- CBFV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

CB Financial Services (CBFV) 425Business combination disclosure

Filed: 16 Nov 17, 12:00am

Filed by CB Financial Services, Inc. (Commission File No. 001-36706)

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12 under the Securities Act of 1934

Subject Company: First West Virginia Bancorp, Inc.

The following is a copy of materials posted on CB Financial Services, Inc.’s website (www.communitybank.tv) on November 16, 2017:

Welcome Progressive Bank

Legal Disclosures

Additional Information About the Merger and Where to Find It

CB Financial Services, Inc. will file a registration statement with the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended. The registration statement will include a joint proxy statement/prospectus and any other relevant documents filed with the SEC in connection with the proposed merger. CB AND FIRST WEST VIRGINIA SHAREHOLDERS ARE ADVISED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

The joint proxy statement/prospectus and other relevant materials (when they become available), and any other documents CB will file with the SEC, may be obtained free of charge at the SEC's website (www.sec.gov). In addition, investors and security holders may obtain free copies of the documents from the CB website at www.communitybank.tv under the tab “About Us—Investor Relations” and then the link “SEC Filings.”

Participants in the Solicitation

CB, First West Virginia and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of CB and First West Virginia in connection with the proposed merger. Information about the directors and executive officers of CB is set forth in the proxy statement for the CB 2017 annual meeting of stockholders, as filed with the SEC on Schedule 14A on April 12, 2017. Information about the directors and executive officers of First West Virginia will be included in the joint proxy statement/prospectus when it becomes available. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction and a description of their direct and indirect interests, by security holdings or otherwise, may be obtained by reading the joint proxy statement/prospectus and other relevant documents regarding the proposed merger to be filed with the SEC when they become available.

Community Bank Welcomes Progressive Bank

For 116 years, Community Bank has been serving the people of the Tri-State area. Our locally owned and locally managed independent bank has grown over the years and now, at over $900 million in assets, Community Bank offers the latest banking products and services to our residents, local businesses, municipalities and non-profits. We are proud that the Bank has been recognized for its community activities, its philanthropy, for its status as an outstanding employer and for its financial performance.

We are so pleased to join with the fine people at Progressive Bank. Many of us have long ties with West Virginia and the Ohio Valley. We know that, Progressive Bank, like us, takes pride in outstanding personal service and in supporting our communities. Together, we will be able to offer more service, better products, and additional locations for our customers.

While our transaction has just been announced, we do not expect to actually close the transaction until the second quarter of 2018. Upon closing, accounts will convert and the two banks will become one.

Please see the message from Progressive Bank below and then view our presentation titled “An Introduction to Community Bank” by clickinghere.

We can’t wait to meet you and, together with Progressive, earn and keep your trust as your Community Bank.

| Pat McCune | Pat O’Brien | |

| CEO of Community Bank | President of Community Bank |

Progressive Bank Welcomes Community Bank

The Progressive Bank family is pleased and proud to join the Community Bank family. We have long known of Community Bank. We have always been impressed by their devotion to their employees, customers and communities. Community Bank represents what Progressive Bank admires--a full service, independent financial institution that has a heart for the community. We ask all of our customers and friends to get to know the good people at Community Bank. We are confident that Community Bank will continue our reputation as an outstanding local bank.

| Bill Petroplus Chairman, | ||

| Chairman, CEO & President of Progressive Bank | ||

Welcome Progressive Bank Employees

Like at Progressive, at Community Bank, our employees are our most valued assets, and now our Banks plan on joining forces! While the next few months will likely be full of emotional ups and downs, we want to reassure the employees of Progressive Bank that we will be here for you whether you’re transitioning to full-time employment post-conversion, or your position was eliminated due to duplication. We pledge to you that there will be open and direct communication throughout the entire process, including a dedicated website where open positions will be posted for your consideration. And in the event that you are in the pool of positions that will be eliminated, job placement and career building resources will be made available.

For those transitioning to full-time employment post-conversion, we will work with you one-on-one while you get to know us and our benefit packages. Rest assured that ALL years of service, vacation time and vesting will remain intact. Community Bank offers many similar benefits as the ones that you’ve had, plus many more. We will talk about this in more detail in the coming months. At this point, we are pleased to announce that the following full-time positions within Progressive Bank, subject to our need to reevaluate staffing in the future, will automatically transition to Community Bank:

| · | Branch Managers, Assistant Managers/Trainees |

| · | CSRs, Tellers, Floaters |

We will communicate with all others at Progressive as quickly and as efficiently as possible as we determine needs of the combined bank.

Community Bank takes pride in its culture as an outstanding employer. We are proud to have won “Employer of the Year” in 2010, 2011 and 2012 as presented by the Washington County Chamber of Commerce. This is an important achievement in our long, rich history…and we look forward to welcoming the employees of Progressive and showing you what we’re all about!

On behalf of Community Bank, WELCOME! We’re glad you’re part of our family now!

Our Culture

Community Bank’s culture is evident when one reads our Mission Statement and Core Values.

Mission Statement

Community Bank will be an exceptional, independent financial institution. We will provide our customers with valuable, appropriate products and outstanding personal service. The Bank will continue to grow and continue to create value for our shareholders. Our employees will be treated fairly and given opportunities for personal growth. We will be closely involved in improving our communities.

Core Values

Take Care of Each Other

Protect the Bank

Give and Expect Mutual Respect

Always Do the Right Thing

Try Hard to Achieve Our Goals

Enjoy Life Every Day, Even the Challenges

This culture is revealed when one considers the many awards Community Bank has received for excellence in community service, employer programs, philanthropy, economic development, and financial performance. Please see the “An Introduction To Community Bank” presentationhere.

Our culture is also displayed by the “Our Community Bank” employee communications program.

“Our Community Bank”

Community Bank cares in many ways about its customers, communities, shareholders and employees. Our performance demonstrates that every day.

In early 2017, the Board of Directors and Senior Management conducted a bank-wide employee survey. The goal of the survey was to gauge employee understanding of and satisfaction with their careers at Community Bank, along with their opinions on all aspects of the company. The results of the survey were thoroughly considered and discussed by the Board of Directors and Senior Management.

The primary concerns coming from the survey were employees’ desire for enhancements in the:

| · | Overall communication within the bank. |

| · | Understanding of the evolving culture of the bank given its recent growth and success. |

| · | Understanding of employees’ career opportunities. |

| · | Understanding of the prioritization for investing in facilities and technology. |

| · | Knowledge of the Senior Management Team and their roles. |

To proactively respond to the employees’ questions and concerns,“Our Community Bank” was born!“Our Community Bank” is defined as “a communication plan designed to respond to the Employee Survey of 2017 and to establish an enhanced, ongoing, internal communication process.”

The first phase of“Our Community Bank” kicked off on September 7, 2017. Twenty-one employees of the bank, along with the Senior Management Team, spent the day digging more deeply into the concerns coming from the employee survey. The group of employees represent a diverse cross section of the bank, in that, some are long-term employees and some are very new. In addition, some participants are from support departments and some are out in the market dealing directly with customers. The group broke out into 3 subgroups, called “huddles,” to tackle those concerns.

The session was capped off with the entire team discussing the issues and provided solutions that came from the work of the huddles. Senior Management then devised strategies to prioritize, act upon and communicate that action within the bank through existing communication channels. We also have developed some innovative and fun methods to enhance the communication within our bank!

To close the session, Doug Lee, President of Waynesburg University, provided an inspirational message on Leadership.

It was a great day for the future of Community Bank as it pays concentrated attention to the needs of its greatest asset, the employees of Community Bank!

“Our Community Bank” is an ongoing “movement” in our company to promote greater understanding, collaboration and cooperation through enhanced communication.

Our Benefits

We’re sure that all Progressive employees will, at some point, have questions about benefits. Whether you’re transitioning to full-time employment post-conversion, or not, there will be many things to consider. We are prepared to assist you through the transition in whatever way possible. Orientation for all new employees (full-time permanent or temporary transitional) will be conducted by Community Bank Human Resources beginning in the second quarter of 2018. We offer medical, dental, vision, life insurance at two times salary, plus the ability to purchase additional coverage through our voluntary life program. We also have wonderful short and long term disability plans, as well as AFLAC and wellness programs. Paid time off benefits include paid holidays, vacation, personal, and sick. Our 401(k) plan includes a match and additional profit sharing component.

Your Future at Community Bank

At this time, Community Bank is beginning to outline the resources that will be needed to operate the combined bank post-conversion. As Community Bank management starts to learn more about the products and services of Progressive, decisions will be made as to what positions will be available. Those positons will be posted on a private site hosted by Community Bank, where Progressive employees will be invited to apply and interview for any open position within the Bank. Management of the two banks will work quickly and diligently to notify those not selected for permanent positions, so that the details of separation (i.e. severance packages, transition of benefits, unemployment, 401k payouts, etc.) can be worked out. We will also work quickly to notify anyone who has been identified as being needed in a “transitional” role. Transitional means that your services may be needed for some time post-conversion (i.e. 30 days, 60 days, 90 days, etc.), but not permanently. Transitional employees will be compensated at the same levels and afforded the same benefits as any other Community Bank employee while employed. We will also work with those who will automatically transition, such as the Retail Branch staff (subject to our need to reevaluate staffing in the future), to ensure a quick and easy move. Regardless of which group you fall into, we will be with you every step of the way.

| Pat McCune | Pat O’Brien | Jennifer George |

| CEO of Community Bank | President of Community Bank | SVP of Retail, HR & Compliance at Community Bank |

Welcome Progressive Bank Customers

We are so excited and proud to introduce ourselves to those Progressive customers that we may not yet know. Please rest assured that Community Bank will continue to take good care of the Progressive customers.

While our transaction has been announced, it is not expected to close until the second quarter of 2018. Until the closing, you may continue to use your Progressive offices and services just as always. As the closing approaches, we will be in touch with more information to answer your many questions.

In order to assure all customers of uninterrupted service, Community Bank has invited all Progressive Bank retail branch employees to join Community Bank, subject to our need to reevaluate staffing in the future. While we evaluate our staffing needs over time, your friendly and knowledgeable Progressive service representative will be there for you. And, as an added value, post conversion, Progressive customers will be able to bank at any of Community Bank’s 16 offices; please see “An Introduction to Community Bank” presentationhere. Also, please visit the rest of our web page for a more complete description of our products, services, and other features.

| Pat McCune | Pat O’Brien | Bill Petroplus |

| CEO of Community Bank | President of Community Bank | Chairman, CEO & President of Progressive Bank |

Welcome Progressive Bank Communities

Community Bank has always had our local communities at heart. In addition to generous corporate donations and employee volunteerism, Community Bank has gone above and beyond when it comes to helping the Tri-State economy. In recognition of these efforts, in 2011, Community Bank was awarded the Pennsylvania Community Bankers Association Overall Winner of the“Community Service Award,” for its outstanding commitment to serving its communities. This award was granted in recognition of Community Bank’s leadership in promoting economic development from the shale gas industry. In particular, Community Bank was the founder of the TriCounty Oil & Gas Expo, a nonprofit effort of business and government to help our local people and our local businesses find work in the shale gas industry. The TriCounty Oil & Gas Expo eventually produced dozens of educational and networking events for our local residents and businesses. In 2016, our CEO, Pat McCune, was selected by Range Resources, a major shale gas producer, for its first ever“Good Neighbor”Award in the “Community” category. Both Pat McCune, CEO, and Pat O’Brien, President, have been named by the Pittsburgh Business Times to the“Who’s Who in Energy,” starting in 2012 and continuing today.

In 2016, Community Bank received the“Charles C. Keller Excellence Award for Corporate Philanthropy,” as awarded by the Washington County Community Foundation. Community Bank also offers its“Community Bank Cares” program, where the customer identifies a charity or church to receive a $100 contribution from Community Bank in honor of the customer. To date, Community Bank has made over 1,600 contributions to an astounding number of local and national charities selected by our customers. For this and other reasons, Community Bank was recently awarded one of the first“Corporate Citizenship” awards as selected by the Pittsburgh Business Times.

Community Bank is well aware that, for it to succeed in the Ohio Valley, it needs the knowledge and talent of the Progressive team. To that end, three Progressive directors, including Bill Petroplus, will be invited to join our Board of Directors. In addition, Community Bank will be forming an “Advisory Board” of Ohio Valley business leaders to help educate us about the needs of the Ohio Valley and how we can help. And, as we mention elsewhere, Community Bank will invite all of the retail branch staff of Progressive to join us, as well as many other Progressive employees, (subject to our need to reevaluate staffing in the future).

| Pat McCune | Pat O’Brien | Bill Petroplus |

| CEO of Community Bank | President of Community Bank | Chairman, CEO & President of Progressive Bank |

Welcome First West Virginia Investors

Community Bank and its parent, CB Financial Services, Inc., look forward to meeting the stockholders of First West Virginia Bancorp, Inc., the holding company of Progressive Bank. CB Financial Services Inc.’s stock trades on NASDAQ under the symbol “CBFV.” We are also registered with the SEC.

In addition to our employer and community related recognition, CBFV has also received recognition from the financial community. In 2015, Ambassador Financial Group named CBFV as the4th Highest Performer in Western PA for its 2014 Return on Equity. In 2015, Mr. McCune received the “World Class CEO” award from the Southpointe CEO Association. Also in 2015, Sandler O’Neill & Partners L.P., designated CBFV as a “Sm-All Star” bank, one of only 34 in the nation. In 2016 and 2017, CBFV was recognized byAmerican Banker magazine as being in the “Top 200” performing community banks nationwide.

CBFV pays a good dividend (presently $0.88 per share per year) and continued its solid performance and dividend throughout the financial crisis.

Community Bank is especially excited about the economic future of the Tri-State area. Pittsburgh and its suburbs are thriving thanks to its education, medical, technology and manufacturing prowess. On top of that, we now have the shale gas revolution. The Marcellus and Utica shale plays will attract incredible capital investments, distribute royalties for landowners and produce a renaissance of manufacturing, as evidenced by the Royal Dutch Shell “Cracker” plant along the Ohio River in Beaver County, as well as the projected PTT “Cracker” south of Wheeling in Dilles Bottom, Ohio.

For additional information, please see “An Introduction to Community Bank” presentationhere on the web site, or clickhere for our third quarter earnings release.

| Pat McCune | Pat O’Brien | Bill Petroplus |

| CEO of Community Bank | President of Community Bank | Chairman, CEO & President of Progressive Bank |

Filed by CB Financial Services, Inc. (Commission File No. 001 - 36706) Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a - 12 under the Securities Act of 1934 Subject Company: First West Virginia Bancorp, Inc. The following is a copy of materials posted on CB Financial Services, Inc.’s website ( www.communitybank.tv ) on November 17, 2017:

An Introduction to Community Bank November 16, 2017

Forward - Looking Statements Statements contained in this investor presentation that are not historical facts may constitute forward - looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Such forward - looking statements are subject to significant risks and uncertainties. The Company intends such forward - looking statements to be covered by the safe harbor provisions contained in the Act. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations and future prospects of the Company and its subsidiaries include, but are not limited to, changes in market interest rates, general economic conditions, changes in federal and state regulation, actions by our competitors, loan delinquency rates, our ability to control costs and expenses, and other factors that may be described in the Company’s periodic reports as filed with the Securities and Exchange Commission. These risks and uncertainties should be considered in evaluating forward - looking statements and undue reliance should not be placed on such statements. The Company assumes no obligation to update any forward - looking statement except as may be required by applicable law or regulation. 3

Legal Disclosures Additional Information About the Merger and Where to Find It CB Financial Services, Inc. will file a registration statement with the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended. The registration statement will include a joint proxy statement/prospectus and any other relevant documents filed with the SEC in connection with the proposed merger. CB AND FIRST WEST VIRGINIA SHAREHOLDERS ARE ADVISED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The joint proxy statement/prospectus and other relevant materials (when they become available), and any other documents CB will file with the SEC, may be obtained free of charge at the SEC's website ( www.sec.gov ). In addition, investors and security holders may obtain free copies of the documents from the CB website at www.communitybank.tv under the tab “About Us — Investor Relations” and then the link “SEC Filings .” Participants in the Solicitation CB , First West Virginia and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of CB and First West Virginia in connection with the proposed merger. Information about the directors and executive officers of CB is set forth in the proxy statement for the CB 2017 annual meeting of stockholders, as filed with the SEC on Schedule 14A on April 12, 2017. Information about the directors and executive officers of First West Virginia will be included in the joint proxy statement/prospectus when it becomes available. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction and a description of their direct and indirect interests, by security holdings or otherwise, may be obtained by reading the joint proxy statement/prospectus and other relevant documents regarding the proposed merger to be filed with the SEC when they become available. 4

Welcome to O ur Presentation About

About Community Bank ▪ Community Bank was founded in 1901 as the First National Bank of Carmichaels in Carmichaels, PA ▪ The name of the Bank was changed to Community Bank in 1987 ▪ The Bank has remained independent and today is locally owned and locally managed ▪ In 2006, Community Bank formed a holding company named CB Financial Services, Inc. ▪ Our stock symbol is CBFV ▪ In October 2014, Community Bank merged with First Federal Savings Bank ▪ At that time, CB Financial Services registered with the SEC and began to trade on NASDAQ 6

About Community Bank ▪ Community Bank operates 16 branches in five counties in Southwestern PA (see the map further in the presentation) ▪ Community Bank does business throughout the Tri - State Area of Pennsylvania, West Virginia and Ohio ▪ Community Bank owns an insurance agency, Exchange Underwriters, Inc. ▪ Community Bank also offers wealth management services through the Bishop Group of Janney, Montgomery & Scott ▪ Community Bank is now over $900 million in assets and has been recognized for its community service, employer practices, philanthropy, and financial performance ▪ To learn more about our history visit the “About Us - History & Mission” section of our website ▪ Our business mix and our financial highlights as of September 30, 2017 are set forth on the next couple of slides 7

Diversified Business Mix Retail Banking & Wealth Management Commercial Banking Insurance Mortgage Banking Nearly a quarter of deposits are noninterest bearing More than 80% non - time deposits Excellent retail branch coverage of Southwestern PA market in the heart of the Marcellus/Utica Shale Region Wealth mgt. services linked strongly to Marcellus/Utica Region footprint F ocus on new commercial business generation and sales culture 11% commercial loan growth achieved year - to - date Well positioned to serve the needs of small and medium sized businesses in the Marcellus/Utica Shale Region Active mortgage origination platform with dedicated mortgage originators Complementary to commercial and retail banking business Insurance revenue accounts for over 45% of fee income 8

Community Bank Highlights (as of 9/30/2017) ▪ Assets of $907 Million ▪ Gross Loans of $704 Million ▪ Deposits and Sweep Accounts of $787 Million ▪ 92% Loans - to - Deposit Ratio ▪ Common Equity Tier 1 Capital of $84 Million ▪ Strong Credit Quality and Credit Administration ▪ High Percentage of Low Cost Deposits ▪ Strong, Efficient Performer 9

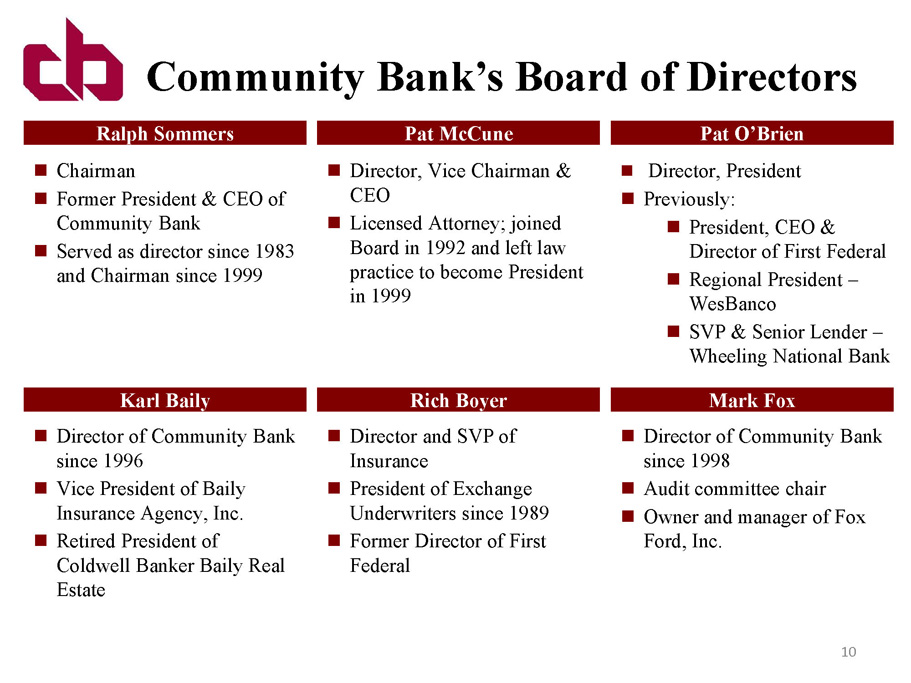

Community Bank’s Board of Directors Pat McCune Ralph Sommers Chairman Former President & CEO of Community Bank Served as director since 1983 and Chairman since 1999 Director, President Previously: President, CEO & Director of First Federal Regional President – WesBanco SVP & Senior Lender – Wheeling National Bank Director, Vice Chairman & CEO Licensed Attorney; joined Board in 1992 and left law practice to become President in 1999 Karl Baily Director of Community Bank since 1996 Vice President of Baily Insurance Agency, Inc. Retired President of Coldwell Banker Baily Real Estate Pat O’Brien Mark Fox Rich Boyer Director and SVP of Insurance President of Exchange Underwriters since 1989 Former Director of First Federal Director of Community Bank since 1998 Audit committee chair Owner and manager of Fox Ford, Inc. 10

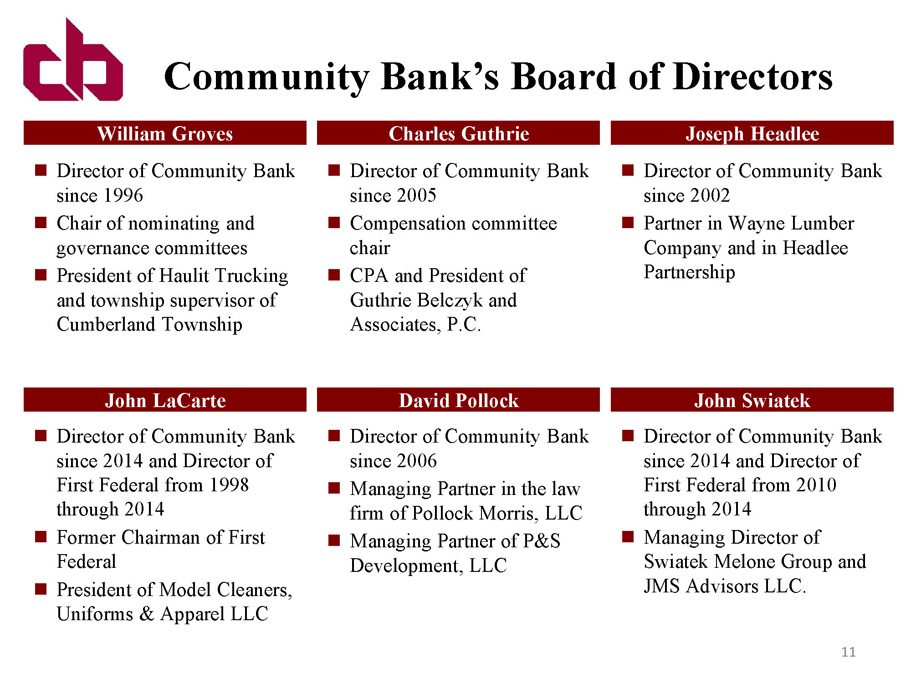

Community Bank’s Board of Directors Charles Guthrie William Groves Director of Community Bank since 1996 Chair of nominating and governance committees President of Haulit Trucking and township supervisor of Cumberland Township Director of Community Bank since 2002 Partner in Wayne Lumber Company and in Headlee Partnership Director of Community Bank since 2005 Compensation committee chair CPA and President of Guthrie Belczyk and Associates, P.C. John LaCarte Director of Community Bank since 2014 and Director of First Federal from 1998 through 2014 Former Chairman of First Federal President of Model Cleaners, Uniforms & Apparel LLC Joseph Headlee John Swiatek David Pollock Director of Community Bank since 2006 Managing Partner in the law firm of Pollock Morris, LLC Managing Partner of P&S Development, LLC Director of Community Bank since 2014 and Director of First Federal from 2010 through 2014 Managing Director of Swiatek Melone Group and JMS Advisors LLC. 11

Community Bank’s Key Senior Management Pat McCune Ralph Sommers Chairman Joined Community Bank in 1979 as EVP Former President & CEO Served as director since 1983 and Chairman since 1999 Director, President Responsible for c ommercial business generation, sales culture & business lines integration Previously: President , CEO & Director of First Federal; Regional President – WesBanco; SVP & Senior Lender – Wheeling National Vice Chairman & CEO Responsibilities include day to day organizational oversight Licensed Attorney; joined Board in 1992 and left law practice to become President in 1999 Kevin Lemley Executive Vice President and Chief Financial Officer Responsible for financial oversight and SEC reporting requirements Joined Community Bank in 2011; previously SVP and CFO of Centra Bank Pat O’Brien Rich Boyer Ralph Burchianti Executive Vice President and Chief Credit Officer Responsibilities include oversight of credit & underwriting policies for the combined organization Over 30 years of experience with Community Bank Bank Director and Senior Vice President – Insurance President of Exchange Underwriters since 1989 Manages day to day operations of Exchange Underwriters and generates new business 12

Community Bank Achievements ▪ Washington County Best Places to Work for 2010, 2011 and 2012 ▪ Pat McCune and Pat O’Brien named as Who’s Who in Energy for multiple years by the Pittsburgh Business Times ▪ Overall Winner of the PACB Community Service Award for 2011 13

October 2014 : Closing of the merger with First Federal November 2014: Our common stock started to trade on the NASDAQ Global Market under the symbol CBFV April 2015: Ambassador Financial Group named Community Bank the 4 th Highest Performer in Western Pennsylvania for its 2014 Return on Equity (1) April 2015: Bauer Financial awarded Community Bank with its highest Five Star rating , available only to the strongest banks in the nation, and we still maintain the “Five Star” rating April 2015 & 2016: American Banker magazine recognized Community Bank as being among the Top 200 performing community banks (2) in the nation for its three year average Return on Equity Community Bank Achievements Since Going Public 14 (1) Ambassador Financial Group 4 th Quarter Community Bank Report. (2) Includes bank holding companies, banks, and thrifts that had total assets of less than $2 billion as of 12/31/14 and that are publicly traded or report financials to the SEC.

June 2015 : CBFV was added to the prestigious ABA NASDAQ Community Bank Index June 2015 : Pat McCune was awarded the World Class CEO award by the Southpointe CEO Association August 2015 : KBW Research initiated coverage of CBFV stock October 2015 : Designated a Sm - All Star by Sandler O’Neill & Partners, L.P., one of only 34 in the nation and one of only two in Pennsylvania March 2017 : D.A. Davidson initiated coverage of CBFV stock 15 Community Bank Achievements Since Going Public

Community Bank Achievements Since Going Public April 2016: Pat McCune received Individual Community Member award presented by Range Resources at their Good Neighbor Awards Banquet November 2016: Community Bank received the Charles C. Keller Excellence Award for Corporate Philanthropy presented by Washington County Community Foundation October 2016: Pat O’Brien and his wife Christine received the Presbyterian Senior Care Foundation Charles W. Pruitt, Jr. Difference Award for outstanding contributions of time, service and support October 2017: Community Bank was recognized with a Pittsburgh Business Times Corporate Citizenship Award for its CB Cares initiative 16

Our Economic Future ▪ Community Bank is excited about the economic prospects for the Tri - State area and particularly for the resurgence of the Ohio Valley ▪ The primary driver for this economic renaissance is the revolution in natural gas production and consumption occasioned by the development of the Marcellus Shale and the Utica Shale 17

Marcellus/Utica Shale - Regional Economic Driver Source: U.S. Energy Information Administration and SNL Financial. Map of Marcellus / Utica Shale Region Community Bank Market Area 18

Shale Gas Drives PetroChemical ▪ Shell Chemical Appalachia is building a “massive multi - billion dollar petrochemical plant” (known as an ethane cracker) in Potter Township, Beaver County ▪ Construction began in 2017, and will create over 6,000 construction jobs and will employ 600 people permanently ▪ Scheduled to be completed in the early 2020’s, it will produce 1.6 million tons a year of ethylene, which is used in products ranging from food packaging to automotive parts 19 Source: Ethane Cracker | State Impact Pennsylvania

Shale Gas Drives PetroChemical ▪ Another game changer would be a proposed cracker plant located in Dilles Bottom, Ohio, approximately 13 miles from Wheeling, WV ▪ The proposed cracker plant would employ thousands during construction and hundreds of permanent petrochemical jobs once the plant enters operation, with thousands of “spin - off” jobs that would result from the ethane cracker’s presence 20 Source: PTTGC America

Shale Gas Drives PetroChemical ▪ WVU - led research identifies areas for a Natural Gas Storage ‘Hub’. Top areas are Belmont, Ohio, Brooke and Hancock Counties. To view the full report, go to, http :// aongrc.nrcce.wvu.edu/wp - content/uploads/MASTER_Final_Report_8 - 29 - 2017.pdf ▪ According to the study Natural Gas Storage facilities could yield up to 100,000 permanent new jobs, and up to $2.9 billion in new federal, state and local tax revenue annually ▪ U.S. Senator Joe Manchin has described the hub this way, “This is a game - changer for us. It’s a real field of dreams.” ▪ Marcellus/Utica average daily production has grown from 3 billion cubic feet (BCF) in 2010 to more than 24 BCF today, forecasted to grow to as much as 40 BCF in the next 5 years ▪ Sweet spots are in the Utica in eastern Ohio and in the Marcellus in northern WV and southwestern PA; These areas represent 40 percent of the total gas production 21 Source: WVU STUDY - A GEOLOGIC STUDY TO DETERMINE THE POTENTIAL TO CREATE AN APPALACHIAN STORAGE HUB FOR NATURAL GAS LIQUIDS

22 Shale Gas Drives PetroChemical ▪ November 2017: West Virginia announces $83.7 billion gas development deal with China Energy ▪ West Virginia Commerce Secretary Woody Thrasher has revealed that the first projects in a blockbuster agreement between the state and China are natural gas power plants, likely one in Harrison County and one in Brooke County ▪ West Virginia enjoys a strong relationship with China Energy, including ongoing research initiatives with West Virginia University SOURCE: Courtesy of the West Virginia Press Association

Our Future with Progressive Bank ▪ With the addition of Progressive Bank, Community Bank will become a $1.25 Billion asset bank with 24 offices in three states ▪ Our Capital will approximate $132 Million ▪ Our Market Capitalization will likely exceed $160 Million ▪ We will be able to offer more services in more markets 23

Source: SNL Financial. CBFV branch count excludes two locations with zero deposits. Geographic Footprint • Community Bank (16) • Progressive (8) 24 Weston

As the map below demonstrates , the combination of Community Bank’s market presence in the heart of the Marcellus, and Progressive Bank’s market presence in the heart of the Utica, will allow Community Bank to serve an economy that has enormous upside potential. Source: U.S. Energy Information Administration and SNL Financial. Map of Marcellus / Utica Shale Region Community Bank Market Area Progressive Market Area 25

Empower our experienced, high quality employees to provide superior customer service in all aspects of our business Create a service culture which builds full relationships with our customers Grow commercial, mortgage, and consumer loans; commercial deposits; insurance; and wealth management Evolve toward more electronic/digital products and processes Qualify for the Russell 2000 Index by achieving a Market Capitalization of over $160 Million Strive for 0.90% ROA and 9.0% ROE Maintain and seek to increase our annual dividend of $0.88 per share Be the Community Bank of choice in the Marcellus/Utica Shale Region for residents and small and medium sized businesses Strategic Vision for Community Bank 26