As filed with the U.S. Securities and Exchange Commission on 04/04/19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-22980

Angel Oak Funds Trust

(Exact name of registrant as specified in charter)

One Buckhead Plaza

3060 Peachtree Rd. NW, Suite 500

Atlanta, Georgia 30305

(Address of principal executive offices) (Zip code)

Dory S. Black, Esq., President

One Buckhead Plaza

3060 Peachtree Rd. NW, Suite 500

Atlanta, Georgia 30305

(Name and address of agent for service)

Copy to:

Douglas P. Dick

Stephen T. Cohen

Dechert LLP

1900 K Street NW

Washington, DC 20006

404-953-4900

Registrant’s telephone number, including area code

Date of fiscal year end: January 31

Date of reporting period: January 31, 2019

Item 1. Reports to Stockholders.

ANNUAL REPORT

January 31, 2019

Angel Oak Multi-Strategy Income Fund

Angel Oak Financials Income Fund

(formerly known as Angel Oak Flexible Income Fund)

Angel Oak High Yield Opportunities Fund

Angel Oak UltraShort Income Fund

Angel Oak Capital Advisors, LLC

One Buckhead Plaza

3060 Peachtree Road NW

Suite 500

Atlanta, GA 30305

(404)953-4900

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary (such as broker-dealer or bank) or, if you are a direct investor, by calling(855) 751-4324.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call (855)751-4324 to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through a financial intermediary or all funds held with the Fund complex if you invest directly with the Funds.

Table of Contents

Dear Shareholder,

2018 will go down as one of the most challenging years in the post-crisis period with fewer asset classes beating inflation than in 2008. Fears of a global and domestic growth slowdown, U.S. recession worries, and trade wars all weighed on risk assets. Most importantly, the U.S. Federal Reserve System’s (the “Fed”) tightening campaign, coupled with the reduction in its bond portfolio (“Quantitative Tightening”) increased volatility and sent most global asset classes lower on the year, including risk-free alternatives that historically offset any weakness in risk portfolios. Interestingly, the current economic expansion is still robust, driven by historically accommodative monetary policy, generationally low unemployment rates, and tax cuts.

Despite recent headlines regarding an impending recession, we are cautiously optimistic about the economic outlook for 2019 and expect this expansion will continue, becoming the longest since the American Civil War. While it is impossible to predict the exact timing of the end of the expansion, we expect that it will last well beyond 2019 and into 2020. Growth will likely slow into 2019 and 2020 as the impact of tax cuts and fiscal stimulus begins to fade, but we do not foresee a recession in the near term. We do not expect last year’s pace of robust economic growth to continue, but a solid2%-3% growth rate is reasonable given the current data.

Market participants are closely watching the shape of the yield curve because it has historically been an excellent indication of potential volatility in the marketplace and a recession. In the past, the Fed has tended to tighten too far too fast sending the U.S. economy into recession. We do ultimately believe the Fed’s Federal Open Market Committee (“FOMC”) will eventually tighten the U.S. into recession, but this expansion will last far longer than market participants expect. Recent rhetoric points to the FOMC dramatically slowing their pace of tightening.

As Fed Chairman Jerome Powell said at the Atlanta Fed’s economic conference on January 4, 2019, the FOMC will continue to reduce the size of their balance sheet in the form of Quantitative Tightening but will be more data-dependent with respect to increases in the target rate. Most enlightening from the Atlanta Fed’s economic conference on January 4, 2019, he reiterated, “[The Fed] will be prepared to adjust policy quickly and flexibly, and to use all of our tools to support the economy, should that be appropriate to keep the expansion on track, to keep the labor market strong and to keep inflation near 2%.” The bottom line is the FOMC is not looking to overtighten in 2019, but to support robust growth over the medium term. We think a pause in 2019 is warranted, and are-steepening of the U.S. yield curve is quite possible as the growth picture stabilizes.

In early 2018, we improved the credit quality across our fund complex. This higher-quality positioning dampened net asset value (“NAV”) volatility during the recent market turmoil enabling us to rotate into more attractive assets. Significant opportunities have begun to emerge in various areas of the U.S. structured credit landscape in 2019, and we see the best risk-adjusted returns in legacy and new issuenon-agency residential mortgage-backed securities (“RMBS”), U.S. financials, shorter duration commercial mortgage-backed securities (“CMBS”), collateralized loan obligations (“CLOs”), and asset-backed securities (“ABS”).

Thank you for your continued support.

Respectfully yours,

Sreeniwas V. Prabhu

Chief Executive Officer and Chief Investment Officer

The opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Must be accompanied or preceded by a prospectus.

Mutual fund investing involves risk. Principal loss is possible.

The Angel Oak Funds are distributed by Quasar Distributors, LLC.

1

Angel Oak Multi-Strategy Income Fund

| 1. | How did the Fund perform during the period? |

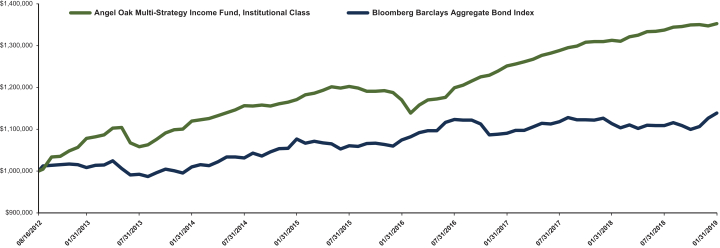

For the12-month period ended January 31, 2019, the Fund’s Institutional Shares (ANGIX) returned 3.05%, while the Fund’s A Shares (ANGLX) and C Shares (ANGCX) returned 2.72% and 2.04%, respectively. During the same period, the Fund’s benchmark, the Bloomberg Barclays Aggregate Bond Index, returned 2.25%.

| 2. | What were the main contributors to and detractors from the Fund’s performance during the period? |

Duration and credit strategies benefited the Fund relative to the benchmark. Duration positioning short of the index was a positive contributor to relative performance as interest rates rose for most of the term structure for the12-month period ended January 31, 2019. The2-year Treasury yield finished up 32 basis points to 2.46% while the10-year Treasury yield fell 8 basis points to 2.63%, flattening the2-year/10-year Treasury spread curve (“2s/10s Curve”) 45 basis points from 62 to 17 basis points. LIBOR rates continued to move higher given the four interest rate hikes by the U.S. Federal Reserve’s (the “Fed”) Federal Open Market Committee (“FOMC”).1-month and3-month LIBOR rose 101 and 93 basis points, respectively. The floating rate bond allocation based primarily onfront-end LIBOR floaters was beneficial to Fund performance relative to the Fund’s benchmark. The flattening of the U.S. yield curve continued to be a focus for market participants during the period as the 2s/10s Curve neared inversion, and market volatility increased sharply in the fourth quarter of 2018.

All three primary sectors of the Fund were positive contributors to performance for the12-month period ended January 31, 2019 withnon-agency residential mortgage-backed securities (“NA RMBS”) up approximately 4.41%, contributing 2.79% to the Fund. The NA RMBS sector had another strong year in 2018 after several years of post-crisis outperformance. The fundamental tailwinds of the broad-based housing recovery have resulted in solid improvement in home equity in the U.S. The combined effect of increased home equity and ongoing amortization has resulted inloan-to-value ratios (“LTVs”) falling below 60% on average for the legacy NA RMBS allocation in the Fund. This has resulted in rising Sharpe ratios for NA RMBS as it continues to exhibit high current carry and lower spread volatility amid spread widening events such as late 2018. Across all of fixed income, 2018 was a year defined by supply and NA RMBS was no different. It was the busiest supply year in the post-crisis period, with over $115 billion of new issuance coming to market. In fact, it was the first year since the crisis where the NA RMBS market actually grew in the total amount of bonds outstanding. Heavy supply weighed on spreads across fixed income and prices moved slightly lower on the year within the space. However, that was more than offset by a positive income return from high-quality, floating rate securities. We sought to be at the senior part of the capital structure inAlt-A and Option ARMsub-sectors as LIBOR moved sharply higher in 2018. Increased prepayment rates provided another tailwind for the asset class, resulting in positive total return and positive excess return for the year.

The commercial mortgage-backed securities (“CMBS”) allocation was a positive contributor to Fund performance as well. CMBS was up 3.68%, contributing 39 basis points to Fund performance. After a strong start early in the period, CMBS gave back their gains later in the period in sympathy with the widening in the broader credit markets. 2018new-issue volumes finished at $93.11 billion,in-line with 2017 volume of $94.3 billion, a very healthy technical for us to observe. In summary, CMBS investors digested over $90 billion of new bonds, and the risk retention structures of these bond transactions continues to be well received as spreads in September reached their tightest levels in a10-year span.

Collateralized Loan Obligations (“CLOs”) were also a positive contributor to the Fund for the period due to the defensive positioning with an overweight toAAA-rated tranches. The CLO allocation was up 3.20% in total return, contributing 38 basis points to Fund performance. CLO spreads began widening from post-crisis tights set earlier in 2018, amidst high supply. General corporate credit spread widening contributed to this phenomenon. Rising risk premiums were orderly until late October, at which point spreads started to widen rapidly intoyear-end. Macro weakness, pooryear-end liquidity and forced selling from fixed income funds facing redemptions exacerbated the latest move. In anticipation of a more volatile market due to a more aggressive Fed and continued froth in the bank loan market, we began shifting our credit exposure in CLOs up the capital stack from BBB/BB to AAA/AA over the last 12 to 18 months. The CLO market has a high ‘beta’ with spread moves that exceed moves in investment grade and high yield corporate bond spreads, which provides significant sector rotation opportunities. The recent widening in the fourth quarter was no different. Moving high in the capital stack softens price volatility and helped the allocation outperform versus the broader CLO market.

| 3. | What is your outlook heading into 2019, and how is the Fund positioned? |

Despite recent headlines of an impending recession, we are cautiously optimistic on the economic outlook for 2019 and expect this will be the longest expansion since the American Civil War. While it is impossible to predict the exact timing of the end of

2

the expansion, expectations are it will last well beyond 2019 and into 2020. Growth will likely slow into 2019 and 2020 as the impact of tax cuts and fiscal stimulus begin to fade, but we don’t foresee a recession in the near term. We do not expect last year’s pace of robust economic growth to continue, but a solid2-3% is reasonable given the current data.

The labor market is very healthy at the moment. The unemployment rate is at 3.9% and wages are rising at approximately 3.1% per annum. Payrolls have added an average of 220,000 jobs over the last four months, well ahead of the 100,000 per month required to continue the downtrend in the unemployment rate, which could remain below 4% throughout 2019.

In early 2018, we improved the credit quality across our fund complex. Significant opportunities have begun to emerge in various areas of the U.S. structured credit landscape in 2019, and we see the best risk-adjusted returns in legacy and new issue NA RMBS, U.S. financials, and shorter duration CMBS, CLOs and asset-backed securities (“ABS”).

Past performance is not a guarantee of future results.

Mutual fund investing involves risk; Principal loss is possible. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater forlonger-term debt securities. Investments in lower rated andnon-rated securities present a greater risk of loss to principal and interest than higher rated securities. Investments inasset-backed andmortgage-backed securities include additional risks that investors should be aware of including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Derivatives involve risks different from, and in certain cases, greater than the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as illiquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investments in derivatives could lose more than the amount invested. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. The Fund can make short sales of securities, which involves the risk that losses in securities may exceed the original amount invested. For more information on these risks and other risks of the Fund, please see the Prospectus.

Definitions:

Alt-A: A classification of mortgages with a risk profile falling between prime and subprime. These loans are usually issued to top credit quality borrowers with good credit histories.

Basis Point (bps): One hundredth of one percent. Used to denote the percentage change in a financial instrument.

Beta: A measure of a stock’s risk of volatility compared to the overall market.

Duration: Measures a portfolio’s sensitivity to changes in interest rates. Generally, the longer the duration, the greater the price change relative to interest rate movements

2s/10s Curve: Refers to the divergence between the10-year U.S. Treasury bond and the2-year Treasury note. In normal economic circumstances, the yield on the10-year should be greater than the2-year, creating a positive spread. This signals some combination of positive future growth expectations, positive future inflation expectations, and basic recognition that more adverse economic events are likelier to transpire over a longer timeframe than a shorter timeframe. Thus investors are compensated for taking on the higher risk of longer-duration bonds in the form of higher yields.

Bloomberg Barclays Aggregate Bond Index: An unmanaged index that measures the performance of the investment-grade universe of bonds issued in the United States. The index includes institutionally traded U.S. Treasury, government-sponsored, mortgage and corporate securities. It is not possible to invest directly in an index.

LIBOR: A benchmark rate that some of the world’s leading banks charge each other for short-term loans. It stands for Intercontinental Exchange London Interbank Offered Rate and serves as the first step to calculating interest rates on various loans throughout the world.

Option ARM: An option adjustable-rate mortgage (ARM) is a type of mortgage where the mortgagor (borrower) has several options as to which type of payment is made to the mortgagee (lender). In addition to having the choice of making payments of interest and principal that amounts to those made in conventional mortgages, option ARMs also have alternative payment options where the mortgagor can make significantly smaller payments by making interest-only payments or minimum payments.

3

Sharpe ratio: A statistical measure that uses standard deviation and excess return to determine reward per unit of risk. A higher Sharpe ratio implies a better historical risk-adjusted performance. The Sharpe ratio has been calculated since inception using the3-month Treasury bill for the risk-free rate of return.

Spread: The difference in yield between LIBOR and a debt security with the same maturity but of lesser quality.

Tranche: A portion of debt or structured financing. Each portion, or tranche, is one of several related securities offered at the same time but with different risks, rewards, and maturities.

4

Angel Oak Financials Income Fund

| 1. | How did the Fund perform during the period? |

For the12-month period ended January 31, 2019, the Fund’s Institutional Shares (ANFIX) returned 3.61%, while the Fund’s A Shares (ANFLX) and C Shares (AFLCX) returned 3.36% and 2.69%, respectively. During the same period, the Fund’s benchmark, the Bloomberg Barclays Aggregate Bond Index, returned 2.25%.

| 2. | What were the main contributors to and detractors from the Fund’s performance during the period? |

There were some significant headwinds that created some challenges for investors in the banking sector in 2018. Interest rates rose, equity valuations collapsed in the second half of the year and credit spreads widened significantly in the fourth quarter. On the other hand, the sector delivered record earnings: higher interest rates resulted in improved net interest margins, credit quality is back topre-crisis levels and lower tax rates helped boost the bottom line. Despite the headwinds, the Fund performed very well and ended the year as the top performing fund based upon total return among the 250 funds in Morningstar’s corporate bond category for the one year period ended December 31, 2018.

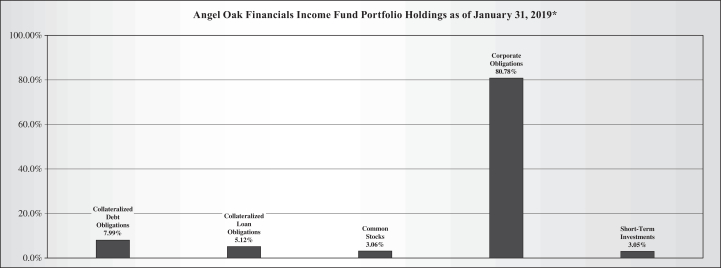

The focus of the Fund shifted more explicitly toward the financial sector in 2018. To emphasize the shift, the name of the fund was changed from Angel Oak Flexible Income Fund to Angel Oak Financials Income Fund effective December 16, 2018. The financial sector now accounts for over 90% of the Fund’s assets. There are three areas of primary focus within the financial sector: community bank debt,non-bank financials debt and community bank equity. The Fund’s asset allocation is comprised of 71% of assets in community bank debt, 18% of assets innon-bank financials, and 3% of assets in community bank equities.

Given the attractiveness of community bank debt, the allocation to Collateralized Loan Obligations (“CLOs”) fell below 3% in 2018, the lowest level since the Fund’s inception. CLOs only contributed marginally to the Fund’s performance in 2018.

| 3. | What is your outlook heading into 2019, and how is the Fund positioned? |

The Fund is focused on three main asset classes in the current environment: community bank debt,non-bank financials debt and community bank equities. Community bank debt offers the highest risk/reward potential over the next18-24 months, in our view.

Our conviction in community bank debt as an asset class is based on the underlying strength of the sector, including higher capital bases, strengthened regulatory oversight and earnings tailwinds. The niche market characteristics and ensuing market dislocation allows investors to extract excess yield. Community bank debt offers credit spreads of250-400 basis points above those of larger institutions with a similar credit profile. Relative to larger banks, community banks have (1) more transparent business models; (2) alow-cost, “sticky” deposit base; (3) lending portfolios tied to local relationships; and (4) balance sheet structures that benefit from higher rates. Additionally, we believe that more-nimble community banks can drive more innovation and higher growth than larger institutions. Community bank debt offers spreads of approximately 350 basis points on average, compared with approximately 150 basis points for investment grade corporate bonds. Finally, increasing consolidation in the banking industry provides the potential for enhanced total return from price appreciation.

Small-capnon-bank financial institution debt (including insurance companies, Real Estate Investment Trusts (“REITs”), Business Development Companies (“BDCs”) and asset managers) is a similarly dislocated market, in our view. With little analyst coverage or institutional following, investors can extract relatively high coupons. This space is more nascent than the community bank debt market, and has really only emerged in size over the past year or so. As such, coupons may be higher than they are for community bank debt, but issuance is smaller and more episodic. We believe the best risk/reward potential in thenon-banks sector over the near to medium term is in shorter duration, rated senior debt.

For 2019, we feel there will be a bifurcation between bank debt and equity performance. While bank equities are underpinned by the same strong industry fundamentals, asset quality is key to bank debt performance whereas equity valuations are based on investors’ perceptions of future earnings growth and the multiple they are willing to pay for that growth. From an asset quality perspective, sector trends remain pristine. By contrast, we see fewer catalysts to drive meaningful equities outperformance from a sector perspective in 2019 as we believe earnings growth has peaked. We do however see stock specific opportunities in community bank equities, which is reflected in our equities allocation, where we have a value bias.

With the increased volatility and downward pressure seen across fixed income and equity markets in the fourth quarter of 2018, we are closely monitoring asset quality trends, including real-time data points amassed through our due diligence process in a particularly robust primary issue market. We remain disciplined in our credit underwriting, with particular emphasis on interest

5

rate risk given increased lending and deposit competition, and on credit risk, as we move into the later innings of the economic cycle. We expect the next credit cycle will be driven by the corporate sector, as higher rates and growing leverage will eventually drive higher defaults and restructurings. On the other hand, the U.S. consumer remains strong, underwriting has become more conservative and banks are in a strong position to absorb loss rates moving towards cycle averages over time.

We do not anticipate oursub-sector allocations within financial services will change materially in 2019.

Past performance is not a guarantee of future results.

Mutual fund investing involves risk; Principal loss is possible. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater forlonger-term debt securities. Investments in lower rated andnon-rated securities present a greater risk of loss to principal and interest than higher rated securities. Investments inasset-backed andmortgage-backed securities include additional risks that investors should be aware of including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Derivatives involve risks different from, and in certain cases, greater than the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as illiquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investments in derivatives could lose more than the amount invested. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. The Fund can make short sales of securities, which involves the risk that losses in securities may exceed the original amount invested. For more information on these risks and other risks of the Fund, please see the Prospectus.

Definitions:

Basis Point (bps): One hundredth of one percent. Used to denote the percentage change in a financial instrument.

Bloomberg Barclays Aggregate Bond Index: An unmanaged index that measures the performance of the investment-grade universe of bonds issued in the United States. The index includes institutionally traded U.S. Treasury, government-sponsored, mortgage and corporate securities. It is not possible to invest directly in an index.

Spread: The difference in yield between two bonds of similar maturity but different credit quality.

Duration: Measures a portfolio’s sensitivity to changes in interest rates. Generally, the longer the duration, the greater the price change relative to interest rate movements

Morningstar Rankings represent a fund’s total-return rank relative to all funds that have the same Morningstar Category. The highest rank is 1 and the lowest is based on the total number of funds ranked in the category. It is based on the Morningstar total return, which includes both income and capital gains or losses and is not adjusted for sales charges or redemption fees.

6

Angel Oak High Yield Opportunities Fund

| 1. | How did the Fund perform during the period? |

For the12-month period ended January 31, 2019, the Fund’s Institutional Shares (ANHIX) returned 0.74% while the Fund’s A Shares (ANHAX) returned 0.41%. During the same period, the Fund’s benchmark, the Bloomberg Barclays U.S. Corporate High Yield Bond Index, returned 1.73%.

| 2. | What were the main contributors to and detractors from the Fund’s performance during the period? |

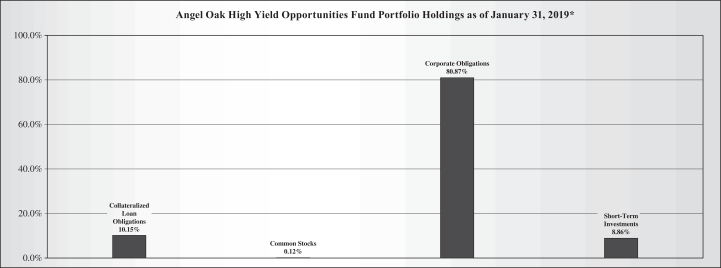

The portfolio’s 10% allocation to collateralized loan obligations (“CLOs”) was a significant positive contributor to performance during the period. CLOs are floating rate instruments and benefited as interest rates rose during the year. The Fund’s CLO allocation is generally comprised of CLOs with short duration and defensive profiles, which outperformed the corporate bond allocation and the benchmark.

For the second consecutive year, the energy sector was the largest positive contributor to corporate bond performance during the period. Oil prices declined due to rising production from U.S. shale producers and the ramp up of production from OPEC to offset the expected reduction in supply from Iran as sanctions were imposed and compounded by softening demand growth as the pace of global economic growth slowed. The positive contribution was primarily the result of selection and was broad based. Additionally, the portfolio benefited from the underweight to exploration and production companies in favor of refining and pipeline companies which are less directly exposed to the price level of oil within the energy sector allocation.

The largest detractors from the corporate bond performance came from the communications and consumernon-cyclical sectors. The performance was driven by a combination of allocation and selection. The portfolio was underweight both sectors which outperformed the benchmark during the period. In addition, performance was further negatively impacted by specific holdings in a printing company and a food and beverage company, both of which underperformed due to competitive pressures and deteriorating operating performance.

| 3. | What is your outlook heading into 2019, and how is the Fund positioned? |

Despite the marketsell-off in late 2018, triggered by the U.S. Federal Reserve Chairman’s comments regarding interest rates being far below neutral and that therun-off of the balance sheet was on auto-pilot, interpreted by the market that the Federal Reserve would programmatically continue to tighten monetary policy, pulling forward the timeline of a recession, the U.S. economic fundamentals appear to be in good shape and supportive of continued economic expansion, especially since the Federal Reserve has since communicated its willingness to be patient and flexible with regard to monetary policy.

The U.S. economy continues to be a consumer-driven economy with the consumer accounting for approximately 70% of economic activity. Unemployment is at the lowest level going back to the 1960s; wage gains are beginning to accelerate; and household leverage is at the lowest levels since the early 2000s, as measured by the percentage of disposable income allocated to debt service and total debt to disposable income.

Corporate earnings growth will slow in 2019 as the benefit of the Tax Cut and Jobs Act fades. However, earnings growth is expected to be positive. As interest rates rise and the pace of economic growth slows, corporations are increasingly focusing on the balance sheet, deemphasizing levered share buybacks and dividends in favor of debt reduction to drive stronger enterprise valuation multiples. For high yield issuers in aggregate, credit profiles have steadily improved with J.P. Morgan’s credit fundamentals update for the third quarter of 2018 indicating leverage has steadily improved for nine consecutive quarters.

Within this context we believe the portfolio is positioned to benefit from the continued economic expansion while also reflecting current valuations and the potential for increased volatility. We are overweight the basic industries, consumer cyclicals and capital goods sectors reflecting our expectation for a continuation of the economic expansion and favorable view on the U.S. housing sector supported by increasing household formation by the millennial generation and favorable supply/demand fundamentals. Given the magnitude of monetary policy tightening to date, and the flatness of the yield curve indicating the economy’s increased sensitivity to the level of interest rates on economic growth, we remain cognizant of taking advantage of opportunities to reduce positions where the risk/reward balance is no longer attractive.

7

Past performance is not a guarantee of future results.

Mutual fund investing involves risk; Principal loss is possible. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater forlonger-term debt securities. Investments in lower rated andnon-rated securities present a greater risk of loss to principal and interest than higher rated securities. Investments inasset-backed andmortgage-backed securities include additional risks that investors should be aware of including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Derivatives involve risks different from, and in certain cases, greater than the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as illiquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investments in derivatives could lose more than the amount invested. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. For more information on these risks and other risks of the Fund, please see the Prospectus.

Definitions

OPEC: Organization of Petroleum Exporting Countries.

Bloomberg Barclays U.S. Corporate High Yield Bond Index: An unmanaged market value-weighted index that covers the universe of fixed rate,non-investment grade debt. It is not possible to invest directly in an index.

Duration: Measures a portfolio’s sensitivity to changes in interest rates. Generally, the longer the duration, the greater the price change relative to interest rate movements

8

Angel Oak UltraShort Income Fund

| 1. | How did the Fund perform during the period? |

For the period since inception (April 2, 2018) through January 31, 2019, the Fund’s Institutional Shares (AOUIX) returned 2.60%, while the Fund’s A Shares (AOUAX) returned 2.12% (April 30, 2018 inception for the A shares). During the same period, the Fund’s benchmark, the Bloomberg Barclays 9-12 Month U.S. Treasury Bill Index, returned 1.84% since April 3, 2018 and 1.77% since April 30, 2018.

| 2. | What were the main contributors to and detractors from the Fund’s performance during the period? |

Credit strategies were the primary benefit to the Fund relative to the benchmark. Duration positioning short of the index was a mixed contributor since inception.1-yr reference rates rose through the first seven months of the period and then fell thereafter. Overall, the interest rate duration was short of the Fund’s benchmark for the whole period but was positioned even shorter during the falling interest rate period. The1-year Treasury yield finished up 47 basis points to 2.55%, peaking at 2.74% in November 2018 before falling 19 basis points to end the period. LIBOR rates continued to move higher given the four hikes by the U.S. Federal Reserve’s (the “Fed”) Federal Open Market Committee (“FOMC”).1-month and3-month LIBOR rose 64 and 43 basis points, respectively. The floating rate bond allocation based primarily onfront-end LIBOR floaters was beneficial to Fund performance relative to the Fund’s benchmark as1-month LIBOR rates rose rapidly throughout most of the period. On average throughout the return period, interest rate duration strategies were a positive contributor to Fund performance given the move higher in short term rates.

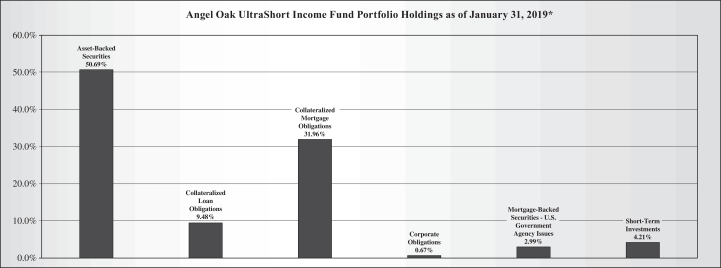

Credit strategies were the primary drivers of performance as the Fund’s overweight to credit, particularly structured credit, over government bonds drove positive relative performance. Residential mortgage-backed securities (“RMBS”), asset-backed securities (“ABS”), and collateralized loan obligations (“CLOs”), the largest asset classes within the Fund, were all positive contributors to Fund performance. RMBS produced a positive total return of 3.00%, contributing 63 basis points to Fund performance. The RMBS allocation is a targeted mix of primarily new issue sectors. Portfolio managers continue to believe the inherent bias within new issue mortgage credit and the dislocation with respect to new issue sectors remains significant. The RMBS allocation was primarily positioned within a targeted mix ofnon-qualified mortgages(“non-QM”),non-performing loans (“NPL”), andre-performing loans (“RPL”), along with legacy and prime 2.0. The higher current weighted average coupon of the underlyingnon-QM collateral is a primary factor for the attractive convexity characteristics of the sector. The sharp rise in Treasury yields in 2018 had an almost insignificant impact on prepayment speeds fornon-QM collateral. Additionally, spreads on NPL andnon-QM moved wider in 2018, creating the opportunity to rotate from ABS into RMBS in the fourth quarter of 2018, limiting price volatility and leading to significant total return opportunities for early 2019. The RMBS allocation remained between20-40% of Fund assets throughout most of the period.

The ABS allocation was a positive contributor to Fund performance as well. ABS was up 2.83%, contributing 150 basis points to Fund performance. The focus of the ABS allocation was within short duration, high credit quality assets. The primary overweight within the ABS allocation was to auto ABS. Thede-levering structures were a significant driver to price stability as credit protection increases each month and principal is paid off. This defensive positioning for approximately 50% of the Fund was a key driver to net asset value (“NAV”) stability in the fourth quarter of 2018 as credit spreads widened across broader U.S. credit. While the majority of the ABS allocation was in fixed-rate tranches, price returns were still net positive, up 0.40% as spreads were marginally tighter overall. The de-levering structures were a catalyst to tighter spreads over time as individual bonds seasoned. Sector selection was a positive contributor as subprime auto tightened relative to prime auto and credit card ABS.

CLOs were also a positive contributor to the Fund for the period due to the defensive positioning with a focus inAAA-rated tranches. The CLO allocation was up 2.21% in total return, contributing 22 basis points to Fund performance. The CLO allocation was a targeted allocation based on the current availability of X tranches. Portfolio managers focused on short maturity(1-2yr weighted average life) X tranches with high credit enhancement and limited optionality. The floating rate nature of the asset class helped to create positive total returns. During the period, spreads on X tranches widened by approximately10-20 basis points, leading a price return of-0.24%. However, the floating rate nature helped limit price volatility and the positive income return of 2.45% offset marginally wider spreads for the short duration asset class. The CLO allocation was a function of the ability to source this attractive area of the U.S. credit markets but is not expected to be a consistent allocation over time.

The commercial mortgage-backed securities (“CMBS”) allocation was a contributor to Fund performance, creating a positive total return of 1.87% and contributing 28 basis points to Fund performance. The focus of the allocation was within floating rate agency CMBS and served the purpose of liquidity and price stability.

9

| 3. | What is your outlook heading into 2019, and how is the Fund positioned? |

The Fund continues to focus across a diversified mix of primarily structured credit. Recently, the allocation to new issue RMBS has increased as the Fund has decreased the exposure to ABS and CMBS. New issue sectors of RMBS were the most sensitive to spread changes in the fourth quarter of 2018, creating more opportunities innon-QM and NPL. The Fund decreased the exposure to agency CMBS. The ABS allocation looked to increased diversification across U.S. sectors while decreasing the absolute allocation within the Fund.

2019 is expected to see increased volatility with similar new issue supply across structured credit. This backdrop should provide opportunities for relative outperformance and sector rotation within the various areas of U.S. credit. The increased short term yield environment and flattening U.S. yield curve have made short duration credit inherently attractive with continued limited volatility given the short maturity nature of the market. This should lead to investor inflows across short term mutual funds. In early 2018, we improved the credit quality across our fund complex. Significant opportunities have begun to emerge in various areas of the U.S. structured credit landscape in 2019, and we see the best risk-adjusted returns in new issuenon-agency RMBS, short-duration CMBS, CLO X tranches; and seasoned floating-rate non-agency CMBS.

Past performance is not a guarantee of future results.

Mutual fund investing involves risk; Principal loss is possible. Investments in debt securities typically decrease when interest rates rise. This risk is usually greater forlonger-term debt securities. Investments in lower rated andnon-rated securities present a greater risk of loss to principal and interest than higher rated securities. Investments inasset-backed andmortgage-backed securities include additional risks that investors should be aware of including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Derivatives involve risks different from, and in certain cases, greater than the risks presented by more traditional investments. Derivatives may involve certain costs and risks such as illiquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investments in derivatives could lose more than the amount invested. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. The Fund can make short sales of securities, which involves the risk that losses in securities may exceed the original amount invested. For more information on these risks and other risks of the Fund, please see the Prospectus.

Definitions:

Basis Point (bps): One hundredth of one percent. Used to denote the percentage change in a financial instrument.

Bloomberg Barclays9-12 Month U.S. Treasury Bill Index: Measures the performance of U.S. Treasury bills, notes, and bonds with a remaining maturity between9-12 months. The index does not include trading and management costs. It is not possible to invest directly in an index.

Duration: Measures a portfolio’s sensitivity to changes in interest rates. Generally, the longer the duration, the greater the price change relative to interest rate movements

LIBOR: A benchmark rate that some of the world’s leading banks charge each other for short-term loans. It stands for Intercontinental Exchange London Interbank Offered Rate and serves as the first step to calculating interest rates on various loans throughout the world.

Spread: The difference in yield between LIBOR and a debt security with the same maturity but of lesser quality.

Tranche: A portion of debt or structured financing. Each portion, or tranche, is one of several related securities offered at the same time but with different risks, rewards, and maturities.

Diversification does not guarantee a profit or protect against a loss in declining markets.

10

Investment Results – (Unaudited)

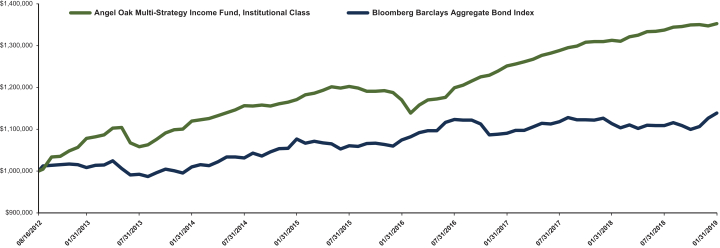

Angel Oak Multi-Strategy Income Fund

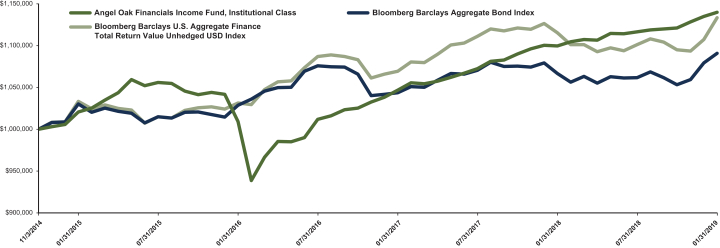

Total Return Based on a $1,000,000 Investment

The Fund is the successor to the investment performance of the Angel Oak Multi-Strategy Income Fund (the “Predecessor Multi-Strategy Income Fund”) as a result of the reorganization of the Predecessor Multi-Strategy Income Fund into the Fund on April 10, 2015. Accordingly, the performance information shown in the chart above and table below for periods prior to April 10, 2015 is that of the Predecessor Multi-Strategy Income Fund. The Predecessor Multi-Strategy Income Fund was also advised by the Adviser and had the same investment objective, policies, and strategies as the Fund.

The chart above assumes an initial investment of $1,000,000 made on August 16, 2012 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

Total Returns(1)

(For the year ended January 31, 2019)

| | | | | | | | | | | | | | | | |

| | | Average Annual Returns | |

| | | One Year | | | Three Year | | | Five Year | | | Since Inception(2) | |

Angel Oak Multi-Strategy Income Fund, Institutional Class | | | 3.05 | % | | | 4.95 | % | | | 3.85 | % | | | 4.78 | % |

Angel Oak Multi-Strategy Income Fund, Class A without load | | | 2.72 | % | | | 4.67 | % | | | 3.60 | % | | | 6.81 | % |

Angel Oak Multi-Strategy Income Fund, Class A with load | | | 0.40 | % | | | 3.88 | % | | | 3.13 | % | | | 6.50 | % |

Angel Oak Multi-Strategy Income Fund, Class C without load | | | 2.04 | % | | | 3.93 | % | | | N/A | | | | 2.40 | % |

Angel Oak Multi-Strategy Income Fund, Class C with load | | | 1.06 | % | | | 3.93 | % | | | N/A | | | | 2.40 | % |

Bloomberg Barclays Aggregate Bond

Index(3) | | | 2.25 | % | | | 1.95 | % | | | 2.44 | % | | | 2.03 | %(4) |

(1) Return figures reflect any change in price per share and assume the reinvestment of all distributions. Total returns for Class A Shares, with load, include the maximum 2.25% sales charge. Total returns for Class C Shares, with load, include the maximum 1.00% deferred sales charge.

(2) Inception date is August 16, 2012 for Institutional Class Shares, June 28, 2011 for Class A Shares, and August 4, 2015 for Class C Shares.

(3) The Bloomberg Barclays Aggregate Bond Index measures the performance of the investment-grade, fixed-rate bond market, including government and credit securities, agency pass-through securities, asset-backed securities and commercial mortgage-backed securities. Performance figures include the change in value of the bonds in the index and the reinvestment of interest. The index return does not reflect expenses, which have been deducted from the Fund’s return. You cannot invest directly in an index; however, an individual can invest in exchange-traded funds or other investments vehicles that attempt to track the performance of a benchmark index.

(4) The return shown for the Bloomberg Barclays Aggregate Bond Index is from the inception date of the Institutional Class Shares. The Bloomberg Barclays Aggregate Bond Index return from the inception date of Class A Shares is 2.70% and for Class C Shares is 2.08%.

11

Investment Results – (Unaudited) (continued)

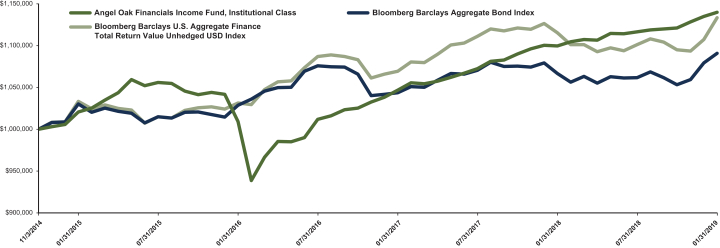

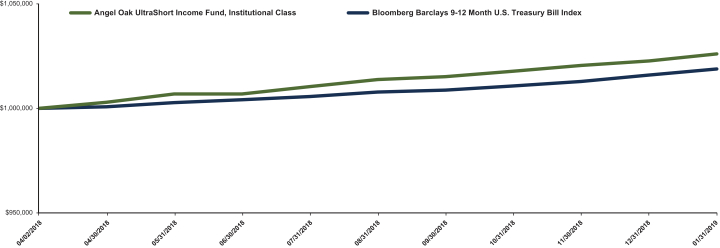

Angel Oak Financials Income Fund

Total Return Based on a $1,000,000 Investment

The chart above assumes an initial investment of $1,000,000 made on November 3, 2014 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

Total Returns(1)

(For the year ended January 31, 2019)

| | | | | | | | | | | | |

| | | Average Annual Returns | |

| | | One Year | | | Three Year | | | Since Inception(2) | |

Angel Oak Financials Income Fund, Institutional Class | | | 3.61 | % | | | 4.09 | % | | | 3.09 | % |

Angel Oak Financials Income Fund, Class A without load | | | 3.36 | % | | | 3.84 | % | | | 2.84 | % |

Angel Oak Financials Income Fund, Class A with load | | | 1.01 | % | | | 3.05 | % | | | 2.29 | % |

Angel Oak Financials Income Fund, Class C without load | | | 2.69 | % | | | 3.07 | % | | | 1.15 | % |

Angel Oak Financials Income Fund, Class C with load | | | 1.71 | % | | | 3.07 | % | | | 1.15 | % |

Bloomberg Barclays Aggregate Bond Index(3) | | | 2.25 | % | | | 1.95 | % | | | 2.04 | %(4) |

Bloomberg Barclays U.S. Aggregate Finance Total Return Value Unhedged USD Index(5) | | | 1.59 | % | | | 3.15 | % | | | 2.95 | %(6) |

(1) Return figures reflect any change in price per share and assume the reinvestment of all distributions. Total returns for Class A Shares, with load, include the maximum 2.25% sales charge. Total returns for Class C Shares, with load, include the maximum 1.00% deferred sales charge.

(2) Inception date is November 3, 2014 for Institutional Class and Class A Shares and August 4, 2015 for Class C Shares.

(3) The Bloomberg Barclays Aggregate Bond Index measures the performance of the investment-grade, fixed-rate bond market, including government and credit securities, agency pass-through securities, asset-backed securities and commercial mortgage-backed securities. Performance figures include the change in value of the bonds in the index and the reinvestment of interest. The index return does not reflect expenses, which have been deducted from the Fund’s return. You cannot invest directly in an index; however, an individual can invest in exchange-traded funds or other investments vehicles that attempt to track the performance of a benchmark index.

(4) The return shown for the Bloomberg Barclays Aggregate Bond Index is from the inception date of the Institutional Class and Class A Shares. The Bloomberg Barclays Aggregate Bond Index return from the inception date of the Class C Shares is 2.08%.

12

(5) The Bloomberg Barclays U.S. Aggregate Finance Total Return Value Unhedged USD Index is the Financial Institutions component of the Bloomberg Barclays U.S. Credit Index. Performance figures include the change in value of the bonds in the index and the reinvestment of interest. The index return does not reflect expenses, which have been deducted from the Fund’s return. You cannot invest directly in an index; however, an individual can invest in exchange-traded funds or other investments vehicles that attempt to track the performance of a benchmark index.

(6) The return shown for the Bloomberg Barclays U.S. Aggregate Finance Total Return Value Unhedged Index is from the inception date of the Institutional Class and Class A Shares. The Bloomberg Barclays U.S. Aggregate Finance Total Return Value Unhedged Index return from the inception date of the Class C Shares is 3.17%.

13

Investment Results – (Unaudited) (continued)

Angel Oak High Yield Opportunities Fund

Total Return Based on a $1,000,000 Investment

The Fund is the successor to the investment performance of the Rainier High Yield Fund (the “Predecessor High Yield Fund”) as a result of the reorganization of the Predecessor High Yield Fund into the Fund on April 15, 2016. Accordingly, the performance information shown in the chart above and table below for periods prior to April 15, 2016 is that of the Predecessor High Yield Fund’s Institutional Shares and Original Shares for the Fund’s Institutional Class and Class A shares, respectively. The Predecessor High Yield Fund was managed by the same portfolio managers as the Fund and had substantially the same investment objectives, policies, and strategies as the Fund.

The chart above assumes an initial investment of $1,000,000 made on March 31, 2009 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

Total Returns(1)

(For the year ended January 31, 2019)

| | | | | | | | | | | | | | | | |

| | | Average Annual Returns | |

| | | One Year | | | Three Year | | | Five Year | | | Since Inception(2) | |

Angel Oak High Yield Opportunities Fund, Institutional Class | | | 0.74 | % | | | 9.03 | % | | | 4.85 | % | | | 8.91 | % |

Angel Oak High Yield Opportunities Fund, Class A without load | | | 0.41 | % | | | 8.77 | % | | | 4.61 | % | | | 5.34 | % |

Angel Oak High Yield Opportunities Fund, Class A with load | | | -1.88 | % | | | 7.96 | % | | | 4.13 | % | | | 4.98 | % |

ICE Bank of America Merrill Lynch High Yield Index(3)(4) | | | 1.57 | % | | | 9.46 | % | | | 4.61 | % | | | 11.13 | %(5) |

Bloomberg Barclays U.S. Corporate High Yield Bond Index(4)(6) | | | 1.73 | % | | | 9.41 | % | | | 4.61 | % | | | 11.16 | %(7) |

(1) Return figures reflect any change in price per share and assume the reinvestment of all distributions. Total returns for Class A Shares, with load, include the maximum 2.25% sales charge.

(2) Inception date is March 31, 2009 for Institutional Class Shares and July 31, 2012 for Class A Shares.

(3) The ICE Bank of America Merrill Lynch High Yield Index tracks the performance of below investment grade, but not in default, U.S. dollar denominated corporate bonds publicly issued in the U.S. domestic market, and includes issues with a credit rating of BBB or below, as rated by Moody’s and S&P.The index return does not reflect expenses, which have been deducted from the Fund’s return. You cannot invest directly in an index; however, an individual can invest in exchange-traded funds or other investments vehicles that attempt to track the performance of a benchmark index.

14

(4) Effective April 1, 2018, the benchmark index changed from the ICE Bank of America Merrill Lynch High Yield Index to the Bloomberg Barclays U.S. Corporate High Yield Bond Index. The benchmark index was changed to more accurately reflect the Fund’s investment style.

(5) The return shown for the ICE Bank of America Merrill Lynch High Yield Index is from the inception date of the Institutional Class Shares. The ICE Bank of America Merrill Lynch High Yield Index return from the inception date of Class A Shares is 5.72%.

(6) The Bloomberg Barclays U.S. Corporate High Yield Bond Index is an unmanaged market value-weighted index that covers the universe of fixed-rate,non-investment grade debt. The index return does not reflect expenses, which have been deducted from the Fund’s return. You cannot invest directly in an index; however, an individual can invest in exchange-traded funds or other investments vehicles that attempt to track the performance of a benchmark index.

(7) The return shown for the Bloomberg Barclays U.S. Corporate High Yield Bond Index is from the inception date of the Institutional Class Shares. The Bloomberg Barclays U.S. Corporate High Yield Bond Index return from the inception date of Class A Shares is 5.72%.

15

Investment Results – (Unaudited) (continued)

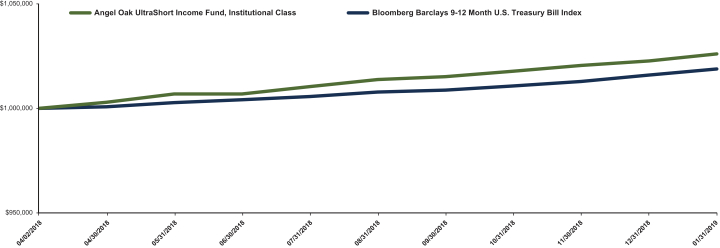

Angel Oak UltraShort Income Fund

Total Return Based on a $1,000,000 Investment

The chart above assumes an initial investment of $1,000,000 made on April 2, 2018 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

Cumulative Returns(1)

(For the period ended January 31, 2019)

| | | | |

| | | Since Inception(2) | |

Angel Oak UltraShort Income Fund, Institutional Class | | | 2.60 | % |

Angel Oak UltraShort Income Fund, Class A | | | 2.12 | % |

Bloomberg Barclays9-12 Month U.S. Treasury Bill Index(3) | | | 1.88 | %(4) |

(1) Return figures reflect any change in price per share and assume the reinvestment of all distributions.

(2) Inception date is April 2, 2018 for Institutional Class and April 30, 2018 for Class A Shares.

(3) The Bloomberg Barclays9-12 Month U.S. Treasury Bill Index measures the performance of U.S. Treasury bills, notes, and bonds with a remaining maturity between9-12 months. Performance figures include the change in value of the bonds in the index and the reinvestment of interest. The index return does not reflect expenses, which have been deducted from the Fund’s return. You cannot invest directly in an index; however, an individual can invest in exchange-traded funds or other investments vehicles that attempt to track the performance of a benchmark index.

(4) The return shown for the Bloomberg Barclays9-12 Month U.S. Treasury Bill Index is from the inception date of the Institutional Class. The Bloomberg Barclays9-12 Month U.S. Treasury Bill Index return from the inception date of the Class A Shares is 1.81%.

16

Summary of Funds’ Expenses – (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees, distribution and/or service(12b-1) fees and other expenses of the Funds. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

Actual Expenses

The first lines of the tables below provide information about actual account values and actual expenses. You may use the information in these lines, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the numbers in the first lines under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second lines of the tables below provide information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second lines of the tables below are useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if these transactoinal costs were included, your costs would have been higher.

| | | | | | | | | | |

| Angel Oak Multi-Strategy Income Fund | | Beginning

Account Value,

August 1, 2018 | | Ending

Account Value,

January 31, 2019 | | Expenses Paid

During Period(1) | | Annualized

Expense Ratio |

Class A | | Actual | | $1,000.00 | | $1,011.10 | | $7.00 | | 1.38% |

| | | Hypothetical(2) | | $1,000.00 | | $1,018.25 | | $7.02 | | 1.38% |

Class C | | Actual | | $1,000.00 | | $1,007.40 | | $10.83 | | 2.14% |

| | | Hypothetical(2) | | $1,000.00 | | $1,014.42 | | $10.87 | | 2.14% |

Institutional Class | | Actual | | $1,000.00 | | $1,011.40 | | $5.73 | | 1.13% |

| | | Hypothetical(2) | | $1,000.00 | | $1,019.51 | | $5.75 | | 1.13% |

| | | | | | | | | | |

| Angel Oak Financials Income Fund | | Beginning

Account Value,

August 1, 2018 | | Ending

Account Value,

January 31, 2019 | | Expenses Paid

During Period(1) | | Annualized

Expense Ratio |

Class A | | Actual | | $1,000.00 | | $1,018.40 | | $4.78 | | 0.94% |

| | | Hypothetical(2) | | $1,000.00 | | $1,020.47 | | $4.79 | | 0.94% |

Class C | | Actual | | $1,000.00 | | $1,015.90 | | $8.59 | | 1.69% |

| | | Hypothetical(2) | | $1,000.00 | | $1,016.69 | | $8.59 | | 1.69% |

Institutional Class | | Actual | | $1,000.00 | | $1,020.80 | | $3.51 | | 0.69% |

| | | Hypothetical(2) | | $1,000.00 | | $1,021.73 | | $3.52 | | 0.69% |

| | | | | | | | | | |

| Angel Oak High Yield Opportunities Fund | | Beginning

Account Value,

August 1, 2018 | | Ending

Account Value,

January 31, 2019 | | Expenses Paid

During Period(1) | | Annualized

Expense Ratio |

Class A | | Actual | | $1,000.00 | | $1,002.60 | | $4.54 | | 0.90% |

| | | Hypothetical(2) | | $1,000.00 | | $1,020.67 | | $4.58 | | 0.90% |

Institutional Class | | Actual | | $1,000.00 | | $1,004.70 | | $3.28 | | 0.65% |

| | | Hypothetical(2) | | $1,000.00 | | $1,021.93 | | $3.31 | | 0.65% |

17

Summary of Funds’ Expenses – (Unaudited) (continued)

| | | | | | | | | | |

| Angel Oak UltraShort Income Fund | | Beginning

Account Value,

August 1, 2018 | | Ending

Account Value,

January 31, 2019 | | Expenses Paid

During Period(1) | | Annualized

Expense Ratio |

Class A | | Actual | | $1,000.00 | | $1,014.20 | | $2.54 | | 0.50% |

| | | Hypothetical(2) | | $1,000.00 | | $1,022.68 | | $2.55 | | 0.50% |

Institutional Class | | Actual | | $1,000.00 | | $1,015.50 | | $1.27 | | 0.25% |

| | | Hypothetical(2) | | $1,000.00 | | $1,023.95 | | $1.28 | | 0.25% |

(1) Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days (184) in the most recent six month period and divided by the number of days in the most recent twelve month period (365). The annualized expense ratios reflects fee waiver and expense limitation arrangements, including interest expense, in effect during the period. The “Financial Highlights” tables in the Funds’ financial statements, included in the report, also show the gross expense ratios, without such reimbursements.

(2) Hypothetical assumes 5% annual return before expenses.

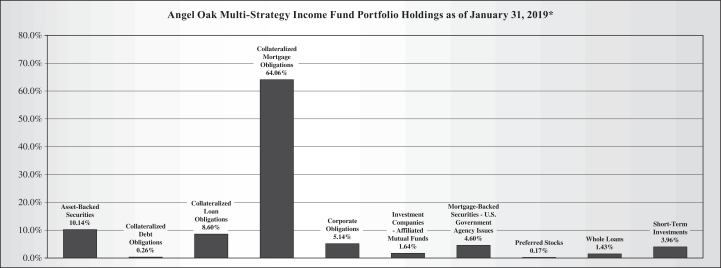

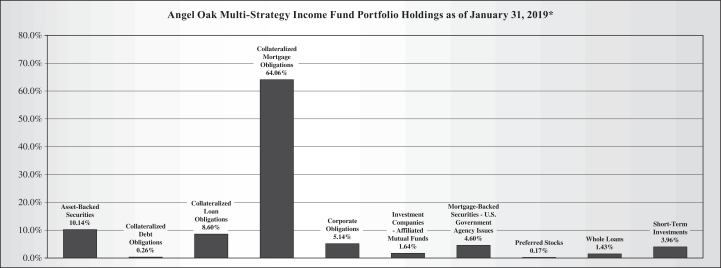

Portfolio Holdings – (Unaudited)

The investment objective of Angel Oak Multi-Strategy Income Fund is to seek current income.

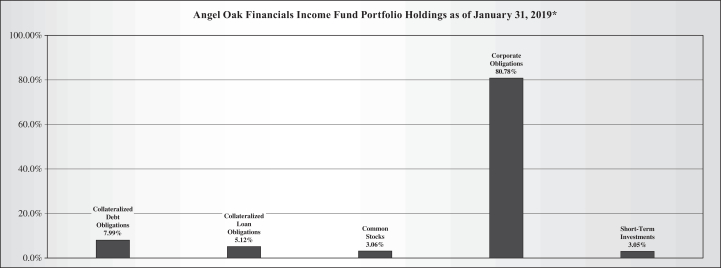

The investment objective of Angel Oak Financials Income Fund is to seek current income with a secondary objective of total return.

18

Portfolio Holdings – (Unaudited) (continued)

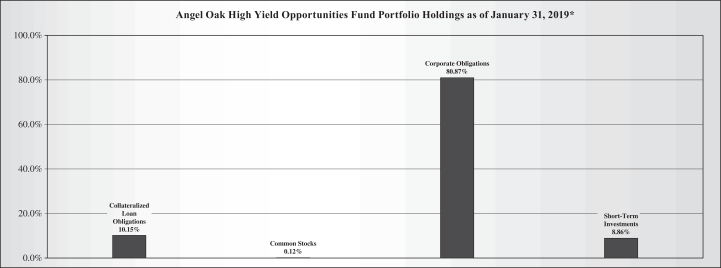

The investment objective of Angel Oak High Yield Opportunities Fund is to earn a high level of current income with a secondary objective of capital appreciation.

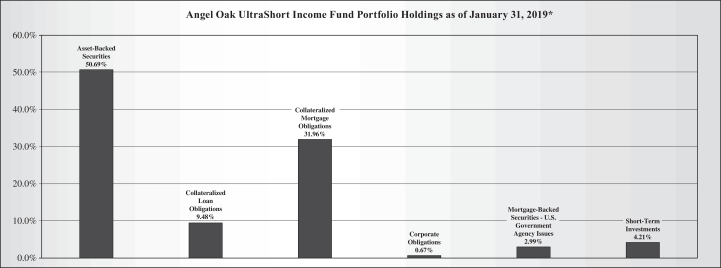

The investment objective of Angel Oak UltraShort Income Fund is to provide current income while seeking to minimize price volatility and maintain liquidity.

* As a percentage of total investments.

19

Angel Oak Multi-Strategy Income Fund

Consolidated Schedule of Investments

January 31, 2019

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Asset-Backed Securities – 10.62% | | | | | | |

ACC Trust, Series2018-1, Class C, 6.810%, 2/21/2023 (a) | | $ | 1,800,000 | | | $ | 1,824,604 | |

Accredited Mortgage Loan Trust, Series2005-4, Class M1,

2.910% (1 Month LIBOR USD + 0.400%), 12/25/2035 (b) | | | 1,128,000 | | | | 1,099,676 | |

American Credit Acceptance Receivables Trust, Series2016-1A, Class C, 5.550%, 6/13/2022 (a) | | | 4,634,161 | | | | 4,686,175 | |

Bayview Financial Mortgage Pass-Through Trust, Series2005-D, Class APO,

0.000%, 12/28/2035 (c) | | | 703,292 | | | | 605,825 | |

Bear Stearns Asset Backed Securities Trust, Series2007-SD3, Class A,

2.760% (1 Month LIBOR USD + 0.250%), 5/25/2037 (b) | | | 53,245 | | | | 51,387 | |

CarFinance Capital Auto Trust, Series2015-1A, Class E, 5.490%, 1/18/2022 (a) | | | 2,250,000 | | | | 2,269,764 | |

Citigroup Mortgage Loan Trust, Inc., Series2006-WF1, Class A2D, 4.980%, 3/25/2036 (d) | | | 4,990,139 | | | | 3,610,939 | |

CPS Auto Receivables Trust, Series2018-D, Class A, 3.060%, 1/18/2022 (a) | | | 3,034,877 | | | | 3,043,711 | |

CPS Auto Receivables Trust, Series2018-A, Class B, 2.770%, 4/18/2022 (a) | | | 1,779,000 | | | | 1,769,769 | |

CPS Auto Receivables Trust, Series2017-D, Class E, 5.300%, 6/17/2024 (a) | | | 3,700,000 | | | | 3,719,862 | |

Credibly Asset Securitization LLC, Series2018-1A, Class A, 4.800%, 11/15/2023 (a) | | | 937,000 | | | | 961,724 | |

Credit Acceptance Auto Loan Trust, Series2017-2A, Class A, 2.550%, 2/17/2026 (a) | | | 1,000,000 | | | | 994,399 | |

Credit Acceptance Auto Loan Trust, Series2017-3A, Class A, 2.650%, 6/15/2026 (a) | | | 4,500,000 | | | | 4,474,201 | |

CWHEQ Revolving Home Equity Loan Resecuritization Trust, Series2006-RES, Class 4P1A, 2.829% (1 Month LIBOR USD + 0.320%), 3/15/2034 (a)(b) | | | 3,238,473 | | | | 3,177,719 | |

CWHEQ Revolving Home Equity Loan Resecuritization Trust, Series2006-RES, Class 5A1A, 2.739% (1 Month LIBOR USD + 0.230%), 4/15/2035 (a)(b) | | | 11,051,939 | | | | 10,724,282 | |

CWHEQ Revolving Home Equity Loan Trust, Series2006-C, Class 1A,

2.689% (1 Month LIBOR USD + 0.180%), 5/15/2036 (b) | | | 27,550,788 | | | | 26,849,455 | |

DT Auto Owner Trust, Series2018-1A, Class B, 3.040%, 1/18/2022 (a) | | | 3,000,000 | | | | 3,002,964 | |

DT Auto Owner Trust, Series2016-1A, Class D, 4.660%, 12/15/2022 (a) | | | 7,376,677 | | | | 7,460,299 | |

Evergreen Credit Card Trust, Series2019-1, Class A,

3.056% (1 Month LIBOR USD + 0.480%), 1/17/2023 (a)(b) | | | 6,000,000 | | | | 6,014,922 | |

Exeter Automobile Receivables Trust, Series2018-3A, Class A, 2.900%, 1/18/2022 (a) | | | 2,209,956 | | | | 2,210,118 | |

Exeter Automobile Receivables Trust, Series2019-1A, Class A, 3.200%, 4/15/2022 (a) | | | 1,335,000 | | | | 1,338,539 | |

Finance of America Structured Securities Trust, Series2018-HB1, Class A, 3.375%, 9/25/2028 (a) | | | 1,511,571 | | | | 1,516,492 | |

First Investors Auto Owner Trust, Series2017-3A, Class E, 4.920%, 8/15/2024 (a) | | | 1,500,000 | | | | 1,503,208 | |

Flagship Credit Auto Trust, Series2015-2, Class B, 3.080%, 12/15/2021 (a) | | | 1,002,877 | | | | 1,005,012 | |

Flagship Credit Auto Trust, Series2015-2, Class D, 5.980%, 8/15/2022 (a) | | | 1,500,000 | | | | 1,530,376 | |

Flagship Credit Auto Trust, Series2017-4, Class D, 3.580%, 1/16/2024 (a) | | | 3,000,000 | | | | 2,977,200 | |

Fremont Home Loan Trust, Series2006-D, Class 1A1,

2.650% (1 Month LIBOR USD + 0.140%), 11/25/2036 (b) | | | 1,442,467 | | | | 985,782 | |

Genesis Sales Finance Master Trust, Series2019-AA, Class A, 4.680%, 8/20/2023 (a) | | | 1,400,000 | | | | 1,410,980 | |

GLS Auto Receivables Trust, Series2018-2A, Class A, 3.250%, 4/18/2022 (a) | | | 1,234,638 | | | | 1,235,688 | |

GLS Auto Receivables Trust, Series2018-3A, Class A, 3.350%, 8/15/2022 (a) | | | 1,952,644 | | | | 1,957,563 | |

Golden Credit Card Trust, Series2017-4, Class A,

3.029% (1 Month LIBOR USD + 0.520%), 7/15/2024 (a)(b) | | | 2,000,000 | | | | 2,001,378 | |

GoldenTree Loan Opportunities IX Ltd., Series2014-9A, Class AR2,

3.862% (3 Month LIBOR USD + 1.110%), 10/29/2029 (a)(b) | | | 7,975,000 | | | | 7,944,280 | |

Goodgreen Trust, Series2017-2A, Class A, 3.260%, 10/15/2053 (a) | | | 8,880,273 | | | | 8,793,353 | |

GSAA Home Equity Trust, Series2005-14, Class 2A2,

2.760% (1 Month LIBOR USD + 0.250%), 12/25/2035 (b) | | | 2,047,156 | | | | 1,578,706 | |

GSAA Home Equity Trust, Series2005-14, Class 2A3,

2.860% (1 Month LIBOR USD + 0.350%), 12/25/2035 (b) | | | 6,214,620 | | | | 5,798,713 | |

GSAA Home Equity Trust, Series2005-15, Class 2A2,

2.760% (1 Month LIBOR USD + 0.250%), 1/25/2036 (b) | | | 2,999,066 | | | | 2,064,956 | |

See accompanying notes which are an integral part of these financial statements.

20

Angel Oak Multi-Strategy Income Fund

Consolidated Schedule of Investments – (continued)

January 31, 2019

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Asset-Backed Securities – (continued) | | | | | | |

GSAA Home Equity Trust, Series2006-10, Class AF2, 5.825%, 6/25/2036 (e) | | $ | 11,668,066 | | | $ | 5,702,114 | |

GSAA Home Equity Trust, Series2006-16, Class A2,

2.680% (1 Month LIBOR USD + 0.170%), 10/25/2036 (b) | | | 1,918,381 | | | | 990,282 | |

GSAA Home Equity Trust, Series2006-18, Class AF3A, 5.772%, 11/25/2036 (e) | | | 3,404,718 | | | | 1,892,247 | |

GSAA Home Equity Trust, Series2006-20, Class 1A2,

2.690% (1 Month LIBOR USD + 0.180%), 1/25/2037 (b) | | | 14,802,991 | | | | 8,394,406 | |

GSAA Home Equity Trust, Series2006-20, Class A4A,

2.740% (1 Month LIBOR USD + 0.230%), 1/25/2037 (b) | | | 3,942,662 | | | | 2,647,293 | |

GSAA Home Equity Trust, Series2007-1, Class 1A2,

2.680% (1 Month LIBOR USD + 0.170%), 2/25/2037 (b) | | | 2,495,673 | | | | 1,331,664 | |

GSAA Home Equity Trust, Series2007-4, Class A2,

2.710% (1 Month LIBOR USD + 0.200%), 3/25/2037 (b) | | | 1,643,859 | | | | 845,918 | |

GSAA Home Equity Trust, Series2007-2, Class AF4A, 5.983%, 3/25/2037 (d) | | | 2,498,224 | | | | 1,285,371 | |

GSAA Home Equity Trust, Series2007-5, Class 2A1A,

2.630% (1 Month LIBOR USD + 0.120%), 5/25/2037 (b) | | | 6,483,781 | | | | 6,069,091 | |

GSAA Home Equity Trust, Series2007-5, Class 1F4A, 6.032%, 5/25/2037 (d) | | | 6,318,174 | | | | 4,091,453 | |

GSAA Home Equity Trust, Series2007-10, Class A2A, 6.500%, 11/25/2037 | | | 2,826,453 | | | | 2,251,680 | |

GSAA Trust, Series2007-3, Class 1A1A,

2.580% (1 Month LIBOR USD + 0.070%), 3/25/2037 (b) | | | 9,231,078 | | | | 6,744,327 | |

GSAMP Trust, Series2007-FM2, Class A2D,

2.750% (1 Month LIBOR USD + 0.240%), 1/25/2037 (b) | | | 25,561,965 | | | | 18,580,481 | |

Harvest SBA Loan Trust, Series2018-1, Class A,

4.760% (1 Month LIBOR USD + 2.250%), 9/26/2044 (a)(b) | | | 3,177,857 | | | | 3,151,010 | |

Hero Funding, Series2017-3A, Class A1, 3.190%, 9/20/2048 (a) | | | 4,271,898 | | | | 4,247,416 | |

Hertz Vehicle Financing II LP, Series2019-1A, Class A, 3.710%, 3/25/2023 (a)(f) | | | 4,500,000 | | | | 4,499,165 | |

Hertz Vehicle Financing II LP, Series2019-1A, Class B, 4.100%, 3/25/2023 (a)(f) | | | 1,500,000 | | | | 1,504,755 | |

HOA Funding LLC, Series2014-1A, Class A2, 4.846%, 8/20/2044 (a) | | | 9,150,000 | | | | 9,063,633 | |

HOA Funding LLC, Series2015-1A, Class B, 9.000%, 8/20/2044 (a) | | | 1,000,000 | | | | 989,829 | |

Home Equity Loan Trust, Series 2007-FRE1, Class 2AV2,

2.670% (1 Month LIBOR USD + 0.160%), 4/25/2037 (b) | | | 718,880 | | | | 717,186 | |

Home Partners of America Trust, Series2017-1, Class A,

3.325% (1 Month LIBOR USD + 0.817%), 7/19/2034 (a)(b) | | | 2,973,761 | | | | 2,958,413 | |

Home Partners of America Trust, Series2017-1, Class C,

4.058% (1 Month LIBOR USD + 1.550%), 7/19/2034 (a)(b) | | | 2,822,453 | | | | 2,824,914 | |

Home Partners of America Trust, Series2017-1, Class D,

4.408% (1 Month LIBOR USD + 1.900%), 7/19/2034 (a)(b) | | | 2,822,453 | | | | 2,828,456 | |

Home Partners of America Trust, Series2018-1, Class F,

4.858% (1 Month LIBOR USD + 2.350%), 7/17/2037 (a)(b) | | | 6,100,000 | | | | 6,038,420 | |

Invitation Homes Trust, Series 2017-SFR2, Class F,

5.508% (1 Month LIBOR USD + 3.000%), 12/19/2036 (a)(b) | | | 4,000,000 | | | | 4,028,688 | |

Invitation Homes Trust, Series 2018-SFR1, Class E,

4.508% (1 Month LIBOR USD + 2.000%), 3/19/2037 (a)(b) | | | 1,375,000 | | | | 1,373,621 | |

Legacy Mortgage Asset Trust, Series2018-SL1, Class A, 4.000%, 2/25/2058 (a)(d) | | | 8,509,531 | | | | 8,534,175 | |

Legacy Mortgage Asset Trust, Series2018-GS1, Class A1, 4.000%, 3/25/2058 (a)(d) | | | 24,302,050 | | | | 24,346,134 | |

Legacy Mortgage Asset Trust, Series2018-GS1, Class A2, 4.250%, 3/25/2058 (a)(d) | | | 21,378,000 | | | | 21,201,225 | |

Legacy Mortgage Asset Trust, Series2018-GS2, Class A1, 4.000%, 4/25/2058 (a)(d) | | | 9,530,354 | | | | 9,536,806 | |

Legacy Mortgage Asset Trust, Series2018-GS3, Class A1, 4.000%, 6/25/2058 (a)(d) | | | 21,479,463 | | | | 21,286,921 | |

Legacy Mortgage Asset Trust, Series2018-GS3, Class A2, 4.250%, 6/25/2058 (a)(d) | | | 13,000,000 | | | | 13,081,601 | |

Legacy Mortgage Asset Trust, Series2019-GS1, Class A1, 4.000%, 1/25/2059 (a)(d) | | | 20,000,000 | | | | 20,018,000 | |

See accompanying notes which are an integral part of these financial statements.

21

Angel Oak Multi-Strategy Income Fund

Consolidated Schedule of Investments – (continued)

January 31, 2019

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Asset-Backed Securities – (continued) | | | | | | |

Legacy Mortgage Asset Trust, Series 2017-RPL1, Class A,

4.252% (1 Month LIBOR USD + 1.750%), 1/28/2070 (a)(b) | | $ | 11,592,223 | | | $ | 11,799,399 | |

Lehman XS Trust, Series2005-3, Class 3A3A, 5.280%, 9/25/2035 (d) | | | 2,300,374 | | | | 2,226,877 | |

Lehman XS Trust, Series2007-9, Class WFIO, 0.550%, 4/25/2037 (e)(g)(h) | | | 35,034,642 | | | | 211,434 | |

LoanCore Issuer Ltd., Series 2018-CRE1, Class C,

5.059% (1 Month LIBOR USD + 2.550%), 5/15/2028 (a)(b) | | | 3,250,000 | | | | 3,216,580 | |

MASTR Asset Backed Securities Trust, Series2005-NC2, Class A3,

3.010% (1 Month LIBOR USD + 0.500%), 11/25/2035 (b) | | | 19,957,304 | | | | 14,290,667 | |

Mercedes-Benz Auto Lease Trust, Series2019-A, Class A2, 3.010%, 2/16/2021 | | | 2,000,000 | | | | 2,005,876 | |

Merrill Lynch Mortgage Investors Trust, Series 2006-WMC2, Class A1, 2.750%, 3/25/2037 (e) | | | 28,465,251 | | | | 10,816,795 | |

MFA LLC, Series 2018-NPL1, Class A1, 3.875%, 5/26/2048 (a)(d) | | | 16,143,475 | | | | 16,166,156 | |

MFA LLC, Series 2018-NPL2, Class A1, 4.164%, 7/27/2048 (a)(d) | | | 3,136,808 | | | | 3,114,847 | |

Morgan Stanley ABS Capital I Inc. Trust, Series2007-HE6, Class A1,

2.570% (1 Month LIBOR USD + 0.060%), 5/25/2037 (b) | | | 3,108,392 | | | | 2,785,315 | |

Morgan Stanley ABS Capital I Inc. Trust, Series2007-HE6, Class A2,

2.650% (1 Month LIBOR USD + 0.140%), 5/25/2037 (b) | | | 10,223,985 | | | | 9,368,370 | |

Morgan Stanley ABS Capital I Inc. Trust, Series2007-HE6, Class A3,

2.690% (1 Month LIBOR USD + 0.180%), 5/25/2037 (b) | | | 23,503,413 | | | | 21,568,307 | |

Morgan Stanley ABS Capital I Inc. Trust, Series2007-NC3, Class A1,

2.710% (1 Month LIBOR USD + 0.200%), 5/25/2037 (a)(b) | | | 1,402,646 | | | | 1,005,149 | |

Morgan Stanley ABS Capital I Inc. Trust, Series2007-HE6, Class A4,

2.760% (1 Month LIBOR USD + 0.250%), 5/25/2037 (b) | | | 3,384,491 | | | | 3,075,552 | |

Morgan Stanley ABS Capital I Trust, Series2006-NC4, Class A2C,

2.660% (1 Month LIBOR USD + 0.150%), 6/25/2036 (b) | | | 1,857,373 | | | | 1,712,894 | |

Morgan Stanley Mortgage Loan Trust, Series 2006-13AX, Class A1,

2.690% (1 Month LIBOR USD + 0.180%), 10/25/2036 (b) | | | 1,612,620 | | | | 834,728 | |

Morgan Stanley Mortgage Loan Trust, Series 2006-13AX, Class A2,

2.850% (1 Month LIBOR USD + 0.340%), 10/25/2036 (b) | | | 17,252,790 | | | | 8,918,053 | |

Morgan Stanley Mortgage Loan Trust, Series2007-7AX, Class 2A1,

2.630% (1 Month LIBOR USD + 0.120%), 4/25/2037 (b) | | | 11,680,234 | | | | 5,811,547 | |

Morgan Stanley Mortgage Loan Trust, Series2007-8XS, Class A5,

3.040% (1 Month LIBOR USD + 0.530%), 4/25/2037 (b) | | | 22,252,502 | | | | 12,187,539 | |

Morgan Stanley Mortgage Loan Trust, Series2007-8XS, Class A9,

3.050% (1 Month LIBOR USD + 0.540%), 4/25/2037 (b) | | | 22,252,502 | | | | 12,134,311 | |

Morgan Stanley Mortgage Loan Trust, Series2007-8XS, Class A2, 6.000%, 4/25/2037 | | | 22,883,555 | | | | 14,172,449 | |

Morgan Stanley Mortgage Loan Trust, Series2007-1XS, Class 2A2, 5.826%, 9/25/2046 (d) | | | 14,597,365 | | | | 7,362,780 | |

Morgan Stanley Mortgage Loan Trust, Series2007-1XS, Class 2A6, 5.858%, 9/25/2046 (d) | | | 5,630,037 | | | | 2,840,061 | |

Morgan Stanley Mortgage Loan Trust, Series2007-1XS, Class 2A3, 5.919%, 9/25/2046 (d) | | | 14,003,434 | | | | 7,686,373 | |

Morgan Stanley Mortgage Loan Trust, Series2007-1XS, Class 2A4C, 6.104%, 9/25/2046 (d) | | | 10,554,566 | | | | 5,100,494 | |

Morgan Stanley Mortgage Loan Trust, Series2007-3XS, Class 2A3S, 5.858%, 1/25/2047 (d) | | | 2,003,707 | | | | 1,263,489 | |

Morgan Stanley Mortgage Loan Trust, Series2007-3XS, Class 2A4S, 5.963%, 1/25/2047 (d) | | | 7,573,459 | | | | 5,269,923 | |

Morgan Stanley Mortgage Loan Trust, Series 2007-10XS, Class A2, 6.250%, 2/25/2047 (e) | | | 10,643,360 | | | | 7,497,928 | |

Mosaic Solar Loan Trust, Series2019-1A, Class B, 0.000%, 12/21/2043 (a)(c)(f) | | | 3,190,000 | | | | 2,360,600 | |

Mosaic Solar Loan Trust, Series2019-1A, Class A, 4.370%, 12/21/2043 (a)(f) | | | 5,000,000 | | | | 5,013,000 | |

Mosaic Solar Loan Trust, Series2018-2GS, Class A, 4.200%, 2/22/2044 (a) | | | 9,956,866 | | | | 10,012,147 | |

Mosaic Solar Loans LLC, Series2017-2A, Class D, 0.000%, 6/22/2043 (a)(c) | | | 4,242,965 | | | | 3,946,997 | |

New Century Home Equity Loan Trust, Series2006-1, Class A2B,

2.690% (1 Month LIBOR USD + 0.180%), 5/25/2036 (b) | | | 913,190 | | | | 863,177 | |

See accompanying notes which are an integral part of these financial statements.

22

Angel Oak Multi-Strategy Income Fund

Consolidated Schedule of Investments – (continued)

January 31, 2019

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Asset-Backed Securities – (continued) | | | | | | |

Newtek Small Business Loan Trust, Series2018-1, Class B,

5.510% (1 Month LIBOR USD + 3.000%), 2/25/2044 (a)(b) | | $ | 3,093,631 | | | $ | 3,059,725 | |

Peaks CLO Ltd., Series2018-3A, Class A1,

4.426% (3 Month LIBOR USD + 1.650%), 1/27/2031 (a)(b) | | | 13,500,000 | | | | 13,537,895 | |

Peaks CLO Ltd., Series2018-3A, Class B1,