UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-22959

1290 FUNDS

(Exact name of registrant as specified in charter)

1290 Avenue of the Americas

New York, New York 10104

(Address of principal executive offices)

WILLIAM T. MACGREGOR ESQ.

Executive Vice President and Secretary

AXA Equitable Funds Management Group, LLC

1290 Avenue of the Americas

New York, New York 10104

(Name and Address of Agent for Service)

Copies to:

MARK C. AMOROSI, ESQ.

K&L Gates LLP

1601 K Street N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (212) 554-1234

Date of fiscal year end: October 31

Date of reporting period: October 31, 2018

| Item 1. | Reports to Stockholders. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Annual Report

October 31, 2018

1290 Funds

Annual Report

October 31, 2018

Table of Contents

Market Overview for the Twelve-Month Period Ended October 31, 2018

Economic Overview

In the twelve-month period ended October 31, 2018, against a generally positive economic backdrop, disruptions related to U.S. trade and foreign policy and a bumpy British exit from the European Union (Brexit) upended global markets, destabilizing business and consumer sentiment around the world.

Central Bank activity continued to be focused on normalizing balance sheets and unwinding stimulus strategies. The U.S. Federal Reserve raised rates four times and suggested it would continue to raise rates through the balance of 2018 and well into 2019. The Bank of England also raised rates. The Bank of Japan held rates and yields steady but widened the band around 10-year yields, potentially allowing them to move higher. In Europe, doubt over Italy’s formation of a new government gave way to concerns over budget deficit negotiations with the European Union. Meanwhile, Brexit negotiations reached an impasse late in the reporting period when the UK’s latest plan was unanimously rejected by Britain’s government, weighing on sentiment. Despite these uncertainties, Bloomberg Economics forecasts interest-rate increases around most of the developed world through next year.

In the emerging world, a stronger U.S. dollar and worsening global trade war kept pressure on financial assets everywhere and dimmed the outlook for China’s economy (despite a series of policies from the Chinese government aimed at boosting domestic demand). Financial instability in Turkey moderated over the quarter, as the country moved toward a more orthodox relationship between the government and the central bank. News in Argentina that the International Monetary Fund may increase the credit line extended to the economically suffering country at first seemed positive, but then varying accounts regarding the size of the increase left market participants skittish.

Even given rampant political uncertainty and worries over the aging U.S. economic expansion, a “risk on” sentiment was reflected in the performance of gold, which declined 5.1% in the past 12 months, as measured by the S&P GSCI Gold Index. Gold is typically a “flight-to-quality” asset that appreciates when investors are fearful of a stock market contraction and depreciates when sentiment is positive. Energy prices, conversely, returned to levels not seen since 2014, before correcting toward the end of the reporting period.

Bonds

Given central bank actions, it is not surprising that global fixed-income struggled. U.S. government bond yields moved higher and the curve flattened. The yield on the bellwether 10-year U.S. Treasury Note rose over the twelve months from 2.38% to 3.14%. As a consequence, U.S. bonds saw sharp price decreases in the intermediate- to long-term range. High-quality U.S. corporate bonds did not offer much relief from the negative trend, except at the short end of the yield curve.

The U.S. high-yield market posted a small but positive return in the twelve-month period ended October 31, 2018, as the ICE BofA Merrill Lynch U.S. High Yield Index generated a modest positive return for the period. Returns were driven by continued economic growth in the U.S., stable credit fundamentals and soft new issue volume which supported secondary trading levels — all partially offset by volatility in the stock market and rising interest rates.

Contractionary central bank actions, combined with higher U.S. rates and a weaker dollar, hurt global fixed-income markets as well, with world government bonds down slightly over the twelve-month period.

U.S. Equity

In the U.S., market distress over trade policy in the past year swamped tax and regulatory reform optimism, creating a volatile trading environment. Based on total return of 7.35% in the S&P 500® Index for the twelve-month period ended October 31, 2018, the twelve months might appear to be a period of seeming complacency. U.S. equity markets were boosted in part by corporate earnings growth, which continued to beat consensus estimates. Furthermore, U.S. consumer spending, consumer sentiment, employment and inflation data were all positive and supportive of economic growth. Nonetheless, the year was punctuated by two sharp sell-offs of approximately 10%. Both times, a sharp move in 30-year Treasury bond yields brought immediate consequences for the equity markets, once in January and February and again in September and October.

As trade-related turbulence led U.S. equities to pull back from highs earlier in the year, technology stocks remained among the highest-flying sectors. Strong returns also came from consumer discretionary stocks, which include many technology-related retailers; health care and consumer staples also outperformed. The weakest returns were reserved for sectors such as financials, industrials and materials.

Alternative sectors reflected the tensions between the relatively benign economic environment and the pressure brought by rising U.S. interest rates. The “risk-on” sentiment that dominated stock markets for much of the year was reflected in the performance of gold, which declined 5.1% in the past 12 months, as measured by the S&P GSCI Gold Index. Gold is typically a “flight-to-quality�� asset that appreciates when investors are fearful of a stock market contraction and depreciates when sentiment is positive. Base metals, also sensitive to softness in emerging markets, suffered even more. Other negative alternative sectors included real estate and agricultural producers.

Energy prices, conversely, returned to levels not seen since 2014, although stock gains were limited by the falling dollar. Other positive sectors included managed futures and commodity tracking securities.

2

International equity

The non-U.S. world’s stock markets struggled throughout the year, as Europe grappled with political crises in Italy, Germany and the U.K. Developed-world international stocks were down 6.85% in the past year, as measured by the MSCI EAFE Index. Hints the European Central Bank would begin curtailing stimulus measures and concerns about protectionism in the U.S. contributed to negative sentiment.

A dominant theme in the emerging markets was the impact of a falling U.S. dollar, rising U.S. interest rates and the trade war between the United States and China. The impact on Chinese equities was severe, as the MSCI China A NR lost 28.62% of its value in the past year. None of the emerging markets was immune, however, with the broad indexes down well into double-digits.

Source: AXA Equitable Funds Management Group, LLC doing business as 1290 Asset Managers®. As of 10/31/18.

This information is provided for general information only and is not intended to provide specific advice or recommendations for any individual investor.

PAST PERFORMANCE IS NO GUARANTEE OP FUTURE RESULTS. No investment is risk-free. Bond investments are subject to interest rate risk so that when interest rates rise, the prices of bonds can decrease and the investor can lose principal value. High yield bonds are subject to a high degree of credit and market risk. International securities carry additional risks including currency exchange fluctuation and different government regulations, economic conditions or accounting standards. Smaller company stocks involve a greater risk than is customarily associated with more established companies. Index performance is referenced for illustrative purposes only. You cannot invest directly in an index.

Fund holdings and sector allocations are subject to change. Please see the Portfolio of Investments for a complete list of fund holdings.

3

NOTES ON PERFORMANCE (Unaudited)

Total Returns

Performance of the 1290 Funds as shown on the following pages compares each Fund’s performance to that of a broad-based securities index and, with respect to certain Funds, customized composite benchmarks. Each Fund’s rates of return are net of investment advisory fees and expenses of the Fund. Each Fund has a separate investment objective it seeks to achieve by following a separate investment policy. There is no guarantee that these objectives will be attained. The objectives and policies of each Fund will affect its return and its risk. Keep in mind that past performance is not an indication of future results.

Benchmarks

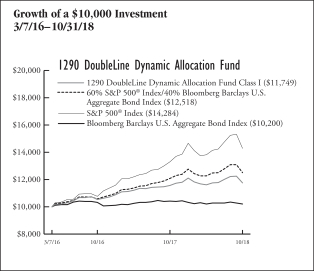

60% S&P 500® Index/40% Bloomberg Barclays U.S. Aggregate Bond Index is a hypothetical combination of unmanaged indexes. The composite index combines the total return of the S&P 500® Index at a weighting of 60% and the Bloomberg Barclays U.S. Aggregate Bond Index at a weighting of 40%.

Bloomberg Barclays U.S. Aggregate Bond Index covers the U.S. dollar denominated investment-grade, fixed-rate, taxable bond market of securities. The index includes bonds from the Treasury, government-related and corporate securities, agency fixed rate and hybrid adjustable mortgage pass through securities, asset-backed securities and commercial mortgage-backed securities.

CBOE Volatility Index® (VIX® Index) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices.

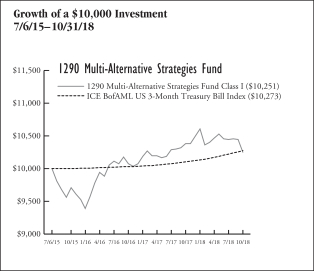

ICE BofAML US 3-Month Treasury Bill Index measures the returns of negotiable debt obligations issued by the U.S. government and backed by its full faith and credit, having a maturity of three months.

ICE BofAML U.S. Convertibles Index consists of U.S. dollar denominated investment grade and non-investment grade convertible securities sold into the U.S. market and publicly traded in the United States. The index constituents are market value weighted based on the convertible securities prices and outstanding shares, and the underlying index is rebalanced daily.

ICE BofAML U.S. High Yield Index tracks the performance of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market. Qualifying securities must have at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $100 million. It is capitalization-weighted.

ICE BofAML USD 3-Month Deposit Offered Rate Constant Maturity Index tracks the performance of a synthetic asset paying the London interbank offered rate (LIBOR) to a stated maturity. The index is based on the assumed purchase at par of a synthetic instrument having exactly its stated maturity and with a coupon equal to that day’s fixing rate. That issue is assumed to be sold the following business day (priced at a yield equal to the current day fixing rate) and rolled into a new instrument.

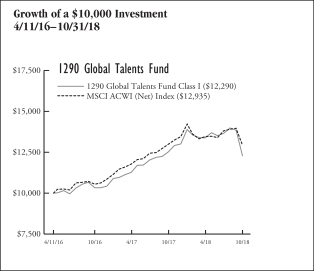

Morgan Stanley Capital International (MSCI) ACWI (Net) Index (“MSCI ACWI (Net) Index”) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of 23 developed markets and 24 emerging markets. The index covers approximately 85% of the global investment opportunities.

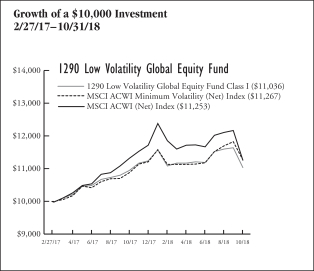

Morgan Stanley Capital International (MSCI) ACWI Minimum Volatility (Net) Index (“MSCI ACWI Minimum Volatility (Net) Index”) aims to reflect the performance characteristics of a minimum variance strategy applied to large and mid cap equities across 23 developed markets and 23 emerging markets countries. The index is calculated by optimizing the MSCI ACWI Index, its parent index, in USD for the lowest absolute risk (within a given set of constraints). Historically, the index has shown lower beta and volatility characteristics relative to the MSCI ACWI Index.

Morgan Stanley Capital International (MSCI) China A Index net return is an unmanaged index designed to measure large and mid-cap representation across China securities listed on the Shanghai and Shenzhen exchanges.

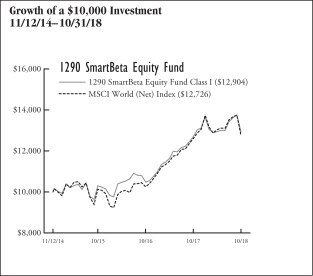

Morgan Stanley Capital International (MSCI) World (Net) Index (“MSCI World (Net) Index”) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The index consists of 23 developed market country indexes.

Russell 2500™ Value Index measures the performance of those Russell 2500TM Index companies with lower price-to-book ratios and lower forecasted growth values. It is market-capitalization weighted.

Standard & Poor’s 500® Composite Stock Price Index (“S&P 500® Index”) is a weighted index of common stocks of 500 leading companies in leading industries of the U.S. economy, capturing 75% coverage of U.S. equities. The index is capitalization weighted, thereby giving greater weight to companies with the largest market capitalizations.

The Standard & Poor’s GSCI Gold Index (“S&P GSCI Gold Index”) is an unmanaged index considered representative of the world gold market.

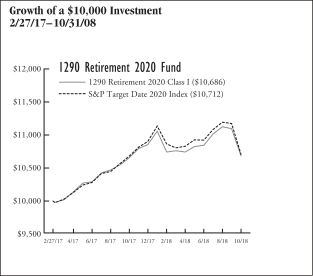

The Standard & Poor’s Target Date Index Series (each, an “S&P Target Date Index”) comprises eleven multi-asset class indices, each corresponding to a particular target retirement date. The asset allocation for each index in the series is determined once a year through survey of large fund management companies that offer target date products. Each index is fully investable, with varying levels of exposure to equities, fixed income and commodities.

Glossary

Derivative is a financial instrument with a price that is dependent upon or derived from one or more underlying assets.

Diversified spread is the sale of multiple, diversified futures contracts and the purchase of other multiple, diversified offsetting futures contracts. A spread tracks the difference between a long and short position.

4

NOTES ON PERFORMANCE (Unaudited)

Flight to quality is the action of investors moving their capital away from riskier investments to safer ones.

Long position is the buying of a security or financial instrument such as a stock, commodity or currency with the expectation the asset will rise in value.

Mortgage backed security (MBS) is a type of asset-backed security that is secured by a mortgage or collection of mortgages.

Quantitative easing is the introduction of new money into the money supply by a central bank.

Shiller Barclays Cyclically Adjusted Price-to-Earnings (CAPE) Total Return Index aims to identify undervalued sectors in the large-cap equity market based on a modified CAPE® ratio, which is designed to assess longer term equity valuations by using an inflation adjusted earnings horizon.

Smart beta defines a set of investment strategies that emphasize the use of alternative index construction rules to traditional market capitalization based indices.

Swap is a derivative contract through which two parties exchange financial instruments.

5

1290 CONVERTIBLE SECURITIES FUND (Unaudited)

INVESTMENT ADVISER

INVESTMENT SUB-ADVISER

| Ø | | Palisade Capital Management, L.L.C. |

PERFORMANCE RESULTS

| | | | | | | | | | | | |

| Annualized Total Returns as of 10/31/18 | |

| | | | | | 1

Year | | | Since

Incept. | |

Fund – Class A Shares* | | | without Sales Charge | | | | (0.46 | )% | | | 3.95 | % |

| | | | with Sales Charge (a) | | | | (4.90 | ) | | | 2.53 | |

Fund – Class I Shares* | | | | | | | (0.23 | ) | | | 4.21 | |

Fund – Class R Shares* | | | | | | | (0.78 | ) | | | 3.67 | |

ICE BofAML U.S. Convertibles Index | | | | | | | 3.67 | | | | 6.27 | |

* Date of inception 7/6/15. (a) A 4.50% front-end sales charge was deducted. Returns for periods greater than one year are annualized. | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For the most current month-end performance data please call 1-888-310-0416 or visit www.1290Funds.com.

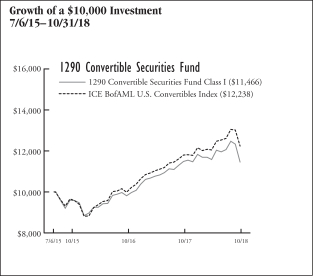

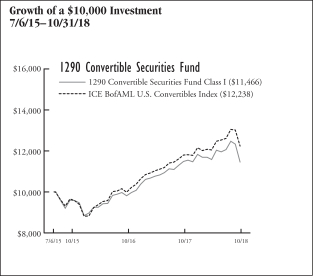

The graph illustrates comparative performance for $10,000 invested in the Class I Shares of the 1290 Convertible Securities Fund and the ICE BofAML U.S. Convertibles Index from 7/6/15 to 10/31/18. The performance of the ICE BofAML U.S. Convertibles Index reflects an initial investment at the end of the month closest to the Fund’s inception. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the ICE BofAML U.S. Convertibles Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends, capital gain distributions, and interest of the securities included in the benchmark.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

PERFORMANCE SUMMARY

The Fund’s Class I shares returned (0.23)% for the year ended October 31, 2018. The Fund’s benchmark, the ICE BofAML U.S. Convertibles Index, returned 3.67% over the same year.

Overview — Palisade Capital Management, L.L.C.

Over the twelve-month period ended October 31, 2018, early tax and regulatory reform optimism collided with headwinds from trade policy uncertainty, interest rate angst, and emerging market distress, creating a volatile trading environment. While our view of stronger economic growth for the period did play out, the uncertainty in the macro environment weighed on some of the investments in the Fund. The Fund’s overweight positioning in industrials, which was beneficial during the prior year, dragged on performance as the sector lagged expectations. Likewise, the Fund’s overweight in technology did not provide the boost we expected as the Fund’s holdings in semiconductor names, in particular, suffered from continued trade tensions, especially with China.

We continue to believe that economic fundamentals remain constructive, which may provide a good foundation for equity and credit markets in the coming months. This may provide opportunities for continued convertible price appreciation. We expect any resolution to current trade disputes to be a potentially positive catalyst and provide an additional tailwind for convertibles. We also believe that rising interest rates will not be a significant negative factor as we have seen historically, as equity-related gains may more than offset any potential interest rate drag. While our longer-term outlook remains positive, it is tempered by our view that volatile conditions could persist for a while. If our positive view does not play out as expected, we do believe that the defensive characteristics of convertibles could help cushion any downside. As such, we continue to believe that the convertibles market remains an attractive vehicle to help investors navigate near-term market volatility.

Fund Highlights

What helped performance during the year?

| • | | The Fund benefited from good security selection in the materials sector where Cleveland-Cliffs Inc. 1.50% generated double digit returns over the period. |

| • | | The Fund also benefited from an overweight to the health care sector, which was among the best performing sectors in the benchmark over the period. |

| • | | In financials, the Fund was well served by an underweight to the real estate investment trust (REITs) industry. |

6

1290 CONVERTIBLE SECURITIES FUND (Unaudited)

What hurt performance during the year?

| • | | Unfavorable security selection in health care weighed down results for the period. Notably, Incyte Corp. 1.25% and Dermira, Inc. 3.00% both experienced double digit declines. |

| • | | Unfavorable security selection in the energy sector further hindered results, where a position in Nabors Industries Ltd. 6.00% disappointed. |

| • | | Underperformance in the industrials sector was attributable to an overweight to the building and construction industry. |

| • | | The Fund was also hindered by underweights in the outperforming telecommunications and consumer staples sectors. |

| | | | |

Fund Characteristics As of October 31, 2018 | | | |

Weighted Average Life (Years) | | | N/A | |

Weighted Average Coupon (%) | | | N/A | |

Weighted Average Modified Duration (Years)* | | | N/A | |

Weighted Average Rating** | | | BB | |

* Modified duration is a measure of the price sensitivity of the Fund to interest rate movements, taking into account specific features of the securities in which it invests. ** Weighted Average Rating has been provided by the Investment Sub-Adviser. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations, including specific securities, money market instruments or other debts. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest); ratings are subject to change without notice. | |

| | | | |

Sector Weightings as of October 31, 2018 | | % of Net Assets | |

Information Technology | | | 34.7 | % |

Health Care | | | 22.5 | |

Financials | | | 8.4 | |

Industrials | | | 7.9 | |

Consumer Discretionary | | | 6.8 | |

Communication Services | | | 5.6 | |

Energy | | | 5.5 | |

Real Estate | | | 2.3 | |

Materials | | | 2.2 | |

Utilities | | | 0.6 | |

Investment Company | | | 0.4 | |

Consumer Staples | | | 0.3 | |

Cash and Other | | | 2.8 | |

| | | | | |

| | | | 100.0 | % |

| | | | | |

Holdings are subject to change without notice. | |

UNDERSTANDING YOUR EXPENSES:

As a shareholder of the Fund, you incur two types of costs:

(1) transaction costs, including applicable sales charges and redemption fees; and (2) ongoing costs, including investment advisory fees, distribution and/or service (12b-1) fees (in the case of Class A and Class R shares of the Fund), and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the six-month period ended October 31, 2018 and held for the entire six-month period.

Actual Expenses

The first line of the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

7

1290 CONVERTIBLE SECURITIES FUND (Unaudited)

EXAMPLE

| | | | | | | | | | | | |

| | | Beginning

Account

Value

5/1/18 | | | Ending

Account

Value

10/31/18 | | | Expenses Paid During Period*

5/1/18 -

10/31/18 | |

Class A | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $988.10 | | | | $6.47 | |

Hypothetical (5% average annual return before expenses) | | | 1,000.00 | | | | 1,018.70 | | | | 6.57 | |

Class I | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 989.20 | | | | 5.22 | |

Hypothetical (5% average annual return before expenses) | | | 1,000.00 | | | | 1,019.95 | | | | 5.30 | |

Class R | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 986.10 | | | | 7.72 | |

Hypothetical (5% average annual return before expenses) | | | 1,000.00 | | | | 1,017.43 | | | | 7.84 | |

* Expenses are equal to the Fund’s Class A, I and R shares annualized expense ratios of 1.29%, 1.04% and 1.54%, respectively, multiplied by the average account value over the period, and multiplied by 184/365 (to reflect the one-half year period). | |

8

1290 FUNDS

1290 CONVERTIBLE SECURITIES FUND

PORTFOLIO OF INVESTMENTS

October 31, 2018

| | | | | | | | |

| | | Principal Amount | | | Value (Note 1) | |

| | | | | | | | |

LONG-TERM DEBT SECURITIES: | |

Convertible Bonds (81.9%) | |

Communication Services (5.6%) | |

Entertainment (1.0%) | | | | | | | | |

Live Nation Entertainment, Inc. | |

2.500%, 5/15/19 | | $ | 56,000 | | | $ | 84,682 | |

2.500%, 3/15/23§ | | | 30,000 | | | | 32,045 | |

Pandora Media, Inc.

1.750%, 12/1/23 | | | 110,000 | | | | 117,847 | |

| | | | | | | | |

| | | | | | | 234,574 | |

| | | | | | | | |

Interactive Media & Services (1.6%) | |

Momo, Inc.

1.250%, 7/1/25§ | | | 61,000 | | | | 53,375 | |

Twitter, Inc. | | | | | | | | |

0.250%, 9/15/19 | | | 65,000 | | | | 62,833 | |

0.250%, 6/15/24§ | | | 171,000 | | | | 160,335 | |

Weibo Corp.

1.250%, 11/15/22§ | | | 91,000 | | | | 80,957 | |

Zillow Group, Inc.

1.500%, 7/1/23 | | | 34,000 | | | | 30,906 | |

| | | | | | | | |

| | | | | | | 388,406 | |

| | | | | | | | |

Media (3.0%) | | | | | | | | |

DISH Network Corp.

3.375%, 8/15/26 | | | 520,000 | | | | 463,294 | |

Liberty Interactive LLC

1.750%, 9/30/46§ | | | 116,000 | | | | 129,512 | |

Liberty Media Corp.

1.375%, 10/15/23 | | | 90,000 | | | | 103,779 | |

| | | | | | | | |

| | | | | | | 696,585 | |

| | | | | | | | |

Total Communication Services | | | | | | | 1,319,565 | |

| | | | | | | | |

Consumer Discretionary (6.8%) | |

Automobiles (1.1%) | | | | | | | | |

Tesla, Inc.

2.375%, 3/15/22 | | | 209,000 | | | | 254,727 | |

| | | | | | | | |

Hotels, Restaurants & Leisure (1.1%) | |

Caesars Entertainment Corp.

5.000%, 10/1/24 | | | 177,000 | | | | 252,770 | |

| | | | | | | | |

Internet & Direct Marketing Retail (4.1%) | |

Booking Holdings, Inc.

0.350%, 6/15/20 | | | 297,000 | | | | 428,844 | |

Ctrip.com International Ltd.

1.250%, 9/15/22 | | | 45,000 | | | | 43,491 | |

Etsy, Inc. | | | | | | | | |

(Zero Coupon), 3/1/23 (b)§ | | | 67,000 | | | | 88,942 | |

IAC FinanceCo, Inc. | | | | | | | | |

0.875%, 10/1/22§ | | | 129,000 | | | | 180,242 | |

Liberty Expedia Holdings, Inc. | | | | | | | | |

1.000%, 6/30/47§ | | | 102,000 | | | | 101,429 | |

MercadoLibre, Inc. | | | | | | | | |

2.000%, 8/15/28§ | | | 122,000 | | | | 117,241 | |

| | | | | | | | |

| | | | | | | 960,189 | |

| | | | | | | | |

Specialty Retail (0.5%) | | | | | | | | |

RH | | | | | | | | |

(Zero Coupon), 7/15/20 | | | 61,000 | | | | 69,376 | |

| | | | | | | | |

(Zero Coupon), 6/15/23§ | | | 61,000 | | | | 53,685 | |

| | | | | | | | |

| | | | | | | 123,061 | |

| | | | | | | | |

Total Consumer Discretionary | | | | | | | 1,590,747 | |

| | | | | | | | |

Energy (4.6%) | | | | | | | | |

Energy Equipment & Services (2.4%) | |

Oil States International, Inc. | | | | | | | | |

1.500%, 2/15/23§ | | | 73,000 | | | | 66,418 | |

SEACOR Holdings, Inc. | | | | | | | | |

3.250%, 5/15/30 | | | 148,000 | | | | 138,195 | |

Transocean, Inc. | | | | | | | | |

0.500%, 1/30/23 | | | 121,000 | | | | 150,680 | |

Weatherford International Ltd. | | | | | | | | |

5.875%, 7/1/21 | | | 271,000 | | | | 208,001 | |

| | | | | | | | |

| | | | | | | 563,294 | |

| | | | | | | | |

Oil, Gas & Consumable Fuels (2.2%) | |

Cheniere Energy, Inc. | | | | | | | | |

4.250%, 3/15/45 | | | 120,000 | | | | 91,814 | |

Chesapeake Energy Corp. | | | | | | | | |

5.500%, 9/15/26 (e) | | | 139,000 | | | | 130,677 | |

Oasis Petroleum, Inc. | | | | | | | | |

2.625%, 9/15/23 | | | 121,000 | | | | 136,369 | |

PDC Energy, Inc. | | | | | | | | |

1.125%, 9/15/21 | | | 159,000 | | | | 149,460 | |

| | | | | | | | |

| | | | | | | 508,320 | |

| | | | | | | | |

Total Energy | | | | | | | 1,071,614 | |

| | | | | | | | |

Financials (2.1%) | | | | | | | | |

Consumer Finance (1.1%) | |

Encore Capital Group, Inc. | | | | | | | | |

3.000%, 7/1/20 | | | 90,000 | | | | 82,755 | |

3.250%, 3/15/22 | | | 30,000 | | | | 25,500 | |

EZCORP, Inc. | | | | | | | | |

2.875%, 7/1/24 | | | 30,000 | | | | 35,085 | |

2.375%, 5/1/25§ | | | 30,000 | | | | 26,250 | |

PRA Group, Inc. | | | | | | | | |

3.500%, 6/1/23 | | | 99,000 | | | | 93,571 | |

| | | | | | | | |

| | | | | | | 263,161 | |

| | | | | | | | |

Mortgage Real Estate Investment Trusts (REITs) (0.3%) | |

Western Asset Mortgage Capital Corp. (REIT) | | | | | | | | |

6.750%, 10/1/22 | | | 60,000 | | | | 59,023 | |

| | | | | | | | |

Thrifts & Mortgage Finance (0.7%) | | | | | | | | |

LendingTree, Inc. | | | | | | | | |

0.625%, 6/1/22 | | | 136,000 | | | | 159,760 | |

| | | | | | | | |

Total Financials | | | | | | | 481,944 | |

| | | | | | | | |

Health Care (20.1%) | | | | | | | | |

Biotechnology (8.8%) | | | | | | | | |

Acorda Therapeutics, Inc. | | | | | | | | |

1.750%, 6/15/21 | | | 65,000 | | | | 54,995 | |

Alder Biopharmaceuticals, Inc. | | | | | | | | |

2.500%, 2/1/25 | | | 115,000 | | | | 105,225 | |

BioMarin Pharmaceutical, Inc. | | | | | | | | |

1.500%, 10/15/20 | | | 211,000 | | | | 248,736 | |

Clovis Oncology, Inc. | | | | | | | | |

2.500%, 9/15/21 | | | 128,000 | | | | 97,120 | |

Exact Sciences Corp. | | | | | | | | |

1.000%, 1/15/25 | | | 332,000 | | | | 387,776 | |

See Notes to Financial Statements.

9

1290 FUNDS

1290 CONVERTIBLE SECURITIES FUND

PORTFOLIO OF INVESTMENTS (Continued)

October 31, 2018

| | | | | | | | |

| | | Principal Amount | | | Value (Note 1) | |

| | | | | | | | |

Flexion Therapeutics, Inc. | | | | | | | | |

3.375%, 5/1/24 | | $ | 144,000 | | | $ | 126,972 | |

Incyte Corp. | | | | | | | | |

1.250%, 11/15/20 | | | 75,000 | | | | 100,121 | |

Insmed, Inc. | | | | | | | | |

1.750%, 1/15/25 | | | 175,000 | | | | 131,672 | |

Ionis Pharmaceuticals, Inc. | | | | | | | | |

1.000%, 11/15/21 | | | 81,000 | | | | 84,516 | |

Ligand Pharmaceuticals, Inc. | | | | | | | | |

0.750%, 5/15/23§ | | | 221,000 | | | | 211,119 | |

Neurocrine Biosciences, Inc. | | | | | | | | |

2.250%, 5/15/24 | | | 65,000 | | | | 100,161 | |

Radius Health, Inc. | | | | | | | | |

3.000%, 9/1/24 | | | 90,000 | | | | 69,887 | |

Retrophin, Inc. | | | | | | | | |

2.500%, 9/15/25 | | | 58,000 | | | | 56,178 | |

Sarepta Therapeutics, Inc. | | | | | | | | |

1.500%, 11/15/24§ | | | 123,000 | | | | 242,213 | |

TESARO, Inc. | | | | | | | | |

3.000%, 10/1/21 | | | 40,000 | | | | 44,550 | |

| | | | | | | | |

| | | | | | | 2,061,241 | |

| | | | | | | | |

Health Care Equipment & Supplies (2.7%) | |

DexCom, Inc. | | | | | | | | |

0.750%, 5/15/22 | | | 60,000 | | | | 86,635 | |

Insulet Corp. | | | | | | | | |

1.375%, 11/15/24§ | | | 91,000 | | | | 102,715 | |

Nevro Corp. | | | | | | | | |

1.750%, 6/1/21 | | | 182,000 | | | | 172,639 | |

NuVasive, Inc. | | | | | | | | |

2.250%, 3/15/21 | | | 107,000 | | | | 119,377 | |

Wright Medical Group NV | | | | | | | | |

2.250%, 11/15/21 | | | 62,000 | | | | 84,893 | |

Wright Medical Group, Inc. | | | | | | | | |

2.000%, 2/15/20 | | | 58,000 | | | | 61,345 | |

| | | | | | | | |

| | | | | | | 627,604 | |

| | | | | | | | |

Health Care Providers & Services (1.9%) | |

Anthem, Inc. | | | | | | | | |

2.750%, 10/15/42 | | | 54,000 | | | | 204,913 | |

Molina Healthcare, Inc. | | | | | | | | |

1.125%, 1/15/20 | | | 74,000 | | | | 230,172 | |

| | | | | | | | |

| | | | | | | 435,085 | |

| | | | | | | | |

Health Care Technology (2.2%) | |

Allscripts Healthcare Solutions, Inc. | | | | | | | | |

1.250%, 7/1/20 | | | 105,000 | | | | 104,108 | |

Evolent Health, Inc. | | | | | | | | |

2.000%, 12/1/21 | | | 91,000 | | | | 105,878 | |

Teladoc Health, Inc. | | | | | | | | |

3.000%, 12/15/22 | | | 152,000 | | | | 263,276 | |

Vocera Communications, Inc. | | | | | | | | |

1.500%, 5/15/23§ | | | 36,000 | | | | 43,687 | |

| | | | | | | | |

| | | | | | | 516,949 | |

| | | | | | | | |

Life Sciences Tools & Services (0.7%) | |

Illumina, Inc. | | | | | | | | |

0.500%, 6/15/21 | | | 122,000 | | | | 164,353 | |

| | | | | | | | |

Pharmaceuticals (3.8%) | |

Assertio Therapeutics, Inc. | | | | | | | | |

2.500%, 9/1/21 | | | 85,000 | | | | 65,142 | |

| | | | | | | | |

Dermira, Inc. | | | | | | | | |

3.000%, 5/15/22 | | | 207,000 | | | | 175,986 | |

Horizon Pharma Investment Ltd. | | | | | | | | |

2.500%, 3/15/22 | | | 125,000 | | | | 121,712 | |

Jazz Investments I Ltd. | | | | | | | | |

1.875%, 8/15/21 | | | 120,000 | | | | 126,112 | |

1.500%, 8/15/24 | | | 59,000 | | | | 58,748 | |

Medicines Co. (The) | | | | | | | | |

2.500%, 1/15/22 | | | 131,000 | | | | 126,432 | |

Pacira Pharmaceuticals, Inc. | | | | | | | | |

2.375%, 4/1/22 | | | 131,000 | | | | 137,086 | |

Paratek Pharmaceuticals, Inc. | | | | | | | | |

4.750%, 5/1/24§ | | | 91,000 | | | | 78,069 | |

| | | | | | | | |

| | | | | | | 889,287 | |

| | | | | | | | |

Total Health Care | | | | | | | 4,694,519 | |

| | | | | | | | |

Industrials (6.4%) | | | | | | | | |

Air Freight & Logistics (1.3%) | | | | | | | | |

Atlas Air Worldwide Holdings, Inc. | | | | | | | | |

1.875%, 6/1/24 | | | 91,000 | | | | 96,744 | |

Echo Global Logistics, Inc. | | | | | | | | |

2.500%, 5/1/20 | | | 200,000 | | | | 197,404 | |

| | | | | | | | |

| | | | | | | 294,148 | |

| | | | | | | | |

Building Products (0.6%) | | | | | | | | |

Patrick Industries, Inc. | | | | | | | | |

1.000%, 2/1/23§ | | | 182,000 | | | | 153,449 | |

| | | | | | | | |

Commercial Services & Supplies (0.3%) | |

Team, Inc. | | | | | | | | |

5.000%, 8/1/23 | | | 57,000 | | | | 66,598 | |

| | | | | | | | |

Construction & Engineering (1.4%) | |

Dycom Industries, Inc. | | | | | | | | |

0.750%, 9/15/21 | | | 179,000 | | | | 180,310 | |

Tutor Perini Corp. | | | | | | | | |

2.875%, 6/15/21 | | | 143,000 | | | | 136,869 | |

| | | | | | | | |

| | | | | | | 317,179 | |

| | | | | | | | |

Machinery (1.8%) | |

Chart Industries, Inc. | | | | | | | | |

1.000%, 11/15/24§ | | | 155,000 | | | | 199,747 | |

Greenbrier Cos., Inc. (The) | | | | | | | | |

2.875%, 2/1/24 | | | 170,000 | | | | 178,647 | |

Meritor, Inc. | | | | | | | | |

3.250%, 10/15/37 | | | 60,000 | | | | 55,356 | |

| | | | | | | | |

| | | | | | | 433,750 | |

| | | | | | | | |

Transportation Infrastructure (1.0%) | |

Macquarie Infrastructure Corp. | | | | | | | | |

2.875%, 7/15/19 | | | 60,000 | | | | 59,511 | |

2.000%, 10/1/23 | | | 191,000 | | | | 169,998 | |

| | | | | | | | |

| | | | | | | 229,509 | |

| | | | | | | | |

Total Industrials | | | | | | | 1,494,633 | |

| | | | | | | | |

Information Technology (33.7%) | | | | | | | | |

Communications Equipment (3.3%) | | | | | | | | |

Finisar Corp. | | | | | | | | |

0.500%, 12/15/36 | | | 81,000 | | | | 72,028 | |

Infinera Corp. | | | | | | | | |

2.125%, 9/1/24 | | | 106,000 | | | | 93,545 | |

See Notes to Financial Statements.

10

1290 FUNDS

1290 CONVERTIBLE SECURITIES FUND

PORTFOLIO OF INVESTMENTS (Continued)

October 31, 2018

| | | | | | | | |

| | | Principal Amount | | | Value (Note 1) | |

| | | | | | | | |

Lumentum Holdings, Inc. | | | | | | | | |

0.250%, 3/15/24 | | $ | 253,000 | | | $ | 287,050 | |

Palo Alto Networks, Inc. | | | | | | | | |

(Zero Coupon), 7/1/19 | | | 145,000 | | | | 239,553 | |

0.750%, 7/1/23§ | | | 73,000 | | | | 70,917 | |

| | | | | | | | |

| | | | | | | 763,093 | |

| | | | | | | | |

Electronic Equipment, Instruments & Components (0.9%) | |

TTM Technologies, Inc. | | | | | | | | |

1.750%, 12/15/20 | | | 105,000 | | | | 137,888 | |

Vishay Intertechnology, Inc. | | | | | | | | |

2.250%, 11/15/40 | | | 50,000 | | | | 73,364 | |

| | | | | | | | |

| | | | | | | 211,252 | |

| | | | | | | | |

IT Services (2.6%) | | | | | | | | |

Akamai Technologies, Inc. | | | | | | | | |

0.125%, 5/1/25§ | | | 61,000 | | | | 59,513 | |

Cardtronics, Inc. | | | | | | | | |

1.000%, 12/1/20 | | | 41,000 | | | | 38,181 | |

GDS Holdings Ltd. | | | | | | | | |

2.000%, 6/1/25§ | | | 122,000 | | | | 89,007 | |

Okta, Inc. | | | | | | | | |

0.250%, 2/15/23§ | | | 90,000 | | | | 122,656 | |

Square, Inc. | | | | | | | | |

0.500%, 5/15/23§ | | | 122,000 | | | | 146,136 | |

Twilio, Inc. | | | | | | | | |

0.250%, 6/1/23§ | | | 82,000 | | | | 102,271 | |

Wix.com Ltd. | | | | | | | | |

(Zero Coupon), 7/1/23§ | | | 48,000 | | | | 47,448 | |

| | | | | | | | |

| | | | | | | 605,212 | |

| | | | | | | | |

Semiconductors & Semiconductor Equipment (14.1%) | |

Advanced Micro Devices, Inc. | | | | | | | | |

2.125%, 9/1/26 | | | 107,000 | | | | 254,902 | |

Cypress Semiconductor Corp. | | | | | | | | |

4.500%, 1/15/22 | | | 96,000 | | | | 113,352 | |

Inphi Corp. | | | | | | | | |

1.125%, 12/1/20 | | | 87,000 | | | | 90,915 | |

0.750%, 9/1/21 | | | 15,000 | | | | 13,912 | |

Intel Corp. | | | | | | | | |

3.250%, 8/1/39 | | | 211,000 | | | | 478,694 | |

Microchip Technology, Inc. | | | | | | | | |

1.625%, 2/15/25 | | | 259,000 | | | | 337,341 | |

1.625%, 2/15/27 | | | 485,000 | | | | 459,071 | |

Micron Technology, Inc. | | | | | | | | |

Series F | | | | | | | | |

2.125%, 2/15/33 | | | 47,000 | | | | 162,093 | |

Series G | | | | | | | | |

3.000%, 11/15/43 | | | 296,000 | | | | 385,687 | |

Novellus Systems, Inc. | | | | | | | | |

2.625%, 5/15/41 | | | 94,000 | | | | 402,856 | |

NXP Semiconductors NV | | | | | | | | |

1.000%, 12/1/19 | | | 45,000 | | | | 45,502 | |

ON Semiconductor Corp. | | | | | | | | |

1.000%, 12/1/20 | | | 120,000 | | | | 134,482 | |

Rambus, Inc. | | | | | | | | |

1.375%, 2/1/23§ | | | 91,000 | | | | 79,676 | |

SunPower Corp. | | | | | | | | |

4.000%, 1/15/23 | | | 30,000 | | | | 24,465 | |

Synaptics, Inc. | | | | | | | | |

0.500%, 6/15/22 | | | 107,000 | | | | 95,230 | |

| | | | | | | | |

Teradyne, Inc. | | | | | | | | |

1.250%, 12/15/23 | | | 121,000 | | | | 151,951 | |

Veeco Instruments, Inc. | | | | | | | | |

2.700%, 1/15/23 | | | 72,000 | | | | 60,197 | |

| | | | | | | | |

| | | | | | | 3,290,326 | |

| | | | | | | | |

Software (11.8%) | | | | | | | | |

Citrix Systems, Inc. | | | | | | | | |

0.500%, 4/15/19 | | | 150,000 | | | | 212,514 | |

Coupa Software, Inc. | | | | | | | | |

0.375%, 1/15/23§ | | | 47,000 | | | | 72,615 | |

DocuSign, Inc. | | | | | | | | |

0.500%, 9/15/23§ | | | 122,000 | | | | 114,375 | |

FireEye, Inc. | | | | | | | | |

0.875%, 6/1/24§ | | | 121,000 | | | | 127,126 | |

Series A | | | | | | | | |

1.000%, 6/1/35 | | | 148,000 | | | | 142,821 | |

Guidewire Software, Inc. | | | | | | | | |

1.250%, 3/15/25 | | | 137,000 | | | | 137,756 | |

HubSpot, Inc. | | | | | | | | |

0.250%, 6/1/22 | | | 61,000 | | | | 92,415 | |

Nutanix, Inc. | | | | | | | | |

(Zero Coupon), 1/15/23§ | | | 181,000 | | | | 199,385 | |

PROS Holdings, Inc. | | | | | | | | |

2.000%, 12/1/19 | | | 80,000 | | | | 87,944 | |

Q2 Holdings, Inc. | | | | | | | | |

0.750%, 2/15/23§ | | | 75,000 | | | | 82,097 | |

RealPage, Inc. | | | | | | | | |

1.500%, 11/15/22 | | | 93,000 | | | | 128,371 | |

Red Hat, Inc. | | | | | | | | |

0.250%, 10/1/19 | | | 118,000 | | | | 274,390 | |

RingCentral, Inc. | | | | | | | | |

(Zero Coupon), 3/15/23§ | | | 78,000 | | | | 88,124 | |

Rovi Corp. | | | | | | | | |

0.500%, 3/1/20 | | | 60,000 | | | | 56,936 | |

ServiceNow, Inc. | | | | | | | | |

(Zero Coupon), 6/1/22 | | | 119,000 | | | | 167,943 | |

Splunk, Inc. | | | | | | | | |

0.500%, 9/15/23§ | | | 243,000 | | | | 232,566 | |

1.125%, 9/15/25§ | | | 61,000 | | | | 57,741 | |

Synchronoss Technologies, Inc. | | | | | | | | |

0.750%, 8/15/19 | | | 95,000 | | | | 90,648 | |

Verint Systems, Inc. | | | | | | | | |

1.500%, 6/1/21 | | | 129,000 | | | | 127,998 | |

Workday, Inc. | | | | | | | | |

0.250%, 10/1/22 | | | 141,000 | | | | 156,613 | |

Zendesk, Inc. | | | | | | | | |

0.250%, 3/15/23§ | | | 90,000 | | | | 98,559 | |

| | | | | | | | |

| | | | | | | 2,748,937 | |

| | | | | | | | |

Technology Hardware, Storage & Peripherals (1.0%) | |

Pure Storage, Inc. | | | | | | | | |

0.125%, 4/15/23§ | | | 145,000 | | | | 147,896 | |

Western Digital Corp. | | | | | | | | |

1.500%, 2/1/24§ | | | 106,000 | | | | 89,348 | |

| | | | | | | | |

| | | | | | | 237,244 | |

| | | | | | | | |

Total Information Technology | | | | | | | 7,856,064 | |

| | | | | | | | |

Materials (1.7%) | | | | | | | | |

Construction Materials (1.0%) | | | | | | | | |

Cemex SAB de CV | | | | | | | | |

3.720%, 3/15/20 | | | 243,000 | | | | 238,719 | |

| | | | | | | | |

See Notes to Financial Statements.

11

1290 FUNDS

1290 CONVERTIBLE SECURITIES FUND

PORTFOLIO OF INVESTMENTS (Continued)

October 31, 2018

| | | | | | | | |

| | | Principal Amount | | | Value (Note 1) | |

| | | | | | | | |

Metals & Mining (0.7%) | | | | | | | | |

Allegheny Technologies, Inc. | | | | | | | | |

4.750%, 7/1/22 | | $ | 42,000 | | | $ | 81,269 | |

Cleveland-Cliffs, Inc. | | | | | | | | |

1.500%, 1/15/25 | | | 61,000 | | | | 87,076 | |

| | | | | | | | |

| | | | | | | 168,345 | |

| | | | | | | | |

Total Materials | | | | | | | 407,064 | |

| | | | | | | | |

Real Estate (0.9%) | | | | | | | | |

Equity Real Estate Investment Trusts (REITs) (0.5%) | |

Colony Capital, Inc. (REIT) | | | | | | | | |

5.000%, 4/15/23 | | | 65,000 | | | | 60,613 | |

IH Merger Sub LLC (REIT) | | | | | | | | |

3.500%, 1/15/22 | | | 54,000 | | | | 57,753 | |

| | | | | | | | |

| | | | | | | 118,366 | |

| | | | | | | | |

Real Estate Management & Development (0.4%) | |

Redfin Corp. | | | | | | | | |

1.750%, 7/15/23 | | | 97,000 | | | | 82,285 | |

| | | | | | | | |

Total Real Estate | | | | | | | 200,651 | |

| | | | | | | | |

Total Convertible Bonds | | | | | | | 19,116,801 | |

| | | | | | | | |

Total Long-Term Debt Securities (81.9%)

(Cost $18,964,625) | | | | | | | 19,116,801 | |

| | | | | | | | |

| | | Number of

Shares | | | Value

(Note 1) | |

CONVERTIBLE PREFERRED STOCKS: | |

Consumer Staples (0.3%) | | | | | | | | |

Food Products (0.3%) | | | | | | | | |

Bunge Ltd., | | | | | | | | |

4.875% | | | 592 | | | | 61,272 | |

| | | | | | | | |

Total Consumer Staples | | | | | | | 61,272 | |

| | | | | | | | |

Energy (0.9%) | | | | | | | | |

Energy Equipment & Services (0.5%) | | | | | | | | |

Nabors Industries Ltd., | | | | | | | | |

6.000% | | | 3,147 | | | | 119,586 | |

| | | | | | | | |

Oil, Gas & Consumable Fuels (0.4%) | | | | | | | | |

Hess Corp., | | | | | | | | |

8.000% | | | 1,390 | | | | 88,251 | |

| | | | | | | | |

Total Energy | | | | | | | 207,837 | |

| | | | | | | | |

Financials (6.3%) | | | | | | | | |

Banks (4.9%) | | | | | | | | |

Bank of America Corp., | | | | | | | | |

Series L | | | | | | | | |

7.250% | | | 292 | | | | 371,220 | |

Wells Fargo & Co., | | | | | | | | |

Series L | | | | | | | | |

7.500% | | | 610 | | | | 775,914 | |

| | | | | | | | |

| | | | | | | 1,147,134 | |

| | | | | | | | |

Capital Markets (0.9%) | | | | | | | | |

AMG Capital Trust II, | | | | | | | | |

5.150% | | | 545 | | | | 28,831 | |

Mandatory Exchangeable Trust, | | | | | | | | |

5.750%§ | | | 1,083 | | | | 174,720 | |

| | | | | | | | |

| | | | | | | 203,551 | |

| | | | | | | | |

| | | | | | | | |

Insurance (0.5%) | | | | | | | | |

Assurant, Inc., | | | | | | | | |

Series D | | | | | | | | |

6.500% | | | 1,218 | | | | 129,952 | |

| | | | | | | | |

Total Financials | | | | | | | 1,480,637 | |

| | | | | | | | |

Health Care (2.4%) | | | | | | | | |

Health Care Equipment & Supplies (2.4%) | |

Becton Dickinson and Co., | | | | | | | | |

Series A | | | | | | | | |

6.125% | | | 9,652 | | | | 566,283 | |

| | | | | | | | |

Total Health Care | | | | | | | 566,283 | |

| | | | | | | | |

Industrials (1.5%) | | | | | | | | |

Machinery (1.5%) | | | | | | | | |

Fortive Corp., | | | | | | | | |

Series A | | | | | | | | |

5.000% | | | 273 | | | | 268,143 | |

Rexnord Corp., | | | | | | | | |

Series A | | | | | | | | |

5.750% | | | 1,335 | | | | 76,322 | |

| | | | | | | | |

Total Industrials | | | | | | | 344,465 | |

| | | | | | | | |

Information Technology (1.0%) | | | | | | | | |

Electronic Equipment, Instruments & Components (1.0%) | |

Belden, Inc., | | | | | | | | |

6.750% | | | 1,833 | | | | 136,173 | |

MTS Systems Corp., | | | | | | | | |

8.750% | | | 812 | | | | 84,355 | |

| | | | | | | | |

Total Information Technology | | | | | | | 220,528 | |

| | | | | | | | |

Materials (0.5%) | | | | | | | | |

Chemicals (0.5%) | | | | | | | | |

International Flavors & Fragrances, Inc., | | | | | | | | |

6.000%* | | | 1,145 | | | | 65,929 | |

Rayonier Advanced Materials, Inc., | | | | | | | | |

Series A | | | | | | | | |

8.000% | | | 548 | | | | 50,553 | |

| | | | | | | | |

Total Materials | | | | | | | 116,482 | |

| | | | | | | | |

Real Estate (1.4%) | |

Equity Real Estate Investment Trusts (REITs) (1.4%) | |

Crown Castle International Corp. (REIT), | | | | | |

Series A | | | | | | | | |

6.875% | | | 186 | | | | 194,370 | |

Welltower, Inc. (REIT), | | | | | | | | |

Series I | | | | | | | | |

6.500% | | | 2,076 | | | | 127,882 | |

| | | | | | | | |

Total Real Estate | | | | | | | 322,252 | |

| | | | | | | | |

Utilities (0.6%) | | | | | | | | |

Electric Utilities (0.3%) | | | | | | | | |

NextEra Energy, Inc., | | | | | | | | |

6.123% | | | 1,095 | | | | 63,510 | |

| | | | | | | | |

Multi-Utilities (0.3%) | | | | | | | | |

Dominion Energy, Inc., | | | | | | | | |

Series A | | | | | | | | |

6.750% | | | 1,210 | | | | 58,020 | |

See Notes to Financial Statements.

12

1290 FUNDS

1290 CONVERTIBLE SECURITIES FUND

PORTFOLIO OF INVESTMENTS (Continued)

October 31, 2018

| | | | | | | | |

| | | Number of

Shares | | | Value

(Note 1) | |

| | | | | | | | |

Sempra Energy, | | | | | | | | |

Series A | | | | | | | | |

6.000% | | | 270 | | | $ | 26,773 | |

| | | | | | | | |

| | | | | | | 84,793 | |

| | | | | | | | |

Total Utilities | | | | | | | 148,303 | |

| | | | | | | | |

Total Convertible Preferred Stocks (14.9%)

(Cost $3,433,317) | | | | | | | 3,468,059 | |

| | | | | | | | |

SHORT-TERM INVESTMENT: | | | | | | | | |

Investment Company (0.4%) | | | | | | | | |

JPMorgan Prime Money Market Fund, IM Shares | | | 105,294 | | | | 105,315 | |

| | | | | | | | |

Total Short-Term Investment (0.4%)

(Cost $105,316) | | | | | | | 105,315 | |

| | | | | | | | |

Total Investments in Securities (97.2%)

(Cost $22,503,258) | | | | | | | 22,690,175 | |

Other Assets Less Liabilities (2.8%) | | | | | | | 651,154 | |

| | | | | | | | |

Net Assets (100%) | | | | | | $ | 23,341,329 | |

| | | | | | | | |

| § | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may only be resold to qualified institutional buyers. At October 31, 2018, the market value of these securities amounted to $4,323,606 or 18.5% of net assets. Securities denoted with “§” but without “b” have been determined to be liquid under the guidelines established by the Board of Trustees. To the extent any securities might provide a right to demand registration, such rights have not been relied upon when determining liquidity. |

| (b) | Rule 144A Illiquid Security. At October 31, 2018, the market value of these securities amounted to $88,942 or 0.4% of net assets. |

| (e) | Step Bond - Coupon rate increases or decreases in increments to maturity. Rate disclosed is as of October 31, 2018. Maturity date disclosed is the ultimate maturity date. |

The following is a summary of the inputs used to value the Fund’s assets and liabilities carried at fair value as of October 31, 2018:

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| | | | | | | | | | | | | | | | |

| | | | | |

| Investment Type | | Level 1

Quoted Prices in

Active Markets for

Identical

Securities | | | Level 2

Significant Other

Observable Inputs

(including quoted prices

for similar securities,

interest rates,

prepayment speeds,

credit risk, etc.) | | | Level 3

Significant Unobservable

Inputs (including the

Fund’s own assumptions in

determining the fair

value of investments) | | | Total | |

Assets: | |

Convertible Bonds | | | | | | | | | | | | | | | | |

Communication Services | | $ | — | | | $ | 1,319,565 | | | $ | — | | | $ | 1,319,565 | |

Consumer Discretionary | | | — | | | | 1,590,747 | | | | — | | | | 1,590,747 | |

Energy | | | — | | | | 1,071,614 | | | | — | | | | 1,071,614 | |

Financials | | | — | | | | 481,944 | | | | — | | | | 481,944 | |

Health Care | | | — | | | | 4,694,519 | | | | — | | | | 4,694,519 | |

Industrials | | | — | | | | 1,494,633 | | | | — | | | | 1,494,633 | |

Information Technology | | | — | | | | 7,856,064 | | | | — | | | | 7,856,064 | |

Materials | | | — | | | | 407,064 | | | | — | | | | 407,064 | |

Real Estate | | | — | | | | 200,651 | | | | — | | | | 200,651 | |

Convertible Preferred Stocks | | | | | | | | | | | | | | | | |

Consumer Staples | | | 61,272 | | | | — | | | | — | | | | 61,272 | |

Energy | | | 207,837 | | | | — | | | | — | | | | 207,837 | |

Financials | | | 1,147,134 | | | | 333,503 | | | | — | | | | 1,480,637 | |

Health Care | | | 566,283 | | | | — | | | | — | | | | 566,283 | |

Industrials | | | 344,465 | | | | — | | | | — | | | | 344,465 | |

Information Technology | | | 136,173 | | | | 84,355 | | | | — | | | | 220,528 | |

Materials | | | 116,482 | | | | — | | | | — | | | | 116,482 | |

Real Estate | | | 322,252 | | | | — | | | | — | | | | 322,252 | |

Utilities | | | 148,303 | | | | — | | | | — | | | | 148,303 | |

See Notes to Financial Statements.

13

1290 FUNDS

1290 CONVERTIBLE SECURITIES FUND

PORTFOLIO OF INVESTMENTS (Continued)

October 31, 2018

| | | | | | | | | | | | | | | | |

| | | | | |

| Investment Type | | Level 1

Quoted Prices in

Active Markets for

Identical

Securities | | | Level 2

Significant Other

Observable Inputs

(including quoted prices

for similar securities,

interest rates,

prepayment speeds,

credit risk, etc.) | | | Level 3

Significant Unobservable

Inputs (including the

Fund’s own assumptions in

determining the fair

value of investments) | | | Total | |

Short-Term Investment | | | | | | | | | | | | | | | | |

Investment Company | | $ | 105,315 | | | $ | — | | | $ | — | | | $ | 105,315 | |

| | | | | | | | | | | | | | | | |

Total Assets | | $ | 3,155,516 | | | $ | 19,534,659 | | | $ | — | | | $ | 22,690,175 | |

| | | | | | | | | | | | | | | | |

Total Liabilities | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total | | $ | 3,155,516 | | | $ | 19,534,659 | | | $ | — | | | $ | 22,690,175 | |

| | | | | | | | | | | | | | | | |

The Fund held no derivatives contracts during the year ended October 31, 2018.

Investment security transactions for the year ended October 31, 2018 were as follows:

| | | | |

Cost of Purchases: | | | | |

Long-term investments other than U.S. government debt securities | | $ | 10,779,037 | |

Net Proceeds of Sales and Redemptions: | | | | |

Long-term investments other than U.S. government debt securities | | $ | 10,570,159 | |

As of October 31, 2018, the gross unrealized appreciation (depreciation) of investments based on the aggregate cost of investments in securities and derivative instruments, if applicable, for Federal income tax purposes was as follows:

| | | | |

Aggregate gross unrealized appreciation | | $ | 1,743,505 | |

Aggregate gross unrealized depreciation | | | (1,697,816 | ) |

| | | | |

Net unrealized appreciation | | $ | 45,689 | |

| | | | |

Federal income tax cost of investments in securities and derivative instruments, if applicable | | $ | 22,644,486 | |

| | | | |

See Notes to Financial Statements.

14

1290 FUNDS

1290 CONVERTIBLE SECURITIES FUND

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2018

| | | | |

|

ASSETS | |

Investments in Securities, at value (Cost $22,503,258) | | $ | 22,690,175 | |

Cash | | | 642,918 | |

Dividends, interest and other receivables | | | 99,202 | |

Prepaid registration and filing fees | | | 16,209 | |

Receivable for securities sold | | | 3,082 | |

Receivable for Fund shares sold | | | 1,147 | |

Other assets | | | 292 | |

| | | | |

Total assets | | | 23,453,025 | |

| | | | |

LIABILITIES | | | | |

Dividends and distributions payable | | | 32,731 | |

Transfer agent fees payable | | | 5,029 | |

Administrative fees payable | | | 2,361 | |

Payable for Fund shares redeemed | | | 807 | |

Distribution fees payable – Class A | | | 111 | |

Distribution fees payable – Class R | | | 57 | |

Accrued expenses | | | 70,600 | |

| | | | |

Total liabilities | | | 111,696 | |

| | | | |

NET ASSETS | | $ | 23,341,329 | |

| | | | |

Net assets were comprised of: | | | | |

Paid in capital | | $ | 22,189,722 | |

Total distributable earnings (loss) | | | 1,151,607 | |

| | | | |

Net assets | | $ | 23,341,329 | |

| | | | |

Class A | | | | |

Net asset value and redemption price per share, $512,496 / 48,735 shares outstanding (unlimited amount authorized: $0.001 par value) | | $ | 10.52 | |

Maximum sales charge (4.50% of offering price) | | | 0.50 | |

| | | | |

Maximum offering price per share | | $ | 11.02 | |

| | | | |

Class I | | | | |

Net asset value and redemption price per share, $22,696,623 / 2,158,028 shares outstanding (unlimited amount authorized: $0.001 par value) | | $ | 10.52 | |

| | | | |

Class R | | | | |

Net asset value and redemption price per share, $132,210 / 12,576 shares outstanding (unlimited amount authorized: $0.001 par value) | | $ | 10.51 | |

| | | | |

STATEMENT OF OPERATIONS

For the Year Ended October 31, 2018

| | | | |

| |

INVESTMENT INCOME | | | | |

Interest | | $ | 338,309 | |

Dividends | | | 248,625 | |

| | | | |

Total income | | | 586,934 | |

| | | | |

EXPENSES | | | | |

Investment advisory fees | | | 168,174 | |

Professional fees | | | 80,125 | |

Administrative fees | | | 36,037 | |

Registration and filing fees | | | 33,823 | |

Transfer agent fees | | | 29,850 | |

Printing and mailing expenses | | | 23,768 | |

Custodian fees | | | 10,800 | |

Trustees’ fees | | | 2,521 | |

Distribution fees – Class A | | | 1,197 | |

Distribution fees – Class R | | | 679 | |

Miscellaneous | | | 21,118 | |

| | | | |

Gross expenses | | | 408,092 | |

Less: Waiver from investment adviser | | | (155,000 | ) |

| | | | |

Net expenses | | | 253,092 | |

| | | | |

NET INVESTMENT INCOME (LOSS) | | | 333,842 | |

| | | | |

REALIZED AND UNREALIZED GAIN (LOSS) | | | | |

Net realized gain (loss) on investments in securities | | | 1,094,133 | |

Net change in unrealized appreciation (depreciation) on investments in securities | | | (1,515,380 | ) |

| | | | |

NET REALIZED AND UNREALIZED GAIN (LOSS) | | | (421,247 | ) |

| | | | |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (87,405 | ) |

| | | | |

See Notes to Financial Statements.

15

1290 FUNDS

1290 CONVERTIBLE SECURITIES FUND

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Year Ended October 31, | |

| | 2018 | | | 2017 | |

INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: | | | | | | | | |

Net investment income (loss) | | $ | 333,842 | | | $ | 389,728 | |

Net realized gain (loss) | | | 1,094,133 | | | | 835,244 | |

Net change in unrealized appreciation (depreciation) | | | (1,515,380 | ) | | | 2,187,146 | |

| | | | | | | | |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | | (87,405 | ) | | | 3,412,118 | |

| | | | | | | | |

Distributions to shareholders: (a) | | | | | | | | |

Class A | | | (14,254 | ) | | | (9,313 | ) |

Class I | | | (777,213 | ) | | | (540,307 | ) |

Class R | | | (3,914 | ) | | | (2,099 | ) |

| | | | | | | | |

Total distributions to shareholders | | | (795,381 | ) | | | (551,719 | ) |

| | | | | | | | |

CAPITAL SHARES TRANSACTIONS: | | | | | | | | |

Class A | | | | | | | | |

Capital shares sold [ 10,198 and 2,344 shares, respectively ] | | | 114,133 | | | | 23,819 | |

Capital shares issued in reinvestment of dividends [ 1,010 and 691 shares, respectively ] | | | 10,820 | | | | 6,958 | |

Capital shares repurchased [ (2,118) and (2,543) shares, respectively ] | | | (23,402 | ) | | | (26,262 | ) |

| | | | | | | | |

Total Class A transactions | | | 101,551 | | | | 4,515 | |

| | | | | | | | |

Class I | | | | | | | | |

Capital shares sold [ 82,739 and 64,823 shares, respectively ] | | | 914,895 | | | | 666,975 | |

Capital shares issued in reinvestment of dividends [ 4,466 and 2,258 shares, respectively ] | | | 47,979 | | | | 22,933 | |

Capital shares repurchased [ (25,797) and (18,804) shares, respectively ] | | | (283,983 | ) | | | (192,919 | ) |

| | | | | | | | |

Total Class I transactions | | | 678,891 | | | | 496,989 | |

| | | | | | | | |

Class R | | | | | | | | |

Capital shares sold [ 2,514 and 0 shares, respectively ] | | | 27,506 | | | | — | |

Capital shares issued in reinvestment of dividends [ 69 and 0# shares, respectively ] | | | 733 | | | | 2 | |

Capital shares repurchased [ (17) and 0 shares, respectively ] | | | (185 | ) | | | — | |

| | | | | | | | |

Total Class R transactions | | | 28,054 | | | | 2 | |

| | | | | | | | |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM CAPITAL SHARE TRANSACTIONS | | | 808,496 | | | | 501,506 | |

| | | | | | | | |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (74,290 | ) | | | 3,361,905 | |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 23,415,619 | | | | 20,053,714 | |

| | | | | | | | |

End of year (b) | | $ | 23,341,329 | | | $ | 23,415,619 | |

| | | | | | | | |

# Number of shares is less than 0.5. | | | | | | | | |

(a) Prior year distributions to shareholders were made up of dividends from net investment income of $9,313, $540,307 and $2,099 for Classes A, I and R, respectively. These amounts were reclassified to conform with the current year presentation. | |

(b) Includes accumulated undistributed (overdistributed) net investment income of $99,779 as of October 31, 2017. The SEC eliminated the requirement to disclose undistributed net investment income in 2018. | |

See Notes to Financial Statements.

16

1290 FUNDS

1290 CONVERTIBLE SECURITIES FUND

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | |

Class A | | Year Ended October 31, | | | July 6, 2015* to

October 31, 2015 | |

| | 2018 | | | 2017 | | | 2016 | |

Net asset value, beginning of period | | $ | 10.91 | | | $ | 9.56 | | | $ | 9.56 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

Net investment income (loss) (e) | | | 0.13 | | | | 0.16 | | | | 0.14 | | | | 0.03 | |

Net realized and unrealized gain (loss) | | | (0.18 | ) | | | 1.43 | | | | 0.04 | | | | (0.44 | ) |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.05 | ) | | | 1.59 | | | | 0.18 | | | | (0.41 | ) |

| | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.23 | ) | | | (0.24 | ) | | | (0.18 | ) | | | (0.03 | ) |

Distributions from net realized gains | | | (0.11 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total dividends and distributions | | | (0.34 | ) | | | (0.24 | ) | | | (0.18 | ) | | | (0.03 | ) |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 10.52 | | | $ | 10.91 | | | $ | 9.56 | | | $ | 9.56 | |

| | | | | | | | | | | | | | | | |

Total return (b) | | | (0.46 | )% | | | 16.82 | % | | | 1.97 | % | | | (4.08 | )% |

| | | | | | | | | | | | | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | $ | 512 | | | $ | 433 | | | $ | 374 | | | $ | 206 | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | |

After waivers and reimbursements (a)(f) | | | 1.30 | % | | | 1.30 | % | | | 1.30 | % | | | 1.30 | % |

Before waivers and reimbursements (a)(f) | | | 1.94 | % | | | 2.07 | % | | | 2.26 | % | | | 2.09 | % |

Ratio of net investment income (loss) to average net assets: | | | | | | | | | | | | | | | | |

After waivers and reimbursements (a)(f) | | | 1.14 | % | | | 1.54 | % | | | 1.49 | % | | | 1.09 | %(l) |

Before waivers and reimbursements (a)(f) | | | 0.49 | % | | | 0.78 | % | | | 0.52 | % | | | 0.30 | %(l) |

Portfolio turnover rate (z)^ | | | 45 | % | | | 41 | % | | | 32 | % | | | 6 | % |

| | | | | | | | | | | | | | | | |

Class I | | Year Ended October 31, | | | July 6, 2015* to

October 31, 2015 | |

| | 2018 | | | 2017 | | | 2016 | |

Net asset value, beginning of period | | $ | 10.91 | | | $ | 9.56 | | | $ | 9.56 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

Net investment income (loss) (e) | | | 0.15 | | | | 0.18 | | | | 0.17 | | | | 0.04 | |

Net realized and unrealized gain (loss) | | | (0.17 | ) | | | 1.43 | | | | 0.04 | | | | (0.44 | ) |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.02 | ) | | | 1.61 | | | | 0.21 | | | | (0.40 | ) |

| | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.26 | ) | | | (0.26 | ) | | | (0.21 | ) | | | (0.04 | ) |

Distributions from net realized gains | | | (0.11 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total dividends and distributions | | | (0.37 | ) | | | (0.26 | ) | | | (0.21 | ) | | | (0.04 | ) |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 10.52 | | | $ | 10.91 | | | $ | 9.56 | | | $ | 9.56 | |

| | | | | | | | | | | | | | | | |

Total return (b) | | | (0.23 | )% | | | 17.11 | % | | | 2.23 | % | | | (4.00 | )% |

| | | | | | | | | | | | | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | $ | 22,697 | | | $ | 22,874 | | | $ | 19,584 | | | $ | 19,073 | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | |

After waivers and reimbursements (a)(f) | | | 1.05 | % | | | 1.05 | % | | | 1.05 | % | | | 1.05 | % |

Before waivers and reimbursements (a)(f) | | | 1.69 | % | | | 1.82 | % | | | 1.99 | % | | | 1.72 | % |

Ratio of net investment income (loss) to average net assets: | | | | | | | | | | | | | | | | |

After waivers and reimbursements (a)(f) | | | 1.40 | % | | | 1.80 | % | | | 1.78 | % | | | 1.37 | %(l) |

Before waivers and reimbursements (a)(f) | | | 0.75 | % | | | 1.03 | % | | | 0.84 | % | | | 0.70 | %(l) |

Portfolio turnover rate (z)^ | | | 45 | % | | | 41 | % | | | 32 | % | | | 6 | % |

See Notes to Financial Statements.

17

1290 FUNDS

1290 CONVERTIBLE SECURITIES FUND

FINANCIAL HIGHLIGHTS (Continued)

| | | | | | | | | | | | | | | | |

Class R | | Year Ended October 31, | | | July 6, 2015* to

October 31, 2015 | |

| | 2018 | | | 2017 | | | 2016 | |

Net asset value, beginning of period | | $ | 10.91 | | | $ | 9.56 | | | $ | 9.56 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

Net investment income (loss) (e) | | | 0.10 | | | | 0.13 | | | | 0.12 | | | | 0.03 | |

Net realized and unrealized gain (loss) | | | (0.18 | ) | | | 1.43 | | | | 0.04 | | | | (0.45 | ) |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.08 | ) | | | 1.56 | | | | 0.16 | | | | (0.42 | ) |

| | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.21 | ) | | | (0.21 | ) | | | (0.16 | ) | | | (0.02 | ) |

Distributions from net realized gains | | | (0.11 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total dividends and distributions | | | (0.32 | ) | | | (0.21 | ) | | | (0.16 | ) | | | (0.02 | ) |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 10.51 | | | $ | 10.91 | | | $ | 9.56 | | | $ | 9.56 | |

| | | | | | | | | | | | | | | | |

Total return (b) | | | (0.78 | )% | | | 16.53 | % | | | 1.72 | % | | | (4.16 | )% |

| | | | | | | | | | | | | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | $ | 132 | | | $ | 109 | | | $ | 96 | | | $ | 96 | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | |

After waivers and reimbursements (a)(f) | | | 1.55 | % | | | 1.55 | % | | | 1.55 | % | | | 1.55 | % |

Before waivers and reimbursements (a)(f) | | | 2.19 | % | | | 2.32 | % | | | 2.49 | % | | | 2.22 | % |

Ratio of net investment income (loss) to average net assets: | | | | | | | | | | | | | | | | |

After waivers and reimbursements (a)(f) | | | 0.90 | % | | | 1.30 | % | | | 1.28 | % | | | 0.87 | %(l) |

Before waivers and reimbursements (a)(f) | | | 0.25 | % | | | 0.53 | % | | | 0.34 | % | | | 0.20 | %(l) |

Portfolio turnover rate (z)^ | | | 45 | % | | | 41 | % | | | 32 | % | | | 6 | % |

| * | Commencement of Operations. |

| ^ | Portfolio turnover rate excludes derivatives, if any. |

| (a) | Ratios for periods less than one year are annualized. Certain non-recurring expenses incurred by the Fund are not annualized for periods less than one year. |

| (b) | Total returns for periods less than one year are not annualized. |

| (e) | Net investment income (loss) per share is based on average shares outstanding. |

| (f) | Expenses do not include the expenses of the underlying funds (“indirect expenses”), if applicable. |

| (l) | The annualized ratio of net investment income to average net assets may not be indicative of operating results for a full year. |

| (z) | Portfolio turnover rate for periods less than one year is not annualized. |

See Notes to Financial Statements.

18

1290 DIVERSIFIED BOND FUND (Unaudited)

INVESTMENT ADVISER

INVESTMENT SUB-ADVISERS

| Ø | | Brandywine Global Investment Management, LLC (Brandywine Global) (Effective June 15, 2018, Brandywine Global replaced Pacific Investment Management Company, LLC and TCW Investment Management Company LLC, as sub-advisers to the Fund) |

PERFORMANCE RESULTS

| | | | | | | | | | | | |

| Annualized Total Returns as of 10/31/18 | |

| | | | | | 1 Year | | | Since

Incept. | |

Fund – Class A Shares* | | | without Sales Charge | | | | (1.44 | )% | | | 1.36 | % |

| | | | with Sales Charge (a) | | | | (5.90 | ) | | | (0.03 | ) |

Fund – Class I Shares* | | | | | | | (1.19 | ) | | | 1.62 | |

Fund – Class R Shares* | | | | | | | (1.69 | ) | | | 1.10 | |

Bloomberg Barclays U.S. Aggregate Bond Index† | | | | | | | (2.05 | ) | | | 1.22 | |

ICE BofAML USD 3-Month Deposit Offered Rate Constant Maturity Index | | | | | | | 1.85 | | | | 1.07 | |

* Date of inception 7/6/15. † In 2018, the Fund’s benchmark index against which the Fund measures its performance, the ICE BofAML USD 3-Month Deposit Offered Rate Constant Maturity Index, was replaced with the Bloomberg Barclays U.S. Aggregate Bond Index. The Investment Adviser believes the Bloomberg Barclays U.S. Aggregate Bond Index serves as a better performance comparison for investors. (a) A 4.50% front-end sales charge was deducted. Returns for periods greater than one year are annualized. | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For the most current month-end performance data please call 1-888-310-0416 or visit www.1290Funds.com.

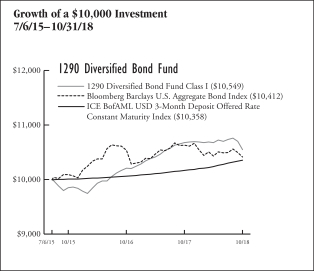

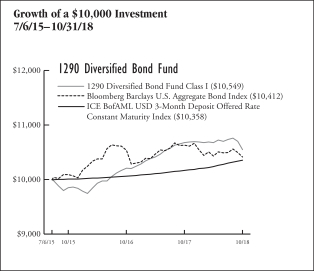

The graph illustrates comparative performance for $10,000 invested in the Class I Shares of the 1290 Diversified Bond Fund and the Bloomberg Barclays U.S. Aggregate Bond Index from 7/6/15 to 10/31/18. The performance of the Bloomberg Barclays U.S. Aggregate Bond Index reflects an initial investment at the end of the month closest to the Fund’s inception. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Bloomberg Barclays U.S. Aggregate Bond Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends, capital gain distributions, and interest of the securities included in the benchmark.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

PERFORMANCE SUMMARY

The Fund’s Class I shares returned (1.19)% for the year ended October 31, 2018. The Fund’s benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index and ICE BofAML USD 3-Month Deposit Offered Rate Constant Maturity Index returned (2.05)% and 1.85%, respectively, over the same year.

Overview — Brandywine Global Investment Management, LLC (Brandywine Global)

On June 15, 2018 the Fund changed its name from 1290 Unconstrained Bond Managers Fund, changed its subadviser to Brandywine Global, and changed its strategy.

Economic Outlook/Review:

| • | | A significant departure from traditional U.S. trade and foreign policy upended global markets in the second half of 2018, causing business and consumer sentiment to retreat around the world. |

| • | | The Federal Reserve (Fed) increased its policy rate in June, sending short-to-intermediate rates higher, while the long end of the Treasury curve remained anchored. |

| • | | Fed rhetoric was hawkish despite a flattening yield curve, strengthening U.S. dollar, and increasing global policy uncertainties — these factors collectively fostered a risk-off environment that profoundly affected global markets. |

Investment Outlook Strategy:

| • | | We believe synchronized global growth was temporarily derailed by trade tensions and should resume, albeit at a more modest pace. |

| • | | The Fed set expectations of a fourth rate hike in 2018 and emphasized that domestic conditions will influence its outlook and pace of tightening. |

| • | | Positive global economic indicators have been obfuscated but we believe they should resurface if protectionist sentiment subsides. |

Fund Highlights

What helped performance during the period June 15, 2018 to October 31, 2018?

| • | | United States Agency mortgage-backed securities (MBS), U.S. Non-Agency MBS, and U.S. corporates performed well and added to performance. |

19

1290 DIVERSIFIED BOND FUND (Unaudited)

| • | | A position in Brazilian bonds and currency added to the Fund — however, other Latin American countries including Mexico and Columbia all detracted from performance. Brazil’s rally came once their election was finished and the political uncertainty surrounding it was resolved. |

| • | | A short position in the Swiss Franc and a long position in the South African Rand were additive to performance. |

What hurt performance during the period June 15, 2018 to October 31, 2018?

| • | | Despite a rebound at period end, emerging countries struggled against risk-off sentiment and volatility. |

| • | | A strong U.S. dollar negatively impacted some currency positions such as the Euro, Pound and Yen. |