UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number | | 811-22970 |

Nuveen Dow 30SM Dynamic Overwrite Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: December 31

Date of reporting period: June 30, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| | |

| | |  |

| Closed-End Funds | |

| | |

| | | Nuveen Investments |

| | | Closed-End Funds |

| | | | | | |

| | | | | | | Semi-Annual Report June 30, 2015 |

| | | |

| | | | | | |

| | | | | | | |

| BXMX | | | | | | |

| Nuveen S&P 500 Buy-Write Income Fund | | |

| | | | | | | |

| DIAX | | | | | | |

| Nuveen Dow 30SM Dynamic Overwrite Fund | | |

| | | | | | | |

| SPXX | | | | | | |

| Nuveen S&P 500 Dynamic Overwrite Fund | | |

| | | | | | | |

| QQQX | | | | | | |

| Nuveen Nasdaq 100 Dynamic Overwrite Fund | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | |

| | | | | | | | |

| | | |

| | Life is Complex | | | | |

| |

| | Nuveen makes things e-simple. It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Investments Fund information is ready – no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish. |

| | |

| | Free e-Reports right to your e-mail! |

| |

| | www.investordelivery.com If you receive your Nuveen Fund dividends and statements from your financial advisor or brokerage account. |

| |

| or | | www.nuveen.com/accountaccess If you receive your Nuveen Fund dividends and statements directly from Nuveen. |

Table

of Contents

Chairman’s Letter

to Shareholders

Dear Shareholders,

For better or for worse, the financial markets have spent the past year waiting for the U.S. Federal Reserve (Fed) to end its ultra-loose monetary policy. The policy has propped up stock and bond markets since the Great Recession, but the question remains: how will markets behave without its influence? This uncertainty has been a considerable source of volatility for stock and bond prices lately, despite the Fed carefully conveying its intention to raise rates slowly and only when the economy shows evidence of readiness.

A large consensus expects at least one rate hike before the end of 2015. After all, the U.S. has reached “full employment” by the Fed’s standards and growth has resumed – albeit unevenly. But the picture is somewhat muddled. Inflation has remained stubbornly low, most recently weighed down by an unexpectedly sharp decline in commodity prices since mid-2014. With the Fed poised to tighten and foreign central banks easing, the U.S. dollar has surged against other currencies, which has weighed on corporate earnings and further contributed to commodity price weakness. U.S. consumers have benefited from an improved labor market and lower prices at the gas pump, but the overall pace of economic expansion has been lackluster.

Nevertheless, the global recovery continues to be led by the U.S. Policy makers around the world are deploying their available tools to try to bolster Europe and Japan’s fragile growth, and manage China’s slowdown. Contagion fears ebb and flow with the headlines about Greece and China. Greece reluctantly agreed to a third bailout package from the European Union in July and China’s central bank and government intervened aggressively to try to stem the sell-off in stock prices. But persistent structural problems in these economies will continue to garner market attention.

Wall Street is fond of saying “markets don’t like uncertainty,” and asset prices are likely to continue to churn in the current macro environment. In times like these, you can look to a professional investment manager with the experience and discipline to maintain the proper perspective on short-term events. And if the daily headlines do concern you, I encourage you to reach out to your financial advisor. Your financial advisor can help you evaluate your investment strategies in light of current events, your time horizon and risk tolerance. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

William J. Schneider

Chairman of the Board

August 24, 2015

Portfolio Managers’

Comments

Nuveen S&P 500 Buy-Write Income Fund (BXMX)

Nuveen Dow 30SM Dynamic Overwrite Fund (DIAX)

Nuveen S&P 500 Dynamic Overwrite Fund (SPXX)

Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX)

The Nuveen S&P 500 Buy-Write Income Fund (BXMX) features portfolio management by Gateway Investment Advisers, LLC (Gateway). Kenneth H. Toft and Michael T. Buckius are co-portfolio managers. Nuveen Dow 30SM Dynamic Overwrite Fund (DIAX), Nuveen S&P 500 Dynamic Overwrite Fund (SPXX) and Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX) feature portfolio management by Nuveen Asset Management, LLC (NAM), an affiliate of Nuveen Investments, Inc. Keith Hembre, CFA, and David Friar serve as co-portfolio managers.

Here the portfolio managers discuss their management strategies and the performance of the Funds for the six-month reporting period ended June 30, 2015.

What key strategies were used to manage the Funds during this six-month reporting period ended June 30, 2015?

BXMX

BXMX seeks attractive total return with less volatility than the S&P 500® Index. During the reporting period ended June 30, 2015, BXMX invested in an equity portfolio which sought to track the price movements of the S&P 500® Index and wrote (sold) listed index call options on approximately 100% of the notional value of its stock portfolio. The premium generated by the index call options is intended to supplement the dividend yield on the underlying stock portfolio to support the Fund’s distribution policy and to provide the potential for growth in value during rising markets and/or risk mitigation in the event of a market decline.

The writing of call options on a broad equity index, while investing in a portfolio of equities, has the potential to enhance returns while exposing BXMX to less risk than unhedged equity investments. The portion of the Fund subject to the overwrite sacrifices some of its upside potential in exchange for the premium received for the written index call options. The downside is buffered by the amount of the cash flow premium received. In flat or declining markets, the option premium can enhance total return relative to the S&P 500® Index. In rising markets, the options can hurt the Fund’s total return relative to the S&P 500® Index.

DIAX

DIAX seeks attractive total return with less volatility than the Dow Jones Industrial Average (DJIA). NAM varies the level of call option overwrite within a range of approximately 35% to 75%, with a long-run target of 55% overwrite. NAM uses its proprietary view of the market’s return and volatility profile to dynamically adjust the overwrite percentage and other factors. Generally, if NAM expects the equity market to appreciate, the overwrite percentage will be reduced to offer

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Portfolio Managers’ Comments (continued)

more potential upside capture. Likewise, if NAM expects equity markets to be flat or to decline, the overwrite percentage may be increased, thus managing the Fund to potentially receive additional cash flow from higher sales of call options. This dynamic option overwrite approach offers potential for greater equity market upside capture than the full overwrite approach, while still offering a measure of downside protection.

The Fund currently expects to carry out its principal investment strategy by emphasizing single name options on individual stocks in the DJIA. It also employs an expanded range of options including index options on the DJIA and other broad-based indexes and options on custom baskets of stocks in addition to exchange-traded funds (ETFs). The Fund also has the opportunity to utilize call spread strategies and sell put options on a portion of the underlying equity portfolio.

SPXX

SPXX seeks attractive total return with less volatility than the S&P 500® Index. NAM varies the level of option overwrite within a range of approximately 35% to 75% overwrite, with a long-run target of 55% overwrite. NAM uses its proprietary view of the market’s return and volatility profile to dynamically adjust the overwrite percentage and other factors. Generally, if NAM expects the equity market to appreciate, the overwrite percentage will be reduced to offer more potential upside capture. Likewise, if NAM expects equity markets to be flat or to decline, the overwrite percentage may be increased, thus managing the Fund to potentially receive additional cash flow from higher sales of call options. This dynamic option overwrite approach offers potential for greater equity market upside capture than the full overwrite approach, while still offering a measure of downside protection.

The Fund currently expects to emphasize index call options on the S&P 500® Index and can also now employ an expanded range of options including index options on other broad-based indexes and options on custom baskets of stocks in addition to exchange-traded funds (ETFs) and single name options. The Fund also has the opportunity to utilize call spread strategies and sell put options on a portion of the underlying equity portfolio.

QQQX

QQQX seeks attractive total return with less volatility than the NASDAQ-100 Index. NAM varies the level of call option overwrite within a range of approximately 35% to 75% overwrite, with a long-run target of 55% overwrite. NAM uses its proprietary view of the market’s return and volatility profile to dynamically adjust the overwrite percentage and other factors. Generally, if NAM expects the equity market to appreciate, the overwrite percentage will be reduced to offer more potential upside capture. Likewise, if NAM expects equity markets to be flat or to decline, the overwrite percentage may be increased, thus managing the Fund to potentially receive additional cash flow from higher sales of call options. This dynamic option overwrite approach offers potential for greater equity market upside capture than the full overwrite approach, while still offering a measure of downside protection.

The Fund, in carrying out its principal options strategy, expects to primarily write index call options on the NASDAQ-100 Index and other broad-based indexes and can also now write call options on a variety of other equity market indexes and options on custom baskets of stocks in addition to exchange-traded funds (ETFs) and single name options. The Fund also has the opportunity to utilize call spread strategies and sell put options on a portion of the underlying equity portfolio.

How did the Funds perform during this six-month reporting period ended June 30, 2015?

The tables in the Performance Overview and Holding Summaries section of this report provide total return for the six-month, one-year, five-year, ten-year and since inception periods ended June 30, 2015. Each Fund’s total returns at net asset value (NAV) are compared with the performance of its corresponding market index. For the six-month reporting period ended June 30, 2015, BXMX shares at NAV outperformed its comparative index the S&P 500® Index , while SPXX underperformed the S&P 500® Index. DIAX outperformed its comparative index, the Dow Jones Industrial Average and QQQX underperformed it comparative index, the NASDAQ 100® Index.

BXMX

Call option premiums added to the Fund’s return in five of the six months ended June 30, 2015, except during February 2015, when the S&P 500® Index advanced 5.75%. As detailed below, the BXMX outperformed its secondary benchmark the Chicago Board Options Exchange’s (CBOE) S&P 500 Buy-Write Index (BXM) in January, February and May while underperforming in March, April and June. In January, adjusting strike prices in the days prior to the BXM call contract approaching expiration when implied volatility was relatively elevated, contributed to the BXMX’s outperformance for the month. Writing call options with short time-to-expiration and relatively high annualized premiums when the CBOE Volatility Index was still in the high teens in early February helped the BXMX outperform the BXM.

In March, the BXMX underperformed the BXM. March’s underperformance was due primarily to the BXM having a very advantageous contract roll as its February index call contract approached expiration on March 20th. The S&P 500® Index had a return of 0.90% that day and a majority of the market’s return came early in the day when the BXM was exposed to the market while its roll was implemented. That market exposure helped the BXM to a 0.89% return on March 20th, while BXMX had a return of 0.29%.

The BXMX underperformed the BXM in April primarily due to the index call option written by the BXM in March having a strike price that was further out-of-the-money than the weighted average strike price of the BXMX’s index call option portfolio at the beginning of the month. This allowed the BXM to have greater participation in the market advance over the first two weeks of April.

In May, most of the Fund’s return advantage occurred on May 15th, when the BXM rolled to its new call option contract expiring in June. With the market declining that morning, while the BXM was unhedged during the execution of its contract roll, the Fund was able to remain hedged throughout the trading day and outperform the BXM.

The BXMX lost 0.52% in June, underperforming the BXM. Underperformance in June was primarily due to the index call option written by the BXM in May having a strike price that was further out-of-the-money than the weighted average strike price of the Fund’s index call option portfolio for most of the month. This allowed the BXM to have greater participation in the market advance over the first three weeks of June and exceed the Fund’s return of 1.15% through June 23th. At the end of the month, BXMX’s lower weighted average call option strike price helped earn back a portion of that underperformance as the Fund declined 1.65% from June 23th through the June 30th, outperforming the BXM.

DIAX

DIAX seeks to dampen the beta (a measure of price volatility) of the overall portfolio by selling call options on a portion of the Fund’s underlying equity portfolio. This overwrite strategy provides incremental cash flow to the Fund and allows the portion of the Fund’s assets that are not overwritten to participate in any equity market rally. Those portions of the Fund that are overwritten have capped upside potential. The downside is buffered by the amount of cash flow premium received. Therefore, in flat or declining markets, the option premiums can enhance total returns relative to the Index. In rising markets, however, the options can hinder the Fund’s total return relative to the Index.

From January through the beginning of February 2015, implied volatility, as measured by the CBOE Volatility Index (VIX), was generally higher. During that time, the Fund had a higher overwrite percentage of 65% to 75%, which helped the Fund outperform as the Index declined. In the second half of the first quarter, however, volatility declined and the Fund still had a high overwrite level when the market began to rebound, which detracted from performance. During that time, the overwrite level ranged from approximately 40% to 75%. As we moved into the second half of the reporting period, U.S. equities traded within a tight band. Market peaks tended to fall around option expiration dates, making it risky to deviate from benchmark strike levels. These factors, combined with low levels of volatility premiums in the market, made the second half of the reporting period a challenging one for relative outperformance. Given the market conditions and uncertainty surrounding a number of near-term macroeconomic events, our strategy during the second half of the reporting period was to manage the Fund defensively. The overwrite levels were kept only modestly above

Portfolio Managers’ Comments (continued)

the passive benchmark, averaging 61.5% versus 55.0% for the benchmark. Further, the strike level of the options written in DIAX was kept very close to the levels in the CBOE DJIA BuyWrite Index.

Several other factors contributed to the Fund’s outperformance. The Fund is able to sell put options on up to 5% of its portfolio. We took advantage of this and the premium received contributed to the Fund’s performance. Also boosting performance were custom baskets of options.

SPXX

SPXX seeks to dampen the beta (a measure of price volatility) of the overall portfolio by selling call options on a portion of the Fund’s underlying equity portfolio. This overwrite strategy provides incremental cash flow to the Fund and allows the portion of the Fund’s assets that are not overwritten to participate in any equity market rally. Those portions of the Fund that are overwritten have capped upside potential. The downside is buffered by the amount of cash flow premium received. Therefore, in flat or declining markets, the option premiums can enhance total returns relative to the Index. In rising markets, however, the options can hinder the Fund’s total return relative to the Index.

From January through the beginning of February 2015, implied volatility, as measured by the CBOE Volatility Index (VIX), was generally higher. During that time, the Fund had a higher overwrite percentage of 65% to 75%, which helped the Fund outperform as the Index declined. However, volatility declined near the end of February throughout March and the Fund still had a high overwrite level when the market began to rebound. This detracted from performance. During the second half of the reporting period, U.S. equities traded within a tight band. The S&P 500® Index advanced only 0.3%, its lowest quarterly gain since the fourth quarter of 2012. Market peaks tended to fall around option expiration dates, making it a risky to deviate from benchmark strike levels. These factors, combined with low levels of volatility premiums in the market, made the second half of the reporting period a challenging one for relative outperformance. Given the market conditions and uncertainty surrounding a number of near-term macroeconomic events, our strategy during the second half of the reporting period was to manage the Fund defensively. The overwrite levels were kept only modestly above the passive benchmark for most of the second half reporting period, averaging 61.5% versus 55.0% for the benchmark. Further, the strike level of the options written in SPXX was kept very close to the levels in the CBOE S&P 500 Buy-Write Index.

The Fund sold NASDAQ-100 Index calls, which expired at the end of March. This also detracted from performance as the calls kept the Fund from more fully participating in the NASDAQ’s rebound in February and March.

The Fund is able to sell put options on up to 5% of its portfolio. We took advantage of this and the premium received contributed to the Fund’s performance. Also boosting performance were custom baskets of options.

QQQX

QQQX seeks to dampen the beta (a measure of price volatility) of the overall portfolio by selling call options on a portion of the Fund’s underlying equity portfolio. This overwrite strategy provides incremental cash flow to the Fund and allows the portion of the Fund’s assets that are not overwritten to participate in any equity market rally. Those portions of the Fund that are overwritten have capped upside potential. The downside is buffered by the amount of cash flow premium received. Therefore, in flat or declining markets, the option premiums can enhance total returns relative to the Index. In rising markets, however, the options can hinder the Fund’s total return relative to the Index.

From January through the beginning of February 2015, implied volatility, as measured by the CBOE Volatility Index (VIX), was generally higher. During that time, the Fund had a higher overwrite percentage of 65% to 75%, which helped the Fund’s performance as the Index declined. In late February through March, however, volatility declined and the Fund still had a high overwrite level when the market began to rebound, which detracted from performance. During that period, the overwrite level ranged from approximately 40% to 75%. During the second half of the reporting period, U.S. equities traded within a tight band. Market peaks tended to fall around option expiration dates, making it a risky to

deviate from benchmark strike levels. These factors, combined with low levels of volatility premiums in the market, made the second half of the reporting period a challenging one for relative outperformance. Given the market conditions and uncertainty surrounding a number of near-term macroeconomic events, our strategy during the second half of the reporting period was to manage the Fund defensively. The overwrite levels were kept only modestly above the passive benchmark for most second half of the reporting period, averaging 61.5% versus 55.0% for the benchmark. Further, the strike level of the options written in QQQX was kept very close to the levels in the CBOE NASDAQ-100 BuyWrite Index.

The Fund is able to sell put options on up to 5% of its portfolio. We took advantage of this and the premium received contributed to the Fund’s performance. Also boosting performance were custom baskets of options.

Share

Information

DISTRIBUTION INFORMATION

The following information regarding each Fund’s distributions is current as of May 31, 2015, the date of the distribution data included within the Fund’s most recent distribution notice at the time this report was prepared. Each Fund’s distribution level may vary over time based on the Fund’s investment activities and portfolio investment value changes.

Each Fund has adopted a managed distribution program. The goal of a Fund’s managed distribution program is to provide shareholders relatively consistent and predictable cash flow by systematically converting its expected long-term return potential into regular distributions. As a result, regular distributions throughout the year will likely include a portion of expected long-term and/or short-term gains (both realized and unrealized), along with net investment income. Important points to understand about Nuveen fund managed distributions are:

| • | | Each Fund seeks to establish a relatively stable common share distribution rate that roughly corresponds to the projected total return from its investment strategy over an extended period of time. However, you should not draw any conclusions about a Fund’s past or future investment performance from its current distribution rate. |

| • | | Actual share returns will differ from projected long-term returns (and therefore a Fund’s distribution rate), at least over shorter time periods. Over a specific timeframe, the difference between actual returns and total distributions will be reflected in an increasing (returns exceed distributions) or a decreasing (distributions exceed returns) Fund net asset value. |

| • | | Each period’s distributions are expected to be paid from some or all of the following sources: |

| | • | | net investment income consisting of regular interest and dividends, |

| | • | | net realized gains from portfolio investments, and |

| | • | | unrealized gains, or, in certain cases, a return of principal (non-taxable distributions). |

| • | | A non-taxable distribution is a payment of a portion of a Fund’s capital. When a Fund’s returns exceed distributions, it may represent portfolio gains generated, but not realized as a taxable capital gain. In periods when the Fund’s returns fall short of distributions, it will represent a portion of your original principal unless the shortfall is offset during other time periods over the life of your investment (previous or subsequent) when the Fund’s total return exceeds distributions. |

| • | | Because distribution source estimates are updated throughout the current fiscal year based on a Fund’s performance, these estimates may differ from both the tax information reported to you in each Fund’s 1099 statement, as well as the ultimate economic sources of distributions over the life of your investment. |

The following table provides information regarding each Fund’s distributions and total return performance over various time periods. This information is intended to help you better understand whether each Fund’s returns for the specified time periods were sufficient to meet their distributions.

Data as of 5/31/2015

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Inception

Date | | | Per Share Distribution | | | Monthly

NII1 | | | YTD Net

Realized

Gain/Loss2 | | | Inception

Unrealized

Gain/Loss2 | | | Current

Distribution

Rate on NAV3 | | | Annualized Total

Return on NAV | | | YTD

Distribution

Rate on NAV4 | |

| Fund | | | Quarterly | | | Monthly

Equivalent | | | | | | | 1-Year | | | 5-Year | | | YTD | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

BXMX | | | 10/2004 | | | $ | 0.2490 | | | $ | 0.0830 | | | $ | 0.0145 | | | $ | 0.6717 | | | $ | 5.6064 | | | | 7.11 | % | | | 7.54 | % | | | 10.75 | % | | | 4.51 | % | | | 3.55 | % |

DIAX | | | 4/2005 | | | $ | 0.2660 | | | $ | 0.0887 | | | $ | 0.0200 | | | $ | 0.4187 | | | $ | 5.5260 | | | | 6.29 | % | | | 7.98 | % | | | 12.70 | % | | | 2.16 | % | | | 3.14 | % |

SPXX | | | 11/2005 | | | $ | 0.2610 | | | $ | 0.0870 | | | $ | 0.0161 | | | $ | 0.2960 | | | $ | 6.3800 | | | | 6.63 | % | | | 6.08 | % | | | 11.22 | % | | | 2.62 | % | | | 3.31 | % |

QQQX | | | 1/2007 | | | $ | 0.3500 | | | $ | 0.1167 | | | $ | 0.0084 | | | $ | 0.4984 | | | $ | 10.9659 | | | | 6.80 | % | | | 17.51 | % | | | 17.30 | % | | | 5.57 | % | | | 3.40 | % |

| 1 | NII is net investment income, which is expressed as a monthly amount using a six-month average. |

| 2 | These are approximations. Actual amounts may be more or less than amounts listed above. |

| 3 | Current distribution, annualized, expressed over the most recent month-end NAV. |

| 4 | Sum of year-to-date distributions expressed over the most recent month-end NAV. |

The following table provides estimates of each Fund’s distribution sources, reflecting year-to-date cumulative experience through the latest month-end. These estimates are for informational purposes only. The Funds attribute these estimates equally to each regular distribution throughout the year. Consequently, the estimated information shown below is for the current distribution, and also represents an updated estimate for all prior months in the year.

The amounts and sources of distributions reported in this notice are only estimates and are not being provided for tax reporting purposes. The actual amounts and character of the distributions for tax reporting purposes will be reported to shareholders on Form 1099-DIV which will be sent to shareholders shortly after calendar year-end. More details about each Fund’s distributions and the basis for these estimates are available on www.nuveen.com/cef.

Data as of 5/31/2015

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Current Quarter | | | Calendar YTD | |

| | | | | | Estimated Source of Distribution | | | Estimated Per Share Amounts | |

| Fund | | Per Share

Distribution | | | NII1 | | | Realized

Gains | | | Return of

Capital2 | | | Distributions3 | | | NII1 | | | Realized

Gains | | | Return of

Capital2 | |

BXMX | | $ | 0.2490 | | | | 17.3 | % | | | 82.7 | % | | | 0.0 | % | | $ | 0.4980 | | | $ | 0.0862 | | | $ | 0.4118 | | | $ | — | |

DIAX | | $ | 0.2660 | | | | 25.0 | % | | | 75.0 | % | | | 0.0 | % | | $ | 0.5320 | | | $ | 0.1328 | | | $ | 0.3992 | | | $ | — | |

SPXX | | $ | 0.2610 | | | | 18.9 | % | | | 56.7 | % | | | 24.4 | % | | $ | 0.5220 | | | $ | 0.0987 | | | $ | 0.2960 | | | $ | 0.1273 | |

QQQX | | $ | 0.3500 | | | | 9.3 | % | | | 71.2 | % | | | 19.5 | % | | $ | 0.7000 | | | $ | 0.0650 | | | $ | 0.4984 | | | $ | 0.1366 | |

| 1 | NII is net investment income and is a projection through the end of the current calendar quarter based on most recent month-end data. |

| 2 | Return of Capital may represent unrealized gains, return of shareholder’s principal, or both. In certain circumstances, all or a portion of the return of capital my be characterized as ordinary income under federal tax law. The actual tax characterization will be provided to shareholders on Form 1099-DIV shortly after calendar year-end. |

| 3 | Includes the most recent quarterly distribution declaration. |

SHARE REPURCHASES

During August 2014, the Funds’ Board of Trustees reauthorized an open-market share repurchase program, allowing each Fund to repurchase an aggregate of up to approximately 10% of its outstanding shares.

As of June 30, 2015, and since the inception of the Funds’ repurchase programs, the Funds have cumulatively repurchased and retired shares as shown in the accompanying table.

| | | | | | | | | | | | | | | | |

| | | BXMX | | | DIAX | | | SPXX | | | QQQX | |

Shares Cumulatively Repurchased and Retired | | | 460,238 | | | | 0 | | | | 383,763 | | | | 0 | |

Shares Authorized for Repurchase | | | 3,845,000 | | | | 1,200,000 | | | | 1,615,000 | | | | 1,855,000 | |

During the current reporting period, the Funds did not repurchase any of their outstanding shares.

Share Information (continued)

OTHER SHARE INFORMATION

As of June 30, 2015, and during the current reporting period, the Funds’ share prices were trading at a premium/(discount) to their NAVs as shown in the accompanying table.

| | | | | | | | | | | | | | | | |

| | | BXMX | | | DIAX | | | SPXX | | | QQQX | |

NAV | | | $13.69 | | | $ | 16.38 | | | $ | 15.26 | | | $ | 19.90 | |

Share Price | | | $12.82 | | | $ | 14.85 | | | $ | 13.68 | | | $ | 18.45 | |

Premium/(Discount) to NAV | | | (6.36 | )% | | | (9.34 | )% | | | (10.35 | )% | | | (7.29 | )% |

6-Month Average Premium/(Discount) to NAV | | | (6.89 | )% | | | (8.78 | )% | | | (9.20 | )% | | | (5.95 | )% |

Risk

Considerations

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation.

Nuveen S&P 500 Buy-Write Income Fund (BXMX)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Common stock returns often have experienced significant volatility. The Fund may not participate in any appreciation of its equity portfolio as fully as it would if the Fund did not sell call options. In addition, the Fund will continue to bear the risk of declines in the value of the equity portfolio. Because index options are settled in cash, sellers of index call options, such as the Fund, cannot provide in advance for their potential settlement obligations by acquiring and holding the underlying securities. For these and other risks, including tax risk, please see the Fund’s web page at www.nuveen.com/BXMX

Nuveen Dow 30SM Dynamic Overwrite Fund (DIAX)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Common stock returns often have experienced significant volatility. The Fund may not participate in any appreciation of its equity portfolio as fully as it would if the Fund did not sell call options. In addition, the Fund will continue to bear the risk of declines in the value of the equity portfolio. Because index options are settled in cash, sellers of index call options, such as the Fund, cannot provide in advance for their potential settlement obligations by acquiring and holding the underlying securities. For these and other risks, including tax risk, please see the Fund’s web page at www.nuveen.com/DIAX

Nuveen S&P 500 Dynamic Overwrite Fund (SPXX)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Common stock returns often have experienced significant volatility. The Fund may not participate in any appreciation of its equity portfolio as fully as it would if the Fund did not sell call options. In addition, the Fund will continue to bear the risk of declines in the value of the equity portfolio. Because index options are settled in cash, sellers of index call options, such as the Fund, cannot provide in advance for their potential settlement obligations by acquiring and holding the underlying securities. For these and other risks, including tax risk, please see the Fund’s web page at www.nuveen.com/SPXX

Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Common stock returns often have experienced significant volatility. The Fund may not participate in any appreciation of its equity portfolio as fully as it would if the Fund did not sell call options. In addition, the Fund will continue to bear the risk of declines in the value of the equity portfolio. Because index options are settled in cash, sellers of index call options, such as the Fund, cannot provide in advance for their potential settlement obligations by acquiring and holding the underlying securities. For these and other risks, including tax risk, please see the Fund’s web page at www.nuveen.com/QQQX

BXMX

Nuveen S&P 500 Buy-Write Income Fund

Performance Overview and Holding Summaries as of June 30, 2015

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of June 30, 2015

| | | | | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | |

| | | 6-Month | | | 1-Year | | | 5-Year | | | 10-Year | |

| BXMX at NAV | | | 3.98% | | | | 6.10% | | | | 11.15% | | | | 5.70% | |

| BXMX at Share Price | | | 10.01% | | | | 5.63% | | | | 10.33% | | | | 4.96% | |

| S&P 500® Index | | | 1.23% | | | | 7.42% | | | | 17.34% | | | | 7.89% | |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

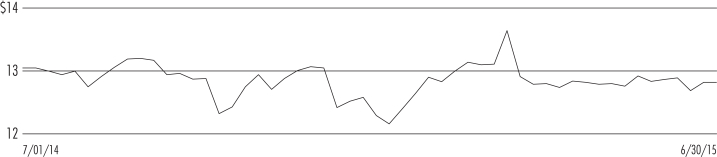

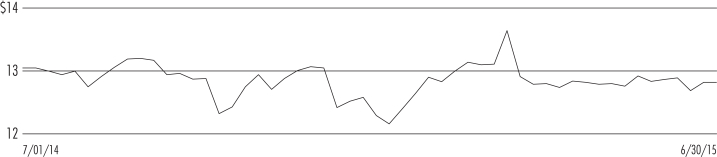

Share Price Performance — Weekly Closing Price

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Fund Allocation

(% of net assets)

| | | | |

| Common Stocks | | | 98.4% | |

| Repurchase Agreements | | | 3.9% | |

| Other Assets Less Liabilities | | | (2.3)% | |

| Net Assets | | | 100% | |

Top Five Issuers

(% of total long-term

investments)1

| | | | |

| Apple, Inc. | | | 4.1% | |

| Exxon Mobil Corporation | | | 2.0% | |

| Microsoft Corporation | | | 2.0% | |

| Berkshire Hathaway Inc., Class B | | | 1.9% | |

| Johnson & Johnson | | | 1.7% | |

Portfolio Composition

(% of total investments)1

| | | | |

Pharmaceuticals | | | 6.1% | |

Oil, Gas & Consumable Fuels | | | 5.9% | |

Banks | | | 5.9% | |

Technology Hardware, Storage & Peripherals | | | 4.8% | |

Internet Software & Services | | | 4.4% | |

Software | | | 3.9% | |

Media | | | 3.5% | |

Biotechnology | | | 3.4% | |

Health Care Providers & Services | | | 3.3% | |

Semiconductors & Semiconductor Equipment | | | 2.7% | |

Insurance | | | 2.6% | |

IT Services | | | 2.5% | |

Aerospace & Defense | | | 2.5% | |

Specialty Retail | | | 2.5% | |

| | | | |

Diversified Financial Services | | | 2.4% | |

Machinery | | | 2.3% | |

Food & Staples Retailing | | | 2.3% | |

Chemicals | | | 2.3% | |

Internet & Catalog Retail | | | 2.2% | |

Industrial Conglomerates | | | 2.2% | |

Capital Markets | | | 2.2% | |

Beverages | | | 2.2% | |

Health Care Equipment & Supplies | | | 1.9% | |

Household Products | | | 1.9% | |

Diversified Telecommunication Services | | | 1.9% | |

Repurchase Agreements | | | 3.8% | |

Other | | | 18.4% | |

Total | | | 100% | |

| 1 | Excluding investments in derivatives. |

DIAX

Nuveen Dow 30SM Dynamic Overwrite Fund

Performance Overview and Holding Summaries as of June 30, 2015

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of June 30, 2015

| | | | | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | |

| | | 6-Month | | | 1-Year | | | 5-Year | | | 10-Year | |

| DIAX at NAV | | | 0.50% | | | | 5.70% | | | | 12.98% | | | | 7.57% | |

| DIAX at Share Price | | | (0.27)% | | | | (0.74)% | | | | 10.60% | | | | 6.41% | |

| Dow Jones Industrial Average (DJIA) | | | 0.03% | | | | 7.21% | | | | 15.41% | | | | 8.32% | |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

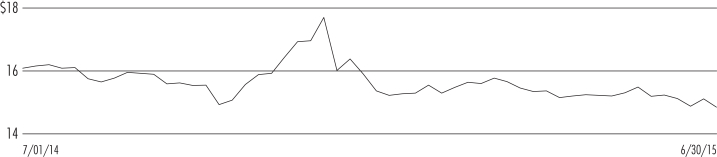

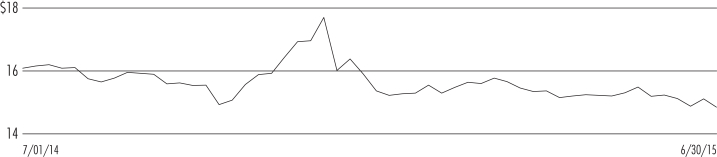

Share Price Performance — Weekly Closing Price

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Fund Allocation

(as a % of net assets)

| | | | |

| Common Stocks | | | 93.9% | |

| Exchange-Traded Funds | | | 6.2% | |

Repurchase Agreements | | | 0.9% | |

| U.S. Government and Agency Obligations | | | 0.8% | |

| Other Assets Less Liabilities | | | (1.8)% | |

| Net Assets | | | 100% | |

Top Five Issuers

(as a % of total long-term investments)1

| | | | |

| Goldman Sachs Group, Inc. | | | 7.4% | |

| International Business Machines Corporation (IBM) | | | 5.8% | |

| 3M Co. | | | 5.5% | |

| Boeing Company | | | 4.9% | |

| SPDR® Dow Jones® Industrial Average ETF Trust | | | 4.8% | |

Portfolio Composition

(as a % of total investments)1

| | | | |

| Aerospace & Defense | | | 8.7% | |

| IT Services | | | 8.0% | |

| Capital Markets | | | 7.3% | |

| Pharmaceuticals | | | 6.6% | |

| Industrial Conglomerates | | | 6.3% | |

| Oil, Gas & Consumable Fuels | | | 6.3% | |

| Technology Hardware, Storage & Peripherals | | | 4.4% | |

| Health Care Providers & Services | | | 4.3% | |

| Media | | | 4.0% | |

| | | | |

| Specialty Retail | | | 3.9% | |

| Textiles, Apparel & Luxury Goods | | | 3.8% | |

| Insurance | | | 3.4% | |

| Hotels, Restaurants & Leisure | | | 3.3% | |

| Machinery | | | 3.0% | |

| Exchange-Traded Funds | | | 6.0% | |

Repurchase Agreements | | | 0.9% | |

| U.S. Government and Agency Obligations | | | 0.8% | |

| Other | | | 19.0% | |

| Total | | | 100% | |

| 1 | Excluding investments in derivatives. |

SPXX

Nuveen S&P 500 Dynamic Overwrite Fund

Performance Overview and Holding Summaries as of June 30, 2015

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of June 30, 2015

| | | | | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | |

| | | 6-Month | | | 1-Year | | | 5-Year | | | Since

Inception | |

| SPXX at NAV | | | 1.12% | | | | 3.56% | | | | 11.44% | | | | 5.62% | |

| SPXX at Share Price | | | (0.70)% | | | | 1.77% | | | | 10.02% | | | | 4.68% | |

| S&P 500® Index | | | 1.23% | | | | 7.42% | | | | 17.34% | | | | 7.51% | |

Performance prior to December 22, 2014, reflects the Fund’s performance under the management of a sub-adviser using investment strategy that differed from those currently in place.

Since inception returns are from 11/22/05. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

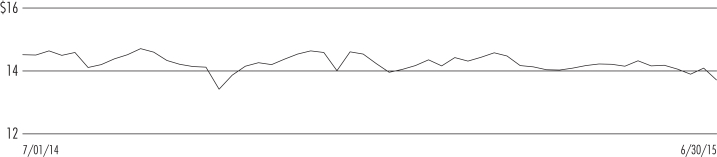

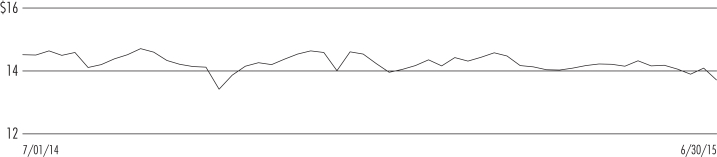

Share Price Performance — Weekly Closing Price

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Fund Allocation

(as a % of net assets)

| | | | |

| Common Stocks | | | 95.8% | |

| Exchange-Traded Funds | | | 4.2% | |

Repurchase Agreements | | | 1.8% | |

| Other Assets Less Liabilities | | | (1.8)% | |

| Net Assets | | | 100% | |

Top Five Issuers

(as a % of total long-term investments)1

| | | | |

| Apple, Inc. | | | 4.5% | |

| SPDR® S&P 500® ETF | | | 4.2% | |

| Exxon Mobil Corporation | | | 2.2% | |

| Microsoft Corporation | | | 2.1% | |

| Johnson & Johnson | | | 1.8% | |

Portfolio Composition

(as a % of total investments)1

| | | | |

Pharmaceuticals | | | 7.1% | |

Banks | | | 6.6% | |

Oil, Gas & Consumable Fuels | | | 6.3% | |

Technology Hardware, Storage & Peripherals | | | 5.1% | |

Internet Software & Services | | | 4.0% | |

Biotechnology | | | 3.3% | |

Media | | | 3.2% | |

Software | | | 3.1% | |

Health Care Providers & Services | | | 3.1% | |

IT Services | | | 2.9% | |

Machinery | | | 2.6% | |

Aerospace & Defense | | | 2.6% | |

Chemicals | | | 2.5% | |

Food & Staples Retailing | | | 2.5% | |

| | | | |

Specialty Retail | | | 2.3% | |

Industrial Conglomerates | | | 2.3% | |

Semiconductors & Semiconductor Equipment | | | 2.2% | |

Diversified Telecommunication Services | | | 2.1% | |

Diversified Financial Services | | | 2.1% | |

Health Care Equipment & Supplies | | | 2.0% | |

Insurance | | | 2.0% | |

Household Products | | | 2.0% | |

Beverages | | | 2.0% | |

Capital Markets | | | 1.8% | |

Exchange-Traded Funds | | | 4.1% | |

Repurchase Agreements | | | 1.7% | |

Other | | | 18.5% | |

Total | | | 100% | |

| 1 | Excluding investments in derivatives. |

QQQX

Nuveen Nasdaq 100 Dynamic Overwrite Fund

Performance Overview and Holding Summaries as of June 30, 2015

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of June 30, 2015

| | | | | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | |

| | | 6-Month | | | 1-Year | | | 5-Year | | | Since

Inception | |

| QQQX at NAV | | | 3.77% | | | | 12.61% | | | | 18.35% | | | | 10.23% | |

| QQQX at Share Price | | | (0.52) | | | | 5.59% | | | | 18.02% | | | | 9.10% | |

| Nasdaq 100® Index | | | 4.42% | | | | 15.58% | | | | 21.81% | | | | 12.42% | |

Since inception returns are from 1/30/07. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

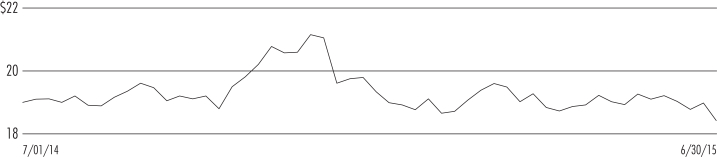

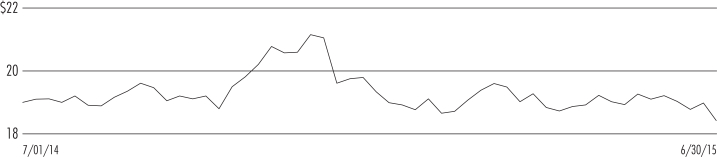

Share Price Performance — Weekly Closing Price

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Fund Allocation

(as a % of net assets)

| | | | |

| Common Stocks | | | 97.5% | |

| Exchange-Traded Funds | | | 3.8% | |

Repurchase Agreements | | | 0.6% | |

| Other Assets Less Liabilities | | | (1.9)% | |

| Net Assets | | | 100% | |

Top Five Issuers

(as a % of total long-term investments)1

| | | | |

| Apple, Inc. | | | 14.5% | |

| Microsoft Corporation | | | 6.9% | |

| Amazon.com, Inc. | | | 4.5% | |

| Facebook Inc., Class A Shares | | | 3.8% | |

| Gilead Sciences, Inc. | | | 3.7% | |

Portfolio Composition

(as a % of total investments)1

| | | | |

Technology Hardware,

Storage & Peripherals | | | 14.8% | |

| Internet Software & Services | | | 14.6% | |

| Biotechnology | | | 10.5% | |

| Software | | | 8.3% | |

| Internet & Catalog Retail | | | 6.1% | |

| Semiconductors & Semiconductor Equipment | | | 5.5% | |

| Communications Equipment | | | 5.5% | |

| | | | |

| Media | | | 4.9% | |

| Health Care Providers & Services | | | 2.8% | |

| Pharmaceuticals | | | 1.9% | |

| IT Services | | | 1.7% | |

| Exchange-Traded Funds | | | 3.7% | |

Repurchase Agreements | | | 0.6% | |

| Other | | | 19.1% | |

| Total | | | 100% | |

| 1 | Excluding investments in derivatives. |

Shareholder

Meeting Report

The annual meeting of shareholders was held in the offices of Nuveen Investments on March 26, 2015 for BXMX and SPXX; at this meeting the shareholders were asked to elect Board Members.

| | | | | | | | |

| | | BXMX | | | SPXX | |

| | | Common

Shares | | | Common

Shares | |

Approval of the Board Members was reached as follows: | | | | | | | | |

Jack B. Evans | | | | | | | | |

For | | | 87,429,921 | | | | 13,811,844 | |

Withhold | | | 1,759,961 | | | | 428,169 | |

Total | | | 89,189,882 | | | | 14,240,013 | |

William J. Schneider | | | | | | | | |

For | | | 87,450,775 | | | | 13,759,546 | |

Withhold | | | 1,739,107 | | | | 480,467 | |

Total | | | 89,189,882 | | | | 14,240,013 | |

Thomas S. Schreier, Jr. | | | | | | | | |

For | | | 87,504,202 | | | | 13,804,805 | |

Withhold | | | 1,685,680 | | | | 435,208 | |

Total | | | 89,189,882 | | | | 14,240,013 | |

BXMX

| | |

Nuveen S&P 500 Buy-Write Income Fund | | |

Portfolio of Investments | | June 30, 2015 (Unaudited) |

| | | | | | | | |

| Shares | | | Description (1) | | Value | |

| | |

| | | | LONG-TERM INVESTMENTS – 98.4% | | | | |

| | |

| | | | COMMON STOCKS – 98.4% (5) | | | | |

| | |

| | | | Aerospace & Defense – 2.5% | | | |

| | |

| | 67,004 | | | Boeing Company | | $ | 9,294,795 | |

| | 85,468 | | | Honeywell International Inc. | | | 8,715,172 | |

| | 8,874 | | | Huntington Ingalls Industries Inc. | | | 999,124 | |

| | 28,502 | | | Northrop Grumman Corporation | | | 4,521,272 | |

| | 54,744 | | | Raytheon Company | | | 5,237,906 | |

| | 63,296 | | | United Technologies Corporation | | | 7,021,425 | |

| | | | Total Aerospace & Defense | | | 35,789,694 | |

| | |

| | | | Air Freight & Logistics – 0.7% | | | |

| | |

| | 104,952 | | | United Parcel Service, Inc., Class B | | | 10,170,898 | |

| | |

| | | | Airlines – 0.3% | | | |

| | |

| | 85,004 | | | United Continental Holdings Inc., (2) | | | 4,506,062 | |

| | |

| | | | Auto Components – 0.2% | | | |

| | |

| | 22,233 | | | Cooper Tire & Rubber Company | | | 752,142 | |

| | 85,832 | | | Gentex Corporation | | | 1,409,361 | |

| | | | Total Auto Components | | | 2,161,503 | |

| | |

| | | | Automobiles – 0.6% | | | |

| | |

| | 388,012 | | | Ford Motor Company | | | 5,824,060 | |

| | 50,303 | | | Harley-Davidson, Inc. | | | 2,834,574 | |

| | | | Total Automobiles | | | 8,658,634 | |

| | |

| | | | Banks – 6.0% | | | |

| | |

| | 914,632 | | | Bank of America Corporation | | | 15,567,037 | |

| | 262,997 | | | Citigroup Inc. | | | 14,527,954 | |

| | 33,724 | | | Comerica Incorporated | | | 1,730,716 | |

| | 71,851 | | | Fifth Third Bancorp | | | 1,495,938 | |

| | 86,613 | | | First Horizon National Corporation | | | 1,357,226 | |

| | 289,842 | | | JP Morgan Chase & Co. | | | 19,639,694 | |

| | 29,619 | | | Lloyds Banking Group PLC, ADR | | | 160,831 | |

| | 188,500 | | | U.S. Bancorp | | | 8,180,900 | |

| | 408,071 | | | Wells Fargo & Company | | | 22,949,913 | |

| | | | Total Banks | | | 85,610,209 | |

| | |

| | | | Beverages – 2.2% | | | |

| | |

| | 317,900 | | | Coca-Cola Company | | | 12,471,217 | |

| | 33,462 | | | Monster Beverage Corporation, (2) | | | 4,484,577 | |

| | 153,014 | | | PepsiCo, Inc. | | | 14,282,327 | |

| | | | Total Beverages | | | 31,238,121 | |

| | |

| | | | Biotechnology – 3.5% | | | |

| | |

| | 74,396 | | | Amgen Inc. | | | 11,421,274 | |

| | 4,500 | | | Biogen Inc., (2) | | | 1,817,730 | |

| | 136,504 | | | Celgene Corporation, (2) | | | 15,798,290 | |

| | 175,601 | | | Gilead Sciences, Inc. | | | 20,559,365 | |

| | | | Total Biotechnology | | | 49,596,659 | |

| | |

| | | | Building Products – 0.1% | | | |

| | |

| | 4,369 | | | Allegion PLC | | | 262,752 | |

| | 42,748 | | | Masco Corporation | | | 1,140,089 | |

| | | | Total Building Products | | | 1,402,841 | |

| | | | |

| BXMX | | Nuveen S&P 500 Buy-Write Income Fund | | |

| | Portfolio of Investments (continued) | | June 30, 2015 (Unaudited) |

| | | | | | | | |

| Shares | | | Description (1) | | Value | |

| | |

| | | | Capital Markets – 2.2% | | | |

| | |

| | 201,302 | | | Charles Schwab Corporation | | $ | 6,572,510 | |

| | 28,291 | | | Eaton Vance Corporation | | | 1,107,027 | |

| | 57,390 | | | Goldman Sachs Group, Inc. | | | 11,982,458 | |

| | 78,237 | | | Legg Mason, Inc. | | | 4,031,553 | |

| | 150,485 | | | Morgan Stanley | | | 5,837,313 | |

| | 47,635 | | | Waddell & Reed Financial, Inc., Class A | | | 2,253,612 | |

| | | | Total Capital Markets | | | 31,784,473 | |

| | |

| | | | Chemicals – 2.3% | | | |

| | |

| | 128,057 | | | Dow Chemical Company | | | 6,552,677 | |

| | 112,864 | | | E.I. Du Pont de Nemours and Company | | | 7,217,653 | |

| | 76,574 | | | Eastman Chemical Company | | | 6,265,285 | |

| | 65,907 | | | Monsanto Company | | | 7,025,027 | |

| | 48,329 | | | Olin Corporation | | | 1,302,467 | |

| | 19,983 | | | Potash Corporation of Saskatchewan Inc. | | | 618,874 | |

| | 80,712 | | | RPM International, Inc. | | | 3,952,467 | |

| | | | Total Chemicals | | | 32,934,450 | |

| | |

| | | | Commercial Services & Supplies – 0.3% | | | |

| | |

| | 14,145 | | | Deluxe Corporation | | | 876,990 | |

| | 26,475 | | | Pitney Bowes Inc. | | | 550,945 | |

| | 28,908 | | | R.R. Donnelley & Sons Company | | | 503,866 | |

| | 60,369 | | | Waste Management, Inc. | | | 2,798,103 | |

| | | | Total Commercial Services & Supplies | | | 4,729,904 | |

| | |

| | | | Communications Equipment – 1.4% | | | |

| | |

| | 9,698 | | | ADTRAN, Inc. | | | 157,593 | |

| | 3,408 | | | Ciena Corporation, (2) | | | 80,701 | |

| | 371,982 | | | Cisco Systems, Inc. | | | 10,214,626 | |

| | 36,243 | | | Motorola Solutions Inc. | | | 2,078,174 | |

| | 117,004 | | | QUALCOMM, Inc. | | | 7,327,961 | |

| | 11,034 | | | Viavi Solutions, Inc., (2) | | | 127,774 | |

| | | | Total Communications Equipment | | | 19,986,829 | |

| | |

| | | | Consumer Finance – 1.0% | | | |

| | |

| | 89,615 | | | American Express Company | | | 6,964,878 | |

| | 84,491 | | | Discover Financial Services | | | 4,868,371 | |

| | 77,393 | | | Navient Corporation | | | 1,409,327 | |

| | 77,393 | | | SLM Corporation, (2) | | | 763,869 | |

| | | | Total Consumer Finance | | | 14,006,445 | |

| | |

| | | | Containers & Packaging – 0.3% | | | |

| | |

| | 3,177 | | | Avery Dennison Corporation | | | 193,606 | |

| | 69,728 | | | Packaging Corp. of America | | | 4,357,303 | |

| | 5,718 | | | Sonoco Products Company | | | 245,073 | |

| | | | Total Containers & Packaging | | | 4,795,982 | |

| | |

| | | | Distributors – 0.2% | | | |

| | |

| | 23,190 | | | Genuine Parts Company | | | 2,076,201 | |

| | |

| | | | Diversified Consumer Services – 0.0% | | | |

| | |

| | 7,623 | | | Apollo Education Group, Inc., (2) | | | 98,184 | |

| | |

| | | | Diversified Financial Services – 2.4% | | | |

| | |

| | 193,497 | | | Berkshire Hathaway Inc., Class B, (2) | | | 26,336,877 | |

| | 41,332 | | | CME Group, Inc. | | | 3,846,356 | |

| | 9,793 | | | FNFV Group, (2) | | | 150,616 | |

| | 12,616 | | | Intercontinental Exchange, Inc. | | | 2,821,064 | |

| | 39,312 | | | Leucadia National Corporation | | | 954,495 | |

| | | | Total Diversified Financial Services | | | 34,109,408 | |

| | | | | | | | |

| Shares | | | Description (1) | | Value | |

| | |

| | | | Diversified Telecommunication Services – 1.9% | | | |

| | |

| | 345,821 | | | AT&T Inc. | | $ | 12,283,562 | |

| | 20,819 | | | CenturyLink Inc. | | | 611,662 | |

| | 192,058 | | | Frontier Communications Corporation | | | 950,687 | |

| | 285,057 | | | Verizon Communications Inc. | | | 13,286,507 | |

| | 3,033 | | | Windstream Holdings Inc. | | | 19,351 | |

| | | | Total Diversified Telecommunication Services | | | 27,151,769 | |

| | |

| | | | Electric Utilities – 1.3% | | | |

| | |

| | 57,289 | | | Companhia Energetica de Minas Gerais, Sponsored ADR | | | 218,271 | |

| | 55,671 | | | Duke Energy Corporation | | | 3,931,486 | |

| | 98,619 | | | Great Plains Energy Incorporated | | | 2,382,635 | |

| | 89,635 | | | OGE Energy Corp. | | | 2,560,872 | |

| | 48,546 | | | Pepco Holdings, Inc. | | | 1,307,829 | |

| | 11,931 | | | Pinnacle West Capital Corporation | | | 678,755 | |

| | 162,938 | | | Southern Company | | | 6,827,102 | |

| | | | Total Electric Utilities | | | 17,906,950 | |

| | |

| | | | Electrical Equipment – 1.0% | | | |

| | |

| | 52,322 | | | Eaton Corporation PLC | | | 3,531,212 | |

| | 76,676 | | | Emerson Electric Company | | | 4,250,151 | |

| | 11,240 | | | Hubbell Incorporated, Class B | | | 1,217,067 | |

| | 44,800 | | | Rockwell Automation, Inc. | | | 5,583,872 | |

| | | | Total Electrical Equipment | | | 14,582,302 | |

| | |

| | | | Electronic Equipment, Instruments & Components – 0.2% | | | |

| | |

| | 151,993 | | | Corning Incorporated | | | 2,998,822 | |

| | |

| | | | Energy Equipment & Services – 1.4% | | | |

| | |

| | 8,826 | | | Diamond Offshore Drilling, Inc. | | | 227,799 | |

| | 26,944 | | | Ensco PLC, Class A | | | 600,043 | |

| | 139,879 | | | Halliburton Company | | | 6,024,589 | |

| | 72,619 | | | Patterson-UTI Energy, Inc. | | | 1,366,326 | |

| | 138,938 | | | Schlumberger Limited | | | 11,975,066 | |

| | 78 | | | Tidewater Inc. | | | 1,773 | |

| | | | Total Energy Equipment & Services | | | 20,195,596 | |

| | |

| | | | Food & Staples Retailing – 2.4% | | | |

| | |

| | 126,797 | | | CVS Health Corporation | | | 13,298,469 | |

| | 115,558 | | | Kroger Co. | | | 8,379,111 | |

| | 69,240 | | | SUPERVALU INC., (2) | | | 560,152 | |

| | 72,491 | | | Walgreens Boots Alliance Inc. | | | 6,121,140 | |

| | 68,690 | | | Wal-Mart Stores, Inc. | | | 4,872,182 | |

| | | | Total Food & Staples Retailing | | | 33,231,054 | |

| | |

| | | | Food Products – 0.7% | | | |

| | |

| | 252,157 | | | Mondelez International Inc., Class A | | | 10,373,739 | |

| | |

| | | | Gas Utilities – 0.4% | | | |

| | |

| | 21,816 | | | AGL Resources Inc. | | | 1,015,753 | |

| | 46,601 | | | Atmos Energy Corporation | | | 2,389,699 | |

| | 44,518 | | | National Fuel Gas Company | | | 2,621,665 | |

| | 4,901 | | | ONE Gas Inc. | | | 208,587 | |

| | | | Total Gas Utilities | | | 6,235,704 | |

| | | | |

| BXMX | | Nuveen S&P 500 Buy-Write Income Fund | | |

| | Portfolio of Investments (continued) | | June 30, 2015 (Unaudited) |

| | | | | | | | |

| Shares | | | Description (1) | | Value | |

| | |

| | | | Health Care Equipment & Supplies – 1.9% | | | |

| | |

| | 163,485 | | | Abbott Laboratories | | $ | 8,023,844 | |

| | 40,852 | | | Baxter International, Inc. | | | 2,856,780 | |

| | 1,463 | | | Halyard Health Inc., (2) | | | 59,252 | |

| | 36,821 | | | Hill-Rom Holdings Inc. | | | 2,000,485 | |

| | 62,936 | | | Hologic Inc., (2) | | | 2,395,344 | |

| | 2,456 | | | Intuitive Surgical, Inc., (2) | | | 1,189,932 | |

| | 148,378 | | | Medtronic, PLC | | | 10,994,810 | |

| | | | Total Health Care Equipment & Supplies | | | 27,520,447 | |

| | |

| | | | Health Care Providers & Services – 3.3% | | | |

| | |

| | 47,337 | | | Aetna Inc. | | | 6,033,574 | |

| | 52,620 | | | Anthem Inc. | | | 8,637,047 | |

| | 69,194 | | | Brookdale Senior Living Inc., (2) | | | 2,401,032 | |

| | 89,014 | | | Express Scripts Holding Company, (2) | | | 7,916,905 | |

| | 42,009 | | | HCA Holdings Inc., (2) | | | 3,811,056 | |

| | 39,774 | | | Henry Schein Inc., (2) | | | 5,652,681 | |

| | 15,942 | | | Kindred Healthcare Inc. | | | 323,463 | |

| | 101,713 | | | UnitedHealth Group Incorporated | | | 12,408,986 | |

| | | | Total Health Care Providers & Services | | | 47,184,744 | |

| | |

| | | | Health Care Technology – 0.2% | | | |

| | |

| | 38,826 | | | Cerner Corporation, (2) | | | 2,681,324 | |

| | |

| | | | Hotels, Restaurants & Leisure – 1.0% | | | |

| | |

| | 41,805 | | | Carnival Corporation | | | 2,064,749 | |

| | 2,272 | | | Interval Leisure Group Inc. | | | 51,915 | |

| | 4,969 | | | Las Vegas Sands Corp. | | | 261,220 | |

| | 85,801 | | | McDonald’s Corporation | | | 8,157,101 | |

| | 21,179 | | | Starwood Hotels & Resorts Worldwide, Inc. | | | 1,717,405 | |

| | 15,729 | | | Wynn Resorts Ltd | | | 1,551,980 | |

| | | | Total Hotels, Restaurants & Leisure | | | 13,804,370 | |

| | |

| | | | Household Durables – 0.8% | | | |

| | |

| | 2,893 | | | Garmin Limited | | | 127,089 | |

| | 50,944 | | | KB Home | | | 845,670 | |

| | 112,138 | | | Newell Rubbermaid Inc. | | | 4,609,993 | |

| | 1,285 | | | Tupperware Brands Corporation | | | 82,934 | |

| | 28,733 | | | Whirlpool Corporation | | | 4,972,246 | |

| | | | Total Household Durables | | | 10,637,932 | |

| | |

| | | | Household Products – 1.9% | | | |

| | |

| | 112,988 | | | Colgate-Palmolive Company | | | 7,390,545 | |

| | 34,108 | | | Kimberly-Clark Corporation | | | 3,614,425 | |

| | 209,355 | | | Procter & Gamble Company | | | 16,379,935 | |

| | | | Total Household Products | | | 27,384,905 | |

| | |

| | | | Industrial Conglomerates – 2.3% | | | |

| | |

| | 68,629 | | | 3M Co. | | | 10,589,455 | |

| | 638,566 | | | General Electric Company | | | 16,966,699 | |

| | 24,839 | | | Roper Technologies, Inc. | | | 4,283,734 | |

| | | | Total Industrial Conglomerates | | | 31,839,888 | |

| | |

| | | | Insurance – 2.6% | | | |

| | |

| | 107,121 | | | Allstate Corporation | | | 6,948,939 | |

| | 92,845 | | | American International Group, Inc. | | | 5,739,678 | |

| | 34,937 | | | Arthur J. Gallagher & Co. | | | 1,652,520 | |

| | 40,755 | | | CNO Financial Group Inc. | | | 747,854 | |

| | 29,385 | | | FNF Group | | | 1,086,951 | |

| | 65,958 | | | Genworth Financial Inc., Class A, (2) | | | 499,302 | |

| | 74,204 | | | Hartford Financial Services Group, Inc. | | | 3,084,660 | |

| | 2,764 | | | Kemper Corporation | | | 106,552 | |

| | | | | | | | |

| Shares | | | Description (1) | | Value | |

| | |

| | | | Insurance (continued) | | | |

| | |

| | 77,588 | | | Lincoln National Corporation | | $ | 4,594,761 | |

| | 161,940 | | | Marsh & McLennan Companies, Inc. | | | 9,181,998 | |

| | 35,787 | | | Travelers Companies, Inc. | | | 3,459,171 | |

| | | | Total Insurance | | | 37,102,386 | |

| | |

| | | | Internet & Catalog Retail – 2.3% | | | |

| | |

| | 38,228 | | | Amazon.com, Inc., (2) | | | 16,594,393 | |

| | 30,273 | | | HSN, Inc. | | | 2,124,862 | |

| | 370 | | | Lands’ End Inc, (2) | | | 9,187 | |

| | 8,140 | | | Netflix Inc., (2) | | | 5,347,492 | |

| | 7,208 | | | Priceline Group, Inc. (The), (2) | | | 8,299,075 | |

| | | | Total Internet & Catalog Retail | | | 32,375,009 | |

| | |

| | | | Internet Software & Services – 4.5% | | | |

| | |

| | 50,540 | | | Akamai Technologies, Inc., (2) | | | 3,528,703 | |

| | 150,929 | | | eBay Inc., (2) | | | 9,091,963 | |

| | 203,647 | | | Facebook Inc., Class A Shares, (2) | | | 17,465,785 | |

| | 32,276 | | | Google Inc., Class A, (2) | | | 17,430,331 | |

| | 21,910 | | | Google Inc., Class C Shares, (2) | | | 11,404,374 | |

| | 20,261 | | | IAC/InterActiveCorp | | | 1,613,991 | |

| | 55,336 | | | VeriSign, Inc., (2) | | | 3,415,338 | |

| | | | Total Internet Software & Services | | | 63,950,485 | |

| | |

| | | | IT Services – 2.6% | | | |

| | |

| | 4,939 | | | Alliance Data Systems Corporation, (2) | | | 1,441,892 | |

| | 115,333 | | | Automatic Data Processing, Inc. | | | 9,253,167 | |

| | 83,491 | | | Fidelity National Information Services, Inc. | | | 5,159,744 | |

| | 56,245 | | | International Business Machines Corporation (IBM) | | | 9,148,812 | |

| | 170,320 | | | Visa Inc., Class A | | | 11,436,988 | |

| | | | Total IT Services | | | 36,440,603 | |

| | |

| | | | Leisure Products – 0.2% | | | |

| | |

| | 29,141 | | | Mattel, Inc. | | | 748,632 | |

| | 18,145 | | | Polaris Industries Inc. | | | 2,687,456 | |

| | | | Total Leisure Products | | | 3,436,088 | |

| | |

| | | | Machinery – 2.4% | | | |

| | |

| | 91,577 | | | Caterpillar Inc. | | | 7,767,561 | |

| | 36,891 | | | Cummins Inc. | | | 4,839,730 | |

| | 21,151 | | | Deere & Company | | | 2,052,705 | |

| | 39,621 | | | Graco Inc. | | | 2,814,280 | |

| | 35,953 | | | Hillenbrand Inc. | | | 1,103,757 | |

| | 36,751 | | | Ingersoll-Rand PLC, Class A | | | 2,477,752 | |

| | 12,886 | | | Joy Global Inc. | | | 466,473 | |

| | 16,893 | | | Parker Hannifin Corporation | | | 1,965,163 | |

| | 10,877 | | | Snap-on Incorporated | | | 1,732,162 | |

| | 22,230 | | | SPX Corporation | | | 1,609,230 | |

| | 47,536 | | | Stanley Black & Decker Inc. | | | 5,002,689 | |

| | 57,774 | | | Timken Company | | | 2,112,795 | |

| | | | Total Machinery | | | 33,944,297 | |

| | |

| | | | Media – 3.6% | | | |

| | |

| | 37,547 | | | CBS Corporation, Class B | | | 2,083,859 | |

| | 222,231 | | | Comcast Corporation, Class A | | | 13,364,972 | |

| | 6,400 | | | DISH Network Corporation, Class A, (2) | | | 433,344 | |

| | 86,999 | | | New York Times Company (The), Class A | | | 1,187,536 | |

| | | | |

| BXMX | | Nuveen S&P 500 Buy-Write Income Fund | | |

| | Portfolio of Investments (continued) | | June 30, 2015 (Unaudited) |

| | | | | | | | |

| Shares | | | Description (1) | | Value | |

| | |

| | | | Media (continued) | | | |

| | |

| | 186,868 | | | News Corporation, Class A Shares, (2) | | $ | 2,726,404 | |

| | 2,025 | | | News Corporation Class B Shares, (2) | | | 28,836 | |

| | 92,661 | | | Omnicom Group, Inc. | | | 6,439,013 | |

| | 31,371 | | | Regal Entertainment Group, Class A | | | 655,968 | |

| | 207,442 | | | Walt Disney Company | | | 23,677,430 | |

| | | | Total Media | | | 50,597,362 | |

| | |

| | | | Metals & Mining – 0.6% | | | |

| | |

| | 253,192 | | | Alcoa Inc. | | | 2,823,091 | |

| | 20,083 | | | Barrick Gold Corporation | | | 214,085 | |

| | 62,035 | | | Freeport-McMoRan, Inc. | | | 1,155,092 | |

| | 148,596 | | | Hecla Mining Company | | | 390,807 | |

| | 38,316 | | | Newmont Mining Corporation | | | 895,062 | |

| | 24,595 | | | Nucor Corporation | | | 1,083,902 | |

| | 41,917 | | | Southern Copper Corporation | | | 1,232,779 | |

| | 156 | | | TimkenSteel Corporation | | | 4,210 | |

| | | | Total Metals & Mining | | | 7,799,028 | |

| | |

| | | | Multiline Retail – 1.1% | | | |

| | |

| | 4,000 | | | Family Dollar Stores, Inc. | | | 315,240 | |

| | 80,174 | | | Macy’s, Inc. | | | 5,409,340 | |

| | 67,816 | | | Nordstrom, Inc. | | | 5,052,292 | |

| | 14,738 | | | Sears Holdings Corporation, (2) | | | 393,505 | |

| | 59,302 | | | Target Corporation | | | 4,840,822 | |

| | | | Total Multiline Retail | | | 16,011,199 | |

| | |

| | | | Multi-Utilities – 1.1% | | | |

| | |

| | 102,253 | | | Ameren Corporation | | | 3,852,893 | |

| | 57,390 | | | Consolidated Edison, Inc. | | | 3,321,733 | |

| | 15,734 | | | NorthWestern Corporation | | | 767,033 | |

| | 157,390 | | | Public Service Enterprise Group Incorporated | | | 6,182,279 | |

| | 32,433 | | | WEC Energy Group, Inc. | | | 1,458,529 | |

| | | | Total Multi-Utilities | | | 15,582,467 | |

| | |

| | | | Oil, Gas & Consumable Fuels – 6.1% | | | |

| | |

| | 118,053 | | | California Resources Corporation | | | 713,040 | |

| | 9,051 | | | Cenovus Energy Inc. | | | 144,907 | |

| | 184,150 | | | Chevron Corporation | | | 17,764,951 | |

| | 159,197 | | | ConocoPhillips | | | 9,776,288 | |

| | 53,708 | | | CONSOL Energy Inc. | | | 1,167,612 | |

| | 66,781 | | | Continental Resources Inc., (2) | | | 2,830,847 | |

| | 181,113 | | | Encana Corporation | | | 1,995,865 | |

| | 335,043 | | | Exxon Mobil Corporation | | | 27,875,578 | |

| | 40,814 | | | Hess Corporation | | | 2,729,640 | |

| | 81,683 | | | Occidental Petroleum Corporation | | | 6,352,487 | |

| | 62,632 | | | ONEOK, Inc. | | | 2,472,711 | |

| | 2,376 | | | PetroChina Company Limited, ADR | | | 263,285 | |

| | 93,255 | | | Phillips 66 | | | 7,512,623 | |

| | 23,753 | | | Suncor Energy, Inc. | | | 653,683 | |

| | 58,070 | | | Valero Energy Corporation | | | 3,635,182 | |

| | | | Total Oil, Gas & Consumable Fuels | | | 85,888,699 | |

| | |

| | | | Pharmaceuticals – 6.2% | | | |

| | |

| | 161,773 | | | AbbVie Inc. | | | 10,869,528 | |

| | 171,532 | | | Bristol-Myers Squibb Company | | | 11,413,739 | |

| | 116,215 | | | Eli Lilly and Company | | | 9,702,790 | |

| | 244,236 | | | Johnson & Johnson | | | 23,803,241 | |

| | 251,757 | | | Merck & Company Inc. | | | 14,332,526 | |

| | 525,734 | | | Pfizer Inc. | | | 17,627,861 | |

| | | | Total Pharmaceuticals | | | 87,749,685 | |

| | | | | | | | |

| Shares | | | Description (1) | | Value | |

| | |

| | | | Professional Services – 0.1% | | | |

| | |

| | 18,195 | | | Manpowergroup Inc. | | $ | 1,626,269 | |

| | |

| | | | Real Estate Investment Trust – 1.8% | | | |

| | |

| | 32,859 | | | Annaly Capital Management Inc. | | | 301,974 | |

| | 69,995 | | | Apartment Investment & Management Company, Class A | | | 2,584,915 | |

| | 109,496 | | | Brandywine Realty Trust | | | 1,454,107 | |

| | 34,687 | | | CBL & Associates Properties Inc. | | | 561,929 | |

| | 3,639 | | | Communications Sales & Leasing, Inc. | | | 89,956 | |

| | 185,124 | | | CubeSmart | | | 4,287,472 | |

| | 57,235 | | | DCT Industrial Trust Inc. | | | 1,799,468 | |

| | 17,768 | | | Equity Commonwealth, (2) | | | 456,105 | |

| | 58,810 | | | Health Care REIT, Inc. | | | 3,859,700 | |

| | 42,070 | | | Healthcare Realty Trust, Inc. | | | 978,548 | |

| | 25,724 | | | Hospitality Properties Trust | | | 741,366 | |

| | 168,278 | | | Lexington Realty Trust | | | 1,426,997 | |

| | 55,742 | | | Liberty Property Trust | | | 1,796,007 | |

| | 17,263 | | | Medical Properties Trust Inc. | | | 226,318 | |

| | 19,790 | | | MFA Financial, Inc. | | | 146,248 | |

| | 26,716 | | | Senior Housing Properties Trust | | | 468,866 | |

| | 42,454 | | | Ventas Inc. | | | 2,635,969 | |

| | 34,826 | | | Weyerhaeuser Company | | | 1,097,019 | |

| | | | Total Real Estate Investment Trust | | | 24,912,964 | |

| | |

| | | | Road & Rail – 0.4% | | | |

| | |

| | 59,230 | | | Norfolk Southern Corporation | | | 5,174,333 | |

| | |

| | | | Semiconductors & Semiconductor Equipment – 2.7% | | | |

| | |

| | 98,918 | | | Altera Corporation | | | 5,064,602 | |

| | 89,419 | | | Analog Devices, Inc. | | | 5,739,359 | |

| | 122,324 | | | Broadcom Corporation, Class A | | | 6,298,463 | |

| | 473,514 | | | Intel Corporation | | | 14,401,928 | |

| | 38,906 | | | Intersil Corporation, Class A | | | 486,714 | |

| | 15,324 | | | Lam Research Corporation | | | 1,246,607 | |

| | 81,111 | | | Linear Technology Corporation | | | 3,587,540 | |

| | 24,776 | | | Microchip Technology Incorporated | | | 1,175,002 | |

| | 27,856 | | | NVIDIA Corporation | | | 560,184 | |

| | | | Total Semiconductors & Semiconductor Equipment | | | 38,560,399 | |

| | |

| | | | Software – 4.0% | | | |

| | |

| | 103,298 | | | Activision Blizzard Inc. | | | 2,500,845 | |

| | 93,084 | | | Adobe Systems Incorporated, (2) | | | 7,540,735 | |

| | 61,718 | | | Autodesk, Inc., (2) | | | 3,090,529 | |

| | 28,116 | | | CDK Global Inc. | | | 1,517,702 | |

| | 621,537 | | | Microsoft Corporation | | | 27,440,859 | |

| | 260,115 | | | Oracle Corporation | | | 10,482,635 | |

| | 55,570 | | | Salesforce.com, Inc., (2) | | | 3,869,339 | |

| | | | Total Software | | | 56,442,644 | |

| | |

| | | | Specialty Retail – 2.5% | | | |

| | |

| | 8,222 | | | Abercrombie & Fitch Co., Class A | | | 176,855 | |

| | 32,842 | | | American Eagle Outfitters, Inc. | | | 565,539 | |

| | 68,470 | | | Best Buy Co., Inc. | | | 2,232,807 | |

| | 46,645 | | | CarMax, Inc., (2) | | | 3,088,365 | |

| | 7,749 | | | CST Brands Inc. | | | 302,676 | |

| | 50,159 | | | Gap, Inc. | | | 1,914,569 | |

| | 101,196 | | | Home Depot, Inc. | | | 11,245,911 | |

| | 50,590 | | | L Brands Inc. | | | 4,337,081 | |

| | 130,011 | | | Lowe’s Companies, Inc. | | | 8,706,837 | |

| | | | |

| BXMX | | Nuveen S&P 500 Buy-Write Income Fund | | |

| | Portfolio of Investments (continued) | | June 30, 2015 (Unaudited) |

| | | | | | | | |

| Shares | | | Description (1) | | Value | |

| | |

| | | | Specialty Retail (continued) | | | |

| | 944 | | | Ross Stores, Inc. | | $ | 45,888 | |

| | 13,465 | | | Tiffany & Co. | | | 1,236,087 | |

| | 28,637 | | | TJX Companies, Inc. | | | 1,894,910 | |

| | | | Total Specialty Retail | | | 35,747,525 | |

| | |

| | | | Technology Hardware, Storage & Peripherals – 4.9% | | | |

| | |

| | 455,176 | | | Apple, Inc. | | | 57,090,450 | |

| | 239,417 | | | EMC Corporation | | | 6,318,215 | |

| | 118,686 | | | Hewlett-Packard Company | | | 3,561,766 | |

| | 65,269 | | | NetApp, Inc. | | | 2,059,889 | |

| | | | Total Technology Hardware, Storage & Peripherals | | | 69,030,320 | |

| | |

| | | | Textiles, Apparel & Luxury Goods – 0.2% | | | |

| | |

| | 35,220 | | | VF Corporation | | | 2,456,243 | |

| | |

| | | | Thrifts & Mortgage Finance – 0.1% | | | |

| | |

| | 50,725 | | | Hudson City Bancorp, Inc. | | | 501,162 | |

| | 40,800 | | | MGIC Investment Corporation, (2) | | | 464,303 | |

| | | | Total Thrifts & Mortgage Finance | | | 965,465 | |

| | |

| | | | Tobacco – 1.5% | | | |

| | |

| | 197,076 | | | Altria Group, Inc. | | | 9,638,986 | |

| | 99,883 | | | Philip Morris International Inc. | | | 8,007,619 | |

| | 53,678 | | | Reynolds American Inc. | | | 4,007,598 | |

| | 5,632 | | | Vector Group Ltd. | | | 132,126 | |

| | | | Total Tobacco | | | 21,786,329 | |

| | |

| | | | Wireless Telecommunication Services – 0.0% | | | |

| | |

| | 116,407 | | | Sprint Corporation, (2) | | | 530,816 | |

| | | | Total Long-Term Investments (cost $844,253,674) | | | 1,395,496,658 | |

| | | | | | | | | | | | | | | | |

| | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | | Maturity | | | Value | |

| | | | |

| | | | SHORT-TERM INVESTMENTS – 3.9% | | | | | | | | | | | | |

| | | | |

| | | | REPURCHASE AGREEMENTS – 3.9% | | | | | | | | | | | | |

| | | | |

| $ | 54,826 | | | Repurchase Agreement with Fixed Income Clearing Corporation, dated 6/30/15, repurchase price $54,826,426, collateralized by $56,920,000 U.S. Treasury Notes, 1.750%, due 4/30/22, value $55,923,900 | | | 0.000% | | | | 7/01/15 | | | $ | 54,826,426 | |

| | | | Short-Term Investments (cost $54,826,426) | | | | | | | | | | | 54,826,426 | |

| | | | Total Investments (cost $899,080,100) – 102.3% | | | | | | | | | | | 1,450,323,084 | |

| | | | Other Assets Less Liabilities – (2.3)% (3) | | | | | | | | | | | (32,661,929 | ) |

| | | | Net Assets – 100% | | | | | | | | | | $ | 1,417,661,155 | |

Investments in Derivatives as of June 30, 2015

Options Written outstanding:

| | | | | | | | | | | | | | | | | | | | |