- RBNC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Reliant Bancorp (RBNC) 425Business combination disclosure

Filed: 23 Aug 17, 12:00am

Filed by Commerce Union Bancshares, Inc.

Pursuant to Rule 425 under the Securities Act of 1933, as amended

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Community First, Inc.

(Commission File No. 000-49966)

Updates and Questions

For updates about our merger, look on our intranet and either bank website. You can also send questions to: HRquestions@reliantbank.com integrationteam@reliantbank.com

reliantbank.com • (877)221-2050

Forward looking statements” Looking Statements within the meaning All statements, of Section other 27A than of the statements Securities of Act historical of 1933, fact, as amended, included in and this Section presentation 21E of the are Securities “forward- Exchange of 1995. The Act words of 1934, “believe,” as amended, “anticipate,” and are “expect,” made pursuant “may,” to “will,” the safe “assume,” harbor “should,” provisions “predict,” of the Private “could,” Securities “would,” Litigation “intend,” Reform “targets,” Act “estimates,” forward-looking “projects,” statements, “plans,” but other “potential” statements and not other based similar on historical words and information expressions may also of the be considered future are forward-looking, intended to identify including such First”) statements of the about proposed the benefits merger to of Commerce Commerce Union Union Bancshares, and Community Inc. First, (“Commerce Commerce Union”) Union’s and and Community Community First’s First, Inc. future (“Community financial and operating company’s results earnings (including per share the and anticipated tangible book impact value) of the and proposed Commerce merger Union’s of Commerce and Community Union First’s and Community plans, objectives First on and the intentions. combined achievements All forward-looking of Commerce statements Union are and subject Community to risks, First uncertainties to differ materially and other from factors any that results, may performance, cause the actual or achievements results, performance expressed or or synergies implied from by such the forward-looking proposed merger statements. of Commerce Such Union factors and include, Community among First others, may not (1) the be realized risk that or the take cost longer savings than and anticipated any revenue to accounting be realized, and (2) the tax ability treatment of Commerce of the proposed Union merger, and Community (3) the effect First to of meet the announcement expectations regarding of the proposed the timing merger and on completion employee and and customer and customers), relationships (4) the and risk operating that integration results of (including, Community without First’s operations limitation, with difficulties those of in Commerce maintaining Union relationships will be materially with employees delayed or the will termination be more costly of the or merger difficult agreement, than expected, (6) the (5) amount the occurrence of the costs, of any fees, event, expenses, change and or charges other circumstances related to the that proposed could merger, give rise (7) to (8) reputational the failure risk of the and closing the reaction conditions of the to parties’ be satisfied, customers, or any suppliers, unexpected employees delay in closing or other the business proposed partners merger, to (9) the the proposed possibility merger, that the the proposed dilution caused merger by may Commerce be more Union’s expensive issuance to complete of additional than anticipated, shares of its including common as stock a result in the of unexpected proposed merger factors and or events, the private (10) placement, looking statements and (11) can general be found competitive, in Commerce economic, Union’s political annual and report market on Form conditions.10-K, quarterly Additional reports factors on which Form10-Q, could and affect current the forward- reports on each Form case8-K, filed or with Community the SEC First’s and available annual on report the SEC’s on Form website10-K, at quarterly http://www. reports sec. gov. on Form Commerce10-Q, and Union current and Community reports on Form First believe8-K, in the statements, forward-looking which are statements based on current contained expectations herein are and reasonable; speak only however, as of the undue date that reliance they should are made. not be Commerce placed on Union any forward-looking and Community First hereof, disclaim whether any as obligation a result of to new update information, or revise any future forward-looking events or otherwise. statements contained in this filing, which speak only as of the date Additional Union intends Information to file a registration About the statement Proposed on Merger FormS-4 and with Where the SEC, to which Find It will In connection include a joint with proxy the proposed statement transaction, of Commerce Commerce Union and with Community the SEC. Before First and making a prospectus any voting of or Commerce investment Union, decision, and each investors party will and file security other documents holders of regarding Commerce the Union proposed and Community transaction as First well are as urged any amendments to carefully read or supplements the entire registration to these documents statement and and any joint other proxy relevant statement/prospectus, documents filed when with they the SEC, become because available, they shareholders will contain important of each institution information seeking about the the required proposed shareholder transaction. approvals. A definitive Investors joint proxy and security statement/prospectus holders will be will able be to sent obtain to the the registration Community

First statement as described and the below. joint proxy statement/prospectus free of charge from the SEC’s website or from Commerce Union or filings Investors with and the security SEC, including holders but are not urged limited to carefully to their annual review reports and consider on Form each10-K, of Commerce their proxy Union’s statements, and Community their current First’s reports public on Form8-K and their quarterly reports on Form10-Q.

The under documents the heading filed “Investor by Commerce Relations” Union with or at the the SEC SEC’s may website be obtained at www. free sec. of charge gov. These at Commerce documents Union’s may website also be at obtained www.reliantbank. free of charge com from Brentwood, Commerce Tennessee Union by 37027 requesting or by calling them (615) in writing221-2020. to J. Daniel Dellinger, Chief Financial Officer, at 1736 Carothers Parkway, Suite 100, The under documents the “Shareholders” filed by Community heading or First at the with SEC’s the website SEC may at be www. obtained sec.gov. free These of charge documents at Community may also First’s be obtained website free at www. of charge cfbk. from com 38401, Community Attention: First by Jon requesting Thompson them or Ashlee in writing Pope, to or Community by calling (931) First,380-2265. Inc., 501 South James M. Campbell Boulevard, Columbia, Tennessee This in any filing jurisdiction shall not in constitute which such an offer, offer solicitation to sell or the or solicitation sale would be of an unlawful offer to prior buy to securities, registration nor or shall qualification there be any under sale the of securities securities laws of such jurisdiction.

Participants deemed participants in the in Solicitation the solicitation Commerce of proxies Union, from Community Commerce Union’s First, and and certain Community of their First’s directors shareholders and executive in connection officers with may the be proposed Union common transaction. stock is Information set forth in the about definitive the directors proxy statement and executive for its officers 2017 annual of Commerce meeting Union of shareholders, and their ownership which was of filed Commerce with the SEC common on April stock 19, is 2017. set Information forth in the definitive about the directors proxy statement and executive for Community officers of First’s Community 2017 annual First and meeting their of ownership shareholders, of Community as previously First filed the registration with the SEC statement on April 3, and 2017. the Shareholders joint proxy statement/prospectus may obtain additional information when they become regarding available. the interests Free copies of such of participants these documents by reading may be obtained as described in the paragraphs above.

Reliant Bank and

Community First

Bank & Trust are

growing together.

“Coming together is a beginning. Keeping together is progress. Working together is success.”

— Henry Ford

[Graphic Appears Here]

The crew at Reliant Bank is thrilled with the opportunity to add Community First Bank & Trust to its winning team.

The decision for Reliant Bank (Reliant) and Community First Bank & Trust (Community First) to merge began with a simple conversation between senior representatives of both banks. As those discussions expanded and became more strategic in nature, possible long-term benefits became apparent — for shareholders, customers, communities and employees, including:

• Similar cultures of commitment to customers and the communities served.

• Markets that fit nicely together and allow customers to transact business at an increased number of locations.

• Advantages of scale. The financial industry is changing faster than at any time in history. Regulatory reform, risk management considerations, disruptive technologies, and demographic changes present challenges

to our continued success. Larger-scale organizations have a competitive advantage.

• A strong and diverse team of employees with opportunities for growth and advancement.

Most importantly, this merger helps ensure Community First remains mostly a locally owned community bank committed to the future prosperity of its shareholders, customers and communities.

As an employee of Community First, you have a role in the success of this merger. Customers will look to you as a guide throughout the process. Educate yourself by carefully reviewing all materials that are provided. Be ready to confidently answer questions that may be posed and convey to customers and coworkers alike the value of becoming part of Reliant.

Please know the management teams of both banks are committed to open and honest dialogue to ensure a seamless transition. This communication element has been created to answer questions you may have regarding the merger. In addition, branch visits are scheduled over the course of the next few days so each of you has an opportunity to interact with the team from Reliant.

1

Who is Reliant Bank?

Reliant is the epitome of a successful de novo bank that reached profitability after only seven full months of operations, surpassed $100 million in assets in less than one year, and in the midst of the economic downturn, reported $300 million in assets — a milestone reached in less than three years.

What began as an initial conversation between DeVan Ard, Jr. and Farzin Ferdowsi in early 2004 set a strategy in motion to create a true community bank — locally owned and operated — and one on which customers could depend. Its name would be Reliant Bank. Tactical milestones were mapped and on January 9, 2006, Reliant Bank opened from a temporary location in Brentwood, Tennessee. That temporary location was quickly replaced with Reliant’s first permanent branch that opened in April 2007 at 1736 Carothers Parkway in Brentwood. Its Lenox location followed in 2008, opening on Nolensville Road in Nashville. In 2009, Reliant opened the doors in Maryland

Farms after acquiring the Brentwood location of

Magna Bank making it Reliant’s third location. In just over three years of operations, Reliant reached over $346 million in assets, expanded into Davidson County with its Nolensville Road location, and acquired a branch location from another bank.

Reliant’s fourth branch opened in 2010 and is located just off South Royal Oaks Boulevard in Franklin. This office is also home to the bank’s operations center which occupies the entire second floor of thetwo-story building.

In the spring of 2014, Reliant announced plans to merge with Commerce Union Bank in Robertson County.

Commerce Union Bank was established in August 2006, by William R. (Ron) DeBerry. Ron’s vision was to create an organization with customer relationships at its core. And, he wanted those relationships to make a difference in the way

Commerce Union conducted business. His bank’s reputation was one of integrity — every day, every deposit or loan, every check cashed, and every customer conversation.

Eight years later, Commerce Union had expanded its presence in Middle Tennessee with two additional branches in Sumner County, a loan and deposit production office in Davidson County, and had grown to approximately $300 million in assets. Similar to the Reliant culture, Commerce Union placed tremendous value on serving the community, treating people with respect, and doing a job well. And from a financial and strategic perspective, this combination was very attractive as the combined scale created opportunities to

Similar to the Reliant culture, Commerce Union placed tremendous value on serving the community, treating people with respect, and doing a job well.

increase profitability, expand the operating footprint and diversify the business mix. The merger was a successful combination of the very best qualities of each bank. Its completion on April 1, 2015 signaled a new era for Reliant Bank — creating a vibrant and resourceful regional financial institution with total assets of $791 million.

By July of that same year, Reliant enhanced its visibility to investors and improved the marketability of its shares for stockholders by listing its shares for trading on The NASDAQ Stock Market. The NASDAQ listing represented an important milestone that highlighted Reliant’s

continued progress toward building long-term shareholder value.

The year 2016 was spent tactically developing growth plans. And rapid announcements began in the first quarter of 2017 including an expansion into Chattanooga, Tennessee — one of the state’s fastest growing metropolitan markets — with a loan production office and plans to expand its loan, deposit and treasury management opportunities through this addition. And at the same time, a new, full-service branch was introduced

— its position along the main corridor in Green Hills strategically connecting Franklin to Nashville on Hillsboro Road.

From the beginning, the Reliant vision was to create a locally owned and operated bank where service to customers and community came first. Reliant is a regional bank dedicated to the growth of its communities. Its purpose is to invoke a warm and welcoming spirit that attracts new generations while honoring longtime relationships.

At Reliant, banking is a people business. That means Reliant employees listen, get to know each customer, provide answers quickly and remain committed to building a community of friends that grow together.

Reliant is a strong, viable $1 billion banking organization integrated into its communities. Its solid foundation in business banking delivery has allowed for successful diversification in consumer lending and deposits. Its continued emphasis on creating an incredible customer experience has allowed Reliant to become a full-service commercial bank offering a variety of deposit, lending and mortgage products to business and consumer customers.

Reliant employees love what they do and consistently deliver exceptional customer service from 10 locations in Middle and East Tennessee. Giving back to the community is an important aspect of its life. And, the Reliant pledge remains the same — to be the source of dependable financial services and the best financial institution at building and being part of the communities it serves, one customer at a time.

Facts and Stats (as of June 30, 2017)

Asset Size: $1.003 Billion Deposits: $840 Million Loans: $719 Million Employees: 125

Locations

Reliant is based in Brentwood, Tennessee and operates banking centers in Davidson, Robertson, Rutherford, Sumner and Williamson Counties in Middle Tennessee and Hamilton County in East Tennessee.

[Graphic Appears Here]

Product Suite

Personal Savings

Whether you’re saving for a new home, a college education, or any of life’s events, Reliant offers a variety of account types including regular savings, student savings, CDs and IRAs, Money Market and HSAs to help customers make the most of their money.

Personal Checking

Reliant offers four checking accounts — Free, 50+,

Interest and Rewards — each with its own unique benefits. All personal checking accounts include:

• Free debit cards

• Free online banking and bill payment

• Free electronic statements with check images

• Free mobile banking and mobile deposit

• Up to $20 reimbursement ofout-of-network ATM fees per month

• Preferred rate on certificates of deposit

Retirement and Investment Services

Whether you are just getting started or have an extensive portfolio, Reliant has the tools to help customers meet their individual investment needs.

Personal Loans

Various financing solutions are available for every life phase. Make your goals a reality with one of these loan types: deposit-secured, stock and bond secured, auto, boat, RV, motorcycle and personal lines of credit.

Online Presence @ reliantbank.com

Reliant’s digital channel includes financial tools and calculators, online banking, bill payment, online check ordering, online statements, and mobile account access — all at absolutely no cost to customers.

Mortgage Loans

A variety of mortgage products are available for home financing including conventional, fixed-rate, adjustable rate, FHA, VA, Jumbo and even new construction.

Business Savings

Reliant’s business savings helps clients’ money work harder. With options from Commercial

Money Market to Certificates of Deposit, we help maximize your earnings.

Business Checking

Reliant understands the demands of building a business and helps clients rise to the challenge with custom account options, the latest in banking technology, productive resources and convenient features.

Business Services

Reliant offers business clients competitive products and services that are technology based with a personal touch including:

• Payroll services through Inova to connect business clients with the area’s biggest payroll provider, offering financial savings through outsourcing payroll that simplifies complexities and tax filings.

• Remote deposit services that include desktop scanners for electronic deposit of checks that make last-minute dashes to a physical branch seem archaic.

• Bank@Work programs — value-added benefits for your employees at no cost to you.

• Positive Pay — an automated tool to help prevent fraud.

• Merchant Services — including credit card acceptance and check services for added convenience.

Business Loans

At Reliant, you’ll find flexible solutions that help your business grow. Whether it’s a first or next real estate acquisition, financing of equipment or assets, short-term financing for working capital, or help with a

business acquisition or refinance of personal debt, we have a

flexible solution and seasoned personal bankers to determine the best option for you.

Honors

• Named a member of the Sandler O’NeillSM

— All Stars Class of 2016, a list of 27top-performing publicly tradedsmall-cap banks and thrifts in the country. Over 400 publicly traded banks and thrifts were evaluated to identify the 27 outstanding institutions with market caps below $2.5 billion that surpassed barriers related to growth, profitability, credit quality and capital growth.

• Named Future 50 Award Winner (consecutively) by the Nashville Area Chamber of Commerce. This award recognizes key indicators of the most successful companies in the region. Recipients exhibit revenue and employment growth, but also possess leadership, innovation, vision, creativity and drive toward building a successful enterprise.

• Recognized by the American Bankers Association and recipient of the Community Impact Award presented by the Nashville Area Chamber of Commerce for its Personal Enrichment Program (PEP). This recognition identifies companies that display long-term commitment to Middle Tennessee through a community program or project. Reliant Bank’s PEP provides each employee with an annual allotment of 20 hours for community service activities. Through its PEP, Reliant Bank and its employees have given their time, talent, and hearts to 17 different agencies in the

Greater Nashville area.

• Named “Best Financial Institution” in the Tennessean’s annual “Toast of Music City Reader’s Choice Awards.”

• Named as one of only twelve companies in the Middle Tennessee area for the Nashville Business Journal’s Corporate Philanthropy Awards. This prestigious award recognizes companies for their outstanding volunteer and financial contributions to Middle Tennessee charities and nonprofit organizations.

• Recognized by the Nashville Business Journal as one of the top five banks headquartered in the Nashville area for small business lending.

Reliant offers a variety of account types to help customers make the most of their money.

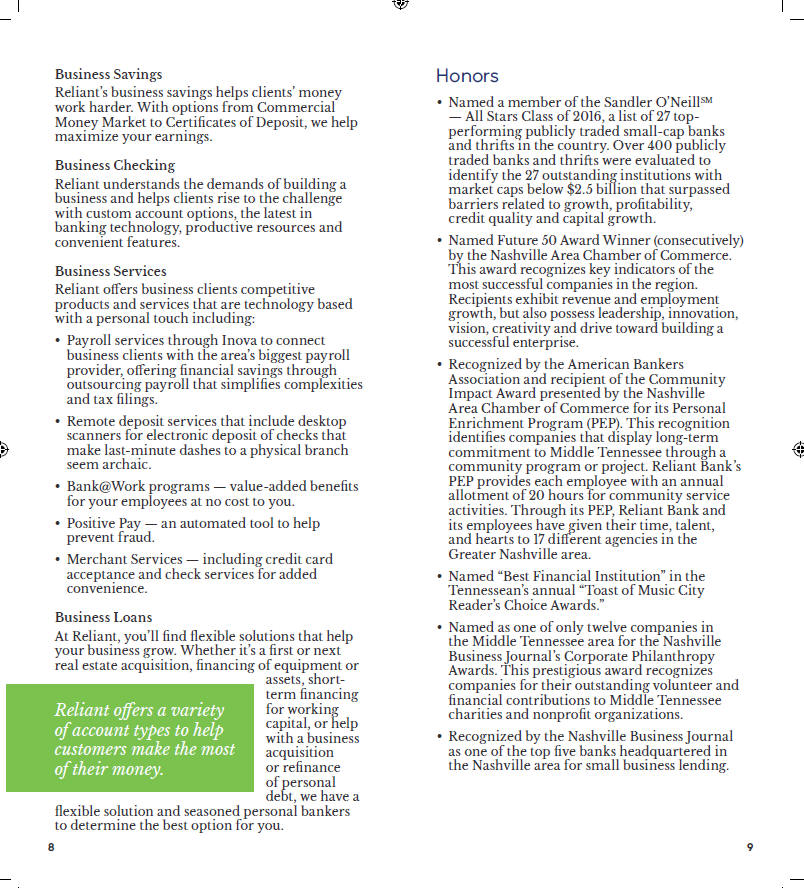

Leadership

DeVan Ard, Jr. is the

President and CEO of

Reliant Bank. Upon completion of the merger and with his guidance, we intend to continue to develop a strong suite of competitive products, expand our branch

network, and build a solid capital base that supports large lending

DeVan Ard, Jr. relationships.

President and CEO

DeVan began his banking career in 1981 at AmSouth Bank. He held various positions through 2004 before leaving to form Reliant Bank. Playing an active role in the business and nonprofit community, his current

Board positions include Chairman of the Board for the We Are Building Lives Foundation, and Board Member for the Tennessee Bankers Association and the Middle Tennessee Council of Boy Scouts of America. He is also a Member of the Rotary Club of Nashville. He is Past President of the PENCIL Foundation and is a Graduate of Leadership Nashville. He holds an MBA from the University of Alabama, Tuscaloosa and earned his BA in business administration and history from Vanderbilt University.

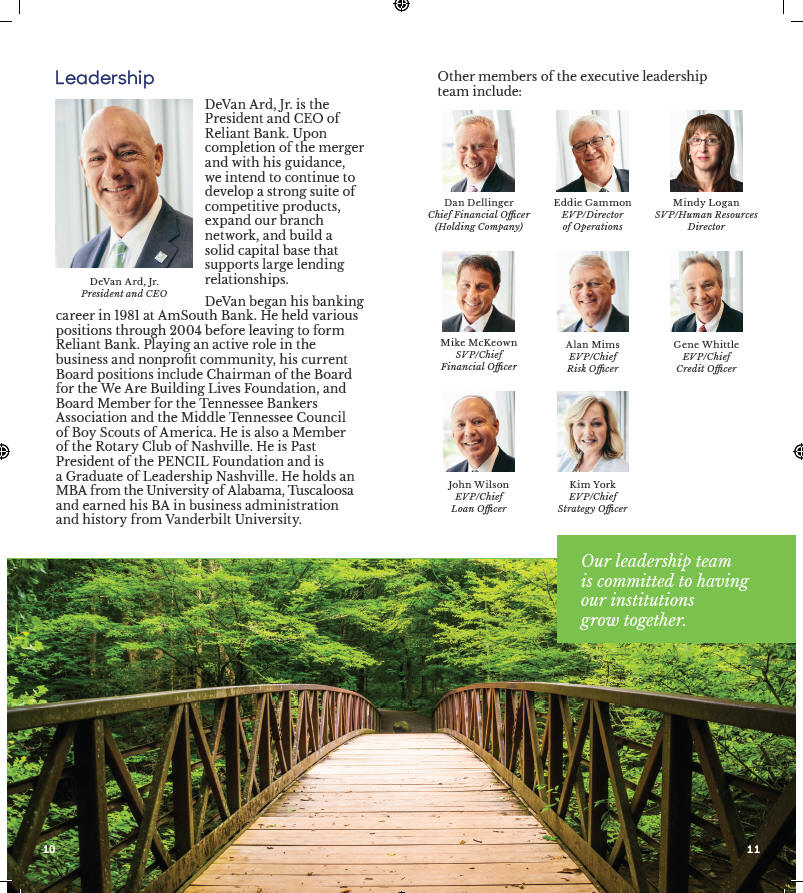

[Graphic Appears Here]

Our leadership team is committed to having our institutions grow together.

[Graphic Appears Here]

Expectations

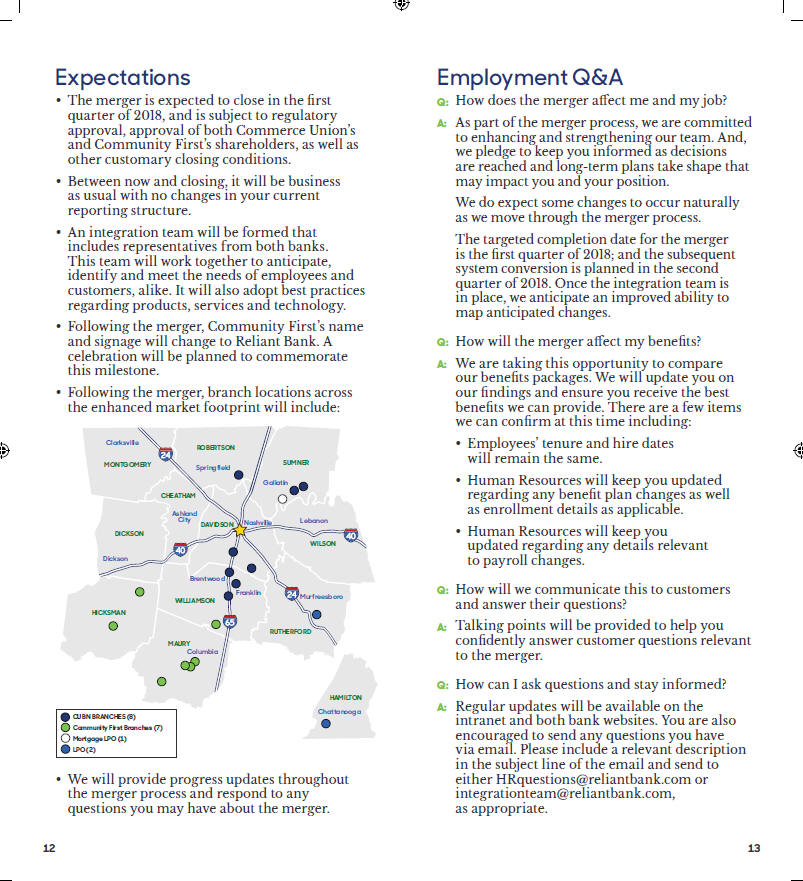

The merger is expected to close in the frst quarter of 2018, and is subject to regulatory approval, approval of both Commerce Union’s and Community First’s shareholders, as well as other customary closing conditions. • Between now and closing, it will be business as usual with no changes in your current reporting structure. • An integration team will be formed that includes representatives from both banks. This team will work together to anticipate, identify and meet the needs of employees and customers, alike. It will also adopt best practices regarding products, services and technology.• Following the merger, Community First’s name and signage will change to Reliant Bank. A celebration will be planned to commemorate this milestone.• Following the merger, branch locations across the enhanced market footprint will include:

We will provide progress updates throughout the merger process and respond to any questions you may have about the merger.

Employment Q&A

How does the merger affct me and my job?As part of the merger process, we are committed to enhancing and strengthening our team. And, we pledge to keep you informed as decisions are reached and long-term plans take shape that may impact you and your position.We do expect some changes to occur naturally as we move through the merger process.The targeted completion date for the merger is the frst quarter of 2018; and the subsequent system conversion is planned in the second quarter of 2018. Once the integration team is in place, we anticipate an improved ability to map anticipated changes.

How will the merger affct my benefts?We are taking this opportunity to compare our benefts packages. We will update you on our fndings and ensure you receive the best benefts we can provide. There are a few items we can confrm at this time including:• Employees’ tenure and hire dates will remain the same.• Human Resources will keep you updated regarding any beneft plan changes as well as enrollment details as applicable.• Human Resources will keep you updated regarding any details relevant to payroll changes.

How will we communicate this to customers and answer their questions?Talking points will be provided to help you confdently answer customer questions relevant to the merger. How can I ask questions and stay informed?Regular updates will be available on the intranet and both bank websites. You are also encouraged to send any questions you have via email. Please include a relevant description in the subject line of the email and send to either HRquestions@reliantbank.com or integrationteam@reliantbank.com, as appropriate.

12 13