TrimTabs ETF Trust

TrimTabs All Cap U.S. Free-Cash-Flow ETF

TrimTabs All Cap International Free-Cash-Flow ETF

Annual Report

July 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the Funds’ reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. Please contact your financial intermediary to elect to receive shareholder reports and other Fund communications electronically.

You may elect to receive all future reports in paper free of charge. Please contact your financial intermediary to inform them that you wish to continue receiving paper copies of shareholder reports and for details about whether your election to receive reports in paper will apply to all funds held with your financial intermediary.

TrimTabs ETF Trust

TABLE OF CONTENTS

| Shareholder Letter for TrimTabs All Cap U.S. Free-Cash-Flow ETF | 1 |

| Performance Summary for TrimTabs All Cap U.S. Free-Cash-Flow ETF | 4 |

| Managers’ Discussion of Fund Performance for | |

| TrimTabs All Cap U.S. Free-Cash-Flow ETF | 5 |

| Shareholder Letter for TrimTabs All Cap International Free-Cash-Flow ETF | 6 |

| Performance Summary for TrimTabs All Cap International Free-Cash-Flow ETF | 9 |

| Managers’ Discussion of Fund Performance for | |

| TrimTabs All Cap International Free-Cash-Flow ETF | 10 |

| Shareholder Expense Examples | 11 |

| Portfolio Holdings Allocation | 13 |

| Schedules of Investments | 14 |

| Statements of Assets and Liabilities | 22 |

| Statements of Operations | 23 |

| Statements of Changes in Net Assets | 24 |

| Financial Highlights | 26 |

| Notes to Financial Statements | 28 |

| Report of Independent Registered Public Accounting Firm | 39 |

| Additional Information | 40 |

TrimTabs All Cap U.S. Free-Cash-Flow ETF

SHAREHOLDER LETTER

July 31, 2020 (Unaudited)

Dear Shareholder,

We are pleased to provide you with the Annual Report of the TrimTabs All Cap U.S. Free-Cash-Flow ETF (“Fund”). This report refers to the twelve-month period starting July 31, 2019 through July 31, 2020.

For the twelve-month period, the Fund returned 6.42% measured in market price and 6.97% measured in net asset value (“NAV”). By comparison, the broad-based benchmark for the Fund, the Russell 3000 Total Return Index (“Russell Index”), returned 10.93% for the period starting July 31, 2019 through July 31, 2020.

Looking specifically at 2020, for the six-month period ending July 31, 2020, the Fund returned 1.31% at market price and 1.41% at NAV. By comparison, the Russell Index returned 2.01%.

From inception, starting September 27, 2016, the Fund returned an annualized rate of 13.45% at market and 13.53% at NAV. The Russell Index during this period returned an annualized rate of 13.11%.

At the start of the reporting period, the US and global stock markets were dealing with a challenging environment driven by a major trade dispute between the US and, primarily, China but also intermittently with Mexico, Canada, and Europe. In October of 2019, both China and the US came to the table to discuss a US – China “Phase 1” trade agreement as tariffs were set to rise on December 15th. This provided some relief to global markets.

The US stock market rallied into the end of 2019 and into early 2020 on the announcement of a deal. At the same time, the US finalized agreements with Mexico and Canada. During the turbulent negotiation period, we noticed that large capitalization companies had more flexibility to adapt and manage their supply chains and thus were outperforming small- and mid-capitalization companies with less flexibility.

By February of 2020, the market was reaching new highs on the back of a narrow group of the largest capitalization companies producing strong organic growth. While we were not surprised to see a pullback in the US stock market, we underestimated the rapid spread and economic severity of the COVID-19 pandemic. The sell-off in US and global stock markets was rapid and relentless as economies were shut down to flatten the virus case curve.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (toll free 800-617-0004).

TrimTabs All Cap U.S. Free-Cash-Flow ETF

SHAREHOLDER LETTER

July 31, 2020 (Unaudited) (Continued)

On March 9, 2020 10-year US treasury yields reached a historical and unprecedented low of 0.54%. Credit markets were stressed, especially in the energy sector. Financial crises have usually started with a credit crisis; as companies struggle to fund on-going operations. The credit crisis was exacerbated by the shutdown across many sectors. Exploding unemployment claims followed.

By late March, the US Federal Reserve and US Government announced unprecedented amounts of fiscal and monetary stimulus to support the US economy during the shutdown. While the US stock market bottomed in late March, the US economy became even more bifurcated as technology, consumer staples, and healthcare companies benefitted from the crisis while other industries such as airlines, restaurants, entertainment, hotels, banks, and energy companies struggled.

The COVID-19 Pandemic accelerated trends in digital consumption that were firmly in place before the pandemic and underscored a bifurcated economy. These behaviors, which include on-line shopping, on-line payments, streaming content, video conferencing, work-from-home, at-home workouts, and video gaming, appear to be sticky and longer lasting. These trends have disrupted companies with traditional business models that do not have the flexibility to adapt, innovate, and serve in this environment.

While the virus remains ubiquitous with rolling outbreaks around the world, the US economy is slowly opening back up and improving. Globally, there have been great strides made towards a commercial vaccination. We have seen unprecedented cooperation between the FDA, public companies, and private foundations to improve treatments, find therapies, and create a vaccine. The market continues to pivot towards the next step of the recovery.

Our Fund uses a “quantamental” process, which combines our proprietary quantitative models, focused on Free Cash Flow, with seasoned and disciplined active, fundamental management to find high quality companies. We believe this strategy identifies organically growing companies that are likely to generate superior investment returns over the long-term. Our research shows that seeking companies with strong free cash flow, good balance sheets and a reduced number of outstanding common shares have improved the odds of outperforming our benchmark over a longer time frame.

Our team looks forward to helping serve your investment goals and we appreciate your trust.

Janet Flanders Johnston, CFA

Co-Chief Investment Officer

Portfolio Manager

Bob Shea

CEO

Co-Chief Investment Officer

TrimTabs All Cap U.S. Free-Cash-Flow ETF

SHAREHOLDER LETTER

July 31, 2020 (Unaudited) (Continued)

Must be preceded or accompanied by a current Fund prospectus.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance is no guarantee of future results.

Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any security. Current and future portfolio holdings are subject to risk. Please refer to the Schedule of Investments contained in this report for a full listing of fund holdings.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Owners of the shares may acquire those shares from the Fund and tender those shares for redemption to the Fund in Creation Unit aggregations only, consisting of 25,000 shares. Brokerage commissions will reduce returns. Investments in the Fund include risks associated with small and mid-cap securities which involve limited liquidity and greater volatility than large-cap securities.

The Russell 3000® Index measures the performance of the 3,000 largest publicly traded U.S. companies, based on market capitalization. The Index measures the performance of approximately 98% of the total market capitalization of the publicly traded U.S. equity market. The Index return reflects the reinvestment of income dividends and capital gain distributions, if any, but does not reflect fees, brokerage commissions, or other expenses of investing. It is not possible to invest directly in the Index.

Free Cash Flow (FCF) represents the cash that a company is able to generate after accounting for capital expenditures.

The TrimTabs All Cap U.S. Free-Cash-Flow ETF is distributed by Quasar Distributors, LLC.

TrimTabs All Cap U.S. Free-Cash-Flow ETF

PERFORMANCE SUMMARY

July 31, 2020 (Unaudited)

Growth of a $10,000 Investment

| | One | Three | Since |

| Average Annual Total Returns (as of July 31, 2020) | Year | Year | Inception(a) |

| TrimTabs All Cap U.S. | | | |

| Free-Cash-Flow ETF – NAV | 6.97% | 10.87% | 13.53% |

| TrimTabs All Cap U.S. | | | |

| Free-Cash-Flow ETF – Market | 6.42% | 10.68% | 13.45% |

Russell 3000® Total Return Index | 10.93% | 11.39% | 13.11% |

This chart assumes an initial gross investment of $10,000 made on September 27, 2016 (commencement of the Fund’s operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.The total operating expense ratio as stated in the fee table to the Fund’s prospectus dated November 29, 2019, as supplemented May 29, 2020, is 0.59%. For performance information current to the most recent month-end, please call 1-800-617-0004.

(a) Commencement of operations on September 27, 2016.

TrimTabs All Cap U.S. Free-Cash-Flow ETF

MANAGERS’ DISCUSSION OF FUND PERFORMANCE

July 31, 2020 (Unaudited)

For the twelve-month period from July 31, 2019 through July 31, 2020, the Fund returned 6.42% measured in market price and 6.97% measured in net asset value (“NAV”). By comparison, the broad-based benchmark for the Fund, the Russell 3000 Index (“Russell Index”), returned 10.93% over the same period.

An important characteristic for the period under review is that there was a bias toward larger capitalization issues. This can be illustrated by measuring the performance of the S&P 500 Index in its normal capitalization-weighted basis and on an equal-weighted basis. For both the twelve-month period and the first half of 2020, the equal-weighted version of the index underperformed the capitalization-weighted version by 11.39% and 8.83%, respectively.

It has often been the case that during market stress, smaller stocks underperform larger ones as investors seek what they believe is the relative safety of larger stocks. Because the cap-weighted version is heavily biased toward larger capitalization stocks, this environment presented headwinds for non-cap-weighted portfolios. The relevance to the Fund is that the Funds holdings are initiated at an equal weight basis, whereas our benchmark is cap-weighted.

As of July 31, 2020, five companies accounted for over 20% of the S&P 500 Index. Because we have an equal weight portfolio construction methodology for the Fund, a market environment that is driven by a handful of names will be a headwind for our Fund’s relative performance. This was the case for the twelve-month period, from July 31, 2019 to July 31, 2020.

A bifurcated US economy has emerged during the COVID-19 pandemic. This pandemic has rapidly accelerated trends in digital consumption and cloud computing. These behaviors, which include on-line shopping, on-line payments, streaming content, video conferencing, work-from-home, at-home workouts, and video gaming, appear to be sticky and longer lasting. These trends have disrupted companies with traditional business models that do not have the flexibility to adapt, innovate, and serve in this environment. The fund has exposure across a wide range of sectors to the digital economy and therefore contributed to fund performance during the reporting period.

In response to the COVID-19 pandemic, we have followed the data and focused on companies with strong Free Cash Flow, robust balance sheets, and where we have a higher level of conviction on a fundamental basis. Most importantly, in this environment, where some sectors have rising levels of bankruptcies, we have paid close attention to credit quality and liquidity. Our main goal of this focus on credit quality is to minimize the risk of large negative surprises.

The views and opinions expressed in this discussion are those of TrimTabs Asset Management, LLC. The views and opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance is no guarantee of future results.

Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any security. Current and future portfolio holdings are subject to risk.

TrimTabs All Cap International Free-Cash-Flow ETF

SHAREHOLDER LETTER

July 31, 2020 (Unaudited)

Dear Shareholder,

We are pleased to provide you with the Annual Report of the TrimTabs All Cap International Free-Cash-Flow ETF (“Fund”). This report refers to the twelve-month period starting July 31, 2019 through July 31, 2020.

For the twelve-month period, the Fund returned 2.97% measured in market price and 2.42% measured in net asset value (“NAV”). By comparison, the broad-based benchmark for the Fund, the S&P Developed Ex-US BMI Index (“S&P Index”), returned -0.29% for the period starting July 31, 2019 through July 31, 2020.

Looking specifically at 2020, for the six-month period ending July 31, 2020, the Fund was down 3.58% at market price and 3.32% at NAV. By comparison, the S&P Index was down 8.45%.

From inception, starting June 27, 2017, the Fund returned an annualized rate of 2.48% at market price and 2.49% at NAV. The S&P Index during this period returned an annualized rate of 1.63%.

At the start of the reporting period, international stock markets were dealing with a challenging environment driven by a major trade dispute between the US and, primarily, China but also intermittently with Mexico, Canada and Europe. International trade is a noticeably larger portion of economic activity outside the US than within. During the second half of 2019, other developed countries continued to be more impacted by these trade disputes than the US.

In October of 2019, both China and the US came to the table to discuss a US – China “Phase 1” trade agreement as tariffs were set to rise on December 15th. This provided some relief to global markets.

On December 31, 2019, China reported clusters of an unfamiliar illness in Wuhan, Hubei Province. By mid-January, COVID-19 had spread to Japan and other parts of Asia. The first cases were reported in Europe during mid-January. Other developed markets, non-US, saw cases peak in mid-February. These markets fell precipitously and bottomed on March 20, 2020 similarly to the US.

It was all hands on deck. An unprecedented amount of global central bank monetary support was used to reduce the impacts from economic shutdowns. Central Banks vowed to do whatever it takes. For the first time, Germany agreed to use fiscal stimulus to help their neighboring EU members and stimulate their own economy.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (toll free 800-617-0004).

TrimTabs All Cap International Free-Cash-Flow ETF

SHAREHOLDER LETTER

July 31, 2020 (Unaudited) (Continued)

The COVID-19 Pandemic accelerated trends in digital consumption that were firmly in place before the pandemic and underscored a bifurcated economy. These behaviors, which include on-line shopping, on-line payments, streaming content, video conferencing, work-from-home, at-home workouts, and video gaming, appear to be sticky and longer lasting. These trends have disrupted companies with traditional business models that do not have the flexibility to adapt, innovate, and serve in this environment.

While the virus remains ubiquitous with rolling outbreaks across the world, the global economy is slowly opening back up and improving. China has returned to work at 100% capacity. Globally, there have been great strides made towards a commercial vaccination. We have seen unprecedented cooperation between regulatory agencies, public companies, and private foundations to improve treatments, find therapies, and create a vaccine. The market continues to pivot towards the next step of the recovery.

Our Fund uses a “quantamental” process, which combines our proprietary quantitative models, focused on Free Cash Flow, with seasoned and disciplined active, fundamental management to find high quality companies. We believe this strategy identifies organically growing companies that are likely to generate superior investment returns over the long-term. Our research shows that seeking companies with strong free cash flow, good balance sheets and a reduced number of outstanding common shares have improved the odds of outperforming our benchmark over a longer time frame.

Our team looks forward to helping serve your investment goals and we appreciate your trust.

Janet Flanders Johnston, CFA

Co-Chief Investment Officer

Portfolio Manager

Bob Shea

CEO

Chief Investment Officer

Must be preceded or accompanied by a current Fund prospectus.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance is no guarantee of future results.

Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any security. Current and future portfolio holdings are subject to risk. Please refer to the Schedule of Investments contained in this report for a full listing of fund holdings.

TrimTabs All Cap International Free-Cash-Flow ETF

SHAREHOLDER LETTER

July 31, 2020 (Unaudited) (Continued)

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Investments in the Fund include risks associated with small-and mid-cap securities which involve limited liquidity and greater volatility than large-cap securities. Returns on investments in foreign securities could be more volatile than investments in securities of domestic issuers.

The S&P Developed Ex-U.S. BMI Index is a market capitalization weighted index that defines and measures the investable universe of publicly traded companies domiciled in developed countries outside the U.S. The S&P Index is float adjusted, meaning that only those shares publicly available to investors are included in the S&P Index calculation. It is not possible to invest directly in the Index. Free Cash Flow (FCF) represents the cash that a company is able to generate after accounting for capital expenditures.

The TrimTabs All Cap International Free-Cash-Flow ETF is distributed by Quasar Distributors, LLC.

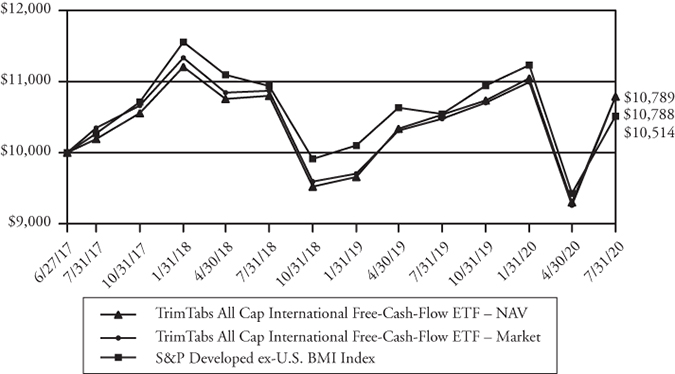

TrimTabs All Cap International Free-Cash-Flow ETF

PERFORMANCE SUMMARY

July 31, 2020 (Unaudited)

Growth of a $10,000 Investment

| | One | Three | Since |

| Average Annual Total Returns (as of July 31, 2020) | Year | Year | Inception(a) |

| TrimTabs All Cap International | | | |

| Free-Cash-Flow ETF – NAV | 2.42% | 1.91% | 2.49% |

| TrimTabs All Cap International | | | |

| Free-Cash-Flow ETF – Market | 2.97% | 1.40% | 2.48% |

| S&P Developed ex-U.S. BMI Index | -0.29%

| 0.79% | 1.63% |

This chart assumes an initial gross investment of $10,000 made on June 27, 2017 (commencement of the Fund’s operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.The total operating expense ratio as stated in the fee table to the Fund’s prospectus dated November 29, 2019, as supplemented May 29, 2020, is 0.61%. For performance information current to the most recent month-end, please call 1-800-617-0004.

(a) Commencement of operations on June 27, 2017.

TrimTabs All Cap International Free-Cash-Flow ETF

MANAGERS’ DISCUSSION OF FUND PERFORMANCE

July 31, 2020 (Unaudited)

For the twelve-month period from July 31, 2019 through July 31, 2020, the Fund returned 2.97% measured in market price and 2.42% measured in net asset value (“NAV”). By comparison, the broad-based benchmark for the Fund, the S&P Developed ex-US BMI Index (“S&P Index”), returned -0.29%.

During the second half of 2019, the global investment and economic environment was sensitive to the development of a major trade dispute between the US and, primarily, China but also intermittently with Mexico, Canada and Europe. International trade is a noticeably larger portion of economic activity outside the US than within.

As the trade conflict progressed, we strived to respond in the Fund in meaningful ways. As always, we emphasized companies with strong Free Cash Flow and robust balance sheets. On a fundamental basis, we looked at companies with other high-quality characteristics such as significant market share, competitive advantages, global brand awareness, and disruptive and/or state of the art technology. When possible, we added highly ranked companies with higher revenue exposure to the US where growth was stronger than the rest of the world.

In response to the COVID-19 pandemic, we have followed the data and focused on companies with strong Free Cash Flow, strong balance sheets, and where we have a higher level of conviction on a fundamental basis. Most importantly, in this environment, where some sectors have rising levels of bankruptcies, we have paid close attention to credit quality and liquidity. Our main goal of this focus on credit quality is to minimize the risk of large negative surprises.

Globally, we have observed the emergence of a bifurcated economy during the COVID-19 pandemic. This pandemic has rapidly accelerated trends in digital consumption and cloud computing. These behaviors, which include on-line shopping, on-line payments, streaming content, video conferencing, work-from-home, at-home workouts, and video gaming, appear to be sticky and longer lasting. These trends have disrupted companies with traditional business models that do not have the flexibility to adapt, innovate, and serve in this environment. The Fund’s portfolio has global exposure to companies with state of the art technology.

The views and opinions expressed in this discussion are those of TrimTabs Asset Management, LLC. The views and opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance is no guarantee of future results.

Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any security. Current and future portfolio holdings are subject to risk.

TrimTabs ETF Trust

SHAREHOLDER EXPENSE EXAMPLES

For the Six-Months Ended July 31, 2020 (Unaudited)

As a shareholder of the Fund you incur two types of costs: (1) transaction costs for purchasing and selling shares; and (2) ongoing costs, including management fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds.

Each example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period as indicated below.

Actual Expenses

The first line in the table below provides information about actual account values and actual expenses. You may use the information provided in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional cost, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line in the table below is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

TrimTabs ETF Trust

SHAREHOLDER EXPENSE EXAMPLES

For the Six-Months Ended July 31, 2020 (Unaudited) (Continued)

| | | | Expenses |

| | Beginning | Ending | Paid During |

| | Account | Account | Period |

| | Value | Value | 2/1/20 – |

| | 2/1/20 | 7/31/20 | 7/31/20(a) |

| TrimTabs All Cap U.S. | | | |

| Free-Cash-Flow ETF | | | |

| Actual | $1,000.00 | $1,016.10 | $2.96 |

| Hypothetical (5% return | | | |

| before expenses) | $1,000.00 | $1,021.93 | $2.97 |

| | | | |

| | | | Expenses |

| | Beginning | Ending | Paid During |

| | Account | Account | Period |

| | Value | Value | 2/1/20 – |

| | 2/1/20 | 7/31/20 | 7/31/20(a) |

| TrimTabs All Cap International | | | |

| Free-Cash-Flow ETF | | | |

| Actual | $1,000.00 | $ 976.70 | $2.90 |

| Hypothetical (5% return | | | |

| before expenses) | $1,000.00 | $1,021.93 | $2.97 |

(a) | Actual Expenses Paid are equal to the Fund’s annualized expense ratio of 0.59%, multiplied by the average account value over the period, multiplied by 182/366 to reflect the period. |

TrimTabs ETF Trust

PORTFOLIO HOLDINGS ALLOCATION (as a % of net assets)

July 31, 2020 (Unaudited)

TrimTabs All Cap U.S. Free-Cash-Flow ETF

| Communication Services | | | 6.6 | % |

| Consumer Discretionary | | | 14.7 | % |

| Consumer Staples | | | 9.9 | % |

| Energy | | | 2.0 | % |

| Financials | | | 14.1 | % |

| Health Care | | | 14.3 | % |

| Industrials | | | 9.4 | % |

| Information Technology | | | 27.0 | %(a) |

| Materials | | | 1.3 | % |

| Short-Term Investments | | | 0.7 | % |

| Liabilities in Excess of Other Assets | | | 0.0 | %(b) |

| Total Net Assets | | | 100.0 | % |

TrimTabs All Cap International Free-Cash-Flow ETF

| Australia | | | 5.9 | % |

| Canada | | | 5.2 | % |

| China | | | 3.3 | % |

| Denmark | | | 2.8 | % |

| Finland | | | 1.3 | % |

| France | | | 8.2 | % |

| Germany | | | 5.6 | % |

| Hong Kong | | | 1.6 | % |

| Ireland | | | 1.5 | % |

| Israel | | | 3.7 | % |

| Japan | | | 21.7 | % |

| Netherlands | | | 1.8 | % |

| Norway | | | 3.2 | % |

| Republic of Korea | | | 5.0 | % |

| Spain | | | 1.7 | % |

| Switzerland | | | 14.6 | % |

| United Kingdom | | | 10.8 | % |

| Other Countries | | | 1.5 | % |

| Short-Term Investments | | | 0.4 | % |

| Other Assets in Excess of Liabilities | | | 0.2 | % |

| Total Net Assets | | | 100.0 | % |

(a) | Amount represents investments in a particular sector. No industry within this sector represented more than 25% of the Fund’s total assets at the time of investment. |

(b) | Less than 0.05%. |

TrimTabs All Cap U.S. Free-Cash-Flow ETF

SCHEDULE OF INVESTMENTS

July 31, 2020

| | | Shares | | | Value | |

| COMMON STOCKS – 99.3% | | | | | | |

| | | | | | | |

| Communication Services – 6.6% | | | | | | |

| Activision Blizzard, Inc. | | | 8,740 | | | $ | 722,186 | |

| Alphabet, Inc. – Class A (a) | | | 1,425 | | | | 2,120,329 | |

| Facebook, Inc. – Class A (a) | | | 8,175 | | | | 2,073,752 | |

| The Walt Disney Co. | | | 10,205 | | | | 1,193,373 | |

| Zillow Group, Inc. – Class C (a) | | | 16,080 | | | | 1,099,711 | |

| | | | | | | | 7,209,351 | |

| Consumer Discretionary – 14.7% | | | | | | | | |

| Alibaba Group Holding Ltd. – ADR (a) | | | 5,628 | | | | 1,412,741 | |

| Amazon.com, Inc. (a) | | | 962 | | | | 3,044,422 | |

| Etsy, Inc. (a) | | | 10,402 | | | | 1,231,389 | |

| iRobot Corp. (a) | | | 9,175 | | | | 666,931 | |

| Lululemon Athletica, Inc. (a) | | | 3,289 | | | | 1,070,865 | |

| Marriott International, Inc. | | | 12,863 | | | | 1,078,241 | |

| NIKE, Inc. – Class B | | | 13,193 | | | | 1,287,769 | |

| Peloton Interactive, Inc. – Class A (a) | | | 14,346 | | | | 978,684 | |

| Starbucks Corp. | | | 13,882 | | | | 1,062,389 | |

| The Home Depot, Inc. | | | 5,259 | | | | 1,396,212 | |

| Thor Industries, Inc. | | | 9,309 | | | | 1,061,133 | |

| Yum China Holdings, Inc. | | | 33,627 | | | | 1,723,047 | |

| | | | | | | | 16,013,823 | |

| Consumer Staples – 9.9% | | | | | | | | |

| Brown-Forman Corp. – Class B | | | 16,302 | | | | 1,130,381 | |

| Colgate-Palmolive Co. | | | 13,485 | | | | 1,041,042 | |

| Costco Wholesale Corp. | | | 4,125 | | | | 1,342,811 | |

| Monster Beverage Corp. (a) | | | 15,840 | | | | 1,243,123 | |

| The Boston Beer Co., Inc. – Class A (a) | | | 2,049 | | | | 1,660,591 | |

| The Clorox Co. | | | 4,550 | | | | 1,076,120 | |

| The Estee Lauder Companies, Inc. | | | 5,266 | | | | 1,040,246 | |

| The Hershey Co. | | | 6,426 | | | | 934,405 | |

| Walmart, Inc. | | | 10,384 | | | | 1,343,690 | |

| | | | | | | | 10,812,409 | |

| Energy – 2.0% | | | | | | | | |

| Exxon Mobil Corp. | | | 52,363 | | | | 2,203,435 | |

The accompanying notes are an integral part of these financial statements.

TrimTabs All Cap U.S. Free-Cash-Flow ETF

SCHEDULE OF INVESTMENTS

July 31, 2020 (Continued)

| | | Shares | | | Value | |

| COMMON STOCKS – 99.3% (Continued) | | | | | | |

| | | | | | | |

| Financials – 14.1% | | | | | | |

| Aon PLC | | | 5,574 | | | $ | 1,143,896 | |

| Bank of America Corp. | | | 47,903 | | | | 1,191,827 | |

| Berkshire Hathaway, Inc. – Class B (a) | | | 7,826 | | | | 1,532,174 | |

| JPMorgan Chase & Co. | | | 27,075 | | | | 2,616,528 | |

| MarketAxess Holdings, Inc. | | | 2,862 | | | | 1,478,796 | |

| Moody’s Corp. | | | 4,035 | | | | 1,135,046 | |

| Morgan Stanley | | | 33,824 | | | | 1,653,317 | |

| Morningstar, Inc. | | | 4,520 | | | | 759,541 | |

| MSCI, Inc. | | | 3,393 | | | | 1,275,700 | |

| S&P Global, Inc. | | | 3,708 | | | | 1,298,727 | |

| The Progressive Corp. | | | 13,795 | | | | 1,246,240 | |

| | | | | | | | 15,331,792 | |

| Health Care – 14.3% | | | | | | | | |

| Abbott Laboratories | | | 11,691 | | | | 1,176,582 | |

| AbbVie, Inc. | | | 13,592 | | | | 1,290,017 | |

| Edwards Lifesciences Corp. (a) | | | 13,003 | | | | 1,019,565 | |

| Gilead Sciences, Inc. | | | 16,869 | | | | 1,172,902 | |

| Humana, Inc. | | | 3,270 | | | | 1,283,311 | |

| Illumina, Inc. (a) | | | 2,999 | | | | 1,146,098 | |

| Intuitive Surgical, Inc. (a) | | | 1,847 | | | | 1,266,008 | |

| Medtronic PLC | | | 6,527 | | | | 629,725 | |

| Regeneron Pharmaceuticals, Inc. (a) | | | 1,635 | | | | 1,033,434 | |

| UnitedHealth Group, Inc. | | | 6,780 | | | | 2,052,848 | |

| Vertex Pharmaceuticals, Inc. (a) | | | 3,396 | | | | 923,712 | |

| Zimmer Biomet Holdings, Inc. | | | 7,857 | | | | 1,059,595 | |

| Zoetis, Inc. | | | 9,829 | | | | 1,490,863 | |

| | | | | | | | 15,544,660 | |

| Industrials – 9.4% | | | | | | | | |

| CoStar Group, Inc. (a) | | | 1,696 | | | | 1,441,193 | |

| Lockheed Martin Corp. | | | 2,670 | | | | 1,011,850 | |

| Norfolk Southern Corp. | | | 5,679 | | | | 1,091,561 | |

| Old Dominion Freight Line, Inc. | | | 8,832 | | | | 1,614,666 | |

| Proto Labs, Inc. (a) | | | 10,831 | | | | 1,301,020 | |

| Rockwell Automation, Inc. | | | 5,408 | | | | 1,179,701 | |

| Trane Technologies PLC | | | 10,520 | | | | 1,176,872 | |

The accompanying notes are an integral part of these financial statements.

TrimTabs All Cap U.S. Free-Cash-Flow ETF

SCHEDULE OF INVESTMENTS

July 31, 2020 (Continued)

| | | Shares | | | Value | |

| COMMON STOCKS – 99.3% (Continued) | | | | | | |

| | | | | | | |

| Industrials – 9.4% (Continued) | | | | | | |

| Trex Co., Inc. (a) | | | 10,020 | | | $ | 1,396,087 | |

| | | | | | | | 10,212,950 | |

| Information Technology – 27.0% (d) | | | | | | | | |

| Accenture PLC – Class A | | | 6,140 | | | | 1,380,149 | |

| ANSYS, Inc. (a) | | | 4,602 | | | | 1,429,381 | |

| Apple, Inc. | | | 5,138 | | | | 2,183,856 | |

| Cadence Design Systems, Inc. (a) | | | 10,594 | | | | 1,157,394 | |

| FLIR Systems, Inc. | | | 25,860 | | | | 1,077,328 | |

| Fortinet, Inc. (a) | | | 8,066 | | | | 1,115,528 | |

| HP, Inc. | | | 59,644 | | | | 1,048,542 | |

| Intel Corp. | | | 23,980 | | | | 1,144,565 | |

| Jack Henry & Associates, Inc. | | | 6,608 | | | | 1,178,206 | |

| Keysight Technologies, Inc. (a) | | | 10,415 | | | | 1,040,354 | |

| Leidos Holdings, Inc. | | | 10,398 | | | | 989,474 | |

| Mastercard, Inc. – Class A | | | 3,743 | | | | 1,154,828 | |

| Maxim Integrated Products, Inc. | | | 16,498 | | | | 1,123,349 | |

| Microsoft Corp. | | | 13,366 | | | | 2,740,164 | |

| Nice Ltd. – ADR (a) | | | 8,505 | | | | 1,745,566 | |

| NVIDIA Corp. | | | 4,152 | | | | 1,762,898 | |

| Qualys, Inc. (a) | | | 8,983 | | | | 1,109,221 | |

| ServiceNow, Inc. (a) | | | 1,661 | | | | 729,511 | |

| Teradyne, Inc. | | | 10,147 | | | | 902,677 | |

| Texas Instruments, Inc. | | | 8,978 | | | | 1,145,144 | |

| VeriSign, Inc. (a) | | | 5,341 | | | | 1,130,583 | |

| Visa, Inc. – Class A | | | 5,480 | | | | 1,043,392 | |

| Zoom Video Communications, Inc. – Class A (a) | | | 3,942 | | | | 1,000,913 | |

| | | | | | | | 29,333,023 | |

| Materials – 1.3% | | | | | | | | |

| Louisiana-Pacific Corp. | | | 43,430 | | | | 1,375,428 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $86,090,589) | | | | | | | 108,036,871 | |

The accompanying notes are an integral part of these financial statements.

TrimTabs All Cap U.S. Free-Cash-Flow ETF

SCHEDULE OF INVESTMENTS

July 31, 2020 (Continued)

| | | Shares | | | Value | |

| SHORT-TERM INVESTMENTS – 0.7% | | | | | | |

| | | | | | | |

| Money Market Funds – 0.7% | | | | | | |

| Fidelity Institutional Money Market Funds – | | | | | | |

| Government Portfolio, Institutional Class, 0.050% (b) | | | 758,524 | | | $ | 758,524 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $758,524) | | | | | | | 758,524 | |

| | | | | | | | | |

| Total Investments (Cost $86,849,113) – 100.0% | | | | | | | 108,795,395 | |

| Liabilities in Excess of Other Assets – 0.0% (c) | | | | | | | (4,263 | ) |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 108,791,132 | |

Percentages are stated as a percent of net assets.

ADR – American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day yield as of July 31, 2020. |

| (c) | Less than 0.05%. |

| (d) | Amount represents investments in a particular sector. No industry within this sector represented more than 25% of the Fund’s total assets at the time of investment. |

For Fund compliance purposes, the Fund’s sector classifications refers to any one or more of the sector classifications used by one or more widely recognized market indexes or ratings group indexes, and/or they may be defined by Fund management. This definition does not apply for all purposes of this report, which may combine classifications for reporting ease.

The accompanying notes are an integral part of these financial statements.

TrimTabs All Cap International Free-Cash-Flow ETF

SCHEDULE OF INVESTMENTS

July 31, 2020

| | | Shares | | | Value | |

| COMMON STOCKS – 94.8% | | | | | | |

| | | | | | | |

| Communication Services – 6.7% | | | | | | |

| Capcom Co. Ltd. | | | 4,296 | | | $ | 167,611 | |

| Kakaku.com, Inc. | | | 5,361 | | | | 128,790 | |

| Nintendo Co. Ltd. | | | 300 | | | | 131,614 | |

| Rightmove PLC | | | 19,207 | | | | 139,086 | |

| Tencent Holdings Ltd. | | | 2,620 | | | | 180,519 | |

| | | | | | | | 747,620 | |

| Consumer Discretionary – 10.5% | | | | | | | | |

| adidas AG (a) | | | 510 | | | | 140,517 | |

| Alibaba Group Holding Ltd. – ADR (a) | | | 652 | | | | 163,665 | |

| Lululemon Athletica, Inc. (a) | | | 873 | | | | 284,240 | |

| Oriental Land Co. Ltd. | | | 986 | | | | 118,016 | |

| Puma SE (a) | | | 1,772 | | | | 137,430 | |

| Toyota Motor Corp. | | | 2,008 | | | | 117,933 | |

| Yum China Holdings, Inc. | | | 3,943 | | | | 202,039 | |

| | | | | | | | 1,163,840 | |

| Consumer Staples – 11.7% | | | | | | | | |

| Alimentation Couche-Tard, Inc. – Class B | | | 3,966 | | | | 137,831 | |

| Diageo PLC | | | 5,571 | | | | 204,262 | |

| Ebro Foods SA | | | 8,330 | | | | 186,435 | |

| Kao Corp. | | | 1,500 | | | | 108,204 | |

| L’Oreal SA | | | 459 | | | | 153,012 | |

| Nestle SA | | | 1,190 | | | | 140,658 | |

| Reckitt Benckiser Group PLC | | | 1,340 | | | | 135,168 | |

| Shiseido Co. Ltd. | | | 1,960 | | | | 108,318 | |

| Strauss Group Ltd. | | | 4,487 | | | | 127,180 | |

| | | | | | | | 1,301,068 | |

| Energy – 2.1% | | | | | | | | |

| Neste Oyj | | | 3,111 | | | | 142,480 | |

| TOTAL SE | | | 2,415 | | | | 89,041 | |

| | | | | | | | 231,521 | |

| Financials – 8.9% | | | | | | | | |

| BNP Paribas SA (a) | | | 4,564 | | | | 183,408 | |

| DNB ASA (a) | | | 12,644 | | | | 192,469 | |

| Partners Group Holding AG | | | 119 | | | | 114,661 | |

The accompanying notes are an integral part of these financial statements.

TrimTabs All Cap International Free-Cash-Flow ETF

SCHEDULE OF INVESTMENTS

July 31, 2020 (Continued)

| | | Shares | | | Value | |

| COMMON STOCKS – 94.8% (Continued) | | | | | | |

| | | | | | | |

| Financials – 8.9% (Continued) | | | | | | |

| Tokio Marine Holdings, Inc. | | | 2,437 | | | $ | 102,126 | |

| UBS Group AG | | | 16,410 | | | | 191,669 | |

| Zurich Insurance Group AG | | | 559 | | | | 205,495 | |

| | | | | | | | 989,828 | |

| Health Care – 10.3% | | | | | | | | |

| Cochlear Ltd. | | | 841 | | | | 114,294 | |

| CSL Ltd. | | | 897 | | | | 173,097 | |

| ICON PLC (a) | | | 868 | | | | 160,979 | |

| Novartis AG | | | 2,652 | | | | 218,847 | |

| Novo Nordisk A/S – Class B | | | 2,059 | | | | 135,786 | |

| Roche Holding AG | | | 670 | | | | 231,575 | |

| Shionogi & Co. Ltd. | | | 1,800 | | | | 106,430 | |

| | | | | | | | 1,141,008 | |

| Industrials – 15.6% | | | | | | | | |

| Ashtead Group PLC | | | 4,386 | | | | 139,801 | |

| Canadian Pacific Railway Ltd. | | | 577 | | | | 158,779 | |

| Daikin Industries Ltd. | | | 1,000 | | | | 174,295 | |

| FANUC Corp. | | | 600 | | | | 100,354 | |

| GEA Group AG | | | 4,065 | | | | 146,668 | |

| Howden Joinery Group PLC | | | 17,214 | | | | 110,480 | |

| Intertek Group PLC | | | 1,808 | | | | 127,280 | |

| Legrand SA | | | 1,583 | | | | 122,101 | |

| Recruit Holdings Co. Ltd. | | | 3,775 | | | | 116,543 | |

| Siemens AG | | | 1,566 | | | | 199,815 | |

| TOMRA Systems ASA (a) | | | 4,006 | | | | 164,301 | |

| Vestas Wind Systems A/S | | | 1,377 | | | | 176,827 | |

| | | | | | | | 1,737,244 | |

| Information Technology – 19.7% | | | | | | | | |

| ASML Holding NV | | | 567 | | | | 200,170 | |

| Atlassian Corp PLC – Class A (a) | | | 1,054 | | | | 186,189 | |

| Dassault Systemes SE | | | 986 | | | | 178,981 | |

| Halma PLC | | | 5,397 | | | | 153,869 | |

| Logitech International SA | | | 2,906 | | | | 210,606 | |

| Nice Ltd. – ADR (a) | | | 1,378 | | | | 282,821 | |

The accompanying notes are an integral part of these financial statements.

TrimTabs All Cap International Free-Cash-Flow ETF

SCHEDULE OF INVESTMENTS

July 31, 2020 (Continued)

| | | Shares | | | Value | |

| COMMON STOCKS – 94.8% (Continued) | | | | | | |

| | | | | | | |

| Information Technology – 19.7% (Continued) | | | | | | |

| Nomura Research Institute Ltd. | | | 6,712 | | | $ | 176,019 | |

| Omron Corp. | | | 3,221 | | | | 229,126 | |

| Samsung Electronics Co. Ltd. – GDR (b) | | | 173 | | | | 208,638 | |

| SCSK Corp. | | | 2,238 | | | | 112,899 | |

| Tokyo Electron Ltd. | | | 565 | | | | 153,720 | |

| Yaskawa Electric Corp. | | | 3,004 | | | | 98,899 | |

| | | | | | | | 2,191,937 | |

| Materials – 6.4% | | | | | | | | |

| Air Liquide SA | | | 1,095 | | | | 180,064 | |

| Fortescue Metals Group Ltd. | | | 17,738 | | | | 220,635 | |

| Givaudan SA | | | 39 | | | | 160,384 | |

| Sika AG | | | 676 | | | | 148,202 | |

| | | | | | | | 709,285 | |

| Real Estate – 2.9% | | | | | | | | |

| Goodman Group (c) | | | 12,656 | | | | 153,082 | |

| Japan Logistics Fund, Inc. (c) | | | 55 | | | | 164,706 | |

| | | | | | | | 317,788 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $8,578,937) | | | | | | | 10,531,139 | |

| | | | | | | | | |

| EXCHANGE TRADED FUNDS – 4.6% | | | | | | | | |

| iShares MSCI Europe Financials ETF | | | 11,336 | | | | 163,465 | |

| iShares MSCI South Korea ETF | | | 5,834 | | | | 351,557 | |

| TOTAL EXCHANGE TRADED FUNDS | | | | | | | | |

| (Cost $563,428) | | | | | | | 515,022 | |

The accompanying notes are an integral part of these financial statements.

TrimTabs All Cap International Free-Cash-Flow ETF

SCHEDULE OF INVESTMENTS

July 31, 2020 (Continued)

| | | Shares | | | Value | |

| SHORT-TERM INVESTMENTS – 0.4% | | | | | | |

| | | | | | | |

| Money Market Funds – 0.4% | | | | | | |

| Fidelity Institutional Money Market Funds – | | | | | | |

| Government Portfolio, Institutional Class, 0.050% (d) | | | 44,803 | | | $ | 44,803 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $44,803) | | | | | | | 44,803 | |

| | | | | | | | | |

| Total Investments (Cost $9,187,169) – 99.8% | | | | | | | 11,090,964 | |

| Other Assets in Excess of Liabilities – 0.2% | | | | | | | 25,239 | |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 11,116,203 | |

Percentages are stated as a percent of net assets.

ADR – American Depositary Receipt

GDR – Global Depositary Receipt

PLC – Public Limited Company

| (a) | Non-income producing security. |

| (b) | Security exempt from registration under Regulation S of the Securities Act of 1933. Such securities are treated as liquid according to the Fund’s liquidity guidelines. At July 31, 2020, the value of this security amounted to $208,638 or 1.9% of net assets. |

| (c) | Real Estate Investment Trust. |

| (d) | Rate disclosed is the seven day yield as of July 31, 2020. |

For Fund compliance purposes, the Fund’s sector classifications refers to any one or more of the sector classifications used by one or more widely recognized market indexes or ratings group indexes, and/or they may be defined by Fund management. This definition does not apply for all purposes of this report, which may combine classifications for reporting ease.

The accompanying notes are an integral part of these financial statements.

TrimTabs ETF Trust

STATEMENTS OF ASSETS & LIABILITIES

July 31, 2020

| | | | | | TrimTabs | |

| | | TrimTabs | | | All Cap | |

| | | All Cap U.S. | | | International | |

| | | Free-Cash-Flow | | | Free-Cash-Flow | |

| | | ETF | | | ETF | |

| ASSETS | | | | | | |

| Investments in Securities, at Value* | | $ | 108,795,395 | | | $ | 11,090,964 | |

| Receivable for Investment Securities Sold | | | 981,805 | | | | — | |

| Interest and Dividends Receivable | | | 66,123 | | | | 30,765 | |

| Total Assets | | | 109,843,323 | | | | 11,121,729 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Management Fees Payable | | | 54,106 | | | | 5,526 | |

| Payable for Fund Shares Redeemed | | | 998,085 | | | | — | |

| Total Liabilities | | | 1,052,191 | | | | 5,526 | |

| NET ASSETS | | $ | 108,791,132 | | | $ | 11,116,203 | |

| | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| Paid-in Capital | | $ | 101,858,167 | | | $ | 11,121,784 | |

| Total Distributable Earnings | | | | | | | | |

| (Accumulated Deficit) | | | 6,932,965 | | | | (5,581 | ) |

| Net Assets | | $ | 108,791,132 | | | $ | 11,116,203 | |

| * Identified Cost: | | | | | | | | |

| Investments in Securities | | $ | 86,849,113 | | | $ | 9,187,169 | |

| | | | | | | | | |

| Net Asset Value (unlimited shares authorized): | | | | | | | | |

| Net Assets | | $ | 108,791,132 | | | $ | 11,116,203 | |

| Shares Outstanding (No Par Value) | | | 2,725,000 | | | | 425,000 | |

| Net Asset Value, Offering and | | | | | | | | |

| Redemption Price per Share | | $ | 39.92 | | | $ | 26.16 | |

The accompanying notes are an integral part of these financial statements.

TrimTabs ETF Trust

STATEMENTS OF OPERATIONS

Year Ended July 31, 2020

| | | | | | TrimTabs | |

| | | TrimTabs | | | All Cap | |

| | | All Cap U.S. | | | International | |

| | | Free-Cash-Flow | | | Free-Cash-Flow | |

| | | ETF | | | ETF | |

| INVESTMENT INCOME | | | | | | |

| Income: | | | | | | |

| Dividends (net of foreign withholding tax | | | | | | |

| of $0 and $27,284, respectively) | | $ | 1,444,646 | | | $ | 181,483 | |

| Interest | | | 20,235 | | | | 2,104 | |

| Total Investment Income | | | 1,464,881 | | | | 183,587 | |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| Management Fees | | | 680,513 | | | | 68,189 | |

| Total Expenses | | | 680,513 | | | | 68,189 | |

| Net Investment Income | | | 784,368 | | | | 115,398 | |

| | | | | | | | | |

| REALIZED & UNREALIZED | | | | | | | | |

| GAIN (LOSS) ON INVESTMENTS | | | | | | | | |

| Net Realized Gain (Loss) on: | | | | | | | | |

| Investment Securities | | | (4,729,815 | ) | | | (1,098,415 | ) |

| Foreign Currencies | | | — | | | | (12,987 | ) |

| Total | | | (4,729,815 | ) | | | (1,111,402 | ) |

| Net Change in Unrealized Appreciation of: | | | | | | | | |

| Investments Securities | | | 9,605,380 | | | | 1,034,212 | |

| Foreign Currency Translations | | | — | | | | 1,892 | |

| Total | | | 9,605,380 | | | | 1,036,104 | |

| Net Realized and Unrealized Gain (Loss) | | | | | | | | |

| on Investments and Foreign Currencies | | | 4,875,565 | | | | (75,298 | ) |

| NET INCREASE IN NET ASSETS | | | | | | | | |

| RESULTING FROM OPERATIONS | | $ | 5,659,933 | | | $ | 40,100 | |

The accompanying notes are an integral part of these financial statements.

TrimTabs All Cap U.S. Free-Cash-Flow ETF

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | July 31, 2020 | | | July 31, 2019 | |

| OPERATIONS | | | | | | |

| Net Investment Income | | $ | 784,368 | | | $ | 1,037,781 | |

| Net Realized Loss on Investments | | | (4,729,815 | ) | | | (296,359 | ) |

| Net Change in Unrealized | | | | | | | | |

| Appreciation of Investments | | | 9,605,380 | | | | 1,466,422 | |

| Net Increase in Net Assets | | | | | | | | |

| Resulting from Operations | | | 5,659,933 | | | | 2,207,844 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Dividends and Distributions | | | (915,650 | ) | | | (684,621 | ) |

| Total Distributions to Shareholders | | | (915,650 | ) | | | (684,621 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from Shares Sold | | | 8,485,742 | | | | 55,574,345 | |

| Payments for Shares Redeemed | | | (28,495,215 | ) | | | (32,254,807 | ) |

| Net Increase (Decrease) in Net Assets Derived | | | | | | | | |

from Capital Share Transactions(a) | | | (20,009,473 | ) | | | 23,319,538 | |

| Net Increase (Decrease) in Net Assets | | | (15,265,190 | ) | | | 24,842,761 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of Year | | | 124,056,322 | | | | 99,213,561 | |

| End of Year | | $ | 108,791,132 | | | $ | 124,056,322 | |

| | | | | | | | | |

| (a) Summary of capital share transactions is as follows: | | | | | | | | |

| | | Shares | | | Shares | |

| Subscriptions | | | 250,000 | | | | 1,500,000 | |

| Redemptions | | | (825,000 | ) | | | (925,000 | ) |

| Net Increase (Decrease) | | | (575,000 | ) | | | 575,000 | |

The accompanying notes are an integral part of these financial statements.

TrimTabs All Cap International Free-Cash-Flow ETF

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | July 31, 2020 | | | July 31, 2019 | |

| OPERATIONS | | | | | | |

| Net Investment Income | | $ | 115,398 | | | $ | 165,219 | |

| Net Realized Loss on Investments | | | | | | | | |

| and Foreign Currencies | | | (1,111,402 | ) | | | (653,938 | ) |

| Net Change in Unrealized Appreciation of | | | | | | | | |

| Investments and Foreign Currencies | | | 1,036,104 | | | | 299,056 | |

| Net Increase (Decrease) in Net Assets | | | | | | | | |

| Resulting from Operations | | | 40,100 | | | | (189,663 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Dividends and Distributions | | | (244,461 | ) | | | (92,157 | ) |

| Total Distributions to Shareholders | | | (244,461 | ) | | | (92,157 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from Shares Sold | | | — | | | | 2,544,445 | |

| Payments for Shares Redeemed | | | (1,040,455 | ) | | | — | |

| Net Increase (Decrease) in Net Assets | | | | | | | | |

Derived from Capital Share Transactions(a) | | | (1,040,455 | ) | | | 2,544,445 | |

| Net Increase (Decrease) in Net Assets | | | (1,244,816 | ) | | | 2,262,625 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of Year | | | 12,361,019 | | | | 10,098,394 | |

| End of Year | | $ | 11,116,203 | | | $ | 12,361,019 | |

| | | | | | | | | |

| (a) Summary of capital share transactions is as follows: | | | | | | | | |

| | | Shares | | | Shares | |

| Subscriptions | | | — | | | | 100,000 | |

| Redemptions | | | (50,000 | ) | | | — | |

| Net Increase (Decrease) | | | (50,000 | ) | | | 100,000 | |

The accompanying notes are an integral part of these financial statements.

TrimTabs All Cap U.S. Free-Cash-Flow ETF

FINANCIAL HIGHLIGHTS

For a capital share outstanding throughout the year/period

| | | Year Ended | | | Year Ended | | | Year Ended | | | Period Ended | |

| | | July 31, | | | July 31, | | | July 31, | | | July 31, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017(a) | |

| Net Asset Value, | | | | | | | | | | | | |

| Beginning of Year/Period | | $ | 37.59 | | | $ | 36.41 | | | $ | 29.81 | | | $ | 25.00 | |

| | | | | | | | | | | | | | | | | |

| Income from Investment | | | | | | | | | | | | | | | | |

| Operations: | | | | | | | | | | | | | | | | |

Net Investment Income(b) | | | 0.25 | | | | 0.30 | | | | 0.21 | | | | 0.16 | |

| Net Realized and Unrealized | | | | | | | | | | | | | | | | |

| Gain on Investments | | | 2.36 | | | | 1.07 | | | | 6.53 | | | | 4.70 | |

| Total from | | | | | | | | | | | | | | | | |

| Investment Operations | | | 2.61 | | | | 1.37 | | | | 6.74 | | | | 4.86 | |

| | | | | | | | | | | | | | | | | |

| Less Distributions: | | | | | | | | | | | | | | | | |

| From Net Investment Income | | | (0.28 | ) | | | (0.19 | ) | | | (0.14 | ) | | | (0.05 | ) |

| Total Distributions | | | (0.28 | ) | | | (0.19 | ) | | | (0.14 | ) | | | (0.05 | ) |

| Net Asset Value, | | | | | | | | | | | | | | | | |

| End of Year/Period | | $ | 39.92 | | | $ | 37.59 | | | $ | 36.41 | | | $ | 29.81 | |

| Total Return | | | 6.97 | % | | | 3.89 | % | | | 22.62 | % | | | 19.47 | %(c) |

| | | | | | | | | | | | | | | | | |

| Supplemental Data: | | | | | | | | | | | | | | | | |

| Net Assets at | | | | | | | | | | | | | | | | |

| End of Year/Period (000’s) | | $ | 108,791 | | | $ | 124,056 | | | $ | 99,214 | | | $ | 27,574 | |

| | | | | | | | | | | | | | | | | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | |

| Expenses to Average Net Assets | | | 0.59 | % | | | 0.59 | % | | | 0.59 | % | | | 0.59 | %(d) |

| Net Investment Income | | | | | | | | | | | | | | | | |

| to Average Net Assets | | | 0.68 | % | | | 0.84 | % | | | 0.60 | % | | | 0.68 | %(d) |

Portfolio Turnover Rate(e) | | | 83 | % | | | 49 | % | | | 42 | % | | | 63 | %(c) |

| (a) | Commencement of operations on September 27, 2016. |

| (b) | Calculated based on average shares outstanding during the period. |

| (c) | Not annualized. |

| (d) | Annualized. |

| (e) | Excludes impact of in-kind transactions. |

The accompanying notes are an integral part of these financial statements.

TrimTabs All Cap International Free-Cash-Flow ETF

FINANCIAL HIGHLIGHTS

For a capital share outstanding throughout the year/period

| | | Year Ended | | | Year Ended | | | Year Ended | | | Period Ended | |

| | | July 31, | | | July 31, | | | July 31, | | | July 31, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017(a) | |

| Net Asset Value, | | | | | | | | | | | | |

| Beginning of Year/Period | | $ | 26.02 | | | $ | 26.93 | | | $ | 25.48 | | | $ | 25.00 | |

| | | | | | | | | | | | | | | | | |

| Income from Investment | | | | | | | | | | | | | | | | |

| Operations: | | | | | | | | | | | | | | | | |

Net Investment Income(b) | | | 0.25 | | | | 0.37 | | | | 0.34 | | | | 0.01 | |

| Net Realized and Unrealized | | | | | | | | | | | | | | | | |

| Gain (Loss) on Investments | | | 0.40 | | | | (1.08 | ) | | | 1.18 | | | | 0.47 | |

| Total from | | | | | | | | | | | | | | | | |

| Investment Operations | | | 0.65 | | | | (0.71 | ) | | | 1.52 | | | | 0.48 | |

| | | | | | | | | | | | | | | | | |

| Less Distributions: | | | | | | | | | | | | | | | | |

| From Net Investment Income | | | (0.51 | ) | | | (0.20 | ) | | | (0.07 | ) | | | — | |

| Total Distributions | | | (0.51 | ) | | | (0.20 | ) | | | (0.07 | ) | | | — | |

| Net Asset Value, | | | | | | | | | | | | | | | | |

| End of Year/Period | | $ | 26.16 | | | $ | 26.02 | | | $ | 26.93 | | | $ | 25.48 | |

| Total Return | | | 2.42 | % | | | -2.47 | % | | | 5.97 | % | | | 1.92 | %(c) |

| | | | | | | | | | | | | | | | | |

| Supplemental Data: | | | | | | | | | | | | | | | | |

| Net Assets at | | | | | | | | | | | | | | | | |

| End of Year/Period (000’s) | | $ | 11,116 | | | $ | 12,361 | | | $ | 10,098 | | | $ | 3,822 | |

| | | | | | | | | | | | | | | | | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | |

| Expenses to Average Net Assets | | | 0.59 | % | | | 0.59 | % | | | 0.59 | % | | | 0.59 | %(d) |

| Net Investment Income | | | | | | | | | | | | | | | | |

| to Average Net Assets | | | 1.00 | % | | | 1.48 | % | | | 1.28 | % | | | 0.35 | %(d) |

Portfolio Turnover Rate(e) | | | 45 | % | | | 43 | % | | | 83 | % | | | 0 | %(c) |

| (a) | Commencement of operations on June 27, 2017. |

| (b) | Calculated based on average shares outstanding during the period. |

| (c) | Not annualized. |

| (d) | Annualized. |

| (e) | Excludes impact of in-kind transactions. |

The accompanying notes are an integral part of these financial statements.

TrimTabs ETF Trust

NOTES TO FINANCIAL STATEMENTS

July 31, 2020

1. ORGANIZATION

The TrimTabs All Cap U.S. Free-Cash-Flow ETF (formerly known as the TrimTabs Float Shrink ETF) and TrimTabs All Cap International Free-Cash-Flow ETF (each, a “Fund” and collectively, the “Funds”) are each a series of the TrimTabs ETF Trust (the “Trust”). The Trust was organized as a Delaware statutory trust on April 2, 2014. Each Fund is classified as a diversified, open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). TrimTabs All Cap U.S. Free-Cash-Flow ETF commenced operations on September 27, 2016 and that is the date the initial creation units were established. The Fund seeks to generate long-term returns in excess of the total return of the Russell 3000® Index (the “Russell Index”), with less volatility than the Russell Index. TrimTabs All Cap International Free-Cash-Flow ETF commenced operations on June 27, 2017 and that is the date the initial creation units were established. The Fund seeks to generate long-term returns in excess of the total return of the S&P Developed ex-U.S. BMI Index, with similar volatility to the S&P Developed ex-U.S. BMI Index.

Shares of the Funds are listed and traded on the Cboe BZX Exchange, Inc. (“Cboe” or the “Exchange”). Market prices for the shares may be different from their net asset value (“NAV”). Each Fund issues and redeems shares on a continuous basis at NAV only in large blocks of shares, called “Creation Units,” which generally consist of 25,000 shares. Creation Units are issued and redeemed principally in-kind for securities included in a specified universe. Once created, shares generally trade in the secondary market at market prices that change throughout the day in amounts less than a Creation Unit. Except when aggregated in Creation Units, shares are not redeemable securities of a Fund. Shares of a Fund may only be purchased directly from or redeemed directly to a Fund by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a DTC participant and, in each case, must have executed a Participant Agreement with Quasar Distributors, LLC (the “Distributor”). Most retail investors do not qualify as Authorized Participants or have the resources to buy and sell whole Creation Units. Therefore, most retail investors may purchase shares in the secondary market with the assistance of a broker and are subject to customary brokerage commissions or fees.

Each Fund currently offers one class of shares, which have no front end sales loads, no deferred sales charges, and no redemption fees. A purchase (i.e., creation) transaction fee is imposed for the transfer and other transaction costs associated with the purchase of Creation Units. TrimTabs All Cap U.S. Free-Cash-Flow ETF charges $500 for the standard fixed creation fee and TrimTabs All Cap International Free-Cash-Flow ETF charges $1,500 for the standard fixed creation fee, payable to the Custodian. In addition, a variable fee may be charged on all cash transactions or substitutes for Creation Units of up to a maximum of 2% as a percentage of the total value of the Creation Units subject to the transaction. Variable fees received by each Fund are

TrimTabs ETF Trust

NOTES TO FINANCIAL STATEMENTS

July 31, 2020 (Continued)

displayed in the Capital Share Transactions section of the Statement of Changes in Net Assets. There were no variable fees charged in either Fund during the fiscal year. Each Fund may issue an unlimited number of shares of beneficial interest, with no par value. Shares of each Fund have equal rights and privileges with respect to such Fund.

2. SIGNIFICANT ACCOUNTING POLICIES

Each Fund is a registered investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 946 Financial Services – Investment Companies.

The following is a summary of significant accounting policies followed by each Fund in the preparation of their financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Security Transactions and Investment Income: Investment securities transactions are accounted for on the trade date. Gains and losses realized on sales of securities are computed on the basis of specific identification. Dividend income is recorded on the ex-dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable tax rules and regulations. Interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are accreted and amortized over the lives of the respective securities.

Dividend Distributions: Distributions to shareholders are recorded on the ex-dividend date and are determined in accordance with federal income tax regulations, which may differ from GAAP. Each Fund distributes all or substantially all of its net investment income to shareholders in the form of dividends.

Federal Income Taxes: The Funds comply with the requirements of subchapter M of the Internal Revenue Code of 1986, as amended, necessary to qualify as regulated investment companies and distribute substantially all net taxable investment income and net realized gains to shareholders in a manner which results in no tax cost to the Funds. Therefore, no federal income tax provision is required. As of and during the year ended July 31, 2020, the Funds did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. As of and during the year ended July 31, 2020, the Funds did not have liabilities for any unrecognized tax benefits on uncertain tax positions as income tax expense in the Statements of Operations. During the year ended July 31, 2020, the Funds did not incur any interest or penalties. The Funds are subject to examination by U.S. taxing authorities for the tax periods since each Fund’s commencement of operations.

Currency Translation: Assets and liabilities, including investment securities, denominated in currencies other than U.S. dollars are translated into U.S. dollars at the exchange rates supplied by one or more pricing vendors on the valuation date. Purchases and sales of investment securities and income and expenses are translated into U.S. dollars at the exchange rates on the dates of such transactions. The effects of changes in exchange rates

TrimTabs ETF Trust

NOTES TO FINANCIAL STATEMENTS

July 31, 2020 (Continued)

on investment securities are included with the net realized gain or loss and net unrealized appreciation or depreciation on investments in the Funds’ Statement of Operations. The realized gain or loss and unrealized appreciation or depreciation resulting from all other transactions denominated in currencies other than U.S. dollars are disclosed separately.

Use of Estimates: The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Share Valuation: The NAV per share of each Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash and other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding for the Fund, rounded to the nearest cent. The offering and redemption price per share for each Fund is equal to the Fund’s net asset value per share.

Guarantees and Indemnifications: The Funds indemnify their officers and trustees for certain liabilities that may arise from the performance of their duties to the Funds. Additionally, in the normal course of business, the Trust enters into contracts with its vendors and others that provide for general indemnifications. The Trust and Funds’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds. However, based on industry experience, the Funds expect that risk of loss to be remote.

Reclassification of Capital Accounts: U.S. GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or NAV per share. For the fiscal year ended July 31, 2020, the following table shows the reclassifications made:

| | Distributable Earnings | | | Paid-In | |

| | (Accumulated Deficit) | | | Capital | |

| TrimTabs All Cap U.S. Free-Cash-Flow ETF | | $ | (4,033,795 | ) | | | $ | 4,033,795 | |

| TrimTabs All Cap International Free-Cash-Flow ETF | | $ | 7,487 | | | | $ | (7,487 | ) |

During the fiscal year ended July 31, 2020, the Funds realized the following net capital gains resulting from in-kind redemptions in which shareholders exchanged Fund shares for securities held by the Funds rather than for cash. Because such gains are not taxable to the Funds, and are not distributed to shareholders, they have been reclassified from distributable earnings to paid-in capital.

| | Gains/(Losses) from | |

| | In-Kind Redemptions | |

| TrimTabs All Cap U.S. Free-Cash-Flow ETF | | $ | 4,123,412 | | |

| TrimTabs All Cap International Free-Cash-Flow ETF | | $ | (3,505 | ) | |

TrimTabs ETF Trust

NOTES TO FINANCIAL STATEMENTS

July 31, 2020 (Continued)

Subsequent Events: The Trust has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. Based on this evaluation, no adjustments or disclosures were required to the financial statements other than the events listed below.

The global outbreak of COVID-19 (commonly referred to as “coronavirus”) has disrupted economic markets and the prolonged economic impact is uncertain. The ultimate economic fallout from the pandemic, and the long-term impact on economies, markets, industries and individual issuers, are not known. The operational and financial performance of the issuers of securities in which the Funds invest depends on future developments, including the duration and spread of the outbreak, and such uncertainty may in turn adversely affect the value and liquidity of the Funds’ investments, impair the Funds’ ability to satisfy redemption requests, and negatively impact the Funds’ performance.

3. SECURITIES VALUATION

Investment Valuation: Each Fund calculates its net asset value (“NAV”) each day the New York Stock Exchange (the “NYSE”) is open for trading as of the close of regular trading on the NYSE, normally 4:00 p.m. Eastern time (the “NAV Calculation Time”).

Equity securities are valued primarily on the basis of market quotations reported on stock exchanges and other securities markets around the world. If an equity security is listed on a national securities exchange, the security is valued at the closing price or, if the closing price is not readily available, the mean of the closing bid and asked prices.

Market quotations and indicative bids are obtained from outside pricing services approved and monitored pursuant to a policy approved by the Funds’ Board of Trustees (the “Board”). If a market quotation is not readily available or is deemed not to reflect market value, the Funds will determine the price of the security held by the Funds based on a determination of the security’s fair value pursuant to policies and procedures approved by the Board. In addition, the Funds may use fair valuation to price securities that trade on a foreign exchange when a significant event has occurred after the foreign exchange closes but before the time at which the Funds’ NAV’s are calculated. Such valuations would typically be categorized as Level 2 or Level 3 in the fair value hierarchy described below.

Foreign exchanges typically close before the time at which Fund share prices are calculated and may be closed altogether on some days when shares of the Funds are traded. Significant events affecting a foreign security may include, but are not limited to: corporate actions, earnings announcements, litigation or other events impacting a single issuer; governmental action that affects securities in one sector or country; natural disasters or armed conflicts affecting a country or region; or significant domestic or foreign market fluctuations.

TrimTabs ETF Trust

NOTES TO FINANCIAL STATEMENTS

July 31, 2020 (Continued)

Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations that would have been used had greater market activity occurred.

Fair Valuation Measurement:

The FASB established a framework for measuring fair value in accordance with GAAP. Under FASB ASC Topic 820, Fair Value Measurement, various inputs are used in determining the value of each Fund’s investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The three Levels of inputs of the fair value hierarchy are defined as follows:

| Level 1 — | Unadjusted quoted prices in active markets for identical assets or liabilities. |

| | |

| Level 2 — | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | |

| Level 3 — | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability and would be based on the best information available. |

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The following is a summary of the inputs used to value the Fund’s investments as of July 31, 2020:

TrimTabs All Cap U.S. Free-Cash-Flow ETF

Description^ | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 108,036,871 | | | $ | — | | | $ | — | | | $ | 108,036,871 | |

| Short-Term Investments | | | 758,524 | | | | — | | | | — | | | | 758,524 | |

| Total Investments | | | | | | | | | | | | | | | | |

| in Securities | | $ | 108,795,395 | | | $ | — | | | $ | — | | | $ | 108,795,395 | |

TrimTabs ETF Trust

NOTES TO FINANCIAL STATEMENTS

July 31, 2020 (Continued)

TrimTabs All Cap International Free-Cash-Flow ETF

Description^ | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 10,531,139 | | | $ | — | | | $ | — | | | $ | 10,531,139 | |

| Exchange Traded Funds | | | 515,022 | | | | — | | | | — | | | | 515,022 | |

| Short-Term Investments | | | 44,803 | | | | — | | | | — | | | | 44,803 | |

| Total Investments | | | | | | | | | | | | | | | | |

| in Securities | | $ | 11,090,964 | | | $ | — | | | $ | — | | | $ | 11,090,964 | |

^ See Schedule of Investments for sector breakouts.

The Funds did not invest in any Level 3 securities during the period.

4. OTHER RELATED PARTY TRANSACTIONS

TrimTabs Asset Management, LLC. (“the Adviser”) serves as the investment adviser to the Funds. Pursuant to an Investment Advisory Agreement (“Investment Advisory Agreement”) between the Trust, on behalf of the Funds, and the Adviser, the Adviser provides investment advice to the Funds and oversees the day-to-day operations of the Funds, subject to the direction and control of the Board and the officers of the Trust. The Adviser administers the Funds’ business affairs, provides office facilities and equipment and certain clerical, bookkeeping and administrative services. The Adviser bears the costs of all advisory and non-advisory services required to operate the Funds, including payment of Trustee compensation, in exchange for a single unitary management fee. For services provided to the Funds, each Fund pays the Adviser 0.59% at an annual rate based on each Fund’s average daily net assets. Certain officers and a Trustee of the Trust are affiliated with the Adviser and are not paid any fees by the Funds for serving in such capacities.

Quasar Distributors, LLC acts as the Fund’s principal underwriter in a continuous public offering of the Funds’ shares. The Trust has adopted a distribution and service plan (“Rule 12b-1 Plan”) pursuant to Rule 12b-1 under the 1940 Act. Under the Rule 12b-1 Plan, each Fund is authorized to pay distribution fees in connection with the sale and distribution of its shares and pay service fees in connection with the provision of ongoing services to shareholders. To date, the Rule 12b-1 Plan has not been implemented for the Funds and there is no current intention to implement the Rule 12b-1 Plan.

5. SERVICE AND CUSTODY AGREEMENTS

The Funds have entered into Service Agreements with U.S. Bancorp Fund Services, LLC (“Fund Services” or “Administrator”), doing business as U.S. Bank Global Fund Services and a Custody Agreement with U.S. Bank, N.A. (“USB”), an affiliate of Fund Services. Under these agreements, Fund Services and USB provide certain transfer agency, administrative, accounting and custody services and are paid by the Adviser under the unitary fee arrangement noted above.

TrimTabs ETF Trust

NOTES TO FINANCIAL STATEMENTS

July 31, 2020 (Continued)

6. INVESTMENT TRANSACTIONS