Exhibit (c)(5)

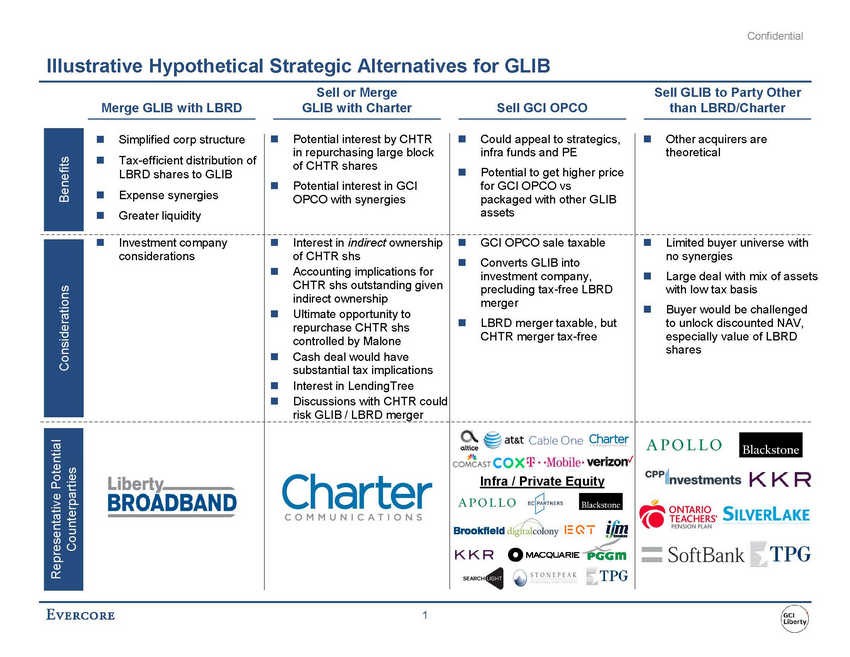

| Confidential Illustrative Hypothetical Strategic Alternatives for GLIB Sell or Merge GLIB with Charter Sell GLIB to Party Other than LBRD/Charter Merge GLIB with LBRD Sell GCI OPCO for GCI OPCO vs s with low tax basis merger to unlock discounted NAV, shares 1 Considerations Benefits Simplified corp structure Tax-efficient distribution of LBRD shares to GLIB Expense synergies Greater liquidity Potential interest by CHTR in repurchasing large block of CHTR shares Potential interest in GCI OPCO with synergies Could appeal to strategics, infra funds and PE Potential to get higher price packaged with other GLIB assets Other acquirers are theoretical Investment company considerations Interest in indirect ownership of CHTR shs Accounting implications for CHTR shs outstanding given indirect ownership Ultimate opportunity to repurchase CHTR shs controlled by Malone Cash deal would have substantial tax implications Interest in LendingTree Discussions with CHTR could risk GLIB / LBRD merger GCI OPCO sale taxable Converts GLIB into investment company, precluding tax-free LBRD LBRD merger taxable, but CHTR merger tax-free Limited buyer universe with no synergies Large deal with mix of asset Buyer would be challenged especially value of LBRD Representative Potential Counterparties Infra / Private Equity |