JOHN P. CALAMOS, SR.

Founder, Chairman, and Global Chief Investment Officer

Dear Fellow Shareholder:

Welcome to your annual report for the 12 months ending October 31, 2023. In this report, you will find commentary from our portfolio management teams, a listing of portfolio holdings, financial statements and highlights, and detailed information about the performance and positioning of the Calamos Closed-End Funds.

A new report format developed to help you with your asset allocation decisions

Each Calamos Closed-End Fund is designed to serve income-oriented investors by providing steady, competitive distributions through a multi-asset, risk-managed, and flexible approach. Since we launched our first closed-end fund in 2002, we have selectively expanded our offerings to provide investors with access to the income and return opportunities of an evolving global economy.

Today, our closed-end suite includes seven offerings, including enhanced fixed income and total return funds, focused on either the US or global markets. (Please see page 5 for an overview of the funds.) Whereas we previously provided an individual report for each of our funds, this consolidated report now includes information about all of them. We hope you will welcome this format as an opportunity to learn more about the different ways we can help you pursue your income and total return goals.

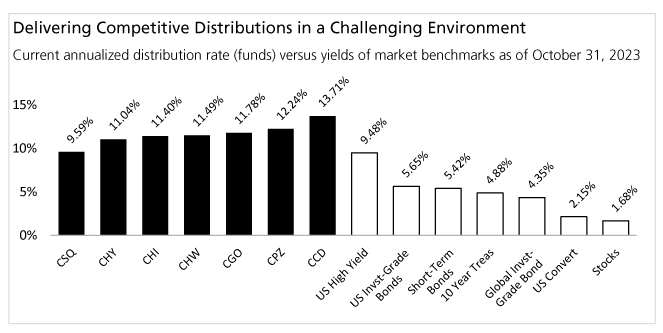

Innovative multi-asset approaches designed to provide steady, attractive income

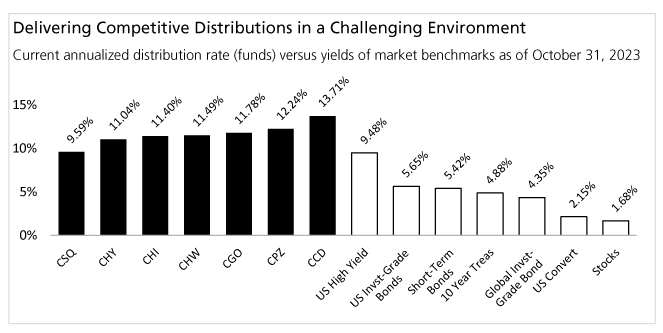

For investors seeking income, we understand the importance of providing a predictable amount of cash from month to month. Each of our closed-end funds is managed with the goal of providing steady (although not assured) monthly distributions through managed rate or level rate distribution policies. As the chart below shows, as of the end of the reporting period, the funds each offered attractive annualized distribution rates versus the yields of market benchmarks. We believe this speaks to the potential benefits of each fund's multi-asset class approach.

www.calamos.com

1

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value of an investment will fluctuate so that your shares, when sold, may be worth more or less than their original cost. You can purchase or sell common shares daily. Like any other stock, the market price will fluctuate with the market. Upon sale, your shares may have a market price that is above or below net asset value and may be worth more or less than your original investment.

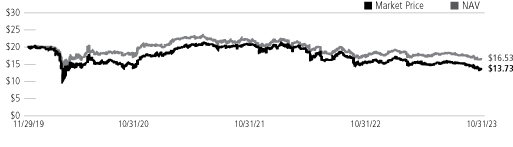

Perspectives on premiums and discounts

I'm often asked about my thoughts on premiums and discounts—specifically, whether investors should be concerned if their fund is trading at a discount to net asset value. Over time, it's quite normal for a closed-end fund to trade at a discount. At Calamos, our teams have a saying, "the flipside of volatility is opportunity." In other words, we recognize that short-term selloffs provide excellent occasions to add favorite positions at a lower cost. Similarly, I believe that for long-term fund investors, when a Calamos closed-end fund trades at a discount, it could be an attractive buying opportunity.

Market review

The reporting period was remarkable for its many ups and downs. Market turmoil reflected uncertainty about interest rates and Federal Reserve policy, energy prices, and inflation. Investors also grappled with anxiety due to a variety of events, including the failures of Silicon Valley Bank and Signature Bank, an autoworkers strike, and contentious debt ceiling negotiations in a polarized US Congress. Emerging secular themes—most notably advances in artificial intelligence and weight loss drugs—disrupted the markets as investors considered which companies and industries were positioned to win or lose.

The final months of the reporting period proved particularly difficult as investors grappled with deepening concerns about the sustainability of corporate earnings, consumer health, and the trajectory of economic growth. Although the Federal Reserve paused its rate tightening in September, the central bank dashed hopes of imminent rate cuts by reinforcing prior guidance that rates would

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

2

be higher for longer. The yield of the US 10-Year Treasury Bond reached multi-decade highs, while the onset of the Israel-Hamas war intensified geopolitical uncertainty.

Outlook

We see many signs pointing to slower economic growth and increasing risks across sectors. Higher interest rates will take time to work through the economy, with far-reaching consequences for businesses and consumers. Global manufacturing data is trending down, and fuel prices are putting significant pressure on many companies and households. Meanwhile, retailers will likely struggle as consumer nest eggs amassed during the pandemic dwindle and student loan repayments resume. Fiscal policy uncertainty, already elevated, will intensify as the US presidential election approaches. We expect geopolitical crosscurrents will take a toll on individual markets, sectors and industries. Monetary policy will also remain a focal point for the markets as investors contemplate the Federal Reserve's next moves. Against this backdrop, we expect saw-toothed and volatile markets to continue.

Asset allocation considerations

When global financial markets are as turbulent as they have been over recent months, investors may be tempted to retreat to the sidelines or give into short-term thinking. Income-oriented investors have faced added uncertainties as rates have risen. However, as we've noted in the past, jumping in and out of the market is a dangerous strategy—investors tend to capture the downturns and miss the upturns. Instead, establishing an asset allocation that aligns with your needs and risk tolerance is a far better course. Our teams are unwavering in their commitment to you and remain dedicated to seeking competitive distributions while paying close attention to the market risks.

We believe our funds, which have multiple levers for pursuing income and total returns, will be better positioned than those with more limited tools at their disposal. For example, we have the flexibility to invest across fixed income markets. Our bond holdings, such as high yield bonds and convertible bonds, have typically been less susceptible to interest rate changes than longer-duration investment-grade corporate or municipal bonds. Additionally, we believe the funds' judicious use of leverage can continue to provide long-term benefits to shareholders, despite the more recent headwinds of higher interest rates.

In the commentaries that follow, you'll read about the many ways our teams are pursuing competitive distributions and returns while seeking to manage the risks in the current environment. In addition to learning more about your current funds, I invite you to learn more about our other offerings as well. As always, thank you for your continued trust. All of us at Calamos Investments are honored that you have chosen us to help you achieve your asset allocation goals.

Sincerely,

John P. Calamos, Sr.

Founder, Chairman and Global Chief Investment Officer

www.calamos.com

3

Before investing, carefully consider a fund's investment objectives, risks, charges and expenses. Please see the prospectus containing this and other information or call 800-582-6959. Please read the prospectus carefully. Performance data represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted.

Diversification and asset allocation do not guarantee a profit or protection against a loss. Investments in alternative strategies may not be suitable for all investors.

Source: Calamos Advisors LLC.

Investments in overseas markets pose special risks, including currency fluctuation and political risks. These risks are generally intensified for investments in emerging markets. Countries, regions, and sectors mentioned are presented to illustrate countries, regions, and sectors in which a fund may invest. There are certain risks involved with investing in convertible securities in addition to market risk, such as call risk, dividend risk, liquidity risk and default risk, which should be carefully considered prior to investing.

Shares of closed-end funds frequently trade at a discount which is a market price that is below their net asset value.

Current Annualized Distribution Rate is the Fund's most recent distribution, expressed as an annualized percentage of the Fund's current market price per share. Estimates are calculated on a tax basis rather than on a generally accepted accounting principles (GAAP) basis but should not be used for tax reporting purposes. Distributions are subject to re-characterization for tax purposes after the end of the fiscal year. This information is not legal or tax advice. Consult a professional regarding your specific legal or tax matters. Under the level rate distribution policy of CGO and CHW and the managed rate distribution policy of CHI, CHY, CSQ, CCD, and CPZ the distributions paid to common shareholders may include net investment income, net realized short-term capital gains and return of capital. When the net investment income and net realized short-term capital gains are not sufficient, a portion of the level rate distribution will be a return of capital. In addition, a limited number of distributions per calendar year may include net realized long-term capital gains. Distribution rate may vary. Dividend yield is shown for stocks, current yield is shown for convertibles, yield to worst for remaining indexes. There are material differences between the indexes and the Calamos closed-end funds. Indexes are unmanaged, do not include fees and expenses and are not available for direct investments. Stocks are represented by the S&P 500 Index; US investment grade bonds are represented by the Bloomberg US Aggregate Bond Index; global investment grade bonds are represented by the Bloomberg Global Aggregate Index; short term bonds are represented by Bloomberg US Govt/Credit 1-3 Year Index and high yield bonds are represented by the ICE BofA US High Yield Index.

Current annualized distribution rate is the Fund's most recent distribution, expressed as an annualized percentage of the Fund's current market price per share. The Distribution Details for the distribution paid on 10/19/23, nearest the end of the reporting period are as follows. CHI: The Fund's distribution was $0.0950 per share. Based on our current estimates, we anticipate that approximately $0.0000 is paid from ordinary income, approximately $0.0650 is paid from short-term capital gains, approximately $0.0300 is paid from long-term capital gains and that approximately $0.0000 represents a return of capital. CHY: The Fund's distribution was $0.1000 per share. Based on our current estimates, we anticipate that approximately $0.0000 is paid from ordinary income, approximately $0.0617 is paid from short-term capital gains, approximately $0.0383 is paid from long-term capital gains and that approximately $0.0000 represents a return of capital. CHW: The Fund's distribution was $0.0500 per share. Based on our current estimates, we anticipate that approximately $0.0000 is paid from ordinary income, approximately $0.0500 is paid from short-term capital gains, approximately $0.0000 is paid from long-term capital gains and that approximately $0.0000 represents a return of capital. CSQ: The Fund's distribution was $0.1025 per share. Based on our current estimates, we anticipate that approximately $0.0000 is paid from ordinary income, approximately $0.0000 is paid from short-term capital gains, approximately $0.1025 is paid from long-term capital gains and that approximately $0.0000 represents a return of capital. CCD: The Fund's distribution was $0.1950 per share. Based on our current estimates, we anticipate that approximately $0.0000 is paid from ordinary income, approximately $0.1337 is paid from short-term capital gains, approximately $0.0613 is paid from long-term capital gains and that approximately $0.0000 represents a return of capital. CGO: The Fund's distribution was $0.0800 per share. Based on our current estimates, we anticipate that approximately $0.0000 is paid from ordinary income, approximately $0.0800 is paid from short-term capital gains, approximately $0.0000 is paid from long-term capital gains and that approximately $0.0000 represents a return of capital. ccd: The Fund's distribution was $0.1400 per share. Based on our current estimates, we anticipate that approximately $0.0000 is paid from ordinary income, approximately $0.1400 is paid from short-term capital gains, approximately $0.0000 is paid from long-term capital gains and that approximately $0.0000 represents a return of capital.

Fund holdings are subject to change daily. The Funds are actively managed. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to accuracy or completeness, has been obtained from sources we believe to be reliable.

Opinions are as of the publication date, subject to change and may not come to pass.

This information is being provided for informational purposes only and should not be considered investment advice or an offer to buy or sell any security in the portfolio.

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

4

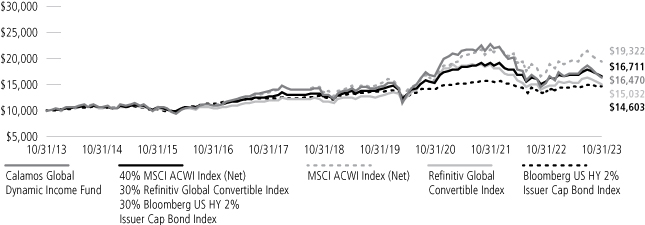

Additional Information About the Funds (Unaudited)

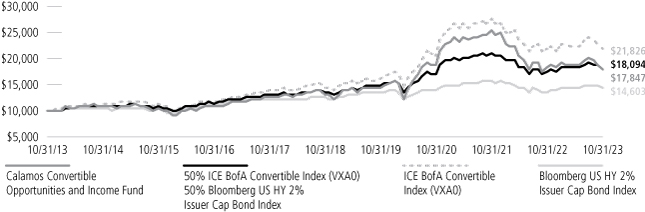

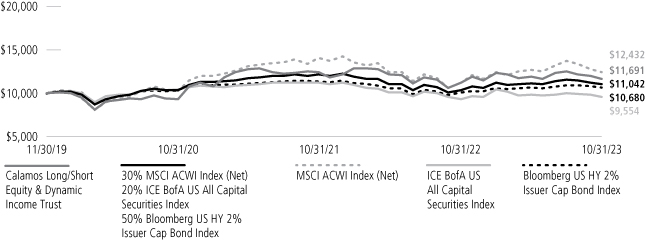

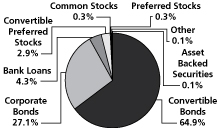

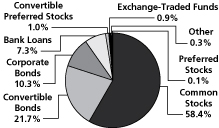

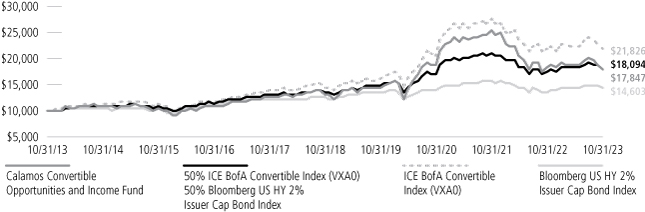

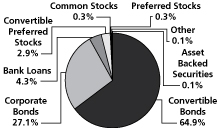

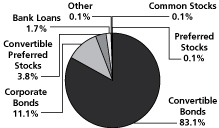

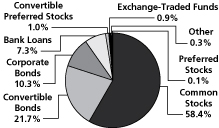

Calamos Convertible Opportunities and Income Fund

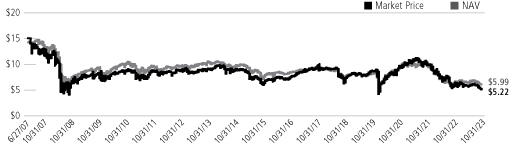

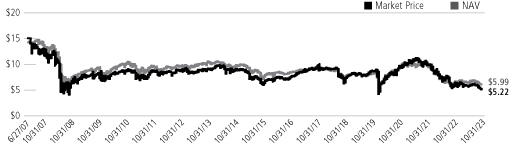

GROWTH OF $10,000: FOR THE 10-YEAR PERIOD ENDED 10/31/23

AVERAGE ANNUAL TOTAL RETURN† AS OF 10/31/23

| | | 1

YEAR | | 5

YEARS | | 10

YEARS | | SINCE

INCEPTION | |

Calamos Convertible Opportunities and Income Fund | |

Market Value | | | 3.37 | % | | | 9.94 | % | | | 7.19 | % | | | 8.72 | % | |

NAV | | | -2.27 | | | | 6.47 | | | | 5.96 | | | | 8.41 | | |

50%VXAO-50%BBGUSHY2%Cap Index | | | 2.88 | | | | 6.05 | | | | 6.11 | | | | 7.65 | | |

ICE BofA All US Convertible Index (VXA0) | | | -0.48 | | | | 8.73 | | | | 8.12 | | | | 8.05 | | |

Bloomberg US HY 2% Issuer Cap Bond Index | | | 6.23 | | | | 3.04 | | | | 3.86 | | | | 6.97 | | |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gain distributions. Source: State Street Corporation and Morningstar Direct.

† Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions.

NOTES:

The graphs do not reflect the income taxes that you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends.

The 50%VXAO-50%BBGUSHY2%Cap Index is blended from 50% - ICE BofA Convertibles Index (VXA0) and 50% - Bloomberg US Corp HY 2% Issuer Cap Bond Index.

The ICE BofA All US Convertibles Index is comprised of approximately 700 issues of only convertible bonds and preferreds of all qualities.

The Bloomberg US Corporate High Yield 2% Issuer Capped Index measures the performance of high-yield corporate bonds with a maximum allocation of 2% to any one issuer.

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

www.calamos.com

7

Additional Information About the Funds (Unaudited)

Calamos Convertible Opportunities and Income Fund

Senior Securities

The following table sets forth information regarding the Fund's outstanding bank loans, and mandatory redeemable preferred shares ("MRPS") as of the end of each of the Fund's last ten fiscal years, as applicable. The information in the table shown below comes from the Fund's financial statements for the fiscal year ended October 31, 2023, and each of the prior nine years then ended, all of which have been audited by Deloitte & Touche LLP, the Fund's independent registered public accounting firm.

| FISCAL YEAR ENDED | | TOTAL

AMOUNT

OUTSTANDING | | ASSET

COVERAGE | | LIQUIDATING

PREFERENCE

PER PREFERRED

SHARE(c) | | AVERAGE

MARKET VALUE

PER PREFERRED

SHARE | | TYPE OF

SENIOR

SECURITY | |

October 31, 2023 | | $ | 314,400,000 | | | $ | 3,564 | (a) | | | — | | | | — | | | Loan | |

October 31, 2023 | | $ | 133,000,000 | | | | 211 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2022 | | $ | 339,400,000 | | | | 3,630 | (a) | | | — | | | | — | | | Loan | |

October 31, 2022 | | $ | 133,000,000 | | | | 232 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2021 | | $ | 399,400,000 | | | | 4,116 | (a) | | | — | | | | — | | | Loan | |

October 31, 2021 | | $ | 133,000,000 | | | | 309 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2020 | | $ | 288,400,000 | | | | 4,431 | (a) | | | — | | | | — | | | Loan | |

October 31, 2020 | | $ | 100,000,000 | | | | 319 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2019 | | $ | 277,400,000 | | | | 4,080 | (a) | | | — | | | | — | | | Loan | |

October 31, 2019 | | $ | 100,000,000 | | | | 283 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2018 | | $ | 288,000,000 | | | | 3,921 | (a) | | | — | | | | — | | | Loan | |

October 31, 2018 | | $ | 100,000,000 | | | | 282 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2017 | | $ | 275,000,000 | | | | 4,265 | (a) | | | — | | | | — | | | Loan | |

October 31, 2017 | | $ | 100,000,000 | | | | 293 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2016 | | $ | 306,000,000 | | | | 3,454 | (a) | | | — | | | | — | | | Loan | |

October 31, 2015 | | $ | 353,000,000 | | | | 3,316 | (a) | | | — | | | | — | | | Loan | |

October 31, 2014 | | $ | 360,000,000 | | | | 3,588 | (a) | | | — | | | | — | | | Loan | |

(a) Calculated by subtracting the Fund's total liabilities (not including notes payable) from the Fund's total assets and dividing this by the amount of notes payable outstanding, and by multiplying the result by 1,000.

(b) Calculated by subtracting the Fund's total liabilities (not including MRPS) from the Fund's total assets and dividing this by the number of MRPS outstanding, and by multiplying the result by 25.

(c) "Liquidating Preference per Preferred Share" means the amount to which a holder of preferred shares would be entitled upon the liquidation of the Fund in preference to common shareholders, expressed as a dollar amount per preferred share.

(d) The MRPS are not listed on any exchange or automated quotation system. The MRPS are considered debt of the issuer; and the liquidation preference approximates fair value.

Summary of Fund Expenses

The following table and example contain information about the costs and expenses that common shareholders will bear directly or indirectly. In accordance with Commission requirements, the table below shows our expenses, including interest payments on borrowed funds, and preferred stock dividend payments, as a percentage of our average net assets as of October 31, 2023, and not as a percentage of gross assets or managed assets.

By showing expenses as a percentage of average net assets, expenses are not expressed as a percentage of all of the assets we invest. The table and example are based on our capital structure as of October 31, 2023. As of October 31, 2023, the Fund had utilized $314 million of the $430 million available under the SSB Agreement ($260 million in advances outstanding, and $54 million in structural leverage consisting of collateral received from counterparties via SSB in connection with securities on loan), representing 28.1% of the Fund's managed assets as of that date, and had $133 million in MRPS outstanding, representing 11.9% of the Fund's managed assets. Combined, the borrowings under the SSB Agreement and the outstanding MRPS represented 39.9% of the Fund's managed assets.

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

8

Additional Information About the Funds (Unaudited)

SHAREHOLDER TRANSACTION EXPENSES | |

Sales Load (as a percentage of offering price) | | | — | (1) | |

Offering Expenses Borne by the Fund (as a percentage of offering price) | | | — | (1) | |

Dividend Reinvestment Plan Fees (per sales transaction fee)(2) | | $ | 15.00 | | |

| ANNUAL EXPENSES | | PERCENTAGE

OF AVERAGE

NET ASSETS

ATTRIBUTABLE

TO COMMON

SHAREHOLDERS | |

Management Fee(3) | | | 1.29 | % | |

Interest Payments on Borrowed Funds(4) | | | 2.39 | % | |

Preferred Stock Dividend Payments(5) | | | 0.62 | % | |

Other Expenses(6) | | | 0.10 | % | |

Total Annual Expenses | | | 4.40 | % | |

The following example illustrates the expenses that common shareholders would pay on a $1,000 investment in common shares, assuming (1) total annual expenses of 4.40% of net assets attributable to common shareholders; (2) a 5% annual return; and (3) all distributions are reinvested at net asset value:

| | | 1 YEAR | | 3 YEARS | | 5 YEARS | | 10 YEARS | |

Total Expenses Paid by Common Shareholders(7) | | $ | 44 | | | $ | 133 | | | $ | 223 | | | $ | 453 | | |

The example should not be considered a representation of future expenses. Actual expenses may be greater or less than those assumed. Moreover, our actual rate of return may be greater or less than the hypothetical 5% return shown in the example.

(1) If the securities to which this prospectus relates are sold to or through underwriters, the prospectus supplement will set forth any applicable sales load and the estimated offering expenses borne by us.

(2) Shareholders will pay a $15.00 transaction fee plus a $0.02 per share brokerage charge if they direct the Plan Agent (as defined below) to sell common shares held in a Plan account. In addition, each participant will pay a pro rata share of brokerage commissions incurred with respect to the Plan Agent's open-market purchases in connection with the reinvestment of dividends or distributions. If a participant elects to have the Plan Agent sell part or all of his or her common shares and remit the proceeds, such participant will be charged his or her pro rata share of brokerage commissions on the shares sold. See "Dividends and Distributions on Common Shares; Automatic Dividend Reinvestment Plan".

(3) The Fund pays Calamos an annual management fee, payable monthly in arrears, for its investment management services in an amount equal to 0.80% of the Fund's average weekly managed assets. In accordance with the requirements of the Commission, the table above shows the Fund's management fee as a percentage of average net assets attributable to common shareholders. By showing the management fee as a percentage of net assets, the management fee is not expressed as a percentage of all of the assets the Fund intends to invest. For purposes of the table, the management fee has been converted to 1.29% of the Fund's average weekly net assets as of October 31, 2023 by dividing the total dollar amount of the management fee by the Fund's average weekly net assets (managed assets less outstanding leverage).

(4) Reflects interest expense paid on $240 million in average borrowings under the SSB Agreement, plus $83 million in additional average structural leverage related to certain securities lending programs, as described under "Leverage".

(5) Reflects estimated dividend expense on $133 million aggregate liquidation preference of mandatory redeemable preferred shares outstanding. See "Leverage".

(6) "Other Expenses" are based on estimated amounts for the Fund's current fiscal year.

(7) The example does not include sales load or estimated offering costs, which would cause the expenses shown in the example to increase. In connection with an offering of common shares, the applicable prospectus supplement will set forth an example including sales load and estimated offering costs.

Effects of Leverage

The SSB Agreement provides for credit availability for the Fund, such that it may borrow up to $430 million. As of October 31, 2023, the Fund had utilized $314 million of the $430 million available under the SSB Agreement ($260 million of advances outstanding, and $54 million in structural leverage consisting of collateral received from counterparties via State Street Bank and Trust Company in connection with securities on loan), representing 28.1% of the Fund's managed assets as of that date,

www.calamos.com

9

Additional Information About the Funds (Unaudited)

and had $133 million of MRP Shares outstanding, representing 11.9% of the Fund's managed assets. Combined, the borrowings under the SSB Agreement and the outstanding MRP Shares represented 39.9% of the Fund's managed assets. Interest on the SSB Agreement was charged on the drawn amount at the rate of the Overnight Bank Financing Rate ("OBFR") plus 0.80%, payable monthly in arrears, from November 1, 2022, through June 30, 2023. The rate from July 1, 2023, through October 31, 2023, was OBFR plus 0.52%. Interest on overdue amounts or interest on the drawn amount paid during an event of default was charged OBFR plus 2.80% from November 1, 2022, through June 30, 2023. The rate from July 1, 2023, through October 31, 2023, was charged at OBFR plus 2.52%. These rates represent floating rates of interest that may change over time. The SSB Agreement has a commitment fee of 0.10% of any undrawn amount.

As of October 31, 2023, the interest rate charged under the SSB Agreement was 5.84%.

The Fund's MRP Shareholders are entitled to receive monthly cash dividends, at a currently effective dividend rate per annum for each series of MRP Shares as follows (subject to adjustment as described in the Fund's prospectus): 4.00% for Series B MRP Shares, 4.24% for Series C MRP Shares, 2.45% for Series D MRP Shares, and 2.68% for Series E MRP Shares.

To cover the interest expense on the borrowings under the SSB Agreement (including "net income" payments made with respect to borrowings offset by collateral for securities on loan) and the dividend payments associated with the MRP Shares, based on rates in effect on October 31, 2023, the Fund's portfolio would need to experience an annual return of 2.06% (before giving effect to expenses associated with senior securities).

The following table illustrates the hypothetical effect on the return to a holder of the Fund's common shares of the leverage obtained by us (and utilized on October 31, 2023). The purpose of this table is to assist you in understanding the effects of leverage. As the table shows, leverage generally increases the return to common shareholders when portfolio return is positive and greater than the cost of leverage and decreases the return when the portfolio return is negative or less than the cost of leverage. The figures appearing in the table are hypothetical and actual returns may be greater or less than those appearing in the table.

Assumed Portfolio Return (Net of Expenses) | | | (10.00 | )% | | | (5.00 | )% | | | 0.00 | % | | | 5.00 | % | | | 10.00 | % | |

Corresponding Common Share Return(1) | | | (20.13 | )% | | | (11.78 | )% | | | (3.43 | )% | | | 4.92 | % | | | 13.27 | % | |

(1) Includes interest expense on the borrowings under the SSB Agreement, accrued at interest rates in effect on October 31, 2023 of 5.84%, and dividend expense on the MRP Shares.

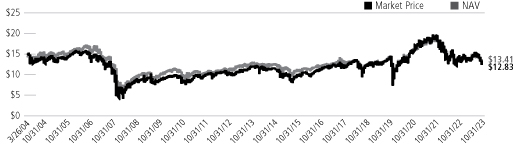

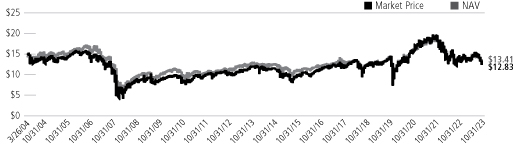

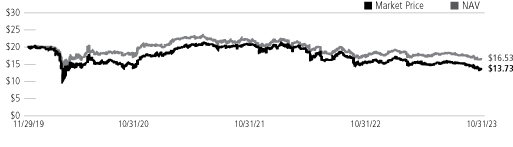

Market and Net Asset Value Information

Our common shares have traded both at a premium and a discount to NAV. We cannot predict whether our shares will trade in the future at a premium or discount to NAV. The provisions of the 1940 Act generally require that the public offering price of common shares (less any underwriting commissions and discounts) must equal or exceed the NAV per share of a company's common stock (calculated within 48 hours of pricing). Our issuance of common shares may have an adverse effect on prices in the secondary market for our common shares by increasing the number of common shares available, which may put downward pressure on the market price for our common shares. Shares of common stock of closed-end investment companies frequently trade at a discount from NAV.

The following table sets forth for each of the periods indicated the high and low closing market prices for our common shares on Nasdaq, the NAV per share and the premium or discount to NAV per share at which our common shares were trading. NAV is shown for the last business day of each quarter. See "Net Asset Value" for information as to the determination of our NAV.

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

10

Additional Information About the Funds (Unaudited)

| | | MARKET PRICE(1) | | NET ASSET

VALUE AT

QUARTER | | PREMIUM/

(DISCOUNT) TO

NET ASSET VALUE(3) | |

QUARTER ENDED | | HIGH | | LOW | | END(2) | | HIGH | | LOW | |

October 31, 2023 | | $ | 11.32 | | | $ | 10.00 | | | $ | 8.99 | | | | 15.20 | % | | | 4.56 | % | |

July 31, 2023 | | $ | 11.36 | | | $ | 9.90 | | | $ | 10.51 | | | | 10.21 | % | | | 1.53 | % | |

April 30, 2023 | | $ | 12.34 | | | $ | 10.21 | | | $ | 9.94 | | | | 16.91 | % | | | 1.49 | % | |

January 31, 2023 | | $ | 12.09 | | | $ | 10.51 | | | $ | 10.61 | | | | 15.03 | % | | | 3.89 | % | |

October 31, 2022 | | $ | 12.90 | | | $ | 9.66 | | | $ | 10.25 | | | | 14.01 | % | | | -3.36 | % | |

July 31, 2022 | | $ | 13.00 | | | $ | 10.17 | | | $ | 11.18 | | | | 16.28 | % | | | -2.33 | % | |

April 30, 2022 | | $ | 14.50 | | | $ | 11.81 | | | $ | 12.05 | | | | 4.69 | % | | | -4.58 | % | |

January 31, 2022 | | $ | 16.34 | | | $ | 12.96 | | | $ | 13.62 | | | | 4.21 | % | | | -4.14 | % | |

October 31, 2021 | | $ | 15.90 | | | $ | 14.93 | | | $ | 15.49 | | | | 3.31 | % | | | -0.20 | % | |

July 31, 2021 | | $ | 15.45 | | | $ | 14.01 | | | $ | 15.05 | | | | 1.25 | % | | | -1.34 | % | |

April 30, 2021 | | $ | 15.32 | | | $ | 13.65 | | | $ | 15.33 | | | | -1.54 | % | | | -8.08 | % | |

January 31, 2021 | | $ | 14.13 | | | $ | 10.94 | | | $ | 15.07 | | | | -9.19 | % | | | -12.97 | % | |

Source: Fund Accounting Records

(1) Based on high and low closing market price per share during the respective quarter and does not reflect commissions.

(2) Based on the NAV calculated on the close of business on the last business day of each calendar quarter.

(3) Premium and discount information is shown for the days when the Fund experienced its high and low closing market prices, respectively, per share during the respective quarter.

www.calamos.com

11

Additional Information About the Funds (Unaudited)

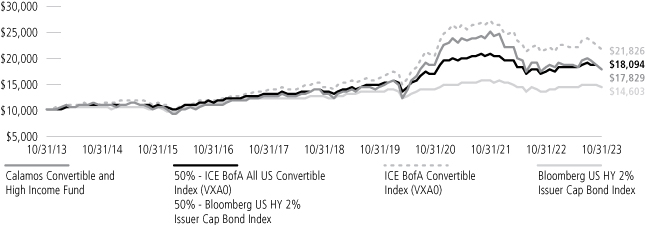

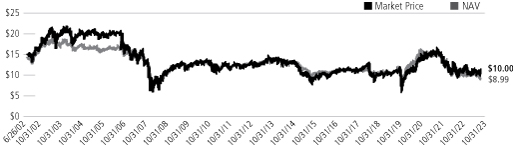

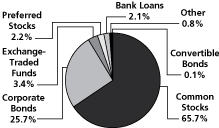

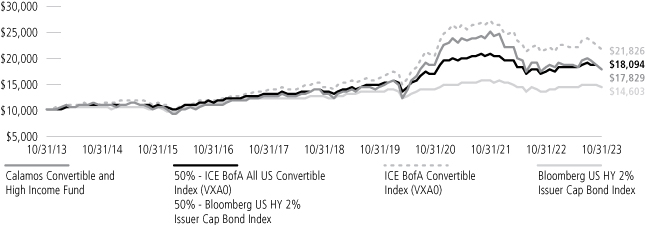

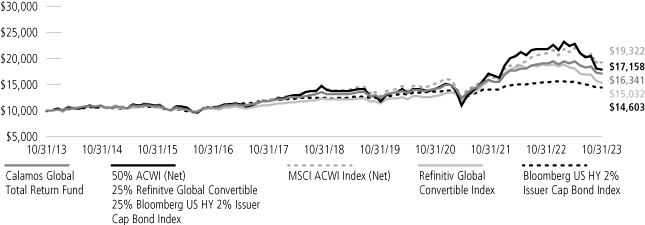

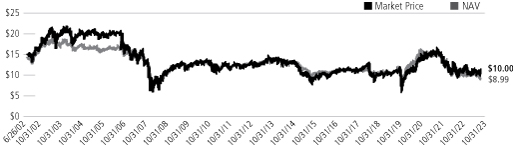

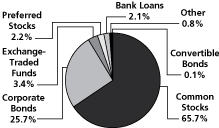

Calamos Convertible and High Income Fund

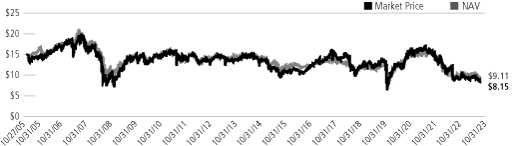

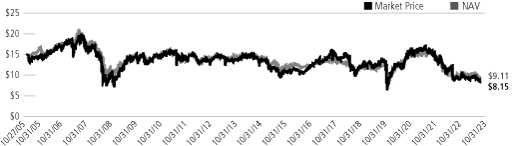

GROWTH OF $10,000: FOR THE 10-YEAR PERIOD ENDED 10/31/23

AVERAGE ANNUAL TOTAL RETURN† AS OF 10/31/23

| | | 1

YEAR | | 5

YEARS | | 10

YEARS | | SINCE

INCEPTION | |

Calamos Convertible and High Income Fund | |

Market Value | | | 10.32 | % | | | 9.81 | % | | | 8.24 | % | | | 8.19 | % | |

NAV | | | -1.99 | | | | 6.56 | | | | 5.95 | | | | 7.72 | | |

50%VXAO-50%BBGUSHY2%Cap Index | | | 2.88 | | | | 6.05 | | | | 6.11 | | | | 7.42 | | |

ICE BofA All US Convertible Index (VXA0) | | | -0.48 | | | | 8.73 | | | | 8.12 | | | | 7.96 | | |

Bloomberg US HY 2% Issuer Cap Bond Index | | | 6.23 | | | | 3.04 | | | | 3.86 | | | | 6.61 | | |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gain distributions. Source: State Street Corporation and Morningstar Direct.

† Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions.

NOTES:

The 50%VXAO-50%BBGUSHY2%Cap Index is blended from 50% - ICE BofA All US Convertibles Index (VXA0) and 50% - Bloomberg US HY 2% Issuer Capped Index.

The ICE BofA All US Convertibles Index is comprised of approximately 700 issues of only convertible bonds and preferreds of all qualities.

The Bloomberg US Corporate High Yield 2% Issuer Capped Index measures the performance of high-yield corporate bonds with a maximum allocation of 2% to any one issuer.

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

12

Additional Information About the Funds (Unaudited)

Calamos Convertible and High Income Fund

Senior Securities

The following table sets forth information regarding the Fund's outstanding bank loans, and mandatory redeemable preferred shares ("MRPS") as of the end of each of the Fund's last ten fiscal years, as applicable. The information in the table shown below comes from the Fund's financial statements for the fiscal year ended October 31, 2023, and each of the prior nine years then ended, all of which have been audited by Deloitte & Touche LLP, the Fund's independent registered public accounting firm.

| FISCAL YEAR ENDED | | TOTAL

AMOUNT

OUTSTANDING | | ASSET

COVERAGE | | LIQUIDATING

PREFERENCE

PER PREFERRED

SHARE(c) | | AVERAGE

MARKET VALUE

PER PREFERRED

SHARE | | TYPE OF

SENIOR

SECURITY | |

October 31, 2023 | | $ | 340,400,000 | | | $ | 3,556 | (a) | | | — | | | | — | | | Loan | |

October 31, 2023 | | $ | 145,000,000 | | | | 209 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2022 | | $ | 365,400,000 | | | | 3,635 | (a) | | | — | | | | — | | | Loan | |

October 31, 2022 | | $ | 145,000,000 | | | | 229 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2021 | | $ | 435,400,000 | | | | 4,106 | (a) | | | — | | | | — | | | Loan | |

October 31, 2021 | | $ | 145,000,000 | | | | 308 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2020 | | $ | 318,400,000 | | | | 4,386 | (a) | | | — | | | | — | | | Loan | |

October 31, 2020 | | $ | 110,000,000 | | | | 317 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2019 | | $ | 303,900,000 | | | | 4,055 | (a) | | | — | | | | — | | | Loan | |

October 31, 2019 | | $ | 110,000,000 | | | | 280 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2018 | | $ | 315,500,000 | | | | 3,904 | (a) | | | — | | | | — | | | Loan | |

October 31, 2018 | | $ | 110,000,000 | | | | 280 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2017 | | $ | 302,500,000 | | | | 4,236 | (a) | | | — | | | | — | | | Loan | |

October 31, 2017 | | $ | 110,000,000 | | | | 291 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2016 | | $ | 337,000,000 | | | | 3,440 | (a) | | | — | | | | — | | | Loan | |

October 31, 2015 | | $ | 398,000,000 | | | | 3,258 | (a) | | | — | | | | — | | | Loan | |

October 31, 2014 | | $ | 400,000,000 | | | | 3,575 | (a) | | | — | | | | — | | | Loan | |

(a) Calculated by subtracting the Fund's total liabilities (not including notes payable) from the Fund's total assets and dividing this by the amount of notes payable outstanding, and by multiplying the result by 1,000.

(b) Calculated by subtracting the Fund's total liabilities (not including MRPS) from the Fund's total assets and dividing this by the number of MRPS outstanding, and by multiplying the result by 25.

(c) "Liquidating Preference per Preferred Share" means the amount to which a holder of preferred shares would be entitled upon the liquidation of the Fund in preference to common shareholders, expressed as a dollar amount per preferred share.

(d) The MRPS are not listed on any exchange or automated quotation system. The MRPS are considered debt of the issuer; and the liquidation preference approximates fair value.

Summary of Fund Expenses

The following table and example contain information about the costs and expenses that common shareholders will bear directly or indirectly. In accordance with Commission requirements, the table below shows our expenses, including interest payments on borrowed funds, and preferred stock dividend payments, as a percentage of our average net assets as of October 31, 2023, and not as a percentage of gross assets or managed assets.

By showing expenses as a percentage of average net assets, expenses are not expressed as a percentage of all of the assets we invest. The table and example are based on our capital structure as of October 31, 2023. As of October 31, 2023, the Fund had utilized $340 million of the $480 million available under the SSB Agreement ($291 million in advances outstanding, and $49 million in structural leverage consisting of collateral received from counterparties via SSB in connection with securities on loan), representing 28.1% of the Fund's managed assets as of that date, and had $145 million in MRPS outstanding, representing 12.0% of the Fund's managed assets. Combined, the borrowings under the SSB Agreement and the outstanding MRPS represented 40.1% of the Fund's managed assets.

www.calamos.com

13

Additional Information About the Funds (Unaudited)

SHAREHOLDER TRANSACTION EXPENSES | |

Sales Load (as a percentage of offering price) | | | — | (1) | |

Offering Expenses Borne by the Fund (as a percentage of offering price) | | | — | (1) | |

Dividend Reinvestment Plan Fees (per sales transaction fee)(2) | | $ | 15.00 | | |

| ANNUAL EXPENSES | | PERCENTAGE

OF AVERAGE

NET ASSETS

ATTRIBUTABLE

TO COMMON

SHAREHOLDERS | |

Management Fee(3) | | | 1.29 | % | |

Interest Payments on Borrowed Funds(4) | | | 2.39 | % | |

Preferred Stock Dividend Payments(5) | | | 0.63 | % | |

Other Expenses(6) | | | 0.10 | % | |

Total Annual Expenses | | | 4.41 | % |

The following example illustrates the expenses that common shareholders would pay on a $1,000 investment in common shares, assuming (1) total annual expenses of 4.41% of net assets attributable to common shareholders; (2) a 5% annual return; and (3) all distributions are reinvested at net asset value:

| | | 1 YEAR | | 3 YEARS | | 5 YEARS | | 10 YEARS | |

Total Expenses Paid by Common Shareholders(7) | | $ | 44 | | | $ | 133 | | | $ | 223 | | | $ | 454 | | |

The example should not be considered a representation of future expenses. Actual expenses may be greater or less than those assumed. Moreover, our actual rate of return may be greater or less than the hypothetical 5% return shown in the example.

(1) If the securities to which this prospectus relates are sold to or through underwriters, the prospectus supplement will set forth any applicable sales load and the estimated offering expenses borne by us.

(2) Shareholders will pay a $15.00 transaction fee plus a $0.02 per share brokerage charge if they direct the Plan Agent (as defined below) to sell common shares held in a Plan account. In addition, each participant will pay a pro rata share of brokerage commissions incurred with respect to the Plan Agent's open-market purchases in connection with the reinvestment of dividends or distributions. If a participant elects to have the Plan Agent sell part or all of his or her common shares and remit the proceeds, such participant will be charged his or her pro rata share of brokerage commissions on the shares sold. See "Dividends and Distributions on Common Shares; Automatic Dividend Reinvestment Plan".

(3) The Fund pays Calamos an annual management fee, payable monthly in arrears, for its investment management services in an amount equal to 0.80% of the Fund's average weekly managed assets. In accordance with the requirements of the Commission, the table above shows the Fund's management fee as a percentage of average net assets attributable to common shareholders. By showing the management fee as a percentage of net assets, the management fee is not expressed as a percentage of all of the assets the Fund intends to invest. For purposes of the table, the management fee has been converted to 1.29% of the Fund's average weekly net assets as of October 31, 2023 by dividing the total dollar amount of the management fee by the Fund's average weekly net assets (managed assets less outstanding leverage).

(4) Reflects interest expense paid on $254 million in average borrowings under the SSB Agreement, plus $96 million in additional average structural leverage related to certain securities lending programs, as described under "Leverage".

(5) Reflects estimated dividend expense on $145 million aggregate liquidation preference of mandatory redeemable preferred shares outstanding. See "Leverage".

(6) "Other Expenses" are based on estimated amounts for the Fund's current fiscal year.

(7) The example does not include sales load or estimated offering costs, which would cause the expenses shown in the example to increase. In connection with an offering of common shares, the applicable prospectus supplement will set forth an example including sales load and estimated offering costs.

Effects of Leverage

The SSB Agreement provides for credit availability for the Fund, such that it may borrow up to $480 million. As of October 31, 2023, the Fund had utilized $340 million of the $480 million available under the SSB Agreement ($291 million of advances outstanding, and $49 million in structural leverage consisting of collateral received from counterparties via State Street Bank and Trust Company in connection with securities on loan), representing 28.1% of the Fund's managed assets as of that date,

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

14

Additional Information About the Funds (Unaudited)

and had $145 million of MRP Shares outstanding, representing 12.0% of the Fund's managed assets. Combined, the borrowings under the SSB Agreement and the outstanding MRP Shares represented 40.1% of the Fund's managed assets. Interest on the SSB Agreement was charged on the drawn amount at the rate of the Overnight Bank Financing Rate ("OBFR") plus 0.80%, payable monthly in arrears, from November 1, 2022, through June 30, 2023. The rate from July 1, 2023, through October 31, 2023, was OBFR plus 0.52%. Interest on overdue amounts or interest on the drawn amount paid during an event of default was charged OBFR plus 2.80% from November 1, 2022, through June 30, 2023. The rate from July 1, 2023, through October 31, 2023, was charged at OBFR plus 2.52%. These rates represent floating rates of interest that may change over time. The SSB Agreement has a commitment fee of 0.10% of any undrawn amount.

As of October 31, 2023, the interest rate charged under the SSB Agreement was 5.84%.

The Fund's MRP Shareholders are entitled to receive monthly cash dividends, at a currently effective dividend rate per annum for each series of MRP Shares as follows (subject to adjustment as described in the Fund's prospectus): 4.00% for Series B MRP Shares, 4.24% for Series C MRP Shares, 2.45% for Series D MRP Shares, and 2.68% for Series E MRP Shares.

To cover the interest expense on the borrowings under the SSB Agreement (including "net income" payments made with respect to borrowings offset by collateral for securities on loan) and the dividend payments associated with the MRP Shares, based on rates in effect on October 31, 2023, the Fund's portfolio would need to experience an annual return of 2.06% (before giving effect to expenses associated with senior securities).

The following table illustrates the hypothetical effect on the return to a holder of the Fund's common shares of the leverage obtained by us (and utilized on October 31, 2023). The purpose of this table is to assist you in understanding the effects of leverage. As the table shows, leverage generally increases the return to common shareholders when portfolio return is positive and greater than the cost of leverage and decreases the return when the portfolio return is negative or less than the cost of leverage. The figures appearing in the table are hypothetical and actual returns may be greater or less than those appearing in the table.

Assumed Portfolio Return (Net of Expenses) | | | (10.00 | )% | | | (5.00 | )% | | | 0.00 | % | | | 5.00 | % | | | 10.00 | % | |

Corresponding Common Share Return(1) | | | (20.13 | )% | | | (11.78 | )% | | | (3.43 | )% | | | 4.92 | % | | | 13.27 | % | |

(1) Includes interest expense on the borrowings under the SSB Agreement, accrued at interest rates in effect on October 31, 2023 of 5.84%, and dividend expense on the MRP Shares.

Market and Net Asset Value Information

Our common shares have traded both at a premium and a discount to NAV. We cannot predict whether our shares will trade in the future at a premium or discount to NAV. The provisions of the 1940 Act generally require that the public offering price of common shares (less any underwriting commissions and discounts) must equal or exceed the NAV per share of a company's common stock (calculated within 48 hours of pricing). Our issuance of common shares may have an adverse effect on prices in the secondary market for our common shares by increasing the number of common shares available, which may put downward pressure on the market price for our common shares. Shares of common stock of closed-end investment companies frequently trade at a discount from NAV.

The following table sets forth for each of the periods indicated the high and low closing market prices for our common shares on Nasdaq, the NAV per share and the premium or discount to NAV per share at which our common shares were trading. NAV is shown for the last business day of each quarter. See "Net Asset Value" for information as to the determination of our NAV.

www.calamos.com

15

Additional Information About the Funds (Unaudited)

| | | MARKET PRICE(1) | | NET ASSET

VALUE AT

QUARTER | | PREMIUM/

(DISCOUNT) TO

NET ASSET VALUE(3) | |

QUARTER ENDED | | HIGH | | LOW | | END(2) | | HIGH | | LOW | |

October 31, 2023 | | $ | 11.64 | | | $ | 10.79 | | | $ | 9.49 | | | | 15.01 | % | | | 3.65 | % | |

July 31, 2023 | | $ | 11.56 | | | $ | 10.03 | | | $ | 11.09 | | | | 4.51 | % | | | -3.00 | % | |

April 30, 2023 | | $ | 12.77 | | | $ | 10.58 | | | $ | 10.50 | | | | 14.88 | % | | | -0.28 | % | |

January 31, 2023 | | $ | 12.38 | | | $ | 10.55 | | | $ | 11.19 | | | | 10.73 | % | | | 0.38 | % | |

October 31, 2022 | | $ | 13.38 | | | $ | 10.09 | | | $ | 10.81 | | | | 10.88 | % | | | -3.54 | % | |

July 31, 2022 | | $ | 13.26 | | | $ | 10.69 | | | $ | 11.77 | | | | 12.66 | % | | | -2.32 | % | |

April 30, 2022 | | $ | 15.21 | | | $ | 12.64 | | | $ | 12.70 | | | | 4.37 | % | | | -3.38 | % | |

January 31, 2022 | | $ | 17.08 | | | $ | 13.68 | | | $ | 14.37 | | | | 4.05 | % | | | -4.07 | % | |

October 31, 2021 | | $ | 16.61 | | | $ | 15.50 | | | $ | 16.38 | | | | 1.37 | % | | | -1.90 | % | |

July 31, 2021 | | $ | 16.45 | | | $ | 14.91 | | | $ | 15.89 | | | | 2.17 | % | | | -0.47 | % | |

April 30, 2021 | | $ | 16.10 | | | $ | 14.28 | | | $ | 16.18 | | | | -1.95 | % | | | -8.87 | % | |

January 31, 2021 | | $ | 15.01 | | | $ | 11.54 | | | $ | 15.90 | | | | -8.75 | % | | | -12.91 | % | |

Source: Fund Accounting Records

(1) Based on high and low closing market price per share during the respective quarter and does not reflect commissions.

(2) Based on the NAV calculated on the close of business on the last business day of each calendar quarter.

(3) Premium and discount information is shown for the days when the Fund experienced its high and low closing market prices, respectively, per share during the respective quarter.

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

16

Additional Information About the Funds (Unaudited)

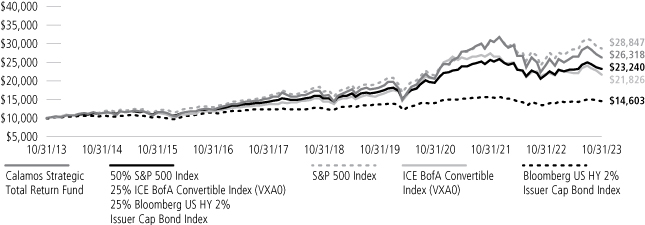

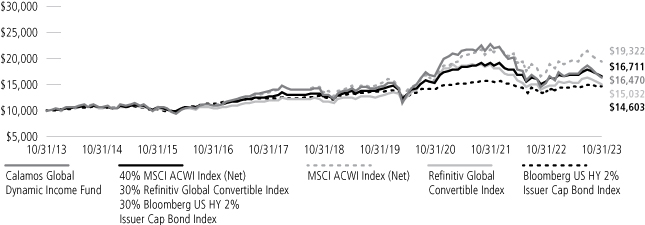

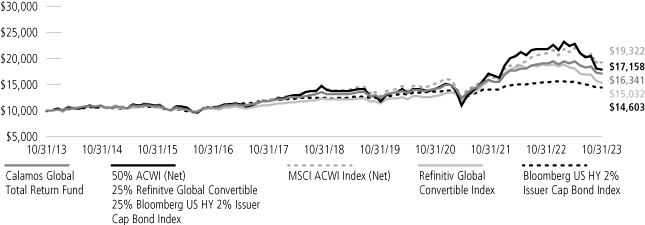

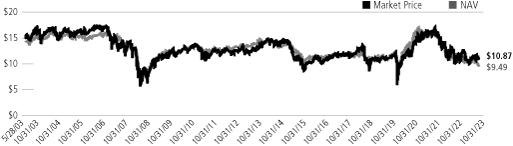

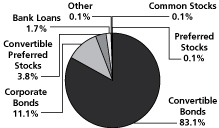

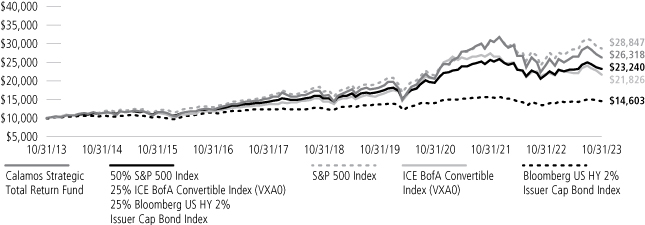

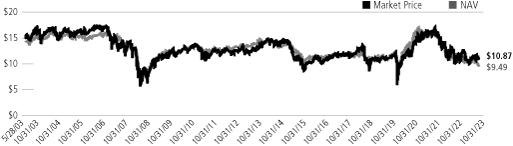

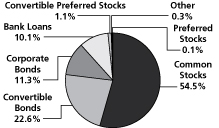

Calamos Strategic Total Return Fund

GROWTH OF $10,000: FOR THE 10-YEAR PERIOD ENDED 10/31/23

AVERAGE ANNUAL TOTAL RETURN† AS OF 10/31/23

| | | 1

YEAR | | 5

YEARS | | 10

YEARS | | SINCE

INCEPTION | |

Calamos Strategic Total Return Fund | |

Market Value | | | 1.80 | % | | | 10.41 | % | | | 10.95 | % | | | 7.89 | % | |

NAV | | | 7.89 | | | | 10.47 | | | | 10.16 | | | | 8.39 | | |

50%SPX-25%VXAO-25%BBGUSHY2%Cap Index | | | 6.59 | | | | 8.78 | | | | 8.80 | | | | 8.29 | | |

S&P 500 Index | | | 10.14 | | | | 11.01 | | | | 11.18 | | | | 9.16 | | |

ICE BofA All US Convertibles Index (VXA0) | | | -0.48 | | | | 8.73 | | | | 8.12 | | | | 7.42 | | |

Bloomberg US HY 2% Issuer Cap Bond Index | | | 6.23 | | | | 3.04 | | | | 3.86 | | | | 6.17 | | |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gain distributions. Source: State Street Corporation and Morningstar Direct.

† Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions.

NOTES:

The 50%SPX-25%VXA0-25%BBGUSHY2%Cap Index is blended from 50% - S&P 500 Index (SPX), 25% - ICE BofA All US Convertibles Index (VXA0) and 25% - Bloomberg US HY 2% Issuer Capped Index.

The S&P 500 Index is an unmanaged index generally considered representative of the US stock market.

The ICE BofA All US Convertibles Index is comprised of approximately 700 issues of only convertible bonds and preferreds of all qualities.

The Bloomberg US Corporate High Yield 2% Issuer Capped Index measures the performance of high-yield corporate bonds with a maximum allocation of 2% to any one issuer.

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

www.calamos.com

17

Additional Information About the Funds (Unaudited)

Calamos Strategic Total Return Fund

Senior Securities

The following table sets forth information regarding the Fund's outstanding bank loans, and mandatory redeemable preferred shares ("MRPS") as of the end of each of the Fund's last ten fiscal years, as applicable. The information in the table shown below comes from the Fund's financial statements for the fiscal year ended October 31, 2023, and each of the prior nine years then ended, all of which have been audited by Deloitte & Touche LLP, the Fund's independent registered public accounting firm.

| FISCAL YEAR ENDED | | TOTAL

AMOUNT

OUTSTANDING | | ASSET

COVERAGE | | LIQUIDATING

PREFERENCE

PER PREFERRED

SHARE(c) | | AVERAGE

MARKET VALUE

PER PREFERRED

SHARE | | TYPE OF

SENIOR

SECURITY | |

October 31, 2023 | | $ | 800,500,000 | | | $ | 4,090 | (a) | | | — | | | | — | | | Loan | |

October 31, 2023 | | $ | 323,500,000 | | | | 253 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2022 | | $ | 800,500,000 | | | | 4,098 | (a) | | | — | | | | — | | | Loan | |

October 31, 2022 | | $ | 323,500,000 | | | | 254 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2021 | | $ | 880,000,000 | | | | 4,673 | (a) | | | — | | | | — | | | Loan | |

October 31, 2021 | | $ | 304,000,000 | | | | 338 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2020 | | $ | 703,000,000 | | | | 4,276 | (a) | | | — | | | | — | | | Loan | |

October 31, 2020 | | $ | 242,000,000 | | | | 311 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2019 | | $ | 668,000,000 | | | | 4,357 | (a) | | | — | | | | — | | | Loan | |

October 31, 2019 | | $ | 242,000,000 | | | | 301 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2018 | | $ | 713,000,000 | | | | 3,995 | (a) | | | — | | | | — | | | Loan | |

October 31, 2018 | | $ | 242,000,000 | | | | 294 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2017 | | $ | 543,000,000 | | | | 5,077 | (a) | | | — | | | | — | | | Loan | |

October 31, 2017 | | $ | 242,000,000 | | | | 285 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2016 | | $ | 682,000,000 | | | | 3,521 | (a) | | | — | | | | — | | | Loan | |

October 31, 2015 | | $ | 716,000,000 | | | | 3,518 | (a) | | | — | | | | — | | | Loan | |

October 31, 2014 | | $ | 725,000,000 | | | | 3,665 | (a) | | | — | | | | — | | | Loan | |

(a) Calculated by subtracting the Fund's total liabilities (not including notes payable) from the Fund's total assets and dividing this by the amount of notes payable outstanding, and by multiplying the result by 1,000.

(b) Calculated by subtracting the Fund's total liabilities (not including MRPS) from the Fund's total assets and dividing this by the number of MRPS outstanding, and by multiplying the result by 25.

(c) "Liquidating Preference per Preferred Share" means the amount to which a holder of preferred shares would be entitled upon the liquidation of the Fund in preference to common shareholders, expressed as a dollar amount per preferred share.

(d) The MRPS are not listed on any exchange or automated quotation system. The MRPS are considered debt of the issuer; and the liquidation preference approximates fair value.

Summary of Fund Expenses

The following table and example contain information about the costs and expenses that common shareholders will bear directly or indirectly. In accordance with Commission requirements, the table below shows our expenses, including interest payments on borrowed funds, and preferred stock dividend payments, as a percentage of our average net assets as of October 31, 2023, and not as a percentage of gross assets or managed assets.

By showing expenses as a percentage of average net assets, expenses are not expressed as a percentage of all of the assets we invest. The table and example are based on our capital structure as of October 31, 2023. As of October 31, 2023, the Fund had utilized $801 million of the $1.13 billion available under the SSB Agreement ($735 million in advances outstanding and $66 million in structural leverage consisting of collateral received from counterparties via SSB in connection with securities on loan), representing 24.5% of the Fund's managed assets as of that date, and had $323.5 million in MRPS outstanding, representing 9.9% of the Fund's managed assets. Combined, the borrowings under the SSB Agreement and the outstanding MRPS represented 34.3% of the Fund's managed assets.

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

18

Additional Information About the Funds (Unaudited)

SHAREHOLDER TRANSACTION EXPENSES | |

Sales Load (as a percentage of offering price) | | | — | (1) | |

Offering Expenses Borne by the Fund (as a percentage of offering price) | | | — | (1) | |

Dividend Reinvestment Plan Fees (per sales transaction fee)(2) | | $ | 15.00 | | |

| ANNUAL EXPENSES | | PERCENTAGE

OF AVERAGE

NET ASSETS

ATTRIBUTABLE

TO COMMON

SHAREHOLDERS | |

Management Fee(3) | | | 1.50 | % | |

Interest Payments on Borrowed Funds(4) | | | 1.97 | % | |

Preferred Stock Dividend Payments(5) | | | 0.55 | % | |

Other Expenses(6) | | | 0.07 | % | |

Total Annual Expenses | | | 4.09 | % |

The following example illustrates the expenses that common shareholders would pay on a $1,000 investment in common shares, assuming (1) total annual expenses of 4.09% of net assets attributable to common shareholders; (2) a 5% annual return; and (3) all distributions are reinvested at net asset value:

| | | 1 YEAR | | 3 YEARS | | 5 YEARS | | 10 YEARS | |

Total Expenses Paid by Common Shareholders(7) | | $ | 41 | | | $ | 124 | | | $ | 209 | | | $ | 428 | | |

The example should not be considered a representation of future expenses. Actual expenses may be greater or less than those assumed. Moreover, our actual rate of return may be greater or less than the hypothetical 5% return shown in the example.

(1) If the securities to which this prospectus relates are sold to or through underwriters, the prospectus supplement will set forth any applicable sales load and the estimated offering expenses borne by us.

(2) Shareholders will pay a $15.00 transaction fee plus a $0.02 per share brokerage charge if they direct the Plan Agent (as defined below) to sell common shares held in a Plan account. In addition, each participant will pay a pro rata share of brokerage commissions incurred with respect to the Plan Agent's open-market purchases in connection with the reinvestment of dividends or distributions. If a participant elects to have the Plan Agent sell part or all of his or her common shares and remit the proceeds, such participant will be charged his or her pro rata share of brokerage commissions on the shares sold. See "Dividends and Distributions on Common Shares; Automatic Dividend Reinvestment Plan".

(3) The Fund pays Calamos an annual management fee, payable monthly in arrears, for its investment management services in an amount equal to 1.00% of the Fund's average weekly managed assets. In accordance with the requirements of the Commission, the table above shows the Fund's management fee as a percentage of average net assets attributable to common shareholders. By showing the management fee as a percentage of net assets, the management fee is not expressed as a percentage of all of the assets the Fund intends to invest. For purposes of the table, the management fee has been converted to 1.50% of the Fund's average weekly net assets as of October 31, 2023 by dividing the total dollar amount of the management fee by the Fund's average weekly net assets (managed assets less outstanding leverage).

(4) Reflects interest expense paid on $65 million in average borrowings under the SSB Agreement, plus $736 million in additional average structural leverage related to certain securities lending programs, as described under "Leverage".

(5) Reflects estimated dividend expense on $323.5 million aggregate liquidation preference of mandatory redeemable preferred shares outstanding. See "Leverage".

(6) "Other Expenses" are based on estimated amounts for the Fund's current fiscal year.

(7) The example does not include sales load or estimated offering costs, which would cause the expenses shown in the example to increase. In connection with an offering of common shares, the applicable prospectus supplement will set forth an example including sales load and estimated offering costs.

Effects of Leverage

The SSB Agreement provides for credit availability for the Fund, such that it may borrow up to $1.13 billion. As of October 31, 2023, the Fund had utilized $801 million of the $1.13 billion available under the SSB Agreement ($735 million of advances outstanding, and $66 million in structural leverage consisting of collateral received from counterparties via State Street Bank and Trust Company in

www.calamos.com

19

Additional Information About the Funds (Unaudited)

connection with securities on loan), representing 24.5% of the Fund's managed assets as of that date, and had $323.5 million of MRP Shares outstanding, representing 24.5% of the Fund's managed assets. Combined, the borrowings under the SSB Agreement and the outstanding MRP Shares represented 34.3% of the Fund's managed assets. Interest on the SSB Agreement was charged on the drawn amount at the rate of the Overnight Bank Financing Rate ("OBFR") plus 0.80%, payable monthly in arrears, from November 1, 2022, through June 30, 2023. The rate from July 1, 2023, through October 31, 2023, was OBFR plus 0.52%. Interest on overdue amounts or interest on the drawn amount paid during an event of default was charged OBFR plus 2.80% from November 1, 2022, through June 30, 2023. The rate from July 1, 2023, through October 31, 2023, was charged at OBFR plus 2.52%. These rates represent floating rates of interest that may change over time. The SSB Agreement has a commitment fee of 0.10% of any undrawn amount.

As of October 31, 2023, the interest rate charged under the SSB Agreement was 5.84%.

The Fund's MRP Shareholders are entitled to receive monthly cash dividends, at a currently effective dividend rate per annum for each series of MRP Shares as follows (subject to adjustment as described in the Fund's prospectus): 4.00% for Series B MRP Shares, 4.24% for Series C MRP Shares, 2.45% for Series D MRP Shares and 3.66% for Series F MRP Shares. To cover the interest expense on the borrowings under the SSB Agreement (including "net income" payments made with respect to borrowings offset by collateral for securities on loan) and the dividend payments associated with the MRP Shares, based on rates in effect on October 31, 2023, the Fund's portfolio would need to experience an annual return of 1.79% (before giving effect to expenses associated with senior securities).

The following table illustrates the hypothetical effect on the return to a holder of the Fund's common shares of the leverage obtained by us (and utilized on October 31, 2023). The purpose of this table is to assist you in understanding the effects of leverage. As the table shows, leverage generally increases the return to common shareholders when portfolio return is positive and greater than the cost of leverage and decreases the return when the portfolio return is negative or less than the cost of leverage. The figures appearing in the table are hypothetical and actual returns may be greater or less than those appearing in the table.

Assumed Portfolio Return (Net of Expenses) | | | (10.00 | )% | | | (5.00 | )% | | | 0.00 | % | | | 5.00 | % | | | 10.00 | % | |

Corresponding Common Share Return(1) | | | (17.93 | )% | | | (10.33 | )% | | | (2.73 | )% | | | 4.87 | % | | | 12.47 | % | |

(1) Includes interest expense on the borrowings under the SSB Agreement, accrued at interest rates in effect on October 31, 2023 of 5.84%, and dividend expense on the MRP Shares.

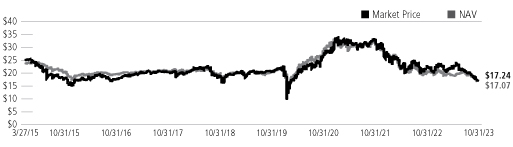

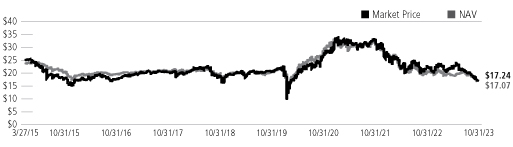

Market and Net Asset Value Information

Our common shares have traded both at a premium and a discount to NAV. We cannot predict whether our shares will trade in the future at a premium or discount to NAV. The provisions of the 1940 Act generally require that the public offering price of common shares (less any underwriting commissions and discounts) must equal or exceed the NAV per share of a company's common stock (calculated within 48 hours of pricing). Our issuance of common shares may have an adverse effect on prices in the secondary market for our common shares by increasing the number of common shares available, which may put downward pressure on the market price for our common shares. Shares of common stock of closed-end investment companies frequently trade at a discount from NAV.

The following table sets forth for each of the periods indicated the high and low closing market prices for our common shares on Nasdaq, the NAV per share and the premium or discount to NAV per share at which our common shares were trading. NAV is shown for the last business day of each quarter. See "Net Asset Value" for information as to the determination of our NAV.

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

20

Additional Information About the Funds (Unaudited)

| | | MARKET PRICE(1) | | NET ASSET

VALUE AT

QUARTER | | PREMIUM/

(DISCOUNT) TO

NET ASSET VALUE(3) | |

QUARTER ENDED | | HIGH | | LOW | | END(2) | | HIGH | | LOW | |

October 31, 2023 | | $ | 15.28 | | | $ | 12.54 | | | $ | 13.41 | | | | 2.99 | % | | | -4.80 | % | |

July 31, 2023 | | $ | 15.28 | | | $ | 13.29 | | | $ | 15.23 | | | | 0.86 | % | | | -3.56 | % | |

April 30, 2023 | | $ | 14.91 | | | $ | 13.15 | | | $ | 14.10 | | | | 3.77 | % | | | -2.41 | % | |

January 31 ,2023 | | $ | 14.62 | | | $ | 12.94 | | | $ | 14.14 | | | | 2.58 | % | | | -1.14 | % | |

October 31, 2022 | | $ | 15.94 | | | $ | 12.20 | | | $ | 13.57 | | | | 3.86 | % | | | -2.92 | % | |

July 31, 2022 | | $ | 15.90 | | | $ | 12.60 | | | $ | 14.98 | | | | 2.40 | % | | | -5.75 | % | |

April 30, 2022 | | $ | 18.33 | | | $ | 15.33 | | | $ | 15.54 | | | | 1.38 | % | | | -2.72 | % | |

January 31, 2022 | | $ | 19.58 | | | $ | 16.66 | | | $ | 17.70 | | | | 3.21 | % | | | -2.96 | % | |

October 31, 2021 | | $ | 18.98 | | | $ | 17.51 | | | $ | 18.62 | | | | 1.93 | % | | | 0.52 | % | |

July 31, 2021 | | $ | 18.41 | | | $ | 16.55 | | | $ | 17.99 | | | | 1.77 | % | | | -1.55 | % | |

April 30, 2021 | | $ | 18.36 | | | $ | 15.91 | | | $ | 17.43 | | | | 5.58 | % | | | 0.13 | % | |

January 31, 2021 | | $ | 16.04 | | | $ | 12.84 | | | $ | 12.84 | | | | -1.72 | % | | | 4.46 | % | |

Source: Fund Accounting Records

(1) Based on high and low closing market price per share during the respective quarter and does not reflect commissions.

(2) Based on the NAV calculated on the close of business on the last business day of each calendar quarter.

(3) Premium and discount information is shown for the days when the Fund experienced its high and low closing market prices, respectively, per share during the respective quarter.

www.calamos.com

21

Additional Information About the Funds (Unaudited)

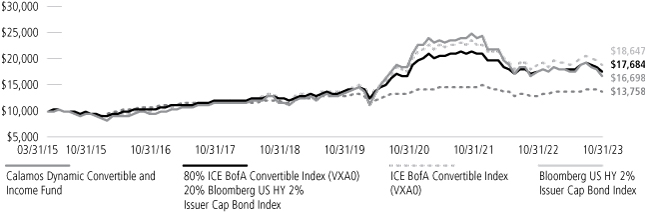

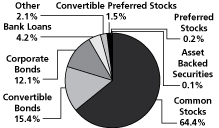

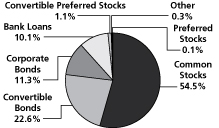

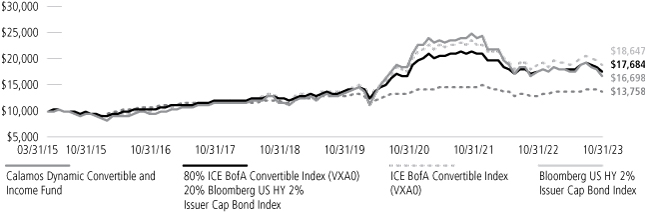

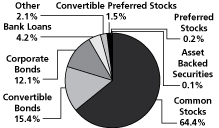

Calamos Dynamic Convertible and Income Fund

GROWTH OF $10,000: SINCE INCEPTION (03/31/15) THROUGH 10/31/23

AVERAGE ANNUAL TOTAL RETURN† AS OF 10/31/23

| | | 1

YEAR | | 5

YEARS | | SINCE

INCEPTION | |

Calamos Dynamic Convertible and Income Fund | |

Market Value | | | -12.56 | % | | | 7.99 | % | | | 5.45 | % | |

NAV | | | -4.26 | | | | 7.52 | | | | 6.14 | | |

80%VXAO-20%BBGUSHY2%Cap Index | | | 0.87 | | | | 7.70 | | | | 6.93 | | |

ICE BofA All US Convertibles Index (VXA0) | | | -0.48 | | | | 8.73 | | | | 7.60 | | |

Bloomberg US HY 2% Issuer Cap Bond Index | | | 6.23 | | | | 3.04 | | | | 3.81 | | |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gain distributions. Source: State Street Corporation and Morningstar Direct.

† Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions.

NOTES:

The graphs do not reflect the income taxes that you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends.

The 80%VXAO-20%BBGUSHY2%Cap Index is blended from 80% - ICE BofA Convertibles Index (VXA0) and 20% - Bloomberg US HY 2% Issuer Capped Index.

The ICE BofA All US Convertibles Index is comprised of approximately 700 issues of only convertible bonds and preferreds of all qualities. Since inception data for the index is shown from 6/30/97, since data is only available for full monthly periods.

The Bloomberg US Corporate High Yield 2% Issuer Capped Index measures the performance of high-yield corporate bonds with a maximum allocation of 2% to any one issuer.

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

22

Additional Information About the Funds (Unaudited)

Calamos Dynamic Convertible and Income Fund

Senior Securities

The following table sets forth information regarding the Fund's outstanding bank loans, and mandatory redeemable preferred shares ("MRPS") as of the end of each of the Fund's last ten fiscal years, as applicable. The information in the table shown below comes from the Fund's financial statements for the fiscal year ended October 31, 2023, and each of the prior eight years then ended, all of which have been audited by Deloitte & Touche LLP, the Fund's independent registered public accounting firm.

| FISCAL YEAR ENDED | | TOTAL

AMOUNT

OUTSTANDING | | ASSET

COVERAGE | | LIQUIDATING

PREFERENCE

PER PREFERRED

SHARE(c) | | AVERAGE

MARKET VALUE

PER PREFERRED

SHARE | | TYPE OF

SENIOR

SECURITY | |

October 31, 2023 | | $ | 210,000,000 | | | $ | 3,626 | (a) | | | — | | | | — | | | Loan | |

October 31, 2023 | | $ | 92,000,000 | | | | 207 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2022 | | $ | 230,000,000 | | | | 3,690 | (a) | | | — | | | | — | | | Loan | |

October 31, 2022 | | $ | 92,000,000 | | | | 231 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2021 | | $ | 270,000,000 | | | | 4,261 | (a) | | | — | | | | — | | | Loan | |

October 31, 2021 | | $ | 92,000,000 | | | | 313 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2020 | | $ | 204,600,000 | | | | 4,304 | (a) | | | — | | | | — | | | Loan | |

October 31, 2020 | | $ | 64,000,000 | | | | 344 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2019 | | $ | 180,600,000 | | | | 4,055 | (a) | | | — | | | | — | | | Loan | |

October 31, 2019 | | $ | 64,000,000 | | | | 286 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2018 | | $ | 187,500,000 | | | | 3,887 | (a) | | | — | | | | — | | | Loan | |

October 31, 2018 | | $ | 64,000,000 | | | | 285 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2017 | | $ | 169,000,000 | | | | 4,413 | (a) | | | — | | | | — | | | Loan | |

October 31, 2017 | | $ | 64,000,000 | | | | 291 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2016 | | $ | 195,000,000 | | | | 3,447 | (a) | | | — | | | | — | | | Loan | |

October 31, 2015 | | $ | 220,000,000 | | | | 3,398 | (a) | | | — | | | | — | | | Loan | |

(a) Calculated by subtracting the Fund's total liabilities (not including notes payable) from the Fund's total assets and dividing this by the amount of notes payable outstanding, and by multiplying the result by 1,000.

(b) Calculated by subtracting the Fund's total liabilities (not including MRPS) from the Fund's total assets and dividing this by the number of MRPS outstanding, and by multiplying the result by 25.

(c) "Liquidating Preference per Preferred Share" means the amount to which a holder of preferred shares would be entitled upon the liquidation of the Fund in preference to common shareholders, expressed as a dollar amount per preferred share.

(d) The MRPS are not listed on any exchange or automated quotation system. The MRPS are considered debt of the issuer; and the liquidation preference approximates fair value.

Summary of Fund Expenses

The following table and example contain information about the costs and expenses that common shareholders will bear directly or indirectly. In accordance with Commission requirements, the table below shows our expenses, including interest payments on borrowed funds, and preferred stock dividend payments, as a percentage of our average net assets as of October 31, 2023, and not as a percentage of gross assets or managed assets.

By showing expenses as a percentage of average net assets, expenses are not expressed as a percentage of all of the assets we invest. The table and example are based on our capital structure as of October 31, 2023. As of October 31, 2023, the Fund had utilized $210 million of the $370 million available under the SSB Agreement ($195 million in advances outstanding and $15 million in structural leverage consisting of collateral received from counterparties via SSB in connection with securities on loan), representing 27.6% of the Fund's managed assets as of that date, and had $92 million in MRPS outstanding, representing 12.1% of the Fund's managed assets. Combined, the borrowings under the SSB Agreement and the outstanding MRPS represented 39.7% of the Fund's managed assets.

www.calamos.com

23

Additional Information About the Funds (Unaudited)

SHAREHOLDER TRANSACTION EXPENSES | |

Sales Load (as a percentage of offering price) | | | — | (1) | |

Offering Expenses Borne by the Fund (as a percentage of offering price) | | | — | (1) | |

Dividend Reinvestment Plan Fees (per sales transaction fee)(2) | | $ | 15.00 | | |

| ANNUAL EXPENSES | | PERCENTAGE

OF AVERAGE

NET ASSETS

ATTRIBUTABLE

TO COMMON

SHAREHOLDERS | |

Management Fee(3) | | | 1.59 | % | |

Interest Payments on Borrowed Funds(4) | | | 2.31 | % | |

Preferred Stock Dividend Payments(5) | | | 0.61 | % | |

Other Expenses(6) | | | 0.11 | % | |

Total Annual Expenses | | | 4.62 | % |

The following example illustrates the expenses that common shareholders would pay on a $1,000 investment in common shares, assuming (1) total annual expenses of 4.62% of net assets attributable to common shareholders; (2) a 5% annual return; and (3) all distributions are reinvested at net asset value:

| | | 1 YEAR | | 3 YEARS | | 5 YEARS | | 10 YEARS | |

Total Expenses Paid by Common Shareholders(7) | | $ | 46 | | | $ | 139 | | | $ | 233 | | | $ | 471 | | |

The example should not be considered a representation of future expenses. Actual expenses may be greater or less than those assumed. Moreover, our actual rate of return may be greater or less than the hypothetical 5% return shown in the example.

(1) If the securities to which this prospectus relates are sold to or through underwriters, the prospectus supplement will set forth any applicable sales load and the estimated offering expenses borne by us.

(2) Shareholders will pay a $15.00 transaction fee plus a $0.02 per share brokerage charge if they direct the Plan Agent (as defined below) to sell common shares held in a Plan account. In addition, each participant will pay a pro rata share of brokerage commissions incurred with respect to the Plan Agent's open-market purchases in connection with the reinvestment of dividends or distributions. If a participant elects to have the Plan Agent sell part or all of his or her common shares and remit the proceeds, such participant will be charged his or her pro rata share of brokerage commissions on the shares sold. See "Dividends and Distributions on Common Shares; Automatic Dividend Reinvestment Plan".

(3) The Fund pays Calamos an annual management fee, payable monthly in arrears, for its investment management services in an amount equal to 1.00% of the Fund's average weekly managed assets. In accordance with the requirements of the Commission, the table above shows the Fund's management fee as a percentage of average net assets attributable to common shareholders. By showing the management fee as a percentage of net assets, the management fee is not expressed as a percentage of all of the assets the Fund intends to invest. For purposes of the table, the management fee has been converted to 1.59% of the Fund's average weekly net assets as of October 31, 2023 by dividing the total dollar amount of the management fee by the Fund's average weekly net assets (managed assets less outstanding leverage).

(4) Reflects interest expense paid on $166 million in average borrowings under the SSB Agreement, plus $52 million in additional average structural leverage related to certain securities lending programs, as described under "Leverage".

(5) Reflects estimated dividend expense on $92 million aggregate liquidation preference of mandatory redeemable preferred shares outstanding. See "Leverage".

(6) "Other Expenses" are based on estimated amounts for the Fund's current fiscal year.

(7) The example does not include sales load or estimated offering costs, which would cause the expenses shown in the example to increase. In connection with an offering of common shares, the applicable prospectus supplement will set forth an example including sales load and estimated offering costs.

Effects of Leverage

The SSB Agreement provides for credit availability for the Fund, such that it may borrow up to $370 million. As of October 31, 2023, the Fund had utilized $210 million of the $370 million available under the SSB Agreement ($195 million of advances outstanding, and $15 million in structural leverage consisting of collateral received from counterparties via State Street Bank and Trust Company in connection with securities on loan), representing 27.6% of the Fund's managed assets as of that date,

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

24

Additional Information About the Funds (Unaudited)