UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20509

Form 20-F

(Mark One)

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report__________

For the transition period from_________to_________

Commission file number: 001-36487

Atlantica Yield plc

(Exact name of Registrant as specified in its charter)

Not applicable

(Translation of Registrant’s name into English)

England and Wales

(Jurisdiction of incorporation or organization)

Great West House, GW1, 17th floor

Great West Road

Brentford, United Kingdom TW8 9DF

Tel: +44 203 499 0465

(Address of principal executive offices)

Santiago Seage

Great West House, GW1, 17th floor

Great West Road

Brentford, United Kingdom TW8 9DF

Tel: +44 203 499 0465

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | | Name of each exchange on which registered |

| Ordinary Shares, nominal value $0.10 per share | | NASDAQ Global Select Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 100,217,260 ordinary shares, nominal value $0.10 per share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒Yes ☐ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer, “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ |

| | | Emerging growth company ☐ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐Yes ☒No

ATLANTICA YIELD PLC

| A. | | 197 |

| B. | | 197 |

| C. | | 197 |

| D. | | 197 |

| ITEM 13. | | 197 |

| ITEM 14. | | 197 |

| ITEM 15. | | 197 |

| ITEM 16. | | 198 |

| ITEM 16A. | | 198 |

| ITEM 16B. | | 198 |

| ITEM 16C. | | 198 |

| ITEM 16D. | | 200 |

| ITEM 16E. | | 200 |

| ITEM 16F. | | 201

|

| ITEM 16G. | | 201

|

| ITEM 16H. | | 201 |

| ITEM 17. | | 202 |

| ITEM 18. | | 202 |

| ITEM 19. | | 202 |

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

This report includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions, strategies, future events or performance (often, but not always, through the use of words or phrases such as may result, are expected to, will continue, is anticipated, believe, will, could, should, would, estimated, may, plan, potential, future, projection, goals, target, outlook, predict and intend or words of similar meaning) are not statements of historical facts and may be forward looking. Such statements occur throughout this report and include statements with respect to our expected trends and outlook, potential market and currency fluctuations, occurrence and effects of certain trigger and conversion events, our capital requirements, changes in market price of our shares, future regulatory requirements, the ability to identify and/or consummate future acquisitions on favourable terms, reputational risks, divergence of interests between our company and that of our largest shareholder’s and affiliates’, tax and insurance implications, and more. Forward-looking statements involve estimates, assumptions and uncertainties. Accordingly, any such statements are qualified in their entirety by reference to, and are accompanied by, important factors included in Part I, Item 3D. Risk Factors (in addition to any assumptions and other factors referred to specifically in connection with such forward-looking statements) that could have a significant impact on our operations and financial results, and could cause our actual results to differ materially from those contained or implied in forward-looking statements made by us or on our behalf in this Form 20-F, in presentations, on our website, in response to questions or otherwise. These forward-looking statements include, but are not limited to, statements relating to:

| · | the condition of the debt and equity capital markets and our ability to borrow additional funds and access capital markets, as well as our substantial indebtedness and the possibility that we may incur additional indebtedness going forward; |

| · | the ability of our counterparties to satisfy their financial commitments or business obligations and our ability to seek new counterparties in a competitive market; |

| · | government regulation, including compliance with regulatory and permit requirements and changes in tax laws, market rules, rates, tariffs, environmental laws and policies affecting renewable energy; |

| · | risks relating to our activities in areas subject to economic, social and political uncertainties; |

| · | our ability to finance and consummate new acquisitions on favorable terms; |

| · | risks relating to new assets and businesses which have a higher risk profile and our ability to transition these successfully; |

| · | potential environmental liabilities and the cost and conditions of compliance with applicable environmental laws and regulations; |

| · | risks related to our reliance on third-party contractors or suppliers; |

| · | risks related to our exposure in the labor market; |

| · | potential issues arising with our operators’ employees including disagreement with employees’ unions and subcontractors; |

| · | risks related to extreme weather events related to climate change could damage our assets or result in significant liabilities and cause an increase in our operation and maintenance costs; |

| · | the effects of litigation and other legal proceedings (including bankruptcy) against us and our subsidiaries; |

| · | price fluctuations, revocation and termination provisions in our offtake agreements and power purchase agreements; |

| · | our electricity generation, our projections thereof and factors affecting production, including weather conditions, energy regulation, availability and curtailment; |

| · | risks related to our relationship with our shareholders including bankruptcy; |

our substantial short-term and long-term indebtedness, including additional debt in the future;

| · | reputational and financial damage caused by our off-taker PG&E and potential default under our project finance agreement due to a breach of our underlying PPA agreement with PG&E; and |

| · | other factors discussed under “Risk Factors”. |

Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances, including, but not limited to, unanticipated events, after the date on which such statement is made, unless otherwise required by law. New factors emerge from time to time and it is not possible for management to predict all of such factors, nor can it assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained or implied in any forward-looking statement.

CURRENCY PRESENTATION AND DEFINITIONS

In this annual report, all references to “U.S. dollar,” “$” and “USD” are to the lawful currency of the United States, all references to “euro,” “€” or “EUR” are to the single currency of the participating member states of the European and Monetary Union of the Treaty Establishing the European Community, as amended from time to time and all references to “South African rand,” “R” and “ZAR” are to the lawful currency of the Republic of South Africa.

Definitions

Unless otherwise specified or the context requires otherwise in this annual report:

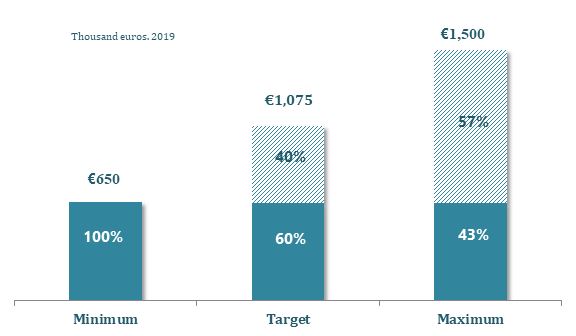

| | · | references to “2016-2018 LTIP” refer to the long-term incentive plan which was in place between 2016 and 2018, to be paid in March 2019. |

| · | references to “2019 Notes” refer to the 7.000% Senior Notes due 2019 in an aggregate principal amount of $255 million issued on November 17, 2014, as further described in “Item 5.B—Liquidity and Capital Resources—Financing Arrangements—2019 Notes”; |

| · | references to “AAGES” refer to the joint venture between Algonquin and Abengoa to invest in the development and construction of clean energy and water infrastructure contracted assets; |

| · | references to “AAGES ROFO Agreement” refer to the agreement we entered into with AAGES on March 5, 2018, which became effective upon completion of the Share Sale, that provides us a right of first offer to purchase any of the AAGES ROFO Assets, as amended and restated from time to time; |

| · | references to “AAGES ROFO Assets” refer to any of AAGES’ contracted assets or proposed contracted assets that we expect to evaluate for future acquisition, with certain exceptions, for which AAGES has provided us a right of first offer to purchase if offered for sale by AAGES; |

| · | references to “Abengoa” refer to Abengoa, S.A., together with its subsidiaries, unless the context otherwise requires; |

| · | references to “Abengoa ROFO Agreement” refer to the agreement we entered into with Abengoa on June 13, 2014, as amended and restated on December 9, 2014, that provides us a right of first offer to purchase any of the present or future contracted assets in renewable energy, efficient natural gas, electric transmission and water of Abengoa that are in operation, and any other renewable energy, efficient natural gas, electric transmission and water asset that is expected to generate contracted revenue and that Abengoa has transferred to an investment vehicle that are located in the United States, Canada, Mexico, Chile, Peru, Uruguay, Brazil, Colombia and the European Union, and four additional assets in other selected regions, including a pipeline of specified assets that we expect to evaluate for future acquisition, for which Abengoa will provide us a right of first offer to purchase if offered for sale by Abengoa or an investment vehicle to which Abengoa has transferred them; |

| | · | references to “ACBH” refer to Abengoa Concessões Brasil Holding, a subsidiary holding company of Abengoa that was engaged in the development, construction, investment and management of concessions in Brazil, comprised mostly of transmission lines and which is currently undergoing a restructuring process in Brazil; |

| · | references to “ACS” refer to ACS Group; |

| · | references to “ACT” refer to the gas-fired cogeneration facility located inside the Nuevo Pemex Gas Processing Facility near the city of Villahermosa in the State of Tabasco, Mexico; |

| · | references to “Algonquin” refer to, as the context requires, either Algonquin Power & Utilities Corp., a North American diversified generation, transmission and distribution utility, or Algonquin Power & Utilities Corp. together with its subsidiaries; |

| · | references to “Algonquin ROFO Agreement” refer to the agreement we entered into with Algonquin on March 5, 2018, which became effective upon completion of the Share Sale, under which Algonquin granted us a right of first offer to purchase any of the assets offered for sale located outside of the United States or Canada as amended from time to time. See “Item 7.B—Related Party Transactions—Algonquin drop down agreement and Right of First Offer on assets outside the United States or Canada”; |

| · | references to “Annual Consolidated Financial Statements” refer to the audited annual consolidated financial statements as of December 31, 2018 and 2017 and for the years ended December 31, 2018, 2017 and 2016, including the related notes thereto, prepared in accordance with IFRS as issued by the IASB (as such terms are defined herein), included in this annual report; |

| · | references to “Asset Transfer” refer to the transfer of assets contributed by Abengoa prior to the consummation of our initial public offering through a series of transactions; |

| · | references to “Atlantica” refer to Atlantica Yield plc and, where the context requires, Atlantica Yield plc together with its consolidated subsidiaries; |

| · | references to “ATN” refer to ATN S.A., the operational electronic transmission asset in Peru, which is part of the Guaranteed Transmission System; |

| · | references to “ATS” refer to Abengoa Transmision Sur S.A.; |

| · | references to “cash available for distribution” refer to the cash distributions received by the Company from its subsidiaries minus cash expenses of the Company, including debt service and general and administrative expenses; |

| · | references to “CNMC” refer to Comision Nacional de los Mercados y de la Competencia, the Spanish state-owned regulator; |

| · | references to “COD” refer to the commercial operation date of the applicable facility; |

| · | references to “DOE” refer to the U.S. Department of Energy; |

| · | references to “DTC” refer to The Depository Trust Company; |

| · | references to “EMEA” refer to Europe, Middle East and Africa; |

| · | references to “EPACT” refer to the Energy Policy Act of 2005; |

| · | references to “EPC” refer to engineering, procurement and construction; |

| · | references to “Exchange Act” refer to the U.S. Securities Exchange Act of 1934, as amended, or any successor statute, and the rules and regulations promulgated by the SEC thereunder; |

| · | references to “Federal Financing Bank” refer to a U.S. government corporation by that name; |

| · | references to “Financial Support Agreement” refer to the Financial Support Agreement we entered into with Abengoa on June 13, 2014, as amended and restated on September 28, 2017, pursuant to which Abengoa agreed to maintain certain guarantees or letters of credit for a period of five years following our IPO; |

| · | references to the “First Dropdown Assets” refer to (i) a solar power complex in Spain, Solacor 1/2, with a capacity of 100 MW; (ii) a solar power complex in Spain, PS10/20, with a capacity of 31 MW; and (iii) one on-shore wind farm in Uruguay, Cadonal, with a capacity of 50 MW, each as further described in “Item 4.B—Business Overview—Our Operations—Renewable Energy”; |

| · | references to “Flip Date” refer to such date that Liberty reaches a certain rate of return; |

| · | references to “FPA” refer to the U.S. Federal Power Act; |

| · | references to “Further Adjusted EBITDA” have the meaning set forth in “Presentation of Financial Information—Non-GAAP Financial Measures” in the section below; |

| · | references to “gross capacity” refers to the maximum, or rated, power generation capacity, in MW, of a facility or group of facilities, without adjusting for the facility’s power parasitics’ consumption, or by our percentage of ownership interest in such facility as of the date of this annual report; |

| · | references to “GWh” refer to gigawatt hour; |

| · | references to “IFRIC 12” refer to International Financial Reporting Interpretations Committee’s Interpretation 12—Service Concessions Arrangements; |

| · | references to “IFRS as issued by the IASB” refer to International Financial Reporting Standards as issued by the International Accounting Standards Board; |

| · | references to “Indenture” refer to the indenture governing the Notes; |

| · | references to “Initial Funding Commitment” refer to the provision of equity funding as required by Atlantica Yield, by AAGES and Algonquin, for the acquisition of assets and/or interests by Atlantica Yield or its subsidiaries during 2018 and 2019, but no more than $100 million, subject to the approval of the board of directors of Algonquin; |

| · | reference to “IPO” refer to our initial public offering of ordinary shares in June 2014; |

| · | references to “ITC” refer to investment tax credits; |

| · | references to “LTIP” refer to the long-term incentive plan approved by the Board of Directors for 2019. |

| · | references to “MACRS” referrer to the Modified Accelerated Cost Recovery System; |

| · | references to “MW” refer to megawatts; |

| · | references to “MWh” refer to megawatt hour; |

| · | references to “NEPA” refer to the National Environment Policy Act; |

| · | references to “NOL” refer to net operating loss; |

| · | references to “Note Issuance Facility” refer to the senior secured note facility dated February 10, 2017, of €275 million (approximately $330 million), with U.S. Bank as facility agent and a group of funds managed by Westbourne Capital as purchasers of the notes issued thereunder; |

| · | references to “O&M” refer to operations and maintenance services provided at our various facilities; |

| · | references to “operation” refer to the status of projects that have reached COD (as defined above); |

| · | references to “Pemex” refer to Petróleos Mexicanos; |

| · | references to “PFIC” refer to passive foreign investment company within the meaning of Section 1297 of the IRC; |

| · | references to “PG&E” refer to PG&E Corporation and its regulated utility subsidiary, Pacific Gas and Electric Company collectively; |

| · | references to “PPA” refer to the power purchase agreements through which our power generating assets have contracted to sell energy to various offtakers; |

| · | references to “PTC” refer to production tax credits; |

| · | references to “PTS” refer to Pemex Transportation System; |

| · | references to “PURPA” refer to the Public Utility Regulatory Policies Act of 1978; |

| · | references to “REC” refer to Renewable Energy Certificate; |

| · | references to “Restructured Debt” refers to the restructuring agreement of Abengoa which we signed and agreed on October 25, 2016, subject to implementation of the restructuring, to receive 30% of the amount owed to us in the form of tradable notes to be issued by Abengoa with the remaining 70% owed to us to be received in the form of equity in Abengoa; |

| · | references to “Registrar” refer to The Bank of New York Mellon; |

| · | references to “Revolving Credit Facility” refers to the credit and guaranty agreement with a syndicate of banks (the “Revolving Credit Facility”) providing for a senior secured revolving credit facility in an aggregate principal amount of $215 million which matures in December 31, 2021. The Revolving Credit Facility replaced tranche A of the Former Revolving Credit Facility, which was repaid in full and cancelled prior to its maturity on June 1, 2018. |

| · | references to “ROFO” refer to a right of first offer; |

| · | references to “ROFO agreements” refer to the AAGES ROFO Agreement, Algonquin ROFO Agreement and Abengoa ROFO Agreement; |

| · | references to “RPS” refer to renewable portfolio standards adopted by 29 U.S. states and the District of Columbia that require a regulated retail electric utility to procure a specific percentage of its total electricity delivered to retail customers in the respective state from eligible renewable generation resources, such as solar or wind generation facilities, by a specific date; |

| · | references to “RRRE” refer to the Specific Remuneration System Register (Registro de Regimen Retributivo Especifico) in Spain; |

| · | references to “Share Sale” refer to the sale by Abengoa to Algonquin of 25% of our ordinary shares pursuant to an agreement for the sale that was entered into in November 2017. All conditions precedent have been satisfied and the parties have commenced the process for the transfer of our shares, which we expect to close in the upcoming days; |

| · | references to the “Shareholders’ Agreement” refer to the agreement by and among Algonquin Power & Utilities Corp., Abengoa-Algonquin Global Energy Solutions and Atlantica Yield plc, dated March 5, 2018 which became effective upon completion of the Share Sale; |

| · | references to “Solnova 1/3/4” refer to a 150 MW concentrating solar power facility wholly owned by Atlantica Yield, located in the municipality of Sanlucar la Mayor, Spain; |

| · | references to “TCJA” refer to the Tax Cuts and Jobs Act of 2017; |

| · | references to “U.K.” refer to the United Kingdom; |

| · | reference to “U.S.” or “United States” refer to the United States of America; |

| · | references to “we,” “us,” “our,” “Atlantica” and the “Company” refer to Atlantica Yield plc and its subsidiaries, unless the context otherwise requires. |

PRESENTATION OF FINANCIAL INFORMATION

The selected financial information as of December 31, 2018 and 2017 and for the years ended December 31, 2018, 2017 and 2016 is derived from, and qualified in its entirety by reference to, our Annual Consolidated Financial Statements, which are included elsewhere in this annual report and prepared in accordance with IFRS as issued by the IASB. The selected financial information as of December 31, 2016 and 2015 and for the years ended December 31, 2015 and 2014, is derived from, and qualified in its entirety by reference to, the annual consolidated financial statements as of December 31, 2017 and 2016 and for the years ended December 31, 2017, 2016 and 2015, which are included in the annual report on Form 20-F filed with the SEC on March 7, 2018, and prepared in accordance with IFRS as issued by the IASB. The selected financial information as of December 31, 2014 is derived from, and qualified in its entirety by reference to, the annual consolidated financial statements as of December 31, 2016 and 2015 and for the years ended December 31, 2016, 2015 and 2014, which are included in the annual report on Form 20-F filed with the SEC on February 28, 2017, and prepared in accordance with IFRS as issued by the IASB.

On June 18, 2014, we closed our IPO. Prior to the consummation of our IPO, Abengoa contributed, through a series of transactions, which we refer to collectively as the “Asset Transfer,” certain contracted and concessional assets and liabilities described in this annual report, certain holding companies and a preferred equity investment in ACBH. For the period in 2014 prior to our IPO, the financial information herein represents the combination of the assets that we acquired and was prepared using Abengoa’s historical basis in the assets and liabilities and the term “Atlantica Yield” (or “Abengoa Yield,” our former name) represents the accounting predecessor, or the combination of the acquired businesses. For all periods subsequent to our IPO, the financial information herein represents our and our subsidiaries’ annual consolidated financial results.

Certain numerical figures set out in this annual report, including financial data presented in millions or thousands and percentages describing market shares, have been subject to rounding adjustments, and, as a result, the totals of the data in this annual report may vary slightly from the actual arithmetic totals of such information. Percentages and amounts reflecting changes over time periods relating to financial and other data set forth in “Item 5.A—Operating and Financial Review and Prospects—Operating Results” are calculated using the numerical data in our Annual Consolidated Financial Statements or the tabular presentation of other data (subject to rounding) contained in this annual report, as applicable, and not using the numerical data in the narrative description thereof.

Non-GAAP Financial Measures

This annual report contains non-GAAP financial measures including Further Adjusted EBITDA.

Further Adjusted EBITDA is calculated as profit/(loss) for the year attributable to the parent company, after adding back loss/(profit) attributable to non-controlling interest from continued operations, income tax, share of profit/(loss) of associates carried under the equity method, finance expense net, depreciation, amortization and impairment charges of entities included in the Annual Consolidated Financial Statements, and dividends received from our preferred equity investment in ACBH prior to December 31, 2017. Further Adjusted EBITDA for 2014 includes preferred dividends received from ACBH for the first time during the third and fourth quarters of 2014. Further Adjusted EBITDA for 2016 and for first quarter of 2017 includes compensation received from Abengoa in lieu of ACBH dividends.

Our management believes Further Adjusted EBITDA is useful to investors and other users of our financial statements in evaluating our operating performance because it provides them with an additional tool to compare business performance across companies and across periods. This measure is widely used by investors to measure a company’s operating performance without regard to items such as interest expense, taxes, depreciation and amortization, which can vary substantially from company to company depending upon accounting methods and book value of assets, capital structure and the method by which assets were acquired. This measure is widely used by other companies in the same industry.

Our management uses Further Adjusted EBITDA as a measure of operating performance to assist in comparing performance from period to period on a consistent basis and to readily view operating trends, as a measure for planning and forecasting overall expectations and for evaluating actual results against such expectations, and in communications with our board of directors, shareholders, creditors, analysts and investors concerning our financial performance.

We present non-GAAP financial measures because we believe that they and other similar measures are widely used by certain investors, securities analysts and other interested parties as supplemental measures of performance and liquidity. The non-GAAP financial measures may not be comparable to other similarly titled measures of other companies and have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our operating results as reported under IFRS as issued by the IASB. Non-GAAP financial measures and ratios are not measurements of our performance or liquidity under IFRS as issued by the IASB and should not be considered as alternatives to operating profit or profit for the year or any other performance measures derived in accordance with IFRS as issued by the IASB or any other generally accepted accounting principles or as alternatives to cash flow from operating, investing or financing activities.

Some of the limitations of these non-GAAP measures are:

| · | they do not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments; |

| · | they do not reflect changes in, or cash requirements for, our working capital needs; |

| · | they may not reflect the significant interest expense, or the cash requirements necessary, to service interest or principal payments, on our debts; |

| · | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often need to be replaced in the future and Further Adjusted EBITDA does not reflect any cash requirements that would be required for such replacements; |

| · | some of the exceptional items that we eliminate in calculating Further Adjusted EBITDA reflect cash payments that were made, or will be made in the future; and |

| · | the fact that other companies in our industry may calculate Further Adjusted EBITDA differently than we do, which limits their usefulness as comparative measures. |

PRESENTATION OF INDUSTRY AND MARKET DATA

In this annual report, we rely on, and refer to, information regarding our business and the markets in which we operate and compete. The market data and certain economic and industry data and forecasts used in this annual report were obtained from internal surveys, market research, governmental and other publicly available information, independent industry publications and reports prepared by industry consultants. We believe that these industry publications, surveys and forecasts are reliable, but we have not independently verified them, and there can be no assurance as to the accuracy or completeness of the included information.

Certain market information and other statements presented herein regarding our position relative to our competitors are not based on published statistical data or information obtained from independent third parties but reflect our best estimates. We have based these estimates upon information obtained from our customers, trade and business organizations and associations and other contacts in the industries in which we operate.

Elsewhere in this annual report, statements regarding our contracted assets and concessions activities, our position in the industries and geographies in which we operate are based solely on our experience, our internal studies and estimates and our own investigation of market conditions.

All of the information set forth in this annual report relating to the operations, financial results or market share of our competitors has been obtained from information made available to the public in such companies’ publicly available reports and independent research, as well as from our experience, internal studies, estimates and investigation of market conditions. We have not funded, nor are we affiliated with, any of the sources cited in this annual report. We have not independently verified the information and cannot guarantee its accuracy.

All third-party information, as outlined above, has to our knowledge been accurately reproduced and, as far as we are aware and are able to ascertain, no facts have been omitted which would render the reproduced information inaccurate or misleading, but there can be no assurance as to the accuracy or completeness of the included information.

PART I

| IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

The tables below present selected consolidated financial and business level information for Atlantica Yield as of and for each of the years ended December 31, 2018, 2017, 2016, 2015 and 2014.

The selected financial information as of December 31, 2018 and 2017 and for the years ended December 31, 2018, 2017 and 2016 is derived from, and qualified in its entirety by reference to, our Annual Consolidated Financial Statements, which are included elsewhere in this annual report and prepared in accordance with IFRS as issued by the IASB. The selected financial information as of December 31, 2016 and 2015 and for the years ended December 31, 2015 and 2014, is derived from, and qualified in its entirety by reference to, the annual consolidated financial statements as of December 31, 2017 and 2016 and for the years ended December 31, 2017, 2016 and 2015, which are included in the annual report on Form 20-F with the SEC on March 7, 2018, and prepared in accordance with IFRS as issued by the IASB. The selected financial information as of December 31, 2014 is derived from, and qualified in its entirety by reference to, the annual consolidated financial statements as of December 31, 2016 and 2015 and for the years ended December 31, 2016, 2015 and 2014, which are included in the annual report on Form 20-F with the SEC on February 28, 2017, and prepared in accordance with IFRS as issued by the IASB.

On June 18, 2014, we closed our IPO. Prior to the consummation of our IPO, Abengoa contributed, through a series of transactions, which we refer to collectively as the “Asset Transfer,” certain contracted and concessional assets and liabilities described in this annual report, certain holding companies and a preferred equity investment in ACBH. For the period of 2014 prior to our IPO, the financial information herein represents the combination of the assets or the combination of businesses that we acquired and was prepared using Abengoa’s historical basis in the assets and liabilities and the term “Atlantica Yield” (or “Abengoa Yield,” our former name) represents the accounting predecessor, or the combination of the acquired businesses. For all periods subsequent to our IPO, the financial information herein represents our and our subsidiaries’ annual consolidated financial results.

The selected financial information as of and for the years ended December 31, 2018, 2017, 2016, 2015 and 2014 is not intended to be an indicator of our financial condition or results of operations in the future. You should review such selected financial information together with our Annual Consolidated Financial Statements and notes thereto, included elsewhere in this annual report.

The following tables should be read in conjunction with “Item 5.A—Operating and Financial Review and Prospects—Operating Results” and our Annual Consolidated Financial Statements and related notes included elsewhere in this annual report.

Consolidated income statements for the years ended December 31, 2018, 2017, 2016, 2015 and 2014

| | | | |

| | | | | | | | | | | | | | | | |

| | | ($ in millions, except for share and per share information) | |

Revenue

| | | 1,043.8 | | | | 1,008.4 | | | | 971.8 | | | | 790.9 | | | | 362.7 | |

Other operating income

| | | 132.5 | | | | 80.8 | | | | 65.5 | | | | 68.8 | | | | 79.9 | |

Raw materials and consumables used

| | | (10.6 | ) | | | (17.0 | ) | | | (26.9 | ) | | | (23.2 | ) | | | (9.4 | ) |

Employee benefit expense

| | | (15.1 | ) | | | (18.7 | ) | | | (14.8 | ) | | | (5.8 | ) | | | (1.7 | ) |

| Depreciation, amortization and impairment charges | | | (362.7 | ) | | | (311.0 | ) | | | (332.9 | ) | | | (261.3 | ) | | | (125.5 | ) |

Other operating expenses

| | | | | | | | | | | | | | | | | | | | |

Operating profit/(loss)

| | | | | | | | | | | | | | | | | | | | |

Financial income

| | | 36.4 | | | | 1.0 | | | | 3.3 | | | | 3.5 | | | | 4.9 | |

Financial expense

| | | (425.0 | ) | | | (463.7 | ) | | | (408.0 | ) | | | (333.9 | ) | | | (210.3 | ) |

Net exchange differences

| | | 1.6 | | | | (4.1 | ) | | | (9.6 | ) | | | 3.9 | | | | 2.1 | |

| Other financial income/(expense), net | | | | | | | | | | | | | | | | | | | | |

Financial expense, net

| | | | | | | | | | | | | | | | | | | | |

| Share of profit/(loss) of associates carried under the equity method | | | | | | | | | | | | | | | | | | | | |

Profit/(loss) before income tax

| | | | | | | | | | | | | | | | | | | | |

Income tax benefit/(expense)

| | | | | | | | | | | | | | | | | | | | |

Profit/(loss) for the year

| | | | | | | | | | | | | | | | | | | | |

| Profit/(loss) attributable to non-controlling interest | | | | | | | | | | | | | | | | | | | | |

| Profit/(loss) for the year attributable to the parent company | | | | | | | | | | | | | | | | | | | | |

| Less Predecessor Loss prior to Initial Public Offering on June 12, 2014 | | | — | | | | — | | | | — | | | | — | | | | (28.2 | ) |

| Net profit/(loss) attributable to the parent company subsequent to Initial Public Offering | | | — | | | | — | | | | — | | | | — | | | | (3.4 | ) |

| Weighted average number of ordinary shares outstanding (millions) | | | 100.2 | | | | 100.2 | | | | 100.2 | | | | 92.8 | | | | 80.0 | |

Basic and diluted earnings per share attributable to the parent company (U.S. dollar per share) (1) | | | 0.42 | | | | (1.12 | ) | | | (0.05 | ) | | | (2.25 | ) | | | (0.04 | ) |

Dividend paid per share(2)

| | | 1.38 | | | | 1.05 | | | | 0.4530 | | | | 1.4292 | | | | 0.2962 | |

Notes:

| (1) | Earnings per share has been calculated considering net profit/(loss) attributable to equity holders of Atlantica Yield generated after our IPO divided by the number of shares outstanding. Basic earnings per share equals diluted earnings per share for the periods presented. |

| (2) | 2018: On February 27, 2018, the board of directors declared a dividend of $0.31 per share corresponding to the fourth quarter of 2017, which was paid on March 27, 2018. On May 11, 2018, the board of directors declared a dividend of $0.32 per share corresponding to the first quarter of 2018, which was paid on June 15, 2018. On July 31, 2018, the board of directors declared a dividend of $0.34 per share corresponding to the second quarter of 2018, which was paid on September 15, 2018. On October 31, 2018, the board of directors declared a dividend of $0.36 per share corresponding to the third quarter of 2018 which was paid on December 14, 2018. |

2017: On February 27, 2017, the board of directors declared a dividend of $0.25 per share corresponding to the fourth quarter of 2016, which was paid on March 15, 2017. From that amount, we retained $10.4 million of the dividend attributable to Abengoa. On May 12, 2017, the board of directors declared a dividend of $0.25 per share corresponding to the first quarter of 2017 which was paid on June 15, 2017. On July 28, 2017, the board of directors declared a dividend of $0.26 per share corresponding to the second quarter of 2017 which was paid on August 31, 2017. On November 10, 2017, the board of directors declared a dividend of $0.29 per share corresponding to the third quarter of 2017 which was paid on December 15, 2017.

2016: In February 2016, taking into consideration the uncertainties resulting from the situation of Abengoa, the board of directors decided to postpone the decision whether to declare a dividend in respect of the fourth quarter of 2015 until the second quarter of 2016. In May 2016, considering the uncertainties in Abengoa’s situation, our board of directors decided not to declare a dividend in respect of the fourth quarter of 2015 and to postpone the decision on whether to declare a dividend in respect of the first quarter 2016 until we had obtained greater clarity on cross default and change of ownership issues. On August 3, 2016, based on waivers or forbearances obtained to that date, our board of directors decided to declare a dividend of $0.145 per share for the first quarter of 2016 and a dividend of $0.145 per share for the second quarter of 2016. The dividend was paid on September 15, 2016, to shareholders of record August 31, 2016. From that amount, we retained $12.3 million of the dividend attributable to Abengoa. On November 11, 2016, our board of directors, based on waivers or forbearances obtained to that date, decided to declare a dividend of $0.163 per share, paid on December 15, 2016, to shareholders of record on November 30, 2016, and from that amount we retained $6.7 million of the dividend attributable to Abengoa in accordance with the provisions of the parent support agreement and an agreement reached with Abengoa in relation to the ACBH preferred equity investment.

2015: On March 16, 2015 we paid a dividend of $0.2592 per share to shareholders of record February 28, 2015. On June 15, 2015 we paid a dividend of $0.34 per share to shareholders of record May 29, 2015. On September 15, 2015 we paid a dividend of $0.40 per share to shareholders of record May 29, 2015. On December 16, 2015, we paid a dividend of $0.43 per share to shareholders of record as of November 30, 2015, corresponding to the third quarter of 2015, and from that amount we retained $9 million of the dividend attributable to Abengoa in accordance with the provisions of the parent support agreement and an agreement reached with Abengoa in relation to the ACBH preferred equity investment. See “Item 4.B—Business Overview—Electric Transmission—Exchangeable Preferred Equity Investment in Abengoa Concessões Brasil Holding.”

2014: On December 15, 2014 we paid a dividend of $0.2962 per share that consisted of $0.2592 per share announced by our board of directors on November 14, 2014 and $0.0370 per share of the pro-rata for the days from IPO on June 18, 2014 to June 30, 2014.

Consolidated statements of financial position as of December 31, 2018, 2017, 2016, 2015 and 2014

| | | | |

| | | | | | | | | | | | | | | | |

| | | ($ in millions) | |

| Non-Current assets: | | | | | | | | | | | | | | | |

| Contracted concessional assets | | | 8,549.2 | | | | 9,084.2 | | | | 8,924.2 | | | | 9,300.9 | | | | 6,725.2 | |

| Investments carried under the equity method | | | 53.4 | | | | 55.8 | | | | 55.0 | | | | 56.2 | | | | 5.7 | |

| Financial investments | | | 52.7 | | | | 45.3 | | | | 69.8 | | | | 93.8 | | | | 373.6 | |

| Deferred tax assets | | | | | | | | | | | | | | | | | | | | |

| Total non-current assets | | | | | | | | | | | | | | | | | | | | |

| Current assets: | | | | | | | | | | | | | | | | | | | | |

| Inventories | | | 18.9 | | | | 17.9 | | | | 15.5 | | | | 14.9 | | | | 22.0 | |

| Clients and other receivables | | | 236.4 | | | | 244.4 | | | | 207.6 | | | | 197.3 | | | | 129.7 | |

| Financial investments | | | 240.8 | | | | 210.1 | | | | 228.0 | | | | 221.4 | | | | 229.4 | |

| Cash and cash equivalents | | | | | | | | | | | | | | | | | | | | |

| Total current assets | | | | | | | | | | | | | | | | | | | | |

| Total assets | | | | | | | | | | | | | | | | | | | | |

| Total equity | | | | | | | | | | | | | | | | | | | | |

| Non-current liabilities: | | | | | | | | | | | | | | | | | | | | |

| Long-term corporate debt | | | 415.2 | | | | 574.2 | | | | 376.3 | | | | 661.3 | | | | 376.2 | |

| Long-term project debt | | | 4,826.7 | | | | 5,228.9 | | | | 4,629.2 | | | | 3,574.5 | | | | 3,491.9 | |

| Other liabilities | | | | | | | | | | | | | | | | | | | | |

| Total non-current liabilities | | | | | | | | | | | | | | | | | | | | |

| Current liabilities: | | | | | | | | | | | | | | | | | | | | |

| Short-term corporate debt | | | 268.9 | | | | 68.9 | | | | 291.9 | | | | 3.2 | | | | 2.3 | |

| Short-term project debt | | | 264.4 | | | | 246.3 | | | | 701.3 | | | | 1,896.1 | | | | 331.2 | |

| Other liabilities | | | | | | | | | | | | | | | | | | | | |

| Total current liabilities | | | | | | | | | | | | | | | | | | | | |

| Equity and total liabilities | | | | | | | | | | | | | | | | | | | | |

Consolidated cash flow statements for the years ended December 31, 2018, 2017, 2016, 2015 and 2014

| | | | |

| | | | | | | | | | | | | | | | |

| | | ($ in millions) | |

| Gross cash flows from operating activities | | | | | | | | | | | | | | | |

| Profit/(loss) for the year | | | 55.3 | | | | (104.9 | ) | | | 1.6 | | | | (198.2 | ) | | | (29.3 | ) |

| Adjustments to reconcile after-tax profit to net cash generated by operating activities | | | | | | | | | | | | | | | | | | | | |

| Profit for the year adjusted by non-monetary items | | | | | | | | | | | | | | | | | | | | |

| Net interest / taxes paid | | | (333.5 | ) | | | (349.5 | ) | | | (334.0 | ) | | | (310.2 | ) | | | (149.7 | ) |

| Variations in working capital | | | | | | | | | | | | | | | | | | | | |

| Total net cash flow provided by/(used in) operating activities | | | | | | | | | | | | | | | | | | | | |

| Net cash flows from investing activities | | | | | | | | | | | | | | | | | | | | |

| Investments in entities under the equity method | | | 4.4 | | | | 3.0 | | | | 5.0 | | | | 4.4 | | | | (44.5 | ) |

Investments in contracted concessional assets(1) | | | 68.0 | | | | 30.1 | | | | (6.0 | ) | | | (106.0 | ) | | | (57.0 | ) |

| Other non-current assets/liabilities | | | (16.7 | ) | | | 8.2 | | | | (3.6 | ) | | | 5.7 | | | | (21.3 | ) |

| Acquisitions / sales of subsidiaries and other financial instruments | | | | | | | | | | | | | | | | | | | | |

| Total net cash flows provided by/ (used in) investing activities | | | | | | | | | | | | | | | | | | | | |

| Net cash flows provided by/ (used in) financing activities | | | (405.2 | ) | | | (416.3 | ) | | | (226.1 | ) | | | 810.9 | | | | 304.4 | |

| Net increase/(decrease) in cash and cash equivalents | | | (19.1 | ) | | | 40.7 | | | | 82.0 | | | | 180.6 | | | | 2.9 | |

| Cash, cash equivalents and bank overdrafts at beginning of the year | | | 669.4 | | | | 594.8 | | | | 514.7 | | | | 354.2 | | | | 357.7 | |

| Translation differences cash or cash equivalents | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents at the end of the year | | | | | | | | | | | | | | | | | | | | |

Note:

| (1) | Investments in contracted concessional assets includes proceeds for $72.6 million and investments for $4.6 million in 2018, and proceeds for $42.5 million and investments for $12.4 million in 2017 See note 6 of the Annual Consolidated Financial Statements. |

Geography and business sector data

Revenue by geography

| | | | |

| | | | | | | | | | | | | | | | |

| | | ($ in millions) | |

| North America | | | 357.2 | | | | 332.7 | | | | 337.0 | | | | 328.1 | | | | 195.5 | |

| South America | | | 123.2 | | | | 120.8 | | | | 118.8 | | | | 112.5 | | | | 83.6 | |

| EMEA | | | | | | | | | | | | | | | | | | | | |

| Total revenue | | | | | | | | | | | | | | | | | | | | |

Revenue by business sector

| | | | |

| | | | | | | | | | | | | | | | |

| | | ($ in millions) | |

| Renewable energy | | | 793.5 | | | | 767.2 | | | | 724.3 | | | | 543.0 | | | | 170.7 | |

| Efficient natural gas | | | 130.8 | | | | 119.8 | | | | 128.1 | | | | 138.7 | | | | 118.8 | |

| Electric transmission | | | 96.0 | | | | 95.1 | | | | 95.1 | | | | 86.4 | | | | 73.2 | |

| Water | | | | | | | | | | | | | | | | | | | | |

| Total revenue | | | | | | | | | | | | | | | | | | | | |

Non-GAAP financial data

Further Adjusted EBITDA by geography

| | | | |

| | | | | | | | | | | | | | | | |

| | | ($ in millions) | |

| North America | | | 308.8 | | | | 282.3 | | | | 284.7 | | | | 279.6 | | | | 175.4 | |

| South America | | | 100.2 | | | | 108.8 | | | | 124.6 | | | | 110.9 | | | | 77.2 | |

EMEA(1) | | | | | | | | | | | | | | | | | | | | |

Further Adjusted EBITDA(2)(3)(4) | | | | | | | | | | | | | | | | | | | | |

Note:

| (1) | Further Adjusted EBITDA for EMEA does not include our pro rata share of EBITDA from unconsolidated affiliates, which was $8.1 million, $7.3 million, $8.8 million, $12.3 million and $0 million for the years ended December 31, 2018, 2017, 2016, 2015 and 2014. |

| (2) | Further Adjusted EBITDA is a supplemental non-GAAP financial measure. We present non-GAAP financial measures because we believe that they and other similar measures are widely used by certain investors, securities analysts and other interest parties. The non-GAAP financial measures may not be comparable to other similarly titled measures of other companies and have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our operating results as reported under IFRS as issued by the IASB. Non-GAAP financial measures are not measurements of our performance or liquidity under IFRS as issued by the IASB and should not be considered as alternatives to operating profit or profit for the year or any other performance measure derived in accordance with IFRS as issued by the IASB or any other generally accepted accounting principles. See “Presentation of Financial Information—Non-GAAP Financial Measures.” |

| (3) | Further Adjusted EBITDA is calculated as profit/(loss) for the year attributable to the parent company, after adding back loss/(profit) attributable to non-controlling interest from continued operations, income tax, share of profit/(loss) of associates carried under the equity method, finance expense net, depreciation, amortization and impairment charges of entities included in the Annual Consolidated Financial Statements, and dividends received from our preferred equity investment in ACBH. Further Adjusted EBITDA for 2014, includes preferred dividends by ACBH for the first time during the third and fourth quarters of 2014. Further Adjusted EBITDA for 2016 and the first quarter of 2017 includes compensation received from Abengoa in lieu of ACBH dividends. Further Adjusted EBITDA is not a measure of performance under IFRS as issued by the IASB and you should not consider Further Adjusted EBITDA as an alternative to operating income or profits or as a measure of our operating performance, cash flows from operating, investing and financing activities or as a measure of our ability to meet our cash needs or any other measures of performance under generally accepted accounting principles. We believe that Further Adjusted EBITDA is a useful indicator of our ability to incur and service our indebtedness and can assist securities analysts, investors and other parties to evaluate us. Further Adjusted EBITDA and similar measures are used by different companies for different purposes and are often calculated in ways that reflect the circumstances of those companies. Further Adjusted EBITDA may not be indicative of our historical operating results, nor is it meant to be predictive of potential future results. |

| (4) | Further Adjusted EBITDA does not include our pro rata share of EBITDA from unconsolidated affiliates, which was $8.1 million, $7.3 million, $8.8 million, $12.3 million and $0 million for the years ended December 31, 2018, 2017, 2016, 2015 and 2014. |

Further Adjusted EBITDA by business sector

| | | | |

| | | | | | | | | | | | | | | | |

| | | ($ in millions) | |

| Renewable energy | | | 664.4 | | | | 569.2 | | | | 538.4 | | | | 414.0 | | | | 137.8 | |

| Efficient natural gas | | | 93.9 | | | | 106.1 | | | | 106.5 | | | | 107.7 | | | | 101.9 | |

| Electric transmission | | | 78.4 | | | | 87.7 | | | | 104.8 | | | | 89.0 | | | | 68.3 | |

Water(1) | | | | | | | | | | | | | | | | | | | | |

Further Adjusted EBITDA(2)(3)(4) | | | | | | | | | | | | | | | | | | | | |

Note:

| (1) | Further Adjusted EBITDA for Water does not include our pro rata share of EBITDA from unconsolidated affiliates, which was $8.1 million, $7.3 million, $8.8 million, $12.3 million and $0 million for the years ended December 31, 2018, 2017, 2016, 2015 and 2014. |

| (2) | Further Adjusted EBITDA is a supplemental non-GAAP financial measure. We present non-GAAP financial measures because we believe that they and other similar measures are widely used by certain investors, securities analysts and other interest parties. The non-GAAP financial measures may not be comparable to other similarly titled measures of other companies and have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our operating results as reported under IFRS as issued by the IASB. Non-GAAP financial measures are not measurements of our performance or liquidity under IFRS as issued by the IASB and should not be considered as alternatives to operating profit or profit for the year or any other performance measure derived in accordance with IFRS as issued by the IASB or any other generally accepted accounting principles. See “Presentation of Financial Information—Non-GAAP Financial Measures.” |

| (3) | Further Adjusted EBITDA is calculated as profit/(loss) for the year attributable to the parent company, after adding back loss/(profit) attributable to non-controlling interest from continued operations, income tax, share of profit/(loss) of associates carried under the equity method, finance expense net, depreciation, amortization and impairment charges of entities included in the Annual Consolidated Financial Statements, and dividends received from our preferred equity investment in ACBH. Further Adjusted EBITDA for 2014, includes preferred dividends by ACBH for the first time during the third and fourth quarters of 2014. Further Adjusted EBITDA for 2016 and the first quarter of 2017 includes compensation received from Abengoa in lieu of ACBH dividends. Further Adjusted EBITDA is not a measure of performance under IFRS as issued by the IASB and you should not consider Further Adjusted EBITDA as an alternative to operating income or profits or as a measure of our operating performance, cash flows from operating, investing and financing activities or as a measure of our ability to meet our cash needs or any other measures of performance under generally accepted accounting principles. We believe that Further Adjusted EBITDA is a useful indicator of our ability to incur and service our indebtedness and can assist securities analysts, investors and other parties to evaluate us. Further Adjusted EBITDA and similar measures are used by different companies for different purposes and are often calculated in ways that reflect the circumstances of those companies. Further Adjusted EBITDA may not be indicative of our historical operating results, nor is it meant to be predictive of potential future results. See “Presentation of Financial Information—Non-GAAP Financial Measures.” |

| (4) | Further Adjusted EBITDA does not include our pro rata share of EBITDA from unconsolidated affiliates, which was $8.1 million, $7.3 million, $8.8 million, $12.3 million and $0 million for the years ended December 31, 2018, 2017, 2016, 2015 and 2014. |

The following table sets forth a reconciliation of Further Adjusted EBITDA to our profit/(loss) for the year from continuing operations:

Reconciliation of profit/(loss) for the year to Further Adjusted EBITDA

| | | | |

| | | | | | | | | | | | | | | | |

| | | ($ in millions) | |

| Profit/(loss) for the year attributable to the parent company | | | 41.6 | | | | (111.8 | ) | | | (4.9 | ) | | | (209.0 | ) | | | (31.6 | ) |

| Profit/(loss) attributable to non-controlling interest from continued operations | | | 13.7 | | | | 6.9 | | | | 6.5 | | | | 10.8 | | | | 2.3 | |

| Income tax | | | 42.6 | | | | 119.8 | | | | 1.7 | | | | 23.8 | | | | 4.4 | |

| Share of loss/(profit) of associates carried under the equity method | | | (5.2 | ) | | | (5.3 | ) | | | (6.7 | ) | | | (7.8 | ) | | | 0.8 | |

| Financial expenses, net | | | 395.2 | | | | 448.4 | | | | 405.8 | | | | 526.7 | | | | 197.4 | |

| Operating profit/(loss) | | | | | | | | | | | | | | | | | | | | |

| Depreciation, amortization and impairment charges | | | 362.7 | �� | | | 311.0 | | | | 332.9 | | | | 261.3 | | | | 125.5 | |

| Dividend from preferred equity investment | | | | | | | | | | | | | | | | | | | | |

| Further Adjusted EBITDA | | | | | | | | | | | | | | | | | | | | |

The following table sets forth a reconciliation of Further Adjusted EBITDA to our net cash generated by or used in operating activities:

Reconciliation of net cash generated by operating activities to Further Adjusted EBITDA

| | | | |

| | | | | | | | | | | | | | | | |

| | | ($ in millions) | |

| Net cash generated by operating activities | | | | | | | | | | | | | | | | | | | | |

| Interests (paid)/received | | | | | | | | | | | | | | | | | | | | |

| Income tax (paid)/received | | | 12.5 | | | | 4.8 | | | | 2.0 | | | | (0.5 | ) | | | 0.4 | |

| Variations in working capital | | | 18.4 | | | | 8.8 | | | | (2.0 | ) | | | (73.1 | ) | | | 68.0 | |

| Non-monetary adjustments, other cash finance costs and other | | | | | | | | | | | | | | | | | | | | |

| Further Adjusted EBITDA | | | | | | | | | | | | | | | | | | | | |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

Investing in our securities involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with the other information contained in this annual report, including our Annual Consolidated Financial Statements and related notes, included elsewhere in this annual report, before making any investment decision. The risks described below may not be the only risks we face. We have described only those risks that we currently consider to be material and there may be additional risks that we do not currently consider to be material or of which we are not currently aware. Any of the following risks and uncertainties could have a material adverse effect on our business, prospects, results of operations and financial condition. The market price of our securities could decline due to any of these risks and uncertainties, and you could lose all or part of your investment.

Risks Related to Our Business and the Markets in Which We Operate

Difficult conditions in the global economy and in the global capital markets have caused, and may continue to cause, a sharp reduction in worldwide demand for our products and services.

Our results of operations have been, and continue to be, materially affected by conditions in the global economy. In the United States, capital markets have been experiencing some volatility recently probably driven by signs of a global economic slowdown, concerns on upcoming decisions on interest rates, inflation fears and trade tensions with China. Concerns over inflation, volatile oil and gas prices, geopolitical issues, the availability and cost of credit, sovereign debt and the instability of the euro have contributed to increased volatility and diminished expectations for the economy and global capital markets going forward. These factors have in the past precipitated economic slowdowns and led to a recent recession and weak economic growth. Adverse events and continuing disruptions in the global economy and in the global capital markets may have a material adverse effect on our business, financial condition, results of operations and cash flows. Moreover, even in the absence of a market downturn, we are exposed to substantial risk of loss due to market volatility with certain factors, including volatile oil prices, interest rates, consumer spending, business investment, government spending, inflation affecting the business and economic environment that could affect the economic and financial situation of our concession contracts counterparties and, ultimately, the profitability and growth of our business.

Generalized or localized downturns or inflationary or deflationary pressures in our key geographical areas could also have a material adverse effect on our business, financial condition, results of operations and cash flows. A significant portion of our business activity is concentrated in the United States, Mexico, Peru and Spain. Consequently, we are significantly affected by the general economic conditions in these countries. Spain, for instance, has experienced negative economic conditions in the last few years, including high unemployment and significant government debt, increased lately by the uncertainty of the Catalonian political situation, which we believe could adversely affect our operations in the future. The effects on the European and global economy of the exit of the United Kingdom from the European Union or of any other member states from the Eurozone, the dissolution of the euro, or the perception that any of these events are imminent, are inherently difficult to predict and could give rise to operational disruptions or other risks of contagion to our business and have a material adverse effect on our business, financial condition, results of operations and cash flows. In addition, to the extent uncertainty regarding the European economic recovery continues to negatively affect government or regional budgets, our business, results of operations and cash flows could be materially adversely affected. Various European political parties who question the recent austerity policies implemented in certain European countries have added political instability to the region. Finally, the next elections to the European Parliament are expected to be held in May 23-26, 2019, and the result may have an impact on government or regional budgets.

Additionally, political changes in key geographies, including the United States, could affect our business in the United States or in other countries including, for example, Mexico.

We may not be able to arrange the required or desired financing for acquisitions and for the successful refinancing of the Company’s project level and corporate level indebtedness.

The global capital and credit markets have experienced in the past and may continue to experience periods of extreme volatility and disruption. During the second half of 2015 and first half of 2016, our access to financing was curtailed by market conditions and other factors. Starting at the end of 2018 and continuing in the beginning of 2019, it has been a period of high volatility in capital markets, particularly in the United States and Europe. These adverse market conditions could prevent us from accessing the capital markets in a manner that would permit the Company to make acquisitions or refinance its debt on satisfactory terms or at all, including the 2019 Notes maturing in November 2019. Continued disruptions, uncertainty or volatility in the global capital and credit markets may limit our access to additional capital required to operate or grow our business, including our access to new debt and equity capital to make further acquisitions or access to project debt, which we may use to fund or refinance many of our projects and corporate level debt, even in cases where such capital has already been committed. Such market conditions may limit our ability to replace, in a timely manner, maturing liabilities and access the capital necessary to grow our business, or replace financing previously committed for a project that ceases to be available to us. As a result, we may be forced to delay raising capital, issue shorter-term securities than we prefer, or bear a higher cost of capital which could decrease our profitability and significantly reduce our financial flexibility or even require us to modify our dividend policy. In the event we are required to replace previously committed financing to certain projects that subsequently becomes unavailable, we may have to postpone or cancel planned acquisitions or capital expenditures. The inability to raise capital, higher costs of capital or postponement or cancellation of planned acquisitions or capital expenditures may have a materially adverse effect on our business, results of operations and cash flows. In addition, our ability to arrange financing, either at the corporate level or at a non-recourse project level subsidiary, and the costs of such capital, are dependent on numerous factors, including:

| | · | general economic and capital market conditions; |

| · | credit availability from banks and other financial institutions; |

| · | investor confidence in us and Algonquin as our largest shareholder |

| · | our financial performance and the financial performance of our subsidiaries; |

| · | our level of indebtedness and compliance with covenants in debt agreements; |

| · | maintenance of acceptable project credit ratings or credit quality; |

| · | provisions of tax and securities laws that may impact raising capital. |

We may not be successful in obtaining additional capital for these or other reasons. Furthermore, we may be unable to refinance or replace project level financing arrangements or other credit facilities on favorable terms or at all upon the expiration or termination thereof. Our failure, or the failure of any of our projects, to obtain additional capital may constitute a default under such existing indebtedness and may have a material adverse effect on our business, financial condition, results of operations and cash flows.

Counterparties to our offtake agreements may not fulfill their obligations and, as our contracts expire, we may not be able to replace them with agreements on similar terms in light of increasing competition in the markets in which we operate.

A significant portion of the electric power we generate, the transmission capacity we have, and our desalination capacity is sold under long-term offtake agreements with public utilities, industrial or commercial end-users or governmental entities, with a weighted average remaining duration of approximately 18 years as of December 31, 2018.

If, for any reason, including, but not limited to, a deterioration in their financial situation or bankruptcy, any of the purchasers of power, transmission capacity or desalination capacity under these agreements are unable or unwilling to fulfill their related contractual obligations or if they refuse to accept delivery of power delivered thereunder or if they otherwise terminate such agreements prior to the expiration thereof, or if prices were re-negotiated under a bankruptcy situation, or if they delayed payments, our assets, liabilities, business, financial condition, results of operations and cash flow may be materially adversely affected. Furthermore, to the extent any of our power, transmission capacity or desalination capacity purchasers are, or are controlled by, governmental entities, our facilities may be subject to sovereign risk or legislative or other political action that may hamper their contractual performance.

On January 29, 2019, PG&E, the off-taker for Atlantica Yield with respect to the Mojave plant, filed for reorganization under Chapter 11 of the Bankruptcy Code in the U.S. Bankruptcy Court for the Northern District of California (the “Bankruptcy Court”). As a consequence, PG&E has not paid the portion of the invoice corresponding to the electricity delivered for the period between January 1 and January 28, 2019, which was due on February 25, given that the services relate to the pre-petition period and any payment therefore would require approval by the Bankruptcy Court. However, PG&E has paid the portion of the invoice corresponding to the electricity delivered after January 28. A default of the PPA agreement with PG&E occurred with the PG&E bankruptcy filing and such default could trigger an event of default under our Mojave project finance agreement if certain other conditions were met, namely if (i) such default could reasonably be expected to result in a material adverse effect to Mojave or (ii) PG&E failed to assume the PPA within 60 days of its chapter 11 filing, extendable to 180 days provided that PG&E continues to perform under the PPA. As of December 31, 2018, Mojave had $739 million outstanding under its project financing agreement with the Federal Financing Bank, with a guarantee from the DOE. Additionally, Mojave represents approximately 13.5% of 2018 project level cash available for distribution. Chapter 11 bankruptcy is a complex process and we do not know at this time whether PG&E will seek to reject the PPA or not. However, PG&E has continued to be in compliance with the remaining terms and conditions of the PPA, including with all payment terms of the PPA up through the date hereof with the exception of services for prepetition services that became due and payable after the chapter 11 filing date. It remains possible that at any time during the chapter 11 proceeding, PG&E may decide to cease performing under the PPA and attempt to reject or renegotiate the terms of its contract with us. If PG&E rejected the contract and stopped making payments in accordance with the PPA, Mojave could fail in servicing its debt under its project finance agreement, which would also cause a default under the project finance agreement. If not cured or waived, an event of default in the project finance agreement could result in debt acceleration and, if such amounts were not timely paid, the DOE could decide to foreclose on the asset. The PG&E bankruptcy has heightened the risk that project level cash distributions could be restricted for an undetermined period of time, thereby impacting our corporate liquidity and corporate leverage. Mojave project cash distributions to the corporate level normally takes place at the end of the year, the last distribution received at the corporate level took place in December 2018. Unless the event or default is cured or waived, distributions may not be made during the pendency of the bankruptcy. Such events may have a material adverse effect on our business, financial condition, results of operations and cash flows.

During recent months, the credit rating of Eskom has also weakened and is currently CCC+ from S&P Global Rating (“S&P”), B2 from Moody’s Investor Service Inc. (“Moody’s”) and BB- from Fitch Ratings Inc. (“Fitch”). Eskom is the offtaker of our Kaxu solar plant, a state-owned, limited liability company, wholly owned by the government of the Republic of South Africa. Eskom’s payment guarantees to our solar plant Kaxu are underwritten by the South African Department of Energy, under the terms of an implementation agreement. The credit ratings of the Republic of South Africa as of the date of this report are BB/Baa3/BB+ by S&P, Moody’s and Fitch, respectively.

The cost of renewable energy has considerably decreased over the past years, becoming a consistently competitive source of power generation compared to traditional fossil fuels in many regions, and it is expected to continue falling in the future. In addition, there has been an increase in the number of players and competition in the renewable energy space in the last few years, industrial companies and other independent power producer as well as large infrastructure funds and other financial players. The reduction in the cost of renewable energy and the intense competition has contributed to a reduction in electricity prices paid by the off-takers. In light of these market conditions, we may not be able to replace an expiring or terminated agreement with an agreement on equivalent terms and conditions, including at prices that permit operation of the related facility on a profitable basis. In addition, we believe many of our competitors have well-established relationships with our current and potential suppliers, lenders and customers and have extensive knowledge of our target markets. As a result, these competitors may be able to respond more quickly to evolving industry standards and changing customer requirements than us. Adoption of technology more advanced than our own could reduce the power production costs of our competitors, resulting in their having a lower cost structure than is achievable with the technologies we currently employ and adversely affect our ability to compete for offtake agreement renewals. If we are unable to replace an expiring or terminated offtake agreement, the affected facility may temporarily or permanently cease operations. External events, such as a severe economic downturn, could also impair the ability of some counterparties to our offtake agreements and other customer agreements to pay for energy and/or other products and services received.

Our inability to enter into new or replacement offtake agreements or to compete successfully against current and future competitors in the markets in which we operate may have a material adverse effect on our business, financial condition, results of operations and cash flows.

Government regulations could change at any time and such changes may negatively impact our current business and our growth strategy.

In some of our assets such as the Spanish solar plants and one of our transmission lines in Chile, revenues are based on existing regulation. We may also acquire in the future additional assets or businesses with regulated revenues. For these types of assets and businesses, if regulation changes, it may have a material adverse effect on our business, financial condition, results of operations and cash flows.

In addition, our strategy to grow our business through the acquisition of renewable energy projects partly depends on current government policies that promote and support renewable energy and enhance the economic viability of owning solar and wind energy projects. Renewable energy projects currently benefit from various U.S. federal, state and local governmental incentives, such as ITCs, PTCs, loan guarantees, RPS programs, or MACRS along with other incentives. These policies have had a significant impact on the development of renewable energy and they could change at any time, especially in the event that the current administration was to embark on further significant changes in federal energy policy. The current U.S. administration has also made public statements regarding overturning or modifying policies of, or regulations enacted by, the prior administration that placed limitations on coal and gas electric generation, mining and/or exploration. Additionally, many of these government incentives, including the ITCs and the PTCs, are subject to phase-out and/or expiration. These incentives make the development of renewable energy projects more competitive by providing tax credits, accelerated depreciation and expensing for a portion of the development costs, decreasing the costs associated with developing such projects or creating demand for renewable energy assets through RPS programs. A loss or reduction in such incentives or the value of such incentives, a change in policy away from limitations on coal and gas electric generation, mining and exploration, or a reduction in the capacity of potential investors to benefit from such incentives could decrease the attractiveness of solar or renewable energy projects to project developers, and the attractiveness of solar energy systems to utilities, retailers and customers. Such a loss or reduction could also reduce our acquisition opportunities and our willingness to pursue renewable energy projects due to higher operating costs or lower revenues from offtake agreements. See also “—Risks Related to Taxation.”

The current U.S. administration’s environmental and tax policies may create regulatory uncertainty in the clean energy sector and may lead to a reduction or removal of various clean energy programs and initiatives designed to curtail climate change. Such a reduction or removal of incentives may diminish the market for future renewable energy offtake agreements and reduce the ability for renewable developers to compete for future energy offtake agreements, which may reduce incentives for project developers to invest in the development and construction of clean energy and water infrastructure contracted assets. To the extent that these policies are changed in a manner that reduces the incentives or the value of such incentives or reduces the capacity of potential investors to benefit from such incentives, this could cause reduced revenues and reduced economic returns, resulting in increased financing costs and difficulty in obtaining financing.

The reduction in the corporate tax rate diminishes the benefit of tax incentives for potential investors and reduces the value of accelerated depreciation deductions and the expensing of certain capital expenditures. Any effort to overturn federal and state laws, regulations or policies that are supportive of existing or new solar energy generation or that remove costs or other limitations on other types of generation that compete with solar energy projects could materially and adversely affect the Company’s business. Additionally, the current U.S. administration has explored potential legal and regulatory strategies to subsidize coal and nuclear generation, which could allow those technologies to become more cost competitive relative to renewable generation sources.

Additionally, some U.S. states with RPS targets have met, or in the near future will meet, their renewable energy targets. For example, California, which has among the most aggressive RPS laws in the United States, is poised to meet its current mandate of 33.0% renewable energy by 2020 with already-proposed new renewable energy projects, though significant additional investments will be required to meet the higher renewable energy mandate of 60.0% by 2030 and 100% by 2045 that was adopted in 2018. If, as a result of achieving these targets, these and other U.S. states do not increase their targets in the near future, demand for additional renewable energy could decrease.