Exhibit (c)(10)

| Confidential Presentation to the Special Committee June 29, 2020 |

| Confidential These materials have been prepared by Evercore Group L.L.C. (“Evercore”) for the Special Committee of the Board of Directors (the “Committee”) of GCI Liberty, Inc. (“GLIB” or the “Company”) to whom such materials are directly addressed and delivered and may not be used or relied upon for any purpose other than as specifically contemplated by a written agreement with Evercore. These materials are based on information provided by or on behalf of the Committee, including from Company management, and/or other potential transaction participants, or from public sources or otherwise reviewed by Evercore. Evercore assumes no responsibility for independent investigation or verification of such information and has relied on such information being complete and accurate in all material respects. To the extent such information includes estimates and forecasts of future financial performance prepared by or reviewed with the management of the Company and/or other potential transaction participants or obtained from public sources, Evercore has assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such management (or, with respect to estimates and forecasts obtained from public sources, represent reasonable estimates). No representation or warranty, express or implied, is made as to the accuracy or completeness of such information and nothing contained herein is, or shall be relied upon as, a representation, whether as to the past, the present or the future. These materials were designed for use by specific persons familiar with the business and affairs of the Company. These materials are not intended to provide the sole basis for evaluating, and should not be considered a recommendation with respect to, any transaction or other matter. These materials have been developed by and are proprietary to Evercore and were prepared exclusively for the benefit and internal use of the Committee. These materials were compiled on a confidential basis for use by the Committee in evaluating the potential transaction described herein and not with a view to public disclosure or filing thereof under state or federal securities laws, and may not be reproduced, disseminated, quoted or referred to, in whole or in part, without the prior written consent of Evercore. These materials do not constitute an offer or solicitation to sell or purchase any securities and are not a commitment by Evercore (or any affiliate) to provide or arrange any financing for any transaction or to purchase any security in connection therewith. Evercore assumes no obligation to update or otherwise revise these materials. These materials may not reflect information known to other professionals in other business areas of Evercore and its affiliates. Evercore and its affiliates do not provide legal, accounting or tax advice. Accordingly, any statements contained herein as to tax matters were neither written nor intended by Evercore or its affiliates to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed on such taxpayer. Each person should seek legal, accounting and tax advice based on his, her or its particular circumstances from independent advisors regarding the impact of the transactions or matters described herein. |

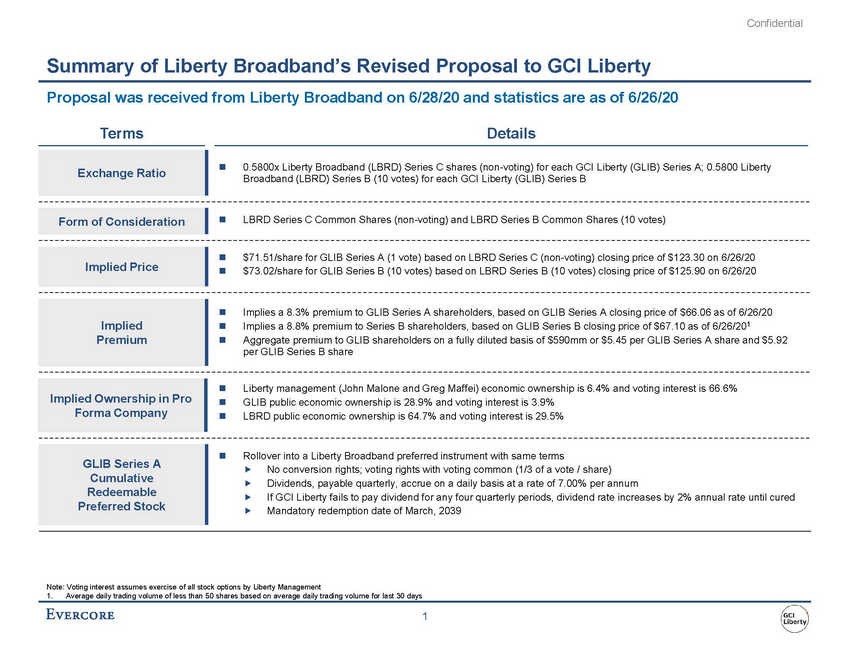

| Confidential Summary of Liberty Broadband’s Revised Proposal to GCI Liberty Proposal was received from Liberty Broadband on 6/28/20 and statistics are as of 6/26/20 Terms Details 0.5800x Liberty Broadband (LBRD) Series C shares (non-voting) for each GCI Liberty (GLIB) Series A; 0.5800 Liberty Broadband (LBRD) Series B (10 votes) for each GCI Liberty (GLIB) Series B LBRD Series C Common Shares (non-voting) and LBRD Series B Common Shares (10 votes) $71.51/share for GLIB Series A (1 vote) based on LBRD Series C (non-voting) closing price of $123.30 on 6/26/20 $73.02/share for GLIB Series B (10 votes) based on LBRD Series B (10 votes) closing price of $125.90 on 6/26/20 Implies a 8.3% premium to GLIB Series A shareholders, based on GLIB Series A closing price of $66.06 as of 6/26/20 Implies a 8.8% premium to Series B shareholders, based on GLIB Series B closing price of $67.10 as of 6/26/201 Aggregate premium to GLIB shareholders on a fully diluted basis of $590mm or $5.45 per GLIB Series A share and $5.92 per GLIB Series B share Liberty management (John Malone and Greg Maffei) economic ownership is 6.4% and voting interest is 66.6% GLIB public economic ownership is 28.9% and voting interest is 3.9% LBRD public economic ownership is 64.7% and voting interest is 29.5% Rollover into a Liberty Broadband preferred instrument with same terms No conversion rights; voting rights with voting common (1/3 of a vote / share) Dividends, payable quarterly, accrue on a daily basis at a rate of 7.00% per annum If GCI Liberty fails to pay dividend for any four quarterly periods, dividend rate increases by 2% annual rate until cured Mandatory redemption date of March, 2039 Note: Voting interest assumes exercise of all stock options by Liberty Management 1. Average daily trading volume of less than 50 shares based on average daily trading volume for last 30 days 1 GLIB Series A Cumulative Redeemable Preferred Stock Implied Ownership in Pro Forma Company Implied Premium Implied Price Form of Consideration Exchange Ratio |

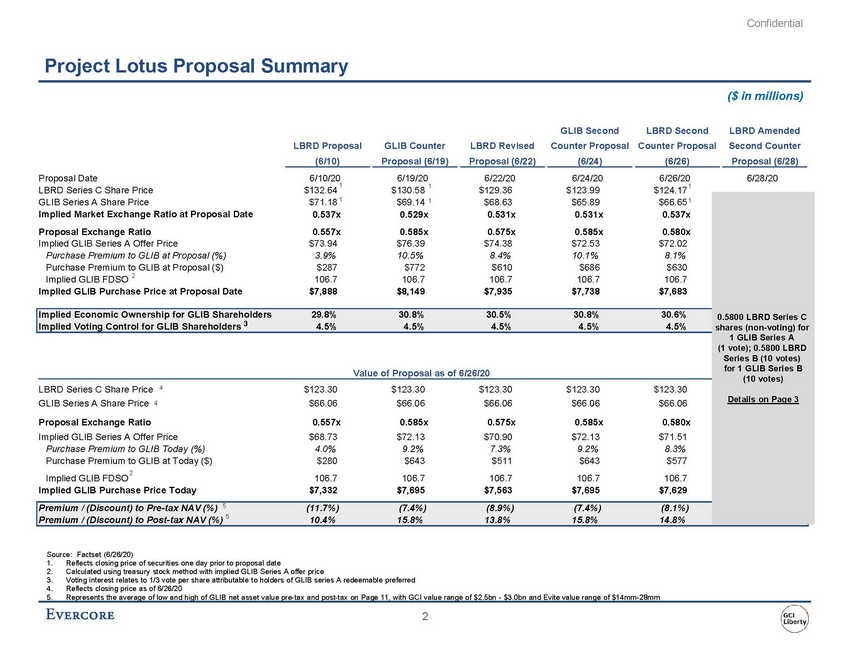

| Confidential Project Lotus Proposal Summary ($ in millions) GLIB Second LBRD Second LBRD Amended LBRD Proposal GLIB Counter LBRD Revised Counter Proposal Counter Proposal Second Counter (6/10) Proposal (6/19) Proposal (6/22) (6/24) (6/26) Proposal (6/28) Proposal Date LBRD Series C Share Price 6/10/20 $132.64 1 6/19/20 $130.58 1 6/22/20 $129.36 6/24/20 $123.99 6/26/20 $124.171 6/28/20 Implied Voting Control for GLIB Shareholders 3 4.5% 4.5% 4.5% 4.5% 4.5% Implied GLIB FDSO 106.7 106.7 106.7 106.7 106.7 Source: Factset (6/26/20) 1. 2. 3. 4. Reflects closing price of securities one day prior to proposal date Calculated using treasury stock method with implied GLIB Series A offer price Voting interest relates to 1/3 vote per share attributable to holders of GLIB series A redeemable preferred Reflects closing price as of 6/26/20 5. Represents the average of low and high of GLIB net asset value pre-tax and post-tax on Page 11, with GCI value range of $2.5bn - $3.0bn and Evite value range of $14mm-28mm 2 GLIB Series A Share Price $71.18 1$69.14 1$68.63 $65.89 $66.651 Implied Market Exchange Ratio at Proposal Date 0.537x 0.529x 0.531x 0.531x 0.537x Proposal Exchange Ratio 0.557x 0.585x 0.575x 0.585x 0.580x Implied GLIB Series A Offer Price $73.94 $76.39 $74.38 $72.53 $72.02 Purchase Premium to GLIB at Proposal (%) 3.9% 10.5% 8.4% 10.1% 8.1% Purchase Premium to GLIB at Proposal ($) $287 $772 $610 $686 $630 Implied GLIB FDSO 2106.7 106.7 106.7 106.7 106.7 Implied GLIB Purchase Price at Proposal Date $7,888 $8,149 $7,935 $7,738 $7,683 0.5800 LBRD Series C shares (non-voting) for 1 GLIB Series A (1 vote); 0.5800 LBRD Series B (10 votes) for 1 GLIB Series B (10 votes) Details on Page 3 Implied Economic Ownership for GLIB Shareholders 29.8% 30.8% 30.5% 30.8% 30.6% Value of Proposal as of 6/26/20 LBRD Series C Share Price 4$123.30 $123.30 $123.30 $123.30 $123.30 GLIB Series A Share Price 4$66.06 $66.06 $66.06 $66.06 $66.06 Proposal Exchange Ratio 0.557x 0.585x 0.575x 0.585x 0.580x Implied GLIB Series A Offer Price $68.73 $72.13 $70.90 $72.13 $71.51 Purchase Premium to GLIB Today (%) 4.0% 9.2% 7.3% 9.2% 8.3% Purchase Premium to GLIB at Today ($) $280 $643 $511 $643 $577 2 Implied GLIB Purchase Price Today $7,332 $7,695 $7,563 $7,695 $7,629 Premium / (Discount) to Pre-tax NAV (%) 5(11.7%) (7.4%) (8.9%) (7.4%) (8.1%) Premium / (Discount) to Post-tax NAV (%) 5 10.4% 15.8% 13.8% 15.8% 14.8% |

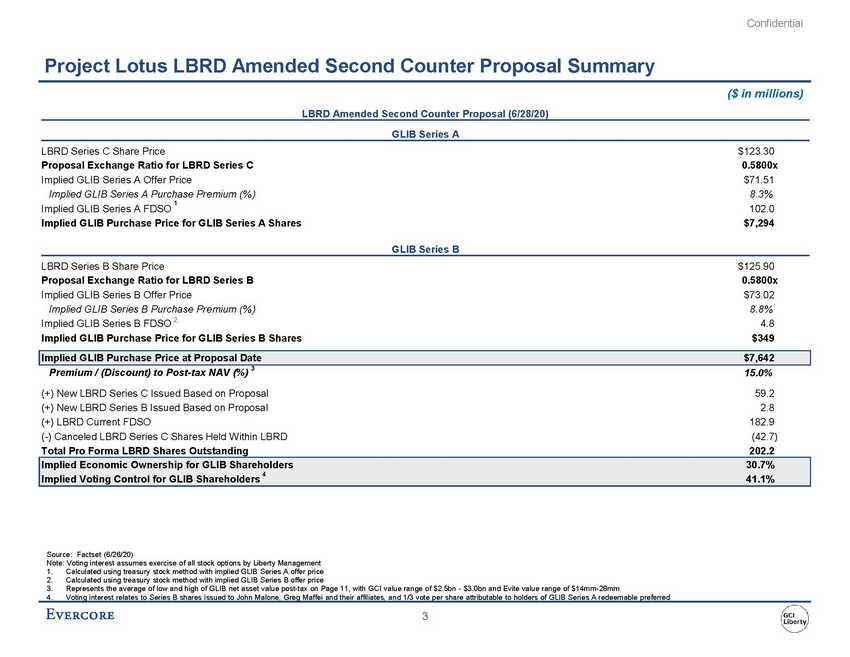

| Confidential Project Lotus LBRD Amended Second Counter Proposal Summary ($ in millions) LBRD Amended Second Counter Proposal (6/28/20) GLIB Series A LBRD Series C Share Price Proposal Exchange Ratio for LBRD Series C Implied GLIB Series A Offer Price Implied GLIB Series A Purchase Premium (%) $123.30 0.5800x $71.51 8.3% 102.0 $7,294 1 Implied GLIB Series A FDSO Implied GLIB Purchase Price for GLIB Series A Shares GLIB Series B LBRD Series B Share Price Proposal Exchange Ratio for LBRD Series B Implied GLIB Series B Offer Price Implied GLIB Series B Purchase Premium (%) Implied GLIB Series B FDSO 2 Implied GLIB Purchase Price for GLIB Series B Shares $125.90 0.5800x $73.02 8.8% 4.8 $349 Premium / (Discount) to Post-tax NAV (%) 3 15.0% 59.2 2.8 182.9 (42.7) 202.2 (+) New LBRD Series C Issued Based on Proposal (+) New LBRD Series B Issued Based on Proposal (+) LBRD Current FDSO (-) Canceled LBRD Series C Shares Held Within LBRD Total Pro Forma LBRD Shares Outstanding Implied Voting Control for GLIB Shareholders 41.1% Source: Factset (6/26/20) Note: Voting interest assumes exercise of all stock options by Liberty Management 1. 2. 3. Calculated using treasury stock method with implied GLIB Series A offer price Calculated using treasury stock method with implied GLIB Series B offer price Represents the average of low and high of GLIB net asset value post-tax on Page 11, with GCI value range of $2.5bn - $3.0bn and Evite value range of $14mm-28mm 4. Voting interest relates to Series B shares issued to John Malone, Greg Maffei and their affiliates, and 1/3 vote per share attributable to holders of GLIB Series A redeemable preferred 3 Implied Economic Ownership for GLIB Shareholders30.7% 4 Implied GLIB Purchase Price at Proposal Date$7,642 |

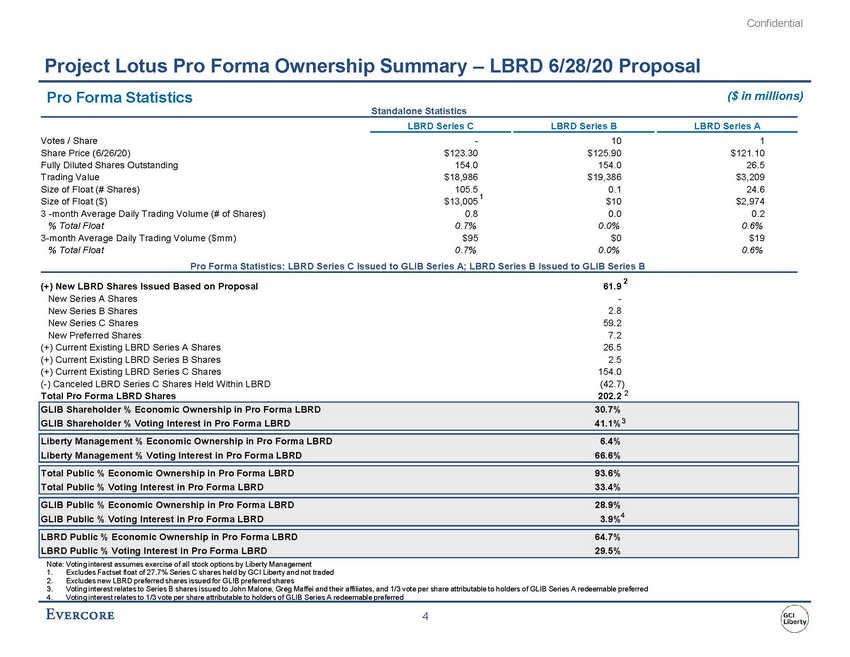

| Confidential Project Lotus Pro Forma Ownership Summary – LBRD 6/28/20 Proposal Pro Forma Statistics ($ in millions) Standalone Statistics LBRD Series C LBRD Series B LBRD Series A Votes / Share Share Price (6/26/20) Fully Diluted Shares Outstanding Trading Value Size of Float (# Shares) Size of Float ($) 3 -month Average Daily Trading Volume (# of Shares) % Total Float 3-month Average Daily Trading Volume ($mm) % Total Float - $123.30 154.0 $18,986 10 $125.90 154.0 $19,386 0.1 $10 0.0 0.0% $0 0.0% 1 $121.10 26.5 $3,209 24.6 $2,974 0.2 0.6% $19 0.6% 105.5 $13,005 1 0.8 0.7% $95 0.7% Pro Forma Statistics: LBRD Series C Issued to GLIB Series A; LBRD Series B Issued to GLIB Series B 2 (+) New LBRD Shares Issued Based on Proposal New Series A Shares New Series B Shares New Series C Shares New Preferred Shares (+) Current Existing LBRD Series A Shares (+) Current Existing LBRD Series B Shares (+) Current Existing LBRD Series C Shares (-) Canceled LBRD Series C Shares Held Within LBRD Total Pro Forma LBRD Shares 61.9 - 2.8 59.2 7.2 26.5 2.5 154.0 (42.7) 202.2 2 Source: Factset (6/26/20) Note: Voting interest assumes exercise of all stock options by Liberty Management 1. 2. 3. Excludes Factset float of 27.7% Series C shares held by GCI Liberty and not traded Excludes new LBRD preferred shares issued for GLIB preferred shares Voting interest relates to Series B shares issued to John Malone, Greg Maffei and their affiliates, and 1/3 vote per share attributable to holders of GLIB Series A redeemable preferred 4. Voting interest relates to 1/3 vote per share attributable to holders of GLIB Series A redeemable preferred 4 GLIB Shareholder % Economic Ownership in Pro Forma LBRD 30.7% GLIB Shareholder % Voting Interest in Pro Forma LBRD 41.1%3 Liberty Management % Economic Ownership in Pro Forma LBRD 6.4% Liberty Management % Voting Interest in Pro Forma LBRD 66.6% Total Public % Economic Ownership in Pro Forma LBRD 93.6% Total Public % Voting Interest in Pro Forma LBRD 33.4% GLIB Public % Economic Ownership in Pro Forma LBRD 28.9% GLIB Public % Voting Interest in Pro Forma LBRD 3.9%4 LBRD Public % Economic Ownership in Pro Forma LBRD 64.7% LBRD Public % Voting Interest in Pro Forma LBRD 29.5% |