manatt manatt | phelps | phillips | Brian Korn Manatt, Phelps & Phillips, LLP Direct Dial: (212) 790-4510 E-mail: BKorn@manatt.com |

December 22, 2015

VIA EDGAR CORRESPONDENCE

U.S. Securities and Exchange Commission

Division of Corporate Finance

100 F Street, N.E.

Washington, D.C. 20549

Attention: Ms. Erin E. Martin, Special Counsel,

Office of Financial Services

Mail Stop 4720

Offering Statement on Form 1-A

Filed December 4, 2015

File No. 024-10498

Dear Ms. Martin:

We are submitting this letter on behalf of our client, StreetShares, Inc. (the “Company”), in response to the written comments of the staff (the “Staff”) of the United States Securities and Exchange Commission (the “SEC”) contained in your letter, dated December 18, 2015 (the “Comment Letter”) in connection with the Company’s Offering Statement on Form 1-A (the “Offering Statement”), as filed with the SEC on December 4, 2015.

For your convenience, our responses are set forth below, with the headings and numbered items of this letter corresponding to the headings and numbered items contained in the Comment Letter. Each of the comments from the Comment Letter is restated in bold and italics prior to the Company’s response. Capitalized terms used but not defined in this letter shall have the respective meanings given to such terms in the Offering Statement. All page number references in Company’s responses are to page numbers in the Offering Statement, which is being filed concurrently with this response.

General

| 1. | We note your response to comment 1 that you will be offering StreetShares Notes on your platform and that StreetShares Note investors will be able to view your full website, including pending and past loan transactions. Please explain in detail how |

7 Times Square, New York, New York 10036 Telephone: 212.790.4500 Fax: 212.790.4545

Albany | Los Angeles| New York | Orange County| Palo Alto| Sacramento| San Francisco | Washington, D.C.

manatt

manatt | phelps | phillips

U.S. Securities and Exchange Commission

December 22, 2015

Page 2

the offers to purchase StreetShares Notes will be made on your website and tell us how Regulation A investors would navigate your platform in order to subscribe for StreetShares Notes. In this regard, please also provide us with screenshots of the platform in development in advance of qualification. Finally, please explain to us in detail what information about pending and past loan transactions you intend to provide to investors on your website and why it is not information material to an investment decision such that it should be provided in the offering circular.

The Company notes the comment. Prospective StreetShares Note investors will first apply to create a StreetShares investor member account on the Company’s website. This requires the entry of basic information, creation of a password, and agreement to the Company’s terms and conditions and privacy policy. The investor member will then have an opportunity to view and purchase StreetShares Notes through the digital platform. The steps of the process are displayed in the attachedExhibit A, which represents the wire frame version of the public offering platform in development.

The Company also expects investors will also visit the public website prior to investing to gain more familiarity with the Company, although such information contained therein is not part of the offering of StreetShares Notes.

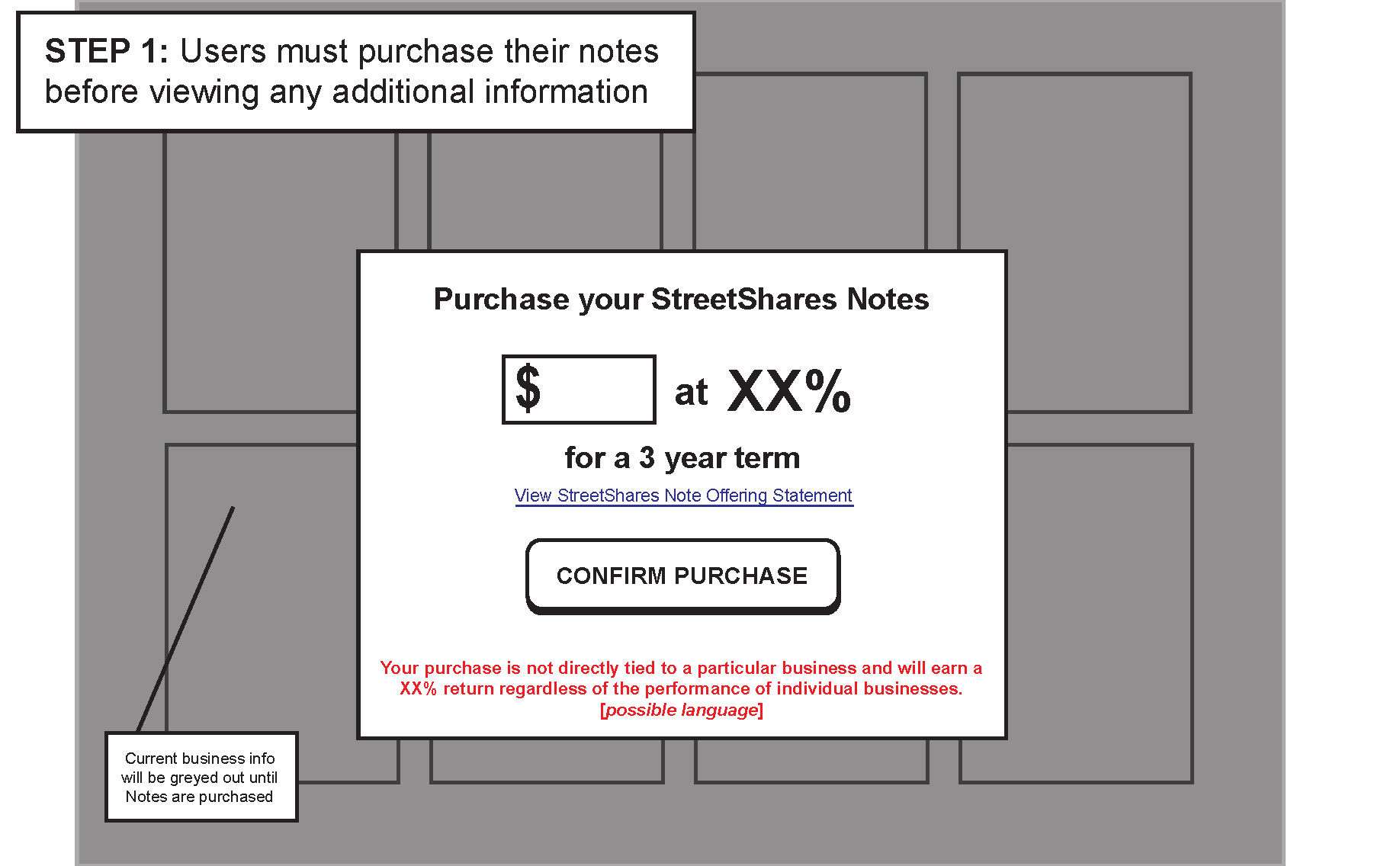

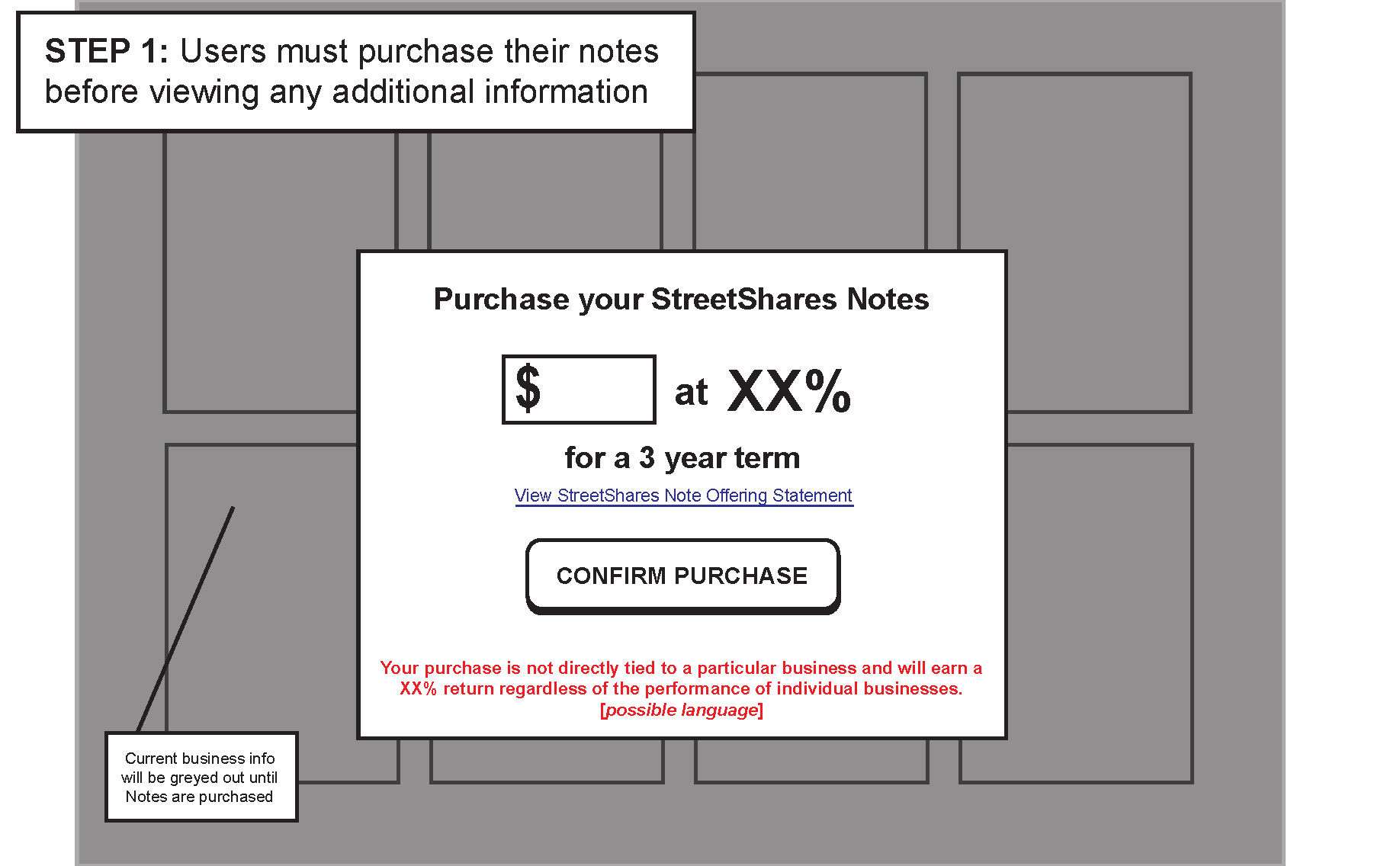

Step 1 – Before Purchase of StreetShares Notes (illustrated on page 1 of Exhibit A)

Investor members will be directed to the offering page where they will be provided with a link to the latest form of the Form 1-A Offering Statement, and other periodic public filings of the Company with the SEC, including risk disclosures related to investment in the Company, the industry, and the StreetShares Notes. After reviewing the disclosures contained therein, interested investor members will be offered the opportunity to review and execute a subscription agreement (a form of which is filed with the Offering Statement as Exhibit 4.1) to purchase StreetShares Notes (a form of which is filed with the Offering Statement as Exhibit 3.1). The screen display (illustrated on page 1 ofExhibit A) will show in summary form the basic terms of the security being purchased (e.g., price, rate, and term), which are detailed in the documents.

At this stage, the Company will make special efforts to avoid any suggestion that the StreetShares Note investor is engaging in direct lending to a small business borrower. The investor will be reminded that his or her purchase is not directly tied to a particular business loan and will earn the stated interest rate regardless of the performance of individual businesses. Additionally (as illustrated on page 1 ofExhibit A), displays of the individual business borrowers will be grayed out and not viewable untilafter an investment in one or more StreetShares Notes.

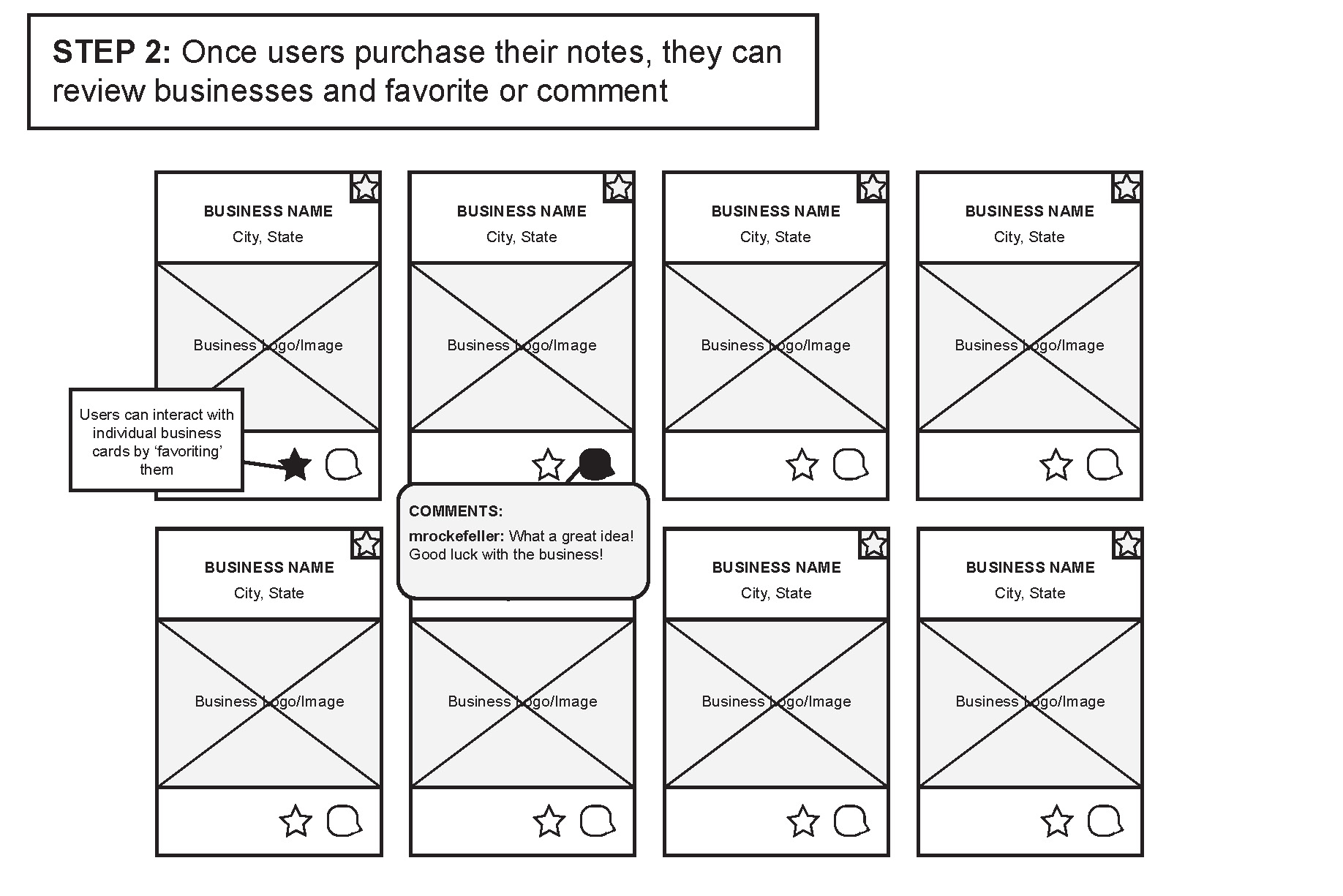

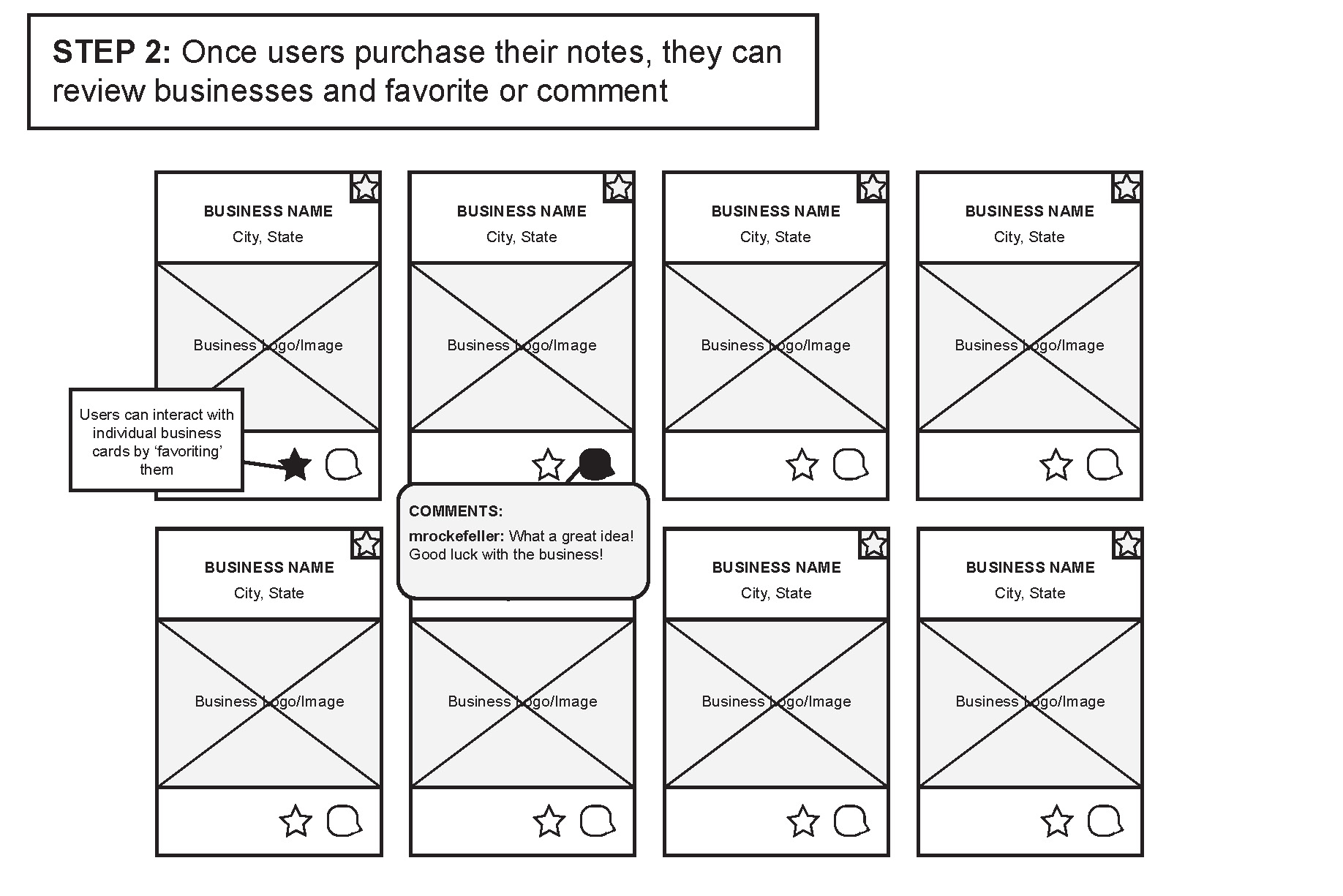

Step 2: After Purchase of StreetShares Notes (illustrated on page 2 of Exhibit A)

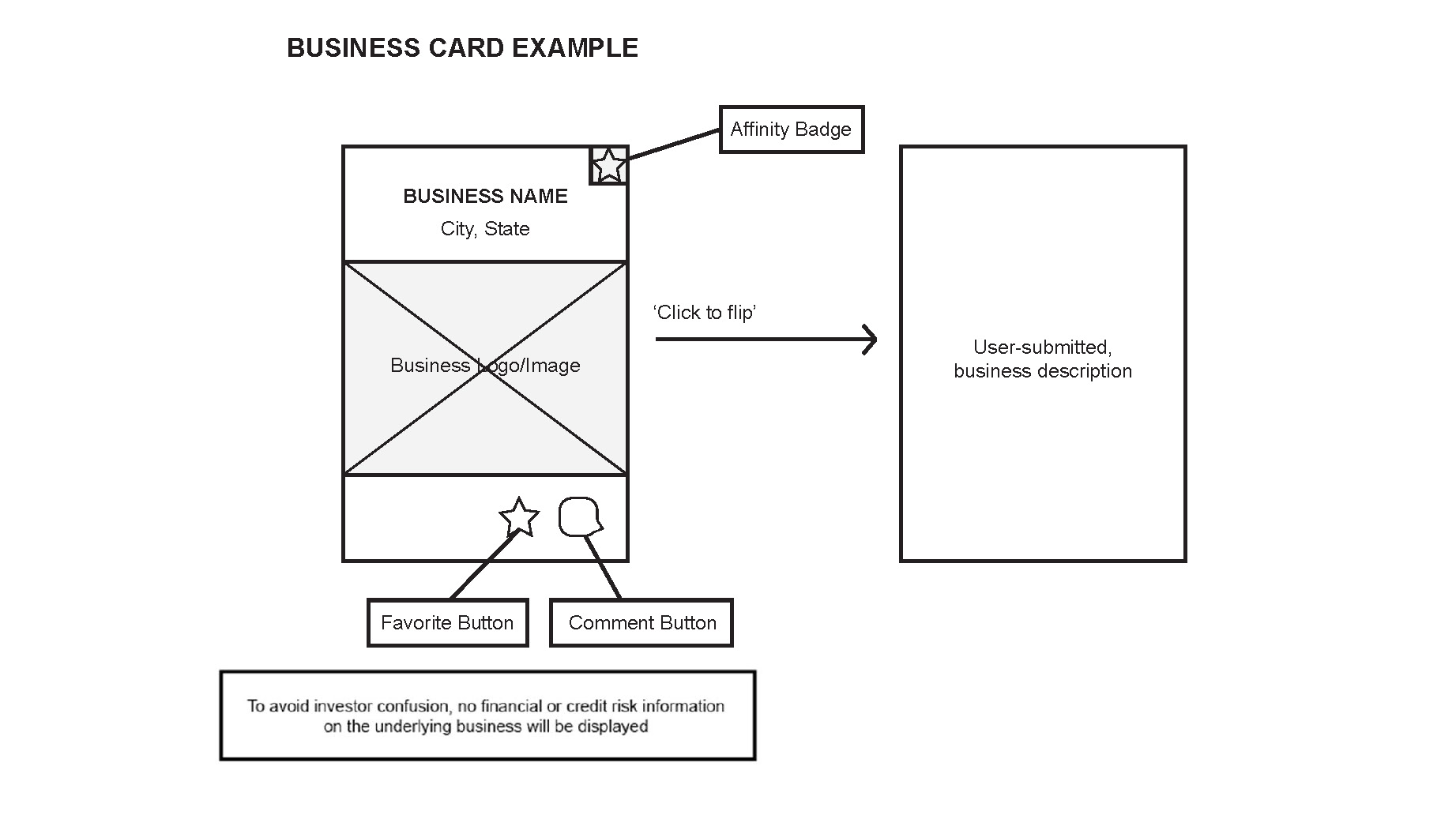

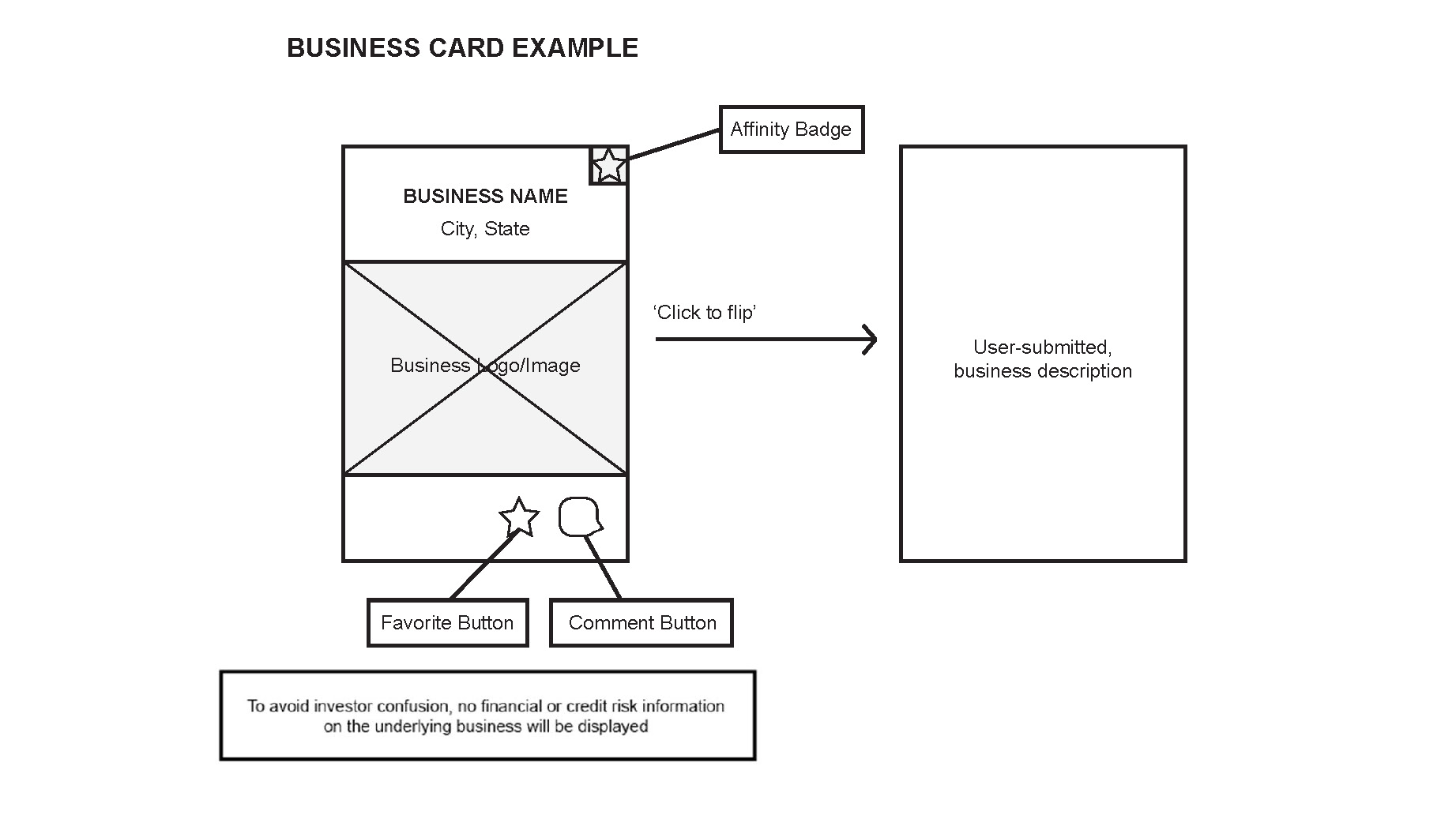

Once a purchase of StreetShares Notes is completed, the investor will have an opportunity to view small businesses who are currently requesting loans from the Company. The view (illustrated on page 2 ofExhibit A) will be of several “business cards” containing summary information about each business – name, city and state, affinity badge (e.g. U.S. Army), and photograph. In the current design, the investor may click to “flip over” the business card (as illustrated in enlarged detail on page 3 ofExhibit A) to read a brief description of the business written by the business owner. The investor will not have access to detailed personal or financial information about the business for privacy purposes, as well as to avoid any confusion that the investor’s purchase is linked to the risk or performance of any individual business borrowers. As the investor browses the businesses, he or she will be provided optional feedback opportunities on the business cards themselves, such as clicking a button to indicate their favorite or commenting on the business idea (see examples on page 2 ofExhibit A). The investor will also have an opportunity to provide feedback directly to the Company by clicking a link at the bottom of the page for suggestions or comments on the user experience, product quality, etc. The Company values such feedback, both to collect data about the popularity of different types of businesses and to learn how it can improve its product offerings and user interface. The Company will monitor comments for appropriateness.

The Company believes that loan-specific information should not be included in the Offering Statement. The StreetShares Notes will not be reliant on any given loan. Indeed, given the Company’s origination of approximately $6 million in loans with an average size of approximately $20,000, no single loan is material enough to require separate disclosure. Moreover, StreetShares Notes are not investments in loans; they are investments in the Company. Displaying the qualities of a loan in the disclosure materials runs the risk of creating the false impression that StreetShares Note investors are investing in the businesses themselves and could be misleading by shifting the focus away from analysis of the risk disclosures of the Company. That is one of the reasons (along with privacy concerns) that detailed financial and related personal information about the businesses and their owners will not be displayed to StreetShares Note investors on the digital platform. Moreover, details of the MPDN auction will also not be visible to StreetShares Notes investors, unless they are also accredited MPDN purchases.

manatt

manatt | phelps | phillips

U.S. Securities and Exchange Commission

December 22, 2015

Page 3

Offering Circular Summary

Business Overview, page 1

| 2. | Please tell us in greater detail how investors “will be able to provide feedback with respect to the Company’s active loan portfolio.” We also note your response to comment 1 that “[i]nvestors will also be able to provide feedback on pending loan transactions that will be visible to [you] and other site users.” |

The Company notes the comment. As explained above in response to Comment No. 1, the Company will provide optional feedback opportunities following the purchase of StreetShares Notes. The Company currently elicits and receives regular feedback from its investor population and routinely incorporates such feedback in order to improve its product offerings and customer experience. The Company intends to continue this useful feature for its StreetShares Notes investors. Additionally, as noted above, allowing investors who have already purchased StreetShares Notes to select their favorite businesses or comment on their ideas will increase the customer engagement and social aspect of the StreetShares member experience. These survey opportunities will be optional. Whether an investor participates and the answers that he or she provides will no bearing on that investor's access to purchasing additional Streetshares Notes.

Use of Proceeds, page 14

| 3. | We note your response and revisions in response to comment 3 that you may investor funds from the sale of StreetShares Notes to fund a portion of the loans listed on your platform that are undersubscribed by purchasers of Member Payment Dependent Notes. Please disclose the maximum percentage or amount, or both, that you would commit to an individual loan in such circumstances. Please revise the discussion of your direct lending account in your “About the Platform” section concerning the potential concentration of your direct lending investment in a small number of loans and include appropriate risk factor disclosure, as applicable. |

manatt

manatt | phelps | phillips

U.S. Securities and Exchange Commission

December 22, 2015

Page 4

The Company notes the comment. It is the Company’s current policy to fund a portion of every loan with its own funds. The Company maintains discretion to fund up to 60% of any given loan with proceeds from this offering. The Company has disclosed this on pages 15 and 16 of the Offering Statement. The Company has also expanded its risk factor disclosure on reliance on a small number of investors and related concentration risk on page 9 and added a cross-reference to this risk in “Use of Proceeds” on page 15.

The Company does not believe it has any meaningful concentration risk with respect to investments in its loan portfolio. The Company’s borrowers are from diverse industries and geographic locations, and the Company does not believe there is meaningful risk at this time in lending too much capital to businesses that may pose concentration risk with respect to industry or geography. The Regulation A offering may diversify the Company’s capital sources and give the Company greater runway to lend more money that had it not opened up the Regulation A process.

The Company believes that the portion of a loan funded by the Company using proceeds of the sale of StreetShares Notes is not relevant since investors in StreetShares Notes receive the same security issued by the Company on a continuous basis. The Company may choose to fund part or all of its portion of a loan with the proceeds of StreetShares Note, or it may choose to apply the proceeds for other purposes, including salaries and benefits, rent and real estate costs, and legal and accounting expenses.

About the Platform

Underwriting Process

Overview, page 16

| 4. | Please delete your disclosure on page 17 that public investors can “elect to support” specific loan requests by approved borrowers “by directing the proceeds of their Company investment,” as well as the disclosure that StreetShares Note investors are required to pre- fund their StreetShares accounts “before they can invest in a loan.” In this regard we note your response to comment 1 that “investors in StreetShares Notes will not be directing the proceeds of their investment.” |

The Company notes the comment and has deleted the disclosure on page 17 (now the carryover paragraph on page 18) that public investors may “elect to support” specific loan requests by “directing the proceeds of their Company investment,” as well as the disclosure on the same page that “StreetShares Note Investors” must pre-fund their StreetShares accounts before they can invest “in a loan.” As the Offering Statement otherwise makes clear, investors in StreetShares Notes will not be investing in individual loans or directing the proceeds of their investment.The use of proceeds will be determined by the Company in its sole discretion and may be used to fund loans or for other purposes.

Plan of Distribution, page 29

| 5. | We note your disclosure that you plan to provide your offering circular to prospective investors “upon their request.” Please revise your plan of distribution to clarify that your offering circular will either accompany or precede all written offers. We further |

manatt

manatt | phelps | phillips

U.S. Securities and Exchange Commission

December 22, 2015

Page 5

note that you “expect to use additional advertising, sales and other promotional materials in connection with this offering” and that “these materials will not give a complete understanding of this offering.” Please explain to us in detail how such communications would be compliant with Regulation A. Please see in particular Rules 251(d), 254 and 255 of Regulation A.

The Company notes the comment. The Company has revised the Plan of Distribution in the Offering Statement to make it clear that it fully intends to comply with Regulation A, including Rules 251(d), 254 and 255 thereof. The original language was referring to the fact that an item of advertising literature circulated for “testing-the-waters” purposes would not suffice for disclosure purposes and that the reader should also consult the Offering Statement and Preliminary Offering Circular contained therein. “Testing-the-waters” materials, if any, will contain all required disclosures, including information on where a prospective investor may find a copy of the Preliminary Offering Circular without charge, and the other disclaimers required by Rule 255. In accordance with Regulation A, all advertising and testing-the-waters materials, if any, will be filed as an exhibit to the Offering Statement at or after first use. See page 30.

Consolidated Financial Statements

Notes to the Consolidated Financial Statements

Note 2 – Summary of Significant Accounting Policies – Allowance for Loan Losses, page F-8

| 6. | We note your response to comment 8 that you estimate your allowance for loan losses at both stages (i.e., losses incurred at the balance sheet date and based on losses expected over the life of the loan). We also note your revised disclosure on page F-8 that the Company uses a proprietary forecasted life of loan loss rate at origination for new loans that have not had the opportunity to make payments when they are first funded. Based on this information, it is unclear whether or not you are attempting to project or forecast changes in facts and circumstances after the balance sheet date or are attempting to follow the principle in ASC 450-20-25-2 that a loss contingency should be recognized only if past and current events indicate that it is probable that an asset has been impaired or that a loss has been incurred as of the balance sheet date. Please explain and revise the filing, if necessary. |

The Company notes the comment. The Company advises the Staff that the loss rate applied at the inception of a loan is based on the combination of historical loss experience within the industry and known factors concerning the loan and/or the portfolio. The Company is not attempting to predict the effect of future events on the ability of borrowers to pay. The Company understands that future guidance (subject to final approval and effectiveness in 2019) may require forecasting of the effect of future events, based on probability, of a loss arising in the portfolio of loans. The Company continues to follow existing guidance (ASC 450) and expects to continue to do so unless and until the new guidance takes effect. Thus, no changes have been made to Note 2.

Part III – Exhibits

| 7. | Please file a form of the subscription agreement that you intend to use for your offering. Refer to Item 17 of Part III of Form 1-A for guidance. |

The Company notes the comment. The Company has filed a draft Subscription Agreement for purchasers of StreetShares Notes as Exhibit 4.1 to the Offering Statement. See Exhibit 4.1

****************

We thank you for your prompt attention to this letter responding to the Offering Statement and look forward to hearing from you at your earliest convenience. Should the Staff have additional questions or comments regarding the foregoing, please do not hesitate to contact the undersigned at (212) 790-4510.

| | Sincerely, |

| | |

| | /s/ Brian Korn |

| | |

| | Brian Korn |

| cc: | Mark L. Rockefeller, Chief Executive Officer |

Hayley Chang, General Counsel & Chief Compliance Officer

StreetShares, Inc.