As filed with the Securities and Exchange Commission on 03/30/17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22980

Angel Oak Funds Trust

(Exact name of registrant as specified in charter)

One Buckhead Plaza

3060 Peachtree Rd. NW, Suite 500

Atlanta, Georgia 30305

(Address of principal executive offices) (Zip code)

Dory S. Black, Esq., President

One Buckhead Plaza

3060 Peachtree Rd. NW, Suite 500

Atlanta, Georgia 30305

(Name and address of agent for service)

Copy to:

Douglas P. Dick

Stephen T. Cohen

Dechert LLP

1900 K Street NW

Washington, DC 20006

404-953-4900

Registrant’s telephone number, including area code

Date of fiscal year end: January 31

Date of reporting period: February 1, 2016 to January 31, 2017

Item 1. Reports to Stockholders.

ANNUAL REPORT

January 31, 2017

Angel Oak Multi-Strategy Income Fund

Angel Oak Flexible Income Fund

Angel Oak High Yield Opportunities Fund

Angel Oak Capital Advisors, LLC

One Buckhead Plaza

3060 Peachtree Road NW

Suite 500

Atlanta, GA 30305

(404) 953-4900

Table of Contents

Dear Shareholder,

2016 was a tale of two halves and two completely unexpected election results. The first half was driven by worries about a corporate credit default cycle led by commodity-related credits, fears of a U.S. recession, and a Chinese currency devaluation, all of which led to a major risk-off environment. Equities and other risk assets were off to a tumultuous start in 2016. The S&P 500 Total Return Index was down as much as 10.27% as of February 11, marking the worst start of all time. Risk assets began to recover by the summer, but the Brexit vote surprised all market participants, and some feared the worst.

The bid for risk-free assets surged on the heels of Brexit, with the 10-year note yield closing at a 1.37% yield on July 8, the lowest in its history. “Lower for longer” seemed here to stay, although ironically Brexit was actually the catalyst for risk-on trades in the second half of 2016. The economic data began to improve in the U.S., recession worries began to subside, equities began to rise, commodities recovered, credit spreads began to tighten, and risk-free rates began to rise off post-Brexit lows.

“Lower for longer” was still the widely held expectation in the U.S. prior to the November election, but the Trump victory changed everything heading into year-end. Inflation and growth expectations completely changed, and the risk-free term structure repriced accordingly. We believe reflationary macro trends will continue in earnest in 2017, buoyed by the rekindling of animal spirits thanks to the surprise Trump victory. We expect the election outcome to pour gas on the Federal Open Market Committee (FOMC) inflation fire smoldering throughout the post-crisis period, through greater fiscal expansion, tax cuts, and deregulation-driven credit expansion. It is still too early to predict what effect a Trump administration will have on the economy, but expectations are high.

We believe all the above will be beneficial for our strategies, as they should all drive higher-than-expected inflation and growth in 2017. We feel our short effective duration profile should continue to benefit performance as U.S. risk-free rates rise, driven by increased inflation and growth expectations in 2017. Tax cuts and fiscal expansion should keep credit spreads stable to tighter throughout the year as corporate earnings and ever-improving consumer balance sheets outweigh the effects of higher interest rates.

We also expect the U.S. economic outlook to be favorable if the Trump administration delivers on market expectations of corporate tax reform, infrastructure spending, large-scale fiscal stimulus, and significant deregulation (“Trumponomics”). We believe Trumponomics will be the final potent cocktail to rid the U.S. of the bitter taste of deflation and anemic growth for this business cycle. The post-crisis expansion, now in its 77th month, may still have a long way to go as the consumer credit box expands. Seventy percent of the U.S. economy is related to consumer spending, and wages have finally begun to outpace inflation seven years into the recovery. Additionally, household leverage is at its lowest level since 2002. Consumer credit expansion through single-family mortgage credit has been hindered due to tightening credit standards, but residential mortgage guidelines have finally begun to relax.

The coming consumer credit expansion, coupled with the potential of Trumponomics, will create some clear winners and losers. We believe the winners could include risk assets that perform well in inflationary environments, such as equities, real estate, real estate-backed assets, floating rate securities, short duration assets, and high current carry credit spread assets. We believe the losers could be duration-sensitive assets, particularly negatively convex fixed income products such as agency mortgages and long duration investment grade corporate bonds.

Thank you for your continued support.

Respectfully yours,

Sreeniwas V. Prabhu

Chief Executive Officer and Chief Investment Officer

The opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Must be accompanied or preceded by a prospectus.

Mutual fund investing involves risk. Principal loss is possible.

The Angel Oak Funds are distributed by Quasar Distributors, LLC.

1

Angel Oak Multi-Strategy Income Fund

| 1. | How did the Fund perform during the period? |

For the 12-month period ended January 31, 2017, the Fund’s Institutional Shares (ANGIX) returned 6.96%, while the A Shares (ANGLX) and C Shares (ANGCX) returned 6.64% and 5.87%, respectively. During the same period, the Fund’s benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, returned 1.45%.

| 2. | What were the main contributors to and detractors from the Fund’s performance during the period? |

Duration and credit strategies benefited the Fund relative to the benchmark. Duration positioning short of the index was a positive contributor to relative performance for the period as the 5 and 10-year U.S. Treasury yields rose 59 and 53 basis points (bps), respectively. The floating rate bond allocation based primarily on front-end LIBOR floaters was beneficial to relative Fund performance as 3-month LIBOR rose 45 bps over the period. Credit strategies benefited the Fund relative to the benchmark for the 12-month period, as the total returns of non-agency residential mortgage-backed securities (NA RMBS), collateralized loan obligations (CLOs) and commercial mortgage-backed securities (CMBS) were all positive contributors to the Fund.

NA RMBS were the primary contributor to Fund performance for the 12-month period. Current income benefited from a rise in LIBOR, increasing bond interest and the boost to yield from rising voluntary prepayment speeds.

CLOs were another sector that exhibited strong performance for the period as prices sharply recovered following steep widening in early 2016. The decision to maintain a significant allocation to CLOs following early 2016 price volatility was a benefit to Fund performance.

Last, the CMBS allocation was a positive contributor for the 12-month period but lagged other structured product asset classes amid headwinds, including negative implications of e-commerce for the bricks-and-mortar retail sector and the upcoming maturity of approximately $228 billion of 2007 CMBS originations. Despite the positive performance in the period, CMBS did underperform relative to the NA RMBS and CLO exposure in the Fund, yet may foreshadow excess opportunities for the period ahead.

| 3. | What is your outlook heading into 2017, and how is the Fund positioned? |

We believe the Federal Open Market Committee (FOMC) may prove to be more hawkish than expected in 2017, marking the first time in the post-crisis period the FOMC will have been less dovish than market participants. Higher headline inflation data should begin to pressure longer duration assets as the reset of higher year-over-year crude prices flow through. Market participants could begin to price in more than the two FOMC hikes currently anticipated in 2017 if the growth and inflation data begin to surprise to the upside. We expect this will lead to a higher, yet slightly flatter, risk-free curve in the U.S.

With this rate view in mind, three overarching themes will drive portfolio positioning for the Fund in early 2017:

| | 1. | Minimize interest rate sensitivity with a bias toward floating rate credit assets |

| | 2. | Overweight structured credit relative to traditional U.S. fixed income |

| | 3. | Target less-levered sectors with positive credit fundamentals |

Therefore, the Fund remains overweight non-agency mortgage credit through both legacy floating rate NA RMBS and investment grade CMBS. Legacy NA RMBS remain attractive due to their floating rate coupons, deeply discounted dollar prices and appreciating collateral. Targeted opportunities also currently exist in non-agency commercial mortgage-backed securities and CLOs due to their recent underperformance relative to corporate credit.

Past performance is not a guarantee of future results.

Investments in debt securities typically decreases when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower rated and non-rated securities present a greater risk of loss to principal and interest than higher rated securities. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Derivatives involve risks different from, and in certain cases, greater than the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as illiquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested.

2

Angel Oak Flexible Income Fund

| 1. | How did the Fund perform during the period? |

For the 12-month period ended January 31, 2017, the Fund’s Institutional Shares (ANFIX) returned 3.69%, while the A Shares (ANFLX) and C Shares (AFLCX) returned 3.47% and 2.73%, respectively. During the same period, the Fund’s benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, returned 1.45%.

| 2. | What were the main contributors to and detractors from the Fund’s performance during the period? |

Credit strategies, senior and subordinated debt of depository institutions, and collateralized loan obligations (CLOs) benefited Fund performance relative to the benchmark during the 12-month reporting period. Duration positioning short of the index was also a positive contributor to relative performance for the period.

Within corporates, bank credit spreads continued to tighten over the 12-month reporting period, more than offsetting the increase in Treasury rates. The corporate allocation was the best contributor for the period. Based on Q4 earnings releases, bank fundamentals continue to improve. Loan growth continues at a moderate pace, and earnings have improved, driven by expense control, low credit charges, and improving net interest margins.

CLOs were a significant positive contributor to performance for the period as prices sharply recovered following steep widening in early 2016. The decision to maintain a significant allocation to CLOs following early 2016 price volatility was a benefit to Fund performance.

| 3. | What is your outlook heading into 2017, and how is the Fund positioned? |

We believe the Federal Open Market Committee (FOMC) may prove to be more hawkish than expected in 2017, marking the first time in the post-crisis period the FOMC will have been less dovish than market participants. Higher headline inflation data should begin to pressure longer duration assets as the reset of higher year-over-year crude prices flow through. Market participants could begin to price in more than the two FOMC hikes currently anticipated in 2017 if the growth and inflation data begin to surprise to the upside. We expect this will lead to a higher, yet slightly flatter, risk-free curve in the U.S.

The Fund’s target allocation to corporate credit has increased to approximately 60% as the regional and community bank debt spreads have lagged generic high-yield and investment-grade corporate spread tightening in 2017. The increase in interest rates and overall steepening of the U.S. yield curve should improve banks’ investment portfolio book yields and net interest margins. The potential for deregulation should also increase efficiencies for the banking industry and improve expected profitability in the future, thus raising expected debt service coverage ratios and leading to lower credit risk premiums. The Fund continues to favor this sector for the attractive spreads of high-quality names amid improving bank fundamentals and mergers and acquisitions activity.

The Fund also continues to favor earlier vintage BBB-rated 2.0 CLOs with short reinvestment periods, as we believe deal deleveraging should lead to stable performance. On a relative basis, CLO spreads look attractive as there is room for further improvement given post-crisis tights that were set in the early part of 2015. Spread duration has decreased in the Fund given the recent outperformance of CLOs versus community bank corporate credit. Furthermore, 3-month LIBOR currently sits at approximately 1%, and the potential for further Fed hikes in 2017 could continue to generate demand for floating rate assets. As a result, we seek for positive relative outperformance compared with investment grade U.S. corporate industrial bonds, as corporate credit has experienced significant spread tightening and has limited ability to absorb further rate increases via the FOMC.

Past performance is not a guarantee of future results.

The Fund can make short sales of securities, which involves the risk that losses in securities may exceed the original amount invested. The Fund may use leverage, which may exaggerate the effect of any increase or decrease in the value of securities in the Fund’s portfolio on the Fund’s Net Asset Value and therefore may increase the volatility of the Fund. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are increased for emerging markets. Investments in fixed income instruments typically decrease in value when interest rates rise. Derivatives involve risks different from and, in certain cases, greater than the risks presented by more traditional investments. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of, such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Investment by the Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. The Fund is non-diversified, so it may be more susceptible to being adversely affected by a single corporate, economic, political or regulatory occurrence than a diversified fund. The Fund will incur higher and duplicative costs when it invests in mutual funds, ETFs and other investment companies. There is also the risk that the Fund may suffer losses due to the investment practices of the underlying funds. For more information on these risks and other risks of the Fund, please see the Prospectus.

3

Angel Oak High Yield Opportunities Fund

| 1. | How did the Fund perform during the period? |

For the 12-month period ended January 31, 2017, the Fund’s Institutional Shares (ANHIX) returned 20.77% while the A Shares (ANHAX) returned 20.53%. During the same period, the Fund’s benchmark, the BofA Merrill Lynch High Yield Index, returned 20.98%.

| 2. | What were the main contributors to and detractors from the Fund’s performance during the period? |

The Fund’s (ANHIX) 20.77% return for the 12-month period ended January 31, 2017 was strong despite being 45 basis points (bps) less than the benchmark. The Fund’s strong performance was driven by a combination of both sector selection and issuer selection. As the year progressed, our view strengthened with regard to the domestic economy relative to the global economy and, therefore, we began to position the portfolio toward sectors and issuers that would benefit from a pickup in growth in the U.S., as well as avoiding companies dependent on exports. With that in mind, we found investment opportunities in the basic industry sector, the capital goods sector, and the financial services sector, which are actually now among our largest overweights in the portfolio.

During the period, the portfolio benefited from a significant underweight to the healthcare sector, which was among the top-performing sectors from an attribution perspective relative to the benchmark. Valuations appeared rich from a risk/reward standpoint, especially as some companies had an increased propensity to buy back stock rather than strengthen their balance sheets. Additionally, following the presidential election, the healthcare sector in general sold off, reflecting increased uncertainty due to the likely repeal of the Affordable Care Act.

Automotive was another sector that was a significant positive contributor to performance for the year. The positive attribution reflects the ongoing strength of automotive demand as well as investment selection. Portfolio investments in specific companies benefited as they were able to capitalize on the strong demand for cars and implement operational improvements that resulted in improved margins and cash flow and a stronger credit profile. Additionally, the portfolio benefited from the consolidation activity taking place among automotive parts suppliers.

Energy and basic materials were among the largest detractors from performance during the period on an attribution basis. These two sectors were among the best-performing sectors in the index, with energy and metals and mining company valuations rebounding following the exceptionally weak performance the prior year, when China’s economic strength was being challenged, fears of a recession were rising in the U.S. and commodity prices were hitting recent lows. Portfolio performance benefited on the way down as we avoided the weakest companies and did not speculate on their potential recovery during the period, resulting in negative attribution as valuations recovered from distressed levels.

| 3. | What is your outlook heading into 2017, and how is the Fund positioned? |

Our positive outlook for the high-yield market in 2017 is supported by the technicals as well as the fundamentals. From a technical perspective, high-yield attracted over $11 billion of inflows in 2016. This follows three years of outflows cumulatively totaling more than $45 billion. We expect the demand for yield and income to remain strong, and high-yield corporates with the potential to improve their credit profiles and valuations as the economy accelerates, potentially mitigating the negative impact of rising interest rates, should continue to be an attractive option in this environment.

The fundamental indicators we follow suggest that the economy will continue to expand, which should be beneficial to high-yield issuers in terms of revenue growth, margins, cash flow and credit profile improvement, which should translate into improving credit spread valuations. One of the fundamental indicators we look at is industrial production, which has turned positive on a year-over-year basis. Early in 2016, it was negative, and this was one of the rare instances when negative industrial production didn’t translate into a recession. Bank lending continues to be strong, increasing at a high-single-digits rate year-over-year. Bank lending standards, which are measured quarterly by the Federal Reserve for commercial and industrial loans, after tightening somewhat, have eased recently.

We think the high-yield market looks attractive when you put it in the context of other risk assets as of January 31, 2017. High-yield, as represented by the BofA Merrill Lynch US High Yield Index, at 400 bps, is still trading wide of its post-crisis tights of 335 bps, and it still yields approximately 6%. At the same time, investment grade corporate, as represented by the BofA Merrill Lynch US Corporate Index, is at 128 bps, only 42 bps off their post-crisis tights, and yield only 3.38%. Relative to investment grade, high-yield still offers significant credit spread tightening potential and yields almost twice as much. This credit spread and

4

yield advantage provides the basis for high-yield to provide an opportunity for outperformance of investment grade if the economy continues to improve, leading to rising interest rates. Additionally, equity valuations are at some of their highest levels since the early 2000s, using price-to-earnings as a proxy, and are looking very stretched. Within that context, high-yield not only looks attractive from an absolute return basis, but also from a risk/reward perspective compared to U.S. stocks and more interest rate sensitive fixed income.

In the context of an expected acceleration of economic growth and considering current valuations, we are focused on the balance of risk and reward and our goal of long-term, superior risk-adjusted returns. As such, we will opportunistically reduce the risk profile at the margin while also focusing on sectors that we believe should directly benefit from the new administration’s policies, such as housing, basic materials, and financial services.

Past performance is not a guarantee of future results.

Investments in debt securities typically decreases when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower rated and non-rated securities present a greater risk of loss to principal and interest than higher rated securities. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Derivatives involve risks different from, and in certain cases, greater than the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as illiquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested.

5

Bank of America Merrill Lynch U.S. High Yield Index: Tracks the performance of below investment grade, but not in default, U.S. dollar denominated corporate bonds publicly issued in the U.S. domestic market, and includes issues with a credit rating of BBB or below, as rated by Moody’s and S&P.

Bank of America Merrill Lynch U.S. Corporate Index: Tracks the performance of the U.S. dollar denominated investment grade corporate debt publicly issued I the U.S. domestic market. Qualifying securities must have an investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $250 million.

Basis Points (bps): A basis point refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01% (0.0001), and is used to denote the percentage change in a financial instrument. The relationship between percentage changes and basis points can be summarized as follows: 1% change = 100 basis points, and 0.01% = 1 basis point.

Bloomberg Barclays U.S. Aggregate Bond Index: The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

Duration: Duration is a measure of the sensitivity of the price – the value of principal – of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond prices are said to have an inverse relationship with interest rates. Therefore, rising interest rates indicate bond prices are likely to fall, while declining interest rates indicate bond prices are likely to rise.

LIBOR: LIBOR or ICE LIBOR (previously BBA LIBOR) is a benchmark rate that some of the world’s leading banks charge each other for short-term loans. It stands for IntercontinentalExchange London Interbank Offered Rate and serves as the first step to calculating interest rates on various loans throughout the world. LIBOR is administered by the ICE Benchmark Administration (IBA), and is based on five currencies: U.S. dollar (USD), Euro (EUR), pound sterling (GBP), Japanese yen (JPY) and Swiss franc (CHF), and serves seven different maturities: overnight, one week, and 1, 2, 3, 6 and 12 months. There are a total of 35 different LIBOR rates each business day. The most commonly quoted rate is the three-month U.S. dollar rate.

Price Earnings Ratio: The price-earnings ratio is the ratio for valuing a company that measures its current share price relative to its per-share earnings.

S&P 500 Total Return Index: S&P 500 Total Return Index is a capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index was developed with a base level of 10 for the 1941-43 base period.

Spread: The difference in yield between a U.S. Treasury bond and a debt security with the same maturity but of lesser quality.

An investment cannot be made directly to an index.

6

Investment Results – (Unaudited)

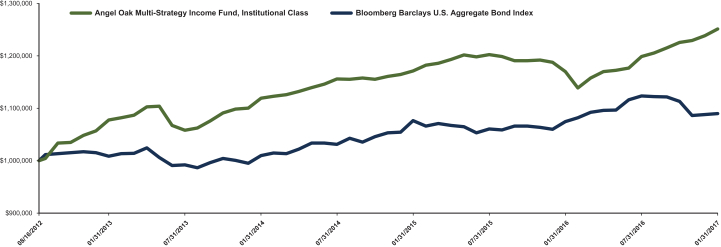

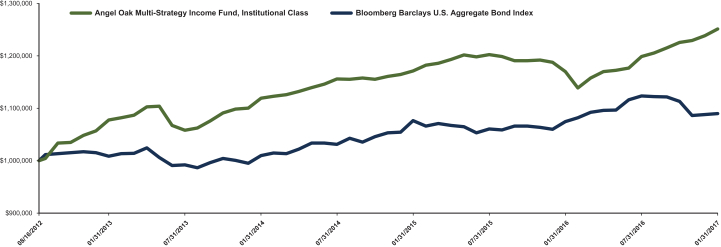

Angel Oak Multi-Strategy Income Fund

Total Return Based on a $1,000,000 Investment

The Fund is the successor to the investment performance of the Angel Oak Multi-Strategy Income Fund (the “Predecessor Multi-Strategy Income Fund”) as a result of the reorganization of the Predecessor Multi-Strategy Income Fund into the Fund on April 10, 2015. Accordingly, the performance information shown in the chart above and table below for periods prior to April 10, 2015 is that of the Predecessor Multi-Strategy Income Fund. The Predecessor Multi-Strategy Income Fund was also advised by the Adviser and had the same investment objective, policies, and strategies as the Fund.

The chart above assumes an initial investment of $1,000,000 made on August 16, 2012 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

Total Returns(1)

(For the year ended January 31, 2017)

| | | | | | | | | | | | | | | | |

| | | Average Annual Returns | |

| | | One Year | | | Three Year | | | Five Year | | | Since Inception(2) | |

Angel Oak Multi-Strategy Income Fund, Institutional Class | | | 6.96 | % | | | 3.78 | % | | | N/A | | | | 5.15 | % |

Angel Oak Multi-Strategy Income Fund, Class A without load | | | 6.64 | % | | | 3.53 | % | | | 7.09 | % | | | 7.95 | % |

Angel Oak Multi-Strategy Income Fund, Class A with load | | | 4.24 | % | | | 2.75 | % | | | 6.59 | % | | | 7.51 | % |

Angel Oak Multi-Strategy Income Fund, Class C without load | | | 5.87 | % | | | N/A | | | | N/A | | | | 1.66 | % |

Angel Oak Multi-Strategy Income Fund, Class C with load | | | 4.88 | % | | | N/A | | | | N/A | | | | 1.66 | % |

Bloomberg Barclays U.S. Aggregate Bond Index(3) | | | 1.45 | % | | | 2.59 | % | | | N/A | | | | 1.95 | %(4) |

(1) Return figures reflect any change in price per share and assume the reinvestment of all distributions. Total returns for Class A Shares, with load, include the maximum 2.25% sales charge. Total returns for Class C Shares, with load, include the maximum 1.00% deferred sales charge.

(2) Inception date is August 16, 2012 for Institutional Class Shares, June 28, 2011 for Class A Shares, and August 4, 2015 for Class C Shares.

(3) The Bloomberg Barclays U.S. Aggregate Bond Index measures the performance of the U.S. investment-grade, fixed-rate bond market, including government and credit securities, agency pass-through securities, asset-backed securities and commercial mortgage-backed securities. Performance figures include the change in value of the bonds in the index and the reinvestment of interest. The index return does not reflect expenses, which have been deducted from the Fund’s return. You cannot invest directly in an index; however, an individual can invest in exchange-traded funds or other investments vehicles that attempt to track the performance of a benchmark index.

(4) The return shown for the Bloomberg Barclays U.S. Aggregate Bond Index is from the inception date of the Institutional Class Shares. The Bloomberg Barclays U.S. Aggregate Bond Index return from the inception date of Class A Shares is 2.88% and 1.92% for Class C Shares, respectively.

7

Investment Results – (Unaudited) (continued)

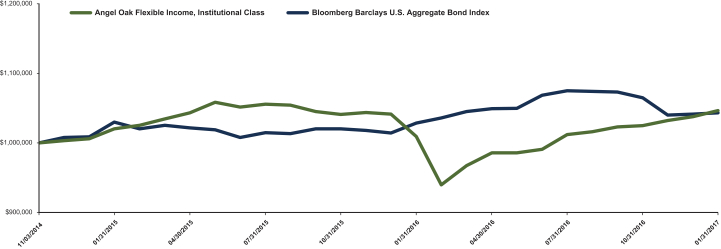

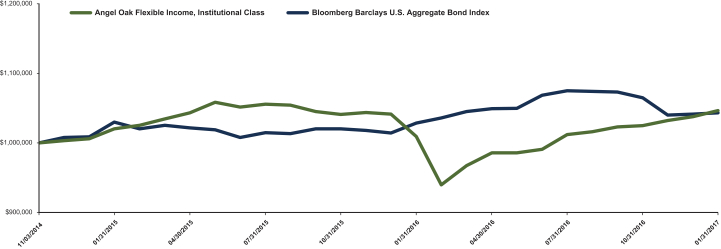

Angel Oak Flexible Income Fund

Total Return Based on a $1,000,000 Investment

The chart above assumes an initial investment of $1,000,000 made on November 3, 2014 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

Total Returns(1)

(For the year ended January 31, 2017)

| | | | | | | | |

| | | Average Annual Returns | |

| | | One Year | | | Since Inception(2) | |

Angel Oak Flexible Income Fund, Institutional Class | | | 3.69 | % | | | 2.03 | % |

Angel Oak Flexible Income Fund, Class A without load | | | 3.47 | % | | | 1.80 | % |

Angel Oak Flexible Income Fund, Class A with load | | | 1.14 | % | | | 0.77 | % |

Angel Oak Flexible Income Fund, Class C without load | | | 2.73 | % | | | -1.59 | % |

Angel Oak Flexible Income Fund, Class C with load | | | 1.75 | % | | | -1.59 | % |

Bloomberg Barclays U.S. Aggregate Bond Index(3) | | | 1.45 | % | | | 1.90 | %(4) |

(1) Return figures reflect any change in price per share and assume the reinvestment of all distributions. Total returns for Class A Shares, with load, include the maximum 2.25% sales charge. Total returns for Class C Shares, with load, include the maximum 1.00% deferred sales charge.

(2) Inception date is November 3, 2014 for Institutional Class and Class A Shares and August 4, 2015 for Class C Shares.

(3) The Bloomberg Barclays U.S. Aggregate Bond Index measures the performance of the U.S. investment-grade, fixed-rate bond market, including government and credit securities, agency pass-through securities, asset-backed securities and commercial mortgage-backed securities. Performance figures include the change in value of the bonds in the index and the reinvestment of interest. The index return does not reflect expenses, which have been deducted from the Fund’s return. You cannot invest directly in an index; however, an individual can invest in exchange-traded funds or other investments vehicles that attempt to track the performance of a benchmark index.

(4) The return shown for the Bloomberg Barclays U.S. Aggregate Bond Index is from the inception date of the Institutional Class and Class A Shares. The Bloomberg Barclays U.S. Aggregate Bond Index return from the inception date of the Class C Shares is 1.92%.

8

Investment Results – (Unaudited) (continued)

Angel Oak High Yield Opportunities Fund

Total Return Based on a $1,000,000 Investment

The Fund is the successor to the investment performance of the Rainier High Yield Fund (the “Predecessor High Yield Fund”) as a result of the reorganization of the Predecessor High Yield Fund into the Fund on April 15, 2016. Accordingly, the performance information shown in the chart above and table below for periods prior to April 15, 2016 is that of the Predecessor High Yield Fund’s Institutional Shares and Original Shares for the Fund’s Institutional Class and Class A shares, respectively. The Predecessor High Yield Fund was managed by the same portfolio managers as the Fund and had substantially the same investment objectives, policies, and strategies as the Fund.

The chart above assumes an initial investment of $1,000,000 made on March 31, 2009 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

Total Returns(1)

(For the period ended January 31, 2017)

| | | | | | | | | | | | | | | | |

| | | Average Annual Returns | |

| | | One Year | | | Three Year | | | Five Year | | | Since Inception(2) | |

Angel Oak High Yield Opportunities Fund, Institutional Class | | | 20.77 | % | | | 5.69 | % | | | 6.93 | % | | | 10.31 | % |

Angel Oak High Yield Opportunities Fund, Class A without load | | | 20.53 | % | | | 5.47 | % | | | N/A | | | | 6.25 | % |

Angel Oak High Yield Opportunities Fund, Class A with load | | | 17.84 | % | | | 4.67 | % | | | N/A | | | | 5.72 | % |

Bank of America Merrill Lynch U.S. High Yield Index(3) | | | 20.98 | % | | | 4.93 | % | | | 7.03 | % | | | 13.00 | %(4) |

(1) Return figures reflect any change in price per share and assume the reinvestment of all distributions. Total returns for Class A Shares, with load, include the maximum 2.25% sales charge.

(2) Institutional Class Shares commenced operations on March 31, 2009 and Class A Shares commenced operations on July 31, 2012.

(3) The Bank of America Merrill Lynch U.S. High Yield Index tracks the performance of below investment grade, but not in default, U.S. dollar denominated corporate bonds publicly issued in the U.S. domestic market, and includes issues with a credit rating of BBB or below, as rated by Moody’s and S&P. The index return does not reflect expenses, which have been deducted from the Fund’s return. You cannot invest directly in an index; however, an individual can invest in exchange-traded funds or other investments vehicles that attempt to track the performance of a benchmark index.

(4) The return shown for the Bank of America Merrill Lynch U.S. High Yield Index is from the inception date of the Institutional Class Shares.The Bank of America Merrill Lynch U.S. High Yield Index return from the inception date of Class A Shares is 6.43%.

9

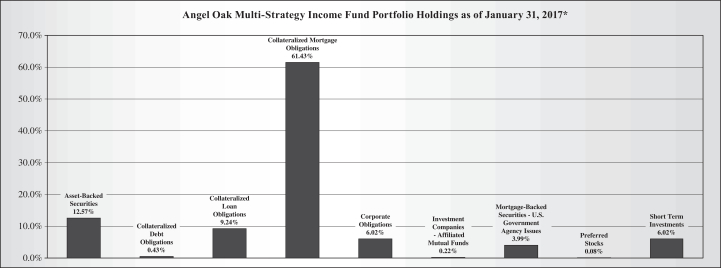

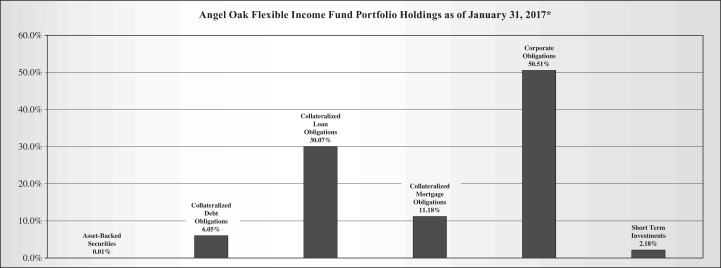

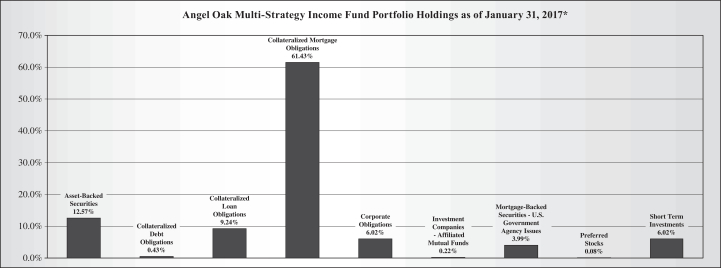

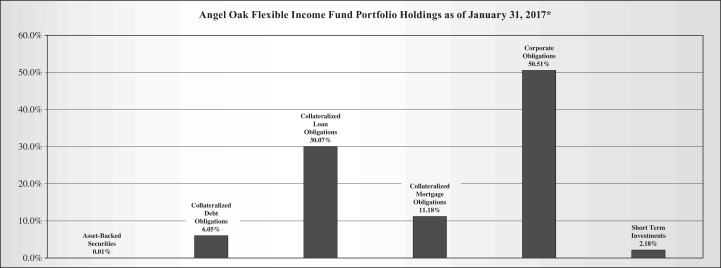

Portfolio Holdings – (Unaudited)

The investment objective of Angel Oak Multi-Strategy Income Fund is current income.

The investment objective of Angel Oak Flexible Income Fund is to seek current income with a secondary objective of total return.

The investment objective of Angel Oak High Yield Opportunities Fund is to earn a high level of current income with a secondary objective of capital appreciation.

* As a percentage of total investments.

10

Summary of Funds’ Expenses – (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other expenses of the Funds. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period, and held for the entire period from August 1, 2016 to January 31, 2017.

Actual Expenses

The first lines of the tables below provide information about actual account values and actual expenses. You may use the information in these lines, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the numbers in the first lines under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second lines of the tables below provide information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second lines of the tables below are useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if these transactoinal costs were included, your costs would have been higher.

| | | | | | | | | | |

| Angel Oak Multi-Strategy Income Fund | | Beginning

Account Value,

August 1, 2016 | | Ending

Account Value,

January 31, 2017 | | Expenses Paid

During Period(1) | | Annualized

Expense Ratio |

Class A | | Actual | | $1,000.00 | | $1,041.90 | | $6.93 | | 1.35% |

| | | Hypothetical(2) | | $1,000.00 | | $1,018.35 | | $6.85 | | 1.35% |

Class C | | Actual | | $1,000.00 | | $1,038.20 | | $10.76 | | 2.10% |

| | | Hypothetical(2) | | $1,000.00 | | $1,014.58 | | $10.63 | | 2.10% |

Institutional Class | | Actual | | $1,000.00 | | $1,043.70 | | $5.65 | | 1.10% |

| | | Hypothetical(2) | | $1,000.00 | | $1,019.61 | | $5.58 | | 1.10% |

| | | | | | | | | | |

| Angel Oak Flexible Income Fund | | Beginning

Account Value,

August 1, 2016 | | Ending

Account Value,

January 31, 2017 | | Expenses Paid

During Period(1) | | Annualized

Expense Ratio |

Class A | | Actual | | $1,000.00 | | $1,033.30 | | $5.37 | | 1.05% |

| | | Hypothetical(2) | | $1,000.00 | | $1,019.86 | | $5.33 | | 1.05% |

Class C | | Actual | | $1,000.00 | | $1,029.90 | | $9.08 | | 1.78% |

| | | Hypothetical(2) | | $1,000.00 | | $1,016.19 | | $9.02 | | 1.78% |

Institutional Class | | Actual | | $1,000.00 | | $1,034.10 | | $4.09 | | 0.80% |

| | | Hypothetical(2) | | $1,000.00 | | $1,021.11 | | $4.06 | | 0.80% |

(1) Expenses are equal to the Funds’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). The annualized expense ratios reflects fee waiver and expense limitation arrangements, including interest expense, in effect during the period. The “Financial Highlights” tables in the Funds’ financial statements, included in the report, also show the gross expense ratios, without such reimbursements.

(2) Hypothetical assumes 5% annual return before expenses.

11

| | | | | | | | | | |

| Angel Oak High Yield Opportunities Fund | | Beginning

Account Value,

August 1, 2016 | | Ending

Account Value,

January 31, 2017 | | Expenses Paid

During Period(1) | | Annualized

Expense Ratio |

Class A | | Actual | | $1,000.00 | | $1,072.60 | | $4.70 | | 0.90% |

| | | Hypothetical(2) | | $1,000.00 | | $1,020.67 | | $4.58 | | 0.90% |

Institutional Class | | Actual | | $1,000.00 | | $1,074.00 | | $3.40 | | 0.65% |

| | | Hypothetical(2) | | $1,000.00 | | $1,021.93 | | $3.31 | | 0.65% |

(1) Expenses are equal to the Funds’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The annualized expense ratios reflects fee waiver and expense limitation arrangements, including interest expense, in effect during the period. The “Financial Highlights” tables in the Funds’ financial statements, included in the report, also show the gross expense ratios, without such reimbursements.

(2) Hypothetical assumes 5% annual return before expenses.

12

Angel Oak Multi-Strategy Income Fund

Schedule of Investments

January 31, 2017

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Asset-Backed Securities – 13.19% | | | | | | | | |

ACE Securities Corp. Home Equity Loan Trust, Series 2006-HE2, Class A2C,

0.931%, 5/25/2036 (a) | | $ | 2,099,909 | | | $ | 2,055,983 | |

Ally Auto Receivables Trust, Series 2017-1, Class A1, 0.830%, 2/15/2018 | | | 5,000,000 | | | | 5,006,250 | |

Ally Auto Receivables Trust, Series 2014-SN2, Class A4, 1.210%, 2/20/2019 | | | 2,732,198 | | | | 2,739,230 | |

Ally Auto Receivables Trust, Series 2014-3, Class A3, 1.280%, 6/17/2019 | | | 1,400,617 | | | | 1,402,404 | |

Ally Auto Receivables Trust, Series 2017-1, Class A3, 1.700%, 6/15/2021 | | | 5,000,000 | | | | 5,006,250 | |

American Express Credit Account Master Trust, Series 2015-1, Class A, 1.058%, 1/15/2020 (a) | | | 9,500,000 | | | | 9,515,704 | |

American Express Credit Account Master Trust, Series 2008-2, Class A, 1.798%, 9/15/2020 (a) | | | 6,550,000 | | | | 6,630,585 | |

AmeriCredit Automobile Receivables Trust, Series 2013-2, Class D, 2.420%, 5/8/2019 | | | 10,000,000 | | | | 10,056,410 | |

AMSR Trust, Series 2016-SFR1, Class A, 2.168%, 11/17/2033 (a)(b) | | | 7,000,000 | | | | 7,074,543 | |

Barclays Dryrock Issuance Trust, Series 2014-2, Class A, 1.108%, 3/16/2020 (a) | | | 10,826,000 | | | | 10,856,107 | |

Bear Stearns Asset Backed Securities Trust, Series 2007-SD3, Class A, 1.021%, 5/25/2037 (a) | | | 80,570 | | | | 70,877 | |

BMW Vehicle Lease Trust, Series 2015-1, Class A4, 1.340%, 6/20/2018 | | | 500,000 | | | | 500,768 | |

BMW Vehicle Lease Trust, Series 2015-2, Class A4, 1.550%, 2/20/2019 | | | 11,340,000 | | | | 11,351,683 | |

BMW Vehicle Lease Trust, Series 2016-2, Class A3, 1.430%, 9/20/2019 | | | 10,000,000 | | | | 9,996,310 | |

Business Loan Express Business Loan Trust, Series 2007-AA, Class A, 1.177%, 10/20/2040 (a)(b) | | | 7,513,700 | | | | 6,085,563 | |

Cajun Global LLC, Series 2011-1A, Class A2, 5.955%, 2/20/2041 (b) | | | 6,168,409 | | | | 6,174,466 | |

Capital One Multi-Asset Execution Trust, Series 2015-A1, Class A1, 1.390%, 1/15/2021 | | | 5,000,000 | | | | 5,002,900 | |

CarMax Auto Owner Trust, Series 2017-1, Class A1, 0.950%, 2/15/2018 (a) | | | 9,000,000 | | | | 8,998,335 | |

CarMax Auto Owner Trust, Series 2015-3, Class A2B, 1.154%, 11/15/2018 (a) | | | 939,823 | | | | 941,623 | |

CarMax Auto Owner Trust, Series 2016-1, Class A2B, 1.234%, 4/15/2019 (a) | | | 9,540,090 | | | | 9,566,821 | |

CarMax Auto Owner Trust, Series 2015-1, Class A3, 1.380%, 11/15/2019 | | | 3,797,023 | | | | 3,797,073 | |

CarMax Auto Owner Trust, Series 2017-1, Class A3, 1.980%, 11/15/2021 | | | 10,000,000 | | | | 9,974,070 | |

Carrington Mortgage Loan Trust, Series 2006-NC5, Class A5, 0.831%, 1/25/2037 (a) | | | 4,773,100 | | | | 3,941,602 | |

Carrington Mortgage Loan Trust, Series 2006-NC5, Class A2, 0.866%, 1/25/2037 (a) | | | 3,307,349 | | | | 2,794,372 | |

Chase Issuance Trust, Series 2015-A2, Class A2, 1.590%, 2/18/2020 | | | 8,673,000 | | | | 8,701,352 | |

Chase Issuance Trust, Series 2015-A7, Class A7, 1.620%, 7/15/2020 | | | 10,000,000 | | | | 10,026,870 | |

Chase Issuance Trust, Series 2017-A1, Class A, 1.080%, 1/18/2022 (a) | | | 17,500,000 | | | | 17,505,145 | |

Citibank Credit Card Issuance Trust, Series 2016-A3, Class A3, 1.170%, 12/7/2023 (a) | | | 10,000,000 | | | | 10,060,260 | |

Colony American Homes, Series 2015-1A, Class A, 1.968%, 7/17/2032 (a)(b) | | | 4,973,060 | | | | 4,990,366 | |

Credit-Based Asset Servicing and Securitization LLC, Series 2006-CB4, Class AV3, 0.906%, 5/25/2036 (a) | | | 19,934,909 | | | | 15,624,942 | |

Credit-Based Asset Servicing and Securitization LLC, Series 2007-CB1, Class AF1B, 3.871%, 1/25/2037 (a) | | | 7,587,276 | | | | 4,002,372 | |

Credit-Based Asset Servicing and Securitization LLC, Series 2007-CB1, Class AF4, 3.871%, 1/25/2037 (a) | | | 2,001,794 | | | | 1,052,203 | |

Credit-Based Asset Servicing and Securitization LLC, Series 2007-CB1, Class AF3, 3.871%, 1/25/2037 (a) | | | 10,008,969 | | | | 5,281,242 | |

Credit-Based Asset Servicing and Securitization LLC, Series 2007-CB1, Class AF2, 3.871%, 1/25/2037 (a) | | | 14,737,206 | | | | 7,775,512 | |

Credit-Based Asset Servicing and Securitization LLC, Series 2007-CB1, Class AF6, 3.871%, 1/25/2037 (a) | | | 12,015,632 | | | | 6,327,011 | |

Dell Equipment Finance Trust, Series 2015-1, Class A3, 1.300%, 3/23/2020 (b) | | | 7,970,758 | | | | 7,971,855 | |

Discover Card Execution Note Trust, Series 2016-A1, Class A1, 1.640%, 7/15/2021 | | | 3,650,000 | | | | 3,654,263 | |

Discover Card Execution Note Trust, Series 2017-A1, Class A1, 1.252%, 7/15/2024 (a) | | | 5,750,000 | | | | 5,785,972 | |

Drive Auto Receivables Trust, Series 2017-AA, Class A1, 0.970%, 2/15/2018 (b) | | | 8,000,000 | | | | 8,020,000 | |

Drive Auto Receivables Trust, Series 2016-CA, Class A2, 1.410%, 1/15/2019 (b) | | | 5,500,000 | | | | 5,508,657 | |

Drive Auto Receivables Trust, Series 2016-CA, Class A3, 1.670%, 11/15/2019 (b) | | | 4,000,000 | | | | 3,994,112 | |

Enterprise Fleet Financing LLC, Series 2017-1, Class A2, 2.130%, 7/20/2022 (b) | | | 1,500,000 | | | | 1,504,023 | |

See accompanying notes which are an integral part of these financial statements.

13

Angel Oak Multi-Strategy Income Fund

Schedule of Investments – (continued)

January 31, 2017

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Asset-Backed Securities – (continued) | | | | | | | | |

Exeter Automobile Receivables Trust, Series 2015-2A, Class A, 1.540%, 11/15/2019 (b) | | $ | 3,091,640 | | | $ | 3,099,307 | |

Fieldstone Mortgage Investment Trust, Series 2007-1, Class 2A3, 1.096%, 4/25/2047 (a) | | | 13,591,183 | | | | 9,990,933 | |

Fifth Third Auto Trust, Series 2015-1, Class A3, 1.420%, 3/16/2020 | | | 6,982,000 | | | | 7,000,055 | |

Flagship Credit Auto Trust, Series 2017-1, Class A, 1.930%, 12/15/2021 (b) | | | 5,000,000 | | | | 5,014,855 | |

Ford Credit Auto Lease Trust, Series 2015-A, Class A3, 1.130%, 6/15/2018 | | | 6,401,030 | | | | 6,408,493 | |

Ford Credit Auto Owner Trust, Series 2017-A, Class A1, 0.840%, 2/15/2018 | | | 9,000,000 | | | | 9,005,724 | |

Ford Credit Auto Owner Trust, Series 2017-A, Class A4, 1.920%, 4/15/2022 | | | 5,000,000 | | | | 5,007,815 | |

GM Financial Automobile Leasing Trust, Series 2015-3, Class A4, 1.810%, 11/20/2019 | | | 5,210,000 | | | | 5,235,831 | |

GSAA Home Equity Trust, Series 2005-14, Class 2A2, 1.006%, 12/25/2035 (a) | | | 1,290,530 | | | | 991,069 | |

GSAA Home Equity Trust, Series 2005-14, Class 2A3, 1.106%, 12/25/2035 (a) | | | 553,490 | | | | 499,295 | |

GSAA Home Equity Trust, Series 2006-1, Class A1, 0.846%, 1/25/2036 (a) | | | 1,681,924 | | | | 984,069 | |

GSAA Home Equity Trust, Series 2005-15, Class 2A2, 1.021%, 1/25/2036 (a) | | | 4,198,805 | | | | 2,820,023 | |

GSAA Home Equity Trust, Series 2006-10, Class AF2, 5.825%, 6/25/2036 (a) | | | 3,609,630 | | | | 1,982,405 | |

GSAA Home Equity Trust, Series 2007-1, Class 1A2, 0.941%, 2/25/2037 (a) | | | 3,065,150 | | | | 1,681,063 | |

GSAA Home Equity Trust, Series 2007-2, Class AF4A, 5.983%, 3/25/2037 (a) | | | 2,979,236 | | | | 1,541,671 | |

GSAA Home Equity Trust, Series 2006-20, Class 1A2, 0.951%, 12/25/2046 (a) | | | 18,080,971 | | | | 9,984,077 | |

GSAA Home Equity Trust, Series 2007-5, Class 1F4A, 6.032%, 3/25/2047 (a) | | | 7,631,263 | | | | 5,104,354 | |

HOA Funding LLC, Series 2014-1A, Class A2, 4.846%, 8/20/2044 (b) | | | 9,550,000 | | | | 8,722,111 | |

HOA Funding LLC, Series 2015-1A, Class B, 9.000%, 8/20/2044 (b) | | | 1,000,000 | | | | 962,980 | |

Huntington Auto Trust, Series 2016-1, Class A1, 0.850%, 12/15/2017 | | | 10,292,932 | | | | 10,313,610 | |

Huntington Auto Trust, Series 2016-1, Class A2, 1.290%, 5/15/2019 | | | 5,500,000 | | | | 5,504,010 | |

Hyundai Auto Lease Securitization Trust, Series 2017-A, Class A1, 0.820%, 1/16/2018 (b) | | | 4,500,000 | | | | 4,505,625 | |

Hyundai Auto Lease Securitization Trust, Series 2017-A, Class A2A, 1.560%, 7/15/2019 (b) | | | 5,000,000 | | | | 5,006,380 | |

Hyundai Auto Lease Securitization Trust, Series 2016-C, Class A3, 1.490%, 2/18/2020 (b) | | | 5,000,000 | | | | 4,992,390 | |

Hyundai Auto Lease Securitization Trust, Series 2017-A, Class A4, 2.130%, 4/15/2021 (b) | �� | | 8,000,000 | | | | 8,024,360 | |

Hyundai Auto Receivables Trust, Series 2015-B, Class A3, 1.120%, 11/15/2019 | | | 3,972,661 | | | | 3,968,410 | |

JGWPT XXVII LLC, Series 2012-3A, Class B, 6.170%, 9/15/2067 (b) | | | 986,788 | | | | 1,153,650 | |

JGWPT XXXII LLC, Series 2014-2A, Class A, 3.610%, 1/17/2073 (b) | | | 5,306,895 | | | | 5,175,948 | |

JGWPT XXXIII LLC, Series 2014-3A, Class A, 3.500%, 6/15/2077 (b) | | | 8,938,773 | | | | 8,641,281 | |

Lehman XS Trust, Series 2007-9, Class WFIO, 0.550%, 4/25/2037 (a)(c) | | | 48,604,339 | | | | 840,952 | |

MASTR Asset Backed Securities Trust, Series 2005-NC2, Class A3, 1.256%, 11/25/2035 (a) | | | 24,683,823 | | | | 16,916,120 | |

Mercedes-Benz Auto Receivables Trust, Series 2014-1, Class A4, 1.310%, 11/16/2020 | | | 3,560,000 | | | | 3,568,355 | |

Morgan Stanley Mortgage Loan Trust, Series 2007-1XS, Class 2A2, 5.826%, 9/25/2046 (a) | | | 16,437,282 | | | | 9,415,242 | |

Morgan Stanley Mortgage Loan Trust, Series 2007-1XS, Class 2A6, 5.858%, 9/25/2046 (a) | | | 6,339,671 | | | | 3,693,721 | |

Morgan Stanley Mortgage Loan Trust, Series 2007-1XS, Class 2A3, 5.919%, 9/25/2046 (a) | | | 15,768,489 | | | | 8,672,858 | |

Morgan Stanley Mortgage Loan Trust, Series 2007-3XS, Class 2A3S, 5.858%, 1/25/2047 (a) | | | 2,380,529 | | | | 1,487,071 | |

Morgan Stanley Mortgage Loan Trust, Series 2007-3XS, Class 2A4S, 5.963%, 1/25/2047 (a) | | | 9,603,239 | | | | 7,018,479 | |

Morgan Stanley Mortgage Loan Trust, Series 2007-10XS, Class A2, 6.250%, 7/25/2047 (a) | | | 2,281,575 | | | | 1,661,856 | |

Nissan Auto Lease Trust, Series 2016-A, Class A4, 1.650%, 10/15/2021 | | | 9,750,000 | | | | 9,768,535 | |

Nissan Auto Receivables Owner Trust, Series 2013-C, Class A3, 0.670%, 8/15/2018 | | | 107,590 | | | | 107,623 | |

Option One Mortgage Loan Trust, Series 2007-3, Class 2A3, 0.996%, 4/25/2037 (a) | | | 3,826,161 | | | | 2,417,965 | |

Ownit Mortgage Loan Trust, Series 2006-1, Class AF2, 3.563%, 10/25/2035 (a) | | | 12,222,569 | | | | 7,907,147 | |

Pretium Mortgage Credit Partners LLC, Series 2016-NPL3, Class A1, 4.375%, 5/27/2031 (b) | | | 7,013,940 | | | | 7,065,983 | |

Progress Residential Trust, Series 2016-SFR1, Class A, 2.268%, 9/17/2033 (a)(b) | | | 5,926,077 | | | | 5,987,548 | |

Residential Asset Mortgage Products, Inc. Trust, Series 2007-RS2, Class A2,

1.036%, 5/25/2037 (a) | | | 6,552,625 | | | | 6,208,291 | |

SolarCity LMC II LLC, Series 2014-1, Class A, 4.590%, 4/20/2044 (b) | | | 1,939,080 | | | | 1,934,453 | |

Soundview Home Loan Trust, Series 2007-OPT1, Class X, 0.049%, 6/25/2037 (a)(c) | | | 563,841,424 | | | | 1,800,910 | |

Stone Street Receivables Funding, LLC, Series 2015-1A, Class C, 5.600%, 12/15/2054 (b) | | | 1,227,000 | | | | 1,110,786 | |

See accompanying notes which are an integral part of these financial statements.

14

Angel Oak Multi-Strategy Income Fund

Schedule of Investments – (continued)

January 31, 2017

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Asset-Backed Securities – (continued) | | | | | | | | |

STORE Master Funding, LLC, Series 2012-1A, Class A, 5.770%, 8/20/2042 (b) | | $ | 6,120,998 | | | $ | 6,449,702 | |

Toyota Auto Receivables Owner Trust, Series 2014-A, Class A4, 1.180%, 6/17/2019 | | | 1,200,000 | | | | 1,202,580 | |

VOLT L LLC, Series 2016-NPL10, Class A1, 3.500%, 9/25/2046 (b) | | | 10,389,513 | | | | 10,464,266 | |

VOLT LII LLC, Series 2016-NPL12, Class A1, 3.625%, 11/26/2046 (b) | | | 9,767,534 | | | | 9,790,791 | |

VOLT LIII LLC, Series 2016-NP13, Class A1, 3.875%, 12/26/2046 (a)(b) | | | 9,931,857 | | | | 10,033,331 | |

VOLT XLIV LLC, Series 2016-NPL4, Class A1, 4.250%, 4/25/2046 (b) | | | 4,013,108 | | | | 4,072,916 | |

VOLT XLV LLC, Series 2016-NPL5, Class A1, 4.000%, 5/25/2046 (b) | | | 2,500,634 | | | | 2,529,083 | |

VOLT XLVII LLC, Series 2016-NPL7, Class A1, 3.750%, 6/25/2046 (a)(b) | | | 8,256,413 | | | | 8,319,682 | |

VOLT XLVIII LLC, Series 2016-NPL8, Class A1, 3.500%, 7/25/2046 (a)(b) | | | 13,058,298 | | | | 13,143,229 | |

VOLT XXII LLC, Series 2015-NPL4, Class A1, 3.500%, 2/25/2055 (b) | | | 192,127 | | | | 192,487 | |

VOLT XXV LLC, Series 2015-NPL8, Class A1, 3.500%, 6/26/2045 (a)(b) | | | 7,473,325 | | | | 7,487,322 | |

VOLT XXXI LLC, Series 2015-NPL2, Class A1, 3.375%, 2/25/2055 (b) | | | 323,003 | | | | 323,772 | |

VOLT XXXIII LLC, Series 2015-NPL5, Class A1, 3.500%, 3/25/2055 (a)(b) | | | 955,774 | | | | 957,571 | |

VOLT XXXIV LLC, Series 2015-NPL7, Class A1, 3.250%, 2/25/2055 (a)(b) | | | 2,147,222 | | | | 2,149,861 | |

VOLT XXXIX LLC, Series 2015-NPL13, Class A1, 4.125%, 10/25/2045 (b) | | | 784,729 | | | | 789,860 | |

VOLT XXXV LLC, Series 2016-NPL9, Class A1, 3.500%, 9/25/2046 (b) | | | 9,504,814 | | | | 9,485,675 | |

| | | | | | | | |

| | |

TOTAL ASSET-BACKED SECURITIES –

(Cost $611,653,504) | | | | | | | 595,623,903 | |

| | | | | | | | |

Collateralized Debt Obligations – 0.45% | | | | | | | | |

Financial Institution Note Securitization Ltd., Series 2015-1A, Class A, 5.000%, 7/30/2026 (b)(j) | | | 3,000,000 | | | | 3,000,000 | |

Financial Institution Note Securitization Ltd., Series 2015-1A, Class C, 7.000%, 7/30/2026 (b)(j) | | | 6,275,000 | | | | 6,306,375 | |

Financial Institution Note Securitization Ltd., Series 2015-1, 11.660%, 7/30/2026

(Acquired 10/20/2015, Cost $11,231,000) (a)(b)(d)(j) | | | 11,231,000 | | | | 11,174,845 | |

| | | | | | | | |

| | |

TOTAL COLLATERALIZED DEBT OBLIGATIONS –

(Cost $20,506,000) | | | | | | | 20,481,220 | |

| | | | | | | | |

Collateralized Loan Obligations – 9.70% | | | | | | | | |

ACAS CLO Ltd., Series 2012-1A, Class DR, 5.247%, 9/20/2023 (a)(b) | | | 3,000,000 | | | | 3,003,132 | |

ALM XVI Ltd., Series 2015-16A, Class D, 6.373%, 7/15/2027 (a)(b) | | | 1,250,000 | | | | 1,237,560 | |

Apidos CLO X, Series 2012-10A, Class E, 7.289%, 10/30/2022 (a)(b) | | | 4,000,000 | | | | 4,000,228 | |

Apidos CLO XI, Series 2012-11A, Class DR, 4.934%, 10/17/2028 (a)(b) | | | 3,950,000 | | | | 3,887,124 | |

Apidos CLO XIV, Series 2013-14A, Class E, 5.423%, 4/15/2025 (a)(b) | | | 3,000,000 | | | | 2,869,449 | |

Ares XLI CLO Ltd., Series 2016-41A, Class D, 5.089%, 1/15/2029 (a)(b) | | | 3,000,000 | | | | 2,999,808 | |

Ares XXVII CLO Ltd., Series 2013-2A, Class E, 5.889%, 7/28/2025 (a)(b) | | | 5,500,000 | | | | 5,388,834 | |

Ares XXXIII CLO Ltd., Series 2015-1A, Class CR, 5.163%, 12/5/2025 (a)(b) | | | 8,000,000 | | | | 8,094,608 | |

Arrowpoint CLO Ltd., Series 2014-3A, Class D, 6.123%, 10/15/2026 (a)(b)(e) | | | 11,000,000 | | | | 11,028,809 | |

BlueMountain CLO Ltd., Series 2012-2A, Class DR, 5.034%, 11/20/2028 (a)(b) | | | 10,000,000 | | | | 10,200,000 | |

Bristol Park CLO Ltd., Series 2016-1A, Class D, 4.984%, 4/15/2029 (a)(b) | | | 8,000,000 | | | | 7,999,376 | |

Carlyle Global Market Strategies CLO Ltd., Series 2013-2A, Class E, 6.024%, 4/18/2025 (a)(b) | | | 4,750,000 | | | | 4,757,310 | |

Carlyle Global Market Strategies CLO Ltd., Series 2016-3A, Class D, 7.788%,

10/20/2029 (a)(b) | | | 500,000 | | | | 500,000 | |

Catamaran CLO Ltd., Series 2012-1A, Class D, 5.357%, 12/20/2023 (a)(b) | | | 13,750,000 | | | | 13,767,820 | |

Cathedral Lake CLO Ltd., Series 2015-3A, Class D, 6.382%, 1/15/2026 (a)(b) | | | 5,000,000 | | | | 5,018,185 | |

CIFC Funding Ltd., Series 2012-2A, Class B3L, 7.942%, 12/5/2024 (a)(b) | | | 2,000,000 | | | | 1,911,330 | |

CIFC Funding Ltd., Series 2012-3A, Class B2L, 6.887%, 1/29/2025 (a)(b)(e) | | | 9,750,000 | | | | 9,759,028 | |

CIFC Funding Ltd., Series 2012-3A, Class B3L, 7.787%, 1/29/2025 (a)(b) | | | 1,000,000 | | | | 952,284 | |

Crown Point CLO Ltd., Series 2012-1A, Class B1L, 5.911%, 11/21/2022 (a)(b)(e) | | | 5,000,000 | | | | 5,003,275 | |

Crown Point CLO Ltd., Series 2012-1A, Class B2L, 7.411%, 11/21/2022

(Acquired 01/28/2014 through 12/17/2015, Cost $5,194,369) (a)(b)(d) | | | 5,250,000 | | | | 5,259,072 | |

See accompanying notes which are an integral part of these financial statements.

15

Angel Oak Multi-Strategy Income Fund

Schedule of Investments – (continued)

January 31, 2017

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Collateralized Loan Obligations – (continued) | | | | | | | | |

Doral CLO I Ltd., Series 2012-3A, Class C, 5.493%, 12/19/2022 (a)(b)(e) | | $ | 13,000,000 | | | $ | 13,016,835 | |

Dryden XXXVI Senior Loan Fund, Series 2014-36A, Class DR, 5.287%, 1/15/2028 (a)(b) | | | 3,000,000 | | | | 3,028,893 | |

Fortress Credit BSL II Ltd., Series 2013-2A, Class D, 4.875%, 10/19/2025 (a)(b) | | | 7,750,000 | | | | 7,830,274 | |

Fortress Credit Opportunities VII CLO Ltd., Series 2016-7A, Class D, 6.564%, 12/15/2028 (a)(b) | | | 4,000,000 | | | | 4,048,792 | |

Highbridge Loan Management Ltd., Series 2012-1A, Class DR, 6.747%, 9/20/2022 (a)(b) | | | 4,500,000 | | | | 4,503,708 | |

JFIN CLO Ltd., Series 2015-2A, Class D, 5.423%, 10/19/2026 (a)(b) | | | 10,000,000 | | | | 10,038,110 | |

JFIN CLO Ltd., Series 2015-2A, Class E, 7.880%, 10/19/2026

(Acquired 01/05/2017, Cost $1,468,493) (a)(b)(d) | | | 1,500,000 | | | | 1,462,453 | |

JFIN Revolver CLO Ltd., Series 2013-1A, Class D, 4.780%, 1/20/2021 (a)(b) | | | 11,010,000 | | | | 11,078,691 | |

JFIN Revolver CLO Ltd., Series 2014-2A, Class C, 3.661%, 2/20/2022 (a)(b) | | | 4,000,000 | | | | 4,009,620 | |

JFIN Revolver CLO Ltd., Series 2014-2A, Class D, 3.661%, 2/20/2022 (a)(b) | | | 5,000,000 | | | | 4,899,735 | |

JFIN Revolver CLO Ltd., Series 2015-3A, Class C, 3.270%, 4/20/2023 (a)(b)(e) | | | 14,000,000 | | | | 13,889,722 | |

JFIN Revolver CLO Ltd., Series 2015-3A, Class D, 4.330%, 4/20/2023 (a)(b)(e) | | | 11,000,000 | | | | 10,985,876 | |

JMP Credit Advisors CLO II Ltd., Series 2013-1A, Class D, 4.873%, 4/30/2023 (a)(b) | | | 4,000,000 | | | | 3,999,916 | |

JMP Credit Advisors CLO III Ltd., Series 2014-1A, Class D, 6.123%, 10/17/2025 (a)(b) | | | 18,600,000 | | | | 18,879,930 | |

JMP Credit Advisors CLO III Ltd., Series 2014-1A, Class E, 8.373%, 10/17/2025

(Acquired 09/02/2014, Cost $7,610,791) (a)(b)(d) | | | 7,650,000 | | | | 7,668,000 | |

KCAP Senior Funding I LLC, Series 2013-1A, Class D, 6.280%, 7/20/2024 (a)(b) | | | 4,500,000 | | | | 4,483,566 | |

LCM XIII LP, Series 13A, Class DR, 4.928%, 7/19/2027 (a)(b) | | | 3,500,000 | | | | 3,499,926 | |

LCM XIV LP, Series 14A, Class D, 4.523%, 7/15/2025 (a)(b) | | | 3,325,000 | | | | 3,326,636 | |

Madison Park Funding Ltd., Series 2012-9A, Class E, 6.156%, 8/15/2022 (a)(b) | | | 2,000,000 | | | | 2,000,386 | |

Madison Park Funding XV Ltd., Series 2014-15A, Class D, 6.487%, 1/27/2026 (a)(b) | | | 5,000,000 | | | | 4,986,565 | |

Monroe Capital BSL CLO Ltd., Series 2015-1A, Class D, 4.866%, 5/22/2027 (a)(b) | | | 3,500,000 | | | | 3,421,870 | |

Muir Woods CLO Ltd., Series 2012-1A, Class D, 5.959%, 9/14/2023 (a)(b) | | | 3,500,000 | | | | 3,505,856 | |

NewStar Clarendon Fund CLO LLC, Series 2014-1A, Class D, 5.388%, 1/25/2027 (a)(b) | | | 7,465,000 | | | | 7,082,113 | |

OFSI Fund VII Ltd., Series 2014-7A, Class D, 6.024%, 10/18/2026 (a)(b)(e) | | | 10,600,000 | | | | 10,621,582 | |

OFSI Fund VII Ltd., Series 2014-7A, Class E, 8.274%, 10/18/2026

(Acquired 08/05/2014, Cost $7,000,000) (a)(b)(d) | | | 7,000,000 | | | | 7,002,975 | |

OZLM Funding II Ltd., Series 2012-2A, Class DR, 8.187%, 10/30/2027 (a)(b) | | | 4,300,000 | | | | 4,335,613 | |

OZLM VII Ltd., Series 2014-7A, Class D, 6.023%, 7/17/2026 (a)(b) | | | 3,000,000 | | | | 2,858,265 | |

Saranac CLO I Ltd., Series 2013-1A, Class D, 4.582%, 10/26/2024 (a)(b) | | | 4,000,000 | | | | 3,876,664 | |

Saratoga Investment Corp. Ltd., Series 2013-1A, Class BR, 3.417%, 10/20/2025 (a)(b) | | | 19,284,000 | | | | 19,511,378 | |

Saratoga Investment Corp. Ltd., Series 2013-1A, Class DR, 5.583%, 10/20/2025 (a)(b) | | | 14,000,000 | | | | 14,085,036 | |

Saratoga Investment Corp. Ltd., Series 2013-1A, Class ER, 7.533%, 10/20/2025

(Acquired 11/07/2016, Cost $13,100,000) (a)(b)(d) | | | 13,100,000 | | | | 13,099,411 | |

Sound Harbor Loan Fund Ltd., Series 2014-1A, Class C, 5.799%, 10/30/2026 (a)(b)(e) | | | 28,400,000 | | | | 28,461,514 | |

Sound Point CLO II Ltd., Series 2013-1A, Class B2L, 5.532%, 4/26/2025 (a)(b) | | | 5,000,000 | | | | 4,730,280 | |

Steele Creek CLO Ltd., Series 2014-1A, Class E2R, 7.687%, 8/21/2026

(Acquired 01/30/2017, Cost $6,250,000) (a)(b)(d) | | | 6,250,000 | | | | 6,250,000 | |

Steele Creek CLO Ltd., Series 2014-1A, Class E2, 7.861%, 8/21/2026

(Acquired 07/18/2014, Cost $1,985,855) (a)(b)(d) | | | 2,000,000 | | | | 2,000,776 | |

Steele Creek CLO Ltd., Series 2014-1X, Class E2, 7.861%, 8/21/2026

(Acquired 02/05/2015, Cost $490,420) (a)(d)(f) | | | 500,000 | | | | 500,194 | |

Symphony CLO VIII Ltd., Series 2012-8A, Class DR, 5.060%, 1/9/2023 (a)(b) | | | 1,950,000 | | | | 1,952,720 | |

Symphony CLO XII Ltd., Series 2013-12A, Class E, 5.923%, 10/15/2025 (a)(b) | | | 2,000,000 | | | | 1,970,982 | |

Symphony CLO XVIII Ltd., Series 2016-18A, Class D, 4.906%, 1/23/2028 (a)(b) | | | 5,000,000 | | | | 4,999,120 | |

Symphony CLO XVIII Ltd., Series 2016-18A, Class E, 7.296%, 1/23/2028 (a)(b) | | | 5,000,000 | | | | 4,854,845 | |

TCP Waterman CLO LLC, Series 2016-1A, Class B, 4.366%, 12/15/2028 (a)(b) | | | 3,000,000 | | | | 2,947,878 | |

TICC CLO LLC, Series 2012-1A, Class D1, 6.575%, 8/25/2023 (a)(b) | | | 8,000,000 | | | | 8,120,792 | |

See accompanying notes which are an integral part of these financial statements.

16

Angel Oak Multi-Strategy Income Fund

Schedule of Investments – (continued)

January 31, 2017

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Collateralized Loan Obligations – (continued) | | | | | | | | |

Tralee CLO III Ltd., Series 2014-3A, Class D2R, 5.113%, 7/20/2026 (a)(b) | | $ | 6,000,000 | | | $ | 6,006,840 | |

Tralee CLO III Ltd., Series 2014-3A, Class E, 8.030%, 7/20/2026

(Acquired 12/30/2014 through 09/09/2015, Cost $5,477,867) (a)(b)(d)(e) | | | 5,540,000 | | | | 5,550,266 | |

Trinitas CLO III Ltd., Series 2015-3A, Class D1, 5.173%, 7/15/2027 (a)(b)(e) | | | 10,250,000 | | | | 10,080,506 | |

Trinitas CLO IV Ltd., Series 2016-4A, Class E, 9.654%, 4/18/2028

(Acquired 10/27/2016 through 12/15/2016, Cost $4,479,313) (a)(d)(b) | | | 4,500,000 | | | | 4,567,046 | |

Venture XI CLO Ltd., Series 2012-11A, Class CR, 3.852%, 11/14/2022 (a)(b) | | | 2,000,000 | | | | 2,020,218 | |

Venture XXIII CLO Ltd., Series 2016-23A, Class E, 8.725%, 7/19/2028 (a)(b) | | | 3,250,000 | | | | 3,278,912 | |

Voya CLO Ltd., Series 2012-3A, Class ER, 6.880%, 10/15/2022 (a)(b) | | | 5,000,000 | | | | 5,005,375 | |

| | | | | | | | |

| | |

TOTAL COLLATERALIZED LOAN OBLIGATIONS –

(Cost $430,233,562) | | | | | | | 437,973,893 | |

| | | | | | | | |

Collateralized Mortgage Obligations – 64.44% | | | | | | | | |

Adjustable Rate Mortgage Trust, Series 2005-3, Class 7A1, 2.936%, 7/25/2035 (a) | | | 1,233,671 | | | | 1,165,150 | |

Adjustable Rate Mortgage Trust, Series 2005-8, Class 3A1, 3.160%, 11/25/2035 (a) | | | 11,461,769 | | | | 10,080,466 | |

Adjustable Rate Mortgage Trust, Series 2005-8, Class 3A21, 3.160%, 11/25/2035 (a) | | | 7,949,913 | | | | 6,862,635 | |

Adjustable Rate Mortgage Trust, Series 2005-10, Class 3A12, 3.124%, 1/25/2036 (a) | | | 1,464 | | | | 26 | |

Adjustable Rate Mortgage Trust, Series 2005-12, Class 2A1, 3.400%, 3/25/2036 (a) | | | 783,707 | | | | 618,841 | |

Adjustable Rate Mortgage Trust, Series 2006-1, Class 2A1, 4.225%, 3/25/2036 (a) | | | 566,606 | | | | 439,134 | |

Adjustable Rate Mortgage Trust, Series 2006-3, Class 4A2, 0.891%, 8/25/2036 (a) | | | 22,304,490 | | | | 14,026,468 | |

Adjustable Rate Mortgage Trust, Series 2006-3, Class 4A11, 0.951%, 8/25/2036 (a) | | | 727,123 | | | | 516,107 | |

Adjustable Rate Mortgage Trust, Series 2007-1, Class 5A1, 0.906%, 3/25/2037 (a) | | | 1,967,655 | | | | 1,607,578 | |

Adjustable Rate Mortgage Trust, Series 2007-1, Class 5A22, 0.986%, 3/25/2037 (a) | | | 5,701,776 | | | | 3,863,118 | |

Adjustable Rate Mortgage Trust, Series 2007-1, Class 3A22, 3.589%, 3/25/2037 (a) | | | 1,224,116 | | | | 1,045,092 | |

Adjustable Rate Mortgage Trust, Series 2007-2, Class 1A21, 4.890%, 6/25/2037 (a) | | | 5,576,071 | | | | 5,008,600 | |

American Home Mortgage Assets Trust, Series 2007-3, Class 3A1, 1.471%, 9/25/2027 (a) | | | 332,889 | | | | 311,697 | |

American Home Mortgage Assets Trust, Series 2006-1, Class XC, 2.387%, 5/25/2046 (a)(c) | | | 50,219,524 | | | | 5,193,352 | |

American Home Mortgage Assets Trust, Series 2006-2, Class 1A1, 1.556%, 9/25/2046 (a) | | | 1,829,511 | | | | 1,275,407 | |

American Home Mortgage Assets Trust, Series 2006-4, Class 1A12, 0.966%, 10/25/2046 (a) | | | 18,106,734 | | | | 12,113,006 | |

American Home Mortgage Assets Trust, Series 2007-1, Class A1, 1.296%, 2/25/2047 (a)(e) | | | 58,948,897 | | | | 35,777,442 | |

American Home Mortgage Assets Trust, Series 2007-5, Class XP, 2.864%, 6/25/2047 (a)(c) | | | 46,972,907 | | | | 5,340,162 | |

American Home Mortgage Investment Trust, Series 2005-2, Class 1A1, 1.071%, 9/25/2045 (a) | | | 17,193,647 | | | | 14,638,035 | |

American Home Mortgage Investment Trust, Series 2005-2, Class 2A1, 2.341%, 9/25/2045 (a) | | | 1,116,450 | | | | 1,005,877 | |

American Home Mortgage Investment Trust, Series 2005-4, Class 3A1, 1.056%, 11/25/2045 (a) | | | 14,331,911 | | | | 11,493,218 | |

American Home Mortgage Investment Trust, Series 2006-3, Class 11A1, 0.951%, 12/25/2046 (a) | | | 3,999,769 | | | | 3,368,174 | |

American Home Mortgage Investment Trust, Series 2007-1, Class Ga1A, 0.931%, 5/25/2047 (a) | | | 21,934,069 | | | | 17,401,766 | |

American Home Mortgage Investment Trust, Series 2007-1, Class GA1C, 0.961%, 5/25/2047 (a) | | | 14,393,118 | | | | 9,090,679 | |

BAMLL Re-REMIC Trust, Series 2015-FR11, Class A705, 1.857%, 9/27/2044 (a)(b) | | | 5,000,000 | | | | 4,859,065 | |

Bank of America Alternative Loan Trust, Series 2005-6, Class 5A2, 5.500%, 7/25/2035 | | | 1,731,404 | | | | 1,471,367 | |

Bank of America Commercial Mortgage Trust, Series 2015-UBS7, Class D, 3.167%, 9/15/2048 | | | 4,000,000 | | | | 3,216,320 | |

Bank of America Commercial Mortgage Trust, Series 2016-UB10, Class C, 4.913%, 7/15/2049 (a) | | | 8,000,000 | | | | 8,489,728 | |

Bank of America Commercial Mortgage Trust, Series 2007-5, Class AJ, 5.981%, 2/10/2051 (a) | | | 5,000,000 | | | | 4,648,245 | |

Bank of America Funding Trust, Series 2005-F, Class 4A1, 3.191%, 9/20/2035 (a) | | | 2,474,265 | | | | 2,124,755 | |

Bank of America Funding Trust, Series 2005-H, Class 1A1, 3.277%, 11/20/2035 (a) | | | 420,905 | | | | 368,664 | |

Bank of America Funding Trust, Series 2007-C, Class 1A3, 3.096%, 5/20/2036 (a) | | | 16,915 | | | | 16,041 | |

Bank of America Funding Trust, Series 2007-C, Class 4A3, 3.109%, 5/20/2036 (a) | | | 17,672,018 | | | | 17,403,456 | |

Bank of America Funding Trust, Series 2007-C, Class 4A2, 3.109%, 5/20/2036 (a) | | | 2,973,831 | | | | 2,902,955 | |

Bank of America Funding Trust, Series 2006-5, Class 1A4, 6.000%, 9/25/2036 | | | 7,500,997 | | | | 6,516,529 | |

See accompanying notes which are an integral part of these financial statements.

17

Angel Oak Multi-Strategy Income Fund

Schedule of Investments – (continued)

January 31, 2017

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Collateralized Mortgage Obligations – (continued) | | | | | | | | |

Bank of America Funding Trust, Series 2006-H, Class 6A1, 0.967%, 10/20/2036 (a) | | $ | 19,421,926 | | | $ | 16,846,695 | |

Bank of America Funding Trust, Series 2006-I, Class 2A2, 2.876%, 12/20/2036 (a) | | | 15,519 | | | | 14,942 | |

Bank of America Funding Trust, Series 2007-3, Class TA4, 1.186%, 4/25/2037 (a) | | | 4,898,685 | | | | 3,440,478 | |

Bank of America Funding Trust, Series 2007-D, Class 3A3, 3.077%, 6/20/2037 (a) | | | 3,511,610 | | | | 3,368,526 | |

Bank of America Funding Trust, Series 2007-D, Class 3A1, 3.233%, 6/20/2037 (a) | | | 454,722 | | | | 431,434 | |

Bank of America Funding Trust, Series 2007-A, Class 2A5, 1.007%, 2/20/2047 (a) | | | 4,102,985 | | | | 3,596,709 | |

Bank of America Mortgage Trust, Series 2005-I, Class 4A1, 3.121%, 10/25/2035 (a) | | | 3,462,335 | | | | 3,358,787 | |

Bank of America Mortgage Trust, Series 2005-K, Class 2A1, 3.498%, 12/25/2035 (a) | | | 422,680 | | | | 398,109 | |

BBCMS Trust, Series 2014-BXO, Class E, 4.517%, 8/15/2027 (a)(b) | | | 8,000,000 | | | | 7,961,472 | |

BCAP LLC, Series 2013-RR1, Class 6A2, 3.306%, 5/26/2036 (a)(b) | | | 7,482,252 | | | | 5,284,018 | |

BCAP LLC Trust, Series 2013-RR7, Class 4A3, 3.702%, 12/27/2034 (a)(b) | | | 9,013,000 | | | | 8,943,050 | |

BCAP LLC Trust, Series 2014-RR1, Class 1A2, 3.044%, 3/26/2035 (a)(b) | | | 3,693,643 | | | | 3,446,162 | |

BCAP LLC Trust, Series 2012-RR1, Class 7A3, 1.256%, 4/26/2035 (a)(b) | | | 1,182,570 | | | | 1,176,332 | |

BCAP LLC Trust, Series 2012-RR7, Class 3A4, 1.086%, 2/26/2036 (a)(b) | | | 27,162,723 | | | | 23,201,637 | |

BCAP LLC Trust, Series 2012-RR7, Class 3A1, 1.086%, 2/26/2036 (a)(b) | | | 1,665,272 | | | | 1,665,633 | |

BCAP LLC Trust, Series 2015-RR2, Class 26A2, 3.054%, 3/28/2036 (a)(b) | | | 6,729,753 | | | | 5,899,079 | |

BCAP LLC Trust, Series 2014-RR2, Class 8A1, 0.856%, 5/26/2036 (a)(b) | | | 3,614,745 | | | | 3,536,114 | |

BCAP LLC Trust, Series 2010-RR7, Class 9A12, 2.722%, 5/26/2036 (a)(b) | | | 3,186,801 | | | | 2,790,439 | |

BCAP LLC Trust, Series 2014-RR2, Class 6A8, 0.996%, 10/26/2036 (a)(b) | | | 17,649,182 | | | | 13,834,788 | |

BCAP LLC Trust, Series 2006-AA2, Class A1, 0.941%, 1/25/2037 (a) | | | 13,351,620 | | | | 11,320,892 | |

BCAP LLC Trust, Series 2007-AA1, Class 2A1, 0.951%, 3/25/2037 (a) | | | 3,556,054 | | | | 3,205,694 | |

BCAP LLC Trust, Series 2007-AA3, Class 1A2, 1.041%, 4/25/2037 (a) | | | 37,965 | | | | 31,342 | |

BCAP LLC Trust, Series 2007-AA2, Class 12A1, 0.981%, 5/25/2047 (a) | | | 116,357 | | | | 96,102 | |

BCAP LLC Trust, Series 2007-AA3, Class 2A1A, 0.991%, 5/25/2047 (a) | | | 8,657,534 | | | | 7,138,942 | |

BCAP LLC Trust, Series 2008-IND1, Class A1, 1.956%, 10/25/2047 (a)(e) | | | 39,022,260 | | | | 35,366,070 | |

Bear Stearns Adjustable Rate Mortgage Trust, Series 2005-1, Class 4A1, 3.191%, 3/25/2035 (a) | | | 2,035,279 | | | | 1,983,206 | |

Bear Stearns Adjustable Rate Mortgage Trust, Series 2005-12, Class 23A1, 2.991%, 2/25/2036 (a) | | | 943,857 | | | | 847,417 | |

Bear Stearns Adjustable Rate Mortgage Trust, Series 2006-2, Class 3A1, 3.145%, 7/25/2036 (a) | | | 2,107,653 | | | | 1,910,497 | |

Bear Stearns Adjustable Rate Mortgage Trust, Series 2006-2, Class 3A2, 3.145%, 7/25/2036 (a) | | | 7,157,517 | | | | 6,411,639 | |

Bear Stearns Adjustable Rate Mortgage Trust, Series 2007-2, Class 3A1, 3.456%, 12/25/2046 (a) | | | 5,636,427 | | | | 5,013,974 | |

Bear Stearns ALT-A Trust, Series 2006-8, Class 3A1, 0.916%, 2/25/2034 (a) | | | 1,961,463 | | | | 1,738,677 | |

Bear Stearns ALT-A Trust, Series 2005-5, Class 21A1, 2.986%, 7/25/2035 (a) | | | 3,044,475 | | | | 2,890,139 | |

Bear Stearns ALT-A Trust, Series 2005-5, Class 22A1, 3.176%, 7/25/2035 (a) | | | 5,325,585 | | | | 4,825,630 | |

Bear Stearns ALT-A Trust, Series 2005-7, Class 22A1, 3.149%, 9/25/2035 (a)(e) | | | 28,753,485 | | | | 25,333,488 | |

Bear Stearns ALT-A Trust, Series 2005-7, Class 21A1, 3.269%, 9/25/2035 (a) | | | 9,713,066 | | | | 8,603,358 | |

Bear Stearns ALT-A Trust, Series 2005-8, Class 11A1, 1.311%, 10/25/2035 (a) | | | 19,757,677 | | | | 18,134,703 | |

Bear Stearns ALT-A Trust, Series 2005-10, Class 11A1, 1.271%, 1/25/2036 (a) | | | 1,977,592 | | | | 1,767,485 | |

Bear Stearns ALT-A Trust, Series 2006-1, Class 11A1, 1.251%, 2/25/2036 (a) | | | 7,699,089 | | | | 6,882,577 | |

Bear Stearns ALT-A Trust, Series 2006-4, Class 11A1, 1.091%, 8/25/2036 (a) | | | 438,812 | | | | 370,247 | |

Bear Stearns Asset Backed Securities Trust, Series 2004-AC6, Class A2, 1.171%, 11/25/2034 (a) | | | 2,625,174 | | | | 2,169,772 | |

Bear Stearns Asset Backed Securities Trust, Series 2005-AC5, Class 1A2, 1.756%, 8/25/2035 (a) | | | 3,326,454 | | | | 2,755,082 | |

Bear Stearns Asset Backed Securities Trust, Series 2007-AC6, Class A1, 6.500%, 10/25/2037 | | | 3,259,472 | | | | 2,503,822 | |

Bear Stearns Commercial Mortgage Securities Trust, Series 2007-PW15, Class AMFX, 5.363%, 2/11/2044 (b) | | | 2,000,000 | | | | 1,924,064 | |

Bear Stearns Commercial Mortgage Securities Trust, Series 2007-PW15, Class AM, 5.363%, 2/11/2044 (e) | | | 2,000,000 | | | | 1,944,404 | |

Bear Stearns Commercial Mortgage Securities Trust, Series 2007-PW17, Class AJ, 5.888%, 6/11/2050 (a) | | | 5,000,000 | | | | 5,063,730 | |

Bear Stearns Mortgage Funding Trust, Series 2006-AR1, Class 1A1, 0.981%, 7/25/2036 (a) | | | 1,534,795 | | | | 1,304,465 | |

See accompanying notes which are an integral part of these financial statements.

18

Angel Oak Multi-Strategy Income Fund

Schedule of Investments – (continued)

January 31, 2017

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Collateralized Mortgage Obligations – (continued) | | | | | | | | |

Bear Stearns Mortgage Funding Trust, Series 2006-AR3, Class 1A1, 0.951%, 10/25/2036 (a)(e) | | $ | 25,689,380 | | | $ | 21,933,207 | |

Bear Stearns Mortgage Funding Trust, Series 2006-AR5, Class 2A1, 0.961%, 1/25/2037 (a) | | | 23,522,804 | | | | 21,187,625 | |

Bear Stearns Mortgage Funding Trust, Series 2007-AR5, Class 2A2, 1.001%, 6/25/2037 (a) | | | 103,576 | | | | 75,996 | |

CD Mortgage Trust, Series 2006-CD3, Class AJ, 5.688%, 10/15/2048 (e) | | | 10,000,000 | | | | 5,619,430 | |

CD Mortgage Trust, Series 2017-CD3, Class D, 3.250%, 2/10/2050 | | | 4,000,000 | | | | 3,164,800 | |

CD Mortgage Trust, Series 2017-CD3, Class C, 4.563%, 2/10/2050 | | | 6,500,000 | | | | 6,719,505 | |

CFCRE Commercial Mortgage Trust, Series 2015-RUM, Class B, 2.917%, 7/15/2030 (a)(b) | | | 5,000,000 | | | | 5,063,270 | |

CFCRE Commercial Mortgage Trust, Series 2011-C1, Class F, 5.000%, 4/15/2044 (a)(b)(g) | | | 7,931,000 | | | | 2,810,754 | |