UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number: 811-23002

LATTICE STRATEGIES TRUST

(Exact name of registrant as specified in charter)

690 Lee Road, Wayne, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Thomas R. Phillips, Esquire

Hartford Funds Management Company, LLC

690 Lee Road

Wayne, Pennsylvania 19087

(Name and Address of Agent for Service)

Copy to:

John V. O’Hanlon, Esq/

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston, MA 02110-2605

Registrant’s telephone number, including area code: (610) 386-4068

Date of fiscal year end: September 30

Date of reporting period: September 30, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Hartford Multifactor ETFs

Annual Report

September 30, 2021

| ■ Hartford Longevity Economy ETF |

| ■ Hartford Multifactor Developed Markets (ex-US) ETF |

| ■ Hartford Multifactor Diversified International ETF |

| ■ Hartford Multifactor Emerging Markets ETF |

| ■ Hartford Multifactor Small Cap ETF |

| ■ Hartford Multifactor US Equity ETF |

A MESSAGE FROM THE PRESIDENT

Dear Shareholders:

Thank you for investing in Hartford Multifactor Exchange-Traded Funds. The following is the Funds’ Annual Report covering the period from October 1, 2020 through September 30, 2021.

Market Review

During the 12 months ended September 30, 2021, U.S. stocks, as measured by the S&P 500 Index,1 gained 30%, a number that underscores a truly remarkable equity-market rebound, particularly when compared with the broad sell-off endured by stocks in March 2020 at the start of the COVID-19 pandemic.

That said, the market’s extraordinary performance occurred against a backdrop of uncertain and sometimes contradictory economic signals: inflation fears; global supply-chain bottlenecks; tight labor markets; political gridlock; a stubbornly persistent pandemic and a U.S. Federal Reserve (Fed) regularly signaling its intention to cut back on the monetary stimulus that helped fuel the recovery.

A year ago, markets had already recovered from their March 2020 lows, yet the economy faced its share of headwinds, not least a fiercely divisive US presidential election and a resurgence of COVID-19 infections. Once the election was settled in November 2020, the emergence of safe and effective COVID-19 vaccines provided a significant lift to equity markets, as did a major $900 billion economic relief package passed by Congress in late December 2020.

As federal, state, and local health officials geared up for one of the largest mass-vaccination programs in history, the markets proved resilient as the S&P 500 Index continued the long streak of positive returns that began in April 2020.

In March 2021, the U.S. Congress fast-tracked approval of the Biden administration’s $1.9 trillion economic stimulus package. In August 2021, a $1.2 trillion proposal for an infrastructure spending package received U.S. Senate approval and, eventually, the approval of the U.S. House of Representatives in early November 2021. But, the outcome for the administration’s $1.75 trillion “Build Back Better” proposal, focused on social-safety-net improvements and climate-change mitigation, remained uncertain.

On the monetary front, the Fed continued to maintain its ongoing policy of near-zero interest rates in support of the recovery for the bulk of the period covered by this report. But in September 2021, Fed Chairman Jerome Powell rattled markets when he announced preparations for reducing the $120 billion in new money the Fed has been pouring into markets each month since the start of the pandemic.

An uptick in the inflation rate that began last spring added to the uncertain sentiment, with the Consumer Price Index rising 5.3% for the twelve-month period ended August 2021. After seven straight months of gains buoyed by record profits and predictions of future growth, the S&P 500 Index in September 2021 suffered a 4.8% decline, its worst monthly drop since the start of the pandemic.

With so many unsettled political and economic-policy questions looming, market volatility may continue. Nowadays, it’s more important than ever to maintain a strong relationship with your financial professional.

Thank you again for investing in Hartford Multifactor Exchange-Traded Funds. For the most up-to-date information on our funds, please take advantage of all the resources available at hartfordfunds.com.

James Davey

President

Hartford Funds

| | 1 S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks. The index is unmanaged and not available for direct investment. Past performance is not indicative of future results. |

Hartford Multifactor ETFs

Table of Contents

The views expressed in each Fund’s Manager Discussion contained in the Fund Overview section are views of that Fund’s sub-adviser and portfolio management team through the end of the period and are subject to change based on market and other conditions. Each Fund’s Manager Discussion is for informational purposes only and does not represent an offer, recommendation or solicitation to buy, hold or sell any security. The specific securities identified and described, if any, do not represent all of the securities purchased or sold and you should not assume that investments in the securities identified and discussed will be profitable.

Hartford Longevity Economy ETF

Fund Overview

September 30, 2021 (Unaudited)

Inception 03/16/2021

Sub-advised by Mellon Investments Corporation | Investment objective – The Fund seeks to provide investment results that, before fees and expenses, correspond to the total return performance of the Hartford Longevity Economy Index (LHLGEX) (the “Index”), which is designed to generate attractive risk-adjusted returns by investing in companies that comprise industries that reflect certain themes that are expected to benefit from the growth of the aging population and the substantial buying power it represents. |

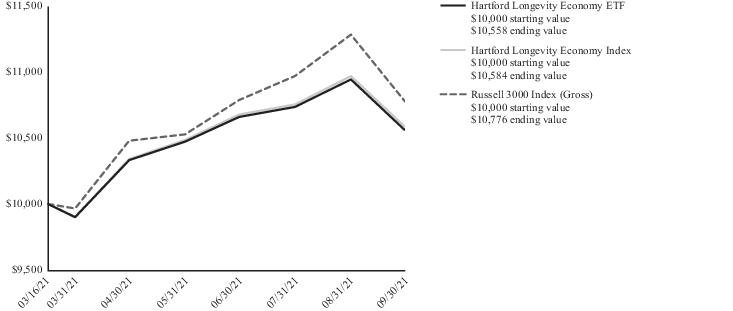

Comparison of Change in Value of $10,000 Investment (03/16/2021 - 09/30/2021)

The chart above represents the hypothetical growth of a $10,000 investment in the Fund. The difference in returns between the Fund and the Index was primarily the result of the Fund’s operating expenses, including transaction costs, that are not reflected in the Index’s results.

| Cumulative Total Returns |

| for the Period Ending 09/30/2021 |

| | Since

Inception1 |

| Hartford Longevity Economy ETF (NAV Return) | 5.58% |

| Hartford Longevity Economy ETF (Market Price Return) | 5.66% |

| Hartford Longevity Economy Index | 5.84% |

| Russell 3000 Index (Gross) | 7.76% |

Information regarding how often shares of the Fund traded on NYSE Arca, Inc. (“NYSE Arca”) at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund can be found at hartfordfunds.com.

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed or sold, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns for the report period presented in the table may differ from the return in the Financial Highlights. The total return presented in the Financial Highlights section of the reports is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles.

ETF shares are bought and sold at market price, not net asset value (NAV). Total returns are calculated using the daily 4:00 p.m. Eastern Time NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange

where Fund shares are listed. Market price returns do not represent the returns an investor would receive if they traded shares at other times. Brokerage commissions apply and will reduce returns.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

The total annual fund operating expense ratio as shown in the Fund’s most recent prospectus was 0.44%. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the period ended 09/30/2021.

Hartford Longevity Economy ETF

Fund Overview – (continued)

September 30, 2021 (Unaudited)

Manager Discussion

Hartford Longevity Economy ETF (“the Fund”) seeks to provide investment results that, before fees and expenses, correspond to the total return performance of the Hartford Longevity Economy Index (LHLGEX), which is designed to generate attractive risk-adjusted returns by investing in companies that comprise industries that reflect certain themes that are expected to benefit from the growth of the aging population and the substantial buying power it represents.

The Fund seeks to generate returns by investing in index constituents that are selected and weighted through a rules-based methodology that seeks to:

1) Provide Top-Down Thematic Exposure by identifying a Longevity Economy opportunity set. Starting with the full investable US equity universe, we seek to identify sub-industries that we believe may benefit from the Longevity themes and the growth of an aging population.

2) Provide Prudent Portfolio Construction and Risk Allocation through conviction-based industry and position size risk controls to help build significant top-down Longevity exposure to higher conviction sub-industries.

3) Enhance Return Potential by selecting companies in the Longevity opportunity set with a favorable combination of low valuation (50%), high momentum (30%), and high quality (20%) investment factors.

4) Maintain Consistency by reapplying the index methodology twice a year in March and September to maintain intended investment exposures.

For the period from March 16, 2021 (commencement of operations) through September 30, 2021, the Fund returned 5.58% at net asset value (“NAV”) as compared to the Hartford Longevity Economy Index which returned 5.84% for the same period. The difference in returns between the Fund and the Index was primarily the result of the Fund’s transaction costs and other operating expenses that are not reflected in the Index’s results.

The Fund invests in companies that comprise industries that reflect certain themes that are expected to benefit from the growth of the aging population and the substantial buying power it represents. Additionally, the Index uses multifactor stock selection and a comprehensive risk framework to help achieve targeted characteristics, relative sector and size constraints, and positive exposures to value, momentum, and quality risk factors. The Fund lagged its reference index, the Russell 3000 Index, for the period from March 16, 2021 (commencement of operations) through September 30, 2021 due to poor stock selection, as Index underweights in technology hardware and services companies, including Microsoft, NVIDIA, Apple, and Alphabet, were top detractors from relative performance for the period. From a risk factor standpoint, the Fund’s positive exposure to the value factor, along with its smaller market capitalization companies compared to the reference index, detracted from relative results for the period.

The Fund did not use derivatives during the period.

U.S. equity markets generated positive results over the trailing twelve-month period ended September 30, 2021, with the Russell 3000 Index returning 31.88%. The rally in equities off market lows in March 2020 was sustained through the fourth quarter of 2020, and strong returns continued during the first half of 2021 on the back of robust earnings, accommodative monetary policy, and optimism around vaccination rates supporting the broad reopening of the economy. Positive forecasts of economic growth and accelerating earnings from strong demand for goods and services provided support for stock prices. Equity results moderated in the third quarter of 2021 as reopening momentum slowed on concerns over inflation, monetary policy normalization, and supply chain disruptions. After posting a return of 32.01% through the first three quarters of the twelve-month period ended September 30, 2021, the Russell 3000 Index returned -0.10% in the final quarter of the period.

Important Risks

The Fund is new and has a limited operating history. Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. • The Fund is not actively managed but rather attempts to track the performance of an index. The Fund’s returns may diverge from that of the index. • The Fund's focus on securities of issuers that are expected to benefit from providing goods and services that are needed by or attractive to the world's aging populations may affect the Fund's exposure to certain industries or types of investments. Certain investments in companies focused on longevity and aging solutions may be affected by government regulations or other factors. • Investments focused in a sector, industry or group of industries may increase volatility and risk.

| Composition by Sector(1) |

| as of 09/30/2021 |

| Sector | Percentage

of Net Assets |

| Equity Securities | |

| Communication Services | 13.6% |

| Consumer Discretionary | 15.4 |

| Consumer Staples | 3.9 |

| Financials | 11.9 |

| Health Care | 21.8 |

| Industrials | 2.6 |

| Information Technology | 28.5 |

| Real Estate | 1.2 |

| Utilities | 1.0 |

| Total | 99.9% |

| Short-Term Investments | 0.9 |

| Other Assets & Liabilities | (0.8) |

| Total | 100.0% |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

Hartford Multifactor Developed Markets (ex-US) ETF

Fund Overview

September 30, 2021 (Unaudited)

Inception 02/25/2015

Sub-advised by Mellon Investments Corporation | Investment objective – The Fund seeks to provide investment results that, before fees and expenses, correspond to the total return performance of an index that tracks the performance of companies located in major developed markets of Europe, Canada and the Pacific Region. |

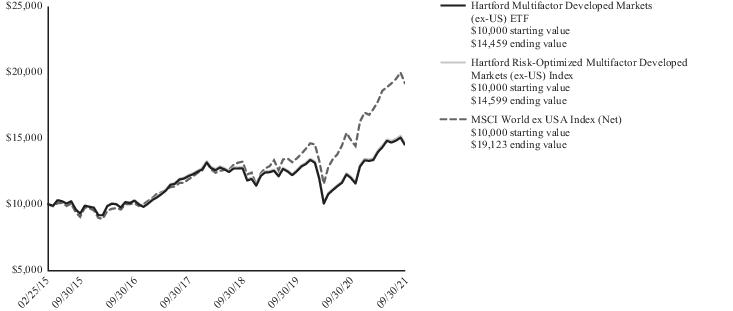

Comparison of Change in Value of $10,000 Investment (02/25/2015 - 09/30/2021)

The chart above represents the hypothetical growth of a $10,000 investment in the Fund. The difference in returns between the Fund and the Index was primarily the result of the Fund’s operating expenses, including transaction costs, that are not reflected in the Index’s results.

| Average Annual Total Returns |

| for the Periods Ending 09/30/2021 |

| | 1 Year | 5 Years | Since

Inception1 |

| Multifactor Developed Markets (ex-US) ETF (NAV Return) | 20.81% | 7.13% | 5.75% |

| Multifactor Developed Markets (ex-US) ETF (Market Price Return) | 20.24% | 6.90% | 5.67% |

| Hartford Risk-Optimized Multifactor Developed Markets (ex-US) Index | 20.96% | 7.25% | 5.91% |

| MSCI World ex USA Index (Net) | 26.50% | 8.88% | 5.80% |

Information regarding how often shares of the Fund traded on NYSE Arca, Inc. (“NYSE Arca”) at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund can be found at hartfordfunds.com.

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed or sold, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns for the report period presented in the table may differ from the return in the Financial Highlights. The total return presented in the Financial Highlights section of the reports is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles.

ETF shares are bought and sold at market price, not net asset value (NAV). Total returns are calculated using the daily 4:00 p.m. Eastern Time NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange

where Fund shares are listed. Market price returns do not represent the returns an investor would receive if they traded shares at other times. Brokerage commissions apply and will reduce returns.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

The total annual fund operating expense ratio as shown in the Fund’s most recent prospectus was 0.29%. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the year ended 09/30/2021.

Hartford Multifactor Developed Markets (ex-US) ETF

Fund Overview – (continued)

September 30, 2021 (Unaudited)

Manager Discussion

Hartford Multifactor Developed Markets (ex-US) ETF (“the Fund”) seeks to provide investment results that, before fees and expenses, correspond to the total return performance of Hartford Risk-Optimized Multifactor Developed Markets (ex-US) Index (LRODMX), which tracks the performance of companies located in major developed markets of Europe, Canada, and the Pacific Region.

The Fund seeks to generate returns by investing in index constituents that are selected and weighted through a rules-based methodology that seeks to:

1) Deliberately Allocate Risks by providing exposure to the growth potential of international companies while explicitly seeking to reduce volatility and drawdown risk.

2) Improve Diversification by diversifying exposure across developed market economies and potentially reducing individual country, currency, and individual company risks.

3) Enhance Return Potential by selecting companies with a favorable combination of low valuation (50%), high momentum (30%), and high quality (20%) investment factors.

4) Maintain Consistency by reapplying the index methodology twice a year in March and September to maintain intended investment exposures.

The Fund returned 20.81% at net asset value (“NAV”) for the fiscal year ended September 30, 2021 compared to the Hartford Risk- Optimized Multifactor Developed Markets (ex-US) Index, which returned 20.96% for the same period. The difference in returns between the Fund and the Index was primarily the result of the Fund’s transaction costs and other operating expenses that are not reflected in the Index’s results.

The Fund seeks exposures to return-enhancing factors along with less volatility and reduced concentration at the country, sector, and market cap levels vs. cap-weighted indices and invests in companies that we believe exhibit a favorable combination of low valuation, high momentum, and high quality. The Fund lagged its reference index, the MSCI World ex USA Index, for the twelve-month period as the Fund’s lower-volatility exposure detracted from relative performance amid a period of strong equity returns. The Fund’s smaller market capitalization companies versus the MSCI World ex USA Index also detracted from performance as larger-cap international stocks outperformed over the period.

The Fund made limited use of derivatives during the year; therefore, derivatives had no material impact on performance.

International developed equity markets generated positive results over the trailing twelve-month period ended September 30, 2021, with the MSCI World ex USA Index returning 26.50%. The rally in equities off market lows in March 2020 was sustained through the fourth quarter of 2020, and strong returns continued during the first half of 2021 on the back of robust earnings, accommodative monetary policy, and optimism around vaccination rates supporting the broad reopening of the economy. Positive forecasts of economic growth and accelerating earnings from strong demand for goods and services provided support for stock prices. Equity results moderated in the third quarter of 2021

as reopening momentum slowed on concerns over inflation, monetary policy normalization, and supply chain disruptions. After posting a return of 27.34% through the first three quarters of the twelve-month period ended September 30, 2021, the MSCI World ex USA Index returned -0.66% in the final quarter of the period.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. • The Fund is not actively managed but rather attempts to track the performance of an index. The Fund’s returns may diverge from that of the index. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse regulatory, political and economic developments. These risks may be greater in particular geographic regions or countries. • Investments focused in a country, region, sector, industry or group of industries may increase volatility and risk. • Mid-cap securities can have greater risks and volatility than large-cap securities.

| Composition by Sector(1) |

| as of 09/30/2021 |

| Sector | Percentage

of Net Assets |

| Equity Securities | |

| Communication Services | 7.1% |

| Consumer Discretionary | 10.1 |

| Consumer Staples | 11.6 |

| Energy | 2.1 |

| Financials | 15.6 |

| Health Care | 12.8 |

| Industrials | 15.1 |

| Information Technology | 8.2 |

| Materials | 6.2 |

| Real Estate | 4.9 |

| Utilities | 5.2 |

| Total | 98.9% |

| Short-Term Investments | 1.8 |

| Other Assets & Liabilities | (0.7) |

| Total | 100.0% |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

Hartford Multifactor Diversified International ETF

Fund Overview

September 30, 2021 (Unaudited)

Inception 05/10/2017

Sub-advised by Mellon Investments Corporation | Investment objective – The Fund seeks to provide investment results that, before fees and expenses, correspond to the total return performance of an index that tracks the performance of companies located in both developed and emerging markets. |

Comparison of Change in Value of $10,000 Investment (05/10/2017 - 09/30/2021)

The chart above represents the hypothetical growth of a $10,000 investment in the Fund. The difference in returns between the Fund and the Index was primarily the result of the Fund’s operating expenses, including transaction costs, that are not reflected in the Index’s results.

| Average Annual Total Returns |

| for the Periods Ending 09/30/2021 |

| | 1 Year | Since

Inception1 |

| Multifactor Diversified International ETF (NAV Return) | 25.06% | 5.94% |

| Multifactor Diversified International ETF (Market Price Return) | 24.41% | 5.88% |

| Hartford Multifactor Diversified International Index | 25.78% | 5.64% 2 |

| MSCI All Country World (ACWI) ex USA Index (Net) | 23.92% | 7.73% |

| 1 | Inception: 05/10/2017 |

| 2 | The Hartford Multifactor Diversified International Index commenced operations on 06/28/2019. Reflects annualized returns starting on 06/28/2019. |

Performance information prior to 11/06/2019 reflects the Fund’s performance when it tracked its prior index.

Information regarding how often shares of the Fund traded on Cboe BZX Exchange, Inc. (“Cboe BZX”) at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund can be found at hartfordfunds.com.

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed or sold, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns for the report period presented in the table may differ from the return in the Financial Highlights. The total return presented in the Financial Highlights section of the reports is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles.

ETF shares are bought and sold at market price, not net asset value (NAV). Total returns are calculated using the daily 4:00 p.m. Eastern Time NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns an investor would receive if they traded shares at other times. Brokerage commissions apply and will reduce returns.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

The total annual fund operating expense ratio as shown in the Fund’s most recent prospectus was 0.29%. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the year ended 09/30/2021.

Hartford Multifactor Diversified International ETF

Fund Overview – (continued)

September 30, 2021 (Unaudited)

Manager Discussion

Hartford Multifactor Diversified International ETF (“the Fund”) seeks to provide investment results that, before fees and expenses, correspond to the total return performance of Hartford Multifactor Diversified International Index (LRODEX), which tracks the performance of companies located in both developed (ex US) and emerging markets.

The Fund seeks to generate returns by investing in index constituents that are selected and weighted through a rules-based methodology that seeks to:

1) Deliberately Allocate Risks by providing exposure to the growth potential of international companies while explicitly seeking to reduce volatility and drawdown risk.

2) Improve Diversification by diversifying exposure across developed (excluding the US) and emerging economies while balancing risk across sectors.

3) Enhance Return Potential by selecting companies with a favorable combination of low valuation (50%), high momentum (30%), and high quality (20%) investment factors.

4) Maintain Consistency by reapplying the index methodology twice a year in March and September to maintain intended investment exposures.

The Fund returned 25.06% at net asset value (“NAV”) for the fiscal year ended September 30, 2021 as compared to the Hartford Multifactor Diversified International Index, which returned 25.78% for the same period. The difference in returns between the Fund and the Index was primarily the result of the Fund’s transaction costs and other operating expenses that are not reflected in the Index’s results.

The Fund seeks exposures to return-enhancing factors along with less volatility and reduced concentration at the country, sector, and market cap levels versus cap-weighted indices and invests in companies that we believe exhibit a favorable combination of low valuation, high momentum, and high quality. The Fund outperformed its reference index, the MSCI All Country World (ACWI) ex USA Index, for the twelve-month period, as developed international and emerging-market value stocks meaningfully outperformed developed international and emerging-market growth stocks. The Fund’s positive active exposure to the value factor was a significant positive contributor to relative performance.

The Fund made limited use of derivatives during the year; therefore, derivatives had no material impact on performance.

International equity markets generated positive results over the trailing twelve-month period ended September 30, 2021, with the MSCI All Country World (ACWI) ex USA Index returning 23.92%. The rally in equities off market lows in March 2020 was sustained through the fourth quarter of 2020, and strong returns continued during the first half of 2021 on the back of robust earnings, accommodative monetary policy, and optimism around vaccination rates supporting the broad reopening of the economy. Positive forecasts of economic growth and accelerating earnings from strong demand for goods and services provided support for stock prices. Equity results moderated in the third quarter of 2021 as reopening momentum slowed on concerns over inflation, monetary policy normalization, and supply

chain disruptions. After posting a return of 27.73% through the first three quarters of the twelve-month period ended September 30, 2021, the MSCI All Country World (ACWI) ex USA Index returned -2.99% in the final quarter of the period.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. • The Fund is not actively managed but rather attempts to track the performance of an index. The Fund’s returns may diverge from that of the index. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse regulatory, political and economic developments. These risks may be greater for investments in emerging markets. • Investments focused in a particular country, region, sector or industry are subject to greater volatility and risk.

| Composition by Sector(1) |

| as of 09/30/2021 |

| Sector | Percentage

of Net Assets |

| Equity Securities | |

| Communication Services | 8.5% |

| Consumer Discretionary | 11.3 |

| Consumer Staples | 10.2 |

| Energy | 5.6 |

| Financials | 16.5 |

| Health Care | 10.8 |

| Industrials | 11.5 |

| Information Technology | 12.0 |

| Materials | 6.4 |

| Real Estate | 3.7 |

| Utilities | 2.8 |

| Total | 99.3% |

| Short-Term Investments | 1.8 |

| Other Assets & Liabilities | (1.1) |

| Total | 100.0% |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

Hartford Multifactor Emerging Markets ETF

Fund Overview

September 30, 2021 (Unaudited)

Inception 02/25/2015

Sub-advised by Mellon Investments Corporation | Investment objective – The Fund seeks to provide investment results that, before fees and expenses, correspond to the total return performance of an index based upon the emerging markets of the world. |

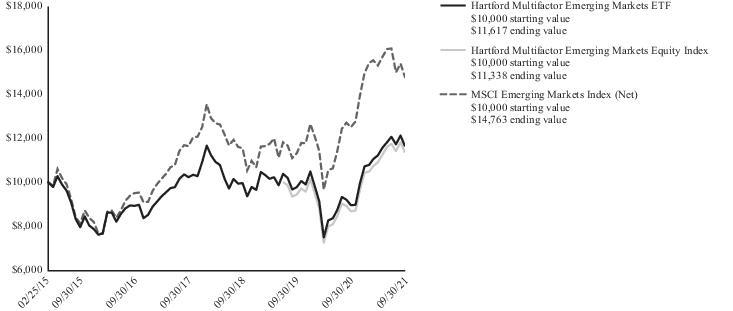

Comparison of Change in Value of $10,000 Investment (02/25/2015 - 09/30/2021)

The chart above represents the hypothetical growth of a $10,000 investment in the Fund. The difference in returns between the Fund and the Index was primarily the result of the Fund’s operating expenses, including transaction costs, that are not reflected in the Index’s results.

| Average Annual Total Returns |

| for the Periods Ending 09/30/2021 |

| | 1 Year | 5 Years | Since

Inception1 |

| Multifactor Emerging Markets ETF (NAV Return) | 29.86% | 5.44% | 2.30% |

| Multifactor Emerging Markets ETF (Market Price Return) | 27.96% | 4.93% | 2.17% |

| Hartford Multifactor Emerging Markets Equity Index | 30.75% | — | 5.72% 2 |

| MSCI Emerging Markets Index (Net) | 18.20% | 9.23% | 6.09% |

| 1 | Inception: 02/25/2015 |

| 2 | The Hartford Multifactor Emerging Markets Equity Index commenced operations on 06/28/2019. Reflects annualized returns starting on 06/28/2019. |

Performance information prior to 09/11/2019 reflects the Fund’s performance when it tracked its prior index.

Information regarding how often shares of the Fund traded on NYSE Arca, Inc. (“NYSE Arca”) at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund can be found at hartfordfunds.com.

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed or sold, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns for the report period presented in the table may differ from the return in the Financial Highlights. The total return presented in the Financial Highlights section of the reports is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles.

ETF shares are bought and sold at market price, not net asset value (NAV). Total returns are calculated using the daily 4:00 p.m. Eastern Time NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns an investor would receive if they traded shares at other times. Brokerage commissions apply and will reduce returns.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

The total annual fund operating expense ratio as shown in the Fund’s most recent prospectus was 0.44%. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the year ended 09/30/2021.

Hartford Multifactor Emerging Markets ETF

Fund Overview – (continued)

September 30, 2021 (Unaudited)

Manager Discussion

Hartford Multifactor Emerging Markets ETF (“the Fund”) seeks to provide investment results that, before fees and expenses, correspond to the total return performance of the Hartford Multifactor Emerging Markets Equity Index (LROEMX), which tracks the performance of companies located in the emerging markets of the world.

The Fund seeks to generate returns and reduce volatility by investing in index constituents that are selected and weighted through a rules-based methodology that seeks to:

1) Deliberately Allocate Risks by expanding the investment opportunity and seeking to harness emerging markets’ growth potential and allocating risk across countries while explicitly seeking to reduce volatility and drawdown risk.

2) Improve Diversification by improving exposure to countries earlier in their growth cycle (beyond the largest emerging countries) as well as to companies tied more closely to local emerging economies.

3) Enhance Return Potential by selecting companies with a favorable combination of low valuation (50%), high momentum (30%), and high quality (20%) investment factors.

4) Maintain Consistency by reapplying the index methodology twice a year in March and September to maintain intended investment exposures.

The Fund returned 29.86% at net asset value (“NAV”) for the fiscal year ended September 30, 2021 as compared to the Hartford Multifactor Emerging Markets Equity Index, which returned 30.75% for the same period. The difference in returns between the Fund and the Index was primarily the result of the Fund’s transaction costs and other operating expenses that are not reflected in the Index’s results.

The Fund seeks exposures to return-enhancing factors along with less volatility and reduced concentration at the country, sector, and market cap levels vs. cap-weighted indices and invests in companies that we believe exhibit a favorable combination of low valuation, high momentum, and high quality. The Fund outperformed its reference index, the MSCI Emerging Markets Index, for the twelve-month period, as emerging-markets value stocks meaningfully outperformed emerging-markets growth stocks as well as emerging-markets stocks overall. The Fund’s positive exposure to the value factor was a significant positive contributor to relative performance. The smaller overall market capitalization of the companies in the Fund's portfolio relative to the companies that comprise the MSCI Emerging Markets Index also contributed to performance, as large-cap emerging markets stocks lagged over the period. In addition, the Fund’s underweight to China versus the MSCI Emerging Markets Index also contributed positively to results.

The Fund made limited use of derivatives during the year; therefore, derivatives had no material impact on performance.

Emerging-markets equities generated positive results over the trailing twelve-month period ending September 30, 2021, with the MSCI Emerging Markets Index returning 18.20%. The rally in equities off market lows reached in March 2020 was sustained through the fourth quarter of 2020 and strong returns continued during the first half of 2021 on the back of robust earnings, accommodative monetary policy,

and optimism around COVID-19 vaccination rates supporting the broad reopening of the economy. Positive forecasts of economic growth and accelerating earnings from strong demand for goods and services provided support for stock prices. Equity results moderated in the third quarter of 2021 as reopening momentum slowed on concerns over inflation, monetary policy normalization, and supply chain disruptions. After posting a return of 28.61% through the first three quarters of the twelve-month period ended September 30, 2021, the MSCI Emerging Markets Index returned -8.09% in the final quarter of the period.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. • The Fund is not actively managed but rather attempts to track the performance of an index. The Fund’s returns may diverge from that of the index. • Foreign investments may be more volatile and less liquid than U.S. investments and are subject to the risk of currency fluctuations and adverse regulatory, political and economic developments. These risks may be greater for investments in emerging markets and in particular geographic regions or countries. • Investments focused in a country, region, sector, industry or group of industries may increase volatility and risk.

| Composition by Sector(1) |

| as of 09/30/2021 |

| Sector | Percentage

of Net Assets |

| Equity Securities | |

| Communication Services | 12.1% |

| Consumer Discretionary | 16.1 |

| Consumer Staples | 6.0 |

| Energy | 6.4 |

| Financials | 19.4 |

| Health Care | 4.2 |

| Industrials | 2.8 |

| Information Technology | 21.8 |

| Materials | 5.2 |

| Real Estate | 2.3 |

| Utilities | 3.1 |

| Total | 99.4% |

| Short-Term Investments | 0.2 |

| Other Assets & Liabilities | 0.4 |

| Total | 100.0% |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

Hartford Multifactor Small Cap ETF

Fund Overview

September 30, 2021 (Unaudited)

Inception 03/23/2015

Sub-advised by Mellon Investments Corporation | Investment objective – The Fund seeks to provide investment results that, before fees and expenses, correspond to the total return performance of an index that tracks the performance of small capitalization exchange traded equity securities. |

Comparison of Change in Value of $10,000 Investment (03/23/2015 - 09/30/2021)

The chart above represents the hypothetical growth of a $10,000 investment in the Fund. The difference in returns between the Fund and the Index was primarily the result of the Fund’s operating expenses, including transaction costs, that are not reflected in the Index’s results.

| Average Annual Total Returns |

| for the Periods Ending 09/30/2021 |

| | 1 Year | 5 Years | Since

Inception1 |

| Multifactor Small Cap ETF (NAV Return) | 50.39% | 11.04% | 9.21% |

| Multifactor Small Cap ETF (Market Price Return) | 50.53% | 10.90% | 9.19% |

| Hartford Multifactor Small Cap Index | 50.96% | — | 17.01% 2 |

| Russell 2000 Index (Gross) | 47.68% | 13.45% | 10.37% |

| 1 | Inception: 03/23/2015 |

| 2 | The Hartford Multifactor Small Cap Index commenced operations on 06/28/2019. Reflects annualized returns starting on 06/28/2019. |

Performance information prior to 11/06/2019 reflects the Fund’s performance when it tracked its prior index.

Information regarding how often shares of the Fund traded on NYSE Arca, Inc. (“NYSE Arca”) at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund can be foundat hartfordfunds.com.

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed or sold, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns for the report period presented in the table may differ from the return in the Financial Highlights. The total return presented in the Financial Highlights section of the reports is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles.

ETF shares are bought and sold at market price, not net asset value (NAV). Total returns are calculated using the daily 4:00 p.m. Eastern Time NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange

where Fund shares are listed. Market price returns do not represent the returns an investor would receive if they traded shares at other times. Brokerage commissions apply and will reduce returns.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

The total annual fund operating expense ratio as shown in the Fund’s most recent prospectus was 0.34%. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the year ended 09/30/2021.

Hartford Multifactor Small Cap ETF

Fund Overview – (continued)

September 30, 2021 (Unaudited)

Manager Discussion

Hartford Multifactor Small Cap ETF (“the Fund”) seeks to provide investment results that, before fees and expenses, correspond to the total return performance of Hartford Multifactor Small Cap Index (LROSCX), which tracks the performance of small cap exchange-traded equity securities.

The Fund seeks to generate returns by investing in index constituents that are selected and weighted through a rules-based methodology that seeks to:

1) Deliberately Allocate Risks by providing exposure to the growth potential of small companies while explicitly seeking to reduce volatility and drawdown risk.

2) Improve Diversification by diversifying exposure across sectors and potentially reducing individual company risks.

3) Enhance Return Potential by selecting companies with a favorable combination of low valuation (50%), high momentum (30%), and high quality (20%) investment factors.

4) Maintain Consistency by reapplying the index methodology twice a year in March and September to maintain intended investment exposures.

The Fund returned 50.39% at net asset value (“NAV”) for the fiscal year ended September 30, 2021 as compared to the Hartford Multifactor Small Cap Index which returned 50.96% for the same period. The difference in returns between the Fund and the Index was primarily the result of the Fund’s transaction costs and other operating expenses that are not reflected in the Index’s results.

The Fund seeks exposures to return-enhancing factors along with less volatility and reduced concentration at the sector level vs. cap-weighted indices and invests in companies that we believe exhibit a favorable combination of low valuation, high momentum, and high quality. The Fund outperformed its reference index, the Russell 2000 Index, for the twelve-month period, as small-cap value stocks meaningfully outperformed and the Fund’s positive exposure to the value factor was a significant contributor to performance relative to the Russell 2000 Index.

The Fund made limited use of derivatives during the year; therefore, derivatives had no material impact on performance.

U.S. small-cap markets generated positive results over the trailing twelve-month period ended September 30, 2021, with the Russell 2000 Index returning 47.68%. The rally in equities off market lows in March 2020 was sustained through the fourth quarter of 2020, and strong returns continued during the first half of 2021 on the back of robust earnings, accommodative monetary policy, and optimism around vaccination rates supporting the broad reopening of the economy. Positive forecasts of economic growth and accelerating earnings from strong demand for goods and services provided support for stock prices. Equity results moderated in the third quarter of 2021 as reopening momentum slowed on concerns over inflation, monetary policy normalization, and supply chain disruptions. After posting a return of 54.41% through the first three quarters of the twelve-month period ended September 30, 2021, the Russell 2000 Index returned -4.36% in the final quarter of the period.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. • The Fund is not actively managed but rather attempts to track the performance of an index. The Fund’s returns may diverge from that of the index. • Small cap securities can have greater risk and volatility than large-cap securities. • Investments focused in a particular sector or industry are subject to greater market volatility risk.

| Composition by Sector(1) |

| as of 09/30/2021 |

| Sector | Percentage

of Net Assets |

| Equity Securities | |

| Communication Services | 5.7% |

| Consumer Discretionary | 13.4 |

| Consumer Staples | 5.8 |

| Energy | 2.8 |

| Financials | 18.3 |

| Health Care | 19.0 |

| Industrials | 13.8 |

| Information Technology | 10.5 |

| Materials | 3.6 |

| Real Estate | 5.9 |

| Utilities | 0.7 |

| Total | 99.5% |

| Short-Term Investments | 0.1 |

| Other Assets & Liabilities | 0.4 |

| Total | 100.0% |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

Hartford Multifactor US Equity ETF

Fund Overview

September 30, 2021 (Unaudited)

Inception 02/25/2015

Sub-advised by Mellon Investments Corporation | Investment objective – The Fund seeks to provide investment results that, before fees and expenses, correspond to the total return performance of an index that tracks the performance of exchange traded U.S. equity securities. |

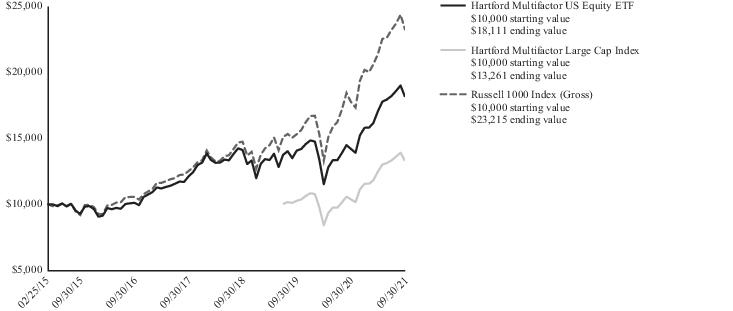

Comparison of Change in Value of $10,000 Investment (02/25/2015 - 09/30/2021)

The chart above represents the hypothetical growth of a $10,000 investment in the Fund. The difference in returns between the Fund and the Index was primarily the result of the Fund’s operating expenses, including transaction costs, that are not reflected in the Index’s results.

| Average Annual Total Returns |

| for the Periods Ending 09/30/2021 |

| | 1 Year | 5 Years | Since

Inception1 |

| Multifactor US Equity ETF (NAV Return) | 27.83% | 12.42% | 9.42% |

| Multifactor US Equity ETF (Market Price Return) | 27.92% | 12.40% | 9.42% |

| Hartford Multifactor Large Cap Index | 28.12% | — | 13.32% 2 |

| Russell 1000 Index (Gross) | 30.96% | 17.11% | 13.62% |

| 1 | Inception: 02/25/2015 |

| 2 | The Hartford Multifactor Large Cap Index commenced operations on 06/28/2019. Reflects annualized returns starting on 06/28/2019. |

Performance information prior to 09/11/2019 reflects the Fund’s performance when it tracked its prior index.

Information regarding how often shares of the Fund traded on NYSE Arca, Inc. (“NYSE Arca”) at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund can be found at hartfordfunds.com.

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed or sold, may be worth more or less than their original cost. The chart and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website hartfordfunds.com.

Total returns for the report period presented in the table may differ from the return in the Financial Highlights. The total return presented in the Financial Highlights section of the reports is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles.

ETF shares are bought and sold at market price, not net asset value (NAV). Total returns are calculated using the daily 4:00 p.m. Eastern Time NAV. Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange

where Fund shares are listed. Market price returns do not represent the returns an investor would receive if they traded shares at other times. Brokerage commissions apply and will reduce returns.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

See “Benchmark Glossary” for benchmark descriptions.

The total annual fund operating expense ratio as shown in the Fund’s most recent prospectus was 0.19%. Actual expenses may be higher or lower. Please see the accompanying Financial Highlights for expense ratios for the year ended 09/30/2021.

Hartford Multifactor US Equity ETF

Fund Overview – (continued)

September 30, 2021 (Unaudited)

Manager Discussion

Hartford Multifactor US Equity ETF (“the Fund”) seeks to provide investment results that, before fees and expenses, correspond to the total return performance of Hartford Multifactor Large Cap Index (LROLCX), which tracks the performance of large-cap exchange-traded U.S. equity securities.

The Fund seeks to generate returns by investing in index constituents that are selected and weighted through a rules-based methodology that seeks to:

1) Deliberately Allocate Risks by allocating capital deeper in the US Large Cap Universe toward companies with more favorable risk/reward potential while explicitly seeking to reduce volatility and drawdown risk.

2) Improve Diversification by providing diversified exposure across the US Large Cap Universe, beyond mega-caps.

3) Enhance Return Potential by selecting companies with a favorable combination of low valuation (50%), high momentum (30%), and high quality (20%) investment factors.

4) Maintain Consistency by reapplying the index methodology twice a year in March and September to maintain intended investment exposures.

The Fund returned 27.83% at net asset value (“NAV”) for the fiscal year ended September 30, 2021 as compared to the Hartford Multifactor Large Cap Index which returned 28.12% for the same period. The difference in returns between the Fund and the Index was primarily the result of the Fund’s transaction costs and other operating expenses that are not reflected in the Index’s results.

The Fund seeks exposures to return-enhancing factors along with less volatility and reduced concentration at the sector and market cap levels versus cap-weighted indices and invests in companies that we believe exhibit a favorable combination of low valuation, high momentum, and high quality. The Fund underperformed its reference index, the Russell 1000 Index, for the twelve-month period, as the Fund’s lower volatility exposure relative to the Russell 1000 Index detracted from relative performance during this period of strong returns generated by equities.

The Fund made limited use of derivatives during the year; therefore, derivatives had no material impact on performance.

U.S. large-cap equity markets generated positive results over the trailing twelve-month period ended September 30, 2021, with the Russell 1000 Index returning 30.96%. The rally in equities off market

lows in March 2020 was sustained through the fourth quarter of 2020, and strong returns continued during the first half of 2021 on the back of robust earnings, accommodative monetary policy, and optimism around vaccination rates supporting the broad reopening of the economy. Positive forecasts of economic growth and accelerating earnings from strong demand for goods and services provided support for stock prices. Equity results moderated in the third quarter of 2021 as reopening momentum slowed on concerns over inflation, monetary policy normalization, and supply chain disruptions. After posting a return of 30.69% through the first three quarters of the twelve-month period ended September 30, 2021, the Russell 1000 Index returned 0.21% in the final quarter of the period.

Important Risks

Investing involves risk, including the possible loss of principal. Security prices fluctuate in value depending on general market and economic conditions and the prospects of individual companies. • The Fund is not actively managed but rather attempts to track the performance of an index. The Fund’s returns may diverge from that of the index. • Investments focused in a sector, industry or group of industries may increase volatility and risk.

| Composition by Sector(1) |

| as of 09/30/2021 |

| Sector | Percentage

of Net Assets |

| Equity Securities | |

| Communication Services | 9.0% |

| Consumer Discretionary | 10.3 |

| Consumer Staples | 7.6 |

| Energy | 0.6 |

| Financials | 10.0 |

| Health Care | 15.4 |

| Industrials | 10.6 |

| Information Technology | 25.6 |

| Materials | 2.1 |

| Real Estate | 4.1 |

| Utilities | 4.3 |

| Total | 99.6% |

| Short-Term Investments | 0.3 |

| Other Assets & Liabilities | 0.1 |

| Total | 100.0% |

| (1) | A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system. These sector classifications are used for financial reporting purposes. |

Hartford Multifactor ETFs

Benchmark Glossary (Unaudited)

| Hartford Longevity Economy Index seeks to generate attractive risk-adjusted returns by investing in companies that comprise industries that reflect certain themes that are expected to benefit from the growth of the aging population and the substantial buying power it represents. |

| Hartford Multifactor Diversified International Index seeks to enhance return potential available from investment in developed market (excluding the US) and emerging market companies while reducing volatility by up to fifteen-percent over a complete market cycle. |

| Hartford Multifactor Emerging Markets Equity Index seeks to enhance return potential available from investment in emerging market companies while reducing volatility by up to fifteen-percent over a complete market cycle. |

| Hartford Multifactor Large Cap Index seeks to enhance return potential available from investment in the initial capitalized-weighted universe while reducing volatility by up to fifteen-percent over a complete market cycle. |

| Hartford Multifactor Small Cap Index seeks to enhance return potential available from investment in the initial capitalization-weighted universe while reducing volatility by up to fifteen-percent over a complete market cycle. |

| Hartford Risk-Optimized Multifactor Developed Markets (ex-US) Index seeks to address risks and opportunities within developed market stocks located outside the United States by selecting equity securities exhibiting a favorable combination of factors, including value, momentum, and quality. |

| MSCI ACWI (All Country World) ex USA Index (Net) (reflects reinvested dividends net of withholding taxes but reflects no deduction for fees, expenses or other taxes) is designed to capture large and mid cap representation across developed markets (excluding the United States) and emerging market countries. |

| MSCI Emerging Markets Index (Net) reflects reinvested dividends net of withholding taxes but (reflects no deduction for fees, expenses or other taxes) is designed to capture large and mid cap representation across emerging market countries. |

| MSCI World ex USA Index (Net) (reflects no deduction for fees, expenses or other taxes) is a free float-adjusted market capitalization index that is designed to capture large and mid cap representation across developed markets countries—excluding the United States. |

| Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent. |

| Russell 1000 Index (Gross) (reflects no deduction for fees, expenses or taxes) is designed to measure the performance of the 1,000 largest companies in the Russell 3000 Index. The Russell 3000 Index is designed to measure the performance of the 3,000 largest U.S. companies based on total market capitalizations. |

| Russell 2000 Index (Gross) (reflects no deduction for fees, expenses or taxes) is an index comprised of 2,000 of the smallest U.S.-domiciled company common stocks based on a combination of their market capitalization and current index membership. |

| Russell 3000 Index (Gross) is designed to measure the performance of the 3,000 largest U.S. companies based on total market capitalization. |

Hartford Multifactor ETFs

Expense Examples (Unaudited)

Your Fund's Expenses

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions paid on purchases and sales of Fund shares and (2) ongoing costs, including investment management fees and certain other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other exchange-traded funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period of April 1, 2021 through September 30, 2021. To the extent a Fund was subject to acquired fund fees and expenses during the period, acquired fund fees and expenses are not included in the annualized expense ratio below.

Actual Expenses

The first set of columns of the table below provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second set of columns of the table below provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of shares of the Funds. Therefore, the second set of columns of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different exchange-traded funds. In addition, if these transactional costs were included, your costs would be higher. Expense ratios may vary period to period because of various factors, such as an increase in expenses not covered by the management fee (extraordinary expenses and interest expense). Expenses are equal to a Fund's annualized expense ratio multiplied by average account value over the period, multiplied by 183/365 (to reflect the one-half year period).

| | Actual Return | | Hypothetical (5% return before expenses) |

| | Beginning

Account Value

April 1, 2021 | | Ending

Account Value

September 30, 2021 | | Expenses paid

during the period

April 1, 2021

through

September 30, 2021 | | Beginning

Account Value

April 1, 2021 | | Ending

Account Value

September 30, 2021 | | Expenses paid

during the period

April 1, 2021

through

September 30, 2021 | | Annualized

expense

ratio |

| Hartford Longevity Economy ETF | $ 1,000.00 | | $ 1,066.50 | | $ 2.28 | | $ 1,000.00 | | $ 1,022.86 | | $ 2.23 | | 0.44% |

| Hartford Multifactor Developed Markets (ex-US) ETF | $ 1,000.00 | | $ 1,037.90 | | $ 1.48 | | $ 1,000.00 | | $ 1,023.61 | | $ 1.47 | | 0.29% |

| Hartford Multifactor Diversified International ETF | $ 1,000.00 | | $ 1,048.10 | | $ 1.49 | | $ 1,000.00 | | $ 1,023.61 | | $ 1.47 | | 0.29% |

| Hartford Multifactor Emerging Markets ETF | $ 1,000.00 | | $ 1,036.60 | | $ 2.25 | | $ 1,000.00 | | $ 1,022.86 | | $ 2.23 | | 0.44% |

| Hartford Multifactor Small Cap ETF | $ 1,000.00 | | $ 1,015.40 | | $ 1.72 | | $ 1,000.00 | | $ 1,023.36 | | $ 1.72 | | 0.34% |

| Hartford Multifactor US Equity ETF | $ 1,000.00 | | $ 1,064.20 | | $ 0.98 | | $ 1,000.00 | | $ 1,024.12 | | $ 0.96 | | 0.19% |

Hartford Longevity Economy ETF

Schedule of Investments

September 30, 2021

| Shares or Principal Amount | | Market Value† |

| COMMON STOCKS - 99.9% |

| | Automobiles & Components - 1.1% |

| 6,215 | Ford Motor Co.* | $ 88,004 |

| 2,917 | General Motors Co.* | 153,755 |

| 561 | Gentex Corp. | 18,502 |

| 119 | Thor Industries, Inc. | 14,609 |

| 185 | Winnebago Industries, Inc. | 13,403 |

| | | | 288,273 |

| | Banks - 4.5% |

| 2,780 | Bank of America Corp. | 118,011 |

| 223 | CIT Group, Inc. | 11,585 |

| 2,642 | Citigroup, Inc. | 185,415 |

| 1,371 | Citizens Financial Group, Inc. | 64,410 |

| 179 | Eagle Bancorp, Inc. | 10,292 |

| 2,481 | Fifth Third Bancorp | 105,294 |

| 131 | First Horizon National Corp. | 2,134 |

| 350 | First Interstate BancSystem, Inc. Class A | 14,091 |

| 1,087 | JP Morgan Chase & Co. | 177,931 |

| 1,610 | KeyCorp. | 34,808 |

| 84 | M&T Bank Corp. | 12,545 |

| 361 | OceanFirst Financial Corp. | 7,729 |

| 385 | PNC Financial Services Group, Inc. | 75,321 |

| 436 | Popular, Inc. | 33,864 |

| 367 | Preferred Bank | 24,472 |

| 738 | Regions Financial Corp. | 15,727 |

| 1,266 | Towne Bank | 39,385 |

| 632 | Trustmark Corp. | 20,363 |

| 1,373 | U.S. Bancorp | 81,611 |

| 932 | Umpqua Holdings Corp. | 18,873 |

| 1,327 | Wells Fargo & Co. | 61,586 |

| | | | 1,115,447 |

| | Capital Goods - 1.9% |

| 467 | General Dynamics Corp. | 91,546 |

| 527 | Huntington Ingalls Industries, Inc. | 101,743 |

| 224 | L3Harris Technologies, Inc. | 49,334 |

| 345 | Lockheed Martin Corp. | 119,059 |

| 335 | Northrop Grumman Corp. | 120,650 |

| | | | 482,332 |

| | Consumer Durables & Apparel - 2.6% |

| 511 | Carter's, Inc. | 49,690 |

| 570 | D.R. Horton, Inc. | 47,863 |

| 732 | Garmin Ltd. | 113,797 |

| 1,010 | Kontoor Brands, Inc. | 50,450 |

| 24 | La-Z-Boy, Inc. | 774 |

| 543 | Leggett & Platt, Inc. | 24,348 |

| 8 | Mohawk Industries, Inc.* | 1,419 |

| 1,345 | Newell Brands, Inc. | 29,778 |

| 6 | NVR, Inc.* | 28,764 |

| 176 | Polaris, Inc. | 21,060 |

| 635 | PulteGroup, Inc. | 29,159 |

| 1,749 | Sturm Ruger & Co., Inc. | 129,041 |

| 583 | Whirlpool Corp. | 118,850 |

| | | | 644,993 |

| | Consumer Services - 2.7% |

| 24 | Booking Holdings, Inc.* | 56,973 |

| 124 | Boyd Gaming Corp.* | 7,844 |

| 715 | Choice Hotels International, Inc. | 90,355 |

| 39 | Churchill Downs, Inc. | 9,363 |

| 6 | Domino's Pizza, Inc. | 2,862 |

| 956 | Everi Holdings, Inc.* | 23,116 |

| 146 | Graham Holdings Co. Class B | 86,017 |

| 1,993 | H&R Block, Inc. | 49,825 |

| 128 | Hilton Worldwide Holdings, Inc.* | 16,910 |

| 286 | McDonald's Corp. | 68,958 |

| Shares or Principal Amount | | Market Value† |

| COMMON STOCKS - 99.9% - (continued) |

| | Consumer Services - 2.7% - (continued) |

| 186 | Monarch Casino & Resort, Inc.* | $ 12,460 |

| 733 | Red Rock Resorts, Inc. Class A* | 37,544 |

| 152 | Starbucks Corp. | 16,767 |

| 531 | Travel + Leisure Co. | 28,955 |

| 104 | Vail Resorts, Inc.* | 34,741 |

| 429 | Wyndham Hotels & Resorts, Inc. | 33,115 |

| 744 | Yum! Brands, Inc. | 90,999 |

| | | | 666,804 |

| | Diversified Financials - 3.8% |

| 1,489 | Ally Financial, Inc. | 76,013 |

| 82 | American Express Co. | 13,737 |

| 2,633 | Bank of New York Mellon Corp. | 136,495 |

| 142 | Berkshire Hathaway, Inc. Class B* | 38,758 |

| 9 | BlackRock, Inc. | 7,548 |

| 554 | Capital One Financial Corp. | 89,731 |

| 268 | Charles Schwab Corp. | 19,521 |

| 118 | Discover Financial Services | 14,496 |

| 197 | Goldman Sachs Group, Inc. | 74,472 |

| 230 | Houlihan Lokey, Inc. | 21,183 |

| 35 | Intercontinental Exchange, Inc. | 4,019 |

| 170 | Janus Henderson Group plc | 7,026 |

| 697 | Jefferies Financial Group, Inc. | 25,880 |

| 68 | Moody's Corp. | 24,147 |

| 484 | Morgan Stanley | 47,098 |

| 236 | Nasdaq, Inc. | 45,553 |

| 493 | Northern Trust Corp. | 53,150 |

| 1,326 | Raymond James Financial, Inc. | 122,363 |

| 10 | S&P Global, Inc. | 4,249 |

| 125 | State Street Corp. | 10,590 |

| 970 | Synchrony Financial | 47,414 |

| 175 | T Rowe Price Group, Inc. | 34,423 |

| 401 | Voya Financial, Inc. | 24,617 |

| | | | 942,483 |

| | Food & Staples Retailing - 0.9% |

| 43 | Costco Wholesale Corp. | 19,322 |

| 2,090 | Kroger Co. | 84,499 |

| 809 | Walgreens Boots Alliance, Inc. | 38,063 |

| 324 | Walmart, Inc. | 45,159 |

| 650 | Weis Markets, Inc. | 34,158 |

| | | | 221,201 |

| | Food, Beverage & Tobacco - 1.1% |

| 1,756 | Flowers Foods, Inc. | 41,494 |

| 111 | General Mills, Inc. | 6,640 |

| 391 | Hershey Co. | 66,177 |

| 390 | Kellogg Co. | 24,929 |

| 1,625 | Tyson Foods, Inc. Class A | 128,277 |

| | | | 267,517 |

| | Health Care Equipment & Services - 13.1% |

| 505 | Abbott Laboratories | 59,656 |

| 625 | Anthem, Inc. | 233,000 |

| 2,159 | Baxter International, Inc. | 173,648 |

| 325 | Becton Dickinson and Co. | 79,892 |

| 594 | Boston Scientific Corp.* | 25,774 |

| 3,235 | Cardinal Health, Inc. | 160,003 |

| 766 | Centene Corp.* | 47,730 |

| 2,421 | Cerner Corp. | 170,729 |

| 1,479 | Change Healthcare, Inc.* | 30,970 |

| 646 | Cigna Corp. | 129,303 |

| 68 | CONMED Corp. | 8,896 |

| 193 | Cooper Cos., Inc. | 79,769 |

| 2,422 | CVS Health Corp. | 205,531 |

| 105 | Danaher Corp. | 31,966 |

The accompanying notes are an integral part of these financial statements.

Hartford Longevity Economy ETF

Schedule of Investments – (continued)

September 30, 2021

| Shares or Principal Amount | | Market Value† |

| COMMON STOCKS - 99.9% - (continued) |

| | Health Care Equipment & Services - 13.1% - (continued) |

| 668 | Edwards Lifesciences Corp.* | $ 75,624 |

| 532 | Encompass Health Corp. | 39,921 |

| 738 | Globus Medical, Inc. Class A* | 56,546 |

| 335 | HCA Healthcare, Inc. | 81,311 |

| 740 | Hill-Rom Holdings, Inc. | 111,000 |

| 275 | Hologic, Inc.* | 20,298 |

| 571 | Humana, Inc. | 222,205 |

| 82 | IDEXX Laboratories, Inc.* | 50,996 |

| 461 | Laboratory Corp. of America Holdings* | 129,744 |

| 395 | Magellan Health, Inc.* | 37,347 |

| 801 | Medtronic plc | 100,405 |

| 307 | Molina Healthcare, Inc.* | 83,292 |

| 176 | National HealthCare Corp. | 12,317 |

| 197 | NuVasive, Inc.* | 11,790 |

| 2,267 | Premier, Inc. Class A | 87,869 |

| 1,178 | Quest Diagnostics, Inc. | 171,175 |

| 124 | ResMed, Inc. | 32,680 |

| 349 | STERIS plc | 71,294 |

| 400 | Stryker Corp. | 105,488 |

| 527 | UnitedHealth Group, Inc. | 205,920 |

| 174 | Universal Health Services, Inc. Class B | 24,076 |

| 85 | West Pharmaceutical Services, Inc. | 36,086 |

| 473 | Zimmer Biomet Holdings, Inc. | 69,228 |

| | | | 3,273,479 |

| | Household & Personal Products - 1.9% |

| 293 | Church & Dwight Co., Inc. | 24,193 |

| 140 | Clorox Co. | 23,185 |

| 1,321 | Colgate-Palmolive Co. | 99,841 |

| 144 | Estee Lauder Cos., Inc. Class A | 43,190 |

| 674 | Kimberly-Clark Corp. | 89,265 |

| 315 | Nu Skin Enterprises, Inc. Class A | 12,748 |

| 450 | Procter & Gamble Co. | 62,910 |

| 764 | Reynolds Consumer Products, Inc. | 20,888 |

| 910 | Spectrum Brands Holdings, Inc. | 87,060 |

| 126 | USANA Health Sciences, Inc.* | 11,617 |

| | | | 474,897 |

| | Insurance - 3.6% |

| 2,051 | Aflac, Inc. | 106,919 |

| 814 | Allstate Corp. | 103,630 |

| 421 | American Financial Group, Inc. | 52,974 |

| 185 | American National Group, Inc. | 34,971 |

| 279 | Arch Capital Group Ltd.* | 10,652 |

| 439 | Athene Holding Ltd. Class A* | 30,234 |

| 445 | Cincinnati Financial Corp. | 50,828 |

| 794 | Employers Holdings, Inc. | 31,355 |

| 140 | Fidelity National Financial, Inc. | 6,348 |

| 59 | First American Financial Corp. | 3,956 |

| 108 | Hanover Insurance Group, Inc. | 13,999 |

| 4 | Markel Corp.* | 4,780 |

| 1,462 | Mercury General Corp. | 81,390 |

| 205 | MetLife, Inc. | 12,655 |

| 4,695 | Old Republic International Corp. | 108,595 |

| 859 | Principal Financial Group, Inc. | 55,320 |

| 1,360 | Prudential Financial, Inc. | 143,072 |

| 63 | Safety Insurance Group, Inc. | 4,993 |

| 203 | Travelers Cos., Inc. | 30,858 |

| 308 | Unum Group | 7,718 |

| | | | 895,247 |

| | Media & Entertainment - 12.3% |

| 585 | Activision Blizzard, Inc. | 45,273 |

| 89 | Alphabet, Inc. Class A* | 237,943 |

| Shares or Principal Amount | | Market Value† |

| COMMON STOCKS - 99.9% - (continued) |

| | Media & Entertainment - 12.3% - (continued) |

| 727 | Altice USA, Inc.* | $ 15,063 |

| 1,565 | Bumble, Inc.* | 78,219 |

| 3,986 | Cargurus, Inc.* | 125,200 |

| 132 | Charter Communications, Inc. Class A* | 96,038 |

| 3,046 | Comcast Corp. Class A | 170,363 |

| 269 | DISH Network Corp. Class A* | 11,691 |

| 470 | Electronic Arts, Inc. | 66,857 |

| 683 | Facebook, Inc. Class A* | 231,803 |

| 1,635 | Fox Corp. | 65,580 |

| 1,760 | IAC/InterActiveCorp * | 229,310 |

| 22 | John Wiley & Sons, Inc. Class A | 1,149 |

| 48 | Liberty Broadband Corp. Class C* | 8,290 |

| 811 | Liberty Media Corp-Liberty Formula One* | 41,694 |

| 3,089 | Lions Gate Entertainment Corp.* | 43,833 |

| 170 | Madison Square Garden Sports Corp.* | 31,611 |

| 1,403 | Match Group, Inc.* | 220,257 |

| 216 | Netflix, Inc.* | 131,833 |

| 1,160 | News Corp. Class A | 27,295 |

| 137 | Nexstar Media Group, Inc. | 20,819 |

| 2,222 | Pinterest, Inc. Class A* | 113,211 |

| 9,923 | QuinStreet, Inc.* | 174,248 |

| 6,849 | Sirius XM Holdings, Inc.(1) | 41,779 |

| 1,255 | Snap, Inc. Class A* | 92,707 |

| 4,004 | TEGNA, Inc. | 78,959 |

| 281 | TripAdvisor, Inc.* | 9,512 |

| 2,147 | Twitter, Inc.* | 129,657 |

| 647 | Walt Disney Co.* | 109,453 |

| 2,678 | World Wrestling Entertainment, Inc. | 150,664 |

| 5,623 | Yelp, Inc.* | 209,401 |

| 581 | Zillow Group, Inc.* | 51,209 |

| 353 | ZoomInfo Technologies, Inc.* | 21,600 |

| | | | 3,082,521 |

| | Pharmaceuticals, Biotechnology & Life Sciences - 8.7% |

| 1,811 | AbbVie, Inc. | 195,353 |

| 675 | Agilent Technologies, Inc. | 106,333 |

| 1,044 | Amgen, Inc. | 222,007 |

| 10 | Bio-Rad Laboratories, Inc. Class A* | 7,460 |

| 2,467 | Bristol-Myers Squibb Co. | 145,972 |

| 346 | Bruker Corp. | 27,023 |

| 75 | Charles River Laboratories International, Inc.* | 30,950 |

| 240 | Eli Lilly & Co. | 55,452 |

| 2,610 | Gilead Sciences, Inc. | 182,308 |

| 151 | Incyte Corp.* | 10,386 |

| 239 | IQVIA Holdings, Inc.* | 57,250 |

| 386 | Jazz Pharmaceuticals plc* | 50,261 |

| 1,249 | Johnson & Johnson | 201,713 |