Quarterly Investor Relations Presentation At and for the three and nine months ended June 30, 2020

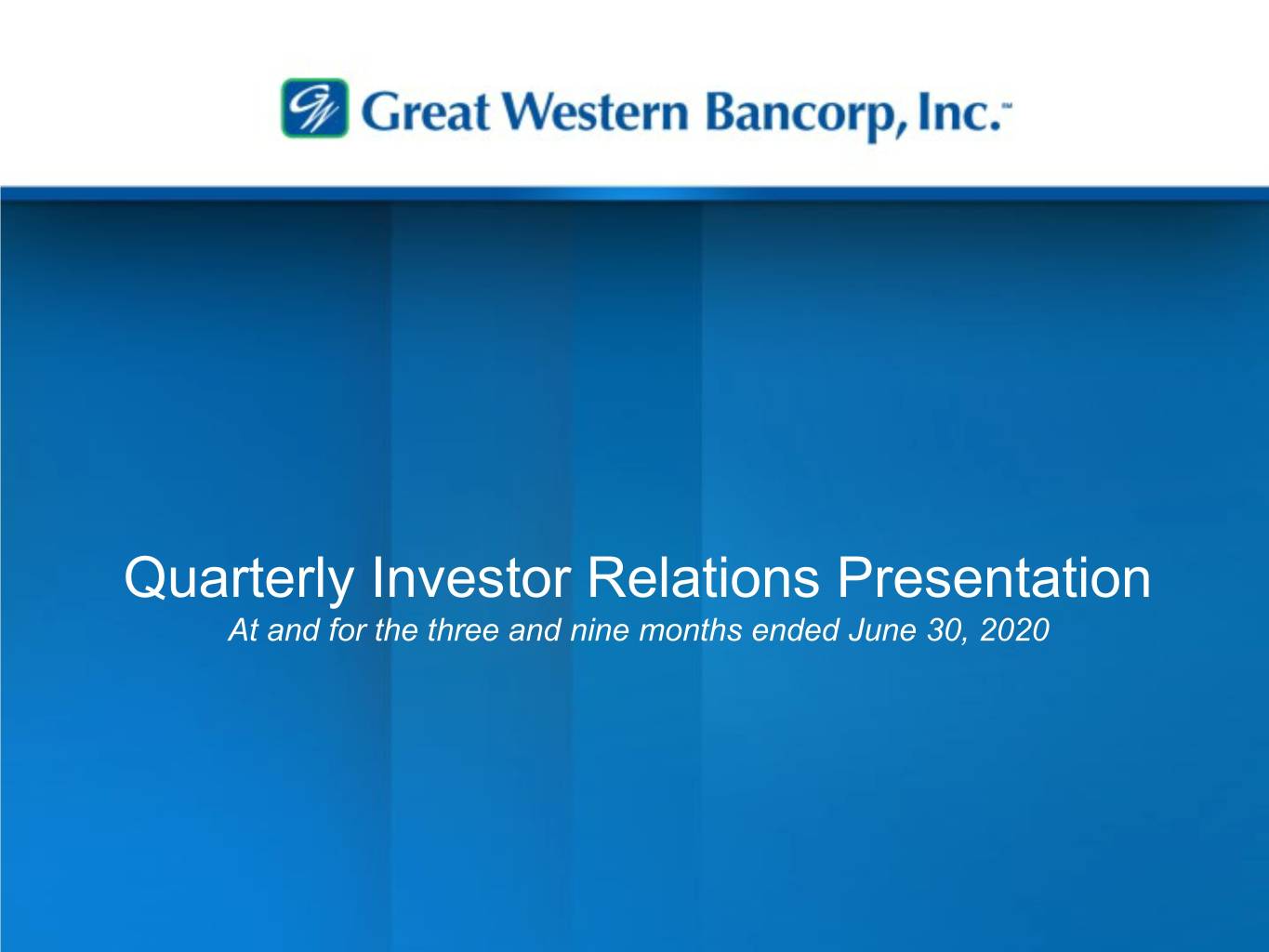

COMPANYFootprint SNAPSHOT Company Overview - NYSE: GWB 3QFY20 Financial Highlights • Full-service regional commercial bank focused on Total Assets $12,934 relationship-based business and agribusiness banking Total Loans $10,314 • Headquartered in Sioux Falls, SD with 175 banking branches across nine states: Arizona, Colorado, Iowa, Kansas, Balance Total Deposits $11,151 Sheet Minnesota, Missouri, Nebraska, North Dakota and South Loan / Deposit Ratio 92.5 % Dakota; approximately 1,700 FTEs Tangible Common Equity 2 $1,154 • Bank charter originated in 1935; purchased by National Total Equity $1,161 Australia Bank ("NAB") in 2008; NAB sold 100% of its stake in GWB to public investors in a series of three equity offerings, Tang. Common Equity / Tang. Assets 2 8.9 % completed in 2015 Tiet 1 Leverage Ratio 9.3 % th 1 • 5 largest farm lender bank in the U.S. as of 03/31/20 Capital CET1 Ratio 10.6 % Tier 1 Capital Ratio 11.3 % Total RBC Ratio 12.9 % Adjusted Net Interest Margin 2 3.47 % Cost of Deposits 0.37 % Return on Avg. Total Assets 2 0.17 % Profitablility Return on Avg. Common Equity 2 1.9 % Return on Avg. Tangible Common Equity 2 2.0 % Efficiency Ratio 2 69.4 % NPAs / Assets 2.27 % Asset NCOs / Avg. Loans 0.37 % Quality Non-accrual Loans / Loans 2.66 % ALLL / Loans 1.44 % 1 Source: American Banker's Association 2 Non-GAAP measures; see Appendix for reconciliation 2

EXPERIENCED MANAGEMENT TEAM x x Industry Great Western Bank Executive Officers experience (yrs) experience (yrs) 1 x Responsible for overall leadership and executive oversight of GWB, serves on the Board of Directors Mark Borrecco Former President & CEO and Board Director of Rabobank; EVP Chief Retail Banking Officer 20 <1 President & CEO Prior senior management roles at Bank of the West and World Savings Bank/Wachovia x Doug Bass Responsible for Business Banking Operations and Wealth Management for our bank 37 11 Executive VP & COO Prior positions with U.S. Bank and First American Bank Group x Responsible for financial / regulatory reporting, planning and strategy, project management, treasury, Peter Chapman loan and deposit operations and information technology 26 16 Executive VP & CFO Prior U.S. experience with E&Y x Responsible for risk framework across GWB including Enterprise Risk, Compliance, BSA and Risk Asset Karlyn Knieriem Review 22 3 Executive VP & CRO Prior experience includes senior management roles with First National Bank of Omaha Responsible for leading overall credit strategy, management, and portfolio administration for our bank Steve Yose Former Executive Vice President and Chief Credit Officer for First Interstate Bank 35 <1 Executive VP & CCO Prior Executive Vice President and Senior credit roles at KeyBank Non-Executive Officers x x x x Eric Bauer x Former Group President, Chief Credit Officer of Ag, Regional Credit Manager, Business Banking 26 18 Director of Agribusiness Manager and Retail Manager for our bank. Prior experience with Wells Fargo and First Savings & Loan Ryan Boschee x Prior experience includes Group President roles for multiple markets along with Treasury Management 21 19 Regional President SD in South Dakota for our bank Scott Erkonen x Prior leadership role representing the United States internationally in the areas of IT Governance and 24 13 Chief Information Officer Information Security — ISO (International Organization for Standardization) Bart Floyd x Prior experience with US Bank, Wells Fargo/South Trust Bank, and commercial banking and private 24 8 Regional President IA & MO financing for organizations in Iowa, Colorado, and Texas Gail Grant x Former Group President for Northern Colorado and Arizona for our bank. 31 11 Regional President CO & AZ Prior experience with Wells Fargo/Norwest x Andy Pederson Prior experience includes Senior Human Resource Generalist for Citibank and Wells Fargo 20 11 Head of P&C and L&D Corinne Safford x Former Regional Retail Manager, Senior Retail Manager, Branch Manager, Education & Development 18 18 Director of Retail Officer and Universal Banker for our bank Donald Straka x General Counsel and Corporate Prior experience includes attorney and executive in banking, securities and M&A 32 6 Secretary x Chris Wiedenfeld Prior experience with American National Bank, US Bank, and Lauritzen Corporation 24 6 Regional President NE & KS NOTE: For Mr. Chapman, includes experience at National Australia Bank, Ltd. and subsidiaries; For Mr. Erkonen, includes experience at HF Financial Corp. 3

KEY DEVELOPMENTS • New Chief Credit Officer Steve Yose on board bringing 35 years of experience Bolster Credit Risk • Third party engaged to provide additive review of Management higher focus areas of the loan portfolios • Utilize enhanced loan risk rating system • Reduced dividend to preserve capital given the uncertain outlook on the economy Conservative and Measured Actions • Increased credit reserves further • Round 2 deferral process developed (currently $257M) • Renewed Agribusiness Focus Organizational Alignment • Implement Simplified Retail Delivery Model for Increased Specialization • Expand Treasury Management • Introduce Small Business Center of Excellence 4

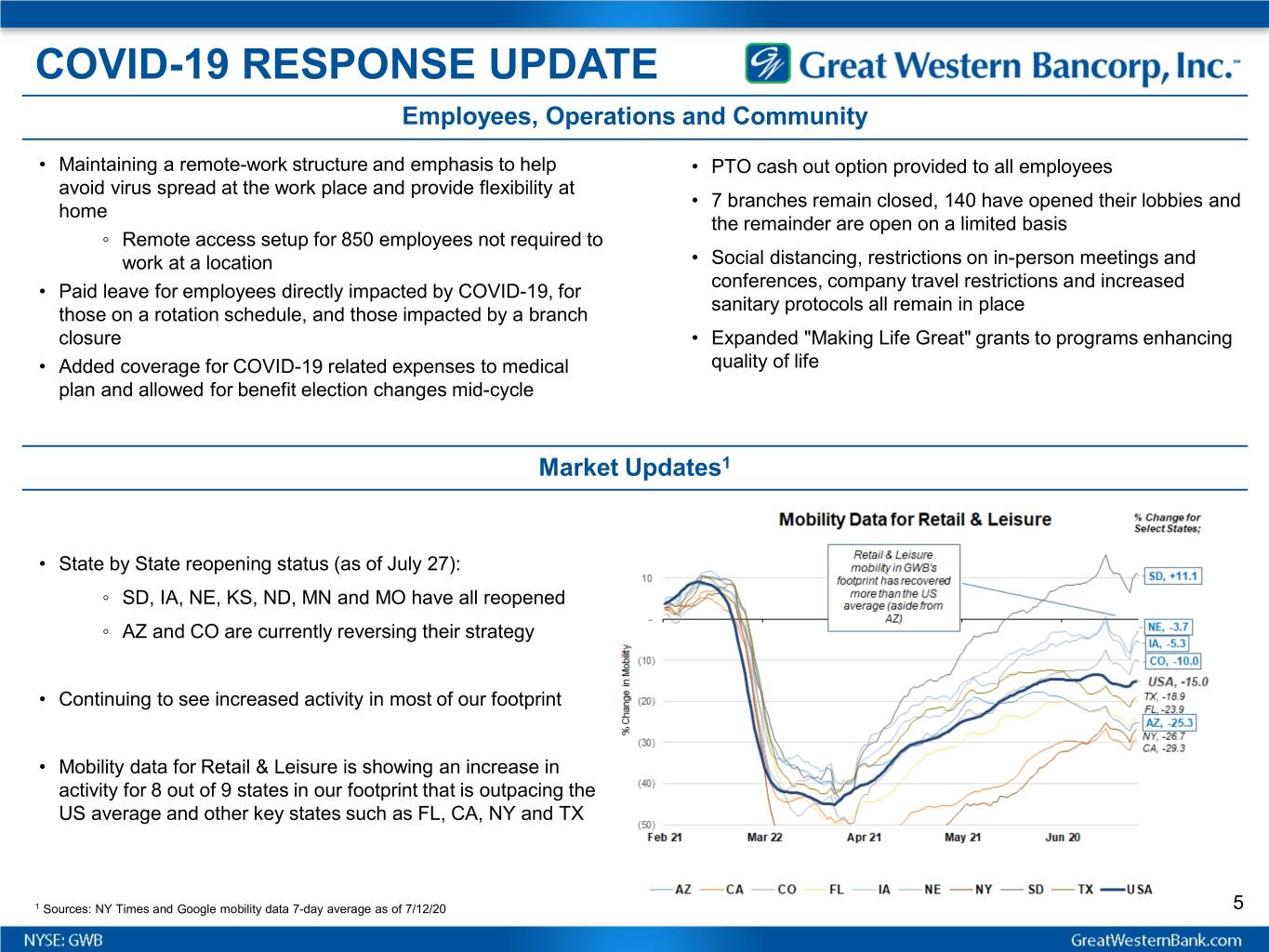

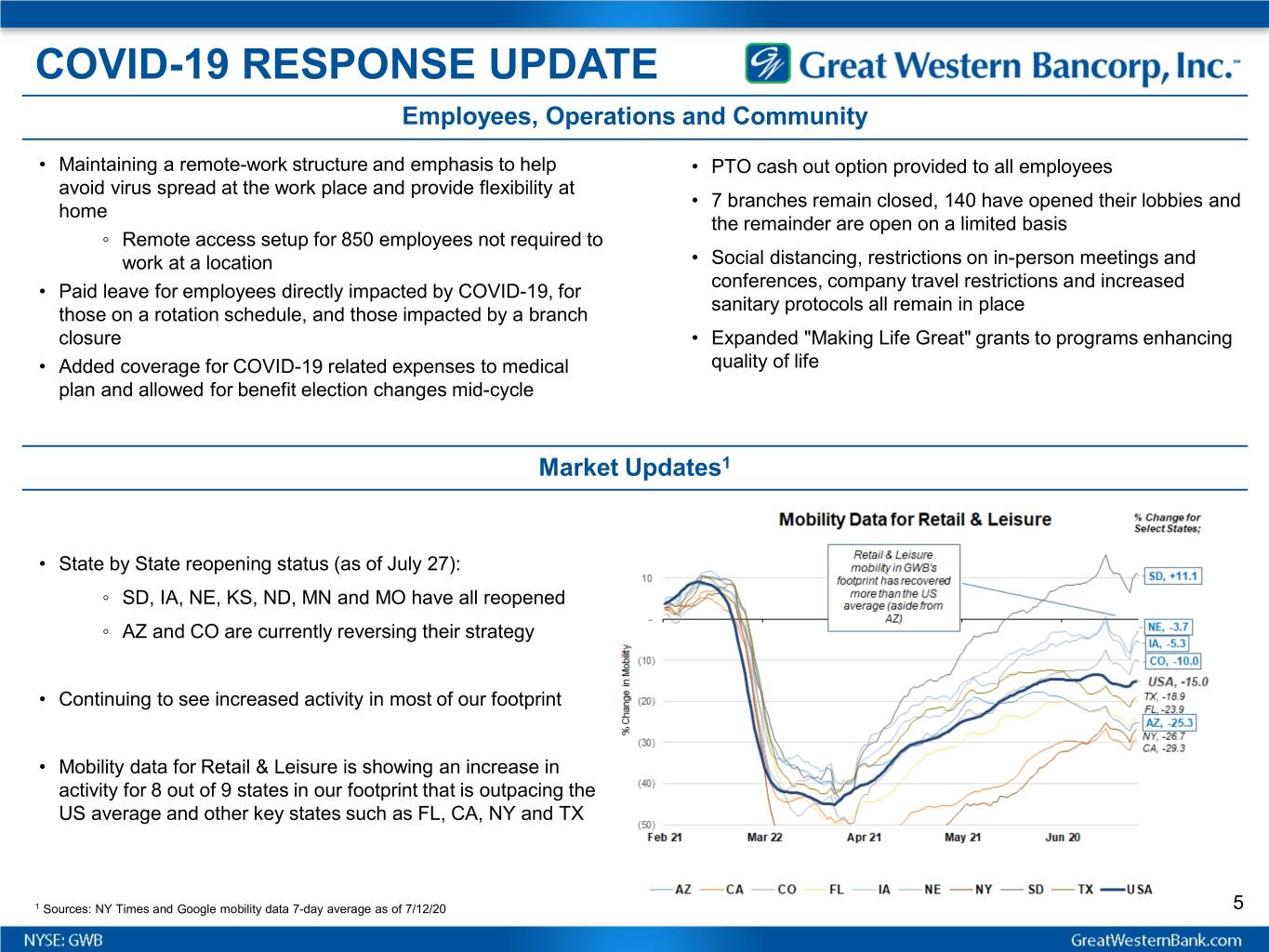

COVID-19 RESPONSE UPDATE Employees, Operations and Community • Maintaining a remote-work structure and emphasis to help • PTO cash out option provided to all employees avoid virus spread at the work place and provide flexibility at • 7 branches remain closed, 140 have opened their lobbies and home the remainder are open on a limited basis ◦ Remote access setup for 850 employees not required to work at a location • Social distancing, restrictions on in-person meetings and conferences, company travel restrictions and increased • Paid leave for employees directly impacted by COVID-19, for sanitary protocols all remain in place those on a rotation schedule, and those impacted by a branch closure • Expanded "Making Life Great" grants to programs enhancing • Added coverage for COVID-19 related expenses to medical quality of life plan and allowed for benefit election changes mid-cycle Market Updates1 • State by State reopening status (as of July 27): ◦ SD, IA, NE, KS, ND, MN and MO have all reopened ◦ AZ and CO are currently reversing their strategy • Continuing to see increased activity in most of our footprint • Mobility data for Retail & Leisure is showing an increase in activity for 8 out of 9 states in our footprint that is outpacing the US average and other key states such as FL, CA, NY and TX 1 Sources: NY Times and Google mobility data 7-day average as of 7/12/20 5

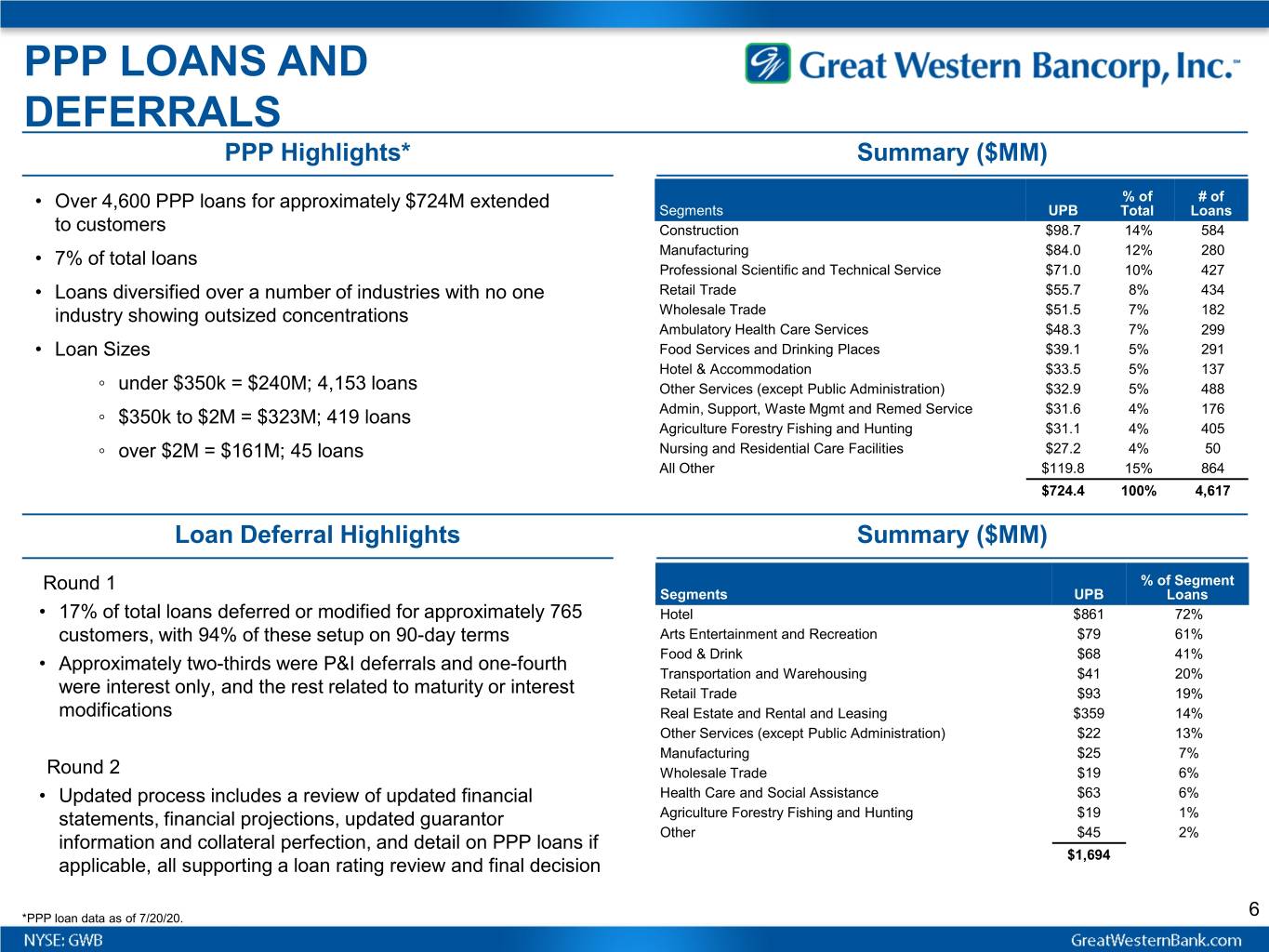

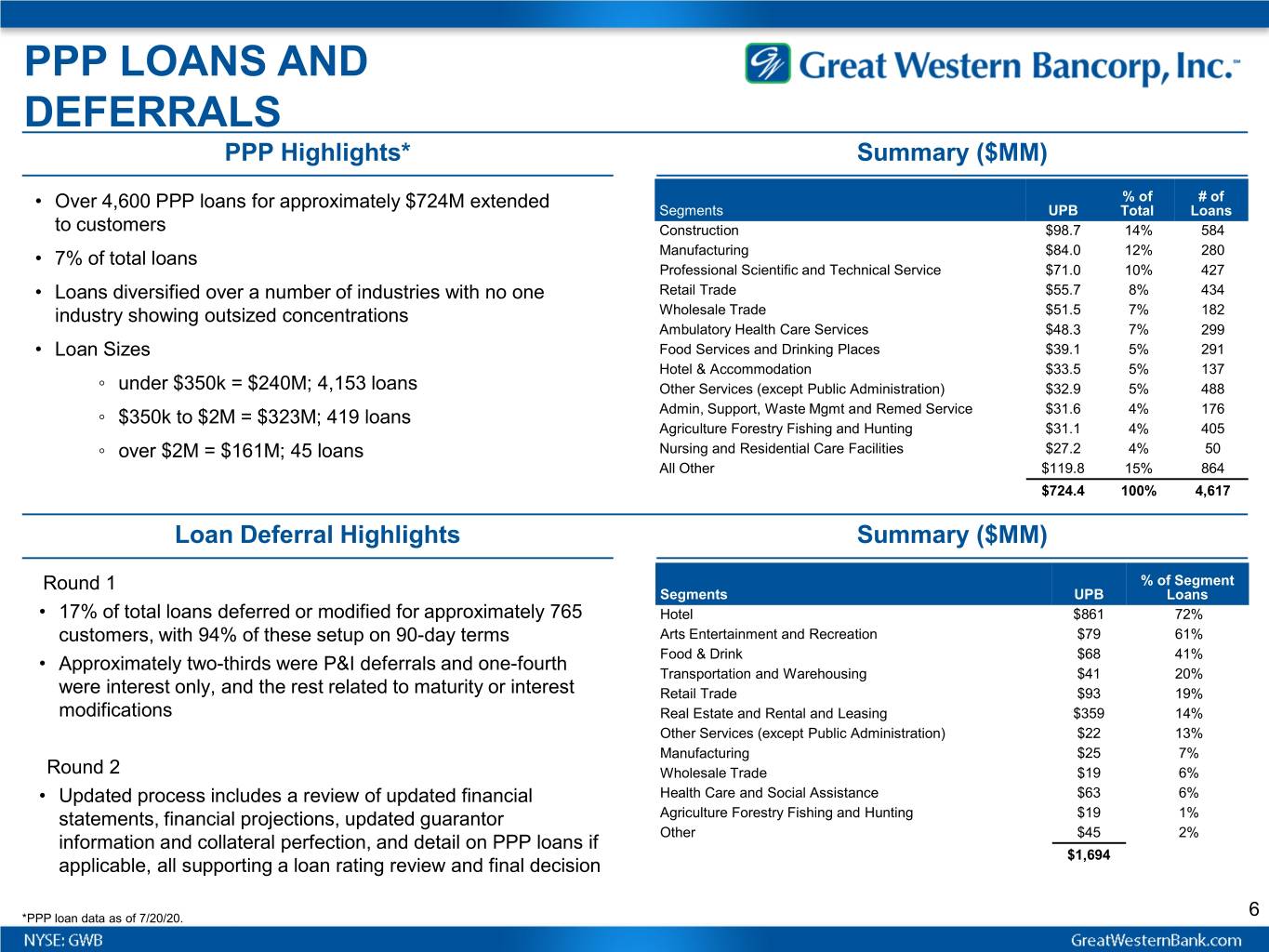

PPP LOANS AND DEFERRALS PPP Highlights* Summary ($MM) % of # of • Over 4,600 PPP loans for approximately $724M extended Segments UPB Total Loans to customers Construction $98.7 14% 584 • 7% of total loans Manufacturing $84.0 12% 280 Professional Scientific and Technical Service $71.0 10% 427 • Loans diversified over a number of industries with no one Retail Trade $55.7 8% 434 industry showing outsized concentrations Wholesale Trade $51.5 7% 182 Ambulatory Health Care Services $48.3 7% 299 • Loan Sizes Food Services and Drinking Places $39.1 5% 291 Hotel & Accommodation $33.5 5% 137 ◦ under $350k = $240M; 4,153 loans Other Services (except Public Administration) $32.9 5% 488 ◦ $350k to $2M = $323M; 419 loans Admin, Support, Waste Mgmt and Remed Service $31.6 4% 176 Agriculture Forestry Fishing and Hunting $31.1 4% 405 ◦ over $2M = $161M; 45 loans Nursing and Residential Care Facilities $27.2 4% 50 All Other $119.8 15% 864 $724.4 100% 4,617 Loan Deferral Highlights Summary ($MM) Round 1 % of Segment Segments UPB Loans • 17% of total loans deferred or modified for approximately 765 Hotel $861 72% customers, with 94% of these setup on 90-day terms Arts Entertainment and Recreation $79 61% Food & Drink $68 41% • Approximately two-thirds were P&I deferrals and one-fourth Transportation and Warehousing $41 20% were interest only, and the rest related to maturity or interest Retail Trade $93 19% modifications Real Estate and Rental and Leasing $359 14% Other Services (except Public Administration) $22 13% Manufacturing $25 7% Round 2 Wholesale Trade $19 6% • Updated process includes a review of updated financial Health Care and Social Assistance $63 6% statements, financial projections, updated guarantor Agriculture Forestry Fishing and Hunting $19 1% Other $45 2% information and collateral perfection, and detail on PPP loans if $1,694 applicable, all supporting a loan rating review and final decision *PPP loan data as of 7/20/20. 6

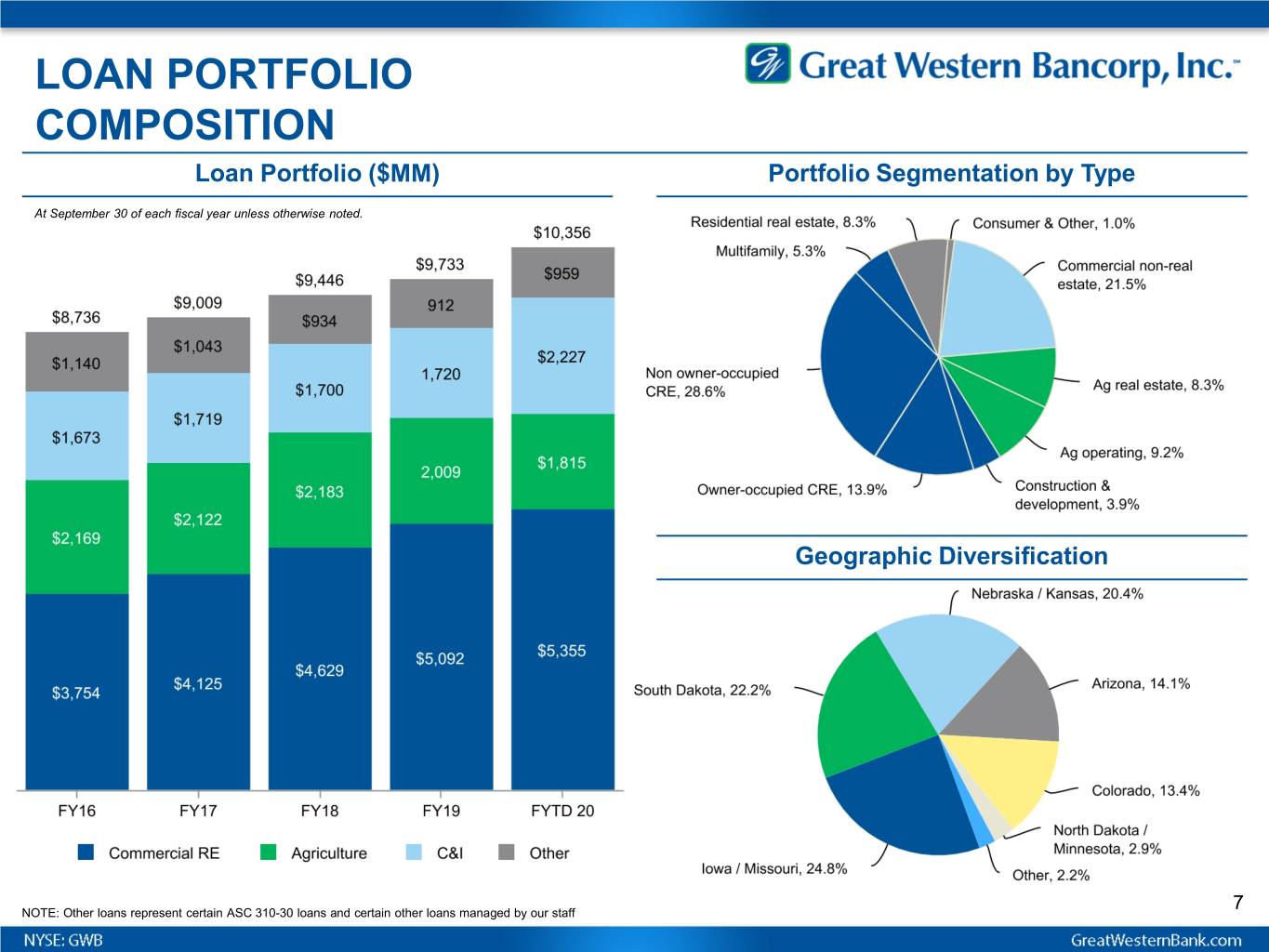

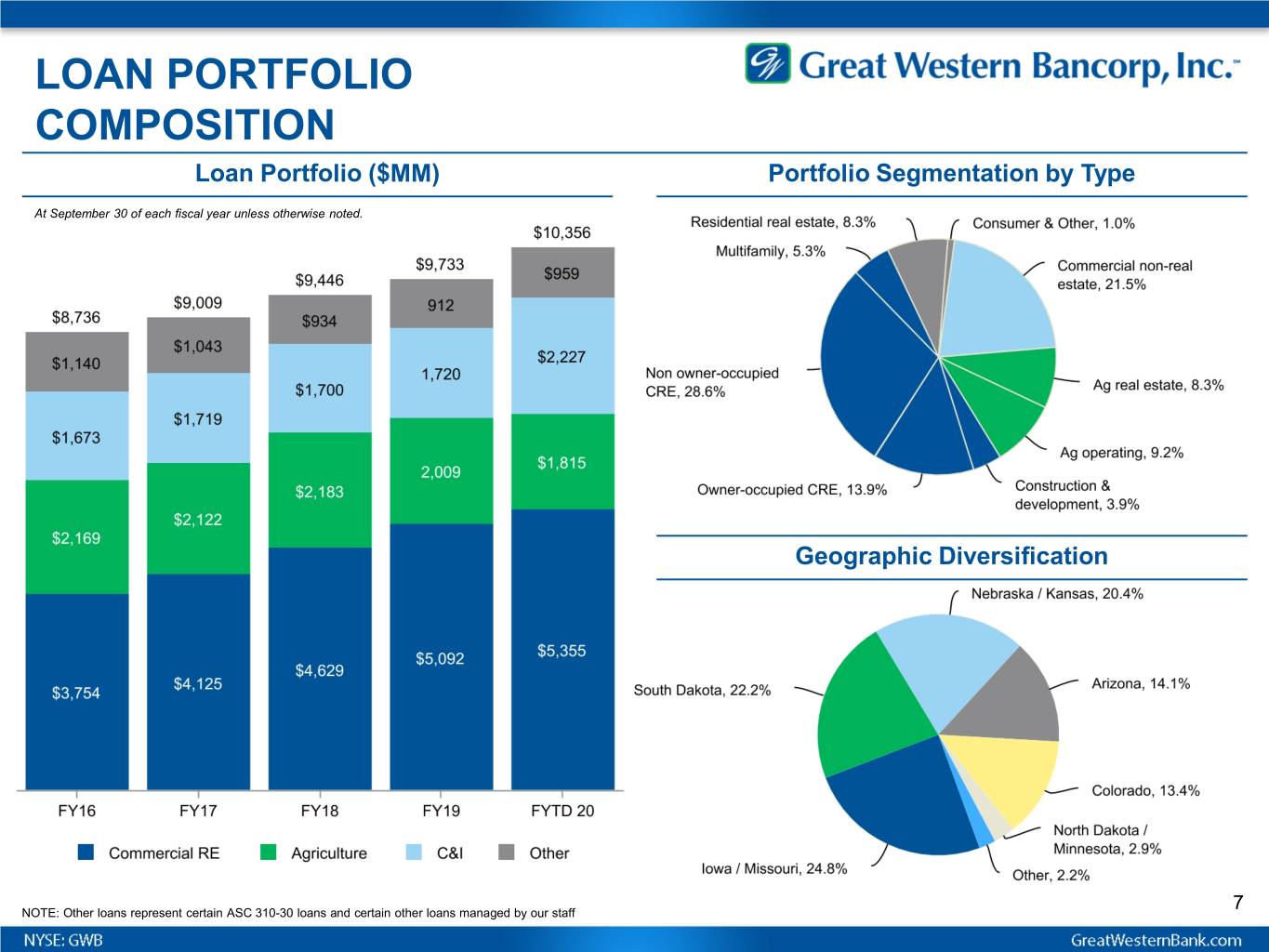

LOAN PORTFOLIO COMPOSITION Loan Portfolio ($MM) Portfolio Segmentation by Type At September 30 of each fiscal year unless otherwise noted. Geographic Diversification NOTE: Other loans represent certain ASC 310-30 loans and certain other loans managed by our staff 7

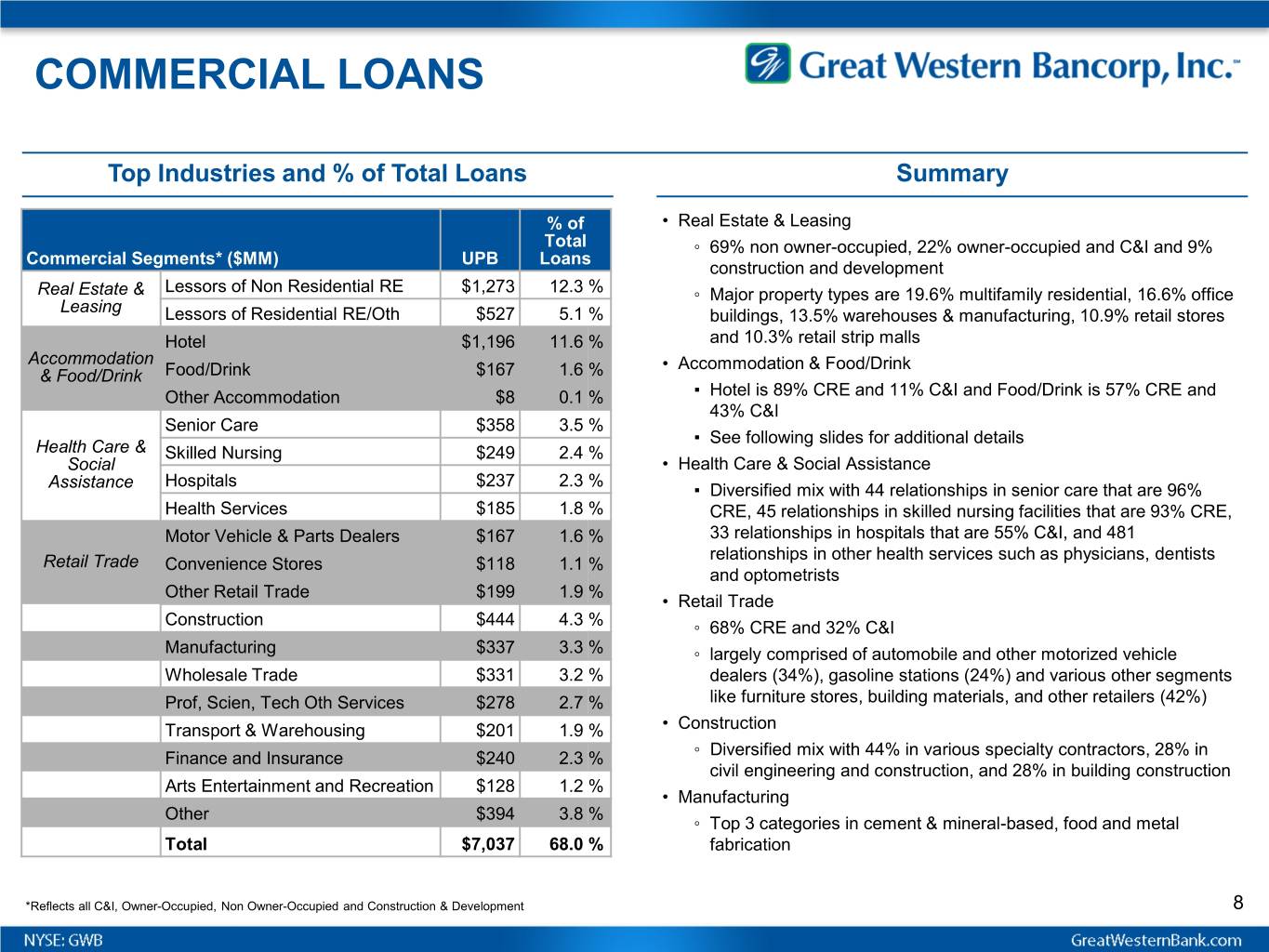

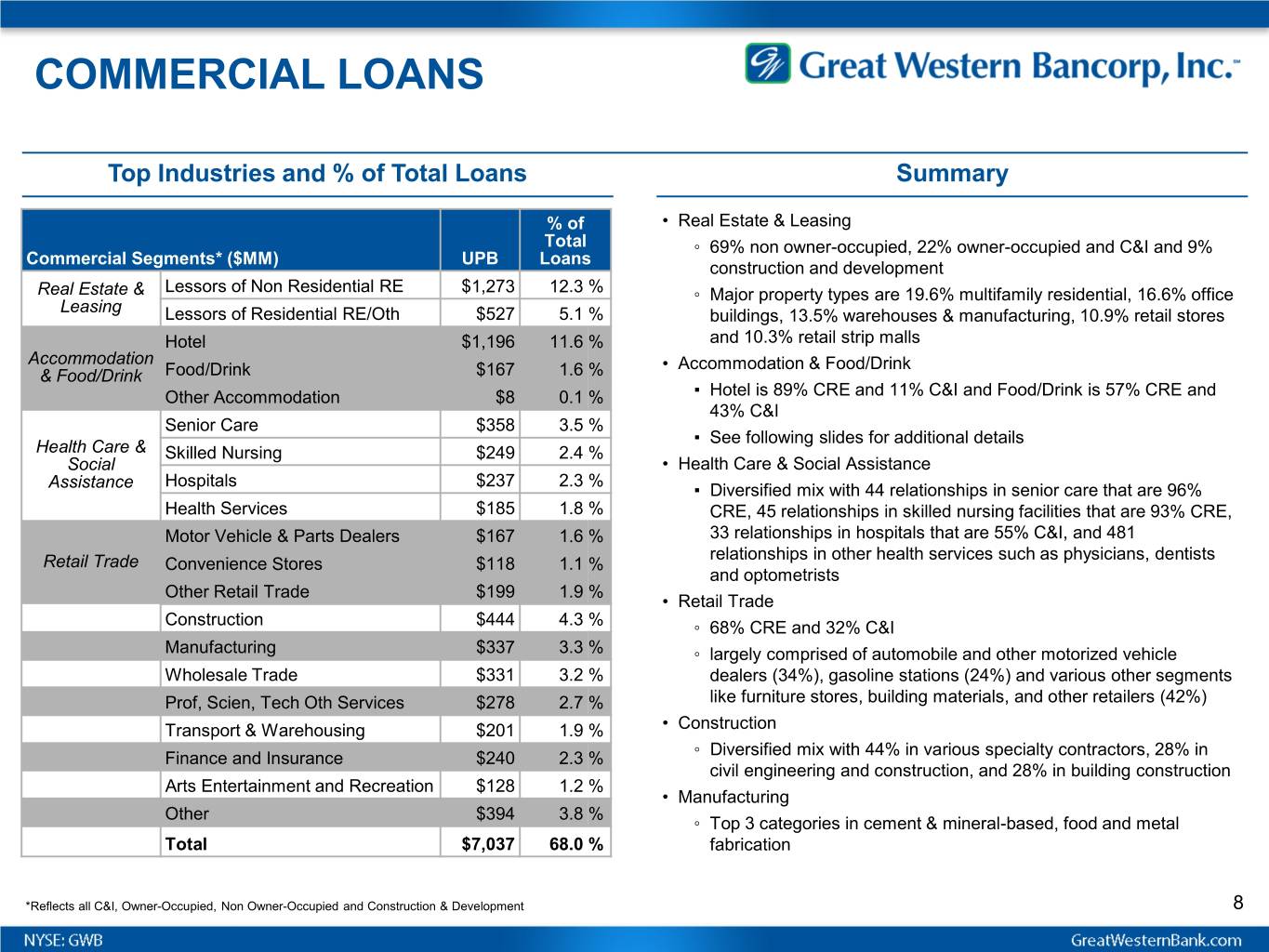

COMMERCIAL LOANS Top Industries and % of Total Loans Summary % of • Real Estate & Leasing Total ◦ 69% non owner-occupied, 22% owner-occupied and C&I and 9% Commercial Segments* ($MM) UPB Loans construction and development Real Estate & Lessors of Non Residential RE $1,273 12.3 % ◦ Major property types are 19.6% multifamily residential, 16.6% office Leasing Lessors of Residential RE/Oth $527 5.1 % buildings, 13.5% warehouses & manufacturing, 10.9% retail stores Hotel $1,196 11.6 % and 10.3% retail strip malls Accommodation • Accommodation & Food/Drink & Food/Drink Food/Drink $167 1.6 % Other Accommodation $8 0.1 % ▪ Hotel is 89% CRE and 11% C&I and Food/Drink is 57% CRE and 43% C&I Senior Care $358 3.5 % ▪ See following slides for additional details Health Care & Skilled Nursing $249 2.4 % Social • Health Care & Social Assistance Hospitals $237 2.3 % Assistance ▪ Diversified mix with 44 relationships in senior care that are 96% Health Services $185 1.8 % CRE, 45 relationships in skilled nursing facilities that are 93% CRE, Motor Vehicle & Parts Dealers $167 1.6 % 33 relationships in hospitals that are 55% C&I, and 481 relationships in other health services such as physicians, dentists Retail Trade Convenience Stores $118 1.1 % and optometrists Other Retail Trade $199 1.9 % • Retail Trade Construction $444 4.3 % ◦ 68% CRE and 32% C&I Manufacturing $337 3.3 % ◦ largely comprised of automobile and other motorized vehicle Wholesale Trade $331 3.2 % dealers (34%), gasoline stations (24%) and various other segments Prof, Scien, Tech Oth Services $278 2.7 % like furniture stores, building materials, and other retailers (42%) Transport & Warehousing $201 1.9 % • Construction ◦ Diversified mix with 44% in various specialty contractors, 28% in Finance and Insurance $240 2.3 % civil engineering and construction, and 28% in building construction Arts Entertainment and Recreation $128 1.2 % • Manufacturing Other $394 3.8 % ◦ Top 3 categories in cement & mineral-based, food and metal Total $7,037 68.0 % fabrication *Reflects all C&I, Owner-Occupied, Non Owner-Occupied and Construction & Development 8

KEY LOAN SEGMENTS Ag Portfolio by Industry $1.8B Segment Update • Ag portfolio remains well diversified across key sub-segments • USDA corn condition good/excellent is 82% in SD, 83% in IA, and 70% in NE and all advantaged to the 69% national average • Similarly, soybean good/excellent is 77%, 83% and 73% for SD, IA and NE, respectively compared to 68% national average • Dairy markets have strengthened as Class III milk prices were $21.04 in June, up $8.90 from May, and are indicative of good and profitable marketing opportunities for producers Health Care Portfolio $1.0B Portfolio Characteristics • Senior Care is $359M which is 3.5% of total loans, 96% CRE, and consists of approximately 44 relationships • Skilled nursing at $249M are 2.4% of total loans, 93% CRE, and consists of approximately 45 relationships • Hospitals at $239M are 2.3% of total loans, more aligned to C&I at 55% and consist of approximately 33 relationships • All other health care at $192M is 1.8% of total loans, is also higher in C&I at 57%, and is much more fragmented across approximately 481 relationships that include physicians, dentists, optometrists, therapists, and other specialty services as well as social assistance 9

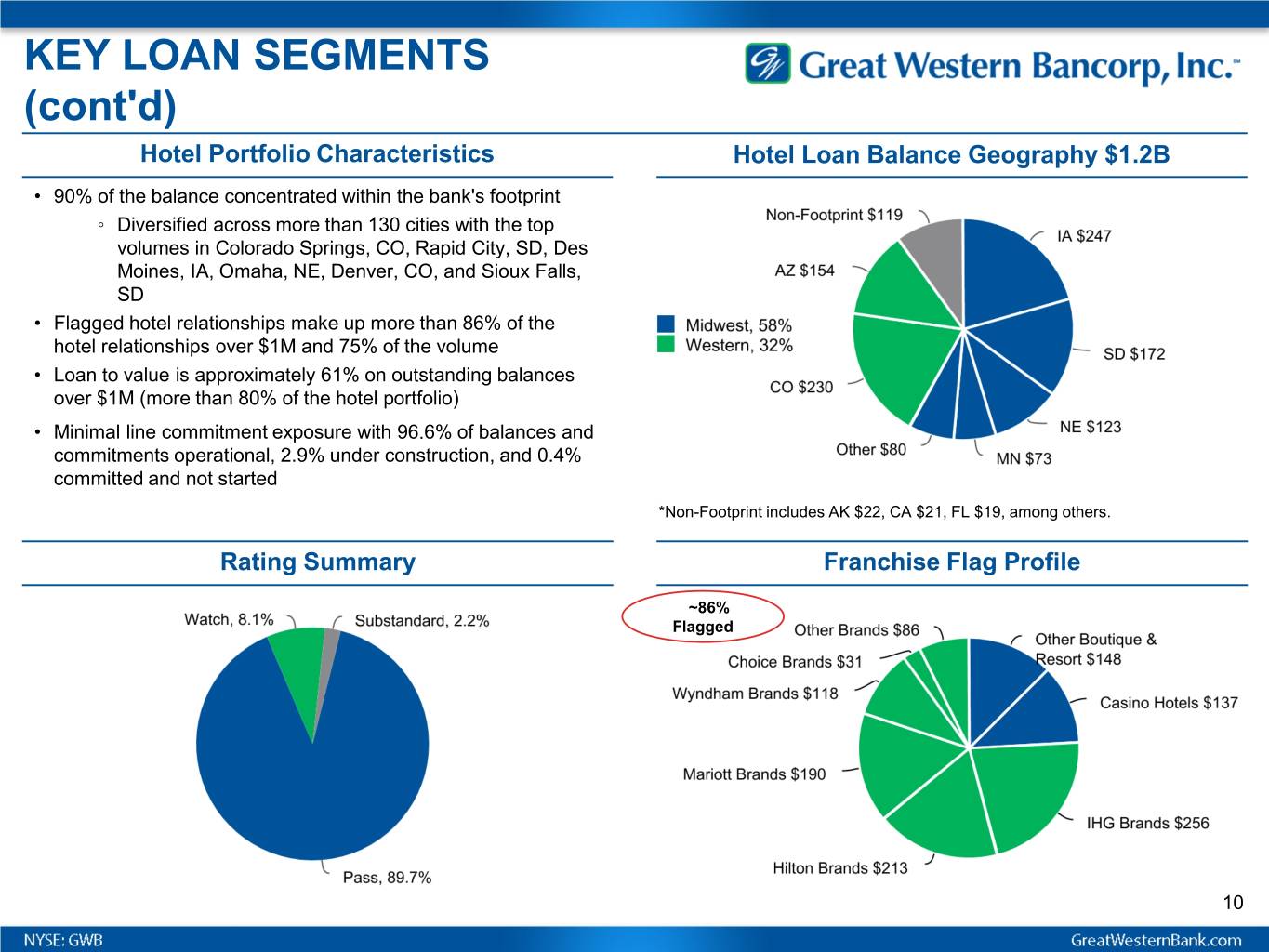

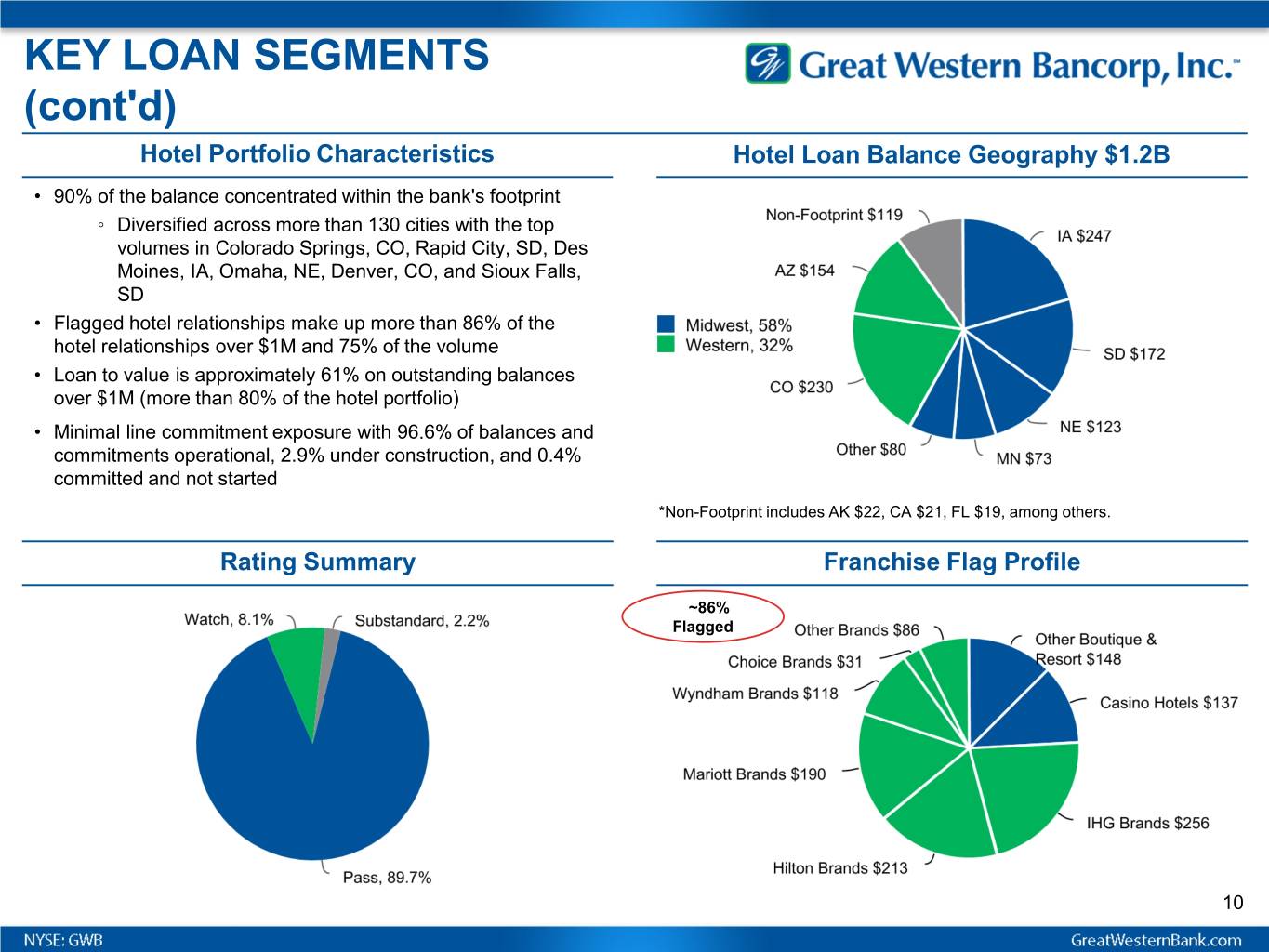

KEY LOAN SEGMENTS (cont'd) Hotel Portfolio Characteristics Hotel Loan Balance Geography $1.2B • 90% of the balance concentrated within the bank's footprint ◦ Diversified across more than 130 cities with the top volumes in Colorado Springs, CO, Rapid City, SD, Des Moines, IA, Omaha, NE, Denver, CO, and Sioux Falls, SD • Flagged hotel relationships make up more than 86% of the hotel relationships over $1M and 75% of the volume • Loan to value is approximately 61% on outstanding balances over $1M (more than 80% of the hotel portfolio) • Minimal line commitment exposure with 96.6% of balances and commitments operational, 2.9% under construction, and 0.4% committed and not started *Non-Footprint includes AK $22, CA $21, FL $19, among others. Rating Summary Franchise Flag Profile ~86% Flagged 10

ASSET QUALITY METRICS Summary Nonaccruals / Total Loans • Net charge-offs for the quarter were stable at 0.37% of average loans on an annualized basis, compared to 0.36% the prior quarter ◦ YTD net charge-offs are 0.33% compared to $0.37% in the prior year • Substandard loans increased $70.8M due largely to two senior care credits deteriorating from watch status • One of the senior care credits previously mentioned and a hotel relationship were part of a 28.8% increase in nonaccruals to $274M Substandard Loans ($MM) Net Charge-offs / Average Total Loans1 1 Annualized for partial periods 11

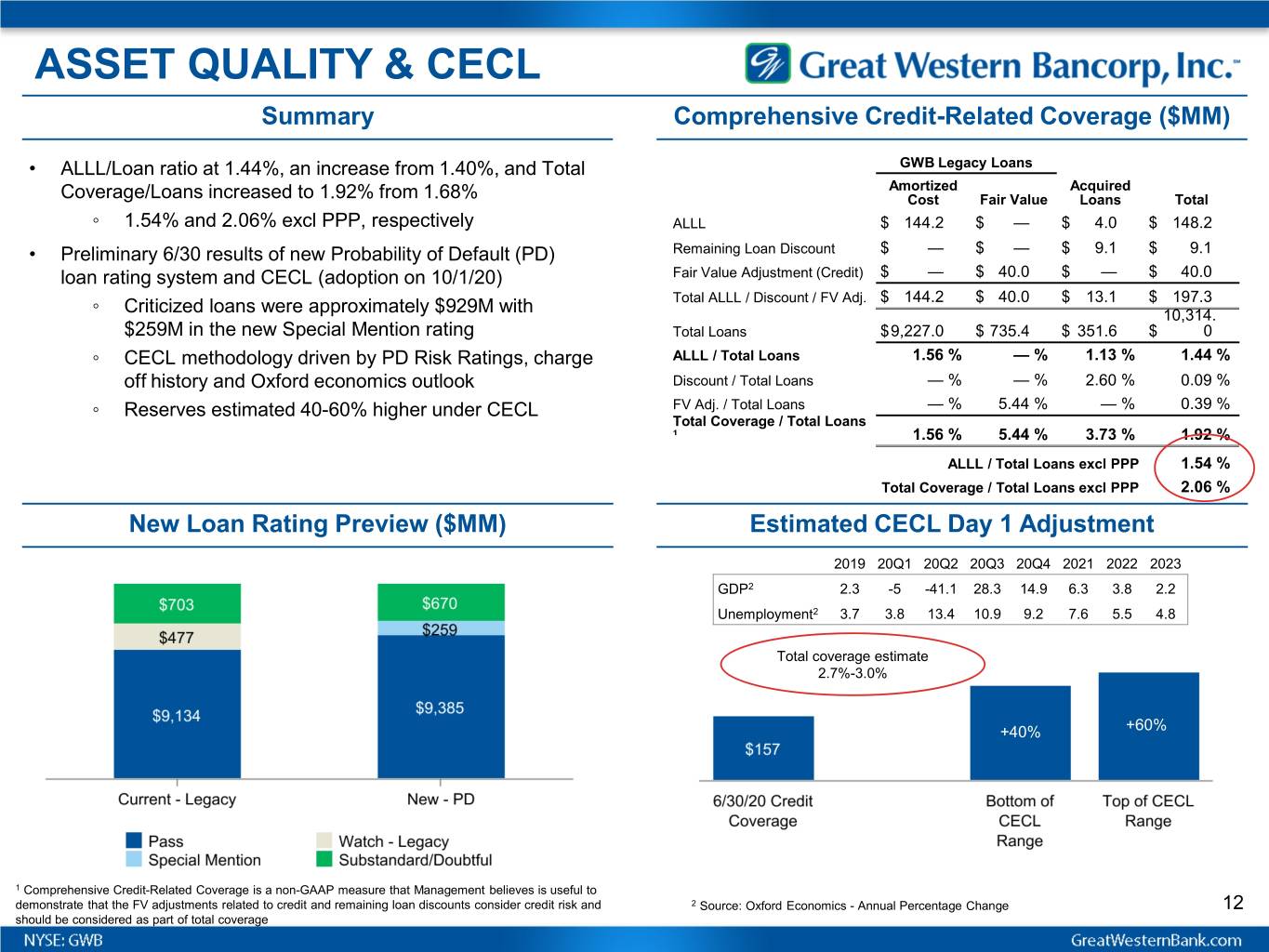

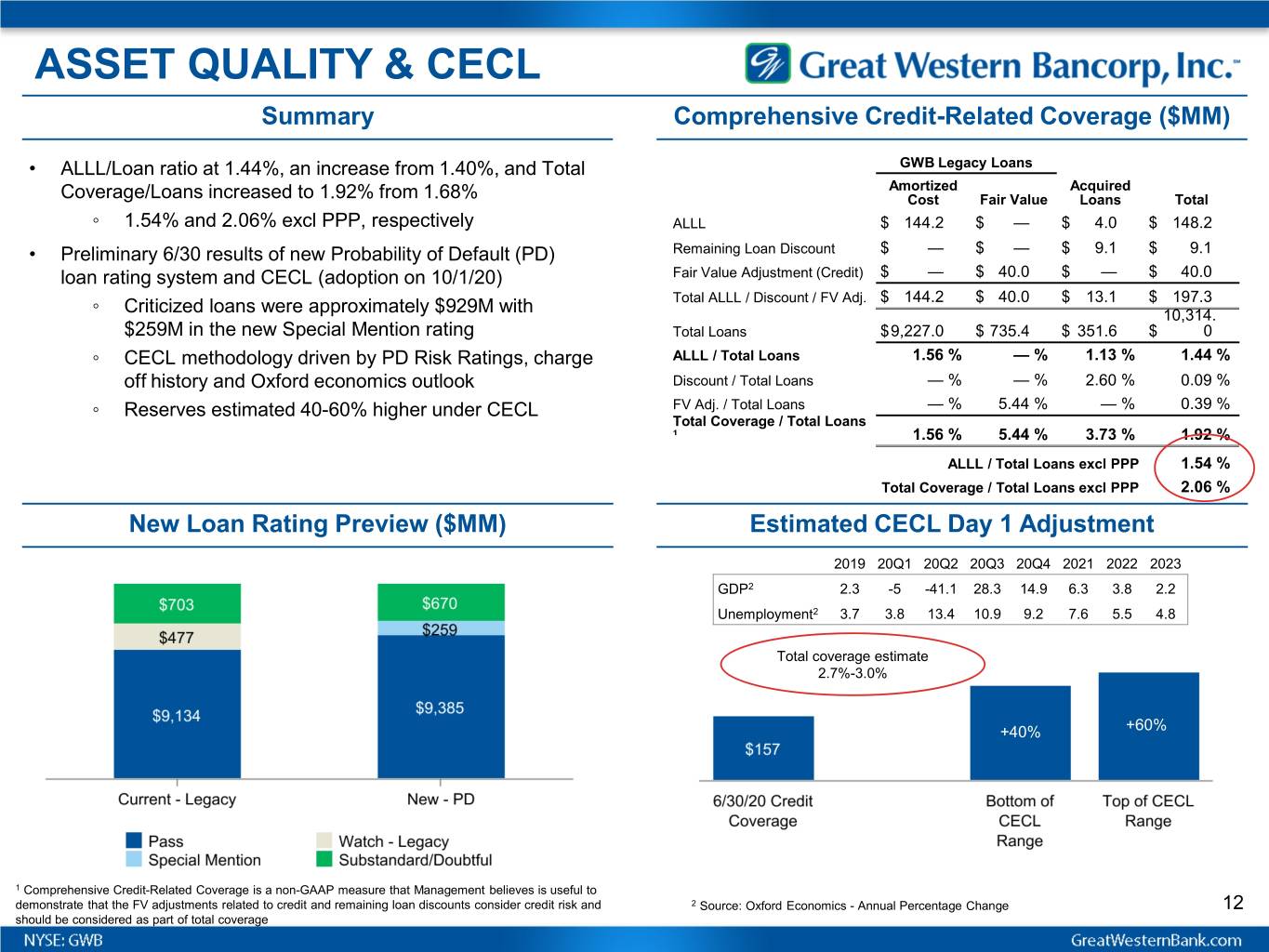

ASSET QUALITY & CECL Summary Comprehensive Credit-Related Coverage ($MM) • ALLL/Loan ratio at 1.44%, an increase from 1.40%, and Total GWB Legacy Loans Amortized Acquired Coverage/Loans increased to 1.92% from 1.68% Cost Fair Value Loans Total ◦ 1.54% and 2.06% excl PPP, respectively ALLL $ 144.2 $ — $ 4.0 $ 148.2 • Preliminary 6/30 results of new Probability of Default (PD) Remaining Loan Discount $ — $ — $ 9.1 $ 9.1 loan rating system and CECL (adoption on 10/1/20) Fair Value Adjustment (Credit) $ — $ 40.0 $ — $ 40.0 Total ALLL / Discount / FV Adj. $ 144.2 $ 40.0 $ 13.1 $ 197.3 ◦ Criticized loans were approximately $929M with 10,314. $259M in the new Special Mention rating Total Loans $9,227.0 $ 735.4 $ 351.6 $ 0 ◦ CECL methodology driven by PD Risk Ratings, charge ALLL / Total Loans 1.56 % — % 1.13 % 1.44 % off history and Oxford economics outlook Discount / Total Loans — % — % 2.60 % 0.09 % ◦ Reserves estimated 40-60% higher under CECL FV Adj. / Total Loans — % 5.44 % — % 0.39 % Total Coverage / Total Loans ¹ 1.56 % 5.44 % 3.73 % 1.92 % ALLL / Total Loans excl PPP 1.54 % Total Coverage / Total Loans excl PPP 2.06 % New Loan Rating Preview ($MM) Estimated CECL Day 1 Adjustment 2019 20Q1 20Q2 20Q3 20Q4 2021 2022 2023 GDP2 2.3 -5 -41.1 28.3 14.9 6.3 3.8 2.2 Unemployment2 3.7 3.8 13.4 10.9 9.2 7.6 5.5 4.8 Total coverage estimate 2.7%-3.0% +40% +60% 1 Comprehensive Credit-Related Coverage is a non-GAAP measure that Management believes is useful to demonstrate that the FV adjustments related to credit and remaining loan discounts consider credit risk and 2 Source: Oxford Economics - Annual Percentage Change 12 should be considered as part of total coverage

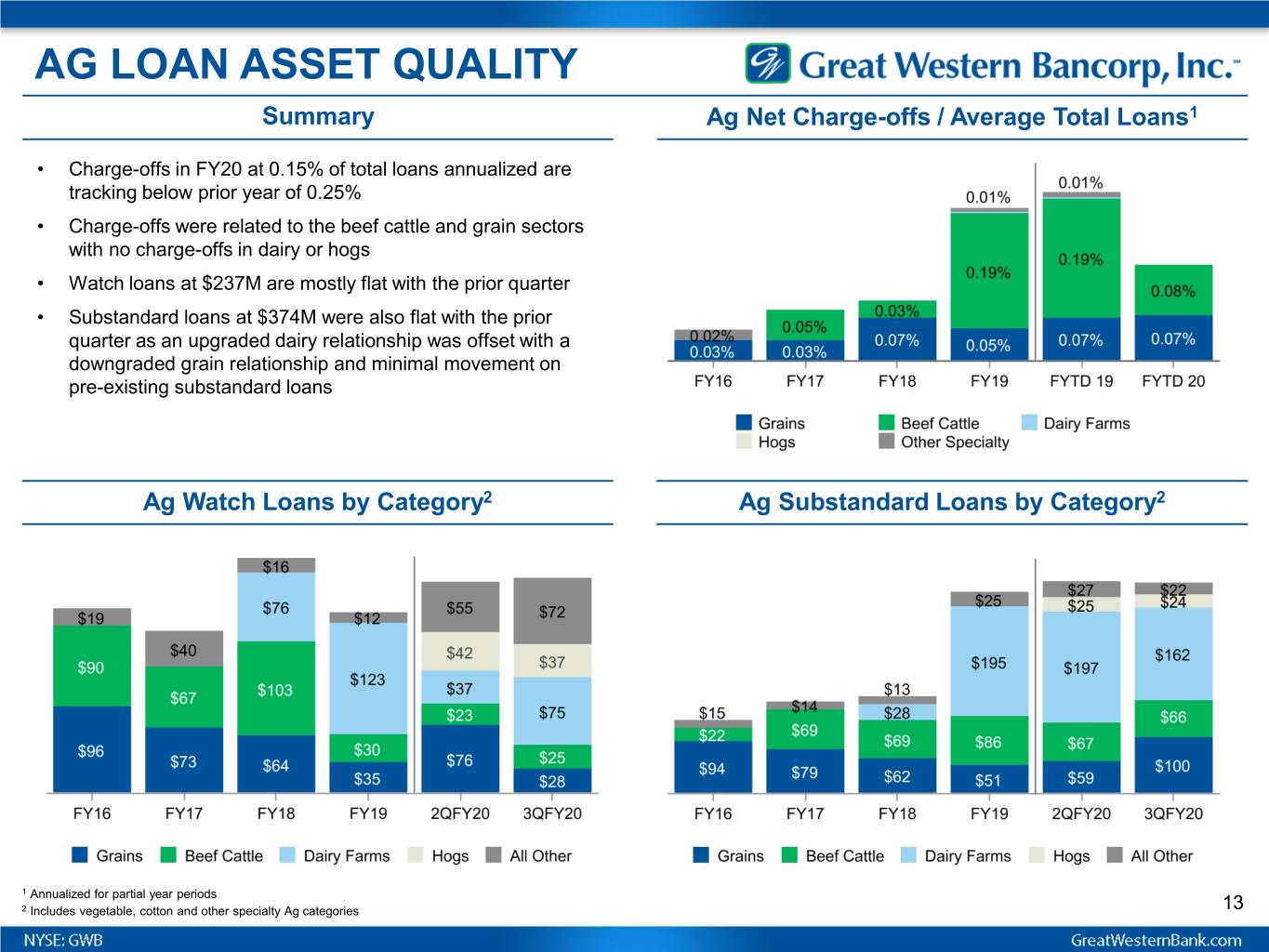

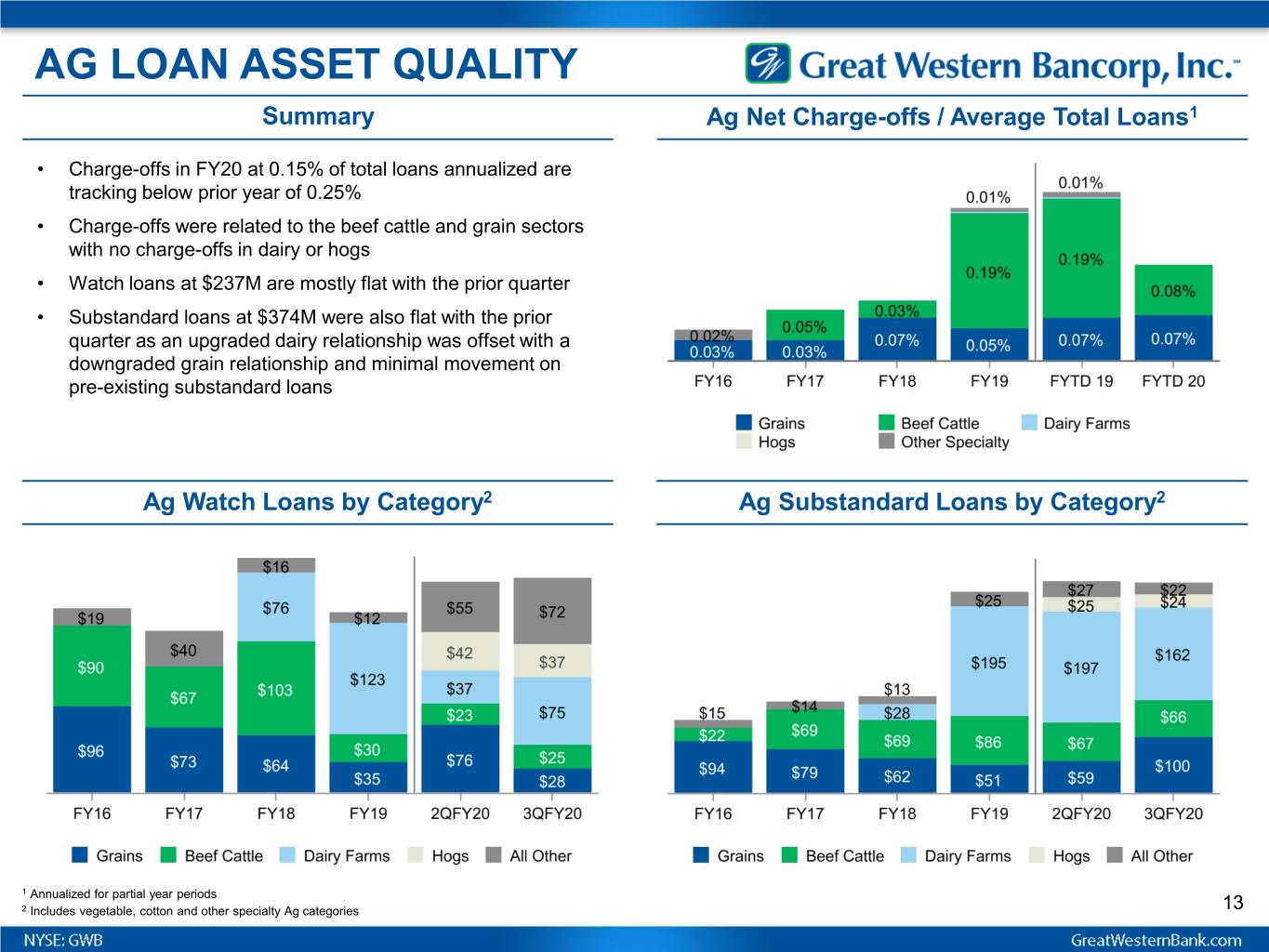

AG LOAN ASSET QUALITY Summary Ag Net Charge-offs / Average Total Loans1 • Charge-offs in FY20 at 0.15% of total loans annualized are tracking below prior year of 0.25% • Charge-offs were related to the beef cattle and grain sectors with no charge-offs in dairy or hogs • Watch loans at $237M are mostly flat with the prior quarter • Substandard loans at $374M were also flat with the prior quarter as an upgraded dairy relationship was offset with a downgraded grain relationship and minimal movement on pre-existing substandard loans Ag Watch Loans by Category2 Ag Substandard Loans by Category2 1 Annualized for partial year periods 2 Includes vegetable, cotton and other specialty Ag categories 13

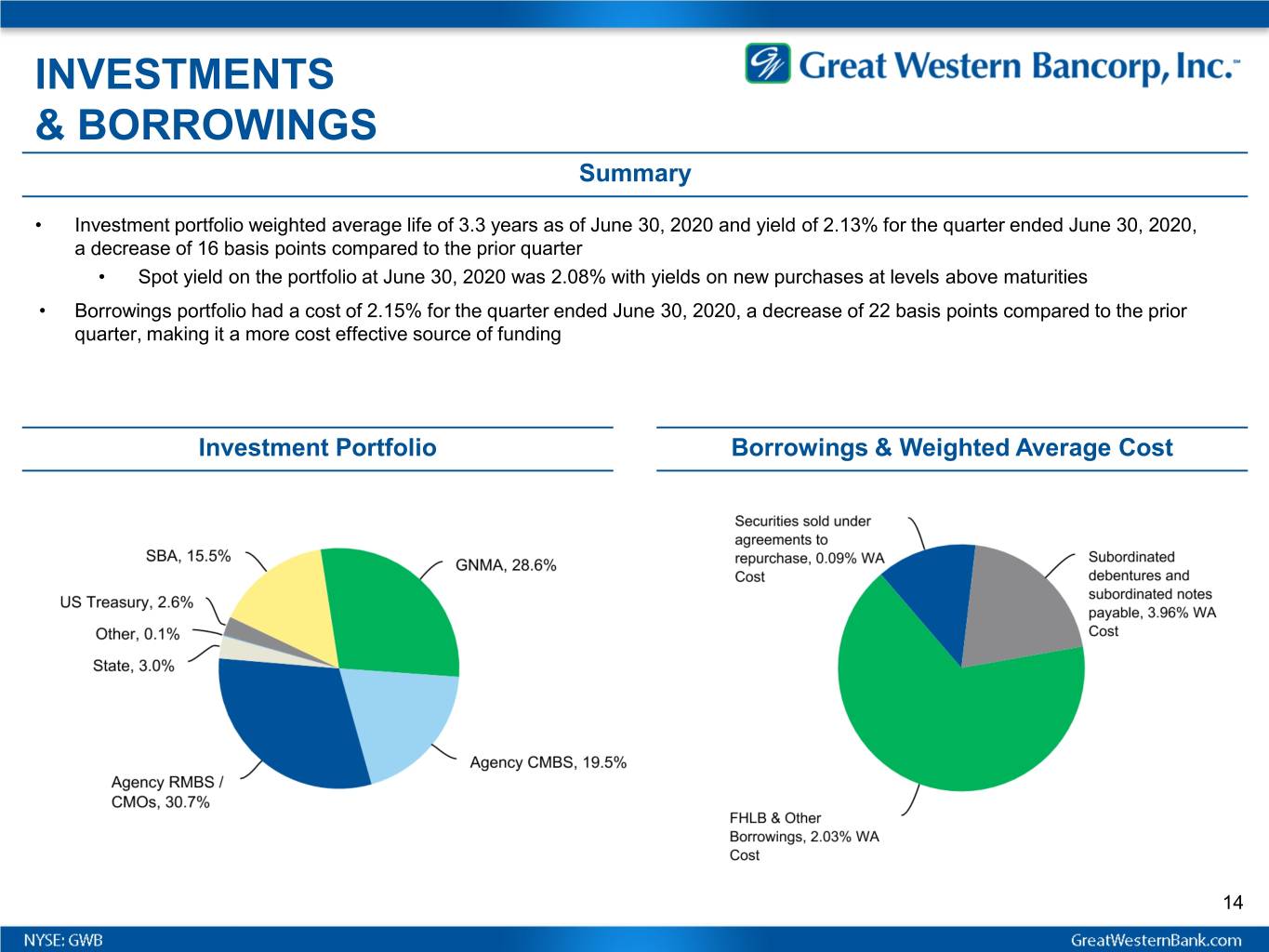

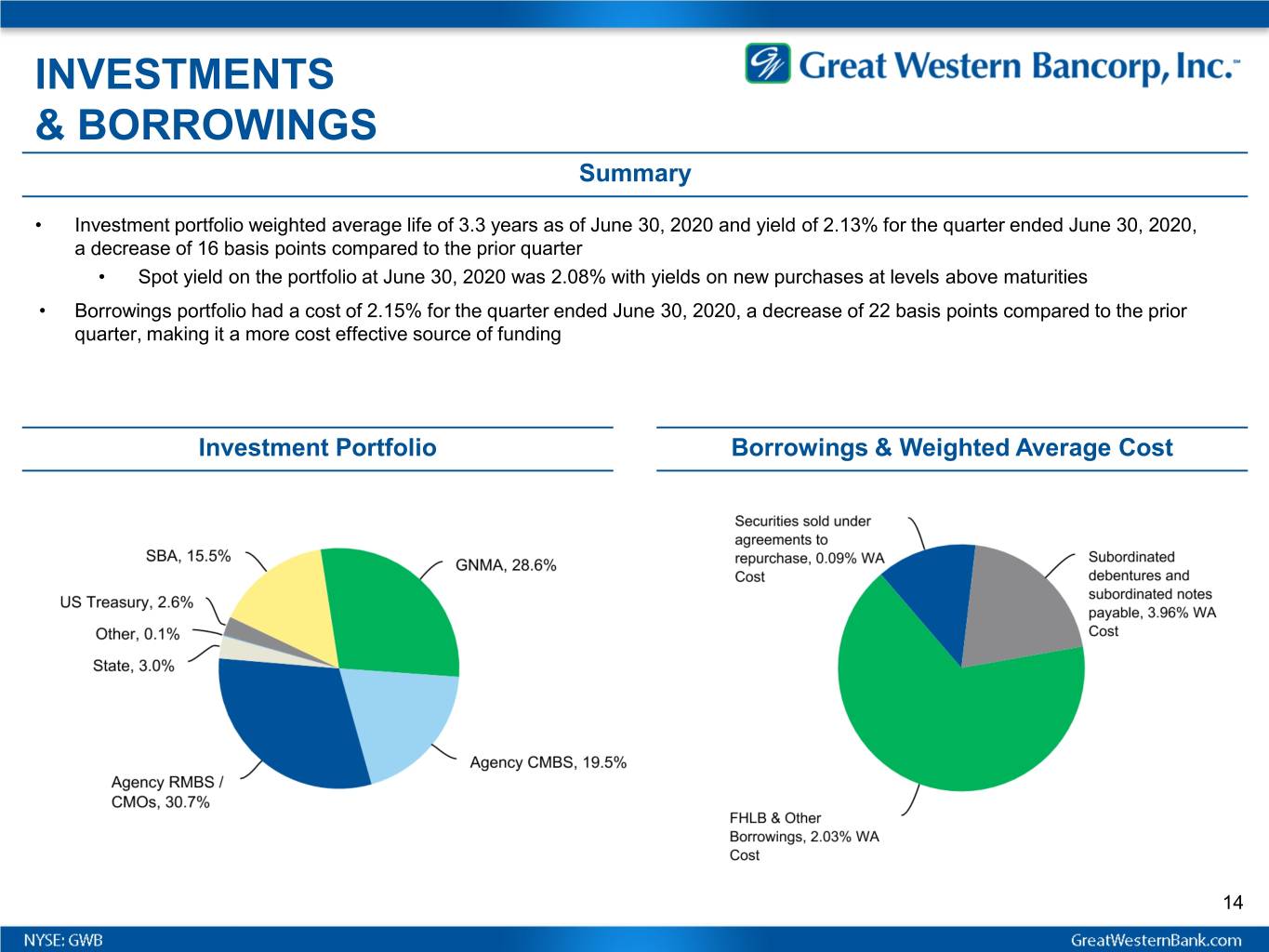

INVESTMENTS & BORROWINGS Summary • Investment portfolio weighted average life of 3.3 years as of June 30, 2020 and yield of 2.13% for the quarter ended June 30, 2020, a decrease of 16 basis points compared to the prior quarter • Spot yield on the portfolio at June 30, 2020 was 2.08% with yields on new purchases at levels above maturities • Borrowings portfolio had a cost of 2.15% for the quarter ended June 30, 2020, a decrease of 22 basis points compared to the prior quarter, making it a more cost effective source of funding Investment Portfolio Borrowings & Weighted Average Cost 14

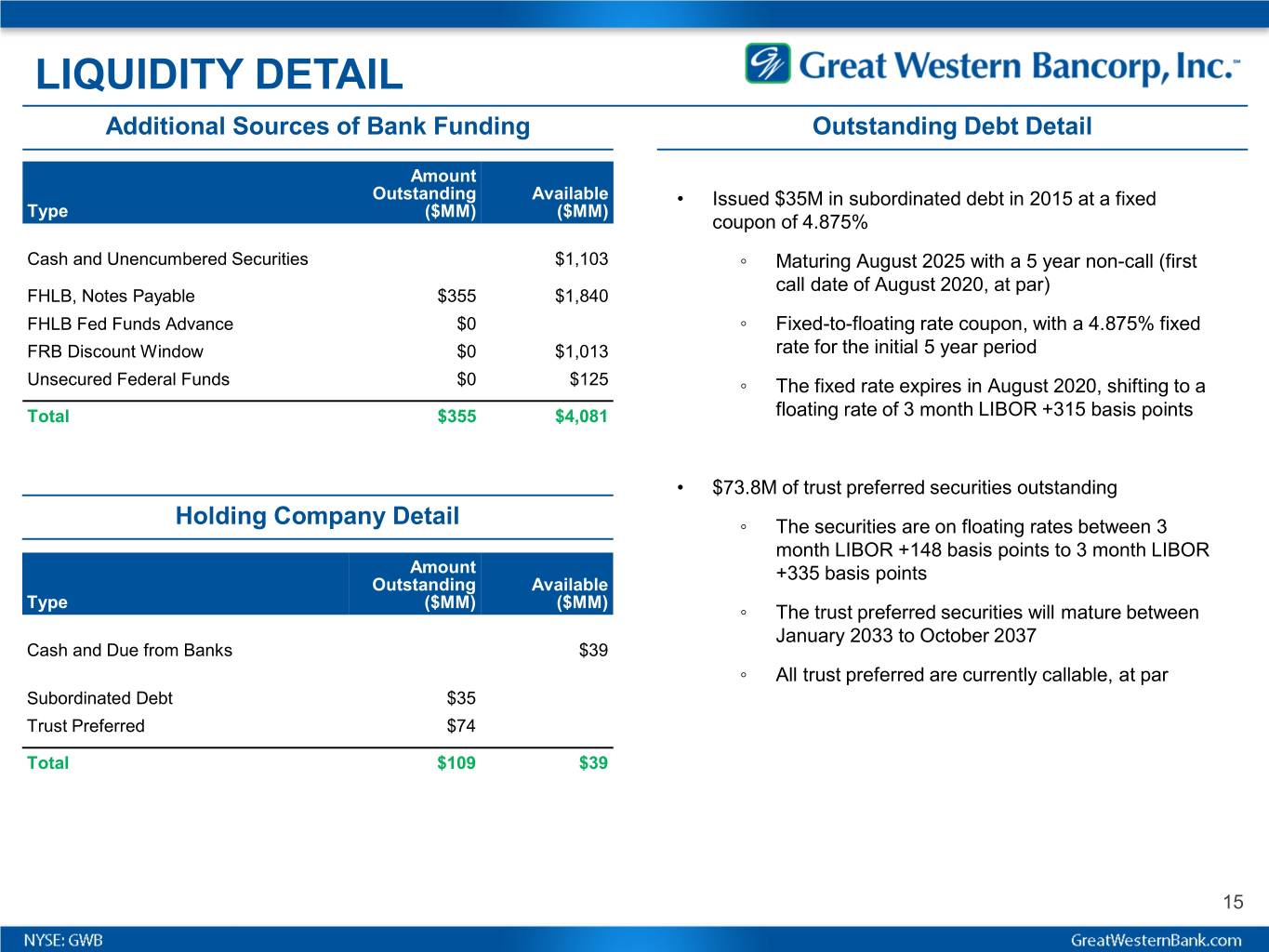

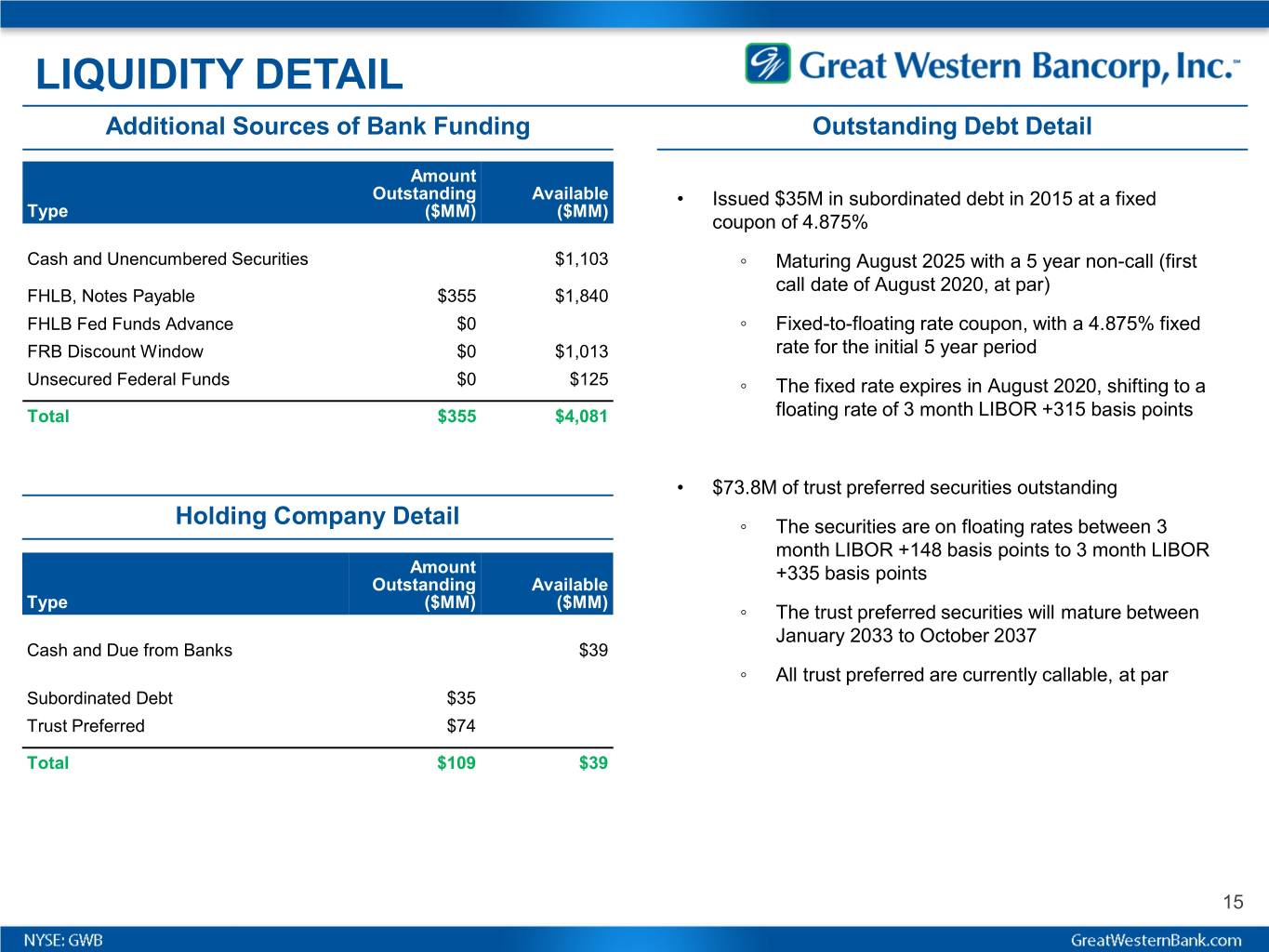

LIQUIDITY DETAIL Additional Sources of Bank Funding Outstanding Debt Detail Amount Outstanding Available • Issued $35M in subordinated debt in 2015 at a fixed Type ($MM) ($MM) coupon of 4.875% Cash and Unencumbered Securities $1,103 ◦ Maturing August 2025 with a 5 year non-call (first call date of August 2020, at par) FHLB, Notes Payable $355 $1,840 FHLB Fed Funds Advance $0 ◦ Fixed-to-floating rate coupon, with a 4.875% fixed FRB Discount Window $0 $1,013 rate for the initial 5 year period Unsecured Federal Funds $0 $125 ◦ The fixed rate expires in August 2020, shifting to a Total $355 $4,081 floating rate of 3 month LIBOR +315 basis points • $73.8M of trust preferred securities outstanding Holding Company Detail ◦ The securities are on floating rates between 3 month LIBOR +148 basis points to 3 month LIBOR Amount +335 basis points Outstanding Available Type ($MM) ($MM) ◦ The trust preferred securities will mature between January 2033 to October 2037 Cash and Due from Banks $39 ◦ All trust preferred are currently callable, at par Subordinated Debt $35 Trust Preferred $74 Total $109 $39 15

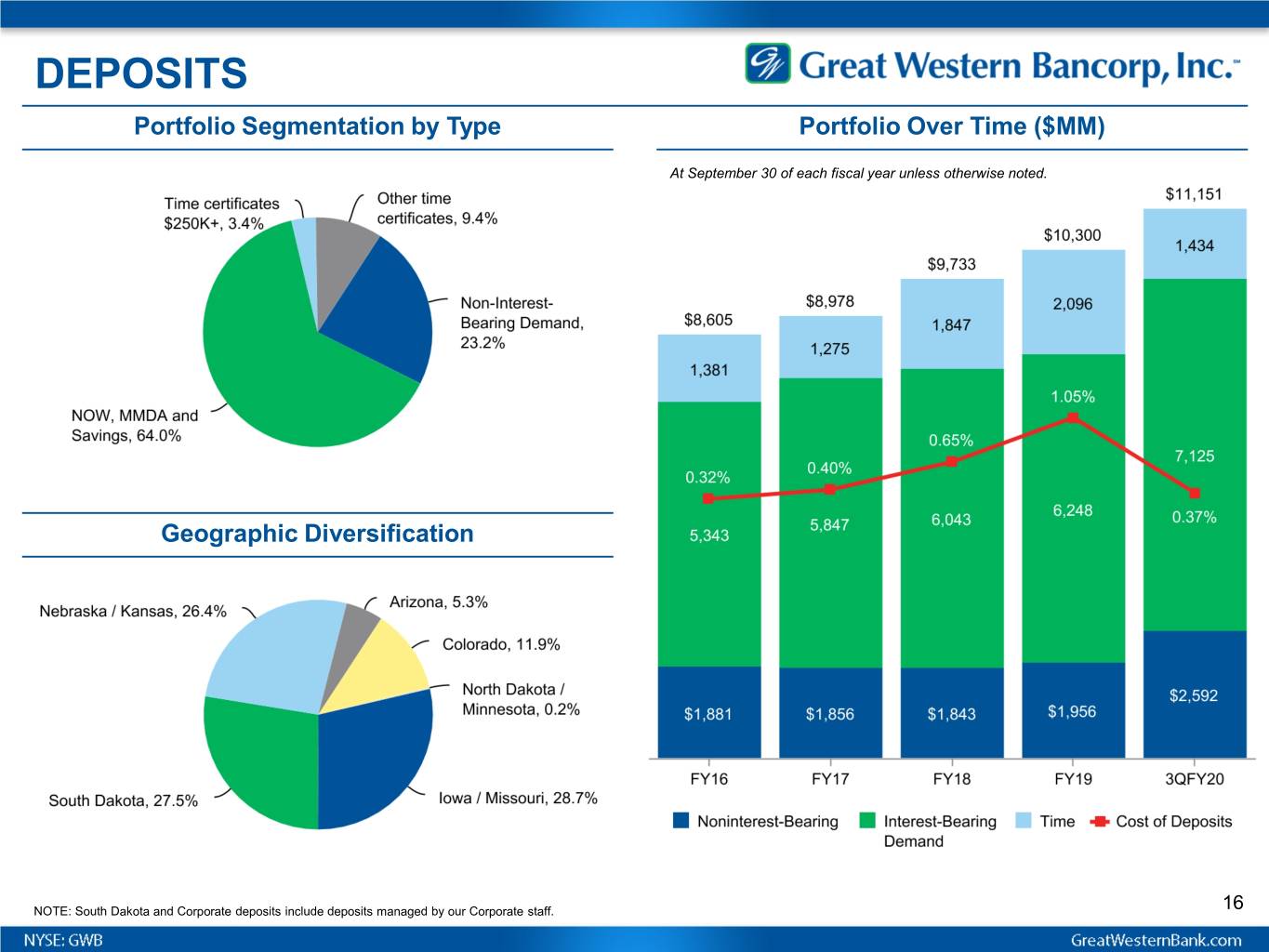

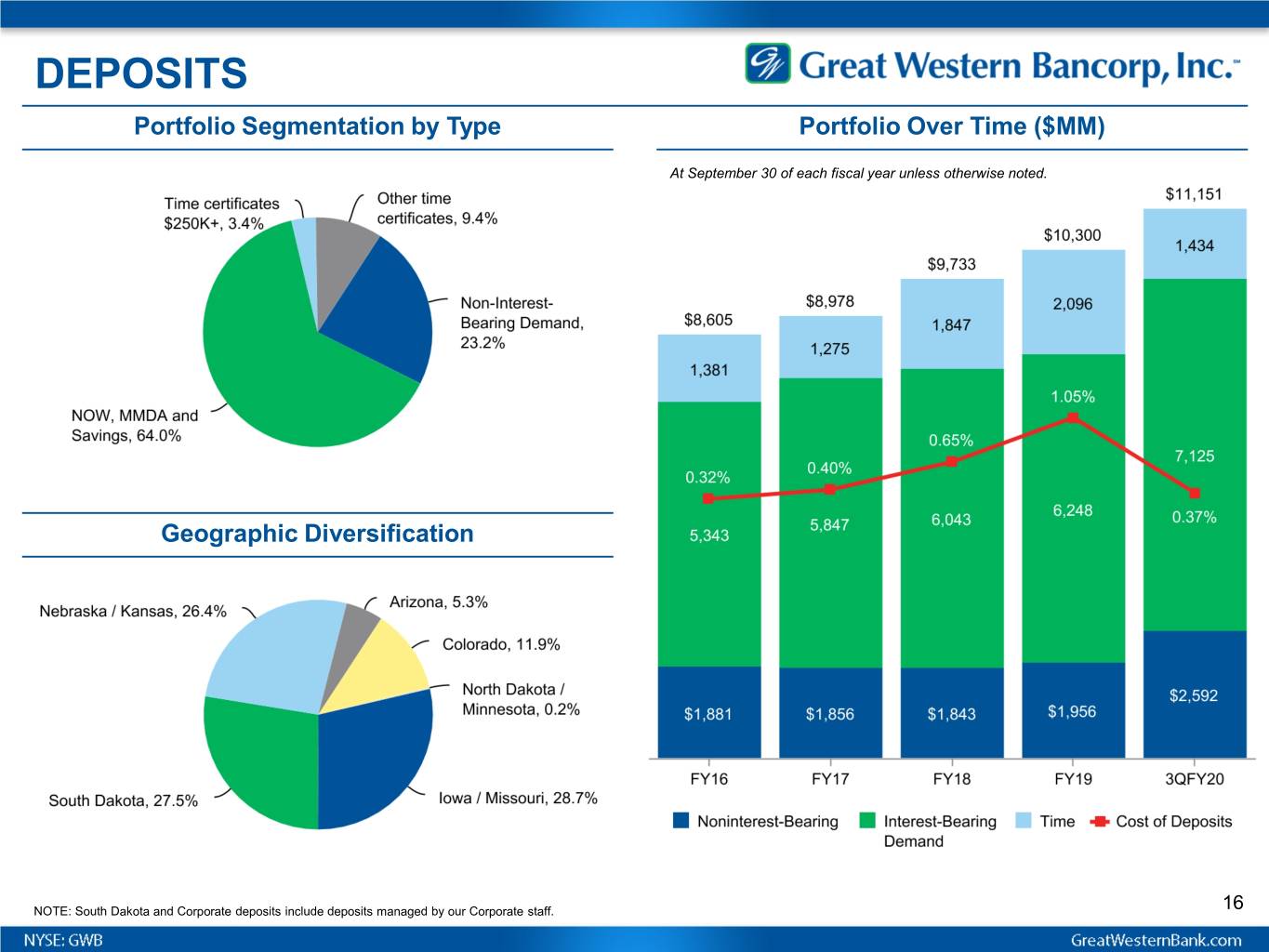

DEPOSITS Portfolio Segmentation by Type Portfolio Over Time ($MM) At September 30 of each fiscal year unless otherwise noted. Geographic Diversification NOTE: South Dakota and Corporate deposits include deposits managed by our Corporate staff. 16

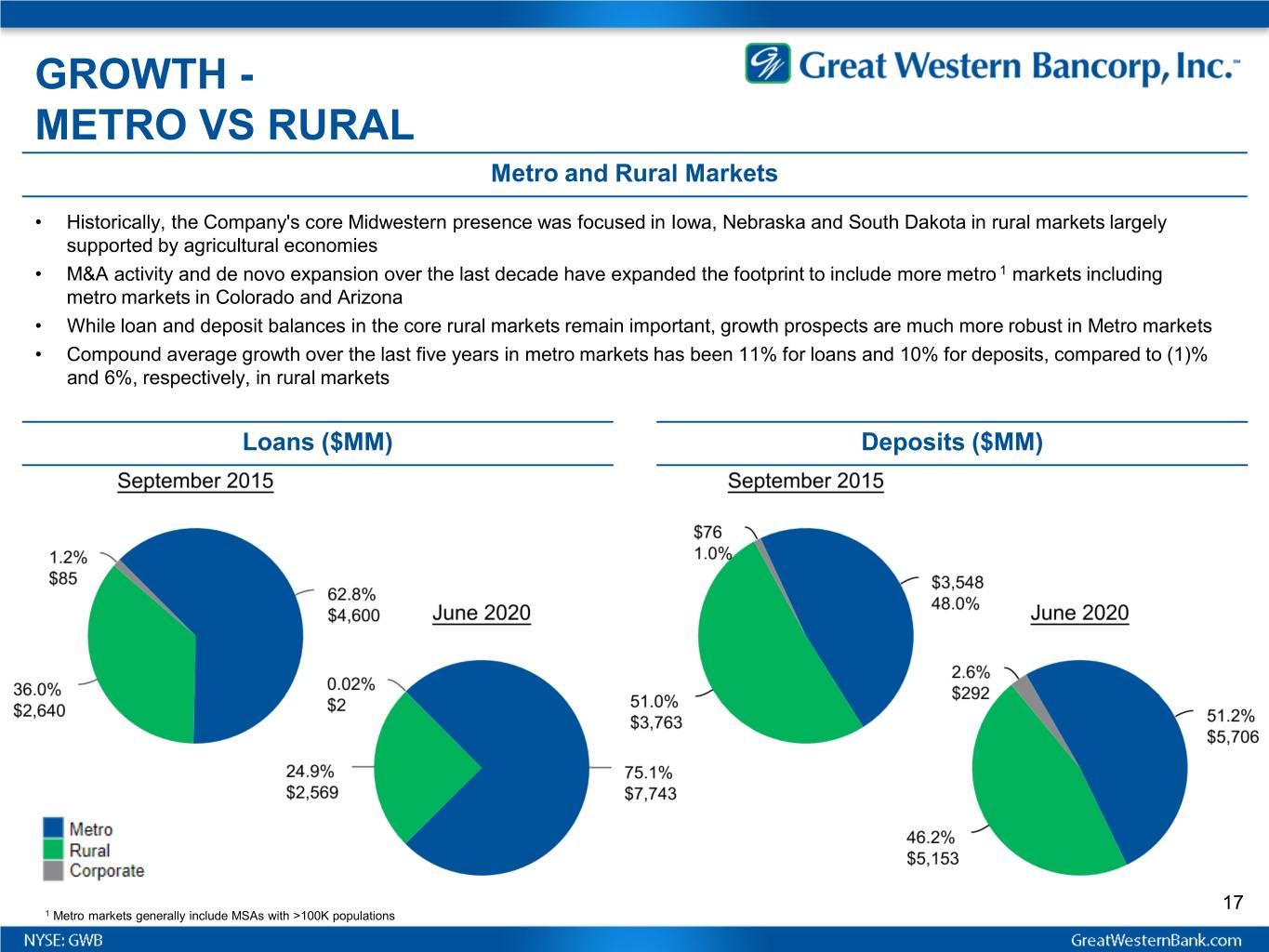

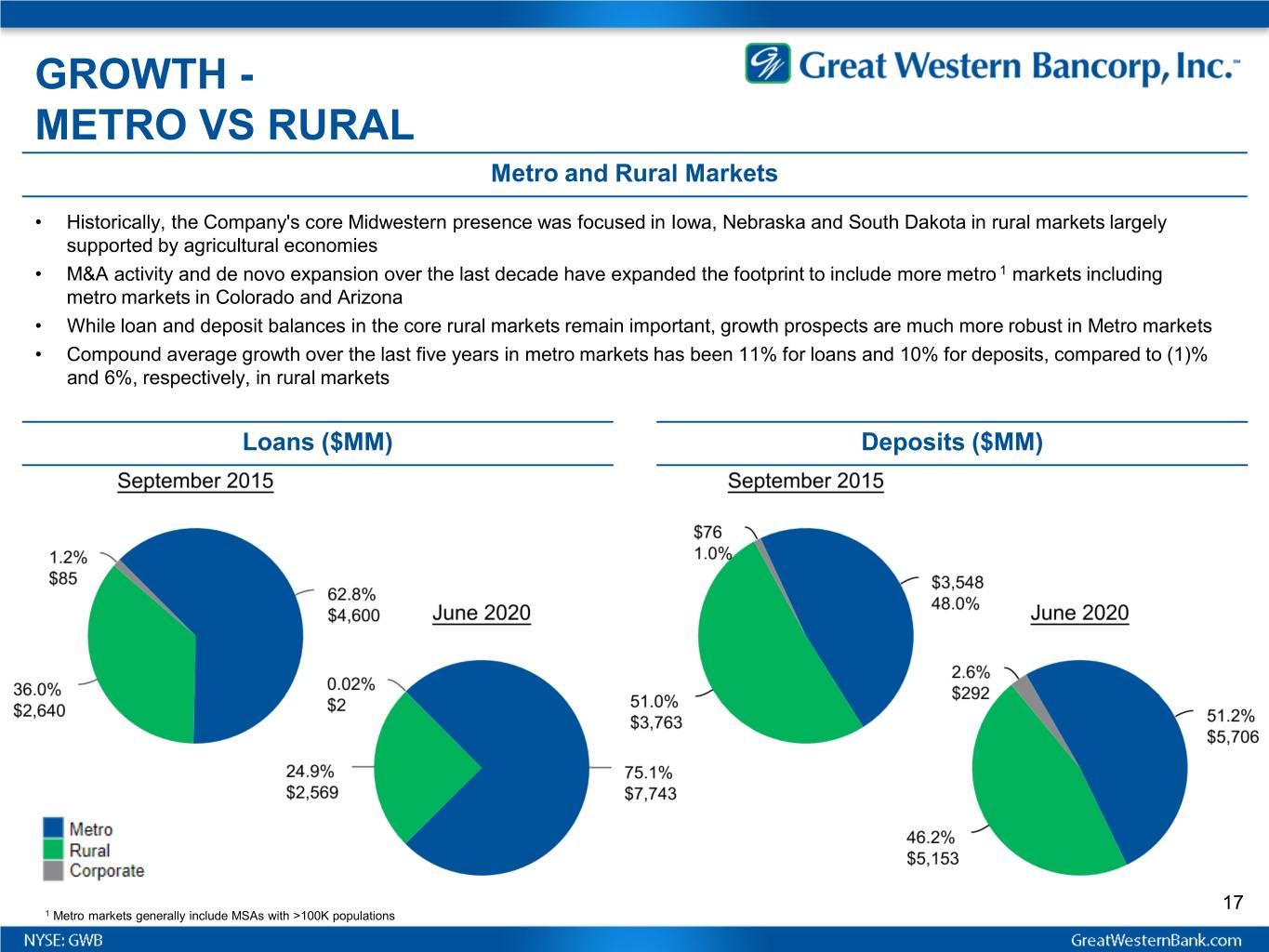

GROWTH - METRO VS RURAL Metro and Rural Markets • Historically, the Company's core Midwestern presence was focused in Iowa, Nebraska and South Dakota in rural markets largely supported by agricultural economies • M&A activity and de novo expansion over the last decade have expanded the footprint to include more metro 1 markets including metro markets in Colorado and Arizona • While loan and deposit balances in the core rural markets remain important, growth prospects are much more robust in Metro markets • Compound average growth over the last five years in metro markets has been 11% for loans and 10% for deposits, compared to (1)% and 6%, respectively, in rural markets Loans ($MM) Deposits ($MM) 17 1 Metro markets generally include MSAs with >100K populations

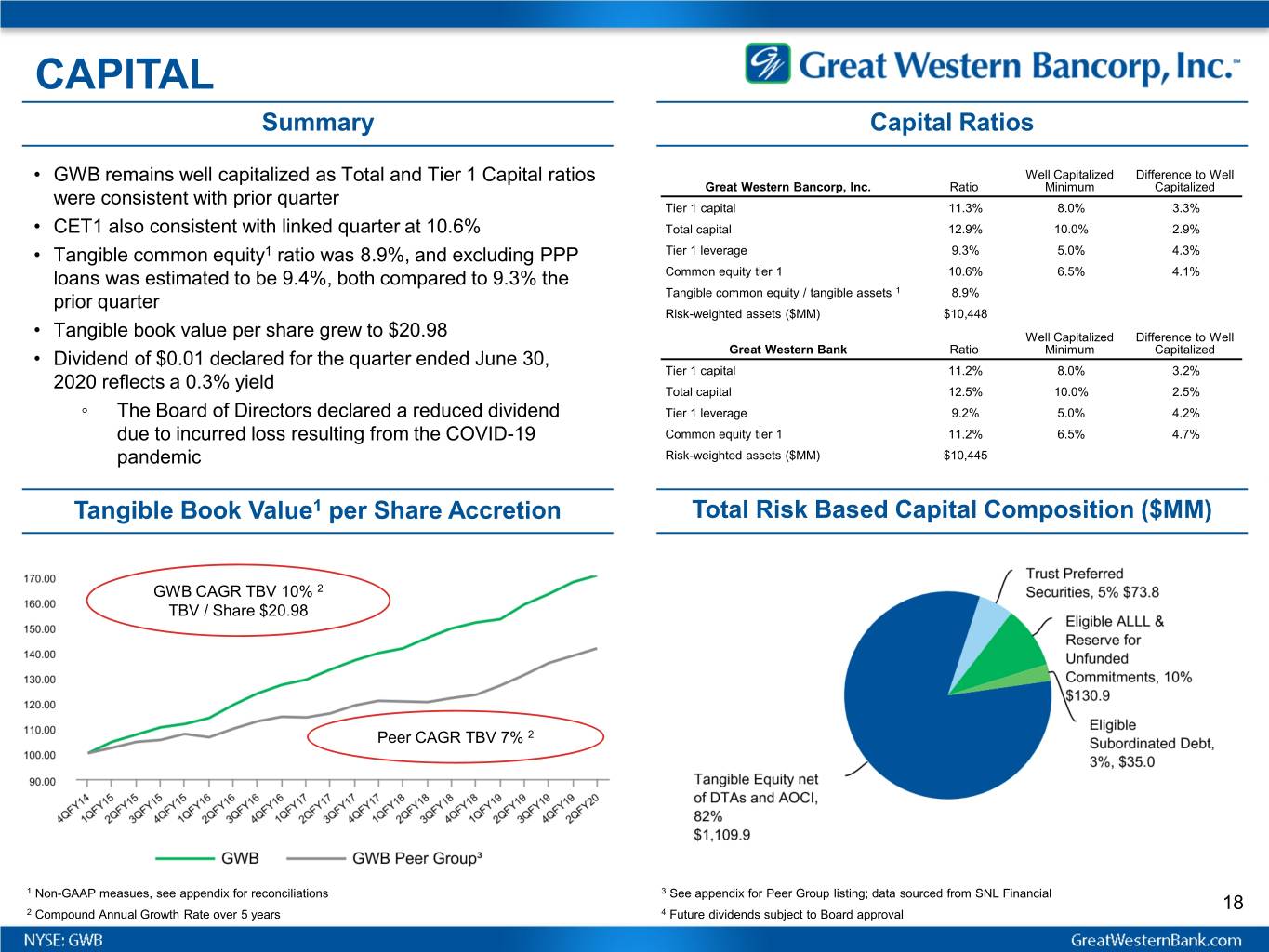

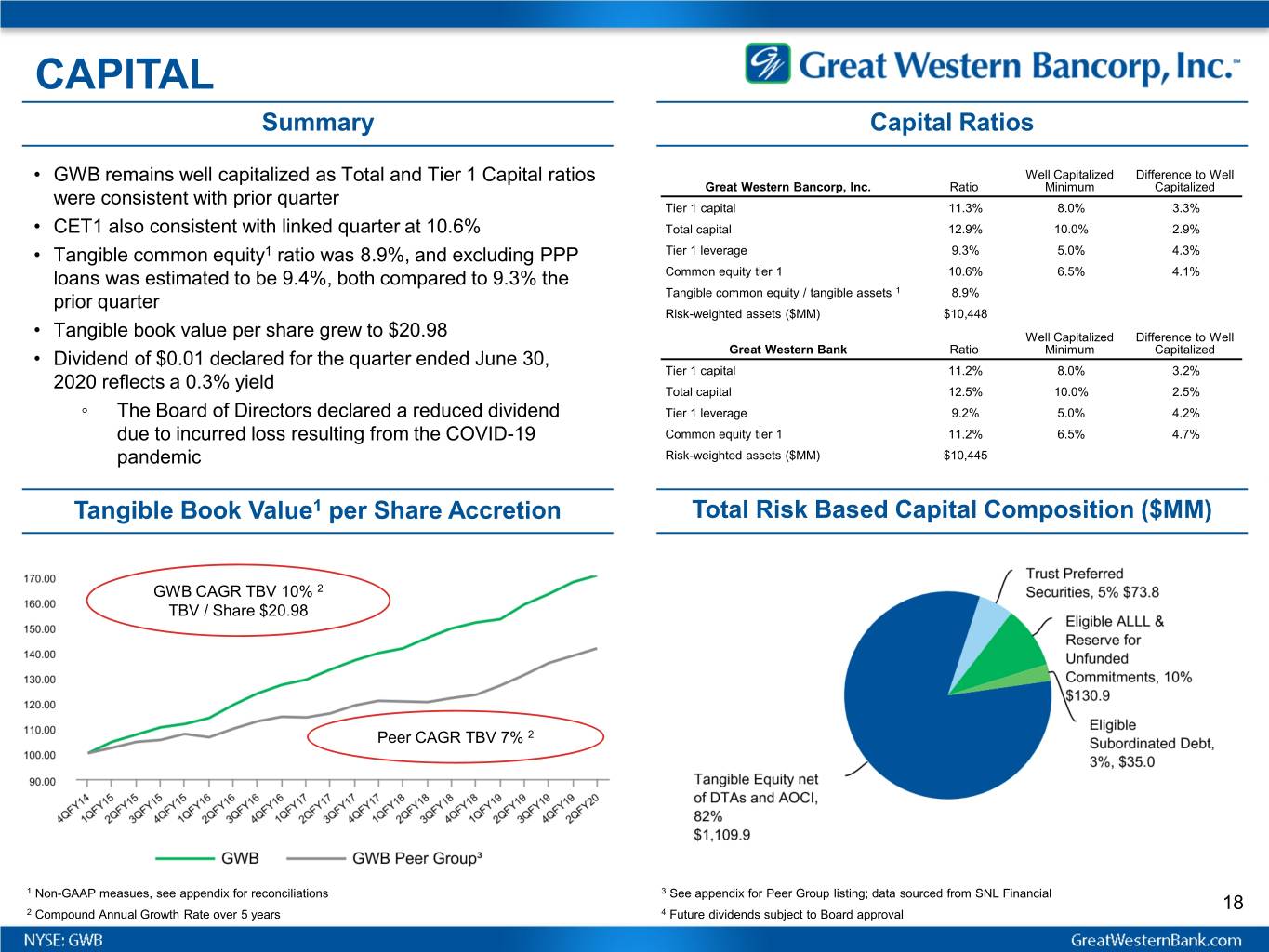

CAPITAL Summary Capital Ratios • GWB remains well capitalized as Total and Tier 1 Capital ratios Well Capitalized Difference to Well Great Western Bancorp, Inc. Ratio Minimum Capitalized were consistent with prior quarter Tier 1 capital 11.3% 8.0% 3.3% • CET1 also consistent with linked quarter at 10.6% Total capital 12.9% 10.0% 2.9% • Tangible common equity1 ratio was 8.9%, and excluding PPP Tier 1 leverage 9.3% 5.0% 4.3% loans was estimated to be 9.4%, both compared to 9.3% the Common equity tier 1 10.6% 6.5% 4.1% Tangible common equity / tangible assets 1 8.9% x x prior quarter Risk-weighted assets ($MM) $10,448 x x • Tangible book value per share grew to $20.98 Well Capitalized Difference to Well Ratio Minimum Capitalized • Dividend of $0.01 declared for the quarter ended June 30, Great Western Bank Tier 1 capital 11.2% 8.0% 3.2% 2020 reflects a 0.3% yield Total capital 12.5% 10.0% 2.5% ◦ The Board of Directors declared a reduced dividend Tier 1 leverage 9.2% 5.0% 4.2% due to incurred loss resulting from the COVID-19 Common equity tier 1 11.2% 6.5% 4.7% pandemic Risk-weighted assets ($MM) $10,445 x x Tangible Book Value1 per Share Accretion Total Risk Based Capital Composition ($MM) GWB CAGR TBV 10% 2 TBV / Share $20.98 Peer CAGR TBV 7% 2 1 Non-GAAP measues, see appendix for reconciliations 3 See appendix for Peer Group listing; data sourced from SNL Financial 18 2 Compound Annual Growth Rate over 5 years 4 Future dividends subject to Board approval

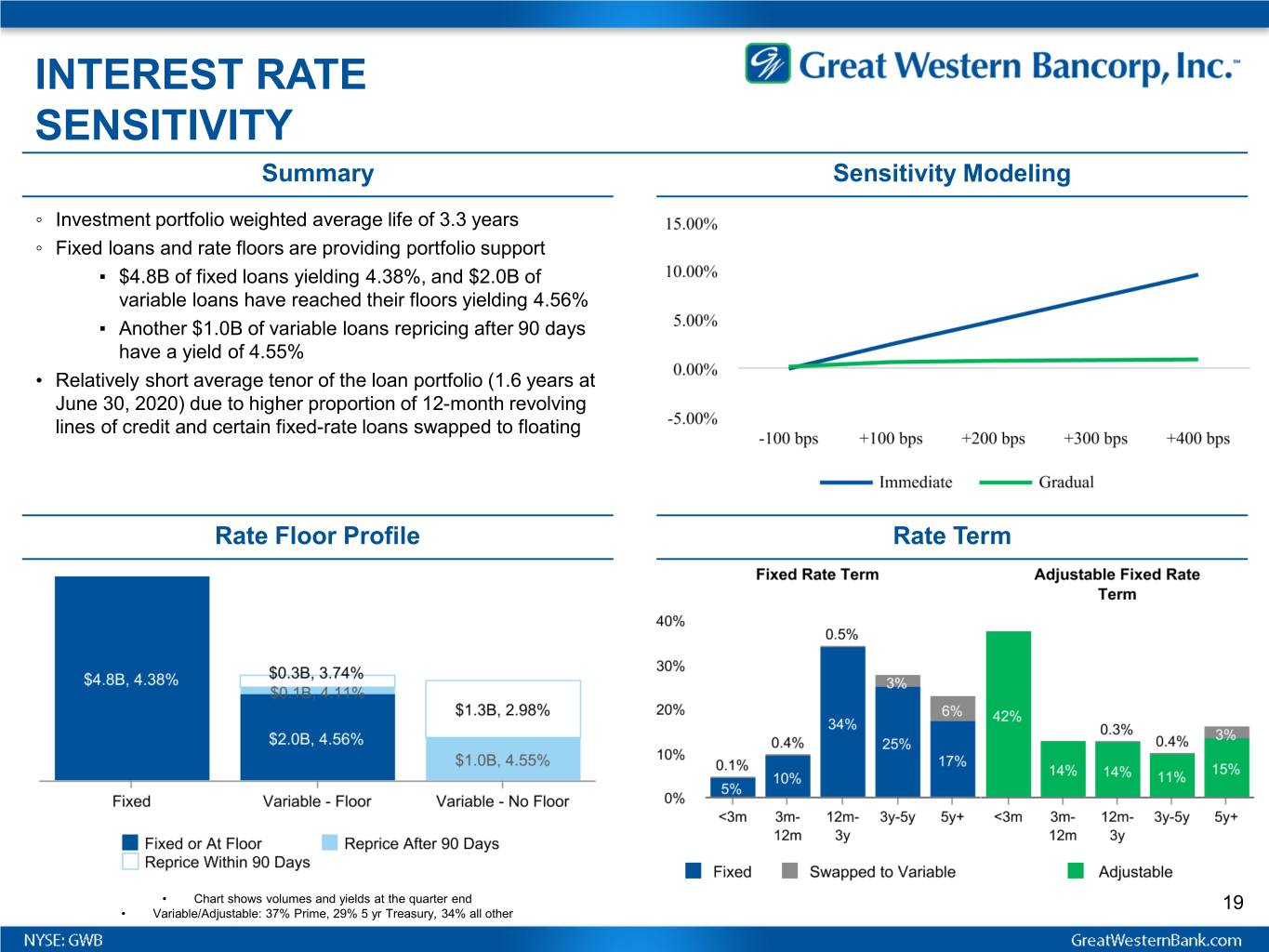

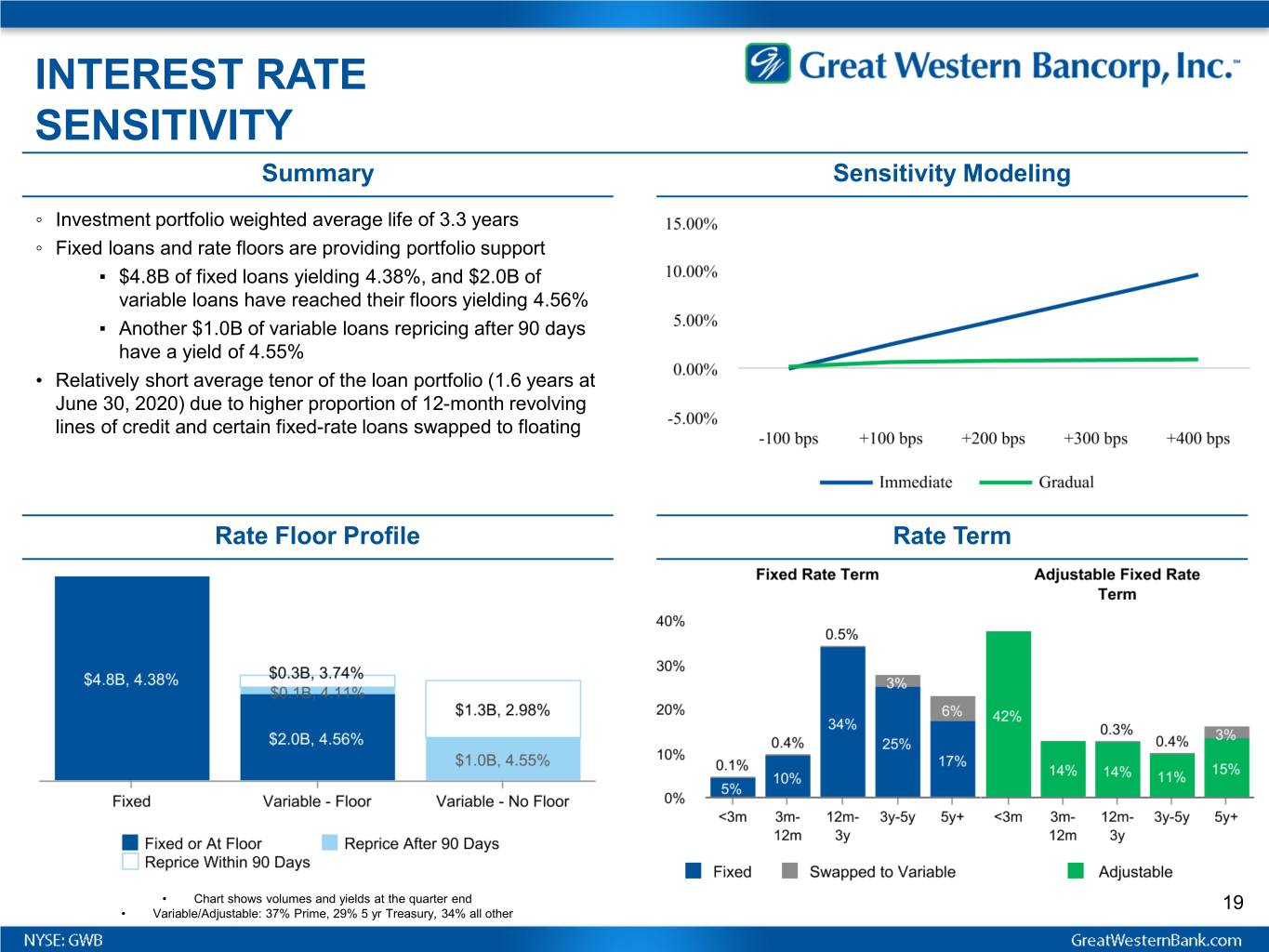

INTEREST RATE SENSITIVITY Summary Sensitivity Modeling ◦ Investment portfolio weighted average life of 3.3 years ◦ Fixed loans and rate floors are providing portfolio support ▪ $4.8B of fixed loans yielding 4.38%, and $2.0B of variable loans have reached their floors yielding 4.56% ▪ Another $1.0B of variable loans repricing after 90 days have a yield of 4.55% • Relatively short average tenor of the loan portfolio (1.6 years at June 30, 2020) due to higher proportion of 12-month revolving lines of credit and certain fixed-rate loans swapped to floating Rate Floor Profile Rate Term • Chart shows volumes and yields at the quarter end 19 • Variable/Adjustable: 37% Prime, 29% 5 yr Treasury, 34% all other

Income Statement Summary

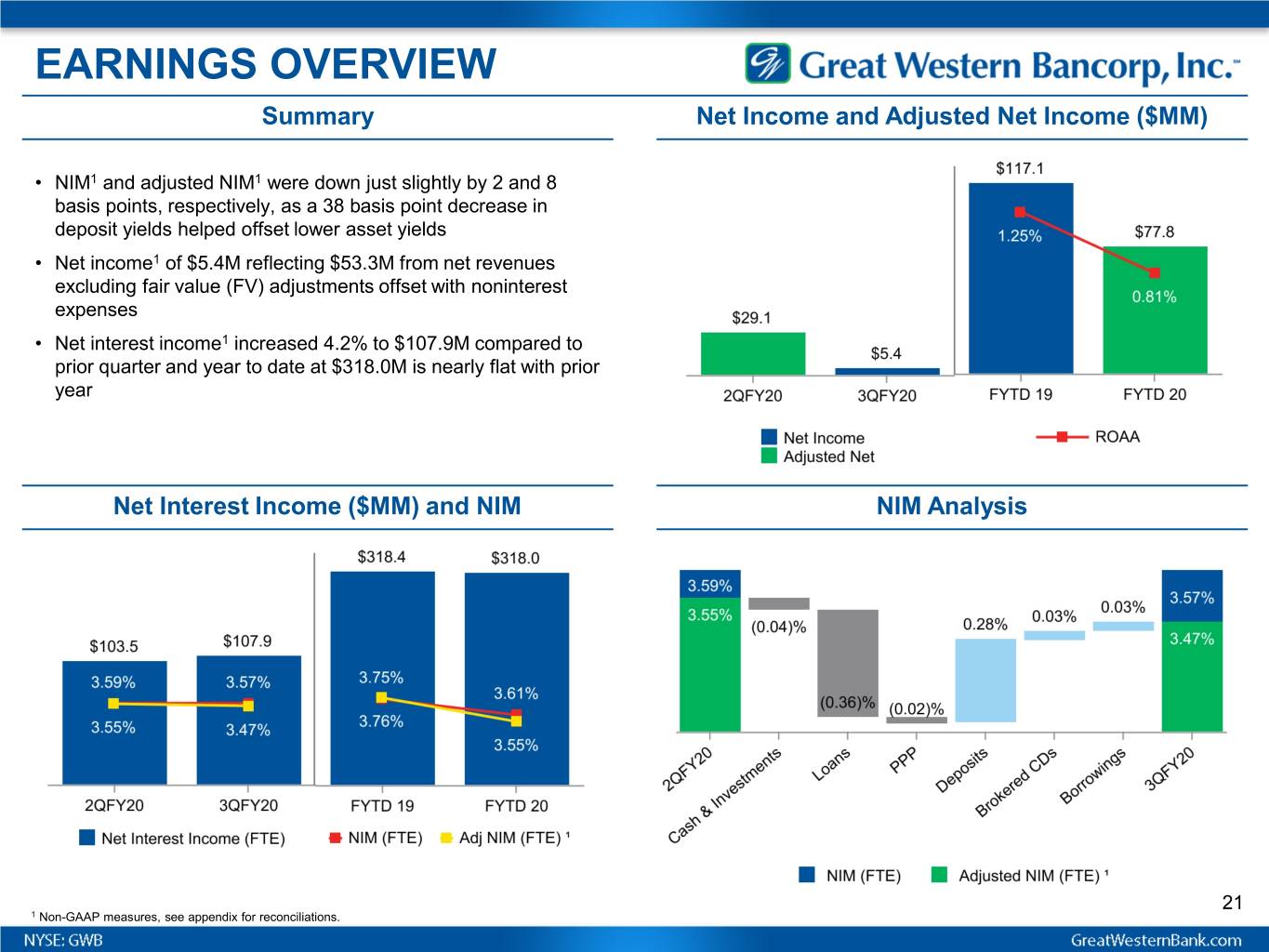

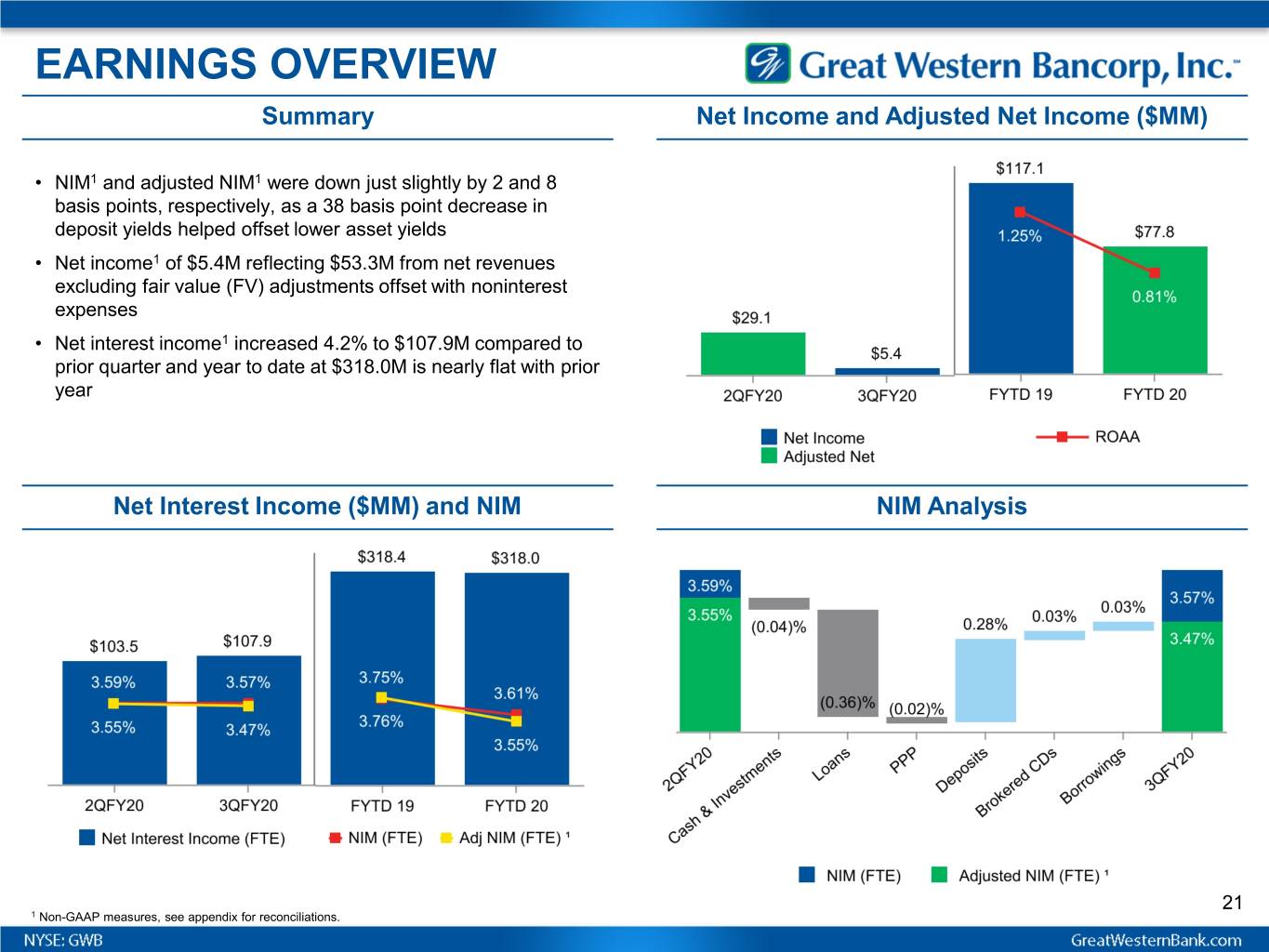

EARNINGS OVERVIEW Summary Net Income and Adjusted Net Income ($MM) • NIM1 and adjusted NIM1 were down just slightly by 2 and 8 basis points, respectively, as a 38 basis point decrease in deposit yields helped offset lower asset yields • Net income1 of $5.4M reflecting $53.3M from net revenues excluding fair value (FV) adjustments offset with noninterest expenses • Net interest income1 increased 4.2% to $107.9M compared to prior quarter and year to date at $318.0M is nearly flat with prior year Net Interest Income ($MM) and NIM NIM Analysis 21 1 Non-GAAP measures, see appendix for reconciliations.

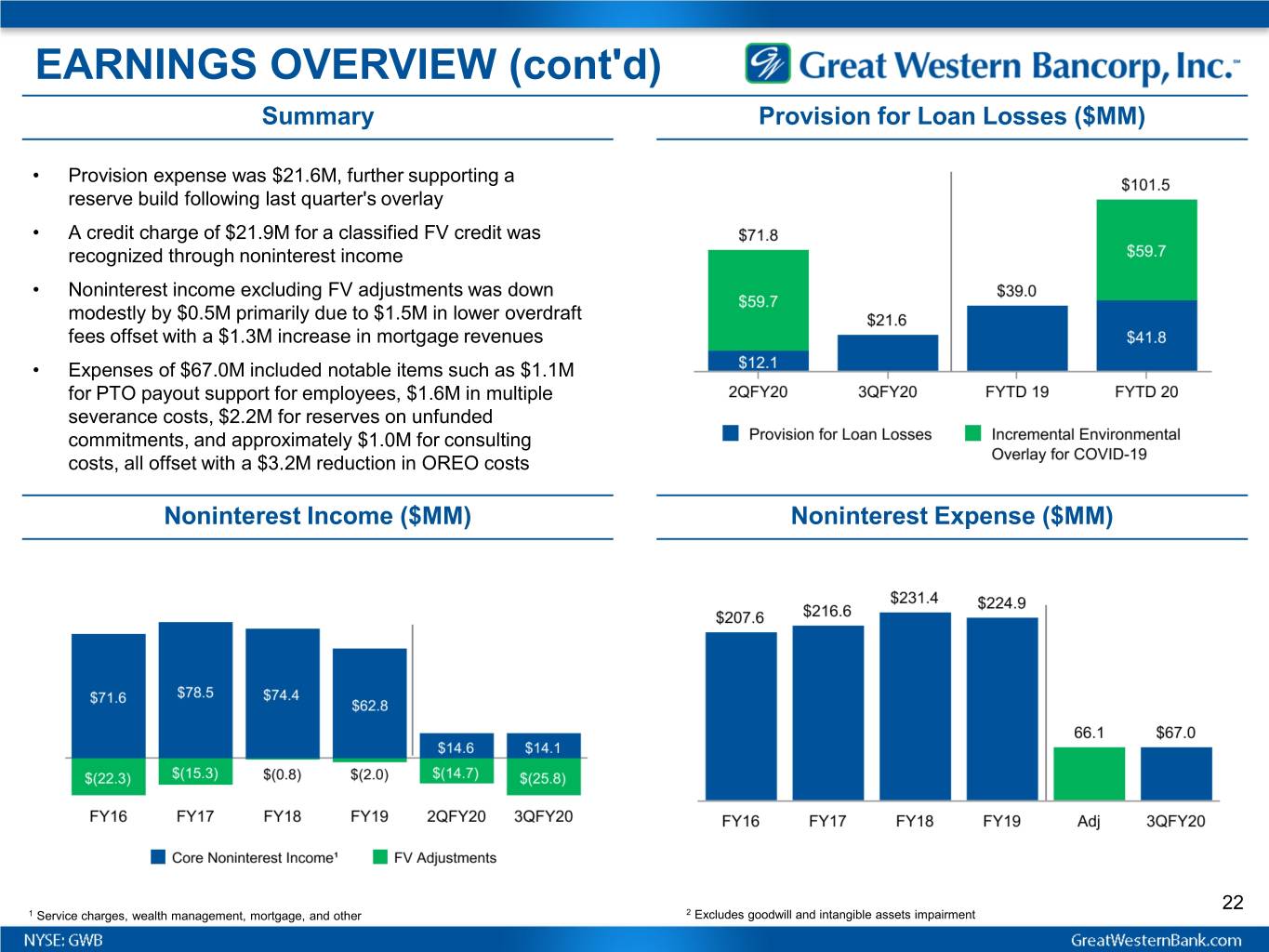

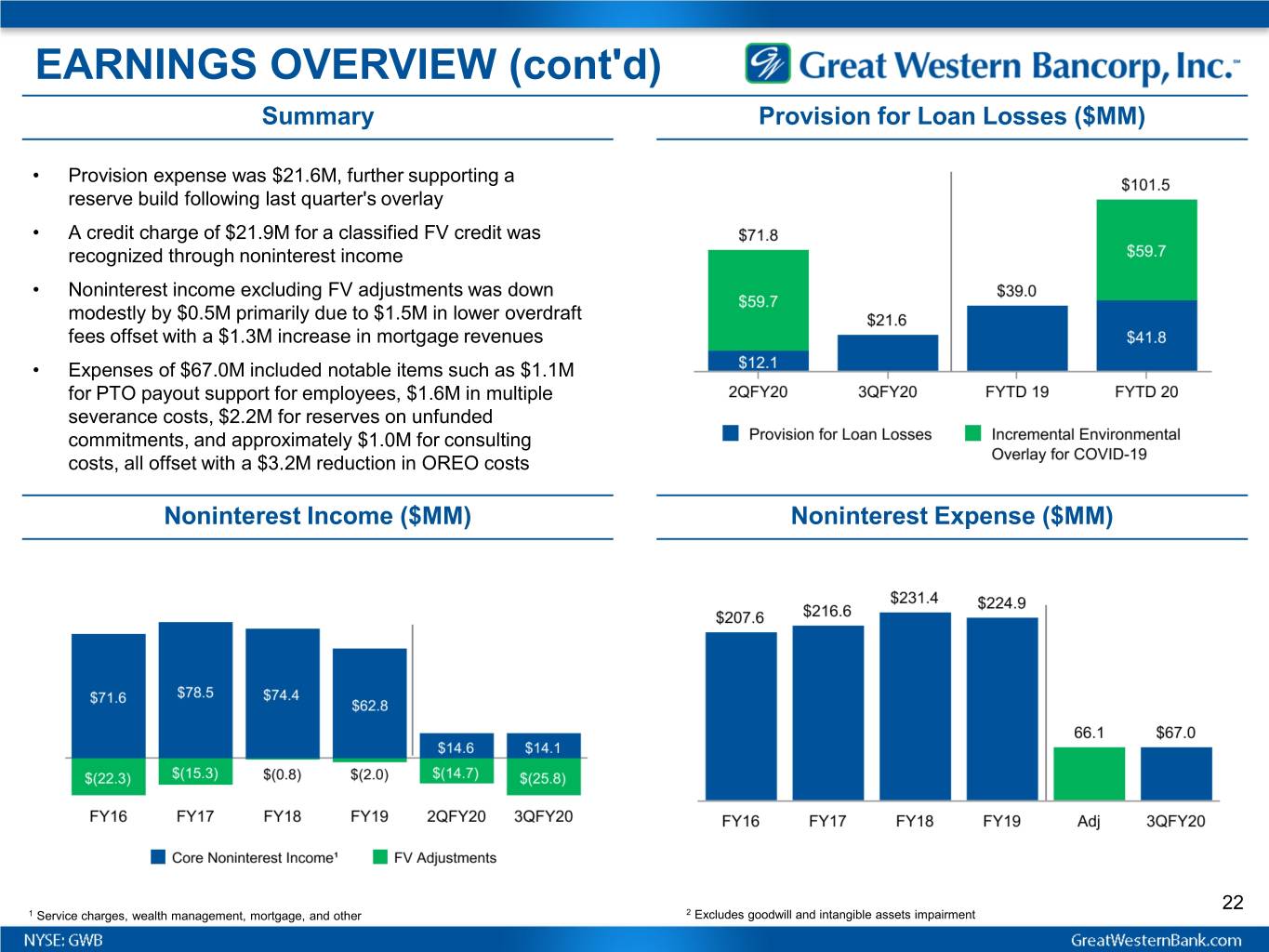

EARNINGS OVERVIEW (cont'd) Summary Provision for Loan Losses ($MM) • Provision expense was $21.6M, further supporting a reserve build following last quarter's overlay • A credit charge of $21.9M for a classified FV credit was recognized through noninterest income • Noninterest income excluding FV adjustments was down modestly by $0.5M primarily due to $1.5M in lower overdraft fees offset with a $1.3M increase in mortgage revenues • Expenses of $67.0M included notable items such as $1.1M for PTO payout support for employees, $1.6M in multiple severance costs, $2.2M for reserves on unfunded commitments, and approximately $1.0M for consulting costs, all offset with a $3.2M reduction in OREO costs Noninterest Income ($MM) Noninterest Expense ($MM) 22 1 Service charges, wealth management, mortgage, and other 2 Excludes goodwill and intangible assets impairment

DISCLOSURES Forward-Looking Statements: This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements about Great Western Bancorp, Inc.’s expectations, beliefs, plans, strategies, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipates,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “views,” “intends” and similar words or phrases. In particular, the statements included in this press release concerning Great Western Bancorp, Inc.’s expected performance and strategy, strategies for managing troubled loans, the impact on the business arising from the COVID-19 outbreak and the interest rate environment are not historical facts and are forward-looking. Accordingly, the forward-looking statements in this press release are only predictions and involve estimates, known and unknown risks, assumptions and uncertainties that could cause actual results to differ materially from those expressed. All forward-looking statements are necessarily only estimates of future results, and there can be no assurance that actual results will not differ materially from expectations, and, therefore, you are cautioned not to place undue reliance on such statements. Any forward-looking statements are qualified in their entirety by reference to the factors discussed in the sections titled “Item 1A. Risk Factors” and "Cautionary Note Regarding Forward-Looking Statements" in Great Western Bancorp, Inc.’s Annual Report on Form 10-K for the most recently ended fiscal year, Form 10-Q for the quarters ended June 30, 2020, March 31, 2020 and December 31, 2019 and in other periodic filings with the Securities and Exchange Commission. Further, any forward-looking statement speaks only as of the date on which it is made, and Great Western Bancorp, Inc. undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Non-GAAP Financial Measures: This presentation contains non-GAAP measures which our management relies on in making financial and operational decisions about our business and which exclude certain items that we do not consider reflective of our business performance. We believe that the presentation of these measures provides investors with greater transparency and supplemental data relating to our financial condition and results of operations. These non-GAAP measures should be considered in context with our GAAP results. A reconciliation of these non-GAAP measures appears in our earnings release dated July 29, 2020 and in Appendix 1 to this presentation. Our earnings release and this presentation are available in the Investor Relations section of our website at www.greatwesternbank.com. Our earnings release and this presentation are also available as part of our Current Report on Form 8-K filed with the Securities and Exchange Commission on July 29, 2020. Explanatory Note: In this presentation, all financial information presented refers to the financial results of Great Western Bancorp, Inc. combined with those of its predecessor, Great Western Bancorporation, Inc. Also note loan balance information is presented using unpaid principal balances (UPB) unless otherwise noted. 23

Appendix 1 Non-GAAP Measures

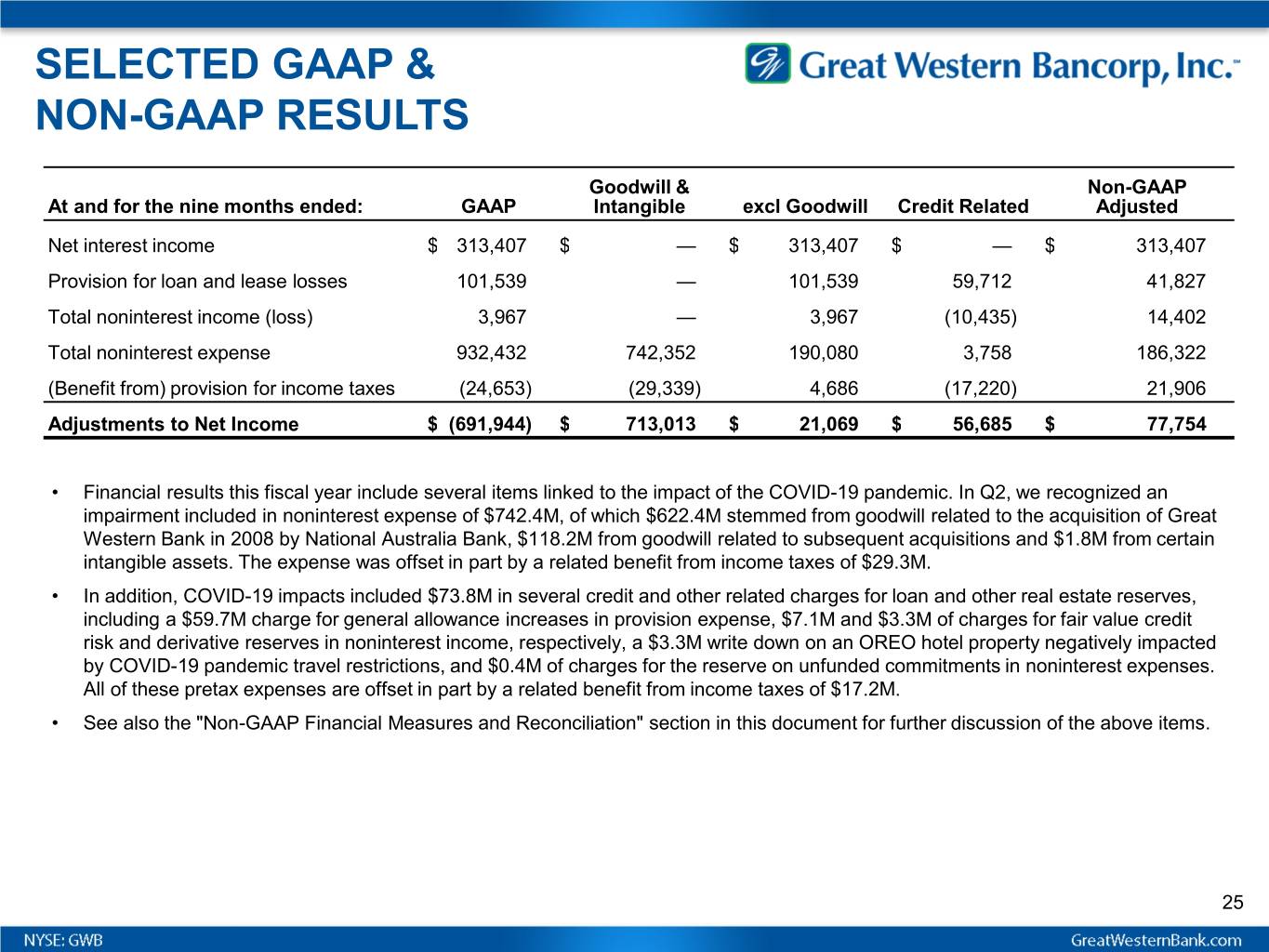

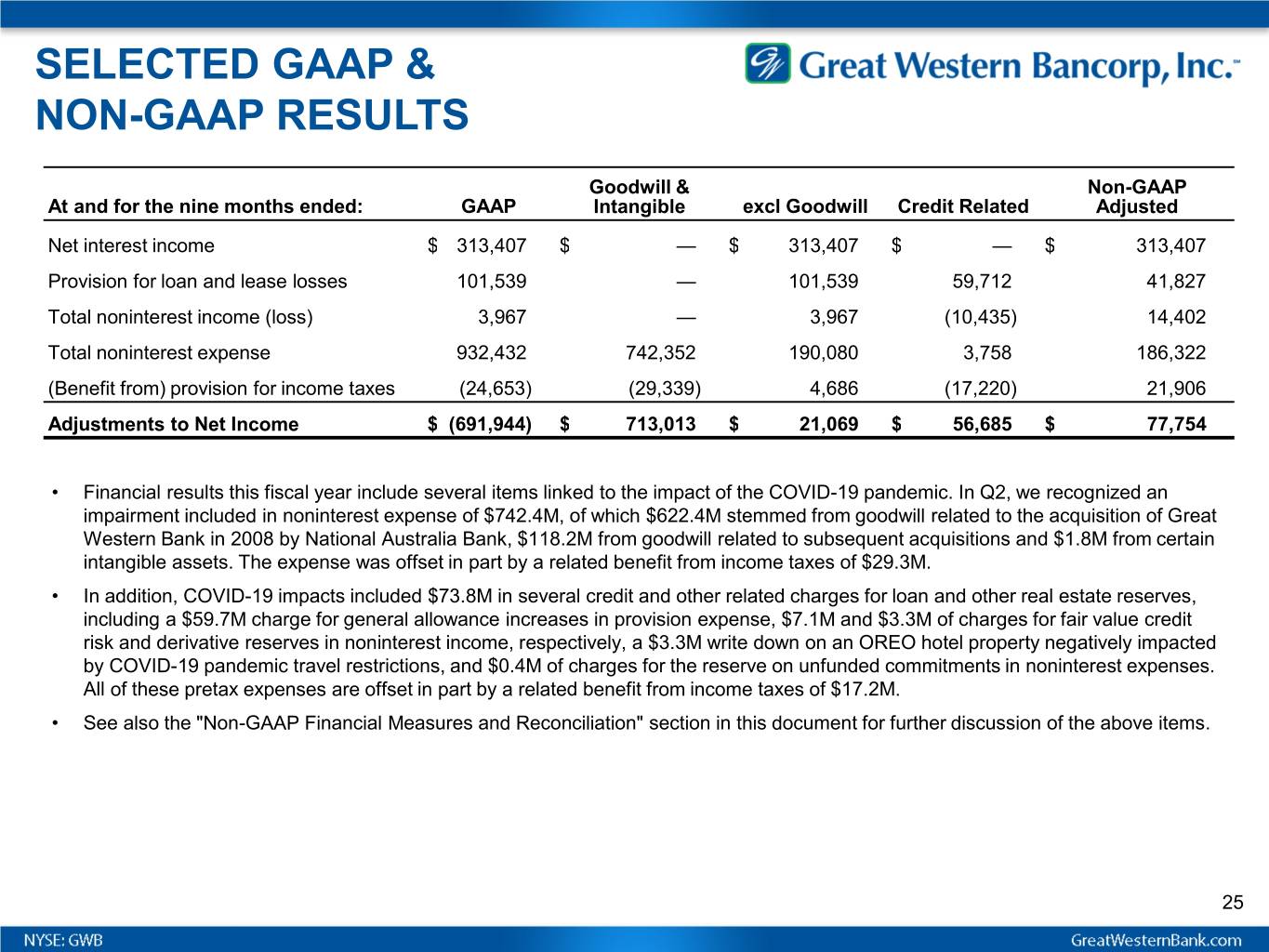

SELECTED GAAP & NON-GAAP RESULTS Goodwill & Non-GAAP At and for the nine months ended: GAAP Intangible excl Goodwill Credit Related Adjusted Net interest income $ 313,407 $ — $ 313,407 $ — $ 313,407 Provision for loan and lease losses 101,539 — 101,539 59,712 41,827 Total noninterest income (loss) 3,967 — 3,967 (10,435) 14,402 Total noninterest expense 932,432 742,352 190,080 3,758 186,322 (Benefit from) provision for income taxes (24,653) (29,339) 4,686 (17,220) 21,906 Adjustments to Net Income $ (691,944) $ 713,013 $ 21,069 $ 56,685 $ 77,754 • Financial results this fiscal year include several items linked to the impact of the COVID-19 pandemic. In Q2, we recognized an impairment included in noninterest expense of $742.4M, of which $622.4M stemmed from goodwill related to the acquisition of Great Western Bank in 2008 by National Australia Bank, $118.2M from goodwill related to subsequent acquisitions and $1.8M from certain intangible assets. The expense was offset in part by a related benefit from income taxes of $29.3M. • In addition, COVID-19 impacts included $73.8M in several credit and other related charges for loan and other real estate reserves, including a $59.7M charge for general allowance increases in provision expense, $7.1M and $3.3M of charges for fair value credit risk and derivative reserves in noninterest income, respectively, a $3.3M write down on an OREO hotel property negatively impacted by COVID-19 pandemic travel restrictions, and $0.4M of charges for the reserve on unfunded commitments in noninterest expenses. All of these pretax expenses are offset in part by a related benefit from income taxes of $17.2M. • See also the "Non-GAAP Financial Measures and Reconciliation" section in this document for further discussion of the above items. 25

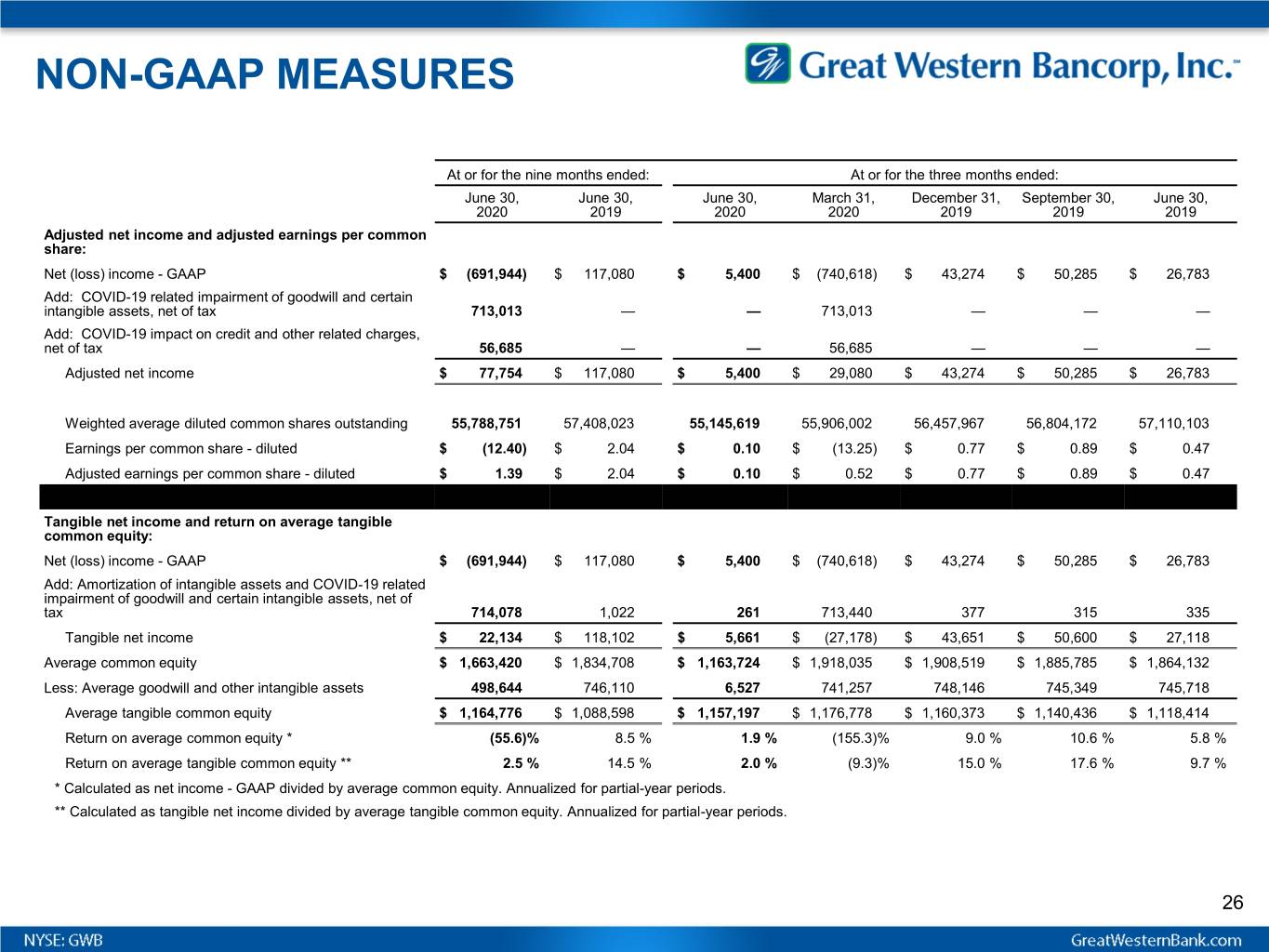

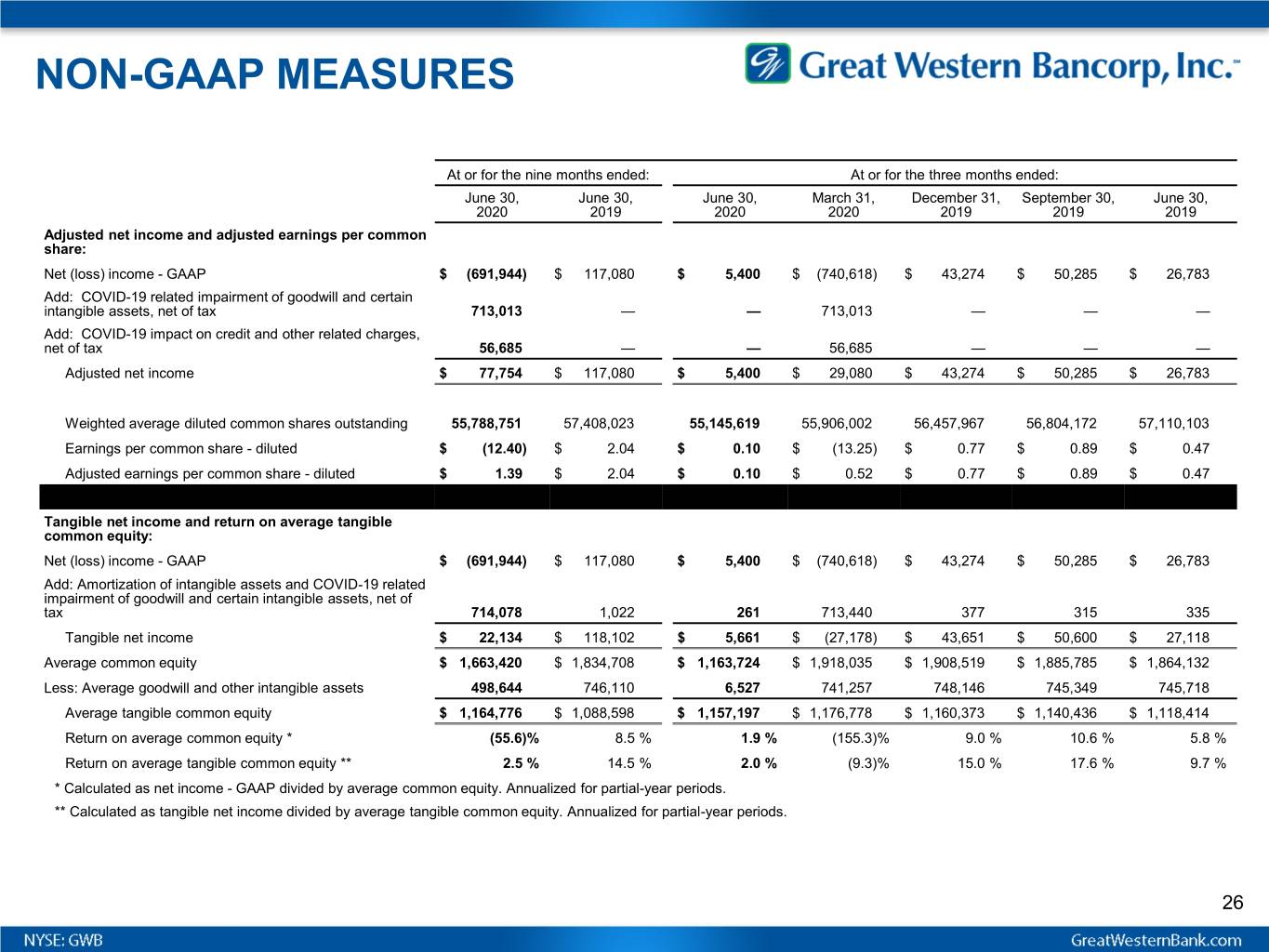

NON-GAAP MEASURES At or for the nine months ended: At or for the three months ended: June 30, June 30, June 30, March 31, December 31, September 30, June 30, 2020 2019 2020 2020 2019 2019 2019 Adjusted net income and adjusted earnings per common share: Net (loss) income - GAAP $ (691,944) $ 117,080 $ 5,400 $ (740,618) $ 43,274 $ 50,285 $ 26,783 Add: COVID-19 related impairment of goodwill and certain intangible assets, net of tax 713,013 — — 713,013 — — — Add: COVID-19 impact on credit and other related charges, net of tax 56,685 — — 56,685 — — — Adjusted net income $ 77,754 $ 117,080 $ 5,400 $ 29,080 $ 43,274 $ 50,285 $ 26,783 Weighted average diluted common shares outstanding 55,788,751 57,408,023 55,145,619 55,906,002 56,457,967 56,804,172 57,110,103 Earnings per common share - diluted $ (12.40) $ 2.04 $ 0.10 $ (13.25) $ 0.77 $ 0.89 $ 0.47 Adjusted earnings per common share - diluted $ 1.39 $ 2.04 $ 0.10 $ 0.52 $ 0.77 $ 0.89 $ 0.47 Tangible net income and return on average tangible common equity: x x x x x Net (loss) income - GAAP $ (691,944) $ 117,080 $ 5,400 $ (740,618) $ 43,274 $ 50,285 $ 26,783 Add: Amortization of intangible assets and COVID-19 related impairment of goodwill and certain intangible assets, net of tax 714,078 1,022 261 713,440 377 315 335 Tangible net income $ 22,134 $ 118,102 $ 5,661 $ (27,178) $ 43,651 $ 50,600 $ 27,118 Average common equity $ 1,663,420 $ 1,834,708 $ 1,163,724 $ 1,918,035 $ 1,908,519 $ 1,885,785 $ 1,864,132 Less: Average goodwill and other intangible assets 498,644 746,110 6,527 741,257 748,146 745,349 745,718 Average tangible common equity $ 1,164,776 $ 1,088,598 $ 1,157,197 $ 1,176,778 $ 1,160,373 $ 1,140,436 $ 1,118,414 Return on average common equity * (55.6)% 8.5 % 1.9 % (155.3)% 9.0 % 10.6 % 5.8 % Return on average tangible common equity ** 2.5 % 14.5 % 2.0 % (9.3)% 15.0 % 17.6 % 9.7 % * Calculated as net income - GAAP divided by average common equity. Annualized for partial-year periods. ** Calculated as tangible net income divided by average tangible common equity. Annualized for partial-year periods. 26

NON-GAAP MEASURES At or for the nine months ended: At or for the three months ended: June 30, June 30, June 30, March 31, December 31, September 30, June 30, 2020 2019 2020 2020 2019 2019 2019 Adjusted net interest income and adjusted net interest margin (fully-tax equivalent basis): Net interest income - GAAP $ 313,407 $ 313,999 $ 106,251 $ 101,983 $ 105,173 $ 106,709 $ 105,629 Add: Tax equivalent adjustment 4,638 4,356 1,601 1,514 1,523 1,487 1,424 Net interest income (FTE) 318,045 318,355 107,852 103,497 106,696 108,196 107,053 Add: Current realized derivative gain (loss) (5,180) 746 (3,040) (1,250) (890) (127) 321 Adjusted net interest income (FTE) $ 312,865 $ 319,101 $ 104,812 $ 102,247 $ 105,806 $ 108,069 $ 107,374 Average interest-earning assets $ 11,763,523 $11,349,960 $ 12,156,505 $11,590,453 $11,543,610 $11,609,823 $11,617,521 Net interest margin (FTE) * 3.61 % 3.75 % 3.57 % 3.59 % 3.68 % 3.70 % 3.70 % Adjusted net interest margin (FTE) ** 3.55 % 3.76 % 3.47 % 3.55 % 3.65 % 3.69 % 3.71 % * Calculated as net interest income (FTE) divided by average interest earning assets. Annualized for partial-year periods. ** Calculated as adjusted net interest income (FTE) divided by average interest earning assets. Annualized for partial-year periods. Adjusted interest income and adjusted yield (fully-tax equivalent basis), on non-ASC 310-30 loans: x x x x x Interest income - GAAP $ 337,404 $ 365,987 $ 107,725 $ 111,970 $ 117,709 $ 124,923 $ 124,098 Add: Tax equivalent adjustment 4,638 4,356 1,601 1,514 1,523 1,487 1,424 Interest income (FTE) 342,042 370,343 109,326 113,484 119,232 126,410 125,522 Add: Current realized derivative gain (loss) (5,180) 746 (3,040) (1,250) (890) (127) 321 Adjusted interest income (FTE) $ 336,862 $ 371,089 $ 106,286 $ 112,234 $ 118,342 $ 126,283 $ 125,843 Average non-ASC 310-30 loans $ 9,675,039 $ 9,583,477 $ 9,974,802 $ 9,496,153 $ 9,554,161 $ 9,693,395 $ 9,699,433 Yield (FTE) * 4.72 % 5.17 % 4.41 % 4.81 % 4.96 % 5.17 % 5.19 % Adjusted yield (FTE) ** 4.65 % 5.18 % 4.29 % 4.75 % 4.93 % 5.17 % 5.20 % * Calculated as interest income (FTE) divided by average loans. Annualized for partial-year periods. ** Calculated as adjusted interest income (FTE) divided by average loans. Annualized for partial-year periods. 27

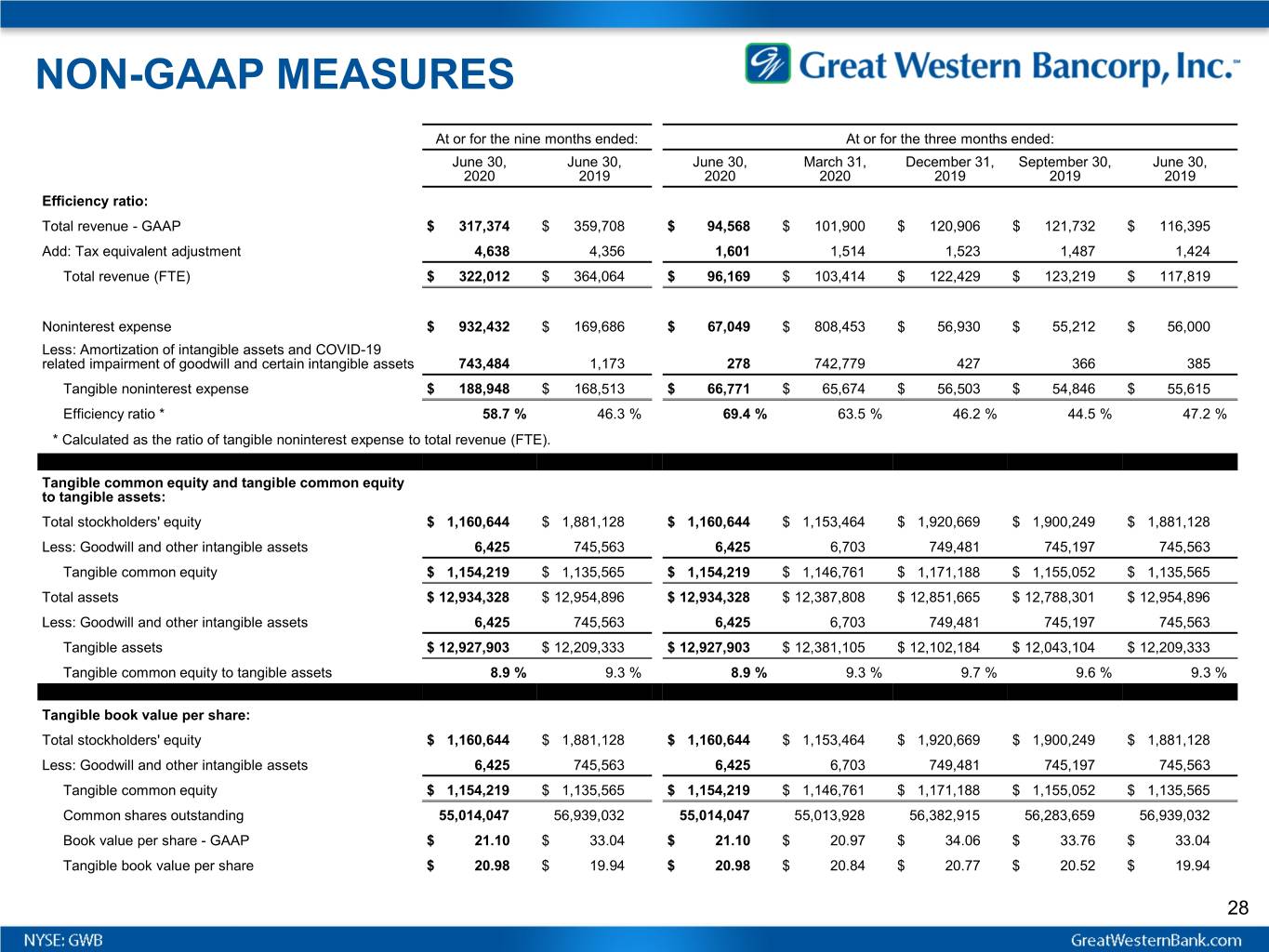

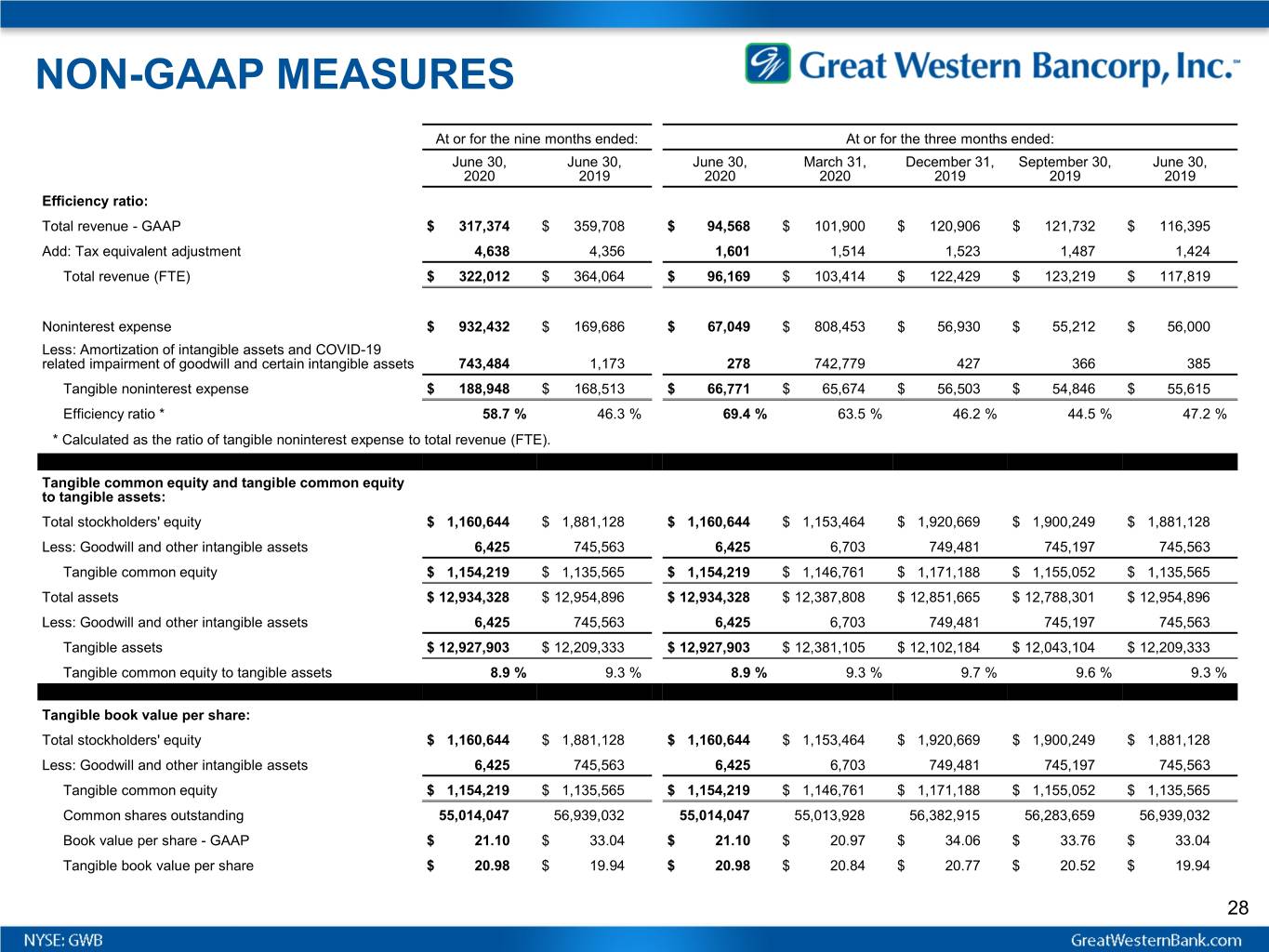

NON-GAAP MEASURES At or for the nine months ended: At or for the three months ended: June 30, June 30, June 30, March 31, December 31, September 30, June 30, 2020 2019 2020 2020 2019 2019 2019 Efficiency ratio: Total revenue - GAAP $ 317,374 $ 359,708 $ 94,568 $ 101,900 $ 120,906 $ 121,732 $ 116,395 Add: Tax equivalent adjustment 4,638 4,356 1,601 1,514 1,523 1,487 1,424 Total revenue (FTE) $ 322,012 $ 364,064 $ 96,169 $ 103,414 $ 122,429 $ 123,219 $ 117,819 Noninterest expense $ 932,432 $ 169,686 $ 67,049 $ 808,453 $ 56,930 $ 55,212 $ 56,000 Less: Amortization of intangible assets and COVID-19 related impairment of goodwill and certain intangible assets 743,484 1,173 278 742,779 427 366 385 Tangible noninterest expense $ 188,948 $ 168,513 $ 66,771 $ 65,674 $ 56,503 $ 54,846 $ 55,615 Efficiency ratio * 58.7 % 46.3 % 69.4 % 63.5 % 46.2 % 44.5 % 47.2 % * Calculated as the ratio of tangible noninterest expense to total revenue (FTE). Tangible common equity and tangible common equity to tangible assets: x x x x x Total stockholders' equity $ 1,160,644 $ 1,881,128 $ 1,160,644 $ 1,153,464 $ 1,920,669 $ 1,900,249 $ 1,881,128 Less: Goodwill and other intangible assets 6,425 745,563 6,425 6,703 749,481 745,197 745,563 Tangible common equity $ 1,154,219 $ 1,135,565 $ 1,154,219 $ 1,146,761 $ 1,171,188 $ 1,155,052 $ 1,135,565 Total assets $ 12,934,328 $ 12,954,896 $ 12,934,328 $ 12,387,808 $ 12,851,665 $ 12,788,301 $ 12,954,896 Less: Goodwill and other intangible assets 6,425 745,563 6,425 6,703 749,481 745,197 745,563 Tangible assets $ 12,927,903 $ 12,209,333 $ 12,927,903 $ 12,381,105 $ 12,102,184 $ 12,043,104 $ 12,209,333 Tangible common equity to tangible assets 8.9 % 9.3 % 8.9 % 9.3 % 9.7 % 9.6 % 9.3 % x x x x x x Tangible book value per share: x x x x x Total stockholders' equity $ 1,160,644 $ 1,881,128 $ 1,160,644 $ 1,153,464 $ 1,920,669 $ 1,900,249 $ 1,881,128 Less: Goodwill and other intangible assets 6,425 745,563 6,425 6,703 749,481 745,197 745,563 Tangible common equity $ 1,154,219 $ 1,135,565 $ 1,154,219 $ 1,146,761 $ 1,171,188 $ 1,155,052 $ 1,135,565 Common shares outstanding 55,014,047 56,939,032 55,014,047 55,013,928 56,382,915 56,283,659 56,939,032 Book value per share - GAAP $ 21.10 $ 33.04 $ 21.10 $ 20.97 $ 34.06 $ 33.76 $ 33.04 Tangible book value per share $ 20.98 $ 19.94 $ 20.98 $ 20.84 $ 20.77 $ 20.52 $ 19.94 28

Appendix 2 Supplemental Ag & Hotel Portfolio Characteristics

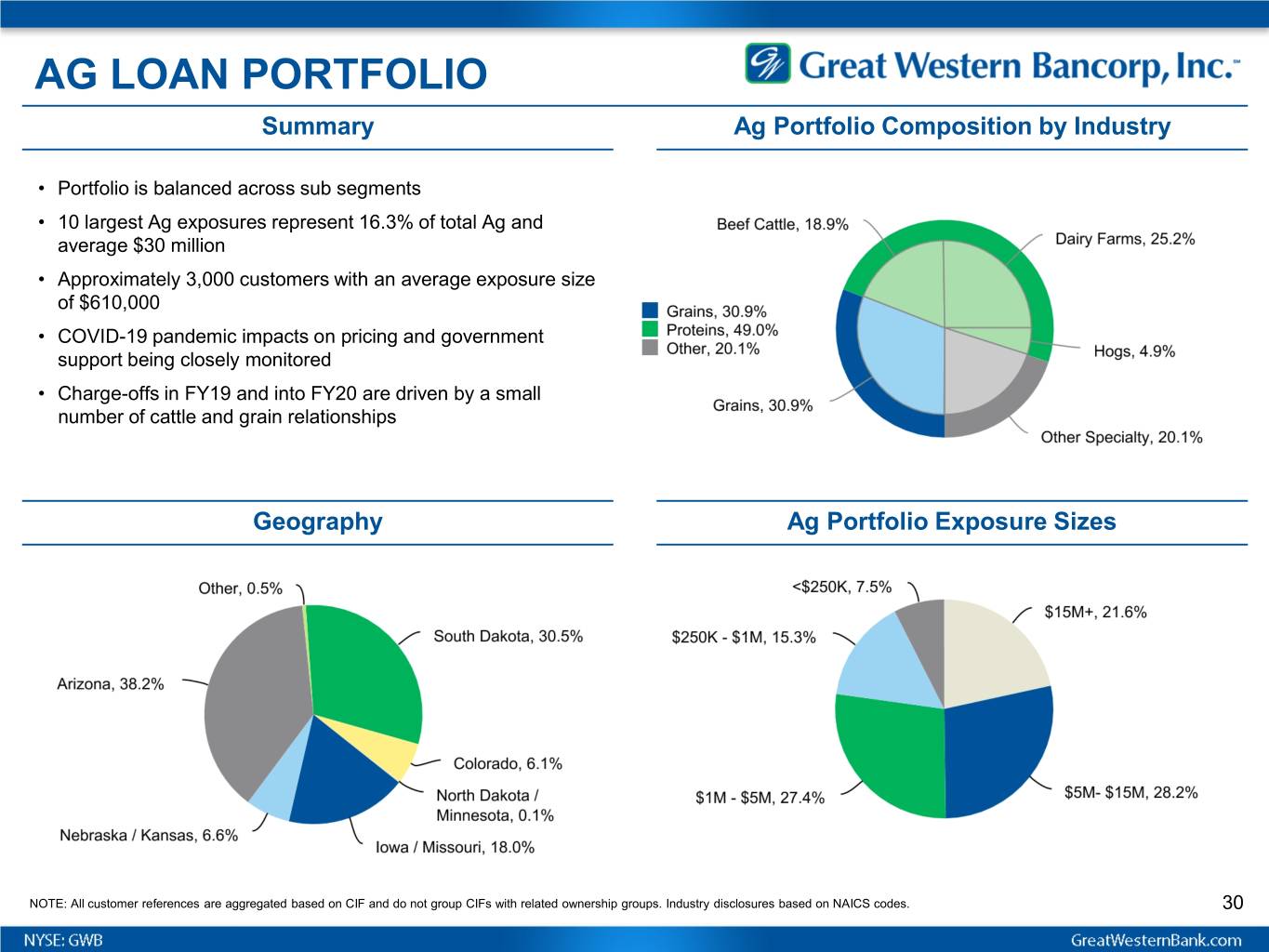

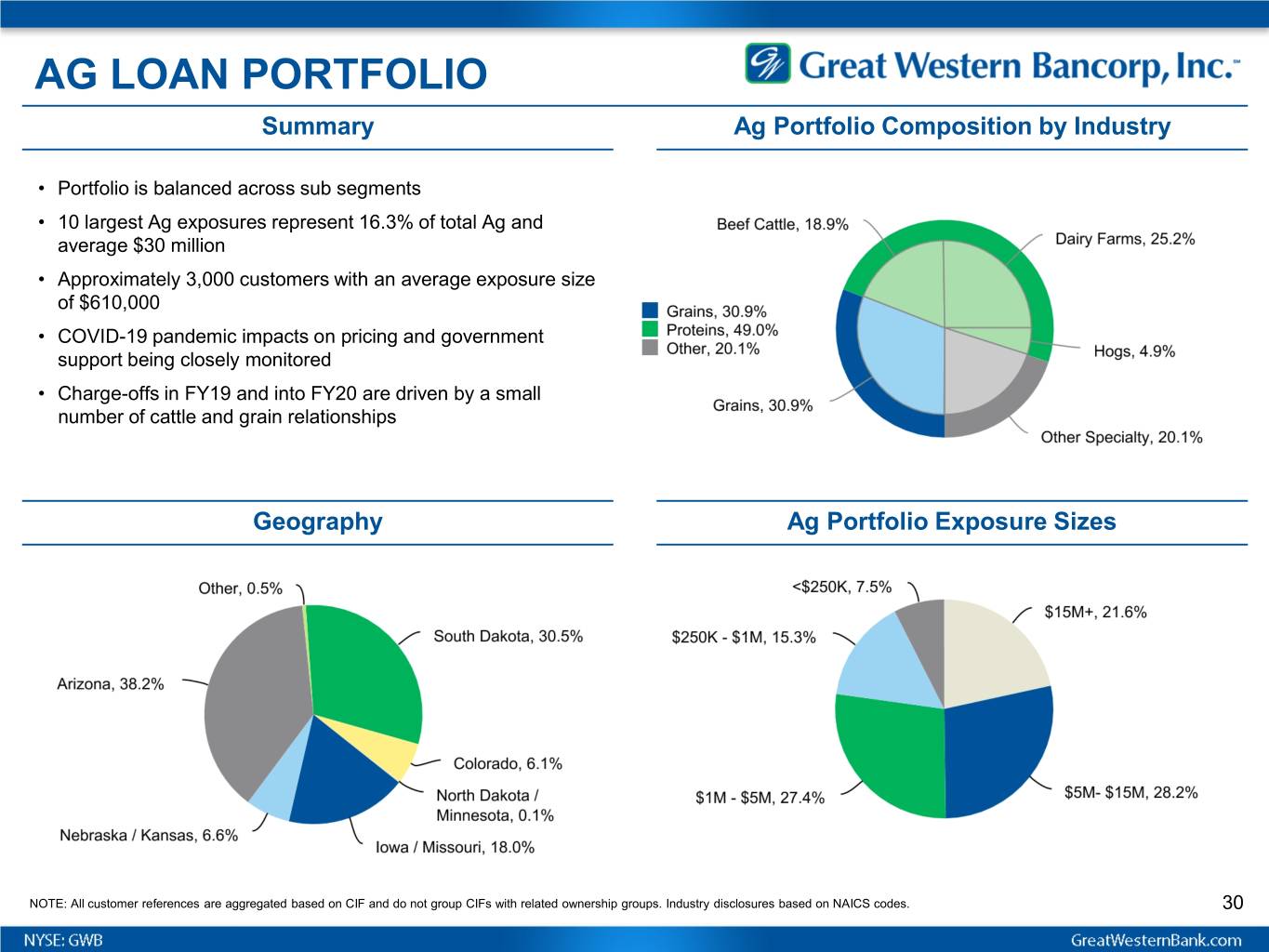

AG LOAN PORTFOLIO Summary Ag Portfolio Composition by Industry • Portfolio is balanced across sub segments • 10 largest Ag exposures represent 16.3% of total Ag and average $30 million • Approximately 3,000 customers with an average exposure size of $610,000 • COVID-19 pandemic impacts on pricing and government support being closely monitored • Charge-offs in FY19 and into FY20 are driven by a small number of cattle and grain relationships Geography Ag Portfolio Exposure Sizes NOTE: All customer references are aggregated based on CIF and do not group CIFs with related ownership groups. Industry disclosures based on NAICS codes. 30

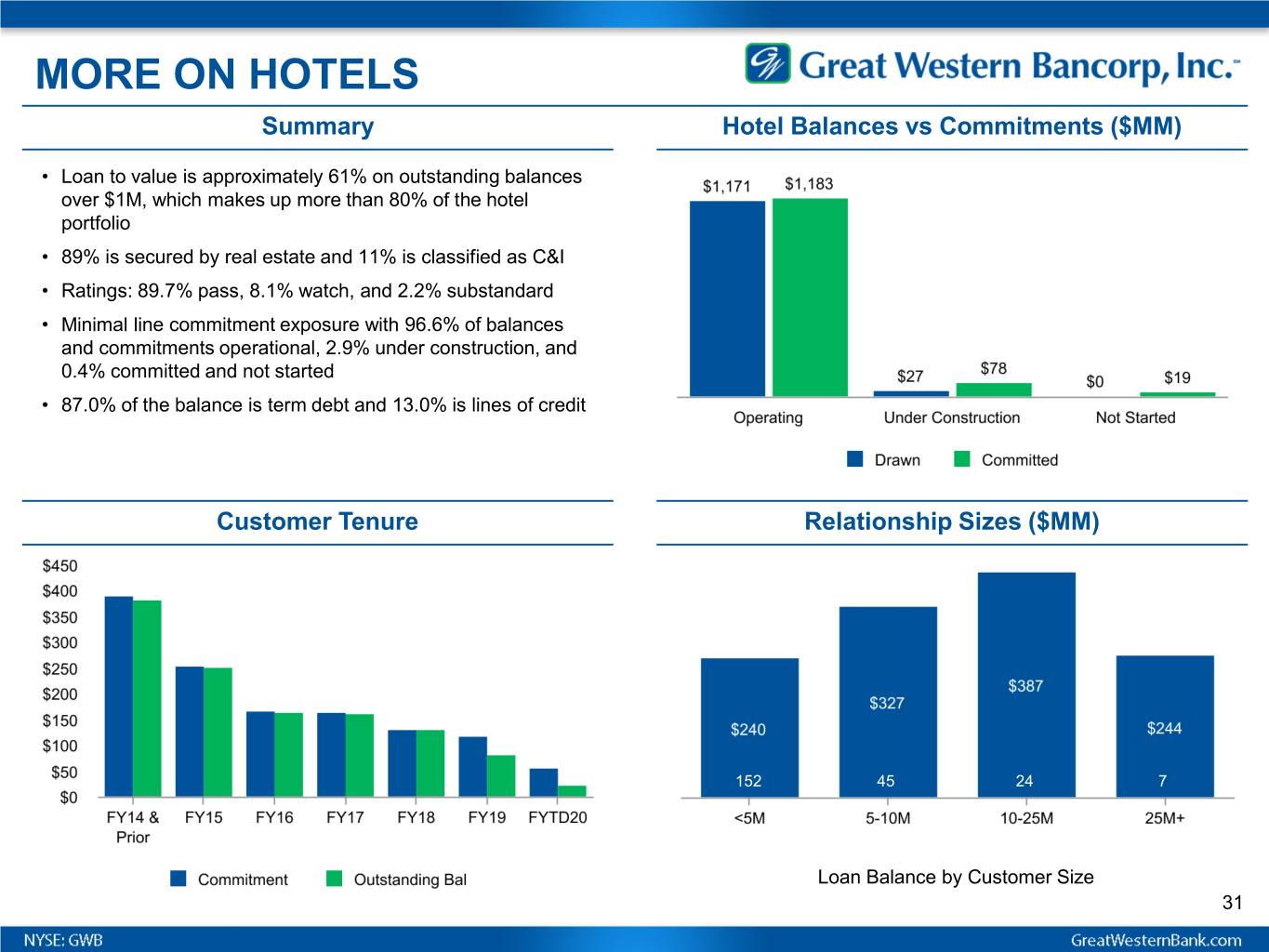

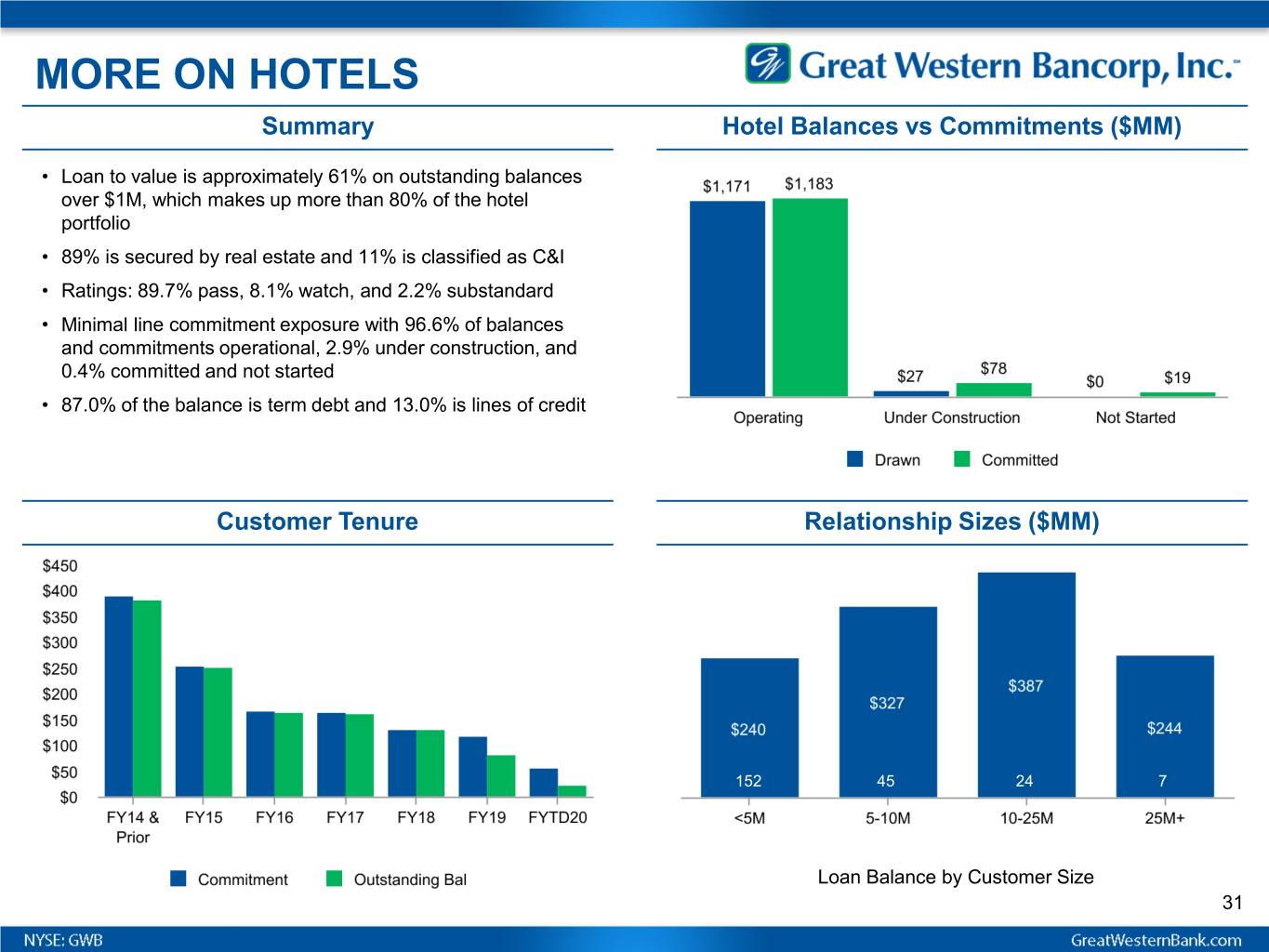

MORE ON HOTELS Summary Hotel Balances vs Commitments ($MM) • Loan to value is approximately 61% on outstanding balances over $1M, which makes up more than 80% of the hotel portfolio • 89% is secured by real estate and 11% is classified as C&I • Ratings: 89.7% pass, 8.1% watch, and 2.2% substandard • Minimal line commitment exposure with 96.6% of balances and commitments operational, 2.9% under construction, and 0.4% committed and not started • 87.0% of the balance is term debt and 13.0% is lines of credit Customer Tenure Relationship Sizes ($MM) 152 45 24 7 Loan Balance by Customer Size 31

Appendix 3 Agriculture Lending & Economy

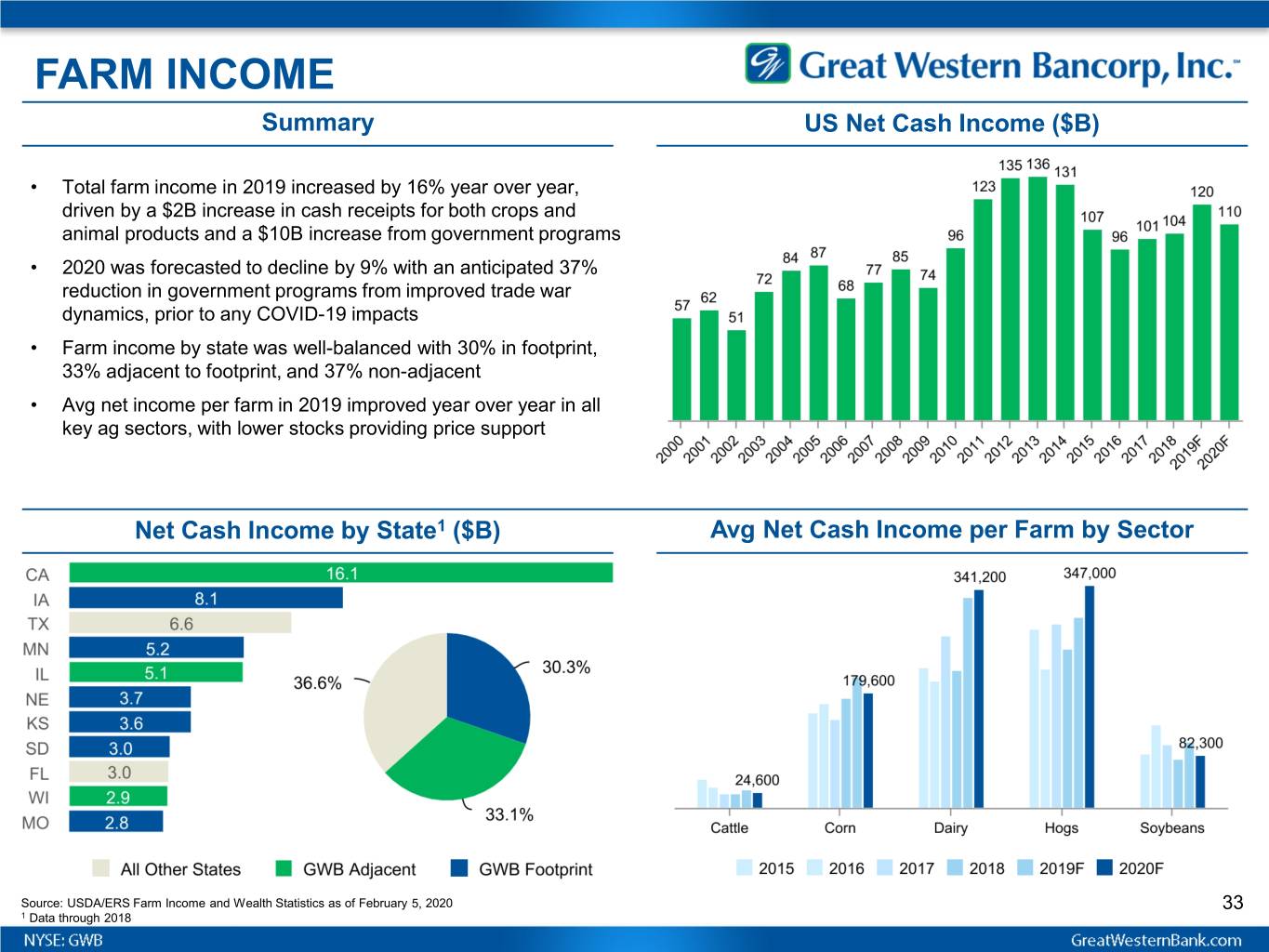

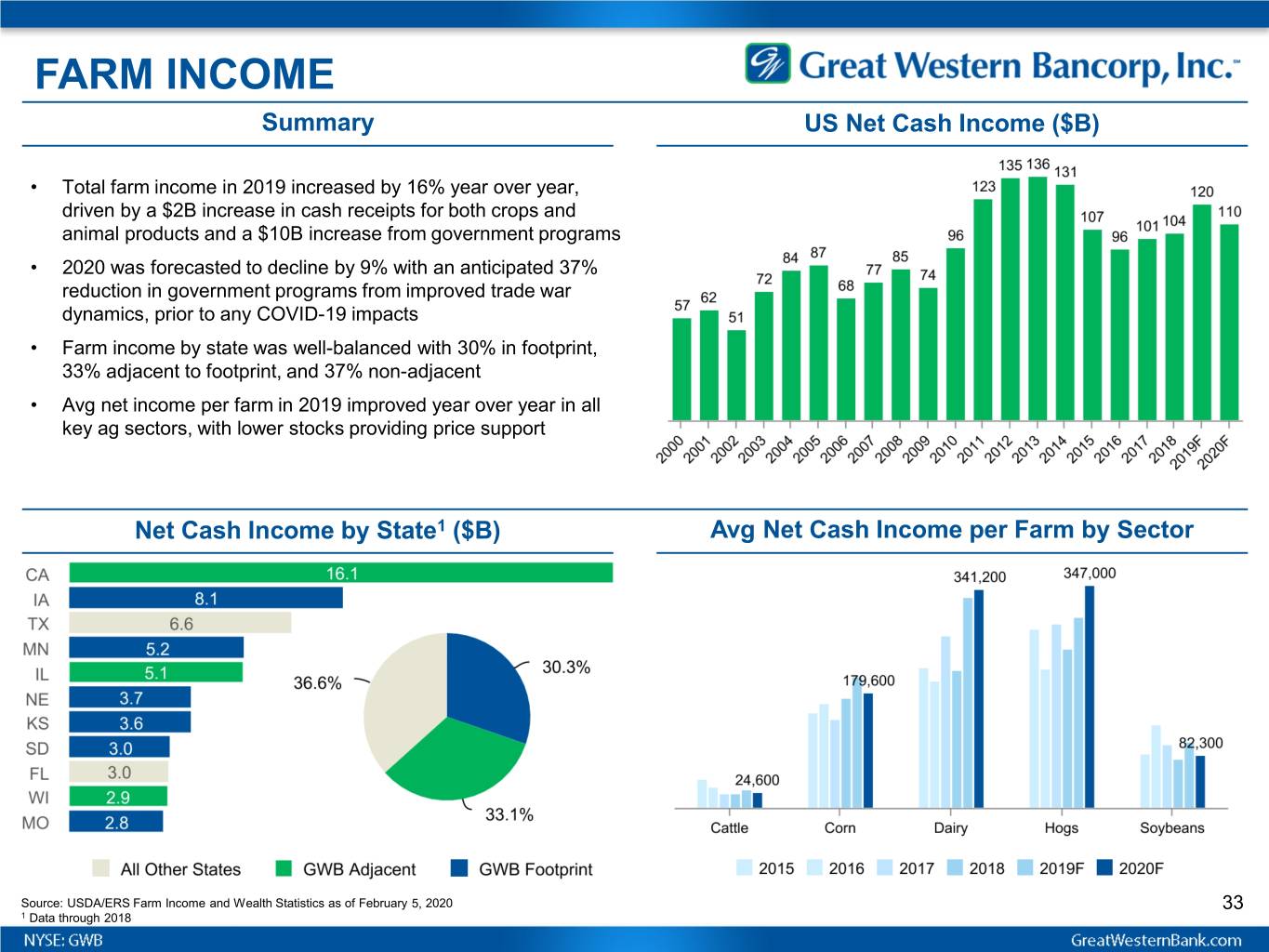

FARM INCOME Summary US Net Cash Income ($B) • Total farm income in 2019 increased by 16% year over year, driven by a $2B increase in cash receipts for both crops and animal products and a $10B increase from government programs • 2020 was forecasted to decline by 9% with an anticipated 37% reduction in government programs from improved trade war dynamics, prior to any COVID-19 impacts • Farm income by state was well-balanced with 30% in footprint, 33% adjacent to footprint, and 37% non-adjacent • Avg net income per farm in 2019 improved year over year in all key ag sectors, with lower stocks providing price support Net Cash Income by State1 ($B) Avg Net Cash Income per Farm by Sector Source: USDA/ERS Farm Income and Wealth Statistics as of February 5, 2020 33 1 Data through 2018

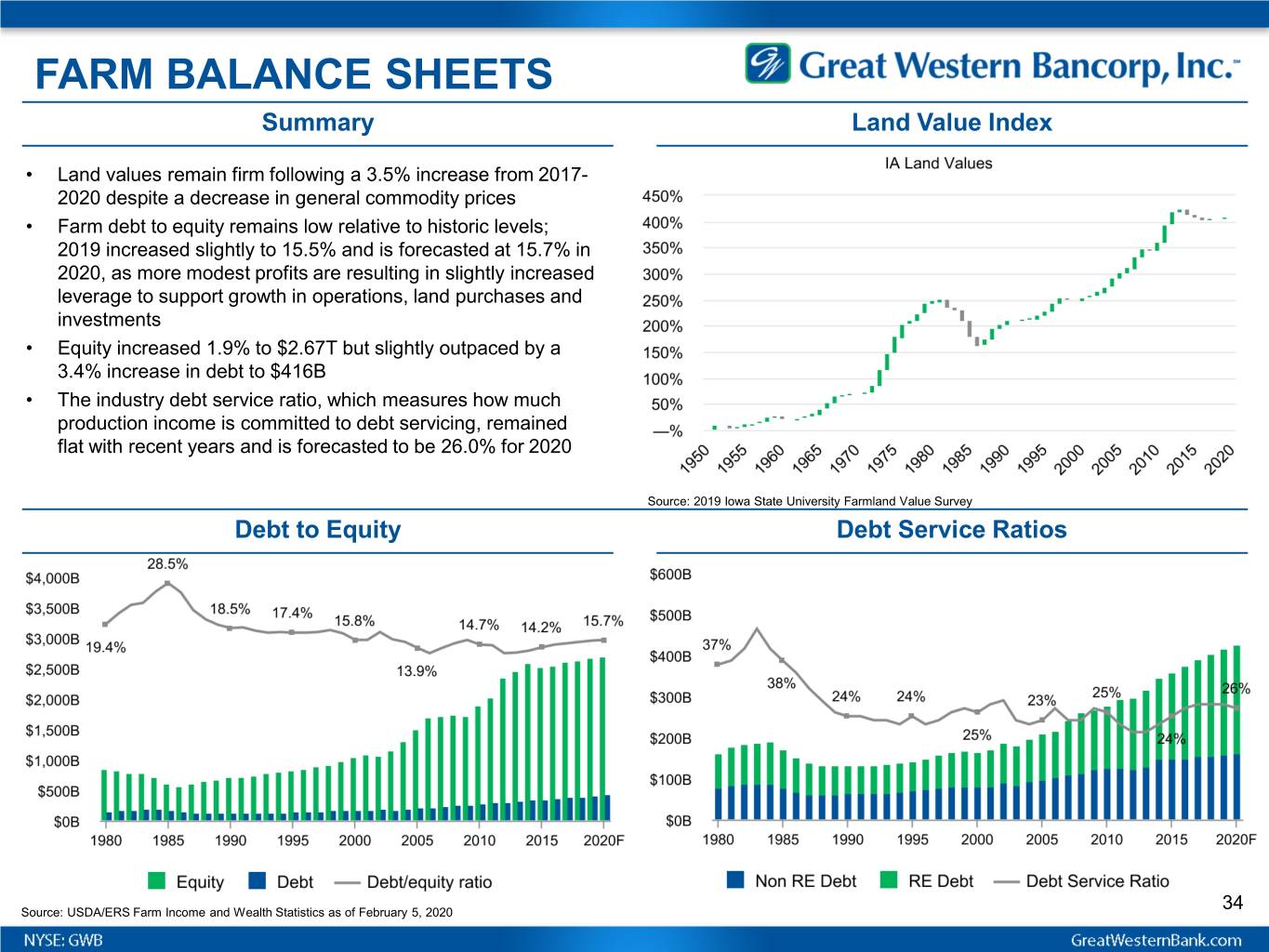

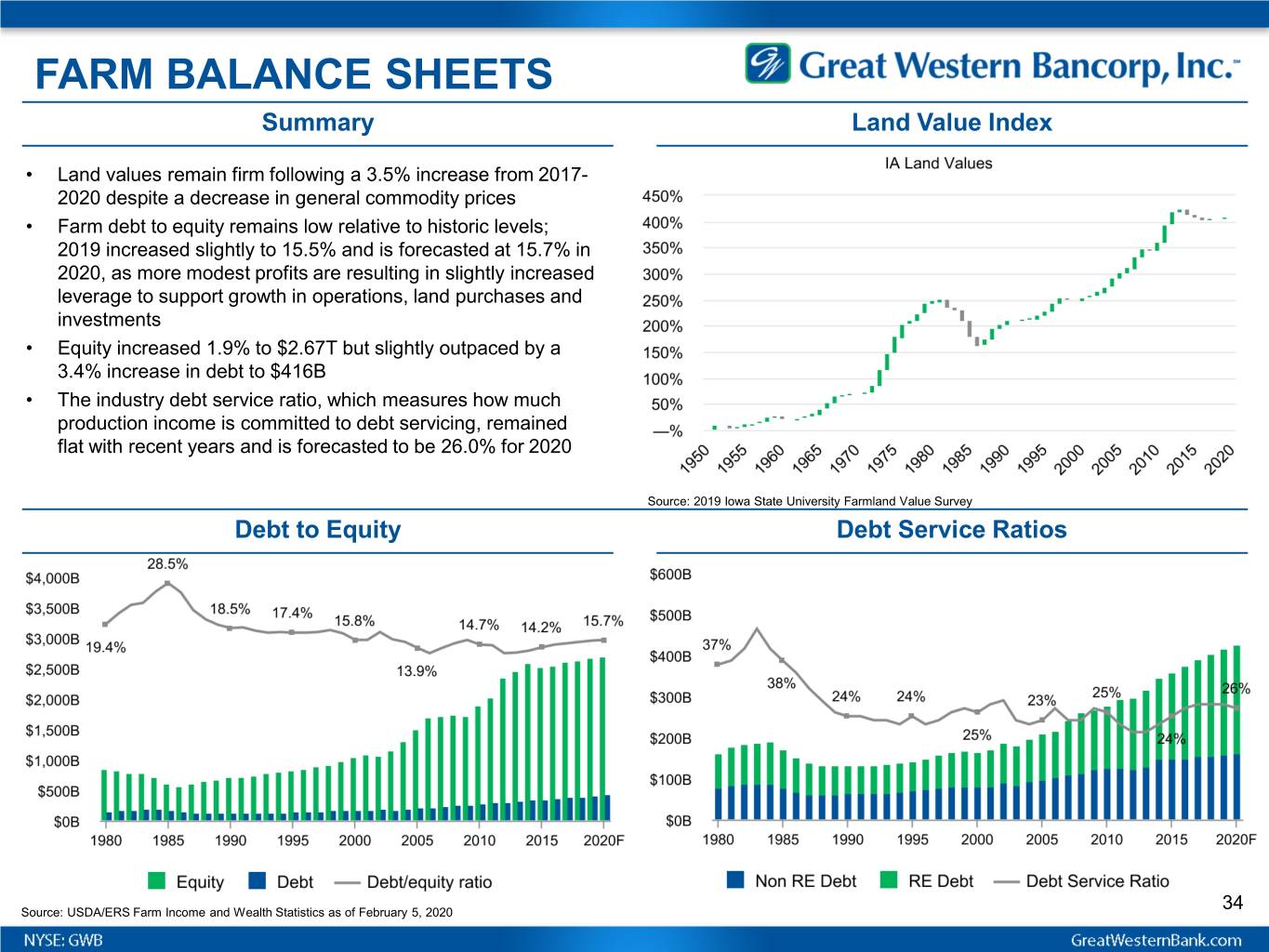

FARM BALANCE SHEETS Summary Land Value Index • Land values remain firm following a 3.5% increase from 2017- 2020 despite a decrease in general commodity prices • Farm debt to equity remains low relative to historic levels; 2019 increased slightly to 15.5% and is forecasted at 15.7% in 2020, as more modest profits are resulting in slightly increased leverage to support growth in operations, land purchases and investments • Equity increased 1.9% to $2.67T but slightly outpaced by a 3.4% increase in debt to $416B • The industry debt service ratio, which measures how much production income is committed to debt servicing, remained flat with recent years and is forecasted to be 26.0% for 2020 Source: 2019 Iowa State University Farmland Value Survey Debt to Equity Debt Service Ratios Source: USDA/ERS Farm Income and Wealth Statistics as of February 5, 2020 34

Appendix 4 Peer Group

PEER GROUP • BancorpSouth Bank • Fulton Financial Corporation • Banner Corporation • Glacier Bancorp, Inc. • Berkshire Hills Bancorp, Inc. • Heartland Financial USA, Inc. • Columbia Banking System, Inc. • Old National Bancorp • Community Bank System, Inc. • Renasant Corporation • Customers Bancorp, Inc. • Trustmark Corporation • CVB Financial Corp. • UMB Financial Corporation • First BanCorp. • United Bankshares, Inc. • First Midwest Bancorp, Inc. • United Community Banks, Inc. 36

Appendix 5 Accounting for Loans at FV and Related Derivatives

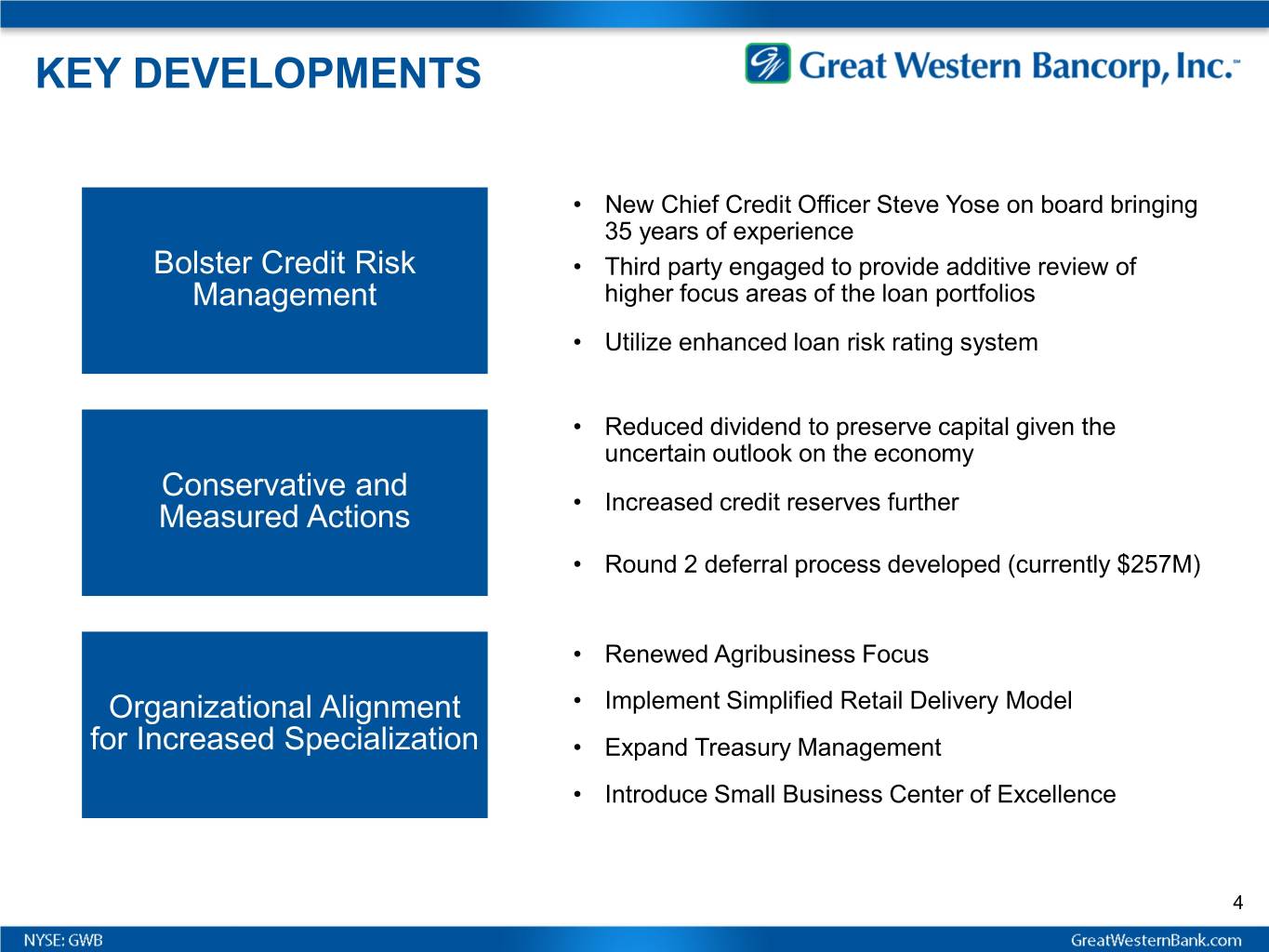

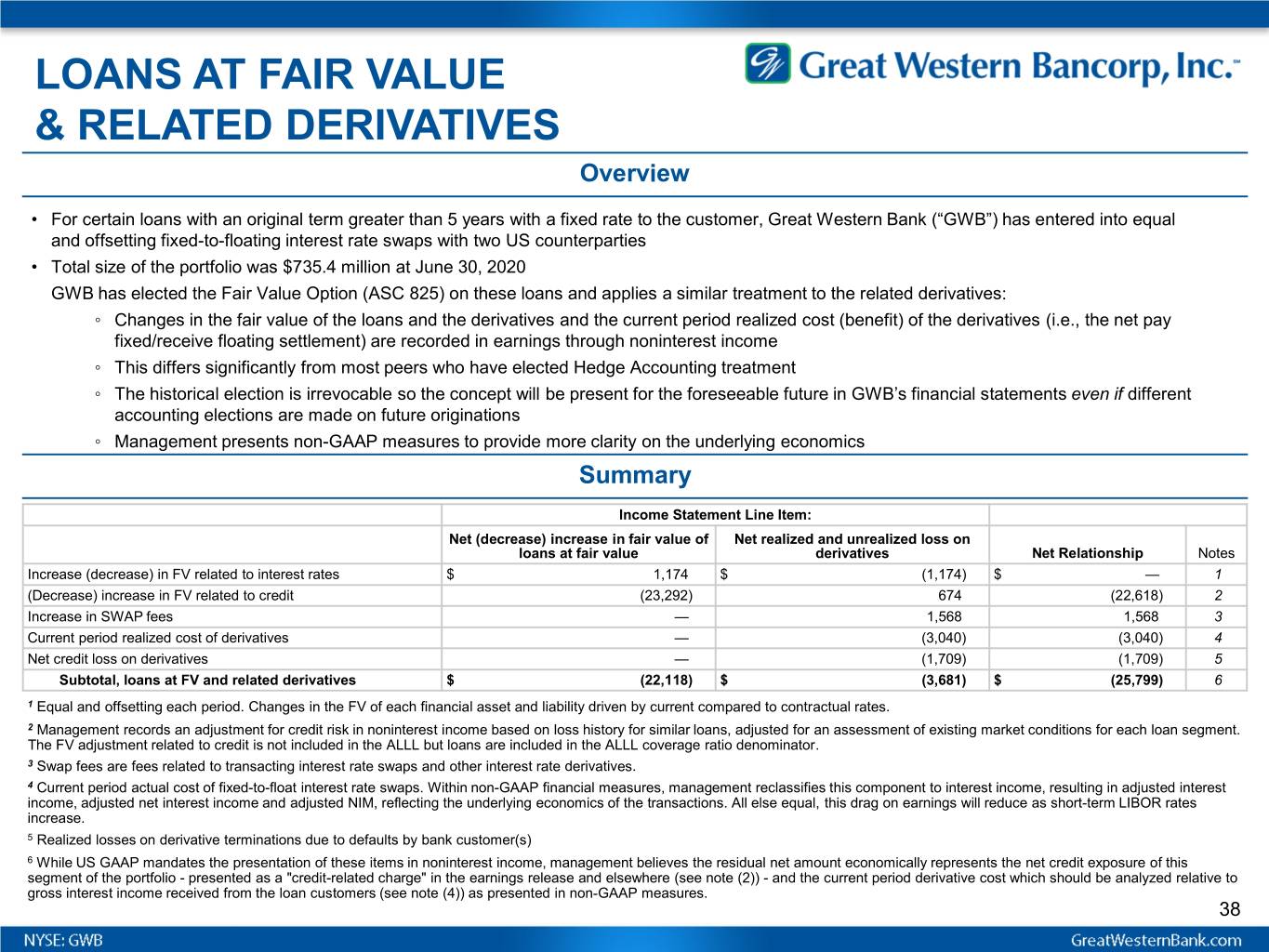

LOANS AT FAIR VALUE & RELATED DERIVATIVES Overview • For certain loans with an original term greater than 5 years with a fixed rate to the customer, Great Western Bank (“GWB”) has entered into equal and offsetting fixed-to-floating interest rate swaps with two US counterparties • Total size of the portfolio was $735.4 million at June 30, 2020 GWB has elected the Fair Value Option (ASC 825) on these loans and applies a similar treatment to the related derivatives: ◦ Changes in the fair value of the loans and the derivatives and the current period realized cost (benefit) of the derivatives (i.e., the net pay fixed/receive floating settlement) are recorded in earnings through noninterest income ◦ This differs significantly from most peers who have elected Hedge Accounting treatment ◦ The historical election is irrevocable so the concept will be present for the foreseeable future in GWB’s financial statements even if different accounting elections are made on future originations ◦ Management presents non-GAAP measures to provide more clarity on the underlying economics Summary x Income Statement Line Item: x x Net (decrease) increase in fair value of Net realized and unrealized loss on x loans at fair value derivatives Net Relationship Notes Increase (decrease) in FV related to interest rates $ 1,174 $ (1,174) $ — 1 (Decrease) increase in FV related to credit (23,292) 674 (22,618) 2 Increase in SWAP fees — 1,568 1,568 3 Current period realized cost of derivatives — (3,040) (3,040) 4 Net credit loss on derivatives — (1,709) (1,709) 5 Subtotal, loans at FV and related derivatives $ (22,118) $ (3,681) $ (25,799) 6 1 Equal and offsetting each period. Changes in the FV of each financial asset and liability driven by current compared to contractual rates. 2 Management records an adjustment for credit risk in noninterest income based on loss history for similar loans, adjusted for an assessment of existing market conditions for each loan segment. The FV adjustment related to credit is not included in the ALLL but loans are included in the ALLL coverage ratio denominator. 3 Swap fees are fees related to transacting interest rate swaps and other interest rate derivatives. 4 Current period actual cost of fixed-to-float interest rate swaps. Within non-GAAP financial measures, management reclassifies this component to interest income, resulting in adjusted interest income, adjusted net interest income and adjusted NIM, reflecting the underlying economics of the transactions. All else equal, this drag on earnings will reduce as short-term LIBOR rates increase. 5 Realized losses on derivative terminations due to defaults by bank customer(s) 6 While US GAAP mandates the presentation of these items in noninterest income, management believes the residual net amount economically represents the net credit exposure of this segment of the portfolio - presented as a "credit-related charge" in the earnings release and elsewhere (see note (2)) - and the current period derivative cost which should be analyzed relative to gross interest income received from the loan customers (see note (4)) as presented in non-GAAP measures. 38