UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number | | 811-22936 |

Diversified Real Asset Income Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: May 31

Date of reporting period: May 31, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| | |

| | |  |

| Closed-End Funds | |

| | |

| | | Nuveen Investments |

| | | Closed-End Funds |

| | | | | | |

| | | | | | | Annual Report May 31, 2015 |

| | | |

| | | | | | |

| | | | | | | |

| DRA | | | | | | |

| Diversified Real Asset Income Fund | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | |

| | | | | | | | |

| | | |

| | Life is Complex | | | | |

| |

| | Nuveen makes things e-simple. It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Investments Fund information is ready – no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish. |

| | |

| | Free e-Reports right to your e-mail! |

| |

| | www.investordelivery.com If you receive your Nuveen Fund dividends and statements from your financial advisor or brokerage account. |

| |

| | www.nuveen.com/accountaccess If you receive your Nuveen Fund dividends and statements directly from Nuveen. |

Table

of Contents

Portfolio Managers’

Comments

Diversified Real Asset Income Fund (DRA)

Diversified Real Asset Income Fund (DRA) (the Fund) is a newly organized closed-end fund managed by Nuveen Fund Advisors, LLC (NFAL) and sub-advised by Nuveen Asset Management, LLC (NAM). The Fund, which commenced operations on September 8, 2014, was formed from the merger of the following four closed-end funds (the Target Funds) that had been advised by U.S. Bancorp Asset Management, Inc. and sub-advised by NFAL and NAM:

| | • | | American Strategic Income Portfolio Inc. (ASP), |

| | • | | American Strategic Income Portfolio Inc. II (BSP), |

| | • | | American Strategic Income Portfolio Inc. III (CSP), and |

| | • | | American Select Portfolio Inc. (SLA). |

The Fund is sub-advised by NAM using its real asset income strategy. For the majority of the reporting period, the Fund’s management team consisted of John Wenker, Jay Rosenberg, Jeffrey Schmitz, CFA, David Yale and Jason O’Brien, CFA. Consistent with the ongoing repositioning of the Fund’s portfolio, effective April 30, 2015, Brenda Langenfeld, CFA, and Tryg Sarsland from NAM were added as co-portfolio managers and Jason O’Brien was removed from the team.

Here the portfolio management team reviews economic and market conditions, the management strategy and the performance of the Fund during the abbreviated reporting period since the Fund’s commencement of operations on September 8, 2014, through May 31, 2015.

What factors affected the U.S. economy during this abbreviated annual reporting period ended May 31, 2015?

During this reporting period, the U.S. economy continued to expand at a moderate pace. The Federal Reserve (Fed) maintained efforts to bolster growth and promote progress toward its mandates of maximum employment and price stability by holding the benchmark fed funds rate at the record low level of zero to 0.25% that it established in December 2008. At its October 2014 meeting, the Fed announced that it would end its bond-buying stimulus program in November after tapering its monthly asset purchases of mortgage-backed and longer-term Treasury securities from the original $85 billion per month to $15 billion per month over the course of seven consecutive meetings (December 2013 through September 2014). The Fed cited substantial improvement in the outlook for the labor market as well as sufficient underlying strength in the broader economy to support ongoing progress toward maximum employment in a context of price stability. Policymakers also reiterated that they would continue to look at a wide range of factors, including labor market conditions, indicators of inflationary pressures and readings on financial developments, in

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service (Moody’s), Inc. or Fitch, Inc. (Fitch). Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

determining future actions. Additionally, the Fed stated that it would likely maintain the current target range for the fed funds rate for a considerable time after the end of the asset purchase program, especially if projected inflation continues to run below its 2% longer run goal. However, if economic data shows faster progress, the Fed indicated that it could raise the fed funds rate sooner than expected.

The Fed changed its language slightly in December, indicating it would be “patient” in normalizing monetary policy. This shift helped ease investors’ worries that rates might be raised too soon. However, as employment data released early in 2015 continued to look strong, anticipation began building that the Fed could raise its main policy rate as soon as June. As widely expected, after its March meeting, the Fed eliminated “patient” from its statement, but also highlighted the policymakers’ less optimistic view of the U.S. economy’s overall health as well as downgraded their inflation projections. April’s meeting seemed to further signal that a June rate hike was off the table. While the Fed attributed the first quarter’s economic weakness to temporary factors, the meeting minutes from April revealed that many Federal Open Market Committee members believed the economic data available in June would be insufficient to meet the Fed’s criteria for initiating a rate increase.

According to the government’s second estimate, the U.S. economy contracted at a 0.7% annualized rate in the first quarter of 2015, as measured by gross domestic product (GDP), compared with an increase of 2.2% in the fourth quarter of 2014 and 5.0% in the third quarter of 2014. The decline in the real GDP growth rate from the fourth quarter to the first quarter primarily reflected a downturn in both state and local government spending as well as declines in exports and consumer spending. These were partly offset by an upturn in federal government spending. The Consumer Price Index (CPI) was unchanged on a year-over-year basis as of May 2015. The core CPI figure (which excludes food and energy) increased 1.7% during the same period, which was below the Fed’s unofficial longer term inflation objective of 2.0%. As of May 2015, the U.S. unemployment rate was 5.5%, a level not seen since mid-2008 and nearly 1% lower than one year ago. This figure is also considered “full employment” by some Fed officials. The housing market continued to post consistent gains as of its most recent reading in April 2015. The average home price in the S&P/Case-Shiller Index of 20 major metropolitan areas rose 4.9% for the twelve months ended April 2015 (most recent data available at the time this report was prepared).

During this abbreviated reporting period from the Fund’s commencement of operations on September 8, 2014 through May 31, 2015, real estate investment trust (REIT) preferreds were the top performing asset class on an absolute basis within the five “real asset” categories represented in the Fund’s blended benchmark. REIT preferreds, which typically have longer durations, benefited from declining rates and gained 6.44% during the period, as measured by the BofA/ Merrill Lynch REIT Preferred Index. The global infrastructure preferred segment, as measured by the BofA/Merrill Lynch Preferred Stock Fixed Rate Index, followed closely behind, gaining 6.13% during the same time frame. REIT common equities also performed fairly well due to several tailwinds including declining interest rates, solid underlying fundamentals, better U.S. economic and jobs data, as well as relatively attractive valuations. As measured by the MSCI U.S. REIT Index, the REIT common equity segment advanced 4.79% during the reporting period. In the high yield market, a confluence of factors pressured the segment during the first half of the period, most notably the outlook for global growth and the precipitous drop in oil prices. The latter had the greatest effect on the high yield market being that up to 14% of common high yield indexes consist of credits exposed to oil, more so than any other sector. However, high yield indices still managed to post positive returns, helped along by a rebound in the price of high yield energy debt in the second half of the reporting period. The high yield market returned 1.31%, as measured by the Barclays U.S. Corporate High Yield Index. The global infrastructure common equity segment underperformed the other segments during the abbreviated reporting period with a -1.37% return as measured by S&P Global Infrastructure Index. After significant outperformance from the electric utilities sector within infrastructure common equity, investors rotated away from the group, taking gains and repositioning based on the likelihood that U.S. interest rates will move higher.

Portfolio Managers’ Comments (continued)

What key strategies were used to manage the Fund during this abbreviated reporting period ended May 31, 2015?

The Fund’s investment objective is a high level of current income and long-term capital appreciation. Since the Fund’s commencement of operations on September 8, 2014, the portfolio management team has been repositioning the assets from the Target Funds to align DRA’s portfolio with its new investment policies and NAM’s real asset income strategy. When fully transitioned, at least 80% of the Fund’s managed assets will be invested in a global portfolio of securities that provide investment exposure to real assets, focusing on infrastructure and REIT securities. The portfolio management team will actively manage the Fund’s allocations among the infrastructure and real estate categories, with the flexibility to invest across the capital structure in any type of equity and debt security offered by a particular company, including common shares, preferred shares, corporate debt instruments and mortgage-backed securities. Although all of the Fund’s debt investments may be rated lower than investment grade (Ba1/BB+ or lower by S&P, Moody’s or Fitch), no more than 10% of the Fund’s managed assets may be invested in securities rated CCC+/Caa1 or lower at any time. We also have the option to invest up to 75% of the Fund’s managed assets in non-U.S. issuers. Over the long term, our goal is to have the Fund’s portfolio fairly equally balanced between U.S. and non-U.S. exposure, although this allocation may change based on market conditions. We may also opportunistically write (sell) call options primarily on securities issued by real asset related companies, seeking to enhance the Fund’s risk-adjusted total returns over time. In addition, we will typically use leverage as part of the Fund’s management strategy, which we are currently doing through the use of bank borrowings. Leverage is discussed in more detail later in the Fund Leverage section of this report.

NAM’s real asset income strategy invests primarily in five security types: global infrastructure common stock, REIT common stock, global infrastructure preferred stock and hybrids, REIT preferred stock and debt securities. The Fund’s primary benchmark is the Morgan Stanley Capital International (MSCI) World Index. The Fund’s secondary benchmark is a Custom Blended Index, which is an index we created to represent a model asset allocation for an income-oriented product providing investment exposure to real assets. The Custom Blended Index is comprised of 33% S&P Global Infrastructure Index, 12% BofA/Merrill Lynch Preferred Fixed Rate Index, 15% MSCI U.S. REIT Index, 20% BofA/Merrill Lynch REIT Preferred Index and 20% Barclays U.S. Corporate High Yield Index. Our real asset income strategy attempts to add value versus the benchmark in two ways: by re-allocating among the five main security types when we see pockets of value at differing times and, more importantly, through individual security selection.

Our security selection process starts with a screen for securities across the real assets markets that provide higher yields. From the group of securities providing significant yields, we focus on owning those securities with the highest total return potential. Our process places a premium on finding securities with revenues that come from tangible assets with long-term concessions, contracts or leases, which are therefore capable of producing steady, predictable and recurring cash flows. We employ a bottom-up, fundamental approach to security selection and portfolio construction. We look for stable companies that demonstrate consistent and growing cash flow, strong balance sheets and histories of being good stewards of shareholder capital.

During this abbreviated reporting period, we made progress in repositioning the Fund’s portfolio with approximately two-thirds of the portfolio realigned with the real asset income strategy as of May 31, 2015. As part of this repositioning, we have been selling holdings that we believe have lower yield and capital appreciation potential and buying assets that have more potential to achieve the Fund’s objectives. This includes looking for ways to opportunistically monetize the Fund’s whole loan positions, but only when we are confident that we are achieving fair value for these assets.

In an effort to protect against potential increases in interest rates, we also sold (shorted) five-year U.S. Treasury futures contracts to hedge some of the duration, or interest rate sensitivity, of the bonds in the portfolio. With rates moving lower during the reporting period, the hedge decreased in value on a mark-to-market basis, partially offsetting the corresponding price increases of the underlying bonds.

How did the Fund perform during this abbreviated reporting period?

The table in the Performance Overview and Holding Summaries section of this report provides total return performance for the Fund for the abbreviated reporting period from the Fund’s commencement of operations on September 8, 2014 through May 31, 2015. For this abbreviated reporting period, the Fund’s total return based on net asset value (NAV) outperformed both the MSCI World Index and its Custom Blended Index.

Throughout the abbreviated reporting period, the management team continued to transition the Fund’s portfolio to a global real asset income strategy. Until this transition is complete, comparisons to the Fund’s global, equity-oriented benchmarks will be less meaningful. Our goal over time is to opportunistically reduce the Fund’s whole loan exposure, while also more equally balancing the Fund’s U.S. and non-U.S. exposure.

The Fund’s exposure to real assets contributed to the Fund’s outperformance relative to the Custom Blended Index and included infrastructure common equities, REIT preferreds and high yield corporate bonds. The Fund’s underweight to the infrastructure common equity segment was the leading contributor to its relative outperformance. Our exposure to infrastructure common equities within the real assets portfolio was roughly half that of the Custom Blended Index’s weighting. Infrastructure common equity was the weakest of the five segments in the index and the only area that produced negative absolute returns. In particular, the Fund’s substantial underweight to the pipeline industry as well as stock selection within that industry contributed the majority of the positive relative performance because that industry significantly underperformed during the period. Stock selection was also favorable in the toll road and electric utilities areas. In the REIT preferred area, the Fund benefited from an overweight to this strongly performing segment. Security selection was also strong in the office and community center REIT preferred sectors. Relative to the benchmark, the high yield portion of the Fund also aided returns, both on an absolute as well as a relative basis. The Fund’s outperformance in the high yield segment was mostly due to stock selection and our underweight to industrials relative to the benchmark.

In the remainder of the Fund’s Real Asset Income portfolio, the REIT common equity portion turned in flat results for the reporting period, while the infrastructure preferred segment detracted. In REIT common equities, an overweight to this strongly performing sector was beneficial to the Fund’s performance, however, this strength was offset by weak security selection in areas such as apartments and malls. The preferred segment of global infrastructure was the only area that experienced relative underperformance for the Fund during the reporting period. Our exposure to select electric utility and pipeline preferreds resulted in the shortfall versus the blended benchmark.

In terms of the Fund’s whole loan portfolio, its credit performance was relatively stable during the reporting period. The whole loan segment benefited as the commercial real estate sector continued the strong performance that it has exhibited over the past year. We sold and/or the borrowers paid off approximately $120 million of whole loans during the reporting period and reallocated the proceeds to the generally higher yielding real asset income strategy. In addition, we completed two tender offers for the Fund, one on November 15, 2014, and the other on May 15, 2015. In each tender offer, the Fund purchased 10% of its outstanding shares at 99% of NAV.

Fund

Leverage

IMPACT OF THE FUND’S LEVERAGE STRATEGY ON PERFORMANCE

One important factor impacting the return of the Fund relative to its benchmarks was the Fund’s utilization of leverage through the use of bank borrowings and reverse repurchase agreements. The Fund uses leverage because our research has shown that, over time, leveraging provides opportunities for additional income and total return for shareholders. However, the use of leverage also can expose shareholders to additional volatility. For example, as the prices of securities held by the Fund decline, the negative impact of these valuation changes on NAV and shareholder total return is magnified by the use of leverage. Conversely, leverage may enhance returns during periods when the prices of securities held by the Fund generally are rising. The Fund’s use of leverage had a positive impact on performance during this reporting period.

As of May 31, 2015, the Fund’s percentages of leverage are as shown in the accompanying table.

| | | | |

| | | DRA | |

Effective Leverage* | | | 29.37 | % |

Regulatory Leverage* | | | 29.37 | % |

| * | Effective leverage is the Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of certain derivative and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. During this reporting period, the Fund was not invested in any derivatives or other investments that resulted in economic leverage. Regulatory leverage consists of borrowings of the Fund. Both of these are part of the Fund’s capital structure. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940. |

THE FUND’S USE OF LEVERAGE

The Fund currently employs leverage through the use of bank borrowings. During the period, the Fund also employed leverage through the use of reverse repurchase agreements, which it ceased utilizing on November 13, 2014.

As of May 31, 2015, the Fund had outstanding bank borrowings of $170,300,000.

Refer to Notes to Financial Statements, Note 3 – Portfolio Securities and Investments in Derivatives and Note 9 – Borrowing Arrangements for further details on the Fund’s use of reverse repurchase agreements and bank borrowings, respectively.

Share

Information

DISTRIBUTION INFORMATION

The following information regarding the Fund’s distributions is current as of May 31, 2015. The Fund’s distribution levels may vary over time based on the Fund’s investment activities and portfolio investment value changes.

The Fund has approved a managed distribution program, but currently operates under a cash-flow distribution policy. The goal of this policy is to provide shareholders with relatively consistent and predictable cash flow by systematically converting the Fund’s cash flows from investment strategies including investments in common equities, corporate bonds, preferred securities and shares of REITs, into regular distributions. Cash flows from REITs received by the Fund are generally comprised of ordinary income, long-term capital gains and a return of REIT capital. As a result, regular distributions throughout the year are likely to include a portion of expected long-term gains (both realized and unrealized), along with net investment income.

Important points to understand about the Fund’s distributions:

| • | | The Fund seeks to establish a relatively stable distribution rate that roughly corresponds to the cash flows from its investment strategy. However, you should not draw any conclusions about the Fund’s past or future investment performance from its current distribution rate. |

| • | | Actual returns will differ from cash flows (and therefore the Fund’s distribution rate), at least over shorter time periods. Over a specific timeframe, the difference between actual returns and total distributions will be reflected in an increasing (returns exceed distributions) or a decreasing (distributions exceed returns) Fund net asset value. |

| • | | Each distribution is expected to be paid from some or all of the following sources: |

| | • | | net investment income (regular interest and dividends), |

| | • | | realized capital gains and |

| | • | | unrealized gains, or, in certain cases, a return of principal (non-taxable distributions). |

| • | | A non-taxable distribution is a payment of a portion of the Fund’s capital. When the Fund’s returns exceed distributions, it may represent portfolio gains generated but not realized as a taxable capital gain. In periods when the Fund’s returns fall short of distributions, the shortfall will represent a portion of your original principal, unless the shortfall is offset during other time periods over the life of your investment (previous or subsequent) when the Fund’s total return exceeds distributions. |

| • | | Because distribution source estimates are updated during the year based on the Fund’s performance and forecast for its current fiscal year, estimates on the nature of your distributions provided at the time the distributions are paid may differ from both the tax information reported to you in your Fund’s IRS Form 1099 statement provided at year end, as well as the ultimate economic sources of distributions over the life of your investment. |

For the period September 8, 2014 (commencement of operations) through May 31, 2015, the Fund’s ratio of net distributable cash flow received to regular monthly Fund distributions paid was 126%.

Share Information (continued)

The following table provides information regarding the Fund’s distributions for the period September 8, 2014 (commencement of operations) through May 31, 2015. This information is intended to help you better understand the accounting and tax character of those distributions.

| | | | |

| As of Fiscal Year Ended May 31, 2015 | | DRA | |

| Inception date (commencement of operations) | | 9/8/14 | |

| |

Total per share regular monthly distributions* | | | $1.04 | |

| |

Distribution character: | | | | |

From net investment income | | | $1.04 | |

From short-term capital gains | | | 0.00 | |

From long-term capital gains | | | 0.00 | |

Return of capital | | | 0.00 | |

| | | | |

Total per share distribution | | | $1.04 | |

| | | | |

| |

Current distribution rate** | | | 8.88 | % |

| |

Cumulative since inception total return on NAV | | | 5.60 | % |

| * | The Fund declared its initial monthly distribution on September 16, 2014. |

| ** | Current distribution rate is based on the Fund’s last monthly distribution during the period, annualized, expressed over the market price on the last day of the period. Distributions may be sourced from a combination of net investment income, net realized capital gains, and/or a return of capital. |

SHARE REPURCHASES

On September 23, 2014, the Fund’s Board of Trustees authorized the Fund to participate in Nuveen’s closed-end fund complex-wide share repurchase program. Under the share repurchase program, the Fund may repurchase up to 10% of its outstanding shares as of the authorization date in open-market transactions at the Adviser’s discretion. The Fund is prohibited, however, from repurchasing its shares during periods when the Fund also has an outstanding tender offer (as described below).

As of May 31, 2015, and since the inception of the Fund’s repurchase program, the Fund has cumulatively repurchased and retired its outstanding shares as shown in the accompanying table.

| | | | |

| | | DRA | |

Shares Cumulatively Repurchased and Retired | | | 126,000 | |

Approximate Number of Shares Authorized for Repurchase | | | 2,535,000 | |

The Fund repurchased and retired its shares at a weighted average price per share and a weighted average discount per share as shown in the accompanying table.

| | | | |

| | | DRA | |

Shares Repurchased and Retired | | | 126,000 | |

Weighted Average Price per Share Repurchased and Retired | | | $17.29 | |

Weighted Average Discount per Share Repurchased and Retired | | | 12.99 | % |

TENDER OFFER

The Fund’s Board of Trustees has authorized the Fund to conduct a series of up to three tender offers pursuant to which the Fund would offer to purchase up to 10% of the Fund’s outstanding shares for cash on a pro rata basis at a price per share equal to 99% of the NAV per common share, as determined as of the close of regular trading on the NYSE on the expiration date of the tender offer.

On September 23, 2014, Nuveen announced the Fund’s first tender offer, which commenced on October 3, 2014 and expired on November 7, 2014. The tender offer was oversubscribed (66% of outstanding shares were tendered), and therefore the Fund purchased 10% of its outstanding shares from participating shareholders on a pro-rata basis based on the number of shares properly tendered.

On March 24, 2015, Nuveen announced the Fund’s second tender offer, which commenced on April 6, 2015 and expired on May 8, 2015. The tender offer was oversubscribed (59% of outstanding shares were tendered), and therefore the Fund purchased 10% of its outstanding shares from participating shareholders on a pro-rata basis based on the number of shares properly tendered.

Subject to Board approval, if the Fund’s average daily trading discount exceeds 10% during the 90 calendar days preceding October 8, 2015, the Fund expects to announce a third tender offer, with payment for shares purchased in the third tender offer to take place prior to December 8, 2015.

Refer to Notes to Financial Statements, Note 4 – Fund Shares, Tender Offer for further details on each tender offer.

OTHER SHARE INFORMATION

As of May 31, 2015, and during the current reporting period, the Fund’s share price was trading at a premium/(discount) to its NAV as shown in the accompanying table.

| | | | |

| | | DRA | |

NAV | | $ | 20.06 | |

Share Price | | $ | 17.91 | |

Premium/(Discount) to NAV | | | (10.72 | )% |

Average Premium/(Discount) to NAV* | | | (11.47 | )% |

| * | The Fund commenced operations on September 8, 2014. |

Risk

Considerations

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation. Shares of closed-end funds are subject to investment risks, including the possible loss of principal invested. Past performance is no guarantee of future results. Fund common shares are subject to a variety of risks, including:

Investment, Market and Price Risk. An investment in common shares is subject to investment risk, including the possible loss of the entire principal amount that you invest. Your investment in common shares represents an indirect investment in the corporate securities owned by the Fund, which generally trade in the over-the-counter markets. Shares of closed-end investment companies like the Fund frequently trade at a discount to their NAV. Your common shares at any point in time may be worth less than your original investment, even after taking into account the reinvestment of Fund dividends and distributions.

Leverage Risk. The Fund’s use of leverage creates the possibility of higher volatility for the Fund’s per share NAV, market price and distributions. Leverage risk can be introduced through regulatory leverage (issuing preferred shares or debt borrowings at the Fund level) or through certain derivative investments held in the Fund’s portfolio. Leverage typically magnifies the total return of the Fund’s portfolio, whether that return is positive or negative. The use of leverage creates an opportunity for increased common share net income, but there is no assurance that the Fund’s leveraging strategy will be successful.

Infrastructure and Real Estate Concentration Risk. The Fund’s investments will be concentrated in issuers of infrastructure and real estate securities. Because the Fund will be concentrated in such securities, it may be subject to more risks than if it were broadly diversified across the economy. General changes in market sentiment towards infrastructure and real estate companies may adversely affect the Fund, and the performance of infrastructure and real estate issuers may lag behind the broader market as a whole. Also, the Fund’s concentration in infrastructure and real estate may subject the Fund to a variety of risks associated with such companies.

Common Stock Risk. Common stock returns often have experienced significant volatility.

Below-Investment Grade Securities Risk. Investments in securities below investment grade quality are predominantly speculative and subject to greater volatility and risk of default.

Non-U.S. Securities Risk. Investments in non-U.S securities involve special risks not typically associated with domestic investments including currency risk and adverse political, social and economic developments. These risks often are magnified in emerging markets.

Interest Rate Risk. Fixed-income securities such as bonds, preferred, convertible and other debt securities will decline in value if market interest rates rise.

Preferred Security Risk. Preferred securities are subordinated to bonds and other debt instruments in a company’s capital structure, and therefore are subject to greater credit risk.

Whole Loan Risk. The Fund invests in individual loans, which may be relatively illiquid and more difficult to value, and which subject the Fund to credit and default risk associated with the individual borrower.

Call Risk or Prepayment Risk. Issuers may exercise their option to prepay principal earlier than scheduled, forcing the Fund to reinvest in lower-yielding securities.

Call Option Risks. The value of call options sold (written) by the Fund will fluctuate. The Fund may not participate in any appreciation of its equity portfolio as fully as it would if the Fund did not sell call options. In addition, the Fund will continue to bear the risk of declines in the value of the equity portfolio.

Mortgage-Backed Securities Risk. Investing in mortgage-backed securities (MBS) entails various risks, including credit risks inherent in the underlying collateral, the risk that the servicer fails to perform its duties, liquidity risks, interest rate risks, structure risks, and geographical concentration risks.

Prepayment Risk. MBS represent an interest in a pool of mortgages. These mortgages typically permit borrowers to prepay amounts owing, often with no penalty. The relationship between borrower prepayments and changes in interest rates may mean some high-yielding mortgage-related and asset-backed securities have less potential for increases in value if market interest rates were to fall than conventional bonds with comparable maturities. In addition, in periods of falling interest rates, the rate of prepayments tends to increase. During such periods, the reinvestment of prepayment proceeds by the Fund will generally be at lower rates than the rates that were carried by the obligations that have been prepaid. Because of these and other reasons, the total return and maturity of mortgage-related and asset-backed securities may be difficult to predict precisely. To the extent that the Fund purchases mortgage-related securities at a premium, prepayments may result in loss of the Fund’s principal investment to the extent of any unamortized premium.

Illiquid Securities Risk. This is the risk that the Fund may not be able to sell securities in its portfolio at the time or price desired by the Fund.

Default Risk. The event in which a bond issuer is unable to make the required payments on their debt obligations.

Derivatives Strategy Risk. Derivative securities, such as calls, puts, warrants, swaps and forwards, carry risks different from, and possibly greater than, the risks associated with the underlying investments.

DRA

Diversified Real Asset Income Fund

Performance Overview and Holding Summaries as of May 31, 2015

Refer to the Glossary of Terms Used in this Report for further definitions of terms used in this section.

Cumulative Total Returns as of May 31, 2015

| | | | |

| | | Since

Inception | |

| DRA at NAV | | | 5.60% | |

| DRA at Share Price | | | 3.99% | |

| MSCI World Index | | | 3.47% | |

| Custom Blended Index | | | 2.68% | |

As previously noted in the Portfolio Managers’ Comments section of this report, the Fund is in the process of transitioning its portfolio to a global real asset income strategy. Therefore, comparisons to the Fund’s global, equity-oriented benchmarks are less meaningful until the Fund’s transitioning is complete. The Fund’s goal over time will be to opportunistically reduce its whole loan exposure while also more equally balancing its U.S. and non-U.S. exposure.

The performance information presented for the Fund is from its commencement of operations on September 8, 2014 and does not include the historical performance information for the funds acquired in the mergers, as previously described in the Portfolio Managers’ Comments section of this report.

Since inception returns are from September 8, 2014. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

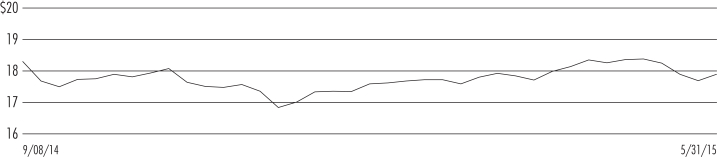

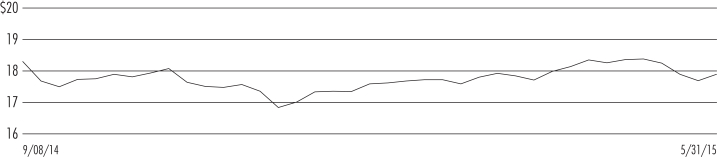

Share Price Performance — Weekly Closing Price

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| | | | |

| Whole Loans | | | 29.1% | |

| Corporate Notes | | | 3.6% | |

| Other Fixed-Income Type Securities2 | | | 54.8% | |

| Equity Type Securities3 | | | 50.4% | |

| Short-Term Investments | | | 4.5% | |

| Other Assets Less Liabilities | | | (0.8)% | |

| Net Assets Plus Borrowings | | | 141.6% | |

| Borrowings | | | (41.6)% | |

| Net Assets | | | 100% | |

Portfolio Asset Allocation

(% of total investments, at value)1

| | | | |

| Whole Loans | | | 20.5% | |

| Corporate Notes | | | 2.5% | |

| Other Fixed-Income Type Securities2 | | | 38.3% | |

| Equity Type Securities3 | | | 35.5% | |

| Short-Term Investments | | | 3.2% | |

| Total | | | 100% | |

Whole Loans and Industries

(% of total investments, at value)1

| | | | |

| Real Estate Investment Trust | | | 31.6% | |

| Whole Loans | | | 20.5% | |

| Electric Utilities | | | 10.2% | |

| Multi-Utilities | | | 5.2% | |

| Oil, Gas & Consumable Fuels | | | 4.8% | |

| Transportation Infrastructure | | | 4.7% | |

| Short-Term Investments | | | 3.2% | |

| Other Industries | | | 19.8% | |

| Total | | | 100% | |

Whole Loan

State Concentration

(% of total whole loans, at value)

| | | | |

| Arizona | | | 23.9% | |

| Texas | | | 13.7% | |

| Florida | | | 13.0% | |

| New Mexico | | | 10.8% | |

| Washington | | | 8.8% | |

| Virginia | | | 7.7% | |

| California | | | 5.5% | |

| Other | | | 16.6% | |

| Total | | | 100% | |

Credit Quality

(% of total other fixed-income type securities, at value)2

| | | | |

| A | | | 1.1% | |

| BBB | | | 27.6% | |

| BB | | | 19.0% | |

| B | | | 22.6% | |

| CCC | | | 2.1% | |

| N/R (not rated) | | | 27.6% | |

| Total | | | 100% | |

Country Allocation

(% of total investments, at value)1

| | | | |

| United States | | | 75.9% | |

| Australia | | | 4.0% | |

| Canada | | | 3.2% | |

| United Kingdom | | | 2.4% | |

| Italy | | | 1.9% | |

| Hong Kong | | | 1.7% | |

| Spain | | | 1.5% | |

| Singapore | | | 1.4% | |

| France | | | 1.4% | |

| Other | | | 6.6% | |

| Total | | | 100% | |

| 1 | Excluding investments in derivatives. |

| 2 | Includes convertible preferred, $25 par (or similar) retail preferred, convertible bonds, corporate bonds and $1,000 par (or similar) institutional preferred. |

| 3 | Includes common stock and investment companies. |

Report of

Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of

Diversified Real Asset Income Fund:

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations, of changes in net assets and of cash flows and the financial highlights present fairly, in all material respects, the financial position of Diversified Real Asset Income Fund (hereinafter referred to as the “Fund”) at May 31, 2015, the results of its operations, the changes in its net assets and its cash flows and the financial highlights for the period September 8, 2014 (commencement of operations) through May 31, 2015, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of securities at May 31, 2015 by correspondence with the custodian and broker, provides a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Chicago, IL

July 28, 2015

DRA

| | |

Diversified Real Asset Income Fund | | |

Portfolio of Investments | | May 31, 2015 |

| | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | | | Description (1) | | Interest

Rate (8) | | | Maturity (8) | | | | | Value | |

| | | |

| | | | | | LONG-TERM INVESTMENTS – 137.9% (96.8% of Total Investments) | | | | |

| | | |

| | | | | | WHOLE LOANS – 29.1% (20.5% of Total Investments) (2), (3), (4) | | | | |

| | | |

| | | | | | Commercial Loans – 22.4% (15.8% of Total Investments) | | | | |

| | | | | | |

| $ | 2,269 | | | | | 150 North Pantano I, AZ | | | 4.900% | | | | 8/01/19 | | | | | $ | 2,269,298 | |

| | 3,216 | | | | | 8324 East Hartford Drive I, Scottsdale, AZ, (5) | | | 6.900% | | | | 5/01/20 | | | | | | 3,216,040 | |

| | 962 | | | | | Bigelow Office Buildings, Las Vegas, NV | | | 6.375% | | | | 4/01/17 | | | | | | 980,791 | |

| | 1,402 | | | | | Carl’s Jr., Idaho Springs, CO | | | 4.125% | | | | 5/01/23 | | | | | | 1,392,236 | |

| | 6,896 | | | | | Clear Lake Central I, Webster, TX, (5) | | | 4.925% | | | | 9/01/15 | | | | | | 6,570,279 | |

| | 2,344 | | | | | Cresthaven Medical, Memphis, TN | | | 3.875% | | | | 6/01/18 | | | | | | 2,339,667 | |

| | 2,040 | | | | | Hacienda Colorado Restaurant, Englewood, CO | | | 4.375% | | | | 7/01/23 | | | | | | 2,045,376 | |

| | 1,759 | | | | | Jilly’s American Grill, Scottsdale, AZ | | | 6.375% | | | | 3/01/17 | | | | | | 1,758,506 | |

| | 11,136 | | | | | La Cholla Plaza I, Tucson, AZ, (5), (6), (7) | | | 3.175% | | | | 8/01/14 | | | | | | 6,666,663 | |

| | 1,195 | | | | | La Costa Meadows Industrial Park I, San Marcos, CA | | | 6.775% | | | | 7/01/17 | | | | | | 1,164,804 | |

| | 1,922 | | | | | La Costa Meadows Industrial Park II, San Marcos, CA | | | 7.525% | | | | 7/01/17 | | | | | | 1,886,206 | |

| | 3,750 | | | | | Magnolia Retail Land, Magnolia, TX, (5) | | | 6.900% | | | | 10/01/16 | | | | | | 3,750,000 | |

| | 14,000 | | | | | NCH Commercial Pool II, Rocky Point, Mexico, (5), (7) | | | 11.925% | | | | 8/01/14 | | | | | | 6,039,600 | |

| | 3,900 | | | | | Office City Plaza, Houston, TX, (5) | | | 4.900% | | | | 3/01/17 | | | | | | 3,720,779 | |

| | 11,831 | | | | | Oyster Point Office Park, Newport News, VA, (5) | | | 4.175% | | | | 5/01/16 | | | | | | 8,800,533 | |

| | 842 | | | | | Oyster Point Office Park II, Newport News, VA | | | 4.875% | | | | 5/01/16 | | | | | | 388,763 | |

| | 1,859 | | | | | Palace Court, Santa Fe, NM, (5) | | | 4.875% | | | | 8/01/15 | | | | | | 1,297,522 | |

| | 1,387 | | | | | PennMont Office Plaza, Albuquerque, NM | | | 5.375% | | | | 7/01/15 | | | | | | 1,386,584 | |

| | 1,246 | | | | | Perkins Restaurant, Maple Grove, MN | | | 6.375% | | | | 1/01/18 | | | | | | 1,270,999 | |

| | 4,523 | | | | | RealtiCorp Fund III, Crystal River, FL, (5) | | | 5.925% | | | | 7/01/16 | | | | | | 4,522,755 | |

| | 3,497 | | | | | RL Stowe Portfolio, Belmont, NC and Chattanooga, TN | | | 3.925% | | | | 1/01/20 | | | | | | 2,892,549 | |

| | 15,000 | | | | | Signal Butte, Mesa, AZ, (5), (9) | | | 4.925% | | | | 7/01/17 | | | | | | 8,800,050 | |

| | 11,000 | | | | | Spa Atlantis, Pompano Beach, (5) | | | 6.425% | | | | 8/01/16 | | | | | | 11,000,000 | |

| | 4,442 | | | | | Superior Ford Dealership, Plymouth, MN | | | 6.425% | | | | 7/01/17 | | | | | | 4,530,680 | |

| | 3,204 | | | | | Tatum Ranch Center, Phoenix, AZ, (5) | | | 6.150% | | | | 10/01/15 | | | | | | 3,204,207 | |

| | 115,622 | | | | | Total Commercial Loans | | | | | | | | | | | | | 91,894,887 | |

| | | |

| | | | | | Multifamily Loans – 6.7% (4.7% of Total Investments) | | | |

| | | | | | |

| | 2,420 | | | | | El Dorado Apartments I, Tucson, AZ, (5) | | | 5.650% | | | | 9/01/17 | | | | | | 2,420,444 | |

| | 244 | | | | | El Dorado Apartments II, Tucson, AZ | | | 7.150% | | | | 9/01/17 | | | | | | 170,377 | |

| | 2,350 | | | | | Good Haven Apartments, Dallas TX, (5) | | | 4.875% | | | | 8/01/17 | | | | | | 2,350,000 | |

| | 4,875 | | | | | Keystone Crossings, Springdale, AR, (5), (10), (11) | | | 8.150% | | | | 7/05/16 | | | | | | 4,250,152 | |

| | 4,933 | | | | | NCH Multifamily Pool, Oklahoma City, OK, (5), (7) | | | 11.925% | | | | 8/01/14 | | | | | | 42,082 | |

| | 4,400 | | | | | NCH Multifamily Pool II, Rocky Point Mexico, (5), (7) | | | 11.925% | | | | 8/01/14 | | | | | | 4,135,560 | |

| | 3,650 | | | | | RiverPark Land Lot III, Oxnard, CA, (5) | | | 4.900% | | | | 4/01/16 | | | | | | 3,472,351 | |

| | 13,288 | | | | | Sapphire Skies I, Cle Elum, WA, (5), (12) | | | 0.925% | | | | 3/01/20 | | | | | | 10,484,232 | |

| | 36,160 | | | | | Total Multifamily Loans | | | | | | | | | | | | | 27,325,198 | |

| | | |

| | | | | | Single Family Loans – 0.0% (0.0% of Total Investments) | | | |

| | | | | | |

| | 5 | | | | | American Portfolio, California | | | 1.626% | | | | 1/01/17 | | | | | | 4,741 | |

| | 10 | | | | | Bank of New Mexico, New Mexico | | | 2.501% | | | | 2/01/18 | | | | | | 9,889 | |

| | 3 | | | | | Bluebonnet Savings & Loan, Texas | | | 1.626% | | | | 11/01/15 | | | | | | 3,051 | |

| | 23 | | | | | McClemore, Matrix Funding Corporation, North Carolina | | | 9.251% | | | | 8/01/19 | | | | | | 23,545 | |

| | 17 | | | | | Merchants Bank, Vermont | | | 10.000% | | | | 5/13/17 | | | | | | 17,252 | |

| | 24 | | | | | Nomura III, California | | | 2.376% | | | | 5/01/19 | | | | | | 23,861 | |

| | 22 | | | | | PHH U.S. Mortgage California and Delaware | | | 2.750% | | | | 2/01/21 | | | | | | 22,858 | |

| | 104 | | | | | Total Single Family Loans | | | | | | | | | | | | | 105,197 | |

| $ | 151,886 | | | | | Total Whole Loans (cost $149,597,075) | | | | | | | | | | | | | 119,325,282 | |

| | | | |

| DRA | | Diversified Real Asset Income Fund | | |

| | Portfolio of Investments (continued) | | May 31, 2015 |

| | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | | | Description (1) | | Coupon | | | Maturity | | | | | Value | |

| | | | | |

| | | | | | CORPORATE NOTES – 3.6% (2.5% of Total Investments) (2), (3), (4) | | | | | | | | | | | |

| | | | | |

| | | | | | Diversified Financial Services – 3.6% (2.5% of Total Investments) | | | | | | | | | |

| | | | | | |

| $ | 3,000 | | | | | Stratus II, Stratus Properties Inc., (5) | | | 7.250% | | | | 12/31/15 | | | | | $ | 3,000,000 | |

| | 8,000 | | | | | Stratus III, Stratus Properties Inc., (5) | | | 7.250% | | | | 12/31/16 | | | | | | 8,080,000 | |

| | 3,500 | | | | | Stratus VII, Stratus Properties Inc., (5) | | | 7.250% | | | | 12/31/15 | | | | | | 3,500,000 | |

| $ | 14,500 | | | | | Total Corporate Notes (cost $14,500,000) | | | | | | | | | | | | | 14,580,000 | |

| | | | | | |

| Shares | | | | | Description (1) | | | | | | | | | | Value | |

| | |

| | | | | | COMMON STOCKS – 49.9% (35.1% of Total Investments) | |

| | |

| | | | | | Air Freight & Logistics – 1.0% (0.7% of Total Investments) | |

| | | | | | |

| | 109,196 | | | | | BPost SA, (13) | | | | | | | | | | | | $ | 3,152,024 | |

| | 16,922 | | | | | Oesterreichische Post AG | | | | | | | | | | | | | 835,044 | |

| | | | | | Total Air Freight & Logistics | | | | | | | | | | | | | 3,987,068 | |

| | |

| | | | | | Commercial Services & Supplies – 0.2% (0.2% of Total Investments) | |

| | | | | | |

| | 39,807 | | | | | Covanta Holding Corporation | | | | | | | | | | | | | 879,735 | |

| | |

| | | | | | Diversified Telecommunication Services – 0.2% (0.1% of Total Investments) | |

| | | | | | |

| | 543,507 | | | | | HKBN Limited, (14) | | | | | | | | | | | | | 689,053 | |

| | |

| | | | | | Electric Utilities – 6.3% (4.4% of Total Investments) | |

| | | | | | |

| | 80,450 | | | | | Alupar Investimento SA | | | | | | | | | | | | | 448,670 | |

| | 514,982 | | | | | AusNet Services, (13) | | | | | | | | | | | | | 598,778 | |

| | 93,006 | | | | | Brookfield Infrastructure Partners LP | | | | | | | | | | | | | 4,022,508 | |

| | 294,181 | | | | | Contact Energy Limited, (13), (WI/DD) | | | | | | | | | | | | | 1,283,441 | |

| | 779,582 | | | | | EDP – Energias de Portugal, S.A., (13) | | | | | | | | | | | | | 3,041,293 | |

| | 4,280 | | | | | Electricite de France S.A, (13) | | | | | | | | | | | | | 105,125 | |

| | 142,582 | | | | | Endesa S.A, (13), (14) | | | | | | | | | | | | | 2,664,497 | |

| | 3,176 | | | | | Hafslund ASA, Class B Shares | | | | | | | | | | | | | 23,704 | |

| | 2,768,161 | | | | | HK Electric Investments Limited, (13) | | | | | | | | | | | | | 1,880,587 | |

| | 690,192 | | | | | Infratil Limited | | | | | | | | | | | | | 1,615,867 | |

| | 102,258 | | | | | Scottish and Southern Energy PLC, (13) | | | | | | | | | | | | | 2,604,079 | |

| | 32,919 | | | | | Southern Company | | | | | | | | | | | | | 1,438,231 | |

| | 889,695 | | | | | Spark Infrastructure Group, (13) | | | | | | | | | | | | | 1,352,162 | |

| | 626,443 | | | | | Terna-Rete Elettrica Nazionale SpA, (13) | | | | | | | | | | | | | 2,991,335 | |

| | 287,507 | | | | | Transmissora Alianca de Energia Eletrica SA | | | | | | | | | | | | | 1,831,715 | |

| | | | | | Total Electric Utilities | | | | | | | | | | | | | 25,901,992 | |

| | |

| | | | | | Gas Utilities – 3.2% (2.2% of Total Investments) | |

| | | | | | |

| | 36,490 | | | | | AmeriGas Partners, LP | | | | | | | | | | | | | 1,798,957 | |

| | 137,189 | | | | | Enagas, (13) | | | | | | | | | | | | | 3,942,996 | |

| | 11,108,541 | | | | | Keppel Infrastructure Trust | | | | | | | | | | | | | 4,408,478 | |

| | 554,172 | | | | | Snam Rete Gas S.p.A, (13) | | | | | | | | | | | | | 2,744,820 | |

| | | | | | Total Gas Utilities | | | | | | | | | | | | | 12,895,251 | |

| | |

| | | | | | Independent Power & Renewable Electricity Producers – 2.3% (1.7% of Total Investments) | |

| | | | | | |

| | 35,795 | | | | | Brookfield Renewable Energy Partners LP | | | | | | | | | | | | | 1,084,589 | |

| | 97,733 | | | | | Pattern Energy Group Inc. | | | | | | | | | | | | | 2,779,527 | |

| | 193,402 | | | | | Saeta Yield S.A, (14) | | | | | | | | | | | | | 2,068,907 | |

| | 359,687 | | | | | TransAlta Renewables Inc. | | | | | | | | | | | | | 3,658,765 | |

| | | | | | Total Independent Power & Renewable Electricity Producers | | | | | | | | | | | | | 9,591,788 | |

| | |

| | | | | | Multi-Utilities – 5.0% (3.5% of Total Investments) | |

| | | | | | |

| | 292,800 | | | | | Centrica PLC, (13) | | | | | | | | | | | | | 1,240,578 | |

| | 1,009,703 | | | | | Duet Group, (13) | | | | | | | | | | | | | 1,965,814 | |

| | 257,839 | | | | | GDF Suez, (13) | | | | | | | | | | | | | 5,197,385 | |

| | 100,064 | | | | | National Grid PLC | | | | | | | | | | | | | 7,172,588 | |

| | 711,276 | | | | | Redes Energeticas Nacionais SA | | | | | | | | | | | | | 2,079,540 | |

| | 50,738 | | | | | TECO Energy, Inc. | | | | | | | | | | | | | 956,411 | |

| | 924,470 | | | | | Vector Limited | | | | | | | | | | | | | 2,033,182 | |

| | | | | | Total Multi-Utilities | | | | | | | | | | | | | 20,645,498 | |

| | | | | | | | | | | | | | | | |

| Shares | | | | | Description (1) | | | | | | | | Value | |

| | |

| | | | | | Oil, Gas & Consumable Fuels – 1.9% (1.3% of Total Investments) | |

| | | | | | |

| | 15,199 | | | | | Arc Logisitics Partners LP | | | | | | | | $ | 277,078 | |

| | 106,698 | | | | | BlueKnight Energy Partners LP | | | | | | | | | 823,709 | |

| | 5,422 | | | | | DCP Midstream Partners LP | | | | | | | | | 204,952 | |

| | 9,536 | | | | | Enbridge Energy Partners LP | | | | | | | | | 353,690 | |

| | 21,499 | | | | | Enviva Partners, LP, (14) | | | | | | | | | 437,720 | |

| | 82,288 | | | | | Kinder Morgan, Inc. | | | | | | | | | 3,414,129 | |

| | 145 | | | | | Phillips 66 Partners LP | | | | | | | | | 10,547 | |

| | 4,155 | | | | | TC Pipelines LP | | | | | | | | | 265,505 | |

| | 27,955 | | | | | USD Partners LP | | | | | | | | | 377,393 | |

| | 102,958 | | | | | Veresen Inc. | | | | | | | | | 1,537,416 | |

| | | | | | Total Oil, Gas & Consumable Fuels | | | | | | | | | 7,702,139 | |

| | |

| | | | | | Real Estate Investment Trust – 22.9% (16.1% of Total Investments) | |

| | | | | | |

| | 77,703 | | | | | Agree Realty Corporation | | | | | | | | | 2,355,178 | |

| | 267,507 | | | | | Apollo Commercial Real Estate Finance, Inc. | | | | | | | | | 4,593,095 | |

| | 56,814 | | | | | Ares Commercial Real Estate Corporation | | | | | | | | | 661,883 | |

| | 190,607 | | | | | Armada Hoffler Properties Inc. | | | | | | | | | 2,018,528 | |

| | 271,481 | | | | | Ascendas Real Estate Investment Trust, (13) | | | | | | | | | 482,797 | |

| | 105,739 | | | | | Blackstone Mortgage Trust Inc, Class A | | | | | | | | | 3,195,433 | |

| | 314,685 | | | | | CapitaMall Trust, (13) | | | | | | | | | 505,569 | |

| | 127,644 | | | | | CBL & Associates Properties Inc. | | | | | | | | | 2,252,917 | |

| | 149,908 | | | | | Colony Financial Inc. | | | | | | | | | 3,846,639 | |

| | 40,151 | | | | | Cominar Real Estate Investment Trust | | | | | | | | | 584,056 | |

| | 39,742 | | | | | Community Healthcare Trust Inc., (14) | | | | | | | | | 778,943 | |

| | 52,274 | | | | | Corrections Corporation of America | | | | | | | | | 1,837,954 | |

| | 336,761 | | | | | Dexus Property Group, (13) | | | | | | | | | 2,054,835 | |

| | 22,789 | | | | | Digital Realty Trust Inc. | | | | | | | | | 1,504,986 | |

| | 111,329 | | | | | Easterly Government Properties, Inc. | | | | | | | | | 1,728,939 | |

| | 37,669 | | | | | Entertainment Properties Trust | | | | | | | | | 2,172,371 | |

| | 112,686 | | | | | Excel Trust Inc. | | | | | | | | | 1,790,581 | |

| | 127,623 | | | | | Franklin Street Properties Corporation | | | | | | | | | 1,481,703 | |

| | 41,326 | | | | | Geo Group Inc. | | | | | | | | | 1,567,495 | |

| | 52,973 | | | | | GPT Group, (13) | | | | | | | | | 186,368 | |

| | 9,624 | | | | | Healthcare Realty Trust, Inc. | | | | | | | | | 229,244 | |

| | 210,073 | | | | | Independence Realty Trust | | | | | | | | | 1,854,945 | |

| | 302,192 | | | | | Inland Real Estate Corporation | | | | | | | | | 3,064,227 | |

| | 74,173 | | | | | Investors Real Estate Trust | | | | | | | | | 537,013 | |

| | 1,125,481 | | | | | Keppel DC REIT, (14) | | | | | | | | | 876,608 | |

| | 29,794 | | | | | Kite Realty Group Trust | | | | | | | | | 765,110 | |

| | 226,033 | | | | | Lexington Corporate Properties Trust | | | | | | | | | 2,074,983 | |

| | 25,983 | | | | | Liberty Property Trust | | | | | | | | | 907,846 | |

| | 25,572 | | | | | LTC Properties Inc. | | | | | | | | | 1,076,325 | |

| | 518,225 | | | | | Mapletree Greater China Commercial Trust, (13), (WI/DD) | | | | | | | | | 411,123 | |

| | 358,188 | | | | | Mapletree Logistics Trust, (13) | | | | | | | | | 309,500 | |

| | 231,322 | | | | | Medical Properties Trust Inc. | | | | | | | | | 3,136,726 | |

| | 153,340 | | | | | Monmouth Real Estate Investment Corporation | | | | | | | | | 1,478,198 | |

| | 9,655 | | | | | National Health Investors Inc. | | | | | | | | | 638,582 | |

| | 54,322 | | | | | National Storage Affiliates Trust | | | | | | | | | 732,804 | |

| | 150,331 | | | | | Northstar Realty Finance Corporation | | | | | | | | | 2,727,004 | |

| | 168,010 | | | | | Omega Healthcare Investors Inc. | | | | | | | | | 6,053,400 | |

| | 582,800 | | | | | Parkway Life Real Estate Investment Trust, (13) | | | | | | | | | 1,015,004 | |

| | 17,334 | | | | | Pebblebrook Hotel Trust | | | | | | | | | 457,618 | |

| | 5,079 | | | | | Penn Real Estate Investment Trust | | | | | | | | | 132,511 | |

| | 234,568 | | | | | Physicians Realty Trust | | | | | | | | | 3,767,160 | |

| | 126,396 | | | | | Plaza Retail REIT | | | | | | | | | 449,236 | |

| | 502,050 | | | | | Pure Industrial Real Estate Trust | | | | | | | | | 1,929,719 | |

| | 7,181 | | | | | Realty Income Corporation | | | | | | | | | 327,238 | |

| | 119,151 | | | | | Retrocom Real Estate Investment Trust | | | | | | | | | 362,167 | |

| | 15,017 | | | | | Sabra Health Care Real Estate Investment Trust Inc. | | | | | | | | | 397,951 | |

| | 217,774 | | | | | Scentre Group, (13) | | | | | | | | | 654,763 | |

| | 113,926 | | | | | Senior Housing Properties Trust | | | | | | | | | 2,279,659 | |

| | 179,040 | | | | | Spirit Realty Capital Inc. | | | | | | | | | 1,931,842 | |

| | 216,441 | | | | | STAG Industrial Inc. | | | | | | | | | 4,610,193 | |

| | 95,786 | | | | | Starwood Property Trust Inc. | | | | | | | | | 2,288,328 | |

| | | | |

| DRA | | Diversified Real Asset Income Fund | | |

| | Portfolio of Investments (continued) | | May 31, 2015 |

| | | | | | | | | | | | | | | | | | | | |

| Shares | | | | | Description (1) | | | | | | | | | | Value | |

| | |

| | | | | | Real Estate Investment Trust (continued) | |

| | | | | | |

| | 88,393 | | | | | STORE Capital Corporation | | | | | | | | | | | | $ | 1,843,878 | |

| | 57,135 | | | | | Sunstone Hotel Investors Inc. | | | | | | | | | | | | | 1,498,651 | |

| | 277,531 | | | | | Suntec Real Estate Investment Trust, (13) | | | | | | | | | | | | | 370,223 | |

| | 308,868 | | | | | TF Administradora Industrial S de RL de CV | | | | | | | | | | | | | 602,737 | |

| | 20,404 | | | | | Universal Health Realty Income Trust | | | | | | | | | | | | | 977,352 | |

| | 27,023 | | | | | Urstadt Biddle Properties Inc. | | | | | | | | | | | | | 543,703 | |

| | 26,193 | | | | | WP Carey Inc. | | | | | | | | | | | | | 1,668,232 | |

| | 169,024 | | | | | WP GLIMCHER, Inc. | | | | | | | | | | | | | 2,378,168 | |

| | 73,416 | | | | | WPT Industrial Real Estate Investment Trust | | | | | | | | | | | | | 932,383 | |

| | | | | | Total Real Estate Investment Trust | | | | | | | | | | | | | 93,892,624 | |

| | |

| | | | | | Real Estate Management & Development – 0.5% (0.4% of Total Investments) | |

| | | | | | |

| | 229,412 | | | | | Killam Properties Inc. | | | | | | | | | | | | | 1,918,531 | |

| | 558,547 | | | | | Langham Hospitality Investments Limited, (13) | | | | | | | | | | | | | 243,328 | |

| | 14,248 | | | | | Road King Infrastructure Limited, (13) | | | | | | | | | | | | | 13,851 | |

| | | | | | Total Real Estate Management & Development | | | | | | | | | | | | | 2,175,710 | |

| | |

| | | | | | Transportation Infrastructure – 6.3% (4.4% of Total Investments) | |

| | | | | | |

| | 658,648 | | | | | China Merchants Holdings Pacific Limited, (13), (WI/DD) | | | | | | | | | | | | | 515,047 | |

| | 42,923 | | | | | Grupo Aeroportuario Centro Norte, SA | | | | | | | | | | | | | 1,613,046 | |

| | 5,300,549 | | | | | Hopewell Highway Infrastructure Limited, (13) | | | | | | | | | | | | | 2,636,426 | |

| | 3,132,475 | | | | | Hutchison Port Holdings Trust, (13) | | | | | | | | | | | | | 2,065,109 | |

| | 547,081 | | | | | Jiangsu Expressway Company Limited, (13) | | | | | | | | | | | | | 757,234 | |

| | 294 | | | | | Kobenhavns Lufthavne, (13) | | | | | | | | | | | | | 165,310 | |

| | 62,939 | | | | | Macquarie Infrastructure Corporation | | | | | | | | | | | | | 5,327,155 | |

| | 922,181 | | | | | Sydney Airport, (13) | | | | | | | | | | | | | 3,998,310 | |

| | 1,113,403 | | | | | Transurban Group, (13) | | | | | | | | | | | | | 8,629,038 | |

| | | | | | Total Transportation Infrastructure | | | | | | | | | | | | | 25,706,675 | |

| | |

| | | | | | Water Utilities – 0.1% (0.1% of Total Investments) | |

| | | | | | |

| | 278,038 | | | | | Inversiones Aguas Metropolitanas SA | | | | | | | | | | | | | 438,185 | |

| | | | | | Total Common Stocks (cost $202,196,593) | | | | | | | | | | | | | 204,505,718 | |

| | | | | | |

| Shares | | | | | Description (1) | | Coupon | | | | | Ratings (15) | | | Value | |

| | |

| | | | | | CONVERTIBLE PREFERRED SECURITIES – 3.8% (2.6% of Total Investments) | |

| | |

| | | | | | Electric Utilities – 1.4% (1.0% of Total Investments) | |

| | | | | | |

| | 114,301 | | | | | Exelon Corporation | | | 6.500% | | | | | | BBB– | | | $ | 5,521,881 | |

| | 6,691 | | | | | NextEra Energy Inc. | | | 5.799% | | | | | | N/R | | | | 374,629 | |

| | | | | | Total Electric Utilities | | | | | | | | | | | | | 5,896,510 | |

| | |

| | | | | | Independent Power & Renewable Electricity Producers – 0.5% (0.3% of Total Investments) | |

| | | | | | |

| | 16,537 | | | | | Dynegy Inc. | | | 5.375% | | | | | | N/R | | | | 1,851,813 | |

| | |

| | | | | | Real Estate Investment Trust – 1.9% (1.3% of Total Investments) | |

| | | | | | |

| | 33,462 | | | | | Alexandria Real Estate Equities Inc., (13) | | | 7.000% | | | | | | N/R | | | | 975,625 | |

| | 7,795 | | | | | American Homes 4 Rent | | | 5.000% | | | | | | N/R | | | | 201,111 | |

| | 52,998 | | | | | American Tower Corporation | | | 5.500% | | | | | | N/R | | | | 5,358,098 | |

| | 2,197 | | | | | Equity Commonwealth | | | 6.500% | | | | | | Ba1 | | | | 54,595 | |

| | 5,780 | | | | | Lexington Corporate Properties Trust, Series B | | | 6.500% | | | | | | N/R | | | | 286,457 | |

| | 11,573 | | | | | Ramco-Gershenson Properties Trust | | | 7.250% | | | | | | N/R | | | | 727,595 | |

| | | | | | Total Real Estate Investment Trust | | | | | | | | | | | | | 7,603,481 | |

| | | | | | Total Convertible Preferred Securities (cost $15,295,874) | | | | | | | | | | | | | 15,351,804 | |

| | | | | | |

| Shares | | | | | Description (1) | | Coupon | | | | | Ratings (15) | | | Value | |

| | | | |

| | | | | | $25 PAR (OR SIMILAR) RETAIL PREFERRED – 25.0% (17.5% of Total Investments) | | | | | | | | |

| | | | | | |

| | | | | | Banks – 0.1% (0.1% of Total Investments) | | | | | | | | | | | |

| | | | | | |

| | 20,692 | | | | | Wells Fargo REIT | | | 6.375% | | | | | | BBB+ | | | $ | 539,234 | |

| | | | | | | | | | | | | | | | | | | | |

| Shares | | | | | Description (1) | | Coupon | | | | | Ratings (15) | | | Value | |

| | | | | | |

| | | | | | Electric Utilities – 3.3% (2.3% of Total Investments) | | | | | | | | | | | |

| | | | | | |

| | 10,503 | | | | | APT Pipelines Limited | | | 7.198% | | | | | | N/R | | | $ | 855,122 | |

| | 114,536 | | | | | Entergy Arkansas Inc., (13) | | | 6.450% | | | | | | BB+ | | | | 2,913,510 | |

| | 37,327 | | | | | Integrys Energy Group Inc. | | | 6.000% | | | | | | Baa1 | | | | 1,002,230 | |

| | 40,785 | | | | | NextEra Energy Inc. | | | 5.700% | | | | | | BBB | | | | 1,017,586 | |

| | 41,362 | | | | | NextEra Energy Inc. | | | 5.625% | | | | | | BBB | | | | 1,036,118 | |

| | 61,673 | | | | | NextEra Energy Inc. | | | 5.000% | | | | | | BBB | | | | 1,466,584 | |

| | 33,664 | | | | | Pacific Gas & Electric Corporation | | | 6.000% | | | | | | BBB+ | | | | 1,008,237 | |

| | 114,025 | | | | | PPL Capital Funding, Inc. | | | 5.900% | | | | | | BBB | | | | 2,933,863 | |

| | 51,669 | | | | | SCE Trust I | | | 5.625% | | | | | | Baa1 | | | | 1,297,409 | |

| | | | | | Total Electric Utilities | | | | | | | | | | | | | 13,530,659 | |

| | | | | | |

| | | | | | Multi-Utilities – 1.6% (1.1% of Total Investments) | | | | | | | | | | | |

| | | | | | |

| | 126,704 | | | | | Dominion Resources Inc. | | | 6.375% | | | | | | Baa3 | | | | 6,383,348 | |

| | | | | | |

| | | | | | Oil, Gas & Consumable Fuels – 0.2% (0.1% of Total Investments) | | | | | | | | | | | |

| | | | | | |

| | 24,711 | | | | | Nustar Logistics Limited Partnership | | | 7.625% | | | | | | Ba2 | | | | 660,525 | |

| | | | | | |

| | | | | | Real Estate Investment Trust – 19.8% (13.9% of Total Investments) | | | | | | | | | | | |

| | | | | | |

| | 6,911 | | | | | American Homes 4 Rent | | | 5.000% | | | | | | N/R | | | | 179,893 | |

| | 657 | | | | | American Realty Capital Properties Inc. | | | 6.700% | | | | | | N/R | | | | 15,801 | |

| | 34,502 | | | | | Apartment Investment & Management Company | | | 6.875% | | | | | | BB | | | | 936,729 | |

| | 37,254 | | | | | Apollo Commercial Real Estate Finance | | | 8.625% | | | | | | N/R | | | | 978,663 | |

| | 43,439 | | | | | Arbor Realty Trust Incorporated | | | 7.375% | | | | | | N/R | | | | 1,073,812 | |

| | 36,894 | | | | | Campus Crest Communities | | | 8.000% | | | | | | N/R | | | | 894,680 | |

| | 80,083 | | | | | CBL & Associates Properties Inc. | | | 6.625% | | | | | | BB | | | | 1,998,071 | |

| | 188,990 | | | | | Cedar Shopping Centers Inc., Series A | | | 7.250% | | | | | | N/R | | | | 4,777,667 | |

| | 5,608 | | | | | Chesapeake Lodging Trust | | | 7.750% | | | | | | N/R | | | | 149,509 | |

| | 132,599 | | | | | Colony Financial Inc. | | | 7.125% | | | | | | N/R | | | | 3,199,614 | |

| | 31,003 | | | | | Colony Financial Inc. | | | 8.500% | | | | | | N/R | | | | 819,099 | |

| | 28,243 | | | | | Colony Financial Inc. | | | 7.500% | | | | | | N/R | | | | 718,784 | |

| | 41,036 | | | | | Coresite Realty Corporation | | | 7.250% | | | | | | N/R | | | | 1,077,195 | |

| | 9,995 | | | | | Corporate Office Properties Trust | | | 7.375% | | | | | | BB | | | | 264,368 | |

| | 27,273 | | | | | DDR Corporation | | | 6.500% | | | | | | Baa3 | | | | 696,280 | |

| | 18,561 | | | | | DDR Corporation | | | 6.250% | | | | | | Baa3 | | | | 469,222 | |

| | 27,676 | | | | | Digital Realty Trust Inc. | | | 7.375% | | | | | | Baa3 | | | | 752,234 | |

| | 109,985 | | | | | Digital Realty Trust Inc. | | | 7.000% | | | | | | Baa3 | | | | 2,839,813 | |

| | 325,716 | | | | | Digital Realty Trust Inc. | | | 6.625% | | | | | | Baa3 | | | | 8,393,701 | |

| | 1,754 | | | | | Digital Realty Trust Inc. | | | 5.875% | | | | | | Baa3 | | | | 42,394 | |

| | 74,481 | | | | | EPR Properties Inc. | | | 9.000% | | | | | | BB | | | | 2,504,051 | |

| | 135,119 | | | | | Equity Commonwealth | | | 7.250% | | | | | | Ba1 | | | | 3,467,154 | |

| | 2,926 | | | | | Equity Commonwealth | | | 5.750% | | | | | | BBB– | | | | 70,780 | |

| | 2,940 | | | | | Equity Lifestyle Properties Inc. | | | 6.750% | | | | | | N/R | | | | 77,969 | |

| | 58,000 | | | | | Equity Residential Properties Trust, (13) | | | 8.290% | | | | | | Baa2 | | | | 3,498,125 | |

| | 2,239 | | | | | Excel Trust Inc. | | | 8.125% | | | | | | BB | | | | 56,759 | |

| | 71,870 | | | | | General Growth Properties | | | 6.375% | | | | | | N/R | | | | 1,836,997 | |

| | 41,797 | | | | | Gramercy Property Trust Inc. | | | 7.125% | | | | | | N/R | | | | 1,124,339 | |

| | 9,344 | | | | | Hersha Hospitality Trust | | | 8.000% | | | | | | N/R | | | | 245,373 | |

| | 67,934 | | | | | Hersha Hospitality Trust | | | 6.875% | | | | | | N/R | | | | 1,749,301 | |

| | 18,460 | | | | | Hudson Pacific Properties Inc. | | | 8.375% | | | | | | BB | | | | 484,390 | |

| | 711 | | | | | Inland Real Estate Corporation | | | 8.125% | | | | | | N/R | | | | 18,664 | |

| | 110,612 | | | | | Inland Real Estate Corporation | | | 6.950% | | | | | | N/R | | | | 2,931,217 | |

| | 71,178 | | | | | Investors Real Estate Trust | | | 7.950% | | | | | | N/R | | | | 1,849,204 | |

| | 2,728 | | | | | Kilroy Realty Corporation | | | 6.375% | | | | | | Baa3 | | | | 69,564 | |

| | 36,621 | | | | | Kimco Realty Corporation, | | | 5.500% | | | | | | Baa2 | | | | 888,059 | |

| | 452 | | | | | LaSalle Hotel Properties | | | 7.500% | | | | | | N/R | | | | 11,662 | |

| | 24,247 | | | | | LaSalle Hotel Properties | | | 6.375% | | | | | | N/R | | | | 620,723 | |

| | 23,992 | | | | | Monmouth Real Estate Investment Corp | | | 7.875% | | | | | | N/R | | | | 622,832 | |

| | 6,090 | | | | | Northstar Realty Finance Corporation | | | 8.875% | | | | | | N/R | | | | 158,340 | |

| | 111,579 | | | | | Northstar Realty Finance Corporation | | | 8.750% | | | | | | N/R | | | | 2,877,622 | |

| | 130,872 | | | | | Pebblebrook Hotel Trust | | | 6.500% | | | | | | N/R | | | | 3,402,672 | |

| | 22,680 | | | | | Penn Real Estate Investment Trust | | | 8.250% | | | | | | N/R | | | | 594,670 | |

| | 17,710 | | | | | Post Properties, Inc., Series A | | | 8.500% | | | | | | Baa3 | | | | 1,133,440 | |

| | 147,469 | | | | | PS Business Parks, Inc. | | | 6.000% | | | | | | Baa2 | | | | 3,698,523 | |

| | | | |

| DRA | | Diversified Real Asset Income Fund | | |

| | Portfolio of Investments (continued) | | May 31, 2015 |

| | | | | | | | | | | | | | | | | | | | | | |

| Shares | | | | | Description (1) | | Coupon | | | | | | Ratings (15) | | | Value | |

| | | | | | |

| | | | | | Real Estate Investment Trust (continued) | | | | | | | | | | | | |

| | | | | | |

| | 30,751 | | | | | PS Business Parks, Inc. | | | 5.750% | | | | | | | | Baa2 | | | $ | 754,322 | |

| | 22,851 | | | | | Rait Financial Trust | | | 7.125% | | | | | | | | N/R | | | | 564,420 | |

| | 1,123 | | | | | Regency Centers Corporation | | | 6.625% | | | | | | | | Baa2 | | | | 28,996 | |

| | 12,809 | | | | | Regency Centers Corporation | | | 6.000% | | | | | | | | Baa2 | | | | 322,915 | |

| | 45,046 | | | | | Retail Properties of America | | | 7.000% | | | | | | | | BB | | | | 1,153,178 | |

| | 16,766 | | | | | Sabra Health Care Real Estate Investment Trust | | | 7.125% | | | | | | | | BB– | | | | 432,563 | |

| | 34,191 | | | | | Saul Centers, Inc. | | | 6.875% | | | | | | | | N/R | | | | 888,282 | |

| | 21,619 | | | | | SL Green Realty Corporation | | | 6.500% | | | | | | | | Ba1 | | | | 561,445 | |

| | 18,912 | | | | | STAG Industrial Inc. | | | 6.625% | | | | | | | | BB+ | | | | 482,823 | |

| | 18,351 | | | | | Summit Hotel Properties Inc. | | | 9.250% | | | | | | | | N/R | | | | 493,825 | |

| | 75,586 | | | | | Summit Hotel Properties Inc. | | | 7.875% | | | | | | | | N/R | | | | 2,041,578 | |

| | 100,633 | | | | | Summit Hotel Properties Inc. | | | 7.125% | | | | | | | | N/R | | | | 2,680,861 | |

| | 184 | | | | | Sun Communities Inc. | | | 7.125% | | | | | | | | N/R | | | | 4,876 | |

| | 50,559 | | | | | Taubman Centers Incorporated, Series K | | | 6.250% | | | | | | | | N/R | | | | 1,284,755 | |

| | 6,999 | | | | | Terreno Realty Corporation | | | 7.750% | | | | | | | | N/R | | | | 188,973 | |

| | 29,437 | | | | | Urstadt Biddle Properties | | | 7.125% | | | | | | | | N/R | | | | 765,068 | |

| | 90,973 | | | | | Urstadt Biddle Properties | | | 6.750% | | | | | | | | N/R | | | | 2,351,652 | |

| | 15,438 | | | | | Vornado Realty Trust | | | 5.400% | | | | | | | | BBB– | | | | 352,604 | |

| | 36,637 | | | | | WP GLIMCHER, Inc. | | | 7.500% | | | | | | | | BB+ | | | | 947,433 | |

| | 24,912 | | | | | WP GLIMCHER, Inc. | | | 6.875% | | | | | | | | BB+ | | | | 632,765 | |

| | | | | | Total Real Estate Investment Trust | | | | | | | | | | | | | | | 81,203,293 | |

| | | | | | Total $25 Par (or similar) Retail Preferred (cost $100,461,191) | | | | 102,317,059 | |

| | | | | | |

Principal

Amount (000) | | | | | Description (1) | | Coupon | | | Maturity | | | Ratings (15) | | | Value | |

| | | | |

| | | | | | CONVERTIBLE BONDS – 1.0% (0.7% of Total Investments) | | | | | | | | | |

| | | | | | |

| | | | | | Multi-Utilities – 0.6% (0.4% of Total Investments) | | | | | | | | | | | | |

| | | | | | |

| $ | 2,235 | | | | | Dominion Resources Inc. | | | 5.750% | | | | 10/01/54 | | | | BBB | | | $ | 2,394,058 | |

| | | |

| | | | | | Oil, Gas & Consumable Fuels – 0.4% (0.3% of Total Investments) | | | | |

| | | | | | |

| | 2,160 | | | | | DCP Midstream LLC, 144A | | | 5.850% | | | | 5/21/43 | | | | BB | | | | 1,782,000 | |

| $ | 4,395 | | | | | Total Convertible Bonds (cost $4,420,031) | | | | | | | | | | | | | | | 4,176,058 | |

| | | | | | |

Principal

Amount (000) (16) | | | | | Description (1) | | Coupon | | | Maturity | | | Ratings (15) | | | Value | |

| | | | |

| | | | | | CORPORATE BONDS – 20.0% (14.0% of Total Investments) | | | | | | | | | |

| | | | |

| | | | | | Commercial Services & Supplies – 1.8% (1.3% of Total Investments) | | | | | | | |

| | | | | | |

| $ | 1,660 | | | | | ADS Waste Holdings Inc. | | | 8.250% | | | | 10/01/20 | | | | CCC+ | | | $ | 1,749,224 | |

| | 1,385 | | | | | Casella Waste Systems Inc. | | | 7.750% | | | | 2/15/19 | | | | B– | | | | 1,423,088 | |

| | 1,700 | | | | | Covanta Holding Corporation | | | 5.875% | | | | 3/01/24 | | | | Ba3 | | | | 1,751,000 | |

| | 1,645 | | | CAD | | GFL Environmental Corporation, 144A | | | 7.500% | | | | 6/18/18 | | | | B | | | | 1,322,773 | |

| | 1,135 | | | EUR | | Waste Italia SPA, 144A | | | 10.500% | | | | 11/15/19 | | | | B2 | | | | 1,134,379 | |

| | | | | | Total Commercial Services & Supplies | | | | | | | | | | | | | | | 7,380,464 | |

| | | |

| | | | | | Communications Equipment – 0.4% (0.2% of Total Investments) | | | | |

| | | | | | |

| | 1,670 | | | | | Goodman Networks Inc. | | | 12.125% | | | | 7/01/18 | | | | B– | | | | 1,436,200 | |

| | | |

| | | | | | Construction & Engineering – 0.7% (0.5% of Total Investments) | | | | |

| | | | | | |

| | 1,095 | | | | | AECOM Technology Corporation, 144A | | | 5.875% | | | | 10/15/24 | | | | BB– | | | | 1,138,800 | |

| | 15,000 | | | NOK | | VV Holding AS, 144A | | | 6.700% | | | | 7/10/19 | | | | N/R | | | | 1,901,428 | |

| | | | | | Total Construction & Engineering | | | | | | | | | | | | | | | 3,040,228 | |

| | | | | | |

| | | | | | Consumer Finance – 0.2% (0.2% of Total Investments) | | | | | | | | | | | | |

| | | | | | |

| | 970 | | | | | Covenant Surgical Partners Inc., 144A | | | 8.750% | | | | 8/01/19 | | | | B– | | | | 974,850 | |

| | | |

| | | | | | Diversified Financial Services – 0.4% (0.2% of Total Investments) | | | | |

| | | | | | |

| | 1,485 | | | | | Jefferies LoanCore LLC Finance Corporation, 144A | | | 6.875% | | | | 6/01/20 | | | | B | | | | 1,444,163 | |

| | | | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) (16) | | | | | Description (1) | | Coupon | | | Maturity | | | Ratings (15) | | | Value | |

| | |