UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22995

TrimTabs ETF Trust

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas

33rd fl

New York, NY 10105

(Address of principal executive offices) (Zip code)

Derin Cohen

1345 Avenue of the Americas

33rd fl

New York, NY 10105

(Name and address of agent for service)

1-212-217-2597

Registrant's telephone number, including area code

Date of fiscal year end: July 31

Date of reporting period: July 31, 2024

Item 1. Reports to Stockholders.

| | |

| FCF US Quality ETF | |

| TTAC (Principal U.S. Listing Exchange: CBOE) |

| Annual Shareholder Report | July 31, 2024 |

This annual shareholder report contains important information about the FCF US Quality ETF for the period of August 1, 2023, to July 31, 2024. This report also describes certain planned changes to the Fund. You can find additional information about the Fund at https://www.fcf-funds.com/ttac/. You can also request this information by contacting us at 1-800-617-0004.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| FCF US Quality ETF | $64 | 0.59% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

During this period, the Fund returned 16.29% (NAV) and 16.48% (Market) and its benchmark returned 21.07%. On a benchmark relative basis, the best active contributors were Consumer Discretionary and Mid Growth stocks. The main active detractors were Information Technology and Large Growth stocks. TTAC owns a portfolio of high-quality stocks selected by our proprietary free cash flow algorithm: as of July 31, 2024, the cash flow return for TTAC was 5.51% compared to 3.37% for R3000.

| |

Top Contributors |

| ↑ | Alphabet, Inc. - Class A |

| |

Top Detractors |

| ↓ | Fortinet, Inc. |

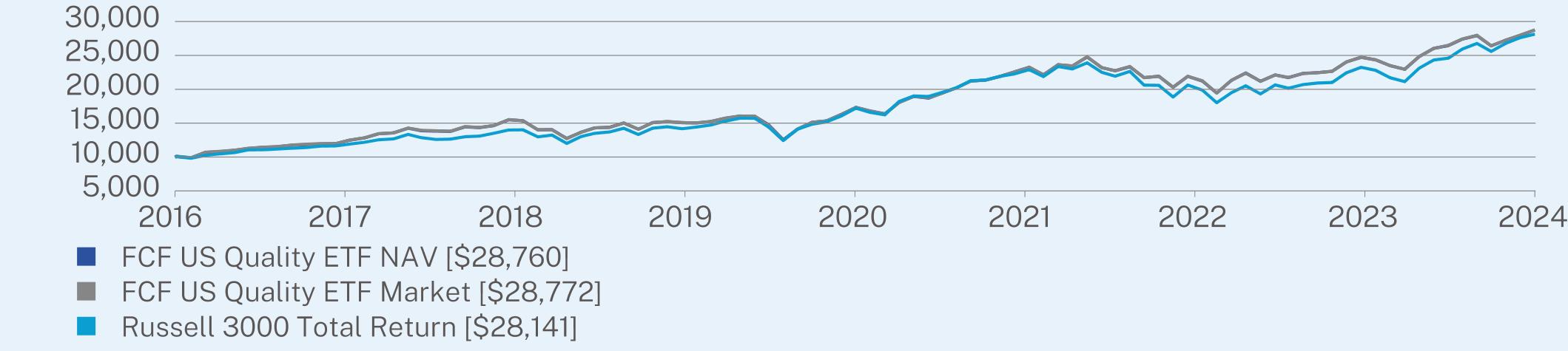

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(09/27/2016) |

FCF US Quality ETF NAV | 16.29 | 13.57 | 14.42 |

FCF US Quality ETF Market | 16.48 | 13.52 | 14.43 |

Russell 3000 Total Return | 21.07 | 14.23 | 14.11 |

Visit https://www.fcf-funds.com/ttac/ for more recent performance information.

| FCF US Quality ETF | PAGE 1 | TSR_AR_89628W302 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of July 31, 2024)

| |

Net Assets | $412,962,077 |

Number of Holdings | 151 |

Net Advisory Fee | $1,891,079 |

Portfolio Turnover | 70% |

30-Day SEC Yield | 0.88% |

30-Day SEC Yield Unsubsidized | 0.88% |

Visit https://www.fcf-funds.com/ttac/ for more recent performance information.

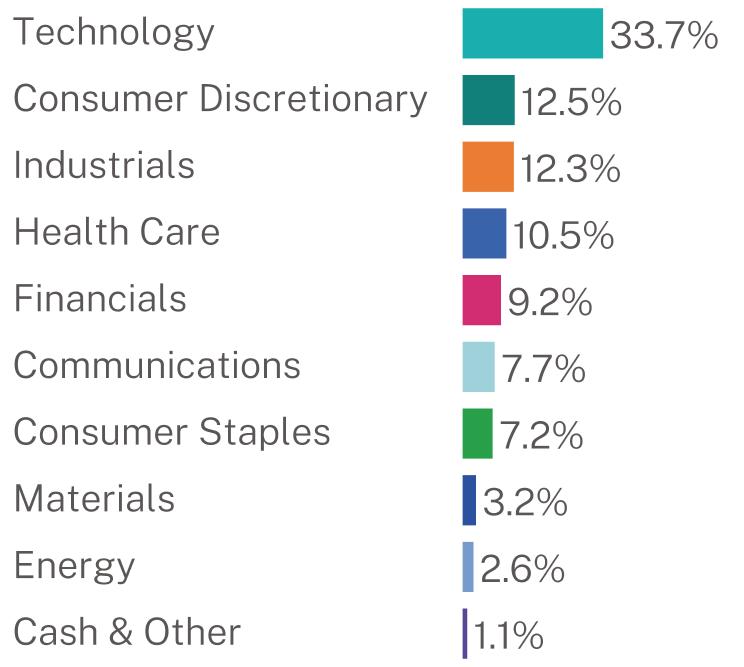

WHAT DID THE FUND INVEST IN? (as of July 31, 2024)

| |

Top 10 Issuers | (% of net assets) |

Apple, Inc. | 6.2% |

Mount Vernon Liquid Assets Portfolio, LLC | 5.1% |

AbbVie, Inc. | 2.7% |

Meta Platforms, Inc. | 2.4% |

Home Depot, Inc. | 2.3% |

Merck & Co., Inc. | 2.0% |

QUALCOMM, Inc. | 2.0% |

American Express Co. | 1.7% |

Adobe, Inc. | 1.5% |

International Business Machines Corp. | 1.5% |

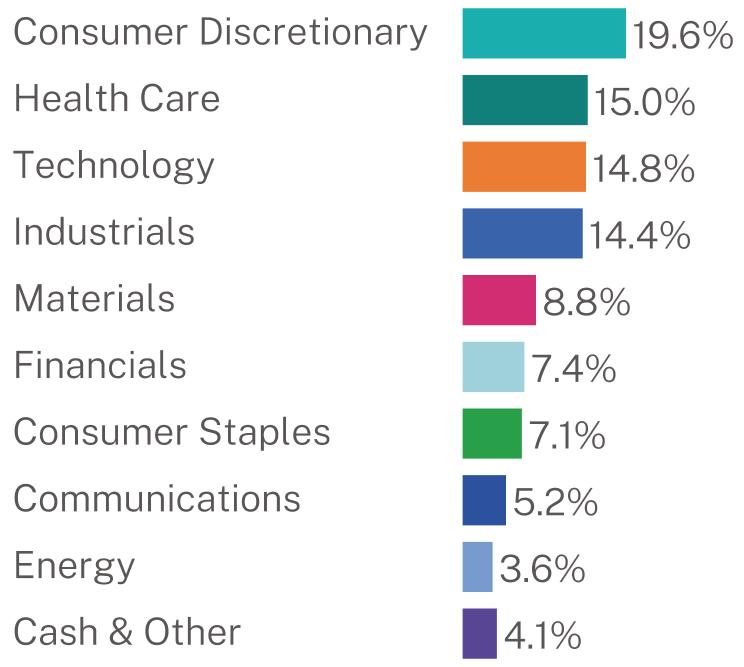

Sector Breakdown (% of net assets)

CERTAIN CHANGES TO THE FUND

This is a summary of certain planned changes to the Fund since August 1, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by November 28, 2024, at https://www.fcf-funds.com/ttac/ or upon request at 1-800-617-0004.

Changes to the Fund’s Investment Adviser

On August 7, 2024, Abacus Life, Inc., a pioneering alternative asset manager specializing in longevity and actuarial technology, announced a definitive agreement to acquire FCF Advisors LLC, the investment adviser for the Fund. The transaction is expected to close in the fourth quarter of 2024.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.fcf-funds.com/ttac/

The Fund is distributed by Quasar Distributors, LLC.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your FCF Advisors LLC documents not be householded, please contact FCF Advisors LLC at 1-800-617-0004, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by FCF Advisors LLC or your financial intermediary.

| FCF US Quality ETF | PAGE 2 | TSR_AR_89628W302 |

11947146501522016281225712191324732287601197814650152591623922566219152470128772116151351914472160532227020633232432814133.712.512.310.59.27.77.23.22.61.1

| | |

| FCF International Quality ETF | |

TTAI (Principal U.S. Listing Exchange: CBOE) |

| Annual Shareholder Report | July 31, 2024 |

This annual shareholder report contains important information about the FCF International Quality ETF for the period of August 1, 2023, to July 31, 2024. This report also describes certain planned changes to the Fund. You can find additional information about the Fund at https://www.fcf-funds.com/ttai/. You can also request this information by contacting us at 1-800-617-0004.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| FCF International Quality ETF | $62 | 0.59% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

During this period, the Fund returned 9.00% (NAV) and 8.78% (Market) and its benchmark returned 9.75%. On a benchmark relative basis, the main active contributors were Information Techology stocks, Large Growth stocks and exposure to Canada; and the main active detractors were Financials stocks, Large Blend stocks, and exposure to Austriasia. TTAI owns a portfolio of high-quality stocks selected by our proprietary free cash flow algorithm: as of July 31, 2024, the weighted average return on assets was 12.80%, compared to benchmark’s 6.20%; and cash flow return for TTAI was 8.28% compared to the benchmark’s -5.44%.

| |

Top Contributors |

| ↑ | Novo Nordisk A/S - Class B |

| |

Top Detractors |

| ↓ | Burbery Group PLC |

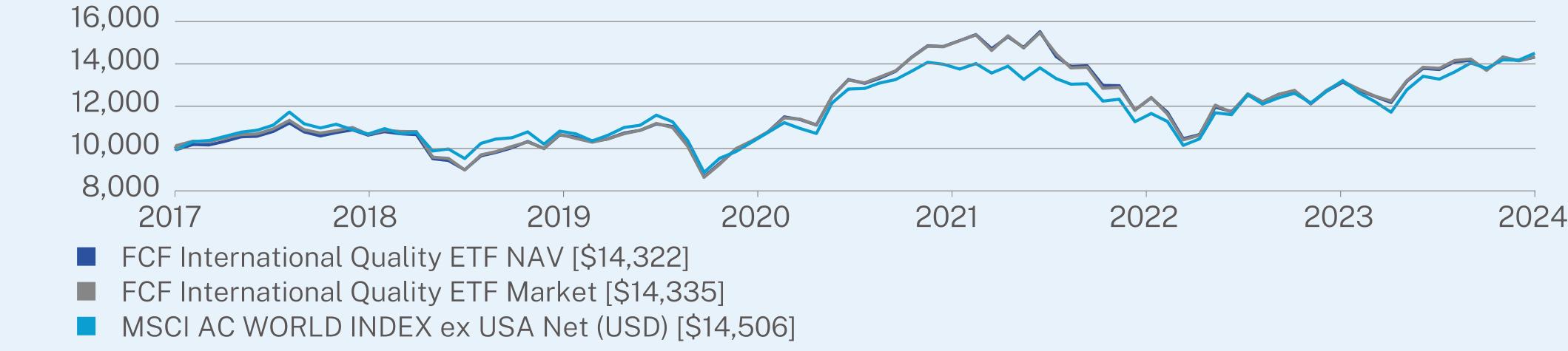

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(06/27/2017) |

FCF International Quality ETF NAV | 9.00 | 6.34 | 5.19 |

FCF International Quality ETF Market | 8.78 | 6.47 | 5.21 |

MSCI AC WORLD INDEX ex USA Net (USD) | 9.75 | 6.29 | 5.38 |

| FCF International Quality ETF | PAGE 1 | TSR_AR_89628W401 |

Visit https://www.fcf-funds.com/ttai/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of July 31, 2024)

| |

Net Assets | $60,455,154 |

Number of Holdings | 150 |

Net Advisory Fee | $348,796 |

Portfolio Turnover | 55% |

30-Day SEC Yield | 2.18% |

30-Day SEC Yield Unsubsidized | 2.18% |

Visit https://www.fcf-funds.com/ttai/ for more recent performance information.

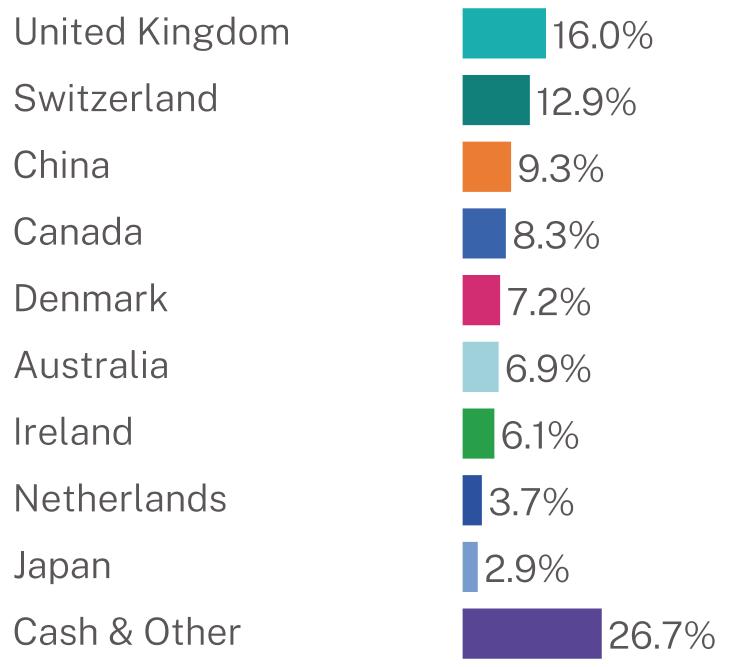

WHAT DID THE FUND INVEST IN? (as of July 31, 2024)

| |

Top 10 Issuers | (% of net assets) |

Novo Nordisk AS - Class B | 5.0% |

Roche Holding AG | 2.9% |

Mount Vernon Liquid Assets Portfolio, LLC | 2.3% |

BHP Group Ltd. | 2.2% |

RELX PLC | 2.2% |

Accenture PLC | 2.1% |

PDD Holdings, Inc. | 2.1% |

Novartis AG | 2.1% |

Constellation Software, Inc. | 1.8% |

Wolters Kluwer NV | 1.6% |

Geographic Breakdown (% of net assets)

Sector Breakdown (% of net assets)

CERTAIN CHANGES TO THE FUND

This is a summary of certain planned changes to the Fund since August 1, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by November 28, 2024, at https://www.fcf-funds.com/ttai/ or upon request at 1-800-617-0004.

Changes to the Fund’s Investment Adviser

On August 7, 2024, Abacus Life, Inc., a pioneering alternative asset manager specializing in longevity and actuarial technology, announced a definitive agreement to acquire FCF Advisors LLC, the investment adviser for the Fund. The transaction is expected to close in the fourth quarter of 2024.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.fcf-funds.com/ttai/

The Fund is distributed by Quasar Distributors, LLC.

| FCF International Quality ETF | PAGE 2 | TSR_AR_89628W401 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your FCF Advisors LLC documents not be householded, please contact FCF Advisors LLC at 1-800-617-0004, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by FCF Advisors LLC or your financial intermediary.

| FCF International Quality ETF | PAGE 3 | TSR_AR_89628W401 |

10192108001053410789151001239713139143221034810870104771078815095124161317814335103281094210693107631375411654132181450616.012.99.38.37.26.96.13.72.926.719.615.014.814.48.87.47.15.23.64.1

| | |

| Donoghue Forlines Tactical High Yield ETF | |

| DFHY (Principal U.S. Listing Exchange: CBOE) |

| Annual Shareholder Report | July 31, 2024 |

This annual shareholder report contains important information about the Donoghue Forlines Tactical High Yield ETF for the period of August 1, 2023, to July 31, 2024. This report also describes certain planned changes to the Fund. You can find additional information about the Fund at https://www.fcf-funds.com/dfhy/. You can also request this information by contacting us at 1-800-617-0004.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Donoghue Forlines Tactical High Yield ETF | $72 | 0.69% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

During this period, the Fund was up 7.39% (NAV) and 7.46% (Market) and its benchmark was up 5.10%. During the reporting period, bond markets began to recover from their steep drawdown in 2022. DFHY is a fund of funds that tactically allocates exposure to high yield bond ETFs or intermediate term treasury bond ETFs on a daily buy-sell signal. The Fund’s underlying index experienced seven risk mitigations signals for the 1-year period ended July 31, 2024. While performance varied for each, the Fund underperformed high yield asset class during the totality of the signal periods. However, the Fund benefited from being fully invested the majority of the period in the high yield market against the aggregate benchmark.

| |

Top Contributors |

| ↑ | iShares Broad USD High Yield Corp. Bd ETF |

| |

Top Detractors |

| ↓ | VanEck Fallen Angel HiYld Bd ETF |

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Donoghue Forlines Tactical High Yield ETF | PAGE 1 | TSR_AR_89628W609 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(12/07/2020) |

Donoghue Forlines Tactical High Yield ETF NAV | 7.39 | -0.61 |

Donoghue Forlines Tactical High Yield ETF Market | 7.46 | -0.58 |

Bloomberg US Aggregate Bond Index | 5.10 | -2.20 |

FCF Tactical High Yield Index | 6.24 | -1.26 |

Visit https://www.fcf-funds.com/dfhy/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of July 31, 2024)

| |

Net Assets | $30,292,766 |

Number of Holdings | 10 |

Net Advisory Fee | $215,499 |

Portfolio Turnover | 662% |

30-Day SEC Yield | 5.98% |

30-Day SEC Yield Unsubsidized | 5.98% |

Visit https://www.fcf-funds.com/dfhy/ for more recent performance information.

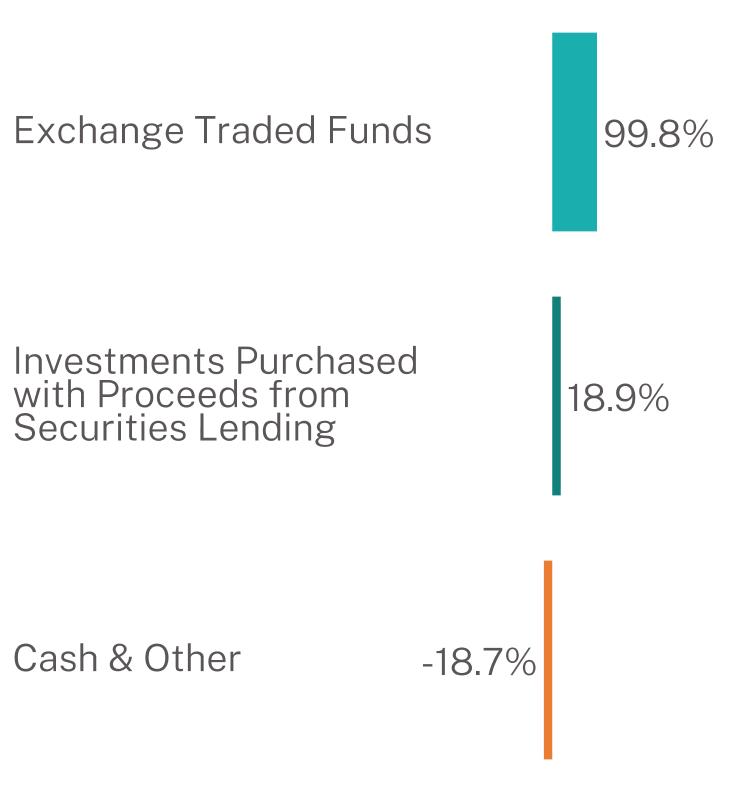

WHAT DID THE FUND INVEST IN? (as of July 31, 2024)

| |

Top 10 Issuers | (% of net assets) |

SPDR Bloomberg High Yield Bond ETF | 19.6% |

iShares Broad USD High Yield Corporate Bond ETF | 19.2% |

Mount Vernon Liquid Assets Portfolio, LLC | 18.9% |

iShares iBoxx $ High Yield Corporate Bond ETF | 16.3% |

iShares 0-5 Year High Yield Corporate Bond ETF | 9.2% |

Xtrackers USD High Yield Corporate Bond ETF | 9.1% |

SPDR Portfolio High Yield Bond ETF | 7.0% |

SPDR Bloomberg Short-Term High Yield Bond ETF | 6.8% |

iShares Fallen Angels USD Bond ETF | 6.5% |

VanEck Fallen Angel High Yield Bond ETF | 6.1% |

Security Type Breakdown (% of net assets)

CERTAIN CHANGES TO THE FUND

This is a summary of certain planned changes to the Fund since August 1, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by November 28, 2024, at https://www.fcf-funds.com/dfhy/ or upon request at 1-800-617-0004.

Changes to the Fund’s Investment Adviser

On August 7, 2024, Abacus Life, Inc., a pioneering alternative asset manager specializing in longevity and actuarial technology, announced a definitive agreement to acquire FCF Advisors LLC, the investment adviser for the Fund. The transaction is expected to close in the fourth quarter of 2024.

| Donoghue Forlines Tactical High Yield ETF | PAGE 2 | TSR_AR_89628W609 |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.fcf-funds.com/dfhy/

The Fund is distributed by Quasar Distributors, LLC.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your FCF Advisors LLC documents not be householded, please contact FCF Advisors LLC at 1-800-617-0004, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by FCF Advisors LLC or your financial intermediary.

| Donoghue Forlines Tactical High Yield ETF | PAGE 3 | TSR_AR_89628W609 |

102929267910797801029792669110979099919080877592221025392298989954999.818.918.7

| | |

| Donoghue Forlines Innovation ETF | |

| DFNV (Principal U.S. Listing Exchange: CBOE) |

| Annual Shareholder Report | July 31, 2024 |

This annual shareholder report contains important information about the Donoghue Forlines Innovation ETF for the period of August 1, 2023, to July 31, 2024. This report also describes changes to the Fund that occurred during the reporting period and certain planned changes to the Fund. You can find additional information about the Fund at https://www.fcf-funds.com/dfnv/. You can also request this information by contacting us at 1-800-617-0004.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Donoghue Forlines Innovation ETF | $75 | 0.69% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

During this period, the Fund was up 18.76% (NAV) and 18.95% (Market) and its style-specific benchmark was up 26.94%. The primary factor for the Fund’s underperformance relative to its benchmark was the size factor, with a small number of stocks in market cap indices attributing the most to their performance. DFNV owns a portfolio of high-quality innovative stocks selected by our proprietary free cash flow algorithm. Growth and innovation stocks outperformed the market. The largest contributors to performance were Information Technology and Communication Services stock. The largest detractors were Consumer Discretionary and Utilities stocks.

| |

Top Contributors |

| ↑ | Nvidia Corp. |

| |

Top Detractors |

| ↓ | Uber Technologies, Inc. |

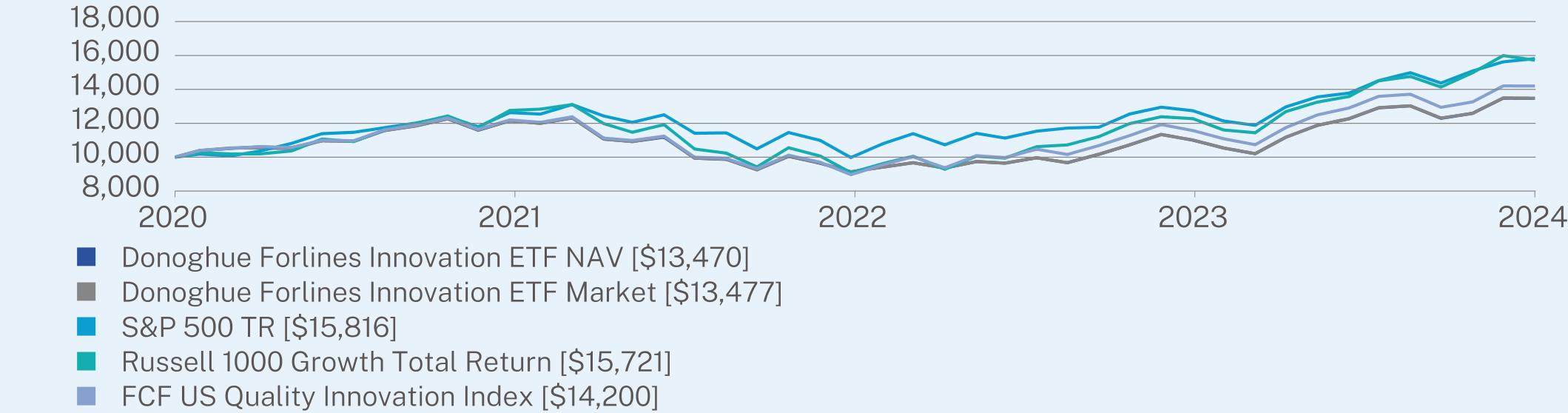

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

In connection with new regulatory requirements, the Fund has changed its broad-based securities market benchmark from the Russell 1000 Growth Index to the S&P 500 Index. The Fund will continue to compare its performance to (i) the Russell 1000 Growth Index, which reflects the market segments in which the Fund invests, and (ii) the FCF US Quality Innovation Index, which is the index the Fund seeks to track, before fees and expenses.

| Donoghue Forlines Innovation ETF | PAGE 1 | TSR_AR_89628W500 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(12/07/2020) |

Donoghue Forlines Innovation ETF NAV | 18.76 | 8.51 |

Donoghue Forlines Innovation ETF Market | 18.95 | 8.53 |

S&P 500 TR | 22.15 | 13.40 |

Russell 1000 Growth Total Return | 26.94 | 13.21 |

FCF US Quality Innovation Index | 19.07 | 10.09 |

Visit https://www.fcf-funds.com/dfnv/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of July 31, 2024)

| |

Net Assets | $44,909,630 |

Number of Holdings | 101 |

Net Advisory Fee | $287,410 |

Portfolio Turnover | 86% |

30-Day SEC Yield | 0.19% |

30-Day SEC Yield Unsubsidized | 0.19% |

Visit https://www.fcf-funds.com/dfnv/ for more recent performance information.

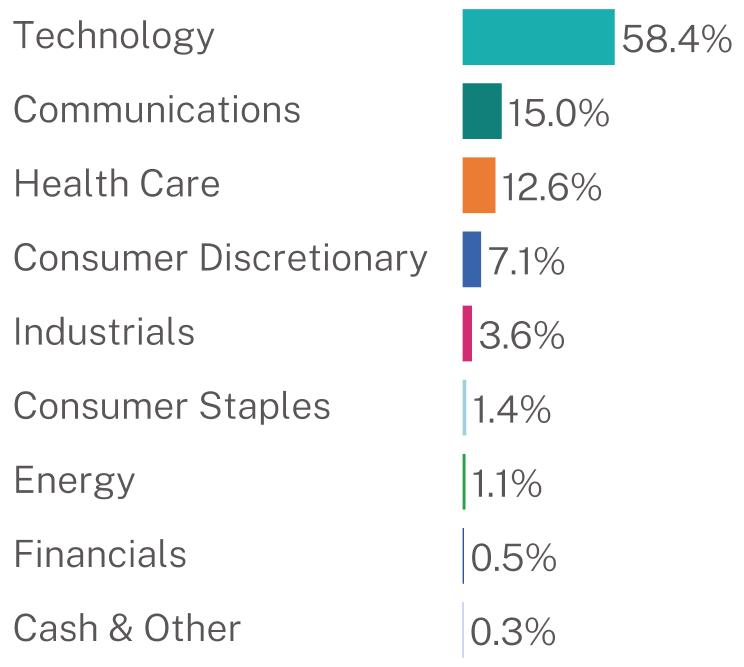

WHAT DID THE FUND INVEST IN? (as of July 31, 2024)

| |

Top 10 Issuers | (% of net assets) |

Mount Vernon Liquid Assets Portfolio, LLC | 8.2% |

Apple, Inc. | 8.0% |

Amazon.com, Inc. | 5.8% |

Meta Platforms, Inc. | 4.6% |

Broadcom, Inc. | 4.1% |

AbbVie, Inc. | 3.0% |

Oracle Corp. | 2.8% |

Adobe, Inc. | 2.8% |

Merck & Co., Inc. | 2.5% |

ServiceNow, Inc. | 2.3% |

Sector Breakdown (% of net assets)

CERTAIN CHANGES TO THE FUND

This is a summary of certain changes and planned changes to the Fund since August 1, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by November 28, 2024, at https://www.fcf-funds.com/dfnv/ or upon request at 1-800-617-0004.

Changes to the Fund’s Principal Investment Strategies

On November 7, 2023, the FCF Risk Managed Quality Innovation Index, which is the Fund’s underlying index, and therefore the Fund, implemented a change to its rules-based methodology to remove the downside protection model. Accordingly, the Fund is 100% invested in a portfolio of high-quality innovative stocks moving forward.

| Donoghue Forlines Innovation ETF | PAGE 2 | TSR_AR_89628W500 |

Changes to the Fund’s Investment Adviser

On August 7, 2024, Abacus Life, Inc., a pioneering alternative asset manager specializing in longevity and actuarial technology, announced a definitive agreement to acquire FCF Advisors LLC, the investment adviser for the Fund. The transaction is expected to close in the fourth quarter of 2024.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.fcf-funds.com/dfnv/

The Fund is distributed by Quasar Distributors, LLC.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your FCF Advisors LLC documents not be householded, please contact FCF Advisors LLC at 1-800-617-0004, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by FCF Advisors LLC or your financial intermediary.

| Donoghue Forlines Innovation ETF | PAGE 3 | TSR_AR_89628W500 |

118481005211343134701184510056113301347712015114571294915816119871055712385157211189210116119261420058.415.012.67.13.61.41.10.50.3

| | |

| Donoghue Forlines Yield Enhanced Real Asset ETF | |

| DFRA (Principal U.S. Listing Exchange: CBOE) |

| Annual Shareholder Report | July 31, 2024 |

This annual shareholder report contains important information about the Donoghue Forlines Yield Enhanced Real Asset ETF for the period of August 1, 2023, to July 31, 2024. This report also describes certain planned changes to the Fund. You can find additional information about the Fund at https://www.fcf-funds.com/dfra/. You can also request this information by contacting us at 1-800-617-0004.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Donoghue Forlines Yield Enhanced Real Asset ETF | $74 | 0.69% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

During this period, the Fund was up 15.86% (NAV) and 16.15% (Market) and its style-specific benchmark was up 6.58%. The Fund’s outperformance of its style-specific benchmark can be attributed to stock selection and sector composition. DFRA owns a portfolio of high-quality real asset stocks selected by our proprietary free cash flow algorithm. Real Assets underperformed the broad market during the time period. The largest contributors to performance were Consumer Staples and Industrials stocks. The largest detractors were Healthcare and Consumer Discretionary stocks.

| |

Top Detractors |

| ↓ | Woodside Energy Group Ltd. - ADR |

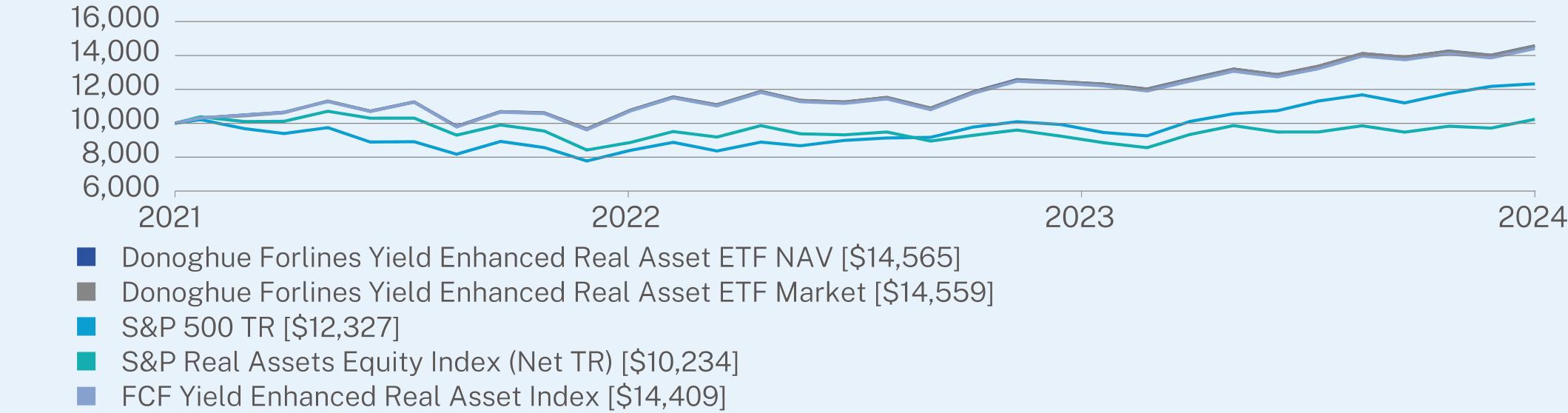

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

In connection with new regulatory requirements, the Fund has changed its broad-based securities market benchmark from the S&P Real Assets Equity Index to the S&P 500 Index. The Fund will continue to compare its performance to (i) the S&P Real Assets Equity Index, which reflects the market segments in which the Fund invests, and (ii) the FCF Yield Enhanced Real Asset Index, which is the index the Fund seeks to track, before fees and expenses.

| Donoghue Forlines Yield Enhanced Real Asset ETF | PAGE 1 | TSR_AR_89628W708 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(12/13/2021) |

Donoghue Forlines Yield Enhanced Real Asset ETF NAV | 15.86 | 15.37 |

Donoghue Forlines Yield Enhanced Real Asset ETF Market | 16.15 | 15.35 |

S&P 500 TR | 22.15 | 8.28 |

S&P Real Assets Equity Index (Net TR) | 6.58 | 0.88 |

FCF Yield Enhanced Real Asset Index | 15.44 | 14.90 |

Visit https://www.fcf-funds.com/dfra/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of July 31, 2024)

| |

Net Assets | $44,675,478 |

Number of Holdings | 75 |

Net Advisory Fee | $304,908 |

Portfolio Turnover | 84% |

30-Day SEC Yield | 3.86% |

30-Day SEC Yield Unsubsidized | 3.86% |

Visit https://www.fcf-funds.com/dfra/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of July 31, 2024)

| |

Top 10 Issuers | (% of net assets) |

Mount Vernon Liquid Assets Portfolio, LLC | 22.9% |

Petroleo Brasileiro SA | 3.5% |

Exxon Mobil Corp. | 2.8% |

Shell PLC | 2.6% |

3M Co. | 2.5% |

BHP Group Ltd. | 2.3% |

Chevron Corp. | 2.3% |

TotalEnergies SE | 2.1% |

BP PLC | 2.0% |

Energy Transfer LP | 1.9% |

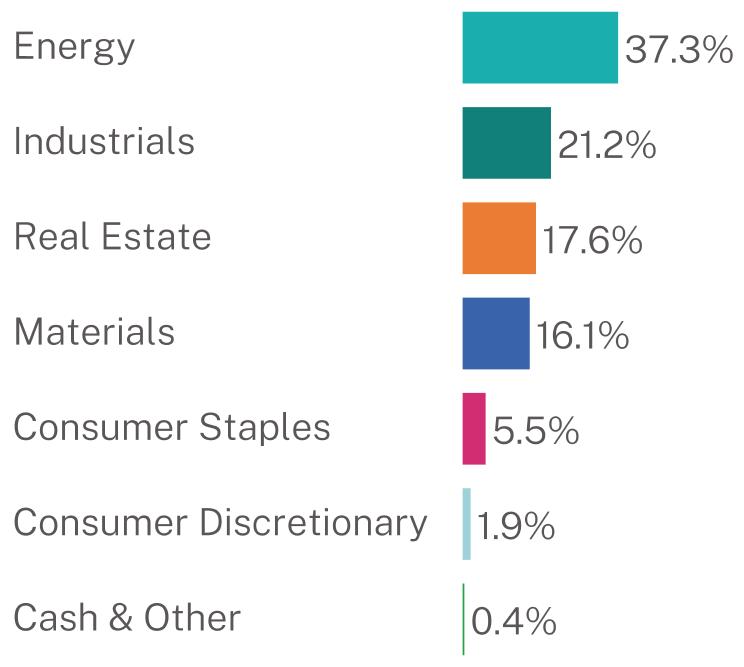

Sector Breakdown (% of net assets)

CERTAIN CHANGES TO THE FUND

This is a summary of certain planned changes to the Fund since August 1, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by November 28, 2024, at https://www.fcf-funds.com/dfra/ or upon request at 1-800-617-0004.

Changes to the Fund’s Investment Adviser

On August 7, 2024, Abacus Life, Inc., a pioneering alternative asset manager specializing in longevity and actuarial technology, announced a definitive agreement to acquire FCF Advisors LLC, the investment adviser for the Fund. The transaction is expected to close in the fourth quarter of 2024.

| Donoghue Forlines Yield Enhanced Real Asset ETF | PAGE 2 | TSR_AR_89628W708 |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.fcf-funds.com/dfra/

The Fund is distributed by Quasar Distributors, LLC.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your FCF Advisors LLC documents not be householded, please contact FCF Advisors LLC at 1-800-617-0004, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by FCF Advisors LLC or your financial intermediary.

| Donoghue Forlines Yield Enhanced Real Asset ETF | PAGE 3 | TSR_AR_89628W708 |

10688125711456510679125351455989301009212327990396021023410658124821440937.321.217.616.15.51.90.4

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s board of the TrimTabs ETF Trust has determined that it does not have an audit committee financial expert serving on its audit committee. At this time, the registrant believes that the experience provided by each member of the audit committee together offers the registrant adequate oversight for the registrant’s level of financial complexity.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. The following tables detail the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

FCF US Quality ETF

| | FYE 07/31/2024 | FYE 07/31/2023 |

| (a) Audit Fees | $12,500 | $12,500 |

| (b) Audit-Related Fees | N/A | N/A |

| (c) Tax Fees | $3,000 | $3,000 |

| (d) All Other Fees | N/A | N/A |

FCF International Quality ETF

| | FYE 07/31/2024 | FYE 07/31/2023 |

| (a) Audit Fees | $14,500 | $14,500 |

| (b) Audit-Related Fees | N/A | N/A |

| (c) Tax Fees | $3,000 | $3,000 |

| (d) All Other Fees | N/A | N/A |

Donoghue Forlines Tactical High Yield ETF

| | FYE 07/31/2024 | FYE 07/31/2023 |

| (a) Audit Fees | $12,500 | $12,500 |

| (b) Audit-Related Fees | N/A | N/A |

| (c) Tax Fees | $3,000 | $3,000 |

| (d) All Other Fees | N/A | N/A |

Donoghue Forlines Innovation ETF

| | FYE 07/31/2024 | FYE 07/31/2023 |

| (a) Audit Fees | $12,500 | $12,500 |

| (b) Audit-Related Fees | N/A | N/A |

| (c) Tax Fees | $3,000 | $3,000 |

(d) All Other Fees | N/A | N/A |

Donoghue Forlines Yield Enhanced Real Asset ETF

| | FYE 07/31/2024 | FYE 07/31/2023 |

| (a) Audit Fees | $12,500 | $12,500 |

| (b) Audit-Related Fees | N/A | N/A |

| (c) Tax Fees | $3,000 | $3,000 |

(d) All Other Fees | N/A | N/A |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Cohen & Company, Ltd. applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

FCF US Quality ETF

| | FYE 07/31/2024 | FYE 07/31/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

FCF International Quality ETF

| | FYE 07/31/2024 | FYE 07/31/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

Donoghue Forlines Tactical High Yield ETF

| | FYE 07/31/2024 | FYE 07/31/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

Donoghue Forlines Innovation ETF

| | FYE 07/31/2024 | FYE 07/31/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

Donoghue Forlines Yield Enhanced Real Asset ETF

| | FYE 07/31/2024 | FYE 07/31/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) Not applicable.

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years.

FCF US Quality ETF

| Non-Audit Related Fees | FYE 07/31/2024 | FYE 07/31/2023 |

| Registrant | — | — |

| Registrant’s Investment Adviser | — | — |

FCF International Quality ETF

| Non-Audit Related Fees | FYE 07/31/2024 | FYE 07/31/2023 |

| Registrant | — | — |

| Registrant’s Investment Adviser | — | — |

Donoghue Forlines Tactical High Yield ETF

| Non-Audit Related Fees | FYE 07/31/2024 | FYE 07/31/2023 |

| Registrant | — | — |

| Registrant’s Investment Adviser | — | — |

Donoghue Forlines Innovation ETF

| Non-Audit Related Fees | FYE 07/31/2024 | FYE 07/31/2023 |

| Registrant | — | — |

| Registrant’s Investment Adviser | — | — |

Donoghue Forlines Yield Enhanced Real Asset ETF

| Non-Audit Related Fees | FYE 07/31/2024 | FYE 07/31/2023 |

| Registrant | — | — |

| Registrant’s Investment Adviser | — | — |

(h) The audit committee of the board of trustees/directors has considered whether the provision of non-audit services that were rendered to the registrant's investment adviser is compatible with maintaining the principal accountant's independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

The registrant has not been identified by the U.S. Securities and Exchange Commission as having filed an annual report issued by a registered public accounting firm branch or office that is located in a foreign jurisdiction where the Public Company Accounting Oversight Board is unable to inspect or completely investigate because of a position taken by an authority in that jurisdiction.

The registrant is not a foreign issuer.

Item 5. Audit Committee of Listed Registrants.

(a) The registrant is an issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934, (the “Act”) and has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Act. The independent members of the committee are as follows: David Kelly and Stephen Posner.

(b) Not applicable.

Item 6. Investments.

| (a) | Schedules of Investments are included within the financial statements filed under Item 7 of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

TRIMTABS ETF TRUST

FCF US Quality ETF (TTAC)

FCF International Quality ETF (TTAI)

Donoghue Forlines Tactical High Yield ETF (DFHY)

Donoghue Forlines Innovation ETF (DFNV)

Donoghue Forlines Yield Enhanced Real Asset ETF (DFRA)

Financial Statements

July 31, 2024

TABLE OF CONTENTS

| | | | |

Schedules of Investments

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Financial Highlights

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

TABLE OF CONTENTS

FCF US Quality ETF

Schedule of Investments

July 31, 2024

| | | | | | | |

COMMON STOCKS - 99.4%

|

Communications - 7.7%

|

AppLovin Corp. - Class A(a) | | | 44,185 | | | $ 3,406,663 |

Booking Holdings, Inc. | | | 1,086 | | | 4,034,501 |

Electronic Arts, Inc. | | | 18,572 | | | 2,803,258 |

Expedia Group, Inc.(a) | | | 16,044 | | | 2,048,337 |

Match Group, Inc.(a) | | | 39,759 | | | 1,516,408 |

Meta Platforms, Inc. - Class A | | | 20,906 | | | 9,926,796 |

Netflix, Inc.(a) | | | 4,897 | | | 3,077,030 |

New York Times Co. - Class A | | | 17,991 | | | 964,138 |

Pinterest, Inc. - Class A(a) | | | 35,368 | | | 1,130,008 |

Trade Desk, Inc. - Class A(a) | | | 34,287 | | | 3,081,716 |

| | | | | | 31,988,855 |

Consumer Discretionary - 12.5%

|

Abercrombie & Fitch Co. - Class A(a) | | | 11,647 | | | 1,717,699 |

American Eagle Outfitters, Inc.(b) | | | 36,621 | | | 807,493 |

Columbia Sportswear Co.(b) | | | 26,588 | | | 2,172,240 |

Coupang, Inc.(a)(b) | | | 51,552 | | | 1,069,704 |

Deckers Outdoor Corp.(a) | | | 3,269 | | | 3,016,077 |

ePlus, Inc.(a) | | | 16,719 | | | 1,536,810 |

Etsy, Inc.(a) | | | 19,486 | | | 1,269,318 |

Fortune Brands Innovations, Inc. | | | 14,844 | | | 1,199,544 |

Gap, Inc. | | | 41,100 | | | 965,028 |

Griffon Corp. | | | 14,964 | | | 1,078,306 |

Hasbro, Inc. | | | 10,540 | | | 679,408 |

Hilton Worldwide Holdings, Inc. | | | 17,386 | | | 3,732,253 |

Home Depot, Inc. | | | 25,658 | | | 9,446,249 |

KB Home | | | 29,722 | | | 2,558,470 |

Kontoor Brands, Inc.(b) | | | 30,158 | | | 2,115,584 |

Las Vegas Sands Corp. | | | 39,695 | | | 1,574,701 |

Lennar Corp. - Class A | | | 10,404 | | | 1,840,780 |

Live Nation Entertainment, Inc.(a)(b) | | | 10,062 | | | 967,864 |

Masco Corp. | | | 34,062 | | | 2,651,727 |

NIKE, Inc. - Class B | | | 35,731 | | | 2,674,823 |

Pool Corp.(b) | | | 4,823 | | | 1,803,995 |

Ralph Lauren Corp. | | | 4,536 | | | 796,476 |

Scotts Miracle-Gro Co.(b) | | | 26,347 | | | 2,070,874 |

Tapestry, Inc. | | | 30,871 | | | 1,237,618 |

Williams-Sonoma, Inc.(b) | | | 16,264 | | | 2,515,715 |

| | | | | | 51,498,756 |

Consumer Staples - 7.2%

| | | | | | |

Altria Group, Inc. | | | 78,662 | | | 3,855,225 |

Archer-Daniels-Midland Co. | | | 23,812 | | | 1,476,582 |

BellRing Brands, Inc.(a) | | | 37,785 | | | 1,937,615 |

Clorox Co. | | | 10,932 | | | 1,442,259 |

Colgate-Palmolive Co. | | | 59,613 | | | 5,913,013 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

FCF US Quality ETF

Schedule of Investments

July 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Consumer Staples - (Continued)

| |

Ingredion, Inc. | | | 19,053 | | | $ 2,369,622 |

Kimberly-Clark Corp. | | | 29,109 | | | 3,931,170 |

Philip Morris International, Inc. | | | 38,689 | | | 4,455,425 |

Procter & Gamble Co. | | | 26,925 | | | 4,328,463 |

| | | | | | 29,709,374 |

Energy - 2.6%

| | | | | | |

ChampionX Corp. | | | 60,528 | | | 2,073,689 |

Enphase Energy, Inc.(a)(b) | | | 11,637 | | | 1,339,535 |

HF Sinclair Corp. | | | 22,031 | | | 1,133,936 |

Marathon Petroleum Corp. | | | 23,341 | | | 4,131,824 |

Weatherford International PLC(a) | | | 17,763 | | | 2,093,547 |

| | | | | | 10,772,531 |

Financials - 9.2%

| | | | | | |

American Express Co. | | | 28,495 | | | 7,210,375 |

American Financial Group, Inc. | | | 9,783 | | | 1,281,182 |

Ameriprise Financial, Inc. | | | 7,767 | | | 3,340,354 |

Artisan Partners Asset Management, Inc. - Class A(b) | | | 46,565 | | | 2,056,310 |

Broadridge Financial Solutions, Inc. | | | 12,447 | | | 2,663,658 |

Cincinnati Financial Corp. | | | 17,262 | | | 2,254,762 |

Erie Indemnity Co. - Class A(b) | | | 2,453 | | | 1,082,141 |

Euronet Worldwide, Inc.(a) | | | 16,182 | | | 1,650,402 |

Fidelity National Information Services, Inc. | | | 20,915 | | | 1,606,899 |

Jack Henry & Associates, Inc. | | | 7,940 | | | 1,361,551 |

OneMain Holdings, Inc. | | | 16,363 | | | 855,130 |

SEI Investments Co. | | | 26,597 | | | 1,804,341 |

Synchrony Financial | | | 62,969 | | | 3,198,196 |

T Rowe Price Group, Inc. | | | 22,895 | | | 2,614,838 |

Visa, Inc. - Class A | | | 15,833 | | | 4,206,353 |

Western Union Co. | | | 62,749 | | | 746,086 |

| | | | | | 37,932,578 |

Health Care - 10.5%

| | | | | | |

AbbVie, Inc. | | | 60,362 | | | 11,186,286 |

Agilent Technologies, Inc. | | | 17,840 | | | 2,522,576 |

Bristol-Myers Squibb Co. | | | 112,001 | | | 5,326,768 |

Chemed Corp. | | | 1,474 | | | 840,416 |

Gilead Sciences, Inc. | | | 69,112 | | | 5,256,659 |

Halozyme Therapeutics, Inc.(a) | | | 47,571 | | | 2,628,773 |

Medpace Holdings, Inc.(a) | | | 9,701 | | | 3,710,826 |

Merck & Co., Inc. | | | 71,856 | | | 8,129,069 |

Mettler-Toledo International, Inc.(a) | | | 1,464 | | | 2,226,788 |

Neurocrine Biosciences, Inc.(a) | | | 10,955 | | | 1,550,899 |

| | | | | | 43,379,060 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

FCF US Quality ETF

Schedule of Investments

July 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Industrials - 12.3%

| | | | | | |

3M Co. | | | 41,538 | | | $ 5,298,172 |

Acuity Brands, Inc. | | | 3,813 | | | 958,397 |

Argan, Inc. | | | 28,838 | | | 2,276,183 |

Automatic Data Processing, Inc. | | | 12,943 | | | 3,399,091 |

Cactus, Inc. - Class A(b) | | | 40,803 | | | 2,575,485 |

Comfort Systems USA, Inc. | | | 3,948 | | | 1,312,394 |

Core & Main, Inc. - Class A(a) | | | 43,763 | | | 2,340,008 |

CSW Industrials, Inc. | | | 3,838 | | | 1,245,124 |

Cummins, Inc. | | | 6,496 | | | 1,895,533 |

Donaldson Co., Inc. | | | 22,275 | | | 1,666,615 |

EMCOR Group, Inc. | | | 4,674 | | | 1,754,806 |

Exponent, Inc. | | | 18,463 | | | 1,958,555 |

Fastenal Co. | | | 30,900 | | | 2,186,175 |

Ferguson PLC | | | 12,325 | | | 2,744,161 |

Gibraltar Industries, Inc.(a) | | | 9,463 | | | 702,817 |

H&R Block, Inc. | | | 43,721 | | | 2,533,195 |

Keysight Technologies, Inc.(a) | | | 4,062 | | | 566,933 |

Landstar System, Inc. | | | 2,393 | | | 455,268 |

Lincoln Electric Holdings, Inc. | | | 3,376 | | | 693,464 |

MSA Safety, Inc. | | | 8,344 | | | 1,574,096 |

Mueller Industries, Inc. | | | 35,003 | | | 2,483,113 |

Paychex, Inc.(b) | | | 20,794 | | | 2,662,048 |

Robert Half International, Inc. | | | 15,693 | | | 1,007,334 |

Rollins, Inc. | | | 37,070 | | | 1,776,024 |

TopBuild Corp.(a)(b) | | | 2,659 | | | 1,272,438 |

Trane Technologies PLC | | | 7,156 | | | 2,392,108 |

Watsco, Inc.(b) | | | 2,571 | | | 1,258,479 |

| | | | | | 50,988,016 |

Materials - 3.2%

| | | | | | |

Apogee Enterprises, Inc. | | | 33,216 | | | 2,279,946 |

Carlisle Cos., Inc. | | | 4,814 | | | 2,015,044 |

Olin Corp. | | | 17,526 | | | 799,361 |

Owens Corning | | | 6,224 | | | 1,160,029 |

RPM International, Inc. | | | 20,543 | | | 2,495,153 |

Sylvamo Corp. | | | 26,006 | | | 1,916,902 |

UFP Industries, Inc. | | | 9,989 | | | 1,317,849 |

WD-40 Co.(b) | | | 4,320 | | | 1,130,155 |

| | | | | | 13,114,439 |

Technology - 33.7%(c)

| | | | | | |

Accenture PLC - Class A | | | 18,898 | | | 6,248,057 |

Adobe, Inc.(a) | | | 11,505 | | | 6,346,733 |

Apple, Inc. | | | 116,125 | | | 25,789,040 |

Applied Materials, Inc. | | | 18,699 | | | 3,967,928 |

Atlassian Corp. - Class A(a) | | | 11,376 | | | 2,008,660 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

FCF US Quality ETF

Schedule of Investments

July 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Technology - (Continued)

|

Autodesk, Inc.(a) | | | 13,084 | | | $ 3,238,552 |

Box, Inc. - Class A(a)(b) | | | 71,232 | | | 2,003,044 |

Cadence Design Systems, Inc.(a) | | | 9,315 | | | 2,493,253 |

CommVault Systems, Inc.(a) | | | 22,779 | | | 3,481,770 |

Crowdstrike Holdings, Inc. - Class A(a) | | | 11,507 | | | 2,669,164 |

Datadog, Inc. - Class A(a) | | | 19,150 | | | 2,229,826 |

DocuSign, Inc.(a) | | | 39,282 | | | 2,179,365 |

Dropbox, Inc. - Class A(a) | | | 53,942 | | | 1,290,293 |

Fortinet, Inc.(a) | | | 56,321 | | | 3,268,871 |

Gartner, Inc.(a) | | | 7,383 | | | 3,700,286 |

Gen Digital, Inc. | | | 49,558 | | | 1,288,012 |

International Business Machines Corp. | | | 32,888 | | | 6,319,100 |

Intuit, Inc. | | | 6,399 | | | 4,142,393 |

KLA Corp. | | | 5,373 | | | 4,422,355 |

Lam Research Corp. | | | 5,089 | | | 4,688,190 |

Manhattan Associates, Inc.(a) | | | 8,638 | | | 2,205,972 |

Microchip Technology, Inc. | | | 27,162 | | | 2,411,442 |

Motorola Solutions, Inc. | | | 11,225 | | | 4,477,877 |

NetApp, Inc. | | | 21,286 | | | 2,702,896 |

Nutanix, Inc. - Class A(a) | | | 29,968 | | | 1,513,684 |

Palo Alto Networks, Inc.(a) | | | 14,390 | | | 4,672,865 |

Pegasystems, Inc. | | | 23,204 | | | 1,617,783 |

Pure Storage, Inc. - Class A(a) | | | 44,726 | | | 2,680,429 |

QUALCOMM, Inc. | | | 44,832 | | | 8,112,350 |

Qualys, Inc.(a) | | | 5,794 | | | 864,117 |

RingCentral, Inc. - Class A(a) | | | 34,173 | | | 1,197,764 |

ServiceNow, Inc.(a) | | | 7,397 | | | 6,024,043 |

Skyworks Solutions, Inc. | | | 16,113 | | | 1,830,759 |

Squarespace, Inc. - Class A(a) | | | 38,977 | | | 1,722,394 |

Tenable Holdings, Inc.(a) | | | 11,853 | | | 544,290 |

Teradata Corp.(a) | | | 11,123 | | | 360,608 |

Workday, Inc. - Class A(a) | | | 7,320 | | | 1,662,518 |

Zoom Video Communications, Inc. - Class A(a) | | | 21,874 | | | 1,321,189 |

Zscaler, Inc.(a) | | | 8,742 | | | 1,567,878 |

| | | | | | 139,265,750 |

Utilities - 0.5%

| | | | | | |

Vistra Corp. | | | 24,989 | | | 1,979,629 |

TOTAL COMMON STOCKS

(Cost $357,334,167) | | | | | | 410,628,988 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

FCF US Quality ETF

Schedule of Investments

July 31, 2024(Continued)

| | | | | | | |

SHORT-TERM INVESTMENTS - 5.1%

| | | | | | |

Investments Purchased with Proceeds from Securities Lending - 5.1%

| | | | | | |

Mount Vernon Liquid Assets Portfolio, LLC, 5.45%(d) | | | 20,931,374 | | | $20,931,374 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $20,931,374) | | | | | | 20,931,374 |

TOTAL INVESTMENTS - 104.5%

(Cost $378,265,541) | | | | | | $431,560,362 |

Money Market Deposit Account - 0.5%(e) | | | | | | 2,234,786 |

Liabilities in Excess of Other Assets - (5.0)% | | | | | | (20,833,071) |

TOTAL NET ASSETS - 100.0% | | | | | | $412,962,077 |

| | | | | | | |

Percentages are stated as a percent of net assets.

PLC - Public Limited Company

(a)

| Non-income producing security. |

(b)

| All or a portion of this security is on loan as of July 31, 2024. The total market value of these securities was $20,722,366 which represented 5.0% of net assets. |

(c)

| Amount represents investments in a particular sector. No industry within this sector represented more than 25% of the Fund’s total assets at the time of investment. |

(d)

| The rate shown represents the 7-day annualized effective yield as of July 31, 2024. |

(e)

| The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on market conditions and is subject to change daily. The rate as of July 31, 2024 was 5.24%. |

For Fund compliance purposes, the Fund’s sector classifications refers to any one or more of the sector classifications used by one or more widely recognized market indexes or ratings group indexes, and/or they may be defined by Fund management. This definition does not apply for all purposes of this report, which may combine classifications for reporting ease.

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

FCF International Quality ETF

Schedule of Investments

July 31, 2024

| | | | | | | |

COMMON STOCKS - 97.2%

|

Communications - 5.2%

| | | | | | |

Auto Trader Group PLC(a) | | | 40,830 | | | $ 428,099 |

Focus Media Information Technology Co. Ltd. - Class A | | | 240,800 | | | 193,252 |

Hellenic Telecommunications Organization SA | | | 6,266 | | | 102,874 |

Koninklijke KPN NV | | | 103,762 | | | 408,310 |

Kuaishou Technology(a)(b) | | | 20,700 | | | 116,047 |

Meituan - Class B(a)(b) | | | 10,000 | | | 139,898 |

NetEase, Inc. - ADR | | | 7,041 | | | 648,546 |

REA Group Ltd. | | | 2,499 | | | 334,394 |

SOOP Co. Ltd. | | | 1,159 | | | 87,130 |

Telstra Group Ltd. | | | 129,337 | | | 333,245 |

Universal Music Group NV | | | 15,670 | | | 372,926 |

| | | | | | 3,164,721 |

Consumer Discretionary - 19.6%

| | | | | | |

Amadeus IT Group SA | | | 2,526 | | | 166,049 |

ANTA Sports Products Ltd. | | | 27,577 | | | 247,432 |

Avolta AG | | | 6,512 | | | 246,310 |

Berkeley Group Holdings PLC | | | 3,021 | | | 197,289 |

Brunello Cucinelli SpA | | | 1,540 | | | 143,917 |

Bunzl PLC | | | 7,303 | | | 305,872 |

Burberry Group PLC | | | 12,605 | | | 125,583 |

Chongqing Changan Automobile Co. Ltd. - Class A | | | 69,500 | | | 140,307 |

Chow Tai Fook Jewellery Group Ltd. | | | 265,083 | | | 240,897 |

Cie Financiere Richemont SA | | | 1,978 | | | 301,968 |

Fast Retailing Co. Ltd. | | | 1,271 | | | 353,374 |

Ferrari NV | | | 1,082 | | | 446,877 |

Games Workshop Group PLC | | | 1,317 | | | 174,385 |

Geberit AG | | | 729 | | | 465,430 |

Gree Electric Appliances, Inc. of Zhuhai - Class A | | | 168,200 | | | 931,412 |

H & M Hennes & Mauritz AB - Class B | | | 35,400 | | | 549,551 |

Haidilao International Holding Ltd.(a) | | | 88,602 | | | 144,025 |

Industria de Diseno Textil SA | | | 15,280 | | | 741,841 |

InterContinental Hotels Group PLC | | | 6,177 | | | 622,560 |

JD Sports Fashion PLC | | | 156,025 | | | 263,960 |

Kia Corp. | | | 5,598 | | | 455,810 |

La Francaise des Jeux SAEM(a) | | | 7,756 | | | 301,342 |

Lululemon Athletica, Inc.(b)(c) | | | 903 | | | 233,570 |

Moncler SpA | | | 2,119 | | | 126,314 |

New Oriental Education & Technology Group, Inc. - ADR(b) | | | 3,332 | | | 209,316 |

Next PLC | | | 4,345 | | | 506,846 |

OPAP SA | | | 15,380 | | | 268,151 |

Pandora AS | | | 3,203 | | | 502,138 |

PDD Holdings, Inc. - ADR(b) | | | 9,932 | | | 1,280,135 |

Subaru Corp. | | | 13,191 | | | 262,975 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

FCF International Quality ETF

Schedule of Investments

July 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Consumer Discretionary - (Continued)

|

Topsports International Holdings Ltd.(a) | | | 152,604 | | | $ 68,168 |

Vipshop Holdings Ltd. - ADR | | | 15,299 | | | 208,678 |

Wesfarmers Ltd. | | | 13,183 | | | 634,938 |

| | | | | | 11,867,420 |

Consumer Staples - 7.1%

| | | | | | |

B&M European Value Retail SA | | | 41,639 | | | 250,568 |

Carlsberg AS - Class B | | | 3,085 | | | 372,863 |

Chongqing Brewery Co. Ltd. - Class A | | | 13,742 | | | 117,815 |

Clicks Group Ltd. | | | 16,924 | | | 328,955 |

Colruyt Group N.V | | | 2,795 | | | 134,063 |

Dollarama, Inc. | | | 8,346 | | | 782,402 |

Imperial Brands PLC | | | 17,213 | | | 474,426 |

Jeronimo Martins SGPS SA | | | 12,596 | | | 220,157 |

Loblaw Cos. Ltd. | | | 3,147 | | | 388,061 |

Nongfu Spring Co. Ltd. - Class H(a) | | | 41,133 | | | 160,313 |

President Chain Store Corp. | | | 22,949 | | | 193,744 |

Unilever PLC | | | 14,079 | | | 864,418 |

| | | | | | 4,287,785 |

Energy - 3.6%

| | | | | | |

Canadian Natural Resources Ltd. | | | 13,572 | | | 481,874 |

Cenovus Energy, Inc. | | | 8,475 | | | 170,771 |

Gaztransport Et Technigaz SA | | | 1,251 | | | 184,671 |

Imperial Oil Ltd. | | | 6,260 | | | 448,467 |

MEG Energy Corp.(b) | | | 8,130 | | | 168,471 |

Petroleo Brasileiro SA - ADR | | | 29,634 | | | 422,877 |

Suncor Energy, Inc. | | | 7,778 | | | 310,635 |

| | | | | | 2,187,766 |

Financials - 7.4%

| | | | | | |

Admiral Group PLC | | | 12,985 | | | 459,720 |

BB Seguridade Participacoes SA - ADR | | | 55,542 | | | 348,248 |

Brookfield Asset Management Ltd. - Class A | | | 7,789 | | | 339,959 |

Capitec Bank Holdings Ltd. | | | 1,854 | | | 288,700 |

Computershare Ltd. | | | 17,916 | | | 323,952 |

Experian PLC | | | 15,674 | | | 739,895 |

Hargreaves Lansdown PLC | | | 24,529 | | | 348,441 |

Medibank Pvt Ltd. | | | 135,785 | | | 353,410 |

Partners Group Holding AG | | | 503 | | | 678,785 |

Singapore Exchange Ltd. | | | 54,145 | | | 398,989 |

Wise PLC - Class A(b) | | | 18,985 | | | 174,870 |

| | | | | | 4,454,969 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

FCF International Quality ETF

Schedule of Investments

July 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Health Care - 15.0%

| | | | | | |

Aier Eye Hospital Group Co. Ltd. - Class A | | | 119,215 | | | $ 182,607 |

Amplifon SpA | | | 11,492 | | | 365,655 |

BioNTech SE - ADR(b)(c) | | | 2,133 | | | 183,865 |

Demant AS(b) | | | 5,447 | | | 208,546 |

Genmab AS(b) | | | 778 | | | 220,580 |

GSK PLC | | | 40,509 | | | 787,391 |

Ipsen SA | | | 2,348 | | | 264,277 |

Lifco AB - Class B(b) | | | 11,940 | | | 354,102 |

Novartis AG | | | 11,099 | | | 1,246,527 |

Novo Nordisk AS - Class B | | | 22,968 | | | 3,037,796 |

Recordati Industria Chimica e Farmaceutica SpA | | | 3,144 | | | 171,321 |

Roche Holding AG | | | 5,302 | | | 1,726,359 |

Sonova Holding AG | | | 1,166 | | | 357,737 |

| | | | | | 9,106,763 |

Industrials - 14.4%

| | | | | | |

ABB Ltd. | | | 5,490 | | | 305,101 |

Air Canada(b) | | | 10,619 | | | 122,369 |

BAE Systems PLC | | | 46,546 | | | 776,086 |

Bureau Veritas SA | | | 10,416 | | | 326,909 |

China CSSC Holdings Ltd. - Class A | | | 40,000 | | | 226,815 |

Ferguson PLC | | | 2,381 | | | 530,130 |

Grupo Aeroportuario del Centro Norte SAB de CV | | | 21,010 | | | 180,509 |

Hanwha Aerospace Co. Ltd. | | | 2,428 | | | 507,909 |

Hyundai Glovis Co. Ltd. | | | 1,794 | | | 158,323 |

Indutrade AB | | | 8,764 | | | 257,293 |

Intertek Group PLC | | | 6,639 | | | 431,004 |

Kuehne + Nagel International AG | | | 1,851 | | | 574,648 |

NARI Technology Co. Ltd. - Class A | | | 37,300 | | | 123,971 |

Recruit Holdings Co. Ltd. | | | 10,078 | | | 582,459 |

RELX PLC | | | 27,876 | | | 1,316,251 |

Schindler Holding AG | | | 1,043 | | | 279,242 |

SGS SA(c) | | | 4,731 | | | 517,971 |

Singapore Airlines Ltd. | | | 70,919 | | | 369,795 |

Voltronic Power Technology Corp. | | | 2,000 | | | 112,869 |

Wolters Kluwer NV | | | 5,911 | | | 992,204 |

| | | | | | 8,691,858 |

Materials - 8.8%

| | | | | | |

Aluminum Corp. of China Ltd. - Class A | | | 267,267 | | | 255,172 |

BHP Group Ltd. | | | 47,778 | | | 1,321,638 |

Brenntag SE | | | 3,951 | | | 281,445 |

EMS-Chemie Holding AG | | | 269 | | | 224,792 |

Evraz PLC(b)(d) | | | 49,526 | | | 0 |

Exxaro Resources Ltd. | | | 15,965 | | | 170,822 |

Fortescue Ltd. | | | 35,640 | | | 439,799 |

Henan Shenhuo Coal Industry & Electricity Power Co. Ltd. - Class A | | | 136,300 | | | 310,242 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

FCF International Quality ETF

Schedule of Investments

July 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Materials - (Continued)

|

IMCD NV | | | 1,379 | | | $ 198,492 |

Kingspan Group PLC | | | 4,318 | | | 403,761 |

Kumba Iron Ore Ltd. | | | 10,308 | | | 224,860 |

Qinghai Salt Lake Industry Co. Ltd. - Class A(b) | | | 141,300 | | | 303,831 |

Shaanxi Coal Industry Co. Ltd. - Class A | | | 105,853 | | | 342,588 |

Shanxi Lu’an Environmental Energy Development Co. Ltd. - Class A | | | 114,189 | | | 245,694 |

Southern Copper Corp.(c) | | | 1,756 | | | 187,207 |

SSAB AB - Class B | | | 17,561 | | | 88,878 |

Tenaris SA | | | 18,865 | | | 298,900 |

| | | | | | 5,298,121 |

Technology - 14.8%

| | | | | | |

Accenture PLC - Class A | | | 3,880 | | | 1,282,806 |

Accton Technology Corp. | | | 15,893 | | | 245,140 |

Atlassian Corp. - Class A(b) | | | 2,566 | | | 453,079 |

BE Semiconductor Industries NV | | | 2,291 | | | 295,425 |

CGI, Inc.(b) | | | 3,887 | | | 443,219 |

Check Point Software Technologies Ltd.(b) | | | 4,145 | | | 760,400 |

Constellation Software, Inc. | | | 352 | | | 1,110,646 |

eMemory Technology, Inc. | | | 2,688 | | | 188,495 |

Infosys Ltd. - ADR(c) | | | 35,152 | | | 777,914 |

Logitech International SA | | | 6,828 | | | 615,940 |

MediaTek, Inc. | | | 11,795 | | | 437,782 |

Monday.com Ltd.(b)(c) | | | 431 | | | 99,048 |

Nemetschek SE | | | 3,083 | | | 294,787 |

Nomura Research Institute Ltd. | | | 6,429 | | | 200,417 |

Novatek Microelectronics Corp. | | | 18,000 | | | 286,401 |

Renesas Electronics Corp. | | | 12,180 | | | 209,606 |

Sage Group PLC | | | 16,199 | | | 226,155 |

Shenzhen Transsion Holdings Co. Ltd. - Class A | | | 25,200 | | | 281,951 |

Temenos AG | | | 3,460 | | | 240,061 |

Trend Micro, Inc. | | | 3,043 | | | 147,249 |

Xero Ltd.(b) | | | 3,662 | | | 330,908 |

| | | | | | 8,927,429 |

Utilities - 1.3%

| | | | | | |

Centrica PLC | | | 233,943 | | | 398,636 |

Verbund AG - Class A | | | 4,930 | | | 394,827 |

| | | | | | 793,463 |

TOTAL COMMON STOCKS

(Cost $53,864,946) | | | | | | 58,780,295 |

PREFERRED STOCKS - 0.4%

| | | | | | |

Materials - 0.4%

| | | | | | |

FUCHS SE | | | 4,895 | | | 213,070 |

TOTAL PREFERRED STOCKS

(Cost $219,561) | | | | | | 213,070 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

FCF International Quality ETF

Schedule of Investments

July 31, 2024(Continued)

| | | | | | | |

WARRANTS - 0.0%(e)

| | | | | | |

Technology - 0.0%(e)

| | | | | | |

Constellation Software, Inc.(b)(d) | | | 438 | | | $0 |

TOTAL WARRANTS

(Cost $0) | | | | | | 0 |

SHORT-TERM INVESTMENTS - 2.3%

| | | | | | |

Investments Purchased with Proceeds from Securities Lending - 2.3%

| | | | | | |

Mount Vernon Liquid Assets Portfolio, LLC , 5.45%(f) | | | 1,375,911 | | | 1,375,911 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $1,375,911) | | | | | | 1,375,911 |

TOTAL INVESTMENTS - 99.9%

(Cost $55,460,418) | | | | | | $60,369,276 |

Money Market Deposit Account - 1.4%(g) | | | | | | 870,079 |

Liabilities in Excess of Other Assets - (1.3)% | | | | | | (784,201) |

TOTAL NET ASSETS - 100.0% | | | | | | $60,455,154 |

| | | | | | | |

Percentages are stated as a percent of net assets.

ADR - American Depositary Receipt

AG - Aktiengesellschaft

NV - Naamloze Vennootschap

PLC - Public Limited Company

SA - Sociedad Anónima

SAB de CV - Sociedad Anónima Bursátil de Capital Variable

(a)

| Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of July 31, 2024, the value of these securities total $1,357,892 or 2.2% of the Fund’s net assets. |

(b)

| Non-income producing security. |

(c)

| All or a portion of this security is on loan as of July 31, 2024. The total market value of these securities was $1,336,493 which represented 2.2% of net assets. |

(d)

| Fair value determined using significant unobservable inputs in accordance with procedures established by and under the supervision of the Adviser, acting as Valuation Designee. These securities represented $0 or 0.0% of net assets as of July 31, 2024. |

(e)

| Represents less than 0.05% of net assets. |

(f)

| The rate shown represents the 7-day annualized effective yield as of July 31, 2024. |

(g)

| The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on market conditions and is subject to change daily. The rate as of July 31, 2024 was 5.24%. |

For Fund compliance purposes, the Fund’s sector classifications refers to any one or more of the sector classifications used by one or more widely recognized market indexes or ratings group indexes, and/or they may be defined by Fund management. This definition does not apply for all purposes of this report, which may combine classifications for reporting ease.

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

FCF International Quality ETF

Schedule of Investments

July 31, 2024(Continued)

Allocation of Portfolio Holdings by Country as of July 31, 2024

(% of Net Assets)

| | | | | | | |

United Kingdom | | | $9,662,690 | | | 16.0% |

Switzerland | | | 7,780,871 | | | 12.9 |

China | | | 5,598,080 | | | 9.3 |

Canada | | | 5,000,445 | | | 8.3 |

Denmark | | | 4,341,923 | | | 7.2 |

Australia | | | 4,194,454 | | | 6.9 |

Ireland | | | 3,706,597 | | | 6.1 |

Netherlands | | | 2,267,357 | | | 3.7 |

Japan | | | 1,756,080 | | | 2.9 |

Taiwan | | | 1,464,431 | | | 2.4 |

Italy | | | 1,254,084 | | | 2.1 |

Sweden | | | 1,249,824 | | | 2.1 |

South Korea | | | 1,209,172 | | | 2.0 |

France | | | 1,077,199 | | | 1.8 |

South Africa | | | 1,013,337 | | | 1.7 |

Germany | | | 973,167 | | | 1.6 |

Spain | | | 907,890 | | | 1.5 |

Israel | | | 859,448 | | | 1.4 |

India | | | 777,914 | | | 1.3 |

Brazil | | | 771,125 | | | 1.3 |

Singapore | | | 768,784 | | | 1.3 |

Austria | | | 394,827 | | | 0.6 |

Greece | | | 371,025 | | | 0.6 |

New Zealand | | | 330,908 | | | 0.5 |

Luxembourg | | | 298,900 | | | 0.5 |

Hong Kong | | | 240,897 | | | 0.4 |

Portugal | | | 220,157 | | | 0.4 |

United States | | | 187,207 | | | 0.3 |

Mexico | | | 180,509 | | | 0.3 |

Belgium | | | 134,063 | | | 0.2 |

Investments Purchased with Proceeds from Securities Lending | | | 1,375,911 | | | 2.3 |

Money Market Deposit Account | | | 870,079 | | | 1.4 |

Liabilities in Excess of Other Assets | | | (784,201) | | | (1.3) |

| | | $60,455,154 | | | 100.0% |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Donoghue Forlines Tactical High Yield ETF

Schedule of Investments

July 31, 2024

| | | | | | | |

EXCHANGE-TRADED FUNDS - 99.8%

|

iShares 0-5 Year High Yield Corporate Bond ETF | | | 65,225 | | | $ 2,787,064 |

iShares Broad USD High Yield Corporate Bond ETF | | | 157,483 | | | 5,811,123 |

iShares Fallen Angels USD Bond ETF | | | 73,749 | | | 1,975,736 |

iShares iBoxx $ High Yield Corporate Bond ETF | | | 62,730 | | | 4,926,814 |

SPDR Bloomberg High Yield Bond ETF(a) | | | 61,923 | | | 5,934,700 |

SPDR Bloomberg Short-Term High Yield Bond ETF | | | 81,880 | | | 2,071,564 |

SPDR Portfolio High Yield Bond ETF | | | 89,296 | | | 2,106,493 |

VanEck Fallen Angel High Yield Bond ETF | | | 63,977 | | | 1,848,295 |

Xtrackers USD High Yield Corporate Bond ETF | | | 76,688 | | | 2,768,437 |

TOTAL EXCHANGE-TRADED FUNDS

(Cost $29,632,713) | | | | | | 30,230,226 |

SHORT-TERM INVESTMENTS - 18.9%

| | | | | | |

Investments Purchased with Proceeds from Securities Lending - 18.9%

| | | | | | |

Mount Vernon Liquid Assets Portfolio, LLC, 5.45%(b) | | | 5,735,438 | | | 5,735,438 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $5,735,438) | | | | | | 5,735,438 |

TOTAL INVESTMENTS - 118.7%

(Cost $35,368,151) | | | | | | $35,965,664 |

Money Market Deposit Account - 0.3%(c) | | | | | | 76,713 |

Liabilities in Excess of Other Assets - (19.0)% | | | | | | (5,749,611) |

TOTAL NET ASSETS - 100.0% | | | | | | $30,292,766 |

| | | | | | | |

Percentages are stated as a percent of net assets.

(a)

| All or a portion of this security is on loan as of July 31, 2024. The total market value of these securities was $5,637,788 which represented 18.6% of net assets. |

(b)

| The rate shown represents the 7-day effective yield as of July 31, 2024. |

(c)

| The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on market conditions and is subject to change daily. The rate as of July 31, 2024 was 5.24%. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Donoghue Forlines Innovation ETF

Schedule of Investments

July 31, 2024

| | | | | | | |

COMMON STOCKS - 99.7%

|

Communications - 15.0%

| | | | | | |

AppLovin Corp. - Class A(a) | | | 4,213 | | | $ 324,822 |

DoorDash, Inc. - Class A(a)(b) | | | 4,057 | | | 449,191 |

Electronic Arts, Inc. | | | 3,179 | | | 479,838 |

Expedia Group, Inc.(a) | | | 2,181 | | | 278,448 |

Maplebear, Inc.(a) | | | 6,804 | | | 234,670 |

Match Group, Inc.(a) | | | 6,469 | | | 246,728 |

Meta Platforms, Inc. - Class A | | | 4,326 | | | 2,054,115 |

New York Times Co. - Class A | | | 3,461 | | | 185,475 |

Pinterest, Inc. - Class A(a) | | | 8,829 | | | 282,087 |

Playtika Holding Corp. | | | 13,206 | | | 100,762 |

Roku, Inc.(a) | | | 3,307 | | | 192,500 |

Spotify Technology SA(a) | | | 1,772 | | | 609,462 |

Trade Desk, Inc. - Class A(a) | | | 4,816 | | | 432,862 |

Uber Technologies, Inc.(a) | | | 11,975 | | | 772,028 |

Yelp, Inc.(a) | | | 2,401 | | | 87,468 |

| | | | | | 6,730,456 |

Consumer Discretionary - 7.1%

| | | | | | |

Amazon.com, Inc.(a) | | | 13,993 | | | 2,616,411 |

Etsy, Inc.(a) | | | 3,176 | | | 206,885 |

Hasbro, Inc. | | | 3,220 | | | 207,561 |

Mattel, Inc.(a)(b) | | | 8,921 | | | 172,086 |

| | | | | | 3,202,943 |

Consumer Staples - 1.4%

| | | | | | |

Clorox Co. | | | 1,745 | | | 230,218 |

Kimberly-Clark Corp. | | | 2,863 | | | 386,648 |

| | | | | | 616,866 |

Energy - 1.1%

| | | | | | |

Enphase Energy, Inc.(a) | | | 2,130 | | | 245,184 |

Fluence Energy, Inc.(a) | | | 4,372 | | | 71,613 |

Weatherford International PLC(a) | | | 1,432 | | | 168,776 |

| | | | | | 485,573 |

Financials - 0.5%

| | | | | | |

Jack Henry & Associates, Inc. | | | 1,251 | | | 214,522 |

Health Care - 12.6%

| | | | | | |

AbbVie, Inc. | | | 7,357 | | | 1,363,399 |

Agilent Technologies, Inc. | | | 2,841 | | | 401,718 |

Bristol-Myers Squibb Co. | | | 16,178 | | | 769,426 |

Corcept Therapeutics, Inc.(a)(b) | | | 3,579 | | | 138,400 |

Gilead Sciences, Inc.(b) | | | 10,055 | | | 764,783 |

Halozyme Therapeutics, Inc.(a)(b) | | | 3,563 | | | 196,891 |

Hologic, Inc.(a) | | | 3,280 | | | 267,681 |

Jazz Pharmaceuticals PLC(a) | | | 1,605 | | | 176,951 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Donoghue Forlines Innovation ETF

Schedule of Investments

July 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Health Care - (Continued)

|

Merck & Co., Inc. | | | 10,106 | | | $ 1,143,292 |

Neurocrine Biosciences, Inc.(a) | | | 1,930 | | | 273,230 |

Solventum Corp.(a) | | | 3,126 | | | 184,059 |

| | | | | | 5,679,830 |

Industrials - 3.6%

| | | | | | |

3M Co. | | | 4,865 | | | 620,531 |

Alarm.com Holdings, Inc.(a) | | | 1,787 | | | 126,073 |

Cimpress PLC(a) | | | 905 | | | 82,599 |

Generac Holdings, Inc.(a) | | | 1,192 | | | 185,571 |

Keysight Technologies, Inc.(a) | | | 2,195 | | | 306,356 |

Vertiv Holdings Co. - Class A | | | 3,949 | | | 310,786 |

| | | | | | 1,631,916 |

Technology - 58.4%(c)

| | | | | | |

Adobe, Inc.(a) | | | 2,245 | | | 1,238,454 |

Altair Engineering, Inc. - Class A(a)(b) | | | 1,721 | | | 152,068 |

Apple, Inc. | | | 16,124 | | | 3,580,818 |

Applied Materials, Inc. | | | 3,803 | | | 806,997 |

Atlassian Corp. - Class A(a) | | | 2,391 | | | 422,179 |

Autodesk, Inc.(a) | | | 2,340 | | | 579,197 |

BlackLine, Inc.(a) | | | 2,199 | | | 104,496 |

Box, Inc. - Class A(a)(b) | | | 5,177 | | | 145,577 |

Broadcom, Inc. | | | 11,362 | | | 1,825,646 |

Cadence Design Systems, Inc.(a) | | | 2,081 | | | 557,000 |

Ciena Corp.(a) | | | 3,612 | | | 190,497 |

Cirrus Logic, Inc.(a) | | | 1,449 | | | 189,065 |

CommVault Systems, Inc.(a) | | | 1,399 | | | 213,837 |

Crane NXT Co. | | | 1,779 | | | 111,864 |

Crowdstrike Holdings, Inc. - Class A(a) | | | 1,990 | | | 461,600 |

Datadog, Inc. - Class A(a)(b) | | | 3,918 | | | 456,212 |

Dolby Laboratories, Inc. - Class A | | | 1,729 | | | 136,176 |

Doximity, Inc. - Class A(a)(b) | | | 4,039 | | | 113,092 |

Dropbox, Inc. - Class A(a) | | | 7,856 | | | 187,916 |

Duolingo, Inc.(a) | | | 1,023 | | | 175,895 |

Dynatrace, Inc.(a) | | | 5,284 | | | 232,073 |

F5, Inc.(a) | | | 1,209 | | | 246,201 |

Fortinet, Inc.(a) | | | 8,088 | | | 469,428 |

Gen Digital, Inc. | | | 10,226 | | | 265,774 |

InterDigital, Inc.(b) | | | 898 | | | 110,238 |

International Business Machines Corp. | | | 4,742 | | | 911,128 |

Intuit, Inc.(b) | | | 1,500 | | | 971,025 |

Lattice Semiconductor Corp.(a)(b) | | | 2,584 | | | 136,952 |

Manhattan Associates, Inc.(a) | | | 1,211 | | | 309,265 |

Microchip Technology, Inc. | | | 4,910 | | | 435,910 |

Motorola Solutions, Inc. | | | 1,465 | | | 584,418 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Donoghue Forlines Innovation ETF

Schedule of Investments

July 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Technology - (Continued)

|

NetApp, Inc. | | | 2,804 | | | $ 356,052 |

Nutanix, Inc. - Class A(a) | | | 4,960 | | | 250,530 |

Oracle Corp. | | | 9,053 | | | 1,262,441 |

Palantir Technologies, Inc. - Class A(a) | | | 20,519 | | | 551,756 |

Palo Alto Networks, Inc.(a) | | | 2,349 | | | 762,791 |

Paylocity Holding Corp.(a)(b) | | | 1,272 | | | 190,889 |

Pegasystems, Inc. | | | 2,870 | | | 200,096 |

Progress Software Corp. | | | 1,538 | | | 89,819 |

PTC, Inc.(a)(b) | | | 1,682 | | | 299,144 |

Pure Storage, Inc. - Class A(a)(b) | | | 5,436 | | | 325,779 |

Qorvo, Inc.(a)(b) | | | 2,121 | | | 254,096 |

QUALCOMM, Inc. | | | 5,345 | | | 967,178 |

Qualys, Inc.(a) | | | 1,191 | | | 177,626 |

Rapid7, Inc.(a) | | | 2,218 | | | 87,256 |

RingCentral, Inc. - Class A(a) | | | 2,928 | | | 102,626 |

ServiceNow, Inc.(a) | | | 1,270 | | | 1,034,275 |

Skyworks Solutions, Inc.(b) | | | 2,822 | | | 320,636 |

Smartsheet, Inc. - Class A(a) | | | 4,418 | | | 211,887 |

Snowflake, Inc. - Class A(a) | | | 3,428 | | | 446,943 |

Sonos, Inc.(a) | | | 4,373 | | | 59,035 |

Tenable Holdings, Inc.(a) | | | 3,798 | | | 174,404 |

Teradata Corp.(a) | | | 3,442 | | | 111,590 |

Veeva Systems, Inc. - Class A(a) | | | 2,030 | | | 389,618 |

Workday, Inc. - Class A(a) | | | 2,066 | | | 469,230 |

Zeta Global Holdings Corp. - Class A(a) | | | 6,753 | | | 144,649 |

Zoom Video Communications, Inc. - Class A(a)(b) | | | 4,363 | | | 263,525 |

Zscaler, Inc.(a) | | | 2,170 | | | 389,189 |

| | | | | | 26,214,058 |

TOTAL COMMON STOCKS

(Cost $39,885,187) | | | | | | 44,776,164 |

SHORT-TERM INVESTMENTS - 8.2%

| | | | | | |

Investments Purchased with Proceeds from Securities Lending - 8.2%

| | | | | | |

Mount Vernon Liquid Assets Portfolio, LLC, 5.45%(d) | | | 3,683,717 | | | 3,683,717 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $3,683,717) | | | | | | 3,683,717 |

TOTAL INVESTMENTS - 107.9%

(Cost $43,568,904) | | | | | | $48,459,881 |

Money Market Deposit Account - 0.3%(e) | | | | | | 137,768 |

Liabilities in Excess of Other Assets - (8.2)% | | | | | | (3,688,019) |

TOTAL NET ASSETS - 100.0% | | | | | | $44,909,630 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Donoghue Forlines Innovation ETF

Schedule of Investments

July 31, 2024(Continued)

Percentages are stated as a percent of net assets.

PLC - Public Limited Company

SA - Sociedad Anónima

(a)

| Non-income producing security. |

(b)

| All or a portion of this security is on loan as of July 31, 2024. The total market value of these securities was $3,639,395 which represented 8.1% of net assets. |

(c)

| The “Certain Risks” section of the Notes to Financial Statements outlines risks associated with significant investments in a particular industry. |

(d)

| The rate shown represents the 7-day annualized effective yield as of July 31, 2024. |

(e)

| The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on market conditions and is subject to change daily. The rate as of July 31, 2024 was 5.24%. |

For Fund compliance purposes, the Fund’s sector classifications refers to any one or more of the sector classifications used by one or more widely recognized market indexes or ratings group indexes, and/or they may be defined by Fund management. This definition does not apply for all purposes of this report, which may combine classifications for reporting ease.

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Donoghue Forlines Yield Enhanced Real Asset ETF

Schedule of Investments

July 31, 2024

| | | | | | | |

COMMON STOCKS - 71.3%

|

Consumer Discretionary - 1.9%

| | | | | | |

Griffon Corp. | | | 4,770 | | | $ 343,726 |

Scotts Miracle-Gro Co.(a) | | | 6,408 | | | 503,669 |

| | | | | | 847,395 |

Consumer Staples - 5.5%

| | | | | | |

Andersons, Inc. | | | 5,877 | | | 320,473 |

Archer-Daniels-Midland Co. | | | 10,830 | | | 671,568 |

Bunge Global SA | | | 5,101 | | | 536,778 |

Cal-Maine Foods, Inc.(a) | | | 5,739 | | | 410,740 |

Ingredion, Inc. | | | 4,337 | | | 539,393 |

| | | | | | 2,478,952 |

Energy - 26.6%(b)

| | | | | | |

Antero Midstream Corp.(a) | | | 35,031 | | | 503,045 |

BP PLC - ADR | | | 25,232 | | | 892,960 |

Chevron Corp.(a) | | | 6,390 | | | 1,025,403 |

Crescent Energy Co. - Class A(a) | | | 18,076 | | | 221,069 |

Devon Energy Corp. | | | 11,164 | | | 525,043 |

Diamondback Energy, Inc. | | | 3,456 | | | 699,183 |

DT Midstream, Inc.(a) | | | 6,758 | | | 509,283 |

Equinor ASA - ADR(a) | | | 1,928 | | | 51,208 |

Exxon Mobil Corp. | | | 10,591 | | | 1,255,987 |

Hess Midstream LP - Class A | | | 11,225 | | | 420,713 |

Kinder Morgan, Inc. | | | 37,963 | | | 802,158 |

Kinetik Holdings, Inc. | | | 9,193 | | | 381,326 |

Marathon Oil Corp. | | | 18,100 | | | 507,705 |

Murphy Oil Corp. | | | 10,181 | | | 421,290 |

Petroleo Brasileiro SA - ADR | | | 57,560 | | | 821,381 |

Shell PLC - ADR(a) | | | 15,836 | | | 1,159,512 |

TotalEnergies SE - ADR(a) | | | 13,814 | | | 936,313 |

Williams Cos., Inc. | | | 17,904 | | | 768,798 |

| | | | | | 11,902,377 |

Industrials - 21.2%

|

3M Co. | | | 8,791 | | | 1,121,292 |

A.O. Smith Corp. | | | 5,509 | | | 468,485 |