UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-22983

Eaton Vance NextShares Trust II

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

September 30

Date of Fiscal Year End

September 30, 2018

Date of Reporting Period

Item 1. Reports to Stockholders

Eaton Vance

Oaktree Diversified Credit NextShares (OKDCC)

Listing Exchange: The NASDAQ Stock Market LLC

Annual Report

September 30, 2018

NextShares® is a registered trademark of NextShares Solutions LLC. All rights reserved.

Commodity Futures Trading Commission Registration. Effective December 31, 2012, the Commodity Futures Trading Commission (“CFTC”) adopted certain regulatory changes that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The Fund has claimed an exclusion from the definition of the term “commodity pool operator” under the Commodity Exchange Act. Accordingly, neither the Fund nor the adviser with respect to the operation of the Fund is subject to CFTC regulation. Because of its management of other strategies, the Fund’s adviser is registered with the CFTC as a commodity pool operator and a commodity trading advisor.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing in NextShares, investors should consider carefully the investment objectives, risks, charges and expenses. This and other important information is contained in the prospectus and summary prospectus, which can be obtained from a financial advisor. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-262-1122.

Annual Report September 30, 2018

Eaton Vance

Oaktree Diversified Credit NextShares

Table of Contents

| | | | |

Management’s Discussion of Fund Performance | | | 2 | |

| |

Performance | | | 3 | |

| |

Fund Profile | | | 4 | |

| |

Endnotes and Additional Disclosures | | | 5 | |

| |

Fund Expenses | | | 6 | |

| |

Financial Statements | | | 7 | |

| |

Report of Independent Registered Public Accounting Firm | | | 28 | |

| |

Federal Tax Information | | | 29 | |

| |

Special Meeting of Shareholders | | | 30 | |

| |

Management and Organization | | | 31 | |

| |

Important Notices | | | 34 | |

Eaton Vance

Oaktree Diversified Credit NextShares

September 30, 2018

Management’s Discussion of Fund Performance1

Economic and Market Conditions

Although geopolitical tensions early in the period involving North Korea rattled markets, accommodative central banks, strong corporate earnings, and global growth muffled the impact of these potential sources of volatility. However, as the year progressed, the growing threat of an international trade war and mounting uncertainties about the course of Brexit raised market worries. Signs of decelerating growth outside the U.S. — as well as concerns about rising inflation and interest rates inside the U.S. — led to an uptick in volatility.

U.S. gross domestic product (GDP) growth accelerated through most of the period, reaching a quarterly annualized rate of 4.2% in the second quarter of 2018, the highest level in four years. Corporate earnings and balance sheets also steadily strengthened and the unemployment rate fell to 3.9% during the period from 4.2% at the start of the period. Wages, which had remained stagnant even as the jobless rate fell, began to rise in the latter stages of the period. Inflation increased modestly with the personal consumption expenditures index rising to nearly 2%, the U.S. Federal Reserve (the Fed) target level.

As the U.S. economy showed signs of accumulating strength, the Fed raised rates three times during the period and projected another hike before the end of 2018 as well as three more in 2019.

Outside the U.S., growth in major economies in the eurozone and China slowed during the period. Eurozone countries shifted away from monetary-easing policies while the Central Bank of China cut interest rates. Both actions contributed to a stronger U.S. dollar. Meanwhile, the Bank of Japan curtailed the easing policies it had pursued since the 2008 financial crisis.

As the Fed adhered to its tightening course, spreads between long- and short-term rates — already unusually narrow at the beginning of the period — converged, further flattening the yield curve. Early in the calendar year, a major U.S. tax cut resulted in a surge in U.S. Treasury bill issuances and large- scale corporate cash repatriation, putting pressure on short-term rates.

Later in the period, a strong supply of issuances from merger- and-acquisition transactions — in addition to concerns about increased leverage and weakening fundamentals in the latter stages of the credit cycle — contributed to widening spreads.

Fund Performance

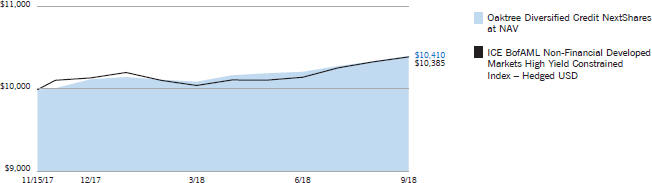

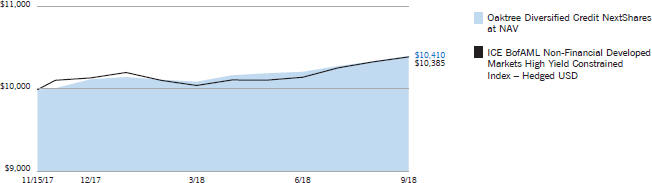

Eaton Vance Oaktree Diversified Credit NextShares (the Fund) had a total return of 4.10% at net asset value (NAV) for the period between the Fund’s inception on November 15, 2017 and its fiscal year ended September 30, 2018. By comparison, the Fund’s primary benchmark, the ICE BofAML Non-Financial Developed Markets High Yield Constrained Index – Hedged USD (the Index),2 returned 3.85%.

Strength in the U.S. economy in 2018 paved the way for a rising-rate environment. The Fund’s strategic allocation to senior loans and other strategies with floating-rate

coupon instruments — such as structured credit, including collateralized loan obligations and certain commercial mortgage-backed securities — benefited Fund performance relative to the Index.

Notably, the returns of these strategies exceeded the Index, with lower volatility and the benefits of a securitized status. This offset the impact of below Index returns from high yield bonds, convertibles, and emerging markets debt held in the Fund during the period.

Market volatility — fueled by an escalating trade war between the U.S. and China — negatively affected the Fund’s convertibles strategies, which are sensitive to equity market movements. However, some of the volatility related to China created buying opportunities for the Fund during the period, particularly in emerging markets debt. The Fund had no allocation to emerging markets debt at the beginning of the period because of the relative risk of such investments, highlighted by emerging markets high yield spreads being similar to U.S. high yield spreads at the time.

Extreme volatility followed in 2018 and the Fund benefited from a negligible allocation early in the period. As spreads widened and opportunities became more attractive, the Fund allocated about 5% of its assets to emerging markets debt at period end.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than indicated. The Fund’s performance at market price will differ from its results at net asset value (NAV). The market price used to calculate the Market Price return is the midpoint between the highest bid and the lowest offer on the exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. If you trade your shares at another time during the day, your return may differ. Returns are historical and are calculated by determining the percentage change in NAV or market price (as applicable) with all distributions reinvested at NAV or closing market price (as applicable) on the payment date of the distribution, and are net of management fees and other expenses. Returns are before taxes unless otherwise noted. Performance less than or equal to one year is cumulative. For performance as of the most recent month-end, including historical trading premiums/discounts relative to NAV, please refer to eatonvance.com.

Eaton Vance

Oaktree Diversified Credit NextShares

September 30, 2018

Performance2,3

Portfolio Manager Bruce A. Karsh, of Oaktree Capital Management, L.P.

| | | | | | | | | | | | | | | | | | | | |

| % Cumulative Total Returns | | Fund

Inception Date | | | Performance

Inception Date | | | One Year | | | Five Years | | | Since

Fund

Inception | |

Fund at NAV | | | 11/15/2017 | | | | 11/15/2017 | | | | — | | | | — | | | | 4.10 | % |

Fund at Market Price | | | 11/15/2017 | | | | 11/15/2017 | | | | — | | | | — | | | | 4.10 | |

ICE BofAML Non-Financial Developed Markets High Yield Constrained Index – Hedged USD | | | — | | | | — | | | | 3.02 | % | | | 5.68 | % | | | 3.85 | % |

Blended Benchmark | | | — | | | | — | | | | 4.10 | | | | 4.92 | | | | 4.26 | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| % Total Annual Operating Expense Ratios4 | | | | | | | | | | | | | | | |

Gross | | | | | | | | | | | | | | | | | | | 1.11 | % |

Net | | | | | | | | | | | | | | | | | | | 0.90 | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| % Distribution Rates/Yields5 | | | | | | | | | | | | | | | |

Distribution Rate at NAV | | | | | | | | | | | | | | | | | | | 4.04 | % |

SEC 30-day Yield – Subsidized | | | | | | | | | | | | | | | | | | | 4.75 | |

SEC 30-day Yield – Unsubsidized | | | | | | | | | | | | | | | | | | | 4.42 | |

Growth of $10,000

This graph shows the change in value of a hypothetical investment of $10,000 in Oaktree Diversified Credit NextShares for the period indicated. For comparison, the same investment is shown in the indicated index.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than indicated. The Fund’s performance at market price will differ from its results at net asset value (NAV). The market price used to calculate the Market Price return is the midpoint between the highest bid and the lowest offer on the exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. If you trade your shares at another time during the day, your return may differ. Returns are historical and are calculated by determining the percentage change in NAV or market price (as applicable) with all distributions reinvested at NAV or closing market price (as applicable) on the payment date of the distribution, and are net of management fees and other expenses. Returns are before taxes unless otherwise noted. Performance less than or equal to one year is cumulative. For performance as of the most recent month-end, including historical trading premiums/discounts relative to NAV, please refer to eatonvance.com.

Eaton Vance

Oaktree Diversified Credit NextShares

September 30, 2018

Fund Profile

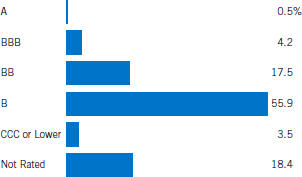

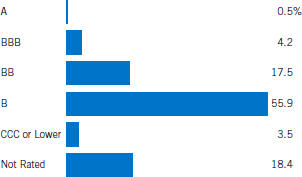

Credit Quality (% of total investments)6,7

See Endnotes and Additional Disclosures in this report.

Eaton Vance

Oaktree Diversified Credit NextShares

September 30, 2018

Endnotes and Additional Disclosures

| 1 | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. This commentary may contain statements that are not historical facts, referred to as “forward looking statements.” The Fund’s actual future results may differ significantly from those stated in any forward looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| 2 | ICE BofAML Non-Financial Developed Markets High Yield Constrained Index – Hedged USD is an unmanaged index of below investment grade corporate bonds from developed market countries. The index excludes financial companies, limits issuer exposure to 2%, and is hedged to the US Dollar. ICE® BofAML® indices are not for redistribution or other uses; provided “as is”, without warranties, and with no liability. Eaton Vance has prepared this report and ICE Data Indices, LLC does not endorse it, or guarantee, review, or endorse Eaton Vance’s products. BofAML® is a licensed registered trademark of Bank of America Corporation in the United States and other countries. S&P/LSTA Leveraged Loan Index is an unmanaged index of institutional leverage loan market. The Blended Index consists of 50% ICE BofAML Non-Financial Developed Markets High Yield Constrained Index – Hedged USD and 50% S&P/ LSTA Leveraged Loan Index. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. Performance since inception for an index, if presented, is the performance since the Fund’s inception. |

| 3 | Shares of NextShares funds are normally bought and sold in the secondary market through a broker, and may not be individually purchased or redeemed from the fund. In the secondary market, buyers and sellers transact with each other, rather than with the fund. Market trading prices of NextShares are linked to the fund’s next-computed net asset value (NAV) and will vary from NAV by a market-determined premium or discount, which may be zero. Buyers and sellers of NextShares will not know the value of their purchases and sales until after the fund’s NAV is determined at the end of the trading day. Market trading prices may vary significantly from anticipated levels. NextShares do not offer investors the opportunity to buy and sell intraday based on current (versus end-of-day) determinations of fund value. NextShares trade execution prices will fluctuate based on changes in NAV. Although limit orders may be used to control trading costs, they cannot be used to control or limit trade execution prices. As a new type of fund, NextShares have a limited operating history and may initially be available through a limited number of brokers. There can be no guarantee that an active trading market for NextShares will develop or be maintained, or that their listing will continue unchanged. Buying and selling NextShares may require payment of brokerage commissions and expose transacting shareholders to other trading costs. Frequent trading may detract from realized investment returns. The return on a shareholder’s NextShares investment will be reduced if the shareholder sells shares at a greater discount or narrower premium to NAV than he or she acquired the shares. |

| | NextShares funds issue and redeem shares only in specified creation unit quantities in transactions by or through authorized participants. In such transactions, a fund issues and redeems shares in exchange for the basket of securities, other instruments and/or cash that the fund specifies each business day. A fund’s basket is not intended to be representative of the fund’s current portfolio positions and may vary significantly from current positions. |

| 4 | Source: Fund prospectus. Net expense ratio reflects a contractual expense reimbursement that continues through 1/31/19. Without the reimbursement, performance would have been lower. The expense ratio for the current reporting period can be found in the Financial Highlights section of this report. |

| 5 | The Distribution Rate is based on the Fund’s last regular distribution per share in the period (annualized) divided by the Fund’s NAV at the end of the period. The Fund’s distributions may be comprised of amounts characterized for federal income tax purposes as tax-exempt income, qualified and non-qualified ordinary dividends, capital gains and nondividend distributions, also known as return of capital. The Fund will determine the federal income tax character of distributions paid to a shareholder after the end of the calendar year. This is reported on the IRS form 1099-DIV and provided to the shareholder shortly after each year-end. The Fund’s distributions are determined by the investment adviser based on its current assessment of the Fund’s long-term return potential. As portfolio and market conditions change, the rate of distributions paid by the Fund could change. The SEC Yield is a standardized measure based on the estimated yield to maturity of a fund’s investments over a 30-day period and is based on the maximum offer price at the date specified. The SEC Yield is not based on the distributions made by the Fund, which may differ. Subsidized yield reflects the effect of fee waivers and expense reimbursements. |

| 6 | Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”), as applicable. If securities are rated differently by the ratings agencies, the lowest rating is applied. Ratings, which are subject to change, apply to the creditworthiness of the issuers of the underlying securities and not to the Fund or its shares. Credit ratings measure the quality of a bond based on the issuer’s creditworthiness, with ratings ranging from AAA, being the highest, to D, being the lowest based on S&P’s measures. Ratings of BBB or higher by S&P or Fitch (Baa or higher by Moody’s) are considered to be investment- grade quality. Credit ratings are based largely on the ratings agency’s analysis at the time of rating. The rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition and does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

| 7 | Excludes cash and cash equivalents. |

| | Fund profile subject to change due to active management. |

Eaton Vance

Oaktree Diversified Credit NextShares

September 30, 2018

Fund Expenses

Example: As a Fund shareholder, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares; and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2018 – September 30, 2018).

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions on purchases and sales of Fund shares. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(4/1/18) | | | Ending

Account Value

(9/30/18) | | | Expenses Paid

During Period*

(4/1/18 – 9/30/18) | | | Annualized

Expense

Ratio | |

| | | |

Actual | | | | | | | | | | | | | |

| | $ | 1,000.00 | | | $ | 1,031.20 | | | $ | 4.58 | ** | | | 0.90 | % |

| | | | |

Hypothetical | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | |

| | $ | 1,000.00 | | | $ | 1,020.60 | | | $ | 4.56 | ** | | | 0.90 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on March 31, 2018. |

| ** | Absent an allocation of certain expenses to an affiliate, expenses would be higher. |

Eaton Vance

Oaktree Diversified Credit NextShares

September 30, 2018

Portfolio of Investments

| | | | | | | | | | | | |

| Senior Floating-Rate Loans — 36.6%(1) | |

| Borrower/Tranche Description | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Aerospace and Defense — 1.4% | |

| TransDigm, Inc. | | | | | | | | | |

Term Loan, 4.74%, (1 mo. USD LIBOR + 2.50%), Maturing May 30, 2025 | | | | | | | 746 | | | $ | 749,190 | |

| | | | | | | | | | | $ | 749,190 | |

|

| Business Equipment and Services — 4.8% | |

| Blitz F18-675 GmbH | | | | | | | | | |

Term Loan, 3.75%, (2 mo. EURIBOR + 3.75%), Maturing July 31, 2025 | | | EUR | | | | 450 | | | $ | 527,104 | |

| Fugue Finance B.V. | | | | | | | | | |

Term Loan, 3.25%, (3 mo. EURIBOR + 3.25%), Maturing September 1, 2024 | | | EUR | | | | 400 | | | | 466,646 | |

| Kiloutou NewCo | | | | | | | | | |

Term Loan, 3.50%, (1 mo. EURIBOR + 3.50%), Maturing January 31, 2025 | | | EUR | | | | 230 | | | | 269,649 | |

| Nets Holding A/S | | | | | | | | | |

Term Loan, 3.00%, (3 mo. EURIBOR + 3.00%), Maturing February 6, 2025 | | | EUR | | | | 176 | | | | 205,513 | |

| PI US MergerCo, Inc. | | | | | | | | | |

Term Loan, 5.74%, (1 mo. USD LIBOR + 3.50%), Maturing December 20, 2024 | | | | | | | 498 | | | | 497,065 | |

| Trans Union, LLC | | | | | | | | | |

Term Loan, 4.24%, (1 mo. USD LIBOR + 2.00%), Maturing June 19, 2025 | | | | | | | 499 | | | | 500,690 | |

| | | | | | | | | | | $ | 2,466,667 | |

|

| Cable and Satellite Television — 2.4% | |

| CSC Holdings, LLC | | | | | | | | | |

Term Loan, 4.66%, (1 mo. USD LIBOR + 2.50%), Maturing January 25, 2026 | | | | | | | 1,247 | | | $ | 1,249,680 | |

| | | | | | | | | | | $ | 1,249,680 | |

|

| Chemicals and Plastics — 0.9% | |

| U.S. Silica Company | | | | | | | | | |

Term Loan, 6.25%, (1 mo. USD LIBOR + 4.00%), Maturing May 1, 2025 | | | | | | | 499 | | | $ | 488,616 | |

| | | | | | | | | | | $ | 488,616 | |

|

| Containers and Glass Products — 0.5% | |

| CCP Lux Holding S.a.r.l. | | | | | | | | | |

Term Loan, 3.75%, (3 mo. EURIBOR + 3.75%), Maturing January 10, 2025 | | | EUR | | | | 200 | | | $ | 233,023 | |

| | | | | | | | | | | $ | 233,023 | |

| | | | | | | | | | | | |

| Borrower/Tranche Description | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Ecological Services and Equipment — 1.9% | |

| ExGen Renewables IV, LLC | | | | | | | | | |

Term Loan, 5.32%, (3 mo. USD LIBOR + 3.00%), Maturing November 28, 2024 | | | | | | | 488 | | | $ | 492,771 | |

| GFL Environmental, Inc. | | | | | | | | | |

Term Loan, 1.00%, Maturing May 30, 2025(2) | | | | | | | 55 | | | | 55,387 | |

Term Loan, 5.14%, (3 mo. USD LIBOR + 2.75%), Maturing May 30, 2025 | | | | | | | 444 | | | | 444,748 | |

| | | | | | | | | | | $ | 992,906 | |

|

| Electronics / Electrical — 4.9% | |

| Financial & Risk US Holdings, Inc. | | | | | | | | | |

Term Loan, Maturing September 14, 2025(3) | | | EUR | | | | 100 | | | $ | 117,016 | |

Term Loan, Maturing October 1, 2025(3) | | | | | | | 750 | | | | 749,264 | |

| Marcel LUX IV S.a.r.l. | | | | | | | | | |

Term Loan, Maturing September 26, 2025(3) | | | EUR | | | | 130 | | | | 151,880 | |

| SolarWinds Holdings, Inc. | | | | | | | | | |

Term Loan, 5.24%, (1 mo. USD LIBOR + 3.00%), Maturing February 5, 2024 | | | | | | | 496 | | | | 499,506 | |

| TriTech Software Systems | | | | | | | | | |

Term Loan, Maturing August 29, 2025(3) | | | | | | | 500 | | | | 502,344 | |

| Vertafore, Inc. | | | | | | | | | |

Term Loan, 5.49%, (1 mo. USD LIBOR + 3.25%), Maturing July 2, 2025 | | | | | | | 500 | | | | 502,723 | |

| | | | | | | | | | | $ | 2,522,733 | |

|

| Financial Intermediaries — 1.1% | |

| Independent Vetcare Holdings Limited | | | | | | | | | |

Term Loan, 5.22%, (1 mo. GBP LIBOR + 4.50%), Maturing January 31, 2024 | | | GBP | | | | 260 | | | $ | 338,884 | |

| Peer Holding III B.V. | | | | | | | | | |

Term Loan, 3.50%, (3 mo. EURIBOR + 3.50%), Maturing March 8, 2025 | | | EUR | | | | 200 | | | | 231,049 | |

| | | | | | | | | | | $ | 569,933 | |

|

| Food Products — 0.4% | |

| Refresco Group B.V. | | | | | | | | | |

Term Loan, 3.25%, (3 mo. EURIBOR + 3.25%), Maturing March 28, 2025 | | | EUR | | | | 200 | | | $ | 230,842 | |

| | | | | | | | | | | $ | 230,842 | |

|

| Health Care — 8.5% | |

| Auris Luxembourg III S.a.r.l. | | | | | | | | | |

Term Loan, Maturing July 20, 2025(3) | | | EUR | | | | 380 | | | $ | 446,478 | |

| | | | |

| | 7 | | See Notes to Financial Statements. |

Eaton Vance

Oaktree Diversified Credit NextShares

September 30, 2018

Portfolio of Investments — continued

| | | | | | | | | | | | |

| Borrower/Tranche Description | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Health Care (continued) | |

| CHG Healthcare Services, Inc. | | | | | | | | | |

Term Loan, 5.31%, (USD LIBOR + 3.00%), Maturing June 7, 2023(4) | | | | | | | 995 | | | $ | 1,001,529 | |

| CTC AcquiCo GmbH | | | | | | | | | |

Term Loan, 5.56%, (3 mo. USD LIBOR + 3.25%), Maturing March 7, 2025 | | | | | | | 200 | | | | 199,500 | |

| Envision Healthcare Corporation | | | | | | | | | |

Term Loan, Maturing September 26, 2025(3) | | | | | | | 500 | | | | 498,750 | |

| Gentiva Health Services, Inc. | | | | | | | | | |

Term Loan, 6.00%, (1 mo. USD LIBOR + 3.75%), Maturing July 2, 2025 | | | | | | | 500 | | | | 506,562 | |

| Innoviva, Inc. | | | | | | | | | |

Term Loan, 6.81%, (3 mo. USD LIBOR + 4.50%), Maturing August 11, 2022 | | | | | | | 41 | | | | 41,456 | |

| Pearl Intermediate Parent, LLC | | | | | | | | | |

Term Loan, 2.08%, (3 mo. USD LIBOR + 2.75%), Maturing February 14, 2025(2) | | | | | | | 227 | | | | 223,425 | |

Term Loan, 4.92%, (1 mo. USD LIBOR + 2.75%), Maturing February 14, 2025 | | | | | | | 769 | | | | 756,370 | |

| Verscend Holding Corp. | | | | | | | | | |

Term Loan, Maturing August 27, 2025(3) | | | | | | | 750 | | | | 754,219 | |

| | | | | | | | | | | $ | 4,428,289 | |

|

| Industrial Equipment — 0.3% | |

| TI Luxembourg S.A. | | | | | | | | | |

Term Loan, 3.50%, (3 mo. EURIBOR + 3.50%), Maturing February 14, 2025 | | | EUR | | | | 140 | | | $ | 163,563 | |

| | | | | | | | | | | $ | 163,563 | |

|

| Insurance — 3.4% | |

| Asurion, LLC | | | | | | | | | |

Term Loan, 5.24%, (1 mo. USD LIBOR + 3.00%), Maturing November 3, 2024 | | | | | | | 499 | | | $ | 502,624 | |

Term Loan - Second Lien, 8.74%, (1 mo. USD LIBOR + 6.50%), Maturing August 4, 2025 | | | | | | | 250 | | | | 257,552 | |

| Mayfield Agency Borrower, Inc. | | | | | | | | | |

Term Loan, 6.74%, (1 mo. USD LIBOR + 4.50%), Maturing February 28, 2025 | | | | | | | 998 | | | | 1,002,488 | |

| | | | | | | | | | | $ | 1,762,664 | |

|

| Lodging and Casinos — 0.9% | |

| Alpha Group S.a.r.l. | | | | | | | | | |

Term Loan, 3.75%, (3 mo. EURIBOR + 3.75%), Maturing January 31, 2025 | | | EUR | | | | 200 | | | $ | 234,170 | |

| | | | | | | | | | | | |

| Borrower/Tranche Description | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Lodging and Casinos (continued) | |

| Stars Group Holdings B.V. (The) | | | | | | | | | |

Term Loan, 3.75%, (3 mo. EURIBOR + 3.75%), Maturing July 10, 2025 | | | EUR | | | | 200 | | | $ | 235,185 | |

| | | | | | | | | | | $ | 469,355 | |

|

| Nonferrous Metals / Minerals — 1.0% | |

| American Rock Salt Company, LLC | | | | | | | | | |

Term Loan, 5.99%, (1 mo. USD LIBOR + 3.75%), Maturing March 21, 2025 | | | | | | | 498 | | | $ | 499,832 | |

| | | | | | | | | | | $ | 499,832 | |

|

| Oil and Gas — 1.0% | |

| HFOTCO, LLC | | | | | | | | | |

Term Loan, 5.00%, (1 mo. USD LIBOR + 2.75%), Maturing June 26, 2025 | | | | | | | 499 | | | $ | 501,399 | |

| | | | | | | | | | | $ | 501,399 | |

|

| Retailers (Except Food and Drug) — 0.4% | |

| EG Group Limited | | | | | | | | | |

Term Loan, 5.55%, (3 mo. GBP LIBOR + 4.75%), Maturing February 6, 2025 | | | GBP | | | | 149 | | | $ | 194,970 | |

| | | | | | | | | | | $ | 194,970 | |

|

| Telecommunications — 1.3% | |

| Securus Technologies Holdings, Inc. | | | | | | | | | |

Term Loan, 6.74%, (1 mo. USD LIBOR + 4.50%), Maturing November 1, 2024 | | | | | | | 99 | | | $ | 99,975 | |

Term Loan, Maturing November 1, 2024(3) | | | | | | | 400 | | | | 401,917 | |

| TDC A/S | | | | | | | | | |

Term Loan, 3.50%, (3 mo. EURIBOR + 3.50%), Maturing May 31, 2025 | | | EUR | | | | 160 | | | | 187,381 | |

| | | | | | | | | | | $ | 689,273 | |

|

| Utilities — 1.5% | |

| Brookfield WEC Holdings, Inc. | | | | | | | | | |

Term Loan, 5.99%, (1 mo. USD LIBOR + 3.75%), Maturing August 1, 2025 | | | | | | | 500 | | | $ | 506,615 | |

Term Loan - Second Lien, 8.99%, (1 mo. USD LIBOR + 6.75%), Maturing August 3, 2026 | | | | | | | 250 | | | | 255,104 | |

| | | | | | | | | | | $ | 761,719 | |

| |

Total Senior Floating-Rate Loans

(identified cost $18,974,664) | | | $ | 18,974,654 | |

| | | | |

| | 8 | | See Notes to Financial Statements. |

Eaton Vance

Oaktree Diversified Credit NextShares

September 30, 2018

Portfolio of Investments — continued

| | | | | | | | | | | | |

| Corporate Bonds & Notes — 26.1% | |

| Security | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Apparel — 0.2% | |

| Samsonite Finco S.a.r.l. | | | | | | | | | |

3.50%, 5/15/26(5) | | | EUR | | | | 110 | | | $ | 124,661 | |

| | | | | | | | | | | $ | 124,661 | |

|

| Building Materials — 0.4% | |

| James Hardie International Finance DAC | | | | | | | | | |

3.625%, 10/1/26(6)(7) | | | EUR | | | | 100 | | | $ | 117,868 | |

| Summit Materials, LLC/Summit Materials Finance Corp. | | | | | | | | | |

6.125%, 7/15/23 | | | | | | | 100 | | | | 101,918 | |

| | | | | | | | | | | $ | 219,786 | |

|

| Chemicals — 0.7% | |

| Braskem Finance, Ltd. | | | | | | | | | |

7.375% to 10/10/18(5)(8) | | | | | | | 75 | | | $ | 75,375 | |

| Chemours Co. (The) | | | | | | | | | |

4.00%, 5/15/26 | | | EUR | | | | 100 | | | | 116,534 | |

| Monitchem HoldCo 3 S.A. | | | | | | | | | |

5.25%, 6/15/21(5) | | | EUR | | | | 150 | | | | 172,883 | |

| | | | | | | | | | | $ | 364,792 | |

|

| Commercial Services — 1.4% | |

| APX Group, Inc. | | | | | | | | | |

7.875%, 12/1/22 | | | | | | | 100 | | | $ | 102,250 | |

| Blitz F18-674 GmbH | | | | | | | | | |

6.00%, 7/30/26(6) | | | EUR | | | | 100 | | | | 117,477 | |

| Carriage Services, Inc. | | | | | | | | | |

6.625%, 6/1/26(6) | | | | | | | 225 | | | | 231,187 | |

| Nexi Capital SpA | | | | | | | | | |

4.125%, 11/1/23(6) | | | EUR | | | | 105 | | | | 123,226 | |

| TMS International Corp. | | | | | | | | | |

7.25%, 8/15/25(6) | | | | | | | 170 | | | | 171,700 | |

| | | | | | | | | | | $ | 745,840 | |

|

| Computers — 0.5% | |

| NCR Corp. | | | | | | | | | |

6.375%, 12/15/23 | | | | | | | 255 | | | $ | 260,419 | |

| | | | | | | | | | | $ | 260,419 | |

|

| Diversified Financial Services — 0.8% | |

| Intrum Justitia AB | | | | | | | | | |

3.125%, 7/15/24(5) | | | EUR | | | | 100 | | | $ | 110,338 | |

| | | | | | | | | | | | |

| Security | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Diversified Financial Services (continued) | |

| LHC3 PLC | | | | | | | | | |

4.125%, (4.125% cash or 4.875% PIK), 8/15/24(5)(9) | | | EUR | | | | 125 | | | $ | 145,355 | |

| Vantiv, LLC/Vanity Issuer Corp. | | | | | | | | | |

3.875%, 11/15/25(5) | | | GBP | | | | 110 | | | | 140,507 | |

| | | | | | | | | | | $ | 396,200 | |

|

| Electric — 0.5% | |

| Genneia S.A. | | | | | | | | | |

8.75%, 1/20/22(5) | | | | | | | 192 | | | $ | 180,672 | |

8.75%, 1/20/22(6) | | | | | | | 91 | | | | 85,631 | |

| | | | | | | | | | | $ | 266,303 | |

|

| Energy – Alternate Sources — 0.3% | |

| Rio Energy S.A./UGEN S.A./UENSA S.A. | | | | | | | | | |

6.875%, 2/1/25(5) | | | | | | | 200 | | | $ | 164,500 | |

| | | | | | | | | | | $ | 164,500 | |

|

| Entertainment — 0.5% | |

| CPUK Finance, Ltd. | | | | | | | | | |

4.25%, 2/28/47(5) | | | GBP | | | | 110 | | | $ | 143,703 | |

| WMG Acquisition Corp. | | | | | | | | | |

4.125%, 11/1/24(5) | | | EUR | | | | 100 | | | | 120,573 | |

| | | | | | | | | | | $ | 264,276 | |

|

| Environmental Control — 0.4% | |

| Covanta Holding Corp. | | | | | | | | | |

5.875%, 3/1/24 | | | | | | | 180 | | | $ | 184,221 | |

| | | | | | | | | | | $ | 184,221 | |

|

| Foods — 0.5% | |

| Ingles Markets, Inc. | | | | | | | | | |

5.75%, 6/15/23 | | | | | | | 150 | | | $ | 152,625 | |

| Sigma Holdco B.V. | | | | | | | | | |

5.75%, 5/15/26(5) | | | EUR | | | | 115 | | | | 126,324 | |

| | | | | | | | | | | $ | 278,949 | |

|

| Forest Products & Paper — 0.3% | |

| WEPA Hygieneprodukte GmbH | | | | | | | | | |

3.75%, 5/15/24(5) | | | EUR | | | | 110 | | | $ | 126,656 | |

| | | | | | | | | | | $ | 126,656 | |

| | | | |

| | 9 | | See Notes to Financial Statements. |

Eaton Vance

Oaktree Diversified Credit NextShares

September 30, 2018

Portfolio of Investments — continued

| | | | | | | | | | | | |

| Security | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Health Care – Services — 0.6% | |

| CHS/Community Health Systems, Inc. | | | | | | | | | |

6.25%, 3/31/23 | | | | | | | 295 | | | $ | 281,356 | |

| | | | | | | | | | | $ | 281,356 | |

|

| Home Builders — 0.5% | |

| Century Communities, Inc. | | | | | | | | | |

5.875%, 7/15/25 | | | | | | | 250 | | | $ | 233,200 | |

| | | | | | | | | | | $ | 233,200 | |

|

| Household Products — 0.5% | |

| Diamond BC B.V. | | | | | | | | | |

5.625%, 8/15/25(5) | | | EUR | | | | 120 | | | $ | 130,763 | |

| Prestige Brands, Inc. | | | | | | | | | |

6.375%, 3/1/24(6) | | | | | | | 125 | | | | 127,031 | |

| | | | | | | | | | | $ | 257,794 | |

|

| Insurance — 0.9% | |

| Hub International, Ltd. | | | | | | | | | |

7.00%, 5/1/26(6) | | | | | | | 200 | | | $ | 200,762 | |

| Nationstar Mortgage Holdings, Inc. | | | | | | | | | |

8.125%, 7/15/23(6) | | | | | | | 245 | | | | 257,201 | |

| | | | | | | | | | | $ | 457,963 | |

|

| Iron & Steel — 0.9% | |

| Metinvest B.V. | | | | | | | | | |

8.50%, 4/23/26(6) | | | | | | | 500 | | | $ | 477,675 | |

| | | | | | | | | | | $ | 477,675 | |

|

| Media — 2.1% | |

| Altice France S.A. | | | | | | | | | |

5.625%, 5/15/24(5) | | | EUR | | | | 100 | | | $ | 121,613 | |

| Cablevision S.A. | | | | | | | | | |

6.50%, 6/15/21(5) | | | | | | | 225 | | | | 222,750 | |

| Tele Columbus AG | | | | | | | | | |

3.875%, 5/2/25(5) | | | EUR | | | | 110 | | | | 116,979 | |

| Telenet Finance VI Luxembourg SCA | | | | | | | | | |

4.875%, 7/15/27(5) | | | EUR | | | | 117 | | | | 147,432 | |

| Univision Communications, Inc. | | | | | | | | | |

5.125%, 5/15/23(6) | | | | | | | 105 | | | | 100,800 | |

| UPCB Finance IV, Ltd. | | | | | | | | | |

4.00%, 1/15/27(5) | | | EUR | | | | 104 | | | | 124,357 | |

| Virgin Media Receivables Financing Notes I DAC | | | | | | | | | |

5.50%, 9/15/24(5) | | | GBP | | | | 100 | | | | 131,113 | |

| | | | | | | | | | | | |

| Security | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Media (continued) | |

| Ziggo Bond Finance B.V. | | | | | | | | | |

4.625%, 1/15/25(5) | | | EUR | | | | 100 | | | $ | 115,374 | |

| | | | | | | | | | | $ | 1,080,418 | |

|

| Metal Fabricate & Hardware — 0.5% | |

| Grinding Media, Inc./Moly-Cop AltaSteel, Ltd. | | | | | | | | | |

7.375%, 12/15/23(6) | | | | | | | 265 | | | $ | 276,459 | |

| | | | | | | | | | | $ | 276,459 | |

|

| Oil & Gas — 2.9% | |

| CITGO Petroleum Corp. | | | | | | | | | |

6.25%, 8/15/22(6) | | | | | | | 375 | | | $ | 375,937 | |

| Comstock Escrow Corp. | | | | | | | | | |

9.75%, 8/15/26(6) | | | | | | | 160 | | | | 160,048 | |

| Oasis Petroleum, Inc. | | | | | | | | | |

6.875%, 1/15/23 | | | | | | | 150 | | | | 152,812 | |

| Rio Oil Finance Trust | | | | | | | | | |

8.20%, 4/6/28(5) | | | | | | | 250 | | | | 256,250 | |

| YPF S.A. | | | | | | | | | |

8.75%, 4/4/24(5) | | | | | | | 82 | | | | 81,898 | |

6.95%, 7/21/27(5) | | | | | | | 508 | | | | 446,253 | |

| | | | | | | | | | | $ | 1,473,198 | |

|

| Packaging & Containers — 1.5% | |

| ARD Finance S.A. | | | | | | | | | |

6.625%, (6.625% cash or 7.375% PIK), 9/15/23(9) | | | EUR | | | | 100 | | | $ | 119,949 | |

| BWAY Holding Co. | | | | | | | | | |

5.50%, 4/15/24(6) | | | | | | | 210 | | | | 206,974 | |

| Guala Closures SpA | | | | | | | | | |

3.50%, (3 mo. EURIBOR + 3.50%), 4/15/24(6)(7)(10) | | | EUR | | | | 100 | | | | 116,975 | |

| Reynolds Group Issuer, Inc./Reynolds Group Issuer, LLC | | | | | | | | | |

7.00%, 7/15/24(6) | | | | | | | 305 | | | | 310,909 | |

| | | | | | | | | | | $ | 754,807 | |

|

| Pharmaceuticals — 1.2% | |

| Bausch Health Companies, Inc. | | | | | | | | | |

5.875%, 5/15/23(6) | | | | | | | 320 | | | $ | 311,840 | |

| Grifols S.A. | | | | | | | | | |

3.20%, 5/1/25(5) | | | EUR | | | | 150 | | | | 176,987 | |

| Nidda Healthcare Holding GmbH | | | | | | | | | |

3.50%, 9/30/24(5) | | | EUR | | | | 130 | | | | 151,395 | |

| | | | | | | | | | | $ | 640,222 | |

| | | | |

| | 10 | | See Notes to Financial Statements. |

Eaton Vance

Oaktree Diversified Credit NextShares

September 30, 2018

Portfolio of Investments — continued

| | | | | | | | | | | | |

| Security | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Pipelines — 0.8% | |

| Transportadora de Gas del Sur S.A. | | | | | | | | | |

6.75%, 5/2/25(5) | | | | | | | 450 | | | $ | 434,250 | |

| | | | | | | | | | | $ | 434,250 | |

|

| Real Estate — 1.9% | |

| China Aoyuan Property Group, Ltd. | | | | | | | | | |

5.375%, 9/13/22(5) | | | | | | | 400 | | | $ | 355,022 | |

| Hunt Cos., Inc. | | | | | | | | | |

6.25%, 2/15/26(6) | | | | | | | 223 | | | | 208,505 | |

| Kennedy-Wilson, Inc. | | | | | | | | | |

5.875%, 4/1/24 | | | | | | | 250 | | | | 247,500 | |

| Times China Holdings, Ltd. | | | | | | | | | |

6.60%, 3/2/23(5) | | | | | | | 200 | | | | 179,002 | |

| | | | | | | | | | | $ | 990,029 | |

|

| Retail — 0.5% | |

| Rite Aid Corp. | | | | | | | | | |

6.125%, 4/1/23(6) | | | | | | | 115 | | | $ | 103,644 | |

Suburban Propane Partners L.P./Suburban Energy

Finance Corp. | | | | | | | | | |

5.50%, 6/1/24 | | | | | | | 155 | | | | 153,062 | |

| | | | | | | | | | | $ | 256,706 | |

|

| Software — 0.9% | |

| First Data Corp. | | | | | | | | | |

5.75%, 1/15/24(6) | | | | | | | 100 | | | $ | 101,650 | |

| InterXion Holding N.V. | | | | | | | | | |

4.75%, 6/15/25(6) | | | EUR | | | | 105 | | | | 128,069 | |

| TeamSystem SpA | | | | | | | | | |

4.00%, (3 mo. EURIBOR + 4.00%), 4/15/23(6)(10) | | | EUR | | | | 200 | | | | 234,079 | |

| | | | | | | | | | | $ | 463,798 | |

|

| Telecommunications — 3.3% | |

| CommScope, Inc. | | | | | | | | | |

5.50%, 6/15/24(6) | | | | | | | 150 | | | $ | 151,687 | |

| Frontier Communications Corp. | | | | | | | | | |

8.50%, 4/1/26(6) | | | | | | | 160 | | | | 151,800 | |

| Intelsat Jackson Holdings S.A. | | | | | | | | | |

8.00%, 2/15/24(6) | | | | | | | 245 | | | | 258,404 | |

| Level 3 Financing, Inc. | | | �� | | | | | | |

5.375%, 1/15/24 | | | | | | | 155 | | | | 155,657 | |

| Oi S.A. | | | | | | | | | |

10.00%, (10.00% cash or 8.00% cash and 4.00% PIK), 7/27/25(9) | | | | | | | 407 | | | | 421,245 | |

| | | | | | | | | | | | |

| Security | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Telecommunications (continued) | |

| Plantronics, Inc. | | | | | | | | | |

5.50%, 5/31/23(6) | | | | | | | 150 | | | $ | 149,625 | |

| SES S.A. | | | | | | | | | |

4.625% to 1/2/22(5)(8)(11) | | | EUR | | | | 100 | | | | 120,860 | |

| Sprint Communications, Inc. | | | | | | | | | |

6.00%, 11/15/22 | | | | | | | 150 | | | | 153,375 | |

| Sprint Corp. | | | | | | | | | |

7.875%, 9/15/23 | | | | | | | 45 | | | | 48,594 | |

7.125%, 6/15/24 | | | | | | | 95 | | | | 98,919 | |

| | | | | | | | | | | $ | 1,710,166 | |

|

| Transportation — 0.6% | |

| Moto Finance PLC | | | | | | | | | |

4.50%, 10/1/22(5) | | | GBP | | | | 100 | | | $ | 129,255 | |

| Watco Cos., LLC/Watco Finance Corp. | | | | | | | | | |

6.375%, 4/1/23(6) | | | | | | | 195 | | | | 199,631 | |

| | | | | | | | | | | $ | 328,886 | |

| | | |

Total Corporate Bonds & Notes

(identified cost $13,530,205) | | | | | | | | | | $ | 13,513,530 | |

|

| Foreign Corporate Bonds — 0.8% | |

| Security | | | | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Electric — 0.4% | |

Pampa Energia S.A., 7.50%, 1/24/27(5) | | | | | | $ | 240 | | | $ | 213,504 | |

| | | | | | | | | | | $ | 213,504 | |

|

| Real Estate — 0.4% | |

Logan Property Holdings Co., Ltd., 5.25%, 2/23/23(5) | | | | | | $ | 200 | | | $ | 175,309 | |

| | | | | | | | | | | $ | 175,309 | |

| |

Total Foreign Corporate Bonds

(identified cost $394,978) | | | $ | 388,813 | |

|

| Foreign Government Bonds — 0.6% | |

| Security | | | | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Argentina — 0.3% | |

Republic of Argentina, 5.875%, 1/11/28 | | | | | | $ | 25 | | | $ | 19,863 | |

| | | | |

| | 11 | | See Notes to Financial Statements. |

Eaton Vance

Oaktree Diversified Credit NextShares

September 30, 2018

Portfolio of Investments — continued

| | | | | | | | | | | | |

| Security | | | | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Argentina (continued) | |

Republic of Argentina, 6.625%, 7/6/28 | | | | | | $ | 150 | | | $ | 123,562 | |

| | | | | | | | | | | $ | 143,425 | |

|

| Turkey — 0.3% | |

Republic of Turkey, 6.125%, 10/24/28 | | | | | | $ | 200 | | | $ | 180,802 | |

| | | | | | | | | | | $ | 180,802 | |

| |

Total Foreign Government Bonds

(identified cost $317,418) | | | $ | 324,227 | |

|

| Convertible Bonds — 16.2% | |

| Security | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Airlines — 0.2% | |

| ANA Holdings, Inc. | | | | | | | | | |

0.00%, 9/19/24(5) | | | JPY | | | | 10,000 | | | $ | 89,443 | |

| | | | | | | | | | | $ | 89,443 | |

|

| Auto Manufacturers — 0.2% | |

| Navistar International Corp. | | | | | | | | | |

4.50%, 10/15/18 | | | | | | | 80 | | | $ | 80,048 | |

| | | | | | | | | | | $ | 80,048 | |

|

| Biotechnology — 0.4% | |

| BioMarin Pharmaceutical, Inc. | | | | | | | | | |

0.599%, 8/1/24 | | | | | | | 35 | | | $ | 37,389 | |

| Illumina, Inc. | | | | | | | | | |

0.00%, 6/15/19 | | | | | | | 35 | | | | 50,950 | |

| Innoviva, Inc. | | | | | | | | | |

2.125%, 1/15/23 | | | | | | | 40 | | | | 40,625 | |

| Ligand Pharmaceuticals, Inc. | | | | | | | | | |

0.75%, 5/15/23(6) | | | | | | | 51 | | | | 62,208 | |

| | | | | | | | | | | $ | 191,172 | |

|

| Building Materials — 0.2% | |

| Cemex SAB de CV | | | | | | | | | |

3.72%, 3/15/20 | | | | | | | 85 | | | $ | 85,842 | |

| | | | | | | | | | | $ | 85,842 | |

| | | | | | | | | | | | |

| Security | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Chemicals — 0.8% | |

| Brenntag Finance B.V. | | | | | | | | | |

1.875%, 12/2/22(5) | | | | | | | 250 | | | $ | 249,250 | |

| Mitsubishi Chemical Holdings Corp. | | | | | | | | | |

0.00%, 3/29/24(5) | | | JPY | | | | 10,000 | | | | 95,824 | |

| Toray Industries, Inc. | | | | | | | | | |

0.00%, 8/30/19(5) | | | JPY | | | | 10,000 | | | | 92,633 | |

| | | | | | | | | | | $ | 437,707 | |

|

| Coal — 0.5% | |

| RAG-Stiftung | | | | | | | | | |

0.00%, 3/16/23(5) | | | EUR | | | | 200 | | | $ | 247,411 | |

| | | | | | | | | | | $ | 247,411 | |

|

| Commercial Services — 1.5% | |

| Cardtronics, Inc. | | | | | | | | | |

1.00%, 12/1/20 | | | | | | | 115 | | | $ | 111,276 | |

| DP World, Ltd. | | | | | | | | | |

1.75%, 6/19/24(5) | | | | | | | 200 | | | | 197,065 | |

| Huron Consulting Group, Inc. | | | | | | | | | |

1.25%, 10/1/19 | | | | | | | 120 | | | | 117,120 | |

| Macquarie Infrastructure Corp. | | | | | | | | | |

2.875%, 7/15/19 | | | | | | | 120 | | | | 119,224 | |

| Shanghai Port Group BVI Holding Co., Ltd. | | | | | | | | | |

0.00%, 8/9/22(5) | | | | | | | 200 | | | | 209,600 | |

| Square, Inc. | | | | | | | | | |

0.50%, 5/15/23(6) | | | | | | | 30 | | | | 42,570 | |

| | | | | | | | | | | $ | 796,855 | |

|

| Diversified Financial Services — 0.8% | |

| JPMorgan Chase Financial Co., LLC | | | | | | | | | |

0.25%, 5/1/23(6) | | | | | | | 55 | | | $ | 53,212 | |

| Orpar S.A. | | | | | | | | | |

0.00%, 6/20/24(5) | | | EUR | | | | 200 | | | | 240,505 | |

| PRA Group, Inc. | | | | | | | | | |

3.00%, 8/1/20 | | | | | | | 115 | | | | 111,187 | |

| | | | | | | | | | | $ | 404,904 | |

|

| Electric — 0.5% | |

| China Yangtze Power International BVI1 Ltd. | | | | | | | | | |

0.00%, 11/9/21(5) | | | | | | | 200 | | | $ | 217,500 | |

| NRG Energy, Inc. | | | | | | | | | |

2.75%, 6/1/48(6) | | | | | | | 56 | | | | 59,093 | |

| | | | | | | | | | | $ | 276,593 | |

| | | | |

| | 12 | | See Notes to Financial Statements. |

Eaton Vance

Oaktree Diversified Credit NextShares

September 30, 2018

Portfolio of Investments — continued

| | | | | | | | | | | | |

| Security | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Energy – Alternate Sources — 0.4% | |

| NextEra Energy Partners, L.P. | | | | | | | | | |

1.50%, 9/15/20(6) | | | | | | | 65 | | | $ | 66,821 | |

| Pattern Energy Group, Inc. | | | | | | | | | |

4.00%, 7/15/20 | | | | | | | 125 | | | | 125,309 | |

| | | | | | | | | | | $ | 192,130 | |

|

| Entertainment — 0.1% | |

| Live Nation Entertainment, Inc. | | | | | | | | | |

2.50%, 3/15/23(6) | | | | | | | 59 | | | $ | 63,896 | |

| | | | | | | | | | | $ | 63,896 | |

|

| Health Care – Products — 0.7% | |

| NuVasive, Inc. | | | | | | | | | |

2.25%, 3/15/21 | | | | | | | 40 | | | $ | 50,775 | |

| QIAGEN N.V. | | | | | | | | | |

0.50%, 9/13/23(5) | | | | | | | 200 | | | | 225,500 | |

| Wright Medical Group, Inc. | | | | | | | | | |

1.625%, 6/15/23(6) | | | | | | | 60 | | | | 63,713 | |

| | | | | | | | | | | $ | 339,988 | |

|

| Health Care – Services — 0.2% | |

| Korian S.A. | | | | | | | | | |

2.50% to 1/1/23(5)(8)(11) | | | EUR | | | | 80 | | | $ | 95,292 | |

| | | | | | | | | | | $ | 95,292 | |

|

| Holding Company – Diversified — 0.5% | |

| RWT Holdings, Inc. | | | | | | | | | |

5.625%, 11/15/19 | | | | | | | 105 | | | $ | 106,495 | |

| Seven Group Holdings, Ltd. | | | | | | | | | |

2.20%, 3/5/25(5) | | | AUD | | | | 200 | | | | 154,148 | |

| | | | | | | | | | | $ | 260,643 | |

|

| Internet — 1.0% | |

| Ctrip.com International, Ltd. | | | | | | | | | |

1.00%, 7/1/20 | | | | | | | 87 | | | $ | 85,352 | |

| CyberAgent, Inc. | | | | | | | | | |

0.00%, 2/17/23(5) | | | JPY | | | | 10,000 | | | | 103,916 | |

| Palo Alto Networks, Inc. | | | | | | | | | |

0.75%, 7/1/23(6) | | | | | | | 50 | | | | 52,510 | |

| Pandora Media, Inc. | | | | | | | | | |

1.75%, 12/1/20 | | | | | | | 90 | | | | 87,140 | |

| Q2 Holdings, Inc. | | | | | | | | | |

0.75%, 2/15/23(6) | | | | | | | 38 | | | | 45,004 | |

| | | | | | | | | | | | |

| Security | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Internet (continued) | |

| Twitter, Inc. | | | | | | | | | |

0.25%, 9/15/19 | | | | | | | 115 | | | $ | 111,635 | |

| Wix.com, Ltd. | | | | | | | | | |

0.00%, 7/1/23(6) | | | | | | | 55 | | | | 58,700 | |

| | | | | | | | | | | $ | 544,257 | |

|

| Investment Companies — 0.3% | |

| Goldman Sachs BDC, Inc. | | | | | | | | | |

4.50%, 4/1/22 | | | | | | | 100 | | | $ | 101,298 | |

| New Mountain Finance Corp. | | | | | | | | | |

5.00%, 6/15/19 | | | | | | | 60 | | | | 60,673 | |

| | | | | | | | | | | $ | 161,971 | |

|

| Iron & Steel — 0.5% | |

| Angang Steel Co., Ltd. | | | | | | | | | |

0.00%, 5/25/23(5) | | | HKD | | | | 2,000 | | | $ | 254,843 | |

| | | | | | | | | | | $ | 254,843 | |

|

| Media — 0.2% | |

| DISH Network Corp. | | | | | | | | | |

3.375%, 8/15/26 | | | | | | | 40 | | | $ | 38,251 | |

| Liberty Media Corp. | | | | | | | | | |

1.00%, 1/30/23 | | | | | | | 25 | | | | 29,277 | |

2.125%, 3/31/48(6) | | | | | | | 55 | | | | 54,442 | |

| | | | | | | | | | | $ | 121,970 | |

|

| Mining — 0.2% | |

| SSR Mining, Inc. | | | | | | | | | |

2.875%, 2/1/33 | | | | | | | 115 | | | $ | 113,203 | |

| | | | | | | | | | | $ | 113,203 | |

|

| Oil & Gas — 0.5% | |

| Ensco Jersey Finance, Ltd. | | | | | | | | | |

3.00%, 1/31/24 | | | | | | | 70 | | | $ | 69,871 | |

| Nabors Industries, Inc. | | | | | | | | | |

0.75%, 1/15/24 | | | | | | | 55 | | | | 43,025 | |

| Whiting Petroleum Corp. | | | | | | | | | |

1.25%, 4/1/20 | | | | | | | 140 | | | | 134,617 | |

| | | | | | | | | | | $ | 247,513 | |

|

| Oil & Gas Services — 0.3% | |

| SEACOR Holdings, Inc. | | | | | | | | | |

3.00%, 11/15/28 | | | | | | | 120 | | | $ | 116,938 | |

| | | | |

| | 13 | | See Notes to Financial Statements. |

Eaton Vance

Oaktree Diversified Credit NextShares

September 30, 2018

Portfolio of Investments — continued

| | | | | | | | | | | | |

| Security | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Oil & Gas Services (continued) | |

| Weatherford International, Ltd. | | | | | | | | | |

5.875%, 7/1/21 | | | | | | | 35 | | | $ | 33,048 | |

| | | | | | | | | | | $ | 149,986 | |

|

| Pharmaceuticals — 0.5% | |

| Herbalife, Ltd. | | | | | | | | | |

2.625%, 3/15/24(6) | | | | | | | 56 | | | $ | 60,164 | |

| Teva Pharmaceutical Finance Co., LLC | | | | | | | | | |

0.25%, 2/1/26 | | | | | | | 90 | | | | 84,622 | |

| Toho Holdings Co., Ltd. | | | | | | | | | |

0.00%, 6/23/23(5) | | | JPY | | | | 10,000 | | | | 94,504 | |

| | | | | | | | | | | $ | 239,290 | |

|

| Real Estate — 1.5% | |

| ADLER Real Estate AG | | | | | | | | | |

2.50%, 7/19/21(5) | | | EUR | | | | 674 | | | $ | 129,316 | |

| CA Immobilien Anlagen AG | | | | | | | | | |

0.75%, 4/4/25(5) | | | EUR | | | | 100 | | | | 134,740 | |

| Consus Real Estate AG | | | | | | | | | |

4.00%, 11/29/22(5) | | | EUR | | | | 200 | | | | 226,986 | |

| Forestar Group, Inc. | | | | | | | | | |

3.75%, 3/1/20 | | | | | | | 115 | | | | 115,008 | |

| Nexity S.A. | | | | | | | | | |

0.125%, 1/1/23(5) | | | EUR | | | | 235 | | | | 181,743 | |

| | | | | | | | | | | $ | 787,793 | |

|

| Real Estate Investment Trusts (REITs) — 2.2% | |

| Apollo Commercial Real Estate Finance, Inc. | | | | | | | | | |

4.75%, 8/23/22 | | | | | | | 85 | | | $ | 84,536 | |

| Arbor Realty Trust, Inc. | | | | | | | | | |

5.25%, 7/1/21(6) | | | | | | | 55 | | | | 55,619 | |

| Blackstone Mortgage Trust, Inc. | | | | | | | | | |

4.375%, 5/5/22 | | | | | | | 75 | | | | 75,194 | |

| Colony Capital, Inc. | | | | | | | | | |

3.875%, 1/15/21 | | | | | | | 426 | | | | 403,224 | |

| Cromwell SPV Finance Pty, Ltd. | | | | | | | | | |

2.50%, 3/29/25(5) | | | EUR | | | | 100 | | | | 114,363 | |

| IH Merger Sub, LLC | | | | | | | | | |

3.50%, 1/15/22 | | | | | | | 65 | | | | 71,765 | |

| KKR Real Estate Finance Trust, Inc. | | | | | | | | | |

6.125%, 5/15/23(6) | | | | | | | 100 | | | | 102,062 | |

| PennyMac Corp. | | | | | | | | | |

5.375%, 5/1/20 | | | | | | | 120 | | | | 119,829 | |

| | | | | | | | | | | | |

| Security | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Real Estate Investment Trusts (REITs) (continued) | |

| Redwood Trust, Inc. | | | | | | | | | |

5.625%, 7/15/24 | | | | | | | 60 | | | $ | 59,363 | |

| Resource Capital Corp. | | | | | | | | | |

6.00%, 12/1/18 | | | | | | | 75 | | | | 75,645 | |

| | | | | | | | | | | $ | 1,161,600 | |

|

| Retail — 0.5% | |

| Carrefour S.A. | | | | | | | | | |

0.00%, 3/27/24(5) | | | | | | | 200 | | | $ | 183,250 | |

| EZCORP, Inc. | | | | | | | | | |

2.125%, 6/15/19 | | | | | | | 60 | | | | 59,605 | |

| Vitamin Shoppe, Inc. | | | | | | | | | |

2.25%, 12/1/20 | | | | | | | 50 | | | | 43,438 | |

| | | | | | | | | | | $ | 286,293 | |

|

| Semiconductors — 0.1% | |

| Inphi Corp. | | | | | | | | | |

1.125%, 12/1/20 | | | | | | | 25 | | | $ | 28,931 | |

| | | | | | | | | | | $ | 28,931 | |

|

| Software — 0.4% | |

| Atlassian, Inc. | | | | | | | | | |

0.625%, 5/1/23(6) | | | | | | | 30 | | | $ | 39,332 | |

| Guidewire Software, Inc. | | | | | | | | | |

1.25%, 3/15/25 | | | | | | | 45 | | | | 48,312 | |

| Nuance Communications, Inc. | | | | | | | | | |

1.25%, 4/1/25 | | | | | | | 58 | | | | 59,990 | |

| Verint Systems, Inc. | | | | | | | | | |

1.50%, 6/1/21 | | | | | | | 51 | | | | 52,781 | |

| | | | | | | | | | | $ | 200,415 | |

|

| Telecommunications — 0.2% | |

| Finisar Corp. | | | | | | | | | |

0.50%, 12/15/36 | | | | | | | 90 | | | $ | 82,669 | |

| GCI Liberty, Inc. | | | | | | | | | |

1.75%, 9/30/46(6) | | | | | | | 40 | | | | 44,162 | |

| | | | | | | | | | | $ | 126,831 | |

|

| Transportation — 0.6% | |

| Golar LNG, Ltd. | | | | | | | | | |

2.75%, 2/15/22 | | | | | | | 188 | | | $ | 197,070 | |

| | | | |

| | 14 | | See Notes to Financial Statements. |

Eaton Vance

Oaktree Diversified Credit NextShares

September 30, 2018

Portfolio of Investments — continued

| | | | | | | | | | | | |

| Security | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Transportation (continued) | |

| Nagoya Railroad Co., Ltd. | | | | | | | | | |

0.00%, 12/11/24(5) | | | JPY | | | | 10,000 | | | $ | 97,056 | |

| | | | | | | | | | | $ | 294,126 | |

|

| Venture Capital — 0.2% | |

| Hercules Capital, Inc. | | | | | | | | | |

4.375%, 2/1/22 | | | | | | | 115 | | | $ | 111,717 | |

| | | | | | | | | | | $ | 111,717 | |

| | | |

Total Convertible Bonds

(identified cost $8,388,907) | | | | | | | | | | $ | 8,392,663 | |

|

| Asset-Backed Securities — 10.6% | |

| Security | | | | | Principal

Amount

(000’s omitted) | | | Value | |

| BSPRT Issuer, Ltd. | | | | | | | | | |

Series 2017-FL1, Class C, 6.408%, (1 mo. USD LIBOR + 4.25%),

6/15/27(6)(10) | | | | | | $ | 250 | | | $ | 253,504 | |

| Dryden Senior Loan Fund | | | | | | | | | |

Series 2016-43A, Class ER, 8.448%, (3 mo. USD LIBOR + 6.10%), 7/20/29(6)(10) | | | | | | | 700 | | | | 701,433 | |

| MidOcean Credit CLO | | | | | | | | | |

Series 2014-3A, Class ER, 8.49%, (3 mo. USD LIBOR + 6.20%),

4/21/31(6)(10) | | | | | | | 500 | | | | 495,927 | |

Series 2017-7A, Class F, 10.439%, (3 mo. USD LIBOR + 8.10%),

7/15/29(6)(10) | | | | | | | 750 | | | | 752,771 | |

| Nassau, Ltd. | | | | | | | | | |

Series 2017-IIA, Class D, 5.019%, (3 mo. USD LIBOR + 2.68%),

1/15/30(6)(10) | | | | | | | 550 | | | | 542,637 | |

| Octagon Investment Partners XIV, Ltd. | | | | | | | | | |

Series 2012-1A, Class ER, 10.689%, (3 mo. USD LIBOR + 8.35%), 7/15/29(6)(10) | | | | | | | 750 | | | | 751,122 | |

| OZLM, Ltd. | | | | | | | | | |

Series 2017-17A, Class D, 8.338%, (3 mo. USD LIBOR + 5.99%),

7/20/30(6)(10) | | | | | | | 250 | | | | 251,072 | |

| Regatta X Funding, Ltd. | | | | | | | | | |

Series 2017-3A, Class D, 5.086%, (3 mo. USD LIBOR + 2.75%),

1/17/31(6)(10) | | | | | | | 250 | | | | 248,312 | |

| TICP CLO I, Ltd. | | | | | | | | | |

Series 2015-1A, Class DR, 4.848%, (3 mo. USD LIBOR + 2.50%),

7/20/27(6)(10) | | | | | | | 500 | | | | 496,271 | |

| | | | | | | | | | |

| Security | | | | Principal

Amount

(000’s omitted) | | | Value | |

| Tralee CLO IV, Ltd. | | | | | | | | |

Series 2017-4A, Class E, 8.448%, (3 mo. USD LIBOR + 6.10%), 1/20/30(6)(10) | | | | $ | 1,000 | | | $ | 995,021 | |

| | | |

Total Asset-Backed Securities

(identified cost $5,456,556) | | | | | | | | $ | 5,488,070 | |

|

| Commercial Mortgage-Backed Securities — 12.8% | |

| Security | | | | Principal

Amount

(000’s omitted) | | | Value | |

| Ashford Hospitality Trust | | | | | | | | |

Series 2018-KEYS, Class F, 8.158%, (1 mo. USD LIBOR + 6.00%), 5/15/35(6)(10) | | | | $ | 300 | | | $ | 302,742 | |

| Barclays Commercial Mortgage Securities Trust | | | | | | | | |

Series 2017-GLKS, Class F, 5.858%, (1 mo. USD LIBOR + 3.70%), 11/15/34(6)(10) | | | | | 500 | | | | 500,878 | |

| BHMS Mortgage Trust | | | | | | | | |

Series 2018-ATLS, Class E, 5.158%, (1 mo. USD LIBOR + 3.00%), 7/15/35(6)(10) | | | | | 300 | | | | 301,231 | |

| BX Trust | | | | | | | | |

Series 2018-GW, Class G, 5.078%, (1 mo. USD LIBOR + 2.92%), 5/15/35(6)(10) | | | | | 250 | | | | 253,060 | |

| CFCRE Commercial Mortgage Trust | | | | | | | | |

Series 2018-TAN, Class E,

6.446%, 2/15/33(6) | | | | | 660 | | | | 675,583 | |

| CGGS Commercial Mortgage Trust | | | | | | | | |

Series 2018-WSS, Class E, 5.308%, (1 mo. USD LIBOR + 3.15%), 2/15/37(6)(10) | | | | | 300 | | | | 303,398 | |

| Citigroup Commercial Mortgage Trust | | | | | | | | |

Series 2018-TBR, Class F, 5.808%, (1 mo. USD LIBOR + 3.65%), 12/15/36(6)(10) | | | | | 400 | | | | 404,522 | |

| Cosmopolitan Hotel Trust | | | | | | | | |

Series 2017-CSMO, Class F, 5.90%, (1 mo. USD LIBOR + 3.74%), 11/15/36(6)(10) | | | | | 1,000 | | | | 1,008,110 | |

| DBCCRE Mortgage Trust | | | | | | | | |

Series 2014-ARCP, Class E, 5.099%, 1/10/34(6)(12) | | | | | 200 | | | | 190,586 | |

| GS Mortgage Securities Corp. Trust | | | | | | | | |

Series 2018-RIVR, Class H, 5.56%, (1 mo. USD LIBOR + 3.40%), 7/15/35(6)(10) | | | | | 300 | | | | 298,392 | |

| Hilton USA Trust | | | | | | | | |

Series 2016-SFP, Class F,

6.155%, 11/5/35(6) | | | | | 500 | | | | 508,006 | |

JP Morgan Chase Commercial Mortgage Securities

Trust: | | | | | | | | |

Series 2018-LAQ, Class E, 5.158%, (1 mo. USD LIBOR + 3.00%), 6/15/35(6)(10) | | | | | 300 | | | | 304,087 | |

Series 2018-PTC, Class D, 5.278%, (1 mo. USD LIBOR + 3.12%), 4/15/31(6)(10) | | | | | 400 | | | | 403,514 | |

| | | | |

| | 15 | | See Notes to Financial Statements. |

Eaton Vance

Oaktree Diversified Credit NextShares

September 30, 2018

Portfolio of Investments — continued

| | | | | | | | | | |

| Security | | | | Principal

Amount

(000’s omitted) | | | Value | |

| Rosslyn Portfolio Trust | | | | | | | | |

Series 2017-ROSS, Class F, 5.908%, (1 mo. USD LIBOR + 3.75%),

6/15/33(6)(10) | | | | $ | 354 | | | $ | 354,782 | |

| SLIDE | | | | | | | | |

Series 2018-FUN, Class F, 5.07%, (1 mo. USD LIBOR + 3.00%),

6/15/31(6)(10) | | | | | 175 | | | | 175,310 | |

| Toorak Mortgage Corp. | | | | | | | | |

Series 2018-1, Class A2, 4.949% to 4/25/21, 8/25/21(6)(13) | | | | | 150 | | | | 150,357 | |

| UBS Commercial Mortgage Trust | | | | | | | | |

Series 2018-NYCH, Class F, 5.979%, (1 mo. USD LIBOR + 3.82%),

2/15/32(6)(10) | | | | | 500 | | | | 498,127 | |

| | | |

Total Commercial Mortgage-Backed Securities

(identified cost $6,564,272) | | | | | | | | $ | 6,632,685 | |

|

| Short-Term Investments — 1.8% | |

| Description | | | | Units | | | Value | |

Eaton Vance Cash Reserves Fund, LLC, 2.19%(14) | | | | | 954,029 | | | $ | 954,029 | |

| |

Total Short-Term Investments

(identified cost $954,029) | | | $ | 954,029 | |

| |

Total Investments — 105.5%

(identified cost $54,581,029) | | | $ | 54,668,671 | |

| |

Less Unfunded Loan Commitments — (0.4)% | | | $ | (219,606 | ) |

| |

Net Investments — 105.1%

(identified cost $54,361,423) | | | $ | 54,449,065 | |

| |

Other Assets, Less Liabilities — (5.1)% | | | $ | (2,652,104 | ) |

| |

Net Assets — 100.0% | | | $ | 51,796,961 | |

The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

| | * | In U.S. dollars unless otherwise indicated. |

| | (1) | Senior floating-rate loans (Senior Loans) often require prepayments from excess cash flows or permit the borrowers to repay at their election. The degree to which borrowers repay, whether as a contractual requirement or at their election, cannot be predicted with accuracy. As a result, the actual remaining maturity may be substantially less than the stated maturities shown. However, Senior Loans will typically have an expected average life of approximately two to four years. Senior Loans typically have rates of interest which are redetermined periodically by reference to a base lending rate, plus a spread. These base lending rates are primarily the London Interbank Offered Rate (“LIBOR”) and secondarily, the prime rate offered by one or more major United States banks (the “Prime Rate”). Base lending rates may be subject to a floor, or minimum rate. |

| | (2) | Unfunded or partially unfunded loan commitments. The stated interest rate reflects the weighted average of the reference rate and spread for the funded portion, if any, and the commitment fees on the portion of the loan that is unfunded. See Note 1G for description. |

| | (3) | This Senior Loan will settle after September 30, 2018, at which time the interest rate will be determined. |

| | (4) | The stated interest rate represents the weighted average interest rate at September 30, 2018 of contracts within the senior loan facility. Interest rates on contracts are primarily redetermined either weekly, monthly or quarterly by reference to the indicated base lending rate and spread and the reset period. |

| | (5) | Security exempt from registration under Regulation S of the Securities Act of 1933, which exempts from registration securities offered and sold outside the United States. Security may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933. At September 30, 2018, the aggregate value of these securities is $9,096,801 or 17.6% of the Fund’s net assets. |

| | (6) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be sold in certain transactions in reliance on an exemption from registration (normally to qualified institutional buyers). At September 30, 2018, the aggregate value of these securities is $18,501,057 or 35.7% of the Fund’s net assets. |

| | (7) | When-issued security. |

| | (8) | Perpetual security with no stated maturity date but may be subject to calls by the issuer. |

| | (9) | Represents a payment-in-kind security which may pay interest in additional principal at the issuer’s discretion. |

| (10) | Variable rate security. The stated interest rate represents the rate in effect at September 30, 2018. |

| (11) | Security converts to floating rate after the indicated fixed-rate coupon period. |

| (12) | Weighted average fixed-rate coupon that changes/updates monthly. Rate shown is the rate at September 30, 2018. |

| (13) | Multi-step coupon bond. Interest rate represents the rate in effect at September 30, 2018. |

| (14) | Affiliated investment company, available to Eaton Vance portfolios and funds, which invests in high quality, U.S. dollar denominated money market instruments. The rate shown is the annualized seven-day yield as of September 30, 2018. |

| | | | |

| | 16 | | See Notes to Financial Statements. |

Eaton Vance

Oaktree Diversified Credit NextShares

September 30, 2018

Portfolio of Investments — continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| Forward Foreign Currency Exchange Contracts | |

| | | | | |

| Currency Purchased | | | Currency Sold | | | Counterparty | | Settlement

Date | | | Unrealized

Appreciation | | | Unrealized

(Depreciation) | |

| | | | | | | |

| AUD | | | 5,400 | | | USD | | | 3,925 | | | State Street Bank and Trust Company | | | 10/18/18 | | | $ | — | | | $ | (22 | ) |

| AUD | | | 4,800 | | | USD | | | 3,555 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | — | | | | (85 | ) |

| EUR | | | 125,000 | | | USD | | | 145,229 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 84 | | | | — | |

| EUR | | | 106,000 | | | USD | | | 125,144 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | — | | | | (1,918 | ) |

| HKD | | | 1,943,000 | | | USD | | | 247,796 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 453 | | | | — | |

| HKD | | | 93,000 | | | USD | | | 11,861 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 21 | | | | — | |

| HKD | | | 60,000 | | | USD | | | 7,649 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 17 | | | | — | |

| HKD | | | 44,200 | | | USD | | | 5,635 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 12 | | | | — | |

| JPY | | | 13,500,000 | | | USD | | | 121,303 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | — | | | | (2,348 | ) |

| USD | | | 148,048 | | | AUD | | | 200,000 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 3,467 | | | | — | |

| USD | | | 3,712 | | | AUD | | | 5,000 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 98 | | | | — | |

| USD | | | 2,905 | | | AUD | | | 4,000 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 13 | | | | — | |

| USD | | | 4,268 | | | AUD | | | 5,900 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 3 | | | | — | |

| USD | | | 3,443 | | | AUD | | | 4,800 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | — | | | | (26 | ) |

| USD | | | 2,693,796 | | | EUR | | | 2,299,432 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 20,699 | | | | — | |

| USD | | | 2,657,742 | | | EUR | | | 2,268,656 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 20,422 | | | | — | |

| USD | | | 1,652,039 | | | EUR | | | 1,410,000 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 12,909 | | | | — | |

| USD | | | 559,595 | | | EUR | | | 477,676 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 4,296 | | | | — | |

| USD | | | 241,217 | | | EUR | | | 204,929 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 2,986 | | | | — | |

| USD | | | 128,226 | | | EUR | | | 109,490 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 943 | | | | — | |

| USD | | | 39,108 | | | EUR | | | 33,400 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 280 | | | | — | |

| USD | | | 548,944 | | | GBP | | | 419,089 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 2,317 | | | | — | |

| USD | | | 535,832 | | | GBP | | | 409,078 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 2,262 | | | | — | |

| USD | | | 11,136 | | | HKD | | | 87,000 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 20 | | | | — | |

| USD | | | 11,612 | | | HKD | | | 91,000 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | — | | | | (15 | ) |

| USD | | | 509,579 | | | HKD | | | 3,995,000 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | — | | | | (844 | ) |

| USD | | | 414,769 | | | JPY | | | 46,511,000 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 4,939 | | | | — | |

| USD | | | 93,255 | | | JPY | | | 10,300,000 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 2,496 | | | | — | |

| USD | | | 95,856 | | | JPY | | | 10,600,000 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 2,455 | | | | — | |

| USD | | | 93,839 | | | JPY | | | 10,400,000 | | | State Street Bank and Trust Company | | | 10/18/18 | | | | 2,200 | | | | — | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | $ | 83,392 | | | $ | (5,258 | ) |

Abbreviations:

| | | | |

| EURIBOR | | – | | Euro Interbank Offered Rate |

| LIBOR | | – | | London Interbank Offered Rate |

| PIK | | – | | Payment In Kind |

Currency Abbreviations:

| | | | |

| AUD | | – | | Australian Dollar |

| EUR | | – | | Euro |

| GBP | | – | | British Pound Sterling |

| HKD | | – | | Hong Kong Dollar |

| JPY | | – | | Japanese Yen |

| USD | | – | | United States Dollar |

| | | | |

| | 17 | | See Notes to Financial Statements. |

Eaton Vance

Oaktree Diversified Credit NextShares

September 30, 2018

Statement of Assets and Liabilities

| | | | |

| Assets | | September 30, 2018 | |

Unaffiliated investments, at value (identified cost, $53,407,394) | | $ | 53,495,036 | |

Affiliated investment, at value (identified cost, $954,029) | | | 954,029 | |

Cash | | | 72,852 | |

Foreign currency, at value (identified cost, $27,675) | | | 27,448 | |

Interest receivable | | | 465,105 | |

Dividends receivable from affiliated investment | | | 2,505 | |

Receivable for investments sold | | | 1,033,979 | |

Receivable for open forward foreign currency exchange contracts | | | 83,392 | |

Total assets | | $ | 56,134,346 | |

| |

| Liabilities | | | | |

Payable for investments purchased | | $ | 3,960,703 | |

Payable for when-issued securities | | | 233,975 | |

Payable for open forward foreign currency exchange contracts | | | 5,258 | |

Payable to affiliates: | | | | |

Investment adviser fee | | | 33,939 | |

Operations agreement fee | | | 2,121 | |

Other | | | 12,108 | |

Accrued expenses | | | 89,281 | |

Total liabilities | | $ | 4,337,385 | |

Net Assets | | $ | 51,796,961 | |

| |

| Sources of Net Assets | | | | |

Paid-in capital | | $ | 51,490,135 | |

Distributable earnings | | | 306,826 | |

Total | | $ | 51,796,961 | |

| |

| Net Asset Value Per Share(1) | | | | |

($51,796,961 ÷ 5,125,000 shares issued and outstanding) | | $ | 10.11 | |

| (1) | Reflects a 2-for-1 stock split effective March 9, 2018 (see Note 8). |

| | | | |

| | 18 | | See Notes to Financial Statements. |

Eaton Vance

Oaktree Diversified Credit NextShares

September 30, 2018

Statement of Operations

| | | | |

| Investment Income | | Period Ended

September 30, 2018(1) | |

Interest (net of foreign taxes, $4,545) | | $ | 1,934,275 | |

Dividends from affiliated investment | | | 90,665 | |

Total investment income | | $ | 2,024,940 | |

| |

| Expenses | | | | |

Investment adviser fee | | $ | 354,793 | |

Operations agreement fee | | | 22,175 | |

Trustees’ fees and expenses | | | 2,672 | |

Custodian fee | | | 55,008 | |

Transfer and dividend disbursing agent fees | | | 12,002 | |

Legal and accounting services | | | 87,644 | |

Printing and postage | | | 8,411 | |

Registration fees | | | 6,412 | |

Listing fee | | | 14,700 | |

Intraday pricing fee | | | 10,476 | |

Miscellaneous | | | 2,275 | |

Total expenses | | $ | 576,568 | |

Deduct — | | | | |

Allocation of expenses to affiliate | | $ | 174,717 | |

Total expense reductions | | $ | 174,717 | |

| |

Net expenses | | $ | 401,851 | |

| |

Net investment income | | $ | 1,623,089 | |

| |

| Realized and Unrealized Gain (Loss) | | | | |

Net realized gain (loss) — | | | | |

Investment transactions | | $ | (140,690 | ) |

Investment transactions — affiliated investment | | | (554 | ) |

Foreign currency transactions | | | (64,339 | ) |

Forward foreign currency exchange contracts | | | 207,236 | |

Net realized gain | | $ | 1,653 | |

Change in unrealized appreciation (depreciation) — | | | | |

Investments | | $ | 87,642 | |

Foreign currency | | | 3,948 | |

Forward foreign currency exchange contracts | | | 78,134 | |

Net change in unrealized appreciation (depreciation) | | $ | 169,724 | |

| |

Net realized and unrealized gain | | $ | 171,377 | |

| |

Net increase in net assets from operations | | $ | 1,794,466 | |