UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________________________________________

Form 10-K

___________________________________________________________________________________

| | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from_____________ to ________________

Commission file number: 001-36421

___________________________________________________________________________________

Aurinia Pharmaceuticals Inc.

(Exact name of registrant as specified in its charter)

___________________________________________________________________________________

| | | | | |

| Alberta, Canada | |

(State or other jurisdiction of

incorporation or organization) | |

#140, 14315 - 118 Avenue Edmonton, Alberta T5L 4S6 | 98-1231763 |

| (Address of principal executive offices) | (I.R.S. Employer

Identification Number) |

Registrant’s telephone number, including area code:

(250) 744-2487

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Symbol | Name of Each Exchange on Which Registered |

| Common shares, no par value | AUPH | The Nasdaq Global Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

___________________________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one): | | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant based on the closing price of the common shares on the Nasdaq Global Market on June 30, 2024 was $0.8 billion.

As of February 25, 2025, there were 137,339,016 of the registrant’s common shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE | | | | | | | | |

| Document Description | | 10-K Part |

| Portions of the registrant’s definitive proxy statement to be filed with the U.S. Securities and Exchange Commission pursuant to Regulation 14A within 120 days after registrant’s fiscal year end of December 31, 2024 are incorporated by reference into Part III of this Annual Report on Form 10-K. | | III |

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K for the year ended December 31, 2024 (this “Annual Report”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are subject to the safe harbor provisions created by those sections, as well as “forward-looking information” as defined in applicable Canadian securities laws. Forward-looking statements can be identified by words such as “intends,” “believes,” “anticipates,” “indicates,” “plans,” “expects,” “suggests,” “may,” “should,” “potential,” “designed to,” “will” and similar expressions that predict or indicate future events and trends that do not relate to historical matters. You should not unduly rely on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, some of which are beyond our control. These risks, uncertainties and other factors may cause our actual results, performance or achievements to be materially different from the anticipated future results, performance or achievements expressed or implied by the forward-looking statements.

These forward-looking statements include, but are not limited to, statements regarding:

•our ability to grow net product sales of LUPKYNIS® (voclosporin);

•our ability to maintain an effective sales and marketing organization;

•the potential market size for LUPKYNIS;

•our ability to obtain an uninterrupted supply of commercial and clinical product from our contract manufacturers;

•LUPKYNIS market exclusivity period as a result of the enforcement of regulatory exclusivity and the validity and enforceability of issued and pending patents covering LUPKYNIS;

•our ability to comply with our obligations under our collaboration and license agreement with Otsuka Pharmaceutical Co., Ltd (“Otsuka”);

•the timing and our ability to develop, obtain regulatory approvals for and commercialize AUR200;

•the rate and degree of market acceptance and clinical utility of AUR200, if approved;

•the relationship between earlier study results (preclinical and clinical) and later clinical study results;

•our ability to hire and retain key employees;

•our overall financial performance, including but not limited to, net product sales and net cash provided by or used for operating activities, including any milestone, royalty and other payments resulting from our collaboration and license agreement and commercial supply agreement with Otsuka;

•our capital requirements and our potential need for, and ability to obtain, additional financing; and

•our ability to maintain effective internal controls.

These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results to differ materially from the anticipated future results, performance or achievements expressed or implied by any forward-looking statements, including the factors described under the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You should evaluate all forward-looking statements made in this Annual Report, including the documents we incorporate by reference, in the context of these risks, uncertainties and other factors.

We caution you that the risks, uncertainties and other factors referred to above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits or developments that we expect or anticipate or, even if substantially realized, that they will affect us or our business in the way expected. All forward-looking statements in this Annual Report apply only as of the date made and are expressly qualified in their entirety by the cautionary statements included in this Annual Report. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

PART I

In this Annual Report, references to “we,” “us,” “our,” “Aurinia” or "the Company," refer to Aurinia Pharmaceuticals Inc., an Alberta, Canada corporation, together with our wholly owned subsidiaries, Aurinia Pharma U.S., Inc., a Delaware corporation, and Aurinia Pharma Limited, a United Kingdom (“U.K.”) corporation, on a consolidated basis.

Item 1. Business

OVERVIEW

Background

Aurinia is a biopharmaceutical company focused on delivering therapies to people living with autoimmune diseases with high unmet medical needs. In January 2021, the Company introduced LUPKYNIS® (voclosporin), the first FDA-approved oral therapy for the treatment of adult patients with active lupus nephritis (“LN”). Aurinia is also developing AUR200, a dual inhibitor of B cell activating factor (“BAFF”) and a proliferation inducing ligand (“APRIL”) for the potential treatment of autoimmune diseases.

Net Product Sales

Aurinia sells LUPKYNIS to two specialty pharmacies and a specialty distributor in the U.S., and Aurinia sells LUPKYNIS inventory to its collaboration partner, Otsuka Pharmaceutical Co., Ltd. (“Otsuka”), for the European and Japanese market.

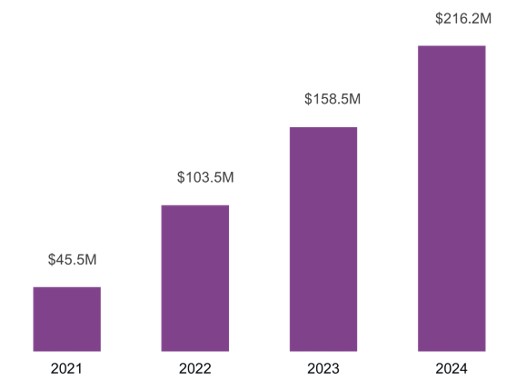

For the year ended December 31, 2024, net product sales were $216.2 million, up 36% from $158.5 million in 2023.

LUPKYNIS Net Product Sales

Cash Flow Provided by (Used in) Operating Activities

For the year ended December 31, 2024, cash flow provided by (used in) operating activities was $44.4 million, compared to $(33.5) million in 2023.

Cash Position

As of December 31, 2024, Aurinia had cash, cash equivalents, restricted cash and investments of $358.5 million, compared to $350.7 million at December 31, 2023. For the year ended December 31, 2024, the Company repurchased 6.1 million of its common shares for $41.0 million.

Otsuka Collaboration

In December 2020, Aurinia entered into a collaboration and licensing agreement with Otsuka to develop and commercialize oral voclosporin in Japan, the European Union (the “E.U.”), the U.K., Switzerland, Russia, Norway, Belarus, Iceland, Liechtenstein and Ukraine (collectively, the “Otsuka Territories”) in exchange for: (i) a $50 million upfront cash payment; (ii) regulatory and commercial milestone payments; and (iii) royalties ranging from 10% to 20% on net sales in the Otsuka Territories.

In August 2022, Aurinia entered into a commercial supply agreement with Otsuka to: (i) supply LUPKYNIS inventory to Otsuka at cost, plus a margin; and (ii) provide manufacturing and other services, including sharing the capacity of a dedicated manufacturing facility at Lonza Ltd. (“Lonza”), Aurinia’s contract manufacturing partner for voclosporin.

Otsuka has obtained regulatory approval of LUPKYNIS in Japan, the E.U., the U.K. and Switzerland.

PRODUCT PORTFOLIO

LUPKYNIS (voclosporin)

In January 2021, the Company introduced LUPKYNIS, the first FDA-approved oral therapy for the treatment of adult patients with active lupus nephritis (“LN”). The Company markets LUPKYNIS in the U.S. directly through its own commercial organization. In Japan, the European Union (the “E.U.”), the United Kingdom (the “U.K.”) and Switzerland, LUPKYNIS is marketed by Aurinia’s collaboration partner, Otsuka Pharmaceutical Co., Ltd. (“Otsuka”).

About Lupus Nephritis (LN)

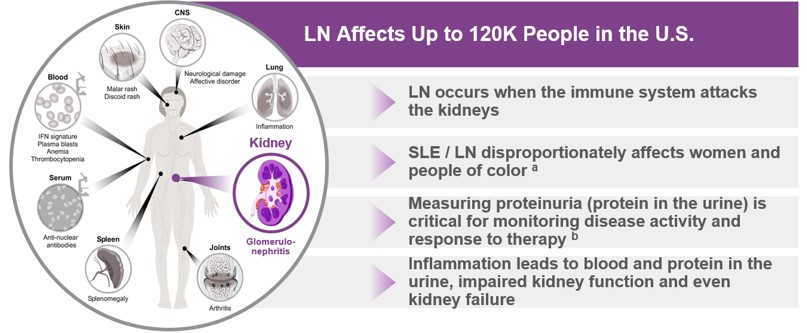

LN is among the most severe and dangerous complications of systemic lupus erythematosus (“SLE”). SLE, commonly known as lupus, is a chronic autoimmune disease where the body's immune system mistakenly attacks its own healthy tissues and organs. Over 200,000 people in the United States are estimated to have SLE (U.S. Centers for Disease Control and Prevention 2024), of which 20% to 60% develop LN (KDIGO Lupus Nephritis Work Group, Kidney Int 2024;105(1S):S1-S69).

a U.S. Centers for Disease Control and Prevention 2024

b Tamirou et al., Ann Rheum Dis 2016;75:526-531

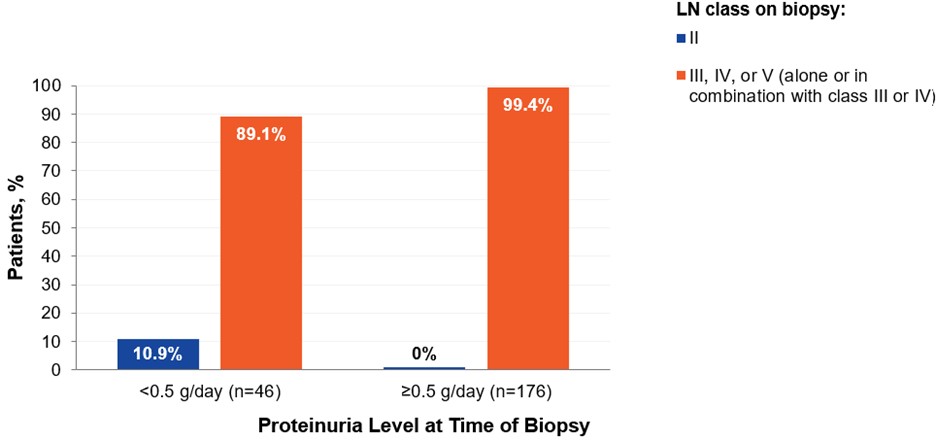

Kidney damage from LN can be progressive and is associated with long-term adverse outcomes. Proteinuria is a significant risk factor for kidney damage. Even low levels of proteinuria may be associated with significant kidney damage. Nearly 90% of SLE patients with proteinuria <0.5 g/day have been reported to have LN class III, IV, or V (alone or in combination with class III or IV) on biopsy (De Rosa et al., Kidney Int Rep., 2020;5(7):1066–1068).

LN Class by Proteinuria Level in Patients with SLE a

a De Rosa et al., Kidney Int Reports 2020;5(7):1066-1068

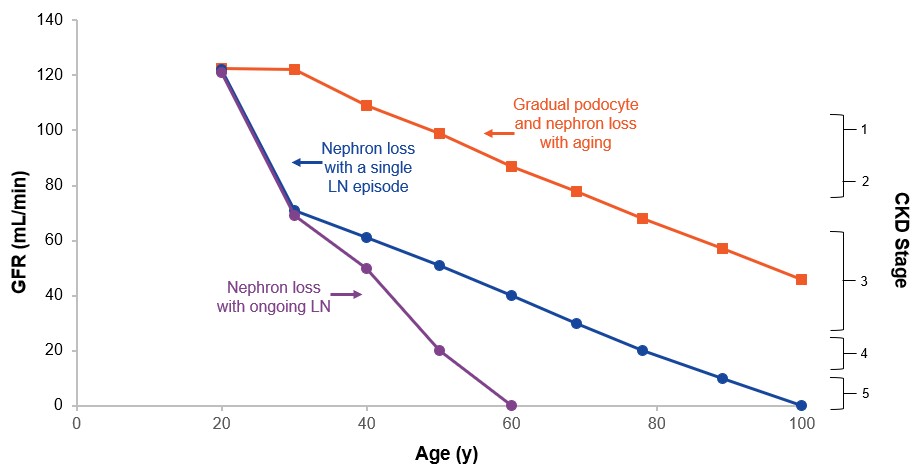

Even a single flare of LN can cause irreversible nephron loss, which can potentially shorten the lifespan of the kidneys by decades (Anders et al., Nat Rev Dis Primers 2020;6(1):7). Every subsequent flare contributes to the accrual of kidney damage, further shortening kidney lifespan and increasing the risk of adverse long-term outcomes such as end-stage kidney disease (“ESKD”) (Anders et al., Nat Rev Dis Primers 2020;6(1):7). Nephron loss and podocyte damage often lead to loss of kidney function as measured by glomerular filtration rate (“GFR”) and proteinuria (Anders et al., Nat Rev Dis Primers 2020;6(1):7 and Maria et al., Nat Rev Rheumatol 2020;16(5):255-267). Proteinuria as a marker of kidney damage routinely precedes GFR decline (Cravedi et al., Br J Clin Pharmacol 2013;76(4):516-523).

Even a Single Flare of LN Can Reduce the Lifespan of the Kidney a

a Adapted with permission from Anders et al., Nat Rev Dis Primers 2020;6(1):7; "CKD" means chronic kidney disease.

Proteinuria reduction is associated with long-term renal protection. The larger the initial reduction in proteinuria in the first several months of management, the lower the risk of ESKD (Chen et al., Clin J Am Soc Nephro 2008;3(1):46-53).

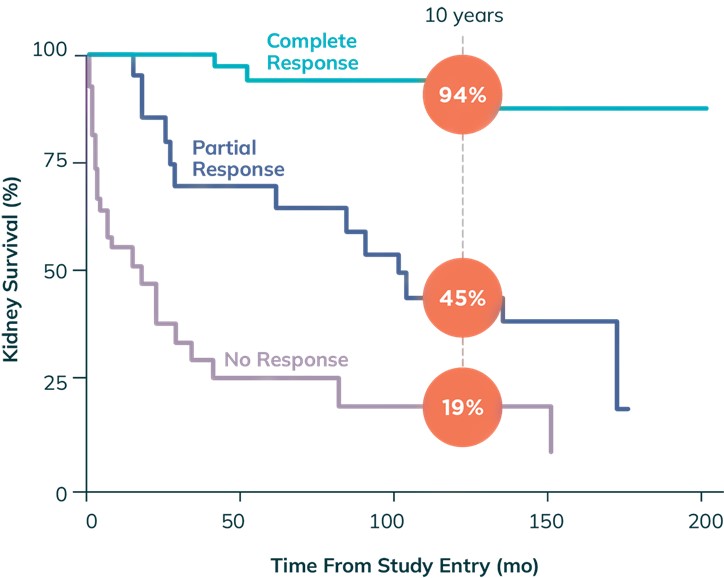

Kidney Survival Based on Proteinuria Response Status a, b

a Adapted with permission from Chen et al., Clin J Am Soc Nephro 2008;3(1):46-53

b Retrospective analysis of patients (N=86) enrolled in the prospective, controlled study of plasmapheresis in severe LN to determine long-term prognosis of achieving partial response. Complete response was defined as SCr ≤1.4 mg/dL and proteinuria ≤0.33 g/day within 5 years of study entry, and partial response was defined as ≤25% increase in baseline SCr and ≥50% reduction in baseline proteinuria to ≤1.5 g/day (but >0.33 g/day) within 5 years of entering the study. Kidney survival was determined by kidney failure (≥6 mg/dL SCr or the initiation of kidney replacement therapy).

Mycophenolate mofetil (“MMF”) and corticosteroids alone frequently fail to substantially reduce proteinuria, with only 20% to 30% of patients achieving a complete response at 1 to 2 years. Thus, the need remains for additional treatment options (Fanouriakis et al., Ann Rheum Dis 2024;83:15-29).

How LUPKYNIS Works

LUPKYNIS is a calcineurin-inhibitor immunosuppressant indicated in combination with a background immunosuppressive therapy regimen for the treatment of adult patients with active LN. LUPKYNIS targets LN with a dual mechanism of action:

1.Promotes podocyte stability, reducing proteinuria

2.Acts as an immunosuppressant through inhibition of T-cell activation and cytokine production

Clinical Study Overview of LUPKYNIS

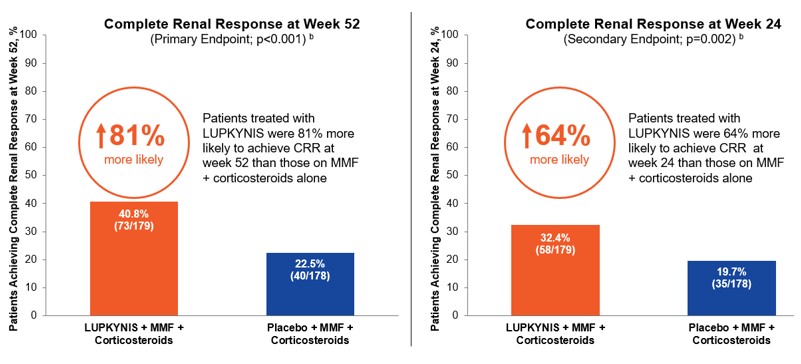

FDA approval of LUPKYNIS was based on our pivotal Phase 3 AURORA 1 study (“AURORA 1”), which demonstrated the ability of LUPKYNIS treatment to significantly improve outcomes for patients when added to the then-typical standard of care, MMF and corticosteroids. AURORA 1 was a randomized, double‑blind, placebo-controlled, Phase 3 study in 357 adults with class III, IV, or V (alone or in combination with class III or IV) LN. In this study, patients receiving LUPKYNIS with MMF plus corticosteroids compared to patients receiving MMF plus corticosteroids alone experienced a significantly higher rate of complete renal response (“CRR”) at both Week 52 (primary endpoint) and Week 24 (secondary endpoint).

Significantly More Patients on LUPKYNIS Achieved a Complete Renal Response in AURORA 1 a

a Rovin et al., Lancet 2021;397:2070-2080

b Stringent criteria of complete renal response as: Urine Protein-to-Creatinine Ratio (“UPCR”) of ≤0.5 mg/mg, maintained stable eGFR, sustained corticosteroids, and no administration of rescue medications

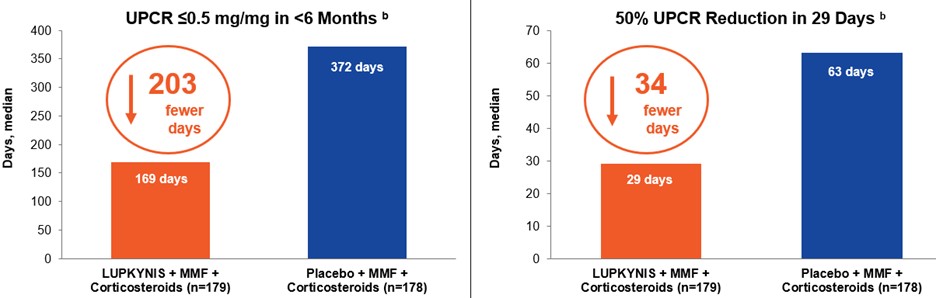

LUPKYNIS in combination with MMF and corticosteroids reduced proteinuria twice as fast as MMF and corticosteroids alone.

LUPKYNIS Rapidly Reduced Proteinuria in Fewer Days in AURORA 1 a

a Rovin et al., Lancet 2021;397:2070-2080

b Secondary endpoint

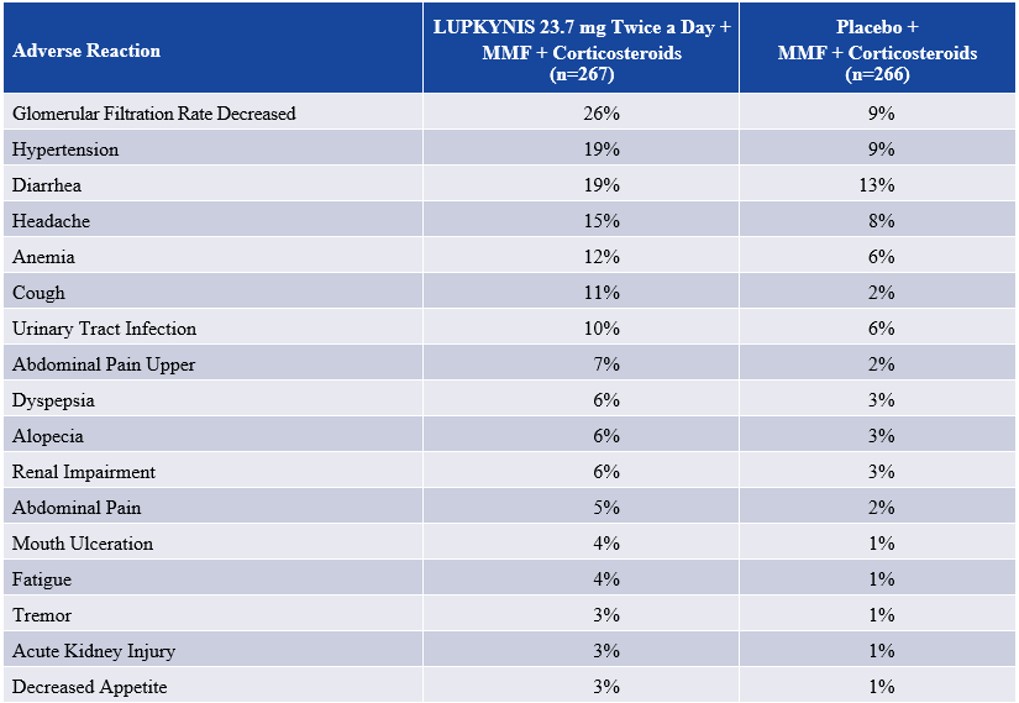

In the pivotal Phase 3 study (AURORA 1) and Phase 2 study (AURA-LV), adverse reactions occurring in ≥3% of patients treated with LUPKYNIS and ≥2% higher than placebo are shown below.

Adverse Reactions Occurring in ≥3% of Patients Treated with LUPKYNIS 23.7 mg Twice a Day and ≥2% Higher than Placebo in AURORA 1 and AURA-LV a

a LUPKYNIS Prescribing Information

In AURORA 2, a double‑blind, placebo-controlled extension study of adults with active LN who completed AURORA 1, LUPKYNIS demonstrated safety comparable to that seen in AURORA 1 with no unexpected safety signals observed through 3 years (LUPKYNIS Prescribing Information and Saxena et al., Arthritis Rheumatol 2024;76(1):59-67). The AURORA Clinical Program is the only clinical program to include 3 years of LN treatment and follow-up.

2024 American College of Rheumatology (“ACR”) Lupus Nephritis Treatment Guidelines

In part due to the clinical study results with LUPKYNIS, ACR now recommends triple immunosuppressive therapy, including treatment with a calcineurin inhibitor (the class of drugs that includes LUPKYNIS), as first-line therapy for patients with LN, with the goal of treatment being the preservation of kidney function (2024 ACR Guideline for the Screening, Treatment, and Management of Lupus Nephritis: Guideline Summary 2024). The ACR-recommended goal of therapy is to reach proteinuria ≤0.5 mg/mg by 6-12 months. LUPKYNIS’ rapid effect on reducing proteinuria facilitates achieving this treatment goal.

AUR200

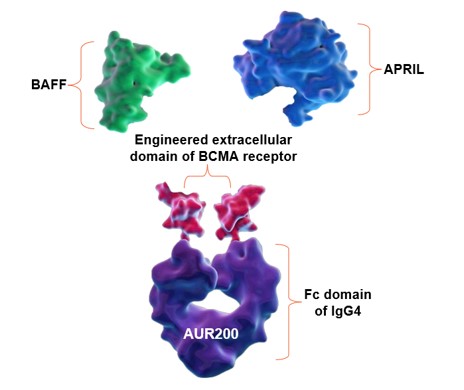

AUR200 is a dual inhibitor of B cell activating factor (“BAFF”) and a proliferation inducing ligand (“APRIL”) for the potential treatment of autoimmune diseases. AUR200 contains a B cell maturation antigen (“BCMA”)-engineered extracellular binding domain optimized for superior affinity to BAFF and APRIL (others use transmembrane activator and CAML interactor (“TACI”)-engineered extracellular binding domain). BCMA has a stronger natural affinity for APRIL than TACI (Mathur, J Clin Med 2023;12:1-18). AUR200 contains an immunoglobulin (“Ig”) G4 fragment crystallizable region (“Fc”) domain with no appreciable effector function (others use IgG1 Fc domain). IgG4 is considered the least inflammatory across the IgG subclasses, in part because it poorly activates the complement system (Oskam et al., Front Immun 2023;14:1-11).

AUR200

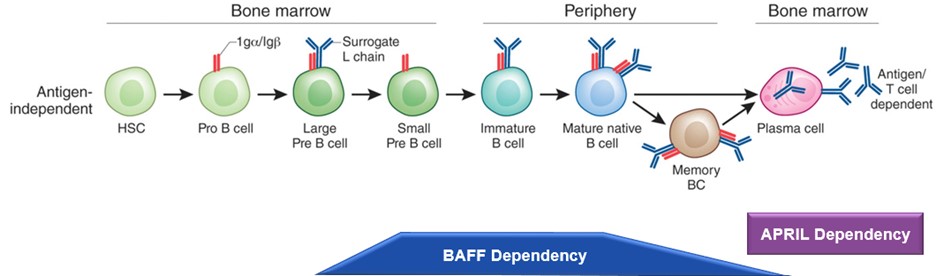

BAFF and APRIL are important cytokines that regulate B cell survival and differentiation (Mathur et al., J Clin Med 2023;12:1-18). BAFF and APRIL receptor targets are expressed on B cells at different stages of B cell development (Mathur et al., J Clin Med 2023;12:1-18). Targeting both BAFF and APRIL depletes a broader set of B cells than targeting a single cytokine. By inhibiting BAFF and APRIL, drugs like AUR200 may prevent the activation of autoreactive B cells and reduce their numbers and associated antibodies in the body, thereby treating autoimmune diseases.

B Cell Maturation a

a Schrezenmeier et al., J Am Soc Nephrol 2018;29:741-758

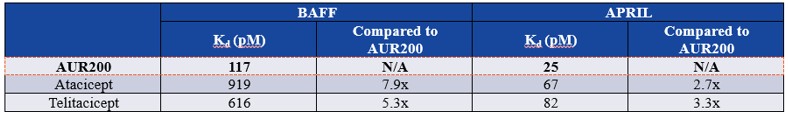

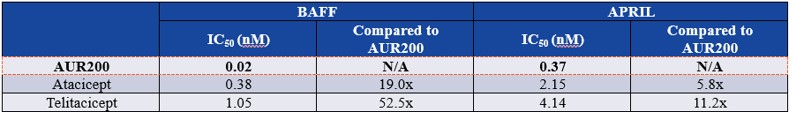

Based on preclinical in vitro testing, AUR200 has high binding affinity for both BAFF and APRIL as compared to competitor dual BAFF/APRIL inhibitors, atacicept and telitacicept.

AUR200 Is a High Affinity Dual BAFF/APRIL Inhibitor a

a Morales et al., ACR Convergence 2022

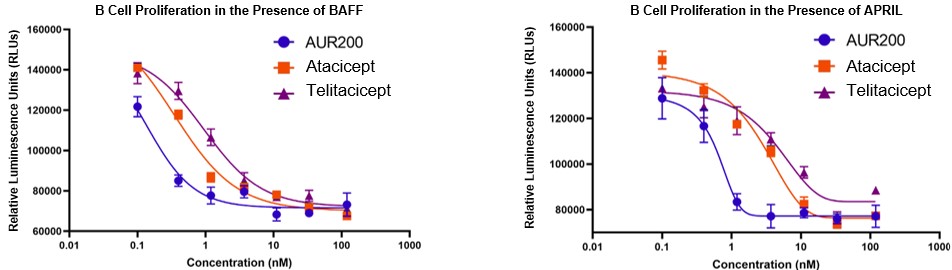

Based on preclinical in vitro testing, AUR200 potently inhibits both BAFF- and APRIL-mediated B cell proliferation as compared to competitor dual BAFF/APRIL inhibitors, atacicept and telitacicept.

AUR200 Potently Inhibits BAFF- and APRIL-Mediated B Cell Proliferation a

a Morales et al., ACR Convergence 2022

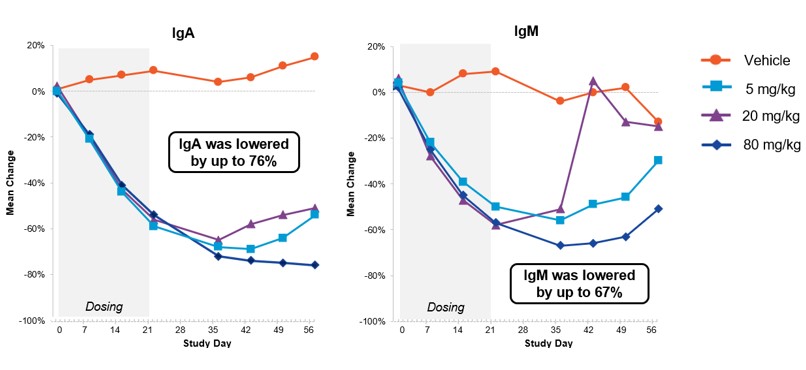

In preclinical testing in non-human primates, subcutaneous dosing of AUR200 resulted in significant and sustained reductions in the B cell antibodies immunoglobulin A (“IgA”) and immunoglobulin M (“IgM”). AUR200 was well-tolerated with no adverse findings at any of the doses tested.

AUR200 Depletes B Cell Antibodies in Non-Human Primates a

a Morales et al., ACR Convergence 2022

A single ascending dose (“SAD”) study to assess the safety, tolerability and pharmacodynamics of AUR200 in healthy volunteers was initiated in September 2024 and is ongoing. Initial results from this study are expected in the second quarter of 2025.

SALES AND MARKETING ORGANIZATION

Aurinia employs an experienced sales and marketing team dedicated to the commercialization of LUPKYNIS, supported by professionals in commercial operations, commercial supply chain, patient services and market access functions.

REGULATORY EXCLUSIVITY

We have received New Chemical Entity (“NCE”) exclusivity for LUPKYNIS in the U.S., which provides for exclusivity until January 22, 2026. In the U.S., NCEs approved by the FDA are eligible for market exclusivity under the U.S. Federal Food, Drug, and Cosmetic Act (the “FDCA”), which can prevent the approval of generic versions of the NCE for 5 to 7.5 years from the date of the initial approval of the NCE. Specifically, the FDCA provides a 5-year period of marketing exclusivity within the U.S. to the applicant that gains approval of a new drug application (“NDA”) for an NCE. A drug is an NCE if the FDA has not previously approved any other new drug containing the same active moiety, which is the molecule or ion responsible for the action of the drug substance. During the first 4 years of the exclusivity period, the FDA may not accept for review an Abbreviated New Drug Application (“ANDA”) or a 505(b)(2) NDA submitted by another company for another version of such drug where the applicant does not own or have a legal right of reference to all of the data required for approval. However, an application may be submitted 4 years after the NDA approval of the NCE if it contains a certification of patent invalidity or non-infringement. The initiation of patent litigation by the patent holder will trigger an automatic stay in the approval of any generic competition until the earlier of: (i) 30 months from the certification; or (ii) a court ruling of patent invalidity or non-infringement for the relevant patents. In the absence of a court ruling, the 30-month stay will be extended by such amount of time (if any) that is required for 7.5 years to have elapsed from the date of NDA approval of the NCE.

We also have NCE-equivalent exclusivity for voclosporin in certain European countries, which provides exclusivity for 10 years in Europe post-approval. Additionally, we have exclusivity for 8 years in Japan post-approval.

INTELLECTUAL PROPERTY

We own granted patents, including U.S. patents, covering LUPKYNIS for composition of matter and methods of use. U.S. Patent Nos. 7,332,472, 10,286,036 and 11,622,991 are listed in the U.S. FDA Orange Book.

•U.S. Patent No. 7,332,472: Patent protection for patents related to the composition of matter of voclosporin are expected to be extended in the U.S. and certain other major markets, including many European markets, until October 2027 under the Hatch-Waxman Act in the U.S., the Supplementary Protection Certificate program in the E.U. and comparable patent extension laws in other countries. In the U.S., we have applied for a patent term extension for U.S. Patent No. 7,332,472 and are awaiting confirmation from the USPTO. As the patent term extension was not granted prior to the expiry of the patent term for our composition of matter patent for voclosporin, we applied for, and have received, an interim patent term extension until October 17, 2025. If the patent term extension is not granted prior to the expiration of the interim patent term extension that was granted, we intend to file future interim patent term extensions to the extent permitted until the USPTO completes its review of the patent term extension application.

•U.S. Patent No. 10,286,036: In May 2019, we were granted U.S. Patent No. 10,286,036 with a term extending to December 2037. The patent claims are directed at the LUPKYNIS dosing protocol for LN used in our clinical trials. We have also filed for protection of this subject matter under the Patent Cooperation Treaty (“PCT”) and are applying for similar protection in certain member countries thereof. Patents issuing from this PCT application have terms extending to May 2038, and such patents have been issued in Australia, Europe, Hong Kong, Israel, Japan, Korea, Mexico, Malaysia, Russia and Singapore. Several third parties have filed oppositions against a granted European patent relating to the LUPKYNIS dosing protocol, which we are vigorously defending. We have also applied for a patent term extension for the issued Japanese counterpart patent and are awaiting confirmation from the Japan Patent Office (“JPO”).

•U.S. Patent No. 11,622,991: In April 2023, we were granted U.S. Patent No. 11,622,991 with a term extending to December 2037. Importantly, the patent claims reflect the unique and proprietary dosing regimen of LUPKYNIS that is consistent with the FDA-approved product label. This patent specifies the method of treating patients with LN by administering LUPKYNIS in combination with MMF and corticosteroids and using eGFR to pharmacodynamically dose the product. Patents claiming this subject matter have been issued in Japan and Israel, with terms extending to May 2038, and are pending in various other jurisdictions. We have also applied for a patent term extension for the issued Japanese counterpart patent and are awaiting confirmation from the JPO.

On February 25, 2025, we received a paragraph IV notice of certification (the “Notice Letter”) related to a submission of an ANDA to the FDA seeking authorization to manufacture, use or sell a generic version of LUPKYNIS in the U.S., prior to the expiry of U.S. Patent Nos. 10,286,036 and 11,622,991 (the “2037 Patents”), which are listed in the FDA's Orange Book. The Notice Letter alleges that the 2037 Patents are invalid, unenforceable and/or will not be infringed by the commercial manufacture, use or sale of the generic product described in the ANDA.

We intend to vigorously defend LUPKYNIS and our intellectual property rights protecting LUPKYNIS. In accordance with the Hatch-Waxman Act, because LUPKYNIS is an NCE, should we file a patent infringement lawsuit within 45 days of receipt of the Notice Letter, the FDA cannot approve any ANDA any earlier than 7.5 years from the approval of the LUPKYNIS NDA unless a District Court finds that all of the asserted claims of the patents-in-suit are invalid, unenforceable and/or not infringed.

COMPETITION

The pharmaceutical industry is competitive. While LUPKYNIS is the only FDA-approved oral therapy for the treatment of adult patients with active LN, BENLYSTA® (belimumab, marketed by GSK plc), an injectable treatment, is also FDA-approved for LN. Additionally, physicians continue to treat LN with an off-label combination of MMF and corticosteroids alone or in combination with first generation calcineurin inhibitors such as tacrolimus.

As a potential treatment for autoimmune disease, AUR200 is subject to competition from both FDA-approved and investigational products. Competing products include, but are not limited to, other dual BAFF/APRIL inhibitors (e.g., povetacicept, atacicept and telitacicept).

MANUFACTURING AND SUPPLY CHAIN

We rely on third-party manufacturers to supply commercial inventory for LUPKYNIS and semi-finished products and expect to continue to do so to meet our development and commercial needs. In all of our manufacturing agreements and commercial supply agreements, we require that contract manufacturers produce drug substance and drug products in accordance with cGMP and all other applicable laws and regulations. We maintain confidentiality agreements with potential and existing manufacturers to protect our proprietary rights related to LUPKYNIS. The long-term commercial success of LUPKYNIS will depend in part on the ability of our contract manufacturers to supply cGMP-compliant drug substance and drug product without interruption.

Manufacturing of Drug Substance

Voclosporin requires a specialized drug substance manufacturing process and is manufactured by Lonza, our sole supplier for drug substance. Pricing for supply is determined through supply agreements between us and Lonza and is based on the volume produced and the cost of the raw materials used in the drug substance manufacturing process. As of the date of this Annual Report, we have not experienced any difficulty in obtaining the raw materials required with respect to the manufacturing of voclosporin. We believe we have enough inventory on hand and manufacturing capacity to meet forecasted demand.

In December 2020, Aurinia entered into a manufacturing services agreement with Lonza for the construction of a dedicated manufacturing facility for voclosporin (the “Monoplant"). The construction of the Monoplant began in January 2021 and manufacturing of voclosporin began in late June 2023. The Monoplant is equipped with state-of-the-art manufacturing equipment to provide cost and production efficiency for the manufacturing of voclosporin, while expanding existing capacity and providing supply security to meet future commercial demand. Aurinia pays a quarterly fixed facility fee of 3.6 million Swiss Francs (approximately $4.0 million) for the exclusive right to use the Monoplant through March 31, 2030.

Encapsulation

Catalent Pharma Solutions (“Catalent”) is currently the sole supplier for the preparation of our voclosporin capsules. Pricing for these services is determined by a supply agreement between Catalent and us. We expect that Catalent will continue to provide contract manufacturing services with respect to encapsulating voclosporin in order to manufacture voclosporin capsules that are required for our future commercial and clinical supply needs.

Packaging

We use a sole supplier for the blistering and packaging of LUPKYNIS commercial cartons for sale in the U.S. and for the blistering of semi-finished products. Pricing for these services is determined by a supply agreement between us and our supplier. We expect no issues in obtaining contract manufacturing services with respect to the packaging of LUPKYNIS commercial cartons for the U.S. market.

GOVERNMENT REGULATION

Pharmaceutical products, including LUPKYNIS, are subject to extensive government regulation. In the U.S., the FDA regulates pharmaceutical products. FDA regulations govern the testing, research and development activities, manufacturing, quality, storage, advertising, promotion, labeling, sale and distribution of pharmaceutical products. Accordingly, there is a rigorous process for the approval of new drugs and ongoing oversight of marketed products. We may also be subject to foreign regulatory requirements governing clinical studies and drug products if products are tested or marketed abroad. The approval process outside of the U.S. varies from jurisdiction to jurisdiction and the time required may be longer or shorter than that required for FDA approval.

Regulation in the U.S.

The FDA testing and approval process requires substantial time, effort and financial resources. We cannot assure you that any of our product candidates will ever obtain approval. The FDA approval process for new drugs includes, without limitation:

•preclinical studies;

•submission in the U.S. of an investigational new drug application for clinical studies conducted in the U.S.;

•adequate and well-controlled clinical studies to establish safety and efficacy of the product;

•review and approval of an NDA in the U.S.; and

•inspection of the facilities used in the manufacturing of the drug to assess compliance with the FDA’s cGMP regulations.

Any products manufactured or distributed by us pursuant to FDA approvals are subject to continuing regulation by the FDA, including record-keeping requirements and reporting of adverse experiences with the drug. Drug manufacturers and their subcontractors are required to register their establishments with the FDA and certain state agencies and are subject to periodic inspections by the FDA and certain state agencies for compliance with the FDA's current Good Manufacturing Practices (“cGMPs”), which impose certain procedural and documentation requirements on us and our third-party manufacturers. Even after regulatory approval is obtained, under certain circumstances, such as later discovery of previously unknown safety risks, the FDA can withdraw approval or subject the drug to additional restrictions.

The FDA closely regulates the marketing and promotion of drugs. Drugs may only be marketed in a manner consistent with their FDA-approved labeling. Approval may be subject to post-marketing surveillance and other record-keeping and reporting obligations. Product approvals may be withdrawn if compliance with regulatory standards is not maintained or if problems occur following initial marketing.

The failure to comply with FDA’s requirements may result in adverse publicity, warning letters, corrective advertising, restrictions on marketing or manufacturing, refusals to review pending product applications, refusals to permit the import or export of products, seizures, injunctions, and civil and criminal penalties.

Refer to the section titled “Risk Factors” in this Annual Report for a discussion of the potential impacts that compliance with government regulation may have on our business.

U.S. Health Care Fraud and Abuse Laws and Compliance Requirements

We are subject to various federal and state laws targeting fraud and abuse in the health care industry. These laws may impact, among other things, our sales and marketing efforts. In addition, we may be subject to patient privacy regulation by both the federal government and the states in which we conduct our business. The laws that may affect our ability to operate include:

•the federal Anti-Kickback Statute (“AKS”), which prohibits, among other things, persons from soliciting, receiving, offering or paying remuneration, directly or indirectly, in cash or in kind, to induce or reward, or in return for, either the referral of an individual for, or the purchase, order or recommendation of, an item or service reimbursable under a federal health care program, such as the Medicare and Medicaid programs. The term “remuneration” has been broadly interpreted to include anything of value, including for example gifts, cash payments, donations, the furnishing of supplies or equipment,

•waivers of payment, ownership interests, and providing any item, service or compensation for something other than fair market value.

•federal false claims and civil monetary penalties laws, including the federal civil False Claims Act, which prohibits anyone from, among other things, knowingly presenting, or causing to be presented, for payment to federal programs (including Medicare and Medicaid) claims for items or services that are false or fraudulent. Although we may not submit claims directly to payors, manufacturers can be held liable under these laws in a variety of ways. These include:

providing inaccurate billing or coding information to customers; improperly promoting a product’s off-label use; violating the federal Anti-Kickback Statute; or misreporting pricing information to government programs.

•provisions of the federal Health Insurance Portability and Accountability Act of 1996 (HIPAA), which created new federal criminal statutes that prohibit, among other things, knowingly and willfully executing a scheme to defraud any health care benefit program or making false statements in connection with the delivery of or payment for health care benefits, items or services.

•the federal Physician Payment Sunshine Act requirements, under the Patient Protection and Affordable Care Act (the ACA), which require manufacturers of certain drugs and biologics to track and report to U.S. Centers for Medicare & Medicaid Services (CMS) payments and other transfers of value they make to U.S. physicians and teaching hospitals as well as physician ownership and investment interests in the manufacturer.

•provisions of HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act and its implementing regulations, which impose certain requirements relating to the privacy, security and transmission of individually identifiable health information.

•section 1927 of the Social Security Act, which requires that manufacturers of drugs and biological products covered by Medicaid report pricing information to CMS on a monthly and quarterly basis, including the best price available to any customer of the manufacturer, with certain exceptions for government programs, and pay prescription rebates to state Medicaid programs based on a statutory formula derived from reported pricing information.

•various state and/or foreign law equivalents of each of the above federal laws, such as the California Consumer Privacy Act, many of which differ from each other in significant ways and may not have the same effect, which complicates our compliance efforts.

Regulation in Non-U.S. Jurisdictions

In addition to regulations in the U.S., we, or our partners, may be subject to a variety of foreign regulations governing clinical studies and commercial sales and distribution of LUPKYNIS or future products. When we, or our partners, market LUPKYNIS in foreign countries, we are also subject to foreign regulatory requirements governing marketing approval for pharmaceutical products. The requirements governing the conduct of clinical studies, product approval, pricing and reimbursement vary widely from country to country. Whether or not FDA approval has been obtained, approval of a product by the regulatory authorities of foreign countries must be obtained before marketing the product in those countries. The approval process varies from country to country, and the time required for such approvals may differ substantially from that required for FDA approval. Foreign regulatory approval processes involve many of the risks associated with FDA marketing approval discussed above. There is no assurance that any FDA approval of any of our product candidates will result in similar foreign approvals or vice versa. The process for clinical studies in the European Union and other countries is similar, and studies are heavily scrutinized by the designated ethics committees and regulatory authorities. In addition, foreign regulations may include applicable post-marketing requirements, including safety surveillance, anti-fraud and abuse laws, and implementation of corporate compliance programs and reporting of payments or other transfers of value to health care professionals and entities.

In Europe, the E.U. General Data Protection Regulation (2016/679) (the “GDPR”) contains provisions specifically directed at the processing of health information. The GDPR provides for potentially significant sanctions and contains extraterritorial measures intended to bring non-E.U. companies under the regulation. In addition to the GDPR, individual countries in Europe and elsewhere in the world have enacted similar data privacy legislation. This legislation imposes increased compliance obligations and regulatory risk, including the potential for significant fines for noncompliance.

Other Laws and Regulations

We are subject to a variety of financial disclosure and securities trading regulations as a public company in the U.S., including laws relating to the oversight activities of the U.S. Securities and Exchange Commission (the “SEC”) and the regulations of the Nasdaq Global Market, on which our common shares are traded.

Coverage and Reimbursement

In the U.S. and internationally, sales of LUPKYNIS, and any other products that we market in the future, and our ability to generate revenues on such sales, are dependent, in significant part, on the availability of adequate coverage and reimbursement from third-party payors, such as state and federal governments, managed care providers and private insurance plans. These organizations routinely implement cost-cutting and reimbursement initiatives that have the ability, or potential, to impact a patient’s overall access to our product. Examples of these initiatives include, but are not limited to, establishing formularies that govern the drugs and biologics that are eligible for reimbursement and the out-of-pocket obligations of member patients for such products.

Political, economic and regulatory influences are subjecting the healthcare industry in the U.S. to fundamental changes. There have been, and we expect there will continue to be, legislative and regulatory proposals to change the healthcare system in ways that could significantly affect our future business. For example, ACA enacted in March 2010, substantially changed the way healthcare is financed by both governmental and private insurers. Among other cost containment measures, the ACA established:

•an annual, nondeductible fee on any entity that manufactures or imports certain branded prescription drugs and biologic agents;

•a Medicare Part D coverage gap discount program, in which pharmaceutical manufacturers who wish to have their drugs covered under Part D must offer discounts for eligible beneficiaries during their coverage gap period, often referred to as the donut hole; and

•a formula that increases the rebates a manufacturer must pay under the Medicaid Drug Rebate Program.

Additionally, in August 2022, the Inflation Reduction Act of 2022 (“IRA”) was passed by the U.S. Congress which, among other things, includes policies that are designed to have a direct impact on drug prices and reduce drug spending by the federal government, which took effect in 2023. This legislation contains substantial drug pricing reforms, including the establishment of a drug price negotiation program within the U.S. Department of Health and Human Services that would require manufacturers to charge a negotiated “maximum fair price” for certain selected drugs covered by Medicare or pay an excise tax for noncompliance, the establishment of rebate payment requirements on manufacturers of certain drugs payable under Medicare Parts B and D to penalize price increases that outpace inflation, and requires manufacturers to provide discounts on Part D drugs. Legislative, administrative, and private payor efforts to control drug costs span a range of proposals, including drug price negotiation, Medicare Part D redesign, drug price inflation rebates, international mechanisms, generic drug promotion and anticompetitive behavior, manufacturer reporting, and reforms that could impact therapies utilizing the accelerated approval pathway.

Individual states in the U.S. have also become increasingly active in passing legislation and implementing regulations designed to control pharmaceutical product pricing, including price or patient reimbursement constraints, discounts, restrictions on certain product access and marketing cost disclosure and transparency measures, and, in some cases, designed to encourage importation from other countries and bulk purchasing. Recently, there has also been heightened governmental (federal and state) scrutiny over the manner in which drug manufacturers set prices for their marketed products, which has resulted in several Congressional inquiries and proposed bills designed to, among other things, bring more transparency to product pricing, review the relationship between pricing and manufacturer patient programs, and reform government program reimbursement methodologies for drug products.

Similar political, economic and regulatory developments are occurring in the E.U. and may affect the ability of pharmaceutical companies to profitably commercialize their products. In addition to continuing pressure on prices and cost containment measures, legislative developments at the E.U. or member state level may result in significant additional requirements or obstacles. The delivery of healthcare in the E.U., including the establishment and operation of health services and the pricing and reimbursement of medicines, is almost exclusively a matter for national, rather than E.U., law and policy. National governments and health service providers have different priorities and approaches to the delivery of health care and the pricing and reimbursement of products in that context. In general, however, the healthcare budgetary constraints in most E.U. member states have resulted in restrictions on the pricing and reimbursement of medicines by relevant health service providers. Coupled with ever-increasing E.U. and national regulatory burdens on those wishing to develop and market products, this could restrict or regulate post-approval activities and affect the ability of pharmaceutical companies to commercialize their products. In international markets, reimbursement and healthcare payment systems vary significantly by country, and many countries have instituted price ceilings on specific products and therapies.

Our ability to successfully commercialize products depends in part on the extent to which reimbursement for the costs of our products and related treatments will be available in the U.S. and worldwide from government health administration authorities, private health insurers and other organizations.

HUMAN CAPITAL

As of February 26, 2025, we had 130 employees. We also hire consultants and contract with third parties, as needed, to provide additional resources to support our business activities. None of our employees are represented by labor unions or covered by collective bargaining agreements, and we consider our relations with our employees to be good. We also hire consultants and contract with third parties, as needed, to provide additional resources to support our business activities.

Our key human capital management objectives are to identify, recruit, integrate, retain and motivate our new and existing employees. We believe that our compensation and benefit programs are appropriately designed to attract and retain qualified talent. Employees receive an annual base salary and are eligible to earn performance-based cash bonuses. To create and maintain a successful work environment, we offer a comprehensive package of additional benefits that support the physical and mental health and wellness of all of our employees and their families. Additionally, we grant equity awards in order to allow for directors, officers and employees of Aurinia to share in the performance of the Company.

CORPORATE INFORMATION

Aurinia is organized as a corporation under the Business Corporations Act (Alberta). We have one wholly owned subsidiary, Aurinia Pharma U.S., Inc., a Delaware corporation. Our principal executive office is located at #140, 14315 - 118 Avenue, Edmonton, Alberta, Canada T5L 4S6 and our phone number is +1 (250) 744-2487. Our website address is www.auriniapharma.com.

We file or furnish electronically with the SEC our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to reports, pursuant to Sections 13(a) and 15(d) of the Exchange Act. We make available on our website, free of charge, copies of these reports as soon as reasonably practicable after filing or furnishing these reports with the SEC. The SEC maintains a website at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The information posted on, or that can be accessed through, our website is not incorporated into this Annual Report and the contents of these websites are not intended to be incorporated by reference into any report or document we file with, or furnish to, the SEC. Certain documents are also filed with securities regulators in Canada and are available under our profile at the website www.sedarplus.ca.

Item 1A. Risk Factors

An investment in our common shares involves a high degree of risk. You should carefully consider the material risks and uncertainties described below before deciding whether to purchase our common shares. Certain risks may be applicable to multiple categories but are only included once below. In assessing these risks, you should also refer to the other information contained in this Annual Report, including our audited financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our business, financial condition, results of operations, cash flow, reputation and prospects could be materially and adversely affected by any of these risks and uncertainties, as well as other risks and uncertainties not currently known to us or that we currently do not believe to be material. In any such case, the trading price of our common shares of stock could decline, and you could lose all or part of your investment.

RISKS RELATED TO COMMERCIALIZATION

We are substantially dependent on the commercial success of LUPKYNIS.

The success of our business is substantially dependent on our ability to successfully commercialize LUPKYNIS, our sole approved product. The Company markets LUPKYNIS in the U.S. directly through its own commercial organization. The market for effective pharmaceutical sales and marketing professionals is competitive, and maintaining these capabilities is expensive and challenging. If we are unable to maintain an effective sales and marketing organization, LUPKYNIS sales could be adversely affected, and our business may suffer. LUPKYNIS’s competition as a treatment in LN patients includes BENLYSTA and physicians continuing to treat LN with an off-label combination of MMF and corticosteroids alone or in combination with first generation calcineurin inhibitors such as tacrolimus. If we are unable to further change treatment practices, further growth of LUPKYNIS net product sales will be limited, and our business may suffer. We may be subject to additional competition from future products.

In an effort to remain competitive in the marketplace, we may determine to change our pricing, dosage forms and strengths and other marketing strategies for LUPKYNIS, including altering the amount or availability of discounts or rebates. Any such changes could have short-term or long-term negative impacts on net product sales, which could cause our business and results of operations to suffer. Price increases or changes to our marketing strategies may also negatively affect our reputation and our ability to secure and maintain reimbursement coverage for LUPKYNIS, which could result in decreased demand and cause our business and results of operations to suffer. If we are unable to successfully price or market LUPKYNIS, the commercial prospects for LUPKYNIS will be limited, and our business may suffer.

Our estimates of the potential market size for LUPKYNIS are based on prescription and sales data for relevant in-market products, the results of clinical studies, medical literature and other information. If the potential market size for LUPKYNIS is smaller than we estimate, the commercial prospects for LUPKYNIS may be limited, and our business may suffer.

Product liability or other lawsuits against us could cause us to incur substantial liabilities and reduce LUPKYNIS sales.

Patients suffering from LN may become gravely ill. The most commonly reported adverse reactions in our AURORA 1 and AURORA 2 clinical studies (≥3%) were: glomerular filtration rate decreased, hypertension, diarrhea, headache, anemia, cough, urinary tract infection, abdominal pain upper, dyspepsia, alopecia, renal impairment, abdominal pain, mouth ulceration, fatigue, tremor, acute kidney injury, and decreased appetite. Some patients who are treated with LUPKYNIS may die due to their underlying illness or suffer adverse events (which may or may not be drug related).

As such, we may face product liability lawsuits. Although we carry product liability insurance, product liability lawsuits against us could cause us to incur substantial liabilities and reduce LUPKYNIS sales. Furthermore, any such lawsuits could impair our business reputation and result in the initiation of investigations by regulators.

Additionally, we may not have and may not be able to obtain insurance on acceptable terms or with adequate coverage against potential liabilities or other losses if any claim or lawsuit is brought against us, regardless of the success or failure of the claim or lawsuit. Even where claims are submitted to insurance carriers for defense and indemnity, there can be no assurance that the claims will be fully covered by insurance or that the indemnitors or insurers will remain financially viable to cover the cost of such claims. Any such claims or lawsuits could materially impact our financial condition, and our business may suffer.

The commercial success of LUPKYNIS in certain ex-U.S. territories is dependent on the fulfillment of contractual obligations under our out-license agreement and commercial supply agreement.

In December 2020, we entered into a collaboration and licensing agreement with Otsuka to develop and commercialize oral voclosporin in Japan, the E.U., the U.K., Switzerland, Russia, Norway, Belarus, Iceland, Liechtenstein and Ukraine

(collectively, the “Otsuka Territories”) in exchange for: (i) a $50 million upfront cash payment; (ii) regulatory and commercial milestone payments; and (iii) royalties ranging from 10% to 20% on net sales in the Otsuka Territories.

In August 2022, we entered into a commercial supply agreement with Otsuka to: (i) supply LUPKYNIS inventory to Otsuka at cost, plus a margin; and (ii) provide manufacturing and other services, including sharing the capacity of a dedicated manufacturing facility at Lonza, our contract manufacturing partner for voclosporin.

If we are held to not have met our commercial supply obligations, or if Otsuka is unable to successfully commercialize oral voclosporin in the Otsuka Territories, the commercial prospects for LUPKYNIS in the Otsuka Territories will be limited, and our business may suffer.

The commercial success of LUPKYNIS is dependent on pricing regulations and/or third-party coverage and reimbursement policies.

In the U.S. and markets in other countries, patients generally rely on third-party reimbursement for all or part of the costs associated with their treatment. Adequate coverage and reimbursement from governmental healthcare programs, such as Medicaid and Medicare, and commercial payors is critical to market acceptance of our products. Government authorities and other third-party payors, such as private health insurers and health maintenance organizations, decide which medication they will pay for and establish reimbursement levels.

Government authorities and third-party payors have attempted to control costs by limiting coverage and the amount of reimbursement for particular products. Increasingly, third-party payors are requiring that drug manufacturers provide them with predetermined discounts from list prices and are challenging the prices charged for products. Net prices for products may be reduced by mandatory discounts or rebates required by government healthcare programs or private payors. Private third-party payors often rely on Medicare coverage policy and payment limitations in setting their own reimbursement policies.

If LUPKYNIS is subject to unfavorable pricing regulations and/or third-party coverage and reimbursement policies, the commercial prospects for LUPKYNIS may be limited, and our business may suffer.

If we fail to comply with our reporting and payment obligations under the Medicaid Drug Rebate Program or other governmental pricing programs in the U.S., we could be subject to additional reimbursement requirements, penalties, sanctions and fines.

We participate in the Medicaid Drug Rebate Program, administered by Centers for Medicare and Medicaid Services, and other federal and state government pricing programs in the U.S., and we may in the future participate in additional government pricing programs. These programs generally require us to pay rebates or otherwise provide discounts to government payors in connection with LUPKYNIS, which is dispensed to beneficiaries of these programs. In some cases, such as with the Medicaid Drug Rebate Program, the rebates are based on pricing and rebate calculations, which are complex.

The Office of Inspector General assesses our compliance with reporting requirements under the Medicaid Drug Rebate Program. We are liable for errors associated with our submission of pricing data and for any overcharging of government payors, which could result in a civil monetary penalty. Failure to make necessary disclosures and/or to identify overpayments could result in allegations against us under the U.S. False Claims Act (“FCA”) and other laws and regulations. Any required refunds to the U.S. government or responding to a government investigation or enforcement action would be expensive and time consuming and could have a material adverse effect on our business, results of operations and financial condition. If Centers for Medicare and Medicaid Services were to terminate our rebate agreement, no federal payments would be available under Medicaid or Medicare for LUPKYNIS, which could harm our business.

We have reported on various commercial metrics relating to LUPKYNIS, and no single metric is indicative of, or directly correlated to, our current or future financial performance.

We have reported on various commercial metrics relating to LUPKYNIS activity, including the number of prescriptions/PSFs, persistency rates, the number of patients on therapy, patient restarts and patients resulting from hospital fills. None of these metrics, in and of themselves, is indicative of current or future financial performance. Even when a patient becomes a patient on LUPKYNIS therapy, there is no guarantee that they will be a patient for which we recognize revenue, or that they will remain on therapy for any period of time. A patient on therapy who discontinues treatment generally results in zero future revenue, and discontinuations can occur at any time once a patient commences therapy.

Our net product sales are primarily the result of our net sales of LUPKYNIS to two specialty pharmacies and a specialty distributor in the U.S., and net sales of LUPKYNIS inventory to our collaboration partner, Otsuka, for the European and

Japanese market. Revenue from the two specialty pharmacies do not necessarily correlate to any of our commercial metrics. Revenue from Otsuka has no relevance to any of the above noted metrics. Our revenue could therefore fluctuate in a manner contrary to any trend of our commercial metrics.

RISKS RELATED TO PATENTS AND PROPRIETARY TECHNOLOGY

LUPKYNIS’s market exclusivity periods will depend on the validity and enforceability of issued and pending patents covering LUPKYNIS.

We depend globally on patents and other granted rights to prevent others from improperly benefiting from our commercial product, LUPKYNIS, and products or inventions that we develop or acquire. Protecting our patents and other intellectual property may require us to file infringement actions, which may be expensive and time-consuming. For material details about our intellectual property portfolio protecting LUPKYNIS, see the section titled “Intellectual Property” in Item 1.

We have and plan to file additional patent applications that, if issued, would provide further protection for LUPKYNIS. Although we believe the bases for our patents and patent applications are sound, they are untested, and there is no assurance that they will not be successfully challenged. There can be no assurance that any issued patent or any patent currently in process will protect LUPKYNIS from generic competition. If our intellectual property does not protect LUPKYNIS from generic competition, LUPKYNIS net product sales may decline, and/or we may incur additional costs for patent protection, including patent infringement litigation costs arising out of ANDA submissions by generic companies to manufacture and sell generic products or arising out of 505(b)(2) submissions, which could have a material adverse effect on our business, results of operations and financial condition, and our business may suffer.

On February 25, 2025, we received a paragraph IV notice of certification (the “Notice Letter”) related to a submission of an ANDA to the FDA seeking authorization to manufacture, use or sell a generic version of LUPKYNIS in the U.S., prior to the expiry of U.S. Patent Nos. 10,286,036 and 11,622,991 (the “2037 Patents”), which are listed in the FDA's Orange Book. The Notice Letter alleges that the 2037 Patents are invalid, unenforceable and/or will not be infringed by the commercial manufacture, use or sale of the generic product described in the ANDA. Although we intend to vigorously defend our intellectual property rights protecting LUPKYNIS, we may incur significant patent litigation costs, and, if any entity that may file an ANDA is successful in the introduction of the generic product described in its ANDA, then LUPKYNIS net product sales may decline, which could have a material adverse effect on our business, results of operations and financial condition.

If our products or our product candidates infringe the rights of others, we could be subject to expensive litigation, become liable for substantial damages, be required to obtain licenses from others or be prohibited from selling our products or product candidates altogether.

Our competitors or others may have patent rights that they choose to assert against us, licensees, suppliers, customers or potential marketing partners. Moreover, we may not know about patents or patent applications that our products or product candidates could infringe. Because patent applications do not publish for at least 18 months, if at all, and can take many years to issue, there may be currently pending applications unknown to us that may later result in issued patents that our products or product candidates could infringe. In addition, if third parties file patent applications or obtain patents claiming inventions also claimed by us in issued patents or pending applications, we may have to participate in interference proceedings in the U.S. Patent and Trademark Office (“USPTO”) to determine priority of invention. If third parties file oppositions in foreign countries, we may also have to participate in opposition proceedings in foreign tribunals to defend the patentability of claims in our foreign patent applications. If a third party claims that we infringe its proprietary rights, any of the following may occur:

•we may become involved in time-consuming and expensive litigation, even if the claim is without merit;

•we may become liable for substantial damages for past infringement if a court decides that we have infringed a patent;

•a court may prohibit us from selling or licensing our products without a license from the patent holder, which may not be available on commercially acceptable terms, if at all, or which may require us to pay substantial royalties or grant cross-licenses to our patents; or

•we may have to redesign our products or product candidates so that they do not infringe patent rights of others, which may not be possible or commercially feasible and may require new regulatory approvals.

Any of these events could have a material adverse effect on our business, results of operations and financial condition, and our business may suffer.

Patent policy and rule changes could increase the uncertainties and costs surrounding the prosecution of our patent applications and the enforcement or defense of our issued patents.

Changes in either the patent laws or interpretation of the patent laws in the U.S. or other countries may diminish the value of our patents or narrow the scope of our patent protection. The laws of foreign countries may not protect our rights to the same extent as the laws of the U.S. Publications of discoveries in the scientific literature often lag behind the actual discoveries, and patent applications in the U.S. and other jurisdictions are typically not published until 18 months after filing, or in some cases not at all. We therefore cannot be certain that we were the first to make the inventions claimed in our patents or pending applications, or that we were the first to file for patent protection of such inventions.

Assuming the other requirements for patentability are met, in the U.S., prior to March 15, 2013, the first to make the claimed invention is entitled to the patent, while, outside the U.S., the first to file a patent application is entitled to the patent. After March 15, 2013, under the Leahy-Smith America Invents Act (“Leahy-Smith Act”), enacted on September 16, 2011, the U.S. has moved to a first-to-file system. The Leahy-Smith Act also includes a number of significant changes that affect the way patent applications will be prosecuted and may also affect patent litigation. In general, the Leahy-Smith Act and its implementation could increase the uncertainties and costs surrounding the prosecution of our patent applications and the enforcement or defense of our issued patents, all of which could have a material adverse effect on our business, results of operations and financial condition, and our business may suffer.

Among some of the other changes introduced by the Leahy-Smith Act are changes that limit where a patentee may file a patent infringement suit and provide new opportunities for third parties to challenge issued patents in the USPTO. We may be subject to the risk of third-party prior art submissions on pending applications or become a party to opposition, derivation, reexamination, inter partes review, post-grant review or interference proceedings challenging our patents for our products or product candidates. There is a lower standard of evidence necessary to invalidate a patent claim in a USPTO proceeding relative to the standard in U.S. federal courts. This could lead third parties to challenge and successfully invalidate our patents that would not otherwise be invalidated if challenged through the court system.

We may not be able to protect the confidentiality of our trade secrets.

There may be an unauthorized disclosure of confidential information under our control, such as information relating to our technology, research and development, production, marketing, and business operations and those of our collaborators, in various forms. Unauthorized disclosures of such information could subject us to complaints or lawsuits for damages, in the U.S., Canada or other jurisdictions, or could otherwise have a negative impact on our business, financial condition, results of operations, reputation and credibility, and our business may suffer.

RISKS RELATED TO FINANCIAL POSITION

Our overall financial performance may not meet our expectations.

Our overall financial performance, including but not limited to, net product sales and net cash provided by or used for operating activities, including any milestone, royalty and other payments resulting from our collaboration and license agreement and commercial supply agreement with Otsuka, is difficult to predict and may fluctuate from quarter to quarter and year to year. Historical performance may not be indicative of future performance. For example, our net product sales may be below expectations, and our costs to operate our business, including cost of product sales, research and development expenses and selling, general and administrative expenses, could exceed our estimates. If our overall performance does not meet our expectations, our business may suffer.

Our restructuring efforts and associated organizational changes may not adequately reduce our operating costs, may lead to additional workforce attrition and may cause operational disruptions.

On February 15, 2024, we announced a strategic restructuring that reduced headcount by approximately 25% and discontinued Aurinia’s AUR300 development program. On November 7, 2024, we announced another strategic restructuring that further reduced headcount by approximately 45% to sharpen the Company's focus on continued LUPKYNIS growth and the rapid development of AUR200. The restructuring efforts may not adequately reduce our operating costs and could yield unintended consequences, such as loss of institutional knowledge and expertise, employee attrition and a reduction in employee morale, as well as substantial demands on our employees, all of which may materially adversely affect our revenues, results of operations or financial condition, and our business may suffer.

Our ability to use our net operating loss carryforwards and tax credit carryforwards to offset future taxable income may be subject to certain limitations. We may also be subject to other potential tax consequences.

Under the provisions of the applicable tax legislation, our net operating loss and tax credit carryforwards are subject to review and possible adjustment by applicable tax regulatory authorities. In addition, proposed or actual changes to applicable tax legislation may significantly impact our ability to utilize our net operating losses and tax credit carryforwards to offset taxable income in the future. This could limit the amount of tax attributes that can be utilized annually to offset future taxable income or tax liabilities. The amount of the annual limitation is determined based on the value of a company immediately prior to the ownership change. Subsequent ownership changes may further affect the limitation in future years. We may not be able to use some or all of our net operating loss and tax credit carryforwards. Additionally, should an event occur that causes or is deemed to cause a change in the residency of Aurinia from Canada to the U.S., for example, we may be subject to certain tax rules that could cause a deemed disposition of our assets for tax purposes. Should that occur, we may be subject to a material amount of tax owing, without corresponding revenue from any actual disposition of our assets, which would have a material adverse effect on our business and financial condition.

RISKS RELATED TO DRUG DEVELOPMENT AND REGULATORY APPROVAL

Drug development involves a lengthy and expensive process with an uncertain outcome, and results of earlier studies may not be predictive of future study results.

Clinical testing is expensive, can take many years to complete and its outcome is inherently uncertain. Failure can occur at any time during the clinical study process. The results of nonclinical studies and early clinical studies of AUR200 may not be predictive of the results of later-stage clinical studies. Promising results shown in early-stage clinical studies may still suffer significant setbacks in subsequent clinical studies. There is a high failure rate for pharmaceutical product candidates proceeding through clinical studies, and product candidates in later stages of clinical studies may fail to show the desired safety and efficacy, despite having progressed through nonclinical studies and initial clinical studies.

A number of companies in the pharmaceutical industry have suffered significant setbacks in advanced clinical studies due to lack of efficacy or adverse safety profiles, notwithstanding promising results in earlier studies. Moreover, nonclinical and clinical data often are susceptible to varying interpretations and analyses. We do not know whether any clinical studies we may conduct will demonstrate consistent or adequate efficacy and safety sufficient to obtain regulatory approval to market AUR200.

Results from studies of AUR200 may not be sufficient to obtain regulatory approvals to market our product candidate on a timely basis, if at all.

Pharmaceutical product candidates are subject to extensive government regulations related to development, clinical studies, manufacturing and commercialization. In order to sell any product that is under development, we must first receive regulatory approval. To obtain regulatory approval, we must conduct nonclinical and clinical studies that demonstrate that AUR200 is safe and effective. The process of obtaining FDA, EC and other regulatory authority approvals is costly, time-consuming, uncertain and subject to unanticipated delays.

The FDA, EC and other regulatory authorities have substantial discretion in the approval process and may not agree that we have demonstrated that AUR200 is safe and effective. If AUR200 is not found to be safe and effective, we would be unable to obtain regulatory approval to manufacture, market and sell AUR200. We can provide no assurances that the FDA, EC or other regulatory authorities will approve AUR200 or, if approved, what the scope of the approved indication might be.

Our development of AUR200 may be delayed or halted.

Our development of AUR200 may be delayed or halted for various reasons, including:

•insufficient financial resources;

•insufficient supplies of drug product to treat the patients in the studies;

•failure of patients to enroll in the studies at the rate we expect;

•ineffectiveness of AUR200;

•patients experiencing unexpected side effects or other safety concerns being raised during treatment;

•changes in governmental regulations or administrative actions;

•failure to conduct studies in accordance with required clinical practices;

•inspection of clinical study operations or study sites by the FDA or other regulatory authorities, resulting in a clinical hold;

•political unrest effecting clinical sites;

•a shutdown of the U.S. government, including the FDA; or

•natural disasters, public health crises or other catastrophic events impacting any of our clinical sites.

If the development of AUR200 is delayed or halted, we may incur significant additional expenses, and the potential approval of AUR200 may be delayed or could be made impossible to obtain, which would have a material adverse effect on our business and financial condition, and our business may suffer.

Compliance with ongoing post-marketing obligations for LUPKYNIS may uncover new safety information that could give rise to a product recall, updated warnings or other regulatory actions.

After a regulator, such as the FDA, approves a product for marketing, the product’s sponsor must comply with post-marketing obligations. Post-marketing obligations include, but are not limited to, the reporting of adverse events to the regulator within specified timeframes, the submission of product-specific annual reports and notification when a drug product is found to have significant deviations from its approved manufacturing specifications. Such deviations may include unforeseen side effects. Our ongoing compliance with such mandatory reporting requirements could result in additional requests for information that could result in a product recall, strengthened warnings, revisions to other label information, conducting additional clinical studies or the imposition of other risk-management measures. Regulators may also require the withdrawal of the product from the market. Any of these post-marketing regulatory actions could materially affect our sales and increase our costs, and our business may suffer.

Failure to obtain regulatory approval in international jurisdictions would prevent our products, our product candidates or any other products we or our current or future out-licensees may develop from being marketed abroad.