manatt manatt | phelps | phillips | Brian Korn Manatt, Phelps & Phillips, LLP Direct Dial: (212) 790-4510 E-mail:BKorn@manatt.com |

Via EDGAR Correspondence

U.S. Securities and Exchange Commission

Division of Corporate Finance

100 F Street, N.E.

Washington, D.C. 20549

Attention: Ms. Erin E. Martin, Special Counsel,

Office of Financial Services

Mail Stop 4720

| Re: | StreetShares, Inc.

Draft Offering Statement on Form 1-A

Submitted September 15, 2015

CIK No. 0001607838 |

Dear Ms. Martin:

We are submitting this letter on behalf of our client, StreetShares, Inc. (the “Company”), in response to the written comment of the staff (the “Staff”) of the United States Securities and Exchange Commission (the “SEC”) contained in your letter dated February 2, 2016 (the “Comment Letter”) in connection with the Company’s Offering Statement on Form 1-A (the “Offering Statement”), as originally submitted in confidential draft format to with the SEC on September 15, 2015.

For your convenience, our response is set forth below, with the Staff’s comment reprinted below just above the Company’s response. Capitalized terms used but not defined in this letter shall have the respective meanings given to such terms in the Offering Statement. All page number references in the Company’s response are to page numbers in the Offering Statement, which is being filed concurrently with this response.

7 Times Square, New York, New York 10036 Telephone: 212.790.4500 Fax: 212.790.4545

Albany | Los Angeles| New York | Orange County| Palo Alto| Sacramento| San Francisco | Washington, D.C.

manatt

U.S. Securities and Exchange Commission

February 5, 2016

Page 2

General

| 1. | Please expand your materiality analysis to comprehensively describe the features of your offering process, including the provision of information regarding the pending loan transactions to StreetShares Notes investors, in writing. Please also disclose the material features of your offering process in the offering circular itself. |

The Company acknowledges the comment. In response to the comment, the Company has revised the Offering Statement to include the material features of the offering process and the investor experience. See “Offering Circular Summary — StreetShares Platforms” on p.1 and “The StreetShares Basic Platform” on p. 30. The Company has also provided a more detailed description of the offering process below:

We currently operate two online platforms: StreetShares Basic and StreetShares Pro. StreetShares Notes will only be offered on the StreetShares Basic site. StreetShares Basic will not offer views of, nor the opportunity to purchase, the member payment dependent notes (“MPDNs”) offered on the StreetShares Pro site. The MPDNs are dependent upon payments made by specific small business borrowers, whereas StreetShares Notes, as more fully described in the Offering Statement, are fully recourse to the Company, regardless of the payments received by any particular customer of the Company.

Prospective StreetShares Note investors will first apply to create a StreetShares member account on the Company’s website. This requires the entry of basic information, creation of a password, and agreement to the Company’s terms and conditions and privacy policy.

As part of these terms and conditions and by registering to purchase StreetShares Notes, investors will be required to certify to us, among other things, that:

| · | they will have had the opportunity to download and view the Offering Statement and any supplement through the Company’s platform each time they purchase StreetShares Notes; |

| · | if they are an individual investor, their purchase order is submitted for and on behalf their account; |

| · | if they are an organization, their purchase order has been submitted by an officer or agent who is authorized to bind the organization; |

| · | they are making their own investment decision and understand the risk of investing in the StreetShares Notes; |

| · | we are not providing them any investment advice, nor are we acting as or registered as a broker, dealer, investment adviser, or other fiduciary; and |

| · | their purchase order and all other consents submitted through our platform are legal, valid, and enforceable contracts. |

After they have successfully registered on the Company’s platform, they will receive a confirmation of their successful registration and may view available StreetShares Note offerings. Prospective investors will be directed to the offering page where they will be linked to the latest version of the Offering Statement and other periodic public filings of the Company with the SEC, which include risk disclosures regarding an invesment in the Company, the industry, and StreetShares Notes. After reviewing the disclosures contained therein, interested prospective investors will be given the opportunity to review and execute a subscription agreement (a form of which is filed with the Offering Statement as Exhibit 4.1) to purchase StreetShares Notes (a form of which is filed with the Offering Statement as Exhibit 3.1).

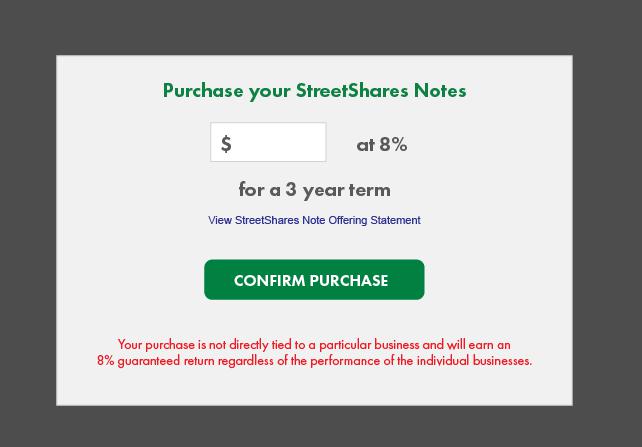

It is important to understand that the Company will make special efforts to avoid any misperception that the StreetShares Note investors are engaging in direct lending to the Company’s small business borrower customers. Of course, the Offering Statement informs prospective investors of the nature of the Company’s business, which is commercial lending. And all material information related to that investment will be included in the Company’s Offering Statement and related public filings. But prospective investors will also be reminded that, just as with an investment in any other type of business, their investment isnot dependent on any particular customer of that business. Specifically, they will be reminded that they will earn interest at the rate stated on their StreetShares Notes, regardless of the underlying performance of any particular borrower customer of the Company. For an illustration of this stage of the process as currently designed, please see the screen display in Figure 1 below.

manatt

U.S. Securities and Exchange Commission

February 5, 2016

Page 3

|

Fig. 1 StreetShares

Note Purchase |

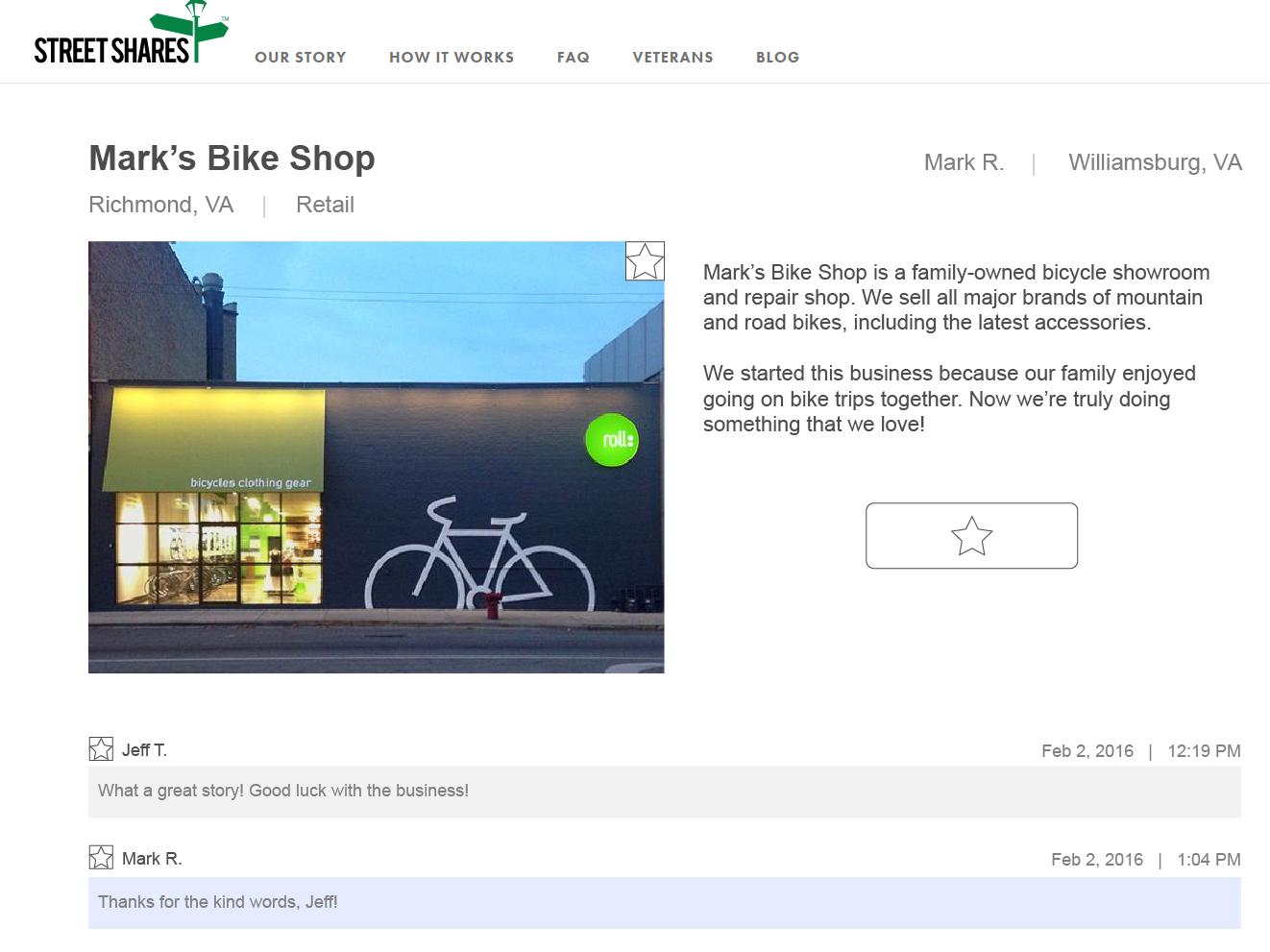

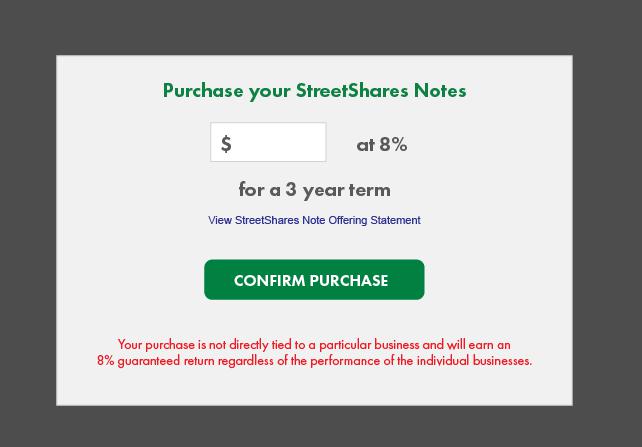

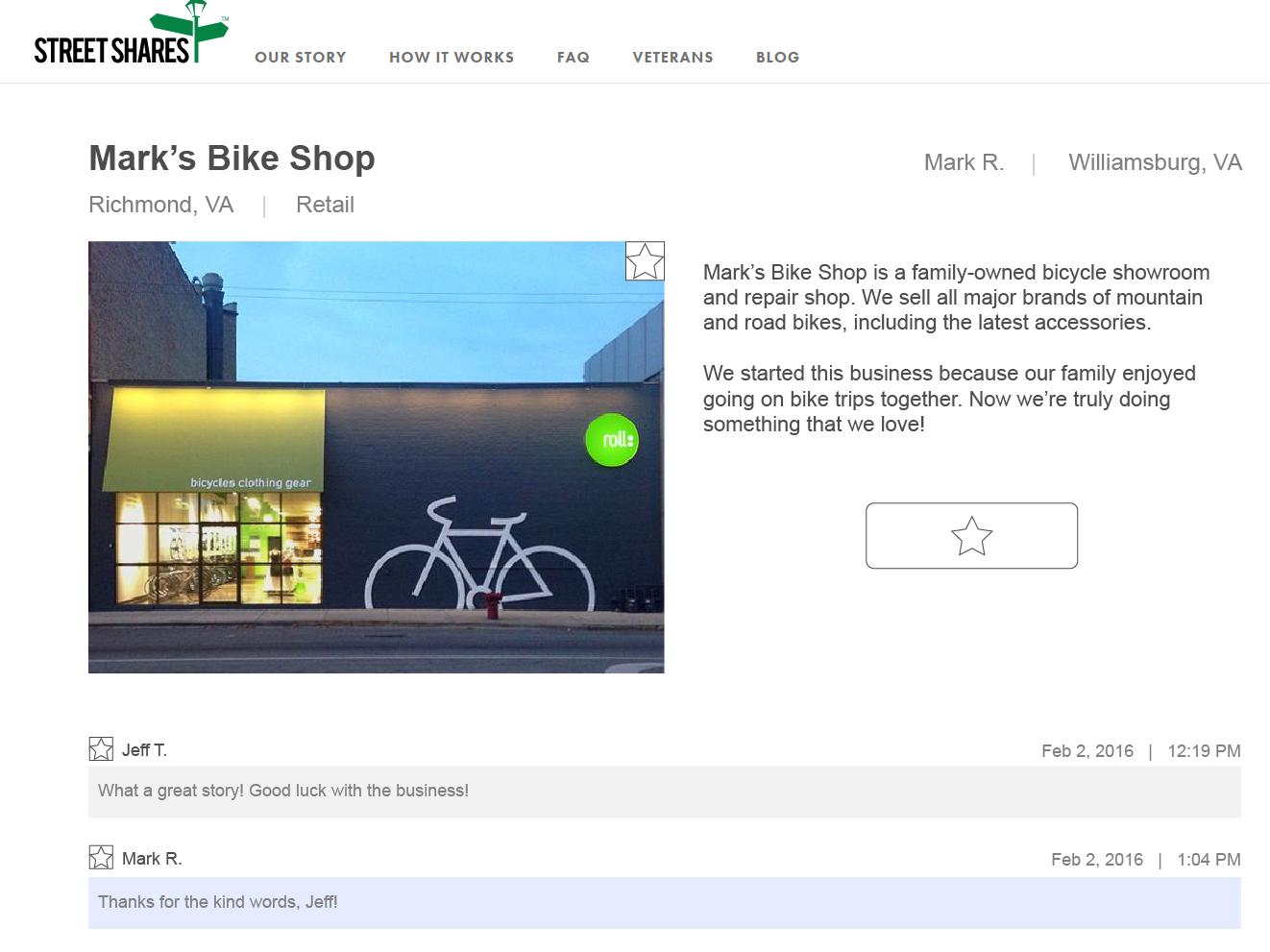

Having clarified that distinction, investors who purchase StreetShares Notes will be offered the opportunity to interact with a small sampling of the Company’s current customers. Specifically, the Company will feature glimpses into the human interest stories of some of its current customers through what it describes as customer “spotlights.” These spotlights are akin to customer testimonials that will appear on a rolling basis and turn over very quickly. As currently designed (see illustration in Figures 2 and 3 below), the view will be of customer “business cards” containing summary information about each featured small business customer. Investors who have already purchased StreetShares Notes will have the opportunity to view the business cards, click to “flip over” the business cards, and provide optional feedback on the business customer. The details of that process are described below.

These customer spotlights will not contain material information related to a decision to invest in the Company. Indeed, at this stage in the process, StreetShares Note investors will have already have been provided with that information through the Offering Statement and related public filings. Specifically, the Offering Statement, as updated and supplemented from time to time, will include hard data on the objective credit risk of its entire lending portfolio. These disclosures include tables reporting the number of loans, dollar amount, interest rate, business owner credit score, business revenue, etc.

manatt

U.S. Securities and Exchange Commission

February 5, 2016

Page 4

Fig. 2

Sample Front of

Business Card | |  |

| | | Fig. 3

Sample Back of

“Business Card” |

By contrast, the customer spotlights will contain softer, subjective information of a human interest nature. The front of the business card will include the sampled customer’s business name, home town, affinity badge (e.g. a star for U.S. Army), and a photograph. Interested investors who click to flip over the the business card will also be able to read a brief personal story. For example, as illustrated above in Figures 2 and 3, the website would show that Mark’s Bike Shop is located in Richmond, Virginia and owned by a military veteran named “Mark R.” who started the business with his family because they loved biking together. But the website wouldnot show that bicycle shop’s revenue, the owner’s credit scores, or any other data that is material to analyzing the credit risk of that business—i.e. the risk of the Company lending to it. This is to further avoid any confusion that the investor’s purchase was linked to the risk or performance of any individual customer of the Company.

manatt

U.S. Securities and Exchange Commission

February 5, 2016

Page 5

The personal story will be very brief (currently, a 400-character limit) and will not include any of the hard credit risk data listed above. As currently designed, the small business borrower will be given an autopopulating form that they will have the ability to edit. For example, as illustrated above, the business name and type of business would be pre-filled, and the small business customer would have the opportunity to fill in why they started the business. Before the personal story is published on the website, the Company’s legal team will review to ensure that no hard credit risk data (e.g. no indication of the customer’s revenue or financial projections) is included. This is to further avoid any misperception that the StreetShares Note is tied to the credit risk of any particular customer.

For various legal and practical reasons, the Company will not display all of its customers at one time. Rather, the customer spotlights will represent only a tiny fraction of the Company’s customer base and will turn over on a rapid basis. Thus, the viewing opportunity for any one customer will be limited in time (current estimate is 24-72 hours, but expected to decrease over time).

As the StreetShares Note investors browse the businesses, they will be provided optional feedback opportunities on the businesses themselves, such as by clicking a button to indicate their favorite or commenting on the business idea. This interaction between StreetShares Note investors and business customers will be viewable only on the StreetShares Basic site, not the StreetShares Pro site. The Company expects the social engagement between the StreetShares Note investors and small business customers will be a positive experience. The Company believes, for example, that its small business customers will enjoy receiving a “favorite” or an encouraging comment, which indicates traction for a business borrower and may increase their likelihood of returning as repeat customers and referring their friends. As such, the Company will enhance the social experience for its customers on the website while separately ensuring that all material information relevant to a StreetShares Note purchase is disclosed in the Offering Statement and related public securities filings and taking affirmative steps to avoid investor confusion about the nature of their investment.

****************

The Company also wishes to advise the Staff once again that it acknowledges the following:

| • | | should the Commission or the Staff, acting pursuant to delegated authority, qualify the filing, it does not foreclose the Commission from taking any action with respect to the filing; |

| • | | the action of the Commission or the Staff, acting pursuant to delegated authority, in qualifying the filing, does not relieve the Company from its full responsibility for the adequacy and accuracy of the disclosure in the filing; and |

| • | | the Company may not assert Staff comments and/or qualification as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

We thank you for your prompt attention to this letter responding to the Offering Statement and look forward to hearing from you at your earliest convenience regarding prompt qualification of the Offering Statement. Should the Staff have additional questions or comments regarding the foregoing, please do not hesitate to contact the undersigned at (212) 790-4510 or the Company’s General Counsel and Chief Compliance Officer, Hayley Chang, at (571) 386-0705.

manatt

U.S. Securities and Exchange Commission

February 5, 2016

Page 6

| | Sincerely, |

| | |

| | /s/ Brian Korn |

| | |

| | Brian Korn |

| cc: | Mark L. Rockefeller, Chief Executive Officer |

Hayley Chang, General Counsel & Chief Compliance Officer

StreetShares, Inc.