ANALYST PRESENTATION February 7, 2017 Paul B. Murphy, Jr. Chairman and CEO First Quarter 2018 Financial Results April 26, 2018 Exhibit 99.2

Disclaimers This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect our current views with respect to, among other things, future events and our results of operations, financial condition and financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Such factors include, without limitation, the “Risk Factors” referenced in our Registration Statement on Form S-1 filed with the Securities and Exchange Commission (SEC), other risks and uncertainties listed from time to time in our reports and documents filed with the SEC, including our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, and the following factors: business and economic conditions generally and in the financial services industry, nationally and within our current and future geographic market areas; economic, market, operational, liquidity, credit and interest rate risks associated with our business; lack of seasoning in our loan portfolio; deteriorating asset quality and higher loan charge-offs; the laws and regulations applicable to our business; our ability to achieve organic loan and deposit growth and the composition of such growth; increased competition in the financial services industry, nationally, regionally or locally; our ability to maintain our historical earnings trends; our ability to raise additional capital to implement our business plan; material weaknesses in our internal control over financial reporting; systems failures or interruptions involving our information technology and telecommunications systems or third-party servicers; the composition of our management team and our ability to attract and retain key personnel; the fiscal position of the U.S. federal government and the soundness of other financial institutions; the composition of our loan portfolio, including the identify of our borrowers and the concentration of loans in energy-related industries and in our specialized industries; the portion of our loan portfolio that is comprised of participations and shared national credits; and the amount of nonperforming and classified assets we hold. Cadence can give no assurance that any goal or plan or expectation set forth in forward-looking statements can be achieved and readers are cautioned not to place undue reliance on such statements. The forward-looking statements are made as of the date of this communication, and Cadence does not intend, and assumes no obligation, to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law. Certain of the financial measures and ratios we present are supplemental measures that are not required by, or are not presented in accordance with, U.S. generally accepted accounting principles (GAAP). We refer to these financial measures and ratios as “non-GAAP financial measures.” We consider the use of select non-GAAP financial measures and ratios to be useful for financial and operational decision making and useful in evaluating period-to-period comparisons. These non-GAAP financial measures should not be considered a substitute for financial information presented in accordance with GAAP and you should not rely on non-GAAP financial measures alone as measures of our performance. More information regarding non-GAAP financial measures, including a reconciliation of non-GAAP financial measures to the comparable GAAP financial measures, is included in our earnings release and in the appendix to this presentation.

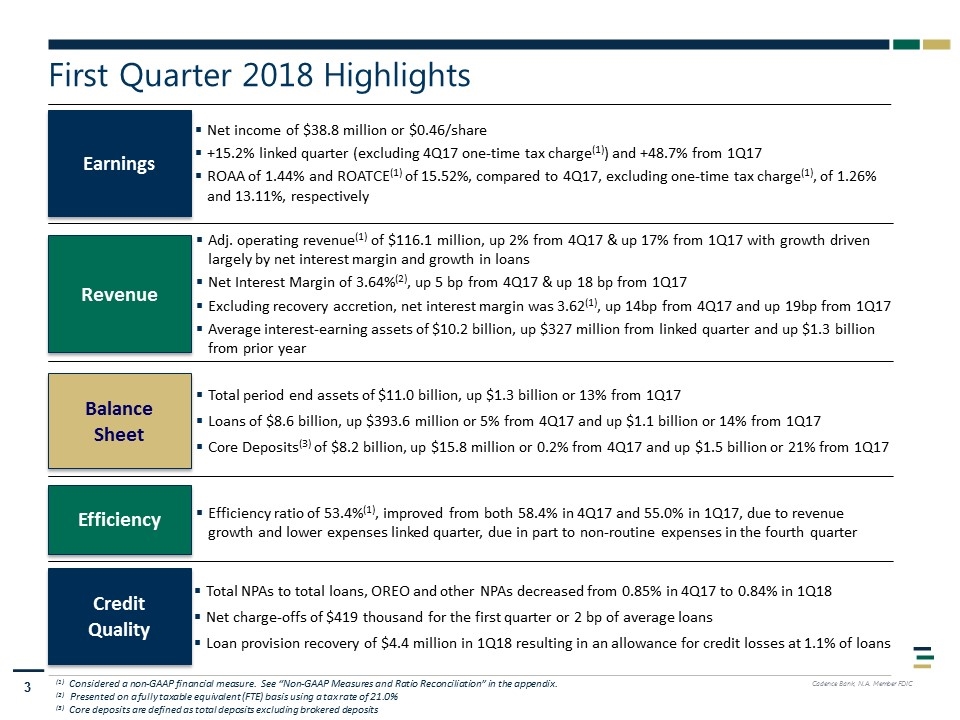

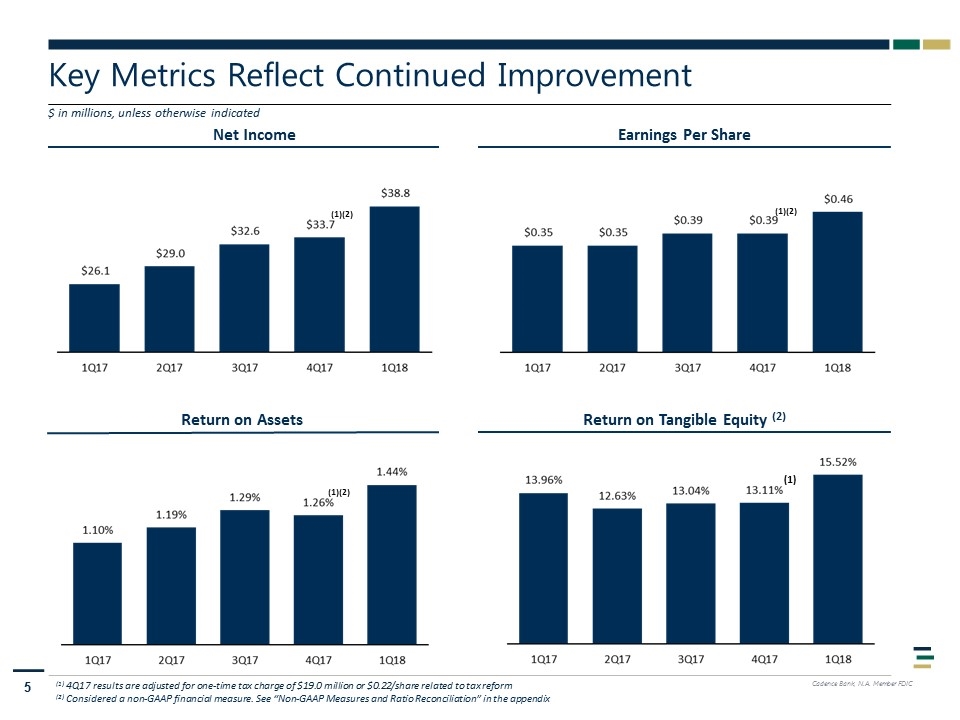

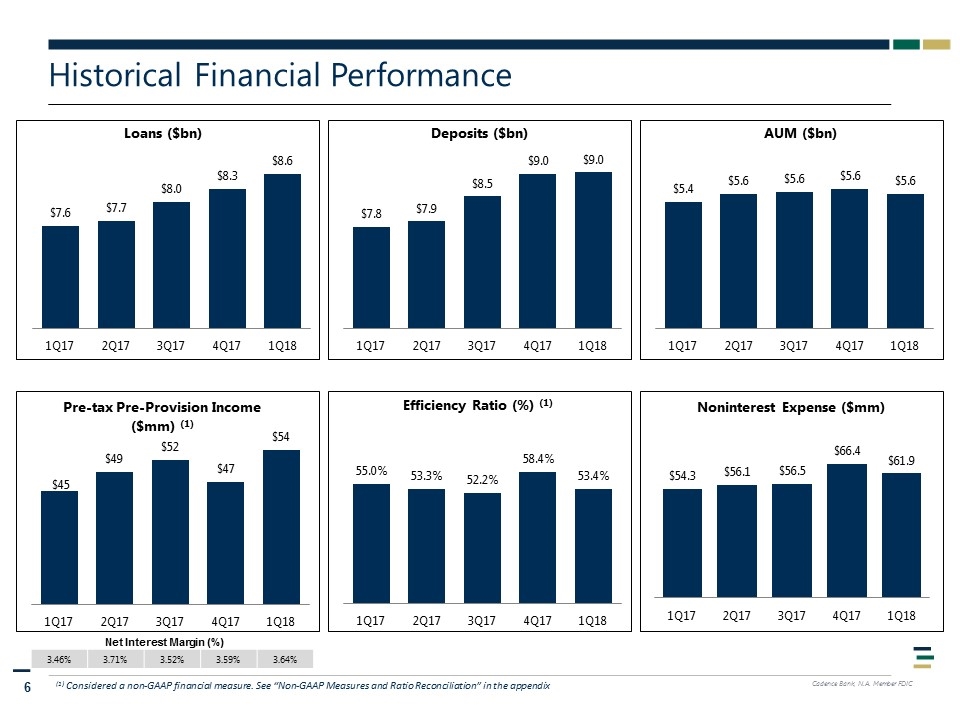

First Quarter 2018 Highlights Earnings Net income of $38.8 million or $0.46/share +15.2% linked quarter (excluding 4Q17 one-time tax charge(1)) and +48.7% from 1Q17 ROAA of 1.44% and ROATCE(1) of 15.52%, compared to 4Q17, excluding one-time tax charge(1), of 1.26% and 13.11%, respectively Revenue Balance Sheet Efficiency Credit Quality (1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix. (2) Presented on a fully taxable equivalent (FTE) basis using a tax rate of 21.0% (3) Core deposits are defined as total deposits excluding brokered deposits Adj. operating revenue(1) of $116.1 million, up 2% from 4Q17 & up 17% from 1Q17 with growth driven largely by net interest margin and growth in loans Net Interest Margin of 3.64%(2), up 5 bp from 4Q17 & up 18 bp from 1Q17 Excluding recovery accretion, net interest margin was 3.62(1), up 14bp from 4Q17 and up 19bp from 1Q17 Average interest-earning assets of $10.2 billion, up $327 million from linked quarter and up $1.3 billion from prior year Total period end assets of $11.0 billion, up $1.3 billion or 13% from 1Q17 Loans of $8.6 billion, up $393.6 million or 5% from 4Q17 and up $1.1 billion or 14% from 1Q17 Core Deposits(3) of $8.2 billion, up $15.8 million or 0.2% from 4Q17 and up $1.5 billion or 21% from 1Q17 Efficiency ratio of 53.4%(1), improved from both 58.4% in 4Q17 and 55.0% in 1Q17, due to revenue growth and lower expenses linked quarter, due in part to non-routine expenses in the fourth quarter Total NPAs to total loans, OREO and other NPAs decreased from 0.85% in 4Q17 to 0.84% in 1Q18 Net charge-offs of $419 thousand for the first quarter or 2 bp of average loans Loan provision recovery of $4.4 million in 1Q18 resulting in an allowance for credit losses at 1.1% of loans

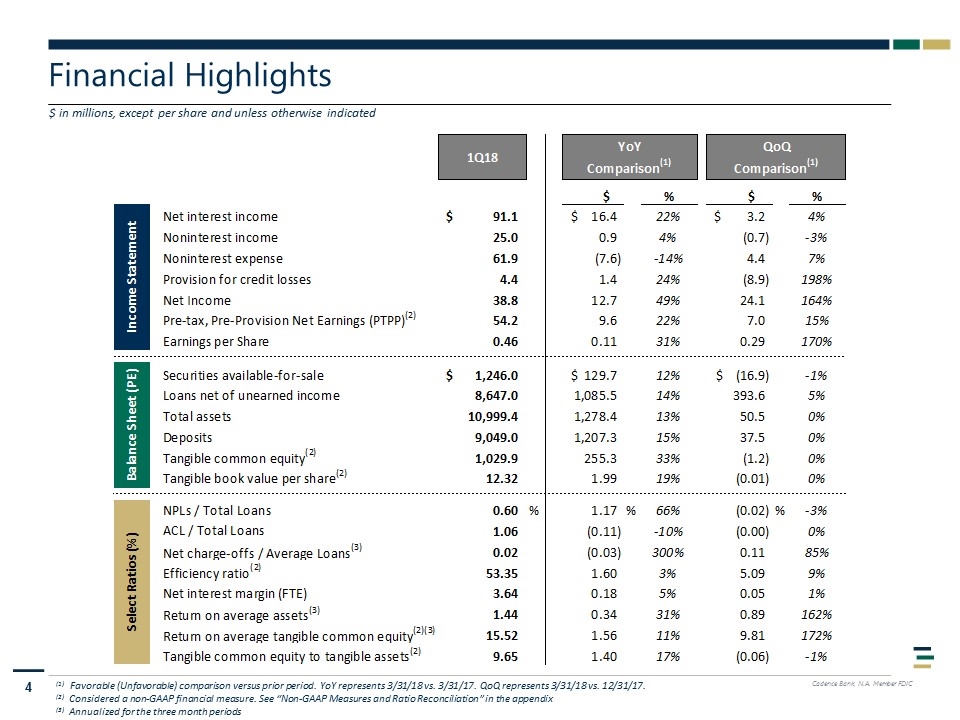

Financial Highlights $ in millions, except per share and unless otherwise indicated (1) Favorable (Unfavorable) comparison versus prior period. YoY represents 3/31/18 vs. 3/31/17. QoQ represents 3/31/18 vs. 12/31/17. (2) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix (3) Annualized for the three month periods

Net Income Key Metrics Reflect Continued Improvement Earnings Per Share Return on Tangible Equity (2) $ in millions, unless otherwise indicated Return on Assets (1) 4Q17 results are adjusted for one-time tax charge of $19.0 million or $0.22/share related to tax reform (2) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix (1)(2) (1)(2) (1)(2) (1)

Historical Financial Performance 44% 62% 74% 17% 26% 74% 80% 84% 20% 16% 92% 8% 96% 4% (1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix Net Interest Margin (%) 3.46% 3.71% 3.52% 3.59% 3.64%

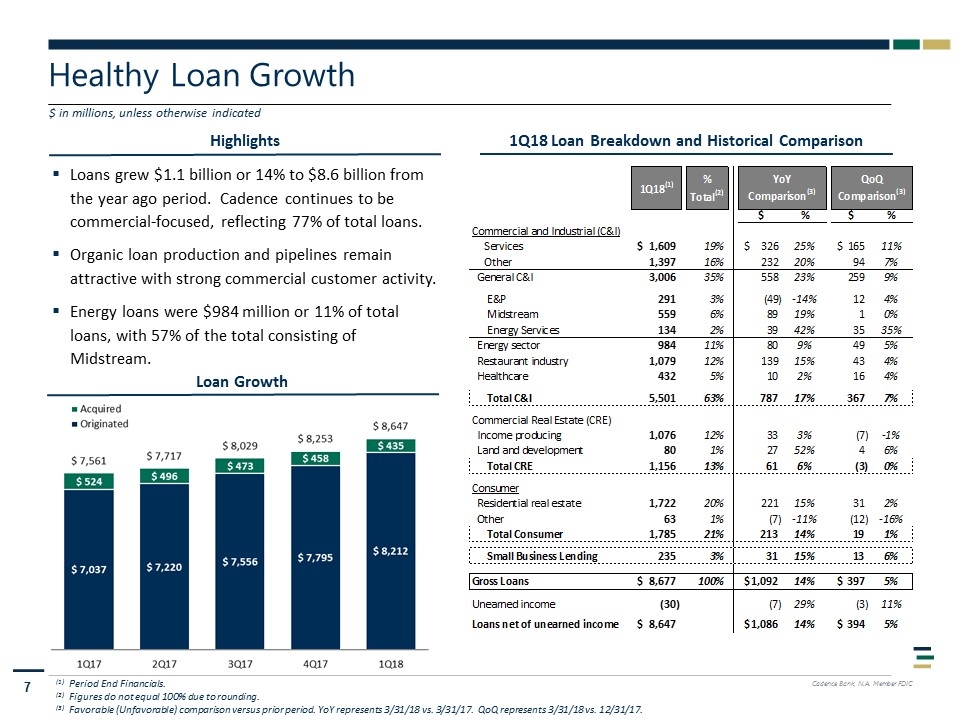

Highlights Healthy Loan Growth $ in millions, unless otherwise indicated Loan Growth Loans grew $1.1 billion or 14% to $8.6 billion from the year ago period. Cadence continues to be commercial-focused, reflecting 77% of total loans. Organic loan production and pipelines remain attractive with strong commercial customer activity. Energy loans were $984 million or 11% of total loans, with 57% of the total consisting of Midstream. (1) Period End Financials. (2) Figures do not equal 100% due to rounding. (3) Favorable (Unfavorable) comparison versus prior period. YoY represents 3/31/18 vs. 3/31/17. QoQ represents 3/31/18 vs. 12/31/17. 1Q18 Loan Breakdown and Historical Comparison

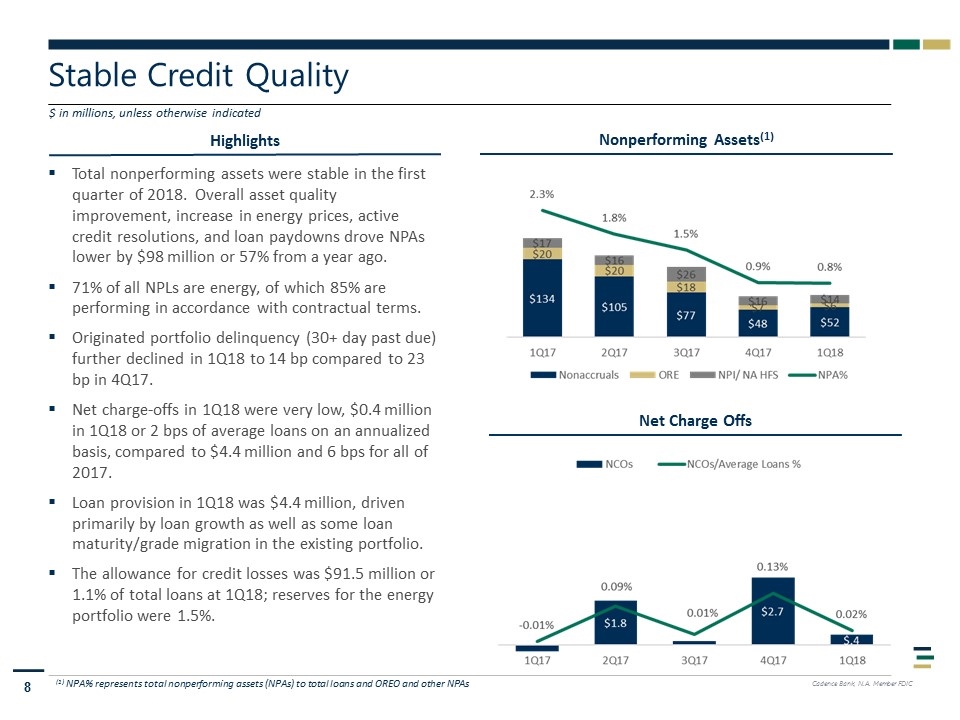

Stable Credit Quality $ in millions, unless otherwise indicated Nonperforming Assets(1) Highlights Net Charge Offs Total nonperforming assets were stable in the first quarter of 2018. Overall asset quality improvement, increase in energy prices, active credit resolutions, and loan paydowns drove NPAs lower by $98 million or 57% from a year ago. 71% of all NPLs are energy, of which 85% are performing in accordance with contractual terms. Originated portfolio delinquency (30+ day past due) further declined in 1Q18 to 14 bp compared to 23 bp in 4Q17. Net charge-offs in 1Q18 were very low, $0.4 million in 1Q18 or 2 bps of average loans on an annualized basis, compared to $4.4 million and 6 bps for all of 2017. Loan provision in 1Q18 was $4.4 million, driven primarily by loan growth as well as some loan maturity/grade migration in the existing portfolio. The allowance for credit losses was $91.5 million or 1.1% of total loans at 1Q18; reserves for the energy portfolio were 1.5%. (1) NPA% represents total nonperforming assets (NPAs) to total loans and OREO and other NPAs

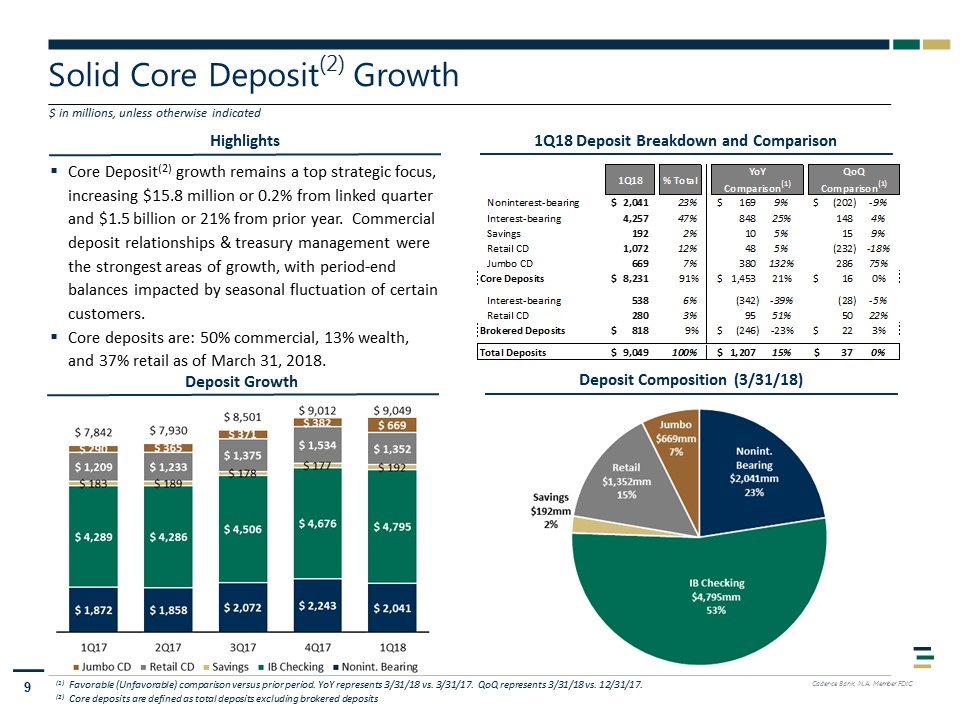

Highlights Solid Core Deposit(2) Growth $ in millions, unless otherwise indicated Deposit Growth 1Q18 Deposit Breakdown and Comparison Core Deposit(2) growth remains a top strategic focus, increasing $15.8 million or 0.2% from linked quarter and $1.5 billion or 21% from prior year. Commercial deposit relationships & treasury management were the strongest areas of growth, with period-end balances impacted by seasonal fluctuation of certain customers. Core deposits are: 50% commercial, 13% wealth, and 37% retail as of March 31, 2018. (1) Favorable (Unfavorable) comparison versus prior period. YoY represents 3/31/18 vs. 3/31/17. QoQ represents 3/31/18 vs. 12/31/17. (2) Core deposits are defined as total deposits excluding brokered deposits Deposit Composition (3/31/18)

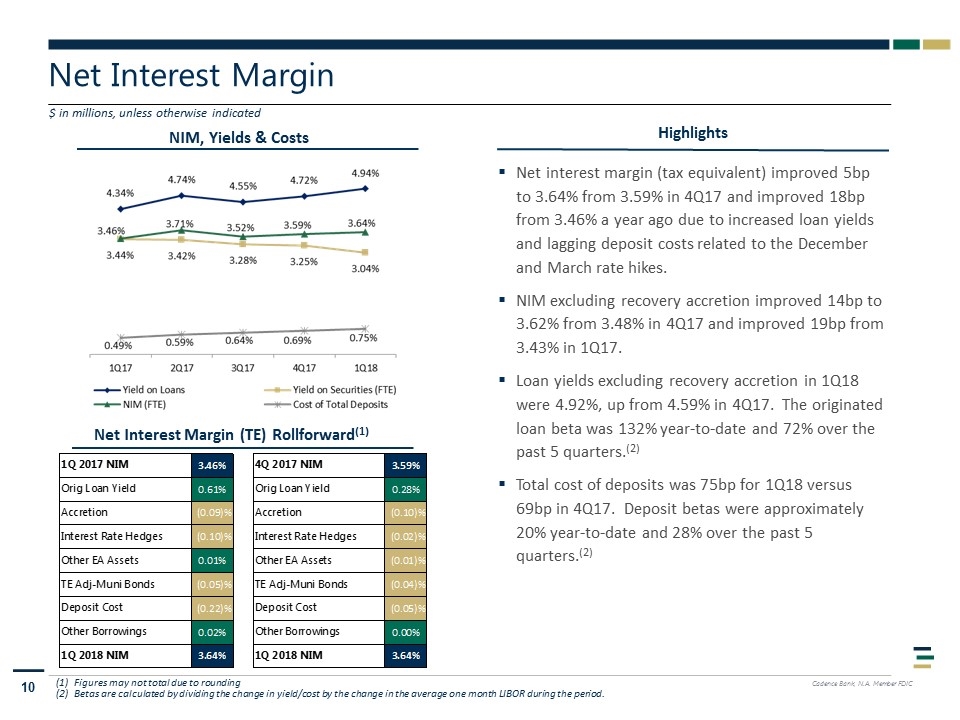

Net Interest Margin $ in millions, unless otherwise indicated Highlights Net interest margin (tax equivalent) improved 5bp to 3.64% from 3.59% in 4Q17 and improved 18bp from 3.46% a year ago due to increased loan yields and lagging deposit costs related to the December and March rate hikes. NIM excluding recovery accretion improved 14bp to 3.62% from 3.48% in 4Q17 and improved 19bp from 3.43% in 1Q17. Loan yields excluding recovery accretion in 1Q18 were 4.92%, up from 4.59% in 4Q17. The originated loan beta was 132% year-to-date and 72% over the past 5 quarters.(2) Total cost of deposits was 75bp for 1Q18 versus 69bp in 4Q17. Deposit betas were approximately 20% year-to-date and 28% over the past 5 quarters.(2) NIM, Yields & Costs Figures may not total due to rounding Betas are calculated by dividing the change in yield/cost by the change in the average one month LIBOR during the period. Net Interest Margin (TE) Rollforward(1)

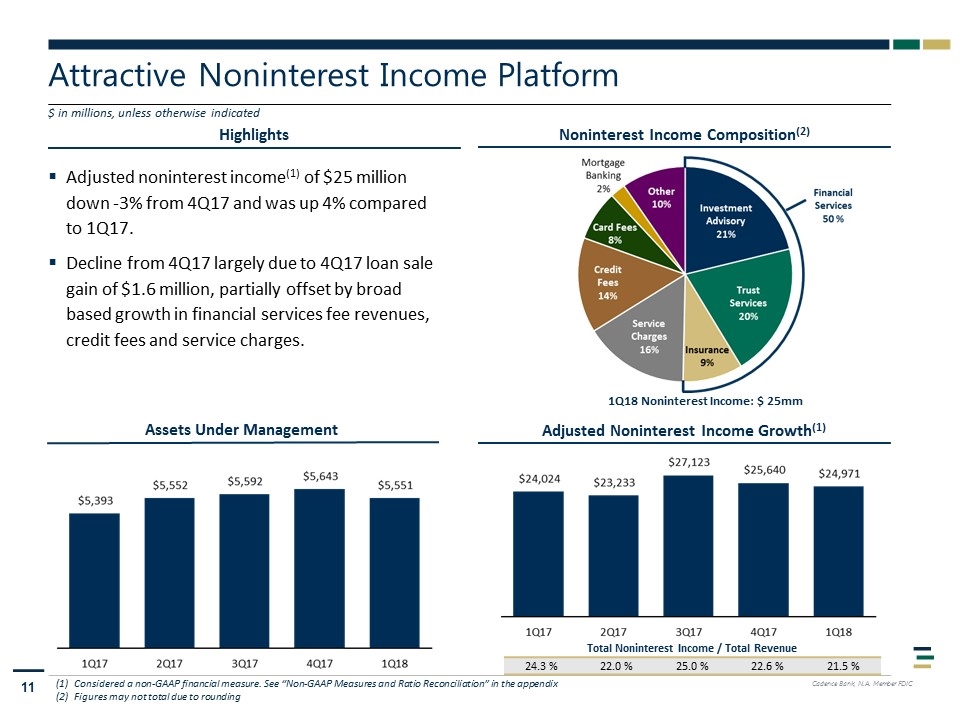

Highlights Attractive Noninterest Income Platform Noninterest Income Composition(2) Adjusted Noninterest Income Growth(1) $ in millions, unless otherwise indicated 1Q18 Noninterest Income: $ 25mm Adjusted noninterest income(1) of $25 million down -3% from 4Q17 and was up 4% compared to 1Q17. Decline from 4Q17 largely due to 4Q17 loan sale gain of $1.6 million, partially offset by broad based growth in financial services fee revenues, credit fees and service charges. Assets Under Management Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix Figures may not total due to rounding Total Noninterest Income / Total Revenue 24.3 % 22.0 % 25.0 % 22.6 % 21.5 %

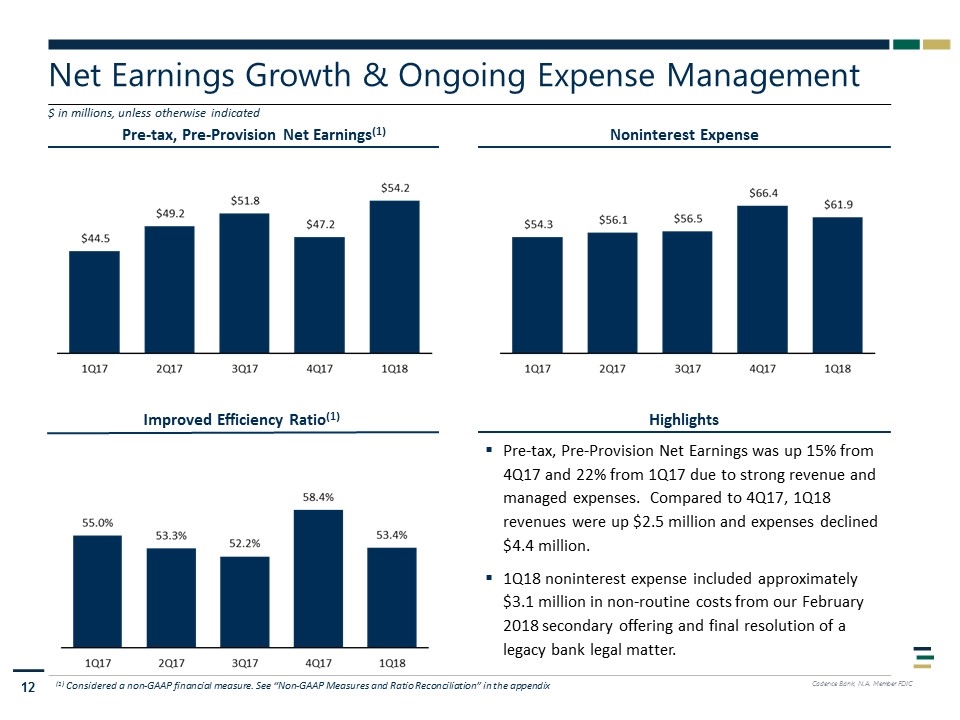

Pre-tax, Pre-Provision Net Earnings(1) Net Earnings Growth & Ongoing Expense Management Noninterest Expense Highlights $ in millions, unless otherwise indicated Pre-tax, Pre-Provision Net Earnings was up 15% from 4Q17 and 22% from 1Q17 due to strong revenue and managed expenses. Compared to 4Q17, 1Q18 revenues were up $2.5 million and expenses declined $4.4 million. 1Q18 noninterest expense included approximately $3.1 million in non-routine costs from our February 2018 secondary offering and final resolution of a legacy bank legal matter. Improved Efficiency Ratio(1) (1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix

Appendix

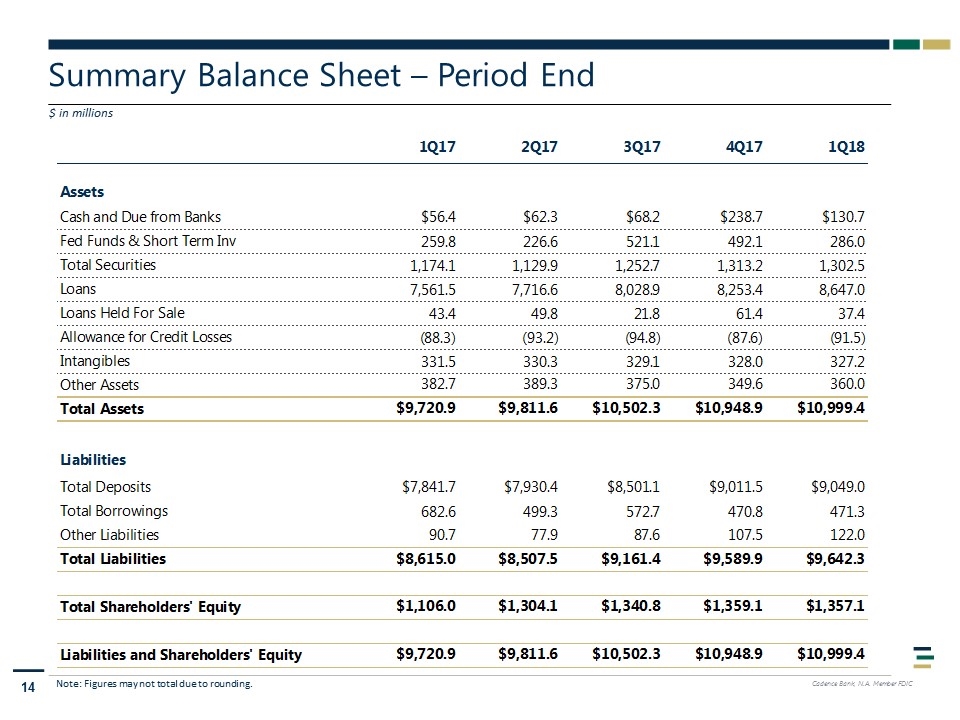

Summary Balance Sheet – Period End $ in millions Note: Figures may not total due to rounding.

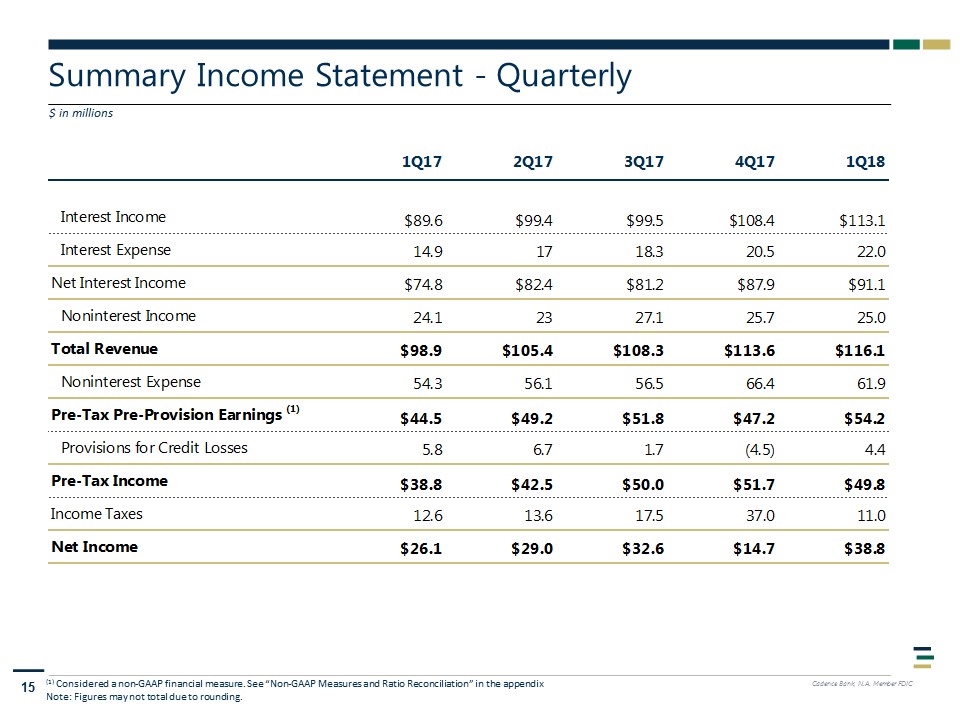

Summary Income Statement - Quarterly $ in millions (1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix Note: Figures may not total due to rounding.

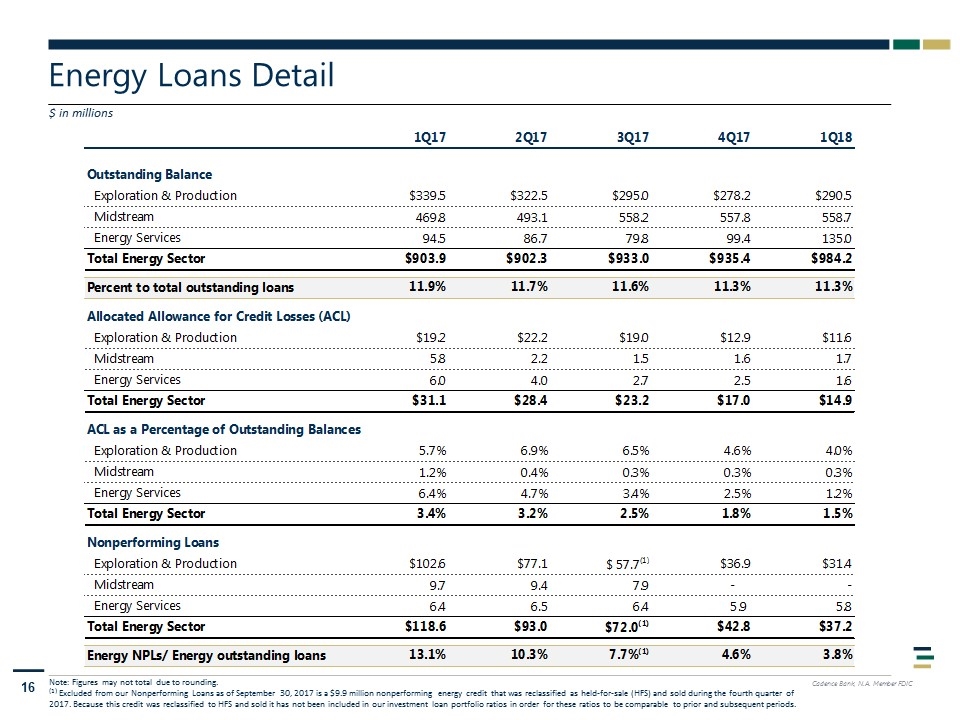

Energy Loans Detail $ in millions Note: Figures may not total due to rounding. (1) Excluded from our Nonperforming Loans as of September 30, 2017 is a $9.9 million nonperforming energy credit that was reclassified as held-for-sale (HFS) and sold during the fourth quarter of 2017. Because this credit was reclassified to HFS and sold it has not been included in our investment loan portfolio ratios in order for these ratios to be comparable to prior and subsequent periods.

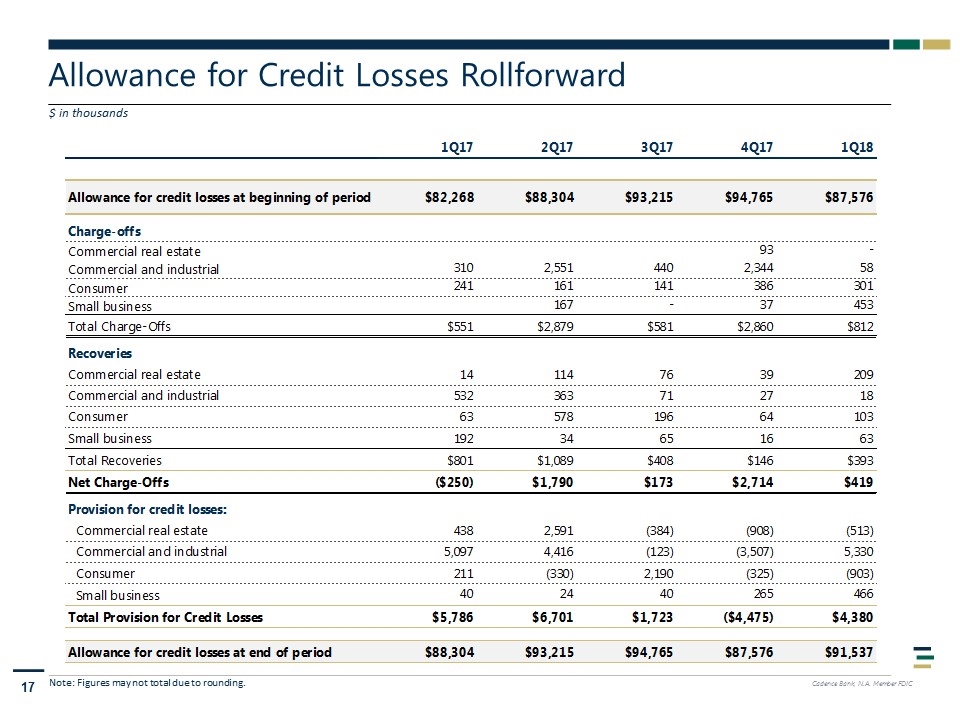

Allowance for Credit Losses Rollforward $ in thousands Note: Figures may not total due to rounding.

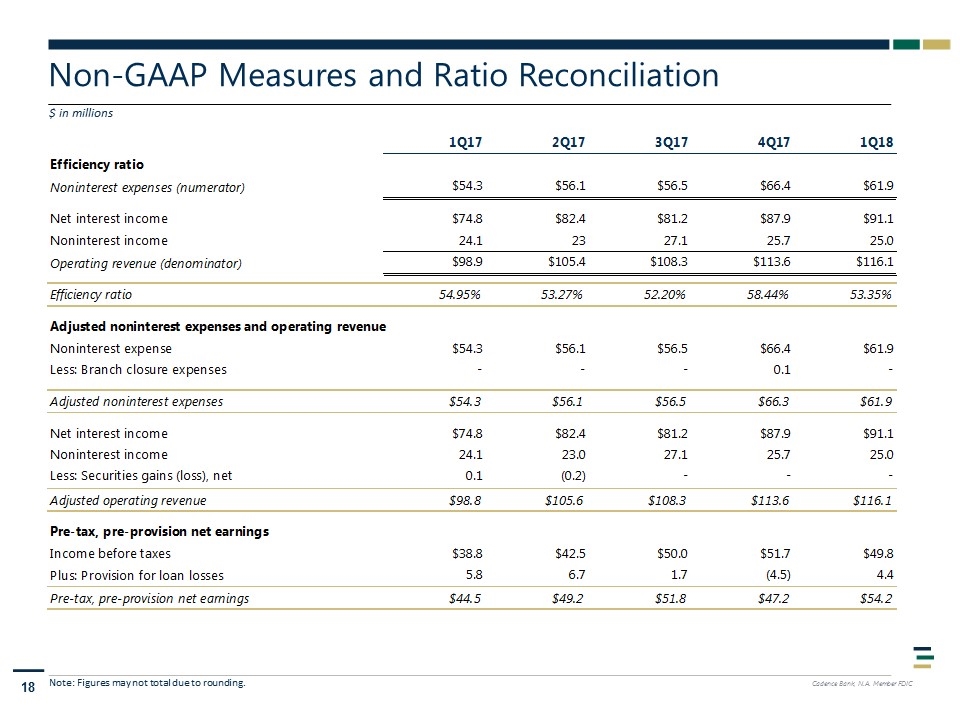

Non-GAAP Measures and Ratio Reconciliation $ in millions Note: Figures may not total due to rounding.

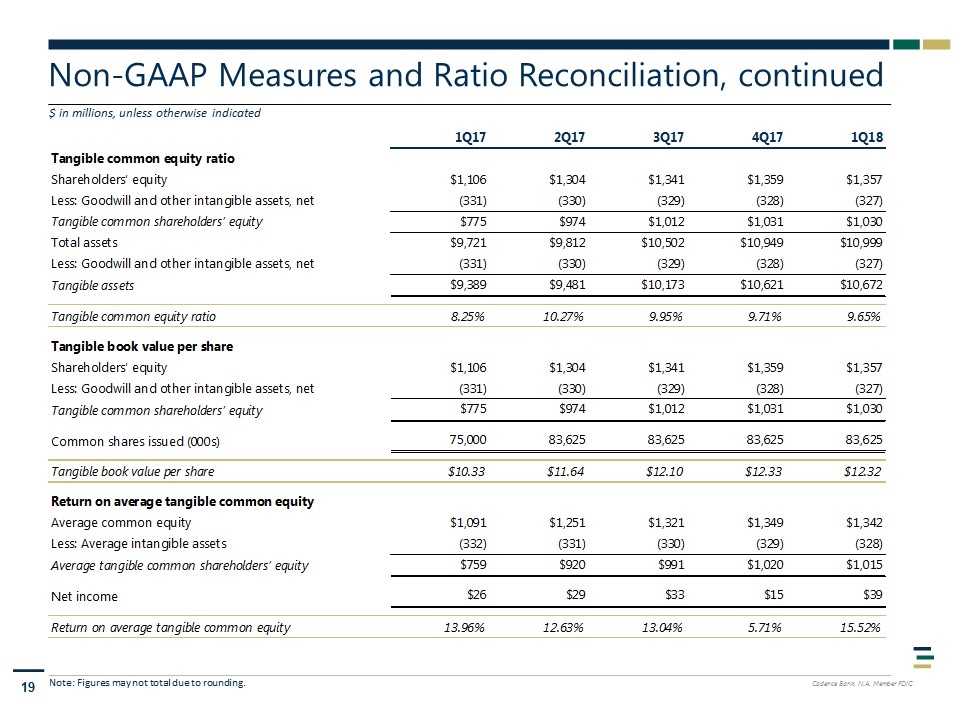

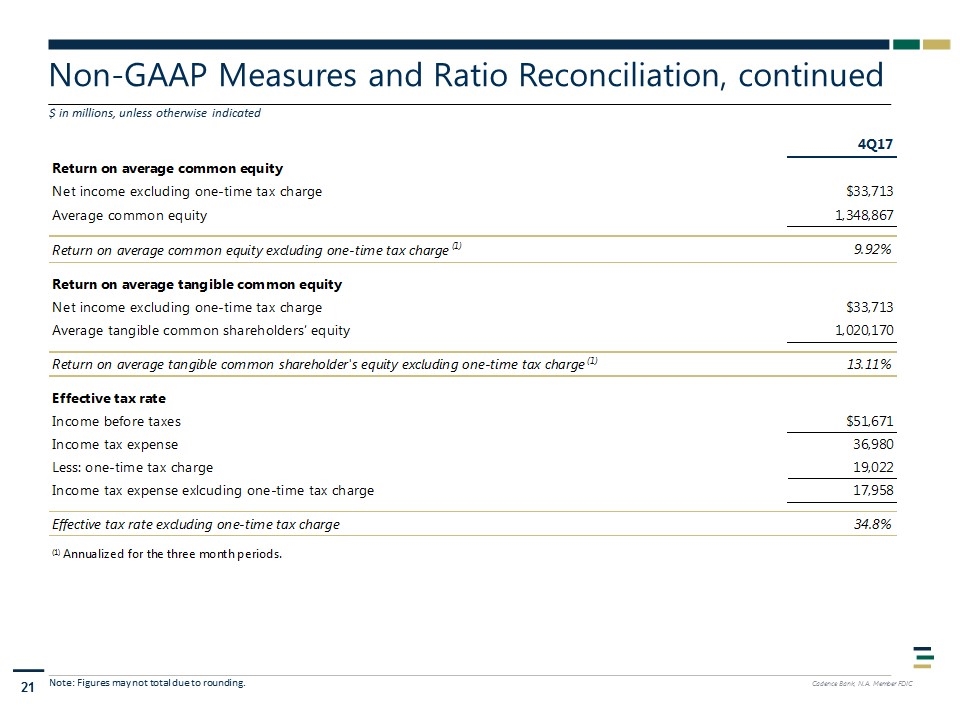

Non-GAAP Measures and Ratio Reconciliation, continued Note: Figures may not total due to rounding. $ in millions, unless otherwise indicated

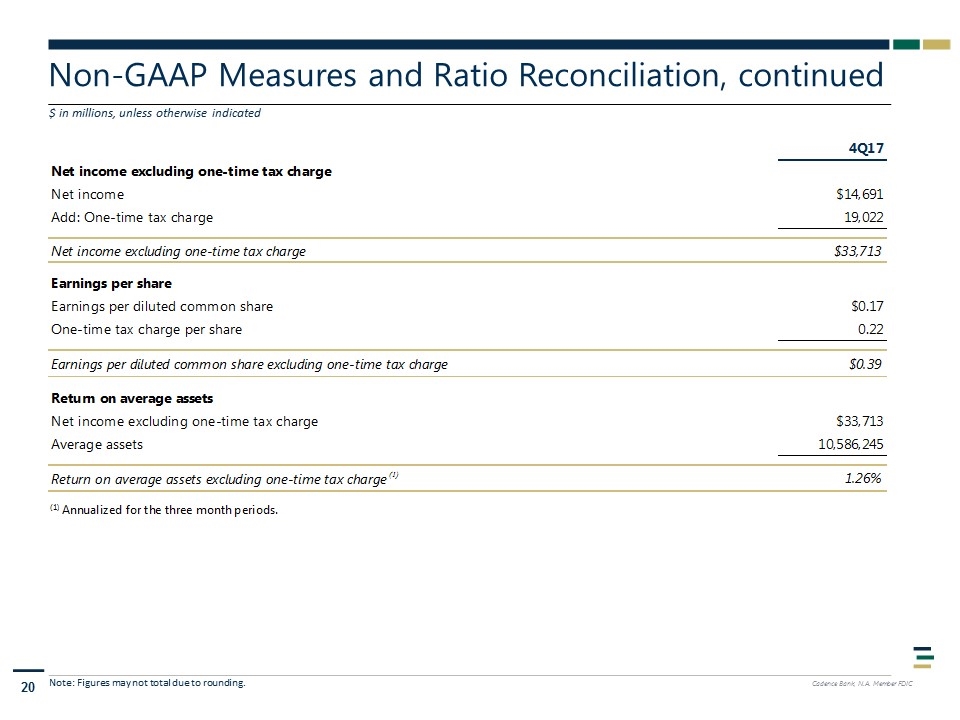

Non-GAAP Measures and Ratio Reconciliation, continued Note: Figures may not total due to rounding. $ in millions, unless otherwise indicated

Non-GAAP Measures and Ratio Reconciliation, continued Note: Figures may not total due to rounding. $ in millions, unless otherwise indicated