UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| INVESTMENT COMPANY ACT FILE NUMBER: | | 811-22949 |

| | | |

| EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER: | | Calamos Dynamic Convertible and Income Fund |

| | |

| ADDRESS OF PRINCIPAL EXECUTIVE OFFICES: | | 2020 Calamos Court Naperville, Illinois 60563-2787 |

| | |

| NAME AND ADDRESS OF AGENT FOR SERVICE: | | John P. Calamos, Sr., Founder, Chairman and Global Chief Investment Officer Calamos Advisors LLC 2020 Calamos Court Naperville, Illinois 60563-2787 |

REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE: (630) 245-7200

DATE OF FISCAL YEAR END: October 31, 2024

DATE OF REPORTING PERIOD: November 1, 2023 through October 31, 2024

Item 1. Reports to Stockholders.

1(a) Reports to Stockholders

TIMELY INFORMATION INSIDE

Family of Closed-End Funds

ANNUAL REPORT OCTOBER 31, 2024

Domestic Funds

Calamos Convertible Opportunities and Income Fund (Ticker: CHI)

Calamos Convertible and High Income Fund (Ticker: CHY)

Calamos Strategic Total Return Fund (Ticker: CSQ)

Calamos Dynamic Convertible and Income Fund (Ticker: CCD)

Global Funds

Calamos Global Dynamic Income Fund (Ticker: CHW)

Calamos Global Total Return Fund (Ticker: CGO)

Calamos Long/Short Equity & Dynamic Income Trust (Ticker: CPZ)

Visit www.calamos.com/paperless to enroll. You can view shareholder communications, including fund prospectuses, annual reports and other shareholder materials online long before the printed publications arrive by traditional mail.

Experience and Foresight

Calamos is a trusted and leading provider of closed-end funds that use a diversified blend of convertible securities, equities, fixed income, and alternative investments across innovative investment strategies to support competitive distributions throughout a market cycle.

Our Managed Distribution Policy*

(for Calamos Convertible Opportunities and Income Fund, Calamos Convertible and High Income Fund, Calamos Strategic Total Return Fund, Calamos Dynamic Convertible and Income Fund, and Calamos Long/Short Equity & Dynamic Income Fund)

Closed-end fund investors often seek a steady stream of income. Recognizing this important need, certain Calamos closed-end funds adhere to a managed distribution policy in which we aim to provide consistent monthly distributions through the disbursement of the following:

• Net investment income

• Net realized short-term capital gains

• Net realized long-term capital gains

• And, if necessary, return of capital

We set distributions at levels that we believe are sustainable for the long term. Each Fund's current monthly distribution per share as of October 31, 2024 is as follows:

• Calamos Convertible Opportunities and Income Fund: $0.0950

• Calamos Convertible and High Income Fund: $0.1000

• Calamos Strategic Total Return Fund: $0.1025

• Calamos Dynamic Convertible and Income Fund: $0.1950

• Calamos Long/Short Equity & Dynamic Income Fund: $0.1400

Our team focuses on delivering an attractive monthly distribution, while maintaining a long-term emphasis on risk management. The level of a Fund's distribution can be greatly influenced by market conditions, including the interest rate environment, the individual performance of securities held by the funds, our view of retaining leverage, fund tax considerations, and regulatory requirements.

You should not draw any conclusions about a Fund's investment performance from the amount of its distribution or from the terms of a Fund's plan. The Funds' Board of Trustees may amend or terminate the managed distribution policy at any time without prior notice to the Fund's shareholders.

For more information about any of the Calamos closed-end funds, we encourage you to contact your financial advisor or Calamos Investments at 800.582.6959 (Monday through Friday from 8:00 a.m. to 6:00 p.m., Central Time). You can also visit us at www.calamos.com.

TABLE OF CONTENTS

Letter to Shareholders | | | 1 | | |

The Calamos Closed-End Funds:

An Overview | | | 6 | | |

Additional Information About the Funds | | | 8 | | |

The Fund's Investment Team Discussion,

Investment Objective and Principal Investment Strategies | | | |

Calamos Convertible Opportunities

and Income Fund | | | 28 | | |

Calamos Convertible and High

Income Fund | | | 34 | | |

Calamos Strategic Total Return Fund | | | 42 | | |

Calamos Dynamic Convertible and

Income Fund | | | 48 | | |

Calamos Global Dynamic Income Fund | | | 53 | | |

Calamos Global Total Return Fund | | | 58 | | |

Calamos Long/Short Equity &

Dynamic Income Trust | | | 64 | | |

Principal Risks of the Funds | | | 70 | | |

Schedules of Investments | | | 90 | | |

Statements of Assets and Liabilities | | | 206 | | |

Statements of Operations | | | 208 | | |

Statements of Changes In Net Assets | | | 210 | | |

Statements of Cash Flows | | | 213 | | |

Financial Highlights | | | 220 | | |

Notes to Financial Statements | | | 229 | | |

Report of Independent Registered

Public Accounting Firm | | | 242 | | |

Trustee Approval of Management

Agreements | | | 243 | | |

Trustees and Officers | | | 246 | | |

Tax Information | | | 251 | | |

About Closed-End Funds | | | 252 | | |

Managed and Level Distribution Policies | | | 253 | | |

Automatic Dividend Reinvestment Plan | | | 254 | | |

Additional Fund Information: Delaware

Statutory Trust Act – Control Share

Acquisitions | | | 255 | | |

* On December 17, 2024, the Board of Trustees approved the transition from a managed distribution policy to a level distribution policy for CCD, CHY and CHI.

JOHN P. CALAMOS, SR.

Founder, Chairman, and Global Chief Investment Officer

Dear Fellow Shareholder:

Welcome to your annual report for the 12 months ending October 31, 2024. In this report, you will find commentary from our portfolio management teams, a listing of portfolio holdings, financial statements and highlights, and detailed information about the performance and positioning of the Calamos Closed-End Funds.

Our goal: Provide steady, attractive income

Each Calamos Closed-End Fund is designed to serve income-oriented investors by providing steady, competitive distributions through a multi-asset, risk-managed, and flexible approach. Our suite includes enhanced fixed income and total return funds, focused on either the US or global markets. You can learn more about each fund in the overview section on page 6 and in the investment team discussions.

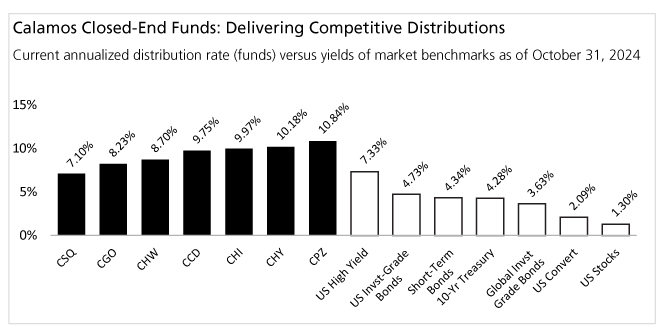

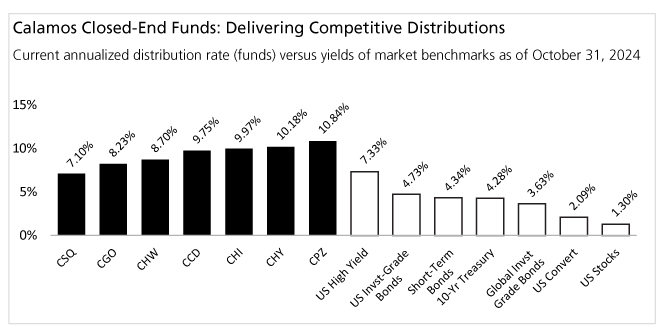

We understand the importance of providing a predictable amount of cash every month. Each of our closed-end funds is managed to provide steady (although not assured) monthly distributions through managed rate or level rate distribution policies. As the chart shows, as of the end of the reporting period, the funds each offered attractive annualized distribution rates versus the yields of market benchmarks. We believe this speaks to the potential benefits of each fund's multi-asset class approach.

www.calamos.com

1

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value of an investment will fluctuate so that your shares, when sold, may be worth more or less than their original cost. You can purchase or sell common shares daily. Like any other stock, the market price will fluctuate with the market. Upon sale, your shares may have a market price that is above or below net asset value and may be worth more or less than your original investment.

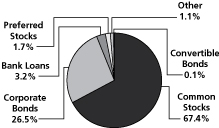

Our multi-asset class approach provides many potential benefits

Each Calamos fund follows a multi-asset approach. This gives us multiple levers for pursuing risk and total return, which we believe provides the Calamos funds with an advantage over portfolios that can invest in more limited choices. For example, we have the flexibility to invest across fixed-income markets. Our fund's bond holdings, such as high-yield bonds and convertible bonds, have typically been less susceptible to interest rate changes than longer-duration investment-grade corporate or municipal bonds. We believe this is an especially important advantage in the wake of the Federal Reserve's recent interest rate cuts.

We also believe that the funds' judicious use of leverage can continue to provide long-term benefits to shareholders, especially as interest rates have fallen.

Premiums and discounts: Perspectives for long-term investors

As we have discussed in past letters, investors often ask how they should view premiums and discounts, and whether they should be concerned if their fund is trading at a discount to net asset value. Above all, it's important to remember that the Calamos closed-end funds are managed to support the long-term needs of income-oriented investors, and we believe that investors are better served by evaluating a fund on the merits of its distributions and returns. Over time, it's quite normal for a closed-end fund to trade at a discount. In fact, I believe that for long-term fund investors, when a Calamos closed-end fund trades at a discount, it could be an attractive buying opportunity to purchase shares.

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

2

Market review

Over the past 12 months, markets have navigated many crosscurrents—including changing inflation expectations, conflicting economic data points, monetary policy unknowns, and political and geopolitical uncertainty. Throughout the year, the Federal Reserve remained the focal point of either investor anxiety or anticipation, depending on the particular moment. Meanwhile, the twists and turns in the run-up to the US presidential election amplified fiscal policy uncertainty.

Nevertheless, as autumn began, market activity reflected confidence in the trajectory of the US economy, supported by moderating inflation and corporate earnings. Equity markets jumped after the Federal Reserve announced a 50-basis point jumbo cut, and China surprised markets with an interest rate cut and announcements of massive fiscal stimulus. In the final weeks of the quarter, market jitters set in again as the world awaited the results of a contentious US presidential election and continued to speculate about how much more central banks would cut and when.

The reporting period was notable for a broadening of leadership within the equity markets, particularly increased recognition of small-cap companies. Within the fixed-income market, high-yield bonds benefited from their reduced sensitivity to interest rate changes and a narrowing of credit spreads.

Our outlook

We believe that our funds are well-positioned for the current environment. Our teams are confident that our ability to dynamically allocate among multi-asset classes, including those that have been historically less vulnerable to interest rate changes, will serve the funds in good stead. Additionally, we maintain a high level of conviction that our proprietary research, which includes rigorous bottom-up fundamental research and top-down macroeconomic and thematic analysis, will prove advantageous in guiding us to attractive opportunities.

As we look to the future, we are cautiously optimistic about the prospects of the economy. For example, fiscal policy has a tremendous impact on the economy, and the incoming presidential administration has advocated for tax and regulatory policies that could catalyze entrepreneurship and business growth, while also creating a more hospitable environment for investment. Business expansion also fuels job growth, and in turn, household prosperity.

It's important to remember ups and downs are always a part of the market particularly in the short term, even as long-term positive economic changes unfold. We would also not be surprised to see periods of choppiness as Washington recalibrates foreign policy, including trade policies.

Our teams have long viewed short-term volatility as an opportunity to position our funds for long-term success, and we will continue to stick to our risk-conscious long-term approach as we navigate the ebbs and flows in the markets.

www.calamos.com

3

In closing

In the commentaries that follow, our teams will discuss how they are pursuing competitive distributions and returns through risk-managed approaches.

As always, thank you for your trust. We are honored that you have chosen Calamos Investments to help you achieve your asset allocation goals.

Sincerely,

John P. Calamos, Sr.

Founder, Chairman and Global Chief Investment Officer

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

4

Before investing, carefully consider a fund's investment objectives, risks, charges and expenses. Please see the prospectus containing this and other information or call 800-582-6959. Please read the prospectus carefully. Performance data represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted.

Diversification and asset allocation do not guarantee a profit or protection against a loss. Investments in alternative strategies may not be suitable for all investors.

Source: Calamos Advisors LLC.

Investments in overseas markets pose special risks, including currency fluctuation and political risks. These risks are generally intensified for investments in emerging markets. Countries, regions, and sectors mentioned are presented to illustrate countries, regions, and sectors in which a fund may invest. There are certain risks involved with investing in convertible securities in addition to market risk, such as call risk, dividend risk, liquidity risk and default risk, which should be carefully considered prior to investing.

Shares of closed-end funds frequently trade at a discount which is a market price that is below their net asset value.

Current Annualized Distribution Rate is the Fund's most recent distribution, expressed as an annualized percentage of the Fund's current market price per share. Estimates are calculated on a tax basis rather than on a generally accepted accounting principles (GAAP) basis but should not be used for tax reporting purposes. Distributions are subject to re-characterization for tax purposes after the end of the fiscal year. This information is not legal or tax advice. Consult a professional regarding your specific legal or tax matters. Under the level rate distribution policy of CGO and CHW and the managed rate distribution policy of CHI, CHY, CSQ, CCD, and CPZ the distributions paid to common shareholders may include net investment income, net realized short-term capital gains and return of capital. When the net investment income and net realized short-term capital gains are not sufficient, a portion of the level rate distribution will be a return of capital. In addition, a limited number of distributions per calendar year may include net realized long-term capital gains. Distribution rate may vary. Dividend yield is shown for stocks, current yield is shown for convertibles, yield to worst for remaining indexes. There are material differences between the indexes and the Calamos closed-end funds. Indexes are unmanaged, do not include fees and expenses and are not available for direct investments. Stocks are represented by the S&P 500 Index; US investment grade bonds are represented by the Bloomberg US Aggregate Bond Index; global investment grade bonds are represented by the Bloomberg Global Aggregate Index; short term bonds are represented by Bloomberg US Govt/Credit 1-3 Year Index and high yield bonds are represented by the ICE BofA US High Yield Index.

Current annualized distribution rate is the Fund's most recent distribution, expressed as an annualized percentage of the Fund's current market price per share. The Distribution Details for the distribution paid on 10/22/24, nearest the end of the reporting period are as follows. CHI: The Fund's distribution was $0.0950 per share. Based on our current estimates, we anticipate that approximately $0.0000 is paid from ordinary income, approximately $0.0950 is paid from short-term capital gains, approximately $0.0000 is paid from long-term capital gains and that approximately $0.0000 represents a return of capital. CHY: The Fund's distribution was $0.1000 per share. Based on our current estimates, we anticipate that approximately $0.0000 is paid from ordinary income, approximately $0.0999 is paid from short-term capital gains, approximately $0.0001 is paid from long-term capital gains and that approximately $0.0000 represents a return of capital. CHW: The Fund's distribution was $0.0500 per share. Based on our current estimates, we anticipate that approximately $0.0000 is paid from ordinary income, approximately $0.0500 is paid from short-term capital gains, approximately $0.0000 is paid from long-term capital gains and that approximately $0.0000 represents a return of capital. CSQ: The Fund's distribution was $0.1025 per share. Based on our current estimates, we anticipate that approximately $0.0000 is paid from ordinary income, approximately $0.0642 is paid from short-term capital gains, approximately $0.0000 is paid from long-term capital gains and that approximately $0.0383 represents a return of capital. CCD: The Fund's distribution was $0.1950 per share. Based on our current estimates, we anticipate that approximately $0.0000 is paid from ordinary income, approximately $0.0344 is paid from short-term capital gains, approximately $0.1606 is paid from long-term capital gains and that approximately $0.0000 represents a return of capital. CGO: The Fund's distribution was $0.0800 per share. Based on our current estimates, we anticipate that approximately $0.0000 is paid from ordinary income, approximately $0.0800 is paid from short-term capital gains, approximately $0.0000 is paid from long-term capital gains and that approximately $0.0000 represents a return of capital. CPZ: The Fund's distribution was $0.1400 per share. Based on our current estimates, we anticipate that approximately $0.0231 is paid from ordinary income, approximately $0.1169 is paid from short-term capital gains, approximately $0.0000 is paid from long-term capital gains and that approximately $0.0000 represents a return of capital.

Fund holdings are subject to change daily. The Funds are actively managed. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to accuracy or completeness, has been obtained from sources we believe to be reliable.

Opinions are as of the publication date, subject to change and may not come to pass.

This information is being provided for informational purposes only and should not be considered investment advice or an offer to buy or sell any security in the portfolio.

www.calamos.com

5

The Calamos Closed-End Funds: An Overview

Offering Domestic and Global Strategies

Calamos closed-end funds draw upon decades of our pioneering experience, including a long history of opportunistically blending asset classes to capture upside potential while seeking to manage downside risk.

Closed-end funds issue a fixed number of shares through an initial public offering and trade on an exchange. They often employ leverage to pursue high current income or returns, but are primarily valued for their regular attractive distributions by investors seeking a steady income stream. Calamos closed-end funds adhere to distribution policies* that aim to provide consistent monthly distributions through the disbursement of the following:

• Net investment income

• Net realized short-term capital gains

• Net realized long-term capital gains

• And, if necessary, return of capital

We set distributions at levels that we believe are sustainable for the long term yet highly competitive versus other sources of yield. In addition, our team emphasizes ongoing risk management. The level of a fund's distribution can be influenced by market conditions, including the interest rate environment, the individual performance of securities, our view of retaining leverage, fund tax considerations, and regulatory requirements. It's important not to draw conclusions about your fund's investment performance from the amount of its distribution.

Although the funds share a focus on producing income, they can be broadly grouped into two categories: domestic and global.

DOMESTIC** | | US ENHANCED FIXED INCOME

Calamos Convertible Opportunities and Income Fund (Ticker: CHI)

Invests in convertible securities and corporate high-yield bonds, primarily in US markets.

Calamos Convertible and High Income Fund (Ticker: CHY)

Invests in convertible securities and corporate high-yield bonds, primarily in US markets. | |

| | | | | US TOTAL RETURN

Calamos Strategic Total Return Fund (Ticker: CSQ)

Invests in equities, higher-yielding convertible securities, and corporate bonds, primarily in US markets.

Calamos Dynamic Convertible and Income Fund (Ticker: CCD)

Invests in convertibles and other fixed-income securities, primarily in US markets. To help generate income and achieve a favorable risk/reward profile, the investment team can also sell options. | |

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

6

The Calamos Closed-End Funds: An Overview

GLOBAL | | GLOBAL ENHANCED FIXED INCOME

Calamos Global Dynamic Income Fund (Ticker: CHW)

Invests in equities, convertibles, and income-producing securities of various rated and unrated instruments in both US and non-US markets, and may use other income-producing strategies for hedging purposes. The Fund may invest between 40% to 100% of its managed assets in securities of foreign issuers in developed and emerging markets, including debt and equity securities of corporate issuers and debt securities of government issuers, unless market conditions are not deemed favorable by the Adviser, in which case the Fund will invest at least 30% of its net assets in securities of foreign issuers. | |

| | | | | GLOBAL TOTAL RETURN

Calamos Global Total Return Fund (Ticker: CGO)

Invests in equities, convertibles and income-producing securities of various rated and unrated instruments in both US and non-US markets. Will invest at least 50% in equities and between 40% and 100% of its managed assets in securities of foreign issuers, unless market conditions are not deemed favorable by the Adviser, in which case the Fund will invest at least 30% of its net assets in securities of foreign issuers.

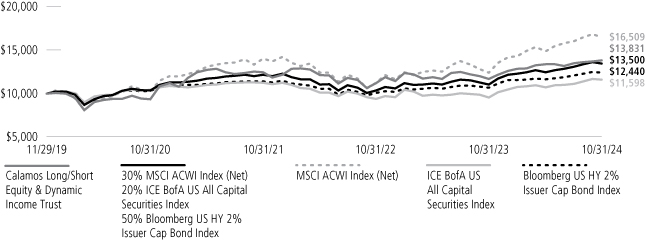

Calamos Long/Short Equity & Dynamic Income Trust (Ticker: CPZ)

Invest at least 80% of its managed assets in a diversified portfolio of equity securities, long and short equity positions, and diversified income-producing securities. The Fund May invest up to 50% of its managed assets in securities of foreign issuers; will not invest more than 25% in a single country, and may invest up to 20% in emerging market countries. | |

* CHI, CHY, CSQ, CPZ, and CCD adhere to a managed distribution policy, and CHW and CGO adhere to a level distribution policy. Both distribution policies represent the investment company's commitment to providing common shareholders with a predictable but not assured level of cash flow. The funds' Board of Trustees may amend or terminate the managed or level distribution policies without prior notice to the funds' shareholders. On December 17, 2024, the Board of Trustees approved the transition from a managed distribution policy to a level distribution policy for CCD, CHY and CHI.

** Although these Funds primarily invest in the securities of US issuers, CHI and CHY may invest up to 25%, CSQ up to 35%, and CCD up to 50% of managed assets in securities of foreign issuers.

www.calamos.com

7

Additional Information About the Funds (Unaudited)

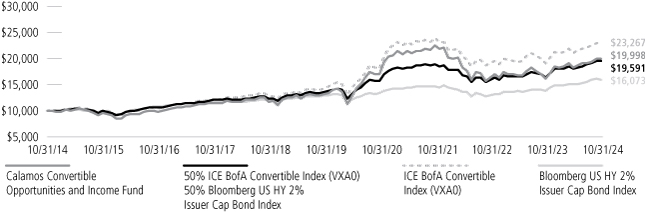

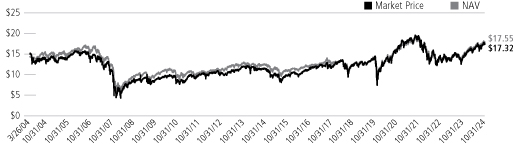

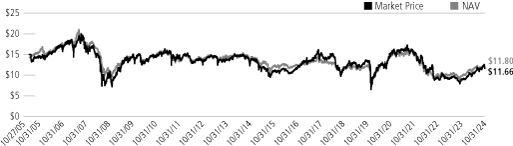

Calamos Convertible Opportunities and Income Fund

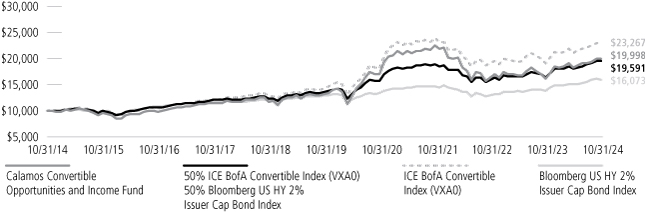

GROWTH OF $10,000: FOR THE 10-YEAR PERIOD ENDED 10/31/24

AVERAGE ANNUAL TOTAL RETURN† AS OF 10/31/24

| | | 1

YEAR | | 5

YEARS | | 10

YEARS | | SINCE

INCEPTION | |

Calamos Convertible Opportunities and Income Fund | |

Market Price | | | 27.31 | % | | | 11.55 | % | | | 8.38 | % | | | 9.48 | % | |

NAV | | | 24.26 | | | | 8.75 | | | | 7.18 | | | | 9.07 | | |

50%VXAO-50%BBGUSHY2%Cap Index | | | 18.76 | | | | 7.59 | | | | 6.96 | | | | 8.12 | | |

ICE BofA All US Convertible Index (VXA0) | | | 20.97 | | | | 10.33 | | | | 8.81 | | | | 8.60 | | |

Bloomberg US HY 2% Issuer Cap Bond Index | | | 16.47 | | | | 4.53 | | | | 4.86 | | | | 7.38 | | |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gain distributions. Source: State Street Corporation and Morningstar Direct.

† Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions.

NOTES:

The graphs do not reflect the income taxes that you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends.

The 50%VXAO-50%BBGUSHY2%Cap Index is blended from 50% - ICE BofA Convertible Index (VXA0) and 50% - Bloomberg US Corp HY 2% Issuer Cap Bond Index.

The ICE BofA All US Convertible Index is comprised of approximately 700 issues of only convertible bonds and preferreds of all qualities.

The Bloomberg US High Yield 2% Issuer Capped Index measures the performance of high-yield corporate bonds with a maximum allocation of 2% to any one issuer.

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

8

Additional Information About the Funds (Unaudited)

Calamos Convertible Opportunities and Income Fund (continued)

Senior Securities

The following table sets forth information regarding the Fund's outstanding bank loans, and mandatory redeemable preferred shares ("MRPS") as of the end of each of the Fund's last ten fiscal years, as applicable. The information in the table shown below comes from the Fund's financial statements for the fiscal year ended October 31, 2024, and each of the prior nine years then ended, all of which have been audited by Deloitte & Touche LLP, the Fund's independent registered public accounting firm.

FISCAL YEAR ENDED | | TOTAL

AMOUNT

OUTSTANDING | | ASSET

COVERAGE | | LIQUIDATING

PREFERENCE

PER PREFERRED

SHARE(c) | | AVERAGE

MARKET VALUE

PER PREFERRED

SHARE | | TYPE OF

SENIOR

SECURITY | |

October 31, 2024 | | $ | 314,650,000 | | | $ | 3,835 | (a) | | | — | | | | — | | | Loan | |

October 31, 2024 | | $ | 132,750,000 | | | | 227 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2023 | | $ | 314,400,000 | | | $ | 3,563 | (a) | | | — | | | | — | | | Loan | |

October 31, 2023 | | $ | 133,000,000 | | | | 211 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2022 | | $ | 339,400,000 | | | | 3,630 | (a) | | | — | | | | — | | | Loan | |

October 31, 2022 | | $ | 133,000,000 | | | | 232 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2021 | | $ | 399,400,000 | | | | 4,116 | (a) | | | — | | | | — | | | Loan | |

October 31, 2021 | | $ | 133,000,000 | | | | 309 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2020 | | $ | 288,400,000 | | | | 4,431 | (a) | | | — | | | | — | | | Loan | |

October 31, 2020 | | $ | 100,000,000 | | | | 319 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2019 | | $ | 277,400,000 | | | | 4,080 | (a) | | | — | | | | — | | | Loan | |

October 31, 2019 | | $ | 100,000,000 | | | | 283 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2018 | | $ | 288,000,000 | | | | 3,921 | (a) | | | — | | | | — | | | Loan | |

October 31, 2018 | | $ | 100,000,000 | | | | 282 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2017 | | $ | 275,000,000 | | | | 4,265 | (a) | | | — | | | | — | | | Loan | |

October 31, 2017 | | $ | 100,000,000 | | | | 293 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2016 | | $ | 306,000,000 | | | | 3,454 | (a) | | | — | | | | — | | | Loan | |

October 31, 2015 | | $ | 353,000,000 | | | | 3,316 | (a) | | | — | | | | — | | | Loan | |

(a) Calculated by subtracting the Fund's total liabilities (not including notes payable) from the Fund's total assets and dividing this by the amount of notes payable outstanding, and by multiplying the result by 1,000.

(b) Calculated by subtracting the Fund's total liabilities (not including MRPS) from the Fund's total assets and dividing this by the number of MRPS outstanding, and by multiplying the result by 25.

(c) "Liquidating Preference per Preferred Share" means the amount to which a holder of preferred shares would be entitled upon the liquidation of the Fund in preference to common shareholders, expressed as a dollar amount per preferred share.

(d) The MRPS are not listed on any exchange or automated quotation system. The MRPS are considered debt of the issuer; and the liquidation preference approximates fair value.

Summary of Fund Expenses

The following table and example contain information about the costs and expenses that common shareholders will bear directly or indirectly. In accordance with Commission requirements, the table below shows our expenses, including interest payments on borrowed funds, and preferred stock dividend payments, as a percentage of our average net assets as of October 31, 2024, and not as a percentage of gross assets or managed assets.

By showing expenses as a percentage of average net assets, expenses are not expressed as a percentage of all of the assets we invest. The table and example are based on our capital structure as of October 31, 2024. As of October 31, 2024, the Fund had utilized $315 million of the $430 million available under the SSB Agreement ($227 million in advances outstanding, and $88 million in structural leverage consisting of collateral received from counterparties via SSB in connection with securities on loan), representing 26.1% of the Fund's managed assets as of that date, and had $133 million in MRPS outstanding, representing 11.0% of the Fund's managed assets. Combined, the borrowings under the SSB Agreement and the outstanding MRPS represented 37.1% of the Fund's managed assets.

www.calamos.com

9

Additional Information About the Funds (Unaudited)

Calamos Convertible Opportunities and Income Fund (continued)

SHAREHOLDER TRANSACTION EXPENSES | |

Sales Load (as a percentage of offering price) | | | 1.00 | %(1) | |

Offering Expenses Borne by the Fund (as a percentage of offering price) | | | — | (1) | |

Dividend Reinvestment Plan Fees (per sales transaction fee)(2) | | $ | 15.00 | | |

ANNUAL EXPENSES | | PERCENTAGE

OF AVERAGE

NET ASSETS

ATTRIBUTABLE

TO COMMON

SHAREHOLDERS | |

Management Fee(3) | | | 1.28 | % | |

Interest Payments on Borrowed Funds(4) | | | 2.50 | % | |

Preferred Stock Dividend Payments(5) | | | 0.64 | % | |

Other Expenses(6) | | | 0.10 | % | |

Total Annual Expenses | | | 4.52 | % | |

The following example illustrates the expenses that common shareholders would pay on a $1,000 investment in common shares, assuming (1) total annual expenses of 4.52% of net assets attributable to common shareholders; (2) a 5% annual return; and (3) all distributions are reinvested at net asset value:

| | | 1 YEAR | | 3 YEARS | | 5 YEARS | | 10 YEARS | |

Total Expenses Paid by Common Shareholders(7) | | $ | 45 | | | $ | 137 | | | $ | 229 | | | $ | 463 | | |

The example should not be considered a representation of future expenses. Actual expenses may be greater or less than those assumed. Moreover, our actual rate of return may be greater or less than the hypothetical 5% return shown in the example.

(1) If the securities to which this prospectus relates are sold to or through underwriters, the prospectus supplement will set forth any applicable sales load and the estimated offering expenses borne by us.

(2) Shareholders will pay a $15.00 transaction fee plus a $0.02 per share brokerage charge if they direct the Plan Agent (as defined below) to sell common shares held in a Plan account. In addition, each participant will pay a pro rata share of brokerage commissions incurred with respect to the Plan Agent's open-market purchases in connection with the reinvestment of dividends or distributions. If a participant elects to have the Plan Agent sell part or all of his or her common shares and remit the proceeds, such participant will be charged his or her pro rata share of brokerage commissions on the shares sold. See "Dividends and Distributions on Common Shares; Automatic Dividend Reinvestment Plan".

(3) The Fund pays Calamos an annual management fee, payable monthly in arrears, for its investment management services in an amount equal to 0.80% of the Fund's average weekly managed assets. In accordance with the requirements of the Commission, the table above shows the Fund's management fee as a percentage of average net assets attributable to common shareholders. By showing the management fee as a percentage of net assets, the management fee is not expressed as a percentage of all of the assets the Fund intends to invest. For purposes of the table, the management fee has been converted to 1.28% of the Fund's average weekly net assets as of October 31, 2024 by dividing the total dollar amount of the management fee by the Fund's average weekly net assets (managed assets less outstanding leverage).

(4) Reflects interest expense paid on $261 million in average borrowings under the SSB Agreement, plus $54 million in additional average structural leverage related to certain securities lending programs, as described under "Leverage".

(5) Reflects estimated dividend expense on $133 million aggregate liquidation preference of mandatory redeemable preferred shares outstanding. See "Leverage".

(6) "Other Expenses" are based on estimated amounts for the Fund's current fiscal year.

(7) The example does not include sales load or estimated offering costs, which would cause the expenses shown in the example to increase. In connection with an offering of common shares, the applicable prospectus supplement will set forth an example including sales load and estimated offering costs.

Effects of Leverage

The SSB Agreement provides for credit availability for the Fund, such that it may borrow up to $430 million. As of October 31, 2024, the Fund had utilized $315 million of the $430 million available under the SSB Agreement ($227 million of advances outstanding, and $88 million in structural leverage consisting of collateral received from counterparties via State Street Bank and Trust Company in connection with securities on loan), representing 26.1% of the Fund's managed assets as of that date,

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

10

Additional Information About the Funds (Unaudited)

Calamos Convertible Opportunities and Income Fund (continued)

and had $133 million of MRP Shares outstanding, representing 11.0% of the Fund's managed assets. Combined, the borrowings under the SSB Agreement and the outstanding MRP Shares represented 37.1% of the Fund's managed assets. Interest on the SSB Agreement was charged on the drawn amount at the rate of the Overnight Bank Financing Rate ("OBFR") plus 0.52%. Interest on overdue amounts or interest on the drawn amount paid during an event of default, was charged at OBFR plus 2.52%. These rates represent floating rates of interest that may change over time. The SSB Agreement has a commitment fee of 0.10% of any undrawn amount. As of October 31, 2024, the interest rate charged under the SSB Agreement was 5.35%.

The Fund's MRP Shareholders are entitled to receive monthly cash dividends, at a currently effective dividend rate per annum for each series of MRP Shares as follows (subject to adjustment as described in the Fund's prospectus): 4.24% for Series C MRP Shares, 2.45% for Series D MRP Shares, 2.68% for Series E MRP Shares and 6.24% for Series G MRP Shares.

To cover the interest expense on the borrowings under the SSB Agreement (including "net income" payments made with respect to borrowings offset by collateral for securities on loan) and the dividend payments associated with the MRP Shares, based on rates in effect on October 31, 2024, the Fund's portfolio would need to experience an annual return of 1.83% (before giving effect to expenses associated with senior securities).

The following table illustrates the hypothetical effect on the return to a holder of the Fund's common shares of the leverage obtained by us (and utilized on October 31, 2024). The purpose of this table is to assist you in understanding the effects of leverage. As the table shows, leverage generally increases the return to common shareholders when portfolio return is positive and greater than the cost of leverage and decreases the return when the portfolio return is negative or less than the cost of leverage. The figures appearing in the table are hypothetical and actual returns may be greater or less than those appearing in the table.

Assumed Portfolio Return (Net of Expenses) | | | (10.00 | )% | | | (5.00 | )% | | | 0.00 | % | | | 5.00 | % | | | 10.00 | % | |

Corresponding Common Share Return(1) | | | (18.81 | ) | | | (10.86 | ) | | | (2.92 | ) | | | 5.03 | | | | 12.98 | | |

(1) Includes interest expense on the borrowings under the SSB Agreement, accrued at interest rates in effect on October 31, 2024 of 5.35%, and dividend expense on the MRP Shares.

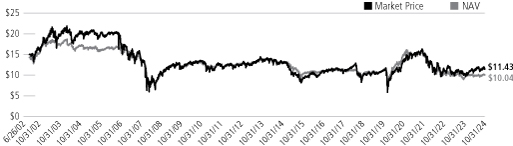

Market and Net Asset Value Information

Our common shares have traded both at a premium and a discount to NAV. We cannot predict whether our shares will trade in the future at a premium or discount to NAV. The provisions of the 1940 Act generally require that the public offering price of common shares (less any underwriting commissions and discounts) must equal or exceed the NAV per share of a company's common stock (calculated within 48 hours of pricing). Our issuance of common shares may have an adverse effect on prices in the secondary market for our common shares by increasing the number of common shares available, which may put downward pressure on the market price for our common shares. Shares of common stock of closed-end investment companies frequently trade at a discount from NAV.

The following table sets forth for each of the periods indicated the high and low closing market prices for our common shares on Nasdaq, the NAV per share and the premium or discount to NAV per share at which our common shares were trading. NAV is shown for the last business day of each quarter. See "Net Asset Value" for information as to the determination of our NAV.

www.calamos.com

11

Additional Information About the Funds (Unaudited)

Calamos Convertible Opportunities and Income Fund (continued)

| | | MARKET PRICE(1) | | NET ASSET

VALUE AT

QUARTER | | PREMIUM/

(DISCOUNT) TO

NET ASSET VALUE(3) | |

QUARTER ENDED | | HIGH | | LOW | | END(2) | | HIGH | | LOW | |

October 31, 2024 | | $ | 12.01 | | | $ | 10.91 | | | $ | 10.04 | | | | 18.20 | % | | | 13.13 | % | |

July 31, 2024 | | $ | 12.02 | | | $ | 11.04 | | | $ | 9.95 | | | | 20.24 | % | | | 11.61 | % | |

April 30, 2024 | | $ | 11.54 | | | $ | 10.55 | | | $ | 9.74 | | | | 14.21 | % | | | 7.46 | % | |

January 31, 2024 | | $ | 10.71 | | | $ | 9.74 | | | $ | 10.00 | | | | 12.00 | % | | | 0.41 | % | |

October 31, 2023 | | $ | 11.32 | | | $ | 10.00 | | | $ | 8.99 | | | | 15.20 | % | | | 4.56 | % | |

July 31, 2023 | | $ | 11.36 | | | $ | 9.90 | | | $ | 10.51 | | | | 10.21 | % | | | 1.53 | % | |

April 30, 2023 | | $ | 12.34 | | | $ | 10.21 | | | $ | 9.94 | | | | 16.91 | % | | | 1.49 | % | |

January 31, 2023 | | $ | 12.09 | | | $ | 10.51 | | | $ | 10.61 | | | | 15.03 | % | | | 3.89 | % | |

October 31, 2022 | | $ | 12.90 | | | $ | 9.66 | | | $ | 10.25 | | | | 14.01 | % | | | -3.36 | % | |

July 31, 2022 | | $ | 13.00 | | | $ | 10.17 | | | $ | 11.18 | | | | 16.28 | % | | | -2.33 | % | |

April 30, 2022 | | $ | 14.50 | | | $ | 11.81 | | | $ | 12.05 | | | | 4.69 | % | | | -4.58 | % | |

January 31, 2022 | | $ | 16.34 | | | $ | 12.96 | | | $ | 13.62 | | | | 4.21 | % | | | -4.14 | % | |

Source: Fund Accounting Records

(1) Based on high and low closing market price per share during the respective quarter and does not reflect commissions.

(2) Based on the NAV calculated on the close of business on the last business day of each calendar quarter.

(3) Premium and discount information is shown for the days when the Fund experienced its high and low closing market prices, respectively, per share during the respective quarter.

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

12

Additional Information About the Funds (Unaudited)

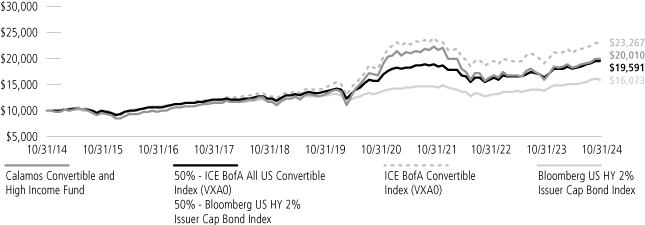

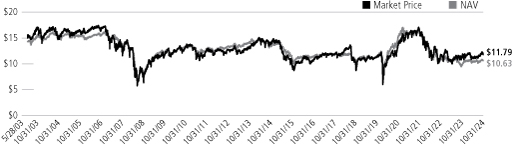

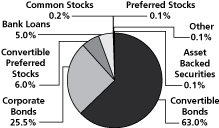

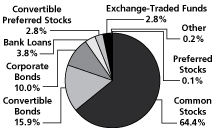

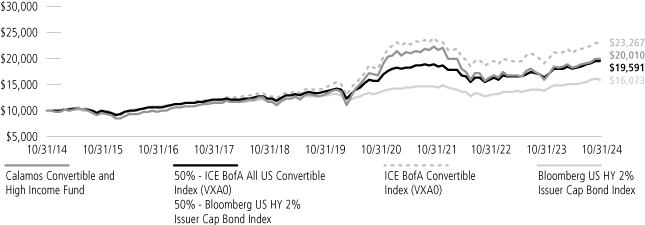

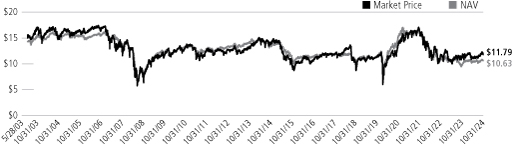

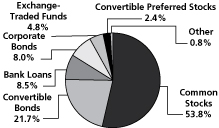

Calamos Convertible and High Income Fund

GROWTH OF $10,000: FOR THE 10-YEAR PERIOD ENDED 10/31/24

AVERAGE ANNUAL TOTAL RETURN† AS OF 10/31/24

| | | 1

YEAR | | 5

YEARS | | 10

YEARS | | SINCE

INCEPTION | |

Calamos Convertible and High Income Fund | |

Market Price | | | 20.87 | % | | | 11.44 | % | | | 8.12 | % | | | 8.75 | % | |

NAV | | | 24.82 | | | | 9.00 | | | | 7.18 | | | | 8.46 | | |

50%VXAO-50%BBGUSHY2%Cap Index | | | 18.76 | | | | 7.59 | | | | 6.96 | | | | 7.92 | | |

ICE BofA All US Convertible Index (VXA0) | | | 20.97 | | | | 10.33 | | | | 8.81 | | | | 8.53 | | |

Bloomberg US HY 2% Issuer Cap Bond Index | | | 16.47 | | | | 4.53 | | | | 4.86 | | | | 7.05 | | |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gain distributions. Source: State Street Corporation and Morningstar Direct.

† Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions.

NOTES:

The 50%VXAO-50%BBGUSHY2%Cap Index is blended from 50% - ICE BofA All US Convertible Index (VXA0) and 50% - Bloomberg US HY 2% Issuer Capped Index.

The ICE BofA All US Convertible Index is comprised of approximately 700 issues of only convertible bonds and preferreds of all qualities.

The Bloomberg US High Yield 2% Issuer Capped Index measures the performance of high-yield corporate bonds with a maximum allocation of 2% to any one issuer.

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

www.calamos.com

13

Additional Information About the Funds (Unaudited)

Calamos Convertible and High Income Fund (continued)

Senior Securities

The following table sets forth information regarding the Fund's outstanding bank loans, and mandatory redeemable preferred shares ("MRPS") as of the end of each of the Fund's last ten fiscal years, as applicable. The information in the table shown below comes from the Fund's financial statements for the fiscal year ended October 31, 2024, and each of the prior nine years then ended, all of which have been audited by Deloitte & Touche LLP, the Fund's independent registered public accounting firm.

FISCAL YEAR ENDED | | TOTAL

AMOUNT

OUTSTANDING | | ASSET

COVERAGE | | LIQUIDATING

PREFERENCE

PER PREFERRED

SHARE(c) | | AVERAGE

MARKET VALUE

PER PREFERRED

SHARE | | TYPE OF

SENIOR

SECURITY | |

October 31, 2024 | | $ | 340,900,000 | | | $ | 3,828 | (a) | | | — | | | | — | | | Loan | |

October 31, 2024 | | $ | 144,500,000 | | | | 226 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2023 | | $ | 340,400,000 | | | $ | 3,556 | (a) | | | — | | | | — | | | Loan | |

October 31, 2023 | | $ | 145,000,000 | | | | 209 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2022 | | $ | 365,400,000 | | | | 3,635 | (a) | | | — | | | | — | | | Loan | |

October 31, 2022 | | $ | 145,000,000 | | | | 229 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2021 | | $ | 435,400,000 | | | | 4,106 | (a) | | | — | | | | — | | | Loan | |

October 31, 2021 | | $ | 145,000,000 | | | | 308 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2020 | | $ | 318,400,000 | | | | 4,386 | (a) | | | — | | | | — | | | Loan | |

October 31, 2020 | | $ | 110,000,000 | | | | 317 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2019 | | $ | 303,900,000 | | | | 4,055 | (a) | | | — | | | | — | | | Loan | |

October 31, 2019 | | $ | 110,000,000 | | | | 280 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2018 | | $ | 315,500,000 | | | | 3,904 | (a) | | | — | | | | — | | | Loan | |

October 31, 2018 | | $ | 110,000,000 | | | | 280 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2017 | | $ | 302,500,000 | | | | 4,236 | (a) | | | — | | | | — | | | Loan | |

October 31, 2017 | | $ | 110,000,000 | | | | 291 | (b) | | | 25 | | | | 25 | (d) | | MRPS | |

October 31, 2016 | | $ | 337,000,000 | | | | 3,440 | (a) | | | — | | | | — | | | Loan | |

October 31, 2015 | | $ | 398,000,000 | | | | 3,258 | (a) | | | — | | | | — | | | Loan | |

(a) Calculated by subtracting the Fund's total liabilities (not including notes payable) from the Fund's total assets and dividing this by the amount of notes payable outstanding, and by multiplying the result by 1,000.

(b) Calculated by subtracting the Fund's total liabilities (not including MRPS) from the Fund's total assets and dividing this by the number of MRPS outstanding, and by multiplying the result by 25.

(c) "Liquidating Preference per Preferred Share" means the amount to which a holder of preferred shares would be entitled upon the liquidation of the Fund in preference to common shareholders, expressed as a dollar amount per preferred share.

(d) The MRPS are not listed on any exchange or automated quotation system. The MRPS are considered debt of the issuer; and the liquidation preference approximates fair value.

Summary of Fund Expenses

The following table and example contain information about the costs and expenses that common shareholders will bear directly or indirectly. In accordance with Commission requirements, the table below shows our expenses, including interest payments on borrowed funds, and preferred stock dividend payments, as a percentage of our average net assets as of October 31, 2024, and not as a percentage of gross assets or managed assets.

By showing expenses as a percentage of average net assets, expenses are not expressed as a percentage of all of the assets we invest. The table and example are based on our capital structure as of October 31, 2024. As of October 31, 2024, the Fund had utilized $341 million of the $480 million available under the SSB Agreement ($307 million in advances outstanding, and $34 million in structural leverage consisting of collateral received from counterparties via SSB in connection with securities on loan), representing 26.1% of the Fund's managed assets as of that date, and had $145 million in MRPS outstanding, representing 11.1% of the Fund's managed assets. Combined, the borrowings under the SSB Agreement and the outstanding MRPS represented 37.2% of the Fund's managed assets.

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

14

Additional Information About the Funds (Unaudited)

Calamos Convertible and High Income Fund (continued)

SHAREHOLDER TRANSACTION EXPENSES | |

Sales Load (as a percentage of offering price) | | | 1.00 | %(1) | |

Offering Expenses Borne by the Fund (as a percentage of offering price) | | | — | (1) | |

Dividend Reinvestment Plan Fees (per sales transaction fee)(2) | | $ | 15.00 | | |

ANNUAL EXPENSES | | PERCENTAGE

OF AVERAGE

NET ASSETS

ATTRIBUTABLE

TO COMMON

SHAREHOLDERS | |

Management Fee(3) | | | 1.28 | % | |

Interest Payments on Borrowed Funds(4) | | | 2.51 | % | |

Preferred Stock Dividend Payments(5) | | | 0.65 | % | |

Other Expenses(6) | | | 0.10 | % | |

Total Annual Expenses | | | 4.54 | % | |

The following example illustrates the expenses that common shareholders would pay on a $1,000 investment in common shares, assuming (1) total annual expenses of 4.54% of net assets attributable to common shareholders; (2) a 5% annual return; and (3) all distributions are reinvested at net asset value:

| | | 1 YEAR | | 3 YEARS | | 5 YEARS | | 10 YEARS | |

Total Expenses Paid by Common Shareholders(7) | | $ | 46 | | | $ | 138 | | | $ | 230 | | | $ | 466 | | |

The example should not be considered a representation of future expenses. Actual expenses may be greater or less than those assumed. Moreover, our actual rate of return may be greater or less than the hypothetical 5% return shown in the example.

(1) If the securities to which this prospectus relates are sold to or through underwriters, the prospectus supplement will set forth any applicable sales load and the estimated offering expenses borne by us.

(2) Shareholders will pay a $15.00 transaction fee plus a $0.02 per share brokerage charge if they direct the Plan Agent (as defined below) to sell common shares held in a Plan account. In addition, each participant will pay a pro rata share of brokerage commissions incurred with respect to the Plan Agent's open-market purchases in connection with the reinvestment of dividends or distributions. If a participant elects to have the Plan Agent sell part or all of his or her common shares and remit the proceeds, such participant will be charged his or her pro rata share of brokerage commissions on the shares sold. See "Dividends and Distributions on Common Shares; Automatic Dividend Reinvestment Plan".

(3) The Fund pays Calamos an annual management fee, payable monthly in arrears, for its investment management services in an amount equal to 0.80% of the Fund's average weekly managed assets. In accordance with the requirements of the Commission, the table above shows the Fund's management fee as a percentage of average net assets attributable to common shareholders. By showing the management fee as a percentage of net assets, the management fee is not expressed as a percentage of all of the assets the Fund intends to invest. For purposes of the table, the management fee has been converted to 1.28% of the Fund's average weekly net assets as of October 31, 2024 by dividing the total dollar amount of the management fee by the Fund's average weekly net assets (managed assets less outstanding leverage).

(4) Reflects interest expense paid on $282 million in average borrowings under the SSB Agreement, plus $59 million in additional average structural leverage related to certain securities lending programs, as described under "Leverage".

(5) Reflects estimated dividend expense on $145 million aggregate liquidation preference of mandatory redeemable preferred shares outstanding. See "Leverage".

(6) "Other Expenses" are based on estimated amounts for the Fund's current fiscal year.

(7) The example does not include sales load or estimated offering costs, which would cause the expenses shown in the example to increase. In connection with an offering of common shares, the applicable prospectus supplement will set forth an example including sales load and estimated offering costs.

Effects of Leverage

The SSB Agreement provides for credit availability for the Fund, such that it may borrow up to $480 million. As of October 31, 2024, the Fund had utilized $341 million of the $480 million available under the SSB Agreement ($307 million of advances outstanding, and $34 million in structural leverage consisting of collateral received from counterparties via State Street Bank and Trust Company in connection with securities on loan), representing 26.1% of the Fund's managed assets as of that date,

www.calamos.com

15

Additional Information About the Funds (Unaudited)

Calamos Convertible and High Income Fund (continued)

and had $145 million of MRP Shares outstanding, representing 11.1% of the Fund's managed assets. Combined, the borrowings under the SSB Agreement and the outstanding MRP Shares represented 37.2% of the Fund's managed assets. Interest on the SSB Agreement was charged on the drawn amount at the rate of the Overnight Bank Financing Rate ("OBFR") plus 0.52%. Interest on overdue amounts or interest on the drawn amount paid during an event of default was charged at OBFR plus 2.52%. These rates represent floating rates of interest that may change over time. The SSB Agreement has a commitment fee of 0.10% of any undrawn amount. As of October 31, 2024, the interest rate charged under the SSB Agreement was 5.35%.

The Fund's MRP Shareholders are entitled to receive monthly cash dividends, at a currently effective dividend rate per annum for each series of MRP Shares as follows (subject to adjustment as described in the Fund's prospectus): 4.24% for Series C MRP Shares, 2.45% for Series D MRP Shares, 2.68% for Series E MRP Shares and 6.24% for Series G MRP Shares.

To cover the interest expense on the borrowings under the SSB Agreement (including "net income" payments made with respect to borrowings offset by collateral for securities on loan) and the dividend payments associated with the MRP Shares, based on rates in effect on October 31, 2024, the Fund's portfolio would need to experience an annual return of 1.84% (before giving effect to expenses associated with senior securities).

The following table illustrates the hypothetical effect on the return to a holder of the Fund's common shares of the leverage obtained by us (and utilized on October 31, 2024). The purpose of this table is to assist you in understanding the effects of leverage. As the table shows, leverage generally increases the return to common shareholders when portfolio return is positive and greater than the cost of leverage and decreases the return when the portfolio return is negative or less than the cost of leverage. The figures appearing in the table are hypothetical and actual returns may be greater or less than those appearing in the table.

Assumed Portfolio Return (Net of Expenses) | | | (10.00 | )% | | | (5.00 | )% | | | 0.00 | % | | | 5.00 | % | | | 10.00 | % | |

Corresponding Common Share Return(1) | | | (18.85 | ) | | | (10.89 | ) | | | (2.93 | ) | | | 5.03 | | | | 12.99 | | |

(1) Includes interest expense on the borrowings under the SSB Agreement, accrued at interest rates in effect on October 31, 2024 of 5.35%, and dividend expense on the MRP Shares.

Market and Net Asset Value Information

Our common shares have traded both at a premium and a discount to NAV. We cannot predict whether our shares will trade in the future at a premium or discount to NAV. The provisions of the 1940 Act generally require that the public offering price of common shares (less any underwriting commissions and discounts) must equal or exceed the NAV per share of a company's common stock (calculated within 48 hours of pricing). Our issuance of common shares may have an adverse effect on prices in the secondary market for our common shares by increasing the number of common shares available, which may put downward pressure on the market price for our common shares. Shares of common stock of closed-end investment companies frequently trade at a discount from NAV.

The following table sets forth for each of the periods indicated the high and low closing market prices for our common shares on Nasdaq, the NAV per share and the premium or discount to NAV per share at which our common shares were trading. NAV is shown for the last business day of each quarter. See "Net Asset Value" for information as to the determination of our NAV.

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

16

Additional Information About the Funds (Unaudited)

Calamos Convertible and High Income Fund (continued)

| | | MARKET PRICE(1) | | NET ASSET

VALUE AT

QUARTER | | PREMIUM/

(DISCOUNT) TO

NET ASSET VALUE(3) | |

QUARTER ENDED | | HIGH | | LOW | | END(2) | | HIGH | | LOW | |

October 31, 2024 | | $ | 12.31 | | | $ | 11.13 | | | $ | 10.63 | | | | 14.21 | % | | | 8.83 | % | |

July 31, 2024 | | $ | 11.48 | | | $ | 11.02 | | | $ | 10.52 | | | | 9.24 | % | | | 5.21 | % | |

April 30, 2024 | | $ | 12.14 | | | $ | 10.86 | | | $ | 10.30 | | | | 14.45 | % | | | 5.44 | % | |

January 31, 2024 | | $ | 11.94 | | | $ | 10.85 | | | $ | 10.57 | | | | 19.56 | % | | | 5.45 | % | |

October 31, 2023 | | $ | 11.64 | | | $ | 10.79 | | | $ | 9.49 | | | | 15.01 | % | | | 3.65 | % | |

July 31, 2023 | | $ | 11.56 | | | $ | 10.03 | | | $ | 11.09 | | | | 4.51 | % | | | -3.00 | % | |

April 30, 2023 | | $ | 12.77 | | | $ | 10.58 | | | $ | 10.50 | | | | 14.88 | % | | | -0.28 | % | |

January 31, 2023 | | $ | 12.38 | | | $ | 10.55 | | | $ | 11.19 | | | | 10.73 | % | | | 0.38 | % | |

October 31, 2022 | | $ | 13.38 | | | $ | 10.09 | | | $ | 10.81 | | | | 10.88 | % | | | -3.54 | % | |

July 31, 2022 | | $ | 13.26 | | | $ | 10.69 | | | $ | 11.77 | | | | 12.66 | % | | | -2.32 | % | |

April 30, 2022 | | $ | 15.21 | | | $ | 12.64 | | | $ | 12.70 | | | | 4.37 | % | | | -3.38 | % | |

January 31, 2022 | | $ | 17.08 | | | $ | 13.68 | | | $ | 14.37 | | | | 4.05 | % | | | -4.07 | % | |

Source: Fund Accounting Records

(1) Based on high and low closing market price per share during the respective quarter and does not reflect commissions.

(2) Based on the NAV calculated on the close of business on the last business day of each calendar quarter.

(3) Premium and discount information is shown for the days when the Fund experienced its high and low closing market prices, respectively, per share during the respective quarter.

www.calamos.com

17

Additional Information About the Funds (Unaudited)

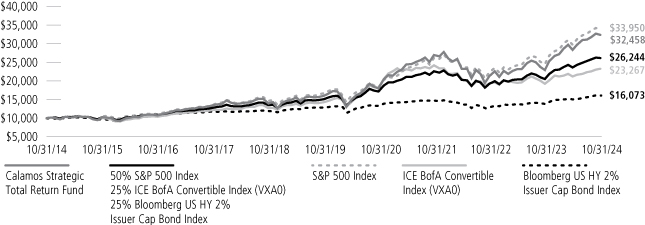

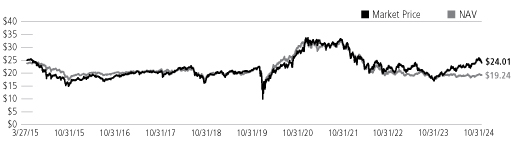

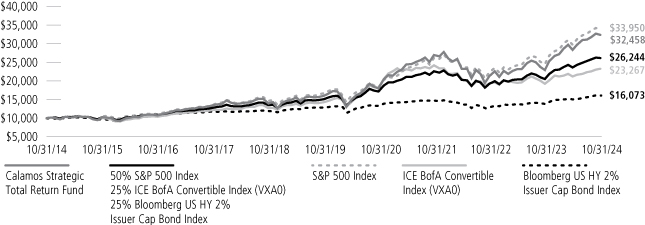

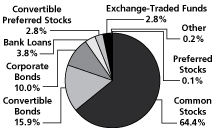

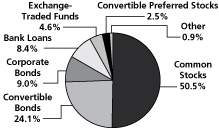

Calamos Strategic Total Return Fund

GROWTH OF $10,000: FOR THE 10-YEAR PERIOD ENDED 10/31/24

AVERAGE ANNUAL TOTAL RETURN† AS OF 10/31/24

| | | 1

YEAR | | 5

YEARS | | 10

YEARS | | SINCE

INCEPTION | |

Calamos Strategic Total Return Fund | |

Market Price | | | 45.67 | % | | | 14.75 | % | | | 12.99 | % | | | 9.47 | % | |

NAV | | | 41.22 | | | | 15.21 | | | | 12.49 | | | | 9.79 | | |

50%SPX-25%VXAO-25%BBGUSHY2%Cap Index | | | 28.16 | | | | 11.64 | | | | 10.13 | | | | 9.18 | | |

S&P 500 Index | | | 38.02 | | | | 15.27 | | | | 13.00 | | | | 10.41 | | |

ICE BofA All US Convertibles Index (VXA0) | | | 20.97 | | | | 10.33 | | | | 8.81 | | | | 8.04 | | |

Bloomberg US HY 2% Issuer Cap Bond Index | | | 16.47 | | | | 4.53 | | | | 4.86 | | | | 6.65 | | |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gain distributions. Source: State Street Corporation and Morningstar Direct.

† Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions.

NOTES:

The 50%SPX-25%VXA0-25%BBGUSHY2%Cap Index is blended from 50% - S&P 500 Index (SPX), 25% - ICE BofA All US Convertible Index (VXA0) and 25% - Bloomberg US HY 2% Issuer Capped Index.

The S&P 500 Index is an unmanaged index generally considered representative of the US stock market.

The ICE BofA All US Convertible Index is comprised of approximately 700 issues of only convertible bonds and preferreds of all qualities.

The Bloomberg US High Yield 2% Issuer Capped Index measures the performance of high-yield corporate bonds with a maximum allocation of 2% to any one issuer.

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

18

Additional Information About the Funds (Unaudited)

Calamos Strategic Total Return Fund (continued)

Effects of Leverage

The SSB Agreement provides for credit availability for the Fund, such that it may borrow up to $1.13 billion. As of October 31, 2024, the Fund had utilized $941 million of the $1.13 billion available under the SSB Agreement ($478 million of advances outstanding, and $463 million in structural leverage consisting of collateral received from counterparties via State Street Bank and Trust Company in connection with securities on loan), representing 23.1% of the Fund's managed assets as of that date, and had $323 million of MRP Shares outstanding, representing 7.9% of the Fund's managed assets. Combined, the borrowings under the SSB Agreement and the outstanding MRP Shares represented 31.0% of the Fund's managed assets. Interest on the SSB Agreement was charged on the drawn amount at the rate of the Overnight Bank Financing Rate ("OBFR") plus 0.52%. Interest on overdue amounts or interest on the drawn amount paid during an event of default was charged at OBFR plus 2.52%. These rates represent floating rates of interest that may change over time. The SSB Agreement has a commitment fee of 0.10% of any undrawn amount. As of October 31, 2024, the interest rate charged under the SSB Agreement was 5.35%.

The Fund's MRP Shareholders are entitled to receive monthly cash dividends, at a currently effective dividend rate per annum for each series of MRP Shares as follows (subject to adjustment as described in the Fund's prospectus): 4.24% for Series C MRP Shares, 2.45% for Series D MRP Shares, 3.66% for Series F MRP Shares and 6.24% for Series G MRP Shares.

To cover the interest expense on the borrowings under the SSB Agreement (including "net income" payments made with respect to borrowings offset by collateral for securities on loan) and the dividend payments associated with the MRP Shares, based on rates in effect on October 31, 2024, the Fund's portfolio would need to experience an annual return of 1.53% (before giving effect to expenses associated with senior securities).

The following table illustrates the hypothetical effect on the return to a holder of the Fund's common shares of the leverage obtained by us (and utilized on October 31, 2024). The purpose of this table is to assist you in understanding the effects of leverage. As the table shows, leverage generally increases the return to common shareholders when portfolio return is positive and greater than the cost of leverage and decreases the return when the portfolio return is negative or less than the cost of leverage. The figures appearing in the table are hypothetical and actual returns may be greater or less than those appearing in the table.

Assumed Portfolio Return (Net of Expenses) | | | (10.00 | )% | | | (5.00 | )% | | | 0.00 | % | | | 5.00 | % | | | 10.00 | % | |

Corresponding Common Share Return(1) | | | (16.71 | ) | | | (9.47 | ) | | | (2.22 | ) | | | 5.02 | | | | 12.27 | | |

(1) Includes interest expense on the borrowings under the SSB Agreement, accrued at interest rates in effect on October 31, 2024 of 5.35%, and dividend expense on the MRP Shares.

www.calamos.com

19

Additional Information About the Funds (Unaudited)

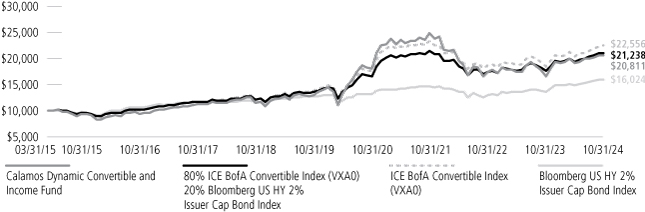

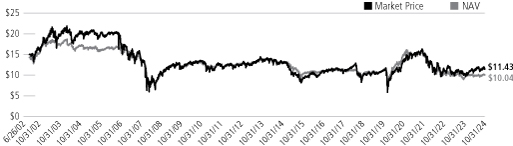

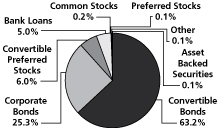

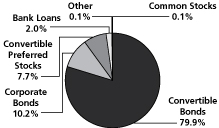

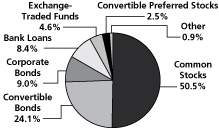

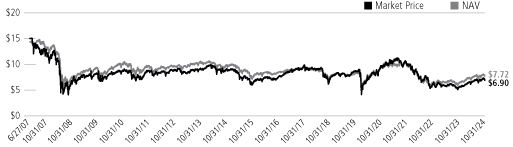

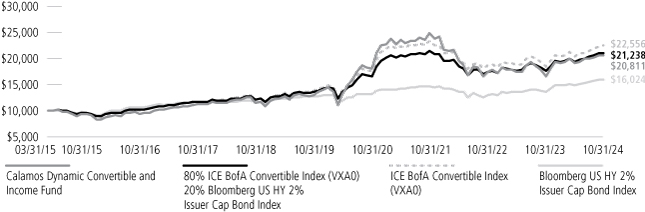

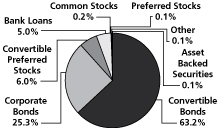

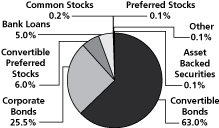

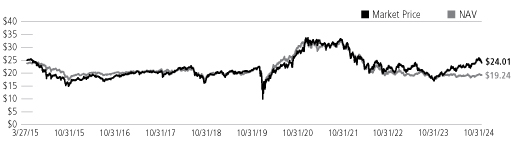

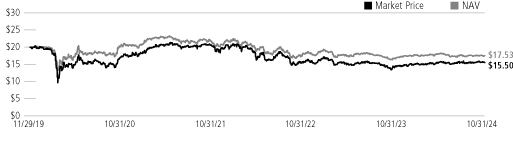

Calamos Dynamic Convertible and Income Fund

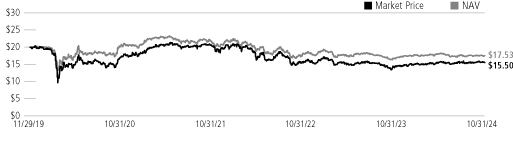

GROWTH OF $10,000: SINCE INCEPTION (03/31/15) THROUGH 10/31/24

AVERAGE ANNUAL TOTAL RETURN† AS OF 10/31/24

| | | 1

YEAR | | 5

YEARS | | SINCE

INCEPTION | |

Calamos Dynamic Convertible and Income Fund | |

Market Price | | | 57.16 | % | | | 13.82 | % | | | 9.93 | % | |

NAV | | | 24.63 | | | | 9.64 | | | | 7.93 | | |

80%VXAO-20%BBGUSHY2%Cap Index | | | 20.09 | | | | 9.28 | | | | 8.23 | | |

ICE BofA All US Convertibles Index (VXA0) | | | 20.97 | | | | 10.33 | | | | 8.92 | | |

Bloomberg US HY 2% Issuer Cap Bond Index | | | 16.47 | | | | 4.53 | | | | 5.06 | | |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gain distributions. Source: State Street Corporation and Morningstar Direct.

† Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions.

NOTES:

The graphs do not reflect the income taxes that you would pay on fund distributions or the redemption of fund shares. Fund performance includes reinvestment of dividends.

The 80%VXAO-20%BBGUSHY2%Cap Index is blended from 80% - ICE BofA Convertible Index (VXA0) and 20% - Bloomberg US HY 2% Issuer Capped Index.

The ICE BofA All US Convertible Index is comprised of approximately 700 issues of only convertible bonds and preferreds of all qualities. Since inception data for the index is shown from 6/30/97, since data is only available for full monthly periods.

The Bloomberg US High Yield 2% Issuer Capped Index measures the performance of high-yield corporate bonds with a maximum allocation of 2% to any one issuer.

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

20

Additional Information About the Funds (Unaudited)

Calamos Dynamic Convertible and Income Fund (continued)

Effects of Leverage

The SSB Agreement provides for credit availability for the Fund, such that it may borrow up to $370 million. As of October 31, 2024, the Fund had utilized $210 million of the $370 million available under the SSB Agreement ($179 million of advances outstanding, and $31 million in structural leverage consisting of collateral received from counterparties via State Street Bank and Trust Company in connection with securities on loan), representing 25.7% of the Fund's managed assets as of that date, and had $92 million of MRP Shares outstanding, representing 11.2% of the Fund's managed assets. Combined, the borrowings under the SSB Agreement and the outstanding MRP Shares represented 36.9% of the Fund's managed assets. Interest on the SSB Agreement was charged on the drawn amount at the rate of the Overnight Bank Financing Rate ("OBFR") was OBFR plus 0.52%. Interest on overdue amounts or interest on the drawn amount paid during an event of default was charged at OBFR plus 2.52%. These rates represent floating rates of interest that may change over time. The SSB Agreement has a commitment fee of 0.10% of any undrawn amount. As of October 31, 2024, the interest rate charged under the SSB Agreement was 5.35%.

The Fund's MRP Shareholders are entitled to receive monthly cash dividends, at a currently effective dividend rate per annum for each series of MRP Shares as follows (subject to adjustment as described in the Fund's prospectus): 4.24% for Series C MRP Shares, 2.45% for Series D MRP Shares, 2.68% for Series E MRP Shares and 6.24% for Series G MRP Shares.

To cover the interest expense on the borrowings under the SSB Agreement (including "net income" payments made with respect to borrowings offset by collateral for securities on loan) and the dividend payments associated with the MRP Shares, based on rates in effect on October 31, 2024, the Fund's portfolio would need to experience an annual return of 1.82% (before giving effect to expenses associated with senior securities).

The following table illustrates the hypothetical effect on the return to a holder of the Fund's common shares of the leverage obtained by us (and utilized on October 31, 2024). The purpose of this table is to assist you in understanding the effects of leverage. As the table shows, leverage generally increases the return to common shareholders when portfolio return is positive and greater than the cost of leverage and decreases the return when the portfolio return is negative or less than the cost of leverage. The figures appearing in the table are hypothetical and actual returns may be greater or less than those appearing in the table.

Assumed Portfolio Return (Net of Expenses) | | | (10.00 | )% | | | (5.00 | )% | | | 0.00 | % | | | 5.00 | % | | | 10.00 | % | |

Corresponding Common Share Return(1) | | | (18.73 | ) | | | (10.81 | ) | | | (2.89 | ) | | | 5.03 | | | | 12.95 | | |

(1) Includes interest expense on the borrowings under the SSB Agreement, accrued at interest rates in effect on October 31, 2024 of 5.35%, and dividend expense on the MRP Shares.

www.calamos.com

21

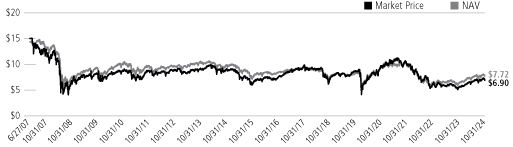

Additional Information About the Funds (Unaudited)

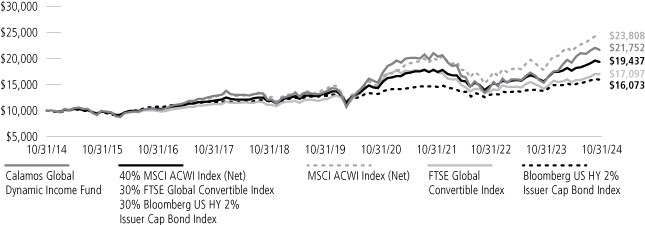

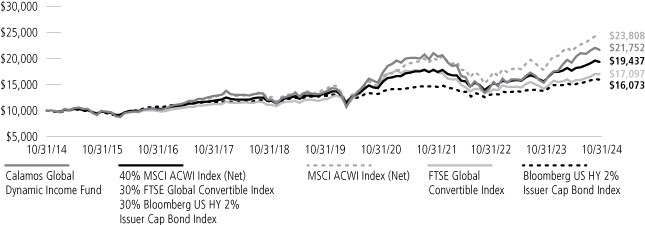

Calamos Global Dynamic Income Fund

GROWTH OF $10,000: FOR THE 10-YEAR PERIOD ENDED 10/31/24

AVERAGE ANNUAL TOTAL RETURN† AS OF 10/31/24

| | | 1

YEAR | | 5

YEARS | | 10

YEARS | | SINCE

INCEPTION | |

Calamos Global Dynamic Income Fund | |

Market Price | | | 44.97 | % | | | 6.93 | % | | | 7.84 | % | | | 5.59 | % | |

NAV | | | 41.34 | | | | 9.99 | | | | 8.08 | | | | 6.56 | | |

40%ACWI(NR)-30%FTSEGlblCv-30%BBGUSHY2%Cap Index | | | 23.85 | | | | 8.08 | | | | 6.87 | | | | 6.30 | | |

MSCI ACWI Index (Net) | | | 32.79 | | | | 11.08 | | | | 9.06 | | | | 6.44 | | |

FTSE Global Convertible index | | | 19.68 | | | | 7.02 | | | | 5.51 | | | | 5.26 | | |

Bloomberg US HY 2% Issuer Cap Bond Index | | | 16.47 | | | | 4.53 | | | | 4.86 | | | | 6.43 | | |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gain distributions. Source: State Street Corporation and Morningstar Direct.

† Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average assuming reinvestment of dividends and capital gains distributions.

NOTES:

The 40%ACWI(NR)-30%FTSEGlblCv-30%BBGHY2%Cap Index is blended from 40% - MSCI ACWI Index (Net), 30% - FTSE Global Convertible Index and 30% - Bloomberg US High Yield 2% Issuer Capped Index.

The MSCI ACWI Index (Net) is a free float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed markets and emerging markets. The index is calculated in both US dollars and local currencies. Net return basis approximates the minimum possible reinvestment of regular cash distributions by deducting withholding tax based on the maximum rate of the company's country of incorporation applicable to institutional investors.

The FTSE Global Convertible Index (USD) is designed to represent the global convertible market.

The Bloomberg US High Yield 2% Issuer Capped Index measures the performance of high-yield corporate bonds with a maximum allocation of 2% to any one issuer.

Index returns assume reinvestment of dividends and do not reflect deduction of fees and expenses. It is not possible to invest directly in an index.

CALAMOS CLOSED-END FAMILY OF FUNDS ANNUAL REPORT

22

Additional Information About the Funds (Unaudited)

Calamos Global Dynamic Income Fund (continued)

Effects of Leverage

The SSB Agreement provides for credit availability for the Fund, such that it may borrow up to $265 million. As of October 31, 2024, the Fund had utilized $212 million of the $265 million available under the SSB Agreement ($187 million of advances outstanding, and $25 million in structural leverage consisting of collateral received from counterparties via State Street Bank and Trust Company in connection with securities on loan), representing 28.1% of the Fund's managed assets as of that date, and had $48.5 million of MRP Shares outstanding, representing 6.4% of the Fund's managed assets. Combined, the borrowings under the SSB Agreement and the outstanding MRP Shares represented 34.5% of the Fund's managed assets. Interest on the SSB Agreement was charged on the drawn amount at the rate of the Overnight Bank Financing Rate ("OBFR") plus 0.52%. Interest on overdue amounts or interest on the drawn amount paid during an event of default was charged at OBFR plus 2.52%. These rates represent floating rates of interest that may change over time. The SSB Agreement has a commitment fee of 0.10% of any undrawn amount. As of October 31, 2024, the interest rate charged under the SSB Agreement was 5.35%.

The Fund's MRP Shareholders are entitled to receive monthly cash dividends, at a currently effective dividend rate per annum for each series of MRP Shares as follows (subject to adjustment as described in the Fund's prospectus): 4.24% for Series C MRP Shares, 2.45% for Series D MRP Shares and 2.68% for Series E MRP Shares.

To cover the interest expense on the borrowings under the SSB Agreement (including "net income" payments made with respect to borrowings offset by collateral for securities on loan) and the dividend payments associated with the MRP Shares, based on rates in effect on October 31, 2024, the Fund's portfolio would need to experience an annual return of 1.71% (before giving effect to expenses associated with senior securities).

The following table illustrates the hypothetical effect on the return to a holder of the Fund's common shares of the leverage obtained by us (and utilized on October 31, 2024). The purpose of this table is to assist you in understanding the effects of leverage. As the table shows, leverage generally increases the return to common shareholders when portfolio return is positive and greater than the cost of leverage and decreases the return when the portfolio return is negative or less than the cost of leverage. The figures appearing in the table are hypothetical and actual returns may be greater or less than those appearing in the table.

Assumed Portfolio Return (Net of Expenses) | | | (10.00 | )% | | | (5.00 | )% | | | 0.00 | % | | | 5.00 | % | | | 10.00 | % | |

Corresponding Common Share Return(1) | | | (17.88 | ) | | | (10.24 | ) | | | (2.61 | ) | | | 5.03 | | | | 12.66 | | |

(1) Includes interest expense on the borrowings under the SSB Agreement, accrued at interest rates in effect on October 31, 2024 of 5.35%, and dividend expense on the MRP Shares.

www.calamos.com

23

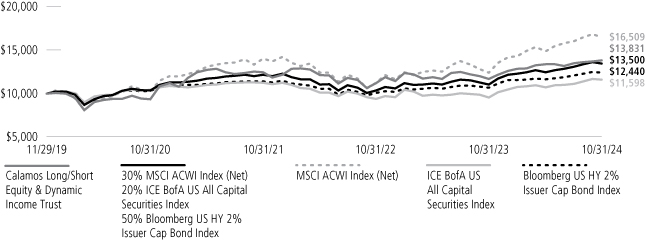

Additional Information About the Funds (Unaudited)

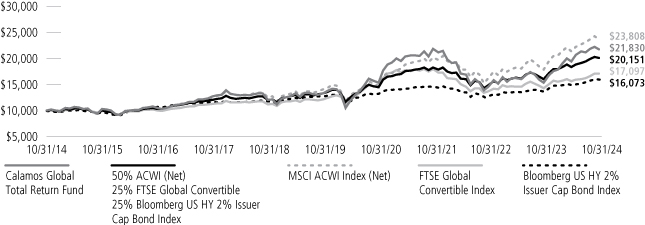

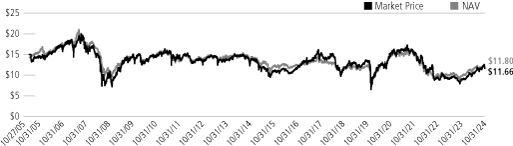

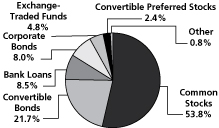

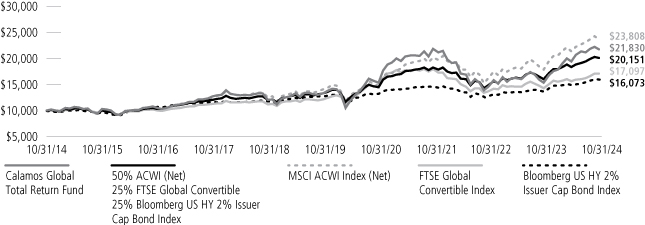

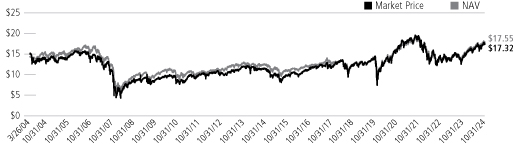

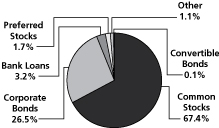

Calamos Global Total Return Fund

GROWTH OF $10,000: FOR THE 10-YEAR PERIOD ENDED 10/31/24

AVERAGE ANNUAL TOTAL RETURN† AS OF 10/31/24

| | | 1

YEAR | | 5

YEARS | | 10

YEARS | | SINCE

INCEPTION | |

Calamos Global Total Return Fund | |

Market Price | | | 56.82 | % | | | 9.18 | % | | | 8.50 | % | | | 8.04 | % | |

NAV | | | 41.86 | | | | 10.39 | | | | 8.12 | | | | 8.37 | | |

50%ACWI(NR)-25%FTSEGlblCv-25%BBGUSHY2%Cap Index | | | 25.31 | | | | 8.60 | | | | 7.26 | | | | 7.35 | | |

MSCI ACWI Index (Net) | | | 32.79 | | | | 11.08 | | | | 9.06 | | | | 7.80 | | |

FTSE Global Convertible index | | | 19.68 | | | | 7.02 | | | | 5.51 | | | | 6.31 | | |

Bloomberg US HY 2% Issuer Cap Bond Index | | | 16.47 | | | | 4.53 | | | | 4.86 | | | | 6.67 | | |

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gain distributions. Source: State Street Corporation and Morningstar Direct.