Shareholder of a total amount of twenty million (20,000,000) euros by way of subscription for two hundred thousand (200,000) common shares issued by the Company and (iii) the contribution by RYAM France and RYAM Inc. of all capital and voting rights of the Subsidiaries to the Company, remunerated by the issue of ninety-five thousand six hundred and forty-five (495,645) common shares in the Company (the “Operation”). (B) As a result of the above, on the Completion Date, at the end of the completion of the Operation, the share capital of the Company is distributed as follows: Shareholder Common shares A ADP Total number of shares % of the capital RYAM France 684,010 0 684,010 approximately 84.68% RYAM Inc. 12,645 0 12,645 approximately 1.57% Investor 0 111,111 111,111 approximately 13.76% Total 696.655 111,111 807.766 100% (C) The objective of the partnership of the Parties within the Group is to continue the development of the Group in accordance with the business plan established by the Majority Shareholder dated 1 August 2024 and appearing in Appendix (C) (the “Business Plan”), as this Business Plan may be updated each year with the agreement of the Supervisory Committee. (D) The Parties have come together with a view to concluding this shareholder pact (the “Pact”), in particular for the purpose of defining and organising (i) the rules of governance of the Company, (ii) the principles applicable to transfers of the shares and any other Securities issued by the Company that the Parties hold and would be required to hold in the future and (iii) more generally their rights and obligations in their capacity as holders, directly or indirectly, of Securities. Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 4 IT HAS BEEN AGREED AS FOLLOWS: SECTION I – DEFINITIONS AND INTERPRETATION 1. Definitions In the Pact, words and expressions beginning with a capital letter shall have the following meanings, while specifying that when terms of the Pact or its Appendices have capital letters and are not defined in this Pact or its Appendices, they shall have the definitions assigned to them in the terms and conditions of the ADPs appearing in the Appendix to the Articles of Association: “Accession Deed” means the accession deed of this Pact set out in Appendix 22.2; “Activity” has the meaning ascribed to it in Article 3.2; “A ADP” means the Class A preference shares notably giving a preferential dividend right for the benefit of the Investor, issued or to be issued by the Company and the terms and conditions of which are described in the Articles of Association; “B ADP” means the Class B preference shares that would result from the conversion of A ADPs, notably giving a preferential dividend right for the benefit of the Investor, as well as any other preference shares of the same class that the Company would be required to issue, if applicable, and whose terms and conditions are described in the Articles of Association; “Affiliate” means: (i) relative to an Entity in question, other than an investment fund, any Person who, directly or indirectly, through one or more intermediaries, Controls or is under the same Control, or who is Controlled by that Entity, while specifying that, in the case of the Investor, the concept of Affiliate excludes portfolio companies; (ii) in relation to an investment fund, any fund managed or advised under an advisory mandate by the same management or advisory company or by any Entity that is Controlled directly or indirectly by that management or advisory company; “Appendix/Appendices” means one (or more) Appendix/Appendices to the Pact; “CS” means the common shares issued or to be issued by the Company; “Article(s)” means one (or more) article(s) of the Pact; “Majority Shareholder” has the meaning ascribed to it in the appearance of the Parties; “Shareholders” means the shareholders of the Company; “Transferor(s)” has the meaning ascribed to it in Article 11; “Transfer Notice” has the meaning ascribed to it in Article 9.3;

Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 5 “Purchase Promise Beneficiary” “Sale Promise Beneficiary” “Joint Transfer Right Beneficiaries” “Pre-Emption Right Beneficiaries” has the meaning assigned to it in Article 15.1; has the meaning assigned to it in Article 14.1; has the meaning assigned to it in Article 11; has the meaning ascribed to it in Article 10.1; “Business Plan” has the meaning ascribed to it in paragraph (C) of the preamble; “Acquiring Candidate” has the meaning ascribed to it in Article 9.3; “CARPA” means the Caisse des Settlements Pécuniaires des Avocats de Paris; “Transferee” Has the meaning ascribed to it in Article 12.1; “Change of Control” “Community of Shareholders” “Supervisory Committee” “Overall Consideration” “Senior Loan Contract” means any Transfer of Securities having the effect of causing the Majority Shareholder, directly or indirectly, to breach the holding threshold of 50.1% of the capital or voting rights of the Company; means the Community of Shareholders of the Company; has the meaning ascribed to it in Article 3.3; has the meaning ascribed to it in Article 9.4; means the senior loan contract entered into by the Company with Arkea Banque, BNP Paribas and Crédit Lyonnais on 12 November 2024 relating to Bank Debt; “Control” means control within the meaning of Article L 233-3 I and II of the French Commercial Code, while specifying that, for the purposes of this definition, (i) an entity is presumed to be controlled by its managing partner or the person who controls the managing partner, its management company, its general partner or the entity that manages it in any capacity whatsoever; “Development Costs” means, in the case of a New Project not anticipated in the Business Plan, the amount excluding tax of all costs incurred or to be incurred by the Group companies for the development of the New Project, while specifying that the amount of the Development Costs, which exclude the so-called “capex” investment expenses, shall be determined by the Supervisory Committee as a Strategic Decision on the basis of the industrial feasibility studies, with the accounting of the Development Costs only being able to take place, in any event, from the date of the industrial feasibility studies; Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 6 “ESG Criteria” Has the meaning ascribed to it in Article 8; Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 7 “Objective Achievement Date” has the meaning ascribed to it in Article 5.1; “Completion Date” means the date of completion of the Operation; “ESG Deadline” has the meaning ascribed to it in Article 8; “Outflows” means, with respect to the calculation of the IRR and the Multiple of A ADPs, all sums paid by the Investor for the release of the subscription price of A ADPs (i.e. €30,000,000, which may be reduced in accordance with Article 20.5) and, with respect to the calculation of the IRR and the Multiple of B ADPs, the relevant INP Amount at the date of conversion of A ADPs to B ADPs. “Important Decisions” “Strategic Decisions” means, the decisions falling within the competence of the Supervisory Committee, acting by a Simple Majority, referred to in Article 5.5.3; means, the decisions falling within the competence of the Supervisory Committee, acting by a Qualified Majority, referred to in Article 5.5.4; “Bank Debt” means the senior debt in a total principal amount of thirty-seven million (37,000,000) euros subscribed by the Company under the Senior Loan Contract; “Chief Executive Officers” “Joint Transfer Right” “Pre-Emption Right” has the meaning ascribed to it in Article 3.3; has the meaning ascribed to it in Article 11; has the meaning ascribed to it in Article 10.1; “Consolidated EBITDA” means the consolidated operating result of the Group within the meaning of the General Accounting Plan: • (i) increased by (w) the interest portion of the leasing and finance lease commitments (x) charges, net of reversals, to depreciation of property, plant and equipment and intangible assets (notably including depreciation of leasing and finance lease commitments restated in the accounts, but excluding depreciation of goodwill or business assets and amortisation of transaction costs), (y) charges, net of reversals, to amortisation of deferred charges and (z) charges, net of reversals, to operating provisions for assets and liabilities and charges, and • (ii) less the allocation to employee profit-sharing and incentive schemes. “Inflows” means, without double counting: • all amounts (in cash and as of the bank value date) received by the Investor (collectively with any Successor) from the Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 8 Company (or any other Group company) in respect of its participation in the capital of the Company (dividends, reduction of capital, etc.), under, as the case may be, A ADPs and B ADPs;

Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 9 • all amounts (in cash and as of the bank value date) received by the Investor (collectively with any Successor) in return for the Transfer of Company Securities, in the context of the sale of A ADPs and B ADPs, notably in the context of the exercise of the Sale Promise or Purchase Promise; • in respect of A ADPs, any INP Amount at the date of conversion from A ADP to B ADP; It being specified that any Inflow under the A ADPs or B ADPs, as the case may be, includes all preferential dividends received by the Investor and any Successor as a result of the holding of A ADPs or B ADPs, as the case may be, as well as any sale price of the corresponding Securities. “Entity” means any legal person, as well as any holding company, group, de facto company, association, trade union or other organisation, public or private, with or without legal personality, as well as any professional private equity fund, trust, limited partnership and any similar or equivalent organisation; “Expert” means the expert appointed from among the experts active in France, recognised in the valuation of companies, practising within one of the auditing firms with an international network and independent of each of the Parties and their Affiliates, appointed and acting in accordance with Appendix 1.1(ii); “FCFE” means the Amount of the FCFE as that term is defined in the Senior Loan Contract relating to the Bank Debt; “Subsidiary” means any Affiliate of the Company that it Controls; “Group” means the Company and its Subsidiaries (while specifying, as necessary, that Rayonier A.M. France Innovation, an economic interest group having its registered office at 1154 avenue du Général Leclerc – 40400 Tartas and registered with the Dax Trade and Companies Register under number 400 920 203 is not controlled by the Company); “Initial Public Offering” means the admission to trading on a regulated market or on any other trading platform, even unregulated, located in the European Union or abroad, of all or part of the Company’s Securities; “Investment” means any acquisition of movable or immovable assets, whether tangible or intangible (excluding all current investments), including acquisitions of assets financed by financial leases, but excluding (i) external growth operations and (ii) any acquisition of marketable securities or any other investment for the sole purpose of short-term cash management and for non-speculative purposes; Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 10 “Majority Shareholder’s Additional Investment” “Investor’s Additional Investment” has the meaning ascribed to it in Article 20.1; has the meaning ascribed to it in Article 20.2; “Investor” has the meaning ascribed to it in the appearances of the Parties; “Business Day” means a day of the week other than a Saturday, Sunday or a public holiday in mainland France or Luxembourg; “Liquidation” means the amicable or judicial liquidation of the Company; “Qualified Majority” has the meaning ascribed to it in Article 5.5.4; “Simple Majority” has the meaning ascribed to it in Article 5.5.3; “Supervisory Committee Member” “Supervisory Committee Member A” “Supervisory Committee Member B” means the Supervisory Committee Members A and the Supervisory Committee Members B; has the meaning ascribed to it in Article 5.1.1(i); has the meaning ascribed to it in Article 5.1.1(ii); “Leaving Member” has the meaning ascribed to it in Article 5.1; “INP Amount” means an amount equal to 50% of the Development Costs (excluding tax) of the New Project, as approved by the Supervisory Committee as a Strategic Decision; “Multiple” means, with respect to A ADPs and/or B ADPs, as the case may be, the ratio of Inflows under the A ADPs and/or B ADPs, as the case may be, to Outflows under the A ADPs and/or B ADPs, as the case may be; “Purchase Promise Exercise Notification” “Sale Promise Exercise Notification” “Joint Assignment Notification” “Pre-Emption Notification” has the meaning ascribed to it in Article 15.2; has the meaning ascribed to it in Article 14.1; has the meaning ascribed to it in Article 11.2; has the meaning ascribed to it in Article 10; “New Projects” means any project for the production of bioethanol, lignosulphonates, Crude Tall Oil, prebiotics, Sustainable Aviation Fuel (SAF) or others Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 11 from the transformation of cellulose feedstock, CO2 or other substrates or the use of heat not anticipated in the Business Plan, it Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 12 “Forced Exit Obligation” being specified that improvements to projects anticipated in the Business Plan will not be considered as New Projects (an improvement being limited to an investment aimed at improving the efficiency of the production of the project in question without modifying the nature of this production); has the meaning ascribed to it in Article 12.1; “Offer” has the meaning ascribed to it in Article 12.1; “Operation” has the meaning ascribed to it in paragraph (A) of the preamble; “Complex Operation” means a Transfer whose remuneration or consideration is not exclusively a price in cash (notably including a Transfer as a result of a donation, exchange, contribution, merger, division or a combined form of these forms of transfer of ownership) and, for the avoidance of doubt, subject to the provisions relating to restrictions on the Transfer of Securities of this Pact; “Pact” has the meaning ascribed to it in paragraph (C) of the preamble; “Party(ies)” has the meaning ascribed to it in the appearances of the Parties; “Defaulting Party” has the meaning ascribed to it in Article 12.2; “Purchase Promise Exercise Period” “Sale Promise Exercise Period” “Lock-Up Period” has the meaning ascribed to it in Article 15.2; has the meaning ascribed to it in Article 14.2; has the meaning ascribed to it in Article 9.2; “Person” means any natural person or Entity; “Chairman” Has the meaning ascribed to it in Article 3.3; “Chairman of the Supervisory Committee” “Purchase Promise Exercise Price” “Sale Promise Exercise Price” has the meaning ascribed to it in Article 5.2; has the meaning ascribed to it in Article 15.3; has the meaning ascribed to it in Article 14.2; “Purchase Promise” has the meaning ascribed to it in Article 15.1; “Sale Promise” has the meaning ascribed to it in Article 14.1; “Promisor A” has the meaning ascribed to it in Article 14.1; “Promiser B” has the meaning ascribed to it in Article 15.1;

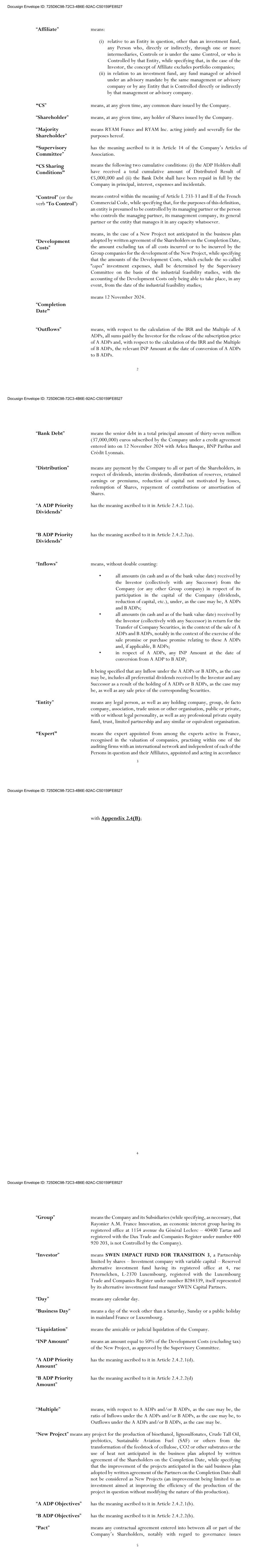

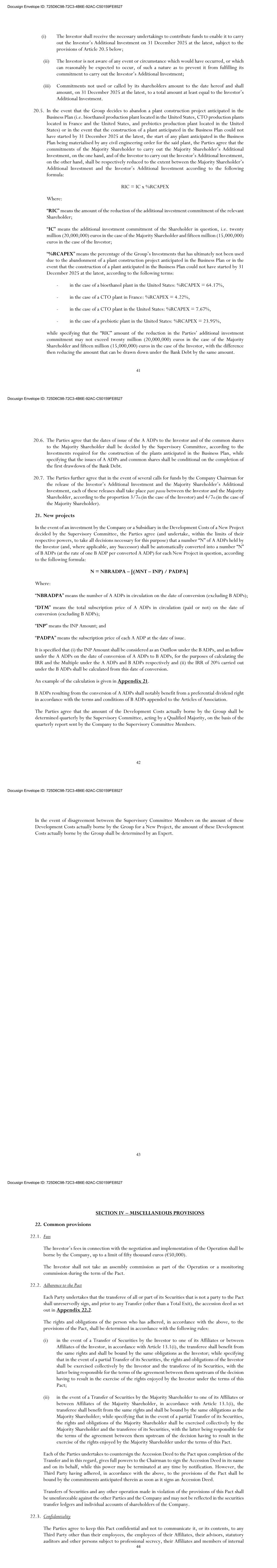

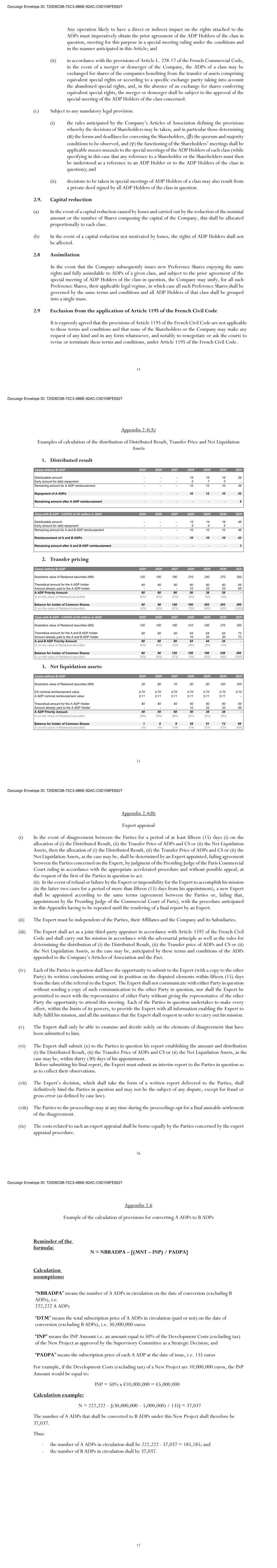

Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 13 “Redwood bis R1 Ratio” Means the leverage ratio (“REDWOOD BIS R1 Ratio”) for a relevant period and for the Redwood Perimeter: (i) Consolidated Net Debts of the Redwood Perimeter over (ii) Consolidated EBITDA of the Redwood Perimeter (as such terms are defined in the Senior Loan Contract relating to Bank Debt); “Escrow Agent” means the Bar Association of Paris, acting as legal escrow agent for the purposes of this Pact; “Financial Emergency Situation” means the situation in which an increase in the equity or quasi-equity of the Company would be required exclusively: (i) in order to prevent an imminent state of cessation of payment or the imminent opening of insolvency proceedings in respect of the Company or any of its Subsidiaries; or (ii) in order to remedy and/or prevent the breach of the Bank covenants under any financing documentation (including in relation to the Bank Debt) entered into by the Company and/or a Subsidiary; “Company” has the meaning ascribed to it in the appearances of the Parties; “Total Exit” means the transfer (voluntary or forced) of 100% of Company Securities to one or more Third Parties; “Articles of Association” means the Company’s Articles of Association as on the date hereof (a copy of which is provided in Appendix 1. 1(iii)) as they may be amended from time to time; “ESG and Impact Strategy” has the meaning ascribed to it in Article 8; “Successor” means any person becoming a holder of A ADPs or B ADPs, as the case may be, after the Completion Date, while specifying that in the event of a Transfer to a Successor, the Investor must Transfer the same percentage of A ADPs and, if applicable, B ADPs; “Third Party” means any person other than a Party or an Affiliate of a Party; “Third Party Purchaser” means any bona fide Third Party wishing to acquire Securities; “Securities” means (i) common shares or preferred shares and all other securities representing the capital or conferring voting rights, issued or to be issued; (ii) preferential subscription or allocation rights and rights of the same nature that could be detached from the shares, securities, rights or securities referred to in (i), (iii) and (iv) of this definition; (iii) securities giving or capable of giving access, in the long term, to the capital or conferring or capable of conferring, in the long term, voting rights; and (iv) any transferable securities which may result from the shares, transferable securities, rights and securities referred to in (i) and (iii) above, or which would be substituted for them as a result of a conversion, exchange, contribution or merger operation to which the Company or one of the companies of the Group would be a party; Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 14 “Transferred Securities” has the meaning ascribed to it in Article 9.3; “Purchase Promise Securities” “Sale Promise Securities” has the meaning ascribed to it in Article 15.1; has the meaning ascribed to it in Article 14.1; “Transfer” Means (i) any operation resulting, directly or indirectly, immediately, at term or under condition, in a transfer of ownership of Securities or the rights attached to the Securities (including subscription or allocation rights, voting rights, dividend rights) or the usufruct or bare ownership of Securities or the rights attached to the Securities, carried out free of charge or for a fee in any form whatsoever, notably by way of contribution to a company, merger, division, exchange, distribution in nature, repurchase sale, securities lending, transfers in trust (or other similar operations), donation, succession, liquidation of company, community or estate, hedging operations, swaps or entering into any other derivative instrument, assignment of any call option, purchase of any put option, whether by contract, operation of law, public auction or by virtue of a court order, (ii) individual renunciation of a subscription or allocation right attached to the Securities, (iii) the creation of security interests on the Securities as well as (iv) the conclusion of any contract, option, promise or other agreement with a view to, or the commitment to carry out, one of the operations described in (i) to (iii) above or the carrying out of any operation having a similar effect (notably economic). “Free Transfers” has the meaning ascribed to it in Article 13; “Group Cash” means the Consolidated Cash of the Redwood Perimeter as that term is defined in the Senior Loan Contract relating to Bank Debt; “IRR” means, whether under A ADPs or B ADPs, the internal rate of return corresponding to the discount rate by which the sum of the discounted flows (by applying this discount rate) on the date of an Inflow by the Investor under an A ADP or B ADP as the case may be, or an Outflow by the Investor, under an A ADP or B ADP as the case may be, is equal to zero (0) and calculated according to the following formula: 𝑛𝑛 𝐹𝐹𝐹𝐹 � 𝐹𝐹 ( ) Where: 𝐹𝐹=0 (1 + 𝑇𝑇𝑇𝑇𝑇𝑇) 365 • “Fi” means the i-th Inflow (if positive) or Outflow (if negative), as the case may be; Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 15 • “i” means the number of days elapsed from the date of subscription of the instruments (inclusive) (while specifying that, in the case of B ADPs, the date of subscription shall be the date of conversion from A ADPs to B ADPs) until the date (inclusive) of an Inflow or Outflow, as the case may be; • “n” means the number of days elapsed from the date of subscription (or conversion of B ADPs) of the instruments (inclusive) until the date of Transfer of the Securities held by the Investor (inclusive). 2. Interpretation rules 2.1. Any reference to the Pact means the Pact and its Appendices, which form an integral part thereof, and references to the preamble, Articles, paragraphs and Appendices mean the preamble, Articles, paragraphs and Appendices of the Pact. The Parties further agree that this Pact is included in the following definition “any contractual agreement entered into between all or part of the Company’s Shareholders, notably with regard to governance issues involving the Group and/or Transfers of Securities” when it shall be used to refer to the said Pact in the Company’s Articles of Association, its appendices, or any other document or contract in which the Company and/or a Party is a party. 2.2. The meaning of the defined terms applies to both the singular and the plural of these terms. 2.3. Unless the context otherwise requires, any reference to a legal provision means the provision as it may be amended, replaced or codified, to the extent that such amendment, replacement or codification is applicable or is likely to apply to the operations anticipated in the Pact. 2.4. Any reference to another document means this document as it may be amended or replaced (other than in violation of the provisions of this Pact), unless expressly provided otherwise in this Pact. 2.5. The examples following the terms “include”, “including”, “notably”, “in particular” and other terms having the same meaning are not limiting. 2.6. Any reference in this Pact to a “day” without further specification is a reference to a calendar day. 2.7. For the calculation of any period during which, or from which, an act or measure must be taken, the rules anticipated in Articles 640 to 642 of the French Code of Civil Procedure shall apply. Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 16 SECTION II – GOVERNANCE 3. Principles applicable to the Company 3.1. The Company is a simplified joint stock company, governed by the provisions of the French Commercial Code, the provisions of the Articles of Association and the provisions of the Pact, while specifying that in case of contradiction between the provisions of the Articles of Association and those of the Pact, the provisions of the Pact shall prevail between the Parties that shall make every effort within the limits of their respective powers to amend the Articles of Association as soon as possible in order to bring them into conformity with the Pact. 3.2. The Company carries out development and production activities of bioethanol, lignosulfonates, Crude Tall Oil and prebiotics through the Subsidiaries of which it holds all capital and voting rights (the “Activity”). 3.3. The Company management is entrusted to the Company Chairman (the “Chairman”), assisted, if necessary, by chief executive officers (the “Chief Executive Officers”), placed under the supervision of a supervisory committee (the “Supervisory Committee”), which shall be in charge of supervising the orientations of the Activity and ensuring their implementation, carrying out permanent control of the management of the Company and the Subsidiaries, and authorising in advance the Important Decisions and the Strategic Decisions under the terms of this Pact. 4. Management of the Company 4.1. Chairman 4.1.1. Powers of the Chairman The Chairman has the broadest powers to act in all circumstances in the name and on behalf of the Company, subject to the decisions that the law, the Pact or the Articles of Association reserve to the competence of the Community of Shareholders and the decisions subject to the prior authorisation of the Supervisory Committee as indicated in this Pact. 4.1.2. Designation and revocation provisions The Company Chairman, a natural or legal person, is appointed by decision of the Supervisory Committee acting by a Qualified Majority, for an indefinite period. As of the date hereof, Rayonier A.M. France is the Company Chairman. It is represented by Christian Ribeyrolle. The duties of Chairman end by resignation (by registered letter with acknowledgment of receipt sent to the Company, the Shareholders and the Chairman of the Supervisory Committee, and subject to three (3) months of notice), dismissal, legal incapacity making it impossible to continue the duties, prohibition to manage, death or, if the Chairman is a legal person, dissolution or opening of insolvency proceedings in the latter case, against the Chairman that is a legal person only. The Company Chairman may be dismissed ad nutum, at any time and without having to justify a reason, by decision of the Supervisory Committee ruling by a Qualified Majority and without compensation.

Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 17 4.1.3. Remuneration The Chairman shall not be remunerated for the performance of his duties as Chairman. The expenses reasonably incurred by the Chairman in the performance of his duties shall be reimbursed by the Company upon presentation of supporting documents, up to a limit of five thousand (5,000) euros per year. 4.2. Chief Executive Officers 4.2.1. Powers of the Chief Executive Officers Each Chief Executive Officer is responsible for assisting the Chairman in the day-to-day management of the Company. He has the same powers of representation with regard to Third Parties and is subject to the same limitations of powers as the Chairman. 4.2.2. Designation and revocation provisions One or more Chief Executive Officers, natural or legal persons, may be appointed by decision of the Supervisory Committee acting by a Qualified Majority, for an indefinite period. The duties of Chief Executive Officer end by resignation (by registered letter with acknowledgment of receipt sent to the Company, the Shareholders and the Chairman of the Supervisory Committee, and subject to three (3) months of notice), dismissal, legal incapacity making it impossible to continue the duties, prohibition to manage, death or, if the Chief Executive Officer is a legal person, dissolution or opening of insolvency proceedings in the latter case, against the Chief Executive Officer that is a legal person only. The Chief Executive Officers may be dismissed ad nutum, at any time and without having to justify a reason, by decision of the Supervisory Committee ruling by a Qualified Majority and without compensation. 4.2.3. Remuneration The Chief Executive Officers shall not be remunerated for the performance of their duties as Chief Executive Officers. The expenses reasonably incurred by the Chief Executive Officers in the performance of their duties shall be reimbursed by the Company upon presentation of supporting documents, up to a limit of five thousand (5,000) euros per year. 5. Supervisory Committee 5.1. Composition of the Supervisory Committee 5.1.1. Throughout the term of the Pact, subject to the provisions of Article 5.1.2, the Supervisory Committee shall be composed of four (4) Supervisory Committee Members, natural or legal persons, appointed by the Community of Shareholders by the reinforced majority referred to in Article 6.5, for an indefinite period, in accordance with the following: Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 18 (i) three (3) members proposed by the Majority Shareholder, each having one (1) vote (the “Supervisory Committee Members A”). These members are, on the date hereof, Messrs. Marcus Moeltner, Colby Slaughter and Christian Ribeyrolle; (ii) one (1) member proposed by the Investor, having one (1) vote (the “Supervisory Committee Member B”). This member is, on the date hereof, Mrs. Charlotte Virally. Each Supervisory Committee Member may be dismissed ad nutum by the Community of Shareholders acting by the reinforced majority referred to in Article 6.5, exclusively on the proposal of the Shareholder who proposed his appointment, it being specified that any replacement for the dismissed Member of the Supervisory Committee will be appointed on the proposal of the Shareholder concerned in accordance with these Articles. The dismissal of a Supervisory Committee Member shall not give rise to the payment of any compensation. In the event of resignation, legal incapacity making it impossible to remain in office, prohibition to manage, death or, if the member is a legal person, dissolution of a Supervisory Committee Member or opening of insolvency proceedings, in the latter case, against a Supervisory Committee Member who is a legal person only (the “Leaving Member”), the Leaving Member shall be renewed or replaced by a person appointed in accordance with the provisions hereof on the proposal of the Shareholder that had proposed the appointment of the Leaving Member. The Leaving Member may be replaced by co-option of the Supervisory Committee. 5.1.2. When the following four (4) cumulative conditions have been met (the “Objective Achievement Date”): (a) the IRR achieved by the Investor (collectively with any Successor) on all of its A ADPs is at least equal to 16%, (b) the IRR achieved by the Investor (collectively with any Successor) on all of its B ADPs is at least equal to 20%, (c) the Multiple achieved by the Investor (collectively with any Successor) is at least equal to 2x on its A ADPs, and (d) the Multiple achieved by the Investor (collectively with any Successor) is at least equal to 2.5x on its B ADPs, the Supervisory Committee shall take its Strategic Decisions by a Simple Majority and the Majority Shareholder shall have the right to appoint one (1) additional Supervisory Committee Member A, the Supervisory Committee then being composed of five (5) members, including four (4) Supervisory Committee Members A and one (1) Supervisory Committee Member B. 5.2. Non-voting members In addition, non-voting members (the “Non-voting members”) may be appointed by the Community of Shareholders. Each Supervisory Committee Member may give power to the Non- voting member appointed by the Shareholder that has itself appointed it for the purpose of representing it or deciding on its behalf. Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 19 The Non-voting members shall not have a deliberative vote (unless they have a proxy of a Supervisory Committee Member), may attend each Supervisory Committee meeting and shall have the same right to information as the Supervisory Committee Members. In this context, the Majority Shareholder shall have the right to appoint one (1) Non-voting member and the Investor shall have the right to appoint two (2) Non-voting members. The first Non-voting member appointed by the Majority Shareholder shall be Mrs. Estelle Hirel. The first Non-voting members appointed by the Investor shall be Messrs Guillaume Tuffigo and Edwyn Blackmore. 5.3. Chairmanship of the Supervisory Committee The Supervisory Committee elects by a Simple Majority, from among the Members of Supervisory Committee A, a Chairman of the Supervisory Committee who is responsible for directing its debates and ensuring its functioning (the “Chairman of the Supervisory Committee”). The Chairman of the Supervisory Committee is elected for the duration of his term of office as a Supervisory Committee Member. In the event of a tie, the Chairman of the Supervisory Committee shall not have a casting vote. The first Chairman of the Supervisory Committee shall be Mr. Marcus Moeltner. The Chairman of the Supervisory Committee is responsible for ensuring the smooth running of the Supervisory Committee meetings and chairs the debates. In the absence of the latter, Supervisory Committee meetings shall be chaired by the Supervisory Committee Member whom the Chairman of the Supervisory Committee shall have appointed for this purpose or, failing this, who shall be appointed by the Supervisory Committee Members by a Simple Majority at the beginning of the meeting. The Chairman of the Supervisory Committee may be dismissed ad nutum at any time, and without compensation, by decision of the Supervisory Committee acting by a Simple Majority. 5.4. Remuneration of the Supervisory Committee Members Supervisory Committee Members (including the Chairman of the Supervisory Committee) shall not receive any remuneration for their duties as Supervisory Committee Members. However, the expenses that they have reasonably incurred in the performance of their duties shall be reimbursed by the Company upon presentation of supporting documents, up to a limit of five thousand (5,000) euros per year and per Supervisory Committee Member. 5.5. Operation of the Supervisory Committee 5.5.1. Meetings – Deliberations – Agenda The Supervisory Committee shall meet when convened by the Chairman of the Supervisory Committee or one of the Supervisory Committee Members, as often as required in the interest of the Company, and at least once per calendar quarter (excluding extraordinary session(s)). The meeting notice, which must include the meeting agenda, the decisions submitted to the vote of the Supervisory Committee Members and the relevant documents making it possible to decide on these decisions, must be sent to the Supervisory Committee Members by any written means (including by e-mail) at least five (5) days before the meeting date. Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 20 However, the Supervisory Committee may validly meet, and no notice of meeting shall be required, when all Supervisory Committee Members are present or represented at the meeting and unanimously waive in writing the requirement for such a prior notice of meeting. Supervisory Committee meetings may be held physically in any place indicated in the meeting notice or agreed unanimously between the Supervisory Committee Members and/or if at least one of the Supervisory Committee Members or a Non-voting member so wishes, by videoconference, teleconference or any other means of communication allowing the identification of the participants. Any Supervisory Committee Member may be represented at the meeting by another Supervisory Committee Member, a Non-voting member, or by an employee or corporate officer of the Party having the right to appoint the Supervisory Committee Member in question. The mandate must be given by any written means (even by e-mail) and communicated to the Chairman of the Supervisory Committee (or to the Supervisory Committee Member who has been appointed or elected Chairman of the meeting) before the start of the meeting. A Supervisory Committee Member or a Non-voting member may represent one or more other Supervisory Committee Members. The decisions of the Supervisory Committee shall be recorded in written minutes and signed by at least two (2) Supervisory Committee Members present or represented. The decisions of the Supervisory Committee (including Strategic Decisions and Important Decisions) may also result, if necessary, from the unanimous consent of all of its members, recorded by a private deed. 5.5.2. Quorum The Supervisory Committee shall deliberate validly when convened for the first and second times only if at least two (2) of the Members of Supervisory Committee A and one (1) Member of Supervisory Committee B are present or represented. On the third convocation, the Supervisory Committee validly deliberates only in the presence of at least half of the Supervisory Committee Members including, if the Supervisory Committee must decide on a Strategic Decision, the presence of Supervisory Committee Member B. It is in fact specified that in any event, until the Objective Achievement Date, no Strategic Decision may be adopted without the presence of at least one (1) Supervisory Committee Member B. If a quorum is not reached during a given meeting and a new Supervisory Committee meeting is convened on the same agenda, it must be held at least five (5) days after the date on which the meeting lacking the sufficient quorum should have been held. 5.5.3. Decisions subject to the prior authorisation of the Supervisory Committee acting by a Simple Majority The following decisions concerning the Company or the Group (the “Important Decisions”) (including when they also require the vote of the Community of Shareholders), shall be submitted to the Supervisory Committee for prior authorisation and cannot be implemented (nor submitted to the Community of Shareholders) without the prior authorisation of the Supervisory Committee acting by a Simple Majority of the votes of the Supervisory Committee Members present or represented (the “Simple Majority”): (a) any adoption or modification of the annual budget or the Business Plan;

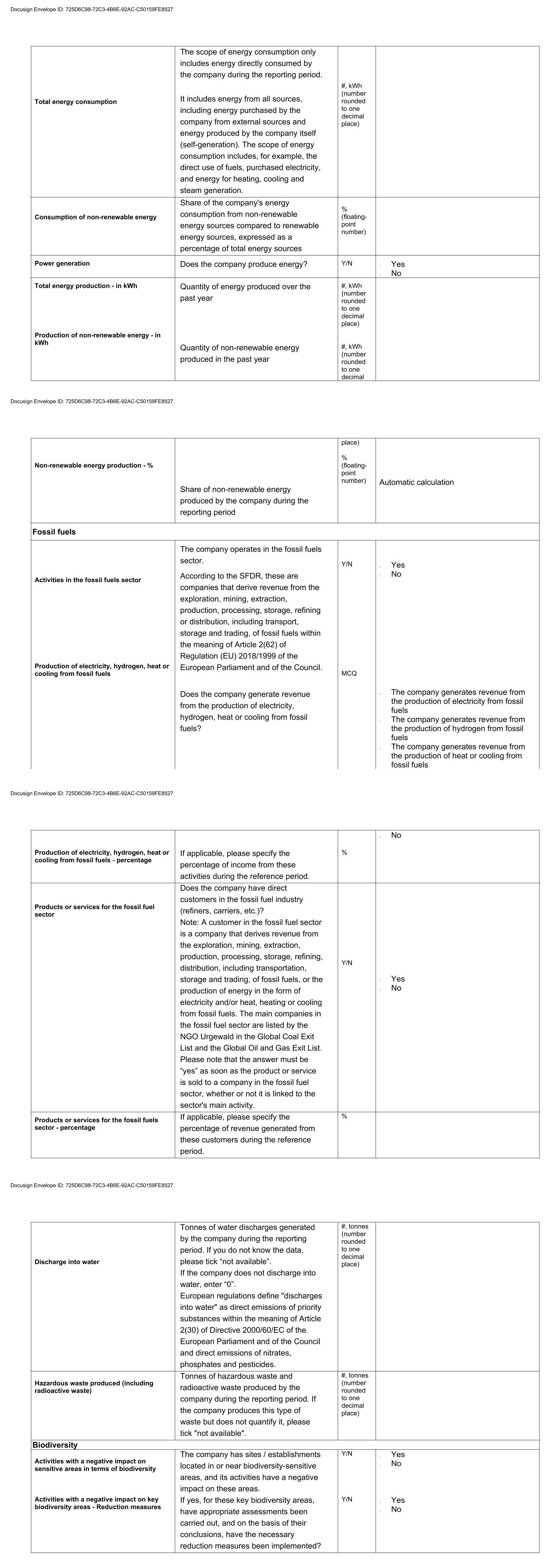

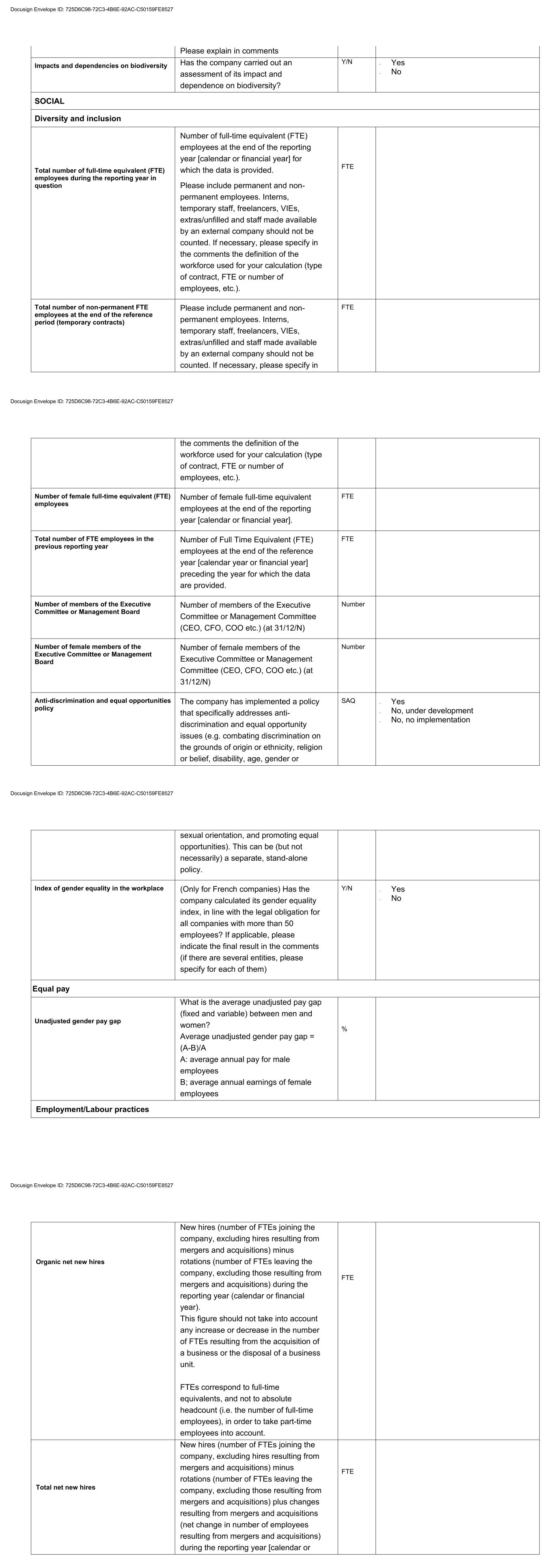

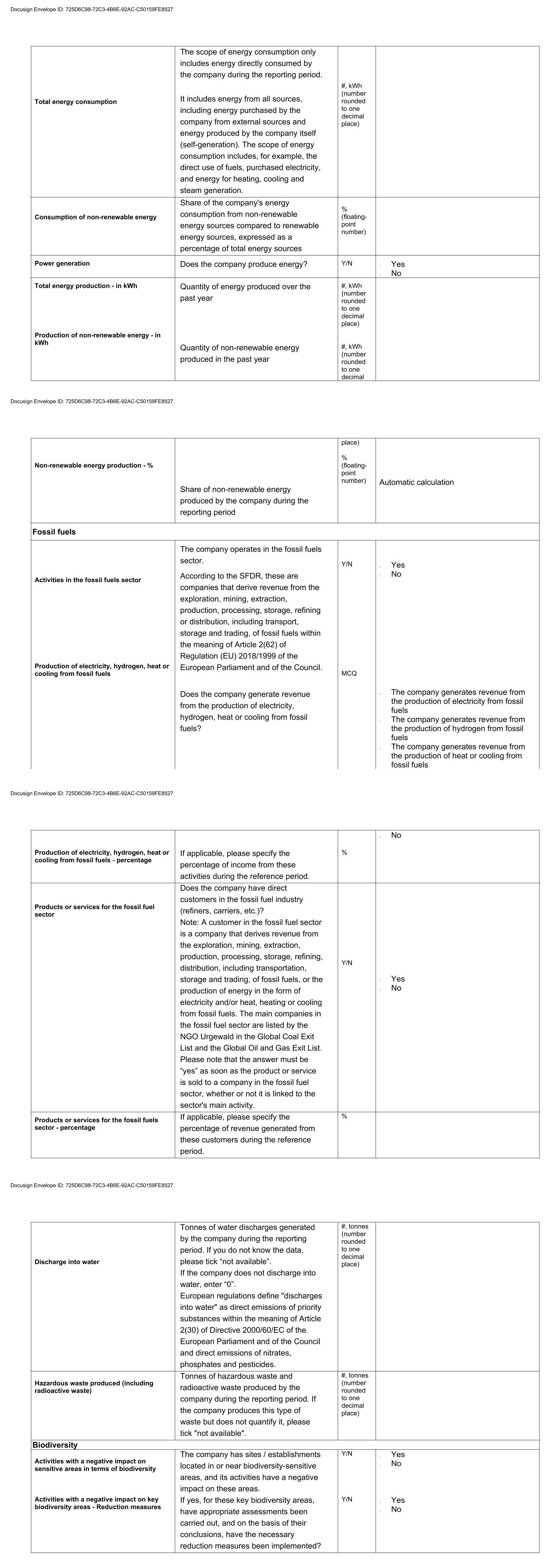

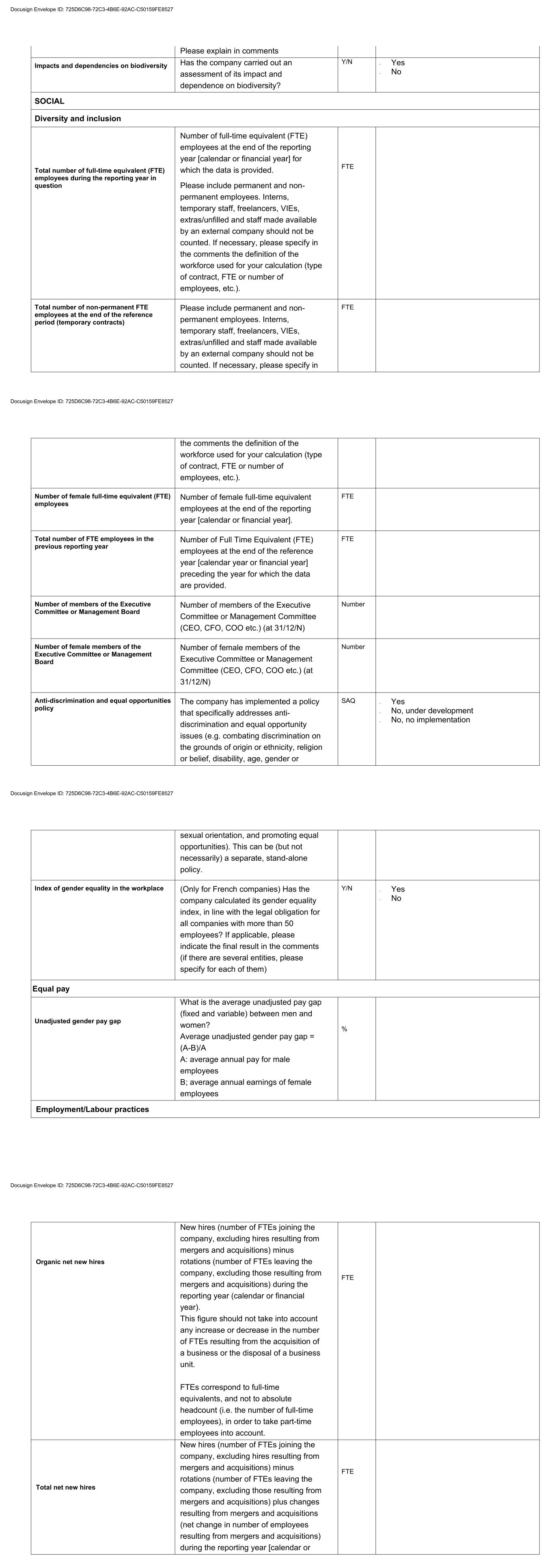

Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 21 (b) any commitment, conduct and/or resolution (settlement protocol, discontinuance of proceedings, etc.) by any Group company of any new judicial, administrative or arbitral proceedings on behalf of the Group companies for a value greater than 500,000 euros; (c) any decision relating to the closing of the annual and consolidated corporate accounts of the Company as well as the annual corporate accounts of the Subsidiaries; (d) appointment of the meeting chairman during Supervisory Committee meetings in the event that the Chairman of the Supervisory Committee fails to appoint one. 5.5.4. Decisions subject to the prior authorisation of the Supervisory Committee acting by a Qualified Majority Until the Objective Achievement Date, the following decisions concerning the Company or the Subsidiaries (the “Strategic Decisions”) (including when they also require the vote of the Community of Shareholders), shall be submitted to the Supervisory Committee for prior authorisation and cannot be implemented (nor submitted to the Community of Shareholders) without the prior authorisation of the Supervisory Committee acting by a majority of the Supervisory Committee Members present or represented, including the favorable vote of the Supervisory Committee Member B (the “Qualified Majority”): (a) any expense or other action by a Group company or decision on a Group company having an impact greater than or equal to two million euros (€2,000,000) on the Group’s EBITDA; (b) the conclusion by any Group company of any long-term debt or the modification of the conditions of any long-term debt in an amount greater than three million euros (€3,000,000) or which results in a cumulative increase in the Group’s total debt over the same financial year of more than five million euros (€5,000,000), the taking of any security interest over a Group asset and the issue by any Group company of any guarantee intended to guarantee the commitments of Third Parties; (c) all investment expenses (excluding current investments anticipated in the budget, which are not expenses relating to the capex of new production plants) by any Group company exceeding four million euros (€4,000,000); (d) the disposal of material assets by any Group company for a value of more than four million euros (€4,000,000); (e) the completion of any acquisition of material assets by any Group company for a value greater than four million euros (€4,000,000); (f) any decision to allocate part of the Group Cash to the Development Costs of a New Project as well as the maximum amount of these Development Costs to be taken into account for the calculation of the INP Amount; (g) any decision relating to the appointment and, in the cases authorised by law, the non-renewal and dismissal of the statutory auditors of the Company and/or a Group company, while specifying that (i) Grant Thornton shall be the initial statutory auditor of the Company and the Group companies and (ii) the representatives of the Investor undertake to vote in favour of any statutory auditor presented by the Majority Shareholder among the following firms: Deloitte, EY, KPMG, PricewaterhouseCoopers and Grant Thornton when the appointment of an auditor is made mandatory in view of the applicable legal conditions; Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 22 (h) any amendment to the Articles of Association of the Company or any Subsidiary; (i) the determination or modification of the remuneration or benefits in kind of the Chairman or Chief Executive Officer, or any corporate officer of a Subsidiary; (j) the creation, conversion, allotment, issue (with or without removal of the shareholders’ preferential subscription right), purchase, redemption or reimbursement of Securities of the Company or of a Subsidiary, except to avoid or remedy the violation of financial covenants) and provided that the majority of ninety percent (90%) is, where applicable, increased to allow the Investor to continue to benefit from a veto right on the decisions referred to in the section “Collective Decisions of the Shareholders”; (k) any IPO decision as well as the determination of the value of the Securities retained in the context of this IPO; (l) the acquisition, sale, transfer, assignment, contribution or assignment in any other way by the Company of the share capital of the Subsidiaries or any part thereof; (m) the realisation by any Group company of acquisitions of assets, securities or goodwill for a value of more than four million euros (€4,000,000); (n) the cessation or the proposal to cease to carry on the activities of any Group company; (o) the liquidation, dissolution or collective proceeding of the Company or any Subsidiary, or the completion of any merger or consolidation by any Group Company; (p) any significant change to the nature of the Group’s Business or to the registered office of any of the Group companies; (q) any adoption, modification or deviation of the ESG and Impact Strategy (or any other equivalent ESG strategy that would be implemented within the Company); (r) any conclusion, modification of the terms and conditions or termination of any contract concluded between the Company and/or a Subsidiary, on the one hand, and the Majority Shareholder or one of its Affiliates on the other hand or any of their corporate officers (including the corporate officers of the Group companies), except for the conclusion, modification or termination anticipated in the annual budget; (s) the conclusion, modification and termination of any secondment agreement relative to employees of the Majority Shareholder or its Affiliates to the Company and its Subsidiaries in the context of their secondment not anticipated in the annual budget; (t) the implementation of any plan involving free shares, BSPCEs, subscription options or purchase of shares or other equivalent incentive instruments, as well as the award of such instruments; (u) any audit of the corporate accounts of any Group company and consolidated accounts at year- end as well as any appropriation of profits by each Group company Group (including the distribution of any dividend between the different classes of shares); Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 23 (v) the creation by any Group company of any Subsidiary or the creation of any activity in a country other than France, the United States or Canada; (w) any restructuring operation (including merger, demerger, contribution in kind, partial contribution of assets) of the Company and/or a Subsidiary, except in the event of collective proceedings of the entity in question. 5.6. Information to the Supervisory Committee The Chairman and the Chief Executive Officers shall provide the Supervisory Committee Members with the documents and information set out in Appendix 5.6. In addition, enhanced information notably making it possible to carry out a legal, technical and financial audit must be provided to the Supervisory Committee Members concerning the project for the production of prebiotics in the United States anticipated in the Business Plan, in order to enable it to decide whether to make the investment on the said project. 5.7. Confidentiality Supervisory Committee Members shall be subject to the usual confidentiality obligations in this area. 6. Decisions of the Community of Shareholders 6.1. The Community of Shareholders shall be consulted upon being convened by (i) the Company Chairman or (ii) a Chief Executive Officer or (iii) any Company shareholder holding at least 10% of its share capital, by any written means (including by e-mail). 6.2. Collective decisions of the Shareholders are necessarily require with regard to: (i) the increase, amortisation or reduction of the Company’s capital; (ii) the creation of preference shares and the conversion of common shares into preference shares or preference shares into preference shares of another class; (iii) any IPO decision; (iv) the merger, demerger, dissolution, liquidation of the Company; (v) the transformation of the Company into a company of another form; (vi) the appointment and dismissal of the Supervisory Committee Members; (vii) the appointment of the Company’s statutory auditors and their dismissal in cases permitted by law; (viii) the approval of the annual accounts of the Company and the appropriation of profits; (ix) all contribution operations by the Company; (x) the transfer of the Company’s registered office outside of the same department or a neighbouring department; Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 24 (xi) the approval of the agreements between the Company and its managers referred to in Article L.227-10 of the French Commercial Code; and (xii) more generally, any modification of the Articles of Association or decision resulting, immediately or in the long term, in a modification of the Articles of Association. 6.3. The decisions of the Community of Shareholders shall result from a postal vote, a written consultation, a deed expressing the consent of all Shareholders or a general meeting (including by videoconference). 6.4. The decisions of the Community of Shareholders are validly taken only if the Shareholders present or represented, or participating by postal vote, hold at least 90% of the voting rights when convened for the first or second times, and half when convened for the third time. 6.5. The decisions of the Community of Shareholders shall be taken by an enhanced majority of 90% of the votes of the Shareholders present or represented, or participating in the postal vote, except for decisions requiring unanimity in all cases in which this is required by the law and the applicable regulations and in each case, after, where applicable, prior authorisation from the Supervisory Committee when such authorisation is anticipated in Articles 5.5.3 or 5.5.4. 6.6. When the Supervisory Committee has previously decided on an Important Decision or a Strategic Decision, the Shareholders undertake, during the collective decisions of the Company, to vote on these decisions, in the sense of the decisions taken by the Supervisory Committee. 7. Audit 7.1. The Investor shall have the right, once a year, to carry out or order an audit of the Company and, subject to the confidentiality commitments entered into by the Company and its Subsidiaries with regard to Third Parties, to consult or have communicated to it the information, elements and documents relating to the activity of the Company and its Subsidiaries, in the financial, accounting, technical, commercial and legal fields. 7.2. To this end, the Chairman and the Chief Executive Officers must ensure that the Company and its Subsidiaries make available to it or to the mandated auditors, within a reasonable time, all documents and information necessary for the performance of this audit. 7.3. It is specified that audits must be carried out under conditions that are not detrimental to the proper functioning of the Company and its Subsidiaries and that any request for an audit must be subject to reasonable notice. 7.4. Audit costs shall be borne by the Investor. 7.5. The audit report(s) carried out within the framework of this Article shall be communicated to the Supervisory Committee Members. 8. ESG and CSR criteria The Company and the Chairman have been informed of the commitments made by the Investor as a fund under Article 9 of the Regulation on Sustainability‐Related Disclosures in the Financial Services Sector (“SFDR”). These SFDR commitments are summarized in Appendix 8(i).

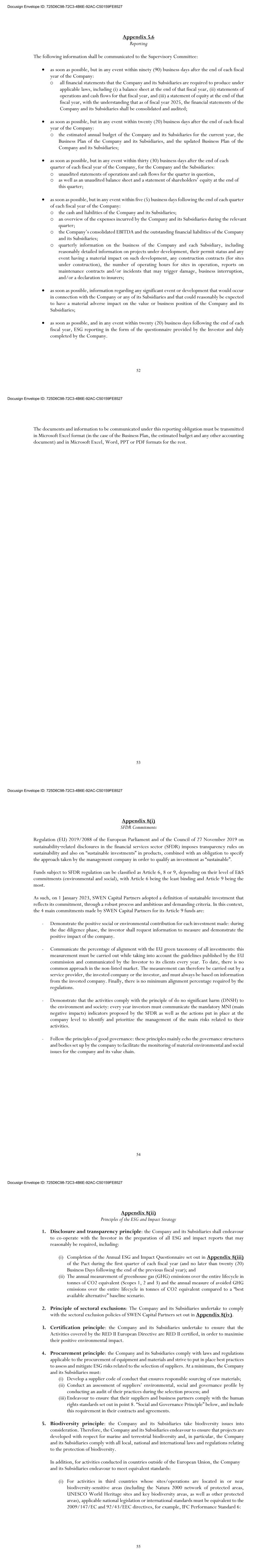

Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 25 The Company and the Chairman have been informed of the Investor’s commitments to take into account in its investments and in the monitoring of its holdings, environmental, social, societal and good corporate governance criteria (the “ESG Criteria”), such as: - use of natural resources, - environmental impacts, - employment, - social dialogue, - human resources, - relationships with suppliers and customers, - relations with the territory and “stakeholders” in general, - governance, - management. The Chairman and the Company undertake to take part in a process of progress so that the Company carries out its Activities under conditions reconciling economic interest and social responsibility of the company. The Company is committed to adopting an environmental, social, governance and impact strategy (the “ESG and Impact Strategy”), covering all its Activities and those of its Subsidiaries, in accordance with the principles of the ESG and Impact Strategy described in Appendix 8(ii) before the first anniversary of the signing of the Pact (the “ESG Deadline”). By this date, the Company must, with the agreement of the Supervisory Committee under the Strategic Decisions, have adopted and implemented an ESG and Impact Strategy. Any deviation from the ESG and Impact Strategy (or any equivalent ESG strategy) shall need to be approved by the Supervisory Committee as a Strategic Decision. The Company notably undertakes, as part of the implementation of the ESG and Impact Strategy, to complete an ESG questionnaire in accordance with the template in Appendix 8(iii) (or in any other format agreed between the Parties) in connection with the Company’s ESG reporting obligations and practices, which shall be communicated as soon as possible to the Supervisory Committee Members as part of the information listed in Appendix 5.6, and in any event within twenty (20) Business Days following the end of each fiscal year, from 1January 2025. If the Company has not adopted such a strategy in accordance with this Article by the ESG Deadline, the Investor may propose an ESG strategy (which must comply with the principles of the ESG and Impact Strategy), which the Company must adopt and implement as soon as possible. In this case, the Company shall provide all reasonable assistance to the Investor in order to help it implement the said ESG strategy. Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 26 SECTION III – RIGHTS ATTACHED TO SECURITIES AND TRANSFERS OF SECURITIES 9. General principles 9.1. General rules applicable to any Transfer of Securities Any Transfer of Company Securities in violation of the provisions of the Pact shall be considered null and void and the Company shall be obliged to refuse the transcription of the Transfer made in violation of the provisions of the Pact in the Company’s securities transfer ledger and the individual accounts of holders of Company Securities. The Investor shall have the possibility, at any time, and without prejudice to the cases of Free Transfers, to transfer all or part of the Securities held by it to a person whose activities are not directly or indirectly in competition, complementary or related to the Activity, subject to the approval of the said person by the community of shareholders in accordance with Article 11.3 of the Articles of Association, with the approval of the Majority Shareholder not being unreasonably refused and without being duly justified. No approval shall be required in the event of a Free Transfer in accordance with Article 11.3.1 of the Articles of Association. The Parties undertake not to grant any pledge on all or part of their Company Securities, or on any securities account in which their Company Securities would be registered, unless otherwise agreed in writing by the other Parties. 9.2. Temporary inalienability of Securities The Parties acknowledge that it is essential and in the Company’s interest to maintain a stable participation of the Majority Shareholder in the capital of the Company for a determined period of time in order to promote the development of its Business. The Parties acknowledge and agree that the restrictions applicable to the Transfers of Securities hereunder are reasonable having regard to the purpose of the Pact and the common intention of the Parties. Consequently, the Majority Shareholder undertakes, until the expiry of a period of six (6) years from the date hereof (the “Lock-Up Period”), not to Transfer any Company Securities, and not to make any firm commitment with any Third Party whatsoever regarding the Transfer of Securities, except in the case of Free Transfers. 9.3. Obligation to notify any Transfer of Securities In the event that a Shareholder intends to Transfer all or part of its Securities (except in the event of a Free Transfer for which Article 13 shall apply) to a Third Party Purchaser or to a Party (or Affiliate of a Party) (an “Acquiring Candidate”), it must immediately inform the other Shareholders and the Company of any expression of interest that may be received by the Shareholder in question and that the latter wishes to pursue, on the part of a possible Acquiring Candidate of Company Securities and any discussion initiated between it and such an Acquiring Candidate. The Shareholder in question undertakes to notify the other Shareholders and the Company of any proposed Transfer of Securities (except in the case of a Free Transfer for which Article 13 shall apply), with the following indications: Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 27 (i) the name (or corporate name) and address (or registered office) of the Acquiring Candidate(s), the identity of the person(s) directly and ultimately Controlling (if this information is known to the Shareholder in question having made every effort to obtain it in good faith) the Acquiring Candidate (if not a natural person); (ii) the number of Securities (by class of Securities) the Transfer of which is envisaged (the “Transferred Securities”) by the Shareholder in question, and, where applicable, whether the envisaged Transfer constitutes a Change of Control; (iii) the price offered per class of Transferred Securities (as well as, where applicable, the methods of adjusting or returning this price) and the payment terms under which the Transfer must be made and, in the event of a Complex Operation, the cash equivalent, per class of Securities, of the price proposed in good faith by the Shareholder in question with the details of the adopted calculation assumptions and elements; (iv) the other terms of the proposed operation, such as guarantee commitments; (v) the direct or indirect financial or capital ties existing, if any, between the relevant Shareholder and the Acquiring Candidate; (vi) a copy of the Acquiring Candidate’s binding offer; this notice being hereinafter referred to as the “Transfer Notice”. 9.4. Distribution of Securities in the event of a Transfer In all cases of Concomitant Transfer of CS, on the one hand, and of A ADPs or B ADPs, on the other hand, the price of the Securities concerned by the Transfer (the “Overall Consideration”) must always be allocated between the holders of Securities according to the distribution rules and in the following order of priority (a numerical illustration appears as an example in Appendix 9.4 of the Pact as agreed between the Parties on the Completion Date): (i) In the first place, the Overall Consideration shall be allocated (in no order of priority) to the holders of A ADPs and, if any, B ADPs, up to the “A ADP Priority Amount” in the case of the Transfer of A ADPs and the “B ADP Priority Amount” in the case of the Transfer of B ADPs, calculated in accordance with the terms and conditions of the A ADPs and B ADPs which appear in the Articles of Association; (ii) then the possible balance of the Overall Consideration, if any, shall be allocated (after completion of step (i) above), in full to any holder of common shares, or, in the case of several holders of common shares, proportionally between them. In the event of disagreement between the Parties regarding the determination of the price of the Company’s Securities according to the distribution rules recalled above, the Company shall be decided by an Expert as indicated in Appendix 1.1(ii). The Parties undertake to take the necessary steps to ensure that the distribution rules indicated above are applied for any Transfer of Securities. In the event that the Investor decides to Transfer only part of its Securities and holds both A ADPs and B ADPs, it must Transfer the same percentage of A ADPs and B ADPs. Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 28 10. Pre-Emption Right 10.1. Principle Without prejudice to the provisions of Article 9.2 and Free Transfers, Transfers of Securities by any Shareholder to any Acquiring Candidate shall be subject to a pre-emption right (the “Pre-Emption Right”) for the benefit of the other Parties (the “Pre-Emption Right Beneficiaries”). The pre-emption right is granted equally to all the Parties without the right of priority. The price of a Security shall be equal to: (i) in the event of a Transfer of Securities for a price in cash only, the price of a Security agreed between the Transferring Shareholder and the Third Party Purchaser and notified in the Transfer Notice; or (ii) in the case of a Complex Operation, the cash equivalent of the consideration for the Transfer of a Security proposed in good faith by the Transferring Shareholder in the Transfer Notice, or in the event of disagreement by one or more Pre-Emption Right Beneficiaries, the cash equivalent of the consideration for the Transfer in question fixed by an Expert under the conditions anticipated in Appendix 1.1(ii). 10.2. Procedure The exercise of the Pre-Emption Right shall be as follows: The issuance of a Transfer Notice shall constitute an irrevocable offer by the Shareholder in question to sell all of the Transferred Securities to the Pre-Emption Right Beneficiaries. Each Pre-Emption Right Beneficiary shall have a period of thirty (30) days from the receipt of a Transfer Notice (this period being extended to forty-five (45) days in the event that the Transfer Notice is received during the months of August or December) to provide the Shareholder in question with a notification in response (with a copy to the other Pre-Emption Right Beneficiaries and to the Company) (the “Pre-Emption Notification”), indicating (a) whether it wishes to acquire all or part of the Transferred Securities under the same price and payment conditions as those offered by the Acquiring Candidate (subject to a disagreement of the Parties in the context of the completion of a Complex Operation), the Pre-Emption Notification then constituting an irrevocable and binding offer by the Shareholder in question to acquire all of the Transferred Securities at the prices and conditions indicated in the Pre-Emption Notification, or (b) if it renounces the exercise of its Pre- Emption Right. Failure to provide a Pre-Emption Notification to a Pre-Emption Right Beneficiary within the above deadlines shall constitute a waiver on its part of the exercise of its Pre-Emption Right. The Pre-Emption Right can only be considered validly exercised if all (and not less than all) of the Transferred Securities are pre-empted by one or more Pre-Emption Right Beneficiaries. Failing this, the Shareholder in question may then freely transfer its Securities to the Acquiring Candidate, but only under the conditions and prices appearing in its Transfer Notice and imperatively within thirty (30) days following either (i) the expiry of the period during which the Pre-Emption Notifications may be sent, or (ii) the date of obtaining the necessary authorisations under the legal and regulatory provisions that may be applicable for the purposes of allowing the said Transfer, failing which the pre-emption procedure must be implemented again (the aforementioned thirty (30) day period being extended to forty-five (45) days in the event that one of the dates mentioned in (i) or (ii) above

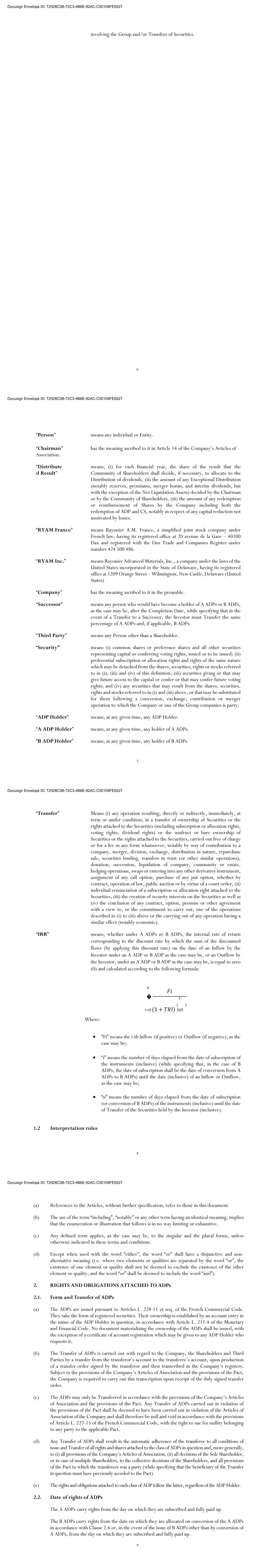

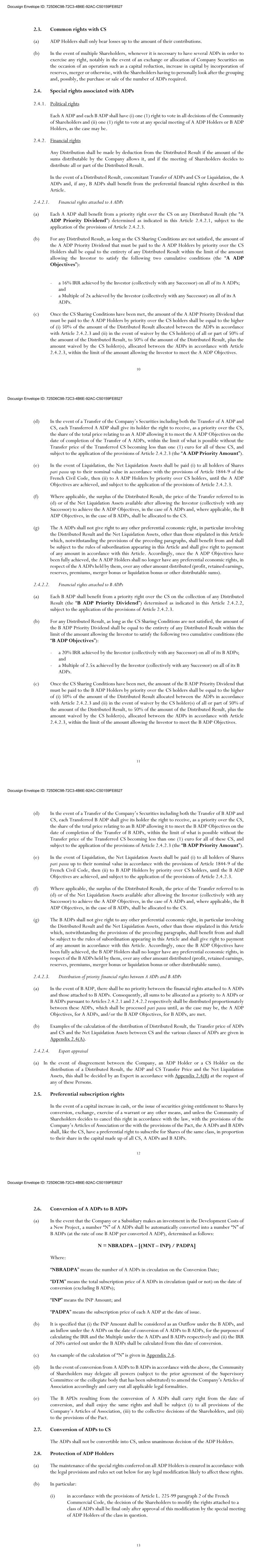

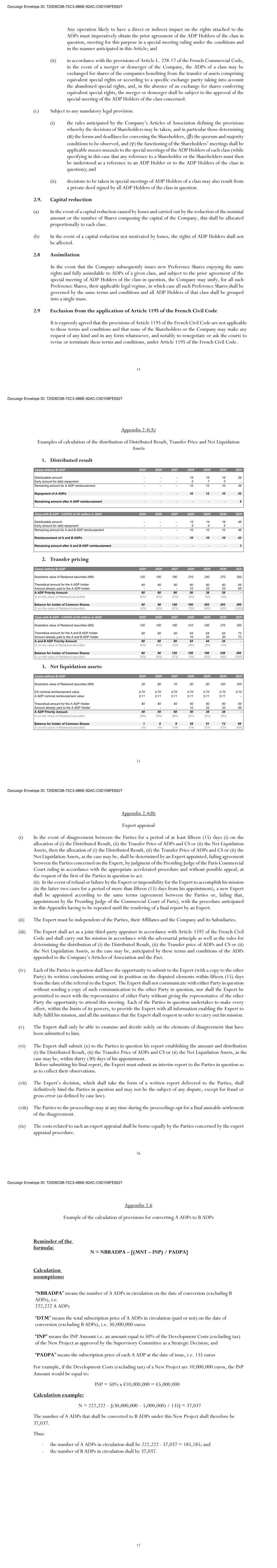

Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 29 occurs during the months of August or December). Any modification (i) of the price of the Transferred Securities (including any consideration that is not in cash) and/or (ii) of the terms and conditions of the proposed Transfer as set out in the initially served Transfer Notice must give rise to the service of a new Transfer Notice incorporating these modifications and the implementation of a new pre-emption procedure in accordance with the terms of this Article. In the event that the redemption offers of the Pre-Emption Right Beneficiaries who have exercised their Pre-Emption Right concern a number of Securities equal to or greater than that of the Transferred Securities: (i) If the total number of Securities that the Pre-Emption Right Beneficiaries intend to pre-empt is strictly equal to the number of Transferred Securities, the Pre-Emption Right Beneficiaries who have exercised their Pre-Emption Right shall be allocated the number of Transferred Securities that they have pre-empted within the limit of their respective requests; (ii) If the total number of Securities that the Pre-Emption Right Beneficiaries intend to pre-empt is greater than the number of Transferred Securities, the Pre-Emption Right Beneficiaries having exercised their Pre-Emption Right shall be allocated a number of Transferred Securities calculated in proportion to the number of Shares that each Pre-Emption Right Beneficiary having exercised its Pre-Emption Right holds in relation to the total number of Shares held collectively by the Pre-Emption Right Beneficiaries having exercised their Pre- Emption Right, within the limit of the requests of each Pre-Emption Right Beneficiary, unless otherwise agreed by the Pre-Emption Right Beneficiaries having exercised their Pre- Emption Right on a different distribution. In the event of a breach, the remaining Security or Securities shall be assigned ex officio to the Pre-Emption Right Beneficiary that has pre- empted the largest number of Transferred Securities or, in the event of equality, to the first of the Pre-Emption Right Beneficiaries to have notified its intention to exercise its Pre- Emption Right, unless otherwise agreed by the Pre-Emption Right Beneficiaries that have exercised their Pre-Emption Right on a different distribution; In the event of a valid exercise by the Pre-Emption Right Beneficiaries of their Pre-Emption Right, the transfer of ownership of the Transferred Securities shall take place for the benefit of the Pre- Emption Right Beneficiaries who have exercised the Pre-Emption Right within thirty (30) days following either (i) the expiry of the period during which the Pre-Emption Notifications may be sent, or (ii) in the event of recourse to an Expert in the context of a Complex Operation, the date of determination of the cash equivalent of the consideration for the Transfer of the Securities in question by the Expert in accordance with the expert procedure set out in Appendix 1.1.(ii), or (iii) the date of obtaining the necessary authorisations under the legal and regulatory provisions that may be applicable for the purposes of allowing said Transfer (the aforementioned period of thirty (30) days being extended to forty-five (45) days in the event that one of the dates mentioned in (i) or (ii) above occurs during the months of August or December). On the date of the said Transfer, the Shareholder in question shall provide to the Beneficiary(-ies) of the Pre-Emption Right having exercised the Pre-Emption Right with one or more transfer orders relating to the Transferred Securities validly established and duly signed against payment of the price of the Transferred Securities. Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 30 11. Joint Transfer Right 11.1. Principle Without prejudice to the provisions of Article 9.2 and Free Transfers, in the event of a proposed Transfer of Securities by any Shareholder (the “Transferor”) to any Third Party Purchaser, each of the other Parties (the “Joint Transfer Right Beneficiaries”) shall have a right to Transfer to the Third Party Purchaser or, failing that, to the Transferor all of the Securities then held by the said Joint Transfer Right Beneficiary, if and only if the Transfer results in a Change of Control for the benefit of the Third Party Purchaser (the “Joint Transfer Right”), in each case in accordance with the terms defined below. The price of a Security of the Joint Transfer Right Beneficiary in the context of the exercise of its Joint Transfer Right shall be equal to: (i) in the event of a Transfer of CS by a Joint Transfer Right Beneficiary (i) for a cash price only, at the price of a CS agreed between the Transferring Shareholder and the Third Party Purchaser and notified in the Transfer Notice and (ii) in the context of a Complex Operation, at the cash equivalent of the consideration for the Transfer of the Securities in question, as proposed in good faith by the Transferring Shareholder, or in the event of disagreement by one or more Joint Transfer Right Beneficiaries on this cash equivalent, the cash equivalent of the consideration for the Transfer of the Securities in question fixed by an Expert under the conditions anticipated in Appendix 1.1(ii); (ii) in the event of a Transfer of A ADPs by the Investor (or any Successor), at the price allowing the Investor (collectively with any Successor) to achieve an IRR of 16% and a Multiple of 2x on these A ADPs, on the date of the Transfer; or (iii) in the event of a Transfer of B ADPs by the Investor (or any Successor), the price allowing the Investor (collectively with any Successor) to achieve an IRR of 20% and a Multiple of 2.5x on these B ADPs, on the date of the Transfer. 11.2. Procedure Each Joint Transfer Right Beneficiary shall have a period of thirty (30) days from receipt of a Transfer Notice (this period being extended to forty-five (45) days in the event that the Transfer Notice is received during the months of August or December) to send the Transferor a notice in response (the “Joint Assignment Notification”), indicating (a) whether it wishes to transfer all of the Securities held by it at the price determined as indicated in Article 11.1 above and, for other terms, in the same manner as those offered by the Third Party Purchaser to the Transferor or (b) whether it waives the exercise of its Joint Transfer Right. Failure to provide a Joint Assignment Notification to a Joint Transfer Right Beneficiary within the above deadlines shall constitute a waiver on its part of the exercise of its Joint Transfer Right. Any modification of the terms and conditions of the proposed Transfer as set out in the initially served Transfer Notice must give rise to the service of a new Transfer Notice incorporating these modifications and the implementation of a new procedure under the Joint Transfer Right in accordance with the terms of this Article. Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 31 In the event of a valid exercise by the Joint Transfer Right Beneficiaries of their Joint Transfer Right, the Transferor undertakes to ensure that the Third Party Purchaser irrevocably offers to the Joint Transfer Right Beneficiaries to acquire all of the Securities then held by the Joint Transfer Right Beneficiaries, under the conditions and in accordance with the terms specified in this Article 11 (and in particular at the price anticipated in Article 11.1). In the event that the Third Party Purchaser refuses to acquire the Securities of the Joint Transfer Right Beneficiaries who have exercised their Joint Transfer Right, the Transferor undertakes to acquire the said Securities under the conditions anticipated in this Article 11 (and in particular at the price anticipated in Article 11.1) or to waive the assignment that gave rise to the Transfer Notice. In any event, each Pre-Emption Right Beneficiary that has exercised its Pre-Emption Right on the occasion of a Transfer is prohibited from simultaneously exercising the Joint Transfer Right which it enjoys under this Article 11 on the occasion of the same Transfer. Conversely, each Joint Transfer Right Beneficiary that has exercised its Joint Transfer Right on the occasion of a Transfer is prohibited from simultaneously exercising the Pre-Emption Right which it enjoys under Article 10 on the occasion of the same Transfer. The Transfer Price of the Securities owned by the Joint Transfer Right Beneficiaries under the Joint Transfer Right shall be as set out in Article 11.1. In the event of disagreement on the price of a Security pursuant to Article 11.1., in the context of a Joint Transfer Right, the price of the Security in question shall be determined by an Expert under the conditions anticipated in Appendix 1.1(ii). The Joint Assignment Notification sent by a Joint Transfer Right Beneficiary under the conditions of this Article, shall carry an unconditional and irrevocable commitment of the said Joint Transfer Right Beneficiary to: (i) Transfer to the Third Party Purchaser, concomitantly with the Transfer made by the Transferor, of all of its Securities, at the price determined in accordance with Article 11.1; (ii) sign any agreement or document allowing the effective Transfer of its Securities to the Third Party Purchaser; and (iii) deliver, on the date of the Transfer, to the Third Party Purchaser, against payment of the price of its Securities determined in accordance with Article 11.1, all documents necessary to carry out the effective Transfer of its Securities, duly completed and signed. The Parties agree and acknowledge that the Investor may not be required, in respect of the Transfer of its A ADPs or B ADPs, to: (i) bear exit costs of any kind; or (ii) grant the Third Party Purchaser any guarantees of liabilities, net assets, price restitution or any other guarantees or insurance or other price adjustment mechanism of any kind to which the Transferor would have agreed in the context of the Transfer in question. Docusign Envelope ID: 725D6C98-72C3-4B6E-92AC-C50159FE8527 32 12. Forced Exit Obligation 12.1. Principle The Parties agree that in the event that a Party receives a binding offer from a bona fide Third Party (the “Transferee”) to acquire one hundred percent (100%) of the Company’s share capital and voting rights on a fully diluted basis (an “Offer”), and provided that: (i) the Majority Shareholder decides to accept the Offer; and (ii) the Offer enables the Investor (collectively with any Successor) (y) in the case of A ADPs, to achieve an IRR equal to 16% on these A ADPs and a Multiple equal to 2x on these A ADPs and (z) in the case of B ADPs, if any, to achieve an IRR equal to 20% on these B ADPs and a Multiple equal to 2.5x on these B ADPs, by a cash payment, the Majority Shareholder shall have the right to require all other Parties holding Company Securities, who accept it and undertake to do so in a firm and irrevocable manner, to transfer all of their Company Securities, jointly and concomitantly, to the Transferee under the terms and conditions indicated in the Offer (the “Forced Exit Obligation”). 12.2. Rules applicable to the Forced Exit Obligation The exercise by the Majority Shareholder of the Forced Exit Obligation pursuant to Article 12.1 shall include an unconditional and irrevocable commitment by the other Parties holding Company Securities (provided, for the Investor, that the Transfer of its Securities allows it to meet the criteria of Article 12.1(ii)) to Transfer all of their Company Securities at the prices, terms and conditions of the Offer within a maximum period of thirty (30) days from receipt of a Transfer Notice sent by the Majority Shareholder to the other Parties specifying its decision to exercise the Forced Exit Obligation (this period being automatically extended for the purposes of obtaining the necessary authorisations under the legal and regulatory provisions that may be applicable for the purposes of enabling the said Transfer). It is specified, for all intents and purposes, that this commitment of the Parties holding Company Securities to Transfer all of their Company Securities in the event of implementation of the Forced Exit Obligation constitutes an irrevocable sale promise within the meaning of the provisions of Article 1124 of the French Civil Code. In the event of implementation of the Forced Exit Obligation, the Pre-Emption Right shall not be applicable. Each of the Parties holding Company Securities undertakes to cooperate actively and in good faith with the Majority Shareholder in the context of the implementation of the Forced Exit Obligation. As part of the Majority Shareholder’s implementation of the Forced Exit Obligation, each of the Parties shall Transfer all of the Company Securities held by it on the day of the Transfer to the Transferee. Each Party shall Transfer its Securities, concurrently with the Transfer by the Majority Shareholder to the Transferee of its Securities. On the date of this Transfer, each Party shall provide the Transferee with all transfer orders and other documents necessary to carry out the effective Transfer of all of its Securities, duly completed and signed.