UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

(Exact name of registrant as specified in charter)

690 Lee Road, Wayne, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Thomas R. Phillips, Esquire

Hartford Funds Management Company, LLC

690 Lee Road

Wayne, Pennsylvania 19087

(Name and Address of Agent for Service)

Copy to:

John V. O’Hanlon, Esquire

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston, Massachusetts 02110-2605

Registrant's telephone number, including area code:

Date of reporting period:

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a)

Annual Shareholder Report

September 30, 2024

Hartford Disciplined US Equity ETF

HDUS/NYSE Arca

This annual shareholder report contains important information about the Hartford Disciplined US Equity ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Hartford Disciplined US Equity ETF | $22 | 0.19% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

Large-Cap U.S. equities generated strong returns over the trailing twelve-month period ending September 30, 2024 as measured by the Russell 1000 Index. Equities generated positive returns across most sectors led by Information Technology.

Top Contributors to Performance

The Fund’s positive exposures to dividend yield, quality, and value risk factors were contributors to performance as these factors generated positive excess return for the trailing twelve-month period.

The Fund also had positive stock selection in the Industrials and Materials sectors that contributed positively to performance for the trailing one-year.

Top Detractors to Performance

The Fund was negatively affected from its positive exposure to low volatility and size as higher volatility stocks and larger-cap equities outperformed.

Negative stock selection negatively affected performance where the Fund’s underweight to NVIDIA was a top detractor as the stock was up 179% for the past year.

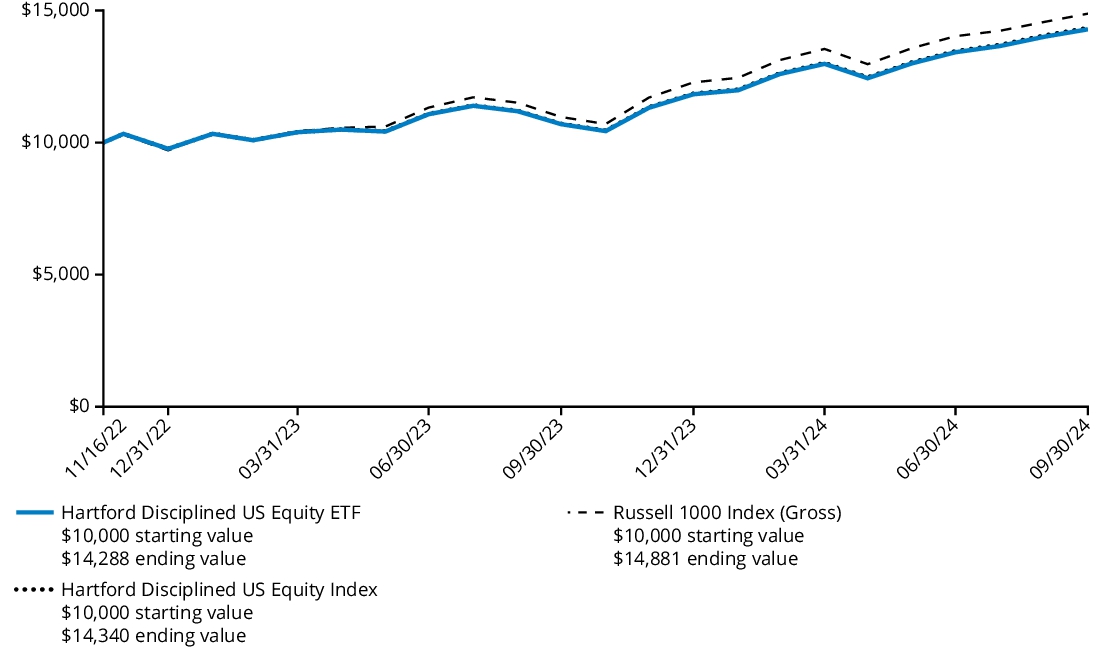

Comparison of Change in Value of $10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices.

Average Annual Total Returns

For the Periods Ended September 30, 2024 | 1 Year | Since Inception

(November 16, 2022) |

| Fund | 33.57% | 21.01% |

| Hartford Disciplined US Equity Index | 33.84% | 21.24% |

| Russell 1000 Index (Gross) | 35.68% | 23.01% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or

sale of Fund shares. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of September 30, 2024

| Fund's net assets | $122,291,921 |

| Total number of portfolio holdings (excluding derivatives, if any) | 271 |

| Total investment advisory fees paid | $208,391 |

| Portfolio turnover rate | 51% |

Graphical Representation of Holdings as of September 30, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 30.0 | % |

| Financials | 10.9 | % |

| Consumer Discretionary | 10.3 | % |

| Health Care | 10.3 | % |

| Communication Services | 9.9 | % |

| Industrials | 9.0 | % |

| Consumer Staples | 7.3 | % |

| Energy | 4.3 | % |

| Real Estate | 4.2 | % |

| Materials | 2.1 | % |

| Utilities | 1.4 | % |

| Other Assets & Liabilities | 0.3 | % |

| Total | 100.0 | % |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The ETFs are distributed by ALPS Distributors, Inc. (ALPS).

Annual Shareholder Report

September 30, 2024

Hartford Longevity Economy ETF

HLGE/NYSE Arca

This annual shareholder report contains important information about the Hartford Longevity Economy ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Hartford Longevity Economy ETF | $51 | 0.44% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

U.S. equities generated strong returns over the trailing twelve-month period ending September 30, 2024 as measured by the Russell 3000 Index. Equities were positive across most sectors led by Information Technology.

Top Contributors to Performance

The Fund’s underweight to the low volatility risk factor and positive exposures to value and quality risk factors contributed positively to performance for the trailing twelve-month period.

The Fund also benefited from an underweight in Energy as the sector underperformed.

Top Detractors to Performance

The Fund was negatively affected from its positive exposure to size as larger-cap equities outperformed.

The Fund’s underweight to NVIDIA was a top detractor as the stock was up 179% for the past year.

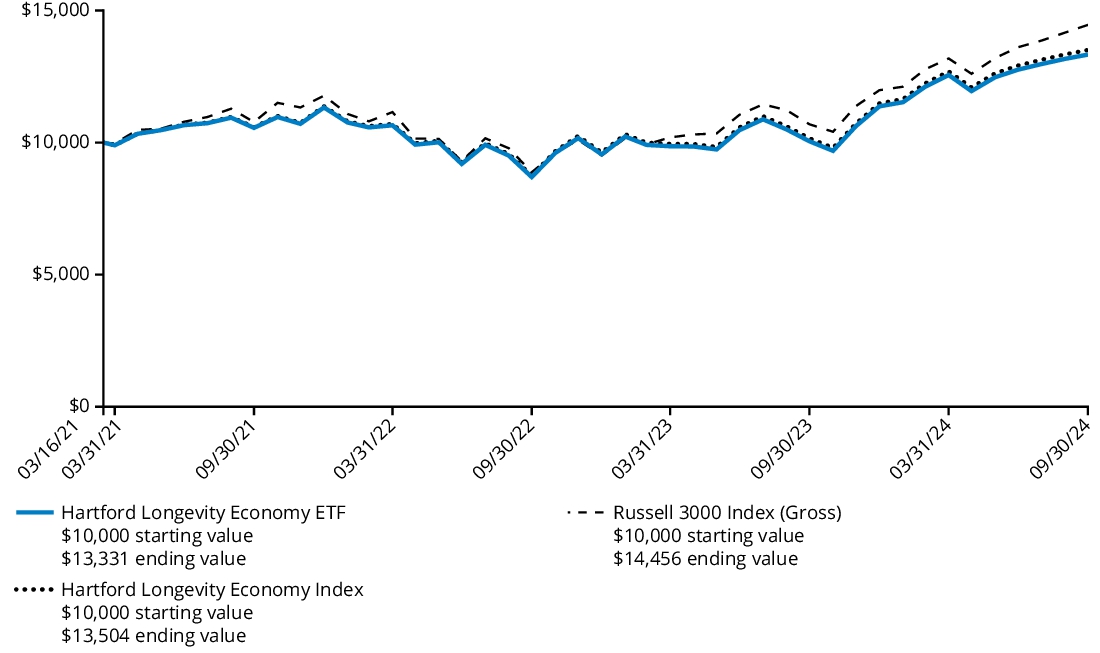

Comparison of Change in Value of $10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices.

Average Annual Total Returns

For the Periods Ended September 30, 2024 | 1 Year | Since Inception

(March 16, 2021) |

| Fund | 32.64% | 8.45% |

| Hartford Longevity Economy Index | 32.85% | 8.85% |

| Russell 3000 Index (Gross) | 35.19% | 10.84% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or

sale of Fund shares. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of September 30, 2024

| Fund's net assets | $11,898,391 |

| Total number of portfolio holdings (excluding derivatives, if any) | 351 |

| Total investment advisory fees paid | $43,716 |

| Portfolio turnover rate | 62% |

Graphical Representation of Holdings as of September 30, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 32.4 | % |

| Health Care | 18.0 | % |

| Consumer Discretionary | 12.6 | % |

| Communication Services | 11.7 | % |

| Financials | 10.4 | % |

| Consumer Staples | 7.4 | % |

| Industrials | 3.1 | % |

| Utilities | 2.2 | % |

| Real Estate | 2.1 | % |

| Short-Term Investments | 0.3 | % |

| Other Assets & Liabilities | (0.2 | ) % |

| Total | 100.0 | % |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The ETFs are distributed by ALPS Distributors, Inc. (ALPS).

Annual Shareholder Report

September 30, 2024

Hartford Multifactor Developed Markets (ex-US) ETF

RODM/NYSE Arca

This annual shareholder report contains important information about the Hartford Multifactor Developed Markets (ex-US) ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Hartford Multifactor Developed Markets (ex-US) ETF | $32 | 0.29% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

Equities in the International developed markets generated strong returns over the trailing twelve-month period ending September 30, 2024 as measured by the MSCI World ex USA Index. Developed Markets equities generated positive returns across countries within the index led by performance from the Financials, Information Technology, and Industrials sectors.

Top Contributors to Performance

The Fund’s positive exposure to quality contributed positively to performance as the factor generated positive excess return for the trailing twelve-month period.

The Fund’s underweight to Energy and positive stock selection in the Consumer Staples and Consumer Discretionary sectors also contributed positively to performance.

Top Detractors to Performance

The Fund was negatively affected by its positive exposure to low volatility and size as higher volatility stocks and larger-cap equities outperformed.

Stock selection in certain sectors detracted, led by security selection in the Utilities and Materials sectors.

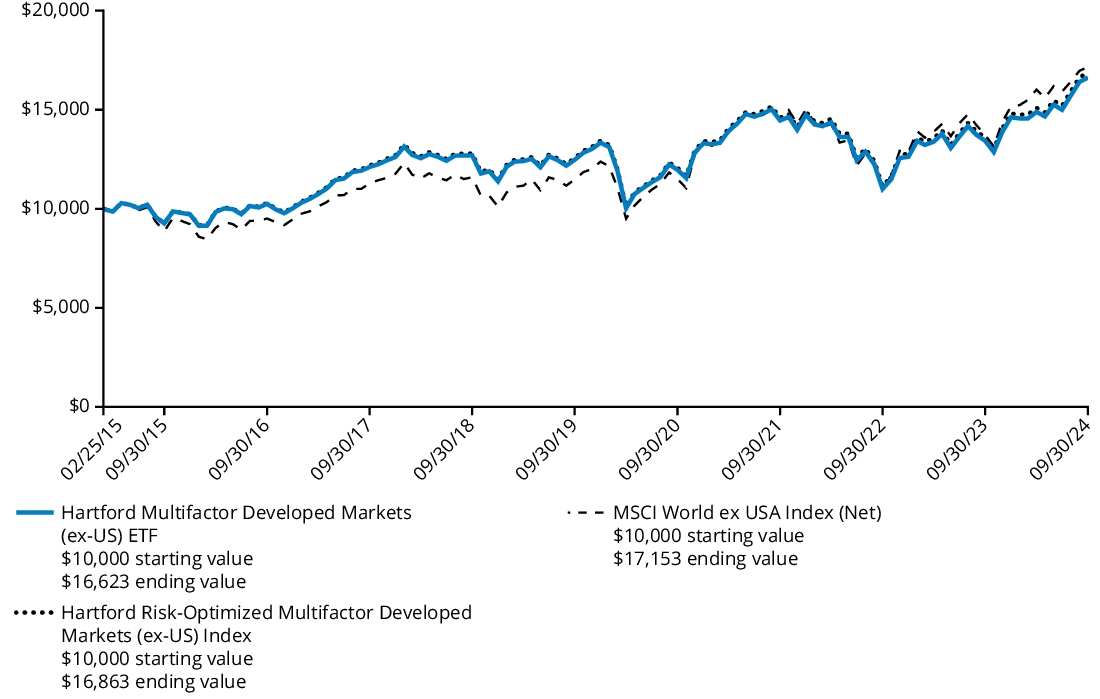

Comparison of Change in Value of $10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices.

Average Annual Total Returns

For the Periods Ended September 30, 2024 | 1 Year | 5 Years | Since Inception

(February 25, 2015) |

| Fund | 23.77% | 5.91% | 5.44% |

| Hartford Risk-Optimized Multifactor Developed Markets (ex-US) Index | 23.89% | 6.07% | 5.60% |

| MSCI World ex USA Index (Net) | 24.98% | 8.36% | 5.78% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or

sale of Fund shares. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of September 30, 2024

| Fund's net assets | $1,140,411,615 |

| Total number of portfolio holdings (excluding derivatives, if any) | 327 |

| Total investment advisory fees paid | $3,683,758 |

| Portfolio turnover rate | 61% |

Graphical Representation of Holdings as of September 30, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Japan | 20.9 | % |

| Canada | 14.4 | % |

| United Kingdom | 11.4 | % |

| Australia | 10.1 | % |

| France | 5.0 | % |

| United States | 5.0 | % |

| Germany | 4.1 | % |

| Singapore | 3.1 | % |

| Switzerland | 3.1 | % |

| Israel | 2.9 | % |

| Other* | 19.0 | % |

| Short-Term Investments | 2.4 | % |

| Other Assets & Liabilities | (1.4 | ) % |

| Total | 100.0 | % |

| * | Ten largest country/geographic regions are presented. Additional country/geographic regions are found in Other. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The ETFs are distributed by ALPS Distributors, Inc. (ALPS).

Annual Shareholder Report

September 30, 2024

Hartford Multifactor Diversified International ETF

RODE/Cboe BZX

This annual shareholder report contains important information about the Hartford Multifactor Diversified International ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Hartford Multifactor Diversified International ETF | $32 | 0.29% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

International equity markets generated strong returns over the trailing twelve-month period ending September 30, 2024 as measured by the MSCI ACWI ex USA Index. Equities generated positive returns across most countries within the index led by performance in the Information Technology, Financials, and Industrials sectors.

Top Contributors to Performance

The Fund was helped from its positive exposures to quality and momentum as these risk factors outperformed for the trailing twelve-month period.

Strong stock selection in Consumer Staples also contributed positively to results.

Top Detractors to Performance

The Fund was negatively affected by its positive exposures to the size and value risk factors as smaller-cap stocks and value stocks underperformed.

An underweight to India and negative stock selection in the Communication Services and Information Technology sectors detracted from performance.

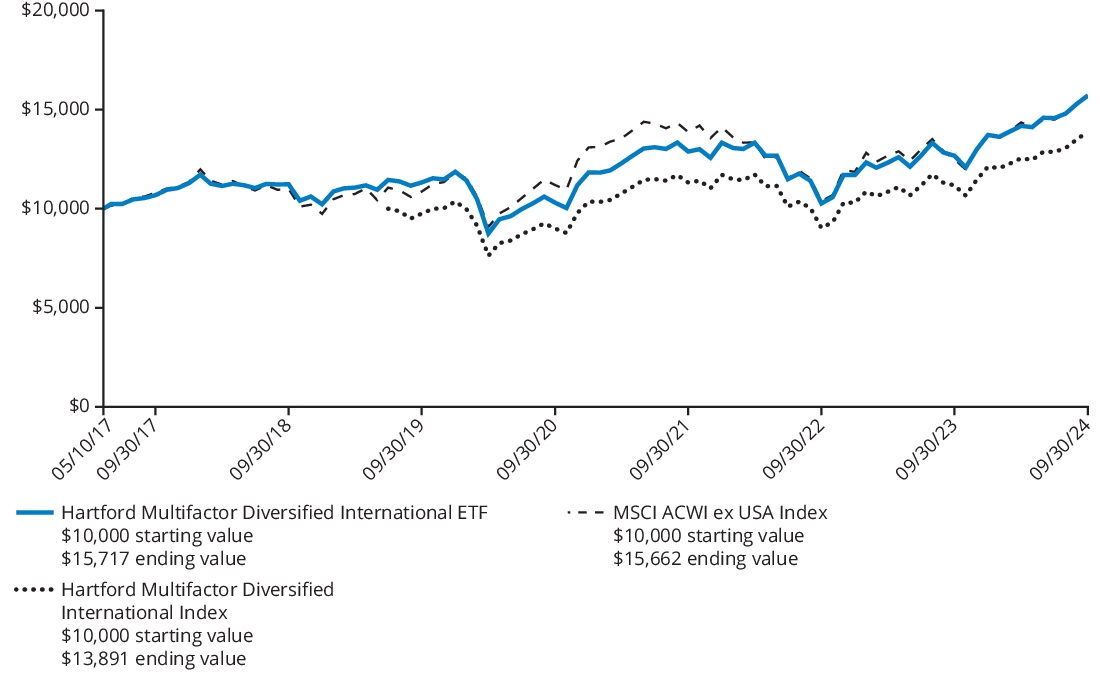

Comparison of Change in Value of $10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices.

Average Annual Total Returns

For the Periods Ended September 30, 2024 | 1 Year | 5 Years | Since Inception

(May 10, 2017) |

| Fund | 24.04% | 6.77% | 6.31% |

| Hartford Multifactor Diversified International Index | 24.25% | 7.33% | 6.45%* |

| MSCI ACWI ex USA Index (Net) | 25.35% | 7.59% | 6.29% |

| * | The Hartford Multifactor Diversified International Index commenced operations on June 28, 2019. Reflects annualized returns starting on June 28, 2019. |

Performance information prior to November 6, 2019 reflects the Fund’s performance when it tracked its prior index.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or

sale of Fund shares. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of September 30, 2024

| Fund's net assets | $19,535,801 |

| Total number of portfolio holdings (excluding derivatives, if any) | 316 |

| Total investment advisory fees paid | $52,017 |

| Portfolio turnover rate | 54% |

Graphical Representation of Holdings as of September 30, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Japan | 12.6 | % |

| China | 11.8 | % |

| Taiwan | 8.4 | % |

| Australia | 8.0 | % |

| South Korea | 5.3 | % |

| Canada | 4.9 | % |

| United Kingdom | 4.3 | % |

| United States | 3.9 | % |

| France | 3.0 | % |

| Sweden | 2.8 | % |

| Other* | 34.0 | % |

| Short-Term Investments | 1.1 | % |

| Other Assets & Liabilities | (0.1 | ) % |

| Total | 100.0 | % |

| * | Ten largest country/geographic regions are presented. Additional country/geographic regions are found in Other. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The ETFs are distributed by ALPS Distributors, Inc. (ALPS).

Annual Shareholder Report

September 30, 2024

Hartford Multifactor Emerging Markets ETF

ROAM/NYSE Arca

This annual shareholder report contains important information about the Hartford Multifactor Emerging Markets ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Hartford Multifactor Emerging Markets ETF | $50 | 0.44% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

Emerging markets equity generated strong returns over the trailing twelve-month period ending September 30, 2024 as measured by the MSCI Emerging Markets Index. Equities generated positive returns across most countries within the index led by performance in the Information Technology and Financials sectors.

Top Contributors to Performance

The Fund’s positive exposures to the momentum and quality risk factors contributed positively to performance as these factors generated positive excess return versus the MSCI Emerging Markets Index for the trailing twelve-month period.

Performance also benefited from positive security selection with particularly strong stock selection in India and South Korea.

Top Detractors to Performance

The Fund was negatively affected by its positive exposures to the size and value risk factors as smaller-cap stocks and value stocks underperformed.

Negative stock selection in certain countries detracted from performance led by weakness in Taiwanese technology stocks.

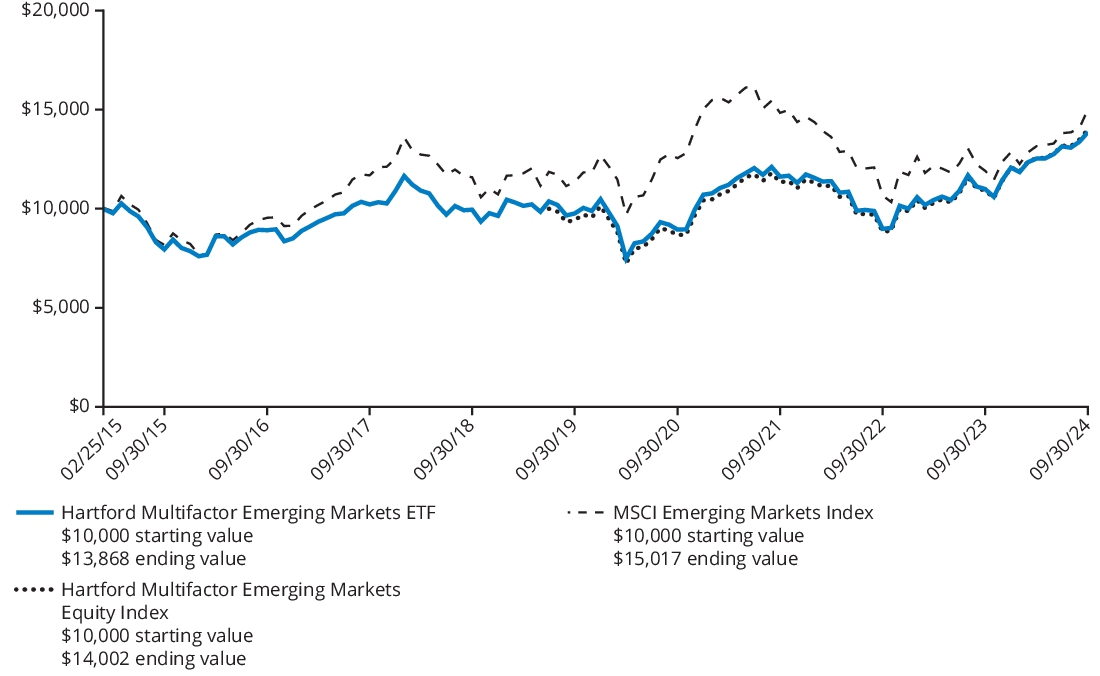

Comparison of Change in Value of $10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices.

Average Annual Total Returns

For the Periods Ended September 30, 2024 | 1 Year | 5 Years | Since Inception

(February 25, 2015) |

| Fund | 26.15% | 7.28% | 3.47% |

| Hartford Multifactor Emerging Markets Equity Index | 28.17% | 8.23% | 6.61%* |

| MSCI Emerging Markets Index (Net) | 26.05% | 5.75% | 4.33% |

| * | The Hartford Multifactor Emerging Markets Equity Index commenced operations on June 28, 2019. Reflects annualized returns starting on June 28, 2019. |

Performance information prior to September 11, 2019 reflects the Fund’s performance when it tracked its prior index.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or

sale of Fund shares. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of September 30, 2024

| Fund's net assets | $31,891,703 |

| Total number of portfolio holdings (excluding derivatives, if any) | 320 |

| Total investment advisory fees paid | $99,166 |

| Portfolio turnover rate | 54% |

Graphical Representation of Holdings as of September 30, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| China | 20.1 | % |

| Taiwan | 18.0 | % |

| India | 16.9 | % |

| South Korea | 10.8 | % |

| Saudi Arabia | 5.6 | % |

| Brazil | 4.7 | % |

| Thailand | 3.9 | % |

| Malaysia | 3.7 | % |

| Indonesia | 3.4 | % |

| Turkey | 2.8 | % |

| Other* | 10.1 | % |

| Short-Term Investments | 0.0 | % ^ |

| Other Assets & Liabilities | 0.0 | % ^ |

| Total | 100.0 | % |

| * | Ten largest country/geographic regions are presented. Additional country/geographic regions are found in Other. |

| ^ | Percentage rounds to zero. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The ETFs are distributed by ALPS Distributors, Inc. (ALPS).

Annual Shareholder Report

September 30, 2024

Hartford Multifactor International Small Company ETF

ROIS/Cboe BZX

This annual shareholder report contains important information about the Hartford Multifactor International Small Company ETF (the "Fund") for the period of March 18, 2024 (commencement of operations) to September 30, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

What were the Fund costs for the last year?*

(Based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment^ |

| Hartford Multifactor International Small Company ETF | $27 | 0.49% |

| * | This annual report covers less than a full 12-month period. Expenses for a full 12-month period would be higher. |

| ^ | Annualized. |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

International small-cap equities generated strong returns over the twelve-month period ending September 30, 2024 as measured by the MSCI ACWI ex USA Small Cap Index. Equities generated positive returns across most countries within the index with strong performance from most sectors.

Top Contributors to Performance

The Fund’s positive exposures to the quality and low volatility risk factors contributed positively to performance as these factors generated positive excess return for the period.

The Fund also benefited from positive stock selection in Japan and Canada along with an overweight to China.

Top Detractors to Performance

The Fund’s overweight to dividend yield along with positive exposures to momentum and value detracted from performance as these risk factors underperformed for the period.

The Fund’s underweight to India was also a top detractor.

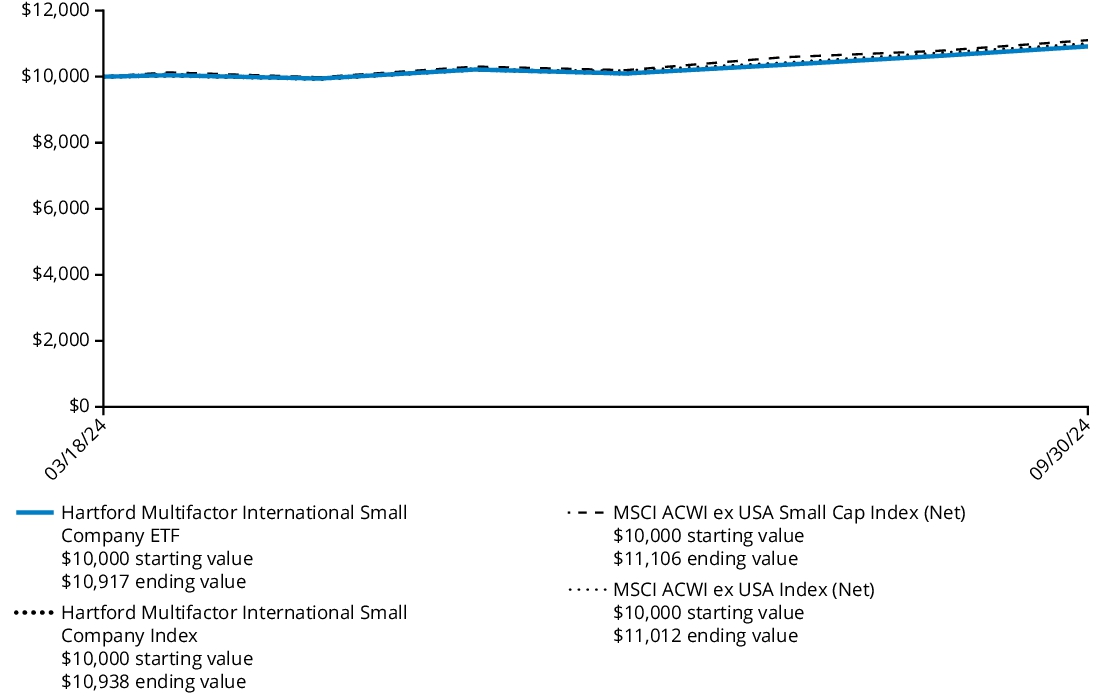

Comparison of Change in Value of $10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices.

Cumulative Total Returns

For the Period Ended September 30, 2024 | Since Inception

(March 18, 2024) |

| Fund | 9.17% |

| Hartford Multifactor International Small Company Index | 9.38% |

| MSCI ACWI ex USA Small Cap Index (Net)^ | 11.50% |

| MSCI ACWI ex USA Index (Net)^ | 10.46% |

| ^ | The MSCI ACWI ex USA Small Cap Index is the Fund’s performance index and the MSCI ACWI ex USA Index serves as the Fund’s regulatory index and provides a broad measure of market performance. |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or

sale of Fund shares. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of September 30, 2024

| Fund's net assets | $5,355,287 |

| Total number of portfolio holdings (excluding derivatives, if any) | 285 |

| Total investment advisory fees paid* | $13,284 |

| Portfolio turnover rate* | 28% |

| * | For the period March 18, 2024 (commencement of operations) through September 30, 2024. |

Graphical Representation of Holdings as of September 30, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Japan | 17.0 | % |

| Taiwan | 9.0 | % |

| Canada | 6.9 | % |

| Australia | 6.7 | % |

| India | 6.4 | % |

| South Korea | 6.4 | % |

| China | 5.4 | % |

| Switzerland | 5.2 | % |

| United Kingdom | 3.9 | % |

| Hong Kong | 3.6 | % |

| Other* | 28.8 | % |

| Other Assets & Liabilities | 0.7 | % |

| Total | 100.0 | % |

| * | Ten largest country/geographic regions are presented. Additional country/geographic regions are found in Other. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The ETFs are distributed by ALPS Distributors, Inc. (ALPS).

Annual Shareholder Report

September 30, 2024

Hartford Multifactor Small Cap ETF

ROSC/NYSE Arca

This annual shareholder report contains important information about the Hartford Multifactor Small Cap ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Hartford Multifactor Small Cap ETF | $38 | 0.34% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

Small-Cap U.S. equities generated strong returns over the trailing twelve-month period ending September 30, 2024 as measured by the Russell 2000 Index. Small-cap equities generated positive returns across most sectors led by the Financials sector.

Top Contributors to Performance

The Fund’s positive exposures to dividend yield, quality, and value risk factors were contributors to performance as these factors generated positive excess return for the trailing twelve-month period.

The Fund also benefited from an underweight in the Energy Sector, as the sector underperformed during the period.

Top Detractors to Performance

The Fund was negatively affected by its positive exposure to low volatility and size as higher volatility stocks and larger-cap equities outperformed.

Negative stock selection in Health Care, Materials, and Consumer Staples detracted from performance. Top detractors include stocks in biotechnology, Healthcare providers & supplies, and Metals and Mining sub-sectors.

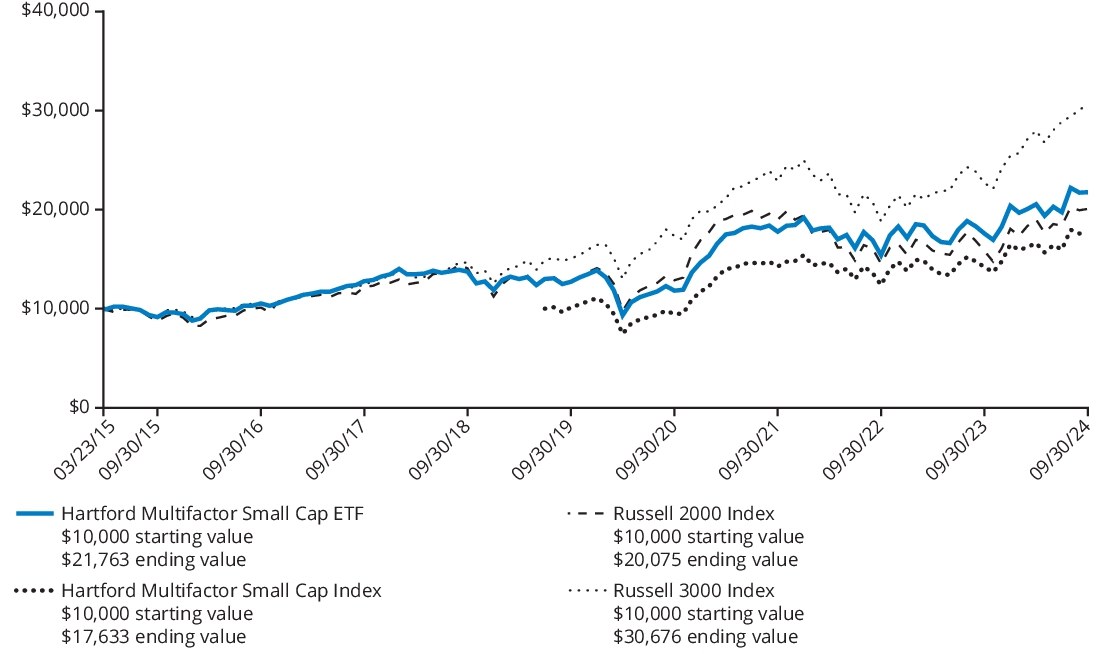

Comparison of Change in Value of $10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices.

Average Annual Total Returns

For the Periods Ended September 30, 2024 | 1 Year | 5 Years | Since Inception

(March 23, 2015) |

| Fund | 23.70% | 11.35% | 8.51% |

| Hartford Multifactor Small Cap Index | 24.10% | 11.73% | 11.39%* |

| Russell 2000 Index (Gross)^ | 26.76% | 9.39% | 7.59% |

| Russell 3000 Index (Gross)^ | 35.19% | 15.26% | 12.49% |

| * | The Hartford Multifactor Small Cap Index commenced operations on June 28, 2019. Reflects annualized returns starting on June 28, 2019. |

| ^ | The Russell 2000 Index is the Fund’s performance index and the Russell 3000 Index serves as the Fund’s regulatory index and provides a broad measure of market performance. |

Performance information prior to November 06, 2019 reflects the Fund’s performance when it tracked its prior index.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or

sale of Fund shares. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of September 30, 2024

| Fund's net assets | $31,712,303 |

| Total number of portfolio holdings (excluding derivatives, if any) | 322 |

| Total investment advisory fees paid | $109,166 |

| Portfolio turnover rate | 41% |

Graphical Representation of Holdings as of September 30, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Financials | 17.6 | % |

| Health Care | 17.0 | % |

| Industrials | 16.2 | % |

| Consumer Discretionary | 14.2 | % |

| Information Technology | 11.2 | % |

| Real Estate | 6.0 | % |

| Consumer Staples | 5.5 | % |

| Materials | 5.4 | % |

| Energy | 3.3 | % |

| Communication Services | 2.4 | % |

| Utilities | 0.9 | % |

| Short-Term Investments | 0.4 | % |

| Other Assets & Liabilities | (0.1 | ) % |

| Total | 100.0 | % |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The ETFs are distributed by ALPS Distributors, Inc. (ALPS).

Annual Shareholder Report

September 30, 2024

Hartford Multifactor US Equity ETF

ROUS/NYSE Arca

This annual shareholder report contains important information about the Hartford Multifactor US Equity ETF (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Hartford Multifactor US Equity ETF | $22 | 0.19% |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

Large-Cap U.S. equities generated strong returns over the trailing twelve-month period ending September 30, 2024 as measured by the Russell 1000 Index. Large cap equities generated positive returns across most sectors led by Information Technology.

Top Contributors to Performance

The Fund’s positive exposures to dividend yield, quality, and value risk factors were contributors to performance as these factors generated positive excess return for the trailing twelve-month period.

The Fund also benefited from stock selection helped by underweights to Microsoft, Apple, Tesla, and Alphabet, which all had negative returns over the trailing one-year.

Top Detractors to Performance.

The Fund was negatively affected from its positive exposure to low volatility and size as higher volatility stocks and larger-cap equities outperformed.

The Fund’s underweight to NVIDIA was a top detractor as the stock was up 179% for the past year.

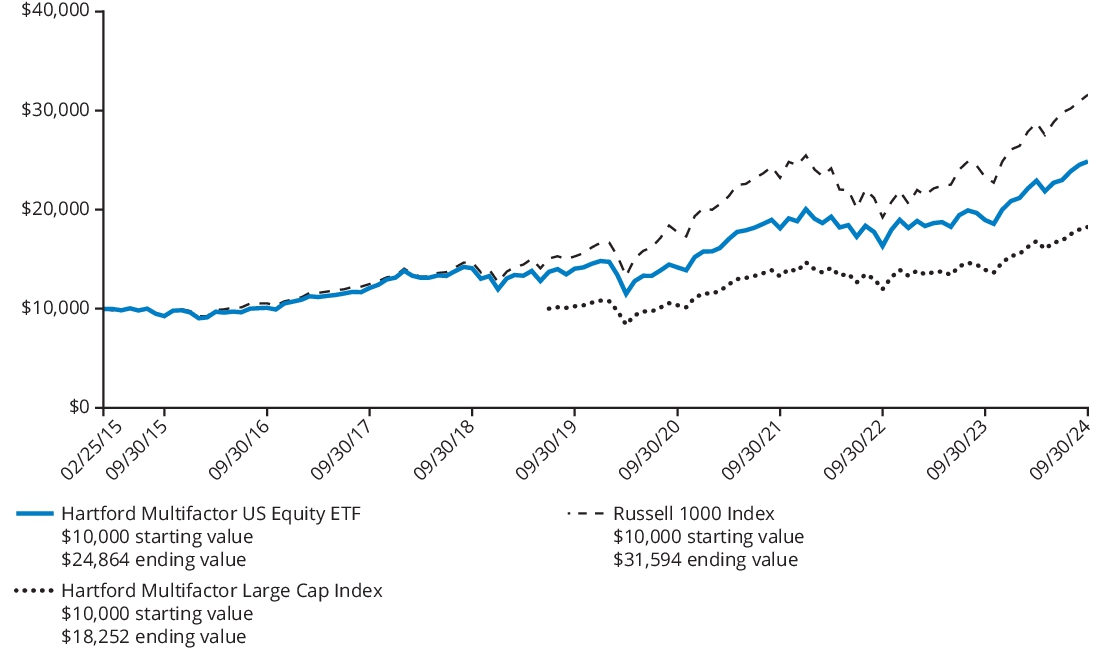

Comparison of Change in Value of $10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices.

Average Annual Total Returns

For the Periods Ended September 30, 2024 | 1 Year | 5 Years | Since Inception

(February 25, 2015) |

| Fund | 31.23% | 12.11% | 9.96% |

| Hartford Multifactor Large Cap Index | 31.12% | 12.25% | 12.12%* |

| Russell 1000 Index (Gross) | 35.68% | 15.64% | 12.73% |

| * | The Hartford Multifactor Large Cap Index commenced operations on June 28, 2019. Reflects annualized returns starting on June 28, 2019. |

Performance information prior to September 11, 2019 reflects the Fund’s performance when it tracked its prior index.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or

sale of Fund shares. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of September 30, 2024

| Fund's net assets | $462,689,864 |

| Total number of portfolio holdings (excluding derivatives, if any) | 348 |

| Total investment advisory fees paid | $775,770 |

| Portfolio turnover rate | 51% |

Graphical Representation of Holdings as of September 30, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 28.2 | % |

| Health Care | 13.1 | % |

| Industrials | 11.5 | % |

| Financials | 11.0 | % |

| Consumer Discretionary | 8.6 | % |

| Consumer Staples | 7.5 | % |

| Communication Services | 6.7 | % |

| Utilities | 4.4 | % |

| Materials | 3.9 | % |

| Energy | 3.0 | % |

| Real Estate | 1.8 | % |

| Other Assets & Liabilities | 0.3 | % |

| Total | 100.0 | % |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The ETFs are distributed by ALPS Distributors, Inc. (ALPS).

Annual Shareholder Report

September 30, 2024

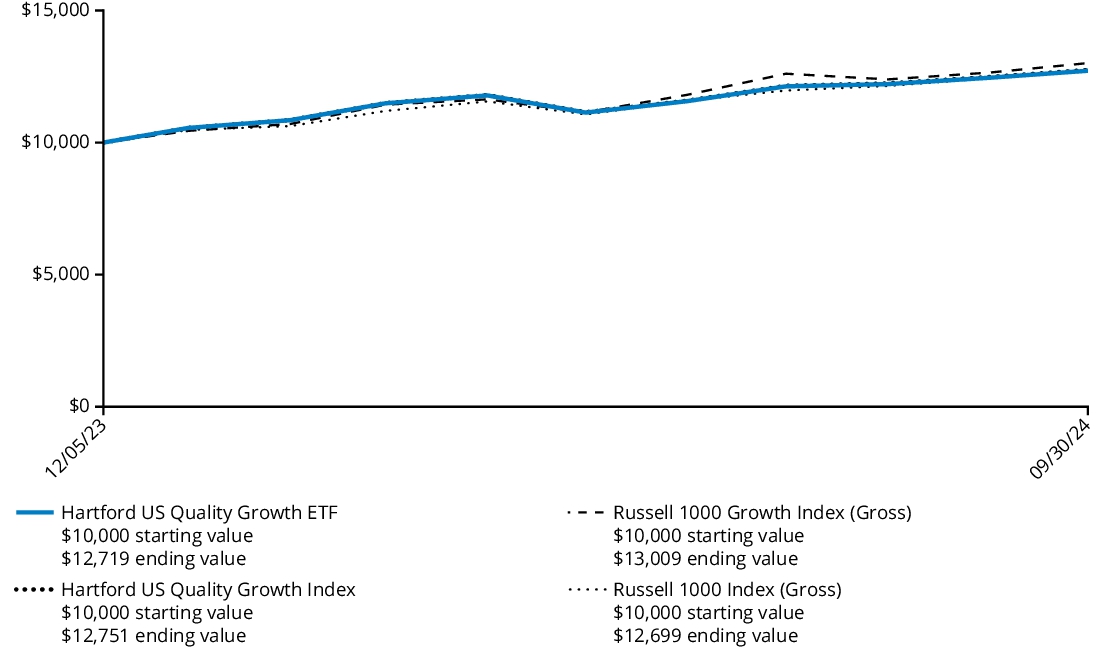

Hartford US Quality Growth ETF

HQGO/The NASDAQ Stock Market LLC

This annual shareholder report contains important information about the Hartford US Quality Growth ETF (the "Fund") for the period of December 5, 2023 (commencement of operations) to September 30, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

What were the Fund costs for the last year?*

(Based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment^ |

| Hartford US Quality Growth ETF | $32 | 0.34% |

| * | This annual report covers less than a full 12-month period. Expenses for a full 12-month period would be higher. |

| ^ | Annualized. |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

U.S. equities generated positive returns over the twelve-month period ending September 30, 2024 as measured by the Russell 1000 Index and led by large-cap growth stocks as the Russell 1000 Growth Index outperformed the broader market. Within the Russell 1000 Growth Index, performance was positive across sectors with strong performance from Information Technology, the largest contributor to return.

Top Contributors to Performance

The Fund’s positive exposures to quality and dividend yield were contributors to performance as these factors generated positive excess returns for the period.

Positive stock selection in the Consumer Discretionary and Consumer Staples sectors also contributed positively to performance.

Top Detractors to Performance

The Fund was negatively affected by its positive exposure to low volatility and size as higher volatility stocks and larger-cap equities outperformed.

Negative stock selection in the Information Technology and Communication Services sectors negatively affected performance during the period.

Comparison of Change in Value of $10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices.

Cumulative Total Returns

For the Period Ended September 30, 2024 | Since Inception

(December 05, 2023) |

| Fund | 27.19% |

| Hartford US Quality Growth Index | 27.53% |

| Russell 1000 Growth Index (Gross)^ | 30.67% |

| Russell 1000 Index (Gross)^ | 26.81% |

| ^ | The Russell 1000 Growth Index is the Fund’s performance index and the Russell 1000 Index serves as the Fund’s regulatory index and provides a broad measure of market performance. |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or

sale of Fund shares. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of September 30, 2024

| Fund's net assets | $6,324,520 |

| Total number of portfolio holdings (excluding derivatives, if any) | 126 |

| Total investment advisory fees paid* | $16,129 |

| Portfolio turnover rate* | 34% |

| * | For the period December 5, 2023 (commencement of operations) through September 30, 2024. |

Graphical Representation of Holdings as of September 30, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 40.7 | % |

| Consumer Discretionary | 12.7 | % |

| Health Care | 12.7 | % |

| Communication Services | 9.2 | % |

| Consumer Staples | 6.9 | % |

| Industrials | 5.8 | % |

| Financials | 4.8 | % |

| Energy | 3.7 | % |

| Materials | 2.3 | % |

| Real Estate | 1.1 | % |

| Other Assets & Liabilities | 0.1 | % |

| Total | 100.0 | % |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The ETFs are distributed by ALPS Distributors, Inc. (ALPS).

Annual Shareholder Report

September 30, 2024

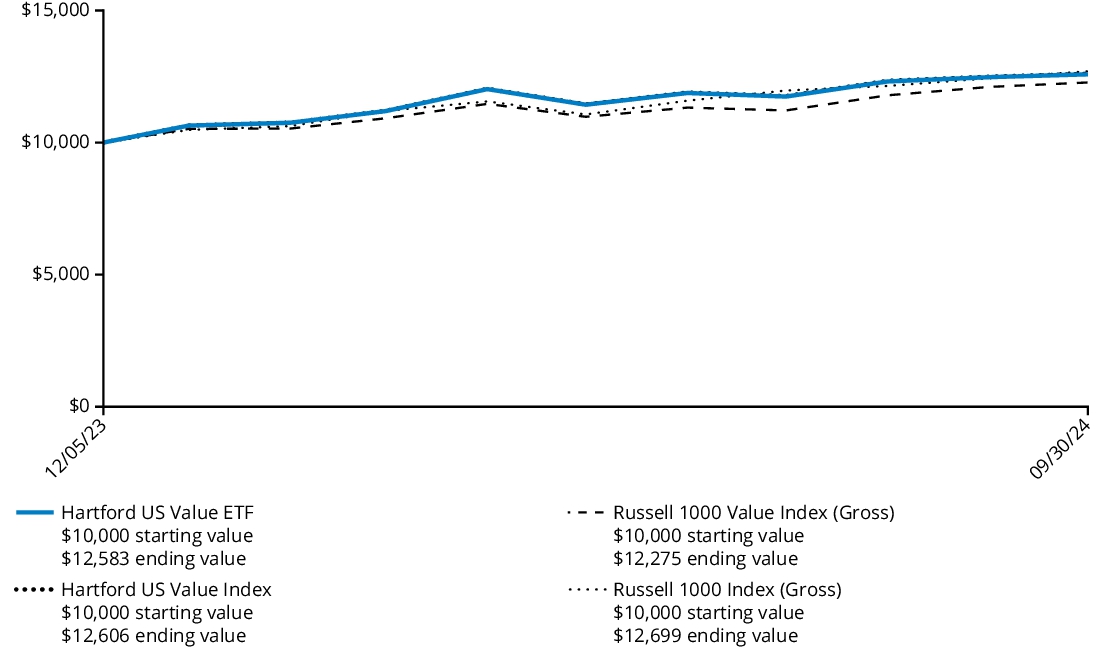

Hartford US Value ETF

VMAX/Cboe BZX

This annual shareholder report contains important information about the Hartford US Value ETF (the "Fund") for the period of December 5, 2023 (commencement of operations) to September 30, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

What were the Fund costs for the last year?*

(Based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment^ |

| Hartford US Value ETF | $27 | 0.29% |

| * | This annual report covers less than a full 12-month period. Expenses for a full 12-month period would be higher. |

| ^ | Annualized. |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

U.S. equities generated positive returns over the twelve-month period ending September 30, 2024 as measured by the Russell 1000 Index. Large-cap value stocks as measured by the Russell 1000 Value Index underperformed the broader market, but still generated strong returns. Within the Russell 1000 Value Index, performance was positive across sectors with particularly strong performance from the Financials and Industrials sectors.

Top Contributors to Performance

The Fund’s positive exposures to momentum, quality, dividend yield, and value were contributors to performance as these factors generated positive excess return for the period. The underweight to low volatility also contributed positively to results.

Positive stock selection contributed positively to results led by strong performance from Information Technology and Communication Services sectors where underweights to Intel Corporation and Meta Platforms were top overall contributors.

Top Detractors to Performance

The Fund was negatively affected from its positive exposure to size as larger-cap equities outperformed.

Negative stock selection in the Industrials, Energy, and Materials sectors detracted from performance.

Comparison of Change in Value of $10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices.

Cumulative Total Returns

For the Period Ended September 30, 2024 | Since Inception

(December 05, 2023) |

| Fund | 25.83% |

| Hartford US Value Index | 25.22% |

| Russell 1000 Value Index (Gross)^ | 21.74% |

| Russell 1000 Index (Gross)^ | 26.81% |

| ^ | The Russell 1000 Value Index is the Fund’s performance index and the Russell 1000 Index serves as the Fund’s regulatory index and provides a broad measure of market performance. |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or

sale of Fund shares. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of September 30, 2024

| Fund's net assets | $6,147,683 |

| Total number of portfolio holdings (excluding derivatives, if any) | 149 |

| Total investment advisory fees paid* | $13,536 |

| Portfolio turnover rate* | 64% |

| * | For the period December 5, 2023 (commencement of operations) through September 30, 2024. |

Graphical Representation of Holdings as of September 30, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Financials | 32.0 | % |

| Energy | 11.0 | % |

| Health Care | 9.6 | % |

| Industrials | 7.8 | % |

| Information Technology | 7.5 | % |

| Utilities | 7.1 | % |

| Communication Services | 5.8 | % |

| Real Estate | 5.2 | % |

| Consumer Discretionary | 4.7 | % |

| Materials | 4.7 | % |

| Consumer Staples | 4.4 | % |

| Other Assets & Liabilities | 0.2 | % |

| Total | 100.0 | % |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The ETFs are distributed by ALPS Distributors, Inc. (ALPS).

Item 2. Code of Ethics.

The registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. There have been no amendments, during the period covered by this report, to a provision of the code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, and that relates to any element of the code of ethics description. The registrant has not granted any waivers, including an implicit waiver, from a provision of the code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, that relates to one or more of the items set forth in paragraph (b) of this item’s instructions. A copy of the code of ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The Board of Trustees of the registrant (the “Board”) has designated David Sung as an Audit Committee Financial Expert. Mr. Sung is considered by the Board to be an independent trustee.

Item 4. Principal Accountant Fees and Services.

| | (a) | Audit Fees: The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years were: |

$202,990 for the fiscal year ended September 30, 2024; $138,097 for the fiscal year ended September 30, 2023.

| | (b) | Audit Related Fees: The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item were: |

$0 for the fiscal year ended September 30, 2024; $0 for the fiscal year ended September 30, 2023.

| | (c) | Tax Fees: The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning were: |

$84,000 for the fiscal year ended September 30, 2024; $71,051 for the fiscal year ended September 30, 2023. Tax-related services are principally in connection with, but not limited to, general tax compliance services and excise tax review.

| | (d) | All Other Fees: The aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item were: |

$123 for the fiscal year ended September 30, 2024; $359 for the fiscal year ended September 30, 2023. These fees were principally in connection with, but not limited to, general audit related products and services and an accounting research tool subscription.

| | (e) | Pre-Approval Policies and Procedures |

(1) The Pre-Approval Policies and Procedures (the “Policy”) adopted by the Audit Committee of the Registrant (also, the “Fund”) sets forth the procedures pursuant to which services performed by the independent registered public accounting firm for the Registrant may be pre-approved. The following summarizes the pre-approval requirements under the Policy.

| | a. | The Audit Committee must pre-approve all audit services and non-audit services that the independent registered public accounting firm provides to the Fund. |

| | b. | The Audit Committee must pre-approve any engagement of the independent registered public accounting firm to provide non-audit services to any Service Affiliate (which is defined to include any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Fund) during the period of the independent registered public accounting firm’s engagement to provide audit services to the Fund, if the non-audit services to the Service Affiliate directly impact the Fund’s operations and financial reporting. |

| | c. | The Audit Committee, from time to time, may designate one or more of its members who are Independent Trustees (each a “Designated Member”) to consider, on the Audit Committee’s behalf, any non-audit services, whether to the Fund or to any Service Affiliate, that have not been pre-approved by the Audit Committee. The Designated Member also shall review, on the Audit Committee’s behalf, any proposed material change in the nature or extent of any non-audit services previously approved. In considering any requested non-audit services or proposed material change in such services, the Designated Member shall not authorize services which would exceed $50,000 in fees for such services. |

| | d. | The independent registered public accounting firm may not provide specified prohibited non-audit services set forth in the Policy to the Fund, the Fund’s investment adviser, the Service Affiliates or any other member of the investment company complex. |

(2) One hundred percent of the services described in items 4(b) through 4(d) were approved in accordance with the Audit Committee’s Pre-Approval Policy. As a result, none of such services was approved pursuant to paragraph (c)(7)(i)(c) of Rule 2-01 of Regulation S-X.

| | (f) | None of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the fiscal year ended September 30, 2024, were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees. |

| | (g) | The aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant, and rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant for each of the last two fiscal years of the registrant were: |

The aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant: $84,123 for the fiscal year ended September 30, 2024; $71,410 for the fiscal year ended September 30, 2023.

The aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser was $121,199 for the fiscal year ended September 30, 2024 and $121,199 for the fiscal year ended September 30, 2023.

| | (h) | The registrant’s audit committee of the board of trustees has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence. |

Item 5. Audit Committee of Listed Registrants.

| | (a) | The Registrant has an audit committee that was established by the Board of Trustees of the Registrant in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. The members of the Registrant’s Audit Committee are Hilary E. Ackermann, Derrick D. Cephas, Paul L. Rosenberg, and David Sung. |

Item 6. Investments.

| | (a) | The Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included in the Annual Financial Statements and Other Information filed under Item 7 of this form. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

Item 9. Proxy Disclosures for Open-End Management Investment Companies.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

Hartford Systematic ETFs

Annual Financial Statements

and Other Information

◼Hartford Disciplined US Equity ETF |

◼Hartford Longevity Economy ETF |

◼Hartford Multifactor Developed Markets (ex-US) ETF |

◼Hartford Multifactor Diversified International ETF |

◼Hartford Multifactor Emerging Markets ETF |

◼Hartford Multifactor International Small Company ETF |

◼Hartford Multifactor Small Cap ETF |

◼Hartford Multifactor US Equity ETF |

◼Hartford US Quality Growth ETF |

|

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Hartford Disciplined US Equity ETF

Schedule of InvestmentsSeptember 30, 2024

Shares or Principal Amount | | |

|

| Automobiles & Components - 1.5% |

| | |

| | |

| | |

| | |

| | | |

| |

| | |

| | |

| | |

| PNC Financial Services Group, Inc. | |

| | |

| | |

| | | |

| |

| | |

| | |

| Allison Transmission Holdings, Inc. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Ferguson Enterprises, Inc. | |

| | |

| | |

| Lennox International, Inc. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

| Commercial & Professional Services - 2.0% |

| Booz Allen Hamilton Holding Corp. | |

| Broadridge Financial Solutions, Inc. | |

| CACI International, Inc. Class A* | |

| | |

| | |

| | |

| | |

| | | |

| Consumer Discretionary Distribution & Retail - 5.2% |

| | |

| | |

| Dick's Sporting Goods, Inc. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

Shares or Principal Amount | | |

COMMON STOCKS - 99.7% - (continued) |

| Consumer Durables & Apparel - 0.5% |

| | |

| | |

| | |

| | | |

| |

| | |

| | |

| Chipotle Mexican Grill, Inc.* | |

| Choice Hotels International, Inc. | |

| | |

| | |

| | |

| | |

| Six Flags Entertainment Corp. | |

| | |

| | |

| | |

| | | |

| Consumer Staples Distribution & Retail - 1.7% |

| Albertsons Cos., Inc. Class A | |

| BJ's Wholesale Club Holdings, Inc.* | |

| | |

| | |

| | |

| | | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

| Equity Real Estate Investment Trusts (REITs) - 4.2% |

| | |

| AvalonBay Communities, Inc. REIT | |

| | |

| EastGroup Properties, Inc. REIT | |

| | |

| Essex Property Trust, Inc. REIT | |

| First Industrial Realty Trust, Inc. REIT | |

| Gaming & Leisure Properties, Inc. REIT | |

| Healthcare Realty Trust, Inc. REIT | |

| | |

| Lamar Advertising Co. Class A, REIT | |

| | |

| Omega Healthcare Investors, Inc. REIT | |

| | |

| Simon Property Group, Inc. REIT | |

| STAG Industrial, Inc. REIT | |

| | | |

| Financial Services - 7.0% |

| AGNC Investment Corp. REIT | |

| | |

The accompanying notes are an integral part of these financial statements.

Hartford Disciplined US Equity ETF

Schedule of Investments – (continued)September 30, 2024

Shares or Principal Amount | | |

COMMON STOCKS - 99.7% - (continued) |

| Financial Services - 7.0% - (continued) |

| Annaly Capital Management, Inc. REIT | |

| Bank of New York Mellon Corp. | |

| Berkshire Hathaway, Inc. Class B* | |

| | |

| Cboe Global Markets, Inc. | |

| Coinbase Global, Inc. Class A* | |

| Corebridge Financial, Inc. | |

| | |

| Goldman Sachs Group, Inc. | |

| Hamilton Lane, Inc. Class A | |

| Interactive Brokers Group, Inc. Class A | |

| Jack Henry & Associates, Inc. | |

| Janus Henderson Group PLC | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Starwood Property Trust, Inc. REIT | |

| | |

| | |

| | | |

| Food, Beverage & Tobacco - 4.0% |

| | |

| | |

| | |

| | |

| Coca-Cola Consolidated, Inc. | |

| | |

| | |

| | |

| | |

| | | |

| Health Care Equipment & Services - 3.2% |

| | |

| | |

| GE HealthCare Technologies, Inc. | |

| | |

| Inspire Medical Systems, Inc.* | |

| Intuitive Surgical, Inc.* | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

| Household & Personal Products - 1.7% |

| | |

| | |

| | |

| | | |

| |

| | |

Shares or Principal Amount | | |

COMMON STOCKS - 99.7% - (continued) |

| Insurance - 2.5% - (continued) |

| Axis Capital Holdings Ltd. | |

| | |

| Cincinnati Financial Corp. | |

| Fidelity National Financial, Inc. | |

| Marsh & McLennan Cos., Inc. | |

| Old Republic International Corp. | |

| | |

| Prudential Financial, Inc. | |

| | |

| | |

| | | |

| |

| | |

| | |

| | |

| | |

| | |

| Packaging Corp. of America | |

| | |

| | |

| | | |

| Media & Entertainment - 7.8% |

| | |

| | |

| | |

| Meta Platforms, Inc. Class A | |

| | |

| New York Times Co. Class A | |

| | |

| | |

| | |

| | | |

| Pharmaceuticals, Biotechnology & Life Sciences - 7.1% |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Regeneron Pharmaceuticals, Inc.* | |

| Thermo Fisher Scientific, Inc. | |

| Vertex Pharmaceuticals, Inc.* | |

| West Pharmaceutical Services, Inc. | |

| | |

| | | |

| Semiconductors & Semiconductor Equipment - 10.1% |

| Advanced Micro Devices, Inc.* | |

| | |

| | |

| | |

| | |

| | |

| Monolithic Power Systems, Inc. | |

| | |

| | |

| | |

| | |

The accompanying notes are an integral part of these financial statements.

Hartford Disciplined US Equity ETF

Schedule of Investments – (continued)September 30, 2024

Shares or Principal Amount | | |

COMMON STOCKS - 99.7% - (continued) |

| Semiconductors & Semiconductor Equipment - 10.1% - (continued) |

| | |

| | |

| | | |

| Software & Services - 12.2% |

| | |

| | |

| Altair Engineering, Inc. Class A* | |

| | |

| Cadence Design Systems, Inc.* | |

| Cloudflare, Inc. Class A* | |

| Cognizant Technology Solutions Corp. Class A | |

| Crowdstrike Holdings, Inc. Class A* | |

| | |

| | |

| | |

| | |

| | |

| | |

| Guidewire Software, Inc.* | |

| | |

| International Business Machines Corp. | |

| | |

| Manhattan Associates, Inc.* | |

| | |

| | |

| | |

| Palantir Technologies, Inc. Class A* | |

| Palo Alto Networks, Inc.* | |

| | |

| | |

| Smartsheet, Inc. Class A* | |

| | |

| | |

| | |

| | |

| | | |

| Technology Hardware & Equipment - 7.8% |

| | |

| | |

| | |

| | |

| Dell Technologies, Inc. Class C | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

Shares or Principal Amount | | |

COMMON STOCKS - 99.7% - (continued) |

| Telecommunication Services - 2.1% |

| | |

| | |

| Verizon Communications, Inc. | |

| | | |

| |

| CH Robinson Worldwide, Inc. | |

| | |

| JB Hunt Transport Services, Inc. | |

| Old Dominion Freight Line, Inc. | |

| | |

| | |

| | | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| Public Service Enterprise Group, Inc. | |

| | |

| | | |

| Total Common Stocks

(cost $101,939,971) | | |

| Total Investments

(cost $101,939,971) | | |

| Other Assets and Liabilities | | |

| | | |

Note:

Percentage of investments as shown is the ratio of the total market value to net assets.

Equity industry classifications used in this report are the Global Industry Classification Standard, which was developed by and is the exclusive property and service mark of MSCI, Inc. and Standard & Poor’s.

For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes.

See “Glossary” for abbreviation descriptions.

Futures Contracts Outstanding at September 30, 2024 |

| | | | Value and

Unrealized

Appreciation/

(Depreciation) |

|

| | | | |

| |

† See Significant Accounting Policies of accompanying Notes to Financial Statements regarding valuation of investments.

The accompanying notes are an integral part of these financial statements.

Hartford Disciplined US Equity ETF

Schedule of Investments – (continued)September 30, 2024

Fair Value Summary

The following is a summary of the fair valuations according to the inputs used as of September 30, 2024 in valuing the Fund’s investments.

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Commercial & Professional Services | | | | |

Consumer Discretionary Distribution & Retail | | | | |

Consumer Durables & Apparel | | | | |

| | | | |

Consumer Staples Distribution & Retail | | | | |

| | | | |

Equity Real Estate Investment Trusts (REITs) | | | | |

| | | | |

| | | | |

Health Care Equipment & Services | | | | |

Household & Personal Products | | | | |

| | | | |

| | | | |

| | | | |

Pharmaceuticals, Biotechnology & Life Sciences | | | | |

Semiconductors & Semiconductor Equipment | | | | |

| | | | |

Technology Hardware & Equipment | | | | |

Telecommunication Services | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| For the year ended September 30, 2024, there were no transfers in and out of Level 3. |

| Derivative instruments (excluding purchased and written options, if applicable) are valued at the unrealized appreciation/(depreciation) on the investments. |

The accompanying notes are an integral part of these financial statements.

Hartford Longevity Economy ETF

Schedule of InvestmentsSeptember 30, 2024

Shares or Principal Amount | | |

|

| Automobiles & Components - 0.9% |

| | |

| | |

| | |

| Winnebago Industries, Inc. | |

| | | |

| |

| | |

| | |

| Citizens Financial Group, Inc. | |

| | |

| First Citizens BancShares, Inc. Class A | |

| Huntington Bancshares, Inc. | |

| | |

| | |

| | |

| | |

| PNC Financial Services Group, Inc. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

| |

| | |

| | |

| | |

| | |

| Honeywell International, Inc. | |

| L3Harris Technologies, Inc. | |

| | |

| | |

| | |

| | |

| | |

| | | |

| Commercial & Professional Services - 0.0% |

| | |

| Consumer Discretionary Distribution & Retail - 7.6% |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Ollie's Bargain Outlet Holdings, Inc.* | |

| | |

| | |

| | |

| | |

| | |

| | | |

| Consumer Durables & Apparel - 1.7% |

| | |

| | |

| | |

| | |

| | |

Shares or Principal Amount | | |

COMMON STOCKS - 99.9% - (continued) |

| Consumer Durables & Apparel - 1.7% - (continued) |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Worthington Enterprises, Inc. | |

| | | |

| |

| | |

| | |

| | |

| Grand Canyon Education, Inc.* | |

| | |

| Hilton Worldwide Holdings, Inc. | |

| | |

| Monarch Casino & Resort, Inc. | |

| | |

| Royal Caribbean Cruises Ltd. | |

| Six Flags Entertainment Corp. | |

| | |

| | |

| | |

| | | |

| Consumer Staples Distribution & Retail - 3.8% |

| Albertsons Cos., Inc. Class A | |

| BJ's Wholesale Club Holdings, Inc.* | |

| Casey's General Stores, Inc. | |

| | |

| Ingles Markets, Inc. Class A | |

| | |

| | |

| Sprouts Farmers Market, Inc.* | |

| | |

| | |

| Walgreens Boots Alliance, Inc. | |

| | |

| | |

| | | |

| Equity Real Estate Investment Trusts (REITs) - 2.0% |

| AvalonBay Communities, Inc. REIT | |

| | |

| | |

| | |

| Lamar Advertising Co. Class A, REIT | |

| LTC Properties, Inc. REIT | |

| National Health Investors, Inc. REIT | |

| | |

| Simon Property Group, Inc. REIT | |

| Sunstone Hotel Investors, Inc. REIT | |

| Urban Edge Properties REIT | |

| | |

| VICI Properties, Inc. REIT | |

| | |

| | | |

| Financial Services - 5.1% |

| Affiliated Managers Group, Inc. | |

| | |

| Ameriprise Financial, Inc. | |

| Apollo Global Management, Inc. | |

| Bank of New York Mellon Corp. | |

| Berkshire Hathaway, Inc. Class B* | |

| | |

| Capital One Financial Corp. | |

The accompanying notes are an integral part of these financial statements.

Hartford Longevity Economy ETF

Schedule of Investments – (continued)September 30, 2024

Shares or Principal Amount | | |

COMMON STOCKS - 99.9% - (continued) |

| Financial Services - 5.1% - (continued) |

| Donnelley Financial Solutions, Inc.* | |

| | |

| | |

| | |

| Goldman Sachs Group, Inc. | |

| | |

| Intercontinental Exchange, Inc. | |

| Jackson Financial, Inc. Class A | |

| Janus Henderson Group PLC | |

| Jefferies Financial Group, Inc. | |

| | |

| | |

| | |

| | |

| PJT Partners, Inc. Class A | |

| | |

| Raymond James Financial, Inc. | |

| | |

| | |

| | |

| | |

| | |

| | |

| Victory Capital Holdings, Inc. Class A | |

| | | |

| Food, Beverage & Tobacco - 1.8% |

| | |

| | |

| Coca-Cola Consolidated, Inc. | |

| | |

| | |

| | |

| Mondelez International, Inc. Class A | |

| | |

| | |

| | | |

| Health Care Equipment & Services - 8.7% |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Hims & Hers Health, Inc.* | |

| | |

| | |

| IDEXX Laboratories, Inc.* | |

| Intuitive Surgical, Inc.* | |

| | |

| | |

| | |

| | |

| Merit Medical Systems, Inc.* | |

| | |

| | |

Shares or Principal Amount | | |

COMMON STOCKS - 99.9% - (continued) |

| Health Care Equipment & Services - 8.7% - (continued) |

| | |

| | |

| | |

| | |

| | |

| Veeva Systems, Inc. Class A* | |

| Zimmer Biomet Holdings, Inc. | |

| | | |

| Household & Personal Products - 1.8% |

| | |

| Church & Dwight Co., Inc. | |

| | |

| Edgewell Personal Care Co. | |

| | |

| | |

| | |

| | | |

| |

| | |

| | |

| American International Group, Inc. | |

| | |

| Axis Capital Holdings Ltd. | |

| | |

| Cincinnati Financial Corp. | |

| | |

| | |

| Old Republic International Corp. | |

| | |

| Prudential Financial, Inc. | |

| | |

| | | |

| Media & Entertainment - 10.2% |

| | |

| | |

| | |

| Charter Communications, Inc. Class A* | |

| | |

| | |

| | |

| Endeavor Group Holdings, Inc. Class A(1) | |

| | |

| | |

| John Wiley & Sons, Inc. Class A | |

| Live Nation Entertainment, Inc.* | |

| Madison Square Garden Entertainment Corp.* | |

| Madison Square Garden Sports Corp.* | |

| | |

| Meta Platforms, Inc. Class A | |

| | |

| New York Times Co. Class A | |

| | |

| | |

| | |

| | |

| | |

| | | |

| Pharmaceuticals, Biotechnology & Life Sciences - 9.3% |

| | |

| Agilent Technologies, Inc. | |

| | |

| ANI Pharmaceuticals, Inc.* | |

| | |

| Catalyst Pharmaceuticals, Inc.* | |

| Collegium Pharmaceutical, Inc.* | |

The accompanying notes are an integral part of these financial statements.

Hartford Longevity Economy ETF

Schedule of Investments – (continued)September 30, 2024

Shares or Principal Amount | | |

COMMON STOCKS - 99.9% - (continued) |

| Pharmaceuticals, Biotechnology & Life Sciences - 9.3% - (continued) |

| Corcept Therapeutics, Inc.* | |

| | |

| | |

| | |

| | |

| | |

| Intra-Cellular Therapies, Inc.* | |

| | |

| | |

| Mettler-Toledo International, Inc.* | |

| | |

| | |

| Prestige Consumer Healthcare, Inc.* | |

| Regeneron Pharmaceuticals, Inc.* | |

| Thermo Fisher Scientific, Inc. | |

| United Therapeutics Corp.* | |

| Vertex Pharmaceuticals, Inc.* | |

| | |

| | |

| | |

| | | |

| Real Estate Management & Development - 0.0% |

| CBRE Group, Inc. Class A* | |

| Semiconductors & Semiconductor Equipment - 12.0% |

| Advanced Micro Devices, Inc.* | |

| | |

| | |

| | |

| Credo Technology Group Holding Ltd.* | |

| | |

| | |

| | |

| | |

| MACOM Technology Solutions Holdings, Inc.* | |

| | |

| Microchip Technology, Inc. | |

| | |

| Monolithic Power Systems, Inc. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| SMART Global Holdings, Inc.* | |

| | |

| | |

| | | |

| Software & Services - 12.5% |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Cadence Design Systems, Inc.* | |

| | |

| Crowdstrike Holdings, Inc. Class A* | |

Shares or Principal Amount | | |

COMMON STOCKS - 99.9% - (continued) |

| Software & Services - 12.5% - (continued) |

| | |

| Dolby Laboratories, Inc. Class A | |

| | |

| | |

| | |

| | |

| | |

| Manhattan Associates, Inc.* | |

| | |

| | |

| Palo Alto Networks, Inc.* | |

| | |

| | |

| | |

| | |

| | |

| Squarespace, Inc. Class A* | |

| | |

| | |

| | |

| Tyler Technologies, Inc.* | |

| | |

| | |

| Zeta Global Holdings Corp. Class A* | |

| | |

| | |

| | | |

| Technology Hardware & Equipment - 8.0% |

| | |

| | |

| Dell Technologies, Inc. Class C | |

| Hewlett Packard Enterprise Co. | |

| | |

| | |

| Pure Storage, Inc. Class A* | |

| Seagate Technology Holdings PLC | |

| Super Micro Computer, Inc.* | |

| | |

| | |

| | |

| | | |

| Telecommunication Services - 1.5% |

| | |

| | |

| Verizon Communications, Inc. | |

| | | |

| |

| | |

| |

| | |

| American Electric Power Co., Inc. | |

| Consolidated Edison, Inc. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Public Service Enterprise Group, Inc. | |

| | |

The accompanying notes are an integral part of these financial statements.

Hartford Longevity Economy ETF

Schedule of Investments – (continued)September 30, 2024

Shares or Principal Amount | | |

COMMON STOCKS - 99.9% - (continued) |

| Utilities - 2.2% - (continued) |

| | |

| | |

| | | |

| Total Common Stocks

(cost $10,014,190) | | |

SHORT-TERM INVESTMENTS - 0.3% |

| Securities Lending Collateral - 0.3% |

| Goldman Sachs Financial Square Funds, Government Fund, Institutional Class, 4.85%(2) | |

| HSBC U.S. Government Money Market Fund, Institutional Class, 4.86%(2) | |

| Invesco Government & Agency Portfolio, Institutional | |

| Morgan Stanley Institutional Liquidity Funds, Government Portfolio, Institutional Class, 4.85%(2) | |

| Total Short-Term Investments

(cost $36,152) | |

| Total Investments

(cost $10,050,342) | | |

| Other Assets and Liabilities | | |

| | | |

Note:

Percentage of investments as shown is the ratio of the total market value to net assets.

Equity industry classifications used in this report are the Global Industry Classification Standard, which was developed by and is the exclusive property and service mark of MSCI, Inc. and Standard & Poor’s.

For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes.

See “Glossary” for abbreviation descriptions.

| |

| Represents entire or partial securities on loan. See Note 8 in the accompanying Notes to Financial Statements for securities lending information. |

| Current yield as of period end. |

| See Significant Accounting Policies of accompanying Notes to Financial Statements regarding valuation of investments. |

The following is a summary of the fair valuations according to the inputs used as of September 30, 2024 in valuing the Fund’s investments.

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Commercial & Professional Services | | | | |

Consumer Discretionary Distribution & Retail | | | | |

Consumer Durables & Apparel | | | | |

| | | | |

Consumer Staples Distribution & Retail | | | | |

Equity Real Estate Investment Trusts (REITs) | | | | |

| | | | |

| | | | |

Health Care Equipment & Services | | | | |

Household & Personal Products | | | | |

| | | | |

| | | | |

Pharmaceuticals, Biotechnology & Life Sciences | | | | |

Real Estate Management & Development | | | | |

Semiconductors & Semiconductor Equipment | | | | |

| | | | |

Technology Hardware & Equipment | | | | |

Telecommunication Services | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| For the year ended September 30, 2024, there were no transfers in and out of Level 3. |

The accompanying notes are an integral part of these financial statements.

Hartford Multifactor Developed Markets (ex-US) ETF

Schedule of InvestmentsSeptember 30, 2024

Shares or Principal Amount | | |

|

| |

| | |

| | |

| | |

| | |

| Bendigo & Adelaide Bank Ltd. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Insurance Australia Group Ltd. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

| |

| | |

| | |

| Raiffeisen Bank International AG | |

| | | |

| |

| Ackermans & van Haaren NV | |

| | |

| | |

| | | |

| |

| Alimentation Couche-Tard, Inc. | |

| | |

| | |

| | |

| | |

| Canadian Imperial Bank of Commerce(1) | |

| Canadian National Railway Co. | |

| CCL Industries, Inc. Class B | |

| | |

| | |

| Constellation Software, Inc. | |

| Descartes Systems Group, Inc.* | |

| | |

| Element Fleet Management Corp. | |

| | |

| Fairfax Financial Holdings Ltd. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Shares or Principal Amount | | |

COMMON STOCKS - 98.6% - (continued) |

| Canada - 14.4% - (continued) |

| | |

| | |

| | |

| | |

| National Bank of Canada(1) | |

| | |

| | |

| | |