UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22969

PALMER SQUARE OPPORTUNISTIC INCOME FUND

(Exact name of registrant as specified in charter)

1900 Shawnee Mission Parkway Suite 315

Mission Woods, KS 66205

(Address of principal executive offices) (Zip code)

Scott Betz

Chief Compliance Officer

1900 Shawnee Mission Parkway Suite 315

Mission Woods, KS 66205

(Name and address of agent for service)

(816) 994-3200

Registrant's telephone number, including area code

Date of fiscal year end: July 31

Date of reporting period: July 31, 2023

Item 1. Report to Stockholders.

The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

Palmer Square Opportunistic Income Fund

(PSOIX)

ANNUAL REPORT

JULY 31, 2023

Palmer Square Opportunistic Income Fund

Table of Contents

| Letter to Shareholders | 1 |

| Fund Performance | 12 |

| Consolidated Schedule of Investments | 13 |

| Consolidated Statement of Assets and Liabilities | 35 |

| Consolidated Statement of Operations | 36 |

| Consolidated Statements of Changes of Net Assets | 37 |

| Consolidated Statement of Cash Flows | 38 |

| Consolidated Financial Highlights | 39 |

| Notes to Consolidated Financial Statements | 40 |

| Report of Independent Registered Public Accounting Firm | 58 |

| Supplemental Information | 59 |

| Expense Example | 61 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the Palmer Square Opportunistic Income Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

www.palmersquarefunds.com

Palmer Square Opportunistic Income Fund (PSOIX)

July 2023

Fund Refresher

As a refresher, the Palmer Square Opportunistic Income Fund (“PSOIX” or the “Fund”) seeks to not only capture a high level of current income, but also long-term capital appreciation by investing with a flexible mandate to find the best relative value opportunities across corporate credit and structured credit.

Performance Summary

The Fund performance was 13.04% (net of fees) for the fiscal year-ending 7/31/2023. We remain confident in our positioning in CLO Debt, bank loans and high yield bonds and believe the total return outlook hasn’t looked this constructive since mid-2020.

Fund Performance Net of Fees as of 7/31/2023 (inception 8/29/20141)

| YTD 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 20141 | |

PSOIX | 10.79% | -4.48% | 6.66% | 5.92% | 7.59% | -0.47% | 11.04% | 12.10% | -5.32% | -0.76% |

| 1 Year | 3 Years | 5 Years | Since Inception Annualized | |

| PSOIX | 13.04% | 8.21% | 4.62% | 4.63% |

The performance data quoted represents past performance and that past performance does not guarantee future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end please call 866-933-9033.

Portfolio Snapshot

Please refer to the table below for a portfolio snapshot by quarter.

| 6/30/2022 | 9/30/2022 | 12/31/2022 | 3/31/2023 | 7/31/2023 | |

| Interest Rate Duration* | 0.53 yrs | 0.51 yrs | 0.48 yrs | 0.43 yrs | 0.41 yrs |

| Spread Duration* | 3.58 yrs | 3.84 yrs | 3.62 yrs | 3.26 yrs | 2.98 yrs |

| Credit Spread | 902 | 997 | 866 | 892 | 733 |

| Weighted Average Price | $90.5 | $89.1 | $90.4 | $90.2 | $93.8 |

| Yield to Expected Call* | 12.04% | 13.97% | 13.24% | 12.59% | 11.36% |

| Yield to Maturity | 11.37% | 12.95% | 12.40% | 11.56% | 10.58% |

| Current Yield | 7.82% | 9.66% | 11.00% | 11.18% | 10.60% |

| Beta vs. S&P 500 | 0.44 | 0.41 | 0.40 | 0.39 | 0.39 |

| Beta vs. Bloomberg U.S. Aggregate Bond Index | 0.31 | 0.34 | 0.38 | 0.35 | 0.34 |

Past performance does not guarantee future results. *Please see Notes and Disclosure for definitions.

| Palmer Square Capital Management LLC 1900 Shawnee Mission Parkway, Suite 315, Mission Woods, KS 66205 | www.palmersquarefunds.com |

1

Relative Value and Current Upside potential

| ● | We see a lot of value in CLO debt at current levels, as spreads are near the wides* only seen for a few short periods since 2008. If CLO debt levels return to their average post crisis spreads, total return potential is attractive. Please see the table below highlighting current price/spreads and potential upside from current levels. Yield to expected illustrates yields if spreads were to stay the same and the bonds pull to par by maturity. The Average 1-year upside represents the 1yr total return if spreads return to their 10yr average levels, and the Tight* 1-year upside represents the 1yr total return if spreads return to their 10yr tight levels1,2. |

| PALMER SQUARE OPPORTUNISTIC INCOME FUND | 1yr Forward Breakeven3 | 3/31/20204 | 2/28/20165 | ||||||

| Rating | Allocation | Price | Spread | YTE* | Average 1yr Upside1 | Tight 1yr Upside2 | Spread | Spread | Spread |

| CLO AA | 1.92% | 94.60 | 342 | 6.57% | 8.16% | 9.43% | 315 | 349 | 284 |

| CLO BBB | 28.36% | 94.27 | 532 | 9.66% | 14.78% | 18.02% | 682 | 755 | 661 |

| CLO BB | 34.21% | 93.09 | 909 | 13.63% | 20.03% | 24.21% | 1117 | 1384 | 1193 |

| CLO B | 5.07% | 84.98 | 1315 | 17.81% | 28.64% | 37.60% | 1541 | 1949 | 1653 |

| CLO Equity | 4.83% | 40.79 | 1695 | 21.03% | 26.61% | 31.61% | 2559 | 2000 | 1850 |

| CMBS | 0.54% | 62.23 | 1457 | 19.16% | 37.71% | 40.28% | 2554 | 1030 | 665 |

| Corp HY | 6.59% | 91.76 | 451 | 8.80% | 7.51% | 11.18% | 674 | 880 | 726 |

| Corp IG | 0.22% | 83.01 | 138 | 4.16% | 3.47% | 7.36% | 203 | 272 | 197 |

| Bank Debt | 18.09% | 97.04 | 500 | 9.32% | 10.78% | 11.53% | 904 | 844 | 639 |

| Total | 100.00% | 93.34 | 740 | 11.77% | 16.59% | 20.06% | 1006 | 1107 | 942 |

Source: Bloomberg, Palmer Square, as of 7/31/2023. *YTE, also known as Yield to Expected Call, is a Yield to Call metric that assumes callable bonds are not called at their call date, but some later date prior to maturity. 1Refers to the potential increase in value of the investment in one year if spreads return to 10-year average levels. 2Refers to the potential increase in value of the investment in one year if spreads return to 10-year tight levels. The potential increase in value is calculated by determining the return resulting from the positive or negative difference between the current price of the securities and the price of the securities at the respective spread levels noted in the hypothetical performance (i.e., spread levels at 10-year averages) plus the income from anticipated coupon payments over the next 12 months. For purposes of this analysis, anticipated coupon payments incorporate the forward LIBOR/SOFR curve. 3Refers to the level at which spreads would need to widen in order to cause a negative value in an individual investment over a one-year period. This is determined by reducing a security’s price by its expected coupon payments over the next 12 months and then calculating the level of spread widening that would need to occur to move the security’s actual price to the reduced price. For purposes of this analysis, anticipated coupon payments incorporate the forward LIBOR/SOFR curve. 4Month end during Covid dislocation. 5Month end of energy market dislocation. Below investment grade ratings are subject to higher risks. Figures shown are not indicative of the performance of the Fund. The presented hypothetical performance does not reflect the impact of material economic and market factors on decision-making, any changes to the strategy over time, and was prepared with the benefit of hindsight. Past performance is no guarantee of future returns. Past performance is not a reliable indicator of future returns. Investment results may vary substantially on a monthly, quarterly, annual and other periodic basis.

| PALMER SQUARE CLO INDEX LEVELS AND 1YR UPSIDE TO AVERAGE/TIGHTS | |||||

| Rating | Current Average Price | Discount Margin | Yield to Expected | Average 1yr Upside1 | Tight 1yr Upside2 |

| CLO AAA | $99.38 | 164 | 6.11% | 7.35% | 7.61% |

| CLO AA | $98.36 | 232 | 6.44% | 8.49% | 9.25% |

| CLO A | $97.69 | 286 | 6.99% | 9.18% | 10.46% |

| CLO BBB | $94.72 | 465 | 8.74% | 13.24% | 15.88% |

| CLO BB | $89.29 | 935 | 13.56% | 19.71% | 26.43% |

| CLO B | $70.76 | 1454 | 18.96% | 36.92% | 48.23% |

Source: JPM / Intex / Palmer Square. As of 7/31/2023. Below investment grade ratings are subject to higher risks. Figures shown are not indicative of the performance of the Fund. 1Refers to the potential increase in value of the investment in one year if spreads return to 10-year average levels. 2Refers to the potential increase in value of the investment in one year if spreads return to 10-year tight levels. The potential increase in value is calculated by determining the return resulting from the positive or negative difference between the current price of the securities and the price of the securities at the respective spread levels noted in the hypothetical performance (i.e., spread levels at 10-year averages) plus the income from anticipated coupon payments over the next 12 months. For purposes of this analysis, anticipated coupon payments incorporate the forward LIBOR/SOFR curve. The presented hypothetical performance does not reflect the impact of material economic and market factors on decision making, any changes to the Fund over time, and was prepared with the benefit of hindsight.

| * | Please see Notes and Disclosure for definitions. |

| Palmer Square Capital Management LLC 1900 Shawnee Mission Parkway, Suite 315, Mission Woods, KS 66205 | www.palmersquarefunds.com |

2

Allocation / Attribution Summary

Select Portfolio Attribution and Characteristic Dashboard

| Allocation | 7/31/2023 Allocation | 8/1/2022 to 7/31/2023 Gross Attribution | Average Price | Yield to Expected Call* |

| CLO Debt | 68.7% | 10.85% | $93.2 | 12.10% |

| Bank Loans | 17.7% | 2.42% | $97.4 | 9.30% |

| High Yield Bonds | 6.5% | 0.68% | $92.5 | 8.81% |

| Sub Notes | 4.7% | 0.38% | $45.3 | 21.03% |

| ABS/MBS | 0.5% | -0.10% | $69.7 | 19.15% |

| IG Corp Debt | 0.2% | 0.01% | $83.0 | 4.16% |

Asset-backed Securities (ABS), Mortgage-backed Securities (MBS).

Historic Positioning Detail by Asset Type:

| 6/30/2022 Allocation | 9/30/2022 Allocation | 12/31/2022 Allocation | 3/31/2023 Allocation | 7/31/2023 Allocation | 8/1/2022 to 7/31/2023 | |

| CLO Debt | 63% | 60% | 63% | 71% | 69% | 10.85% |

| Bank Loans | 17% | 24% | 25% | 17% | 18% | 2.42% |

| High Yield Bonds | 11% | 9% | 7% | 6% | 7% | 0.68% |

| Sub Notes | 6% | 5% | 5% | 5% | 5% | 0.38% |

| ABS/MBS | 1% | 0% | 0% | 0% | 1% | -0.10% |

| IG Corp Debt | 1% | 1% | 0% | 0% | 0% | 0.01% |

Please note the allocation above is on a gross exposure basis as a percent of NAV and does not include cash. Gross attribution does not include hedges, expenses and fees if applicable. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. Attribution refers to the process of measuring returns generated by various sources.

| ● | Performance and Attribution: The Fund performance was 13.04% (net of fees) for the fiscal year-ending 7/31/2023. Floating rate assets continued to perform very well as rising inflation was top of mind throughout the year. The regional banking crisis in Q1 2023 was (and still is) seemingly contained to a few weak links and not a systemic issue. This led to a mostly steady and broad-based grind tighter in credit spreads throughout 2023, which finished the year near the tights last seen in early March. Partially offsetting the spread move was another leg higher in interest rates as the market went from “pause” to “skip” and quickly priced in two more hikes in 2023. Therefore, it’s not surprising the outperforming areas of credit were floating rate product - bank loans and CLOs – which was the obvious driver of the Fund’s outperformance versus the Bloomberg U.S. Aggregate Bond Index (-3.37%) over the same one-year period ending 7/31/2023. |

| ● | Qualitatively, the 12-month period ending July 2023 was very eventful. The period started with credit spreads generally higher across the board, which in turn was due to a deteriorating macro environment combined with high inflation and extremely hawkish monetary policy in both North America and Europe. Spread and rate volatility remained high for the first part of the period until the market started to receive positive data on inflation. This positive data combined with favorable technicals (lack of primary supply, high cash levels, and negative sentiment) led to a broad based rally in both credit and equity markets early in the calendar year. In late March volatility surged after several regional banks failed. However this drawdown proved to be short lived as both credit and equity markets quickly recouped losses and finished the period at the highs (spread tights). |

| * | Please see Notes and Disclosure for definitions. |

| Palmer Square Capital Management LLC 1900 Shawnee Mission Parkway, Suite 315, Mission Woods, KS 66205 | www.palmersquarefunds.com |

3

| ● | Macro-economic data continues to support our house view of a higher-for-longer (than the market expects) interest rate environment. The labor market remains extremely strong with both near record-low unemployment AND historically elevated wage growth. Retail spending remains robust, although some areas (services) are clearly stronger than others (goods). Even the housing market has found new life as, somewhat ironically, the lack of supply of existing homes is pushing home buyers into the new build market. Taking all this into account, plus the absence of something else “breaking” in the system since March, the Fed clearly has scope to continue raising rates. So we agree with the market pricing in 2 more hikes this year, but we don’t necessarily agree with the shape of the curve from January 2024 on, which from that point the market is pricing in a full 100bps of cuts throughout the next year. We sympathize with this view - the excess COVID stimulus savings are clearly running out, the resumption in student loan payments in October, plus the general delayed impact of the cumulative increase in interest rates will act as a big liquidity drain on consumer bank accounts. But given the strength of the labor market and lack of a real negative catalyst in the corporate world – inventories are low, balance sheets remain in decent shape, cost inflation is moderating – we think the odds point to a proverbial soft landing rather than a sharp 2%+ contraction in real GDP (Gross Domestic Product). And as long as core inflation is running 3.5%+ AND the labor market remains strong we don’t think the Fed would cut rates in a soft landing environment. |

| Selected Indicies | Performance 7/29/2022 to 7/31/2023 |

| Bloomberg U.S. Treasury Index | -4.01% (+1.60% yield change) |

| Bloomberg U.S. Aggregate Bond Index | -3.37% (-2bps spread change) |

| Bloomberg U.S. Corporate Index | -1.30% (-31bps) |

| Bloomberg 1-3 Year U.S. Corporate Index | +1.43% (-18bps) |

| Bloomberg U.S. High Yield Index | +4.41% (-98bps) |

| iBoxx Liquid Leveraged Loan Index | +9.22% (-37bps) |

| Palmer Square CLO Senior Debt Index | +7.56% (-39bps) |

| Palmer Square CLO Debt Index | +12.62% (-62bps) |

| S&P 500 Index | +12.99% |

| STOXX 600 Index | +18.67% |

Source: Bloomberg as of 7/31/2023

| ● | CLO Allocation/Opportunity to Capture Income and Total Return: As of 7/31/2023, 69% (CLO debt and sub notes) of the portfolio. CLO BBBs are currently trading on average at a spread of 592bps with prices in the low $90s and BBs are at a spread of 980bps with prices in the low to mid to high $80s/low $90s. Since 2008 we have only seen wider levels during two short time-frames, February 2016 and March-May 2020 (please see table below). Looking at CLO BBs in particular, there have only been 9 months in the past 10 years where spreads were wider than 900bps. Looking at 12 month forward returns from those points in time, the average return was +40.33% and the minimum return was +25.04%1. The breakeven spread widening on CLO BBs is approximately 360bps, which means that spreads could widen a further 360bps over the next 12 months before one lost money on $1 invested2. That type of spread widening from here would put us back at levels we saw in March of 2020. Another tailwind for CLO debt going forward is the increase in LIBOR/SOFR*. In July almost the entire CLO portion of the portfolio reset higher by almost 30bps (3m LIBOR/SOFR is currently at 5.56%/5.30%). We continue to add to CLO portfolios that are higher quality and more liquid as we believe they will continue to outperform portfolios with more risky collateral. |

| * | Please see Notes and Disclosure for definitions. 1,2See next page, BB Spreads and 1Yr Forward Returns table and disclosure. This example is provided for illustrative purposes only. |

| Palmer Square Capital Management LLC 1900 Shawnee Mission Parkway, Suite 315, Mission Woods, KS 66205 | www.palmersquarefunds.com |

4

| BB SPREADS AND HISTORICAL 1-YEAR FORWARD RETURNS | ||

| Period | CLO BB Spread | 1yr Forward Return1 |

| 1/29/2016 | 954 | 32.57% |

| 2/29/2016 | 1193 | 51.32% |

| 3/31/2016 | 972 | 35.39% |

| 5/31/2016 | 916 | 30.62% |

| 6/30/2016 | 909 | 30.77% |

| 3/31/2020 | 1384 | 63.03% |

| 4/30/2020 | 1299 | 55.59% |

| 5/29/2020 | 1094 | 38.61% |

| 7/31/2020 | 916 | 25.04% |

Past performance is not a reliable indicator of future returns. Investment results may vary substantially on a monthly, quarterly, annual and other periodic basis. Source: Bloomberg / Palmer Square CLO Indices. As of 12/31/2022. 2Refers to the level at which spreads would need to widen in order to cause a negative value in an individual investment over a one-year period. This is determined by reducing a security’s price by its expected coupon payments over the next 12 months and then calculating the level of spread widening that would need to occur to move the security’s actual price to the reduced price. The presented hypothetical performance does not reflect the impact of material economic and market factors on decision making, any changes to the Fund over time, and was prepared with the benefit of hindsight. The above analysis looks specifically at CLO BB’s. Upon request, Palmer Square will provide this analysis for other CLO rating classes.

Outlook / Focus on CLO Relative Value

| ● | CLO Issuance Forecast and Outlook: CLO issuance ended 2022 with about $132BN in new issue volumes. This is impressive given the volatility we have seen so far this year and is only down 28% from last year’s record setting issuance and the 3rd highest issuance year ever. The size of the CLO market continues to grow in the U.S. and is now $1 trillion and over $1.2 trillion globally, which is now the largest credit sector within securitized products. So far in 2023, we see new issue slowly ramping higher throughout the first half, which is currently sitting at 56.4B (down 22$ YoY). Barring a material tightening in AAAs, we expect issuance to be in the $80-100BN range in 2023. |

| ● | Pause, Not Pivot: Recent inflation data is mixed at best, with “goods” prices decelerating but “services” inflation remaining stubbornly high. Core inflation has also likely peaked, but what is not clear is how long it will take to normalize back to the Fed’s target level of 2%. Due to the way core inflation is calculated, the housing component of the Consumer Price Index (CPI (42% weight in headline, 54% in core)) works on a lag and will take time to fully reflect the current state of the housing and rental markets. Additionally, the inflation in core services is also unlikely to trend meaningfully lower without a sustained loosening in the labor market, which remains incredibly robust (unemployment at record lows and job openings still near record highs). Therefore, our base case is core y/y numbers, currently +6.0% y/y, will remain stubbornly high throughout 2023. And until the Fed feels core inflation has normalized, they will be forced to keep rates in restrictive territory (i.e. > 5%). That said, we also believe the Fed will pause the current hiking cycle in 1H 2023 once the Fed Funds Rate reaches 5.25% in order to observe the cumulative impact of higher interest rates on the economy. Furthermore, we do not see the Fed cutting rates in 2023 without a material weakening of the labor market combined with negative GDP growth, which is not our base case. In summary, we believe short term interest rates will remain higher for longer than the market is currently pricing in. This would be positive for floating-rate securities as their coupons would remain higher for longer than the market currently anticipates. |

| * | Please see Notes and Disclosure for definitions. |

| Palmer Square Capital Management LLC 1900 Shawnee Mission Parkway, Suite 315, Mission Woods, KS 66205 | www.palmersquarefunds.com |

5

| ● | Soft(ish) Landing: Our view that rates will stay higher for longer is, in part, based on our view that the macro picture looks resilient. The labor market is as strong as ever, literally. In fact, so strong that the Fed would like to see it cool a bit to ease inflation pressure. We have seen some layoffs starting, but so far this has been isolated to the tech space. The consumer remains in decent shape, with debt/income levels still historically low and excess savings still high. In Europe, the macro picture has improved substantially thanks to warmer weather and government actions. And lastly, geopolitical risks have eased as well – Russia in a stalemate in Ukraine, Ukraine exporting grain, China reopening, European unity, etc. Growth will undoubtedly slow as high interest rates restrict investment, but we don’t envision a hard landing. |

| ● | Defaults Contained: The current cycle started with default rates practically at zero. So to say they will increase is certainly no hot take. In fact, they have already increased to around 1.25-1.50% depending on how one treats distressed exchanges. From a historical perspective, around half of CCCs default in an economic downturn. The weight of CCCs in the HY and bank loan market are 10% and 6% respectively. So you could make the argument that half of those might default in 2023. You might also make the argument that another 1-3% from companies with 1) bad/disrupted business models and/or 2) bad capital structures, inadequate liquidity/maturities and you get to 4-5%. We have noticed several prognosticators calling for 10+% default rates, which is nearly what the market experienced during the GFC (Global Financial Crisis). We do not subscribe to that view. We’ve found that people have forgotten just how bad the set up was in 2008: corporates were max levered, consumers were max levered, and the banking system was massively over levered and dependent on short term financing. All 3 pillars of the economy are in significantly better shape today. This underpins our view that defaults will increase but be contained in 2023. |

| » | Bonds are Back: After the worst year for fixed income in decades, the silver lining is that yields are as attractive as they’ve been since the mid 2000s. Fortunately for this Fund, we got the historically high yields without the 10+% drawdown seen in most duration strategies. Credit spreads are also wider than average, which combined with high base rates allows for great carry plus upside if/when spreads tighten. And versus equities, fixed income hasn’t looked this relatively attractive in most investors’ lifetimes. |

| ● | Earnings Headwinds to Intensify: The numerous headwinds facing corporate earnings in 2H 2022 will continue into 2023 and likely intensify as the lagged impact of higher interest rates pressures more parts of the global economy. Revenue growth will slow on overall weaker demand and less ability to pass through inflation. Margins will be impacted by both lower revenue and continued cost pressure in wages and labor scarcity. But as we have highlighted previously (many times!), corporates started this current cycle from a period of strength, particularly when compared to previous cycles when corporates entered recessions over-levered and under prepared. On the whole, most measures of credit metrics are stable: debt leverage, interest coverage, liquidity, maturity profile, etc. (Exhibit 1-2 below). As such, we think most corporates are well positioned to withstand several quarters of weak earnings without a deterioration in credit profiles. The exception to this will be the weakest cohort of companies with bad business models and/or bad capital structures. But this is why fundamental credit research and selection remains so important. |

| * | Please see Notes and Disclosure for definitions. |

| Palmer Square Capital Management LLC 1900 Shawnee Mission Parkway, Suite 315, Mission Woods, KS 66205 | www.palmersquarefunds.com |

6

Exhibit 1: Loan gross leverage still near multi year low

Source: JP Morgan Research as of 6/21/2023.

Exhibit 2: Interest coverage ratios in line with historical averages

Source: JP Morgan Research as of 6/21/2023.

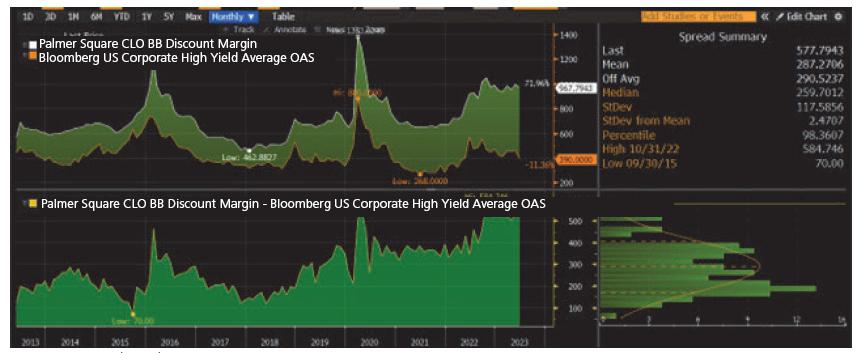

| ● | CLO BBs remain a significant allocation in the portfolio and at current valuations offer a lot of potential value on an absolute and relative basis. As compared to High Yield (HY) opportunities, CLO BBs on a historical basis still look very cheap. CLO BBs currently pick up 577bps of spread versus HY, which looking back to 2012 is a 98th percentile reading (meaning CLO BBs have been relatively cheaper only 2% of the time). The median spread differential over the same time period is 260bps, which means CLO BBs need to tighten about 317bps just to get back to historical average levels vs HY. |

CLO BB vs HY Spreads

Source: Bloomberg.

| Palmer Square Capital Management LLC 1900 Shawnee Mission Parkway, Suite 315, Mission Woods, KS 66205 | www.palmersquarefunds.com |

7

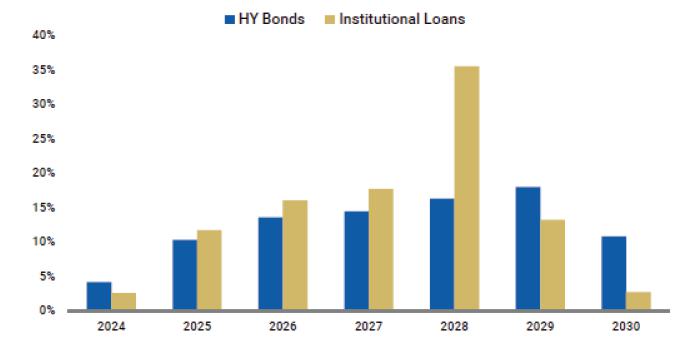

Fundamentals

| ● | As spreads drift wider with broader macro concerns, underlying loan fundamentals have been resilient. Loan defaults are hovering around longer term averages at 2.41%, with current defaults in CLO portfolios lower at 0.81%. We expect defaults to tick modestly higher in the next year but remain in the longer term averages of 2-4% range. The percentage of underlying CLO collateral trading at distressed levels (under $80) is currently around 6%, which is typically a good barometer of future defaults (Palmer Square deals are much lower in the 3-4% range). Also, loans with maturities before 2024 represent a small portion of the loan market at about 3%, meaning refinancing risk is low. The current CCC% in CLO portfolios is 5% (Palmer Square deals are lower in the 2-3% range) and still have ample cushion to withstand an uptick in downgrades. |

Exhibit 3 - Loan default rates off the lows, but still below long term average

Source: J.P. Morgan as of 6/30/2023

Exhibit 4 - Loan Maturity Wall

US Leveraged Debt Maturity Profile

Source: Morgan Stanley Research, S&P LCD as of 6/30/2023

| Palmer Square Capital Management LLC 1900 Shawnee Mission Parkway, Suite 315, Mission Woods, KS 66205 | www.palmersquarefunds.com |

8

Exhibit 5 - CCC Assets Closer to Longer Term Averages

Median CCC Assets in CLO Portfolios

Source: Morgan Stanley Research, Intex as of 6/30/2023

Summary

Given the portfolio positioning, we are confident in the outlook moving forward. We believe our portfolio is embedded with strong catalysts that will not only drive potential returns, but may also help mitigate volatility. More specifically, the portfolio has high current yield and the potential to generate price appreciation, and finally the portfolio has been providing low interest rate and relatively low spread duration*.

Please do not hesitate to contact us at investorrelations@palmersquarecap.com or 816-994-3200 should you desire more information. We would also be happy to set up a call and/or meeting at your convenience.

| * | Please see Notes and Disclosure for definitions. Current performance is not a guarantee of future performance of the Fund. |

| Palmer Square Capital Management LLC 1900 Shawnee Mission Parkway, Suite 315, Mission Woods, KS 66205 | www.palmersquarefunds.com |

9

Notes and Disclosure

This overview is for informational and comparative purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any interests in the Palmer Square Opportunistic Income Fund, the (“Fund”), and/or any other securities, or to provide any other advisory services. Any offer to invest in the funds will be made pursuant to the Fund’s prospectus, which will contain material information not contained herein and to which prospective investors are directed. Before investing, you should carefully read such materials in their entirety. This overview is not intended to replace such materials, and any information herein should not be relied upon for the purposes of investing in the Funds or for any other purpose. This overview is a summary and does not purport to be complete.

The Palmer Square Opportunistic Income Fund is a closed-end interval fund. You should not expect to be able to sell your Shares other than through the Fund’s repurchase policy, regardless of how the Fund performs.

Interest Rate Duration measures a portfolio’s sensitivity to changes in interest rates. Spread Duration measures the sensitivity of a bond price based on basis point changes of more than 100. Yield To Call is the yield of a bond or note if you were to buy and hold the security until the call date. Yield To Maturity is the rate of return anticipated on a bond if held until the end of its lifetime. Current Yield is annual income divided by price paid. Beta describes an investment’s volatility in relation to that of the stock or bond market as a whole. For example, the S&P 500 is typically considered to be “the equity market” and it has a beta of 1.0. Yield to Expected Call is a Yield to Call metric that assumes callable bonds are not called on their call date, but at some later date prior to maturity. Yield to Expected Call considers contractual terms in a bond’s indenture or other similar governing document. A bond may be called before or after this date, which has the potential to increase or decrease the Yield to Expected Call calculation. All else equal, when a bond’s price is below par, Yield to Expected Call is a more conservative yield metric than Yield to Call. If a bond is not callable, Yield to Expected Call calculates the bond’s Yield to Maturity. Credit Spreads are often a good barometer of economic health - wide or widening (bearish sentiment) and narrowing/tight or tightening (bullish sentiment). The option-adjusted spread (OAS) is the measurement of the spread of a fixed-income security rate and the risk-free rate of return, which is then adjusted to take into account an embedded option. Typically, an analyst uses Treasury yields for the risk-free rate.

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index of publicly issued investment grade corporate, US Treasury and government agency securities with remaining maturities of one to three years. The Bloomberg Barclays 1-3 Year US Corporate Index measures the performance of investment grade, US dollar-denominated, fixed-rate, taxable corporate and government-related debt with 1 to 2.9999 years to maturity. It is composed of a corporate and a non-corporate component that includes non-US agencies, sovereigns, supranationals and local authorities. S&P 500 Index is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. U.S. Treasury index is an index based on recent auctions of U.S. Treasury bills and is commonly used as a benchmark when determining interest rates, such as mortgage rates. Bloomberg Barclays U.S. Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. Bloomberg Barclays U.S. High Yield Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Bloomberg Barclays U.S. HY BB Corporates Index tracks the performance of USD-denominated below investment grade rated corporate debt publicly issued in the U.S. domestic market. Credit Suisse Leveraged Loan Index tracks the investable market of the U.S. dollar denominated leveraged loan market. Palmer Square CLO Senior Debt Index (CLOSE) seeks to reflect the investable universe for U.S. dollar denominated CLOs. CLOSE is comprised of original rated AAA and AA debt issued after January 1, 2009 subject to certain inclusion criteria. Palmer Square CLO Debt Index (CLODI) seeks to reflect the investable universe for U.S. dollar denominated CLOs. CLODI is comprised of original rated A, BBB, and BB debt issued after January 1, 2009 subject to certain inclusion criteria. Palmer Square CLO BB TR Index (PCLOBBTR) seeks to reflect the investable universe for U.S. dollar denominated CLOs. The index is comprised of original rated BB debt issued after January 1, 2009 subject to certain inclusion criteria. LIBOR (London Interbank Offered Rate) is the benchmark interest rate at which major global banks lend to one another. As of January 1, 2022 many banks are no longer required to submit the data needed to calculate the LIBOR rate. In June 2023, LIBOR will be replaced by SOFR. A Reference Rate is an interest rate benchmark used to set other interest rates. Various types of transactions use different reference rate benchmarks, but the most common include the Fed Funds Rate, LIBOR, the prime rate, and the rate on benchmark U.S. Treasury securities. Unlike mutual funds, indices are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

The allocation and credit quality distribution figures shown are used for illustrative purposes only. Palmer Square does not guarantee to execute that allocation and credit quality distribution. Allocation and exposures information, as well as other referenced categorizations, reflect classifications determined by Palmer Square as well as certain Palmer Square assumptions based on estimated portfolio characteristic information. Allocation and credit quality distribution figures may not sum to 100%. Ratings listed herein are assigned by Standard & Poor’s (S&P) and Moody’s Investor Service (Moody’s). Credit quality ratings are measured on a scale with S&P’s credit quality ratings ranging from AAA (highest) to D (lowest) and Moody’s credit quality ratings ranging from Aaa (highest) to C (lowest). We use the higher of the two ratings. Credit ratings listed are subject to change. Please contact Palmer Square for more information.

| Palmer Square Capital Management LLC 1900 Shawnee Mission Parkway, Suite 315, Mission Woods, KS 66205 | www.palmersquarefunds.com |

10

Notes and Disclosure cont’d

Market opportunities and/or yields shown are for illustration purposes only and are subject to change without notice. Palmer Square does not represent that these or any other strategy/opportunity will prove to be profitable or that the Fund’s investment objective will be met.

This material represents an assessment of the market environment at a specific point in time, is subject to change without notice, and should not be relied upon by the reader as research or investment advice. With regard to sources of information, certain of the economic and market information contained herein has been obtained from published sources and/or prepared by third parties. While such sources are believed to be reliable, Palmer Square or their employees or representatives do not assume any responsibility for the accuracy of such information. Palmer Square is under no obligation to verify its accuracy.

The performance presented here is past performance and not indicative of future returns. Different types of investments involve varying degrees of risk and there can be no assurance that any specific investment will be profitable. Please note that the performance of the funds may not be comparable to the performance of any index shown. Palmer Square has not verified, and is under no obligation to verify, the accuracy of these returns. Past performance does not guarantee future results.

Collateralized Loan Obligations Risk – The Fund may invest in CLOs. The Fund is subject to asset manager, legal and regulatory, limited recourse, liquidity, redemption, and reinvestment risks as a result of the structure of CLOs in which the Fund may invest. A CLO’s performance is linked to the expertise of the CLO manager and its ability to manage the CLO portfolio. Changes in the regulation of CLOs may adversely affect the value of the CLO investments held by the Fund and the ability of the Fund to execute its investment strategy. CLO debt is payable solely from the proceeds of the CLO’s underlying assets and, therefore, if the income from the underlying loans is insufficient to make payments on the CLO debt, no other assets will be available for payment. CLO debt securities may be subject to redemption and the timing of redemptions may adversely affect the returns on CLO debt. The CLO manager may not find suitable assets in which to invest and the CLO manager’s opportunities to invest may be limited.

The risks of an investment in a collateralized debt obligation depend largely on the type of the collateral securities and the class of the debt obligation in which the Fund invests. Collateralized debt obligations are generally subject to credit, interest rate, valuation, prepayment and extension risks. These securities are also subject to risk of default on the underlying asset, particularly during periods of economic downturn. Defaults, downgrades, or perceived declines in creditworthiness of an issuer or guarantor of a debt security held by the Fund, or a counterparty to a financial contract with the Fund, can affect the value of the Fund’s portfolio. Credit loss can vary depending on subordinated securities and non-subordinated securities. If interest rates fall, an issuer may exercise its right to prepay their securities. If this happens, the Fund will not benefit from the rise in market price, and will reinvest prepayment proceeds at a later time. The Fund may lose any premium it paid on the security. If interest rates rise, repayments of fixed income securities may occur more slowly than anticipated by the market which may result in driving the prices of these securities down. The Fund is “non-diversified,” meaning the Fund may invest a larger percentage of its assets in the securities of a smaller number of issuers than a diversified fund. Investment in securities of a limited number of issuers exposes the Fund to greater market risk and potential losses than if its assets were diversified among the securities of a greater number of issuers. Foreign investments present additional risk due to currency fluctuations, economic and political factors, government regulations, differences in accounting standards and other factors. Investments in emerging markets involve even greater risks. High yield securities, commonly referred to as “junk bonds,” are rated below investment grade by at least one of Moody’s, S&P or Fitch (or if unrated, determined by the Fund’s advisor to be of comparable credit quality high yield securities).

Palmer Square Capital Management LLC (“Palmer Square”) is an SEC registered investment adviser with its principal place of business in the State of Kansas. Registration of an investment adviser does not imply a certain level of skill or training. Palmer Square and its representatives are in compliance with the current registration and notice filing requirements imposed upon registered investment advisers by those states in which Palmer Square maintains clients. Palmer Square may only transact business in those states in which it is notice filed, or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by Palmer Square with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about Palmer Square, including fees and services, send for our disclosure statement as set forth on Form ADV using the contact information herein or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

| Palmer Square Capital Management LLC 1900 Shawnee Mission Parkway, Suite 315, Mission Woods, KS 66205 | www.palmersquarefunds.com |

11

Palmer Square Opportunistic Income Fund

FUND PERFORMANCE at July 31, 2023 (Unaudited)

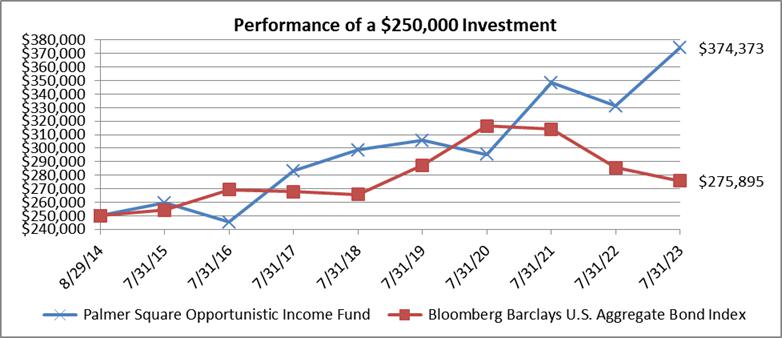

This graph compares a hypothetical $250,000 investment in the Fund’s shares, made at its inception, with a similar investment in the Bloomberg Barclays US Aggregate Bond Index. Results include the reinvestment of all dividends and capital gains.

The Bloomberg Barclays US Aggregate Bond Index is an unmanaged index of publicly issued investment grade corporate, US Treasury and government agency securities with remaining maturities of one to three years. The index does not reflect expenses, fees or sales charge, which would lower performance. The index is unmanaged and it is not possible to invest in an index.

| Average Annual Total Return as of July 31, 2023 | 1 Year | 5 Years | Since Inception | Inception Date |

| Palmer Square Opportunistic Income Fund | 13.04% | 4.62% | 4.63% | 8/29/14 |

| Bloomberg Barclays US Aggregate Bond Index | -3.37% | 0.75% | 1.11% | 8/29/14 |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (866) 933-9033.

Expense ratio for the Fund was 2.69%, which was the amount stated in the current prospectus dated December 1, 2022. For the Fund’s current one year expense ratios, please refer to the Financial Highlights Section of this report. The Advisor has contractually agreed to waive or reduce its fee and/or to absorb other operating expenses (excluding taxes, leverage interest, brokerage commissions, dividend and interest expenses on short sales, acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization, and extraordinary expenses such as litigation expenses) do not exceed 1.50% of the Fund’s average daily net assets. In the absence of such waivers, the Fund’s returns would be lower. This agreement is in effect until December 1, 2023, and it may be terminated before that date only by the Fund’s Board of Trustees.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

12

Palmer Square Opportunistic Income Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS

As of July 31, 2023

| Principal Amount1 | Value | |||||||

| BANK LOANS — 17.7% | ||||||||

| 740,434 | Acrisure LLC 8.693% (1-Month USD Libor+350 basis points), 2/15/20272,3,4 | $ | 723,370 | |||||

| 495,000 | AI Aqua Merger Sub, Inc. 8.944% (1-Month USD Libor+400 basis points), 7/30/20282,3,4 | 489,369 | ||||||

| 742,302 | Alliance Laundry Systems LLC 8.559% (3-Month USD Libor+350 basis points), 10/8/20272,3,4 | 742,116 | ||||||

| 740,578 | Alliant Holdings Intermediate LLC 8.650% (1-Month USD Libor+350 basis points), 11/6/20272,3,4 | 739,597 | ||||||

| 500,000 | American Rock Salt Co. LLC 12.467% (1-Month USD Libor+725 basis points), 6/11/20292,4 | 451,250 | ||||||

| 500,000 | Amynta Agency Borrower, Inc. 10.253% (1-Month Term SOFR+500 basis points), 2/28/20282,3,4 | 493,792 | ||||||

| 493,750 | AP Gaming I LLC 9.392% (1-Month Term SOFR+400 basis points), 2/15/20292,3,4 | 490,820 | ||||||

| 498,747 | Apple Bidco LLC 9.102% (1-Month Term SOFR+400 basis points), 9/23/20282,3,4 | 498,747 | ||||||

| 742,228 | AppLovin Corp. 8.452% (1-Month Term SOFR+325 basis points), 8/15/20252,3,4 | 743,096 | ||||||

| Aruba Investments Holdings, LLC | ||||||||

| 244,397 | 9.193% (1-Month USD Libor+400 basis points), 11/24/20272,3,4 | 237,829 | ||||||

| 400,000 | 12.943% (1-Month USD Libor+775 basis points), 11/24/20282,3,4 | 364,000 | ||||||

| Asurion LLC | ||||||||

| 750,000 | 10.452% (1-Month USD Libor+525 basis points), 2/3/20282,3,4 | 669,641 | ||||||

| 161,497 | 9.202% (3-Month Term SOFR+400 basis points), 8/19/20282,3,4 | 155,093 | ||||||

| 742,424 | Autokiniton U.S. Holdings, Inc. 9.717% (1-Month USD Libor+450 basis points), 4/6/20282,3,4 | 743,352 | ||||||

| 746,250 | Barracuda Networks, Inc. 9.545% (1-Month Term SOFR+450 basis points), 8/15/20292,3,4 | 734,765 | ||||||

| 740,285 | BCP Renaissance Parent LLC 8.742% (3-Month Term SOFR+350 basis points), 10/31/20262,3,4 | 740,152 | ||||||

| 701,648 | Birkenstock U.S. BidCo, Inc. 8.555% (1-Month USD Libor+375 basis points), 4/28/20282,3,4 | 702,174 | ||||||

| 746,231 | Brightview Landscapes LLC 8.352% (1-Month Term SOFR+325 basis points), 4/22/20292,3,4 | 744,052 | ||||||

| 293,250 | CCI Buyer, Inc. 9.242% (3-Month Term SOFR+400 basis points), 12/17/20272,3,4 | 287,630 | ||||||

| 150,000 | CCS-CMGC Holdings, Inc. 14.476% (3-Month USD Libor+900 basis points), 10/1/20262,3,4 | 93,563 | ||||||

| 494,778 | Chemours Co. 5.420% (3-Month Euribor+200 basis points), 4/3/20252,3,4 | 545,597 | ||||||

| 742,443 | CHG Healthcare Services, Inc. 8.443% (1-Month USD Libor+325 basis points), 9/30/20282,3,4 | 741,890 | ||||||

13

Palmer Square Opportunistic Income Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS - Continued

As of July 31, 2023

| Principal Amount1 | Value | |||||||

| BANK LOANS (Continued) | ||||||||

| 738,963 | CP Atlas Buyer, Inc. 8.952% (1-Month Term SOFR+350 basis points), 11/23/20272,4 | $ | 704,723 | |||||

| 748,125 | Creative Artists Agency LLC 8.602% (1-Month Term SOFR+350 basis points), 11/26/20282,3,4 | 745,652 | ||||||

| 740,434 | Dcert Buyer, Inc. 9.264% (1-Month Term SOFR+400 basis points), 10/16/20262,3,4 | 738,583 | ||||||

| 800,000 | Dedalus Finance GmbH 7.712% (6-Month Euribor+375 basis points), 5/31/20272,4 | 797,264 | ||||||

| 742,347 | Deerfield Dakota Holding LLC 8.992% (1-Month Term SOFR+375 basis points), 4/9/20272,3,4 | 716,250 | ||||||

| 740,578 | Dotdash Meredith, Inc. 9.202% (1-Month Term SOFR+400 basis points), 12/1/20282,3,4 | 701,698 | ||||||

| 740,602 | EAB Global, Inc. 8.340% (3-Month USD Libor+350 basis points), 8/16/20282,3,4 | 735,895 | ||||||

| 731,250 | ECI Macola/Max Holding LLC 9.253% (3-Month USD Libor+375 basis points), 11/9/20272,3,4 | 729,232 | ||||||

| 748,057 | Ensemble RCM LLC 8.526% (1-Month Term SOFR+375 basis points), 8/1/20262,3,4 | 748,233 | ||||||

| 627,828 | EW Scripps Co. 7.967% (1-Month Term SOFR+275 basis points), 1/7/20282,3,4 | 617,977 | ||||||

| 740,625 | Fertitta Entertainment LLC 9.102% (1-Month Term SOFR+400 basis points), 1/27/20292,3,4 | 733,933 | ||||||

| 748,125 | Filtration Group Corp. 9.454% (1-Month Term SOFR+425 basis points), 10/24/20282,3,4 | 751,398 | ||||||

| 739,294 | Flexera Software LLC 8.967% (1-Month USD Libor+375 basis points), 3/3/20282,3,4 | 730,186 | ||||||

| 703,125 | Forest City Enterprises LP 8.717% (1-Month USD Libor+350 basis points), 12/7/20252,3,4 | 617,871 | ||||||

| 585,079 | Great Outdoors Group LLC 8.943% (1-Month USD Libor+375 basis points), 3/5/20282,3,4 | 584,529 | ||||||

| 500,000 | HUB International Ltd. 9.584% (1-Month Term SOFR+425 basis points), 6/20/20302,3,4 | 502,670 | ||||||

| 746,183 | Hudson River Trading LLC 8.217% (1-Month Term SOFR+300 basis points), 3/18/20282,3,4 | 733,707 | ||||||

| 679,728 | Idera, Inc. 8.963% (1-Month USD Libor+375 basis points), 3/2/20282,3,4 | 666,984 | ||||||

| 750,000 | INEOS Enterprises Holdings U.S. Finco LLC 9.127% (1-Month Term SOFR+375 basis points), 7/7/20302,4 | 741,330 | ||||||

| 461,898 | INEOS U.S. Finance LLC 8.952% (1-Month Term SOFR+375 basis points), 11/8/20272,3,4 | 458,965 | ||||||

| 450,000 | INEOS U.S. Petrochem LLC 8.952% (1-Month Term SOFR+375 basis points), 3/1/20302,3,4 | 447,187 | ||||||

| 638,666 | Ivanti Software, Inc. 9.758% (3-Month USD Libor+425 basis points), 12/1/20272,3,4 | 539,356 | ||||||

14

Palmer Square Opportunistic Income Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS - Continued

As of July 31, 2023

| Principal Amount1 | Value | |||||||

| BANK LOANS (Continued) | ||||||||

| 740,385 | Jazz Acquisition, Inc. 9.202% (3-Month USD Libor+425 basis points), 6/19/20262,3,4 | $ | 741,773 | |||||

| 754,180 | Kestrel Acquisition LLC 9.450% (3-Month USD Libor+425 basis points), 6/30/20252,3,4 | 732,079 | ||||||

| Lightstone Holdco LLC | ||||||||

| 702,398 | 10.852% (1-Month Term SOFR+575 basis points), 1/30/20272,3,4 | 636,696 | ||||||

| 39,727 | 10.852% (1-Month Term SOFR+575 basis points), 1/30/20272,3,4 | 36,011 | ||||||

| 746,222 | Medline Borrower LP 8.352% (1-Month USD Libor+325 basis points), 10/21/20282,3,4 | 739,565 | ||||||

| 750,000 | MH Sub I LLC 9.352% (1-Month Term SOFR+425 basis points), 5/3/20282,3,4 | 724,395 | ||||||

| 740,335 | Minotaur Acquisition, Inc. 9.952% (1-Month Term SOFR+500 basis points), 3/29/20262,3,4 | 733,961 | ||||||

| 750,000 | Mitchell International, Inc. 11.654% (3-Month USD Libor+650 basis points), 10/15/20292,3,4 | 675,000 | ||||||

| 748,125 | Momentive Performance Materials USA LLC 9.602% (1-Month Term SOFR+450 basis points), 3/29/20282,3,4 | 743,135 | ||||||

| 742,462 | NAB Holdings LLC 8.392% (3-Month Term SOFR+300 basis points), 11/23/20282,3,4 | 742,277 | ||||||

| 542,985 | NFP Corp. 8.467% (1-Month USD Libor+325 basis points), 2/13/20272,4 | 533,784 | ||||||

| OMNIA Partners LLC | ||||||||

| 42,936 | 4.250% (1-Month Term SOFR+425 basis points), 7/19/20302,3,4,5,6 | 43,011 | ||||||

| 457,064 | 4.500% (1-Month Term SOFR+425 basis points), 7/19/20302,3,4,5,6 | 457,854 | ||||||

| 740,602 | OneDigital Borrower LLC 9.452% (3-Month Term SOFR+425 basis points), 11/16/20272,4 | 740,142 | ||||||

| 740,356 | Peraton Corp. 8.952% (1-Month Term SOFR+375 basis points), 2/1/20282,3,4 | 735,903 | ||||||

| 723,058 | Petco Health & Wellness Co., Inc. 8.753% (3-Month Term SOFR+325 basis points), 3/4/20282,3,4 | 721,634 | ||||||

| 742,443 | PODS LLC 8.217% (1-Month USD Libor+300 basis points), 3/31/20282,3,4 | 734,963 | ||||||

| 100,000 | Prairie ECI Acquiror LP 9.943% (1-Month USD Libor+475 basis points), 3/11/20262,3,4 | 99,580 | ||||||

| 740,625 | Pre-Paid Legal Services, Inc. 8.943% (3-Month USD Libor+375 basis points), 12/15/20282,3,4 | 731,460 | ||||||

| 500,000 | Quest Software, Inc. 12.695% (3-Month Term SOFR+750 basis points), 2/1/20302,3,4 | 334,000 | ||||||

| 742,481 | Quikrete Holdings, Inc. 8.217% (1-Month Term SOFR+300 basis points), 3/18/20292,3,4 | 744,181 | ||||||

| 740,578 | RealPage, Inc. 8.217% (1-Month USD Libor+300 basis points), 4/22/20282,3,4 | 728,851 | ||||||

15

Palmer Square Opportunistic Income Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS - Continued

As of July 31, 2023

| Principal Amount1 | Value | |||||||

| BANK LOANS (Continued) | ||||||||

| 738,722 | Red Planet Borrower LLC 8.952% (1-Month USD Libor+375 basis points), 9/30/20282,3,4 | $ | 668,543 | |||||

| 750,000 | Redstone Holdco 2 LP 13.042% (3-Month USD Libor+775 basis points), 8/6/20292,3,4 | 474,641 | ||||||

| Renaissance Holdings Corp. | ||||||||

| 750,000 | 9.992% (3-Month USD Libor+325 basis points), 5/30/20252,3,4 | 748,009 | ||||||

| 400,000 | 12.193% (1-Month USD Libor+700 basis points), 5/29/20262,3,4 | 398,418 | ||||||

| 742,771 | Reverb Buyer, Inc. 8.240% (3-Month USD Libor+350 basis points), 11/1/20282,3,4 | 713,803 | ||||||

| 742,500 | Scientific Games International, Inc. 8.302% (1-Month Term SOFR+300 basis points), 4/14/20292,3,4 | 742,441 | ||||||

| 985,463 | Surf Holdings LLC 8.701% (3-Month USD Libor+350 basis points), 3/5/20272,3,4 | 983,354 | ||||||

| 379,700 | Thryv, Inc. 13.717% (1-Month USD Libor+850 basis points), 3/1/20262,3,4 | 378,990 | ||||||

| 898,272 | Traverse Midstream Partners LLC 8.937% (6-Month Term SOFR+425 basis points), 9/27/20242,3,4 | 895,842 | ||||||

| 464,240 | UGI Energy Services LLC 8.452% (1-Month Term SOFR+325 basis points), 2/22/20302,3,4 | 464,270 | ||||||

| 742,288 | UKG, Inc. 8.895% (3-Month Term SOFR+375 basis points), 5/3/20262,3,4 | 742,292 | ||||||

| 742,500 | Univision Communications, Inc. 9.492% (3-Month Term SOFR+425 basis points), 6/24/20292,3,4 | 743,198 | ||||||

| 746,173 | Vertiv Group Corp. 7.977% (1-Month Term SOFR+275 basis points), 3/2/20272,3,4 | 747,364 | ||||||

| 589,500 | Vision Solutions, Inc. 9.863% (3-Month USD Libor+400 basis points), 5/28/20282,3,4 | 565,973 | ||||||

| 654,313 | WaterBridge Midstream Operating LLC 11.363% (6-Month USD Libor+575 basis points), 6/21/20262,3,4 | 656,414 | ||||||

| 740,602 | Whatabrands LLC 8.467% (1-Month USD Libor+325 basis points), 8/3/20282,3,4 | 738,520 | ||||||

| 740,506 | Zelis Payments Buyer, Inc. 8.693% (1-Month USD Libor+350 basis points), 9/30/20262,3,4 | 740,817 | ||||||

| Total Bank Loans | ||||||||

| (Cost $51,642,657) | 51,388,662 | |||||||

| BONDS — 79.9% | ||||||||

| ASSET-BACKED SECURITIES — 72.8% | ||||||||

| 522 Funding CLO Ltd. | ||||||||

| 1,000,000 | Series 2020-6A, Class F, 13.647% (3-Month Term SOFR+830.16 basis points), 10/23/20343,4,7 | 832,705 | ||||||

| 1,500,000 | Series 2019-5A, Class ER, 12.068% (3-Month Term SOFR+676 basis points), 4/15/20353,4,7 | 1,412,027 | ||||||

16

Palmer Square Opportunistic Income Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS - Continued

As of July 31, 2023

| Principal Amount1 | Value | |||||||

| BONDS (Continued) | ||||||||

| ASSET-BACKED SECURITIES (Continued) | ||||||||

| 1,000,000 | Allegany Park CLO Ltd. Series 2019-1A, Class ER, 11.726% (3-Month Term SOFR+640 basis points), 1/20/20353,4,7 | $ | 923,112 | |||||

| 1,000,000 | ALM Ltd. Series 2020-1A, Class D, 11.570% (3-Month Term SOFR+626.16 basis points), 10/15/20293,4,7 | 946,162 | ||||||

| 1,400,000 | Anchorage Credit Funding Ltd. Series 2015-1A, Class ERV, 6.700%, 7/28/20373,7 | 1,138,717 | ||||||

| 750,000 | Annisa CLO Series 2016-2A, Class DR, 8.588% (3-Month USD Libor+300 basis points), 7/20/20313,4,7 | 722,579 | ||||||

| 1,250,000 | Apidos CLO Series 2017-28A, Class D, 11.088% (3-Month Term SOFR+576.16 basis points), 1/20/20313,4,7 | 1,129,376 | ||||||

| 1,250,000 | Apidos CLO Series 2017-28A, Class C, 8.088% (3-Month Term SOFR+276.16 basis points), 1/20/20313,4,7 | 1,170,924 | ||||||

| 500,000 | Apidos CLO Ltd. Series 2023-45A, Class E, 13.564% (3-Month Term SOFR+840 basis points), 4/26/20363,4,7 | 502,165 | ||||||

| Ares CLO Ltd. | ||||||||

| 1,000,000 | Series 2017-42A, Class E, 11.657% (3-Month Term SOFR+631.16 basis points), 1/22/20283,4,7 | 868,019 | ||||||

| 650,000 | Series 2015-38A, Class DR, 8.088% (3-Month Term SOFR+276.16 basis points), 4/20/20303,4,7 | 603,495 | ||||||

| 2,000,000 | Series 2021-62A, Class SUB, 0.000%, 1/25/20343,7,8 | 1,266,667 | ||||||

| 1,000,000 | ASSURANT CLO Ltd. Series 2017-1A, Class ER, 12.788% (3-Month Term SOFR+746.16 basis points), 10/20/20343,4,7 | 935,000 | ||||||

| 500,000 | Bain Capital Credit CLO Series 2018-1A, Class D, 8.307% (3-Month USD Libor+270 basis points), 4/23/20313,4,7 | 460,304 | ||||||

| 1,000,000 | Bain Capital Credit CLO Ltd. Series 2021-7A, Class D, 8.857% (3-Month Term SOFR+351.16 basis points), 1/22/20353,4,7 | 956,795 | ||||||

| Ballyrock CLO Ltd. | ||||||||

| 1,500,000 | Series 2019-2A, Class CR, 8.529% (3-Month USD Libor+315 basis points), 11/20/20303,4,7 | 1,487,342 | ||||||

| 750,000 | Series 2019-1A, Class DR, 12.320% (3-Month Term SOFR+701.16 basis points), 7/15/20323,4,7 | 724,691 | ||||||

| 1,100,000 | Series 2023-23A, Class D, 13.161% (3-Month Term SOFR+817 basis points), 4/25/20363,4,7 | 1,102,564 | ||||||

17

Palmer Square Opportunistic Income Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS - Continued

As of July 31, 2023

| Principal Amount1 | Value | |||||||

| BONDS (Continued) | ||||||||

| ASSET-BACKED SECURITIES (Continued) | ||||||||

| Barings CLO Ltd. | ||||||||

| 1,500,000 | Series 2017-1A, Class E, 11.572% (3-Month Term SOFR+626.16 basis points), 7/18/20293,4,7 | $ | 1,396,173 | |||||

| 1,000,000 | Series 2017-1A, Class F, 13.022% (3-Month Term SOFR+771.16 basis points), 7/18/20293,4,7 | 863,760 | ||||||

| 1,000,000 | Series 2016-2A, Class DR2, 8.738% (3-Month Term SOFR+341.16 basis points), 1/20/20323,4,7 | 984,696 | ||||||

| 1,000,000 | Barings CLO Ltd. Series 2015-IA, Class DR, 8.188% (3-Month Term SOFR+286.16 basis points), 1/20/20313,4,7 | 927,718 | ||||||

| 1,500,000 | Barings Euro CLO DAC Series 2015-1X, Class DRR, 7.371% (3-Month Euribor+365 basis points), 7/25/20353,4 | 1,484,211 | ||||||

| 500,000 | Battalion CLO Ltd. Series 2016-10A, Class CR2, 9.057% (3-Month Term SOFR+371.16 basis points), 1/25/20353,4,7 | 454,351 | ||||||

| 1,000,000 | Bean Creek CLO Ltd. Series 2015-1A, Class DR, 8.338% (3-Month Term SOFR+301.16 basis points), 4/20/20313,4,7 | 945,122 | ||||||

| Benefit Street Partners CLO Ltd. | ||||||||

| 1,000,000 | Series 2013-IIIA, Class DR, 12.188% (3-Month Term SOFR+686.16 basis points), 7/20/20293,4,7 | 900,006 | ||||||

| 1,050,000 | Series 2017-12A, Class C, 8.620% (3-Month Term SOFR+331.16 basis points), 10/15/20303,4,7 | 1,024,421 | ||||||

| 1,000,000 | Series 2017-12A, Class D, 11.980% (3-Month Term SOFR+667.16 basis points), 10/15/20303,4,7 | 878,415 | ||||||

| 1,250,000 | Series 2018-14A, Class E, 10.938% (3-Month Term SOFR+561.16 basis points), 4/20/20313,4,7 | 1,068,576 | ||||||

| 1,250,000 | Series 2020-21A, Class DR, 8.920% (3-Month Term SOFR+361.16 basis points), 10/15/20343,4,7 | 1,197,539 | ||||||

| 1,000,000 | Series 2019-18A, Class DR, 8.970% (3-Month Term SOFR+366.16 basis points), 10/15/20343,4,7 | 972,780 | ||||||

| 1,500,000 | Series 2020-21A, Class ER, 12.270% (3-Month Term SOFR+696.16 basis points), 10/15/20343,4,7 | 1,420,189 | ||||||

| 1,000,000 | Series 2019-18A, Class ER, 12.320% (3-Month Term SOFR+701.16 basis points), 10/15/20343,4,7 | 941,990 | ||||||

| 1,250,000 | Series 2021-25A, Class E, 12.420% (3-Month Term SOFR+711.16 basis points), 1/15/20353,4,7 | 1,213,502 | ||||||

| 1,000,000 | BlueMountain CLO Ltd. Series 2020-29A, Class D2R, 9.863% (3-Month Term SOFR+451.16 basis points), 7/25/20343,4,7 | 951,769 | ||||||

18

Palmer Square Opportunistic Income Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS - Continued

As of July 31, 2023

| Principal Amount1 | Value | |||||||

| BONDS (Continued) | ||||||||

| ASSET-BACKED SECURITIES (Continued) | ||||||||

| 500,000 | Canyon Capital CLO Ltd. Series 2014-1A, Class CR, 8.381% (3-Month Term SOFR+301.16 basis points), 1/30/20313,4,7 | $ | 460,609 | |||||

| Carlyle Global Market Strategies CLO Ltd. | ||||||||

| 750,000 | Series 2014-1A, Class DR, 8.170% (3-Month Term SOFR+286.16 basis points), 4/17/20313,4,7 | 696,415 | ||||||

| 1,500,000 | Series 2014-2RA, Class C, 8.121% (3-Month USD Libor+280 basis points), 5/15/20313,4,7 | 1,404,037 | ||||||

| 1,000,000 | Carlyle Global Market Strategies Euro CLO Series 2022-5X, Class A2B, 6.500%, 10/25/20353 | 1,092,342 | ||||||

| 2,000,000 | CIFC European Funding CLO Series 3X, Class D, 7.263% (3-Month Euribor+360 basis points), 1/15/20343,4 | 2,065,207 | ||||||

| 1,050,000 | CIFC Funding Ltd. Series 2012-2RA, Class D, 11.038% (3-Month Term SOFR+571.16 basis points), 1/20/20283,4,7 | 1,050,000 | ||||||

| CIFC Funding Ltd. | ||||||||

| 2,000,000 | Series 2015-3A, Class ER, 10.532% (3-Month Term SOFR+521.16 basis points), 4/19/20293,4,7 | 1,776,660 | ||||||

| 1,500,000 | Series 2013-4A, Class DRR, 8.419% (3-Month Term SOFR+306.16 basis points), 4/27/20313,4,7 | 1,441,925 | ||||||

| 1,000,000 | Series 2013-4A, Class ERR, 11.069% (3-Month Term SOFR+571.16 basis points), 4/27/20313,4,7 | 883,638 | ||||||

| 500,000 | Series 2018-3A, Class E, 11.072% (3-Month Term SOFR+576.16 basis points), 7/18/20313,4,7 | 458,037 | ||||||

| 1,000,000 | Series 2016-1A, Class D2RR, 9.845% (3-Month Term SOFR+451.16 basis points), 10/21/20313,4,7 | 979,108 | ||||||

| 1,000,000 | Series 2019-2A, Class ER, 12.160% (3-Month Term SOFR+685.16 basis points), 4/17/20343,4,7 | 975,873 | ||||||

| 500,000 | Series 2019-5A, Class DR, 12.350% (3-Month Term SOFR+704.16 basis points), 1/15/20353,4,7 | 479,014 | ||||||

| 1,000,000 | Series 2021-3A, Class E1, 11.970% (3-Month Term SOFR+666.16 basis points), 7/15/20363,4,7 | 939,535 | ||||||

| 1,000,000 | Clear Creek CLO Series 2015-1A, Class DR, 8.538% (3-Month Term SOFR+321.16 basis points), 10/20/20303,4,7 | 972,662 | ||||||

| Crestline Denali CLO Ltd. | ||||||||

| 750,000 | Series 2018-1A, Class D, 8.188% (3-Month Term SOFR+286.16 basis points), 1/20/20303,4,7 | 656,059 | ||||||

| 1,250,000 | Series 2017-1A, Class D, 9.318% (3-Month Term SOFR+399.16 basis points), 4/20/20303,4,7 | 1,171,627 | ||||||

| 1,000,000 | Series 2016-1A, Class DR, 8.957% (3-Month Term SOFR+361.16 basis points), 10/23/20313,4,7 | 892,156 | ||||||

19

Palmer Square Opportunistic Income Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS - Continued

As of July 31, 2023

| Principal Amount1 | Value | |||||||

| BONDS (Continued) | ||||||||

| ASSET-BACKED SECURITIES (Continued) | ||||||||

| 1,750,000 | Dartry Park CLO DAC Series 1X, Class CRR, 7.064% (3-Month Euribor+335 basis points), 1/28/20343,4 | $ | 1,779,564 | |||||

| 1,000,000 | Denali Capital CLO Ltd. Series 2016-1A, Class DR, 8.320% (3-Month Term SOFR+301.16 basis points), 4/15/20313,4,7 | 872,852 | ||||||

| Dryden CLO Ltd. | ||||||||

| 4,000,000 | Series 2020-86A, Class SUB, 0.000%, 7/17/20303,7,8 | 2,222,945 | ||||||

| 750,000 | Series 2018-65A, Class D, 8.672% (3-Month Term SOFR+336.16 basis points), 7/18/20303,4,7 | 711,862 | ||||||

| 995,000 | Series 2018-57A, Class D, 7.871% (3-Month USD Libor+255 basis points), 5/15/20313,4,7 | 919,709 | ||||||

| 330,000 | Series 2018-57A, Class E, 10.521% (3-Month USD Libor+520 basis points), 5/15/20313,4,7 | 278,141 | ||||||

| 1,000,000 | Series 2020-77A, Class ER, 11.249% (3-Month USD Libor+587 basis points), 5/20/20343,4,7 | 885,620 | ||||||

| 1,000,000 | Series 2020-77A, Class FR, 12.969% (3-Month USD Libor+759 basis points), 5/20/20343,4,7 | 802,176 | ||||||

| Dryden Euro CLO | ||||||||

| 1,000,000 | Series 2021-91X, Class D, 8.510% (3-Month Euribor+485 basis points), 4/18/20353,4 | 1,092,906 | ||||||

| 1,250,000 | Series 2021-103X, Class B2, 7.500%, 1/19/20363 | 1,378,136 | ||||||

| 1,000,000 | Dryden Euro CLO B.V. Series 2013-29X, Class B2RE, 2.050%, 7/15/20323 | 981,834 | ||||||

| Dryden Senior Loan Fund | ||||||||

| 2,500,000 | Series 2013-30A, Class DR, 7.921% (3-Month USD Libor+260 basis points), 11/15/20283,4,7 | 2,379,876 | ||||||

| 1,000,000 | Series 2013-30A, Class FR, 12.571% (3-Month USD Libor+725 basis points), 11/15/20283,4,7 | 724,502 | ||||||

| 750,000 | Series 2014-36A, Class DR3, 9.260% (3-Month Term SOFR+395.16 basis points), 4/15/20293,4,7 | 741,006 | ||||||

| 1,875,000 | Series 2015-38A, Class DR, 8.570% (3-Month Term SOFR+326.16 basis points), 7/15/20303,4,7 | 1,760,965 | ||||||

| 750,000 | Series 2016-45A, Class DR, 8.720% (3-Month Term SOFR+341.16 basis points), 10/15/20303,4,7 | 720,619 | ||||||

| Eaton Vance CLO Ltd. | ||||||||

| 1,075,000 | Series 2015-1A, Class DR, 8.088% (3-Month Term SOFR+276.16 basis points), 1/20/20303,4,7 | 985,929 | ||||||

| 850,000 | Series 2015-1A, Class ER, 11.188% (3-Month Term SOFR+586.16 basis points), 1/20/20303,4,7 | 752,980 | ||||||

| 500,000 | Series 2014-1RA, Class E, 11.270% (3-Month Term SOFR+596.16 basis points), 7/15/20303,4,7 | 438,818 | ||||||

20

Palmer Square Opportunistic Income Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS - Continued

As of July 31, 2023

| Principal Amount1 | Value | |||||||

| BONDS (Continued) | ||||||||

| ASSET-BACKED SECURITIES (Continued) | ||||||||

| 1,250,000 | Series 2018-1A, Class D, 8.770% (3-Month Term SOFR+346.16 basis points), 10/15/20303,4,7 | $ | 1,211,405 | |||||

| 1,500,000 | Series 2013-1A, Class D3R, 12.370% (3-Month Term SOFR+706.16 basis points), 1/15/20343,4,7 | 1,444,396 | ||||||

| 1,000,000 | Series 2020-2A, Class ER, 12.070% (3-Month Term SOFR+676.16 basis points), 1/15/20353,4,7 | 943,265 | ||||||

| Elmwood CLO Ltd. | ||||||||

| 1,000,000 | Series 2019-2A, Class DR, 8.588% (3-Month USD Libor+300 basis points), 4/20/20343,4,7 | 984,313 | ||||||

| 600,000 | Series 2019-3A, Class FR, 13.328% (3-Month Term SOFR+800.16 basis points), 10/20/20343,4,7 | 554,193 | ||||||

| Flatiron CLO Ltd. | ||||||||

| 5,425,000 | Series 2017-1A, Class SUB, 0.000%, 5/15/20303,7,8 | 2,498,887 | ||||||

| 3,500,000 | Series 2018-1A, Class SUB, 0.000%, 4/17/20313,7,8 | 1,742,054 | ||||||

| 750,000 | Series 2021-1A, Class E, 11.582% (3-Month USD Libor+600 basis points), 7/19/20343,4,7 | 697,074 | ||||||

| 750,000 | Flatiron RR CLO LLC Series 2021-2A, Class E, 11.770% (3-Month Term SOFR+646.16 basis points), 10/15/20343,4,7 | 711,037 | ||||||

| Galaxy CLO Ltd. | ||||||||

| 1,320,000 | Series 2017-23A, Class E, 11.757% (3-Month Term SOFR+641.16 basis points), 4/24/20293,4,7 | 1,230,368 | ||||||

| 1,250,000 | Series 2017-24A, Class D, 8.020% (3-Month Term SOFR+271.16 basis points), 1/15/20313,4,7 | 1,185,019 | ||||||

| 1,125,000 | Series 2017-24A, Class E, 11.070% (3-Month Term SOFR+576.16 basis points), 1/15/20313,4,7 | 1,015,062 | ||||||

| Generate CLO Ltd. | ||||||||

| 1,000,000 | Series 3A, Class ER, 11.988% (3-Month USD Libor+640 basis points), 10/20/20293,4,7 | 990,134 | ||||||

| 1,250,000 | Series 2A, Class DR, 8.207% (3-Month Term SOFR+286.16 basis points), 1/22/20313,4,7 | 1,192,366 | ||||||

| 1,250,000 | Series 7A, Class D, 9.407% (3-Month Term SOFR+406.16 basis points), 1/22/20333,4,7 | 1,219,963 | ||||||

| 1,000,000 | Series 9A, Class E, 12.438% (3-Month Term SOFR+711.16 basis points), 10/20/20343,4,7 | 975,136 | ||||||

| 1,000,000 | Series 6A, Class ER, 12.407% (3-Month Term SOFR+706.16 basis points), 1/22/20353,4,7 | 945,846 | ||||||

| 2,000,000 | Series 2023-11A, Class D, 10.751% (3-Month Term SOFR+575 basis points), 4/20/20353,4,7 | 2,009,518 | ||||||

| 2,000,000 | Gilbert Park CLO Ltd. Series 2017-1A, Class E, 11.970% (3-Month Term SOFR+666.16 basis points), 10/15/20303,4,7 | 1,732,175 | ||||||

21

Palmer Square Opportunistic Income Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS - Continued

As of July 31, 2023

| Principal Amount1 | Value | |||||||

| BONDS (Continued) | ||||||||

| ASSET-BACKED SECURITIES (Continued) | ||||||||

| 750,000 | GoldenTree Loan Management EUR CLO DAC Series 5X, Class E, 8.955% (3-Month Euribor+525 basis points), 4/20/20343,4 | $ | 743,610 | |||||

| GoldenTree Loan Management U.S. CLO Ltd. | ||||||||

| 1,000,000 | Series 2020-7A, Class FR, 13.338% (3-Month Term SOFR+801.16 basis points), 4/20/20343,4,7 | 895,742 | ||||||

| 750,000 | Series 2021-10A, Class F, 13.378% (3-Month Term SOFR+805.16 basis points), 7/20/20343,4,7 | 631,492 | ||||||

| GoldenTree Loan Opportunities Ltd. | ||||||||

| 1,500,000 | Series 2014-9A, Class ER2, 11.291% (3-Month Term SOFR+592.16 basis points), 10/29/20293,4,7 | 1,481,430 | ||||||

| 1,500,000 | Series 2016-12A, Class ER, 10.995% (3-Month Term SOFR+566.16 basis points), 7/21/20303,4,7 | 1,366,169 | ||||||

| 1,000,000 | Series 2015-11A, Class FR2, 12.022% (3-Month Term SOFR+671.16 basis points), 1/18/20313,4,7 | 834,595 | ||||||

| 500,000 | Greenwood Park CLO Ltd. Series 2018-1A, Class E, 10.520% (3-Month Term SOFR+521.16 basis points), 4/15/20313,4,7 | 404,819 | ||||||

| 1,000,000 | Griffith Park CLO DAC Series 1X, Class DR, 8.903% (3-Month Euribor+552 basis points), 11/21/20313,4 | 995,814 | ||||||

| Grippen Park CLO Ltd. | ||||||||

| 4,000,000 | Series 2017-1A, Class SUB, 0.000%, 1/20/20303,7,8 | 749,115 | ||||||

| 1,000,000 | Series 2017-1A, Class E, 11.288% (3-Month Term SOFR+596.16 basis points), 1/20/20303,4,7 | 893,632 | ||||||

| 1,000,000 | Harvest CLO DAC Series 16A, Class B1RR, 4.963% (3-Month Euribor+130 basis points), 10/15/20313,4,7 | 1,048,180 | ||||||

| Highbridge Loan Management Ltd. | ||||||||

| 850,000 | Series 3A-2014, Class CR, 9.172% (3-Month Term SOFR+386.16 basis points), 7/18/20293,4,7 | 826,669 | ||||||

| 1,250,000 | Series 5A-2015, Class DRR, 8.720% (3-Month Term SOFR+341.16 basis points), 10/15/20303,4,7 | 1,149,418 | ||||||

| 3,500,000 | Series 12A-18, Class SUB, 0.000%, 7/18/20313,7,8 | 1,587,750 | ||||||

| 2,360,000 | Series 12A-18, Class D, 10.722% (3-Month Term SOFR+541.16 basis points), 7/18/20313,4,7 | 2,090,171 | ||||||

| HPS Loan Management Ltd. | ||||||||

| 500,000 | Series 8A-2016, Class ER, 11.088% (3-Month Term SOFR+576.16 basis points), 7/20/20303,4,7 | 429,870 | ||||||

| 1,500,000 | Series 6A-2015, Class CR, 7.826% (3-Month USD Libor+250 basis points), 2/5/20313,4,7 | 1,356,975 | ||||||

22

Palmer Square Opportunistic Income Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS - Continued

As of July 31, 2023

| Principal Amount1 | Value | |||||||

| BONDS (Continued) | ||||||||

| ASSET-BACKED SECURITIES (Continued) | ||||||||

| 2,000,000 | Series 15A-19, Class ER, 12.146% (3-Month Term SOFR+680 basis points), 1/22/20353,4,7 | $ | 1,863,174 | |||||

| Invesco CLO Ltd. | ||||||||

| 1,000,000 | Series 2021-1A, Class E, 12.030% (3-Month Term SOFR+672.16 basis points), 4/15/20343,4,7 | 932,101 | ||||||

| 1,000,000 | Series 2022-3A, Class D, 10.346% (3-Month Term SOFR+500 basis points), 10/22/20353,4,7 | 1,005,212 | ||||||

| 1,500,000 | Invesco U.S. CLO Ltd. Series 2023-1A, Class E, 13.230% (3-Month Term SOFR+836 basis points), 4/22/20353,4,7 | 1,503,697 | ||||||

| 1,000,000 | Jay Park CLO Ltd. Series 2016-1A, Class DR, 10.788% (3-Month Term SOFR+546.16 basis points), 10/20/20273,4,7 | 978,783 | ||||||

| 750,000 | LCM LP Series 18A, Class DR, 8.388% (3-Month Term SOFR+306.16 basis points), 4/20/20313,4,7 | 661,186 | ||||||

| Madison Park Funding Ltd. | ||||||||

| 1,250,000 | Series 2015-19A, Class CR, 7.757% (3-Month Term SOFR+241.16 basis points), 1/22/20283,4,7 | 1,231,799 | ||||||

| 1,000,000 | Series 2015-19A, Class ER, 11.707% (3-Month Term SOFR+636.16 basis points), 1/22/20283,4,7 | 965,206 | ||||||

| 2,000,000 | Series 2014-13A, Class ER, 11.332% (3-Month Term SOFR+601.16 basis points), 4/19/20303,4,7 | 1,965,257 | ||||||

| 1,000,000 | Series 2014-13A, Class FR, 13.532% (3-Month Term SOFR+821.16 basis points), 4/19/20303,4,7 | 967,252 | ||||||

| 1,000,000 | Series 2017-26A, Class DR, 8.631% (3-Month Term SOFR+326.16 basis points), 7/29/20303,4,7 | 994,326 | ||||||

| 875,000 | Magnetite Ltd. Series 2016-18A, Class ER, 10.571% (3-Month USD Libor+525 basis points), 11/15/20283,4,7 | 843,675 | ||||||

| Magnetite Ltd. | ||||||||

| 1,000,000 | Series 2014-8A, Class ER2, 11.220% (3-Month Term SOFR+591.16 basis points), 4/15/20313,4,7 | 926,322 | ||||||

| 1,000,000 | Series 2019-22A, Class ER, 11.920% (3-Month Term SOFR+661.16 basis points), 4/15/20313,4,7 | 970,514 | ||||||

| 1,050,000 | Series 2015-12A, Class FR, 13.520% (3-Month Term SOFR+821.16 basis points), 10/15/20313,4,7 | 898,426 | ||||||

| 1,500,000 | Series 2015-14RA, Class F, 13.502% (3-Month Term SOFR+819.16 basis points), 10/18/20313,4,7 | 1,276,597 | ||||||

| 800,000 | Milos CLO Ltd. Series 2017-1A, Class ER, 11.738% (3-Month Term SOFR+641.16 basis points), 10/20/20303,4,7 | 713,717 | ||||||

23

Palmer Square Opportunistic Income Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS - Continued

As of July 31, 2023

| Principal Amount1 | Value | |||||||

| BONDS (Continued) | ||||||||

| ASSET-BACKED SECURITIES (Continued) | ||||||||

| Morgan Stanley Eaton Vance CLO Ltd. | ||||||||

| 1,000,000 | Series 2021-1A, Class E, 12.357% (3-Month Term SOFR+701.16 basis points), 10/20/20343,4,7 | $ | 941,945 | |||||

| 1,250,000 | Series 2022-16A, Class E, 12.158% (3-Month Term SOFR+685 basis points), 4/15/20353,4,7 | 1,183,140 | ||||||

| 1,000,000 | Series 2022-18A, Class E, 13.826% (3-Month Term SOFR+850 basis points), 10/20/20353,4,7 | 1,010,431 | ||||||

| 1,000,000 | Series 2023-19A, Class E, 14.156% (3-Month Term SOFR+890 basis points), 7/20/20363,4,7 | 1,017,373 | ||||||

| 750,000 | Mountain View CLO Ltd. Series 2019-1A, Class DR, 9.510% (3-Month Term SOFR+420.16 basis points), 10/15/20343,4,7 | 744,431 | ||||||

| Neuberger Berman CLO Ltd. | ||||||||

| 1,000,000 | Series 2016-22A, Class ER, 11.630% (3-Month Term SOFR+632.16 basis points), 10/17/20303,4,7 | 890,465 | ||||||

| 5,000,000 | Series 2015-20A, Class SUB, 0.000%, 7/15/20343,7,8 | 1,891,589 | ||||||

| Neuberger Berman Loan Advisers CLO Ltd. | ||||||||

| 1,000,000 | Series 2018-27A, Class E, 10.770% (3-Month Term SOFR+546.16 basis points), 1/15/20303,4,7 | 895,657 | ||||||

| 1,000,000 | Series 2020-36A, Class ER, 12.338% (3-Month Term SOFR+701.16 basis points), 4/20/20333,4,7 | 990,064 | ||||||

| 1,000,000 | Neuberger Berman Loan Advisers Euro CLO Series 2021-1X, Class D, 6.663% (3-Month Euribor+300 basis points), 4/17/20343,4 | 1,001,961 | ||||||

| 1,000,000 | New Mountain CLO Ltd. Series CLO-3A, Class E, 12.188% (3-Month Term SOFR+686.16 basis points), 10/20/20343,4,7 | 956,970 | ||||||

| New Mountain CLO Ltd. | ||||||||

| 1,175,000 | Series CLO-2A, Class E, 11.930% (3-Month Term SOFR+662.16 basis points), 4/15/20343,4,7 | 1,096,461 | ||||||

| 1,500,000 | Series CLO-1A, Class ER, 12.250% (3-Month Term SOFR+694.16 basis points), 10/15/20343,4,7 | 1,442,103 | ||||||

| 500,000 | Series CLO-4A, Class E, 13.037% (3-Month Term SOFR+815 basis points), 4/20/20363,4,7 | 501,298 | ||||||

| 1,250,000 | Newark BSL CLO Ltd. Series 2017-1A, Class CR, 8.763% (3-Month Term SOFR+341.16 basis points), 7/25/20303,4,7 | 1,188,706 | ||||||

| 1,250,000 | Oak Hill Credit Partners Ltd. Series 2014-10RA, Class D2R, 10.338% (3-Month Term SOFR+501.16 basis points), 4/20/20343,4,7 | 1,251,024 | ||||||

24

Palmer Square Opportunistic Income Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS - Continued

As of July 31, 2023

| Principal Amount1 | Value | |||||||

| BONDS (Continued) | ||||||||

| ASSET-BACKED SECURITIES (Continued) | ||||||||

| OCP CLO Ltd. | ||||||||

| 1,000,000 | Series 2017-14A, Class C, 7.979% (3-Month USD Libor+260 basis points), 11/20/20303,4,7 | $ | 951,906 | |||||

| 1,550,000 | Series 2014-5A, Class CR, 8.512% (3-Month Term SOFR+316.16 basis points), 4/26/20313,4,7 | 1,430,143 | ||||||

| 500,000 | Series 2020-8RA, Class D, 12.570% (3-Month Term SOFR+726.16 basis points), 1/17/20323,4,7 | 473,169 | ||||||

| 1,250,000 | Series 2020-18A, Class ER, 12.018% (3-Month Term SOFR+669.16 basis points), 7/20/20323,4,7 | 1,165,046 | ||||||

| 1,000,000 | Series 2019-17A, Class ER, 12.088% (3-Month Term SOFR+676.16 basis points), 7/20/20323,4,7 | 904,426 | ||||||

| 1,000,000 | Series 2016-12A, Class ER2, 12.460% (3-Month Term SOFR+715 basis points), 4/18/20333,4,7 | 964,038 | ||||||

| 1,000,000 | Series 2021-22A, Class D, 8.688% (3-Month Term SOFR+336.16 basis points), 12/2/20343,4,7 | 956,557 | ||||||

| 1,000,000 | Series 2021-22A, Class E, 12.188% (3-Month Term SOFR+686.16 basis points), 12/2/20343,4,7 | 930,682 | ||||||

| 1,000,000 | Series 2023-28A, Class E, 0.000% (3-Month Term SOFR+840 basis points), 7/16/20363,4,7,9 | 980,000 | ||||||

| Octagon Investment Partners Ltd. | ||||||||

| 1,000,000 | Series 2012-1A, Class CRR, 9.470% (3-Month Term SOFR+416.16 basis points), 7/15/20293,4,7 | 948,896 | ||||||

| 1,500,000 | Series 2013-1A, Class DR2, 8.113% (3-Month Term SOFR+276.16 basis points), 1/25/20313,4,7 | 1,367,408 | ||||||

| 500,000 | Series 2019-3A, Class ER, 12.320% (3-Month Term SOFR+701.16 basis points), 7/15/20343,4,7 | 466,256 | ||||||

| 750,000 | Series 2020-1A, Class ER, 11.838% (3-Month Term SOFR+651.16 basis points), 7/20/20343,4,7 | 687,579 | ||||||

| 1,500,000 | Series 2020-4A, Class ER, 12.370% (3-Month Term SOFR+706.16 basis points), 1/15/20353,4,7 | 1,376,148 | ||||||

| 1,000,000 | OSD CLO Ltd. Series 2021-23A, Class E, 11.570% (3-Month Term SOFR+626.16 basis points), 4/17/20313,4,7 | 914,991 | ||||||

| OZLM Ltd. | ||||||||