united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22963

iCapital KKR Private Markets Fund

(Exact name of registrant as specified in charter)

60 East 42nd Street, 26th Floor, New York, NY 10165

(Address of principal executive offices) (Zip code)

Kyle Hartley, iCapital Registered Fund Adviser LLC

60 East 42nd Street, 26th Floor, New York, NY 10165

(Name and address of agent for service)

Registrant's telephone number, including area code: (646) 214-7277

Date of fiscal year end: 3/31

Date of reporting period: 3/31/21

Item 1. Reports to Stockholders.

| |

| |

|

| | | |

| |

| iCAPITAL KKR PRIVATE MARKETS FUND |

| (FORMERLY, ALTEGRIS KKR COMMITMENTS MASTER FUND) |

| |

| |

| |

| |

| |

| |

| ANNUAL REPORT |

| March 31, 2021 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| ADVISED BY: | SUB-ADVISED BY: |

| iCapital Registered Fund Adviser LLC | StepStone Group LP |

| 60 East 42nd Street | 4275 Executive Square |

| 26th Floor | Suite 500 |

| New York, NY 10165 | La Jolla, CA 92037 |

| | |

| | |

| | |

| | |

| | |

| | |

| iCapital KKR Private Markets Fund |

| (Formerly, Altegris KKR Commitments Master Fund) |

| March 31, 2021 |

| |

Table of Contents

| Letter to Shareholders (Unaudited) | | 1 |

| Report of Independent Registered Public Accounting Firm | | 5 |

| Portfolio Review (Unaudited) | | 6 |

| Consolidated Portfolio of Investments | | 7 |

| Consolidated Statement of Assets and Liabilities | | 9 |

| Consolidated Statement of Operations | | 10 |

| Consolidated Statements of Changes in Net Assets | | 11 |

| Consolidated Statement of Cash Flows | | 12 |

| Consolidated Statements of Financial Highlights | | 13 |

| Notes to Consolidated Financial Statements | | 14 |

| Approval of Investment Advisory And Sub-Advisory Agreements (Unaudited) | | 25 |

| Supplemental Information | | 27 |

| Privacy Notice | | 31 |

| Letter to Shareholders |

| Annual Report for the iCapital KKR Private Markets Fund (the “Fund”) |

| Twelve-Month Period Ended March 31, 2021 |

| |

Transaction Overview

On January 29, 2021, the Fund’s shareholders approved iCapital Registered Fund Adviser LLC (“iCapital RF Adviser”) as the new investment advisor, replacing Altegris Advisors, LLC. In conjunction, the Fund was renamed the iCapital KKR Private Markets Fund (formerly the Altegris KKR Commitments Master Fund). KKR also acquired less than 25% of iCapital RF Adviser, which we believe creates additional economic alignment with investors in the Fund.

iCapital RF Adviser is an affiliate of Institutional Capital Network (“iCapital”), a firm which offers investment solutions and develops technology-based services to transform the private capital industry. Founded in 2013, iCapital is based in New York City with five additional offices globally and over 400 employees.

iCapital RF Adviser consists of a four-person portfolio management team with 50+ years of combined experience in private equity, including Nick Veronis (Co-Founder & Managing Partner) and David Shyu (Co-Portfolio Manager). Prior to co-founding iCapital, Mr. Veronis spent 11 years at Veronis Suhler Stevenson (VSS), a middle market private equity firm where he was a Managing Director responsible for originating and structuring investment opportunities. Mr. Shyu was previously a Director of Newbury Partners and began his career as an Analyst at Goldman Sachs. He is a graduate of Princeton University.

Subject to investment availability and market conditions, we currently expect to focus on four key investment themes that capitalize on KKR strengths and already represent over 60% of the Fund’s fair value in underlying investments as of March 31, 2021:

| ● | Rise of the Global Millennial & Middle Class |

KKR has extensive experience in each of these themes with a deep pool of dedicated investment professionals sourcing opportunities and working closely with portfolio companies to create value. KKR, one of the pioneers of the private equity industry, has 44 years of experience, over $250 billion in AUM and over 500 investment professionals. Furthermore, we currently intend to emphasize co-investments and secondaries to potentially mitigate cash drag and reduce the level of acquired fund fees going forward.

The Fund will continue aiming to deliver attractive returns with less volatility than public equities, while providing broad diversification across strategies, types, geographies, sectors, vintage years, and underlying investments.

Market Overview

The one-year period ended March 31, 2021 was marked by high levels of uncertainty in financial markets driven by the outbreak of the COVID-19 pandemic. Following a sharp decline in public stock prices in

March 2020, equity markets saw a strong rebound in Q2 with the help of highly accommodative monetary policy and historically low interest rates. However, gains were largely uneven, driven mostly by large technology stocks, which many investors viewed as somewhat of a safe haven as demand for tech solutions surged in a remote working environment. Investors showed less optimism for small cap stocks and more cyclical sectors, evidenced by the outperformance of the NASDAQ Composite Index relative to other major U.S. stock indices.

Markets continued their upward trend into the early parts of Q3 2020 before seeing a pullback near the end of September due to uncertainty surrounding U.S. elections and concerns about frothy tech valuations. However, equities rebounded strongly in the final months of 2020 and into Q1 2021, driven by growing optimism over a successful vaccine rollout and beliefs that pent-up demand during the pandemic would lead to a strong economic rebound. This was combined with continued accommodative monetary policy and aggressive government spending on stimulus packages to promote a bullish market environment. Looking forward, we are closely focused on rising interest rates as an indication of future economic activity, as the yield on the 10-year U.S. treasury has surged from historic lows over the last several months. While this could hinder capital raising and acquisition activity, it is also a strong indication of continued investor optimism around an economic recovery.

Activity across private markets followed a similar sentiment to public equities. Deal activity slowed significantly relative to prior years during the first half of 2020 but ticked up significantly in the latter half of the year, with sectors such as technology recovering more quickly and at valuations even surpassing pre-pandemic levels due to strong investor demand for tech-enabled business models that address the Digital Age theme. Deal volumes have remained robust in Q1 2021 following a record-breaking rebound in Q4 2020, as 1,762 U.S. private equity deals were completed in Q1 with a total deal value of $203 billion, according to PitchBook1. Further, fund managers have been making more opportunistic investments in verticals that are still facing difficulties in the aftermath of the pandemic, such as retail and hospitality. There were also a handful of large corporate carve-outs and take-privates completed during the first quarter.

With respect to the secondaries market, the rapid growth in GP-led transactions provides a significant opportunity set for the Fund. Well-established, blue-chip GPs are now utilizing the secondary market to hold onto their attractive assets longer, and at the same time, offer liquidity to existing LPs in a timely manner while creating proper alignment with the new secondary buyers. This development provides GPs with an increasingly reliable “third” exit option for their portfolio companies, aside from a sale or IPO, that allows continued participation in the value creation of assets that they already know well.

Fund Overview as of March 31, 2021

During the most recent quarter, the Fund generated returns of 12.0% for the Class I shares and 11.9% for the Class A shares, compared to 4.6% for the MSCI ACWI Index and 6.2% for the S&P 500 Total Return Index. Over 60% of the Fund’s underlying investment gain during the most recent quarter was driven by underlying investments within the Digital Age and Health & Wellness themes. Of note, approximately 35% of the Fund’s underlying investment gain during the most recent quarter was attributable to one underlying investment within the Digital Age theme that subsequently held an IPO in April 2021.

| 1 | Source: PitchBook Q1 2021 US PE Breakdown |

Since inception, the Fund’s annualized returns have been 10.8% for the Class I shares and 10.1% for the Class A shares, compared to 10.5% for the MSCI ACWI Index and 14.1% for the S&P 500 Total Return Index over the same time frame. The Fund has generated these annualized returns with approximately half the volatility2 of the MSCI ACWI Index and the S&P 500 Total Return Index. That being said, the Fund’s annualized returns have been meaningfully impacted by high levels of historical net cash, which ranged from approximately 30% to 50% of NAV between mid-2016 and mid-2018. As noted, subject to investment availability and market conditions, we currently intend to emphasize co-investments and secondaries to potentially mitigate cash drag going forward. Furthermore, in parallel with becoming the new investment advisor, we negotiated significant amendments to the existing line of credit in order to facilitate the optimization of cash management – the size of the line was increased from $30 million to $70 million, while the drawn interest rate spread was reduced from 2.25% to 1.90% and the undrawn fee was reduced from 1.20% to 0.80%.

With respect to diversification as of March 31, 2021, some quantitative examples include:

| ● | Strategy3 - 93% Buyouts & Growth Equity, 7% Real Estate, 3% Other |

| ● | Type3 - 41% Primary Investments, 39% Secondary Investments, 23% Co-investments |

| ● | Geographies3 - 71% North America, 20% Asia, 12% Europe |

| ● | Sectors4 - 33% Information Technology, 12% Health Care, 10% Consumer Staples, and others |

Moreover, the portfolio is relatively seasoned with over 80% of the Fund’s fair value in underlying investments either in value creation mode (2-4 years old) or harvest mode (4+ years old) – as a result, we believe there is considerable potential for near to medium term liquidity events.

We are enthusiastic to serve as the new investment advisor and appreciate your continued partnership. We look forward to pursuing the opportunities ahead together.

| 2 | As measured by standard deviation |

| 3 | By fair value as % of Net Assets |

| 4 | By fair value in underlying investments |

NOTES TO PERFORMANCE

Monthly returns are net of fees and Fund expenses and based on NAV at month-end.

The inception date of both the Fund’s Class A shares (including predecessor feeder fund shares), and Class I shares (as re-classified), is 07/31/2015.

Class A shares are subject to a maximum sales load of 3.5%. Class I shares have no sales load.

The total annual fund expense ratio, gross of any fee waivers or expense reimbursements, is 3.56% for Class A shares and 2.97% for Class I shares. See the Prospectus for more information.

The performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance data shown above. Investment return and principal value will fluctuate, so that shares, when sold, may be worth more or less than their original cost. The returns reflect the expense limitation and reimbursement, without which, the performance would have been lower. A Fund’s performance, especially for short periods of time, should not be the sole factor in making your investment decision.

For the period from the Fund’s inception through May 31, 2016, the returns and expenses of Class A shares reflect the performance of the prior feeder fund; and the returns of Class I shares reflect the performance of the Fund prior to its issuance of multiple share classes and reclassification of existing shares. From June 1, 2016 forward, the returns reflect performance of Class A and Class I shares, respectively, of the iCapital KKR Private Markets Fund.

INDEX DESCRIPTIONS

The indices shown are for general market comparisons and are not meant to represent any actual fund. An index is unmanaged and not available for direct investment.

S&P 500 Total Return Index. The total return version of S&P 500 index; generally representative of certain portions of the U.S. equity markets. Returns assume reinvestment of dividends.

MSCI All-Country World Index. The MSCI ACWI captures large and mid-cap representation across 23 Developed Markets and 24 Emerging Markets countries. With more than 2,400 constituents, the index covers approximately 85% of the global investable equity opportunity set.

RISKS AND IMPORTANT CONSIDERATIONS

This material is being provided for informational purposes only. The author’s assessments do not constitute investment research and the views expressed are not intended to be and should not be relied upon as investment advice. The opinions are based on market conditions as of the date of writing and are subject to change without notice.

Past performance is not indicative of future results. There is no guarantee that any forecasts made will come to pass. There can be no assurance that any investment product or strategy, including diversification, will achieve its objectives, generate profits or avoid losses.

It is important to note that all investments carry a certain degree of risk including the possible loss of principal and performance may be affected by different market cycles. Complex or alternative strategies may not be suitable for every investor and the value of a portfolio will fluctuate based on the value of the underlying securities.

There are significant differences between public and private equity investments, which include but are not limited to, the fact that public equity investments have a lower barrier to entry. There is also greater access to information about public companies. Private equity investments typically have a longer time horizon than public equity investments before profits, if any, are realized. Public equity investments provide far greater liquidity, whereas private equity investments, like those made by the Fund, are considered highly illiquid.

| |

| | Deloitte & Touche LLP |

| | 111 South Wacker Drive |

| | Chicago, IL 60606-4301 |

| | USA |

| | Tel:+1 312 486 1000 |

| | Fax:+1 312 486 1486 |

| To the shareholders and the Board of Trustees of iCapital KKR Private Markets Fund: | www.deloitte.com |

| | |

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying consolidated statement of assets and liabilities of iCapital KKR Private Markets Fund (formerly known as Altegris KKR Commitments Master Fund) (the “Fund”), including the consolidated portfolio of investments, as of March 31, 2021, the related consolidated statements of operations and consolidated cash flows for the year then ended, the consolidated statement of changes in net assets for each of the two years in the period then ended, the consolidated financial highlights for each of the five years in the period then ended, and the related notes. In our opinion, the consolidated financial statements and consolidated financial highlights present fairly, in all material respects, the financial position of the Fund as of March 31, 2021, the results of its consolidated operations and its consolidated cash flows for the year then ended, the consolidated changes in its net assets for each of the two years in the period then ended, and the consolidated financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements and consolidated financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements and consolidated financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements and consolidated financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements and consolidated financial highlights. Our procedures included confirmation of securities owned as of March 31, 2021, by correspondence with the custodian and underlying fund managers and advisers. We believe that our audits provide a reasonable basis for our opinion.

Emphasis of Matter

As discussed in Note 1 to the consolidated financial statements, the Fund’s investor adviser changed from Altegris Advisors LLC to iCapital Registered Fund Adviser LLC effective February 16, 2021. Our opinion is not modified in respect of this matter.

May 28, 2021

We have served as the auditor of iCapital KKR Private Markets Fund (formerly known as Altegris KKR Commitments Master Fund) since 2014.

| iCapital KKR Private Markets Fund (Formerly, Altegris KKR Commitments Master Fund) |

| PORTFOLIO REVIEW (Unaudited) |

| March 31, 2021 |

| |

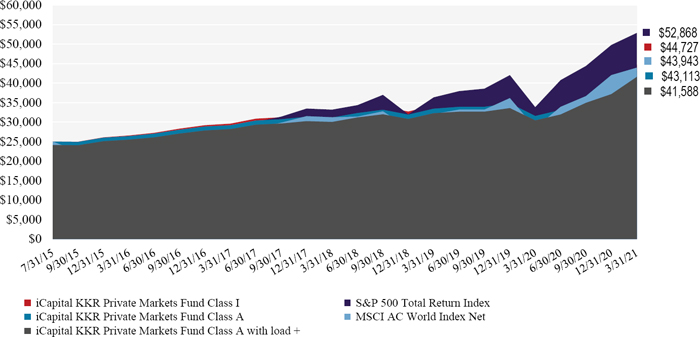

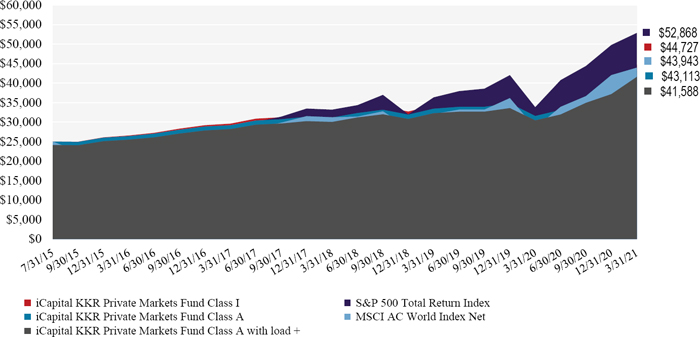

The Fund’s performance figures* for the Periods ended March 31, 2021, compared to its benchmarks:

| | One Year | Three Year | Five Year | Annualized

Since Inception

July 31, 2015 ** |

| iCapital KKR Private Markets Fund - Class A | 36.67% | 11.45% | 10.31% | 10.09% |

| iCapital KKR Private Markets Fund - Class A with load *** | 31.85% | 10.13% | 9.53% | 9.39% |

| iCapital KKR Private Markets Fund - Class I | 37.48% | 12.09% | 10.98% | 10.81% |

| MSCI AC World Index Net **** | 54.60% | 12.07% | 13.21% | 10.46% |

| S&P 500 Total Return Index ***** | 56.35% | 16.78% | 16.29% | 14.12% |

| | | | | |

| * | The Performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Per the fee table in the Fund’s August 3, 2020, prospectus, the total annual operating expense are 3.56% and 2.97% for the Fund’s Class A and Class I shares, respectively. For performance information current to the most recent month-end, please call 1-212-994-7400. |

| ** | The inception date of both the Fund’s Class A shares (including predecessor feeder fund shares), and Class I Shares (as re-classified), is July 31, 2015. The Fund was reorganized as of June 1, 2016 to offer the Class A and Class I shares. |

| *** | Class A with load total return is calculated using the maximum sales charge of 3.50%. |

| **** | The MSCI All Country World Index (ACWI) is a market-cap-weighted global equity index that tracks emerging and developed markets. It currently monitors nearly 3,000 large- and mid-cap stocks in 49 countries. |

| ***** | The S&P 500 Total Return Index is a widely accepted, unmanaged index of U.S. stock market performance which does not take into account charges, fees and other expenses. Investors may not invest in the index directly. |

Comparison of the Change in Value of a $25,000 Investment | July 31, 2015–March 31, 2021

Past performance is not necessarily indicative of future results.

| + | Initial investment has been adjusted for the maximum sales charge of 3.50%. |

| Holdings by Type of Investment as of March 31, 2021 | | % of Net Assets | |

| Investments in Private Equity Funds: | | | | |

| Primary Investments | | | 40.74 | % |

| Secondary Investments | | | 38.92 | % |

| Co-Investments | | | 23.12 | % |

| Common Stock | | | 0.00 | % |

| Short Term Investments: | | | | |

| Private Money Market Funds | | | 0.40 | % |

| Liabilities in Excess of Other Assets | | | (3.18 | )% |

| Total | | | 100.00 | % |

| | | | | |

Please refer to the Consolidated Portfolio of Investments in this report for a detailed analysis of the Fund’s holdings.

| iCapital KKR Private Markets Fund (Formerly, Altegris KKR Commitments Master Fund) |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS |

| March 31, 2021 |

| | | Investment

Strategy | | Geographic Region | | Cost | | | Fair Value | | | % of Net

Assets | | Initial

Acquisition

Date |

| INVESTMENTS IN PRIVATE EQUITY FUNDS (a) - 102.78% | | | | | | | | |

| CO-INVESTMENTS - 23.12% | | | | | | | | | | | | |

| Independence Energy Co-Invest L.P. (b) | | Buyout | | Americas | | $ | 10,250,862 | | | $ | 8,152,584 | | | 1.78% | | 2/26/2018 |

| KKR Banff Co-Invest L.P. * | | Buyout | | Americas | | | 10,000,000 | | | | 13,000,000 | | | 2.84% | | 9/28/2018 |

| KKR Byzantium Infrastructure Co-Invest L.P. | | Infrastructure | | Europe | | | 6,435,450 | | | | 7,300,516 | | | 1.60% | | 10/3/2017 |

| KKR Caribou Co-Invest L.P. * | | Growth | | Americas | | | 17,500,000 | | | | 19,442,982 | | | 4.25% | | 2/26/2018 |

| KKR Element Co-Invest L.P. * | | Buyout | | Americas | | | — | | | | 359 | | | 0.00% | | 8/12/2016 |

| KKR Enterprise Co-Invest L.P AIV B. * | | Buyout | | Americas | | | 2,294,701 | | | | 7,925,717 | | | 1.73% | | 7/14/2020 |

| KKR Enterprise Co-Invest L.P. * | | Buyout | | Americas | | | 20,000,000 | | | | 3,400,624 | | | 0.74% | | 9/6/2018 |

| KKR Sigma Co-Invest L.P. * | | Buyout | | Europe | | | 7,500,000 | | | | 14,063,762 | | | 3.08% | | 6/11/2018 |

| LC Sports Pte. Ltd. (c)* | | Buyout | | Asia | | | 2,282,797 | | | | 2,146,816 | | | 0.47% | | 11/2/2018 |

| Nutraceutical Investco LP (c)* | | Buyout | | Americas | | | 1,344,891 | | | | 1,812,070 | | | 0.40% | | 7/15/2019 |

| OnyxPoint Permian Equity Feeder III LLC (c)* | | Buyout | | Americas | | | 2,723,512 | | | | (7,615 | ) | | 0.00% | | 9/7/2018 |

| Uno Co-Invest L.P. * | | Buyout | | Americas | | | 15,000,000 | | | | 28,500,000 | | | 6.23% | | 6/7/2017 |

| TOTAL CO-INVESTMENTS | | | | | 95,332,213 | | | | 105,737,815 | | | 23.12% | | |

| | | | | | | | | | | | | | | | | |

| PRIMARY INVESTMENTS - 40.74% | | | | | | | | | | | | |

| Bridge Growth Partners (Parallel), L.P. * | | Growth | | Americas | | | 925,471 | | | | 1,379,978 | | | 0.30% | | 2/23/2016 |

| HPH Specialized International Fund 1, L.P. (c) | | Buyout | | Americas | | | 652,886 | | | | 329 | | | 0.00% | | 10/9/2015 |

| KKR Americas Fund XII L.P. * | | Buyout | | Americas | | | 45,379,416 | | | | 85,629,732 | | | 18.73% | | 3/31/2017 |

| KKR Asian Fund III L.P. | | Buyout | | Asia | | | 42,484,681 | | | | 61,990,298 | | | 13.56% | | 3/31/2017 |

| KKR European Fund IV, L.P. | | Buyout | | Europe | | | 3,904,354 | | | | 5,475,951 | | | 1.20% | | 12/17/2015 |

| KKR European Fund V, L.P. SCSp | | Buyout | | Europe | | | 12,397,364 | | | | 14,087,775 | | | 3.08% | | 11/5/2018 |

| KKR Health Care Strategic Growth Fund L.P. * | | Growth | | Americas | | | 7,409,504 | | | | 9,807,382 | | | 2.14% | | 8/4/2017 |

| KKR Next Generation Technology Growth Fund II SCSp (b) | | Growth | | Americas | | | 2,218,402 | | | | 2,968,540 | | | 0.65% | | 7/11/2019 |

| L Catterton Asia 3 LP (c) | | Buyout | | Asia | | | 1,635,847 | | | | 1,405,377 | | | 0.31% | | 12/4/2018 |

| Oak Hill Capital Partners IV, L.P. (c)* | | Buyout | | Americas | | | 937,412 | | | | 1,005,549 | | | 0.22% | | 3/31/2017 |

| Providence Strategic Growth Europe L.P. (b) | | Growth | | Europe | | | — | | | | 32,211 | | | 0.01% | | 11/11/2019 |

| RB Equity Fund II-A, L.P. * | | Growth | | Americas | | | 684,182 | | | | 815,660 | | | 0.18% | | 12/3/2018 |

| The Resolute Fund IV | | Buyout | | Americas | | | 857,212 | | | | 1,630,563 | | | 0.36% | | 9/28/2018 |

| TOTAL PRIMARY INVESTMENTS | | | | | 119,486,731 | | | | 186,229,345 | | | 40.74% | | |

| | | | | | | | | | | | | | | | | |

| SECONDARY INVESTMENTS - 38.92% | | | | | | | | | | | | |

| Artisan Partners Asset Management, Inc. TRA (c,d) | | Credit | | Americas | | | 2,864,802 | | | | 3,400,699 | | | 0.74% | | 10/12/2018 |

| Charles River Partnership XIII, L.P. * | | Growth | | Americas | | | 49,016 | | | | 321,492 | | | 0.07% | | 6/29/2018 |

| Eurazeo Capital IV A SCSp (c)* | | Buyout | | Europe | | | 1,781,536 | | | | 2,224,446 | | | 0.49% | | 1/28/2019 |

| Eurazeo Capital IV D SCSp (c)* | | Buyout | | Europe | | | 1,070,489 | | | | 1,309,519 | | | 0.29% | | 1/28/2019 |

| Foundation Capital III L.P. * | | Growth | | Americas | | | 102 | | | | 1,555 | | | 0.00% | | 6/29/2018 |

| Foundation Capital V L.P. * | | Growth | | Americas | | | 20,861 | | | | 221,957 | | | 0.05% | | 6/29/2018 |

| Foundation Capital VI L.P. * | | Growth | | Americas | | | 152,984 | | | | 254,407 | | | 0.05% | | 6/29/2018 |

| Foundation Capital VII L.P. * | | Growth | | Americas | | | 570,323 | | | | 917,855 | | | 0.20% | | 6/29/2018 |

| Foundation Capital VIII L.P. * | | Growth | | Americas | | | 677,985 | | | | 3,245,214 | | | 0.71% | | 6/29/2018 |

| KKR 2006 Fund L.P . * | | Buyout | | Americas | | | 17,410,703 | | | | 15,834,386 | | | 3.46% | | 12/31/2015 |

| KKR 2006 Fund (Allstar) L.P. (b)* | | Buyout | | Americas | | | 1,909,793 | | | | 2,237,605 | | | 0.49% | | 12/31/2015 |

| KKR 2006 Fund (GDG) L.P. (b)* | | Buyout | | Americas | | | 1,955,996 | | | | — | | | 0.00% | | 12/31/2015 |

| KKR 2006 Fund (Overseas) L.P. | | Buyout | | Americas | | | 9,554,332 | | | | 3,794,639 | | | 0.83% | | 12/31/2015 |

| KKR Asian Fund L.P. * | | Buyout | | Asia | | | 1,756,028 | | | | (4,955 | ) | | 0.00% | | 12/29/2016 |

| KKR Asian Fund (Ireland III MIT) I L.P. * | | Buyout | | Asia | | | 1,088,708 | | | | 249,125 | | | 0.05% | | 12/29/2016 |

| KKR Asian Fund II Private Investors Offshore, L.P. | | Buyout | | Asia | | | 3,420,479 | | | | 3,184,929 | | | 0.70% | | 9/30/2017 |

| KKR China Growth Fund, L.P. | | Growth | | Asia | | | 14,271,188 | | | | 12,096,449 | | | 2.65% | | 6/29/2018 |

| KKR European Fund III, L.P. * | | Buyout | | Europe | | | 2,318,266 | | | | 885,714 | | | 0.19% | | 12/31/2015 |

| KKR Gaudi Investors L.P. * | | Buyout | | Europe | | | 8,615,337 | | | | 9,423,760 | | | 2.06% | | 5/4/2017 |

| KKR Lending Partners II L.P. (b) | | Credit | | Americas | | | 3,135,628 | | | | 1,552,025 | | | 0.34% | | 3/31/2017 |

| KKR North America Fund XI L.P. (b) | | Buyout | | Americas | | | 23,858,481 | | | | 26,185,177 | | | 5.73% | | 10/29/2015 |

| KKR North America Fund XI (Indigo) L.P. (b)* | | Buyout | | Americas | | | 1,656,323 | | | | 9,464,383 | | | 2.07% | | 10/29/2015 |

| KKR North America Fund XI (Wave) L.P. (b)* | | Buyout | | Americas | | | 1,158,120 | | | | 927,714 | | | 0.20% | | 10/29/2015 |

| KKR Real Estate Partners Americas II L.P. | | Real Estate | | Americas | | | 33,090,770 | | | | 33,829,346 | | | 7.40% | | 5/31/2018 |

| L Catterton VIII Offshore, L.P. (b,c)* | | Buyout | | Americas | | | 2,586,654 | | | | 3,254,086 | | | 0.71% | | 9/27/2019 |

| Lime Rock Partners IV AF, L.P. * | | Buyout | | Americas | | | 5,025,289 | | | | 6,493,650 | | | 1.42% | | 6/21/2018 |

| Menlo Ventures IX LP * | | Growth | | Americas | | | 38,532 | | | | 90,193 | | | 0.02% | | 12/31/2017 |

| Menlo Ventures X LP * | | Growth | | Americas | | | 2,493,985 | | | | 215,953 | | | 0.05% | | 12/31/2017 |

| Menlo Ventures XI LP * | | Growth | | Americas | | | 5,121,980 | | | | 2,223,767 | | | 0.49% | | 12/31/2017 |

| | | | | | | | | | | | | | | | | |

See accompanying notes to consolidated financial statements.

| iCapital KKR Private Markets Fund (Formerly, Altegris KKR Commitments Master Fund) |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| March 31, 2021 |

| | | Investment

Strategy | | Geographic Region | | Cost | | | Fair Value | | | % of Net

Assets | | Initial

Acquisition

Date |

| SECONDARY INVESTMENTS (Continued) - 38.92% | | | | | | | | | | |

| Oak Hill Capital Partners III (AIV I), L.P. (c)* | | Buyout | | Americas | | $ | 274,469 | | | $ | 702,907 | | | 0.15% | | 3/17/2017 |

| Oak Hill Capital Partners III, L.P. (c) | | Buyout | | Americas | | | 944,478 | | | | 389,049 | | | 0.08% | | 3/17/2017 |

| Oak Hill Special Opportunities Fund (Offshore II), Ltd. (c)* | | Buyout | | Americas | | | 4,449 | | | | — | | | 0.00% | | 3/17/2017 |

| OHCP III BC COI, L.P. (c)* | | Buyout | | Americas | | | 1,940,403 | | | | 4,575,702 | | | 1.00% | | 3/17/2017 |

| OHCP III BC RO, L.P. (c)* | | Buyout | | Americas | | | 725,406 | | | | 1,125,542 | | | 0.25% | | 12/31/2018 |

| Orchid Asia III, L.P. (c) | | Buyout | | Asia | | | 932,796 | | | | 1,419,723 | | | 0.31% | | 8/15/2016 |

| Pueblo Co-Invest LP | | Growth | | Americas | | | 3,447,261 | | | | 5,337,924 | | | 1.17% | | 6/25/2019 |

| RB Equity Fund I-A LP * | | Growth | | Americas | | | 3,427,257 | | | | 6,822,672 | | | 1.49% | | 12/31/2018 |

| Salient Solutions LLC (c,e)* | | Growth | | Americas | | | 1,057,149 | | | | 2,012,175 | | | 0.44% | | 2/10/2016 |

| The Resolute Fund II | | Buyout | | Americas | | | 3,628,531 | | | | 3,851,964 | | | 0.84% | | 8/31/2018 |

| Warburg Pincus XI (ASIA), L.P. * | | Growth | | Asia | | | 7,421,100 | | | | 6,872,674 | | | 1.50% | | 9/30/2017 |

| Yorktown Energy Partners IX, L.P (b,c)* | | Buyout | | Americas | | | 327,161 | | | | 190,885 | | | 0.04% | | 9/30/2018 |

| Yorktown Energy Partners VI, L.P (b,c) | | Buyout | | Americas | | | 63,741 | | | | 28,899 | | | 0.01% | | 9/30/2018 |

| Yorktown Energy Partners VII, L.P (b,c) | | Buyout | | Americas | | | 181,069 | | | | 76,260 | | | 0.02% | | 9/30/2018 |

| Yorktown Energy Partners VIII, L.P (b,c) | | Buyout | | Americas | | | 598,695 | | | | 291,595 | | | 0.06% | | 9/30/2018 |

| Yorktown Energy Partners X, L.P (b,c) | | Buyout | | Americas | | | 573,064 | | | | 450,122 | | | 0.10% | | 9/30/2018 |

| TOTAL SECONDARY INVESTMENTS | | | | | | | 173,201,719 | | | | 177,983,183 | | | 38.92% | | |

| | | | | | | | | | | | | | | | | |

| TOTAL INVESTMENTS IN PRIVATE EQUITY FUNDS | | $ | 388,020,663 | | | $ | 469,950,343 | | | 102.78% | | |

| | | | | | | | | | | | | | | | | |

| | | Shares | | | | | | | | | | | | | | |

| COMMON STOCK- 0.00% ** | | | | | | | | | | | | | | | | |

| ENERGY - 0.00% ** | | | | | | | | | | | | | | | | |

| Antero Resources (Common Stock) ^ (b) | | 1,550 | | Americas | | $ | 15,393 | | | | 15,393 | | | 0.00% | | 3/16/2021 |

| Antero Midstream (Common Stock) ^^ (b) | | 401 | | Americas | | | 3,779 | | | | 3,779 | | | 0.00% | | 3/11/2021 |

| TOTAL COMMON STOCK | | $ | 19,172 | | | $ | 19,172 | | | 0.00% | | |

| | | | | | | | | | | | | | | | | |

| SHORT TERM INVESTMENTS - 0.40% | | | | | | | | | | | | |

| PRIVATE MONEY MARKET FUNDS - 0.40% | | | | | | | | | | | | |

| Federated Prime Private Liquidity Fund, Premier Class | | 962,187 | | | | $ | 962,187 | | | $ | 962,187 | | | 0.21% | | 12/29/2017 |

| Prime Liquidity LLC Fund, Capital Class | | 854,127 | | | | | 854,127 | | | | 854,127 | | | 0.19% | | 12/29/2017 |

| TOTAL PRIVATE MONEY MARKET FUNDS | | | | $ | 1,816,314 | | | $ | 1,816,314 | | | 0.40% | | |

| | | | | | | | | | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | $ | 1,816,314 | | | $ | 1,816,314 | | | 0.40% | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| TOTAL INVESTMENTS - 103.18% (Cost - $389,856,149) (f) | | | | | | $ | 471,785,829 | | | | | |

| LIABILITIES IN EXCESS OF OTHER ASSETS - (3.18)% | | | | | | | (14,558,706 | ) | | | | |

| NET ASSETS - 100.00% | | | | | | | | | | $ | 457,227,123 | | | | | |

| ^ | Common stock received as an in-kind distribution from Yorktown Energy Partners VI and Yorktown Energy Partners VII LP. |

| ^^ | Common stock received as an in-kind distribution from Yorktown Energy Partners VII, L.P. |

| (a) | Securities restricted to resale represents $469,950,343 or 102.78% of net assets. |

| (b) | All or part of these investments are holdings of iKF, LLC. |

| (c) | The fair value of this investment is determined using significant unobservable inputs and is classified as level 3 on the GAAP hierarchy (See Note 2). |

| (d) | Artisan Partners Asset Management TRA - A tax receivable agreement (“TRA”) with Artisan Partners Asset Management (NYSE: APAM) was acquired from a private equity fund in a secondary transaction. |

| (e) | Salient Solutions LLC - An existing equity co-investment interest in Salient Solutions LLC, a technology company, was acquired from a private equity fund in a secondary transaction. |

| (f) | The fair value of total investments consists of the following regions: |

| | | Cost | | | Fair Value | | | % of Net Assets | |

| Americas | | $ | 268,723,415 | | | | 325,805,425 | | | | 71.26 | % |

| Asia | | | 75,293,624 | | | | 89,360,436 | | | | 19.54 | % |

| Europe | | | 44,022,796 | | | | 54,803,654 | | | | 11.98 | % |

| Total Investments | | $ | 388,039,835 | | | $ | 469,969,515 | | | | 102.78 | % |

See accompanying notes to consolidated financial statements.

| iCapital KKR Private Markets Fund |

| (Formerly, Altegris KKR Commitments Master Fund) |

| CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES |

| March 31, 2021 |

| ASSETS | | | | |

| Investment securities: | | | | |

| Investments at cost | | $ | 389,856,149 | |

| Investments at fair value | | $ | 471,785,829 | |

| Cash | | | 6,417,932 | |

| Prepaid expenses and other assets | | | 530,381 | |

| TOTAL ASSETS | | $ | 478,734,142 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for Fund shares repurchased | | | 12,403,631 | |

| Line of credit outstanding | | | 7,450,000 | |

| Management fee payable to the Adviser | | | 545,272 | |

| Service fees payable to related parties | | | 334,793 | |

| Distribution and servicing fees payable to Distributor | | | 177,168 | |

| Line of credit fees payable | | | 153,193 | |

| Subscriptions received in advance | | | 25,000 | |

| Accrued expenses and other liabilities | | | 417,962 | |

| TOTAL LIABILITIES * | | | 21,507,019 | |

| | | | | |

| NET ASSETS | | $ | 457,227,123 | |

| | | | | |

| Composition of Net Assets: | | | | |

| Paid in capital | | $ | 336,370,592 | |

| Accumulated earnings | | | 120,856,531 | |

| NET ASSETS | | $ | 457,227,123 | |

| | | | | |

| Class A Shares: | | | | |

| Net Assets | | $ | 315,874,048 | |

| Shares of beneficial interest outstanding [$0 par value] | | | 19,159,630 | |

| Net asset value (Net Assets ÷ Shares Outstanding) and redemption price per share | | $ | 16.49 | |

| Maximum offering price per share (net asset value plus maximum sales charge of 3.50%) | | $ | 17.09 | |

| | | | | |

| Class I Shares: | | | | |

| Net Assets | | $ | 141,353,075 | |

| Shares of beneficial interest outstanding [$0 par value] | | | 3,965,790 | |

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share | | $ | 35.64 | |

| * | Commitments and contingencies (See Notes 2 and 7) |

See accompanying notes to consolidated financial statements.

| iCapital KKR Private Markets Fund |

| (Formerly, Altegris KKR Commitments Master Fund) |

| CONSOLIDATED STATEMENT OF OPERATIONS |

| For the Year Ended March 31, 2021 |

| INVESTMENT INCOME | | | | |

| Dividend distributions from underlying investments | | $ | 13,037,316 | |

| Dividend income | | | 63,703 | |

| TOTAL INVESTMENT INCOME | | | 13,101,019 | |

| | | | | |

| EXPENSES | | | | |

| Management fees | | | 4,918,941 | |

| Distribution and servicing fees | | | 1,723,429 | |

| Line of credit fees | | | 618,652 | |

| Sub accounting and sub transfer agent fees | | | 441,689 | |

| Administrative services fees | | | 295,460 | |

| Legal fees | | | 281,871 | |

| Audit and tax fees | | | 147,471 | |

| Printing and postage expenses | | | 141,165 | |

| Trustees fees and expenses | | | 130,784 | |

| Custodian fees | | | 129,911 | |

| Accounting services fees | | | 66,808 | |

| Transfer Agent Fees | | | 62,481 | |

| Registration fees | | | 44,163 | |

| Chief compliance officer fees | | | 32,984 | |

| Insurance expense | | | 24,503 | |

| Other expenses | | | 66,551 | |

| TOTAL EXPENSES | | | 9,126,863 | |

| Tax overpayment | | | (485,000 | ) |

| NET EXPENSES | | | 8,641,863 | |

| | | | | |

| NET INVESTMENT INCOME | | | 4,459,156 | |

| | | | | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | | |

| | | | | |

| Capital gain distributions from underlying investments | | | 24,434,724 | |

| Net change in unrealized appreciation on investments | | | 101,996,538 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 126,431,262 | |

| | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 130,890,418 | |

See accompanying notes to consolidated financial statements.

| iCapital KKR Private Markets Fund |

| (Formerly, Altegris KKR Commitments Master Fund) |

| CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | March 31, 2021 | | | March 31, 2020 | |

| INCREASE/(DECREASE) IN NET ASSETS FROM OPERATIONS | | | | | | | | |

| Net investment income/(loss) | | $ | 4,459,156 | | | $ | (193,475 | ) |

| Capital gain distributions from underlying investments | | | 24,434,724 | | | | 17,206,219 | |

| Net realized gain/loss from investments | | | — | | | | 162,226 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | 101,996,538 | | | | (38,637,583 | ) |

| Net increase/(decrease) in net assets resulting from operations | | | 130,890,418 | | | | (21,462,613 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO MEMBERS | | | | | | | | |

| Total Distributions : | | | | | | | | |

| Class A | | | (11,889,074 | ) | | | (11,281,983 | ) |

| Class I | | | (5,027,808 | ) | | | (4,368,305 | ) |

| Total distributions to members | | | (16,916,882 | ) | | | (15,650,288 | ) |

| | | | | | | | | |

| SHARES OF BENEFICIAL INTEREST | | | | | | | | |

| Proceeds from shares sold: | | | | | | | | |

| Class A | | | 1,321,568 | | | | 4,503,278 | |

| Class I | | | 5,770,880 | | | | 12,446,516 | |

| Reinvestment of distributions | | | | | | | | |

| Class A | | | 11,402,631 | | | | 10,887,840 | |

| Class I | | | 4,671,971 | | | | 4,047,854 | |

| Repurchase of shares | | | | | | | | |

| Class A | | | (37,815,885 | ) | | | (24,689,295 | ) |

| Class I | | | (11,388,110 | ) | | | (8,337,357 | ) |

| Total Decrease in Net Assets from Shares of Beneficial Interest | | | (26,036,945 | ) | | | (1,141,164 | ) |

| | | | | | | | | |

| NET INCREASE/(DECREASE) IN SHARES OF BENEFICIAL INTEREST | | | 87,936,591 | | | | (38,254,065 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of Year | | | 369,290,532 | | | | 407,544,597 | |

| End of Year | | $ | 457,227,123 | | | $ | 369,290,532 | |

| | | | | | | | | |

| SHARE ACTIVITY | | | | | | | | |

| Class A: | | | | | | | | |

| Shares Sold | | | 99,102 | | | | 325,722 | |

| Shares Reinvested | | | 841,093 | | | | 803,269 | |

| Shares Repurchased | | | (2,578,535 | ) | | | (1,830,668 | ) |

| Net decrease in shares outstanding | | | (1,638,340 | ) | | | (701,677 | ) |

| | | | | | | | | |

| Class I: | | | | | | | | |

| Shares Sold | | | 197,830 | | | | 420,554 | |

| Shares Reinvested | | | 159,830 | | | | 139,393 | |

| Shares Repurchased | | | (367,391 | ) | | | (286,101 | ) |

| Net increase/(decrease) in shares outstanding | | | (9,731 | ) | | | 273,846 | |

See accompanying notes to consolidated financial statements.

| iCapital KKR Private Markets Fund |

| (Formerly, Altegris KKR Commitments Master Fund) |

| CONSOLIDATED STATEMENT OF CASH FLOWS |

| For the Year Ended March 31, 2021 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | |

| Net increase in net assets resulting from operations | | $ | 130,890,418 | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by operating activities: | | | | |

| Purchase of investments | | $ | (59,028,172 | ) |

| Net Proceeds (Purchase) of short-term investments | | | 30,386,297 | |

| Net change in unrealized appreciation on investments | | | (101,996,538 | ) |

| Return of capital from underlying investments | | | 24,855,807 | |

| Increase in prepaid expenses and other assets | | | (116,319 | ) |

| Decrease in interest, dividend and distributions receivables | | | 26,598 | |

| Decrease in payable for securities purchased | | | (59,767 | ) |

| Increase in payable due to Adviser | | | 49,784 | |

| Decrease in service fees payable to related parties | | | (69,255 | ) |

| Increase in distribution and servicing fees payable to Distributor | | | 2,861 | |

| Increase in line of credit legal fees | | | 153,193 | |

| Increase in accrued expenses and other liabilities | | | 197,961 | |

| Net Cash Provided by Operating Activities | | $ | 25,292,868 | |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | |

| Proceeds from Shares issued, net of change in subscriptions received in advance | | $ | 6,211,917 | |

| Payment of Shares repurchased, net of change in payable for Shares repurchased | | | (44,758,697 | ) |

| Distributions paid to shareholders | | | (842,280 | ) |

| Increase in line of credit outstanding | | | 7,450,000 | |

| Net Cash Used in Financing Activities | | $ | (31,939,060 | ) |

| | | | | |

| NET DECREASE IN CASH | | $ | (6,646,192 | ) |

| CASH - BEGINNING OF PERIOD | | | 13,064,124 | |

| CASH - END OF PERIOD | | $ | 6,417,932 | |

| SUPPLEMENTAL NON-CASH DICLOSURE INFORMATION: | | | | |

| Non-cash financing activities not included herein consisted of reinvestment of distributions: | | $ | 16,074,602 | |

| | | | | |

See accompanying notes to consolidated financial statements.

| iCapital KKR Private Markets Fund (Formerly, Altegris KKR Commitments Master Fund) |

| CONSOLIDATED STATEMENTS OF FINANCIAL HIGHLIGHTS |

| |

| Per Unit Data and Ratios for a Share of Beneficial Interest Outstanding Throughout each Year or Period |

| | | Class A (1) | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Period Ended | |

| | | March 31, 2021 | | | March 31, 2020 | | | March 31, 2019 | | | March 31, 2018 | | | March 31, 2017 | |

| Net asset value, beginning of year | | $ | 12.59 | | | $ | 13.86 | | | $ | 13.72 | | | $ | 13.43 | | | $ | 12.61 | |

| | | | | | | | | | | | | | | | | | | | | |

| Gain (Loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income/(loss) (3) | | | 0.13 | | | | (0.03 | ) | | | (0.23 | ) | | | (0.20 | ) | | | (0.11 | ) |

| Net realized and unrealized gain/(loss) on investments | | | 4.35 | | | | (0.71 | ) | | | 1.20 | | | | 1.07 | | | | 1.50 | |

| Net increase/(decrease) in net assets resulting from operations | | | 4.48 | | | | (0.74 | ) | | | 0.97 | | | | 0.87 | | | | 1.39 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net realized gains | | | (0.58 | ) | | | (0.53 | ) | | | (0.83 | ) | | | (0.58 | ) | | | (0.57 | ) |

| Total distributions | | | (0.58 | ) | | | (0.53 | ) | | | (0.83 | ) | | | (0.58 | ) | | | (0.57 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 16.49 | | | $ | 12.59 | | | $ | 13.86 | | | $ | 13.72 | | | $ | 13.43 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return (4) | | | 36.67 | % | | | (5.64 | )% | | | 7.35 | % | | | 6.62 | % | | | 11.19 | % (5) |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000s) | | $ | 315,874 | | | $ | 261,763 | | | $ | 297,902 | | | $ | 287,217 | | | $ | 189,454 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of gross expenses to average net assets (6,7) | | | 2.35 | % (9) | | | 2.62 | % | | | 2.40 | % | | | 2.31 | % | | | 2.47 | % |

| Ratio of net expenses to average net assets (7) | | | 2.35 | % (9) | | | 2.62 | % (8) | | | 2.49 | % (8) | | | 2.40 | % (8) | | | 2.47 | % |

| Ratio of net investment income (loss) to average net assets (7) | | | 0.94 | % | | | (0.20 | )% | | | (1.66 | )% | | | (1.40 | )% | | | (0.97 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio Turnover Rate | | | 0 | % | | | 0 | % | | | 1 | % | | | 0 | % | | | 0 | % (5) |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | Class I (2) | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | March 31, 2021 | | | March 31, 2020 | | | March 31, 2019 | | | March 31, 2018 | | | March 31, 2017 | |

| Net asset value, beginning of year | | $ | 27.05 | | | $ | 29.62 | | | $ | 29.15 | | | $ | 28.36 | | | $ | 26.57 | |

| | | | | | | | | | | | | | | | | | | | | |

| Gain (Loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (3) | | | 0.45 | | | | 0.10 | | | | (0.32 | ) | | | (0.22 | ) | | | (0.01 | ) |

| Net realized and unrealized gain/(loss) on investments | | | 9.40 | | | | (1.54 | ) | | | 2.56 | | | | 2.24 | | | | 3.00 | |

| Net increase/(decrease) in net assets resulting from operations | | | 9.85 | | | | (1.44 | ) | | | 2.24 | | | | 2.02 | | | | 2.99 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net realized gains | | | (1.26 | ) | | | (1.13 | ) | | | (1.77 | ) | | | (1.23 | ) | | | (1.20 | ) |

| Total distributions | | | (1.26 | ) | | | (1.13 | ) | | | (1.77 | ) | | | (1.23 | ) | | | (1.20 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Redemption fees collected (3) | | | — | | | | — | | | | — | | | | — | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 35.64 | | | $ | 27.05 | | | $ | 29.62 | | | $ | 29.15 | | | $ | 28.36 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return (4) | | | 37.48 | % | | | (5.13 | )% | | | 7.98 | % | | | 7.27 | % | | | 11.43 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000s) | | $ | 141,353 | | | $ | 107,528 | | | $ | 109,643 | | | $ | 91,307 | | | $ | 54,767 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of gross expenses to average net assets (6) | | | 1.74 | % (9) | | | 2.03 | % | | | 1.81 | % | | | 1.72 | % | | | 2.77 | % |

| Ratio of net expenses to average net assets | | | 1.74 | % (9) | | | 2.11 | % (8) | | | 1.89 | % (8) | | | 1.77 | % (8) | | | 1.83 | % |

| Ratio of net investment income (loss) to average net assets | | | 1.54 | % | | | (0.36 | )% | | | (1.07 | )% | | | (0.75 | )% | | | (0.05 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio Turnover Rate | | | 0 | % | | | 0 | % | | | 1 | % | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | | | | | | |

| (1) | Class A commenced operation on June 1, 2016 with the reorganization of the master/feeder structure. See Note 1 in the notes to consolidated financial statements. |

| (2) | The Fund commenced operations on July 31, 2015, existing shares were reclassified to Class I Shares on June 1, 2016. See Note 1 in the notes to consolidated financial statements. |

| (3) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (4) | Total returns shown exclude the effect of applicable sales charges and redemption fees and assumes reinvestment of all distributions. |

| (6) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the Advisor. |

| (7) | Annualized for periods less than one full year. |

| (8) | The net expense ratio is greater than gross expense ratio due to the expenses recaptured. See Note 4 in the notes to consolidated financial statements. |

| (9) | The Fund estimates it tax expense on iKF LLC a wholly owned subsidiary in which the Fund invests. Due to the timing of tax estimates the Fund had a tax overpayment from prior year that reduced the gross and net expense ratios. Without this reduction the gross and net expenses ratios would have been 2.47% and 1.86% for class A and I, respectively |

See accompanying notes to consolidated financial statements.

| iCapital KKR Private Markets Fund |

| (formerly, Altegris KKR Commitments Master Fund) |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| March 31, 2021 |

iCapital KKR Private Markets Fund (formerly, Altegris KKR Commitments Master Fund) (the “Fund”) is a Delaware statutory trust organized on April 22, 2014 and commenced operations on July 31, 2015. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end investment management company. Prior to February 16, 2021, Altegris Advisors, LLC (the “Previous Adviser”) served as the Fund’s investment adviser. Thereafter iCapital Registered Fund Adviser LLC (the “Adviser” or the “iCapital RF Adviser”), an affiliate of Institutional Capital Network, Inc. (“iCapital Network”), became the Fund’s investment adviser. StepStone Group LP serves as the Fund’s Sub-Adviser (the “Sub-Adviser”).

On November 9, 2020, the Board of Trustees (the “Board”) of the Fund approved a new investment advisory agreement between iCapital RF Adviser and the Fund (the “New Advisory Agreement”). On November 9, 2020, the Board also approved a new investment sub-advisory agreement between iCapital RF Adviser and the Sub-Adviser and a new distribution agreement with iCapital Securities, LLC (“iCapital Securities”), a registered broker/dealer affiliate of iCapital Network (the “New Distribution Agreement”), to serve as the Fund’s new distributor. The New Advisory Agreement and the New Sub-Advisory Agreement were subsequently approved by the affirmative vote of the holders of a majority of the outstanding voting securities of the Fund (as defined in the 1940 Act) entitled to vote at a special meeting of Fund shareholders on January 29, 2021 (the “Special Meeting”). On February 16, 2021, following the approval of the New Advisory Agreement and New Sub-Advisory Agreement at the Special Meeting, iCapital RF Adviser replaced the Previous Adviser as the Fund’s investment adviser, the Sub-Adviser continues to serve as the Fund’s sub- adviser, the Fund entered into the New Distribution Agreement with iCapital Securities, and the Fund’s name was changed to iCapital KKR Private Markets Fund. At the Special Meeting, the shareholders also elected Nick Veronis as an Interested Trustee of the Fund. Following the Special Meeting, Matthew Osborne resigned as an Interested Trustee of the Fund. Officers associated with the Previous Adviser have also resigned and the Board has appointed certain new officers associated with iCapital RF Adviser.

The Fund currently offers two separate classes of shares of beneficial interest designated Class A and Class I (each, “Shares”) on a continuous basis at the net asset value (“NAV”) per Share plus any applicable sales loads.

The minimum investment for an investor in the Fund is $25,000. Class A Shares are offered at NAV plus a maximum sales charge of 3.50%. Class I Shares are sold at NAV without an initial sales charge and are not subject to distribution fees. All classes of Shares have equal voting privileges except that each class has exclusive voting rights with respect to its service and/or distribution plans. The Fund’s income, expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each month based upon the relative net assets of each class.

The Fund’s investment objective is to seek long-term capital appreciation. The Fund invests and/or makes capital commitments of at least 80% of its assets in or to private equity investments of any type, sponsored or advised by Kohlberg Kravis Roberts & Co. Inc. or an affiliate thereof (collectively, “KKR”), including primary offerings and secondary acquisitions of interests in alternative investment funds that pursue private equity strategies (“Investment Funds”) and co-investment opportunities in operating companies (“Co-Investment Opportunities”) presented by such KKR Investment Funds or by KKR. However, the Fund may at any time determine to allocate its assets to investments not sponsored or issued by, or otherwise linked to, KKR or its affiliates and to strategies and asset classes not representative of private equity.

Consolidation of a Subsidiary – The consolidated financial statements of the Fund include iKF LLC (formerly, AKCF LLC Series A) (“iKF”), a limited liability company in which the Fund invests and the results of which are reported on a consolidated basis with the Fund. iKF is a wholly owned subsidiary of the Fund; therefore all intercompany accounts and transactions have been eliminated. The inception date of iKF is September 18, 2015.

A summary of the Fund’s investment in iKF is as follows:

| iKF Net Assets at | | % of Total Net Assets |

| March 31, 2021 | | at March 31, 2021 |

| $39,020,815 | | 8.53% |

| iCapital KKR Private Markets Fund |

| (formerly, Altegris KKR Commitments Master Fund) |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) |

| March 31, 2021 |

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The policies are in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”). The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the year then ended. Actual results could differ from those estimates. The Fund qualifies as an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services – Investment Companies (“ASC Topic 946”), and therefore is applying the specialized accounting and reporting guidance in ASC Topic 946.

Investment Funds Valuation – The Fund has adopted valuation procedures pursuant to which it will fair value its interests in Investment Funds. These valuation procedures, which have been approved by the Board, provide that the unaudited valuations determined by the general partner, managing member or affiliated investment adviser of the Investment Funds (the “Investment Managers”) will be reviewed by the Adviser. The Fund will generally rely on such valuations even in instances where an Investment Manager may have a conflict of interest in valuing the securities. Furthermore, the Investment Funds will typically provide the Adviser with estimated net asset values or other valuation information on a quarterly basis, and such data will be subject to revision through the end of each Investment Fund’s annual audit. While such information is provided on a quarterly basis, the Fund calculates its NAV and issues Shares on a monthly basis.

In August 2018, the FASB issued Accounting Standards Update (“ASU”) No. 2018-13, Fair Value Measurement (Topic 820), Disclosure Framework- Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”), which changes the fair value measurement disclosure requirements of ASC Topic 820. The Fund adopted ASU 2018-13 as of March 31, 2021, with no material impact to the financial statement disclosures.

The fair value of the investment in the portfolio is determined at the date of the Consolidated Statement of Assets and Liabilities. The Fund follows the provisions of the Fair Value Measurement of the ASC Topic 820. The Fund defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The Adviser is responsible for the Fund’s written valuation policies, processes and procedures, conducting periodic reviews of the valuation policies and evaluating the overall fairness and consistent application of the valuation policies. The Fund’s pricing committee is comprised of officers of the Fund, the Adviser, and representatives from Gemini Fund Services, LLC (“GFS”), the Fund’s administrator. The Fund’s pricing committee meets monthly, or as needed, to determine the valuation of the Fund’s investments. The pricing committee certifies to the Board that the Fund’s valuation policy and procedures are properly followed. Any revision or updates of the valuation policies and procedures must be approved by the Board.

The Fund utilizes various methods to measure the fair value of all of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument in an inactive market prices for similar instruments, and fair value is determined through the use of models or other valuation methodologies.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. The categorization of Level 2 or Level 3 is based on the

iCapital KKR Private Markets Fund

(formerly, Altegris KKR Commitments Master Fund)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

March 31, 2021

significance of the unobservable inputs to the overall valuation. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of March 31, 2021 for the Fund’s assets measured at fair value:

| | | | | | | | | | | | Investments Valued | | | | |

| Assets * | | Level 1 | | | Level 2 | | | Level 3 | | | at NAV ** | | | Total | |

| Investments | | | | | | | | | | | | | | | |

| Private Equity Funds | | $ | — | | | $ | — | | | $ | 27,814,135 | | | $ | 442,136,208 | | | $ | 469,950,343 | |

| Common Stock | | | 19,172 | | | | — | | | | — | | | | — | | | | 19,172 | |

| Short-Term Investments | | | 1,816,314 | | | | — | | | | — | | | | — | | | | 1,816,314 | |

| Total Investments: | | $ | 1,835,486 | | | $ | — | | | $ | 27,814,135 | | | $ | 442,136,208 | | | $ | 471,785,829 | |

| * | Refer to the Consolidated Portfolio of Investments for asset classification. |

| ** | Assets valued using NAV as the practical expedient, an indicator of fair value, are listed in a separate column to permit reconciliation to totals presented on the Consolidated Statement of Assets and Liabilities. |

Transfers to and from Level 3 occurred due to an increase/decrease in the significance of an unobservable input to the estimate of fair value as of and during the year ended March 31, 2021.

The following table is a reconciliation of assets in which Level 3 inputs were used in determining value:

| | | | | | | | | Proceeds from | | | | | | Change in | | | | | | | | | | |

| | | | | | | | | sales and | | | | | | unrealized | | | | | | | | | | |

| | | Beginning | | | Cost of | | | principal | | | Net realized | | | appreciation/ | | | Transfers into | | | Transfers out of | | | Ending Balance | |

| Investments | | Balance 3/31/20 | | | purchases | | | paydowns | | | gain (loss) | | | (depreciation) | | | Level 3 | | | Level 3 | | | 3/31/21 | |

| Private Equity Funds | | $ | 16,393,482 | | | $ | 1,127,822 | | | $ | (4,899,339 | ) | | $ | 2,150,473 | | | $ | 1,901,605 | | | $ | 14,605,357 | | | $ | (3,465,265 | ) | | $ | 27,814,135 | |

The following table is a summary of the valuation techniques and unobservable inputs used in the fair value measurements as of March 31, 2021:

| Investment Type | | Value at 3/31/21 | | | Valuation Technique(s) | | | Unobservable Input(s) | | | Single Input or Range

of Inputs | |

| Co-Investment Interest | | $ | 2,012,175 | | | Ownership percentage applied to adjusted third party valuation | | | Third party valuation | | | N/A | |

| Tax Receivable Agreement | | | 3,400,699 | | | Discounted cash flow | | | Discount factor*

Tax rate** | | | 17%

23.97% | |

| Private Equity Funds | | | 22,401,261 | | | Adjusted reported investment net asset value | | | Fair value adjustment*** | | | N/A | |

| * | An increase of the input would indicate a decrease in fair value. |

| ** | An increase of the input would indicate an increase in fair value. |

| *** | The significant unobservable input applied to fair value adjusted investments, in part or in whole, is the application of a beta to a benchmark. The benchmark used is a world market index, and the beta is calculated through analysis and backtested by the Adviser. As of March 31, 2021, the beta applied was 33%. An increase of the beta would indicate an increase in the effect of the input to the fair value. |

iCapital KKR Private Markets Fund

(formerly, Altegris KKR Commitments Master Fund)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

March 31, 2021

The valuation process involved in Level 3 measurements is designed to subject the valuation of the investments to an appropriate level of consistency, oversight and review. The valuation of the Fund’s Level 3 investments relies on evaluations of multiple observable and unobservable inputs including financial and operating data; company specific developments, stock prices, earnings and tax rates; market valuations of comparable companies; analysis of market segments; and model projections. The output of these evaluations is typically reviewed and approved by an outside valuation committee for which the Fund receives information surrounding their valuation process and, in some circumstances, the valuation analysis. In certain circumstances, the outside valuation committee may at its discretion employ third party valuation firms as appropriate.

Investments Valued at NAV – ASC Topic 820 permits a reporting entity to measure the fair value of an investment fund that does not have a readily determinable fair value based on the NAV per share, or its equivalent, of the investment fund as a practical expedient, without further adjustment, unless it is probable that the investment would be sold at a value significantly different than the NAV. If the practical expedient NAV is not as of the reporting entity’s measurement date, then the NAV should be adjusted to reflect any significant events that may change the valuation. In using the NAV as a practical expedient, certain attributes of the investment that may impact its fair value are not considered in measuring fair value. Attributes of those investments include the investment strategies of the investment and may also include, but are not limited to, restrictions on the investor’s ability to redeem its investments at the measurement date and any unfunded commitments. The Fund is permitted to invest in alternative investments that do not have a readily determinable fair value and, as such, has elected to use the NAV as calculated on the reporting entity’s measurement date as the fair value of the investment.

Adjustments to the NAV provided by the Adviser would be considered if the practical expedient NAV was not as of the Fund’s measurement date; if it was probable that the alternative investment would be sold at a value materially different than the reported expedient NAV; or if it was determined by the Fund’s valuation policies and procedures that the private investment is not being reported at fair value.

A listing of the private investments held by the Fund and their attributes, as of March 31, 2021, that qualify for these valuations are shown in the table below:

Investment

Category | | Investment Strategy | | Fair Value | | | Unfunded

Commitments | | | Remaining Life | | Redemption

Frequency * | | Notice

Period (In

Days) | | Redemption restrictions

Terms ** |

Private Equity -

Buyout | | Investments in nonpublic companies; the acquisition of the company uses some percentage of debt. | | $ | 348,786,719 | | | | 87,473,306 | | | N/A | | None | | N/A | | Liquidity in form of distributions from Investment Funds. |

Private Equity -

Growth Equity | | Investments in nonpublic companies; the acquisition of the company that create value through profitable revenue. | | $ | 75,081,039 | | | $ | 15,011,617 | | | N/A | | None | | N/A | | Liquidity in form of distributions from Investment Funds. |

Private Equity -

Other | | Investments in nonpublic companies; strategies may include infrastructure, real estate, energy and direct lending/mezzanine, private equity fund of funds | | $ | 46,082,586 | | | $ | 9,617,899 | | | N/A | | None | | N/A | | Liquidity in form of distributions from Investment Funds. |

| * | The information summarized in the table above represent the general terms for the specified asset class. Individual Investment Funds may have terms that are more or less restrictive than those terms indicated for the asset class as a whole. In addition, most Investment Funds have the flexibility, as provided for in their constituent documents, to modify and waive such terms. |

| ** | Distributions from Investment Funds occur at irregular intervals, and the exact timing of distributions from Investment Funds cannot be determined. It is estimated that distributions will occur over the life of the Investment Funds. |

iCapital KKR Private Markets Fund

(formerly, Altegris KKR Commitments Master Fund)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

March 31, 2021

Unfunded Commitments – As of March 31, 2021, the Fund had total unfunded commitments of $112,102,822 which consist of $ 87,473,306 Private Equity-Buyout, $15,011,617 Private Equity-Growth Equity and $9,617,899 Private Equity - Other. The Fund expects to fulfill these unfunded commitments through the use of liquid investments, future distributions from Investment Funds and line of credit proceeds.

Security Transactions and Related Income – Security transactions are accounted for on a trade date basis. Interest income is recognized on an accrual basis. Discounts are accreted and premiums are amortized on securities purchased over the lives of the respective securities. Dividend income is recorded on the ex-dividend date. Realized gains or losses from sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds.

Dividends and Distributions to Shareholders – Dividends from net investment income are declared and distributed at least annually and are recorded on ex-dividend date. Distributable net realized capital gains are declared and distributed at least annually. Dividends from net investment income and distributions from net realized gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are considered either temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification.

Federal Income Taxes – The Fund’s policy is to continue to qualify as a regulated investment company by complying with the provisions of the Internal Revenue Code that are applicable to regulated investment companies and to distribute substantially all of its taxable income and net realized (after reduction for capital loss carryforwards) gains to shareholders. Therefore, no federal income tax provision has been recorded for the Fund.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities in accordance with the FASB ASC 740 Accounting for Uncertainty in Income Taxes. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions expected to be taken on returns filed for open tax year ended September 30, 2018 through September 30, 2020 or expected to be taken in the Fund’s September 30, 2021 tax return. The Fund identifies its major tax jurisdictions as U.S. Federal and foreign jurisdictions where the Fund makes significant investments. However, the Fund is not aware of any uncertain tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

iKF, the wholly owned subsidiary of the fund, is a domestic limited liability company that has elected to be treated as a C Corporation for federal and state income tax purposes. State tax returns are filed in various states in which an economic presence exists. Current state taxes consist of income taxes, franchise taxes, business taxes, excise taxes or gross receipts taxes, depending on the state in which the returns are filed. Income taxes are charged based on apportioned income for each state.

iKF recognizes deferred income taxes for differences in the basis of assets and liabilities for financial and income tax purposes. Deferred tax assets are recognized for deductible temporary differences, tax credit carryforwards or net operating loss carryforwards and deferred tax liabilities are recognized for taxable temporary differences. Deferred tax assets are reduced by a valuation allowance when, in the opinion of the Adviser, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and the rates on the date of enactment.

When tax returns are filed, some positions taken may be sustained upon examination by the taxing authorities, while other positions are subject to uncertainty about the merits of the position taken or the amount of the position that would be sustained. The Adviser considers the likelihood of changes by taxing authorities in its filed income tax returns and recognizes a liability for or discloses potential changes that it believes are more likely than not to occur upon examination by taxing authorities.

The Adviser has not identified any uncertain tax positions in filed income tax returns that require recognition or disclosure in the accompanying consolidated financial statements. iKF’s income federal tax returns for the past three years and state tax returns for the past four years are subject to examination by taxing authorities and may change upon examination. iKF recognizes interest and penalties, if any, related to unrecognized tax benefits in operating expense. No interest expense or

iCapital KKR Private Markets Fund

(formerly, Altegris KKR Commitments Master Fund)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

March 31, 2021

penalties were recognized during the years ended March 31, 2021 and 2020.

The estimated provision for (benefit from) income taxes for the years ended March 31, 2021 and 2020 consist of the following:

| Current: | | 2021 | | | 2020 | |

| Federal | | $ | 348,050 | | | $ | 141,563 | |

| State | | | 156,857 | | | | 64,974 | |

| | | | 504,907 | | | | 206,537 | |

| Deferred: | | | | | | | | |

| Federal | | | 852,353 | | | | (1,226,208 | ) |

| State | | | 384,133 | | | | (560,214 | ) |

| Valuation allowance | | | — | | | | 1,786,422 | |

| | | | 1,236,486 | | | | — | |

| | | | | | | | | |

| Estimated provision for income taxes | | $ | 1,741,393 | | | $ | 206,537 | |

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amount of assets and liabilities for financial reporting and tax purposes.

At March 31, 2021 and 2020, components of the estimated deferred tax assets and liabilities are as follows:

| Deferred tax assets: | | 2021 | | | 2020 | |

| Net unrealized loss on investment securities | | $ | — | | | $ | 1,786,422 | |

| | | | | | | | | |

| Valuation allowance | | | — | | | | (1,786,422 | ) |

| Deferred tax liabilities: | | | | | | | | |

| Net unrealized gains on investment securities | | | (1,236,486 | ) | | | — | |

| | | | | | | | | |

| Net estimated deferred tax assets (liabilities) | | $ | (1,236,486 | ) | | $ | — | |

The Adviser reviews the recoverability of its deferred tax assets based upon the weight of available evidence. When assessing the recoverability of its deferred tax assets, significant weight was given to the effects of potential future realized and unrealized gains on investments and the period over which these deferred tax assets can be realized.

Previously valued attributes have been utilized in the current period, and therefore no longer require a valuation allowance. The Adviser will continue to assess the need for a valuation allowance in the future.

iCapital KKR Private Markets Fund

(formerly, Altegris KKR Commitments Master Fund)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

March 31, 2021