- CBFV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

CB Financial Services (CBFV) 425Business combination disclosure

Filed: 9 Jul 14, 12:00am

Company Overview July 2014 Filed by CB Financial Services, Inc. Pursuant to Rule 425 under the Securities Act of 1933 Subject Company: FedFirst Financial Corporation Commission File No.: 000-54124 |

1 This investor presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act, relating to present or future trends or factors affecting the banking industry and, specifically, the financial operations, markets and products of CB Financial Services, Inc. (“CBFV”) and FedFirst Financial Corporation (“FFCO”). Forward-looking statements are typically identified by words such as "believe", "plan", "expect", "anticipate", "intend", "outlook", "estimate", "forecast", "will", "should", "project", "goal", and other similar words and expressions. These forward- looking statements involve certain risks and uncertainties. In addition to factors previously disclosed in FFCO’s reports filed with the SEC and those identified elsewhere in this investor presentation or in the Registration Statement on Form S-4 filed by CBFV with the SEC, the following factors among others, could cause actual results to differ materially from forward- looking statements or historical performance: ability to obtain regulatory approvals and meet other closing conditions to the merger, including approval by FFCO’s stockholders, on the expected terms and schedule; delay in closing the merger; difficulties and delays in integrating the respective businesses of CBFV and FFCO or fully realizing cost savings and other benefits; business disruption following the merger; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of CBFV products and services; customer borrowing, repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; economic conditions; and the impact, extent and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. CBFV and FFCO undertake no obligation to revise these forward-looking statements or to reflect events or circumstances after the date of this investor presentation. Forward-Looking Statements |

2 FedFirst Transaction Creating the Premier Community Bank in the Marcellus Shale Region |

3 Transaction Highlights Strategically Compelling Combined banking institution of nearly $900 million in total assets, located in Southwestern Pennsylvania, the heart of the Marcellus Shale Region Significantly improves market share in the Pittsburgh MSA as a leading independent community bank with the size and scale to take advantage of market opportunities CBFV will apply to become an exchange traded public company (NASDAQ Global Market) Enhances breadth of banking products to commercial and personal customers Complementary cultures and strong ties to community Exchange Underwriters, bank owned insurance agency, provides attractive, consistent fee income stream and is highly correlated with CBFV’s commercial bank business lines Deep and experienced management with an average of more than 30 years of experience in the Southwestern Pennsylvania market area Combined Board of Directors, including four new members from FFCO, focused on driving shareholder value Expected double digit earnings per share accretion in 2015 and 2016, excluding any transaction related expenses Compelling profitability ratios; pro forma estimated return on tangible common equity of approximately 12% Conservative and achievable expected cost savings Limited tangible book value dilution at closing with an expected earnback period of less than 3 years Expected internal rate of return of approximately 19% Accretive to CBFV’s regulatory capital and tangible common equity to assets ratios at closing Financially Attractive |

4 Pro Forma Highlights (3/31/2014) Assets $873 M Loans $663 M Deposits $722 M Attractive franchise in heart of the Marcellus Shale Region Top 10 pro forma market share in core operating area (1) ; focused in South Hills market of the Pittsburgh metropolitan area and in Greene County Pennsylvania Increased scale – serving a larger, more diversified client base with an increased lending limit Expanded product offering and improved ability to cross sell Increased market visibility from anticipated NASDAQ listing Pro Forma Franchise Summary Source: SNL Financial as provided by the FDIC. Deposit market share data as of June 30, 2013, as adjusted for acquisitions to the extent discernable. Note: Pro forma data is unaudited and does not include purchase accounting adjustments. (1) Core operating area excludes Allegheny County. |

5 Attractive Southwestern PA Market Source: SNL Financial for all demographic data and the Pennsylvania Department of Labor and Industry. Summary county statistics are deposit-weighted. Combined franchise (with FedFirst) encompasses the following counties: Washington Greene Westmoreland Fayette Allegheny The Washington Hospital CONSOL Energy, Inc. Meadows Racetrack and Casino Monongahela Valley Hospital Caterpillar Alpha Natural Resources GMS Mine Repair and Maintenance Westmoreland Regional Hospital Summary Statistics (5 County Franchise) Population of nearly 2 million 2013 median household income of approximately $46,000 Unemployment rate (May 2014) of 5.1% (vs. 5.7% in PA and 6.3% nationally), driven by strong employment in primary Washington and Greene County markets Projected household income growth (2013-2019) of 21.1% (vs. 14.7% in PA and 8.9% nationally) Major Employers in Core Operating Area (1) Region Overview Scarcity of Community Banks in Core Operating Area Operating Area (1) Deposit Bank Market Total Bank Name Rank Share Assets ($000) PNC Bank, NA 1 27.03% 313,362,161 Citizens Bank, NA 2 9.92% 127,295,624 First National Bank of PA 3 8.74% 14,291,715 First Commonwealth Bank 4 6.92% 6,174,978 S&T Bank 5 6.05% 4,687,373 Washington Financial Bank (2) 6 5.96% 1,003,284 First Niagara Bank, NA 7 5.33% 37,930,363 First Federal SLA of Greene Cty (2) 8 5.19% 894,157 Community Bank (3) 9 4.60% 873,456 Charleroi Federal Savings Bank (2) 10 3.13% 546,042 (1) Core operating area excludes Allegheny County. (2) Mutual institution. (3) Total assets are CBFV total assets pro forma for the FedFirst transaction. Pro forma data is unaudited and does not include purchase accounting adjustments. |

6 Currently produces about 12 billion cubic feet of natural gas daily (would rank 8 th in natural gas production worldwide) Production has increased six- fold since 2009 The bulk of the natural gas is produced in Pennsylvania and West Virginia; New York has placed moratorium on shale gas drilling As of November 2013, more than 10,000 wells had been drilled Expected to account for nearly 25% of domestic natural gas production by 2015 Directly and indirectly supports an estimated 245,000 Pennsylvania jobs, with an annual economic impact in excess of $7 billion Marcellus Shale - Regional Economic Driver Sources: marcelluscoalition.org, Penn State University Marcellus Center for Outreach and Research, the Wall Street Journal, the Philadelphia Inquirer, Morningstar and the PA Department of Labor and Statistics. Marcellus Shale Overview Map of Marcellus / Utica Shale Region |

7 Loans ($663 M) Source: SNL Financial; Data is regulatory data as of 3/31/14 for comparability purposes. Pro forma data is unaudited and does not include purchase accounting adjustments. Yield and cost data is for the quarter ended 3/31/14 and is annualized. Yield on Loans: 4.25% Cost of Deposits: 0.53% Deposits ($722 M) Well leveraged balance sheet with pro forma loan to deposit ratio in excess of 90% Pro Forma Loan and Deposit Composition |

8 Board Composition Transaction Value / Pricing Ownership Split Name Executive Management $54.8 million (2) 58% CBFV / 42% FFCO Holding Company: CB Financial Services, Inc. Bank Subsidiary: Community Bank Chairman: Ralph Sommers, Jr. (CBFV) 54 years experience Vice Chairman, President & CEO: Barron P. “Pat” McCune, Jr. (CBFV) 22 years experience COO: Patrick O’Brien (FFCO) 31 years experience CFO: Kevin Lemley (CBFV) 30 years experience CCO: Ralph Burchianti (CBFV) 36 years experience VP – Insurance Operations: Rich Boyer (FFCO) 33 years experience Four members of FFCO’s board of directors appointed to CBFV’s board CBFV’s board will be comprised of 12 total members Required Approvals & Timing FFCO shareholder and customary regulatory approvals Targeted closing date of late Q3 or early Q4 2014 Consideration Fixed exchange ratio of 1.1590 (1) shares of CBFV common stock or $23.00 cash for each share of FFCO common stock 65% CBFV stock / 35% cash (1) Based on 20 day volume weighted average CBFV price for the period ended 4/11/14. (2) Per the Form S-4 filed 6/13/14. Transaction Overview |

9 EPS Tangible Book Value Consolidated Capital IRR Internal rate of return of approximately 19% Accretive to CBFV’s capital ratios at closing TCE / TA > 8% at closing Total RBC ratio approximately 13% at closing ~3% dilution estimated at closing Accretive to standalone tangible book value in less than 3 years (1) Immediately accretive to earnings per share, excluding one time costs Expected double digit earnings per share accretion long term Attractive Financial Returns (1) Earn-back period is defined as the number of years for pro forma tangible book value per share to exceed stand-alone projected tangible book value per share. Pro Forma Financial Impact |

10 Strategic Outlook |

11 Key Senior Management Pat McCune Ralph Sommers Chairman Joined Community Bank in 1979 as EVP Became President in 1984 and President & CEO in 1988 Served as director since 1983 and Chairman since 1999 Director, EVP and Chief Operating Officer Will be responsible for new commercial business generation, sales culture and business line integration Joined FedFirst in 2005; previously a Regional President of WSBC Vice Chairman, President & CEO Responsibilities to include day to day organizational oversight Attorney by training; joined Board in 1992 and left law practice to become President in 1999 Kevin Lemley SVP and Chief Financial Officer Responsible for financial oversight and new SEC reporting requirements Joined CBFV in 2011; previously SVP and CFO of Centra Bank Pat O’Brien Rich Boyer Ralph Burchianti SVP and Chief Credit Officer Responsibilities include oversight of credit & underwriting policies for the combined organization Nearly 30 years of experience with CBFV Director and Vice President - Insurance Will manage day to day operations of Exchange Underwriters and continue to generate new business President of Exchange Underwriters since 1989; sold 80% interest to FedFirst in 2002 |

12 Diversified Business Mix Retail Banking (1) & Wealth Management Commercial Lending Insurance Mortgage Banking Nearly a quarter of deposits will be noninterest bearing Approximately 75% non-time deposits Excellent retail branch coverage of Southwestern PA market in the heart of the Marcellus Shale Region Wealth management services linked strongly to Marcellus Region footprint FedFirst augments legacy team of experienced commercial bankers Pat O’Brien to be focused on new commercial business generation Increased scale better positions us to serve the needs of businesses in the Marcellus Shale Region Originated $50 million of residential mortgages on a combined basis in 2013 (1) FedFirst historically retained much of its production; provides opportunity for revenue enhancement not currently modeled into impact Complementary to commercial lending business More than $3 million in fee income in 2013; essentially doubles legacy fee income mix 20%+ pre-tax returns All production staff to be retained Source: SNL Financial and company documents. (1) Deposit data is pro forma. Pro forma data is unaudited and does not include purchase accounting adjustments. |

13 Balanced Fee Revenue Mix With Opportunity For Continued Improvement Source: FedFirst and CBFV company documents. Combined Fee Revenue Mix – 2013 (1) Fee income sources to approach 25% of total revenue Opportunity to improve deposit fee income from legacy FedFirst franchise Wealth management business to be incorporated into legacy FedFirst locations No revenue enhancements considered in transaction modeling Combined Fee Income: $7.5 Million (1) (1) Combined data is unaudited and does not reflect purchase accounting adjustments. Excludes gain on sale of OREO. |

14 Successful integration of FedFirst into the Community Bank organization Organic growth to over $1.0 billion in total assets Maintain focus on region southwest of metro Pittsburgh Fully integrate business lines and create a sales culture which builds full relationships with our commercial business customers 1% ROAA and double digit ROAE Empower our experienced, high quality employees to provide superior customer service in all aspects of our business Be the Community Bank of choice in the Marcellus Shale Region for small and medium sized businesses Strategic Vision for CB Financial Services |

15 Summary |

16 Strong legacy operating results and asset quality FedFirst transaction significantly increases scale with attractive return and payback metrics Experienced combined senior management team with strong community ties Improved ability to serve customer needs in attractive Marcellus Shale Region Post-transaction exchange listing should improve trading liquidity and market visibility Pro forma price to earnings metrics represent a substantial discount to peer median price to 2015 estimated earnings multiple of 12.6x (1) Investment Highlights Source: SNL Financial. (1) Peers defined as exchange traded banks with assets $500 million to $1.5 billion, MRQ ROAA greater than 0.50% and NPAs/Assets less than 3.0%. Pricing data as of 7/1/14. |

17 Supplemental Historical Information on CB Financial Services |

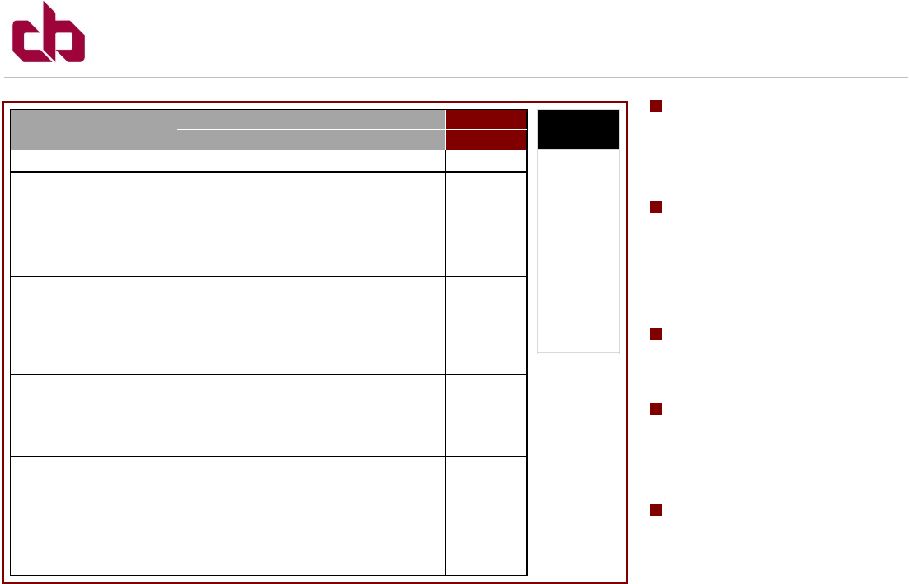

18 Source: SNL Financial, company documents and S-4 filed 6/13/14. Note: Pro forma data is unaudited and includes estimated purchase accounting adjustments. (1) Represents bank level for 2011 and 2012. (2) NPLs include nonaccrual loans, loans 90+ days past due and TDRs. NPAs include NPLs and OREO. (3) Efficiency Ratio = Noninterest expense before OREO impairment and amortization of intangibles / net interest income + noninterest revenues (excludes securities gains and OREO gains and losses) Consistently profitable throughout the financial crisis Return on tangible common equity in excess of 10% on a standalone basis 6.5% annualized loan growth in Q1 2014 Nonperforming assets less than 80 basis points of total assets Net charge-offs and nonperforming asset levels consistently below peer median levels Historical Financial Highlights 2011 FY 2012 FY 2013 FY 2013 YTD 3/31/14 ($000s except per share) 12/31/11 12/31/12 12/31/13 3/31/14 Pro Forma Balance Sheet Total Assets $533,636 $546,753 $546,486 $550,173 $857,378 Total Gross Loans 340,256 348,130 379,146 385,350 659,397 Total Deposits 450,883 471,273 480,335 488,783 723,754 Tangible Common Equity 39,821 42,261 42,847 41,362 69,155 Capital Ratios (%) Tang. CE / Tang Assets 7.49% 7.76% 7.87% 7.55% 8.14% Tier 1 Ratio (1) 11.60 11.87 12.12 11.37 11.87 Risk-Based Capital Ratio (1) 12.86 13.13 13.38 12.62 12.79 TBV Per Share $16.47 $17.29 $17.36 $17.68 $17.03 Asset Quality (%) (2) NPAs/ Assets 1.15% 1.23% 0.78% 0.77% NCOs/ Avg Loans 0.11 0.12 0.17 0.01 Reserves/ NPLs 107.0 102.1 137.0 134.1 Profitability Net Income $4,396 $4,217 $4,256 $1,079 ROAA 0.88% 0.78% 0.79% 0.79% ROATCE 11.6 10.3 10.0 10.3 Net Interest Margin (FTE) 3.61 3.27 3.29 3.45 Efficiency Ratio (FTE) (3) 62.3 63.6 66.6 68.3 Diluted EPS $1.78 $1.70 $1.72 $0.46 |

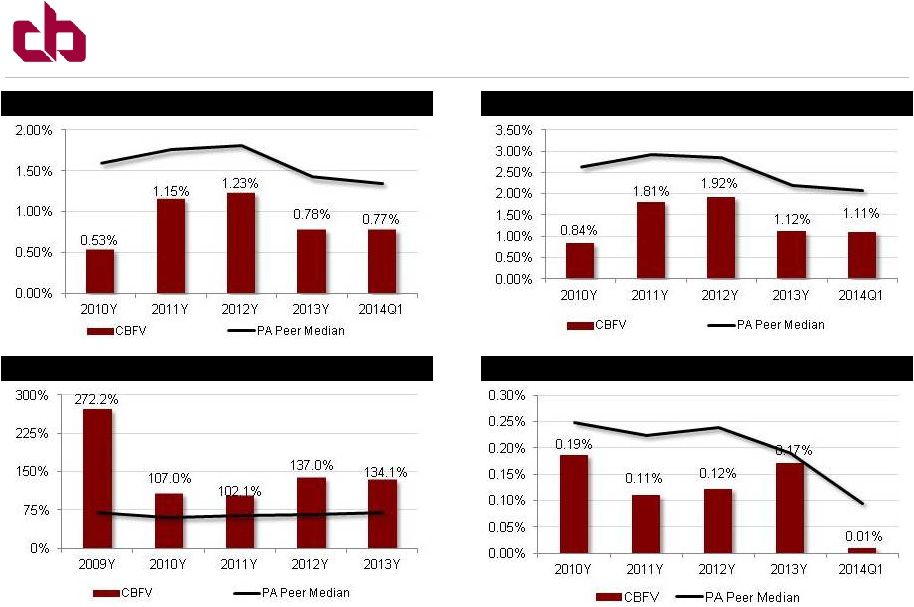

19 Nonperforming Assets / Assets (1) Nonperforming Assets / Loans + OREO (1) Allowance for Loan Losses / NPLs (2) NCOs / Avg. Loans Source: SNL Financial and company documents, Peers include all commercial banks and bank holding companies headquartered in Pennsylvania with assets $150 million to $1.0 billion. Strong Historical Asset Quality Relative to PA Peers (1) Non-Performing Assets = Nonaccrual + TDRs + 90 day past due and still accruing + OREO. (2) Non-Performing Loans = Nonaccrual + TDRs + 90 day past due and still accruing. |

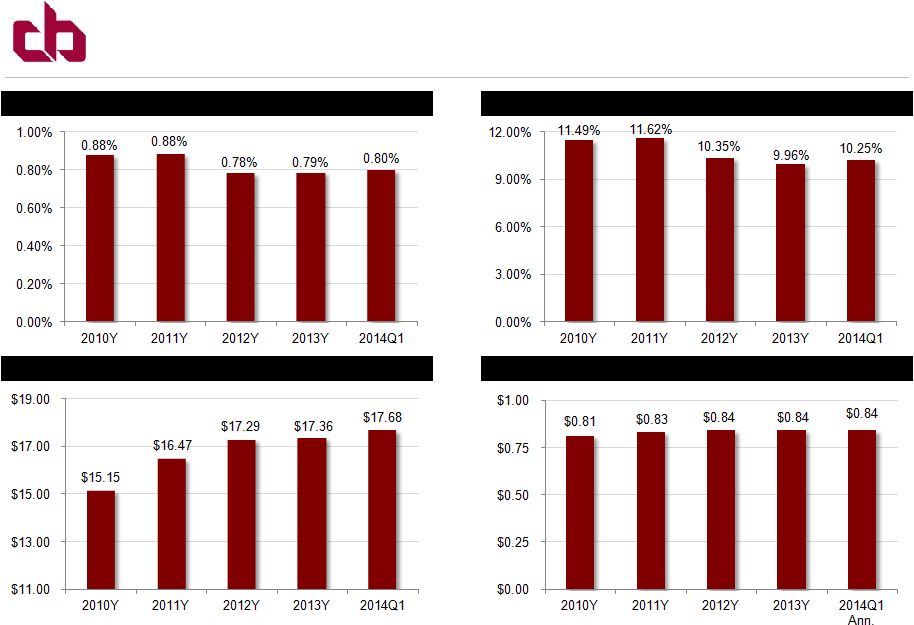

20 Return on Assets Return on Tangible Common Equity Tangible Book Value Per Share (2) Dividends Per Share (1) Source: Company documents. (1) 2014 Q1 data is annualized. (2) 133,000 shares were repurchased at $21.75 from a former director during Q1 2014. Legacy of Strong Profitability & Consistent Shareholder Value Creation |

21 Communications in this presentation do not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any proxy vote or approval. The proposed merger and issuance of CBFV common stock in connection with the proposed merger will be submitted to FFCO’s shareholders for their consideration and approval. CBFV has filed with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 that includes a preliminary proxy statement to be used by FFCO to solicit the required approval of its shareholders in connection with the proposed merger, and which constitutes a preliminary prospectus of CBFV. CBFV and FFCO may also file other documents with the SEC concerning the proposed merger. INVESTORS AND SECURITY HOLDERS OF FFCO ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER AND OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors and security holders may obtain a free copy of the definitive proxy statement/prospectus and other documents containing important information about CBFV and FFCO, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by FFCO will be available free of charge on FFCO’s website at www.firstfederal-savings.com/investor-relations.aspx FFCO and certain of its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of FFCO in connection with the proposed merger. Information concerning such participants' ownership of shares of FFCO common stock is set forth in the definitive proxy statement for FFCO’s 2014 annual meeting of stockholders filed with the SEC on April 17, 2014. This document can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the definitive proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. Additional Information |