UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR/A

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-22959

1290 FUNDS

(Exact name of registrant as specified in charter)

1290 Avenue of the Americas

New York, New York 10104

(Address of principal executive offices)

WILLIAM T. MACGREGOR ESQ.

Executive Vice President, General Counsel and Secretary

Equitable Investment Management Group, LLC

1290 Avenue of the Americas

New York, New York 10104

(Name and Address of Agent for Service)

Copies to:

MARK C. AMOROSI, ESQ.

K&L Gates LLP

1601 K Street N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (212) 554-1234

Date of fiscal year end: October 31

Date of reporting period: October 31, 2020

| Item 1. | Reports to Stockholders. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Annual Report

October 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the shareholder reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the shareholder reports will be made available on the Funds’ website (www.1290Funds.com/literature.php), and you will be notified by mail each time a shareholder report is posted and provided with a website link to access the shareholder report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive the Funds’ shareholder reports and other communications electronically by contacting your financial intermediary or, if you invest directly with the Funds, by calling 1-888-310-0416 or by sending an e-mail request to 1290Funds@dfinsolutions.com.

You may elect to receive all future shareholder reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call 1-888-310-0416 or send an e-mail request to 1290Funds@dfinsolutions.com to let the Funds know that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all 1290 Funds held in your account if you invest through your financial intermediary or all 1290 Funds held with the fund complex if you invest directly with the Funds.

1290 Funds

Annual Report

October 31, 2020

Table of Contents

Market Overview for the year ended October 31, 2020

The economy and financial markets were driven by the impact of the emerging COVID-19 pandemic for much of the reporting period. The markets have seen unprecedented volatility, with unemployment soaring from a 60-year low to a 90-year high over the course of two months (U.S. Bureau of Labor Statistics). Extraordinary monetary and fiscal response then gave rise to a market rebound and the shortest recession on record during the Spring. Against this backdrop, a bull market in selected sectors and regions was driven by monetary and fiscal stimulus, the evolving Chinese and U.S. economic recoveries, and heightened virus vaccine hopes.

Economic growth was driven by attempts to control the expansion of the pandemic, along with global central bank actions to support economies and the proper functioning of the financial markets. Looking at the U.S. economy, fourth quarter 2019 annualized gross domestic product (GDP) annualized growth was 2.4%. Lockdowns and social distancing then started to take a toll on the economy, as the Commerce Department reported that first-quarter 2020 annualized GDP growth was down 5.0%. Second-quarter annualized GDP growth then contracted 31.4%, marking the steepest quarterly decline on record. The economy then rebounded, as the initial estimate for third-quarter GDP growth was 33.1% (U.S. Bureau of Economic Analysis).

The U.S. bond markets produced positive gains as the Federal Reserve Board (Fed) took a number of aggressive actions in March 2020. First, the Fed lowered the federal funds rate from a range between 1.50% and 1.75% to a range between 1.00% and 1.25%, then lowered again to a range between 0.00% and 0.25%. On March 23, the Fed announced that it would make unlimited purchases of Treasury and mortgage-backed securities, and introduced a new credit facility to buy investment-grade credit rated down to BBB- in the primary and secondary markets. During the second quarter, the Fed expanded its credit facilities to include the purchase of individual corporate bonds, which supported spread tightening. In August 2020, Fed Chair Jerome Powell said the central bank had changed how it viewed the tradeoff between lower unemployment and higher inflation. Its new approach to setting U.S. monetary policy will entail letting inflation and employment run higher, which could mean interest rates remain “low for longer.” Finally, at its meeting in September, projections from individual members of the Federal Open Market Committee indicated that rates could stay anchored near zero through 2023.

U.S. equity markets proved resilient, if uneven, beginning the period strongly amid improved economic data and optimism that a new ‘Phase One’ deal between the U.S. and China could be a step towards the resolution of their protracted trade war. From February 2020, however, growing concerns about the spread of a deadly coronavirus caused a sharp shift in investor sentiment. In a bid to contain the virus, governments around the world enacted extraordinary measures to lock-down their citizens, halting economic activity across many sectors. With fears about the impact of the virus mounting, equity markets suffered steep losses and volatility spiked to record highs. Beginning in late March, equity markets started to recover, underpinned by strong monetary and fiscal policy support worldwide. Gradual reopening of economies and optimism about a vaccine provided further support. Stock markets nevertheless reversed course in September with investors focusing on rising cases, particularly in Europe, which appeared to imperil the nascent economic recovery. U.S. equities slipped in October as the economic recovery slowed and a surge in coronavirus cases dented investor sentiment. As of this writing, the results of the U.S. presidential election are providing some clarity for markets and positive initial data from vaccine trials have helped to instill some confidence despite the increase in coronavirus cases.

Source: Equitable Investment Management Group, LLC. As of 10/31/20. This information is provided for general information only and is not intended to provide specific advice or recommendations for any individual investor.

PAST PERFORMANCE IS NO GUARANTEE OP FUTURE RESULTS. No investment is risk-free. Bond investments are subject to interest rate risk so that when interest rates rise, the prices of bonds can decrease and the investor can lose principal value. High yield bonds are subject to a high degree of credit and market risk. International securities carry additional risks including currency exchange fluctuation and different government regulations, economic conditions or accounting standards. Smaller company stocks involve a greater risk than is customarily associated with more established companies. Index performance is referenced for illustrative purposes only. You cannot invest directly in an index.

Fund holdings and sector allocations are subject to change. Please see the Portfolio of Investments for a complete list of fund holdings.

1

NOTES ON PERFORMANCE (Unaudited)

Total Returns

Performance of the 1290 Funds as shown on the following pages compares each Fund’s performance to that of a broad-based securities index and, with respect to certain Funds, customized composite benchmarks. Each Fund’s rates of return are net of investment advisory fees and expenses of the Fund. Each Fund has a separate investment objective it seeks to achieve by following a separate investment policy. There is no guarantee that these objectives will be attained. The objectives and policies of each Fund will affect its return and its risk. Keep in mind that past performance is not an indication of future results.

Benchmarks

60% S&P 500® Index/40% Bloomberg Barclays U.S. Aggregate Bond Index is a hypothetical combination of unmanaged indexes. The composite index combines the total return of the S&P 500® Index at a weighting of 60% and the Bloomberg Barclays U.S. Aggregate Bond Index at a weighting of 40%.

Bloomberg Barclays U.S. Aggregate Bond Index covers the U.S. dollar denominated investment-grade, fixed-rate, taxable bond market of securities. The index includes bonds from the Treasury, government-related and corporate securities, agency fixed rate and hybrid adjustable mortgage pass through securities, asset-backed securities and commercial mortgage-backed securities.

ICE BofA U.S. 3-Month Treasury Bill Index measures the returns of negotiable debt obligations issued by the U.S. government and backed by its full faith and credit, having a maturity of three months.

ICE BofA U.S. High Yield Index tracks the performance of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market. Qualifying securities must have at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $100 million. It is capitalization-weighted.

Morgan Stanley Capital International (MSCI) World (Net) Index (“MSCI World (Net) Index”) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The index consists of 23 developed market country indexes.

Russell 2500™ Value Index measures the performance of those Russell 2500TM Index companies with lower price-to-book ratios and lower forecasted growth values. It is market-capitalization weighted.

Standard & Poor’s 500® Composite Stock Price Index (“S&P 500® Index”) is a weighted index of common stocks of 500 leading companies in leading industries of the U.S. economy, capturing 75% coverage of U.S. equities. The index is capitalization weighted, thereby giving greater weight to companies with the largest market capitalizations.

The Standard & Poor’s Target Date Index Series (each, an “S&P Target Date Index”) comprises eleven multi-asset class indices, each corresponding to a particular target retirement date. The asset allocation for each index in the series is determined once a year through survey of large fund management companies that offer target date products. Each index is fully investable, with varying levels of exposure to equities, fixed income and commodities.

Glossary

Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Index is a sub-index of the Bloomberg Barclays U.S. Corporate High Yield Index which measures the USD-denominated, high yield, fixed-rate corporate bond market. This sub-index caps exposure caps any issuer exposure to a fixed percentage of 2%.

CBOE Volatility Index (known as the VIX), is measure of constant, 30-day expected volatility of the U.S. stock market, derived from prices of the S&P 500 Index call and put options.

Credit ratings: Investment grade is a rating that signifies a municipal or corporate bond presents a relatively low risk of default. Bond rating firms like Standard & Poor’s and Moody’s use different designations, consisting of the upper- and lower-case letters “A” and “B,” to identify a bond’s credit quality rating. “AAA” and “AA” (high credit quality) and “A” and “BBB” (medium credit quality) are considered investment grade. Credit ratings for bonds below these designations (“BB,” “BBB-,” “B,” “CCC,” etc.) are considered low credit quality, and are commonly referred to as “junk bonds.”

Corporate bonds are a type of debt security that is issued by a firm and sold to investors. Corporate bonds are typically seen as somewhat riskier than U.S. government bonds, so they usually have higher interest rates to compensate for this additional risk.

Derivative is a financial instrument with a price that is dependent upon or derived from one or more underlying assets.

Diversified spread is the sale of multiple, diversified futures contracts and the purchase of other multiple, diversified offsetting futures contracts. A spread tracks the difference between a long and short position.

Drawdown is a peak-to-trough decline during a specific period for an investment, trading account, or fund. A drawdown is usually quoted as the percentage

2

NOTES ON PERFORMANCE (Unaudited)

between the peak and the subsequent trough. If a trading account has $10,000 in it, and the funds drop to $9,000 before moving back above $10,000, then the trading account witnessed a 10% drawdown.

Duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates.

Factor returns are he return attributable to a particular common factor.

Federal funds rate is the target interest rate set by the Federal Open Market Committee (FOMC) at which commercial banks borrow and lend their excess reserves to each other overnight.

Futures are derivative financial contracts that obligate the parties to transact an asset at a predetermined future date and price. drawdown

Inflation is the decline of purchasing power of a given currency over time.

JPMorgan Emerging Markets Bond Index Global (“EMBI Global”) measures the performance of fix-rate for external-currency denominated debt instruments including brady bonds, loans, Eurobonds in emerging markets. Countries covered are Argentina, Brazil, Bulgaria, Mexico, Morocco, Nigeria, the Philippines, Poland, Russia, and South Africa. It covers more of the eligible instruments than the EMBI+ by relaxing somewhat the strict EMBI+ limits on secondary market trading liquidity.

Monetary policy accommodation is when a central bank sets low interest rates so that credit is easily attainable. This makes borrowing easy for business, which stimulates investment and expansion of operations.

Mortgage backed security (MBS) is a type of asset-backed security that is secured by a mortgage or collection of mortgages.

Quantitative easing is the introduction of new money into the money supply by a central bank.

Shiller Barclays Cyclically Adjusted Price-to-Earnings (CAPE) Total Return Index aims to identify undervalued sectors in the large-cap equity market based on a modified CAPE® ratio, which is designed to assess longer term equity valuations by using an inflation adjusted earnings horizon.

Smart beta defines a set of investment strategies that emphasize the use of alternative index construction rules to traditional market capitalization-based indices.

Spread Sectors are nongovernmental fixed income investments with higher yields at greater risk than governmental investments.

Swap is a derivative contract through which two parties exchange financial instruments.

Treasury securities, or Treasuries, are debt obligations of the U.S. government. When you buy a U.S. Treasury security, you are lending money to the federal government for a specified period of time.

Yield refers to the earnings generated and realized on an investment over a particular period of time.

Yield spread is the difference between yields on differing debt instruments of varying maturities, credit ratings, issuer, or risk level, calculated by deducting the yield of one instrument from the other.

Spread tightening is when that difference contracts.

3

1290 DIVERSIFIED BOND FUND (Unaudited)

INVESTMENT ADVISER

| Ø | | Equitable Investment Management Group, LLC |

INVESTMENT SUB-ADVISER

| Ø | | Brandywine Global Investment Management, LLC (Brandywine Global) |

PERFORMANCE RESULTS

| | | | | | | | | | | | | | |

| |

| Annualized Total Returns as of 10/31/20 | |

| | | | | |

| | | | | 1

Year | | | 5

Years | | | Since

Incept. | |

Fund – Class A Shares* | | without Sales Charge | | | 8.32 | % | | | 5.39 | % | | | 4.75 | % |

| | | with Sales Charge (a) | | | 3.32 | | | | 4.43 | | | | 3.85 | |

Fund – Class I Shares* | | | | | 8.34 | | | | 5.65 | | | | 5.00 | |

Fund – Class R Shares* | | | | | 7.77 | | | | 5.09 | | | | 4.46 | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | | | 6.19 | | | | 4.08 | | | | 4.01 | |

| |

* Date of inception 7/6/15. (a) A 4.50% front-end sales charge was deducted. Returns for periods greater than one year are annualized. | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For the most current month-end performance data please call 1-888-310-0416 or visit www.1290Funds.com.

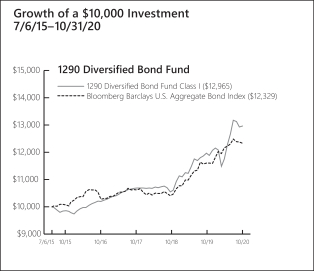

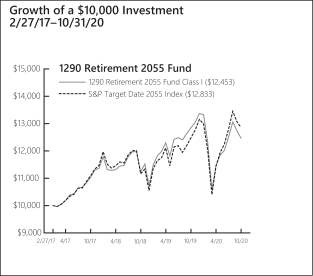

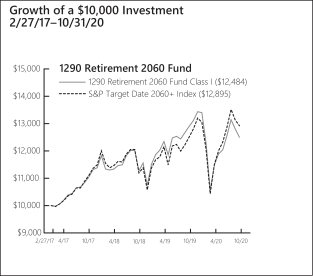

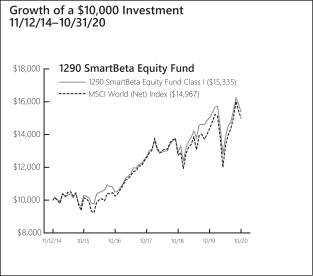

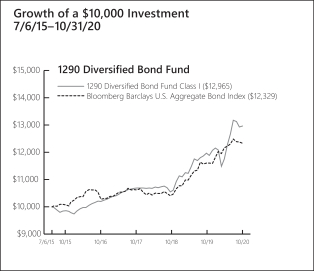

The graph illustrates comparative performance for $10,000 invested in the Class I Shares of the 1290 Diversified Bond Fund and the Bloomberg Barclays U.S. Aggregate Bond Index from 7/6/15 to 10/31/20. The performance of the Bloomberg Barclays U.S. Aggregate Bond Index reflects an initial investment at the end of the month closest to the Fund’s inception. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Bloomberg Barclays U.S. Aggregate Bond Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends, capital gain distributions, and interest of the securities included in the benchmark.

As of March 1, 2020, the gross expense ratios for Class A, I and R shares were 1.55%, 1.34% and 1.88%, respectively. The net expense ratios for Class A, I and R shares were 0.75%, 0.50% and 1.00%, respectively. The net expense ratios reflect the Adviser’s decision to contractually limit expenses through April 30, 2021. Fund Performance may also reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower.

In addition, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

PERFORMANCE SUMMARY

The Fund’s Class I shares returned 8.34% for the year ended October 31, 2020. The Fund’s benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, returned 6.19% over the same year.

Overview — Brandywine Global Investment Management, LLC (Brandywine Global)

Market Overview

The fixed-income markets generated mixed results over the twelve-months ended October 31, 2020 (Source: Brandywine Global). Most spread sectors (non-Treasuries) underperformed equal-duration Treasuries given periods of heightened risk aversion. This was driven by the ongoing pandemic, sharply falling global growth, aggressive monetary policy accommodation, ongoing trade conflicts, and a number of geopolitical issues.

Both short- and long-term U.S. Treasury yields moved sharply lower during the reporting period. Two-year Treasury yields began the reporting period at 1.52% and rose as high as 1.68% on November 7 and 8, 2019. Their low for the period of 0.11% occurred several times during the third quarter of 2020 and ended at 0.14% on October 31, 2020. Ten-year Treasury yields began the reporting period at 1.69% and moved as high as 1.94% on November 8, 2019. Their low of 0.52% occurred on August 4, 2020 and ended the reporting period at 0.88%.

All told, the Bloomberg Barclays U.S. Aggregate Bond Index, returned 6.19% for the twelve months ended October 31, 2020. For comparison purposes, riskier fixed-income securities, including high-yield bond and emerging market debt, produced weaker results. Over the fiscal year, the Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Index and the JPMorgan Emerging Markets Bond Index Global (“EMBI Global”) returned 3.42% and 1.97%, respectively.

4

1290 DIVERSIFIED BOND FUND (Unaudited)

Fund Highlights

The subadvisor believed the flexibility of the investment guidelines allowed them to nimbly position the Fund to take advantage of tactical opportunities and reallocate when risk on/risk off sentiment presented itself.

Portfolio Positioning:

| • | | U.S. Government/Investment Grade — At period end, we were negative U.S. Treasury duration as we are down on the space. Our bond model is presenting Treasuries as being extremely overvalued relative to their history. During times like these, our inclination has been to buy high quality corporate bonds that have strong balance sheets and resilient business models. |

| • | | International Sovereigns (Developed Markets) — We ended the period with tactical allocations in core Europe. At period end, we had sold out of our Italian sovereign exposure, but continued to have a short duration position in French OATs (government bonds) through futures. |

| • | | International Sovereigns (Emerging Markets) — At period end, we maintained exposure to select Emerging Markets that we believe exhibit attractive levels of high real yield and strong valuation tailwinds. |

| • | | Structured Credit — At period end, we maintained our position in structured credit. In the wake of the collapse of treasury yields, we had sold down our U.S. Treasury position and repatriated our profits into structured credit. |

| • | | Currency — We continue to believe the U.S. dollar is overvalued, and in the intermediate term, we expect the significant amount of quantitative easing (QE) to put downward pressure on the U.S. dollar. We focused non-dollar exposure in select emerging market and European currencies. |

What helped performance during the year?

| • | | The largest contributor to the Fund’s performance by far was its U.S. investment-grade corporate bond holdings. We regarded the significant widening of corporate spreads during the first quarter of 2020 and subsequent policy initiative as the kind of classic opportunity that we seek. We rotated heavily into this sector during the second quarter of 2020. More corporate spread tightening during the third quarter of 2020 further enhanced the Fund’s results. |

| • | | The Fund’s Italian BTP (government securities indexed to the Italian inflation rate) exposure was another notable positive performer. We initiated a position during the period through both the actual bonds and futures as its spreads greatly widened off the initial COVID-19 market sell-off. Italy had been devasted by the health crisis. Yet, the government’s aggressive efforts to combat the novel coronavirus had helped put the country in a position to open its economy. This, along with the fiscal and monetary aid from the European Central Bank (ECB) helped Italy’s economy and allowed Italian spreads to eventually compress. We closed out of the position in October 2020. |

| • | | Lastly, some emerging market bond holdings contributed to the Fund’s performance, with our local currency Mexican government bond exposure adding much value. Mexico’s central bank continued its interest rate cutting program during the period, bringing borrowing costs to their lowest since 2016. As a result, economic activity began to recover in Mexico during the summer, although uncertainty and downside risks are still present due to the lingering pandemic. |

What hurt performance during the year?

| • | | Much of the performance detraction came from our currency exposures, including the Brazilian real, Russian ruble, and Australian dollar. The risk-off selling of investors during the start of the COVID-19 pandemic affected many currencies, including the Brazilian real. However, instead of participating in the later emerging market asset rebound, the currency tumbled as economic headwinds remained for the country and the pandemic pushed Brazil’s public sector debt to a record 86% of gross domestic product in July 2020. For the ruble, the position was adversely impacted by rising COVID-19 cases, inflation, and geopolitical risks within Russia. Lastly, a short position in the Australian dollar as a risk-off hedge was a drag on performance. The Australian dollar appreciated significantly, as improving Purchasing Manager Index data in China helped lift the currencies of its trading partners. |

| • | | Another negative performer was the Fund’s agency mortgage backed security (MBS) allocations. During the March decline mortgage real estate investment trusts and traditional money managers, suffering margin calls and large redemptions during the downturn, were forced to liquidate MBS positions, largely driving the precipitous drop in prices from which the sector has yet to fully rebound. |

| | | | |

| | |

Fund Characteristics As of October 31, 2020 | | | |

Weighted Average Life (Years) | | | 9.39 | |

Weighted Average Coupon (%) | | | 4.39 | |

Weighted Average Effective Duration (Years)* | | | 3.20 | |

Weighted Average Rating** | | | A- | |

| |

* Effective duration is a measure of the price sensitivity of the Fund to interest rate movements, taking into account specific features of the securities in which it invests. ** Weighted Average Rating has been provided by the Investment Sub-Adviser. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations, including specific securities, money market instruments or other debts. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest); ratings are subject to change without notice. | |

5

1290 DIVERSIFIED BOND FUND (Unaudited)

| | | | |

| | |

Sector Weightings

as of October 31, 2020 | | % of

Net Assets | |

Foreign Government Securities | | | 21.6 | % |

U.S. Treasury Obligations | | | 17.5 | |

Industrials | | | 8.6 | |

Financials | | | 8.4 | |

Energy | | | 7.4 | |

Information Technology | | | 6.9 | |

Materials | | | 6.0 | |

Commercial Mortgage-Backed Securities | | | 4.1 | |

Consumer Discretionary | | | 3.4 | |

Consumer Staples | | | 3.2 | |

Collateralized Mortgage Obligations | | | 2.9 | |

Investment Companies | | | 2.1 | |

Utilities | | | 1.8 | |

Communication Services | | | 1.8 | |

Asset-Backed Securities | | | 1.2 | |

Health Care | | | 0.6 | |

Cash and Other | | | 2.5 | |

| | | | | |

| | | | 100.0 | % |

| | | | | |

Holdings are subject to change without notice. | | | | |

UNDERSTANDING YOUR EXPENSES:

As a shareholder of the Fund, you incur two types of costs:

(1) transaction costs, including applicable sales charges and redemption fees; and (2) ongoing costs, including investment advisory fees, distribution and/or service (12b-1) fees (in the case of Class A and Class R shares of the Fund), and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the six-month period ended October 31, 2020 and held for the entire six-month period.

Actual Expenses

The first line of the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

EXAMPLE

| | | | | | | | | | | | |

| | | | |

| | | Beginning

Account

Value

5/1/20 | | | Ending

Account

Value

10/31/20 | | | Expenses

Paid

During

Period*

5/1/20 -

10/31/20 | |

Class A | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,103.30 | | | | $3.97 | |

Hypothetical (5% average annual return before expenses) | | | 1,000.00 | | | | 1,021.37 | | | | 3.81 | |

Class I | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,103.00 | | | | 2.64 | |

Hypothetical (5% average annual return before expenses) | | | 1,000.00 | | | | 1,022.62 | | | | 2.54 | |

Class R | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,099.30 | | | | 5.28 | |

Hypothetical (5% average annual return before expenses) | | | 1,000.00 | | | | 1,020.11 | | | | 5.08 | |

| |

* Expenses are equal to the Portfolio’s A, I and R shares annualized expense ratio of 0.75%, 0.50% and 1.00%, respectively, multiplied by the average account value over the period, and multiplied by 184/366 (to reflect the one-half year period). | |

6

1290 FUNDS

1290 DIVERSIFIED BOND FUND

PORTFOLIO OF INVESTMENTS

October 31, 2020

| | | | | | | | |

| | | |

| | | Principal Amount | | | Value

(Note 1) | |

LONG-TERM DEBT SECURITIES: | | | | | | | | |

Asset-Backed Securities (1.2%) | | | | | |

Aames Mortgage Investment Trust, | |

Series 2006-1 A4

0.709%, 4/25/36 (l) | | $ | 849,593 | | | $ | 837,319 | |

Park Place Securities, Inc. Asset-Backed Pass-Through Certificates, | | | | | |

Series 2005-WHQ2 M2

0.839%, 5/25/35 (l) | | | 366,869 | | | | 364,700 | |

Popular ABS Mortgage Pass-Through Trust, | |

Series 2005-5 MV1

0.589%, 11/25/35 (l) | | | 548,273 | | | | 537,903 | |

Towd Point Mortgage Trust, | |

Series 2018-3 A2

3.875%, 5/25/58 (l)§ | | | 345,000 | | | | 367,195 | |

| | | | | | | | |

Total Asset-Backed Securities | | | | | | | 2,107,117 | |

| | | | | | | | |

Collateralized Mortgage Obligations (2.9%) | |

Angel Oak Mortgage Trust, | |

Series 2019-5 A2

2.716%, 10/25/49 (l)§ | | | 2,335,280 | | | | 2,361,811 | |

Connecticut Avenue Securities Trust, | |

Series 2018-R07 1M2

2.549%, 4/25/31 (l)§ | | | 481,761 | | | | 479,089 | |

FNMA, | | | | | | | | |

Series 2018-C06 1M2

2.149%, 3/25/31 (l) | | | 487,558 | | | | 472,875 | |

Residential Mortgage Loan Trust, | |

Series 2019-3 A1

2.633%, 9/25/59 (l)§ | | | 1,154,028 | | | | 1,175,769 | |

TDA CAM FTA, | |

Series 9 B

0.000%, 4/28/50 (l)(m) | | EUR | 800,000 | | | | 702,173 | |

| | | | | | | | |

Total Collateralized Mortgage Obligations | | | | | | | 5,191,717 | |

| | | | | | | | |

Commercial Mortgage-Backed Securities (4.1%) | |

Credit Suisse Mortgage Capital Certificates, | |

Series 2019-ICE4 A

1.128%, 5/15/36 (l)§ | | $ | 730,000 | | | | 729,092 | |

FREMF Mortgage Trust, | |

Series 2015-K48 B

3.639%, 8/25/48 (l)§ | | | 2,710,000 | | | | 2,924,987 | |

Series 2017-K61 C

3.684%, 12/25/49 (l)§ | | | 1,305,000 | | | | 1,360,383 | |

JPMBB Commercial Mortgage Securities Trust, | |

Series 2015-C32 C

4.654%, 11/15/48 (l) | | | 2,765,280 | | | | 2,308,435 | |

| | | | | | | | |

Total Commercial Mortgage-Backed Securities | | | | | | | 7,322,897 | |

| | | | | | | | |

Corporate Bonds (48.1%) | | | | | | | | |

Communication Services (1.8%) | | | | | |

Entertainment (0.7%) | | | | | | | | |

Walt Disney Co. (The)

4.625%, 3/23/40 | | | 275,000 | | | | 347,083 | |

4.700%, 3/23/50 | | | 710,000 | | | | 926,309 | |

| | | | | | | | |

| | | | | | | 1,273,392 | |

| | | | | | | | |

Interactive Media & Services (1.1%) | | | | | |

Baidu, Inc. | | | | | | | | |

2.375%, 10/9/30 | | | 390,000 | | | | 395,487 | |

Tencent Holdings Ltd. | | | | | | | | |

3.240%, 6/3/50§ | | | 1,450,000 | | | | 1,456,163 | |

| | | | | | | | |

| | | | | | | 1,851,650 | |

| | | | | | | | |

Total Communication Services | | | | | | | 3,125,042 | |

| | | | | | | | |

Consumer Discretionary (3.4%) | | | | | |

Automobiles (0.9%) | | | | | | | | |

General Motors Co. | | | | | | | | |

6.800%, 10/1/27 | | | 470,000 | | | | 580,022 | |

6.250%, 10/2/43 | | | 835,000 | | | | 1,025,435 | |

| | | | | | | | |

| | | | | | | 1,605,457 | |

| | | | | | | | |

Hotels, Restaurants & Leisure (2.5%) | | | | | |

Marriott International, Inc. | |

Series GG

3.500%, 10/15/32 | | | 3,375,000 | | | | 3,333,262 | |

McDonald’s Corp. | | | | | | | | |

3.600%, 7/1/30 | | | 80,000 | | | | 92,080 | |

3.625%, 9/1/49 | | | 105,000 | | | | 117,275 | |

4.200%, 4/1/50 | | | 320,000 | | | | 388,418 | |

Scientific Games International, Inc. | | | | | | | | |

5.000%, 10/15/25§ | | | 535,000 | | | | 535,669 | |

| | | | | | | | |

| | | | | | | 4,466,704 | |

| | | | | | | | |

Total Consumer Discretionary | | | | | | | 6,072,161 | |

| | | | | | | | |

Consumer Staples (3.2%) | | | | | | | | |

Beverages (1.0%) | | | | | | | | |

Anheuser-Busch InBev Worldwide, Inc. | | | | | | | | |

4.500%, 6/1/50 | | | 1,480,000 | | | | 1,753,502 | |

| | | | | | | | |

Food & Staples Retailing (1.9%) | | | | | |

Walgreens Boots Alliance, Inc. | | | | | | | | |

4.650%, 6/1/46 | | | 1,530,000 | | | | 1,656,151 | |

4.100%, 4/15/50 | | | 1,700,000 | | | | 1,704,313 | |

| | | | | | | | |

| | | | | | | 3,360,464 | |

| | | | | | | | |

Food Products (0.3%) | | | | | | | | |

BRF SA | | | | | | | | |

4.875%, 1/24/30§ | | | 510,000 | | | | 510,775 | |

| | | | | | | | |

Total Consumer Staples | | | | | | | 5,624,741 | |

| | | | | | | | |

Energy (7.4%) | | | | | | | | |

Oil, Gas & Consumable Fuels (7.4%) | | | | | |

Apache Corp. | | | | | | | | |

4.250%, 1/15/44 | | | 2,055,000 | | | | 1,741,613 | |

Cheniere Energy, Inc. | | | | | | | | |

4.625%, 10/15/28§ | | | 195,000 | | | | 202,129 | |

Concho Resources, Inc. | | | | | | | | |

4.875%, 10/1/47 | | | 1,235,000 | | | | 1,518,329 | |

Devon Energy Corp. | | | | | | | | |

5.600%, 7/15/41 | | | 190,000 | | | | 195,643 | |

5.000%, 6/15/45 | | | 90,000 | | | | 86,874 | |

Exxon Mobil Corp. | | | | | | | | |

4.114%, 3/1/46 | | | 1,250,000 | | | | 1,424,866 | |

See Notes to Financial Statements.

7

1290 FUNDS

1290 DIVERSIFIED BOND FUND

PORTFOLIO OF INVESTMENTS (Continued)

October 31, 2020

| | | | | | | | |

| | | |

| | | Principal Amount | | | Value

(Note 1) | |

Occidental Petroleum Corp. | | | | | | | | |

4.200%, 3/15/48 | | $ | 2,415,000 | | | $ | 1,569,750 | |

Petrobras Global Finance BV | | | | | | | | |

6.900%, 3/19/49 | | | 2,280,000 | | | | 2,580,139 | |

Petroleos Mexicanos | | | | | | | | |

6.500%, 6/2/41 | | | 665,000 | | | | 513,712 | |

7.690%, 1/23/50 | | | 3,065,000 | | | | 2,543,797 | |

Total Capital International SA

3.127%, 5/29/50 | | | 780,000 | | | | 770,564 | |

| | | | | | | | |

| | | | | | | 13,147,416 | |

| | | | | | | | |

Total Energy | | | | | | | 13,147,416 | |

| | | | | | | | |

Financials (8.4%) | | | | | | | | |

Banks (6.2%) | | | | | | | | |

Banco Mercantil del Norte SA | | | | | | | | |

(US Treasury Yield Curve Rate T Note Constant Maturity

5 Year + 4.97%),

6.750%, 9/27/24 (k)(m)(y) | | | 1,695,000 | | | | 1,688,644 | |

Bank of America Corp. | | | | | | | | |

(ICE LIBOR USD 3 Month + 3.15%), 4.083%, 3/20/51 (k) | | | 1,860,000 | | | | 2,271,069 | |

Bank of Nova Scotia (The) | | | | | | | | |

(SOFR + 0.55%), 0.650%, 9/15/23 (k) | | | 3,575,000 | | | | 3,574,486 | |

Itau Unibanco Holding SA | | | | | | | | |

(US Treasury Yield Curve Rate T Note Constant Maturity

5 Year + 3.98%),

6.125%, 12/12/22 (k)(m)(y) | | | 1,660,000 | | | | 1,583,432 | |

Wells Fargo & Co. | | | | | | | | |

(ICE LIBOR USD 3 Month + 3.77%), 4.478%, 4/4/31 (k) | | | 1,020,000 | | | | 1,225,879 | |

(ICE LIBOR USD 3 Month + 4.24%), 5.013%, 4/4/51 (k) | | | 515,000 | | | | 692,468 | |

| | | | | | | | |

| | | | | | | 11,035,978 | |

| | | | | | | | |

Capital Markets (1.8%) | | | | | | | | |

Ares Capital Corp. | | | | | | | | |

4.250%, 3/1/25 | | | 280,000 | | | | 292,706 | |

FS KKR Capital Corp. | | | | | | | | |

4.750%, 5/15/22 | | | 287,000 | | | | 293,684 | |

4.625%, 7/15/24 | | | 150,000 | | | | 151,627 | |

Intercontinental Exchange, Inc. | | | | | | | | |

3.000%, 6/15/50 | | | 910,000 | | | | 941,789 | |

Owl Rock Capital Corp. | | | | | | | | |

5.250%, 4/15/24 | | | 1,110,000 | | | | 1,164,746 | |

4.000%, 3/30/25 | | | 335,000 | | | | 336,569 | |

| | | | | | | | |

| | | | | | | 3,181,121 | |

| | | | | | | | |

Insurance (0.4%) | | | | | | | | |

Markel Corp. | | | | | | | | |

3.350%, 9/17/29 | | | 165,000 | | | | 181,007 | |

Teachers Insurance & Annuity Association of America | | | | | | | | |

3.300%, 5/15/50§ | | | 475,000 | | | | 481,748 | |

| | | | | | | | |

| | | | | | | 662,755 | |

| | | | | | | | |

Total Financials | | | | | | | 14,879,854 | |

| | | | | | | | |

Health Care (0.6%) | | | | | | | | |

Biotechnology (0.6%) | | | | | | | | |

Amgen, Inc. | | | | | | | | |

3.150%, 2/21/40 | | | 815,000 | | | | 857,387 | |

3.375%, 2/21/50 | | | 235,000 | | | | 249,919 | |

| | | | | | | | |

| | | | | | | 1,107,306 | |

| | | | | | | | |

Total Health Care | | | | | | | 1,107,306 | |

| | | | | | | | |

Industrials (8.6%) | | | | | | | | |

Aerospace & Defense (3.5%) | | | | | | | | |

Boeing Co. (The) | | | | | | | | |

3.750%, 2/1/50 | | | 3,665,000 | | | | 3,246,191 | |

5.805%, 5/1/50 | | | 845,000 | | | | 994,051 | |

3.950%, 8/1/59 | | | 365,000 | | | | 331,111 | |

Embraer Netherlands Finance BV | | | | | | | | |

6.950%, 1/17/28§ | | | 1,645,000 | | | | 1,644,105 | |

| | | | | | | | |

| | | | | | | 6,215,458 | |

| | | | | | | | |

Airlines (2.3%) | | | | | | | | |

Delta Air Lines, Inc. | | | | | | | | |

7.000%, 5/1/25§ | | | 693,000 | | | | 756,236 | |

4.750%, 10/20/28§ | | | 1,665,000 | | | | 1,698,300 | |

Southwest Airlines Co. | | | | | | | | |

5.125%, 6/15/27 | | | 1,505,000 | | | | 1,673,545 | |

| | | | | | | | |

| | | | | | | 4,128,081 | |

| | | | | | | | |

Construction & Engineering (0.8%) | | | | | |

Valmont Industries, Inc. | | | | | | | | |

5.000%, 10/1/44 | | | 1,300,000 | | | | 1,424,044 | |

| | | | | | | | |

Industrial Conglomerates (2.0%) | | | | | |

3M Co. | | | | | | | | |

3.700%, 4/15/50 | | | 285,000 | | | | 338,443 | |

General Electric Co. | | | | | | | | |

4.350%, 5/1/50 | | | 2,940,000 | | | | 3,123,232 | |

| | | | | | | | |

| | | | | | | 3,461,675 | |

| | | | | | | | |

Total Industrials | | | | | | | 15,229,258 | |

| | | | | | | | |

Information Technology (6.9%) | | | | | |

IT Services (1.2%) | | | | | | | | |

International Business Machines Corp. | | | | | | | | |

4.250%, 5/15/49 | | | 1,805,000 | | | | 2,224,576 | |

| | | | | | | | |

Semiconductors & Semiconductor Equipment (1.4%) | |

Intel Corp. | | | | | | | | |

4.750%, 3/25/50 | | | 625,000 | | | | 853,620 | |

4.950%, 3/25/60 | | | 150,000 | | | | 217,006 | |

NVIDIA Corp. | | | | | | | | |

3.500%, 4/1/40 | | | 195,000 | | | | 225,657 | |

3.500%, 4/1/50 | | | 485,000 | | | | 560,630 | |

NXP BV | | | | | | | | |

3.400%, 5/1/30§ | | | 515,000 | | | | 566,227 | |

| | | | | | | | |

| | | | | | | 2,423,140 | |

| | | | | | | | |

Software (2.7%) | | | | | | | | |

Oracle Corp. | | | | | | | | |

3.600%, 4/1/50 | | | 1,010,000 | | | | 1,101,306 | |

3.850%, 4/1/60 | | | 1,690,000 | | | | 1,928,147 | |

VMware, Inc. | | | | | | | | |

4.700%, 5/15/30 | | | 1,465,000 | | | | 1,722,763 | |

| | | | | | | | |

| | | | | | | 4,752,216 | |

| | | | | | | | |

See Notes to Financial Statements.

8

1290 FUNDS

1290 DIVERSIFIED BOND FUND

PORTFOLIO OF INVESTMENTS (Continued)

October 31, 2020

| | | | | | | | |

| | | |

| | | Principal Amount | | | Value

(Note 1) | |

Technology Hardware, Storage & Peripherals (1.6%) | |

Dell International LLC | | | | | | | | |

7.125%, 6/15/24§ | | $ | 485,000 | | | $ | 500,956 | |

6.020%, 6/15/26§ | | | 1,955,000 | | | | 2,318,122 | |

Hewlett Packard Enterprise Co. | | | | | | | | |

6.200%, 10/15/35 (e) | | | 75,000 | | | | 92,813 | |

| | | | | | | | |

| | | | | | | 2,911,891 | |

| | | | | | | | |

Total Information Technology | | | | | | | 12,311,823 | |

| | | | | | | | |

Materials (6.0%) | | | | | | | | |

Chemicals (0.3%) | | | | | | | | |

LYB International Finance III LLC | | | | | | | | |

4.200%, 5/1/50 | | | 510,000 | | | | 554,098 | |

| | | | | | | | |

Construction Materials (0.8%) | | | | | |

Cemex SAB de CV | | | | | | | | |

7.375%, 6/5/27§ | | | 1,290,000 | | | | 1,422,225 | |

| | | | | | | | |

Metals & Mining (4.9%) | | | | | | | | |

Anglo American Capital plc | | | | | | | | |

5.625%, 4/1/30§ | | | 1,365,000 | | | | 1,678,422 | |

First Quantum Minerals Ltd. | | | | | | | | |

6.500%, 3/1/24§ | | | 590,000 | | | | 585,575 | |

Freeport-McMoRan, Inc. | | | | | | | | |

5.450%, 3/15/43 | | | 3,165,000 | | | | 3,592,275 | |

Steel Dynamics, Inc. | | | | | | | | |

3.450%, 4/15/30 | | | 1,145,000 | | | | 1,261,576 | |

3.250%, 10/15/50 | | | 1,638,000 | | | | 1,587,530 | |

| | | | | | | | |

| | | | | | | 8,705,378 | |

| | | | | | | | |

Total Materials | | | | | | | 10,681,701 | |

| | | | | | | | |

Utilities (1.8%) | | | | | | | | |

Independent Power and Renewable Electricity Producers (0.9%) | |

AES Corp. (The) | | | | | | | | |

3.950%, 7/15/30§ | | | 1,450,000 | | | | 1,603,943 | |

| | | | | | | | |

Multi-Utilities (0.9%) | | | | | | | | |

Consolidated Edison Co. of New York, Inc. | |

Series 20A 3.350%, 4/1/30 | | | 1,145,000 | | | | 1,305,113 | |

Series 20B 3.950%, 4/1/50 | | | 210,000 | | | | 249,101 | |

| | | | | | | | |

| | | | | | | 1,554,214 | |

| | | | | | | | |

Total Utilities | | | | | | | 3,158,157 | |

| | | | | | | | |

Total Corporate Bonds | | | | | | | 85,337,459 | |

| | | | | | | | |

Foreign Government Securities (21.6%) | |

Commonwealth of Australia | |

5.750%, 7/15/22 (m) | | AUD | 6,695,000 | | | | 5,156,978 | |

Mex Bonos Desarr Fix Rt | | | | | | | | |

8.000%, 11/7/47 | | MXN | 199,000,000 | | | | 10,170,353 | |

Series M 6.500%, 6/9/22 | | | 71,400,000 | | | | 3,469,185 | |

Republic of Indonesia | | | | | | | | |

7.500%, 6/15/35 | | IDR | 46,700,000,000 | | | | 3,290,953 | |

7.500%, 4/15/40 | | | 53,300,000,000 | | | | 3,726,445 | |

Republic of South Africa | | | | | | | | |

8.750%, 2/28/48 | | ZAR | 271,330,000 | | | | 12,644,974 | |

| | | | | | | | |

Total Foreign Government Securities | | | | | | | 38,458,888 | |

| | | | | | | | |

U.S. Treasury Obligations (17.5%) | |

U.S. Treasury Notes | | | | | | | | |

(US Treasury 3 Month Bill Money Market Yield + 0.11%), 0.214%, 4/30/22 (k) | | $ | 17,540,000 | | | | 17,556,898 | |

(US Treasury 3 Month Bill Money Market Yield + 0.06%), 0.155%, 7/31/22 (k) | | | 13,475,000 | | | | 13,474,683 | |

| | | | | | | | |

Total U.S. Treasury Obligations | | | | | | | 31,031,581 | |

| | | | | | | | |

Total Long-Term Debt Securities (95.4%)

(Cost $165,464,106) | | | | | | | 169,449,659 | |

| | | | | | | | |

| | | |

| | | Number of

Shares | | | Value

(Note 1) | |

| | |

SHORT-TERM INVESTMENT: | | | | | | | | |

Investment Company (2.1%) | | | | | | | | |

JPMorgan Prime Money Market Fund, IM Shares | | | 3,677,346 | | | | 3,679,553 | |

| | | | | | | | |

Total Short-Term Investment (2.1%)

(Cost $3,679,892) | | | | | | | 3,679,553 | |

| | | | | | | | |

Total Investments in Securities (97.5%)

(Cost $169,143,998) | | | | | | | 173,129,212 | |

Other Assets Less Liabilities (2.5%) | | | | | | | 4,373,615 | |

| | | | | | | | |

Net Assets (100%) | | | | | | $ | 177,502,827 | |

| | | | | | | | |

| § | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may only be resold to qualified institutional buyers. At October 31, 2020, the market value of these securities amounted to $25,358,921 or 14.3% of net assets. Securities denoted with “§” but without “b” have been determined to be liquid under the guidelines established by the Board of Trustees. To the extent any securities might provide a right to demand registration, such rights have not been relied upon when determining liquidity. |

| (e) | Step Bond - Coupon rate increases or decreases in increments to maturity. Rate disclosed is as of October 31, 2020. Maturity date disclosed is the ultimate maturity date. |

| (k) | Variable or floating rate security, linked to the referenced benchmark. The interest rate shown was the current rate as of October 31, 2020. |

| (l) | Variable or floating rate security, the interest rate of which adjusts periodically based on changes in current interest rates and prepayments on the underlying pool of assets. The interest rate shown was the current rate as of October 31, 2020. |

| (m) | Regulation S is an exemption for securities offerings that are made outside of the United States and do not involve direct selling efforts in the United States. Resale restrictions may apply for purposes of the Securities Act of 1933. At October 31, 2020, the market value of these securities amounted to $9,131,227 or 5.1% of net assets. |

| (y) | Securities are perpetual and, thus, do not have a predetermined maturity date. The coupon rate for these securities are fixed for a period of time and may be structured to adjust thereafter. The date shown, if applicable, reflects the next call date. The coupon rate shown is the rate in effect as of October 31, 2020. |

See Notes to Financial Statements.

9

1290 FUNDS

1290 DIVERSIFIED BOND FUND

PORTFOLIO OF INVESTMENTS (Continued)

October 31, 2020

Glossary:

| | EUR | — European Currency Unit |

| | FNMA | — Federal National Mortgage Association |

| | ICE | — Intercontinental Exchange |

| | LIBOR | — London Interbank Offered Rate |

| | SOFR | — Secured Overnight Financing Rate |

| | USD | — United States Dollar |

| | | | |

| | |

Country Diversification As a Percentage of Total Net Assets | | | |

Australia | | | 2.9 | % |

Belgium | | | 1.0 | |

Brazil | | | 3.6 | |

Canada | | | 2.0 | |

China | | | 1.0 | |

France | | | 0.4 | |

Indonesia | | | 3.9 | |

Mexico | | | 11.2 | |

Netherlands | | | 0.3 | |

South Africa | | | 8.1 | |

Spain | | | 0.4 | |

United States | | | 62.4 | |

Zambia | | | 0.3 | |

Cash and Other | | | 2.5 | |

| | | | | |

| | | | 100.0 | % |

| | | | | |

Futures contracts outstanding as of October 31, 2020 (Note 1):

| | | | | | | | | | | | | | | | | | | | |

Description | | Number of

Contracts | | | Expiration

Date | | | Trading

Currency | | | Notional

Amount ($) | | | Value and

Unrealized

Appreciation

(Depreciation) ($) | |

Short Contracts | | | | | | | | | | | | | | | | | | | | |

Euro-OAT | | | (99 | ) | | | 12/2020 | | | | EUR | | | | (19,613,743 | ) | | | (266,585 | ) |

U.S. Treasury 10 Year Note | | | (141 | ) | | | 12/2020 | | | | USD | | | | (19,488,844 | ) | | | 138,547 | |

U.S. Treasury Ultra Bond | | | (102 | ) | | | 12/2020 | | | | USD | | | | (21,930,000 | ) | | | 532,638 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 404,600 | |

| | | | | | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

10

1290 FUNDS

1290 DIVERSIFIED BOND FUND

PORTFOLIO OF INVESTMENTS (Continued)

October 31, 2020

Forward Foreign Currency Contracts outstanding as of October 31, 2020 (Note 1):

| | | | | | | | | | | | | | | | | | | | |

Currency Purchased | | | Currency Sold | | | Counterparty | | Settlement

Date | | | Unrealized

Appreciation

(Depreciation) ($) | |

NZD | | | 11,010,000 | | | USD | | | 7,261,205 | | | HSBC Bank plc | | | 11/4/2020 | | | | 18,607 | |

USD | | | 13,644,774 | | | NZD | | | 20,520,000 | | | JPMorgan Chase Bank | | | 11/4/2020 | | | | 76,950 | |

MXN | | | 170,600,000 | | | USD | | | 7,761,531 | | | JPMorgan Chase Bank | | | 11/5/2020 | | | | 279,274 | |

USD | | | 2,757,534 | | | PEN | | | 9,800,000 | | | HSBC Bank plc** | | | 11/6/2020 | | | | 47,014 | |

ZAR | | | 55,400,000 | | | USD | | | 3,302,278 | | | JPMorgan Chase Bank | | | 11/13/2020 | | | | 98,070 | |

USD | | | 5,282,088 | | | RUB | | | 411,000,000 | | | Citibank NA** | | | 11/17/2020 | | | | 115,913 | |

USD | | | 17,865,901 | | | HUF | | | 5,530,000,000 | | | HSBC Bank plc | | | 11/18/2020 | | | | 312,387 | |

USD | | | 8,332,866 | | | AUD | | | 11,780,000 | | | HSBC Bank plc | | | 11/25/2020 | | | | 51,736 | |

USD | | | 7,430,088 | | | AUD | | | 10,360,000 | | | JPMorgan Chase Bank | | | 11/25/2020 | | | | 147,193 | |

KRW | | | 3,060,000,000 | | | USD | | | 2,582,714 | | | HSBC Bank plc** | | | 12/11/2020 | | | | 113,923 | |

USD | | | 13,051,506 | | | CHF | | | 11,840,000 | | | Goldman Sachs Bank USA | | | 12/11/2020 | | | | 123,753 | |

USD | | | 3,345,834 | | | CHF | | | 3,050,000 | | | HSBC Bank plc | | | 12/11/2020 | | | | 15,627 | |

USD | | | 8,433,475 | | | EUR | | | 7,190,000 | | | Citibank NA | | | 1/12/2021 | | | | 44,662 | |

USD | | | 5,084,664 | | | EUR | | | 4,300,000 | | | HSBC Bank plc | | | 1/12/2021 | | | | 67,711 | |

MXN | | | 6,500,000 | | | USD | | | 301,568 | | | Citibank NA | | | 2/3/2021 | | | | 1,696 | |

| | | | | | | | | | | | | | | | | | | | |

Total unrealized appreciation | | | | | | | 1,514,516 | |

| | | | | | | | | | | | | | | | | | | | |

NZD | | | 9,830,000 | | | USD | | | 6,567,472 | | | JPMorgan Chase Bank | | | 11/4/2020 | | | | (67,876 | ) |

USD | | | 210,493 | | | NZD | | | 320,000 | | | Morgan Stanley | | | 11/4/2020 | | | | (1,091 | ) |

USD | | | 6,868,885 | | | MXN | | | 156,800,000 | | | Citibank NA | | | 11/5/2020 | | | | (521,492 | ) |

USD | | | 608,862 | | | MXN | | | 13,800,000 | | | National Australia Bank Ltd. | | | 11/5/2020 | | | | (41,567 | ) |

PEN | | | 9,800,000 | | | USD | | | 2,788,265 | | | HSBC Bank plc** | | | 11/6/2020 | | | | (77,745 | ) |

USD | | | 8,996,089 | | | ZAR | | | 151,600,000 | | | Citibank NA | | | 11/13/2020 | | | | (308,833 | ) |

USD | | | 3,435,512 | | | ZAR | | | 60,700,000 | | | HSBC Bank plc | | | 11/13/2020 | | | | (290,140 | ) |

USD | | | 2,956,324 | | | ZAR | | | 50,800,000 | | | JPMorgan Chase Bank | | | 11/13/2020 | | | | (161,684 | ) |

USD | | | 198,835 | | | ZAR | | | 3,400,000 | | | Morgan Stanley | | | 11/13/2020 | | | | (9,851 | ) |

RUB | | | 1,110,000,000 | | | USD | | | 14,583,477 | | | Citibank NA** | | | 11/17/2020 | | | | (631,034 | ) |

HUF | | | 4,180,000,000 | | | USD | | | 13,708,763 | | | HSBC Bank plc | | | 11/18/2020 | | | | (440,465 | ) |

HUF | | | 1,350,000,000 | | | USD | | | 4,370,161 | | | Morgan Stanley | | | 11/18/2020 | | | | (84,945 | ) |

CZK | | | 191,000,000 | | | USD | | | 8,342,068 | | | HSBC Bank plc | | | 11/19/2020 | | | | (177,930 | ) |

GBP | | | 200,000 | | | USD | | | 267,703 | | | Citibank NA | | | 11/20/2020 | | | | (8,575 | ) |

GBP | | | 7,150,000 | | | USD | | | 9,422,823 | | | HSBC Bank plc | | | 11/20/2020 | | | | (159,010 | ) |

USD | | | 4,587,623 | | | GBP | | | 3,560,000 | | | Citibank NA | | | 11/20/2020 | | | | (24,849 | ) |

USD | | | 2,965,753 | | | GBP | | | 2,320,000 | | | HSBC Bank plc | | | 11/20/2020 | | | | (40,127 | ) |

AUD | | | 10,360,000 | | | USD | | | 7,615,636 | | | HSBC Bank plc | | | 11/25/2020 | | | | (332,740 | ) |

AUD | | | 11,780,000 | | | USD | | | 8,474,827 | | | JPMorgan Chase Bank | | | 11/25/2020 | | | | (193,696 | ) |

CLP | | | 7,810,000,000 | | | USD | | | 10,199,151 | | | HSBC Bank plc** | | | 12/4/2020 | | | | (101,407 | ) |

USD | | | 6,075,564 | | | CLP | | | 4,815,000,000 | | | HSBC Bank plc** | | | 12/4/2020 | | | | (149,870 | ) |

GBP | | | 4,810,000 | | | USD | | | 6,398,238 | | | Citibank NA | | | 12/8/2020 | | | | (165,368 | ) |

GBP | | | 120,000 | | | USD | | | 159,120 | | | JPMorgan Chase Bank | | | 12/8/2020 | | | | (3,622 | ) |

USD | | | 2,617,432 | | | KRW | | | 3,060,000,000 | | | HSBC Bank plc** | | | 12/11/2020 | | | | (79,206 | ) |

EUR | | | 6,500,000 | | | USD | | | 7,640,685 | | | Citibank NA | | | 1/12/2021 | | | | (56,918 | ) |

BRL | | | 36,900,000 | | | USD | | | 6,593,878 | | | HSBC Bank plc** | | | 1/14/2021 | | | | (179,575 | ) |

COP | | | 65,800,000,000 | | | USD | | | 16,973,856 | | | JPMorgan Chase Bank** | | | 1/22/2021 | | | | (36,343 | ) |

USD | | | 5,301,305 | | | JPY | | | 555,000,000 | | | JPMorgan Chase Bank | | | 1/26/2021 | | | | (6,577 | ) |

USD | | | 8,876,704 | | | ZAR | | | 147,000,000 | | | HSBC Bank plc | | | 1/29/2021 | | | | (63,668 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total unrealized depreciation | | | | | | | (4,416,204 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net unrealized depreciation | | | | | | | (2,901,688 | ) |

| | | | | | | | | | | | | | | | | | | | |

| ** | Non-deliverable forward. |

See Notes to Financial Statements.

11

1290 FUNDS

1290 DIVERSIFIED BOND FUND

PORTFOLIO OF INVESTMENTS (Continued)

October 31, 2020

Centrally Cleared Credit default swap contracts outstanding — sell protection as of October 31, 2020 (Note 1):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reference

Obligation/Index | | Financing

Rate (Paid) /

Received

by the

Fund (%) | | | Frequency of

Payments

Made/

Received | | | Maturity

Date | | | Implied

Credit

Spread (%) | | | Notional

Amount | | | Upfront

(Payments)

Receipts ($) | | | Unrealized

Appreciation

(Depreciation) ($) | | | Value ($) | |

Goodyear Tire & Rubber Co. (The) | | | 5.00 | | | | Quarterly | | | | 6/20/2022 | | | | 1.30 | | | USD | 1,010,000 | | | | 62,960 | | | | 3,780 | | | | 66,740 | |

United States Steel Corp. | | | 5.00 | | | | Quarterly | | | | 6/20/2021 | | | | 4.95 | | | USD | 520,000 | | | | 13,094 | | | | (10,049 | ) | | | 3,045 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | 76,054 | | | | (6,269 | ) | | | 69,785 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Centrally Cleared Credit default swap contracts outstanding — buy protection as of October 31, 2020 (Note 1):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reference

Obligation/Index | | Financing

Rate (Paid) /

Received

by the

Fund (%) | | | Frequency of

Payments

Made/

Received | | | Maturity

Date | | | Implied

Credit

Spread (%) | | | Notional

Amount | | | Upfront

(Payments)

Receipts ($) | | | Unrealized

Appreciation

(Depreciation) ($) | | | Value ($) | |

CDX North American High Yield Index Series 35-V1 | | | 5.00 | | | | Quarterly | | | | 12/20/2025 | | | | 4.23 | | | USD | 8,435,000 | | | | (324,633 | ) | | | (11,917 | ) | | | (336,550 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Centrally Cleared Credit default swap contracts outstanding | | | | (248,579 | ) | | | (18,186 | ) | | | (266,765 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The following is a summary of the inputs used to value the Fund’s assets and liabilities carried at fair value as of October 31, 2020:

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| | | | | | | | | | | | | | | | |

| | | | | |

| Investment Type | | Level 1

Quoted Prices in

Active Markets for

Identical

Securities | | | Level 2

Significant Other

Observable Inputs

(including quoted prices

for similar securities,

interest rates,

prepayment speeds,

credit risk, etc.) | | | Level 3

Significant Unobservable

Inputs (including the

Fund’s own

assumptions in

determining the fair

value of investments) | | | Total | |

Assets: | |

Asset-Backed Securities | | $ | — | | | $ | 2,107,117 | | | $ | — | | | $ | 2,107,117 | |

Centrally Cleared Credit Default Swaps | | | — | | | | 3,780 | | | | — | | | | 3,780 | |

Collateralized Mortgage Obligations | | | — | | | | 5,191,717 | | | | — | | | | 5,191,717 | |

Commercial Mortgage-Backed Securities | | | — | | | | 7,322,897 | | | | — | | | | 7,322,897 | |

Corporate Bonds | | | | | | | | | | | | | | | | |

Communication Services | | | — | | | | 3,125,042 | | | | — | | | | 3,125,042 | |

Consumer Discretionary | | | — | | | | 6,072,161 | | | | — | | | | 6,072,161 | |

Consumer Staples | | | — | | | | 5,624,741 | | | | — | | | | 5,624,741 | |

Energy | | | — | | | | 13,147,416 | | | | — | | | | 13,147,416 | |

Financials | | | — | | | | 14,879,854 | | | | — | | | | 14,879,854 | |

Health Care | | | — | | | | 1,107,306 | | | | — | | | | 1,107,306 | |

Industrials | | | — | | | | 15,229,258 | | | | — | | | | 15,229,258 | |

Information Technology | | | — | | | | 12,311,823 | | | | — | | | | 12,311,823 | |

Materials | | | — | | | | 10,681,701 | | | | — | | | | 10,681,701 | |

Utilities | | | — | | | | 3,158,157 | | | | — | | | | 3,158,157 | |

See Notes to Financial Statements.

12

1290 FUNDS

1290 DIVERSIFIED BOND FUND

PORTFOLIO OF INVESTMENTS (Continued)

October 31, 2020

| | | | | | | | | | | | | | | | |

| | | | | |

| Investment Type | | Level 1

Quoted Prices in

Active Markets for

Identical

Securities | | | Level 2

Significant Other

Observable Inputs

(including quoted prices

for similar securities,

interest rates,

prepayment speeds,

credit risk, etc.) | | | Level 3

Significant Unobservable

Inputs (including the

Fund’s own

assumptions in

determining the fair

value of investments) | | | Total | |

Foreign Government Securities | | $ | — | | | $ | 38,458,888 | | | $ | — | | | $ | 38,458,888 | |

Forward Currency Contracts | | | — | | | | 1,514,516 | | | | — | | | | 1,514,516 | |

Futures | | | 671,185 | | | | — | | | | — | | | | 671,185 | |

Short-Term Investment | | | | | | | | | | | | | | | | |

Investment Company | | | 3,679,553 | | | | — | | | | — | | | | 3,679,553 | |

U.S. Treasury Obligations | | | — | | | | 31,031,581 | | | | — | | | | 31,031,581 | |

| | | | | | | | | | | | | | | | |

Total Assets | | $ | 4,350,738 | | | $ | 170,967,955 | | | $ | — | | | $ | 175,318,693 | |

| | | | | | | | | | | | | | | | |

| | | | |

Liabilities: | | | | | | | | | | | | | | | | |

Centrally Cleared Credit Default Swaps | | $ | — | | | $ | (21,966 | ) | | $ | — | | | $ | (21,966 | ) |

Forward Currency Contracts | | | — | | | | (4,416,204 | ) | | | — | | | | (4,416,204 | ) |

Futures | | | (266,585 | ) | | | — | | | | — | | | | (266,585 | ) |

| | | | | | | | | | | | | | | | |

Total Liabilities | | $ | (266,585 | ) | | $ | (4,438,170 | ) | | $ | — | | | $ | (4,704,755 | ) |

| | | | | | | | | | | | | | | | |

Total | | $ | 4,084,153 | | | $ | 166,529,785 | | | $ | — | | | $ | 170,613,938 | |

| | | | | | | | | | | | | | | | |

Fair Values of Derivative Instruments as of October 31, 2020:

| | | | | | |

| | | Statement of Assets and Liabilities | |

Derivatives Contracts^ | | Asset Derivatives | | Fair Value | |

Interest rate contracts | | Receivables, Net assets - Unrealized appreciation | | $ | 671,185 | * |

Foreign exchange contracts | | Receivables | | | 1,514,516 | |

Credit contracts | | Receivables | | | 3,780 | |

| | | | | | |

Total | | | | $ | 2,189,481 | |

| | | | | | |

| | |

| | | Liability Derivatives | | | |

Interest rate contracts | | Payables, Net assets - Unrealized depreciation | | $ | (266,585 | )* |

Foreign exchange contracts | | Payables | | | (4,416,204 | ) |

Credit contracts | | Payables | | | (21,966 | ) |

| | | | | | |

Total | | | | $ | (4,704,755 | ) |

| | | | | | |

| * | Includes cumulative appreciation/depreciation of futures contracts as reported in the Portfolio of Investments. Only variation margin is reported within the Statement of Assets & Liabilities. |

The Effect of Derivative Instruments on the Statement of Operations for the year ended October 31, 2020:

| | | | | | | | | | | | | | | | |

| Amount of Realized Gain or (Loss) on Derivatives Recognized in Income | |

Derivatives Contracts^ | | Futures | | | Forward

Foreign

Currency

Contracts | | | Swaps | | | Total | |

Interest rate contracts | | $ | 1,500,672 | | | $ | — | | | $ | 122,133 | | | $ | 1,622,805 | |

Foreign exchange contracts | | | — | | | | (1,001,536 | ) | | | — | | | | (1,001,536 | ) |

Credit contracts | | | — | | | | — | | | | (1,805,608 | ) | | | (1,805,608 | ) |

| | | | | | | | | | | | | | | | |

Total | | $ | 1,500,672 | | | $ | (1,001,536 | ) | | $ | (1,683,475 | ) | | $ | (1,184,339 | ) |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

13

1290 FUNDS

1290 DIVERSIFIED BOND FUND

PORTFOLIO OF INVESTMENTS (Continued)

October 31, 2020

| | | | | | | | | | | | | | | | |

| Amount of Unrealized Appreciation or (Depreciation) on Derivatives Recognized in Income | |

Derivatives Contracts^ | | Futures | | | Forward

Foreign

Currency

Contracts | | | Swaps | | | Total | |

Interest rate contracts | | $ | 374,592 | | | $ | — | | | $ | — | | | $ | 374,592 | |

Foreign exchange contracts | | | — | | | | (3,068,660 | ) | | | — | | | | (3,068,660 | ) |

Credit contracts | | | — | | | | — | | | | (43,038 | ) | | | (43,038 | ) |

| | | | | | | | | | | | | | | | |

Total | | $ | 374,592 | | | $ | (3,068,660 | ) | | $ | (43,038 | ) | | $ | (2,737,106 | ) |

| | | | | | | | | | | | | | | | |

^ This Fund held forward foreign currency contracts, futures and swaps contracts as a substitute for investing in conventional securities, hedging and in an attempt to enhance returns.

The Fund held swap contracts with an average notional balance of approximately $11,976,000, forward foreign currency contracts with an average settlement value of approximately $172,877,000 and futures contracts with an average notional balance of approximately $42,313,000 during the year ended October 31, 2020.

The following table presents the Fund’s gross derivative assets and liabilities by counterparty net of amounts available for offset under netting arrangements and any related collateral received or pledged by the Fund as of October 31, 2020:

| | | | | | | | | | | | | | | | |

Counterparty | | Gross Amount of

Derivative Assets

Presented in the

Statement of Assets

and Liabilities (a) | | | Derivatives

Available

for Offset | | | Collateral

Received | | | Net Amount Due

from Counterparty | |

Citibank NA | | $ | 162,271 | | | $ | (162,271 | ) | | $ | — | | | $ | — | |

Goldman Sachs Bank USA | | | 123,753 | | | | — | | | | — | | | | 123,753 | |

HSBC Bank plc | | | 627,005 | | | | (627,005 | ) | | | — | | | | — | |

JPMorgan Chase Bank | | | 601,487 | | | | (469,798 | ) | | | (70,000 | ) | | | 61,689 | |

| | | | | | | | | | | | | | | | |

Total | | $ | 1,514,516 | | | $ | (1,259,074 | ) | | $ | (70,000 | ) | | $ | 185,442 | |

| | | | | | | | | | | | | | | | |

| | | | |

Counterparty | | Gross Amount of

Derivative Liabilities

Presented in the

Statement of Assets

and Liabilities (a) | | | Derivatives

Available

for Offset | | | Collateral

Pledged | | | Net Amount Due

to Counterparty | |

Citibank NA | | $ | 1,717,069 | | | $ | (162,271 | ) | | $ | (490,000 | ) | | $ | 1,064,798 | |

HSBC Bank plc | | | 2,091,883 | | | | (627,005 | ) | | | (430,000 | ) | | | 1,034,878 | |

JPMorgan Chase Bank | | | 469,798 | | | | (469,798 | ) | | | — | | | | — | |

Morgan Stanley | | | 95,887 | | | | — | | | | — | | | | 95,887 | |

National Australia Bank Ltd. | | | 41,567 | | | | — | | | | — | | | | 41,567 | |

| | | | | | | | | | | | | | | | |

Total | | $ | 4,416,204 | | | $ | (1,259,074 | ) | | $ | (920,000 | ) | | $ | 2,237,130 | |

| | | | | | | | | | | | | | | | |

| (a) | For financial reporting purposes the Fund does not offset derivative assets and derivative liabilities subject to master netting arrangements in the Statement of Assets and Liabilities. |

Investment security transactions for the year ended October 31, 2020 were as follows:

| | | | |

Cost of Purchases: | | | | |

Long-term investments other than U.S. government debt securities | | $ | 199,525,489 | |

Long-term U.S. government debt securities | | | 108,440,259 | |

| | | | |

| | $ | 307,965,748 | |

| | | | |

Net Proceeds of Sales and Redemptions: | | | | |

Long-term investments other than U.S. government debt securities | | $ | 143,502,986 | |

Long-term U.S. government debt securities | | | 82,931,218 | |

| | | | |

| | $ | 226,434,204 | |

| | | | |

See Notes to Financial Statements.

14

1290 FUNDS

1290 DIVERSIFIED BOND FUND

PORTFOLIO OF INVESTMENTS (Continued)

October 31, 2020

As of October 31, 2020, the gross unrealized appreciation (depreciation) of investments based on the aggregate cost of investments in securities and derivative instruments, if applicable, for Federal income tax purposes was as follows:

| | | | |

Aggregate gross unrealized appreciation | | $ | 9,106,087 | |

Aggregate gross unrealized depreciation | | | (5,675,112 | ) |

| | | | |

Net unrealized appreciation | | $ | 3,430,975 | |

| | | | |

Federal income tax cost of investments in securities and derivative instruments, if applicable | | $ | 166,934,384 | |

| | | | |

See Notes to Financial Statements.

15

1290 FUNDS

1290 DIVERSIFIED BOND FUND

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2020

| | | | |

ASSETS | | | | |

Investments in Securities, at value

(Cost $169,143,998) | | $ | 173,129,212 | |

Cash | | | 1,363,174 | |

Foreign cash (Cost $913) | | | 907 | |

Cash held as collateral for forward foreign currency contracts | | | 920,000 | |

Due from broker for futures variation margin | | | 2,027,510 | |

Receivable for Fund shares sold | | | 1,785,226 | |

Dividends, interest and other receivables | | | 1,755,138 | |

Unrealized appreciation on forward foreign currency contracts | | | 1,514,516 | |

Variation Margin on Centrally Cleared Swaps | | | 1,501,887 | |

Prepaid registration and filing fees | | | 30,043 | |

Other assets | | | 3,961 | |

| | | | |

Total assets | | | 184,031,574 | |

| | | | |

LIABILITIES | | | | |

Unrealized depreciation on forward foreign currency contracts | | | 4,416,204 | |

Payable for securities purchased | | | 1,769,011 | |

Payable for Fund shares redeemed | | | 120,875 | |

Payable for return of cash collateral on forward foreign currency contracts | | | 70,000 | |

Administrative fees payable | | | 15,290 | |

Transfer agent fees payable | | | 6,762 | |

Trustees’ fees payable | | | 3,549 | |

Distribution fees payable – Class A | | | 1,650 | |

Distribution fees payable – Class R | | | 125 | |

Accrued expenses | | | 125,281 | |

| | | | |

Total liabilities | | | 6,528,747 | |

| | | | |

NET ASSETS | | $ | 177,502,827 | |

| | | | |

Net assets were comprised of: | | | | |

Paid in capital | | $ | 171,182,627 | |

Total distributable earnings (loss) | | | 6,320,200 | |

| | | | |

Net assets | | $ | 177,502,827 | |

| | | | |

Class A | | | | |

Net asset value and redemption price per share, $7,795,721 / 730,095 shares outstanding (unlimited amount authorized: $0.001 par value) | | $ | 10.68 | |

Maximum sales charge (4.50% of offering price) | | | 0.50 | |

| | | | |

Maximum offering price per share | | $ | 11.18 | |

| | | | |

Class I | | | | |

Net asset value, offering and redemption price per share, $169,408,721 / 15,824,941 shares outstanding (unlimited amount authorized: $0.001 par value) | | $ | 10.71 | |

| | | | |

Class R | | | | |

Net asset value, offering and redemption price per share, $298,385 / 28,058 shares outstanding (unlimited amount authorized: $0.001 par value) | | $ | 10.63 | |

| | | | |

STATEMENT OF OPERATIONS

For the Year Ended October 31, 2020

| | | | |

INVESTMENT INCOME | | | | |

Interest (net of $75,954 foreign withholding tax) | | $ | 5,341,518 | |

Dividends | | | 31,398 | |

| | | | |

Total income | | | 5,372,916 | |

| | | | |

EXPENSES | |

Investment advisory fees | | | 724,551 | |

Administrative fees | | | 181,139 | |

Professional fees | | | 143,440 | |

Transfer agent fees | | | 118,100 | |

Printing and mailing expenses | | | 81,495 | |

Registration and filing fees | | | 49,429 | |

Custodian fees | | | 45,900 | |

Distribution fees – Class A | | | 15,464 | |

Trustees’ fees | | | 10,234 | |

Distribution fees – Class R | | | 948 | |

Miscellaneous | | | 58,783 | |

| | | | |

Gross expenses | | | 1,429,483 | |

Less: Waiver from investment adviser | | | (809,448 | ) |

| | | | |

Net expenses | | | 620,035 | |

| | | | |

NET INVESTMENT INCOME (LOSS) | | | 4,752,881 | |

| | | | |

REALIZED AND UNREALIZED GAIN (LOSS) | |

Realized gain (loss) on: | | | | |

Investments in securities | | | 3,729,634 | |

Futures contracts | | | 1,500,672 | |

Forward foreign currency contracts | | | (1,001,536 | ) |

Foreign currency transactions | | | (834,304 | ) |

Swaps | | | (1,683,475 | ) |

| | | | |

Net realized gain (loss) | | | 1,710,991 | |

| | | | |

Change in unrealized appreciation (depreciation) on: | |

Investments in securities | | | 4,107,958 | |

Futures contracts | | | 374,592 | |

Forward foreign currency contracts | | | (3,068,660 | ) |

Foreign currency translations | | | 9,144 | |

Swaps | | | (43,038 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) | | | 1,379,996 | |

| | | | |

NET REALIZED AND UNREALIZED GAIN (LOSS) | | | 3,090,987 | |

| | | | |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 7,843,868 | |

| | | | |

See Notes to Financial Statements.

16

1290 FUNDS

1290 DIVERSIFIED BOND FUND

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Year Ended October 31, | |

| | | 2020 | | | 2019 | |

INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: | | | | | | | | |

Net investment income (loss) | | $ | 4,752,881 | | | $ | 2,144,112 | |

Net realized gain (loss) | | | 1,710,991 | | | | 2,739,734 | |

Net change in unrealized appreciation (depreciation) | | | 1,379,996 | | | | 1,170,648 | |

| | | | | | | | |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | | 7,843,868 | | | | 6,054,494 | |

| | | | | | | | |

Distributions to shareholders: | | | | | | | | |

Class A | | | (285,275 | ) | | | (81,362 | ) |

Class I | | | (4,265,925 | ) | | | (2,130,998 | ) |

Class R | | | (6,818 | ) | | | (4,205 | ) |

| | | | | | | | |

Total distributions to shareholders | | | (4,558,018 | ) | | | (2,216,565 | ) |

| | | | | | | | |

CAPITAL SHARES TRANSACTIONS: | | | | | | | | |

Class A | | | | | | | | |

Capital shares sold [632,166 and 432,884 shares, respectively] | | | 6,539,329 | | | | 4,348,727 | |

Capital shares issued in reinvestment of dividends [28,380 and 7,599 shares, respectively] | | | 280,472 | | | | 77,418 | |

Capital shares repurchased [(302,477) and (88,427) shares, respectively] | | | (3,076,148 | ) | | | (910,471 | ) |

| | | | | | | | |

Total Class A transactions | | | 3,743,653 | | | | 3,515,674 | |

| | | | | | | | |

Class I | | | | | | | | |

Capital shares sold [10,858,869 and 5,191,046 shares, respectively] | | | 113,708,337 | | | | 52,777,026 | |

Capital shares issued in reinvestment of dividends [286,239 and 87,879 shares, respectively] | | | 2,834,997 | | | | 899,213 | |

Capital shares repurchased [(3,157,638) and (650,622) shares, respectively] | | | (31,454,948 | ) | | | (6,704,718 | ) |

| | | | | | | | |

Total Class I transactions | | | 85,088,386 | | | | 46,971,521 | |

| | | | | | | | |

Class R | | | | | | | | |

Capital shares sold [15,969 and 3,873 shares, respectively] | | | 161,483 | | | | 39,837 | |

Capital shares issued in reinvestment of dividends [209 and 48 shares, respectively] | | | 2,059 | | | | 490 | |

Capital shares repurchased [(2,149) and (17) shares, respectively] | | | (20,526 | ) | | | (166 | ) |

| | | | | | | | |

Total Class R transactions | | | 143,016 | | | | 40,161 | |

| | | | | | | | |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM CAPITAL SHARE TRANSACTIONS | | | 88,975,055 | | | | 50,527,356 | |

| | | | | | | | |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 92,260,905 | | | | 54,365,285 | |

NET ASSETS: | |

Beginning of year | | | 85,241,922 | | | | 30,876,637 | |

| | | | | | | | |

End of year | | $ | 177,502,827 | | | $ | 85,241,922 | |

| | | | | | | | |

See Notes to Financial Statements.

17

1290 FUNDS

1290 DIVERSIFIED BOND FUND

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended October 31, | |

| Class A | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

Net asset value, beginning of year | | $ | 10.34 | | | $ | 9.52 | | | $ | 10.12 | | | $ | 9.89 | | | $ | 9.82 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

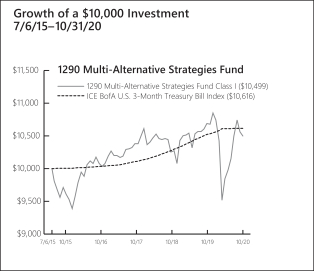

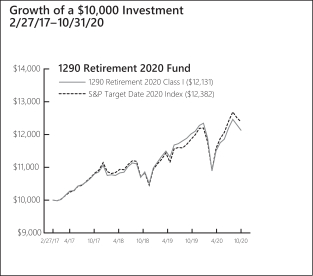

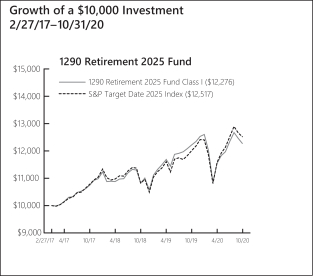

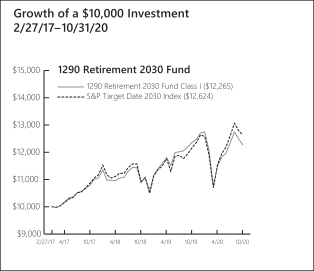

Net investment income (loss) (e) | | | 0.39 | * | | | 0.41 | ** | | | 0.26 | | | | 0.19 | | | | 0.16 | |